Delaware (State or other jurisdiction of incorporation or organization) | 52-1568099 (I.R.S. Employer Identification No.) | |

388 Greenwich Street, New York, NY (Address of principal executive offices) | 10013 (Zip code) | |

(212) 559-1000 (Registrant's telephone number, including area code) | ||

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o Emerging growth company o | |||

| OVERVIEW | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| Executive Summary | |

| Summary of Selected Financial Data | |

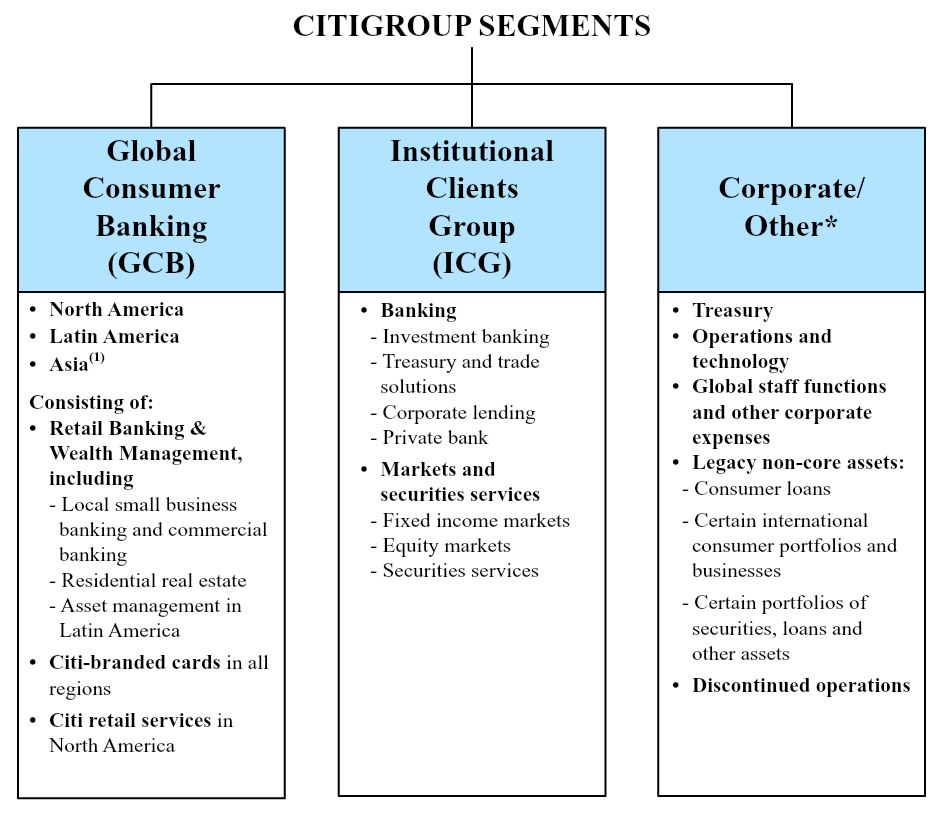

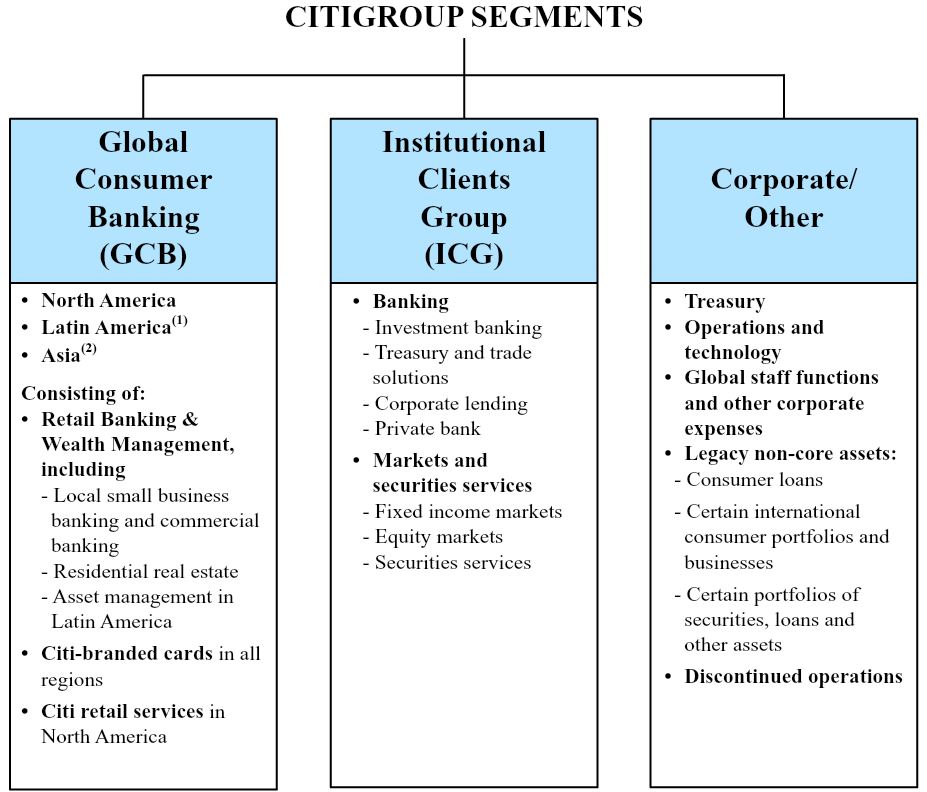

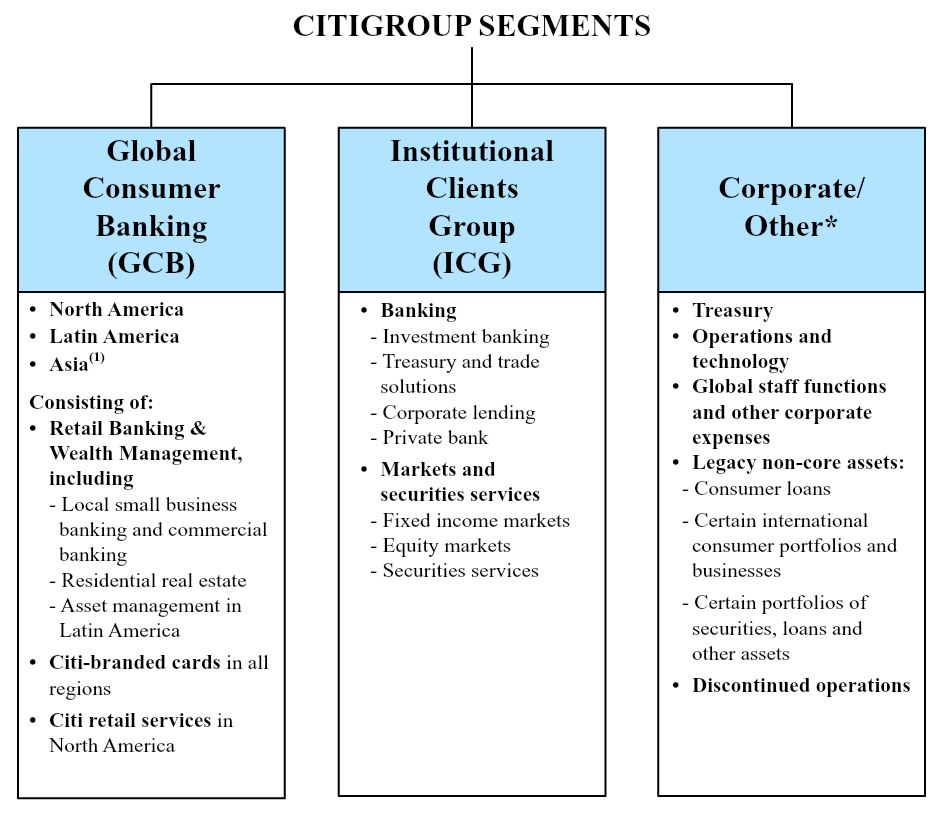

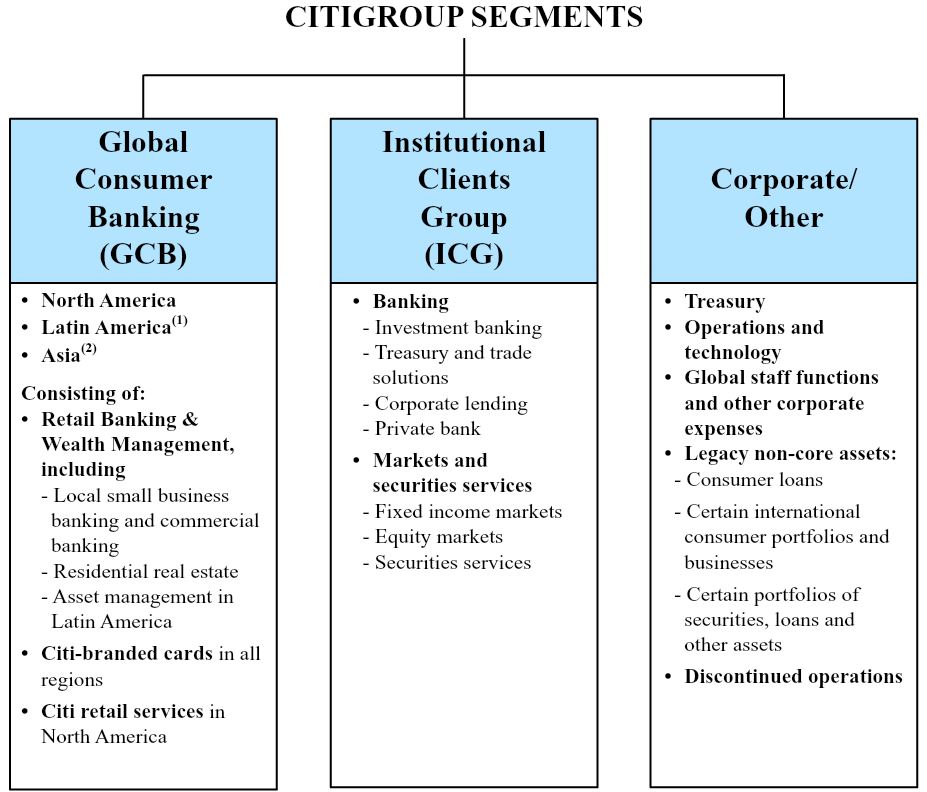

SEGMENT AND BUSINESS—INCOME (LOSS) AND REVENUES | |

| SEGMENT BALANCE SHEET | |

| Global Consumer Banking (GCB) | |

| North America GCB | |

| Latin America GCB | |

| Asia GCB | |

| Institutional Clients Group | |

| Corporate/Other | |

OFF-BALANCE SHEET ARRANGEMENTS | |

| CAPITAL RESOURCES | |

MANAGING GLOBAL RISK TABLE OF CONTENTS | |

| MANAGING GLOBAL RISK | |

| INCOME TAXES | |

FUTURE APPLICATION OF ACCOUNTING STANDARDS | |

DISCLOSURE CONTROLS AND PROCEDURES | |

DISCLOSURE PURSUANT TO SECTION 219 OF THE IRAN THREAT REDUCTION AND SYRIA HUMAN RIGHTS ACT | |

| FORWARD-LOOKING STATEMENTS | |

FINANCIAL STATEMENTS AND NOTES TABLE OF CONTENTS | |

| CONSOLIDATED FINANCIAL STATEMENTS | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

UNREGISTERED SALES OF EQUITY SECURITIES, PURCHASES OF EQUITY SECURITIES AND DIVIDENDS | |

| (1) | Latin America GCB consists of Citi’s consumer banking businessin Mexico. |

| (2) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

North |

| First Quarter | First Quarter | |||||||||||||||

| In millions of dollars, except per-share amounts and ratios | 2017 | 2016 | % Change | 2018 | 2017 | % Change | ||||||||||

| Net interest revenue | $ | 10,857 | $ | 11,227 | (3 | )% | $ | 11,172 | $ | 10,955 | 2 | % | ||||

| Non-interest revenue | 7,263 | 6,328 | 15 | 7,700 | 7,411 | 4 | ||||||||||

| Revenues, net of interest expense | $ | 18,120 | $ | 17,555 | 3 | % | $ | 18,872 | $ | 18,366 | 3 | % | ||||

| Operating expenses | 10,477 | 10,523 | — | 10,925 | 10,723 | 2 | ||||||||||

| Provisions for credit losses and for benefits and claims | 1,662 | 2,045 | (19 | ) | 1,857 | 1,662 | 12 | |||||||||

| Income from continuing operations before income taxes | $ | 5,981 | $ | 4,987 | 20 | % | $ | 6,090 | $ | 5,981 | 2 | % | ||||

| Income taxes | 1,863 | 1,479 | 26 | 1,441 | 1,863 | (23 | ) | |||||||||

| Income from continuing operations | $ | 4,118 | $ | 3,508 | 17 | % | $ | 4,649 | $ | 4,118 | 13 | % | ||||

Income (loss) from discontinued operations, net of taxes | (18 | ) | (2 | ) | NM | (7 | ) | (18 | ) | 61 | ||||||

Net income before attribution of noncontrolling interests | $ | 4,100 | $ | 3,506 | 17 | % | $ | 4,642 | $ | 4,100 | 13 | % | ||||

| Net income attributable to noncontrolling interests | 10 | 5 | 100 | 22 | 10 | NM | ||||||||||

| Citigroup’s net income | $ | 4,090 | $ | 3,501 | 17 | % | $ | 4,620 | $ | 4,090 | 13 | % | ||||

| Less: | ||||||||||||||||

| Preferred dividends—Basic | $ | 301 | $ | 210 | 43 | % | $ | 272 | $ | 301 | (10 | )% | ||||

| Dividends and undistributed earnings allocated to employee restricted and deferred shares that contain nonforfeitable rights to dividends, applicable to basic EPS | 55 | 40 | 38 | 51 | 55 | (7 | ) | |||||||||

Income allocated to unrestricted common shareholders for basic and diluted EPS | $ | 3,734 | $ | 3,251 | 15 | % | $ | 4,297 | $ | 3,734 | 15 | % | ||||

| Earnings per share | ||||||||||||||||

| Basic | ||||||||||||||||

| Income from continuing operations | $ | 1.36 | $ | 1.11 | 23 | 1.68 | 1.36 | 24 | ||||||||

| Net income | 1.35 | 1.10 | 23 | 1.68 | 1.35 | 24 | ||||||||||

| Diluted | ||||||||||||||||

| Income from continuing operations | $ | 1.36 | $ | 1.11 | 23 | % | $ | 1.68 | $ | 1.36 | 24 | % | ||||

| Net income | 1.35 | 1.10 | 23 | 1.68 | 1.35 | 24 | ||||||||||

| Dividends declared per common share | 0.16 | 0.05 | NM | 0.32 | 0.16 | 100 | ||||||||||

| Citigroup Inc. and Consolidated Subsidiaries | Citigroup Inc. and Consolidated Subsidiaries | Citigroup Inc. and Consolidated Subsidiaries | ||||||||||||||

| First Quarter | First Quarter | |||||||||||||||

In millions of dollars, except per-share amounts, ratios and direct staff | 2017 | 2016 | % Change | 2018 | 2017 | % Change | ||||||||||

| At March 31: | ||||||||||||||||

| Total assets | $ | 1,821,635 | $ | 1,800,967 | 1 | % | $ | 1,922,104 | $ | 1,821,479 | 6 | % | ||||

| Total deposits | 949,990 | 934,591 | 2 | 1,001,219 | 949,990 | 5 | ||||||||||

| Long-term debt | 208,530 | 207,835 | — | 237,938 | 208,530 | 14 | ||||||||||

| Citigroup common stockholders’ equity | 208,879 | 209,769 | — | 182,759 | 208,723 | (12 | ) | |||||||||

| Total Citigroup stockholders’ equity | 228,132 | 227,522 | — | 201,915 | 227,976 | (11 | ) | |||||||||

Direct staff (in thousands) | 215 | 225 | (4 | ) | 209 | 215 | (3 | ) | ||||||||

| Performance metrics | ||||||||||||||||

| Return on average assets | 0.91 | % | 0.79 | % | 0.98 | % | 0.91 | % | ||||||||

Return on average common stockholders’ equity | 7.4 | 6.4 | 9.7 | 7.4 | ||||||||||||

Return on average total stockholders’ equity | 7.3 | 6.3 | 9.3 | 7.3 | ||||||||||||

| Efficiency ratio (Total operating expenses/Total revenues) | 58 | 60 | ||||||||||||||

| Efficiency ratio (total operating expenses/total revenues) | 58 | 58 | ||||||||||||||

| Basel III ratios—full implementation | ||||||||||||||||

Common Equity Tier 1 Capital | 12.83 | % | 12.34 | % | 12.05 | % | 12.81 | % | ||||||||

Tier 1 Capital | 14.49 | 13.81 | 13.67 | 14.48 | ||||||||||||

Total Capital | 16.54 | 15.71 | 16.01 | 16.52 | ||||||||||||

Supplementary Leverage ratio | 7.28 | 7.44 | 6.71 | 7.27 | ||||||||||||

| Citigroup common stockholders’ equity to assets | 11.47 | % | 11.65 | % | 9.51 | % | 11.46 | % | ||||||||

| Total Citigroup stockholders’ equity to assets | 12.52 | 12.63 | 10.50 | 12.52 | ||||||||||||

Dividend payout ratio | 11.9 | 4.5 | 19.0 | 11.9 | ||||||||||||

Total payout ratio(6) | 59 | % | 44 | % | ||||||||||||

Total payout ratio(7) | 71 | 59 | ||||||||||||||

| Book value per common share | $ | 75.86 | $ | 71.47 | 6 | % | $ | 71.67 | $ | 75.81 | (5 | )% | ||||

Tangible book value (TBV) per share | $ | 65.94 | $ | 62.58 | 5 | % | 61.02 | 65.88 | (7 | ) | ||||||

| Ratio of earnings to fixed charges and preferred stock dividends | 2.51x | 2.54x | 2.10x | 2.51x | ||||||||||||

| (1) | The first quarter of 2018 reflects the impact of Tax Reform. For additional information on Tax Reform, including the impact on Citi’s fourth quarter and full-year 2017 results, see Citi’s 2017 Annual Report on Form 10-K. |

| (2) | See Note 2 to the Consolidated Financial Statements for additional information on Citi’s discontinued operations. |

| The return on average common stockholders’ equity is calculated using net income less preferred stock dividends divided by average common stockholders’ equity. The return on average total Citigroup stockholders’ equity is calculated using net income divided by average Citigroup stockholders’ equity. |

| Citi’s |

| (5) | Citi’s risk-based capital and leverage ratios as of March 31, 2017 are non-GAAP financial measures, which reflect full implementation of regulatory capital adjustments and deductions prior to the effective date of January 1, 2018. |

| (6) | Dividends declared per common share as a percentage of net income per diluted share. |

| Total common dividends declared plus common stock repurchases as a percentage of net income available to common shareholders. See “Consolidated Statement of Changes in Stockholders’ |

| For information on TBV, see “Capital Resources—Tangible Common Equity, Book Value Per Share, Tangible Book Value Per Share and Returns on Equity” below. |

| First Quarter | First Quarter | |||||||||||||||

| In millions of dollars | 2017 | 2016 | % Change | 2018 | 2017 | % Change | ||||||||||

| Income from continuing operations | ||||||||||||||||

| Global Consumer Banking | ||||||||||||||||

| North America | $ | 627 | $ | 833 | (25 | )% | $ | 838 | $ | 614 | 36 | % | ||||

| Latin America | 130 | 146 | (11 | ) | 183 | 135 | 36 | |||||||||

Asia(1) | 246 | 215 | 14 | 373 | 249 | 50 | ||||||||||

| Total | $ | 1,003 | $ | 1,194 | (16 | )% | $ | 1,394 | $ | 998 | 40 | % | ||||

| Institutional Clients Group | ||||||||||||||||

| North America | $ | 1,100 | $ | 546 | NM | $ | 857 | $ | 1,077 | (20 | )% | |||||

| EMEA | 855 | 374 | NM | 1,113 | 862 | 29 | ||||||||||

| Latin America | 475 | 330 | 44 | 491 | 482 | 2 | ||||||||||

| Asia | 581 | 619 | (6 | ) | 868 | 590 | 47 | |||||||||

| Total | $ | 3,011 | $ | 1,869 | 61 | % | $ | 3,329 | $ | 3,011 | 11 | % | ||||

| Corporate/Other | 104 | 445 | (77 | )% | (74 | ) | 109 | NM | ||||||||

| Income from continuing operations | $ | 4,118 | $ | 3,508 | 17 | % | $ | 4,649 | $ | 4,118 | 13 | % | ||||

| Discontinued operations | $ | (18 | ) | $ | (2 | ) | NM | $ | (7 | ) | $ | (18 | ) | 61 | % | |

| Net income attributable to noncontrolling interests | 10 | 5 | 100 | % | 22 | 10 | NM | |||||||||

| Citigroup’s net income | $ | 4,090 | $ | 3,501 | 17 | % | $ | 4,620 | $ | 4,090 | 13 | % | ||||

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

| First Quarter | First Quarter | |||||||||||||||

| In millions of dollars | 2017 | 2016 | % Change | 2018 | 2017 | % Change | ||||||||||

| Global Consumer Banking | ||||||||||||||||

| North America | $ | 4,944 | $ | 4,830 | 2 | % | $ | 5,157 | $ | 4,945 | 4 | % | ||||

| Latin America | 1,151 | 1,229 | (6 | ) | 1,347 | 1,167 | 15 | |||||||||

Asia(1) | 1,722 | 1,655 | 4 | 1,929 | 1,734 | 11 | ||||||||||

| Total | $ | 7,817 | $ | 7,714 | 1 | % | $ | 8,433 | $ | 7,846 | 7 | % | ||||

| Institutional Clients Group | ||||||||||||||||

| North America | $ | 3,455 | $ | 2,980 | 16 | % | $ | 3,265 | $ | 3,522 | (7 | )% | ||||

| EMEA | 2,807 | 2,167 | 30 | 3,167 | 2,854 | 11 | ||||||||||

| Latin America | 1,127 | 962 | 17 | 1,210 | 1,169 | 4 | ||||||||||

| Asia | 1,737 | 1,786 | (3 | ) | 2,206 | 1,774 | 24 | |||||||||

| Total | $ | 9,126 | $ | 7,895 | 16 | % | $ | 9,848 | $ | 9,319 | 6 | % | ||||

| Corporate/Other | 1,177 | 1,946 | (40 | ) | 591 | 1,201 | (51 | ) | ||||||||

| Total Citigroup Net Revenues | $ | 18,120 | $ | 17,555 | 3 | % | ||||||||||

| Total Citigroup net revenues | $ | 18,872 | $ | 18,366 | 3 | % | ||||||||||

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

| In millions of dollars | Global Consumer Banking | Institutional Clients Group | Corporate/Other and consolidating eliminations(2) | Citigroup Parent company- issued long-term debt and stockholders’ equity(3) | Total Citigroup consolidated | Global Consumer Banking | Institutional Clients Group | Corporate/Other and consolidating eliminations(2) | Citigroup parent company- issued long-term debt and stockholders’ equity(3) | Total Citigroup consolidated | ||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||

| Cash and deposits with banks | $ | 9,371 | $ | 64,322 | $ | 106,352 | $ | — | $ | 180,045 | $ | 7,493 | $ | 65,194 | $ | 130,017 | $ | — | $ | 202,704 | ||||||||||

| Federal funds sold and securities borrowed or purchased under agreements to resell | 302 | 242,241 | 386 | — | 242,929 | 291 | 257,288 | 308 | — | 257,887 | ||||||||||||||||||||

| Trading account assets | 6,512 | 235,799 | 2,592 | — | 244,903 | 662 | 260,226 | 7,920 | — | 268,808 | ||||||||||||||||||||

| Investments | 11,172 | 112,252 | 222,409 | — | 345,833 | 1,475 | 111,464 | 239,032 | — | 351,971 | ||||||||||||||||||||

| Loans, net of unearned income and | ||||||||||||||||||||||||||||||

| allowance for loan losses | 282,901 | 305,404 | 28,260 | — | 616,565 | |||||||||||||||||||||||||

Loans, net of unearned income and allowance for loan losses | 294,808 | 345,478 | 20,298 | — | 660,584 | |||||||||||||||||||||||||

| Other assets | 38,422 | 94,798 | 58,140 | — | 191,360 | 37,341 | 107,949 | 34,860 | — | 180,150 | ||||||||||||||||||||

Liquidity assets(4) | 63,128 | 259,291 | (322,419 | ) | — | — | ||||||||||||||||||||||||

Net inter-segment liquid assets(4) | 80,816 | 259,120 | (339,936 | ) | — | — | ||||||||||||||||||||||||

| Total assets | $ | 411,808 | $ | 1,314,107 | $ | 95,720 | $ | — | $ | 1,821,635 | $ | 422,886 | $ | 1,406,719 | $ | 92,499 | $ | — | $ | 1,922,104 | ||||||||||

| Liabilities and equity | ||||||||||||||||||||||||||||||

| Total deposits | $ | 311,383 | $ | 619,513 | $ | 19,094 | $ | — | $ | 949,990 | $ | 314,355 | $ | 665,987 | $ | 20,877 | $ | — | $ | 1,001,219 | ||||||||||

| Federal funds purchased and securities loaned or sold under agreements to repurchase | 3,597 | 144,624 | 9 | — | 148,230 | 4,359 | 167,391 | 9 | — | 171,759 | ||||||||||||||||||||

| Trading account liabilities | 24 | 143,464 | 582 | — | 144,070 | 142 | 143,018 | 801 | — | 143,961 | ||||||||||||||||||||

| Short-term borrowings | 578 | 19,299 | 6,250 | — | 26,127 | 588 | 20,256 | 15,250 | — | 36,094 | ||||||||||||||||||||

Long-term debt(3) | 1,225 | 32,739 | 32,940 | 141,626 | 208,530 | 1,977 | 36,913 | 45,974 | 153,074 | 237,938 | ||||||||||||||||||||

| Other liabilities | 17,811 | 77,000 | 20,724 | — | 115,535 | 18,379 | 95,702 | 14,186 | — | 128,267 | ||||||||||||||||||||

Net inter-segment funding (lending)(3) | 77,190 | 277,468 | 15,100 | (369,758 | ) | — | 83,086 | 277,452 | (5,549 | ) | (354,989 | ) | — | |||||||||||||||||

| Total liabilities | $ | 411,808 | $ | 1,314,107 | $ | 94,699 | $ | (228,132 | ) | $ | 1,592,482 | $ | 422,886 | $ | 1,406,719 | $ | 91,548 | $ | (201,915 | ) | $ | 1,719,238 | ||||||||

Total equity(5) | — | — | 1,021 | 228,132 | 229,153 | |||||||||||||||||||||||||

Total stockholders’ equity(5) | — | — | 951 | 201,915 | 202,866 | |||||||||||||||||||||||||

| Total liabilities and equity | $ | 411,808 | $ | 1,314,107 | $ | 95,720 | $ | — | $ | 1,821,635 | $ | 422,886 | $ | 1,406,719 | $ | 92,499 | $ | — | $ | 1,922,104 | ||||||||||

| (1) | The supplemental information presented in the table above reflects Citigroup’s consolidated GAAP balance sheet by reporting segment as of March 31, |

| (2) | Consolidating eliminations for total Citigroup and Citigroup parent company assets and liabilities are recorded within Corporate/Other. |

| (3) | The total stockholders’ equity and the majority of long-term debt of Citigroup reside in the Citigroup parent company Consolidated Balance Sheet. Citigroup allocates stockholders’ equity and long-term debt to its businesses through inter-segment allocations as shown above. |

| (4) | Represents the attribution of Citigroup’s |

| (5) | Corporate/ |

| First Quarter | First Quarter | |||||||||||||||

| In millions of dollars except as otherwise noted | 2017 | 2016 | % Change | 2018 | 2017 | % Change | ||||||||||

| Net interest revenue | $ | 6,522 | $ | 6,352 | 3 | % | $ | 6,980 | $ | 6,579 | 6 | % | ||||

| Non-interest revenue | 1,295 | 1,362 | (5 | ) | 1,453 | 1,267 | 15 | |||||||||

| Total revenues, net of interest expense | $ | 7,817 | $ | 7,714 | 1 | % | $ | 8,433 | $ | 7,846 | 7 | % | ||||

| Total operating expenses | $ | 4,415 | $ | 4,401 | — | % | $ | 4,681 | $ | 4,451 | 5 | % | ||||

| Net credit losses | $ | 1,603 | $ | 1,371 | 17 | % | $ | 1,736 | $ | 1,603 | 8 | % | ||||

| Credit reserve build (release) | 177 | 85 | NM | 144 | 177 | (19 | ) | |||||||||

| Provision (release) for unfunded lending commitments | 6 | 1 | NM | (1 | ) | 6 | NM | |||||||||

| Provision for benefits and claims | 29 | 28 | 4 | 26 | 29 | (10 | ) | |||||||||

| Provisions for credit losses and for benefits and claims | $ | 1,815 | $ | 1,485 | 22 | % | ||||||||||

| Provisions for credit losses and for benefits and claims (LLR & PBC) | $ | 1,905 | $ | 1,815 | 5 | % | ||||||||||

| Income from continuing operations before taxes | $ | 1,587 | $ | 1,828 | (13 | )% | $ | 1,847 | $ | 1,580 | 17 | % | ||||

| Income taxes | 584 | 634 | (8 | ) | 453 | 582 | (22 | ) | ||||||||

| Income from continuing operations | $ | 1,003 | $ | 1,194 | (16 | )% | $ | 1,394 | $ | 998 | 40 | % | ||||

| Noncontrolling interests | 1 | 2 | (50 | ) | 2 | 1 | 100 | |||||||||

| Net income | $ | 1,002 | $ | 1,192 | (16 | )% | $ | 1,392 | $ | 997 | 40 | % | ||||

Balance Sheet data (in billions of dollars) | ||||||||||||||||

| Total EOP assets | $ | 412 | $ | 384 | 7 | % | $ | 423 | $ | 411 | 3 | % | ||||

| Average assets | $ | 411 | $ | 377 | 9 | 423 | 410 | 3 | ||||||||

| Return on average assets | 0.99 | % | 1.27 | % | 1.33 | % | 0.99 | % | ||||||||

| Efficiency ratio | 56 | % | 57 | % | 56 | 57 | ||||||||||

| Average deposits | $ | 304 | $ | 294 | 3 | $ | 309 | $ | 303 | 2 | ||||||

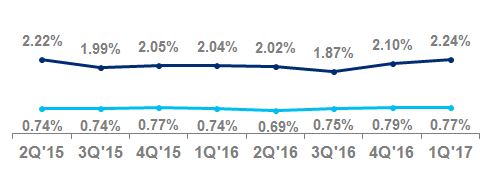

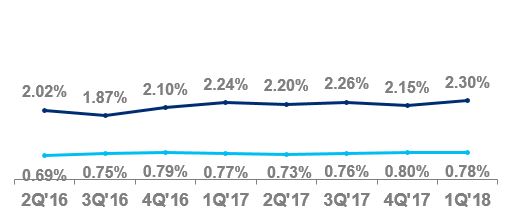

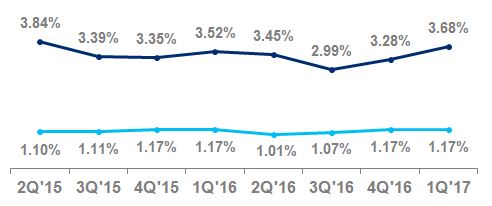

| Net credit losses as a percentage of average loans | 2.24 | % | 2.04 | % | 2.30 | % | 2.24 | % | ||||||||

| Revenue by business | ||||||||||||||||

| Retail banking | $ | 3,155 | $ | 3,187 | (1 | )% | $ | 3,471 | $ | 3,175 | 9 | % | ||||

Cards(1) | 4,662 | 4,527 | 3 | 4,962 | 4,671 | 6 | ||||||||||

| Total | $ | 7,817 | $ | 7,714 | 1 | % | $ | 8,433 | $ | 7,846 | 7 | % | ||||

| Income from continuing operations by business | ||||||||||||||||

| Retail banking | $ | 339 | $ | 298 | 14 | % | $ | 524 | $ | 333 | 57 | % | ||||

Cards(1) | 664 | 896 | (26 | ) | 870 | 665 | 31 | |||||||||

| Total | $ | 1,003 | $ | 1,194 | (16 | )% | $ | 1,394 | $ | 998 | 40 | % | ||||

| Foreign currency (FX) translation impact | ||||||||||||||||

| Total revenue—as reported | $ | 7,817 | $ | 7,714 | 1 | % | $ | 8,433 | $ | 7,846 | 7 | % | ||||

Impact of FX translation(2) | — | (103 | ) | — | 139 | |||||||||||

Total revenues—ex-FX(3) | $ | 7,817 | $ | 7,611 | 3 | % | $ | 8,433 | $ | 7,985 | 6 | % | ||||

| Total operating expenses—as reported | $ | 4,415 | $ | 4,401 | — | % | $ | 4,681 | $ | 4,451 | 5 | % | ||||

Impact of FX translation(2) | — | (42 | ) | — | 87 | |||||||||||

Total operating expenses—ex-FX(3) | $ | 4,415 | $ | 4,359 | 1 | % | $ | 4,681 | $ | 4,538 | 3 | % | ||||

| Total provisions for LLR & PBC—as reported | $ | 1,815 | $ | 1,485 | 22 | % | $ | 1,905 | $ | 1,815 | 5 | % | ||||

Impact of FX translation(2) | — | (30 | ) | — | 27 | |||||||||||

Total provisions for LLR & PBC—ex-FX(3) | $ | 1,815 | $ | 1,455 | 25 | % | $ | 1,905 | $ | 1,842 | 3 | % | ||||

| Net income—as reported | $ | 1,002 | $ | 1,192 | (16 | )% | $ | 1,392 | $ | 997 | 40 | % | ||||

Impact of FX translation(2) | — | (25 | ) | — | 18 | |||||||||||

Net income—ex-FX(3) | $ | 1,002 | $ | 1,167 | (14 | )% | $ | 1,392 | $ | 1,015 | 37 | % | ||||

| (1) | Includes both Citi-branded cards and Citi retail services. |

| (2) | Reflects the impact of FX translation into U.S. dollars at the first quarter of |

| (3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

| First Quarter | % Change | First Quarter | ||||||||||||||

| In millions of dollars, except as otherwise noted | 2017 | 2016 | 2018 | 2017 | % Change | |||||||||||

| Net interest revenue | $ | 4,617 | $ | 4,398 | 5 | % | $ | 4,750 | $ | 4,617 | 3 | % | ||||

| Non-interest revenue | 327 | 432 | (24 | ) | 407 | 328 | 24 | |||||||||

| Total revenues, net of interest expense | $ | 4,944 | $ | 4,830 | 2 | % | $ | 5,157 | $ | 4,945 | 4 | % | ||||

| Total operating expenses | $ | 2,576 | $ | 2,500 | 3 | % | $ | 2,645 | $ | 2,597 | 2 | % | ||||

| Net credit losses | $ | 1,190 | $ | 933 | 28 | % | $ | 1,296 | $ | 1,190 | 9 | % | ||||

| Credit reserve build (release) | 152 | 79 | 92 | 123 | 152 | (19 | ) | |||||||||

| Provision for unfunded lending commitments | 7 | — | NM | (4 | ) | 7 | NM | |||||||||

| Provisions for benefits and claims | 6 | 9 | (33 | ) | ||||||||||||

| Provision for benefits and claims | 6 | 6 | — | |||||||||||||

| Provisions for credit losses and for benefits and claims | $ | 1,355 | $ | 1,021 | 33 | % | $ | 1,421 | $ | 1,355 | 5 | % | ||||

| Income from continuing operations before taxes | $ | 1,013 | $ | 1,309 | (23 | )% | $ | 1,091 | $ | 993 | 10 | % | ||||

| Income taxes | 386 | 476 | (19 | ) | 253 | 379 | (33 | ) | ||||||||

| Income from continuing operations | $ | 627 | $ | 833 | (25 | )% | $ | 838 | $ | 614 | 36 | % | ||||

| Noncontrolling interests | — | — | — | — | — | NM | ||||||||||

| Net income | $ | 627 | $ | 833 | (25 | )% | $ | 838 | $ | 614 | 36 | % | ||||

Balance Sheet data (in billions of dollars) | ||||||||||||||||

| Average assets | $ | 245 | $ | 211 | 16 | % | $ | 248 | $ | 245 | 1 | % | ||||

| Return on average assets | 1.04 | % | 1.59 | % | 1.37 | % | 1.02 | % | ||||||||

| Efficiency ratio | 52 | % | 52 | % | 51 | 53 | ||||||||||

| Average deposits | $ | 185.5 | $ | 180.6 | 3 | $ | 180.9 | $ | 184.6 | (2 | ) | |||||

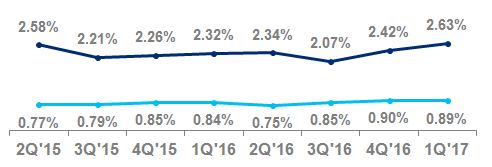

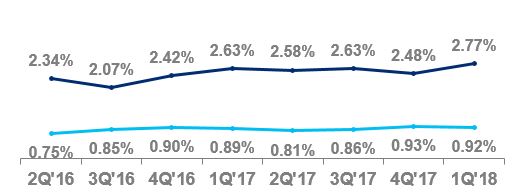

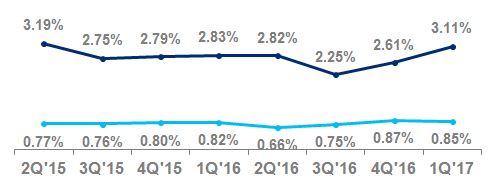

| Net credit losses as a percentage of average loans | 2.63 | % | 2.32 | % | 2.77 | % | 2.63 | % | ||||||||

| Revenue by business | ||||||||||||||||

| Retail banking | $ | 1,256 | $ | 1,290 | (3 | )% | $ | 1,307 | $ | 1,257 | 4 | % | ||||

| Citi-branded cards | 2,096 | 1,860 | 13 | 2,232 | 2,096 | 6 | ||||||||||

| Citi retail services | 1,592 | 1,680 | (5 | ) | 1,618 | 1,592 | 2 | |||||||||

| Total | $ | 4,944 | $ | 4,830 | 2 | % | $ | 5,157 | $ | 4,945 | 4 | % | ||||

| Income from continuing operations by business | ||||||||||||||||

| Retail banking | $ | 83 | $ | 89 | (7 | )% | $ | 140 | $ | 72 | 94 | % | ||||

| Citi-branded cards | 248 | 353 | (30 | ) | 425 | 246 | 73 | |||||||||

| Citi retail services | 296 | 391 | (24 | ) | 273 | 296 | (8 | ) | ||||||||

| Total | $ | 627 | $ | 833 | (25 | )% | $ | 838 | $ | 614 | 36 | % | ||||

| First Quarter | % Change | First Quarter | ||||||||||||||

| In millions of dollars, except as otherwise noted | 2017 | 2016 | 2018 | 2017 | % Change | |||||||||||

| Net interest revenue | $ | 800 | $ | 853 | (6 | )% | $ | 997 | $ | 848 | 18 | % | ||||

| Non-interest revenue | 351 | 376 | (7 | ) | 350 | 319 | 10 | |||||||||

| Total revenues, net of interest expense | $ | 1,151 | $ | 1,229 | (6 | )% | $ | 1,347 | $ | 1,167 | 15 | % | ||||

| Total operating expenses | $ | 659 | $ | 718 | (8 | )% | $ | 759 | $ | 667 | 14 | % | ||||

| Net credit losses | $ | 253 | $ | 278 | (9 | )% | $ | 278 | $ | 253 | 10 | % | ||||

| Credit reserve build (release) | 12 | 17 | (29 | ) | 42 | 12 | NM | |||||||||

| Provision (release) for unfunded lending commitments | — | 1 | (100 | ) | 1 | — | NM | |||||||||

| Provision for benefits and claims | 23 | 19 | 21 | 20 | 23 | (13 | ) | |||||||||

| Provisions for credit losses and for benefits and claims (LLR & PBC) | $ | 288 | $ | 315 | (9 | )% | $ | 341 | $ | 288 | 18 | % | ||||

| Income from continuing operations before taxes | $ | 204 | $ | 196 | 4 | % | $ | 247 | $ | 212 | 17 | % | ||||

| Income taxes | 74 | 50 | 48 | 64 | 77 | (17 | ) | |||||||||

| Income from continuing operations | $ | 130 | $ | 146 | (11 | )% | $ | 183 | $ | 135 | 36 | % | ||||

| Noncontrolling interests | 1 | 1 | — | — | 1 | (100 | ) | |||||||||

| Net income | $ | 129 | $ | 145 | (11 | )% | $ | 183 | $ | 134 | 37 | % | ||||

Balance Sheet data (in billions of dollars) | ||||||||||||||||

| Average assets | $ | 43 | $ | 50 | (14 | )% | $ | 44 | $ | 42 | 5 | % | ||||

| Return on average assets | 1.22 | % | 1.17 | % | 1.69 | 1.29 | ||||||||||

| Efficiency ratio | 57 | % | 58 | % | 56 | % | 57 | % | ||||||||

| Average deposits | $ | 25.3 | $ | 26.1 | (3 | ) | $ | 28.9 | $ | 25.3 | 14 | |||||

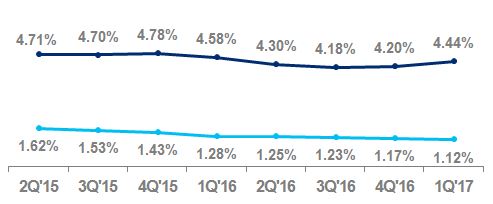

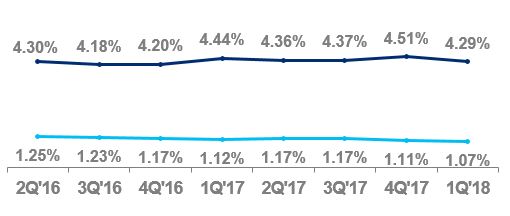

| Net credit losses as a percentage of average loans | 4.44 | % | 4.58 | % | 4.29 | % | 4.44 | % | ||||||||

| Revenue by business | ||||||||||||||||

| Retail banking | $ | 836 | $ | 856 | (2 | )% | $ | 966 | $ | 850 | 14 | % | ||||

| Citi-branded cards | 315 | 373 | (16 | ) | 381 | 317 | 20 | |||||||||

| Total | $ | 1,151 | $ | 1,229 | (6 | )% | $ | 1,347 | $ | 1,167 | 15 | % | ||||

| Income from continuing operations by business | ||||||||||||||||

| Retail banking | $ | 86 | $ | 90 | (4 | )% | $ | 138 | $ | 90 | 53 | % | ||||

| Citi-branded cards | 44 | 56 | (21 | ) | 45 | 45 | — | |||||||||

| Total | $ | 130 | $ | 146 | (11 | )% | $ | 183 | $ | 135 | 36 | % | ||||

| FX translation impact | ||||||||||||||||

| Total revenues—as reported | $ | 1,151 | $ | 1,229 | (6 | )% | $ | 1,347 | $ | 1,167 | 15 | % | ||||

Impact of FX translation(1) | — | (122 | ) | — | 75 | |||||||||||

Total revenues—ex-FX(2) | $ | 1,151 | $ | 1,107 | 4 | % | $ | 1,347 | $ | 1,242 | 8 | % | ||||

| Total operating expenses—as reported | $ | 659 | $ | 718 | (8 | )% | $ | 759 | $ | 667 | 14 | % | ||||

Impact of FX translation(1) | — | (57 | ) | — | 37 | |||||||||||

Total operating expenses—ex-FX(2) | $ | 659 | $ | 661 | — | % | $ | 759 | $ | 704 | 8 | % | ||||

| Provisions for LLR & PBC—as reported | $ | 288 | $ | 315 | (9 | )% | $ | 341 | $ | 288 | 18 | % | ||||

Impact of FX translation(1) | — | (31 | ) | — | 20 | |||||||||||

Provisions for LLR & PBC—ex-FX(2) | $ | 288 | $ | 284 | 1 | % | $ | 341 | $ | 308 | 11 | % | ||||

| Net income—as reported | $ | 129 | $ | 145 | (11 | )% | $ | 183 | $ | 134 | 37 | % | ||||

Impact of FX translation(1) | — | (27 | ) | — | 13 | |||||||||||

Net income—ex-FX(2) | $ | 129 | $ | 118 | 9 | % | $ | 183 | $ | 147 | 24 | % | ||||

| (1) | Reflects the impact of FX translation into U.S. dollars at the first quarter of |

| (2) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

| First Quarter | % Change | First Quarter | ||||||||||||||

In millions of dollars, except as otherwise noted (1) | 2017 | 2016 | 2018 | 2017 | % Change | |||||||||||

| Net interest revenue | $ | 1,105 | $ | 1,101 | — | % | $ | 1,233 | $ | 1,114 | 11 | % | ||||

| Non-interest revenue | 617 | 554 | 11 | 696 | 620 | 12 | ||||||||||

| Total revenues, net of interest expense | $ | 1,722 | $ | 1,655 | 4 | % | $ | 1,929 | $ | 1,734 | 11 | % | ||||

| Total operating expenses | $ | 1,180 | $ | 1,183 | — | % | $ | 1,277 | $ | 1,187 | 8 | % | ||||

| Net credit losses | $ | 160 | $ | 160 | — | % | $ | 162 | $ | 160 | 1 | % | ||||

| Credit reserve build (release) | 13 | (11 | ) | NM | (21 | ) | 13 | NM | ||||||||

| Provision (release) for unfunded lending commitments | (1 | ) | — | (100 | ) | 2 | (1 | ) | NM | |||||||

| Provisions for credit losses | $ | 172 | $ | 149 | 15 | % | $ | 143 | $ | 172 | (17 | )% | ||||

| Income from continuing operations before taxes | $ | 370 | $ | 323 | 15 | % | $ | 509 | $ | 375 | 36 | % | ||||

| Income taxes | 124 | 108 | 15 | 136 | 126 | 8 | ||||||||||

| Income from continuing operations | $ | 246 | $ | 215 | 14 | % | $ | 373 | $ | 249 | 50 | % | ||||

| Noncontrolling interests | — | 1 | (100 | ) | 2 | — | NM | |||||||||

| Net income | $ | 246 | $ | 214 | 15 | % | $ | 371 | $ | 249 | 49 | % | ||||

Balance Sheet data (in billions of dollars) | ||||||||||||||||

| Average assets | $ | 123 | $ | 116 | 6 | % | $ | 131 | $ | 123 | 7 | % | ||||

| Return on average assets | 0.81 | % | 0.74 | % | 1.15 | % | 0.82 | % | ||||||||

| Efficiency ratio | 69 | % | 71 | % | 66 | 68 | ||||||||||

| Average deposits | $ | 92.7 | $ | 87.2 | 6 | $ | 99.1 | $ | 92.7 | 7 | ||||||

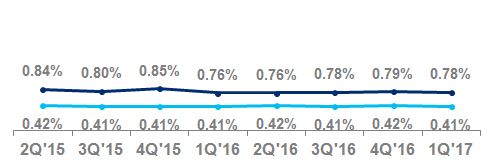

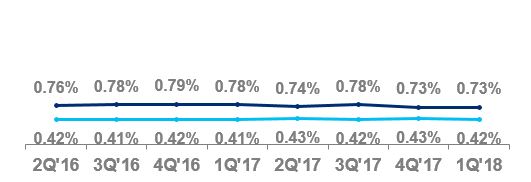

| Net credit losses as a percentage of average loans | 0.78 | % | 0.76 | % | 0.73 | % | 0.78 | % | ||||||||

| Revenue by business | ||||||||||||||||

| Retail banking | $ | 1,063 | $ | 1,041 | 2 | % | $ | 1,198 | $ | 1,068 | 12 | % | ||||

| Citi-branded cards | 659 | 614 | 7 | 731 | 666 | 10 | ||||||||||

| Total | $ | 1,722 | $ | 1,655 | 4 | % | $ | 1,929 | $ | 1,734 | 11 | % | ||||

| Income from continuing operations by business | ||||||||||||||||

| Retail banking | $ | 170 | $ | 119 | 43 | % | $ | 246 | $ | 171 | 44 | % | ||||

| Citi-branded cards | 76 | 96 | (21 | ) | 127 | 78 | 63 | |||||||||

| Total | $ | 246 | $ | 215 | 14 | % | $ | 373 | $ | 249 | 50 | % | ||||

| FX translation impact | ||||||||||||||||

| Total revenues—as reported | $ | 1,722 | $ | 1,655 | 4 | % | $ | 1,929 | $ | 1,734 | 11 | % | ||||

Impact of FX translation(2) | — | 19 | — | 64 | ||||||||||||

Total revenues—ex-FX(3) | $ | 1,722 | $ | 1,674 | 3 | % | $ | 1,929 | $ | 1,798 | 7 | % | ||||

| Total operating expenses—as reported | $ | 1,180 | $ | 1,183 | — | % | $ | 1,277 | $ | 1,187 | 8 | % | ||||

Impact of FX translation(2) | — | 15 | — | 50 | ||||||||||||

Total operating expenses—ex-FX(3) | $ | 1,180 | $ | 1,198 | (2 | )% | $ | 1,277 | $ | 1,237 | 3 | % | ||||

| Provisions for loan losses—as reported | $ | 172 | $ | 149 | 15 | % | $ | 143 | $ | 172 | (17 | )% | ||||

Impact of FX translation(2) | — | 1 | — | 7 | ||||||||||||

Provisions for loan losses—ex-FX(3) | $ | 172 | $ | 150 | 15 | % | $ | 143 | $ | 179 | (20 | )% | ||||

| Net income—as reported | $ | 246 | $ | 214 | 15 | % | $ | 371 | $ | 249 | 49 | % | ||||

Impact of FX translation(2) | — | 2 | — | 5 | ||||||||||||

Net income—ex-FX(3) | $ | 246 | $ | 216 | 14 | % | $ | 371 | $ | 254 | 46 | % | ||||

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

| (2) | Reflects the impact of FX translation into U.S. dollars at the first quarter of |

| (3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

| First Quarter | % Change | First Quarter | ||||||||||||||

| In millions of dollars, except as otherwise noted | 2017 | 2016 | 2018 | 2017 | % Change | |||||||||||

| Commissions and fees | $ | 985 | $ | 1,004 | (2 | )% | $ | 1,213 | $ | 1,024 | 18 | % | ||||

| Administration and other fiduciary fees | 644 | 597 | 8 | 694 | 635 | 9 | ||||||||||

| Investment banking | 1,044 | 740 | 41 | 985 | 1,110 | (11 | ) | |||||||||

| Principal transactions | 2,668 | 1,576 | 69 | 2,884 | 2,731 | 6 | ||||||||||

Other | (5 | ) | (7 | ) | 29 | 418 | 1 | NM | ||||||||

| Total non-interest revenue | $ | 5,336 | $ | 3,910 | 36 | % | $ | 6,194 | $ | 5,501 | 13 | % | ||||

| Net interest revenue (including dividends) | 3,790 | 3,985 | (5 | ) | 3,654 | 3,818 | (4 | ) | ||||||||

| Total revenues, net of interest expense | $ | 9,126 | $ | 7,895 | 16 | % | $ | 9,848 | $ | 9,319 | 6 | % | ||||

| Total operating expenses | $ | 4,945 | $ | 4,872 | 1 | % | $ | 5,503 | $ | 5,138 | 7 | % | ||||

| Net credit losses | $ | 25 | $ | 211 | (88 | )% | $ | 105 | $ | 25 | NM | |||||

| Credit reserve build (release) | (176 | ) | 108 | NM | (175 | ) | (176 | ) | 1 | |||||||

| Provision (release) for unfunded lending commitments | (54 | ) | 71 | NM | 29 | (54 | ) | NM | ||||||||

| Provisions for credit losses | $ | (205 | ) | $ | 390 | NM | $ | (41 | ) | $ | (205 | ) | 80 | % | ||

| Income from continuing operations before taxes | $ | 4,386 | $ | 2,633 | 67 | % | $ | 4,386 | $ | 4,386 | — | % | ||||

| Income taxes | 1,375 | 764 | 80 | 1,057 | 1,375 | (23 | ) | |||||||||

| Income from continuing operations | $ | 3,011 | $ | 1,869 | 61 | % | $ | 3,329 | $ | 3,011 | 11 | % | ||||

| Noncontrolling interests | 15 | 10 | 50 | 15 | 15 | — | ||||||||||

| Net income | $ | 2,996 | $ | 1,859 | 61 | % | $ | 3,314 | $ | 2,996 | 11 | % | ||||

| EOP assets (in billions of dollars) | $ | 1,314 | $ | 1,293 | 2 | % | $ | 1,407 | $ | 1,314 | 7 | % | ||||

Average assets (in billions of dollars) | $ | 1,318 | $ | 1,272 | 4 | % | 1,388 | 1,318 | 5 | |||||||

| Return on average assets | 0.92 | % | 0.59 | % | 0.97 | % | 0.92 | % | ||||||||

| Efficiency ratio | 54 | % | 62 | % | 56 | 55 | ||||||||||

| Revenues by region | ||||||||||||||||

| North America | $ | 3,455 | $ | 2,980 | 16 | % | $ | 3,265 | $ | 3,522 | (7 | )% | ||||

| EMEA | 2,807 | 2,167 | 30 | 3,167 | 2,854 | 11 | ||||||||||

| Latin America | 1,127 | 962 | 17 | 1,210 | 1,169 | 4 | ||||||||||

| Asia | 1,737 | 1,786 | (3 | ) | 2,206 | 1,774 | 24 | |||||||||

| Total | $ | 9,126 | $ | 7,895 | 16 | % | $ | 9,848 | $ | 9,319 | 6 | % | ||||

| Income from continuing operations by region | ||||||||||||||||

| North America | $ | 1,100 | $ | 546 | NM | $ | 857 | $ | 1,077 | (20 | )% | |||||

| EMEA | 855 | 374 | NM | 1,113 | 862 | 29 | ||||||||||

| Latin America | 475 | 330 | 44 | 491 | 482 | 2 | ||||||||||

| Asia | 581 | 619 | (6 | ) | 868 | 590 | 47 | |||||||||

| Total | $ | 3,011 | $ | 1,869 | 61 | % | $ | 3,329 | $ | 3,011 | 11 | % | ||||

Average loans by region (in billions of dollars) | ||||||||||||||||

| North America | $ | 140 | $ | 133 | 5 | % | $ | 160 | $ | 146 | 10 | % | ||||

| EMEA | 65 | 63 | 3 | 78 | 65 | 20 | ||||||||||

| Latin America | 37 | 39 | (5 | ) | 34 | 34 | — | |||||||||

| Asia | 60 | 60 | — | 67 | 57 | 18 | ||||||||||

| Total | $ | 302 | $ | 295 | 2 | % | $ | 339 | $ | 302 | 12 | % | ||||

EOP deposits by business (in billions of dollars) | ||||||||||||||||

| Treasury and trade solutions | $ | 417 | $ | 417 | — | % | $ | 449 | $ | 417 | 8 | % | ||||

All other ICG businesses | 203 | 192 | 6 | 217 | 203 | 7 | ||||||||||

| Total | $ | 620 | $ | 609 | 2 | % | $ | 666 | $ | 620 | 8 | % | ||||

| First Quarter | ||||||||

| In millions of dollars | 2018 | 2017 | % Change | |||||

Investment banking revenue details | ||||||||

| Advisory | $ | 215 | $ | 249 | (14 | )% | ||

| Equity underwriting | 216 | 250 | (14 | ) | ||||

| Debt underwriting | 699 | 763 | (8 | ) | ||||

| Total investment banking | $ | 1,130 | $ | 1,262 | (10 | )% | ||

| Treasury and trade solutions | 2,268 | 2,108 | 8 | |||||

Corporate lending—excluding gains (losses) on loan hedges(1) | 521 | 438 | 19 | |||||

| Private bank | 904 | 749 | 21 | |||||

| Total banking revenues (ex-gains (losses) on loan hedges) | $ | 4,823 | $ | 4,557 | 6 | % | ||

Corporate lending—gains (losses) on loan hedges(1) | $ | 23 | $ | (115 | ) | NM | ||

| Total banking revenues (including gains (losses) on loan hedges) | $ | 4,846 | $ | 4,442 | 9 | % | ||

| Fixed income markets | $ | 3,418 | $ | 3,678 | (7 | )% | ||

| Equity markets | 1,103 | 802 | 38 | |||||

| Securities services | 641 | 552 | 16 | |||||

| Other | (160 | ) | (155 | ) | (3 | ) | ||

| Total markets and securities services revenues | $ | 5,002 | $ | 4,877 | 3 | % | ||

| Total revenues, net of interest expense | $ | 9,848 | $ | 9,319 | 6 | % | ||

| Commissions and fees | $ | 176 | $ | 142 | 24 | % | ||

Principal transactions(2) | 2,184 | 2,360 | (7 | ) | ||||

| Other | 276 | 151 | 83 | |||||

| Total non-interest revenue | $ | 2,636 | $ | 2,653 | (1 | )% | ||

| Net interest revenue | 782 | 1,025 | (24 | ) | ||||

| Total fixed income markets | $ | 3,418 | $ | 3,678 | (7 | )% | ||

| Rates and currencies | $ | 2,470 | $ | 2,530 | (2 | )% | ||

| Spread products/other fixed income | 948 | 1,148 | (17 | ) | ||||

| Total fixed income markets | $ | 3,418 | $ | 3,678 | (7 | )% | ||

| Commissions and fees | $ | 361 | $ | 326 | 11 | % | ||

Principal transactions(2) | 537 | 189 | NM | |||||

| Other | 80 | 9 | NM | |||||

| Total non-interest revenue | $ | 978 | $ | 524 | 87 | % | ||

| Net interest revenue | 125 | 278 | (55 | ) | ||||

| Total equity markets | $ | 1,103 | $ | 802 | 38 | % | ||

| (1) |

| First Quarter | % Change | |||||||

| In millions of dollars | 2017 | 2016 | ||||||

Investment banking revenue details | ||||||||

| Advisory | $ | 246 | $ | 227 | 8 | % | ||

| Equity underwriting | 235 | 118 | 99 | |||||

| Debt underwriting | 733 | 528 | 39 | |||||

| Total investment banking | $ | 1,214 | $ | 873 | 39 | % | ||

| Treasury and trade solutions | 2,075 | 1,903 | 9 | |||||

Corporate lending—excluding (loss) on loan hedges(1) | 434 | 448 | (3 | ) | ||||

| Private bank | 744 | 684 | 9 | |||||

| Total banking revenues (ex-(loss) on loan hedges) | $ | 4,467 | $ | 3,908 | 14 | % | ||

Corporate lending—(loss) on loan hedges(1) | $ | (115 | ) | $ | (66 | ) | (74 | )% |

| Total banking revenues (including (loss) on loan hedges) | $ | 4,352 | $ | 3,842 | 13 | % | ||

| Fixed income markets | $ | 3,622 | $ | 3,051 | 19 | % | ||

| Equity markets | 769 | 697 | 10 | |||||

| Securities services | 543 | 561 | (3 | ) | ||||

Other(2) | (160 | ) | (256 | ) | 38 | |||

| Total markets and securities services revenues | $ | 4,774 | $ | 4,053 | 18 | % | ||

| Total revenues, net of interest expense | $ | 9,126 | $ | 7,895 | 16 | % | ||

| Commissions and fees | $ | 140 | $ | 124 | 13 | % | ||

Principal transactions(3) | 2,318 | 1,344 | 72 | |||||

| Other | 149 | 216 | (31 | ) | ||||

| Total non-interest revenue | $ | 2,607 | $ | 1,684 | 55 | % | ||

| Net interest revenue | 1,015 | 1,367 | (26 | ) | ||||

| Total fixed income markets | $ | 3,622 | $ | 3,051 | 19 | % | ||

| Rates and currencies | $ | 2,503 | $ | 2,236 | 12 | % | ||

| Spread products / other fixed income | 1,119 | 815 | 37 | |||||

| Total fixed income markets | $ | 3,622 | $ | 3,051 | 19 | % | ||

| Commissions and fees | $ | 316 | $ | 357 | (11 | )% | ||

Principal transactions(3) | 166 | 51 | NM | |||||

| Other | 8 | 2 | NM | |||||

| Total non-interest revenue | $ | 490 | $ | 410 | 20 | % | ||

| Net interest revenue | 279 | 287 | (3 | ) | ||||

| Total equity markets | $ | 769 | $ | 697 | 10 | |||

| First Quarter | % Change | First Quarter | ||||||||||||||

| In millions of dollars | 2017 | 2016 | 2018 | 2017 | % Change | |||||||||||

| Net interest revenue | $ | 545 | $ | 890 | (39 | )% | $ | 538 | $ | 558 | (4 | )% | ||||

| Non-interest revenue | 632 | 1,056 | (40 | )% | 53 | 643 | (92 | ) | ||||||||

| Total revenues, net of interest expense | $ | 1,177 | $ | 1,946 | (40 | )% | $ | 591 | $ | 1,201 | (51 | )% | ||||

| Total operating expenses | $ | 1,117 | $ | 1,250 | (11 | )% | $ | 741 | $ | 1,134 | (35 | )% | ||||

| Net credit losses | $ | 81 | $ | 142 | (43 | )% | $ | 26 | $ | 81 | (68 | )% | ||||

| Credit reserve build (release) | (35 | ) | (31 | ) | (13 | ) | (33 | ) | (35 | ) | 6 | |||||

| Provision (release) for unfunded lending commitments | 5 | (1 | ) | NM | — | 1 | (100 | ) | ||||||||

| Provision for benefits and claims | 1 | 60 | (98 | ) | — | 5 | (100 | ) | ||||||||

| Provisions for loan losses and for benefits and claims | 52 | 170 | (69 | )% | ||||||||||||

| Income from continuing operations before taxes | $ | 8 | $ | 526 | (98 | )% | ||||||||||

| Provisions for credit losses and for benefits and claims | $ | (7 | ) | $ | 52 | NM | ||||||||||

| Income (loss) from continuing operations before taxes | $ | (143 | ) | $ | 15 | NM | ||||||||||

| Income taxes (benefits) | (96 | ) | 81 | NM | (69 | ) | (94 | ) | 27 | |||||||

| Income from continuing operations | $ | 104 | $ | 445 | (77 | )% | ||||||||||

| Income (loss) from continuing operations | $ | (74 | ) | $ | 109 | NM | ||||||||||

| Income (loss) from discontinued operations, net of taxes | (18 | ) | (2 | ) | NM | (7 | ) | (18 | ) | 61 | ||||||

| Net income before attribution of noncontrolling interests | $ | 86 | $ | 443 | (81 | )% | ||||||||||

| Net income (loss) before attribution of noncontrolling interests | $ | (81 | ) | $ | 91 | NM | ||||||||||

| Noncontrolling interests | (6 | ) | (7 | ) | 14 | % | 5 | (6 | ) | NM | ||||||

| Net income | $ | 92 | $ | 450 | (80 | )% | ||||||||||

| Net income (loss) | $ | (86 | ) | $ | 97 | NM | ||||||||||

| Variable interests and other obligations, including contingent obligations, arising from variable interests in nonconsolidated VIEs | See Note 18 to the Consolidated Financial Statements. |

| Letters of credit, and lending and other commitments | See Note 22 to the Consolidated Financial Statements. |

| Guarantees | See Note 22 to the Consolidated Financial Statements. |

| March 31, 2017 | December 31, 2016 | March 31, 2018 | December 31, 2017 | ||||||||||||||||||||||

| In millions of dollars, except ratios | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | |||||||||||||||||

| Common Equity Tier 1 Capital | $ | 161,665 | $ | 161,665 | $ | 167,378 | $ | 167,378 | $ | 144,128 | $ | 144,128 | $ | 142,822 | $ | 142,822 | |||||||||

| Tier 1 Capital | 177,104 | 177,104 | 178,387 | 178,387 | 163,490 | 163,490 | 162,377 | 162,377 | |||||||||||||||||

Total Capital (Tier 1 Capital + Tier 2 Capital) | 201,500 | 214,080 | 202,146 | 214,938 | 188,668 | 200,892 | 187,877 | 199,989 | |||||||||||||||||

| Total Risk-Weighted Assets | 1,166,202 | 1,142,579 | 1,166,764 | 1,126,314 | 1,178,127 | 1,195,981 | 1,152,644 | 1,155,099 | |||||||||||||||||

Common Equity Tier 1 Capital ratio(2) | 13.86 | % | 14.15 | % | 14.35 | % | 14.86 | % | |||||||||||||||||

Tier 1 Capital ratio(2) | 15.19 | 15.50 | 15.29 | 15.84 | |||||||||||||||||||||

Total Capital ratio(2) | 17.28 | 18.74 | 17.33 | 19.08 | |||||||||||||||||||||

| Credit Risk | $ | 790,466 | $ | 1,125,602 | $ | 767,102 | $ | 1,089,372 | |||||||||||||||||

| Market Risk | 69,577 | 70,379 | 65,003 | 65,727 | |||||||||||||||||||||

| Operational Risk | 318,084 | — | 320,539 | — | |||||||||||||||||||||

Common Equity Tier 1 Capital ratio(1)(2) | 12.23 | % | 12.05 | % | 12.39 | % | 12.36 | % | |||||||||||||||||

Tier 1 Capital ratio(1)(2) | 13.88 | 13.67 | 14.09 | 14.06 | |||||||||||||||||||||

Total Capital ratio(1)(2) | 16.01 | 16.80 | 16.30 | 17.31 | |||||||||||||||||||||

| In millions of dollars, except ratios | March 31, 2017 | December 31, 2016 | March 31, 2018 | December 31, 2017 | |||||||||||||

Quarterly Adjusted Average Total Assets(3) | $ | 1,776,048 | $ | 1,768,415 | $ | 1,862,802 | $ | 1,868,326 | |||||||||

Total Leverage Exposure(4) | 2,375,616 | 2,351,883 | 2,436,817 | 2,432,491 | |||||||||||||

| Tier 1 Leverage ratio | 9.97 | % | 10.09 | % | 8.78 | % | 8.69 | % | |||||||||

| Supplementary Leverage ratio | 7.46 | 7.58 | 6.71 | 6.68 | |||||||||||||

| (1) |

| As of March 31, |

| (2) | Citi’s risk-based capital and leverage ratios and related components as of December 31, 2017 are non-GAAP financial measures, which reflect full implementation of regulatory capital adjustments and deductions prior to the effective date of January 1, 2018. |

| (3) | Tier 1 Leverage ratio denominator. |

| (4) | Supplementary Leverage ratio denominator. |

| In millions of dollars | March 31, 2017 | December 31, 2016 | ||||

| Common Equity Tier 1 Capital | ||||||

Citigroup common stockholders’ equity(1) | $ | 209,063 | $ | 206,051 | ||

| Add: Qualifying noncontrolling interests | 197 | 259 | ||||

| Regulatory Capital Adjustments and Deductions: | ||||||

Less: Net unrealized losses on securities available-for-sale (AFS), net of tax(2)(3) | (116 | ) | (320 | ) | ||

Less: Defined benefit plans liability adjustment, net of tax(3) | (1,035 | ) | (2,066 | ) | ||

Less: Accumulated net unrealized losses on cash flow hedges, net of tax(4) | (562 | ) | (560 | ) | ||

Less: Cumulative unrealized net loss related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax(3)(5) | (138 | ) | (37 | ) | ||

| Less: Intangible assets: | ||||||

Goodwill, net of related deferred tax liabilities (DTLs)(6) | 21,448 | 20,858 | ||||

Identifiable intangible assets other than mortgage servicing rights (MSRs), net of related DTLs(3) | 3,790 | 2,926 | ||||

Less: Defined benefit pension plan net assets(3) | 669 | 514 | ||||

Less: Deferred tax assets (DTAs) arising from net operating loss, foreign tax credit and general business credit carry-forwards(3)(7) | 16,862 | 12,802 | ||||

Less: Excess over 10%/15% limitations for other DTAs, certain common stock investments, and MSRs(3)(7)(8) | 6,677 | 4,815 | ||||

| Total Common Equity Tier 1 Capital | $ | 161,665 | $ | 167,378 | ||

| Additional Tier 1 Capital | ||||||

Qualifying perpetual preferred stock(1) | $ | 19,069 | $ | 19,069 | ||

Qualifying trust preferred securities(9) | 1,372 | 1,371 | ||||

| Qualifying noncontrolling interests | 23 | 17 | ||||

| Regulatory Capital Adjustment and Deductions: | ||||||

Less: Cumulative unrealized net loss related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax(3)(5) | (35 | ) | (24 | ) | ||

Less: Defined benefit pension plan net assets(3) | 167 | 343 | ||||

Less: DTAs arising from net operating loss, foreign tax credit and general business credit carry-forwards(3)(7) | 4,215 | 8,535 | ||||

Less: Permitted ownership interests in covered funds(10) | 618 | 533 | ||||

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries(11) | 60 | 61 | ||||

| Total Additional Tier 1 Capital | $ | 15,439 | $ | 11,009 | ||

| Total Tier 1 Capital (Common Equity Tier 1 Capital + Additional Tier 1 Capital) | $ | 177,104 | $ | 178,387 | ||

| Tier 2 Capital | ||||||

| Qualifying subordinated debt | $ | 23,278 | $ | 22,818 | ||

Qualifying trust preferred securities(12) | 319 | 317 | ||||

| Qualifying noncontrolling interests | 30 | 22 | ||||

Excess of eligible credit reserves over expected credit losses(13) | 827 | 660 | ||||

| Regulatory Capital Adjustment and Deduction: | ||||||

| Add: Unrealized gains on AFS equity exposures includable in Tier 2 Capital | 2 | 3 | ||||

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries(11) | 60 | 61 | ||||

| Total Tier 2 Capital | $ | 24,396 | $ | 23,759 | ||

| Total Capital (Tier 1 Capital + Tier 2 Capital) | $ | 201,500 | $ | 202,146 | ||

| March 31, 2017 | December 31, 2016 | ||||||||||||

| In millions of dollars | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | |||||||||

Credit Risk(14) | $ | 766,382 | $ | 1,070,053 | $ | 773,483 | $ | 1,061,786 | |||||

| Market Risk | 72,247 | 72,526 | 64,006 | 64,528 | |||||||||

| Operational Risk | 327,573 | — | 329,275 | — | |||||||||

| Total Risk-Weighted Assets | $ | 1,166,202 | $ | 1,142,579 | $ | 1,166,764 | $ | 1,126,314 | |||||

| In millions of dollars | March 31, 2018 | December 31, 2017 | ||||

| Common Equity Tier 1 Capital | ||||||

Citigroup common stockholders’ equity(1) | $ | 182,943 | $ | 181,671 | ||

| Add: Qualifying noncontrolling interests | 140 | 153 | ||||

| Regulatory Capital Adjustments and Deductions: | ||||||

Less: Accumulated net unrealized losses on cash flow hedges, net of tax(2) | (920 | ) | (698 | ) | ||

Less: Cumulative unrealized net loss related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax(3) | (498 | ) | (721 | ) | ||

| Less: Intangible assets: | ||||||

Goodwill, net of related DTLs(4) | 22,482 | 22,052 | ||||

Identifiable intangible assets other than MSRs, net of related DTLs | 4,209 | 4,401 | ||||

| Less: Defined benefit pension plan net assets | 871 | 896 | ||||

Less: DTAs arising from net operating loss, foreign tax credit and general business credit carry-forwards(5) | 12,811 | 13,072 | ||||

| Total Common Equity Tier 1 Capital (Standardized Approach and Advanced Approaches) | $ | 144,128 | $ | 142,822 | ||

| Additional Tier 1 Capital | ||||||

Qualifying noncumulative perpetual preferred stock(1) | $ | 18,972 | $ | 19,069 | ||

Qualifying trust preferred securities(6) | 1,379 | 1,377 | ||||

| Qualifying noncontrolling interests | 59 | 61 | ||||

| Regulatory Capital Deductions: | ||||||

Less: Permitted ownership interests in covered funds(7) | 997 | 900 | ||||

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries(8) | 51 | 52 | ||||

| Total Additional Tier 1 Capital (Standardized Approach and Advanced Approaches) | $ | 19,362 | $ | 19,555 | ||

Total Tier 1 Capital (Common Equity Tier 1 Capital + Additional Tier 1 Capital) (Standardized Approach and Advanced Approaches) | $ | 163,490 | $ | 162,377 | ||

| Tier 2 Capital | ||||||

| Qualifying subordinated debt | $ | 23,430 | $ | 23,673 | ||

Qualifying trust preferred securities(9) | 334 | 329 | ||||

| Qualifying noncontrolling interests | 51 | 50 | ||||

Eligible allowance for credit losses(10) | 13,638 | 13,612 | ||||

| Regulatory Capital Deduction: | ||||||

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries(8) | 51 | 52 | ||||

| Total Tier 2 Capital (Standardized Approach) | $ | 37,402 | $ | 37,612 | ||

| Total Capital (Tier 1 Capital + Tier 2 Capital) (Standardized Approach) | $ | 200,892 | $ | 199,989 | ||

Adjustment for excess of eligible credit reserves over expected credit losses(10) | $ | (12,224 | ) | $ | (12,112 | ) |

Total Tier 2 Capital (Advanced Approaches) | $ | 25,178 | $ | 25,500 | ||

| Total Capital (Tier 1 Capital + Tier 2 Capital) (Advanced Approaches) | $ | 188,668 | $ | 187,877 | ||

| (1) | Issuance costs of $184 million related to noncumulative perpetual preferred stock outstanding at March 31, |

| In millions of dollars | Three months ended March 31, 2017 | ||

| Common Equity Tier 1 Capital | |||

| Balance, beginning of period | $ | 167,376 | |

| Net income | 4,090 | ||

| Common and preferred stock dividends declared | (746 | ) | |

| Net increase in treasury stock | (1,277 | ) | |

| Net decrease in common stock and additional paid-in capital | (429 | ) | |

| Net decrease in foreign currency translation adjustment net of hedges, net of tax | 1,318 | ||

| Net decrease in unrealized losses on securities AFS, net of tax | 16 | ||

| Net increase in defined benefit plans liability adjustment, net of tax | (1,043 | ) | |

Net change in adjustment related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax | 41 | ||

| Net increase in goodwill, net of related DTLs | (590 | ) | |

| Net increase in identifiable intangible assets other than MSRs, net of related DTLs | (864 | ) | |

| Net increase in defined benefit pension plan net assets | (155 | ) | |

Net increase in DTAs arising from net operating loss, foreign tax credit and general business credit carry-forwards | (4,034 | ) | |

Net increase in excess over 10%/15% limitations for other DTAs, certain common stock investments and MSRs | (1,886 | ) | |

| Other | (152 | ) | |

| Net decrease in Common Equity Tier 1 Capital | $ | (5,711 | ) |

| Common Equity Tier 1 Capital Balance, end of period | $ | 161,665 | |

| Additional Tier 1 Capital | |||

| Balance, beginning of period | $ | 10,992 | |

| Net increase in qualifying trust preferred securities | 1 | ||

Net change in adjustment related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax | 11 | ||

| Net decrease in defined benefit pension plan net assets | 176 | ||

Net decrease in DTAs arising from net operating loss, foreign tax credit and general business credit carry-forwards | 4,337 | ||

| Net increase in permitted ownership interests in covered funds | (85 | ) | |

| Other | 7 | ||

| Net increase in Additional Tier 1 Capital | $ | 4,447 | |

| Tier 1 Capital Balance, end of period | $ | 177,104 | |

| Tier 2 Capital | |||

| Balance, beginning of period | $ | 23,759 | |

| Net increase in qualifying subordinated debt | 460 | ||

| Net increase in qualifying trust preferred securities | 2 | ||

| Net increase in excess of eligible credit reserves over expected credit losses | 167 | ||

| Other | 8 | ||

| Net increase in Tier 2 Capital | $ | 637 | |

| Tier 2 Capital Balance, end of period | $ | 24,396 | |

| Total Capital (Tier 1 Capital + Tier 2 Capital) | $ | 201,500 | |

| In millions of dollars | Three months ended March 31, 2017 | ||

| Total Risk-Weighted Assets, beginning of period | $ | 1,166,764 | |

| Changes in Credit Risk-Weighted Assets | |||

Net decrease in retail exposures(1) | (4,312 | ) | |

Net increase in wholesale exposures(2) | 4,445 | ||

| Net decrease in repo-style transactions | (197 | ) | |

| Net decrease in securitization exposures | (235 | ) | |

| Net increase in equity exposures | 465 | ||

Net decrease in over-the-counter (OTC) derivatives(3) | (4,199 | ) | |

Net decrease in derivatives CVA(4) | (1,061 | ) | |

Net decrease in other exposures(5) | (1,665 | ) | |

Net decrease in supervisory 6% multiplier(6) | (342 | ) | |

| Net decrease in Credit Risk-Weighted Assets | $ | (7,101 | ) |

| Changes in Market Risk-Weighted Assets | |||

Net increase in risk levels(7) | $ | 10,995 | |

Net decrease due to model and methodology updates(8) | (2,754 | ) | |

| Net increase in Market Risk-Weighted Assets | $ | 8,241 | |

Net decrease in Operational Risk-Weighted Assets(9) | $ | (1,702 | ) |

| Total Risk-Weighted Assets, end of period | $ | 1,166,202 | |

| March 31, 2017 | December 31, 2016 | ||||||||||||

| In millions of dollars, except ratios | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | |||||||||

| Common Equity Tier 1 Capital | $ | 126,543 | $ | 126,543 | $ | 126,220 | $ | 126,220 | |||||

| Tier 1 Capital | 127,859 | 127,859 | 126,465 | 126,465 | |||||||||

Total Capital (Tier 1 Capital + Tier 2 Capital)(1) | 140,431 | 151,628 | 138,821 | 150,291 | |||||||||

| Total Risk-Weighted Assets | 984,660 | 1,016,037 | 973,933 | 1,001,016 | |||||||||

Common Equity Tier 1 Capital ratio(2)(3) | 12.85 | % | 12.45 | % | 12.96 | % | 12.61 | % | |||||

Tier 1 Capital ratio(2)(3) | 12.99 | 12.58 | 12.99 | 12.63 | |||||||||

Total Capital ratio(2)(3) | 14.26 | 14.92 | 14.25 | 15.01 | |||||||||

| In millions of dollars, except ratios | March 31, 2017 | December 31, 2016 | |||||||

Quarterly Adjusted Average Total Assets(4) | $ | 1,350,921 | $ | 1,333,161 | |||||

Total Leverage Exposure(5) | 1,885,462 | 1,859,394 | |||||||

Tier 1 Leverage ratio(3) | 9.46 | % | 9.49 | % | |||||

| Supplementary Leverage ratio | 6.78 | 6.80 | |||||||

Common Equity Tier 1 Capital ratio | Tier 1 Capital ratio | Total Capital ratio | ||||

| In basis points | Impact of $100 million change in Common Equity Tier 1 Capital | Impact of $1 billion change in risk- weighted assets | Impact of $100 million change in Tier 1 Capital | Impact of $1 billion change in risk- weighted assets | Impact of $100 million change in Total Capital | Impact of $1 billion change in risk- weighted assets |

| Citigroup | ||||||

| Advanced Approaches | 0.9 | 1.2 | 0.9 | 1.3 | 0.9 | 1.5 |

| Standardized Approach | 0.9 | 1.2 | 0.9 | 1.4 | 0.9 | 1.6 |

| Citibank | ||||||

| Advanced Approaches | 1.0 | 1.3 | 1.0 | 1.3 | 1.0 | 1.4 |

| Standardized Approach | 1.0 | 1.2 | 1.0 | 1.2 | 1.0 | 1.5 |

| Tier 1 Leverage ratio | Supplementary Leverage ratio | |||

| In basis points | Impact of $100 million change in Tier 1 Capital | Impact of $1 billion change in quarterly adjusted average total assets | Impact of $100 million change in Tier 1 Capital | Impact of $1 billion change in Total Leverage Exposure |

| Citigroup | 0.6 | 0.6 | 0.4 | 0.3 |

| Citibank | 0.7 | 0.7 | 0.5 | 0.4 |

| March 31, 2017 | December 31, 2016 | ||||||||||||

| In millions of dollars, except ratios | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | |||||||||

| Common Equity Tier 1 Capital | $ | 152,835 | $ | 152,835 | $ | 149,516 | $ | 149,516 | |||||

| Tier 1 Capital | 172,626 | 172,626 | 169,390 | 169,390 | |||||||||

Total Capital (Tier 1 Capital + Tier 2 Capital)(1) | 197,027 | 209,607 | 193,160 | 205,975 | |||||||||

| Total Risk-Weighted Assets | 1,191,503 | 1,166,447 | 1,189,680 | 1,147,956 | |||||||||

Common Equity Tier 1 Capital ratio(2)(3) | 12.83 | % | 13.10 | % | 12.57 | % | 13.02 | % | |||||

Tier 1 Capital ratio(2)(3) | 14.49 | 14.80 | 14.24 | 14.76 | |||||||||

Total Capital ratio(2)(3) | 16.54 | 17.97 | 16.24 | 17.94 | |||||||||

| In millions of dollars, except ratios | March 31, 2017 | December 31, 2016 | |||||||

Quarterly Adjusted Average Total Assets(4) | $ | 1,772,780 | $ | 1,761,923 | |||||

Total Leverage Exposure(5) | 2,372,348 | 2,345,391 | |||||||

Tier 1 Leverage ratio(3) | 9.74 | % | 9.61 | % | |||||

Supplementary Leverage ratio(3) | 7.28 | 7.22 | |||||||

| In millions of dollars | March 31, 2017 | December 31, 2016 | ||||

| Common Equity Tier 1 Capital | ||||||

Citigroup common stockholders’ equity(1) | $ | 209,063 | $ | 206,051 | ||

| Add: Qualifying noncontrolling interests | 133 | 129 | ||||

| Regulatory Capital Adjustments and Deductions: | ||||||

Less: Accumulated net unrealized losses on cash flow hedges, net of tax(2) | (562 | ) | (560 | ) | ||

Less: Cumulative unrealized net loss related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax(3) | (173 | ) | (61 | ) | ||

| Less: Intangible assets: | ||||||

Goodwill, net of related DTLs(4) | 21,448 | 20,858 | ||||

Identifiable intangible assets other than MSRs, net of related DTLs | 4,738 | 4,876 | ||||

| Less: Defined benefit pension plan net assets | 836 | 857 | ||||

Less: DTAs arising from net operating loss, foreign tax credit and general business credit carry-forwards(5) | 21,077 | 21,337 | ||||

Less: Excess over 10%/15% limitations for other DTAs, certain common stock investments, and MSRs(5)(6) | 8,997 | 9,357 | ||||

| Total Common Equity Tier 1 Capital | $ | 152,835 | $ | 149,516 | ||

| Additional Tier 1 Capital | ||||||

Qualifying perpetual preferred stock(1) | $ | 19,069 | $ | 19,069 | ||

Qualifying trust preferred securities(7) | 1,372 | 1,371 | ||||

| Qualifying noncontrolling interests | 28 | 28 | ||||

| Regulatory Capital Deductions: | ||||||

Less: Permitted ownership interests in covered funds(8) | 618 | 533 | ||||

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries(9) | 60 | 61 | ||||

| Total Additional Tier 1 Capital | $ | 19,791 | $ | 19,874 | ||

| Total Tier 1 Capital (Common Equity Tier 1 Capital + Additional Tier 1 Capital) | $ | 172,626 | $ | 169,390 | ||

| Tier 2 Capital | ||||||

| Qualifying subordinated debt | $ | 23,278 | $ | 22,818 | ||

Qualifying trust preferred securities(10) | 319 | 317 | ||||

| Qualifying noncontrolling interests | 37 | 36 | ||||

Excess of eligible credit reserves over expected credit losses(11) | 827 | 660 | ||||

| Regulatory Capital Deduction: | ||||||

Less: Minimum regulatory capital requirements of insurance underwriting subsidiaries(9) | 60 | 61 | ||||

| Total Tier 2 Capital | $ | 24,401 | $ | 23,770 | ||

Total Capital (Tier 1 Capital + Tier 2 Capital)(12) | $ | 197,027 | $ | 193,160 | ||

| (2) | Common Equity Tier 1 Capital is adjusted for accumulated net unrealized gains (losses) on cash flow hedges included in AOCI that relate to the hedging of items not recognized at fair value on the balance sheet. |

| (3) | The cumulative impact of changes in Citigroup’s own creditworthiness in valuing liabilities for which the fair value option has been elected, and own-credit valuation adjustments on derivatives, are excluded from Common Equity Tier 1 Capital, in accordance with the U.S. Basel III rules. |

| (4) | Includes goodwill “embedded” in the valuation of significant common stock investments in unconsolidated financial institutions. |

| (5) | Of Citi’s |

| (6) |

| Represents Citigroup Capital XIII trust preferred securities, which are permanently grandfathered as Tier 1 Capital under the U.S. Basel III rules. |

| Banking entities are required to be in compliance with the Volcker Rule of the Dodd-Frank Act, |

| 50% of the minimum regulatory capital requirements of insurance underwriting subsidiaries must be deducted from each of Tier 1 Capital and Tier 2 Capital. |

| Represents the amount of non-grandfathered trust preferred securities eligible for inclusion in Tier 2 Capital under the U.S. Basel III rules, which will be fully phased-out of Tier 2 Capital by January 1, 2022. |

| In millions of dollars | Three months ended March 31, 2017 | Three Months Ended March 31, 2018 | ||||

| Common Equity Tier 1 Capital | ||||||

| Balance, beginning of period | $ | 149,512 | ||||

| Common Equity Tier 1 Capital, beginning of period | $ | 142,822 | ||||

| Net income | 4,090 | 4,620 | ||||

| Common and preferred stock dividends declared | (746 | ) | (1,098 | ) | ||

| Net increase in treasury stock | (1,277 | ) | (1,806 | ) | ||

| Net decrease in common stock and additional paid-in capital | (429 | ) | (409 | ) | ||

| Net decrease in foreign currency translation adjustment net of hedges, net of tax | 1,318 | 1,120 | ||||

| Net decrease in unrealized losses on securities AFS, net of tax | 220 | |||||

| Net increase in defined benefit plans liability adjustment, net of tax | (12 | ) | ||||

| Net increase in unrealized losses on debt securities AFS, net of tax | (1,061 | ) | ||||

| Net decrease in defined benefit plans liability adjustment, net of tax | 88 | |||||

Net change in adjustment related to changes in fair value of financial liabilities attributable to own creditworthiness, net of tax | 52 | (95 | ) | |||

| Net increase in ASC 815—excluded Component of Fair Value Hedges | (4 | ) | ||||

| Net increase in goodwill, net of related DTLs | (590 | ) | (430 | ) | ||

| Net decrease in identifiable intangible assets other than MSRs, net of related DTLs | 138 | 192 | ||||

| Net decrease in defined benefit pension plan net assets | 21 | 25 | ||||

Net decrease in DTAs arising from net operating loss, foreign tax credit and general business credit carry-forwards | 303 | 261 | ||||

Net decrease in excess over 10%/15% limitations for other DTAs, certain common stock investments and MSRs | 321 | |||||

| Other | (86 | ) | (97 | ) | ||

| Net increase in Common Equity Tier 1 Capital | $ | 3,323 | $ | 1,306 | ||

| Common Equity Tier 1 Capital Balance, end of period | $ | 152,835 | ||||

| Additional Tier 1 Capital | ||||||

| Balance, beginning of period | $ | 19,874 | ||||

Common Equity Tier 1 Capital, end of period (Standardized Approach and Advanced Approaches) | $ | 144,128 | ||||

| Additional Tier 1 Capital, beginning of period | $ | 19,555 | ||||

| Net decrease in qualifying perpetual preferred stock | (97 | ) | ||||

| Net increase in qualifying trust preferred securities | 1 | 2 | ||||

| Net increase in permitted ownership interests in covered funds | (85 | ) | (97 | ) | ||

| Other | 1 | (1 | ) | |||

| Net decrease in Additional Tier 1 Capital | $ | (83 | ) | $ | (193 | ) |

| Tier 1 Capital Balance, end of period | $ | 172,626 | ||||

| Tier 2 Capital | ||||||

| Balance, beginning of period | $ | 23,770 | ||||

| Net increase in qualifying subordinated debt | 460 | |||||

| Net increase in excess of eligible credit reserves over expected credit losses | 167 | |||||

Tier 1 Capital, end of period (Standardized Approach and Advanced Approaches) | $ | 163,490 | ||||

| Tier 2 Capital, beginning of period (Standardized Approach) | $ | 37,612 | ||||

| Net decrease in qualifying subordinated debt | (243 | ) | ||||

| Net increase in eligible allowance for credit losses | 26 | |||||

| Other | 4 | 7 | ||||

| Net increase in Tier 2 Capital | $ | 631 | ||||

| Tier 2 Capital Balance, end of period | $ | 24,401 | ||||

| Total Capital (Tier 1 Capital + Tier 2 Capital) | $ | 197,027 | ||||

| Net decrease in Tier 2 Capital (Standardized Approach) | $ | (210 | ) | |||

| Tier 2 Capital, end of period (Standardized Approach) | $ | 37,402 | ||||

| Total Capital, end of period (Standardized Approach) | $ | 200,892 | ||||

| Tier 2 Capital, beginning of period (Advanced Approaches) | $ | 25,500 | ||||

| Net decrease in qualifying subordinated debt | (243 | ) | ||||

| Net decrease in excess of eligible credit reserves over expected credit losses | (86 | ) | ||||

| Other | 7 | |||||

| Net decrease in Tier 2 Capital (Advanced Approaches) | $ | (322 | ) | |||

| Tier 2 Capital, end of period (Advanced Approaches) | $ | 25,178 | ||||

| Total Capital, end of period (Advanced Approaches) | $ | 188,668 | ||||

| March 31, 2017 | December 31, 2016 | ||||||||||||

| In millions of dollars | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | |||||||||

| Credit Risk | $ | 791,683 | $ | 1,093,921 | $ | 796,399 | $ | 1,083,428 | |||||

| Market Risk | 72,247 | 72,526 | 64,006 | 64,528 | |||||||||

| Operational Risk | 327,573 | — | 329,275 | — | |||||||||

| Total Risk-Weighted Assets | $ | 1,191,503 | $ | 1,166,447 | $ | 1,189,680 | $ | 1,147,956 | |||||

| In millions of dollars | Three Months Ended March 31, 2018 | ||

| Total Risk-Weighted Assets, beginning of period | $ | 1,155,099 | |

| Changes in Credit Risk-Weighted Assets | |||

Net decrease in general credit risk exposures(1) | (1,252 | ) | |

Net increase in repo-style transactions(2) | 8,253 | ||

| Net increase in securitization exposures | 1,827 | ||

| Net increase in equity exposures | 878 | ||

Net increase in over-the-counter (OTC) derivatives(3) | 10,433 | ||

Net increase in other exposures(4) | 7,952 | ||

Net increase in off-balance sheet exposures(5) | 8,139 | ||

| Net increase in Credit Risk-Weighted Assets | $ | 36,230 | |

| Changes in Market Risk-Weighted Assets | |||

Net increase in risk levels(6) | $ | 7,232 | |

Net decrease due to model and methodology updates(7) | (2,580 | ) | |

| Net increase in Market Risk-Weighted Assets | $ | 4,652 | |

| Total Risk-Weighted Assets, end of period | $ | 1,195,981 | |

| (1) | General credit risk exposures include cash and balances due from depository institutions, securities, and loans and leases. General credit risk exposures increased during the three months ended March 31, 2018 primarily due to corporate loan growth. |

| (2) | Repo-style transactions include repurchase or reverse repurchase transactions and securities borrowing or securities lending transactions. |

| (3) | OTC derivatives increased during the three months ended March 31, 2018 primarily due to increased notional amounts for bilateral trades resulting from increased seasonal business activity. |

| (4) | Other exposures include cleared transactions, unsettled transactions, and other assets. Other exposures increased during the three months ended March 31, 2018 primarily due to additional DTAs arising from temporary differences, which are subject to risk-weighting at 250%. |

| (5) | Off-balance sheet exposures increased during the three months ended March 31, 2018 primarily due to an increase in commitments to extend credit that will drive future corporate loan growth. |

| (6) | Risk levels increased during the three months ended March 31, 2018 primarily due to increases in exposure levels subject to Stressed Value at Risk and Value at Risk. |

| (7) | Risk-weighted assets declined during the three months ended March 31, 2018 primarily due to methodology changes for standard specific risk charges. |

| In millions of dollars | Three months ended March 31, 2017 | Three Months Ended March 31, 2018 | ||||

| Total Risk-Weighted Assets, beginning of period | $ | 1,189,680 | $ | 1,152,644 | ||

| Changes in Credit Risk-Weighted Assets | ||||||

Net decrease in retail exposures(1) | (4,312 | ) | (9,405 | ) | ||

Net increase in wholesale exposures(2) | 4,445 | 9,288 | ||||

| Net decrease in repo-style transactions | (197 | ) | ||||

| Net decrease in securitization exposures | (235 | ) | ||||

Net increase in repo-style transactions(3) | 4,189 | |||||

| Net increase in securitization exposures | 1,980 | |||||

| Net increase in equity exposures | 542 | 1,029 | ||||

Net decrease in over-the-counter (OTC) derivatives(3) | (4,199 | ) | ||||

Net decrease in derivatives CVA(4) | (1,061 | ) | ||||

Net increase in over-the-counter (OTC) derivatives(4) | 3,047 | |||||

Net increase in derivatives CVA(5) | 7,120 | |||||

Net increase in other exposures | 508 | 5,196 | ||||

Net decrease in supervisory 6% multiplier(6) | (207 | ) | ||||

| Net decrease in Credit Risk-Weighted Assets | $ | (4,716 | ) | |||

Net increase in supervisory 6% multiplier(7) | 920 | |||||

| Net increase in Credit Risk-Weighted Assets | $ | 23,364 | ||||

| Changes in Market Risk-Weighted Assets | ||||||

Net increase in risk levels | $ | 10,995 | $ | 7,154 | ||

Net decrease due to model and methodology updates | (2,754 | ) | (2,580 | ) | ||

| Net increase in Market Risk-Weighted Assets | $ | 8,241 | $ | 4,574 | ||

Net decrease in Operational Risk-Weighted Assets(9) | $ | (1,702 | ) | |||

Net decrease in Operational Risk-Weighted Assets(10) | $ | (2,455 | ) | |||

| Total Risk-Weighted Assets, end of period | $ | 1,191,503 | $ | 1,178,127 | ||

| (1) | Retail exposures decreased during the three months ended March 31, |

| (2) | Wholesale exposures increased during the three months ended March 31, |

| (3) | Repo-style transactions include repurchase or reverse repurchase transactions and securities borrowing or securities lending transactions. |

| (4) | OTC derivatives |

| Derivatives CVA |

| Other exposures include cleared transactions, unsettled transactions, assets other than those reportable in specific exposure categories and non-material portfolios. Other exposures increased during the three months ended March 31, 2018 primarily due to additional temporary difference deferred tax assets subject to risk weighting. |

| Supervisory 6% multiplier does not apply to derivatives CVA. |

| Risk levels increased during the three months ended March 31, |

| Risk-weighted assets declined during the three months ended March 31, |

| In millions of dollars, except ratios | March 31, 2017 | December 31, 2016 | March 31, 2018 | December 31, 2017 | ||||||||

| Tier 1 Capital | $ | 172,626 | $ | 169,390 | $ | 163,490 | $ | 162,377 | ||||

| Total Leverage Exposure (TLE) | ||||||||||||

On-balance sheet assets(1) | $ | 1,830,554 | $ | 1,819,802 | $ | 1,904,223 | $ | 1,909,699 | ||||

Certain off-balance sheet exposures:(2) | ||||||||||||

| Potential future exposure on derivative contracts | 220,573 | 211,009 | 190,824 | 191,555 | ||||||||

Effective notional of sold credit derivatives, net(3) | 65,584 | 64,366 | 51,006 | 59,207 | ||||||||

Counterparty credit risk for repo-style transactions(4) | 25,205 | 22,002 | 26,673 | 27,005 | ||||||||

| Unconditionally cancellable commitments | 67,101 | 66,663 | 68,240 | 67,644 | ||||||||

| Other off-balance sheet exposures | 221,105 | 219,428 | 237,272 | 218,754 | ||||||||

| Total of certain off-balance sheet exposures | $ | 599,568 | $ | 583,468 | $ | 574,015 | $ | 564,165 | ||||

| Less: Tier 1 Capital deductions | 57,774 | 57,879 | 41,421 | 41,373 | ||||||||

| Total Leverage Exposure | $ | 2,372,348 | $ | 2,345,391 | $ | 2,436,817 | $ | 2,432,491 | ||||

| Supplementary Leverage ratio | 7.28 | % | 7.22 | % | 6.71 | % | 6.68 | % | ||||

| (1) | Represents the daily average of on-balance sheet assets for the quarter. |

| (2) | Represents the average of certain off-balance sheet exposures calculated as of the last day of each month in the quarter. |

| (3) | Under the U.S. Basel III rules, banking organizations are required to include in TLE the effective notional amount of sold credit derivatives, with netting of exposures permitted if certain conditions are met. |

| (4) | Repo-style transactions include repurchase or reverse repurchase transactions and securities borrowing or securities lending transactions. |

| March 31, 2018 | December 31, 2017 | |||||||||||

| In millions of dollars, except ratios | Advanced Approaches | Standardized Approach | Advanced Approaches | Standardized Approach | ||||||||

| Common Equity Tier 1 Capital | $ | 126,413 | $ | 126,413 | $ | 122,848 | $ | 122,848 | ||||

| Tier 1 Capital | 128,546 | 128,546 | 124,952 | 124,952 | ||||||||

Total Capital (Tier 1 Capital + Tier 2 Capital)(1) | 141,702 | 152,431 | 138,008 | 148,946 | ||||||||

| Total Risk-Weighted Assets | 962,395 | 1,039,774 | 965,435 | 1,024,502 | ||||||||

| Credit Risk | $ | 677,461 | $ | 999,860 | $ | 674,659 | $ | 980,324 | ||||

| Market Risk | 39,328 | 39,914 | 43,300 | 44,178 | ||||||||

| Operational Risk | 245,606 | — | 247,476 | — | ||||||||

Common Equity Tier 1 Capital ratio(2)(3)(4) | 13.14 | % | 12.16 | % | 12.72 | % | 11.99 | % | ||||

Tier 1 Capital ratio(2)(3)(4) | 13.36 | 12.36 | 12.94 | 12.20 | ||||||||

Total Capital ratio(2)(3)(4) | 14.72 | 14.66 | 14.29 | 14.54 | ||||||||

| In millions of dollars, except ratios | March 31, 2018 | December 31, 2017 | ||||||

Quarterly Adjusted Average Total Assets(5) | $ | 1,386,249 | $ | 1,401,187 | ||||

Total Leverage Exposure(6) | 1,897,742 | 1,900,641 | ||||||

Tier 1 Leverage ratio(2)(4) | 9.27 | % | 8.92 | % | ||||

Supplementary Leverage ratio(2)(4) | 6.77 | 6.57 | ||||||

| (1) | Under the Advanced Approaches framework, eligible credit reserves that exceed expected credit losses are eligible for inclusion in Tier 2 Capital to the extent the excess reserves do not exceed 0.6% of credit risk-weighted assets, which differs from the Standardized Approach in which the allowance for credit losses is eligible for inclusion in Tier 2 Capital up to 1.25% of credit risk-weighted assets, with any excess allowance for credit losses being deducted in arriving at credit risk-weighted assets. |

| (2) | Citibank’s risk-based capital and leverage ratios and related components as of December 31, 2017 are non-GAAP financial measures, which reflect full implementation of regulatory capital adjustments and deductions prior to the effective date of January 1, 2018. |

| (3) | As of March 31, 2018, Citibank’s reportable Common Equity Tier 1 Capital, Tier 1 Capital and Total Capital ratios were the lower derived under the Basel III Standardized Approach. As of December 31, 2017, Citibank’s reportable Common Equity Tier 1 Capital and Tier 1 Capital ratios were the lower derived under the Basel III Standardized Approach, whereas the reportable Total Capital ratio was the lower derived under the Basel III Advanced Approaches framework. |

| (4) | Citibank must maintain minimum Common Equity Tier 1 Capital, Tier 1 Capital, Total Capital and Tier 1 Leverage ratios of 6.5%, 8.0%, 10.0% and 5.0%, respectively, to be considered “well capitalized” under the revised Prompt Corrective Action (PCA) regulations applicable to insured depository institutions as established by the U.S. Basel III rules. Effective January 1, 2018, Citibank must also maintain a minimum Supplementary Leverage ratio of 6.0% to be considered “well capitalized.” For additional information, see “Capital Resources—Current Regulatory Capital Standards—Prompt Corrective Action Framework” in Citigroup’s 2017 Annual Report on Form 10-K. |

| (5) | Tier 1 Leverage ratio denominator. |

| (6) | Supplementary Leverage ratio denominator. |

Common Equity Tier 1 Capital ratio | Tier 1 Capital ratio | Total Capital ratio | ||||

| In basis points | Impact of $100 million change in Common Equity Tier 1 Capital | Impact of $1 billion change in risk- weighted assets | Impact of $100 million change in Tier 1 Capital | Impact of $1 billion change in risk- weighted assets | Impact of $100 million change in Total Capital | Impact of $1 billion change in risk- weighted assets |

| Citigroup | ||||||

| Advanced Approaches | 0.8 | 1.0 | 0.8 | 1.2 | 0.8 | 1.4 |

| Standardized Approach | 0.8 | 1.0 | 0.8 | 1.1 | 0.8 | 1.4 |

| Citibank | ||||||

| Advanced Approaches | 1.0 | 1.4 | 1.0 | 1.4 | 1.0 | 1.5 |

| Standardized Approach | 1.0 | 1.2 | 1.0 | 1.2 | 1.0 | 1.4 |

| Tier 1 Leverage ratio | Supplementary Leverage ratio | |||