UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| | | | |

x☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 30, 2017

January 1, 2022

or

|

| | | | |

o☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________to _________

Commission File Number: 001-12696

Plantronics, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| Delaware | 77-0207692 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

345 Encinal Street

Santa Cruz, California 95060

(Address of principal executive offices)

(Zip Code)

(831) 426-5858420-3002

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | POLY | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒ No o☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x☒ No o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

Large accelerated filerx | ☒ | Accelerated filero | ☐ |

Non-accelerated filero | ☐ | Smaller reporting companyo | ☐ |

| | Emerging growth companyo |

| | (Do not check if a smaller reporting company) | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o ☐No x☒

As of January 26, 2018, 33,075,564 of February 3, 2022,42,778,870 shares of the registrant's common stock were outstanding.

Plantronics, Inc.PLANTRONICS, INC.

FORM 10-Q

TABLE OF CONTENTS

| | | | | | | | |

| |

PART I. FINANCIAL INFORMATION | Page No. |

| PART I | FINANCIAL INFORMATION | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

| | |

PART II. II | OTHER INFORMATION | |

| |

| | |

| | |

| |

| |

| |

| | |

| | |

| |

| |

| |

| |

| |

Plantronics®Plantronics, Poly, the Propeller design, the Poly logo, and Simply Smarter Communications®Polycom are trademarks or registered trademarks of Plantronics, Inc.

DECT™ is a trademark of ETSI registered for the benefit of its members in France and other jurisdictions.

The Bluetooth name and the Bluetooth® trademarks are owned by Bluetooth SIG, Inc. and are used by Plantronics, Inc. under license. All other trademarks are the property of their respective owners.

Part

PART I --- FINANCIAL INFORMATION

Management’s Discussion and Analysis of Financial Condition and Results of OperationsITEM 1. FINANCIAL STATEMENTS

CERTAIN FORWARD-LOOKING INFORMATION:

PLANTRONICS, INC.

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 ("Securities Act") and Section 21E of the Securities Exchange Act of 1934 ("Exchange Act"). Forward-looking statements may generally be identified by the use of such words as "anticipate," "believe," “could,” "expect," "intend," “may,” "plan," "potential," "shall," "will," “would,” or variations of such words and similar expressions, or the negativeCONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| January 1, 2022 | | April 3,

2021 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 182,700 | | | $ | 202,560 | |

| Restricted cash | — | | | 493,908 | |

| Short-term investments | 17,017 | | | 14,559 | |

| Accounts receivable, net | 275,913 | | | 267,464 | |

| Inventory, net | 216,750 | | | 194,405 | |

| Other current assets | 61,484 | | | 65,214 | |

| Total current assets | 753,864 | | | 1,238,110 | |

| Non-current assets | | | |

| | | |

| Property, plant, and equipment, net | 126,973 | | | 140,875 | |

| Purchased intangibles, net | 255,564 | | | 341,614 | |

| Goodwill | 796,216 | | | 796,216 | |

| Deferred tax assets | 211,543 | | | 95,800 | |

| Other non-current assets | 70,332 | | | 51,654 | |

| Total assets | $ | 2,214,492 | | | $ | 2,664,269 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | |

| Current liabilities | | | |

| Accounts payable | $ | 160,529 | | | $ | 151,244 | |

| Accrued liabilities | 328,551 | | | 394,084 | |

| Current portion of long-term debt | — | | | 478,807 | |

| Total current liabilities | 489,080 | | | 1,024,135 | |

| Non-current liabilities | | | |

| Long-term debt, net | 1,499,228 | | | 1,496,064 | |

| | | |

| Long-term income taxes payable | 76,095 | | | 86,227 | |

| | | |

| Other non-current liabilities | 139,469 | | | 138,609 | |

| Total liabilities | 2,203,872 | | | 2,745,035 | |

| Commitments and contingencies (Note 6) | 0 | | 0 |

| Stockholders' equity (deficit) | | | |

| Common stock | 926 | | | 912 | |

| Additional paid-in capital | 1,596,313 | | | 1,556,272 | |

| Accumulated other comprehensive income (loss) | 11,454 | | | (3,221) | |

| Accumulated deficit | (716,423) | | | (765,233) | |

| Total stockholders' equity before treasury stock | 892,270 | | | 788,730 | |

| Less: Treasury stock, at cost | (881,650) | | | (869,496) | |

| Total stockholders' equity (deficit) | 10,620 | | | (80,766) | |

| Total liabilities and stockholders' equity (deficit) | $ | 2,214,492 | | | $ | 2,664,269 | |

The accompanying notes are an integral part of these terms. Specific forward-looking statements contained within this Form 10-Q include, butcondensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| | January 1, 2022 | | December 26, 2020 | | January 1, 2022 | | December 26, 2020 |

| Net revenues | | | | | | | |

| Net product revenues | $ | 354,022 | | | $ | 420,711 | | | $ | 1,086,607 | | | $ | 1,059,846 | |

| Net service revenues | 55,544 | | | 63,974 | | | 173,155 | | | 191,529 | |

| Total net revenues | 409,566 | | | 484,685 | | | 1,259,762 | | | 1,251,375 | |

| Cost of revenues | | | | | | | |

| Cost of product revenues | 226,994 | | | 236,842 | | | 682,360 | | | 622,718 | |

| Cost of service revenues | 18,386 | | | 21,186 | | | 58,334 | | | 64,921 | |

| Total cost of revenues | 245,380 | | | 258,028 | | | 740,694 | | | 687,639 | |

| | | | | | | |

| Gross profit | 164,186 | | | 226,657 | | | 519,068 | | | 563,736 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Research, development, and engineering | 46,216 | | | 54,150 | | | 136,090 | | | 156,327 | |

| Selling, general, and administrative | 121,387 | | | 129,641 | | | 364,417 | | | 361,892 | |

| Loss, net from litigation settlements | — | | | — | | | — | | | 17,561 | |

| Restructuring and other related charges | 2,398 | | | 13,977 | | | 33,977 | | | 49,477 | |

| Total operating expenses | 170,001 | | | 197,768 | | | 534,484 | | | 585,257 | |

| | | | | | | |

| Operating (loss) income | (5,815) | | | 28,889 | | | (15,416) | | | (21,521) | |

| | | | | | | |

| Interest expense | 15,948 | | | 18,417 | | | 53,871 | | | 58,182 | |

| Other non-operating income, net | (995) | | | (2,596) | | | (1,664) | | | (4,188) | |

| (Loss) income before income taxes | (20,768) | | | 13,068 | | | (67,623) | | | (75,515) | |

| | | | | | | |

| Income tax benefit | (9,604) | | | (7,045) | | | (116,433) | | | (7,208) | |

| Net (loss) income | $ | (11,164) | | | $ | 20,113 | | | $ | 48,810 | | | $ | (68,307) | |

| | | | | | | |

| Per share data | | | | | | | |

| Basic (loss) earnings per common share | $ | (0.26) | | | $ | 0.49 | | | $ | 1.15 | | | $ | (1.67) | |

| Diluted (loss) earnings per common share | $ | (0.26) | | | $ | 0.48 | | | $ | 1.11 | | | $ | (1.67) | |

| Basic shares used in computing (loss) earnings per common share | 42,745 | | | 41,252 | | | 42,450 | | | 40,894 | |

| Diluted shares used in computing (loss) earnings per common share | 42,745 | | | 42,184 | | | 43,811 | | | 40,894 | |

| | | | | | | |

The accompanying notes are not limited to, statements regarding (i) our beliefs regarding the Enterprise market, market dynamicsan integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 1, 2022 | | December 26, 2020 | | January 1, 2022 | | December 26, 2020 |

| Net (loss) income | $ | (11,164) | | | $ | 20,113 | | | $ | 48,810 | | | $ | (68,307) | |

| | | | | | | |

| Other comprehensive income, before tax | | | | | | | |

| Unrealized gains on cash flow hedges | | | | | | | |

| Unrealized cash flow hedge gains (losses) | 7,846 | | | (3,754) | | | 8,520 | | | (8,339) | |

| Net (gains) losses reclassified into net revenues | (1,804) | | | 1,054 | | | (671) | | | 1,797 | |

| Net gains reclassified into cost of revenues | (10) | | | — | | | (489) | | | — | |

| Net losses reclassified into interest expense | 2,100 | | | 3,039 | | | 7,582 | | | 10,290 | |

| Net unrealized gains on cash flow hedges | 8,132 | | | 339 | | | 14,942 | | | 3,748 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Income tax benefit (expense) in other comprehensive income | 38 | | | 599 | | | (267) | | | 1,122 | |

| Other comprehensive income | 8,170 | | | 938 | | | 14,675 | | | 4,870 | |

| | | | | | | |

| Comprehensive (loss) income | $ | (2,994) | | | $ | 21,051 | | | $ | 63,485 | | | $ | (63,437) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended |

| | January 1, 2022 | | December 26, 2020 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 48,810 | | | $ | (68,307) | |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities | | | |

| Depreciation and amortization | 112,796 | | | 124,881 | |

| Amortization of debt issuance costs | 5,046 | | | 3,962 | |

| Stock-based compensation | 34,214 | | | 31,104 | |

| Deferred income taxes | (115,660) | | | (15,373) | |

| Provision for excess and obsolete inventories | 8,160 | | | 12,767 | |

| Restructuring and other related charges | 33,977 | | | 49,477 | |

| Cash payments for restructuring charges | (27,515) | | | (28,794) | |

| Other operating activities | (1,526) | | | (6,000) | |

| Changes in assets and liabilities | | | |

| Accounts receivable, net | (8,569) | | | (71,439) | |

| Inventory, net | (24,699) | | | (39,941) | |

| Current and other assets | (9,129) | | | (15,246) | |

| Accounts payable | 9,170 | | | 62,454 | |

| Accrued liabilities | (45,502) | | | 47,529 | |

| Income taxes | (19,625) | | | (15,925) | |

| Net cash (used in) provided by operating activities | (52) | | | 71,149 | |

| | | |

| Cash flows from investing activities | | | |

| Proceeds from sales of short-term investments | 264 | | | 667 | |

| | | |

| Purchases of short-term investments | (760) | | | (394) | |

| | | |

| Capital expenditures | (20,682) | | | (16,753) | |

| Proceeds from sale of property, plant, and equipment | — | | | 1,900 | |

| Other investing activities | (4,000) | | | — | |

| Net cash used in investing activities | (25,178) | | | (14,580) | |

| | | |

| Cash flows from financing activities | | | |

| | | |

| Employees' tax withheld and paid for restricted stock and restricted stock units | (12,154) | | | (3,193) | |

| Proceeds from issuances under stock-based compensation plans | 5,841 | | | 5,731 | |

| Proceeds from revolving line of credit | — | | | 50,000 | |

| Repayments of revolving line of credit | — | | | (50,000) | |

| | | |

| | | |

| Repayments of long-term debt | (480,689) | | | (46,980) | |

| | | |

| Net cash used in financing activities | (487,002) | | | (44,442) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | (1,536) | | | 4,059 | |

| Net (decrease) increase in cash and cash equivalents and restricted cash | (513,768) | | | 16,186 | |

| | | |

| Cash and cash equivalents and restricted cash at beginning of period | 696,468 | | | 213,879 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 182,700 | | | $ | 230,065 | |

| | | |

| | | |

| | | |

| | | |

| | | |

The following table provides a reconciliation of cash and customer behavior as well as our position in the market, (ii) our beliefs regarding the Consumer market, our new product introductions and the expected effect of such introductions, (iii) our belief that our "as-a-service" offerings will benefit our growth long-term but their contribution will not be material in the near term, (iv) our intention to provide customer data insight through software and service solutions, (v) the Unified Communications ("UC") market, including adoption of UC products, our position, and timing and growth expectations in this market, (vi) our plans regarding our "as a service" offerings including sales and marketing efforts, (vii) our intentions regarding investments in long-term growth opportunities and our core research and development efforts, in particular in the UC market, (viii) our intentions regarding the focus of our sales, marketing and customer services and support teams on UC, (ix) the future of UC technologies, including the transition of businesses to UC-supported systems and the effects on headset adoption and use, enterprises that adopt UC and our revenue opportunity and profit growth, (x) our expenses, including research, development and engineering expenses and selling, general and administrative expenses, (xi) fluctuations in our cash provided by operating activities as a result of various factors, including fluctuations in revenues and operating expenses, timing of product shipments, accounts receivable collections, inventory and supply chain management, and the timing and amount of taxes and other payments, (xii) our future tax rate and payments related to unrecognized tax benefits, (xiii) our anticipated range of capital expenditures for the remainder of Fiscal Year 2018 and the sufficiency of our cash, cash equivalents and restricted cash from operationsreported within the condensed consolidated balance sheets that sum to sustain future operationsthe total of the same amounts shown in the condensed consolidated statements of cash flows:

| | | | | | | | | | | |

| (in thousands) | January 1, 2022 | | April 3, 2021 |

| Cash and cash equivalents | $ | 182,700 | | | $ | 202,560 | |

| Restricted cash | — | | | 493,908 | |

| Total cash and cash equivalents and restricted cash shown in the condensed consolidated statements of cash flows | $ | 182,700 | | | $ | 696,468 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 1, 2022 |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income | | Accumulated Deficit | | Treasury Stock | | Total Stockholders' (Deficit) Equity |

| | Shares | | Amount | | | | | |

| Balances at October 2, 2021 | 42,721 | | | $ | 926 | | | $ | 1,584,088 | | | $ | 3,284 | | | $ | (705,259) | | | $ | (880,806) | | | $ | 2,233 | |

| Net loss | — | | | — | | | — | | | — | | | (11,164) | | | — | | | (11,164) | |

| | | | | | | | | | | | | |

| Net unrealized gains on cash flow hedges, net of tax | — | | | — | | | — | | | 8,170 | | | — | | | — | | | 8,170 | |

| | | | | | | | | | | | | |

| Proceeds from issuances under stock-based compensation plans | 43 | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 12,225 | | — | | | — | | | — | | | 12,225 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Employees' tax withheld and paid for restricted stock and restricted stock units | — | | | — | | | — | | | — | | | — | | | (844) | | | (844) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balances at January 1, 2022 | 42,764 | | | $ | 926 | | | $ | 1,596,313 | | | $ | 11,454 | | | $ | (716,423) | | | $ | (881,650) | | | $ | 10,620 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 26, 2020 |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Treasury Stock | | Total Stockholders' Deficit |

| | Shares | | Amount | | | | | |

| Balances at September 26, 2020 | 41,246 | | | $ | 907 | | | $ | 1,526,677 | | | $ | (9,650) | | | $ | (796,324) | | | $ | (866,615) | | | $ | (145,005) | |

| Net income | — | | | — | | | — | | | — | | | 20,113 | | | — | | | 20,113 | |

| | | | | | | | | | | | | |

| Net unrealized gains on cash flow hedges, net of tax | — | | | — | | | — | | | 938 | | | — | | | — | | | 938 | |

| | | | | | | | | | | | | |

| Proceeds from issuances under stock-based compensation plans | 19 | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 11,486 | | | — | | | — | | | — | | | 11,486 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Employees' tax withheld and paid for restricted stock and restricted stock units | (6) | | | — | | | — | | | — | | | — | | | (144) | | | (144) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other equity changes | — | | | — | | | (3) | | | (409) | | | 3 | | | — | | | (409) | |

| Balances at December 26, 2020 | 41,259 | | | $ | 907 | | | $ | 1,538,160 | | | $ | (9,121) | | | $ | (776,208) | | | $ | (866,759) | | | $ | (113,021) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended January 1, 2022 | | | | | | |

| Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive (Loss) Income | | Accumulated Deficit | | Treasury Stock | | Total Stockholders' (Deficit) Equity | | | | | | |

| Shares | | Amount | | | | | | | | | | | |

| Balances at April 3, 2021 | 41,751 | | | $ | 912 | | | $ | 1,556,272 | | | $ | (3,221) | | | $ | (765,233) | | | $ | (869,496) | | | $ | (80,766) | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 48,810 | | — | | | 48,810 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net unrealized gains on cash flow hedges, net of tax | — | | | — | | | — | | | 14,675 | | — | | | — | | | 14,675 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Proceeds from issuances under stock-based compensation plans | 785 | | 11 | | — | | | — | | | — | | | — | | | 11 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 34,214 | | — | | | — | | | — | | | 34,214 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Employees' tax withheld and paid for restricted stock and restricted stock units | — | | | — | | | — | | | — | | | — | | | (12,154) | | | (12,154) | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Proceeds from Employee Stock Purchase Program | 228 | | 3 | | 5,827 | | — | | | — | | | — | | | 5,830 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Balances at January 1, 2022 | 42,764 | | | $ | 926 | | | $ | 1,596,313 | | | $ | 11,454 | | | $ | (716,423) | | | $ | (881,650) | | | $ | 10,620 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended December 26, 2020 |

| Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Treasury Stock | | Total Stockholders' Deficit |

| Shares | | Amount | | | | | |

| Balances at March 28, 2020 | 40,406 | | | $ | 896 | | | $ | 1,501,340 | | | $ | (13,582) | | | $ | (707,904) | | | $ | (863,566) | | | $ | (82,816) | |

| Net loss | — | | | — | | | — | | | — | | | (68,307) | | | — | | | (68,307) | |

| | | | | | | | | | | | | |

| Net unrealized gains on cash flow hedges, net of tax | — | | | — | | | — | | | 4,870 | | | — | | | — | | | 4,870 | |

| | | | | | | | | | | | | |

| Proceeds from issuances under stock-based compensation plans | 667 | | | 6 | | | — | | | — | | | — | | | — | | | 6 | |

| Repurchase of restricted common stock | (10) | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 31,104 | | | — | | | — | | | — | | | 31,104 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Employees' tax withheld and paid for restricted stock and restricted stock units | (261) | | | — | | | — | | | — | | | — | | | (3,193) | | | (3,193) | |

| | | | | | | | | | | | | |

| Proceeds from Employee Stock Purchase Program | 457 | | | 5 | | | 5,719 | | | — | | | — | | | — | | | 5,724 | |

| | | | | | | | | | | | | |

| Other equity changes | — | | | — | | | (3) | | | (409) | | | 3 | | | — | | | (409) | |

| Balances at December 26, 2020 | 41,259 | | | $ | 907 | | | $ | 1,538,160 | | | $ | (9,121) | | | $ | (776,208) | | | $ | (866,759) | | | $ | (113,021) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BACKGROUND AND BASIS OF PRESENTATION

Plantronics, Inc. (“Poly,” the “Company”) is a leading global communications company that designs, manufactures, and discretionary cash requirements, (xiv) our abilitymarkets integrated communications and collaboration solutions that span headsets, open Session Initiation Protocol ("SIP") and native ecosystem desktop phones, conference room phones, video conferencing solutions and peripherals, including cameras, speakers, and microphones, cloud management and analytics software solutions, and services. The Company has two operating and reportable segments, Products and Services, and offers its products under the  , Plantronics and Polycom brands.

, Plantronics and Polycom brands.

Founded in 1961, the Company is incorporated in the state of Delaware under the name Plantronics, Inc. and in March 2019, the Company changed the name under which it markets itself to pay future stockholder dividends, (xv) our ability to draw fundsPoly. The Company is listed on our credit facilitythe New York Stock Exchange ("NYSE") under the ticker symbol "POLY."

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared on a basis materially consistent with, and should be reviewed in conjunction with, the Company's audited consolidated financial statements as needed, (xvi)of and for the sufficiency of our capital resources to fund operations,year ended April 3, 2021 and other statements regarding our future operations, financial condition and prospects, and business strategies. Such forward-looking statements are based on current expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially fromnotes thereto included in the forward-looking statements. Factors that could cause actual results and events to differ materially from such forward-looking statements are included, but not limited to, those discussed in this Quarterly Report on Form 10-Q; in Part I, "Item 1A. Risk Factors" of ourCompany's Annual Report on Form 10-K, for the fiscal year ended March 31, 2017,which was filed with the Securities and Exchange Commission (“SEC”("SEC") on May 10, 2017;18, 2021 and other documents weinclude all adjustments necessary to fairly state the information set forth herein. Certain information and footnote disclosures normally included in financial statements prepared pursuant to the rules and regulations of the SEC applicable to interim financial information and in accordance with accounting principles generally accepted in the United States of America ("GAAP") have filed withbeen condensed or omitted pursuant to such rules and regulations. These condensed consolidated financial statements contain all adjustments necessary for a fair presentation of the SEC. We undertake no obligation to update or revise publicly any forward-looking statements, whetherCompany’s consolidated financial position and the consolidated results of operations and cash flows as a result of new information, future events, or otherwise, except as required by applicable law. Given these risksthe dates and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

OVERVIEW

We are a leading designer, manufacturer, and marketer of lightweight communications headsets, telephone headset systems, other communication endpoints, and accessories for the worldwide businessperiods presented and consumer markets under the Plantronics brand. Our major product categories are Enterprise, which includes headsets optimized for Unified Communications (“UC”), other cordednormal and cordless communication headsets, audio processors,recurring in nature. The Company's reporting currency is United States Dollars ("USD.") The interim period results are subject to variation and telephone systems; and Consumer, which includes Bluetooth and corded products for mobile device applications and personal computer gaming headsets. Until July 1, 2017, we also offered specialty products marketed for hearing impaired individuals under our Clarity brand, which was included in our Consumer product category.

We ship our products to approximately 80 countries through a network of distributors, retailers, resellers, wireless carriers, original equipment manufacturers, and telephony service providers. We have well-developed distribution channels in North America, Europe, and in some partsare not necessarily indicative of the Asia Pacific region where useresults of our products is widespread.

|

| |

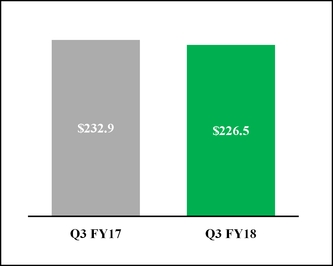

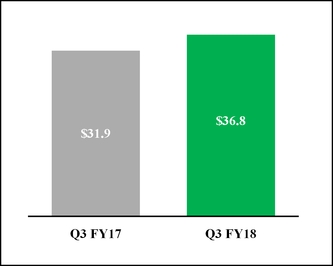

Net Revenues (in millions)

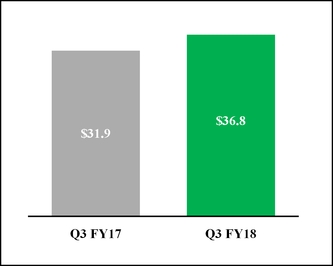

| Operating Income (in millions)

|

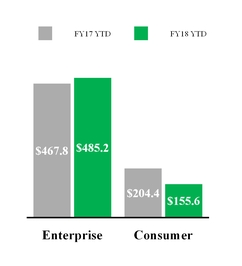

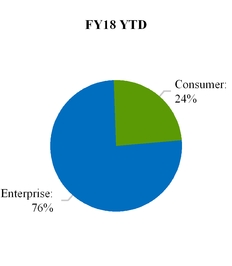

Compared to the third quarter of Fiscal Year 2017, net revenues decreased 2.7% to $226.5 million. The decrease in net revenues was driven by lower revenues within our Consumer product category, which declined 22.1%, or $16.7 million, from the year ago period. Of the declines in Consumer, approximately $8.0 million related to the divestiture of Clarity in the first quarter of Fiscal Year 2018. These declines were partially offset by higher revenues within our Enterprise product category, which grew 6.5%, or $10.3 million from the year ago period.

Operating income for the third quarter of Fiscal Year 2018 was $36.8 million and 16.2% of net revenue, compared to $31.9 million and 13.7% of net revenue in the prior year period. The divestiture of Clarity had a negligible impact on operating income for the third quarter of Fiscal Year 2018, and we expect the impactoperations to be negligibleexpected for the full Fiscal Year 2018.

We reported a net loss of $49.5 million forfiscal year. The financial statements include the third quarter of Fiscal Year 2018, representing a decrease of 322.8% from the same quarter last year and driven by the impactaccounts of the Tax CutsCompany and Jobs Act ("its subsidiaries, all of which are wholly-owned. All intercompany balances and transactions have been eliminated.

The Company’s fiscal year ends on the Act")Saturday closest to the last day of March. The Company’s current fiscal year ends on April 2, 2022 and consists of 52 weeks. The Company's prior fiscal year ended on April 3, 2021 and consisted of 53 weeks. The three and nine months ended January 1, 2022 and December 26, 2020 each contain 13 and 39 weeks, respectively.

Risks and uncertainties

The Company is subject to a greater degree of uncertainty than normal in making the judgments and estimates needed to apply its significant accounting policies due to the ongoing COVID-19 pandemic and supply chain disruptions. The Company has assessed accounting estimates and other matters, including those using prospective financial information, using information that was signed into law on December 22, 2017, which resulted in a $76.4 million discrete charge for the quarter. For additional details regarding the impactsis reasonably available as of the Act, referissuance date of the condensed consolidated financial statements. The accounting estimates and other matters the Company has assessed included, but were not limited to, the incomeimpairment of goodwill and other long-lived assets, provisions for doubtful accounts, valuation allowances for deferred tax discussionassets, inventory and related reserves, and revenue recognition and related reserves. The Company may make changes to these estimates and judgments, which could result in Results of Operations and Note 13, Income Taxes, in the accompanying footnotesmaterial impacts to the condensed consolidated financial statements. Instatements in future periods. The extent and duration of the year ago period net income was $22.2 millionimpact of the COVID-19 pandemic and 9.5%the shortage of revenues.

Our primary focus, long-term growth opportunities, strategic initiatives,adequate component supply on the Company's business is highly uncertain and majoritydifficult to predict. The Company relies on contract manufacturers and sourcing of our revenuematerials from the Asia Pacific region, as well as its owned manufacturing facility in Mexico. The Company has experienced disruptions in both its own supply chain as well as those of its contract manufacturers and profits are in our Enterprise business. Withinsuppliers both as a result of COVID-19 as well as the Enterprise product category, we anticipate theglobal shortage of key driver of long-term revenue growthcomponents. Such disruptions have had, and profit opportunity willmay continue to be UC audio solutions. We believe enterprises are increasing adoptionhave, a material impact on the Company's ability to source critical component parts, complete production of UC systemsits products, fulfill customer orders, and adversely affect the ability to reduce costs, improve collaboration,meet customer demands as companies utilize work-from-home and migrate technology from obsolete legacy systems. We expect growth of UC will increase overall headset adoption in enterprise environments, and we believe mosthybrid work models. Additionally, if a significant number of the growthCompany's workforce employed in our Enterprise product category over the next three years will come from headsets designed for UC. As such, UC remains the central focusany of our sales, marketing, and support functions, and we will continue investing in key strategic alliances and integrations with major UC vendors.

Our Enterprise revenues increasedthese manufacturing facilities or in the third quarter of Fiscal Year 2018 when comparedCompany's offices were to contract the same prior year period, resulting from continued growth in UC product sales, which grew atvirus, the Company may experience delays or the inability to develop, produce, and deliver the Company's products on a rate above our long-term growth expectations, partially offsettimely basis. Furthermore, capital markets and economies worldwide have also been negatively impacted by declines in sales of non-UC corded and cordless products.

Revenues from our Consumer products are seasonal and typically strongest in our third fiscal quarter, which includes the majority of the holiday shopping season. Additionally, other factors directly impact our Consumer product category performance, such as product life-cycles (including the introduction and pace of adoption of new technology), the market acceptance of new product introductions, consumer preferencesCOVID-19 pandemic and the competitive retail environment, changes in consumer confidence and other macroeconomic factors, and fluctuations in foreign currency rates relative to the U.S. Dollar ("USD"). In addition, the timing or non-recurrence of retailer placements can cause volatility in quarter-to-quarter results.

When compared to the same prior year period, the decline in Consumer revenues in the third quarter of Fiscal Year 2018 was primarily attributable to a decline in sales of our stereo Bluetooth products where new product introductions have not yet fully integrated into the market to replace revenues from certain older stereo products. Consumer product refreshes and launches typically take multiple quarters to fully integrate into the market,supply chain disruptions, and it is difficult to predict at what point, if ever, these productspossible that it could cause a local and/or global economic recession.

The severity of the impact of the COVID-19 pandemic and supply chain disruptions on the Company's business will materially contribute to results or replace the salesdepend on a number of preceding models. We are currently refreshing our Consumer portfolio, having recently launched the BackBeat 300 and 500, refreshed BackBeat FIT Training and Boost editions, and RIG 800 series. Additionally, the divestiture of our Clarity line of business negatively impacted our Consumer results when comparedfactors, including, but not limited to, the sameduration and severity of these factors and the extent and severity of the impact on its customers and suppliers, all of which are uncertain and cannot be predicted. The Company's future results of operations and liquidity could be adversely impacted by delays in payments of outstanding receivable amounts beyond normal payment terms, including potential write-offs due to financial weakness and/or bankruptcy of its customers, supply chain disruptions and uncertain demand, and the impact of any initiatives or programs that the Company may undertake to address financial and operational challenges faced by its customers and suppliers.

As of the issuance date of these condensed consolidated financial statements, the extent to which the COVID-19 pandemic and supply chain disruptions may materially impact the Company's financial condition, liquidity, or results of operations is uncertain.

Reclassifications

Certain prior year period.amounts have been reclassified for consistency with current year presentation. Each of the reclassifications was immaterial and had no effect on the Company's results of operations or cash flows.

We continue

2. RECENT ACCOUNTING PRONOUNCEMENTS

Recent accounting pronouncements issued by the Financial Accounting Standards Board ("FASB") did not and are not expected to investhave a material impact on the Company's financial position, results of operations, or cash flows.

3. DEFERRED COMPENSATION

As of January 1, 2022, the Company held investments in new ideasmutual funds with a fair value totaling $17.0 million, whose holdings are publicly traded debt and technologyequity securities that are held in a rabbi trust under non-qualified deferred compensation plans. The total related deferred compensation liability was $17.0 million as of January 1, 2022. As of April 3, 2021, the Company held investments in mutual funds with a fair value totaling $14.6 million, all of which related to create additional growth opportunities,debt and equity securities that are held in a rabbi trust under non-qualified deferred compensation plans. The total related deferred compensation liability as of April 3, 2021 was $14.6 million. The investments are recorded at fair value in short-term investments in the condensed consolidated balance sheets. The liability is recorded in accrued liabilities and other non-current liabilities in the condensed consolidated balance sheets.

4. DETAILS OF CERTAIN BALANCE SHEET ACCOUNTS

Accounts receivable, net

| | | | | | | | | | | | | | | |

| (in thousands) | | January 1, 2022 | | April 3, 2021 | |

| Accounts receivable | | $ | 358,877 | | | $ | 352,108 | | |

| | | | | |

| Provisions for promotions, rebates, and other | | (82,155) | | | (82,315) | | |

| Provisions for doubtful accounts and sales allowances | | (809) | | | (2,329) | | |

| Accounts receivable, net | | $ | 275,913 | | | $ | 267,464 | | |

The Company maintains a provision for doubtful accounts for estimated losses resulting from the inability of its customers to make required payments. The Company regularly performs credit evaluations of its customers’ financial conditions and considers factors such as Plantronics Manager Pro, our software-as-a-service ("SaaS") data insights offering introducedhistorical experience, credit quality, age of the accounts receivable balances, geographic or country-specific risks, and economic conditions that may affect a customer's ability to pay.

Inventory, net

| | | | | | | | | | | | | | |

| (in thousands) | | January 1, 2022 | | April 3, 2021 |

| Raw materials | | $ | 85,820 | | | $ | 87,050 | |

| Work in process | | 3,277 | | | 9,511 | |

| Finished goods | | 127,653 | | | 97,844 | |

| Inventory, net | | $ | 216,750 | | | $ | 194,405 | |

Accrued Liabilities

| | | | | | | | | | | | | | | |

| (in thousands) | | January 1, 2022 | | April 3, 2021 | |

| Short-term deferred revenue | | $ | 132,498 | | | $ | 141,375 | | |

| Employee compensation and benefits | | 65,757 | | | 84,318 | | |

| Operating lease liabilities, current | | 16,504 | | | 21,701 | | |

| Warranty obligation | | 16,044 | | | 14,774 | | |

| Provision for returns | | 14,133 | | | 25,133 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Accrued other | | 83,615 | | | 106,783 | | |

| Accrued liabilities | | $ | 328,551 | | | $ | 394,084 | | |

The Company's warranty obligation is recorded in Fiscal Year 2017,accrued liabilities and Habitat Soundscaping, our intelligent acoustic management solution launched in July 2017. While we anticipate these investments will benefit our growthother non-current liabilities in the long term, their contribution will not be materialcondensed consolidated balance sheets. Changes in the near term.warranty obligation during the nine months ended January 1, 2022 and December 26, 2020 were as follows:

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| (in thousands) | | January 1, 2022 | | December 26, 2020 |

| Warranty obligation at beginning of period | | $ | 17,384 | | | $ | 15,261 | |

| | | | |

| Warranty provision related to products shipped | | 13,179 | | | 17,092 | |

| Deductions for warranty claims processed | | (19,424) | | | (12,736) | |

| Adjustments related to preexisting warranties | | 8,307 | | | (4,097) | |

| Warranty obligation at end of period | | $ | 19,446 | | | $ | 15,520 | |

We remain cautious about

5. PURCHASED INTANGIBLE ASSETS

As of January 1, 2022 and April 3, 2021, the macroeconomic environment, based primarily on uncertainty around tradecarrying value of purchased intangible assets, excluding fully amortized assets and fiscal policy in the U.S. and broader economic uncertainty in many parts of Europe and Asia Pacific. We will continue to monitor our expenditures and prioritize those that further our strategic long-term growth opportunities, suchgoodwill, is as innovative product development. UC and SaaS are the central focus of our sales force, marketing group, and other customer service and support teams as we continue investing in key strategic alliances and integrations with major UC vendors, and work to expand the market opportunity for our SaaS offering.follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | January 1, 2022 | | April 3, 2021 |

| (in thousands) | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Weighted Average Remaining Useful Life | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| Amortizing Assets | | | | | | | | | | | | | | |

| Existing technology | | $ | 427,123 | | | $ | (325,787) | | | $ | 101,336 | | | 1.6 years | | $ | 427,123 | | | $ | (277,071) | | | $ | 150,052 | |

| Customer relationships | | 240,024 | | | (156,441) | | | 83,583 | | | 2.5 years | | 240,024 | | | (128,740) | | | 111,284 | |

| Trade name/Trademarks | | 115,600 | | | (44,955) | | | 70,645 | | | 5.5 years | | 115,600 | | | (35,322) | | | 80,278 | |

| Total intangible assets | | $ | 782,747 | | | $ | (527,183) | | | $ | 255,564 | | | 3.0 years | | $ | 782,747 | | | $ | (441,133) | | | $ | 341,614 | |

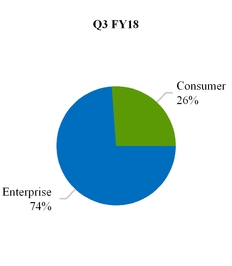

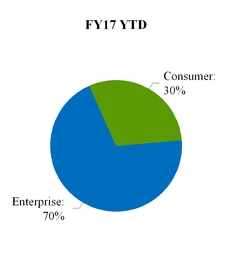

RESULTS OF OPERATIONS

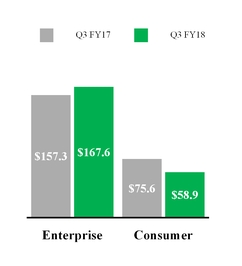

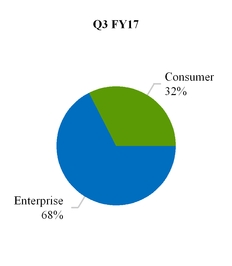

The following graphs display net revenues by product category forDuring the three and nine months ended December 31, 2016January 1, 2022, the Company recognized amortization expense of $27.8 million and 2017:

Net Revenues(in millions) Revenue by Product Category (percent)

Net revenues decreased in the three and nine months ended December 31, 2017 compared to the prior year periods due primarily to lower revenues within our Consumer product category, partially offset by increases in our Enterprise product revenues driven by UC revenues.

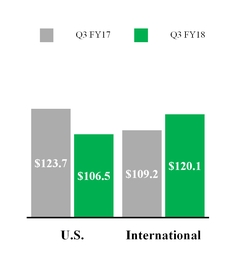

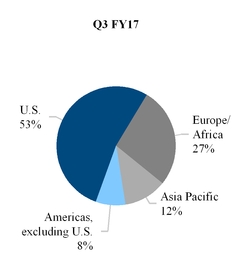

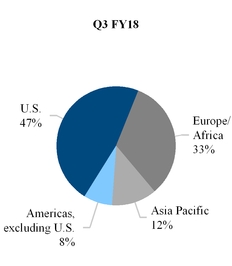

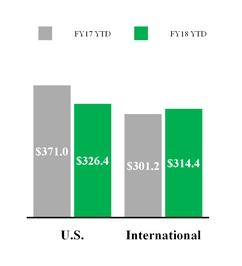

Geographic Information (in millions) Revenue by Region (percent)

Compared to the prior year periods, U.S. net revenues decreased in the three and nine months ended December 31, 2017due primarily to a decline in Consumer product sales volumes, driven by a decline in sales of our stereo Bluetooth products and the divestiture of our Clarity business. These declines were partially offset by increases in Enterprise, resulting from continued growth in UC within both the Voyager and Blackwire product families.

International net revenues for the three and nine months ended December 31, 2017 increased from the same year ago periods due to growth in our Enterprise category, driven primarily by UC product sales. Changes in foreign exchange rates increased net revenues by $4.1$86.0 million, net of the effects of hedging, for the three months ended December 31, 2017, compared to an immaterial impact in the prior year period. During the nine months ended December 31, 2017, changes in foreign exchange rates positively impacted net revenues by $1.3 million, net of the effects of hedging, compared to an immaterial amount in the prior year period.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues consists primarily of direct and contract manufacturing costs, warranty, freight, depreciation, duties, charges for excess and obsolete inventory, royalties, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

| Net revenues | | $ | 232,933 |

| | $ | 226,534 |

| | $ | (6,399 | ) | | (2.7 | )% | | $ | 672,222 |

| | $ | 640,760 |

| | $ | (31,462 | ) | | (4.7 | )% |

| Cost of revenues | | 122,753 |

| | 112,409 |

| | (10,344 | ) | | (8.4 | )% | | 338,523 |

| | 315,720 |

| | (22,803 | ) | | (6.7 | )% |

| Gross profit | | $ | 110,180 |

| | $ | 114,125 |

| | $ | 3,945 |

| | 3.6 | % | | $ | 333,699 |

| | $ | 325,040 |

| | $ | (8,659 | ) | | (2.6 | )% |

| Gross profit % | | 47.3 | % | | 50.4 | % | |

|

| | | | 49.6 | % | | 50.7 | % | | | | |

Compared to the same prior year periods, gross profit as a percentage of net revenues increased in the three and nine months ended December 31, 2017, due primarily to product cost reductions and a favorable product mix. Gross profit for the nine months ended December 31, 2017 was also negatively impacted by the loss recorded on the sale of our Clarity division and the write-off of an indirect tax asset in our Brazilian entity, both of which are discussed in detail in Note 8, Restructuring and other related charges (credits), in the accompanying footnotes to the condensed consolidated financial statements.

There are significant variances in gross profit percentages between our higher and lower margin products; therefore, small variations in product mix, which can be difficult to predict, can have a significant impact on gross profit as a percentage of net revenues. Gross profit percentages may also vary based on distribution channel, return rates, and other factors.

RESEARCH, DEVELOPMENT, AND ENGINEERING

Research, development, and engineering costs are expensed as incurred and consist primarily of compensation costs, outside services, including legal fees associated with protecting our intellectual property, expensed materials, travel expenses, depreciation, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

| Research, development, and engineering | | $ | 21,393 |

| | $ | 21,257 |

| | $ | (136 | ) | | (0.6 | )% | | $ | 66,116 |

| | $ | 62,402 |

| | $ | (3,714 | ) | | (5.6 | )% |

| % of net revenues | | 9.2 | % | | 9.4 | % | |

| | | | 9.8 | % | | 9.7 | % | | | | |

respectively. During the three and nine months ended December 31, 2017, research, development,26, 2020, the Company recognized amortization expense of $30.7 million and engineering expenses declined when compared$94.5 million, respectively.

Expected amortization expense attributable to purchased intangible assets for each of the prior yearnext five years and thereafter as of January 1, 2022 is as follows:

| | | | | | | | |

| (in thousands) | | Amount |

| 2022 (remaining three months) | | 27,808 |

| 2023 | | 111,232 |

| 2024 | | 65,936 |

| 2025 | | 21,688 |

| 2026 | | 12,844 |

| Thereafter | | 16,056 |

| Total | | $ | 255,564 | |

6. COMMITMENTS AND CONTINGENCIES

Future Minimum Lease Payments

Future minimum lease payments under non-cancelable operating leases as of January 1, 2022 were as follows:

| | | | | | | | |

| (in thousands) | | Operating Leases(1) |

| 2022 (remaining three months) | | $ | 6,443 | |

| 2023 | | 14,875 | |

| 2024 | | 13,419 | |

| 2025 | | 9,669 | |

| 2026 | | 8,100 | |

| Thereafter | | 17,244 | |

| Total lease payments | | 69,750 | |

Less: Imputed interest(2) | | (7,958) | |

| Present value of lease liabilities | | $ | 61,792 | |

(1) The weighted average remaining lease term was 4.8 years as of January 1, 2022.

(2) The weighted average discount rate was 4.6% as of January 1, 2022.

Unconditional Purchase Obligations

We use several contract manufacturers to manufacture raw materials, components, and subassemblies for our products through our supply and demand information that can cover periods due primarilyup to lower compensation expenses, driven primarily by reduced funding78 weeks. The contract manufacturers use this information to acquire components and build products. We also obtain individual components for our products from a wide variety of our variable compensation plansindividual suppliers using a combination of purchase orders, supplier contracts, including annual minimum purchase obligations, and cost reductions from our restructuring actions initiated in prior periods.

SELLING, GENERAL, AND ADMINISTRATIVE

Selling,open orders based on projected demand information. As of January 1, 2022, we had outstanding off-balance sheet third-party manufacturing, component purchase, and other general and administrative expenses consist primarilycommitments of compensation costs, marketing costs, travel expenses, litigation and professional service fees, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

| Selling, general, and administrative | | $ | 56,919 |

| | $ | 56,196 |

| | $ | (723 | ) | | (1.3 | )% | | $ | 169,581 |

| | $ | 170,125 |

| | $ | 544 |

| | 0.3 | % |

| % of net revenues | | 24.4 | % |

| 24.8 | % | |

|

| | | | 25.2 | % |

| 26.6 | % | | | | |

Compared to the same year ago periods, selling, general, and administrative expenses were flat in the three and nine months ended December 31, 2017, with increases in legal fees related to our litigation with GN Netcom being offset by lower compensation expenses, driven primarily by reduced funding $615.5 million, including off-balance sheet consigned inventories of our variable compensation plans, lower executive transition costs, cost savings from cost control initiatives and prior period restructuring actions. The litigation with GN Netcom was resolved in October 2017 in favor of the Company on all counts, as discussed further in Note 6, Commitments and Contingencies, in the accompanying footnotes to the condensed consolidated financial statements. As such, we expect legal fees to decrease in future quarters given there are currently no material outstanding legal matters.

(GAIN) LOSS, NET FROM LITIGATION SETTLEMENTS

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

| (Gain) loss, net from litigation settlements | | $ | (103 | ) | | $ | (15 | ) | | $ | 88 |

| | (85.4 | )% | | $ | 4,287 |

| | $ | (295 | ) | | $ | (4,582 | ) | | (106.9 | )% |

| % of net revenues | | — | % | | — | % | | | | | | 0.6 | % | | — | % | | | | |

We recognized immaterial gains from litigation in the three months ended December 31, 2016 and 2017. In the nine months ended December 31, 2017, we recognized immaterial gains compared to the prior year period when we recognized a $4.9$65.3 million charge related to discovery sanctions in the GN Netcom litigation.

RESTRUCTURING AND OTHER RELATED CHARGES (CREDITS)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

| Restructuring and other related charges (credits) | | $ | 113 |

| | $ | (84 | ) | | $ | (197 | ) | | (174.3 | )% | | $ | (1,350 | ) | | $ | 2,438 |

| | $ | 3,788 |

| | (280.6 | )% |

| % of net revenues | | — | % | | — | % | | | | | | (0.2 | )% | | 0.4 | % | | | | |

In the three months ended December 31, 2016 and 2017, we recognized immaterial adjustments resulting from changes to the estimates related to restructuring actions recorded in prior periods.

Compared to the prior year period, restructuring and other related charges (credits) increased in the nine months ended December 31, 2017, due to restructuring actions initiated during the first quarter of Fiscal Year 2018. In the prior year period we recorded a net reduction to expenses resulting from changes to the estimates related to our restructuring actions recorded in Fiscal Year 2016.

For more information regarding restructuring activities, refer to Note 8, Restructuring and other related charges (credits), of the accompanying notes to condensed consolidated financial statements.

INTEREST EXPENSE

Interest expense for the three and nine months ended December 31, 2016 and 2017 was $7.3 million and $21.9 million, respectively and relates primarily to our 5.50% Senior Notes.

OTHER NON-OPERATING INCOME AND (EXPENSE), NET |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

Other non-operating income and (expense), net

| | $ | 427 |

| | $ | 2,490 |

| | $ | 2,063 |

| | 483.1 | % | | $ | 4,119 |

| | $ | 5,230 |

| | $ | 1,111 |

| | 27.0 | % |

| % of net revenues | | 0.2 | % | | 1.1 | % | | | | | | 0.6 | % | | 0.8 | % | | | | |

Other non-operating income and (expense), net for the three months ended December 31, 2017 increased primarily due to favorable changes in the Mexican Peso exchange rate and an increase in interest income from higher average yields on our investment portfolio.

Other non-operating income and (expense), net for the nine months ended December 31, 2017 increased primarily due to increases in interest income from higher average yields on our investment portfolio.

INCOME TAX EXPENSE

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | | | Nine Months Ended | | | | |

| | | December 31, | | Increase | | December 31, | | Increase |

| (in thousands except percentages) | | 2016 |

| 2017 | | (Decrease) | | 2016 |

| 2017 | | (Decrease) |

| Income before income taxes | | $ | 24,963 |

| | $ | 31,920 |

| | $ | 6,957 |

| | 27.9 | % | | $ | 77,317 |

| | $ | 73,696 |

| | $ | (3,621 | ) | | (4.7 | )% |

| Income tax expense | | 2,742 |

| | 81,424 |

| | 78,682 |

| | 2,869.5 | % | | 14,235 |

| | 84,419 |

| | 70,184 |

| | 493.0 | % |

| Net income | | $ | 22,221 |

| | $ | (49,504 | ) | | $ | (71,725 | ) | | (322.8 | )% | | $ | 63,082 |

| | $ | (10,723 | ) | | $ | (73,805 | ) | | (117.0 | )% |

| Effective tax rate | | 11.0 | % | | 255.1 | % | |

|

| |

| | 18.4 | % | | 114.6 | % | | | | |

On December 22, 2017, the Tax Cuts and Jobs Act (H.R. 1) (the “Act”) was signed into law in the United States. The Act includes several changes to existing tax law, including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21% and the move from a worldwide to a territorial tax system.

The move to a territorial tax system was accompanied by federal taxation of a one-time deemed repatriation of accumulated unremitted earnings (hereafter, the "toll charge"), which we will elect to pay over an eight-year period as permitted under the Act. We recorded a $69.3 million toll charge as part of income tax expense in the quarter ended December 31, 2017, representing a provisional estimate that will be finalized when we complete our review of data spanning a 30-year period. The provisional toll charge increased our effective tax rate by 217.2% and 94.1% for the three and nine months ended December 31, 2017, respectively.

As part of the Act, we also completed our remeasurement of deferred tax assets as of December 31, 2017 to the new future federal tax rate of 21.0%, thereby reducing our deferred tax assets by $2.1 million. The rate change resulted in an overall increase to our effective tax rate by 6.6% and 2.9% for the three and nine months ended December 31, 2017, respectively. In addition, prior to our third quarter of Fiscal Year 2018, we did not recognize a deferred tax liability related to unremitted foreign earnings because our plans did not require us to repatriate earnings from foreign operations to fund U.S. operations. We expect to fund payment of the toll charge by repatriating a portion of our foreign earnings and as such, have recorded a deferred tax liability of $5.0 million related to state income taxes and foreign withholding taxes that will become due as we repatriate our foreign earnings. This increased our effective tax rate by 15.6% and 6.8% for the three and nine months ended December 31, 2017, respectively. Finally, due to our fiscal year-end we are required to pro-rate the new and old tax rates during Fiscal Year 2018. The blended, annualized tax rate applied to Fiscal Year 2018 income is 31.56%. This reduction in the federal tax rate reduced our global tax rate by 2.3% and 1.0% for the three and nine months ended December 31, 2017, respectively.

The provisional estimate for the toll charge will be finalized when we complete our substantive review of unremitted foreign earnings through examination of statutory filings and tax returns of our foreign subsidiaries and fiscal branches that span a 30-year period. We must also analyze the impact of foreign exchange rates and inflation on the historical information to support foreign tax credits available to offset the toll charge. In addition, our estimate of the toll charge obligation may change due to legislative technical corrections, the IRS' promulgation of regulations to interpret the Act, and changes in accounting standards for income taxes or related interpretations in response to the Act. This review and finalization of the toll charge provisional estimate will be completed within a twelve month measurement period from the date of enactment.

We adopted the new stock-based compensation accounting guidance effective the beginning of Fiscal Year 2018. Excess tax benefits associated with employee equity plans were previously recorded in additional paid-in capital and the adoption of this guidance had an immaterial impact on our effective tax rate for the three months ended December 31, 2017, but resulted in a reduction to our effective tax rate by 2.6 percentage points for the nine months ended December 31, 2017. The amount of excess tax benefits or deficiencies will fluctuate from period-to-period based on the price of our stock, the volume of share-based instruments settled or vested, and the value assigned to employee equity awards under U.S. GAAP.

We recorded a correction to the geographic mix of income during the nine months ended December 31, 2017 related to Fiscal Year 2017, which reduced income in a high tax jurisdiction and increased income in a low tax jurisdiction. This correcting adjustment had no impact on the three months ended December 31, 2017, but resulted in a reduction to our effective tax rate by 3.5 percentage points for the nine months ended December 31, 2017 as compared to the prior year period. For additional details regarding this correction refer to Note 1, Basis of Presentation, in the accompanying footnotes to the condensed consolidated financial statements.

We are subject to taxation in various foreign and state jurisdictions, including the U.S. Our Fiscal Year 2016 federal income tax return is currently under examination by the Internal Revenue Service. Foreign income tax matters for material tax jurisdictions have been concluded for tax years prior to Fiscal Year 2012.

FINANCIAL CONDITION

|

| | |

Operating Cash Flow (in millions)

| Investing Cash Flow(in millions)

| Financing Cash Flow (in millions)

|

Our primary source of liquidity is cash provided by operating activities and, on occasion, financing obtained from capital markets and other financing sources, such as our revolving credit line. We believe that internally generated cash flows are generally sufficient to support our business operations, capital expenditures, restructuring activities, principal and interest payment of debt, income tax payments and the payment of stockholder dividends, in addition to investments and share repurchases. We expect that cash provided by operating activities will fluctuate in future periods as a result of a number of factors, including fluctuations in our revenues and operating income, the timing of product shipments during the quarter, accounts receivable collections, inventory and supply chain management, and the timing and amount of tax, interest, annual bonus, and other payments.

Operating Activities

Compared to the same year ago period, net cash provided by operating activities during the nine months ended December 31, 2017 decreased primarily as a result of higher payouts in the first quarter of Fiscal Year 2018 related to Fiscal Year 2017 variable compensation than payouts during the prior year period for Fiscal Year 2016 variable compensation, due to better achievements against Corporate targets in Fiscal Year 2017.

Investing Activities

Compared to the same year ago period, we used more cash for investing activities during the nine months ended December 31, 2017 for increased investment purchases, net of proceeds received from the sale and maturity of securities in our portfolio. This increase was partially offset by lower capital expenditures.

We estimate total capital expenditures for Fiscal Year 2018 will be approximately $14.0 million to $17.0 million. We expect capital expenditures for the remainder of Fiscal Year 2018 to consist primarily of IT investments, capital investment in our manufacturing capabilities, including tooling for new products, and facilities upgrades.

Financing Activities

Net cash used for financing activities during the nine months ended December 31, 2017 increased from the prior year period resulting primarily from an increase in cash used for common stock repurchases due to a lower average stock price, partially offset by higher net proceeds from stock-based compensation plans.

On January 30, 2018, we announced that the Audit Committee of our Board ("the Audit Committee") had declared a cash dividend of $0.15 per share, payable on March 9, 2018 to stockholders of record at the close of business on February 20, 2018. We expect to continue paying a quarterly dividend of $0.15 per share; however, the actual declaration of dividends and the establishment of record and payment dates are subject to final determination by the Audit Committee each quarter after its review of our financial performance and financial position.

Liquidity and Capital Resources

At December 31, 2017, we had working capital of $619.4 million, including $499.1 million of cash, cash equivalents, and short-term investments, compared with working capital of $581.8 million, including $480.1 million of cash, cash equivalents, and short-term investments at March 31, 2017.

Our cash and cash equivalents as of December 31, 2017 consisted of bank deposits with third party financial institutions, US Treasury Bills, and Commercial Paper. We monitor bank balances in our operating accounts and adjust the balances as appropriate. Cash balances are held throughout the world, including substantial amounts held outside of the U.S. As of December 31, 2017, of our $499.1 million of cash, cash equivalents, and short-term investments, $17.8 million was held domestically while $481.2 million was held by foreign subsidiaries, approximately 90% of which was based in USD-denominated investments.

Prior to our third quarter of Fiscal Year 2018, we did not recognize a deferred tax liability related to unremitted foreign earnings because our plans did not require us to repatriate earnings from foreign operations to fund our U.S. operations. The Tax Cuts and Jobs Act (H.R. 1) (the "Act") was signed into law in the U.S. on December 22, 2017, which, among other things, introduced the move from a worldwide to a territorial tax system and imposed a one-time tax on a deemed repatriation of accumulated foreign earnings (hereafter, the "toll charge"). We recorded a $69.3 million toll charge as part of income tax expense in the quarter ended December 31, 2017, representing a provisional estimate of our obligation and which we will pay over an eight-year period as permitted under the Act. We expect to fund payment of the toll charge by repatriating a portion of our foreign earnings and as such, we recorded a deferred tax liability of $5 million related to state income taxes and foreign withholding taxes that will become due as we repatriate foreign earnings. For additional details, refer to Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Our primary discretionary cash requirements have historically been for repurchases of our common stock and to fund stockholder dividends. As a result of the issuance of the 5.50% Senior Notes in May 2015, we are required to make interest payments of approximately $13.8 million each November and May through the life of the notes. Both the interest payments on the 5.50% Senior Notes and the payments for the toll charge described above will decrease our liquidity. We generate sufficient operating cash flow and have access to external funding under our revolving credit facility to provide for these payments. For additional details, refer to Note 7, Debt, and Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Our short and long-term investments are intended to establish a high-quality portfolio that preserves principal and meets liquidity needs. As of December 31, 2017, our investments were composed of Mutual Funds, US Treasury Notes, Government Agency Securities, Commercial Paper, Corporate Bonds, and Certificates of Deposits ("CDs").

From time to time, depending on market conditions, our Board has authorized plans under which we may repurchase shares of our common stock in the open market or through privately negotiated transactions. During the nine months ended December 31, 2017, we repurchased 1,138,903 shares of our common stock in the open market as part of these publicly announced repurchase programs. The total cost of these repurchases was $52.9 million, with an average price of $46.46 per share. In addition, we withheld 210,416 shares with a total value of $11.2 million in satisfaction of employee tax withholding obligations upon the vesting of restricted stock granted under our stock plans.

As of December 31, 2017, there remained 730,932 shares authorized for repurchase under the stock repurchase program approved by the Board on July 27, 2017. For more information regarding our stock repurchase programs, refer to Note 10, Common Stock Repurchases, in the accompanying notes to the condensed consolidated financial statements.

In May 2011, we entered into a credit agreement with Wells Fargo Bank, National Association ("the Bank"), which was most recently amended in April 2017 (as amended, the "Credit Agreement"). The Credit Agreement provides for a $100.0 million unsecured revolving credit facility. Revolving loans under the Credit Agreement will bear interest, at our election, at (i) the Bank’s announced prime rate less 1.20% per annum or (ii) a daily one-month LIBOR rate plus 1.40% per annum. Principal, together with all accrued and unpaid interest, on the revolving loans is due and payable on May 9, 2020. We are also obligated to pay a commitment fee of 0.37% per annum on the average daily unused amount of the revolving line of credit, which fee shall be payable quarterly in arrears. We may prepay the loans and terminate the commitments under the Credit Agreement at any time, without premium or penalty, subject to the reimbursement of certain costs. During the third quarter of Fiscal Year 2018 we borrowed and repaid $8 million from our line of credit and as of December 31, 2017, we had no outstanding borrowings. The line of credit requires us to comply with the following two financial covenant ratios, in each case at each fiscal quarter end and determined on a rolling four-quarter basis:

maximum ratio of funded debt to earnings before interest, taxes, depreciation and amortization ("EBITDA") of 3.25:1 (previously 3:1); and

minimum EBITDA coverage ratio, which is calculated as interest payments divided by EBITDA.

In addition, we and our subsidiaries are required to maintain unrestricted cash, cash equivalents, and marketable securities plus availability under the Credit Agreement at the end of each fiscal quarter of at least $300.0 million. The Credit Agreement contains customary events of default that include, among other things, payment defaults, covenant defaults, cross-defaults with certain other indebtedness, bankruptcy and insolvency defaults, and judgment defaults. The occurrence of an event of default could result in the acceleration of the obligations under the Credit Agreement. As of December 31, 2017, we were in compliance with all ratios and covenants.

During Fiscal Year 2016, we obtained $488.4 million in aggregate principal amount, net of issuance costs, from the issuance of our 5.50% Senior Notes. The Notes mature on May 31, 2023, and bear interest at a rate of 5.50% per annum, payable semi-annually

on May 15 and November 15. A portion of the proceeds was used to repay all then-outstanding amounts under our revolving line of credit agreement with Wells Fargo Bank and the remaining proceeds were used primarily for share repurchases.

Our liquidity, capital resources, and results of operations in any period could be affected by repurchases of our common stock, the payment of cash dividends, the exercise of outstanding stock options, restricted stock grants under stock plans, and the issuance of common stock under our Employee Stock Purchase Plan ("ESPP"). We receive cash from the exercise of outstanding stock options under our stock plan and the issuance of shares under our ESPP. However, the resulting increase in the number of outstanding shares from these equity grants and issuances could affect our earnings per share. We cannot predict the timing or amount of proceeds from the sale or exercise of these securities or whether they will be exercised, forfeited, canceled, or will expire.

We believe that our current cash and cash equivalents, short-term investments, cash provided by operations, and the availability of additional funds under the Credit Agreement will be sufficient to fund operations for at least the next 12 months; however, any projections of future financial needs and sources of working capital are subject to uncertainty. Readers are cautioned to review the risks, uncertainties, and assumptions set forth in this Quarterly Report on Form 10-Q, including the section entitled "Certain Forward-Looking Information" and the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the SEC on May 10, 2017, and other periodic filings with the SEC, any of which could affect our estimates for future financial needs and sources of working capital.

OFF BALANCE SHEET ARRANGEMENTS AND CONTRACTUAL OBLIGATIONS

We have not entered into any transactions with unconsolidated entities giving rise to financial guarantees, subordinated retained interests, derivative instruments, or other contingent arrangements that expose us to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an unconsolidated entity that provides us with financing and liquidity support, market risk, or credit risk support.

A substantial portion of the raw materials, components, and subassemblies used in our products are provided by our suppliers on a consignment basis. These consigned inventories are not recorded on our condensed consolidated balance sheetsheets until we take title to the raw materials, components, and subassemblies, which occurs when they are consumed in the production process. Prior to consumption in the production process, our suppliers bear the risk of loss and retain title to the consigned inventory. The terms of the agreements allow us to return parts in excess of maximum order quantities to the suppliers at the supplier’s expense. Returns for other reasons are negotiated with the suppliers on a case-by-case basis and to date have been immaterial. If our suppliers were to discontinue financing consigned inventory, it would require us to make cash outlays and we could incur expenses which, if material, could negatively affect our business and financial results. As of March 31, 2017 and December 31, 2017, we had off-balance sheet consigned inventories of $52.3 million and $56.1 million, respectively.

Unconditional Purchase Obligations

We utilize several contract manufacturers to procure raw materials, components, and subassemblies for our products. We provide these contract manufacturers with demand information that typically covers periods up to 13 weeks, and they use this information to acquire components and build products. We also obtain individual components for our products from a wide variety of individual suppliers. Consistent with industry practice, we acquire components through a combination of purchase orders, supplier contracts, and open orders based on projected demand information. As of December 31, 2017, we had outstanding off-balance sheet third-party manufacturing, component purchase, and other general and administrative commitments of $192.3 million, including off-balance sheet consigned inventories of $56.1 million as discussed above.

During the quarter ended December 31, 2017, our short and long-term tax obligations increased due to introduction of the Tax Cuts and Jobs Act (H.R. 1) (the “Act”), signed into law on December 22, 2017 and requiring the payment of a one-time deemed repatriation of accumulated unremitted earnings (the "toll charge"). As permitted under the Act, we have elected to pay the toll charge obligation over an 8-year period, as follows:

|

| | | | | | | | | | | | | | | |

| (in millions) | Total | Less than 1 year | 1 - 3 years | 3 - 5 years | More than 5 years |

| Toll charge | $ | 69.3 |

| $ | 5.5 |

| $ | 11.0 |

| $ | 11.2 |

| $ | 41.6 |

|

For additional details regarding the Act and the toll charge, refer to Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Except as described above, there have been no material changes in our contractual obligations as described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2017.

CRITICAL ACCOUNTING ESTIMATES

For a complete description of what we believe to be the critical accounting estimates used in the preparation of our condensed consolidated financial statements, refer to our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the SEC on May 10, 2017.