UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| | |

| (Mark one) | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended September 30, 2017 |

For the quarterly period ended June 30, 2019

OR

|

| | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | |

| | For the transition period from to | |

Commission file number: 1-8606

Verizon Communications Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 23-2259884 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | | |

1095 Avenue of the Americas New York, New York

| | 10036 |

| New York | New York | | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) (212) 395-1000

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Exchange on Which Registered |

| Common Stock, par value $0.10 | | VZ | | New York Stock Exchange |

| Common Stock, par value $0.10 | | VZ | | The NASDAQ Global Select Market |

| 2.375% Notes due 2022 | | VZ22A | | New York Stock Exchange |

| 0.500% Notes due 2022 | | VZ22B | | New York Stock Exchange |

| 1.625% Notes due 2024 | | VZ24B | | New York Stock Exchange |

| 4.073% Notes due 2024 | | VZ24C | | New York Stock Exchange |

| 0.875% Notes due 2025 | | VZ25 | | New York Stock Exchange |

| 3.25% Notes due 2026 | | VZ26 | | New York Stock Exchange |

| 1.375% Notes due 2026 | | VZ26B | | New York Stock Exchange |

| 0.875% Notes due 2027 | | VZ27E | | New York Stock Exchange |

| 1.375% Notes due 2028 | | VZ28 | | New York Stock Exchange |

| 1.875% Notes due 2029 | | VZ29B | | New York Stock Exchange |

| 1.250% Notes due 2030 | | VZ30 | | New York Stock Exchange |

| 2.625% Notes due 2031 | | VZ31 | | New York Stock Exchange |

| 2.500% Notes due 2031 | | VZ31A | | New York Stock Exchange |

| 4.75% Notes due 2034 | | VZ34 | | New York Stock Exchange |

| 3.125% Notes due 2035 | | VZ35 | | New York Stock Exchange |

| 3.375% Notes due 2036 | | VZ36A | | New York Stock Exchange |

| 2.875% Notes due 2038 | | VZ38B | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. |

| | | | | |

| Large accelerated filer | ☒ | ☒ | Accelerated filer | | ☐ |

| Non-accelerated filer | ☐ | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

At SeptemberJune 30, 2017, 4,079,440,8362019, 4,135,764,809 shares of the registrant’s common stock were outstanding, after deducting 162,933,404155,668,837 shares held in treasury.

|

|

Table of ContentsTABLE OF CONTENTS |

|

| | |

| Item No. | | Page |

| | |

| |

| | | |

| Item 1. | | |

| | | |

| | | |

| | Three and ninesix months ended SeptemberJune 30, 20172019 and 20162018 | |

| | | |

| | | |

| | Three and ninesix months ended SeptemberJune 30, 20172019 and 20162018 | |

| | | |

| | | |

| | At SeptemberJune 30, 20172019 and December 31, 20162018 | |

| | | |

| | | |

| | NineSix months ended SeptemberJune 30, 20172019 and 20162018 | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | |

| |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | | |

| Item 6. | | |

| | |

| |

| | |

| |

|

|

| Part I - Financial Information |

|

|

| Item 1. Financial Statements (Unaudited) |

|

|

Condensed Consolidated Statements of Income Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | Six Months Ended | |

| | June 30, | | | June 30, | |

| (dollars in millions, except per share amounts) (unaudited) | 2019 |

| | 2018 |

| | 2019 |

| | 2018 |

|

| | | | | | | | |

| Operating Revenues | | | | | | | |

| Service revenues and other | $ | 27,351 |

| | $ | 27,159 |

| | $ | 54,548 |

| | $ | 53,891 |

|

| Wireless equipment revenues | 4,720 |

| | 5,044 |

| | 9,651 |

| | 10,084 |

|

| Total Operating Revenues | 32,071 |

| | 32,203 |

| | 64,199 |

| | 63,975 |

|

| | | | | | | | |

| Operating Expenses | | | | | | | |

| Cost of services (exclusive of items shown below) | 7,702 |

| | 8,234 |

| | 15,494 |

| | 16,180 |

|

| Cost of wireless equipment | 5,019 |

| | 5,397 |

| | 10,217 |

| | 10,706 |

|

| Selling, general and administrative expense | 7,268 |

| | 7,605 |

| | 14,466 |

| | 14,449 |

|

| Depreciation and amortization expense | 4,232 |

| | 4,350 |

| | 8,463 |

| | 8,674 |

|

| Total Operating Expenses | 24,221 |

| | 25,586 |

| | 48,640 |

| | 50,009 |

|

| | | | | | | | |

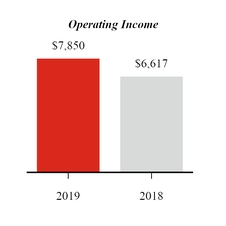

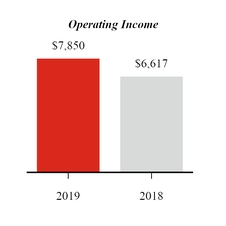

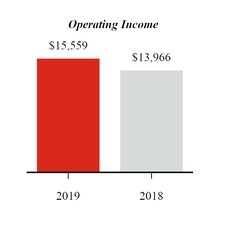

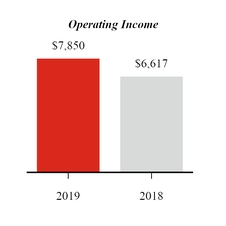

| Operating Income | 7,850 |

| | 6,617 |

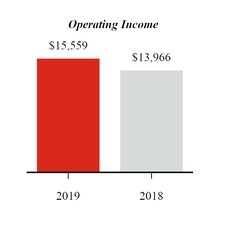

| | 15,559 |

| | 13,966 |

|

| Equity in losses of unconsolidated businesses | (13 | ) | | (228 | ) | | (19 | ) | | (247 | ) |

| Other income (expense), net | (1,312 | ) | | 360 |

| | (1,017 | ) | | 285 |

|

| Interest expense | (1,215 | ) | | (1,222 | ) | | (2,425 | ) | | (2,423 | ) |

| Income Before Provision For Income Taxes | 5,310 |

| | 5,527 |

| | 12,098 |

| | 11,581 |

|

| Provision for income taxes | (1,236 | ) | | (1,281 | ) | | (2,864 | ) | | (2,669 | ) |

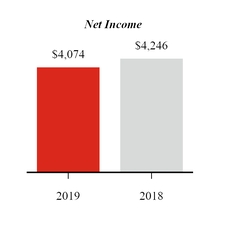

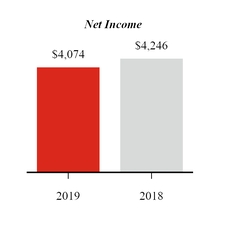

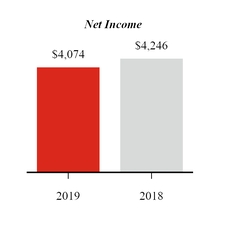

| Net Income | $ | 4,074 |

| | $ | 4,246 |

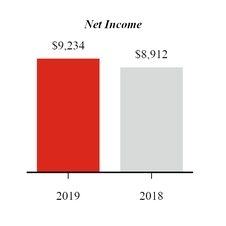

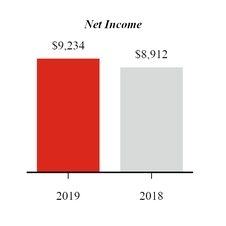

| | $ | 9,234 |

| | $ | 8,912 |

|

| | | | | | | | |

| Net income attributable to noncontrolling interests | $ | 130 |

| | $ | 126 |

| | $ | 258 |

| | $ | 247 |

|

| Net income attributable to Verizon | 3,944 |

| | 4,120 |

| | 8,976 |

| | 8,665 |

|

| Net Income | $ | 4,074 |

| | $ | 4,246 |

| | $ | 9,234 |

| | $ | 8,912 |

|

| | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | |

| Net income attributable to Verizon | $ | 0.95 |

| | $ | 1.00 |

| | $ | 2.17 |

| | $ | 2.10 |

|

| Weighted-average shares outstanding (in millions) | 4,138 |

| | 4,135 |

| | 4,138 |

| | 4,120 |

|

| | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | |

| Net income attributable to Verizon | $ | 0.95 |

| | $ | 1.00 |

| | $ | 2.17 |

| | $ | 2.10 |

|

| Weighted-average shares outstanding (in millions) | 4,139 |

| | 4,139 |

| | 4,140 |

| | 4,123 |

|

See Notes to Condensed Consolidated Financial Statements

|

|

Condensed Consolidated Statements of Comprehensive Income Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| (dollars in millions, except per share amounts) (unaudited) | 2017 |

| | 2016 |

| | 2017 |

| | 2016 |

|

| | | | | | | | |

| Operating Revenues | | | | | | | |

| Service revenues and other | $ | 27,365 |

| | $ | 26,813 |

| | $ | 79,665 |

| | $ | 81,858 |

|

| Wireless equipment revenues | 4,352 |

| | 4,124 |

| | 12,414 |

| | 11,782 |

|

| Total Operating Revenues | 31,717 |

| | 30,937 |

| | 92,079 |

| | 93,640 |

|

| | | | | | | | |

| Operating Expenses | | | | | | | |

| Cost of services (exclusive of items shown below) | 7,640 |

| | 6,989 |

| | 21,573 |

| | 22,180 |

|

| Wireless cost of equipment | 4,965 |

| | 5,240 |

| | 14,808 |

| | 14,882 |

|

| Selling, general and administrative expense (including net gain on sale of divested | | | | | | | |

| businesses of $1,774 and $1,007 for the nine months ended September 30, 2017 | | | | | | | |

| and 2016, respectively) | 7,632 |

| | 8,226 |

| | 20,579 |

| | 25,601 |

|

| Depreciation and amortization expense | 4,272 |

| | 3,942 |

| | 12,498 |

| | 11,941 |

|

| Total Operating Expenses | 24,509 |

| | 24,397 |

| | 69,458 |

| | 74,604 |

|

| | | | | | | | |

| Operating Income | 7,208 |

| | 6,540 |

| | 22,621 |

| | 19,036 |

|

| Equity in losses of unconsolidated businesses | (22 | ) | | (23 | ) | | (71 | ) | | (63 | ) |

| Other income (expense), net | (511 | ) | | 97 |

| | (1,376 | ) | | (1,697 | ) |

| Interest expense | (1,164 | ) | | (1,038 | ) | | (3,514 | ) | | (3,239 | ) |

| Income Before Provision For Income Taxes | 5,511 |

| | 5,576 |

| | 17,660 |

| | 14,037 |

|

| Provision for income taxes | (1,775 | ) | | (1,829 | ) | | (5,893 | ) | | (5,029 | ) |

| Net Income | $ | 3,736 |

| | $ | 3,747 |

| | $ | 11,767 |

| | $ | 9,008 |

|

| | | | | | | | |

| Net income attributable to noncontrolling interests | $ | 116 |

| | $ | 127 |

| | $ | 335 |

| | $ | 376 |

|

| Net income attributable to Verizon | 3,620 |

| | 3,620 |

| | 11,432 |

| | 8,632 |

|

| Net Income | $ | 3,736 |

| | $ | 3,747 |

| | $ | 11,767 |

| | $ | 9,008 |

|

| | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | |

| Net income attributable to Verizon | $ | 0.89 |

| | $ | 0.89 |

| | $ | 2.80 |

| | $ | 2.12 |

|

| Weighted-average shares outstanding (in millions) | 4,084 |

| | 4,079 |

| | 4,083 |

| | 4,080 |

|

| | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | |

| Net income attributable to Verizon | $ | 0.89 |

| | $ | 0.89 |

| | $ | 2.80 |

| | $ | 2.11 |

|

| Weighted-average shares outstanding (in millions) | 4,089 |

| | 4,086 |

| | 4,088 |

| | 4,086 |

|

| | | | | | | | |

| Dividends declared per common share | $ | 0.5900 |

| | $ | 0.5775 |

| | $ | 1.7450 |

| | $ | 1.7075 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | Six Months Ended | |

| | June 30, | | | June 30, | |

| (dollars in millions) (unaudited) | 2019 |

| | 2018 |

| | 2019 |

| | 2018 |

|

| | | | | | | | |

| Net Income | $ | 4,074 |

| | $ | 4,246 |

| | $ | 9,234 |

| | $ | 8,912 |

|

| Other Comprehensive Income (Loss), Net of Tax (Expense) Benefit | | | | | | | |

| Foreign currency translation adjustments, net of tax of $3, $13, $(2) and $6 | (67 | ) | | (176 | ) | | (43 | ) | | (83 | ) |

| Unrealized gain (loss) on cash flow hedges, net of tax of $193, $55, $198 and $(125) | (537 | ) | | (152 | ) | | (550 | ) | | 349 |

|

| Unrealized gain (loss) on marketable securities, net of tax of $0, $0, $(2) and $1 | 4 |

| | 1 |

| | 8 |

| | (4 | ) |

| Defined benefit pension and postretirement plans, net of tax of $56, $58, $112 and $118 | (169 | ) | | (173 | ) | | (338 | ) | | (346 | ) |

| Other comprehensive loss attributable to Verizon | (769 | ) | | (500 | ) | | (923 | ) | | (84 | ) |

| Total Comprehensive Income | $ | 3,305 |

| | $ | 3,746 |

| | $ | 8,311 |

| | $ | 8,828 |

|

| | | | | | | | |

| Comprehensive income attributable to noncontrolling interests | $ | 130 |

| | $ | 126 |

| | $ | 258 |

| | $ | 247 |

|

| Comprehensive income attributable to Verizon | 3,175 |

| | 3,620 |

| | 8,053 |

| | 8,581 |

|

| Total Comprehensive Income | $ | 3,305 |

| | $ | 3,746 |

| | $ | 8,311 |

| | $ | 8,828 |

|

See Notes to Condensed Consolidated Financial Statements

Condensed Consolidated Statements of Comprehensive Income |

|

Condensed Consolidated Balance Sheets Verizon Communications Inc. and Subsidiaries |

Verizon Communications Inc. and Subsidiaries

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| (dollars in millions) (unaudited) | 2017 |

| | 2016 |

| | 2017 |

| | 2016 |

|

| | | | | | | | |

| Net Income | $ | 3,736 |

| | $ | 3,747 |

| | $ | 11,767 |

| | $ | 9,008 |

|

| Other Comprehensive Income (loss), net of taxes | | | | | | | |

| Foreign currency translation adjustments | 117 |

| | (78 | ) | | 205 |

| | (23 | ) |

| Unrealized gain (loss) on cash flow hedges | 104 |

| | 147 |

| | (94 | ) | | (58 | ) |

| Unrealized gain (loss) on marketable securities | 1 |

| | (19 | ) | | (5 | ) | | (35 | ) |

| Defined benefit pension and postretirement plans | 177 |

| | (139 | ) | | (96 | ) | | 2,324 |

|

| Other comprehensive income (loss) attributable to Verizon | 399 |

| | (89 | ) | | 10 |

| | 2,208 |

|

| Total Comprehensive Income | $ | 4,135 |

| | $ | 3,658 |

| | $ | 11,777 |

| | $ | 11,216 |

|

| | | | | | | | |

| Comprehensive income attributable to noncontrolling interests | $ | 116 |

| | $ | 127 |

| | $ | 335 |

| | $ | 376 |

|

| Comprehensive income attributable to Verizon | 4,019 |

| | 3,531 |

| | 11,442 |

| | 10,840 |

|

| Total Comprehensive Income | $ | 4,135 |

| | $ | 3,658 |

| | $ | 11,777 |

| | $ | 11,216 |

|

|

| | | | | | | |

| | At June 30, |

| | At December 31, |

|

| (dollars in millions, except per share amounts) (unaudited) | 2019 |

| | 2018 |

|

| | | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,949 |

| | $ | 2,745 |

|

| Accounts receivable, net of allowances of $745 and $765 | 24,926 |

| | 25,102 |

|

| Inventories | 1,167 |

| | 1,336 |

|

| Prepaid expenses and other | 5,266 |

| | 5,453 |

|

| Total current assets | 33,308 |

| | 34,636 |

|

| | | | |

| Property, plant and equipment | 257,395 |

| | 252,835 |

|

| Less accumulated depreciation | 169,577 |

| | 163,549 |

|

| Property, plant and equipment, net | 87,818 |

| | 89,286 |

|

| | | | |

| Investments in unconsolidated businesses | 650 |

| | 671 |

|

| Wireless licenses | 94,333 |

| | 94,130 |

|

| Goodwill | 24,632 |

| | 24,614 |

|

| Other intangible assets, net | 9,474 |

| | 9,775 |

|

| Operating lease right-of-use assets | 22,467 |

| | — |

|

| Other assets | 10,426 |

| | 11,717 |

|

| Total assets | $ | 283,108 |

| | $ | 264,829 |

|

| | | | |

| Liabilities and Equity | | | |

| Current liabilities | | | |

| Debt maturing within one year | $ | 8,773 |

| | $ | 7,190 |

|

| Accounts payable and accrued liabilities | 17,633 |

| | 22,501 |

|

| Current operating lease liabilities | 3,154 |

| | — |

|

| Other current liabilities | 8,654 |

| | 8,239 |

|

| Total current liabilities | 38,214 |

| | 37,930 |

|

| | | | |

| Long-term debt | 104,598 |

| | 105,873 |

|

| Employee benefit obligations | 18,040 |

| | 18,599 |

|

| Deferred income taxes | 34,225 |

| | 33,795 |

|

| Non-current operating lease liabilities | 18,254 |

| | — |

|

| Other liabilities | 11,830 |

| | 13,922 |

|

| Total long-term liabilities | 186,947 |

| | 172,189 |

|

| | | | |

| Commitments and Contingencies (Note 12) |

| |

|

| | | | |

| Equity | | | |

| Series preferred stock ($0.10 par value; 250,000,000 shares authorized; none issued) | — |

| | — |

|

| Common stock ($0.10 par value; 6,250,000,000 shares authorized in each period; 4,291,433,646 issued in each period) | 429 |

| | 429 |

|

| Additional paid in capital | 13,419 |

| | 13,437 |

|

| Retained earnings | 47,945 |

| | 43,542 |

|

| Accumulated other comprehensive income | 1,447 |

| | 2,370 |

|

| Common stock in treasury, at cost (155,668,837 and 159,400,267 shares outstanding) | (6,823 | ) | | (6,986 | ) |

| Deferred compensation – employee stock ownership plans and other | 165 |

| | 353 |

|

| Noncontrolling interests | 1,365 |

| | 1,565 |

|

| Total equity | 57,947 |

| | 54,710 |

|

| Total liabilities and equity | $ | 283,108 |

| | $ | 264,829 |

|

See Notes to Condensed Consolidated Financial Statements

Condensed Consolidated Balance Sheets |

|

Condensed Consolidated Statements of Cash Flows Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | |

| | At September 30, |

| | At December 31, |

|

| (dollars in millions, except per share amounts) (unaudited) | 2017 |

| | 2016 |

|

| | | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 4,487 |

| | $ | 2,880 |

|

| Accounts receivable, net of allowances of $908 and $845 | 21,549 |

| | 17,513 |

|

| Inventories | 1,276 |

| | 1,202 |

|

| Assets held for sale | 275 |

| | 882 |

|

| Prepaid expenses and other | 3,280 |

| | 3,918 |

|

| Total current assets | 30,867 |

| | 26,395 |

|

| | | | |

| Plant, property and equipment | 242,608 |

| | 232,215 |

|

| Less accumulated depreciation | 155,986 |

| | 147,464 |

|

| Plant, property and equipment, net | 86,622 |

| | 84,751 |

|

| | | | |

| Investments in unconsolidated businesses | 1,054 |

| | 1,110 |

|

| Wireless licenses | 87,883 |

| | 86,673 |

|

| Goodwill | 28,725 |

| | 27,205 |

|

| Other intangible assets, net | 10,993 |

| | 8,897 |

|

| Non-current assets held for sale | — |

| | 613 |

|

| Other assets | 8,538 |

| | 8,536 |

|

| Total assets | $ | 254,682 |

| | $ | 244,180 |

|

| | | | |

| Liabilities and Equity | | | |

| Current liabilities | | | |

| Debt maturing within one year | $ | 2,180 |

| | $ | 2,645 |

|

| Accounts payable and accrued liabilities | 18,434 |

| | 19,593 |

|

| Other | 8,316 |

| | 8,102 |

|

| Total current liabilities | 28,930 |

| | 30,340 |

|

| | | | |

| Long-term debt | 115,317 |

| | 105,433 |

|

| Employee benefit obligations | 21,131 |

| | 26,166 |

|

| Deferred income taxes | 48,345 |

| | 45,964 |

|

| Other liabilities | 12,508 |

| | 12,245 |

|

| | | | |

| Equity | | | |

| Series preferred stock ($.10 par value; none issued) | — |

| | — |

|

| Common stock ($.10 par value; 4,242,374,240 shares issued in each period) | 424 |

| | 424 |

|

| Contributed capital | 11,098 |

| | 11,182 |

|

| Reinvested earnings | 19,373 |

| | 15,059 |

|

| Accumulated other comprehensive income | 2,683 |

| | 2,673 |

|

| Common stock in treasury, at cost | (7,141 | ) | | (7,263 | ) |

| Deferred compensation – employee stock ownership plans and other | 411 |

| | 449 |

|

| Noncontrolling interests | 1,603 |

| | 1,508 |

|

| Total equity | 28,451 |

| | 24,032 |

|

| Total liabilities and equity | $ | 254,682 |

| | $ | 244,180 |

|

|

| | | | | | | |

| | Six Months Ended | |

| | June 30, | |

| (dollars in millions) (unaudited) | 2019 |

| | 2018 |

|

| | | | |

| Cash Flows from Operating Activities | | | |

| Net Income | $ | 9,234 |

| | $ | 8,912 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization expense | 8,463 |

| | 8,674 |

|

| Employee retirement benefits | (294 | ) | | (300 | ) |

| Deferred income taxes | 588 |

| | 1,354 |

|

| Provision for uncollectible accounts | 738 |

| | 462 |

|

| Equity in losses of unconsolidated businesses, net of dividends received | 50 |

| | 268 |

|

| Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses | (4,593 | ) | | (1,538 | ) |

| Discretionary employee benefits contributions | (300 | ) | | (1,679 | ) |

| Other, net | 1,950 |

| | 280 |

|

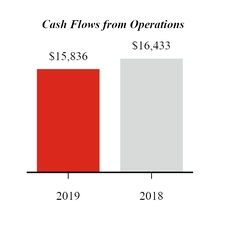

| Net cash provided by operating activities | 15,836 |

| | 16,433 |

|

| | | | |

| Cash Flows from Investing Activities | | | |

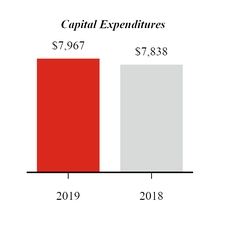

| Capital expenditures (including capitalized software) | (7,967 | ) | | (7,838 | ) |

| Acquisitions of businesses, net of cash acquired | (28 | ) | | (38 | ) |

| Acquisitions of wireless licenses | (199 | ) | | (1,155 | ) |

| Other, net | (395 | ) | | 303 |

|

| Net cash used in investing activities | (8,589 | ) | | (8,728 | ) |

| | | | |

| Cash Flows from Financing Activities | | | |

| Proceeds from long-term borrowings | 6,237 |

| | 4,584 |

|

| Proceeds from asset-backed long-term borrowings | 3,982 |

| | 1,716 |

|

| Repayments of long-term borrowings and finance lease obligations | (9,630 | ) | | (6,568 | ) |

| Repayments of asset-backed long-term borrowings | (2,817 | ) | | (2,000 | ) |

| Dividends paid | (4,981 | ) | | (4,845 | ) |

| Other, net | (834 | ) | | (752 | ) |

| Net cash used in financing activities | (8,043 | ) | | (7,865 | ) |

| | | | |

| Decrease in cash, cash equivalents and restricted cash | (796 | ) | | (160 | ) |

| Cash, cash equivalents and restricted cash, beginning of period | 3,916 |

| | 2,888 |

|

| Cash, cash equivalents and restricted cash, end of period (Note 1) | $ | 3,120 |

| | $ | 2,728 |

|

See Notes to Condensed Consolidated Financial Statements

Condensed Consolidated Statements of Cash Flows

Verizon Communications Inc. and Subsidiaries

|

| | | | | | | |

| | Nine Months Ended | |

| | September 30, | |

| (dollars in millions) (unaudited) | 2017 |

| | 2016 |

|

| | | | |

| Cash Flows from Operating Activities | | | |

| Net Income | $ | 11,767 |

| | $ | 9,008 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization expense | 12,498 |

| | 11,941 |

|

| Employee retirement benefits | (334 | ) | | 4,531 |

|

| Deferred income taxes | 2,577 |

| | (2,331 | ) |

| Provision for uncollectible accounts | 842 |

| | 963 |

|

| Equity in losses of unconsolidated businesses, net of dividends received | 100 |

| | 94 |

|

| Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses | (5,513 | ) | | (4,010 | ) |

| Discretionary contributions to qualified pension plans | (3,411 | ) | | (186 | ) |

| Net gain on sale of divested businesses | (1,774 | ) | | (1,007 | ) |

| Other, net | 469 |

| | (1,279 | ) |

| Net cash provided by operating activities | 17,221 |

| | 17,724 |

|

| | | | |

| Cash Flows from Investing Activities | | | |

| Capital expenditures (including capitalized software) | (11,282 | ) | | (11,398 | ) |

| Acquisitions of businesses, net of cash acquired | (6,295 | ) | | (963 | ) |

| Acquisitions of wireless licenses | (469 | ) | | (410 | ) |

| Proceeds from dispositions of businesses | 3,614 |

| | 9,882 |

|

| Other, net | 731 |

| | 350 |

|

| Net cash used in investing activities | (13,701 | ) | | (2,539 | ) |

| | | | |

| Cash Flows from Financing Activities | | | |

| Proceeds from long-term borrowings | 21,915 |

| | 8,152 |

|

| Proceeds from asset-backed long-term borrowings | 2,878 |

| | 2,594 |

|

| Repayments of long-term borrowings and capital lease obligations | (16,457 | ) | | (14,510 | ) |

| Decrease in short-term obligations, excluding current maturities | (160 | ) | | (120 | ) |

| Dividends paid | (7,067 | ) | | (6,908 | ) |

| Other, net | (3,022 | ) | | (2,422 | ) |

| Net cash used in financing activities | (1,913 | ) | | (13,214 | ) |

| | | | |

| Increase in cash and cash equivalents | 1,607 |

| | 1,971 |

|

| Cash and cash equivalents, beginning of period | 2,880 |

| | 4,470 |

|

| Cash and cash equivalents, end of period | $ | 4,487 |

| | $ | 6,441 |

|

See Notes to Condensed Consolidated Financial Statements

Notes to Condensed Consolidated Financial Statements

Verizon Communications Inc. and Subsidiaries

(Unaudited)

|

|

Notes to Condensed Consolidated Financial Statements(Unaudited) Verizon Communications Inc. and Subsidiaries |

|

| |

| Note 1. | Basis of Presentation |

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) in the United States (U.S.) and based upon Securities and Exchange Commission (SEC) rules that permit reduced disclosure for interim periods. For a more complete discussion of significant accounting policies and certain other information, you should refer to the financial statements included in theof Verizon Communications Inc. (Verizon or the Company) included in our Annual Report on Form 10-K for the year ended December 31, 2016.2018. These financial statements reflect all adjustments that are necessary for a fair presentation of results of operations and financial condition for the interim periods shown, including normal recurring accruals and other items. The results for the interim periods are not necessarily indicative of results for the full year.

In November 2018, we announced a strategic reorganization of our business. Under the new structure, effective April 1, 2019, there are two reportable segments that we operate and manage as strategic business units - Verizon Consumer Group (Consumer) and Verizon Business Group (Business). In conjunction with the new reporting structure, we recast our segment disclosures for all periods presented.

Our Consumer segment provides consumer-focused wireless and wireline communications services and products. Our wireless services are provided across one of the most extensive wireless networks in the U.S. under the Verizon Wireless brand and through wholesale and other arrangements. Our wireline services are provided in nine states in the Mid-Atlantic and Northeastern U.S., as well as Washington D.C., over our 100% fiber-optic network under the Fios brand and over a traditional copper-based network to customers who are not served by Fios. Our Consumer segment’s wireless and wireline products and services are available to our retail customers, as well as resellers that purchase wireless network access from us on a wholesale basis.

Our Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long distance voice services and network access to deliver various Internet of Things (IoT) services and products. We provide these products and services to businesses, government customers and wireless and wireline carriers across the U.S. and select products and services to customers around the world.

Basis of Presentation

We have reclassified certain prior periodyear amounts to conform to the current period presentation.year presentation, including impacts for changes in our reportable segments.

Earnings Per Common Share

There were a total of approximately 52 million outstanding dilutive securities, primarily consisting of restricted stock units, included in the computation of diluted earnings per common share for both the three and ninesix months ended SeptemberJune 30, 2017, respectively.2019. There were a total of approximately 7 million and 64 million outstanding dilutive securities, primarily consisting of restricted stock units, included in the computation of diluted earnings per common share for both the three and ninesix months ended SeptemberJune 30, 2016, respectively.2018.

Cash, Cash Equivalents and Restricted Cash

We consider all highly liquid investments with an original maturity of 90 days or less when purchased to be cash equivalents. Cash equivalents are stated at cost, which approximates quoted market value and includes amounts held in money market funds.

Cash collections on the device payment plan agreement receivables collateralizing asset-backed debt securities are required at certain specified times to be placed into segregated accounts. Deposits to the segregated accounts are considered restricted cash and are included in Prepaid expenses and other and Other assets in our condensed consolidated balance sheets.

Cash, cash equivalents and restricted cash are included in the following line items on the condensed consolidated balance sheets:

|

| | | | | | | | | | | |

| | At June 30, |

| | At December 31, |

| | Increase / (Decrease) |

|

| (dollars in millions) | 2019 |

| | 2018 |

| |

| Cash and cash equivalents | $ | 1,949 |

| | $ | 2,745 |

| | $ | (796 | ) |

| Restricted cash: | | | | | |

| Prepaid expenses and other | 1,055 |

| | 1,047 |

| | 8 |

|

| Other assets | 116 |

| | 124 |

| | (8 | ) |

| Cash, cash equivalents and restricted cash | $ | 3,120 |

| | $ | 3,916 |

| | $ | (796 | ) |

Goodwill

Goodwill is the excess of the acquisition cost of businesses over the fair value of the identifiable net assets acquired. Impairment testing for goodwill is performed annually in the fourth quarter or more frequently if impairment indicators are present. We transitioned into our new segment reporting structure effective April 1, 2019, which resulted in certain changes to our operating segments and reporting units. Upon the

date of reorganization, the goodwill of our historical Wireless reporting unit, historical Wireline reporting unit and historical Verizon Connect reporting unit were reallocated to our new Consumer and Business reporting units using a relative fair value approach.

We performed an impairment assessment of the impacted reporting units, specifically our historical Wireless, historical Wireline and historical Connect reporting units on March 31, 2019, immediately before our strategic reorganization became effective. Our impairment assessments indicated that the fair value for each of our historical Wireless, historical Wireline and historical Connect reporting units exceeded their respective carrying value, and therefore did not result in a goodwill impairment. We then performed an impairment assessment for our Consumer and Business reporting units on April 1, 2019, immediately following our strategic reorganization. Our impairment assessments indicated that the fair value for each of our Consumer and Business reporting units exceeded their respective carrying values and therefore, did not result in a goodwill impairment. Our Media reporting unit was not impacted by the strategic reorganization and there was no indicator of impairment.

Recently Adopted Accounting StandardsStandard

In January 2017, theThe following Accounting Standard Updates (ASUs) were issued by Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2017-04, “Intangibles - Goodwill, and Other (Topic 350): Simplifying the Test for Goodwill Impairment.” have been recently adopted by Verizon.

|

| | | | | |

| Description | Date of Adoption | Effect on Financial Statements |

| ASU 2016-02, ASU 2018-01, ASU 2018-10, ASU 2018-11, ASU 2018-20 and ASU 2019-01, Leases (Topic 842) |

| The FASB issued Topic 842 requiring entities to recognize assets and liabilities on the balance sheet for all leases, with certain exceptions. In addition, Topic 842 will enable users of financial statements to further understand the amount, timing and uncertainty of cash flows arising from leases. Topic 842 allows for a modified retrospective application and is effective as of the first quarter of 2019. Entities are allowed to apply the modified retrospective approach: (1) retrospectively to each prior reporting period presented in the financial statements with the cumulative-effect adjustment recognized at the beginning of the earliest comparative period presented; or (2) retrospectively at the beginning of the period of adoption (January 1, 2019) through a cumulative-effect adjustment. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply. | 1/1/2019 | We adopted Topic 842 beginning on January 1, 2019, using the modified retrospective approach with a cumulative-effect adjustment to opening retained earnings recorded at the beginning of the period of adoption. Therefore, upon adoption, we have recognized and measured leases without revising comparative period information or disclosure. We recorded an increase of $410 million (net of tax) to retained earnings on January 1, 2019 which related to deferred sale leaseback gains recognized from prior transactions. Additionally, the adoption of the standard had a significant impact in our condensed consolidated balance sheet due to the recognition of $22.1 billion of operating lease liabilities, along with $23.2 billion of operating lease right-of-use-assets. |

|

The amendments in this update eliminate the requirement to perform step twocumulative after-tax effect of the goodwill impairment test, which requires a hypothetical purchase price allocation when an impairment is determinedchanges made to have occurred. A goodwill impairment will now be the amount by which a reporting unit’s carrying value exceeds its fair value, not to exceed the carrying amount of goodwill. This standard update is effective as of the first quarter of 2020; however, early adoption is permitted for any interim or annual impairment tests performed after January 1, 2017. Verizon early adopted this standard as of January 1, 2017.

In March 2016, the FASB issued ASU 2016-09, “Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting.” This standard update intends to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. This standard update is effective as of the first quarter of 2017. The adoption of this standard update did not have a significant impact on our condensed consolidated financial statements.balance sheet for the adoption of Topic 842 were as follows:

|

| | | | | | | | | | | |

| (dollars in millions) | At December 31, 2018 |

| | Adjustments due to Topic 842 |

| | At January 1, 2019 |

|

| Prepaid expenses and other | $ | 5,453 |

| | $ | (329 | ) | | $ | 5,124 |

|

| Operating lease right-of-use assets | — |

| | 23,241 |

| | 23,241 |

|

| Other assets | 11,717 |

| | (2,048 | ) | | 9,669 |

|

| Accounts payable and accrued liabilities | 22,501 |

| | (3 | ) | | 22,498 |

|

| Other current liabilities | 8,239 |

| | (2 | ) | | 8,237 |

|

| Current operating lease liabilities | — |

| | 2,931 |

| | 2,931 |

|

| Deferred income taxes | 33,795 |

| | 139 |

| | 33,934 |

|

| Non-current operating lease liabilities | — |

| | 19,203 |

| | 19,203 |

|

| Other liabilities | 13,922 |

| | (1,815 | ) | | 12,107 |

|

| Retained earnings | 43,542 |

| | 410 |

| | 43,952 |

|

| Noncontrolling interests | 1,565 |

| | 1 |

| | 1,566 |

|

In addition to the increase to the operating lease liabilities and right-of-use assets and the derecognition of deferred sale leaseback gains through opening retained earnings, Topic 842 also resulted in reclassifying the presentation of prepaid and deferred rent to operating lease right-of-use assets. The operating lease right-of-use assets amount also includes the balance of any prepaid lease payments, unamortized initial direct costs, and lease incentives.

We elected the package of practical expedients permitted under the transition guidance within the new standard. Accordingly, we have adopted these practical expedients and did not reassess: (1) whether an expired or existing contract is a lease or contains an embedded lease; (2) lease classification of an expired or existing lease; or (3) capitalization of initial direct costs for an expired or existing lease. In addition, we have elected the land easement transition practical expedient, and did not reassess whether an existing or expired land easement is a lease or contains a lease if it has not historically been accounted for as a lease.

We lease network equipment including towers, distributed antenna systems, small cells, real estate, connectivity mediums which include dark fiber, equipment leases, and other various types of assets for use in our operations under both operating and finance leases. We assess whether an arrangement is a lease or contains a lease at inception. For arrangements considered leases or that contain a lease that is accounted for

Recently Issued Accounting Standardsseparately, we determine the classification and initial measurement of the right-of-use asset and lease liability at the lease commencement date, which is the date that the underlying asset becomes available for use.

For both operating and finance leases, we recognize a right-of-use asset, which represents our right to use the underlying asset for the lease term, and a lease liability, which represents the present value of our obligation to make payments arising over the lease term. The present value of the lease payments is calculated using the incremental borrowing rate for operating and finance leases. The incremental borrowing rate is determined using a portfolio approach based on the rate of interest that the Company would have to pay to borrow an amount equal to the lease payments on a collateralized basis over a similar term. Management uses the unsecured borrowing rate and risk-adjusts that rate to approximate a collateralized rate, which will be updated on a quarterly basis for measurement of new lease liabilities.

In August 2017,those circumstances where the FASB issuedCompany is the lessee, we have elected to account for non-lease components associated with our leases (e.g., common area maintenance costs) and lease components as a single lease component for substantially all of our asset classes. Additionally, in arrangements where we are the lessor, we have customer premise equipment for which we apply the lease and non-lease component practical expedient and account for non-lease components (e.g., service revenue) and lease components as combined components under the revenue recognition guidance in ASU 2017-12, “Derivatives and Hedging2014-09, "Revenue from Contracts with Customers" (Topic 815): Targeted Improvements to Accounting606) as the service revenues are the predominant components in the arrangements.

Rent expense for Hedging Activities.” The amendments in this update simplify the application of hedge accounting and increase the transparency of hedge results. The updated standard also amends the presentation and disclosure requirements and changes how companies can assess the effectiveness of their hedging relationships. Companies will now have until the end of the first quarter in whichoperating leases is recognized on a hedge is entered into to perform an initial assessment of a hedge’s effectiveness. After initial qualification, the new guidance permits a qualitative effectiveness assessment for certain hedges instead of a quantitative test if the company can reasonably support an expectation of high effectiveness throughoutstraight-line basis over the term of the hedge. An initial quantitative test to establish that the hedge relationshiplease and is highly effective is still required. For cash flow hedges, if the hedge is highly effective, all changesincluded in the fair valueeither Cost of the derivative hedging instrument will be recorded in Other comprehensive income (loss). These changes in fair value will be reclassified to earnings when the hedged item impacts earnings. The standard update is effective as of the first quarter of 2019; however, early adoption is permitted within an interim period. We intend to early adopt this standard in the fourth quarter of 2017services or Selling, general and do not expect it to have a significant impact on our condensed consolidated financial statements.

In March 2017, the FASB issued ASU 2017-07, “Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost.” The amendments in this update require an employer to report the service cost component in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period. The other components of net benefit cost, including the recognition of prior service credits, will be presented in the income statement separately from the service cost component and outside a subtotal of income from operations. The amendments in this update also allow only the service cost component of pension and other postretirement benefit costs to be eligible for capitalization when applicable. The amendments in this update would be applied retrospectively for the presentation of the service cost component and other components of net periodic benefit cost in the income statement and prospectively, on and after the effective date, for the capitalization of the service cost component of net periodic benefit cost in assets. Disclosures of the nature of and reason for the change in accounting principle would be required in the first interim and annual reporting periods of adoption. This standard update is effective as of the first quarter of 2018; however, early adoption is permitted as of the beginning of an annual period for which financial statements have not been issued. We will adopt this standard in the first quarter of 2018. The impact of the retrospective adoption of this standard update will be a decrease to consolidated operating income of approximately $0.2 billion and $0.7 billion for the three and nine months ended September 30, 2017, respectively, and an increase to consolidated operating income of approximately $0.4 billion and $4.1 billion for the three and nine months ended September 30, 2016, respectively. There will be no impact to consolidated net income for the three and nine months ended September 30, 2017 and 2016.

In February 2017, the FASB issued ASU 2017-05, “Other Income - Gains and Losses From the Derecognition of Nonfinancial Assets (Subtopic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets.” The new guidance defines an “in substance nonfinancial asset” as an asset or group of assets for which substantially all of the fair value consists of nonfinancial assets and the group or subsidiary is not a business. The standard requires entities to derecognize nonfinancial assets or in substance nonfinancial assets when the entity no longer has (or ceases to have) a controlling financial interest in the legal entity that holds the asset and the entity transfers control of the asset. The standard update also unifies guidance related to partial sales of nonfinancial assets to be more consistent with the sale of a business. This standard update is effective as of the first quarter of 2018; however, early adoption is permitted. We do not expect that this standard update will have a significant impact on our condensed consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business.” The amendments in this update provide a framework, the screen, in which to evaluate whether a set of transferred assets and activities is a business. The screen requires that the set is not a business when substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. The standard also aligns the definition of outputs with how outputs are described in Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers. This standard is effective as of the first quarter of 2018; however, early adoption is permitted. We plan to early adopt this standard, on a prospective basis in the fourth quarter of 2017.

In November 2016, the FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash.” The amendments in this update require that cash and cash equivalent balances in a statement of cash flows include those amounts deemed to be restricted cash and restricted cash equivalents. This standard update is effective as of the first quarter of 2018; however, early adoption is permitted. We do not expect the adoption of this standard will have a significant impact on our condensed consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments.” This standard update addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice for these issues. Among the updates, this standard update requires cash receipts from payments on a transferor’s beneficial interests in securitized trade receivables to be classified as cash inflows from investing activities. This standard update is effective as of the first quarter of 2018; however, early adoption is permitted. We expect the amendment relating to beneficial interests in securitization transactions will have an impact on our presentation of collections of the deferred purchase price from sales of wireless device payment plan agreement receivablesadministrative expense in our condensed consolidated statements of cash flows. Upon adoptionincome, based on the use of this standard updatethe facility on which rent is being paid. Variable rent payments related to both operating and finance leases are expensed in the first quarterperiod incurred. Our variable lease payments consist of 2018,payments dependent on various external indicators, including real estate taxes, common area maintenance charges and utility usage.

Operating leases with a term of 12 months or less are not recorded on the balance sheet; we expect to retrospectively reclassify approximately $0.6 billionrecognize a rent expense for these leases on a straight-line basis over the lease term.

We recognize the amortization of collectionsthe right-of-use asset for our finance leases on a straight-line basis over the shorter of deferred purchase price related to collections from customers from Cash flows from operating activities to Cash flows from investing activitiesthe term of the lease or the useful life of the right-of-use asset in Depreciation and amortization expense in our condensed consolidated statementstatements of cash flows forincome. The interest expense related to finance leases is recognized using the nine months ended September 30, 2017 and $1.1 billion in our consolidated statement of cash flows for the year ended December 31, 2016.

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments.” This standard update requires that certain financial assets be measured at amortized cost net of an allowance for estimated credit losses such that the net receivable represents the present value of expected cash collection. In addition, this standard update requires that certain financial assets be measured at amortized cost reflecting an allowance for estimated credit losses expected to occur over the life of the assets. The estimate of credit losses must beeffective interest method based on all relevant information including historical information, current conditionsthe discount rate determined at lease commencement and reasonable and supportable forecasts that affect the collectability of the amounts. This standard update is effective as of the first quarter of 2020; however, early adoption is permitted. We are currently evaluating the impact that this standard update will have onincluded within Interest expense in our condensed consolidated financial statements.statements of income.

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842).” This standard update intends to increase transparency and improve comparability by requiring entities to recognize assets and liabilities on the balance sheetSee Note 5 for all leases, with certain exceptions. In addition, through improved disclosure requirements, the standard update will enable users of financial statements to further understand the amount, timing, and uncertainty of cash flows arising from leases. This standard update is effective as of the first quarter of 2019; however, early adoption is permitted. Verizon’s current operating lease portfolio is primarily comprised of network, real estate, and equipment leases. Upon adoption of this standard, we expect our balance sheet to include a right of use asset and liabilityadditional information related to substantially all operating lease arrangements. Weleases, including disclosure required under Topic 842.

Recently Issued Accounting Standards

The following ASUs have established a cross-functional coordinated implementation team to implementbeen recently issued by the standard update related to leases. We are in the process of determining the scope of arrangements that will be subject to this standard as well as assessing the impact to our systems, processes and internal controls to meet the standard update’s reporting and disclosure requirements.FASB.

|

| | | | | |

| Description | Date of Adoption | Effect on Financial Statements |

| ASU 2016-13, ASU 2018-19, ASU 2019-04, ASU 2019-05, Financial Instruments - Credit Losses (Topic 326) |

| In June 2016, the FASB issued this standard update which requires certain financial assets be measured at amortized cost net of an allowance for estimated credit losses such that the net receivable represents the present value of expected cash collection. In addition, this standard update requires that certain financial assets be measured at amortized cost reflecting an allowance for estimated credit losses expected to occur over the life of the assets. The estimate of credit losses must be based on all relevant information including historical information, current conditions and reasonable and supportable forecasts that affect the collectability of the amounts. An entity will apply the update through a cumulative effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective (January 1, 2020). A prospective transition approach is required for debt securities for which an other-than-temporary impairment has been recognized before the effective date. Early adoption of this standard is permitted. | 1/1/2020 | We are currently evaluating the impacts that this standard update will have on our various financial assets, which we expect to include, but are not limited to, our device payment plan agreement receivables, service receivables and contract assets.

We have established a cross-functional coordinated team to implement the standard update. We are in the process of determining the potential impacts to our processes, including allowance estimation models, and internal controls in order to meet the standard update's accounting and reporting requirements.

|

|

|

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606).” This standard update, along with related subsequently issued updates, clarifies the principles for recognizing revenue and develops a common revenue standard for United States (U.S.) generally accepted accounting principles (GAAP). The standard update also amends current guidance for the recognition of costs to obtain and fulfill contracts with customers such that incremental costs of obtaining and direct costs of fulfilling contracts with customers will be deferred and amortized consistent with the transfer of the related good or service. The standard update intends to provide a more robust framework for addressing revenue issues; improve comparability of revenue recognition practices across entities, industries, jurisdictions, and capital markets; and provide more useful information to users of financial statements through improved disclosure requirements. The two permitted transition methods under the new standard are the full retrospective method, in which case the standard would be applied to each prior reporting period presented and the cumulative effect of applying the standard would be recognized at the earliest period shown, or the modified retrospective method, in which case the standard is applied only to the most current period presented and the cumulative effect of applying the standard would be recognized at the date of initial application. In August 2015, an accounting standard update was issued that delayed the effective date of this standard until the first quarter of 2018, at which time we plan to adopt the standard using the modified retrospective approach.

We are in the process of evaluating the impact of the standard update. The ultimate impact on revenue resulting from the application of the new standard will be subject to assessments that are dependent on many variables, including, but not limited to, the terms of our contractual arrangements and our mix of business. Upon adoption, we expect that the allocation of revenue between equipment and service for our wireless fixed-term service plans will result in more revenue allocated to equipment and recognized earlier as compared with current GAAP. We expect the timing of recognition of our sales commission expenses will also be impacted, as a substantial portion of these costs, which are currently expensed, will be capitalized and amortized as described above. In 2016, total sales commission expenses were approximately $4.2 billion. In 2017, we expect total sales commission expenses to decline as our wireless customers continue to migrate from our fixed-term service plans to device payment plans which have lower commission structures.

We have established a cross-functional coordinated implementation team to implement the standard update related to the recognition of revenue from contracts with customers. We have identified and are in the process of implementing changes to our systems, processes and internal controls to meet the standard update’s reporting and disclosure requirements.

|

|

| Note 2. Revenues and Contract Costs |

We earn revenue from contracts with customers, primarily through the provision of telecommunications and other services and through the sale of wireless equipment.

Revenue by Category

We have two reportable segments that we operate and manage as strategic business units - Consumer and Business. Revenue is disaggregated by products and services within Consumer, and customer groups (Global Enterprise, Small and Medium Business, Public Sector and Other, and Wholesale) within Business. See Note 11 for additional information on revenue by segment.

Corporate and other includes the results of our media business, Verizon Media Group (Verizon Media), which operated under the "Oath" brand until January 2019, and other businesses. Verizon Media generated revenues from contracts with customers under Topic 606 of approximately $1.8 billion and $3.6 billion, during the three and six months ended June 30, 2019, respectively. Verizon Media generated revenues from contracts with customers under Topic 606 of approximately $1.9 billion and $3.8 billion during the three and six months ended June 30, 2018, respectively.

We also earn revenues, that are not accounted for under Topic 606, from leasing arrangements (such as towers), captive reinsurance arrangements primarily related to wireless device insurance and the interest on equipment financed on a device payment plan agreement when sold to the customer by an authorized agent. As allowed by the practical expedient within Topic 842, we have elected to combine the lease and non-lease components for those arrangements of customer premise equipment where we are the lessor as components accounted for under Topic 606. During the three and six months ended June 30, 2019, revenues from arrangements that were not accounted for under Topic 606 were approximately $797 million and $1.6 billion, respectively. During the three and six months ended June 30, 2018, revenues from arrangements that were not accounted for under Topic 606 were approximately $1.1 billion and $2.3 billion, respectively.

Remaining Performance Obligations

When allocating the total contract transaction price to identified performance obligations, a portion of the total transaction price may relate to service performance obligations which were not satisfied or are partially satisfied as of the end of the reporting period. Below we disclose information relating to these unsatisfied performance obligations. Upon adoption, we elected to apply the practical expedient available under Topic 606 that provides the option to exclude the expected revenues arising from unsatisfied performance obligations related to contracts that have an original expected duration of one year or less. This situation primarily arises with respect to certain month-to-month service contracts. At June 30, 2019, month-to-month service contracts represented approximately 87% of our wireless postpaid contracts and approximately 57% of our wireline Consumer and Small and Medium Business contracts, compared to June 30, 2018, for which month-to-month service contracts represented approximately 83% of our wireless postpaid contracts and 56% of our wireline Consumer and Small and Medium Business contracts.

Additionally, certain contracts provide customers the option to purchase additional services. The fees related to these additional services are recognized when the customer exercises the option (typically on a month-to-month basis).

Contracts for wireless services are generally either month-to-month and cancellable at any time (typically under a device payment plan) or contain terms ranging from greater than one month to up to two years (typically under a fixed-term plan). Additionally, customers may incur charges based on usage or additional optional services purchased in conjunction with entering into a contract that can be cancelled at any time and therefore are not included in the transaction price. The transaction price allocated to service performance obligations, which are not satisfied or are partially satisfied as of the end of the reporting period, are generally related to our fixed-term plans.

Our Consumer group customers also include other telecommunications companies who utilize Verizon's networks to resell wireless service to their respective end customers. Reseller arrangements generally include a stated contract term, which typically extends longer than two years. These arrangements generally include an annual minimum revenue commitment over the term of the contract for which revenues will be recognized in future periods.

Consumer customer contracts for wireline services generally have a service term of two years; however, this term may be shorter than twelve months or may be month-to-month. Certain contracts with Business customers for wireline services extend into future periods, contain fixed monthly fees and usage-based fees, and can include annual commitments in each year of the contract or commitments over the entire specified contract term; however, a significant number of contracts for wireline services with our Business customers have a contract term that is twelve months or less.

Additionally, there are certain contracts with Business customers for wireline services that have a contractual minimum fee over the total contract term. We cannot predict the time period when revenue will be recognized related to those contracts; thus, they are excluded from the time bands below. These contracts have varying terms spanning over approximately five years ending in June 2024 and have aggregate contract minimum payments totaling $3.9 billion.

At June 30, 2019, the transaction price related to unsatisfied performance obligations for total Verizon that is expected to be recognized for 2019, 2020 and thereafter was $10.8 billion, $14.7 billion and $5.9 billion, respectively. Remaining performance obligation estimates are subject to change and are affected by several factors, including terminations and changes in the timing and scope of contracts, arising from contract modifications.

Accounts Receivable and Contract Balances

The timing of revenue recognition may differ from the time of billing to our customers. Receivables presented in our consolidated balance sheet represent an unconditional right to consideration. Contract balances represent amounts from an arrangement when either Verizon has performed, by transferring goods or services to the customer in advance of receiving all or partial consideration for such goods and services from the customer,

or the customer has made payment to Verizon in advance of obtaining control of the goods and/or services promised to the customer in the contract.

Contract assets primarily relate to our rights to consideration for goods or services provided to customers but for which we do not have an unconditional right at the reporting date. Under a fixed-term plan, total contract revenue is allocated between wireless service and equipment revenues. In conjunction with these arrangements, a contract asset is created, which represents the difference between the amount of equipment revenue recognized upon sale and the amount of consideration received from the customer when the performance obligation related to the transfer of control of the equipment is satisfied. The contract asset is reclassified to accounts receivable as wireless services are provided and billed. We have the right to bill the customer as service is provided over time, which results in our right to the payment being unconditional. The contract asset balances are presented in our consolidated balance sheet as Prepaid expenses and other and Other assets. We assess our contract assets for impairment on a quarterly basis and will recognize an impairment charge to the extent their carrying amount is not recoverable.

Contract liabilities arise when we bill our customers and receive consideration in advance of providing the goods or services promised in the contract. We typically bill service one month in advance, which is the primary component of the contract liability balance. Contract liabilities are recognized as revenue when services are provided to the customer. The contract liability balances are presented in our condensed consolidated balance sheet as Other current liabilities and Other liabilities.

The following table presents information about receivables from contracts with customers:

|

| | | | | | | | | | | | | | | |

| | At June 30, |

| | At January 1, |

| | At June 30, |

| | At January 1, |

|

| (dollars in millions) | 2019 |

| | 2019 |

| | 2018 |

| | 2018 |

|

Receivables(1) | $ | 12,173 |

| | $ | 12,104 |

| | $ | 11,412 |

| | $ | 12,073 |

|

Device payment plan agreement receivables(2) | 10,053 |

| | 8,940 |

| | 5,258 |

| | 1,461 |

|

| |

2.(1) | Balances do not include receivables related to the following contracts: leasing arrangements (such as towers), captive reinsurance arrangements primarily related to wireless device insurance and the interest on equipment financed on a device payment plan agreement when sold to the customer by an authorized agent. |

| |

(2) | Included in device payment plan agreement receivables presented in Note 7. Balances do not include receivables related to contracts completed prior to January 1, 2018 and receivables derived from the sale of equipment on a device payment plan through an authorized agent. |

The following table presents information about contract balances:

|

| | | | | | | | | | | | | | | |

| | At June 30, |

| | At January 1, |

| | At June 30, |

| | At January 1, |

|

| | 2019 |

| | 2019 |

| | 2018 |

| | 2018 |

|

| Contract asset | $ | 1,059 |

| | $ | 1,003 |

| | $ | 1,059 |

| | $ | 1,170 |

|

Contract liability (1) | 4,946 |

| | 4,943 |

| | 4,652 |

| | 4,452 |

|

(1) Revenue recognized related to contract liabilities existing at January 1, 2019 and January 1, 2018 were $194 million and $3.9 billion, for the three and six months ended June 30, 2019, respectively, and $327 million and $3.8 billion, for the three and six months ended June 30, 2018.

The balance of contract assets and contract liabilities recorded in our condensed consolidated balance sheet were as follows:

|

| | | | | | | |

| At June 30, |

| | At December 31, |

|

| (dollars in millions) | 2019 |

| | 2018 |

|

| Assets | | | |

| Prepaid expenses and other | $ | 812 |

| | $ | 757 |

|

| Other assets | 247 |

| | 246 |

|

| Total | $ | 1,059 |

| | $ | 1,003 |

|

| | | | |

| Liabilities | | | |

| Other current liabilities | $ | 4,323 |

| | $ | 4,207 |

|

| Other liabilities | 623 |

| | 736 |

|

| Total | $ | 4,946 |

| | $ | 4,943 |

|

Contract Costs

Topic 606 requires the recognition of an asset for incremental costs to obtain a customer contract, which are then amortized to expense over the respective periods of expected benefit. We recognize an asset for incremental commission expenses paid to internal and external sales personnel and agents in conjunction with obtaining customer contracts. We only defer these costs when we have determined the commissions are incremental costs that would not have been incurred absent the customer contract and are expected to be recoverable. Costs to obtain a contract are amortized and recorded ratably as commission expense over the period representing the transfer of goods or services to which the assets relate. Costs to obtain wireless contracts are amortized over both of our Consumer and Business customers' estimated device upgrade cycles, as such costs are typically incurred each time a customer upgrades. Costs to obtain wireline contracts are amortized as expense over the estimated customer relationship period for our Consumer customers. Incremental costs to obtain wireline contracts for our Business customers are insignificant.

We also defer costs incurred to fulfill contracts that: (1) relate directly to the contract; (2) are expected to generate resources that will be used to satisfy our performance obligation under the contract; and (3) are expected to be recovered through revenue generated under the contract. Contract fulfillment costs are expensed as we satisfy our performance obligations and recorded in Cost of services. These costs principally relate to direct costs that enhance our wireline business resources, such as costs incurred to install circuits. Costs to obtain contracts are recorded in Selling, general and administrative expense.

We determine the amortization periods for our costs incurred to obtain or fulfill a customer contract at a portfolio level due to the similarities within these customer contract portfolios.

Other costs, such as general costs or costs related to past performance obligations, are expensed as incurred.

Collectively, costs to obtain a contract and costs to fulfill a contract are referred to as Deferred contract costs, and amortized over a two- to five-year period. Deferred contract costs are classified as current or non-current within Prepaid expenses and other and Other assets, respectively.

The balances of Deferred contract costs included in our condensed consolidated balance sheet were as follows:

|

| | | | | | | |

| At June 30, |

| | At December 31, |

|

| (dollars in millions) | 2019 |

| | 2018 |

|

| Assets | | | |

| Prepaid expenses and other | $ | 2,352 |

| | $ | 2,083 |

|

| Other assets | 1,774 |

| | 1,812 |

|

| Total | $ | 4,126 |

| | $ | 3,895 |

|

For the three and six months ended June 30, 2019, we recognized expense of $639 million and $1.3 billion, respectively, associated with the amortization of Deferred contract costs, primarily within Selling, general and administrative expense in our condensed consolidated statements of income. For the three and six months ended June 30, 2018, we recognized expense of $471 million and $877 million, respectively, associated with the amortization of Deferred contract costs, primarily within Selling, general and administrative expense in our condensed consolidated statements of income.

We assess our Deferred contract costs for impairment on a quarterly basis. We recognize an impairment charge to the extent the carrying amount of a deferred cost exceeds the remaining amount of consideration we expect to receive in exchange for the goods and services related to the cost, less the expected costs related directly to providing those goods and services that have not yet been recognized as expenses. There have been no impairment charges recognized for the three and six months ended June 30, 2019 or June 30, 2018.

|

|

| Note 3. Acquisitions and Divestitures |

Wireless

Spectrum License Transactions

DuringIn 2019, the fourth quarterFederal Communications Commission (FCC) completed two millimeter wave spectrum license auctions. Verizon participated in these auctions and was the high bidder on 9 and 1,066 licenses, respectively, in the 24 Gigahertz (GHz) and 28 GHz bands. We submitted an application to the FCC and paid cash of 2016, we entered into a license exchange agreement with affiliates of AT&T Inc. to exchange certain Advanced Wireless Services (AWS) and Personal Communication Services (PCS) spectrum licenses. This non-cash exchange was completed in February 2017, at which time we received $1.0 billion of AWS and PCS spectrum licenses at fair value and recorded a pre-tax gain of $0.1 billion in Selling, general and administrative expense on our condensed consolidated statement of incomeapproximately $521 million for the nine months ended September 30, 2017.

During the first quarter of 2017, we entered into a license exchange agreement with affiliates of Sprint Corporation, which provides for the exchange of certain PCSlicenses that will be issued. The deposits related to these spectrum licenses. This non-cash exchange was completed in May 2017. As a result, we received $0.1 billion of PCS spectrum licenses at fair value and recorded an insignificant gain in Selling, general and administrative expense on our condensed consolidated statement of income for the nine months ended September 30, 2017.

During the third quarter of 2017, we entered into a license exchange agreement with affiliates of T-Mobile USA, Inc. to exchange certain AWS and PCS spectrum licenses. As a result of this agreement, $0.3 billion of Wireless licenses are classified as held for sale onwithin Other assets in our condensed consolidated balance sheet at Septembersheets as of June 30, 2017. This non-cash exchange is subject to customary closing conditions and is expected to be completed in the fourth quarter of 2017. Upon completion of this transaction, we expect to record a gain which will be determined upon the closing of the transaction.2019.

During both the three and ninesix months ended SeptemberJune 30, 2017,2019, we entered into and completed various other wireless license transactions for an insignificant amount of cash consideration.

Straight PathOther

On May 11, 2017, we entered into a purchase agreement to acquire Straight Path Communications Inc. (Straight Path), a holder of millimeter wave spectrum configured for fifth-generation (5G) wireless services, for consideration reflecting an enterprise value of approximately $3.1 billion. Under the terms of the purchase agreement, we agreed to pay (i) Straight Path shareholders $184.00 per share, payable in Verizon shares, and (ii) certain transaction costs payable in cash of approximately $0.7 billion, consisting primarily of a fee to be paid to the Federal Communications Commission (FCC). The acquisition is subject to customary regulatory approvals and closing conditions, and is expected to close by the end of the first quarter of 2018.

Wireline

XO Holdings

In February 2016, we entered into a purchase agreement to acquire XO Holdings’ wireline business (XO), which owns and operates one of the largest fiber-based Internet Protocol (IP) and Ethernet networks. Concurrently, we entered into a separate agreement to lease certain wireless spectrum from a wholly-owned subsidiary of XO Holdings that holds its wireless spectrum, which included an option, subject to certain conditions, to buy the subsidiary. In February 2017, we completed our acquisition of XO for total cash consideration of approximately $1.8 billion, of which $0.1 billion was paid in 2015. In April 2017, we exercised our option to buy the subsidiary for approximately $0.2 billion, subject to certain adjustments. The transaction is subject to customary regulatory approvals and is expected to close by the end of 2017. Upon closing, the spectrum acquired as part of the transaction will be used for our 5G technology deployment.

The condensed consolidated financial statements include the results of XO’s operations from the date the acquisition closed. If the acquisition of XO had been completed as of January 1, 2016, the results of operations of Verizon would not have been significantly different than our previously reported results of operations.

The acquisition of XO was accounted for as a business combination. Since the business combination and the lease agreement with the purchase option were entered into contemporaneously, the total cash consideration of $1.8 billion has been preliminarily allocated between them on a relative fair value basis. The preliminary allocation of the purchase price for the business combination will be finalized within 12 months following the close of the acquisition. We preliminarily recorded approximately $0.4 billion of goodwill, and $0.3 billion of other intangible assets. Goodwill