UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| | | |

| þ | | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended May 31,November 30, 2017. |

| or |

| o | | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number: 001-36079

CHS Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Minnesota (State or other jurisdiction of incorporation or organization) | | 41-0251095 (I.R.S. Employer Identification Number) |

| | | |

5500 Cenex Drive Inver Grove Heights, Minnesota 55077 (Address of principal executive offices, including zip code) | | (651) 355-6000 (Registrant’s telephone number, including area code) |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

YES þ NO o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ | Smaller reporting company o | Emerging growth company o |

| | | (Do not check if a smaller reporting company) | | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO þ

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date: The Registrant has no common stock outstanding.

INDEX

Unless the context otherwise requires, for purposes of this Quarterly Report on Form 10-Q, the words “we,” “us,” “our,” the “Company” and “CHS” refer to CHS Inc., a Minnesota cooperative corporation, and its subsidiaries as of May 31,November 30, 2017.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains and our other publicly available documents may contain, and our officers, directors and other representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our businesses, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements are discussed or identified in our public filings made with the U.S. Securities and Exchange Commission ("SEC"), including in the "Risk Factors" discussion in Item 1A of our Annual Report on Form 10-K for the year ended August 31, 2016.2017. Any forward-looking statements made by us in this Quarterly Report on Form 10-Q are based only on information currently available to us and speak only as of the date on which the statement is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by applicable law.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CHS INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | May 31,

2017 | | August 31,

2016 | November 30,

2017 | | August 31,

2017 |

| | (Dollars in thousands) | (Dollars in thousands) |

| ASSETS | | | | | | |

| Current assets: | |

| |

|

| |

| |

|

|

| Cash and cash equivalents | $ | 267,229 |

| | $ | 279,313 |

| $ | 252,129 |

| | $ | 181,379 |

|

| Receivables | 2,722,325 |

| | 2,880,763 |

| 2,059,623 |

| | 1,869,632 |

|

| Inventories | 2,684,087 |

| | 2,370,699 |

| 3,046,101 |

| | 2,576,585 |

|

| Derivative assets | 388,188 |

| | 543,821 |

| 283,256 |

| | 232,017 |

|

| Margin deposits | 251,695 |

| | 310,276 |

| 206,955 |

| | 206,062 |

|

| Supplier advance payments | 431,433 |

| | 347,600 |

| 542,139 |

| | 249,234 |

|

| Other current assets | 255,236 |

| | 202,708 |

| 289,250 |

| | 299,618 |

|

| Total current assets | 7,000,193 |

| | 6,935,180 |

| 6,679,453 |

| | 5,614,527 |

|

| Investments | 3,841,749 |

| | 3,795,976 |

| 3,777,000 |

| | 3,750,993 |

|

| Property, plant and equipment | 5,409,151 |

| | 5,488,323 |

| 5,266,408 |

| | 5,356,434 |

|

| Other assets | 970,704 |

| | 1,092,656 |

| 1,061,562 |

| | 1,251,802 |

|

| Total assets | $ | 17,221,797 |

| | $ | 17,312,135 |

| $ | 16,784,423 |

| | $ | 15,973,756 |

|

| LIABILITIES AND EQUITIES | | | | | | |

| Current liabilities: | |

| | |

| |

| | |

|

| Notes payable | $ | 3,321,808 |

| | $ | 2,731,479 |

| $ | 2,480,264 |

| | $ | 1,988,215 |

|

| Current portion of long-term debt | 193,096 |

| | 214,329 |

| 71,022 |

| | 156,345 |

|

| Customer margin deposits and credit balances | 132,479 |

| | 208,991 |

| 139,868 |

| | 157,914 |

|

| Customer advance payments | 390,576 |

| | 412,823 |

| 414,441 |

| | 413,163 |

|

| Accounts payable | 1,809,868 |

| | 1,819,049 |

| 2,380,998 |

| | 1,951,292 |

|

| Derivative liabilities | 284,212 |

| | 513,599 |

| 226,279 |

| | 316,018 |

|

| Accrued expenses | 422,371 |

| | 422,494 |

| 409,522 |

| | 437,527 |

|

| Dividends and equities payable | 134,718 |

| | 198,031 |

| 121,209 |

| | 12,121 |

|

| Total current liabilities | 6,689,128 |

| | 6,520,795 |

| 6,243,603 |

| | 5,432,595 |

|

| Long-term debt | 2,046,264 |

| | 2,082,876 |

| 1,936,744 |

| | 2,023,448 |

|

| Long-term deferred tax liabilities | 350,966 |

| | 487,762 |

| 350,841 |

| | 333,221 |

|

| Other liabilities | 276,483 |

| | 354,452 |

| 315,460 |

| | 278,667 |

|

| Commitments and contingencies |

|

| |

|

| |

| Commitments and contingencies (Note 12) | |

|

| |

|

|

| Equities: | |

| | |

| |

| | |

|

| Preferred stock | 2,264,063 |

| | 2,244,132 |

| 2,264,038 |

| | 2,264,038 |

|

| Equity certificates | 4,214,657 |

| | 4,237,174 |

| 4,319,840 |

| | 4,341,649 |

|

| Accumulated other comprehensive loss | (209,700 | ) | | (211,726 | ) | (178,445 | ) | | (183,670 | ) |

| Capital reserves | 1,577,469 |

| | 1,582,380 |

| 1,520,218 |

| | 1,471,217 |

|

| Total CHS Inc. equities | 7,846,489 |

| | 7,851,960 |

| 7,925,651 |

| | 7,893,234 |

|

| Noncontrolling interests | 12,467 |

| | 14,290 |

| 12,124 |

| | 12,591 |

|

| Total equities | 7,858,956 |

| | 7,866,250 |

| 7,937,775 |

| | 7,905,825 |

|

| Total liabilities and equities | $ | 17,221,797 |

| | $ | 17,312,135 |

| $ | 16,784,423 |

| | $ | 15,973,756 |

|

The accompanying notes are an integral part of the consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | For the Three Months Ended

May 31, | | For the Nine Months Ended

May 31, | For the Three Months Ended

November 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2017 | | 2016 |

| | (Dollars in thousands) | (Dollars in thousands) |

| Revenues | $ | 8,614,090 |

| | $ | 7,796,588 |

| | $ | 23,982,746 |

| | $ | 22,164,710 |

| $ | 8,048,889 |

| | $ | 8,048,250 |

|

| Cost of goods sold | 8,366,988 |

| | 7,479,076 |

| | 23,142,205 |

| | 21,346,376 |

| 7,735,627 |

| | 7,695,553 |

|

| Gross profit | 247,102 |

| | 317,512 |

| | 840,541 |

| | 818,334 |

| 313,262 |

| | 352,697 |

|

| Marketing, general and administrative | 153,498 |

| | 143,436 |

| | 459,831 |

| | 468,394 |

| 140,168 |

| | 147,849 |

|

| Reserve and impairment charges | 323,901 |

| | 26,016 |

| | 414,009 |

| | 33,869 |

| |

| Reserve and impairment charges (recoveries), net | | (3,787 | ) | | 18,357 |

|

| Operating earnings (loss) | (230,297 | ) | | 148,060 |

| | (33,299 | ) | | 316,071 |

| 176,881 |

| | 186,491 |

|

| (Gain) loss on investments | (393 | ) | | (700 | ) | | 4,226 |

| | (9,422 | ) | (2,819 | ) | | 7,401 |

|

| Interest expense | 39,201 |

| | 37,466 |

| | 117,411 |

| | 71,553 |

| 40,702 |

| | 38,265 |

|

| Other income | (11,554 | ) | | (10,774 | ) | | (70,409 | ) | | (22,155 | ) | |

| Other (income) loss | | (22,195 | ) | | (44,401 | ) |

| Equity (income) loss from investments | (48,393 | ) | | (72,453 | ) | | (124,521 | ) | | (131,819 | ) | (38,362 | ) | | (40,328 | ) |

| Income (loss) before income taxes | (209,158 | ) | | 194,521 |

| | 39,994 |

| | 407,914 |

| 199,555 |

| | 225,554 |

|

| Income tax expense (benefit) | (163,018 | ) | | 4,838 |

| | (137,781 | ) | | (17,761 | ) | 19,936 |

| | 16,612 |

|

| Net income (loss) | (46,140 | ) | | 189,683 |

| | 177,775 |

| | 425,675 |

| 179,619 |

| | 208,942 |

|

| Net income (loss) attributable to noncontrolling interests | (955 | ) | | (592 | ) | | (757 | ) | | (92 | ) | (464 | ) | | (208 | ) |

| Net income (loss) attributable to CHS Inc. | $ | (45,185 | ) | | $ | 190,275 |

| | $ | 178,532 |

| | $ | 425,767 |

| $ | 180,083 |

| | $ | 209,150 |

|

The accompanying notes are an integral part of the consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| | | | For the Three Months Ended

May 31, | | For the Nine Months Ended

May 31, | For the Three Months Ended

November 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2017 | | 2016 |

| | (Dollars in thousands) | (Dollars in thousands) |

| Net income (loss) | $ | (46,140 | ) | | $ | 189,683 |

| | $ | 177,775 |

| | $ | 425,675 |

| $ | 179,619 |

| | $ | 208,942 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | | | |

| Postretirement benefit plan activity, net of tax expense (benefit) of $2,257, $2,122, $6,580 and $5,911, respectively | 3,635 |

| | 3,378 |

| | 10,599 |

| | 9,806 |

| |

| Unrealized net gain (loss) on available for sale investments, net of tax expense (benefit) of $(72), $744, $1,010 and $303, respectively | (117 | ) | | 1,201 |

| | 1,627 |

| | 462 |

| |

| Cash flow hedges, net of tax expense (benefit) of $233, $1,595, $1,238 and $(2,456), respectively | 375 |

| | 2,574 |

| | 1,993 |

| | (3,945 | ) | |

| Foreign currency translation adjustment, net of tax expense (benefit) of $(334), $0, $(329) and $0, respectively | (2,151 | ) | | 7,761 |

| | (12,193 | ) | | (5,910 | ) | |

| Postretirement benefit plan activity, net of tax expense (benefit) of $2,620 and $2,011, respectively | | 4,196 |

| | 3,239 |

|

| Unrealized net gain (loss) on available for sale investments, net of tax expense (benefit) of $404 and $482, respectively | | 3,640 |

| | 777 |

|

| Cash flow hedges, net of tax expense (benefit) of $(2) and $406, respectively | | (4 | ) | | 654 |

|

| Foreign currency translation adjustment, net of tax expense (benefit) of $(443) and $(209), respectively | | (2,607 | ) | | (19,164 | ) |

| Other comprehensive income (loss), net of tax | 1,742 |

| | 14,914 |

| | 2,026 |

| | 413 |

| 5,225 |

| | (14,494 | ) |

| Comprehensive income (loss) | (44,398 | ) | | 204,597 |

| | 179,801 |

| | 426,088 |

| 184,844 |

| | 194,448 |

|

| Less: comprehensive income (loss) attributable to noncontrolling interests | (955 | ) | | (592 | ) | | (757 | ) | | (92 | ) | (464 | ) | | (208 | ) |

| Comprehensive income (loss) attributable to CHS Inc. | $ | (43,443 | ) | | $ | 205,189 |

| | $ | 180,558 |

| | $ | 426,180 |

| $ | 185,308 |

| | $ | 194,656 |

|

The accompanying notes are an integral part of the consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | For the Nine Months Ended May 31, | For the Three Months Ended November 30, |

| | 2017 | | 2016 | 2017 | | 2016 |

| | (Dollars in thousands) | (Dollars in thousands) |

| Cash flows from operating activities: | |

| | |

| |

| | |

|

| Net income | $ | 177,775 |

| | $ | 425,675 |

| |

| Net income (loss) | | $ | 179,619 |

| | $ | 208,942 |

|

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |

| | |

| |

| | |

|

| Depreciation and amortization | 362,118 |

| | 324,952 |

| 120,148 |

| | 121,372 |

|

| Amortization of deferred major repair costs | 50,565 |

| | 55,074 |

| 16,418 |

| | 18,302 |

|

| (Income) loss from equity investments | (124,521 | ) | | (131,819 | ) | |

| Equity (income) loss from investments | | (38,362 | ) | | (40,328 | ) |

| Distributions from equity investments | | 12,514 |

| | 16,393 |

|

| Provision for doubtful accounts | 198,304 |

| | 33,869 |

| (3,601 | ) | | 27,812 |

|

| Distributions from equity investments | 105,558 |

| | 75,435 |

| |

| Unrealized (gain) loss on crack spread contingent liability | (13,273 | ) | | (51,321 | ) | |

| Long-lived asset impairment | 85,431 |

| | 14,428 |

| |

| Reserve against supplier advance payments | 130,705 |

| | — |

| |

| Deferred taxes | (145,357 | ) | | (16,356 | ) | 15,044 |

| | 6,199 |

|

| Other, net | 25,559 |

| | (23,414 | ) | 2,976 |

| | 6,093 |

|

| Changes in operating assets and liabilities, net of acquisitions: | |

| | |

| |

| | |

|

| Receivables | (55,498 | ) | | 120,613 |

| (80,637 | ) | | (16,555 | ) |

| Inventories | (344,914 | ) | | (164,652 | ) | (472,180 | ) | | (754,253 | ) |

| Derivative assets | 120,294 |

| | (65,651 | ) | 67,365 |

| | 110,306 |

|

| Margin deposits | 58,581 |

| | (23,988 | ) | (893 | ) | | (2,623 | ) |

| Supplier advance payments | (214,538 | ) | | (208,679 | ) | (292,905 | ) | | (133,109 | ) |

| Other current assets and other assets | 19,289 |

| | 91,095 |

| 2,689 |

| | 12,082 |

|

| Customer margin deposits and credit balances | (76,355 | ) | | 2,657 |

| (18,045 | ) | | (28,141 | ) |

| Customer advance payments | (23,700 | ) | | (54,136 | ) | 1,278 |

| | 131,444 |

|

| Accounts payable and accrued expenses | 152,094 |

| | (72,161 | ) | 441,071 |

| | 743,427 |

|

| Derivative liabilities | (229,881 | ) | | 9,315 |

| (97,329 | ) | | (195,545 | ) |

| Other liabilities | (53,471 | ) | | (78,511 | ) | 4,376 |

| | 6,599 |

|

| Net cash provided by (used in) operating activities | 204,765 |

| | 262,425 |

| (140,454 | ) | | 238,417 |

|

| Cash flows from investing activities: | |

| | |

| |

| | |

|

| Acquisition of property, plant and equipment | (298,015 | ) | | (557,689 | ) | (85,824 | ) | | (116,986 | ) |

| Proceeds from disposition of property, plant and equipment | 17,702 |

| | 7,023 |

| 56,079 |

| | 2,574 |

|

| Proceeds from sale of business | | 29,457 |

| | — |

|

| Expenditures for major repairs | (1,146 | ) | | (19,338 | ) | (1,039 | ) | | (239 | ) |

| Investments in joint ventures and other | (13,853 | ) | | (2,833,968 | ) | |

| Investments redeemed | 7,698 |

| | 24,912 |

| 5,195 |

| | — |

|

| Proceeds from sale of investments | 6,170 |

| | 19,477 |

| |

| Changes in CHS Capital notes receivable, net | (104,773 | ) | | (230,874 | ) | (69,227 | ) | | (218,296 | ) |

| Financing extended to customers | (57,783 | ) | | (31,681 | ) | (15,778 | ) | | (14,353 | ) |

| Payments from customer financing | 67,126 |

| | 23,005 |

| 16,520 |

| | 21,523 |

|

| Business acquisitions, net of cash acquired | (2,253 | ) | | (10,139 | ) | |

| Other investing activities, net | 4,975 |

| | 4,911 |

| 1,847 |

| | (1,245 | ) |

| Net cash provided by (used in) investing activities | (374,152 | ) | | (3,604,361 | ) | (62,770 | ) | | (327,022 | ) |

| Cash flows from financing activities: | |

| | |

| |

| | |

|

| Proceeds from lines of credit and long-term borrowings | 29,890,570 |

| | 21,377,619 |

| 8,006,980 |

| | 10,300,476 |

|

| Payments on lines of credit, long term-debt and capital lease obligations | (29,362,970 | ) | | (18,090,681 | ) | (7,657,713 | ) | | (9,936,369 | ) |

| Mandatorily redeemable noncontrolling interest payments | — |

| | (153,022 | ) | |

| Changes in checks and drafts outstanding | (118,844 | ) | | 1,680 |

| (31,417 | ) | | 14,334 |

|

| Preferred stock dividends paid | (125,475 | ) | | (121,499 | ) | (42,167 | ) | | (41,825 | ) |

| Retirements of equities | (25,503 | ) | | (17,117 | ) | (3,682 | ) | | (9,528 | ) |

| Cash patronage dividends paid | (103,879 | ) | | (253,150 | ) | |

| Other financing activities, net | 1,539 |

| | (3,246 | ) | (263 | ) | | 384 |

|

| Net cash provided by (used in) financing activities | 155,438 |

| | 2,740,584 |

| 271,738 |

| | 327,472 |

|

| Effect of exchange rate changes on cash and cash equivalents | 1,865 |

| | (6,060 | ) | 2,236 |

| | (2,696 | ) |

| Net increase (decrease) in cash and cash equivalents | (12,084 | ) | | (607,412 | ) | 70,750 |

| | 236,171 |

|

| Cash and cash equivalents at beginning of period | 279,313 |

| | 953,813 |

| 181,379 |

| | 279,313 |

|

| Cash and cash equivalents at end of period | $ | 267,229 |

| | $ | 346,401 |

| $ | 252,129 |

| | $ | 515,484 |

|

The accompanying notes are an integral part of the consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

Note 1 Organization, Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The unaudited Consolidated Balance Sheet as of May 31,November 30, 2017, the Consolidated Statements of Operations for the three and nine months ended May 31,November 30, 2017, and 2016, the Consolidated Statements of Comprehensive Income for the three and nine months ended May 31,November 30, 2017, and 2016, and the Consolidated Statements of Cash Flows for the ninethree months ended May 31,November 30, 2017, and 2016, reflect in the opinion of our management, all normal recurring adjustments necessary for a fair statement of the financial position, results of operations and cash flows for the interim periods presented. The results of operations and cash flows for interim periods are not necessarily indicative of results for a full fiscal year because of, among other things, the seasonal nature of our businesses. Our Consolidated Balance Sheet data as of August 31, 20162017, has been derived from our audited consolidated financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America ("U.S. GAAP").

The Consolidated StatementsOver the course of Operations include a separate line called “Reserve and impairment charges” for the three and nine months ended May 31,fiscal year 2017, and 2016, duewe incurred charges relating to the materiality of certain charges incurred during the periods presented. The charges relate to reserves recorded as a result of a trading partner of ours in Brazil, enteringwhich entered into bankruptcybankruptcy-like proceedings under Brazilian law, intangible and fixed asset impairment charges associated with moving certain assets within our Ag segmentmeeting the criteria to be classified as held for sale, a fixed asset impairment charge relatedcharges due to an asset inthe cancellation of a capital project at one of our Energy segmentrefineries and all bad debt and loan loss reserve charges of which a significant portion relatesrelating to a single large producer borrowerborrower. Charges and impairments of this nature, as well as any recoveries related to amounts previously reserved, are included in the Consolidated Statements of Operations in the line item, "Reserve and impairment charges (recoveries), net" for the three months ended November 30, 2017, and 2016. The timing and amounts of these charges and impairments, and any recoveries were determined utilizing facts and circumstances that were present in the respective quarters in which the majority of chargescharge, impairments or recoveries were recorded in the first and second quarters of the current fiscal year.recorded. Prior year information has been revised to conform to the current year presentation. See additional information related to the reserves and impairment charges in Note 2, Receivables and Note 5, Goodwill and Other Intangible Assets.

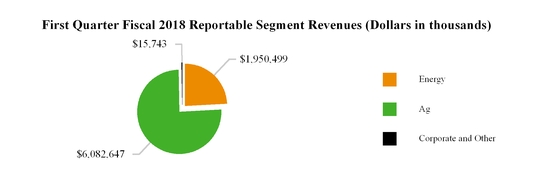

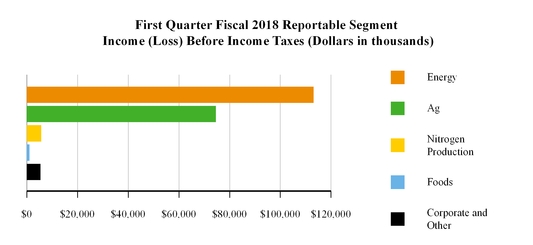

The notes to our consolidated financial statements make reference to our Energy, Ag, Nitrogen Production and Foods reportable segments, as well as our Corporate and Other category, which represents an aggregation of individually immaterial operating segments. The Nitrogen Production reportable segment resulted from our investment in CF Industries Nitrogen, LLC ("CF Nitrogen") in February 2016. The Foods segment resulted from our investment in Ventura Foods, LLC ("Ventura Foods") becoming a significant operating segment in fiscal 2016. See Note 10,9, Segment Reporting for more information.

Our consolidated financial statements include the accounts of CHS and all of our wholly owned and majority owned subsidiaries. The effects of all significant intercompany transactions have been eliminated.

These unaudited consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto for the year ended August 31, 2016,2017, included in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the "SEC").

Recent Accounting Pronouncements

Adopted

In January 2017,October 2016, the Financial Accounting Standards Board (the “FASB”("FASB") issued Accounting Standards Update ("ASU") No. 2017-04, Simplifying2016-16, Income Taxes - Intra-Entity Transfers of Assets Other Than Inventory (Topic 740). This ASU is intended to improve the Testaccounting for Goodwill Impairment. The amendments within this ASU eliminate Step 2the income tax consequences of the goodwill impairment test, which requiresintra-entity transfers of assets other than inventory by requiring an entity to determine goodwill impairment by calculatingrecognize the implied fair valueincome tax consequences when a transfer occurs, instead of goodwill by hypothetically assigningwhen an asset is sold to an outside party. This ASU is effective for periods beginning after December 15, 2017; however, early adoption of this ASU is permitted during the fair value offirst interim period if an entity issues interim financial statements and the amendments in this ASU should be applied on a reporting unitmodified retrospective basis through a cumulative-effect adjustment directly to all of its assets and liabilitiesretained earnings as if that reporting unit had been acquired in a business combination. Under the amended standard, goodwill impairment is instead measured using Step 1 of the goodwill impairment test with goodwill impairment being equal tobeginning of the amount by which a reporting unit’s carrying value exceeds its fair value, not to exceed the carrying valueperiod of goodwill.adoption. We elected to early adopt ASU No. 2017-042016-16 during the secondfirst quarter of fiscal 2017.2018. The amendmentsadoption did not have been applied to the annual goodwill impairment testing performed as of May 31, 2017, and will be applied prospectively to all future goodwill impairment tests performeda material impact on an interim or annual basis.our consolidated financial statements.

Not Yet Adopted

In April 2015,August 2017, the FASB issued ASU No. 2015-03, Interest-Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs2017-12, which simplifiesDerivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. This ASU is intended to improve the financial reporting of hedging relationships to better represent the economic results of an entity’s risk management activities in its financial statements and make certain improvements to simplify the application of the hedge accounting guidance. The amendments in this ASU will make more financial and nonfinancial hedging strategies eligible for hedge accounting, amend the presentation and disclosure requirements and change how entities assess effectiveness. Entities are required to apply this ASU's provisions as a cumulative-effect adjustment to retained earnings as of debt issuance costs.the beginning of the first reporting period in which the guidance is adopted. This ASU requires the presentation of debt issuance costs on the balance sheet as a deduction from the carrying amount of the related debt liability instead of a deferred financing cost. This ASU wasis effective for us beginning September 1, 2016,2019, for our fiscal year 20172020 and for interim periods within that fiscal year. As a result, $5.6 million of deferred issuance costs related to private placement debt and bank financingWe are currently evaluating the impact the adoption will have been reclassified from other assets to long-term debt as of August 31, 2016.

In August 2015, the FASB issued ASU No. 2015-15, Interest-Imputation of Interest (Subtopic 835-30): Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements, which codifies an SEC staff announcement that entities are permitted to defer and present debt issuance costs related to line of credit arrangements as assets. ASU No. 2015-15 was effective immediately. At August 31, 2016, we had unamortized deferred financing costs related toon our line of credit arrangements, and we will continue to present debt issuance costs related to line of credit arrangements as an asset in our Consolidated Balance Sheets.consolidated financial statements.

Not Yet Adopted

In March 2017, the FASB issued ASU No. 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Costs and Net Postretirement Benefit Cost. This ASU is intended to improvechanges the presentation of net periodic pension cost and net periodic postretirement benefit cost.cost in the income statement. This ASU requires that the service cost component should be included in the same income statement line item as other compensation costs arising from services rendered by the employees during the period. The other components of net periodic benefit cost should be presented in the income statement separately outside of operating income if that subtotal is presented. Additionally, only service cost may be capitalized in assets. This ASU is effective for us beginning September 1, 2018, for our fiscal year 2019 and for interim periods within that fiscal year. Early adoption is permitted asThe guidance on the presentation of the beginningcomponents of an annual period for which interim financial statementsnet periodic benefit cost in the income statement should be applied retrospectively and the guidance regarding the capitalization of the service cost component in assets should be applied prospectively. The adoption of this amended guidance is not expected to have not been issued or made available for issuance. We are currently evaluating thea material impact the adoption will have on our consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. The amendments within this ASU narrow the existing definition of a business and provide a more robust framework for evaluating whether a transaction should be accounted for as an acquisition (or disposal) of assets or a business. The definition of a business impacts various areas of accounting, including acquisitions, disposals and goodwill. Under the new guidance, fewer acquisitions are expected to be considered businesses. This ASU is effective for us beginning September 1, 2018, for our fiscal year 2019 and for interim periods within that fiscal year. Early adoption is permitted and the guidance should be applied prospectively to transactions following the adoption date. We are currently evaluating theThe adoption of this amended guidance is not expected to have a material impact the adoption will have on our consolidated financial statements.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. This ASU is intended to reduce diversity in practice by adding or clarifying guidance on classification and presentation of changes in restricted cash on the statement of cash flows. This ASU is effective for us beginning September 1, 2018, for our fiscal year 2019 and for interim periods within that fiscal year. Early adoption is permitted, including in an interim period. The amendments in this ASU should be applied retrospectively to all periods presented. We are currently evaluating theThe adoption of this amended guidance is not expected to have a material impact the adoption will have on our consolidated financial statements.

In October 2016, the FASB issued ASU No. 2016-16, Income Taxes - Intra-Entity Transfersstatement of Assets Other Than Inventory (Topic 740). This ASU is intended to improve the accounting for the income tax consequences of intra-entity transfers of assets other than inventory by requiring an entity to recognize the income tax consequences when a transfer occurs, instead of when an asset is sold to an outside party. The amendments in this ASU should be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. This ASU is effective for us beginning September 1, 2018, for our fiscal year 2019 and for interim periods within that fiscal year. Early adoption is permitted as of the beginning of an annual reporting period for which interim or annual financial statements have not been issued. We are currently evaluating the impact the adoption will have on our consolidated financial statements.cash flows.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. This ASU is intended to reduce existing diversity in practice in how certain cash receipts and payments are presented and classified in the statement of cash flows. This ASU is effective for us beginning September 1, 2018, for our fiscal year 2019 and for interim periods within that fiscal year. EarlyThe adoption of this amended guidance is permitted, including in an interim period. We are currently evaluating thenot expected to have a material impact the adoption will have on our consolidated financial statements.statement of cash flows.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The amendments in this ASU introduce a new approach, based on expected losses, to estimate credit losses on certain types of financial instruments. This ASU is intended to provide financial statement users with more decision-useful information about the expected credit losses associated with most financial assets measured at amortized

cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, net investments in leases, and off-balance-sheet credit exposures. Entities are required to apply the standard’sthis ASU’s provisions as a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is adopted. This ASU is effective for us beginning September 1, 2020, for our fiscal year 2021 and for interim periods within that fiscal year. We are currently evaluating the impact the adoption will have on our consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic(Topic 842), which replaces the existing guidance in Accounting Standards Codification ("ASC") 840 - Leases. The amendments within this ASU introduce a lessee model requiring

entities to recognize assets and liabilities for most leases, but continue recognizing the associated expenses in a manner similar to existing accounting guidance. This ASU does not make fundamental changes to existing lessor accounting; however, it does modify what constitutes a sales-type or direct financing lease and the related accounting, and aligns a number of the underlying principles with those of the new revenue standard, ASU No. 2014-09. The guidance also eliminates existing real estate-specific provisions and requires expanded qualitative and quantitative disclosures.Entities are required to apply the standard’s provisions using a modified retrospective approach at the beginning of the earliest comparative period presented in the year of adoption. This ASU is effective for us beginning September 1, 2019, for our fiscal year 2020 and for interim periods within that fiscal year.year, and the ASU’s provisions are required to be applied using a modified retrospective approach. We have initiated a preliminary assessment of the new lease standard, including the implementation of a new lease software that will improve the collection, maintenance, and aggregation of lease data necessary for the reporting and disclosure requirements under the new lease standard. One of the more significant changes arising from the new lease standard relates to a number of operating lease agreements not currently recognized on our Consolidated Balance Sheets. The new lease guidance will require these lease agreements to be recognized on the Consolidated Balance Sheets as a right-of-use asset along with a corresponding lease liability. As a result, our preliminary assessment indicates the provisions of ASU No. 2016-02 are currently evaluatingexpected to have a material impact on our Consolidated Balance Sheets. Although we expect the new lease guidance to have a material impact on our Consolidated Balance Sheets, we are continuing to evaluate the extent of potential impact the adoptionnew lease guidance will have on our consolidated financial statements.

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers. The amendments within this ASU, as well as within additional clarifying ASUs issued by the FASB, provide a single comprehensive model to be used in the accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. This ASUThe new revenue recognition guidance includes a five stepfive-step model for the recognition of revenue, including (1) identifying the contract with a customer, (2) identifying the performance obligations in the contract, (3) determining the transaction price, (4) allocating the transaction price to the performance obligations, and (5) recognizing revenue when (or as) an entity satisfies a performance obligation. This ASUThe new revenue recognition guidance also specifies the accounting for certain costs to obtain or fulfill a contract with a customer and requires expanded disclosures about the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. In August 2015,We have completed an initial assessment of our revenue streams and do not believe that the FASB issued ASU No. 2015-14 delayingnew revenue recognition guidance will have a material impact on our consolidated financial statements. Certain revenue streams are expected to fall within the effective datescope of adoptionthe new revenue recognition guidance; however, a substantial portion of our revenue falls outside the scope of the new revenue recognition guidance and will continue to follow existing guidance, primarily ASC 815, Derivatives and Hedging. We are continuing to evaluate the impact of the new revenue recognition guidance, including potential changes to business practices and/or contractual terms for CHS to September 1, 2018. The FASB issued four subsequent ASUs in 2016 containing implementation guidancescope revenue streams, as well as the scope of expanded disclosures related to ASU No. 2014-09, including: ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (ReportingRevenue Gross versus Net), which is intendedrevenue. We expect to improve the operabilitycomplete our final evaluation and understandabilityimplementation of the implementationnew revenue recognition guidance on principal versus agent considerations; ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): IdentifyingPerformance Obligations and Licensing,throughout fiscal 2018, which is intended to clarify two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance; ASU No. 2016-12, Revenue from Contracts with Customers (Topic606): Narrow-Scope Improvements and Practical Expedients, which contains certain provision and practical expedients in response to identified implementation issues; and ASU No. 2016-20, Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers, which contains certain corrections and clarifications to increase stakeholders’ awareness of the proposals and to expedite improvements. ASU No. 2014-09 permits the use of either a full or modified retrospective method upon adoption. Although early application as of the original date is permitted, we expectwill allow us to adopt ASU No. 2014-09 and the related ASUs on September 1, 2018, in the first quarter of fiscal 2019. We are continuing to evaluate2019, using the effect this guidance will have on our consolidated financial statements, including potential impacts on the timing of revenue recognition and additional information that may be necessary for expanded disclosures regarding revenue. We have completed an initial assessment of our revenue streams and are currently evaluating the quantitative and qualitative impacts of the new standard on our businesses. We expect to complete our evaluation by the end of fiscal 2017, which will allow us to select an adoption method and determine the impact that the new standard will have on our businesses.modified retrospective method.

Note 2 Receivables

| | | | May 31, 2017 | | August 31, 2016 | November 30, 2017 | | August 31, 2017 |

| | (Dollars in thousands) | (Dollars in thousands) |

| Trade accounts receivable | $ | 1,739,027 |

| | $ | 1,804,646 |

| $ | 1,329,887 |

| | $ | 1,234,500 |

|

| CHS Capital notes receivable | 766,731 |

| | 858,805 |

| 184,301 |

| | 164,807 |

|

| Deferred purchase price receivable | | 216,996 |

| | 202,947 |

|

| Other | 464,051 |

| | 380,956 |

| 556,275 |

| | 493,104 |

|

| | 2,969,809 |

| | 3,044,407 |

| 2,287,459 |

| | 2,095,358 |

|

| Less allowances and reserves | 247,484 |

| | 163,644 |

| 227,836 |

| | 225,726 |

|

| Total receivables | $ | 2,722,325 |

| | $ | 2,880,763 |

| $ | 2,059,623 |

| | $ | 1,869,632 |

|

Trade accounts receivable are initially recorded at a selling price, which approximates fair value, upon the sale of goods or services to customers. Subsequently, trade accounts receivable are carried at net realizable value, which includes an allowance for estimated uncollectible amounts. We calculate this allowance based on our history of write-offs, level of past due accounts, and our relationships with, and the economic status of, our customers.

CHS Capital

Notes Receivable

CHS Capital, LLC ("CHS Capital"), our wholly-owned subsidiary, has short-term notes receivable from commercial and producer borrowers. The short-term notes receivable have maturity terms of 12 months or less and are reported at their outstanding unpaid principal balances, adjusted for the allowance of loan losses, as CHS Capital has the intent and ability to hold the applicable loans for the foreseeable future or until maturity or pay-off. The carrying value of CHS Capital LLC ("CHS Capital") short-term notes receivable approximates fair value, given the notes' short duration and the use of market pricing adjusted for risk. Other receivables is comprised of certain other amounts recorded in the normal course of business, including receivables related to valued added taxes and production cost financing.

During the third quarter of fiscal 2017, a trading partner of ours in Brazil entered bankruptcy proceedings under Brazilian law, resulting in a $98.7 million increase to our accounts receivable reserve. We also recorded a reserve of approximately $130.7 million related to supplier advance payments held by this trading partner. We have initiated efforts to recover these losses; however, as such actions are in the early stages and are considered neither probable nor estimable, no recoveries have been recorded as of the date of this Quarterly Report on Form 10-Q.

CHS Capital has notes receivable from commercial and producer borrowers. The short-term notes receivable generally have terms of 12-14 months and are reported at their outstanding principal balances as CHS Capital has the ability and intent to hold these notes to maturity. The notes receivable from commercial borrowers are collateralized by various combinations of mortgages, personal property, accounts and notes receivable, inventories and assignments of certain regional cooperatives'cooperative’s capital stock. These loans are primarily originated in the states of Minnesota, Wisconsin and North Dakota. CHS Capital also has loans receivable from producer borrowers which are collateralized by various combinations of growing crops, livestock, inventories, accounts receivable, personal property and supplemental mortgages and are originated in the same states as the commercial notes with the addition of Michigan.

In addition to the short-term balances included in the table above, CHS Capital had long-term notes receivable, with durations of generally not more than 10 years, of $252.4totaling $14.8 million and $322.4$17.0 million as of May 31,at November 30, 2017, and August 31, 2016,2017, respectively. The long-term notes receivable are included in otherOther assets on our Consolidated Balance Sheets. As of May 31,November 30, 2017, and August 31, 2016,2017, the commercial notes represented 52%32% and 26%17%, respectively, and the producer notes represented 48%68% and 74%83%, respectively, of the total CHS Capital notes receivable. As of November 30, 2017, and August 31, 2016, a single producer borrower2017, CHS Capital had no third-party borrowers that accounted for 20%more than 10% of the total outstanding CHS Capital notes receivable. During the third quarter of fiscal 2017, CHS Capital concluded a transaction with the single producer borrower whereby CHS Capital obtained from the borrower title to approximately 14,000 acres of land and improvements that, prior to the transaction, was owned by the borrower and served as collateral for the outstanding loans to CHS Capital. The amount corresponding to the fair value of the land and improvements, approximately $139.0 million, was credited against the notes receivable from this single producer borrower. As a result of this arrangement, all remaining outstanding notes receivable balances and corresponding reserves related to this single producer borrower were removed from the balance sheet of CHS Capital. However, we continue to enforce our rights under the various agreements between us and the producer borrower to pursue future potential recoveries. The collateral received in connection with the arrangement has been recorded in “Property, plant and equipment” on the Consolidated Balance Sheet.outstanding.

CHS Capital evaluateshas commitments to extend credit to customers if there are no violations of any contractually established conditions. As of November 30, 2017, CHS Capital's customers have additional available credit of $529.4 million.

Allowance for Loan Losses and Impairments

CHS Capital maintains an allowance for loan losses which is the collectabilityestimate of both commercialpotential incurred losses inherent in the loans receivable portfolio. In accordance with FASB ASC 450-20, Accounting for Loss Contingencies, and producer notes onASC 310-10, Accounting by Creditors for Impairment of a Loan, the allowance for loan losses consists of general and specific identification basis, based on the amount and quality of the collateral obtained, and records specific loan loss reserves when appropriate. Acomponents. The general reservecomponent is also maintained based on historical loss experience and various qualitative factors. Further,factors addressing operational risks and industry trends. The specific component relates to loans receivable that are classified as impaired. Additions to the allowance for loan losses are reflected within reserve and impairment charges (recoveries), net in the Consolidated Statements of Operations. The portion of loans receivable deemed uncollectible is charged off against the allowance. Recoveries of previously charged off amounts increase the allowance for loan losses. The amount of CHS Capital notes that were past due was not significant at any reporting date presented.

Interest Income

Interest income is recognized on the accrual basis using a method that computes simple interest daily. The accrual of interest incomeon commercial loans receivable is discontinued at the time the commercial loan receivable is 90 days past due unless the credit is well-collateralized and in process of collection. Past due amounts were approximately 5.0% and 2.5%status is based on contractual terms of the totalloan. Producer loans receivable are placed in non-accrual status based on estimates and analysis due to the annual debt service terms inherent to CHS Capital notes outstanding asCapital’s producer loans. In all cases, loans are placed in nonaccrual status or charged off at an earlier date if collection of May 31, 2017, and August 31, 2016, respectively.principal or interest is considered doubtful.

SpecificSale of Receivables

Receivables Securitization Facility

On July 18, 2017, we amended an existing receivables and loans securitization facility (“Securitization Facility”) with certain unaffiliated financial institutions (the "Purchasers"). Under the Securitization Facility, we and certain of our subsidiaries sell trade accounts and notes receivable (the “Receivables”) to Cofina Funding, LLC (“Cofina”), a wholly-owned bankruptcy-remote indirect subsidiary of CHS. Cofina in turn sells the purchased Receivables in their entirety to the Purchasers. Prior to amending the Securitization Facility in July 2017, the transfer of Receivables was accounted for as a secured borrowing. Under the terms of the amended Securitization Facility CHS accounts for Receivables sold under the Facility as a sale of financial

assets pursuant to ASC 860, Transfers and Servicing and derecognizes the sold Receivables from its Consolidated Balance Sheets.

Sales of Receivables by Cofina occur continuously and are settled with the Purchasers on a monthly basis. The proceeds from the sale of these Receivables comprise a combination of cash and a deferred purchase price (“DPP”) receivable. The DPP receivable is ultimately realized by CHS following the collection of the underlying Receivables sold to the Purchasers. The amount available under the Securitization Facility fluctuates over time based on the total amount of eligible Receivables generated during the normal course of business, with maximum availability of $700.0 million. As of November 30, 2017, the total availability under the Securitization Facility was $700.0 million, of which all has been utilized. The Securitization Facility terminates on July 17, 2018, but may be extended. We use the proceeds from the sale of Receivables under the Securitization Facility for general loan loss reserves related to CHS Capital totaled $17.2 million and $45.8 million as of May 31, 2017, and August 31, 2016, respectively. The reductioncorporate purposes.

We have no retained interests in the reservetransferred Receivables, other than our right to the DPP receivable and collection and administrative services. The DPP receivable is substantially allrecorded at fair value within the Consolidated Balance Sheets, including a current portion within receivables and a long-term portion within other assets. Subsequent cash receipts related to the single producer borrower agreement discussedDPP receivable have been reflected as investing activities and additional sales of Receivables under the Securitization Facility are reflected in operating or investing activities, based on the underlying Receivable, in our Consolidated Statements of Cash Flows. Losses incurred on the sale of Receivables are recorded in interest expense and fees received related to the servicing of the Receivables are recorded in other income (loss) in the Consolidated Statements of Operations. We consider the fees received adequate compensation for services rendered, and accordingly have recorded no servicing asset or liability.

The fair value of the DPP receivable is determined by discounting the expected cash flows to be received based on unobservable inputs consisting of the face amount of the Receivables adjusted for anticipated credit losses. The DPP receivable is being measured like an investment in debt securities classified as available for sale, with changes to the fair value being recorded in other comprehensive income in accordance with ASC 320 - Investments - debt and equity securities. Our risk of loss following the transfer of Receivables under the Securitization Facility is limited to the DPP receivable outstanding and any short-falls in collections for specified non-credit related reasons after sale. Payment of the DPP receivable is not subject to significant risks other than delinquencies and credit losses on accounts receivable sold under the Securitization Facility.

The following table is a reconciliation of the beginning and ending balances of the DPP receivable for the quarter ended November 30, 2017:

|

| | | | |

| | | (Dollars in thousands) |

| Balance - as of August 31, 2017 | | $ | 548,602 |

|

| Monthly settlements, net | | (27,100 | ) |

| Balance - as of November 30, 2017 | | $ | 521,502 |

|

There was no DPP receivable as of November 30, 2016, and therefore, no comparative period is included in the table above.

CHS Capital has commitments

Other Receivables

Other receivables are comprised of certain other amounts recorded in the normal course of business, including receivables related to extend creditvalued added taxes and pre-crop financing, primarily to customers as long as there are no violationsBrazilian farmers, to finance a portion of supplier production costs. We do not bear any contractually established conditions. As of May 31, 2017, customersthe costs or operational risks associated with the related growing crops. The financing is largely collateralized by future crops and physical assets of CHS Capital had additional available credit of approximately $966.2 million.

the suppliers, carries a local market interest rate and settles when the farmer’s crop is harvested and sold.

| | | | May 31, 2017 | | August 31, 2016 | November 30, 2017 | | August 31, 2017 |

| | (Dollars in thousands) | (Dollars in thousands) |

| Grain and oilseed | $ | 1,171,408 |

| | $ | 937,258 |

| $ | 1,545,313 |

| | $ | 1,145,285 |

|

| Energy | 750,170 |

| | 729,695 |

| 720,938 |

| | 755,886 |

|

| Crop nutrients | 181,380 |

| | 217,521 |

| 222,053 |

| | 248,699 |

|

| Feed and farm supplies | 530,081 |

| | 417,431 |

| 483,805 |

| | 353,130 |

|

| Processed grain and oilseed | 27,991 |

| | 48,930 |

| 54,916 |

| | 49,723 |

|

| Other | 23,057 |

| | 19,864 |

| 19,076 |

| | 23,862 |

|

| Total inventories | $ | 2,684,087 |

| | $ | 2,370,699 |

| $ | 3,046,101 |

| | $ | 2,576,585 |

|

As of May 31,November 30, 2017, we valued approximately 19%15% of inventories, primarily related to our Energy segment, using the lower of cost, determined on the LIFO method, or marketnet realizable value (19% as of August 31, 2016)2017). If the FIFO method of accounting had been used, inventories would have been higher than the reported amount by $140.9$99.0 million and $93.9$186.2 million as of May 31,November 30, 2017, and August 31, 2016,2017, respectively. An actual valuation of inventory under the LIFO method can be made only at the end of each year based on the inventory levels and costs at that time. Interim LIFO calculations are based on management's estimates of expected year-end inventory levels, and are subject to the final year-end LIFO inventory valuation.

Note 4 Investments

| | | | 2017 | | 2016 | November 30, 2017 | | August 31, 2017 |

| | (Dollars in thousands) | (Dollars in thousands) |

| Equity method investments: | | | | | | |

| CF Industries Nitrogen, LLC | $ | 2,808,993 |

| | $ | 2,796,323 |

| $ | 2,776,412 |

| | $ | 2,756,076 |

|

| Ventura Foods, LLC | 374,006 |

| | 369,487 |

| 350,602 |

| | 347,016 |

|

| Ardent Mills, LLC | 195,869 |

| | 194,986 |

| 209,926 |

| | 206,529 |

|

| TEMCO, LLC | 41,581 |

| | 44,578 |

| 39,235 |

| | 41,323 |

|

| Other equity method investments | 290,391 |

| | 263,025 |

| 265,621 |

| | 268,444 |

|

| Cost method investments | 130,909 |

| | 127,577 |

| 135,204 |

| | 131,605 |

|

| Total investments | $ | 3,841,749 |

| | $ | 3,795,976 |

| $ | 3,777,000 |

| | $ | 3,750,993 |

|

Equity Method Investments

Joint ventures and other investments, in which we have significant ownership and influence, but not control, are accounted for in our consolidated financial statements using the equity method of accounting. Our primary equity method investments are described below.

On February 1, 2016, we invested $2.8 billion in CF Nitrogen, commencing our strategic venture with CF Industries Holdings, Inc. ("CF Industries"). The investment consists of an 11.4% membership interest (based on product tons) in CF Nitrogen. We also entered into an 80-year supply agreement that entitles us to purchase up to 1.1 million tons of granular urea and 580,000 tons of urea ammonium nitrate ("UAN") annually from CF Nitrogen for ratable delivery. Our purchases under the supply agreement are based on prevailing market prices and we receive semi-annual cash distributions (in January and July of each year) from CF Nitrogen via our membership interest. These distributions are based on actual volumes purchased from CF Nitrogen under the strategic venture and will have the effect of reducing our investment to zero over 80 years on a straight-line basis. We account for this investment using the hypothetical liquidation at book value method, recognizing our share of the earnings and losses of CF Nitrogen based upon our contractual claims on the entity's net assets pursuant to the liquidation provisions of CF Nitrogen's limited liability company agreement, adjusted for the semi-annual cash distributions.distributions we receive as a result of our membership interest in CF Nitrogen. For the three months ended May 31,November 30, 2017, and 2016, this amount was $24.5$20.3 million and $41.3 million, respectively. For the nine months ended May 31, 2017, and 2016, this amount was $60.8 million and $53.1$14.7 million, respectively. These amounts are included as equity income from investments in our Nitrogen Production segment.

We have a 50% interest in Ventura Foods, a joint venture which produces and distributes primarily vegetable oil-based products, and which constitutes our Foods segment. We account for Ventura Foods as an equity method investment, and as of

May 31, November 30, 2017,, our carrying value of Ventura Foods exceeded our share of its equity by $12.9 million, which represents equity method goodwill. The earnings are reported as equity income from investments in our Foods segment.

We have a 12% interest in Ardent Mills, LLC ("Ardent Mills"), a joint venture with Cargill Incorporated ("Cargill") and ConAgra Foods, Inc., which combines the North American flour milling operations of the three parent companies. We account for Ardent Mills as an equity method investment included in Corporate and Other.

TEMCO, LLC ("TEMCO") is owned and governed by Cargill (50%) and CHS (50%). Both owners have committed to sell all of their feedgrains, wheat, oilseeds and by-product origination that are tributary to the Pacific Northwest, United States ("Pacific Northwest") to TEMCO and to use TEMCO as their exclusive export-marketing vehicle for such grains exported through the Pacific Northwest through January 2037. We account for TEMCO as an equity method investment included in our Ag segment.

The following table provides aggregate summarized unaudited financial information for our equity method investments in CF Nitrogen, Ventura Foods and Ardent Mills for the three and nine months ended May 31, 2017, and 2016:

|

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended May 31, | | For the Nine Months Ended May 31, |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| | | (Dollars in thousands) |

| Net sales | | $ | 2,043,628 |

| | $ | 1,623,696 |

| | $ | 5,807,777 |

| | $ | 4,673,341 |

|

| Gross profit | | 234,055 |

| | 255,191 |

| | 651,705 |

| | 638,093 |

|

| Net earnings | | 133,132 |

| | 121,022 |

| | 317,674 |

| | 283,996 |

|

| Earnings attributable to CHS Inc. | | 38,662 |

| | 64,615 |

| | 104,568 |

| | 118,845 |

|

Note 5 Goodwill and Other Intangible Assets

Goodwill of $153.3$153.7 million and $160.4$154.1 million as of May 31,November 30, 2017, and August 31, 2016,2017, respectively, is included in other assets on our Consolidated Balance Sheets. Changes in the net carrying amount of goodwill for the ninethree months ended May 31,November 30, 2017, by segment, are as follows:

|

| | | | | | | | | | | | | | | |

| | Energy | | Ag | | Corporate

and Other | | Total |

| | (Dollars in thousands) |

| Balances, August 31, 2016 | $ | 552 |

| | $ | 148,916 |

| | $ | 10,946 |

| | $ | 160,414 |

|

| Effect of foreign currency translation adjustments | — |

| | (868 | ) | | — |

| | (868 | ) |

| Impairment | — |

| | (5,542 | ) | | — |

| | (5,542 | ) |

| Other | — |

| | (298 | ) | | (372 | ) | | (670 | ) |

| Balances, May 31, 2017 | $ | 552 |

| | $ | 142,208 |

| | $ | 10,574 |

| | $ | 153,334 |

|

|

| | | | | | | | | | | | | | | |

| | Energy | | Ag | | Corporate

and Other | | Total |

| | (Dollars in thousands) |

| Balances, August 31, 2017 | $ | 552 |

| | $ | 142,929 |

| | $ | 10,574 |

| | $ | 154,055 |

|

| Effect of foreign currency translation adjustments | — |

| | (389 | ) | | — |

| | (389 | ) |

| Balances, November 30, 2017 | $ | 552 |

| | $ | 142,540 |

| | $ | 10,574 |

| | $ | 153,666 |

|

No goodwill has been allocated to our Nitrogen Production or Foods segments, which consist of investments accounted for under the equity method.

All long-lived assets, including property, plant and equipment, goodwill, investments in unconsolidated affiliates and other identifiable intangible assets, are evaluated for impairment in accordance with GAAP. Goodwill is evaluated for impairment annually as of May 31. All long-lived assets, including goodwill, are also evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset group or reporting unit may not be recoverable. No impairments were identified as a result of the Company’s annual goodwill analyses performed as of May 31, 2017.

During the three months ended May 31, 2017, certain assets and liabilities associated with a disposal group in our Ag segment were classified as held for sale, including $5.5 million of goodwill allocated to the disposal group on a relative fair value basis. As a result of an impairment test performed over the disposal group, an impairment charge of $51.8 million which includes the allocated goodwill discussed above, was recorded in the Reserve and impairment charges line item in the Consolidated Statements of Operations for the three and nine months ended May 31, 2017. Following the impairment charge,

the assets remaining within the disposal group primarily include property, plant and equipment of $32.4 million, inventories of $23.9 million, accounts receivable of $8.7 million, and intangible assets of $2.4 million. The disposal group represents assets being sold as part of a broader asset portfolio review project. Negotiations for the sale of these assets is ongoing and we believe their sale will be consummated within the next 12 months. The held for sale assets and liabilities are recorded in other current assets and accounts payable in our Consolidated Balance Sheet as of May 31, 2017.

Intangible assets subject to amortization primarily include customer lists, trademarks and non-compete agreements, and are amortized over their respective useful lives (ranging from 2 to 30 years). Information regarding intangible assets that are included in other assets on our Consolidated Balance Sheets is as follows:

| | | | May 31,

2017 | | August 31,

2016 | November 30,

2017 | | August 31,

2017 |

| | Carrying Amount | | Accumulated Amortization | | Net | | Carrying Amount | | Accumulated Amortization | | Net | Carrying Amount | | Accumulated Amortization | | Net | | Carrying Amount | | Accumulated Amortization | | Net |

| | (Dollars in thousands) | (Dollars in thousands) |

| Customer lists | $ | 48,975 |

| | $ | (14,568 | ) | | $ | 34,407 |

| | $ | 51,554 |

| | $ | (15,550 | ) | | $ | 36,004 |

| $ | 42,391 |

| | $ | (11,695 | ) | | $ | 30,696 |

| | $ | 46,180 |

| | $ | (14,695 | ) | | $ | 31,485 |

|

| Trademarks and other intangible assets | 23,618 |

| | (21,713 | ) | | 1,905 |

| | 35,015 |

| | (26,253 | ) | | 8,762 |

| 6,536 |

| | (4,752 | ) | | 1,784 |

| | 23,623 |

| | (21,778 | ) | | 1,845 |

|

| Total intangible assets | $ | 72,593 |

| | $ | (36,281 | ) | | $ | 36,312 |

| | $ | 86,569 |

| | $ | (41,803 | ) | | $ | 44,766 |

| $ | 48,927 |

| | $ | (16,447 | ) | | $ | 32,480 |

| | $ | 69,803 |

| | $ | (36,473 | ) | | $ | 33,330 |

|

Total amortization expense for intangible assets during the three and nine months ended May 31,November 30, 2017, and 2016, was $1.0$0.9 million and $3.3 million, respectively. Total amortization expense for intangible assets during the three and nine months ended May 31, 2016, was $1.1 million and $4.9$1.3 million, respectively. The estimated annual amortization expense related to intangible assets subject to amortization for the next five years is as follows:

| | | | (Dollars in thousands) | (Dollars in thousands) |

| Year 1 | $ | 3,654 |

| $ | 3,395 |

|

| Year 2 | 3,653 |

| 3,373 |

|

| Year 3 | 3,487 |

| 3,095 |

|

| Year 4 | 3,344 |

| 3,037 |

|

| Year 5 | 3,170 |

| 2,755 |

|

Note 6 Notes Payable and Long-Term Debt

Our notes payable and long-term debt are subject to various restrictive requirements for maintenance of minimum consolidated net worth and other financial ratios. We were in compliance with our debt covenants as of May 31,November 30, 2017.

| |

| May 31, 2017 |

| August 31, 2016 | November 30, 2017 |

| August 31, 2017 |

| (Dollars in thousands) | (Dollars in thousands) |

| Notes payable | $ | 2,465,333 |

|

| $ | 1,803,174 |

| $ | 2,182,243 |

|

| $ | 1,695,423 |

|

| CHS Capital notes payable | 856,475 |

|

| 928,305 |

| 298,021 |

|

| 292,792 |

|

| Total notes payable | $ | 3,321,808 |

|

| $ | 2,731,479 |

| $ | 2,480,264 |

|

| $ | 1,988,215 |

|

On May 31,November 30, 2017, our primary line of credit was a five-year, unsecured revolving credit facility with a committed amount of $3.0 billion which expires in September 2020. The outstanding balance on this facility was $1.1 billion and $700.0$480.0 million as of May 31,November 30, 2017, and August 31, 2016,2017, respectively.

During the nine months ended May 31, 2017, we re-advanced $130.0 million under the revolving provision of our ten-year term loan with a syndication of banks that was originally arranged in September 2015. The terms of the re-advance are the same as the terms of the original term loan, with principal due on September 4, 2025, and interest calculated at a London Interbank Offered Rate ("LIBOR") plus an applicable margin ranging between 1.50% and 2.00%.

Interest expense for the three months ended May 31,November 30, 2017, and 2016, was $39.2$40.7 million and $37.5$38.3 million, respectively, net of capitalized interest of $1.6$1.8 million and $6.5 million, respectively. Interest expense for the nine months

ended May 31, 2017, and 2016, was $117.4 million and $71.6 million, respectively, net of capitalized interest of $4.7 million and $27.3$1.6 million, respectively.

Note 7 Income Taxes

During the three months ended May 31, 2017, our Board of Directors adopted a resolution to treat equity redemptions of non-qualified equity certificates issued in fiscal 2013 and fiscal 2014 in the same manner as qualified equity certificates are treated and redeemed under the “Eligible Annual Association Equity” provision of the Board's Policy for the Redemption of CHS Inc. Equities. Previously we had not established an intent regarding the redemption of non-qualified equity certificates issued to cooperative association members and other corporate entity non-qualified equity participants, thus the tax benefit associated with redemption would have been recognized in future periods as those redemptions occurred. As a result of the new resolution, we recorded a $75.0 million deferred tax benefit during the third quarter of fiscal 2017 related to the future redemption, at the discretion of our Board of Directors, of non-qualified equity certificates to cooperative association members and other corporate entity non-qualified equity participants.

During the three months ended May 31, 2017, we incurred losses associated with a trading partner of ours in Brazil entering into bankruptcy proceedings under Brazilian law, and we will be required to fund approximately $230.0 million of losses in our Brazilian operations via guarantees in place with our Brazilian subsidiary and its lending syndicate. Performance of these guarantees results in a bad debt deduction on our U.S. tax return, subject to the insurance and subrogation recovery provisions within the U.S. Tax Code. As a result of performance on the guarantee, we recorded an $84.4 million deferred tax benefit during the third quarter of fiscal 2017.

These two tax benefits are the primary contributors to our tax benefit position for the three and nine month periods ended May 31, 2017, within the Consolidated Statements of Operations.

Note 8 Equities

Changes in Equities

Changes in equities for the ninethree months ended May 31,November 30, 2017, are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equity Certificates | | | | Accumulated

Other

Comprehensive

Loss | | | | | | |

| | Capital

Equity

Certificates | | Nonpatronage

Equity

Certificates | | Nonqualified Equity Certificates | | Preferred

Stock | | | Capital

Reserves | | Noncontrolling

Interests | | Total

Equities |

| | (Dollars in thousands) |

| Balance, August 31, 2016 | $ | 3,932,513 |

| | $ | 22,894 |

| | $ | 281,767 |

| | $ | 2,244,132 |

| | $ | (211,726 | ) | | $ | 1,582,380 |

| | $ | 14,290 |

| | $ | 7,866,250 |

|

| Reversal of prior year patronage and redemption estimates | (121,892 | ) | | — |

| | — |

| | — |

| | — |

| | 278,968 |

| | — |

| | 157,076 |

|

| Distribution of 2016 patronage refunds | 153,589 |

| | — |

| | — |

| | — |

| | — |

| | (257,468 | ) | | — |

| | (103,879 | ) |

| Redemptions of equities | (43,949 | ) | | (154 | ) | | (1,386 | ) | | — |

| | — |

| | — |

| | — |

| | (45,489 | ) |

| Equities issued, net | 3,176 |

| | — |

| | — |

| | 19,986 |

| | — |

| | — |

| | — |

| | 23,162 |

|

| Preferred stock dividends | — |

| | — |

| | — |

| | — |

| | — |

| | (139,760 | ) | | — |

| | (139,760 | ) |

| Other, net | (7,560 | ) | | 7,300 |

| | (391 | ) | | (55 | ) | | — |

| | 3,046 |

| | (1,066 | ) | | 1,274 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | — |

| | 178,532 |

| | (757 | ) | | 177,775 |

|

| Other comprehensive income (loss), net of tax | — |

| | — |

| | — |

| | — |

| | 2,026 |

| | — |

| | — |

| | 2,026 |

|

| Estimated 2017 cash patronage refunds | — |

| | — |

| | — |

| | — |

| | — |

| | (68,229 | ) | | — |

| | (68,229 | ) |

| Estimated 2017 equity redemptions | (11,250 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (11,250 | ) |

| Balance, May 31, 2017 | $ | 3,904,627 |

| | $ | 30,040 |

| | $ | 279,990 |

| | $ | 2,264,063 |

| | $ | (209,700 | ) | | $ | 1,577,469 |

| | $ | 12,467 |

| | $ | 7,858,956 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equity Certificates | | | | Accumulated

Other

Comprehensive

Loss | | | | | | |

| | Capital

Equity

Certificates | | Nonpatronage

Equity

Certificates | | Nonqualified Equity Certificates | | Preferred

Stock | | | Capital

Reserves | | Noncontrolling

Interests | | Total

Equities |

| | (Dollars in thousands) |

| Balance, August 31, 2017 | $ | 3,906,426 |

| | $ | 29,836 |

| | $ | 405,387 |

| | $ | 2,264,038 |

| | $ | (183,670 | ) | | $ | 1,471,217 |

| | $ | 12,591 |

| | $ | 7,905,825 |

|

| Reversal of prior year redemption estimates | 1,561 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1,561 |

|

| Redemptions of equities | (1,449 | ) | | (53 | ) | | (59 | ) | | — |

| | — |

| | — |

| | — |

| | (1,561 | ) |

| Preferred stock dividends | — |

| | — |

| | — |

| | — |

| | — |

| | (84,334 | ) | | — |

| | (84,334 | ) |

| Other, net | (1,498 | ) | | (66 | ) | | (344 | ) | | — |

| | — |

| | 3,954 |

| | (3 | ) | | 2,043 |

|

| Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | 180,083 |

| | (464 | ) | | 179,619 |

|

| Other comprehensive income (loss), net of tax | — |

| | — |

| | — |

| | — |

| | 5,225 |

| | — |

| | — |

| | 5,225 |

|

| Estimated 2018 cash patronage refunds | — |

| | — |

| | — |

| | — |

| | — |

| | (50,702 | ) | | — |

| | (50,702 | ) |

| Estimated 2018 equity redemptions | (19,901 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (19,901 | ) |

| Balance, November 30, 2017 | $ | 3,885,139 |

| | $ | 29,717 |

| | $ | 404,984 |

| | $ | 2,264,038 |

| | $ | (178,445 | ) | | $ | 1,520,218 |

| | $ | 12,124 |

| | $ | 7,937,775 |

|

Accumulated Other Comprehensive Loss

Changes in accumulated other comprehensive income (loss) by component, net of tax, are as follows for the ninethree months endedMay 31, November 30, 2017,, and 2016:

|

| | | | | | | | | | | | | | | | | | | |

| | Pension and Other Postretirement Benefits | | Unrealized Net Gain on Available for Sale Investments | | Cash Flow Hedges | | Foreign Currency Translation Adjustment | | Total |

| | (Dollars in thousands) |

| Balance as of August 31, 2016 | $ | (165,146 | ) | | $ | 5,656 |

| | $ | (9,196 | ) | | $ | (43,040 | ) | | $ | (211,726 | ) |

| Current period other comprehensive income (loss), net of tax | (309 | ) | | 1,627 |

| | 1,184 |

| | (12,208 | ) | | (9,706 | ) |

| Amounts reclassified from accumulated other comprehensive income (loss), net of tax | 10,908 |

| | — |

| | 809 |

| | 15 |

| | 11,732 |

|

| Net other comprehensive income (loss), net of tax | 10,599 |

| | 1,627 |

| | 1,993 |

| | (12,193 | ) | | 2,026 |

|

| Balance as of May 31, 2017 | $ | (154,547 | ) | | $ | 7,283 |

| | $ | (7,203 | ) | | $ | (55,233 | ) | | $ | (209,700 | ) |

|

| | | | | | | | | | | | | | | | | | | |

| | Pension and Other Postretirement Benefits | | Unrealized Net Gain on Available for Sale Investments | | Cash Flow Hedges | | Foreign Currency Translation Adjustment | | Total |

| | (Dollars in thousands) |

| Balance as of August 31, 2017, net of tax | $ | (135,046 | ) | | $ | 10,041 |

| | $ | (6,954 | ) | | $ | (51,711 | ) | | $ | (183,670 | ) |

| Other comprehensive income (loss), before tax: | | | | | | | | | |

| Amounts before reclassifications | — |

| | 4,044 |

| | (435 | ) | | (1,008 | ) | | 2,601 |

|

| Amounts reclassified out | 6,816 |

| | — |

| | 429 |

| | (2,042 | ) | | 5,203 |

|

| Total other comprehensive income (loss), before tax | 6,816 |

| | 4,044 |

| | (6 | ) | | (3,050 | ) | | 7,804 |

|

| Tax effect | (2,620 | ) | | (404 | ) | | 2 |

| | 443 |