UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 20232024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 000-26770

NOVAVAX, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 22-2816046 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

21 Firstfield700 Quince Orchard Road,

| Gaithersburg, | MD | 20878 |

| (Address of principal executive offices) | (Zip code) |

(240) 268-2000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 per share | NVAX | The Nasdaq Global Select Market |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated Filer | o |

| | | |

| Non-accelerated filer | o | Smaller reporting company | o |

| | | |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of shares outstanding of the Registrant's Common Stock, $0.01 par value, was 86,305,085140,403,554 as of April 30, 2023.2024.

NOVAVAX, INC.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

NOVAVAX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share information)

(unaudited)

| | For the Three Months Ended

March 31, | |

| 2023 | | 2022 | |

| For the Three Months Ended

March 31, | |

| For the Three Months Ended

March 31, | |

| For the Three Months Ended

March 31, | |

| 2024 | |

| 2024 | |

| 2024 | |

| Revenue: | |

| Revenue: | |

| Revenue: | Revenue: | | | | |

| Product sales | Product sales | $ | (7,457) | | | $ | 585,628 | | |

| Product sales | |

| Product sales | |

| Grants | |

| Grants | |

| Grants | Grants | 87,379 | | | 99,301 | | |

| Royalties and other | Royalties and other | 1,029 | | | 19,042 | | |

| Royalties and other | |

| Royalties and other | |

| Total revenue | |

| Total revenue | |

| Total revenue | Total revenue | 80,951 | | | 703,971 | | |

| | Expenses: | Expenses: | | |

| | Expenses: | |

| | Expenses: | |

| Cost of sales | |

| Cost of sales | |

| Cost of sales | Cost of sales | 34,086 | | | 15,204 | | |

| Research and development | Research and development | 247,101 | | | 383,483 | | |

| Research and development | |

| Research and development | |

| Selling, general, and administrative | |

| Selling, general, and administrative | |

| Selling, general, and administrative | Selling, general, and administrative | 112,532 | | | 95,992 | | |

| Total expenses | Total expenses | 393,719 | | | 494,679 | | |

| Income (Loss) from operations | (312,768) | | | 209,292 | | |

| Total expenses | |

| Total expenses | |

| Loss from operations | |

| Loss from operations | |

| Loss from operations | |

| Other income (expense): | |

| Other income (expense): | |

| Other income (expense): | Other income (expense): | | |

| | Interest expense | Interest expense | (4,316) | | | (4,876) | | |

| | Interest expense | |

| | Interest expense | |

| Other income | Other income | 24,362 | | | 1,654 | | |

| Income (Loss) before income tax expense | (292,722) | | | 206,070 | | |

| Other income | |

| Other income | |

| Loss before income taxes | |

| Loss before income taxes | |

| Loss before income taxes | |

| Income tax expense | Income tax expense | 1,183 | | | 2,662 | | |

| Net income (loss) | $ | (293,905) | | | $ | 203,408 | | |

| Income tax expense | |

| Income tax expense | |

| Net loss | |

| Net loss | |

| Net loss | |

| | Net income (loss) per share: | | |

| Basic | $ | (3.41) | | | $ | 2.66 | | |

| Diluted | $ | (3.41) | | | $ | 2.56 | | |

| Weighted average number of common shares outstanding | | | | |

| Basic | 86,158 | | | 76,457 | | |

| Diluted | 86,158 | | | 80,711 | | |

| Net loss per share: | |

| | Net loss per share: | |

| | Net loss per share: | |

| Basic and diluted | |

| Basic and diluted | |

| Basic and diluted | |

| | Weighted average number of common shares outstanding: | |

| | Weighted average number of common shares outstanding: | |

| | Weighted average number of common shares outstanding: | |

| Basic and diluted | |

| Basic and diluted | |

| Basic and diluted | |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)LOSS

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | |

| For the Three Months Ended

March 31, | | |

| 2023 | | 2022 | | | | |

| Net income (loss) | $ | (293,905) | | | $ | 203,408 | | | | | |

| Other comprehensive income: | | | | | | | |

| Foreign currency translation adjustment | 3,211 | | | 41 | | | | | |

| Other comprehensive income | 3,211 | | | 41 | | | | | |

| Comprehensive income (loss) | $ | (290,694) | | | $ | 203,449 | | | | | |

| | | | | | | | | | | | | | | |

| For the Three Months Ended

March 31, | | |

| 2024 | | 2023 | | | | |

| Net loss | $ | (147,550) | | | $ | (293,905) | | | | | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation adjustment | (13,547) | | | 3,211 | | | | | |

| Other comprehensive income (loss) | (13,547) | | | 3,211 | | | | | |

| Comprehensive loss | $ | (161,097) | | | $ | (290,694) | | | | | |

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share information)

| | March 31,

2023 | | December 31,

2022 |

| (unaudited) | | |

| March 31,

2024 | | | March 31,

2024 | | December 31,

2023 |

| (unaudited) | |

| ASSETS | |

| ASSETS | |

| ASSETS | ASSETS | |

| Current assets: | Current assets: | |

| Current assets: | |

| Current assets: | |

| Cash and cash equivalents | |

| Cash and cash equivalents | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 624,950 | | | $ | 1,336,883 | |

| | Restricted cash | |

| Restricted cash | |

| Restricted cash | Restricted cash | 10,330 | | | 10,303 | |

| Accounts receivable | Accounts receivable | 112,849 | | | 82,375 | |

| Inventory | Inventory | 34,185 | | | 36,683 | |

| Prepaid expenses and other current assets | Prepaid expenses and other current assets | 188,714 | | | 237,147 | |

| Total current assets | Total current assets | 971,028 | | | 1,703,391 | |

| Property and equipment, net | Property and equipment, net | 307,414 | | | 294,247 | |

| Right of use asset, net | Right of use asset, net | 103,923 | | | 106,241 | |

| | Goodwill | Goodwill | 129,827 | | | 126,331 | |

| Goodwill | |

| Goodwill | |

| Other non-current assets | Other non-current assets | 30,507 | | | 28,469 | |

| Total assets | Total assets | $ | 1,542,699 | | | $ | 2,258,679 | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | |

| Current liabilities: | Current liabilities: | |

| Current liabilities: | |

| Current liabilities: | |

| Accounts payable | |

| Accounts payable | |

| Accounts payable | Accounts payable | $ | 124,801 | | | $ | 216,517 | |

| Accrued expenses | Accrued expenses | 518,706 | | | 591,158 | |

| Deferred revenue | Deferred revenue | 415,764 | | | 370,137 | |

| Current portion of finance lease liabilities | Current portion of finance lease liabilities | 1,205 | | | 27,196 | |

| Convertible notes payable | — | | | 324,881 | |

| Other current liabilities | Other current liabilities | 858,382 | | | 930,055 | |

| Total current liabilities | Total current liabilities | 1,918,858 | | | 2,459,944 | |

| Deferred revenue | Deferred revenue | 274,062 | | | 179,414 | |

| Convertible notes payable | Convertible notes payable | 166,857 | | | 166,466 | |

| Non-current finance lease liabilities | Non-current finance lease liabilities | 30,993 | | | 31,238 | |

| Other non-current liabilities | Other non-current liabilities | 47,511 | | | 55,695 | |

| Total liabilities | Total liabilities | 2,438,281 | | | 2,892,757 | |

| | Commitments and contingencies (Note 15) | |

| Commitments and contingencies (Note 13) | |

| Commitments and contingencies (Note 13) | |

| Commitments and contingencies (Note 13) | | | | |

| | Preferred stock, $0.01 par value, 2,000,000 shares authorized at March 31, 2023 and December 31, 2022; no shares issued and outstanding at March 31, 2023 and December 31, 2022. | — | | | — | |

| Preferred stock, $0.01 par value, 2,000,000 shares authorized at March 31, 2024 and December 31, 2023; no shares issued and outstanding at March 31, 2024 and December 31, 2023 | |

| Preferred stock, $0.01 par value, 2,000,000 shares authorized at March 31, 2024 and December 31, 2023; no shares issued and outstanding at March 31, 2024 and December 31, 2023 | |

| Preferred stock, $0.01 par value, 2,000,000 shares authorized at March 31, 2024 and December 31, 2023; no shares issued and outstanding at March 31, 2024 and December 31, 2023 | |

| | Stockholders' deficit: | Stockholders' deficit: | |

| Common stock, $0.01 par value, 600,000,000 shares authorized at March 31, 2023 and December 31, 2022; 87,139,831 shares issued and 86,291,473 shares outstanding at March 31, 2023 and 86,806,554 shares issued and 86,039,923 shares outstanding at December 31, 2022 | 871 | | | 868 | |

| Stockholders' deficit: | |

| Stockholders' deficit: | |

| Common stock, $0.01 par value, 600,000,000 shares authorized at March 31, 2024 and December 31, 2023; 141,700,972 shares issued and 140,373,255 shares outstanding at March 31, 2024 and 140,506,093 shares issued and 139,505,770 shares outstanding at December 31, 2023 | |

| Common stock, $0.01 par value, 600,000,000 shares authorized at March 31, 2024 and December 31, 2023; 141,700,972 shares issued and 140,373,255 shares outstanding at March 31, 2024 and 140,506,093 shares issued and 139,505,770 shares outstanding at December 31, 2023 | |

| Common stock, $0.01 par value, 600,000,000 shares authorized at March 31, 2024 and December 31, 2023; 141,700,972 shares issued and 140,373,255 shares outstanding at March 31, 2024 and 140,506,093 shares issued and 139,505,770 shares outstanding at December 31, 2023 | |

| Additional paid-in capital | Additional paid-in capital | 3,767,733 | | | 3,737,979 | |

| Accumulated deficit | Accumulated deficit | (4,569,794) | | | (4,275,889) | |

| Treasury stock, cost basis, 848,358 shares at March 31, 2023 and 766,631 shares at December 31, 2022 | (91,226) | | | (90,659) | |

| Accumulated other comprehensive loss | (3,166) | | | (6,377) | |

Treasury stock, cost basis, 1,327,717 shares at March 31, 2024 and 1,000,323 shares at December 31, 2023 | |

| Accumulated other comprehensive income (loss) | |

| Total stockholders’ deficit | Total stockholders’ deficit | (895,582) | | | (634,078) | |

| Total liabilities and stockholders’ deficit | Total liabilities and stockholders’ deficit | $ | 1,542,699 | | | $ | 2,258,679 | |

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)DEFICIT

Three Months Ended March 31, 20232024 and 20222023

(in thousands, except share information)

(unaudited)

| | Common Stock | | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Treasury

Stock | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders' Deficit |

| Shares | |

| Balance at December 31, 2023 | |

| Balance at December 31, 2023 | |

| Balance at December 31, 2023 | |

| Stock-based compensation | |

| Stock issued under incentive programs | |

| | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Treasury

Stock | | Accumulated Other

Comprehensive

Loss | | Total Stockholders'

Equity (Deficit) |

| Foreign currency translation adjustment | |

| Foreign currency translation adjustment | |

| Foreign currency translation adjustment | |

| Net loss | |

| Balance at March 31, 2024 | |

| | Shares | | Amount | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Treasury

Stock | | Accumulated Other

Comprehensive

Loss | | Total Stockholders'

Equity (Deficit) |

| Balance at December 31, 2022 | |

| Balance at December 31, 2022 | |

| Balance at December 31, 2022 | Balance at December 31, 2022 | 86,806,554 | | | $ | 868 | | | $ | 3,737,979 | | | $ | (4,275,889) | | | $ | (90,659) | | | $ | (6,377) | | | $ | (634,078) | |

| Stock-based compensation | Stock-based compensation | — | | | — | | | 28,647 | | | — | | | — | | | — | | | 28,647 | |

| Stock issued under incentive programs | Stock issued under incentive programs | 333,277 | | | 3 | | | 1,107 | | | — | | | (567) | | | — | | | 543 | |

| | | Foreign currency translation adjustment | |

| | Foreign currency translation adjustment | |

| | Foreign currency translation adjustment | Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 3,211 | | | 3,211 | |

| Net loss | Net loss | — | | | — | | | — | | | (293,905) | | | — | | | — | | | (293,905) | |

| Balance at March 31, 2023 | Balance at March 31, 2023 | 87,139,831 | | | $ | 871 | | | $ | 3,767,733 | | | $ | (4,569,794) | | | $ | (91,226) | | | $ | (3,166) | | | $ | (895,582) | |

| | Balance at December 31, 2021 | 76,433,151 | | | $ | 764 | | | $ | 3,351,967 | | | $ | (3,617,950) | | | $ | (85,101) | | | $ | (1,353) | | | $ | (351,673) | |

| Stock-based compensation | — | | | — | | | 32,933 | | | — | | | — | | | — | | | 32,933 | |

| Stock issued under incentive programs | 91,788 | | | 1 | | | 2,029 | | | — | | | (800) | | | — | | | 1,230 | |

| Issuance of common stock, net of issuance costs of $2,311 | 2,197,398 | | | 22 | | | 179,363 | | | — | | | — | | | — | | | 179,385 | |

| | Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 41 | | | 41 | |

| Net income | — | | | — | | | — | | | 203,408 | | | — | | | — | | | 203,408 | |

| Balance at March 31, 2022 | 78,722,337 | | | $ | 787 | | | $ | 3,566,292 | | | $ | (3,414,542) | | | $ | (85,901) | | | $ | (1,312) | | | $ | 65,324 | |

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | Three Months Ended March 31, |

| 2023 | | 2022 |

| Three Months Ended March 31, | | | Three Months Ended March 31, |

| 2024 | | | 2024 | | 2023 |

| Operating Activities: | Operating Activities: | | | |

| Net income (loss) | $ | (293,905) | | | $ | 203,408 | |

| Reconciliation of net income (loss) to net cash provided by (used in) operating activities: | |

| Net loss | |

| Net loss | |

| Net loss | |

| Reconciliation of net loss to net cash used in operating activities: | |

| Depreciation and amortization | |

| Depreciation and amortization | |

| Depreciation and amortization | Depreciation and amortization | 9,043 | | | 6,765 | |

| | Non-cash stock-based compensation | Non-cash stock-based compensation | 28,647 | | | 32,933 | |

| Non-cash stock-based compensation | |

| Non-cash stock-based compensation | |

| Provision for excess and obsolete inventory | Provision for excess and obsolete inventory | 12,490 | | | — | |

| Right-of-use assets expensed, net of credits received | — | | | 214 | |

| Impairment of long-lived assets | |

| | Other items, net | |

| Other items, net | |

| Other items, net | Other items, net | (1,252) | | | 634 | |

| Changes in operating assets and liabilities: | Changes in operating assets and liabilities: | |

| Inventory | |

| Inventory | |

| Inventory | Inventory | (9,222) | | | (99,557) | |

| Accounts receivable, prepaid expenses, and other assets | Accounts receivable, prepaid expenses, and other assets | 18,430 | | | (56,016) | |

| Accounts payable, accrued expenses, and other liabilities | Accounts payable, accrued expenses, and other liabilities | (230,099) | | | (115,500) | |

| Deferred revenue | Deferred revenue | 140,275 | | | (61,391) | |

| Net cash used in operating activities | Net cash used in operating activities | (325,593) | | | (88,510) | |

| | Investing Activities: | Investing Activities: | |

| Investing Activities: | |

| Investing Activities: | |

| Capital expenditures | |

| Capital expenditures | |

| Capital expenditures | Capital expenditures | (19,801) | | | (16,826) | |

| Internal-use software | Internal-use software | (3,757) | | | — | |

| Net cash used in investing activities | Net cash used in investing activities | (23,558) | | | (16,826) | |

| | Financing Activities: | Financing Activities: | |

| Financing Activities: | |

| Financing Activities: | |

| Net proceeds from sales of common stock | |

| Net proceeds from sales of common stock | |

| Net proceeds from sales of common stock | Net proceeds from sales of common stock | — | | | 179,385 | |

| Net proceeds from the exercise of stock-based awards | Net proceeds from the exercise of stock-based awards | 543 | | | 1,318 | |

| Finance lease payments | Finance lease payments | (26,331) | | | (20,838) | |

| Repayment of 2023 Convertible notes | Repayment of 2023 Convertible notes | (325,000) | | | — | |

| Payments of costs related to issuance of 2027 Convertible notes | Payments of costs related to issuance of 2027 Convertible notes | (3,591) | | | — | |

| Net cash provided by (used in) financing activities | Net cash provided by (used in) financing activities | (354,379) | | | 159,865 | |

| Effect of exchange rate on cash, cash equivalents, and restricted cash | Effect of exchange rate on cash, cash equivalents, and restricted cash | (8,372) | | | 1,312 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (711,902) | | | 55,841 | |

| Net decrease in cash, cash equivalents, and restricted cash | |

| Cash, cash equivalents, and restricted cash at beginning of period | Cash, cash equivalents, and restricted cash at beginning of period | 1,348,845 | | | 1,528,259 | |

| Cash, cash equivalents, and restricted cash at end of period | Cash, cash equivalents, and restricted cash at end of period | $ | 636,943 | | | $ | 1,584,100 | |

| | Supplemental disclosure of non-cash activities: | Supplemental disclosure of non-cash activities: | |

| Supplemental disclosure of non-cash activities: | |

| Supplemental disclosure of non-cash activities: | |

| | Right-of-use assets from new lease agreements | $ | — | | | $ | 58,352 | |

| | Capital expenditures included in accounts payable and accrued expenses | Capital expenditures included in accounts payable and accrued expenses | $ | 10,847 | | | $ | 15,874 | |

| | | Capital expenditures included in accounts payable and accrued expenses | |

| | Capital expenditures included in accounts payable and accrued expenses | |

| Internal-use software included in accounts payable and accrued expenses | |

| | Supplemental disclosure of cash flow information: | |

| Supplemental disclosure of cash flow information: | |

| Supplemental disclosure of cash flow information: | Supplemental disclosure of cash flow information: | |

| Cash interest payments, net of amounts capitalized | Cash interest payments, net of amounts capitalized | $ | 6,566 | | | $ | 6,654 | |

| Cash paid for income taxes | $ | — | | | $ | 15,451 | |

| Cash interest payments, net of amounts capitalized | |

| Cash interest payments, net of amounts capitalized | |

| Cash paid for income taxes, net of refunds | |

The accompanying notes are an integral part of these financial statements.

NOVAVAX, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

March 31, 20232024

(unaudited)

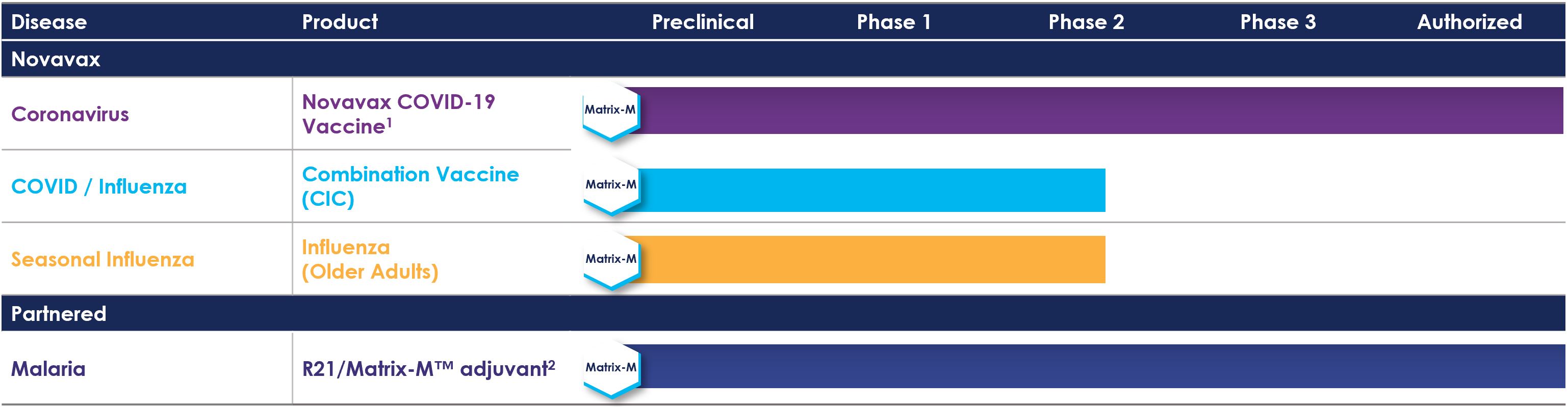

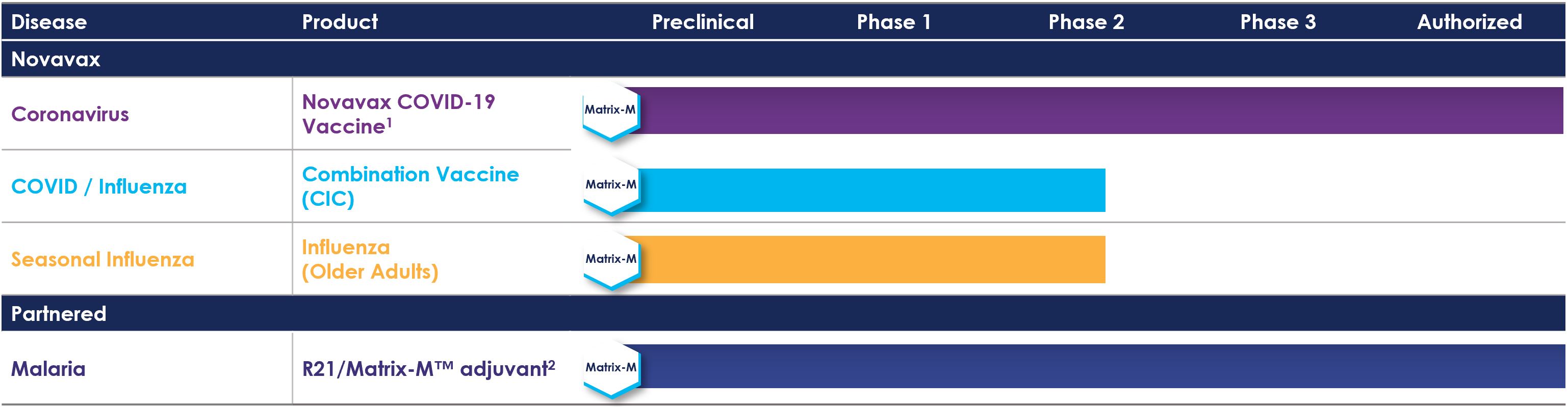

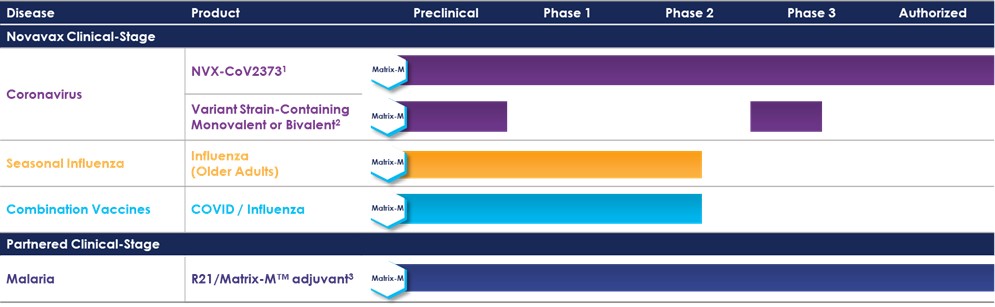

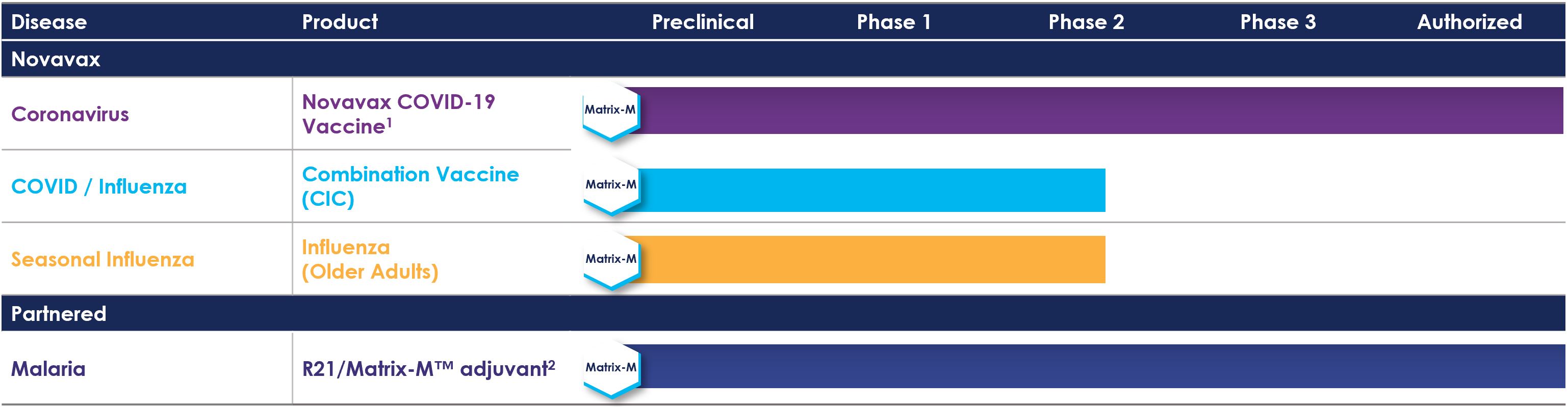

Note 1 – Organization and Business

Novavax, Inc. (“Novavax,” and together with its wholly owned subsidiaries, the “Company”) is a biotechnology company that promotes improved health globally through the discovery, development,by discovering, developing, and commercialization ofcommercializing innovative vaccines to prevent serious infectious diseases. The Company’sNovavax offers a differentiated vaccine platform that combines a recombinant protein approach, innovative nanoparticle technology and patented Matrix-M™ adjuvant to enhance the immune response. Novavax currently has one commercial program, for vaccines to prevent COVID-19, which includes Nuvaxovid™ prototype COVID-19 vaccine (“("NVX-CoV2373,” “Nuvaxovid™,or “prototype vaccine”) and Nuvaxovid™ updated COVID-19 vaccine (“NVX-CoV2601,” “Covovax™or “updated vaccine”) (collectively, “COVID-19 Vaccine”). Local regulatory authorities have also specified nomenclature for the labeling of the prototype and updated vaccines within their territories (e.g.,” “Novavax COVID-19 Vaccine, Adjuvanted” and “Novavax COVID-19, Adjuvanted (2023-2024 Formula),” respectively, for the U.S.); influenza. The Company’s partner, Serum Institute of India Pvt. Ltd. (“SIIPL”), markets NVX-CoV2373 as “Covovax™.”

Beginning in 2022, the Company received approval, interim authorization, provisional approval, conditional marketing authorization, and emergency use authorization (“EUA”) from multiple regulatory authorities globally for its prototype vaccine candidate;for both adult and adolescent populations as a primary series and for both homologous and heterologous booster indications in select territories. In October 2023, the U.S. Food and Drug Administration amended the EUA for its prototype vaccine to include its updated vaccine. The amended EUA authorizes use of the Company’s updated vaccine in individuals 12 years and older. In October 2023, the European Commission (“EC”) granted approval for the Company’s updated vaccine for active immunization to prevent COVID-19 caused by SARS-CoV-2 in individuals aged 12 and older. Currently, the Company significantly depends on its supply agreement with SIIPL and its subsidiary, Serum Life Sciences Limited (“SLS”), for co-formulation, filling and finishing (other than in Europe) and on its service agreement with PCI Pharma Services for finishing in Europe.

Novavax is advancing development of other vaccine candidates, including its COVID-19-Influenza Combination (“CIC”) vaccine candidate;candidate and additional vaccine candidates, including for Omicron subvariantscandidates. The Company’s COVID-19 Vaccine and bivalent formulations with prototype vaccine (“NVX-CoV2373”), are genetically engineered nanostructures of conformationally correct recombinant proteins critical to disease pathogenesis and may elicit differentiated immune responses, which may be more efficacious than naturally occurring immunity or other vaccine approaches. NVX-CoV2373 and the Company’sits other vaccine candidates incorporate the Company'sCompany’s proprietary Matrix-M™ adjuvant to enhance the immune response and stimulate higher levels of functional antibodies and induce a cellular immune response. The Company has announced data from its ongoing PREVENT-19 study supporting the use of NVX-CoV2373 for homologous boosting in adults and adolescents aged 12 through 17. Additional findings in Phase 3 COVID-19 Omicron (study 311) trial showed utility of the prototype vaccine as a heterologous booster, inducing broad immune responses against contemporary Omicron variants.

The Company has received approval, interim authorization, provisional approval, conditional marketing authorization, and emergency use authorization (“EUA”) from multiple regulatory authorities globally for NVX-CoV2373 for both adult and adolescent populations as a primary series and for both homologous and heterologous booster indications, and commenced commercial shipments of NVX-CoV2373 doses under the name “Novavax COVID-19 Vaccine, Adjuvanted” and the brand name “Nuvaxovid™” during the first quarter 2022.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. The consolidated financial statements are unaudited but include all adjustments (consisting of normal recurring adjustments) that the Company considers necessary for a fair presentation of the financial position, operating results, comprehensive loss, changes in stockholders’ equity (deficit),deficit, and cash flows for the periods presented. Although the Company believes that the disclosures in these unaudited consolidated financial statements are adequate to make the information presented not misleading, certain information and footnote information normally included in consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted as permitted under the rules and regulations of the United States Securities and Exchange Commission (“SEC”).

The unaudited consolidated financial statements include the accounts of Novavax, Inc. and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation. Accumulated other comprehensive loss included a foreign currency translation loss of $3.2 million and $6.4 million at March 31, 2023 and December 31, 2022, respectively. The aggregate foreign currency transaction gains and losses resulting from the conversion of the transaction currency to functional currency were a $5.1 million loss and a $16.3 million and $2.2 milliongain for the three months ended March 31, 20232024 and 2022,2023, respectively, which are reflected in Other income.income (expense).

The accompanying unaudited consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022.2023. Results for this or any interim period are not necessarily indicative of results for any future interim period or for the entire year. The Company operates in one business segment.

Liquidity and Going Concern

The accompanying unaudited consolidated financial statements have been prepared assuming that the Company will continue as a going concern within one year after the date that the financial statements are issued and contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of the uncertainty described below.

Management’s plans discussed below, including specifically the execution of the collaboration and license agreement (the “Collaboration and License Agreement”) and securities subscription agreement (the “Subscription Agreement”) effective May 10, 2024, with Sanofi Pasteur Inc. (“Sanofi”) which will result in cash proceeds to the Company of $568.8 million during the second quarter of 2024, has alleviated the substantial doubt outlined below regarding the Company’s ability to continue as a going concern for the one year period from the date that these financial statements were issued. At

As of March 31, 2023,2024, the Company had $636.9$480.6 million in cash and cash equivalents and restricted cash. In April 2023, the Company repaid $112.5 million related to the refund due under the Amended and Restated SARS-CoV-2 Vaccine Supply Agreement, dated July 1, 2022, as further amended on September 26, 2022, (the “Amended and Restated UK Supply Agreement”) with The Secretary of

State for Business, Energy and Industrial Strategy (as assigned to the UK Health Security Agency), acting on behalf of the government of the United Kingdom of Great Britain and Northern Ireland, which amended and restated in its entirety the SARS-CoV-2 Vaccine Supply Agreement, dated October 22, 2020, between the parties, and $27.0 million related tohad a Settlement Agreement and Release of Claims between the Company and Par Sterile Products, LLC (“Par”), as described in Note 15 below, which was fully accrued as of March 31, 2023.working capital deficiency. During the three months ended March 31, 2023,2024, the Company incurred a net loss of $293.9$147.6 million and had net cash flows used in operating activities of $325.6$83.6 million.

In accordance with Accounting Standards Codification (“ASC”) Topic 205-40, Presentation of Financial Statements - Going Concern,, the Company evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year after the date that these unaudited consolidated financial statements are issued. While the Company’s current cash flow forecast for the one-year going concern look forward period estimates that there will be sufficient capital available to fund operations, this forecast is subject to significant uncertainty, including as it relates to revenue for the next 12 months funding fromand the U.S. government, and a pending matter subjectCompany’s ability to arbitration proceedings.execute on certain cost-reduction initiatives. The Company’s revenue projections depend on its ability to successfully develop, manufacture, distribute, and market anits updated monovalent or bivalent formulation of a vaccine candidate for COVID-19 for the Fall 2023 COVID vaccine2024-2025 vaccination season, which is inherently uncertain and subject to a number of risks, including the Company’s ability to obtain regulatory approvalauthorizations, introduce a single-dose vial or pre-filled syringe product presentation for the U.S. commercial and certain other markets, the incidence of COVID-19 during the 2024-2025 vaccination season, and the Company’s ability to timely deliver doses and achieve commercial adoption. In February 2023,adoption and market acceptance of its updated vaccine. Further, the Company’s revenue projections also depend on its ability to achieve expected product sales and related cash flows under its advance purchase agreements (“APAs”), including APAs in connection with the execution of Modification 17Australia and Canada, which are subject to the USG Agreement (as definedregulatory uncertainties as described in Note 3),3.

Failure to meet regulatory milestones or achieve product volume or delivery timing obligations under the U.S. government indicated toCompany’s APAs may require the Company that the award may not be extended past its current periodto refund portions of performance. If the USG Agreement is not amended, asupfront and other payments or result in reduced future payments, which would adversely affect the Company’s management had previously expected, then the Company may not receive all of the remaining $336.4 million in funding that was previously anticipated pursuantability to the USG Agreement. On January 24, 2023, Gavi, the Vaccine Alliance (“Gavi”) filedcontinue as a demand for arbitration with the International Court of Arbitration regarding an alleged material breach by the Company of the Company’s advance purchase agreement with Gavi (the “Gavi APA”). The outcome of that arbitration is inherently uncertain, and it is possible the Company could be required to refund all or a portion of the remaining advance payments of $697.4 million (see Note 3 and Note 15).

Management believes that, given the significancehistory of these uncertainties,recurring losses, negative working capital, and accumulated deficit, conditions or events exist that raise substantial doubt exists regardingabout the Company’s ability to continue as a going concern through one year from the date that these financial statements are issued. Management’s plans to potentially alleviate such conditions or events include the execution effective May 10, 2024, of the Collaboration and License Agreement with Sanofi that grants a co-exclusive license to Sanofi of the Company’s current COVID-19 and related vaccine products, which will provide the Company with an initial $500 million nonrefundable upfront payment, as well as the execution effective May 10, 2024, of the Subscription Agreement with Sanofi, which will provide the Company with a $68.8 million equity investment, both of which are expected to be received in the second quarter of 2024 and are described further below. Management’s plans also include execution of its commercial plans and its ongoing restructuring and cost reduction measures.

On May 10, 2024, the Company entered into the Collaboration and License Agreement with Sanofi pursuant to which Sanofi received:

i) A co-exclusive license to commercialize with the Company all of the Company’s current stand-alone COVID-19 vaccine products, including the Company’s Nuvaxovid™ prototype COVID-19 vaccine and Nuvaxovid™ updated COVID-19 vaccine, and updated versions that address seasonal variants throughout the world (“COVID Mono Products”),

ii) A sole license to develop and commercialize combination products containing a potential combination of the Company’s COVID-19 vaccine and Sanofi’s seasonal influenza vaccine (“COVID and influenza Combination Products” or “CIC Products”),

iii) A non-exclusive license to develop and commercialize combination products containing both the Company’s COVID-19 vaccine and one or more non-influenza vaccines (“Other Combination Products” and together with the COVID Mono Products, CIC Products, and Other Combination Products (“Licensed COVID-19 Products” )), and

iv) A non-exclusive license to develop and commercialize other vaccine products selected by Sanofi that include the Company’s Matrix-M™ adjuvant (as described below, the “Adjuvant Products”).

Under the Collaboration and License Agreement, the Company will receive a non-refundable upfront payment of $500 million. In addition, the Company will also be eligible to receive development, technology transfer, launch, and sales milestone payments totaling up to $700 million in the aggregate with respect to the Licensed COVID-19 Products and royalty payments on Sanofi’s sales of such licensed products. In addition, the Company is eligible to receive development, launch, and sales milestone payments of up to $200 million for each of the first four Adjuvant Products and $210 million for each Adjuvant Product thereafter, and royalty payments on Sanofi’s sales of all such licensed products.

Commencing shortly after the Effective Date of the Collaboration and License Agreement, the Company will perform a technology transfer of its manufacturing process for the COVID Mono Products and Matrix-M™ components to Sanofi. Until the successful completion of such transfer, the Company will supply Sanofi with both COVID Mono Products and Matrix-M™ intermediary components for Sanofi’s use and is eligible for reimbursement of such costs from Sanofi. Additionally, Sanofi will reimburse the Company for its research and development and medical affairs costs related to the COVID Mono Products in accordance with agreed upon plans and budgets.

Under the Collaboration and License Agreement, the Company will continue to commercialize the COVID Mono Products in 2024. Beginning in 2025 and continuing during the term of the Collaboration and License Agreement, Sanofi and the Company will commercialize the COVID Mono Products worldwide in accordance with a commercialization plan agreed by the Company and Sanofi, under which the Company will continue to supply its existing APA customers and strategic partners, including Takeda, SK Biosciences, and the Serum Institute of India. Upon completion of the existing advance purchase agreements, Novavax and Sanofi will jointly agree on commercialization activities of each party in each jurisdiction.

Effective May 10, 2024, the Company also entered into the Subscription Agreement with Sanofi, pursuant to which the Company sold and issued to Sanofi, in a private placement, 6,880,481 shares of the Company’s common stock, par value $0.01 per share at a price of $10.00 per share for aggregate gross proceeds to the Company of $68.8 million.

In May 2023, the Company announced a global restructuring and cost reduction plan. This plan (the “2023 Restructuring Plan”), which includes a more focused investment in its NVX-CoV2373 program,COVID-19 Vaccine, reduction to its pipeline spending, the continued rationalization of its manufacturing network, a reduction to the Company’s global workforce, as well as the consolidation of facilities, and infrastructure. The planned workforce reduction includes an approximately 25% reductionIn January 2024, as part of reducing combined research and development and selling, general and administrative expenses, the Company announced further reductions in the Company’sits global workforce comprised of an approximately 20% reduction in full-time Novavax employees and the remainder comprised of contractors and consultants.(the “2024 Cost Reduction Plan”). The Company intends to prioritize improvements to its long-term supply chain efficiency. The Company expects the full annual impact of the cost savings2023 Restructuring Plan to be realized in 2024, the full annual impact of the 2024 Cost Reduction Plan to be realized in 2025, and approximately half85% of the annual impact of the 2024 Cost Reduction Plan, excluding one-time charges, to be realized in 2024. The 2024 Cost Reduction Plan supplemented the 2023 dueRestructuring Plan and hereafter both are jointly referred to timing of implementingas the measures, and“Restructuring Plan.” During the applicable laws, regulations, and other factors in the jurisdictions in whichthree months ended March 31, 2024, the Company operates. The Company expects to recordrecorded a charge of approximately $10 million to $15$4.4 million related to one-time employee severance and benefit costs the majorityand recorded an impairment charge of which are expected to be incurred in the second quarter of 2023 and is evaluating the anticipated costs$1.7 million related to the consolidationimpairment of facilities and infrastructure.capitalized internal-use software (see Note 14).

The Company’s ability to fund Company operations is dependent upon revenue related to vaccine sales for its products and product candidates, if such product candidates receive marketing approval and are successfully commercialized; the resolution of certain matters, including whether, when, and how the dispute with Gavi is resolved; and management’s plans, which include resolving the dispute with Gavi and cost reductions associated with the Company’s global restructuring and cost reduction plan. Management’s plans may also include raising additional capital through a combination of additional equity and debt financing, additional collaborations, strategic alliances, asset sales, and marketing, distribution, or licensing arrangements. New financings may not be available to the Company on commercially acceptable terms, or at all. Also, any additional collaborations, strategic alliances, asset sales and marketing, distribution, or licensing arrangements may require the Company to give up some or all of its rights to a product or technology, which in some cases may be at less than the full potential value of such rights. In addition, the regulatory and commercial success of NVX-CoV2373 and the Company’s other vaccine candidates, including an influenza vaccine candidate, a CIC vaccine candidate, and a COVID-19 variant strain-containing monovalent or bivalent formulation, remains uncertain. If the Company is unable to obtain additional capital, the Company will assess its capital resources and may be required to delay, reduce the scope of, or eliminate some or all of its operations, or further downsize its organization, any of which may have a material adverse effect on its business, financial condition, results of operations, and ability to operate as a going concern.

Management’s plans discussed above, including specifically the execution of the Collaboration and License Agreement and the Subscription Agreement effective May 10, 2024, with Sanofi which will result in cash proceeds to the Company of $568.8 million during the second quarter of 2024, has alleviated the substantial doubt outlined below regarding the Company’s ability to continue as a going concern for the one year period from the date that these financial statements were

issued.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ materially from those estimates.

Revenue Recognition ConstraintsRestructuring

The Company constrains the transaction price for customer arrangements until it is probable that a significant reversal in cumulative revenue recognized will not occur. Specifically, if a customer arrangement includes a provision whereby the customer may request a discount, return or refund for a previously satisfied performance obligation or otherwise could have the effectrecognizes restructuring charges when such costs are incurred. The Company’s restructuring charges consist of decreasing the transaction price, revenue is constrained based on an estimate of the impactemployee severance and other termination benefits related to the transaction price recognized until it isreduction of its workforce, the consolidation of facilities, and infrastructure and other costs. Termination benefits are expensed on the date the Company notifies the employee, unless the employee must provide future service, in which case the benefits are expensed ratably over the future service period. Ongoing benefits are expensed when restructuring activities are probable that a significant reversaland the benefit estimable.

See Note 14 for additional information on the severance and employee benefit costs for terminated employees and impairment of assets in cumulative revenue recognized will not occur.connection with the Company’s Restructuring Plan.

Recent Accounting Pronouncements

Not Yet Adopted

In June 2016,October 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement2023-06, Disclosure Improvements (“ASU 2023-06”), to clarify or improve disclosure and presentation requirements of Credit Lossesa variety of topics and align the requirements in the FASB ASC with the SEC's regulations. The Company is currently evaluating ASU 2023-06 to determine its impact on Financial Instrumentsthe Company's consolidated financial statements and disclosures.

In December 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures (“ASU 2016-13”2023-09”), with amendments. The standard enhances transparency in 2018, 2019, 2020,income tax disclosures by requiring, on an annual basis, certain disaggregated information about a reporting entity’s effective tax rate reconciliation and 2022.income taxes paid. The ASU sets forth a “current expected credit loss” model thatalso requires companiesdisaggregated disclosure related to measure all expected credit lossespre-tax income (or loss) and income tax expense (or benefit) and eliminates certain disclosures related to the balance of an entity’s unrecognized tax benefit and the cumulative amount of certain temporary differences. The ASU is effective for financial instruments held at the reporting date based on historical experience, current conditions, and reasonable supportable forecasts. ASU 2016-13 applies to financial instruments that are not measured at fair value, including receivables that result from revenue transactions. The Company adopted ASU 2020-06beginning on January 1, 2023, using a modified retrospective approach, and it did not have a material2025. The Company is currently evaluating ASU 2023-09 to determine its impact on the Company’s consolidated financial statements.Company's disclosures.

Note 3 – Revenue

The Company's accounts receivable included $70.2 million, $53.8 million, $425.9$21.2 million and $419.7$286.4 million related to amounts that were billed to customers and $42.7 million, $28.6 million, $52.3$0.2 million and $35.3$10.8 million related to amounts which had not yet been billed to customers as of March 31, 2023, December 31, 2022, March 31, 2022,2024 and December 31, 2021,2023, respectively. During the three months ended March 31, 20232024 and 2022,2023, changes in the Company'sCompany’s accounts receivables, allowance for doubtful accounts,credit losses, and deferred revenue balances were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, Beginning of Period | | Additions | | Deductions | | Balance, End of Period |

| Accounts receivable: | | | | | | | |

| Three months ended March 31, 2023 | $ | 96,210 | | | $ | 146,424 | | | $ | (115,950) | | | $ | 126,684 | |

| Three months ended March 31, 2022 | 454,993 | | | 625,124 | | | (601,961) | | | 478,156 | |

Allowance for doubtful accounts(1): | | | | | | | |

| Three months ended March 31, 2023 | $ | (13,835) | | | $ | — | | | $ | — | | | $ | (13,835) | |

| Three months ended March 31, 2022 | — | | | — | | | — | | | — | |

| Deferred revenue: | | | | | | | |

| Three months ended March 31, 2023 | $ | 549,551 | | | $ | 140,324 | | | $ | (49) | | | $ | 689,826 | |

| Three months ended March 31, 2022 | 1,595,472 | | | 49,094 | | | (108,586) | | | 1,535,980 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, Beginning of Period | | Additions | | Deductions | | Balance, End of Period |

| Accounts receivable: | | | | | | | |

| Three Months Ended March 31, 2024 | $ | 304,916 | | | $ | 136,510 | | | $ | (412,370) | | | $ | 29,056 | |

| Three Months Ended March 31, 2023 | 96,210 | | | 146,424 | | | (115,950) | | | 126,684 | |

Allowance for credit losses(1): | | | | | | | |

| Three Months Ended March 31, 2024 | $ | (7,676) | | | $ | — | | | $ | — | | | $ | (7,676) | |

| Three Months Ended March 31, 2023 | (13,835) | | | — | | | — | | | (13,835) | |

Deferred revenue:(2) | | | | | | | |

| Three Months Ended March 31, 2024 | $ | 863,521 | | | $ | 225,000 | | | $ | (6,148) | | | $ | 1,082,373 | |

| Three Months Ended March 31, 2023 | 549,551 | | | 140,324 | | | (49) | | | 689,826 | |

(1) There was no bad debt expenseallowance for credit losses recorded during the three months ended March 31, 20232024 or 2022.2023. To estimate the allowance for doubtful accounts,credit losses, the Company evaluates the credit risk related to its customers based on historical loss experience, economic conditions, the aging of receivables, and customer-specific risks.

(2) Deductions from Deferred revenue generally related to the recognition of revenue once performance obligations on a contract with a customer are met. During the three months ended March 31, 2024, deductions included a $2.2 million reclassification of refundable upfront payments previously included in Deferred revenue to Other current liabilities. During the three months ended March 31, 2024, additions included a $225.0 million reclassification of refundable upfront payment from Other current liabilities to Deferred revenue related to the settlement with Gavi as discussed below. There were no such reclassifications during the three months ended March 31, 2023.

As of March 31, 2023,2024, the aggregate amount of the transaction price allocated to performance obligations that were unsatisfied (or partially unsatisfied), excluding amounts related to sales-based royalties, the Gavi APA, and the reduction in doses related to the Amended and Restated UK Supply Agreement, was approximately $3$2 billion of which $689.8 million$1.1 billion was included in Deferred revenue. Failure to meet regulatory milestones, obtain timely obtain supportive recommendations from governmental advisory committees, or achieve product volume or delivery timing obligations under the Company’s advance purchase agreements (“APAs”)APAs may require the Company to refund portions of upfront and other payments or result in reduced future payments, which could adversely impact the Company’s ability to realize revenue from its unsatisfied performance obligations. The timing to fulfill performance obligations related to grant agreementsAPAs will depend on the results of the Company's research and development activities, including clinical trials, and delivery of doses. The timing to fulfill performance obligations related to APAs will depend on timing of product manufacturing, receipt of marketing authorizations for additional indications, delivery of doses based on customer demand, and the ability of the customer to request variant vaccine in place of the prototype

NVX-CoV2373Company’s updated vaccine under certain of ourthe Company’s APAs. The remaining unfilled performance obligations not related to grant agreements or APAs are expected to be fulfilled in less than 12 months.

Under the terms of the Gavian APA and a separate purchase agreement between Gavi and Serum Institute of India Pvt. Ltd. (“SIIPL”), 1.1 billion doses of NVX-CoV2373 were to be made available to countries participating in the COVAX Facility. The Company expected to manufacture and distribute 350 million doses of NVX-CoV2373 to countries participating under the COVAX Facility. Under a separate purchase agreement with Gavi, SIIPL was expected to manufacture and deliver the balance of the 1.1 billion doses of NVX-CoV2373 for low- and middle-income countries participating in the COVAX Facility. The Company expected to deliver doses with antigen and adjuvant manufactured at facilities directly funded under the Company's funding agreement with Coalition for Epidemic Preparedness InnovationsVaccine Alliance (“CEPI”Gavi”), with initial doses supplied by SIIPL and Serum Life Sciences Limited (“SLS”) under a supply agreement. The Company expected to supply significant doses that Gavi would allocate to low-, middle- and high-income countries, subject to certain limitations, utilizing a tiered pricing schedule and Gavi could prioritize such doses to low- and middle- income countries, at lower prices. Additionally, the Company could provide additional doses of NVX-CoV2373, to the extent available from CEPI-funded manufacturing facilities,entered into in the event that SIIPL could not materially deliver expected vaccine doses to the COVAX Facility. Under the agreement,May 2021 (the “Gavi APA”), the Company received an upfront paymentpayments of $350.0$700 million from Gavi in 2021 and an additional payment of $350 million in 2022 related to the Company’s achieving an emergency use license for NVX-CoV2373 by the WHO (the “Advance Payment Amount”).

On November 18, 2022, the Company delivered written notice to Gavi to terminate the Gavi APA on the basis of Gavi’s failure to procure the purchase of 350 million doses of NVX-CoV2373 from the Company as required by the Gavi APA. As of November 18, 2022, the Company had only received orders under the Gavi APA for approximately 2 million doses. On December 2, 2022, Gavi issued a written notice purporting to terminate the Gavi APA based on Gavi’s contention that the Company repudiated the agreement and, therefore, materially breached the Gavi APA. Gavi also contends that, based on its purported terminationbe applied against purchases of the Gavi APA, it is entitled to a refund of the Advance Payment Amount less any amounts that have been credited against the purchase price for binding orders placedCompany’s prototype vaccine by a buyercertain countries participating in the COVAX Facility. As of MarchDecember 31, 2023, the remaining Gavi Advance Payment Amount was $696.4 million. On February 16, 2024, the Company entered into a Termination and Settlement Agreement with Gavi (the “Gavi Settlement Agreement”) terminating the Gavi APA, settling the arbitration proceedings, and releasing both parties of $697.4all claims arising from, under, or otherwise in connection with the Gavi APA. On February 22, 2024, the claims and counterclaims were dismissed with prejudice. Pursuant to the Gavi Settlement Agreement, the Company is responsible for payment to Gavi of (i) an initial settlement payment of $75 million, pending resolutionwhich the Company paid in February 2024, and (ii) deferred payments, in equal annual amounts of $80 million payable each calendar year through a deferred payment term ending December 31, 2028. The deferred payments are due in variable quarterly installments beginning in the second quarter of 2024 and total $400 million during the deferred payment term. Such deferred payments may be reduced through Gavi’s use of an annual vaccine credit equivalent to the unpaid balance of such deferred payments each year, which may be applied to qualifying sales of any of the disputeCompany’s vaccines for supply to certain low-income and lower-middle income countries. The Company has the right to price the vaccines offered to such low-income and lower-middle income countries in its discretion, and, when utilized by Gavi, the Company will credit the actual price per vaccine paid against the applicable credit. The Company intends to price vaccines offered via the tender process, consistent with its shared goal with Gavi related to a returnprovide equitable access to those countries. Also, pursuant to the Gavi Settlement Agreement,

the Company granted Gavi an additional credit of up to $225 million that may be applied against qualifying sales of any of the Company’s vaccines for supply to such low-income and lower-middle income countries that exceed the $80 million deferred payment amount in any calendar year during the deferred payment term. In total, the Gavi settlement agreement is comprised of $700 million of potential consideration, consisting of the $75 million initial settlement payment, deferred payments of up to $400 million that may be reduced through annual vaccine credits, and the additional credit of up to $225 million that may be applied for certain qualifying sales.

The Company recorded the $3.6 million difference between the refund liability recorded as of December 31, 2023 of $696.4 million and the $700 million of total consideration under the arrangement as a reduction to revenue during the three months ended March 31, 2024. As of March 31, 2024, the remaining Advance Payment Amount, was reclassified from Deferred revenue to Other current liabilities inamounts included on the Company’s consolidated balance sheets. On January 24, 2023, Gavi filed a demandsheet are classified as $225 million in non-current Deferred revenue for arbitration with the International Court of Arbitration based on the claims described above. The Company filed its Answeradditional credit that may be applied against future qualifying sales, $80 million in Other current liabilities, and Counterclaims on March 2, 2023. On April 5, 2023, Gavi filed its Reply to the Company’s Counterclaims. Arbitration is inherently uncertain, and while$320 million in Other non-current liabilities. In addition, the Company believes that it is entitledand Gavi entered into a security agreement pursuant to retainwhich Novavax granted Gavi a security interest in accounts receivable from SIIPL under the remaining Advance Payment Amount received from Gavi, it is possible that it could be required to refund all or a portionSIIPL R21 Agreement (see Note 4), which will continue for the deferred payment term of the remaining Advance Payment Amount from Gavi.Gavi Settlement Agreement.

Product Sales

Product sales by the Company’s customer’s geographic location was as follows (in thousands):

| | Three Months Ended

March 31, |

| 2023 | | 2022 |

| Three Months Ended

March 31, | | | Three Months Ended

March 31, |

| 2024 | | | 2024 | | 2023 |

| North America | North America | $ | — | | | $ | 64,762 | |

| Europe | Europe | 57,267 | | | 413,745 | | Europe | 90,416 | | 57,267 |

| Rest of the world | Rest of the world | (64,724) | | | 107,121 | | Rest of the world | (1,731) | | (64,724) |

| Total product revenue | $ | (7,457) | | | $ | 585,628 | |

| Total product sales revenue | |

In May 2023,Product sales in the Company extended a credit for certain doses deliveredU.S. are primarily made through large pharmaceutical wholesale distributors at the wholesale acquisition cost (“WAC”). Product sales in 2022 that qualified for replacement under the contract with the customer. This credit is the resultU.S. are recorded net of a single lot sold to the Australian government that upon pre-planned 6-month stability testing was found to have fallen below the defined specifications and the lot was therefore removed from the market. The credit will be applied against the future sale of doses to the customer and, duringgross-to-net deductions. During the three months ended March 31, 2024, product sales in North America includes $6.4 million of gross-to-net deductions in excess of the WAC, primarily due to wholesale distributor fees for shipments expected to be returned and adjustments made to estimated returns of prior period product sales. Product sales for the rest of the world includes a $3.6 million reduction to revenue recognized pursuant to the Gavi Settlement Agreement as discussed above.

As of March 31, 2024, changes in the Company’s gross-to-net deductions balances were as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| Wholesale Distributor Fees, Discounts, and Chargebacks | | Product Returns | | Total |

| Balance as of December 31, 2023 | $ | 21,072 | | | $ | 84,616 | | | $ | 105,688 | |

Amounts charged against product sales(1) | 16,076 | | | 19,296 | | | 35,372 | |

| Payments | (26,979) | | | (10,999) | | | (37,978) | |

| Balance as of March 31, 2024 | $ | 10,169 | | | $ | 92,913 | | | $ | 103,082 | |

(1) Amounts charged against product sales include $3.4 million of adjustments made to prior period product sales due primarily to changes in the estimate of product returns.

As of March 31, 2024 and December 31, 2023, $5.4 million and $2.6 million of gross-to-net deductions were included in Accounts receivable, respectively, and $97.7 million and $103.1 million were included in Accrued expenses, respectively.

The Company has an APA with the Commonwealth of Australia (“Australia”) for the purchase of doses of COVID-19 Vaccine (the “Australia APA”). In November 2023, the Company recordedfiled with the Therapeutic Goods Administration (“TGA”) for authorization for its updated vaccine. Based on subsequent communication from the TGA that it will not recommend

approval of the filing as submitted and new data and information generated since that filing, the Company is evaluating the regulatory path for approval, including the potential to update the filing with new data and information, and resubmit in the coming months. In March 2024, the Company and Australia agreed to cancel the COVID-19 Vaccine doses previously scheduled for delivery in the fourth quarter of 2023. As a reductionresult of $64.7the cancellation, the total contract value was reduced by $54.0 million, including $6.0 million of deferred revenue related to the cancelled doses that will be applied as a credit towards future deliveries of doses. Under the Australia APA, Australia is not required to purchase the updated COVID-19 Vaccine doses until the Company receives authorization from TGA. The Company plans to seek an amendment to the Australia APA to address performance obligations and future delivery schedule, which may not be achievable on acceptable terms or at all.

The Company had an APA with the EC acting on behalf of various European Union member states to supply a minimum of 20 million and up to 100 million initial doses of prototype vaccine, with the option for the EC to purchase an additional 100 million doses up to a maximum aggregate of 200 million doses in product sales,one or more tranches, through 2023. In January 2023, the Company finalized a revised delivery schedule for the remaining committed doses under the APA that were originally scheduled for delivery during the first and second quarters of 2022. The APA expired in August 2023 and required that any open and outstanding orders from European Union member states be satisfied by February 2024. All outstanding orders were delivered to European Union Member states by February 2024.

The Company has an APA with a corresponding increaseHis Majesty the King in Right of Canada as represented by the Minister of Public Works and Government Services, as successor in interest to Her Majesty the Queen in Right of Canada, as represented by the Minister of Public Works and Government Services (the “Canadian government”), for the purchase of doses of COVID-19 Vaccine (the “Canada APA”). The Canadian government may terminate the Canada APA, as amended, if the Company fails to receive regulatory approval for its COVID-19 Vaccine using bulk antigen produced at Biologics Manufacturing Centre (“BMC”) Inc. on or before December 31, 2024. The Company does not anticipate achieving regulatory approval of its COVID-19 Vaccine using bulk antigen produced at BMC on or before December 31, 2024. Therefore, the Company plans to seek an amendment to the Canada APA to address possible alternatives, which may not be achievable on acceptable terms or at all. As of March 31, 2024, $110.6 million was classified as current Deferred revenue non-current.and $477.6 million was classified as non-current Deferred revenue with respect to the Canadian APA in the Company’s consolidated balance sheet. If the Canadian government terminates the Canada APA, $28.0 million of the deferred revenue would become refundable and approximately $224 million of the contract value related to future deliverables would no longer be available.

Grants

The Company’s U.S. government agreement consistsconsisted of a Project Agreement (the “Project Agreement”) and a Base Agreement with Advanced Technology International, the Consortium Management Firm acting on behalf of the Medical CBRN Defense Consortium in connection with the partnership formerly known as Operation Warp Speed (the Base Agreement

together with the Project Agreement are referred to as the “USG Agreement”). In February 2023, in connection with the execution of Modification 17 to the Project Agreement, the U.S. government indicated to the Company that the award may not be extended past its current period of performance, December 31, 2023. Also, Modification 17 included provisions requiring that the payment of $60.0 million of consideration associated with manufacturing work now be contingent upon meeting certain milestones, including the delivery of up to 1.5 million doses of NVX-CoV2373 and development and regulatory milestones related to commercial readiness, expansion of the EUA and development of multiple vial presentations. As of MarchDecember 31, 2023, the Company constrainedrecognized the total transaction price by $48.0 million for consideration associated with milestones that are not fully within the Company’s control. This constraint,full $1.8 billion funding in addition torevenue.

Royalties and Other

Royalties and other contract changes included within Modification 17, resulted in an approximately $29 million cumulative reduction to revenue previously recognized under the contract forincludes royalty milestone payments, sales-based royalties, and Matrix-M™ adjuvant sales.

During the three months ended March 31, 2023.2024, the Company recognized $4.0 million in revenue related to license fees and $7.5 million in revenue related to a Matrix-M™ adjuvant sales. During the three months ended March 31, 2024, the Company did not recognize revenue related to milestone payments.

Royalties and Other

During the three months ended March 31, 2023, the Company recognized $1.0 million in revenue related to a Matrix-M™ adjuvant sales. During the three months ended March 31, 2023, the Company did not recognize revenue related to sales-based royalties. The Company recognized $7.4 million in revenue related to sales-based royalties during the three months ended March 31, 2022.license fees or milestone payments.

Note 4 – Collaboration, License, and Supply Agreements

Serum InstituteSIIPL

The Company previously granted SIIPL exclusive and non-exclusive licenses for the development, co-formulation, filling and finishing, registration, and commercialization of NVX-CoV2373,its prototype vaccine, its proprietary COVID-19 variant antigen candidate(s), its quadrivalent influenza vaccine candidate, and its CIC vaccine candidate. SIIPL agreed to purchase the Company's Matrix-M™ adjuvant and the Company granted SIIPL a non-exclusive license to manufacture the antigen drug substance component of NVX-CoV2373the Company’s COVID-19 Vaccine in SIIPL’s licensed territory solely for use in the manufacture of NVX-CoV2373.COVID-19 Vaccine. The Company and SIIPL equally split the revenue from SIIPL’s sale of NVX-CoV2373COVID-19 Vaccine in its licensed territory, net of agreed costs. The Company also has a supply agreement with SIIPL and SLS under which SIIPL and SLS supply the Company with NVX-CoV2373,prototype vaccine, its proprietary COVID-19 variant antigen candidate(s), its quadrivalent influenza vaccine candidate, and its CIC vaccine candidate for commercialization and sale in certain territories, as well as a contract development manufacture agreement with SLS, under which SLS manufactures and supplies finished vaccine product to the Company using antigen drug substance and Matrix-M™ adjuvant supplied by the Company. In March 2020, the Company entered into an agreement with SIIPL that granted SIIPL a non-exclusive license for the use of Matrix-M™ adjuvant supplied by the Company to develop, manufacture, and commercialize R21/Matrix-M™ adjuvant (“SIIPL R21 Agreement”), a malaria candidate developedvaccine created by the Jenner Institute, University of Oxford (“R21/Malaria”Matrix-M™”). In December 2023, R21/Matrix-M™ received prequalification by the World Health Organization (“WHO”). Under the agreement,SIIPL R21 Agreement, SIIPL purchases the Company's Matrix-M™ adjuvant to manufacture R21/Malariafor use in development activities at cost and SIIPLfor commercial purposes at a tiered commercial supply price, and pays a royalty in the single to lowsingle-to low- double-digit range based on vaccine sales for a period of 15 years after the first commercial sale of productthe vaccine in each country.

Takeda Pharmaceutical Company Limited

The Company has a collaboration and license agreement with Takeda Pharmaceutical Company Limited (“Takeda”) under which the Company granted Takeda an exclusive license to develop, manufacture, and commercialize NVX-CoV2373the Company’s COVID-19 Vaccine in Japan. Under the agreement, Takeda purchases Matrix-M™ adjuvant from the Company to manufacture doses of NVX-CoV2373COVID-19 Vaccine, and the Company is entitled to receive milestone and sales-based royalty payments from Takeda based on the achievement of certain development and commercial milestones, as well as a portion of net profits from the sale of NVX-CoV2373.COVID-19 Vaccine. In September 2021, Takeda finalized an agreement with the Government of Japan’s Ministry of Health, Labour and Welfare ("MHLW") for the purchase of 150 million doses of NVX-CoV2373.its prototype vaccine. In February 2023, MHLW cancelledcanceled the remainder of doses under its agreement with Takeda. As a result, it is uncertain whether the Company will receive future sales-based royalty payments from Takeda under the terms and conditions of their current collaboration and licensing agreement.

Sanofi

Effective May 10, 2024, the Company entered into the Collaboration and License Agreement with Sanofi pursuant to which Sanofi received:

i) A co-exclusive license to commercialize with the Company all of the COVID Mono Products,

ii) A sole license to develop and commercialize combination COVID and influenza Combination Products,

iii) A non-exclusive license to develop and commercialize Other Combination Products, and

iv) A non-exclusive license to develop and commercialize Adjuvant Products.

Under the Collaboration and License Agreement, the Company will receive a non-refundable upfront payment of $500 million. In addition, the Company will also be eligible to receive development, technology transfer, launch, and sales milestone payments totaling up to $700 million in the aggregate with respect to the Licensed COVID-19 Products and royalty payments on Sanofi’s sales of such licensed products. In addition, the Company is eligible to receive development, launch, and sales milestone payments of up to $200 million for each of the first four Adjuvant Products and $210 million for each Adjuvant Product thereafter, and royalty payments on Sanofi’s sales of all such licensed products.

Commencing shortly after the Effective Date of the Collaboration and License Agreement, the Company will perform a technology transfer of its manufacturing process for the COVID Mono Products and Matrix-M™ components to Sanofi. Until the successful completion of such transfer, the Company will supply Sanofi with both COVID Mono Products and Matrix-M™ intermediary components for Sanofi’s use and is eligible for reimbursement of such costs from Sanofi. Additionally, Sanofi will reimburse the Company for its research and development and medical affairs costs related to the COVID Mono Products in accordance with agreed upon plans and budgets.

Under the Collaboration and License Agreement, the Company will continue to commercialize the COVID Mono Products in 2024. Beginning in 2025 and continuing during the term of the Collaboration and License Agreement, Sanofi and the Company will commercialize the COVID Mono Products worldwide in accordance with a commercialization plan agreed by the Company and Sanofi, under which the Company will continue to supply its existing APA customers and strategic partners, including Takeda, SK Biosciences, and the Serum Institute of India. Upon completion of the existing advance purchase agreements, Novavax and Sanofi will jointly agree on commercialization activities of each party in each jurisdiction.

Bill & Melinda Gates Medical Research Institute

In May 2023, the Company entered into a three-year agreement with the Bill & Melinda Gates Medical Research Institute to provide the Company’s Matrix-M™ adjuvant for use in preclinical vaccine research.

Other Supply Agreements

On September 30, 2022,In March 2024, the Company, FUJIFILM Diosynth Biotechnologies UK Limited (“FDBK”), FUJIFILM Diosynth Biotechnologies Texas, LLC (“FDBT”), and FUJIFILM Diosynth Biotechnologies USA, Inc. (“FDBU” and together with FDBK and FDBT, “Fujifilm”) entered into a Confidential Settlement Agreement and Release (the “Fujifilm Settlement“Settlement Agreement”) to resolve disputes regarding amounts that Fujifilm claimed were due to Fujifilm in connection with the termination of manufacturing activity at FDBT under the Commercial Supplya prior Confidential Settlement Agreement and Release effective September 30, 2022 (the “CSA”) dated August 20, 2021 and Master Services Agreement dated June 30, 2020 and associated statements of work (the “MSA”“CSAR”) by and between the Company and Fujifilm. The MSA and CSA established

Under the general terms and conditions applicable to Fujifilm’s manufacturing and supply activities related to NVX-CoV2373 under the associated statements of work.

Pursuant to the Fujifilm Settlement Agreement,CSAR, the Company is responsible for payment ofagreed to pay up to $185.0 million (the “Settlement Payment”) to Fujifilm in connection with the cancellation of manufacturing activity at FDBTFDBT. The final two quarterly installments due to Fujifilm in 2023 under the CSA, of which (i) $47.8CSAR, totaling $68.6 million, constituting the initial reservation fee under the CSA, was credited against the Settlement Payment on September 30, 2022 and (ii) the remaining balance iswere subject to be paid in four equal quarterly installments of $34.3 million each, which began on March 31, 2023. As of March 31, 2023, the remaining payment of $102.9 million was reflected in Accrued expenses. Under the Fujifilm Settlement Agreement, Fujifilm is requiredFujifilm’s obligation to use commercially reasonable efforts to mitigate the losses associated with the vacant manufacturing capacity caused by the termination of manufacturing activities at FDBT underFDBT. In October 2023, the Company sent Fujifilm CSA,a notice of breach and refused to pay the final two quarterly installments will be mitigated by any replacement revenue achieved bybased on its contention that Fujifilm between July 1,had not used commercially reasonable efforts to mitigate losses and should have offset some portion of the final two payments. In October 2023, Fujifilm filed a demand for arbitration with Judicial Arbitration and DecemberMediation Services (“JAMS”) seeking payment of the full amount (the “Fujifilm Arbitration”).

Pursuant to the Settlement Agreement, in March 2024 the Company paid $42.0 million to Fujifilm, the parties agreed to a mutual release of claims arising from, under or otherwise in connection with the CSAR, and Fujifilm agreed to dismiss the Fujifilm Arbitration. This payment is less than amounts previously accrued for and reflected in Research and development expense, and accordingly, the Company recorded a benefit of $26.6 million as Research and development expense during the three months ended March 31, 2023.2024 upon the execution of the Settlement Agreement.

The Company continues to assess its manufacturing needs and intends to modify its global manufacturing footprint consistent with its contractual obligations to supply, and anticipated demand for, NVX-CoV2373,its COVID-19 Program, and in doing so, recognizes that significant costs may be incurred.

Note 5 – Earnings (Loss) per Share

Basic and diluted net income (loss) per share were calculated as follows (in thousands, except per share data):

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2023 | | 2022 | | | | |

| Numerator: | | | | | | | |

| Net income (loss), basic | $ | (293,905) | | | $ | 203,408 | | | | | |

| Interest on convertible notes, net | — | | | 3,403 | | | | | |

| Net income (loss), dilutive | (293,905) | | | 206,811 | | | | | |

| Denominator: | | | | | | | |

| Weighted average number of common shares outstanding, basic | 86,158 | | | 76,457 | | | | | |

| Effect of dilutive securities | — | | | 4,254 | | | | | |

| Weighted average number of common shares outstanding, dilutive | 86,158 | | | 80,711 | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | (3.41) | | | $ | 2.66 | | | | | |

| Diluted | $ | (3.41) | | | $ | 2.56 | | | | | |

| | | | | | | |

| Anti-dilutive securities excluded from calculations of diluted net income (loss) per share | 23,971 | | | 1,474 | | | | | |

Note 65 – Cash, Cash Equivalents, and Restricted Cash

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported in the consolidated

balance sheets that sums to the total of such amounts shown in the consolidated statements of cash flows (in thousands):

| | March 31, 2023 | | December 31, 2022 |

| March 31, 2024 | | | March 31, 2024 | | December 31, 2023 |

| Cash and cash equivalents | Cash and cash equivalents | $ | 624,950 | | | $ | 1,336,883 | |

| Restricted cash, current | Restricted cash, current | 10,330 | | | 10,303 | |