UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: December 31, 2008September 30, 2009

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the transition period from --- to ---

Commission File Number: 000-51910001-31810

Access Integrated Technologies, Inc.Cinedigm Digital Cinema Corp.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 22-3720962 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

55 Madison Avenue, Suite 300, Morristown New Jersey 07960

(Address of Principal Executive Offices, Zip Code)

(973-290-0080)

(Registrant’s Telephone Number, Including Area Code)

Access Integrated Technologies, Inc.

(Former name, former address and former fiscal year, if changed since last report)

| Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes x No o |

| | |

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes o No o |

| |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): |

| | |

Large accelerated filer o | Accelerated filer xo |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

| | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes o No x |

| | |

| |

As of February 4,November 12, 2009, 27,272,87528,032,875 shares of Class A Common Stock, $0.001 par value, and 733,811 shares of Class B Common Stock, $0.001 par value, were outstanding. |

ACCESS INTEGRATED TECHNOLOGIES, INC.

d/b/a CINEDIGM DIGITAL CINEMA CORP.

CONTENTS TO FORM 10-Q

| PART I -- | FINANCIAL INFORMATION | Page |

| | |

| Item 1. | Financial Statements (Unaudited) | |

| | Condensed Consolidated Balance Sheets at March 31, 20082009 and December 31, 2008September 30, 2009 (Unaudited) | 1 |

| | | |

| Unaudited Condensed Consolidated Statements of Operations for the Three and NineSix Months ended December 31, 2007September 30, 2008 and 20082009 | 3 |

| | | |

| Unaudited Condensed Consolidated Statements of Cash Flows for the NineSix Months ended December 31, 2007September 30, 2008 and 20082009 | 4 |

| | | |

| Notes to Unaudited Condensed Consolidated Financial Statements | 5 |

| | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 29 |

| Item 4T. | | |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 41 |

| | |

Item 4. | Controls and Procedures | 42 |

| | 43 |

| PART II -- | OTHER INFORMATION | |

| | |

| Item 1. | Legal Proceedings | 42 |

| | 43 |

| Item 1A. | Risk Factors | 42 |

| | 43 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 45 |

| | |

| Item 3. | Defaults Upon Senior Securities | 45 |

| | |

| Item 4. | Submission of Matters to a Vote of Security Holders | 45 |

| Item 5. | Other Information | 46 |

| Item 6. | Exhibits | 45 |

| | 46 |

| Signatures | | 4647 |

| |

Exhibit Index | 4748 |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

ACCESS INTEGRATED TECHNOLOGIES, INC.

d/b/a CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share data)

| | | March 31, 2008 | | | December 31, 2008 | |

| ASSETS | | | | | (Unaudited) | |

| | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 29,655 | | | $ | 22,565 | |

| Accounts receivable, net | | | 21,494 | | | | 16,400 | |

| Unbilled revenue | | | 6,393 | | | | 5,451 | |

| Deferred costs | | | 3,859 | | | | 3,803 | |

| Prepaid and other current assets | | | 1,316 | | | | 1,986 | |

| Note receivable | | | 158 | | | | 913 | |

| Total current assets | | | 62,875 | | | | 51,118 | |

| | | | | | | | | |

| Property and equipment, net | | | 269,031 | | | | 246,980 | |

| Intangible assets, net | | | 13,592 | | | | 11,473 | |

| Capitalized software costs, net | | | 2,777 | | | | 3,001 | |

| Goodwill | | | 14,549 | | | | 8,024 | |

| Deferred costs, net of current portion | | | 6,595 | | | | 4,712 | |

| Unbilled revenue, net of current portion | | | 2,075 | | | | 1,755 | |

| Note receivable, net of current portion | | | 1,220 | | | | 1,002 | |

| Security deposits | | | 408 | | | | 425 | |

| Accounts receivable, net of current portion | | | 299 | | | | 299 | |

| Restricted cash | | | 255 | | | | 255 | |

| Total assets | | $ | 373,676 | | | $ | 329,044 | |

| | | March 31, 2009 | | | September 30, 2009 | |

| ASSETS | | | | | (Unaudited) | |

Current assets | | | | | | |

| Cash and cash equivalents | | $ | 26,329 | | | $ | 19,732 | |

| Restricted short-term investment securities | | | — | | | | 5,594 | |

| Accounts receivable, net | | | 13,884 | | | | 11,527 | |

| Deferred costs, current portion | | | 3,936 | | | | 2,999 | |

| Unbilled revenue, current portion | | | 3,082 | | | | 3,522 | |

| Prepaid and other current assets | | | 1,798 | | | | 3,159 | |

| Note receivable, current portion | | | 616 | | | | 170 | |

| Total current assets | | | 49,645 | | | | 46,703 | |

Restricted long-term investment securities | | | — | | | | 4,974 | |

| Restricted cash | | | 255 | | | | 7,161 | |

| Security deposits | | | 424 | | | | 427 | |

| Property and equipment, net | | | 243,124 | | | | 235,853 | |

| Intangible assets, net | | | 10,707 | | | | 9,192 | |

| Capitalized software costs, net | | | 3,653 | | | | 3,738 | |

| Goodwill | | | 8,024 | | | | 8,024 | |

| Deferred costs, net of current portion | | | 3,967 | | | | 7,735 | |

| Unbilled revenue, net of current portion | | | 1,253 | | | | 1,062 | |

| Note receivable, net of current portion | | | 959 | | | | 878 | |

| Accounts receivable, net of current portion | | | 386 | | | | 386 | |

| Total assets | | $ | 322,397 | | | $ | 326,133 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

ACCESS INTEGRATED TECHNOLOGIES, INC.

d/b/a CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share data)

(continued)

| | | March 31, 2008 | | | December 31, 2008 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | (Unaudited) | |

| | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable and accrued expenses | | $ | 25,213 | | | $ | 9,682 | |

| Notes payable | | | 16,998 | | | | 24,729 | |

| Deferred revenue | | | 6,204 | | | | 5,511 | |

| Customer security deposits | | | 333 | | | | 358 | |

| Capital leases | | | 89 | | | | 128 | |

| Total current liabilities | | | 48,837 | | | | 40,408 | |

| | | | | | | | | |

| Notes payable, net of current portion | | | 250,689 | | | | 232,416 | |

| Capital leases, net of current portion | | | 5,814 | | | | 5,785 | |

| Deferred revenue, net of current portion | | | 283 | | | | 953 | |

| Customer security deposits, net of current portion | | | 46 | | | | 34 | |

| Preferred stock subscription proceeds | | | — | | | | 2,000 | |

| Fair value of interest rate swap | | | — | | | | 3,846 | |

| Total liabilities | | | 305,669 | | | | 285,442 | |

| | | | | | | | | |

| Commitments and contingencies (see Note 7) | | | | | | | | |

| | | | | | | | | |

| Stockholders’ Equity | | | | | | | | |

| Class A common stock, $0.001 par value per share; 40,000,000 and 65,000,000 shares authorized at March 31, 2008 and December 31, 2008, respectively; 26,143,612 and 27,104,091 shares issued and 26,092,172 and 27,052,651 shares outstanding at March 31, 2008 and December 31, 2008, respectively | | | 26 | | | | 27 | |

| Class B common stock, $0.001 par value per share; 15,000,000 shares authorized; 733,811 shares issued and outstanding at each of March 31, 2008 and December 31, 2008 | | | 1 | | | | 1 | |

| Additional paid-in capital | | | 168,844 | | | | 172,460 | |

| Treasury stock, at cost; 51,440 Class A shares | | | (172 | ) | | | (172 | ) |

| Accumulated deficit | | | (100,692 | ) | | | (128,714 | ) |

| Total stockholders’ equity | | | 68,007 | | | | 43,602 | |

| Total liabilities and stockholders’ equity | | $ | 373,676 | | | $ | 329,044 | |

| | | March 31, 2009 | | | September 30, 2009 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | (Unaudited) | |

Current liabilities | | | | | | |

| Accounts payable and accrued expenses | | $ | 14,954 | | | $ | 8,995 | |

| Current portion of notes payable, non-recourse | | | 24,824 | | | | 24,758 | |

| Current portion of notes payable | | | 424 | | | | 177 | |

| Current portion of capital leases | | | 175 | | | | 700 | |

| Current portion of deferred revenue | | | 5,535 | | | | 5,860 | |

| Current portion of customer security deposits | | | 314 | | | | 314 | |

| Total current liabilities | | | 46,226 | | | | 40,804 | |

| | | | | | | | | |

| Notes payable, non-recourse, net of current portion | | | 170,624 | | | | 162,112 | |

| Notes payable, net of current portion | | | 55,333 | | | | 65,627 | |

| Capital leases, net of current portion | | | 5,832 | | | | 5,778 | |

| Warrant liability | | | — | | | | 14,308 | |

| Interest rate swap | | | 4,529 | | | | 3,306 | |

| Deferred revenue, net of current portion | | | 1,057 | | | | 2,013 | |

| Customer security deposits, net of current portion | | | 9 | | | | 9 | |

| Total liabilities | | | 283,610 | | | | 293,957 | |

Commitments and contingencies (see Note 7) | | | | | | | | |

Stockholders’ Equity | | | | | | | | |

Preferred stock, 15,000,000 shares authorized; Series A 10% - $0.001 par value per share; 20 shares authorized; 8 shares issued and outstanding at March 31, 2009 and September 30, 2009, respectively. Liquidation preference $4,050 | | | 3,476 | | | | 3,529 | |

| Class A common stock, $0.001 par value per share; 65,000,000 shares authorized; 27,544,315 and 28,084,315 shares issued and 27,492,875 and 28,032,875 shares outstanding at March 31, 2009 and September 30, 2009, respectively | | | 27 | | | | 28 | |

| Class B common stock, $0.001 par value per share; 15,000,000 shares authorized; 733,811 shares issued and outstanding, at March 31, 2009 and September 30, 2009, respectively | | | 1 | | | | 1 | |

| Additional paid-in capital | | | 173,565 | | | | 175,281 | |

| Treasury stock, at cost; 51,440 Class A shares | | | (172 | ) | | | (172 | ) |

| Accumulated deficit | | | (138,110 | ) | | | (146,474 | ) |

| Accumulated other comprehensive loss | | | — | | | | (17 | ) |

| Total stockholders’ equity | | | 38,787 | | | | 32,176 | |

| Total liabilities and stockholders’ equity | | $ | 322,397 | | | $ | 326,133 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

ACCESS INTEGRATED TECHNOLOGIES, INC.

d/b/a CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for share and per share data)

(Unaudited)

| | For the Three Months Ended December 31, | | For the Nine Months Ended December 31, | For the Three Months Ended September 30, | | For the Six Months Ended September 30, |

| | | | 2007 | | | | 2008 | | | | 2007 | | | | 2008 | | | | 2008 | | | | 2009 | | | | 2008 | | | | 2009 | |

| Revenues | | $ | 21,480 | | | $ | 22,710 | | | $ | 59,092 | | | $ | 65,129 | | | $ | 21,849 | | | $ | 19,881 | | | $ | 42,419 | | | $ | 38,547 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Costs and Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct operating (exclusive of depreciation and amortization shown below) | | | 6,608 | | | | 7,068 | | | | 19,798 | | | | 19,597 | | | | 6,732 | | | | 6,066 | | | | 12,529 | | | | 11,528 | |

| Selling, general and administrative | | | 6,090 | | | | 4,691 | | | | 17,127 | | | | 13,711 | | | | 4,187 | | | | 4,073 | | | | 9,020 | | | | 7,942 | |

| Provision for doubtful accounts | | | 321 | | | | 98 | | | | 691 | | | | 271 | | | | 145 | | | | 136 | | | | 173 | | | | 264 | |

| Research and development | | | 180 | | | | 107 | | | | 503 | | | | 207 | | | | 93 | | | | 64 | | | | 100 | | | | 104 | |

| Stock-based compensation | | | 162 | | | | 295 | | | | 361 | | | | 653 | | | | 200 | | | | 441 | | | | 358 | | | | 766 | |

| Impairment of goodwill | | | — | | | | 6,525 | | | | — | | | | 6,525 | | |

| Depreciation of property and equipment | | | 8,020 | | | | 8,126 | | | | 20,950 | | | | 24,394 | | |

| Depreciation and amortization of property and equipment | | | | 8,133 | | | | 8,323 | | | | 16,268 | | | | 16,476 | |

| Amortization of intangible assets | | | 1,071 | | | | 821 | | | | 3,210 | | | | 2,669 | | | | 901 | | | | 750 | | | | 1,848 | | | | 1,515 | |

| Total operating expenses | | | 22,452 | | | | 27,731 | | | | 62,640 | | | | 68,027 | | | | 20,391 | | | | 19,853 | | | | 40,296 | | | | 38,595 | |

| Loss from operations | | | (972 | ) | | | (5,021 | ) | | | (3,548 | ) | | | (2,898 | ) | |

| | | | | | | | | | | | | | | | | | |

| Income (loss) from operations | | | | 1,458 | | | | 28 | | | | 2,123 | | | | (48 | ) |

| Interest income | | | 448 | | | | 88 | | | | 1,174 | | | | 311 | | | | 99 | | | | 95 | | | | 223 | | | | 135 | |

| Interest expense | | | (7,703 | ) | | | (6,935 | ) | | | (20,530 | ) | | | (21,101 | ) | | | (6,990 | ) | | | (8,791 | ) | | | (14,166 | ) | | | (16,341 | ) |

| Debt refinancing expense | | | — | | | | — | | | | (1,122 | ) | | | — | | |

| Extinguishment of debt | | | | — | | | | 10,744 | | | | — | | | | 10,744 | |

| Other expense, net | | | (125 | ) | | | (162 | ) | | | (426 | ) | | | (488 | ) | | | (176 | ) | | | (158 | ) | | | (326 | ) | | | (301 | ) |

| Change in fair value of interest rate swap | | | — | | | | (5,411 | ) | | | — | | | | (3,846 | ) | | | (687 | ) | | | 540 | | | | 1,565 | | | | 1,223 | |

| Change in fair value of warrants | | | | — | | | | (3,576 | ) | | | — | | | | (3,576 | ) |

| Net loss | | $ | (8,352 | ) | | $ | (17,441 | ) | | $ | (24,452 | ) | | $ | (28,022 | ) | | $ | (6,296 | ) | | $ | (1,118 | ) | | $ | (10,581 | ) | | $ | (8,164 | ) |

| | | | | | | | | | | | | | | | | | |

Preferred stock dividends | | | | — | | | | (100 | ) | | | — | | | | (200 | ) |

| Net loss attributable to common stockholders | | | $ | (6,296 | ) | | $ | (1,218 | ) | | $ | (10,581 | ) | | $ | (8,364 | ) |

| Net loss per Class A and Class B common share - basic and diluted | | $ | (0.32 | ) | | $ | (0.63 | ) | | $ | (0.96 | ) | | $ | (1.03 | ) | | $ | (0.23 | ) | | $ | (0.04 | ) | | $ | (0.39 | ) | | $ | (0.29 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of Class A and Class B common shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted | | | 25,931,467 | | | | 27,566,462 | | | | 25,344,944 | | | | 27,324,324 | | | | 27,536,371 | | | | 28,663,959 | | | | 27,202,593 | | | | 28,475,217 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

ACCESS INTEGRATED TECHNOLOGIES, INC.

d/b/a CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

| | | For the Nine Months Ended December 31, | | For the Six Months Ended September 30, | |

| | | 2007 | | | 2008 | | | 2008 | | | | 2009 | |

| Cash flows from operating activities | | | | | | | | | | | | |

| Net loss | | $ | (24,452 | ) | | $ | (28,022 | ) | $ | (10,581 | ) | | $ | (8,164 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | | | | | | | |

| Loss on disposal of property and equipment | | | 49 | | | | 164 | | |

| Loss on impairment of goodwill | | | — | | | | 6,525 | | |

| Depreciation of property and equipment and amortization of intangible assets | | | 24,160 | | | | 27,063 | | |

| Amortization of software development costs | | | 448 | | | | 601 | | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Loss on disposal of assets | | | 79 | | | 4 | |

| Depreciation and amortization of property and equipment and amortization of intangible assets | | | 18,116 | | | 17,991 | |

| Amortization of capitalized software costs | | | 387 | | | 323 | |

| Amortization of debt issuance costs included in interest expense | | | 1,065 | | | | 1,134 | | | 749 | | | 938 | |

| Provision for doubtful accounts | | | 691 | | | | 271 | | | 173 | | | 264 | |

| Stock-based compensation | | | 361 | | | | 653 | | | 358 | | | 766 | |

| Non-cash interest expense | | | 3,882 | | | | 3,937 | | | 3,018 | | | 1,861 | |

| Debt refinancing expense | | | 1,122 | | | | — | | |

| Gain on available-for-sale securities | | | (53 | ) | | | — | | |

| Change in fair value of interest rate swap | | | — | | | | 3,846 | | |

| Change in fair value of interest rate swap and warrant | | | (1,565 | ) | | 2,353 | |

| Loss on available-for-sale investments | | | — | | | 2 | |

| Note payable included in interest expense | | | — | | | 817 | |

| Gain on extinguishment of debt | | | — | | | (10,744 | ) |

| Accretion of note payable discount included in interest expense | | | — | | | 300 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | |

| Accounts receivable | | | (8,097 | ) | | | 4,823 | | | 4,012 | | | 2,093 | |

| Unbilled revenue | | | (4,457 | ) | | | 1,262 | | | 1,318 | | | (250 | ) |

| Prepaids and other current assets | | | (499 | ) | | | (670 | ) | | (1,535 | ) | | (1,308 | ) |

| Other assets | | | (102 | ) | | | (434 | ) | | 150 | | | 533 | |

| Accounts payable and accrued expenses | | | 593 | | | | 472 | | | 943 | | | (2,194 | ) |

| Deferred revenue | | | 230 | | | | (23 | ) | | (407 | ) | | 1,236 | |

| Other liabilities | | | 210 | | | | 13 | | | 9 | | | | — | |

| Net cash (used in) provided by operating activities | | | (4,849 | ) | | | 21,615 | | |

| | | | | | | | | | |

| Net cash provided by operating activities | | | 15,224 | | | 6,821 | |

| Cash flows from investing activities | | | | | | | | | | | | | | |

| Purchases of property and equipment | | | (65,653 | ) | | | (18,115 | ) | | (16,008 | ) | | (12,573 | ) |

| Deposits paid for property and equipment | | | (20,052 | ) | | | — | | |

| Purchases of intangible assets | | | — | | | | (550 | ) | |

| Additions to capitalized software costs | | | (704 | ) | | | (825 | ) | | (508 | ) | | (408 | ) |

| Acquisition of UniqueScreen Media, Inc. | | | (121 | ) | | | — | | |

| Acquisition of The Bigger Picture | | | (15 | ) | | | — | | |

| Additional purchase price for EZZI.net | | | (35 | ) | | | — | | |

| Maturities and sales of available-for-sale securities | | | 6,053 | | | | — | | |

| Purchase of available-for-sale securities | | | (6,000 | ) | | | — | | |

| Restricted long-term investment | | | (75 | ) | | | — | | |

| Maturities of available-for-sale investments | | | — | | | 671 | |

| Purchase of available-for-sale investments | | | — | | | (11,265 | ) |

| Restricted cash | | | — | | | | (6,906 | ) |

| Net cash used in investing activities | | | (86,602 | ) | | | (19,490 | ) | | (16,516 | ) | | (30,481 | ) |

| | | | | | | | | | | | | | | |

| Cash flows from financing activities | | | | | | | | | | | | | | |

| Proceeds from notes payable | | | — | | | 76,513 | |

| Repayment of notes payable | | | (12,694 | ) | | | (1,434 | ) | | (1,100 | ) | | (42,862 | ) |

| Proceeds from notes payable | | | 51,491 | | | | — | | |

| Repayment of credit facilities | | | — | | | | (9,676 | ) | | (3,858 | ) | | (18,950 | ) |

| Proceeds from credit facilities | | | 62,161 | | | | 569 | | | 200 | | | 8,884 | |

| Payments of debt issuance costs | | | (3,054 | ) | | | (518 | ) | | (368 | ) | | (6,064 | ) |

| Principal payments on capital leases | | | (55 | ) | | | (83 | ) | | (53 | ) | | (432 | ) |

| Proceeds for subscription of preferred stock | | | — | | | | 2,000 | | |

| Costs associated with issuance of preferred stock | | | — | | | (8 | ) |

| Costs associated with issuance of Class A common stock | | | (33 | ) | | | (73 | ) | | (37 | ) | | | (18 | ) |

| Net proceeds from issuance of Class A common stock | | | 35 | | | | — | | |

| Net cash provided by (used in) financing activities | | | 97,851 | | | | (9,215 | ) | |

| Net increase (decrease) in cash and cash equivalents | | | 6,400 | | | | (7,090 | ) | |

| Net cash (used in) provided by financing activities | | | (5,216 | ) | | | 17,063 | |

| Net decrease in cash and cash equivalents | | | (6,508 | ) | | (6,597 | ) |

| Cash and cash equivalents at beginning of period | | | 29,376 | | | | 29,655 | | | 29,655 | | | | 26,329 | |

| Cash and cash equivalents at end of period | | $ | 35,776 | | | $ | 22,565 | | $ | 23,147 | | | $ | 19,732 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

ACCESS INTEGRATED TECHNOLOGIES, INC.

d/b/a CINEDIGM DIGITAL CINEMA CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2008September 30, 2009

($ in thousands, except for per share data)

(Unaudited)

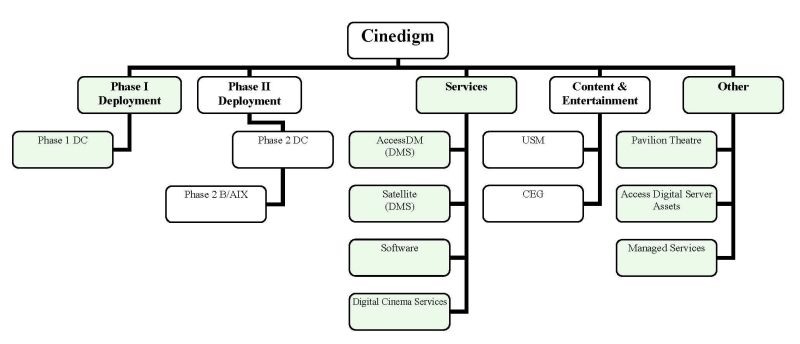

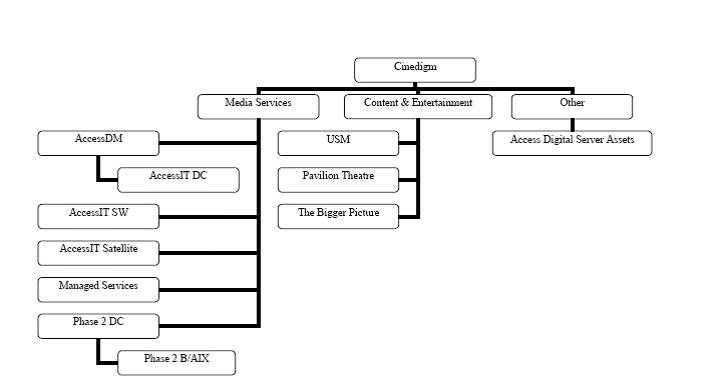

Access Integrated Technologies, Inc. d/b/a Cinedigm Digital Cinema Corp. was incorporated in Delaware on March 31, 2000 and began doing business as Cinedigm Digital Cinema Corp. on November 25, 2008 (“Cinedigm”, and collectively with its subsidiaries, the “Company”). On September 30, 2009, the Company’s stockholders approved a change in the Company’s name from Access Integrated Technologies, Inc., to Cinedigm Digital Cinema Corp. and such change was effected October 5, 2009. The Company provides fully managed storage,technology solutions, financial services and advice, software services, electronic delivery and softwarecontent distribution services and technology solutions forto owners and distributors of digital content to movie theatres and other venues. Beginning September 1, 2009, the Company made changes to its organizational structure which impacted its reportable segments, but did not impact its consolidated financial position, results of operations or cash flows. The Company has threerealigned its focus to five primary businesses mediaas follows: the first digital cinema deployment (“Phase I Deployment”), the second digital cinema deployment (“Phase II Deployment”), services (“Media Services”), media content and entertainment (“Content & Entertainment”) and other (“Other”). The Company’s MediaPhase I Deployment and Phase II Deployment segments are the non-recourse, financing vehicles and administrators for the Company’s digital cinema equipment (the “Systems”) installed in movie theatres nationwide. The Company’s Services businesssegment provides software, services and technology solutionssupport to the Phase I Deployment and Phase II Deployment segments as well as to other third party customers. Included in these services are asset management services for a specified fee via service agreements with Phase I Deployment and Phase II Deployment; software license, maintenance and consulting services; and electronic content delivery services via satellite and hard drive to the motion picture and television industries,industry. These services primarily to facilitate the conversion from analog (film) to digital cinema and have positioned the Company at what the Companyit believes to be the forefront of ana rapidly developing industry relating to the delivery and management of digital cinema and other content to entertainmenttheatres and other remote venues worldwide. The Company’s Content & Entertainment businesssegment provides content distribution services to alternative and theatrical content owners and to theatrical exhibitors and in-theatre advertising. The Company’s Other segment provides motion picture exhibition to the general public, information technology consulting and cinema advertisingmanaged network monitoring services and film distribution services to movie exhibitors. The Company’s Other business provides hosting services and network access for other web hosting services (“Access Digital Server Assets”). Overall, the Company’s goal is to aid in the transformation of movie theatres to entertainment centers by providing a platform of hardware, software and content choices. Additional information related to the Company’s reporting segments can be found in Note 9.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

BASIS OF PRESENTATION, USE OF ESTIMATES AND CONSOLIDATION

The Company has incurred net losses historically and through the current period, and until recently, has used cash in operating activities, and has an accumulated deficit of $128,714$146,474 as of December 31, 2008.September 30, 2009. The Company also has significant contractual obligations related to its recourse and non-recourse debt for the remaining part of fiscal year 20092010 and beyond. Management expects that the Company will continue to generate net losses for the foreseeable future. Certain of the Company’s costs could be reduced if the Company’s working capital requirements increased. Based on the Company’s cash position at December 31, 2008,September 30, 2009, and expected cash flows from operations, management believes that the Company has the ability to meet its obligations through December 31, 2009.September 30, 2010. In August 2009, the Company entered into a private placement of a senior secured note and extinguished its existing senior notes, which provided net proceeds after repayment of existing debt, funding of an interest reserve and transactions fees and expenses of approximately $11,300 of working capital funding. The Company is seeking to raisehas signed commitment letters for additional non-recourse debt capital, to refinance certain outstanding debt,primarily to meet equipment requirements related to the Company’s second digital cinema deployment (the “PhasePhase II Deployment”) and for working capital as necessary.Deployment (see Note 11). Although the Company recently entered into certain agreements related to the Phase II Deployment (see Note 7), there is no assurance that financing for the Phase II Deployment will be completed as contemplated or under terms acceptable to the Company or its existing shareholders.stockholders. Failure to generate additional revenues, raise additional capital or manage discretionary spending could have a material adverse effect on the Company’s ability to continue as a going concern. The accompanying unaudited condensed consolidated financial statements do not reflect any adjustments which may result from the Company’s inability to continue as a going concern.

The condensed consolidated balance sheet as of March 31, 2008,2009, which has been derived from audited financial statements, and the unaudited condensed consolidated financial statements were prepared following the interim reporting requirements of the Securities and Exchange Commission (“SEC”). As permitted under those rules, certain footnotes or otherThey do not include all disclosures normally

made in financial information that are normally required bystatements contained in Form 10-K. In management’s opinion, all adjustments necessary for a fair presentation of financial position, the results of operations and cash flows in accordance with accounting principles generally accepted in the United States of America (“GAAP”),(GAAP) for the periods presented have been made. The results of operations for the respective interim periods are not necessarily indicative of the results to be expected for the full year. The accompanying condensed or omitted. Inconsolidated financial statements should be read in conjunction with the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessaryfinancial statements and notes thereto included in the Company’s Annual Report on Form 10-K for a fair presentation have been included.the fiscal year ended March 31, 2009 filed with the SEC on June 15, 2009 (the “Form 10-K”).

The Company’s unaudited condensed consolidated financial statements include the accounts of Cinedigm, Access Digital Media, Inc. (“AccessDM”), Hollywood Software, Inc. d/b/a AccessIT Software (“AccessIT SW”Software”), Core Technology Services, Inc. (“Managed Services”), FiberSat Global Services, Inc. d/b/a AccessIT Satellite and Support Services (“AccessIT Satellite”), ADM Cinema Corporation (“ADM Cinema”) d/b/a the Pavilion Theatre (the “Pavilion Theatre”), Christie/AIX, Inc. d/b/a AccessIT Digital Cinema (“AccessITPhase 1 DC”), PLX Acquisition Corp., UniqueScreen Media, Inc. (“USM”), Vistachiara Productions, Inc. d/b/f/k/a The Bigger Picture, currently d/b/a Cinedigm Content and Entertainment Group (“The Bigger Picture”CEG”),Access Digital Cinema Phase 2 Corp. (“Phase 2 DC”) and Access Digital Cinema Phase 2 B/AIX Corp.

(“ (“Phase 2 B/AIX’AIX”). AccessDM and AccessIT Satellite are together referred to as the Digital Media Services Division (“DMS”). All intercompany transactions and balances have been eliminated.

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the unaudited condensed consolidated financial statements and accompanying notes. On an on-going basis, the Company evaluates its estimates, including those related to the carrying values of its long-lived assets, intangible assets and goodwill, the valuation of deferred tax assets, the valuation of assets acquired and liabilities assumed in purchase business combinations, stock-based compensation expense, revenue recognition and capitalization of software development costs. The Company bases its estimates on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. ActualBecause of the uncertainty inherent in such estimates, actual results could differ materially from these estimates under different assumptions or conditions.

The results of operations for the respective interim periods are not necessarily indicative of the results to be expected for the full year. The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto included in Cinedigm’s Annual Report on Form 10-K for the fiscal year ended March 31, 2008 filed with2009 consolidated balance sheets were reclassified to break out the SEC on June 16, 2008recourse and as amended on June 26, 2008 and on September 11, 2008 (the “Form 10-K”).non-recourse notes payable to conform to the current period presentation.

REVENUE RECOGNITION

Media ServicesPhase I Deployment and Phase II Deployment

Media Services revenues are generated as follows:

Revenues consist of: | | Accounted for in accordance with: |

Virtual print fees (“VPFs”) and alternative content fees (“ACFs”). | | Staff Accounting Bulletin (“SAB”) No. 104 “Revenue Recognition in Financial Statements” (“SAB No. 104”). |

Software multi-element licensing arrangements, software maintenance contracts, and professional consulting services, which includes systems implementation, training, and other professional services, delivery revenues via satellite and hard drive, data encryption and preparation fee revenues, satellite network monitoring and maintenance fees. | | Statement of Position (“SOP”) 97-2, “Software Revenue Recognition” |

Custom software development services. | | SOP 81-1, “Accounting for Performance of Construction-Type and Certain Production-Type Contracts” (“SOP 81-1”) |

Customer licenses and application service provider (“ASP Service”) agreements. | | SAB No. 104 |

VPFs are earned pursuant to contracts with movie studios and distributors, whereby amounts are payable to AccessITPhase 1 DC and will be payable to Phase 2 DC, according to a fixed fee schedule, when movies distributed by the studio are displayed on screens utilizing the Company’s digital cinema equipment (the “Systems”) installed in movie theatres. VPFs are earned and payable to Phase 1 DC based on a defined fee schedule with a reduced VPF rate year over year until the sixth year (calendar 2011) at which point the VPF rate remains unchanged through the tenth year. One VPF is payable for every movie title displayed per System. The amount of VPF revenue is therefore dependent on the number of movie titles released and displayed on the Systems in any given accounting period. VPF revenue is recognized in the period in which the movie first opens for general audience viewing in that digitally-equipped movie theatre, as AccessITPhase 1 DC’s and Phase 2 DC’s performance obligations have been substantially met at that time.

ACFsPhase 2 DC’s agreements with distributors require the payment of VPFs, according to a defined fee schedule, for 10 years from the date each system is installed; however, Phase 2 DC may no longer collect VPFs once “cost recoupment,” as defined in the agreements, is achieved. Cost recoupment will occur once the cumulative VPFs and other cash receipts collected by Phase 2 DC have equaled the total of all cash outflows, including the purchase price of all Systems, all financing costs, all “overhead and ongoing costs”, as defined and including the Company’s service fees, subject to maximum agreed upon amounts during the three-year rollout period and thereafter, plus a compounded return on any billed but unpaid overhead and ongoing costs, of 15% per year. Further, if cost recoupment occurs before the end of the eighth contract year, a one-time “cost recoupment bonus” is payable by the studios to Cinedigm. Any other cash flows, net of expenses, received by Phase 2 DC following the achievement of cost recoupment are required to be returned to the distributors on a pro-rata basis. At this time, the Company cannot estimate the timing or probability of the achievement of cost recoupment.

Alternative content fees (“ACFs”) are earned pursuant to contracts with movie exhibitors, whereby amounts are payable to AccessITPhase 1 DC and will be payable to Phase 2 DC, generally as a percentage of the applicable box office revenue derived from the exhibitor’s showing of content other than feature films, such as concerts and sporting events (typically referred to as “alternative content”). ACF revenue is recognized in the period in which the alternative content opens for audience viewing.

For software multi-element licensing arrangements that do not require significant production, modification or customization of the licensed software, revenue is recognized for the various elements as follows: Revenuerevenue for the licensed software element is recognized upon delivery and acceptance of the licensed software product, as that represents the culmination of the earnings process and the Company has no further obligations to the customer, relative to the software license. Revenue earned from consulting services is recognized upon the performance and completion of these services. Revenue earned from annual software maintenance is recognized ratably over the maintenance term (typically one year).

Revenues relating to customized software development contracts are recognized on a percentage-of-completion method of accounting in accordance with SOP 81-1.

Revenue is deferred in cases where: (1) a portion or the entire contract amount cannot be recognized as revenue, due to non-delivery or pre-acceptance of licensed software or custom programming, (2) uncompleted implementation of application service provider arrangements (“ASP Service arrangements,Service”), or (3) unexpired pro-rata periods of maintenance, minimum ASP Service fees or website subscription fees. As license fees, maintenance fees, minimum ASP Service fees and website subscription fees are often paid in advance, a portion of this revenue is deferred until the contract ends. Such amounts are classified as deferred revenue and are recognized as earned revenue in accordance with the Company’s revenue recognition policies described above.

Managed Services’ revenues, which consistRevenues from the delivery of monthly recurring billings pursuant to network monitoringdata via satellite and maintenance contracts,hard drive are recognized upon delivery, as revenues in the month earned, and other non-recurring billings are recognized on a time and materials basis as revenues in the period in which the services were provided.DMS’ performance obligations have been substantially met at that time.

Content & Entertainment

Content & Entertainment revenues are generated as follows:

Revenues consist of: | | Accounted for in accordance with: |

Movie theatre admission and concession revenues. | | SAB No. 104 |

Cinema advertising service revenues and distribution fee revenues. | | SOP 00-2, “Accounting by Producers or Distributors of Films” (“SOP 00-2”) |

Cinema advertising barter revenues | | The Emerging Issues Task Force (“EITF”) 99-17, “Accounting for Advertising Barter Transactions” (“EITF 99-17”) |

Movie theatre admission and concession revenues are generated at the Company’s nine-screen digital movie theatre, the Pavilion Theatre. Movie theatre admission revenues are recognized on the date of sale, as the related movie is viewed on that date and the Company’s performance obligation is met at that time. Concession revenues consist of food and beverage sales and are also recognized on the date of purchase.

USM has contracts with exhibitors to display pre-show advertisements on their screens, in exchange for certain fees paid to the exhibitors. USM then contracts with businesses of various types to place their advertisements in select theatre locations, designs the advertisement, and places it on-screen for specific periods of time, generally ranging from three to twelve months. Cinema advertising service revenue, and the associated direct selling, production and support cost, is recognized on a straight-line basis over the period the related in-theatre advertising is displayed, pursuant to the specific terms of each advertising contract. USM has the right to receive or bill the entire amount of the advertising contract upon execution, and therefore such amount is recorded as a receivable at the time of execution, and all related advertising revenue and all direct costs actually incurred are deferred until such time as the aan in-theatre advertising is displayed.

The right to sell and display such advertising, or other in-theatre programs, products and services, is based upon advertising contracts with exhibitors which stipulate payment terms to such exhibitors for this right. Payment terms generally consist of either fixed annual payments or annual minimum guarantee payments, plus a revenue share of the excess of a percentage of advertising revenue over the minimum guarantee, if any. The Company recognizes the cost of fixed and minimum guarantee payments on a straight-line basis over each advertising contract year, and the revenue share cost, if any, in accordance with the terms of the advertising contract.

Distribution fee revenue is recognized for the theatrical distribution of third party feature films and alternative content at the time of exhibition based on the Bigger Picture’s participation in box office receipts. The Bigger

Picture has the right to receive or bill a portion of the theatrical distribution fee in advance of the exhibition date, and therefore such amount is recorded as a receivable at the time of execution, and all related distribution revenue is deferred until the third party feature films’ or alternative content’s theatrical release date.

Barter advertising revenue is recognized for the fair value of the advertising time surrendered in exchange for alternative content. The Company includes the value of such exchanges in both Content & Entertainment’s net revenues and direct operating expenses. There may be a timing difference between the screening of alternative content and the screening of the underlying advertising used to acquire the content. In accordance with EITF 99-17, theThe acquisition cost is being recorded and recognized as a direct operating expense by The Bigger PictureCEG when the alternative content is screened, and the underlying advertising is being deferred and recognized as revenue ratably over the period such advertising is screened by USM. For the nine months ended December 31, 2007 and 2008, theThe Company has not recorded $0 and $1,152, respectively, inany net revenues andor direct operating expenses with no impactrelated to barter advertising during the three and six months ended September 30, 2008 and 2009.

CEG has contracts for the theatrical distribution of third party feature films and alternative content. CEG’s distribution fee revenue is recognized at the time a feature film and alternative content is viewed, based on net loss.CEG’s participation in box office receipts. CEG has the right to receive or bill a portion of the theatrical distribution fee in advance of the exhibition date, and therefore such amount is recorded as a receivable at the time of execution, and

all related distribution revenue is deferred until the third party feature films’ or alternative content’s theatrical release date.

Other

Movie theatre admission and concession revenues are generated at the Company’s nine-screen digital movie theatre, the Pavilion Theatre. Movie theatre admission revenues are recognized on the date of sale, as the related movie is viewed on that date and the Company’s performance obligation is met at that time. Concession revenues consist of food and beverage sales and are also recognized on the date of sale.

Managed Services’ revenues, which consist of monthly recurring billings pursuant to network monitoring and maintenance contracts, are recognized as revenues in the period the services are provided, and other non-recurring billings are recognized on a time and materials basis as revenues in the period in which the services were provided.

Other revenues, attributable to the Access Digital Server Assets, were generatedwhich consist of monthly recurring billings for hosting and network access fees, are recognized as follows:

Revenues consist of: | | Accounted for in accordance with: |

Hosting and network access fees. | | SAB No. 104 |

revenues in the period the services are provided.

Since May 1, 2007, the Company’s three internet data centers (“IDCs”) have been operated by FiberMedia AIT, LLC and Telesource Group, Inc. (together, “FiberMedia”), unrelated third parties, pursuant to a master collocation agreement. Although the Company is still the lessee of the IDCs, substantially all of the revenues and expenses were being realized by FiberMedia and not the Company and since May 1, 2008, 100% of the revenues and expenses are being realized by FiberMedia. In June 2009, one of the IDC leases expired, leaving two IDC leases with the Company as lessee.

RESTRICTED INVESTMENT SECURITIES

In connection with the $75,000 Senior Secured Note issued in August 2009 (see Note 5), the Company was required to segregate $11,265 of the proceeds into marketable securities which will be used to repay interest over the next two years. The Company classifies the marketable securities as available-for-sale securities and accordingly, these investments are recorded at fair value. The maturity dates of these investments coincide with the quarterly interest payment dates through September 2011. The changes in the value of these securities are recorded in other comprehensive loss in the condensed consolidated financial statements. Realized gains and losses are recorded in earnings when securities mature or are redeemed. There were realized losses of $2 recorded during the three months ended September 30, 2009.

The Company held no available-for-sale securities at March 31, 2009. During the three months ended September 30, 2009, the Company made the first scheduled quarterly interest payment in the amount of $715. Investment securities with a maturity of twelve months or less are classified as short-term; those that mature in greater than twelve months are classified as long-term. The carrying value and fair value of investment securities available-for-sale at September 30, 2009 were as follows:

| | | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized Losses | | | Fair Value | |

| U.S. Treasury securities | | $ | 4,517 | | | $ | 1 | | | $ | (8 | ) | | $ | 4,510 | |

| Obligations of U.S. government agencies and FDIC guaranteed bank debt | | | 5,099 | | | | 2 | | | | (11 | ) | | | 5,090 | |

| Corporate debt securities | | | 506 | | | | — | | | | — | | | | 506 | |

| Other interest bearing securities | | | 463 | | | | — | | | | (1 | ) | | | 462 | |

| | | $ | 10,585 | | | $ | 3 | | | $ | (20 | ) | | $ | 10,568 | |

DEFERRED COSTS

Deferred costs primarily consist of the unamortized debt issuance costs related to the credit facility with General Electric Capital Corporation (“GECC”) and, the $55,000 of 10% Senior Notes issued in August 2007 up to August 2009 (see Note 5) and the $75,000 Senior Secured Note issued in August 2009 (see Note 5), which are amortized on a straight-line basis over the term of the respective debt.debt (see Note 5 for extinguishment of debt). The straight-line basis is not materially different from the effective interest method. Also included in deferred costs is advertising production, post production and technical support costs related to developing and displaying advertising in the amount of $778, which are capitalized and amortized on a straight-line basis over the same period as the related cinema advertising revenues of $4,704 are recognized.

DIRECT OPERATING COSTS

Direct operating costs consistsconsist of facility operating costs such as rent, utilities, real estate taxes, repairs and maintenance, insurance and other related expenses, direct personnel costs, film rent expense, amortization of capitalized software development costs, exhibitors payments for displaying cinema advertising and other deferred expenses, such as advertising production, post production and technical support related to developing and displaying advertising. These other deferred expenses are capitalized and amortized on a straight-line basis over the same period as the related cinema advertising revenues are recognized.

STOCK-BASED COMPENSATION

The Company has two stock-based employee compensation plans, which are described more fully in Note 6. Effective April 1, 2006, the Company adopted Statement of Financial Accounting Standards (“SFAS”) No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123(R)”), which is a revision of SFAS No. 123, “Accounting for Stock-Based Compensation”. Under SFAS 123(R), the Company is required to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award (with limited exceptions) and recognize such cost in the statement of operations over the period during which an employee is required to provide service in exchange for the award (usually the vesting period). Pro forma disclosure is no longer an alternative.

For the three months ended December 31, 2007September 30, 2008 and 2008,2009, the Company recorded stock-based compensation expense of $162$200 and $295,$441, respectively, and $361$358 and $653,$766, for the ninesix months ended December 31, 2007September 30, 2008 and 2008,2009, respectively. The Company estimatedestimates that the stock-based compensation expense related to current

outstanding stock options, using a Black-Scholes option valuation model, and current outstanding restricted stock awards will be approximately $950$1,432 in fiscal 2009.2010.

The weighted-average grant-date fair value of options granted during the three months ended December 31, 2007September 30, 2008 and 2008September 30, 2009 was $2.56$0.55 and $0,$0.57, respectively, and during$0.58 and $0.57, for the ninesix months ended December 31, 2007September 30, 2008 and 2008 was $2.90 and $0.58, respectively. The total intrinsic value of options exercised during the nine months ended December 31, 2007 and 2008 was approximately $25 and $0,2009, respectively. There were no stock options exercised during the three months and ninesix months ended December 31, 2008.September 30, 2008 and 2009.

The Company estimated the fair value of stock options at the date of each grant using a Black-Scholes option valuation model with the following assumptions:

| | | For the Three Months Ended December 31, | | | For the Nine Months Ended December 31, | | | For the Three Months Ended September 30, | | | For the Six Months Ended

September 30, | |

| | | 2007 | | | 2008 | | | 2007 | | | 2008 | | | 2008 | | | 2009 | | | 2008 | | | 2009 | |

| Range of risk-free interest rates | | | 3.2-4.2 | % | | | 2.5-5.2 | % | | | 3.2-5.0 | % | | | 2.5-5.2 | % | | | 2.7-4.4 | % | | | 2.7 | % | | | 2.5-5.2 | % | | | 2.7 | % |

| Dividend yield | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Expected life (years) | | | 5 | | | | 5 | | | | 5 | | | | 5 | | | | 5 | | | | 5 | | | | 5 | | | | 5 | |

| Range of expected volatilities | | | 52.5-54.6 | % | | | 52.5-58.7 | % | | | 52.5-54.6 | % | | | 52.5-58.7 | % | | | 52.6-58.7 | % | | | 77.4 | % | | | 52.5-58.7 | % | | | 77.4 | % |

The risk-free interest rate used in the Black-Scholes option pricingvaluation model for options granted under Cinedigm’s equity incentivethe Company’s stock option plan awards is the historical yield on U.S. Treasury securities with equivalent remaining lives. The Company does not currently anticipate paying any cash dividends on its common stock in the foreseeable future. Consequently, an expected dividend yield of zero is used in the Black-Scholes option pricingvaluation model. The Company estimates the expected life of options granted under the Company’s stock option plans using both exercise behavior and post-vesting termination behavior.behavior, as well as consideration of outstanding options. The Company estimates expected volatility for options granted under Cinedigm’s equity incentive planthe Company’s stock option plans based on a measure of historical volatility in the trading market for the Company’s shares of Class A Common Stock.common stock.

CAPITALIZED SOFTWARE DEVELOPMENT COSTS

Internal Use Software

The Company accounts for theseinternal use software development costs under Statement of Position (“SOP”) 98-1, “Accounting for the Costs of Computer Software Developed or Obtained for Internal Use” (“SOP 98-1”). SOP 98-1 states that there arebased on three distinct stages to the software development process for internal use software. The first stage, the preliminary project stage, includes the conceptual

formulation, design and testing of alternatives. The second stage, or the program instruction phase, includes the development of the detailed functional specifications, coding and testing. The final stage, the implementation stage, includes the activities associated with placing a software project into service. All activities included within the preliminary project stage would beare considered research and development and expensed as incurred. During the program instruction phase, all costs incurred until the software is substantially complete and ready for use, including all necessary testing, are capitalized, andCapitalized costs are amortized on a straight-line basis over estimated lives ranging from three to five years. The Company has not sold, leased or licensedyears, beginning when the software developedis ready for internal use to the Company’s customers and the Company has no intention of doing so in the future.its intended use.

Software to be Sold, Licensed or Otherwise Marketed

The Company accounts for these software development costs under SFAS No. 86, “Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed” (“SFAS No. 86”). SFAS No. 86 states that software development costs that are incurred subsequent to establishing technological feasibility are capitalized until the product is available for general release. Amounts capitalized as software development costs are amortized using the greater of revenues during the period compared to the total estimated revenues to be earned or on a straight-line basis over estimated lives ranging from three to five years. The Company reviews capitalized software costs for impairment on a periodic basis. To the extent that the carrying amount exceeds the estimated net realizable value of the capitalized software cost, an impairment charge is recorded. No impairment charge was recorded for the nine months ended December 31, 2007 and 2008, respectively.basis with other long-lived assets. Amortization of capitalized software development costs, included in direct operating costs, for the three months ended December 31, 2007September 30, 2008 and 20082009 amounted to $153$194 and

$214, $161, respectively and $448$387 and $601$323 for the ninesix months ended December 31, 2007September 30, 2008 and 2008,2009, respectively. At December 31, 2007 and 2008,September 30, 2009, there were no unbilled receivables under such customized software development contracts was $1,528 and $885, respectively, which is included in unbilled revenue in the condensed consolidated balance sheets. During the three months ended December 31, 2008, the Company reached an agreement with a customer regarding a customized product contract whereby the Company will cease development efforts on the customized product and the customer will complete the development of the product going forward at their sole expense and deliver the completed product back to the Company. The Company will continue to own the product at all times and retains the rights to market the finished product to others. The customer agreed to make certain payments to the Company as settlement of all billed and unbilled amounts. After all such payments have been received, the Company will have approximately $400 of unbilled amounts remaining. The Company believes this amount will be recoverable from future sales of the product to other customers.

BUSINESS COMBINATIONS

The Company adopted SFAS No. 141, “Business Combinations” (“SFAS No. 141”) which requires all business combinations to be accounted for using the purchase method of accounting and that certain intangible assets acquired in a business combination must be recognized as assets separate from goodwill. During the nine months ended December 31, 2008, the Company did not enter into any business combinations.

GOODWILL AND INTANGIBLE ASSETS

The carryingGoodwill is the excess of the purchase price paid over the fair value of goodwill and other intangiblethe net assets with indefinite lives are reviewed for possible impairment in accordance with SFAS No. 142 “Goodwill and Other Intangible Assets” (“SFAS No. 142”). SFAS No. 142 addressesof the recognition and measurement of goodwill and other intangible assets subsequent to their acquisition.acquired business. The Company testsassesses its goodwill for impairment at least annually and in interim periods if certain triggering events occur indicating that the carrying value of goodwill may be impaired. The Company also reviews possible impairment of finite lived intangible assets in accordance with SFAS No. 144, “Accounting forannually. During the Impairment or Disposalsix months ended September 30, 2008 and 2009, no impairment charge was recorded.

As of Long-Lived Assets”. The Company records goodwill andSeptember 30, 2009, the Company’s finite-lived intangible assets resultingconsisted of customer relationships and agreements, theatre relationships, covenants not to compete, trade names and trademarks and Federal Communications Commission licenses (for satellite transmission services), which are estimated to have useful lives ranging from past business combinations.

The Company’s process of evaluating goodwill for impairment involves the determination of fair value of its four goodwill reporting units: AccessIT SW, The Pavilion Theatre, USM and The Bigger Picture. Identification of reporting units is based on the criteria contained in SFAS No. 142. The Company normally conducts its annual goodwill impairment analysis during the fourth quarter of each fiscal year, measured as of March 31, unless triggering events occur which require goodwilltwo to be tested as of an interim date. As discussed further below, the Company concluded that one or more triggering events had occurredten years. No intangible assets were acquired during the three and six months ended December 31,September 30, 2009. During the six months ended September 30, 2008 and conducted impairment tests as of December 31, 2008.

Inherent in the fair value determination for each reporting unit are certain judgments and estimates relating to future cash flows, including management’s interpretation of current economic indicators and market conditions, and assumptions about the Company’s strategic plans with regard to its operations. To the extent additional information arises, market conditions change or the Company’s strategies change, it is possible that the conclusion regarding whether the Company’s remaining goodwill is impaired could change and result in future goodwill impairment charges that will have a material effect on the Company’s consolidated financial position or results of operations.

The discounted cash flow methodology establishes fair value by estimating the present value of the projected future cash flows to be generated from the reporting unit. The discount rate applied to the projected future cash flows to arrive at the present value is intended to reflect all risks of ownership and the associated risks of realizing the stream of projected future cash flows. The discounted cash flow methodology uses our projections of financial performance for a five-year period. The most significant assumptions used in the discounted cash flow methodology are the discount rate, the terminal value and expected future revenues and gross margins, which vary among reporting units. The discount rates utilized as of the December 31, 2008 testing date range from 16.0% - 27.5% based on the estimated market participant weighted average cost of capital (“WACC”) for each unit. The market participant based WACC for each unit gives consideration to factors including, but not limited to, capital structure, historic and projected financial performance, and size.

The market multiple methodology establishes fair value by comparing the reporting unit to other companies that are similar, from an operational or industry standpoint and considers the risk characteristics in order to determine the risk profile relative to the comparable companies as a group. The most significant assumptions are the market

multiplies and the control premium. The Company has elected not to apply a control premium to the fair value conclusions for the purposes of impairment testing.

The Company then assigns a weighting to the discounted cash flows and market multiple methodologies to derive the fair value of the reporting unit. The income approach is weighted 60% to 70% and the market approach is weighted 40% to 30% to derive the fair value of the reporting unit. The weightings are evaluated each time a goodwill impairment assessment is performed and give consideration to the relative reliability of each approach at that time.

Based on the results of our impairment evaluation, the Company recorded an2009, no impairment charge of $6,525 in the quarter ended December 31, 2008 related to our content and entertainment reporting segment.

The changes in the carrying amount of goodwill for the nine months ended December 31, 2008 are as follows:

| Balance at March 31, 2008 | | $ | 14,549 | |

| Goodwill impairment | | | (6,525 | ) |

| Balance at December 31, 2008 | | $ | 8,024 | |

PROPERTY AND EQUIPMENT

Property and equipment are stated at cost, less accumulated depreciation.depreciation and amortization. Depreciation expense is recorded using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are being amortized over the shorter of the lease term or the estimated useful life of the improvement. Maintenance and repair costs are charged to expense as incurred. Major renewals, improvements and additions are capitalized. Upon the sale or other disposition of any property and equipment, the cost and related accumulated depreciation and amortization are removed from the accounts and the gain or loss is included in the condensed consolidated statement of operations.

IMPAIRMENT OF LONG-LIVED ASSETS

The Company reviews the recoverability of its long-lived assets on a periodic basis in order to identify businesswhen events or conditions which mayexist that indicate a possible impairment.impairment exists. The assessment for potential impairmentrecoverability is based primarily on the Company’s ability to recover the carrying value of its long-lived assets from expected future undiscounted net cash flows. If the total of expected future undiscounted net cash flows is less than the total carrying value of the assets athe asset is deemed not to be recoverable and possibly impaired. The Company then estimates the fair value of the asset to determine whether an impairment loss isshould be recognized. An impairment loss will be recognized if for the difference between the fair value (computed based upon the expected future discounted cash flows)upon) and the carrying value of the assets.asset exceeds its fair value. Fair value is estimated by computing the expected future discounted cash flows. During the ninesix months ended December 31, 2007September 30, 2008 and 2008,2009, no impairment charge for long-lived assets was recorded.

NET LOSS PER SHARE

Computations of basic and diluted net loss per share of the Company’s Class A common stock (“Class A Common Stock”) and Class B common stock (“Class B Common Stock”, and together with the Class A Common Stock, the “Common Stock”) have been made in accordance with SFAS No. 128, “Earnings Per Share”. Basic and diluted net loss per share havehas been calculated as follows:

| Basic and diluted net loss per share = | Net loss | |

| | Weighted average number of Common Stock outstanding during the period | |

Shares issued and any shares that are reacquired during the period are weighted for the portion of the period that they are outstanding.

The Company incurred net losses for each of the three and ninesix months ended December 31, 2007September 30, 2008 and 20082009 and, therefore, the impact of dilutive potential common shares from outstanding stock options, warrants, restricted stock, and restricted stock units, totaling 2,934,1684,360,882 shares and 4,335,38223,451,352 shares as of December 31, 2007September 30, 2008 and 2008,2009, respectively, were excluded from the computation as it would be anti-dilutive.

ACCOUNTING FOR DERIVATIVESDERIVATIVE ACTIVITIES

In April 2008, the Company executed an interest rate swap agreement (the “Interest Rate Swap”) (see Note 5) to limit the Company’s exposure to changes in interest rates. The Interest Rate Swap is a derivative financial instrument, which the Company accounts for pursuant to Statement of Financial Accounting Standards (“SFAS”) No. 133, "Accounting for Derivative Instruments and Hedging Activities," as amended and interpreted ("SFAS No. 133"). SFAS No. 133 establishes accounting and reporting standards for derivative instruments and requires that all derivatives be recorded at fair value on the balance sheet. Changes in fair value of derivative financial instruments are either recognized in other comprehensive income (a component of stockholders' equity) or in the condensed consolidated statement of operations depending on whether the derivative is being used to hedge changes in cash flows or fair value. The Company has determined that this is not a hedging transaction and changes in the value of its Interest Rate Swap were recorded in the condensed consolidated statementstatements of operations (see Note 5).

Fair Value of Financial Instruments

On April 1, 2008, the Company adopted SFAS No. 157, “Fair Value Measurements” (SFAS 157), for financial assets and liabilities. The statement defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The fair value measurement disclosures are grouped into three levels based on valuation factors:

| · | Level 1 – quoted prices in active markets for identical investments |

| · | Level 2 – other significant observable inputs (including quoted prices for similar investments, market corroborated inputs, etc.) |

| · | Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments) |

Assets and liabilities measured at fair value on a recurring basis use the market approach, where prices and other relevant information is generated by market transactions involving identical or comparable assets or liabilities.

The following table summarizes the levels of fair value measurements of the Company’s financial assets:

| | | Financial Assets at Fair Value as of December 31, 2008 | | | Financial Assets at Fair Value as of September 30, 2009 | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Level 1 | | | Level 2 | | | Level 3 | |

| Cash and cash equivalents | | $ | 22,565 | | | $ | — | | | $ | — | | | $ | 19,732 | | | $ | — | | | $ | — | |

| Investment securities, available-for-sale | | | $ | 885 | | | $ | 9,683 | | | $ | — | |

| Interest rate swap | | | — | | | $ | (3,846 | ) | | | — | | | $ | — | | | $ | (3,306 | ) | | $ | — | |

| 3. | RECENT ACCOUNTING PRONOUNCEMENTS |

In September 2006,Effective July 1, 2009, the Financial Accounting Standards BoardBoard’s (“FASB”) Accounting Standards Codification (“ASC”) became the single official source of authoritative, nongovernmental generally accepted accounting principles (“GAAP”) in the United States. The historical GAAP hierarchy was eliminated and the ASC became the only level of authoritative GAAP, other than guidance issued SFAS No. 157 “Fair Value Measurements” (“SFAS 157”). SFAS 157 defines fair value, establishes a framework for measuring fair valueby the SEC. Our accounting policies were not affected by the conversion to ASC. However, references to specific accounting standards in GAAP, and expands disclosures about fair value measurements. SFAS 157 appliesthe footnotes to derivatives and other financial instruments measured at fair value under SFAS No. 133 “Accounting for Derivative Instruments and Hedging Activities” (“SFAS 133”) at initial recognition and in all subsequent periods. Therefore, SFAS 157 nullifies the guidance in footnote 3 of the Emerging Issues Task Force (“EITF”) Issue No. 02-3, “Issues Involved in Accounting for Derivative Contracts Held for Trading Purposes and Contracts Involved in Energy Trading and Risk Management Activities” (“EITF 02-3”). SFAS 157 also amends SFAS 133 to remove the similar guidance to that in EITF 02-3, which was added by SFAS 155. SFAS 157 is effective forour condensed consolidated financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years.

Relativehave been changed to SFAS 157,refer to the FASB issued FASB Staff Positions (“FSP”) FAS 157-1 and FSP FAS 157-2. FSP FAS 157-1 amends SFAS 157 to exclude SFAS No. 13, “Accounting for Leases” (SFAS 13), and its related interpretive accounting pronouncements that address leasing transactions, while FSP FAS 157-2 delays the effective dateappropriate section of the application of SFAS 157 to fiscal years beginning after November 15, 2008 for all nonfinancial assets and nonfinancial liabilities that are recognized or disclosed at fair value in the financial statements on a nonrecurring basis.ASC.

The Company adopted SFAS 157 asAt its September 23, 2009 board meeting, the FASB ratified final EITF consensus on revenue arrangements with multiple deliverables (“Issue 08-1”). This Issue supersedes Issue 00-21 (codified in ASC 605-25). Issue 08-1 addresses the unit of April 1, 2008, withaccounting for arrangements involving multiple deliverables. It also addresses how arrangement consideration should be allocated to the exceptionseparate units of accounting, when applicable. However, guidance on determining when the criteria for revenue recognition are met and on how an entity should recognize revenue for a given unit of accounting are located in other sections of the application of the statement to non-recurring nonfinancial assets and nonfinancial liabilities. Non-recurring nonfinancial assets and nonfinancial liabilities for which the Company has not applied the provisions of SFAS 157 include those measured at fair value in goodwill impairment testing, indefinite lived intangible assets measured at fair value for impairment testing, and those non-recurring nonfinancial assets and nonfinancial liabilities initially measured at fair value in a business combination. The adoption of SFAS 157 did not have a material impact the Company’s consolidated financial statements (see Note 2).

In October 2008, the FASBCodification. Issue 08-1 will ultimately be issued FSP FAS 157-3, "Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active” (“FSP FAS 157-3”). FSP FAS 157-3 clarifies the application of SFAS No. 157 in a marketas an Accounting Standards Update (ASU) that is not active. FSP FAS 157-3 is effective upon issuance, including prior periods for which financial statements have not been issued. Revisions resulting from a change in the valuation technique or its application should be accounted for as a change in accounting estimate following the guidance in FASB Statement No. 154, “Accounting Changes and Error Corrections.” FSP FAS 157-3 was effective for the financial statements included in the Company’s quarterly report for the period ended September 30, 2008, and application of FSP FAS 157-3 had no impact on the Company’s condensed consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities—including an amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 permits entities to elect to measure many financial instruments and certain other items at fair value. The objective is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS 159 is expected to expand the use of fair value measurement, which is consistent with the FASB’s long-term measurement objectives for accounting for financial instruments. SFAS 159 is effective for fiscal years beginning after November 15, 2007 and early adoption is permitted provided the entity also elects to apply the provisions of SFAS 157. The Company adopted SFAS 159 on April 1, 2008 and elected not to measure any additional financial instruments and other items at fair value.

In December 2007, the FASB released SFAS No. 141(R), “Business Combinations (revised 2007)” (“SFAS 141(R)”), which changes many well-established business combination accounting practices and significantly affects how acquisition transactions are reflected in the financial statements. Additionally, SFAS 141(R) will affect how companies negotiate and structure transactions, model financial projections of acquisitions and communicate to stakeholders. SFAS 141(R) must be applied prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. SFAS 141(R) will have an impact on the Company’s consolidated financial statements related to any future acquisitions.

In December 2007, the FASB issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements—an amendment of Accounting Research Bulletin No. 51” (“SFAS 160”). SFAS 160 establishes new accounting and reporting standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS No. 160amend ASC 605-25. Final consensus is effective for fiscal years beginning on or after DecemberJune 15, 2008. 2010. Entities can elect to apply this Issue (1) prospectively to new or materially modified arrangements after the Issue’s effective date or (2) retrospectively for all periods presented. The Company does not believe that SFAS 160revisions to ASC 605-25 will have a material impact on itsthe Company’s consolidated financial statements.

In March 2008,At its September 23, 2009 board meeting, the FASB issued SFAS No. 161, “Disclosures about Derivative Instrumentsalso ratified final EITF consensus on software revenue recognition (“Issue 09-3”). This Issue amends ASC 985-605 (formerly SOP 97-2) and Hedging Activities—an amendmentASC 985-605-15-3 (formerly Issue 03-5) to exclude from their scope all tangible products containing both software and non-software components that function together to deliver the product’s essential functionality. That is, the entire product (including the software deliverables and non-software deliverables) would be outside the scope of FASB Statement No. 133” (“SFAS 161”). SFAS 161 changes the disclosure requirements for derivative instrumentsASC 985-605 and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items arewould be accounted for under FASB Statement No. 133 and its related interpretations, and (c) how derivative instruments and related hedged items affectother accounting literature. The revised scope of ASC 985-605 (Issue 09-3) will ultimately be issued as an entity’s financial position, financial performance, and cash flows. SFAS 161Accounting Standards Update (ASU) that will amend the ASC. The final consensus is effective for financial statements issued for fiscal years and interimbeginning on or after June 15, 2010. Entities can elect to apply this Issue (1) prospectively to new or materially modified arrangements after the Issue’s effective date or (2) retrospectively for all periods beginning after November 15, 2008, with earlypresented. Early application encouraged. SFAS 161 encourages, but does not require, comparative disclosures for earlier periods at initial adoption.is permitted. The Company does not believe that SFAS 161ASC 985-605 (Issue 09-3) will have a material impact on itsthe Company’s consolidated financial statements.

In April 2008, the FASB issued FASB Staff Position No. FAS 142-3,”Determination of the Useful Life of Intangible Assets” (“FSP FAS 142-3”). FSP FAS 142-3 applies to all recognized intangible assets and its guidance is restricted to estimating the useful life of recognized intangible assets. FSP FAS 142-3 is effective for the first fiscal period beginning after December 15, 2008 and must be applied prospectively to intangible assets acquired after the effective date. The Company will be required to adopt FSP FAS 142-3 to intangible assets acquired beginning with the first quarter of fiscal 2010.