Provision (Recovery)same period last year. The provision for Loan Losses:

For the Quarters Ended March 31, 2023 and 2022. Duringcredit losses recorded in the third quarter of fiscal 2023, the Corporation recorded a provision for loan losses of $169,000, compared2024 was primarily attributable to a $645,000 recoverylonger estimated life of the single-family loan portfolio resulting from increased market interest rates and lower loan prepayment estimates, while the allowance for loan losses recorded during the same quarter last year. The provision for loan losses primarily reflects an increase inoutstanding balance of loans held for investment in the third quarter of fiscalat March 31, 2024 declined one percent to $1.07 billion from $1.08 billion at December 31, 2023.

For the Nine Months Ended March 31, 20232024 and 2022.2023. During the first nine months of fiscal 2023,2024, the Corporation recorded a recovery of credit losses of $51,000, compared to a provision for loancredit losses of $430,000 compared to a recovery from the allowance for loan losses of $2.1 million in the same period of fiscal 2022.2023. The provision for loanrecovery of credit losses primarily reflects an increase in loans held for investmentrecorded in the first nine months of fiscal 2023.

Non-performing assets, comprised solely2024 was primarily attributable to a shorter estimated life of non-performingthe loan portfolio resulting in higher loan prepayment estimates and the decline in the outstanding balance of loans with underlying collateral located in California, decreased $478,000 or 34 percent to $945,000, or 0.07 percent of total assets,held for investment at March 31, 2023, compared2024 to $1.4 million, or 0.12 percent of total assets,$1.07 billion from $1.08 billion at June 30, 2022. Non-performing2023.

On July 1, 2023, the Corporation adopted ASC 326 resulting in a one-time increase to the ACL of $1.2 million, an $824,000 reduction to stockholders’ equity, a $345,000 increase to deferred tax assets and a $28,000 decrease to the mark on loans held at March 31, 2023 were comprised of five single-family loans, while non-performing loans at June 30, 2022 were comprised of seven single-family loans. At both March 31, 2023 and June 30, 2022, there was no real estate owned.

Net loan recoveries for the quarter ended March 31, 2023 were $2,000 or 0.00 percent (annualized) of average loans receivable, as comparedfair value. Prior to net loan recoveries of $6,000 or 0.00 percent (annualized) of average loans receivable for the quarter ended March 31, 2022. For the nine months ended March 31, 2023, net loan recoveries were $7,000 or 0.00 percent (annualized) of average loans receivable, as compared to net loan recoveries of $433,000 or 0.07 percent (annualized) of average loans receivable for the nine months ended March 31, 2022.

Classified assets were $3.0 million at March 31, 2023, consisting of $1.5 million of loans in the special mention category and $1.5 million of loans in the substandard category; while classified assets at June 30, 2022 were $1.6 million, consisting of $224,000 of loans in the special mention category and $1.4 million of loans in the substandard category.

At March 31,July 1, 2023, the allowance for loan losses was $6.0calculated using the incurred loss methodology, which is not directly comparable to the new CECL methodology used to calculate ACL due to the future forecast of loss component within CECL.

At March 31, 2024, the ACL on loans held for investment was $7.1 million, comprised of collectively evaluated allowances of $6.0$7.1 million and individually evaluated allowances of $38,000;$37,000; up eight20 percent from $5.6$5.9 million at June 30, 2022.2023. The allowance for loan lossesACL on loans as a percentage of gross loans held for investment was 0.560.67 percent at March 31, 2023,2024, compared to 0.590.55 percent at June 30, 2022.2023. The allowanceincrease in the ACL on loans was due primarily to the adoption of the CECL methodology ($1.2 million), partly offset by the recovery of credit losses in the first nine months of fiscal 2024 ($51,000, which includes $16,000 for the recovery of unfunded loan losses was determined through quantitative and qualitative adjustments includingcommitment reserves).

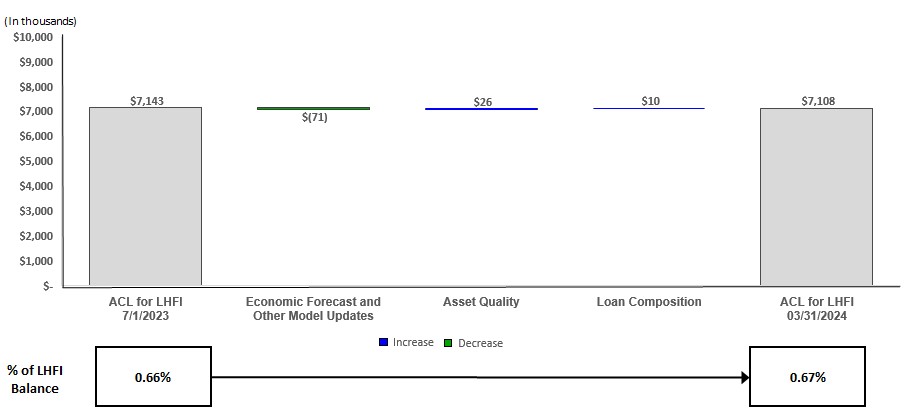

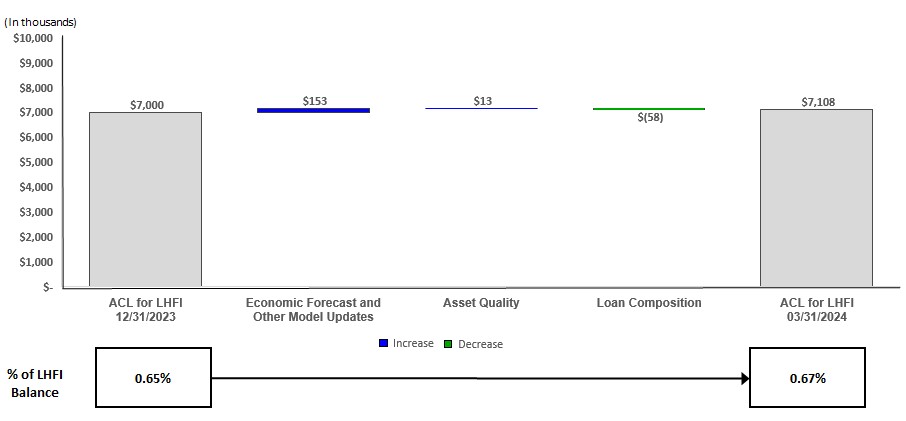

The following chart quantifies the Bank’s charge-off experience and reflectsfactors contributing to the impactchanges in the ACL on loans held for investment from(“LHFI”) for the current general economic conditionsquarter and nine months ended March 31, 2024 subsequent to the adoption of the U.S. and California economies.CECL methodology on July 1, 2023.

The changes in the ACL on LHFI for the quarter ended March 31, 2024:

52