The following discussion and analysis should be read in conjunction with the consolidated financial statements and accompanyingthe notes filed as partthereto of United States Oil Fund, LP ("USOF") included elsewhere in this quarterly report. on Form 10-Q.

Forward-Looking Information

This quarterly report on Form 10-Q contains forward-looking statements regarding the plans and objectives of management for future operations. This information may involve known and unknown risks, uncertainties and other factors which may cause USOF’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe USOF's future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and USOF cannot assure investors that the projections included in these forward-looking statements will come to pass. USOF's actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors.

USOF has based the forward-looking statements included in this quarterly report on Form 10-Q on information available to it on the date of this quarterly report on Form 10-Q, and USOF assumes no obligation to update any such forward-looking statements. Although USOF undertakes no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, investors are advised to consult any additional disclosures that USOF may make directly to them or through reports that USOF in the future files with the U.S. Securities and Exchange Commission (the "SEC"), including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Except for historical information contained herein, thethis “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, as amended. These statementsthat involve known and unknown risks and uncertainties that may cause ourUSOF's actual results or outcome to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause such differences include, but are not limited to the risk factors set forth under the caption “Risk Factors” in our Registration Statement declared effective on October 18, 2006, as filed with the U.S. Securities and Exchange Commission. In addition to statements that explicitly describe such risks and uncertainties, investors are urged to consider statements labeled with the terms “believes,” “belief,” “expects,” “intends,” “plans” or “anticipates” to be uncertain and forward-looking.

Introduction

USOF seeks to achieve its investment objective by investing in a combination of oil futures contracts and other oil interests such that changes in USOF’s NAV, measured in percentage terms, will closely track the changes in the price of a specified oil futures contract (“("Benchmark Oil Futures Contract”Contract"), also measured in percentage terms. USOF’s General Partner believes the Benchmark Oil Futures Contract historically exhibited a close correlation with the spot price of WTI light, sweet crude oil. It is not the intent of USOF to be operated in a fashion such that its NAV will equal, in dollar terms, the spot price of WTI light, sweet crude oil or any particular futures contract based on WTI light, sweet crude oil. Management believes that it is not practical to manage the portfolio to achieve such an investment goal when investing in listed crude oil futures contracts.

At present, on any valuation day the Benchmark Oil Futures Contract is the near month futures contract for WTI light, sweet crude oil traded on the New York Mercantile Exchange (the "NYMEX") unless the Near Month Contractnear month contract will expire within two weeks of the valuation day, in which case the Benchmark Oil Futures Contract is the Second to Nearest Out Month Contractnext month contract for WTI light, sweet crude oil traded on the New York Mercantile Exchange.NYMEX. “Near Month Contract”month contract” means the next contract traded on the New York Mercantile ExchangeNYMEX due to expire; “Second to Nearest Out Month Contract”expire. “Next month contract” means the first contract traded on the New York Mercantile ExchangeNYMEX due to expire after the Near Month Contract.near month contract.

USOF may also invest in futures contracts for other types of crude oil, heating oil, gasoline, natural gas, and other petroleum-based fuels that are traded on the New York Mercantile ExchangeNYMEX, ICE Futures or other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”) and other oil interests such as cash-settled options on Oil Futures Contracts, forward contracts for oil, and over-the-counter transactions that are based on the price of oil, other petroleum-based fuels, Oil Futures Contracts and indices based on the foregoing (collectively, “Other Oil Interests”). The General Partner of USOF, Victoria Bay Asset Management, LLC the (“General Partner”(the "General Partner"), which is registered as a commodity pool operator, is authorized by the FirstThird Amended and Restated Agreement of Limited Partnership (“LP Agreement”(the "LP Agreement") to manage USOF. The General Partner is authorized by USOF in its sole judgment to employ, establish the terms of employment for, and terminate commodities trading advisors or futures commission merchants.

11

Valuation of Crude Oil Futures Contracts and the Computation of the Net Asset ValueNAV

The NAV of USOF Unitsunits is calculated once each trading day.day as of the earlier of the close of the New York Stock Exchange (the "NYSE") or 4:00 p.m. New York time. The NAV for a particular trading day is released after 4:15 p.m. New York time. NAV is calculated as of the earlier of the close of the New York Stock Exchange or 4:00 p.m. New York time. Trading on the American Stock ExchangeAMEX typically closes at 4:15 p.m. New York time. USOF uses the New York

Management’s Discussion of Results of OperationOperations and the Crude Oil Market

Results of operations.Operations. On April 10, 2006, USOF listed its Unitsunits on the American Stock ExchangeAMEX under the ticker symbol “USO.” On that day USOF established its initial NAV by setting theoffering price at $67.39 per Unit and issued 200,000 Unitsunits to the Initial Authorized Purchaser,initial authorized purchaser, KV Execution Services LLC, in exchange for $13,478,000 in cash. USOF also commenced investment operationsAs of March 31, 2007, the total unrealized gain on that day by purchasing oil futures contracts traded on the New York Mercantile Exchange that are based on WTI light, sweet crude oil. The total market value of the crude oil futures contracts purchasedowned or held on that day was $13,418,501 at the time of purchase.$61,523,560 and USOF established cash deposits were equal to $13,478,000 at the time of the initial sale of Units.$112,254,100. The majority of those cash assets were held at USOF’s custodian bank while less than 10% of the cash balance was held as margin deposits with USOF’s futures commission merchant relating to the Oil Futures Contracts purchased. The ending per Unit NAV on March 31, 2007 was $53.56.

Since its initial offering of 17,000,000 units, USOF has had two follow up offerings of its units, 30,000,000 units which were registered with the SEC on October 18, 2006 and an additional 50,000,000 units which were registered with the SEC on January 30, 2007. Units offered by USOF following its initial offering were sold by it for cash at the units’ NAV as described in the applicable prospectus. As of April 26, 2007, USOF had issued 60,100,000 units, of which 18,200,000 were outstanding.

More units were issued than are outstanding due to the redemption of units as contemplated and permitted by USOF under the LP Agreement. Unlike funds that are registered under the Investment Company Act of 1940, as amended, units that have been redeemed by USOF cannot be resold by USOF without registration of their offering with the SEC.

As a result, USOF anticipates that further offerings of its units will be registered with the SEC in the future in anticipation of additional issuances.

Portfolio Expenses. USOF’s expenses consist of investmentits management fees, brokerage fees and commissions.commissions, certain offering costs, licensing fees and the fees and expenses of the independent directors. The investment advisory fee that USOF pays to the General Partner is calculated as a percentage of the total net assets of USOF. For total net assets of up to $1 billion, the investment advisory fee is 0.5%. For assets over $1 billion, the investment advisory fee is 0.2% on the incremental amount of assets. During the period from JulyJanuary 1, 20062007 to September 30, 2006,March 31, 2007, the daily average total net assets of the USOF were approximately $359,609,583. At no time during$970,772,068. During the period from JulyJanuary 1, 20062007 to September 30, 2006, didMarch 31, 2007 the total net assets of USOF did exceed $1 billion.billion on a number of days. The investment advisory fee paid by USOF amounted to $452,264,$1,144,115, which was calculated at the 0.50% rate for total net assets up to and including $1 billion and at the rate of 0.20% on total net assets over $1 billion, and accrued daily. The management expenses as a percentage of total net assets averaged 0.48% over the course of the quarter.

The Fund pays for all brokerage fees, taxes and other expenses, including licensing fees for the use of intellectual property, registration or other fees paid to the SEC, the National Association of Securities Dealers, or any other regulatory agency in connection with follow on offers and sales of its units and all legal, accounting, printing and other expenses associated therewith. The Fund also pays the fees and expenses, including for directors and officers' liability insurance, of the independent directors. For the three month period ended March 31, 2007, the Fund has incurred $369,059 in ongoing registration fees. In addition, the Fund agreed to pay the independent directors $184,000 to cover their expenses and pay for their services for 2007.

USOF also incurs commissions to brokers for the purchase and sale of futures contracts, other oil interests, or U.S. Treasury bills and notes.short-term obligations of the United States of two years or less ("Treasuries"). During the period from JulyJanuary 1, 20062007 to September 30, 2006,March 31, 2007, total commissions paid to brokers amounted to $129,645.$420,212. Prior to the initial offering, USOF had estimated that the annual level of such commissions for USOF was expected to be 0.35% of total net assets. As an annualized percentage of total net assets, the thirdfigures for the first quarter figure representsof 2007 represent approximately 0.14%0.18% of total net assets. However, there can be no assurance that commission costs and portfolio turnover will not cause commission expenses to rise in future quarters.

Interest Income. USOF seeks to invest its assets such that it holds crude oil futures contractsOil Futures Contracts and other oil interestsOther Oil Interests in an amount equal to the total net assets of the portfolio. Typically, such investments do not require USOF to pay the full amount of the contract value at the time of purchase, but rather require USOF to post an amount as a margin deposit against the eventual settlement of the contract. As a result, USOF retains an amount that is approximately equal to its total net assets, which USOF invests in cash deposits or in U.S. Treasuries. This includes both the amount on deposit with the futures brokerage firmscommission merchant as margin as well as unrestricted cash held with USOF’s custodian bank. The cash or U.S. Treasuries earn interest that accrues on a daily basis. For the period from JulyJanuary 1, 20062007 through September 30, 2006,March 31, 2007, USOF earned $4,233,056$11,928,573 in interest income on such cash holdings. Based on USOF’s average daily total net assets, this is equivalent to an annualized yield of 4.7%4.98%. USOF did not purchase U.S. Treasury bills or notesTreasuries during the period from JulyJanuary 1, 20062007 through

12

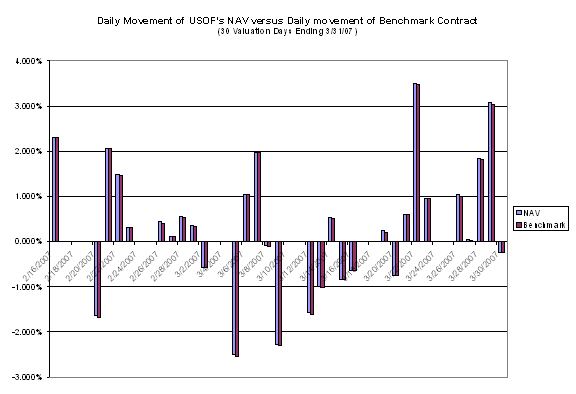

Tracking USOF’s Benchmark. USOF seeks to manage its portfolio such that changes in its average daily NAV, on a percentage basis, closely track changes in the average daily price of the Benchmark Oil Futures Contract, also on a percentage basis. Specifically, USOF seeks to manage the portfolio such that over any rolling 30-day period of 30 valuation days, the average daily change in the NAV is within a range of 90% to 110% (0.9 to 1.1), of the average daily change of the Benchmark Oil Futures Contract. As an example, if the average daily movement of the Benchmark Oil Futures Contract for a particular 30-day time period was 0.5% per day, USOF management would attempt to manage the portfolio such that the average daily movement of the NAV during that same time period fell between 0.45% and 0.55% (i.e., between 0.9 and 1.1 of the benchmark’s results). USOF’s portfolio management goals do not include trying to make the nominal price of USOF’s NAV equal to the nominal price of the current Benchmark Oil Futures Contract. Management believes that it is not practical to manage the portfolio to achieve such an investment goal when investing in listed crude oil futures contracts.

For the 30 valuation days ending September 30, 2006,ended March 31, 2007, the simple average daily change in the Benchmark Oil Futures Contract was -0.456 %,0.331%, while the simple average daily change in the NAV of USOF over the same time period was -0.473 %.0.348%. The average daily difference was 0.017 %0.017% (or 1.7 basis points, where 1 basis point equals 1/100 of 1%). As a percentage of the daily movement of the Benchmark Oil Futures Contract, the average error in daily tracking by the NAV was 4.47 %,3%, meaning that over this time period USOF’s tracking error was within the plus or minus 10% range established as its benchmark tracking goal.

13

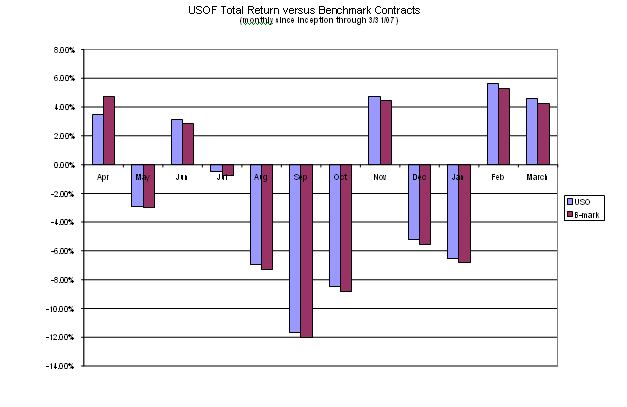

Since the offering of USOF Unitsunits to the public on April 10, 2006 to March 31, 2007, the simple average daily change in the Benchmark Oil Futures Contract was -0.0133%-0.0880%, while the simple average daily change in the NAV of USOF over the same time period was -0.0147 %.-0.0785%. The average daily difference was 0.013%0.0095% (or 1.3-0.9 basis points),points, where 1 basis point equals 1/100 of 1%). As a percentage of the daily movement of the Benchmark Oil Futures Contract, the average error in daily tracking by the NAV was 3.54 %,3%, meaning that over this time period USOF’s tracking error was within the plus or

minus 10% range established as its benchmark tracking goal.

An alternative tracking measurement of the return performance of USOF versus the return of its benchmark can be calculated by comparing the actual return of USOF, measured by changes in its Net Asset Value (NAV),NAV, versus the expected changes in its NAV under the assumption that USOF’s returns had been exactly the same as the daily changes in its benchmark. As a point of reference, the second quarter ended and the third quarter began with the August 2006 contract as the Benchmark Oil Futures Contract. The Benchmark Oil Futures Contract then became the September 2006 contract and the third quarter ended with the October 2006 contract as the Benchmark Oil Futures Contract.

For the period from JulyJanuary 1, 20062007 through September 30, 2006,March 31, 2007, the actual total return of USOF as measured by changes in its NAV was -18.28%3.26%. This is based on an initial NAV of $69.82$51.87 on June 30January 1, 2007 and an ending NAV as of September 30March 31, 2007 of $57.06 (During$53.56 (during this time period USOF made no distributions to its unit holders)unitholders). However, if USOF’s daily changes in its NAV had instead exactly tracked the changes in the daily return of the Benchmark Oil Futures Contracts, USOF would have ended the thirdfirst quarter of 2007 with an estimated NAV of $56.54,$53.01, for a total return over the relevant time period of -19%2.2%. The difference between the actual NAV total return of USOF of -18.2%3.26% and the expected total return based on the Benchmark Oil Futures Contracts of 19%2.2% was an error over the time period of +0.8%+1.06%, which is to say that USOF’s actual total return exceeded the benchmark result by that percentage. Management believes that the majoritya portion of the difference between the actual return and the expected benchmark return can be attributed to the impact of the interest that USOF collects on its cash and cash equivalent holdings less any expenses.holdings. In addition, during the period USOF also collected fees from brokerage firms creating or redeeming baskets of Units.units. This income also contributed to USOF’s actual return exceeding the benchmark results. However, if the total assets of USOF continue to increase, Managementmanagement believes that the impact on total returns of these fees from creations and redemptions will diminish as a percentage of the total return.

Of the various factors that could impact USOF’s ability to accurately track its benchmark, there are currently three factors that have, during the latest period, or are most likely to impact in the future, these tracking results.

The first major factor that could affect tracking results is if USOF buys or sells its holdings in the then current Benchmark Oil Futures Contract at a price other than the closing settlement price of that contract on the day in which USOF executes the trade. In that case, USOF may get a price that is higher, or lower, than that of the Benchmark Oil Futures Contract, which, if such transactions did occur, could cause the changes in the daily NAV of USOF to either be too high or too low relative to the changes in the daily benchmark. In the thirdfirst quarter of 2006,2007, management attempted to minimize the effect of these transactions by seeking to execute its purchase or sales of the Benchmark Oil Futures Contracts at, or as close as possible to, the end of the day settlement price. However, it is not always possible for USOF to obtain the closing settlement price and there is no assurance that failure to obtain the closing settlement price in the future will not adversely impact USOF’s attempt to track its benchmark over time.

The second major factor that could affect tracking results is the interest that USOF earns on its cash and U.S. Treasury holdings. USOF is not required to distribute any portion of its income to its unit holdersunitholders and did not make any distribution to unit holdersunitholders in the thirdfirst quarter of 2006.2007. Interest payments, and any other income, were retained within the portfolio and added to USOF’s NAV. When this income exceeds the level of USOF’s expenses for its investment advisory fee, and its brokerage commissions and other expenses (inlcuding ongoing registration fees, licensing fees and the fees and expenses of the independent directors), USOF will realize a net yield that will tend to cause daily changes in the NAV of USOF to track slightly higher than daily changes in the Benchmark Oil Futures Contracts. During the thirdfirst quarter of 2006,2007, USOF earned on an annualized basis approximately 4.7%4.98% on its cash holdings. It also incurred cash expenses on an annualized basis of .5%0.48% for investment advisory fees and approximately 0.14%0.18% in brokerage commission costs related to the purchase and sale of futures contracts. During the latest period, thecontracts, and 0.08% for other expenses. The foregoing fees and expenses resulted in a net yield on an annualized basis of approximately 4.1%4.24% and affected USOF’s ability to track its benchmark. If short-term interest rates rise above the current levels, the level of deviation created by the yield would increase. Conversely, if short-term interest rates were to decline, the amount of error created by the yield would decrease. If short term yields drop to a level lower than the combined expenses of the

investment advisory fee and the brokerage commissions, then the tracking error would become a negative number and would tend to cause the daily returns of the NAV to under performunderperform the daily returns of the Benchmark Oil Futures Contracts.

14

The third major factor affecting tracking results is if USOF holds oil related investments in its portfolios other than the current Benchmark Oil Futures Contract that fail to closely track the Benchmark Oil Futures Contract’sContract's total return movements. In that case, the error in tracking the benchmark can result in daily changes in the NAV of USOF that are either too high, or too low, relative to the daily changes in the benchmark. During the thirdfirst quarter of 2006, since2007, USOF did not hold any oil related investments other than the then current Benchmark Oil Futures Contract. However, there can be no assurance that in future quarters USOF will not make use of such non-benchmark oil related investments.

Crude oil market.Oil Market. During the period from JulyJanuary 1, 20062007 to September 30, 2006,March 31, 2007, crude oil prices were impacted by several factors. On the consumption side, demand remained strong as continued global economic growth, especially in emerging economies such as China and India, remained brisk. On the supply side, production remained steady despite concerns about the possible negative impact of hurricanes in the U.S. Gulf Coast area and violence impactedimpacting production in Iraq and Nigeria. During the third quarter, the oil producing portionsIn addition, a series of production cuts by members of the Gulf Coast was not subject to a repeatOrganization of 2005’s disastrous storms. In addition, althoughOil Exporting Countries have tightened world oil markets. Though the crude oil market’s concerns about geo-political issues regarding othertensions with key crude oil producing countries, such as Iran and Venezuela, remained, such concerns appear to have moderated somewhat, at least in the short term. As a result of the foregoing, crude oil prices trended lower over the course of the third quarter of 2006fell sharply during early and mid January 2007 and showed periods of greater volatility than usual volatility.usual. However, over the balance of the first quarter, crude oil prices gained back in price and finished the quarter higher than where they started.

As an example, assume that the price of crude oil for immediate delivery (the “spot” price), was $73.98. During$50 per barrel, and the period from July 1, 2006 to September 30, 2006,value of a position in the highestnear month futures contract was also $50. Over time the price of the USOF’s Benchmark Oil Future Contract was $78.71, which occurredbarrel of crude oil will fluctuate based on a number of market factors, including demand for oil relative to its supply. The value of the near month contract will likewise fluctuate in mid Julyreaction to a number of market factors. If investors seek to maintain their holding in a near month contract position and not take delivery of the oil, every month they must sell their current near month contract as it approaches expiration and invest in the next month contract.

If the futures market is in backwardation, e.g., when the expected price of oil in the future would be less, the investor would be buying a next month contract for a lower price than the current near month contract. Hypothetically, and assuming no other changes to either prevailing crude oil prices or the price relationship between the spot price, the near month contract and the next month contract (and ignoring the impact of commission costs and the interest earned on cash), the value of the next month contract would rise as it approaches expiration and becomes the new near month contract. In this example, the value of the $50 investment would tend to rise faster than the spot price of crude oil, or fall slower. As a result, it would be possible in this hypothetical example for the price of spot crude oil to have risen to $60 after some period of time, while the value of the investment in the futures contract would have risen to $65, assuming backwardation is large enough or enough time has elapsed. Similarly, the spot price of crude oil could have fallen to $40 while the value of an investment in the futures contract could have fallen to only $45. Over time, if backwardation remained constant, the difference would continue to increase.

If the futures market is in contango, the investor would be buying a next month contract for a higher price than the current near month contract. Hypothetically, and assuming no other changes to either prevailing crude oil prices or the price relationship between the spot price, the near month contract and the next month contract (and ignoring the impact of commission costs and the interest earned on cash), the value of the next month contract would fall as it approaches expiration and becomes the new near month contract. In this example, it would mean that the value of the $50 investment would tend to rise slower than the spot price of crude oil, or fall faster. As a result, it would be possible in this hypothetical example for the price of spot crude oil to have risen to $60 after some period of time, while the value of the investment in the futures contract will have risen to only $55, assuming contango is large enough or enough time has elapsed. Similarly, the spot price of crude oil could have fallen to $45 while the value of an investment in the futures contract could have fallen to $50. Over time, if contango remained constant, the difference would continue to increase.

15

Historically, the futures oil markets have experienced periods of contango and backwardation, with backwardation being in place more often than contango. During the past two years, including 2006 and the lowestearly part of 2007, these markets have experienced contango. This has impacted the total return on an investment in USOF units during the past year relative to a hypothetical direct investment in crude oil. For example, an investment made in USOF units on December 31, 2006 and held to March 31, 2007, increased, based upon the changes in the closing market prices for USOF units on those days, by 3.26%, while the spot price was $60.55, which was reachedof crude oil for immediate delivery during the same period increased 7.90% (note: this comparison ignores the potential costs associated with physically owning and storing crude oil). However, the investment objective of USOF is not to have the market price of its units match, dollar for dollar, changes in late September 2006. Asthe spot price of September 30, 2006,oil, or changes in the closing price of the then near month WTI light, sweet crude oil futures contract traded onBenchmark Oil Futures Contract. This period of contango did not meaningfully impact USOF’s investment objective of having percentage changes in its per unit price track percentage changes in the New York Mercantile Exchange was $62.91.price of the Benchmark Oil Futures Contract since the impact of backwardation and contango tended to equally impact the percentage changes in price of both USOF’s units and the Benchmark Oil Futures Contract. It is impossible to predict with any degree of certainty whether backwardation or contango will occur in the future. It is likely that both conditions will occur during different periods.

Subsequent Events

Effective April 18, 2007, the commodity trading unitGeneral Partner pays Brown Brothers Harriman & Co. for its Custody, Fund Accounting and Fund Administration services the greater of USOF’s clearing futures commission merchant, ABN AMRO Incorporated, was acquired by UBS Securities LLC. As a result, USOF’s new futures commission merchant is now UBS Securities LLC.minimum amount of $125,000 annually or an asset charge of (a) 0.06% for the first $500 million of USOF and USNG's combined net assets, (b) 0.0465% for USOF and USNG's combined net assets greater than $500 million but less than $1 billion, and (c) 0.035% for USOF and USNG's combined net assets in excess of $1 billion.

On OctoberApril 18, 2006,2007, USOF's Registration Statementcurrent registration statement was declared effectiveamended by the U.S. SecuritiesForm S-3 to allow incorporation by reference of USOF's past and Exchange Commission. A primary purpose of that filing was to register an additional 30,000,000 Units for sale. Several changes to the existing effective S-1 dated April 10, 2006 relating to languagefuture SEC reports on Form 10-K, Form 10-Q and procedures were also made in this filing. This included one change that was made in the redemption procedures. The cut-off on the third day following the placing of a redemption basket order (“T+3”), for delivery of the Units to USOF’s custodian bank was moved to 3:00 pm New York time from 11:00 am New York time.Form 8-K into its prospectus.

Critical Accounting Policies

Preparation of the financial statements and related disclosures in compliance with accounting principles generally accepted in the United States of America requires the application of appropriate accounting rules and guidance, as well as the use of estimates. USOF's application of these policies involves judgments and actual results may differ from the estimates used. The General Partner has evaluated the nature and types of estimates that it makes in preparing USOF's financial statements and related disclosures and has determined that the valuation of its investments which are not traded on a United States or internationally recognized futures exchange (such as forward contracts and over-the-counter contracts) involves a critical accounting policy. While not currently applicable given the fact that during the time period covered by this report, USOF was not involvedinvesting in this type of trading activity,futures contracts not traded on a United States futures exchange to the extent USOF makes such investments in the future, the values used by USOF for its forward contracts arewill be provided by its commodity broker who uses market prices when available, while over-the-counter contracts arewill be valued based on the

present value of estimated future cash flows that would be received from or paid to a third party in settlement of these derivative contracts prior to their delivery date and valued on a daily basis.

Liquidity and Capital Resources

USOF does not anticipate making use of borrowings or other lines of credit to meet its obligations. USOF has met, and it is anticipated that USOF will continue to meet, its liquidity needs in the normal course of business from the proceeds of the sale of its investments or from cash and/or short-term U.S. Treasuries that it intends to hold at all times. USOF’s liquidity needs include: redeeming Units,units, providing margin deposits for its existing oil futures contracts onor the purchase of additional crude oil futures contracts and posting collateral for its over-the-counter contracts and payment of its expenses, summarized below under “Contractual Obligations.”

USOF currently generates cash primarily from (i) the sale of Creation Baskets and (ii) interest earned on cash. USOF has allocated substantially all of its nets assets to trading in oil interests. A significant portion of the NAV was held in cash that was used as margin for USOF's trading in oil interests. Cash or U.S. Treasuries as a percentage of the total net assets will vary from period to period as the market values of the oil interests change. The balance of the net assets is held in USOF's Oil Futures Contracts and Other Oil Interests trading account. Interest earned on USOF's interest bearing-funds is paid to USOF.

16

USOF's investment in oil interests willmay be subject to periods of illiquidity because of market conditions, regulatory considerations and other reasons. For example, commodity exchanges limit the fluctuations in Oil Futures Contracts prices during a single day by regulations referred to as “daily limits.” During a single day, no trades may be executed at prices beyond the daily limit. Once the price of an Oil Futures Contract has increased or decreased by an amount equal to the daily limit, positions in the contracts can neither be taken or liquidated unless the traders are willing to effect trades at or within the limit. Such market conditions could prevent USOF from promptly liquidating its positions in Oil Futures Contracts. Through April 10,March 31, 2007, USOF was not forced to liquidate any of its positions as a result of daily limits, however, USOF cannot predict whether such an event may occur in the future. Through December 31, 2006, all of USOF's and the General Partner's expenses werehave been funded by their affiliates. Since April 10, 2006, these expenses have been borne by USOF and the General Partner except that their affiliate provided the funds for USOF's payment of a portion of the fees due to the SEC and the NASD in connection with USOF's registration of additional units during October. Neither USOF nor the General Partner hashave any obligation or intention to refund such payments by their affiliates. These affiliates are under no obligation to continue payment of USOF's or the General Partner's expenses. Currently, the General Partner is solely responsible for paying its and USOF's expenses. If (1) it were unable to pay such expenses, (2) such affiliates were to discontinue the payment of these expenses and (3) the General Partner and USOF are unsuccessful in raising sufficient funds to cover USOF's expenses or in locating any other source of funding, USOF will terminate and investors may lose all or part of their investment.

Market Risk

Trading in Oil Futures Contracts and Other Oil Interests, such as forwards, will involveinvolves USOF entering into contractual commitments to purchase or sell oil at a specified date in the future. The gross or face amount of the contracts will significantly exceed USOF's future cash requirements since USOF intends to close out its open positions prior to settlement. As a result, USOF shouldis generally only be subject to the risk of loss arising from the change in value of the contracts. USOF considers the "fair value'' of its derivative instruments to be the unrealized gain or loss on the contracts. The market risk associated with USOF's commitments to purchase oil will beis limited to the gross face amount of the contacts held. However, should USOF enter into a contractual commitment to sell oil, it would be required to make delivery of the oil at the contract price, repurchase the contract at prevailing prices or settle in cash. Since there are no limits on the future price of oil, the market risk to USOF could be unlimited. USOF's exposure to market risk will dependdepends on a number of factors, including the markets for oil, the volatility of interest rates and foreign exchange rates, the liquidity of the Oil Futures Contracts and Other Oil Interests markets and the relationships among the contracts held by USOF. The limited experience that USOF has had in utilizing its model to trade in oil interests in a manner intended to track the spot price of oil, as well as drastic market occurrences, could ultimately lead to the loss of all or substantially all of an investor’s capital.

Credit Risk

When USOF enters into Oil Futures Contracts and Other Oil Interests, it will beis exposed to the credit risk that the counterparty will not be able to meet its obligations. The counterparty for the Oil Futures Contracts traded on the New York Mercantile ExchangeNYMEX and on most other foreign futures exchanges is the clearinghouse associated with the particular exchange. In general, clearinghouses are backed by their members who may be required to share in the financial burden resulting from the nonperformance of one of their members and, therefore, this additional member support should significantly reduce credit risk. Some foreign exchanges are not backed by their clearinghouse members but may be backed by a consortium of banks or other financial institutions. During the first quarter of 2007, the only foreign exchange USOF made on investments of oil interests was the ICE Futures. There can be no assurance that any counterparty, clearinghouse, or their members or financial backers willwould satisfy their obligations to USOF.USOF in such circumstances. The General Partner will attemptattempts to manage the credit risk of USOF by following various trading limitations and policies. In particular, USOF intends to postposts margin and/or holdholds liquid assets that will beare approximately equal to the face amount of its obligations to counterparties under the Oil Futures Contracts and Other Oil Interests it holds. The General Partner will implementhas implemented procedures that will include, but willare not be limited to, executing and clearing trades only with creditworthy parties and/or requiring the posting of collateral or margin by such parties for the benefit of USOF to limit its credit exposure. UBS Securities LLC, formerly ABN AMRO Incorporated, USOF's commodity broker (the "Broker"), or any other broker that may be retained by USOF in the future, when acting as USOF's futures commission merchant in accepting orders to purchase or sell Oil Futures Contracts on United States exchanges, will beis required by the U.S. Commodities Futures Trading Commission (“CFTC”(the "CFTC") regulations to separately account for and segregate as belonging to USOF, all assets of USOF relating to domestic Oil Futures Contracts trading. These commodity brokers are not allowed to commingle USOF's assets with their other assets. In addition, the CFTC requires commodity brokers to hold in a secure account the USOF assets related to foreign Oil Futures Contracts trading.

Off Balance Sheet Financing

As of September 30, 2006,March 31, 2007, USOF has no loan guarantee, credit support or other off-balance sheet arrangements of any kind other than agreements entered into in the normal course of business, which may include indemnification provisions relating to certain risks that service providers undertake in performing services that are in the best interests of USOF. While USOF's exposure under these indemnification provisions cannot be estimated, they are not expected to have a material impact on USOF's financial position.

17

Redemption Basket Obligation

Contractual Obligations

USOF's primary contractual obligations are with the General Partner. In return for its services, the General Partner is entitled to a management fee calculated as a fixed percentage of USOF's NAV, currently .50%0.50% for an NAV of $1 billion or less, and thereafter .20%0.20% of the NAV above $1 billion. The General Partner or its affiliate has agreed to pay the start-up costs associated with the formation of USOF, primarily its legal, accounting and other costs in connection with its registration with the CFTC as a commodity pool operator and the registration and listing of USOF and its Units with the U.S. Securities and Exchange Commission (“SEC”)SEC and the American Stock Exchange,AMEX, respectively. However, the costs of registering and listing additional shares of USOF with the SEC are directly borne on an ongoing basis by USOF, and not by the General Partner.

The General Partner has agreed to pay the fees of the custodian and transfer agent, Brown Brothers Harriman & Co., as well as Brown Brothers Harriman & Co.'s fees for performing administrative services, including in connection with USOF's preparation of its financial statements and its SEC and CFTC reports. The General Partner will also pay the fees of USOF's accountants and a separate firm for providing tax-relatedtax related services, as well as those of itsUSOF's marketing agent, ALPS Distributors, Inc. The General Partner is also in the process of negotiating a licensing agreement with the

In addition to the General Partner's management fee, USOF pays its brokerage fees, over-the-counter dealer spreads, fees to the Broker (or any other Futures Clearing Merchant that the General Partner may elect to use for execution or clearing of futures trades), and extraordinary expenses. The latter are expenses not in the ordinary course of its business, including the indemnification of any person against liabilities and obligations to the extent permitted by law and under the LP Agreement, the bringing or defending of actions in law or in equity or otherwise conducting litigation and incurring legal expenses and the settlement of claims and litigation. Other expenses not in the ordinary course of business include brokerage fees, licensing fees for intellectual property used by USOF and the fees and costs associated with the offering of USOF's Units. Commission payments to the Broker or any other Futures Clearing Merchant are on a contract-by-contract, or round turn, basis. USOF also pays a portion of the fees and expenses of the independent directors.

The parties cannot anticipate the amount of payments that will be required under these arrangements for future periods, as USOF's net asset valuesNAVs and trading levels to meet its investment objectives will not be known until a future date. These agreements are effective for a specific term agreed upon by the parties with an option to renew, or, in some cases, are in effect for the duration of USOF's existence. The parties may terminate these agreements earlier for certain reasons listed in the agreements.