0000759944 us-gaap:FederalHomeLoanBankAdvancesMember 2019-12-310000759944us-gaap:SeriesFPreferredStockMember2020-04-012020-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended

SeptemberJune 30, 20202021

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From

(Not Applicable)

Commission File Number 001-36636

(Exact name of the registrant as specified in its charter)

|

| | | | | | | |

| Delaware | | 05-0412693 |

(State or Other Jurisdiction of

Incorporation or Organization)

| | (I.R.S. Employer

Identification Number)

|

One Citizens Plaza,, Providence,, RI02903

(Address of principal executive offices, including zip code)

(401) (401) 456-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | CFG | New York Stock Exchange |

Depositary Shares, each representing a 1/40th interest in a share of 6.350% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series D

| CFG PrD | New York Stock Exchange |

Depositary Shares, each representing a 1/40th interest in a share of 5.000% Fixed-Rate Non-Cumulative Perpetual Preferred Stock, Series E

| CFG PrE | New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

| | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

There were 427,073,084426,083,147 shares of Registrant’s common stock ($0.01 par value) outstanding on October 30, 2020.July 23, 2021.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | |

| | Table of Contents | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | |

| | | |

| | | |

| | | | |

| | | |

| | | | |

| | | |

| | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | |

| Item 6. Exhibits | | | |

| | | |

| | | |

| Signature | | | |

| | | |

| | | |

| | | |

Citizens Financial Group, Inc. | 2

GLOSSARY OF ACRONYMS AND TERMS

The following is a list of common acronyms and terms we regularly use in our financial reporting:

|

| | | | | | | |

AACL2020 Form 10-K | | Annual Report on Form 10-K for the year ended December 31, 2020 |

| AACL | | Adjusted Allowance for Credit Losses |

| ACL | | Allowance for Credit Losses: Allowance for Loan and Lease Losses plus ReserveAllowance for Unfunded Lending Commitments |

| AFS | | Available for Sale |

| ALLL | | Allowance for Loan and Lease Losses |

| ALM | | Asset and Liability Management |

| AOCI | | Accumulated Other Comprehensive Income (Loss) |

ATMARRC | | Alternative Reference Rate Committee |

| ASU | | Accounting Standards Update |

| ATM | | Automated Teller Machine |

| | |

| Board or Board of Directors | | The Board of Directors of Citizens Financial Group, Inc. |

| bps | | Basis Points |

| | |

| Capital Plan Rule | | Federal Reserve’s Regulation Y Capital Plan Rule |

| CARES Act | | Coronavirus Aid, Relief, and Economic Security Act |

| CBNA | | Citizens Bank, National Association |

| CCAR | | Comprehensive Capital Analysis and Review |

| CCB | | Capital Conservation Buffer |

| CCMI | | Citizens Capital Markets, Inc. |

| CECL | | Current Expected Credit Losses (ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments) |

| CET1 | | Common Equity Tier 1 |

| | |

| | |

| CET1 capital ratio | | Common Equity Tier 1 capital divided by total risk-weighted assets as defined under the U.S. Basel III Standardized approach |

CFPB | | Consumer Financial Protection Bureau |

| | |

| Citizens, CFG, the Company, we, us, or our | | Citizens Financial Group, Inc. and its Subsidiaries |

CLTVCLO | | Combined Loan-to-ValueCollateralized Loan Obligation |

CRECLTV | | Combined Loan-to-Value |

| | |

| COVID-19 pandemic | | Coronavirus Disease 2019 Pandemic |

| | |

| CRE | | Commercial Real Estate |

| | |

| | |

| | |

| Dodd-Frank Act | | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 |

EAD | | Exposure at Default |

EGRRCPA | | Economic Growth, Regulatory Relief and Consumer Protection Act |

EPS | | |

| Elevated cash | | Cash above targeted operating levels |

| EPS | | Earnings Per Share |

| | |

| | |

| EVE | | Economic Value of Equity |

| Exchange Act | | The Securities Exchange Act of 1934 |

| | |

| | |

| Fannie Mae (FNMA) | | Federal National Mortgage Association |

FDIC | | |

| FCA | | Financial Conduct Authority |

| FDIC | | Federal Deposit Insurance Corporation |

FHLBFHA | | Federal Housing Administration |

| FHLB | | Federal Home Loan Bank |

| FICO | | Fair Isaac Corporation (credit rating) |

| | |

| FRB or Federal Reserve | | Board of Governors of the Federal Reserve System and, as applicable, Federal Reserve Bank(s) |

| Freddie Mac (FHLMC) | | Federal Home Loan Mortgage Corporation |

FTE | | |

| FTE | | Fully Taxable Equivalent |

GAAP | | |

| GAAP | | Accounting Principles Generally Accepted in the United States of America |

| GDP | | Gross Domestic Product |

| | |

| Ginnie Mae (GNMA) | | Government National Mortgage Association |

Citizens Financial Group, Inc. | 3

| | | | | | | | |

| GSE | | Government Sponsored Entity |

HTM | | Held To Maturity |

LCR | | Liquidity Coverage Ratio |

LDR | | Loans-to-Deposits Ratio |

LGD | | Loss Given Default |

LHFS | | Loans Held for Sale |

LIBOR | | London Interbank Offered Rate |

|

| | |

LIHTCHSBC | | HSBC Bank U.S.A., N.A. |

| HTM | | Held To Maturity |

| | |

| | |

| ICE | | Intercontinental Exchange |

| Investors | | Investors Bancorp, Inc. |

| Last-of-Layer | | Last-of-layer is a fair value hedge of the interest rate risk of a portfolio of similar prepayable assets whereby the last dollar amount within the portfolio of assets is identified as the hedged item |

| | |

| | |

| | |

| LHFS | | Loans Held for Sale |

| LIBOR | | London Interbank Offered Rate |

| LIHTC | | Low Income Housing Tax Credit |

| LTV | | Loan to Value |

| MBS | | Mortgage-Backed Securities |

Mid-AtlanticMD&A | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Mid-Atlantic | | District of Columbia, Delaware, Maryland, New Jersey, New York, Pennsylvania, Virginia, and West Virginia |

| Midwest | | Illinois, Indiana, Michigan, and Ohio |

MD&A | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Modified CECL Transition | | The Day-1 CECL adoption entry booked to retained earnings plus 25% of subsequent CECL ACL reserve build |

| Modified AACL Transition | | The Day-1 CECL adoption entry booked to ACL plus 25% of subsequent CECL ACL reserve build |

| MSRs | | Mortgage Servicing Rights |

NCONCOs | | Net charge-offs |

| New England | | Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont |

NM | | Not meaningful |

NPLs | | |

| | |

| NPLs | | Nonaccrual loans and leases |

| OCC | | Office of the Comptroller of the Currency |

| OCI | | Other Comprehensive Income (Loss) |

| | |

| Operating Leverage | | Period-over-period percent change in total revenue, less the period-over-period percent change in noninterest expense |

| | |

| Parent Company | | Citizens Financial Group, Inc. (the Parent Company of Citizens Bank, National Association and other subsidiaries) |

PD | | Probability of Default |

PPP | | |

| PPP | | Paycheck Protection Program |

REIT | | Real estate investment trust |

| ROTCE | | Return on Average Tangible Common Equity |

| RPA | | Risk Participation Agreement |

SBARWA | | Risk-Weighted Assets |

| SBA | | United States Small Business Administration |

SCB | | |

| | |

| SCB | | Stress Capital Buffer |

| SEC | | United States Securities and Exchange Commission |

SVaRSOFR | | Secured Overnight Financing Rate |

| SVaR | | Stressed Value at Risk |

TBAsTailoring Rules | | Rules establishing risk-based categories for determining prudential standards for large U.S. and foreign banking organizations, consistent with the Dodd-Frank Act, as amended by the Economic Growth, Regulatory Relief and Consumer Protection Act |

| TBAs | | To-Be-Announced Mortgage Securities |

| TDR | | Troubled Debt Restructuring |

| Tier 1 capital ratio | | Tier 1 capital, which includes Common Equity Tier 1 capital plus non-cumulative perpetual preferred equity that qualifies as additional tier 1 capital, divided by total risk-weighted assets as defined under the U.S. Basel III Standardized approach |

| Tier 1 leverage ratio | | Tier 1 capital, which includes Common Equity Tier 1 capital plus non-cumulative perpetual preferred equity that qualifies as additional tier 1 capital, divided by quarterly adjusted average assets as defined under the U.S. Basel III Standardized approach |

Citizens Financial Group, Inc. | 4

| | | | | | | | |

| Total capital ratio | | Total capital, which includes Common Equity Tier 1 capital, tier 1 capital and allowance for credit losses and qualifying subordinated debt that qualifies as tier 2 capital, divided by total risk-weighted assets as defined under the U.S. Basel III Standardized approach |

VaRUSDA | | United States Department of Agriculture |

| VA | | United States Department of Veterans Affairs |

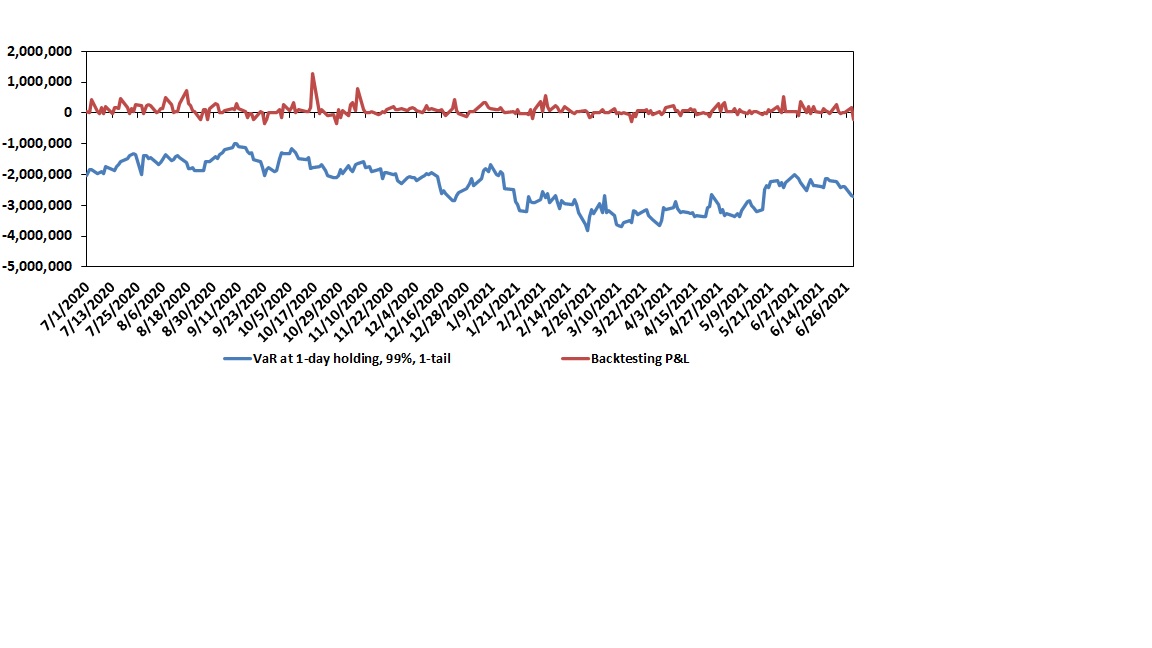

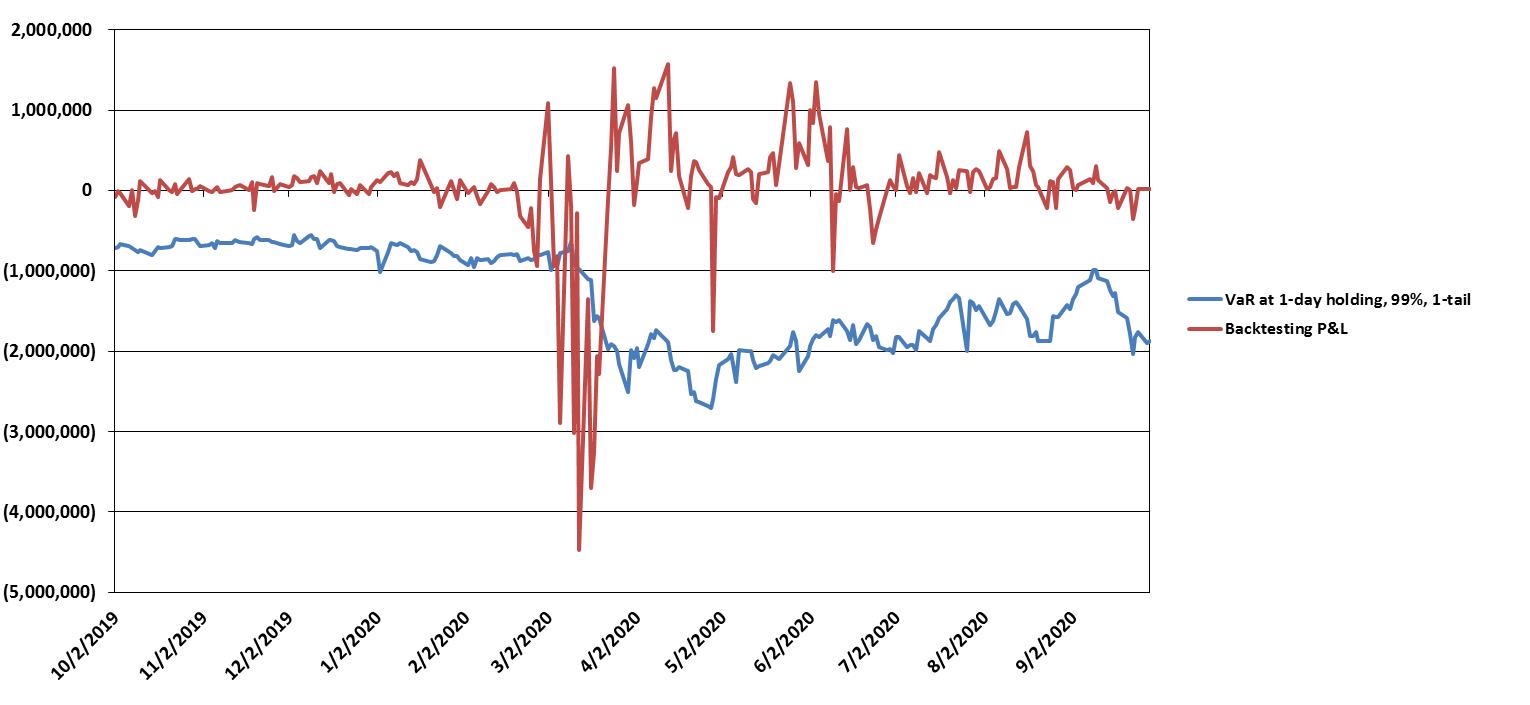

| VaR | | Value at Risk |

| VIE | | Variable Interest Entities |

| | |

Citizens Financial Group, Inc. | 5

PART I. FINANCIAL INFORMATION

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

| | | | | | | | |

| | Page |

| Forward-Looking Statements | | |

| | |

| | |

| | Page |

Forward-Looking Statements | | |

| | |

| | |

| Selected Consolidated Financial Data | | |

| Results of Operations | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Analysis of Financial Condition | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Citizens Financial Group, Inc. | 6

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements regarding potential future share repurchases and future dividends as well as the potential effects of the COVID-19 pandemic and associated lockdowns on our business, operations, financial performance and prospects, are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook”“outlook,” “guidance” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.”

Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation:

•Negative economic and political conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense;

| |

• | Negative economic and political conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense;

|

| |

• | The rate of growth in the economy and employment levels, as well as general business and economic conditions, and changes in the competitive environment;

|

| |

• | Our ability to implement our business strategy, including the cost savings and efficiency components, and achieve our financial performance goals;

|

| |

• | The COVID-19 pandemic and associated lockdowns and their effects on the economic and business environments in which we operate;

|

| |

• | Our ability to meet heightened supervisory requirements and expectations;

|

| |

• | Liabilities and business restrictions resulting from litigation and regulatory investigations;

|

| |

• | Our capital and liquidity requirements under regulatory capital standards and our ability to generate capital internally or raise capital on favorable terms;

|

| |

• | The effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale;

|

| |

• | Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets;

|

| |

• | The effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin;

|

| |

• | Financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses;

|

| |

• | A failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber-attacks; and

|

| |

• | Management’s ability to identify and manage these and other risks.

|

•The rate of growth in the economy and employment levels, as well as general business and economic conditions, and changes in the competitive environment;

•Our ability to implement our business strategy, including the cost savings and efficiency components, and achieve our financial performance goals, including through the integration of Investors and the HSBC branches;

•The COVID-19 pandemic and associated lockdowns and their effects on the economic and business environments in which we operate;

•Our ability to meet heightened supervisory requirements and expectations;

•Liabilities and business restrictions resulting from litigation and regulatory investigations;

•Our capital and liquidity requirements under regulatory capital standards and our ability to generate capital internally or raise capital on favorable terms;

•The effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale;

•Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets;

•The effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin;

•Financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses;

•A failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber-attacks;

•An inability to complete the acquisitions of Investors or the HSBC branches, or changes in the current anticipated timeframe, terms or manner of such acquisitions;

•Greater than expected costs or other difficulties related to the integration of our business and that of Investors and the relevant HSBC branches;

•The inability to retain existing Investors or HSBC clients and employees following the closings of the Investors and HSBC branch acquisitions;

Citizens Financial Group, Inc. | 7

•The occurrence of any event change or other circumstance that could give rise to the right of one or both parties to terminate (i) the agreement to acquire Investors or (ii) the agreement to acquire branches from HSBC; and

•Management’s ability to identify and manage these and other risks.

In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, risk-weighted assets, capital impacts of strategic initiatives, market conditions and regulatory and accounting considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares from or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends. Further, statements about the effects of the COVID-19 pandemic and associated lockdowns on our business, operations, financial performance and prospects may constitute forward-looking statements and are subject to the risk that the actual impacts may differ, possibly

materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and us. In addition, statements about our net charge-off guidance constitute forward-looking statements and are subject to the risk that the actual charge-offs may differ, possibly materially, from what is reflected in those statements due to, among other potential factors, the impact of the COVID-19 pandemic and the effectiveness of stimulus and forbearance programs in response, changes in economic conditions, and idiosyncratic events affecting our commercial loans. Statements about Citizens’ agreement and plan of merger, dated July 28, 2021 (the “Investors acquisition agreement”) with Investors Bancorp, Inc. and CBNA’s agreement dated May 26, 2021 (“HSBC branch acquisition agreement”) with HSBC to acquire certain branches from HSBC also constitute forward-looking statements and are subject to the risk that actual results could be materially different from those expressed in those statements, including if either of both transactions are not consummated in a timely manner or at all, or if integration is more costly or difficult than expected.

More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in the “Risk Factors” section in Part II, Item 1A of this report and Part I, Item 1A of our Annual Report on2020 Form 10-K for the year ended December 31, 2019 and Part II, Item 1A of our Quarterly Report on Form 10-Q for the period ended June 30, 2020.10-K.

INTRODUCTION

Citizens Financial Group, Inc. is one of the nation’s oldest and largest financial institutions with $179.2$185.1 billion in assets as of SeptemberJune 30, 2020. 2021. Our mission is to help customers, colleagues and communities each reach their potential by listening to them and understanding their needs in order to offer tailored advice, ideas and solutions. Headquartered in Providence, Rhode Island, we offer a broad range of retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations and institutions. In Consumer Banking, we provide an integrated experience that includes mobile and online banking, a 24/7 customer contact center as well as the convenience of approximately 2,700 3,000 ATMs and 1,000 branches in 11 states in the New England, Mid-Atlantic, and Midwest regions. Consumer Banking products and services include a full range of banking, lending, savings, wealth management and small business offerings. In Commercial Banking, we offer corporate, institutional and not-for-profit clients a full range of wholesale banking products and services including lending and deposits, capital markets, treasury services, foreign exchange and interest rate products, and asset finance. More information is available at www.citizensbank.com.

On May 26, 2021, CBNA entered into an agreement to acquire 80 East Coast branches and the national online deposit business from HSBC. The acquisition provides an attractive entry into important metro markets and supports our national expansion strategy. Under the agreement, CBNA will acquire approximately $9.0 billion in deposits and approximately $2.2 billion in loans for a 2.0 percent premium paid on deposits at closing. The 80 branch purchase includes 66 locations in the New York City Metro area, 9 locations in the Mid-Atlantic/Washington D.C. area, and 5 locations in Southeast Florida. The transaction is expected to close in the first quarter of 2022, subject to customary closing terms and conditions and regulatory approvals.

On July 28, 2021 Citizens entered into a definitive agreement and a plan of merger under which Citizens will acquire Investors for a combination of stock and cash. The acquisition of Investors enhances Citizens’ banking franchise, adding an attractive middle market/small business and consumer customer base while building its physical presence in the northeast with the addition of 154 branches located in the greater New York City and Philadelphia metropolitan areas and across New Jersey. See Note 17 in Item 1 for further information.

Citizens Financial Group, Inc. | 8

The following MD&A is intended to assist readers in their analysis of the accompanying unaudited interim Consolidated Financial Statements and supplemental financial information. It should be read in conjunction with the unaudited interim Consolidated Financial Statements and Notes to the unaudited interim Consolidated Financial Statements in Part I, Item 1, as well as other information contained in this document and our 20192020 Form 10-K.

Non-GAAP Financial Measures

This document contains non-GAAP financial measures denoted as “Underlying” results., “excluding elevated cash”, “excluding PPP loans”, as well as other results excluding the impact of certain items. Underlying results for any given reporting period exclude certain items that may occur in that period which management does not consider indicative of our on-going financial performance. We believe these non-GAAP financial measures provide useful information to investors because they are used by management to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe our Underlying results or results excluding the impact of certain items in any given reporting period reflect our on-going financial performance and increase comparability of period-to-period results, and accordingly, are useful to consider in addition to our GAAP financial results.

Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by such companies. We caution investors not to place undue reliance on such non-GAAP financial measures, but to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for our results reported under GAAP.

Non-GAAP measures are denoted throughout our MD&A by the use of the term Non-GAAPUnderlying or Underlyingidentified as excluding the impact of certain items and where there is a reference to Non-GAAP or Underlying resultsthese metrics in that paragraph, all measures that follow that reference are on the same basis when applicable. For more information on the computation of non-GAAP financial measures, see “—Non-GAAP Financial Measures and Reconciliations.”

FINANCIAL PERFORMANCE

Quarterly Results - Key Highlights

Third Second quarter 20202021 net income of $314$648 million decreased 30%increased 156% from $449$253 million in the thirdsecond quarter of 2019,2020, with earnings per diluted common share of $0.68, down $0.29$1.44, up $0.91 from $0.97$0.53 per diluted common share in thirdthe second quarter 2019. Thirdof 2020. Second quarter 20202021 ROTCE of 8.3%17.5% compared to 12.4%6.6% in thirdthe second quarter 2019.of 2020.

Third Second quarter 2021 results reflected $8 million of expenses, net of tax benefit, or $0.02 per diluted common share, from notable items largely tied to TOP 6 transformational and revenue and efficiency initiatives as well as integration costs. Second quarter 2020 results reflected $24$10 million after-tax,of expenses, net of tax benefit, or $0.05$0.02 per diluted common share, of notable items largely tied to TOP 6 transformational and revenue and efficiency initiatives.initiatives as well as integration costs. On an Underlying basis, which excludes notable items, thirdsecond quarter 20202021 net income available to common stockholders of $313$624 million compared with $436$235 million in the thirdsecond quarter of 2019.2020. Underlying EPS of $0.73$1.46 compared to $0.98$0.55 in the thirdsecond quarter of 2019.2020. Underlying thirdsecond quarter 20202021 ROTCE of 9.0%17.7% compared with 12.6%6.9% in the thirdsecond quarter of 2019. Tangible2020. Second quarter 2021 tangible book value per common share of $32.24$33.95 increased 2%6% from thirdthe second quarter 2019.of 2020.

| | | Table 1: Notable Items | | Table 1: Notable Items | | | | | | | | |

| | Three Months Ended September 30, | | | Three Months Ended June 30, |

| | 2020 | | 2019 | | | 2021 | | | 2020 |

| (in millions) | Noninterest expense | | Income tax expense | | Net Income | | Noninterest expense | | Income tax expense | | Net Income | (in millions) | | Noninterest expense | | | Income tax expense | | Net Income | | | Noninterest expense | | | Income tax expense | | Net Income |

| Reported results (GAAP): |

| $988 |

| |

| $61 |

| |

| $314 |

| |

| $973 |

| |

| $115 |

| |

| $449 |

| Reported results (GAAP): | | $991 | | | | $183 | | | $648 | | | | $979 | | | | $54 | | | $253 | |

| Less notable items: | | | | | | | | | | | | Less notable items: | | | | | | | | |

| Total integration costs | 2 |

| | — |

| | (2 | ) | | 4 |

| | (1 | ) | | (3 | ) | Total integration costs | | 2 | | | | (1) | | | (1) | | | | 2 | | | | (1) | | | (1) | |

Other notable items(1) | 29 |

| | (7 | ) | | (22 | ) | | 15 |

| | (14 | ) | | (1 | ) | Other notable items(1) | | 9 | | | | (2) | | | (7) | | | | 17 | | | | (8) | | | (9) | |

| Total notable items | 31 |

| | (7 | ) | | (24 | ) | | 19 |

| | (15 | ) | | (4 | ) | Total notable items | | 11 | | | | (3) | | | (8) | | | | 19 | | | | (9) | | | (10) | |

| Underlying results* (non-GAAP) |

| $957 |

| |

| $68 |

| |

| $338 |

| |

| $954 |

| |

| $130 |

| |

| $453 |

| |

| Underlying results (non-GAAP) | | Underlying results (non-GAAP) | | $980 | | | | $186 | | | $656 | | | | $960 | | | | $63 | | | $263 | |

(1) Other notable items for the second quarter of 2021 and 2020 include noninterest expense of $29$9 million and $17 million, respectively, related to our TOP 6

Citizens Financial Group, Inc. | 9

transformational and revenue and efficiency initiatives.

* Where there is a reference•Total revenue of $1.6 billion decreased $141 million, or 8%, from the second quarter of 2020, driven by declines of 18% and 3% in noninterest income and net interest income, respectively.

•Net interest income of $1.1 billion decreased 3% compared to Non-GAAP or “Underlying” results in a paragraph, all measures that follow that reference are on the same basis when applicable. For more information on the computationsecond quarter of non-GAAP financial measures, see “—Introduction — Non-GAAP Financial Measures” and “—Non-GAAP Financial Measures and Reconciliations.”

| |

• | Total revenue of2020 given lower net interest margin, $1.8 billionincreased $153 million, or 9%, from the third quarter2019, reflecting increased noninterest income and a slight decrease in net interest income.

|

| |

◦ | Net interest income of $1.1 billion was down 1% compared to the third quarter2019, as lower net interest margin was only partially offset by growth in average interest-earning assets of 9%.

|

| |

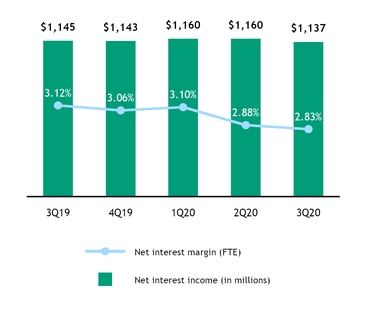

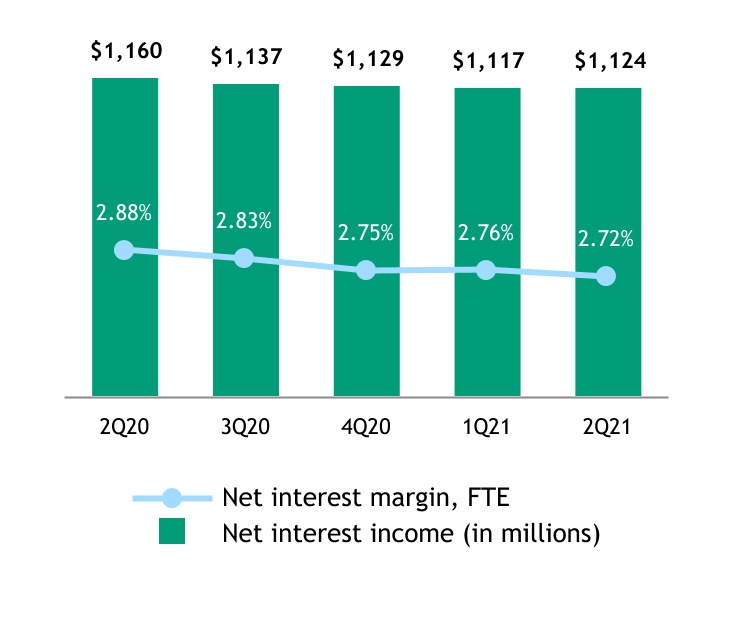

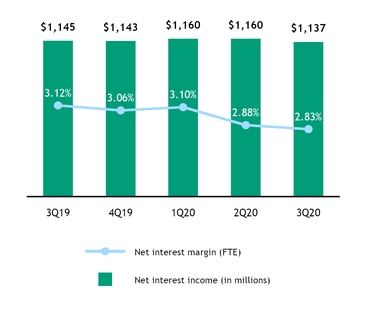

◦ | Net interest margin of 2.82%decreased 28 basis points compared to 3.10% in third quarter2019, reflecting the impact of lower interest rates and higher cash balances given strong deposit flows, partially offset by improved funding mix and lower funding costs.

|

| |

– | Net interest margin on a fully taxable-equivalent basis of 2.83%decreased by 29 basis points, compared to 3.12% in third quarter2019.

|

| |

– | Average loans and leases of $124.9 billionincreased $7.7 billion, or 7%, from $117.3 billion in the third quarter2019, reflecting a $6.9 billionincrease in commercial loans and leases, which includes $4.7 billion of PPP loans, and a $777 millionincrease in retail loans.

|

| |

– | Average deposits of $141.4 billionincreased $17.4 billion, or 14%, from $123.9 billion in the third quarter2019, reflecting growth in demand deposits, money market accounts, regular savings, and checking with interest, partially offset by lower term deposits.

|

| |

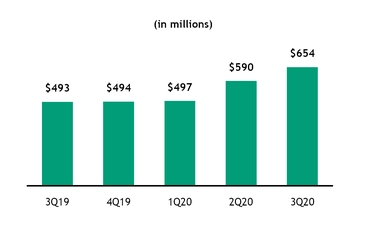

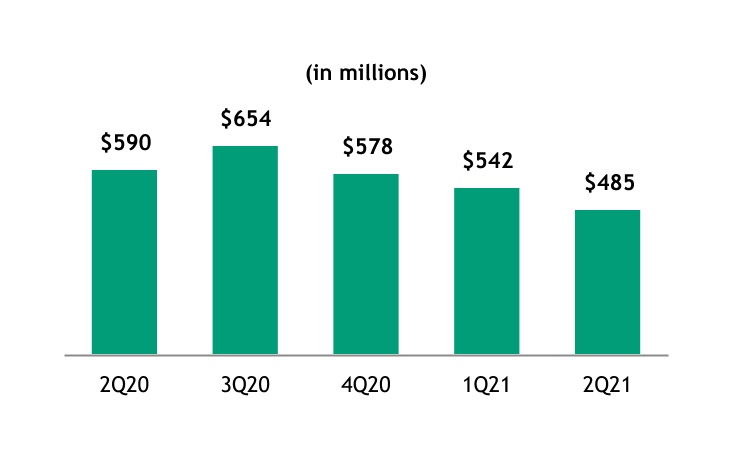

◦ | Noninterest income of $654 millionincreased $161 million, or 33%, from the third quarter2019, driven by higher mortgage banking fees and strength in capital markets fees and trust and investment services fees, partially offset by lower services charges and fees, card fees, and foreign exchange and interest rate products reflecting the impact of COVID-19 and associated lockdowns. Other income reflected the gain on sale of education loans and increased from third quarter 2019, which included a benefit related to a lease restructuring.

|

| |

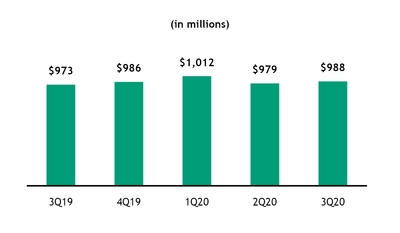

• | Noninterest expense of $988 millionincreased $15 million, or 2%, compared to $973 million in third quarter2019.

|

| |

◦ | On an Underlying basis, noninterest expense was stable with third quarter2019, reflecting higher equipment and software, salaries and employee benefits and outside services expense, almost wholly

|

offset by 2% growth in interest-earning assets.

◦Net interest margin of 2.71% decreased 16 basis points compared to 2.87% in the second quarter of 2020, primarily reflecting the impact of a lower rate environment, lower interest-earning asset yields and elevated cash balances given strong deposit flows, partially offset by improved funding mix and deposit pricing.

–Net interest margin on a fully taxable-equivalent basis of 2.72% decreased 16 basis points compared to 2.88% in the second quarter of 2020.

–Average loans and leases of $123.5 billion decreased $5.3 billion, or 4%, from $128.8 billion in the second quarter of 2020, driven by a $6.8 billion decrease in commercial reflecting line of credit repayments and net payoffs partially offset by a $1.2 billion increase in PPP loans. The overall decrease in commercial was partially offset by a $1.5 billion increase in retail driven by growth in education and residential mortgage, which reflects the exercise of the early buyout option of loans previously sold to GNMA, partially offset by decreases in home equity and other retail given run-off of personal unsecured installment loans.

–Average deposits of $150.3 billion increased $8.8 billion, or 6%, from $141.6 billion in the second quarter of 2020, reflecting an increase in demand deposits, money market accounts, savings and checking with interest, partially offset by a decrease in term deposits.

◦Noninterest income of $485 million decreased $105 million, or 18%, from the second quarter of 2020, driven by a decline in mortgage banking fees, partially offset by higher capital markets fees, trust and investment services fees, services charges and fees, and card fees.

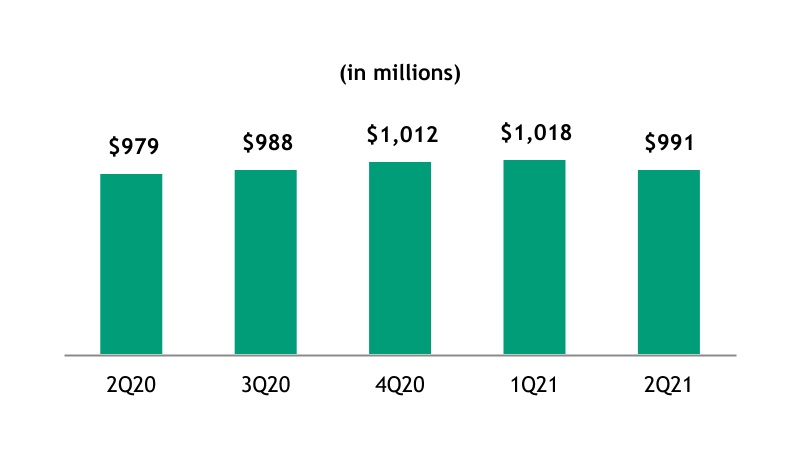

•Noninterest expense of $991 millionwas stable compared to the second quarter of 2020.

◦On an Underlying basis, noninterest expense of $980 million increased $20 million, or 2%, from the second quarter of 2020, reflecting higher outside services, equipment and software expense and salaries and employee benefits, partially offset by a decrease in other operating expense given lower travel and advertising expenses, as well as a $10 million charge relatedexpense.

•The efficiency ratio of 61.6% compared to a lease restructuring55.9% in the prior year.second quarter of 2020.

| |

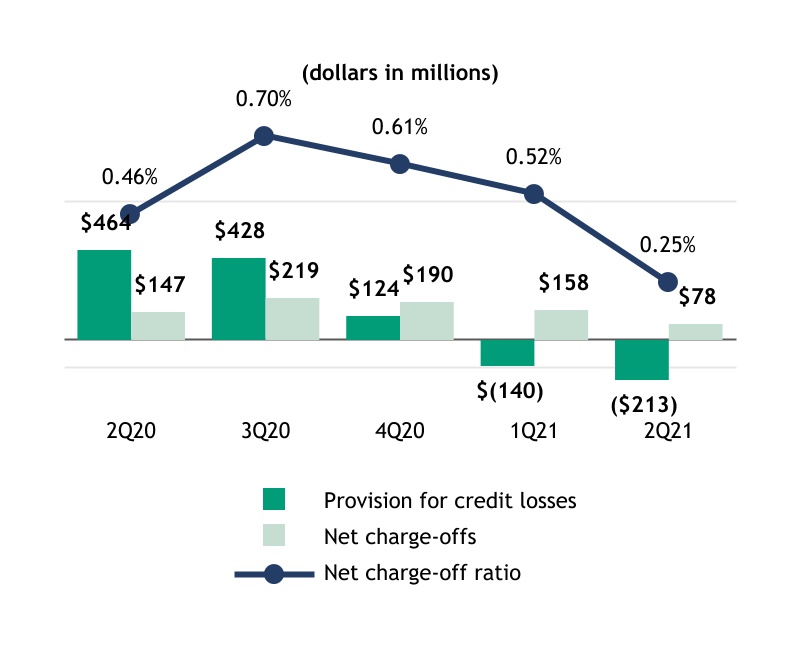

• | The efficiency ratio of 55.2% compared to 59.4% in third quarter2019.◦On an Underlying basis, the efficiency ratio of 60.9% compared to 54.9% in the second quarter of 2020. •Credit provision benefit of $213 million compares with a $464 million credit provision expense in the second quarter of 2020, reflecting strong credit performance across the retail and commercial loan portfolios and improvement in the macroeconomic outlook. |

| |

◦ | On an Underlying basis, the efficiency ratio of 53.4% compared to 58.2% in the third quarter2019.

|

| |

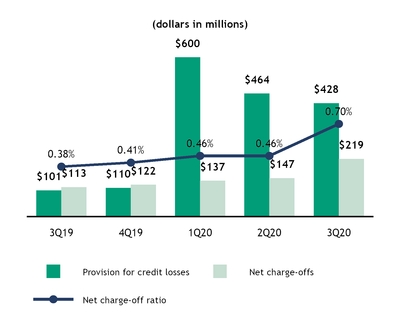

• | Provision for credit losses of $428 millionincreased $327 million from $101 million in the third quarter2019, primarily driven by a $209 million reserve build largely associated with commercial.

|

Year to Date and Period End - Key Highlights

Net income of $601$1.3 billion increased $972 million decreased 55% from the first nine monthshalf of 2019,2020, with earnings per diluted common share of $1.23, down $1.60$2.81, up $2.26 from $2.83$0.55 per diluted common share in the first nine monthshalf of 2019.2020. ROTCE of 5.1% declined17.3% increased from 12.7%3.5% in the first nine monthshalf of 2019.2020. Improved results primarily reflect the impact of the COVID-19 pandemic and associated lockdowns in the first half of 2020, resulting in a significant ACL reserve build in the first half of 2020.

In the first nine monthshalf of 2020,2021, results reflected a $59$23 million after-tax reduction,of expenses, net of tax benefit, or $0.14$0.06 per diluted common share, from notable items, largely tied to TOP 6 transformational and revenue and efficiency initiatives.initiatives as well as integration costs. In the first nine monthshalf of 2019,2020, there were $13$35 million of expenses, net of tax benefit, or $0.03$0.09 per diluted common share, after-tax offrom notable items, largely tied to integration costs associated with acquisitions and TOP 6 transformational and revenue and efficiency initiatives. initiatives as well as integration costs.

Citizens Financial Group, Inc. | 10

| | | Table 2: Notable Items | | Table 2: Notable Items | | | | | | | | |

| | Nine Months Ended September 30, | | | Six Months Ended June 30, |

| | 2020 | | 2019 | | | 2021 | | | 2020 |

| (in millions) | Noninterest expense | | Income tax expense | | Net Income | | Noninterest expense | | Income tax expense | | Net Income | (in millions) | | Noninterest expense | | | Income tax expense | | Net Income | | | Noninterest expense | | | Income tax expense | | Net Income |

| Reported results (GAAP) |

| $2,979 |

| |

| $126 |

| |

| $601 |

| |

| $2,861 |

| |

| $369 |

| |

| $1,341 |

| Reported results (GAAP) | | $2,009 | | | | $353 | | | $1,259 | | | | $1,991 | | | | $65 | | | $287 | |

| Less notable items: | | | | | | | | | | | | Less notable items: | | | | | | | | |

| Total integration costs | 8 |

| | (2 | ) | | (6 | ) | | 16 |

| | (4 | ) | | (12 | ) | Total integration costs | | 2 | | | | (1) | | | (1) | | | | 6 | | | | (2) | | | (4) | |

Other notable items(1) | 75 |

| | (22 | ) | | (53 | ) | | 15 |

| | (14 | ) | | (1 | ) | Other notable items (1) | | 29 | | | | (7) | | | (22) | | | | 46 | | | | (15) | | | (31) | |

| Total notable items | 83 |

| | (24 | ) | | (59 | ) | | 31 |

| | (18 | ) | | (13 | ) | Total notable items | | 31 | | | | (8) | | | (23) | | | | 52 | | | | (17) | | | (35) | |

| Underlying results* (non-GAAP) |

| $2,896 |

| |

| $150 |

| |

| $660 |

| |

| $2,830 |

| |

| $387 |

| |

| $1,354 |

| |

| Underlying results (non-GAAP) | | Underlying results (non-GAAP) | | $1,978 | | | | $361 | | | $1,282 | | | | $1,939 | | | | $82 | | | $322 | |

(1) For the six months ended June 30, 2021 and 2020, Other notable items include noninterest expense of $75of $29 million and $46 million, respectively, related to our TOP 6 transformational and revenue and efficiency initiatives and aninitiatives. Other notable items for the six months ended June 30, 2020 also included a $4 million income tax benefit of $4 million related to legacy tax matters.

| |

• | •Net income available to common stockholders of $1.2 billion increased $967 million, compared to $237 million in the first half of 2020.$526 milliondecreased $765 million, or 59%, compared to $1.3 billion in the first nine months of 2019. |

| |

◦ | On an Underlying basis, which excludes notable items, first nine months2020 net income available to common stockholders of $585 million compared with $1.3 billion in the first nine months of 2019.

|

| |

◦ | On an Underlying basis, EPS of $1.37 per share compared to $2.86 in the first nine months of 2019.

|

| |

• | Total revenue of $5.2 billionincreased $344 million, or 7%, from the first nine months of 2019, reflecting a 26%increase in noninterest income and stable net interest income.

|

| |

◦ | Net interest income of $3.5 billion was stable, reflecting 8% growth in average interest-earning assets offset by the impact of the lower rate and challenging yield-curve environment.

|

| |

◦ | Net interest margin of 2.93%decreased 25 basis points from 3.18% in the first nine months of 2019, reflecting the impact of lower interest rates, partially offset by lower funding costs and improved funding mix, as well as continued mix shift towards higher yielding assets.

|

| |

– | Net interest margin on a fully taxable-equivalent basis of 2.93%decreased by 26 basis points, compared to 3.19% in the first nine months of 2019.

|

| |

– | Average loans and leases of $124.9 billionincreased $7.3 billion, or 6%, from $117.6 billion in the first nine months of 2019, reflecting a $6.1 billionincrease in commercial loans and leases primarily driven by $2.7 billion of PPP loans and growth in commercial real estate loans as well as a $1.3 billionincrease in retail loans.

|

| |

– | Period-end loan growth of $5.0 billion, or 4%, from the fourth quarter of 2019, reflected 8% growth in total commercial loans and leases driven by $4.7 billion of PPP loans.

|

| |

– | Average deposits of $136.5 billionincreased $14.0 billion, or 11%, from $122.5 billion in the first nine months of 2019, reflecting growth in money market accounts, demand deposits, savings and checking with interest, partially offset by a decrease in term deposits.

|

| |

– | Period-end deposit growth of $17.6 billion, or 14%, from the fourth quarter of 2019, outpacing loan growth.

|

| |

◦ | Noninterest income of $1.7 billionincreased $358 million, or 26%, from the first nine months of 2019, driven by mortgage banking, partially offset by lower service charges and fees, card fees, foreign exchange and interest rate products revenue, and other income.

|

| |

• | Noninterest expense of $3.0 billionincreased $118 million, or 4%, from $2.9 billion in the first nine months of 2019, driven by higher salaries and employee benefits, outside services, and equipment and software expense, partially offset by lower other operating expense given lower travel and advertising expenses.

|

| |

◦ | On an Underlying basis, noninterest expense increased 2% from the first nine months of 2019.

|

| |

• | The efficiency ratio of 57.3% compared to 58.9% for the first nine months of 2019, and ROTCE of 5.1% compared to 12.7%.

|

| |

◦ | On an Underlying basis, the efficiency ratio of 55.7% compared to 58.3% for the first nine months of 2019 and ROTCE of 5.7%compared to12.9%, reflecting the challenging environment presented by COVID-19, in particular, provision impact.

|

| |

• | Provision for credit losses of $1.5 billionincreased $1.2 billion from $283 million for the first nine months of 2019, reflecting our adoption of CECL and its reliance on forecasts of expected future losses, combined with the approximate $990 million impact from COVID-19 and associated lockdowns and the resulting sudden rise in unemployment and drop in GDP.

|

| |

• | Tangible book value per common share of $32.24 increased 2% from the first nine months of 2019. Fully diluted average common shares outstanding decreased 28.1 million shares, or 6%, over the same period.

|

◦On an Underlying basis, which excludes notable items, first half 2021 net income available to common stockholders of $1.2 billion compared with $272 million in the first half of 2020.

◦On an Underlying basis, EPS of $2.87 compared to $0.64 in the first half of 2020.

•Total revenue of $3.3 billion decreased $139 million, or 4%, from the first half of 2020, driven by declines of 6% and 3% in noninterest income and net interest income, respectively.

◦Net interest income of $2.2 billion decreased 3% given lower net interest margin, partially offset by 6% growth in interest-earning assets.

◦Net interest margin of 2.73% decreased 25 basis points from 2.98% in the first half of 2020, primarily reflecting the impact of a lower rate environment, lower interest-earning asset yields and elevated cash balances given strong deposit flows, partially offset by improved funding mix and deposit pricing.

–Net interest margin on a FTE basis of 2.74% decreased by 25 basis points, compared to 2.99% in the first half of 2020.

–Average loans and leases of $123.2 billion decreased $1.7 billion, or 1%, from $124.9 billion in the first half of 2020, driven by a $2.7 billion decrease in commercial reflecting line of credit repayments and net payoffs, partially offset by a $960 million increase in retail driven by growth in education and residential mortgage, which reflects the exercise of the early buyout option of loans previously sold to GNMA, partially offset by decreases in home equity and other retail given run-off of personal unsecured installment loans.

–Period-end loans declined $509 million from the fourth quarter of 2020, reflecting a 3% decline in commercial, partially offset by 2% growth in retail.

–Average deposits of $148.5 billion increased $14.4 billion, or 11%, from $134.1 billion in the first half of 2020, reflecting an increase in demand deposits, money market accounts, savings and checking with interest, partially offset by a decrease in term deposits.

–Period-end deposit growth of $3.5 billion, or 2%, from the fourth quarter of 2020, reflecting growth in demand deposits, savings and checking with interest, partially offset by a decline in term deposits and money market accounts.

◦Noninterest income of $1.0 billion decreased $60 million, or 6%, from the first half of 2020, driven by by a decline in mortgage banking fees, partially offset by higher capital markets fees, trust and investment services fees, card fees, and letter of credit and loan fees.

•Noninterest expense of $2.0 billion was stable compared to the first half of 2020.

◦On an Underlying basis, noninterest expense increased 2% from the first half of 2020, reflecting higher outside services, equipment and software expense, and salaries and employee benefits, partially offset by a decrease in other operating expense.

Citizens Financial Group, Inc. | 11

•The efficiency ratio of 61.5% compared to 58.4% for the first half of 2020, and ROTCE of 17.3% compared to 3.5%.

◦On an Underlying basis, the efficiency ratio of 60.6% compared to 56.9% for the first half of 2020, and ROTCE of 17.7%compared to4.0%.

•Credit provision benefit of $353 million compares with a $1.1 billion credit provision expense for the first half of 2020, reflecting strong credit performance across the retail and commercial loan portfolios and improvement in the macroeconomic outlook.

•Tangible book value per common share of $33.95 increased 6% from the first half of 2020. Fully diluted average common shares outstanding was stable over the same period.

Citizens Financial Group, Inc. | 12

SELECTED CONSOLIDATED FINANCIAL DATA

The summary of the Consolidated Operating Data for the for the three and ninesix months ended SeptemberJune 30, 20202021 and 20192020 and the summary Consolidated Balance Sheet data as of SeptemberJune 30, 20202021 and December 31, 20192020 are derived from our unaudited interim Consolidated Financial Statements, included in Part I, Item 1. Our historical results are not necessarily indicative of the results expected for any future period.

| | | Table 3: Summary of Consolidated Operating Data | | Table 3: Summary of Consolidated Operating Data | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended June 30, | | Six Months Ended June 30, |

| (dollars in millions, except per share amounts) | 2020 |

| | 2019 |

| | 2020 | | 2019 | (dollars in millions, except per share amounts) | 2021 | | 2020 | | 2021 | | 2020 |

| OPERATING DATA: | | | | | | | | OPERATING DATA: | | | | | | | |

| Net interest income |

| $1,137 |

| |

| $1,145 |

| |

| $3,457 |

| |

| $3,471 |

| Net interest income | $1,124 | | | $1,160 | | | $2,241 | | | $2,320 | |

| Noninterest income | 654 |

| | 493 |

| | 1,741 |

| | 1,383 |

| Noninterest income | 485 | | | 590 | | | 1,027 | | | 1,087 | |

| Total revenue | 1,791 |

| | 1,638 |

| | 5,198 |

| | 4,854 |

| Total revenue | 1,609 | | | 1,750 | | | 3,268 | | | 3,407 | |

| Provision for credit losses | 428 |

| | 101 |

| | 1,492 |

| | 283 |

| Provision for credit losses | (213) | | | 464 | | | (353) | | | 1,064 | |

| Noninterest expense | 988 |

| | 973 |

| | 2,979 |

| | 2,861 |

| Noninterest expense | 991 | | | 979 | | | 2,009 | | | 1,991 | |

| Income before income tax expense | 375 |

| | 564 |

| | 727 |

| | 1,710 |

| Income before income tax expense | 831 | | | 307 | | | 1,612 | | | 352 | |

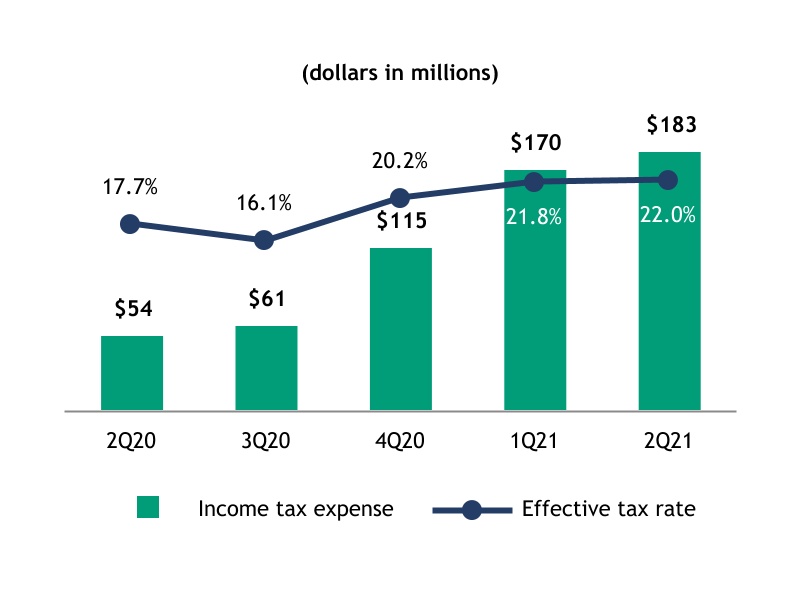

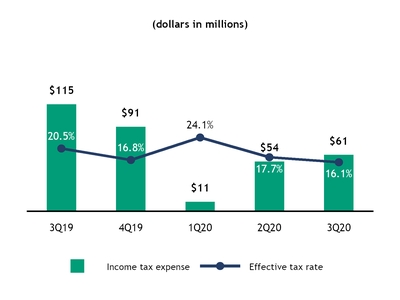

| Income tax expense | 61 |

| | 115 |

| | 126 |

| | 369 |

| Income tax expense | 183 | | | 54 | | | 353 | | | 65 | |

| Net income |

| $314 |

| |

| $449 |

| |

| $601 |

| |

| $1,341 |

| Net income | $648 | | | $253 | | | $1,259 | | | $287 | |

| Net income available to common stockholders |

| $289 |

| |

| $432 |

| |

| $526 |

| |

| $1,291 |

| Net income available to common stockholders | $616 | | | $225 | | | $1,204 | | | $237 | |

| Net income per common share - basic |

| $0.68 |

| |

| $0.97 |

| |

| $1.23 |

| |

| $2.84 |

| Net income per common share - basic | $1.45 | | | $0.53 | | | $2.83 | | | $0.56 | |

| Net income per common share - diluted |

| $0.68 |

| |

| $0.97 |

| |

| $1.23 |

| |

| $2.83 |

| Net income per common share - diluted | $1.44 | | | $0.53 | | | $2.81 | | | $0.55 | |

| OTHER OPERATING DATA: | | | | | | | | OTHER OPERATING DATA: | |

| Return on average common equity | 5.60 | % | | 8.35 | % | | 3.45 | % | | 8.50 | % | Return on average common equity | 11.85 | % | | 4.44 | % | | 11.71 | % | | 2.35 | % |

| Return on average tangible common equity | 8.33 |

| | 12.44 |

| | 5.15 |

| | 12.72 |

| Return on average tangible common equity | 17.50 | | | 6.62 | | | 17.34 | | | 3.51 | |

| Return on average total assets | 0.70 |

| | 1.10 |

| | 0.46 |

| | 1.11 |

| Return on average total assets | 1.41 | | | 0.57 | | | 1.38 | | | 0.33 | |

| Return on average total tangible assets | 0.73 |

| | 1.15 |

| | 0.48 |

| | 1.16 |

| Return on average total tangible assets | 1.46 | | | 0.59 | | | 1.44 | | | 0.35 | |

| Efficiency ratio | 55.18 |

| | 59.40 |

| | 57.31 |

| | 58.94 |

| Efficiency ratio | 61.63 | | | 55.91 | | | 61.49 | | | 58.43 | |

Operating leverage(1) | 7.77 |

| | (2.16 | ) | | 2.95 |

| | (0.18 | ) | (9.42) | | | 4.60 | | | (5.02) | | | 0.48 | |

Net interest margin, FTE(2)(1) | 2.83 |

| | 3.12 |

| | 2.93 |

| | 3.19 |

| 2.72 | | | 2.88 | | | 2.74 | | | 2.99 | |

| Effective income tax rate | 16.10 |

| | 20.46 |

| | 17.27 |

| | 21.58 |

| Effective income tax rate | 21.96 | | | 17.69 | | | 21.86 | | | 18.51 | |

(1)“Operating leverage” represents the period-over-period percent change in total revenue, less the period-over-period percent change in noninterest expense.

(2) Net interest margin is presented on ana FTE basis using the federal statutory tax rate of 21%.

Citizens Financial Group, Inc. | 13

| | | Table 4: Summary of Consolidated Balance Sheet data | | Table 4: Summary of Consolidated Balance Sheet data | |

| (dollars in millions) | September 30,

2020 | | December 31,

2019 | (dollars in millions) | June 30, 2021 | | December 31, 2020 |

| BALANCE SHEET DATA: | | | | BALANCE SHEET DATA: | | | |

| Total assets |

| $179,228 |

| |

| $165,733 |

| Total assets | $185,104 | | | $183,349 | |

| Loans held for sale, at fair value | 3,587 |

| | 1,946 |

| Loans held for sale, at fair value | 3,616 | | | 3,564 | |

| Other loans held for sale | 127 |

| | 1,384 |

| Other loans held for sale | 82 | | | 439 | |

| Loans and leases | 124,071 |

| | 119,088 |

| Loans and leases | 122,581 | | | 123,090 | |

| Allowance for loan and lease losses | (2,542 | ) | | (1,252 | ) | Allowance for loan and lease losses | (1,947) | | | (2,443) | |

| Total securities | 26,124 |

| | 24,669 |

| Total securities | 27,976 | | | 26,847 | |

| Goodwill | 7,050 |

| | 7,044 |

| Goodwill | 7,050 | | | 7,050 | |

| Total liabilities | 156,759 |

| | 143,532 |

| Total liabilities | 161,905 | | | 160,676 | |

| Total deposits | 142,921 |

| | 125,313 |

| Total deposits | 150,636 | | | 147,164 | |

| Short-term borrowed funds | 252 |

| | 274 |

| Short-term borrowed funds | 62 | | | 243 | |

| Long-term borrowed funds | 9,109 |

| | 14,047 |

| Long-term borrowed funds | 6,957 | | | 8,346 | |

| Total stockholders’ equity | 22,469 |

| | 22,201 |

| Total stockholders’ equity | 23,199 | | | 22,673 | |

| OTHER BALANCE SHEET DATA: | | | | OTHER BALANCE SHEET DATA: | |

| Asset Quality Ratios: | | | | Asset Quality Ratios: | |

| Allowance for loan and lease losses to loans and leases | 2.05 | % | | 1.05 | % | Allowance for loan and lease losses to loans and leases | 1.59 | % | | 1.98 | % |

| Allowance for credit losses to loans and leases | 2.21 |

| | 1.09 |

| Allowance for credit losses to loans and leases | 1.70 | | | 2.17 | |

Allowance for credit losses to loans and leases, excluding the impact of PPP loans(1) | 2.29 |

| | 1.09 |

| Allowance for credit losses to loans and leases, excluding the impact of PPP loans(1) | 1.75 | | | 2.24 | |

| Allowance for loan and lease losses to nonaccruing loans and leases | 199.04 |

| | 177.99 |

| Allowance for loan and lease losses to nonaccruing loans and leases | 250 | | | 240 | |

| Allowance for credit losses to nonaccruing loans and leases | 214.22 |

| | 184.31 |

| Allowance for credit losses to nonaccruing loans and leases | 267 | | | 262 | |

| Nonaccruing loans and leases to loans and leases | 1.03 |

| | 0.59 |

| Nonaccruing loans and leases to loans and leases | 0.64 | | | 0.83 | |

| Capital Ratios: | | | | Capital Ratios: | |

| CET1 capital ratio | 9.8 | % | | 10.0 | % | CET1 capital ratio | 10.3 | % | | 10.0 | % |

| Tier 1 capital ratio | 11.2 |

| | 11.1 |

| Tier 1 capital ratio | 11.6 | | | 11.3 | |

| Total capital ratio | 13.3 |

| | 13.0 |

| Total capital ratio | 13.5 | | | 13.4 | |

| Tier 1 leverage ratio | 9.5 |

| | 10.0 |

| Tier 1 leverage ratio | 9.7 | | | 9.4 | |

(1) For more information on the computation of non-GAAP financial measures, see “—Introduction — Non-GAAP Financial Measures” and “—Non-GAAP Financial Measures and Reconciliations.”

Citizens Financial Group, Inc. | 14

RESULTS OF OPERATIONS

Net Interest Income

Net interest income is our largest source of revenue andrevenue. It is the difference between the interest earned on interest-earning assets, (generallygenerally loans, leases and investment securities)securities, and the interest expense incurred in connection with interest-bearing liabilities, (generallygenerally deposits and borrowed funds).funds. The level of net interest income is primarily a function of the difference between the effective yield on our average interest-earning assets and the effective cost of our interest-bearing liabilities. These factors are influenced by the pricing and mix of interest-earning assets and interest-bearing liabilities which, in turn, are impacted by external factors such as local economic conditions, competition for loans and deposits, the monetary policy of the FRB and market interest rates. For further discussion, refer to “—Market Risk — Non-Trading Risk,” and “—Risk Governance” as described in our 20192020 Form 10-K.

Third

Second quarter 20202021 versus secondfirst quarter 2020:2021: Net interest income of $1.1 billion was down 2%up 1% given the impact of lower interest ratesinterest-earning asset growth, higher day count and a 1% decrease in interest-earning assets as commercial line draws were repaid,improved funding mix, partially offset by an improvement in funding mix and disciplined deposit pricing actions.lower net interest margin. Net interest margin (FTE)on a FTE basis of 2.83%2.72% was down 54 basis points, reflecting the impact of lower rates, higher cash balances and day count, which wereearning asset yields, partially offset by improved funding mix and disciplined deposit pricing actions.pricing. Interest-bearing depositsdeposit costs of 0.16% decreased 134 basis points.

The following table presents the major components of net interest income and net interest margin:

Citizens Financial Group, Inc. | 15

| | | Table 5: Major Components of Net Interest Income, Quarter-to-Date | | Table 5: Major Components of Net Interest Income, Quarter-to-Date | |

| | Three Months Ended September 30, | | | | Three Months Ended June 30, | | |

| 2020 | | 2019 | | Change | 2021 | | 2020 | | Change |

| (dollars in millions) | Average

Balances | Income/

Expense | Yields/

Rates | | Average

Balances | Income/

Expense | Yields/

Rates | | Average

Balances | Yields/

Rates (bps) | (dollars in millions) | Average

Balances | Income/

Expense | Yields/

Rates | | Average

Balances | Income/

Expense | Yields/

Rates | | Average

Balances | Yields/

Rates (bps) |

| Assets | | | | | | | | | Assets | | | | | |

| Interest-bearing cash and due from banks and deposits in banks |

| $6,250 |

|

| $2 |

| 0.10 | % | |

| $1,474 |

|

| $8 |

| 2.09 | % | |

| $4,776 |

| (199) bps | Interest-bearing cash and due from banks and deposits in banks | $11,259 | | $3 | | 0.12 | % | | $5,231 | | $1 | | 0.09 | % | | $6,028 | | 3 bps |

| Taxable investment securities | 24,654 |

| 121 |

| 1.95 |

| | 25,635 |

| 153 |

| 2.38 |

| | (981 | ) | (43 | ) | Taxable investment securities | 27,597 | | 124 | | 1.80 | | | 25,180 | | 130 | | 2.15 | | | 2,417 | | (35) |

| Non-taxable investment securities | 4 |

| — |

| 2.60 |

| | 5 |

| — |

| 2.60 |

| | (1 | ) | — |

| Non-taxable investment securities | 3 | | — | | 2.60 | | | 4 | | — | | 2.60 | | | (1) | | — |

| Total investment securities | 24,658 |

| 121 |

| 1.95 |

| | 25,640 |

| 153 |

| 2.38 |

| | (982 | ) | (43 | ) | Total investment securities | 27,600 | | 124 | | 1.80 | | | 25,184 | | 130 | | 2.15 | | | 2,416 | | (35) |

| Commercial | 46,844 |

| 383 |

| 3.20 |

| | 41,476 |

| 442 |

| 4.17 |

| | 5,368 |

| (97 | ) | |

| Commercial and industrial | | Commercial and industrial | 44,388 | | 345 | | 3.08 | | | 50,443 | | 412 | | 3.23 | | | (6,055) | | (15) |

| Commercial real estate | 14,644 |

| 96 |

| 2.57 |

| | 12,892 |

| 155 |

| 4.70 |

| | 1,752 |

| (213 | ) | Commercial real estate | 14,473 | | 95 | | 2.58 | | | 14,540 | | 106 | | 2.87 | | | (67) | | (29) |

| Leases | 2,373 |

| 16 |

| 2.65 |

| | 2,615 |

| 19 |

| 2.85 |

| | (242 | ) | (20 | ) | Leases | 1,792 | | 12 | | 2.76 | | | 2,426 | | 16 | | 2.75 | | | (634) | | 1 |

| Total commercial loans and leases | 63,861 |

| 495 |

| 3.03 |

| | 56,983 |

| 616 |

| 4.23 |

| | 6,878 |

| (120 | ) | Total commercial loans and leases | 60,653 | | 452 | | 2.96 | | | 67,409 | | 534 | | 3.14 | | | (6,756) | | (18) |

| Residential mortgages | 19,427 |

| 153 |

| 3.15 |

| | 19,405 |

| 171 |

| 3.53 |

| | 22 |

| (38 | ) | Residential mortgages | 20,242 | | 154 | | 3.04 | | | 18,872 | | 150 | | 3.19 | | | 1,370 | | (15) |

| Home equity | 12,416 |

| 100 |

| 3.21 |

| | 13,501 |

| 178 |

| 5.24 |

| | (1,085 | ) | (203 | ) | Home equity | 11,825 | | 92 | | 3.13 | | | 12,736 | | 111 | | 3.50 | | | (911) | | (37) |

| Automobile | 12,019 |

| 128 |

| 4.23 |

| | 12,036 |

| 129 |

| 4.25 |

| | (17 | ) | (2 | ) | Automobile | 12,526 | | 125 | | 4.00 | | | 11,998 | | 129 | | 4.33 | | | 528 | | (33) |

| Education | 10,929 |

| 130 |

| 4.74 |

| | 9,459 |

| 141 |

| 5.89 |

| | 1,470 |

| (115 | ) | Education | 12,632 | | 135 | | 4.26 | | | 11,183 | | 145 | | 5.21 | | | 1,449 | | (95) |

| | Other retail | 6,260 |

| 114 |

| 7.22 |

| | 5,873 |

| 121 |

| 8.21 |

| | 387 |

| (99 | ) | Other retail | 5,612 | | 100 | | 7.13 | | | 6,557 | | 123 | | 7.52 | | | (945) | | (39) |

| Total retail loans | 61,051 |

| 625 |

| 4.08 |

| | 60,274 |

| 740 |

| 4.88 |

| | 777 |

| (80 | ) | Total retail loans | 62,837 | | 606 | | 3.86 | | | 61,346 | | 658 | | 4.31 | | | 1,491 | | (45) |

| Total loans and leases | 124,912 |

| 1,120 |

| 3.54 |

| | 117,257 |

| 1,356 |

| 4.56 |

| | 7,655 |

| (102 | ) | Total loans and leases | 123,490 | | 1,058 | | 3.42 | | | 128,755 | | 1,192 | | 3.69 | | | (5,265) | | (27) |

| Loans held for sale, at fair value | 3,295 |

| 21 |

| 2.60 |

| | 1,970 |

| 19 |

| 3.71 |

| | 1,325 |

| (111 | ) | Loans held for sale, at fair value | 3,751 | | 24 | | 2.55 | | | 2,710 | | 20 | | 2.85 | | | 1,041 | | (30) |

| Other loans held for sale | 1,061 |

| 16 |

| 6.02 |

| | 134 |

| 2 |

| 6.42 |

| | 927 |

| (40 | ) | Other loans held for sale | 233 | | 2 | | 2.99 | | | 510 | | 7 | | 4.66 | | | (277) | | (167) |

| Interest-earning assets | 160,176 |

| 1,280 |

| 3.15 |

| | 146,475 |

| 1,538 |

| 4.15 |

| | 13,701 |

| (100 | ) | Interest-earning assets | 166,333 | | 1,211 | | 2.90 | | | 162,390 | | 1,350 | | 3.33 | | | 3,943 | | (43) |

| Allowance for loan and lease losses | (2,444 | ) | | | | (1,226 | ) | | | | (1,218 | ) | | |

| Goodwill | 7,050 |

| | | | 7,044 |

| | | | 6 |

| | |

| Other noninterest-earning assets | 12,893 |

| | | | 9,817 |

| | | | 3,076 |

| | |

| | Noninterest-earning assets | | Noninterest-earning assets | 18,123 | | | 17,403 | | | 720 | | |

| Total assets |

| $177,675 |

| | | |

| $162,110 |

| | | |

| $15,565 |

| | Total assets | $184,456 | | | $179,793 | | | $4,663 | | |

| Liabilities and Stockholders’ Equity | | | | | | | | | Liabilities and Stockholders’ Equity | | | | | | |

| Checking with interest |

| $26,638 |

|

| $8 |

| 0.13 | % | |

| $23,422 |

|

| $52 |

| 0.88 | % | |

| $3,216 |

| (75) | Checking with interest | $27,278 | | $5 | | 0.08 | % | | $26,312 | | $11 | | 0.17 | % | | $966 | | (9) |

| Money market accounts | 45,187 |

| 33 |

| 0.28 |

| | 37,161 |

| 116 |

| 1.24 |

| | 8,026 |

| (96) | Money market accounts | 49,394 | | 21 | | 0.17 | | | 45,187 | | 39 | | 0.35 | | | 4,207 | | (18) |

| Regular savings | 16,902 |

| 10 |

| 0.24 |

| | 13,442 |

| 20 |

| 0.59 |

| | 3,460 |

| (35) | Regular savings | 20,077 | | 5 | | 0.10 | | | 15,883 | | 15 | | 0.39 | | | 4,194 | | (29) |

| Term deposits | 12,032 |

| 38 |

| 1.25 |

| | 20,951 |

| 109 |

| 2.05 |

| | (8,919 | ) | (80) | Term deposits | 6,970 | | 11 | | 0.61 | | | 16,470 | | 59 | | 1.44 | | | (9,500) | | (83) |

| Total interest-bearing deposits | 100,759 |

| 89 |

| 0.35 |

| | 94,976 |

| 297 |

| 1.24 |

| | 5,783 |

| (89) | Total interest-bearing deposits | 103,719 | | 42 | | 0.16 | | | 103,852 | | 124 | | 0.48 | | | (133) | | (32) |

| | Short-term borrowed funds | 240 |

| — |

| 0.13 |

| | 600 |

| 2 |

| 1.43 |

| | (360 | ) | (130) | Short-term borrowed funds | 69 | | — | | 0.87 | | | 222 | | — | | 0.29 | | | (153) | | 58 |

| Long-term borrowed funds | 9,196 |

| 54 |

| 2.35 |

| | 12,134 |

| 94 |

| 3.07 |

| | (2,938 | ) | (72) | Long-term borrowed funds | 7,434 | | 45 | | 2.41 | | | 11,755 | | 66 | | 2.22 | | | (4,321) | | 19 |

| Total borrowed funds | 9,436 |

| 54 |

| 2.30 |

| | 12,734 |

| 96 |

| 3.00 |

| | (3,298 | ) | (70) | Total borrowed funds | 7,503 | | 45 | | 2.40 | | | 11,977 | | 66 | | 2.18 | | | (4,474) | | 22 |

| Total interest-bearing liabilities | 110,195 |

| 143 |

| 0.52 |

| | 107,710 |

| 393 |

| 1.45 |

| | 2,485 |

| (93) | Total interest-bearing liabilities | 111,222 | | 87 | | 0.31 | | | 115,829 | | 190 | | 0.66 | | | (4,607) | | (35) |

| Demand deposits | 40,608 |

| | | | 28,945 |

| | | | 11,663 |

| | Demand deposits | 46,630 | | | 37,745 | | | 8,885 | | |

| Other liabilities | 4,374 |

| | | | 3,789 |

| | | | 585 |

| | Other liabilities | 3,741 | | | 4,086 | | | (345) | | |

| Total liabilities | 155,177 |

| | | | 140,444 |

| | | | 14,733 |

| | Total liabilities | 161,593 | | | 157,660 | | | 3,933 | | |

| Stockholders’ equity | 22,498 |

| | | | 21,666 |

| | | | 832 |

| | Stockholders’ equity | 22,863 | | | 22,133 | | | 730 | | |

| Total liabilities and stockholders’ equity |

| $177,675 |

| | | |

| $162,110 |

| | | |

| $15,565 |

| | Total liabilities and stockholders’ equity | $184,456 | | | $179,793 | | | $4,663 | | |

| Interest rate spread | | 2.63 | % | | | 2.70 | % | | | (7) | Interest rate spread | | | 2.59 | % | | | | 2.67 | % | | | (8) |

| Net interest income and net interest margin | |

| $1,137 |

| 2.82 | % | | |

| $1,145 |

| 3.10 | % | | | (28) | Net interest income and net interest margin | | $1,124 | | 2.71 | % | | $1,160 | | 2.87 | % | | (16) |

Net interest income and net interest margin, FTE(1) | |

| $1,140 |

| 2.83 | % | | |

| $1,150 |

| 3.12 | % | | | (29) | Net interest income and net interest margin, FTE(1) | | $1,126 | | 2.72 | % | | $1,163 | | 2.88 | % | | (16) |

| Memo: Total deposits (interest-bearing and demand) |

| $141,367 |

|

| $89 |

| 0.25 | % | |

| $123,921 |

|

| $297 |

| 0.95 | % | |

| $17,446 |

| (70) bps | Memo: Total deposits (interest-bearing and demand) | $150,349 | | $42 | | 0.11 | % | | $141,597 | | $124 | | 0.35 | % | | $8,752 | | (24) bps |

(1) Net interest income and net interest margin is presented on a fully taxable-equivalent (“FTE”) basis using the federal statutory tax rate of 21%. The FTE impact is predominantly attributable to commercial loans for the periods presented.

Quarterly Results:Net interest income of $1.1 billion was stable with third quarter 2019, despite the lower rate and challenging yield curve environment, given 9% growth in interest-earning assets.

Net interest margin on an FTE basis of 2.83% decreased 29 basis points compared to 3.12% in third quarter 2019, reflecting the impact of lower interest rates and higher cash balances given strong deposit flows, partially offset by improved funding mix and lower funding costs. Interest-bearing deposit costs decreased 89 basis points, reflecting strong pricing discipline. Average interest-earning asset yields of 3.15% decreased 100 basis points from 4.15% in third quarter 2019, while average interest-bearing liability costs of 0.52% decreased 93 basis points from 1.45% in third quarter 2019.

Average interest-earning assets of $160.2 billion increased $13.7 billion, or 9%, from third quarter 2019, driven by a $9.9 billion, or 8% increase in average loans and leases and LHFS. Results reflected a $6.9 billion increase

in average commercial loans and leases, a $4.8 billion increase in average interest-bearing cash and due from banks and deposits in banksand a $777 million increase in average retail loans. Commercial loan and lease growth was driven by the impact of PPP loans. Interest-bearing cash and due from banks and deposits in banks growth was driven by strong deposit flows. Retail loan growth was driven by education, partially offset by loan sales, and other retail, partially offset by lower home equity.

Average deposits of $141.4 billion increased $17.4 billion, or 14%, from third quarter 2019, reflecting growth in demand deposits, money market accounts, checking with interest, and savings resulting from the impact of government stimulus as well as corporate clients building liquidity. These results were partially offset by a decline in term deposits. Average total borrowed funds of $9.4 billion decreased $3.3 billion from third quarter 2019, reflecting a decrease in long-term and short-term borrowed funds, resulting from deposit growth. Total borrowed funds costs of $54 million decreased $42 million from third quarter 2019. The total borrowed funds cost of 2.30% decreased 70 basis points from 3.00% in third quarter 2019 due to a decrease in the rate environment and decreased use of FHLB advances as a funding source resulting from improved deposit mix.

The following table presents the major components of net interest income and net interest margin:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | |

| 2020 | | 2019 | | Change |

| (dollars in millions) | Average

Balances | Income/

Expense | Yields/

Rates | | Average

Balances | Income/

Expense | Yields/

Rates | | Average

Balances | Yields/

Rates (bps) |

| Assets: | | | | | | | | | | |

| Interest-bearing cash and due from banks and deposits in banks |

| $4,453 |

|

| $8 |

| 0.24 | % | |

| $1,400 |

|

| $23 |

| 2.15 | % | �� |

| $3,053 |

| (191) bps |

| Taxable investment securities | 25,056 |

| 398 |

| 2.12 |

| | 25,466 |

| 483 |

| 2.53 |

| | (410 | ) | (41 | ) |

| Non-taxable investment securities | 4 |

| — |

| 2.60 |

| | 5 |

| — |

| 2.60 |

| | (1 | ) | — |

|

| Total investment securities | 25,060 |

| 398 |

| 2.12 |

| | 25,471 |

| 483 |

| 2.53 |

| | (411 | ) | (41 | ) |

| Commercial | 46,813 |

| 1,212 |

| 3.40 |

| | 41,597 |

| 1,373 |

| 4.35 |

| | 5,216 |

| (95 | ) |

| Commercial real estate | 14,354 |

| 341 |

| 3.12 |

| | 13,179 |

| 486 |

| 4.86 |

| | 1,175 |

| (174 | ) |

| Leases | 2,427 |

| 50 |

| 2.74 |

| | 2,744 |

| 59 |

| 2.86 |

| | (317 | ) | (12 | ) |

| Total commercial loans and leases | 63,594 |

| 1,603 |

| 3.31 |

| | 57,520 |

| 1,918 |

| 4.40 |

| | 6,074 |

| (109 | ) |

| Residential mortgages | 19,056 |

| 467 |

| 3.27 |

| | 19,245 |

| 522 |

| 3.61 |

| | (189 | ) | (34 | ) |

| Home equity | 12,730 |

| 363 |

| 3.81 |

| | 13,774 |

| 541 |

| 5.26 |

| | (1,044 | ) | (145 | ) |

| Automobile | 12,063 |

| 388 |

| 4.30 |

| | 12,030 |

| 374 |

| 4.16 |

| | 33 |

| 14 |

|

| Education | 10,908 |

| 424 |

| 5.19 |

| | 9,256 |

| 412 |

| 5.94 |

| | 1,652 |

| (75 | ) |

| Other retail | 6,556 |

| 369 |

| 7.51 |

| | 5,736 |

| 362 |

| 8.43 |

| | 820 |

| (92 | ) |

| Total retail loans | 61,313 |

| 2,011 |

| 4.38 |

| | 60,041 |

| 2,211 |

| 4.92 |

| | 1,272 |

| (54 | ) |

| Total loans and leases | 124,907 |

| 3,614 |

| 3.84 |

| | 117,561 |

| 4,129 |

| 4.67 |

| | 7,346 |

| (83 | ) |

| Loans held for sale, at fair value | 2,635 |

| 56 |

| 2.85 |

| | 1,514 |

| 45 |

| 3.92 |

| | 1,121 |

| (107 | ) |

| Other loans held for sale | 791 |

| 32 |

| 5.32 |

| | 161 |

| 8 |

| 6.41 |

| | 630 |

| (109 | ) |

| Interest-earning assets | 157,846 |

| 4,108 |

| 3.45 |

| | 146,107 |

| 4,688 |

| 4.26 |

| | 11,739 |

| (81 | ) |

| Allowance for loan and lease losses | (2,109 | ) | | | | (1,239 | ) | | | | (870 | ) | |

| Goodwill | 7,049 |

| | | | 7,034 |

| | | | 15 |

| |

| Other noninterest-earning assets | 12,106 |

| | | | 9,442 |

| | | | 2,664 |

| |

| Total assets |

| $174,892 |

| | | |

| $161,344 |

|

|

| | |

| $13,548 |

| |

| Liabilities and Stockholders’ Equity: | | | | | | | | | | |

| Checking with interest |

| $25,857 |

|

| $56 |

| 0.29 | % | |

| $23,444 |

|

| $161 |

| 0.92 | % | |

| $2,413 |

| (63) |

| Money market accounts | 43,411 |

| 165 |

| 0.51 |

| | 35,873 |

| 340 |

| 1.27 |

| | 7,538 |

| (76) |

| Regular savings | 15,667 |

| 43 |

| 0.37 |

| | 13,134 |

| 58 |

| 0.59 |

| | 2,533 |

| (22) |

| Term deposits | 15,692 |

| 176 |

| 1.49 |

| | 21,456 |

| 333 |

| 2.07 |

| | (5,764 | ) | (58) |

| Total interest-bearing deposits | 100,627 |

| 440 |

| 0.58 |

| | 93,907 |

| 892 |

| 1.27 |

| | 6,720 |

| (69) |

| Short-term borrowed funds | 368 |

| 1 |

| 0.53 |

| | 720 |

| 8 |

| 1.56 |

| | (352 | ) | (103) |

| Long-term borrowed funds | 11,660 |

| 210 |

| 2.39 |

| | 13,076 |

| 317 |

| 3.22 |

| | (1,416 | ) | (83) |

| Total borrowed funds | 12,028 |

| 211 |

| 2.33 |

| | 13,796 |

| 325 |

| 3.13 |

| | (1,768 | ) | (80) |

| Total interest-bearing liabilities | 112,655 |

| 651 |

| 0.77 |

| | 107,703 |

| 1,217 |

| 1.51 |

| | 4,952 |

| (74) |

| Demand deposits | 35,922 |

| | | | 28,601 |

| | | | 7,321 |

|

|

| Other liabilities | 4,172 |

| | | | 3,637 |

| | | | 535 |

|

|

| Total liabilities | 152,749 |

| | | | 139,941 |

| | | | 12,808 |

|

|

| Stockholders’ equity | 22,143 |

| | | | 21,403 |

| | | | 740 |

|

|

| Total liabilities and stockholders’ equity |

| $174,892 |

| | | |

| $161,344 |

| | | |

| $13,548 |

|

|

| Interest rate spread | | | 2.68 | % | | | | 2.75 | % | | | (7) |

| Net interest income and net interest margin | |

| $3,457 |

| 2.93 | % | | |

| $3,471 |

| 3.18 | % | | | (25) |

Net interest income and net interest margin, FTE(1) | |

| $3,467 |

| 2.93 | % | | |

| $3,488 |

| 3.19 | % | | | (26) |

| Memo: Total deposits (interest-bearing and demand) |

| $136,549 |

|

| $440 |

| 0.43 | % | |

| $122,508 |

|

| $892 |

| 0.97 | % | |

| $14,041 |

| (54) bps |

(1) Net interest income and net interest margin is presented on an FTE basis using the federal statutory tax rate of 21%. The FTE impact is predominantly attributable to commercial and industrial loans for the periods presented.

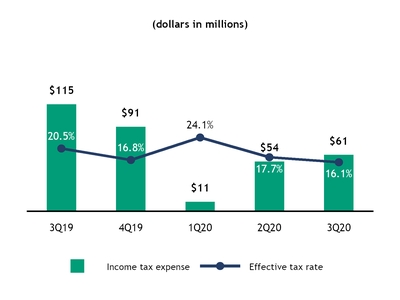

Second quarter 2021 vs second quarter 2020:Year-To-Date Results: Net interest income of $3.5$1.1 billion was stable withdecreased 3% from the first nine months 2019, despite thesecond quarter of 2020 given lower rate and challenging yield-curve environment, given 8%net interest margin, partially offset by 2% growth in interest-earning assets.