UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20162017

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-19311

BIOGEN INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 33-0112644 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

225 Binney Street, Cambridge, MA 02142

(617) 679-2000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act (Check One):

|

| | |

Large accelerated filer x | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company o |

| (Do not check if a smaller reporting company) | | Emerging growth companyo |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes o No x

The number of shares of the issuer’s Common Stock, $0.0005 par value, outstanding as of July 15, 2016,21, 2017 was 219,120,762211,431,746 shares.

BIOGEN INC.

FORM 10-Q — Quarterly Report

For the Quarterly Period Ended June 30, 20162017

TABLE OF CONTENTS

|

| | |

| | | Page |

|

| | | |

| Item 1. | Financial Statements (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Certain totals may not sum due to rounding. | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| |

|

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | | |

| Item 6. | | |

| | |

| |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are being made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995 (the Act) with the intention of obtaining the benefits of the “Safe Harbor” provisions of the Act. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,“possible,” “will” and other words and terms of similar meaning. Reference is made in particular to forward-looking statements regarding:

the anticipated amount, timing and accounting of revenues, contingent payments, milestone, royalty and other payments under licensing, collaboration or acquisition agreements, tax positions and contingencies, collectability of receivables, pre-approval inventory, cost of sales, research and development costs, compensation and other selling, general and administrative expenses, amortization of intangible assets, foreign currency exchange risk, estimated fair value of assets and liabilities and impairment assessments;

expectations, plans and prospects relating to sales, pricing, growth and launch of our marketed and pipeline products;

the potential impact of increased product competition in the markets in which we compete;

the proposed spin offpatent terms, patent term extensions, patent office actions and expected availability and period of our hemophilia business, including the completion and timing of the spin off and its anticipated benefits, costs and tax treatment;regulatory exclusivity;

the costs and timing of potential clinical trials, filing and approvals, and the potential therapeutic scope of the development and commercialization of our and our collaborators’ pipeline products;

the drivers for growing our business, including our plans and intent to commit resources relating to business development opportunities and research and development programs;

our manufacturing capacity, use of third-party contract manufacturing organizations and plans and timing relating to the expansion of our manufacturing capabilities, including anticipated investments and activities in new manufacturing facilities;

the expected financialpotential impact on our results of ceasing manufacturing activitiesoperations and fully or partially vacating our biologics manufacturing facility in Cambridge, MA and warehouse space in Somerville, MA;liquidity of the United Kingdom's (U.K.'s) intent to voluntarily depart from the European Union (E.U.);

the impact of the continued uncertainty of the credit and economic conditions in certain countries in Europe and our collection of accounts receivable in such countries;

the potential impact on our results of operations and liquidity of the United Kingdom's (U.K.'s) intent to voluntarily depart from the European Union (E.U.);

the potential impact of healthcare reform in the United States (U.S.) and measures being taken worldwide designed to reduce healthcare costs to constrainlimit the overall level of government expenditures, including the impact of pricing actions and reduced reimbursement for our products;

the timing, outcome and impact of administrative, regulatory, legal and other proceedings related to our patents and other proprietary and intellectual property rights, tax audits, assessments and settlements, pricing matters, sales and promotional practices, product liability and other matters;

the anticipated benefits, costs and tax treatment of the spin-off of our hemophilia business;

lease commitments, purchase obligations and the timing and satisfaction of other contractual obligations;

potential costs and expenses incurred to execute business transformation and optimization initiatives;

our ability to finance our operations and business initiatives and obtain funding for such activities; and

the impact of new laws and accounting standards.

These forward-looking statements involve risks and uncertainties, including those that are described in the “Risk Factors” section of this report and elsewhere in this report that could cause actual results to differ materially from those reflected in such statements. You should not place undue reliance on these statements. Forward-looking statements speak only as of the date of this report. Except as required by law, we do not undertake any obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

NOTE REGARDING COMPANY AND PRODUCT REFERENCES

ThroughoutReferences in this report “Biogen,to:

“Biogen,” the “Company,“company,” “we,” “us” and “our” refer to Biogen Inc. and its consolidated subsidiaries. References to “RITUXAN” refersubsidiaries;

“RITUXAN” refers to both RITUXAN (the trade name for rituximab in the U.S., Canada and Japan) and MabThera (the trade name for rituximab outside the U.S., Canada and Japan). References to "ELOCTATE" refer;

"ELOCTATE" refers to both ELOCTATE (the trade name for Antihemophilic Factor (Recombinant), Fc Fusion Protein in the U.S., Canada and Japan) and ELOCTA (the trade name for Antihemophilic Factor (Recombinant), Fc Fusion Protein in the E.U.).

NOTE REGARDING TRADEMARKS

ALPROLIX®AVONEX®, PLEGRIDY®, RITUXAN®, SPINRAZA®, TECFIDERA®, TYSABRI® and ZINBRYTA® AVONEX®, BENEPALI®, ELOCTATE®, FLIXABI®, PLEGRIDY®, RITUXAN®, TECFIDERA® and TYSABRI®are registered trademarks of Biogen. FUMADERMBENEPALITM, CIRARATM, FLIXABITM, FUMADERMTM and ZINBRYTAIMRALDITM are trademarks of Biogen. ENBRELALPROLIX®,®ELOCTATE®, ENBREL®, FAMPYRATM, GAZYVAGAZYVA®, HUMIRA®, OCREVUS®TM, HUMIRA®, REMICADE®REMICADE® and other trademarks referenced in this report are the property of their respective owners.

PART I FINANCIAL INFORMATION

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited, in millions, except per share amounts)

| | | | For the Three Months

Ended June 30, | | For the Six Months

Ended June 30, | For the Three Months

Ended June 30, | | For the Six Months

Ended June 30, |

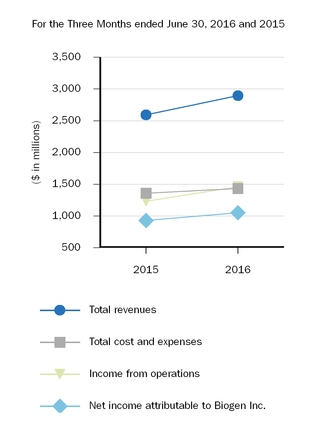

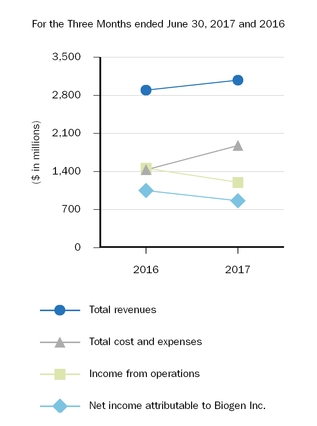

| | 2016 | | 2015 | | 2016 | | 2015 | 2017 | | 2016 | | 2017 | | 2016 |

| Revenues: | | | | | | | | | | | | | | |

| Product, net | $ | 2,466.0 |

| | $ | 2,198.6 |

| | $ | 4,775.4 |

| | $ | 4,370.9 |

| $ | 2,639.7 |

| | $ | 2,466.0 |

| | $ | 5,019.8 |

| | $ | 4,775.4 |

|

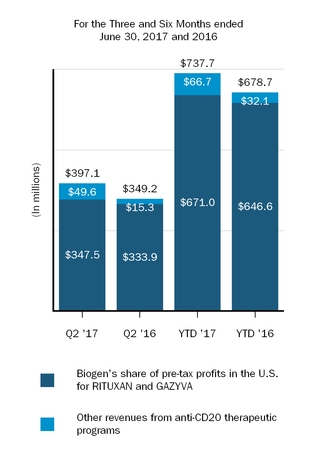

| Revenues from anti-CD20 therapeutic programs | 349.2 |

| | 337.5 |

| | 678.7 |

| | 668.1 |

| 397.1 |

| | 349.2 |

| | 737.7 |

| | 678.7 |

|

| Other | 79.0 |

| | 55.6 |

| | 166.9 |

| | 107.6 |

| 41.6 |

| | 79.0 |

| | 131.6 |

| | 166.9 |

|

| Total revenues | 2,894.2 |

| | 2,591.6 |

| | 5,621.0 |

| | 5,146.6 |

| 3,078.4 |

| | 2,894.2 |

| | 5,889.1 |

| | 5,621.0 |

|

| Cost and expenses: | | | | | | | | | | | | | | |

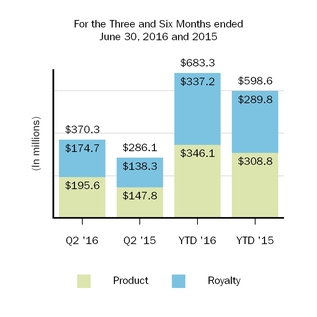

| Cost of sales, excluding amortization of acquired intangible assets | 370.3 |

| | 286.1 |

| | 683.3 |

| | 598.6 |

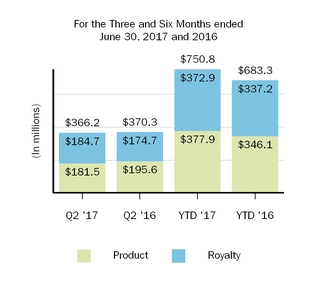

| 366.2 |

| | 370.3 |

| | 750.8 |

| | 683.3 |

|

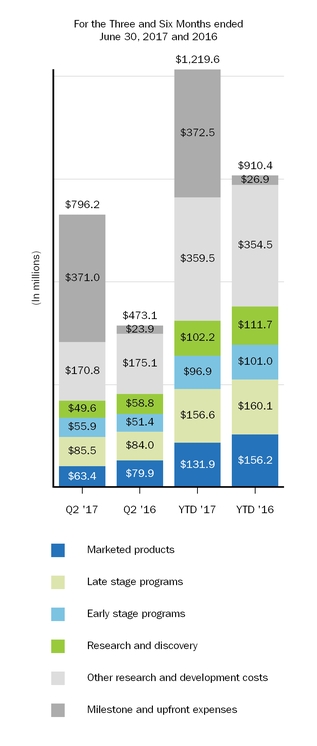

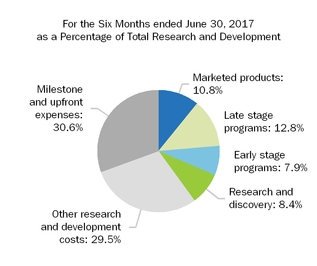

| Research and development | 473.1 |

| | 490.7 |

| | 910.4 |

| | 951.3 |

| 796.2 |

| | 473.1 |

| | 1,219.6 |

| | 910.4 |

|

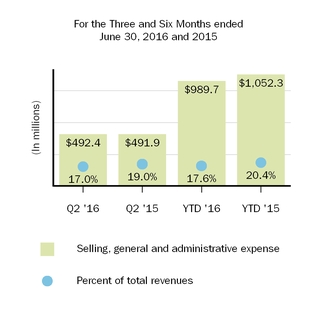

| Selling, general and administrative | 492.4 |

| | 491.9 |

| | 989.7 |

| | 1,052.3 |

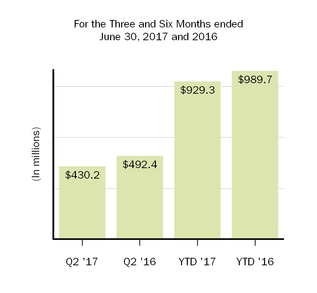

| 430.2 |

| | 492.4 |

| | 929.3 |

| | 989.7 |

|

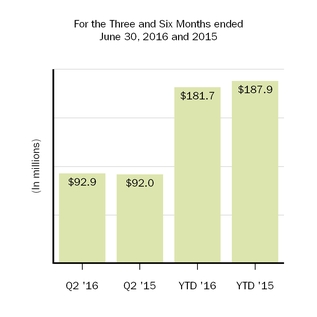

| Amortization of acquired intangible assets | 92.9 |

| | 92.0 |

| | 181.7 |

| | 187.9 |

| 117.5 |

| | 92.9 |

| | 566.0 |

| | 181.7 |

|

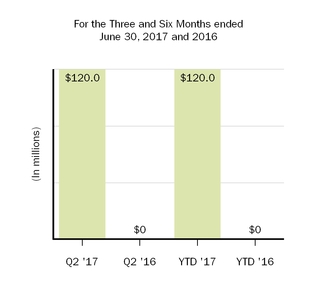

| Acquired in-process research and development | | 120.0 |

| | — |

| | 120.0 |

| | — |

|

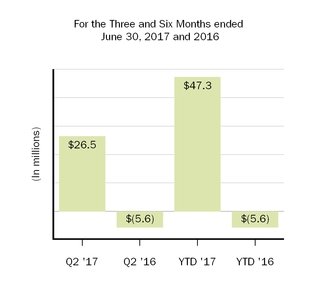

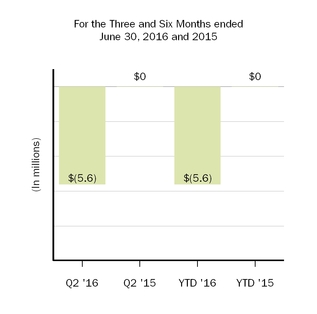

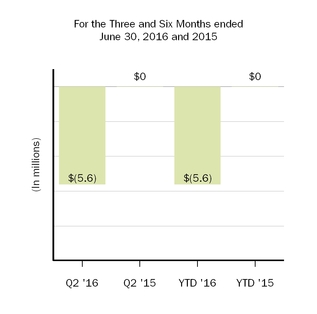

| Collaboration profit (loss) sharing | | 26.5 |

| | (5.6 | ) | | 47.3 |

| | (5.6 | ) |

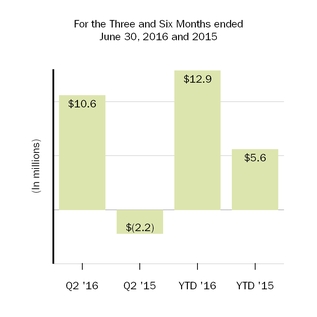

| (Gain) loss on fair value remeasurement of contingent consideration | 10.6 |

| | (2.2 | ) | | 12.9 |

| | 5.6 |

| 21.2 |

| | 10.6 |

| | 31.2 |

| | 12.9 |

|

| Restructuring charges | — |

| | — |

| | 9.7 |

| | — |

| — |

| | — |

| | — |

| | 9.7 |

|

| Collaboration profit (loss) sharing | (5.6 | ) | | — |

| | (5.6 | ) | | — |

| |

| Total cost and expenses | 1,433.7 |

| | 1,358.5 |

| | 2,782.1 |

| | 2,795.6 |

| 1,877.8 |

| | 1,433.7 |

| | 3,664.2 |

| | 2,782.1 |

|

| Income from operations | 1,460.5 |

| | 1,233.1 |

| | 2,838.9 |

| | 2,351.0 |

| 1,200.6 |

| | 1,460.5 |

| | 2,224.9 |

| | 2,838.9 |

|

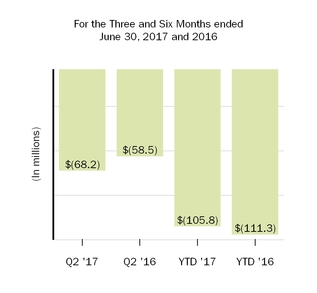

| Other income (expense), net | (58.5 | ) | | (10.9 | ) | | (111.3 | ) | | (25.9 | ) | (68.2 | ) | | (58.5 | ) | | (105.8 | ) | | (111.3 | ) |

| Income before income tax expense and equity in loss of investee, net of tax | 1,402.0 |

| | 1,222.2 |

| | 2,727.6 |

| | 2,325.1 |

| 1,132.4 |

| | 1,402.0 |

| | 2,119.1 |

| | 2,727.6 |

|

| Income tax expense | 353.6 |

| | 292.5 |

| | 710.0 |

| | 574.4 |

| 269.6 |

| | 353.6 |

| | 508.8 |

| | 710.0 |

|

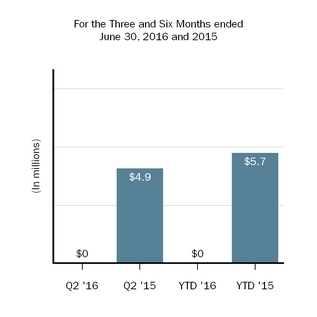

| Equity in loss of investee, net of tax | — |

| | 4.9 |

| | — |

| | 5.7 |

| — |

| | — |

| | — |

| | — |

|

| Net income | 1,048.4 |

| | 924.8 |

| | 2,017.6 |

| | 1,745.0 |

| 862.8 |

| | 1,048.4 |

| | 1,610.3 |

| | 2,017.6 |

|

| Net income (loss) attributable to noncontrolling interests, net of tax | (1.4 | ) | | (2.5 | ) | | (3.1 | ) | | (4.8 | ) | — |

| | (1.4 | ) | | (0.1 | ) | | (3.1 | ) |

| Net income attributable to Biogen Inc. | $ | 1,049.8 |

| | $ | 927.3 |

| | $ | 2,020.7 |

| | $ | 1,749.8 |

| $ | 862.8 |

| | $ | 1,049.8 |

| | $ | 1,610.4 |

| | $ | 2,020.7 |

|

| Net income per share: | | | | | | | | | | | | | | |

| Basic earnings per share attributable to Biogen Inc. | $ | 4.79 |

| | $ | 3.94 |

| | $ | 9.23 |

| | $ | 7.44 |

| $ | 4.07 |

| | $ | 4.79 |

| | $ | 7.53 |

| | $ | 9.23 |

|

| Diluted earnings per share attributable to Biogen Inc. | $ | 4.79 |

| | $ | 3.93 |

| | $ | 9.21 |

| | $ | 7.42 |

| $ | 4.07 |

| | $ | 4.79 |

| | $ | 7.52 |

| | $ | 9.21 |

|

| Weighted-average shares used in calculating: | | | | | | | | | | | | | | |

| Basic earnings per share attributable to Biogen Inc. | 219.1 |

| | 235.3 |

| | 219.0 |

| | 235.1 |

| 211.9 |

| | 219.1 |

| | 213.7 |

| | 219.0 |

|

| Diluted earnings per share attributable to Biogen Inc. | 219.4 |

| | 235.7 |

| | 219.3 |

| | 235.7 |

| 212.2 |

| | 219.4 |

| | 214.0 |

| | 219.3 |

|

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in millions)

| | | | For the Three Months

Ended June 30, | | For the Six Months

Ended June 30, | For the Three Months

Ended June 30, | | For the Six Months

Ended June 30, |

| | 2016 | | 2015 | | 2016 | | 2015 | 2017 | | 2016 | | 2017 | | 2016 |

| Net income attributable to Biogen Inc. | $ | 1,049.8 |

| | $ | 927.3 |

| | $ | 2,020.7 |

| | $ | 1,749.8 |

| $ | 862.8 |

| | $ | 1,049.8 |

| | $ | 1,610.4 |

| | $ | 2,020.7 |

|

| Other comprehensive income: | | | | | | | | | | | | | | |

| Unrealized gains (losses) on securities available for sale, net of tax | 4.5 |

| | (0.2 | ) | | 7.0 |

| | 1.1 |

| 7.2 |

| | 4.5 |

| | 5.6 |

| | 7.0 |

|

| Unrealized gains (losses) on cash flow hedges, net of tax | 29.3 |

| | (96.2 | ) | | (18.3 | ) | | (8.9 | ) | (103.0 | ) | | 29.3 |

| | (126.8 | ) | | (18.3 | ) |

| Unrealized gains (losses) on pension benefit obligation | 0.7 |

| | 2.9 |

| | 0.9 |

| | 4.1 |

| |

| Unrealized gains (losses) on pension benefit obligation, net of tax | | (0.6 | ) | | 0.7 |

| | (0.5 | ) | | 0.9 |

|

| Currency translation adjustment | (58.0 | ) | | 63.0 |

| | (48.4 | ) | | (37.8 | ) | 82.8 |

| | (58.0 | ) | | 102.8 |

| | (48.4 | ) |

| Total other comprehensive income (loss), net of tax | (23.5 | ) | | (30.5 | ) | | (58.8 | ) | | (41.5 | ) | (13.6 | ) | | (23.5 | ) | | (18.9 | ) | | (58.8 | ) |

| Comprehensive income attributable to Biogen Inc. | 1,026.3 |

| | 896.8 |

| | 1,961.9 |

| | 1,708.3 |

| 849.2 |

| | 1,026.3 |

| | 1,591.5 |

| | 1,961.9 |

|

| Comprehensive income (loss) attributable to noncontrolling interests, net of tax | (1.4 | ) | | (2.3 | ) | | (3.1 | ) | | (4.5 | ) | — |

| | (1.4 | ) | | (0.1 | ) | | (3.1 | ) |

| Comprehensive income | $ | 1,024.9 |

| | $ | 894.5 |

| | $ | 1,958.8 |

| | $ | 1,703.7 |

| $ | 849.2 |

| | $ | 1,024.9 |

| | $ | 1,591.4 |

| | $ | 1,958.8 |

|

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in millions, except per share amounts)

| | | | As of June 30,

2016 | | As of December 31,

2015 | As of June 30,

2017 | | As of December 31,

2016 |

ASSETS | | Current assets: | | | | | | |

| Cash and cash equivalents | $ | 1,362.0 |

| | $ | 1,308.0 |

| $ | 1,169.5 |

| | $ | 2,326.5 |

|

| Marketable securities | 2,434.8 |

| | 2,120.5 |

| 1,723.5 |

| | 2,568.6 |

|

| Accounts receivable, net | 1,293.0 |

| | 1,227.0 |

| 1,630.2 |

| | 1,441.6 |

|

| Due from anti-CD20 therapeutic programs | 334.1 |

| | 314.5 |

| 502.9 |

| | 300.6 |

|

| Inventory | 996.4 |

| | 893.4 |

| 936.5 |

| | 1,001.6 |

|

| Other current assets | 1,027.4 |

| | 836.9 |

| 1,146.1 |

| | 1,093.3 |

|

| Total current assets | 7,447.7 |

| | 6,700.3 |

| 7,108.7 |

| | 8,732.2 |

|

| Marketable securities | 3,477.6 |

| | 2,760.4 |

| 2,632.7 |

| | 2,829.4 |

|

| Property, plant and equipment, net | 2,301.8 |

| | 2,187.6 |

| 2,827.6 |

| | 2,501.8 |

|

| Intangible assets, net | 3,967.6 |

| | 4,085.1 |

| 4,051.3 |

| | 3,808.3 |

|

| Goodwill | 3,167.1 |

| | 2,663.8 |

| 3,870.4 |

| | 3,669.3 |

|

| Investments and other assets | 1,153.0 |

| | 1,107.6 |

| 1,268.3 |

| | 1,335.8 |

|

| Total assets | $ | 21,514.8 |

| | $ | 19,504.8 |

| $ | 21,759.0 |

| | $ | 22,876.8 |

|

LIABILITIES AND EQUITY | | Current liabilities: | | | | | | |

| Current portion of notes payable and other financing arrangements | $ | 4.8 |

| | $ | 4.8 |

| $ | 559.9 |

| | $ | 4.7 |

|

| Taxes payable | 212.8 |

| | 208.7 |

| 52.6 |

| | 231.9 |

|

| Accounts payable | 225.9 |

| | 267.4 |

| 330.3 |

| | 279.8 |

|

| Accrued expenses and other | 2,072.7 |

| | 2,096.8 |

| 2,436.9 |

| | 2,903.5 |

|

| Total current liabilities | 2,516.2 |

| | 2,577.7 |

| 3,379.7 |

| | 3,419.9 |

|

| Notes payable and other financing arrangements | 6,538.3 |

| | 6,521.5 |

| 5,954.0 |

| | 6,512.7 |

|

| Long-term deferred tax liability | 105.6 |

| | 124.9 |

| |

| Deferred tax liability | | 100.8 |

| | 93.1 |

|

| Other long-term liabilities | 951.0 |

| | 905.8 |

| 750.9 |

| | 722.5 |

|

| Total liabilities | 10,111.1 |

| | 10,129.9 |

| 10,185.4 |

| | 10,748.2 |

|

| Commitments and contingencies |

|

| |

|

|

|

| |

|

|

| Equity: | | | | | | |

| Biogen Inc. shareholders’ equity | | | | | | |

| Preferred stock, par value $0.001 per share | — |

| | — |

| — |

| | — |

|

| Common stock, par value $0.0005 per share | 0.1 |

| | 0.1 |

| 0.1 |

| | 0.1 |

|

| Additional paid-in capital | 69.1 |

| | — |

| 19.3 |

| | — |

|

| Accumulated other comprehensive loss | (282.8 | ) | | (224.0 | ) | (338.8 | ) | | (319.9 | ) |

| Retained earnings | 14,229.1 |

| | 12,208.4 |

| 14,881.7 |

| | 15,071.6 |

|

| Treasury stock, at cost | (2,611.7 | ) | | (2,611.7 | ) | (2,977.1 | ) | | (2,611.7 | ) |

| Total Biogen Inc. shareholders’ equity | 11,403.8 |

| | 9,372.8 |

| 11,585.2 |

| | 12,140.1 |

|

| Noncontrolling interests | (0.1 | ) | | 2.1 |

| (11.6 | ) | | (11.5 | ) |

| Total equity | 11,403.7 |

| | 9,374.9 |

| 11,573.6 |

| | 12,128.6 |

|

| Total liabilities and equity | $ | 21,514.8 |

| | $ | 19,504.8 |

| $ | 21,759.0 |

| | $ | 22,876.8 |

|

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in millions)

|

| | | | | | | |

| | For the Six Months

Ended June 30, |

| | 2016 | | 2015 |

| Cash flows from operating activities: | | | |

| Net income | $ | 2,017.6 |

| | $ | 1,745.0 |

|

| Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| Depreciation and amortization | 325.1 |

| | 292.5 |

|

| Share-based compensation | 84.1 |

| | 93.7 |

|

| Deferred income taxes | (30.2 | ) | | (90.6 | ) |

| Other | 19.8 |

| | (5.8 | ) |

| Changes in operating assets and liabilities, net: | | | |

| Accounts receivable | (65.0 | ) | | (38.9 | ) |

| Inventory | (128.3 | ) | | (81.3 | ) |

| Accrued expenses and other current liabilities | (162.3 | ) | | (169.9 | ) |

| Current taxes payable | (151.7 | ) | | 102.0 |

|

| Other changes in operating assets and liabilities, net | 50.1 |

| | (66.4 | ) |

| Net cash flows provided by operating activities | 1,959.2 |

| | 1,780.3 |

|

| Cash flows from investing activities: | | | |

| Proceeds from sales and maturities of marketable securities | 2,823.6 |

| | 975.5 |

|

| Purchases of marketable securities | (3,833.3 | ) | | (2,045.0 | ) |

| Acquisitions of business, net of cash acquired | — |

| | (198.8 | ) |

| Purchases of property, plant and equipment | (263.7 | ) | | (227.7 | ) |

| Contingent consideration related to Fumapharm AG acquisition | (600.0 | ) | | (250.0 | ) |

| Other | (65.9 | ) | | (10.1 | ) |

| Net cash flows used in investing activities | (1,939.3 | ) | | (1,756.1 | ) |

| Cash flows from financing activities: | | | |

| Purchase of treasury stock | — |

| | (42.2 | ) |

| Proceeds from issuance of stock for share-based compensation arrangements | 23.9 |

| | 34.7 |

|

| Excess tax benefit from share-based awards | 9.0 |

| | 69.7 |

|

| Other | 1.1 |

| | 15.0 |

|

| Net cash flows provided by financing activities | 34.0 |

| | 77.2 |

|

| Net increase in cash and cash equivalents | 53.9 |

| | 101.4 |

|

| Effect of exchange rate changes on cash and cash equivalents | 0.1 |

| | (24.2 | ) |

| Cash and cash equivalents, beginning of the period | 1,308.0 |

| | 1,204.9 |

|

| Cash and cash equivalents, end of the period | $ | 1,362.0 |

| | $ | 1,282.1 |

|

|

| | | | | | | |

| | For the Six Months

Ended June 30, |

| | 2017 | | 2016 |

| Cash flows from operating activities: | | | |

| Net income | $ | 1,610.3 |

| | $ | 2,017.6 |

|

| Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| Depreciation, amortization and acquired in-process research and development | 814.6 |

| | 325.1 |

|

| Share-based compensation | 67.3 |

| | 84.1 |

|

| Deferred income taxes | (20.5 | ) | | (30.2 | ) |

| Other | 73.5 |

| | 28.9 |

|

| Changes in operating assets and liabilities, net: | | | |

| Accounts receivable | (301.2 | ) | | (65.0 | ) |

| Inventory | (85.3 | ) | | (128.3 | ) |

| Accrued expenses and other current liabilities | (452.3 | ) | | (116.4 | ) |

| Income tax assets and liabilities | (114.7 | ) | | (76.7 | ) |

| Other changes in operating assets and liabilities, net | (187.3 | ) | | (25.1 | ) |

| Net cash flows provided by operating activities | 1,404.4 |

| | 2,014.0 |

|

| Cash flows from investing activities: | | | |

| Proceeds from sales and maturities of marketable securities | 3,584.5 |

| | 2,823.6 |

|

| Purchases of marketable securities | (2,536.0 | ) | | (3,833.3 | ) |

| Contingent consideration related to Fumapharm AG acquisition | (600.0 | ) | | (600.0 | ) |

| Acquired in-process research and development | (120.0 | ) | | — |

|

| Purchases of property, plant and equipment | (407.7 | ) | | (263.7 | ) |

| Acquisitions of intangible assets | (860.3 | ) | | — |

|

| Other | (7.3 | ) | | (65.9 | ) |

| Net cash flows used in investing activities | (946.8 | ) | | (1,939.3 | ) |

| Cash flows from financing activities: | | | |

| Purchases of treasury stock | (1,365.4 | ) | | — |

|

| Payments related to issuance of stock for share-based compensation arrangements, net | (17.8 | ) | | (21.9 | ) |

| Net cash contribution to Bioverativ Inc. | (302.7 | ) | | — |

|

| Other | 33.5 |

| | 1.1 |

|

| Net cash flows used in financing activities | (1,652.4 | ) | | (20.8 | ) |

| Net (decrease) increase in cash and cash equivalents | (1,194.8 | ) | | 53.9 |

|

| Effect of exchange rate changes on cash and cash equivalents | 37.8 |

| | 0.1 |

|

| Cash and cash equivalents, beginning of the period | 2,326.5 |

| | 1,308.0 |

|

| Cash and cash equivalents, end of the period | $ | 1,169.5 |

| | $ | 1,362.0 |

|

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Summary of Significant Accounting Policies

Business Overview

Biogen is a global biopharmaceutical company focused on discovering, developing, manufacturing and delivering therapies to patients for the treatment ofpeople living with serious neurological diseases, autoimmune disorders and rareneurodegenerative diseases.

Our marketed products include TECFIDERA, AVONEX, PLEGRIDY, TYSABRI, ZINBRYTA and FAMPYRA for multiple sclerosis (MS), ELOCTATESPINRAZA for hemophilia A and ALPROLIX for hemophilia Bthe treatment of spinal muscular atrophy (SMA) and FUMADERM for the treatment of severe plaque psoriasis. We also have a collaboration agreement with Genentech, Inc. (Genentech), a wholly-owned member of the Roche Group, which entitles us to certain business and financial rights with respect to RITUXAN for the treatment of non-Hodgkin's lymphoma, chronic lymphocytic leukemia (CLL) and other conditions, GAZYVA indicated for the treatment of CLL and follicular lymphoma, OCREVUS indicated for the treatment of primary progressive MS and relapsing MS, and other potential anti-CD20 therapies.therapies under a collaboration agreement with Genentech, Inc., a wholly-owned member of the Roche Group.

We support our drug discovery and development efforts through the commitment of significant resources to discovery, research and development programs and business development opportunities, particularly within areas of our scientific, manufacturing and technical capabilities. We intend to invest in the future across our core growth areas of MS and neuroimmunology, Alzheimer's disease and dementia, Parkinson's disease and movement disorders, and neuromuscular diseases including SMA and amyotrophic lateral sclerosis (ALS). Further, we see opportunities to invest in emerging growth areas such as pain, ophthalmology, neuropsychiatry, and acute neurology. In addition, we are employing innovative technologies to ourdiscover potential treatments for rare and genetic disorders, including new ways of treating diseases through gene therapy.

Our innovative drug development efforts, we aimand commercialization activities are complemented by our biosimilar therapies that expand access to leveragemedicines and reduce the cost burden for healthcare systems. We are leveraging our manufacturing capabilities and scientific expertiseknow-how to develop, manufacture and market biosimilars through Samsung Bioepis, our joint venture with Samsung BioLogics Co. Ltd. (Samsung Biologics) that develops, manufactures and markets biosimilars as well as through other strategic contract manufacturing partners.. Under our commercial agreement, with Samsung Bioepis, we market and sell BENEPALI, an etanercept biosimilar referencing ENBREL, and FLIXABI, an infliximab biosimilar referencing REMICADE, in the European Union (E.U.).

In May 2016,Hemophilia Spin-Off

On February 1, 2017, we announced our intention to spin offcompleted the spin-off of our hemophilia business, Bioverativ Inc. (Bioverativ), as an independent, publicly traded company. The new company will focus onOur consolidated results of operations and financial position included in these unaudited condensed consolidated financial statements reflect the discovery and development of therapies for the treatment of hemophilia and other blood disorders, with existing marketed products ELOCTATE and ALPROLIX. The transaction is expected to be completed in early 2017, subject to the satisfaction of certain conditions, including, among others, final approval of our Board of Directors, receipt of a favorable opinion with respect to the tax-free nature of the transaction and the effectiveness of a Form 10 registration statement that will be filed with the Securities and Exchange Commission. Thefinancial results of our hemophilia business will be included infor all periods through January 31, 2017.

For additional information related to the spin-off of our hemophilia business, please read Note 3, Hemophilia Spin-Off, to these condensed consolidated financial statements until the transaction is completed.statements.

Basis of Presentation

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring accruals, necessary for a fair statementpresentation of our financial statements for interim periods in accordance with accounting principles generally accepted in the United States (U.S. GAAP). The information included in this quarterly report on Form 10-Q should be read in conjunction with our consolidated financial statements and the accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2015 (20152016 (2016 Form 10-K). Our accounting policies are described in the “Notes to Consolidated Financial Statements” in our 20152016 Form 10-K and updated, as necessary, in this Form 10-Q. The year-end condensed consolidated balance sheet data presented for comparative purposes was derived from our audited financial statements, but does not include all disclosures required by U.S. GAAP. The results of operations for the three and six months ended June 30, 2016,2017, are not necessarily indicative of the operating results for the full year or for any other subsequent interim period.

We operate as one operating segment, which is focused on discovering, developing, manufacturing and delivering therapies to patients for the treatmentpeople living with serious neurological and neurodegenerative diseases.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Consolidation

Our condensed consolidated financial statements reflect our financial statements, those of our wholly-owned subsidiaries and those of certain variable interest entities where we are the primary beneficiary. For consolidated entities where we own or are exposed to less than 100% of the economics, we record net income (loss) attributable to noncontrolling interests in our condensed consolidated statements of income equal to the percentage of the economic or ownership interest retained in such entities by the respective noncontrolling parties. Intercompany balances and transactions are eliminated in consolidation.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

In determining whether we are the primary beneficiary of an entity, we apply a qualitative approach that determines whether we have both (1) the power to direct the economically significant activities of the entity and (2) the obligation to absorb losses of, or the right to receive benefits from, the entity that could potentially be significant to that entity. These considerations impact the way we account for our existing collaborative relationships and other arrangements. We continuously assess whether we are the primary beneficiary of a variable interest entity as changes to existing relationships or future transactions may result in us consolidating or deconsolidating one or more of our collaborators or partners.

Use of Estimates

The preparation of our condensed consolidated financial statements requires us to make estimates, judgments and assumptions that may affect the reported amounts of assets, liabilities, equity, revenues and expenses and related disclosure of contingent assets and liabilities. On an on-goingongoing basis we evaluate our estimates, judgments and methodologies. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable, the results of which form the basis for making judgments about the carrying values of assets, liabilities and equity and the amount of revenues and expenses. Actual results may differ from these estimates under different assumptions or conditions.

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (FASB) or other standard setting bodies that we adopt as of the specified effective date. Unless otherwise discussed, we do not believe that the impact of recently issued standards that are not yet effective will have a material impact on our financial position or results of operations upon adoption.

We adopted the following new standards effective January 1, 2017:

ASU No. 2016-06, Derivatives and Hedging (Topic 815): Contingent Put and Call Options in Debt Instruments.

ASU No. 2016-07, Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting.

ASU No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting.

The adoption of these standards did not have a material impact on our financial position, results of operations or statement of cash flows; however, the adoption of ASU No. 2016-09 resulted in the reclassification of certain prior year amounts in our condensed consolidated statements of cash flows to conform to our current year presentation. Specifically, amounts previously disclosed in net cash flows used in financing activities related to our excess tax benefit from share-based compensation have been reclassified to net cash flows provided by operating activities and amounts related to cash paid when withholding shares for tax withholding purposes, previously disclosed in net cash flows provided by operating activities, have been reclassified to net cash flows used in financing activities.

For additional information related to these standards, please read Note 1, Summary of Significant Accounting Policies: New Accounting Pronouncements, to our consolidated financial statements included in our 2016 Form 10-K.

In May 2014 the FASB issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes all existing revenue recognition requirements, including most industry-specific guidance. The new standard requires a company to recognize revenue when it transfers goods or services to customers in an amount that reflects the consideration that the company expects to receive for those goods or services. In August 2015, theThe FASB has subsequently issued amendments to ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which delayed the effective date of the new standard from January 1, 2017 to January 1, 2018. The FASB also agreed to allow entities to choose to adopt the standard as of the original effective date. In March 2016, the FASB issued ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations, which clarifies the implementation guidance on principal versus agent considerations. In April 2016, the FASB issued ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarifies certain aspects of identifying performance obligations and licensing implementation guidance. In May 2016, the FASB issued ASU No. 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients related to disclosures of remaining performance obligations, as well as other amendments to guidance on collectibility, non-cash consideration and the presentation of sales and other similar taxes collected from customers. These standards2014-09 that have the same effective date and transition date of January 1, 2018. We are currently evaluating the method of adoption and the potential impact thatexpect to adopt these standards may have on our financial position and results of operations.

During 2015,using the FASB issued the following new standards, which we adopted on January 1, 2016:

ASU No. 2015-05, Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer's Accounting for Fees Paid in a Cloud Computing Arrangement.

ASU No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory.

ASU No. 2015-16, Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments.

The adoption of these standards did not have an impact on our financial position or results of operations. For additional information related to these standards, please read Note 1, Summary of Significant Accounting Policies: New Accounting Pronouncements to our consolidated financial statements included in our 2015 Form 10-K.modified retrospective

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)(unaudited, continued)

method. We have performed a review of the new standards as compared to our current accounting policies with respect to our product revenues, and a review of our customer contracts is in process. As of June 30, 2017, we have not identified any accounting changes that would materially impact the amount of reported product revenues. During the second half of 2017, we plan to finalize our review of product revenues as well as our other revenue streams to determine the impact that this standard may have on our results of operations, financial position and disclosures.

In January 2016 the FASB issued ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The new standard amends certain aspects of accounting and disclosure requirements of financial instruments, including the requirement that equity investments with readily determinable fair values be measured at fair value with changes in fair value recognized in oura company's results of operations. The new standard does not apply to investments accounted for under the equity method of accounting or those that result in consolidation of the investee. Equity investments that do not have readily determinable fair values may be measured at fair value or at cost minus impairment adjusted for changes in observable prices. A financial liability that is measured at fair value in accordance with the fair value option is required to be presented separately in other comprehensive income for the portion of the total change in the fair value resulting from change in the instrument-specific credit risk. In addition, a valuation allowance should be evaluated on deferred tax assets related to available-for-sale debt securities in combination with other deferred tax assets. The new standard will be effective for us on January 1, 2018. TheBased on our current investment holdings, the adoption of this standard is not expected to have a material impact on our financial position or results of operations.operations; however, it will result in the reclassification of certain investments.

In February 2016 the FASB issued ASU No. 2016-02, Leases (Topic 842). The new standard requires that all lessees recognize the assets and liabilities that arise from leases on thetheir balance sheet and disclose qualitative and quantitative information about itstheir leasing arrangements. The new standard will be effective for us on January 1, 2019. We are currently evaluating the impact that this standard may have on our results of operations, financial position and disclosures. The adoption of this standard is not expected to have a material impact on our net financial position, but willmay materially impact ourthe reported amount of total assets and total liabilities. We are currently evaluating the potential impact that this standard may have on our results of operations.

In March 2016, the FASB issued ASU No. 2016-06, Derivatives and Hedging (Topic 815): Contingent Put and Call Options in Debt Instruments. The new standard simplifies the embedded derivative analysis for debt instruments containing contingent call or put options by removing the requirement to assess whether a contingent event is related to interest rates or credit risks. The new standard will be effective for us on January 1, 2017. The adoption of this standard is not expected to have an impact on our financial position or results of operations.

In March 2016, the FASB issued ASU No. 2016-07, Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting. The new standard eliminates the requirement that when an investment qualifies for use of the equity method as a result of an increase in the level of ownership interest or degree of influence, an adjustment must be made to the investment, results of operations and retained earnings retroactively on a step-by-step basis as if the equity method had been in effect during all previous periods that the investment had been held. The new standard will be effective for us on January 1, 2017. The adoption of this standard is not expected to have a material impact on our financial position or results of operations.

In March 2016, the FASB issued ASU No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. The new standard requires recognition of the income tax effects of vested or settled awards in the income statement and involves several other aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities and classification on the statement of cash flows. The new standard will be effective for us on January 1, 2017. This standard is not expected to have a material impact on our financial position, results of operations or statements of cash flows upon adoption.

In June 2016 the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The new standard changes the impairment model for most financial assets and certain other instruments. Under the new standard, entities holding financial assets and net investment in leases that are not accounted for at fair value through net income are to be presented at the net amount expected to be collected. An allowance for credit losses will be a valuation account that will be deducted from the amortized cost basis of the financial asset to present the net carrying value at the amount expected to be collected on the financial asset. The new standard will be effective for us on January 1, 2020. The adoption of this standard is not expected to have a material impact on our financial position or results of operations.

In August 2016 the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The new standard clarifies certain aspects of the statement of cash flows, including the classification of debt prepayment or debt extinguishment costs, settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing, contingent consideration payments made after a business combination, proceeds from the settlement of insurance claims, proceeds from the settlement of corporate-owned life insurance policies, distributions received from equity method investees and beneficial interests in securitization transactions. The new standard also clarifies that an entity should determine each separately identifiable source or use within the cash receipts and cash payments on the basis of the nature of the underlying cash flows. In situations in which cash receipts and payments have aspects of more than one class of cash flows and cannot be separated by source or use, the appropriate classification should depend on the activity that is likely to be the predominant source or use of cash flows for the item. The new standard will be effective for us on January 1, 2018. The adoption of this standard is not expected to have a material impact on our statements of cash flows upon adoption.

In October 2016 the FASB issued ASU No. 2016-16, Income Taxes (Topic 740): Intra-Entity Transfer of Assets Other Than Inventory. The new standard eliminates the deferral of the tax effects of intra-entity transfers of an asset other than inventory. Under the new standard, entities should recognize the income tax consequences on an intra-entity transfer of an asset other than inventory when the transfer occurs. The new standard will be effective for us on January 1, 2018. We expect to adopt this standard using the modified retrospective method applied through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. The adoption

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

2. Restructuringof this standard is expected to have a material impact on our net financial position; however, the final effect of the adoption of this standard will depend on the nature and amount of future transactions.

On October 21, 2015, we announcedIn January 2017 the FASB issued ASU No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a corporate restructuring, which includedBusiness. The new standard clarifies the terminationdefinition of certain pipeline programsa business and provides a screen to determine when an 11% reductionintegrated set of assets and activities is not a business. The screen requires that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in workforce. Under this restructuring, cash payments will total approximately $120 million,a single identifiable asset or a group of which $15.9 million were related to previously accrued 2015 incentive compensation, resulting in net expected restructuring charges totaling approximately $105 million. These amountssimilar identifiable assets, the set is not a business. The new standard will be substantially paideffective for us on January 1, 2018; however, we have adopted this standard as of January 1, 2017, with prospective application to any business development transaction.

In January 2017 the FASB issued ASU No. 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test of Goodwill Impairment. The new standard eliminates Step 2 from the goodwill impairment test. Under the amendments in ASU No. 2017-04, an entity should recognize an impairment charge for the amount by which the endcarrying amount of 2016.a reporting unit exceeds that reporting unit’s fair value; however, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. The new standard will be effective for us on January 1, 2020; however, early adoption is permitted. We intend to early adopt this standard as of October 31, 2017, during our annual review of goodwill. The adoption of this standard is not expected to have a material impact on our financial position or results of operations.

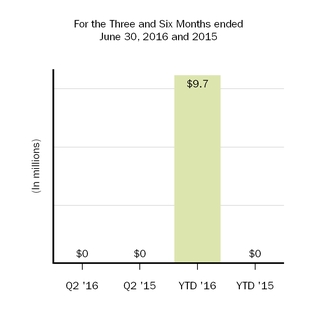

ForIn March 2017 the threeFASB issued ASU No. 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and six months ended June 30, 2016, we recognized restructuring charges totaling $0.0 millionNet Periodic Postretirement Benefit Cost. The new standard will require that an employer disaggregate the service cost component from the other components of net benefit cost. The amendments also provide explicit guidance on how to present the service cost component and $9.7 million, respectively. We previously recognized $93.4 millionthe other components of restructuring chargesnet benefit cost in ourthe income statement and allow only the service cost component of net benefit cost to be eligible for capitalization. The other components of the net periodic benefit cost must be presented separately from the line items that include service cost and outside of any subtotal of operating income on the condensed consolidated statements of income duringincome. The new standard will be effective for us on January 1, 2018. The adoption of this standard is not expected to have a material impact on our financial position or results of operations.

In March 2017 the fourth quarterFASB issued ASU No. 2017-08, Receivables - Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The new standard amends the amortization period for certain purchased callable debt securities held at a premium by shortening the amortization period for the premium to the earliest call date. The new standard will be effective for us on January 1, 2019. We are currently evaluating the potential impact that this standard may have on our financial position and results of 2015. Our restructuring reserveoperations.

In May 2017 the FASB issued ASU No. 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting. The new standard provides guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. The new standard will be effective for us on January 1, 2018; however, early adoption is included in accrued expenses and other inpermitted. The adoption of this standard is not expected to have a material impact on our condensed consolidated balance sheets.

The following table summarizes the charges and spending related to our restructuring efforts during the six months ended June 30, 2016:

|

| | | | | | | | | | | |

| (In millions) | Workforce Reduction | | Pipeline Programs | | Total |

| Restructuring reserve as of December 31, 2015 | $ | 33.7 |

| | $ | 3.6 |

| | $ | 37.3 |

|

| Expense | 4.9 |

| | 5.4 |

| | 10.3 |

|

| Payments | (28.7 | ) | | (6.0 | ) | | (34.7 | ) |

| Adjustments to previous estimates, net | (3.5 | ) | | 2.9 |

| | (0.6 | ) |

| Restructuring reserve as of June 30, 2016 | $ | 6.4 |

| | $ | 5.9 |

| | $ | 12.3 |

|

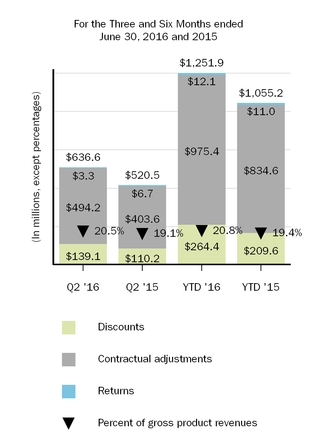

3. Reserves for Discounts and Allowances

An analysisfinancial position or results of the change in reserves for discounts and allowances is summarized as follows:

|

| | | | | | | | | | | | | | | |

| (In millions) | Discounts | | Contractual Adjustments | | Returns | | Total |

| Balance, as of December 31, 2015 | $ | 56.1 |

| | $ | 548.7 |

| | $ | 57.9 |

| | $ | 662.7 |

|

| Current provisions relating to sales in current year | 266.8 |

| | 973.8 |

| | 17.6 |

| | 1,258.2 |

|

| Adjustments relating to prior years | (2.4 | ) | | 1.6 |

| | (5.5 | ) | | (6.3 | ) |

| Payments/credits relating to sales in current year | (210.2 | ) | | (605.1 | ) | | (0.7 | ) | | (816.0 | ) |

| Payments/credits relating to sales in prior years | (51.5 | ) | | (384.9 | ) | | (10.4 | ) | | (446.8 | ) |

| Balance, as of June 30, 2016 | $ | 58.8 |

| | $ | 534.1 |

| | $ | 58.9 |

| | $ | 651.8 |

|

The total reserves above, included in our condensed consolidated balance sheets, are summarized as follows:

|

| | | | | | | |

| (In millions) | As of

June 30,

2016 | | As of

December 31,

2015 |

| Reduction of accounts receivable | $ | 161.3 |

| | $ | 144.6 |

|

| Component of accrued expenses and other | 490.5 |

| | 518.1 |

|

| Total reserves | $ | 651.8 |

| | $ | 662.7 |

|

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

4. Inventory2. Acquisitions

On May 15, 2017, we completed an asset purchase of the Phase 3 candidate, CIRARA (now known as BIIB093), from Remedy Pharmaceuticals Inc. (Remedy). The componentstarget indication for BIIB093 is large hemispheric infarction (LHI), a severe form of inventory are summarized as follows:

|

| | | | | | | |

| (In millions) | As of

June 30,

2016 | | As of

December 31,

2015 |

| Raw materials | $ | 235.0 |

| | $ | 213.0 |

|

| Work in process | 654.6 |

| | 577.6 |

|

| Finished goods | 139.1 |

| | 143.0 |

|

| Total inventory | $ | 1,028.7 |

| | $ | 933.6 |

|

| | | | |

| Balance Sheet Classification: | | | |

| Inventory | $ | 996.4 |

| | $ | 893.4 |

|

| Investments and other assets | 32.3 |

| | 40.2 |

|

| Total inventory | $ | 1,028.7 |

| | $ | 933.6 |

|

Inventory included in investmentsischemic stroke where brain swelling (cerebral edema) often leads to a disproportionately large share of stroke-related morbidity and other assets in our condensed consolidated balance sheets primarily consisted of work in process.

As of December 31, 2015, our inventory included $24.7 million associated with our ZINBRYTA program, $24.2 million associated with the FLIXABI program and $18.4 million associated with the BENEPALI program, which had been capitalized in advance of regulatory approval.mortality. The European Commission (EC) approved the marketing authorization applications for BENEPALI and FLIXABI, two anti-tumor necrosis factor (TNF) biosimilars, for marketing in the E.U. in January 2016 and May 2016, respectively, and the U.S. Food and Drug Administration (FDA) approved ZINBRYTArecently granted BIIB093 Orphan Drug Designation for severe cerebral edema in patients with acute ischemic stroke. The FDA has also granted BIIB093 Fast Track designation. Under the terms of the purchase agreement, we will have responsibility for the treatmentfuture development and commercialization of relapsing forms of MSBIIB093 and have agreed to pay Remedy certain development and sales based milestone payments, which are substantially payable upon or after regulatory approval, as well as royalties on future commercial sales. Remedy will share in the U.S.cost of development for the target indication for BIIB093 in May 2016.LHI stroke.

We are accounting for this transaction as an asset acquisition as we did not acquire any employees from Remedy nor did we acquire any significant processes required in the development of BIIB093. Upon closing of the transaction, we made a $120.0 million upfront payment, which was recorded as acquired in-process research and development in our condensed consolidated statements of income as BIIB093 has not yet reached technological feasibility.

5. Intangible Assets3. Hemophilia Spin-Off

On February 1, 2017, we completed the spin-off of our hemophilia business, Bioverativ, as an independent, publicly traded company trading under the symbol "BIVV" on the Nasdaq Global Select Market. The spin-off was accomplished through the distribution of all the then outstanding shares of common stock of Bioverativ to Biogen shareholders, who received one share of Bioverativ common stock for every two shares of Biogen common stock they owned. The separation and Goodwilldistribution was structured to be tax-free for shareholders for federal income tax purposes. Bioverativ assumed all of our rights and obligations under our collaboration agreement with Swedish Orphan Biovitrum AB and our collaboration and license agreement with Sangamo Biosciences Inc.

Intangible AssetsIn connection with the distribution, Biogen and Bioverativ entered into a separation agreement and various other agreements (including a transition services agreement, a tax matters agreement, a manufacturing and supply agreement, an employee matters agreement, an intellectual property matters agreement and certain other commercial agreements). These agreements govern the separation and distribution and the relationship between the two companies going forward. They also provide for the performance of services by each company for the benefit of the other for a period of time. In addition, under the terms of the separation agreement, Bioverativ is obligated to indemnify us for many liabilities that may exist relating to its business activities, whether incurred prior to or after the distribution, including any pending or future litigation.

Intangible assets, netThe services under these agreements generally commenced on February 1, 2017 (the distribution date), and are expected to terminate within 12 months of accumulated amortization, impairment chargesthe distribution date, with the exception of the manufacturing and adjustments, are summarized as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of June 30, 2016 | | As of December 31, 2015 |

| (In millions) | Estimated Life | | Cost | | Accumulated Amortization | | Net | | Cost | | Accumulated Amortization | | Net |

| Out-licensed patents | 13-23 years | | $ | 543.3 |

| | $ | (514.9 | ) | | $ | 28.4 |

| | $ | 543.3 |

| | $ | (506.0 | ) | | $ | 37.3 |

|

Developed technology | 15-23 years | | 3,005.3 |

| | (2,604.5 | ) | | 400.8 |

| | 3,005.3 |

| | (2,552.9 | ) | | 452.4 |

|

| In-process research and development | Indefinite until commercialization | | 692.3 |

| | — |

| | 692.3 |

| | 730.5 |

| | — |

| | 730.5 |

|

Trademarks and tradenames | Indefinite | | 64.0 |

| | — |

| | 64.0 |

| | 64.0 |

| | — |

| | 64.0 |

|

Acquired and in-licensed rights and patents | 6-18 years | | 3,405.4 |

| | (623.3 | ) | | 2,782.1 |

| | 3,303.2 |

| | (502.3 | ) | | 2,800.9 |

|

| Total intangible assets | | | $ | 7,710.3 |

| | $ | (3,742.7 | ) | | $ | 3,967.6 |

| | $ | 7,646.3 |

| | $ | (3,561.2 | ) | | $ | 4,085.1 |

|

For the threesupply agreement, which has an initial term of five years, with a five year extension at Bioverativ's sole discretion and six months ended June 30, 2016, amortization of acquired intangible assets totaled $92.9 milliona further five year extension with Bioverativ's and $181.7 million, respectively, as compared to $92.0 million and $187.9 million, respectively, in the prior year comparative periods. In-process research and development amounts include adjustments for foreign exchange rate fluctuations.our consent.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

In connection with the distribution we made a net cash contribution to Bioverativ, during the first quarter of 2017, totaling $302.7 million. The following table summarizes the assets and liabilities that were charged against equity as a result of the spin-off of our hemophilia business:

|

| | | |

| (In millions) | |

| Assets | |

| Cash | $ | 302.7 |

|

| Accounts receivable | 144.7 |

|

| Inventory | 116.1 |

|

| Property, plant and equipment, net | 20.2 |

|

| Intangible assets, net | 56.8 |

|

| Goodwill | 314.1 |

|

| Other, net | 53.7 |

|

| Assets transferred, net | $ | 1,008.3 |

|

| | |

| Liabilities | |

| Accrued expenses and other current liabilities | $ | 87.8 |

|

| Other long-term liabilities | 67.7 |

|

| Liabilities transferred, net | $ | 155.5 |

|

Under the manufacturing and supply agreement, we manufacture and supply certain products and materials to Bioverativ. For the three and six months ended June 30, 2017, we recognized $4.0 million and $7.1 million, respectively, in revenues in relation to these services, which is reflected as a component of other revenues in our condensed consolidated statements of income. We also recorded $3.7 million and $6.6 million as cost of sales in relation to these services during the three and six months ended June 30, 2017, respectively.

Pursuant to the terms of our agreements with Bioverativ, upon completion of the spin-off, we have continued to distribute ALPROLIX and ELOCTATE on behalf of Bioverativ and expect to do so until Bioverativ obtains appropriate regulatory authorizations in certain countries, including the United States (U.S.) and Canada. Under this arrangement, we are distributing these products as an agent of Bioverativ and will also provide related cash management services in connection with sales transactions, including the collection of receivables and the remittance of applicable discounts and allowances. Our consolidated financial position and results of operations do not reflect recognition of activity or balances related to these transactions.

Amounts earned under the non-manufacturing and supply related transaction service agreements are recorded as a reduction of costs and expenses in their respective expense line items, primarily in selling, general and administrative expenses, in our condensed consolidated statements of income. For the three and six months ended June 30, 2017, these amounts were not significant.

Hemophilia related product revenues reflected in our condensed consolidated statements of income for the six months ended June 30, 2017, totaled $74.4 million, as compared to $205.0 million and $387.7 million for the three and six months ended June 30, 2016, respectively. Results for the six months ended June 30, 2017, only reflect hemophilia-related product revenues through January 31, 2017.

Patents

Prior to the spin-off of our hemophilia business, we were awarded various methods of treatment and composition of matter patents related to ELOCTATE and ALPROLIX. Upon completion of the spin-off, these patents were transferred to the patent portfolio of Bioverativ.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

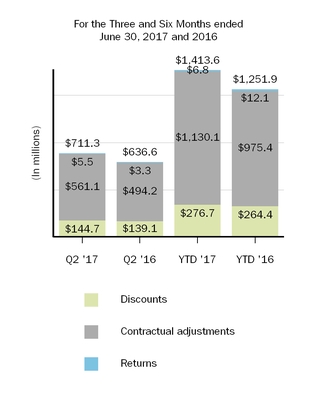

4. Reserves for Discounts and Allowances

An analysis of the change in reserves for discounts and allowances is summarized as follows:

|

| | | | | | | | | | | | | | | |

| (In millions) | Discounts | | Contractual Adjustments | | Returns | | Total |

| Balance, as of December 31, 2016 | $ | 71.6 |

| | $ | 482.7 |

| | $ | 51.2 |

| | $ | 605.5 |

|

| Current provisions relating to sales in current year | 276.9 |

| | 1,120.0 |

| | 15.2 |

| | 1,412.1 |

|

| Adjustments relating to prior years | (0.2 | ) | | 10.1 |

| | (8.4 | ) | | 1.5 |

|

| Payments/credits relating to sales in current year | (186.5 | ) | | (649.9 | ) | | — |

| | (836.4 | ) |

| Payments/credits relating to sales in prior years | (67.6 | ) | | (379.1 | ) | | (11.7 | ) | | (458.4 | ) |

| Balance, as of June 30, 2017 | $ | 94.2 |

| | $ | 583.8 |

| | $ | 46.3 |

| | $ | 724.3 |

|

The total reserves above, which are included in our condensed consolidated balance sheets, are summarized as follows:

|

| | | | | | | |

| (In millions) | As of

June 30,

2017 | | As of

December 31,

2016 |

| Reduction of accounts receivable | $ | 191.0 |

| | $ | 166.9 |

|

| Component of accrued expenses and other | 533.3 |

| | 438.6 |

|

| Total reserves | $ | 724.3 |

| | $ | 605.5 |

|

5. Inventory

The components of inventory are summarized as follows:

|

| | | | | | | |

| (In millions) | As of

June 30,

2017 | | As of

December 31,

2016 |

| Raw materials | $ | 148.3 |

| | $ | 170.4 |

|

| Work in process | 629.3 |

| | 698.7 |

|

| Finished goods | 184.2 |

| | 170.3 |

|

| Total inventory | $ | 961.8 |

| | $ | 1,039.4 |

|

| | | | |

| Balance Sheet Classification: | | | |

| Inventory | $ | 936.5 |

| | $ | 1,001.6 |

|

| Investments and other assets | 25.3 |

| | 37.8 |

|

| Total inventory | $ | 961.8 |

| | $ | 1,039.4 |

|

Long-term inventory, which primarily consists of work in process, is included in investments and other assets in our condensed consolidated balance sheets.

Balances in the table above as of June 30, 2017, also reflect the elimination of certain amounts transferred to Bioverativ in connection with the completion of the spin-off of our hemophilia business. Balances transferred to Bioverativ related to work in process and finished goods inventory totaled $84.5 million and $31.6 million, respectively.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

6. Intangible Assets and Goodwill

Intangible Assets

Intangible assets, net of accumulated amortization, impairment charges and adjustments, are summarized as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of June 30, 2017 | | As of December 31, 2016 |

| (In millions) | Estimated Life | | Cost | | Accumulated Amortization | | Net | | Cost | | Accumulated Amortization | | Net |

| Out-licensed patents | 13-23 years | | $ | 543.3 |

| | $ | (529.8 | ) | | $ | 13.5 |

| | $ | 543.3 |

| | $ | (523.6 | ) | | $ | 19.7 |

|

Developed technology | 15-23 years | | 3,005.3 |

| | (2,662.2 | ) | | 343.1 |

| | 3,005.3 |

| | (2,634.3 | ) | | 371.0 |

|

| In-process research and development | Indefinite until commercialization | | 668.6 |

| | — |

| | 668.6 |

| | 648.0 |

| | — |

| | 648.0 |

|

Trademarks and tradenames | Indefinite | | 64.0 |

| | — |

| | 64.0 |

| | 64.0 |

| | — |

| | 64.0 |

|

Acquired and in-licensed rights and patents | 4-18 years | | 3,937.1 |

| | (975.0 | ) | | 2,962.1 |

| | 3,481.7 |

| | (776.1 | ) | | 2,705.6 |

|

| Total intangible assets | | | $ | 8,218.3 |

| | $ | (4,167.0 | ) | | $ | 4,051.3 |

| | $ | 7,742.3 |

| | $ | (3,934.0 | ) | | $ | 3,808.3 |

|

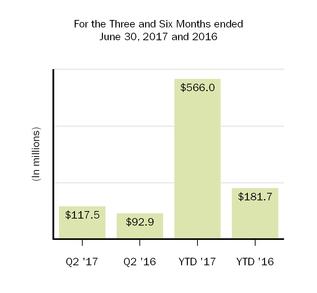

For the three and six months ended June 30, 2017, amortization of acquired intangible assets totaled $117.5 million and $566.0 million, respectively, as compared to $92.9 million and $181.7 million, respectively, in the prior year comparative periods. Amortization of acquired intangible assets for the three and six months ended June 30, 2017, includes $29.4 million and $383.0 million, respectively, of amortization and impairment charges related to our U.S. and rest of world licenses to Forward Pharma A/S' (Forward Pharma) intellectual property related to TECFIDERA, as further discussed below. In-process research and development balances include adjustments related to foreign currency exchange rate fluctuations.

Balances in the table above as of June 30, 2017, also reflect the elimination of certain amounts transferred to Bioverativ in connection with the completion of the spin-off of our hemophilia business. For additional information relating to the spin-off of our hemophilia business, please read Note 3, Hemophilia Spin-Off, to these condensed consolidated financial statements.

Developed Technology

Developed technology primarily relates to our AVONEX product, which was recorded in connection with the merger of Biogen, Inc. and IDEC Pharmaceuticals Corporation in 2003. The net book value of this asset as of June 30, 20162017, was $392.8$335.9 million.

Acquired and In-licensed Rights and Patents

Acquired and in-licensed rights and patents primarily relate to our acquisition of all remaining rights to TYSABRI from Elan Corporation plc (Elan).plc. The net book value of this asset as of June 30, 20162017, was $2,633.4$2,351.8 million.

The increase in acquired and in-licensed rights and patents during the six months ended June 30, 2016, primarily reflects:

$50.02017, reflects the $50.0 million in total milestone payments due to Samsung Bioepis, which became payable uponIonis Pharmaceuticals, Inc. for the approval of BENEPALI and FLIXABISPINRAZA for the treatment of SMA in the E.U. inand net amounts related to our TECFIDERA license rights, as described below.

TECFIDERA License Rights

In January 20162017 we entered into a settlement and May 2016, respectively;

$20.0 million milestone payment due to AbbVie Biotherapeutics, Inc. (AbbVie)license agreement among Biogen Swiss Manufacturing GmbH, Biogen International Holding Ltd., Forward Pharma and certain related parties, which became payable upon the regulatory approvalwas effective as of ZINBRYTA in the U.S. in May 2016; and

$26.5 million upon the approval of ALPROLIX in the E.U. in May 2016, which is comprised of a $20.0 million contingent payment dueFebruary 1, 2017. Pursuant to the former ownersagreement, we obtained U.S. and rest of Syntonix Pharmaceuticals, Inc. (Syntonix) and $6.5 millionworld licenses to Forward Pharma's intellectual property, including Forward Pharma's intellectual property related to TECFIDERA. In exchange, we agreed to pay Forward Pharma $1.25 billion in cash. During the establishmentfourth quarter of 2016, we recognized a corresponding deferred tax liability.pre-tax charge of $454.8 million related to this agreement, representing the fair value of our license to Forward Pharma’s intellectual property for the period April 2014, when we started selling TECFIDERA, through December 31, 2016. For additional

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

For additional information on our relationship with Samsung Bioepis, please read Note 17, Collaborative and Other Relationshipsrelated to these condensed consolidated financial statements. For additional information on our relationship with Syntonix,this agreement, please read Note 21, Commitments and Contingencies, to our consolidated financial statements included in our 20152016 Form 10-K.

We paid the $1.25 billion in February 2017 and recognized an intangible asset of $795.2 million. The asset represented the fair value of the U.S. and rest of world licenses to Forward Pharma’s intellectual property related to TECFIDERA revenues for the period January 2017, the month in which we entered into this agreement, through December 2020, the last month before royalty payments could first commence pursuant to this agreement.

We have two intellectual property disputes with Forward Pharma, one in the U.S. and one in the E.U., concerning intellectual property related to TECFIDERA. In March 2017 the U.S. intellectual property dispute was decided in our favor. Forward Pharma has appealed to the U.S. Court of Appeals for the Federal Circuit and the appeal is pending. For additional information on our relationship with AbbVie,related to these disputes, please read Note 19, Collaborative and Other RelationshipsLitigation, to ourthese condensed consolidated financial statements includedstatements.

As we prevailed in the U.S. proceeding in March 2017, we evaluated the recoverability of the U.S. asset acquired from Forward Pharma and recorded an impairment charge to adjust the carrying value of the acquired U.S. asset to fair value reflecting the impact of the developments in the U.S. legal dispute. We also continue to amortize the remaining net book value of the U.S. and rest of world intangible assets in our 2015 Form 10-K.condensed consolidated statements of income utilizing an economic consumption model.

Estimated Future Amortization of Intangible Assets

Our amortization expense is based on the economic consumption of intangible assets. Our most significant intangible assets are related to our AVONEX and TYSABRI products. Annually, during our long-range planning cycle, we perform an analysis of anticipated lifetime revenues of AVONEX and TYSABRI. This analysis is also updated whenever we determine events or changes in circumstances would significantly affect the anticipated lifetime revenues of either product.

Our most recent long range planning cycle was completed in the third quarter of 2015. 2016.

Based upon this analysis,the above, the estimated future amortization of acquired intangible assets for the next five years is expected to be as follows:

| | | (In millions) | As of

June 30,

2016 | As of

June 30,

2017 |

| 2016 (remaining six months) | $ | 181.6 |

| |

| 2017 | 325.1 |

| |

| 2017 (remaining six months) | | $ | 222.6 |

|

| 2018 | 298.2 |

| 425.8 |

|

| 2019 | 282.7 |

| 412.5 |

|

| 2020 | 277.1 |

| 378.6 |

|

| 2021 | 265.0 |

| 239.3 |

|

| 2022 | | 216.7 |

|

Goodwill

The following table provides a roll forward of the changes in our goodwill balance:

|

| | | |

| (In millions) | As of

June 30,

2017 |

| Goodwill, beginning of period | $ | 3,669.3 |

|

| Elimination of goodwill allocated to our hemophilia business | (314.1 | ) |

| Increase to goodwill | 508.9 |

|

| Other | 6.3 |

|

| Goodwill, end of period | $ | 3,870.4 |

|

The elimination of goodwill represents an allocation based upon the relative enterprise fair value of the hemophilia business as of the distribution date. For additional information relating to the spin-off of our hemophilia business, please read Note 3, Hemophilia Spin-Off, to these condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Goodwill

The following table provides a roll forward of the changes in our goodwill balance:

|

| | | |

| (In millions) | As of

June 30,

2016 |

| Goodwill, beginning of period | $ | 2,663.8 |

|

| Increase to goodwill | 515.0 |

|

| Other | (11.7 | ) |

| Goodwill, end of period | $ | 3,167.1 |

|

The increase in goodwill during the six months ended June 30, 20162017, was related to $600.0 million in contingent milestones achieved (exclusive of $85.0$91.1 million in tax benefits) and payable to the former shareholders of Fumapharm AG or holders of their rights. Other includes changes in foreign currency exchange rates. For additional information related to future contingent payments to the former shareholders of Fumapharm AG or holders of their rights, please read Note 19,21, Commitments and Contingencies, to these condensedour consolidated financial statements.statements included in our 2016 Form 10-K.

As of June 30, 2016,2017, we had no accumulated impairment losses related to goodwill.

6.7. Fair Value Measurements

The tables below present information about our assets and liabilities that are regularly measured and carried at fair value and indicate the level within the fair value hierarchy of the valuation techniques we utilized to determine such fair value:

| | | As of June 30, 2016 (In millions) | Total | | Quoted Prices in Active Markets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | |

| As of June 30, 2017 (In millions) | | Total | | Quoted Prices in Active Markets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| Assets: | | | | | | | | | | | | | | |

| Cash equivalents | $ | 874.6 |

| | $ | — |

| | $ | 874.6 |

| | $ | — |

| $ | 836.0 |

| | $ | — |

| | $ | 836.0 |

| | $ | — |

|

| Marketable debt securities: | | | | | | | | | | | | | | |

| Corporate debt securities | 2,290.3 |

| | — |

| | 2,290.3 |

| | — |

| 2,297.9 |

| | — |

| | 2,297.9 |

| | — |

|

| Government securities | 2,973.4 |

| | — |

| | 2,973.4 |

| | — |

| 1,567.8 |

| | — |

| | 1,567.8 |

| | — |

|

| Mortgage and other asset backed securities | 648.7 |

| | — |

| | 648.7 |

| | — |

| 490.5 |

| | — |

| | 490.5 |

| | — |

|

| Marketable equity securities | 32.4 |

| | 32.4 |

| | — |