UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

|

| |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 20182019

or

|

| |

☐

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Pennsylvania | | 25-1435979 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

The Tower at PNC Plaza, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2401

(Address of principal executive offices, including zip code)

(888) 762-2265

(Registrant’s telephone number including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $5.00 | PNC | New York Stock Exchange |

Depositary Shares Each Representing a 1/4,000 Interest in a Share of Fixed-to- Floating Rate Non-Cumulative Perpetual Preferred Stock, Series P | PNC P | New York Stock Exchange |

Depositary Shares Each Representing a 1/4,000 Interest in a Share of 5.375% Non-Cumulative Perpetual Preferred Stock, Series Q | PNC Q | New York Stock Exchange |

As of April 20, 2018,19, 2019, there were 469,498,755451,437,916 shares of the registrant’s common stock ($5 par value) outstanding.

THE PNC FINANCIAL SERVICES GROUP, INC.

Cross-Reference Index to First Quarter 20182019 Form 10-Q

|

| |

| |

| | Pages |

| PART I – FINANCIAL INFORMATION | |

| Item 1. Financial Statements (Unaudited). | |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A). | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Item 3. Quantitative and Qualitative Disclosures about Market Risk. | 20-37, 64-7318-33, 55-61 and 76-8164-69 |

| Item 4. Controls and Procedures. | |

| |

| |

| |

| |

| |

| |

| |

| |

THE PNC FINANCIAL SERVICES GROUP, INC.

Cross-Reference Index to First Quarter 20182019 Form 10-Q (continued)

| | | | | |

| MD&A TABLE REFERENCE | MD&A TABLE REFERENCE | | MD&A TABLE REFERENCE | |

| Table | Description | Page | Description | Page |

| 1 | | | | |

| 2 | | | | |

| 3 | | | | |

| 4 | | | | |

| 5 | | | | |

| 6 | | | | |

| 7 | | | | |

| 8 | | | | |

| 9 | | | | |

| 10 | | | | |

| 11 | | | | |

| 12 | | | | |

| 13 | | | | |

| 14 | | | | |

| 15 | | | | |

| 16 | | | | |

| 17 | | | | |

| 18 | | | | |

| 19 | | | | |

| 20 | | | | |

| 21 | | | | |

| 22 | | | | |

| 23 | | | | |

| 24 | | | | |

| 25 | | | | |

| 26 | | | | |

| 27 | | | | |

| 28 | | | | |

| 29 | | | | |

| 30 | | | | |

| 31 | | | | |

| 32 | | | | |

| 33 | | | |

| 34 | | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE REFERENCE | | |

| Table | Description | Page | |

| 35 | | | |

| 36 | | | |

| 37 | | | |

| 38 | | | |

| 39 | | | |

| 40 | | | |

| 41 | | | |

| 42 | | | |

| 43 | | | |

| 44 | | | |

| 45 | | | |

| 46 | | | |

| 47 | | | |

THE PNC FINANCIAL SERVICES GROUP, INC.

Cross-Reference Index to First Quarter 20182019 Form 10-Q (continued)

| | | | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE REFERENCE (Continued) | | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE REFERENCE | | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE REFERENCE | |

| Table | Description | Page | Description | Page |

| 33 | | | |

| 34 | | | |

| 35 | | | |

| 36 | | | |

| 37 | | | |

| 38 | | | |

| 39 | | | |

| 40 | | | |

| 41 | | | |

| 42 | | | |

| 43 | | | |

| 44 | | | |

| 45 | | | |

| 46 | | | |

| 47 | | | |

| 48 | | | | |

| 49 | | | | |

| 50 | | | | |

| 51 | | | | |

| 52 | | | | |

| 53 | | | | |

| 54 | | | | |

| 55 | | | | |

| 56 | | | | |

| 57 | | | | |

| 58 | | | | |

| 59 | | | | |

| 60 | | | | |

| 61 | | | | |

| 62 | | | | |

| 63 | | | | |

| 64 | | | | |

| 65 | | | | |

| 66 | | | | |

| 67 | | | | |

| 68 | | | | |

| 69 | | | | |

| 70 | | | | |

| 71 | | | | |

| 72 | | | | |

| 73 | | | | |

| 74 | | | | |

| 75 | | | | |

| 76 | | | | |

| 77 | | | |

| 78 | | | |

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review, including the Consolidated Financial Highlights, should be read together with our unaudited Consolidated Financial Statements and unaudited Statistical Information included elsewhere in this Quarterly Report on Form 10-Q (the Report or Form 10-Q) and with Items 6, 7, 8 and 9A of our 20172018 Annual Report on Form 10-K (2017(2018 Form 10-K). We have reclassified certain prior period amounts to conform with the current period presentation, which we believe is more meaningful to readers of our consolidated financial statements. For information regarding certain business, regulatory and legal risks, see the following: the Risk Management section of this Financial Review and of Item 7 in our 20172018 Form 10-K; Item 1A Risk Factors included in our 20172018 Form 10-K; and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements included in Item 1 of this Report and Item 8 of our 20172018 Form 10-K. Also, see the Cautionary Statement Regarding Forward-Looking Information section in this Financial Review and the Critical Accounting Estimates And Judgments section in this Financial Review and in our 20172018 Form 10-K for certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and from those anticipated in the forward-looking statements included in this Report. See Note 14 Segment Reporting in the Notes To Consolidated Financial Statements included in this Report for a reconciliation of total business segment earnings to total PNC consolidated net income as reported on a generally accepted accounting principles (GAAP) basis. In this Report, “PNC”, “we” or “us” refers to The PNC Financial Services Group, Inc. and its subsidiaries on a consolidated basis (except when referring to PNC as a public company, its common stock or other securities issued by PNC, which just refer to The PNC Financial Services Group, Inc.). References to The PNC Financial Services Group, Inc. or to any of its subsidiaries are specifically made where applicable.

Table 1: Consolidated Financial Highlights

| | Dollars in millions, except per share data Unaudited | Three months ended March 31 | | Three months ended

March 31 |

| 2018 | 2017 | | 2019 | 2018 |

| Financial Results (a) | | | | |

| Revenue | | | | |

| Net interest income | $ | 2,361 |

| $ | 2,160 |

| | $ | 2,475 |

| $ | 2,361 |

|

| Noninterest income | 1,750 |

| 1,724 |

| | 1,811 |

| 1,750 |

|

| Total revenue | 4,111 |

| 3,884 |

| | 4,286 |

| 4,111 |

|

| Provision for credit losses | 92 |

| 88 |

| | 189 |

| 92 |

|

| Noninterest expense | 2,527 |

| 2,402 |

| | 2,578 |

| 2,527 |

|

| Income before income taxes and noncontrolling interests | $ | 1,492 |

| $ | 1,394 |

| | $ | 1,519 |

| $ | 1,492 |

|

| Net income | $ | 1,239 |

| $ | 1,074 |

| | $ | 1,271 |

| $ | 1,239 |

|

| Less: | | | | |

| Net income attributable to noncontrolling interests | 10 |

| 17 |

| | 10 |

| 10 |

|

| Preferred stock dividends | 63 |

| 63 |

| | 63 |

| 63 |

|

| Preferred stock discount accretion and redemptions | 1 |

| 21 |

| | 1 |

| 1 |

|

| Net income attributable to common shareholders | 1,165 |

| 973 |

| | 1,197 |

| 1,165 |

|

| Less: | | | | |

| Dividends and undistributed earnings allocated to nonvested restricted shares | 5 |

| 6 |

| | |

| Dividends and undistributed earnings allocated to participating securities | | 5 |

| 5 |

|

| Impact of BlackRock earnings per share dilution | 2 |

| 4 |

| | 3 |

| 2 |

|

| Net income attributable to diluted common shares | $ | 1,158 |

| $ | 963 |

| | $ | 1,189 |

| $ | 1,158 |

|

| Diluted earnings per common share | $ | 2.43 |

| $ | 1.96 |

| | $ | 2.61 |

| $ | 2.43 |

|

| Cash dividends declared per common share | $ | .75 |

| $ | .55 |

| | $ | .95 |

| $ | .75 |

|

| Effective tax rate (b) | 17.0 | % | 23.0 | % | | 16.3 | % | 17.0 | % |

| Performance Ratios | | | | |

| Net interest margin (c) | 2.91 | % | 2.77 | % | | 2.98 | % | 2.91 | % |

| Noninterest income to total revenue | 43 | % | 44 | % | | 42 | % | 43 | % |

| Efficiency | 61 | % | 62 | % | | 60 | % | 61 | % |

| Return on: | | | | |

| Average common shareholders’ equity | 11.04 | % | 9.50 | % | | 11.13 | % | 11.04 | % |

| Average assets | 1.34 | % | 1.19 | % | | 1.34 | % | 1.34 | % |

| |

| (a) | The Executive Summary and Consolidated Income Statement Review portions of this Financial Review section provide information regarding items impacting the comparability of the periods presented. |

| |

| (b) | The effective income tax rates are generally lower than the statutory rate due to the relationship of pretax income to tax credits and earnings that are not subject to tax. The first quarter 2018 results reflected the change in the statutory federal income tax rate from 35% to 21%, effective as of January 1, 2018, as a result of the new federal tax legislation. |

| |

| (c) | Calculated as annualized taxable-equivalent net interest income divided by average earninginterest-earning assets. To provide more meaningful comparisons of net interest margins, we use net interest income on a taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP in the Consolidated Income Statement. For additional information, see Reconciliation of Taxable-Equivalent Net Interest Income (Non-GAAP) in the Statistical Information (Unaudited) section in Item 1 of this Report. |

The PNC Financial Services Group, Inc. – Form 10-Q 1

Table 1: Consolidated Financial Highlights (Continued) (a)

| | | Unaudited | March 31

2018 |

| December 31

2017 |

| March 31

2017 |

| | March 31

2019 |

| December 31

2018 |

| March 31

2018 |

| |

Balance Sheet Data (dollars in millions, except per share data) | | | | |

| Assets | $ | 379,161 |

| $ | 380,768 |

| $ | 370,944 |

| | $ | 392,837 |

| $ | 382,315 |

| $ | 379,161 |

| |

| Loans | $ | 221,614 |

| $ | 220,458 |

| $ | 212,826 |

| | $ | 232,293 |

| $ | 226,245 |

| $ | 221,614 |

| |

| Allowance for loan and lease losses | $ | 2,604 |

| $ | 2,611 |

| $ | 2,561 |

| | $ | 2,692 |

| $ | 2,629 |

| $ | 2,604 |

| |

| Interest-earning deposits with banks (b) | $ | 28,821 |

| $ | 28,595 |

| $ | 27,877 |

| | $ | 15,261 |

| $ | 10,893 |

| $ | 28,821 |

| |

| Investment securities | $ | 74,562 |

| $ | 76,131 |

| $ | 76,432 |

| | $ | 83,869 |

| $ | 82,701 |

| $ | 74,562 |

| |

| Loans held for sale | $ | 965 |

| $ | 2,655 |

| $ | 1,414 |

| | $ | 686 |

| $ | 994 |

| $ | 965 |

| |

| Equity investments (c) | $ | 12,008 |

| $ | 11,392 |

| $ | 10,900 |

| | $ | 12,567 |

| $ | 12,894 |

| $ | 12,008 |

| |

| Mortgage servicing rights | $ | 1,979 |

| $ | 1,832 |

| $ | 1,867 |

| | $ | 1,812 |

| $ | 1,983 |

| $ | 1,979 |

| |

| Goodwill | $ | 9,218 |

| $ | 9,173 |

| $ | 9,103 |

| | $ | 9,218 |

| $ | 9,218 |

| $ | 9,218 |

| |

| Other assets | $ | 27,949 |

| $ | 27,894 |

| $ | 28,083 |

| | $ | 34,761 |

| $ | 34,408 |

| $ | 27,949 |

| |

| Noninterest-bearing deposits | $ | 78,303 |

| $ | 79,864 |

| $ | 79,246 |

| | $ | 71,606 |

| $ | 73,960 |

| $ | 78,303 |

| |

| Interest-bearing deposits | $ | 186,401 |

| $ | 185,189 |

| $ | 181,464 |

| | $ | 199,615 |

| $ | 193,879 |

| $ | 186,401 |

| |

| Total deposits | $ | 264,704 |

| $ | 265,053 |

| $ | 260,710 |

| | $ | 271,221 |

| $ | 267,839 |

| $ | 264,704 |

| |

| Borrowed funds | $ | 58,039 |

| $ | 59,088 |

| $ | 55,062 |

| | $ | 59,860 |

| $ | 57,419 |

| $ | 58,039 |

| |

| Total shareholders’ equity | $ | 46,969 |

| $ | 47,513 |

| $ | 45,754 |

| | $ | 48,536 |

| $ | 47,728 |

| $ | 46,969 |

| |

| Common shareholders’ equity | $ | 42,983 |

| $ | 43,530 |

| $ | 41,774 |

| | $ | 44,546 |

| $ | 43,742 |

| $ | 42,983 |

| |

| Accumulated other comprehensive income (loss) | $ | (699 | ) | $ | (148 | ) | $ | (279 | ) | | $ | (5 | ) | $ | (725 | ) | $ | (699 | ) | |

| Book value per common share | $ | 91.39 |

| $ | 91.94 |

| $ | 86.14 |

| | $ | 98.47 |

| $ | 95.72 |

| $ | 91.39 |

| |

| Period-end common shares outstanding (in millions) | 470 |

| 473 |

| 485 |

| | 452 |

| 457 |

| 470 |

| |

| Loans to deposits | 84 | % | 83 | % | 82 | % | | 86 | % | 84 | % | 84 | % | |

| Common shareholders’ equity to total assets | | 11.3 | % | 11.4 | % | 11.3 | % | |

Client Assets (in billions) | | | | |

| Discretionary client assets under management | $ | 148 |

| $ | 151 |

| $ | 141 |

| | $ | 158 |

| $ | 148 |

| $ | 148 |

| |

| Nondiscretionary client assets under administration | 129 |

| 131 |

| 123 |

| | 130 |

| 124 |

| 129 |

| |

| Total client assets under administration | 277 |

| 282 |

| 264 |

| | 288 |

| 272 |

| 277 |

| |

| Brokerage account client assets | 49 |

| 49 |

| 46 |

| | 51 |

| 47 |

| 49 |

| |

| Total client assets | $ | 326 |

| $ | 331 |

| $ | 310 |

| | $ | 339 |

| $ | 319 |

| $ | 326 |

| |

| Capital Ratios | | | |

| Basel III (d) (e) (f) | | | |

| Basel III Capital Ratios (d) | | | |

| Common equity Tier 1 | 9.6 | % | N/A |

| N/A |

| | 9.8 | % | 9.6 | % | 9.6 | % | |

| Tier 1 risk-based | 10.8 | % | N/A |

| N/A |

| | 10.9 | % | 10.8 | % | 10.8 | % | |

Total capital risk-based | 12.8 | % | N/A |

| N/A |

| | 13.0 | % | 13.0 | % | 12.8 | % | |

| Leverage | 9.4 | % | N/A |

| N/A |

| | 9.6 | % | 9.4 | % | 9.4 | % | |

| Supplementary leverage | 7.9 | % | N/A |

| N/A |

| | 8.0 | % | 7.8 | % | 7.9 | % | |

| Fully Phased-In Basel III (Non-GAAP) (f) (g) | | | |

| Common equity Tier 1 | N/A |

| 9.8 | % | 10.0 | % | | |

| 2017 Transitional Basel III (d) (f) | | | |

| Common equity Tier 1 | N/A |

| 10.4 | % | 10.5 | % | | |

| Tier 1 risk-based | N/A |

| 11.6 | % | 11.8 | % | | |

| Total capital risk-based | N/A |

| 13.7 | % | 14.1 | % | | |

| Leverage | N/A |

| 9.9 | % | 9.9 | % | | |

| Common shareholders’ equity to total assets | 11.3 | % | 11.4 | % | 11.3 | % | | |

| Asset Quality | | | | |

| Nonperforming loans to total loans | .83 | % | .85 | % | .94 | % | | .71 | % | .75 | % | .83 | % | |

| Nonperforming assets to total loans, OREO, foreclosed and other assets | .90 | % | .92 | % | 1.04 | % | | |

| Nonperforming assets to total loans, OREO and foreclosed assets | | .77 | % | .80 | % | .90 | % | |

| Nonperforming assets to total assets | .53 | % | .53 | % | .60 | % | | .45 | % | .47 | % | .53 | % | |

| Net charge-offs to average loans (for the three months ended) (annualized) | .21 | % | .22 | % | .23 | % | | .24 | % | .19 | % | .21 | % | |

| Allowance for loan and lease losses to total loans | 1.18 | % | 1.18 | % | 1.20 | % | | 1.16 | % | 1.16 | % | 1.18 | % | |

| Allowance for loan and lease losses to total nonperforming loans | 141 | % | 140 | % | 128 | % | | 163 | % | 155 | % | 141 | % | |

| Accruing loans past due 90 days or more (in millions) | $ | 628 |

| $ | 737 |

| $ | 699 |

| | $ | 590 |

| $ | 629 |

| $ | 628 |

| |

| |

| (a) | The Executive Summary and Consolidated Balance Sheet Review portions of this Financial Review provide information regarding items impacting the comparability of the periods presented. |

| |

| (b) | Amounts include balances held with the Federal Reserve Bank of Cleveland (Federal Reserve Bank) of $28.6$15.0 billion, $28.3$10.5 billion and $27.5$28.6 billion as of March 31, 2018,2019, December 31, 20172018 and March 31, 2017,2018, respectively. |

| |

| (c) | Amounts include our equity interest in BlackRock. The amount at March 31, 2018 includes $.6 billion of trading and available for sale securities that were reclassified to Equity investments on January 1, 2018 in accordance with the adoption of Accounting Standard Update 2016-01. See the Recently Adopted Accounting Standards portion of Note 1 Accounting Policies in the Notes To Consolidated Financial Statements of this Report for additional detail on this adoption. |

| |

| (d) | All ratios are calculated using the regulatory capital methodology applicable to PNC during each period presented and calculated based on the standardized approach. |

| |

(e) | The Basel III ratios for common equity Tier 1 capital, Tier 1 risk-based capital, Leverage and Supplementary leverage reflect the full phase-in of all Basel III adjustments to these metrics applicable to PNC. The Basel III total risk-based capital ratio includes $80 million of nonqualifying trust preferred capital securities that are subject to a phase-out period that runs through 2022. |

| |

(f) | See Basel III Capital discussion in the Capital Management portion of the Risk Management section of this Financial Review and the capital discussion in the Banking Regulation and Supervision section of Item 1 Business and Item 1A Risk Factors in our 20172018 Form 10-K. See also the Transitional Basel III and Fully Phased-In Basel III Common Equity Tier 1 Capital Ratios (Non-GAAP) – March 31, 2017 table in the Statistical Information section of this Report for a reconciliation of the March 31, 2017 ratios. |

| |

(g)(e) | 2017 Fully Phased-inThe 2019 and 2018 Basel III resultsTotal risk-based capital ratios include nonqualifying trust preferred capital securities of $60 million and $80 million, respectively, that are presented as Pro forma estimates.subject to a phase-out period that runs through 2021. |

2 The PNC Financial Services Group, Inc. – Form 10-Q

EXECUTIVE SUMMARY

The PNC Financial Services Group, Inc. isHeadquartered in Pittsburgh, Pennsylvania, we are one of the largest diversified financial services companies in the United States and is headquartered in Pittsburgh, Pennsylvania.

States. We have businesses engaged in retail banking, including residential mortgage, corporate and institutional banking and asset management, providing many of our products and services nationally. Our primary geographicretail branch network is located in markets are located inacross the Mid-Atlantic, Midwest and Southeast. We also provide certain products and services internationally.have strategic international offices in four countries outside the U.S.

Key Strategic Goals

At PNC we manage our company for the long term. We are focused on the fundamentals of growing customers, loans, deposits and revenue and improving profitability, while investing for the future and managing risk, expenses and capital. We continue to invest in our products, markets and brand, and embrace our commitments to our customers, shareholders, employees and the communities where we do business.

We strive to expand and deepen customer relationships by offering a broad range of deposit, credit and fee-based products and services. We are focused on delivering those products and services to our customers with the goal of addressing their financial objectives and putting customers’ needs first. Our business model is built on customer loyalty and engagement, understanding our customers’ financial goals and offering our diverse products and services to help them achieve financial well-being. Our approach is concentrated on organically growing and deepening client relationships across our businesses that meet our risk/return measures.

We are focused on our strategic priorities, which are designed to enhance value over the long term, and consist of:

Expanding our leading banking franchise to new markets and digital platforms;

Deepening customer relationships by delivering a superior banking experience and financial solutions; and

Leveraging technology to innovate and enhance products, services, security and processes.

Our capital priorities are to support client growth and business investment, maintain appropriate capital in light of economic conditions, and the Basel III framework, and other regulatory expectations, and return excess capital to shareholders, in accordance with the currently effective capital plan included in our Comprehensive Capital Analysis and Review (CCAR) submission to the Board of Governors of the Federal Reserve System (Federal Reserve).shareholders. For more detail, see the Capital Highlights portion of this Executive Summary and the Liquidity and Capital Management portion of the Risk Management section of this Financial Review and the Supervision and Regulation section in Item 1 Business of our 20172018 Form 10-K.

Income Statement Highlights

Net income for the first quarter of 20182019 increased 15%3% to $1.3 billion, or $2.61 per diluted common share, compared to $1.2 billion, or $2.43 per diluted common share, compared to $1.1 billion, or $1.96 per diluted common share, for the first quarter of 2017.2018.

Total revenue increased $227$175 million, or 6%4%, to $4.1$4.3 billion.

Net interest income increased $201$114 million, or 9%5%, to $2.4$2.5 billion.

Net interest margin increased to 2.91%2.98% compared to 2.77%2.91% for the first quarter of 2017.2018.

Noninterest income increased $26$61 million, or 2%3%, to $1.8 billion.

Provision for credit losses was $92$189 million compared to $88$92 million for the first quarter of 2017.2018.

Noninterest expense increased $125$51 million, or 5%2%, to $2.5$2.6 billion.

Income tax expense decreased to $253 million compared to $320 million for the first quarter of 2017.

Federal tax reform legislation, the Tax Cuts and Jobs Act, lowered the statutory federal income tax rate for corporations to 21% from 35% effective January 1, 2018.

For additional detail, see the Consolidated Income Statement Review section inof this Financial Review.

Balance Sheet Highlights

Our balance sheet was strong and well positioned at March 31, 20182019 and December 31, 2017.2018. In comparison to December 31, 2017:2018:

Total assets increased $10.5 billion to $392.8 billion.

Total loans increased $6.0 billion, or 3%, to $232.3 billion.

Total commercial lending grew $6.1 billion, or 4%.

Total consumer lending decreased $.1 billion.

Investment securities increased $1.2 billion, or 1%, to $221.6$83.9 billion.

Total commercial lending grew $1.5Interest-earning deposits with banks, primarily with the Federal Reserve Bank, increased $4.4 billion, or 1%.

Total consumer lending decreased $.340%, to $15.3 billion.

Total deposits decreased $.3 billion to $264.7 billion.

Investment securities decreased $1.6increased $3.4 billion, or 2%1%, to $74.6$271.2 billion.

For additional detail, see the Consolidated Balance Sheet Review section of this Financial Review.

The PNC Financial Services Group, Inc. – Form 10-Q 3

Credit Quality Highlights

Overall credit quality remained stable.strong.

At March 31, 20182019 compared to December 31, 2017:2018:

Nonperforming assets decreased $31$23 million, or 2%, to $2.0 billion.1%.

Overall loan delinquencies decreased $131$49 million, or 9%.3%, to $1.4 billion.

Net charge-offs of $113were $136 million in the first quarter of 2018 decreased 4%2019 compared to net charge-offs of $118$113 million for the first quarter of 2017.2018.

The allowance for loan and lease losses to total loans of 1.16% at March 31, 2019 was unchanged compared to December 31, 2018.

For additional detail, see the Credit Risk Management portion of the Risk Management section of this Financial Review.

Capital Highlights

We maintained a strong capital position and continued to return capital to shareholders.

The Basel III common equity Tier 1 capital ratio which includes the full phase-in of all Basel III adjustments and became effective for PNC as of January 1, 2018, was 9.6%9.8% at March 31, 2018,2019, compared with 9.8%9.6% at December 31, 2017, calculated on the same basis.2018.

In the first quarter of 2018,2019, we returned $1.1$1.2 billion of capital to shareholders through repurchases of 4.85.9 million common shares for $.7 billion$725 million and dividends on common shares of $.4 billion.$438 million.

Common shareholders' equity increased to $44.5 billion at March 31, 2019 compared to $43.7 billion at December 31, 2018.

See the Liquidity and Capital Management portion of the Risk Management section of this Financial Review for more detail on our 20182019 liquidity and capital actions as well as our capital ratios.

Our ability to take certain capital actions, including plans to pay or increase common stock dividends or to repurchase shares under current or future programs, is subject to the results of the supervisory assessment of capital adequacy undertaken by the Board of Governors of the Federal Reserve System (Federal Reserve) as part of the CCARComprehensive Capital Analysis and Review (CCAR) process. For additional information, see the Supervision and Regulation section in Item 1 Business of our 20172018 Form 10-K.

Business Outlook

Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our current view that that:

U.S. economic growth will accelerate somewhat in 2018, in light of stimulus from corporate and personal income tax cuts passed in late 2017 that arehas accelerated over the past two years to above its long-run trend.

Growth is expected to support business investmentrebound in the second quarter following a soft first quarter 2019, and consumer spending, respectively. We expect an increase in federal government spending will also support economic growth in 2018. slow over the remaining course of 2019 and into 2020.

Further gradual improvement in the labor market will occur this year, including job gains and rising wages, is anotherwhich would be a positive indicator for consumer spending. Other sources of growth for the U.S. economy in 2018 will be the global economic expansion

Trade restrictions and the housing market, although trade restrictionsgeopolitical concerns are a downside riskrisks to the forecast. Although inflation

Inflation has slowed in 2017, it should pick up as the labor market continuesearly 2019, to tighten. Short-term interest rates and bond yields are expected to rise throughout 2018; afterbelow the Federal Open Market Committee raisedCommittee's (FOMC) 2% objective, but is expected to rise in the second half of the year.

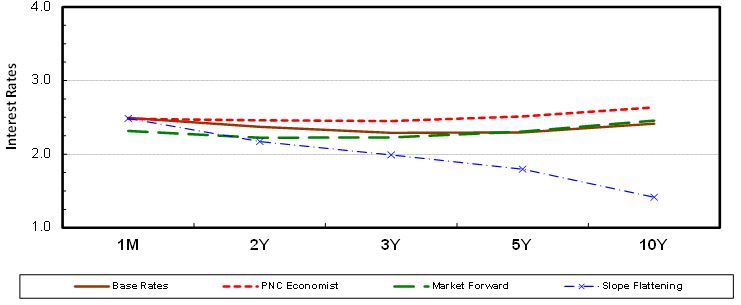

Our baseline forecast is for no change to the federal funds rate in March, our baseline forecast is for two additional2019 and 2020, with the rate hikesstaying in June and December 2018, pushing the federal funds rate to aits current range of 2.002.25% to 2.25% by the end of the year. Longer-term rates are also expected to increase as the Federal Reserve slowly reduces the size of its balance sheet and the federal government borrows more. Long-term rates will rise more slowly than short-term rates, so we anticipate that the yield curve will flatten but not invert.2.50%.

For the second quarter of 20182019 compared to the first quarter of 2018,2019, we expect:

ModestAverage loan growth;growth to be up approximately 1%;

Net interest income to increase by low singlelow-single digits, on a percentage basis;

Fee income to increase by mid-single digits, on a percentage basis. Fee income consists of asset management, consumer services, corporate services, residential mortgage and service charges on deposits;

Provision for credit losses to be between $100 million and $150 million; and

Noninterest expense to increase by low single digits, on a percentage basis.

We expect theThe quarterly run rate forof other noninterest income to be in the range of $225$275 million to $275$325 million, excluding net securities gains (losses) and Visa activity.activity;

Provision for credit losses to be between $125 million and $200 million; and

Noninterest expense to increase by low-single digits, on a percentage basis.

Our outlook for certain financial information forFor full year 2018 is2019 compared to full year 2017 results as adjusted for2018, we expect:

Average loan growth to be between 3% and 4%;

Revenue growth on the following fourth quarter 2017higher end of low-single digits, on a percentage basis;

Noninterest expense to increase on the lower end of low-single digits, on a percentage basis;

The effective tax legislationrate to be approximately 17%; and significant items: $26 million in lower net interest income from the impact of tax legislation on leveraged leases; a total of $54 million of higher noninterest income, consisting of the flow through impact of tax legislation on our equity investment in BlackRock, Visa Class B derivative fair value adjustments, and the appreciation of BlackRock stock contributed to the PNC Foundation, partially offset by negative adjustments for residential mortgage servicing rights fair value assumption updates; a total of $502 million of higher noninterest expense, consisting of a contribution to the PNC Foundation, charges for real estate dispositions and exits, and employee cash payments and pension account credits; and a $1.2 billion tax benefit recognized as a result of the federal tax legislation, primarily attributable to revaluation of net deferred tax liabilities and $230 million from the tax

To generate positive operating leverage.

4 The PNC Financial Services Group, Inc. – Form 10-Q

effect of the aforementioned significant items. For additional information on these fourth quarter 2017 items, see the Income Statement Highlights portion of the Executive Summary section in Item 7 of our 2017 Form 10-K.

For full year 2018 compared to full year 2017 on an adjusted basis, we expect:

Loan growth to be up mid-single digits, on a percentage basis;

Revenue to increase mid-single digits, on a percentage basis;

Noninterest expense to increase by low single digits, on a percentage basis; and

The effective tax rate to be approximately 17%.

See the Cautionary Statement Regarding Forward-Looking Information section in this Financial Review and Item 1A Risk Factors in our 20172018 Form 10-K for other factors that could cause future events to differ, perhaps materially, from those anticipated in these forward-looking statements.

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income Statement is presented in Part I, Item 1 of this Report.

Net income for the first quarter of 20182019 was $1.2$1.3 billion, or $2.43$2.61 per diluted common share, an increase of 15%3% compared to $1.1$1.2 billion, or $1.96$2.43 per diluted common share, for the first quarter of 2017. 2018.The increase was driven by a 6%4% increase in revenue, and a lower effective tax rate, partially offset by a 5%higher provision for credit losses and a 2% increase in noninterest expense. Higher revenue in the comparison reflected a 9%5% increase in net interest income and a 2%3% increase in noninterest income.

Net Interest Income

Table 2: Summarized Average Balances and Net Interest Income (a) | | | | | 2018 |

| 2017 | | | 2019 |

| 2018 | |

Three months ended March 31

Dollars in millions | | Average Balances |

| | Average Yields/ Rates |

| | Interest Income/ Expense |

| | Average Balances |

| | Average Yields/ Rates |

| | Interest Income/ Expense |

| | | Average Balances |

| | Average Yields/ Rates |

| | Interest Income/ Expense |

| | Average Balances |

| | Average Yields/ Rates |

| | Interest Income/ Expense |

| |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment securities | | $ | 74,656 |

| | 2.78 | % | | $ | 519 |

| | $ | 76,253 |

| | 2.67 | % | | $ | 508 |

| | | $ | 82,318 |

| | 3.05 | % | | $ | 627 |

| | $ | 74,656 |

| | 2.78 | % | | $ | 519 |

| |

| Loans | | 221,104 |

| | 4.09 | % | | 2,250 |

| | 212,253 |

| | 3.67 | % | | 1,941 |

| | | 228,545 |

| | 4.61 | % | | 2,622 |

| | 221,104 |

| | 4.09 | % | | 2,250 |

| |

| Interest-earning deposits with banks | | 25,667 |

| | 1.52 | % | | 98 |

| | 24,192 |

| | .81 | % | | 49 |

| | | 15,017 |

| | 2.43 | % | | 91 |

| | 25,667 |

| | 1.52 | % | | 98 |

| |

| Other | | 7,904 |

| | 4.11 | % | | 80 |

| | 8,395 |

| | 3.54 | % | | 74 |

| | | 11,068 |

| | 4.14 | % | | 115 |

| | 7,904 |

| | 4.11 | % | | 80 |

| |

| Total interest-earning assets/interest income | | $ | 329,331 |

| | 3.59 | % | | 2,947 |

| | $ | 321,093 |

| | 3.22 | % | | 2,572 |

| | | $ | 336,948 |

| | 4.11 | % | | 3,455 |

| | $ | 329,331 |

| | 3.59 | % | | 2,947 |

| |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 183,438 |

| | .47 | % | | 213 |

| | $ | 176,871 |

| | .28 | % | | 120 |

| | | $ | 195,816 |

| | .98 | % | | 472 |

| | $ | 183,438 |

| | .47 | % | | 213 |

| |

| Borrowed funds | | 59,638 |

| | 2.31 | % | | 344 |

| | 54,942 |

| | 1.74 | % | | 240 |

| | | 59,783 |

| | 3.21 | % | | 481 |

| | 59,638 |

| | 2.31 | % | | 344 |

| |

| Total interest-bearing liabilities/interest expense | | $ | 243,076 |

| | .91 | % | | 557 |

| | $ | 231,813 |

| | .62 | % | | 360 |

| | | $ | 255,599 |

| | 1.50 | % | | 953 |

| | $ | 243,076 |

| | .91 | % | | 557 |

| |

| Net interest margin/income (Non-GAAP) | | | | 2.91 | % | | 2,390 |

| | | | 2.77 | % | | 2,212 |

| | | | | 2.98 | % | | 2,502 |

| | | | 2.91 | % | | 2,390 |

| |

| Taxable-equivalent adjustments | | | | | | (29 | ) | | | | | | (52 | ) | | | | | | | (27 | ) | | | | | | (29 | ) | |

| Net interest income (GAAP) | | | | | | $ | 2,361 |

| | | | | | $ | 2,160 |

| | | | | | | $ | 2,475 |

| | | | | | $ | 2,361 |

| |

| |

| (a) | Interest income calculated as taxable-equivalent interest income. To provide more meaningful comparisons of interest income and yields for all interest-earning assets, as well as net interest margins, we use interest income on a taxable-equivalent basis in calculating average yields and net interest margins by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. For more information, see Reconciliation of Taxable-Equivalent Net Interest Income (Non-GAAP) in the Statistical Information (Unaudited) section of this Report. |

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information (Unaudited) – Average Consolidated Balance Sheet And Net Interest Analysis section of this Report for additional information.

Net interest income increased by $201$114 million, or 9%5%, in the first quarter of 20182019 compared with the first quarter of 2017,2018. This increase reflected higher loan and netsecurities yields and balances, partially offset by higher deposit and borrowing costs and balances. Net interest margin increased 147 basis points. These increases reflected higher loans and securities yields from higher interest rates, partially offset by increased balances and rates paid on borrowed funds and deposits. Net interest income also benefited from higher loan balances in the comparison.

Higher average rates on borrowed funds reflectedpoints reflecting the impact of an increase in three-month LIBOR. Interest rates on our borrowed funds portfolio are largely indexed to three-month LIBOR, either issued at this floating rate or throughhigher interest rate swaps.

The PNC Financial Services Group, Inc. – Form 10-Q5

rates.

Average investment securities decreased $1.6increased $7.7 billion, or 2%10%, reflecting portfolio runoff and lower reinvestments, including declines in average commercialdriven by net purchase activity of agency residential mortgage-backed securities of $1.9$4.4 billion and asset-backed securities of $1.2 billion, partially offset by net purchases of U.S. Treasury and government agency securities of $1.4 billion and residential mortgage-backed securities of $1.3$3.9 billion.

The decline in averageAverage investment securities also reflected the January 1, 2018 reclassification of $.6 billion of available for sale securitiesincreased to equity investments in accordance with the adoption of Accounting Standards Update (ASU) 2016-01. See the Recently Adopted Accounting Standards portion of Note 1 Accounting Policies in the Notes To Consolidated Financial Statements of this Report for additional detail on this adoption.

Total investment securities were 23%24% of average interest-earning assets for the first quarter of 20182019 compared to 24%23% for the first quarter of 2017.2018.

Average loans grew $8.9$7.4 billion, or 4%3%, reflecting an increase in average commercial lending of $8.5$6.5 billion, or 4%, driven by broad-based growth in ourthe Corporate Banking Equipment Finance and Business Credit businesses in our Corporate & Institutional Banking segment. Growth in Equipment Finance included the impact of the acquisition of a commercial and vendor finance business with $1.0 billion of loans and leases in the second quarter of 2017.

Average consumer lending increased $.4$.9 billion, in the comparison, as growthor 1%. Growth in residential real estate, automobile and credit card loans was largelypartially offset by declines in home equity and education loans. Lower home equity loans reflected paydowns and payoffs exceeding new originated volume. In addition, run-off in the non-strategic consumer loan portfoliosrunoff of brokered home equity and government guaranteed education loans contributed to the

The PNC Financial Services Group, Inc. – Form 10-Q5

declines. Average loans represented 67%68% of average interest-earning assets for the first quarter of 20182019 compared to 66%67% for the first quarter of 2017.2018.

Average totalinterest-earning deposits increased $5.7with banks decreased $10.7 billion, or 2%. 41%, reflecting lower average balances held with the Federal Reserve Bank as investment of liquidity continued.

Average interest-bearing deposits grew $6.6$12.4 billion, or 4%7%, reflecting the higher interest rate environmentoverall deposit and customer growth. Average savingsAdditionally, the increase reflects a shift of commercial deposits to interest-bearing from noninterest-bearing deposits, which declined $5.8 billion to $71.4 billion, as deposit rates have risen. In total, average interest-bearing deposits increased $9.4 billion due in part to a shift to relationship-based savings products from money market deposits, which decreased $5.4 billion. Additionally, average interest-bearing demand deposits grew $2.8 billion. Average interest-bearing deposits represented 75%77% of average interest-bearing liabilities compared to 75% for the first quarter of 2018 compared to 76% for the same period in 2017. Average noninterest-bearing deposits declined $.9 billion to $77.2 billion.2018.

Further details regarding average loans and deposits are included in the Business Segments Review section of this Financial Review.

Average borrowed funds increased $4.7 billion, or 9%, largely reflecting higher average bank notes and senior debt, partially offset by a decline in average subordinated debt. See the Consolidated Balance Sheet Review portion of this Financial Review for additional detail on the level and composition of borrowed funds.

Noninterest Income

Table 3: Noninterest Income

| | | | | Three months ended March 31 |

|

| Three months ended March 31 | |

| | | | | | | Change | | | | | | | Change | |

| Dollars in millions | | 2018 |

|

| 2017 |

| | $ | | % | | | 2019 |

| | 2018 |

| | $ |

| | % |

| |

| Noninterest income | | | | | | | | | | | | | | | | | | |

| Asset management | | $ | 455 |

| | $ | 403 |

| | $ | 52 |

| | 13 | % | | | $ | 437 |

| | $ | 455 |

| | $ | (18 | ) | | (4 | )% | |

| Consumer services | | 357 |

| | 332 |

| | 25 |

| | 8 | % | | | 371 |

| | 357 |

| | 14 |

| | 4 | % | |

| Corporate services | | 429 |

| | 414 |

| | 15 |

| | 4 | % | | | 462 |

| | 429 |

| | 33 |

| | 8 | % | |

| Residential mortgage | | 97 |

| | 113 |

| | (16 | ) | | (14 | )% | | | 65 |

| | 97 |

| | (32 | ) | | (33 | )% | |

| Service charges on deposits | | 167 |

| | 161 |

| | 6 |

| | 4 | % | | | 168 |

| | 167 |

| | 1 |

| | 1 | % | |

| Other | | 245 |

| | 301 |

| | (56 | ) | | (19 | )% | | | 308 |

| | 245 |

| | 63 |

| | 26 | % | |

| Total noninterest income | | $ | 1,750 |

|

| $ | 1,724 |

|

| $ | 26 |

| | 2 | % | | | $ | 1,811 |

|

| $ | 1,750 |

|

| $ | 61 |

| | 3 | % | |

Noninterest income as a percentage of total revenue was 43%42% for the first quarter of 20182019 compared to 44%43% for the same period in 2017.2018.

Asset management revenue increased reflecting higherdeclined due to changes in the mix of assets under management and lower earnings from our equity investment in BlackRock and stronger equity markets.BlackRock. PNC's discretionary client assets under management increased to $158 billion at March 31, 2019 compared to $148 billion at March 31, 2018 compared with $141 billion at March 31, 2017.

6 The PNC Financial Services Group, Inc. – Form 10-Q

Growth in consumer service fees included a $13 million increaseresulted from increases in debit card, credit card, fees, net of rewards, and debit cardbrokerage fees which reflectedreflecting continued momentum in customer activity in both transaction trends and customer growth. In addition, brokerage fees increased $10 million,

Higher corporate services revenue was primarily driven by higher brokerage assets under management.

Corporate services revenue reflected growth in treasury managementmerger and acquisition advisory fees of $15 million and treasury management product revenue of $14 million.

Residential mortgage revenue decreased as a $13 million increase in operating lease income related to the commercial and vendor finance business acquired in the second quarterresult of 2017. These increases were partially offset by a $12 million lower benefit from commercialnegative adjustment for residential mortgage servicing rights valuation, net of economic hedge.

Lower residential mortgage revenue was driven byhedge, compared with a $12 million declinebenefit in first quarter 2018, and lower loan sales revenue, which reflected compressed pricing margins and lower refinancing origination volume.revenue.

The decreaseincrease in other noninterest income was driven by an $88 million decline inlargely attributable to higher gains on asset sales and higher revenue from private equity investments, which included the impact of first quarter 2017 positive valuation adjustments related to the Volcker Rule provisions of the Dodd-Frank Act. This decrease was partially offset by a $14 million decline in negative derivative fair value adjustments related to Visa Class B common shares of $31 million in the comparison.

In the first quarter of 2018, and as a result of the commercial and vendor finance business we acquired2019 compared to $2 million in the second quarter of 2017, we have reclassified operating lease income to corporate services noninterest income from other noninterest income on the Consolidated Income Statement. Operating lease income was $34 million for the first quarter of 2018. First quarter 2017 operating lease income was $21 million and was reclassified to reflect this change.

Provision For Credit Losses

The provision for credit losses was $92increased $97 million for the first quarter of 2018 compared with $88to $189 million in the first quarter of 2017.2019 compared to $92 million in the first quarter of 2018 reflecting loan growth, including new loans and increased utilization, and reserve increases in the auto loan portfolio.

The Credit Risk Management portion of the Risk Management section of this Financial Review includes additional information regarding factors impacting the provision for credit losses.

6 The PNC Financial Services Group, Inc. – Form 10-Q

Noninterest Expense

Table 4: Noninterest Expense

| | | | | Three months ended March 31 | | | Three months ended March 31 | |

| | | | | | | Change | | | | | | | Change | |

| Dollars in millions | | 2018 |

|

| 2017 |

| | $ | | % | | | 2019 |

| | 2018 |

| | $ |

| | % |

| |

| Noninterest expense | | | | | | | | | | | | | | | | | | |

| Personnel | | $ | 1,354 |

| | $ | 1,257 |

| | $ | 97 |

| | 8 | % | | | $ | 1,414 |

| | $ | 1,354 |

| | $ | 60 |

| | 4 | % | |

| Occupancy | | 218 |

| | 222 |

| | (4 | ) | | (2 | )% | | | 215 |

| | 218 |

| | (3 | ) | | (1 | )% | |

| Equipment | | 273 |

| | 251 |

| | 22 |

| | 9 | % | | | 273 |

| | 273 |

| | — |

| | — |

| |

| Marketing | | 55 |

| | 55 |

| | — |

| | — |

| | | 65 |

| | 55 |

| | 10 |

| | 18 | % | |

| Other | | 627 |

| | 617 |

| | 10 |

| | 2 | % | | | 611 |

| | 627 |

| | (16 | ) | | (3 | )% | |

| Total noninterest expense | | $ | 2,527 |

|

| $ | 2,402 |

|

| $ | 125 |

| | 5 | % | | | $ | 2,578 |

| | $ | 2,527 |

| | $ | 51 |

| | 2 | % | |

The increaseNoninterest expense increased in noninterest expense was due to our ongoingthe comparison as investments in technology andsupport of business growth were reflected in our businesses and employees, and was reflected primarily inhigher personnel and equipment expense.marketing expense, which included costs for PNC's national retail digital strategy. These increases included operating expense related towere offset in part by a decrease in Federal Deposit Insurance Corporation (FDIC) deposit insurance as a result of the second quarter 2017 acquisitionelimination of a commercial and vendor finance business, as well as the investments we have made in new markets and our announced increase in hourly wages for eligible employees and in enhanced employee benefits.surcharge assessment.

PNC continued to focus on disciplined expense management. As of March 31, 2018,management, and for full-year 2019 we were on track to achieve our full-year 2018have a goal of $250$300 million in cost savings through our continuous improvement program, which we expect will partiallyhelp fund a portion of our ongoing business and technologystrategic investments.

Effective Income Tax Rate

The effective income tax rate was 16.3% in the first quarter of 2019 compared to 17.0% in the first quarter of 2018 compared to 23.0% in the same period of 2017. First quarter 2018 reflected the change in the statutory federal income tax rate from 35% to 21%, effective as of January 1, 2018, as a result of the new federal tax legislation.2018.

The PNC Financial Services Group, Inc. – Form 10-Q7

CONSOLIDATED BALANCE SHEET REVIEW

Table 5: Summarized Balance Sheet Data

| | | | March 31 |

| | December 31 |

| | Change | | March 31 |

| | December 31 |

| | Change | |

| Dollars in millions | 2018 |

| | 2017 |

| | $ | % | | 2019 |

| | 2018 |

| | $ | % | |

| Assets | | | | | | | | | | | | | | |

| Interest-earning deposits with banks | $ | 28,821 |

| | $ | 28,595 |

| | $ | 226 |

| 1 | % | | $ | 15,261 |

| | $ | 10,893 |

| | $ | 4,368 |

| 40 | % | |

| Loans held for sale | 965 |

| | 2,655 |

| | (1,690 | ) | (64 | )% | | 686 |

| | 994 |

| | (308 | ) | (31 | )% | |

| Investment securities | 74,562 |

| | 76,131 |

| | (1,569 | ) | (2 | )% | | 83,869 |

| | 82,701 |

| | 1,168 |

| 1 | % | |

| Loans | 221,614 |

| | 220,458 |

| | 1,156 |

| 1 | % | | 232,293 |

| | 226,245 |

| | 6,048 |

| 3 | % | |

| Allowance for loan and lease losses | (2,604 | ) | | (2,611 | ) | | 7 |

| — |

| | (2,692 | ) | | (2,629 | ) | | (63 | ) | (2 | )% | |

| Mortgage servicing rights | 1,979 |

| | 1,832 |

| | 147 |

| 8 | % | | 1,812 |

| | 1,983 |

| | (171 | ) | (9 | )% | |

| Goodwill | 9,218 |

| | 9,173 |

| | 45 |

| — |

| | 9,218 |

| | 9,218 |

| | — |

| — |

| |

| Other, net | 44,606 |

| | 44,535 |

| | 71 |

| — |

| | 52,390 |

| | 52,910 |

| | (520 | ) | (1 | )% | |

| Total assets | $ | 379,161 |

| | $ | 380,768 |

| | $ | (1,607 | ) | — |

| | $ | 392,837 |

| | $ | 382,315 |

| | $ | 10,522 |

| 3 | % | |

| Liabilities | | | | |

|

|

|

| | | | | |

|

|

|

| |

| Deposits | $ | 264,704 |

| | $ | 265,053 |

| | $ | (349 | ) | — |

| | $ | 271,221 |

| | $ | 267,839 |

| | $ | 3,382 |

| 1 | % | |

| Borrowed funds | 58,039 |

| | 59,088 |

| | (1,049 | ) | (2 | )% | | 59,860 |

| | 57,419 |

| | 2,441 |

| 4 | % | |

| Other | 9,383 |

| | 9,042 |

| | 341 |

| 4 | % | | 13,181 |

| | 9,287 |

| | 3,894 |

| 42 | % | |

| Total liabilities | 332,126 |

| | 333,183 |

| | (1,057 | ) | — |

| | 344,262 |

| | 334,545 |

| | 9,717 |

| 3 | % | |

| Equity | | | | |

|

|

|

| | | | | |

|

|

|

| |

| Total shareholders’ equity | 46,969 |

| | 47,513 |

| | (544 | ) | (1 | )% | | 48,536 |

| | 47,728 |

| | 808 |

| 2 | % | |

| Noncontrolling interests | 66 |

| | 72 |

| | (6 | ) | (8 | )% | | 39 |

| | 42 |

| | (3 | ) | (7 | )% | |

| Total equity | 47,035 |

| | 47,585 |

| | (550 | ) | (1 | )% | | 48,575 |

| | 47,770 |

| | 805 |

| 2 | % | |

| Total liabilities and equity | $ | 379,161 |

| | $ | 380,768 |

| | $ | (1,607 | ) | — |

| | $ | 392,837 |

| | $ | 382,315 |

| | $ | 10,522 |

| 3 | % | |

The summarized balance sheet data in Table 5 is based upon our Consolidated Balance Sheet in Part 1, Item 1 of this Report.

Our balance sheet was strong and well positioned at both March 31, 20182019 and December 31, 2017.2018.

Total assets decreased due to lower loans held for saleincreased driven by loan growth, higher interest-earning deposits with banks and higher investment securities, partially offset by higher loans;securities;

Total liabilities decreasedincreased due to lower borrowed funds;deposit growth, higher federal funds purchased and timing of securities purchases;

Total equity decreased due to share repurchases and lower accumulated other comprehensive income (loss) related to net unrealized securities losses, partially offset byincreased as higher retained earnings driven by net income.income and higher accumulated other comprehensive income (AOCI) was partially offset by share repurchases.

The PNC Financial Services Group, Inc. – Form 10-Q7

The following discussion provides additional information about the major components of our balance sheet. Information regarding our capital and regulatory compliance is included in the Liquidity and Capital Management portion of the Risk Management section in this Financial Review and in Note 18 Regulatory Matters in the Notes To Consolidated Financial Statements included in our 20172018 Form 10-K.

Loans

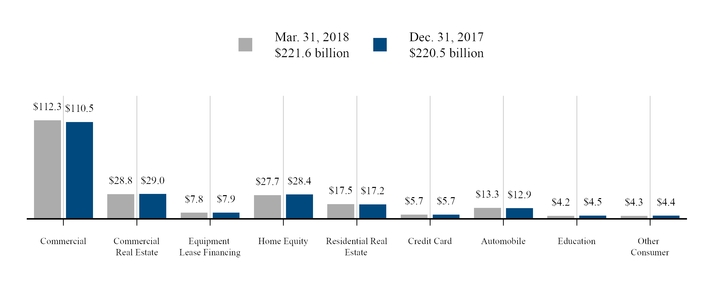

Table 6: Loans

|

| | | | | | | | | | | | | | |

| | March 31 |

| | December 31 |

| | Change | |

| Dollars in millions | 2018 |

| | 2017 |

| | $ | % | |

| Commercial lending | | | | | | | |

| Commercial | $ | 112,308 |

| | $ | 110,527 |

| | $ | 1,781 |

| 2 | % | |

| Commercial real estate | 28,835 |

| | 28,978 |

| | (143 | ) | — |

| |

| Equipment lease financing | 7,802 |

| | 7,934 |

| | (132 | ) | (2 | )% | |

| Total commercial lending | 148,945 |

| | 147,439 |

| | 1,506 |

| 1 | % | |

| Consumer lending | | | | |

|

|

|

| |

| Home equity | 27,699 |

| | 28,364 |

| | (665 | ) | (2 | )% | |

| Residential real estate | 17,456 |

| | 17,212 |

| | 244 |

| 1 | % | |

| Credit card | 5,657 |

| | 5,699 |

| | (42 | ) | (1 | )% | |

| Other consumer | | | | |

|

|

|

| |

| Automobile | 13,295 |

| | 12,880 |

| | 415 |

| 3 | % | |

| Education | 4,228 |

| | 4,454 |

| | (226 | ) | (5 | )% | |

| Other | 4,334 |

| | 4,410 |

| | (76 | ) | (2 | ) | |

| Total consumer lending | 72,669 |

| | 73,019 |

| | (350 | ) | — |

| |

| Total loans | $ | 221,614 |

| | $ | 220,458 |

| | $ | 1,156 |

| 1 | % | |

8 The PNC Financial Services Group, Inc. – Form 10-Q

Loan growth was driven by commercial lending partially offset by a decline in consumer lending balances. |

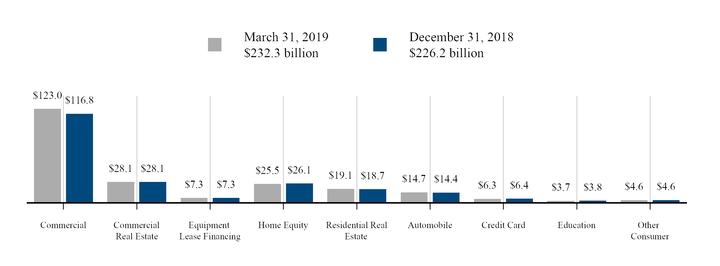

| | | | | | | | | | | | | | |

| | March 31 |

| | December 31 |

| | Change | |

| Dollars in millions | 2019 |

| | 2018 |

| | $ | % | |

| Commercial lending | | | | | | | |

| Commercial | $ | 122,993 |

| | $ | 116,834 |

| | $ | 6,159 |

| 5 | % | |

| Commercial real estate | 28,101 |

| | 28,140 |

| | (39 | ) | — |

| |

| Equipment lease financing | 7,348 |

| | 7,308 |

| | 40 |

| 1 | % | |

| Total commercial lending | 158,442 |

| | 152,282 |

| | 6,160 |

| 4 | % | |

| Consumer lending | | | | |

|

|

|

| |

| Home equity | 25,500 |

| | 26,123 |

| | (623 | ) | (2 | )% | |

| Residential real estate | 19,107 |

| | 18,657 |

| | 450 |

| 2 | % | |

| Automobile | 14,707 |

| | 14,419 |

| | 288 |

| 2 | % | |

| Credit card | 6,267 |

| | 6,357 |

| | (90 | ) | (1 | )% | |

| Education | 3,707 |

| | 3,822 |

| | (115 | ) | (3 | )% | |

| Other consumer | 4,563 |

| | 4,585 |

| | (22 | ) | — |

| |

| Total consumer lending | 73,851 |

| | 73,963 |

| | (112 | ) | — |

| |

| Total loans | $ | 232,293 |

| | $ | 226,245 |

| | $ | 6,048 |

| 3 | % | |

Commercial loans increased reflecting broad-based growth across our Corporate Banking, Business Credit and Real Estate and Business Credit businesses within our Corporate & Institutional Banking segment. In Corporate Banking, commercial loans increased $.8 billion, or 1%, largely due to strong growth inprimarily driven by asset-backed finance securitizations as well as middle marketincreased lending to large and largemidsize corporate lending. Commercialclients. In Business Credit, commercial loans in ourincreased driven by new originations and higher utilization. In the Real Estate business, increased $.6 billion, or 5%, primarily driven by higher multifamily agency warehouse lending. In Business Credit, higher utilization resulted in an increaselending also contributed to the growth in commercial loans of $.4 billion, or 3%.loans.

For commercial loans by industry and commercial real estate loans by geography, see Loan Portfolio Characteristics and Analysis in the Credit Risk Management portion of the Risk Management section in this Financial Review.

Consumer lending balances declineddecreased as lower home equity loans, education loans, and credit card balances were partially offset by growth in automobile and residential real estate loans were more than offset by lower home equity and educationautomobile loans.

Home equity loans declined as paydowns and payoffs exceeded new originated volume. In addition, the declines in both home equityvolume and education loans included the continued runoff in our non-strategic brokered home equity and governmentloans continued to runoff. Education loans declined primarily due to runoff of the guaranteed education loan portfolios.portfolio. Credit card balances declined due to seasonally lower consumer spending.

Residential real estate loans increased as a result of growth inprimarily from originations of nonconforming residential mortgage loans, both nationwide and within our branch network. Nonconforming residential mortgage loanswhich are loans that do not meet government agency standards such as a maximum loan amount, property type or credit requirements, among other factors. The growth in residential real estate loans was primarily due to nonconforming loans that exceededresult of exceeding agency conforming loan limits. AutomobileThe growth in automobile loans grew in partwas due to higher indirect auto loans as a result of continued new loan growth and expansion into franchised dealers in our Southeastnew markets.

For information on home equity and residential real estate loans, including by geography, and automobile loans, see Loan Portfolio Characteristics and Analysis in the Credit Risk Management portion of the Risk Management section in this Financial Review.

See the Credit Risk Management portion of the Risk Management section of this Financial Review, and Note 1 Accounting Policies, Note 3 Asset Quality and Note 4 Allowance for Loan and Lease Losses in our Notes To Consolidated Financial Statements included in this Report, and Note 1 Accounting Policies in our 2018 Form 10-K for additional information regarding our loan portfolio.

8 The PNC Financial Services Group, Inc. – Form 10-Q

Investment Securities

Investment securities of $83.9 billion at March 31, 2019 increased $1.2 billion, or 1%, compared to December 31, 2018, driven by net purchases of U.S. Treasury and government agency securities of $.9 billion and asset-backed securities of $.6 billion, partially offset by a decline of other securities of $.5 billion.

The level and composition of the investment securities portfolio fluctuates over time based on many factors including market conditions, loan and deposit growth, and balance sheet management activities. We manage our investment securities portfolio to optimize returns, while providing a reliable source of liquidity for our banking and other activities, considering the Liquidity Coverage Ratio (LCR) and other internal and external guidelines and constraints.

Table 7: Investment Securities

| | | | March 31, 2018 | | December 31, 2017 | | Ratings (a) as of March 31, 2018 | | March 31, 2019 | | December 31, 2018 | | Ratings (a) as of March 31, 2019 | |

| Dollars in millions | Amortized Cost |

| | Fair Value |

| | Amortized Cost |

| | Fair Value |

| | AAA/ AA |

| | A |

| | BBB |

| | BB and Lower |

| | No Rating |

| | Amortized Cost |

| | Fair Value |

| | Amortized Cost |

| | Fair Value |

| | AAA/ AA |

| | A |

| | BBB |

| | BB and Lower |

| | No Rating |

| |

| U.S. Treasury and government agencies | $ | 14,390 |

| | $ | 14,335 |

| | $ | 15,173 |

| | $ | 15,286 |

| | 100 | % | |

| |

| |

| |

| | $ | 19,621 |

| | $ | 19,778 |

| | $ | 18,862 |

| | $ | 18,863 |

| | 100 | % | |

| |

| |

| |

| |

| Agency residential mortgage-backed | 41,175 |

| | 40,301 |

| | 40,037 |

| | 39,847 |

| | 100 | % | |

| |

| |

| |

| | 44,866 |

| | 44,750 |

| | 45,153 |

| | 44,407 |

| | 100 | % | |

| |

| |

| |

| |

| Non-agency residential mortgage-backed | 2,483 |

| | 2,802 |

| | 2,610 |

| | 2,932 |

| | 11 | % | |

| | 3 | % | | 66 | % | | 20 | % | | 1,983 |

| | 2,278 |

| | 2,076 |

| | 2,365 |

| | 13 | % | | 2 | % | | 2 | % | | 48 | % | | 35 | % | |

| Agency commercial mortgage-backed | 2,222 |

| | 2,146 |

| | 2,367 |

| | 2,315 |

| | 100 | % | |

| |

| |

| |

| | 2,705 |

| | 2,681 |

| | 2,773 |

| | 2,720 |

| | 100 | % | |

| |

| |

| |

| |

| Non-agency commercial mortgage-backed (b) | 3,109 |

| | 3,098 |

| | 3,141 |

| | 3,161 |

| | 84 | % | | 6 | % | |

|

| |

|

| | 10 | % | | 3,304 |

| | 3,308 |

| | 3,177 |

| | 3,145 |

| | 88 | % | | 5 | % | |

|

| |

|

| | 7 | % | |

| Asset-backed (c) | 5,325 |

| | 5,380 |

| | 5,531 |

| | 5,598 |

| | 84 | % | | 3 | % | | 6 | % | | 7 | % | |

| | 5,682 |

| | 5,739 |

| | 5,115 |

| | 5,155 |

| | 88 | % | | 3 | % | | 3 | % | | 5 | % | | 1 | % | |

| Other debt (d) | 6,081 |

| | 6,179 |

| | 6,279 |

| | 6,459 |

| | 74 | % | | 15 | % | | 7 | % | | 1 | % | | 3 | % | | |

| Other (e) | | | | | 587 |

| | 585 |

| | | | | | | | | | | | |

Total investment securities (f) | $ | 74,785 |

| | $ | 74,241 |

| | $ | 75,725 |

| | $ | 76,183 |

| | 93 | % | | 2 | % | | 1 | % | | 3 | % | | 1 | % | | |

| Other (d) | | 5,181 |

| | 5,325 |

| | 5,670 |

| | 5,753 |

| | 72 | % | | 15 | % | | 9 | % | | 1 | % | | 3 | % | |

Total investment securities (e) | | $ | 83,342 |

| | $ | 83,859 |

| | $ | 82,826 |

| | $ | 82,408 |

| | 95 | % | | 1 | % | | 1 | % | | 2 | % | | 1 | % | |

| |

| (a) | Ratings percentages allocated based on amortized cost. |

| |

| (b) | Collateralized primarily by retail properties, office buildings, lodging properties and multi-family housing. |

| |

| (c) | Collateralized primarily by corporate debt, government guaranteed education loans and other consumer credit products. |

| |

| (d) | Includes state and municipal securities. |

| |

| (e) | On January 1, 2018, $.6 billion of available for sale securities, primarily money market funds, were reclassified to equity investments in accordance with the adoption of ASU 2016-01. See the Recently Adopted Accounting Standards portion of Note 1 Accounting Policies in the Notes To Consolidated Financial Statements of this Report for additional detail on this adoption. |

| |

(f) | Includes available for sale and held to maturity securities, which are recorded on our balance sheet at fair value and amortized cost, respectively. |

The PNC Financial Services Group, Inc. – Form 10-Q9

Investment securities decreased $1.6 billion at March 31, 2018 compared to December 31, 2017, driven by declines in U.S. Treasury and government agencies securities of $.9 billion, other debt securities of $.3 billion, commercial mortgage-backed securities of $.2 billion and asset-backed securities of $.2 billion. These declines were partially offset by net purchases of agency residential mortgage-backed securities of $.8 billion. The overall decrease includes a $.6 billion decline in the valuation of our available for sale securities portfolio reflecting the impact of higher interest rates, primarily for U.S. Treasury and government agencies and agency residential mortgage-backed securities.

The decline in total investment securities at March 31, 2018 compared to December 31, 2017 also reflected the reclassification of $.6 billion of available for sale securities, primarily money market funds, to equity investments as part of the adoption of ASU 2016-01. See Note 1 Accounting Policies in the Notes To Consolidated Financial Statements for additional detail on our adoption of this ASU.

The level and composition of the investment securities portfolio fluctuates over time based on many factors including market conditions, loan and deposit growth, and balance sheet management activities. We manage our investment securities portfolio to optimize returns, while providing a reliable source of liquidity for our banking and other activities, considering LCR and other internal and external guidelines and constraints.

Table 7 presents the distribution of our total investment securities portfolio by amortized cost and fair value, as well as by credit rating. We have included credit ratings information because we believe that the information is an indicator of the degree of credit risk to which we are exposed, which could affect our risk-weighted assets and, therefore, our risk-based regulatory capital ratios under the current regulatory capital rules. Changes in credit ratings classifications could indicate increased or decreased credit risk and could be accompanied by a reduction or increase in the fair value of our investment securities portfolio.

At least quarterly, we conduct a comprehensive security-level impairment assessment on all securities. If economic conditions, including home prices, were to deteriorate from current levels, and if market volatility and liquidity were to deteriorate from current levels, or if market interest rates were to increase or credit spreads were to widen appreciably, the valuation of our investment securities portfolio would likely be adversely affected and we could incur additional other than temporary impairment (OTTI) credit losses that would impact our Consolidated Income Statement.

The duration of investment securities was 3.73.1 years at March 31, 2018.2019. We estimate that at March 31, 20182019 the effective duration of investment securities was 3.83.3 years for an immediate 50 basis points parallel increase in interest rates and 3.52.9 years for an immediate 50 basis points parallel decrease in interest rates.

Based on expected prepayment speeds, the weighted-average expected maturity of the investment securities portfolio (excluding other) was 5.74.9 years at March 31, 20182019 compared to 5.25.3 years at December 31, 2017.2018.

Table 8: Weighted-Average Expected Maturities of Mortgage and Other Asset-Backed Debt Securities

|

| | | |

March 31, 20182019 | Years |

| |

| Agency residential mortgage-backed | 6.65.6 |

| |

| Non-agency residential mortgage-backed | 6.36.2 |

| |

| Agency commercial mortgage-backed | 3.54.1 |

| |

| Non-agency commercial mortgage-backed | 3.12.7 |

| |

| Asset-backed | 2.52.1 |

| |

Additional information regarding our investment securities is included in Note 5 Investment Securities and Note 6 Fair Value in the Notes To Consolidated Financial Statements included in this Report.

10The PNC Financial Services Group, Inc. – Form 10-Q9

Funding Sources

Table 9: Details of Funding Sources | | | | March 31 |

| | December 31 |

| | Change | | March 31 |

| | December 31 |

| | Change | |

| Dollars in millions | 2018 |

| | 2017 |

| | $ | % | | 2019 |

| | 2018 |

| | $ | % | |

| Deposits | | | | | | | | | | | | | | |

| Noninterest-bearing | $ | 78,303 |

| | $ | 79,864 |

| | $ | (1,561 | ) | (2 | )% | | $ | 71,606 |

| | $ | 73,960 |

| | $ | (2,354 | ) | (3 | )% | |

| Interest-bearing | | | | |

|

|

|

| | | | | |

|

|

|

| |

| Money market | 57,260 |

| | 59,735 |

| | (2,475 | ) | (4 | )% | | 53,037 |

| | 53,368 |

| | (331 | ) | (1 | )% | |

| Demand | 62,289 |

| | 61,213 |

| | 1,076 |

| 2 | % | | 65,643 |

| | 65,211 |

| | 432 |

| 1 | % | |

| Savings | 50,582 |

| | 46,980 |

| | 3,602 |

| 8 | % | | 61,315 |

| | 56,793 |

| | 4,522 |

| 8 | % | |

| Time deposits | 16,270 |

| | 17,261 |

| | (991 | ) | (6 | )% | | 19,620 |

| | 18,507 |

| | 1,113 |

| 6 | % | |

| Total interest-bearing deposits | 186,401 |

| | 185,189 |

| | 1,212 |

| 1 | % | | 199,615 |

| | 193,879 |

| | 5,736 |

| 3 | % | |

| Total deposits | 264,704 |

| | 265,053 |

| | (349 | ) | — |

| | 271,221 |

| | 267,839 |

| | 3,382 |

| 1 | % | |

| Borrowed funds | | | | |

|

|

|

| | | | | |

|

|

|

| |

| Federal Home Loan Bank (FHLB) borrowings | 19,537 |

| | 21,037 |

| | (1,500 | ) | (7 | )% | | 20,501 |

| | 21,501 |

| | (1,000 | ) | (5 | )% | |

| Bank notes and senior debt | 28,773 |

| | 28,062 |

| | 711 |

| 3 | % | | 25,598 |

| | 25,018 |

| | 580 |

| 2 | % | |

| Subordinated debt | 5,121 |

| | 5,200 |

| | (79 | ) | (2 | )% | | 5,977 |

| | 5,895 |

| | 82 |

| 1 | % | |

| Other | 4,608 |

| | 4,789 |

| | (181 | ) | (4 | )% | | 7,784 |

| | 5,005 |

| | 2,779 |

| 56 | % | |

| Total borrowed funds | 58,039 |

| | 59,088 |

| | (1,049 | ) | (2 | )% | | 59,860 |

| | 57,419 |

| | 2,441 |

| 4 | % | |

| Total funding sources | $ | 322,743 |

| | $ | 324,141 |

| | $ | (1,398 | ) | — |

| | $ | 331,081 |

| | $ | 325,258 |

| | $ | 5,823 |

| 2 | % | |

Total deposits declined slightly in the comparisonincreased as growth in interest-bearing deposits was more thanpartially offset by decreasesa decrease in noninterest-bearing deposits.

The increase in interest-bearing deposits reflected consumer deposit growth, including from the national retail digital strategy. Noninterest-bearing deposits decreased due to seasonal declines in commercial deposits. Within interest-bearing deposits savings deposits grew reflecting, in part, a shift from consumer money market to relationship-based savings products, as well as growth in consumer demand deposit balances. The decline in timea shift of commercial deposits largely reflected lower certificates of depositto interest-bearing.

Borrowed funds increased due to the net runoff of maturing accounts.

The declinehigher federal funds purchased, included in other borrowed funds, in the comparison was primarily due to lower FHLB borrowings, partially offset by growth inand bank notes and senior debt, including $2.0 billion issuedwhich were partially offset by decreases in January 2018.FHLB borrowings. The level and composition of borrowed funds fluctuates over time based on many factors including market conditions, loan, investment securities and deposit growth, and capital considerations. We manage our borrowed funds to provide a reliable source of liquidity for our banking and other activities, considering our LCR and other internal and external guidelines and constraints.

See the Liquidity and Capital Management portion of the Risk Management section of this Financial Review for additional information regarding our 20182019 liquidity and capital activities.

Shareholders’ Equity

Total shareholders’ equity was $47.0$48.5 billion at March 31, 2018, a decrease2019, an increase of $.5$.8 billion compared to December 31, 2017.2018. The decreaseincrease resulted from common share repurchasesnet income of $1.3 billion and higher AOCI of $.7 billion lower accumulated other comprehensive income (loss) related to net unrealized securities lossesgains, partially offset by common share repurchases of $.6 billion$725 million and common and preferred dividends of $.4 billion, partially offset by net income of $1.2 billion.$438 million.

Common shares outstanding were 470452 million and 473457 million at March 31, 20182019 and December 31, 2017,2018, respectively, as repurchases of 4.85.9 million shares during the period were partially offset by share issuances from treasury stock related to warrants exercised and stock-based compensation activity.

The PNC Financial Services Group, Inc. – Form 10-Q11

BUSINESS SEGMENTS REVIEW

We have four reportable business segments:

Retail Banking

Corporate & Institutional Banking

Asset Management Group

BlackRock