UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 20202021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36373

TRINET GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | | | | | | | | | |

| Delaware | | 95-3359658 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| One Park Place, | Suite 600 | | |

| Dublin, | CA | | 94568 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (510) (510) 352-5000

Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock par value $0.000025 per share | TNET | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| | | |

| Non-accelerated filer | o | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes o No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of shares of Registrant’s Common Stock outstanding as of April 21, 202019, 2021 was 67,290,388.

TRINET GROUP, INC.

Form 10-Q - Quarterly Report

For the Quarterly Period Ended March 31, 20202021

TABLE OF CONTENTS

|

| | | | | | | |

| Form 10-Q Cross Reference | Page |

| | |

| Part I, Item 1. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Part I, Item 2. | |

| Part I, Item 3. | |

| Part I, Item 4. | |

| Part II, Item 1. | |

| Part II, Item 1A. | |

| Part II, Item 2. | |

| Part II, Item 3. | |

| Part II, Item 4. | |

| Part II, Item 5. | |

| Part II, Item 6. | |

Glossary of Acronyms and Abbreviations

Acronyms and abbreviations are used throughout this report, particularly in Part I, Item 1. Unaudited Condensed Consolidated Financial Statements and Part I, Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

| | | | | |

| |

AFS | Available-for-sale |

ASC2021 Credit Program | Accounting standards codificationA program that, subject to certain predefined conditions, is designed to take certain pandemic related excess health care cost savings and provide credits to certain 2021 customers. |

ASU2018 Term Loan | Accounting standards updateOur $425 million term loan A that we entered into in June 2018 |

CEOAFS | Available-for-sale |

| |

| |

| CARES Act | Coronavirus Aid Relief and Economic Security Act |

| |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

COPSCOBRA | Consolidated Omnibus Budget Reconciliation Act |

| COPS | Cost of providing services |

COVID-19 | Novel coronavirus |

| COVID-19 | Novel coronavirus |

| |

| |

| D&A | Depreciation and Amortizationamortization expenses |

| EBITDA | Earnings before interest expense, taxes, depreciation and amortization of intangible assets |

EPS | |

| EPS | Earnings Per Share |

| ERISA | Employee Retirement Income Security Act of 1974 |

ETRESAC | Employer Services Assurance Corporation |

| |

| ETR | Effective tax rate |

FASB | Financial Accounting Standards Board |

| FFCRA | Families First Coronavirus Response Act |

| G&A | General and administrative |

| GAAP | Generally Accepted Accounting Principles in the United States |

HR | Human Resources |

IRS | |

| HR | Human Resources |

| |

| |

| |

| IRS | Internal Revenue Service |

| ISR | Insurance service revenues |

LIBOR | |

| |

| LIBOR | London Inter-bank Offered Rate |

MCT | Medical cost trend |

| MD&A | Management's Discussion and Analysis of Financial Condition and Results of Operations |

| NIM | Net Insurance Margin |

| NISR | Net Insurance Service Revenues |

| NSR | Net service revenues |

| OE | Operating expenses |

PFC | |

| PEO | Professional Employer Organization |

| PFC | Payroll funds collected |

PSR | |

| PPP | Paycheck Protection Program, a loan program administered by the U.S. Small Business Administration |

| PSR | Professional service revenues |

| Recovery Credit | Program to provide clients with one-time reductions against fees for future services |

| Reg FD | Regulation Fair Disclosure |

RSAROU | Right-of-use |

| RSA | Restricted Stock Award |

| RSU | Restricted Stock Unit |

| SBC | Stock Based Compensation |

| S&M | Sales and marketing |

| S&P | Standard & Poor's |

| SD&P | Systems development and programming |

| SEC | U.S. Securities and Exchange Commission |

| SMB | Small to midsizeand medium-size business |

U.S. | United States |

WSE | |

| U.S. | United States |

| |

| WSE | Worksite employee |

| YTD | Year to date |

| |

|

| | | | |

| FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION | |

Cautionary Note Regarding Forward-Looking Statements and Other Financial Information

For purposes of this Quarterly Report on Form 10-Q (Form 10-Q), the terms “TriNet,” “the Company,” “we,” “us” and “our” refer to TriNet Group, Inc., and its subsidiaries. This Form 10-Q contains statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as, but not limited to, "ability," “anticipate,” “believe,” “can,” “continue,” “could,” “design,” “estimate,” “expect,” “forecast,” “hope,” "impact," “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” "value," “will,” “would” and similar expressions or variations intended to identify forward-looking statements. Examples of forward-looking statements include, among others, TriNet’s expectations regarding: our ability to support the economic recovery of our clients and SMBs; our ability to respond appropriately to the impact of COVID-19 on our business and our clients' businesses; the impact of our Connect 360 service model; the effect that our offering of $500 million of our 3.50% senior notes and of our replacement of our existing revolving facility with our new $500 million revolving facility will have on our business; the timing and strategies we employ with respect to corporate investments and capital expenditures; expectations regarding medical utilization rates by our WSEs; the impact of the COVID-19 pandemic;pandemic on regulations and government programs; the impact of our Recovery Credit program and our 2021 Credit Program and their suitability for generating client loyalty and retention; our ability to modify product andor develop service offerings to assist clients affected by COVID-19; the impact of our vertical approach,approach; our ability to leverage our scale and industry HR experience to deliver vertical product and service offerings; the growth of our customerclient base; planned improvements to our technology platform; our ability to drive operating efficiencies and improve the customerclient experience; the impact of our customerclient service initiatives; the volume and severity of insurance claims and the impact of COVID-19;COVID-19 on those claims; metrics that may be indicators of future financial performance; the relative value of our benefit offerings versus those SMBs can independently obtain; the principal competitive drivers in our market; our plans to retain clients and manage client attrition; our investment strategy and its impact on our ability to generate future interest income, net income, and Adjusted EBITDA; seasonal trends and their impact on our business, and the impact ofincluding due to COVID-19; fluctuations in the period-to-period timing of when we incur certain operating expenses; the estimates and assumptions we use to prepare our financial statements; and other expectations, outlooks and forecasts on our future business, operational and financial performance.

Important factors that could cause actual results, level of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements are discussed above and throughout our Annual Report on Form 10-K for the year ended December 31, 20192020 filed with the SEC on February 13,16, 2021 (our 2020 (2019 Form 10-K), including those appearing under the heading “Risk Factors” in Item 1A, and under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of our 20192020 Form 10-K, the risks appearing under the heading “Risk Factors” in Item Part II, Item 1A of this Form 10-Q, as well as in our other periodic filings with the SEC, and including risk factors associated with: the economic, health and business disruption caused by the COVID-19 pandemic; the impact of the COVID-19 pandemic on our businessclients and prospects, insurance costs and operations; the businessimpact of the COVID-19 pandemic on the laws and regulations that impact our industry and clients; our ability to mitigate the business risks we face as a co-employer; our ability to manage unexpected changes in workers’ compensation and health insurance claims and costs by worksite employees; the effects of volatility in the financial and economic environment on the businesses that make up our client base; the impact ofbase and the concentration of our clients in certain geographies and industries; the impact of failures or limitations in the business systems we rely upon; the impact of our Recovery Credit program; adverse changes in our insurance coverage or our relationships with key insurance carriers; our ability to manage our client attrition; our ability to improve our technology to satisfy regulatory requirements and meet the expectations of our clients;clients and manage client attrition; our ability to effectively integrate businesses we have acquired or may acquire in the future; our ability to effectively manage and improve our operational processes; our ability to attract and retain qualified personnel; the effects of increased competition and our ability to compete effectively; the impact on our business of cyber-attacks and security breaches; our ability to secure our information technology infrastructure and our confidential, sensitive and personal information from cyber-attacks and security breaches;information; our ability to comply with constantly evolving data privacy and security laws; our ability to manage changes in, uncertainty regarding, or adverse application of the complex laws and regulations that govern our business; changing laws and regulations governing health insurance and employee benefits; our ability to be recognized as an employer of worksite employees under federal and state regulations; changes in the laws and regulations that govern what it means to be an employer, employee or independent contractor; our ability to comply with the laws and regulations that govern PEOs and other similar industries; the outcome of existing and future legal and tax proceedings; fluctuation in our results of operation and stock price due to factors outside of our control, such as the volume and severity of our workers’ compensation and health insurance claims and the amount and timing of our insurance costs, operating expenses and capital expenditure requirements; our ability to comply with the restrictions of our credit facility and meet our debt obligations; and the impact of concentrated ownership in our stock. Any of these factors could cause our actual results to differ materially from our anticipated results.

| | | | | |

| FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION | |

Forward-looking statements are not guarantees of future performance, but are based on management’s expectations as of the date of this Form 10-Q and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current

|

| |

FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION | |

expectations and any past results, performance or achievements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The information provided in this Form 10-Q is based upon the facts and circumstances known as of the date of this Form 10-Q, and any forward-looking statements made by us in this Form 10-Q speak only as of the date of this Form 10-Q. We undertake no obligation to revise or update any of the information provided in this Form 10-Q, except as required by law.

The MD&A of this Form 10-Q includes references to our performance measures presented in conformity with GAAP and other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plans. Refer to the Non-GAAP Financial Measures in our Key Financial and Operating Metrics section within our MD&A for definitions and reconciliations from GAAP measures.

Website Disclosures

We use our website (www.trinet.com) to announce material non-public information to the public and to comply with our disclosure obligations under Regulation Fair Disclosure (Reg FD). We also use our website to communicate with the public about our Company, our services, and other issues.matters. Our SEC filings, press releases and recent public conference calls and webcasts can also be found on our website. The information we post on our website could be deemed to be material information under Reg FD. We encourage investors and others interested in our Company to review the information we post on our website. Information contained in or accessible through our website is not a part of this report.

Risk Factors

Other than the inclusion of the additional risk factor below, there have been no material changes in our risk factors disclosed in Part 1, Item 1A. of our 2019 Form 10-K.

The unprecedented economic, health and business disruption caused by the COVID-19 pandemic is impacting our business and could result in a material adverse effect on our business, results of operation and/or financial condition.

The outbreak of the novel coronavirus (COVID-19) pandemic and the measures being taken at every level of government to prevent its spread have resulted in an economic slowdown and an unprecedented disruption to our business and the businesses of our small and mid-size business clients. We cannot predict or control all of these disruptions, and any such disruptions may have a material adverse effect on our financial condition and results of operations.

Actual and potential impact on clients and prospects

This change in the economic environment is starting to have, and will continue to have, an adverse economic impact on our small and mid-size business clients and potential clients. We are seeing affected businesses freeze and furlough headcount, terminate employees, partially or completely shut down business operations, and business failures. Impacted businesses may also face liquidity issues, reduced budgets, and may otherwise be unable to pay for our services or the same level of our services. All of these issues have the potential to result in a material adverse effect on our revenues and margins, our financial condition and results of operations, and/or on our ability to attract and retain customers. See the risk factor titled “Our SMB clients are particularly affected by volatility in the financial and economic environment, which could harm our business” in our 2019 Form 10-K for more details.

Shelter-in-place, quarantine and other similar orders have been widely issued across the United States, including in all or nearly all of the locations where our clients and potential clients are located. We cannot predict the length of such measures in any given location. To the extent that these regions become hot spots for COVID-19 the length of these measures may be extended, which could have a further negative impact on the businesses of our clients and potential clients and result in a material adverse effect on our business.

Actual and potential impact on insurance costs

The spread of COVID-19 has changed how and when our WSEs incur group health insurance expenses. As a result, we are beginning to experience and expect to continue to experience higher than normal volatility and variability in the amounts that we pay for group health insurance expenses incurred by WSEs within our deductible layer under our risk-based health insurance policies, due to changing trends in the volume and severity of medical and pharmaceutical claims, including COVID-19 testing and treatment costs. This variability arises from changes to the timing and components of medical cost trend (MCT), defined as changes in participant use of services, the introduction of new treatment options, changes in treatment guidelines and mandates, and changes in the mix, unit cost and timing of services provided to plan participants. It is difficult for us to predict how this MCT and these aspects of our business will change as a result of the COVID-19 pandemic, and any such changes may have a material adverse effect on our business. COVID-19 stay-at-home orders and social distancing policies are decreasing, and we expect will continue to decrease, the near-term utilization of medical services as enrollees defer or cancel elective procedures and reduce outpatient medical, dental and vision services, however, we cannot predict the rate at which enrollees will increase utilization of medical services in subsequent quarters once COVID-19 stay-at-home order and social distancing policies are lifted. For details on how medical cost trend impacts our insurance costs, see Critical Accounting Judgments and Estimates in Part II, Item 7. MD&A, in our Form 10-K, and see the risk factor titled “Unexpected changes in workers’ compensation and health insurance costs and claims by worksite employees could harm our business” in our 2019 Form 10-K for more details. In addition, California and Illinois are contemplating proposals that could require employers to presumptively cover COVID-19 related workers’ compensation claims of employees working during stay-at-home orders. Our insurance costs are affected by our WSE’s workers’ compensation insurance claims experience, and any law that increases the number of workers’ compensation claims under our insurance policies could have a material adverse effect on our insurance costs and financial condition. See the risk factor titled “Unexpected changes in workers’ compensation and health insurance costs and claims by worksite employees could harm our business” in our 2019 Form 10-K for more details.

Actual and potential impact of the laws governing our industry

Every level of government is enacting new laws and programs to help the economy, employers and employees. For example, Congress recently enacted the Families First Coronavirus Relief Act and the Coronavirus Aid, Relief and Economic Security Act, which created numerous new programs, including new mandatory employee leave requirements, new payroll tax deferral and tax credit programs and other employment- and employment tax-related incentives. Additional federal laws may be passed and many states are following suit with similar sweeping legislation. We are spending, and will continue to spend, significant time and resources to comply with new laws and to provide the COVID-10 assistance programs created by these laws for our clients. Most of these laws and programs have not been, and we do not anticipate will be, enacted with the PEO industry in mind. As a result, we cannot guarantee we will be able to support all of these laws and programs in a timely and cost effective manner or at all, which could reduce or eliminate the attractiveness of our products and services and/or affect the ability of our clients to realize all the benefits of these laws and programs. In addition, since many of these laws do not specifically address the PEO industry and regulators are unfamiliar with the PEO industry, we expect to experience unpredictable and inconsistent application, interpretation and enforcement of these laws and regulations, which could have a material adverse effect on our business. See the risk factor titled “Our business is subject to numerous complex laws, and changes in, uncertainty regarding, or adverse application of these laws could negatively affect our business” in our 2019 Form 10-K for more details.

Actual and potential impact on human resources and cyber security

In response to local laws and guidance intended to reduce the spread of COVID-19, in mid-March we closed our offices across the country and implemented remote working. Remote work increases our risk of experiencing a material cyber-attack or other security-related incident. See the risk factor titled “Cyber-attacks or other security-related incidents could result in reduced revenue, increased costs, liability claims, regulatory penalties, and damage to our reputation” in our 2019 Form 10-K for more details. In addition, responding to the COVID-19 pandemic has diverted, and will continue to divert, the time and attention of our management and service teams. Certain of our employees and their immediate families have been and will likely become ill as a result of COVID-19, which may reduce the staff we have available. As a result, our ability to provide products and services in the same way and in the same timeframe that our clients have come to expect may be negatively impacted.

Actual and potential impact of the risks described above

Any of the risks above could have a material adverse effect on our business, results of operations or financial condition. However, the extent to which such COVID-19 related risks will impact our business remains uncertain and will depend on a variety of factors that are changing on a day-to-day basis and that we may not be able to accurately predict, such as the duration and scope of the pandemic, the disruption of the national and global economy caused by the pandemic, the length of the economic downturn, the laws, programs and actions that governments will take in response to the pandemic, the extent to which our clients businesses contract or fail during the pandemic, the extent to which new laws intended to help small and mid-size businesses can be supported by the PEO industry, the extent to which our own operations are impacted by office closures, remote work and/or infections. and how quickly and to what extent normal economic and operating conditions can resume. Any of these factors could exacerbate the risks and uncertainties identified above or that are set forth in our 2019 Form 10-K, and result in a material adverse effect on our business, financial condition and results of operations.

|

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Overview

TriNet is a leading provider of HR expertise, payroll services, employee benefits and employment risk mitigation services for SMBs. We deliver a comprehensive suite of products and services that facilitates the administrationhelp our clients administer and management ofmanage various HR-related needs and functions, for our clients, includingsuch as compensation and benefits, payroll processing, employee data, health insurance and workers' compensation programs, and other transactional HR needs using our technology platform and HR, benefits and compliance expertise. We empower SMBs to focus on what matters most - growing their business.

We also leverage our scale and industry HR experience to deliver product andour service offerings for SMBs in specific industries.industry verticals. We believe our approach, which we call our vertical approach is a key differentiator for us and creates additional value for our clients driven by allowing our product and service offerings that are tailored to address industry-specific HR needs in different client industries.needs. We offer six industry-tailored vertical products,services: TriNet Financial Services, TriNet Life Sciences, TriNet Main Street, TriNet Nonprofit, TriNet Professional Services, and TriNet Technology.

Operational Highlights

Our consolidated results for the first quarter of 20202021 reflect growth, disciplined financial management, and our continuing focus on servingefforts to serve our customers and improving our brand awareness through our marketing campaign: People Matter.

Our customers are our focus, and we are investing in our processes to ensure a stronger customer experience. We expect this investment will further enhance our value to our customers, support retention and provide further efficiency and scale for our operations. We started this work in 2018 and expect this to continue inexisting clients throughout the near-term.

During the first quarter of 2020:

we continued to grow our revenues,

exercised discretion in our spending,

maintained our net insurance margin by pricing to risk and working with our carriers to manage costs, and

enhanced our short-term cash reserves by drawing down $234 million on our credit facility.

The outbreak of the novel coronavirus (“COVID-19”)COVID-19 pandemic and to support the measures being taken at every leveleconomic recovery of governmentSMBs. We will continue to prevent its spread have resulted in an economic slowdownmonitor and an unprecedented disruptionevaluate developments relating to our businessthe COVID-19 pandemic and the businesses of our small and mid-size business clients.

We are actively evaluating and respondingwill work to respond appropriately to the impact of the COVID-19 pandemic on our business and our clients' businesses.

Actions we have takenDuring the first quarter of 2021 we:

•delivered profitable growth as a result of revenue growth and lower insurance costs,

•launched 'Connect 360', an innovative service model intended to date include:better meet client needs,

providing ongoing and timely information, resources and offerings•continued to customers and other SMBs to help them navigate the rapidly changing and complicated COVID-19 business landscape,

facilitating access to alternative health plan options in addition to COBRA,

enacting new programs in response to the Families First Coronavirus Relief Act and the Coronavirus Aid, Relief and Economic Security Act to enable new payroll tax deferral and tax credit programs and other employment and non-employment tax-related incentivesgrow our revenues, while recognizing a $12 million revenue reduction for our customers,Recovery Credit program to support our eligible, renewing clients,

•established our 2021 Credit Program to benefit our eligible clients, resulting in a $25 million reduction in insurance service revenues recognized,

•completed a $500 million senior notes offering and repaid and terminated our outstanding term loan, and

helping•replaced our customers navigate the various small business relief loan programs,

We have delivered on these customer-focused initiatives and in March 2020, we have implemented remote working and office closures around the country for non-essential activities as the health and well-being of our employees is importantexisting revolving credit facility with a new $500 million revolving credit facility to us.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Performance Highlights

These operational achievements drove the financial performance improvements noted below inOur results for the first quarter of 20202021 when compared to the same period of 2019:2020 are noted below:

Q1 20202021

|

| | | | | | | | | | | |

| | $1.0B | | $120M | | $283M |

| | Total revenues | | Operating income | | Net Service Revenue * |

| | 12 | % | increase | | 46 | % | increase | | 13 | % | increase |

| | | | | | | | | |

| | $91M | | $1.31 | | $97M |

| | Net income | | Diluted EPS | | Adjusted Net income * |

| | 44 | % | increase | | 47 | % | increase | | 41 | % | increase |

| | | | | | | | | |

| * | Non-GAAP measure as defined in the section below.

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $1.1B | | $138M | | $309M |

| Total revenues | | Operating income | | Net Service Revenues * |

| 1 | % | increase | | 15 | % | increase | | 9 | % | increase |

| | | | | | | | |

| $101M | | $1.51 | | $111M |

| Net income | | Diluted EPS | | Adjusted Net income * |

| 11 | % | increase | | 15 | % | increase | | 14 | % | increase |

| | | | | | | | |

| * | Non-GAAP measure. See definitions below under the heading "Non-GAAP Financial Measures". |

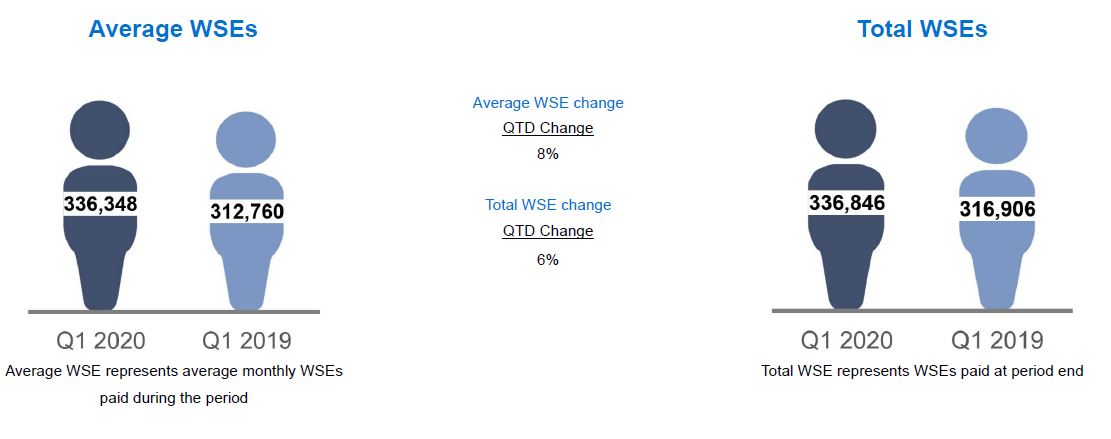

Our results for WSEs in the first quarter of 20202021 when compared to the same period of 20192020 were:

|

| | | | | | | |

| | 336,348 | | 336,846 |

| | Average WSEs | | Total WSEs |

| | 8 | % | increase | | 6 | % | increase |

| | | | | | |

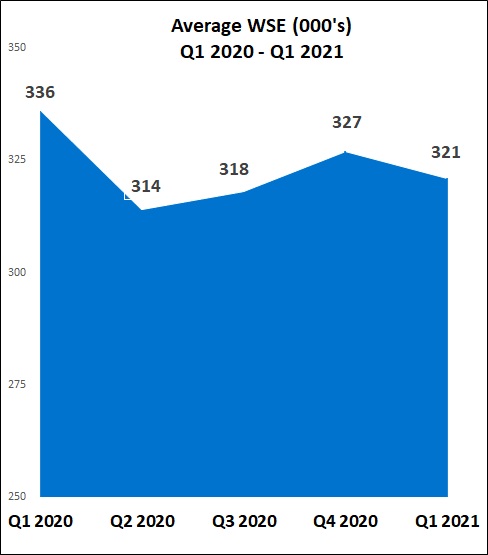

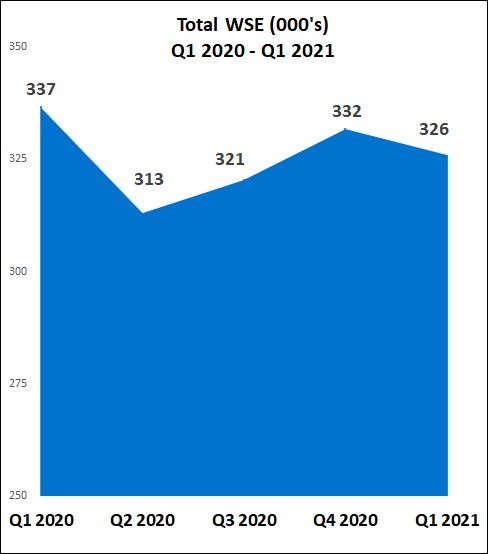

| | | | | | | | | | | | | | | | | |

| 321,295 | | 326,216 |

| Average WSEs | | Total WSEs |

| (4) | % | decrease | | (3) | % | decrease |

| | | | | |

During the first quarter of 2020,2021, we continued to achieve year-over-year revenue growth, reflecting our rate increases and higher health plan enrollment. This was partially offset by lower Average WSEs and a $12 million reduction recognized under our Recovery Credit program.

We also recognized a $25 million reduction to revenue under our 2021 Credit Program initiated in the first quarter of 2021. This amount reflects estimated credits that will be paid to eligible clients under this program, based on the expected performance of our health insurance costs in 2021, and is currently limited to $25 million. To the extent we experience higher than expected health insurance costs during the remainder of 2021, this estimate may be reduced.

During the first quarter of 2021, our Average WSEs declined 4% and total revenues grew by 12% and NSR grew by 13%WSEs declined 3%, primarily as a result of the impact of COVID-19 on our Average WSE growth.clients in 2020 and seasonal attrition.

Decreases in medical services utilization, as a result of WSEs continuing to delay or avoid medical services during the COVID-19 pandemic, drove lower insurance costs, resulting in year-over-year increases in our net income, Net income increased 44%Service Revenue, and adjusted net income increased 41% due to continued expense discipline in the first quarter of 2020.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Key Financial MetricsResults of Operations

The following key financial metrics should be readtable summarizes our results of operations for the first quarter of 2021 when compared to the same period of 2020. For details of the critical accounting judgments and estimates that could affect the Results of Operations, see the Critical Accounting Judgments and Estimates section within the MD&A in conjunction withItem 7 of our condensed consolidated financial statements and related notes included in this2020 Form 10-Q.10-K.

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| (in millions, except operating metrics data) | 2021 | 2020 | % Change |

| Income Statement Data: | | | |

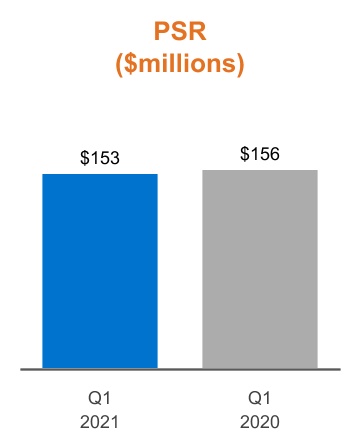

| Professional service revenues | $ | 153 | | $ | 156 | | (2) | % |

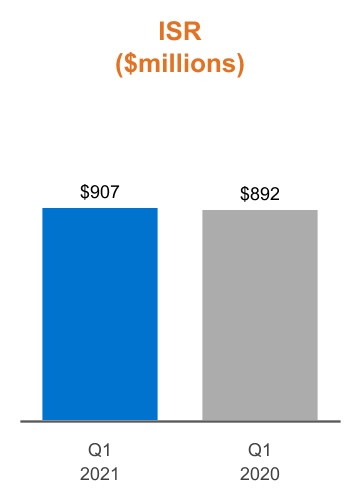

| Insurance service revenues | 907 | | 892 | | 2 | |

| Total revenues | 1,060 | | 1,048 | | 1 | |

| Insurance costs | 751 | | 765 | | (2) | |

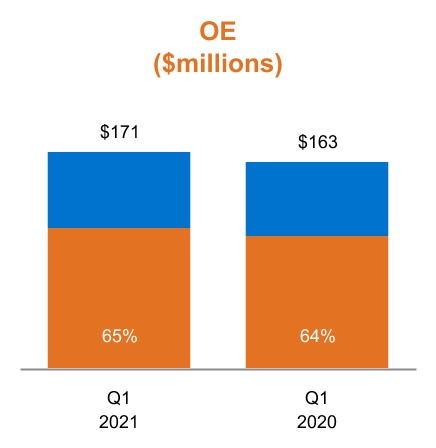

| Operating expenses | 171 | | 163 | | 5 | |

| Total costs and operating expenses | 922 | | 928 | | (1) | |

| Operating income | 138 | | 120 | | 15 | |

| Other income (expense): | | | |

| Interest expense, bank fees and other | (5) | | (4) | | 25 | |

| Interest income | 2 | | 5 | | (60) | |

| | | |

| | | |

| Income before provision for income taxes | 135 | | 121 | | 12 | |

| Income taxes | 34 | | 30 | | 13 | |

| Net income | $ | 101 | | $ | 91 | | 11 | % |

| | | |

| | | |

| Cash Flow Data: | | | |

| Net cash used in operating activities | (175) | | $ | (282) | | (38) | |

| Net cash used in investing activities | (3) | | (94) | | (97) | |

| Net cash provided by financing activities | 56 | | 185 | | (70) | |

| | | |

Non-GAAP measures (1): | | | |

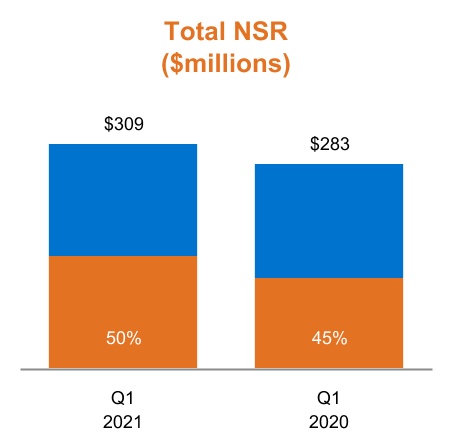

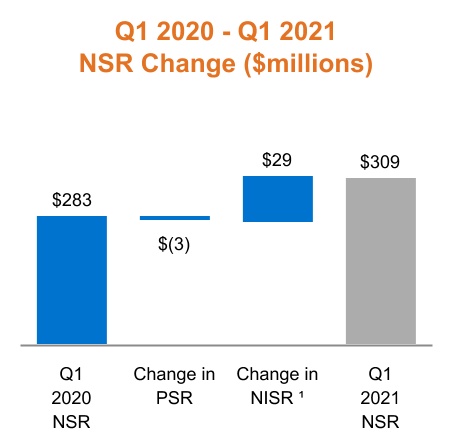

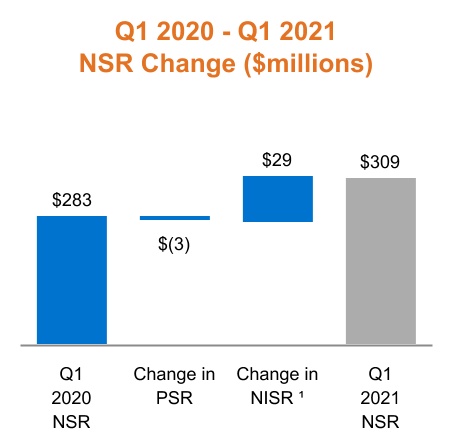

| Net Service Revenues | $ | 309 | | $ | 283 | | 9 | % |

| Net Insurance Service Revenues | $ | 156 | | $ | 127 | | 23 | |

| Net Insurance Margin | 17 | % | 14 | % | 2 | |

| Adjusted EBITDA | 163 | | 145 | | 12 | |

| Adjusted Net income | 111 | | 97 | | 14 | |

| Corporate Operating Cash Flows | 131 | | 119 | | 10 | |

| | | |

| Operating Metrics: | | | |

| Average WSEs | 321,295 | | 336,348 | | (4) | % |

| Total WSEs | 326,216 | | 336,846 | | (3) | |

| | | |

| | | |

|

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| (in millions, except per share and WSE data) | 2020 | | 2019 | | % Change |

| Income Statement Data: | | | | | | |

| Total revenues | $ | 1,048 |

| | $ | 934 |

| | 12 |

| % |

| Net income | 91 |

| | 63 |

| | 44 |

| |

| Diluted net income per share of common stock | 1.31 |

| | 0.89 |

| | 47 |

| |

Non-GAAP measures (1): | | | | |

|

| |

| Net Service Revenues | 283 |

| | 251 |

| | 13 |

| |

| Net Insurance Service Revenues | 127 |

| | 115 |

| | 10 |

| |

| Adjusted EBITDA | 145 |

| | 108 |

| | 34 |

| |

| Adjusted Net Income | 97 |

| | 69 |

| | 41 |

| |

(1) Refer to Non-GAAP Financial Measures section below formeasures definitions and reconciliations from GAAP measures.measures under the heading "Non-GAAP Financial Measures".

The following table summarizes our balance sheet data as of March 31, 2021 compared to December 31, 2020.

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | March 31,

2021 | | December 31,

2020 | | % Change | |

| Balance Sheet Data: | | | | | | |

| Working capital | $ | 520 | | | $ | 290 | | | 79 | | % |

| Total assets | 3,005 | | | 3,043 | | | (1) | | |

| Debt | 494 | | | 370 | | | 34 | | |

| Total stockholders’ equity | 653 | | | 607 | | | 8 | | |

|

| | | | | | | | |

| (in millions) | March 31,

2020 | | December 31,

2019 | | % Change | |

| Balance Sheet Data: | | | | | | |

| Working capital | 284 |

| | 228 |

| | 25 | % |

| Total assets | 2,765 |

| | 2,748 |

| | 1 | |

| Debt | 620 |

| | 391 |

| | 59 | |

| Total stockholders’ equity | 533 |

| | 475 |

| | 12 | |

|

| | | | | | | | | | | | |

| | Three Months Ended March 31, |

| (in millions) | 2020 | | 2019 | | % Change |

| Cash Flow Data: | | | | | | |

| Net cash used in operating activities | $ | (282 | ) | | $ | (142 | ) | | 99 |

| % |

| Net cash used in investing activities | (94 | ) | | (11 | ) | | 755 |

| |

| Net cash provided by (used in) financing activities | 185 |

| | (47 | ) | | (494 | ) | |

Non-GAAP measure(1): | | | | |

|

| |

| Corporate operating cash flows | 119 |

| | 78 |

| 169 |

| 53 |

| |

(1) Refer to Non-GAAP Financial Measures section below for definitions and reconciliations from GAAP measures.

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with GAAP, we monitor other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plan. These key financial measures provide an additional view of our operational performance over the long-term and provide information that we use to maintain and grow our business.

The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation from, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

|

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS | |

|

| | |

| Non-GAAP Measure | Definition | How We Use The Measure |

| Net Service Revenues | • Sum of professional service revenues and Net Insurance Service Revenues,

or total revenues less insurance costs. | • Provides a comparable basis of revenues on a net basis. Professional service revenues are presented net of client payroll costs whereas insurance service revenues are presented gross of insurance costs for financial reporting purposes.

• Acts as the basis to allocate resources to different functions and evaluates the effectiveness of our business strategies by each business function.

• Provides a measure, among others, used in the determination of incentive compensation for management.

|

| Net Insurance Service Revenues | • Insurance service revenues less insurance costs. | • Is a component of Net Service Revenues. • Provides a comparable basis of revenues on a net basis. Professional service revenues are presented net of client payroll costs whereas insurance service revenues are presented gross of insurance costs for financial reporting purposes. Promotes an understanding of our insurance services business by evaluating insurance service revenues net of our WSE related costs which are substantially pass-through for the benefit of our WSEs. Under GAAP, insurance service revenues and costs are recorded gross as we have latitude in establishing the price, service and supplier specifications.

|

| Net Insurance Margin | • We also sometimes refer to Net Insurance Margin (NIM), which is the ratio of Net Insurance RevenueServices Revenues to insurance service revenues. | • Provides a comparable basis of Net Insurance Service Revenue.Revenues relative to insurance service revenues. Promotes an understanding of our pricing to risk performance. |

| Adjusted EBITDA | • Net income, excluding the effects of: - income tax provision, - interest expense, bank fees and other, - depreciation, - amortization of intangible assets, and - stock based compensation expense.

| • Provides period-to-period comparisons on a consistent basis and an understanding as to how our management evaluates the effectiveness of our business strategies by excluding certain non-cash charges such as depreciation and amortization, and stock-based compensation recognized based on the estimated fair values. We believe these charges are either not directly resulting from our core operations or not indicative of our ongoing operations. • Enhances comparisons to prior periods and, accordingly, facilitates the development of future projections and earnings growth prospects. • Provides a measure, among others, used in the determination of incentive compensation for management. • We also sometimes refer to Adjusted EBITDA margin, which is the ratio of Adjusted EBITDA to Net Service Revenue.

|

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

| | | | | | | | |

| Adjusted Net Income | • Net income, excluding the effects of: - effective income tax rate (1), - stock based compensation, - amortization of intangible assets, - non-cash interest expense (2), and - the income tax effect (at our effective tax rate (1)) of these pre-tax adjustments. | • Provides information to our stockholders and board of directors to understand how our management evaluates our business, to monitor and evaluate our operating results, and analyze profitability of our ongoing operations and trends on a consistent basis by excluding certain non-cash charges.

|

|

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS | |

|

| | |

| Corporate Operating Cash Flows | • Net cash provided by (used in) operating activities, excluding the effects of:

- Assets associated with WSEs (accounts receivable, unbilled revenue, prepaid expenses and other current assets) and

- Liabilities associated with WSEs (client deposits and other client liabilities, accrued wages, payroll tax liabilities and other payroll withholdings, accrued health benefit costs, accrued workers' compensation costs, insurance premiums and other payables, and other current liabilities).

| • Provides information that our stockholders and management can use to evaluate our cash flows from operations independent of the current assets and liabilities associated with our WSEs.

• Enhances comparisons to prior periods and, accordingly, used as a liquidity measure to manage liquidity between corporate and WSE related activities, and to help determine and plan our cash flow and capital strategies.

|

| |

(1) | Non-GAAP effective tax rate is 25.5% and 26% for first quarter of 2020 and 2019, respectively, which excludes the income tax impact from stock based compensation, changes in uncertain tax positions, and nonrecurring benefits or expenses from federal legislative changes. |

| |

(2) | Non-cash interest expense represents amortization and write-off of our debt issuance costs. |

(1) Non-GAAP effective tax rate is 25.5% for 2021 and 2020, which excludes the income tax impact from stock-based compensation, changes in uncertain tax positions and nonrecurring benefits or expenses from federal legislative changes.

(2) Non-cash interest expense represents amortization and write-off of our debt issuance costs and loss on derivative.

Reconciliation of GAAP to Non-GAAP Measures

The table below presents a reconciliation of Total revenues to Net Service Revenues: | | | | Three Months Ended March 31, | | Three Months Ended March 31, | |

| (in millions) | 2020 | 2019 | (in millions) | 2021 | 2020 | |

| Total revenues | $ | 1,048 |

| $ | 934 |

| Total revenues | $ | 1,060 | | $ | 1,048 | | |

| Less: Insurance costs | 765 |

| 683 |

| Less: Insurance costs | 751 | | 765 | | |

| Net Service Revenues | $ | 283 |

| $ | 251 |

| Net Service Revenues | $ | 309 | | $ | 283 | | |

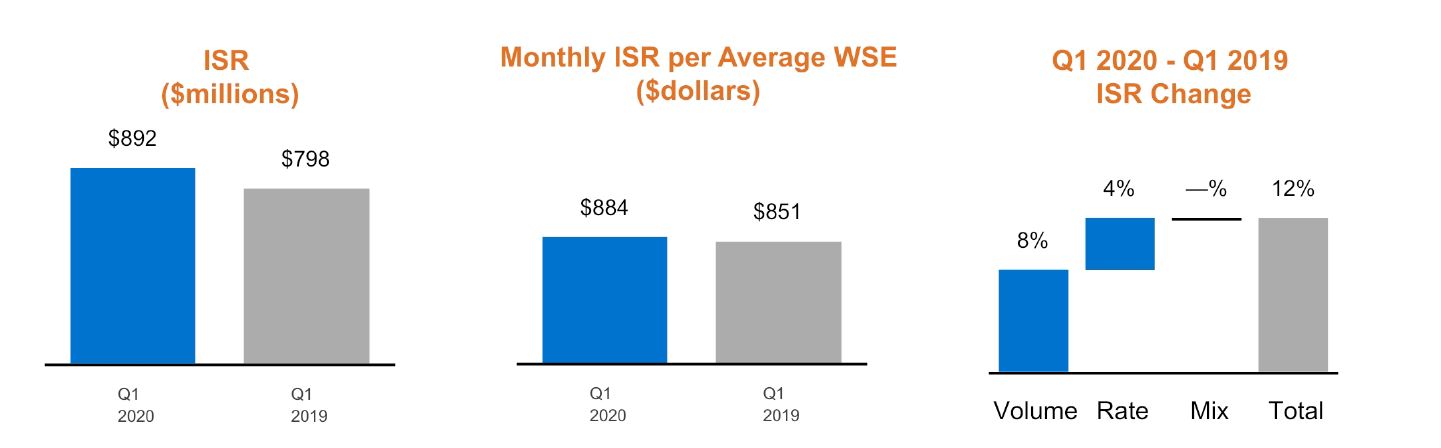

The table below presents a reconciliation of Insurance service revenues to Net Insurance Service Revenues:

|

| | | | | | |

| | Three Months Ended March 31, |

| (in millions) | 2020 | 2019 |

| Insurance service revenues | $ | 892 |

| $ | 798 |

|

| Less: Insurance costs | 765 |

| 683 |

|

| Net Insurance Service Revenues | $ | 127 |

| $ | 115 |

|

| NIM | 14 | % | 14 | % |

| | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (in millions) | 2021 | 2020 | | | |

| Insurance service revenues | $ | 907 | | $ | 892 | | | | |

| Less: Insurance costs | 751 | | 765 | | | | |

| Net Insurance Service Revenues | $ | 156 | | $ | 127 | | | | |

| Net Insurance Margin | 17 | % | 14 | % | | | |

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

The table below presents a reconciliation of Net income to Adjusted EBITDA:

| | | | Three Months Ended

March 31, | | Three Months Ended March 31, | |

| (in millions) | 2020 | 2019 | (in millions) | 2021 | 2020 | |

| Net income | $ | 91 |

| $ | 63 |

| Net income | $ | 101 | | $ | 91 | | |

| Provision for income taxes | 30 |

| 20 |

| Provision for income taxes | 34 | | 30 | | |

| Stock based compensation | 9 |

| 9 |

| Stock based compensation | 11 | | 9 | | |

| Interest expense and bank fees | 4 |

| 5 |

| |

| Interest expense, bank fees and other | | Interest expense, bank fees and other | 5 | | 4 | | |

| Depreciation and amortization of intangible assets | 11 |

| 11 |

| Depreciation and amortization of intangible assets | 12 | | 11 | | |

| Adjusted EBITDA | $ | 145 |

| $ | 108 |

| Adjusted EBITDA | $ | 163 | | $ | 145 | | |

| Adjusted EBITDA Margin | 51 | % | 43 | % | Adjusted EBITDA Margin | 53 | % | 51 | % | |

The table below presents a reconciliation of Net income to Adjusted Net Income:

| | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (in millions) | 2021 | 2020 | | | |

| Net income | $ | 101 | | $ | 91 | | | | |

| Effective income tax rate adjustment | — | | (1) | | | | |

| Stock based compensation | 11 | | 9 | | | | |

| Amortization of intangible assets | 1 | | 1 | | | | |

| Non-cash interest expense | 2 | | — | | | | |

| Income tax impact of pre-tax adjustments | (4) | | (3) | | | | |

| Adjusted Net Income | $ | 111 | | $ | 97 | | | | |

|

| | | | | | |

| | Three Months Ended

March 31, |

| (in millions) | 2020 | 2019 |

| Net income | $ | 91 |

| $ | 63 |

|

| Effective income tax rate adjustment | (1 | ) | (1 | ) |

| Stock based compensation | 9 |

| 9 |

|

| Amortization of intangible assets | 1 |

| 1 |

|

| Income tax impact of pre-tax adjustments | (3 | ) | (3 | ) |

| Adjusted Net Income | $ | 97 |

| $ | 69 |

|

The table below presents a reconciliation of net cash used in(used in) provided by operating activities to corporate operating cash flows:Corporate Operating Cash Flows:

| | | | | | | | |

| Three Months Ended

March 31, |

| (in millions) | 2021 | 2020 |

| Net cash used in operating activities | $ | (175) | | $ | (282) | |

| Less: Change in WSE related other current assets | (85) | | (110) | |

| Less: Change in WSE related liabilities | (221) | | (291) | |

| Net cash used in operating activities - WSE | $ | (306) | | $ | (401) | |

| Net cash provided by operating activities - Corporate | $ | 131 | | $ | 119 | |

|

| | | | | | |

| | Three Months Ended

March 31, |

| (in millions) | 2020 | 2019 |

| Net cash used in operating activities | $ | (282 | ) | $ | (142 | ) |

| Change in WSE related other current assets | 110 |

| 45 |

|

| Change in WSE related liabilities | 291 |

| 175 |

|

Corporate Operating Cash Flows

| $ | 119 |

| $ | 78 |

|

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Results of Operations

Operating Metrics

Worksite Employees (WSE)

Average WSE growth is a volume measure we use to monitor the performance of our business. Average WSEs increased 8%We have historically experienced our highest volumes of changes in new and exiting clients during the first quarter of 2020, comparedthe year, as clients generally change their payroll service providers at the beginning of the payroll tax year. Average WSEs decreased 4% when comparing the first quarter of 2021 to the same period in 2019, primarily in our Technology and Professional Services verticals2020 due to reducedlower Total WSEs at the beginning of 2021 compared to 2020 due to COVID-19 impact, combined with seasonal attrition and continuedlower new sales. This was partially offset by increased hiring in all verticals of our installed base, especially in the final three quarters of 2019, offset by seasonal attrition in the current quarter.our technology, life sciences and financial services verticals.

Total WSEs can generally be used to estimate our beginning WSEs for the next period and, as a result, can be used as an indicator of our potential future success in growing our business and retaining clients. Total WSEs decreased 1% compared to December 2019 due to seasonal attrition of clients, partially offset by new sales and WSE growth in our installed base. As a result of the COVID-19 pandemic, we believe that we will experience increased attrition and a reduction of WSEs in our installed base across all verticals in the coming quarters, particularly within our Main Street and Professional Services verticals.

Anticipated revenues for future periods can diverge from the revenue expectation derived from Average WSEs or Total WSEs due to pricing differences across our HR solutions and services and the degree to which clients and WSEs elect to participate in our solutions during future periods. In addition to focusing on growing our Average WSE and Total WSE counts, we also focus on pricing strategies, productbenefit participation and productservice differentiation to expand our revenue opportunities. We report the impact of client and WSE participation differences as a change in mix.

We are focusedIn addition to focusing on retaining and growing our WSE base, andwe continue to review acquisition opportunities that would add appropriately to our scale. We continue to invest in our efforts intended to enhance our customers'client experiences and WSEs' experiences,manage attrition, through operational and process improvements and manage attrition that we believe we will experience as a result of the COVID-19 pandemic.improvements.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

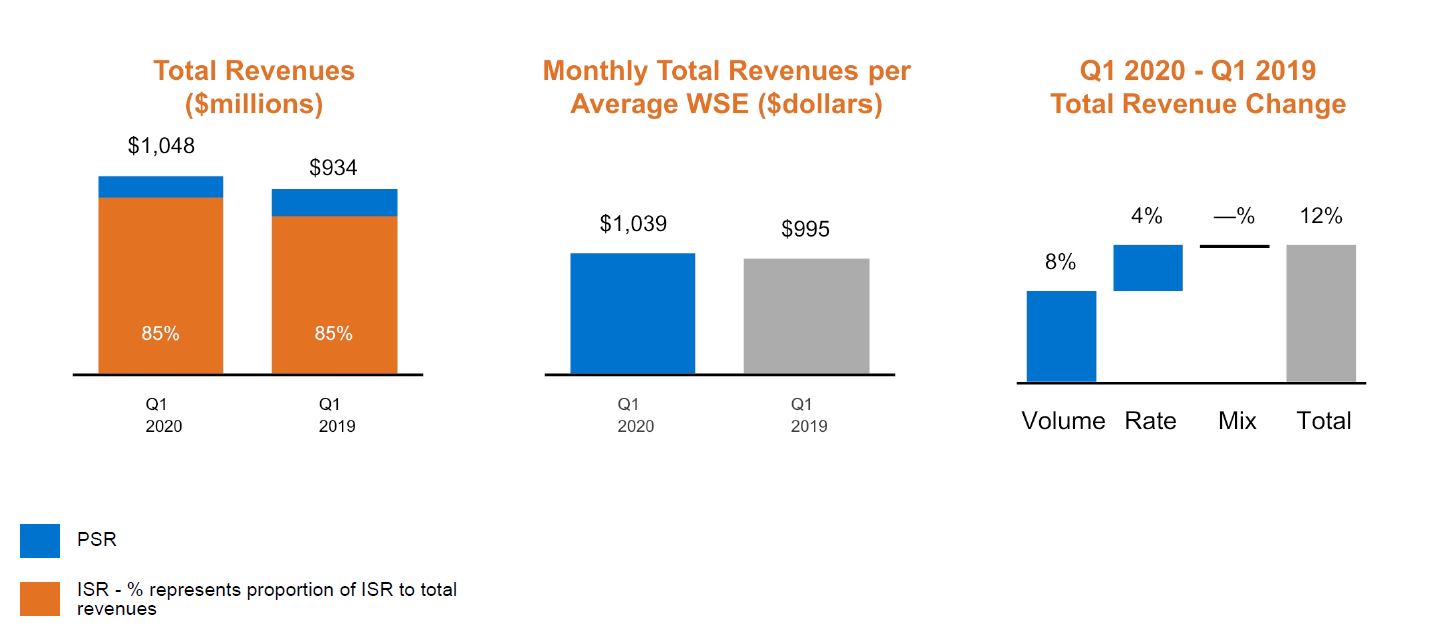

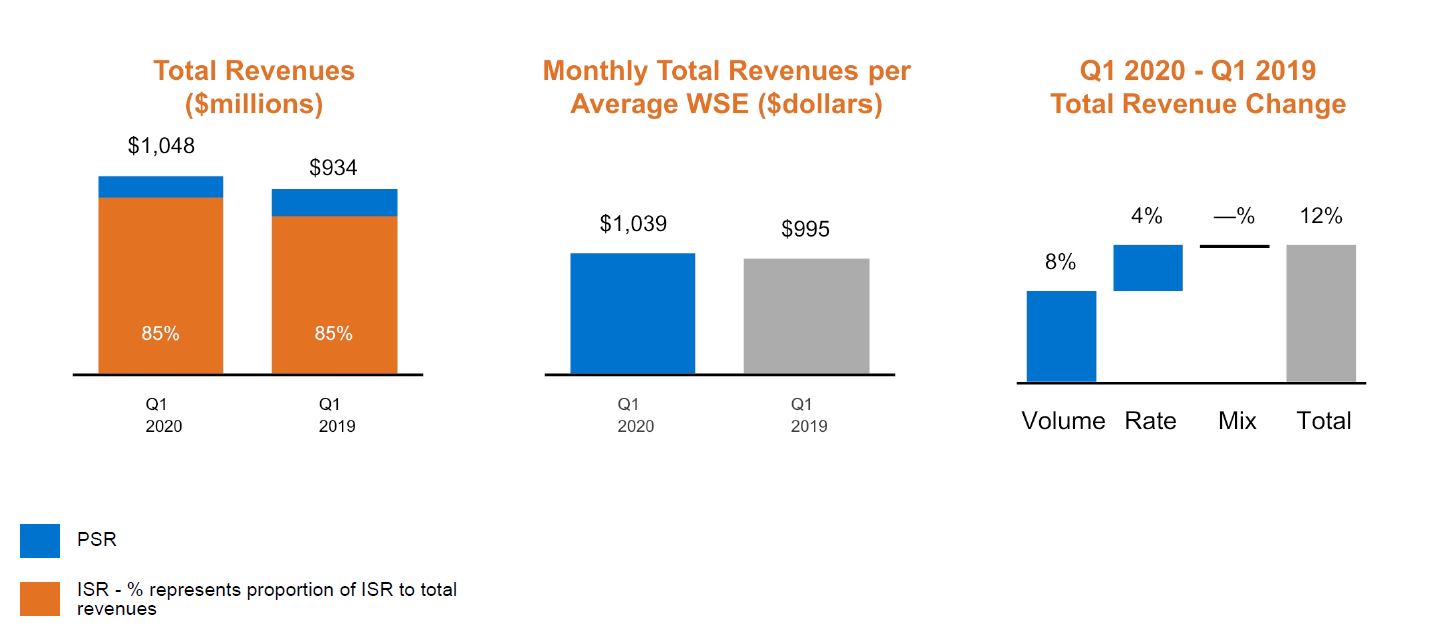

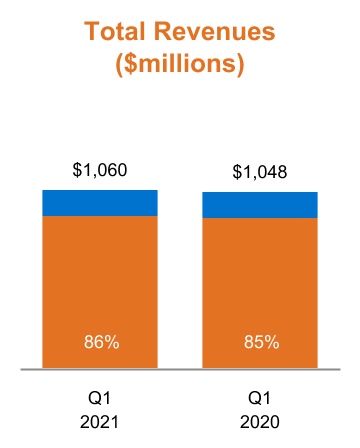

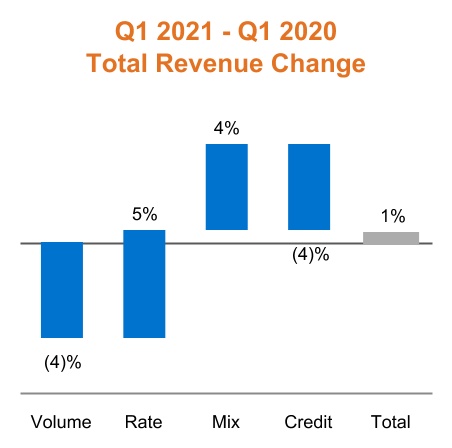

Total Revenues

Our revenues consist of professional service revenues (PSR) and insurance service revenues (ISR). PSR represents fees charged to clients for processing payroll-related transactions on behalf of our clients, access to our HR expertise, employment and benefit law compliance services, and other HR-related services. ISR consists of insurance-related billings and administrative fees collected from clients and withheld from WSEs for workers' compensation insurance and health benefit insurance plans provided by third-party insurance carriers.

In April 2020, we created our Recovery Credit program to assist in the economic recovery of our existing SMB clients and enhance our ability to retain these clients. Eligible clients will receive one-time reductions against fees for future services, accounted for as a discount, to be received over the following 12 months. We recognized a reduction in total revenues of $12 million in the first quarter of 2021 for the Recovery Credit, allocated proportionally to PSR ($5 million) and ISR ($7 million).

The reduction in revenue is estimated each period based on the timing of when eligible clients will receive the Recovery Credit and the ultimate amount of the total Recovery Credit. We will recognize a further $5 million reduction to revenues in 2021 for the remaining Recovery Credit over the period that our clients will earn the right to receive credits.

We also recognized a $25 million reduction to revenue under our 2021 Credit Program. This amount reflects estimated credits that will be paid to eligible clients under this program, based on the expected performance of our health insurance costs in 2021, and is currently limited to $25 million. These credits are recorded as a reduction to ISR and are payable within 12 months to eligible clients as of March 31, 2021. To the extent we experience higher than expected health insurance costs during the remainder of 2021, this estimate may be reduced.

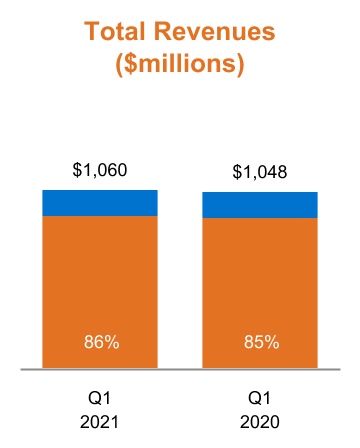

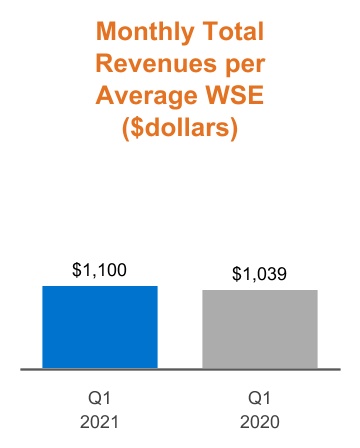

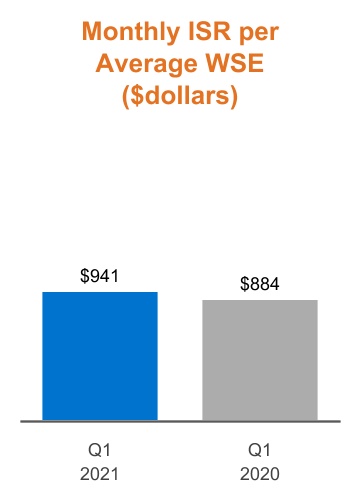

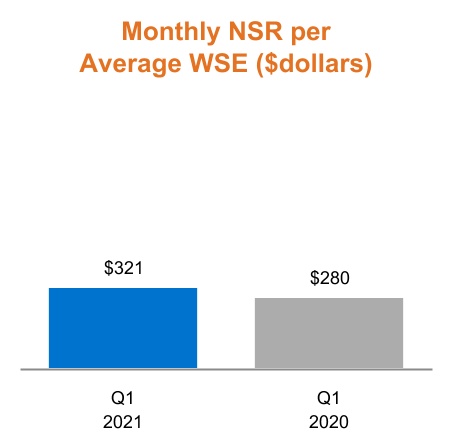

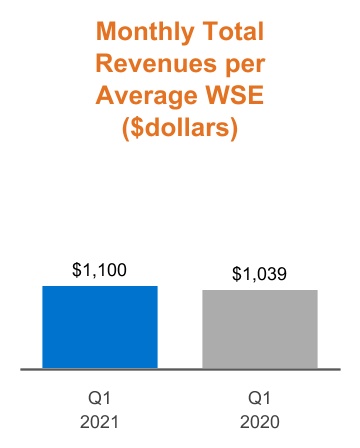

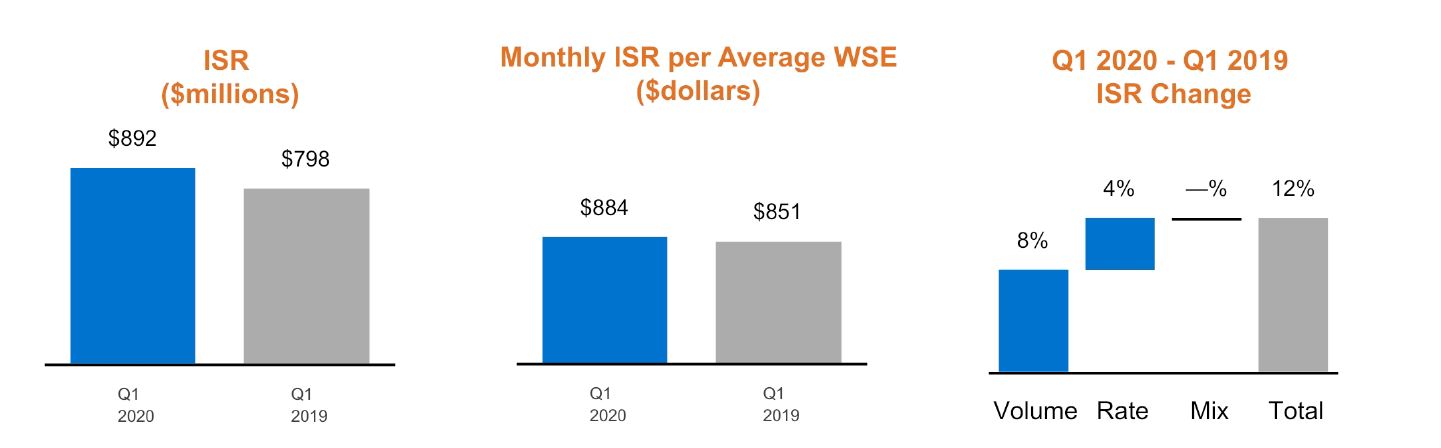

Monthly total revenues per Average WSE is a measure we use to monitor the success of our product and service pricing strategies. This measure increased 4%6% during the first quarter of 20202021 compared to the same period in 2019.2020.

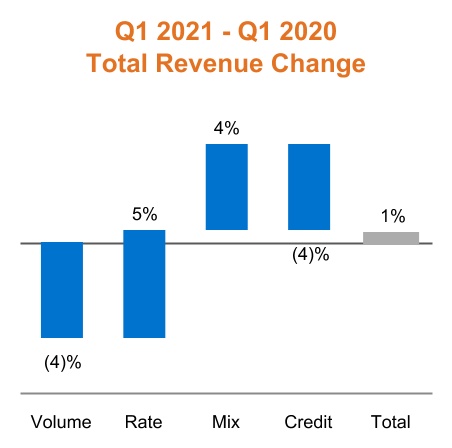

We also use the following measures to further analyze changes in total revenue:

•Volume - the percentage change in period over period Average WSEs,

•Rate - the combined weighted average percentage changes in service fees for each vertical productservice and changes in service fees associated with each insurance service offering, and

•Mix - the change in composition of Average WSEs within our verticals combined with the composition of our enrolled WSEs within our insurance service offerings.offerings, and

The changes in volume during the first quarter of 2020, when compared to the same period in 2019, were primarily driven by WSE growth, especially in our Technology and Professional Services verticals. We continued to price to the value of our services and, for our insurance offerings, to our expected risk, resulting in the change in rate during the first quarter of 2020, when compared to the same period in 2019.

The change in the U.S. economy due to COVID-19 is having a negative impact on our SMB customers and prospects. Affected businesses, particularly in our Main Street and Professional Services verticals, are furloughing and terminating employees and reducing hiring. These actions by our customers, combined with business shutdowns and failures will negatively impact revenue volume growth in subsequent quarters. The adverse economic environment will also reduce our ability to achieve rate increases in subsequent quarters. As a result, we expect PSR, ISR and total revenues to decrease in subsequent quarters.

|

| | ISR - % represents proportion of ISR to total revenues | |

| | |

| | |

The growth in total revenues, was primarily driven by rate increases and higher health plan enrollment in our insurance service offerings. This was partially offset by lower Average WSEs, the $12 million reduction recognized for our Recovery Credit and the $25 million reduction under our 2021 Credit Program.

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Operating Income

Our operating income consists of total revenues less insurance costs and OE. Our insurance costs include insurance premiums for coverage provided by insurance carriers, reimbursement of claims payments made by insurance carriers or third-party administrators, and changes in accrued costs related to contractual obligations with our workers' compensation and health benefit carriers. Our OE consists primarily of our corporate employees' compensation related expenses, which includes payroll, payroll taxes, SBC, bonuses, commissions and other payroll-and benefits-related costs.

The table below provides a view of the changes in components of operating income for the first quarter of 2020,2021, as compared to the same period in 2019.

|

| | | | | | | | |

| (in millions) | |

$82120 | | | First Quarter 20192020 Operating Income |

| +11412 |

| | Higher total revenues, primarily as a result of WSE growth, especiallyincreased health plan enrollment in our Technologyinsurance service offerings, together with rate increases, partially offset by lower Average WSEs, the $12 million reduction recognized under our Recovery Credit and Professional Services verticals and increases in ISR fees.the $25 million reduction recognized under our 2021 Credit Program. |

| -82+14 |

| | HigherLower insurance costs primarily as a result of an increase in WSE growth.lower utilization of medical services and lower Average WSEs, partially offset by higher health plan enrollments. |

| +6-8 |

| | LowerHigher OE primarily as a result of reduction inincreased compensation related expenses.to support initiatives to improve client experience, enhance service offerings, and improve processes. |

$120138 | | | First Quarter 20202021 Operating Income |

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Professional Service Revenues

Our clients are billed either based on a fee per WSE per month per transaction or on a percentage of the WSEs’ payroll. For those clients (primarily Main Street clients) that are billed on a percentage of WSEs' payroll, as our clients' payrolls increase or decrease, our fees also increase or decrease, respectively.

transaction. Our vertical approach provides us the flexibility to offer our clients in different industries with varied services at different prices, which we believe potentially reduces the value of solely using Average WSE and Total WSE counts as indicators of future potential revenue performance.

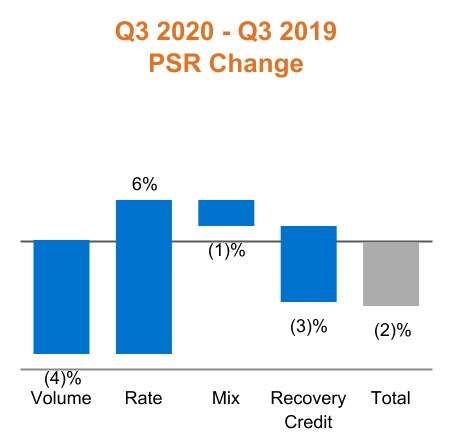

We also analyze changes in PSR with the following measures:

•Volume - the percentage change in period over period Average WSEs,

•Rate - the weighted average percentage change in fees for each vertical, and

•Mix - the change in composition of Average WSEs across our verticals.verticals, and

The increasedecrease in PSR for the first quarter of 2020, when compared to the same period in 2019, reflects the result of WSE growthdecrease in our TechnologyAverage WSEs and Professional Services verticals, the result of our vertical pricing strategy and ongoing change$5 million Recovery Credit recognized in mix of our WSEs.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Insurance Service Revenues

ISR consists of insurance services-related billings and administrative fees collected from clients and withheld from WSE payroll for health benefits and workers' compensation insurance provided by third-party insurance carriers.

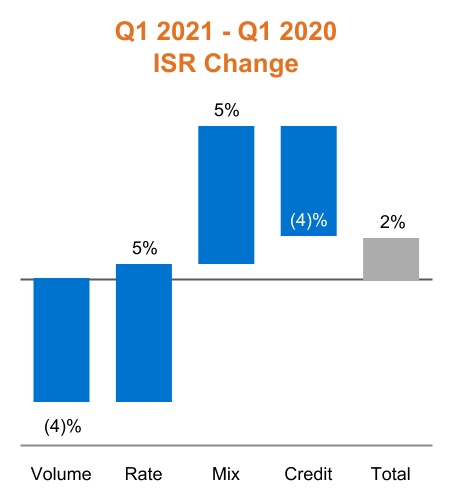

We use the following measures to analyze changes in ISR:

•Volume - the percentage change in period over period Average WSEs,

•Rate - the weighted average percentage change in fees associated with each of our insurance service offerings, and

•Mix - all other changes including the composition of our enrolled WSEs within our insurance service offerings (health plan enrollment)., and

The growth in ISR for the first quarter of 2020, as compared to the same period in 2019, primarily resulted fromreflects rate increases inand higher health plan enrollment by clients. This was partially offset by lower Average WSEs and changesthe $7 million Recovery Credit and $25 million recognized under our 2021 Credit Program in rate due to higher insurance service fees per plan participant.2021.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

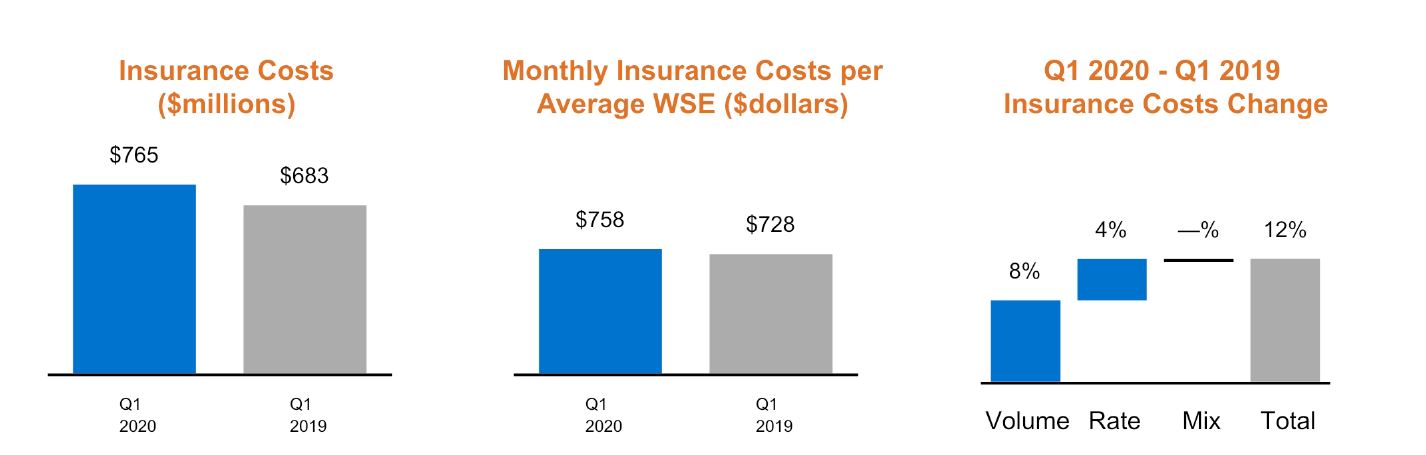

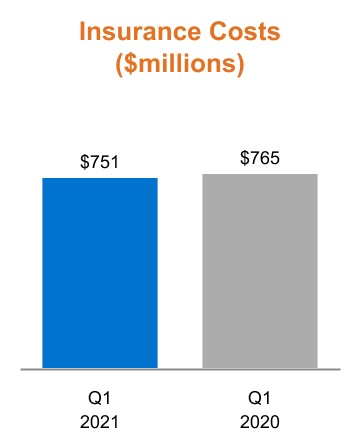

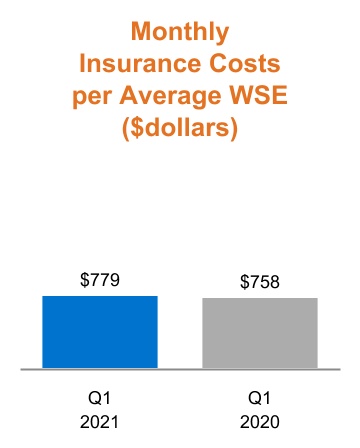

Insurance Costs

Insurance costs include insurance premiums for coverage provided by insurance carriers, payments for claims costs and other risk management services, reimbursement of claims payments made by insurance carriers or third-party administrators below a predefined deductible limit, and changes in accrued costs related to contractual obligations with our workers' compensation and health benefit carriers.

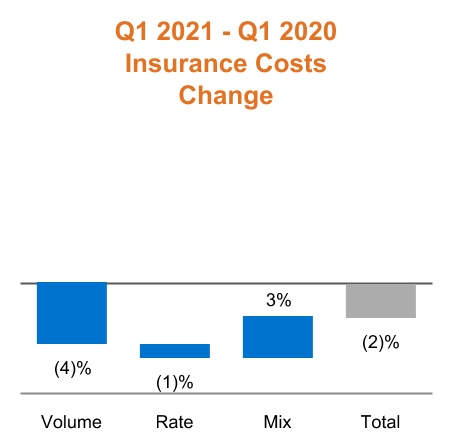

We use the following measures to analyze changes in insurance costs:

•Volume - the percentage change in period over period Average WSEs,

•Rate - the weighted average percentage change in cost trend associated with each of our insurance service offerings, and

•Mix - all other changes including the composition of our enrolled WSEs within our insurance service offerings (health plan enrollment).

The growth in insurance costs forDuring the first quarter of 2021, we continued to experience higher than normal volatility and variability in the amounts that we pay for group health insurance expenses incurred by WSEs within our deductible layer under our risk-based health insurance policies. Stay-at-home orders and social distancing practices impacted WSEs utilization of outpatient medical services from mid-December 2020 as compared tothrough January 2021, causing the same perioddecrease in 2019, primarily resulted from increases in Average WSEs. The increase in insurance cost rates duringrate for the first quarter of 2021. The decrease in utilization in December 2020 resulted in larger positive claims development as compared to the same period in 2019, was primarily driven by increased severity ofour accrued health costs per enrollee (medical cost trend)were paid during the first quarter of 2020.2021. This was partially offset by a return to more normal utilization by end of March 2021, combined with COVID-19 testing, treatment and vaccination costs in 2021.

We did not incur significant insurance costs related to COVID-19 duringThe decrease in volume in the first quarter of 2020. We expect2021, due to incur costslower Average WSEs for the testing and treatment of enrollees affectedquarter, was offset by COVID-19an increase in subsequent quarters.mix from higher health plan enrollments.

Historically, health claims costs have tended to increase throughout the year as the utilization of medical services above each WSE's deductible causes our insurance costs to increase. While medical services utilization did not vary significantly in the first quarter of 2020 due to the late emergence of COVID-19, we expect the utilization of medical services in subsequent quarters to decrease as enrollees defer or cancel non-essential elective procedures and reduce outpatient medical, dental and vision services.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

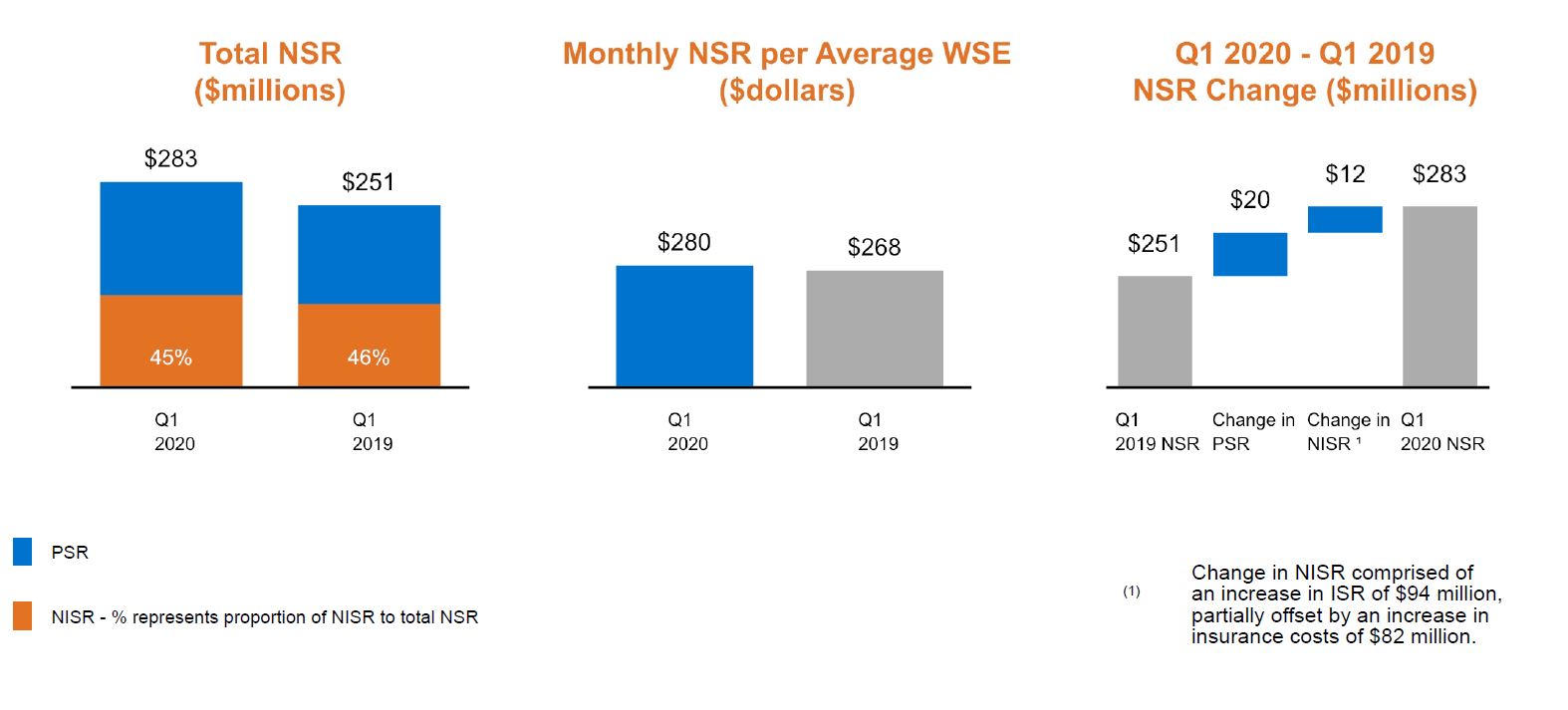

Net Service Revenues

NSR provides us with a comparable basis of revenues on a net basis, acts as the basis to allocate resources to different functions and helps us evaluate the effectiveness of our business strategies by each business function.

NIM remained consistent year-over-year.

| | | | | | | | |

| | PSR |

| | |

| | |

| | Net insurance service revenues - % represents proportion of Net Insurance Service Revenues to total Net Service Revenues |

| | |

The primary drivers to the changes in our NSR are presented below:

19(1) Change in NISR is comprised of an increase in ISR of $15 million, offset by an increase in insurance costs of $14 million.

NIM was 17% for the first quarter of 2021, representing an increase of 3% when compared to the same period in 2020, due to higher ISR and lower utilization of medical services, as discussed previously. 18

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Operating Expenses

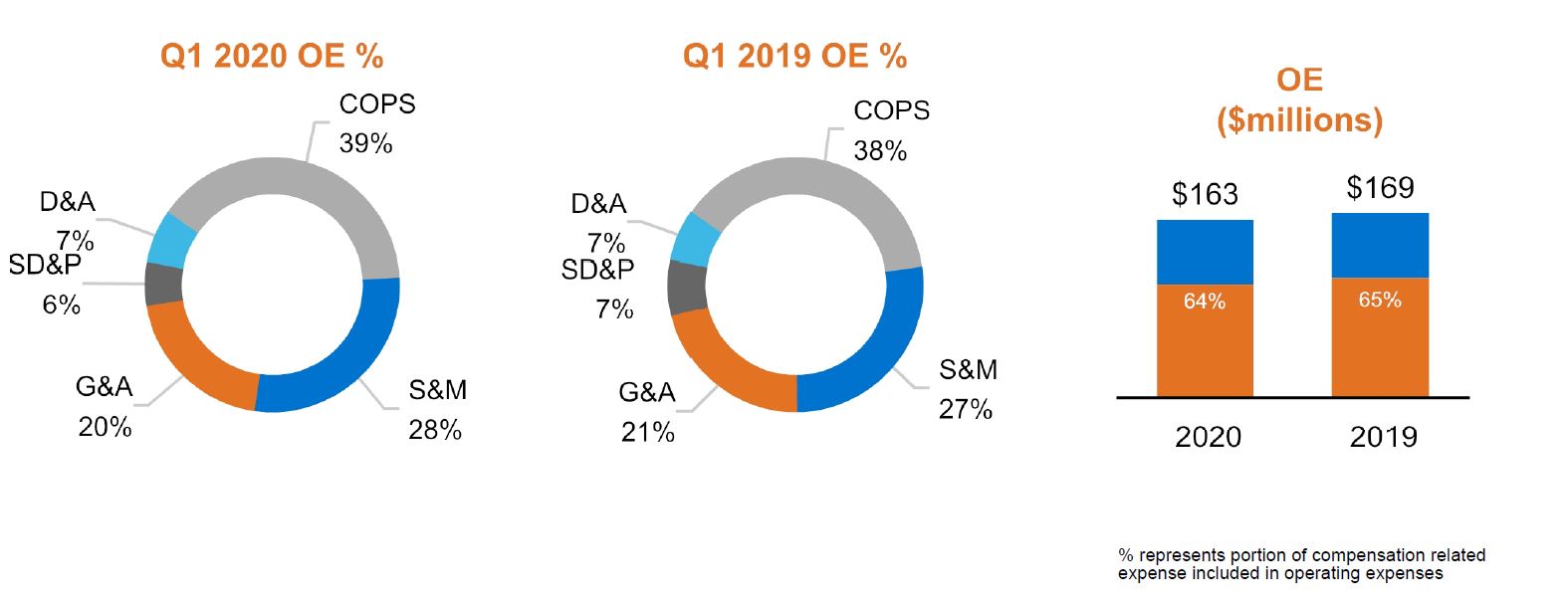

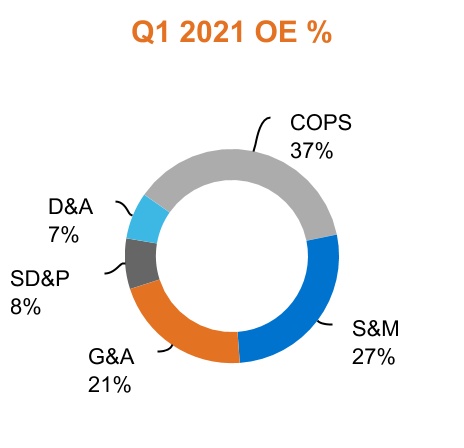

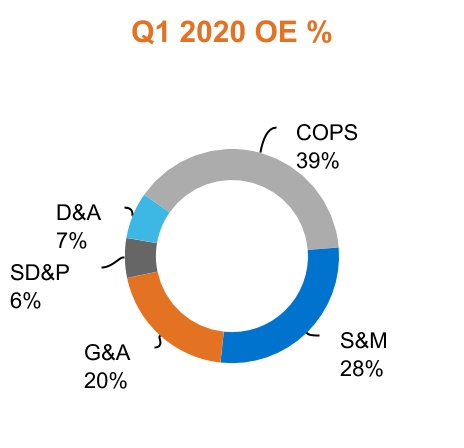

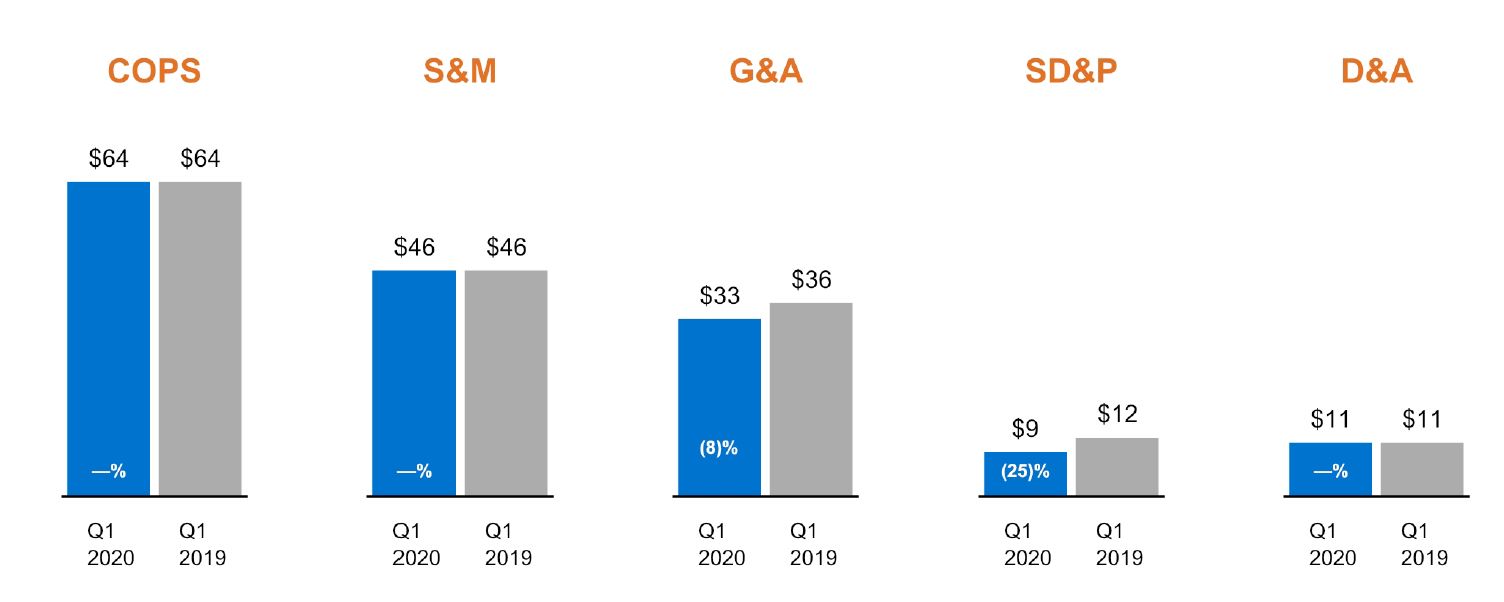

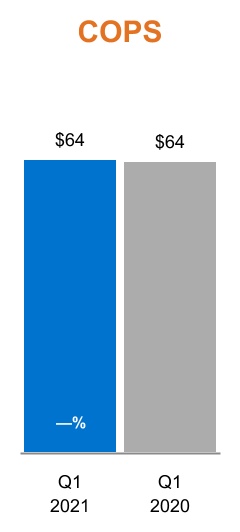

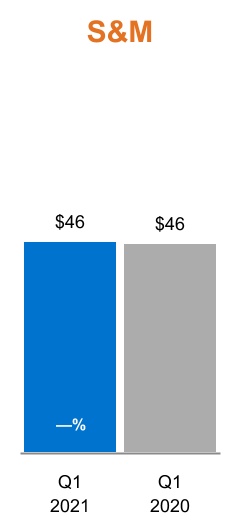

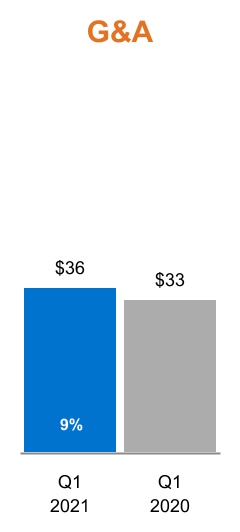

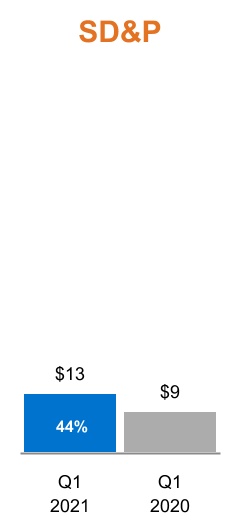

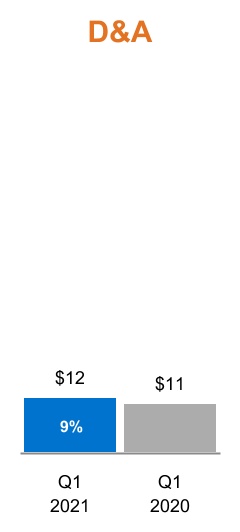

OE includes cost of providing services (COPS), sales and marketing (S&M), general and administrative (G&A), systems development and programming (SD&P), and depreciation and amortization expenses (D&A).

We manage our operating expensesOE and allocate resources across different business functions based on a percentage of NSR, which has decreased to 58%55% in the first quarter of 20202021 from 67% in58% when compared to the same period in 2019.2020. The lower percentage of OE to NSR in 2021 when compared to 2020 was primarily driven by the increase in NSR.

We had approximately 2,8002,600 corporate employees as of March 31, 20202021 in 4815 offices across the U.S. In the first quarter of 2021, we continued to exit expiring leases due to our evolving remote work practices and policies. Our corporate employees' compensation-related expenses represent a majority of our operating expenses. Compensation costs for our corporate employees include payroll, payroll taxes, SBC, bonuses, commissions and other payroll- and benefits-related costs. Compensation-related expense represented 65% and 64% of our OE in the first quarterquarters of 2021 and 2020, compared to 65% in the same period in 2019.respectively.

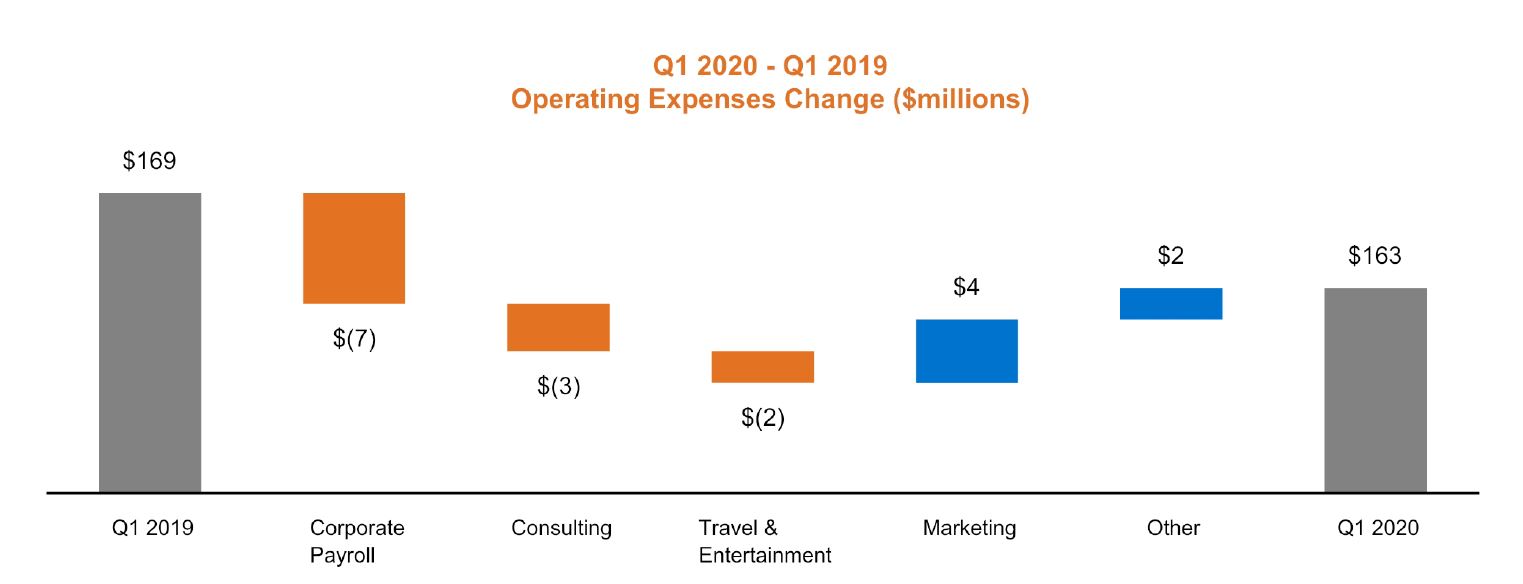

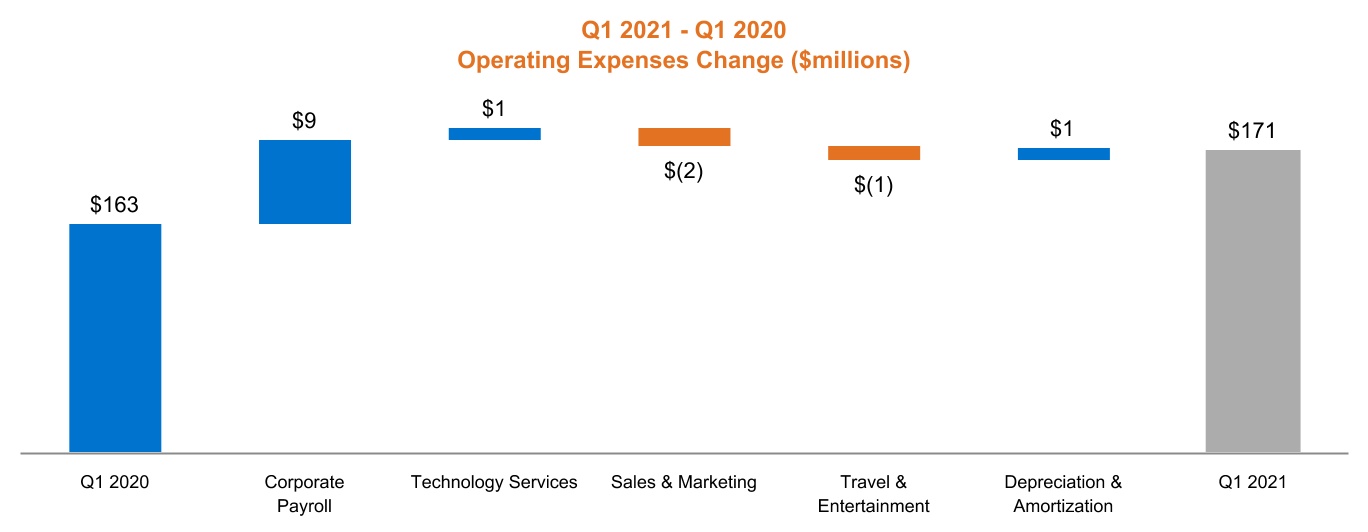

During the first quarter of 2020,2021, we experienced operating expense decreaseOE growth of 4%5% when compared to the same period in 2019. During the first quarter of 2020, the percent2020. The ratio of OE to total revenues was 16%, compared to 18% in the same period in 2019. While expense discipline initiatives will continue, we expect the ratiofirst quarter of OE to total revenues to increase in subsequent quarters as total revenues decrease2021 and we continue to invest in projects to improve our customer and WSE experience.2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | % represents portion of compensation related expense included in operating expenses |

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

We analyze and present our OE based upon the business functions COPS, S&M, G&A and SD&P and depreciation and amortization.D&A. The charts below provide a view of the expenses of the business functions. Dollars are presented in millions and percentages represent year-over-year change.

|

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS | |

|

| | | | |

| (in millions) | |

$169163 | | | Q1 20192020 Operating ExpenseExpenses |

| -3 |

| |

| | | |

| +3 | | | G&A decreasedincreased, driven primarily by increases in compensation related expenses. |

| +4 | | | SD&P increased, driven primarily by higher consulting expenses as we continue to work to improve our client experience and our systems and processes. |

| +1 | | | D&A remained consistent to the first quarter of 2020, driven by a decrease in compensation related expenses and professional fees such as consulting costs.2020. |

| $171 | -3 |

| | SD&P decreased in the first quarter of 2020, primarily due to a decrease in compensation related expenses. |

$163 | | | Q1 20202021 Operating Expenses |

We break outThe primary drivers to the changechanges in expenses that make up our OE in the chartare presented below:

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Other Income (Expense)

Other income (expense) consists primarily of interest and dividend income from investments, and interest expense under our previous credit facility.facility and interest on our 3.50% Senior Notes due 2029 (our 2029 Notes) issued in February 2021.

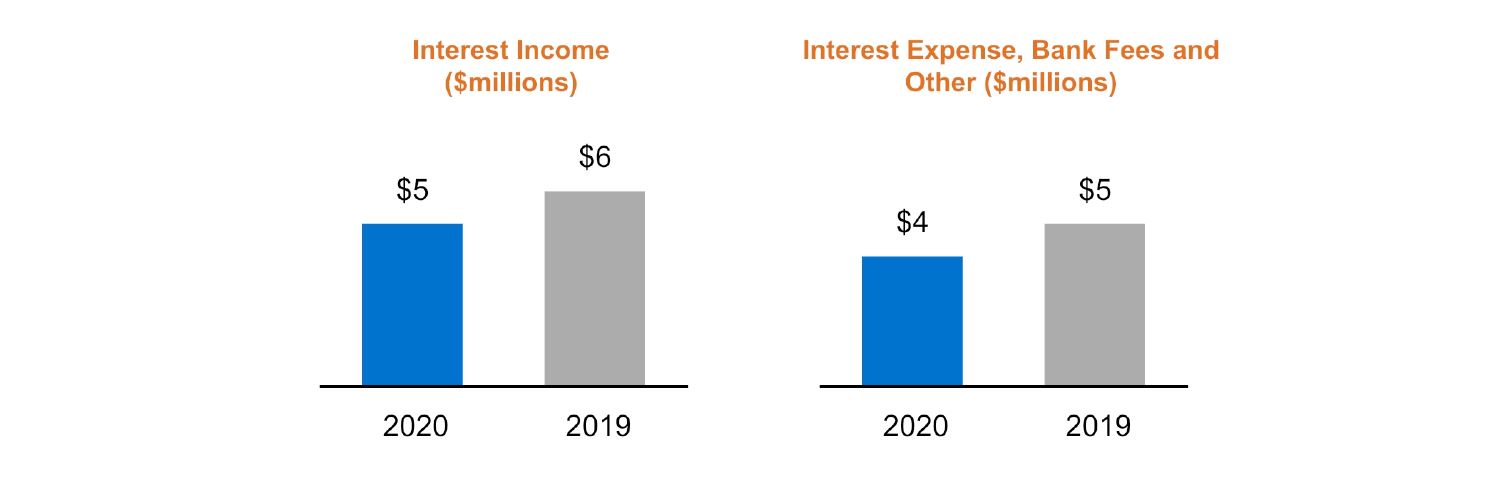

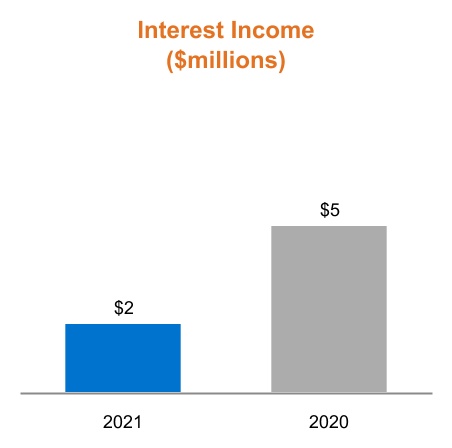

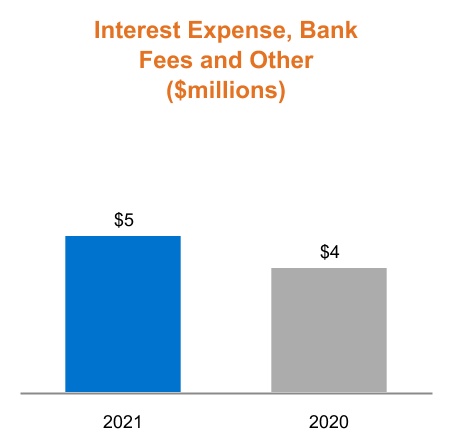

Interest income remained consistent year-over-year. Our investment strategy contributes decreased in the first quarter of 2021 primarily due to ourlower average market interest income, net income, Adjusted Net Income and Adjusted EBITDA.rates. Interest expense, bank fees and other decreased year-over-year due to the lower effective interest rateincreased in the first quarter of 2020 combined with the2021, as lower remaining balanceinterest rates on our long-term debt. Our2018 Term Loan for the two months outstanding was offset by higher interest expense is expected to increase in the future as a result of the $234 million draw down on our revolving credit facility in March 2020, which is intended2029 Notes and costs incurred due to enhancethe early repayment and termination of our short-term cash reserves.floating rate debt.

|

| |

MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Provision for Income Taxes

Our effective tax rate (ETR) was 25% and 24% for the first quarter of 20202021 and 2019, respectively. The change in ETR was driven by a 2% increase primarily from a decrease in tax benefits recognized from excess tax benefits related to stock-based compensation offset by a 1% decrease from a benefit associated with prior year tax expense.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Liquidity and Capital Resources

Liquidity

Liquidity is a measure of our ability to access sufficient cash flows to meet the short-term and long-term cash requirements of our business operations. We believe that we have sufficient liquidity and capital resources to satisfy future requirements and meet our obligations to our clients, creditors and debt holders.

Included in our balance sheets are assets and liabilities resulting from transactions directly or indirectly associated with WSEs, including payroll and related taxes and withholdings, our sponsored workers' compensation and health insurance programs, and other benefit programs. Although we are not subject to regulatory restrictions that require us to do so, we distinguish and manage our corporate assets and liabilities separately from those current assets and liabilities held by us to satisfy our employer obligations associated with our WSEs as follows:

| | | | March 31, 2020 | | December 31, 2019 | | March 31, 2021 | | December 31, 2020 |

| (in millions) | Corporate | WSE | Total | | Corporate | WSE | Total | (in millions) | Corporate | WSE | Total | | Corporate | WSE | Total |

| Current assets: | | | | Current assets: | |

| Cash and cash equivalents | $ | 521 |

| $ | — |

| $ | 521 |

| | $ | 213 |

| $ | — |

| $ | 213 |

| Cash and cash equivalents | $ | 500 | | $ | — | | $ | 500 | | | $ | 301 | | $ | — | | $ | 301 | |

| Investments | 65 |

| — |

| 65 |

| | 68 |

| — |

| 68 |

| Investments | 71 | | — | | 71 | | | 57 | | — | | 57 | |

| Restricted cash, cash equivalents and investments | 15 |

| 764 |

| 779 |

| | 15 |

| 1,165 |

| 1,180 |

| Restricted cash, cash equivalents and investments | 15 | | 1,066 | | 1,081 | | | 15 | | 1,373 | | 1,388 | |

| Other current assets | 52 |

| 475 |

| 527 |

| | 45 |

| 365 |

| 410 |

| Other current assets | 68 | | 440 | | 508 | | | 59 | | 355 | | 414 | |

| Total current assets | $ | 653 |

| $ | 1,239 |

| $ | 1,892 |

| | $ | 341 |

| $ | 1,530 |

| $ | 1,871 |

| Total current assets | $ | 654 | | $ | 1,506 | | $ | 2,160 | | | $ | 432 | | $ | 1,728 | | $ | 2,160 | |

| | | | | |

| | Total current liabilities | $ | 369 |

| $ | 1,239 |

| $ | 1,608 |

| | $ | 113 |

| $ | 1,530 |

| $ | 1,643 |

| Total current liabilities | $ | 134 | | $ | 1,506 | | $ | 1,640 | | | $ | 142 | | $ | 1,728 | | $ | 1,870 | |

| | | | | |

| Working capital | $ | 284 |

| $ | — |

| $ | 284 |

| | $ | 228 |

| $ | — |

| $ | 228 |

| Working capital | $ | 520 | | $ | — | | $ | 520 | | | $ | 290 | | $ | — | | $ | 290 | |

|

Working capital for WSEs related activities

We designate funds to ensure that we have adequate current assets to satisfy our current obligations associated with WSEs.WSEs, the Recovery Credit liability and 2021 Credit Program liability. We expect the Recovery Credit and 2021 Credit Program liability of $102 million as of March 31, 2021 to be settled over the following 12 months. We manage our WSE payroll and benefits obligations through collections of payments from our clients which generally occurs two to three days in advance of client payroll dates. We regularly review our short-term obligations associated with our WSEs (such as payroll and related taxes, insurance premium and claim payments) and designate funds required to fulfill these short-term obligations, which we refer to as PFC. PFC is included in current assets as restricted cash, cash equivalents and investments.

We manage our sponsored benefit and workers' compensation insurance obligations by maintaining collateral funds in restricted cash, cash equivalents and investments. These collateral amounts are generally determined at the beginning of each plan year and we may be required by our insurance carriers to adjust our collateral balances when facts and circumstances change. We regularly review our collateral balances with our insurance carriers and anticipate funding further collateral in the future based upon our capital requirements. We classify our restricted cash, cash equivalents and investments as current and noncurrent assets to match against the anticipated timing of payments to carriers.

Working capital for corporate purposes

Corporate working capital as of March 31, 20202021 increased $56$230 million from December 31, 2019,2020, primarily driven by positive operating cashflow offset by stock repurchasesa $199 million increase in corporate unrestricted cash and investments in available for sales marketable securities. cash equivalents.

We use our available cash and cash equivalents to satisfy our operational and regulatory requirements and to fund capital expenditures. We believe that we can meet our present and reasonably foreseeable operating cash needs and future commitments through existing liquid assets, continuing cash flows from corporate operating activities and the potential issuance of debt or equity securities. We believe that our existing corporate cash and cash equivalents and positive working capital will be sufficient to meet our working capital and capital expenditure needs for at least the next twelve months.

|

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

Cash Flows

The following table presents our cash flow activities for the stated periods:

| | | | Three Months Ended March 31, | | Three Months Ended March 31, |

| (in millions) | 2020 | | 2019 | (in millions) | 2021 | | 2020 |

| | Corporate | WSE | Total | | Corporate | WSE | Total | | Corporate | WSE | Total | | Corporate | WSE | Total |

| Net cash provided by (used in): | | | | | | Net cash provided by (used in): | | | |

| Operating activities | $ | 119 |

| $ | (401 | ) | $ | (282 | ) | | $ | 78 |

| $ | (220 | ) | $ | (142 | ) | Operating activities | $ | 131 | | $ | (306) | | $ | (175) | | | $ | 119 | | $ | (401) | | $ | (282) | |

| Investing activities | (19 | ) | (75 | ) | (94 | ) | | (11 | ) | — |

| (11 | ) | Investing activities | 6 | | (9) | | (3) | | | (19) | | (75) | | (94) | |

| Financing activities | 185 |

| — |

| 185 |

| | (47 | ) | — |

| (47 | ) | Financing activities | 56 | | — | | 56 | | | 185 | | — | | 185 | |

| Net increase (decrease) in cash and cash equivalents, unrestricted and restricted | $ | 285 |

| $ | (476 | ) | $ | (191 | ) | | $ | 20 |

| $ | (220 | ) | $ | (200 | ) | Net increase (decrease) in cash and cash equivalents, unrestricted and restricted | $ | 193 | | $ | (315) | | $ | (122) | | | $ | 285 | | $ | (476) | | $ | (191) | |

| Cash and cash equivalents, unrestricted and restricted: | | | | Cash and cash equivalents, unrestricted and restricted: | |

| Beginning of period | 291 |

| 1,165 |

| 1,456 |

| | 425 |

| 924 |

| 1,349 |

| Beginning of period | 352 | | 1,291 | | 1,643 | | | 291 | | 1,165 | | 1,456 | |

| End of period | $ | 576 |

| $ | 689 |

| $ | 1,265 |

| | $ | 445 |

| $ | 704 |

| $ | 1,149 |

| End of period | $ | 545 | | $ | 976 | | $ | 1,521 | | | $ | 576 | | $ | 689 | | $ | 1,265 | |

| | | | | |

| Net increase (decrease) in cash and cash equivalents: | | | | Net increase (decrease) in cash and cash equivalents: | |

| Unrestricted | $ | 308 |

| $ | — |

| $ | 308 |

| | $ | 23 |

| $ | — |

| $ | 23 |

| Unrestricted | $ | 199 | | $ | — | | $ | 199 | | | $ | 308 | | $ | — | | $ | 308 | |

| Restricted | (23 | ) | (476 | ) | (499 | ) | | (3 | ) | (220 | ) | (223 | ) | Restricted | (6) | | (315) | | (321) | | | (23) | | (476) | | (499) | |

Operating Activities

Components of net cash provided by (used in) operating activities are as follows:

| | | | | | | | |

| | Three Months Ended March 31, |

| (in millions) | 2021 | 2020 |

| Net cash used in operating activities | $ | (175) | | $ | (282) | |

| Net cash used in operating activities - WSE | (306) | | $ | (401) | |

| Net cash provided by operating activities - Corporate | 131 | | 119 | |

|

| | | | | | |

| | Three Months Ended March 31, |

| (in millions) | 2020 | 2019 |

| Net income | $ | 91 |

| $ | 63 |

|

| Depreciation and amortization | 15 |

| 18 |

|

| Noncash lease expense | 4 |

| — |

|

| Stock based compensation expense | 9 |

| 9 |

|

| Payment of interest | (3 | ) | (4 | ) |

| Income tax payments, net | (1 | ) | (1 | ) |

| Changes in other operating assets | (16 | ) | (4 | ) |

| Changes in other operating liabilities | 20 |

| (3 | ) |

| Net cash provided by operating activities - Corporate | $ | 119 |

| $ | 78 |

|

| Collateral (paid to) refunded from insurance carriers, net | 1 |

| — |

|

| Changes in other operating assets | (110 | ) | (45 | ) |

| Changes in other operating liabilities | (292 | ) | (175 | ) |

| Net cash used in operating activities - WSE | $ | (401 | ) | $ | (220 | ) |

| Net cash used in operating activities | $ | (282 | ) | $ | (142 | ) |