0001099219us-gaap:EquityContractMembersrt:MaximumMembermet:MeasurementInputCorrelationMember2020-12-31 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

Form 10-Q

(Mark One)

|

| | | | |

þ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBERJUNE 30, 20172021

or

|

| | | | |

¨☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number: 001-15787

_____________________________________________________________________________

MetLife, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | | | | | | | | | | |

| Delaware | | 13-4075851 |

(State or other jurisdiction of

incorporation or organization)

| | (I.R.S. Employer

Identification No.)

|

| | | |

| 200 Park Avenue, | New York, N.Y. | NY | | 10166-0188 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 578-9500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | MET | New York Stock Exchange |

| Floating Rate Non-Cumulative Preferred Stock, Series A, par value $0.01 | MET PRA | New York Stock Exchange |

| Depositary Shares, each representing a 1/1,000th interest in a share of 5.625% Non-Cumulative Preferred Stock, Series E | MET PRE | New York Stock Exchange |

Depositary Shares, each representing a 1/1,000th interest in

a share of 4.75% Non-Cumulative Preferred Stock, Series F | MET PRF | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ ☑No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ ☑No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

| Large accelerated filer | þ☑ | Accelerated filer | ¨☐ |

Non-accelerated filer (Do not check if a smaller reporting company) | ¨

☐ | Smaller reporting company | ¨

☐ |

| | Emerging growth company | ¨

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐No þ☑

At October 25, 2017, 1,052,299,271July 30 2021, 856,897,461 shares of the registrant’s common stock $0.01 par value per share, were outstanding.

Table of Contents

| | | | | | | | |

| | Page |

| |

| Item 1. | Financial Statements (Unaudited) (at SeptemberJune 30, 2017 (Unaudited)2021 and December 31, 20162020 and for the Three Months and NineSix Months Ended SeptemberJune 30, 20172021 and 2016 (Unaudited))2020) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 6. | | |

| | |

| |

| |

| |

| |

As used in this Form 10‑Q, “MetLife,” the “Company,” “we,” “our” and “us” refer to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates.

Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10‑Q, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that theyevents and do not relate strictly to historical or current facts. They use words and terms such as “anticipate,” “estimate,“assume,” “become,” “believe,” “continue,” “could,” “expect,” “project,“forecast,” “future,” “if,” “intend,” “likely,” “may,” “permit,” “plan,” “believe”“possible,” “potential,” “probable,” “project,” “propose,” “prospect,” “remain,” “renew,” “risk,” “should,” “target,” “ultimate,” “unlikely,” “well positioned,” “when,” “will,” “would” and other words and terms of similar meaning or that are otherwise tied to future periods or future performance, in connection with a discussion of future operating or financial performance. In particular, theseeach case in all derivative forms. They include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, future sales efforts, future expenses, the outcome of contingencies such as legal proceedings, and future trends in operations and financial results.

Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknownMany factors determine Company results, and they involve unpredictable risks and uncertainties. Many such factors will be important in determining the actual future results of MetLife, Inc., its subsidiaries and affiliates. TheseOur forward-looking statements are baseddepend on currentour assumptions, our expectations, and our understanding of the current economic environment. They involve a number of risksenvironment, but they may be inaccurate and uncertainties that are difficult to predict. These statements aremay change. We do not guarantees ofguarantee any future performance. ActualOur results could differ materially from those expressedwe express or impliedimply in the forward-looking statements. Risks, uncertainties, and other factors that might cause such differences include theThe risks, uncertainties and other factors identified in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission.Commission, and others, may cause such differences. These factors include:

(1) difficult conditions in the global capital markets; (2) increased volatilityeconomic condition difficulties, including risks relating to public health, interest rates, credit spreads, equity, real estate, obligors and disruption of thecounterparties, currency exchange rates, derivatives, and terrorism and security;

(2) global capital and credit markets, which may affect our abilitymarket adversity;

(3) credit facility inaccessibility;

(4) financial strength or credit ratings downgrades;

(5) unavailability, unaffordability, or inadequate reinsurance;

(6) statutory life insurance reserve financing costs or limited market capacity;

(7) legal, regulatory, and supervisory and enforcement policy changes;

(8) changes in tax rates, tax laws or interpretations;

(9) litigation and regulatory investigations;

(10) London Interbank Offered Rate termination and transition to alternative reference rates;

(11) unsuccessful efforts to meet liquidity needsall environmental, social, and access capital, including throughgovernance standards or to enhance our credit facilities, generate fee incomesustainability;

(12) MetLife, Inc.’s inability to pay dividends and market-related revenue and finance statutory reserve requirements and may require usrepurchase common stock;

(13) MetLife, Inc.’s subsidiaries’ inability to pledgepay it dividends;

(14) investment defaults, downgrades, or volatility;

(15) investment sales or lending difficulties;

(16) collateral or make payments related to declines in value of specified assets, including assets supporting risks ceded to certain of our captive reinsurersderivative-related payments;

(17) investment valuations, allowances, or hedging arrangements associated with those risks; (3) exposure to global financial and capital market risks, including as a result of the United Kingdom’s notice of withdrawal from the European Union, other disruption in Europe and possible withdrawal of one or more countries from the Euro zone; (4) impact on us of comprehensive financial services regulation reform, including potential regulation of MetLife, Inc. as a non-bank systemically important financial institution, or otherwise; (5) numerous rulemaking initiatives required or permitted by the Dodd-Frank Wall Street Reform and Consumer Protection Act which may impact how we conduct our business, including those compelling the liquidation of certain financial institutions; (6) regulatory, legislative or tax changes relating to our insurance, international,impairments changes;

(18) claims or other operationsresults that may affect the cost of,differ from our estimates, assumptions, or demand for,models;

(19) global political, legal, or operational risks;

(20) business competition;

(21) technological change;

(22) catastrophes;

(23) climate changes or responses to it;

(24) deficiencies in our products or services, or increase the cost or administrative burdens of providing benefits to employees; (7) adverse resultsclosed block;

(25) goodwill or other consequences from litigation, arbitrationasset impairment, or regulatory investigations; (8) unanticipated or adverse developments that could adversely affect our achieving expected operational or other benefits from the separationdeferred income tax asset allowance;

(26) acceleration of Brighthouse Financial, Inc. and it subsidiaries (“Brighthouse”); (9) our equity market exposure to Brighthouse Financial, Inc. following the separationamortization of Brighthouse; (10) liabilities, losses or indemnification obligations arising from our transitional services, investment management or tax arrangements or other agreements with Brighthouse; (11) failure of the separation of Brighthouse to qualify for intended tax-free treatment; (12) our ability to address difficulties, unforeseen liabilities, asset impairments, or rating agency actions arising from (a) business acquisitions and integrating and managing the growth of such acquired businesses, (b) dispositions of businesses via sale, initial public offering, spin-off or otherwise, including failure to achieve projected operational benefit from such transactions and any restrictions, liabilities, losses or indemnification obligations arising from any transitional services or tax arrangements related to the separation of any business, or from the failure of such a separation to qualify for any intended tax-free treatment, (c) entry into joint ventures, or (d) legal entity reorganizations; (13) potential liquidity and other risks resulting from our participation in a securities lending program and other transactions; (14) investment losses and defaults, and changes to investment valuations; (15) changes in assumptions related to investment valuations, deferred policy acquisition costs, deferred sales inducements, value of business acquired, or goodwill; (16) impairmentsvalue of goodwillcustomer relationships acquired;

(27) product guarantee volatility, costs, and realized lossescounterparty risks;

(28) risk management failures;

(29) insufficient protection from operational risks;

(30) confidential information protection or market value impairments to illiquid assets; (17) defaults on our mortgage loans; (18) the defaultsother cybersecurity or deteriorating credit of other financial institutions that could adversely affect us; (19) economic, political, legal, currencydisaster recovery failures;

(31) accounting standards changes;

(32) excessive risk-taking;

(33) marketing and distribution difficulties;

(34) pension and other risks relatingpostretirement benefit assumption changes;

(35) inability to protect our international operations, including with respect to fluctuations of exchange rates; (20) downgrades in our claims paying ability, financial strengthintellectual property or credit ratings; (21) a deterioration in the experience of the closed block established in connection with theavoid infringement claims;

(36) acquisition, integration, growth, disposition, or reorganization of Metropolitan Life Insurance Company; (22) availability and effectiveness of reinsurance, hedging or indemnification arrangements, as well as any default or failure of counterparties to perform; (23) differences between actual claims experience and underwriting and reserving assumptions; (24) ineffectiveness of risk management policies and procedures; (25) catastrophe losses; (26) increasing cost and limited market capacity for statutory life insurance reserve financings; (27) heightened competition, including with respect to pricing, entry of new competitors, consolidation of distributors, the development of new products by new and existing competitors, and for personnel; (28) exposure to losses related to variable annuity guarantee benefits, including from significant and sustained downturns or extreme volatility in equity markets, reduced interest rates, unanticipated policyholder behavior, mortality or longevity, and any adjustment for nonperformance risk; (29) legal, regulatory and other restrictions affecting MetLife, Inc.’s ability to pay dividends and repurchase common stock; (30) MetLife, Inc.’s and its subsidiary holding companies’ primary reliance, as holding companies, on dividends from subsidiaries to meet free cash flow targets and debt payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; (31) the possibility thatdifficulties;

(37) Brighthouse separation risks;

(38) MetLife, Inc.’s Board of Directors may influence over the outcome of stockholder votes through the voting provisions of the MetLife Policyholder Trust; (32) changes in accounting standards, practices and/or policies; (33) increased expenses relating to pension and postretirement benefit plans, as well as health care and other employee benefits; (34) inability to protect our intellectual property rights or claims of infringement of the intellectual property rights of others; (35) difficulties in marketing and distributing products through our distribution channels; (36) provisions of laws and our incorporation documents may delay, deter or prevent takeovers

(39) legal- and corporate combinations involving MetLife; (37) thegovernance-related effects ofon business disruption or economic contraction due to disasters such as terrorist attacks, cyberattacks, other hostilities, or natural catastrophes, including any related impact on the value of our investment portfolio, our disaster recovery systems, cyber- or other information security systems and management continuity planning; (38) any failure to protect the confidentiality of client information; (39) the effectiveness of our programs and practices in avoiding giving our associates incentives to take excessive risks; and (40) other risks and uncertainties described from time to time in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission.combinations.

MetLife, Inc. doesThe Company will not undertake any obligation to publicly correct or update any forward-looking statementstatements if MetLife, Inc. later becomes aware that such statement iswe believe we are not likely to be achieved.achieve them or for any other reasons. Please consult any further disclosures MetLife, Inc. makes on related subjects in subsequent reports to the U.S. Securities and Exchange Commission.

Corporate Information

We announce financial and other information about MetLife to our investors on our website (www.metlife.com) through the MetLife Investor Relations web page at www.metlife.com,(https://investor.metlife.com), as well as in U.S. Securities and Exchange Commission filings, news releases, public conference calls and webcasts. MetLife encourages investors to visit the Investor Relations web page from time to time, as information is updated and new information is posted. The information found on our website is not incorporated by reference into this Quarterly Report on Form 10-Q or in any other report or document we file with the U.S. Securities and Exchange Commission, and any references to our website are intended to be inactive textual references only.

Note Regarding Reliance on Statements in Our Contracts

See “Item 6. Exhibits“Exhibits — Note Regarding Reliance on Statements in Our Contracts” for information regarding agreements included as exhibits to this Quarterly Report on Form 10-Q.

Part I — Financial Information

Item 1. Financial Statements

MetLife, Inc.

Interim Condensed Consolidated Balance Sheets

SeptemberJune 30, 2017 (Unaudited)2021 and December 31, 20162020 (Unaudited)

(In millions, except share and per share data)

| | | | | | | | | | | | | | |

| | June 30, 2021 | | December 31, 2020 |

| Assets | | | | |

| Investments: | | | | |

| Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $307,102 and $310,811, respectively; allowance for credit loss of $99 and $81, respectively) | | $ | 340,695 | | | $ | 354,809 | |

| Equity securities, at estimated fair value | | 1,001 | | | 1,079 | |

| Contractholder-directed equity securities and fair value option securities, at estimated fair value | | 12,177 | | | 13,319 | |

| Mortgage loans (net of allowance for credit loss of $570 and $590, respectively; includes $140 and $165, respectively, under the fair value option) | | 81,497 | | | 83,919 | |

| Policy loans | | 9,256 | | | 9,493 | |

| Real estate and real estate joint ventures (includes $191 and $169, respectively, under the fair value option and $78 and $128, respectively, of real estate held-for-sale) | | 11,901 | | | 11,933 | |

| Other limited partnership interests | | 11,980 | | | 9,470 | |

| Short-term investments, principally at estimated fair value | | 3,759 | | | 3,904 | |

| Other invested assets (includes $2,132 and $2,156, respectively, of leveraged and direct financing leases and $391 and $332, respectively, relating to variable interest entities) | | 18,977 | | | 20,593 | |

| Total investments | | 491,243 | | | 508,519 | |

| Cash and cash equivalents, principally at estimated fair value (includes $5 and $12, respectively, relating to variable interest entities) | | 25,037 | | | 19,795 | |

| Accrued investment income | | 3,202 | | | 3,388 | |

| Premiums, reinsurance and other receivables (includes $5 and $4, respectively, relating to variable interest entities) | | 18,236 | | | 17,870 | |

| Deferred policy acquisition costs and value of business acquired | | 16,527 | | | 16,389 | |

| Current income tax recoverable | | 52 | | | 0 | |

| Goodwill | | 9,768 | | | 10,112 | |

| | | | |

| Assets held-for-sale | | 7,590 | | | 7,418 | |

| Other assets (includes $2 and $1, respectively, relating to variable interest entities) | | 11,651 | | | 11,685 | |

| Separate account assets | | 189,947 | | | 199,970 | |

| Total assets | | $ | 773,253 | | | $ | 795,146 | |

| Liabilities and Equity | | | | |

| Liabilities | | | | |

| Future policy benefits | | $ | 199,376 | | | $ | 206,656 | |

| Policyholder account balances | | 204,948 | | | 205,176 | |

| Other policy-related balances | | 17,527 | | | 17,101 | |

| Policyholder dividends payable | | 572 | | | 587 | |

| Policyholder dividend obligation | | 2,115 | | | 2,969 | |

| Payables for collateral under securities loaned and other transactions | | 30,620 | | | 29,475 | |

| Short-term debt | | 393 | | | 393 | |

| Long-term debt (includes $0 and $5, respectively, relating to variable interest entities) | | 14,518 | | | 14,603 | |

| Collateral financing arrangement | | 818 | | | 845 | |

| Junior subordinated debt securities | | 3,154 | | | 3,153 | |

| | | | |

| Current income tax payable | | 0 | | | 129 | |

| Deferred income tax liability | | 9,748 | | | 11,008 | |

| Liabilities held-for-sale | | 6,844 | | | 4,650 | |

| Other liabilities (includes $10 and $1, respectively, relating to variable interest entities) | | 23,250 | | | 23,614 | |

| Separate account liabilities | | 189,947 | | | 199,970 | |

| Total liabilities | | 703,830 | | | 720,329 | |

| Contingencies, Commitments and Guarantees (Note 15) | | 0 | | 0 |

| Equity | | | | |

| MetLife, Inc.’s stockholders’ equity: | | | | |

| Preferred stock, par value $0.01 per share; $3,905 and $4,405 aggregate liquidation preference | | 0 | | | 0 | |

| Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 1,185,931,582 and 1,181,614,288 shares issued, respectively; 861,057,466 and 892,910,600 shares outstanding, respectively | | 12 | | | 12 | |

| Additional paid-in capital | | 33,440 | | | 33,812 | |

| Retained earnings | | 39,318 | | | 36,491 | |

| Treasury stock, at cost; 324,874,116 and 288,703,688 shares, respectively | | (15,941) | | | (13,829) | |

| Accumulated other comprehensive income (loss) ("AOCI") | | 12,309 | | | 18,072 | |

| Total MetLife, Inc.’s stockholders’ equity | | 69,138 | | | 74,558 | |

| Noncontrolling interests | | 285 | | | 259 | |

| Total equity | | 69,423 | | | 74,817 | |

| Total liabilities and equity | | $ | 773,253 | | | $ | 795,146 | |

|

| | | | | | | | |

| | | September 30, 2017 | | December 31, 2016 |

| Assets | | | | |

| Investments: | | | | |

| Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $286,684 and $271,701, respectively) | | $ | 308,894 |

| | $ | 289,563 |

|

| Equity securities available-for-sale, at estimated fair value (cost: $2,386 and $2,464, respectively) | | 2,776 |

| | 2,894 |

|

| Fair value option securities, at estimated fair value (includes $7 and $8, respectively, relating to variable interest entities) | | 16,538 |

| | 13,923 |

|

| Mortgage loans (net of valuation allowances of $316 and $304, respectively; includes $564 and $566, respectively, under the fair value option) | | 68,057 |

| | 65,167 |

|

| Policy loans | | 9,585 |

| | 9,511 |

|

| Real estate and real estate joint ventures (includes $61 and $59, respectively, of real estate held-for-sale) | | 9,486 |

| | 8,891 |

|

| Other limited partnership interests (includes $0 and $14, respectively, relating to variable interest entities) | | 5,501 |

| | 5,136 |

|

| Short-term investments, principally at estimated fair value | | 7,217 |

| | 6,523 |

|

| Other invested assets (includes $133 and $31, respectively, relating to variable interest entities) | | 17,652 |

| | 19,303 |

|

| Total investments | | 445,706 |

| | 420,911 |

|

| Cash and cash equivalents, principally at estimated fair value (includes $9 and $1, respectively, relating to variable interest entities) | | 13,023 |

| | 12,651 |

|

| Accrued investment income | | 3,692 |

| | 3,308 |

|

| Premiums, reinsurance and other receivables (includes $3 and $2, respectively, relating to variable interest entities) | | 18,588 |

| | 15,445 |

|

| Deferred policy acquisition costs and value of business acquired | | 18,399 |

| | 17,590 |

|

| Current income tax recoverable | | 3 |

| | 20 |

|

| Goodwill | | 9,556 |

| | 9,220 |

|

| Assets of disposed subsidiary | | — |

| | 216,983 |

|

| Other assets (includes $3 and $3, respectively, relating to variable interest entities) | | 8,149 |

| | 7,058 |

|

| Separate account assets | | 203,399 |

| | 195,578 |

|

| Total assets | | $ | 720,515 |

| | $ | 898,764 |

|

| Liabilities and Equity | | | | |

| Liabilities | | | | |

| Future policy benefits | | $ | 176,005 |

| | $ | 166,701 |

|

| Policyholder account balances | | 182,513 |

| | 173,168 |

|

| Other policy-related balances | | 15,026 |

| | 13,030 |

|

| Policyholder dividends payable | | 730 |

| | 696 |

|

| Policyholder dividend obligation | | 2,201 |

| | 1,931 |

|

| Payables for collateral under securities loaned and other transactions | | 27,132 |

| | 25,873 |

|

| Short-term debt | | 214 |

| | 242 |

|

| Long-term debt (includes $6 and $12, respectively, at estimated fair value, relating to variable interest entities) | | 16,688 |

| | 16,441 |

|

| Collateral financing arrangement | | 1,220 |

| | 1,274 |

|

| Junior subordinated debt securities | | 3,144 |

| | 3,169 |

|

| Liabilities of disposed subsidiary | | — |

| | 202,707 |

|

| Deferred income tax liability | | 8,554 |

| | 6,774 |

|

| Other liabilities | | 26,745 |

| | 23,700 |

|

| Separate account liabilities | | 203,399 |

| | 195,578 |

|

| Total liabilities | | 663,571 |

| | 831,284 |

|

| Contingencies, Commitments and Guarantees (Note 14) | |

| |

|

| Equity | | | | |

| MetLife, Inc.’s stockholders’ equity: | | | | |

| Preferred stock, par value $0.01 per share; $2,100 aggregate liquidation preference | | — |

| | — |

|

| Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 1,167,535,225 and 1,164,029,985 shares issued, respectively; 1,054,286,620 and 1,095,519,005 shares outstanding, respectively | | 12 |

| | 12 |

|

| Additional paid-in capital | | 31,066 |

| | 30,944 |

|

| Retained earnings | | 24,410 |

| | 34,480 |

|

| Treasury stock, at cost; 113,248,605 and 68,510,980 shares, respectively | | (5,779 | ) | | (3,474 | ) |

| Accumulated other comprehensive income (loss) | | 7,005 |

| | 5,347 |

|

| Total MetLife, Inc.’s stockholders’ equity | | 56,714 |

| | 67,309 |

|

| Noncontrolling interests | | 230 |

| | 171 |

|

| Total equity | | 56,944 |

| | 67,480 |

|

| Total liabilities and equity | | $ | 720,515 |

| | $ | 898,764 |

|

MetLife, Inc.

Interim Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

For the Three Months and NineSix Months Ended SeptemberJune 30, 20172021 and 20162020 (Unaudited)

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months

Ended

June 30, | | Six Months

Ended

June 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Revenues | | | | | | | | |

| Premiums | | $ | 9,132 | | | $ | 8,736 | | | $ | 19,459 | | | $ | 18,202 | |

| Universal life and investment-type product policy fees | | 1,422 | | | 1,299 | | | 2,813 | | | 2,730 | |

| Net investment income | | 5,280 | | | 4,087 | | | 10,594 | | | 7,148 | |

| Other revenues | | 664 | | | 456 | | | 1,295 | | | 895 | |

| Net investment gains (losses) | | 1,605 | | | 231 | | | 1,739 | | | (57) | |

| Net derivative gains (losses) | | 421 | | | (710) | | | (1,814) | | | 3,491 | |

| Total revenues | | 18,524 | | | 14,099 | | | 34,086 | | | 32,409 | |

| Expenses | | | | | | | | |

| Policyholder benefits and claims | | 9,405 | | | 8,667 | | | 19,928 | | | 17,689 | |

| Interest credited to policyholder account balances | | 1,515 | | | 1,962 | | | 2,866 | | | 2,042 | |

| Policyholder dividends | | 236 | | | 290 | | | 483 | | | 582 | |

| Other expenses | | 2,881 | | | 2,983 | | | 6,031 | | | 6,256 | |

| Total expenses | | 14,037 | | | 13,902 | | | 29,308 | | | 26,569 | |

| Income (loss) before provision for income tax | | 4,487 | | | 197 | | | 4,778 | | | 5,840 | |

| Provision for income tax expense (benefit) | | 1,075 | | | 47 | | | 1,003 | | | 1,289 | |

| Net income (loss) | | 3,412 | | | 150 | | | 3,775 | | | 4,551 | |

| Less: Net income (loss) attributable to noncontrolling interests | | 5 | | | 5 | | | 10 | | | 8 | |

| Net income (loss) attributable to MetLife, Inc. | | 3,407 | | | 145 | | | 3,765 | | | 4,543 | |

| Less: Preferred stock dividends | | 35 | | | 77 | | | 103 | | | 109 | |

| Preferred stock redemption premium | | 6 | | | 0 | | | 6 | | | 0 | |

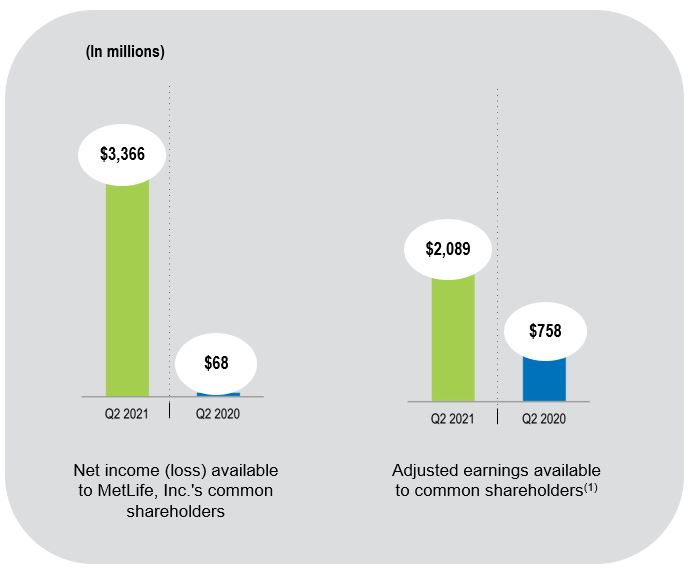

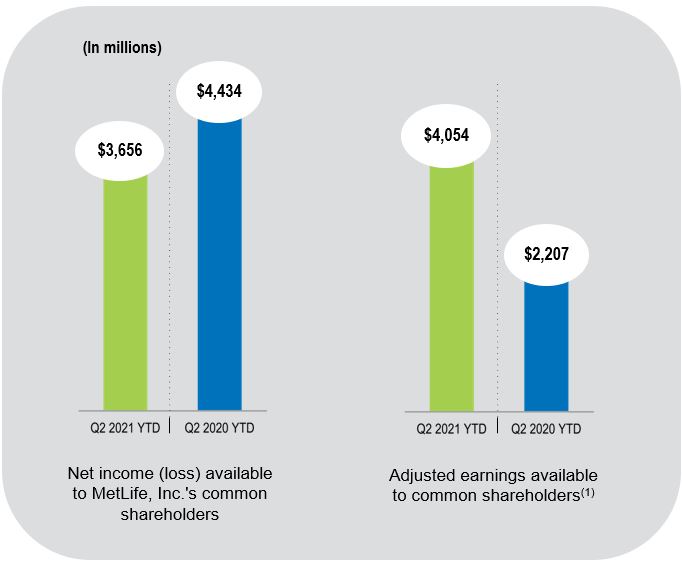

| Net income (loss) available to MetLife, Inc.’s common shareholders | | $ | 3,366 | | | $ | 68 | | | $ | 3,656 | | | $ | 4,434 | |

| Comprehensive income (loss) | | $ | 5,325 | | | $ | 5,957 | | | $ | (1,987) | | | $ | 10,064 | |

| Less: Comprehensive income (loss) attributable to noncontrolling interests, net of income tax | | 6 | | | 6 | | | 11 | | | 10 | |

| Comprehensive income (loss) attributable to MetLife, Inc. | | $ | 5,319 | | | $ | 5,951 | | | $ | (1,998) | | | $ | 10,054 | |

|

| | | | | | | | | | | | | | | |

| | Three Months

Ended

September 30, | | Nine Months

Ended

September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Revenues | | | | | | | |

| Premiums | $ | 10,876 |

| | $ | 9,839 |

| | $ | 29,421 |

| | $ | 27,956 |

|

| Universal life and investment-type product policy fees | 1,428 |

| | 1,341 |

| | 4,152 |

| | 4,127 |

|

| Net investment income | 4,295 |

| | 4,609 |

| | 12,909 |

| | 12,527 |

|

| Other revenues | 301 |

| | 356 |

| | 935 |

| | 1,309 |

|

| Net investment gains (losses): | | | | | | | |

| Other-than-temporary impairments on fixed maturity securities | (6 | ) | | (4 | ) | | (8 | ) | | (74 | ) |

| Other-than-temporary impairments on fixed maturity securities transferred to other comprehensive income (loss) | 1 |

| | (5 | ) | | 1 |

| | (9 | ) |

| Other net investment gains (losses) | (601 | ) | | 240 |

| | (432 | ) | | 681 |

|

| Total net investment gains (losses) | (606 | ) | | 231 |

| | (439 | ) | | 598 |

|

| Net derivative gains (losses) | (190 | ) | | (543 | ) | | (663 | ) | | 1,438 |

|

| Total revenues | 16,104 |

| | 15,833 |

| | 46,315 |

| | 47,955 |

|

| Expenses | | | | | | | |

| Policyholder benefits and claims | 10,645 |

| | 9,612 |

| | 28,923 |

| | 27,394 |

|

| Interest credited to policyholder account balances | 1,338 |

| | 1,544 |

| | 4,081 |

| | 3,819 |

|

| Policyholder dividends | 302 |

| | 302 |

| | 925 |

| | 924 |

|

| Other expenses | 3,318 |

| | 3,216 |

| | 9,904 |

| | 10,296 |

|

| Total expenses | 15,603 |

| | 14,674 |

| | 43,833 |

| | 42,433 |

|

| Income (loss) from continuing operations before provision for income tax | 501 |

| | 1,159 |

| | 2,482 |

| | 5,522 |

|

| Provision for income tax expense (benefit) | (392 | ) | | 135 |

| | (148 | ) | | 1,253 |

|

| Income (loss) from continuing operations, net of income tax | 893 |

| | 1,024 |

| | 2,630 |

| | 4,269 |

|

| Income (loss) from discontinued operations, net of income tax | (968 | ) | | (451 | ) | | (989 | ) | | (1,379 | ) |

| Net income (loss) | (75 | ) | | 573 |

| | 1,641 |

| | 2,890 |

|

| Less: Net income (loss) attributable to noncontrolling interests | 6 |

| | (4 | ) | | 12 |

| | 2 |

|

| Net income (loss) attributable to MetLife, Inc. | (81 | ) | | 577 |

| | 1,629 |

| | 2,888 |

|

| Less: Preferred stock dividends | 6 |

| | 6 |

| | 58 |

| | 58 |

|

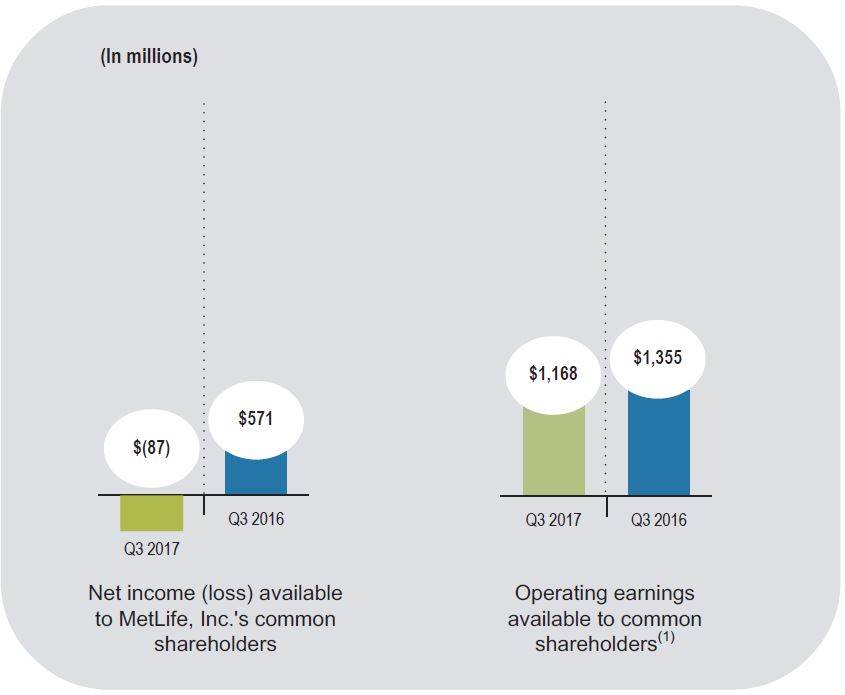

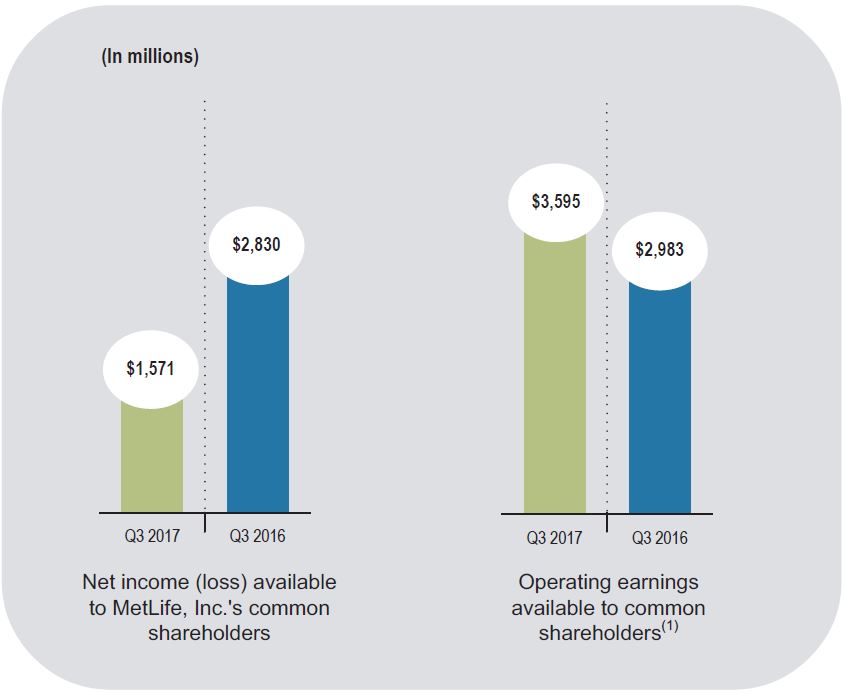

| Net income (loss) available to MetLife, Inc.’s common shareholders | $ | (87 | ) | | $ | 571 |

| | $ | 1,571 |

| | $ | 2,830 |

|

| Comprehensive income (loss) | $ | (182 | ) | | $ | (463 | ) | | $ | 4,623 |

| | $ | 11,809 |

|

| Less: Comprehensive income (loss) attributable to noncontrolling interests, net of income tax | 10 |

| | (3 | ) | | 16 |

| | 97 |

|

| Comprehensive income (loss) attributable to MetLife, Inc. | $ | (192 | ) | | $ | (460 | ) | | $ | 4,607 |

| | $ | 11,712 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income (loss) available to MetLife, Inc.’s common shareholders per common share: | | | | | | | | |

| Basic | | $ | 3.85 | | | $ | 0.07 | | | $ | 4.16 | | | $ | 4.86 | |

| Diluted | | $ | 3.83 | | | $ | 0.07 | | | $ | 4.13 | | | $ | 4.84 | |

| | | | | | | | |

|

| | | | | | | | | | | | | | | |

| Income (Loss) from Continuing Operations: | | | | | | | |

| Basic | $ | 0.83 |

| | $ | 0.93 |

| | $ | 2.38 |

| | $ | 3.82 |

|

| Diluted | $ | 0.82 |

| | $ | 0.92 |

| | $ | 2.36 |

| | $ | 3.80 |

|

| Net income (loss) available to MetLife, Inc.’s common shareholders per common share: | | | | | | | |

| Basic | $ | (0.08 | ) | | $ | 0.52 |

| | $ | 1.46 |

| | $ | 2.57 |

|

| Diluted | $ | (0.08 | ) | | $ | 0.51 |

| | $ | 1.45 |

| | $ | 2.55 |

|

| Cash dividends declared per common share | $ | 0.400 |

| | $ | 0.400 |

| | $ | 1.200 |

| | $ | 1.175 |

|

See accompanying notes to the interim condensed consolidated financial statements.

MetLife, Inc.

Interim Condensed Consolidated Statements of Equity

For the NineSix Months Ended SeptemberJune 30, 20172021 and 20162020 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | Preferred

Stock | | Common

Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Treasury

Stock

at Cost | | Accumulated

Other

Comprehensive

Income (Loss) | | Total

MetLife, Inc.’s

Stockholders’

Equity | | Noncontrolling

Interests | | Total

Equity |

| | | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Treasury Stock at Cost | | Accumulated Other Comprehensive Income (Loss) | | Total MetLife, Inc.’s Stockholders’ Equity | | Noncontrolling Interests | | Total Equity | |

| Balance at December 31, 2016 | | $ | — |

| | $ | 12 |

| | $ | 30,944 |

| | $ | 34,480 |

| | $ | (3,474 | ) | | $ | 5,347 |

| | $ | 67,309 |

| | $ | 171 |

| | $ | 67,480 |

| |

| Balance at December 31, 2020 | | Balance at December 31, 2020 | | $ | 0 | | | $ | 12 | | | $ | 33,812 | | | $ | 36,491 | | | $ | (13,829) | | | $ | 18,072 | | | $ | 74,558 | | | $ | 259 | | | $ | 74,817 | |

| Treasury stock acquired in connection with share repurchases | | | |

| |

|

| | | | (2,305 | ) | | | | (2,305 | ) | | | | (2,305 | ) | Treasury stock acquired in connection with share repurchases | | (999) | | | (999) | | | (999) | |

| Stock-based compensation | | | | | | 122 |

| | | | | | | | 122 |

| | | | 122 |

| Stock-based compensation | | 98 | | | 98 | | | 98 | |

| Dividends on preferred stock | | | | | | | | (58 | ) | | | | | | (58 | ) | | | | (58 | ) | Dividends on preferred stock | | (68) | | | (68) | | | (68) | |

| Dividends on common stock | | | | | | | | (1,295 | ) | | | | | | (1,295 | ) | | | | (1,295 | ) | |

| Distribution of Brighthouse (Note 3) | | | | | | | | (10,346 | ) | | | | (1,320 | ) | | (11,666 | ) | | | | (11,666 | ) | |

| Dividends on common stock (declared per share of $0.460) | | Dividends on common stock (declared per share of $0.460) | | (408) | | | (408) | | | (408) | |

| Change in equity of noncontrolling interests | | | | | | | | | | | | | | — |

| | 43 |

| | 43 |

| Change in equity of noncontrolling interests | | 0 | | | 9 | | | 9 | |

| Net income (loss) | | | | | | | | 1,629 |

| | | | | | 1,629 |

| | 12 |

| | 1,641 |

| Net income (loss) | | 358 | | | 358 | | | 5 | | | 363 | |

| Other comprehensive income (loss), net of income tax | | | | | | | | | | | | 2,978 |

| | 2,978 |

| | 4 |

| | 2,982 |

| Other comprehensive income (loss), net of income tax | | (7,675) | | | (7,675) | | | 0 | | | (7,675) | |

| Balance at September 30, 2017 | | $ | — |

| | $ | 12 |

| | $ | 31,066 |

| | $ | 24,410 |

| | $ | (5,779 | ) | | $ | 7,005 |

| | $ | 56,714 |

| | $ | 230 |

| | $ | 56,944 |

| |

| Balance at March 31, 2021 | | Balance at March 31, 2021 | | 0 | | | 12 | | | 33,910 | | | 36,373 | | | (14,828) | | | 10,397 | | | 65,864 | | | 273 | | | 66,137 | |

| Redemption of preferred stock | | Redemption of preferred stock | | (494) | | | (494) | | | (494) | |

| Preferred stock redemption premium | | Preferred stock redemption premium | | (6) | | | (6) | | | (6) | |

| Treasury stock acquired in connection with share repurchases | | Treasury stock acquired in connection with share repurchases | | (1,113) | | | (1,113) | | | (1,113) | |

| Stock-based compensation | | Stock-based compensation | | 24 | | | 24 | | | 24 | |

| Dividends on preferred stock | | Dividends on preferred stock | | (35) | | | (35) | | | (35) | |

| Dividends on common stock (declared per share of $0.480) | | Dividends on common stock (declared per share of $0.480) | | (421) | | | (421) | | | (421) | |

| Change in equity of noncontrolling interests | | Change in equity of noncontrolling interests | | 0 | | | 6 | | | 6 | |

| Net income (loss) | | Net income (loss) | | 3,407 | | | 3,407 | | | 5 | | | 3,412 | |

| Other comprehensive income (loss), net of income tax | | Other comprehensive income (loss), net of income tax | | 1,912 | | | 1,912 | | | 1 | | | 1,913 | |

| Balance at June 30, 2021 | | Balance at June 30, 2021 | | $ | 0 | | | $ | 12 | | | $ | 33,440 | | | $ | 39,318 | | | $ | (15,941) | | | $ | 12,309 | | | $ | 69,138 | | | $ | 285 | | | $ | 69,423 | |

| | | | | | | | | | | | | | | | | | | | | | Preferred

Stock | | Common

Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Treasury

Stock

at Cost | | Accumulated

Other

Comprehensive

Income (Loss) | | Total

MetLife, Inc.’s

Stockholders’

Equity | | Noncontrolling

Interests | | Total

Equity |

| | | Preferred Stock | | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Treasury Stock at Cost | | Accumulated Other Comprehensive Income (Loss) | | Total MetLife, Inc.’s Stockholders’ Equity | | Noncontrolling Interests | | Total Equity | |

| Balance at December 31, 2015 | | $ | — |

| | $ | 12 |

| | $ | 30,749 |

| | $ | 35,519 |

| | $ | (3,102 | ) | | $ | 4,771 |

| | $ | 67,949 |

| | $ | 470 |

| | $ | 68,419 |

| |

| Balance at December 31, 2019 | | Balance at December 31, 2019 | | $ | 0 | | | $ | 12 | | | $ | 32,680 | | | $ | 33,078 | | | $ | (12,678) | | | $ | 13,052 | | | $ | 66,144 | | | $ | 238 | | | $ | 66,382 | |

| Cumulative effects of changes in accounting principles, net of income tax | | Cumulative effects of changes in accounting principles, net of income tax | | (121) | | | (121) | | | (121) | |

| Preferred stock issuance | | Preferred stock issuance | | 972 | | 972 | | | 972 | |

| Treasury stock acquired in connection with share repurchases | | | | | | | | | | (70 | ) | | | | (70 | ) | | | | (70 | ) | Treasury stock acquired in connection with share repurchases | | (500) | | | (500) | | | (500) | |

| Stock-based compensation | | | | | | 48 |

| | | | | | | | 48 |

| | | | 48 |

| Stock-based compensation | | 59 | | | 59 | | | 59 | |

| Dividends on preferred stock | | | | | | | | (58 | ) | | | | | | (58 | ) | | | | (58 | ) | Dividends on preferred stock | | (32) | | | (32) | | | (32) | |

| Dividends on common stock | | | | | | | | (1,295 | ) | | | | | | (1,295 | ) | | | | (1,295 | ) | |

| Dividends on common stock (declared per share of $0.440) | | Dividends on common stock (declared per share of $0.440) | | (404) | | | (404) | | | (404) | |

| Net income (loss) | | Net income (loss) | | 4,398 | | | 4,398 | | | 3 | | | 4,401 | |

| Other comprehensive income (loss), net of income tax | | Other comprehensive income (loss), net of income tax | | (295) | | | (295) | | | 1 | | | (294) | |

| Balance at March 31, 2020 | | Balance at March 31, 2020 | | 0 | | | 12 | | | 33,711 | | | 36,919 | | | (13,178) | | | 12,757 | | | 70,221 | | | 242 | | | 70,463 | |

| Stock-based compensation | | Stock-based compensation | | 17 | | | 17 | | | 17 | |

| Dividends on preferred stock | | Dividends on preferred stock | | (77) | | | (77) | | | (77) | |

| Dividends on common stock (declared per share of $0.460) | | Dividends on common stock (declared per share of $0.460) | | (419) | | | (419) | | | (419) | |

| Change in equity of noncontrolling interests | | | | | | | | | | | | | | — |

| | (387 | ) | | (387 | ) | Change in equity of noncontrolling interests | | 0 | | | (1) | | | (1) | |

| Net income (loss) | | | | | | | | 2,888 |

| | | | | | 2,888 |

| | 2 |

| | 2,890 |

| Net income (loss) | | 145 | | | 145 | | | 5 | | | 150 | |

| Other comprehensive income (loss), net of income tax | | | | | | | | | | | | 8,824 |

| | 8,824 |

| | 95 |

| | 8,919 |

| Other comprehensive income (loss), net of income tax | | 5,806 | | | 5,806 | | | 1 | | | 5,807 | |

| Balance at September 30, 2016 | | $ | — |

| | $ | 12 |

| | $ | 30,797 |

| | $ | 37,054 |

| | $ | (3,172 | ) | | $ | 13,595 |

| | $ | 78,286 |

| | $ | 180 |

| | $ | 78,466 |

| |

| Balance at June 30, 2020 | | Balance at June 30, 2020 | | $ | 0 | | | $ | 12 | | | $ | 33,728 | | | $ | 36,568 | | | $ | (13,178) | | | $ | 18,563 | | | $ | 75,693 | | | $ | 247 | | | $ | 75,940 | |

See accompanying notes to the interim condensed consolidated financial statements.

MetLife, Inc.

Interim Condensed Consolidated Statements of Cash Flows

For the NineSix Months Ended SeptemberJune 30, 20172021 and 20162020 (Unaudited)

(In millions)

| | | | | | | | | | | |

| Six Months

Ended

June 30, |

| 2021 | | 2020 |

| Net cash provided by (used in) operating activities | $ | 3,750 | | | $ | 2,693 | |

| Cash flows from investing activities | | | |

| Sales, maturities and repayments of: | | | |

| Fixed maturity securities available-for-sale | 44,199 | | | 40,034 | |

| Equity securities | 335 | | | 125 | |

| Mortgage loans | 8,626 | | | 5,057 | |

| Real estate and real estate joint ventures | 736 | | | 103 | |

| Other limited partnership interests | 332 | | | 160 | |

| Purchases and originations of: | | | |

| Fixed maturity securities available-for-sale | (46,011) | | | (47,511) | |

| Equity securities | (34) | | | (49) | |

| Mortgage loans | (6,235) | | | (7,740) | |

| Real estate and real estate joint ventures | (429) | | | (942) | |

| Other limited partnership interests | (1,347) | | | (874) | |

| Cash received in connection with freestanding derivatives | 1,769 | | | 5,256 | |

| Cash paid in connection with freestanding derivatives | (5,602) | | | (2,017) | |

| | | |

| Sales of businesses, net of cash and cash equivalents disposed of $611 and $0, respectively | 3,329 | | | 0 | |

| | | |

| | | |

| Net change in policy loans | 137 | | | 12 | |

| Net change in short-term investments | 116 | | | (1,572) | |

| Net change in other invested assets | 40 | | | 65 | |

| Other, net | (6) | | | 165 | |

| Net cash provided by (used in) investing activities | (45) | | | (9,728) | |

| Cash flows from financing activities | | | |

| Policyholder account balances: | | | |

| Deposits | 50,865 | | | 50,120 | |

| Withdrawals | (46,995) | | | (43,109) | |

| Payables for collateral under securities loaned and other transactions: | | | |

| Net change in payables for collateral under securities loaned and other transactions | 506 | | | 7,401 | |

| Cash received for other transactions with tenors greater than three months | 0 | | | 50 | |

| Cash paid for other transactions with tenors greater than three months | (100) | | | (50) | |

| Long-term debt issued | 15 | | | 1,074 | |

| Long-term debt repaid | (28) | | | (13) | |

| Collateral financing arrangement repaid | (27) | | | (25) | |

| | | |

| Financing element on certain derivative instruments and other derivative related transactions, net | 318 | | | (242) | |

| Treasury stock acquired in connection with share repurchases | (2,112) | | | (500) | |

| Preferred stock issued, net of issuance costs | 0 | | | 972 | |

| Redemption of preferred stock | (494) | | | 0 | |

| Preferred stock redemption premium | (6) | | | 0 | |

| Dividends on preferred stock | (103) | | | (109) | |

| Dividends on common stock | (829) | | | (823) | |

| Other, net | 58 | | | 91 | |

| Net cash provided by (used in) financing activities | 1,068 | | | 14,837 | |

| Effect of change in foreign currency exchange rates on cash and cash equivalents balances | (192) | | | (111) | |

| Change in cash and cash equivalents | 4,581 | | | 7,691 | |

| Cash and cash equivalents, including subsidiary held-for-sale, beginning of period | 20,560 | | | 16,598 | |

| Cash and cash equivalents, including subsidiary held-for-sale, end of period | $ | 25,141 | | | $ | 24,289 | |

| Cash and cash equivalents, subsidiary held-for-sale, beginning of period | $ | 765 | | | $ | 0 | |

| Cash and cash equivalents, subsidiary held-for-sale, end of period | $ | 104 | | | $ | 0 | |

| Cash and cash equivalents, beginning of period | $ | 19,795 | | | $ | 16,598 | |

| Cash and cash equivalents, end of period | $ | 25,037 | | | $ | 24,289 | |

| | | | | | | | | | | |

| Supplemental disclosures of cash flow information | | | |

| Net cash paid (received) for: | | | |

| Interest | $ | 440 | | | $ | 426 | |

| Income tax | $ | 748 | | | $ | 130 | |

| Subsidiaries held-for-sale (Note 3): | | | |

| Assets held-for-sale | $ | 7,590 | | | $ | 0 | |

| Liabilities held-for-sale | 6,844 | | | 0 | |

| Net assets held-for-sale | $ | 746 | | | $ | 0 | |

| Non-cash transactions: | | | |

| | | |

| Operating lease liability associated with the recognition of right-of-use assets | $ | 179 | | | $ | 52 | |

| | | |

| Real estate and real estate joint ventures acquired in satisfaction of debt | $ | 171 | | | $ | 0 | |

| Increase in equity securities due to in-kind distributions received from other limited partnership interests | $ | 151 | | | $ | 40 | |

| Increase in policyholder account balances associated with funding agreement backed notes issued but not settled | $ | 0 | | | $ | 750 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | | | | | |

| | Nine Months

Ended

September 30, |

| | 2017 | | 2016 |

| Net cash provided by (used in) operating activities | $ | 10,233 |

| | $ | 9,131 |

|

| Cash flows from investing activities | | | |

| Sales, maturities and repayments of: | | | |

| Fixed maturity securities | 66,544 |

| | 101,614 |

|

| Equity securities | 904 |

| | 1,019 |

|

| Mortgage loans | 6,721 |

| | 10,518 |

|

| Real estate and real estate joint ventures | 689 |

| | 323 |

|

| Other limited partnership interests | 882 |

| | 1,025 |

|

| Purchases of: | | | |

| Fixed maturity securities | (76,010 | ) | | (108,418 | ) |

| Equity securities | (705 | ) | | (802 | ) |

| Mortgage loans | (9,988 | ) | | (14,686 | ) |

| Real estate and real estate joint ventures | (1,078 | ) | | (958 | ) |

| Other limited partnership interests | (1,064 | ) | | (806 | ) |

| Cash received in connection with freestanding derivatives | 4,890 |

| | 3,258 |

|

| Cash paid in connection with freestanding derivatives | (7,404 | ) | | (4,317 | ) |

| Cash disposed due to distribution of Brighthouse | (663 | ) | | — |

|

| Sales of businesses, net of cash and cash equivalents disposed of $0 and $135, respectively | — |

| | 156 |

|

| Purchases of businesses | (211 | ) | | — |

|

Purchases of investments in operating joint ventures

| — |

| | (39 | ) |

| Net change in policy loans | (16 | ) | | 201 |

|

| Net change in short-term investments | (209 | ) | | (2,232 | ) |

| Net change in other invested assets | (184 | ) | | (58 | ) |

| Other, net | (256 | ) | | (384 | ) |

| Net cash provided by (used in) investing activities | (17,158 | ) | | (14,586 | ) |

| Cash flows from financing activities | | | |

| Policyholder account balances: | | | |

| Deposits | 67,565 |

| | 65,225 |

|

| Withdrawals | (62,233 | ) | | (61,145 | ) |

| Net change in payables for collateral under securities loaned and other transactions | 2,316 |

| | 7,227 |

|

| Long-term debt issued | 3,657 |

| | — |

|

| Long-term debt repaid | (60 | ) | | (1,273 | ) |

| Collateral financing arrangements repaid | (2,852 | ) | | (55 | ) |

| Distribution of Brighthouse | (2,793 | ) | | — |

|

| Financing element on certain derivative instruments and other derivative related transactions, net | (109 | ) | | (336 | ) |

| Treasury stock acquired in connection with share repurchases | (2,305 | ) | | (70 | ) |

| Dividends on preferred stock | (58 | ) | | (58 | ) |

| Dividends on common stock | (1,295 | ) | | (1,295 | ) |

| Other, net | (144 | ) | | 60 |

|

| Net cash provided by (used in) financing activities | 1,689 |

| | 8,280 |

|

| Effect of change in foreign currency exchange rates on cash and cash equivalents balances | 382 |

| | 306 |

|

| Change in cash and cash equivalents | (4,854 | ) | | 3,131 |

|

| Cash and cash equivalents, beginning of period | 17,877 |

| | 12,752 |

|

| Cash and cash equivalents, end of period | $ | 13,023 |

| | $ | 15,883 |

|

| Cash and cash equivalents, of disposed subsidiary, beginning of period | $ | 5,226 |

| | $ | 1,570 |

|

| Cash and cash equivalents, of disposed subsidiary, end of period | $ | — |

| | $ | 2,825 |

|

| Cash and cash equivalents, from continuing operations, beginning of period | $ | 12,651 |

| | $ | 11,182 |

|

| Cash and cash equivalents, from continuing operations, end of period | $ | 13,023 |

| | $ | 13,058 |

|

|

| | | | | | | |

| | Nine Months

Ended

September 30, |

| | 2017 | | 2016 |

| Supplemental disclosures of cash flow information | | | |

| Net cash paid (received) for: | | | |

| Interest | $ | 806 |

| | $ | 875 |

|

| Income tax | $ | 633 |

| | $ | 464 |

|

| Non-cash transactions: | | | |

Disposal of Brighthouse (See Note 3):

| | | |

Assets disposed

| $ | 225,502 |

| | $ | — |

|

Liabilities disposed

| (210,999 | ) | | — |

|

Net assets disposed

| $ | 14,503 |

| | $ | — |

|

Cash disposed

| (3,456 | ) | | — |

|

Net non-cash disposed

| $ | 11,047 |

| | $ | — |

|

Fixed maturity securities received in connection with pension risk transfer transactions

| $ | — |

| | $ | 985 |

|

| Reduction of fixed maturity securities in connection with a reinsurance transaction | $ | — |

| | $ | 224 |

|

| Deconsolidation of operating joint venture: | | | |

| Reduction of fixed maturity securities | $ | — |

| | $ | 917 |

|

| Reduction of noncontrolling interests | $ | — |

| | $ | 373 |

|

See accompanying notes to the interim condensed consolidated financial statements.

statements.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies

Business

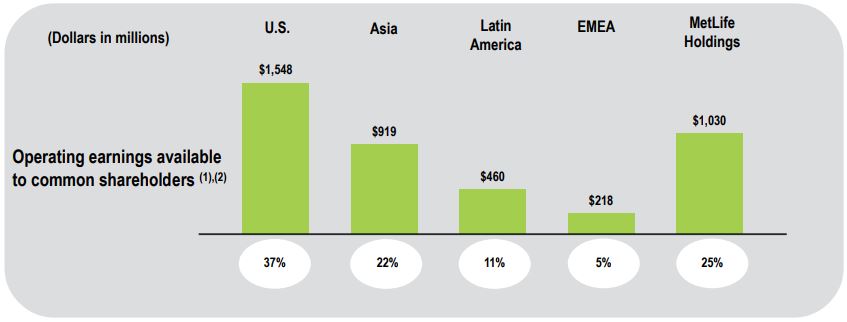

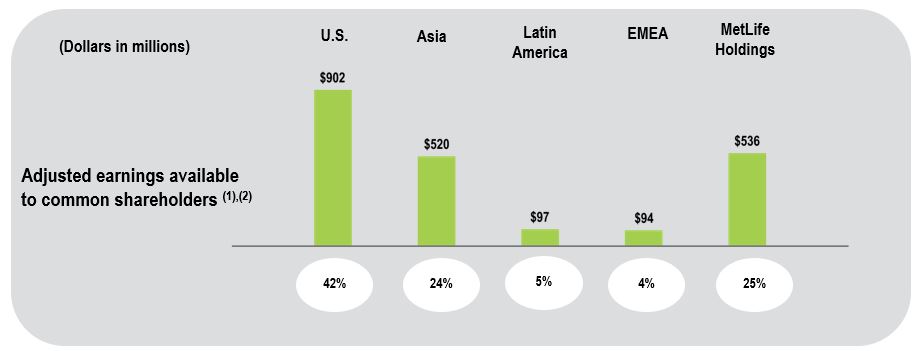

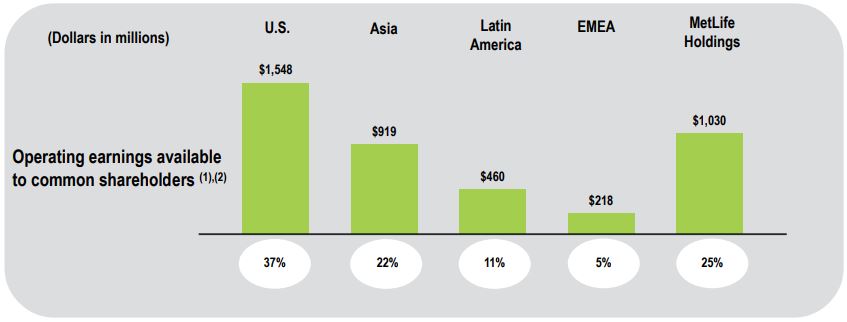

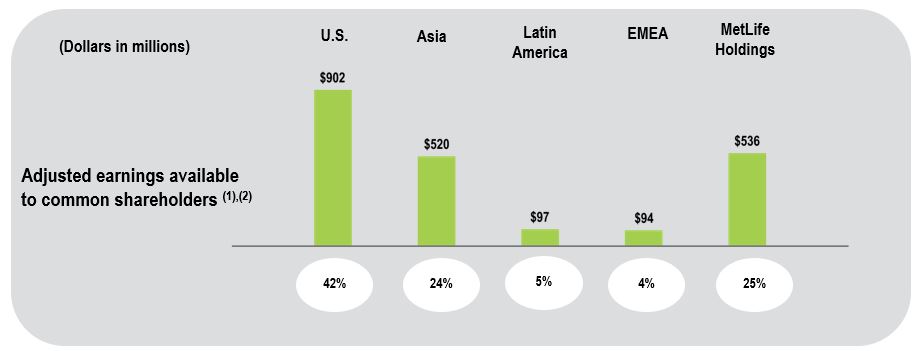

“MetLife” and the “Company” refer to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates. MetLife is one of the world’s leading financial services companies, providing insurance, annuities, employee benefits and asset management. MetLife is organized into five5 segments: U.S.; Asia; Latin America; Europe, the Middle East and Africa (“EMEA”); and MetLife Holdings.

On August 4, 2017, MetLife, Inc. completed the separation of Brighthouse Financial, Inc. and its subsidiaries (“Brighthouse”) through a distribution of 96,776,670 shares of Brighthouse Financial, Inc. common stock to the MetLife, Inc. common shareholders (the “Separation”). See Note 3 for additional information on the Separation.

Basis of Presentation

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to adopt accounting policies and make estimates and assumptions that affect amounts reported on the interim condensed consolidated financial statements. In applying these policies and estimates, management makes subjective and complex judgments that frequently require assumptions about matters that are inherently uncertain.uncertain, including uncertainties associated with the novel coronavirus COVID-19 pandemic (the “COVID-19 Pandemic”). Many of these policies, estimates and related judgments are common in the insurance and financial services industries; others are specific to the Company’s business and operations. Actual results could differ from these estimates.

The accompanying interim condensed consolidated financial statements are unaudited and reflect all adjustments (including normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows for the interim periods presented in conformity with GAAP. Interim results are not necessarily indicative of full year performance. The December 31, 2020 consolidated balance sheet data was derived from audited consolidated financial statements included in MetLife, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2020 (the “2020 Annual Report”), which include all disclosures required by GAAP. Therefore, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company included in the 2020 Annual Report.

Consolidation

The accompanying interim condensed consolidated financial statements include the accounts of MetLife, Inc. and its subsidiaries, as well as partnerships and joint ventures in which the Company has control, and variable interest entities (“VIEs”) for which the Company is the primary beneficiary. Intercompany accounts and transactions have been eliminated.

The Company uses the equity method of accounting for equity securities when it has significant influence or at least 20% interest andthe fair value option (“FVO”) for real estate joint ventures and other limited partnership interests (“investees”investee”) when it has more than a minor ownership interest or more than a minor influence over the investee’s operations. The Company generally recognizes its share of the investee’s earnings in net investment income on a three-month lag in instances where the investee’s financial information is not sufficiently timely or when the investee’s reporting period differs from the Company’s reporting period.

Held-for-Sale

The Company usesclassifies a business as held-for-sale when management has approved or received approval to sell the business, the sale is probable to occur during the next 12 months at a price that is reasonable in relation to its current estimated fair value and certain other specified criteria are met. The business classified as held-for-sale is recorded at the lower of the carrying value and estimated fair value, less cost methodto sell. If the carrying value of accounting for investmentsthe business exceeds its estimated fair value, less cost to sell, a loss is recognized and reported in net investment gains (losses). Assets and liabilities related to the business classified as held-for-sale are separately reported in the Company's consolidated balance sheets in the period in which it has virtually no influence over the investee’s operations.

Discontinued Operations

The results of operations ofbusiness is classified as held-for-sale. See Note 3. If a component of the Company that has either been disposed of or is classified as held-for-sale are reported in discontinued operations if certain criteria are met. A disposal of a component is reported as discontinued operations if the disposaland represents a strategic shift that has or will have a major effect on the Company’s operations and financials. Thefinancial results, the results of Brighthousethe component are reflectedreported in the Company’s interim condensed consolidated financial statements as discontinued operations. Prior period results have been revised to reflect discontinued operations. Intercompany transactions between the Company and Brighthouse prior to the Separation have been eliminated. Transactions between the Company and Brighthouse after the Separation are reflected in continuing operations for the Company. See Note 3 for information on discontinued operations and transactions with Brighthouse.

Reclassifications

Certain amounts in the prior year periods’ interim condensed consolidated financial statements and related footnotes thereto have been reclassified to conform to the 20172021 presentation as discussed throughout the Notes to the Interim Condensed Consolidated Financial Statements.

The accompanying interim condensed consolidated financial statements are unaudited and reflect all adjustments (including normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows for the interim periods presented in conformity with GAAP. Interim results are not necessarily indicative of full year performance. The December 31, 2016 consolidated balance sheet data was derived from audited consolidated financial statements included in MetLife, Inc.’s Annual Report on Form 10‑K for the year ended December 31, 2016 (the “2016 Annual Report”), which include all disclosures required by GAAP. Therefore, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company included in the 2016 Annual Report.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

Adoption of NewRecent Accounting Pronouncements

Effective January 1, 2017, the Company early adopted guidance relatingChanges to business combinations. The new guidance clarifies the definition of a business and requires that an entity apply certain criteria in order to determine when a set of assets and activities qualifies as a business. The adoption of this standard will result in fewer acquisitions qualifying as businesses and, accordingly, acquisition costs for those acquisitions that do not qualify as businesses will be capitalized rather than expensed. The adoption did not have a material impact on the Company’s consolidated financial statements.

Effective January 1, 2017, the Company retrospectively adopted guidance relating to consolidation. The new guidance does not change the characteristics of a primary beneficiary under current GAAP. It changes how a reporting entity evaluates whether it is the primary beneficiary of a VIEGAAP are established by changing how a reporting entity that is a single decisionmaker of a VIE handles indirect interests in the entity held through related parties that are under common control with the reporting entity. The adoption of this new guidance did not have a material impact on the Company’s consolidated financial statements.

Effective January 1, 2017, the Company adopted guidance related to stock-based compensation. The new guidance changes several aspects of the accounting for share-based payment and award transactions, including (i) income tax consequences when awards vest or are settled; (ii) classification as either equity or liability due to statutory tax withholding requirements; and (iii) classification on the statement of cash flows. In addition, the new guidance provides an accounting policy election to account for forfeitures as they occur, rather than to account for them based on an estimate of expected forfeitures. The Company has elected to continue to account for forfeitures based on an estimate of expected forfeitures. In addition, the Company elected to apply the change in presentation in the statement of cash flows related to excess tax benefits prospectively and prior periods have not been adjusted. The change in presentation for cash paid to a taxing authority when directly withholding equivalent shares has been classified as a financing activity in the statement of cash flows. The change was applied retrospectively and thus the directly withheld share equivalent amount was reclassified from an operating activity to a financing activity in the consolidated statements of cash flows. The adoption of this new guidance did not have a material impact on the Company’s consolidated financial statements.

Other

Effective January 3, 2017, the Chicago Mercantile Exchange (“CME”) amended its rulebook, resulting in the characterization of variation margin transfers as settlement payments, as opposed to adjustments to collateral. These amendments impacted the accounting treatment of the Company’s centrally cleared derivatives for which the CME serves as the central clearing party. As of the effective date, the application of the amended rulebook reduced gross derivative assets by $1.8 billion, gross derivative liabilities by $2.0 billion, accrued investment income by $101 million, accrued investment expense recorded within other liabilities by $14 million, collateral receivables recorded within premiums, reinsurance and other receivables of $991 million, and collateral payables recorded within payables for collateral under securities loaned and other transactions of $816 million.

Future Adoption of New Accounting Pronouncements

In August 2017, the Financial Accounting Standards Board (“FASB”) issued new guidance on hedging activities (Accounting Standards Update (“ASU”) 2017-12,Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities). The new guidance is effective for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years and should be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings. Early adoption is permitted. The new guidance simplifies the application of hedge accounting in certain situations and amends the hedge accounting model to enable entities to better portray the economics of their risk management activities in the financial statements.form of accounting standards updates (“ASUs”) to the FASB Accounting Standards Codification. The Company is currently evaluatingconsiders the applicability and impact of all ASUs. The following tables provide a description of new ASUs issued by the FASB and the impact of this guidancethe adoption on itsthe Company’s interim condensed consolidated financial statements.

In May 2017,Adoption of New Accounting Pronouncements

The table below describes the FASB issued new guidance on share-based payment awards (ASU 2017-09, Compensation - Stock Compensation (Topic 718) - Scopeimpacts of Modification Accounting).The new guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years. The new guidance should be applied prospectively to an award modified on or after the adoption date. Early adoption is permitted. The ASU includes guidance on determining which changes toASUs recently adopted by the terms and conditions of share-based payment awards require an entity to apply modification accounting under Topic 718. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.Company.

| | | | | | | | | | | |

| Standard | Description | Effective Date and

Method of Adoption | Impact on Financial Statements |

ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting; as clarified and amended by ASU 2021-01, Reference Rate Reform (Topic 848): Scope | The new guidance provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. The expedients and exceptions provided by the amendments do not apply to contract modifications made and hedging relationships entered into or evaluated after December 31, 2022, with certain exceptions. ASU 2021-01 amends the scope of the recent reference rate reform guidance. New optional expedients allow derivative instruments impacted by changes in the interest rate used for margining, discounting, or contract price alignment to qualify for certain optional relief. | Effective for contract modifications made between March 12, 2020 and December 31, 2022.

| The new guidance reduces the operational and financial impacts of contract modifications that replace a reference rate, such as London Interbank Offered Rate (“LIBOR”), affected by reference rate reform. The adoption of the new guidance provides relief from current GAAP and is not expected to have a material impact on the Company’s interim condensed consolidated financial statements. The Company will continue to evaluate the impacts of reference rate reform on contract modifications and hedging relationships through December 31, 2022. |

ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes

| The new guidance simplifies the accounting for income taxes by removing certain exceptions to the tax accounting guidance and providing clarification to other specific tax accounting guidance to eliminate variations in practice. Specifically, it removes the exceptions related to the a) incremental approach for intraperiod tax allocation when there is a loss from continuing operations and income or a gain from other items, b) recognition of a deferred tax liability when foreign investment ownership changes from equity method investment to consolidated subsidiary and vice versa and c) use of interim period tax accounting for year-to-date losses that exceed anticipated losses. The guidance also simplifies the application of the income tax guidance for franchise taxes that are partially based on income and the accounting for tax law changes during interim periods, clarifies the accounting for transactions that result in a step-up in tax basis of goodwill, provides for the option to elect allocation of consolidated income taxes to entities disregarded by taxing authorities for their stand-alone reporting, and requires that an entity reflect the effect of an enacted change in tax laws or rates in the annual effective tax rate computation in the interim period that includes the enactment date. | January 1, 2021. The Company adopted, using a prospective approach. | The adoption of the new guidance did not have a material impact on the Company’s interim condensed consolidated financial statements. |

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

Future Adoption of New Accounting Pronouncements

In March 2017, the FASB issued new guidance on purchased callable debt securities (ASU 2017-08, Receivables -Nonrefundable FeesASUs not listed below were assessed and Other Costs (Subtopic 310-20), Premium Amortization on Purchased Callable Debt Securities). The new guidance is effective for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years and should be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings. Early adoption is permitted. The ASU shortens the amortization period for certain callable debt securities held at a premium and requires the premiumeither determined to be amortized to the earliest call date. However, the new guidance does not require an accounting change for securities held at a discount whose discount continues to be amortized to maturity. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In March 2017, the FASB issued new guidance on the presentation of net periodic pension cost and net periodic postretirement benefit cost (ASU 2017-07,Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost). The new guidance is effective for annual periods beginning after December 15, 2017 and interim periods within those annual periods. Early adoption is permitted as of the beginning of an annual period for which financial statements (interimapplicable or annual) haveare not been issued or made available for issuance. The guidance requires that an employer that offers to its employees defined benefit pension or other postretirement benefit plans report the service cost component in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period. The other components of net benefit cost are required to be presented in the income statement separately from the service cost component and outside a subtotal of income from operations, if one is presented. The guidance should be applied retrospectively for the presentation of the service cost component in the income statement and allows a practical expedient for the estimation basis for applying the retrospective presentation requirements. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In February 2017, the FASB issued new guidance on derecognition of nonfinancial assets (ASU 2017-05,Other Income-Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets). The new guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years. Early adoption was permitted for interim or annual reporting periods beginning after December 15, 2016. The guidance may be applied retrospectively for all periods presented or retrospectively with a cumulative-effect adjustment at the date of adoption. The new guidance clarifies the scope and accounting of a financial asset that meets the definition of an “in-substance nonfinancial asset” and defines the term, “in-substance nonfinancial asset.” The ASU also adds guidance for partial sales of nonfinancial assets. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In January 2017, the FASB issued new guidance on goodwill impairment (ASU 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment). The new guidance is effective for fiscal years beginning after December 15, 2019 and interim periods within those fiscal years, and should be applied on a prospective basis. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The new guidance simplifies the current two-step goodwill impairment test by eliminating Step 2 of the test. The new guidance requires a one-step impairment test in which an entity compares the fair value of a reporting unit with its carrying amount and recognizes an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value, if any. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In November 2016, the FASB issued new guidance on restricted cash (ASU 2016-18,Statement of Cash Flows (Topic 230): a consensus of the FASB Emerging Issues Task Force). The new guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years, and should be applied on a retrospective basis. Early adoption is permitted. The new guidance requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. As a result, the new guidance requires that amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The new guidance does not provide a definition of restricted cash or restricted cash equivalents. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

MetLife, Inc.

Notes to the Interim Condensed Consolidated Financial Statements (Unaudited) — (continued)

1. Business, Basis of Presentation and Summary of Significant Accounting Policies (continued)

In October 2016, the FASB issued new guidance on tax accounting for intra-entity transfers of assets (ASU 2016-16,Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory). The new guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years, and should be applied on a modified retrospective basis. Early adoption is permitted in the first interim or annual reporting period. Current guidance prohibits the recognition of current and deferred income taxes for an intra-entity asset transfer until the asset has been sold to an outside party. The new guidance requires an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. Also, the guidance eliminates the exception for an intra-entity transfer of an asset other than inventory. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In August 2016, the FASB issued new guidance on cash flow statement presentation (ASU 2016-15,Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments). The new guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years, and should be applied retrospectively to all periods presented. Early adoption is permitted in any interim or annual period. This ASU addresses diversity in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.