UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended MarchDecember 31, 2023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-35839

ENANTA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

| 04-3205099 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification Number) |

500 Arsenal Street Watertown, Massachusetts |

| 02472 |

(Address of principal executive offices) |

| (Zip Code) |

(Registrants telephone number, including area code:) (617) 607-0800

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | ENTA | NASDAQ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☒ | Accelerated filer | ☐ | ||||||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||

Emerging growth company |

| ☐ |

|

|

|

| |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 28, 2023,January 31, 2024, the registrant had 21,055,39221,155,983 shares of common stock, $0.01 par value per share, outstanding.

Table of Contents

Page | ||

PART I. | ||

Item 1. | 3 | |

3 | ||

4 | ||

5 | ||

| 6 | |

7 | ||

Notes to Condensed Consolidated Financial Statements (unaudited) | 8 | |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 3. |

| |

Item 4. |

| |

PART II. |

| |

Item 1A. |

| |

Item 5. | 27 | |

Item 6. |

| |

| ||

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q ("Quarterly Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Quarterly Report, including statements regarding our future results of operations and financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, forward-looking statements may be identified by words such as “anticipate,” “believe,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “predict,” “project,” “should,” “will” or the negative of these terms or other similar expressions. We caution you that the foregoing list may not encompass all of the forward-looking statements made in this Quarterly Report.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks described in the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2022.2023 and as updated in Item 1A herein.

2

PART I—UNAUDITED FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(in thousands, except per share amounts)data)

|

| March 31, |

| September 30, |

|

| December 31, |

| September 30, |

| ||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2023 |

| ||||

Assets |

|

|

|

|

|

|

|

|

|

| ||||||

Current assets: |

|

|

|

|

|

|

|

|

|

| ||||||

Cash and cash equivalents |

| $ | 73,178 |

|

| $ | 43,994 |

|

| $ | 39,933 |

|

| $ | 85,388 |

|

Short-term marketable securities |

|

| 136,906 |

|

|

| 205,238 |

|

|

| 297,218 |

|

|

| 284,522 |

|

Accounts receivable |

|

| 17,795 |

|

|

| 20,318 |

|

|

| 8,173 |

|

|

| 8,614 |

|

Prepaid expenses and other current assets |

|

| 14,484 |

|

|

| 13,445 |

|

|

| 13,245 |

|

|

| 13,263 |

|

Income tax receivable |

|

| 28,774 |

|

|

| 28,718 |

|

|

| 31,734 |

|

|

| 31,004 |

|

Total current assets |

|

| 271,137 |

|

|

| 311,713 |

|

|

| 390,303 |

|

|

| 422,791 |

|

Long-term marketable securities |

|

| 15,040 |

|

|

| 29,285 |

| ||||||||

Property and equipment, net |

|

| 11,050 |

|

|

| 6,173 |

|

|

| 12,119 |

|

|

| 11,919 |

|

Operating lease, right-of-use assets |

|

| 24,554 |

|

|

| 23,575 |

|

|

| 21,344 |

|

|

| 22,794 |

|

Restricted cash |

|

| 3,968 |

|

|

| 3,968 |

|

|

| 3,968 |

|

|

| 3,968 |

|

Other long-term assets |

|

| 696 |

|

|

| 696 |

|

|

| 765 |

|

|

| 803 |

|

Total assets |

| $ | 326,445 |

|

| $ | 375,410 |

|

| $ | 428,499 |

|

| $ | 462,275 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

|

| ||||||

Current liabilities: |

|

|

|

|

|

|

|

|

|

| ||||||

Accounts payable |

| $ | 11,761 |

|

| $ | 6,000 |

|

| $ | 9,326 |

|

| $ | 4,097 |

|

Accrued expenses and other current liabilities |

|

| 15,482 |

|

|

| 20,936 |

|

|

| 11,603 |

|

|

| 18,339 |

|

Liability related to the sale of future royalties |

|

| 36,512 |

|

|

| 35,076 |

| ||||||||

Operating lease liabilities |

|

| 4,923 |

|

|

| 2,891 |

|

|

| 4,966 |

|

|

| 5,275 |

|

Total current liabilities |

|

| 32,166 |

|

|

| 29,827 |

|

|

| 62,407 |

|

|

| 62,787 |

|

Liability related to the sale of future royalties, net of current portion |

|

| 151,612 |

|

|

| 159,429 |

| ||||||||

Operating lease liabilities, net of current portion |

|

| 23,073 |

|

|

| 22,372 |

|

|

| 20,524 |

|

|

| 21,238 |

|

Series 1 nonconvertible preferred stock |

|

| 1,423 |

|

|

| 1,423 |

|

|

| 1,423 |

|

|

| 1,423 |

|

Other long-term liabilities |

|

| 408 |

|

|

| 454 |

|

|

| 649 |

|

|

| 663 |

|

Total liabilities |

|

| 57,070 |

|

|

| 54,076 |

|

|

| 236,615 |

|

|

| 245,540 |

|

Commitments and contingencies (Note 9) |

|

|

|

|

| |||||||||||

Commitments and contingencies (Note 11) |

|

|

|

|

| |||||||||||

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Common stock; $0.01 par value per share, 100,000 shares authorized; |

|

| 210 |

|

|

| 208 |

| ||||||||

Common stock; $0.01 par value per share, 100,000 shares authorized; |

|

| 212 |

|

|

| 211 |

| ||||||||

Additional paid-in capital |

|

| 410,803 |

|

|

| 398,029 |

|

|

| 432,608 |

|

|

| 424,693 |

|

Accumulated other comprehensive loss |

|

| (1,815 | ) |

|

| (3,724 | ) |

|

| (534 | ) |

|

| (1,174 | ) |

Accumulated deficit |

|

| (139,823 | ) |

|

| (73,179 | ) |

|

| (240,402 | ) |

|

| (206,995 | ) |

Total stockholders' equity |

|

| 269,375 |

|

|

| 321,334 |

|

|

| 191,884 |

|

|

| 216,735 |

|

Total liabilities and stockholders' equity |

| $ | 326,445 |

|

| $ | 375,410 |

|

| $ | 428,499 |

|

| $ | 462,275 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except per share amounts)data)

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

| Three Months Ended March 31, |

|

| Six Months Ended March 31, |

|

| Three Months Ended December 31, |

| |||||||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Royalty revenue |

| $ | 17,795 |

|

| $ | 18,716 |

|

| $ | 40,380 |

|

| $ | 46,364 |

|

| $ | 18,003 |

|

| $ | 22,585 |

|

License revenue |

|

| — |

|

|

| — |

|

|

| 1,000 |

|

|

| — |

|

|

| — |

|

|

| 1,000 |

|

Total revenue |

|

| 17,795 |

|

|

| 18,716 |

|

|

| 41,380 |

|

|

| 46,364 |

|

|

| 18,003 |

|

|

| 23,585 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Research and development |

|

| 43,468 |

|

|

| 42,087 |

|

|

| 84,370 |

|

|

| 90,636 |

|

|

| 36,371 |

|

|

| 40,902 |

|

General and administrative |

|

| 13,778 |

|

|

| 10,476 |

|

|

| 26,474 |

|

|

| 19,984 |

|

|

| 16,518 |

|

|

| 12,696 |

|

Total operating expenses |

|

| 57,246 |

|

|

| 52,563 |

|

|

| 110,844 |

|

|

| 110,620 |

|

|

| 52,889 |

|

|

| 53,598 |

|

Loss from operations |

|

| (39,451 | ) |

|

| (33,847 | ) |

|

| (69,464 | ) |

|

| (64,256 | ) |

|

| (34,886 | ) |

|

| (30,013 | ) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Interest expense |

|

| (3,441 | ) |

|

| — |

| ||||||||||||||||

Interest and investment income, net |

|

| 1,837 |

|

|

| 255 |

|

|

| 2,830 |

|

|

| 549 |

|

|

| 4,298 |

|

|

| 993 |

|

Total other income, net |

|

| 1,837 |

|

|

| 255 |

|

|

| 2,830 |

|

|

| 549 |

|

|

| 857 |

|

|

| 993 |

|

Loss before income taxes |

|

| (37,614 | ) |

|

| (33,592 | ) |

|

| (66,634 | ) |

|

| (63,707 | ) |

|

| (34,029 | ) |

|

| (29,020 | ) |

Income tax expense |

|

| (44 | ) |

|

| — |

|

|

| (10 | ) |

|

| — |

| ||||||||

Income tax benefit |

|

| 622 |

|

|

| 34 |

| ||||||||||||||||

Net loss |

| $ | (37,658 | ) |

| $ | (33,592 | ) |

| $ | (66,644 | ) |

| $ | (63,707 | ) |

| $ | (33,407 | ) |

| $ | (28,986 | ) |

Net loss per share, basic and diluted |

| $ | (1.79 | ) |

| $ | (1.63 | ) |

| $ | (3.19 | ) |

| $ | (3.11 | ) |

| $ | (1.58 | ) |

| $ | (1.39 | ) |

Weighted average common shares outstanding, basic and |

|

| 21,035 |

|

|

| 20,551 |

|

|

| 20,882 |

|

|

| 20,473 |

|

|

| 21,088 |

|

|

| 20,816 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(unaudited)

(in thousands)

|

|

|

|

|

|

| ||||||||||

|

| Three Months Ended March 31, |

|

| Six Months Ended March 31, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Net loss |

| $ | (37,658 | ) |

| $ | (33,592 | ) |

| $ | (66,644 | ) |

| $ | (63,707 | ) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net unrealized gains (losses) on marketable securities |

|

| 860 |

|

|

| (2,031 | ) |

|

| 1,909 |

|

|

| (2,655 | ) |

Total other comprehensive income (loss) |

|

| 860 |

|

|

| (2,031 | ) |

|

| 1,909 |

|

|

| (2,655 | ) |

Comprehensive loss |

| $ | (36,798 | ) |

| $ | (35,623 | ) |

| $ | (64,735 | ) |

| $ | (66,362 | ) |

|

|

|

| |||||

|

| Three Months Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Net loss |

| $ | (33,407 | ) |

| $ | (28,986 | ) |

Other comprehensive income: |

|

|

|

|

|

| ||

Net unrealized gains on marketable securities |

|

| 640 |

|

|

| 1,049 |

|

Total other comprehensive income |

|

| 640 |

|

|

| 1,049 |

|

Comprehensive loss |

| $ | (32,767 | ) |

| $ | (27,937 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited)

(in thousands)

|

|

|

|

|

|

|

| Accumulated |

|

|

|

|

|

|

|

|

|

|

|

| Accumulated |

|

|

|

|

| ||||||||||||||||||||||

|

|

|

|

|

| Additional |

| Other |

|

|

| Total |

|

|

|

|

|

| Additional |

| Other |

|

|

| Total |

| ||||||||||||||||||||||

|

| Common Stock |

|

| Paid-In |

| Comprehensive |

| Accumulated |

| Stockholders' |

|

| Common Stock |

|

| Paid-In |

| Comprehensive |

| Accumulated |

| Stockholders' |

| ||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Loss |

|

| Deficit |

|

| Equity |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Loss |

|

| Deficit |

|

| Equity |

| ||||||||||||

Balances at September 30, 2022 |

|

| 20,791 |

|

| $ | 208 |

|

| $ | 398,029 |

|

| $ | (3,724 | ) |

| $ | (73,179 | ) |

| $ | 321,334 |

| ||||||||||||||||||||||||

Exercise of stock options |

|

| 56 |

|

|

| 1 |

|

|

| 1,125 |

|

|

| — |

|

|

| — |

|

|

| 1,126 |

| ||||||||||||||||||||||||

Balances, September 30, 2023 |

|

| 21,059 |

|

| $ | 211 |

|

| $ | 424,693 |

|

| $ | (1,174 | ) |

| $ | (206,995 | ) |

| $ | 216,735 |

| ||||||||||||||||||||||||

Vesting of restricted stock units, net of |

|

| 37 |

|

|

| — |

|

|

| (825 | ) |

|

| — |

|

|

| — |

|

|

| (825 | ) |

|

| 97 |

|

|

| 1 |

|

|

| (184 | ) |

|

| — |

|

|

| — |

|

|

| (183 | ) |

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 7,139 |

|

|

| — |

|

|

| — |

|

|

| 7,139 |

|

|

| — |

|

|

| — |

|

|

| 8,099 |

|

|

| — |

|

|

| — |

|

|

| 8,099 |

|

Other comprehensive income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1,049 |

|

|

| — |

|

|

| 1,049 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 640 |

|

|

| — |

|

|

| 640 |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (28,986 | ) |

|

| (28,986 | ) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (33,407 | ) |

|

| (33,407 | ) |

Balances at December 31, 2022 |

|

| 20,884 |

|

|

| 209 |

|

|

| 405,468 |

|

|

| (2,675 | ) |

|

| (102,165 | ) |

|

| 300,837 |

| ||||||||||||||||||||||||

Exercise of stock options |

|

| 61 |

|

|

| 1 |

|

|

| 881 |

|

|

| — |

|

|

| — |

|

|

| 882 |

| ||||||||||||||||||||||||

Vesting of restricted stock units, net of |

|

| 104 |

|

|

| — |

|

|

| (2,909 | ) |

|

| — |

|

|

| — |

|

|

| (2,909 | ) | ||||||||||||||||||||||||

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 7,363 |

|

|

| — |

|

|

| — |

|

|

| 7,363 |

| ||||||||||||||||||||||||

Other comprehensive income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 860 |

|

|

| — |

|

|

| 860 |

| ||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (37,658 | ) |

|

| (37,658 | ) | ||||||||||||||||||||||||

Balances at March 31, 2023 |

|

| 21,049 |

|

| $ | 210 |

|

| $ | 410,803 |

|

| $ | (1,815 | ) |

| $ | (139,823 | ) |

| $ | 269,375 |

| ||||||||||||||||||||||||

Balances, December 31, 2023 |

|

| 21,156 |

|

| $ | 212 |

|

| $ | 432,608 |

|

| $ | (534 | ) |

| $ | (240,402 | ) |

| $ | 191,884 |

| ||||||||||||||||||||||||

|

|

|

|

|

|

|

| Accumulated |

| Retained |

|

|

|

|

|

|

|

|

|

| Accumulated |

|

|

|

|

| ||||||||||||||||||||||

|

|

|

|

|

| Additional |

| Other |

| Earnings |

| Total |

|

|

|

|

|

| Additional |

| Other |

|

|

| Total |

| ||||||||||||||||||||||

|

| Common Stock |

|

| Paid-In |

| Comprehensive |

| (Accumulated |

|

| Stockholders' |

|

| Common Stock |

|

| Paid-In |

| Comprehensive |

| Accumulated |

|

| Stockholders' |

| ||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Loss |

|

| Deficit) |

|

| Equity |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Loss |

|

| Deficit |

|

| Equity |

| ||||||||||||

Balances at September 30, 2021 |

|

| 20,238 |

|

| $ | 202 |

|

| $ | 351,033 |

|

| $ | (382 | ) |

| $ | 48,576 |

|

| $ | 399,429 |

| ||||||||||||||||||||||||

Balances, September 30, 2022 |

|

| 20,791 |

|

| $ | 208 |

|

| $ | 398,029 |

|

| $ | (3,724 | ) |

| $ | (73,179 | ) |

| $ | 321,334 |

| ||||||||||||||||||||||||

Exercise of stock options |

|

| 248 |

|

|

| 2 |

|

|

| 10,407 |

|

|

| — |

|

|

| — |

|

|

| 10,409 |

|

|

| 56 |

|

|

| 1 |

|

|

| 1,125 |

|

|

| — |

|

|

| — |

|

|

| 1,126 |

|

Vesting of restricted stock units, net of |

|

| 20 |

|

|

| 1 |

|

|

| (778 | ) |

|

| — |

|

|

| — |

|

|

| (777 | ) |

|

| 37 |

|

|

| — |

|

|

| (825 | ) |

|

| — |

|

|

| — |

|

|

| (825 | ) |

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 6,062 |

|

|

| — |

|

|

| — |

|

|

| 6,062 |

|

|

| — |

|

|

| — |

|

|

| 7,139 |

|

|

| — |

|

|

| — |

|

|

| 7,139 |

|

Other comprehensive loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (624 | ) |

|

| — |

|

|

| (624 | ) | ||||||||||||||||||||||||

Other comprehensive income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1,049 |

|

|

| — |

|

|

| 1,049 |

| ||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (30,115 | ) |

|

| (30,115 | ) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (28,986 | ) |

|

| (28,986 | ) |

Balances at December 31, 2021 |

|

| 20,506 |

|

|

| 205 |

|

|

| 366,724 |

|

|

| (1,006 | ) |

|

| 18,461 |

|

|

| 384,384 |

| ||||||||||||||||||||||||

Exercise of stock options |

|

| 97 |

|

|

| 1 |

|

|

| 3,801 |

|

|

| — |

|

|

| — |

|

|

| 3,802 |

| ||||||||||||||||||||||||

Vesting of restricted stock units, net of |

|

| 15 |

|

|

| — |

|

|

| (451 | ) |

|

| — |

|

|

| — |

|

|

| (451 | ) | ||||||||||||||||||||||||

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 6,471 |

|

|

| — |

|

|

| — |

|

|

| 6,471 |

| ||||||||||||||||||||||||

Other comprehensive loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (2,031 | ) |

|

| — |

|

|

| (2,031 | ) | ||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (33,592 | ) |

|

| (33,592 | ) | ||||||||||||||||||||||||

Balances at March 31, 2022 |

|

| 20,618 |

|

| $ | 206 |

|

| $ | 376,545 |

|

| $ | (3,037 | ) |

| $ | (15,131 | ) |

| $ | 358,583 |

| ||||||||||||||||||||||||

Balances, December 31, 2022 |

|

| 20,884 |

|

| $ | 209 |

|

| $ | 405,468 |

|

| $ | (2,675 | ) |

| $ | (102,165 | ) |

| $ | 300,837 |

| ||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

ENANTA PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

|

| Six Months Ended March 31, |

|

| Three Months Ended December 31, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net loss |

| $ | (66,644 | ) |

| $ | (63,707 | ) |

| $ | (33,407 | ) |

| $ | (28,986 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Stock-based compensation expense |

|

| 14,502 |

|

|

| 12,533 |

|

|

| 8,099 |

|

|

| 7,139 |

|

Depreciation and amortization expense |

|

| 1,051 |

|

|

| 1,602 |

|

|

| 642 |

|

|

| 511 |

|

Premium paid on marketable securities |

|

| (42 | ) |

|

| (802 | ) | ||||||||

Non-cash interest expense associated with the sale of future royalties |

|

| 299 |

|

|

| — |

| ||||||||

Non-cash royalty revenue |

|

| 487 |

|

|

| — |

| ||||||||

Amortization (accretion) of premiums (discounts) on marketable securities |

|

| (1,345 | ) |

|

| 928 |

|

|

| 274 |

|

|

| (339 | ) |

Loss on disposal of property and equipment |

|

| 7 |

|

|

| — |

| ||||||||

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Accounts receivable |

|

| 2,523 |

|

|

| 4,860 |

|

|

| 441 |

|

|

| (2,267 | ) |

Prepaid expenses and other current assets |

|

| (1,039 | ) |

|

| 110 |

|

|

| 18 |

|

|

| (4,501 | ) |

Income tax receivable |

|

| (56 | ) |

|

| 8,507 |

|

|

| (730 | ) |

|

| 15 |

|

Operating lease, right-of-use assets |

|

| 1,891 |

|

|

| 2,784 |

|

|

| 1,450 |

|

|

| 834 |

|

Other long-term assets |

|

| 38 |

|

|

| (5 | ) | ||||||||

Accounts payable |

|

| 5,963 |

|

|

| (3,473 | ) |

|

| 5,174 |

|

|

| (686 | ) |

Accrued expenses |

|

| (6,052 | ) |

|

| (808 | ) |

|

| (6,736 | ) |

|

| (6,599 | ) |

Operating lease liabilities |

|

| (137 | ) |

|

| (2,498 | ) |

|

| (1,023 | ) |

|

| (717 | ) |

Other long-term liabilities |

|

| (46 | ) |

|

| 318 |

|

|

| (14 | ) |

|

| (40 | ) |

Net cash used in operating activities |

|

| (49,424 | ) |

|

| (39,646 | ) |

|

| (24,988 | ) |

|

| (35,641 | ) |

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Purchase of marketable securities |

|

| (90,627 | ) |

|

| (124,631 | ) |

|

| (146,845 | ) |

|

| (67,375 | ) |

Proceeds from maturities and sales of marketable securities |

|

| 176,500 |

|

|

| 135,514 |

| ||||||||

Proceeds from maturities and sale of marketable securities |

|

| 134,515 |

|

|

| 104,100 |

| ||||||||

Purchase of property and equipment |

|

| (5,539 | ) |

|

| (437 | ) |

|

| (787 | ) |

|

| (3,156 | ) |

Net cash provided by investing activities |

|

| 80,334 |

|

|

| 10,446 |

| ||||||||

Net cash provided by (used in) investing activities |

|

| (13,117 | ) |

|

| 33,569 |

| ||||||||

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Proceeds from exercise of stock options |

|

| 2,008 |

|

|

| 14,211 |

| ||||||||

Payments on royalty sale liability, net of imputed interest |

|

| (7,167 | ) |

|

| — |

| ||||||||

Payments for settlement of share-based awards |

|

| (3,734 | ) |

|

| (1,228 | ) |

|

| (183 | ) |

|

| (825 | ) |

Proceeds from the exercise of stock options |

|

| — |

|

|

| 1,126 |

| ||||||||

Net cash provided by (used in) financing activities |

|

| (1,726 | ) |

|

| 12,983 |

|

|

| (7,350 | ) |

|

| 301 |

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

| 29,184 |

|

|

| (16,217 | ) | ||||||||

Net decrease in cash, cash equivalents and restricted cash |

|

| (45,455 | ) |

|

| (1,771 | ) | ||||||||

Cash, cash equivalents and restricted cash at beginning of period |

|

| 47,962 |

|

|

| 57,814 |

|

|

| 89,356 |

|

|

| 47,962 |

|

Cash, cash equivalents and restricted cash at end of period |

| $ | 77,146 |

|

| $ | 41,597 |

|

| $ | 43,901 |

|

| $ | 46,191 |

|

Supplemental disclosure of noncash information: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Purchases of fixed assets included in accounts payable and |

| $ | 1,611 |

|

| $ | 174 |

|

| $ | 479 |

|

| $ | 1,079 |

|

Operating lease liabilities arising from obtaining right-of-use assets |

| $ | 2,870 |

|

| $ | 15,559 |

|

| $ | — |

|

| $ | 799 |

|

Supplemental disclosure of cash flow information |

|

|

|

|

| |||||||||||

Cash paid for interest |

| $ | 3,143 |

|

| $ | — |

| ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(amounts in thousands, except per share data)

1. Nature of the Business and Basis of Presentation

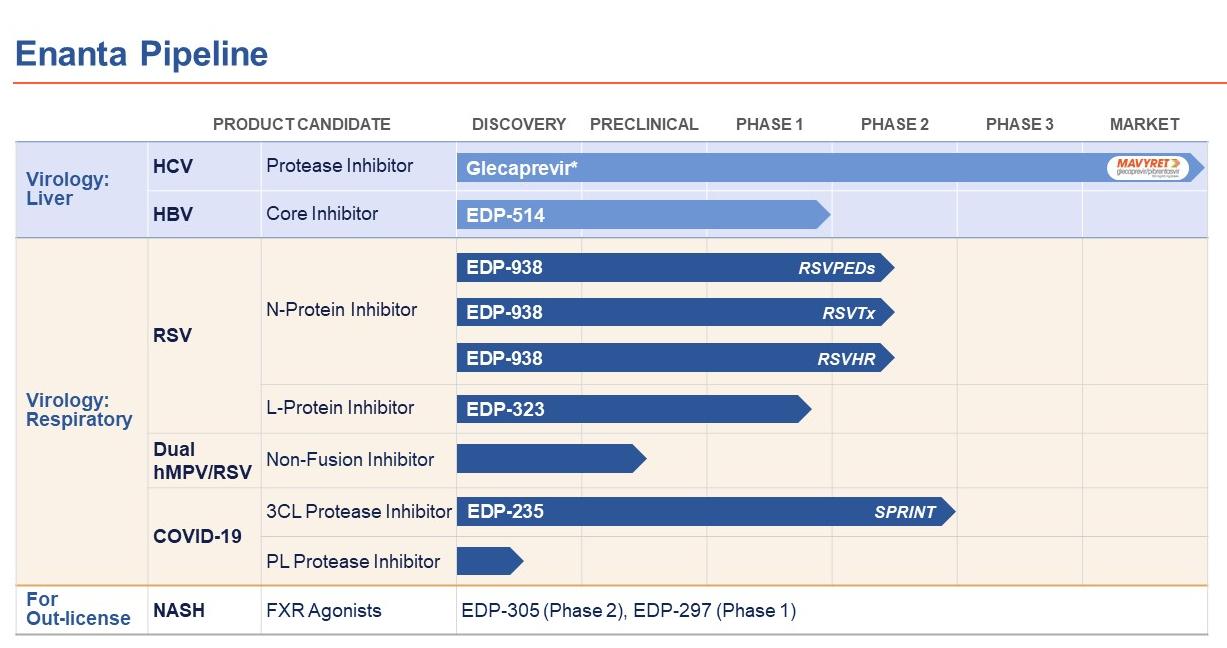

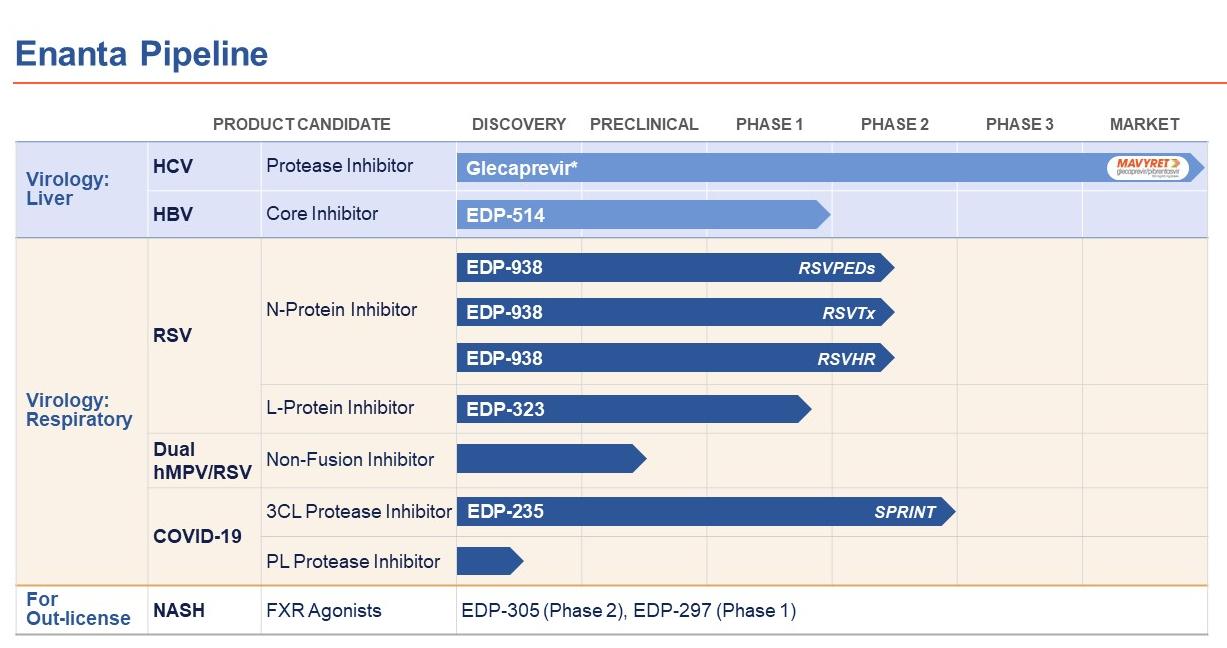

Enanta Pharmaceuticals, Inc. (the(collectively with its subsidiary, the “Company”), incorporated in Delaware in 1995, is a biotechnology company that uses its robust, chemistry-driven approach and drug discovery capabilities to become a leader in the discoverydiscover and development ofdevelop small molecule drugs with an emphasis on treatments for viral infections.virology and immunology indications. The Company discovered glecaprevir, the second of two protease inhibitors discovered and developed through its collaboration with AbbVie for the treatment of chronic infection with hepatitis C virus (“HCV”). Glecaprevir is co-formulated as part of AbbVie’s leading direct-acting antiviral (“DAA”) combination treatment for HCV, which is marketed under the tradenames MAVYRET® (U.S.) and MAVIRET®(ex-U.S.) (glecaprevir/pibrentasvir). Royalties from the Company’s AbbVie collaboration and its existing financial resources provide funding to support the Company’s wholly-owned research and development programs, which are primarily focused on the following disease targets: respiratory syncytial virus (“RSV”), SARS-CoV-2, human metapneumovirus (“hMPV”) and hepatitis B virus (“HBV”) and Chronic Spontaneous Urticaria (“CSU”).

The Company is subject to many of the risks common to companies in the biotechnology industry, including but not limited to, the uncertainties of research and development, competition from technological innovations of others, dependence on collaborative arrangements, protection of proprietary technology, dependence on key personnel and compliance with government regulation. Product candidates currently under development will require significant additional research and development efforts, including extensive preclinical and clinical testing and regulatory approvals, prior to commercialization. These efforts require significant amounts of capital, adequate personnel and infrastructure, and extensive compliance reporting capabilities.

COVID-19

In March 2020, the World Health Organization declared COVID-19 a global pandemic and countries worldwide implemented various measures to contain the spread of the SARS-CoV-2 virus. National, state and local governments in affected regions implemented varying safety precautions, including quarantines, border closures, increased border controls, travel restrictions, shelter-in-place orders and shutdowns, business closures, cancellations of public gatherings and other measures. The extent and severity of any continuing impact on the Company’s business and clinical trials will be determined largely by the extent to which there are disruptions in the supply chains for its research and product candidates, delays in the conduct of ongoing and future clinical trials, or reductions in the number of patients accessing AbbVie’s HCV regimens, or any combination of those events. In addition, AbbVie experienced a decline in HCV sales compared to periods prior to March 2020 as a result of reduced numbers of patients accessing AbbVie’s HCV regimens due to the COVID-19 pandemic.

The extent to which the COVID-19 pandemic will continue to impact, directly or indirectly, the Company’s business, results of operations and financial condition will depend on future developments that are highly uncertain and cannot be accurately predicted, including new variants and public health actions taken to contain their impact, as well as the cumulative economic impact of both of those factors and the public health impact of the announced ending of emergency public health measures.

Unaudited Interim Financial Information

The condensed consolidated balance sheet atas of September 30, 20222023 was derived from audited financial statements but does not include all disclosures required by accounting principles generally accepted in the United States of America (“GAAP”). The accompanying unaudited condensed consolidated financial statements as of MarchDecember 31, 2023 and for the three and six months ended MarchDecember 31, 2023 and 2022 have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial statements. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. These condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022.2023.

In the opinion of management, all adjustments, consisting of normal recurring adjustments necessary for a fair statement of the Company’s financial position as of MarchDecember 31, 2023 and results of operations for the three and six months ended MarchDecember 31, 2023 and 2022 and cash flows for the sixthree months ended MarchDecember 31, 2023 and 2022 have been made. The results of operations for the three and six months ended MarchDecember 31, 2023 are not necessarily indicative of the results of operations that may be expected for subsequent quarters or the year ending September 30, 2023.

8

2024.

The accompanying condensed consolidated financial statements have been prepared in conformity with GAAP. All amounts in the condensed consolidated financial statements and in the notes to the condensed consolidated financial statements, except per share amounts, are in thousands unless otherwise indicated.

The accompanying condensed consolidated financial statements have been prepared based on continuity of operations, realization of assets and the satisfaction of liabilities and commitments in the ordinary course of business. The Company began reporting a net loss in fiscal 2020 and reported a net loss of $66,64433,407 for the sixthree months ended MarchDecember 31, 2023 and $121,755133,816 for the year ended September 30, 2022.2023. As of MarchDecember 31, 2023, the Company had an accumulated deficit of $139,823240,402. The Company expects to continue to generate operating losses for the foreseeable future as the Company continues to advance its wholly-owned programs. As of MarchDecember 31, 2023, the Company had $225,124337,151 in cash, cash equivalents and short-term and long-term marketable securities. The Company expects that its cash, cash equivalents short-term and long-termshort-term marketable securities as well as the $200,000 payment received in April 2023 from the sale of a portion of the MAVYRET/MAVIRET royalties and cash flows from the continuing portion of HCV royalties will be sufficient to fund its operating expenses and capital expenditure requirements for at least 12 months from the issuance date of the interim condensed consolidated financial statements. The Company may seek additional funding through equity offerings, non-dilutive financings, collaborations, strategic alliances or licensing agreements. The Company may not be able to obtain sufficient financing on acceptable terms, or at all, and the Company may not be able to enter into collaborations or other arrangements. The terms of any financing may adversely affect the holdings or the rights of the Company’s stockholders. If the Company is unable to obtain funding, the Company could be forced to delay, reduce or eliminate some or all of its research and development programs, product expansion or commercialization efforts, or the Company may be unable to continue operations.

8

2. Summary of Significant Accounting Policies

For the Company’s Significant Accounting Policies, please refer to its Annual Report on Form 10-K for the fiscal year ended September 30, 2022.2023. Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification and Accounting Standards Update (“ASU”) of the Financial Accounting Standards Board (“FASB”).

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions reflected in these condensed consolidated financial statements include, but are not limited to, management’s judgments with respect to its revenue arrangements; liability related to the sale of future royalties; valuation of stock-based awards and the accrual of research and development expenses. Estimates are periodically reviewed in light of changes in circumstances, facts and experience. The future developments of the COVID-19 pandemic also may directly or indirectly impact the Company’s business. The Company has made estimates of the impact of COVID-19 in the Company’s consolidated financial statements as of March 31, 2023. Actual results could differ from the Company’s estimates.

Net Income (Loss)Loss per Share

Basic net income (loss)loss per common share is computed by dividing the net income (loss)loss by the weighted average number of shares of common stock outstanding for the period. DilutedIn periods in which the Company has reported a net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of common shares outstanding for the period, including potential dilutive common shares assuming the dilutive effect of outstanding stock options and unvested restricted stock units. For periods presented,loss, diluted net loss per common share is the same as basic net loss per common share since dilutive common shares are not assumed to have been issued if their effect is anti-dilutive.

The Company reported net losses for each of the three and six months ended March 31, 2023 and 2022. TheTherefore, the Company excluded the following potential common shares, presented based on amounts outstanding at each period end, from the computation of diluted net loss per share for the periods indicated because including themas its effect would have had an anti-dilutive effect:been anti-dilutive:

|

| As of March 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

| (in thousands) |

| |||||

Options to purchase common stock |

|

| 4,522 |

|

|

| 4,124 |

|

Unvested rTSRUs |

|

| 81 |

|

|

| 112 |

|

Unvested PSUs |

|

| 81 |

|

|

| 112 |

|

Unvested restricted stock units |

|

| 430 |

|

|

| 217 |

|

9

|

| As of December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

| (in thousands) |

| |||||

Options to purchase common stock |

|

| 5,213 |

|

|

| 4,511 |

|

Unvested rTSRUs |

|

| 129 |

|

|

| 151 |

|

Unvested PSUs |

|

| 129 |

|

|

| 151 |

|

Unvested restricted stock units |

|

| 455 |

|

|

| 439 |

|

Recently Issued Accounting Pronouncements

Other accounting standards that have been issued or proposed byIn November 2023, the FASB orissued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires public entities to disclose information about their reportable segments’ significant expenses and other standards-setting bodiessegment items on an interim and annual basis. Public entities with a single reportable segment are required to apply the disclosure requirements in ASU 2023-07, as well as all existing segment disclosures and reconciliation requirements in ASC 280 on an interim and annual basis. This amendment is effective for the Company in the fiscal year beginning October 1, 2024, with early adoption permitted. The Company is currently evaluating the potential impact that do not requireASU 2023-07 may have on its financial statement disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires public entities, on an annual basis, to provide disclosure of specific categories in the rate reconciliation, as well as disclosure of income taxes paid disaggregated by jurisdiction. ASU 2023-09 is effective for the Company in the fiscal year beginning October 1, 2025, with early adoption until a future date are not expected topermitted. The Company is currently evaluating the potential impact that ASU 2023-09 may have a material impact on the Company’s consolidatedits financial statements upon adoption.statement disclosures.

9

3. Fair Value of Financial Assets and Liabilities

The following tables present information about the Company’s financial assets and liabilities that were subject to fair value measurement on a recurring basis as of MarchDecember 31, 2023 and September 30, 2022,2023, and indicate the fair value hierarchy of the valuation inputs utilized to determine such fair value:

|

| Fair Value Measurements at March 31, 2023 Using: |

|

| Fair Value Measurements as of December 31, 2023 Using: |

| ||||||||||||||||||||||||||

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||||||

|

| (in thousands) |

|

| (in thousands) |

| ||||||||||||||||||||||||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Money market funds |

| $ | 70,562 |

|

| $ | — |

|

| $ | — |

|

| $ | 70,562 |

|

| $ | 38,905 |

|

| $ | — |

|

| $ | — |

|

| $ | 38,905 |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

U.S. Treasury notes |

|

| 22,003 |

|

|

| — |

|

|

| — |

|

|

| 22,003 |

|

|

| 264,537 |

|

|

| — |

|

|

| — |

|

|

| 264,537 |

|

Corporate bonds |

|

| — |

|

|

| 46,124 |

|

|

| — |

|

|

| 46,124 |

|

|

| — |

|

|

| 26,706 |

|

|

| — |

|

|

| 26,706 |

|

Commercial paper |

|

| — |

|

|

| 83,819 |

|

|

| — |

|

|

| 83,819 |

|

|

| — |

|

|

| 5,975 |

|

|

| — |

|

|

| 5,975 |

|

|

| $ | 92,565 |

|

| $ | 129,943 |

|

| $ | — |

|

| $ | 222,508 |

|

| $ | 303,442 |

|

| $ | 32,681 |

|

| $ | — |

|

| $ | 336,123 |

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Series 1 nonconvertible preferred stock |

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

|

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

|

| Fair Value Measurements at September 30, 2022 Using: |

|

| Fair Value Measurements as of September 30, 2023 Using: |

| ||||||||||||||||||||||||||

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||||||

|

| (in thousands) |

|

| (in thousands) |

| ||||||||||||||||||||||||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Money market funds |

| $ | 13,905 |

|

| $ | — |

|

| $ | — |

|

| $ | 13,905 |

|

| $ | 55,357 |

|

| $ | — |

|

| $ | — |

|

| $ | 55,357 |

|

U.S. Treasury notes |

|

| 29,755 |

|

|

| — |

|

|

| — |

|

|

| 29,755 |

| ||||||||||||||||

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

U.S. Treasury notes |

|

| 91,328 |

|

|

| — |

|

|

| — |

|

|

| 91,328 |

|

|

| 236,782 |

|

|

| — |

|

|

| — |

|

|

| 236,782 |

|

Corporate bonds |

|

| — |

|

|

| 76,411 |

|

|

| — |

|

|

| 76,411 |

|

|

| — |

|

|

| 26,435 |

|

|

| — |

|

|

| 26,435 |

|

Commercial paper |

|

| — |

|

|

| 66,784 |

|

|

| — |

|

|

| 66,784 |

|

|

| — |

|

|

| 21,305 |

|

|

| — |

|

|

| 21,305 |

|

|

| $ | 105,233 |

|

| $ | 143,195 |

|

| $ | — |

|

| $ | 248,428 |

|

| $ | 321,894 |

|

| $ | 47,740 |

|

| $ | — |

|

| $ | 369,634 |

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Series 1 nonconvertible preferred stock |

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

|

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

| $ | — |

|

| $ | — |

|

| $ | 1,423 |

|

| $ | 1,423 |

|

During the three and six months ended MarchDecember 31, 2023 and 2022, there were no transfers between Level 1, Level 2 and Level 3.

The fair value of Level 2 instruments classified as marketable securities were determined through third-party pricing services. The pricing services use many observable market inputs to determine value, including reportable trades, benchmark yields, credit spreads, broker/dealer quotes, bids, offers, and current spot rates.

The outstanding shares of Series 1 nonconvertible preferred stock as of MarchDecember 31, 2023 and September 30, 20222023 are measured at fair value. These outstanding shares are financial instruments that might require a transfer of assets because of the liquidation features in the contract and are therefore recorded as liabilities and measured at fair value. The fair value of the outstanding shares is based on significant inputs not observable in the market, which represent a Level 3 measurement within the fair value hierarchy. The Company utilizes a probability-weighted valuation model which takes into consideration various outcomes that may require the Company to transfer assets upon liquidation. Changes in the fair values of the Series 1 nonconvertible preferred stock are recognized in other income (expense) in the condensed consolidated statements of operations.

The recurring Level 3 fair value measurements of the Company’s outstanding Series 1 nonconvertible preferred stock using probability-weighted discounted cash flow include the following significant unobservable inputs:

|

| Range |

|

| Range |

| ||||

|

| March 31, |

| September 30, |

|

| December 31, |

| September 30, |

|

Unobservable Input |

| 2023 |

| 2022 |

|

| 2023 |

| 2023 |

|

Probabilities of payout |

| 0%-65% |

| 0%-65% |

|

| 0%-65% |

| 0%-65% |

|

Discount rate |

| 7.25% |

| 7.25% |

|

| 7.25% |

| 7.25% |

|

10

There were no changes in the fair value of nonconvertible preferred stock during the three and six months ended MarchDecember 31, 2023 orand 2022.

In April 2023, the Company entered into a royalty sale agreement with an affiliate of OMERS, pursuant to which the Company was paid a $200,000 cash purchase price in exchange for 54.5% of future quarterly royalty payments on net sales of MAVYRET/MAVIRET, after June 30, 2023, through June 30, 2032, subject to a cap on aggregate payments equal to 1.42 times the purchase price. The Company accounted for the upfront payment as a liability related to the sale of future royalties. The carrying value of the liability related to the sale of future royalties approximates fair value as of December 31, 2023 and is based on current estimates of future royalties expected to be paid to OMERS over the next 10 years, which are considered Level 3 inputs. See Note 7 for a rollforward of the liability.

4. Marketable Securities

As of MarchDecember 31, 2023 and September 30, 2022,2023, the fair value of available-for-sale marketable securities, by type of security, was as follows:

|

| March 31, 2023 |

|

| December 31, 2023 |

| ||||||||||||||||||||||||||||||||||

|

| Amortized |

|

| Gross |

|

| Gross |

|

| Credit Losses |

|

| Fair Value |

|

| Amortized |

|

| Gross |

|

| Gross |

|

| Credit Losses |

|

| Fair Value |

| ||||||||||

|

| (in thousands) |

|

| (in thousands) |

| ||||||||||||||||||||||||||||||||||

Corporate bonds |

| $ | 47,329 |

|

| $ | 4 |

|

| $ | (1,209 | ) |

| $ | — |

|

| $ | 46,124 |

|

| $ | 27,043 |

|

| $ | — |

|

| $ | (337 | ) |

| $ | — |

|

| $ | 26,706 |

|

Commercial paper |

|

| 83,819 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 83,819 |

|

|

| 5,975 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 5,975 |

|

U.S. Treasury notes |

|

| 22,229 |

|

|

| 14 |

|

|

| (240 | ) |

|

| — |

|

|

| 22,003 |

|

|

| 264,350 |

|

|

| 207 |

|

|

| (20 | ) |

|

| — |

|

|

| 264,537 |

|

|

| $ | 153,377 |

|

| $ | 18 |

|

| $ | (1,449 | ) |

| $ | — |

|

| $ | 151,946 |

|

| $ | 297,368 |

|

| $ | 207 |

|

| $ | (357 | ) |

| $ | — |

|

| $ | 297,218 |

|

|

| September 30, 2022 |

|

| September 30, 2023 |

| ||||||||||||||||||||||||||||||||||

|

| Amortized |

|

| Gross |

|

| Gross |

|

| Credit Losses |

|

| Fair Value |

|

| Amortized |

|

| Gross |

|

| Gross |

|

| Credit Losses |

|

| Fair Value |

| ||||||||||

|

| (in thousands) |

|

| (in thousands) |

| ||||||||||||||||||||||||||||||||||

Corporate bonds |

| $ | 78,663 |

|

| $ | — |

|

| $ | (2,252 | ) |

| $ | — |

|

| $ | 76,411 |

|

| $ | 27,127 |

|

| $ | — |

|

| $ | (692 | ) |

| $ | — |

|

| $ | 26,435 |

|

Commercial paper |

|

| 66,784 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 66,784 |

|

|

| 21,305 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 21,305 |

|

U.S. Treasury notes |

|

| 92,416 |

|

|

| — |

|

|

| (1,088 | ) |

|

| — |

|

|

| 91,328 |

|

|

| 236,880 |

|

|

| 12 |

|

|

| (110 | ) |

|

| — |

|

|

| 236,782 |

|

|

| $ | 237,863 |

|

| $ | — |

|

| $ | (3,340 | ) |

| $ | — |

|

| $ | 234,523 |

|

| $ | 285,312 |

|

| $ | 12 |

|

| $ | (802 | ) |

| $ | — |

|

| $ | 284,522 |

|

As of MarchDecember 31, 2023 and September 30, 2022,2023, marketable securities consisted of investments that mature within one year, with the exception of certain corporate bonds and U.S. Treasury notes, which have maturities between one and two years and an aggregate fair value of $15,040 and $29,285, respectively..

5. Accrued Expenses

Accrued expenses and other current liabilities consisted of the following as of MarchDecember 31, 2023 and September 30, 2022:2023:

|

| March 31, |

|

| September 30, |

|

| December 31, |

|

| September 30, |

| ||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2023 |

| ||||

|

| (in thousands) |

|

| (in thousands) |

| ||||||||||

Accrued pharmaceutical drug manufacturing |

| $ | 4,521 |

|

| $ | 6,932 |

|

| $ | 1,099 |

|

| $ | 3,083 |

|

Accrued research and development expenses |

|

| 5,380 |

|

|

| 5,532 |

|

|

| 3,707 |

|

|

| 6,120 |

|

Accrued payroll and related expenses |

|

| 3,075 |

|

|

| 6,439 |

|

|

| 4,310 |

|

|

| 7,037 |

|

Accrued professional fees |

|

| 1,639 |

|

|

| 1,273 |

| ||||||||

Accrued other |

|

| 867 |

|

|

| 760 |

|

|

| 2,487 |

|

|

| 2,099 |

|

|

| $ | 15,482 |

|

| $ | 20,936 |

|

| $ | 11,603 |

|

| $ | 18,339 |

|

11

6. AbbVie Collaboration

The Company has a Collaborative Development and License Agreement (as amended, the “AbbVie Agreement”), with AbbVie to identify, develop and commercialize HCV NS3 and NS3/4A protease inhibitor compounds, including paritaprevir and glecaprevir, under which the Company has received license payments, proceeds from a sale of preferred stock, research funding payments, milestone payments and royalties totaling approximately $1,250,0001,296,000 through MarchDecember 31, 2023. Since the Company satisfied all of its performance obligations under the AbbVie Agreement by the end of fiscal 2011, all milestone payments received since then have been recognized as revenue when the milestones were achieved by AbbVie.

The Company is receiving annually tiered royalties per Company protease product ranging from ten percent up to twenty percent, or on a blended basis from ten percent up to the high teens, on the portion of AbbVie’s calendar year net sales of each HCV regimen that is allocated to the protease inhibitor in the regimen. Beginning with each January 1, the cumulative net sales of a given royalty-bearing protease inhibitor product start at zero for purposes of calculating the tiered royalties on a product-by-product basis.

117. Liability Related to the Sale of Future Royalties

In April 2023, the Company entered into a royalty sale agreement with an affiliate of OMERS, pursuant to which the Company was paid a $200,000 cash purchase price in exchange for 54.5% of future quarterly royalty payments on net sales of MAVYRET/MAVIRET, after June 30, 2023, through June 30, 2032, subject to a cap on aggregate payments equal to 1.42 times the purchase price.

Because the royalty sale agreement will be paid back to OMERS up to a capped amount as well as the Company’s significant continuing involvement in the generation of future cash flows under its AbbVie Agreement, the Company recorded the proceeds from the transaction as a liability on its condensed consolidated balance sheets which will be amortized as interest expense in the condensed consolidated statements of operations under the effective interest rate method over the life of the royalty sale agreement. The Company will continue to record the full amount of royalties earned on MAVYRET/MAVIRET sales as royalty revenue in the condensed consolidated statements of operations.

The Company’s liability related to the sale of future royalties is estimated based on forecasted worldwide MAVYRET/MAVYRET royalties to be paid to OMERS over the course of the royalty sale agreement. This estimate requires significant judgment, including the amount and timing of royalty payments up until the end of the royalty sale agreement, which is estimated to be the stated term of June 30, 2032. As royalties are earned by OMERS, the liability is reduced on the Company’s condensed consolidated balance sheets.

At December 31, 2023, the estimated future cash flows resulted in an effective annual imputed interest rate of approximately 7.05%.

7.The following table summarizes the activity of the liability related to the sale of future royalties:

|

| Liability related to the sale of future royalties |

| |

|

| (in thousands) |

| |

Balance - September 30, 2023 |

| $ | 194,505 |

|

Royalty payable to purchaser |

|

| (9,822 | ) |

Interest expense |

|

| 3,441 |

|

Balance - December 31, 2023 |

| $ | 188,124 |

|

8. Series 1 Nonconvertible Preferred Stock

As of MarchDecember 31, 2023, 1,930 shares of Series 1 nonconvertible preferred stock were issued and outstanding. Since theseThe outstanding shares qualify asare financial instruments that might require a derivative,transfer of assets because of the outstanding sharesliquidation features in the contract and are carried at fair value as a liability on the Company’s condensed consolidated balance sheets.sheets.

8.9. Stock-Based Awards

The Company grants stock-based awards, including stock options, restricted stock units and other unit awards under its 2019 Equity Incentive Plan (the “2019 Plan”), which was approved by its stockholders on February 28, 2019 and amended in March 2021, March 2022 and March 2023. The Company also has outstanding stock option awards under its 2012 Equity Incentive Plan (the “2012 Plan”) and its amended and restated 1995 Equity Incentive Plan (the “1995 Plan”), but is no longer granting awards under these plans.this plan.

12

The following table summarizes stock option activity, including performance-based options, for the year-to-date period ending MarchDecember 31, 2023:

|

| Shares |

|

| Weighted |

|

| Weighted |

|

| Aggregate |

| ||||

|

| (in thousands) |

|

|

|

|

| (in years) |

|

| (in thousands) |

| ||||

Outstanding as of September 30, 2022 |

|

| 3,993 |

|

| $ | 53.57 |

|

|

| 6.2 |

|

| $ | 28,778 |

|

Granted |

|

| 728 |

|

|

| 45.44 |

|

|

|

|

|

|

| ||

Exercised |

|

| (117 | ) |

|

| 17.14 |

|

|

|

|

|

|

| ||

Forfeited |

|

| (82 | ) |

|

| 65.95 |

|

|

|

|

|

|

| ||

Outstanding as of March 31, 2023 |

|

| 4,522 |

|

| $ | 52.98 |

|

|

| 6.5 |

|

| $ | 7,572 |

|

Options vested and expected to vest as of |

|

| 4,522 |

|

| $ | 52.98 |

|

|

| 6.5 |

|

| $ | 7,572 |

|

Options exercisable as of March 31, 2023 |

|

| 2,801 |

|

| $ | 51.94 |

|

|

| 5.0 |

|

| $ | 7,554 |

|

|

| Shares |

|

| Weighted |

|

| Weighted |

|

| Aggregate |

| ||||

|

| (in thousands) |

|

|

|

|

| (in years) |

|

| (in thousands) |

| ||||

Outstanding as of September 30, 2023 |

|

| 4,365 |

|

| $ | 52.68 |

|

|

| 5.9 |

|

| $ | — |

|

Granted |

|

| 1,092 |

|

|

| 8.99 |

|

|

|

|

|

|

| ||

Exercised |

|

| — |

|

|

| — |

|

|

|

|

|

|

| ||

Forfeited |

|

| (244 | ) |

|

| 38.99 |

|

|

|

|

|

|

| ||

Outstanding as of December 31, 2023 |

|

| 5,213 |

|

| $ | 44.17 |

|

|

| 6.7 |

|

| $ | 459 |

|

Options vested and expected to vest as of |

|

| 5,213 |

|

| $ | 44.17 |

|

|

| 6.7 |

|

| $ | 459 |

|

Options exercisable as of December 31, 2023 |

|

| 3,028 |

|

| $ | 53.37 |

|

|

| 5.1 |

|

| $ | — |

|

Market and Performance-Based Stock Unit Awards

The Company awards both performance share units, or PSUs, and relative total stockholder return units, or rTSRUs, to its executive officers. The number of units granted represents the target number of shares of common stock that may be earned; however, the actual number of shares that may be earned ranges from 0% to 150% of the target number. The number of shares cancelled represents the target number of shares, less any shares that vested. The following table summarizes PSU and rTSRU activity for the year-to-date period ending MarchDecember 31, 2023:

|

| PSUs |

|

| rTSRUs |

| ||||||||||

|

| Shares |

|

| Weighted |

|

| Shares |

|

| Weighted |

| ||||

|

| (in thousands, except per share data) |

| |||||||||||||

Unvested at September 30, 2022 |

|

| 101 |

|

| $ | 54.50 |

|

|

| 101 |

|

| $ | 36.14 |

|

Granted |

|

| 50 |

|

|

| 47.24 |

|

|

| 50 |

|

|

| 36.91 |

|

Vested |

|

| (70 | ) |

|

| 44.58 |

|

|

| (70 | ) |

|

| 23.89 |

|

Cancelled |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Unvested at March 31, 2023 |

|

| 81 |

|

| $ | 58.58 |

|

|

| 81 |

|

| $ | 45.82 |

|

During the six months ended March 31, 2023, a total of 100% of the target PSUs and 127% of the target rTSRUs granted in December 2020 vested, resulting in the issuance of an aggregate of 104 common shares, net of share withholding.

|

| PSUs |

|

| rTSRUs |

| ||||||||||

|

| Shares |

|

| Weighted |

|

| Shares |

|

| Weighted |

| ||||

|

| (in thousands) |

|

|

|

|

| (in thousands) |

|

|

|

| ||||

Unvested as of September 30, 2023 |

|

| 81 |

|

| $ | 58.58 |

|

|

| 81 |

|

| $ | 45.82 |

|

Granted |

|

| 48 |

|

|

| 9.21 |

|

|

| 48 |

|

|

| 9.89 |

|

Vested |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Unvested as of December 31, 2023 |

|

| 129 |

|

| $ | 40.23 |

|

|

| 129 |

|

| $ | 32.47 |

|

12

Restricted Stock Units

The following table summarizes the restricted stock unit activity for the year-to-date period ending MarchDecember 31, 2023:

|

| Restricted Stock |

|

| Weighted |

|

| Restricted Stock |

|

| Weighted |

| ||||

|

| (in thousands, except per share data) |

|

| (in thousands) |

|

|

| ||||||||

Unvested at September 30, 2022 |

|

| 219 |

|

| $ | 64.03 |

| ||||||||

Unvested as of September 30, 2023 |

|

| 411 |

|

| $ | 51.78 |

| ||||||||

Granted |

|

| 277 |

|

|

| 45.00 |

|

|

| 162 |

|

|

| 8.99 |

|

Vested |

|

| (56 | ) |

|

| 61.10 |

|

|

| (116 | ) |

|

| 52.00 |

|

Cancelled |

|

| (10 | ) |

|

| 54.51 |

|

|

| (2 | ) |

|

| 54.27 |

|

Unvested at March 31, 2023 |

|

| 430 |

|

| $ | 52.37 |

| ||||||||

Unvested as of December 31, 2023 |

|

| 455 |

|

| $ | 36.45 |

| ||||||||

Stock-Based Compensation Expense

During the three and six months ended MarchDecember 31, 2023 and 2022 the Company recognized the following stock-based compensation expense:

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

|

| Three Months Ended March 31, |

|

| Six Months Ended March 31, |

|

| Three Months Ended December 31, |

| |||||||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||||

|

| (in thousands) |

|

| (in thousands) |

| ||||||||||||||||||

Research and development |

| $ | 2,520 |

|

| $ | 2,710 |

|

| $ | 5,052 |

|

| $ | 5,294 |

|

| $ | 2,055 |

|

| $ | 2,532 |

|

General and administrative |

|

| 4,843 |

|

|

| 3,761 |

|

|

| 9,450 |

|

|

| 7,239 |

|

|

| 6,044 |

|

|

| 4,607 |

|

| $ | 7,363 |

|

| $ | 6,471 |

|

| $ | 14,502 |

|

| $ | 12,533 |

|

| $ | 8,099 |

|

| $ | 7,139 |

| |

|

|

|

|

|

|

|

|

|

| |||||||

|

| Three Months Ended March 31, |

|

| Six Months Ended March 31, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

|

| (in thousands) |

| |||||||||||||

Stock options |

| $ | 5,011 |

|

| $ | 4,962 |

|

| $ | 10,057 |

|

| $ | 9,710 |

|

rTSRUs |

|

| 546 |

|

|

| 531 |

|

|

| 1,007 |

|

|

| 823 |

|

Performance stock units |

|

| 175 |

|

|

| 79 |

|

|

| 542 |

|

|

| 512 |

|

Restricted stock units |

|

| 1,631 |

|

|

| 899 |

|

|

| 2,896 |

|

|

| 1,488 |

|

| $ | 7,363 |

|

| $ | 6,471 |

|

| $ | 14,502 |

|

| $ | 12,533 |

| |

13

|

|

|

| |||||

|

| Three Months Ended December 31, |

| |||||