NOTE 1 - ORGANIZATION AND BUSINESS

United States Oil Fund, LP (the “Fund” or "USOF"(“USOF”) iswas organized as a limited partnership under the laws of the state of Delaware. The FundDelaware on May 12, 2005. USOF is a commodity pool that issues units that may be purchased and sold on the American Stock Exchange (the "AMEX"“AMEX”). The FundUSOF will continue in perpetuity, unless terminated sooner upon the occurrence of one or more events as described in its ThirdFourth Amended and Restated Agreement of Limited Partnership dated as of November 13, 2007 (the “Limited Partnership“LP Agreement”). The investment objective of the FundUSOF is for the changes in percentage terms of its net asset value to reflect the changes in percentage terms of the price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the price of the futures contract on light, sweet crude oil as traded on the New York Mercantile Exchange (the "NYMEX"“NYMEX”) that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case the futures contract will be the next month contract to expire, less the Fund’sUSOF’s expenses. The FundUSOF will accomplish its objective through investments in futures contracts for light, sweet crude oil, and other types of crude oil, heating oil, gasoline, natural gas and other petroleum-based fuels that are traded on the NYMEX, ICE Futures andor other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”) and other oil interestsrelated investments such as cash-settled options on Oil Futures Contracts, forward contracts for oil and over-the-counter transactions that are based on the price of oil.crude oil, heating oil, gasoline, natural gas and other petroleum-based fuels, Oil Futures Contracts and indices based on the foregoing (collectively, “Other Oil Interests”). As of September 30, 2007,March 31, 2008, USOF held 4,9927,122 Oil Futures Contracts traded on the NYMEX and 300 Oil Futures Contracts traded on the ICE Futures.NYMEX.

The accompanying unaudited condensed financial statements have been prepared in accordance with Rule 10-01 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission (the "SEC"“SEC”) and, therefore, do not include all information and footnote disclosure required under accounting principles generally accepted in the United States of America. The financial information included herein is unaudited, however, such information reflects all adjustments which are, in the opinion of management, necessary for the fair presentation of the condensed financial statements for the interim period.

In April 2006, the FundUSOF initially registered 17,000,000 Unitsunits on Form S-1 with the SEC. On April 10, 2006, the FundUSOF listed its Unitsunits on the AMEX under the ticker symbol “USO”. On that day, the FundUSOF established its initial net asset value by setting the price at $67.39 per Unitunit and issued 200,000 Unitsunits in exchange for $13,478,000. The initial offering price of the initial Creation Basket was based on the closing price of the near month Oil Futures Contracts as traded and reported on the NYMEX on the last business day prior to the effective date of the Fund'sUSOF’s initial registration statement filed on Form S-1. As of September 30, 2007, the Fund had registered a total of 97,000,000 Units. The FundUSOF also commenced investment operations on April 10, 2006 by purchasing Oil Futures Contracts traded on the NYMEX based on light, sweet crude oil. As of March 31, 2008, USOF had registered a total of 227,000,000 units.

7

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Revenue Recognition

Commodity futures contracts, forward contracts, physical commodities, and related options are recorded on the trade date. All such transactions are recorded on the identified cost basis and marked to market daily. Unrealized gains or losses on open contracts are reflected in the condensed statement of financial condition and in the difference between the original contract amount and the market value (as determined by exchange settlement prices for futures contracts and related options and cash dealer prices at a predetermined time for forward contracts, physical commodities, and their related options) as of the last business day of the year or as of the last date of the condensed financial statements. Changes in the unrealized gains or losses between periods are reflected in the condensed statement of operations. The FundUSOF earns interest on its assets denominated in U.S. dollars on deposit with the futures commission merchant at the 90-day Treasury bill rate less 50 basis points.rate. In addition, the FundUSOF earns interest on funds held at the custodian at prevailing market rates earned on such investments.

Brokerage Commissions

Brokerage commissions on all open commodity futures contracts are accrued on a full-turn basis.

Income Taxes

Additions and Redemptions

Authorized purchasersPurchasers may purchase Creation Baskets consisting of 100,000 Units from the FundUSOF as of the beginning of each business day based upon the prior day’s net asset value. Authorized purchasersPurchasers may redeem Unitsunits from the FundUSOF only in blocks of 100,000 Unitsunits called “Redemption Baskets.”Baskets”. The amount of the redemption proceeds for a Redemption Basket will be equal to the net asset value of the Unitsunits in the Redemption Basket determined as of 4:00 p.m. New York time on the day the order to redeem the basket is properly received.

Partnership Capital and Allocation of Partnership Income and Losses

Profit or loss is allocated among the partners of the FundUSOF in proportion to the number of Unitsunits each partner holds as of the close of each month. The General Partner may revise, alter or otherwise modify this method of allocation as described in the Limited PartnershipLP Agreement.

Calculation of Net Asset Value

8

Net Income (Loss) per Unit

Net income (loss) per Unitunit is the difference between the net asset value per Unitunit at the beginning of each period and at the end of each period. The weighted average number of Unitsunits outstanding was computed for purposes of disclosing net loss per weighted average Unit.unit. The weighted average Unitsunits are equal to the number of Unitsunits outstanding at the end of the period, adjusted proportionately for Unitsunits redeemed based on the amount of time the Unitsunits were outstanding during such period. There were no Unitsunits held by the General Partner at September 30, 2007.March 31, 2008.

Offering Costs

Offering costs incurred in connection with the registration of additional Unitsunits after the initial registration of Unitsunits are borne by the Fund.USOF. These costs include registration fees paid to regulatory agencies and all legal, accounting, printing and other expenses associated therewith. These costs will be accounted for as a deferred charge and thereafter amortized to expense over twelve months on a straight linestraight-line basis or a shorter period if warranted.

Cash Equivalents

Cash and cash equivalents include money market portfolios and overnight time deposits with original maturity dates of three months or less.

Use of Estimates

The preparation of condensed financial statements in conformity with accounting principles generally accepted in the United States of America requires the Fund’sUSOF’s management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed financial statements, and the reported amounts of the revenue and expenses during the reporting period. Actual results could differ from those estimates and assumptions.

NOTE 3 - FEES PAID BY THE FUNDUSOF AND RELATED PARTY TRANSACTIONS

General Partner Management Fee

Under the Limited PartnershipLP Agreement, the General Partner is responsible for investing the assets of the FundUSOF in accordance with the objectives and policies of the Fund.USOF. In addition, the General Partner has arranged for one or more third parties to provide administrative, custody, accounting, transfer agency and other necessary services to the Fund.USOF. For these services, the FundUSOF is contractually obligated to pay the General Partner a fee, which is paid monthly and based on average daily net assets, that is equal to 0.50% per annum on average daily net assets of $1,000,000,000 or less and 0.20% per annum on average daily net assets that are greater than $1,000,000,000.

Ongoing Registration Fees and Other Offering Expenses

Since January 19, 2007, offering costs incurred in connection with the registration of additional Unitsunits are borne by the Fund.USOF. These costs include registration or other fees paid to regulatory agencies in connection with the offer and sale of Units,units, and all legal, accounting, printing and other expenses associated with such offer and sale. For the ninethree month periodperiods ended September 30,March 31, 2008 and 2007, the FundUSOF incurred $384,058$105,629 and $369,059, respectively, in registration fees and other offering expenses.

9

Licensing Fees

As discussed in Note 4, the FundUSOF entered into a licensing agreement with the NYMEX on May 30, 2007. The agreement has an effective date of April 10, 2006. Pursuant to the agreement, the FundUSOF and the affiliated funds managed by the General Partner pay a licensing fee that is equal to 0.04% for the first $1,000,000,000 of combined assets of the funds and 0.02% for combined assets above $1,000,000,000. Since inception,During the Fund hasthree month period ended March 31, 2008 and 2007, USOF incurred $336,372$41,367 and $36,719 under this arrangement.

Investor Tax Reporting Cost

The fees and expenses associated with the Fund'sUSOF’s tax accounting and reporting requirements, with the exception of certain initial implementation service fees and base service fees which will bewere borne by the General Partner, will beare paid by the Fund.USOF. These costs are estimated to be $450,000$928,749 for the year ending December 31, 2007.

2008. Other Expenses and Fees

In addition to the fees described above, the FundUSOF pays all brokerage fees, taxes and other expenses in connection with the operation of the Fund,USOF, excluding costs and expenses paid by the General Partner as outlined in Note 4.

NOTE 4 - CONTRACTS AND AGREEMENTS

The above fees do not include the following expenses, which are also borne by the General Partner: the cost of placing advertisements in various periodicals; web construction and development; andor the printing and production of various marketing materials.

Currently, the General Partner pays Brown BrothersBBH&Co. for its services, in the foregoing capacities, the greater of a minimum amount of $125,000 annually or an assetasset-based charge of (a) 0.06% for the first $500 million of USOF'sUSOF’s, USNG’s, US12OF’s, USG’s and USNG'sUSHO’s combined net assets, (b) 0.0465% for USOF'sUSOF’s, USNG’s, US12OF’s, USG’s and USNG'sUSHO’s combined net assets greater than $500 million but less than $1 billion, and (c) 0.035% for USOF'sUSOF’s, USNG’s, US12OF’s, USG’s and USNG'sUSHO’s combined net assets in excess of $1 billion. The General Partner also pays a $25,000 annual fee for the transfer agency services and transaction fees ranging from $7.00 to $15.00 per transaction.

USOF has entered into a brokerage agreement with UBS Securities LLC (“UBS Securities”). The Fundagreement requires UBS Securities to provide services to USOF in connection with the purchase and sale of Oil Futures Contracts and Other Oil Interests that may be purchased and sold by or through UBS Securities for USOF’s account. The agreement provides that UBS Securities charge USOF commissions of approximately $7 per round-turn trade, plus applicable exchange and NFA fees for Oil Futures Contracts and options on Oil Futures Contracts.

10

USOF invests primarily in Oil Futures Contracts traded on the NYMEX. On May 30, 2007, the FundUSOF and the NYMEX entered into a license agreement whereby the FundUSOF was granted a non-exclusive license to use certain of the NYMEX’s settlement prices and service marks. The agreement has an effective date of April 10, 2006. Under the license agreement, the FundUSOF and the affiliated funds managed by the General Partner pay the NYMEX an asset-based fee for the license, the terms of which are described in Note 3.

NOTE 5 - FINANCIAL INSTRUMENTS, OFF-BALANCE SHEET RISKS AND CONTINGENCIES

All of the contracts currently traded by the FundUSOF are exchange-traded. The risks associated with exchange-traded contracts are generally perceived to be less than those associated with over-the-counter transactions since, in over-the-counter transactions, the FundUSOF must rely solely on the credit of its respective individual counterparties. However, in the future, if the FundUSOF were to enter into non-exchange traded contracts, it would be subject to the credit risk associated with counterparty non-performance. The credit risk from counterparty non-performance associated with such instruments is the net unrealized gain, if any. The FundUSOF also has credit risk since the sole counterparty to all domestic and foreign futures contracts is the exchange on which the relevant contracts are traded. In addition, the FundUSOF bears the risk of financial failure by the clearing broker.

The purchase and sale of futures and options on futures contracts requiresrequire margin deposits with a futures commission merchant. Additional deposits may be necessary for any loss on contract value. The Commodity Exchange Act requires a futures commission merchant to segregate all customer transactions and assets from the futures commission merchant’s proprietary activities.

USOF invests its cash in money market funds that seek to maintain a stable net asset value. USOF is exposed to any risk of loss associated with an investment in these money market funds. As of September 30,March 31, 2008 and December 31, 2007, USOF had deposits in domestic and foreign financial institutions, including cash investments in money market funds, in the amount of $293,572,960.$630,349,360 and $441,146,799, respectively. This amount is subject to loss should these institutions cease operations.

For derivatives, risks arise from changes in the market value of the contracts. Theoretically, the FundUSOF is exposed to a market risk equal to the value of futures contracts purchased and unlimited liability on such contracts sold short. As both a buyer and a seller of options, the FundUSOF pays or receives a premium at the outset and then bears the risk of unfavorable changes in the price of the contract underlying the option.

The financial instruments held by the FundUSOF are reported in its condensed statement of financial condition at market or fair value, or at carrying amounts that approximate fair value, because of their highly liquid nature and short-term maturity.

11

Goldman, Sachs & Co. (“Goldman Sachs”) sent USOF a letter on March 17, 2006, providing USOF and the FundGeneral Partner notice under 35 U.S.C. Section 154(d) of two pending United States patent applications, Publication Nos. 2004/0225593A1 and 2006/0036533A1. The Fund is currently reviewing the Goldman Sachs published patent applications, and has engaged in discussions with Goldman Sachs regarding its pending applications and the Fund’s own pending patent application. The Fund is unable to determine the outcome of this matter at this time, due in part to the fact that the Goldman SachsBoth patent applications are pendinggenerally directed to a method and havesystem for creating and administering a publicly traded interest in a commodity pool. In particular, the abstract of each patent application defines a means for creating and administering a publicly traded interest in a commodity pool that includes the steps of forming a commodity pool having a first position in a futures contract and a corresponding second position in a margin investment, and issuing equity interests of the commodity pool to third party investors. Subsequently, two U.S. patents were issued; the first, patent number US7,283,978B2, was issued on October 16, 2007, and the second, patent number US7,319,984B2, was issued on January 15, 2008.

Preliminarily, USOF’s management is of the view that the structure and operations of USOF and its affiliated commodity pools do not been issued as U.S. Patents.infringe these patents. USOF is also in the process of reviewing prior art (prior structures and operations of similar investment vehicles) that may invalidate one or more of the claims in these patents. In addition, USOF has retained patent counsel to advise it on these matters and is in the process of obtaining their opinions regarding the non-infringement of each of these patents by USOF and/or the patents’ invalidity based on prior art. If the patents were alleged to apply to USOF’s structure and/or operations, and are found by a court to be valid and infringed, Goldman Sachs may be awarded significant monetary damages and/or injunctive relief.

NOTE 6 - FINANCIAL HIGHLIGHTS

The following table presents per Unitunit performance data and other supplemental financial data for the ninethree months ended September 30,March 31, 2008 and March 31, 2007 and the period from April 10, 2006 (commencement of operations) to September 30, 2006 for the limited partners. This information has been derived from information presented in the condensed financial statements.

For the period from | |||||||

For the nine months ended | April 10, 2006 to | ||||||

September 30, 2007 | September 30, 2006 | ||||||

(Unaudited) | (Unaudited) | ||||||

Per Unit Operating Performance: | |||||||

| Net asset value, beginning of period | $ | 51.87 | $ | 67.39 | |||

| Total income (loss) | 11.10 | (10.13 | ) | ||||

| Total expenses | (0.31 | ) | (0.20 | ) | |||

| Net increase/(decrease) in net asset value | 10.79 | (10.33 | ) | ||||

| Net asset value, end of period | $ | 62.66 | $ | 57.06 | |||

Total Return | 20.80 | % | (15.33 | )% | |||

Ratios to Average Net Assets (annualized) | |||||||

| Total income (loss) | 30.94 | % | (62.31 | )% | |||

| Expenses excluding management fees | (0.33 | )% | (0.15 | )% | |||

| Management fees | (0.50 | )% | (0.50 | )% | |||

| Net income (loss) | 30.11 | % | (62.96 | )% | |||

For the three months ended | For the three months ended | ||||||

March 31, 2008 | March 31, 2007 | ||||||

(Unaudited) | Unaudited) | ||||||

Per Unit Operating Performance: | |||||||

| Net asset value, beginning of period | $ | 75.82 | $ | 51.87 | |||

| Total income | 5.75 | 1.78 | |||||

| Total expenses | (0.24 | ) | (0.09 | ) | |||

| Net increase in net asset value | 5.51 | 1.69 | |||||

| Net asset value, end of period | $ | 81.33 | $ | 53.56 | |||

Total Return | 7.27 | % | 3.26 | % | |||

Ratios to Average Net Assets | |||||||

| Total income | 7.20 | % | 9.96 | % | |||

| Expenses excluding management fees* | (0.77 | )% | (0.26 | )% | |||

| Management fees* | (0.50 | )% | (0.48 | )% | |||

| Net income | 6.89 | % | 9.78 | % | |||

| *Annualized | |||||||

Total returns are calculated based on the change in value during the period. An individual limited partner’s total return and ratio may vary from the above total returns and ratios based on the timing of contributions to and withdrawals from the Fund.USOF.

12

NOTE 7 - SUBSEQUENT EVENTSRECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Effective January 1, 2008, USOF adopted FAS 157 - Fair Value Measurements (“FAS 157” or the “Statement”). FAS 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (“GAAP”), and expands disclosures about fair value measurement. The changes to current practice resulting from the application of the Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurement. The Statement establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from sources independent of USOF (observable inputs) and (2) USOF’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the FAS 157 hierarchy are as follows:

Level I - Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level II - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level II assets include the following: quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market-corroborated inputs).

Level III - Unobservable pricing input at the measurement date for the asset or liability. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available.

In some instances, the inputs used to measure fair value might fall in different levels of the fair value hierarchy. The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest input level that is significant to the fair value measurement in its entirety.

The following table summarizes the valuation of USOF’s securities at March 31, 2007,2008 using the Fund filed a Registration Statement on Form S-3 with the SEC to register an additional 30,000,000 Units.fair value hierarchy:

At March 31, 2008 | Total | Level I | Level II | Level III | |||||||||

| Investments | $ | 100,176,411 | $ | 100,176,411 | $ | - | $ | - | |||||

| Derivative assets | (13,349,470 | ) | (13,349,470 | ) | - | - | |||||||

The following discussion should be read in conjunction with the consolidatedcondensed financial statements and the notes thereto of the United States Oil Fund, LP ("USOF"(“USOF”) included elsewhere in this quarterly report on Form 10-Q.

Forward-Looking Information

This quarterly report on Form 10-Q, including this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding the plans and objectives of management for future operations. This information may involve known and unknown risks, uncertainties and other factors that may cause USOF’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe USOF'sUSOF’s future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project,” the negative of these words, other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and USOF cannot assure investors that the projections included in these forward-looking statements will come to pass. USOF'sUSOF’s actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors.

USOF has based the forward-looking statements included in this quarterly report on Form 10-Q on information available to it on the date of this quarterly report on Form 10-Q, and USOF assumes no obligation to update any such forward-looking statements. Although USOF undertakes no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, investors are advised to consult any additional disclosures that USOF may make directly to them or through reports that USOF in the future files with the U.S. Securities and Exchange Commission (the "SEC"“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

Introduction

USOF, a Delaware limited partnership, is a commodity pool that issues units that may be purchased and sold on the American Stock Exchange (the "AMEX"“AMEX”). The investment objective of USOF is for changes in percentage terms of theits units’ net asset value ("NAV"(“NAV”) on a daily basis to reflect the changes in percentage terms in the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, also on a daily basis, as measured by the changes in the price of the futures contract on light, sweet crude oil as traded on the New York Mercantile Exchange (the "NYMEX"“NYMEX”) that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case the futures contract will be the next month contract to expire, less USOF’s expenses.

USOF seeks to achieve its investment objective by investing in a combination of oil futures contracts and other oil interests such that changes in USOF’s NAV, measured in percentage terms, will closely track the changes in the price of a specified oil futures contract (the "Benchmark“Benchmark Oil Futures Contract"Contract”), also measured in percentage terms. USOF’s General Partner believes the Benchmark Oil Futures Contract historically has exhibited a close correlation with the spot price of light, sweet crude oil. It is not the intent of USOF to be operated in a fashion such that itsthe NAV will equal, in dollar terms, the spot price of light, sweet crude oil or any particular futures contract based on light, sweet crude oil. Management believes that it is not practical to manage the portfolio to achieve such an investment goal when investing in listed crude oil futures contracts.

USOF may also invest in futures contracts for other types of crude oil, heating oil, gasoline, natural gas and other petroleum-based fuels that are traded on the NYMEX, ICE Futures or other U.S. and foreign exchanges (collectively, “Oil Futures Contracts”) and other oil interests such as cash-settled options on Oil Futures Contracts, forward contracts for oil and over-the-counter transactions that are based on the price of oil, other petroleum-based fuels, Oil Futures Contracts and indices based on the foregoing (collectively, “Other Oil Interests”). For convenience and unless otherwise specified, Oil Futures Contracts and Other Oil Interests collectively are referred to as “Oil Interests” in this quarterly report on Form 10-Q.

14

The general partner of USOF, Victoria Bay Asset Management, LLC (the "General Partner"“General Partner”), which is registered as a commodity pool operator (“CPO”) with the U.S. Commodity Futures Trading Commission (the “CFTC”), is authorized by the ThirdFourth Amended and Restated Agreement of Limited Partnership of USOF (the "LP Agreement"“LP Agreement”) to manage USOF. The General Partner is authorized by USOF in its sole judgment to employ and establish the terms of employment for, and terminatetermination of, commodity trading advisors or futures commission merchants.

Valuation of Crude Oil Futures Contracts and the Computation of the NAV

The NAV of theUSOF units is calculated once each trading day as of the earlier of the close of the New York Stock Exchange (the "NYSE"“NYSE”) or 4:00 p.m. New York time. The NAV for a particular trading day is released after 4:15 p.m. New York time. Trading on the AMEX typically closes at 4:15 p.m. New York time. USOF uses the NYMEX closing price (determined at the earlier of the close of that exchangethe NYMEX or 2:30 p.m. New York time) for the contracts held on the NYMEX, but calculates or determines the value of all other USOF investments, including ICE Futures or other futures contracts, as of the earlier of the close of the NYSE or 4:00 p.m. New York time.

Management’s Discussion of Results of Operations and the Crude Oil Market

Results of Operations. On April 10, 2006, USOF listed its units on the AMEX under the ticker symbol “USO.” On that day, USOF established its initial offering price at $67.39 per Unitunit and issued 200,000 units to the initial authorized purchaser, KV Execution Services LLC, in exchange for $13,478,000 in cash.

Since its initial offering of 17,000,000 units, USOF has made twofour subsequent offerings of its units: 30,000,000 units which were registered with the SEC on October 18, 2006, and an additional 50,000,000 units which were registered with the SEC on January 30, 2007.2007, 30,000,000 units which were registered with the SEC on December 4, 2007 and an additional 100,000,000 units which were registered with the SEC on February 7, 2008. Units offered by USOF in subsequent offerings were sold by it for cash at the units’ NAV as described in the applicable prospectus. As of September 30, 2007,March 31, 2008, USOF had issued 85,700,000139,200,000 units, 8,900,000 of which 6,900,000 were outstanding. As of March 31, 2008 there were 87,800,000 units registered but not yet issued.

More units may have been issued by USOF than are outstanding due to the redemption of units as contemplated and permitted under the LP Agreement.units. Unlike funds that are registered under the Investment Company Act of 1940, as amended, units that have been redeemed by USOF cannot be resold by USOF without registration of theirthe offering of such units with the SEC. As a result, USOF anticipatescontemplates that furtheradditional offerings of its units will be registered with the SEC in the future in anticipation of additional issuances.

issuances and redemptions.As of September 30, 2007,March 31, 2008, the total unrealized gainloss on crude oil futures contractsOil Futures Contracts owned or held on that day was $12,811,880$13,349,470 and USOF established cash deposits, including cash investments in money market funds, that were equal to $451,821,955.$630,349,360. The majority of those cash assets were held in overnight deposits at USOF’s custodian bank, while 11.4%10.05% of the cash balance was held as margin deposits with the Futures Commission Merchantfutures commission merchant for the Oil Futures Contracts purchased. The ending per unit NAV on September 30, 2007March 31, 2008 was $62.66.$81.33.

Portfolio Expenses. USOF’s expenses consist of investment management fees, brokerage fees and commissions, certain offering costs, licensing fees and the fees and expenses of the independent directors of the General Partner. The management fee that USOF pays to the General Partner is calculated as a percentage of the total net assets of USOF. For total net assets of up to $1 billion, the management fee is 0.5%. For total net assets over $1 billion, the management fee is 0.2% on the incremental amount of assets. The fee is accrued daily.

During the three month period from January 1, 2007 to September 30, 2007,ended March 31, 2008, the daily average total net assets of USOF were $815,003,993.$427,078,224. During the three month period from January 1,ended March 31, 2008, the total net assets of USOF did not exceed $1 billion on any day. The management fee paid by USOF during the period amounted to $530,931. Management fees as a percentage of total net assets averaged 0.50% over the course of this three month period. By comparison, for the three month period ended March 31, 2007, to September 30,the average daily total net assets of USOF were $970,772,068. During the three month period ended March 31, 2007, the total net assets of USOF did exceed $1 billion on a number of days. The management fee paid by USOF for this three month period amounted to $3,007,089,$1,144,115, which was calculated at the 0.50% rate for total net assets up to and including $1 billion and at the rate of 0.20% on totalaverage net assets over $1 billion, and accrued daily. Management expensesfees as a percentage of totalaverage net assets averaged 0.50% over the course of the nine month period. By comparison, for the three months ended September 30, 2006, the average daily total net assets of USOF was approximately $359,609,583. At no time during the quarter did the total net assets rise above the $1 billion level. The investment advisory fee paid by USOF amounted to $452,264. Management expenses as a percentage of total net assets averaged 0.50%0.48% over the course of this three month period.

15

USOF pays for all brokerage fees, taxes and other expenses, including certain tax reporting costs, licensing fees for the use of intellectual property, ongoing registration or other fees paid to the SEC, the Financial Industry Regulatory Authority ("FINRA"(“FINRA”) and any other regulatory agency in connection with subsequent offers and sales of its units subsequent to the initial offering and all legal, accounting, printing and other expenses associated therewith. For the ninethree month period ended September 30, 2007,March 31, 2008, USOF incurred $384,058$105,629 in ongoing registration fees and other offering expenses. USOF is responsible for paying the fees and expenses, including directors'directors’ and officers'officers’ liability insurance, of the independent directors of the General Partner who are also audit committee members. USOF shares these fees with United States Natural Gas Fund, LP ("USNG")USNG, US12OF, USG and USHO based on the relative assets of each fund computed on a daily basis. These fees for calendar year 20072008 are estimated to be a total of $276,000$286,000 for bothall five funds. By comparison, for the three monthsmonth period ended September 30, 2006, the cost ofMarch 31, 2007, USOF incurred $369,059 in ongoing registration fees as well as director’s and officer’s liability insurance forother offering expenses. In addition, USOF agreed to pay the independent directors of the General Partner who are also audit committee members, were paid$184,000 to cover their expenses and pay for by the General Partner and were not an expense of USOF.their services for 2007.

USOF also incurs commissions to brokers for the purchase and sale of futures contracts,Oil Futures Contracts, Other Oil Interests or short-term obligations of the United States of two years or less ("Treasuries"(“Treasuries”). ForDuring the three and nine monthsmonth period ended September 30, 2007,March 31, 2008, total commissions paid to brokers amounted to $194,908 and $951,049, respectively.$238,589. Prior to the initial offering of its units, USOF had estimated that its annual level of such commissions was expected to be 0.35% of total net assets. As an annualized percentage of total net assets, the figuresfigure for the three and nine monthsmonth period ended September 30, 2007 representMarch 31, 2008 represented approximately 0.14% and 0.16%, respectively,0.22% of totalaverage net assets. By comparison, for the three monthsmonth period ended September 30, 2006,March 31, 2007, total commissions paid amounted to $129,645.$420,212. However, the average daily net assets of USOF during that time period were smallerlarger than during the same time period in 2007.2008. As an annualized percentage of totalaverage net assets, the third quarterfigure for the three month period ended March 31, 2007 represented approximately 0.18% of 2006 figure represents approximately 0.14%.average net assets. However, there can be no assurance that commission costs and portfolio turnover will not cause commission expenses to rise in future quarters.

Interest Income. USOF seeks to invest its assets such that it holds Oil Futures Contracts and Other Oil Interests in an amount equal to the total net assets of the portfolio. Typically, such investments do not require USOF to pay the full amount of the contract value at the time of purchase, but rather require USOF to post an amount as a margin deposit against the eventual settlement of the contract. As a result, USOF retains an amount that is approximately equal to its total net assets, which USOF invests in Treasuries, cash and/or cash equivalents. This includes both the amount on deposit with the Futures Commission Merchantfutures commission merchant as margin, as well as unrestricted cash held with USOF’s custodian bank. The Treasuries, cash and/or cash equivalents earn interest that accrues on a daily basis. For the three and nine monthsmonth period ended September 30, 2007,March 31, 2008, USOF earned $7,187,424 and $30,175,872, respectively,$2,895,300 in interest income on such cash holdings. Based on USOF’s average daily total net assets during this time period, this is equivalent to an annualized yield of 5.05% and 4.95%, respectively.2.73%. USOF did not purchase Treasuries during the three month period from January 1, 2007 through September 30, 2007ended March 31, 2008 and held all of its funds in cash and/or cash equivalents during this time period. By comparison, for the three monthsmonth period ended September 30, 2006,March 31, 2007, USOF earned $4,235,056$11,928,573 in interest income on cash holdings. Based on USOF’s average daily total net assets during this time period, which were smallerlarger than forUSOF’s assets during the same time period in 2007, the interest earned equaled2008, this is equivalent to an annualized yield of 4.7%4.98%.

Tracking USOF’s Benchmark. USOF seeks to manage its portfolio such that changes in its average daily NAV, on a percentage basis, closely track changes in the average of the daily price of the Benchmark Oil Futures Contract, also on a percentage basis. Specifically, USOF seeks to manage itsthe portfolio such that over any rolling period of 30 valuation days, the average daily change in the NAV is within a range of 90% to 110% (0.9 to 1.1) of the average daily change of the Benchmark Oil Futures Contract. As an example, if the average daily movement of the Benchmark Oil Futures Contract for a particular 30-day time period was 0.5% per day, USOF management would attempt to manage the portfolio such that the average daily movement of the NAV during that same time period fell between 0.45% and 0.55% (i.e., between 0.9 and 1.1 of the benchmark’s results). USOF’s portfolio management goals do not include trying to make the nominal price of USOF’s NAV equal to the nominal price of the current Benchmark Oil Futures Contract or the spot price for crude oil. Management believes that it is not practical to manage the portfolio to achieve such an investment goal when investing in listed crude oil futures contracts.Oil Futures Contracts.

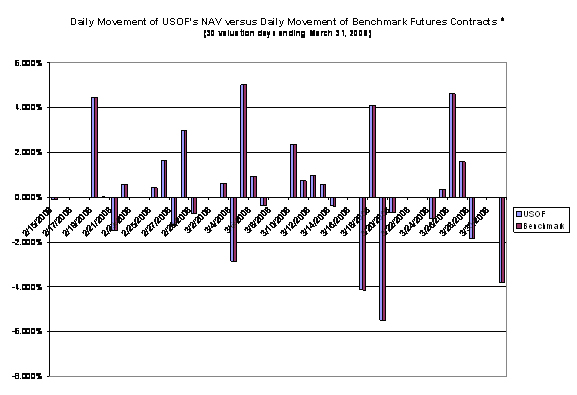

For the 30 valuation days ended September 30, 2007,March 31, 2008, the simple average daily change in the Benchmark Oil Futures Contract was 0.525%0.261%, while the simple average daily change in the NAV of USOF over the same time period was 0.541%0.267%. The average daily difference was 0.017%0.005% (or 1.70.05 basis points, where 1 basis point equals 1/100 of 1%). As a percentage of the daily movement of the Benchmark Oil Futures Contract, the average error in daily tracking by the NAV was 2.07%0.34%, meaning that over this time period USOF’s tracking error was within the plus or minus 10% range established as its benchmark tracking goal.

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

Since the offering of USOF units to the public on April 10, 2006 to September 30, 2007,March 31, 2008, the simple average daily change in the Benchmark Oil Futures Contract was -0.017%0.043%, while the simple average daily change in the NAV of USOF over the same time period was -0.006%0.054%. The average daily difference was 0.011% (or 1.1 basis point,points, where 1 basis point equals 1/100 of 1%). As a percentage of the daily movement of the Benchmark Oil Futures Contract, the average error in daily tracking by the NAV was 3.17%2.69%, meaning that over this time period USOF’s tracking error was within the plus or minus 10% range established as its benchmark tracking goal.

An alternative tracking measurement of the return performance of USOF versus the return of its Benchmark Oil Futures Contract can be calculated by comparing the actual return of USOF, measured by changes in its NAV, versus the expected changes in its NAV under the assumption that USOF’s returns had been exactly the same as the daily changes in its Benchmark Oil Futures Contract.

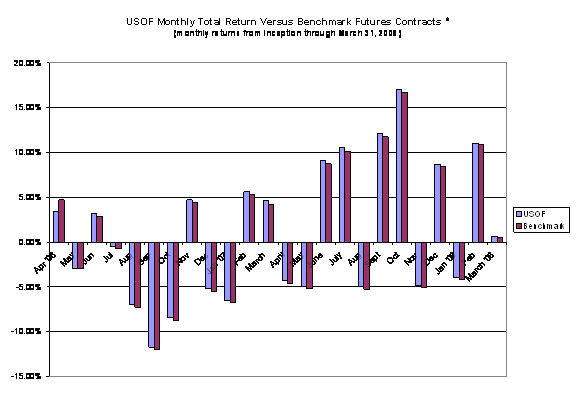

For the three month period from July 1, 2007 through September 30, 2007,ended March 31, 2008, the actual total return of USOF as measured by changes in its NAV was 17.83%7.27%. This is based on an initial NAV of $53.18$75.82 on June 30,December 31, 2007 and an ending NAV as of September 30, 2007March 31, 2008 of $62.66.$81.33. During this time period, USOF made no distributions to its unitholders. However, if USOF’s daily changes in its NAV had instead exactly tracked the changes in the daily return of the Benchmark Oil Futures Contracts,Contract, USOF would have ended the thirdfirst quarter of 20072008 with an estimated NAV of $61.99,$81.01, for a total return over the relevant time period of 16.58%6.86%. The difference between the actual NAV total return of USOF of 17.83%7.27% and the expected total return based on the Benchmark Oil Futures ContractsContract of 16.58%6.86% was an error over the time period of +1.25%0.41%, which is to say that USOF’s actual total return exceeded the benchmark result by that percentage. Management believes that a portion of the difference between the actual return and the expected benchmark return can be attributed to the impact of the interest that USOF collects on its cash and cash equivalent holdings. In addition, during the ninethree month period ended September 30, 2007,March 31, 2008, USOF also collected fees from brokerage firms creating or redeeming baskets of units. This income also contributed to USOF’s actual return exceeding the benchmark results. However, if the total assets of USOF continue to increase, management believes that the impact on total returns of these fees from creations and redemptions will diminish as a percentage of the total return.

18

By comparison, for the three month period ended March 31, 2007, the actual total return of USOF as measured by changes in its NAV was 3.26%. This was based on an initial NAV of $51.87 on January 1, 2007 and an ending NAV as of March 31, 2007 of $53.56. During this time period, USOF made no distributions to its unitholders. However, if USOF’s daily changes in its NAV had instead exactly tracked the changes in the daily return of the Benchmark Oil Futures Contract, USOF would have ended the first quarter of 2007 with an estimated NAV of $53.01, for a total return over the relevant time period of 2.2%. The difference between the actual NAV total return of USOF of 3.26% and the expected total return based on the Benchmark Oil Futures Contract of 2.2% was an error over the time period of +1.06%, which is to say that USOF’s actual total return exceeded the benchmark result by that percentage. Management believes that a portion of the difference between the actual return and the expected benchmark return can be attributed to the impact of the interest that USOF collects on its cash and cash equivalent holdings. In addition, during the three month period ended March 31, 2007, USOF also collected fees from brokerage firms creating or redeeming baskets of units. This income also contributed to USOF’s actual return exceeding the benchmark results.

There are currently three factors that have impacted, during the latest period, or are most likely to impact, USOF’s ability to accurately track its Benchmark Oil Futures Contract.

First, USOF may buy or sell its holdings in the then current Benchmark Oil Futures Contract at a price other than the closing settlement price of that contract on the day in which USOF executes the trade. In that case, USOF may get a price that is higher, or lower, than that of the Benchmark Oil Futures Contract, which could cause the changes in the daily NAV of USOF to either be too high or too low relative to the changes in the daily benchmark. InDuring the third quarter of 2007,three month period ended March 31, 2008, management attempted to minimize the effect of these transactions by seeking to execute its purchase or sales of the Benchmark Oil Futures Contracts at, or as close as possible to, the end of the day settlement price. However, it may not always be possible for USOF to obtain the closing settlement price and there is no assurance that failure to obtain the closing settlement price in the future will not adversely impact USOF’s attempt to track its benchmark over time.

Second, USOF earns interest on its cash, cash equivalents and Treasury holdings. USOF is not required to distribute any portion of its income to its unitholders and did not make any distributiondistributions to unitholders induring the third quarter of 2007.three month period ended March 31, 2008. Interest payments, and any other income, were retained within the portfolio and added to USOF’s NAV. When this income exceeds the level of USOF’s expenses for its management fee, brokerage commissions and other expenses (including ongoing registration fees, licensing fees and the fees and expenses of the independent directors of the General Partner), USOF will realize a net yield that will tend to cause daily changes in the NAV of USOF to track slightly higher than daily changes in the Benchmark Oil Futures Contracts.Contract. During the third quarter of 2007,three month period ended March 31, 2008, USOF earned, on an annualized basis, approximately 5.05%2.73% on its cash holdings. It also incurred cash expenses on an annualized basis of 0.50% for management fees and approximately 0.14%0.22% in brokerage commission costs related to the purchase and sale of futures contracts, and 0.19%0.54% for other expenses. The foregoing fees and expenses resulted in a net yield on an annualized basis of approximately 4.21%1.46% and affected USOF’s ability to track its benchmark. If short-term interest rates rise above the current levels, the level of deviation created by the yield would increase. Conversely, if short-term interest rates were to decline, the amount of error created by the yield would decrease. If short-term yields drop to a level lower than the combined expenses of the management fee and the brokerage commissions, then the tracking error would become a negative number and would tend to cause the daily returns of the NAV to underperform the daily returns of the Benchmark Oil Futures Contracts.Contract.

Third, USOF may hold Other Oil Interests in its portfolio that may fail to closely track the Benchmark Oil Futures Contract'sContract’s total return movements. In that case, the error in tracking the benchmark could result in daily changes in the NAV of USOF that are either too high, or too low, relative to the daily changes in the benchmark. During the third quarter of 2007,three month period ended March 31, 2008, USOF did not hold any Other Oil Interests. However, there can be no assurance that in future quarters USOF will not make use of such Other Oil Interests.

During the third quarter of 2007,three month period ended March 31, 2008, the prices of front month futures contracts rose from near the $70.00$96.00 level to approximately the $81.00$102.00 level. The priceprices of front month contracts were also higher than the priceprices of second or third month contracts for most of this time period.

19

Term Structure of Crude Oil Futures Prices and the Impact on Total Returns. Several factors determine the total return from investing in a futures contract position. One factor that impacts the total return that will result from investing in near month crude oil futures contracts and “rolling” those contracts forward each month is the price relationship between the current near month contract and the nextlater month contract. Ifcontracts. For example, if the price of the near month contract is higher than the next month contract (a situation referred to as “backwardation” in the futures market), then absent any other change there is a tendency for the price of a next month contract to rise in value as it becomes the near month contract and approaches expiration. Conversely, if the price of a near month contract is lower than the next month contract (a situation referred to as “contango” in the futures market), then absent any other change there is a tendency for the price of a next month contract to decline in value as it becomes the near month contract and approaches expiration.

As an example, assume that the price of crude oil for immediate delivery (the “spot” price), was $50 per barrel, and the value of a position in the near month futures contract was also $50. Over time, the price of the barrel of crude oil will fluctuate based on a number of market factors, including demand for oil relative to its supply. The value of the near month contract will likewise fluctuate in reaction to a number of market factors. If investors seek to maintain their holding in a near month contract position and not take delivery of the oil, every month they must sell their current near month contract as it approaches expiration and invest in the next month contract.

If the futures market is in backwardation, e.g.e.g., when the expected price of crude oil in the future would be less, the investor would be buying a next month contract for a lower price than the current near month contract. Hypothetically, and assuming no other changes to either prevailing crude oil prices or the price relationship between the spot price, the near month contract and the next month contract (and ignoring the impact of commission costs and the interest earned on Treasuries, cash and/or cash equivalents), the value of the next month contract would rise as it approaches expiration and becomes the new near month contract. In this example, the value of the $50 investment would tend to rise faster than the spot price of crude oil, or fall slower. As a result, it would be possible in this hypothetical example for the price of spot crude oil to have risen to $60 after some period of time, while the value of the investment in the futures contract would have risen to $65, assuming backwardation is large enough or enough time has elapsed. Similarly, the spot price of crude oil could have fallen to $40 while the value of an investment in the futures contract could have fallen to only $45. Over time, if backwardation remained constant, the difference would continue to increase.

If the futures market is in contango, the investor would be buying a next month contract for a higher price than the current near month contract. Hypothetically, and assuming no other changes to either prevailing crude oil prices or the price relationship between the spot price, the near month contract and the next month contract (and ignoring the impact of commission costs and the interest earned on cash), the value of the next month contract would fall as it approaches expiration and becomes the new near month contract. In this example, it would mean that the value of the $50 investment would tend to rise slower than the spot price of crude oil, or fall faster. As a result, it would be possible in this hypothetical example for the spot price of crude oil to have risen to $60 after some period of time, while the value of the investment in the futures contract will have risen to only $55, assuming contango is large enough or enough time has elapsed. Similarly, the spot price of crude oil could have fallen to $45 while the value of an investment in the futures contract could have fallen to $50.$40. Over time, if contango remained constant, the difference would continue to increase.

Historically, the oil futures markets have experienced periods of contango and backwardation, with backwardation being in place more often than contango. During the pastprevious two years, including 2006 and the first half of 2007, these markets have experienced contango. However, starting early in the third quarter of 2007, the crude oil futures market moved into backwardation and remained in that condition for the rest of the year. The crude oil markets remained in backwardation for all of the first quarter of 2008. The chart below compares the price of the front month contract to the average price of the first 12 months over the last 10 years (1998-2007). When the price of the front month contract is higher than the average price of the front 12 month contracts, the market would be described as being in backwardation. When the price of the front month contract is lower than the average price of the front 12 month contracts, the market would be described as being in contango. Although the prices of the front month contract and the average price of the front 12 month contracts do tend to move up or down together, it can be seen that at times the front month prices are clearly higher than the average price of the 12 month contracts (backwardation), and other times they are below the average price of the front 12 month contracts (contango).

20

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

An alternative way to view the same data is to subtract from the dollar price of the front month contract the average dollar price of the front 12 month contracts. If the resulting number is a positive number, then the front month price is higher than the average price of the front 12 months and the market could be described as being in backwardation. If the resulting number is a negative number, then the front month price is lower than the average price of the front 12 months and the market could be described as being in contango. The chart below shows the results from subtracting from the front month price the average price of the front 12 month contracts for the 10 year period between 1998 and 2007.

21

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

A hypothetical investment in a portfolio that involved owning only the front month contract would produce a different result than a hypothetical investment in a portfolio that owned an equal number of each of the front 12 month’s worth of contracts. Generally speaking, when the crude oil futures market is in backwardation, the front month only portfolio would tend to have a higher total return than the 12 month portfolio. Conversely, if the crude oil futures market was in contango, the portfolio containing 12 months worth of contracts would tend to outperform the front month only portfolio. The chart below shows the hypothetical results of owning a portfolio consisting of the front month contract versus a portfolio containing the front 12 month’s worth of contracts. In this example, each month, the front month only portfolio would sell the front month contract at expiration and buy the next month out contract. The portfolio holding an equal number of the front 12 month’s worth of contracts would sell the front month contract at expiration and replace it with the contract that becomes the new twelfth month contract.

22

*PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

As seen in the chart, there have been periods of both positive and negative annual total returns for both portfolios over the last 10 years. In addition, there have been periods during which the front month only approach had higher returns, and periods where the 12 month approach had higher total return. The above chart does not represent the performance history of USOF or affiliated funds.

Historically, the oil futures markets have experienced periods of contango and backwardation, with backwardation being in place more often than contango. During the previous two years, including 2006 and the first half of 2007, these markets have experienced contango. However, starting early in the third quarter of 2007 the crude oil futures market moved into backwardation. The crude oil markets remained in backwardation through the end of 2007 and for all of the first quarter of 2008. While the investment objective of USOF is not to have the market price of its units match, dollar for dollar, changes in the spot price of oil, contango and backwardation have impacted the total return on an investment in USOF units during the past year relative to a hypothetical direct investment in crude oil. For example, an investment made in USOF units made during the second quarter of 2007, a period of contango in the crude oil markets, decreased by -0.71%, while the spot price of crude oil for immediate delivery during the same period increased by 7.30%. Conversely, an investment made in USOF units during the third quarter of 2007, a period in which the crude oil futures market was mostly in backwardation, increased by 17.82% while the spot price of crude oil increased by 15.53% (note: these comparisons ignore the potential costs associated with physically owning and storing crude oil which could be substantial).These periods

Periods of contango or backwardation do not meaningfully impact USOF’s investment objective of having percentage changes in its per unit NAV track percentage changes in the price of the Benchmark Oil Futures Contract since the impact of backwardation and contango tended to equally impact the percentage changes in price of both USOF’s units and the Benchmark Oil Futures Contract. It is impossible to predict with any degree of certainty whether backwardation or contango will occur in the future. It is likely that both conditions will occur during different periods.

23

Crude Oil Market. During the three month period from July 1, 2007 to September 30, 2007,ended March 31, 2008, crude oil prices were impacted by several factors. On the consumption side, demand remained strong as continued global economic growth, especially in emerging economies such as China and India, remained brisk. Additionally, a falling U.S. dollar, the currency in which crude oil is traded globally, continued to be weak, effectively making crude oil cheaper for most non-U.S. dollar economies. Concerns about a weakening U.S. economy leading to reduced demand for oil products was a factor in the first quarter of 2008. On the supply side, production remained steady despite concerns about violence impacting production in Iraq and Nigeria. At the same time, a concern remainsremained about the ability of major oil producing countries to continue to raise their production to accommodate increasing demand. However, oil prices trended upward during the quarter as a slowing U.S. economy was not enough to improve the global supply and demand balance.

Critical Accounting Policies

Preparation of the condensed financial statements and related disclosures in compliance with accounting principles generally accepted in the United States of America requires the application of appropriate accounting rules and guidance, as well as the use of estimates. USOF'sUSOF’s application of these policies involves judgments and actual results may differ from the estimates used.

The General Partner has evaluated the nature and types of estimates that it makes in preparing USOF'sUSOF’s condensed financial statements and related disclosures and has determined that the valuation of its investments which are not traded on a United States or internationally recognized futures exchange (such as forward contracts and over-the-counter contracts) involves a critical accounting policy. To the extent USOF makes such investments, theThe values which are used by USOF for its forward contracts will beare provided by its commodity broker who valuesuses market prices when available, while over-the-counter contracts are valued based on the present value of estimated future cash flows that would be received from or paid to a third party in settlement of these derivative contracts prior to their delivery date and valued on a daily basis. In addition, USOF estimates interest income on a daily basis using prevailing interest rates earned on its cash and cash equivalents. These estimates are adjusted to the actual amount received on a monthly basis and the difference, if any, is not considered material.

Liquidity and Capital Resources

USOF has not made, and does not anticipate making, use of borrowings or other lines of credit to meet its obligations. USOF has met, and it is anticipated that USOF will continue to meet, its liquidity needs in the normal course of business from the proceeds of the sale of its investments, or from the Treasuries, cash and/or cash equivalents that it intends to hold at all times. USOF’s liquidity needs include: redeeming units, providing margin deposits for its existing oil futures contractsOil Futures Contracts or the purchase of additional crude oil futures contractsOil Futures Contracts and posting collateral for its over-the-counter contracts and payment of its expenses, summarized below under “Contractual Obligations.”

USOF currently generates cash primarily from (i) the sale of Creation Baskets and (ii) interest earned on Treasuries, cash and/or cash equivalents. USOF has allocated substantially all of its net assets to trading in oil interests.Oil Interests. USOF invests in Oil Interests to the fullest extent possible without being leveraged or unable to satisfy its current or potential margin or collateral obligations with respect to its investments in Oil Futures Contracts and Other Oil Interests. A significant portion of itsthe NAV wasis held in Treasuries, cash and/orand cash equivalents that wasare used as margin and as collateral for USOF'sUSOF’s trading in oil interests.Oil Interests. The percentage that Treasuries cash and/or cash equivalents as a percentage ofwill bear to the total net assets vary from period to period as the market values of the oil interestsOil Interests change. The balance of the net assets is held in USOF'sUSOF’s Oil Futures Contracts and Other Oil Interests trading account. Interest earned on USOF's interest bearing-fundsUSOF’s interest-bearing funds is paid to USOF.

24

Prior to March 23, 2007, all payments with respect to USOF'sUSOF’s and the General Partner'sPartner’s expenses were paid by their affiliates. Neither USOF nor the General Partner has any obligation or intention to refund such payments by their affiliates. These affiliates are under no obligation to pay USOF’s or the General Partner'sPartner’s current or future expenses. If the General Partner and USOF are unsuccessful in raising sufficient funds to cover USOF’s expenses or in locating any other source of funding, USOF will terminate and investors may lose all or part of their investment.

Market Risk

Trading in Oil Futures Contracts and Other Oil Interests, such as forwards, involves USOF entering into contractual commitments to purchase or sell oil at a specified date in the future. The gross or face amount of the contracts will significantly exceed USOF'sUSOF’s future cash requirements since USOF intends to close out its open positions prior to settlement. As a result, USOF is generally only subject to the risk of loss arising from the change in value of the contracts. USOF considers the "fair value''“fair value” of its derivative instruments to be the unrealized gain or loss on the contracts. The market risk associated with USOF'sUSOF’s commitments to purchase oil is limited to the gross face amount of the contracts held. However, should USOF enter into a contractual commitment to sell oil, it would be required to make delivery of the oil at the contract price, repurchase the contract at prevailing prices or settle in cash. Since there are no limits on the future price of oil, the market risk to USOF could be unlimited.

Credit Risk

When USOF enters into Oil Futures Contracts and Other Oil Interests, it is exposed to the credit risk that the counterparty will not be able to meet its obligations. The counterparty for the Oil Futures Contracts traded on the NYMEX and on most other foreign futures exchanges is the clearinghouse associated with the particular exchange. In general, clearinghouses are backed by their members who may be required to share in the financial burden resulting from the nonperformance of one of their members and, therefore, this additional member support should significantly reduce credit risk. Some foreign exchanges are not backed by their clearinghouse members but may be backed by a consortium of banks or other financial institutions.

There can be no assurance that any counterparty, clearinghouse, or their members or their financial backers will satisfy their obligations to USOF in such circumstances.

The General Partner attempts to manage the credit risk of USOF by following various trading limitations and policies. In particular, USOF generally posts margin and/or holds liquid assets that are approximately equal to the face amount of its obligations to counterparties under the Oil Futures Contracts and Other Oil Interests it holds. The General Partner has implemented procedures that include, but are not limited to, executing and clearing trades only with creditworthy parties and/or requiring the posting of collateral or margin by such parties for the benefit of USOF to limit its credit exposure. UBS Securities LLC, USOF'sUSOF’s commodity broker, or any other broker that may be retained by USOF in the future, when acting as USOF'sUSOF’s futures commission merchant in accepting orders to purchase or sell Oil Futures Contracts on United States exchanges, is required by U.S. Commodity Futures Trading Commission ("CFTC")CFTC regulations to separately account for and segregate as belonging to USOF, all assets of USOF relating to domestic Oil Futures Contracts trading. AThese futures commission merchant ismerchants are not allowed to commingle USOF'sUSOF’s assets with its other assets. In addition, the CFTC requires commodity brokers to hold in a secure account the USOF assets related to foreign Oil Futures ContractContracts trading. During the third quarter of 2007,three month period ended March 31, 2008, the only foreign exchange on which USOF made investments was the ICE Futures, which is a London based futures exchange. Those crude oil contracts are denominated in U.S. dollars.

As of September 30, 2007,March 31, 2008, USOF had deposits in domestic and foreign financial institutions, including cash investments in money market funds, in the amount of $293,572,960.$630,349,360. This amount is subject to loss should these institutions cease operations.

25

��

Off Balance Sheet Financing

As of September 30, 2007,March 31, 2008, USOF has no loan guarantee, credit support or other off-balance sheet arrangements of any kind other than agreements entered into in the normal course of business, which may include indemnification provisions relating to certain risks that service providers undertake in performing services which are in the best interests of USOF. While USOF'sUSOF’s exposure under these indemnification provisions cannot be estimated, they are not expected to have a material impact on USOF'sUSOF’s financial position.

Redemption Basket Obligation

In order to meet its investment objective and pay its contractual obligations described below, USOF requires liquidity to redeem units, which redemptions must be in blocks of 100,000 units called Redemption Baskets. USOF has to date satisfied this obligation by paying from the cash or cash equivalents it holds or through the sale of its Treasuries in an amount proportionate to the number of units being redeemed.

Contractual Obligations

The General Partner agreed to pay the start-up costs associated with the formation of USOF, primarily its legal, accounting and other costs in connection with the General Partner'sPartner’s registration with the CFTC as a commodity pool operatorCPO and the registration and listing of USOF and its units with the SEC, FINRA and the AMEX, respectively. However, the costs of registering and listing additional units of USOF with the SEC are directly borne on an ongoing basis by USOF, and not by the General Partner.

The General Partner pays the fees of USOF’s marketing agent, ALPS Distributors, Inc., and the fees of the custodian and transfer agent, Brown Brothers Harriman & Co. (“BBH&Co.”), as well as Brown Brothers Harriman & Co.'sBBH&Co.’s fees for performing administrative services, including in connection with the preparation of USOF'sUSOF’s condensed financial statements and its SEC and CFTC reports. The General Partner also pays the fees of USOF's accountants and a separate firm for providing tax related services, as well as those of USOF's marketing agent, ALPS Distributors, Inc. The General Partner and USOF have also entered into a licensing agreement with the NYMEX pursuant to which USOF and the affiliated funds managed by the General Partner pay a licensing fee to the NYMEX. The General Partner also pays any fees for implementation of services and base service fees charged by the accounting firm responsible for preparing USOF’s tax reporting forms; however, USOF pays the fees and expenses associated with its tax accounting and reporting requirements.

In addition to the General Partner'sPartner’s management fee, USOF pays its brokerage fees (including fees to a futures commission merchant), over-the-counter dealer spreads, any licensing fees for the use of intellectual property, registration and, subsequent to the initial offering, the fees paid to the SEC, FINRA, or any other regulatory agencyagencies in connection with the offer and sale of units, as well as the legal, printing, accounting and other expenses associated therewith, and extraordinary expenses. The latter are expenses not incurred in the ordinary course of USOF'sUSOF’s business, including expenses relating to the indemnification of any person against liabilities and obligations to the extent permitted by law and under the LP Agreement, the bringing or defending of actions in law or in equity or otherwise conducting litigation and incurring legal expenses and the settlement of claims and litigation. Commission payments to a futures commission merchant are on a contract-by-contract, or round turn, basis. USOF also pays a portion of the fees and expenses of the independent directors of the General Partner. See Note 3 to the Notes to Condensed Financial Statements (Unaudited).

The parties cannot anticipate the amount of payments that will be required under these arrangements for future periods, as USOF'sUSOF’s NAVs and trading levels to meet its investment objectives will not be known until a future date. These agreements are effective for a specific term agreed upon by the parties and havewith an option to renew, or, in some cases, are in effect for the duration of USOF'sUSOF’s existence. Either party may terminate these agreements earlier for certain reasons described in the agreements.

Over-the-Counter Derivatives (Including Spreads and Straddles)

In the future, USOF may purchase over-the-counter contracts. Unlike most of the exchange-traded oil futures contractsOil Futures Contracts or exchange-traded options on such futures, each party to an over-the-counter contractscontract bears the credit risk that the other party may not be able to perform its obligations under its contract.

Some crude oil-based derivatives transactions contain fairly generic terms and conditions and are available from a wide range of participants. Other crude oil-based derivatives have highly customized terms and conditions and are not as widely available. Many of these over-the-counter contracts are cash-settled forwards for the future delivery of crude oil- or petroleum-based fuels that have terms similar to the Oil Futures Contracts. Others take the form of “swaps” in which the two parties exchange cash flows based on pre-determined formulas tied to the spot price of crude oil, forward crude oil prices or crude oil futures prices. For example, USOF may enter into over-the-counter derivative contracts whose value will be tied to changes in the difference between the spot price of light, sweet crude oil, the price of Oil Futures Contracts traded on the NYMEX and the prices of other Oil Futures Contracts that may be invested in by USOF.

To protect itself from the credit risk that arises in connection with such contracts, USOF may enter into agreements with each counterparty that provide for the netting of its overall exposure to its counterparty, such as the agreements published by the International Swaps and Derivatives Association, Inc. USOF also may require that the counterparty be highly rated and/or provide collateral or other credit support to address USOF’s exposure to the counterparty. In addition, it is also possible for USOF and its counterparty to agree to clear their agreement through an established futures clearing house such as those connected to the NYMEX or the ICE Futures. In that event, USOF would no longer have credit risk of its original counterparty, as the clearing houseclearinghouse would now be USOF’s counterparty. USOF would still retain any price risk associated with its transaction.

The creditworthiness of each potential counterparty is assessed by the General Partner. The General Partner assesses or reviews, as appropriate, the creditworthiness of each potential or existing counterparty to an over-the-counter contract pursuant to guidelines approved by the General Partner’s board of directors. Furthermore, the General Partner on behalf of USOF only enters into over-the-counter contracts with (a) members of the Federal Reserve System or foreign banks with branches regulated by the Federal Reserve Board; (b) primary dealers in U.S. government securities; (c) broker-dealers; (d) commodities futures merchants; or (e) affiliates of the foregoing. Existing counterparties are also reviewed periodically by the General Partner.

USOF anticipates that the use of Other Crude Oil-Related Investments together with its investments in Futures Contracts will produce price and total return results that closely track the investment goals of USOF.

USOF may employ spreads or straddles in its trading to mitigate the differences in its investment portfolio and its goal of tracking the price of the Benchmark Oil Futures Contract. USOF would use a spread when it chooses to take simultaneous long and short positions in futures written on the same underlying asset, but with different delivery months. The effect of holding such combined positions is to adjust the sensitivity of USOF to changes in the price relationship between futures contracts which will expire sooner and those that will expire later. USOF would use such a spread if the General Partner felt that taking such long and short positions, when combined with the rest of its holdings, would more closely track the investment goals of USOF, or if the General Partner felt if it would lead to an overall lower cost of trading to achieve a given level of economic exposure to movements in oil prices. USOF would enter into a straddle when it chooses to take an option position consisting of a long (or short) position in both a call option and put option. The economic effect of holding certain combinations of put options and call options can be very similar to that of owning the underlying futures contracts. USOF would make use of such a straddle approach if, in the opinion of the General Partner, the resulting combination would more closely track the investment goals of USOF or if it would lead to an overall lower cost of trading to achieve a given level of economic exposure to movements in oil prices.

During the nine monthsthree month period ended September 30, 2007,March 31, 2008, USOF did not employ any hedging methods since all of its investments were made over an exchange. Therefore, USOF was not exposed to counterparty risk.

27 |

Disclosure Controls and Procedures.Procedures

USOF maintains disclosure controls and procedures that are designed to ensure that material information required to be disclosed in USOF’s periodic reports filed or submitted under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time period specified in the SEC’s rules and forms.

The duly appointed officers of the General Partner, including its chief executive officer and chief financial officer, who perform functions equivalent to those of a principal executive officer and principal financial officer of USOF if USOF had any officers, have evaluated the effectiveness of USOF’s disclosure controls and procedures and have concluded that the disclosure controls and procedures of USOF have been effective as of the end of the period covered by this quarterly report.

Change in Internal Control Over Financial Reporting.Reporting

There were no changes in USOF’s internal control over financial reporting during USOF’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, USOF’s internal control over financial reporting.

Part II.OTHER INFORMATION

| Item 1. Legal Proceedings. |

| Not applicable. |

| There has not been a material change from the risk factors previously disclosed in USOF’s annual report on Form 10-K for the fiscal year ended December 31, 2007. |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds. |

| Not applicable. |

| Not applicable. |

| Item 4. Submission of Matters to a Vote of Security Holders. |

| Not applicable. |

Item 5.Other Information.

Monthly Account Statements

Pursuant to the requirement under part 4.22 of the Commodity Exchange Act, each month USOF publishes an account statement for its unitholders, which includes a Statement of Income (Loss) and a Statement of Changes in NAV. The account statement is filed with the SEC on a current report on Form 8-K pursuant to Section 13 or 15(d) of the Exchange Act and posted each month on USOF’s website at www.unitedstatesoilfund.com.www.unitedstatesoilfund.com.

Listed below are the exhibits which are filed or furnished as part of this quarterly report on Form 10-Q (according to the number assigned to them in Item 601 of Regulation S-K):

Exhibit Number | Description of Document | ||

* Filed herewith

** Furnished herewith

29

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

United States Oil Fund, LP (Registrant)