UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2020March 31, 2021

Commission File No. 001-11241

CATERPILLAR FINANCIAL SERVICES CORPORATION

(Exact name of Registrant as specified in its charter)

|

| | | | | | | |

| Delaware | 37-1105865 |

| (State of incorporation) | (IRS Employer I.D. No.) |

| |

| 2120 West End Ave., Nashville, Tennessee | 37203-0001 |

| (Address of principal executive offices) | (Zip Code) |

Registrant'sRegistrant’s telephone number, including area code:(615) 341-1000

|

| | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | | Name of each exchange on which registered |

| Medium-Term Notes, Series H,

3.300% Notes Due 2024

| CAT/24 | | New York Stock Exchange

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ü ]☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [ü ]☒ No [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated”“accelerated filer," "smaller”“smaller reporting company,"” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | | | | |

| Large accelerated filer | [ ]☐ | | Accelerated filer | [ ]☐ |

| Non-accelerated filer | [ü ]

☒ | | Smaller reporting company | [ ]☐ |

| | | Emerging growth company | [ ]☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ]☐ No [ü ]☒

As of AugustMay 5, 2020, one2021, 1 share of common stock of the registrant was outstanding, which is owned by Caterpillar Inc.

The registrant is a wholly owned subsidiary of Caterpillar Inc. and meets the conditions set forth in General Instruction (H)(1)(a) and (b) of Form 10-Q, and is therefore filing this form with the reduced disclosure format.

PART I. FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

In addition to the accompanying unaudited consolidated financial statements for Caterpillar Financial Services Corporation (together with its subsidiaries, "Cat“Cat Financial," "the” “the Company," "we," "us"” “we,” “us” or "our"“our”), we suggest that you read our 20192020 Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) on February 19, 2020.17, 2021. The Company files electronically with the SEC required reports on Form 8-K, Form 10-Q, Form 10-K; registration statements on Form S-3; and other forms or reports as required. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Copies of our annual reportreports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished with the SEC are available free of charge through Caterpillar’s website (www.caterpillar.com/secfilings) as soon as reasonably practicable after filing with the SEC. In addition, the public may obtain more detailed information about our parent company, Caterpillar, by visiting its website (www.caterpillar.com). None of the information contained at any time on our website or Caterpillar’s website is incorporated by reference into this document.

Caterpillar Financial Services Corporation

CONSOLIDATED STATEMENTS OF PROFIT

(Unaudited)

(Dollars in Millions)

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| | 2021 | | 2020 | | | | |

| | | | | | | |

| Revenues: | | | | | | | |

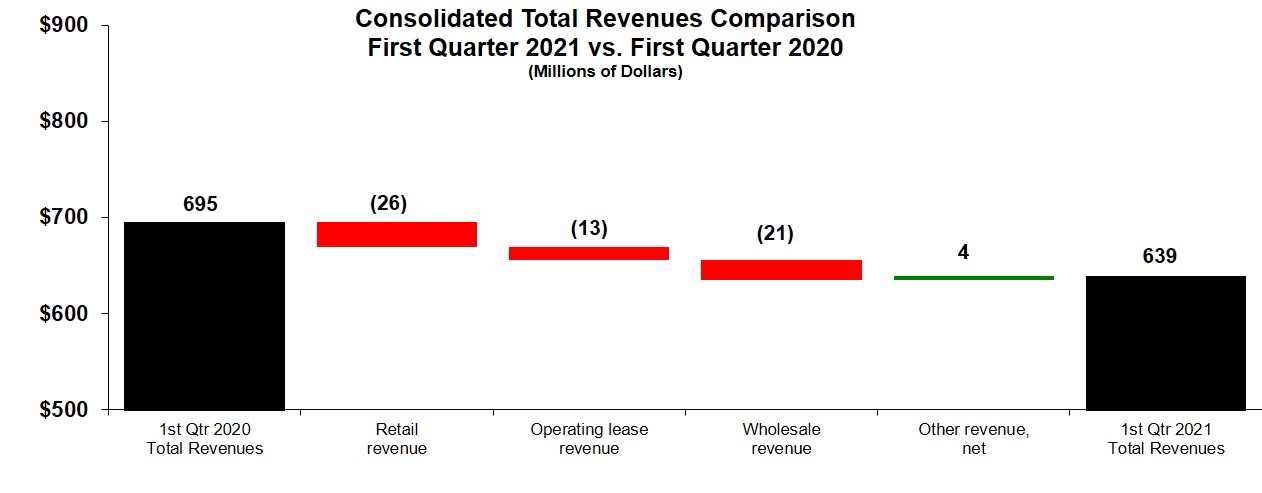

| Retail finance | $ | 303 | | | $ | 329 | | | | | |

| Operating lease | 244 | | | 257 | | | | | |

| Wholesale finance | 78 | | | 99 | | | | | |

| Other, net | 14 | | | 10 | | | | | |

| Total revenues | 639 | | | 695 | | | | | |

| | | | | | | |

| Expenses: | | | | | | | |

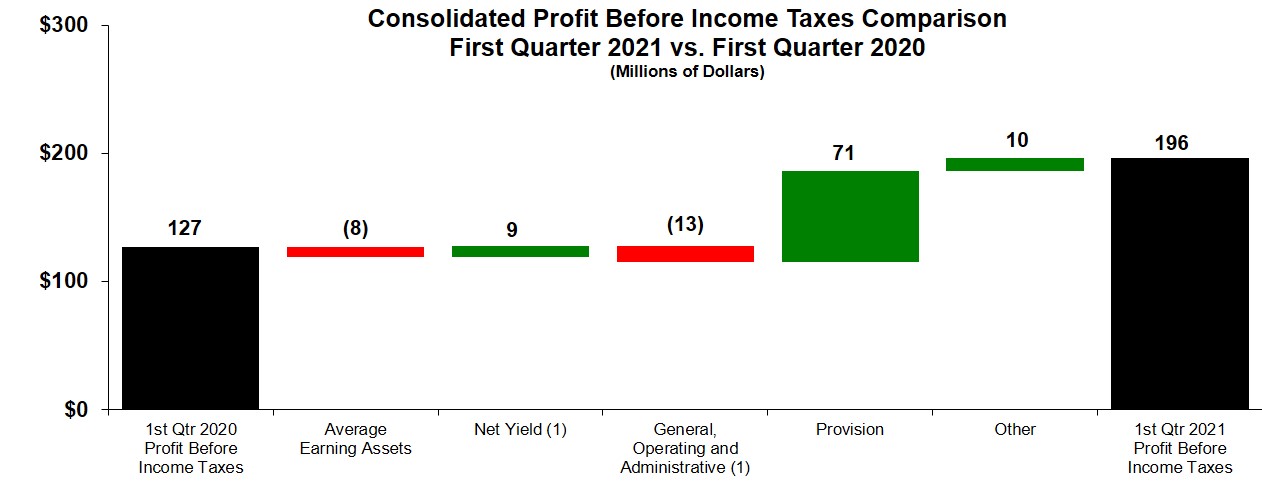

| Interest | 125 | | | 175 | | | | | |

| Depreciation on equipment leased to others | 192 | | | 201 | | | | | |

| General, operating and administrative | 121 | | | 108 | | | | | |

| Provision for credit losses | (10) | | | 61 | | | | | |

| Other | 7 | | | 13 | | | | | |

| Total expenses | 435 | | | 558 | | | | | |

| | | | | | | |

| Other income (expense) | (8) | | | (10) | | | | | |

| | | | | | | |

| Profit before income taxes | 196 | | | 127 | | | | | |

| | | | | | | |

| Provision for income taxes | 53 | | | 33 | | | | | |

| | | | | | | |

| Profit of consolidated companies | 143 | | | 94 | | | | | |

| | | | | | | |

| Less: Profit attributable to noncontrolling interests | 3 | | | 4 | | | | | |

| | | | | | | |

Profit(1) | $ | 140 | | | $ | 90 | | | | | |

| | | | | | | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2020 |

| 2019 | | 2020 | | 2019 |

| | | | | | | | |

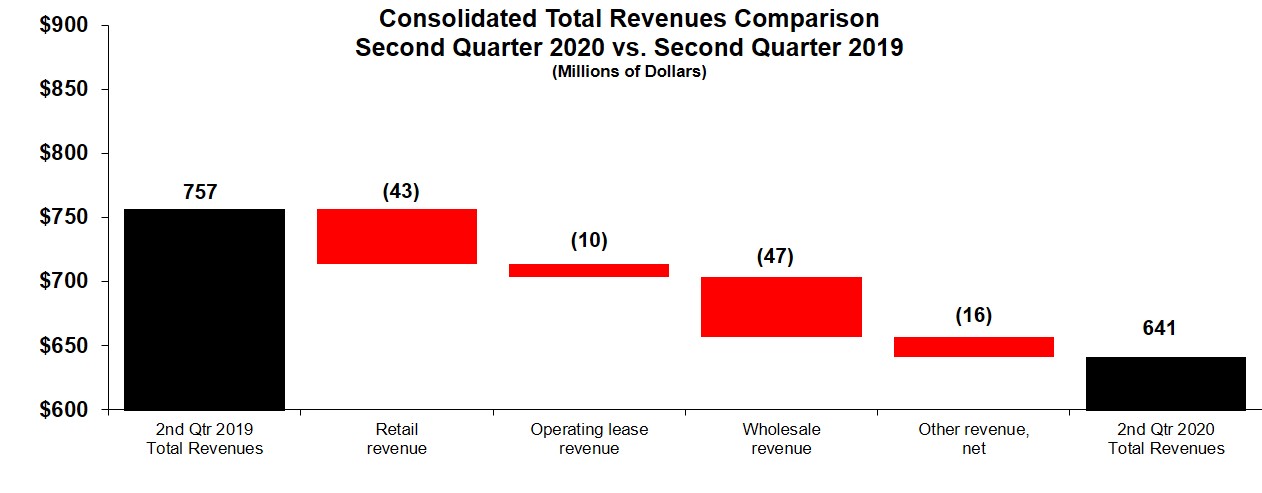

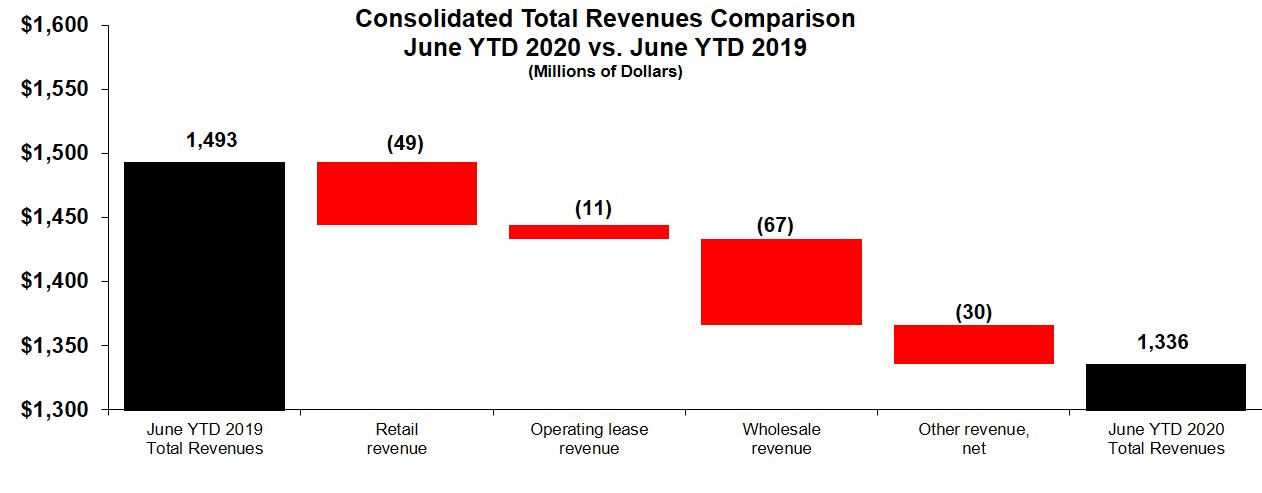

| Revenues: | | | | | | | |

| Retail finance | $ | 307 |

| | $ | 350 |

| | $ | 636 |

| | $ | 685 |

|

| Operating lease | 247 |

| | 257 |

| | 504 |

| | 515 |

|

| Wholesale finance | 84 |

| | 131 |

| | 183 |

| | 250 |

|

| Other, net | 3 |

| | 19 |

| | 13 |

| | 43 |

|

| Total revenues | 641 |

| | 757 |

| | 1,336 |

| | 1,493 |

|

| | | | | | | | |

| Expenses: | |

| | |

| | |

| | |

|

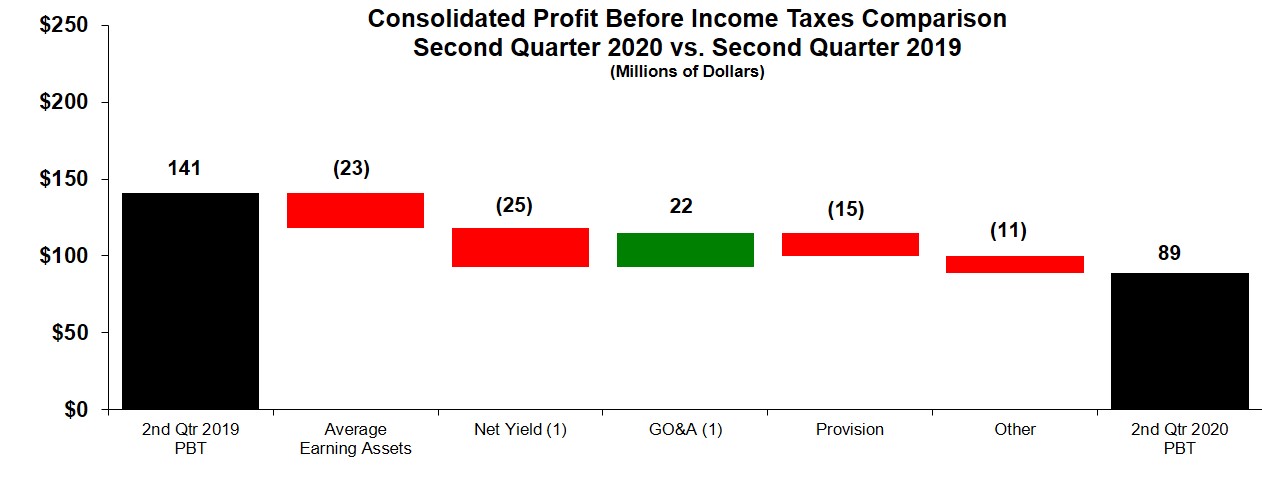

| Interest | 150 |

| | 200 |

| | 325 |

| | 401 |

|

| Depreciation on equipment leased to others | 194 |

| | 204 |

| | 395 |

| | 406 |

|

| General, operating and administrative | 104 |

| | 126 |

| | 212 |

| | 250 |

|

| Provision for credit losses | 86 |

| | 71 |

| | 147 |

| | 124 |

|

| Other | 12 |

| | 9 |

| | 25 |

| | 19 |

|

| Total expenses | 546 |

| | 610 |

| | 1,104 |

| | 1,200 |

|

| | | | | | | | |

| Other income (expense) | (6 | ) | | (6 | ) | | (16 | ) | | (10 | ) |

| | | | | | | | |

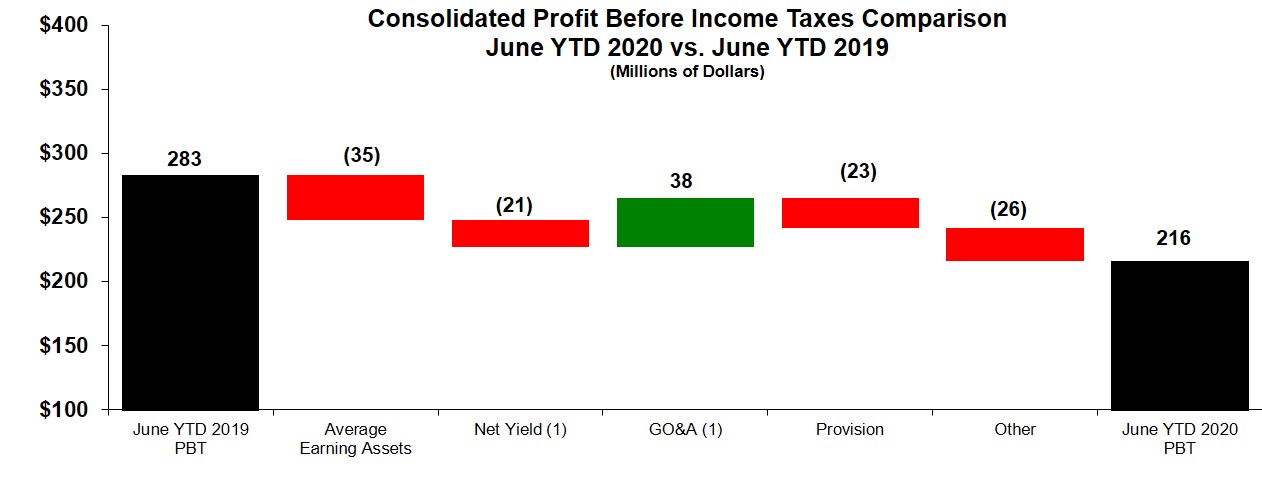

| Profit before income taxes | 89 |

| | 141 |

| | 216 |

| | 283 |

|

| | | | | | | | |

| Provision for income taxes | 25 |

| | 57 |

| | 58 |

| | 95 |

|

| | | | | | | | |

| Profit of consolidated companies | 64 |

| | 84 |

| | 158 |

| | 188 |

|

| | | | | | | | |

| Less: Profit attributable to noncontrolling interests | 5 |

| | 5 |

| | 9 |

| | 11 |

|

| | | | | | | | |

Profit(1) | $ | 59 |

| | $ | 79 |

| | $ | 149 |

| | $ | 177 |

|

| | | | | | | | |

(1) Profit attributable to Caterpillar Financial Services Corporation.

See Notes to Consolidated Financial Statements (Unaudited).

Caterpillar Financial Services Corporation

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(Dollars in Millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2020 |

| 2019 | | 2020 | | 2019 |

| | | | | | | | |

| Profit of consolidated companies | $ | 64 |

| | $ | 84 |

| | $ | 158 |

| | $ | 188 |

|

| | | | | | | | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

Foreign currency translation, net of tax (expense)/benefit of:

2020 $11 three months, $(1) six months; 2019 $7 three months, $3 six months | 125 |

| | 18 |

| | (182 | ) | | 33 |

|

| Derivative financial instruments: | | | | | | | |

Gains (losses) deferred, net of tax (expense)/benefit of:

2020 $9 three months, $(10) six months; 2019 $5 three months, $6 six months | (35 | ) | | (19 | ) | | 32 |

| | (22 | ) |

(Gains) losses reclassified to earnings, net of tax expense/(benefit) of:

2020 $(11) three months, $5 six months; 2019 $- three months, $3 six months | 42 |

| | (3 | ) | | (19 | ) | | (14 | ) |

| Total Other comprehensive income (loss), net of tax | 132 |

| | (4 | ) | | (169 | ) | | (3 | ) |

| |

|

| | | | | | |

| Comprehensive income (loss) | 196 |

| | 80 |

| | (11 | ) | | 185 |

|

| | | | | | | | |

Less: Comprehensive income (loss) attributable to the noncontrolling interests | 4 |

| | 3 |

| | 7 |

| | 11 |

|

| | | | | | | | |

Comprehensive income (loss) attributable to Caterpillar Financial Services Corporation | $ | 192 |

| | $ | 77 |

| | $ | (18 | ) | | $ | 174 |

|

| | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| | 2021 | | 2020 | | | | |

| | | | | | | |

| Profit of consolidated companies | $ | 143 | | | $ | 94 | | | | | |

| | | | | | | |

| Other comprehensive income (loss), net of tax (Note 5): | | | | | | | |

| Foreign currency translation | (121) | | | (307) | | | | | |

| Derivative financial instruments | 11 | | | 6 | | | | | |

| Total Other comprehensive income (loss), net of tax | (110) | | | (301) | | | | | |

| | | | | | | |

| Comprehensive income (loss) | 33 | | | (207) | | | | | |

| | | | | | | |

| Less: Comprehensive income (loss) attributable to the noncontrolling interests | 1 | | | 3 | | | | | |

| | | | | | | |

| Comprehensive income (loss) attributable to Caterpillar Financial Services Corporation | $ | 32 | | | $ | (210) | | | | | |

| | | | | | | |

See Notes to Consolidated Financial Statements (Unaudited).

Caterpillar Financial Services Corporation

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited)

(Dollars in Millions, except share data)

| | | | June 30,

2020 | | December 31,

2019 | | March 31,

2021 | | December 31,

2020 |

| Assets: | | | | Assets: | | | |

| Cash and cash equivalents | $ | 630 |

| | $ | 690 |

| Cash and cash equivalents | $ | 735 | | | $ | 411 | |

| Finance receivables, net of Allowance for credit losses of $515 and $424 | 26,341 |

| | 27,832 |

| |

| Finance receivables, net of Allowance for credit losses of $441 and $479 | | Finance receivables, net of Allowance for credit losses of $441 and $479 | 26,500 | | | 26,575 | |

| Notes receivable from Caterpillar | 339 |

| | 296 |

| Notes receivable from Caterpillar | 331 | | | 356 | |

| Equipment on operating leases, net | 3,355 |

| | 3,583 |

| Equipment on operating leases, net | 3,237 | | | 3,366 | |

| | Other assets | 1,408 |

| | 1,292 |

| Other assets | 1,280 | | | 1,283 | |

| Total assets | $ | 32,073 |

| | $ | 33,693 |

| Total assets | $ | 32,083 | | | $ | 31,991 | |

| | | | | | | | |

| Liabilities and shareholder’s equity: | |

| | |

| Liabilities and shareholder’s equity: | | | |

| Payable to dealers and others | $ | 116 |

| | $ | 135 |

| Payable to dealers and others | $ | 148 | | | $ | 144 | |

| Payable to Caterpillar - borrowings and other | 179 |

| | 693 |

| Payable to Caterpillar - borrowings and other | 96 | | | 1,087 | |

| Accrued expenses | 180 |

| | 241 |

| Accrued expenses | 259 | | | 400 | |

| | Short-term borrowings | 4,301 |

| | 5,161 |

| Short-term borrowings | 3,625 | | | 2,005 | |

| Current maturities of long-term debt | 6,006 |

| | 6,194 |

| Current maturities of long-term debt | 6,898 | | | 7,729 | |

| Long-term debt | 17,178 |

| | 17,140 |

| Long-term debt | 16,605 | | | 16,250 | |

| Other liabilities | 901 |

| | 893 |

| Other liabilities | 928 | | | 885 | |

| Total liabilities | 28,861 |

| | 30,457 |

| Total liabilities | 28,559 | | | 28,500 | |

| | | | | | | | |

| Commitments and contingent liabilities (Note 7) |

|

| |

|

| Commitments and contingent liabilities (Note 7) | 0 | | 0 |

| | | | | |

| Common stock - $1 par value | | | |

| Common stock - $1 par value | | |

| Authorized: 2,000 shares; Issued and | |

| | |

| Authorized: 2,000 shares; Issued and | | | |

| outstanding: one share (at paid-in amount) | 745 |

| | 745 |

| |

| outstanding: 1 share (at paid-in amount) | | outstanding: 1 share (at paid-in amount) | 745 | | | 745 | |

| Additional paid-in capital | 2 |

| | 2 |

| Additional paid-in capital | 2 | | | 2 | |

| Retained earnings | 3,298 |

| | 3,162 |

| Retained earnings | 3,282 | | | 3,142 | |

| Accumulated other comprehensive income (loss) | (1,012 | ) | | (845 | ) | Accumulated other comprehensive income (loss) | (703) | | | (595) | |

| Noncontrolling interests | 179 |

| | 172 |

| Noncontrolling interests | 198 | | | 197 | |

| Total shareholder’s equity | 3,212 |

| | 3,236 |

| Total shareholder’s equity | 3,524 | | | 3,491 | |

| | | | | | | | |

| Total liabilities and shareholder’s equity | $ | 32,073 |

| | $ | 33,693 |

| Total liabilities and shareholder’s equity | $ | 32,083 | | | $ | 31,991 | |

| | | | | | | | |

See Notes to Consolidated Financial Statements (Unaudited).

Caterpillar Financial Services Corporation

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDER'SSHAREHOLDER’S EQUITY

(Unaudited)

| | Three Months Ended March 31, 2020 | | Three Months Ended March 31, 2020 | Common

stock | | Additional

paid-in

capital | | Retained

earnings | | Accumulated

other

comprehensive

income (loss) | | Noncontrolling

interests | | Total |

| Balance at December 31, 2019 | | Balance at December 31, 2019 | $ | 745 | | | $ | 2 | | | $ | 3,162 | | | $ | (845) | | | $ | 172 | | | $ | 3,236 | |

| Profit of consolidated companies | | Profit of consolidated companies | | | | | 90 | | | | | 4 | | | 94 | |

| | Three Months Ended June 30, 2019 | Common stock | | Additional paid-in capital | | Retained earnings | | Accumulated other comprehensive income (loss) | | Noncontrolling interests | | Total | |

| Balance at March 31, 2019 | $ | 745 |

| | $ | 2 |

| | $ | 2,875 |

| | $ | (829 | ) | | $ | 161 |

| | $ | 2,954 |

| |

| Profit of consolidated companies | | | | | 79 |

| | | | 5 |

| | 84 |

| |

| Foreign currency translation, net of tax | | | | | | | 20 |

| | (2 | ) | | 18 |

| |

| Derivative financial instruments, net of tax | | | | | | | (22 | ) | | | | (22 | ) | |

| Balance at June 30, 2019 | $ | 745 |

| | $ | 2 |

| | $ | 2,954 |

| | $ | (831 | ) | | $ | 164 |

| | $ | 3,034 |

| |

| | | | | | | | | | | | | |

| Three Months Ended June 30, 2020 | | | | | | | | | | | | |

| Balance at March 31, 2020 | $ | 745 |

| | $ | 2 |

| | $ | 3,239 |

| | $ | (1,145 | ) | | $ | 175 |

| | $ | 3,016 |

| |

| Profit of consolidated companies | | | | | 59 |

| | | | 5 |

| | 64 |

| |

| Foreign currency translation, net of tax | | | | | | | 126 |

| | (1 | ) | | 125 |

| |

| Derivative financial instruments, net of tax | | | | | | | 7 |

| | | | 7 |

| |

| Balance at June 30, 2020 | $ | 745 |

| | $ | 2 |

| | $ | 3,298 |

| | $ | (1,012 | ) | | $ | 179 |

| | $ | 3,212 |

| |

| | | | | | | | | | | | | |

| Six Months Ended June 30, 2019 | | | | | | | | | | | | |

| Balance at December 31, 2018 | $ | 745 |

| | $ | 2 |

| | $ | 2,874 |

| | $ | (925 | ) | | $ | 153 |

| | $ | 2,849 |

| |

| Profit of consolidated companies | |

| | |

| | 177 |

| | |

| | 11 |

| | 188 |

| |

| Foreign currency translation, net of tax | |

| | |

| | |

| | 33 |

| | — |

| | 33 |

| Foreign currency translation, net of tax | | (306) | | | (1) | | | (307) | |

| Derivative financial instruments, net of tax | |

| | |

| | |

| | (36 | ) | | |

| | (36 | ) | Derivative financial instruments, net of tax | | 6 | | | 6 | |

Adjustment to adopt new accounting guidance(1) | | | | | (97 | ) | | 97 |

| | | | — |

| Adjustment to adopt new accounting guidance(1) | | (13) | | | (13) | |

| Balance at June 30, 2019 | $ | 745 |

| | $ | 2 |

| | $ | 2,954 |

| | $ | (831 | ) | | $ | 164 |

| | $ | 3,034 |

| |

| | | | | | | | | | | | | |

| Six Months Ended June 30, 2020 | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2019 | $ | 745 |

| | $ | 2 |

| | $ | 3,162 |

| | $ | (845 | ) | | $ | 172 |

| | $ | 3,236 |

| |

| Balance at March 31, 2020 | | Balance at March 31, 2020 | $ | 745 | | | $ | 2 | | | $ | 3,239 | | | $ | (1,145) | | | $ | 175 | | | $ | 3,016 | |

| | Three Months Ended March 31, 2021 | | Three Months Ended March 31, 2021 | |

| Balance at December 31, 2020 | | Balance at December 31, 2020 | $ | 745 | | | $ | 2 | | | $ | 3,142 | | | $ | (595) | | | $ | 197 | | | $ | 3,491 | |

| Profit of consolidated companies | |

| | |

| | 149 |

| | |

| | 9 |

| | 158 |

| Profit of consolidated companies | | | | | 140 | | | | | 3 | | | 143 | |

| | Foreign currency translation, net of tax | |

| | |

| | |

| | (180 | ) | | (2 | ) | | (182 | ) | Foreign currency translation, net of tax | | (119) | | | (2) | | | (121) | |

| Derivative financial instruments, net of tax | |

| | |

| | |

| | 13 |

| | |

| | 13 |

| Derivative financial instruments, net of tax | | 11 | | | 11 | |

Adjustment to adopt new accounting guidance(2) | | | | | (13 | ) | |

|

| | | | (13 | ) | |

| Balance at June 30, 2020 | $ | 745 |

| | $ | 2 |

| | $ | 3,298 |

| | $ | (1,012 | ) | | $ | 179 |

| | $ | 3,212 |

| |

| | | | | | | | | | | | | |

| | Balance at March 31, 2021 | | Balance at March 31, 2021 | $ | 745 | | | $ | 2 | | | $ | 3,282 | | | $ | (703) | | | $ | 198 | | | $ | 3,524 | |

| |

(1) Adjustment to adopt new accounting guidance related to reclassification of certain tax effects from accumulated other comprehensive income (loss).

(2) Adjustment to adopt new accounting guidance related to credit losses (See Note 2).losses.

See Notes to Consolidated Financial Statements (Unaudited).

Caterpillar Financial Services Corporation

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollars in Millions)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| | 2021 | | 2020 |

| Cash flows from operating activities: | | | |

| Profit of consolidated companies | $ | 143 | | | $ | 94 | |

| Adjustments for non-cash items: | | | |

| Depreciation and amortization | 195 | | | 205 | |

| Accretion of Caterpillar purchased receivable revenue | (74) | | | (91) | |

| Provision for credit losses | (10) | | | 61 | |

| | | |

| Other, net | 23 | | | 150 | |

| Changes in assets and liabilities: | | | |

| Other assets | (12) | | | (42) | |

| Payable to dealers and others | 13 | | | 35 | |

| Accrued expenses | 28 | | | (17) | |

| Other payables with Caterpillar | 6 | | | 9 | |

| Other liabilities | 23 | | | (3) | |

| Net cash provided by operating activities | 335 | | | 401 | |

| | | |

| Cash flows from investing activities: | | | |

| Expenditures for equipment on operating leases | (224) | | | (246) | |

| Capital expenditures - excluding equipment on operating leases | (4) | | | (1) | |

| Proceeds from disposals of equipment | 244 | | | 155 | |

| Additions to finance receivables | (2,867) | | | (3,213) | |

| Collections of finance receivables | 3,062 | | | 3,422 | |

| Net changes in Caterpillar purchased receivables | (411) | | | 376 | |

| Proceeds from sales of receivables | 5 | | | 31 | |

| Net change in variable lending to Caterpillar | 19 | | | 0 | |

| Additions to other notes receivable with Caterpillar | (23) | | | 0 | |

| Collections on other notes receivable with Caterpillar | 28 | | | 6 | |

| | | |

| Settlements of undesignated derivatives | (51) | | | 35 | |

| Other, net | 1 | | | 0 | |

| Net cash provided by (used for) investing activities | (221) | | | 565 | |

| | | |

| Cash flows from financing activities: | | | |

| Net change in variable lending from Caterpillar | (1,000) | | | (596) | |

| | | |

| | | |

| Proceeds from debt issued (original maturities greater than three months) | 1,779 | | | 2,126 | |

| Payments on debt issued (original maturities greater than three months) | (2,243) | | | (2,460) | |

| Short-term borrowings, net (original maturities three months or less) | 1,669 | | | (35) | |

| | | |

| Net cash provided by (used for) financing activities | 205 | | | (965) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 0 | | | (22) | |

| | | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 319 | | | (21) | |

Cash, cash equivalents and restricted cash at beginning of year(1) | 425 | | | 695 | |

Cash, cash equivalents and restricted cash at end of period(1) | $ | 744 | | | $ | 674 | |

| | | |

|

| | | | | | | |

| | Six Months Ended

June 30, |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Profit of consolidated companies | $ | 158 |

| | $ | 188 |

|

| Adjustments for non-cash items: | |

| | |

|

| Depreciation and amortization | 402 |

| | 413 |

|

| Amortization of receivables purchase discount | (166 | ) | | (231 | ) |

| Provision for credit losses | 147 |

| | 124 |

|

| Other, net | 139 |

| | 74 |

|

| Changes in assets and liabilities: | |

| | |

|

| Other assets | (20 | ) | | 56 |

|

| Payable to dealers and others | 11 |

| | 294 |

|

| Accrued expenses | (53 | ) | | (38 | ) |

| Other payables with Caterpillar | (20 | ) | | (4 | ) |

| Other liabilities | (15 | ) | | 31 |

|

| Net cash provided by operating activities | 583 |

| | 907 |

|

| | | | |

| Cash flows from investing activities: | |

| | |

|

| Expenditures for equipment on operating leases | (496 | ) | | (694 | ) |

| Capital expenditures - excluding equipment on operating leases | (7 | ) | | (11 | ) |

| Proceeds from disposals of equipment | 282 |

| | 354 |

|

| Additions to finance receivables | (7,352 | ) | | (7,027 | ) |

| Collections of finance receivables | 7,444 |

| | 6,543 |

|

| Net changes in Caterpillar purchased receivables | 920 |

| | 15 |

|

| Proceeds from sales of receivables | 31 |

| | 119 |

|

| Net change in variable lending to Caterpillar | (30 | ) | | 69 |

|

| Additions to other notes receivable with Caterpillar | (25 | ) | | (80 | ) |

| Collections on other notes receivable with Caterpillar | 12 |

| | 33 |

|

| Settlements of undesignated derivatives | 22 |

| | (31 | ) |

| Net cash provided by (used for) investing activities | 801 |

| | (710 | ) |

| | | | |

| Cash flows from financing activities: | |

| | |

|

| Net change in variable lending from Caterpillar | (497 | ) | | (118 | ) |

| Payments on borrowings with Caterpillar | — |

| | (93 | ) |

| Proceeds from debt issued (original maturities greater than three months) | 4,168 |

| | 5,340 |

|

| Payments on debt issued (original maturities greater than three months) | (4,617 | ) | | (4,897 | ) |

| Short-term borrowings, net (original maturities three months or less) | (485 | ) | | (436 | ) |

| Net cash provided by (used for) financing activities | (1,431 | ) | | (204 | ) |

| | | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (14 | ) | | (2 | ) |

| | | | |

| Increase (decrease) in cash, cash equivalents and restricted cash | (61 | ) | | (9 | ) |

Cash, cash equivalents and restricted cash at beginning of year(1) | 695 |

| | 773 |

|

Cash, cash equivalents and restricted cash at end of period(1) | $ | 634 |

| | $ | 764 |

|

| | | | |

(1) As of June 30, 2020March 31, 2021 and December 31, 2019,2020, restricted cash, which is included in Other assets in the Consolidated Statements of Financial Position, was $4$9 million and $5$14 million, respectively. Restricted cash primarily includes cash related to syndication activities.

See Notes to Consolidated Financial Statements (Unaudited).

Notes to Consolidated Financial Statements

(Unaudited)

| |

1. | Summary of Significant Accounting Policies |

1.Basis of Presentation

In the opinion of management, the accompanying unaudited consolidated financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated profit for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, (b) the consolidated comprehensive income for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, (c) the consolidated financial position at June 30, 2020March 31, 2021 and December 31, 2019,2020, (d) the consolidated changes in shareholder'sshareholder’s equity for the three and six months ended June 30,March 31, 2021 and 2020 and 2019 and (e) the consolidated cash flows for the sixthree months ended June 30, 2020March 31, 2021 and 2019.2020. The preparation of financial statements, in conformity with generally accepted accounting principles and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC), requires management to make estimates and assumptions that affect the reported amounts. Significant estimates include residual values for leased assets, allowance for credit losses and income taxes. The continued impact of the COVID-19 pandemic could cause our actualActual results tomay differ materially from the estimates and assumptions used in preparation of the financial statements. Changes in estimates are recorded in the period that the events or circumstances giving rise to such changes occur.these estimates.

Interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with the audited consolidated financial statements and notes thereto included in our annual report on Form 10-K for the year ended December 31, 2019 (20192020 (2020 Form 10-K). The December 31, 20192020 financial position data included herein was derived from the audited consolidated financial statements included in the 20192020 Form 10-K but does not include all disclosures required by generally accepted accounting principles. Certain amounts for prior periods have been reclassified to conform to the current period financial statement presentation.

We consolidate all variable interest entities (VIEs) where we are the primary beneficiary. For VIEs, we assess whether we are the primary beneficiary as prescribed by the accounting guidance on the consolidation of VIEs. The primary beneficiary of a VIE is the party that has both the power to direct the activities that most significantly impact the entity’s economic performance and the obligation to absorb losses or the right to receive benefits that could potentially be significant to the entity. Please refer to Note 7 for more information.

We have customers and dealers that are VIEs of which we are not the primary beneficiary. Although we have provided financial support to these entities and therefore have a variable interest, we do not have the power to direct the activities that most significantly impact their economic performance. Our maximum exposure to loss from our involvement with these VIEs is limited to the credit risk inherently present in the financial support that we have provided. Credit risk was evaluated and reflected in our financial statements as part of our overall portfolio of finance receivables and related allowance for credit losses.

| |

B. | Accounting Policy Updates |

For a discussion of our significant accounting policies, see Note 1 in our 2019 Form 10-K. Significant accounting policies that have been revised since our 2019 Form 10-K are shown below. These accounting policy changes were effective January 1, 2020 with the adoption of the new credit loss accounting guidance discussed in Note 2. Prior period comparative information has not been recast and continues to be reported under the accounting guidance in effect for those periods.New Accounting Pronouncements

Finance Receivables

Finance receivables are generally classified as held for investment and recorded at amortized cost given that we have the intent and ability to hold them for the foreseeable future. Amortized cost is the principal balance outstanding plus accrued interest less write-downs, net of unamortized purchase discounts and deferred fees and costs.

Allowance for Credit Losses

The allowance for credit losses is management’s estimate of expected losses over the life of our finance receivable portfolio calculated using loss forecast models that take into consideration historical credit loss experience, current economic conditions and forecasts and scenarios that capture country and industry-specific economic factors. In addition, qualitative factors not able to be fully captured in our loss forecast models, including borrower-specific and company-specific macro-economic factors, are considered in the evaluation of the adequacy of our allowance for credit losses. These qualitative factors are subjective and require a degree of management judgment.

The allowance for credit losses is measured on a collective (pool) basis when similar risk characteristics exist and on an individual basis when it is determined that similar risk characteristics do not exist. Finance receivables are identified for individual evaluation based on past-due status and information available about the customer, such as financial statements, news reports and published credit ratings, as well as general information regarding industry trends and the economic environment in which our customers operate. The allowance for credit losses attributable to finance receivables that are individually evaluated is based on the present value of expected future cash flows discounted at the receivables' effective interest rate, the fair value of the collateral for collateral-dependent receivables or the observable market price of the receivable. In determining collateral value, we estimate the current fair market value of the collateral less selling costs. We also consider credit enhancements such as additional collateral and contractual third-party guarantees. See Note 3 for a description of our portfolio segments and allowance methodologies.

Receivable balances, including accrued interest, are written off against the allowance for credit losses when, in the judgment of management, they are considered uncollectible (generally upon repossession of the collateral). The amount of the write-off is determined by comparing the fair value of the collateral, less cost to sell, to the amortized cost. Subsequent recoveries, if any, are credited to the allowance for credit losses when received.

| |

2. | New Accounting Pronouncements |

| |

A. | Adoption of New Accounting Standards |

A.Adoption of New Accounting Standards

Credit losses (Accounting

Reference rate reform (Accounting Standards Update (ASU) 2016-13)2020-04) – In June 2016,March 2020, the Financial Accounting Standards Board (FASB) issued new accounting guidance to introduce a new model for recognizing credit losses on financial instruments based on an estimate of current expected credit losses. The new guidance applies to loans, accounts receivable, trade receivables, other financial assets measured at amortized cost, loan commitments and other off-balance sheet credit exposures. The new guidance also applies to debt securities and other financial assets measured at fair value through other comprehensive income. The new guidance was effective January 1, 2020. We applied the new guidance using a modified retrospective approach through a cumulative effect adjustment to retained earnings as of January 1, 2020. We have not recast prior period comparative information, which we continue to report under the accounting guidance in effect for those periods.

The most significant effects of adoption relate to the change in methodology for estimating our Allowance for credit losses from an incurred loss model to a current expected credit loss model. We elected to present accrued interest receivable related to our finance receivables in Finance receivables, net. In prior period comparative information, accrued interest receivable continues to be reported in Other assets. Our adoption of the new guidance did not have a material impact on our financial statements.

The cumulative effect of initially applying the new credit loss guidance to our consolidated financial statements on January 1, 2020 was as follows:

|

| | | | | | | | | | | |

Consolidated Statement of Financial Position (Millions of dollars) | Balance as of

December 31, 2019 | | Cumulative Impact

from Adopting New

Credit Loss Standard | | Balance as of

January 1, 2020 |

| Assets: | | | | | |

| Finance receivables, net | $ | 27,832 |

| | $ | 42 |

| | $ | 27,874 |

|

| Other assets | $ | 1,292 |

| | $ | (53 | ) | | $ | 1,239 |

|

| | | | | |

|

| Liabilities: | | | | |

|

| Other liabilities | $ | 893 |

| | $ | 2 |

| | $ | 895 |

|

| | | | | |

|

| Shareholder's equity | | | | |

|

| Retained earnings | $ | 3,162 |

| | $ | (13 | ) | | $ | 3,149 |

|

| | | | | | |

See Note 3 for additional information.

We adopted the following ASUs effective January 1, 2020, none of which had a material impact on our financial statements:

|

| |

ASU | Description |

2018-13 | Fair value measurement |

2018-15 | Internal-use software |

2018-19 | Codification improvements - Credit losses |

2019-04 | Codification improvements - Credit losses, Derivatives & hedging, and Financial instruments |

2019-05 | Financial instruments - Credit losses |

2019-11 | Codification improvements - Credit losses |

2019-12 | Simplifying accounting for income taxes |

2020-02 | Financial instruments - Credit losses |

2020-03 | Codification improvements - Financial instruments |

| |

B. | Accounting Standards Issued But Not Yet Adopted |

Reference rate reform (ASU 2020-04) – In March 2020, the FASB issued accounting guidance to ease the potential burden in accounting for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance is optional and may be elected over time as reference rate reform activities occur between March 12, 2020 through December 31, 2022. In January 2021, we elected to adopt optional expedients impacting our derivative instruments. We are evaluatingcontinue to evaluate the impact of reference rate reform on our other contracts and assessingassess the impacts of adopting this guidance on our financial statements.

We adopted the following ASUs effective January 1, 2021, none of which had a material impact on our financial statements:

| | | | | |

| ASU | Description |

| |

| 2020-08 | Codification improvements – Receivables – Nonrefundable fees and other costs |

| 2021-01 | Reference rate reform – Scope |

B.Accounting Standards Issued But Not Yet Adopted

We consider the applicability and impact of all ASUs. We assessed the ASUs not listed above and determined that they either were not applicable or were not expected to have a material impact on our financial statements.

Effective January 1, 2020, we implemented the new credit loss guidance using a modified retrospective approach. Prior period comparative information has not been recast and continues to be reported under the accounting guidance in effect for those periods. See Note 2 for additional information.

3.Finance Receivables

A summary of finance receivables included in the Consolidated Statements of Financial Position was as follows:

| | | | | | | | | | | | | | |

| (Millions of dollars) | | March 31,

2021 | | December 31,

2020 |

Retail loans, net(1) | | $ | 14,698 | | | $ | 15,037 | |

| Retail leases, net | | 7,734 | | | 7,812 | |

| Caterpillar purchased receivables, net | | 4,065 | | | 3,646 | |

Wholesale loans, net(1) | | 423 | | | 533 | |

| Wholesale leases, net | | 21 | | | 26 | |

| Total finance receivables | | 26,941 | | | 27,054 | |

| Less: Allowance for credit losses | | (441) | | | (479) | |

| Total finance receivables, net | | $ | 26,500 | | | $ | 26,575 | |

| | | | |

|

| | | | | | | | |

| (Millions of dollars) | | June 30,

2020 | | December 31,

2019 |

Retail loans, net(1) | | $ | 15,063 |

| | $ | 15,424 |

|

| Retail leases, net | | 7,466 |

| | 7,660 |

|

| Caterpillar purchased receivables, net | | 3,514 |

| | 4,448 |

|

Wholesale loans, net(1) | | 773 |

| | 664 |

|

| Wholesale leases, net | | 40 |

| | 60 |

|

| Total finance receivables | | 26,856 |

| | 28,256 |

|

| Less: Allowance for credit losses | | (515 | ) | | (424 | ) |

| Total finance receivables, net | | $ | 26,341 |

|

| $ | 27,832 |

|

| | | | | |

(1) Includes failed sale leasebacks.

Finance leases

Revenues from finance leases were $119$122 million and $135$125 million for the three months ended June 30,March 31, 2021 and 2020, and 2019, respectively, and $244 million and $253 million for the six months ended June 30, 2020 and 2019, respectively, and are included in retail and wholesale finance revenue in the Consolidated Statements of Profit. The residual values for leases classified as finance leases are included in Finance receivables, net in the Consolidated Statements of Financial Position. For finance leases, residualResidual value adjustments are recognized through a reduction of finance revenue over the remaining lease term.

Allowance for credit losses

Portfolio segments

A portfolio segment is the level at which we develop a systematic methodology for determining our allowance for credit losses. Our portfolio segments and related methods for estimating expected credit losses are as follows:

Customer

We provide loans and finance leases to end-user customers primarily for the purpose of financing new and used Caterpillar machinery, engines and equipment for commercial use, the majority of which operate in construction-related industries. We also provide financing for vehicles, power generation facilities and marine vessels that, in most cases, incorporate Caterpillar products. The average original term of our customer finance receivable portfolio was approximately 48 months with an average remaining term of approximately 2326 months as of June 30, 2020.March 31, 2021.

We typically maintain a security interest in financed equipment and we require physical damage insurance coverage on the financed equipment, both of which provide us with certain rights and protections. If our collection efforts fail to bring a defaulted account current, we generally can repossess the financed equipment, after satisfying local legal requirements, and sell it within the Caterpillar dealer network or through third-party auctions.

We estimate the allowance for credit losses related to our customer finance receivables based on loss forecast models utilizing probabilities of default and our estimated loss given default based on past loss experience adjusted for current conditions and reasonable and supportable forecasts capturing country and industry-specific macro-economiceconomic factors.

As of June 30, 2020,During the three months ended March 31, 2021, our forecasts for the markets in which we operate continued to reflect a declinereflected an overall rebound in economic conditions, resulting from a contracting economy, elevated unemployment rates and an increase in the level and trend of delinquencieswhich had deteriorated due to the COVID-19 pandemic.pandemic, resulting from a growing economy, improved unemployment rates and a decrease in delinquencies. We believe the economic forecasts employed represent reasonable and supportable forecasts, followed by a reversion to long-term trends.

Dealer

We provide financing to Caterpillar dealers in the form of wholesale financing plans. Our wholesale financing plans provide assistance to dealers by financing their mostly new Caterpillar equipment inventory and rental fleets on a secured and are generally secured by the financed equipment.unsecured basis. In addition, we provide a variety of secured and unsecured loans to Caterpillar dealers for working capital.dealers.

We estimate the allowance for credit losses for dealer finance receivables based on historical loss rates with consideration of current economic conditions and reasonable and supportable forecasts.

Although forecasts continued to indicate a decline in economic conditions,In general, our Dealer portfolio segment has not historically experienced increasedlarge increases or decreases in credit losses during priorbased on changes in economic downturnsconditions due to our close working relationships with the dealers and their financial strength. Therefore, we made no adjustments to historical loss rates were made during the three and six months ended June 30, 2020.March 31, 2021.

Caterpillar Purchased Receivables

We purchase receivables from Caterpillar, primarily related to the sale of equipment and parts to dealers. Caterpillar purchased receivables are non-interest-bearing short-term trade receivables that are purchased at a discount.

We estimate the allowance for credit losses for Caterpillar purchased receivables based on historical loss rates with consideration of current economic conditions and reasonable and supportable forecasts.

Although forecasts continued to indicate a decline in economic conditions,In general, our Caterpillar Purchased Receivables portfolio segment has not historically experienced increasedlarge increases or decreases in credit losses during priorbased on changes in economic downturnsconditions due to the short-term maturities of the receivables and our close working relationships with the dealers and their financial strength. Therefore, we made no adjustments to historical loss rates were made during the three and six months ended June 30, 2020.March 31, 2021.

Classes of finance receivables

We further evaluate our portfolio segments by the class of finance receivables, which is defined as a level of information (below a portfolio segment) in which the finance receivables have the same initial measurement attribute and a similar method for assessing and monitoring credit risk. Typically, our finance receivables within a geographic area have similar credit risk profiles and methods for assessing and monitoring credit risk. Our classes, which align with management reporting for credit losses, are as follows:

•North America - Finance receivables originated in the United States and Canada.

•EAME - Finance receivables originated in Europe, Africa, the Middle East and the Commonwealth of Independent States.

•Asia/Pacific - Finance receivables originated in Australia, New Zealand, China, Japan, Southeast Asia and India.

•Mining - Finance receivables related to large mining customers worldwide.

•Latin America - Finance receivables originated in Mexico and Central and South American countries.

•Caterpillar Power Finance - Finance receivables originated worldwide related to marine vessels with Caterpillar engines and Caterpillar electrical power generation, gas compression and co-generation systems and non-Caterpillar equipment that is powered by these systems.

An analysis of the allowance for credit losses was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | March 31, 2021 |

| Allowance for Credit Losses: | Customer | | Dealer | | Caterpillar

Purchased

Receivables | | Total |

| Balance at beginning of year | $ | 431 | | | $ | 44 | | | $ | 4 | | | $ | 479 | |

| Receivables written off | (34) | | | 0 | | | 0 | | | (34) | |

| Recoveries on receivables previously written off | 10 | | | 0 | | | 0 | | | 10 | |

| Provision for credit losses | (10) | | | 0 | | | 0 | | | (10) | |

| | | | | | | |

| Foreign currency translation adjustment | (4) | | | 0 | | | 0 | | | (4) | |

| Balance at end of period | $ | 393 | | | $ | 44 | | | $ | 4 | | | $ | 441 | |

| | | | | | | |

| Individually evaluated | $ | 185 | | | $ | 39 | | | $ | 0 | | | $ | 224 | |

| Collectively evaluated | 208 | | | 5 | | | 4 | | | 217 | |

| Ending Balance | $ | 393 | | | $ | 44 | | | $ | 4 | | | $ | 441 | |

| | | | | | | |

| Finance Receivables: | | | | | | | |

| Individually evaluated | $ | 579 | | | $ | 78 | | | $ | 0 | | | $ | 657 | |

| Collectively evaluated | 19,219 | | | 3,000 | | | 4,065 | | | 26,284 | |

| Ending Balance | $ | 19,798 | | | $ | 3,078 | | | $ | 4,065 | | | $ | 26,941 | |

| | | | | | | |

|

| | | | | | | | | | | | | | | |

| (Millions of dollars) | June 30, 2020 |

| Allowance for Credit Losses: | Customer | | Dealer | | Caterpillar Purchased Receivables | | Total |

| Balance at beginning of year | $ | 375 |

| | $ | 45 |

| | $ | 4 |

| | $ | 424 |

|

Adjustment to adopt new accounting guidance(1) | 12 |

| | — |

| | — |

| | 12 |

|

| Receivables written off | (73 | ) | | — |

| | — |

| | (73 | ) |

| Recoveries on receivables previously written off | 13 |

| | — |

| | — |

| | 13 |

|

| Provision for credit losses | 146 |

| | — |

| | (1 | ) | | 145 |

|

| Foreign currency translation adjustment | (6 | ) | | — |

| | — |

| | (6 | ) |

| Balance at end of period | $ | 467 |

| | $ | 45 |

| | $ | 3 |

| | $ | 515 |

|

| | | | | | | | |

| Individually evaluated | $ | 184 |

| | $ | 39 |

| | $ | — |

| | $ | 223 |

|

| Collectively evaluated | 283 |

| | 6 |

| | 3 |

| | 292 |

|

| Ending Balance | $ | 467 |

| | $ | 45 |

| | $ | 3 |

| | $ | 515 |

|

| | | | | | | | |

| Finance Receivables: | |

| | |

| | |

| | |

|

| Individually evaluated | $ | 601 |

| | $ | 78 |

| | $ | — |

| | $ | 679 |

|

| Collectively evaluated | 18,538 |

| | 4,125 |

| | 3,514 |

| | 26,177 |

|

| Ending Balance | $ | 19,139 |

| | $ | 4,203 |

| | $ | 3,514 |

| | $ | 26,856 |

|

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | December 31, 2020 |

| Allowance for Credit Losses: | Customer | | Dealer | | Caterpillar

Purchased

Receivables | | Total |

| Balance at beginning of year | $ | 375 | | | $ | 45 | | | $ | 4 | | | $ | 424 | |

Adjustment to adopt new accounting guidance(1) | 12 | | | 0 | | | 0 | | | 12 | |

| Receivables written off | (263) | | | 0 | | | 0 | | | (263) | |

| Recoveries on receivables previously written off | 41 | | | 0 | | | 0 | | | 41 | |

| Provision for credit losses | 262 | | | (1) | | | 0 | | | 261 | |

| | | | | | | |

| Foreign currency translation adjustment | 4 | | | 0 | | | 0 | | | 4 | |

| Balance at end of year | $ | 431 | | | $ | 44 | | | $ | 4 | | | $ | 479 | |

| | | | | | | |

| Individually evaluated | $ | 187 | | | $ | 39 | | | $ | 0 | | | $ | 226 | |

| Collectively evaluated | 244 | | | 5 | | | 4 | | | 253 | |

| Ending Balance | $ | 431 | | | $ | 44 | | | $ | 4 | | | $ | 479 | |

| | | | | | | |

| Finance Receivables: | | | | | | | |

| Individually evaluated | $ | 594 | | | $ | 78 | | | $ | 0 | | | $ | 672 | |

| Collectively evaluated | 19,333 | | | 3,403 | | | 3,646 | | | 26,382 | |

| Ending Balance | $ | 19,927 | | | $ | 3,481 | | | $ | 3,646 | | | $ | 27,054 | |

| | | | | | | |

(1) See Note 2 regardingAdjustment to adopt new accounting guidance related to credit losses.

|

| | | | | | | | | | | | | | | |

| (Millions of dollars) | December 31, 2019 |

| Allowance for Credit Losses: | Customer | | Dealer | | Caterpillar Purchased Receivables | | Total |

| Balance at beginning of year | $ | 486 |

| | $ | 21 |

| | $ | 4 |

| | $ | 511 |

|

| Receivables written off | (281 | ) | | — |

| | — |

| | (281 | ) |

| Recoveries on receivables previously written off | 44 |

| | — |

| | — |

| | 44 |

|

| Provision for credit losses | 138 |

| | 24 |

| | — |

| | 162 |

|

| Adjustment due to sale of receivables | (11 | ) | | — |

| | — |

| | (11 | ) |

| Foreign currency translation adjustment | (1 | ) | | — |

| | — |

| | (1 | ) |

| Balance at end of year | $ | 375 |

| | $ | 45 |

| | $ | 4 |

| | $ | 424 |

|

| | | | | | | | |

| Individually evaluated | $ | 178 |

| | $ | 39 |

| | $ | — |

| | $ | 217 |

|

| Collectively evaluated | 197 |

| | 6 |

| | 4 |

| | 207 |

|

| Ending Balance | $ | 375 |

| | $ | 45 |

| | $ | 4 |

| | $ | 424 |

|

| | | | | | | | |

| Finance Receivables: | |

| | |

| | |

| | |

|

| Individually evaluated | $ | 594 |

| | $ | 78 |

| | $ | — |

| | $ | 672 |

|

| Collectively evaluated | 18,770 |

| | 4,366 |

| | 4,448 |

| | 27,584 |

|

| Ending Balance | $ | 19,364 |

| | $ | 4,444 |

| | $ | 4,448 |

| | $ | 28,256 |

|

| | | | | | | | |

Credit quality of finance receivables

At origination, we evaluate credit risk based on a variety of credit quality factors including prior payment experience, customer financial information, credit-rating agencycredit ratings, loan-to-value ratios, probabilities of default, industry trends, macroeconomic factors and other internal metrics. On an ongoing basis, we monitor credit quality based on past-due status as there is a meaningful correlation between the past-due status of customers and the risk of loss. In determining past-due status, we consider the entire finance receivable past due when any installment is over 30 days past due.

Customer

The tabletables below summarizessummarize the aging category of our amortized cost of finance receivables in the Customer portfolio segment by origination year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | March 31, 2021 |

| 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | Prior | | Revolving

Finance

Receivables | | | | Total

Finance

Receivables |

| North America | | | | | | | | | | | | | | | | | |

| Current | $ | 1,149 | | | $ | 3,551 | | | $ | 2,192 | | | $ | 1,156 | | | $ | 425 | | | $ | 166 | | | $ | 61 | | | | | $ | 8,700 | |

| 31-60 days past due | 5 | | | 34 | | | 30 | | | 18 | | | 7 | | | 8 | | | 1 | | | | | 103 | |

| 61-90 days past due | 0 | | | 14 | | | 9 | | | 7 | | | 4 | | | 1 | | | 0 | | | | | 35 | |

| 91+ days past due | 0 | | | 18 | | | 35 | | | 22 | | | 16 | | | 10 | | | 1 | | | | | 102 | |

| | | | | | | | | | | | | | | | | |

| EAME | | | | | | | | | | | | | | | | | |

| Current | 459 | | | 1,307 | | | 811 | | | 419 | | | 164 | | | 56 | | | 0 | | | | | 3,216 | |

| 31-60 days past due | 1 | | | 8 | | | 5 | | | 3 | | | 1 | | | 0 | | | 0 | | | | | 18 | |

| 61-90 days past due | 0 | | | 3 | | | 3 | | | 1 | | | 1 | | | 0 | | | 0 | | | | | 8 | |

| 91+ days past due | 0 | | | 9 | | | 5 | | | 12 | | | 5 | | | 81 | | | 0 | | | | | 112 | |

| | | | | | | | | | | | | | | | | |

| Asia/Pacific | | | | | | | | | | | | | | | | | |

| Current | 448 | | | 1,431 | | | 775 | | | 297 | | | 85 | | | 25 | | | 34 | | | | | 3,095 | |

| 31-60 days past due | 0 | | | 16 | | | 16 | | | 10 | | | 1 | | | 0 | | | 0 | | | | | 43 | |

| 61-90 days past due | 0 | | | 7 | | | 9 | | | 7 | | | 4 | | | 0 | | | 0 | | | | | 27 | |

| 91+ days past due | 0 | | | 8 | | | 12 | | | 12 | | | 2 | | | 0 | | | 0 | | | | | 34 | |

| | | | | | | | | | | | | | | | | |

| Mining | | | | | | | | | | | | | | | | | |

| Current | 230 | | | 473 | | | 567 | | | 315 | | | 109 | | | 206 | | | 86 | | | | | 1,986 | |

| 31-60 days past due | 5 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | | | 5 | |

| 61-90 days past due | 0 | | | 0 | | | 0 | | | 1 | | | 0 | | | 0 | | | 0 | | | | | 1 | |

| 91+ days past due | 0 | | | 1 | | | 2 | | | 4 | | | 2 | | | 0 | | | 0 | | | | | 9 | |

| | | | | | | | | | | | | | | | | |

| Latin America | | | | | | | | | | | | | | | | | |

| Current | 124 | | | 490 | | | 264 | | | 106 | | | 35 | | | 23 | | | 0 | | | | | 1,042 | |

| 31-60 days past due | 0 | | | 6 | | | 6 | | | 6 | | | 3 | | | 0 | | | 0 | | | | | 21 | |

| 61-90 days past due | 0 | | | 3 | | | 4 | | | 6 | | | 1 | | | 13 | | | 0 | | | | | 27 | |

| 91+ days past due | 0 | | | 3 | | | 9 | | | 10 | | | 22 | | | 10 | | | 0 | | | | | 54 | |

| | | | | | | | | | | | | | | | | |

| Caterpillar Power Finance | | | | | | | | | | | | | | | | | |

| Current | 6 | | | 219 | | | 175 | | | 102 | | | 214 | | | 207 | | | 112 | | | | | 1,035 | |

| 31-60 days past due | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | | | 0 | |

| 61-90 days past due | 0 | | | 0 | | | 0 | | | 0 | | | 1 | | | 1 | | | 0 | | | | | 2 | |

| 91+ days past due | 0 | | | 2 | | | 0 | | | 25 | | | 3 | | | 93 | | | 0 | | | | | 123 | |

| | | | | | | | | | | | | | | | | |

| Total | $ | 2,427 | | | $ | 7,603 | | | $ | 4,929 | | | $ | 2,539 | | | $ | 1,105 | | | $ | 900 | | | $ | 295 | | | | | $ | 19,798 | |

| | | | | | | | | | | | | | | | | |

| | | (Millions of dollars) | June 30, 2020 | (Millions of dollars) | December 31, 2020 |

| | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | Prior | | Revolving

Finance

Receivables | | Total Finance Receivables | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | Prior | | Revolving

Finance

Receivables | | | Total

Finance

Receivables |

| North America | | | | | | | | | | | | | | | | North America | | | | | | | | | | | | | | | | |

| Current | $ | 1,863 |

| | $ | 3,035 |

| | $ | 1,836 |

| | $ | 814 |

| | $ | 374 |

| | $ | 97 |

| | $ | 102 |

| | $ | 8,121 |

| Current | $ | 3,780 | | | $ | 2,423 | | | $ | 1,344 | | | $ | 522 | | | $ | 212 | | | $ | 27 | | | $ | 89 | | | | $ | 8,397 | |

| 31-60 days past due | 13 |

| | 28 |

| | 20 |

| | 15 |

| | 5 |

| | 2 |

| | — |

| | 83 |

| 31-60 days past due | 52 | | | 49 | | | 33 | | | 16 | | | 7 | | | 2 | | | 0 | | | | 159 | |

| 61-90 days past due | 4 |

| | 15 |

| | 14 |

| | 8 |

| | 3 |

| | 1 |

| | — |

| | 45 |

| 61-90 days past due | 22 | | | 25 | | | 16 | | | 9 | | | 2 | | | 1 | | | 0 | | | | 75 | |

| 91+ days past due | 3 |

| | 24 |

| | 31 |

| | 19 |

| | 15 |

| | 6 |

| | — |

| | 98 |

| 91+ days past due | 14 | | | 35 | | | 31 | | | 20 | | | 9 | | | 4 | | | 2 | | | | 115 | |

| | EAME | | | | | | | | | | | | | | | | EAME | | | |

| Current | 545 |

| | 1,104 |

| | 727 |

| | 336 |

| | 113 |

| | 33 |

| | — |

| | 2,858 |

| Current | 1,605 | | | 931 | | | 501 | | | 203 | | | 60 | | | 18 | | | 0 | | | | 3,318 | |

| 31-60 days past due | 5 |

| | 13 |

| | 12 |

| | 5 |

| | 2 |

| | — |

| | — |

| | 37 |

| 31-60 days past due | 5 | | | 15 | | | 3 | | | 2 | | | 0 | | | 0 | | | 0 | | | | 25 | |

| 61-90 days past due | 6 |

| | 7 |

| | 2 |

| | 2 |

| | — |

| | — |

| | — |

| | 17 |

| 61-90 days past due | 1 | | | 1 | | | 2 | | | 1 | | | 0 | | | 0 | | | 0 | | | | 5 | |

| 91+ days past due | — |

| | 11 |

| | 14 |

| | 15 |

| | 51 |

| | 62 |

| | — |

| | 153 |

| 91+ days past due | 7 | | | 7 | | | 12 | | | 4 | | | 39 | | | 43 | | | 0 | | | | 112 | |

| | Asia/Pacific | | | | | | | | | | | | | | | | Asia/Pacific | | | |

| Current | 790 |

| | 1,153 |

| | 609 |

| | 195 |

| | 50 |

| | 20 |

| | 29 |

| | 2,846 |

| Current | 1,583 | | | 933 | | | 412 | | | 115 | | | 32 | | | 6 | | | 32 | | | | 3,113 | |

| 31-60 days past due | 4 |

| | 22 |

| | 18 |

| | 5 |

| | — |

| | — |

| | — |

| | 49 |

| 31-60 days past due | 13 | | | 23 | | | 13 | | | 6 | | | 0 | | | 0 | | | 0 | | | | 55 | |

| 61-90 days past due | 2 |

| | 11 |

| | 8 |

| | 3 |

| | — |

| | — |

| | — |

| | 24 |

| 61-90 days past due | 7 | | | 11 | | | 7 | | | 1 | | | 0 | | | 0 | | | 0 | | | | 26 | |

| 91+ days past due | 1 |

| | 19 |

| | 18 |

| | 5 |

| | 1 |

| | — |

| | — |

| | 44 |

| 91+ days past due | 4 | | | 10 | | | 9 | | | 3 | | | 0 | | | 0 | | | 0 | | | | 26 | |

| | Mining | | | | | | | | | | | | | | | | Mining | | | |

| Current | 213 |

| | 655 |

| | 375 |

| | 236 |

| | 124 |

| | 190 |

| | 270 |

| | 2,063 |

| Current | 515 | | | 574 | | | 289 | | | 181 | | | 92 | | | 151 | | | 137 | | | | 1,939 | |

| 31-60 days past due | — |

| | — |

| | 13 |

| | 5 |

| | — |

| | — |

| | — |

| | 18 |

| 31-60 days past due | 5 | | | 0 | | | 5 | | | 1 | | | 0 | | | 0 | | | 0 | | | | 11 | |

| 61-90 days past due | — |

| | 1 |

| | 3 |

| | — |

| | — |

| | — |

| | — |

| | 4 |

| 61-90 days past due | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | | 0 | |

| 91+ days past due | — |

| | 12 |

| | 3 |

| | 25 |

| | — |

| | — |

| | 1 |

| | 41 |

| 91+ days past due | 0 | | | 11 | | | 8 | | | 2 | | | 0 | | | 0 | | | 1 | | | | 22 | |

| | Latin America | | | | | | | | | | | | | | | | Latin America | | | |

| Current | 286 |

| | 440 |

| | 214 |

| | 74 |

| | 22 |

| | 27 |

| | — |

| | 1,063 |

| Current | 561 | | | 348 | | | 151 | | | 48 | | | 13 | | | 34 | | | 0 | | | | 1,155 | |

| 31-60 days past due | 2 |

| | 6 |

| | 8 |

| | 1 |

| | 1 |

| | 1 |

| | — |

| | 19 |

| 31-60 days past due | 3 | | | 6 | | | 4 | | | 3 | | | 0 | | | 0 | | | 0 | | | | 16 | |

| 61-90 days past due | — |

| | 3 |

| | 9 |

| | 5 |

| | 1 |

| | — |

| | — |

| | 18 |

| 61-90 days past due | 1 | | | 7 | | | 6 | | | 3 | | | 2 | | | 0 | | | 0 | | | | 19 | |

| 91+ days past due | — |

| | 19 |

| | 40 |

| | 29 |

| | 8 |

| | 6 |

| | — |

| | 102 |

| 91+ days past due | 2 | | | 14 | | | 11 | | | 24 | | | 5 | | | 4 | | | 0 | | | | 60 | |

| | Caterpillar Power Finance | | | | | | | | | | | | | | | | Caterpillar Power Finance | | | |

| Current | 106 |

| | 279 |

| | 172 |

| | 278 |

| | 119 |

| | 143 |

| | 134 |

| | 1,231 |

| Current | 217 | | | 199 | | | 111 | | | 273 | | | 99 | | | 117 | | | 119 | | | | 1,135 | |

| 31-60 days past due | — |

| | — |

| | 2 |

| | — |

| | — |

| | — |

| | — |

| | 2 |

| 31-60 days past due | 0 | | | 0 | | | 6 | | | 0 | | | 0 | | | 0 | | | 0 | | | | 6 | |

| 61-90 days past due | — |

| | — |

| | — |

| | — |

| | — |

| | 2 |

| | — |

| | 2 |

| 61-90 days past due | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 9 | | | 0 | | | | 9 | |

| 91+ days past due | — |

| | — |

| | 20 |

| | 13 |

| | 33 |

| | 135 |

| | — |

| | 201 |

| 91+ days past due | 2 | | | 0 | | | 20 | | | 3 | | | 25 | | | 79 | | | 0 | | | | 129 | |

| | Total | $ | 3,843 |

| | $ | 6,857 |

| | $ | 4,168 |

| | $ | 2,088 |

| | $ | 922 |

| | $ | 725 |

| | $ | 536 |

| | $ | 19,139 |

| Total | $ | 8,399 | | | $ | 5,622 | | | $ | 2,994 | | | $ | 1,440 | | | $ | 597 | | | $ | 495 | | | $ | 380 | | | | $ | 19,927 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Finance receivables in the Customer portfolio segment are substantially secured by collateral, primarily in the form of Caterpillar and other machinery. For those contracts where the borrower is experiencing financial difficulty, repayment of the outstanding amounts is generally expected to be provided through the operation or repossession and sale of the machinery.

Dealer

As of June 30, 2020,March 31, 2021, our total amortized cost of finance receivables within the Dealer portfolio segment was current, with the exception of $78 million that was 91+ days past due in Latin America, all of which was originated in 2017. As of December 31, 2020, our total amortized cost of finance receivables within the Dealer portfolio segment was current, with the exception of $81 million that was 91+ days past due in Latin America. TheseOf these past due receivables, $78 million were originated in 2017.2017 and $3 million were originated prior to 2016.

Caterpillar Purchased Receivables

The tabletables below summarizessummarize the aging category of our amortized cost of finance receivables in the Caterpillar Purchased Receivables portfolio segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | | |

| | March 31, 2021 |

| | 31-60

Days

Past Due | | 61-90

Days

Past Due | | 91+

Days

Past Due | | Total

Past Due | | Current | |

Total Finance

Receivables | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| North America | $ | 7 | | | $ | 3 | | | $ | 3 | | | $ | 13 | | | $ | 2,070 | | | $ | 2,083 | | | |

| EAME | 0 | | | 0 | | | 1 | | | 1 | | | 777 | | | 778 | | | |

| Asia/Pacific | 2 | | | 1 | | | 2 | | | 5 | | | 802 | | | 807 | | | |

| Mining | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | |

| Latin America | 0 | | | 0 | | | 0 | | | 0 | | | 392 | | | 392 | | | |

| Caterpillar Power Finance | 0 | | | 0 | | | 0 | | | 0 | | | 5 | | | 5 | | | |

| Total | $ | 9 | | | $ | 4 | | | $ | 6 | | | $ | 19 | | | $ | 4,046 | | | $ | 4,065 | | | |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | |

| | June 30, 2020 |

| | 31-60 Days Past Due | | 61-90 Days Past Due | | 91+ Days Past Due | | Total Past Due | | Current | |

Total Finance Receivables |

| North America | $ | 15 |

| | $ | 8 |

| | $ | 16 |

| | $ | 39 |

| | $ | 1,789 |

| | $ | 1,828 |

|

| EAME | 1 |

| | — |

| | 1 |

| | 2 |

| | 633 |

| | 635 |

|

| Asia/Pacific | 2 |

| | — |

| | 1 |

| | 3 |

| | 579 |

| | 582 |

|

| Mining | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Latin America | 1 |

| | — |

| | — |

| | 1 |

| | 459 |

| | 460 |

|

| Caterpillar Power Finance | 2 |

| | — |

| | 1 |

| | 3 |

| | 6 |

| | 9 |

|

| Total | $ | 21 |

| | $ | 8 |

| | $ | 19 |

| | $ | 48 |

| | $ | 3,466 |

| | $ | 3,514 |

|

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | | | |

| | December 31, 2020 |

| | 31-60

Days

Past Due | | 61-90

Days

Past Due | | 91+

Days

Past Due | | Total

Past Due | | Current | |

Total Finance

Receivables | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| North America | $ | 14 | | | $ | 11 | | | $ | 6 | | | $ | 31 | | | $ | 1,889 | | | $ | 1,920 | | | |

| EAME | 1 | | | 0 | | | 1 | | | 2 | | | 632 | | | 634 | | | |

| Asia/Pacific | 2 | | | 1 | | | 1 | | | 4 | | | 581 | | | 585 | | | |

| Mining | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | |

| Latin America | 0 | | | 0 | | | 0 | | | 0 | | | 501 | | | 501 | | | |

| Caterpillar Power Finance | 0 | | | 0 | | | 0 | | | 0 | | | 6 | | | 6 | | | |

| Total | $ | 17 | | | $ | 12 | | | $ | 8 | | | $ | 37 | | | $ | 3,609 | | | $ | 3,646 | | | |

| | | | | | | | | | | | | |

The table below summarizes our recorded investment in finance receivables by aging category.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | | | | | |

| | December 31, 2019 |

| | 31-60 Days Past Due | | 61-90 Days Past Due | | 91+ Days Past Due | | Total Past Due | | Current | |

Total Finance Receivables |

| Customer | |

| | |

| | |

| | | | | | |

| North America | $ | 72 |

| | $ | 23 |

| | $ | 55 |

| | $ | 150 |

| | $ | 8,085 |

| | $ | 8,235 |

|

| EAME | 30 |

| | 31 |

| | 141 |

| | 202 |

| | 2,882 |

| | 3,084 |

|

| Asia/Pacific | 40 |

| | 14 |

| | 29 |

| | 83 |

| | 2,733 |

| | 2,816 |

|

| Mining | 5 |

| | — |

| | 19 |

| | 24 |

| | 2,266 |

| | 2,290 |

|

| Latin America | 41 |

| | 23 |

| | 80 |

| | 144 |

| | 1,131 |

| | 1,275 |

|

| Caterpillar Power Finance | 10 |

| | 10 |

| | 225 |

| | 245 |

| | 1,419 |

| | 1,664 |

|

| Dealer | |

| | |

| | |

| | | | | | |

| North America | — |

| | — |

| | — |

| | — |

| | 2,514 |

| | 2,514 |

|

| EAME | — |

| | — |

| | — |

| | — |

| | 600 |

| | 600 |

|

| Asia/Pacific | — |

| | — |

| | — |

| | — |

| | 487 |

| | 487 |

|

| Mining | — |

| | — |

| | — |

| | — |

| | 4 |

| | 4 |

|

| Latin America | — |

| | — |

| | 78 |

| | 78 |

| | 758 |

| | 836 |

|

| Caterpillar Power Finance | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

|

| Caterpillar Purchased Receivables | |

| | |

| | |

| | | | | | |

| North America | 15 |

| | 6 |

| | 18 |

| | 39 |

| | 2,450 |

| | 2,489 |

|

| EAME | 1 |

| | — |

| | 2 |

| | 3 |

| | 574 |

| | 577 |

|

| Asia/Pacific | 1 |

| | — |

| | — |

| | 1 |

| | 891 |

| | 892 |

|

| Mining | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Latin America | — |

| | — |

| | — |

| | — |

| | 475 |

| | 475 |

|

| Caterpillar Power Finance | — |

| | — |

| | — |

| | — |

| | 15 |

| | 15 |

|

| Total | $ | 215 |

| | $ | 107 |

| | $ | 647 |

| | $ | 969 |

| | $ | 27,287 |

| | $ | 28,256 |

|

| | | | | | | | | | | | |

Impaired finance receivables

A finance receivable is considered impaired, based on current information and events, if it is probable that we will be unable to collect all amounts due according to the contractual terms. Impaired finance receivables include finance receivables that have been restructured and are considered to be troubled debt restructures.

In our Customer portfolio segment, impaired finance receivables and the related unpaid principal balances and allowance were as follows:

|

| | | | | | | | | | | |

| (Millions of dollars) | | | | | |

| | As of December 31, 2019 |

Impaired Finance Receivables With No Allowance Recorded | Recorded Investment | | Unpaid Principal Balance | | Related Allowance |

| North America | $ | 6 |

| | $ | 6 |

| | $ | — |

|

| EAME | — |

| | — |

| | — |

|

| Asia/Pacific | — |

| | — |

| | — |

|

| Mining | 22 |

| | 22 |

| | — |

|

| Latin America | 8 |

| | 8 |

| | — |

|

| Caterpillar Power Finance | 58 |

| | 58 |

| | — |

|

| Total | $ | 94 |

| | $ | 94 |

| | $ | — |

|

Impaired Finance Receivables With An Allowance Recorded | |

| | |

| | �� |

|

| North America | $ | 30 |

| | $ | 30 |

| | $ | 11 |

|

| EAME | 61 |

| | 61 |

| | 29 |

|

| Asia/Pacific | 8 |

| | 8 |

| | 2 |

|

| Mining | 37 |

| | 36 |

| | 9 |

|

| Latin America | 58 |

| | 58 |

| | 20 |

|

| Caterpillar Power Finance | 306 |

| | 319 |

| | 107 |

|

| Total | $ | 500 |

| | $ | 512 |

| | $ | 178 |

|

| Total Impaired Finance Receivables | |

| | |

| | |

|

| North America | $ | 36 |

| | $ | 36 |

| | $ | 11 |

|

| EAME | 61 |

| | 61 |

| | 29 |

|

| Asia/Pacific | 8 |

| | 8 |

| | 2 |

|

| Mining | 59 |

| | 58 |

| | 9 |

|

| Latin America | 66 |

| | 66 |

| | 20 |

|

| Caterpillar Power Finance | 364 |

| | 377 |

| | 107 |

|

| Total | $ | 594 |

| | $ | 606 |

| | $ | 178 |

|

| | | | | | |

|

| | | | | | | | | | | | | | | |

| (Millions of dollars) | | | | | | | |

| | Three Months Ended

June 30, 2019 | | Six Months Ended

June 30, 2019 |

Impaired Finance Receivables With No Allowance Recorded | Average Recorded Investment | | Interest Income Recognized | | Average Recorded Investment | | Interest Income Recognized |

| North America | $ | 10 |

| | $ | — |

| | $ | 10 |

| | $ | — |

|

| EAME | 1 |

| | — |

| | 1 |

| | — |

|

| Asia/Pacific | — |

| | — |

| | — |

| | — |

|

| Mining | 29 |

| | 1 |

| | 30 |

| | 1 |

|

| Latin America | 20 |

| | 1 |

| | 23 |

| | 1 |

|

| Caterpillar Power Finance | 41 |

| | — |

| | 51 |

| | 1 |

|

| Total | $ | 101 |

| | $ | 2 |

| | $ | 115 |

| | $ | 3 |

|

Impaired Finance Receivables With An Allowance Recorded | |

| | |

| | |

| | |

|

| North America | $ | 35 |

| | $ | — |

| | $ | 37 |

| | $ | 1 |

|

| EAME | 94 |

| | — |

| | 94 |

| | 1 |

|

| Asia/Pacific | 9 |

| | — |

| | 8 |

| | — |

|

| Mining | 39 |

| | — |

| | 42 |

| | 1 |

|

| Latin America | 74 |

| | 2 |

| | 75 |

| | 3 |

|

| Caterpillar Power Finance | 443 |

| | 4 |

| | 446 |

| | 7 |

|

| Total | $ | 694 |

| | $ | 6 |

| | $ | 702 |

| | $ | 13 |

|

| Total Impaired Finance Receivables | |

| | |

| | |

| | |

|

| North America | $ | 45 |

| | $ | — |

| | $ | 47 |

| | $ | 1 |

|

| EAME | 95 |

| | — |

| | 95 |

| | 1 |

|

| Asia/Pacific | 9 |

| | — |

| | 8 |

| | — |

|

| Mining | 68 |

| | 1 |

| | 72 |

| | 2 |

|

| Latin America | 94 |

| | 3 |

| | 98 |

| | 4 |

|

| Caterpillar Power Finance | 484 |

| | 4 |

| | 497 |

| | 8 |

|

| Total | $ | 795 |

| | $ | 8 |

| | $ | 817 |

| | $ | 16 |

|

| | | | | | | | |

There were $78 million in impaired finance receivables with a related allowance of $39 million as of December 31, 2019 for the Dealer portfolio segment, all of which was in Latin America. There were no impaired finance receivables as of December 31, 2019 for the Caterpillar Purchased Receivables portfolio segment.

Non-accrual finance receivables

Recognition of income is suspended and the finance receivable is placed on non-accrual status when management determines that collection of future income is not probable. Contracts on non-accrual status are generally more than 120 days past due or have been restructured in a troubled debt restructuring (TDR). Recognition is resumed and previously suspended income is recognized when the finance receivable becomes current and collection of remaining amounts is considered probable. Payments received while the finance receivable is on non-accrual status are applied to interest and principal in accordance with the contractual terms. Interest earned but uncollected prior to the receivable being placed on non-accrual status is written off through Provision for credit losses when, in the judgment of management, it is considered uncollectible.

In our Customer portfolio segment, finance receivables which were on non-accrual status and finance receivables over 90 days past due and still accruing income were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Millions of dollars) | March 31, 2021 | | December 31, 2020 |

| Amortized Cost | | Amortized Cost |

| Non-accrual

With an

Allowance | | Non-accrual

Without an

Allowance | | 91+ Still

Accruing | | Non-accrual

With an

Allowance | | Non-accrual

Without an