UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

|

| | | | |

x

☒ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2017March 31, 2021

or

|

| | | | |

o

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 1-9819

DYNEX CAPITAL, INC.

(Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | | | | | | |

| Virginia | | 52-1549373 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

4991 Lake Brook Drive, Suite 100 Glen Allen, Virginia | 23060-9245 | | |

| Glen Allen, | Virginia | | 23060-9245 |

| (Address of principal executive offices) | | (Zip Code) |

| | | (804) | 217-5800 | |

(804) 217-5800

(Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | DX | | New York Stock Exchange |

| 7.625% Series B Cumulative Redeemable Preferred Stock, par value $0.01 per share | | N/A | | None |

| 6.900% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share | | DXPRC | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x☒ No o☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x☒ No o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

| Large accelerated filer | o☐ | Accelerated filer | x☒ |

| Non-accelerated filer | o (Do not check if a smaller reporting company)

☐ | Smaller reporting company | o☐ |

| | Emerging growth company | o☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o☐ No x☒

On October 31, 2017,April 30, 2021, the registrant had 53,219,28630,879,569 shares outstanding of common stock, $0.01 par value, which is the registrant’s only class of common stock.

DYNEX CAPITAL, INC.

FORM 10-Q

INDEX

| | | | | | | | | | | |

| | | Page |

| PART I. FINANCIAL INFORMATION | |

| | | |

| Item 1. | Financial Statements | Page |

| | |

| | | |

| | | |

| | | |

| | Consolidated Balance Sheets as of September 30, 2017March 31, 2021 (unaudited) and December 31, 20162020 | |

| | | |

| | Consolidated Statements of Comprehensive Income (Loss) for the three and nine months ended September 30, 2017

March 31, 2021 (unaudited) and September 30, 2016March 31, 2020 (unaudited) | |

| | | |

| | Consolidated StatementStatements of Shareholders' Equity for the ninethree months ended September 30, 2017

March 31, 2021 (unaudited) and March 31, 2020 (unaudited) | |

| | | |

| | Consolidated Statements of Cash Flows for the ninethree months ended September 30, 2017

March 31, 2021 (unaudited) and September 30, 2016March 31, 2020 (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| Item 1. | Legal Proceedings | | | |

| Item 1A. | | |

| Risk Factors | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 5. | | |

| Other Information | | | |

| Item 6. | | |

| Exhibits | | | |

| | | |

| |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

CONSOLIDATED BALANCE SHEETS

(amounts in thousands except share data) | | | | September 30, 2017 | | December 31, 2016 | | March 31, 2021 | | December 31, 2020 |

| ASSETS | (unaudited) | |

| ASSETS | (unaudited) | | |

| Mortgage-backed securities (including pledged of $2,714,312 and $3,150,610, respectively) | $ | 2,921,444 |

| | $ | 3,212,084 |

| |

| Mortgage loans held for investment, net | 16,523 |

| | 19,036 |

| |

| Cash and cash equivalents | 117,702 |

| | 74,120 |

| |

| Restricted cash | 43,987 |

| | 24,769 |

| |

| Cash | | Cash | $ | 328,936 | | | $ | 295,602 | |

| Cash collateral posted to counterparties | | Cash collateral posted to counterparties | 49,180 | | | 14,758 | |

| Mortgage-backed securities (including pledged of $2,173,333 and $2,467,859, respectively), at fair value | | Mortgage-backed securities (including pledged of $2,173,333 and $2,467,859, respectively), at fair value | 2,380,373 | | | 2,596,255 | |

| Mortgage loans held for investment, at fair value | | Mortgage loans held for investment, at fair value | 5,749 | | | 6,264 | |

| Receivable for sales pending settlement | | Receivable for sales pending settlement | 5,067 | | | 150,432 | |

| Derivative assets | 368 |

| | 28,534 |

| Derivative assets | 109,746 | | | 11,342 | |

| Receivable for securities sold | 13,435 |

| | — |

| |

| Principal receivable on investments | 3,359 |

| | 11,978 |

| |

| Accrued interest receivable | 19,267 |

| | 20,396 |

| Accrued interest receivable | 15,480 | | | 14,388 | |

| Other assets, net | 7,193 |

| | 6,814 |

| Other assets, net | 6,577 | | | 6,394 | |

| Total assets | $ | 3,143,278 |

| | $ | 3,397,731 |

| Total assets | $ | 2,901,108 | | | $ | 3,095,435 | |

| | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | |

| Liabilities: | |

| | |

| Liabilities: | | | |

| Repurchase agreements | $ | 2,519,230 |

| | $ | 2,898,952 |

| Repurchase agreements | $ | 2,032,089 | | | $ | 2,437,163 | |

| Payable for unsettled securities | 77,357 |

| | — |

| |

| Non-recourse collateralized financing | 5,706 |

| | 6,440 |

| |

| Payable for purchases pending settlement | | Payable for purchases pending settlement | 24,455 | | | 5 | |

| Derivative liabilities | 133 |

| | 6,922 |

| Derivative liabilities | 19,866 | | | 1,634 | |

| Cash collateral posted by counterparties | | Cash collateral posted by counterparties | 83,776 | | | 7,681 | |

| Accrued interest payable | 2,720 |

| | 3,156 |

| Accrued interest payable | 418 | | | 1,410 | |

| Accrued dividends payable | 11,620 |

| | 12,268 |

| Accrued dividends payable | 5,639 | | | 5,814 | |

| Other liabilities | 2,413 |

| | 2,809 |

| Other liabilities | 3,589 | | | 8,275 | |

| Total liabilities | 2,619,179 |

| | 2,930,547 |

| Total liabilities | 2,169,832 | | | 2,461,982 | |

| |

|

| | | |

| Shareholders’ equity: | |

| | |

| Shareholders’ equity: | | | |

| Preferred stock, par value $.01 per share; 50,000,000 shares authorized; 5,665,101 and 4,571,937 shares issued and outstanding, respectively ($141,628 and $114,298 aggregate liquidation preference, respectively) | $ | 135,828 |

| | $ | 110,005 |

| |

Common stock, par value $.01 per share, 200,000,000 shares authorized; 51,262,350 and 49,153,463 shares issued and outstanding, respectively | 513 |

| | 492 |

| |

| Preferred stock, par value $0.01 per share; 50,000,000 shares authorized; 4,460,000 and 7,248,330 shares issued and outstanding, respectively ($111,500 and $181,208 aggregate liquidation preference, respectively) | | Preferred stock, par value $0.01 per share; 50,000,000 shares authorized; 4,460,000 and 7,248,330 shares issued and outstanding, respectively ($111,500 and $181,208 aggregate liquidation preference, respectively) | $ | 107,843 | | | $ | 174,564 | |

Common stock, par value $0.01 per share, 90,000,000 shares authorized; 30,879,569 and 23,697,970 shares issued and outstanding, respectively | | Common stock, par value $0.01 per share, 90,000,000 shares authorized; 30,879,569 and 23,697,970 shares issued and outstanding, respectively | 309 | | | 237 | |

| Additional paid-in capital | 742,845 |

| | 727,369 |

| Additional paid-in capital | 997,326 | | | 869,495 | |

| Accumulated other comprehensive income (loss) | 5,886 |

| | (32,609 | ) | |

| Accumulated other comprehensive income | | Accumulated other comprehensive income | 15,105 | | | 80,261 | |

| Accumulated deficit | (360,973 | ) | | (338,073 | ) | Accumulated deficit | (389,307) | | | (491,104) | |

| Total shareholders' equity | 524,099 |

| | 467,184 |

| |

| Total shareholders’ equity | | Total shareholders’ equity | 731,276 | | | 633,453 | |

| Total liabilities and shareholders’ equity | $ | 3,143,278 |

| | $ | 3,397,731 |

| Total liabilities and shareholders’ equity | $ | 2,901,108 | | | $ | 3,095,435 | |

See notes to the unaudited consolidated financial statements.

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)(unaudited)

(amounts in thousands except per share data)

| | | | Three Months Ended | | Nine Months Ended | | Three Months Ended | |

| | September 30, | | September 30, | | March 31, | |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2021 | | 2020 | |

| Interest income | $ | 23,103 |

| | $ | 21,135 |

| | $ | 70,378 |

| | 69,040 |

| Interest income | $ | 13,892 | | | $ | 39,822 | | |

| Interest expense | 9,889 |

| | 6,068 |

| | 26,122 |

| | 18,478 |

| Interest expense | (1,633) | | | (22,101) | | |

| Net interest income | 13,214 |

| | 15,067 |

| | 44,256 |

| | 50,562 |

| Net interest income | 12,259 | | | 17,721 | | |

| | | | | | | | | | |

| Gain on sale of investments, net | | Gain on sale of investments, net | 4,697 | | | 84,783 | | |

| Loss on investments, net | | Loss on investments, net | (980) | | | (372) | | |

| Gain (loss) on derivative instruments, net | 5,993 |

| | 2,409 |

| | (9,634 | ) | | (62,153 | ) | Gain (loss) on derivative instruments, net | 107,801 | | | (195,567) | | |

| Loss on sale of investments, net | (5,211 | ) | | — |

| | (10,628 | ) | | (4,238 | ) | |

| Fair value adjustments, net | 23 |

| | 34 |

| | 63 |

| | 86 |

| |

| Other (loss) income, net | (109 | ) | | 545 |

| | (150 | ) | | 898 |

| |

| Other operating expense, net | | Other operating expense, net | (380) | | | (423) | | |

| General and administrative expenses: | | | | |

|

| | | General and administrative expenses: | | |

| Compensation and benefits | (2,070 | ) | | (1,736 | ) | | (6,356 | ) | | (5,829 | ) | Compensation and benefits | (3,096) | | | (2,163) | | |

| Other general and administrative | (1,529 | ) | | (1,619 | ) | | (5,620 | ) | | (5,288 | ) | Other general and administrative | (2,372) | | | (2,458) | | |

| Net income (loss) | 10,311 |

| | 14,700 |

| | 11,931 |

| | (25,962 | ) | Net income (loss) | 117,929 | | | (98,479) | | |

| Preferred stock dividends | (2,808 | ) | | (2,294 | ) | | (7,885 | ) | | (6,882 | ) | Preferred stock dividends | (2,559) | | | (3,841) | | |

| Preferred stock redemption charge | | Preferred stock redemption charge | (2,987) | | | (3,914) | | |

| Net income (loss) to common shareholders | $ | 7,503 |

| | $ | 12,406 |

| | $ | 4,046 |

| | $ | (32,844 | ) | Net income (loss) to common shareholders | $ | 112,383 | | | $ | (106,234) | | |

| | | | | | | | | | | | | |

| Other comprehensive income: | | | | |

|

| | | Other comprehensive income: | | |

| Unrealized gain on available-for-sale investments, net | $ | 981 |

| | $ | 769 |

| | $ | 28,087 |

| | $ | 61,260 |

| |

| Reclassification adjustment for loss on sale of investments, net | 5,211 |

| | — |

| | 10,628 |

| | 4,238 |

| |

| Reclassification adjustment for de-designated cash flow hedges | (48 | ) | | (99 | ) | | (220 | ) | | (152 | ) | |

| Total other comprehensive income | 6,144 |

| | 670 |

| | 38,495 |

| | 65,346 |

| |

| Comprehensive income to common shareholders | $ | 13,647 |

| | $ | 13,076 |

| | $ | 42,541 |

| | $ | 32,502 |

| |

| Unrealized (loss) gain on available-for-sale investments, net | | Unrealized (loss) gain on available-for-sale investments, net | $ | (60,459) | | | $ | 157,755 | | |

| Reclassification adjustment for realized gain on sale of available-for-sale investments, net | | Reclassification adjustment for realized gain on sale of available-for-sale investments, net | (4,697) | | | (84,783) | | |

| Total other comprehensive (loss) income | | Total other comprehensive (loss) income | (65,156) | | | 72,972 | | |

| Comprehensive income (loss) to common shareholders | | Comprehensive income (loss) to common shareholders | $ | 47,227 | | | $ | (33,262) | | |

| | | | | | | | | | | | | |

| Net income (loss) per common share-basic and diluted | $ | 0.15 |

| | $ | 0.25 |

| | $ | 0.08 |

| | $ | (0.67 | ) | Net income (loss) per common share-basic and diluted | $ | 4.20 | | | $ | (4.63) | | |

| Weighted average common shares-basic and diluted | 49,832 |

| | 49,147 |

| | 49,411 |

| | 49,102 |

| Weighted average common shares-basic and diluted | 26,788,693 | | | 22,963,084 | | |

See notes to the unaudited consolidated financial statements.

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTSTATEMENTS OF SHAREHOLDERS’ EQUITY

(UNAUDITED)(unaudited)

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Additional

Paid-in

Capital | | AOCI | | Accumulated

Deficit | | Total Shareholders’ Equity |

| Shares | Amount | Shares | Amount |

Balance as of

December 31, 2019 | 6,788,330 | | $ | 162,807 | | | 22,945,993 | | $ | 229 | | | $ | 858,347 | | | $ | 173,806 | | | $ | (612,201) | | | $ | 582,988 | |

| Cumulative effect of adopting accounting standard ASU 2019-05 | — | | — | | | — | | — | | | — | | | — | | | (548) | | | (548) | |

| Adjusted Balance, January 1, 2020 | 6,788,330 | | 162,807 | | | 22,945,993 | | 229 | | | 858,347 | | | 173,806 | | | (612,749) | | | 582,440 | |

| Stock issuance | 4,460,000 | | 107,988 | | | — | | — | | | — | | | — | | | — | | | 107,988 | |

| Redemption of preferred stock | (4,000,000) | | (96,086) | | | — | | — | | | — | | | — | | | (3,914) | | | (100,000) | |

| Restricted stock granted, net of amortization | — | | — | | | 67,511 | | 1 | | | 306 | | | — | | | — | | | 307 | |

| Stock repurchase | — | | — | | | (18,782) | | 0 | | | (206) | | | — | | | — | | | (206) | |

| Adjustments for tax withholding on share-based compensation | — | | — | | | (12,744) | | 0 | | | (235) | | | — | | | — | | | (235) | |

| Stock issuance costs | — | | — | | | — | | — | | | (9) | | | — | | | — | | | (9) | |

| Net loss | — | | — | | | — | | — | | | — | | | — | | | (98,479) | | | (98,479) | |

| Dividends on preferred stock | — | | — | | | — | | — | | | — | | | — | | | (3,841) | | | (3,841) | |

| Dividends on common stock | — | | — | | | — | | — | | | — | | | — | | | (10,330) | | | (10,330) | |

| Other comprehensive income | — | | — | | | — | | — | | | — | | | 72,972 | | | — | | | 72,972 | |

| Balance as of March 31, 2020 | 7,248,330 | | $ | 174,709 | | | 22,981,978 | | $ | 230 | | | $ | 858,203 | | | $ | 246,778 | | | $ | (729,313) | | | $ | 550,607 | |

| | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Additional

Paid-in

Capital | | AOCI | | Accumulated

Deficit | | Total Shareholders’ Equity |

| Shares | Amount | Shares | Amount |

Balance as of

December 31, 2020 | 7,248,330 | | $ | 174,564 | | | 23,697,970 | | $ | 237 | | | $ | 869,495 | | | $ | 80,261 | | | $ | (491,104) | | | $ | 633,453 | |

| Stock issuance | — | | — | | | 7,187,500 | | 72 | | | 128,078 | | | — | | | — | | | 128,150 | |

| Redemption of preferred stock | (2,788,330) | | (66,721) | | | — | | — | | | — | | | — | | | (2,987) | | | (69,708) | |

| Restricted stock granted, net of amortization | — | | — | | | 16,722 | | 0 | | | 451 | | | — | | | — | | | 451 | |

| Adjustments for tax withholding on share-based compensation | — | | — | | | (22,623) | | 0 | | | (428) | | | — | | | — | | | (428) | |

| Stock issuance costs | — | | — | | | — | | — | | | (270) | | | — | | | — | | | (270) | |

| Net income | — | | — | | | — | | — | | | — | | | — | | | 117,929 | | | 117,929 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive (Loss) Income | | Accumulated Deficit | | Total Shareholders' Equity |

| | Shares | Amount | Shares | Amount |

| Balance as of December 31, 2016 | 4,571,937 |

| $ | 110,005 |

| | 49,153,463 |

| $ | 492 |

| | $ | 727,369 |

| | $ | (32,609 | ) | | $ | (338,073 | ) | | $ | 467,184 |

|

| Stock issuance | 1,093,164 |

| 25,884 |

| | 2,048,288 |

| 21 |

| | 14,474 |

| | — |

| | — |

| | 40,379 |

|

| Restricted stock granted, net of amortization | — |

| — |

| | 138,166 |

| 1 |

| | 1,565 |

| | — |

| | — |

| | 1,566 |

|

| Adjustments for tax withholding on share-based compensation | — |

| — |

| | (77,567 | ) | (1 | ) | | (520 | ) | | — |

| | — |

| | (521 | ) |

| Stock issuance costs | — |

| (61 | ) | | — |

| — |

| | (43 | ) | | — |

| | — |

| | (104 | ) |

| Net income | — |

| — |

| | — |

| — |

| | — |

| | — |

| | 11,931 |

| | 11,931 |

|

| Dividends on preferred stock | — |

| — |

| | — |

| — |

| | — |

| | — |

| | (7,885 | ) | | (7,885 | ) |

| Dividends on common stock | — |

| — |

| | — |

| — |

| | — |

| | — |

| | (26,946 | ) | | (26,946 | ) |

| Other comprehensive income | — |

| — |

| | — |

| — |

| | — |

| | 38,495 |

| | — |

| | 38,495 |

|

| Balance as of September 30, 2017 | 5,665,101 |

| $ | 135,828 |

| | 51,262,350 |

| $ | 513 |

| | $ | 742,845 |

| | $ | 5,886 |

| | $ | (360,973 | ) | | $ | 524,099 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Additional

Paid-in

Capital | | AOCI | | Accumulated

Deficit | | Total Shareholders’ Equity |

| Shares | Amount | Shares | Amount |

| Dividends on preferred stock | — | | — | | | — | | — | | | — | | | — | | | (2,559) | | | (2,559) | |

| Dividends on common stock | — | | — | | | — | | — | | | — | | | — | | | (10,586) | | | (10,586) | |

| Other comprehensive income | — | | — | | | — | | — | | | — | | | (65,156) | | | — | | | (65,156) | |

| Balance as of March 31, 2021 | 4,460,000 | | $ | 107,843 | | | 30,879,569 | | $ | 309 | | | $ | 997,326 | | | $ | 15,105 | | | $ | (389,307) | | | $ | 731,276 | |

See notes to the unaudited consolidated financial statements.

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)(unaudited)

| | | | Nine Months Ended | | Three Months Ended |

| | September 30, | | March 31, |

| | 2017 | | 2016 | | 2021 | | 2020 |

| Operating activities: | | | | Operating activities: | | | |

| Net income (loss) | $ | 11,931 |

| | $ | (25,962 | ) | Net income (loss) | $ | 117,929 | | | $ | (98,479) | |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: | |

| | |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: | | |

| Decrease in accrued interest receivable | 1,129 |

| | 3,263 |

| |

| (Decrease) increase in accrued interest payable | (436 | ) | | 420 |

| |

| Loss on derivative instruments, net | 9,634 |

| | 62,153 |

| |

| Loss on sale of investments, net | 10,628 |

| | 4,238 |

| |

| Fair value adjustments, net | (63 | ) | | (86 | ) | |

| (Gain) loss on derivative instruments, net | | (Gain) loss on derivative instruments, net | (107,801) | | | 195,567 | |

| Gain on sale of investments, net | | Gain on sale of investments, net | (4,697) | | | (84,783) | |

| Loss on investments, net | | Loss on investments, net | 980 | | | 372 | |

| Amortization of investment premiums, net | 122,621 |

| | 112,418 |

| Amortization of investment premiums, net | 30,161 | | | 33,118 | |

| Other amortization and depreciation, net | 983 |

| | 1,186 |

| Other amortization and depreciation, net | 599 | | | 499 | |

| Stock-based compensation expense | 1,567 |

| | 2,066 |

| Stock-based compensation expense | 452 | | | 307 | |

| Increase in other assets and liabilities, net | (1,905 | ) | | (2,060 | ) | |

| Net cash and cash equivalents provided by operating activities | 156,089 |

| | 157,636 |

| |

| (Increase) decrease in accrued interest receivable | | (Increase) decrease in accrued interest receivable | (1,092) | | | 3,105 | |

| Decrease in accrued interest payable | | Decrease in accrued interest payable | (992) | | | (5,979) | |

| Change in other assets and liabilities, net | | Change in other assets and liabilities, net | (5,350) | | | 254 | |

| Net cash provided by operating activities | | Net cash provided by operating activities | 30,189 | | | 43,981 | |

| Investing activities: | |

| | |

| Investing activities: | | | |

| Purchase of investments | (772,590 | ) | | (96,816 | ) | Purchase of investments | (68,543) | | | (155,594) | |

| Principal payments received on investments | 248,298 |

| | 337,719 |

| Principal payments received on investments | 118,022 | | | 140,032 | |

| Proceeds from sales of investments | 792,984 |

| | 94,033 |

| Proceeds from sales of investments | 220,194 | | | 487,464 | |

| Principal payments received on mortgage loans held for investment, net | 2,641 |

| | 3,709 |

| |

| Distributions received from limited partnership | — |

| | 10,835 |

| |

| Principal payments received on mortgage loans held for investment | | Principal payments received on mortgage loans held for investment | 488 | | | 615 | |

| Net receipts (payments) on derivatives, including terminations | 11,743 |

| | (24,483 | ) | Net receipts (payments) on derivatives, including terminations | 52,079 | | | (187,822) | |

| Other investing activities | (214 | ) | | (105 | ) | |

| Net cash and cash equivalents provided by investing activities | 282,862 |

| | 324,892 |

| |

| Increase in cash collateral posted by counterparties | | Increase in cash collateral posted by counterparties | 76,095 | | | 3,185 | |

| | Net cash provided by investing activities | | Net cash provided by investing activities | 398,335 | | | 287,880 | |

| Financing activities: | |

| | |

| Financing activities: | | | |

| Borrowings under repurchase agreements | 60,229,426 |

| | 19,293,243 |

| Borrowings under repurchase agreements | 4,494,067 | | | 16,555,552 | |

| Repayments of repurchase agreement borrowings and FHLB advances | (60,609,148 | ) | | (19,661,384 | ) | |

| Repayments of repurchase agreement borrowings | | Repayments of repurchase agreement borrowings | (4,899,141) | | | (16,899,794) | |

| Principal payments on non-recourse collateralized financing | (747 | ) | | (1,443 | ) | Principal payments on non-recourse collateralized financing | (118) | | | (569) | |

| Proceeds from issuance of preferred stock | 25,884 |

| | — |

| Proceeds from issuance of preferred stock | 0 | | | 107,988 | |

| Proceeds from issuance of common stock | 14,495 |

| | 102 |

| Proceeds from issuance of common stock | 128,150 | | | 0 | |

| Cash paid for redemption of preferred stock | | Cash paid for redemption of preferred stock | (69,708) | | | (100,000) | |

| Cash paid for stock issuance costs | (61 | ) | | — |

| Cash paid for stock issuance costs | (270) | | | 0 | |

| Cash paid for repurchases of common stock | — |

| | (310 | ) | |

| Cash paid for common stock repurchases | | Cash paid for common stock repurchases | 0 | | | (206) | |

| Payments related to tax withholding for stock-based compensation | (521 | ) | | (485 | ) | Payments related to tax withholding for stock-based compensation | (428) | | | (235) | |

| Dividends paid | (35,479 | ) | | (39,285 | ) | Dividends paid | (13,320) | | | (15,027) | |

| Net cash and cash equivalents used in financing activities | (376,151 | ) | | (409,562 | ) | |

| Net cash used in financing activities | | Net cash used in financing activities | (360,768) | | | (352,291) | |

| | | | | | | | |

| Net increase in cash, cash equivalents, and restricted cash | 62,800 |

| | 72,966 |

| |

| Cash, cash equivalents, and restricted cash at beginning of period | 98,889 |

| | 85,125 |

| |

| Cash, cash equivalents, and restricted cash at end of period | $ | 161,689 |

| | $ | 158,091 |

| |

| Net increase (decrease) in cash and cash posted to counterparties | | Net increase (decrease) in cash and cash posted to counterparties | 67,756 | | | (20,430) | |

| Cash and cash posted to counterparties at beginning of period | | Cash and cash posted to counterparties at beginning of period | 310,360 | | | 136,230 | |

| Cash and cash posted to counterparties at end of period | | Cash and cash posted to counterparties at end of period | $ | 378,116 | | | $ | 115,800 | |

| Supplemental Disclosure of Cash Activity: | |

| | |

| Supplemental Disclosure of Cash Activity: | | | |

| Cash paid for interest | $ | 26,766 |

| | $ | 18,185 |

| Cash paid for interest | $ | 2,619 | | | $ | 28,074 | |

See notes to the unaudited consolidated financial statements.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Dynex Capital, Inc., ("Company" (“Company”) was incorporated in the Commonwealth of Virginia on December 18, 1987 and commenced operations in February 1988. The Company is an internally managed mortgage real estate investment trust, or mortgage REIT, which primarily earns income from investing on a leveraged basis in debt securities, the majority of which are specified pools of Agency and non-Agency mortgage-backed securities (“MBS”) consisting of commercial MBS (“CMBS”), residential MBS (“RMBS”), commercial MBS (“CMBS”) and CMBS interest-only ("IO"(“IO”) securities thatand non-Agency MBS, which consist mainly of CMBS IO. Agency MBS have a guaranty of principal payment by a U.S. government-sponsored entity (“GSE”) such as Fannie Mae and Freddie Mac, which are in conservatorship and are currently supported by a senior preferred stock purchase agreement from the U.S. Treasury. Non-Agency MBS are issued or guaranteed by the U.S. Government or U.S. Government sponsored agencies ("Agency MBS")non-governmental enterprises and MBS issued by others ("non-Agency MBS"). Wedo not have a guaranty of principal payment. The Company also investinvests in other types of mortgage-related securities, such as to-be-announced securities (“TBA”) forward contracts for the purchaseTBAs” or sale of generic (also referred to as "non-specified"“TBA securities”) pools of Agency MBS..

Basis of Presentation

The accompanying unaudited consolidated financial statements of Dynex Capital, Inc.the Company and its subsidiaries (together, “Dynex” or, as appropriate, the “Company”) have been prepared in accordance with accounting principlesU.S. generally accepted in the United States of Americaaccounting principles (“GAAP”) for interim financial information and with the instructions to the Quarterly Report on Form 10-Q and Article 10, Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all significant adjustments, consisting of normal recurring accruals, considered necessary for a fair presentation of the consolidated financial statements have been included. Operating results for the three months ended September 30, 2017March 31, 2021 are not necessarily indicative of the results that may be expected for any other interim periods or for the entire year ending December 31, 2017.2021. The unaudited consolidated financial statements included herein should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 20162020 (the “2020 Form 10-K”) filed with the SEC.

Consolidation

The consolidated financial statements include the accounts of the Company and the accounts of its majority owned subsidiaries and variable interest entities ("VIE") for which it is the primary beneficiary. As a primary beneficiary, the Company has both the power to direct the activities that most significantly impact the economic performance of the VIE and a right to receive benefits or absorb losses of the entity that could be potentially significant to the VIE. The Company is required to reconsider its evaluation of whether to consolidate a VIE each reporting period, based upon changes in the facts and circumstances pertaining to the VIE. The Company consolidates certain trusts through which it has securitized mortgage loans as a result of not meeting the sale criteria under GAAP at the time the financial assets were transferred to the trust. All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported amounts of revenue and expenses during the reported period. Actual results could differ from those estimates. The most significant estimates used by management include, but are not limited to, amortization of premiums and discounts and fair value measurements of its investments, and other-than-temporary impairments.investments. These items are discussed further below within this note to the consolidated financial statements.

The Company believes the estimates and assumptions underlying the consolidated financial statements included herein are reasonable and supportable based on the information available as of March 31, 2021; however, the uncertainty over the impact that the COVID-19 pandemic may continue to have on the global economy and on the Company’s business makes any estimates and assumptions inherently less certain than they would be absent the current and potential impacts of COVID-19. The COVID-19 pandemic and resulting emergency measures have led (and may continue to lead) to significant disruptions in the global capital markets and supply chains as well as the economy of the U.S. and other countries impacted by COVID-19. In particular, as part of the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act passed by the U.S. Congress, which includes assistance to homeowners and renters, both Fannie Mae and Freddie Mac have implemented mortgage forbearance policies that allow borrowers to delay their mortgage payments for up to 18 months and placed a moratorium on foreclosures on single-family homes until June 30, 2021. The impact of high levels of forbearance on the Company’s MBS could range from immaterial to significant depending upon not only actual losses incurred on underlying loans but also future public policy choices and actions by the GSEs, their regulator the Federal Housing Finance Agency (“FHFA”), the U.S. Federal Reserve (“Federal Reserve”), and federal and state governments. The nature and timing of any such future public policy choices and actions are unpredictable, including the potential impact on MBS prices and prepayment speeds. Though these supportive actions have helped cushion the economic damage from the disruption of the

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

pandemic to date, the Company can give no assurance as to how, in the long term, these and other actions by the U.S. government and GSEs will affect the efficiency, liquidity and stability of the financial and mortgage markets.

Reclassifications

Certain items on the Company’s consolidated balance sheet as of December 31, 2020 have been reclassified to conform to the current period’s presentation. In the Company’s 2020 Form 10-K, restricted cash on the consolidated balance sheet as of December 31, 2020 consisted of the cash collateral posted by the Company to its counterparties to cover initial and variation margin related to its financing and derivative instruments, net of any cash collateral received by the Company from its counterparties. Restricted cash has been renamed “cash collateral posted to counterparties” within total assets, and cash collateral of $7,681 posted by counterparties as of December 31, 2020 has been reclassified to “cash collateral posted by counterparties” within total liabilities.

Consolidation and Variable Interest Entities

The consolidated financial statements include the accounts of the Company and the accounts of its majority owned subsidiaries and variable interest entities (“VIE”) for which it is the primary beneficiary. All intercompany accounts and transactions have been eliminated in consolidation.

The Company consolidates a VIE if the Company is determined to be the VIE’s primary beneficiary, which is defined as the party that has both: (i) the power to control the activities that most significantly impact the VIE’s financial performance and (ii) the right to receive benefits or absorb losses that could potentially be significant to the VIE. The Company reconsiders its evaluation of whether to consolidate a VIE on an ongoing basis, based on changes in the facts and circumstances pertaining to the VIE. Though the Company invests in Agency and non-Agency MBS which are generally considered to be interests in VIEs, the Company does not consolidate these entities because it does not meet the criteria to be deemed a primary beneficiary.

The Company consolidates a securitization trust, which has residential mortgage loans included in “mortgage loans held for investment” on its consolidated balance sheet, of which a portion is pledged as collateral for one remaining non-recourse collateralized bond classified within “other liabilities” on its consolidated balance sheet. The Company owns the subordinate class in the trust and has been deemed the primary beneficiary.

Income Taxes

The Company has elected to be taxed as a real estate investment trust ("REIT"(“REIT”) under the Internal Revenue Code of 1986 and the corresponding provisions of state law. To qualify as a REIT, the Company must meet certain tests including investing in primarily real estate-related assets and the required distribution of at least 90% of its annual REIT taxable income to stockholdersshareholders after consideration of its net operating loss ("NOL"(“NOL”) carryforward and not including taxable income retained in its taxable subsidiaries. As a REIT, the Company generally will not be subject to federal income tax on the amount of its income or capital gains that is distributed as dividends to shareholders.

The Company assesses its tax positions for all open tax years and determines whether the Company has any material unrecognized liabilities in accordance with Accounting Standards Codification ("ASC") Topic 740. The Companyand records these liabilities, if any, to the extent they are deemed more likely than not to have been incurred.

Net Income (Loss) Per Common Share

The Company calculates basic net income (loss) per common share by dividing net income (loss) to common shareholders for the period by weighted-average shares of common stock outstanding for that period. The Company did not have any potentially dilutive securities outstanding during the three or nine months ended September 30, 2017March 31, 2021 or September 30, 2016.March 31, 2020.

The Company currently has unvested service-based restricted stock issued and outstanding. Holders of unvested shares of the Company's issued and outstanding restricted common stock are eligible to receive non-forfeitable dividends. As such, these unvested shares of restricted stock are considered participating securities as per ASC Topic 260-10 and therefore are included in the computation of basic net income (loss) per common share using

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

the two-class method. Upon vesting, restrictions on transfer expire on each share of restricted stock, and each such share of restricted stock represents one unrestricted share of common stock.

Because the Company's 8.50%Company’s 6.900% Series AC Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (the “Series AC Preferred Stock”) and 7.625% Series B Cumulative Redeemable Preferred Stock (the “Series B Preferred Stock”) areis redeemable at the Company'sCompany’s option for cash only and may convertconvertible into shares of common stock only upon a change of control of the Company (and subject to other circumstances) as described in Article IIIC of the Company’s Articles of Amendment to the Restated Articles of Incorporation (the “Restated Articles of Incorporation, as amended”), the effect of those shares and their related dividends iswere excluded from the calculation of diluted net income (loss) per common share.share for the periods presented.

Cash

Cash includes unrestricted demand deposits at highly rated financial institutions. The Company’s cash balances fluctuate throughout the year and Cash Equivalentsmay exceed Federal Deposit Insurance Company insured limits from time to time. Although the Company bears risk to amounts in excess of those insured by the FDIC, it does not anticipate any losses as a result due to the financial position and creditworthiness of the depository institutions in which those deposits are held.

Cash and cash equivalents include cash on hand and highly liquid investments with original maturities of three months or less.Collateral Posted To/By Counterparties

Restricted Cash

Restricted cash consists of cash the Company has pledged collateral posted to/by counterparties represents amounts pledged/received to cover initial and variation margin with itsrelated to the Company’s financing and derivative counterparties.instruments.

The Company early adopted Accounting Standards Update ("ASU") No. 2016-18, Statement of Cash Flows (Topic 230) - Restricted Cash, which requires amounts generally described as restricted cash or restricted cash equivalents to be included with cash and cash equivalents when reconciling the beginning of period and end of period total amounts shown on the statement of cash flows. Because this ASU is to be applied retrospectively to each period presented, "net cash and cash equivalents used in financing activities" on the Company's consolidated statement of cash flows for the nine months ended September 30, 2016 now omits "increase in restricted cash" previously reported in the Quarterly Report on Form 10-Q for that period, and that increase is now included within "net increase in cash, cash equivalents, and restricted cash" for that period in order to conform to the current period's presentation.

The following table provides a reconciliation of cash and cash equivalents, and restricted cashposted to counterparties reported on the Company's consolidated balance sheet as of September 30, 2017the period indicated that sum to the total of the same such amounts shown on the Company'sCompany’s consolidated statement of cash flows for the ninethree months ended September 30, 2017:March 31, 2021:

| | | | | | | |

| March 31, 2021 | | |

| Cash | $ | 328,936 | | | |

| Cash collateral posted to counterparties | 49,180 | | | |

| Total cash and cash posted to counterparties shown on consolidated statement of cash flows | $ | 378,116 | | | |

|

| | | | |

| | | September 30, 2017 |

| Cash and cash equivalents | | $ | 117,702 |

|

| Restricted cash | | 43,987 |

|

| Total cash, cash equivalents, and restricted cash shown on consolidated statement of cash flows | | $ | 161,689 |

|

Mortgage-Backed Securities

The Company's investments in Agency and non-Agency RMBS, CMBS, and CMBS IO securities are designated as available-for-sale ("AFS") andCompany’s MBS are recorded at fair value on the Company'sCompany’s consolidated balance sheet. ChangesMBS purchased prior to January 1, 2021 are designated as available for sale (“AFS”) with changes in unrealized gain (loss) on the Company's MBS arefair value reported in other comprehensive income ("OCI"(“OCI”) as an unrealized gain (loss) until itthe investment is sold matures, or is determined to be other than temporarily impaired. Although the Company generally intends to hold its AFS securities until maturity, it may sell any of these securities as part of the overall management of its business.matures. Upon the sale of an AFS security, any unrealized gain or loss is reclassified out of accumulated other comprehensive income ("AOCI"(“AOCI”) into net income as a realized "gain“gain (loss) on sale of investments, net"net” using the specific identification method.

The Company’s MBS pledged as collateral against repurchase agreements and derivative instruments are included in MBS on Effective January 1, 2021, the consolidated balance sheets withCompany elected the fair value option for all MBS purchased on or after that date with changes in fair value reported in net income as “gain (loss) on investments, net”. Management is electing the fair value option so that GAAP net income will reflect the changes in fair value for its future purchases of MBS in a manner consistent with the presentation and timing of the MBS pledgedchanges in fair value of its derivative instruments. Electing the fair value option is increasing as collateral disclosed parenthetically.an industry trend for mortgage REITs who have not elected cash flow hedge accounting. “Gain (loss) on investments, net”, which was titled “fair value adjustments, net” in prior reporting periods, also includes changes in fair value for mortgage loans held for investment for which the Company elected the fair value option effective January 1, 2020.

Interest Income, Premium Amortization, and Discount Accretion.Interest income on MBS is accrued based on the outstanding principal balance (or notional balance in the case of interest-only, or "IO",“IO” securities) and their contractual terms. Premiums andor discounts onassociated with the Company'spurchase of Agency MBS as well as any non-Agency MBS rated 'AA' and higher at the time of purchase are amortized or accreted into interest income over the expectedprojected life of such securities using the effective yield method, and adjustments to premium amortization and discount accretion are made for actual cash payments. The Company may also adjust premium amortization and discount accretion for changes in projected future cash payments. The Company'sCompany’s projections of future cash payments are based on input and analysis received from external sources and internal models and include assumptions about the amount and timing of loan prepayment rates, fluctuations in interest rates, credit losses, and other factors. On at least a

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

quarterly basis, the Company reviews and makes any necessary adjustments to its cash flow projections and updates the yield recognized on these assets.

The Company does not estimate future prepayments on its fixed-rate Agency RMBS.

The Company holds certaincurrently hold any non-Agency MBS that hadwere purchased at a discount with credit ratings of less than 'AA' at the time of purchase‘AA’ or were not rated by any of the nationally recognized credit rating agencies. A portionagencies at the time of these non-Agency MBS were purchased at discounts to their par value, which management does not believe to be substantial. The discount is accreted into income over the security's expected life based on management's estimate of the security's projected cash flows. Future changes in the timing of projected cash flows or differences arising between projected cash flows and actual cash flows received may result in a prospective change in the effective yield on those securities.purchase.

Determination of MBS Fair Value.The Company estimates the fair value of the majority of its MBS based upon prices obtained from third-party pricing services and broker quotes. The remainder of the Company'sCompany’s MBS are valued by discounting the estimated future cash flows derived from cash flow models that utilize information such as the security'ssecurity’s coupon rate, estimated prepayment speeds, expected weighted average life, collateral composition, estimated future interest rates, expected losses, and credit enhancements as well as certain other relevant information. ReferPlease refer to Note 5 for further discussion of MBS fair value measurements.

Other-than-Temporary Impairment. AnAllowance for Credit Losses.On at least a quarterly basis, the Company evaluates any MBS is considered impaired when itsdesignated as AFS with a fair value is less than its amortized cost. The Company evaluates all of its impaired MBScost for other-than-temporary impairments ("OTTI") on at least a quarterly basis. An impairment is considered other-than-temporary if: (1) the Company intends to sell the MBS; (2) it is more likely than not that the Company will be required to sell the MBS before its fair value recovers; or (3) the Company does not expect to recover the full amortized cost basis of the MBS.credit losses. If either of the first two conditions is met, the entire amount of the impairment is recognized in earnings. If the impairment is solely due to the inability to fully recover the amortized cost basis, the security is further analyzed to quantify any credit loss, which is the difference between the present value of cash flows expected to be collected on the MBS andis less than its amortized cost. Thecost, the difference is recorded as an allowance for credit loss if any, is thenthrough net income up to and not exceeding the amount that the amortized cost exceeds current fair value. Subsequent changes in credit loss estimates are recognized in earnings whilein the balanceperiod in which they occur. Because the majority of impairmentthe Company’s investments are higher credit quality and most are guaranteed by a GSE, the Company is not likely to have an allowance for credit losses related to other factors is recognized in other comprehensive income.its MBS recorded on its consolidated balance sheet.

Following the recognition of an OTTI through earnings, a new cost basis is established for the security. Any subsequent recoveries in fair value may be accreted back into the amortized cost basis of the MBS on a prospective basis through interest income. Please see Note 2 for additional information related to the Company's evaluation for OTTI.

Repurchase Agreements

The Company'sCompany’s repurchase agreements, which are used to finance its purchases of MBS, are accounted for as secured borrowings under which the Company pledges its securities as collateral to secure a loan, which is equal in value to a specified percentage of the estimated fair value of the pledged collateral. The Company retains beneficial ownership of the pledged collateral.collateral, which is disclosed parenthetically on the Company’s consolidated balance sheets. At the maturity of a repurchase agreement, the Company is required to repay the loan and concurrently receives back its pledged collateral from the lender or, with the consent of the lender, the Company may renew the agreement at the then prevailing financing rate. A repurchase agreement lender may require the Company to pledge additional collateral in the event of a decline in the fair value of the collateral pledged. Repurchase agreement financing is recourse to the Company and the assets pledged. Most of the Company’s repurchase agreements are based on the September 1996 version of the Bond Market Association Master Repurchase Agreement, which generally provides that the lender, as buyer, is responsible for obtaining collateral valuations from a generally recognized source agreed to by both the Company and the lender, or, in an instance when such source is not available, the value determination is made by the lender.

Derivative Instruments

The Company'sAs of March 31, 2021, the Company’s derivative instruments include U.S. Treasury futures, options on U.S. Treasury futures, options on interest rate swaps (“swaptions”) and TBA securities, which are forward contracts for the purchase or sale of generic Agency RMBS commonly referred to as "TBA securities" or "TBA contracts".on a non-specified pool basis. Derivative instruments are accounted forreported at thetheir fair value of their unit of account. Derivative instrumentson the Company’s consolidated balance sheet as derivative assets if in a gain position are reportedor as derivative assets and derivative instrumentsliabilities if in a loss position, are reported as derivative liabilities onat the Company's consolidated balance sheet.end of the period reported. All periodic interest benefits/costs and changes in fair value of derivative instruments, including gains and losses realized upon termination, maturity, or settlement are recorded in "gain“gain (loss) on derivative instruments, net"net” on the Company'sCompany’s consolidated statement of comprehensive income.income (loss). Cash receipts and payments related to derivative instruments are classified in the investing activities section of ourthe consolidated statements of cash flows in accordance with the underlying nature or purpose of the derivative transactions.

Our interest rate swap agreementsThe Company currently has short positions in U.S. Treasury futures contracts, which are privately negotiated invalued based on exchange pricing with daily margin settlements. The Company realizes gains or losses on these contracts upon expiration at an amount equal to the over-the-counter ("OTC") market and the majority of these agreements are centrally cleared through the Chicago Mercantile Exchange ("CME") with the rest being subject to bilateral agreementsdifference between the Company and the swap counterparty. The Company's CME cleared swaps require that the Company post initial margin as determined by the CME, and in addition, variation margin is exchanged, typically in cash, for changes in thecurrent fair value of the CME cleared swaps. Beginning in January 2017, as a resultunderlying asset and the contractual price of a change in the CME's rulebook,futures contract. Daily margin exchanges for the exchange of variation margin for CME cleared swaps is legallyCompany’s U.S. Treasury futures are not considered to be thelegal settlement of the derivative itself as opposed to a pledge of collateral. Accordingly, beginninginstrument.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in 2017,thousands except share data)

The Company’s options on U.S. Treasury futures provide the Company accountsthe right, but not an obligation, to buy U.S. Treasury futures at a predetermined notional amount and stated term in the future. Options on U.S. Treasury futures are valued based on exchange pricing without daily exchanges of margin amounts. The Company records the premium paid for the daily exchange of variation margin associated with its CME cleared interest rate swapsoption contract as a direct increase or decrease to the carrying value of the related derivative asset or liability. The carrying value of CME cleared interest rate swaps on the Company'sits consolidated balance sheets issheet and adjusts the unsettledbalance for changes in fair value through “gain (loss) on derivative instruments” until the option is exercised or the contract expires. The Company may also purchase swaptions and defer the premium payment until the effective date. The premium payable and underlying swaption are accounted for as a single unit of those instruments.account.

A TBA security is a forward contract (“TBA contract”) for the purchase (“long position”) or sale (“short position”) of a genericnon-specified Agency MBS at a predetermined price with certain principal and interest terms and certain types of collateral, but the particular Agency securities to be delivered are not identified until shortly before the TBA settlement date. The Company executes TBA dollar roll transactions which effectively delay the settlement of a forward purchase of a TBA Agency RMBS by entering into an offsettingaccounts for long and short position (referred to as a "pair off"), net settling the paired-off positions in cash, and simultaneously entering a similar TBA contract for a later settlement date. TBA securities purchased for a forward settlement month are generally priced at a discount relative to TBA securities sold for settlement in the current month. This discount, often referred to as “drop income” is the economic equivalent of net interest income on the underlying Agency securities over the roll period (interest income less implied financing cost).

The Company accounts for TBA securitiesTBAs as derivative instruments because the Company cannot assert that it is probable at inception and throughout the term of an individual TBA contracttransaction that its settlement will result in physical delivery of the underlying Agency RMBS or that the individual TBA contracttransaction will not settle in the shortest time period possible.

Please refer to Note 4 for additional information regarding the Company'sCompany’s derivative instruments as well as Note 5 for information on how the fair value of these instruments areis calculated.

Share-Based Compensation

Pursuant to the Company’s 20092020 Stock and Incentive Plan (the “2020 Plan”), the Company may grant share-based compensation to eligible employees, non-employee directors or consultants or advisersadvisors to the Company, including restricted stock awards, stock options, stock appreciation rights, dividend equivalent rights, performance shares,performance-based and service-based restricted stock units. The Company'sunits, and performance cash awards. Currently, the Company has shares of restricted stock currently issued and outstanding under this plan may be settled only in shares of its common stock, and thereforewhich are treated as equity awards withand recorded at their fair value which is measured atusing the grantclosing stock price on the date and recognized asof the grant. The compensation cost is recognized over the requisite servicevesting period with a corresponding credit to shareholders' equity.shareholders’ equity using the straight-line method. The requisite service period is the period during which an employee is required to provide service in exchangeCompany does not estimate forfeiture rates, but adjusts for an award, which is equivalent to the vesting period specifiedactual forfeitures in the terms of the time-based restricted stock award. None of the Company's restricted stock awards have performance based conditions.periods in which they occur. The Company does not currently have any share-based compensation issued or outstanding other than restricted stock issued to its employees, officers, and directors.

Contingencies

In the normal course of business, there may be various lawsuits, claims, and other contingencies pending against the Company. On a quarterly basis, the Company evaluates whether to establish provisions for estimated losses from those matters. The Company recognizes a liability for a contingent loss when: (a) the underlying causal event has occurred prior to the balance sheet date; (b) it is probable that a loss has been incurred; and (c) there is a reasonable basis for estimating that loss. A liability is not recognized for a contingent loss when it is only possible or remotely possible that a loss has been incurred, however, possible contingent losses shall be disclosed. If the contingent loss (or an additional loss in excess of any accrual) is at least a reasonable possibility and material, then the Company discloses a reasonable estimate of the possible loss or range of loss, if such reasonable estimate can be made. If the Company cannot make a reasonable estimate of the possible material loss, or range of loss, then that fact is disclosed.

RecentAs previously disclosed in the 2020 Form 10-K, the receiver (the “Receiver”) for one of the plaintiffs awarded damages in a judgment (the "DCI Judgment") against Dynex Commercial, Inc. ("DCI"), a subsidiary of a former affiliate of the Company, filed a separate claim in May 2018 against the Company seeking payment of the damages awarded in connection with the DCI Judgment, alleging that the Company breached a litigation cost sharing agreement, as amended (the "Agreement"), that was initially entered into by the Company and DCI in December 2000. On November 21, 2019, the U.S. District Court, Northern District of Texas ("Northern District Court") granted in part and denied in part summary judgment on the Receiver’s claim and the Company’s claim for offset and recoupment. The Northern District Court found that the Company breached the Agreement and therefore must pay damages to the Receiver. The Northern District Court simultaneously granted the Company’s motion for summary judgment finding that DCI also breached the Agreement and that the Company can recover amounts due to it from DCI under the Agreement. The Receiver subsequently filed a claim for damages with the Northern District Court of approximately $12,600, while the Company filed claims for damages ranging

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

from $13,300 to $30,600, including interest. The Receiver filed objections (the "Objections") with the Northern District Court to, among other things, the Company recovering amounts incurred prior to entry into the Agreement and amounts incurred under the Agreement after January 31, 2006, including interest, which is the date that DCI’s corporate existence ceased under Virginia law. The Company has disputed the Receiver’s Objections, arguing, among other things, that the Receiver's Objections are not supportable under Virginia law and has further refined its damages claim to range from $15,961 based on simple interest to $22,752 based on a combination of simple and compound interest, which the Company believes is supportable under Virginia law. There have been no material developments in this matter during the three months ended March 31, 2021. After consultation with litigation counsel, the Company believes, based upon information currently available and its evaluation of Virginia law, that the likelihood of loss is not probable, and given the range of potential claims for damages by the Company to offset the Receiver's claims, the amount of possible loss cannot be reasonably estimated, and therefore, no contingent liability has been recorded.

Recently Issued Accounting Pronouncements

The Company evaluates Accounting Standards Updates (“ASU”) issued by the Financial Accounting Standards Board ("FASB"(“FASB”) on at least a quarterly basis to evaluate applicability and significance of any impact on its financial condition and results of operations. There were no accounting pronouncements issued ASU No. 2017-08, Receivables-Nonrefundable Fees and Other Costs, which shortensduring the amortization period for certain callable debt securities held at a premium, requiring the premium to be amortized to the earliest call date. The amendments in this ASUthree months ended March 31, 2021 that are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018 and early adoption is permitted. The amendments in this Update should be applied using the modified-retrospective transition approach and will require disclosures for the change in accounting principle. The Company does not expect this ASUexpected to have a material impact on the Company's consolidatedCompany’s financial statements.condition or results of operations.

FASB issued ASU No. 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which contains significant amendments to hedge accounting with the main objective of better aligning an entity’s risk management activities and financial reporting for hedging relationships through changes to both the designation and measurement guidance for qualifying hedging relationships and the presentation of hedge results. To meet that objective, the amendments expand and refine hedge accounting for both non-financial and financial risk components and align the recognition and presentation of the effects of the hedging instrument and the hedged item in the financial statements. This ASU also includes certain targeted improvements to ease the application of current guidance related to the assessment of hedge effectiveness as well as changes to current disclosure requirements. The amendments in this ASU are effective for public business entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years, and early adoption is permitted. All transition requirements and elections will be applied to hedging relationships existing on the date of adoption. The effect of adoption will be reflected as of the beginning of the fiscal year of adoption, and the amended presentation and disclosure guidance is required only prospectively. The Company does not currently apply hedge accounting, but is evaluating the impact this ASU would have on its consolidated financial statements if the Company elects to adopt hedge accounting in the future.

NOTE 2 – MORTGAGE-BACKED SECURITIES

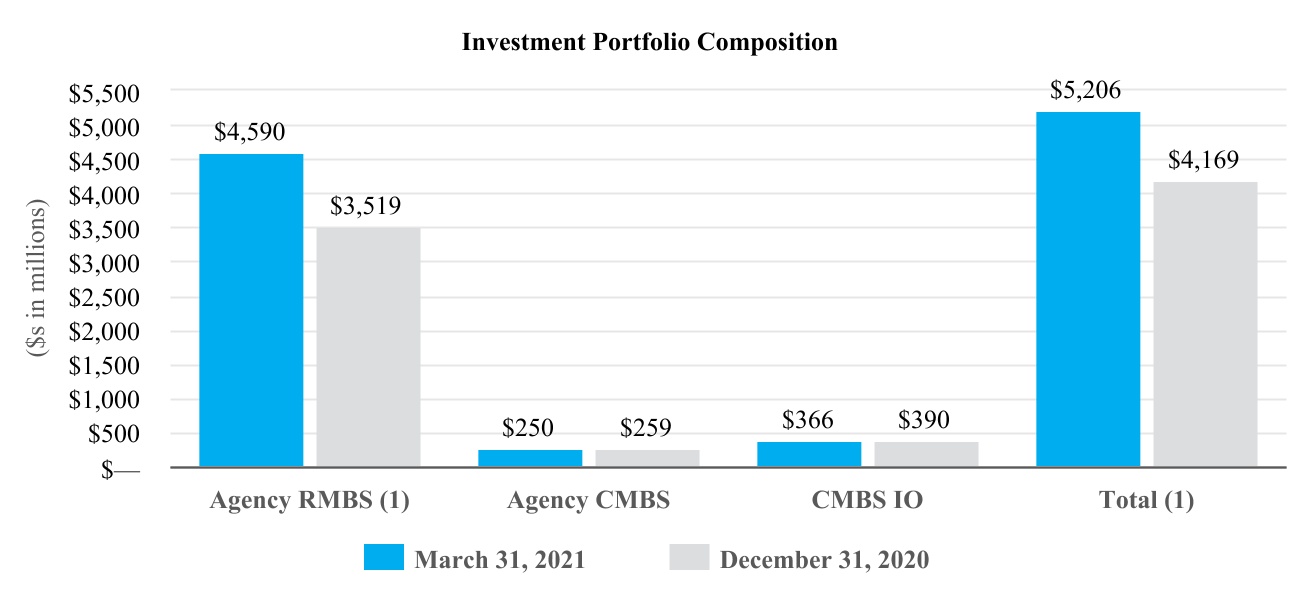

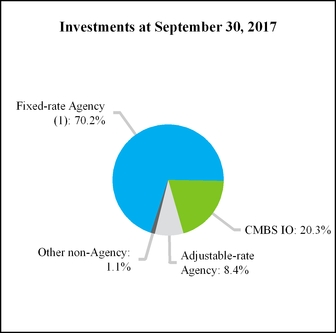

The majority of the Company's MBS are pledged as collateral for the Company's secured borrowings. The following tables present the Company’s MBS by investment type as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2021 |

| Agency RMBS | | Agency CMBS | | CMBS IO (1) | | Non-Agency Other | | Total |

| MBS designated as AFS: | | | | | | | | | |

| Par value | $ | 1,651,864 | | | $ | 234,091 | | | $ | 0 | | | $ | 1,354 | | | $ | 1,887,309 | |

| Unamortized premium (discount) | 55,118 | | | 2,975 | | | 352,655 | | | (370) | | | 410,378 | |

| Amortized cost | 1,706,982 | | | 237,066 | | | 352,655 | | | 984 | | | 2,297,687 | |

| Gross unrealized gain | 13,646 | | | 12,551 | | | 14,200 | | | 202 | | | 40,599 | |

| Gross unrealized loss | (24,473) | | | 0 | | | (979) | | | (43) | | | (25,495) | |

| Fair value | 1,696,155 | | | 249,617 | | | 365,876 | | | 1,143 | | | 2,312,791 | |

| | | | | | | | | |

| MBS measured at fair value through net income: | | | | | | | | |

| Par value | $ | 67,692 | | | $ | — | | | $ | — | | | $ | — | | | $ | 67,692 | |

| Unamortized premium (discount) | 850 | | | — | | | — | | | — | | | 850 | |

| Amortized cost | 68,542 | | | — | | | — | | | — | | | 68,542 | |

| Gross unrealized gain | 0 | | | — | | | — | | | — | | | 0 | |

| Gross unrealized loss | (960) | | | — | | | — | | | — | | | (960) | |

| Fair value | 67,582 | | | — | | | — | | | — | | | 67,582 | |

| | | | | | | | | |

| Total as of March 31, 2021 | $ | 1,763,737 | | | $ | 249,617 | | | $ | 365,876 | | | $ | 1,143 | | | $ | 2,380,373 | |

(1) The notional balance for Agency CMBS IO and non-Agency CMBS IO was $11,097,619 and $9,209,025 respectively, as of March 31, 2021.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2017 |

| | Par | | Net Premium (Discount) | | Amortized Cost | | Gross Unrealized Gain | | Gross Unrealized Loss | | Fair Value | | WAC (1) |

| CMBS: | | | | | | | | | | | | | |

| Agency | $ | 1,302,237 |

| | $ | 12,688 |

| | 1,314,925 |

| | $ | 6,187 |

| | $ | (13,623 | ) | | 1,307,489 |

| | 2.99 | % |

| Non-Agency | 40,780 |

| | (4,452 | ) | | 36,328 |

| | 2,877 |

| | — |

| | 39,205 |

| | 5.48 | % |

| | 1,343,017 |

| | 8,236 |

| | 1,351,253 |

| | 9,064 |

| | (13,623 | ) | | 1,346,694 |

| | |

CMBS IO (2): | | | | | | | | | | | | | |

| Agency | — |

| | 394,380 |

| | 394,380 |

| | 7,592 |

| | (164 | ) | | 401,808 |

| | 0.63 | % |

| Non-Agency | — |

| | 322,735 |

| | 322,735 |

| | 6,254 |

| | (330 | ) | | 328,659 |

| | 0.61 | % |

| | — |

| | 717,115 |

| | 717,115 |

| | 13,846 |

| | (494 | ) | | 730,467 |

| | |

| RMBS: | | | | | | | | | | | | | |

| Agency fixed-rate | 522,099 |

| | 19,163 |

| | 541,262 |

| | — |

| | (1,903 | ) | | 539,359 |

| | 3.52 | % |

| Agency adjustable-rate | 294,254 |

| | 11,011 |

| | 305,265 |

| | 1,263 |

| | (2,746 | ) | | 303,782 |

| | 3.05 | % |

| Non-Agency | 1,113 |

| | — |

| | 1,113 |

| | 49 |

| | (20 | ) | | 1,142 |

| | 6.75 | % |

| | 817,466 |

| | 30,174 |

| | 847,640 |

| | 1,312 |

| | (4,669 | ) | | 844,283 |

| | |

| | | | | | | | | | | | | |

|

|

| Total AFS securities: | $ | 2,160,483 |

| | $ | 755,525 |

| | $ | 2,916,008 |

| | $ | 24,222 |

| | $ | (18,786 | ) | | $ | 2,921,444 |

| | |

| |

(1) | The weighted average coupon ("WAC") is the gross interest rate of the security weighted by the outstanding principal balance (or by notional balance in the case of an IO security). |

| |

(2) | The notional balance for Agency CMBS IO and non-Agency CMBS IO was $14,253,392 and $11,061,377, respectively, as of September 30, 2017. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2020 |

| Agency RMBS | | Agency CMBS | | CMBS IO (1) | | Non-Agency Other | | Total |

| MBS designated as AFS: | | | | | | | | | |

| Par value | $ | 1,839,046 | | | $ | 235,801 | | | $ | 0 | | | $ | 1,499 | | | $ | 2,076,346 | |

| Unamortized premium (discount) | 57,997 | | | 3,152 | | | 378,940 | | | (440) | | | 439,649 | |

| Amortized cost | 1,897,043 | | | 238,953 | | | 378,940 | | | 1,059 | | | 2,515,995 | |

| Gross unrealized gain | 49,348 | | | 19,597 | | | 12,081 | | | 267 | | | 81,293 | |

| Gross unrealized loss | 0 | | | 0 | | | (982) | | | (51) | | | (1,033) | |

| Fair value | 1,946,391 | | | 258,550 | | | 390,039 | | | 1,275 | | | 2,596,255 | |

| | | | | | | | | |

| MBS measured at fair value through net income: | | | | | | | | |

| Par value | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Unamortized premium (discount) | — | | | — | | | — | | | — | | | — | |

| Amortized cost | — | | | — | | | — | | | — | | | — | |

| Gross unrealized gain | — | | | — | | | — | | | — | | | — | |

| Gross unrealized loss | — | | | — | | | — | | | — | | | — | |

| Fair value | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | |

| Total as of December 31, 2020 | $ | 1,946,391 | | | $ | 258,550 | | | $ | 390,039 | | | $ | 1,275 | | | $ | 2,596,255 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

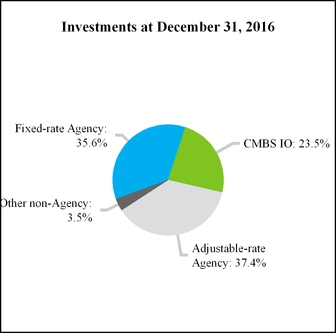

| | December 31, 2016 |

| | Par | | Net Premium (Discount) | | Amortized Cost | | Gross Unrealized Gain | | Gross Unrealized Loss | | Fair Value | | WAC (1) |

| CMBS: | | | | | | | | | | | | | |

| Agency | $ | 1,152,586 |

| | $ | 13,868 |

| | $ | 1,166,454 |

| | $ | 6,209 |

| | $ | (28,108 | ) | | $ | 1,144,555 |

| | 3.12 | % |

| Non-Agency | 79,467 |

| | (6,718 | ) | | 72,749 |

| | 5,467 |

| | — |

| | 78,216 |

| | 4.72 | % |

| | 1,232,053 |

| | 7,150 |

| | 1,239,203 |

| | 11,676 |

| | (28,108 | ) | | 1,222,771 |

| | |

CMBS IO (2): | | | | | | | | | | | | | |

| Agency | — |

| | 411,737 |

| | 411,737 |

| | 3,523 |

| | (3,362 | ) | | 411,898 |

| | 0.67 | % |

| Non-Agency | — |

| | 346,155 |

| | 346,155 |

| | 1,548 |

| | (5,055 | ) | | 342,648 |

| | 0.61 | % |

| | — |

| | 757,892 |

| | 757,892 |

| | 5,071 |

| | (8,417 | ) | | 754,546 |

| | |

| RMBS: | | | | | | | | | | | | | |

| Agency adjustable-rate | $ | 1,157,258 |

| | $ | 57,066 |

| | $ | 1,214,324 |

| | $ | 2,832 |

| | $ | (15,951 | ) | | $ | 1,201,205 |

| | 3.05 | % |

| Non-Agency | 33,572 |

| | (24 | ) | | 33,548 |

| | 64 |

| | (50 | ) | | 33,562 |

| | 3.58 | % |

| | 1,190,830 |

| | 57,042 |

| | 1,247,872 |

| | 2,896 |

| | (16,001 | ) | | 1,234,767 |

| | |

|

|

| | | |

|

| |

|

| | | |

|

| | |

| Total AFS securities: | $ | 2,422,883 |

| | $ | 822,084 |

| | $ | 3,244,967 |

| | $ | 19,643 |

| | $ | (52,526 | ) | | $ | 3,212,084 |

| |

|

|

| |

(1) | The WAC is the gross interest rate of the pool of mortgages underlying the security weighted by the outstanding principal balance (or by notional balance in the case of an IO security). |

| |

(2) | The notional balance for the Agency CMBS IO and non-Agency CMBS IO was $13,106,912 and $10,884,964, respectively, as of December 31, 2016. |

The majority of the Company’s MBS are pledged as collateral for the Company’s repurchase agreements which are disclosed in Note 3. Actual maturities of MBS are affected by the contractual lives of the underlying mortgage collateral, periodic payments of principal, prepayments of principal, and the payment priority structure of the security; therefore, actual maturities are generally shorter than the securities' stated contractual maturities.

The following table presents information regarding the sales included in "loss"gain on sale of investments, net" on the Company'sCompany’s consolidated statements of comprehensive income (loss) for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, |

| 2021 | | 2020 |

| Proceeds Received | | Realized Gain | | Proceeds Received | | Realized Gain |

| Agency RMBS-designated as AFS | $ | 74,829 | | | $ | 4,697 | | | $ | 1,817,350 | | | $ | 64,094 | |

| Agency CMBS-designated as AFS | 0 | | | 0 | | | 173,684 | | | 20,689 | |

| $ | 74,829 | | | $ | 4,697 | | | $ | 1,991,034 | | | $ | 84,783 | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30, |

| | 2017 | | 2016 |

| | Proceeds Received | | Realized Gain (Loss) | | Proceeds Received | | Realized Gain (Loss) |

| Agency RMBS | $ | 393,502 |

| | $ | (5,160 | ) | | $ | — |

| | $ | — |

|

| Agency CMBS | 13,433 |

| | (51 | ) | | — |

| | — |

|

| | $ | 406,935 |

| | $ | (5,211 | ) | | $ | — |

| | $ | — |

|

| | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2017 | | 2016 |

| | Proceeds Received | | Realized Gain (Loss) | | Proceeds Received | | Realized Gain (Loss) |

| Agency RMBS | $ | 716,560 |

| | $ | (12,392 | ) | | $ | 54,178 |

| | $ | (3,010 | ) |

| Agency CMBS | 206,993 |

| | 523 |

| | — |

| | — |

|

| Non-Agency CMBS | 35,705 |

| | 1,199 |

| | 33,640 |

| | (1,228 | ) |

| Non-Agency RMBS | 16,407 |

| | 42 |

| | — |

| | — |

|

| | $ | 975,665 |

| | $ | (10,628 | ) | | $ | 87,818 |

| | $ | (4,238 | ) |

The following table presents certain information for those MBSthe AFS securities in an unrealized loss position as of the dates indicated:

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

(amounts in thousands except share data)

| | | | September 30, 2017 | | December 31, 2016 | | March 31, 2021 | | December 31, 2020 |

| | Fair Value | | Gross Unrealized Losses | | # of Securities | | Fair Value | | Gross Unrealized Losses | | # of Securities | | Fair Value | | Gross Unrealized Losses | | # of Securities | | Fair Value | | Gross Unrealized Losses | | # of Securities |

| Continuous unrealized loss position for less than 12 months: | | | | | | | | | Continuous unrealized loss position for less than 12 months: | | | | | | | | | | | |

| Agency MBS | $ | 1,377,438 |

| | $ | (13,201 | ) | | 76 | | $ | 1,738,094 |

| | $ | (38,469 | ) | | 133 | Agency MBS | $ | 1,446,354 | | | $ | (25,019) | | | 32 | | $ | 19,266 | | | $ | (399) | | | 19 |

| Non-Agency MBS | 38,979 |

| | (151 | ) | | 6 | | 205,484 |

| | (2,773 | ) | | 48 | Non-Agency MBS | 5,221 | | | (111) | | | 5 | | 33,417 | | | (408) | | | 23 |

| | | | | | | | | | |

| Continuous unrealized loss position for 12 months or longer: | | | | | | | | | Continuous unrealized loss position for 12 months or longer: | |

| Agency MBS | $ | 206,045 |

| | $ | (5,236 | ) | | 17 | | $ | 427,405 |

| | $ | (8,952 | ) | | 72 | Agency MBS | $ | 846 | | | $ | (224) | | | 5 | | $ | 749 | | | $ | (133) | | | 2 |

| Non-Agency MBS | 15,749 |

| | (199 | ) | | 11 | | 81,660 |

| | (2,332 | ) | | 26 | Non-Agency MBS | 5,029 | | | (140) | | | 8 | | 2,156 | | | (93) | | | 5 |

BecauseThe unrealized losses on the Company’s MBS were the result of declines in market prices and were not credit related; therefore the Company’s allowance for credit losses on its MBS designated as AFS was $0 as of March 31, 2021. The principal related to Agency MBS is guaranteed by the government-sponsored entitiesGSEs Fannie Mae and Freddie Mac which have the implicit guarantee of the U.S. government, the Company does not consider any of the unrealized

losses on its Agency MBS to be credit related.Mac. Although the unrealized losses are not credit related, the Company assesses its ability and intent to hold any Agency MBS with an unrealized loss until the recovery in its value in accordance with GAAP. This assessment is based on the amount of the unrealized loss and significance of the related investment as well as the Company’s leverage and liquidity position. Based on this analysis,In addition, for its non-Agency MBS, the Company has determined that the unrealized losses on its Agency MBS as of September 30, 2017 and December 31, 2016 were temporary.

The Company reviews any non-Agency MBS in an unrealized loss position to evaluate whether any decline in fair value represents an OTTI. The evaluation includes a review of the credit ratings, of the non-Agency MBS, the credit characteristics of the mortgage loans collateralizing these securities, and the estimated future cash flows including projected collateral losses. The Company performed this evaluation for its non-Agency MBS in an unrealized loss position and has determined that there have not been any adverse changes in the timing or amount of estimated future cash flows that necessitate a recognition of OTTI amounts as of September 30, 2017 or December 31, 2016.

NOTE 3 – REPURCHASE AGREEMENTS

The Company’s repurchase agreements outstanding as of September 30, 2017March 31, 2021 and December 31, 20162020 are summarized in the following tables:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |