UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended JuneSeptember 30, 2017

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36373

TRINET GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | |

| Delaware | | 95-3359658 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 1100 San Leandro Blvd., Suite 400, San Leandro, CA | | 94577 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (510) 352-5000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

| Large accelerated filer | x | Accelerated filer | o |

| | | | |

| Non-accelerated filer | o (do not check if a smaller reporting company) | Smaller reporting company | o |

| | | | |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes o No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares of Registrant’s Common Stock outstanding as of JulyOctober 24, 2017 was 69,385,775.69,485,274.

TRINET GROUP, INC.

Form 10-Q - Quarterly Report

For the Quarterly Period Ended JuneSeptember 30, 2017

TABLE OF CONTENTS

|

| | |

| | Form 10-Q Cross Reference | Page |

| Part I, Item 1. | |

| | |

| | |

| | |

| | |

| Part I, Item 2. | |

| Part I, Item 3. | |

| Part I, Item 4. | |

| Part II, Item 1. | |

| Part II, Item 1A. | |

| Part II, Item 2. | |

| Part II, Item 3. | |

| Part II, Item 4. | |

| Part II, Item 5. | |

| Part II, Item 6. | |

| | | |

| | | |

|

| |

| FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION | |

Cautionary Note Regarding Forward-Looking Statements and Other Financial Information

For purposes of this report the terms “TriNet," "the Company," “we,” “us” and “our" refer to TriNet Group, Inc., and its consolidated subsidiaries. This report contains statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance, but are based on management’s expectations as of the date of this report and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current expectations and any past results, performance or achievements. Important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include, but are not limited to, those discussed in our Form 10-K for the year ended December 31, 2016 (2016 Form 10-K) and our Form 10-Q for the quarterquarters ended March 31, 2017 and June 30, 2017. The information provided in this Form 10-Q is based upon the facts and circumstances known at this time, and any forward-looking statements made by us in this Form 10-Q speak only as of the date on which they are made. All information provided in this report is as of the date of this report and we undertake no duty to update this information except as required by law.

Our Management's Discussion & Analysis of Financial Condition and Results of Operations (MD&A) includes references to our performance measures presented in accordanceconformity with U.S. Generally Accepted Accounting Principlesaccounting principles generally accepted in the United States of America (GAAP) and other non-GAAP financial measures that we use to manage our business, make planning decisions, allocate resources and as performance measures in our executive compensation plan. Refer to the Non-GAAP Financial Measures in our Key Financial and Operating Metrics section within our MD&A for definitions and reconciliations from GAAP measures.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Overview

We are a leading provider of human resources (HR) solutions for small to midsize businesses (SMBs). Under our co-employment model, we assume certain of the responsibilities of being an employer and help our clients mitigate employer-related risks and manage many of the complex and burdensome responsibilities of being an employer, helping our clients minimize employer-related risks and manage administrative and compliance responsibilities associated with employment.

We deliver a comprehensive suite of products and services, which allow our clients and their worksite employees (WSEs) to administer and manage HR-related functions, including compensation and benefits, payroll and other transactional HR needs, employee data, and health insurance and workers' compensation programs, using our technology platform and HR expertise.

We operate in one reportable segment. Less than 1% of revenue is generated outside of the U.S.

Technology Platform

Technology PlatformOur technology platform provides our clients and WSEs online and mobile tools to store, view, and manage core HR information and administer a variety of HR transactions, such as payroll processing, tax administration, employee onboarding and termination, compensation reporting, expense management, and benefits enrollment and administration.

HR Expertise

HR ExpertiseWe use the collective insights and experience of our teams of HR, benefits, risk management, and compliance professionals to help clients mitigatemanage many of the administrative, regulatory, and practical risks associated with their responsibilities as employers. Our teams provide HR expertisesexpertise to assist our clients in talent management, recruiting and training, performance management,running their business by providing a variety of HR services, including employee onboarding and terminations, benefits enrollment and support, claims administration and employment practices risk management. In addition, we have the ability to provide benchmarking datamanagement and relevant HR formadministration, talent management, recruiting and document templates to our clients to help them run their business.training, and performance management. Under our vertical strategy, we tailorseek to design our product and service offerings tofor specific industries by identifying common needs and leveraging scale and shared experience to provide more efficient and relevant offerings.

Benefits

BenefitsWe offer our WSEs access to a broad range of TriNet-sponsored benefit and insurance programs that many of our clients may be unable to obtain for their WSEs on their own and that are compliant with state, local, and federal regulations. Our benefit and insurance service offerings include plan design and administration, enrollment management, and WSE and client communications relating to our sponsored benefits and insurance programs.

We pay premiums to third-party insurance carriers for WSE insurance benefits and reimburse the insurance carriers and third-party administrators for claims payments made on our behalf within our insurance deductible layer, where applicable.

Compliance

ComplianceOur products and services are designed to help our clients comply with local, state, and federal employment and benefit laws. We monitor employer-related legal and regulatory developments and assist clients in complying with changing regulations and requirements at all levels, from changes in local minimum wage and family leave ordinances to sweeping reforms such as the Patient Protection and Affordable Care Act (ACA). Often these changes are staggered and require additional guidance from a variety of local, state or federal agencies, making compliance a continuous challenge. Each component of our HR solutions is designed with compliance in mind, whether it is payroll processing and tax administration, HR services focused on creating a compliant workplace, or offering ACA-compliant benefit plans.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

and tax administration, HR services focused on creating a compliant workplace, or offering ACA-compliant benefit plans.

Significant Developments in 2017

Our consolidated results for the first sixnine months of 2017 reflect our continued progress with vertical productproducts and insurance service offerings combined with slower growth in insurance costs as a result of favorable experience in our health programs and cost management with our insurance providers.

We also experienced modest Average WSE growth as compared to the first six months of 2016 as we continued our migration from legacy platforms to our common TriNet platform. Furthermore, we moderated our new customer growth as we prepared for the launch of TriNet Main Street, our new industry vertical product.

Our other operating expenses reflect our continued focus on developing new vertical products and platform integrations, and additional costs associated with our internal control remediation efforts.

We began 2017 with significant operational initiatives to improve our products and platform for our clients. During the first halfnine months of 2017, we provided our users with improved online and mobile productivity tools and upgraded our architecture allowing our platform to integrate more effectively with third party products. In July 2017, we launched and started onboarding clients to TriNet Main Street, our solutionvertical offering designed for a variety of "main street" industries, includingclients in the hospitality, retail and manufacturing businesses,industries.

Over the last year, we have benefited from our scale as we decreased administrative costs associated with our insurance offerings and are bringing forward this benefit to our clients. In October 2017, we launched the 2017 Fee Credit initiative designed to reward a portion of our existing clients. This incentive will be based on our full-year 2017 results and we are currently onboardingexpect our clients to receive the incentives under the program in the first quarter of 2018. The credit will be treated as a reduction of revenues.

Additionally in October 2017, we changed the contract terms with one of our health insurers. Previously we contracted with this carrier on a fully insured, guaranteed-cost basis; under this new clientsarrangement we will be responsible for this product.reimbursement of claim payments within our deductible layer.

We experienced flat Average WSE growth compared to the first nine months of 2016 as we continued our migration from legacy platforms to our common TriNet platform and we moderated our new customer growth as we expanded the functionality of TriNet Main Street.

Our other operating expenses reflect our continued focus on developing new vertical products and platform integrations, and additional costs associated with our internal control remediation efforts.

Performance Highlights

Q2Q3 2017

During the secondthird quarter of 2017, we:

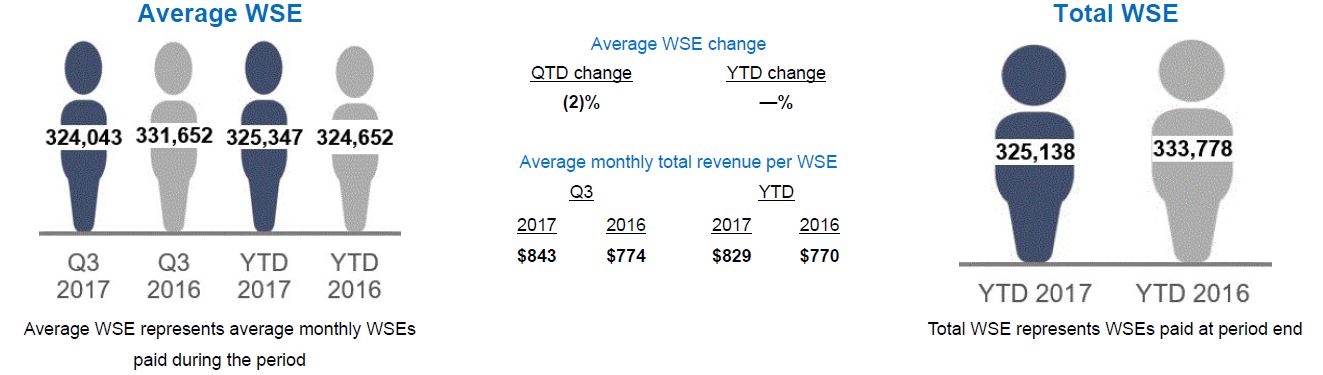

served over 14,000approximately 15,000 clients and co-employed Average WSEs of 324,000, consistent whena 2% decrease in Average WSEs compared to the same period in 2016, and

processed approximately $8.0$8.1 billion in payroll and payroll tax payments for our clients, an increase of 2%5% over the same period in 2016.

Our financial performance for the secondthird quarter of 2017, compared to the same period in 2016, included:

Total revenues increased 7%6% to $800.5$819.3 million, due to increased insurance service revenues from higher participation in our health coverage participation by our WSEsplans combined with an equal increase in health insurance services price increases,service fees per plan participant, while Net Service Revenues increased 35%28% to $201.0$205.9 million primarily due to thean increase in insurance service revenues increases noted above.

Operating income increased 116%117% to $56.8$62.8 million primarily due to improvement in our insurance service revenues,Net Service Revenues, partially offset by an increase in other operating expenses incurred to support our growth.initiatives.

Net income increased 225%194% to $40.0$42.8 million, or $0.56$0.60 per diluted share, Adjusted Net Income increased 88%94% to $36.7$40.3 million and Adjusted EBITDA increased 70%77% to $72.4$80.3 million primarily due to increased operating income as described above.

YTD 2017

During the first half of 2017, we:

co-employed Average WSEs of 326,000, a 2% increase over the same period in 2016,

processed approximately $17.8 billion in payroll and payroll tax payments for our clients, an increase of 3% over the same period in 2016, and

increased Cash and cash equivalents $49.9 million, or 27%, to $233.9 million.

Our financial performance for the first half of 2017, compared to the same period in 2016, included:

Total revenues increased 9% to $1.6 billion, while Net Service Revenues increased 28% to $400.0 million primarily due to higher health coverage participation by our WSEs and insurance services price increases as well as a 2% increase in Average WSEs. Net Service Revenues also benefited from slower growth in insurance costs as compared to growth in insurance service revenues primarily due to reductions in related premium and claim costs.

Operating income increased 103%to $106.3 million primarily due to increases in insurance service revenues and moderated growth in insurance costs described above, partially offset by an increase in other operating expenses to support our growth.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

YTD 2017

During the first nine months of 2017, we:

co-employed Average WSEs of 325,000, consistent with the same period in 2016,

processed approximately $25.8 billion in payroll and payroll tax payments for our clients, an increase of 4% over the same period in 2016, and

increased Cash and cash equivalents $79.5 million, or 43%, to $263.5 million.

Our financial performance for the first nine months of 2017, compared to the same period in 2016, included:

Total revenues increased 8% to $2.4 billion, while Net Service Revenues increased 28% to $605.9 million attributable primarily to increased participation in our health plans combined with an increase in health insurance fees per plan participant. Net Service Revenues also benefited from slower growth in insurance claims costs and reduced administrative costs.

Operating income increased 108%to $169.1 million primarily due to increases in Net Service Revenues, partially offset by an increase in other operating expenses to support our initiatives.

Net income increased 188%190% to $68.7$111.5 million, or $0.97$1.57 per diluted share, Adjusted Net Income increased 75%82% to $68.3$108.6 million and Adjusted EBITDA increased 60%66% to $135.7$216.0 million primarily due to increased operating income.income as described above.

Cash provided by operating activities increased 138%97% to $104.1$159.0 million primarily as a result of increased operating income reductionsas described above, decreased payments of our tax liabilities, and a decrease in paymentpayments of collateral to our workers' compensation collateral held by insurance carriers and reduction in cash taxes paid.carriers.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Key Financial and Operating Metrics

The following key financial and operating metrics should be read in conjunction with our condensed consolidated financial statements and related notes included in this Form 10-Q.

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | | Percent Change | Three Months Ended September 30, | | Nine Months Ended September 30, | | Percent Change |

(in thousands, except per share and operating metrics data) | 2017 | | 2016 | | 2017 | | 2016 | | Q2 2017 vs. 2016 | YTD 2017 vs. 2016 | 2017 | | 2016 | | 2017 | | 2016 | | Q3 2017 vs. 2016 | YTD 2017 vs. 2016 |

| Income Statement Data: | | | | | | | | | | | | | | | | | | |

| Total revenues | $ | 800,541 |

| | $ | 745,846 |

| | $ | 1,608,151 |

| | $ | 1,478,785 |

| | 7 | % | 9 | % | $ | 819,293 |

| | $ | 770,457 |

| | $ | 2,427,444 |

| | $ | 2,249,242 |

| | 6 |

| % | 8 | % |

| Operating income | 56,835 |

| | 26,367 |

| | 106,322 |

| | 52,269 |

| | 116 | | 103 | | 62,759 |

| | 28,972 |

| | 169,081 |

| | 81,241 |

| | 117 |

| | 108 | |

| Net income | 39,951 |

| | 12,282 |

| | 68,688 |

| | 23,859 |

| | 225 | | 188 | | 42,836 |

| | 14,581 |

| | 111,524 |

| | 38,440 |

| | 194 |

| | 190 | |

| Diluted net income per share of common stock | 0.56 |

| | 0.17 |

| | 0.97 |

| | 0.33 |

| | 229 | | 194 | | 0.60 |

| | 0.20 |

| | 1.57 |

| | 0.53 |

| | 200 |

| | 196 | |

Non-GAAP measures (1): | | | | | | | | | | | | | | | | | | |

Net Service Revenues (1) | 201,006 |

| | 149,173 |

| | 399,974 |

| | 312,423 |

| | 35 | | 28 | | 205,896 |

| | 161,035 |

| | 605,870 |

| | 473,458 |

| | 28 |

| | 28 | |

Net Insurance Service Revenues (1) | 92,364 |

| | 39,580 |

| | 171,211 |

| | 90,427 |

| | 133 | | 89 | | 93,366 |

| | 50,542 |

| | 264,577 |

| | 140,969 |

| | 85 |

| | 88 | |

Adjusted EBITDA (1) | 72,372 |

| | 42,602 |

| | 135,715 |

| | 84,755 |

| | 70 | | 60 | | 80,283 |

| | 45,399 |

| | 215,998 |

| | 130,154 |

| | 77 |

| | 66 | |

Adjusted Net Income (1) | 36,691 |

| | 19,466 |

| | 68,268 |

| | 38,999 |

| | 88 | | 75 | | 40,297 |

| | 20,800 |

| | 108,565 |

| | 59,798 |

| | 94 |

| | 82 | |

| | | | | | | | | | | | | | | | | | | |

| Operating Metrics: | | | | | | | | | | | | | | | | | | |

| Total WSEs payroll and payroll taxes processed (in millions) | $ | 7,958 |

| | $ | 7,811 |

| | $ | 17,774 |

| | $ | 17,213 |

| | 2 | % | 3 | % | $ | 8,061 |

| | $ | 7,703 |

| | $ | 25,835 |

| | $ | 24,916 |

| | 5 |

| % | 4 | % |

| Average WSEs | 324,194 |

| | 322,881 |

| | 325,999 |

| | 321,152 |

| | — | | 2 | | 324,043 |

| | 331,652 |

| | 325,347 |

| | 324,652 |

| | (2 | ) | | — | |

| |

| (1) | Refer to Non-GAAP Financial Measures section below for definitions and reconciliations from GAAP measures. |

| | | | Six Months Ended June 30, | | Percent | Nine Months Ended September 30, | | Percent |

| (in thousands, except operating metrics data) | 2017 | | 2016 | | Change | 2017 | | 2016 | | Change |

| Operating Metrics: | | | | | | | | | | | |

| Total WSEs at period end | 329,095 |

| | 325,466 |

| | 1 | % | 325,138 |

| | 333,778 |

| | (3 | ) | % |

| Cash Flow Data: | | | | | | | | | | |

| Net cash provided by operating activities | $ | 104,113 |

| | $ | 43,667 |

| | 138 | | $ | 158,951 |

| | $ | 80,699 |

| | 97 |

| |

| Net cash used in investing activities | (9,256 | ) | | (6,975 | ) | | 33 | | (14,763 | ) | | (17,411 | ) | | (15 | ) | |

| Net cash used in financing activities | (45,141 | ) | | (36,230 | ) | | 25 | | (65,063 | ) | | (68,998 | ) | | (6 | ) | |

| | | (in thousands) | June 30,

2017 | | December 31,

2016 | | Percent Change | | September 30,

2017 | | December 31,

2016 | | Percent Change | |

| Balance Sheet Data: | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 233,883 |

| | $ | 184,004 |

| | 27 |

| % | $ | 263,527 |

| | $ | 184,004 |

| | 43 |

| % |

| Working capital | 168,681 |

| | 156,771 |

| | 8 |

| | 186,842 |

| | 156,771 |

| | 19 |

| |

| Total assets | 1,758,695 |

| | 2,095,143 |

| | (16 | ) | | 1,836,925 |

| | 2,095,143 |

| | (12 | ) | |

| Notes and capital leases payable | 440,805 |

| | 459,054 |

| | (4 | ) | | 431,690 |

| | 459,054 |

| | (6 | ) | |

| Total liabilities | 1,667,182 |

| | 2,060,553 |

| | (19 | ) | | 1,705,066 |

| | 2,060,553 |

| | (17 | ) | |

| Total stockholders’ equity | 91,513 |

| | 34,590 |

| | 165 |

| | 131,859 |

| | 34,590 |

| | 281 |

| |

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with GAAP, we monitor other non-GAAP financial measures that we use to manage our business, make planning decisions, allocate resources and as performance measures in our executive compensation plan. These key financial measures provide an additional view of our operational performance over the long termlong-term and provide useful information that we use in order to maintain and grow our business.

The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

|

| | |

| Non-GAAP Measure | Definition | How We Use The Measure |

| Net Service Revenues | • Sum of professional service revenues and Net Insurance Service Revenues, or total revenues less insurance costs. | • Provides a comparable basis of revenues on a net basis. Professional service revenues are represented net of client payroll costs whereas insurance service revenues are presented gross of insurance costs for financial reporting purposes. • Acts as the basis to allocate resources to different functions and evaluates the effectiveness of our business strategies by each business function. • Provides a measure, among others, used in the determination of incentive compensation for management. |

| Net Insurance Service Revenues | • Insurance revenues less insurance costs. | • Is a component of Net Service Revenues. • Provides a comparable basis of revenues on a net basis. Professional service revenues are represented net of client payroll costs whereas insurance service revenues are presented gross of insurance costs for financial reporting purposes. Promotes an understanding of our insurance services business by evaluating insurance service revenues net of our WSE related costs which are substantially pass-through for the benefit of our WSEs. Under GAAP, insurance service revenues and costs are recorded gross as we have latitude in establishing the price, service and supplier specifications. |

| Adjusted EBITDA | • Net income, excluding the effects of: - income tax provision, - interest expense, - depreciation, - amortization of intangible assets, and - stock-based compensation expense.

| • Provides period-to-period comparisons on a consistent basis and an understanding as to how our management evaluates the effectiveness of our business strategies by excluding certain non-cash charges such as depreciation and amortization, and stock-based compensation recognized based on the estimated fair values. We believe these charges are not directly resulting from our core operations or indicative of our ongoing operations. • Enhances comparisons to prior periods and, accordingly, facilitates the development of future projections and earnings growth prospects. • Provides a measure, among others, used in the determination of incentive compensation for management. |

| Adjusted Net Income | • Net income, excluding the effects of: - effective income tax rate (1), - stock-based compensation, - amortization of intangible assets, - non-cash interest expense (2), and - the income tax effect (at our effective tax rate (1)) of these pre-tax adjustments. | • Provides information to our stockholders and board of directors to understand how our management evaluates our business, to monitor and evaluate our operating results, and analyze profitability of our ongoing operations and trends on a consistent basis by excluding certain non-cash charges.

|

| |

| (1) | We have adjusted the non-GAAP effective tax rate to 40.5% for 2017 from 42.5% for 2016 due to a decrease in state income taxes from an increase in excludable income for state income tax purposes. These non-GAAP effective tax rates exclude the income tax impact from stock-based compensation and changes in uncertain tax positions. |

| |

| (2) | Non-cash interest expense represents amortization and write-off of our debt issuance costs. |

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Reconciliation of GAAP to Non-GAAP Measures

The table below presents a reconciliation of Total revenues to Net Service Revenues: | | | | Three Months Ended

June 30, | | Six Months Ended June 30, | Three Months Ended

September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2017 | 2016 | | 2017 | 2016 | 2017 | 2016 | | 2017 | 2016 |

| Total revenues | $ | 800,541 |

| $ | 745,846 |

| | $ | 1,608,151 |

| $ | 1,478,785 |

| $ | 819,293 |

| $ | 770,457 |

| | $ | 2,427,444 |

| $ | 2,249,242 |

|

| Less: Insurance costs | 599,535 |

| 596,673 |

| | 1,208,177 |

| 1,166,362 |

| 613,397 |

| 609,422 |

| | 1,821,574 |

| 1,775,784 |

|

| Net Service Revenues | $ | 201,006 |

| $ | 149,173 |

| | $ | 399,974 |

| $ | 312,423 |

| $ | 205,896 |

| $ | 161,035 |

| | $ | 605,870 |

| $ | 473,458 |

|

The table below presents a reconciliation of Insurance service revenues to Net Insurance Service Revenues:

| | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 | | 2017 | 2016 | 2017 | 2016 | | 2017 | 2016 |

| Insurance service revenues | $ | 691,899 |

| $ | 636,253 |

| | $ | 1,379,388 |

| $ | 1,256,789 |

| $ | 706,763 |

| $ | 659,964 |

| | $ | 2,086,151 |

| $ | 1,916,753 |

|

| Less: Insurance costs | 599,535 |

| 596,673 |

| | 1,208,177 |

| 1,166,362 |

| 613,397 |

| 609,422 |

| | 1,821,574 |

| 1,775,784 |

|

| Net Insurance Service Revenues | $ | 92,364 |

| $ | 39,580 |

| | $ | 171,211 |

| $ | 90,427 |

| $ | 93,366 |

| $ | 50,542 |

| | $ | 264,577 |

| $ | 140,969 |

|

The table below presents a reconciliation of Net income to Adjusted EBITDA:

| | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 | | 2017 | 2016 | 2017 | 2016 | | 2017 | 2016 |

| Net income | $ | 39,951 |

| $ | 12,282 |

| | $ | 68,688 |

| $ | 23,859 |

| $ | 42,836 |

| $ | 14,581 |

| | $ | 111,524 |

| $ | 38,440 |

|

| Provision for income taxes | 12,298 |

| 9,210 |

| | 28,451 |

| 18,451 |

| 15,268 |

| 9,107 |

| | 43,719 |

| 27,558 |

|

| Stock-based compensation | 7,499 |

| 6,508 |

| | 13,706 |

| 13,905 |

| 7,700 |

| 6,264 |

| | 21,406 |

| 20,169 |

|

| Interest expense and bank fees | 4,857 |

| 5,038 |

| | 9,605 |

| 10,080 |

| 5,425 |

| 5,597 |

| | 15,030 |

| 15,677 |

|

| Depreciation | 6,451 |

| 4,559 |

| | 12,599 |

| 8,475 |

| 7,754 |

| 5,188 |

| | 20,353 |

| 13,663 |

|

| Amortization of intangible assets | 1,316 |

| 5,005 |

| | 2,666 |

| 9,985 |

| 1,300 |

| 4,662 |

| | 3,966 |

| 14,647 |

|

| Adjusted EBITDA | $ | 72,372 |

| $ | 42,602 |

| | $ | 135,715 |

| $ | 84,755 |

| $ | 80,283 |

| $ | 45,399 |

| | $ | 215,998 |

| $ | 130,154 |

|

The table below presents a reconciliation of Net income to Adjusted Net Income:

| | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 | | 2017 | 2016 | 2017 | 2016 | | 2017 | 2016 |

| Net income | $ | 39,951 |

| $ | 12,282 |

| | $ | 68,688 |

| $ | 23,859 |

| $ | 42,836 |

| $ | 14,581 |

| | $ | 111,524 |

| $ | 38,440 |

|

| Effective income tax rate adjustment | (8,863 | ) | 76 |

| | (10,890 | ) | 469 |

| (8,264 | ) | (960 | ) | | (19,154 | ) | (491 | ) |

| Stock-based compensation | 7,499 |

| 6,508 |

| | 13,706 |

| 13,905 |

| 7,700 |

| 6,264 |

| | 21,406 |

| 20,169 |

|

| Amortization of intangible assets | 1,316 |

| 5,005 |

| | 2,666 |

| 9,985 |

| 1,300 |

| 4,662 |

| | 3,966 |

| 14,647 |

|

| Non-cash interest expense | 602 |

| 849 |

| | 1,224 |

| 1,624 |

| 622 |

| 1,559 |

| | 1,846 |

| 3,183 |

|

| Income tax impact of pre-tax adjustments | (3,814 | ) | (5,254 | ) | | (7,126 | ) | (10,843 | ) | (3,897 | ) | (5,306 | ) | | (11,023 | ) | (16,150 | ) |

| Adjusted Net Income | $ | 36,691 |

| $ | 19,466 |

| | $ | 68,268 |

| $ | 38,999 |

| $ | 40,297 |

| $ | 20,800 |

| | $ | 108,565 |

| $ | 59,798 |

|

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Results of Operations

Revenues and Income

Q2Q3 2017 - Q2Q3 2016 Commentary

Total revenues were $800.5$819.3 million for the secondthird quarter of 2017, a 7%6% increase compared to the same period in 2016:2016.

Insurance service revenues grew 9%7% over the same quarter in 2016 to $691.9$706.8 million.

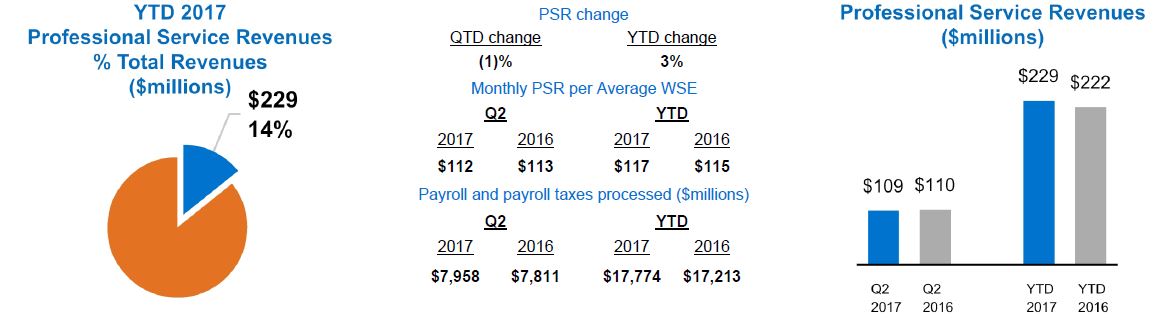

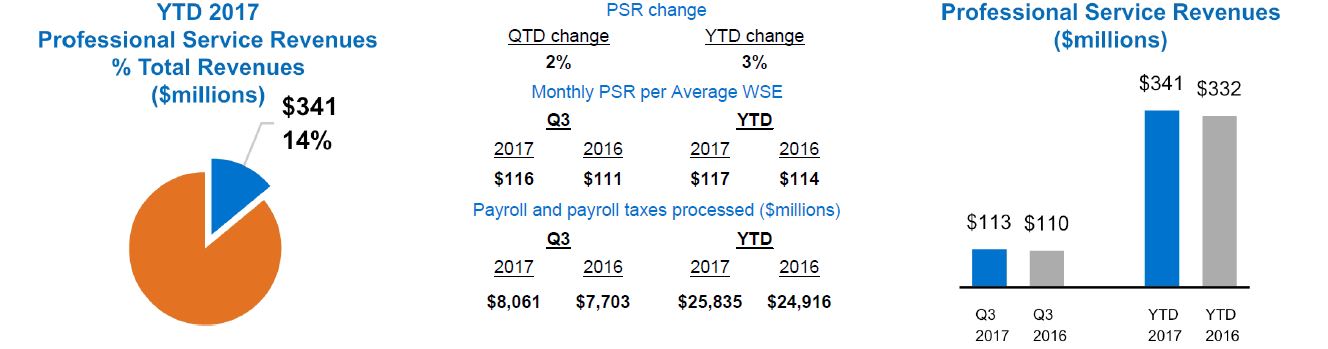

Professional service revenues decreased 1%increased 2% over the same quarter in 2016 to $108.6$112.5 million.

Net Service Revenues were $201.0$205.9 million for the secondthird quarter of 2017, representing a 35%28% increase from the same quarterperiod in 2016. This was driven by the increase in Net Insurance Service Revenues, which grew 133%85% over the same period in 2016.2016 due to increased participation in our health plans combined with an equal increase in health insurance service fees per plan participant. Insurance service revenues per Average WSE increased by 8%10% while insurance costs per Average WSE remained flat.increased 3%.

Operating income was $56.8$62.8 million, up 116%117% from the secondthird quarter of 2016, primarily due to improvement in our insurance service revenues as noted above, partially offset by a 20%10% increase in other operating expenses to support our growthinitiatives and additional costs associated with our internal control remediation efforts. Refer to the Other Operating Expenses section in this Results of Operations for further detail.

YTD 2017 - YTD 2016 Commentary

Total revenues were $1.6$2.4 billion for the first halfnine months of 2017, a 9%an 8% increase compared to the same period in 2016.

Insurance service revenues grew 10%9% over the same period in 2016 to $1.4 billion.$2,086.2 million.

Professional service revenues increased 3% over the same period in 2016 to $228.8$341.3 million.

Net Service Revenues were $400.0$605.9 million for the first halfnine months of 2017, representing a 28% increase from the same period in 2016. This was driven by the increase in Net Insurance Service Revenues which grew 89%88% over the same period in 2016.2016 which was primarily attributable to increased participation in our health plans combined with an increase in health insurance service fees per plan participant. Insurance service revenues per Average WSE increased by 8%9%, while insurance costs per Average WSE increased 2%.

Operating income was $106.3$169.1 million, up 103%108% from the first halfnine months of 2016, primarily due to improvement in our insurance services revenues as noted above, partially offset by a 15%13% increase in other operating expenses to support our growthinitiatives and additional costs associated with our internal control remediation efforts. Refer to the Other Operating Expenses section in this Results of Operations for further detail.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Worksite Employees (WSE)

Historically, Total WSE comparisons have served as an indicator of our success in growing our business and retaining clients. Average WSE growth is another volume measure we use to monitor the performance of our business.

Average WSEs was flatdecreased 2% in the secondthird quarter of 2017 compared to the same period in 2016 and increased 2%remained flat in the first halfnine months of 2017 compared to the same period in 2016. This 2% increase was driven byThe quarter and year to date changes in Average WSEs are a result of WSE growth in our established customer base, largely offset by higher attrition, resultingincluding attrition from migrating our disciplined approach of migrating clients to a common platform. Furthermore, we moderated our new customer growth as we prepared forexpanded the launchfunctionality of our new industry vertical, TriNet Main Street.

Anticipated revenues for future periods can diverge from Total WSEs due to pricing differences across our HR solutions and services and the degree to which clients and WSEs elect to participate in our solutions. In addition to driving the growth in WSE count, we also focus on pricing strategies and product differentiation to maximize our revenue opportunities. Average monthly total revenues per WSE, as a measure to monitor the success of such pricing strategies, have increased 7%9% and 8% in the secondthird quarter and first halfnine months of 2017, respectively, compared to the same periods in 2016.

Professional Service Revenues (PSR)

Professional service revenues represented 14% of total revenues in both the second quarter and first half of 2017. The slight decrease in professional service revenues during the second quarter of 2017 was primarily attributed to the timing of a payroll tax service fee adjustment.

The 3% increase in PSR during the first half of 2017 was primarily attributed to the 2% growth in Average WSEs when compared to the same period in 2016.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Professional Service Revenues (PSR)

Professional service revenues represented 14% of total revenues in both the third quarter and first nine months of 2017. The slight increase in professional service revenues during the third quarter of 2017 was primarily attributed to a 5% increase in PSR per Average WSE when compared to the same period in 2016, partially offset by a decrease in Average WSEs when compared to the same period in 2016.

The increase in PSR during the first nine months of 2017 was attributed to the 3% increase in PSR per Average WSE when compared to the same period in 2016.

Insurance Service Revenues (ISR)

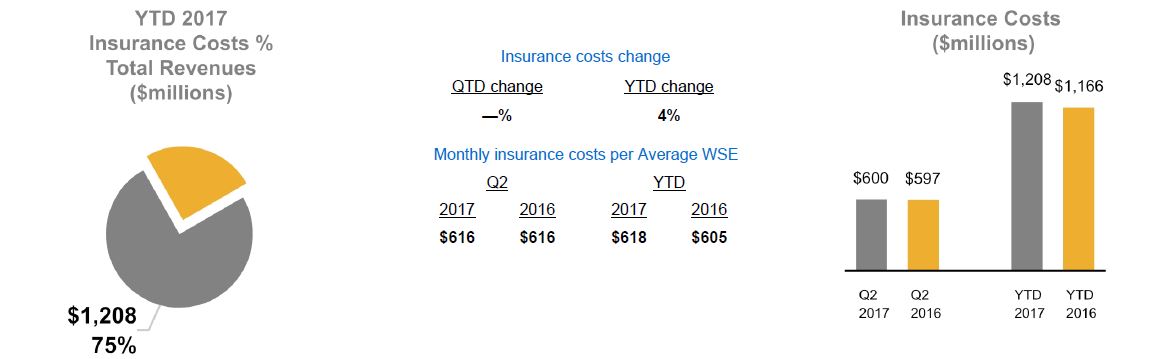

Insurance service revenues represented 86% of total revenue in the secondthird quarter and first halfnine months of 2017. Insurance service revenues increased 9%7% and 10%9% in the secondthird quarter and first halfnine months of 2017, respectively, when compared to the same periods in 2016. The growth in insurance service revenues for the secondthird quarter and first half of 2017 was equally attributable to increased participation in our health plans andcombined with an equal increase in health insurance service fees per plan participant. The growth in insurance service revenues for the first nine months of 2017 was primarily attributable to increased participation in our health plans combined with an increase in health insurance service fees per plan participant.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

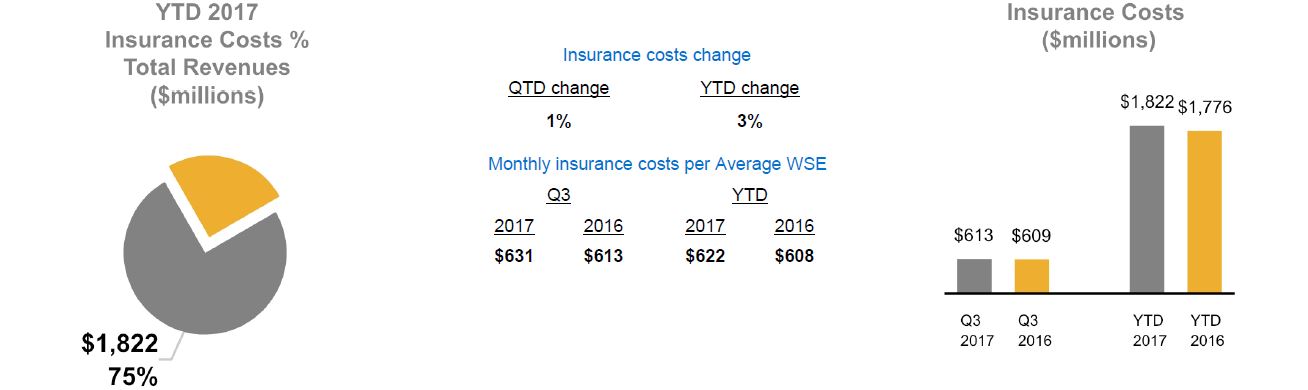

Insurance Costs

Insurance costs remained consistentincreased 1% and 3% for the secondthird quarter and first nine months of 2017, when compared to the same period in 2016, with flat Average WSEs and costs per Average WSE.

Insurance costs increased 4% for the first half of 2017,respectively, compared to the same period in 2016, primarily as a result of an increase in health plan participants, and a 2% increase in Average WSEs, partially offset by a reductiondecrease in monthly insurance claims costs and premiumadministrative costs per average participant.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

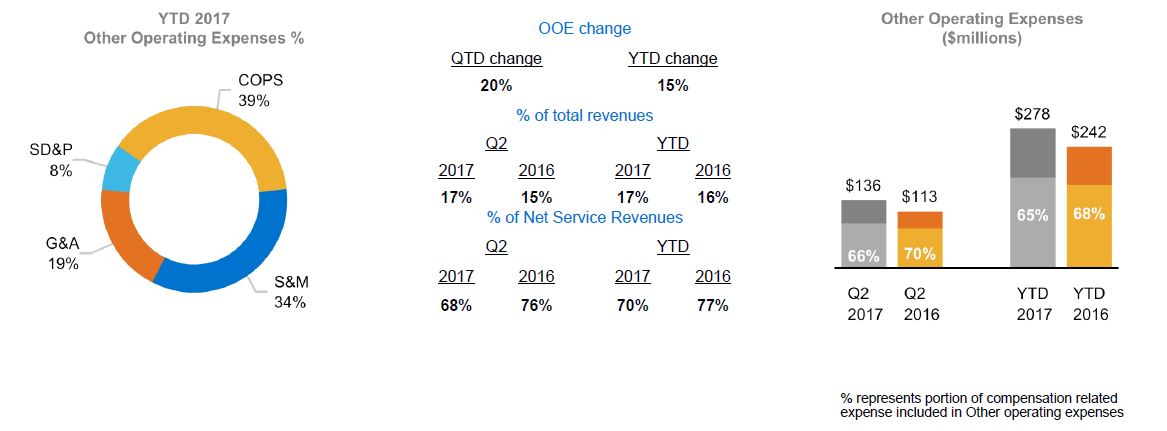

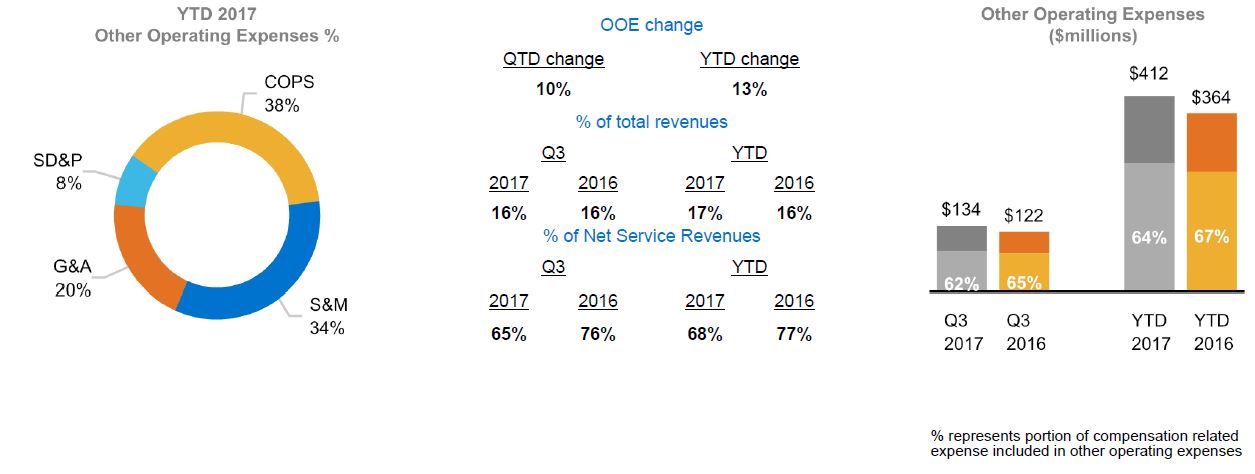

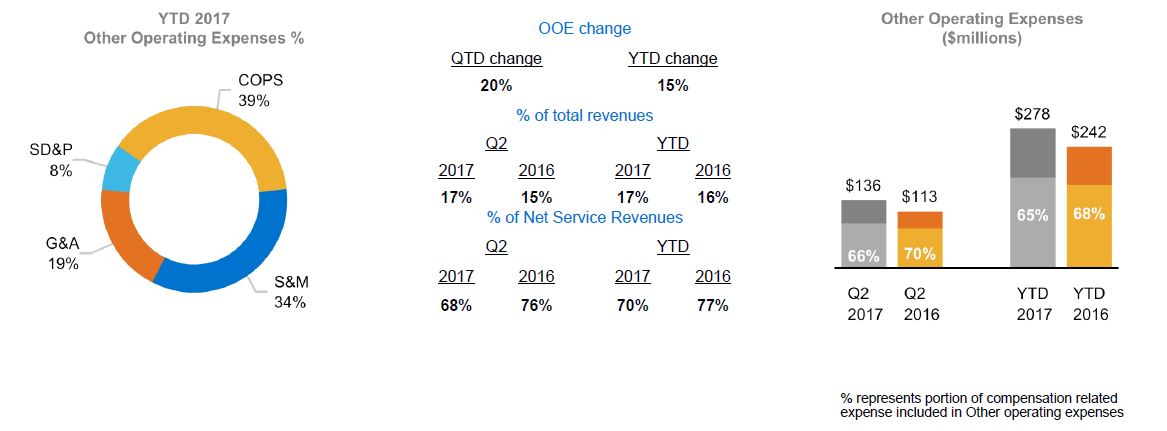

Other Operating Expenses (OOE)

Other operating expenses includes cost of providing services (COPS), sales and marketing (S&M), general and administrative (G&A), and systems development and programming (SD&P) expenses.

We manage other operating expenses and allocate resources across different business functions based on percentage of Net Service Revenues. This ratio has decreased to 68%65% from 76% in the secondthird quarter of 2017 and has decreased to 70%68% from 77% in the first halfnine months of 2017, when compared to the same periods in 2016. These decreases are due to our revenues increasing faster than other operating expenses.

We had approximately 2,700 corporate employees as of JuneSeptember 30, 2017 in 4847 offices across the U.S. Our corporate employees' compensation related expenses represent a majority of our operating expenses. Compensation costs for our corporate employees include payroll, payroll taxes, stock-based compensation, bonuses, commissions and other payroll and benefits related costs. The percentage of compensation related expense to other operating expense has decreased to 66%62% from 70%65% in the secondthird quarter of 2017, and has decreased to 65%64% from 68%67% in in the first halfnine months of 2017, when compared to the same periods in 2016. These decreases are primarily due to increased non-compensation related costs associated with our vertical product development, platform integrations, and internal control remediation efforts.

We expect our operating expenses to increase in the foreseeable future due to expected growth, our continued strategy to develop new vertical products, andcontinued platform integrations, and additional costs associated with our internal control remediation efforts. We will continue to improve our systems, processes, and internal controls to gain efficiencies.controls. These expenses may fluctuate as a percentage of our total revenues from period-to-period depending on the timing of when expenses are incurred.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

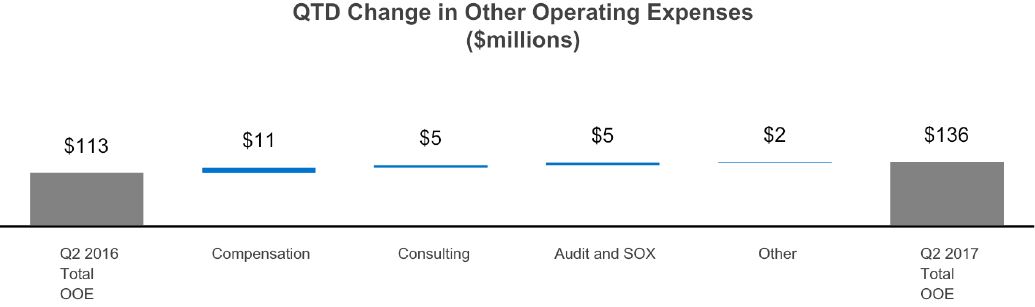

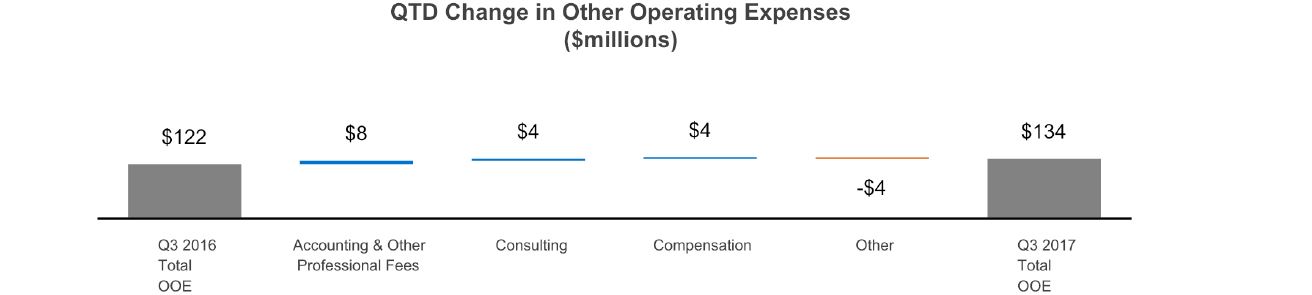

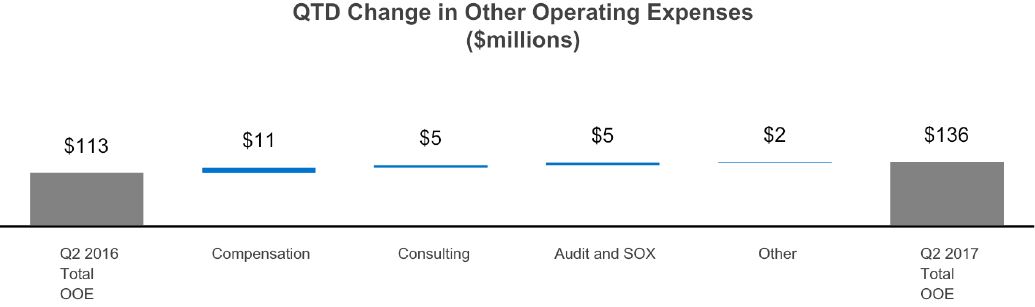

Q2Q3 2017 - Q2Q3 2016 Commentary

Other operating expenses increased $23.2$11.9 million or 20%10% in the secondthird quarter of 2017 compared to the same period in 2016 as part of our continued investment in supporting our infrastructure, and improving our technology platform user experience for our clients.clients, and our internal control remediation efforts. Significant drivers of our increased spending are as follows:

Compensation costs for our corporate employees including payroll, payroll taxes, stock-based compensation, bonuses, commissions and other payroll and benefits related costs, increased $10.6 million or 13% primarily due to increased headcount related to investments in client service and technology functions to support product delivery and platform integration.

Consulting expenses increased $4.8 million and included costs associated with enhancing our product offerings as well as payroll tax compliance initiatives.

Accounting and other professional fees increased $4.8$8.1 million in the second quarter of 2017 primarily as a result of increased professional fees to support our internal control remediation efforts.

Compensation costs for our corporate employees increased $3.5 million primarily due to increased headcount related to investments in technology, sales and client services functions to support product delivery and platform integration.

Other expenses decreased $3.5 million primarily due to a reduction in local tax compliance costs.

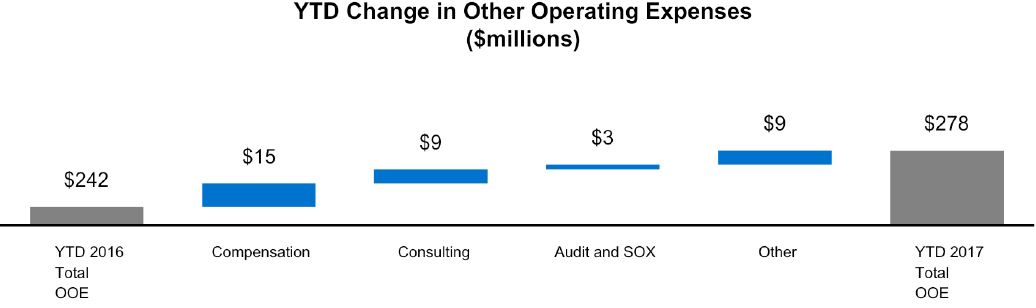

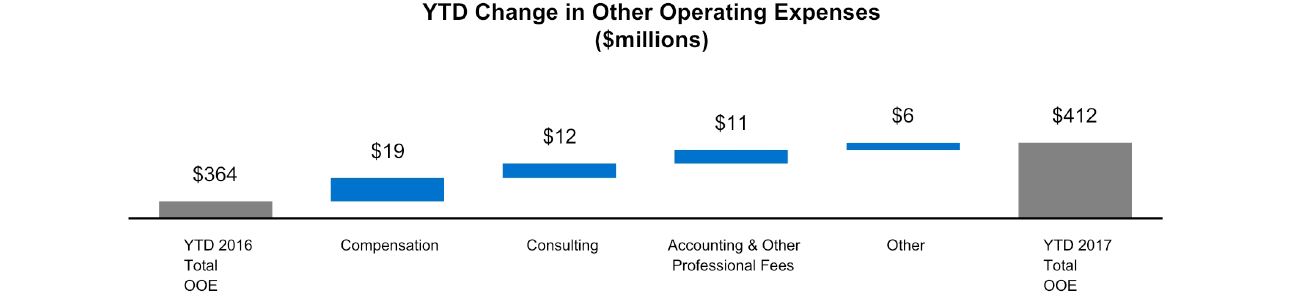

YTD 2017 - YTD 2016 Commentary

Other operating expenses increased $36.7$48.6 million, or 15%13%, in the first halfnine months of 2017 compared to the same period in 2016. Significant drivers of our increased spending are as follows:

Total compensation costs increased $15.1$18.9 million, or 9%8%, primarily due to increased headcount related to investments in technology and consultingclient services functions to support product delivery and platform integration as well as an increase in sales related compensation costs associated with a new sales performance incentive program.

Consulting expenses increased $8.8$11.9 million primarily due to the factors described above.above and also included costs associated with payroll tax compliance initiatives.

Accounting and other professional fees increased $2.6$11.4 million primarily as a result of the timing of professional fees to support our internal control remediation efforts.

Other expenses increased $10.2$6.4 million primarily due to additional compliance costs and external sales costs.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Amortization of Intangible Assets

Amortization of intangible assets represents costs associated with acquired companies' developed technologies, client lists, trade names and contractual agreements. Amortization expenses decreased 74%72% and 73% in the secondthird quarter and first halfnine months of 2017, respectively, compared to the same periods in 2016, as a result of the revision to the expected useful life in October 2016 of certain client lists and trademarks primarily related to our previous acquisitions.

Depreciation

Depreciation expense increased 42% and 49% in the secondthird quarter and first halfnine months of 2017, respectively, compared to the same periods in 2016, as a result of our additional investment in technology products and platforms and the associated depreciation of those assets.

Other Income (Expense)

Other income (expense) consists primarily of interest expense under our credit facility whichand decreased 4%3% and 5%4% in the secondthird quarter and first halfnine months of 2017, respectively, compared to the same periods in 2016 due to a decreasing principal balance on our outstanding debt.

Provision for Income Taxes

Our effective income tax rate (ETR) was 23.5%26.3% and 38.4% for the second quarter ofthree months ended September 30, 2017 compared to an ETR of 42.9%and 2016, respectively, and 28.2% and 41.8% for the same period in 2016. The 19.4% decrease in ETR isnine months ended September 30, 2017 and 2016, respectively. These decreases are primarily due to the following:

a decrease of 12.0%, or $6.5 million, attributable todiscrete tax benefitsbenefit recognized from theupon adoption of Accounting Standards UpdateASU 2016-09, - Stock Compensation (ASU 2016-09) additionally described in Note 1 of our condensed consolidated financial statements and related notes,

a decrease of 4.3% in state income taxestax benefit resulting from qualified production activities deduction for certain software offerings, a tax benefit from an increase in excludable income for state income tax purposes andwhich is partially offset by a discrete charge due to changes in apportionmentuncertain tax positions, and statutorya tax rates,

a decrease of 2.3%benefit in non-deductible expenses due to the abatement of penalties previously assessed by the Internal Revenue Service (IRS), and

a. The remaining decrease of 0.8% resulting from an increase inis attributable to tax credits and decrease in non-deductible stock-baseddisqualifying dispositions of previously nondeductible stock based compensation.

Our ETR was 29.3% for the first half of 2017, compared to an ETR of 43.6% for the same period in 2016. The 14.3% decrease in ETR is primarily due to the following:

a decrease of 10.1%, or $10.1 million, attributable to tax benefits recognized from the adoption of ASU 2016-09,

a decrease of 3.8% in state income taxes from an increase in excludable income for state income tax purposes and changes in apportionment and statutory tax rates,

a decrease of 2.4% resulting from an increase in tax credits and decrease in both non-deductible stock-based compensation and non-deductible expenses, partially offset by a

an increase of 2.0% due to changes in uncertain tax positions where we may not prevail in our position associated with state income tax audits.

|

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Liquidity and Capital Resources

Liquidity

We manage our liquidity separately between assets and liabilities that are WSE related from our corporate assets and liabilities.

WSE related assets and liabilities primarily consist of current assets and current liabilities resulting from transactions directly or indirectly associated with WSEs, including payroll and related taxes and withholdings, our sponsored workers' compensation and health insurance programs, and other benefit programs. Our cash flows related to WSE payroll and benefits is generally matched by advance collection from our clients which is reported as payroll funds collected within WSE related assets.

We report our corporate cash and cash equivalents on the condensed consolidated balance sheets separately from WSE related assets. We rely on our corporate cash and cash equivalents and cash from operations to satisfy our operational and regulatory requirements and to fund capital expenditures. We believe that we have sufficient corporate liquidity and capital resources to satisfy future requirements and meet our obligations to clients, creditors and debt holders. We believe that our existing corporate cash and cash equivalents, working capital and cash provided by operating activities will be sufficient to meet our working capital and capital expenditure needs for at least the next 12 months.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Our liquid assets are as follows:

| | | (in thousands) | June 30,

2017 | December 31,

2016 | September 30,

2017 | December 31,

2016 |

| Cash and cash equivalents | $ | 233,883 |

| $ | 184,004 |

| $ | 263,527 |

| $ | 184,004 |

|

| Working capital: | | |

| Corporate working capital | 163,195 |

| 151,295 |

| 180,497 |

| 151,295 |

|

| WSE related assets, net of WSE related liabilities | 5,486 |

| 5,476 |

| 6,345 |

| 5,476 |

|

We manage our sponsored benefit and workers' compensation insurance obligations by maintaining funds in restricted cash, cash equivalents and investments as collateral. As of JuneSeptember 30, 2017, we had $155.3$157.0 million of restricted cash, cash equivalents and investments included in WSE related assets and $150.9$160.2 million of marketable securities designated as long-term restricted cash, cash equivalents and investments on the condensed consolidated balance sheets. These collateral amounts are generally determined at the beginning of each plan year and we may be required by our insurance carriers to adjust the balance when facts and circumstances change. We regularly review our collateral balances with our insurance carriers, and anticipate funding further collateral as needed based on program development.

Capital Resources

We believe that we can meet our present and reasonably foreseeable operating cash needs and future commitments through existing liquid assets, continuing cash flows from operations, our borrowing capacity under our revolving credit facility and the potential issuance of debt or equity securities.

We maintain a $75.0 million revolving credit facility. The total unused portion of our revolving credit facility was $59.5 million as of JuneSeptember 30, 2017.

|

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Cash Flows

We generated positive cash flows from operating activities for the first halfnine months of 2017 and 2016. We also have borrowing capacity under our revolving credit facility and the potential to generate cash through the issuance of debt or equity securities, to meet short-term funding requirements. The following table presents our cash flow activities for the stated periods:

|

| | | | | | |

| | Six Months Ended

June 30, |

| (in thousands) | 2017 | 2016 |

| Net cash provided by (used in): | | |

| Operating activities | $ | 104,113 |

| $ | 43,667 |

|

| Investing activities | (9,256 | ) | (6,975 | ) |

| Financing activities | (45,141 | ) | (36,230 | ) |

| Effect of exchange rates on cash and cash equivalents | 163 |

| 24 |

|

| Net increase in cash and cash equivalents | $ | 49,879 |

| $ | 486 |

|

Operating Activities

Components of net cash provided by operating activities are as follows:

|

| | | | | | |

| | Six Months Ended

June 30, |

| (in thousands) | 2017 | 2016 |

| Net income | $ | 68,688 |

| $ | 23,859 |

|

| Depreciation and amortization | 16,496 |

| 17,919 |

|

| Stock-based compensation expense | 13,706 |

| 13,905 |

|

| Payment of interest | (8,006 | ) | (8,091 | ) |

| Income tax (payments) refunds, net | 169 |

| (21,374 | ) |

| Collateral (paid to) refunded from insurance carriers, net | 4,729 |

| (14,053 | ) |

| Changes in other operating assets and liabilities | 8,331 |

| 31,502 |

|

| Net cash provided by operating activities | $ | 104,113 |

| $ | 43,667 |

|

The period-to-period fluctuation in cash provided by operating activities is primarily driven by the 188% increase in our net income, changes in other operating assets and liabilities, which are primarily driven by timing of payments related to WSE related assets and liabilities and our accrued expenses related to corporate employee compensation related payables, reductions to our taxes paid, and decreases in collateral payments made to our insurance carriers. |

| | | | | | |

| | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 |

| Net cash provided by (used in): | | |

| Operating activities | $ | 158,951 |

| $ | 80,699 |

|

| Investing activities | (14,763 | ) | (17,411 | ) |

| Financing activities | (65,063 | ) | (68,998 | ) |

| Effect of exchange rates on cash and cash equivalents | 398 |

| 90 |

|

| Net increase in cash and cash equivalents | $ | 79,523 |

| $ | (5,620 | ) |

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Operating Activities

Components of net cash provided by operating activities are as follows:

|

| | | | | | |

| | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 |

| Net income | $ | 111,524 |

| $ | 38,440 |

|

| Depreciation and amortization | 26,177 |

| 27,810 |

|

| Stock-based compensation expense | 21,406 |

| 20,169 |

|

| Payment of interest | (12,186 | ) | (11,651 | ) |

| Income tax (payments) refunds, net | 138 |

| (27,650 | ) |

| Collateral (paid to) refunded from insurance carriers, net | (3,163 | ) | (22,911 | ) |

| Changes in other operating assets and liabilities | 15,055 |

| 56,492 |

|

| Net cash provided by operating activities | $ | 158,951 |

| $ | 80,699 |

|

The period-to-period fluctuation in cash provided by operating activities is primarily driven by the 190% increase in our net income, decrease in payments of our tax liabilities, decreases in collateral paid to our workers' compensation insurance carriers, changes in other operating assets and liabilities, which are primarily driven by the timing of payments related to WSE related assets and liabilities, and our accrued expenses related to corporate employee compensation related payables.

Investing Activities

Net cash used in investing activities in the first halfnine months of 2017 and 2016 primarily consisted of cash paid for capital expenditures, offset partially by proceeds from the maturity of investments.

| | | | Six Months Ended

June 30, | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 | 2017 | 2016 |

| Capital expenditures: | | |

| Software and hardware | $ | 13,279 |

| $ | 12,870 |

| $ | 22,816 |

| $ | 21,515 |

|

| Office furniture, equipment and leasehold improvements | 7,446 |

| 3,844 |

| 6,394 |

| 6,427 |

|

| Cash used in capital expenditures | $ | 20,725 |

| $ | 16,714 |

| $ | 29,210 |

| $ | 27,942 |

|

| | | |

| Investments: | | |

| Purchases of restricted investments | $ | — |

| $ | (14,959 | ) | $ | — |

| $ | (14,959 | ) |

| Proceeds from maturity of restricted investments | 11,469 |

| 24,998 |

| 14,447 |

| 25,790 |

|

| Cash provided by investments | $ | 11,469 |

| $ | 10,039 |

| $ | 14,447 |

| $ | 10,831 |

|

Capital expenditures increased in the first halfnine months of 2017 compared to the same period in 2016, primarily due to the build out of our technology and client service centers. We also increased our investments in software and hardware to introduce new products, enhance existing products and platforms, as well as complete platform integrations. We expect capital investments in our software and hardware to continue in the future.

We invest cash held as collateral to satisfy our long-term obligation towards the workers' compensation liabilities in U.S. long-term treasuries and mutual funds. We review the amount of investment and the anticipated holding period regularly, in conjunction with our estimated long-term workers' compensation liabilities and anticipated claims payment trend.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Financing Activities

Net cash used in financing activities in the first halfnine months of 2017 and 2016 consisted primarily of repurchases of our common stock and repayment of debt.

The board of directors from time to time authorizes stock repurchases of our outstanding common stock primarily to offset dilution from the issuance of stock under our equity-based incentive plan and employee stock purchase plan. During the first halfnine months of 2017, we repurchased 1.11.4 million shares of common stock for $29.5$39.3 million. As of JuneSeptember 30, 2017, approximately $30.5$20.7 million remained available for repurchase. Our debt repayments were also $3.7 million lower in the first half of 2017 compared to the same periods in 2016.

Critical Accounting Policies, Estimates and Judgments

There have been no material changes to our critical accounting policies as discussed in our 2016 Form 10-K.

Recent Accounting Pronouncements

Refer to Note 1 in the condensed consolidated financial statements and related notes included in this Form 10-Q.

|

| |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK AND CONTROLS AND PROCEDURES | |

Quantitative and Qualitative Disclosures About Market Risk

There has been no material change in our exposure to market risks from that discussed in Item 7A of our 2016 Form 10-K.

Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We have, with the participation of our Chief Executive Officer (CEO) and our Chief Financial Officer (CFO), evaluated the effectiveness of our disclosure controls and procedures as of JuneSeptember 30, 2017. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended, or the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms.

Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure. Based on the evaluation of our disclosure controls and procedures as of JuneSeptember 30, 2017, our Chief Executive OfficerCEO and Chief Financial OfficerCFO concluded that, as of such date, our disclosure controls and procedures were not effective as a result of the material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

Notwithstanding the material weaknesses in our internal control over financial reporting, we have concluded that the condensed consolidated financial statements included in this Quarterly Report on Form 10-Q fairly present, in all material respects, our financial position, results of operations and cash flows for the periods presented in conformity with accounting principles generally accepted in the United States of America. Additionally, the material weaknesses did not result in any restatements of our condensed consolidated financial statements or disclosures for any prior period.

Additional Analyses and Procedures and Remediation Plan

We are taking specific steps to remediate the material weaknesses identified by management and described in greater detail in our 2016 Form 10-K. Although we intend to complete the remediation process with respect to these material weaknesses as quickly as possible, we cannot at this time estimate how long it will take, and our remediation plan may not prove to be successful.

Because the reliability of the internal control process requires repeatable execution, the successful remediation of these material weaknesses will require review and evidence of effectiveness prior to concluding that the controls are effective and there is no assurance that additional remediation steps will not be necessary. As such, as we continue to evaluate and work to improve our internal control over financial reporting, our management may decide to take additional measures to address the material weaknesses or modify the remediation steps already underway. As noted above, although we plan to complete the remediation process as quickly as possible, we cannot at this time estimate how long it will take, and our initiatives may not prove to be successful. Accordingly, until these weaknesses are remediated, we plan to perform additional analyses and other procedures to ensure that our condensed consolidated financial statements are prepared in accordance with GAAP.

Changes in Internal Control Over Financial Reporting

Other than the remediation efforts underway, there were no changes in our internal control over financial reporting identified in connection with the evaluation required by Rule 13a-15(d) and 15d-15(d) of the Exchange Act that occurred during the quarter ended JuneSeptember 30, 2017, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Limitations on Effectiveness of Controls and Procedures

In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives. In addition, the design of disclosure controls and procedures must reflect the fact that there are resource constraints and that management is required to apply judgment in evaluating the benefits of possible controls and procedures relative to their costs.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | (in thousands, except share and per share data) | June 30,

2017 | December 31,

2016 | September 30,

2017 | December 31,

2016 |

| Assets |

| | |

| Current assets: |

| | | |

| Cash and cash equivalents | $ | 233,883 |

| $ | 184,004 |

| $ | 263,527 |

| $ | 184,004 |

|

| Restricted cash and cash equivalents | 14,589 |

| 14,569 |

| 15,445 |

| 14,569 |

|

| Prepaid income taxes | 14,716 |

| 42,381 |

| — |

| 42,381 |

|

| Prepaid expenses | 13,013 |

| 10,784 |

| 11,013 |

| 10,784 |

|

| Other current assets | 2,172 |

| 2,145 |

| 2,360 |

| 2,145 |

|

| Worksite employee related assets | 898,596 |

| 1,281,471 |

| 941,213 |

| 1,281,471 |

|

| Total current assets | 1,176,969 |

| 1,535,354 |

| 1,233,558 |

| 1,535,354 |

|

| Workers' compensation collateral receivable | 27,063 |

| 31,883 |

| 39,931 |

| 31,883 |

|

| Restricted cash, cash equivalents and investments | 150,939 |

| 130,501 |

| 160,207 |

| 130,501 |

|

| Property and equipment, net | 66,827 |

| 58,622 |

| 68,470 |

| 58,622 |

|

| Goodwill | 289,207 |

| 289,207 |

| 289,207 |

| 289,207 |

|

| Other intangible assets, net | 28,408 |

| 31,074 |

| 27,108 |

| 31,074 |

|

| Other assets | 19,282 |

| 18,502 |

| 18,444 |

| 18,502 |

|

| Total assets | $ | 1,758,695 |

| $ | 2,095,143 |

| $ | 1,836,925 |

| $ | 2,095,143 |

|

| Liabilities and stockholders’ equity | |

| | |

| |

| Current liabilities: | |

| | |

| |

| Accounts payable | $ | 26,599 |

| $ | 22,541 |

| $ | 28,995 |

| $ | 22,541 |

|

| Accrued corporate wages | 38,196 |

| 30,937 |

| 31,814 |

| 30,937 |

|

| Notes and capital leases payable, net | 36,648 |

| 36,559 |

| 36,718 |

| 36,559 |

|

| Other current liabilities | 13,735 |

| 12,551 |

| 14,321 |

| 12,551 |

|

| Worksite employee related liabilities | 893,110 |

| 1,275,995 |

| 934,868 |

| 1,275,995 |

|

| Total current liabilities | 1,008,288 |

| 1,378,583 |

| 1,046,716 |

| 1,378,583 |

|

| Notes and capital leases payable, net, noncurrent | 404,157 |

| 422,495 |

| 394,972 |

| 422,495 |

|

Workers' compensation loss reserves

(net of collateral paid of $22,911 and $22,377 at June 30, 2017 and December 31, 2016, respectively) | 151,837 |

| 159,301 |

| |

Workers' compensation loss reserves

(net of collateral paid of $20,307 and $22,377 at September 30, 2017 and December 31, 2016, respectively) | | 157,999 |

| 159,301 |

|

| Deferred income taxes | 91,828 |

| 92,373 |

| 90,845 |

| 92,373 |

|

| Other liabilities | 11,072 |

| 7,801 |

| 14,534 |

| 7,801 |

|

| Total liabilities | 1,667,182 |

| 2,060,553 |

| 1,705,066 |

| 2,060,553 |

|

| Commitments and contingencies (see Note 9) |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

| |

|

| |

Preferred stock

($0.000025 par value per share; 20,000,000 shares authorized; no shares issued and outstanding at June 30, 2017 and December 31, 2016) | — |

| — |

| |

Common stock and additional paid-in capital

($0.000025 par value per share; 750,000,000 shares authorized; 69,429,088 and 69,015,690 shares issued and outstanding at June 30, 2017 and December 31, 2016, respectively) | 557,183 |

| 535,132 |

| |

Preferred stock

($0.000025 par value per share; 20,000,000 shares authorized; no shares issued and outstanding at September 30, 2017 and December 31, 2016) | | — |

| — |

|

Common stock and additional paid-in capital

($0.000025 par value per share; 750,000,000 shares authorized; 69,536,268 and 69,015,690 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively) | | 567,971 |

| 535,132 |

|

| Accumulated deficit | (465,146 | ) | (499,938 | ) | (435,739 | ) | (499,938 | ) |

| Accumulated other comprehensive loss | (524 | ) | (604 | ) | (373 | ) | (604 | ) |

| Total stockholders’ equity | 91,513 |

| 34,590 |

| 131,859 |

| 34,590 |

|

| Total liabilities and stockholders’ equity | $ | 1,758,695 |

| $ | 2,095,143 |

| $ | 1,836,925 |

| $ | 2,095,143 |

|

See accompanying notes.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (in thousands, except share and per share data) | 2017 | 2016 | | 2017 | 2016 |

| Professional service revenues | $ | 108,642 |

| $ | 109,593 |

| | $ | 228,763 |

| $ | 221,996 |

|

| Insurance service revenues | 691,899 |

| 636,253 |

| | 1,379,388 |

| 1,256,789 |

|

| Total revenues | 800,541 |

| 745,846 |

| | 1,608,151 |

| 1,478,785 |

|

| Insurance costs | 599,535 |

| 596,673 |

| | 1,208,177 |

| 1,166,362 |

|

| Cost of providing services (exclusive of depreciation and amortization of intangible assets) | 50,825 |

| 44,034 |

| | 107,275 |

| 89,739 |

|

| Sales and marketing | 45,940 |

| 43,800 |

| | 95,131 |

| 92,508 |

|

| General and administrative | 28,224 |

| 18,951 |

| | 53,526 |

| 46,601 |

|

| Systems development and programming | 11,415 |

| 6,457 |

| | 22,455 |

| 12,846 |

|

| Amortization of intangible assets | 1,316 |

| 5,005 |

| | 2,666 |

| 9,985 |

|

| Depreciation | 6,451 |

| 4,559 |

| | 12,599 |

| 8,475 |

|

| Total costs and operating expenses | 743,706 |

| 719,479 |

| | 1,501,829 |

| 1,426,516 |

|

| Operating income | 56,835 |

| 26,367 |

| | 106,322 |

| 52,269 |

|

| Other income (expense): | | | | | |

| Interest expense and bank fees | (4,857 | ) | (5,038 | ) | | (9,605 | ) | (10,080 | ) |

| Other, net | 271 |

| 163 |

| | 422 |

| 121 |

|

| Income before provision for income taxes | 52,249 |

| 21,492 |

| | 97,139 |

| 42,310 |

|

| Income tax expense | 12,298 |

| 9,210 |

| | 28,451 |

| 18,451 |

|

| Net income | $ | 39,951 |

| $ | 12,282 |

| | $ | 68,688 |

| $ | 23,859 |

|

| Other comprehensive income, net of tax | 68 |

| 74 |

| | 80 |

| 425 |

|

| Comprehensive income | $ | 40,019 |

| $ | 12,356 |

| | $ | 68,768 |

| $ | 24,284 |

|

| | | | | | |

| Net income per share: | | | | | |

| Basic | $ | 0.58 |

| $ | 0.17 |

| | $ | 1.00 |

| $ | 0.34 |

|

| Diluted | $ | 0.56 |

| $ | 0.17 |

| | $ | 0.97 |

| $ | 0.33 |

|

| Weighted average shares: | | | | |

| |

| Basic | 69,029,749 |

| 70,728,934 |

| | 68,770,976 |

| 70,625,000 |

|

| Diluted | 71,167,177 |

| 72,319,992 |

| | 71,101,716 |

| 72,022,065 |

|

See accompanying notes.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWSINCOME AND COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | |

| | Six Months Ended

June 30, |

| (in thousands) | 2017 | 2016 |

| Operating activities | | |

| Net income | $ | 68,688 |

| $ | 23,859 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| Depreciation and amortization | 16,496 |

| 17,919 |

|

| Stock-based compensation | 13,706 |

| 13,905 |

|

| Changes in operating assets and liabilities: | | |

| Restricted cash and cash equivalents | (31,982 | ) | (21,041 | ) |

| Prepaid income taxes | 27,665 |

| (2,863 | ) |

| Prepaid expenses and other current assets | (2,601 | ) | (5,033 | ) |

| Workers' compensation collateral receivable | 4,820 |

| (10,599 | ) |

| Other assets | 91 |

| 238 |

|

| Accounts payable | 4,002 |

| 2,488 |

|

| Accrued corporate wages and other current liabilities | 8,299 |

| (719 | ) |

| Workers' compensation loss reserves and other non-current liabilities | (5,061 | ) | 25,792 |

|

| Worksite employee related assets | 382,875 |

| 425,815 |

|

| Worksite employee related liabilities | (382,885 | ) | (426,094 | ) |

| Net cash provided by operating activities | 104,113 |

| 43,667 |

|

| Investing activities | | |

| Acquisitions of businesses | — |

| (300 | ) |

| Purchases of marketable securities | — |

| (14,959 | ) |

| Proceeds from maturity of marketable securities | 11,469 |

| 24,998 |

|

| Acquisitions of property and equipment | (20,725 | ) | (16,714 | ) |

| Net cash used in investing activities | (9,256 | ) | (6,975 | ) |

| Financing activities | | |

| Repurchase of common stock | (29,510 | ) | (16,459 | ) |

| Proceeds from issuance of common stock on exercised options | 5,586 |

| 2,220 |

|

| Proceeds from issuance of common stock on employee stock purchase plan | 2,441 |

| 2,304 |

|

| Awards effectively repurchased for required employee withholding taxes | (4,507 | ) | (1,485 | ) |

| Repayment of notes and capital leases payable | (19,151 | ) | (22,810 | ) |

| Net cash used in financing activities | (45,141 | ) | (36,230 | ) |

| Effect of exchange rate changes on cash and cash equivalents | 163 |

| 24 |

|

| Net increase in cash and cash equivalents | 49,879 |

| 486 |

|

| Cash and cash equivalents at beginning of period | 184,004 |

| 166,178 |

|

| Cash and cash equivalents at end of period | $ | 233,883 |

| $ | 166,664 |

|

| | | |

| Supplemental disclosures of cash flow information | | |

| Interest paid | $ | 8,006 |

| $ | 8,091 |

|

| Income taxes paid (refunded), net | (169 | ) | 21,374 |

|

| Supplemental schedule of noncash investing and financing activities | | |

| Payable for purchase of property and equipment | $ | 1,580 |

| $ | 1,581 |

|

|

| | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands, except share and per share data) | 2017 | 2016 | | 2017 | 2016 |

| Professional service revenues | $ | 112,530 |

| $ | 110,493 |

| | $ | 341,293 |

| $ | 332,489 |

|

| Insurance service revenues | 706,763 |

| 659,964 |

| | 2,086,151 |

| 1,916,753 |

|

| Total revenues | 819,293 |

| 770,457 |

| | 2,427,444 |

| 2,249,242 |

|

| Insurance costs | 613,397 |

| 609,422 |

| | 1,821,574 |

| 1,775,784 |

|

| Cost of providing services (exclusive of depreciation and amortization of intangible assets) | 49,989 |

| 50,142 |

| | 157,264 |

| 139,881 |

|

| Sales and marketing | 44,407 |

| 41,470 |

| | 139,538 |

| 133,978 |

|

| General and administrative | 28,505 |

| 22,477 |

| | 82,031 |

| 69,078 |

|

| Systems development and programming | 11,182 |

| 8,124 |

| | 33,637 |

| 20,970 |

|

| Amortization of intangible assets | 1,300 |

| 4,662 |

| | 3,966 |

| 14,647 |

|

| Depreciation | 7,754 |

| 5,188 |

| | 20,353 |

| 13,663 |

|

| Total costs and operating expenses | 756,534 |

| 741,485 |

| | 2,258,363 |

| 2,168,001 |

|

| Operating income | 62,759 |

| 28,972 |

| | 169,081 |

| 81,241 |

|

| Other income (expense): | | | | | |

| Interest expense and bank fees | (5,425 | ) | (5,597 | ) | | (15,030 | ) | (15,677 | ) |

| Other, net | 770 |

| 313 |

| | 1,192 |

| 434 |

|

| Income before provision for income taxes | 58,104 |

| 23,688 |

| | 155,243 |

| 65,998 |

|

| Income tax expense | 15,268 |

| 9,107 |

| | 43,719 |

| 27,558 |

|

| Net income | $ | 42,836 |

| $ | 14,581 |

| | $ | 111,524 |

| $ | 38,440 |

|

| Other comprehensive income, net of tax | 151 |

| (125 | ) | | 231 |

| 300 |

|

| Comprehensive income | $ | 42,987 |

| $ | 14,456 |

| | $ | 111,755 |

| $ | 38,740 |

|

| | | | | | |

| Net income per share: | | | | | |

| Basic | $ | 0.62 |

| $ | 0.21 |

| | $ | 1.62 |

| $ | 0.55 |

|

| Diluted | $ | 0.60 |

| $ | 0.20 |

| | $ | 1.57 |

| $ | 0.53 |

|

| Weighted average shares: | | | | |

| |

| Basic | 69,498,218 |

| 70,187,989 |

| | 69,016,054 |

| 70,478,266 |

|

| Diluted | 71,499,591 |

| 71,964,603 |

| | 71,138,743 |

| 72,126,060 |

|

See accompanying notes.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

| | | | | | |

| | Nine Months Ended

September 30, |

| (in thousands) | 2017 | 2016 |

| Operating activities | | |

| Net income | $ | 111,524 |

| $ | 38,440 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| Depreciation and amortization | 26,177 |

| 27,810 |

|

| Stock-based compensation | 21,406 |

| 20,169 |

|

| Changes in operating assets and liabilities: | | |

| Restricted cash and cash equivalents | (45,570 | ) | (31,409 | ) |

| Prepaid income taxes | 42,448 |

| 386 |

|

| Prepaid expenses and other current assets | (961 | ) | (5,253 | ) |

| Workers' compensation collateral receivable | (8,048 | ) | (11,374 | ) |

| Other assets | 925 |

| 438 |

|

| Accounts payable | 5,505 |

| 4,538 |

|

| Accrued corporate wages and other current liabilities | 2,331 |

| 4,548 |

|

| Workers' compensation loss reserves and other non-current liabilities | 3,574 |

| 33,510 |

|

| Worksite employee related assets | 340,767 |