| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Delaware | 13-3317783 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| Indicate by check mark: | Yes | No | |

| • whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ý | ¨ | |

| • whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | ý | ¨ | |

| • whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, | |||

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ | |||

| • whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) | ¨ | ý | |

| Item | Description | Page | Description | Page |

| 1. | FINANCIAL STATEMENTS | |||

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

Condensed Consolidated Statements of Operations — For the Three Months Ended March 31, 2016 and 2015 | CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |||

Condensed Consolidated Statements of Comprehensive Income — For the Three Months Ended March 31, 2016 and 2015 | CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |||

Condensed Consolidated Balance Sheets — As of March 31, 2016 and December 31, 2015 | CONDENSED CONSOLIDATED BALANCE SHEETS - AS OF MARCH 31, 2017 AND DECEMBER 31, 2016 | |||

Condensed Consolidated Statements of Changes in Stockholders’ Equity — For the Three Months Ended March 31, 2016 and 2015 | CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |||

Condensed Consolidated Statements of Cash Flows — For the Three Months Ended March 31, 2016 and 2015 | CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 | |||

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | ||||

| 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |||

| 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||

| 4. | CONTROLS AND PROCEDURES | |||

| 1. | LEGAL PROCEEDINGS | |||

| 1A. | RISK FACTORS | |||

| 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |||

| 6. | EXHIBITS | |||

| SIGNATURE | ||||

| EXHIBITS INDEX | ||||

| ◦ | challenges related to the Company’s current operating environment, including global political, economic and market conditions, and the effect of financial market disruptions, economic downturns or other potentially adverse macroeconomic developments on the |

| ◦ | financial risk related to the continued reinvestment of our investment portfolios and performance of our hedge program for our |

| ◦ | market risks associated with our business, including changes in |

| ◦ | the impact on our investment portfolio if our investment portfolio is concentrated in any particular segment of the economy; |

| ◦ | the possibility of unfavorable loss development, including with respect to long-tailed exposures; |

| ◦ | the possibility of a pandemic, earthquake, or other natural or man-made disaster that may adversely affect our businesses; |

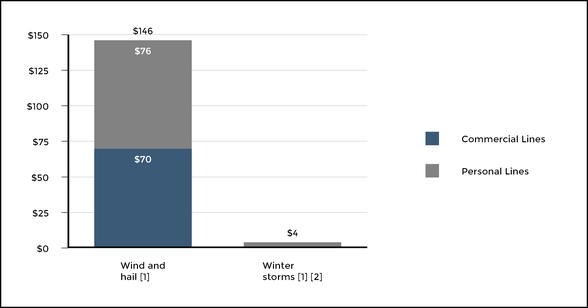

| ◦ | weather and other natural physical events, including the severity and frequency of storms, hail, winter storms, hurricanes and tropical storms, as well as climate change and its potential impact on weather patterns; |

| ◦ | the possible occurrence of terrorist attacks and the Company’s |

| ◦ | the |

| ◦ | actions by |

| ◦ | technology changes, such as usage-based methods of determining premiums, advancement in automotive safety features, the development of autonomous vehicles, and platforms that facilitate ride sharing, which may alter demand for the Company's products, impact the frequency or severity of losses, and/or impact the way the Company markets, distributes and underwrites its products; |

| ◦ | the Company’s ability to market, distribute and provide insurance products and investment advisory services through current and future distribution channels and advisory firms; |

| ◦ | the |

| ◦ | volatility in our statutory and United States ("U.S.") |

| ◦ |

| ◦ | the impact on our statutory capital of |

| ◦ |

| ◦ | the potential for losses due to our reinsurers’ unwillingness or inability to meet their obligations under reinsurance contracts and the availability, pricing and adequacy of reinsurance to protect the Company against losses; |

| ◦ | risk associated with the use of analytical models in |

| ◦ | the |

| ◦ | the potential for further acceleration of deferred policy acquisition cost amortization and an increase in reserve for certain guaranteed benefits in our variable annuities; |

| ◦ | the potential for further impairments of our goodwill or the potential for changes in |

| ◦ | the significant uncertainties that limit our ability to estimate the ultimate reserves necessary for asbestos and |

| ◦ | risks associated with the |

| ◦ | the Company’s ability to maintain the availability of its systems and safeguard the security of its data in the event of a disaster, cyber or other information security incident or other unanticipated event; |

| ◦ | the |

| ◦ | the potential for difficulties arising from outsourcing and similar third-party relationships; |

| ◦ | the Company’s ability to protect its intellectual property and defend against claims of |

| ◦ | the cost and other potential effects of increased regulatory and legislative developments, including those that could adversely impact the demand for the Company’s products, operating costs and required capital levels; |

| ◦ | unfavorable judicial or legislative developments; |

| ◦ | the impact of changes in federal or state tax laws; |

| ◦ | regulatory requirements that could delay, deter or prevent a takeover attempt that shareholders might consider in their best interests; and |

| ◦ | the impact of potential changes in accounting principles and related financial reporting requirements. |

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||

| (In millions, except for per share data) | 2016 | 2015 | 2017 | 2016 | ||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Revenues | ||||||||||||

| Earned premiums | $ | 3,404 | $ | 3,322 | $ | 3,473 | $ | 3,404 | ||||

| Fee income | 426 | 459 | 455 | 445 | ||||||||

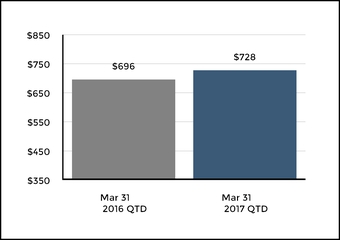

| Net investment income | 696 | 809 | 728 | 696 | ||||||||

| Net realized capital gains (losses): | ||||||||||||

| Total other-than-temporary impairment ("OTTI") losses | (27 | ) | (12 | ) | (3 | ) | (27 | ) | ||||

| OTTI losses recognized in other comprehensive income (loss) (“OCI”) | 4 | — | ||||||||||

| OTTI losses recognized in other comprehensive income (“OCI”) | 2 | 4 | ||||||||||

| Net OTTI losses recognized in earnings | (23 | ) | (12 | ) | (1 | ) | (23 | ) | ||||

| Other net realized capital gains (losses) | (132 | ) | 17 | |||||||||

| Total net realized capital gains (losses) | (155 | ) | 5 | |||||||||

| Other net realized capital losses | (19 | ) | (132 | ) | ||||||||

| Total net realized capital losses | (20 | ) | (155 | ) | ||||||||

| Other revenues | 20 | 22 | 19 | 20 | ||||||||

| Total revenues | 4,391 | 4,617 | 4,655 | 4,410 | ||||||||

| Benefits, losses and expenses | ||||||||||||

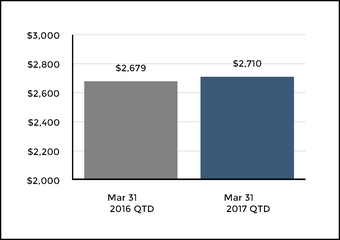

| Benefits, losses and loss adjustment expenses | 2,641 | 2,563 | 2,757 | 2,641 | ||||||||

| Amortization of deferred policy acquisition costs ("DAC") | 374 | 387 | 363 | 374 | ||||||||

| Insurance operating costs and other expenses | 909 | 948 | 965 | 928 | ||||||||

| Interest expense | 86 | 94 | 83 | 86 | ||||||||

| Total benefits, losses and expenses | 4,010 | 3,992 | 4,168 | 4,029 | ||||||||

| Income before income taxes | 381 | 625 | 487 | 381 | ||||||||

| Income tax expense | 58 | 158 | 109 | 58 | ||||||||

| Net income | $ | 323 | $ | 467 | $ | 378 | $ | 323 | ||||

| Net income per common share | ||||||||||||

| Basic | $ | 0.81 | $ | 1.11 | $ | 1.02 | $ | 0.81 | ||||

| Diluted | $ | 0.79 | $ | 1.08 | $ | 1.00 | $ | 0.79 | ||||

| Cash dividends declared per common share | $ | 0.21 | $ | 0.18 | $ | 0.23 | $ | 0.21 | ||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||

| (In millions) | 2016 | 2015 | 2017 | 2016 | ||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Net income | $ | 323 | $ | 467 | $ | 378 | $ | 323 | ||||

| Other comprehensive income (loss): | ||||||||||||

| Changes in net unrealized gain on securities | 522 | 208 | 137 | 522 | ||||||||

| Changes in OTTI losses recognized in other comprehensive income | (8 | ) | (3 | ) | (1 | ) | (8 | ) | ||||

| Changes in net gain on cash flow hedging instruments | 54 | 27 | (18 | ) | 54 | |||||||

| Changes in foreign currency translation adjustments | 6 | (20 | ) | 2 | 6 | |||||||

| Changes in pension and other postretirement plan adjustments | 9 | 10 | 10 | 9 | ||||||||

| OCI, net of tax | 583 | 222 | 130 | 583 | ||||||||

| Comprehensive income | $ | 906 | $ | 689 | $ | 508 | $ | 906 | ||||

| (In millions, except for share and per share data) | March 31, 2016 | December 31, 2015 | March 31, 2017 | December 31, 2016 | ||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Assets | ||||||||||||

| Investments: | ||||||||||||

| Fixed maturities, available-for-sale, at fair value (amortized cost of $57,378 and $56,965) | $ | 60,693 | $ | 59,196 | ||||||||

| Fixed maturities, at fair value using the fair value option (includes variable interest entity assets of $0 and $150) | 486 | 503 | ||||||||||

| Equity securities, available-for-sale, at fair value (cost of $767 and $1,135) (includes equity securities, at fair value using the fair value option, of $0 and $282, and variable interest entity assets of $0 and $1) | 798 | 1,121 | ||||||||||

| Mortgage loans (net of allowances for loan losses of $22 and $23) | 5,637 | 5,624 | ||||||||||

| Fixed maturities, available-for-sale, at fair value (amortized cost of $53,908 and $53,805) | $ | 56,326 | $ | 56,003 | ||||||||

| Fixed maturities, at fair value using the fair value option | 160 | 293 | ||||||||||

| Equity securities, available-for-sale, at fair value (cost of $1,135 and $1,020) (includes equity securities, at fair value using the fair value option, of $123 and $0) | 1,223 | 1,097 | ||||||||||

| Mortgage loans (net of allowances for loan losses of $19 and $19) | 5,685 | 5,697 | ||||||||||

| Policy loans, at outstanding balance | 1,444 | 1,447 | 1,442 | 1,444 | ||||||||

| Limited partnerships and other alternative investments (includes variable interest entity assets of $394 and $2) | 2,654 | 2,874 | ||||||||||

| Limited partnerships and other alternative investments | 2,418 | 2,456 | ||||||||||

| Other investments | 280 | 120 | 340 | 403 | ||||||||

| Short-term investments (includes variable interest entity assets, at fair value, of $60 and $3) | 1,918 | 1,843 | ||||||||||

| Short-term investments | 4,595 | 3,244 | ||||||||||

| Total investments | 73,910 | 72,728 | 72,189 | 70,637 | ||||||||

| Cash (includes variable interest entity assets, at fair value, of $5 and $10) | 479 | 448 | ||||||||||

| Cash (includes variable interest entity assets, at fair value, of $5 and $5) | 337 | 882 | ||||||||||

| Premiums receivable and agents’ balances, net | 3,605 | 3,537 | 3,764 | 3,731 | ||||||||

| Reinsurance recoverables, net | 23,125 | 23,189 | 23,405 | 23,311 | ||||||||

| Deferred policy acquisition costs | 1,694 | 1,816 | 1,693 | 1,711 | ||||||||

| Deferred income taxes, net | 2,868 | 3,206 | 3,105 | 3,281 | ||||||||

| Goodwill | 498 | 498 | 567 | 567 | ||||||||

| Property and equipment, net | 995 | 974 | 984 | 991 | ||||||||

| Other assets (includes variable interest entity assets of $4 and $0) | 1,958 | 1,829 | ||||||||||

| Other assets | 1,839 | 1,786 | ||||||||||

| Assets held for sale | 923 | 870 | ||||||||||

| Separate account assets | 118,361 | 120,123 | 116,582 | 115,665 | ||||||||

| Total assets | $ | 227,493 | $ | 228,348 | $ | 225,388 | $ | 223,432 | ||||

| Liabilities | ||||||||||||

| Reserve for future policy benefits and unpaid losses and loss adjustment expenses | $ | 41,842 | $ | 41,572 | ||||||||

| Unpaid losses and loss adjustment expenses | $ | 27,687 | $ | 27,605 | ||||||||

| Reserve for future policy benefits | 14,051 | 13,929 | ||||||||||

| Other policyholder funds and benefits payable | 31,525 | 31,670 | 30,863 | 31,176 | ||||||||

| Unearned premiums | 5,497 | 5,385 | 5,609 | 5,499 | ||||||||

| Short-term debt | 690 | 275 | 320 | 416 | ||||||||

| Long-term debt | 4,633 | 5,084 | 4,817 | 4,636 | ||||||||

| Other liabilities (includes variable interest entity liabilities of $5 and $12) | 6,833 | 6,597 | ||||||||||

| Other liabilities (includes variable interest entity liabilities of $5 and $5) | 7,789 | 6,992 | ||||||||||

| Liabilities held for sale | 661 | 611 | ||||||||||

| Separate account liabilities | 118,361 | 120,123 | 116,582 | 115,665 | ||||||||

| Total liabilities | $ | 209,381 | $ | 210,706 | $ | 208,379 | $ | 206,529 | ||||

| Commitments and Contingencies (Note 8) | ||||||||||||

| Commitments and Contingencies (Note 12) | ||||||||||||

| Stockholders’ Equity | ||||||||||||

| Common stock, $0.01 par value — 1,500,000,000 shares authorized, 490,923,222 and 490,923,222 shares issued | 5 | 5 | ||||||||||

| Common stock, $0.01 par value — 1,500,000,000 shares authorized, 402,923,222 and 402,923,222 shares issued | 4 | 4 | ||||||||||

| Additional paid-in capital | 8,885 | 8,973 | 5,177 | 5,247 | ||||||||

| Retained earnings | 12,789 | 12,550 | 13,406 | 13,114 | ||||||||

| Treasury stock, at cost — 95,319,786 and 89,102,038 shares | (3,821 | ) | (3,557 | ) | ||||||||

| Treasury stock, at cost — 33,726,771 and 28,974,069 shares | (1,371 | ) | (1,125 | ) | ||||||||

| Accumulated other comprehensive income ("AOCI"), net of tax | 254 | (329 | ) | (207 | ) | (337 | ) | |||||

| Total stockholders’ equity | $ | 18,112 | $ | 17,642 | $ | 17,009 | $ | 16,903 | ||||

| Total liabilities and stockholders’ equity | $ | 227,493 | $ | 228,348 | $ | 225,388 | $ | 223,432 | ||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||

| (In millions, except for share data) | 2016 | 2015 | 2017 | 2016 | ||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Common Stock | $ | 5 | $ | 5 | $ | 4 | $ | 5 | ||||

| Additional Paid-in Capital, beginning of period | 8,973 | 9,123 | 5,247 | 8,973 | ||||||||

| Issuance of shares under incentive and stock compensation plans | (124 | ) | (150 | ) | (66 | ) | (124 | ) | ||||

| Stock-based compensation plans expense | 19 | 16 | 36 | 19 | ||||||||

| Tax benefit on employee stock options and share-based awards | 24 | 26 | — | 24 | ||||||||

| Issuance of shares for warrant exercise | (7 | ) | (19 | ) | (40 | ) | (7 | ) | ||||

| Additional Paid-in Capital, end of period | 8,885 | 8,996 | 5,177 | 8,885 | ||||||||

| Retained Earnings, beginning of period | 12,550 | 11,191 | 13,114 | 12,550 | ||||||||

| Net income | 323 | 467 | 378 | 323 | ||||||||

| Dividends declared on common stock | (84 | ) | (75 | ) | (86 | ) | (84 | ) | ||||

| Retained Earnings, end of period | 12,789 | 11,583 | 13,406 | 12,789 | ||||||||

| Treasury Stock, at cost, beginning of period | (3,557 | ) | (2,527 | ) | (1,125 | ) | (3,557 | ) | ||||

| Treasury stock acquired | (350 | ) | (250 | ) | (325 | ) | (350 | ) | ||||

| Issuance of shares under incentive and stock compensation plans | 125 | 154 | 72 | 125 | ||||||||

| Net shares acquired related to employee incentive and stock compensation plans | (46 | ) | (53 | ) | (33 | ) | (46 | ) | ||||

| Issuance of shares for warrant exercise | 7 | 19 | 40 | 7 | ||||||||

| Treasury Stock, at cost, end of period | (3,821 | ) | (2,657 | ) | (1,371 | ) | (3,821 | ) | ||||

| Accumulated Other Comprehensive Income (Loss), net of tax, beginning of period | (329 | ) | 928 | (337 | ) | (329 | ) | |||||

| Total other comprehensive income (loss) | 583 | 222 | 130 | 583 | ||||||||

| Accumulated Other Comprehensive Income (Loss), net of tax, end of period | 254 | 1,150 | (207 | ) | 254 | |||||||

| Total Stockholders’ Equity | $ | 18,112 | $ | 19,077 | $ | 17,009 | $ | 18,112 | ||||

| Common Shares Outstanding, beginning of period (in thousands) | 401,821 | 424,416 | 373,949 | 401,821 | ||||||||

| Treasury stock acquired | (8,394 | ) | (6,128 | ) | (6,709 | ) | (8,394 | ) | ||||

| Issuance of shares under incentive and stock compensation plans | 3,069 | 3,923 | 1,690 | 3,069 | ||||||||

| Return of shares under incentive and stock compensation plans to treasury stock | (1,066 | ) | (1,299 | ) | (674 | ) | (1,066 | ) | ||||

| Issuance of shares for warrant exercise | 173 | 477 | 940 | 173 | ||||||||

| Common Shares Outstanding, at end of period | 395,603 | 421,389 | 369,196 | 395,603 | ||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||

| (In millions) | 2016 | 2015 | 2017 | 2016 | ||||||||

| Operating Activities | (Unaudited) | (Unaudited) | ||||||||||

| Net income | $ | 323 | $ | 467 | $ | 378 | $ | 323 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||

| Net realized capital (gains) losses | 155 | (5 | ) | |||||||||

| Net realized capital losses | 20 | 155 | ||||||||||

| Amortization of deferred policy acquisition costs | 374 | 387 | 363 | 374 | ||||||||

| Additions to deferred policy acquisition costs | (354 | ) | (354 | ) | (352 | ) | (354 | ) | ||||

| Depreciation and amortization | 95 | 101 | 96 | 95 | ||||||||

| Other operating activities, net | 81 | 22 | 111 | 81 | ||||||||

| Change in assets and liabilities: | ||||||||||||

| Decrease in reinsurance recoverables | 53 | 37 | ||||||||||

| (Increase) decrease in reinsurance recoverables | (7 | ) | 53 | |||||||||

| Increase (decrease) in deferred and accrued income taxes | (14 | ) | 168 | 256 | (14 | ) | ||||||

| Increase in reserve for future policy benefits and unpaid losses and loss adjustment expenses and unearned premiums | 158 | 120 | 293 | 158 | ||||||||

| Net change in other assets and other liabilities | (473 | ) | (496 | ) | (933 | ) | (473 | ) | ||||

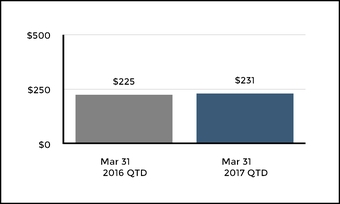

| Net cash provided by operating activities | 398 | 447 | 225 | 398 | ||||||||

| Investing Activities | ||||||||||||

| Proceeds from the sale/maturity/prepayment of: | ||||||||||||

| Fixed maturities, available-for-sale | 5,460 | 6,584 | 8,020 | 5,460 | ||||||||

| Fixed maturities, fair value option | 19 | 36 | 62 | 19 | ||||||||

| Equity securities, available-for-sale | 414 | 363 | 216 | 414 | ||||||||

| Mortgage loans | 114 | 104 | 213 | 114 | ||||||||

| Partnerships | 235 | 179 | 83 | 235 | ||||||||

| Payments for the purchase of: | ||||||||||||

| Fixed maturities, available-for-sale | (5,752 | ) | (7,375 | ) | (7,809 | ) | (5,752 | ) | ||||

| Fixed maturities, fair value option | (38 | ) | (59 | ) | — | (38 | ) | |||||

| Equity securities, available-for-sale | (130 | ) | (566 | ) | (278 | ) | (130 | ) | ||||

| Mortgage loans | (128 | ) | (154 | ) | (199 | ) | (128 | ) | ||||

| Partnerships | (88 | ) | (106 | ) | (86 | ) | (88 | ) | ||||

| Net proceeds from derivatives | 189 | 45 | ||||||||||

| Net increase (decrease) in policy loans | 2 | (24 | ) | |||||||||

| Net (payments for) proceeds from derivatives | (56 | ) | 189 | |||||||||

| Net increase in policy loans | 2 | 2 | ||||||||||

| Net additions to property and equipment | (84 | ) | (58 | ) | (41 | ) | (84 | ) | ||||

| Net proceeds from (payments for) short-term investments | (29 | ) | 1,325 | |||||||||

| Net payments for short-term investments | (1,317 | ) | (29 | ) | ||||||||

| Other investing activities, net | 10 | 1 | (18 | ) | 10 | |||||||

| Net cash provided by investing activities | 194 | 295 | ||||||||||

| Net cash provided (used) by investing activities | (1,208 | ) | 194 | |||||||||

| Financing Activities | ||||||||||||

| Deposits and other additions to investment and universal life-type contracts | 1,165 | 1,209 | 1,398 | 1,165 | ||||||||

| Withdrawals and other deductions from investment and universal life-type contracts | (4,174 | ) | (4,682 | ) | (3,773 | ) | (4,174 | ) | ||||

| Net transfers from separate accounts related to investment and universal life-type contracts | 2,810 | 3,175 | 2,057 | 2,810 | ||||||||

| Repayments at maturity or settlement of consumer notes | (5 | ) | (2 | ) | (7 | ) | (5 | ) | ||||

| Net increase in securities loaned or sold under agreements to repurchase | 64 | 323 | 1,115 | 64 | ||||||||

| Repayment of debt | — | (289 | ) | (416 | ) | — | ||||||

| Net issuance (return) of shares under incentive and stock compensation plans and excess tax benefit | 10 | (25 | ) | |||||||||

| Proceeds from the issuance of debt | 500 | — | ||||||||||

| Net (return) issuance of shares under incentive and stock compensation plans | (26 | ) | 10 | |||||||||

| Treasury stock acquired | (350 | ) | (250 | ) | (325 | ) | (350 | ) | ||||

| Dividends paid on common stock | (85 | ) | (78 | ) | (87 | ) | (85 | ) | ||||

| Net cash used for financing activities | (565 | ) | (619 | ) | ||||||||

| Net cash provided (used) for financing activities | 436 | (565 | ) | |||||||||

| Foreign exchange rate effect on cash | 4 | (22 | ) | 2 | 4 | |||||||

| Net increase in cash | 31 | 101 | ||||||||||

| Net (decrease) increase in cash | (545 | ) | 31 | |||||||||

| Cash – beginning of period | 448 | 399 | 882 | 448 | ||||||||

| Cash – end of period | $ | 479 | $ | 500 | $ | 337 | $ | 479 | ||||

| Supplemental Disclosure of Cash Flow Information | ||||||||||||

| Income tax refunds received | $ | — | $ | 47 | $ | 132 | $ | — | ||||

| Interest paid | $ | 71 | $ | 77 | $ | 71 | $ | 71 | ||||

| Carrying Value as of | ||

| March 31, 2017 | December 31, 2016 | |

| Assets | ||

| Cash and investments | $657 | $657 |

| Reinsurance recoverables and other [1] | 266 | 213 |

| Total assets held for sale | $923 | $870 |

| Liabilities | ||

| Reserve for future policy benefits and unpaid losses and loss adjustment expenses | $646 | $600 |

| Other liabilities | 15 | 11 |

| Total liabilities held for sale | $661 | $611 |

| [1] | Includes intercompany reinsurance recoverables of $69 and $71 to be settled in cash or securities prior to closing as of March 31, 2017 and December 31, 2016, respectively. |

| Computation of Basic and Diluted Earnings per Common Share | Computation of Basic and Diluted Earnings per Common Share | |||||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||

| (In millions, except for per share data) | 2016 | 2015 | 2017 | 2016 | ||||||||

| Earnings | ||||||||||||

| Net income | $ | 323 | $ | 467 | $ | 378 | $ | 323 | ||||

| Shares | ||||||||||||

| Weighted average common shares outstanding, basic | 398.5 | 422.6 | 371.4 | 398.5 | ||||||||

| Dilutive effect of stock compensation plans | 4.2 | 5.5 | 4.2 | 4.2 | ||||||||

| Dilutive effect of warrants | 3.6 | 5.6 | 3.0 | 3.6 | ||||||||

| Weighted average common shares outstanding and dilutive potential common shares | 406.3 | 433.7 | 378.6 | 406.3 | ||||||||

| Net income per common share | ||||||||||||

| Basic | $ | 0.81 | $ | 1.11 | $ | 1.02 | $ | 0.81 | ||||

| Diluted | $ | 0.79 | $ | 1.08 | $ | 1.00 | $ | 0.79 | ||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||

| Net Income (Loss) | 2016 | 2015 | 2017 | 2016 | ||||||||

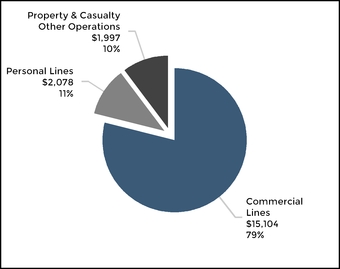

| Commercial Lines | $ | 228 | $ | 240 | ||||||||

| Personal Lines | 20 | 76 | ||||||||||

| Commercial Lines [1] | $ | 231 | $ | 225 | ||||||||

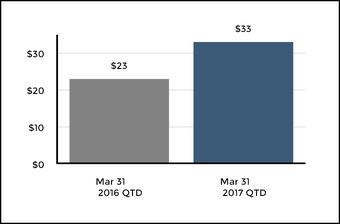

| Personal Lines [1] | 33 | 23 | ||||||||||

| Property & Casualty Other Operations | 17 | 23 | 24 | 17 | ||||||||

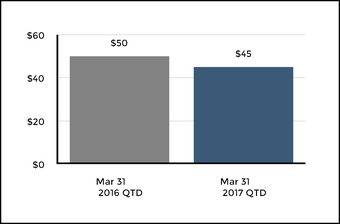

| Group Benefits | 50 | 52 | 45 | 50 | ||||||||

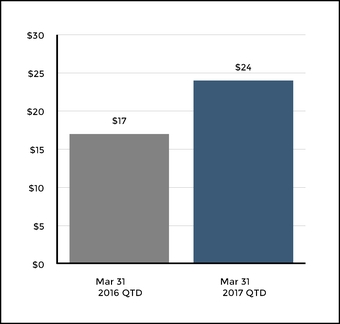

| Mutual Funds | 20 | 22 | 23 | 20 | ||||||||

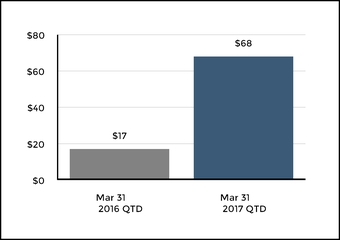

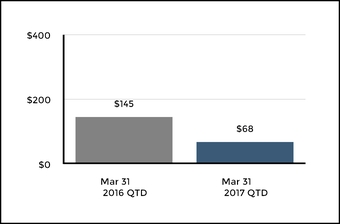

| Talcott Resolution | 17 | 111 | 68 | 17 | ||||||||

| Corporate | (29 | ) | (57 | ) | (46 | ) | (29 | ) | ||||

| Net income | $ | 323 | $ | 467 | $ | 378 | $ | 323 | ||||

| [1] | For the three months ended March 31, 2017 and 2016 there was a segment change which resulted in a movement from Commercial Lines to Personal Lines of $3 of net servicing revenues associated with our participation in the National Flood Insurance Program. |

| Three Months Ended March 31, | ||||||

| Revenues | 2017 | 2016 | ||||

| Earned premiums and fee income | ||||||

| Commercial Lines | ||||||

| Workers’ compensation | $ | 813 | $ | 759 | ||

| Liability | 148 | 143 | ||||

| Package business | 314 | 308 | ||||

| Automobile | 161 | 158 | ||||

| Professional liability | 60 | 53 | ||||

| Bond | 55 | 53 | ||||

| Property | 147 | 159 | ||||

| Total Commercial Lines [1] | 1,698 | 1,633 | ||||

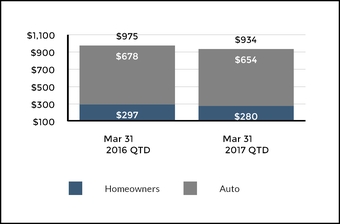

| Personal Lines | ||||||

| Automobile | 662 | 685 | ||||

| Homeowners | 283 | 299 | ||||

| Total Personal Lines [1] [2] | 945 | 984 | ||||

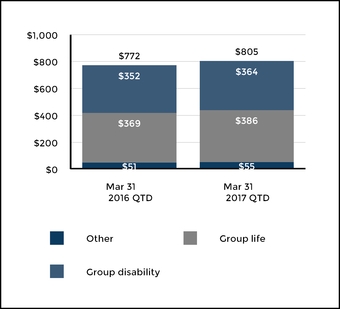

| Group Benefits | ||||||

| Group disability | 381 | 369 | ||||

| Group life | 399 | 375 | ||||

| Other | 55 | 51 | ||||

| Total Group Benefits | 835 | 795 | ||||

| Mutual Funds | ||||||

| Mutual Fund | 167 | 142 | ||||

| Talcott | 24 | 25 | ||||

| Total Mutual Funds | 191 | 167 | ||||

| Talcott Resolution | 258 | 269 | ||||

| Corporate | 1 | 1 | ||||

| Total earned premiums and fee income | 3,928 | 3,849 | ||||

| Net investment income | 728 | 696 | ||||

| Net realized capital losses | (20 | ) | (155 | ) | ||

| Other revenues | 19 | 20 | ||||

| Total revenues | $ | 4,655 | $ | 4,410 | ||

| [1] | Commercial Lines and Personal Lines includes installment fees of $10 and $11, respectively, for the three months ended March 31, 2017. Commercial Lines and Personal Lines includes installment fees of $10 and $9, respectively, for the three months ended March 31, 2016. |

| [2] | For the three months endedMarch 31, 2017 and 2016, AARP members accounted for earned premiums of $800 and $807, respectively. |

| Three Months Ended March 31, | ||||||

| Revenues | 2016 | 2015 | ||||

| Earned premiums and fee income | ||||||

| Commercial Lines | ||||||

| Workers’ compensation | $ | 755 | $ | 744 | ||

| Property | 159 | 156 | ||||

| Automobile | 157 | 148 | ||||

| Package business | 303 | 292 | ||||

| Liability | 143 | 135 | ||||

| Bond | 53 | 53 | ||||

| Professional liability | 53 | 55 | ||||

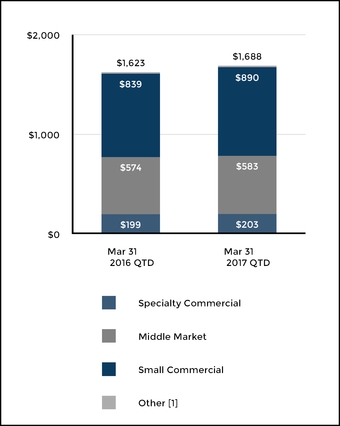

| Total Commercial Lines | 1,623 | 1,583 | ||||

| Personal Lines | ||||||

| Automobile | 678 | 655 | ||||

| Homeowners | 297 | 297 | ||||

| Total Personal Lines [1] | 975 | 952 | ||||

| Group Benefits | ||||||

| Group disability | 369 | 371 | ||||

| Group life | 375 | 365 | ||||

| Other | 51 | 44 | ||||

| Total Group Benefits | 795 | 780 | ||||

| Mutual Funds | ||||||

| Mutual Fund | 142 | 149 | ||||

| Talcott | 25 | 30 | ||||

| Total Mutual Funds | 167 | 179 | ||||

| Talcott Resolution | 269 | 285 | ||||

| Corporate | 1 | 2 | ||||

| Total earned premiums and fee income | 3,830 | 3,781 | ||||

| Net investment income | 696 | 809 | ||||

| Net realized capital gains (losses) | (155 | ) | 5 | |||

| Other revenues | 20 | 22 | ||||

| Total revenues | $ | 4,391 | $ | 4,617 | ||

| Level 1 |

| Level 2 |

| Level 3 |

| March 31, 2016 | ||||||||||||||||||||||||

| Assets and (Liabilities) Carried at Fair Value by Hierarchy Level as of March 31, 2017 | Assets and (Liabilities) Carried at Fair Value by Hierarchy Level as of March 31, 2017 | |||||||||||||||||||||||

| Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||||||

| Assets accounted for at fair value on a recurring basis | ||||||||||||||||||||||||

| Fixed maturities, AFS | ||||||||||||||||||||||||

| Asset-backed-securities ("ABS") | $ | 2,665 | $ | — | $ | 2,633 | $ | 32 | $ | 2,265 | $ | — | $ | 2,140 | $ | 125 | ||||||||

| Collateralized debt obligations ("CDOs") | 3,107 | — | 2,565 | 542 | 2,311 | — | 1,992 | 319 | ||||||||||||||||

| Commercial mortgage-backed securities ("CMBS") | 5,224 | — | 5,090 | 134 | 5,099 | — | 4,982 | 117 | ||||||||||||||||

| Corporate | 27,297 | — | 26,463 | 834 | 25,730 | — | 24,652 | 1,078 | ||||||||||||||||

| Foreign government/government agencies | 1,189 | — | 1,113 | 76 | 1,187 | — | 1,121 | 66 | ||||||||||||||||

| Municipal | 12,303 | — | 12,253 | 50 | ||||||||||||||||||||

| Bonds of municipalities and political subdivisions ("municipal bonds") | 11,780 | — | 11,663 | 117 | ||||||||||||||||||||

| Residential mortgage-backed securities ("RMBS") | 4,338 | — | 2,452 | 1,886 | 3,921 | — | 1,873 | 2,048 | ||||||||||||||||

| U.S. Treasuries | 4,570 | 67 | 4,503 | — | 4,033 | 688 | 3,345 | — | ||||||||||||||||

| Total fixed maturities | 60,693 | 67 | 57,072 | 3,554 | 56,326 | 688 | 51,768 | 3,870 | ||||||||||||||||

| Fixed maturities, FVO | 486 | — | 472 | 14 | 160 | — | 160 | — | ||||||||||||||||

| Equity securities, trading [1] | 11 | 11 | — | — | 11 | 11 | — | — | ||||||||||||||||

| Equity securities, AFS | 798 | 548 | 158 | 92 | 1,223 | 936 | 188 | 99 | ||||||||||||||||

| Derivative assets | ||||||||||||||||||||||||

| Credit derivatives | 16 | — | 16 | — | 2 | — | 2 | — | ||||||||||||||||

| Equity derivatives | 2 | — | — | 2 | 4 | — | — | 4 | ||||||||||||||||

| Foreign exchange derivatives | 5 | — | 5 | — | 3 | — | 3 | — | ||||||||||||||||

| Interest rate derivatives | (138 | ) | — | (138 | ) | — | 48 | — | 43 | 5 | ||||||||||||||

| Guaranteed minimum withdrawal benefit ("GMWB") hedging instruments | 146 | — | 61 | 85 | ||||||||||||||||||||

| GMWB hedging instruments | 80 | — | 36 | 44 | ||||||||||||||||||||

| Macro hedge program | 64 | — | — | 64 | 113 | — | 9 | 104 | ||||||||||||||||

| Other derivative contracts | 5 | — | — | 5 | ||||||||||||||||||||

| Total derivative assets [2] | 100 | — | (56 | ) | 156 | 250 | — | 93 | 157 | |||||||||||||||

| Short-term investments | 1,918 | 447 | 1,471 | — | 4,595 | 2,077 | 2,518 | — | ||||||||||||||||

| Limited partnerships and other alternative investments [3] | 394 | — | — | — | ||||||||||||||||||||

| Reinsurance recoverable for GMWB | 99 | — | — | 99 | 60 | — | — | 60 | ||||||||||||||||

| Modified coinsurance reinsurance contracts | 57 | — | 57 | — | 66 | — | 66 | — | ||||||||||||||||

| Separate account assets [4] | 115,959 | 74,486 | 40,156 | 155 | ||||||||||||||||||||

| Separate account assets [3] | 113,585 | 73,539 | 38,882 | 277 | ||||||||||||||||||||

| Total assets accounted for at fair value on a recurring basis | $ | 180,515 | $ | 75,559 | $ | 99,330 | $ | 4,070 | $ | 176,276 | $ | 77,251 | $ | 93,675 | $ | 4,463 | ||||||||

| Liabilities accounted for at fair value on a recurring basis | ||||||||||||||||||||||||

| Other policyholder funds and benefits payable | ||||||||||||||||||||||||

| GMWB | $ | (361 | ) | $ | — | $ | — | $ | (361 | ) | ||||||||||||||

| GMWB embedded derivative | $ | (157 | ) | $ | — | $ | — | $ | (157 | ) | ||||||||||||||

| Equity linked notes | (25 | ) | — | — | (25 | ) | (36 | ) | — | — | (36 | ) | ||||||||||||

| Total other policyholder funds and benefits payable | (386 | ) | — | — | (386 | ) | (193 | ) | — | — | (193 | ) | ||||||||||||

| Derivative liabilities | ||||||||||||||||||||||||

| Credit derivatives | (39 | ) | — | (39 | ) | — | (2 | ) | — | (2 | ) | — | ||||||||||||

| Equity derivatives | 28 | — | 25 | 3 | 37 | — | 37 | — | ||||||||||||||||

| Foreign exchange derivatives | (338 | ) | — | (338 | ) | — | (262 | ) | — | (262 | ) | — | ||||||||||||

| Interest rate derivatives | (665 | ) | — | (637 | ) | (28 | ) | (517 | ) | — | (488 | ) | (29 | ) | ||||||||||

| GMWB hedging instruments | 46 | — | (13 | ) | 59 | 3 | — | 1 | 2 | |||||||||||||||

| Macro hedge program | 81 | — | — | 81 | 58 | — | 3 | 55 | ||||||||||||||||

| Total derivative liabilities [5] | (887 | ) | — | (1,002 | ) | 115 | ||||||||||||||||||

| Total derivative liabilities [4] | (683 | ) | — | (711 | ) | 28 | ||||||||||||||||||

| Contingent consideration [5] | (26 | ) | — | — | (26 | ) | ||||||||||||||||||

| Total liabilities accounted for at fair value on a recurring basis | $ | (1,273 | ) | $ | — | $ | (1,002 | ) | $ | (271 | ) | $ | (902 | ) | $ | — | $ | (711 | ) | $ | (191 | ) | ||

| December 31, 2015 | ||||||||||||

| Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||

| Assets accounted for at fair value on a recurring basis | ||||||||||||

| Fixed maturities, AFS | ||||||||||||

| ABS | $ | 2,499 | $ | — | $ | 2,462 | $ | 37 | ||||

| CDOs | 3,038 | — | 2,497 | 541 | ||||||||

| CMBS | 4,717 | — | 4,567 | 150 | ||||||||

| Corporate | 26,802 | — | 25,948 | 854 | ||||||||

| Foreign government/government agencies | 1,308 | — | 1,248 | 60 | ||||||||

| Municipal | 12,121 | — | 12,072 | 49 | ||||||||

| RMBS | 4,046 | — | 2,424 | 1,622 | ||||||||

| U.S. Treasuries | 4,665 | 740 | 3,925 | — | ||||||||

| Total fixed maturities | 59,196 | 740 | 55,143 | 3,313 | ||||||||

| Fixed maturities, FVO | 503 | 2 | 485 | 16 | ||||||||

| Equity securities, trading [1] | 11 | 11 | ||||||||||

| Equity securities, AFS | 1,121 | 874 | 154 | 93 | ||||||||

| Derivative assets | ||||||||||||

| Credit derivatives | 21 | — | 21 | — | ||||||||

| Foreign exchange derivatives | 15 | — | 15 | — | ||||||||

| Interest rate derivatives | (227 | ) | — | (227 | ) | — | ||||||

| GMWB hedging instruments | 111 | — | 27 | 84 | ||||||||

| Macro hedge program | 74 | — | — | 74 | ||||||||

| Other derivative contracts | 7 | — | — | 7 | ||||||||

| Total derivative assets [2] | 1 | — | (164 | ) | 165 | |||||||

| Short-term investments | 1,843 | 333 | 1,510 | — | ||||||||

| Limited partnerships and other alternative investments [3] | 622 | — | — | — | ||||||||

| Reinsurance recoverable for GMWB | 83 | — | — | 83 | ||||||||

| Modified coinsurance reinsurance contracts | 79 | — | 79 | — | ||||||||

| Separate account assets [4] | 118,174 | 78,110 | 38,700 | 140 | ||||||||

| Total assets accounted for at fair value on a recurring basis | $ | 181,633 | $ | 80,070 | $ | 95,907 | $ | 3,810 | ||||

| Liabilities accounted for at fair value on a recurring basis | ||||||||||||

| Other policyholder funds and benefits payable | ||||||||||||

| GMWB | $ | (262 | ) | $ | — | $ | — | $ | (262 | ) | ||

| Equity linked notes | (26 | ) | — | — | (26 | ) | ||||||

| Total other policyholder funds and benefits payable | (288 | ) | — | — | (288 | ) | ||||||

| Derivative liabilities | ||||||||||||

| Credit derivatives | (16 | ) | — | (16 | ) | — | ||||||

| Equity derivatives | 41 | — | 41 | — | ||||||||

| Foreign exchange derivatives | (374 | ) | — | (374 | ) | — | ||||||

| Interest rate derivatives | (569 | ) | — | (547 | ) | (22 | ) | |||||

| GMWB hedging instruments | 47 | — | (4 | ) | 51 | |||||||

| Macro hedge program | 73 | — | — | 73 | ||||||||

| Total derivative liabilities [5] | (798 | ) | — | (900 | ) | 102 | ||||||

| Total liabilities accounted for at fair value on a recurring basis | $ | (1,086 | ) | $ | — | $ | (900 | ) | $ | (186 | ) | |

| Assets and (Liabilities) Carried at Fair Value by Hierarchy Level as of December 31, 2016 | ||||||||||||

| Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||

| Assets accounted for at fair value on a recurring basis | ||||||||||||

| Fixed maturities, AFS | ||||||||||||

| ABS | $ | 2,382 | $ | — | $ | 2,300 | $ | 82 | ||||

| CDOs | 1,916 | — | 1,502 | 414 | ||||||||

| CMBS | 4,936 | — | 4,856 | 80 | ||||||||

| Corporate | 25,666 | — | 24,586 | 1,080 | ||||||||

| Foreign government/government agencies | 1,171 | — | 1,107 | 64 | ||||||||

| Municipal bonds | 11,486 | — | 11,368 | 118 | ||||||||

| RMBS | 4,767 | — | 2,795 | 1,972 | ||||||||

| U.S. Treasuries | 3,679 | 620 | 3,059 | — | ||||||||

| Total fixed maturities | 56,003 | 620 | 51,573 | 3,810 | ||||||||

| Fixed maturities, FVO | 293 | 1 | 281 | 11 | ||||||||

| Equity securities, trading [1] | 11 | 11 | — | — | ||||||||

| Equity securities, AFS | 1,097 | 821 | 177 | 99 | ||||||||

| Derivative assets | ||||||||||||

| Credit derivatives | 17 | — | 17 | — | ||||||||

| Foreign exchange derivatives | 27 | — | 27 | — | ||||||||

| Interest rate derivatives | (427 | ) | — | (427 | ) | — | ||||||

| GMWB hedging instruments | 74 | — | 14 | 60 | ||||||||

| Macro hedge program | 128 | — | 8 | 120 | ||||||||

| Other derivative contracts | 1 | — | — | 1 | ||||||||

| Total derivative assets [2] | (180 | ) | — | (361 | ) | 181 | ||||||

| Short-term investments | 3,244 | 878 | 2,366 | — | ||||||||

| Reinsurance recoverable for GMWB | 73 | — | — | 73 | ||||||||

| Modified coinsurance reinsurance contracts | 68 | — | 68 | — | ||||||||

| Separate account assets [3] | 111,634 | 71,606 | 38,856 | 201 | ||||||||

| Total assets accounted for at fair value on a recurring basis | $ | 172,243 | $ | 73,937 | $ | 92,960 | $ | 4,375 | ||||

| Liabilities accounted for at fair value on a recurring basis | ||||||||||||

| Other policyholder funds and benefits payable | ||||||||||||

| GMWB embedded derivative | $ | (241 | ) | $ | — | $ | — | $ | (241 | ) | ||

| Equity linked notes | (33 | ) | — | — | (33 | ) | ||||||

| Total other policyholder funds and benefits payable | (274 | ) | — | — | (274 | ) | ||||||

| Derivative liabilities | ||||||||||||

| Credit derivatives | (13 | ) | — | (13 | ) | — | ||||||

| Equity derivatives | 33 | — | 33 | — | ||||||||

| Foreign exchange derivatives | (237 | ) | — | (237 | ) | — | ||||||

| Interest rate derivatives | (542 | ) | — | (521 | ) | (21 | ) | |||||

| GMWB hedging instruments | 20 | — | (1 | ) | 21 | |||||||

| Macro hedge program | 50 | — | 3 | 47 | ||||||||

| Total derivative liabilities [4] | (689 | ) | — | (736 | ) | 47 | ||||||

| Contingent consideration [5] | (25 | ) | — | — | (25 | ) | ||||||

| Total liabilities accounted for at fair value on a recurring basis | $ | (988 | ) | $ | — | $ | (736 | ) | $ | (252 | ) | |

| [1] | Included in other investments on the Condensed Consolidated Balance Sheets. |

| [2] | Includes |

| [3] | Approximately $3.0 billion and |

| [ | Includes OTC and OTC-cleared derivative instruments in a net negative fair value position (derivative liability) after consideration of the accrued interest and impact of collateral posting requirements, which may be imposed by agreements, clearing house rules and applicable law. |

| [5] | For additional information see the |

| Valuation Inputs Used in Levels 2 and 3 Measurements for Securities and Freestanding Derivatives | |||

Level 2 Primary Observable Inputs | Level 3 Primary Unobservable Inputs | ||

| Fixed Maturity Investments | |||

| Structured securities (includes ABS, CDOs CMBS and RMBS) | |||

• Benchmark yields and spreads • Monthly payment information • Collateral performance, which varies by vintage year and includes delinquency rates, loss severity rates and refinancing assumptions • Credit default swap indices Other inputs for ABS and RMBS: • Estimate of future principal prepayments, derived based on the characteristics of the • Prepayment speeds previously experienced at the interest rate levels projected for the collateral | • Independent broker quotes • Credit spreads beyond observable curve • Interest rates beyond observable curve Other inputs for less liquid securities • Estimated cash flows • Credit spreads, which include illiquidity premium • Constant prepayment rates • Constant default rates • Loss severity | ||

| Corporates | |||

• Benchmark yields and • Reported trades, bids, offers of the same or similar securities • Issuer spreads Other inputs for • Credit spreads for public securities | • Independent broker quotes • Credit spreads beyond observable curve • Interest rates beyond observable curve Other inputs for • Independent broker quotes • Credit spreads for public securities of similar quality, maturity, and sector, adjusted for non-public nature | ||

| U.S Treasuries, Municipals, and Foreign government/government agencies | |||

• Benchmark yields and spreads • Issuer credit default swap curves • Political events in emerging market economies • Municipal Securities Rulemaking Board reported trades and material event notices • Issuer financial statements | • Independent broker quotes • Credit spreads beyond observable curve • Interest rates beyond observable curve | ||

| Equity Securities | |||

| • Quoted prices in markets that are | • For privately traded equity securities, internal discounted cash flow models utilizing earnings multiples or | ||

| Short Term Investments | |||

• Benchmark yields and • Reported trades, bids, offers • Issuer spreads and • Material event notices and new issue money market rates | Not applicable | ||

| Derivatives | |||

| Credit derivatives | |||

• Swap yield curve • Credit default swap | • Independent broker quotes • Yield curves beyond observable | ||

| Equity derivatives | |||

• Equity index levels • Swap yield curve | • Independent broker quotes • Equity volatility | ||

| Foreign exchange derivatives | |||

• Swap yield curve • Currency spot and forward rates • Cross currency basis curves | • Independent broker quotes | ||

| Interest rate derivatives | |||

| • Swap yield curve | • Independent broker quotes • Interest rate volatility | ||

| Securities | Unobservable Inputs | ||||||||

| As of March 31, 2016 | |||||||||

| Assets Accounted for at Fair Value on a Recurring Basis | Fair Value | Predominant Valuation Technique | Significant Unobservable Input | Minimum | Maximum | Weighted Average [1] | Impact of Increase in Input on Fair Value [2] | ||

| CMBS [3] | $ | 115 | Discounted cash flows | Spread (encompasses prepayment, default risk and loss severity) | 31 bps | 1,035 bps | 409 bps | Decrease | |

| Corporate [3] | 320 | Discounted cash flows | Spread | 62 bps | 725 bps | 298 bps | Decrease | ||

| Municipal [3] | 32 | Discounted cash flows | Spread | 219 bps | 219 bps | 219 bps | Decrease | ||

| RMBS | 1,886 | Discounted cash flows | Spread | 34 bps | 1,281 bps | 217 bps | Decrease | ||

| Constant prepayment rate | —% | 20% | 3% | Decrease [4] | |||||

| Constant default rate | 1% | 10% | 6% | Decrease | |||||

| Loss severity | 40% | 100% | 80% | Decrease | |||||

| As of December 31, 2015 | |||||||||

| CMBS [3] | $ | 122 | Discounted cash flows | Spread (encompasses prepayment, default risk and loss severity) | 31 bps | 1,505 bps | 266 bps | Decrease | |

| Corporate [3] | 339 | Discounted cash flows | Spread | 63 bps | 800 bps | 306 bps | Decrease | ||

| Municipal [3] | 31 | Discounted cash flows | Spread | 193 bps | 193 bps | 193 bps | Decrease | ||

| RMBS | 1,622 | Discounted cash flows | Spread | 30 bps | 1,696 bps | 178 bps | Decrease | ||

| Constant prepayment rate | —% | 20% | 2% | Decrease [4] | |||||

| Constant default rate | 1% | 10% | 6% | Decrease | |||||

| Loss severity | —% | 100% | 78% | Decrease | |||||

| Significant Unobservable Inputs for Level 3 - Securities | |||||||||

| Assets accounted for at fair value on a recurring basis | Fair Value | Predominant Valuation Technique | Significant Unobservable Input | Minimum | Maximum | Weighted Average [1] | Impact of Increase in Input on Fair Value [2] | ||

| As of March 31, 2017 | |||||||||

| CMBS [3] | $ | 76 | Discounted cash flows | Spread (encompasses prepayment, default risk and loss severity) | 9 bps | 1,272 bps | 463 bps | Decrease | |

| Corporate [4] | 438 | Discounted cash flows | Spread | 107 bps | 963 bps | 328 bps | Decrease | ||

| Municipal [3] | 101 | Discounted cash flows | Spread | 186 bps | 241 bps | 208 bps | Decrease | ||

| RMBS [3] | 2,038 | Discounted cash flows | Spread | 34 bps | 1,371 bps | 179 bps | Decrease | ||

| Constant prepayment rate | —% | 20% | 4% | Decrease [5] | |||||

| Constant default rate | 1% | 10% | 5% | Decrease | |||||

| Loss severity | —% | 100% | 73% | Decrease | |||||

| As of December 31, 2016 | |||||||||

| CMBS [3] | $ | 52 | Discounted cash flows | Spread (encompasses prepayment, default risk and loss severity) | 10 bps | 1,273 bps | 366 bps | Decrease | |

| Corporate [4] | 510 | Discounted cash flows | Spread | 122 bps | 1,302 bps | 359 bps | Decrease | ||

| Municipal [3] | 101 | Discounted cash flows | Spread | 135 bps | 286 bps | 221 bps | Decrease | ||

| RMBS [3] | 1,963 | Discounted cash flows | Spread | 16 bps | 1,830 bps | 192 bps | Decrease | ||

| Constant prepayment rate | —% | 20% | 4% | Decrease [5] | |||||

| Constant default rate | —% | 11% | 5% | Decrease | |||||

| Loss severity | —% | 100% | 75% | Decrease | |||||

| [1] | The weighted average is determined based on the fair value of the securities. |

| [2] | Conversely, the impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. |

| [3] |

| [4] | Excludes securities for which the Company bases fair value on broker |

| [ | Decrease for above market rate coupons and increase for below market rate coupons. |

| Freestanding Derivatives | Unobservable Inputs | |||||||||||||||||||

| Significant Unobservable Inputs for Level 3 - Freestanding Derivatives | Significant Unobservable Inputs for Level 3 - Freestanding Derivatives | |||||||||||||||||||

| As of March 31, 2016 | Fair Value | Predominant Valuation Technique | Significant Unobservable Input | Minimum | Maximum | Impact of Increase in Input on Fair Value [1] | ||||||||||||||

Fair Value | Predominant Valuation Technique | Significant Unobservable Input | Minimum | Maximum | Impact of Increase in Input on Fair Value [1] | |||||||||||||||

| Interest rate derivative | ||||||||||||||||||||

| As of March 31, 2017 | As of March 31, 2017 | |||||||||||||||||||

| Interest rate derivatives | ||||||||||||||||||||

| Interest rate swaps | $ | (32 | ) | Discounted cash flows | Swap curve beyond 30 years | 2 | % | 2 | % | Decrease | $ | (29 | ) | Discounted cash flows | Swap curve beyond 30 years | 3 | % | 3 | % | Decrease |

| Interest rate swaptions [2] | 4 | Option model | Interest rate volatility | 2 | % | 2 | % | Increase | 5 | Option model | Interest rate volatility | 2 | % | 2 | % | Increase | ||||

| GMWB hedging instruments | ||||||||||||||||||||

| Equity variance swaps | (34 | ) | Option model | Equity volatility | 22 | % | 24 | % | Increase | (39 | ) | Option model | Equity volatility | 16 | % | 20 | % | Increase | ||

| Equity options | 28 | Option model | Equity volatility | 26 | % | 29 | % | Increase | 9 | Option model | Equity volatility | 26 | % | 28 | % | Increase | ||||

| Customized swaps | 150 | Discounted cash flows | Equity volatility | 12 | % | 30 | % | Increase | 76 | Discounted cash flows | Equity volatility | 9 | % | 30 | % | Increase | ||||

| Macro hedge program [3] | ||||||||||||||||||||

| Equity options | 178 | Option model | Equity volatility | 12 | % | 27 | % | Increase | 164 | Option model | Equity volatility | 15 | % | 32 | % | Increase | ||||

| As of December 31, 2015 | ||||||||||||||||||||

| Interest rate derivative | ||||||||||||||||||||

| As of December 31, 2016 | As of December 31, 2016 | |||||||||||||||||||

| Interest rate derivatives | ||||||||||||||||||||

| Interest rate swaps | $ | (30 | ) | Discounted cash flows | Swap curve beyond 30 years | 3 | % | 3 | % | Decrease | $ | (29 | ) | Discounted cash flows | Swap curve beyond 30 years | 3 | % | 3 | % | Decrease |

| Interest rate swaptions [2] | 8 | Option model | Interest rate volatility | 1 | % | 2 | % | Increase | 8 | Option model | Interest rate volatility | 2 | % | 2 | % | Increase | ||||

| GMWB hedging instruments | ||||||||||||||||||||

| Equity variance swaps | (31 | ) | Option model | Equity volatility | 19 | % | 21 | % | Increase | (36 | ) | Option model | Equity volatility | 20 | % | 23 | % | Increase | ||

| Equity options | 35 | Option model | Equity volatility | 27 | % | 29 | % | Increase | 17 | Option model | Equity volatility | 27 | % | 30 | % | Increase | ||||

| Customized swaps | 131 | Discounted cash flows | Equity volatility | 10 | % | 40 | % | Increase | 100 | Discounted cash flows | Equity volatility | 12 | % | 30 | % | Increase | ||||

| Macro hedge program [3] | ||||||||||||||||||||

| Equity options | 179 | Option model | Equity volatility | 14 | % | 28 | % | Increase | 188 | Option model | Equity volatility | 17 | % | 28 | % | Increase | ||||

| [1] | Conversely, the impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. Changes are based on long positions, unless otherwise noted. Changes in fair value will be inversely impacted for short positions. |

| [2] | The swaptions presented are purchased options that have the right to enter into a pay-fixed swap. |

| [3] |

| GMWB Embedded Derivatives | The Company formerly offered certain variable annuity products with GMWB riders that provide the policyholder with a guaranteed remaining balance ("GRB") which is generally equal to premiums less withdrawals. If the policyholder’s account value is reduced to a specified level through a combination of market declines and withdrawals but the GRB still has value, the Company is obligated to continue to make annuity payments to the policyholder until the GRB is exhausted. When payments of the GRB are not life-contingent, the GMWB represents an embedded derivative carried at fair value reported in other policyholder funds and benefits payable in the Condensed Consolidated Balance Sheets with changes in fair value reported in net realized capital gains and losses. |

| Free-standing Customized Derivatives | The Company holds free-standing customized derivative contracts to provide protection from certain capital markets risks for the remaining term of specified blocks of non-reinsured GMWB riders. These customized derivatives are based on policyholder behavior assumptions specified at the inception of the derivative contracts. The Company retains the risk for differences between assumed and actual policyholder behavior and between the performance of the actively managed funds underlying the separate accounts and their respective indices. These derivatives are reported in the Condensed Consolidated Balance Sheets within other investments or other liabilities, as appropriate, after considering the impact of master netting agreements. |

| GMWB Reinsurance Derivative | The Company has reinsurance arrangements in place to transfer a portion of its risk of loss due to GMWB. These arrangements are recognized as derivatives carried at fair value and reported in reinsurance recoverables in the Condensed Consolidated Balance Sheets. Changes in the fair value of the reinsurance agreements are reported in net realized capital gains and losses. |

| Valuation Inputs Used in Levels 2 and 3 Measurements for GMWB Embedded, Customized and Reinsurance Derivatives | |||

| Level 2 Primary Observable Inputs | Level 3 Primary Unobservable Inputs | ||

• Risk-free rates as represented by the Eurodollar futures, LIBOR deposits and swap rates to derive forward curve rates • Correlations of 10 years of observed historical returns across underlying well-known market indices • Correlations of historical index returns compared to separate account fund returns • Equity index levels | • Market implied equity volatility assumptions Assumptions about policyholder behavior, including: • Withdrawal utilization • Withdrawal rates • Lapse rates • Reset elections | ||

| Significant Unobservable Inputs for Level 3 GMWB Embedded Customized and Reinsurance Derivatives | Significant Unobservable Inputs for Level 3 GMWB Embedded Customized and Reinsurance Derivatives | |||||

| As of March 31, 2016 | As of March 31, 2017 | |||||

| Significant Unobservable Input | Unobservable Inputs (Minimum) | Unobservable Inputs (Maximum) | Impact of Increase in Input on Fair Value Measurement [1] | Unobservable Inputs (Minimum) | Unobservable Inputs (Maximum) | Impact of Increase in Input on Fair Value Measurement [1] |

| Withdrawal Utilization [2] | 20% | 100% | Increase | 15% | 100% | Increase |

| Withdrawal Rates [3] | —% | 8% | Increase | —% | 8% | Increase |

| Lapse Rates [4] | —% | 75% | Decrease | —% | 40% | Decrease |

| Reset Elections [5] | 20% | 75% | Increase | 20% | 75% | Increase |

| Equity Volatility [6] | 12% | 30% | Increase | 9% | 30% | Increase |

| As of December 31, 2015 | As of December 31, 2016 | |||||

| Significant Unobservable Input | Unobservable Inputs (Minimum) | Unobservable Inputs (Maximum) | Impact of Increase in Input on Fair Value Measurement [1] | Unobservable Inputs (Minimum) | Unobservable Inputs (Maximum) | Impact of Increase in Input on Fair Value Measurement [1] |

| Withdrawal Utilization [2] | 20% | 100% | Increase | 15% | 100% | Increase |

| Withdrawal Rates [3] | —% | 8% | Increase | —% | 8% | Increase |

| Lapse Rates [4] | —% | 75% | Decrease | —% | 40% | Decrease |

| Reset Elections [5] | 20% | 75% | Increase | 20% | 75% | Increase |

| Equity Volatility [6] | 10% | 40% | Increase | 12% | 30% | Increase |

| [1] | Conversely, the impact of a decrease in input would have the opposite impact to the fair value as that presented in the table. |

| [2] | Range represents assumed cumulative percentages of policyholders taking withdrawals. |

| [3] | Range represents assumed cumulative annual amount withdrawn by policyholders. |

| [4] | Range represents assumed annual percentages of full surrender of the underlying variable annuity contracts across all policy durations for in force business. |

| [5] | Range represents assumed cumulative percentages of policyholders that would elect to reset their guaranteed benefit base. |

| [6] | Range represents implied market volatilities for equity indices based on multiple pricing sources. |

| Fair Value Roll-forwards for Financial Instruments Classified as Level 3 for the Three Months Ended March 31, 2017 | ||||||||||||||||||||||||||||

| Total realized/unrealized gains (losses) | ||||||||||||||||||||||||||||

| Fair value as of January 1, 2017 | Included in net income [1] [2] [6] | Included in OCI [3] | Purchases [8] | Settlements | Sales | Transfers into Level 3 [4] | Transfers out of Level 3 [4] | Fair value as of March 31, 2017 | ||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||

| Fixed Maturities, AFS | ||||||||||||||||||||||||||||

| ABS | $ | 82 | $ | — | $ | — | $ | 45 | $ | (5 | ) | $ | — | $ | 26 | $ | (23 | ) | $ | 125 | ||||||||

| CDOs | 414 | — | 4 | — | (1 | ) | — | — | (98 | ) | 319 | |||||||||||||||||

| CMBS | 80 | (1 | ) | — | 56 | (3 | ) | — | — | (15 | ) | 117 | ||||||||||||||||

| Corporate | 1,080 | 6 | 16 | 169 | (36 | ) | (160 | ) | 40 | (37 | ) | 1,078 | ||||||||||||||||

| Foreign Govt./Govt. Agencies | 64 | — | 3 | — | (1 | ) | — | — | — | 66 | ||||||||||||||||||

| Municipal | 118 | — | 5 | — | — | (6 | ) | — | — | 117 | ||||||||||||||||||

| RMBS | 1,972 | — | 6 | 173 | (96 | ) | (7 | ) | — | — | 2,048 | |||||||||||||||||

| Total Fixed Maturities, AFS | 3,810 | 5 | 34 | 443 | (142 | ) | (173 | ) | 66 | (173 | ) | 3,870 | ||||||||||||||||

| Fixed Maturities, FVO | 11 | — | — | 4 | (2 | ) | (13 | ) | — | — | — | |||||||||||||||||

| Equity Securities, AFS | 99 | — | (4 | ) | 4 | — | — | — | — | 99 | ||||||||||||||||||

| Freestanding Derivatives, net [5] | ||||||||||||||||||||||||||||

| Equity | — | (1 | ) | — | 5 | — | — | — | — | 4 | ||||||||||||||||||

| Interest rate | (21 | ) | (3 | ) | — | — | — | — | — | — | (24 | ) | ||||||||||||||||

| GMWB hedging instruments | 81 | (35 | ) | — | — | — | — | — | — | 46 | ||||||||||||||||||

| Macro hedge program | 167 | (8 | ) | — | — | — | — | — | — | 159 | ||||||||||||||||||

| Other contracts | 1 | (1 | ) | — | — | — | — | — | — | — | ||||||||||||||||||

| Total Freestanding Derivatives, net [5] | 228 | (48 | ) | — | 5 | — | — | — | — | 185 | ||||||||||||||||||

| Reinsurance Recoverable for GMWB | 73 | (17 | ) | — | — | 4 | — | — | — | 60 | ||||||||||||||||||

| Separate Accounts | 201 | — | 3 | 97 | (4 | ) | (8 | ) | 3 | (15 | ) | 277 | ||||||||||||||||

| Total Assets | $ | 4,422 | $ | (60 | ) | $ | 33 | $ | 553 | $ | (144 | ) | $ | (194 | ) | $ | 69 | $ | (188 | ) | $ | 4,491 | ||||||

| Liabilities | ||||||||||||||||||||||||||||

| Other Policyholder Funds and Benefits Payable | ||||||||||||||||||||||||||||

| Guaranteed Withdrawal Benefits | $ | (241 | ) | $ | 100 | $ | — | $ | — | $ | (16 | ) | $ | — | $ | — | $ | — | $ | (157 | ) | |||||||

| Equity Linked Notes | (33 | ) | (3 | ) | — | — | — | — | — | — | (36 | ) | ||||||||||||||||

| Total Other Policyholder Funds and Benefits Payable | (274 | ) | 97 | — | — | (16 | ) | — | — | — | (193 | ) | ||||||||||||||||

| Contingent Consideration [7] | (25 | ) | (1 | ) | — | — | — | — | — | — | (26 | ) | ||||||||||||||||

| Total Liabilities | $ | (299 | ) | $ | 96 | $ | — | $ | — | $ | (16 | ) | $ | — | $ | — | $ | — | $ | (219 | ) | |||||||

| Fixed Maturities, AFS | |||||||||||||||||||||||||||

| Assets | ABS | CDOs | CMBS | Corporate | Foreign Govt./Govt. Agencies | Municipal | RMBS | Total Fixed Maturities, AFS | Fixed Maturities, FVO | ||||||||||||||||||

| Fair value as of January 1, 2016 | $ | 37 | $ | 541 | $ | 150 | $ | 854 | $ | 60 | $ | 49 | $ | 1,622 | $ | 3,313 | $ | 16 | |||||||||

| Total realized/unrealized gains (losses) | |||||||||||||||||||||||||||

| Included in net income [1] [2] [6] | — | — | (1 | ) | (13 | ) | — | — | — | (14 | ) | (2 | ) | ||||||||||||||

| Included in OCI [3] | — | — | (8 | ) | (7 | ) | 5 | 1 | (14 | ) | (23 | ) | — | ||||||||||||||

| Purchases | — | — | 40 | 30 | 14 | — | 333 | 417 | 5 | ||||||||||||||||||

| Settlements | (3 | ) | 1 | (9 | ) | (5 | ) | (1 | ) | — | (57 | ) | (74 | ) | (1 | ) | |||||||||||

| Sales | — | — | — | (25 | ) | (2 | ) | — | — | (27 | ) | — | |||||||||||||||

| Transfers into Level 3 [4] | 5 | — | — | 58 | — | — | 2 | 65 | — | ||||||||||||||||||

| Transfers out of Level 3 [4] | (7 | ) | — | (38 | ) | (58 | ) | — | — | — | (103 | ) | (4 | ) | |||||||||||||

| Fair value as of March 31, 2016 | $ | 32 | $ | 542 | $ | 134 | $ | 834 | $ | 76 | $ | 50 | $ | 1,886 | $ | 3,554 | $ | 14 | |||||||||

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2016 [2] [7] | $ | — | $ | — | $ | (1 | ) | $ | (13 | ) | $ | — | $ | — | $ | — | $ | (14 | ) | $ | (1 | ) | |||||

| Freestanding Derivatives [5] | |||||||||||||||||||||

| Assets (Liabilities) | Equity Securities, AFS | Equity | Interest Rate | GMWB Hedging | Macro Hedge Program | Other Contracts | Total Free- Standing Derivatives [5] | ||||||||||||||

| Fair value as of January 1, 2016 | $ | 93 | $ | — | $ | (22 | ) | $ | 135 | $ | 147 | $ | 7 | $ | 267 | ||||||

| Total realized/unrealized gains (losses) | |||||||||||||||||||||

| Included in net income [1] [2] [6] | (1 | ) | (11 | ) | (6 | ) | 9 | — | (2 | ) | (10 | ) | |||||||||

| Included in OCI [3] | 2 | — | — | — | — | — | — | ||||||||||||||

| Purchases | — | 16 | — | — | — | — | 16 | ||||||||||||||

| Settlements | — | — | — | — | (2 | ) | — | (2 | ) | ||||||||||||

| Sales | (2 | ) | — | — | — | — | — | — | |||||||||||||

| Transfers into Level 3 [4] | — | — | — | — | — | — | — | ||||||||||||||

| Transfers out of Level 3 [4] | — | — | — | — | — | — | — | ||||||||||||||

| Fair value as of March 31, 2016 | $ | 92 | $ | 5 | $ | (28 | ) | $ | 144 | $ | 145 | $ | 5 | $ | 271 | ||||||

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2016 [2] [7] | $ | (1 | ) | $ | (11 | ) | $ | (6 | ) | $ | 9 | $ | (1 | ) | $ | (2 | ) | $ | (11 | ) | |

| Assets | Reinsurance Recoverable for GMWB | Separate Accounts | ||||

| Fair value as of January 1, 2016 | $ | 83 | $ | 139 | ||

| Total realized/unrealized gains (losses) | ||||||

| Included in net income [1] [2] [6] | 12 | — | ||||

| Included in OCI [3] | — | 4 | ||||

| Purchases | — | 38 | ||||

| Settlements | 4 | (5 | ) | |||

| Sales | — | (10 | ) | |||

| Transfers into Level 3 [4] | — | 3 | ||||

| Transfers out of Level 3 [4] | — | (15 | ) | |||

| Fair value as of March 31, 2016 | $ | 99 | $ | 154 | ||

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2016 [2] [7] | $ | 12 | $ | — | ||

| Other Policyholder Funds and Benefits Payable | |||||||||

| Liabilities | Guaranteed Withdrawal Benefits | Equity Linked Notes | Total Other Policyholder Funds and Benefits Payable | ||||||

| Fair value as of January 1, 2016 | $ | (262 | ) | $ | (26 | ) | $ | (288 | ) |

| Total realized/unrealized gains (losses) | |||||||||

| Included in net income [1] [2] [6] | (82 | ) | 1 | (81 | ) | ||||

| Settlements | (17 | ) | — | (17 | ) | ||||

| Fair value as of March 31, 2016 | $ | (361 | ) | $ | (25 | ) | $ | (386 | ) |

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2016 [2] [7] | $ | (82 | ) | $ | 1 | $ | (81 | ) | |

| Fixed Maturities, AFS | |||||||||||||||||||||||||||

| Assets | ABS | CDOs | CMBS | Corporate | Foreign Govt./Govt. Agencies | Municipal | RMBS | Total Fixed Maturities, AFS | Fixed Maturities, FVO | ||||||||||||||||||

| Fair value as of January 1, 2015 | $ | 122 | $ | 623 | $ | 284 | $ | 1,040 | $ | 59 | $ | 66 | $ | 1,281 | $ | 3,475 | $ | 92 | |||||||||

| Total realized/unrealized gains (losses) | |||||||||||||||||||||||||||

| Included in net income [1] [2] [6] | — | (2 | ) | (1 | ) | (4 | ) | — | — | (1 | ) | (8 | ) | (5 | ) | ||||||||||||

| Included in OCI [3] | — | 19 | (3 | ) | (28 | ) | 1 | (2 | ) | (1 | ) | (14 | ) | — | |||||||||||||

| Purchases | 43 | — | 21 | 5 | 5 | — | 310 | 384 | 12 | ||||||||||||||||||

| Settlements | (1 | ) | (9 | ) | (13 | ) | 1 | (1 | ) | — | (46 | ) | (69 | ) | — | ||||||||||||

| Sales | — | — | — | (7 | ) | (16 | ) | — | (31 | ) | (54 | ) | (4 | ) | |||||||||||||

| Transfers into Level 3 [4] | 1 | — | 5 | 139 | — | — | 4 | 149 | — | ||||||||||||||||||

| Transfers out of Level 3 [4] | (4 | ) | (47 | ) | (25 | ) | (34 | ) | — | — | (53 | ) | (163 | ) | (10 | ) | |||||||||||

| Fair value as of March 31, 2015 | $ | 161 | $ | 584 | $ | 268 | $ | 1,112 | $ | 48 | $ | 64 | $ | 1,463 | $ | 3,700 | $ | 85 | |||||||||

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2015 [2] [7] | $ | — | $ | (1 | ) | $ | (1 | ) | $ | (2 | ) | $ | — | $ | — | $ | (1 | ) | $ | (5 | ) | $ | (1 | ) | |||

| Freestanding Derivatives [5] | ||||||||||||||||||||||||

| Assets (Liabilities) | Equity Securities, AFS | Credit | Equity | Interest Rate | GMWB Hedging | Macro Hedge Program | Other Contracts | Total Free-Standing Derivatives [5] | ||||||||||||||||

| Fair value as of January 1, 2015 | $ | 98 | $ | (9 | ) | $ | 6 | $ | (7 | ) | $ | 170 | $ | 141 | $ | 12 | $ | 313 | ||||||

| Total realized/unrealized gains (losses) | ||||||||||||||||||||||||

| Included in net income [1] [2] [6] | 1 | 5 | 17 | (11 | ) | 9 | (1 | ) | (1 | ) | 18 | |||||||||||||

| Included in OCI [3] | (3 | ) | — | — | — | — | — | — | — | |||||||||||||||

| Purchases | 8 | (7 | ) | — | — | — | 47 | — | 40 | |||||||||||||||

| Settlements | — | — | (15 | ) | — | (20 | ) | — | — | (35 | ) | |||||||||||||

| Sales | (2 | ) | — | — | — | — | — | — | — | |||||||||||||||

| Transfers into Level 3 [4] | — | — | — | — | — | — | — | — | ||||||||||||||||

| Transfers out of Level 3 [4] | — | — | — | — | — | — | — | — | ||||||||||||||||

| Fair value as of March 31, 2015 | $ | 102 | $ | (11 | ) | $ | 8 | $ | (18 | ) | $ | 159 | $ | 187 | $ | 11 | $ | 336 | ||||||

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2015 [2] [7] | $ | 1 | $ | 5 | $ | 3 | $ | (19 | ) | $ | 16 | $ | 3 | $ | (1 | ) | $ | 7 | ||||||

| Assets | Reinsurance Recoverable for GMWB | Separate Accounts | ||||

| Fair value as of January 1, 2015 | $ | 56 | $ | 112 | ||

| Total realized/unrealized gains (losses) | ||||||

| Included in net income [1] [2] [6] | 4 | 1 | ||||

| Purchases | — | 38 | ||||

| Settlements | 5 | (5 | ) | |||

| Sales | — | (6 | ) | |||

| Transfers into Level 3 [4] | — | 1 | ||||

| Transfers out of Level 3 [4] | — | (4 | ) | |||

| Fair value as of March 31, 2015 | $ | 65 | $ | 137 | ||

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2015 [2] [7] | $ | 4 | $ | 1 | ||

| Other Policyholder Funds and Benefits Payable | ||||||||||||

| Liabilities | Guaranteed Withdrawal Benefits | Equity Linked Notes | Total Other Policyholder Funds and Benefits Payable | Consumer Notes | ||||||||

| Fair value as of January 1, 2015 | $ | (139 | ) | $ | (26 | ) | $ | (165 | ) | $ | (3 | ) |

| Total realized/unrealized gains (losses) | ||||||||||||

| Included in net income [1] [2] [6] | (19 | ) | — | (19 | ) | — | ||||||

| Settlements | (18 | ) | — | (18 | ) | — | ||||||

| Fair value as of March 31, 2015 | $ | (176 | ) | $ | (26 | ) | $ | (202 | ) | $ | (3 | ) |

| Changes in unrealized gains (losses) included in net income related to financial instruments still held at March 31, 2015 [2] [7] | $ | (19 | ) | $ | — | $ | (19 | ) | $ | — | ||

| Fair Value Roll-forwards for Financial Instruments Classified as Level 3 for the Three Months Ended March 31, 2016 | ||||||||||||||||||||||||||||

| Total realized/unrealized gains (losses) | ||||||||||||||||||||||||||||

| Fair value as of January 1, 2016 | Included in net income [1] [2] [6] | Included in OCI [3] | Purchases [8] | Settlements | Sales | Transfers into Level 3 [4] | Transfers out of Level 3 [4] | Fair value as of March 31, 2016 | ||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||

| Fixed Maturities, AFS | ||||||||||||||||||||||||||||

| ABS | $ | 37 | $ | — | $ | — | $ | — | $ | (3 | ) | $ | — | $ | 5 | $ | (7 | ) | $ | 32 | ||||||||

| CDOs | 541 | — | — | — | 1 | — | — | — | 542 | |||||||||||||||||||

| CMBS | 150 | (1 | ) | (8 | ) | 40 | (9 | ) | — | — | (38 | ) | 134 | |||||||||||||||

| Corporate | 854 | (13 | ) | (7 | ) | 30 | (5 | ) | (25 | ) | 58 | (58 | ) | 834 | ||||||||||||||

| Foreign Govt./Govt. Agencies | 60 | — | 5 | 14 | (1 | ) | (2 | ) | — | — | 76 | |||||||||||||||||

| Municipal | 49 | — | 1 | — | — | — | — | — | 50 | |||||||||||||||||||

| RMBS | 1,622 | — | (14 | ) | 333 | (57 | ) | — | 2 | — | 1,886 | |||||||||||||||||

| Total Fixed Maturities, AFS | 3,313 | (14 | ) | (23 | ) | 417 | (74 | ) | (27 | ) | 65 | (103 | ) | 3,554 | ||||||||||||||

| Fixed Maturities, FVO | 16 | (2 | ) | — | 5 | (1 | ) | — | — | (4 | ) | 14 | ||||||||||||||||

| Equity Securities, AFS | 93 | (1 | ) | 2 | — | — | (2 | ) | — | — | 92 | |||||||||||||||||

| Freestanding Derivatives, net [5] | ||||||||||||||||||||||||||||

| Equity | — | (11 | ) | — | 16 | — | — | — | — | 5 | ||||||||||||||||||

| Interest rate | (22 | ) | (6 | ) | — | — | — | — | — | — | (28 | ) | ||||||||||||||||

| GMWB hedging instruments | 135 | 9 | — | — | — | — | — | — | 144 | |||||||||||||||||||

| Macro hedge program | 147 | — | — | — | (2 | ) | — | — | — | 145 | ||||||||||||||||||

| Other contracts | 7 | (2 | ) | — | — | — | — | — | — | 5 | ||||||||||||||||||

| Total Freestanding Derivatives, net [5] | 267 | (10 | ) | — | 16 | (2 | ) | — | — | — | 271 | |||||||||||||||||

| Reinsurance Recoverable for GMWB | 83 | 12 | — | — | 4 | — | — | — | 99 | |||||||||||||||||||

| Separate Accounts | 139 | — | 4 | 38 | (5 | ) | (10 | ) | 3 | (15 | ) | 154 | ||||||||||||||||

| Total Assets | $ | 3,911 | $ | (15 | ) | $ | (17 | ) | $ | 476 | $ | (78 | ) | $ | (39 | ) | $ | 68 | $ | (122 | ) | $ | 4,184 | |||||

| Liabilities | ||||||||||||||||||||||||||||

| Other Policyholder Funds and Benefits Payable | ||||||||||||||||||||||||||||

| Guaranteed Withdrawal Benefits | $ | (262 | ) | $ | (82 | ) | $ | — | $ | — | $ | (17 | ) | $ | — | $ | — | $ | — | $ | (361 | ) | ||||||

| Equity Linked Notes | (26 | ) | 1 | — | — | — | — | — | — | (25 | ) | |||||||||||||||||

| Total Other Policyholder Funds and Benefits Payable | (288 | ) | (81 | ) | — | — | (17 | ) | — | — | — | (386 | ) | |||||||||||||||

| Total Liabilities | $ | (288 | ) | $ | (81 | ) | $ | — | $ | — | $ | (17 | ) | $ | — | $ | — | $ | — | $ | (386 | ) | ||||||

| [1] | The Company classifies realized and unrealized gains (losses) on GMWB reinsurance derivatives and GMWB embedded derivatives as unrealized gains (losses) for purposes of disclosure in this table because it is impracticable to track on a contract-by-contract basis the realized gains (losses) for these derivatives and embedded derivatives. |

| [2] |

| [3] | All amounts are before income taxes and amortization of DAC. |

| [4] | Transfers in and/or (out) of Level 3 are primarily attributable to the availability of market observable information and the re-evaluation of the observability of pricing inputs. |

| [5] | Derivative instruments are reported in this table on a net basis for asset (liability) positions and reported in the Condensed Consolidated Balance Sheets in other investments and other liabilities. |

| [6] | Includes both market and non-market impacts in deriving realized and unrealized gains (losses). |

| [7] | For additional information, see the Contingent Consideration section of Note 5 - Fair Value Measurements of Notes to Condensed Consolidated Financial Statements. |

| [8] | Includes issuance of contingent consideration associated with the Lattice acquisition, see Note 2 - Business Disposition of Notes to Condensed Consolidated Financial Statements for |

| Changes in Unrealized Gains (Losses) Included in Net Income for Financial Instruments Classified as Level 3 Still Held at: | |||||||

| March 31, 2017 [1] [2] | March 31, 2016 [1] [2] | ||||||

| Assets | |||||||

| Fixed Maturities, AFS | |||||||

| ABS | $ | — | $ | — | |||

| CDOs | — | — | |||||

| CMBS | (1 | ) | (1 | ) | |||

| Corporate | — | (13 | ) | ||||

| Foreign Govt./Govt. Agencies | — | — | |||||

| Municipal | — | — | |||||

| RMBS | — | — | |||||

| Total Fixed Maturities, AFS | (1 | ) | (14 | ) | |||

| Fixed Maturities, FVO | — | (1 | ) | ||||

| Equity Securities, AFS | — | (1 | ) | ||||

| Freestanding Derivatives, net | |||||||

| Equity | (1 | ) | (11 | ) | |||

| Interest rate | (3 | ) | (6 | ) | |||

| GMWB hedging instruments | (36 | ) | 9 | ||||

| Macro hedge program | (8 | ) | (1 | ) | |||

| Other Contracts | — | (2 | ) | ||||

| Total Freestanding Derivatives, net | (48 | ) | (11 | ) | |||

| Reinsurance Recoverable for GMWB | (17 | ) | 12 | ||||

| Separate Accounts | — | — | |||||

| Total Assets | $ | (66 | ) | $ | (15 | ) | |

| Liabilities | |||||||

| Other Policyholder Funds and Benefits Payable | |||||||

| Guaranteed Withdrawal Benefits | $ | 100 | $ | (82 | ) | ||

| Equity Linked Notes | (3 | ) | 1 | ||||

| Total Other Policyholder Funds and Benefits Payable | 97 | (81 | ) | ||||

| Contingent Consideration [3] | (1 | ) | — | ||||

| Total Liabilities | $ | 96 | $ | (81 | ) | ||

| [1] | All amounts in these rows are reported in net realized capital gains (losses). The realized/unrealized gains (losses) included in net income for separate account assets are offset by an equal amount for separate account liabilities, which results in a net zero impact on net income for the Company. All amounts are before income taxes and amortization of DAC. |

| [2] | Amounts presented are for Level 3 only and therefore may not agree to other disclosures included herein. |

| [3] | For additional information, see the Contingent Consideration section of Note 5 - Fair Value Measurements of Notes to Condensed Consolidated Financial Statements. |

| Three Months Ended March 31, | ||||||

| 2016 | 2015 | |||||

| Assets | ||||||

| Fixed maturities, FVO | ||||||

| CDOs | $ | — | $ | 1 | ||

| Foreign government | (1 | ) | — | |||

| RMBS | 1 | 1 | ||||

| Total fixed maturities, FVO | $ | — | $ | 2 | ||

| Equity, FVO | (34 | ) | 2 | |||

| Total realized capital gains (losses) | $ | (34 | ) | $ | 4 | |

| March 31, 2016 | December 31, 2015 | |||||

| Assets | ||||||

| Fixed maturities, FVO | ||||||

| ABS | $ | 9 | $ | 13 | ||

| CDOs | 4 | 6 | ||||

| CMBS | 16 | 24 | ||||

| Corporate | 62 | 87 | ||||

| Foreign government | 8 | 2 | ||||

| U.S government | 3 | 3 | ||||

| RMBS | 384 | 368 | ||||

| Total fixed maturities, FVO | $ | 486 | $ | 503 | ||

| Equity, FVO [1] | $ | — | $ | 282 | ||

| Changes in Fair Value of Assets using Fair Value Option | ||||||

| Three Months Ended March 31, | ||||||

| 2017 | 2016 | |||||

| Assets | ||||||

| Fixed maturities, FVO | ||||||

| Corporate | $ | (1 | ) | $ | — | |

| Foreign government | — | (1 | ) | |||

| RMBS | 1 | 1 | ||||

| Total fixed maturities, FVO | $ | — | $ | — | ||

| Equity, FVO | (1 | ) | (34 | ) | ||

| Total realized capital gains (losses) | $ | (1 | ) | $ | (34 | ) |

| March 31, 2016 | December 31, 2015 | ||||||||||||

| Fair Value Hierarchy Level | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||

| Assets | |||||||||||||

| Policy loans | Level 3 | $ | 1,444 | $ | 1,444 | $ | 1,447 | $ | 1,447 | ||||

| Mortgage loans | Level 3 | 5,637 | 5,900 | 5,624 | 5,736 | ||||||||

| Liabilities | |||||||||||||

| Other policyholder funds and benefits payable [1] | Level 3 | $ | 6,636 | $ | 6,888 | $ | 6,706 | $ | 6,898 | ||||

| Senior notes [2] | Level 2 | 4,240 | 4,836 | 4,259 | 4,811 | ||||||||

| Junior subordinated debentures [2] | Level 2 | 1,083 | 1,283 | 1,100 | 1,304 | ||||||||

| Consumer notes [3] | Level 3 | 33 | 33 | 38 | 38 | ||||||||

| Assumed investment contracts [3] | Level 3 | 668 | 730 | 619 | 682 | ||||||||

| Fair Value of Assets and Liabilities using the Fair Value Option | ||||||

| March 31, 2017 | December 31, 2016 | |||||

| Assets | ||||||

| Fixed maturities, FVO | ||||||

| ABS | $ | — | $ | 7 | ||

| CDOs | — | 3 | ||||

| CMBS | — | 8 | ||||

| Corporate | — | 40 | ||||

| U.S government | — | 7 | ||||

| RMBS | 160 | 228 | ||||

| Total fixed maturities, FVO | $ | 160 | $ | 293 | ||

| Equity, FVO [1] | $ | 123 | $ | — | ||

| [1] | Included in equity securities, AFS on the Condensed Consolidated Balance Sheets. |

| Financial Assets and Liabilities Not Carried at Fair Value | |||||||

| Fair Value Hierarchy Level | Carrying Amount | Fair Value | |||||

| March 31, 2017 | |||||||

| Assets | |||||||