| Common Stock | Accumulated Other Comprehensive Loss | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except shares in thousands) | Shares | Amount | Additional Paid-In Capital | Retained Earnings | Shares | Amount | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2023 | 146,222 | $ | — | $ | 2,176 | $ | 600 | $ | (212) | 2,050 | $ | (35) | $ | 2,529 | |||||||||||||||||||||||||||||||||

| Net income | — | — | — | 57 | — | — | — | 57 | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax | — | — | — | — | 12 | — | — | 12 | |||||||||||||||||||||||||||||||||||||||

| Common stock issuance, net of shares withheld for taxes | 862 | — | 3 | — | — | 497 | (9) | (6) | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | 12 | — | — | — | — | 12 | |||||||||||||||||||||||||||||||||||||||

| Balance at April 1, 2023 | 147,084 | $ | — | $ | 2,191 | $ | 657 | $ | (200) | 2,547 | $ | (44) | $ | 2,604 | |||||||||||||||||||||||||||||||||

| Common Stock | Accumulated Other Comprehensive Loss | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except shares in thousands) | Shares | Amount | Additional Paid-In Capital | Retained Earnings | Shares | Amount | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2022 | 144,808 | $ | — | $ | 2,121 | $ | 317 | $ | (165) | 1,440 | $ | (21) | $ | 2,252 | |||||||||||||||||||||||||||||||||

| Net income | — | — | — | 87 | — | — | — | 87 | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | 14 | — | — | 14 | |||||||||||||||||||||||||||||||||||||||

| Common stock issuance, net of shares withheld for taxes | 564 | — | 3 | — | — | 256 | (6) | (3) | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | 11 | — | — | — | — | 11 | |||||||||||||||||||||||||||||||||||||||

| Balance at April 2, 2022 | 145,372 | $ | — | $ | 2,135 | $ | 404 | $ | (151) | 1,696 | $ | (27) | $ | 2,361 | |||||||||||||||||||||||||||||||||

Any forward-looking statements made by us in this Form 10-Q speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise.

PART I

The financial statements and related footnotes as of April 2, 2022 should be read in conjunction with the financial statements for the year ended December 31, 2021 contained in our 2021 Annual Report on Form 10-K.

4

Item 1. Financial Statements

RESIDEO TECHNOLOGIES, INC.

CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS

(In millions except shares in thousands and per share data)

(Unaudited)

|

| Three Months Ended |

| |||||

|

| April 2, |

|

| April 3, |

| ||

Net revenue |

| $ | 1,506 |

|

| $ | 1,419 |

|

Cost of goods sold |

|

| 1,072 |

|

|

| 1,051 |

|

Gross profit |

|

| 434 |

|

|

| 368 |

|

Research and development expenses |

|

| 24 |

|

|

| 21 |

|

Selling, general and administrative expenses |

|

| 238 |

|

|

| 217 |

|

Operating profit |

|

| 172 |

|

|

| 130 |

|

Other expense, net |

|

| 40 |

|

|

| 44 |

|

Interest expense |

|

| 11 |

|

|

| 13 |

|

Income before taxes |

|

| 121 |

|

|

| 73 |

|

Tax expense |

|

| 34 |

|

|

| 24 |

|

Net income |

| $ | 87 |

|

| $ | 49 |

|

Weighted Average Number of Common Shares Outstanding (in thousands) |

|

|

|

|

|

| ||

Basic |

|

| 145,118 |

|

|

| 143,382 |

|

Diluted |

|

| 148,760 |

|

|

| 147,656 |

|

Earnings Per Share |

|

|

|

|

|

| ||

Basic |

| $ | 0.60 |

|

| $ | 0.34 |

|

Diluted |

| $ | 0.58 |

|

| $ | 0.33 |

|

The unaudited

5

RESIDEO TECHNOLOGIES, INC.

CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE INCOME

(In millions)

(Unaudited)

|

| Three Months Ended |

| |||||

|

| April 2, |

|

| April 3, |

| ||

Net income |

| $ | 87 |

|

| $ | 49 |

|

Other comprehensive income (loss), net of tax |

|

|

|

|

|

| ||

Foreign exchange translation adjustment |

|

| (9 | ) |

|

| (26 | ) |

Changes in unrealized gain on derivatives |

|

| 23 |

|

|

| 2 |

|

Total other comprehensive income (loss), net of tax |

|

| 14 |

|

|

| (24 | ) |

Comprehensive income |

| $ | 101 |

|

| $ | 25 |

|

The unaudited Notes to Consolidated Interim Financial Statements are an integral part of these statements.

6

RESIDEO TECHNOLOGIES, INC.

CONSOLIDATED INTERIM BALANCE SHEETS

(In millions, except number of shares which are reflected in thousands and par value)

(Unaudited)

|

| April 2, 2022 |

|

| December 31, 2021 |

| ||

ASSETS |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 244 |

|

| $ | 779 |

|

Accounts receivable – net |

|

| 1,008 |

|

|

| 876 |

|

Inventories – net |

|

| 922 |

|

|

| 740 |

|

Other current assets |

|

| 165 |

|

|

| 146 |

|

Total current assets |

|

| 2,339 |

|

|

| 2,541 |

|

Property, plant and equipment – net |

|

| 350 |

|

|

| 287 |

|

Goodwill |

|

| 3,125 |

|

|

| 2,661 |

|

Other assets |

|

| 431 |

|

|

| 364 |

|

Total assets |

| $ | 6,245 |

|

| $ | 5,853 |

|

LIABILITIES |

|

|

|

|

|

| ||

Current liabilities: |

|

|

|

|

|

| ||

Accounts payable |

| $ | 958 |

|

| $ | 883 |

|

Current maturities of debt |

|

| 12 |

|

|

| 10 |

|

Accrued liabilities |

|

| 576 |

|

|

| 601 |

|

Total current liabilities |

|

| 1,546 |

|

|

| 1,494 |

|

Long-term debt |

|

| 1,412 |

|

|

| 1,220 |

|

Obligations payable under Indemnification Agreements |

|

| 592 |

|

|

| 585 |

|

Other liabilities |

|

| 334 |

|

|

| 302 |

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

| ||

EQUITY |

|

|

|

|

|

| ||

Common stock, $0.001 par value, 700,000 shares authorized, |

|

| 0 |

|

|

| 0 |

|

Additional paid-in capital |

|

| 2,135 |

|

|

| 2,121 |

|

Treasury stock, at cost |

|

| (27 | ) |

|

| (21 | ) |

Retained earnings |

|

| 404 |

|

|

| 317 |

|

Accumulated other comprehensive loss |

|

| (151 | ) |

|

| (165 | ) |

Total equity |

|

| 2,361 |

|

|

| 2,252 |

|

Total liabilities and equity |

| $ | 6,245 |

|

| $ | 5,853 |

|

The unaudited Notes to Consolidated Interim Financial Statements are an integral part of these statements.

7

RESIDEO TECHNOLOGIES, INC.

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

|

| Three Months Ended |

| |||||

|

| April 2, 2022 |

|

| April 3, 2021 |

| ||

Cash flows (used for) provided by operating activities: |

|

|

|

|

|

| ||

Net income |

| $ | 87 |

|

| $ | 49 |

|

Adjustments to reconcile net income to net cash (used for) provided by operating activities: |

|

|

|

|

|

| ||

Depreciation and amortization |

|

| 20 |

|

|

| 23 |

|

Stock compensation expense |

|

| 11 |

|

|

| 9 |

|

Other |

|

| 2 |

|

|

| 25 |

|

Changes in assets and liabilities, net of acquired companies: |

|

|

|

|

|

| ||

Accounts receivable |

|

| (61 | ) |

|

| (17 | ) |

Inventories – net |

|

| (66 | ) |

|

| (10 | ) |

Other current assets |

|

| (12 | ) |

|

| 16 |

|

Accounts payable |

|

| 17 |

|

|

| (15 | ) |

Accrued liabilities |

|

| (66 | ) |

|

| (66 | ) |

Obligations payable under Indemnification Agreements |

|

| 7 |

|

|

| (7 | ) |

Other |

|

| 2 |

|

|

| (2 | ) |

Net cash (used for) provided by operating activities |

|

| (59 | ) |

|

| 5 |

|

Cash flows used for investing activities: |

|

|

|

|

|

| ||

Expenditures for property, plant, equipment and other intangibles |

|

| (19 | ) |

|

| (19 | ) |

Cash paid for acquisitions, net of cash acquired |

|

| (633 | ) |

|

| (5 | ) |

Other |

|

| (13 | ) |

|

| - |

|

Net cash used for investing activities |

|

| (665 | ) |

|

| (24 | ) |

Cash flows provided by financing activities: |

|

|

|

|

|

| ||

Proceeds from long-term debt |

|

| 200 |

|

|

| 950 |

|

Payment of debt facility issuance and modification costs |

|

| (4 | ) |

|

| (21 | ) |

Repayment of long-term debt |

|

| (3 | ) |

|

| (921 | ) |

Other |

|

| (4 | ) |

|

| 5 |

|

Net cash provided by financing activities |

|

| 189 |

|

|

| 13 |

|

Effect of foreign exchange rate changes on cash and cash equivalents |

|

| 0 |

|

|

| (3 | ) |

Net decrease in cash and cash equivalents |

|

| (535 | ) |

|

| (9 | ) |

Cash and cash equivalents at beginning of period |

|

| 779 |

|

|

| 517 |

|

Cash and cash equivalents at end of period |

| $ | 244 |

|

| $ | 508 |

|

The unaudited Notes to Consolidated Interim Financial Statements are an integral part of these statements.

8

RESIDEO TECHNOLOGIES, INC.

CONSOLIDATED INTERIM STATEMENTS OF EQUITY

(In millions, shares in thousands)

(Unaudited)

Three Months Ended April 2, 2022 |

| Common |

|

| Treasury |

|

| Common |

|

| Treasury |

|

| Additional |

|

| Retained |

|

| Accumulated |

|

| Total |

| ||||||||

Balance at January 1, 2022 |

|

| 144,808 |

|

|

| 1,440 |

|

| $ | 0 |

|

| $ | (21 | ) |

| $ | 2,121 |

|

| $ | 317 |

|

| $ | (165 | ) |

| $ | 2,252 |

|

Net income |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 87 |

|

|

| - |

|

|

| 87 |

|

Other comprehensive income, net of tax |

|

| - |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 14 |

|

|

| 14 |

|

Stock issuances, net of shares withheld for taxes |

|

| 564 |

|

|

| 256 |

|

|

| 0 |

|

|

| (6 | ) |

|

| 3 |

|

|

| 0 |

|

|

| 0 |

|

|

| (3 | ) |

Stock-based compensation |

|

| - |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 11 |

|

|

| - |

|

|

| - |

|

|

| 11 |

|

Balance at April 2, 2022 |

|

| 145,372 |

|

|

| 1,696 |

|

| $ | 0 |

|

| $ | (27 | ) |

| $ | 2,135 |

|

| $ | 404 |

|

| $ | (151 | ) |

| $ | 2,361 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Three Months Ended April 3, 2021 |

| Common |

|

| Treasury |

|

| Common |

|

| Treasury |

|

| Additional |

|

| Retained |

|

| Accumulated |

|

| Total |

| ||||||||

Balance at January 1, 2021 |

|

| 143,059 |

|

|

| 900 |

|

| $ | 0 |

|

| $ | (6 | ) |

| $ | 2,070 |

|

| $ | 75 |

|

| $ | (146 | ) |

| $ | 1,993 |

|

Net income |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 49 |

|

|

| - |

|

|

| 49 |

|

Other comprehensive loss, net of tax |

|

| - |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| - |

|

|

| 0 |

|

|

| (24 | ) |

|

| (24 | ) |

Stock issuances, net of shares withheld for taxes |

|

| 760 |

|

|

| 169 |

|

|

| 0 |

|

|

| (4 | ) |

|

| 9 |

|

|

| 0 |

|

|

| 0 |

|

|

| 5 |

|

Stock-based compensation |

|

| - |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 9 |

|

|

| - |

|

|

| - |

|

|

| 9 |

|

Balance at April 3, 2021 |

|

| 143,819 |

|

|

| 1,069 |

|

| $ | 0 |

|

| $ | (10 | ) |

| $ | 2,088 |

|

| $ | 124 |

|

| $ | (170 | ) |

| $ | 2,032 |

|

The unaudited Notes to Consolidated Interim Financial Statements are an integral part of these statements.

9

RESIDEO TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(In millions, unless otherwise noted)

(Unaudited)

The Company was incorporated in Delaware on April 24, 2018. The Company separated from Honeywell International Inc. (“Honeywell”) on October 29, 2018, becoming an independent publicly traded company as a result of a pro rata distribution of the Company’s common stock to shareholders of Honeywell (the “Spin-Off”).

The Company reports

Reclassification

Certain reclassifications have been made to the prior period financial statements to conform to the classification adopted in the current period.

The prior period unaudited consolidated interim statement of operations was reclassified to present researchquarter and development expenses asonly exist within a separate line item within the statement. Research and development expenses were formerly included within Selling, general and administrative expenses.reporting year.

The Company’s accounting policies are set forth in Note 2. Summary of Significant Accounting Policies of the Company’s Notes to Consolidated and Combined Financial Statements included in the 2021 Annual Report on Form 10-K.10-K for the year ended December 31, 2022. There have been no significant changes to these policies that have had a material impact on the Unaudited Consolidated Financial Statements and accompanying notes for three months ended April 1, 2023.

Recent Accounting Pronouncements—The Company considers

10

RESIDEO TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(In millions, unless otherwise noted)

(Unaudited)

clarifications, is effective. ASU 2022-06 defers the sunset date of Topic 848 from March 12, 2020 through December 31, 2022 to December 31, 2024. This guidance may be applied prospectively to contract modifications made and is applicable for the Company’s A&R Senior Credit Facilities and Swap Agreements, which use LIBOR as a reference rate.hedging relationships entered into or evaluated on or before December 31, 2024. The A&R Senior Credit Facilities include a transition clause to a new reference rate in the event LIBOR is discontinued and the Swap Agreements will be amended to match the new reference rate. We are currently evaluatinghave evaluated the potential impact of adopting this guidance, butstandard and do not expect it to have a material impact on our consolidated financial statements.statements and related disclosures. Refer to Note 12. Long-Term Debt and Note 13. Long-term DebtDerivative Financial Instruments to the Unaudited Consolidated Financial Statements.

Note 3. Revenue Recognition

Disaggregated Revenue

The Company has two operating segments, Products & Solutions and ADI Global Distribution. Disaggregated revenue information for Products & Solutions is presented by product grouping while ADI Global Distribution is presented by region. Beginning January 1, 2022, the Products & Solutions segment further disaggregated the Comfort product grouping into Air and Water. Residential Thermal Solutions is now referenced as Energy.

Revenues by product grouping and region are as follows:

|

| Three Months Ended |

| |||||

|

| April 2, |

|

| April 3, |

| ||

Air |

| $ | 214 |

|

| $ | 191 |

|

Water |

|

| 91 |

|

|

| 88 |

|

Energy |

|

| 159 |

|

|

| 150 |

|

Security |

|

| 155 |

|

|

| 177 |

|

Products & Solutions |

|

| 619 |

|

|

| 606 |

|

|

|

|

|

|

|

| ||

U.S. and Canada |

|

| 752 |

|

|

| 667 |

|

EMEA (1) |

|

| 126 |

|

|

| 134 |

|

APAC (2) |

|

| 9 |

|

|

| 12 |

|

ADI Global Distribution |

|

| 887 |

|

|

| 813 |

|

Net revenue |

| $ | 1,506 |

|

| $ | 1,419 |

|

(1) EMEA represents Europe, the Middle East and Africa.

(2) APAC represents Asia and Pacific countries.

The Company recognizes the majority of its revenue from performance obligations outlined in contracts with its customers that are satisfied at a point in time. Less than 3% of the Company’s revenue is satisfied over time. As of April 2, 2022 and April 3, 2021, contract assets and liabilities were not material.

Segment information is consistent with how management reviews the businesses, makes investing and resource allocation decisions, and assesses operating performance. Three Months Ended April 2, April 3, Revenue Total Products & Solutions revenue $ 714 $ 700 Less: Intersegment revenue 95 94 External Products & Solutions revenue 619 606 External ADI Global Distribution revenue 887 813 Total revenue $ 1,506 $ 1,419 Three Months Ended April 2, April 3, Operating profit Products & Solutions $ 153 $ 130 ADI Global Distribution 80 59 Corporate (61 ) (59 ) Total $ 172 $ 130 Three Months Ended April 2, April 3, Cost of goods sold $ 3 $ 4 Selling, general and administrative 12 12 Total operating lease costs $ 15 $ 16 Financial At April 2, At December 31, Operating right-of-use assets Other assets $ 164 $ 141 Operating lease liabilities - current Accrued liabilities $ 36 $ 32 Operating lease liabilities - noncurrent Other liabilities $ 140 $ 120 At April 2, 2022 $ 33 2023 40 2024 31 2025 25 2026 21 Thereafter 55 Total lease payments 205 Less: imputed interest 29 Present value of operating lease liabilities $ 176 Weighted-average remaining lease term (years) 6.10 Weighted-average incremental borrowing rate 5.08 % Three Months Ended April 2, 2022 April 3, 2021 Operating cash outflows $ 8 $ 8 Operating right-of-use assets obtained in exchange for operating lease liabilities $ 32 $ 10 The Three Months Ended April 2, April 3, Numerator: Net income $ 87 $ 49 Denominator - Weighted average common shares outstanding (in thousands): Basic 145,118 143,382 Add: dilutive effect of common stock equivalents 3,642 4,274 Diluted 148,760 147,656 Earnings per share: Basic $ 0.60 $ 0.34 Diluted $ 0.58 $ 0.33 The Company monitors its2our two operating segments,segments: Products &and Solutions and ADI Global DistributionDistribution.reports Corporate separately from the two operating segments.Products & Solutions—The Products & Solutions business is a leading global provider of products, software solutions and technologies that help homeowners stay connected and in control of their comfort, security, and energy use.ADI Global Distribution—The ADI Global Distribution business is the leading distributor of low-voltage security products including access control, fire detection, intrusion, and video products and participates significantly11RESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)in the broaderother expenses related markets of audio, communications, data communications, networking, power, ProAV, smart home, and wire and cable.Corporate—Corporate includesto executive, legal, finance, information technology,tax, treasury, human resources, IT, strategy, communications, and communications activities not allocated directlycorporate travel expenses. Additional unallocated amounts primarily include non-operating items such as Reimbursement Agreement expense, interest income, interest expense, and other income (expense). The Reimbursement Agreement is further described in Note 16. Commitments and Contingencies to either business units.the Unaudited Consolidated Financial Statements.

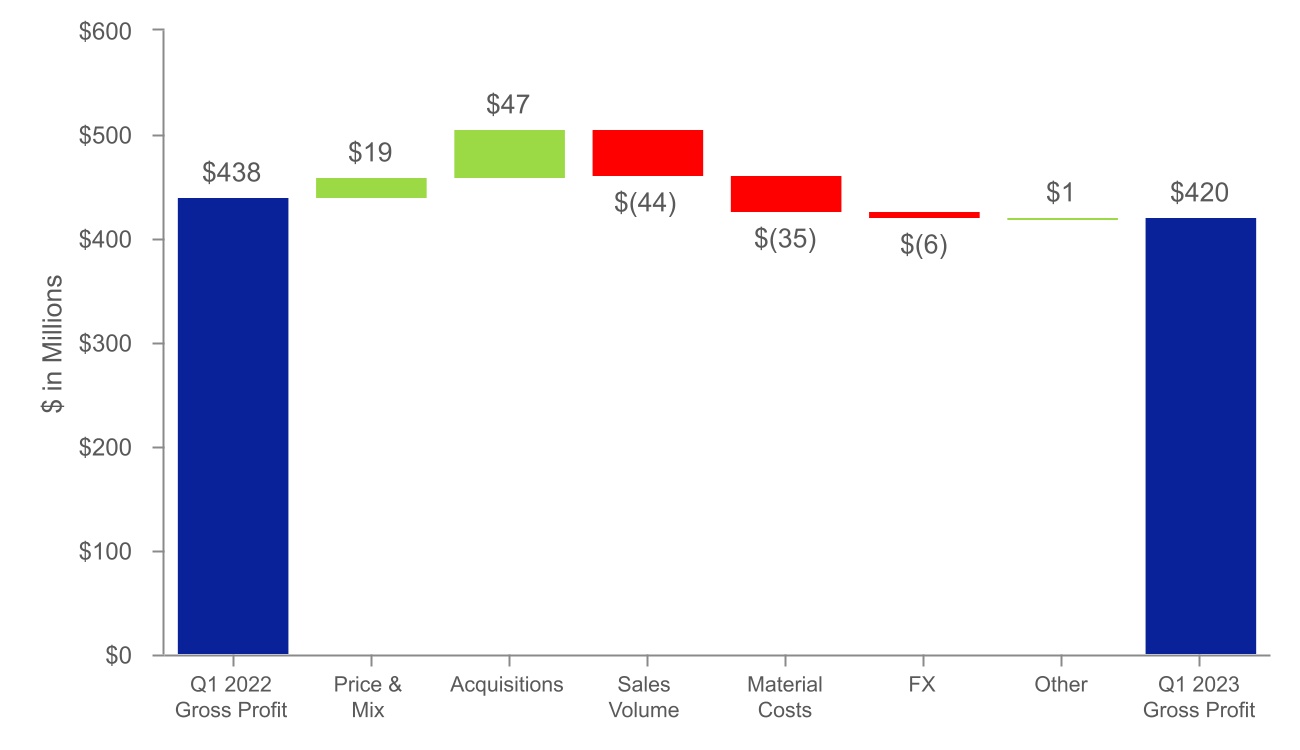

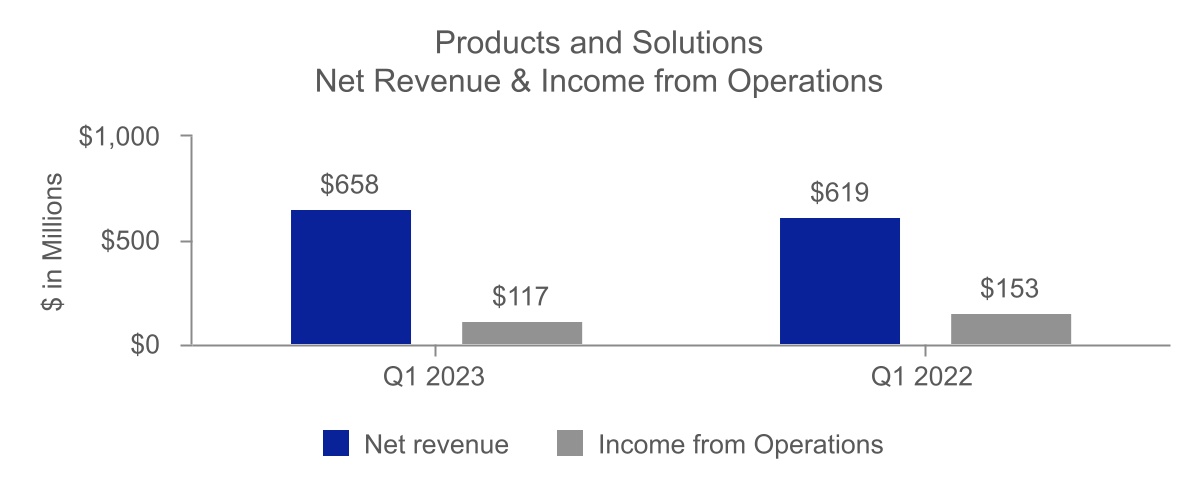

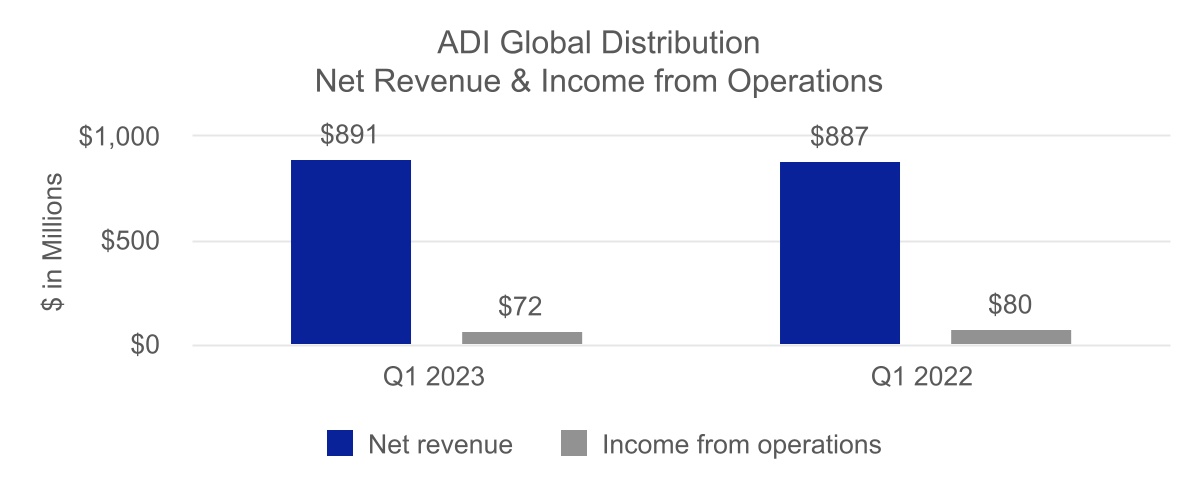

2022

2021Three Months Ended (in millions) April 1, 2023 April 2, 2022 Net revenue Products and Solutions $ 658 $ 619 ADI Global Distribution 891 887 Total net revenue $ 1,549 $ 1,506 Three Months Ended (in millions) April 1, 2023 April 2, 2022 Income from operations Products and Solutions $ 117 $ 153 ADI Global Distribution 72 80 Corporate (51) (61) Total income from operations $ 138 $ 172

2022

2021disclosed.reported.Stock-Based CompensationRevenue RecognitionThree Months Ended (in millions) April 1, 2023 April 2, 2022 Products and Solutions Air $ 211 $ 214 Safety and Security 228 155 Energy 136 159 Water 83 91 Total Products and Solutions 658 619 ADI Global Distribution U.S. and Canada 768 752 123 126 — 9 Total ADI Global Distribution 891 887 Total net revenue $ 1,549 $ 1,506 (in millions) April 1, 2023 December 31, 2022 Beginning of period $ 27 $ 9 Charges 2 26 (4) (5) Other (2) (3) End of period $ 23 $ 27 Restricted Stock Units (“RSUs”) and Performance Stock Unit (“PSUs”)2, 2022, as part1, 2023, we recognized a pension settlement loss of $3 million related to our U.S qualified defined benefit pension plan. The non-cash pension settlement loss resulted from a voluntary lump sum window offering and the purchase of a group annuity contract that transferred a portion of the Company’s annual long-term compensation underassets and liabilities to an insurance company. The corresponding remeasurement resulted in a decrease in both the 2018 Stock Incentive PlanU.S. qualified defined benefit pension plan assets and liabilities of Resideo Technologies, Inc. and its Affiliates and the 2018 Stock Incentive Plan for Non-Employee Directors of Resideo Technologies, Inc. as may be amended from time to time (together, the “Stock Incentive Plan”), it granted 672,453 market-based PSUs and 808,919 service-based RSUs to eligible employees. The weighted average grant date fair value per share for market-based PSUs and service-based RSUs was $36.11 and $24.87, respectively.Note 6. LeasesThe Company is party to operating leases for the majority of its manufacturing sites, offices, engineering and lab sites, stocking locations, warehouses, automobiles, and certain equipment.Certain of the Company’s real estate leases include variable rental payments which adjust periodically based on inflation. Generally, the Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.12RESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)The Company’s operating lease costs for the three months ended April 2, 2022 and April 3, 2021 consisted of the following:

2022

2021Total operating lease costs include variable lease costs of $4 million for the three months ended April 2, 2022 and April 3, 2021. Total operating lease costs also include offsetting sublease income which is immaterial for the three months ended April 2, 2022 and April 3, 2021.The Company recognized the following related to its operating leases:

Statement

Line Item

2022

2021Maturities of the Company’s operating lease liabilities were as follows:

2022Supplemental cash flow information related to the Company’s operating leases was as follows:Note 7. Income TaxesThe Company recorded tax expense of $34 million and $24 million for the three months ended April 2, 2022 and April 3, 2021 respectively.13RESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)For interim periods, income tax is equal to the total of (1) year-to-date pretax income multiplied by the Company’s forecasted effective tax rate plus (2) tax expense items specific to the period. In situations where the Company expects to report losses for which the Company does not expect to receive tax benefits, the Company applies separate forecasted effective tax rates to those jurisdictions rather than including them in the consolidated forecasted effective tax rate.For the three months ended April 2, 2022 the net tax expense of $34 million consists primarily of interim period tax expense of $35 million based on year-to-date pretax income multiplied by the Company’s forecasted effective tax rate, partially offset by a tax benefit specific to the period of approximately $1 million consisting primarily of excess deductions for share-based compensation and the release of a previously unrecognized tax benefit. In addition to items specific to the period, the Company’s income tax rate is impacted by the mix of earnings across the jurisdictions in which the Company operates, non-deductible expenses, and U.S. taxation of foreign earnings.Earnings Per ShareStock-Based Compensation Plansfollowing table sets forthStock Incentive Plan, which consists of the computationAmended and Restated 2018 Stock Incentive Plan of basicResideo Technologies, Inc. and diluted earnings per share (in millions, except shares in thousandsits Affiliates and per share data):

2022

2021Diluted earnings per share is computed based upon the weighted average number2018 Stock Incentive Plan for Non-Employee Directors of common shares outstandingResideo Technologies, Inc., provides for the period plusgrant of stock options, stock appreciation rights, restricted stock units, restricted stock, and other stock-based awards.

| Three Months Ended April 1, 2023 | Three Months Ended April 2, 2022 | ||||||||||||||||||||||

| Number of Stock Units Granted | Weighted average grant date fair value per share | Number of Stock Units Granted | Weighted average grant date fair value per share | ||||||||||||||||||||

| Performance Stock Units (“PSUs”) | 553,071 | $ | 29.89 | 672,453 | $ | 36.11 | |||||||||||||||||

| Restricted Stock Units (“RSUs”) | 1,466,307 | $ | 19.03 | 808,919 | $ | 24.87 | |||||||||||||||||

| (in millions) | April 1, 2023 | December 31, 2022 | ||||||||||||

| Raw materials | $ | 271 | $ | 251 | ||||||||||

| Work in process | 24 | 25 | ||||||||||||

| Finished products | 713 | 699 | ||||||||||||

| Total inventories, net | $ | 1,008 | $ | 975 | ||||||||||

| (in millions) | Products and Solutions | ADI Global Distribution | Total | ||||||||||||||

| Balance at December 31, 2022 | $ | 2,072 | $ | 652 | $ | 2,724 | |||||||||||

| Acquisitions | — | 4 | 4 | ||||||||||||||

| Impact of foreign currency translation | 6 | 2 | 8 | ||||||||||||||

| Balance at April 1, 2023 | $ | 2,078 | $ | 658 | $ | 2,736 | |||||||||||

| (in millions) | April 1, 2023 | December 31, 2022 | |||||||||

| Intangible assets subject to amortization | $ | 291 | $ | 295 | |||||||

| Indefinite-lived intangible assets | 180 | 180 | |||||||||

| Total intangible assets | $ | 471 | $ | 475 | |||||||

| April 1, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | |||||||||||||||||||||||||||||||||||||||||

| Patents and technology | $ | 65 | $ | (29) | $ | 36 | $ | 65 | $ | (28) | $ | 37 | |||||||||||||||||||||||||||||||||||

| Customer relationships | 315 | (123) | 192 | 313 | (117) | 196 | |||||||||||||||||||||||||||||||||||||||||

| Trademarks | 14 | (9) | 5 | 14 | (8) | 6 | |||||||||||||||||||||||||||||||||||||||||

| Software | 180 | (122) | 58 | 175 | (119) | 56 | |||||||||||||||||||||||||||||||||||||||||

| Total intangible assets | $ | 574 | $ | (283) | $ | 291 | $ | 567 | $ | (272) | $ | 295 | |||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| (in millions) | April 1, 2023 | April 2, 2022 | |||||||||||||||||||||

| Operating lease cost: | |||||||||||||||||||||||

| Cost of goods sold | $ | 5 | $ | 3 | |||||||||||||||||||

| Selling, general and administrative expenses | 14 | 12 | |||||||||||||||||||||

| Total operating lease costs | $ | 19 | $ | 15 | |||||||||||||||||||

Note 9. Inventories—Net

|

| April 2, 2022 |

|

| December 31, 2021 |

| ||

Raw materials |

| $ | 273 |

|

| $ | 174 |

|

Work in process |

|

| 25 |

|

|

| 17 |

|

Finished products |

|

| 624 |

|

|

| 549 |

|

|

| $ | 922 |

|

| $ | 740 |

|

Note 10. Acquisitions

14

RESIDEO TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(In millions, unless otherwise noted)

(Unaudited)

On February 6, 2022, the Company entered into an agreement to acquire 100% of the issued and outstanding capital stock of First Alert, Inc. (“First Alert”), a leading provider of home safety products. The acquisition closed on March 31, 2022 for an aggregate cash purchase price of $620 million, subject to post-closing adjustment. First Alert is expected to expand and leverage the Company's footprint in the home with complementary smoke and carbon monoxide detection home safety products and fire suppression products. The business is included within the Products & Solutions segment.

The Company has not completed the valuation analysis and calculations necessary to finalize the required purchase price allocations. The consideration paid by the Company to complete the acquisition has been allocated preliminarily to the assets acquired and liabilities assumed based upon the net book values. The purchase price in excess of the net book value was recorded as goodwill, as of the date of the acquisition, as a temporary measure pending the completion of the valuation analysis. The Company included net assets and Goodwill of $156 million and $464 million, respectively, in the Consolidated Interim Balance Sheets as of April 2, 2022. Accordingly, the purchase price allocations are preliminary and are subject to future adjustments during the maximum one-year allocation period. In addition to goodwill, the final purchase price allocation is expected to include adjustments to the net assets recognized at book value and significant allocations from Goodwill to intangible assets, such as customer relationships, trade name, developed technology, and leasehold interests.

The following table summarizes the preliminary allocationcarrying amounts of our operating lease assets and liabilities:

| (in millions) | Financial Statement Line Item | April 1, 2023 | December 31, 2022 | ||||||||||||||

| Operating lease assets | Other assets | $ | 192 | $ | 191 | ||||||||||||

| Operating lease liabilities - current | Accrued liabilities | $ | 38 | $ | 37 | ||||||||||||

| Operating lease liabilities - non-current | Other liabilities | $ | 166 | $ | 166 | ||||||||||||

| Three Months Ended | |||||||||||||||||

| (in millions) | April 1, 2023 | April 2, 2022 | |||||||||||||||

| Cash paid for operating lease liabilities | $ | 9 | $ | 8 | |||||||||||||

| Non-cash activities: operating lease assets obtained in exchange for new operating lease liabilities | $ | 7 | $ | 32 | |||||||||||||

| (in millions) | April 1, 2023 | December 31, 2022 | |||||||||

| 4.000% Senior Notes due 2029 | $ | 300 | $ | 300 | |||||||

| Variable rate A&R Term B Facility | 1,128 | 1,131 | |||||||||

| Gross debt | 1,428 | 1,431 | |||||||||

| Less: current portion of long-term debt | (12) | (12) | |||||||||

| Less: unamortized deferred financing costs | (14) | (15) | |||||||||

| Total long-term debt | $ | 1,402 | $ | 1,404 | |||||||

| Fair Value of Derivative Assets | |||||||||||||||||

| (in millions) | Financial Statement Line Item | April 1, 2023 | December 31, 2022 | ||||||||||||||

| Derivatives designated as hedging instruments: | |||||||||||||||||

| Interest rate swaps | Other current assets | $ | 21 | $ | 23 | ||||||||||||

| Interest rate swaps | Other assets | 17 | 22 | ||||||||||||||

| Total derivative assets designated as hedging instruments | $ | 38 | $ | 45 | |||||||||||||

| Unrealized gain | Accumulated other comprehensive loss | $ | 35 | $ | 42 | ||||||||||||

| (in millions) | Financial Statement Line Item | April 1, 2023 | April 2, 2022 | ||||||||||||||||||||

| Gains recorded in accumulated other comprehensive loss, beginning of period: | $ | 42 | $ | 6 | |||||||||||||||||||

| Current period (loss) gain recognized in other comprehensive income | (7) | 23 | |||||||||||||||||||||

| Gains recorded in accumulated other comprehensive loss, end of period | $ | 35 | $ | 29 | |||||||||||||||||||

| April 1, 2023 | December 31, 2022 | ||||||||||||||||||||||

| (in millions) | Carrying Value | Fair Value | Carrying Value | Fair Value | |||||||||||||||||||

| Debt: | |||||||||||||||||||||||

| 4.000% Senior Notes due 2029 | $ | 300 | $ | 253 | $ | 300 | $ | 242 | |||||||||||||||

| Variable rate A&R Term B Facility | 1,128 | 1,124 | 1,131 | 1,125 | |||||||||||||||||||

| Total debt | $ | 1,428 | $ | 1,377 | $ | 1,431 | $ | 1,367 | |||||||||||||||

Accounts receivable – net |

| $ | 72 |

|

Inventories – net |

|

| 113 |

|

Cash and other current assets |

|

| 5 |

|

Property, plant and equipment – net |

|

| 64 |

|

Goodwill (includes unallocated identified intangible assets) |

|

| 464 |

|

Other assets (non-current) |

|

| 30 |

|

Total assets |

| $ | 748 |

|

Accounts payable |

|

| 57 |

|

Accrued liabilities |

|

| 43 |

|

Other liabilities |

|

| 28 |

|

Net assets acquired |

| $ | 620 |

|

The Company expensed approximately $Refer to 10Note 12. Long-Term Debt million of costs related to the acquisition of First Alert during the three months ended April 2, 2022. These costs, which consist primarily of advisory, insurance,Unaudited Consolidated Financial Statements.

On February 14, 2022,movements in interest rates. The fair values of interest rate swaps have been determined based on market value equivalents at the Company acquired balance sheet date, taking into account the current interest rate environment and therefore, were classified as Level 2 measurements in the fair value hierarchy.

| April 1, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||

| (in millions) | Carrying Value | Fair Value | Carrying Value | Fair Value | |||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||

| Interest rate swaps | $ | 38 | $ | 38 | $ | 45 | $ | 45 | |||||||||||||||||||||||||||

15

RESIDEO TECHNOLOGIES, INC.

NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(In millions, unless otherwise noted)

(Unaudited)

| (in millions) | April 1, 2023 | December 31, 2022 | |||||||||

| Obligations payable under Indemnification Agreements | $ | 140 | $ | 140 | |||||||

| Compensation, benefit and other employee-related | 79 | 108 | |||||||||

| Customer rebate reserve | 75 | 98 | |||||||||

| Product warranties | 24 | 40 | |||||||||

| Current operating lease liability | 38 | 37 | |||||||||

| Taxes payable | 46 | 38 | |||||||||

Other (1) | 161 | 179 | |||||||||

| Total accrued liabilities | $ | 563 | $ | 640 | |||||||

|

| April 2, 2022 |

|

| December 31, 2021 |

| ||

Obligations payable under Indemnification Agreements |

| $ | 140 |

|

| $ | 140 |

|

Taxes payable |

|

| 79 |

|

|

| 54 |

|

Compensation, benefit and other employee-related |

|

| 75 |

|

|

| 114 |

|

Customer rebate reserve |

|

| 66 |

|

|

| 94 |

|

Other |

|

| 216 |

|

|

| 199 |

|

|

| $ | 576 |

|

| $ | 601 |

|

Refer to Note 12.16. Commitments and Contingencies for further details on Obligations payable under Indemnification Agreements.

Three Months Ended April 2, April 3, Beginning balance $ 597 $ 591 Accruals for indemnification liabilities deemed probable and reasonably estimable 41 36 Indemnification payment (35 ) (35 ) Ending balance (1) $ 603 $ 592 April 2, 2022 December 31, 2021 Accrued liabilities $ 140 $ 140 Obligations payable under Indemnification Agreements 463 457 $ 603 $ 597 The following table summarizes information concerning recorded obligations for product warranties and product performance guarantees: Three Months Ended April 2, April 3, Beginning of period $ 23 $ 22 Accruals for warranties/guarantees issued during the year 6 4 Additions from acquisitions 8 - Adjustment of pre-existing warranties/guarantees (2 ) (1 ) Settlement of warranty/guarantee claims (5 ) (5 ) End of period $ 30 $ 20 April 2, 2022 December 31, 2021 4.000% notes due 2029 $ 300 $ 300 Seven-year variable rate term loan B due 2028 1,140 943 Revolving Credit Facility 0 - Unamortized deferred financing costs (16 ) (13 ) Total outstanding indebtedness 1,424 1,230 Less: Amounts expected to be paid within one year 12 10 Total long-term debt due after one year $ 1,412 $ 1,220 Three Months Ended April 2, April 3, Net revenue $ 1,506 $ 1,419 Cost of goods sold 1,072 1,051 Gross profit 434 368 Research and development expenses 24 21 Selling, general and administrative expenses 238 217 Operating profit 172 130 Other expense, net 40 44 Interest expense 11 13 Income before taxes 121 73 Tax expense 34 24 Net income $ 87 $ 49 Weighted Average Number of Common Shares Outstanding (in thousands) Basic 145,118 143,382 Diluted 148,760 147,656 Earnings Per Share Basic $ 0.60 $ 0.34 Diluted $ 0.58 $ 0.33 Three Months Ended April 2, April 3, Net revenue $ 1,506 $ 1,419 % change compared with prior period 6 % Three Months Ended April 2, April 3, 2022 2021 Cost of goods sold $ 1,072 $ 1,051 % change compared with prior period 2 % Gross profit percentage 28.8 % 25.9 % Three Months Ended April 2, April 3, 2022 2021 Research and development expenses $ 24 $ 21 % of revenue 2 % 1 % Three Months Ended April 2, April 3, 2022 2021 Selling, general and administrative $ 238 $ 217 % of revenue 16 % 15 % Three Months Ended April 2, April 3, 2022 2021 Other expense, net $ 40 $ 44 Three Months Ended April 2, April 3, 2022 2021 Tax expense $ 34 $ 24 Effective tax rate 29 % 32 % Three Months Ended April 2, April 3, 2022 2021 % Change Total revenue $ 714 $ 700 Less: Intersegment revenue 95 94 External revenue $ 619 $ 606 2 % Operating profit $ 153 $ 130 18 % Operating profit percentage 25 % 21 % Three Months Ended April 2, April 3, 2022 2021 % Change External revenue $ 887 $ 813 9 % Operating profit $ 80 $ 59 36 % Operating profit percentage 9 % 7 % Three Months Ended April 2, April 3, 2022 2021 % Change Corporate costs $ 61 $ 59 3 % contingency has not been satisfied. Three Months Ended April 2, April 3, 2022 2021 Cash (used for) provided by: Operating activities $ (59 ) $ 5 Investing activities (665 ) (24 ) Financing activities 189 13 Effect of exchange rate changes on cash and cash equivalents - (3 ) Net decrease in cash and cash equivalents $ (535 ) $ (9 ) Exhibit Exhibit Description 4.1 31.1 31.2 32.1 32.2 101.INS Inline XBRL Instance Document (filed herewith) 101.SCH Inline XBRL Taxonomy Extension Schema (filed herewith) 101.CAL Inline XBRL Taxonomy Extension Calculation Linkbase (filed herewith) 101.DEF Inline XBRL Taxonomy Extension Definition Linkbase (filed herewith) 101.LAB Inline XBRL Taxonomy Extension Label Linkbase (filed herewith) 101.PRE Inline XBRL Taxonomy Extension Presentation Linkbase (filed herewith) 104 Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) Date: May 3, By: /s/ Anthony L. Trunzo Anthony L. Trunzo12.16. Commitments and ContingenciesThe Company isaccruesaccrue costs related to environmental matters when it is probable that it haswe have incurred a liability related to a contaminated site and the amount can be reasonably estimated. Environmental-relatedWe believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage and personal injury and that our handling, manufacture, use and disposal of hazardous substances are in accordance with environmental and safety laws and regulations. We have incurred remedial response and voluntary cleanup costs for site contamination and are a party to claims associated with environmental and safety matters, including products containing hazardous substances. Additional claims and costs involving environmental matters are likely to continue to arise in the future.Resideous are presented within Costcost of goods sold for operating sites. For the three months ended April 2, 20221, 2023 and April 3, 2021,2, 2022, environmental expenses related to these operating sites were not material. Liabilities for environmental costs were $22$22 million as ofat April 2, 20221, 2023 and December 31, 2021.2022.indemnification and reimbursement agreement (the “Reimbursement Agreement”)Reimbursement Agreement and the tax matters agreement (the “TaxTax Matters Agreement”)Agreement (collectively, the “Indemnification Agreements”) are further described below.the Companywe entered into the Reimbursement Agreement, with Honeywell pursuant to which the Company haswe have an obligation to make cash payments to Honeywell in amounts equal to 90%90% of payments for certain Honeywell environmental-liability payments, which include amounts billed (“payments”)(payments), less 90%90% of Honeywell’s net insurance receipts relating to such liabilities, and less 90%90% of the net proceeds received by Honeywell in connection with (i) affirmative claims relating to such liabilities, (ii) contributions by other parties relating to such liabilities and (iii) certain property sales (the “recoveries”)recoveries). TheWhile the amount payable by the Companyus in respect of such liabilities arising in respect of any given year is subject to a cap of $$140 million under the Reimbursement Agreement, the estimated liability for resolution of pending and future environmental-related liabilities recorded on our balance sheet are calculated as if we were responsible for 100% of the environmental-liability payments associated with certain sites. Refer to 140 million. See Note 17.15. Commitments and Contingencies in the Company’s 2021our 2022 Annual Report on Form 10-K for further discussion.The following table summarizes information concerning the Company’s Reimbursement Agreement liabilities:

2022

2021(1)Reimbursement Agreement liabilities deemed probable and reasonably estimable, however, it is possible the Company could pay $140 million per year (exclusive of any late payment fees up to 5% per annum) until the earlier of (1) December 31, 2043; or (2) December 31 of the third consecutive year during which the annual reimbursement obligation (including in respect of deferred payment amounts) has been less than $25 million.16Table of ContentsRESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)For the three months ended April 2, 2022 and April 3, 2021 net expenses relatedthe Reimbursement Agreement were $41 million and $36 million, respectively and are recorded in Other expense, net.Consolidated Financial StatementsReimbursement Agreement liabilities are included in the following balance sheet accounts:The Company does not currently possess sufficient information to reasonably estimate the amounts of indemnification liabilities to be recorded upon future completion of studies, litigation or settlements, and neither the timing nor the amount of the ultimate costs associated with such indemnification liability payments can be determined although they could be material to the Company’s unaudited consolidated results of operations and operating cash flows in the periods recognized or paid.the Companywe entered into the Tax Matters Agreement with Honeywell, pursuant to which it iswe are responsible and will indemnify Honeywell for certain taxes, including certain income taxes, sales taxes, VAT and payroll taxes, relating to the business for all periods, including periods prior to the consummation of the Spin-Off. In addition, the Tax Matters Agreement addresses the allocation of liability for taxes that are incurred as a result of restructuring activities undertaken to effectuate the Spin-Off. As(in millions) Reimbursement Agreement Tax Matters Agreement Total Balance as of December 31, 2022 $ 614 $ 106 $ 720 41 (2) 39 Payments to Honeywell (35) — (35) Balance as of April 1, 2023 $ 620 $ 104 $ 724 (in millions) April 1, 2023 December 31, 2022 Accrued liabilities $ 140 $ 140 Obligations payable under Indemnification Agreements 584 580 Total indemnification liabilities $ 724 $ 720 and December 31, 2021, the Company has recorded a liability in respectnet expenses related to the Tax MattersReimbursement Agreement were $41 million and are recorded in other expense, net.$indemnification liabilities to be recorded upon future completion of studies, litigation or settlements, and neither the timing nor the amount of the ultimate costs associated with such indemnification liability payments can be determined although they could be material to our consolidated results of operations and operating cash flows in the periods recognized or paid.128 million,is included in Obligations payable under Indemnification Agreements.are part of our ongoing business.In connection with the Spin-Off, the Company and Honeywell40-year40-year Trademark License Agreement (the “Trademark Agreement”)with Honeywell that authorizes the Company’sour use of certain licensed trademarks in the operation of Resideo’sour business for the advertising, sale and distribution of certain licensed products. In exchange, the Company payswe will pay to Honeywell a royalty fee which is generally equal to 1.5%of 1.5% on net revenue to Honeywell related to such licensed products, which is recorded in Selling,selling, general and administrative expensesexpense on the unauditedUnaudited Consolidated Interim Statements of Operations. For the three months ended April 2, 20221, 2023 and April 3, 2021,2, 2022, royalty fees were $6$4 million and $5$6 million, respectively.The Company isWe are subject to lawsuits, investigations and disputes arising out of the conduct of itsour business, including matters relating to commercial transactions, government contracts, product liability, prior acquisitions and divestitures, employee matters, intellectual property, and environmental, health, and safety matters. The Company recognizesWe recognize a liability for any contingency that is probable of occurrence and reasonably estimable. The CompanyWe continually assessesassess the likelihood of adverse judgments or outcomes in these matters, as well as potential ranges of possible losses (taking into consideration any insurance recoveries), based on a careful analysis of each matter with the assistance of outside legal counsel and, if applicable, other experts. No such matters are material to the Company's unauditedour financial statements.The Company, the Company’s former CEO Michael Nefkens, the Company’s former CFO Joseph Ragan, and the Company’s former CIO Niccolo de Masi were named defendants in a class action securities suit that was filed in the U.S. District Court for the District of Minnesota styled In re Resideo Technologies, Inc. Securities Litigation, (the “Securities Litigation”). The amended complaint asserted claims under Section 10(b) and Section 20(a) of the Securities Exchange Act of 1934, broadly alleging, among other things, that the defendants (or some of them) made false and misleading statements regarding, among other things, Resideo’s business, performance, the efficiency of its supply chain, operational and administrative issues resulting from the spin-off from Honeywell, certain business initiatives, and financial guidance in 2019.17RESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)On August 18, 2021, the Company and plaintiffs’ representative executed a definitive Stipulation and Agreement of Settlement providing for, among other things, a total settlement payment of $ Refer to 55 million (the “Settlement”). Insurance recoveries of approximately $39 million were received related to the Settlement. On March 25, 2022, the court entered a final judgement approving the Settlement, which was amended to provide a dismissal of the Securities Litigation with prejudice on April, 14, 2022.Certain current or former directors and officers of the Company were defendants in a consolidated derivative action in the District Court for the District of Delaware under the caption In re Resideo Technologies, Inc. Derivative Litigation, (the “Federal Derivative Action”). On September 23, 2021 the Federal Derivative Action was transferred to the District of Minnesota, where Securities Litigation was pending. On September 1, 2021, an additional shareholder derivative complaint was filed by Riviera Beach, part of the leadership group in the Federal Derivative Action, and City of Hialeah Employees Retirement System against certain current or former directors and officers of the Company in the District of Minnesota, alleging substantially that the same facts and making substantially the same claims against the same defendants as in the Federal Derivative Action, and additionally referencing board materials obtained through a demand made pursuant to Section 220 of the Delaware Code Title 8 (the “Riviera Beach Action”). On December 1, 2021, the Federal Derivative Action and the Riviera Beach Action were consolidated into a single action under the caption: In re Resideo Technologies, Inc. Derivative Litigation, (the “Consolidated Federal Derivative Action”) and was stayed pending entry of final judgement in the Securities Litigation. On April 19, 2022, after entry of the final judgement in the Securities Litigation, the court entered the parties' stipulation suspending all deadlines in the case for sixty days to facilitate settlement discussions.On June 25, 2021, the Bud & Sue Frashier Family Trust U/A DTD 05/05/98, filed a shareholder derivative complaint against certain current or former directors and officers of the Company in the Court of Chancery of the State of Delaware, captioned Bud & Sue Frashier Trust U/A DTD 05/05/98 v. Fradin, (“Delaware Chancery Derivative Action”). The Delaware Chancery Derivative Action alleges substantially the same facts and makes substantially the same claims as the Federal Derivative Action, and additionally references board materials obtained through a demand made pursuant to Section 220 of the Delaware Code Title 8. The Delaware Chancery Derivative Action remains stayed by agreement of the parties.While the Company is engaged in discussions concerning potential settlement of the Federal Derivative Action and the Delaware Chancery Derivative Action, there can be no guarantees that a settlement will be reached or approved. In the event that no settlement is reached, the Company intends to defend these actions vigorously, but there can be no assurance that the defense will be successful.See Note 17.15. Commitments and Contingencies of Notes to Consolidated and Combined Financial Statements in the Company’s 2021our 2022 Annual Report on Form 10-K for further discussion of these matters.the Company issueswe issue product warranties and product performance guarantees. It accruesWe accrue for the estimated cost of product warranties and product performance guarantees based on contract terms and historical experience at the time of sale. Adjustments to initial obligations for warranties and guarantees are made as changes to the obligations become reasonably estimable. Product warranties and product performance guarantees are included in Accruedother accrued liabilities.18RESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)

2022

2021Note 13. Long-term Debt and Credit AgreementThe Company’s debt asTable of April 2, 2022 and December 31, 2021 consisted of the following:ContentsAt April 2, 2022 and April 3, 2021, the interest rate for the A&R Term B Facility (defined below) was 2.76% and 2.75%, respectively, and there were 0 borrowings and 0 letters of credit issued under the A&R Revolving Credit Facility (as defined below). During the three months ended April 3, 2021, the Company incurred debt extinguishment costs of $23 million related to the execution of the A&R Credit Agreement (as defined below) and a partial redemption of previously outstanding senior notes. As of April 2, 2022, the Company was in compliance with all covenants related to the A&R Credit Agreement and the Senior Notes due 2029 (as defined below).The Company assessed the amounts recorded under the A&R Term B Facility, the Senior Notes due 2029, and the A&R Revolving Credit Facility. The Company determined that the A&R Revolving Credit Facility approximated fair value. The A&R Term B Facility and the Senior Notes due 2029 had approximate fair values of $1,126 million and $272 million, respectively. The fair values of the debt are based on the quoted inactive prices and are therefore classified as Level 2 within the valuation hierarchy.Senior Notes due 2029On August 26, 2021, the Company issued $300 million in principal amount of 4% senior unsecured notes due in 2029 (the “Senior Notes due 2029”). The Senior Notes due 2029 are senior unsecured obligations of Resideo guaranteed by Resideo’s existing and future domestic subsidiaries and rank equally with all of Resideo’s senior unsecured debt and senior to all of Resideo’s subordinated debt.Credit AgreementOn February 12, 2021, the Company entered into an Amendment and Restatement Agreement with JP Morgan Chase Bank N.A. as administrative agent (the “A&R Credit Agreement”). This agreement effectively replaced the Company’s previous senior secured credit facilities.The A&R Credit Agreement provides for a (i) seven-year senior secured term B loan facility in an aggregate principal amount of $950 million (the “A&R Term B Facility”) and (ii) a five-year senior secured revolving credit19RESIDEO TECHNOLOGIES, INC.NOTES TO CONSOLIDATED INTERIM FINANCIAL STATEMENTS(In millions, unless otherwise noted)(Unaudited)facility in an aggregate principal amount of $500 million (the “A&R Revolving Credit Facility” and, together with the A&R Term B Facility, the “A&R Senior Credit Facilities”).On March 28, 2022, the A&R Credit Agreement was further amended to include an additional aggregate principal amount of $200 million in the loans.Refer to Note 18. Long-Term Debt and Credit Agreement in the Company’s 2021 Annual Report on Form 10-K for further discussion regarding the Company’s long-term debt and credit agreement.Note 14. Derivative InstrumentsThe Company uses interest rate swap agreements to manage exposure to interest rate risks. The Company does not use interest rate swap agreements for speculative or trading purposes. The gain or loss on the interest rate swaps that qualify as derivatives is recorded in Accumulated other comprehensive loss and is subsequently recognized as Interest expense in the Interim Consolidated Statements of Operations when the hedged exposure affects earnings. If the related debt or the interest rate swap is terminated prior to maturity, the fair value of the interest rate swap recorded in Accumulated other comprehensive loss may be recognized in the Consolidated Interim Statements of Operations based on an assessment of the agreements at the time of termination.In March 2021, the Company entered into 8 interest rate swap agreements (the “Swap Agreements”) with several financial institutions for a combined notional value of $560 million. The effect of the Swap Agreements is to convert a portion of the Company’s variable interest rate obligations based on three-month LIBOR with a minimum rate of 0.50% per annum to a base fixed weighted average rate of 0.9289% over terms ranging from two to four years. The Swap Agreements are adjusted to fair value on a quarterly basis. The estimated fair value is based on Level 2 inputs primarily including the forward LIBOR curve available to swap dealers. Contract gains or losses recognized in other comprehensive income (loss) totaled $23 million for the three months ended April 2, 2022. Amounts reclassified from Accumulated other comprehensive loss into earnings were not material for any of the periods presented. The fair value of the Swap Agreements as of April 2, 2022 was $28 million. Amounts expected to be reclassified into earnings in the next 12 months were not material as of April 2, 2022.Note 15. PensionThe Company sponsors multiple funded and unfunded U.S. and non-U.S. defined benefit pension plans. Pension benefits for many of its U.S. employees are provided through non-contributory, qualified and non-qualified defined benefit plans. It also sponsors defined benefit pension plans which cover non-U.S. employees who are not U.S. citizens, in certain jurisdictions, principally Germany, Austria, Belgium, France, India, Switzerland, and the Netherlands.The pension obligations as of April 2, 2022 and December 31, 2021 were $115 million and $114 million, respectively, and are included in Other liabilities in the unaudited Consolidated Interim Balance Sheets. Net periodic benefit cost recognized in Comprehensive income (loss) is $2 million for the three months ended April 2, 2022 and April 3, 2021.The components of net periodic benefit costs other than the service cost are included in Other expense, net in the unaudited Consolidated Interim Statements of Operations for the three months ended April 2, 2022 and April 3, 2021.20Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations(In millions, except per share amounts)The following Management’s Discussion and Analysis of Financial Condition and Results of Operations is intended to help you understand the results of operations and financial condition of Resideo Technologies, Inc. and its consolidated subsidiaries (“Resideo” or “the Company”, “we”, “us” or “our”) for the three months ended April 2, 2022 and should be read in conjunction with the unaudited Consolidated Interim Financial Statements and the notes thereto contained elsewhere in this Form 10-Q. The financial information as of April 2, 2022 should be read in conjunction with the consolidated and combined financial statements for the year ended December 31, 2021 contained in our 2021 Annual Report on Form 10-K (the “2021 Annual Report on Form 10-K”).Overview and Business TrendsWe are a leading global manufacturer and distributor of technology-driven products and solutions that help homeowners and businesses stay connected and in control of their comfort, security, and energy use. We are a leader in the home heating, ventilation and air conditioning controls, including smoke and carbon monoxide detection home safety products, and security markets. We have a global footprint serving commercial and residential end-markets. We manage our business operations through two operating segments, Products & Solutions and ADI Global Distribution. Our Products & Solutions segment offerings include temperature and humidity control, energy products and solutions, water and air solutions, as well as smoke and carbon monoxide detection home safety products, security panels, sensors, peripherals, wire and cable, communications devices, video cameras, awareness solutions, cloud infrastructure, installation and maintenance tools, and related software. Our ADI Global Distribution business is the leading wholesale distributor of low-voltage security products including access control, fire detection, intrusion, and video products and participates significantly in the broader related markets of audio, communications, data communications, networking, power, ProAV, smart home, and wire and cable. The Products & Solutions segment, consistent with our industry, has a higher gross and operating profit margin profile in comparison to the ADI Global Distribution segment.Our financial performance is influenced by several macro factors such as repair and remodeling activity, residential and non-residential construction, employment rates, and overall macro environment. We are experiencing global shortages in key materials and components in certain instances impacting our ability to supply certain products as well as labor shortages, materials price inflation, and increased freight costs.Current Quarter DevelopmentsIn March 2022, we completed the acquisition of First Alert, Inc. (“First Alert”), a leading provider of home safety products. This acquisition was integrated into the Products & Solutions portfolio and expands our footprint in the home with complementary smoke and carbon monoxide detection home safety products and fire suppression products.In March 2022, the A&R Credit Agreement was further amended to increase the aggregate principal amount of the A&R Term B Facility by $200 million. A portion of the proceeds of this increased borrowing under the A&R Term B Facility was used to finance the First Alert acquisition.First Quarter HighlightsNet revenue increased $87 million, or 6%, in the first quarter of 2022 compared to the same quarter of 2021, driven by price increases. During the first quarter of 2022, gross profit was favorably impacted due to timing impacts of selling through lower cost inventory in the quarter. Gross profit as a percent of net revenues increased to 29% in the first quarter of 2022 from 26% in the first quarter of 2021. The primary items driving the 300 basis point (“bps”) increase in gross profit percentage were a 300 bps benefit from price increases and sales mix.Research and development expense for the three months ended April 2, 2022 was $24 million, an increase of $3 million from $21 million for the three months ended April 3, 2021. The increase was primarily due to planned investment to support new product launches.21Selling, general and administrative expense for the three months ended April 2, 2022 was $238 million, an increase of $21 million from $217 million for the three months ended April 3, 2021. The increase was driven by transaction costs associated with the First Alert acquisition, increased commercial investment, and labor inflation and other items totaling $27 million. The increases were partially offset by foreign currency translation, and other cost reductions totaling $6 million.First quarter net income was $87 million for the three months ended April 2, 2022 compared to net income of $49 million for the three months ended April 3, 2021.We ended the first quarter with $244 million in cash and cash equivalents. Net cash used for operating activities was $59 million for the three months ended April 2, 2022. At April 2, 2022, accounts receivable were $1,008 million, inventories were $922 million, accounts payable were $958 million, and there were no borrowings under our revolving credit facility.COVID-19 and Recent Macroeconomic EnvironmentOur visibility toward future performance is more limited than is typical due to the uncertainty surrounding the duration and ultimate impact of COVID-19 and its variants, and the overall prevailing macroeconomic environment, including due to COVID-19. For example, recent business conditions have been impacted by shortages in key materials and components which have impacted our ability to supply certain products. We have also experienced increased labor rates, labor shortages, materials price inflation, and increased freight costs. In response to these challenges, we have, among other measures, aggressively managed supplier relationships to mitigate some of these shortages, developed contingency plans for future supply, aligned our production schedules with demand in a proactive manner; and pursued further improvements in the productivity and effectiveness of our manufacturing, selling, and administrative activities.Basis of PresentationOur financial statements are presented on a consolidated basis (collectively, the “Interim Financial Statements”). The Interim Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).ReclassificationThe prior period unaudited consolidated interim statement of operations was reclassified to present Research and development expenses as a separate line item within the statement. Research and development expenses were formerly included within Selling, general and administrative expenses.Components of Operating ResultsNet RevenueWe manage our global business operations through two operating segments, Products & Solutions and ADI Global Distribution:Products & Solutions: We generate the majority of our Products & Solutions net revenue primarily from residential end-markets. Our Products & Solutions segment includes traditional products, as well as connected products, which we define as any device with the capability to be monitored or controlled from a remote location by an end-user or service provider. Our products are sold primarily through a network of HVAC, plumbing, security, and electrical distributors including our ADI Global Distribution business, OEMs, and service providers such as HVAC contractors, security dealers, and plumbers, and additionally through retail and online channels for specific markets.ADI Global Distribution: We generate revenue through the distribution of low-voltage electronic and security products, as well as audio, communications, data communications, fire, networking, smart home, power, ProAV, and wire and cable that are delivered through a comprehensive network of professional contractors, distributors and OEMs, as well as major retailers and online merchants. In addition to our own security products, ADI Global Distribution distributes products from industry-leading manufacturers and carries a line of private label products. We sell these22products to contractors that service non-residential and residential end-users. 14% of ADI Global Distribution’s net revenue is supplied by our Products & Solutions segment. Management estimates that in 2022 and 2021 approximately two-thirds of ADI Global Distribution’s net revenue was attributed to commercial end markets and one-third to residential end markets.Cost of Goods SoldProducts & Solutions:Cost of goods sold includes costs associated with raw materials, assembly, shipping and handling of those products; costs of personnel-related expenses, equipment associated with manufacturing support, logistics and quality assurance, non-research and development engineering costs, and costs of certain intangible assets.ADI GlobalDistribution: Cost of goods sold consists primarily of inventory-related costs and includes labor and personnel-related expenses.Research and Development ExpensesResearch and development expenses include expenses related to development of new products as well as enhancements and improvements to existing products that substantially change the product. These expenses are primarily related to employee compensation and consulting fees.Selling, General and Administrative ExpensesSelling, general and administrative expenses include trademark royalty expenses, sales incentives and commissions, professional fees, legal fees, promotional and advertising expenses, and personnel-related expenses, including stock compensation expense and pension benefits.Other Expense, NetOther expense, net consists primarily of Reimbursement Agreement expenses. For further information see Note 12. Commitments and Contingencies of InterimConsolidated Financial Statements of this Form 10-Q. Other expense, net also includes debt extinguishment costs incurred as a result of the redemption of our previously outstanding senior notes due 2026 and the execution of the A&R Credit Agreement as well as foreign exchange gains and losses and other non-operating related expenses or income.Three Months Ended (in millions) April 1, 2023 April 2, 2022 Beginning balance $ 48 $ 23 Accruals for warranties/guarantees issued during the year 5 6 Adjustment of pre-existing warranties/guarantees — (2) Settlement of warranty/guarantee claims (20) (5) Reserve of acquired company at date of acquisition — 8 Ending balance $ 33 $ 30 Interest ExpenseInterest expense consists of interest on our short and long-term obligations, including our senior notes, term credit facilities, revolving credit facilities, and any realized gains or losses from our interest rate swaps. Interest expense on our obligations includes contractual interest, amortization of the debt discount, and amortization of deferred financing costs.Tax ExpenseProvision for income taxes includes both domestic and foreign income taxes at the applicable statutory tax rates, adjusted for U.S. taxation of foreign earnings, non-deductible expenses, and other permanent differences.Results of OperationsThe following table sets forth our selected unaudited consolidated interim statements of operations for the periods presented:23Unaudited Consolidated Interim Statements of Operations(In millions except shares in thousands and per share data)

2022

2021Results of Operations for the Three Months Ended April 2, 2022 and April 3, 2021Net Revenue

2022