UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: September 30, 20092010

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the transition period from --- to ---

CommissionC ommission File Number: 001-31810

Cinedigm Digital Cinema Corp.

(Exact Name of Registrant as Specified in its Charter)

| |

| Delaware | 22-3720962 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

55 Madison Avenue, Suite 300, Morristown New Jersey 07960

(Address of Principal Executive Offices, Zip Code)

(973-290-0080)

(Registrant’s Telephone Number, Including Area Code)

Access Integrated Technologies, Inc.Indicate by check mark w hether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

(Former name, former address

Indicate by check mark whether the registrant has submitted electronically and former fiscal year,posted on its corporate Web site, if changed since last report)any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S - -T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes x No o

|

| |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes o No o

|

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): |

| |

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes o No x

|

| |

As of November 12, 2009, 28,032,875 shares of Class A Common Stock, $0.001 par value, and 733,811 shares of Class B Common Stock, $0.001 par value, were outstanding. |

Indicate by c heck mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 10, 2010, 30,592,394 shares of Class A Common Stock, $0.001 par value, and 733,811 shares of Class B Common Stock, $0.001 par value, were outstanding.

CINEDIGM DIGITAL CINEMA CORP.

CONTENTS TO FORM 10-Q

| | |

| PART I -- | FINANCIAL INFORMATION | Page |

| Item 1. | Financial Statements (Unaudited) | |

| | Condensed Consolidated Balance Sheets at September 30, 2010 (Unaudited) and March 31, 2009 and September 30, 2009 (Unaudited) 2010 | |

| | Unaudited Condensed Consolidated Statements of Operations for the Three and Six Months ended September 30, 20082010 and 2009 | |

| | Unaudited Condensed Consolidated Statements of Cash Flows for the Six Months ended September 30, 20082010 and 2009 | |

| | Notes to Unaudited Condensed Consolidated Financial Statements | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 29 |

Item 4T.4 T. | Controls and Procedures | 43 |

| PART II -- | OTHER INFORMATION | |

| Item 1. | Legal Proceedings | 43 |

Item 1A. | | 43 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 45 |

| Item 3. | Defaults Upon Senior Securities | 45 |

Item 4. | Submission of Matters to a Vote of Security Holders42 | 45 |

| Item 5. | Other Information | 46 |

| Item 6. | Exhibits | 46 |

| Signatures | | 47 |

Exhibit Index | 48 |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share data)

| | | March 31, 2009 | | | September 30, 2009 | |

| ASSETS | | | | | (Unaudited) | |

Current assets | | | | | | |

| Cash and cash equivalents | | $ | 26,329 | | | $ | 19,732 | |

| Restricted short-term investment securities | | | — | | | | 5,594 | |

| Accounts receivable, net | | | 13,884 | | | | 11,527 | |

| Deferred costs, current portion | | | 3,936 | | | | 2,999 | |

| Unbilled revenue, current portion | | | 3,082 | | | | 3,522 | |

| Prepaid and other current assets | | | 1,798 | | | | 3,159 | |

| Note receivable, current portion | | | 616 | | | | 170 | |

| Total current assets | | | 49,645 | | | | 46,703 | |

Restricted long-term investment securities | | | — | | | | 4,974 | |

| Restricted cash | | | 255 | | | | 7,161 | |

| Security deposits | | | 424 | | | | 427 | |

| Property and equipment, net | | | 243,124 | | | | 235,853 | |

| Intangible assets, net | | | 10,707 | | | | 9,192 | |

| Capitalized software costs, net | | | 3,653 | | | | 3,738 | |

| Goodwill | | | 8,024 | | | | 8,024 | |

| Deferred costs, net of current portion | | | 3,967 | | | | 7,735 | |

| Unbilled revenue, net of current portion | | | 1,253 | | | | 1,062 | |

| Note receivable, net of current portion | | | 959 | | | | 878 | |

| Accounts receivable, net of current portion | | | 386 | | | | 386 | |

| Total assets | | $ | 322,397 | | | $ | 326,133 | |

| | | | | | | |

| | September 30,

2010 | | March 31,

2010 |

| ASSETS | (Unaudited) | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 11,414 | | | $ | 9,094 | |

| Restricted available-for-sale investments | 9,120 | | | 5,927 | |

| Accounts receivable, net | 14,450 | | | 13,265 | |

| Deferred costs, current portion | 2,788 | | | 3,046 | ; |

| Unbilled revenue, current portion | 6,165 | | | 4,335 | |

| Prepaid and other current assets | 956 | | | 1,320 | |

| Note receivable, current portion | 349 | | | 737 | |

| Assets held for sale | 5,422 | | | 8,231 | |

| Total current assets | 50,664 | | | 45,955 | |

| Restricted available-for-sale investments | — | | | 2,004 | |

| Restricted cash | 6,011 | | | 7,168 | |

| Security deposits | 44 | | | 254 | |

| Property and equipment, net | 204,920 | | | 215,601 | |

| Intangible assets, net | 6,282 | | | 7,719 | |

| Capitalized software costs, net | 3,713 | | | 3,831 | |

| Goodwill | 5,874 | | | 5,874 | |

| Deferred costs, net of current portion | 7,559 | | | 6,763 | |

| Unbilled revenue, net of current portion | 920 | | | 964 | |

| Note receivable, net of current portion | 1,653 | | | 816 | |

| Accounts receivable, net of current portion | 198 | | | 198 | |

| Total assets | $ | 287,838 | &nbs p; | | $ | 297,147 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share data)

(continued)

| | | March 31, 2009 | | | September 30, 2009 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | (Unaudited) | |

Current liabilities | | | | | | |

| Accounts payable and accrued expenses | | $ | 14,954 | | | $ | 8,995 | |

| Current portion of notes payable, non-recourse | | | 24,824 | | | | 24,758 | |

| Current portion of notes payable | | | 424 | | | | 177 | |

| Current portion of capital leases | | | 175 | | | | 700 | |

| Current portion of deferred revenue | | | 5,535 | | | | 5,860 | |

| Current portion of customer security deposits | | | 314 | | | | 314 | |

| Total current liabilities | | | 46,226 | | | | 40,804 | |

| | | | | | | | | |

| Notes payable, non-recourse, net of current portion | | | 170,624 | | | | 162,112 | |

| Notes payable, net of current portion | | | 55,333 | | | | 65,627 | |

| Capital leases, net of current portion | | | 5,832 | | | | 5,778 | |

| Warrant liability | | | — | | | | 14,308 | |

| Interest rate swap | | | 4,529 | | | | 3,306 | |

| Deferred revenue, net of current portion | | | 1,057 | | | | 2,013 | |

| Customer security deposits, net of current portion | | | 9 | | | | 9 | |

| Total liabilities | | | 283,610 | | | | 293,957 | |

Commitments and contingencies (see Note 7) | | | | | | | | |

Stockholders’ Equity | | | | | | | | |

Preferred stock, 15,000,000 shares authorized; Series A 10% - $0.001 par value per share; 20 shares authorized; 8 shares issued and outstanding at March 31, 2009 and September 30, 2009, respectively. Liquidation preference $4,050 | | | 3,476 | | | | 3,529 | |

| Class A common stock, $0.001 par value per share; 65,000,000 shares authorized; 27,544,315 and 28,084,315 shares issued and 27,492,875 and 28,032,875 shares outstanding at March 31, 2009 and September 30, 2009, respectively | | | 27 | | | | 28 | |

| Class B common stock, $0.001 par value per share; 15,000,000 shares authorized; 733,811 shares issued and outstanding, at March 31, 2009 and September 30, 2009, respectively | | | 1 | | | | 1 | |

| Additional paid-in capital | | | 173,565 | | | | 175,281 | |

| Treasury stock, at cost; 51,440 Class A shares | | | (172 | ) | | | (172 | ) |

| Accumulated deficit | | | (138,110 | ) | | | (146,474 | ) |

| Accumulated other comprehensive loss | | | — | | | | (17 | ) |

| Total stockholders’ equity | | | 38,787 | | | | 32,176 | |

| Total liabilities and stockholders’ equity | | $ | 322,397 | | | $ | 326,133 | |

| | | | | | | | |

| | | September 30,

2010 | | March 31,

2010 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | (Unaudited) | | |

| Current liabilities | | | | |

| Accounts payable and accrued expenses | | $ | 7,314 | | | $ | 7,761 | |

| Current portion of notes payable, non-recourse | | 25,715 | | | 26,508 | |

| Current portion of notes payable | | 192 | | | 185 | |

| Current portion of capital leases | | 57 | | | 126 | |

| Current portion of deferred revenue | | 5,705 | | | 5,881 | |

| Current portion of customer security deposits | | 60 | | | 12 | |

| Liabilities as part of held for sale assets | | 5,835 | | | 6,315 | |

| Total current liabilities | | 44,878 | | | 46,788 | |

| Notes payable, non-recourse, net of current portion | | 151,378 | | | 146,793 | |

| Notes payable, net of current portion | | 73,847 | | | 69,669 | |

| Capital leases, net of current portion | | 36 | | | 38 | |

| Warrant liability | | — | | | 19,195 | |

| Interest rate swap | | 2,091 | | | 1,535 | |

| Deferred revenue, net of current portion | | 3,457 | | | 1,828 | |

| Customer security deposits, net of current portion | | 9 | | | 9 | |

| Total liabilities | | 275,696 | | | 285,855 | |

| Commitments and contingencies (see Note 7) | | | | | | |

| Stockholders’ Equity | | | | | | |

Preferred stock, 15,000,000 shares authorized;

Series A 10% - $0.001 par value per share; 20 shares

authorized; 8 shares issued and outstanding at September 30, 2010 and March 31, 2010, respectively. Liquidation

prefe rence $4,050 | | 3,637 | | | 3,583 | |

Class A common stock, $0.001 par value per share; 75,000,000

shares authorized; 30,643,834 and 28,084,315 shares issued

and 30,592,394 and 28,032,875 shares outstanding at September 30, 2010 and March 31, 2010, respectively | | 30 | | | 28 | |

Class B common stock, $0.001 par value per share; 15,000,000

shares authorized; 733,811 shares issued and outstanding, at

September 30, 2010 and March 31, 2010, respectively | | 1 | | | 1 | |

| Additional paid-in capital | | 194,848 | | | 175,937 | |

| Treasury stock, at cost; 51,440 Class A shares | | (172 | ) | | (172 | ) |

| Accumulated deficit | | (186,117 | ) | | (168,018 | ) |

| Accumulated other comprehensive loss | | (85 | ) | | (67 | ) |

| Total stockholders’ equity | | 12,142 | | | 11,292 | |

| Total liabilities and stockholders’ equity | | $ | 287,838 | | | $ | 297,147 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for share and per share data)

(Unaudited)

| | For the Three Months Ended September 30, | | For the Six Months Ended September 30, |

| | | | 2008 | | | | 2009 | | | | 2008 | | | | 2009 | |

| Revenues | | $ | 21,849 | | | $ | 19,881 | | | $ | 42,419 | | | $ | 38,547 | |

| | | | | | | | | | | | | | | | | |

| Costs and Expenses: | | | | | | | | | | | | | | | | |

| Direct operating (exclusive of depreciation and amortization shown below) | | | 6,732 | | | | 6,066 | | | | 12,529 | | | | 11,528 | |

| Selling, general and administrative | | | 4,187 | | | | 4,073 | | | | 9,020 | | | | 7,942 | |

| Provision for doubtful accounts | | | 145 | | | | 136 | | | | 173 | | | | 264 | |

| Research and development | | | 93 | | | | 64 | | | | 100 | | | | 104 | |

| Stock-based compensation | | | 200 | | | | 441 | | | | 358 | | | | 766 | |

| Depreciation and amortization of property and equipment | | | 8,133 | | | | 8,323 | | | | 16,268 | | | | 16,476 | |

| Amortization of intangible assets | | | 901 | | | | 750 | | | | 1,848 | | | | 1,515 | |

| Total operating expenses | | | 20,391 | | | | 19,853 | | | | 40,296 | | | | 38,595 | |

| Income (loss) from operations | | | 1,458 | | | | 28 | | | | 2,123 | | | | (48 | ) |

Interest income | | | 99 | | | | 95 | | | | 223 | | | | 135 | |

| Interest expense | | | (6,990 | ) | | | (8,791 | ) | | | (14,166 | ) | | | (16,341 | ) |

| Extinguishment of debt | | | — | | | | 10,744 | | | | — | | | | 10,744 | |

| Other expense, net | | | (176 | ) | | | (158 | ) | | | (326 | ) | | | (301 | ) |

| Change in fair value of interest rate swap | | | (687 | ) | | | 540 | | | | 1,565 | | | | 1,223 | |

| Change in fair value of warrants | | | — | | | | (3,576 | ) | | | — | | | | (3,576 | ) |

| Net loss | | $ | (6,296 | ) | | $ | (1,118 | ) | | $ | (10,581 | ) | | $ | (8,164 | ) |

Preferred stock dividends | | | — | | | | (100 | ) | | | — | | | | (200 | ) |

| Net loss attributable to common stockholders | | $ | (6,296 | ) | | $ | (1,218 | ) | | $ | (10,581 | ) | | $ | (8,364 | ) |

Net loss per Class A and Class B common share - basic and diluted | | $ | (0.23 | ) | | $ | (0.04 | ) | | $ | (0.39 | ) | | $ | (0.29 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average number of Class A and Class B common shares outstanding: | | | | | | | | | | | | | | | | |

| Basic and diluted | | | 27,536,371 | | | | 28,663,959 | | | | 27,202,593 | | | | 28,475,217 | |

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended

September 30, | | For the Six Months Ended

September 30, |

| | | 2010 | | 2009 | | 2 010 | | 2009 |

| Revenues | | $ | 18,899 | | | $ | 17,538 | | | $ | 38,249 | | | $ | 33,746 | |

| Costs and Expenses: | | | | | | | | |

Direct operating (exclusive of depreciation and amortization shown below) | | 4,303 | | | 4,241 | | | 9,242 | | | 7,793 | |

| Selling, general and administrative | | 5,001 | | | 4,262 | | | 10,477 | | | 8,220 | |

| Provision for doubtful accounts | | 228 | | | 136 | | | 332 | | | 264 | |

| Research and development | | 97 | | | 73 | | | 162 | | | 123 | |

| Depreciation and amortization of property and equipment | | 8,293 | | | 8,126 | | | 16,454 | | | 16,064 | |

| Amortization of intangible assets | | 722 | | | 749 | | | 1,443 | | | 1,513 | |

| Total operating expenses | | 18,644 | | | 17,587 | | | 38,110 | | | 33,977 | |

| Income (loss) from operations | | 255 | | | (49 | ) | | 139 | | | (231 | ) |

| Interest income | | 39 | | | 95 | | | 106 | | | 135 | |

| Interest expense | | (6,647 | ) | | (8,531 | ) | | (13,478 | ) | | (15,820 | ) |

| Gain (loss) on extinguishment of note payable | | — | | | 10,744 | | | (4,448 | ) | | 10,744 | |

| Other expense, net | | (165 | ) | | (158 | ) | | (316 | ) | | (301 | ) |

| Change in fair value of interest rate swap | | (987 | ) | | 540 | | | (1,445 | ) | | 1,223 | |

| Change in fair value of warrant liability | | (1,891 | ) | | (3,576 | ) | | 3,142 | | | (3,576 | ) |

| Net loss from continuing operations | | (9,396 | ) | | (935 | ) | | (16,300 | ) | | (7,826 | ) |

| | | | | | | | | |

| Loss from discontinued operations | | (1,439 | ) | | (183 | ) | | (1,594 | ) | | (338 | ) |

| Net loss | | (10,835 | ) | | (1,118 | ) | | (17,894 | ) | | (8,164 | ) |

| Preferred stock dividends | | (105 | ) | | (100 | ) | | (205 | ) | | (200 | ) |

| Net loss attributable to common stockholders | | $ | (10,940 | ) | | $ | (1,218 | ) | | $ | (18,099 | ) | | $ | (8,364 | ) |

| Net loss per Class A and Class B common share - basic and diluted | | | | | | &nbs p; | | | | | | |

| Loss from continuing operations | | $ | (0.31 | ) | | $ | (0.03 | ) | | $ | (0.55 | ) | | $ | (0.27 | ) |

| Loss from discontinued operations | | (0.05 | ) | | (0.01 | ) | | (0.05 | ) | | (0.02 | ) |

| | | $ | (0.36 | ) | | $ | (0.04 | ) | | $ | (0.60 | ) | | $ | (0.29 | ) |

| Weighted average number of Class A and Class B common shares outstanding: Basic and diluted | | 30,294,306 | | | 28,663,959 | | | 29,860,122 | | | 28,475,217 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

CINEDIGM DIGITAL CINEMA CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

| | | For the Six Months Ended September 30, | | For the Six Months Ended

September 30, |

| | | 2008 | | | | 2009 | | 2010 | | 2009 |

| Cash flows from operating activities | | | | | | | | | |

| Net loss | $ | (10,581 | ) | | $ | (8,164 | ) | $ | (17,894 | ) | | $ | (8,164 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | | | |

| Loss on disposal of assets | | 79 | | | 4 | | — | | | 4 | |

| Gain from sale of the information technology services operation | | (622 | ) | | — | |

| Depreciation and amortization of property and equipment and amortization of intangible assets | | 18,116 | | | 17,991 | | 17,897 | | | 17,991 | |

| Amortization of capitalized software costs | | 387 | | | 323 | | 372 | | | 323 | |

| Amortization of debt issuance costs included in interest expense | | 749 | | | 938 | | |

| Amortization of debt issuance costs includ ed in interest expense | | 1,020 | | | 938 | |

| Provision for doubtful accounts | | 173 | | | 264 | | 136 | | | 264 | |

| Stock-based compensation | | 358 | | | 766 | | 1,361 | | | 766 | |

| Non-cash interest expense | | 3,018 | | | 1,861 | | — | | | 1,861 | |

| Change in fair value of interest rate swap and warrant | | (1,565 | ) | | 2,353 | | |

| Loss on available-for-sale investments | | — | | | 2 | | |

| Note payable included in interest expense | | — | | | 817 | | |

| Gain on extinguishment of debt | | — | | | (10,744 | ) | |

| Change in fair value of interest rate swap | | 1,445 | | | (1,223 | ) |

| Change in fair value of warrant liability | | (3,142 | ) | | 3,576 | |

| Realized loss on restricted available-for-sale investments | | 44 | | | 2 | |

| Interest expense added to note payable | | 3,187 | | | 817 | |

| Extinguishment of note payable | | 4,448 | | | (10,744 | ) |

| Accretion of note payable discount included in interest expense | | — | | | 300 | | 1,193 | | | 300 | |

| Changes in operating assets and liabilities: | | | | | | | | | |

| Accounts receivable | | 4,012 | | | 2,093 | | (1,321 | ) | | 2,093 | |

| Unbilled revenue | | 1,318 | | | (250 | ) | 269 | | | (250 | ) |

| Prepaids and other current assets | | (1,535 | ) | | (1,308 | ) | (1,786 | ) | | (1,308 | ) |

| Other assets | | 150 | | | 533 | | 2,730 | | | 533 | |

| Accounts payable and accrued expenses | | 943 | | | (2,194 | ) | 4 | | | (2,194 | ) |

| Deferred revenue | | (407 | ) | | 1,236 | | 1,461 | | | 1,236 | |

| Other liabilities | | 9 | | | | — | | 49 | | | — | |

| Net cash provided by operating activities | | 15,224 | | | 6,821 | | 10,851 | | | 6,821 | |

Cash flows from investing activities | | | | | | | | | | | |

| Purchases of property and equipment | | (16,008 | ) | | (12,573 | ) | (5,746 | ) | | (12,573 | ) |

| Purchases of intangible assets | | (6 | ) | | — | |

| Additions to capitalized software costs | | (508 | ) | | (408 | ) | (254 | ) | | (408 | ) |

| Maturities of available-for-sale investments | | — | | | 671 | | |

| Purchase of available-for-sale investments | | — | | | (11,265 | ) | |

| Restricted cash | | — | | | | (6,906 | ) | |

| Sales/maturities of restricted available-for-sale investments | | 3,110 | | | 671 | |

| Purchase of restricted available-for-sale investments | | (4,276 | ) | | (11,265 | ) |

| &nb sp; Restricted cash | | 1,156 | | | (6,906 | ) |

| Net cash used in investing activities | | (16,516 | ) | | (30,481 | ) | (6,016 | ) | | (30,481 | ) |

| | | | | | | | |

| Cash flows from financing activities | | | | | | | | | | | |

| Repayment of notes payable | | (19,287 | ) | | (42, 862 | ) |

| Proceeds from notes payable | | — | | | 76,513 | | 170,775 | | | 76,513 | |

| Repayment of notes payable | | (1,100 | ) | | (42,862 | ) | |

| Repayment of credit facilities | | (3,858 | ) | | (18,950 | ) | (154,932 | ) | | (18,950 | ) |

| Proceeds from credit facilities | | 200 | | | 8,884 | | 5,025 | | | 8,884 | |

| Payments of debt issuance costs | | (368 | ) | | (6,064 | ) | (4,894 | ) | | (6,064 | ) |

| Principal payments on capital leases | | (53 | ) | | (432 | ) | (99 | ) | | (432 | ) |

| Costs associated with issuance of preferred stock | | — | | | (8 | ) | — | | | (8 | ) |

| Net proceeds from issuance of Class A common stock | | 941 | | | — | |

| Costs associated with issuance of Class A common stock | | (37 | ) | | | (18 | ) | (44 | ) | | (18 | ) |

| Net cash (used in) provided by financing activities | | (5,216 | ) | | | 17,063 | | (2,515 | ) | | 17,063 | |

| Net decrease in cash and cash equivalents | | (6,508 | ) | | (6,597 | ) | |

| Net increase (decrease) in cash and cash equivalents | | 2,320 | | | (6,597 | ) |

| Cash and cash equivalents at beginning of period | | 29,655 | | | | 26,329 | | 9,094 | | | 26,329 | |

| Cash and cash equivalents at end of period | $ | 23,147 | | | $ | 19,732 | | $ | 11,414 | | | $ | 19,732 | |

See accompanying notes to Unaudited Condensed Consolidated Financial Statements

CINEDIGM DIGITAL CINEMA CORP.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 20092010

($ in thousands, except for per share data)

(Unaudited)

Cinedigm Digital Cinema Corp. was incorporated in Delaware on March 31, 2000 (“Cinedigm”, and collectively with its subsidiaries,subsidiar ies, the “Company”). On September 30, 2009,

The Company is a digital cinema services and a content marketing and distribution company driving the Company’s stockholders approved a change inconversion of the Company’s nameexhibition industry from Access Integrated Technologies, Inc.,film to Cinedigm Digital Cinema Corp. and such change was effected October 5, 2009.digital technology. The Company provides a digital cinema platform that combines technology solutions, provides financial advice and guidance, software services and advice, software services, electronic delivery and content distribution services to content owners and distributors of digital contentand to movie theatresexhibitors. Cinedigm leverages this digital cinema platform with a series of business applications that utilize the platform to capitalize on the new business opportunities created by the transformation of movie theaters into networked entertainment centers. The three main applications currently provided by Cinedigm include (i) its digi tal entertainment origination, marketing and other venues. Beginning September 1, 2009,distribution business focused on alternative content and independent film; (ii) its operational and analytical software applications; and (iii) its pre-show advertising and theatrical marketing business. Historically, the conversion of an industry from analog to digital has created new revenue and growth opportunities as well as an opening for new players to emerge for capitalizing on this technological shift at the expense of incumbents.

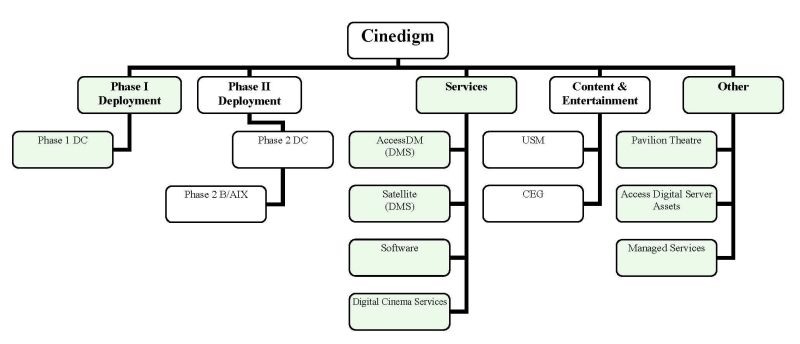

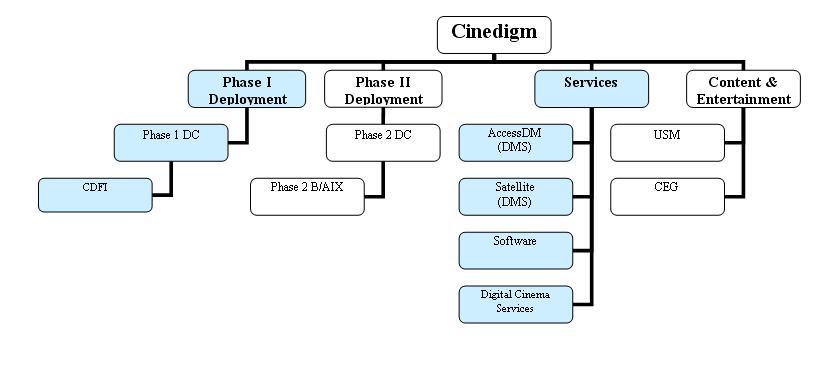

During the quarter ended June 30, 2010, the Company made changesmodified how its decision makers review and allocate resources to its organizational structureoperating segments, which impacted itsresulted in revised reportable segments, but did not impact itsour consolidated financial position, results of operations or cash flows. The Company realigned itsWe realigne d our focus to fivefour primary businesses as follows: the first digital cinema deployment (“Phase I Deployment”), the second digital cinema deployment (“Phase II Deployment”), digital cinema services (“Services”), and media content and entertainment (“Content & Entertainment”) and other (“Other”). The Company’s Phase I Deployment and Phase II Deployment segments are the non-recourse, financing vehicles and administrators for the Company’s digital cinema equipment (the “Systems”) installed in movie theatres nationwide. The Company’s Services segment provides services and support to the Phase I Deployment and Phase II Deployment segments as well as to other third party customers. Included in these services are asset management services for a specified fee via service agreements with Phase I Deployment and Phase II Deployment; software license, maintenance and consulting services; and electronic content delivery services via satellite and hard drive to the motion picture industry. These services primarily facilitate the conversion from analog (film) to digital cinema and have positioned the Company at what it believes to be the forefront of a rapidly developing industry relating to the delivery and management of digital cinema and other content to theatres and other remote venues worldwide. The Company’s Content & Entertainment segment provides content marketing and distribution services to alternative and theatrical content owners and to theatrical exhibitors and in-theatre advertising. The Company’s Other segment provides

Since June 2010, the Company has classified certain businesses as discontinued operations, including the motion picture exhibition to the general public information(“Pavilion Theatre”) , i nformation technology consulting services and managed network monitoring services (“Managed Services”), and hosting services and network access for other web hosting services (“Access Digital Server Assets”)., which are all separate reporting units previously included in our former "Other" segment. The Company is pursuing a sale of the Pavilion Theatre. In August 2010, the Company sold both Managed Services and the Access Digital Server Assets. Additional information on the discontinued operations can be found in Note 3. Overall, the Company’s goal is to aid in the transformation of movie theatres to entertainment centers by providing a platform of hardware, software and content choices. Additional information related to the Company’s reportingreportable segments can be found in Note 9.

| |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

BASIS OF PRESENTATION, USE OF ESTIMATES AND CONSOLIDATION

The Company has incurred net losses historically and has an accumulated deficit of $146,474$186,117 as of September 30, 2009.2010. The Company also has significant contractual obligations related to its recourse and non-recourse debt for the remaining part of fiscal year 20102011 and beyond. Management expects that the Company will continue to generate net losses for the foreseeable future. Based on the Company’s cash position at September 30, 2009,2010, and expected cash flows from operations, management believes that the Company has the ability to meet its obligations through September 30 2010. In August 2009, the Company entered into a private placement of a senior secured note and extinguished its existing senior notes, which provided net proceeds after repayment of existing debt, funding of an interest reserve and transactions fees and expenses of approximately $11,300 of working capital funding., 2011. The Company has signed commitment letters for additional non-recourse debt capital, primarily to meet equipment requirements related to the Company’s Phase II Deployment, (see Note 11). Although the Company recently entered into certain agreements related to the Phase II Deployment (see Note 7),and there is no assurance that financing for the Phase II Deployment will be completed as contemplated or under terms acceptable to the Company or its existing stockholders. Failure to generate additional revenues,

raise additional capital or manage discretionary spending could have a material adverse effect on the Company’s ability to continue as a going concern. The accompanying unaudited condensed consolidated financial statements do not reflect any adjustments which may result from the Company’s inability to continue as a going concern.

The condensed consolidated balance sheet as of March 31, 2009,2010, which has been derived from audited financial statements, and the unaudited interim condensed consolidated financial statements were prepared following the interim reporting requirements of the SecuritiesSecuriti es and Exchange Commission (“SEC”). They do not include all disclosures normally

made in financial statements contained in the Form 10-K. In management’s opinion, all adjustments necessary for a fair presentation of financial position, the results of operations and cash flows in accordance with U.S. generally accepted accounting principles generally accepted in the United States (GAAP)(“GAAP”) for the periods presented have been made. The results of operations for the respective interim periods are not necessarily indicative of the results to be expected for the full year. The accompanying condensed consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 20092010 filed with the SEC on June 15, 200914, 2010 (the “Form 10-K”10 - -K”).

The Company’s condensed consolidated financial statements include the accounts of Cinedigm, Access Digital Media, Inc. (“AccessDM”), Hollywood Software, Inc. d/b/a AccessITCinedigm Software (“Software”), Core Technology Services, Inc. (“Managed Services”), FiberSat Global Services, Inc. d/b/a AccessITCinedigm Satellite and Support Services (“Satellite”), ADM Cinema Corporation (“ADM Cinema”) d/b/a the Pavilion Theatre (the “Pavilion Theatre”), Christie/AIX, Inc. d/b/a AccessITCinedigm Digital Cinema (“Phase 1 DC”), PLX Acquisition Corp., UniqueScreen Media, Inc. (“USM”), Vistachiara Productions, Inc. f/k/a The Bigger Picture, currently d/b/a Cinedigm Content and Entertainment Group &n bsp;(“CEG”), Access Digital Cinema Phase 2 Corp. (“Phase 2 DC”) and, Access Digital Cinema Phase 2 B/AIX Corp. (“Phase 2 B/AIX”) and Cinedigm Digital Funding I, LLC (“CDF I”). AccessDM and Satellite are together referred to as the Digital Media Services Division (“DMS”). All intercompany transactions and balances have been eliminated.

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. On an on-going basis, the Company evaluates its estimates, includingActual results may differ from those related to the carrying values of its long-lived assets, intangible assets and goodwill, the valuation of deferred tax assets, the valuation of assets acquired and liabilities assumed in purchase business combinations, stock-based compensation expense, revenue recognition and capitalization of software development costs. estimates.

& nbsp;

RECLASSIFICATION

The Company bases its estimates on historical experience and on other assumptions that the Company believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Because of the uncertainty inherent in such estimates, actual results could differ materially from these estimates under different assumptions or conditions.

Pavilion Theatre, Managed Services and the Access Digital Server Assets have been reported as assets held for sale and discontinued operations for all periods presented. The March 31, 20092010 consolidated balance sheetssheet and the unaudited interim condensed consolidated statement of operations for the three and six months ended September 30, 2009 were reclassified to break out the recourse and non-recourse notes payable to conform to the current period presentation.

REVENUE RECOGNITION

Phase I Deployment and Phase II Deployment

Virtual print fees (“VPFs”) are earned pursuant to contracts with movie studios and distributors, wherebywhere by amounts are payable to Phase 1 DC, CDF I and to Phase 2 DC, when movies distributed by the studio are displayed on screens utilizing the Company’s digital cinema equipment (the “Systems”)Systems installed in movie theatres. VPFs are earned and payable to Phase 1 DC and CDF I based on a defined fee schedule with a reduced VPF rate year over year until the sixth year (calendar 2011) at which point the VPF rate remains unchanged through the tenth year. One VPF is payable for every movie title displayed per System. The amount of VPF revenue is therefore dependent on the number of movie titles released and displayed onusing the Systems in any given accounting period. VPF revenue is recognized in the period in which the movie first opens for general audience viewing in thata digitally-equipped movie theatre, as Phase 1 DC’s, CDF I’s and Phase 2 DC’s performance obligations have been substantially met at that time.

Phase 2 DC’s agreements with distributors require the payment of VPFs, according to a defined fee schedule, for 10ten years from the date each system is installed; however, Phase 2 DC may no longer collect VPFs once “cost recoupment,” as defined in the agreements, is achieved. Cost recoupment will occur once the cumulative VPFs and other cash receipts collected by Phase 2 DC have equaled the total of all cash outflows, including the purchase price of all Systems, all financing costs, all “overhead and ongoing costs”, as defined, and including the Company’s service fees, subject to maximum agreed upon amounts during the three-year rollout period and thereafter, plus a compounded return on any billed but unpaid overhead and ongoing costs, of 15% per year. Further, if cost recoupment occurs before the end of the eighth contract year, a one-time “cost“ cost recoupment bonus” is payable by the studios to Cinedigm.the Company. Any other cash flows, net of expenses, received by Phase 2 DC following the achievement of cost recoupment are required to be returned to the distributors on a pro-rata basis. At this time, the Company cannot estimate the timing or probability of the achievement of cost recoupment.

Alternative content fees (“ACFs”) are earned pursuant to contracts with movie exhibitors, whereby amountsa mounts are payable to Phase 1 DC, CDF I and to Phase 2 DC, generally as a percentage of the applicable box office revenue derived from the exhibitor’s showing of content other than feature films, such as concerts and sporting events (typically referred to as “alternative content”). ACF revenue is recognized in the period in which the alternative content first opens for audience viewing.

Services

For software multi-element licensing arrangements that do not require significant production, modification or customizationcu stomization of the licensed software, revenue is recognized for the various elements as follows: revenue for the licensed software element is recognized upon delivery and acceptance of the licensed software product, as that represents the culmination of the earnings process and the Company has no further obligations to the customer, relative to the software license. Revenue earned from consulting services is recognized upon the performance and completion of these services. Revenue earned from annual software maintenance is recognized ratably over the maintenance term (typically one year).

Revenue is deferred in cases where: (1) a portion or the entire contract amount cannot be recognized as revenue, due to non-delivery or pre-acceptance of licensed software or custom programming,programmin g, (2) uncompleted implementation of application service provider arrangements (“ASP Service”), or (3) unexpired pro-rata periods of maintenance, minimum ASP Service fees or website subscription fees. As license fees, maintenance fees, minimum ASP Service fees and website subscription fees are often paid in advance, a portion of this revenue is deferred until the contract ends. Such amounts are classified as deferred revenue and are recognized as earned revenue in accordance with the Company’s revenue recognition policies described above.

Revenues from the delivery of data via satellite and hard drive are recognized upon delivery, as DMS’ performance obligations have been substantially met at that time.

Exhibitors who will purchase and own Systems using their own financing will pay an upfront activation fee of $2 thousand per screen to the Company (the “Exhibitor-Buyer Structure”). These upfront activation fees are recognized in the period in which these exhibitor owned Systems are ready for content, as the Company has no further obligations to the customer. The Company will then manage the billing and collection of VPFs and will remit all VPFs collected to the exhibitors, less an administrative fee that will approximate 10% of the VPFs collected. This administrative fee is recognized in the period in which the billing of VPFs occurs, as performance obligations have been substantially met at that time. The Company does not recognize VPF revenue within Services.

Content & Entertainment

USM has contracts with exhibitors to display pre-show advertisements on their screens, in exchange for certain fees paid to the exhibitors. USM then contracts with businesses of various types to place their advertisements in select theatre locations, designs the advertisement, and places it on-screen for specific periods of time, generally ranging from three to twelve months. Cinema advertising service revenue, and the associated direct selling, production and support cost, is recognized on a straight-line basis over the period the related in-theatre advertising is displayed, pursuant to the specific terms of each advertising contract. USM has the right to receive or bill the entire amount of the advertising contract upon execution, and therefore such amount is recorded as a receivable at the time of execution, and all related advertising revenue and all direct costs actually incurred are deferred until such time as the an in-theatre advertising is displayed.

The right to sell and display such advertising, or other in-theatre programs, products and services, is based upon advertising contracts with exhibitors which stipulate payment terms to such exhibitors for this right. Payment terms generally consist of fixed annual payments or annual minimum guarantee payments, plus a revenue share of the excess of a percentagepercenta ge of advertising revenue over the minimum guarantee, if any. The Company recognizes the cost of fixed and minimum guarantee payments on a straight-line basis over each advertising contract year, and the revenue share cost, if any, in accordance with the terms of the advertising contract.

Barter advertising revenue is recognized for the fair value of the advertising time surrendered in exchange for alternative content. The Company includes the value of such exchanges in both Content & Entertainment’s net revenues and direct operating expenses.costs. There may be a timing difference between the screening of alternative content and the screening of the underlying advertising used to acquire the content. The acquisitionacqu isition cost is being recorded and recognized as a direct operating expensecost by CEG when the alternative content is screened, and the underlying advertising is being deferred and recognized as revenue ratably over the period such advertising is screened by USM. TheFor the three months ended September 30, 2010 and 2009, the Company has not recorded any net revenues orand direct operating expensescosts related to barter advertising duringof $0 and $541, respectively. For the three and six months ended September 30, 20082010 and 2009.2009, the Company recorded net revenues and direct operating costs related

to barter advertising of $356 and $541, respectively.

CEG has contracts for the theatrical distribution of third party feature films and alternative content. CEG’s distribution fee revenue is recognized at the time a feature film and alternative content is viewed, based on CEG’s participation in box office receipts. CEG has the right to receive or bill a portion of the theatrical distribution fee in advance of the exhibition date, andan d therefore such amount is recorded as a receivable at the time of execution, and

all related distribution revenue is deferred until the third party feature films’ or alternative content’s theatrical release date.

Other

Movie theatre admission and concession revenues are generated at the Company’s nine-screen digital movie theatre, the Pavilion Theatre. Movie theatre admission revenues are recognized on the date of sale, as the related movie is viewed on that date and the Company’s performance obligation is met at that time. Concession revenues consist of food and beverage sales and are also recognized on the date of sale.

Managed Services’ revenues, which consist of monthly recurring billings pursuant to network monitoring and maintenance contracts, are recognized as revenues in the period the services are provided, and other non-recurring billings are recognized on a time and materials basis as revenues in the period in which the services were provided.

Other revenues, attributable to the Access Digital Server Assets, which consist of monthly recurring billings for hosting and network access fees, are recognized as revenues in the period the services are provided.

Since May 1, 2007, the Company’s three internet data centers (“IDCs”) have been operated by FiberMedia AIT, LLC and Telesource Group, Inc. (together, “FiberMedia”), unrelated third parties, pursuant to a master collocation agreement. Although the Company is still the lessee of the IDCs, substantially all of the revenues and expenses were being realized by FiberMedia and not the Company and since May 1, 2008, 100% of the revenues and expenses are being realized by FiberMedia. In June 2009, one of the IDC leases expired, leaving two IDC leases with the Company as lessee.

RESTRICTED INVESTMENT SECURITIESAVAILABLE-FOR-SALE INVESTMENTS

In connection with the $75,000 Senior Secured Note issued in August 2009 (see Note 5), the Company was required to segregate $11,265a portion of the proceeds into marketable securities which will be used to repaypay interest over the next two years. The Company classifies the marketable securitiessec urities as restricted available-for-sale securitiesinvestments and accordingly, these investments are recorded at fair value. The maturity dates of these investments coincide

In connection with the $172,500 term loans issued in May 2010 (see Note 5), the Company segregated $3,873 of the proceeds into an account which will be used to fund the purchase of satellite equipment for DMS.

During the three months ended September 30, 2010 and 2009, the Company made scheduled quarterly interest payment dates through payments of $715 and $1,408, respectively, and $2,788 and $715, for the six months ended September 2011. 30, 2010 and 2009, respectively. Investment securities with a maturity of twelve months or less are classified as short-term and investment securities with a maturity greater than twelve months are classified as long-term. As of September 30, 2010, there were no long-term restricted available-for-sale investments.

The changes in the value of these securitiesinvestments are recorded in other comprehensive loss in the condensed consolidated financial statements. Realized gains and losses are recorded in earnings when securities mature or are redeemed. ThereDuring the six months ended September 30, 2010 and 2009, there were realized losses of $2 recorded during the three months ended September 30, 2009.$44 and $2, respectively.

The Company held no available-for-sale securities at March 31, 2009. During the three months ended September 30, 2009, the Company made the first scheduled quarterly interest payment in the amount of $715. Investment securities with a maturity of twelve months or less are classified as short-term; those that mature in greater than twelve months are classified as long-term. The carrying value and fair value of investment securitiesrestricted available-for-sale investments at September 30, 20092010 were as follows:

| | | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized Losses | | | Fair Value | |

| U.S. Treasury securities | | $ | 4,517 | | | $ | 1 | | | $ | (8 | ) | | $ | 4,510 | |

| Obligations of U.S. government agencies and FDIC guaranteed bank debt | | | 5,099 | | | | 2 | | | | (11 | ) | | | 5,090 | |

| Corporate debt securities | | | 506 | | | | — | | | | — | | | | 506 | |

| Other interest bearing securities | | | 463 | | | | — | | | | (1 | ) | | | 462 | |

| | | $ | 10,585 | | | $ | 3 | | | $ | (20 | ) | | $ | 10,568 | |

| | | | | | | | | | | | | | | | |

| | | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Va lue |

| U.S. Treasury securities | | $ | 1, 395 | | | $ | — | | | $ | (26 | ) | | $ | 1,369 | |

Obligations of U.S. government agencies and FDIC guaranteed bank debt | | 3,499 | | | — | | | (55 | ) | | 3,444 | |

| Corporate debt securities | | — | | | — | | | — | | | — | |

Other interest bearing securities | | 4,311 | | | — | | | (4 | ) | | 4,307 | |

| | | $ | 9,205 | | | $ | — | | | $ | (85 | ) | | $ | 9,120 | |

The carrying value and fair value of restricted available-for-sale investments at March 31, 2010 were as follows:

| | | | | | | | | | | | | | | | |

| | | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

| U.S. Treasury securities | | $ | 2,709 | | | $ | 1 | | | $ | (29 | ) | | $ | 2,681 | |

Obligations of U.S. government agencies and FDIC guaranteed bank debt | | 4,395 | | | — | | | (36 | ) | | 4,359 | |

| Corporate debt securities | | 506 | | | — | | | (1 | ) | | 505 | |

Other interest bearing securities | | 388 | | | — | | | (2 | ) | | 386 | |

| | | $ | 7,998 | | | $ | 1 | | | $ | (68 | ) | | $ | 7,931 | |

RESTRICTED CASH

Restricted cash was comprised of the following:

| | | | | | | | |

| | | September 30,

2010 | | March 31,

2010 |

| Interest reserve account related to the GE Credit Facility (see Note 5) | | $ | — | | | $ | 6,913 | |

| Interest reserve account related to the 2010 Term Loans (see Note 5) | | 5,756 | | | — | |

| Bank certificate of deposit underlying an outstanding bank standby letter of credit for an office space lease | | 255 | | | 255 | |

| | | $ | 6,011 | | | $ | 7,168 | |

DEFERRED COSTS

Deferred costs primarily consist of the unamortized debt issuance costs related to the credit facility with General Electric Capital Corporation (“GECC”), the $55,000 of 10% Senior Notes issued in August 2007 up to August 2009 (see Note 5) and the $75,000 Senior Secured Note issued in August 2009 (see Note 5),cos ts which are amortized on a straight-line basis over the term of the respective debt (see Note 5 for extinguishment of debt).debt. The straight-line basis is not materially different from the effective interest method. Also included inOther deferred costs isare advertising production, post production and technical support costs related to developing and displaying advertising in the amount of $778, which are capitalized and amortized on a straight-line basis over the same period as the related cinema advertising revenues of $4,704 are recognized.advertising.

DIRECT OPERATING COSTS

Direct operating costs consist of facility operating costs such as rent, utilities, real estate taxes, repairs and maintenance, insurance and other related expenses, direct personnel costs, film rent expense, amortizationamortiza tion of capitalized software development costs, exhibitors payments for displaying cinema advertising and other deferred expenses, such as advertising production, post production and technical support related to developing and displaying advertising.

STOCK-BASED COMPENSATION

For the three months ended September 30, 20082010 and 2009, the Company recorded stock-based compensation expense of $200$674 and $441,$438, respectively, and $358$1,364 and $766,$760, for the six months ended September 30, 20082010 and 2009, respectively. The Company estimates thatDuring the three months ended June 30, 2010, certain stock-based awards were accelerated upon the retirement of the CEO, which resulted in recognition of $266 of additional stock-based compensation expense related to current outstanding stock options, using a Black-Scholes option valuation model, and current outstanding restricted stock awards will be approximately $1,432 in fiscal 2010.expense.

The weighted-average grant-date fair value of options granted during the three months ended September 30, 20082010 and 2009 was $0.00 and $0.57, respectively, and $0.91 and $0.57, for the six months ended September 30, 2009 was $0.552010 and $0.57, respectively, and $0.58 and $0.57, for the six months ended September 30, 2008 and 2009, respectively. There were no stock options exercised during the three and six months ended September 30, 20082010 and 2009.2009.

The Company estimated the fair value of stock options at the date of each grant using a Black-Scholes option valuation model with the following assumptions:

| | | For the Three Months Ended September 30, | | | For the Six Months Ended

September 30, | |

| | | 2008 | | | 2009 | | | 2008 | | | 2009 | |

| Range of risk-free interest rates | | | 2.7-4.4 | % | | | 2.7 | % | | | 2.5-5.2 | % | | | 2.7 | % |

| Dividend yield | | | — | | | | — | | | | — | | | | — | |

| Expected life (years) | | | 5 | | | | 5 | | | | 5 | | | | 5 | |

| Range of expected volatilities | | | 52.6-58.7 | % | | | 77.4 | % | | | 52.5-58.7 | % | | | 77.4 | % |

| | | | | | | | | | | | |

| | | For the Three Months Ended

September 30, | | For the Six Months Ended

September 30, |

| Assumptions for Option Grants | | 2010 | | 2009 | | 2010 | | 2009 |

| Range of risk-free interest rates | | — | | | 2.7 | % | | 2.0-2.2% | | | 2.7 | % |

| Dividend yield | | — | | | — | | | — | | | — | |

| Expected life (years) | | — | | | 5 | | | 5 | | | 5 | |

| Range of expected volatilities | | — | | | 77.4 | % | | 78.5-78.8% | | | 77.4 | % |

The risk-free interest rate used in the Black-Scholes option valuationpricing model for options granted under the Company’s stock option plan awards is the historical yield on U.S. Treasury securities with equivalent remaining lives. The Company does not currently anticipate paying any cash dividends on common stock in the foreseeable future. Consequently, an expected dividend yield of zero is used in the Black-Scholes option valuationopti on pricing model. The Company estimates the expected life of options granted under the Company’s stock option plans using both exercise behavior and post-vesting termination behavior, as well as consideration of outstanding options. The Company estimates expected volatility for options granted under the Company’s

stock option plans based on a measure of historical volatility in the trading market for the Company’s common stock.

CAPITALIZED SOFTWARE COSTS

Internal Use Software

The Company accounts for internal use software development costs based on three distinct stagesEmployee stock-based compensation expense related to the software development process for internal use software. The first stage, the preliminary project stage, includes the conceptual

formulation, design and testing of alternatives. The second stage, or the program instruction phase, includes the development of the detailed functional specifications, coding and testing. The final stage, the implementation stage, includes the activities associated with placing a software project into service. All activities included within the preliminary project stage are considered research and development and expensedCompany’s stock-based awards was as incurred. During the program instruction phase, all costs incurred until the software is substantially complete and ready for use, including all necessary testing, are capitalized, Capitalized costs are amortized on a straight-line basis over estimated lives ranging from three to five years, beginning when the software is ready for its intended use.

Software to be Sold, Licensed or Otherwise Marketed

Software development costs that are incurred subsequent to establishing technological feasibility are capitalized until the product is available for general release. Amounts capitalized as software development costs are amortized using the greater of revenues during the period compared to the total estimated revenues to be earned or on a straight-line basis over estimated lives ranging from three to five years. The Company reviews capitalized software costs for impairment on a periodic basis with other long-lived assets. Amortization of capitalized software development costs, included in direct operating costs,follows for the three months ended September 30, 2008 and 2009 amounted to $194 and $161, respectively and $387 and $323 for the six months ended September 30, 2008 and 2009, respectively. At September 30, 2009, there were no unbilled receivables under such customized software development contracts included in unbilled revenue in the condensed consolidated balance sheets.periods presented:

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended

September 30, | | For the Six Months Ended

September 30, |

| | | 2010 | | 2009 | | 2010 | | 2009 |

| Direct operating | | 17 | | | 15 | | | 34 | | | 33 | |

| Selling, general and administrative | | 642 | | | 414 | | | 1,303 | | | 708 | |

| Research and development | | 15 | | | 9 | | | 27 | | | 19 | |

| | | $ | 674 | | | $ | 438 | | | $ | 1,364 | | | $ | 760 | |

GOODWILL AND INTANGIBLE ASSETS

Goodwill is the excess of the purchase price paid over the fair value of the net assets of the acquired business. Goodwill and intangible assets with indefinite lives are not amortized; rather, they are tested for impairment on at least an annual basis. Intangible assets with finite lives, primarily customer relationships, non-compete agreements, patents and software technology, are amortized over their useful lives.

In order to test goodwill and intangible assets with indefinite lives, a determination of the fair value of our reporting units and intangible assets with indefinite lives is required and is based, among other things, on estimates of future operating performance of the reporting unit and/or the component of the entity being valued. The Company assesses itsis required to complete an impairment test for goodwill forand intangible assets with indefinite lives and record any resulting impairment losses at least annually andon an annual basis or more often if warranted by events or changes in interim periods if certain triggering events occurcircumstances indicating that the carrying value may exceed fair value (“impairment indicators”). This impairment test includes the projection and discounting of goodwill may be impaired. The Company also reviews possible impairmentcash flows, analysis of finite livedour market factors impacting the businesses the Compan y operates and estimating the fair values of tangible and intangible assets annually. During the six months ended and liabilities. Estimating future cash flows and determining their present values are based upon, among other things, certain assumptions about expected future operating performance and appropriate discount rates determined by management.

As of September 30, 2008 and 2009, no impairment charge was recorded.

As of September 30, 2009,2010, the Company’s finite-lived intangible assets consisted of customer relationships and agreements, theatre relationships, covenants not to compete, trade names and trademarks and Federal Communications Commission licenses (for satellite transmission services), which are estimated to have useful livesliv es ranging from two to ten years. NoDuring the three and six months ended September 30, 2010 the Company acquired intangible assets were acquiredof $6 thousand. No impairment charge for intangible assets was recorded during the three and six months ended September 30, 2009. During2010.

Information related to the six months ended September 30, 2008 and 2009, no impairment charge was recorded.goodwill allocated to the Company’s continuing operations is detailed below:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Phase I | | Phase II | | Services | | Content & Entertainment | | Corporate | | Consolidated |

| As of September 30, 2010 | | $ | — | | | $ | — | | | $ | 4,306 | | | 1,568 | | | $ | — | | | $ | 5,874 | |

| | | | | | | | | | | | | |

| As of March 31, 2010 | | $ | — | | | $ | — | | | $ | 4,306 | | | 1,568 | | | — | | | $ | 5,874 | |

See Note 3 for information related to the goodwill allocated to the Company’s discontinued operations.

PROPERTY AND EQUIPMENT

Property and equipment are stated at cost, less accumulated depreciation and amortization. Depreciation expense is recorded using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are being amortized over the shorter of the lease term or the estimated useful life of the improvement. Maintenance and repair costs are charged to expense as incurred. Major renewals, improvements and additions are capitalized. Upon the sale or other disposition of any property and equipment, the cost and related accumulated depreciation and amortization are removed from the accounts and the gain or loss is included in the condensed consolidated statementstate ment of operations.

IMPAIRMENT OF LONG-LIVEDLONG-LIVED ASSETS

The Company reviews the recoverability of its long-lived assets when events or conditions exist that indicate a possible impairment exists. The assessmentasse ssment for recoverability is based primarily on the Company’s ability to recover the carrying value of its long-lived assets from expected future undiscounted net cash flows. If the total of expected future undiscounted net cash flows is less than the total carrying value of the assets the asset is deemed not to be recoverable and possibly impaired. The Company then estimates the fair value of the asset to determine whether an impairment loss should be recognized. An impairment loss will be recognized if for the difference between the fair value (computed based upon) and the carrying value of the asset exceeds its fair value. Fair value is estimateddetermined by computing the expected future discounted cash flows. During the three and six months ended SeptemberSepte mber 30, 20082010 and 2009, no impairment charge for long-lived assets was recorded.

NET LOSS PER SHARE

Basic and diluted net loss per common share has been calculated as follows:

| |

| Basic and diluted net loss per common share = | Net loss | – preferred dividends |

| | Weighted average number of Common Stockcommon stock outstanding during the period | |

Shares issued and any shares that are reacquired during the period are weighted for the portion of the period that they are outstanding.

The Company incurredincu rred net losses for each of the three and six months ended September 30, 20082010 and 2009 and, therefore, the impact of dilutive potential common shares from outstanding stock options, warrants, restricted stock, and restricted stock units, totaling 4,360,88220,949,329 shares and 23,451,352 shares as of September 30, 20082010 and 2009, respectively, were excluded from the computation as it would be anti-dilutive.

ACCOUNTING FOR DERIVATIVE ACTIVITIES

Derivative financial instruments are recorded as either assets or liabilities at fair valu e. In April 2008,May 2010, the Company settled the interest rate swap in place with the GE Credit Facility. In June 2010, the Company executed anthree separate interest rate swap agreementagreements (the “Interest Rate Swap”Swaps”) (see Note 5) to limit the Company’s exposure to changes in interest rates.rates related to the 2010 Term Loans. Changes in fair value of derivative financial instruments are either recognized in accumulated other comprehensive incomeloss (a component of stockholders' equity) or in the condensed consolidated statement of operations depending on whether the derivative is being used to hedge changes in cash flows or fair value. The Company has determined that this is not a hedging transactionsought hedge accounting and therefore, changes in the value of its Interest Rate SwapSwaps were recorded in the condensed consolidated statements of operations (see Note 5).

Fair Value of Financial InstrumentsFAIR VALUE OF FINANCIAL INSTRUMENTS

The fair value measurement disclosures are grouped into three levels based on valuation factors:

· | |

| • | Level 1 – quotedquot ed prices in active markets for identical investments |

· | |

| • | Level 2 – other significant observable inputs (including quoted prices for similar investments, market corroborated inputs, etc.) |

· | |

| • | Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments) |

Assets and liabilities measured at fair value on a recurring basis use the market approach, where prices and other relevant information isare generated by market transactions involving identical or comparable assets or liabilities.

The following table summarizestables summarize the levels of fair value measurements of the Company’s financial assets:

| | | | | | | | | | | | | | | | |

| | | As of September 30, 2010 |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash and cash equivalents | | $ | 11,414 | | | $ | — | &nb sp; | | $ | — | | | $ | 11,414 | |

| Restricted available-for-sale investments | | 299 | | | 8,821 | | | — | | | 9,120 | |

| Restricted cash | | 6,011 | | | — | | | — | | | 6,011 | |

| Interest rate swap | | — | | | (2,091 | ) | | — | | | (2,091 | ) |

| | | $ | 17,724 | | | $ | 6,730 | | | $ | — | | | $ | 24,454 | |

| | | Financial Assets at Fair Value as of September 30, 2009 | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| Cash and cash equivalents | | $ | 19,732 | | | $ | — | | | $ | — | |

| Investment securities, available-for-sale | | $ | 885 | | | $ | 9,683 | | | $ | — | |

| Interest rate swap | | $ | — | | | $ | (3,306 | ) | | $ | — | |

| | | | | | | | | | | | | | | | |

| | | As of March 31, 2010 |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash and cash equivalents | | $ | 9,094 | | | $ | — | | | $ | — | | | $ | 9,094 | |

| Restricted available-for-sale investments | | 153 | | | 7,778 | | | — | | | 7,931 | |

| Restricted cash | | 7,168 | | | — | | | — | | | 7,168 | |

| Interest rate swap | | — | | | (1,535 | ) | | — | | | (1,535 | ) |

| | | $ | 16,415 | | | $ | 6,243 | | | $ | — | | | $ | 22,658 | |

| |

| 3. | ASSETS HELD FOR SALE AND DISCONTINUED OPERATIONS |

The Pavilion Theatre generates movie theatre admission and concession revenues. Movie theatre admission revenues are recognized on the date of sale, as the related movie is viewed on that date and the Company's performance obligation is met at that time. Concession revenues consist of food and beverage sales and are also recognized on the date of sale. The Pavilion Theatre, while once a digital cinema test site and showcase for digital cinema technology, is no longer needed in that capacity due to widespread adoption of the technology. Management decided to pursue its sale during the fourth quarter of the year ended March 31, 2010. The Company had preliminary offers from interested buyers and expects a sale to be concluded within a year. Accordingly, the Company classified the Pavilion Theatre as assets held for sale in the quarter ended March 31, 2010 and reported the results of Pavilion Theatre as discontinued operation for the year ended March 31, 2010 and all prior periods.

During the quarter ended September 30, 2010, the Company experienced a reduction in its estimated sales price of the Pavilion Theater as well as decline in its operating performance. Accordingly, the Company recorded an impairment charge of $1,763 and the estimate used to measure the impairment loss is a Level 3 fair value estimate. As of September 30, 2010, there is no goodwill associated with the Pavilion Theatre.

The Company's other segment consists of Managed Services and Access Digital Server Assets. In August 2010, the Company sold the stock of Managed Services and the Access Digital Server Assets in exchange for $268 in cash and $1,150 in service credits under a 46-month service agreement (the "Managed Services Agreement"). The service credits will serve to pay the balance of the purchase price pursuant to the Managed Services Agreement under which the buyer will continue to perform certain information technology related services for the Company. The Access Digital Server Assets currently host the Company's websites, and provide networking and other information technology services to the Company. If there is an event of default by the buyer or if the Managed Services Agreement is terminated pursuant to its terms, the buyer would be required to pay all of the then outstanding (unused) service credits in cash, with immediate acceleration. The operations and cash flows of the other segment has been eliminated from the ongoing operation as a result of the sale, and the Company will have no significant continuing involvement in the operations of these businesses after they are sold. The results of the other segment has been reported in disconti nued operation for the quarter ended September 30, 2010, and all prior period presentation has been reclassified accordingly.

The assets and liabilities of held for sale assets were comprised of the following:

| | | | | | | | |

| | | September 30,

2010 | | March 31,

2010 |

| Accounts receivable, net | | $ | 130 | | | $ | 348 | |

| Prepaid expenses and other current assets | | 226 | | | 323 | |

| Security deposits | | 39 | | | 65 | |

| Property and equipment, net | | 5,027 | | | 5,334 | |

| Intangible assets, net | | — | | | 11 | |

| Goodwill | | — | | | 2,150 | |

| Assets held for sale | | $ | 5,422 | | | $ | 8,231 | |

| Accounts payable and accrued expenses | | $ | 185 | | | $ | 456 | |

| Customer security deposits | | — | | | 49 | |

| Capital leases | | 5,647 | | | 5,792 | |

| Deferred revenue | | 3 | | | 18 | |

| Liabilities as part of held for sale assets | | $ | 5,835 | | | $ | 6,315 | |

At September 30, 2010, the assets and liabilities of held for sale assets are comprised entirely of the assets and liabilities of the Pavilion Theatre.

The results of the Pavilion Theatre, Managed Services and the Access Digital Server Assets have been reported as discontinued operations for all periods presented. The loss from discontinued operations was as follows:

| | | | | | | | | | | | | | | | |

| | | For the Three Months EndedSeptember 30, | | For the Six Months Ended

September 30, |

| | | 2010 | | 2009 | | 2010 | | 2009 |

| Revenues | | $ | 1,486 | | | $ | 2,343 | | | $ | 3,567 | | | $ | 4,801 | |

| Costs and Expenses: | | | | | | | | | |

| Direct operating (exclusive of depreciation and amortization shown below) | | 1,267 | | | 1,840 | | | 2,971 | | | 3,768 | |

| Selling, general and administrative | | 99 | | | 224 | | | 331 | | &n bsp; | 430 | |

| Provision for doubtful accounts | | 46 | | | — | | | 46 | | | |

| Stock-based compensation | | — | | | 3 | | | (3 | ) | | 6 | |

| Loss on disposal of asset | | 120 | | | — | | | 120 | | | |

| Impairment of goodwill | | 1,763 | | | — | | | 1,763 | | | — | |

| Gain from sale of the information technology services operation | | (622 | ) | | — | | | (622 | ) | | — | |

| Depreciation of property and equipment | | — | | | 198 | | | 48 | | | 412 | |

| Amortization of intangible assets | | — | | | 1 | | | 1 | | | 2 | |

| Total operating expenses | | 2,673 | | | 2,266 | | | 4,655 | | | 4,618 | |

| Income from operations | | (1,187 | ) | | 77 | | | (1,088 | ) | | 183 | |

| Interest expense | | (252 | ) | | (260 | ) | | (506 | ) | | (521 | ) |

| Loss from discontinued operations | | $ | (1,439 | ) | | $ | (183 | ) | | (1,594 | ) | | $ | (338 | ) |

| |

| 4. | RECENT ACCOUNTING PRONOUNCEMENTS |

Effective July 1, 2009, the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) became the single official source of authoritative, nongovernmental generally accepted accounting principles (“GAAP”) in the United States. The historical GAAP hierarchy was eliminated and the ASC became the only level of authoritative GAAP, other than guidance issued by the SEC. Our accounting policies were not affected by the conversion to ASC. However, references to specific accounting standards in the footnotes to our condensed consolidated financial statements have been changed to refer to the appropriate section of ASC.

At its September 23, 2009 board meeting, the FASB ratified final EITF consensus on revenue arrangements with multiple deliverables (“Issue 08-1”). This Issue supersedes Issue 00-21 (codified in ASC 605-25). Issue 08-1 addresses the unit of accounting for arrangements involving multiple deliverables. It also addresses how arrangement consideration should be allocated to the separate units of accounting, when applicable. However, guidance on determining when the criteria for revenue recognition are met and on how an entity should recognize revenue for a given unit of accounting are located in other sections of the Codification. Issue 08-1 will ultimately be issued as an Accounting Standards Update (ASU) that will amend ASC 605-25. Final consensus is effective for fiscal years beginning on or after June 15, 2010. Entities can elect to apply this Issue (1) prospectively to new or materially modified arrangements after the Issue’s effective date or (2) retrospectively for all periods presented. The Company does not believe that revisions to ASC 605-25 will have a material impact on the Company’s consolidated financial statements.

At its September 23, 2009 board meeting, the FASB also ratified final EITF consensus on software revenue recognition (“Issue 09-3”). This Issue amends ASC 985-605 (formerly SOP 97-2) and ASC 985-605-15-3 (formerly Issue 03-5) to exclude from their scope all tangible products containing both software and non-software components that function together to deliver the product’s essential functionality. That is, the entire product (including the software deliverables and non-software deliverables) would be outside the scope of ASC 985-605 and would be accounted for under other accounting literature. The revised scope of ASC 985-605 (Issue 09-3) will ultimately be issued as an Accounting Standards Update (ASU) that will amend the ASC. The final consensus is effective for fiscal years beginning on or after June 15, 2010. Entities can elect to apply this Issue (1) prospectively to new or materially modified arrangements after the Issue’s effective date or (2) retrospectively for all periods presented. Early application is permitted. The Company does not believe that ASC 985-605 (Issue 09-3) will have a material impact on the Company’s consolidated financial statements.

In June 2009, the FASBFinancial Accounting Standards Board (“FASB”) issued SFAS No. 167 “AmendmentsAmendments to FASB Interpretation No. 46(R)” (“SFAS 167”) (which will be codified in ASC 810-10). Revisions to ASC 810-10 improves financial reporting by enterprises involved with variable interest entitiesent ities and to address (1) the effects on certain provisions of FASB Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities”, as a result of the elimination of the qualifying special-purpose entity concept in SFAS 166 and (2) constituent concerns about the application of certain key provisions of Interpretation 46(R), including those in which the accounting and disclosures under the Interpretation do not always provide timely and useful information about an enterprise’s involvement in a variable interest entity. Revisions toOn April 1, 2010, the Company adopted ASC 810-10 and its adoption did not have a material impact on the Company’s condensed consolidated financial statements.

In October 2009, the FASB issued ASU 2009-13, Multiple-Deliverable Revenue Arrangements (“ASU 2009-13”), which requires an entity to allocate consideration at the inception of an arrangement to all of its deliverables based on their relative selling prices. This consensus eliminates the use of the residual method of allocation and requires allocation using the relative-selling-price method in all circumstances in which an entity recognizes revenue for an arrangement with multiple deliverables. ASU 2009-13 is effective as of thefor fiscal years beginning of each reporting entity’s first annual reporting period that beginson or after NovemberJune 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter.2010. The Company is currently evaluatingwill adopt ASU 2009-13 on April 1, 2011 and apply it prospectively. The Company does not expect the impactadoption of adoption and application of revisionsASU 2009-13 to ASC 810-10 will have a material impact on the Company’s consolidated financial statements.

Notes receivable consistedIn October 2009, the FASB issued ASU No. 2009-14, “Software (Topic 985): Certain Revenue Arrangements That Include Software Elements (a consensus of the following:FASB Emerging Issues Task Force)” (“ASU 2009-14”). ASU 2009-14 amends ASC 985-605, “Software: Revenue Recognition,” such that tangible products, containing both software and non-software components that function together to deliver the tangible product’s essential functionality, are no longer within the scope of ASC 985-605. It also amends the determination of how arrangement consideration should be allocated to deliverables in a multiple-deliverable revenue arrangement. ASU 2009-14 will become effective for the Company for revenue arrangements entered into or materially modified on or after April 1, 2011. Earlier application is permitte d with required transition disclosures based on the period of adoption. The Company does not expect the adoption of ASU 2009-14 will have a material impact on the Company’s consolidated financial statements.

| | | As of March 31, 2009 | | | As of September 30, 2009 | |

| Note Receivable (as defined below) | | Current Portion | | | Long Term Portion | | | Current Portion | | | Long Term Portion | |

| Exhibitor Note | | $ | 54 | | | $ | 37 | | | $ | 56 | | | $ | 8 | |

| Exhibitor Install Notes | | | 118 | | | | 908 | | | | 89 | | | | 863 | |

| FiberMedia Note | | | 431 | | | | — | | | | — | | | | — | |

| Other | | | 13 | | | | 14 | | | | 25 | | | | 7 | |

| | | $ | 616 | | | $ | 959 | | | $ | 170 | | | $ | 878 | |