UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31,June 30, 2016

OR

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _______ to ________

Commission file number: 001-12935

DENBURY RESOURCES INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 20-0467835 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

5320 Legacy Drive, Plano, TX | | 75024 |

| (Address of principal executive offices) | | (Zip Code) |

|

| | |

| Registrant’s telephone number, including area code: | | (972) 673-2000 |

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

| | | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

| | | |

| Class | | Outstanding at April 30,July 31, 2016 |

| Common Stock, $.001 par value | | 350,593,956398,326,717 |

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Denbury Resources Inc.

Unaudited Condensed Consolidated Balance Sheets

(In thousands, except par value and share data)

| | | | | March 31, | | December 31, | | June 30, | | December 31, |

| | | 2016 | | 2015 | | 2016 | | 2015 |

Assets | | Current assets | | | | | | | | |

| Cash and cash equivalents | | $ | 8,252 |

|

| $ | 2,812 |

| | $ | 2,545 |

|

| $ | 2,812 |

|

| Accrued production receivable | | 95,934 |

|

| 100,413 |

| | 120,473 |

|

| 100,413 |

|

| Trade and other receivables, net | | 87,228 |

|

| 87,924 |

| | 70,700 |

|

| 87,093 |

|

| Derivative assets | | 72,798 |

|

| 142,846 |

| | 4,699 |

|

| 142,846 |

|

| Other current assets | | 8,763 |

|

| 10,005 |

| | 14,402 |

|

| 10,005 |

|

| Total current assets | | 272,975 |

|

| 344,000 |

| | 212,819 |

|

| 343,169 |

|

| Property and equipment | | |

|

| |

| | |

|

| |

|

| Oil and natural gas properties (using full cost accounting) | | |

|

| |

| | |

|

| |

|

| Proved properties | | 10,296,792 |

|

| 10,245,195 |

| | 10,346,027 |

|

| 10,245,195 |

|

| Unevaluated properties | | 902,990 |

|

| 894,948 |

| | 909,310 |

|

| 894,948 |

|

CO2 properties | | 1,186,607 |

|

| 1,187,458 |

| | 1,186,596 |

|

| 1,187,458 |

|

| Pipelines and plants | | 2,293,102 |

|

| 2,293,219 |

| | 2,294,295 |

|

| 2,293,219 |

|

| Other property and equipment | | 405,039 |

|

| 408,194 |

| | 399,880 |

|

| 408,194 |

|

| Less accumulated depletion, depreciation, amortization and impairment | | (9,982,733 | ) |

| (9,653,205 | ) | | (10,521,061 | ) |

| (9,653,205 | ) |

| Net property and equipment | | 5,101,797 |

|

| 5,375,809 |

| | 4,615,047 |

|

| 5,375,809 |

|

| Derivative assets | |

| 31 |

| | — |

|

| Other assets | | 163,775 |

| | 166,555 |

| | 162,076 |

| | 166,555 |

|

| Total assets | | $ | 5,538,547 |

| | $ | 5,886,364 |

| | $ | 4,989,973 |

| | $ | 5,885,533 |

|

Liabilities and Stockholders’ Equity | | Current liabilities | | |

| | |

| | |

| | |

|

| Accounts payable and accrued liabilities | | $ | 186,715 |

| | $ | 253,197 |

| | $ | 162,334 |

|

| $ | 253,197 |

|

| Oil and gas production payable | | 79,765 |

| | 87,337 |

| | 83,713 |

|

| 87,337 |

|

| Derivative liabilities | | 25,005 |

| | — |

| | 107,105 |

|

| — |

|

| Current maturities of long-term debt | | 32,917 |

| | 32,481 |

| | 83,762 |

|

| 32,481 |

|

| Total current liabilities | | 324,402 |

| | 373,015 |

| | 436,914 |

|

| 373,015 |

|

| Long-term liabilities | | |

| | |

| | |

| | |

|

| Long-term debt, net of current portion | | 3,222,497 |

| | 3,245,114 |

| | 2,998,268 |

|

| 3,245,114 |

|

| Asset retirement obligations | | 142,101 |

| | 138,919 |

| | 143,981 |

|

| 138,919 |

|

| Derivative liabilities | | | 67 |

| | — |

|

| Deferred tax liabilities, net | | 742,148 |

| | 837,263 |

| | 519,207 |

|

| 852,089 |

|

| Other liabilities | | 26,121 |

| | 27,484 |

| | 26,232 |

|

| 27,484 |

|

| Total long-term liabilities | | 4,132,867 |

| | 4,248,780 |

| | 3,687,755 |

|

| 4,263,606 |

|

| Commitments and contingencies (Note 7) | |

|

| |

|

| |

|

| |

|

|

| Stockholders’ equity | | | | | | | | |

| Preferred stock, $.001 par value, 25,000,000 shares authorized, none issued and outstanding | | — |

| | — |

| | — |

|

| — |

|

| Common stock, $.001 par value, 600,000,000 shares authorized; 354,340,533 and 354,541,626 shares issued, respectively | | 354 |

| | 355 |

| |

| Common stock, $.001 par value, 600,000,000 shares authorized; 395,347,234 and 354,541,626 shares issued, respectively | | | 395 |

|

| 355 |

|

| Paid-in capital in excess of par | | 2,356,069 |

| | 2,353,134 |

| | 2,520,760 |

|

| 2,353,549 |

|

| Accumulated deficit | | (1,228,039 | ) | | (1,042,882 | ) | | (1,608,701 | ) |

| (1,058,954 | ) |

| Treasury stock, at cost, 3,734,768 and 3,124,311 shares, respectively | | (47,106 | ) | | (46,038 | ) | |

| Treasury stock, at cost, 3,745,901 and 3,124,311 shares, respectively | | | (47,150 | ) |

| (46,038 | ) |

Total stockholders’ equity | | 1,081,278 |

| | 1,264,569 |

| | 865,304 |

|

| 1,248,912 |

|

| Total liabilities and stockholders’ equity | | $ | 5,538,547 |

| | $ | 5,886,364 |

| | $ | 4,989,973 |

|

| $ | 5,885,533 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Resources Inc.

Unaudited Condensed Consolidated Statements of Operations

(In thousands, except per share data)

| | | | | Three Months Ended March 31, | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| Revenues and other income | | | | | | | | | | | | |

| Oil, natural gas, and related product sales | | $ | 187,803 |

| | $ | 297,470 |

| | $ | 246,668 |

| | $ | 366,891 |

| | $ | 434,471 |

| | $ | 664,361 |

|

CO2 sales and transportation fees | | 6,272 |

| | 6,972 |

| | 6,622 |

| | 7,152 |

| | 12,894 |

| | 14,124 |

|

| Interest income and other income | | 769 |

| | 3,207 |

| | 1,858 |

| | 2,651 |

| | 2,627 |

| | 5,858 |

|

| Total revenues and other income | | 194,844 |

| | 307,649 |

| | 255,148 |

| | 376,694 |

| | 449,992 |

| | 684,343 |

|

| Expenses | | |

| | |

| | |

| | |

| | |

| | |

|

| Lease operating expenses | | 102,447 |

| | 141,084 |

| | 100,019 |

| | 132,170 |

| | 202,466 |

| | 273,254 |

|

| Marketing and plant operating expenses | | 13,194 |

| | 11,685 |

| | 12,999 |

| | 14,215 |

| | 26,193 |

| | 25,900 |

|

CO2 discovery and operating expenses | | 607 |

| | 947 |

| | 1,071 |

| | 945 |

| | 1,678 |

| | 1,892 |

|

| Taxes other than income | | 20,092 |

| | 26,679 |

| | 19,504 |

| | 33,555 |

| | 39,596 |

| | 60,234 |

|

| General and administrative expenses | | 33,901 |

| | 46,280 |

| | 22,545 |

| | 37,947 |

| | 56,446 |

| | 84,227 |

|

| Interest, net of amounts capitalized of $5,780 and $8,409, respectively | | 42,171 |

| | 40,099 |

| |

| Interest, net of amounts capitalized of $6,289, $8,738, $12,069, and $17,147, respectively | | | 36,058 |

| | 39,863 |

| | 78,229 |

| | 79,962 |

|

| Depletion, depreciation, and amortization | | 77,366 |

| | 149,958 |

| | 66,541 |

| | 147,940 |

| | 143,907 |

| | 297,898 |

|

| Commodity derivatives expense (income) | | 22,826 |

| | (83,076 | ) | | 98,209 |

| | 48,926 |

| | 121,035 |

| | (34,150 | ) |

| Gain on debt extinguishment | | (94,991 | ) | | — |

| | (12,278 | ) | | — |

| | (107,269 | ) | | — |

|

| Write-down of oil and natural gas properties | | 256,000 |

| | 146,200 |

| | 479,400 |

| | 1,705,800 |

| | 735,400 |

| | 1,852,000 |

|

| Other expenses | | 1,544 |

| | — |

| | 34,688 |

| | — |

| | 36,232 |

| | — |

|

| Total expenses | | 475,157 |

| | 479,856 |

| | 858,756 |

| | 2,161,361 |

| | 1,333,913 |

| | 2,641,217 |

|

| Loss before income taxes | | (280,313 | ) | | (172,207 | ) | | (603,608 | ) | | (1,784,667 | ) | | (883,921 | ) | | (1,956,874 | ) |

| Income tax benefit | | (95,120 | ) | | (64,461 | ) | | (222,940 | ) | | (636,168 | ) | | (318,060 | ) | | (700,629 | ) |

| Net loss | | $ | (185,193 | ) | | $ | (107,746 | ) | | $ | (380,668 | ) | | $ | (1,148,499 | ) | | $ | (565,861 | ) | | $ | (1,256,245 | ) |

| | | | | | |

|

| | | | | | |

| Net loss per common share | | | | | |

|

| | | | | | |

| Basic | | $ | (0.53 | ) | | $ | (0.31 | ) | | $ | (1.03 | ) | | $ | (3.28 | ) | | $ | (1.58 | ) | | $ | (3.59 | ) |

| Diluted | | $ | (0.53 | ) | | $ | (0.31 | ) | | $ | (1.03 | ) | | $ | (3.28 | ) | | $ | (1.58 | ) | | $ | (3.59 | ) |

| |

|

| |

|

| |

|

| | | | | | |

| Dividends declared per common share | | $ | — |

| | $ | 0.0625 |

| | $ | — |

| | $ | 0.0625 |

| | $ | — |

| | $ | 0.1250 |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

| Weighted average common shares outstanding | | |

| | |

| | |

| | |

| | |

| | |

|

| Basic | | 347,235 |

| | 350,688 |

| | 370,566 |

| | 350,039 |

| | 358,901 |

| | 349,653 |

|

| Diluted | | 347,235 |

| | 350,688 |

| | 370,566 |

| | 350,039 |

| | 358,901 |

| | 349,653 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Resources Inc.

Unaudited Condensed Consolidated Statements of Comprehensive Operations

(In thousands)

| | | | | Three Months Ended March 31, | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| Net loss | | $ | (185,193 | ) | | $ | (107,746 | ) | | $ | (380,668 | ) | | $ | (1,148,499 | ) | | $ | (565,861 | ) | | $ | (1,256,245 | ) |

| Other comprehensive income, net of income tax: | | |

| | |

| | |

| | |

| | |

| | |

|

| Interest rate lock derivative contracts reclassified to income, net of tax of $0 and $11, respectively | | — |

| | 17 |

| |

| Interest rate lock derivative contracts reclassified to income, net of tax of $0, $10, $0, and $21, respectively | | | — |

| | 18 |

| | — |

| | 35 |

|

| Total other comprehensive income | | — |

| | 17 |

| | — |

| | 18 |

| | — |

| | 35 |

|

| Comprehensive loss | | $ | (185,193 | ) | | $ | (107,729 | ) | | $ | (380,668 | ) | | $ | (1,148,481 | ) | | $ | (565,861 | ) | | $ | (1,256,210 | ) |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Resources Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(In thousands)

| | | | | Three Months Ended March 31, | | Six Months Ended June 30, |

| | | 2016 | | 2015 | | 2016 | | 2015 |

| Cash flows from operating activities | | | | | | | | |

| Net loss | | $ | (185,193 | ) | | $ | (107,746 | ) | | $ | (565,861 | ) | | $ | (1,256,245 | ) |

| Adjustments to reconcile net loss to cash flows from operating activities | | | | |

| |

|

| | |

|

| Depletion, depreciation, and amortization | | 77,366 |

| | 149,958 |

| | 143,907 |

| | 297,898 |

|

| Write-down of oil and natural gas properties | | 256,000 |

| | 146,200 |

| | 735,400 |

| | 1,852,000 |

|

| Deferred income taxes | | (95,115 | ) | | (66,036 | ) | | (318,055 | ) | | (700,508 | ) |

| Stock-based compensation | | 859 |

| | 7,849 |

| | 4,122 |

| | 14,967 |

|

| Commodity derivatives expense (income) | | 22,826 |

| | (83,076 | ) | | 121,035 |

| | (34,150 | ) |

| Receipt on settlements of commodity derivatives | | 72,227 |

| | 148,465 |

| | 124,253 |

| | 272,616 |

|

| Gain on debt extinguishment | | (94,991 | ) | | — |

| | (107,269 | ) | | — |

|

| Amortization of debt issuance costs and discounts | | 3,306 |

| | 2,221 |

| |

| Debt issuance costs and discounts | | | 14,072 |

| | 4,501 |

|

| Other, net | | (416 | ) | | (2,359 | ) | | (1,743 | ) | | (4,019 | ) |

| Changes in assets and liabilities, net of effects from acquisitions | | |

| | |

| | |

| | |

|

| Accrued production receivable | | 4,479 |

| | 33,636 |

| | (20,060 | ) | | 17,683 |

|

| Trade and other receivables | | 812 |

| | 16,828 |

| | 17,568 |

| | 57,865 |

|

| Other current and long-term assets | | 1,437 |

| | (6,136 | ) | | (7,974 | ) | | (7,770 | ) |

| Accounts payable and accrued liabilities | | (53,548 | ) | | (83,248 | ) | | (71,830 | ) | | (71,892 | ) |

| Oil and natural gas production payable | | (7,572 | ) | | (17,716 | ) | | (3,624 | ) | | (13,217 | ) |

| Other liabilities | | (448 | ) | | (1,076 | ) | | (997 | ) | | (3,008 | ) |

| Net cash provided by operating activities | | 2,029 |

| | 137,764 |

| | 62,944 |

| | 426,721 |

|

| | | | | | | | | |

| Cash flows from investing activities | | |

| | |

| | |

| | |

|

| Oil and natural gas capital expenditures | | (65,692 | ) | | (162,192 | ) | | (126,302 | ) | | (276,783 | ) |

CO2 capital expenditures | | (315 | ) | | (14,855 | ) | | (451 | ) | | (15,608 | ) |

| Pipelines and plants capital expenditures | | (635 | ) | | (12,455 | ) | | (1,965 | ) | | (20,349 | ) |

| Other | | (312 | ) | | (3,076 | ) | | 1,198 |

| | (23,772 | ) |

| Net cash used in investing activities | | (66,954 | ) | | (192,578 | ) | | (127,520 | ) | | (336,512 | ) |

| | | | | | | | |

| Cash flows from financing activities | | |

| | |

| | |

| | |

|

| Bank repayments | | (696,000 | ) | | (595,000 | ) | | (994,000 | ) | | (1,007,000 | ) |

| Bank borrowings | | 831,000 |

| | 665,000 |

| | 1,139,000 |

| | 962,000 |

|

| Repurchases of senior subordinated notes | | (55,521 | ) | | — |

| | (55,521 | ) | | — |

|

| Pipeline financing and capital lease debt repayments | | | (14,336 | ) | | (17,122 | ) |

| Cash dividends paid | | (387 | ) | | (22,068 | ) | | (413 | ) | | (43,528 | ) |

| Other | | (8,727 | ) | | (10,250 | ) | | (10,421 | ) | | (3,299 | ) |

| Net cash provided by financing activities | | 70,365 |

| | 37,682 |

| |

| Net increase (decrease) in cash and cash equivalents | | 5,440 |

| | (17,132 | ) | |

| Net cash provided by (used in) financing activities | | | 64,309 |

| | (108,949 | ) |

| Net decrease in cash and cash equivalents | | | (267 | ) | | (18,740 | ) |

| Cash and cash equivalents at beginning of period | | 2,812 |

| | 23,153 |

| | 2,812 |

| | 23,153 |

|

| Cash and cash equivalents at end of period | | $ | 8,252 |

| | $ | 6,021 |

| | $ | 2,545 |

| | $ | 4,413 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Resources Inc.

Unaudited Condensed Consolidated Statement of Changes in Stockholders' Equity

(Dollar amounts in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock ($.001 Par Value) | | Paid-In

Capital in

Excess of Par | | Retained Earnings (Accumulated Deficit) | | Treasury Stock (at cost) | | |

| | Shares | | Amount | Shares | | Amount | Total Equity |

| Balance – December 31, 2015 | 354,541,626 |

| | $ | 355 |

| | $ | 2,353,549 |

| | $ | (1,058,954 | ) | | 3,124,311 |

| | $ | (46,038 | ) | | $ | 1,248,912 |

|

| Cumulative effect of accounting change | — |

| | — |

| | (415 | ) | | 16,072 |

| | — |

| | — |

| | 15,657 |

|

| Issued or purchased pursuant to employee stock compensation plans | 44,346 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Issued pursuant to directors’ compensation plan | 31,930 |

| | — |

| | 50 |

| | — |

| | — |

| | — |

| | 50 |

|

| Issued as part of debt exchange | 40,729,332 |

| | 40 |

| | 160,451 |

| | — |

| | — |

| | — |

| | 160,491 |

|

| Stock-based compensation | — |

| | — |

| | 7,125 |

| | — |

| | — |

| | — |

| | 7,125 |

|

| Tax withholding – stock compensation | — |

| | — |

| | — |

| | — |

| | 621,590 |

| | (1,112 | ) | | (1,112 | ) |

| Dividends adjustments | — |

| | — |

| | — |

| | 42 |

| | — |

| | — |

| | 42 |

|

| Net loss | — |

| | — |

| | — |

| | (565,861 | ) | | — |

| | — |

| | (565,861 | ) |

| Balance – June 30, 2016 | 395,347,234 |

| | $ | 395 |

| | $ | 2,520,760 |

| | $ | (1,608,701 | ) | | 3,745,901 |

| | $ | (47,150 | ) | | $ | 865,304 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1. Basis of Presentation

Organization and Nature of Operations

Denbury Resources Inc., a Delaware corporation, is an independent oil and natural gas company with operations focused in two key operating areas: the Gulf Coast and Rocky Mountain regions. Our goal is to increase the value of our properties through a combination of exploitation, drilling and proven engineering extraction practices, with the most significant emphasis relating to CO2 enhanced oil recovery operations.

Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements of Denbury Resources Inc. and its subsidiaries have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. These financial statements and the notes thereto should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2015 (the “Form 10-K”). Unless indicated otherwise or the context requires, the terms “we,” “our,” “us,” “Company” or “Denbury,” refer to Denbury Resources Inc. and its subsidiaries.

Accounting measurements at interim dates inherently involve greater reliance on estimates than at year end, and the results of operations for the interim periods shown in this report are not necessarily indicative of results to be expected for the year. In management’s opinion, the accompanying unaudited condensed consolidated financial statements include all adjustments of a normal recurring nature necessary for a fair statement of our consolidated financial position as of March 31,June 30, 2016, our consolidated results of operations for the three and six months ended March 31,June 30, 2016 and 2015, our consolidated cash flows for the six months ended June 30, 2016 and 2015, and our consolidated cash flowsstatement of changes in stockholders’ equity for the threesix months ended March 31, 2016 and 2015.June 30, 2016.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current year presentation. On the Unaudited Condensed Consolidated Balance Sheets, beginning “Other current assets,” “Deferred tax liabilities, net,” “Paid-in capital in excess of par” and “Accumulated deficit” have been adjusted for changes related to (1) the accounting for excess tax benefits and forfeitures associated with share-based payment transactions, (2) debt issuance costs associated with our senior subordinated notes have been reclassified from “Other assets” to “Long-term debt, net of current portion” and (3)(2) deferred tax assets have been reclassified from “Deferred tax assets, net” to “Deferred tax liabilities, net.” Such reclassifications were made as a result of our adoption of new accounting pronouncements described in Recent Accounting Pronouncements – Recently Adopted below and had no impact on our previously reported net income or cash flows.

Net Loss per Common Share

Basic net loss per common share is computed by dividing the net loss attributable to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per common share is calculated in the same manner, but includes the impact of potentially dilutive securities. Potentially dilutive securities consist of nonvested restricted stock, stock options, stock appreciation rights (“SARs”), nonvested restricted stock and nonvested performance-based equity awards. For the three and six months ended March 31,June 30, 2016 and 2015, there were no adjustments to net loss for purposes of calculating basic and diluted net loss per common share.

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

The following is a reconciliation of the weighted average shares used in the basic and diluted net loss per common share calculations for the periods indicated:

| | | | | Three Months Ended | | Three Months Ended | | Six Months Ended |

| | | March 31, | | June 30, | | June 30, |

| In thousands | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| Basic weighted average common shares outstanding | | 347,235 |

| | 350,688 |

| | 370,566 |

| | 350,039 |

| | 358,901 |

| | 349,653 |

|

| Potentially dilutive securities | | |

| | |

| | |

| | |

| | |

| | |

|

| Restricted stock, stock options, SARs and performance-based equity awards | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Diluted weighted average common shares outstanding | | 347,235 |

| | 350,688 |

| | 370,566 |

| | 350,039 |

| | 358,901 |

| | 349,653 |

|

Basic weighted average common shares exclude shares of nonvested restricted stock. As these restricted shares vest, they will be included in the shares outstanding used to calculate basic net loss per common share (although time-vesting restricted stock is issued and outstanding upon grant).

The following securities could potentially dilute earnings per share in the future, but were excluded from the computation of diluted net loss per share, as their effect would have been antidilutive:

| | | | | Three Months Ended | | Three Months Ended | | Six Months Ended |

| | | March 31, | | June 30, | | June 30, |

| In thousands | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| Stock options and SARs | | 7,412 |

| | 10,507 |

| | 6,265 |

| | 9,949 |

| | 6,839 |

| | 10,228 |

|

| Restricted stock and performance-based equity awards | | 5,097 |

| | 2,948 |

| | 4,374 |

| | 2,241 |

| | 4,491 |

| | 2,595 |

|

Write-Down of Oil and Natural Gas Properties

The net capitalized costs of oil and natural gas properties are limited to the lower of unamortized cost or the cost center ceiling. The cost center ceiling is defined as (1) the present value of estimated future net revenues from proved oil and natural gas reserves before future abandonment costs (discounted at 10%), based on the average first-day-of-the-month oil and natural gas price for each month during a 12-month rolling period prior to the end of a particular reporting period; plus (2) the cost of properties not being amortized; plus (3) the lower of cost or estimated fair value of unproved properties included in the costs being amortized, if any; less (4) related income tax effects. Our future net revenues from proved oil and natural gas reserves are not reduced for development costs related to the cost of drilling for and developing CO2 reserves nor those related to the cost of constructing CO2 pipelines, as thosewe do not have to incur additional costs have previously been incurred byto develop the Company.proved oil and natural gas reserves. Therefore, we include in the ceiling test, as a reduction of future net revenues, that portion of our capitalized CO2 costs related to CO2 reserves and CO2 pipelines that we estimate will be consumed in the process of producing our proved oil and natural gas reserves. The fair value of our oil and natural gas derivative contracts is not included in the ceiling test, as we do not designate these contracts as hedge instruments for accounting purposes. The cost center ceiling test is prepared quarterly.

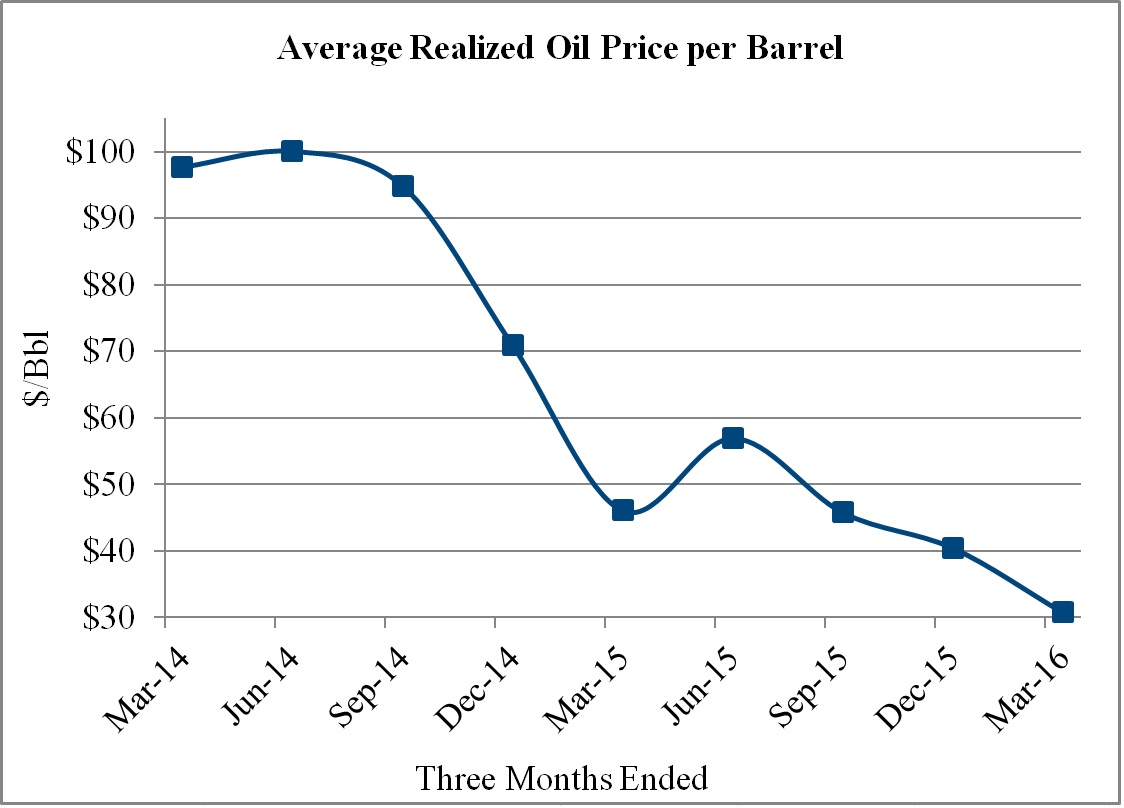

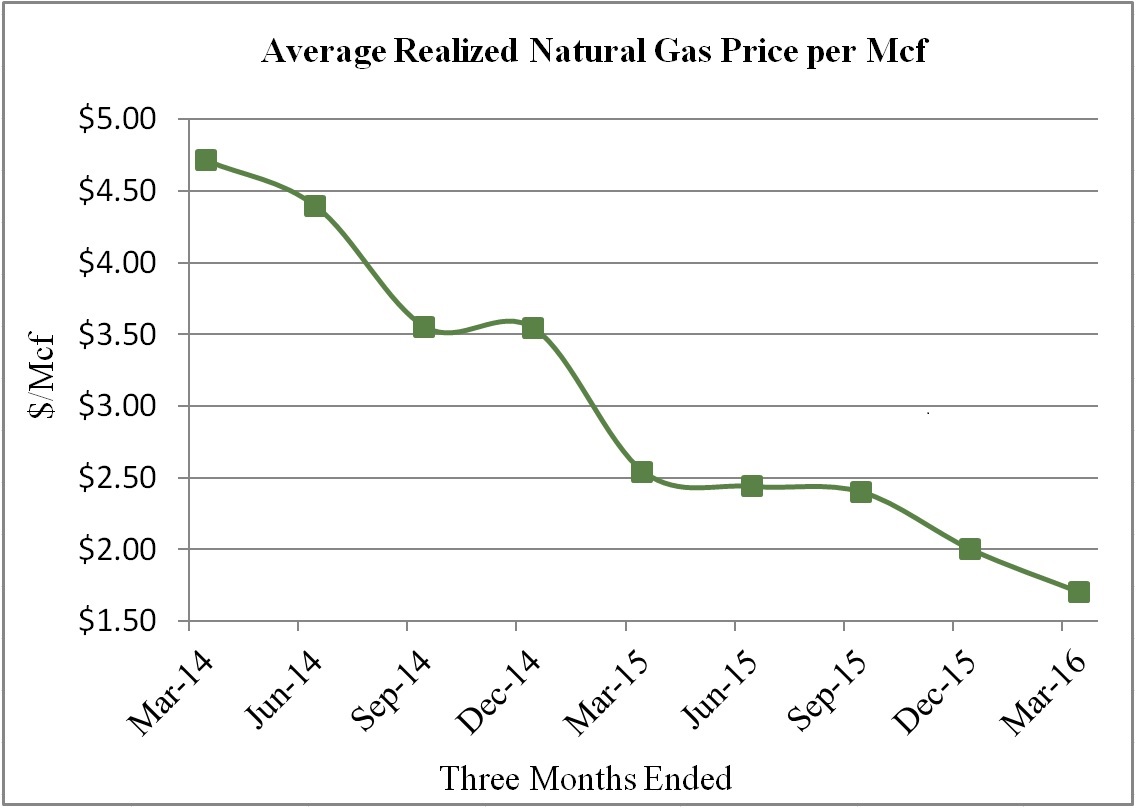

As a result of the precipitous and continuing decline in NYMEX oil prices since the fourth quarter of 2014, the rollingaverage first-day-of-the-month averageNYMEX oil price for the preceding 12 months, after adjustments for market differentials by field,used in estimating our proved reserves has fallen throughout 2015 and the first quarterhalf of 2016, from $79.55$71.68 per Bbl for the firstsecond quarter of 2015 to $44.03$43.12 per Bbl for the firstsecond quarter of 2016. In addition, the average first-day-of-the-month averageNYMEX natural gas price used in estimating our proved reserves was $3.38 per MMBtu for the preceding 12 months, after adjustments for market differentials by field, was $3.95 per Mcf for the firstsecond quarter of 2015 and $2.22$2.33 per McfMMBtu for the firstsecond quarter of 2016. These falling prices have led to our recognizing full cost pool ceiling test write-downs of $479.4 million and $256.0 million during the three months ended June 30 and March 31, 2016, respectively, and $1.7 billion and $146.2 million during the three months ended March 31, 2016June 30 and March 31, 2015, respectively.

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Recent Accounting Pronouncements

Recently Adopted

Stock Compensation. In March 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-09, Improvements to Employee Share-Based Payment Accounting (“ASU 2016-09”). ASU 2016-09

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

simplifies the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The amendments in this ASU are effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years, and early adoption is permitted. The standard contains various amendments, each requiring a specific method of adoption, and designates whether each amendment should be adopted using a retrospective, modified retrospective, or prospective transition method. Effective January 1, 2016, we adopted ASU 2016-09. The amendments within ASU 2016-09 related to the timing of when excess tax benefits are recognized and accounting for forfeitures were adopted using a modified retrospective method. In accordance with this method, we recorded a cumulative-effect adjustment in our Unaudited Condensed Consolidated Balance Sheet as of December 31, 2015,on January 1, 2016, relating to the timing of recognition of excess tax benefits, representing a $15.7 million reduction to beginning “Accumulated deficit” with the offset to “Deferred tax liabilities, net” ($14.8 million) and “Other current assets” ($0.8 million). We also recorded a cumulative-effect adjustment in our Unaudited Condensed Consolidated Balance Sheet as of December 31, 2015,on January 1, 2016, to reflect actual forfeitures versus the previously-estimated forfeiture rate, representing a $0.4 million reduction to beginning “Accumulated deficit” with the offset to “Paid-in capital in excess of par.” The amendments within ASU 2016-09 related to the recognition of excess tax benefits and tax shortfalls in the income statement and presentation of excess tax benefits on the statement of cash flows were adopted prospectively, with no adjustments made to prior periods.

Income Taxes. In November 2015, the FASB issued ASU 2015-17, Income Taxes (“ASU 2015-17”). ASU 2015-17 simplifies the presentation of deferred income taxes and requires deferred tax assets and liabilities to be classified as noncurrent in the balance sheet. The amendments in this ASU are effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years, and early adoption is permitted. Entities can transition to the standard either retrospectively to each period presented or prospectively. Effective January 1, 2016, we adopted ASU 2015-17, which has been applied retrospectively for all comparative periods presented. Accordingly, current deferred tax assets of $1.5 million have been reclassified from “Deferred tax assets, net” to “Deferred tax liabilities, net” in our Unaudited Condensed Consolidated Balance Sheet as of December 31, 2015. The adoption of ASU 2015-17 did not have an impact on our consolidated results of operations or cash flows.

Debt Issuance Costs. In April 2015, the FASB issued ASU 2015-03, Interest – Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”). ASU 2015-03 requires debt issuance costs related to a recognized debt liability to be presented as a direct reduction of the carrying amount of that debt in the balance sheet, consistent with the presentation of debt discounts. The amendments in this ASU are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Entities are required to apply the guidance on a retrospective basis to each period presented as a change in accounting principle. In August 2015, the FASB issued ASU 2015-15, Interest – Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-15”) which amends ASU 2015-03 to clarify the presentation and subsequent measurement of debt issuance costs associated with line of credit arrangements, such that entities may continue to apply current practice. Effective January 1, 2016, we adopted ASU 2015-03 and ASU 2015-15, which have been applied retrospectively for all comparative periods presented. Accordingly, debt issuance costs of $32.8 million associated with our previously issued senior subordinated notes of $32.8 million have been reclassified from “Other assets” to “Long-term debt, net of current portion” in our Unaudited Condensed Consolidated Balance Sheet as of December 31, 2015. The adoption of ASU 2015-03 and ASU 2015-15 did not have an impact on our consolidated results of operations or cash flows.flows for any periods.

Not Yet Adopted

Leases. In February 2016, the FASB issued ASU 2016-02, Leases (“ASU 2016-02”). ASU 2016-02 amends the guidance for lease accounting to require lease assets and liabilities to be recognized on the balance sheet, along with additional disclosures regarding key leasing arrangements. The amendments in this ASU are effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years, and early adoption is permitted. Entities must adopt the standard using a modified retrospective transition and apply the guidance to the earliest comparative period presented, with certain practical expedients that entities may elect to apply. Management is currently assessing the impact the adoption of ASU 2016-02 will have on our consolidated financial statements.

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Revenue Recognition. In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (“ASU 2014-09”). ASU 2014-09 amends the guidance for revenue recognition to replace numerous, industry-specific requirements. The core principle of the ASU is that an entity should recognize revenue for the transfer of goods or services equal to the amount that it expects to be entitled to receive for those goods or services. The ASU implements a five-step process for customer contract revenue recognition that focuses on transfer of control, as opposed to transfer of risk and rewards. The amendment also requires enhanced disclosures regarding the nature, amount, timing and uncertainty of revenues and cash flows arising from contracts with

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

customers. In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers (“ASU 2015-14”) which amends ASU 2014-09 and delays the effective date for public companies, such that the amendments in the ASU are effective for reporting periods beginning after December 15, 2017, and early adoption will be permitted for periods beginning after December 15, 2016. In March, April and May 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (“ASU 2016-08”)four additional ASUs which clarifiesprimarily clarified the implementation guidance on principal versus agent considerations.considerations, performance obligations and licensing, collectibility, presentation of sales taxes and other similar taxes collected from customers, and non-cash consideration. Entities can transition to the standard either retrospectively to each period presented or as a cumulative-effect adjustment as of the date of adoption. Management is currently assessing the impact the adoption of ASU 2014-09, ASU 2015-14 and ASU 2016-08these standards will have on our consolidated financial statements.

Note 2. Long-Term Debt

The following long-term debt and capital lease obligations were outstanding as of the dates indicated:

| | | | | March 31, | | December 31, | | June 30, | | December 31, |

| In thousands | | 2016 | | 2015 | | 2016 | | 2015 |

| Senior Secured Bank Credit Agreement | | $ | 310,000 |

| | $ | 175,000 |

| | $ | 320,000 |

|

| $ | 175,000 |

|

| 9% Senior Secured Second Lien Notes due 2021 | | | 614,919 |

|

| — |

|

| 6⅜% Senior Subordinated Notes due 2021 | | 396,000 |

| | 400,000 |

| | 220,939 |

|

| 400,000 |

|

| 5½% Senior Subordinated Notes due 2022 | | 1,207,745 |

| | 1,250,000 |

| | 796,712 |

|

| 1,250,000 |

|

| 4⅝% Senior Subordinated Notes due 2023 | | 1,094,000 |

| | 1,200,000 |

| | 622,297 |

|

| 1,200,000 |

|

| Other Subordinated Notes, including premium of $6 and $7, respectively | | 2,256 |

| | 2,257 |

| |

| Other Subordinated Notes, including premium of $5 and $7, respectively | | | 2,255 |

|

| 2,257 |

|

| Pipeline financings | | 209,399 |

| | 211,766 |

| | 207,448 |

|

| 211,766 |

|

| Capital lease obligations | | 65,817 |

| | 71,324 |

| | 60,124 |

|

| 71,324 |

|

| Total | | 3,285,217 |

| | 3,310,347 |

| |

| Total principal balance | | | 2,844,694 |

|

| 3,310,347 |

|

Future interest payable on 9% Senior Secured Second Lien Notes due 2021 (1) | | | 254,660 |

|

| — |

|

| Issuance costs on senior subordinated notes | | (29,803 | ) | | (32,752 | ) | | (17,324 | ) |

| (32,752 | ) |

| Total, net of debt issuance costs on senior subordinated notes | | 3,255,414 |

| | 3,277,595 |

| |

| Less: current obligations | | (32,917 | ) | | (32,481 | ) | |

| Total debt, net of debt issuance costs on senior subordinated notes | | | 3,082,030 |

|

| 3,277,595 |

|

Less: current maturities of long-term debt (1) | | | (83,762 | ) |

| (32,481 | ) |

| Long-term debt and capital lease obligations | | $ | 3,222,497 |

| | $ | 3,245,114 |

| | $ | 2,998,268 |

|

| $ | 3,245,114 |

|

| |

| (1) | Future interest payable on our 9% Senior Secured Second Lien Notes due 2021 represents most of the interest due over the term of this obligation, which has been accounted for as debt in accordance with Financial Accounting Standards Board Codification (“FASC”) 470-60, Troubled Debt Restructuring by Debtors. Our current maturities of long-term debt as of June 30, 2016 include $51.0 million of future interest payable related to this balance that is due within the next twelve months. See 2016 Senior Subordinated Notes Exchange below for further discussion. |

The ultimate parent company in our corporate structure, Denbury Resources Inc. (“DRI”), is the sole issuer of all of our outstanding senior secured second lien notes and senior subordinated notes. DRI has no independent assets or operations. Each of the subsidiary guarantors of such notes is 100% owned, directly or indirectly, by DRI, and the guarantees of the notes are full and unconditional and joint and several; any subsidiaries of DRI that are not subsidiary guarantors of such notes are minor subsidiaries.

Senior Secured Bank Credit Facility

In December 2014, we entered into an Amended and Restated Credit Agreement with JPMorgan Chase Bank, N.A., as administrative agent, and other lenders party thereto (the “Bank Credit Agreement”). The Bank Credit Agreement is a senior secured revolving credit facility with a maturity date of December 9, 2019. As of April 18, 2016, inIn connection with our May 2016 borrowing base

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

redetermination, requirement, we have reduced our borrowing base and lender commitments were reduced to $1.05 billion, with the next such redetermination scheduled for November 2016.

In order to provide more flexibility in managing our balance sheet, the credit extended by our lenders, and continuing compliance with maintenance financial covenants in this low oil price environment, we have entered into three amendments to the Bank Credit Agreement between May 2015 and April 2016 that have modified the Bank Credit Agreement as follows:

for 2016 and 2017, the maximum permitted ratio of consolidated total net debt to consolidated EBITDAX covenant has been suspended and replaced by a maximum permitted ratio of consolidated senior secured debt to consolidated EBITDAX covenant of 3.0 to 1.0 (currently, only debt under our Bank Credit Agreement is considered consolidated senior secured debt for purposes of this ratio);

for 2016 and 2017, a new covenant has been added to require a minimum permitted ratio of consolidated EBITDAX to consolidated interest charges of 1.25 to 1.0;

beginning in the first quarter of 2018, the ratio of consolidated total net debt to consolidated EBITDAX covenant will be reinstated, utilizing an annualized EBITDAX amount for the first, quartersecond, and third quarters of 2018 and building to a trailing four quarters

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

by the end of 2018, with the maximum permitted ratios being 6.0 to 1.0 for the first quarter ending March 31, 2018, 5.5 to 1.0 for the second quarter ending June 30, 2018, and 5.0 to 1.0 for the third and fourth quarters ending September 30 and December 31, 2018, and returning to 4.25 to 1.0 for the first quarter ending March 31, 2019;

allows for the incurrence of up to $1.0 billion of junior lien debt (subject to customary requirements);, with $385.1 million of future incurrence available as of June 30, 2016;

limits unrestricted cash and cash equivalents to $225 million if more than $250 million of borrowings are outstanding under the Bank Credit Agreement; and

limits the amount spent on repurchases or other redemptions of our senior subordinated notes to $225 million.million, with $169.5 million available as of June 30, 2016.

Additionally, such amendments provide formade the following changes to the Bank Credit Agreement: (1) increasesincreased the applicable margin for ABR Loans and LIBOR Loans by 75 basis points such that the margin for ABR Loans now ranges from 1% to 2% per annum and the margin for LIBOR Loans now ranges from 2% to 3% per annum, (2) increasesincreased the commitment fee rate to 0.50%, and (3) providesprovided for semi-annual scheduled redeterminations of the borrowing base in May and November of each year. As of March 31,June 30, 2016, we were in compliance with all debt covenants under the Bank Credit Agreement. The weighted average interest rate on borrowings outstanding as of March 31,June 30, 2016, under the Bank Credit Agreement was 2.4%2.8%.

The above description of our Bank Credit Agreement financial covenants and the changes provided for within the three amendments are qualified by the express language and defined terms contained in the Bank Credit Agreement, the First Amendment to the Bank Credit Agreement dated May 4, 2015, the Second Amendment to the Bank Credit Agreement dated February 17, 2016, and the Third Amendment to the Bank Credit Agreement dated April 18, 2016, each of which are filed as exhibits to our periodic reports filed with the SEC.

2016 Senior Subordinated Notes Exchange

During May 2016, we entered into privately negotiated exchange agreements to exchange a total of $1,057.8 million of our existing senior subordinated notes for $614.9 million principal amount of our 9% Senior Secured Second Lien Notes due 2021(the “2021 Senior Secured Notes”) plus 40.7 million shares of Denbury common stock, resulting in a net reduction from these exchanges of $442.9 million in our debt principal. The exchanged notes consisted of $175.1 million principal amount of our 6⅜% Senior Subordinated Notes due 2021 (“2021 Notes”), $411.0 million principal amount of our 5½% Senior Subordinated Notes due 2022 (“2022 Notes”), and $471.7 million principal amount of our 4⅝% Senior Subordinated Notes due 2023 (“2023 Notes”).

In accordance with FASB ASC 470-60, the exchanges were accounted for as a troubled debt restructuring due to the level of concession provided by our lenders. Under this guidance, future interest applicable to the 2021 Senior Secured Notes is recorded as debt up to the point that the principal and future interest of the new notes is equal to the principal amount of the extinguished notes, rather than recognizing a gain on extinguishment for this amount. As a result, $254.7 million of future interest on the 2021 Senior Secured Notes has been recorded as debt, which will be reduced as semi-annual interest payments are made, with the remaining $22.8 million of future interest to be recognized as interest expense over the term of these notes. Therefore, future interest expense on the 2021 Senior Secured Notes will be significantly lower than the actual cash interest payments. In addition,

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

we recognized a gain of $12.3 million as a result of this debt exchange, which is included in “Gain on debt extinguishment” in the accompanying Unaudited Condensed Consolidated Statements of Operations.

9% Senior Secured Second Lien Notes due 2021

In May 2016, we issued $614.9 million of 2021 Senior Secured Notes. The 2021 Senior Secured Notes, which bear interest at a rate of 9% per annum, were issued at par in connection with privately negotiated exchanges with a limited number of holders of $1,057.8 million of existing senior subordinated notes (see 2016 Senior Subordinated Notes Exchange above). The 2021 Senior Secured Notes mature on May 15, 2021, and interest is payable semi-annually in arrears on May 15 and November 15 of each year, beginning November 15, 2016. We may redeem the 2021 Senior Secured Notes in whole or in part at our option beginning December 15, 2018, at a redemption price of 109% of the principal amount, and at declining redemption prices thereafter, as specified in the indenture governing the 2021 Senior Secured Notes (the “Indenture”). Prior to December 15, 2018, we may at our option redeem up to an aggregate of 35% of the principal amount of the 2021 Senior Secured Notes at a price of 109% of par with the proceeds of certain equity offerings. In addition, at any time prior to December 15, 2018, we may redeem the 2021 Senior Secured Notes in whole or in part at a price equal to 100% of the principal amount plus a “make-whole” premium and accrued and unpaid interest. The 2021 Senior Secured Notes are not subject to any sinking fund requirements.

The Indenture contains customary covenants that restrict our ability and the ability of our restricted subsidiaries’ to (1) incur additional debt; (2) make investments; (3) create liens on our assets or the assets of our restricted subsidiaries; (4) create limitations on the ability of our restricted subsidiaries to pay dividends or make other payments to DRI or other restricted subsidiaries; (5) engage in transactions with our affiliates; (6) transfer or sell assets or subsidiary stock; (7) consolidate, merge or transfer all or substantially all of our assets and the assets of our restricted subsidiaries; and (8) make restricted payments (which includes paying dividends on our common stock or redeeming, repurchasing or retiring such stock or subordinated debt (including existing senior subordinated notes)), provided that in certain circumstances we may make unlimited restricted payments so long as we maintain a ratio of total debt to EBITDA (as defined in the Indenture) not to exceed 2.5 to 1.0 (both before and after giving effect to any restricted payment).

The 2021 Senior Secured Notes are guaranteed jointly and severally by our subsidiaries representing substantially all of our assets, operations and income and are secured by second-priority liens on substantially all of the assets that secure the Bank Credit Agreement, which second-priority liens are contractually subordinated to liens that secure our Bank Credit Agreement and any future additional priority lien debt.

2016 Repurchases of Senior Subordinated Notes

During February and March 2016, we repurchased a total of $152.3 million of our outstanding long-term indebtedness, consisting of $4.0 million in aggregate principal amount of our 6⅜% Senior Subordinated2021 Notes, due 2021 (the “2021 Notes”), $42.3 million in aggregate principal amount of our 5½% Senior Subordinated2022 Notes, due 2022 (the “2022 Notes”), and $106.0 million in aggregate principal amount of our 4⅝% Senior Subordinated2023 Notes due 2023 (the “2023 Notes”) in open-market transactions for a total purchase price of $55.5 million, excluding accrued interest. In connection with these transactions, we recognized a $95.0 million gain on extinguishment, net of unamortized debt issuance costs written off. During July 2016, we repurchased an additional $19.6 million of senior subordinated notes in open-market transactions, consisting of $3.3 million principal amount of our 2021 Notes and $16.3 million principal amount of our 2022 Notes, for a total purchase price of $14.2 million, excluding accrued interest. As of May 4,August 3, 2016, under the Bank Credit Agreement, an additional $169.5$155.3 million may be spent on senior subordinated notes repurchases under the Bank Credit Agreement.or other redemptions.

Note 3. Income Taxes

We evaluate our estimated annual effective income tax rate based on current and forecasted business results and enacted tax laws on a quarterly basis and apply this tax rate to our ordinary income or loss to calculate our estimated tax liability or benefit. As of March 31,June 30, 2016, we had $34.5 million of deferred tax assets associated with State of Louisiana net operating losses. As the result of a new tax law enacted in the State of Louisiana effective June 30, 2015, which limits a company’s utilization of certain deductions, including our net operating loss carryforwards, we recognized tax valuation allowances totaling $33.6 million during 2015 and an additional $0.9 million during the first quarter of 2016, to reducewhich reduced the carrying value of our deferred tax assets. The valuation allowances will remain until the realization of future deferred tax benefits are more likely than not to become utilized.

As of March 31,June 30, 2016, we had an unrecognized tax benefit of $5.4 million related to an uncertain tax position. The unrecognized tax benefit was recorded during the fourth quarter of 2015 as a direct reduction of the associated deferred tax asset and, if recognized,

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

would not materially affect our annual effective tax rate. The tax benefit from an uncertain tax position will only be recognized if it is more likely than not that the tax position will be sustained upon examination by the taxing authorities, based upon the technical merits of the position. We currently do not expect a material change to the uncertain tax position within the next 12 months. Our policy is to recognize penalties and interest related to uncertain tax positions in income tax expense; however, no such amounts were accrued related to the uncertain tax position as of March 31,June 30, 2016.

In connection with the privately negotiated exchange agreements to exchange a portion of our existing senior subordinated notes for 2021 Senior Secured Notes, we realized a tax gain due to the concession extended by our note holders. This tax gain was offset by net operating losses and other deferred tax asset attributes.

Note 4. Stockholders’ Equity

Dividends

During the first three quarters of 2015, the Company’s Board of Directors declared quarterly cash dividends of $0.0625 per common share, with dividends totaling $22.1$43.5 million paid to stockholders during the threesix months ended March 31,June 30, 2015. In

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

September 2015, in light of the continuing low oil price environment and our desire to maintain our financial strength and flexibility, the Company’s Board of Directors suspended our quarterly cash dividend.

Note 5. Commodity Derivative Contracts

We do not apply hedge accounting treatment to our oil and natural gas derivative contracts; therefore, the changes in the fair values of these instruments are recognized in income in the period of change. These fair value changes, along with the settlements of expired contracts, are shown under “Commodity derivatives expense (income)” in our Unaudited Condensed Consolidated Statements of Operations.

Historically, we have entered into various oil and natural gas derivative contracts to provide an economic hedge of our exposure to commodity price risk associated with anticipated future oil and natural gas production and to provide more certainty to our future cash flows. We do not hold or issue derivative financial instruments for trading purposes. Generally, these contracts have consisted of various combinations of price floors, collars, three-way collars, fixed-price swaps and fixed-price swaps enhanced with a sold put. The production that we hedge has varied from year to year depending on our levels of debt, financial strength and expectation of future commodity prices.

We manage and control market and counterparty credit risk through established internal control procedures that are reviewed on an ongoing basis. We attempt to minimize credit risk exposure to counterparties through formal credit policies, monitoring procedures and diversification, and all of our commodity derivative contracts are with parties that are lenders under our Bank Credit Agreement (or affiliates of such lenders). As of March 31,June 30, 2016, all of our outstanding derivative contracts were subject to enforceable master netting arrangements whereby payables on those contracts can be offset against receivables from separate derivative contracts with the same counterparty. It is our policy to classify derivative assets and liabilities on a gross basis on our balance sheets, even if the contracts are subject to enforceable master netting arrangements.

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

The following table summarizes our commodity derivative contracts as of March 31,June 30, 2016, none of which are classified as hedging instruments in accordance with the Financial Accounting Standards Board Codification (“FASC”)FASC Derivatives and Hedging topic:

| | | Months | | Index Price | | Volume (Barrels per day) | | Contract Prices ($/Bbl) | | Index Price | | Volume (Barrels per day) | | Contract Prices ($/Bbl) |

Range (1) | | Weighted Average Price | Range (1) | | Weighted Average Price |

| Swap | | Sold Put | | Floor | | Ceiling | Swap | | Sold Put | | Floor | | Ceiling |

| Oil Contracts: | Oil Contracts: | | | | | | | | | | | | | Oil Contracts: | | | | | | | | | | | | |

2016 Enhanced Swaps (2) | | | | | | | | | | | |

| Apr – June | | NYMEX | | 2,000 | | $ | 90.35 | – | 90.35 |

| | $ | 90.35 |

| | $ | 68.00 |

| | $ | — |

| | $ | — |

| |

| Apr – June | | LLS | | 6,000 | | 93.30 | – | 93.50 |

| | 93.38 |

| | 70.00 |

| | — |

| | — |

| |

| 2016 Fixed-Price Swaps | 2016 Fixed-Price Swaps | | | | | | | | | | | 2016 Fixed-Price Swaps | | | | | | | | | | |

| Apr – June | | NYMEX | | 11,500 | | $ | 60.30 | – | 63.75 |

| | $ | 61.84 |

| | $ | — |

| | $ | — |

| | $ | — |

| |

| Apr – June | | LLS | | 3,500 | | 64.20 | – | 66.15 |

| | 64.99 |

| | — |

| | — |

| | — |

| |

| July – Sept | | NYMEX | | 16,500 | | 36.25 | – | 40.65 |

| | 38.24 |

| | — |

| | — |

| | — |

| | NYMEX | | 18,500 | | $ | 36.25 | – | 45.08 |

| | $ | 38.96 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| July – Sept | | LLS | | 7,000 | | 37.24 | – | 42.15 |

| | 39.61 |

| | — |

| | — |

| | — |

| | LLS | | 7,000 | | 37.24 | – | 42.15 |

| | 39.61 |

| | — |

| | — |

| | — |

|

| Oct – Dec | | NYMEX | | 23,000 | | 36.25 | – | 40.00 |

| | 37.97 |

| | — |

| | — |

| | — |

| | NYMEX | | 26,000 | | 36.25 | – | 45.40 |

| | 38.70 |

| | — |

| | — |

| | — |

|

| Oct – Dec | | LLS | | 7,000 | | 37.24 | – | 41.00 |

| | 39.16 |

| | — |

| | — |

| | — |

| | LLS | | 7,000 | | 37.24 | – | 41.00 |

| | 39.16 |

| | — |

| | — |

| | — |

|

2016 Three-Way Collars (3) | | | | | | | | | | | |

| Apr – June | | NYMEX | | 2,000 | | $ | 85.00 | – | 95.50 |

| | $ | — |

| | $ | 68.00 |

| | $ | 85.00 |

| | $ | 95.50 |

| |

| Apr – June | | LLS | | 2,000 | | 88.00 | – | 98.25 |

| | — |

| | 70.00 |

| | 88.00 |

| | 98.25 |

| |

| 2016 Collars | | | | | | | | | | | | | | | | | | | | |

| Apr – June | | NYMEX | | 5,000 | | $ | 55.00 | – | 72.25 |

| | $ | — |

| | $ | — |

| | $ | 55.00 |

| | $ | 71.01 |

| |

| Apr – June | | LLS | | 2,000 | | 58.00 | – | 73.00 |

| | — |

| | — |

| | 58.00 |

| | 73.00 |

| |

| July – Sept | | NYMEX | | 4,500 | | 55.00 | – | 72.65 |

| | — |

| | — |

| | 55.00 |

| | 71.22 |

| | NYMEX | | 4,500 | | $ | 55.00 | – | 72.65 |

| | $ | — |

| | $ | — |

| | $ | 55.00 |

| | $ | 71.22 |

|

| July – Sept | | LLS | | 3,000 | | 58.00 | – | 74.30 |

| | — |

| | — |

| | 58.00 |

| | 73.85 |

| | NYMEX | | 4,000 | | 40.00 | – | 51.80 |

| | — |

| | — |

| | 40.00 |

| | 51.40 |

|

| July – Sept | | | LLS | | 3,000 | | 58.00 | – | 74.30 |

| | — |

| | — |

| | 58.00 |

| | 73.85 |

|

| July – Sept | | | LLS | | 5,000 | | 40.00 | – | 54.25 |

| | — |

| | — |

| | 40.00 |

| | 53.74 |

|

| Oct – Dec | | | NYMEX | | 4,000 | | 40.00 | – | 54.00 |

| | — |

| | — |

| | 40.00 |

| | 53.48 |

|

| Oct – Dec | | | LLS | | 4,000 | | 40.00 | – | 56.00 |

| | — |

| | — |

| | 40.00 |

| | 55.79 |

|

| 2017 Fixed-Price Swaps | 2017 Fixed-Price Swaps | | | | | | | | | | | 2017 Fixed-Price Swaps | | | | | | | | | | |

| Jan – Mar | | NYMEX | | 20,000 | | $ | 41.15 | – | 44.35 |

| | $ | 42.39 |

| | $ | — |

| | $ | — |

| | $ | — |

| | NYMEX | | 22,000 | | $ | 41.15 | – | 45.45 |

| | $ | 42.67 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Jan – Mar | | LLS | | 9,000 | | 42.35 | – | 45.60 |

| | 43.51 |

| | — |

| | — |

| | — |

| | LLS | | 10,000 | | 42.35 | – | 46.15 |

| | 43.77 |

| | — |

| | — |

| | — |

|

| Apr – June | | | NYMEX | | 22,000 | | 41.20 | – | 46.50 |

| | 43.99 |

| | — |

| | — |

| | — |

|

| Apr – June | | | LLS | | 7,000 | | 42.65 | – | 46.65 |

| | 45.35 |

| | — |

| | — |

| | — |

|

| 2017 Collars | | | | | | | | | | | |

| Jan – Mar | | | NYMEX | | 4,000 | | $ | 40.00 | – | 55.40 |

| | $ | — |

| | $ | — |

| | $ | 40.00 |

| | $ | 54.80 |

|

| Jan – Mar | | | LLS | | 3,000 | | 40.00 | – | 57.35 |

| | — |

| | — |

| | 40.00 |

| | 57.23 |

|

2017 Three-Way Collars (2) | | 2017 Three-Way Collars (2) | | | | | | | | | | |

| July – Sept | | | NYMEX | | 6,500 | | $ | 40.00 | – | 70.25 |

| | $ | — |

| | $ | 30.00 |

| | $ | 40.00 |

| | $ | 69.74 |

|

| July – Sept | | | LLS | | 1,000 | | 41.00 | – | 69.25 |

| | — |

| | 31.00 |

| | 41.00 |

| | 69.25 |

|

| |

| (1) | Ranges presented for fixed-price swaps and enhanced swaps represent the lowest and highest fixed prices of all open contracts for the period presented. For collars and three-way collars, ranges represent the lowest floor price and highest ceiling price for all open contracts for the period presented. |

| |

| (2) | An enhanced swap is a fixed-price swap contract combined with a sold put feature (at a lower price) with the same counterparty. The value associated with the sold put is used to increase or enhance the fixed price of the swap. At the contract settlement date, (1) if the index price is higher than the swap price, we pay the counterparty the difference between the index price and swap price for the contracted volumes, (2) if the index price is lower than the swap price but at or above the sold put price, the counterparty pays us the difference between the index price and the swap price for the contracted volumes and (3) if the index price is lower than the sold put price, the counterparty pays us the difference between the swap price and the sold put price for the contracted volumes. |

| |

(3) | A three-way collar is a costless collar contract combined with a sold put feature (at a lower price) with the same counterparty. The value received for the sold put is used to enhance the contracted floor and ceiling price of the related collar. At the contract settlement date, (1) if the index price is higher than the ceiling price, we pay the counterparty the difference between the index price and ceiling price for the contracted volumes, (2) if the index price is between the floor and ceiling price, no settlements occur, (3) if the index price is lower than the floor price but at or above the sold put price, the counterparty pays us the difference between the index price and the floor price for the contracted volumes and (4) if the index price is lower than the sold put price, the counterparty pays us the difference between the floor price and the sold put price for the contracted volumes. |

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 6. Fair Value Measurements

The FASC Fair Value Measurement topic defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (often referred to as the “exit price”). We utilize market data or assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated or generally unobservable. We primarily apply the income approach for recurring fair value measurements and endeavor to utilize the best available information. Accordingly, we utilize valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. We are able to classify fair value balances based on the observability

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

of those inputs. The FASC establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The three levels of the fair value hierarchy are as follows:

Level 1 – Quoted prices in active markets for identical assets or liabilities as of the reporting date.

Level 2 – Pricing inputs are other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reported date. Level 2 includes those financial instruments that are valued using models or other valuation methodologies. Instruments in this category include non-exchange-traded oil derivatives that are based on NYMEX pricing and fixed-price swaps that are based on regional pricing other than NYMEX (e.g., Light Louisiana Sweet). The fixed-price swap features of our enhanced swaps are valued using a discounted cash flow model based upon forward commodity price curves. Our costless collars and the sold put features of our enhanced oil swaps and three-way collars are valued using the Black-Scholes model, an industry standard option valuation model that takes into account inputs such as contractual prices for the underlying instruments, maturity, quoted forward prices for commodities, interest rates, volatility factors and credit worthiness, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace throughout the full term of the instrument, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace.

Level 3 – Pricing inputs include significant inputs that are generally less observable. These inputs may be used with internally developed methodologies that result in management’s best estimate of fair value. At March 31,June 30, 2016, instruments in this category include non-exchange-traded enhanced swaps, costless collars and three-way collars that are based on regional pricing other than NYMEX (e.g., Light Louisiana Sweet). The valuation models utilized for enhanced swaps, costless collars and three-way collars are consistent with the methodologies described above; however, the implied volatilities utilized in the valuation of Level 3 instruments are developed using a benchmark, which is considered a significant unobservable input. An increase or decrease of 100 basis points in the implied volatility inputs utilized in our fair value measurement would result in a change of approximately $14$80 thousand in the fair value of these instruments as of March 31,June 30, 2016.

We adjust the valuations from the valuation model for nonperformance risk, using our estimate of the counterparty’s credit quality for asset positions and our credit quality for liability positions. We use multiple sources of third-party credit data in determining counterparty nonperformance risk, including credit default swaps.

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

The following table sets forth, by level within the fair value hierarchy, our financial assets and liabilities that were accounted for at fair value on a recurring basis as of the periods indicated:

| | | | | Fair Value Measurements Using: | | Fair Value Measurements Using: |

| In thousands | | Quoted Prices in Active Markets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total | | Quoted Prices in Active Markets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total |

| March 31, 2016 | | | | | | | | | |

| June 30, 2016 | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| Oil derivative contracts – current | | $ | — |

| | $ | 49,758 |

| | $ | 23,040 |

| | $ | 72,798 |

| | $ | — |

| | $ | 2,619 |

| | $ | 2,080 |

| | $ | 4,699 |

|

| Oil derivative contracts – long-term | | | — |

| | 31 |

| | — |

| | 31 |

|

| Total Assets | | $ | — |

| | $ | 49,758 |

| | $ | 23,040 |

| | $ | 72,798 |

| | $ | — |

| | $ | 2,650 |

| | $ | 2,080 |

| | $ | 4,730 |

|

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Oil derivative contracts – current | | $ | — |

| | $ | 25,005 |

| | $ | — |

| | $ | 25,005 |

| | $ | — |

| | $ | 105,310 |

| | $ | 1,795 |

| | $ | 107,105 |

|

| Oil derivative contracts – long-term | | | — |

| | 22 |

| | 45 |

| | 67 |

|

| Total Liabilities | | $ | — |

| | $ | 25,005 |

| | $ | — |

| | $ | 25,005 |

| | $ | — |

| | $ | 105,332 |

| | $ | 1,840 |

| | $ | 107,172 |

|

| | | | | | | | | | | | | | | | | |

| December 31, 2015 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Assets | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Oil derivative contracts – current | | $ | — |

| | $ | 90,012 |

| | $ | 52,834 |

| | $ | 142,846 |

| | $ | — |

| | $ | 90,012 |

| | $ | 52,834 |

| | $ | 142,846 |

|

| Total Assets | | $ | — |

| | $ | 90,012 |

| | $ | 52,834 |

| | $ | 142,846 |

| | $ | — |

| | $ | 90,012 |

| | $ | 52,834 |

| | $ | 142,846 |

|

Since we do not apply hedge accounting for our commodity derivative contracts, any gains and losses on our assets and liabilities are included in “Commodity derivatives expense (income)” in the accompanying Unaudited Condensed Consolidated Statements of Operations.

Level 3 Fair Value Measurements

The following table summarizes the changes in the fair value of our Level 3 assets and liabilities for the three and six months ended March 31,June 30, 2016 and 2015:

| | | | | Three Months Ended | | Three Months Ended | | Six Months Ended |

| | | March 31, | | June 30, | | June 30, |

| In thousands | | 2016 | | 2015 | | 2016 | | 2015 | | 2016 | | 2015 |

| Fair value of Level 3 instruments, beginning of period | | $ | 52,834 |

| | $ | 188,446 |

| | $ | 23,040 |

| | $ | 165,015 |

| | $ | 52,834 |

| | $ | 188,446 |

|

| Fair value adjustments on commodity derivatives | | 281 |

| | 25,085 |

| | (4,818 | ) | | (7,302 | ) | | (4,536 | ) | | 17,783 |

|

| Payment (receipts) on settlements of commodity derivatives | | (30,075 | ) | | (48,516 | ) | |

| Receipts on settlements of commodity derivatives | | | (17,982 | ) | | (45,355 | ) | | (48,058 | ) | | (93,871 | ) |

| Fair value of Level 3 instruments, end of period | | $ | 23,040 |

| | $ | 165,015 |

| | $ | 240 |

| | $ | 112,358 |

| | $ | 240 |

| | $ | 112,358 |

|

| | | | | | | | | | | | | |

| The amount of total gains for the period included in earnings attributable to the change in unrealized gains relating to assets still held at the reporting date | | $ | 133 |

| | $ | 23,099 |

| |

| The amount of total gains (losses) for the period included in earnings attributable to the change in unrealized gains (losses) relating to assets or liabilities still held at the reporting date | | | $ | (3,857 | ) | | $ | (4,325 | ) | | $ | (3,870 | ) | | $ | 14,142 |

|

We utilize an income approach to value our Level 3 enhanced swaps, costless collars and three-way collars. We obtain and ensure the appropriateness of the significant inputs to the calculation, including contractual prices for the underlying instruments, maturity, forward prices for commodities, interest rates, volatility factors and credit worthiness, and the fair value estimate is prepared and

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

reviewed on a quarterly basis. The following table details fair value inputs related to implied volatilities utilized in the valuation of our Level 3 oil derivative contracts:

Denbury Resources Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

|

| | | | | | | | | | |

| | | Fair Value at

3/31/2016

(in thousands) | | Valuation Technique | | Unobservable Input | | Volatility Range |

| Oil derivative contracts | | $ | 23,040 |

| | Discounted cash flow / Black-Scholes | | Volatility of Light Louisiana Sweet for settlement periods beginning after March 31, 2016 | | 26.9% – 38.0% |

|

| | | | | | | | | | |

| | | Fair Value at

6/30/2016

(in thousands) | | Valuation Technique | | Unobservable Input | | Volatility Range |

| Oil derivative contracts | | $ | 240 |

| | Discounted cash flow / Black-Scholes | | Volatility of Light Louisiana Sweet for settlement periods beginning after June 30, 2016 | | 21.1% - 41.4% |

Other Fair Value Measurements

The carrying value of our loans under our Bank Credit Agreement approximate fair value, as they are subject to short-term floating interest rates that approximate the rates available to us for those periods. We use a market approach to determine the fair value of our fixed-rate long-term debt using observable market data. The fair values of our senior secured second lien notes and senior subordinated notes are based on quoted market prices. The estimated fair value of the principal amount of our debt as of March 31,June 30, 2016 and December 31, 2015, excluding pipeline financing and capital lease obligations, was $1,487.42,033.6 million and $1,119.0 million, respectively.respectively, which increase is primarily driven by an increase in quoted market prices. We have other financial instruments consisting primarily of cash, cash equivalents, short-term receivables and payables that approximate fair value due to the nature of the instrument and the relatively short maturities.

Note 7. Commitments and Contingencies

Commitments

In the second quarter of 2016, we amended our CO2 offtake agreement with Mississippi Power Company (“MSPC”), which amendment included increasing our offtake percentage from 70% to 100% of CO2 quantities produced and lowering the base price related to the cost of CO2, deliveries of which are currently expected to begin in the second half of 2016. Based on the amended terms in the agreement, we concluded for accounting purposes that the agreement contains an embedded lease related to the pipeline owned by MSPC used to transport CO2 to Denbury. We currently plan to record a capital lease on the balance sheet of approximately $110 million upon lease commencement.

Litigation

We are involved in various lawsuits, claims and regulatory proceedings incidental to our businesses. We are also subject to audits for various taxes (income, sales and use, and severance) in the various states in which we operate, and from time to time receive assessments for potential taxes that we may owe. While we currently believe that the ultimate outcome of these proceedings, individually and in the aggregate, will not have a material adverse effect on our financial position, results of operations or cash flows, litigation is subject to inherent uncertainties. Although a single or multiple adverse rulings or settlements could possibly have a material adverse effect on our finances, we only accrue for losses from litigation and claims if we determine that a loss is probable and the amount can be reasonably estimated.

NGS Sub Corp., Evolution, et al v. Denbury Onshore, LLC

In March 2015,On June 24, 2016, we entered into a settlement agreement with Evolution Petroleum Corporation (together with its subsidiaries, “Evolution”), resolving all outstanding disputes and claims the parentparties had or may have had against each other, including pending litigation claims, involving the Delhi Field in northeastern Louisiana.