UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| | | | | | | |

þ☑ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 20172022

OR

|

| | | | | | | |

o☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-09397 | | |

| Baker Hughes Holdings LLC |

Baker Hughes, a GE company, LLC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 76-0207995 |

| (State or other jurisdiction | (I.R.S. Employer Identification No.) |

| of incorporation or organization) | |

| |

Delaware | 76-0207995 |

(State or other jurisdiction | (I.R.S. Employer Identification No.) |

of incorporation or organization) | |

| |

17021 Aldine Westfield Houston, Texas - 77073-5101, United States | |

| Houston, | Texas | 77073-5101 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (713) 439-8600

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| 5.125% Senior Notes due 2040 | - | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO oYes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES þ NO oYes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" "smaller reporting company"company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filerþ | ☐ | | Accelerated filero | ☐ | | Non-accelerated filero | ☑ | | Smaller reporting companyo | ☐ | | Emerging growth companyo |

| | (Do not check if a smaller reporting company) | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO þYes ☐ No ☑

As of October 18, 2017,13, 2022, the registrant had 1,145,286,805 outstanding Common Units, $0.0001 par value per unit.outstanding 1,008,467,549 common units. None of the common units are publicly traded.

Baker Hughes a GE company,Holdings LLC

Table of Contents

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | i

PART I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

Baker Hughes a GE company,Holdings LLC

Condensed Consolidated and Combined Statements of Income (Loss)

(Unaudited)

| | | | Three Months Ended September 30, | Nine Months Ended September 30, |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| (In millions, except per unit amounts) | 2017 | 2016 | 2017 | 2016 | (In millions, except per unit amounts) | 2022 | 2021 | 2022 | 2021 |

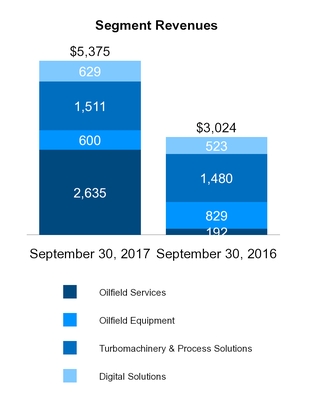

| Revenue: | | Revenue: | |

| Sales of goods | $ | 3,097 |

| $ | 2,182 |

| $ | 7,541 |

| $ | 6,889 |

| Sales of goods | $ | 3,084 | | $ | 2,984 | | $ | 8,710 | | $ | 8,997 | |

| Sales of services | 2,278 |

| 842 |

| 3,955 |

| 2,864 |

| Sales of services | 2,285 | | 2,109 | | 6,541 | | 6,020 | |

| Total revenue | 5,375 |

| 3,024 |

| 11,496 |

| 9,753 |

| Total revenue | 5,369 | | 5,093 | | 15,251 | | 15,017 | |

| | | |

| Costs and expenses: | | Costs and expenses: | |

| Cost of goods sold | 2,589 |

| 1,800 |

| 6,341 |

| 5,760 |

| Cost of goods sold | 2,639 | | 2,561 | | 7,502 | | 7,769 | |

| Cost of services sold | 1,766 |

| 494 |

| 2,818 |

| 1,680 |

| Cost of services sold | 1,606 | | 1,522 | | 4,686 | | 4,404 | |

| Selling, general and administrative expenses | 792 |

| 475 |

| 1,750 |

| 1,476 |

| |

| Selling, general and administrative | | Selling, general and administrative | 620 | | 607 | | 1,865 | | 1,836 | |

| | Restructuring, impairment and other | 191 |

| 77 |

| 292 |

| 452 |

| Restructuring, impairment and other | 230 | | 14 | | 653 | | 219 | |

| Merger and related costs | 159 |

| 2 |

| 310 |

| 10 |

| |

| Separation related | | Separation related | 5 | | 11 | | 23 | | 53 | |

| Total costs and expenses | 5,497 |

| 2,848 |

| 11,511 |

| 9,378 |

| Total costs and expenses | 5,100 | | 4,715 | | 14,729 | | 14,281 | |

| Operating income (loss) | (122 | ) | 176 |

| (15 | ) | 375 |

| |

| Other non operating income (loss), net | (3 | ) | 6 |

| 65 |

| 18 |

| |

| Operating income | | Operating income | 269 | | 378 | | 522 | | 736 | |

| Other non-operating loss, net | | Other non-operating loss, net | (60) | | (102) | | (657) | | (791) | |

| Interest expense, net | (42 | ) | (21 | ) | (75 | ) | (74 | ) | Interest expense, net | (65) | | (67) | | (188) | | (205) | |

| Income (loss) before income taxes and equity in loss of affiliate | (167 | ) | 161 |

| (25 | ) | 319 |

| |

| Equity in loss of affiliate | (13 | ) | — |

| (13 | ) | — |

| |

| Income (loss) before income taxes | | Income (loss) before income taxes | 144 | | 209 | | (323) | | (260) | |

| Provision for income taxes | (96 | ) | (70 | ) | (125 | ) | (132 | ) | Provision for income taxes | (145) | | (189) | | (422) | | (422) | |

| Net income (loss) | (276 | ) | 91 |

| (163 | ) | 187 |

| Net income (loss) | (1) | | 20 | | (745) | | (682) | |

| Less: Net income (loss) attributable to noncontrolling interests | 1 |

| (5 | ) | 5 |

| (68 | ) | |

| Net income (loss) attributable to Baker Hughes, a GE company, LLC | $ | (277 | ) | $ | 96 |

| $ | (168 | ) | $ | 255 |

| |

| Less: Net income attributable to noncontrolling interests | | Less: Net income attributable to noncontrolling interests | 8 | | 5 | | 20 | | 24 | |

| Net income (loss) attributable to Baker Hughes Holdings LLC | | Net income (loss) attributable to Baker Hughes Holdings LLC | $ | (9) | | $ | 15 | | $ | (765) | | $ | (706) | |

| | | |

| | | |

| Cash distribution per Common Unit | $ | 0.17 |

|

|

| $ | 0.17 |

|

|

| |

| | | Cash distribution per common unit | | Cash distribution per common unit | $ | 0.18 | | $ | 0.18 | | $ | 0.54 | | $ | 0.54 | |

See accompanying Notes to Unaudited Condensed Consolidated and Combined Financial Statements.

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | 1

Baker Hughes a GE company,Holdings LLC

Condensed Consolidated and Combined Statements of Comprehensive Income (Loss)

(Unaudited)

|

| | | | | | | | | | | | |

| | Three Months Ended September 30, | Nine Months Ended September 30, |

| (In millions) | 2017 | 2016 | 2017 | 2016 |

| Net income (loss) | $ | (276 | ) | $ | 91 |

| $ | (163 | ) | $ | 187 |

|

| Less: Net income (loss) attributable to noncontrolling interests | 1 |

| (5 | ) | 5 |

| (68 | ) |

| Net income (loss) attributable to Baker Hughes, a GE company, LLC | (277 | ) | 96 |

| (168 | ) | 255 |

|

| Other comprehensive income (loss): | | | | |

| Investment securities | 1 |

| — |

| 2 |

| — |

|

| Foreign currency translation adjustments | 272 |

| (140 | ) | 207 |

| (161 | ) |

| Cash flow hedges | 9 |

| (1 | ) | 17 |

| (5 | ) |

| Benefit plans | (4 | ) | 31 |

| (6 | ) | 69 |

|

| Other comprehensive income (loss) | 278 |

| (110 | ) | 220 |

| (97 | ) |

| Less: Other comprehensive income attributable to noncontrolling interests | — |

| 3 |

| 4 |

| 2 |

|

Other comprehensive income (loss) attributable to Baker Hughes, a GE company, LLC

| 278 |

| (113 | ) | 216 |

| (99 | ) |

| Comprehensive income (loss) | 2 |

| (19 | ) | 57 |

| 90 |

|

| Less: Comprehensive income (loss) attributable to noncontrolling interests | 1 |

| (2 | ) | 9 |

| (66 | ) |

| Comprehensive income (loss) attributable to Baker Hughes, a GE company, LLC | $ | 1 |

| $ | (17 | ) | $ | 48 |

| $ | 156 |

|

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| (In millions) | 2022 | 2021 | 2022 | 2021 |

| Net income (loss) | $ | (1) | | $ | 20 | | $ | (745) | | $ | (682) | |

| Less: Net income attributable to noncontrolling interests | 8 | | 5 | | 20 | | 24 | |

| Net income (loss) attributable to Baker Hughes Holdings LLC | (9) | | 15 | | (765) | | (706) | |

| Other comprehensive income (loss): | | | | |

| | | | |

| Foreign currency translation adjustments | (321) | | (158) | | (474) | | (51) | |

| Cash flow hedges | — | | (2) | | 1 | | (13) | |

| Benefit plans | (27) | | 25 | | 5 | | 78 | |

| Other comprehensive income (loss) | (348) | | (135) | | (468) | | 14 | |

| Less: Other comprehensive income (loss) attributable to noncontrolling interests | 1 | | (1) | | (2) | | (1) | |

| Other comprehensive income (loss) attributable to Baker Hughes Holdings LLC | (349) | | (134) | | (466) | | 15 | |

| Comprehensive loss | (349) | | (115) | | (1,213) | | (668) | |

| Less: Comprehensive income attributable to noncontrolling interests | 9 | | 4 | | 18 | | 23 | |

| Comprehensive loss attributable to Baker Hughes Holdings LLC | $ | (358) | | $ | (119) | | $ | (1,231) | | $ | (691) | |

See accompanying Notes to Unaudited Condensed Consolidated and Combined Financial Statements.

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | 2

Baker Hughes a GE company,Holdings LLC

Condensed Consolidated and Combined Statements of Financial Position

| | | (In millions) | September 30, 2017 | December 31, 2016 | (In millions) | September 30,

2022 | December 31,

2021 |

| ASSETS | ASSETS | ASSETS |

| Current assets: |

| Current assets: | |

Cash and equivalents (a) | $ | 4,775 |

| $ | 981 |

| |

| Cash and cash equivalents | | Cash and cash equivalents | $ | 2,848 | | $ | 3,843 | |

| Current receivables, net | 5,310 |

| 2,563 |

| Current receivables, net | 5,722 | | 5,718 | |

| Inventories, net | 5,309 |

| 3,224 |

| Inventories, net | 4,111 | | 3,979 | |

| All other current assets | 1,279 |

| 633 |

| All other current assets | 1,790 | | 1,582 | |

| Total current assets | 16,673 |

| 7,401 |

| Total current assets | 14,471 | | 15,122 | |

Property, plant and equipment - less accumulated depreciation

| 6,255 |

| 2,325 |

| |

| Property, plant and equipment (net of accumulated depreciation of $4,961 and $5,003) | | Property, plant and equipment (net of accumulated depreciation of $4,961 and $5,003) | 4,381 | | 4,877 | |

| Goodwill | 20,086 |

| 6,680 |

| Goodwill | 5,196 | | 5,721 | |

| Other intangible assets, net | 6,826 |

| 2,449 |

| Other intangible assets, net | 3,980 | | 4,131 | |

| Contract assets | 2,761 |

| 1,967 |

| |

| Contract and other deferred assets | | Contract and other deferred assets | 1,526 | | 1,598 | |

| All other assets | 1,654 |

| 573 |

| All other assets | 2,976 | | 3,102 | |

| Deferred income taxes | 338 |

| 326 |

| Deferred income taxes | 701 | | 735 | |

| Total assets | $ | 54,593 |

| $ | 21,721 |

| Total assets | $ | 33,231 | | $ | 35,286 | |

| LIABILITIES AND EQUITY | LIABILITIES AND EQUITY | LIABILITIES AND EQUITY |

| Current liabilities: |

| Current liabilities: | |

| Accounts payable | $ | 3,217 |

| $ | 1,898 |

| Accounts payable | $ | 3,801 | | $ | 3,745 | |

Short-term debt and current portion of long-term debt (a) | 1,866 |

| 239 |

| |

| Progress collections | 1,543 |

| 1,596 |

| |

| Current portion of long-term debt | | Current portion of long-term debt | 43 | | 40 | |

| Progress collections and deferred income | | Progress collections and deferred income | 3,262 | | 3,232 | |

| All other current liabilities | 2,119 |

| 1,201 |

| All other current liabilities | 2,415 | | 2,163 | |

| Total current liabilities | 8,745 |

| 4,934 |

| Total current liabilities | 9,521 | | 9,180 | |

| Long-term debt | 3,039 |

| 38 |

| Long-term debt | 6,612 | | 6,687 | |

| Deferred income taxes | 341 |

| 880 |

| Deferred income taxes | 119 | | 73 | |

| Liabilities for pensions and other postretirement benefits | 1,262 |

| 519 |

| Liabilities for pensions and other postretirement benefits | 1,020 | | 1,110 | |

| All other liabilities | 996 |

| 495 |

| All other liabilities | 1,500 | | 1,510 | |

| Members' equity: | | |

| Members' capital (Common Units 1,145 & Nil, issued and outstanding as of September 30, 2017 and December 31, 2016, respectively ) | 42,024 |

| — |

| |

| Parent's net investment | — |

| 16,582 |

| |

| Members' Equity: | | Members' Equity: | |

| | Members' capital, common units, 1,019 and 1,026 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | | Members' capital, common units, 1,019 and 1,026 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | 34,560 | | 35,589 | |

| Retained loss | (277 | ) | — |

| Retained loss | (17,075) | | (16,311) | |

| Accumulated other comprehensive loss | (1,678 | ) | (1,894 | ) | Accumulated other comprehensive loss | (3,158) | | (2,691) | |

| Baker Hughes, a GE company, LLC members' equity | 40,069 |

| 14,688 |

| |

| Baker Hughes Holdings LLC equity | | Baker Hughes Holdings LLC equity | 14,327 | | 16,587 | |

| Noncontrolling interests | 141 |

| 167 |

| Noncontrolling interests | 132 | | 139 | |

| Total equity | 40,210 |

| 14,855 |

| Total equity | 14,459 | | 16,726 | |

| Total liabilities and equity | $ | 54,593 |

| $ | 21,721 |

| Total liabilities and equity | $ | 33,231 | | $ | 35,286 | |

| |

(a)

| Cash and equivalents includes $1,267 million of cash at September 30, 2017 held on behalf of GE, and a corresponding liability is reported in short-term borrowings. See "Note 14. Related Party Transactions" for further details. |

See accompanying Notes to Unaudited Condensed Consolidated and Combined Financial Statements.

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | 3

Baker Hughes a GE company,Holdings LLC

Condensed Consolidated and Combined Statements of Changes in Members' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| (In millions, except per unit amounts) | | Members' Capital | Retained

Loss | Accumulated

Other

Comprehensive

Loss | Non-

controlling

Interests | Total Equity |

| Balance at December 31, 2021 | | $ | 35,589 | | $ | (16,311) | | $ | (2,691) | | $ | 139 | | $ | 16,726 | |

| Comprehensive loss: | | | | | | |

| Net income (loss) | | | (765) | | | 20 | | (745) | |

| Other comprehensive loss | | | | (466) | | (2) | | (468) | |

| Regular cash distribution to Members ($0.54 per unit) | | (552) | | | | | (552) | |

| | | | | | |

| | | | | | |

| Repurchase and cancellation of common units | | (727) | | | | | (727) | |

| Baker Hughes stock-based compensation cost | | 155 | | | | | 155 | |

| | | | | | |

| Other | | 95 | | 1 | | (1) | | (25) | | 70 | |

| Balance at September 30, 2022 | | $ | 34,560 | | $ | (17,075) | | $ | (3,158) | | $ | 132 | | $ | 14,459 | |

|

| | | | | | | | | | | | | | | | | | | | |

| (In millions) | Number of Common Units | Common Unitholders | Parent's Net Investment | Retained

Loss | Accumulated

Other

Comprehensive

Loss | Non-controlling

Interests | Total Equity |

| Balance at December 31, 2016 | — |

| $ | — |

| $ | 16,582 |

| $ | — |

| $ | (1,894 | ) | $ | 167 |

| $ | 14,855 |

|

| Net income |

|

| 109 |

|

|

| 4 |

| 113 |

|

| Other comprehensive income |

|

|

|

| (62 | ) | 4 |

| (58 | ) |

| Changes in Parent's net investment |

|

|

|

| 900 |

|

|

|

| 900 |

|

| Net activity related to noncontrolling interests |

|

|

|

|

|

|

| 4 |

| 4 |

|

| Cash contribution received from General Electric Company (GE) |

|

|

|

| 7,400 |

|

|

|

| 7,400 |

|

| Issuance of Common Units to GE on business combination | 717 |

| 24,991 |

| (24,991 | ) |

|

|

| — |

|

| Issuance of Common Units to Baker Hughes, a GE company (BHGE) on business combination | 428 |

| 24,798 |

|

|

|

|

|

| 77 |

| 24,875 |

|

| Distribution to BHGE |

| (7,498 | ) |

|

|

|

|

|

| (7,498 | ) |

| Activity after business combination of July 3, 2017: | | | | | | | |

| Net income (loss) |

|

|

|

| (277 | ) |

| 1 |

| (276 | ) |

| Other comprehensive income |

|

|

|

|

|

| 278 |

|

| 278 |

|

| Cash distribution to members ($0.17 per unit) |

| (198 | ) |

|

|

|

|

|

| (198 | ) |

| Net activity related to noncontrolling interests |

| (92 | ) |

|

|

| (116 | ) | (208 | ) |

| Other |

| 23 |

|

|

|

|

| 23 |

|

| Balance at September 30, 2017 | 1,145 |

| $ | 42,024 |

| $ | — |

| $ | (277 | ) | $ | (1,678 | ) | $ | 141 |

| $ | 40,210 |

|

| | | (In millions) | Number of Common Units | Common Unitholders | Parent's Net Investment | Retained Loss | Accumulated Other Comprehensive Loss | Non-controlling Interests | Total Equity | |

| Balance at December 31, 2015 | | $ | 15,920 |

|

| $ | (1,532 | ) | $ | 157 |

| $ | 14,545 |

| |

| (In millions, except per unit amounts) | | (In millions, except per unit amounts) | | Members' Capital | Retained

Loss | Accumulated

Other

Comprehensive

Loss | Non-

controlling

Interests | Total Equity |

| Balance at June 30, 2022 | | Balance at June 30, 2022 | | $ | 34,923 | | $ | (17,067) | | $ | (2,809) | | $ | 108 | | $ | 15,155 | |

| Comprehensive loss: | |

|

|

| | Comprehensive loss: | | |

| Net income (loss) | | 255 |

|

|

| (68 | ) | $ | 187 |

| Net income (loss) | | | (9) | | | 8 | | (1) | |

| Other comprehensive income (loss) | |

|

| (99 | ) | 2 |

| $ | (97 | ) | Other comprehensive income (loss) | | | (349) | | 1 | | (348) | |

| Changes in Parent's net investment | | 542 |

|

|

| $ | 542 |

| |

| Regular cash distribution to Members ($0.18 per unit) | | Regular cash distribution to Members ($0.18 per unit) | | (183) | | | (183) | |

| | Repurchase and cancellation of common units | | Repurchase and cancellation of common units | | (265) | | | (265) | |

| Baker Hughes stock-based compensation cost | | Baker Hughes stock-based compensation cost | | 52 | | | 52 | |

| Other | |

|

|

| 87 |

| $ | 87 |

| Other | | 33 | | 1 | | | 15 | | 49 | |

| Balance at September 30, 2016 | | $ | 16,717 |

| | $ | (1,631 | ) | $ | 178 |

| $ | 15,264 |

| |

| Balance at September 30, 2022 | | Balance at September 30, 2022 | | $ | 34,560 | | $ | (17,075) | | $ | (3,158) | | $ | 132 | | $ | 14,459 | |

See accompanying Notes to Unaudited Condensed Consolidated and Combined Financial Statements.

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | 4

Baker Hughes a GE company,Holdings LLC

Condensed Consolidated and Combined Statements of Cash FlowsChanges in Members' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| (In millions, except per unit amounts) | | Members' Capital | Retained

Loss | Accumulated

Other

Comprehensive

Loss | Non-

controlling

Interests | Total Equity |

| Balance at December 31, 2020 | | $ | 36,512 | | $ | (15,939) | | $ | (2,542) | | $ | 132 | | $ | 18,163 | |

| Comprehensive income (loss): | | | | | | |

| Net income (loss) | | | (706) | | | 24 | | (682) | |

| Other comprehensive income (loss) | | | | 15 | | (1) | | 14 | |

| Regular cash distribution to Members ($0.54 per unit) | | (563) | | | | | (563) | |

| | | | | | |

| | | | | | |

| Repurchase and cancellation of common units | | (106) | | | | | (106) | |

| Baker Hughes stock-based compensation cost | | 153 | | | | | 153 | |

| | | | | | |

| Other | | 42 | | | | (13) | | 29 | |

| Balance at September 30, 2021 | | $ | 36,038 | | $ | (16,645) | | $ | (2,527) | | $ | 142 | | $ | 17,008 | |

|

| | | | | | |

| | Nine Months Ended September 30, |

| (In millions) | 2017 | 2016 |

| Cash flows from operating activities: | | |

| Net income (loss) | $ | (163 | ) | $ | 187 |

|

| Less: Net income (loss) attributable to noncontrolling interests | 5 |

| (68 | ) |

| Net income (loss) after noncontrolling interests | (168 | ) | 255 |

|

| Adjustments to reconcile net income (loss) to net cash flows from operating activities: | | |

| Depreciation and amortization | 716 |

| 439 |

|

| Provision for deferred income taxes | (17 | ) | (40 | ) |

| Changes in operating assets and liabilities: | | |

| Current receivables | (366 | ) | 343 |

|

| Inventories | 162 |

| 11 |

|

| Accounts payable | 98 |

| (271 | ) |

| Progress collections | (126 | ) | (566 | ) |

| Deferred charges | (600 | ) | (217 | ) |

| Other operating items, net | (284 | ) | (149 | ) |

| Net cash flows used in operating activities | (585 | ) | (195 | ) |

| Cash flows from investing activities: | | |

| Expenditures for capital assets | (417 | ) | (330 | ) |

| Proceeds from disposal of assets | 76 |

| 21 |

|

| Net cash paid for acquisitions | (3,365 | ) | (1 | ) |

| Other investing items, net | (173 | ) | (36 | ) |

| Net cash flows used in investing activities | (3,879 | ) | (346 | ) |

| Cash flows from financing activities: | | |

| Net repayments of short-term debt and other borrowings | (325 | ) | (188 | ) |

| Distribution to members | (198 | ) | — |

|

| Contribution received from GE | 7,400 |

| — |

|

| Net transfers from Parent | 1,574 |

| 552 |

|

| Other financing items, net | (241 | ) | (135 | ) |

| Net cash flows from financing activities | 8,210 |

| 229 |

|

| Effect of currency exchange rate changes on cash and equivalents | 48 |

| (122 | ) |

| Increase/ (decrease) in cash and equivalents | 3,794 |

| (434 | ) |

| Cash and equivalents, beginning of period | 981 |

| 1,432 |

|

| Cash and equivalents, end of period | $ | 4,775 |

| $ | 998 |

|

| Supplemental cash flows disclosures: | | |

| Income taxes paid (refunded), net | $ | 122 |

| $ | (7 | ) |

| Interest paid | $ | 31 |

| $ | 29 |

|

| | | | | | | | | | | | | | | | | | |

| (In millions, except per unit amounts) | | Members' Capital | Retained

Loss | Accumulated

Other

Comprehensive

Loss | Non-

controlling

Interests | Total Equity |

| Balance at June 30, 2021 | | $ | 36,266 | | $ | (16,660) | | $ | (2,393) | | $ | 142 | | $ | 17,355 | |

| Comprehensive income (loss): | | | | | | |

| Net income | | | 15 | | | 5 | | 20 | |

| Other comprehensive loss | | | | (134) | | (1) | | (135) | |

| Regular cash distribution to Members ($0.18 per unit) | | (188) | | | | | (188) | |

| | | | | | |

| | | | | | |

| Repurchase and cancellation of common units | | (106) | | | | | (106) | |

| Baker Hughes stock-based compensation cost | | 51 | | | | | 51 | |

| Other | | 15 | | | | (4) | | 11 | |

| Balance at September 30, 2021 | | $ | 36,038 | | $ | (16,645) | | $ | (2,527) | | $ | 142 | | $ | 17,008 | |

See accompanying Notes to Unaudited Condensed Consolidated and Combined Financial Statements.

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | 5

Baker Hughes a GE company,Holdings LLC

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | |

| Nine Months Ended September 30, |

| (In millions) | 2022 | 2021 |

| Cash flows from operating activities: | | |

| Net loss | $ | (745) | | $ | (682) | |

| Adjustments to reconcile net loss to net cash flows from operating activities: | | |

| Depreciation and amortization | 806 | | 832 | |

| Loss on assets held for sale | 426 | | — | |

| Loss on equity securities | 164 | | 955 | |

| Property, plant and equipment impairment, net | 168 | | 21 | |

| | |

| | |

| Inventory impairment | 31 | | — | |

| | |

| | |

| Changes in operating assets and liabilities: | | |

| Current receivables | (452) | | 319 | |

| Inventories | (626) | | 151 | |

| Accounts payable | 263 | | (10) | |

| Progress collections and deferred income | 705 | | (157) | |

| Contract and other deferred assets | (151) | | 178 | |

| Other operating items, net | 408 | | (9) | |

| Net cash flows from operating activities | 997 | | 1,598 | |

| Cash flows from investing activities: | | |

| Expenditures for capital assets | (720) | | (590) | |

| Proceeds from disposal of assets | 189 | | 178 | |

| | |

| | |

| | |

| Other investing items, net | (49) | | 200 | |

| Net cash flows used in investing activities | (580) | | (212) | |

| Cash flows from financing activities: | | |

| Net repayments of debt and other borrowings | (22) | | (60) | |

| Repayment of commercial paper | — | | (832) | |

| | |

| Distributions to Members | (552) | | (563) | |

| | |

| Repurchase of common units | (727) | | (106) | |

| | |

| Other financing items, net | 4 | | (24) | |

| Net cash flows used in financing activities | (1,297) | | (1,585) | |

| Effect of currency exchange rate changes on cash and cash equivalents | (115) | | (9) | |

| Decrease in cash and cash equivalents | (995) | | (208) | |

| Cash and cash equivalents, beginning of period | 3,843 | | 4,125 | |

| Cash and cash equivalents, end of period | $ | 2,848 | | $ | 3,917 | |

| Supplemental cash flows disclosures: | | |

| Income taxes paid, net of refunds | $ | 395 | | $ | 181 | |

| Interest paid | $ | 190 | | $ | 204 | |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Baker Hughes Holdings LLC 2022 Third Quarter Form 10-Q | 6

Baker Hughes Holdings LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

NOTE 1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

DESCRIPTION OF THE BUSINESS

Baker Hughes a GE company,Holdings LLC, a Delaware limited liability company (the Company, BHGE LLC, we, us,("the Company", "BHH LLC", "we", "us", or our "our") and the successor to Baker Hughes Incorporated ("BHI"), is an energy technology company with a Delaware corporation (Baker Hughes)diversified portfolio of technologies and services that span the energy and industrial value chain. As of September 30, 2022, General Electric ("GE") owns 0.7% of our common units and Baker Hughes Company ("Baker Hughes") owns directly or indirectly 99.3% of our common units (collectively, "the Members"). BHH LLC is a fullstream oilfield technology provider that has a unique mix of equipmentSecurities and service capabilities. We conduct business in more than 120 countriesExchange Commission ("SEC") Registrant with separate filing requirements with the SEC and employ over 65,000 employees.its separate financial information can be obtained from www.sec.gov.

BASIS OF PRESENTATION

On July 3, 2017, we closed our previously announced business combination (the Transactions) to combine the oil and gas business (GE O&G) of General Electric Company (GE) and Baker Hughes (refer to "Note 2. Business Acquisition" for further details on the Transactions). In connection with the Transactions, we entered into and are governed by an Amended & Restated Operating Agreement, dated as of July 3, 2017 (the BHGE LLC Agreement). Under the BHGE LLC Agreement, EHHC Newco, LLC (EHHC), a wholly owned subsidiary of Baker Hughes, a GE company (BHGE), is our sole managing member and BHGE is the sole managing member of EHHC. As our managing member, EHHC conducts, directs and exercises full control over all our activities, including our day-to-day business affairs and decision-making, without the approval of any other member. As such, EHHC is responsible for all our operational and administrative decisions and the day-to-day management of our business. GE owns approximately 62.5% of our Common Units and BHGE owns approximately 37.5% of our Common Units indirectly through two wholly owned subsidiaries.

The Transactions were treated as a "reverse acquisition" for accounting purposes and, as such, the historical financial statements of the accounting acquirer, GE O&G, are the historical financial statements of the Company.

The accompanying unaudited condensed consolidated and combined financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S.("U.S." and such principles, U.S. GAAP)"U.S. GAAP") and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC)SEC for interim financial information. All intercompany accountsAccordingly, certain information and transactionsdisclosures normally included in our annual financial statements have been eliminated. condensed or omitted. Therefore, these unaudited condensed consolidated financial statements should be read in conjunction with our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021 ("2021 Annual Report").

In the opinion of management, the condensed consolidated and combined financial statements reflect all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of theby management to fairly state our results of operations, financial position and cash flows of the Company and its subsidiaries for the periods presented and are not indicative of the results that may be expected for a full year.

The Company's financial statements have been prepared on a consolidated basis, effective July 3, 2017. Under this basis of presentation, ourbasis. The condensed consolidated financial statements consolidateinclude the accounts of BHH LLC and all of ourits subsidiaries (entities inand affiliates which it controls or variable interest entities for which we have a controlling financial interest, most often becausedetermined that we hold a majority voting interest).are the primary beneficiary. All subsequent periods will also be presented on a consolidated basis. For all periods prior to July 3, 2017,intercompany accounts and transactions have been eliminated.

In the Company's financial statements were prepared on a combined basis. The combined financial statements combineand notes, certain accounts of GE and its subsidiaries that were historically managed as part of its Oil & Gas business. The condensed consolidated and combined statements of income reflect intercompany expense allocations made to us by GE for certain corporate functions and for shared services provided by GE. Where possible, these allocations were made on a specific identification basis, and in other cases, these expenses were allocated by GE based on relative percentages of net operating costs or some other basis depending on the nature of the allocated cost. See "Note 14. Related Party Transactions" for further information on expenses allocated by GE. The historical financial results in the condensed consolidated and combined financial statements presented may not be indicative of the results that wouldprior year amounts have been achieved had GE O&G operated as a separate, stand-alone entity during those periods.

The GE O&G numbers in the condensed consolidated and combined statements of income (loss) have been reclassedreclassified to conform to the current year presentation. We believe that the current presentation is a more appropriate presentation of the combined businesses. Merger and related costs includes all costs associated with the Transactions described in Note 2. Refer to "Note 2. Business Acquisition" for further details.

In the notes to the unaudited condensed consolidated and combined financial statements, all dollar and common unit amounts in tabulations are in millions of dollars and units, respectively, unless otherwise indicated.

Baker Hughes, a GE company, LLC

Notes Certain columns and rows in our financial statements and notes thereto may not add due to Unaudited Condensed Consolidated and Combined Financial Statements

the use of rounded numbers.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

UsePlease refer to "Note 1. Basis of Estimates

The preparationPresentation and Summary of Significant Accounting Policies," to our consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and judgments that affect the reported amounts of assets and liabilities, disclosure of any contingent assets or liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. We basefrom our estimates and judgments on historical experience and on various other assumptions and information that we believe to be reasonable under the circumstances. Estimates and assumptions about future events and their effects cannot be perceived with certainty, and accordingly, these estimates may change as new events occur, as more experience is acquired, as additional information is obtained and as our operating environment changes. While we believe that the estimates and assumptions used in the preparation of the condensed consolidated and combined financial statements are appropriate, actual results could differ from those estimates. Estimates are used for, but are not limited to, determining the following: allowance for doubtful accounts and inventory valuation reserves; recoverability of long-lived assets, including revenue recognition on long term contracts, valuation of goodwill; useful lives used in depreciation and amortization; income taxes and related valuation allowances; accruals for contingencies; actuarial assumptions to determine costs and liabilities related to employee benefit plans; stock-based compensation expense, valuation of derivatives and the fair value of assets acquired and liabilities assumed in acquisitions, and expense allocations for certain corporate functions and shared services provided by GE.

Foreign Currency

Assets and liabilities of non‑U.S. operations with a functional currency other than the U.S. dollar have been translated into U.S. dollars at the quarterly exchange rates, and revenues, expenses, and cash flows have been translated at average rates2021 Annual Report for the respective periods. Any resulting translation gains and losses are included in other comprehensive income (loss).

Gains and losses from foreign currency transactions, such as those resulting from the settlement of receivables or payables in the non-functional currency and those resulting from remeasurements of monetary items, are included in the condensed consolidated and combined statement of income (loss).

Cost and Equity Method Investment

Investments in privately held companies in which we do not have the ability to exercise significant influence, most often because we hold a voting interest of 0% to 20% are accounted for using the cost method.

Associated companies are entities in which we do not have a controlling financial interest, but over which we have significant influence, most often because we hold a voting interest of 20% to 50%. Associated companies are accounted for as equity method investments. Results of associated companies are presented on a one-line basis in the caption "Equity in loss of affiliate" in our condensed consolidated and combined statements of income (loss). Investments in, and advances to, associated companies are presented on a one-line basis in the caption "All other assets" in our condensed consolidated and combined statement of financial position.

Sales of Goods and Services

We record all sales of goods and services only when a firm sales agreement is in place, delivery has occurred or services have been rendered and collectability of the fixed or determinable sales price is reasonably assured.

Except for goods sold under long-term construction type contracts and service agreements, we recognize sales of goods under the provisions of SEC Staff Accounting Bulletin (SAB) 104, Revenue Recognition. In situations where arrangements include customer acceptance provisions based on seller or customer-specified objective criteria, we recognize revenue when we have reliably demonstrated that all specified acceptance criteria have been met or when formal acceptance occurs, respectively. We do not provide for anticipated losses before we record sales.

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

We recognize revenue on larger construction and equipment contracts using long-term construction accounting. We estimate total long-term contract revenue net of price concessions as well as total contract costs. For larger construction and equipment contracts, we recognize sales based on our progress toward contract completion measured by actual costs incurred in relation to our estimate of total expected costs. We routinely update our estimates of future costs for agreements in process and report any cumulative effects of such adjustments in current operations. We provide for any loss that we expect to incur on these agreements when that loss is probable.

We sell product services under long-term product maintenance agreements, where costs of performing services are incurred on an other than straight-line basis. We recognize related sales based on the extentdiscussion of our progress toward completion measured by actual costs incurred in relation to our estimate of total expected costs. We routinely update our estimates of future costs for agreements in process and report any cumulative effects of such adjustments in current operations.

For our long-term product maintenance agreements, we regularly assess customer credit risk inherent in the carrying amounts of receivables and contract costs and estimated earnings, including the risk that contractual penalties may not be sufficient to offset our accumulated costs in the event of customer termination. We gain insight into future utilization and cost trends, as well as credit risk, through our knowledge of the installed base of equipment and the close interaction with our customers that comes with supplying critical services and parts over extended periods. Revisions, after applying the cumulative catch up basis ofsignificant accounting may affect a product services agreement's total estimated profitability resulting in an adjustment of earnings. We provide for probable losses when they become evident.

Arrangements for the sale of goods and services sometimes include multiple components. Our arrangements with multiple components usually involve an upfront deliverable of equipment and future service deliverables such as installation, commissioning, training or the future delivery of ancillary products. In most cases, the relative values of the undelivered components are not significant to the overall arrangement and are typically delivered within three to six months after the core product has been delivered. In such agreements, selling price is determined for each component and any difference between the total of the separate selling prices and total contract consideration (i.e., discount) is allocated pro rata across each of the components in the arrangement. The value assigned to each component is objectively determined and obtained primarily from sources such as the separate selling price for that or a similar item or from competitor prices for similar items. If such evidence is not available, we use our best estimate of selling price, which is established consistent with the pricing strategy of the business and considers product configuration, geography, customer type, and other market specific factors.

Research and Development

Research and development costs are expensed as incurred and relate to the research and development of new products and services. These costs amounted to $162 million and $343 million for the three and nine months ended September 30, 2017, respectively, and $87 million and $253 million for the three and nine months ended September 30, 2016, respectively. Research and development expenses were reported in cost of goods sold and cost of services sold.policies.

Cash and Cash Equivalents

Short-term investments with original maturities of three months or less are included in cash equivalents unless designated as available-for-sale and classified as investment securities.

As of September 30, 2017,2022 and December 31, 2016, $1,2472021, we had $611 million of which approximately $1 billion is related to cash held on behalf of GE, and $752$601 million, respectively, of cash and equivalents were held in bank accounts andthat cannot be readily released, transferred or otherwise converted into a currency that is regularly transacted internationally, due to lack of market liquidity, capital controls or similar monetary or exchange limitations limiting the flow of capital out of the jurisdiction. CashThese funds are available to fund operations and equivalents includes $1,267 million of cash at September 30, 2017 held on behalf of GE and a corresponding liability is reportedgrowth in short term borrowings. See "Note 14. Related Party Transactions" for further details.

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

Allowance for Doubtful Accounts

We establish an allowance for doubtful accounts based on various factors including the payment history and financial condition of our debtors and the economic environment. Provisions for doubtful accounts are recorded based on the aging status of the debtor accounts or when it becomes evident that the debtor will not make the required payments at either contractual due dates or in the future.

Concentration of Credit Risk

We grant credit to our customers who primarily operate in the oil and natural gas industry. Although this concentration affects our overall exposure to credit risk, our current receivables are spread over a diverse group of customers across many countries, which mitigates this risk. We perform periodic credit evaluations of our customers' financial conditions, including monitoring our customers' payment history and current credit worthiness to manage this risk. We do not generally require collateral in support of our current receivables, but we may require payment in advance or security in the form of a letter of credit or a bank guarantee.

Inventories

All inventories are stated at the lower of cost or net realizable values and they are measured on a first-in, first-out (FIFO) or average cost basis. As necessary, we record provisions and maintain reserves for excess, slow moving and obsolete inventory. To determine these reserve amounts, we regularly review inventory quantities on hand and compare them to estimates of future product demand, market conditions, production requirements and technological developments.

Property, Plant and Equipment (PP&E)

Property, plant and equipment is initially stated at cost and is depreciated over its estimated economic life. Subsequently, property, plant and equipment is measured at cost less accumulated depreciation and impairment losses. We manufacture a substantial portion of our tools and equipment and the cost of these items, which includes direct and indirect manufacturing costs, is capitalized and carried in inventory until it is completed.

Other Intangible Assets

We amortize the cost of other intangible assets over their estimated useful lives unless such lives are deemed indefinite. The cost of intangible assets is generally amortized on a straight-line basis over the asset's estimated economic life. Amortizable intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the related carrying amounts may not be recoverable. In these circumstances, they are tested for impairment based on undiscounted cash flows and, if impaired, written down to fair value based on either discounted cash flows or appraised values. Intangible assets with indefinite lives are tested annually for impairment and written down to fair value as required. Refer to the Impairment of Goodwill and Other Long-Lived Assets accountingpolicy.

Impairment of Goodwill and Other Long-lived Assets

We perform an annual impairment test of goodwill on a qualitative or quantitative basis for each of our reporting units as of July 1, or more frequently when circumstances indicate an impairment may exist at the reporting unit level. When performing the annual impairment test we have the option of first performing a qualitative assessment to determine the existence of events and circumstances that would lead to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If such a conclusion is reached, we would then be required to perform a quantitative impairment assessment of goodwill. However, if the assessment leads to a determination that it is more likely than not that the fair value of a reporting unit is greater than its carrying amount, then no further assessments are required. A quantitative assessment for the determination of impairment is made by comparing the carrying amount of each reporting unit with its fair value, which is generally calculated using a combination of market, comparable transaction and discounted cash flow approaches. See "Note 6. Goodwill and Other Intangible Assets" for further information on valuation methodology and impairment of goodwill.

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

We review PP&E, intangible assets and certain other long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable and at least annually for indefinite-lived intangible assets. When testing for impairment, we group our long-lived assets with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities (or asset group). The determination of recoverability is made based upon the estimated undiscounted future net cash flows. The amount of impairment loss, if any, is determined by comparing the fair value, as determined by a discounted cash flow analysis, with the carrying value of the related assets.

Financial Instruments

Our financial instruments include cash and equivalents, current receivables, investments, accounts payables, short and long-term debt, and derivative financial instruments.

We monitor our exposure to various business risks including commodity prices and foreign currency exchange rates and we regularly use derivative financial instruments to manage these risks. At the inception of a new derivative, we designate the derivative as a hedge or we determine the derivative to be undesignated as a hedging instrument. We document the relationships between the hedging instruments and the hedged items, as well as our risk management objectives and strategy for undertaking various hedge transactions. We assess whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in cash flows of the hedged item at both the inception of the hedge and on an ongoing basis.

We have a program that utilizes foreign currency forward contracts to reduce the risks associated with the effects of certain foreign currency exposures. Under this program, our strategy is to have gains or losses on the foreign currency forward contracts mitigate the foreign currency transaction and translation gains or losses to the extent practical. These foreign currency exposures typically arise from changes in the value of assets (for example, current receivables) and liabilities (for example, current payables) which are denominated in currencies other than the functional currency of the respective entity. We record all derivatives as of the end of our reporting period in our consolidated and combined statement of financial position at fair value. For the forward contracts held as undesignated hedging instruments, we record the changes in fair value of the forward contracts in our condensed consolidated and combined statements of income along with the change in the fair value, related to foreign exchange movements, of the hedged item. Changes in the fair value of forward contracts designated as cash flow hedging instruments are recognized in other comprehensive income until the hedged item is recognized in earnings. If derivatives designated as a cash flow hedge are determined to be ineffective, the ineffective portion of that derivative's change in fair value is recognized in earnings.

Fair Value Measurements

For financial assets and liabilities measured at fair value on a recurring basis, fair value is the price we would receive to sell an asset or pay to transfer a liability in an orderly transaction with a market participant at the measurement date. In the absence of active markets for the identical assets or liabilities, such measurements involve developing assumptions based on market observable data and, in the absence of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs at the measurement date.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions. Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level 1 - Quoted prices for identical instruments in active markets.

Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 - Significant inputs to the valuation model are unobservable.

We maintain policies and procedures to value instruments using the best and most relevant data available. In addition, we perform reviews to assess the reasonableness of the valuations. With regard to Level 3 valuations

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

(including instruments valued by third parties), we perform a variety of procedures to assess the reasonableness of the valuations. Such reviews include an evaluation of instruments whose fair value change exceeds predefined thresholds (and/or does not change) and consider the current interest rate, currency and credit environment, as well as other published data, such as rating agency market reports and current appraisals.

Recurring Fair Value Measurements

Derivatives

We use closing prices for derivatives included in Level 1, which are traded either on exchanges or liquid over-the-counter markets. The majority of our derivatives are valued using internal models. The models maximize the use of market observable inputs including interest rate curves and both forward and spot prices for currencies and commodities. Derivative assets and liabilities included in Level 2 primarily represent foreign currency and commodity forward contracts for the Company.

Investments in Debt and Equity Securities

When available, we use quoted market prices to determine the fair value of investment securities, and they are included in Level 1. Level 1 securities primarily include publicly traded equity securities.

For investment securities for which market prices are observable for identical or similar investment securities but not readily accessible for each of those investments individually (that is, it is difficult to obtain pricing information for each individual investment security at the measurement date), we use pricing models that are consistent with what other market participants would use. The inputs and assumptions to the models are derived from market observable sources including: benchmark yields, reported trades, broker/dealer quotes, issuer spreads, benchmark securities, bids, offers, and other market-related data. Thus, certain securities may not be priced using quoted prices, but rather determined from market observable information. These investments are included in Level 2. When we use valuations that are based on significant unobservable inputs, we classify the investment securities in Level 3.

Non-Recurring Fair Value Measurements

Certain assets are measured at fair value on a non-recurring basis. These assets are not measured at fair value on an ongoing basis, but are subject to fair value adjustments only in certain circumstances. These assets can include long-lived assets that have been reduced to fair value when they are held for sale, cost and equity method investments and long-lived assets that are written down to fair value when they are impaired and the remeasurement of retained investments in formerly consolidated subsidiaries upon a change in control that results in a deconsolidation of a subsidiary, if we sell a controlling interest and retain a noncontrolling stake in the entity. Assets that are written down to fair value when impaired and retained investments are not subsequently adjusted to fair value unless further impairment occurs.

Cost and Equity Method Investments

Cost and equity method investments are valued using market observable data such as quoted prices when available. When market observable data is unavailable, investments are valued using a discounted cash flow model, comparative market multiples or a combination of both approaches as appropriate and other third-party pricing sources.

Long-lived Assets

Fair values of long-lived assets, including real estate, are primarily derived internally and are based on observed sales transactions for similar assets. In other instances, for example, collateral types for which we do not have comparable observed sales transaction data, collateral values are developed internally and corroborated by external appraisal information. Adjustments to third-party valuations may be performed in circumstances where market comparables are not specific to the attributes of the specific collateral or

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

appraisal information may not be reflective of current market conditions due to the passage of time and the occurrence of market events since receipt of the information.

Income Taxes

We are treated as a partnership for U.S. federal income tax purposes. As such, we will not be subject to U.S. federal income tax under current U.S. tax laws. Non-U.S. current and deferred income taxes owed by our subsidiaries are reflected in the financial statements.

We account for taxes under the asset and liability method. Under this method, deferred income taxes are recognized for temporary differences between the financial statement and tax return bases of assets and liabilities as well as from net operating losses and tax credit carryforwards, based on enacted tax rates expected to be in effect when taxes actually are paid or recovered and other provisions of the tax law. The effect of a change in tax laws or rates on deferred tax assets and liabilities is recognized in income in the period in which such change is enacted. Future tax benefits are recognized to the extent that realization of such benefits is more likely than not, and a valuation allowance is established for any portion of a deferred tax asset that management believes may not be realized.

We currently intend to indefinitely reinvest substantially all earnings of our foreign subsidiaries with operations outside the U.S. Most of these earnings have been reinvested in active non-U.S. business operationsjurisdictions, and we do not intendcurrently anticipate a need to repatriatetransfer these earningsfunds to fundthe U.S. operations. If the earnings of our foreign subsidiaries were repatriated, the tax consequence would be applicable at the partner level as we are treated as a pass-through entity for U.S. federal income tax purposes.

Significant judgment is required in determining our tax expense and in evaluating our tax positions, including evaluating uncertainties. We operate in more than 120 countries and our tax filings are subject to audit by the tax authorities in the jurisdictions where we conduct business. These audits may result in assessments of additional taxes that are resolved with the tax authorities or through the courts. We have provided for the amounts that we believe will ultimately result from these proceedings. We recognize uncertain tax positions that are “more likely than not” to be sustained if the relevant tax authority were to audit the position with full knowledge of all the relevant facts and other information. For those tax positions that meet this threshold, we measure the amount of tax benefit based on the largest amount of tax benefit that has a greater than 50% chance of realizing in a final settlement with the relevant authority. We classify interest and penalties associated with uncertain tax positions as income tax expense. The effects of tax adjustments and settlements from taxing authorities are presented in the combined financial statements in the period they are recorded.

Environmental Liabilities

We are involved in numerous remediation actions to clean up hazardous waste as required by federal and state laws. Liabilities for remediation costs exclude possible insurance recoveries and, when dates and amounts of such costs are not known, are not discounted. When there appears to be a range of possible costs with equal likelihood, liabilities are based on the low end of such range. It is reasonably possible that our environmental remediation exposure will exceed amounts accrued. However, due to uncertainties about the status of laws, regulations, technology and information related to individual sites, such amounts are not reasonably estimable. The determination of the required accruals for remediation costs is subject to uncertainty, including the evolving nature of environmental regulations and the difficulty in estimating the extent and type of remediation activity that is necessary.

NEW ACCOUNTING STANDARDS ADOPTED

On January 1, 2017, we adopted the Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) No. 2015-11, Simplifying the Measurement of Inventory, which was intended to simplify the subsequent measurement of inventory held by an entity not measured using last-in, first-out (LIFO) or retail inventory method. The amendments eliminated the requirement that entities consider the replacement cost of inventory and the net realizable value less a normal profit margin, which was historically used to establish a floor

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

and ceiling for an assessment of market value. The adoption of this standard was immaterial to our financial statements.

NEW ACCOUNTING STANDARDS TO BE ADOPTED

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers. The ASU will supersede most of the existing revenue recognition requirements in U.S. GAAP and will require entities to recognize revenue at an amount that reflects the consideration to which the Company expects to be entitled in exchange for transferring goods or services to a customer. The new standard also requires significantly expanded disclosures regarding the qualitative and quantitative information of an entity's nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The pronouncement is effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period.

The standard permits either a full retrospective method of adoption, in which the standard is applied to all the periods presented, or a modified retrospective method of adoption, in which the standard is applied only to the current period with a cumulative-effect adjustment reflected in retained earnings. We will adopt the standard on January 1, 2018, will apply it retrospectively to all periods presented, and will elect the practical expedient for contract modifications.

The new standard requires companies to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time based on when control of goods and services transfer to a customer. As a result, we expect changes in the presentation of our financial statements, including: (1) timing of revenue recognition, and (2) changes in classification between revenue and costs. The new standard will have no cash impact and, as such, does not affect the economics of our underlying customer contracts. The effect of applying the new guidance to our existing book of contracts will result in lower reported earnings in 2018 (and comparative periods previously reported) and in the early years after adoption. However, we expect to experience an increase in reported earnings, on that existing book of contracts, as they mature.

We expect that the timing of revenue recognition on our long-term product service agreements will be significantly affected. Although we expect to continue to recognize revenue over time on these contracts, we also expect that there will be changes to how contract modifications, termination clauses and purchase options are accounted for by us. In particular, under our existing processes, the cumulative impact from a contract modification on revenue already recorded is recognized in the period in which the modification is agreed. Under the new standard, we expect the impact from certain types of modifications to be recognized over the remaining life of the contract.

Based on our assessment and best estimates to date, we expect a non-cash charge to our January 1, 2016 retained earnings balance of approximately $500 million. This amount includes significant estimates and will remain subject to change as we complete our evaluation of the new standard and reflect actual activity for 2017. We do not currently believe that the adoption of the ASU will have any material impact on post acquisition revenue and operating profits of legacy Baker Hughes, and will validate the impact as we continue the integration of the acquired business.

In February 2016, the FASB issued ASU No. 2016-02, Leases. The new standard establishes a right-of-use (ROU) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition. Similarly, lessors will be required to classify leases as sales-type, finance or operating, with classification affecting the pattern of income recognition. Classification for both lessees and lessors will be based on an assessment of whether risks and rewards as well as substantive control have been transferred through a lease contract. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, with early adoption permitted. A modified retrospective transition approach is required for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. While we continue to evaluate the effect of the standard on our ongoing financial reporting, we anticipate that the adoption of the ASU may materially affect our condensed consolidated and combined financial statements.

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

In October 2016, the FASB issued ASU No. 2016-16, Accounting for Income Taxes: Intra-Entity Asset Transfers of Assets Other than Inventory. The ASU eliminates the deferral of tax effects of intra-entity asset transfers other than inventory. As a result, the tax expense from the intercompany sale of assets, other than inventory, and associated changes to deferred taxes will be recognized when the sale occurs even though the pre-tax effects of the transaction have not been recognized. The new standard is effective for annual periods beginning after December 15, 2017, and interim periods within those annual periods. The effect of the adoption of the standard will depend on the nature and amount of future transactions but is currently expected as an increase to retained earnings of approximately $300 million. Future earnings will be reduced in total by this amount. The effect of the change on future transactions will depend on the nature and amount of future transactions as it will affect the timing of recognition of both tax expenses and tax benefits, with no change in the associated cash flows.

In March 2017, the FASB issued ASU No. 2017-07, Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which changes the income statement presentation of net periodic benefit cost by requiring separation between the service cost component and all other components. The service cost component is required to be presented as an operating expense with other similar compensation costs arising for services rendered by the pertinent employees during the period. The non-operating components must be presented outside of income from operations. This pronouncement is effective for annual reporting periods beginning after December 15, 2017, and the presentation disclosure should be applied using a retrospective approach. Early adoption is permitted. We are currently evaluating the impact of this ASU on our condensed consolidated and combined financial statements and related disclosures.

All other newNew accounting pronouncements that have been issued but not yet effective are currently being evaluated and at this time are not expected to have a material impact on our financial position or results of operations.

NOTE 2. BUSINESS ACQUISITION

On July 3, 2017, we closed the Transactions to combine GE O&G and Baker Hughes creating a fullstream oilfield technology provider that has a unique mix of equipment and service capabilities. The Transactions were executed using a partnership structure, pursuant to which GE O&G and Baker Hughes each contributed their operating assets to the Company. As a partnership, we will not be subject to U.S. federal income tax under current US tax laws and, accordingly, will not incur any material current or deferred U.S. federal income taxes. Our foreign subsidiaries, however, are expected to incur current and deferred foreign income taxes. GE holds an approximate 62.5% interest in us and former Baker Hughes shareholders hold an approximate 37.5% interest through the ownership of 100% of Class A Common Stock of BHGE. GE holds its voting interest through Class B Common Stock in BHGE and its economic interest through a corresponding number of our Common Units. Former Baker Hughes shareholders immediately after the completion of the Transactions also received a Special Dividend of $17.50 per share paid by BHGE to holders of record of the Company's Class A Common Stock. GE contributed $7.4 billion to us to fund substantially all of the Special Dividend.Holdings LLC 2022 Third Quarter Form 10-Q | 7

Prior to the Transactions, shares of Baker Hughes common stock were registered pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended (the Exchange Act) and listed on the New York Stock Exchange and the SIX Swiss Exchange. Shares of Baker Hughes common stock were suspended from trading on the New York Stock Exchange and the SIX Swiss Exchange prior to the open of trading on July 5, 2017. The New York Stock Exchange filed a Form 25 on Baker Hughes' behalf to provide notice to the SEC regarding the withdrawal of shares of Baker Hughes common stock from listing and to terminate the registration of such shares under Section 12(b) of the Exchange Act.

As a result of the Transactions, on July 3, 2017, the Company issued 428 million Common Units to BHGE and 717 million Common Units to GE.

Based on the relative voting rights of former Baker Hughes shareholders and GE immediately following completion of the Transactions, and after taking into consideration all relevant facts, GE O&G is considered to be the "acquirer" for accounting purposes. As a result,the Transactions are reported as a business combination using the acquisition method of accounting with GE O&G treated as the "acquirer" and Baker Hughes treated as the "acquired" company.

Baker Hughes a GE company,Holdings LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

NOTE 2. REVENUE RELATED TO CONTRACTS WITH CUSTOMERS

DISAGGREGATED REVENUE

We disaggregate our revenue from contracts with customers by primary geographic markets.

| | | | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| Total Revenue | 2022 | 2021 | 2022 | 2021 |

| U.S. | $ | 1,286 | | $ | 1,199 | | $ | 3,611 | | $ | 3,337 | |

| Non-U.S. | 4,083 | | 3,894 | | 11,640 | | 11,680 | |

| Total | $ | 5,369 | | $ | 5,093 | | $ | 15,251 | | $ | 15,017 | |

REMAINING PERFORMANCE OBLIGATIONS

The tables below presentAs of September 30, 2022 and 2021, the fair valueaggregate amount of the consideration exchangedtransaction price allocated to the unsatisfied (or partially unsatisfied) performance obligations was $24.7 billion and $23.5 billion, respectively. As of September 30, 2022, we expect to recognize revenue of approximately 55%, 68% and 87% of the total remaining performance obligations within 2, 5, and 15 years, respectively, and the preliminary estimates ofremaining thereafter. Contract modifications could affect both the fair value of assets acquired and liabilities assumed and the associated fair value of the noncontrolling interest relatedtiming to the acquired net assets of Baker Hughes. The final determination of fair value for certain assets and liabilities will be completedcomplete as soonwell as the information necessaryamount to completebe received as we fulfill the analysis is obtained. These amounts, which may differ materiality from these preliminary estimates, will be finalized as soon as possible, but no later than one year from the acquisition date. The primary areas of the preliminary estimates that are not yet finalized relate to inventory, property, plant and equipment, identifiable intangible assets, deferred income taxes, uncertain tax positions and contingencies.related remaining performance obligations.

|

| | | |

| Purchase consideration | |

| (In millions, except share and per share amounts) | July 3, 2017 |

| Baker Hughes shares outstanding | 426,097,407 |

|

| Restricted stock units vested upon closing | 1,611,566 |

|

| Total Baker Hughes shares outstanding for purchase consideration | 427,708,973 |

|

| Baker Hughes share price on July 3, 2017 per share | $ | 57.68 |

|

| Purchase consideration | $ | 24,670 |

|

| Rollover of outstanding options into options to purchase Class A shares of BHGE (fair value) | 114 |

|

| Precombination service of restricted stock units (fair value) | $ | 14 |

|

Total purchase consideration

| $ | 24,798 |

|

|

| | | |

| Preliminary identifiable assets acquired and liabilities assumed | Estimated fair value at July 3, 2017 |

| Assets | |

| Cash and equivalents | $ | 4,133 |

|

| Current receivables | 2,378 |

|

| Inventories | 1,975 |

|

| Property, plant and equipment | 4,048 |

|

Other intangible assets (a) | 4,400 |

|

All other assets | 1,395 |

|

| Liabilities | |

| Accounts payable | $ | (1,115 | ) |

| Borrowings | (3,373 | ) |

| Liabilities for pension and other postretirement benefits | (684 | ) |

All other liabilities (b) | (1,426 | ) |

| Total identifiable net assets | $ | 11,731 |

|

| Noncontrolling interest associated with net assets acquired | (77 | ) |

Goodwill (c) | 13,144 |

|

| Total purchase consideration | $ | 24,798 |

|

| |

(a)

| Intangible assets, as provided in the table below, are recorded at estimated fair value, as determined by management based on available information which includes a preliminary valuation. The estimated useful lives for intangible assets were determined based upon the remaining useful economic lives of the intangible assets that are expected to contribute directly or indirectly to future cash flows. We consider the Baker Hughes trade name to be an indefinite life intangible asset, which will not be amortized and will be subject to an annual impairment test. |

|

| | | | |

| | Estimated Fair Value | Estimated Weighted

Average Life (Years) |

Customer relationships

| $ | 1,300 |

| 15 |

| Trade name - Baker Hughes | 2,000 |

| Indefinite-lived |

| Trade names - other | 200 |

| 10 |

| Developed technology | 900 |

| 10 |

| Total | $ | 4,400 |

| |

Baker Hughes, a GE company, LLC

Notes to Unaudited Condensed Consolidated and Combined Financial Statements

| |

(b)

| All other liabilities includes approximately $188 million of net deferred tax liabilities related to the estimated fair value of intangible assets included in the preliminary purchase consideration and approximately $134 million of other net deferred tax assets. |

| |

(c)

| Goodwill represents the excess of the total purchase consideration over fair value of the net assets recognized and represents the future economic benefits that we believe will result from combining the operations of GE O&G and Baker Hughes, including expected future synergies and operating efficiencies. Goodwill resulting from the Transactions has been preliminarily allocated to the Oilfield Services segment of which $67 million is deductible for tax purposes. |

INCOME TAXES

We are treated as a partnership for U.S. federal income tax purposes. As such, we will not be subject to U.S. federal income tax under current U.S. tax laws. Our members will each be required to take into account for U.S. federal income tax purposes their distributive share of our items of income, gain, loss and deduction, which generally will include the U.S. operations of both Baker Hughes and GE O&G. BHGE and GE will each be taxed on their distributive share of income and gain, whether or not a corresponding amount of cash or other property is distributed to them. For assets held indirectly by us through subsidiaries, the taxes attributable to those subsidiaries will be reflected in our condensed consolidated and combined financial statements.

MERGER AND RELATED COSTS