A summary of finance receivables included in the Consolidated Statements of Financial Position was as follows:

We further evaluate our portfolio segments by the class of finance receivables, which is defined as a level of information (below a portfolio segment) in which the finance receivables have the same initial measurement attribute and a similar method for assessing and monitoring credit risk. Typically, our finance receivables within a geographic area have similar credit risk profiles and methods for assessing and monitoring credit risk. Our classes, which align with management reporting for credit losses, are as follows:

At origination, we evaluate credit risk based on a variety of credit quality factors including prior payment experience, customer financial information, credit-rating agencycredit ratings, loan-to-value ratios, probabilities of default, industry trends, macroeconomic factors and other internal metrics. On an ongoing basis, we monitor credit quality based on past-due status and collection experience as there is a meaningful correlation between the past-due status of customers and the risk of loss.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | | |

| | September 30, 2017 |

| | 31-60 Days Past Due | | 61-90 Days Past Due | | 91+ Days Past Due | | Total Past Due | | Current | | Recorded Investment in Finance Receivables | | 91+ Still Accruing |

| Customer | |

| | |

| | |

| | | | | | | | |

| North America | $ | 64 |

| | $ | 17 |

| | $ | 49 |

| | $ | 130 |

| | $ | 7,916 |

| | $ | 8,046 |

| | $ | 8 |

|

| Europe | 27 |

| | 9 |

| | 56 |

| | 92 |

| | 2,642 |

| | 2,734 |

| | 4 |

|

| Asia/Pacific | 27 |

| | 13 |

| | 17 |

| | 57 |

| | 2,299 |

| | 2,356 |

| | 9 |

|

| Mining | 8 |

| | 4 |

| | 52 |

| | 64 |

| | 1,682 |

| | 1,746 |

| | 1 |

|

| Latin America | 53 |

| | 28 |

| | 180 |

| | 261 |

| | 1,672 |

| | 1,933 |

| | — |

|

| Caterpillar Power Finance | 11 |

| | 34 |

| | 124 |

| | 169 |

| | 2,589 |

| | 2,758 |

| | 11 |

|

| Dealer | |

| | |

| | |

| | | | | | | | |

| North America | — |

| | — |

| | — |

| | — |

| | 2,816 |

| | 2,816 |

| | — |

|

| Europe | — |

| | — |

| | — |

| | — |

| | 350 |

| | 350 |

| | — |

|

| Asia/Pacific | — |

| | — |

| | — |

| | — |

| | 580 |

| | 580 |

| | — |

|

| Mining | — |

| | — |

| | — |

| | — |

| | 5 |

| | 5 |

| | — |

|

| Latin America | 5 |

| | — |

| | 3 |

| | 8 |

| | 783 |

| | 791 |

| | — |

|

| Caterpillar Power Finance | — |

| | — |

| | — |

| | — |

| | 2 |

| | 2 |

| | — |

|

| Caterpillar Purchased Receivables | |

| | |

| | |

| | | | | | | | |

| North America | 13 |

| | 5 |

| | 3 |

| | 21 |

| | 1,666 |

| | 1,687 |

| | 3 |

|

| Europe | 2 |

| | — |

| | — |

| | 2 |

| | 333 |

| | 335 |

| | — |

|

| Asia/Pacific | 1 |

| | — |

| | — |

| | 1 |

| | 396 |

| | 397 |

| | — |

|

| Mining | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Latin America | — |

| | — |

| | — |

| | — |

| | 400 |

| | 400 |

| | — |

|

| Caterpillar Power Finance | — |

| | — |

| | — |

| | — |

| | 4 |

| | 4 |

| | — |

|

| Total | $ | 211 |

| | $ | 110 |

| | $ | 484 |

| | $ | 805 |

| | $ | 26,135 |

| | $ | 26,940 |

| | $ | 36 |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | December 31, 2021 |

| 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | Prior | | Revolving

Finance

Receivables | | | | Total

Finance

Receivables |

| North America | | | | | | | | | | | | | | | | | |

| Current | $ | 4,792 | | | $ | 2,596 | | | $ | 1,426 | | | $ | 630 | | | $ | 182 | | | $ | 32 | | | $ | 182 | | | | | $ | 9,840 | |

| 31-60 days past due | 27 | | | 32 | | | 20 | | | 12 | | | 4 | | | 1 | | | 5 | | | | | 101 | |

| 61-90 days past due | 7 | | | 8 | | | 5 | | | 3 | | | 1 | | | 1 | | | 5 | | | | | 30 | |

| 91+ days past due | 9 | | | 17 | | | 12 | | | 13 | | | 5 | | | 4 | | | 5 | | | | | 65 | |

| | | | | | | | | | | | | | | | | |

| EAME | | | | | | | | | | | | | | | | | |

| Current | 1,499 | | | 836 | | | 577 | | | 352 | | | 140 | | | 26 | | | — | | | | | 3,430 | |

| 31-60 days past due | 5 | | | 4 | | | 3 | | | 1 | | | 1 | | | — | | | — | | | | | 14 | |

| 61-90 days past due | 3 | | | 3 | | | 3 | | | 1 | | | — | | | — | | | — | | | | | 10 | |

| 91+ days past due | 3 | | | 11 | | | 2 | | | 2 | | | — | | | 2 | | | — | | | | | 20 | |

| | | | | | | | | | | | | | | | | |

| Asia/Pacific | | | | | | | | | | | | | | | | | |

| Current | 1,456 | | | 943 | | | 420 | | | 119 | | | 40 | | | 3 | | | 36 | | | | | 3,017 | |

| 31-60 days past due | 10 | | | 14 | | | 10 | | | 2 | | | — | | | — | | | — | | | | | 36 | |

| 61-90 days past due | 3 | | | 7 | | | 4 | | | 1 | | | — | | | — | | | — | | | | | 15 | |

| 91+ days past due | 2 | | | 10 | | | 10 | | | 3 | | | — | | | — | | | — | | | | | 25 | |

| | | | | | | | | | | | | | | | | |

| Mining | | | | | | | | | | | | | | | | | |

| Current | 944 | | | 356 | | | 332 | | | 194 | | | 36 | | | 161 | | | 36 | | | | | 2,059 | |

| 31-60 days past due | 6 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 6 | |

| 61-90 days past due | 1 | | | — | | | — | | | — | | | 4 | | | — | | | — | | | | | 5 | |

| 91+ days past due | — | | | 1 | | | 8 | | | 9 | | | 3 | | | 1 | | | — | | | | | 22 | |

| | | | | | | | | | | | | | | | | |

| Latin America | | | | | | | | | | | | | | | | | |

| Current | 617 | | | 299 | | | 160 | | | 70 | | | 17 | | | 18 | | | — | | | | | 1,181 | |

| 31-60 days past due | 4 | | | 7 | | | 3 | | | 3 | | | 1 | | | — | | | — | | | | | 18 | |

| 61-90 days past due | 3 | | | 3 | | | 1 | | | 1 | | | — | | | — | | | — | | | | | 8 | |

| 91+ days past due | 4 | | | 9 | | | 9 | | | 7 | | | 7 | | | 14 | | | — | | | | | 50 | |

| | | | | | | | | | | | | | | | | |

| Caterpillar Power Finance | | | | | | | | | | | | | | | | | |

| Current | 120 | | | 152 | | | 119 | | | 70 | | | 180 | | | 104 | | | 101 | | | | | 846 | |

| 31-60 days past due | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | |

| 61-90 days past due | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | |

| 91+ days past due | — | | | — | | | — | | | — | | | — | | | 44 | | | — | | | | | 44 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Totals by Aging Category | | | | | | | | | | | | | | | | | |

| Current | 9,428 | | | 5,182 | | | 3,034 | | | 1,435 | | | 595 | | | 344 | | | 355 | | | | | 20,373 | |

| 31-60 days past due | 52 | | | 57 | | | 36 | | | 18 | | | 6 | | | 1 | | | 5 | | | | | 175 | |

| 61-90 days past due | 17 | | | 21 | | | 13 | | | 6 | | | 5 | | | 1 | | | 5 | | | | | 68 | |

| 91+ days past due | 18 | | | 48 | | | 41 | | | 34 | | | 15 | | | 65 | | | 5 | | | | | 226 | |

| Total | $ | 9,515 | | | $ | 5,308 | | | $ | 3,124 | | | $ | 1,493 | | | $ | 621 | | | $ | 411 | | | $ | 370 | | | | | $ | 20,842 | |

| | | | | | | | | | | | | | | | | |

Finance receivables in the Customer portfolio segment are substantially secured by collateral, primarily in the form of Caterpillar and other equipment. For those contracts where the borrower is experiencing financial difficulty, repayment of the outstanding amounts is generally expected to be provided through the operation or repossession and sale of the equipment.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | | |

| | December 31, 2016 |

| | 31-60 Days Past Due | | 61-90 Days Past Due | | 91+ Days Past Due | | Total Past Due | | Current | | Recorded Investment in Finance Receivables | | 91+ Still Accruing |

| Customer | |

| | |

| | |

| | | | | | | | |

| North America | $ | 50 |

| | $ | 16 |

| | $ | 59 |

| | $ | 125 |

| | $ | 8,051 |

| | $ | 8,176 |

| | $ | 5 |

|

| Europe | 16 |

| | 12 |

| | 39 |

| | 67 |

| | 2,388 |

| | 2,455 |

| | 6 |

|

| Asia/Pacific | 18 |

| | 7 |

| | 15 |

| | 40 |

| | 1,944 |

| | 1,984 |

| | 4 |

|

| Mining | 3 |

| | 2 |

| | 63 |

| | 68 |

| | 1,756 |

| | 1,824 |

| | 2 |

|

| Latin America | 40 |

| | 33 |

| | 214 |

| | 287 |

| | 1,808 |

| | 2,095 |

| | — |

|

| Caterpillar Power Finance | 11 |

| | 9 |

| | 73 |

| | 93 |

| | 3,018 |

| | 3,111 |

| | 1 |

|

| Dealer | |

| | |

| | |

| | | | | | | | |

| North America | — |

| | — |

| | — |

| | — |

| | 2,705 |

| | 2,705 |

| | — |

|

| Europe | — |

| | — |

| | — |

| | — |

| | 336 |

| | 336 |

| | — |

|

| Asia/Pacific | — |

| | — |

| | — |

| | — |

| | 582 |

| | 582 |

| | — |

|

| Mining | — |

| | — |

| | — |

| | — |

| | 6 |

| | 6 |

| | — |

|

| Latin America | — |

| | — |

| | — |

| | — |

| | 848 |

| | 848 |

| | — |

|

| Caterpillar Power Finance | — |

| | — |

| | — |

| | — |

| | 2 |

| | 2 |

| | — |

|

| Caterpillar Purchased Receivables | |

| | |

| | |

| | | | | | | | |

| North America | 11 |

| | 3 |

| | 1 |

| | 15 |

| | 1,303 |

| | 1,318 |

| | 1 |

|

| Europe | — |

| | — |

| | 1 |

| | 1 |

| | 268 |

| | 269 |

| | — |

|

| Asia/Pacific | — |

| | — |

| | — |

| | — |

| | 475 |

| | 475 |

| | — |

|

| Mining | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Latin America | — |

| | — |

| | — |

| | — |

| | 366 |

| | 366 |

| | — |

|

| Caterpillar Power Finance | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

| | — |

|

| Total | $ | 149 |

| | $ | 82 |

| | $ | 465 |

| | $ | 696 |

| | $ | 25,859 |

| | $ | 26,555 |

| | $ | 19 |

|

| | | | | | | | | | | | | | |

Dealer

Impaired finance receivables

For all classes, a finance receivable is considered impaired, based on current information and events, if it is probable that we will be unable to collect all amounts due according to the contractual terms. ImpairedAs of March 31, 2022, our total amortized cost of finance receivables includewithin the Dealer portfolio segment was current, with the exception of $81 million. Of these past due receivables, $78 million were 91+ days past due in Latin America and were originated in 2017. As of December 31, 2021, our total amortized cost of finance receivables within the Dealer portfolio segment was current, with the exception of $78 million that have been restructured and are considered to be Troubled Debt Restructures.was 91+ days past due in Latin America, all of which was originated in 2017.

There were no impairedCaterpillar Purchased Receivables

The tables below summarize the aging category of our amortized cost of finance receivables as of September 30, 2017 and December 31, 2016, forin the Dealer and Caterpillar Purchased Receivables portfolio segments. Our recorded investment in impairedsegment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | | |

| | March 31, 2022 |

| | 31-60

Days

Past Due | | 61-90

Days

Past Due | | 91+

Days

Past Due | | Total

Past Due | | Current | |

Total Finance

Receivables | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| North America | $ | 5 | | | $ | 12 | | | $ | 5 | | | $ | 22 | | | $ | 2,481 | | | $ | 2,503 | | | |

| EAME | 2 | | | — | | | 1 | | | 3 | | | 714 | | | 717 | | | |

| Asia/Pacific | 1 | | | — | | | — | | | 1 | | | 885 | | | 886 | | | |

| Mining | — | | | — | | | — | | | — | | | — | | | — | | | |

| Latin America | 3 | | | 1 | | | — | | | 4 | | | 532 | | | 536 | | | |

| Caterpillar Power Finance | 1 | | | — | | | — | | | 1 | | | 4 | | | 5 | | | |

| Total | $ | 12 | | | $ | 13 | | | $ | 6 | | | $ | 31 | | | $ | 4,616 | | | $ | 4,647 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | | |

| | December 31, 2021 |

| | 31-60

Days

Past Due | | 61-90

Days

Past Due | | 91+

Days

Past Due | | Total

Past Due | | Current | |

Total Finance

Receivables | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| North America | $ | 8 | | | $ | 6 | | | $ | 5 | | | $ | 19 | | | $ | 2,499 | | | $ | 2,518 | | | |

| EAME | 1 | | | — | | | 1 | | | 2 | | | 844 | | | 846 | | | |

| Asia/Pacific | — | | | — | | | 1 | | | 1 | | | 620 | | | 621 | | | |

| Mining | — | | | — | | | — | | | — | | | — | | | — | | | |

| Latin America | 1 | | | 1 | | | — | | | 2 | | | 472 | | | 474 | | | |

| Caterpillar Power Finance | — | | | — | | | — | | | — | | | 3 | | | 3 | | | |

| Total | $ | 10 | | | $ | 7 | | | $ | 7 | | | $ | 24 | | | $ | 4,438 | | | $ | 4,462 | | | |

| | | | | | | | | | | | | |

Non-accrual finance receivables and the related unpaid principal balances and allowance for the Customer portfolio segment were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | |

| | As of September 30, 2017 | | As of December 31, 2016 |

Impaired Finance Receivables With No Allowance Recorded | Recorded Investment | | Unpaid Principal Balance | | Related Allowance | | Recorded Investment | | Unpaid Principal Balance | | Related Allowance |

| North America | $ | 16 |

| | $ | 21 |

| | $ | — |

| | $ | 10 |

| | $ | 10 |

| | $ | — |

|

| Europe | 47 |

| | 47 |

| | — |

| | 49 |

| | 48 |

| | — |

|

| Asia/Pacific | 32 |

| | 31 |

| | — |

| | 3 |

| | 2 |

| | — |

|

| Mining | 127 |

| | 125 |

| | — |

| | 129 |

| | 129 |

| | — |

|

| Latin America | 60 |

| | 60 |

| | — |

| | 68 |

| | 68 |

| | — |

|

| Caterpillar Power Finance | 187 |

| | 200 |

| | — |

| | 271 |

| | 271 |

| | — |

|

| Total | $ | 469 |

| | $ | 484 |

| | $ | — |

| | $ | 530 |

| | $ | 528 |

| | $ | — |

|

Impaired Finance Receivables With An Allowance Recorded | |

| | |

| | |

| | |

| | |

| | |

|

| North America | $ | 36 |

| | $ | 35 |

| | $ | 13 |

| | $ | 61 |

| | $ | 60 |

| | $ | 22 |

|

| Europe | 8 |

| | 8 |

| | 5 |

| | 7 |

| | 7 |

| | 3 |

|

| Asia/Pacific | 25 |

| | 25 |

| | 3 |

| | 50 |

| | 50 |

| | 8 |

|

| Mining | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Latin America | 92 |

| | 104 |

| | 35 |

| | 93 |

| | 104 |

| | 34 |

|

| Caterpillar Power Finance | 239 |

| | 241 |

| | 44 |

| | 45 |

| | 44 |

| | 18 |

|

| Total | $ | 400 |

| | $ | 413 |

| | $ | 100 |

| | $ | 256 |

| | $ | 265 |

| | $ | 85 |

|

| Total Impaired Finance Receivables | |

| | |

| | |

| | |

| | |

| | |

|

| North America | $ | 52 |

| | $ | 56 |

| | $ | 13 |

| | $ | 71 |

| | $ | 70 |

| | $ | 22 |

|

| Europe | 55 |

| | 55 |

| | 5 |

| | 56 |

| | 55 |

| | 3 |

|

| Asia/Pacific | 57 |

| | 56 |

| | 3 |

| | 53 |

| | 52 |

| | 8 |

|

| Mining | 127 |

| | 125 |

| | — |

| | 129 |

| | 129 |

| | — |

|

| Latin America | 152 |

| | 164 |

| | 35 |

| | 161 |

| | 172 |

| | 34 |

|

| Caterpillar Power Finance | 426 |

| | 441 |

| | 44 |

| | 316 |

| | 315 |

| | 18 |

|

| Total | $ | 869 |

| | $ | 897 |

| | $ | 100 |

| | $ | 786 |

| | $ | 793 |

| | $ | 85 |

|

| | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | |

| | Three Months Ended

September 30, 2017 | | Three Months Ended

September 30, 2016 |

Impaired Finance Receivables With No Allowance Recorded | Average Recorded Investment | | Interest Income Recognized | | Average Recorded Investment | | Interest Income Recognized |

| North America | $ | 14 |

| | $ | 1 |

| | $ | 24 |

| | $ | — |

|

| Europe | 47 |

| | — |

| | 49 |

| | 1 |

|

| Asia/Pacific | 30 |

| | 1 |

| | 1 |

| | — |

|

| Mining | 128 |

| | 1 |

| | 90 |

| | 2 |

|

| Latin America | 68 |

| | 1 |

| | 58 |

| | — |

|

| Caterpillar Power Finance | 171 |

| | 1 |

| | 282 |

| | 3 |

|

| Total | $ | 458 |

| | $ | 5 |

| | $ | 504 |

| | $ | 6 |

|

Impaired Finance Receivables With An Allowance Recorded | |

| | |

| | |

| | |

|

| North America | $ | 44 |

| | $ | — |

| | $ | 42 |

| | $ | — |

|

| Europe | 6 |

| | — |

| | 10 |

| | — |

|

| Asia/Pacific | 28 |

| | 1 |

| | 35 |

| | — |

|

| Mining | — |

| | — |

| | 19 |

| | — |

|

| Latin America | 102 |

| | 1 |

| | 67 |

| | 1 |

|

| Caterpillar Power Finance | 251 |

| | 3 |

| | 43 |

| | — |

|

| Total | $ | 431 |

| | $ | 5 |

| | $ | 216 |

| | $ | 1 |

|

| Total Impaired Finance Receivables | |

| | |

| | |

| | |

|

| North America | $ | 58 |

| | $ | 1 |

| | $ | 66 |

| | $ | — |

|

| Europe | 53 |

| | — |

| | 59 |

| | 1 |

|

| Asia/Pacific | 58 |

| | 2 |

| | 36 |

| | — |

|

| Mining | 128 |

| | 1 |

| | 109 |

| | 2 |

|

| Latin America | 170 |

| | 2 |

| | 125 |

| | 1 |

|

| Caterpillar Power Finance | 422 |

| | 4 |

| | 325 |

| | 3 |

|

| Total | $ | 889 |

| | $ | 10 |

| | $ | 720 |

| | $ | 7 |

|

| | | | | | | | |

|

| | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | |

| | Nine Months Ended

September 30, 2017 | | Nine Months Ended

September 30, 2016 |

Impaired Finance Receivables With No Allowance Recorded | Average Recorded Investment | | Interest Income Recognized | | Average Recorded Investment | | Interest Income Recognized |

| North America | $ | 12 |

| | $ | 1 |

| | $ | 19 |

| | $ | 1 |

|

| Europe | 48 |

| | 1 |

| | 45 |

| | 1 |

|

| Asia/Pacific | 22 |

| | 2 |

| | 2 |

| | — |

|

| Mining | 128 |

| | 5 |

| | 84 |

| | 3 |

|

| Latin America | 69 |

| | 2 |

| | 39 |

| | — |

|

| Caterpillar Power Finance | 233 |

| | 7 |

| | 269 |

| | 8 |

|

| Total | $ | 512 |

| | $ | 18 |

| | $ | 458 |

| | $ | 13 |

|

Impaired Finance Receivables With An Allowance Recorded | |

| | |

| | |

| | |

|

| North America | $ | 52 |

| | $ | 1 |

| | $ | 28 |

| | $ | — |

|

| Europe | 6 |

| | — |

| | 11 |

| | — |

|

| Asia/Pacific | 35 |

| | 2 |

| | 34 |

| | 2 |

|

| Mining | — |

| | — |

| | 15 |

| | — |

|

| Latin America | 101 |

| | 3 |

| | 59 |

| | 2 |

|

| Caterpillar Power Finance | 141 |

| | 4 |

| | 50 |

| | 1 |

|

| Total | $ | 335 |

| | $ | 10 |

| | $ | 197 |

| | $ | 5 |

|

| Total Impaired Finance Receivables | |

| | |

| | |

| | |

|

| North America | $ | 64 |

| | $ | 2 |

| | $ | 47 |

| | $ | 1 |

|

| Europe | 54 |

| | 1 |

| | 56 |

| | 1 |

|

| Asia/Pacific | 57 |

| | 4 |

| | 36 |

| | 2 |

|

| Mining | 128 |

| | 5 |

| | 99 |

| | 3 |

|

| Latin America | 170 |

| | 5 |

| | 98 |

| | 2 |

|

| Caterpillar Power Finance | 374 |

| | 11 |

| | 319 |

| | 9 |

|

| Total | $ | 847 |

| | $ | 28 |

| | $ | 655 |

| | $ | 18 |

|

| | | | | | | | |

Recognition of income is suspended and the finance receivable is placed on non-accrual status when management determines that collection of future income is not probable (generally afterprobable. Contracts on non-accrual status are generally more than 120 days past due).due or have been restructured in a TDR. Recognition is resumed and previously suspended income is recognized when the finance receivable becomes current and collection of remaining amounts is considered probable. Payments received while the finance receivable is on non-accrual status are applied to interest and principal in accordance with the contractual terms. Interest earned but uncollected prior to the receivable being placed on non-accrual status is written off through Provision for credit losses when, in the judgment of management, it is considered uncollectible.

In our Customer portfolio segment, finance receivables which were on non-accrual status and finance receivables over 90 days past due and still accruing income were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | March 31, 2022 | | December 31, 2021 |

| Amortized Cost | | Amortized Cost |

| Non-accrual

With an

Allowance | | Non-accrual

Without an

Allowance | | 91+ Still

Accruing | | Non-accrual

With an

Allowance | | Non-accrual

Without an

Allowance | | 91+ Still

Accruing |

| North America | $ | 43 | | | $ | 6 | | | $ | 13 | | | $ | 47 | | | $ | 9 | | | $ | 12 | |

| EAME | 20 | | | 1 | | | 2 | | | 18 | | | 1 | | | 2 | |

| Asia/Pacific | 13 | | | — | | | 18 | | | 19 | | | — | | | 7 | |

| Mining | 28 | | | 1 | | | 1 | | | 8 | | | 1 | | | 14 | |

| Latin America | 56 | | | — | | | 1 | | | 52 | | | 4 | | | 1 | |

| Caterpillar Power Finance | 31 | | | 12 | | | — | | | 40 | | | 11 | | | — | |

| Total | $ | 191 | | | $ | 20 | | | $ | 35 | | | $ | 184 | | | $ | 26 | | | $ | 36 | |

| | | | | | | | | | | |

There was $1 million and $3 million of September 30, 2017interest income recognized during the three months ended March 31, 2022 and 2021, respectively, for customer finance receivables on non-accrual status.

There were $78 million in finance receivables in our Dealer portfolio segment on non-accrual status as of March 31, 2022 and December 31, 2016, there2021, all of which was in Latin America. There were no finance receivables in our Dealer portfolio segment more than 90 days past due and still accruing income as of March 31, 2022 and December 31, 2021 and no interest income was recognized on dealer finance receivables on non-accrual status forduring the Dealer portfolio segment of $3 millionthree months ended March 31, 2022 and $-, respectively, all of which were in the Latin America finance receivable class. As of September 30, 2017 and December 31, 2016, there were finance receivables on non-accrual status for the Caterpillar Purchased Receivables portfolio segment of $- and $1 million, respectively, all of which were in the Europe finance receivable class. The recorded investment in Customer finance receivables on non-accrual status was as follows: 2021.

|

| | | | | | | |

| (Millions of dollars) | September 30,

2017 | | December 31,

2016 |

| North America | $ | 48 |

| | $ | 66 |

|

| Europe | 56 |

| | 35 |

|

| Asia/Pacific | 11 |

| | 12 |

|

| Mining | 55 |

| | 69 |

|

| Latin America | 242 |

| | 307 |

|

| Caterpillar Power Finance | 277 |

| | 90 |

|

| Total | $ | 689 |

| | $ | 579 |

|

| | | | |

Troubled debt restructurings

A restructuring of a finance receivable constitutes a troubled debt restructuring (TDR)TDR when the lender grants a concession it would not otherwise consider to a borrower experiencing financial difficulties. Concessions granted may include extended contract maturities, inclusion of interest only periods, below market interest rates, extended skip payment periodsdeferrals and reduction of principal and/or accrued interest. We individually evaluate TDR contracts and establish an allowance based on the present value of expected future cash flows discounted at the receivable’s effective interest rate, the fair value of the collateral for collateral-dependent receivables or the observable market price of the receivable.

As of September 30, 2017, there were no additional funds committed to lend to a borrower whose terms have been modified in a TDR. As of December 31, 2016, there were $11 million of additional funds committed to lend to a borrower whose terms have been modified in a TDR.

There were no finance receivables modified as TDRs during the three and nine months ended September 30, 2017March 31, 2022 and 20162021 for the Dealer or Caterpillar Purchased Receivables portfolio segments. Our recorded investment in financeFinance receivables in the Customer portfolio segment modified as TDRs were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | Three Months Ended

March 31, 2022 | | Three Months Ended

March 31, 2021 |

| | Pre-TDR

Amortized

Cost | | Post-TDR

Amortized

Cost | | Pre-TDR

Amortized

Cost | | Post-TDR

Amortized

Cost |

| | | | | | | |

| EAME | $ | 1 | | | $ | 1 | | | $ | — | | | $ | — | |

| | | | | | | |

| Mining | — | | | — | | | 11 | | | 5 | |

| | | | | | | |

| Caterpillar Power Finance | 6 | | | 6 | | | — | | | — | |

| Total | $ | 7 | | | $ | 7 | | | $ | 11 | | | $ | 5 | |

| | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Three Months Ended

September 30, 2017 | | Three Months Ended

September 30, 2016 |

| | Number of Contracts | | Pre-TDR Recorded Investment | | Post-TDR Recorded Investment | | Number of Contracts | | Pre-TDR Recorded Investment | | Post-TDR Recorded Investment |

| North America | 11 |

| | $ | 4 |

| | $ | 5 |

| | 2 |

| | $ | — |

| | $ | — |

|

| Europe | 1 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Asia/Pacific | — |

| | — |

| | — |

| | 4 |

| | 1 |

| | 1 |

|

| Mining | — |

| | — |

| | — |

| | 1 |

| | 33 |

| | 30 |

|

Latin America(1) | 3 |

| | 21 |

| | 22 |

| | 341 |

| | 105 |

| | 74 |

|

| Caterpillar Power Finance | 5 |

| | 51 |

| | 44 |

| | 4 |

| | 13 |

| | 13 |

|

| Total | 20 |

| | $ | 76 |

| | $ | 71 |

| | 352 |

| | $ | 152 |

| | $ | 118 |

|

| | | | | | | | | | | | |

| | Nine Months Ended

September 30, 2017 | | Nine Months Ended

September 30, 2016 |

| | Number of Contracts | | Pre-TDR Recorded Investment | | Post-TDR Recorded Investment | | Number of Contracts | | Pre-TDR Recorded Investment | | Post-TDR Recorded Investment |

| North America | 37 |

| | $ | 13 |

| | $ | 13 |

| | 15 |

| | $ | 16 |

| | $ | 16 |

|

| Europe | 2 |

| | — |

| | — |

| | 3 |

| | 11 |

| | 8 |

|

| Asia/Pacific | 6 |

| | 39 |

| | 30 |

| | 8 |

| | 4 |

| | 4 |

|

| Mining | 2 |

| | 57 |

| | 56 |

| | 2 |

| | 43 |

| | 35 |

|

| Latin America | 17 |

| | 26 |

| | 27 |

| | 431 |

| | 117 |

| | 87 |

|

Caterpillar Power Finance(2) | 59 |

| | 319 |

| | 305 |

| | 34 |

| | 196 |

| | 177 |

|

| Total | 123 |

| | $ | 454 |

| | $ | 431 |

| | 493 |

| | $ | 387 |

| | $ | 327 |

|

| | | | | | | | | | | | |

(1) ForThe Post-TDR amortized cost of TDRs in the three months ended September 30, 2016, 321 contracts with a pre-TDR recorded investment of $94 million and a post-TDR recorded investment of $64 million are related to four customers.

(2) For the nine months ended September 30, 2017, 44 contracts with a pre-TDR recorded investment of $200 million and a post-TDR recorded investment of $200 million are related to four customers.

During the nine months ended September 30, 2017, there were 241 contracts, primarily related to two customers, with a recorded investment of $16 millionCustomer portfolio segment with a payment default (defined as 91+ days past due) which had been modified within twelve months prior to the default date, in the Customer portfolio segment, all of which were in the Latin America finance receivable class.was as follows:

UNAUDITED | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | Three Months Ended March 31, | | | | | | |

| 2022 | | 2021 | | | | | | | | |

| North America | $ | — | | | $ | 1 | | | | | | | | | |

| | | | | | | | | | | |

| Asia/Pacific | — | | | 4 | | | | | | | | | |

| Mining | 5 | | | — | | | | | | | | | |

| | | | | | | | | | | |

| Caterpillar Power Finance | — | | | 5 | | | | | | | | | |

| Total | $ | 5 | | | $ | 10 | | | | | | | | | |

| | | | | | | | | | | |

4.Derivative Financial Instruments and Risk Management

| |

4. | Derivative Financial Instruments and Risk Management |

Our earnings and cash flow are subject to fluctuations due to changes in foreign currency exchange rates and interest rates. Our Risk Management Policy (policy) allows for the use of derivative financial instruments to prudently manage foreign currency exchange rate and interest rate exposures. Our policy specifies that derivatives are not to be used for speculative purposes. Derivatives that we use are primarily foreign currency forward, option and cross currency contracts and interest rate contracts. Our derivative activities are subject to the management, direction and control of our senior financial officers. Risk management practices, including the use of financial derivative instruments, are presentedWe present at least annually to our Board of Directors and the Audit Committee of the Caterpillar Inc. Board of Directors at least annually.on our risk management practices, including our use of financial derivative instruments.

All derivatives are recognized on the Consolidated Statements of Financial Position at their fair value. On the date the derivative contract is entered into, the derivative instrument is (1) designated as a hedge of the fair value of a recognized asset or liability (fair value hedge), (2) designated as a hedge of a forecasted transaction or the variability of cash flows (cash flow hedge) or (3) undesignated. ChangesWe record in current earnings changes in the fair value of a derivative that is qualified, designated and highly effective as a fair value hedge, along with the gain or loss on the hedged recognized asset or liability that is attributable to the hedged risk, are recordedrisk. We record in current earnings. ChangesAccumulated other comprehensive income (loss) (AOCI) changes in the fair value of a derivative that is qualified, designated and highly effective as a cash flow hedge, are recorded in Accumulated other comprehensive income/(loss) (AOCI), to the extent effective, on the Consolidated Statements of Financial Position until they are reclassifiedwe reclassify them to earnings in the same period or periods during which the hedged transaction affects earnings. ChangesWe report changes in the fair value of undesignated derivative instruments and the ineffective portion of designated derivative instruments are reported in current earnings. CashWe classify cash flows from designated derivative financial instruments are classified within the same category as the item being hedged on the Consolidated Statements of Cash Flows. CashWe include cash flows from undesignated derivative financial instruments are included in the investing category on the Consolidated Statements of Cash Flows.

We formally document all relationships between hedging instruments and hedged items, as well as the risk-management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives that are designated as fair value hedges to specific assets and liabilities on the Consolidated Statements of Financial Position and linking cash flow hedges to specific forecasted transactions or variability of cash flow.

We also formally assess, both at the hedge’s inception and on an ongoing basis, whether the designated derivatives that are used in hedging transactions are highly effective in offsetting changes in fair value or cash flow of hedged items. When a derivative is determined not to be highly effective as a hedge or the underlying hedged transaction is no longer probable, we discontinue hedge accounting prospectively, in accordance with the derecognition criteria for hedge accounting.

Foreign currency exchange rate risk

We have balance sheet positions and expected future transactions denominated in foreign currencies, thereby creating exposure to movements in exchange rates. In managing foreign currency risk, our objective is to minimize earnings volatility resulting from conversion and the remeasurement of net foreign currency balance sheet positions and future transactions denominated in foreign currencies. Our policy allows the use of foreign currency forward, option and cross currency contracts to offset the risk of currency mismatch between our assets and liabilities and exchange rate risk associated with future transactions denominated in foreign currencies. Our foreign currency forward option and cross currencyoption contracts are primarily undesignated. We designate fixed-to-fixed cross currency contracts as cash flow hedges to protect against movements in exchange rates on foreign currency fixed ratefixed-rate assets and liabilities.

Interest rate risk

Interest rate movements create a degree of risk by affecting the amount of our interest payments and the value of our fixed-rate debt. Our practice is to use interest rate contracts to manage our exposure to interest rate changes.

We have a match-funding policy that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate and duration) of our debt portfolio with the interest rate profile of our finance receivable portfolio within predetermined ranges on an ongoing basis. In connection with that policy, we use interest rate derivative instruments to modify the debt structure to match assets within the finance receivable portfolio. This matched funding reduces the volatility of margins between interest-bearing assets and interest-bearing liabilities, regardless of which direction interest rates move.

Our policy allows us to use fixed-to-floating, floating-to-fixed and floating-to-floating interest rate contracts to meet the match-funding objective. We designate fixed-to-floating interest rate contracts as fair value hedges to protect debt against changes in fair value due to changes in the benchmark interest rate. We designate most floating-to-fixed interest rate contracts as cash flow hedges to protect against the variability of cash flows due to changes in the benchmark interest rate. We have, at certain times, liquidated fixed-to-floating and floating-to-fixed interest rate contracts. We amortize the gains or losses associated with these contracts at the time of liquidation into earnings over the original term of the previously designated hedged item.

The location and fair value of derivative instruments reported in the Consolidated Statements of Financial Position were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | |

| | |

| | March 31, 2022 | | December 31, 2021 |

| | Assets1 | | Liabilities2 | | Assets1 | | Liabilities2 |

| Designated derivatives | | | | | | | | |

| Foreign exchange contracts | | $ | 131 | | | $ | (78) | | | $ | 142 | | | $ | (32) | |

| Interest rate contracts | | 75 | | | (59) | | | 38 | | | (15) | |

| | $ | 206 | | | $ | (137) | | | $ | 180 | | | $ | (47) | |

| Undesignated derivatives | | | | | | | | |

| Foreign exchange contracts | | $ | 35 | | | $ | (81) | | | $ | 28 | | | $ | (36) | |

| | $ | 35 | | | $ | (81) | | | $ | 28 | | | $ | (36) | |

| | | | | | | | |

(1) Assets are classified on the Consolidated Statements of Financial Position as Other assets.

(2) Liabilities are classified on the Consolidated Statements of Financial Position as Accrued expenses.

The total notional amount of our derivative instruments was $13.42 billion and $13.85 billion as of March 31, 2022 and December 31, 2021, respectively. The notional amounts of derivative financial instruments do not represent amounts exchanged by the parties. We calculate the amounts exchanged by the parties by referencing the notional amounts and by other terms of the derivatives, such as foreign currency exchange rates and interest rates.

The effect of derivatives on the Consolidated Statements of Profit was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | |

| | Fair Value /

Undesignated Hedges | | Cash Flow Hedges |

| | Gains (Losses) Recognized1 | | Gains (Losses)

Recognized in AOCI | | Gains (Losses) Reclassified from AOCI2 |

| | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2022 | | 2021 | | 2022 | | 2021 | | 2022 | | 2021 |

| Foreign exchange contracts | | $ | (79) | | | $ | 86 | | | $ | (27) | | | $ | 119 | | | $ | 16 | | | $ | 114 | |

| Interest rate contracts | | 6 | | | 6 | | | 56 | | | — | | | (6) | | | (10) | |

| | $ | (73) | | | $ | 92 | | | $ | 29 | | | $ | 119 | | | $ | 10 | | | $ | 104 | |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) Foreign exchange contract gains (losses) are primarily from undesignated forward contracts and are included in Other income (expense). Interest rate contract gains (losses) are from designated fair value hedges and are included in Interest expense.

(2) Foreign exchange contract gains (losses) are primarily included in Other income (expense). Interest rate contract gains (losses) are included in Interest expense.

The following amounts were recorded in the Consolidated Statements of Financial Position related to cumulative basis adjustments for fair value hedges:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | |

| | Carrying Value of

the Hedged Liabilities | | Cumulative Amount of Fair Value

Hedging Adjustment Included in the

Carrying Value of the Hedged

Liabilities |

| | March 31, 2022 | | December 31, 2021 | | March 31, 2022 | | December 31, 2021 |

| Current maturities of long-term debt | | $ | 750 | | | $ | 755 | | | $ | — | | | $ | 5 | |

| Long-term debt | | 1,447 | | | 1,304 | | | (59) | | | (2) | |

| Total | | $ | 2,197 | | | $ | 2,059 | | | $ | (59) | | | $ | 3 | |

| | | | | | | | |

As of September 30, 2017, $2March 31, 2022, $10 million of deferred net gains, net of tax, included in equity (AOCI in the Consolidated Statements of Financial Position), related to our floating-to-fixed interest rate contracts,cash flow hedges, are expected to be reclassified to Interest expenseearnings over the next twelve months. The actual amount recorded in Interest expenseearnings will vary based on interest rates and exchange rates at the time the hedged transactions impact earnings.

We have, at certain times, liquidated fixed-to-floating interest rate contracts that resulted in deferred gains at the time of liquidation. The deferred gains associated with these interest rate contracts are included in Long-term debt in the Consolidated Statements of Financial Position and are being amortized to Interest expense over the remaining term of the previously designated hedged item.

The location and fair value of derivative instruments reported in the Consolidated Statements of Financial Position were as follows:

|

| | | | | | | | | |

| (Millions of dollars) | | | | | |

| | | | Asset (Liability) Fair Value |

| | Consolidated Statements of Financial Position Location | | September 30,

2017 | | December 31,

2016 |

| Designated derivatives | | | | | |

| Interest rate contracts | Other assets | | $ | 3 |

| | $ | 4 |

|

| Interest rate contracts | Accrued expenses | | (1 | ) | | (1 | ) |

| Cross currency contracts | Other assets | | 8 |

| | 29 |

|

| Cross currency contracts | Accrued expenses | | (41 | ) | | (3 | ) |

| | | | $ | (31 | ) | | $ | 29 |

|

| Undesignated derivatives | | | |

| | |

| Foreign exchange contracts | Other assets | | $ | 17 |

| | $ | 12 |

|

| Foreign exchange contracts | Accrued expenses | | (8 | ) | | (4 | ) |

| Cross currency contracts | Other assets | | 25 |

| | 27 |

|

| | | | $ | 34 |

| | $ | 35 |

|

| | | | | | |

The total notional amount of our derivative instruments was $3.56 billion and $2.63 billion as of September 30, 2017 and December 31, 2016, respectively. The notional amounts of derivative financial instruments do not represent amounts exchanged by the parties. The amounts exchanged by the parties are calculated by reference to the notional amounts and by other terms of the derivatives, such as foreign currency exchange rates and interest rates.

The effect of derivatives designated as hedging instruments on the Consolidated Statements of Profit was as follows:

|

| | | | | | | | | | | | | | | | | |

| Fair Value Hedges |

| (Millions of dollars) | | | Three Months Ended

September 30, 2017 | | Three Months Ended

September 30, 2016 |

| | Classification | | Gains (Losses) on Derivatives | | Gains (Losses) on Borrowings | | Gains (Losses) on Derivatives | | Gains (Losses) on Borrowings |

| Interest rate contracts | Other income (expense) | | $ | — |

| | $ | — |

| | $ | (11 | ) | | $ | 11 |

|

| | | | | | | | | | |

| | | | Nine Months Ended

September 30, 2017 | | Nine Months Ended

September 30, 2016 |

| | Classification | | Gains (Losses) on Derivatives | | Gains (Losses) on Borrowings | | Gains (Losses) on Derivatives | | Gains (Losses) on Borrowings |

| Interest rate contracts | Other income (expense) | | $ | (1 | ) | | $ | 1 |

| | $ | (11 | ) | | $ | 10 |

|

| | | | | | | | | | |

|

| | | | | | | | | | | | |

| Cash Flow Hedges |

| (Millions of dollars) | Three Months Ended September 30, 2017 |

| | | Recognized in Earnings |

| | Amounts of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification | | Reclassified from AOCI to Earnings (Effective Portion) | | Recognized in Earnings (Ineffective Portion) |

| Interest rate contracts | $ | (1 | ) | Interest expense | | $ | 1 |

| | $ | — |

|

| Cross currency contracts | (21 | ) | Other income (expense) | | (20 | ) | | — |

|

| Cross currency contracts | | Interest expense | | 1 |

| | — |

|

| | $ | (22 | ) | | | $ | (18 | ) | | $ | — |

|

| | | | | | | |

| | Three Months Ended September 30, 2016 |

| | | Recognized in Earnings |

| | Amounts of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification | | Reclassified from AOCI to Earnings (Effective Portion) | | Recognized in Earnings (Ineffective Portion) |

| Interest rate contracts | $ | 2 |

| Interest expense | | $ | — |

| | $ | — |

|

| Cross currency contracts | (17 | ) | Other income (expense) | | (10 | ) | | — |

|

| | $ | (15 | ) | | | $ | (10 | ) | | $ | — |

|

| | | | | | | |

| | Nine Months Ended September 30, 2017 |

| | | Recognized in Earnings |

| | Amounts of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification | | Reclassified from AOCI to Earnings (Effective Portion) | | Recognized in Earnings (Ineffective Portion) |

| Interest rate contracts | $ | (1 | ) | Interest expense | | $ | 2 |

| | $ | — |

|

| Cross currency contracts | (62 | ) | Other income (expense) | | (69 | ) | | — |

|

| Cross currency contracts | | Interest expense | | 3 |

| | — |

|

| | $ | (63 | ) | | | $ | (64 | ) | | $ | — |

|

| | | | | | | |

| | Nine Months Ended September 30, 2016 |

| | | Recognized in Earnings |

| | Amounts of Gains (Losses) Recognized in AOCI (Effective Portion) | Classification | | Reclassified from AOCI to Earnings (Effective Portion) | | Recognized in Earnings (Ineffective Portion) |

| Interest rate contracts | $ | — |

| Interest expense | | $ | (3 | ) | | $ | — |

|

| Cross currency contracts | (23 | ) | Other income (expense) | | (16 | ) | | — |

|

| | $ | (23 | ) | | | $ | (19 | ) | | $ | — |

|

| | | | | | | |

The effect of derivatives not designated as hedging instruments on the Consolidated Statements of Profit was as follows: |

| | | | | | | | | |

| (Millions of dollars) | | | Three Months Ended September 30, |

| | Classification | | 2017 | | 2016 |

| Foreign exchange contracts | Other income (expense) | | $ | 14 |

| | $ | (5 | ) |

| Cross currency contracts | Other income (expense) | | (3 | ) | | — |

|

| | | | $ | 11 |

| | $ | (5 | ) |

| | | | | | |

| | | | Nine Months Ended September 30, |

| | Classification | | 2017 | | 2016 |

| Foreign exchange contracts | Other income (expense) | | $ | 25 |

| | $ | (21 | ) |

| Cross currency contracts | Other income (expense) | | (4 | ) | | (12 | ) |

| | | | $ | 21 |

| | $ | (33 | ) |

| | | | | | |

Balance sheet offsetting

We enter into International Swaps and Derivatives Association (ISDA) master netting agreements that permit the net settlement of amounts owed under their respective derivative contracts. Under these master netting agreements, net settlement generally permits us or the counterparty to determine the net amount payable for contracts due on the same date and in the same currency for similar types of derivative transactions. The master netting agreements generally also provide for net settlement of all outstanding contracts with a counterparty in the case of an event of default or a termination event.

Collateral is generally not required of the counterparties or us under the master netting agreements. As of September 30, 2017March 31, 2022 and December 31, 2016,2021, no cash collateral was received or pledged under the master netting agreements.

The effect of net settlement provisions of the master netting agreements on our derivative balances upon an event of default or a termination event was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | |

| | March 31, 2022 | | December 31, 2021 |

| | Assets | | Liabilities | | Assets | | Liabilities |

| Gross amounts recognized | | $ | 241 | | | $ | (218) | | | $ | 208 | | | $ | (83) | |

| Financial instruments not offset | | (96) | | | 96 | | | (67) | | | 67 | |

| | | | | | | | |

| Net amount | | $ | 145 | | | $ | (122) | | | $ | 141 | | | $ | (16) | |

| | | | | | | | |

|

| | | | | | | | | |

| Offsetting of Derivative Assets and Liabilities | | | | |

| (Millions of dollars) | | | | |

| | | September 30,

2017 | | December 31,

2016 |

| Derivative Assets | | | | |

| Gross Amount of Recognized Assets | | $ | 53 |

| | $ | 72 |

|

| Gross Amounts Offset | | — |

| | — |

|

Net Amount of Assets(1) | | 53 |

| | 72 |

|

| Gross Amounts Not Offset | | (8 | ) | | (7 | ) |

| Net Amount | | $ | 45 |

| | $ | 65 |

|

| | | | | |

| Derivative Liabilities | | | | |

| Gross Amount of Recognized Liabilities | | $ | (50 | ) | | $ | (8 | ) |

| Gross Amounts Offset | | — |

| | — |

|

Net Amount of Liabilities(1) | | (50 | ) | | (8 | ) |

| Gross Amounts Not Offset | | 8 |

| | 7 |

|

| Net Amount | | $ | (42 | ) | | $ | (1 | ) |

| | | | | |

(1) As presented in the Consolidated Statements of Financial Position.

5.Accumulated Other Comprehensive Income (Loss)

| |

5. | Accumulated Other Comprehensive Income/(Loss) |

We present Comprehensive income/income (loss) and its components are presented in the Consolidated Statements of Comprehensive Income. Changes in Accumulated other comprehensive income/income (loss), net of tax, included in the Consolidated Statements of Changes in Shareholder'sShareholder’s Equity consisted of the following:

| | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | Three Months Ended

March 31, | | |

| | 2022 | | 2021 | | | | |

| Foreign currency translation | | | | | | | | |

| Balance at beginning of period | | $ | (762) | | | $ | (551) | | | | | |

| | | | | | | | |

| | | | | | | | |

| Gains (losses) on foreign currency translation | | 19 | | | (94) | | | | | |

| Less: Tax provision/(benefit) | | 11 | | | 25 | | | | | |

| Net gains (losses) on foreign currency translation | | 8 | | | (119) | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive income (loss), net of tax | | 8 | | | (119) | | | | | |

| Balance at end of period | | $ | (754) | | | $ | (670) | | | | | |

| | | | | | | | |

| Derivative financial instruments | | | | | | | | |

| Balance at beginning of period | | $ | (12) | | | $ | (44) | | | | | |

| | | | | | | | |

| | | | | | | | |

| Gains (losses) deferred | | 29 | | | 119 | | | | | |

| Less: Tax provision/(benefit) | | 6 | | | 25 | | | | | |

| Net gains (losses) deferred | | 23 | | | 94 | | | | | |

| (Gains) losses reclassified to earnings | | (10) | | | (104) | | | | | |

| Less: Tax (provision)/benefit | | (3) | | | (21) | | | | | |

| Net (gains) losses reclassified to earnings | | (7) | | | (83) | | | | | |

| Other comprehensive income (loss), net of tax | | 16 | | | 11 | | | | | |

| Balance at end of period | | $ | 4 | | | $ | (33) | | | | | |

| | | | | | | | |

| Total Accumulated other comprehensive income (loss) at end of period | | $ | (750) | | | $ | (703) | | | | | |

| | | | | | | | |

|

| | | | | | | | | | | | | | | |

| (Millions of dollars) | Foreign currency translation | | Derivative financial instruments | | Available-for- sale securities | | Total |

| | | | | | | | |

| Three Months Ended September 30, 2016 | | | | | | | |

| Balance at June 30, 2016 | $ | (790 | ) | | $ | 1 |

| | $ | (2 | ) | | $ | (791 | ) |

Other comprehensive income/(loss) before reclassifications | (5 | ) | | (10 | ) | | 1 |

| | (14 | ) |

Amounts reclassified from accumulated other comprehensive (income)/loss | — |

| | 7 |

| | — |

| | 7 |

|

| Other comprehensive income/(loss) | (5 | ) | | (3 | ) | | 1 |

| | (7 | ) |

| Balance at September 30, 2016 | $ | (795 | ) | | $ | (2 | ) | | $ | (1 | ) | | $ | (798 | ) |

| | | | | | | | |

| Three Months Ended September 30, 2017 | | | | | | | |

| Balance at June 30, 2017 | $ | (756 | ) | | $ | 2 |

| | $ | 1 |

| | $ | (753 | ) |

Other comprehensive income/(loss) before reclassifications | 151 |

| | (14 | ) | | (1 | ) | | 136 |

|

Amounts reclassified from accumulated other comprehensive (income)/loss | — |

| | 11 |

| | — |

| | 11 |

|

| Other comprehensive income/(loss) | 151 |

| | (3 | ) | | (1 | ) | | 147 |

|

| Balance at September 30, 2017 | $ | (605 | ) | | $ | (1 | ) | | $ | — |

| | $ | (606 | ) |

| | | | | | | | |

| Nine Months Ended September 30, 2016 | | | | | | | |

| Balance at December 31, 2015 | $ | (897 | ) | | $ | — |

| | $ | — |

| | $ | (897 | ) |

Other comprehensive income/(loss) before reclassifications | 102 |

| | (15 | ) | | (1 | ) | | 86 |

|

Amounts reclassified from accumulated other comprehensive (income)/loss | — |

| | 13 |

| | — |

| | 13 |

|

| Other comprehensive income/(loss) | 102 |

| | (2 | ) | | (1 | ) | | 99 |

|

| Balance at September 30, 2016 | $ | (795 | ) | | $ | (2 | ) | | $ | (1 | ) | | $ | (798 | ) |

| | | | | | | | |

| Nine Months Ended September 30, 2017 | | | | | | | |

| Balance at December 31, 2016 | $ | (994 | ) | | $ | (1 | ) | | $ | — |

| | $ | (995 | ) |

Other comprehensive income/(loss) before reclassifications | 389 |

| | (41 | ) | | — |

| | 348 |

|

Amounts reclassified from accumulated other comprehensive (income)/loss | — |

| | 41 |

| | — |

| | 41 |

|

| Other comprehensive income/(loss) | 389 |

| | — |

| | — |

| | 389 |

|

| Balance at September 30, 2017 | $ | (605 | ) | | $ | (1 | ) | | $ | — |

| | $ | (606 | ) |

| | | | | | | | |

6.Segment Information

The effect of the reclassifications out of Accumulated other comprehensive income/(loss) on the Consolidated Statements of Profit was as follows:

|

| | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | Classification of income (expense) | | 2017 | | 2016 | | 2017 | | 2016 |

| Cross currency contracts | Other income (expense) | | $ | (20 | ) | | $ | (10 | ) | | $ | (69 | ) | | $ | (16 | ) |

| Cross currency contracts | Interest expense | | 1 |

| | — |

| | 3 |

| | — |

|

| Interest rate contracts | Interest expense | | 1 |

| | — |

| | 2 |

| | (3 | ) |

| Reclassifications before tax | | | (18 | ) | | (10 | ) | | (64 | ) | | (19 | ) |

| Tax (provision) benefit | | | 7 |

| | 3 |

| | 23 |

| | 6 |

|

Total reclassifications from Accumulated other comprehensive income/(loss) | | $ | (11 | ) | | $ | (7 | ) | | $ | (41 | ) | | $ | (13 | ) |

| | | | | | | | | | |

A. Basis for Segment Information

We report information internally for operating segments based on management responsibility. Our operating segments offerprovide financing alternatives to customers and dealers foraround the purchase and lease of Caterpillar and other equipment, as well as financingworld for Caterpillar sales to dealers.products and services and vehicles, power generation facilities and marine vessels that, in most cases, incorporate Caterpillar products. Financing plansproducts include operating and finance leases, installment sale contracts,retail loans, working capital loans to Caterpillar dealers and wholesale financing plans within each of the respectiveoperating segments. Certain operating segments also purchase short-term trade receivables from Caterpillar.

B. Description of Segments

We have fivesix operating segments that offer financing services. Following is a brief description of our segments:

•North America - Includes our operations in the United States and Canada.

Europe •EAME - Includes our operations in Europe, Africa, the Middle East and the Commonwealth of Independent States.

•Asia/Pacific - Includes our operations in Australia, New Zealand, China, Japan, Southeast Asia and Southeast Asia.

India.•Latin Americaand Caterpillar Power Finance - Includes our operations in Mexico and Central and South American countries. This segment also includes

•Mining - Provides financing for large mining customers worldwide.

•Caterpillar Power Finance (CPF), which finances- Provides financing worldwide for marine vessels with Caterpillar engines worldwide and also provides financing for Caterpillar electrical power generation, gas compression and co-generation systems and non-Caterpillar equipment that is powered by these systems worldwide.

systems.Mining - Serves large mining customers worldwide and provides project financing in various countries.

C. Segment Measurement and Reconciliations

Cash, debt and other expenses are allocated to our segments based on their respective portfolios. The related Interest expense is calculated based on the amount of allocated debt and the rates associated with that debt. The performance of each segment is assessed based on a consistent leverage ratio. The Provision for credit losses is based on each segment'ssegment’s respective finance receivable portfolio. Capital expenditures include expenditures for equipment on operating leases and other miscellaneous capital expenditures.

Reconciling items are created based on accounting differences between segment reporting and consolidated external reporting. For the reconciliation of profitProfit before income taxes, we have grouped the reconciling items as follows:

•Unallocated - This item is related to corporate requirements and strategies that are considered to be for the benefit of the entire organization. Also included are the consolidated results of the special purpose corporation (see Note 7 for additional information) and other miscellaneous items.

•Timing - Timing differences in the recognition of costs between segment reporting and consolidated external reporting.

•Methodology - Methodology differences between segment reporting and consolidated external reporting are as follows:

◦Segment assets include off-balance sheet managed assets for which we maintain servicing responsibilities.

◦The impact of differences between the actual leverage and the segment leverage ratios.

◦Interest expense includes realized forward points on foreign currency forward contracts.

◦The net gain or loss from interest rate derivatives is excluded from segment reporting.

| |

◦ | Segment assets include off-balance sheet managed assets for which we maintain servicing responsibilities. |

| |

◦ | The impact of differences between the actual leverage and the segment leverage ratios. |

| |

◦ | Interest expense includes realized forward points on foreign currency forward contracts. |

| |

◦ | The net gain or loss from interest rate derivatives. |

| |

◦ | The profit attributable to noncontrolling interests is considered a component of segment profit. |

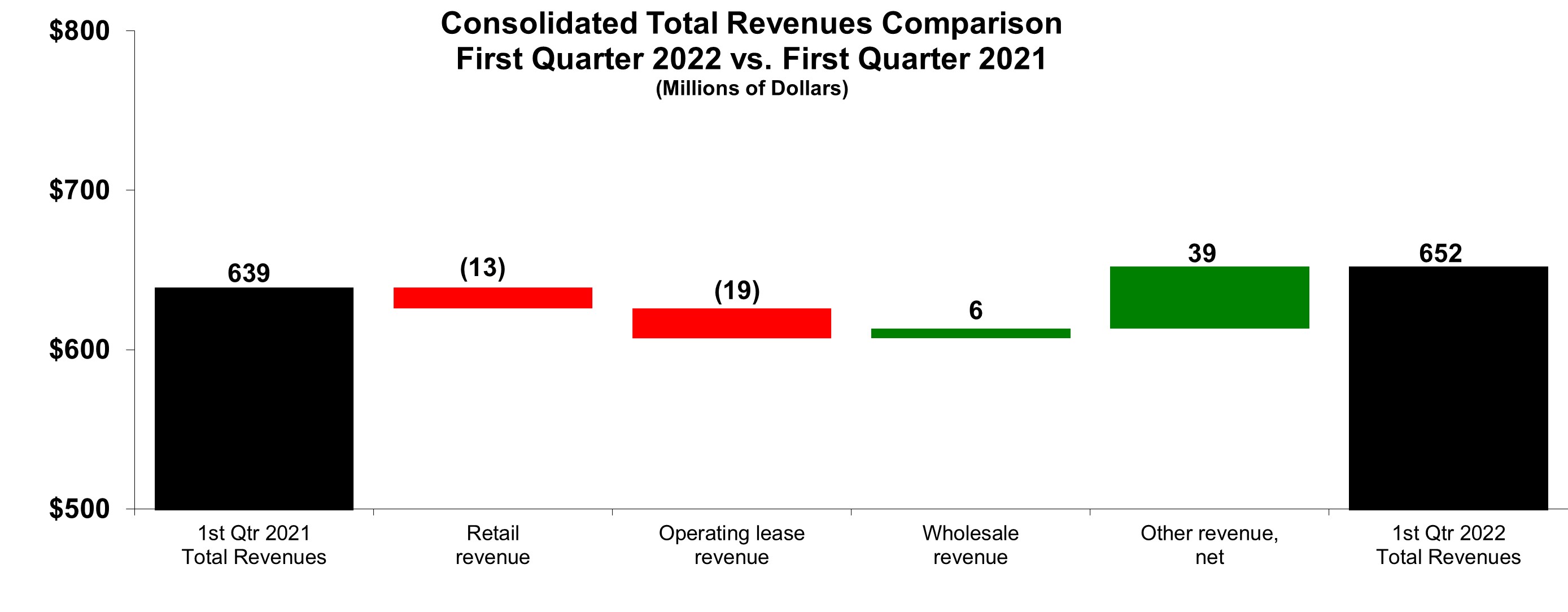

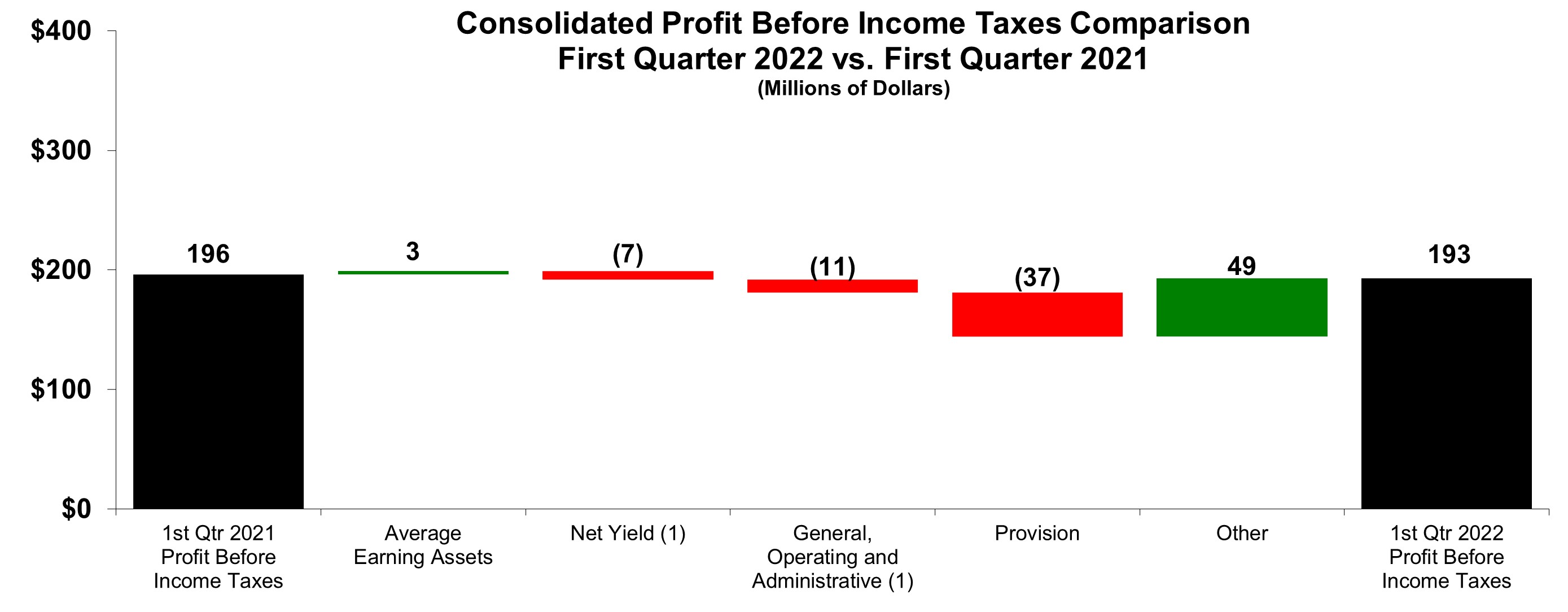

Supplemental segment data and reconciliations to consolidated external reporting for the three months ended September 30March 31 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Millions of dollars)

2022 | External

Revenues | | Profit

before

income

taxes | | Interest

Expense | | Depreciation

on equipment

leased to

others | | Provision

for

credit

losses | | Assets at

March 31,

2022 | | Capital

expenditures |

| North America | $ | 359 | | | $ | 127 | | | $ | 54 | | | $ | 128 | | | $ | 6 | | | $ | 15,846 | | | $ | 199 | |

| EAME | 67 | | | — | | | 7 | | | 14 | | | 26 | | | 4,959 | | | 14 | |

| Asia/Pacific | 75 | | | 37 | | | 17 | | | 1 | | | 1 | | | 4,255 | | | 2 | |

| Latin America | 58 | | | 19 | | | 26 | | | 2 | | | (1) | | | 2,541 | | | 2 | |

| Mining | 72 | | | 20 | | | 8 | | | 38 | | | (2) | | | 2,679 | | | 22 | |

| Caterpillar Power Finance | 19 | | | 15 | | | 3 | | | 1 | | | (3) | | | 909 | | | — | |

| Total Segments | 650 | | | 218 | | | 115 | | | 184 | | | 27 | | | 31,189 | | | 239 | |

| Unallocated | 5 | | | (72) | | | 42 | | | — | | | — | | | 1,477 | | | 2 | |

| Timing | (3) | | | 1 | | | — | | | — | | | — | | | 16 | | | — | |

| Methodology | — | | | 46 | | | (51) | | | — | | | — | | | 82 | | | — | |

Inter-segment Eliminations (1) | — | | | — | | | — | | | — | | | — | | | (169) | | | — | |

| Total | $ | 652 | | | $ | 193 | | | $ | 106 | | | $ | 184 | | | $ | 27 | | | $ | 32,595 | | | $ | 241 | |

| | | | | | | | | | | | | |

| 2021 | External

Revenues | | Profit

before

income

taxes | | Interest

Expense | | Depreciation

on equipment

leased to

others | | Provision

for

credit

losses | | Assets at

December 31,

2021 | | Capital

expenditures |

| North America | $ | 347 | | | $ | 99 | | | $ | 69 | | | $ | 137 | | | $ | 1 | | | $ | 15,755 | | | $ | 178 | |

| EAME | 67 | | | 30 | | | 5 | | | 15 | | | (4) | | | 5,192 | | | 10 | |

| Asia/Pacific | 92 | | | 51 | | | 23 | | | 2 | | | — | | | 4,117 | | | 3 | |

| Latin America | 47 | | | 16 | | | 14 | | | 2 | | | 3 | | | 2,405 | | | 7 | |

| Mining | 71 | | | 18 | | | 10 | | | 35 | | | (3) | | | 2,672 | | | 26 | |

| Caterpillar Power Finance | 13 | | | 11 | | | 4 | | | 1 | | | (7) | | | 957 | | | — | |

| Total Segments | 637 | | | 225 | | | 125 | | | 192 | | | (10) | | | 31,098 | | | 224 | |

| Unallocated | 5 | | | (72) | | | 50 | | | — | | | — | | | 1,458 | | | 4 | |

| Timing | (3) | | | 1 | | | — | | | — | | | — | | | 15 | | | — | |

| Methodology | — | | | 42 | | | (50) | | | — | | | — | | | 18 | | | — | |

Inter-segment Eliminations (1) | — | | | — | | | — | | | — | | | — | | | (202) | | | — | |

| Total | $ | 639 | | | $ | 196 | | | $ | 125 | | | $ | 192 | | | $ | (10) | | | $ | 32,387 | | | $ | 228 | |

| | | | | | | | | | | | | |

|

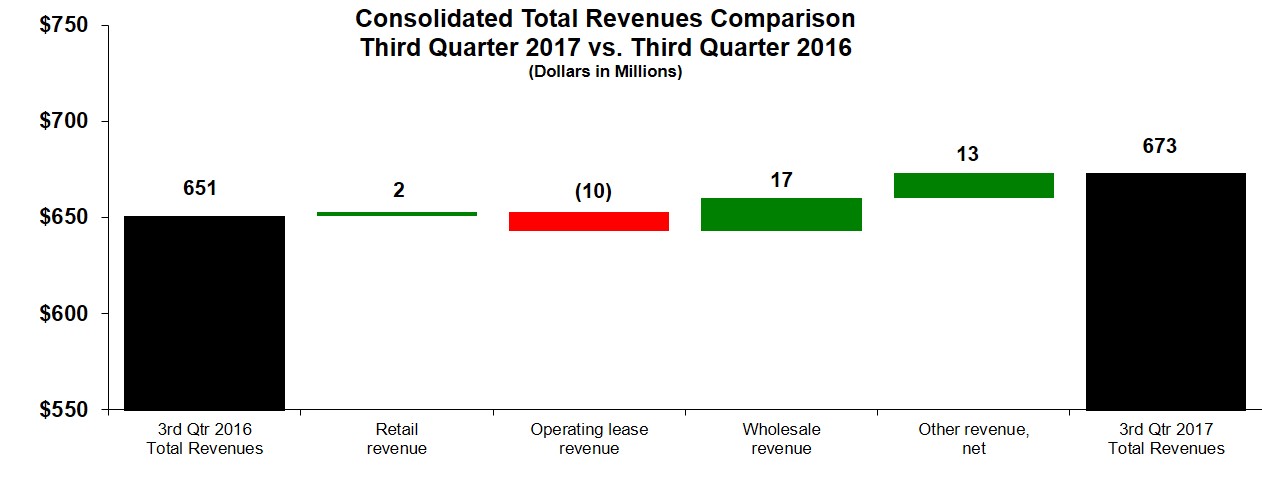

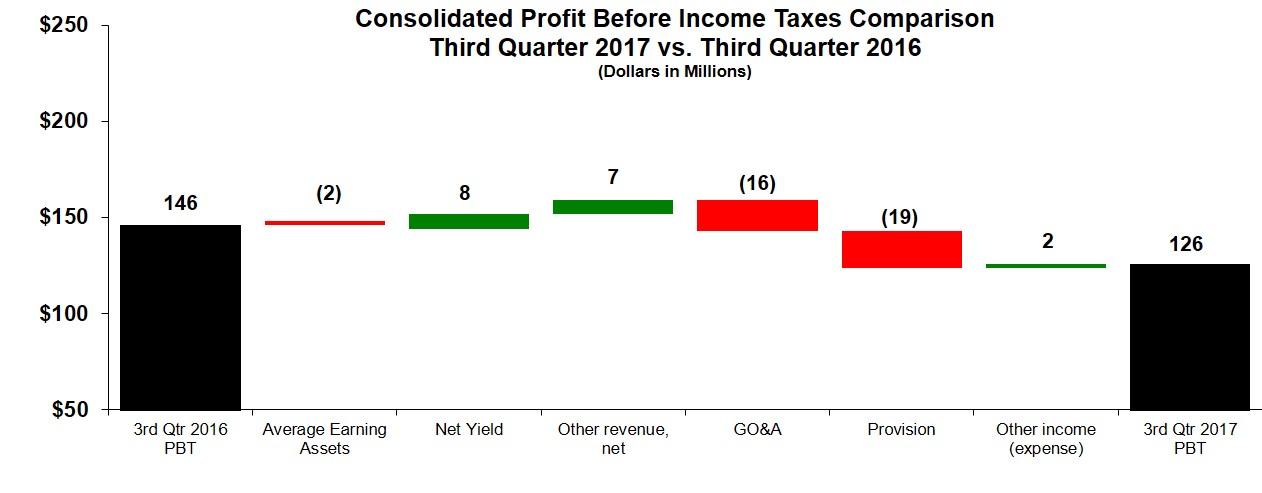

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Millions of dollars)

2017 | External Revenues | | Profit before income taxes | | Interest Expense | | Depreciation on equipment leased to others | | Provision for credit losses | | Assets at September 30, 2017 | | Capital expenditures |

| North America | $ | 338 |

| | $ | 90 |

| | $ | 77 |

| | $ | 130 |

| | $ | 11 |

| | $ | 14,703 |

| | $ | 187 |

|

| Europe | 68 |

| | 20 |

| | 9 |

| | 19 |

| | 2 |

| | 4,084 |

| | 25 |

|

| Asia/Pacific | 68 |

| | 25 |

| | 22 |

| | 5 |

| | 1 |

| | 3,924 |

| | 2 |

|

| Latin America and CPF | 101 |

| | 2 |

| | 41 |

| | 10 |

| | 20 |

| | 6,371 |

| | 6 |

|

| Mining | 71 |

| | 12 |

| | 12 |

| | 36 |

| | 4 |

| | 2,372 |

| | 88 |

|

| Total Segments | 646 |

| | 149 |

| | 161 |

| | 200 |

| | 38 |

| | 31,454 |

| | 308 |

|

| Unallocated | 35 |

| | (47 | ) | | 50 |

| | — |

| | — |

| | 2,718 |

| | — |

|

| Timing | (8 | ) | | (13 | ) | | — |

| | 1 |

| | 10 |

| | 16 |

| | — |

|

| Methodology | — |

| | 37 |

| | (42 | ) | | — |

| | — |

| | (225 | ) | | — |

|

Inter-segment Eliminations (1) | — |

| | — |

| | — |

| | — |

| | — |

| | (280 | ) | | — |

|

| Total | $ | 673 |

| | $ | 126 |

| | $ | 169 |

| | $ | 201 |

| | $ | 48 |

| | $ | 33,683 |

| | $ | 308 |

|

| | | | | | | | | | | | | | |

| 2016 | External Revenues | | Profit before income taxes | | Interest Expense | | Depreciation on equipment leased to others | | Provision for credit losses | | Assets at December 31, 2016 | | Capital expenditures |

| North America | $ | 310 |

| | $ | 79 |

| | $ | 70 |

| | $ | 123 |

| | $ | 10 |

| | $ | 14,925 |

| | $ | 281 |

|

| Europe | 68 |

| | 21 |

| | 8 |

| | 21 |

| | 1 |

| | 3,834 |

| | 44 |

|

| Asia/Pacific | 65 |

| | 20 |

| | 21 |

| | 8 |

| | 1 |

| | 3,620 |

| | 4 |

|

| Latin America and CPF | 122 |

| | 31 |

| | 36 |

| | 15 |

| | 17 |

| | 7,270 |

| | 11 |

|

| Mining | 73 |

| | 14 |

| | 11 |

| | 45 |

| | (3 | ) | | 2,734 |

| | 19 |

|

| Total Segments | 638 |

| | 165 |

| | 146 |

| | 212 |

| | 26 |

| | 32,383 |

| | 359 |

|

| Unallocated | 21 |

| | (35 | ) | | 32 |

| | — |

| | — |

| | 1,688 |

| | (3 | ) |

| Timing | (8 | ) | | (7 | ) | | — |

| | 1 |

| | 3 |

| | 27 |

| | — |

|

| Methodology | — |

| | 23 |

| | (27 | ) | | — |

| | — |

| | (220 | ) | | — |

|

Inter-segment Eliminations (1) | — |

| | — |

| | — |

| | — |

| | — |

| | (263 | ) | | — |

|

| Total | $ | 651 |

| | $ | 146 |

| | $ | 151 |

| | $ | 213 |

| | $ | 29 |

| | $ | 33,615 |

| | $ | 356 |

|

| | | | | | | | | | | | | | |

Eliminations are Elimination is primarily related to intercompany loans.loans

.

UNAUDITED

7.Commitments and Contingent Liabilities

Supplemental segment data and reconciliations to consolidated external reporting for the nine months ended September 30 was as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Millions of dollars)

2017 | External Revenues | | Profit before income taxes | | Interest Expense | | Depreciation on equipment leased to others | | Provision for credit losses | | Assets at September 30, 2017 | | Capital expenditures |

| North America | $ | 989 |

| | $ | 262 |

| | $ | 224 |

| | $ | 388 |

| | $ | 25 |

| | $ | 14,703 |

| | $ | 722 |

|

| Europe | 200 |

| | 62 |

| | 27 |

| | 60 |

| | — |

| | 4,084 |

| | 71 |

|

| Asia/Pacific | 197 |

| | 73 |

| | 64 |

| | 19 |

| | (5 | ) | | 3,924 |

| | 5 |

|

| Latin America and CPF | 335 |

| | 48 |

| | 124 |

| | 33 |

| | 56 |

| | 6,371 |

| | 48 |

|

| Mining | 213 |

| | 57 |

| | 37 |

| | 107 |

| | (5 | ) | | 2,372 |

| | 168 |

|

| Total Segments | 1,934 |

| | 502 |

| | 476 |

| | 607 |

| | 71 |

| | 31,454 |

| | 1,014 |

|

| Unallocated | 100 |

| | (128 | ) | | 139 |

| | — |

| | — |

| | 2,718 |

| | 4 |

|

| Timing | (23 | ) | | (20 | ) | | — |

| | 1 |

| | 11 |

| | 16 |

| | — |

|

| Methodology | — |

| | 103 |

| | (116 | ) | | — |

| | — |

| | (225 | ) | | — |

|

Inter-segment Eliminations (1) | — |

| | — |

| | — |

| | — |

| | — |

| | (280 | ) | | — |

|

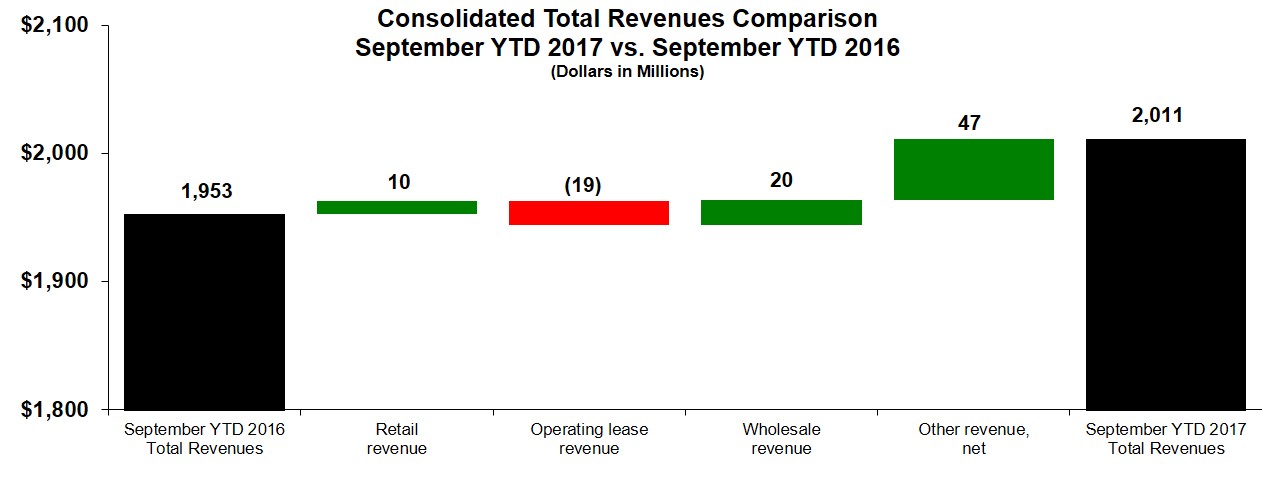

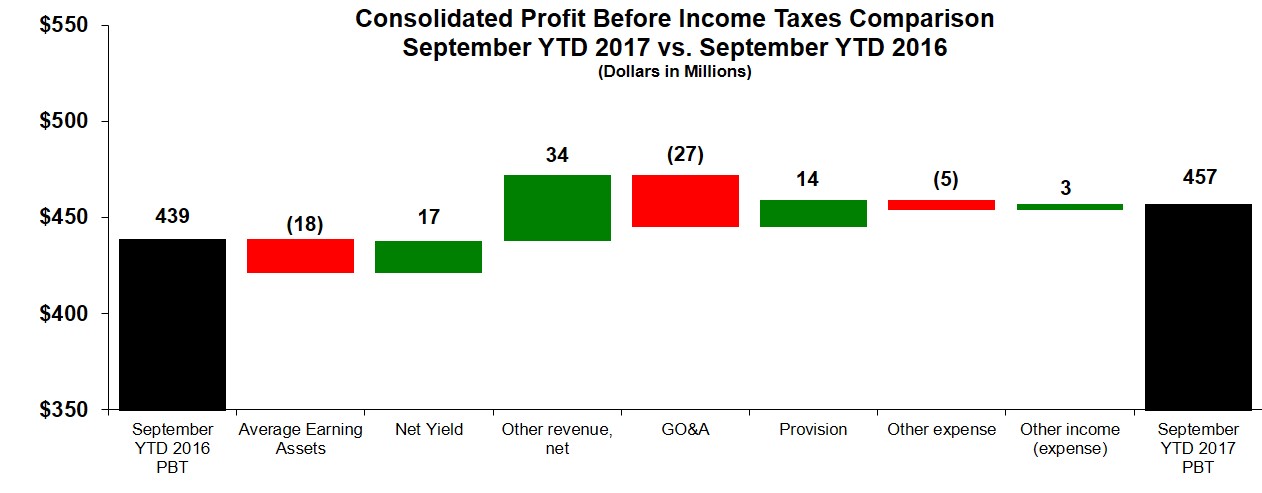

| Total | $ | 2,011 |

| | $ | 457 |

| | $ | 499 |

| | $ | 608 |

| | $ | 82 |

| | $ | 33,683 |

| | $ | 1,018 |

|

| | | | | | | | | | | | | | |

| 2016 | External Revenues | | Profit before income taxes | | Interest Expense | | Depreciation on equipment leased to others | | Provision for credit losses | | Assets at December 31, 2016 | | Capital expenditures |

| North America | $ | 927 |

| | $ | 255 |

| | $ | 216 |

| | $ | 350 |

| | $ | 23 |

| | $ | 14,925 |

| | $ | 933 |

|

| Europe | 202 |

| | 63 |

| | 25 |

| | 62 |

| | 3 |

| | 3,834 |

| | 120 |

|

| Asia/Pacific | 190 |

| | 56 |

| | 62 |

| | 21 |

| | 6 |

| | 3,620 |

| | 73 |

|

| Latin America and CPF | 367 |

| | 76 |

| | 118 |

| | 47 |

| | 59 |

| | 7,270 |

| | 35 |

|

| Mining | 232 |

| | 35 |

| | 35 |

| | 145 |

| | 3 |

| | 2,734 |

| | 105 |

|

| Total Segments | 1,918 |

| | 485 |

| | 456 |

| | 625 |

| | 94 |

| | 32,383 |

| | 1,266 |

|

| Unallocated | 60 |

| | (99 | ) | | 81 |

| | — |

| | 1 |

| | 1,688 |

| | — |

|

| Timing | (25 | ) | | (13 | ) | | — |

| | 2 |

| | 1 |

| | 27 |

| | (1 | ) |

| Methodology | — |

| | 66 |

| | (79 | ) | | — |

| | — |

| | (220 | ) | | — |

|

Inter-segment Eliminations (1) | — |

| | — |

| | — |

| | — |

| | — |

| | (263 | ) | | — |

|

| Total | $ | 1,953 |

| | $ | 439 |

| | $ | 458 |

| | $ | 627 |

| | $ | 96 |

| | $ | 33,615 |

| | $ | 1,265 |

|

| | | | | | | | | | | | | | |

(1) Eliminations are primarily related to intercompany loans.

We provide loancredit guarantees to third-party lenders for financing associated with machinery purchased by customers. These guarantees have varying terms and are secured by the machinery being financed. We also provide residual value guarantees to third-party lendersthird parties for financing and leasing associated with machinery leased to customers. These guarantees have varying terms.Caterpillar machinery. In addition, we participate inprovide standby letters of credit issued to third parties on behalf of our customers. These guarantees and standby letters of credit have varying terms and beneficiaries and are generally secured by customer assets.

No significant loss has been experienced or is anticipated under any of these guarantees. At September 30, 2017March 31, 2022 and December 31, 2016,2021, the related recorded liability was less than $1 million and $1 million, respectively.million. The maximum potential amount of future payments (undiscounted and without reduction for any amounts that may possibly be recovered under recourse or collateralized provisions) we could be required to make under the guarantees was $87$35 million and $43$36 million at September 30, 2017March 31, 2022 and December 31, 2016,2021, respectively.

We provide guarantees to repurchasepurchase certain loans of Caterpillar dealers from a special purposespecial-purpose corporation (SPC) that qualifies as a VIE (see Note 1 for additional information regarding the accounting guidance on the consolidation of VIEs). The purpose of the SPC is to provide short-term working capital loans to Caterpillar dealers. This SPC issues commercial paper and uses the proceeds to fund its loan program. We have a loan purchase agreement with the SPC that obligates us to purchase certain loans that are not paid at maturity. We receive a fee for providing this guarantee, which provides a source of liquidity for the SPC.guarantee. We are the primary beneficiary of the SPC as our guarantees result in us having both the power to direct the activities that most significantly impact the SPC'sSPC’s economic performance and the obligation to absorb losses and therefore we have consolidated the financial statements of the SPC. As of September 30, 2017March 31, 2022 and December 31, 2016,2021, the SPC’s assets of $1.10 billion$839 million and $1.09 billion,$888 million, respectively, were primarily comprised of loans to dealers, which are included in Finance receivables, net in the Consolidated Statements of Financial Position, and the SPC'sSPC’s liabilities of $1.10 billion$838 million and $1.09 billion,$888 million, respectively, were primarily comprised of commercial paper, which is included in Short-term borrowings in the Consolidated Statements of Financial Position. The assets of the SPC are not available to pay our creditors. We may be obligated to perform under the guarantee if the SPC experiences losses. No loss has been experienced or is anticipated under this loan purchase agreement.

| |

8. | Fair Value Measurements |

We are involved in unresolved legal actions that arise in the normal course of business. Although it is not possible to predict with certainty the outcome of our unresolved legal actions, we believe that these unresolved legal actions will neither individually nor in the aggregate have a material adverse effect on our consolidated results of operations, financial position or liquidity. | |

A. | Fair Value Measurements |

8.Fair Value Measurements

A.Fair Value Measurements

The guidance on fair value measurements defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. This guidance also specifies a fair value hierarchy based upon the observability of inputs used in valuation techniques. Observable inputs (highest level) reflect market data obtained from independent sources, while unobservable inputs (lowest level) reflect internally developed market assumptions. In accordance with this guidance, fair value measurements are classified under the following hierarchy:

•Level 1 – Quoted prices for identical instruments in active markets.

•Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs or significant value-drivers are observable in active markets.

•Level 3 – Model-derived valuations in which one or more significant inputs or significant value-drivers are unobservable.