UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended SeptemberJune 30, 20212022

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-55825

TRICCARCORRELATE INFRASTRUCTURE PARTNERS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 84-4250492 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

220 Travis Street, Suite 501 Shreveport, Louisiana | 71101 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(318855)-425-5000264-4060

(Registrant’s(Registrant’s telephone number, including area code)

(Former

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Symbol(s) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☐ ☒ No No☒☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☐ ☒ No No☒☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer ☐ | Smaller reporting company ☒ |

| Accelerated Filer ☐ | Emerging growth company ☐ |

| Non-accelerated Filer ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

AsThe number of November 12, 2021 there were shares of Class A common stock outstanding.Common Stock, par value $0.0001 per share, outstanding as of August 12, 2022 was .

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

TRICCAR, INC.

Index

CORRELATE INFRASTRUCTURE PARTNERS INC.

Index

PART 1 — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CORRELATE INFRASTRUCTURE PARTNERS INC.TRICCAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)JUNE 30, 2022 AND DECEMBER 31, 2021

(Unaudited)

| September 30, 2021 | December 31, 2020 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 9,197 | $ | 1,699 | ||||

| Total current assets | 9,197 | 1,699 | ||||||

| Total assets | $ | 9,197 | $ | 1,699 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 311,587 | $ | 228,411 | ||||

| Accrued liabilities, related party | — | 48,830 | ||||||

| Total current liabilities | 311,587 | 277,241 | ||||||

| Total Liabilities | 311,587 | 277,241 | ||||||

| Commitments and Contingencies (Note 5) | ||||||||

| Stockholders’ Deficit: | ||||||||

| Preferred stock $ par value; authorized shares with outstanding as June 30, 2021 and December 31, 2020 | — | — | ||||||

| Common stock- Class A $ par value; authorized shares with and shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | 2,000 | 7,250 | ||||||

| Common stock- Class B $ par value; authorized shares with and shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | 0 | 2,750 | ||||||

| Additional paid-in capital | 207,588 | 0 | ||||||

| Accumulated deficit | (511,978 | ) | (285,542 | ) | ||||

| Total stockholders’ deficit | (302,390 | ) | (275,542 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 9,197 | $ | 1,699 | ||||

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | 414,940 | $ | 252,189 | ||||

| Accounts receivable, net of allowance for doubtful accounts | 139,272 | 40,807 | ||||||

| Inventory | 546,384 | - | ||||||

| Prepaid expenses and other current assets | 509,053 | - | ||||||

| Total current assets | 1,609,649 | 292,996 | ||||||

| Other assets | ||||||||

| Intangible assets - trademark/trade name | 139,700 | 139,700 | ||||||

| Intangible assets - customer relationships, net | 210,420 | 233,800 | ||||||

| Intangible assets - developed technology, net | 20,810 | 27,750 | ||||||

| Goodwill | 762,851 | 762,851 | ||||||

| Total other assets | 1,133,781 | 1,164,101 | ||||||

| Total assets | $ | 2,743,430 | $ | 1,457,097 | ||||

| Liabilities and Stockholders' Equity (Deficit) | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 733,011 | $ | 819,413 | ||||

| Accrued expenses | 233,836 | 58,345 | ||||||

| Customer deposits | 1,114,154 | - | ||||||

| Shareholder advances | 96,519 | 96,519 | ||||||

| Line of credit | 30,000 | 30,000 | ||||||

| Notes payable, current portion, net of discount | 979,014 | - | ||||||

| Total current liabilities | 3,186,534 | 1,004,277 | ||||||

| Notes payable, net of current portion | 20,400 | 20,400 | ||||||

| Total liabilities | 3,206,934 | 1,024,677 | ||||||

| Commitments and contingencies (Note 3) | ||||||||

| Stockholders' equity (deficit) | ||||||||

| Preferred stock $ par value; authorized shares with -- issued and outstanding at June 30, 2022 and December 31, 2021, respectively | - | - | ||||||

| Common stock- Class A $ par value; authorized shares with -- and shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | - | 3,464 | ||||||

| Common stock- Class B $ par value; authorized shares with -- shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | - | - | ||||||

| Common stock $ par value; authorized shares with and -- shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively | 3,514 | - | ||||||

| Additional paid-in capital | 3,313,290 | 1,534,474 | ||||||

| Accumulated deficit | (3,780,308 | ) | (1,105,518 | ) | ||||

| Total stockholders' equity (deficit) | (463,504 | ) | 432,420 | |||||

| Total liabilities and stockholders' equity (deficit) | $ | 2,743,430 | $ | 1,457,097 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 1 |

CORRELATE INFRASTRUCTURE PARTNERS INC.

TRICCAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2022 AND 2021

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | |||||||||||||

| Revenue, net of discounts | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| Costs and expenses: | ||||||||||||||||

| Operating costs, related party | 60,147 | — | 90,147 | 45,000 | ||||||||||||

| General and administrative | 78,451 | 7,384 | 136,289 | 9,050 | ||||||||||||

| Total costs and expenses | 138,598 | 7,384 | 226,436 | 54,050 | ||||||||||||

| Operating loss | (138,598 | ) | (7,384 | ) | (226,436 | ) | (54,050 | ) | ||||||||

| Other (income) expense: | ||||||||||||||||

| Other income (Note 6) | 0 | 0 | 0 | (10,000 | ) | |||||||||||

| Interest expense | 0 | 0 | 0 | 0 | ||||||||||||

| Loss before provision for income taxes | (138,598 | ) | (7,384 | ) | (226,436 | ) | (44,050 | ) | ||||||||

| Provision for income taxes | 0 | 0 | 0 | 0 | ||||||||||||

| Net loss | $ | (138,598 | ) | $ | (7,384 | ) | $ | (226,436 | ) | (44,050 | ) | |||||

| Net loss per common share – basic: | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Weighted Average Common Shares Outstanding: | ||||||||||||||||

| Basic | 20,000,000 | 100,000,000 | 58,966,790 | 93,333,333 | ||||||||||||

(Unaudited)

| For the three months ended | For the six months ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Revenues | $ | 236,690 | $ | 1,584 | $ | 305,098 | $ | 9,235 | ||||||||

| Cost of revenues | 193,946 | 855 | 263,060 | 3,716 | ||||||||||||

| Gross profit (loss) | 42,744 | 729 | 42,038 | 5,519 | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | 648,974 | 1,181 | 1,195,208 | 3,505 | ||||||||||||

| Insurance | 2,221 | - | 3,392 | - | ||||||||||||

| Legal and professional | 756,914 | 1,385 | 938,922 | 2,738 | ||||||||||||

| Travel | 21,525 | 2,371 | 50,480 | 6,991 | ||||||||||||

| Depreciation and amortization | 15,160 | - | 30,320 | - | ||||||||||||

| Total operating expenses | 1,444,794 | 4,937 | 2,218,322 | 13,234 | ||||||||||||

| Loss from operations | (1,402,050 | ) | (4,208 | ) | (2,176,284 | ) | (7,715 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Interest expense | (37,623 | ) | - | (70,364 | ) | - | ||||||||||

| Amortization of debt discount | (261,657 | ) | - | (428,142 | ) | - | ||||||||||

| Total other income (expense) | (299,280 | ) | - | (498,506 | ) | - | ||||||||||

| Net loss | $ | (1,701,330 | ) | $ | (4,208 | ) | $ | (2,674,790 | ) | $ | (7,715 | ) | ||||

| Loss per share | $ | (0.05 | ) | $ | (0.00 | ) | $ | (0.08 | ) | $ | (0.00 | ) | ||||

| Weighted average shares outstanding - basic | 34,843,217 | 57,752,809 | 34,742,130 | 78,994,413 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 2 |

CORRELATE INFRASTRUCTURE PARTNERS INC.TRICCAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS STOCKHOLDERS’ EQUITY (DEFICIT)

(UNAUDITED)FOR THE SIX MONTHS ENDED JUNE 30, 2022 AND 2021

| For the Nine Months Ended | ||||||||

September 30, 2021 | September 30, 2020 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (226,436 | ) | $ | (44,050 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Increase (decrease) in operating liabilities: | ||||||||

| Accounts payable | 83,176 | — | ||||||

| Accrued liabilities | 0 | 16,339 | ||||||

| Net cash used in operating activities | (143,260 | ) | (27,711 | ) | ||||

| Cash Flows from Investing Activities | 0 | 0 | ||||||

| Cash Flows from Financing Activities: | ||||||||

| Contributed capital | 150,758 | 0 | ||||||

| Proceeds from equity investment | — | 2,075 | ||||||

| Net cash provided from financing activities: | 150,758 | 2,075 | ||||||

| Net increase (decrease) in cash | 7,498 | (25,636 | ) | |||||

| Cash at beginning of the period | 1,699 | 29,467 | ||||||

| Cash at end of the period | $ | 9,197 | $ | 3,831 | ||||

| Supplemental Cash Flow Disclosures | ||||||||

| Cash paid for: | ||||||||

| Interest | $ | 0 | $ | 0 | ||||

| Taxes | $ | 0 | $ | 0 | ||||

| Supplemental Disclosure of Non-Cash Investing and Financing | ||||||||

| Accrued liabilities forgiven through May 2021 Recission Agreement (See Note 7) | $ | 48,830 | $ | 0 | ||||

| Accounts payable acquired in reverse merger | $ | 0 | $ | 168,411 | ||||

(Unaudited)

| Class A Common Stock | Class B Common Stock | Common Stock | Additional | Accumulated | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Paid in Capital | Deficit | Total | ||||||||||||||||||||||||||||

| Balances, December 31, 2020 | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | - | $ | - | $ | 457,700 | $ | (1,015,269 | ) | $ | (547,569 | ) | |||||||||||||||||||

| Net loss | - | 0 | - | 0 | - | 0 | 0 | (3,507 | ) | (3,507 | ) | |||||||||||||||||||||||||

| Balances, March 31, 2021 | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | - | $ | - | $ | 457,700 | $ | (1,018,776 | ) | $ | (551,076 | ) | |||||||||||||||||||

| Effect of pre-merger TCCR transactions | (52,500,000 | ) | (5,250 | ) | (27,500,000 | ) | (2,750 | ) | - | - | 8,000 | - | - | |||||||||||||||||||||||

| Net loss | - | 0 | - | 0 | - | 0 | 0 | (4,208 | ) | (4,208 | ) | |||||||||||||||||||||||||

| Balances, June 30, 2021 | 20,000,000 | $ | 2,000 | 0 | $ | - | - | $ | - | $ | 465,700 | $ | (1,022,984 | ) | $ | (555,284 | ) | |||||||||||||||||||

| Balances, December 31, 2021 | 34,639,920 | $ | 3,464 | 0 | $ | - | - | $ | - | $ | 1,534,474 | $ | (1,105,518 | ) | $ | 432,420 | ||||||||||||||||||||

| Issuance of warrants in connection with debt | - | 0 | - | 0 | - | 0 | 799,128 | 0 | 799,128 | |||||||||||||||||||||||||||

| Stock based compensation | - | 0 | - | 0 | - | 0 | 150,504 | 0 | 150,504 | |||||||||||||||||||||||||||

| Issuances of shares for cash | - | - | 0 | - | 0 | 150,000 | 0 | 150,000 | ||||||||||||||||||||||||||||

| Net loss | - | 0 | - | 0 | - | 0 | 0 | (973,460 | ) | (973,460 | ) | |||||||||||||||||||||||||

| Balances, March 31, 2022 | 34,639,920 | $ | 3,464 | 0 | $ | - | - | $ | - | $ | 2,634,106 | $ | (2,078,978 | ) | $ | 558,592 | ||||||||||||||||||||

| Stock based compensation | - | 0 | - | 0 | - | 0 | 179,234 | 0 | 179,234 | |||||||||||||||||||||||||||

| Elimination of Class A and Class B common stock for single class of common stock | (34,639,920 | ) | (3,464 | ) | - | - | 34,639,920 | 3,464 | - | - | - | |||||||||||||||||||||||||

| Issuances of shares for services | - | - | - | - | 500,000 | 50 | 499,950 | - | 500,000 | |||||||||||||||||||||||||||

| Net loss | - | 0 | - | 0 | - | 0 | 0 | (1,701,330 | ) | (1,701,330 | ) | |||||||||||||||||||||||||

| Balances, June 30, 2022 | 0 | $ | - | 0 | $ | - | 35,139,920 | $ | 3,514 | $ | 3,313,290 | $ | (3,780,308 | ) | $ | (463,504 | ) | |||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

CORRELATE INFRASTRUCTURE PARTNERS INC.TRICCAR, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINESIX MONTHS ENDED SEPTEMBERJUNE 30, 2022 AND 2021

(UNAUDITED)(Unaudited)

| Additional | Total | |||||||||||||||||||||||||||

| Common Stock Class A | Common Stock Class B | Paid-In | Accumulated | Stockholders’ | ||||||||||||||||||||||||

| Shares | Par Value | Shares | Par Value | Capital | Deficit | Equity (Deficit) | ||||||||||||||||||||||

| Balance December 31, 2019 of TRICCAR Holdings, Inc. | 52,500,000 | $ | 525 | 27,500,000 | $ | 275 | $ | 101,401 | $ | (105,225 | ) | $ | (3,024 | ) | ||||||||||||||

| Contribution by shareholders | — | 0 | — | 0 | 2,075 | 0 | $ | 2,075 | ||||||||||||||||||||

| Recapitalization on reverse merger - purging previous share | (52,500,000 | ) | (525 | ) | (27,500,000 | ) | (275 | ) | (103,476 | ) | 0 | $ | (104,276 | ) | ||||||||||||||

| Recapitalization on reverse merger - issuance of new share | 72,500,000 | 7,250 | 27,500,000 | 2,750 | 0 | (74,135 | ) | $ | (64,135 | ) | ||||||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (44,050 | ) | $ | (44,050 | ) | ||||||||||||||||||

| Balance September 30, 2020 | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | $ | 0 | $ | (223,410 | ) | $ | (213,410 | ) | ||||||||||||||

| Balance December 31, 2020 of TRICCAR Holdings, Inc. | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | $ | 0 | $ | (285,542 | ) | $ | (275,542 | ) | ||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (15,609 | ) | $ | (15,609 | ) | ||||||||||||||||||

| Balance March 31, 2021 | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | $ | 0 | $ | (301,151 | ) | $ | (291,151 | ) | ||||||||||||||

| Contribution by shareholders | — | 0 | — | 0 | 150,758 | 0 | $ | 150,758 | ||||||||||||||||||||

| Accrued liabilities forgiven through May 2021 Recission Agreement (See Note 7) | — | 0 | — | 0 | 48,830 | 0 | $ | 48,830 | ||||||||||||||||||||

| Cancellation of shares related to May 2021 Recission Agreement | (52,500,000 | ) | (5,250 | ) | (27,500,000 | ) | (2,750 | ) | 8,000 | — | $ | — | ||||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (72,229 | ) | $ | (72,229 | ) | ||||||||||||||||||

| Balance June 30, 2021 | 20,000,000 | $ | 2,000 | 0 | $ | 0 | $ | 207,588 | $ | (373,380 | ) | $ | (163,792 | ) | ||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (138,598 | ) | $ | (138,598 | ) | ||||||||||||||||||

| Balance September 30, 2021 | 20,000,000 | $ | 2,000 | 0 | $ | 0 | $ | 207,588 | $ | (511,978 | ) | $ | (302,390 | ) | ||||||||||||||

| For the six months ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| Operating activities | ||||||||

| Net loss | $ | (2,674,790 | ) | $ | (7,715 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Depreciation and amortization | 30,320 | - | ||||||

| Amortization of debt discount | 428,142 | - | ||||||

| Shares issued for services | 500,000 | - | ||||||

| Stock-based compensation | 329,738 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (11,360 | ) | (6,859 | ) | ||||

| Unbilled revenues | (87,105 | ) | - | |||||

| Inventory | (546,384 | ) | - | |||||

| Prepaid expenses and other current assets | (509,053 | ) | 0 | |||||

| Accounts payable | (86,402 | ) | (28,224 | ) | ||||

| Accrued expenses | 175,491 | (163 | ) | |||||

| Customer deposits | 1,114,154 | - | ||||||

| Net cash used in operating activities | (1,337,249 | ) | (42,961 | ) | ||||

| Investing activities | ||||||||

| Net cash provided by investing activities | - | - | ||||||

| Financing activities | ||||||||

| Proceeds from issuance of notes payable | 1,350,000 | - | ||||||

| Proceeds from issuance of common stock | 150,000 | - | ||||||

| Net cash provided by financing activities | 1,500,000 | - | ||||||

| Net increase (decrease) in cash | $ | 162,751 | $ | (42,961 | ) | |||

| Cash - beginning of period | 252,189 | 74,375 | ||||||

| Cash - end of period | $ | 414,940 | $ | 31,414 | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| Cash paid for interest | $ | 32,141 | $ | - | ||||

| Supplemental schedule of non-cash investing and financing activities | ||||||||

| Discount on note payable from issuance of warrants | $ | 799,128 | $ | - | ||||

| Original issuance discount on note payable | $ | 135,000 | $ | - | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

CORRELATE INFRASTRUCTURE PARTNERS INC.TRICCAR, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2021

| NOTE 1 – NATURE OF THE ORGANIZATION AND BUSINESS |

(UNAUDITED)Name Change

1. BASIS OF PRESENTATIONEffective April 5, 2022, Triccar, Inc. changed its name to Correlate Infrastructure Partners Inc. (“CIPI” or the “Company”) to better reflect its operations.

Nature of the Business

The accompanying condensed consolidated financial statements included hereininclude the accounts of the Company, and its subsidiaries Correlate, Inc. (“Correlate”), a Delaware corporation, and Loyal Enterprises LLC dba Solar Site Design (“Loyal”), a Tennessee limited liability company.

Correlate is a portfolio-scale development and finance platform offering commercial and industrial facilities access to clean electrification solutions focused on locally-sited solar, energy storage, EV infrastructure, and intelligent efficiency measures. Its unique data-driven approach is powered by proprietary analytics and concierge subscription services.

Loyal provides consulting services on acquisitions and project development tools to customers in the commercial solar industry.

Going Concern

The accompanying condensed consolidated financial statements have been prepared by TRICCAR, Inc. (“assuming the Company”), without audit, pursuantCompany will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. The Company has incurred losses since inception and has not generated positive cash flows from operations. These matters, among others, raise substantial doubt about the Company's ability to continue as a going concern.

The Company’s ability to continue in existence is dependent on its ability to develop additional sources of capital, and/or achieve profitable operations and positive cash flows. Management’s plans with respect to operations include aggressive marketing, acquisitions, and raising additional capital through sales of equity or debt securities as may be necessary to pursue its business plans and sustain operations until such time as the rulesCompany can achieve profitability. Management believes that aggressive marketing combined with acquisitions and regulationsadditional financing as necessary will result in improved operations and cash flow in 2022 and beyond. However, there can be no assurance that management will be successful in obtaining additional funding or in attaining profitable operations. The accompanying condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The accompanying condensed consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and the interim reporting rules of the Securities and Exchange Commission. Certain informationCommission (“SEC”) and footnote disclosures normally includedshould be read in conjunction with the audited financial statements preparedand notes thereto contained in accordancethe Company’s latest Annual Report filed with U.S. generally accepted accounting principles have been omitted. However, inthe SEC on Form 10-K. In the opinion of management, all adjustments, (which include onlyconsisting of normal recurring adjustments unless(unless otherwise indicated), necessary to present fairlyfor a fair presentation of the financial position and the results of operations for the interim periods presented have been made.reflected herein. The results of operations for interim periods are not necessarily indicative of trends or ofthe results to be expected for the full year.

2. BUSINESS ACTIVITIES

On December 12, 2019, Frontier Oilfield Services, Inc., a Texas Corporation (“FOSI”) entered into a Reorganization and Stock Purchase Agreement (the “Agreement”) to change its corporate domicile from Texas to Nevada, assume the name TRICCAR, Inc. (“TRICCAR”), and to acquire 100%Principles of the issued and outstanding equity of TRICCAR Holdings, Inc., a Nevada Corporation (“TRICCAR Holdings”).

Pursuant to the Agreement, effective on February 28, 2020, the parties closed the Agreement.

TRICCAR acquired 100% of the issued and outstanding equity of TRICCAR Holdings. TRICCAR issued 80,000,000 shares of stock to acquire all the issued and outstanding equity stock of TRICCAR Holdings while TRICCAR shareholders retained shares of stock. As a consequence, immediately subsequent to the acquisition TRICCAR will have approximately shares of common stock outstanding. The issuance of the new shares has already been reflected on TRICCAR’s book and is pending the name and symbol change with transfer agent.

The accompanying consolidated financial statements include the accounts of the Company., and its subsidiary TRICCAR Holdings.

Through May 14, 2021, TRICCAR was a biomedical research, development, and marketing firm whose focus was to develop, acquire, and partner to bring bioceutical solutions (not requiring FDA approval) and pharmaceutical drugs (requiring FDA approval) to the market. The Company was in the development stage of bioceutical and pharmaceutical products designed to support the well-being of humans and animals that have common diseases.

On May 14, 2021, TRICCAR and TRICCAR Holdings entered into a Mutual Rescission Agreement and General Release (“Rescission Agreement”), pursuant to which the Reorganization and Stock Purchase Agreement (“Agreement”) entered into by and between the TRICCAR and TRICCAR Holdings on December 12, 2019 was rescinded. Pursuant to the terms of the Rescission Agreement, the shares that were to be issued to the shareholders of TRICCAR Holdings will be returned by the shareholders of TRICCAR Holdings and in exchange therefor, TRICCAR will return the shares of TRICCAR Holdings it received to the shareholders of TRICCAR Holdings and the Company will disclaim any right, title and/or interest in or to any shares of capital stock of TRICCAR Holdings.

3. GOING CONCERNConsolidation

The Company’s financial statements are prepared using U.S. generally accepted accounting principles (“U.S. GAAP”) applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. As of the date of the financial statements, the Company has generated losses from operations, has an accumulated deficit and working capital deficiency. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern.

To continue as a going concern and achieve a profitable level of operations, the Company will need, among other things, to increase its business volume and grow revenues, reduce its operating expenses, raise additional capital resources and develop new and stable sources of revenue to meet its operating expenses.

The Company’s ability to continue as a going concern will be dependent upon management’s ability to successfully implement management’s plans to pursue additional business volumes from new and existing customers, reduce indebtedness through sales of non-performing assets and conversions of debt to equity, and rationalize the Company’s cost structure to achieve profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. The Company’s continued existence will ultimately be dependent on its ability to generate cash flows to support its operations as well as provide sufficient resources to retire existing liabilities on a timely basis. The Company faces significant risk in implementing its business plan and there can be no assurance that financing for its operations and business plan will be available or, if available, such financing will be on satisfactory terms.

4. SUMMARY OF SELECTED ACCOUNTING POLICIES

Principles of Consolidation

Thecondensed consolidated financial statements include the accounts of the Company and its wholly-ownedwholly owned subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation.

Fair Value of Financial Instruments

| 5 |

In accordance with the reporting requirements of ASC Topic 825, Financial Instruments, the Company calculates the fair value of its assets and liabilities which qualify as financial instruments under this standard and includes thisCORRELATE INFRASTRUCTURE PARTNERS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

additional information in the notes to the financial statements when the fair value is different than the carrying value of those financial instruments. The Company does not have assets or liabilities measured at fair value on a recurring basis. Consequently, the Company did not have any fair value adjustments for assets and liabilities measured at fair value at the balance sheet dates, nor gains or losses reported in the statements of operations that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still held during the three months ended March 31, 2021 and 2020, except as disclosed.

Basic earnings per common share are calculated by dividing net income or loss by the weighted average number of shares outstanding during the period. Diluted earnings per common share are calculated by adjusting outstanding shares, assuming conversion of all potentially dilutive stock options and warrants. The computation of diluted EPS does not assume conversion, exercise, or contingent issuance of shares that would have an anti-dilutive effect on earnings per common share. Anti-dilution results from an increase in earnings per share or reduction in loss per share from the inclusion of potentially dilutive shares in EPS calculations. Currently there are no common stock dilutive instruments in 2021 or 2020 which have been excluded from EPS that could potentially have a dilutive effect on EPS in the future.

Use of Estimates

The preparation of the unaudited consolidated financial statements in conformity with accounting principles generally accepted in the U.S.accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities revenues, expenses, and the related disclosuresdisclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from thesethose estimates.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments and other short-term investments with maturity of three months or less, when purchased, to be cash equivalents. There were no cash equivalents as of June 30, 2022 and December 31, 2021.

The Company maintains its cash balances at financial institutions that are insured by the Federal Deposit Insurance Corporation (“FDIC”). The FDIC provides coverage of up to $250,000 per depositor, per financial institution, for the aggregate total of depositors' interest and non-interest-bearing accounts. At June 30, 2022, $97,171 of the Company's cash balances were in excess of FDIC limits. The Company has not experienced any losses on these accounts and management does not believe that the Company is exposed to any significant risks.

Accounts Receivable

Accounts receivable consists of unpaid revenues. The Company records an allowance for doubtful accounts to allow for any amounts that may not be recoverable, which is based on an analysis of the Company’s prior collection experience, customer credit worthiness, and current economic trends. Accounts are considered delinquent when payments have not been received within the agreed upon terms and are written off when management determines that collection is not probable. As of June 30, 2022 and December 31, 2021, the Company’s allowance for doubtful accounts was $90,189, respectively.

Intangible Assets

Intangible assets are amortized over their estimated useful lives. Each period, the Company evaluates the estimated remaining useful life of its intangible assets and whether events or changes in circumstances warrant a revision to the remaining period of amortization. Management tests for impairment whenever events or changes in circumstances occur that could impact the recoverability of these assets.

Impairment Assessment

The Company evaluates intangible assets and other long-lived assets for possible impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. This includes but is not limited to significant adverse changes in business climate, market conditions or other events that indicate an asset's carrying amount may not be recoverable. Recoverability of these assets is measured by comparing the carrying amount of each asset to the future cash flows the asset is expected to generate. If the cash flows used in the test for recoverability are less than the carrying amount of these assets, the carrying amount of such assets is reduced to fair value.

The Company evaluates and tests the recoverability of its goodwill for impairment at least annually during its fourth quarter of each fiscal year or more often if and when circumstances indicate that goodwill may not be recoverable.

| 6 |

CORRELATE INFRASTRUCTURE PARTNERS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Revenue Recognition

In May 2014, the

The Company accounts for revenue in accordance with FASB issued ASU 2014-09,ASC 606, Revenue from Contracts with Customers (Topic 606)Customers.

A performance obligation is a promise in a contract to transfer a distinct good or service to the client and is the unit of accounting in Topic 606. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. For contracts with multiple performance obligations, the Company allocates the contract’s transaction price to each performance obligation based on the relative standalone selling price. Determining relative standalone selling price and identifying separate performance obligations require judgment. Contract modifications may occur in the performance of the Company’s contracts. Contracts may be modified to account for changes in the contract specifications, requirements or duration. If a contract modification results in the addition of performance obligations priced at a standalone selling price or if the post-modification services are distinct from the services provided prior to the modification, the modification is accounted for separately. If the modified services are not distinct, they are accounted for as part of the existing contract.

The Company’s revenues are derived from contracts for consulting and engineering, procurement and construction services (“EPC”). This update providesThese contracts may have different terms based on the scope, performance obligations and complexity of the engagement, which may require us to make judgments and estimates in recognizing revenues.

The Company’s performance obligations are satisfied over time as work progresses or at a comprehensive new revenue recognition model thatpoint in time (for defined milestones). The selection of the method to measure progress towards completion requires a company to recognize revenue to depictjudgment and is based on the transfercontract and the nature of goods orthe services to be provided.

The Company’s contracts for consulting services are typically less than a customer atyear in duration and require us to a) assist the client in achieving certain defined milestones for milestone fees or b) provide a series of distinct services each period over the contract term for a pre-determined fee for each period. When contractual billings represent an amount that reflectscorresponds directly with the consideration it expectsvalue provided to receivethe client, revenues are recognized as amounts become billable in exchangeaccordance with contract terms.

The Company’s contracts for those goods or services. The guidance also requires additional disclosure about the nature, amount, timingEPC services are typically less than a year in duration and uncertainty of revenuerequire us to a) provide engineering services and cash flows arising from customer contracts.

Our salt water disposal services provide oilb) obtain and gas operators that produce hydrocarbonsinstall materials to dispose of their by-product of salt water (produced water) in an industry approved manner. Revenue is primarily based on a per-barrel price or other throughput metrics as specified in the contract.agreed-upon specifications. The Company recognizes revenuerevenues as servicesmaterials are performed. We have adopted this updatetransferred to the client and have generated no revenues during the period of this report.as performance obligations are satisfied.

Effect of Recent Accounting PronouncementsFinancial Instruments

The Company reviews new accounting standardsCompany’s financial instruments include cash and updates as issued. No new standards or updates had any material effect on these financial statements.cash equivalents, receivables, payables, and debt and are accounted for under the provisions of ASC Topic 825, “Financial Instruments”. The accounting pronouncements and updates issued subsequent to the datecarrying amount of these financial statementsinstruments, with the exception of discounted debt, as reflected in the balance sheets approximates fair value.

Commitments and Contingencies

Liabilities for loss contingencies arising from claims, assessments, litigation, fines, penalties and other sources are recorded when management assesses that were considered significant by management were evaluated forit is probably that a liability has been incurred and the potential effect on these financial statements.amount can be reasonable estimated.

| 7 |

The outbreak of the coronavirus (COVID-19) resulted in increased travel restrictions, and shutdown of businesses, which may cause slower recovery of the economy. We may experience impact from quarantines, market downturns and changes in customer behavior related to pandemic fears and impact on our workforce if the virus continues to spread. In addition, one or more of our customers, partners, service providers or suppliers may experience financial distress, delayed or defaults on payment, file for bankruptcy protection, sharp diminishing of business, or suffer disruptions in their business due to the outbreak. The extent to which the coronavirus impacts our results will depend on future developments and reactions throughout the world, which are highly uncertain and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private businesses to attempt to contain the coronavirus. It is likely to result in a potential material adverse impact on our business, results of operations and financial condition. Wider-spread COVID-19 globally could prolong the deterioration in economic conditions and could cause decreases in or delays in advertising spending and reduce and/or negatively impact our short-term ability to grow our revenues. Any decreased collectability of accounts receivable, bankruptcy of small and medium businesses, or early termination of agreements due to deterioration in economic conditions could negatively impact our results of operations.

5. COMMITMENTS AND CONTINGENCIESCORRELATE INFRASTRUCTURE PARTNERS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

LitigationIncome Taxes

In accordance with FASB ASC Topic 740, "Income Taxes," the Company provides for the recognition of deferred tax assets if realization of such assets is more likely than not. Deferred income tax assets and liabilities are computed for differences between the financial statement and tax basis of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities.

In addition, the Company’s management performs an evaluation of all uncertain income tax positions taken or expected to be taken in the course of preparing the Company’s income tax returns to determine whether the income tax positions meet a “more likely than not” standard of being sustained under examination by the applicable taxing authorities. This evaluation is required to be performed for all open tax years, as defined by the various statutes of limitations, for federal and state purposes. If the Company has interest or penalties associated with insufficient taxes paid, such expenses are reported in income tax expense.

FASB ASC Topic 260, Earnings Per Share, requires a reconciliation of the numerator and denominator of the basic and diluted earnings (loss) per share (EPS) computations.

Basic earnings (loss) per share are computed by dividing income available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive.

The Company had potential additional dilutive securities outstanding at June 30, 2022 except for the options and warrants detailed at Note 5.

Recently Issued Accounting Standards

During the period ended June 30, 2022, there were several new accounting pronouncements issued by the FASB. Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe the adoption of any of these accounting pronouncements has had or will have a material impact on the Company’s condensed consolidated financial statements.

| NOTE 3 – COMMITMENTS AND CONTINGENCIES |

From time to time, the Company may be subject to routineinvolved in litigation claims, or disputes in the ordinary course of business. In the opinion of management, no pending or known threatened claims, actions or proceedings againstThe Company is not currently involved in any litigation that the Company that are expected tobelieves could have a material adverse effect on its financial position,condition or results of operations or cash flows. Theoperations.

Executive Employment Agreements

On January 18, 2022, the Company cannot predictentered into an employment agreement with certainty, however, the outcome or effectMr. Channing Chen, CFO, providing for an annual salary of any$200,000 per year. As part of the litigation or investigatory matters specifically described above or any other pending litigation or claims. There can be no assurance as toagreement, the ultimate outcome of any lawsuits and investigations.Company issued Mr. Chen options exercisable at $ per share for years. The options, valued at approximately $, vest monthly over 36 months upon issuance.

| 8 |

6. OTHER INCOMECORRELATE INFRASTRUCTURE PARTNERS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| NOTE 4 – DEBT |

The other income of $10,000 for the three and six months ended June 30,

Notes Payable

On May 29, 2020, was anLoyal received a $20,400 Economic Injury Disaster Loan (“EIDL”) program advance provided bythrough the Small Business Administration which is designed to provide emergency economic relief to business that were impacted by COVID-10 pandemic.Administration. The advance will not have to be repaid. TRICCAR Holdings, Inc. received the advance but were not approved for a EIDL loan.note bears interest at 3.75% until maturity in March 2050. The note requires $100 monthly payments beginning in May 2022 until maturity.

7.On January 11, 2022, the Company entered into a EQUITY10% note agreement with P&C Ventures, Inc. totaling $1,485,000, including an additional issuance discount of $135,000. The note requires quarterly interest payments with the principal due at maturity on January 11, 2023. In connection with the note agreement, the Company issued P&C Ventures, Inc., 2,700,000 warrants exercisable at $0.25 per share (Note 5). The warrants were fully vested at issuance and expire on July 11, 2023. The warrants, valued at approximately $1,958,000, represented approximately 59% of the total consideration received and resulted in an additional discount on the note totaling $799,128 pursuant to ASC 470-20-30. The discount is being amortized over the life of the note with a discount balance of $505,986 at June 30, 2022.

Line of Credit

On October 3, 2014, Loyal entered into a $30,000 line of credit agreement. The line of credit has no maturity with interest increasing from 8.00% at issuance to 34.00% for the period ended June 30, 2022. As of June 30, 2022, the outstanding principal and accrued interest totaled $40,930.

| NOTE 5 – EQUITY |

The total number shares of common stock authorized that may be issued by the Company is four hundred million () shares of common stock with a par value of one hundredth of one cent ($) per share consistingshare.

The total number of preferred stock authorized that may be issued by the Company is fifty million () shares of preferred stock with a par value of one hundredth of one cent ($) per share.

At December 31, 2021, common stock authorized consisted of three hundred seventy-two million five hundred thousand () shares Class A shares with 1:1 voting rights and twenty-seven million five hundred thousand () Class B shares with 20:1 voting rights, and fifty million () shares of preferred stock with a par value of one hundredth of a cent ($) per share.

On April 5, 2022, the Company amended its Articles of Incorporation such that Class A or Class B common shares were eliminated and replaced by a single class of common stock with 1:1 voting rights.

At June 30, 2022, common stock authorized consisted of four hundred million () common shares with 1:1 voting rights and fifty million () shares of preferred stock with a par value of one hundredth of a cent ($) per share.

To the fullest extent permitted by the laws of the state of Nevada (currently set forth in NRS 78.195), as the same now exists or may hereafter be amended or supplemented, the board of directors may fix and determine the designations, rights, preferences or other variations of each class or series within each class of capital stock of the corporation.

In May 2021 Recission Agreement,During January 2022, the Company agreedreceived proceeds totaling $ for Class A shares issued in December 2021.

During May 2022, the Company issued 500,000 shares of common stock valued at $500,000 for services.

| 9 |

CORRELATE INFRASTRUCTURE PARTNERS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Warrants

During the period ended June 30, 2022, the Company calculated the fair value of the warrants granted based on assumptions used in the Cox-Ross-Rubinstein binomial pricing model using the following inputs: the price of the Company’s common stock on the date of issuance; a risk-free interest rate of %, and volatility of % based on the historical volatility of the Company’s common stock, exercise price of $, and terms of months.

During January 2022, the Company issued 2,700,000 warrants valued at $ as part of a note agreement (Note 4).

The following table presents the Company’s warrants as of June 30, 2022:

| Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Life (in years) | ||||||||||

| Warrants as of December 31, 2021 | 0 | $ | 0 | - | ||||||||

| Issued | 2,700,000 | $ | 0.25 | 1.50 | ||||||||

| Exercised | 0 | $ | 0 | - | ||||||||

| Warrants as of June 30, 2022 | 2,700,000 | $ | 0.25 | 1.03 | ||||||||

At June 30, 2022, all of the Company’s outstanding warrants were vested.

Options

During the period ended June 30, 2022, the Company calculated the fair value of the options granted based on assumptions used in the Cox-Ross-Rubinstein binomial pricing model using the following inputs: the price of the Company’s common stock on the date of issuance, risk-free interest rates ranging from % to rescind2.54%, volatility ranging from % to 285% based on the merger transactionhistorical volatility of the Company’s common stock, exercise prices ranging from $ to $1.00, and terms of years. The fair value of options granted is expensed as vesting occurs over the applicable service periods.

During January 2022, the Company issued options valued at $ as part of an executive employment agreement (Note 3).

During February 2022, the Company issued options valued at $ as part of three non-executive employment agreements.

During March 2022, the Company issued options valued at $ as part of a non-executive employment agreement.

The following table presents the Company’s options as of June 30, 2022:

| Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Life (in years) | ||||||||||

| Options as of December 31, 2021 | 2,059,068 | $ | 0.52 | 5.13 | ||||||||

| Issued | 1,245,000 | $ | 0.96 | 5.00 | ||||||||

| Forfeited | 0 | $ | 0 | - | ||||||||

| Exercised | 0 | $ | 0 | - | ||||||||

| Options as of June 30, 2022 | 3,304,068 | $ | 0.68 | 4.61 | ||||||||

At June, 2022, options to purchase shares of common stock were vested and options to purchase shares of common stock remained unvested. The Company expects to incur expenses for the unvested options totaling $ as they vest.

| 10 |

CORRELATE INFRASTRUCTURE PARTNERS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| NOTE 6 – CONCENTRATIONS |

The Company had the following revenue concentrations for the three and six months ended June 30, 2022 and 2021 and accounts receivable concentrations as of June 30, 2022 and December 31, 2021:

| Revenues | Revenues | Accounts Receivable | ||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | June 30, | December 31, | |||||||||

| Customer | 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | ||||||

| Customer A | 56% | * | 43% | * | * | * | ||||||

| Customer B | 37% | * | 40% | * | 14% | * | ||||||

| Customer C | * | * | * | 83% | 63% | 69% | ||||||

| Customer D | * | 100% | * | 17% | * | * | ||||||

| Customer E | 11% | 12% | ||||||||||

| Customer F | * | 19% | ||||||||||

| * = Less than 10% | ||||||||||||

| NOTE 7 – RELATED PARTY TRANSACTIONS |

Shareholder Advances and Payables

At June 30, 2022 and December 31, 2021, the Company had informal advances payable of $22,154, respectively, due to the Company’s President and CEO, Mr. Todd Michaels.

At June 30, 2022 and December 31, 2021, the Company had advances payable of $11,865, respectively, due to an individual who holds 3% of the Company’s Common Stock.

At June 30, 2022 and December 31, 2021, the Company had advances payable of $ due to an individual who is the Company’s largest shareholder.

At June 30, 2022 and December 31, 2021, the Company had accounts payable of $120,000, respectively, due to Elysian Fields Disposal, LLC, an entity owned by the Company’s largest shareholder.

Michaels Consulting

As of June 30, 2022 and December 31, 2021, the Company had accounts payable due to Michaels Consulting totaling $344,000 and $364,000, respectively.

P&C Ventures, Inc.

Mr. Cory Hunt, who was named a director of the Company on December 28, 2021, is an owner and officer of P&C Ventures, Inc. During January 2022, the Company entered into a note agreement with TRICCAR Holdings that was effective December 12, 2019.P&C Ventures, Inc. and issued warrants related to the note, as disclosed in Note 4.

| NOTE 8 – SUBSEQUENT EVENTS |

During July 2022, the Company issued options valued at $ as part of a non-executive employment agreement.

During July 2022, the Company issued a 10% secured promissory note in the amount of $50,000 to an accredited investor. The note requires quarterly interest payments with the principal due at maturity on January 29, 2024. In connection with the Recission Agreement,issuance of the Note, the Company receivedalso issued a warrant to the investor for the purchase of up to shares of itsthe Company’s common stock from the previous transaction and subsequently cancelled the shares. Therefore the common stock outstanding of the company was reduced from 100,000,000 to during the period and treasury stock is outstanding. Additionally, accrued liabilitiesat a price of $ was forgiven in connection with TRICCAR Holdings during the period.

8. RELATED PARTY TRANSACTIONS

For the quarter periods ending September 30, 2021 and 2020, the Company paid Elysian Fields Disposal LLC., an affiliate of our stockholder Newton Dorsett,per share. The warrants, valued at $ and $15,00072,936, respectively, These are included as operating costswere fully vested at issuance and expire on the Statement of Operations for contract operating and management services of our SWD wells. The account payables outstanding balance with Elysian Fields Disposal was $220,000 and $175,000, as of September 30, 2021 and December 31, 2020, respectively.

For the quarter period ending September 30, 2021, the Company paid Loutex Production Company LLC., an affiliate of our stockholder Newton Dorsett, $11,171, These are included as operating costs on the Statement of Operations for contract operating costs and services of our SWD wells. The account payables outstanding balance with Loutex Production Company was $11,171, as of September 30, 2021.

During 2021, $150,758 was contributed to the Company from an affiliate and stockholder.

9. SUBSEQUENT EVENTSJanuary 29, 2024.

On October 13, 2021, a stockholder loanedAugust 11, 2022, the Company issued a 10% secured promissory note in the amount of $25,000150,000 for working capital.to an accredited investor. The note isrequires quarterly interest payments with the principal due at maturity on February 11, 2024. In connection with the issuance of the Note, the Company also issued a demand note that matures November 13, 2021 and extends maturity for thirty day intervals upon permission fromwarrant to the holder, and bears an interest rate of 5% per annum.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CAUTIONARY STATEMENT

Statements in this report which are not purely historical facts, including statements regarding the Company’s anticipations, beliefs, expectations, hopes, intentions or strategiesinvestor for the future, may be forward-looking statements within the meaningpurchase of Section 21E of the Securities Act of 1934, as amended. All forward-looking statements in this report are based upon information availableup to us on the date of the report. Any forward-looking statements involve risks and uncertainties that could cause actual results or events to differ materially from events or results described in the forward-looking statements. Important factors with respect to any such forward-looking statements, including certain risks and uncertainties that could cause actual results to differ materially from the Company’s expectations (“Cautionary Statements”), are disclosed in the Company’s annual report on Form 10-K, including, without limitation, in conjunction with the forward-looking statements under the caption “Risk Factors.” In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements included herein include, but are not limited to, limited working capital, limited access to capital, changes from anticipated levels of sales and revenues future national or regional economic and competitive conditions, changes in relationships with customers, difficulties in developing new business, difficulties integrating any new businesses or products acquired, regulatory change, the ability of the Company to meet its stated business goals, the Company’s restructuring initiatives, the Company’s ability to sustain profitability, and general economic and business conditions. Although the Company believes the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the Cautionary Statements. We do not undertake to update any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The following discussion highlights the Company’s results of operations and the principal factors that have affected its consolidated financial condition as well as its liquidity and capital resources for the periods described and provides information that management believes is relevant for an assessment and understanding shares of the Company’s consolidated financial conditioncommon stock at a price of $ per share. The warrants, valued at $, were fully vested at issuance and results of operations presented herein. expire on February 11, 2024.

| 11 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis are based on the Company’s unauditedof our results of operations and financial condition should be read in conjunction with our financial statements containedand related notes appearing elsewhere in this Current Report,report. This discussion and analysis contains forward looking statements that involve risks, uncertainties and assumptions. The actual results may differ materially from those anticipated in these forwarding looking statements as a result of certain factors, including but not limited to, those which have been prepared in accordanceare not within our control.

Overview

Correlate Infrastructure Partners Inc. (OTCQB: CIPI), formerly Triccar Inc., together with generally accepted accounting principlesits subsidiaries (collectively the “Company”, “Correlate”, “we”, “us” and “our”), is a technology-enabled clean energy optimization provider that offers a complete suite of proprietary clean energy assessment and deployment solutions for commercial and industrial (C&I) building and property owners in the United States. You should read the discussionThrough our true tech-enabled project development and analysis together with such financial statementsfinancing platform, we provide portfolio energy optimization and the related notes thereto.

OVERVIEW

TRICCAR Inc. (or “TRICCAR” or “the Company”) focusesclean energy solutions for sustainable profit growth in the oilfield service industrybuildings nationwide and more specifically as the owner of three saltwater disposal wells (“SWDs”) located in Wise County Texas and the Barnett Shale region in north central Texas.bring project financing where needed.

We havewere originally formed as a Texas corporation in 1995 under the name TBX Resources, Inc. In December 2011 we changed our name to Frontier Oilfield Services Inc. In January 2020, we merged with and into Triccar Inc., a Nevada corporation and Triccar Inc. was the surviving entity. In December 2021, we acquired one hundred percent of the equity interests of each of Correlate Inc. and Loyal Enterprises LLC. In February 2022, a majority of our stockholders approved an operating and management agreement with Elysian Fields Disposal LLC (“Elysian Fields”)amendment to serve as operator, management and consultantour articles of various field operational assets. Under the contract agreement, Elysian Fields has the authority to operate the wells and provide accounting, regulatory compliance filings, and operating services through itself or qualified sub-contractors. This agreement remains in placeincorporation and the three SWD wells continuechange of our corporate name from Triccar Inc. to Correlate Infrastructure Partners Inc., to better reflect our future growth and focus. On April 5, 2022, we filed an amendment to our articles of incorporation with the State of Nevada to change our corporate name from Triccar Inc. to Correlate Infrastructure Partners Inc. Our principal executive offices are located at 220 Travis Street, Suite 501, Shreveport, Louisiana 71101, and our telephone number is (855) 264-4060.

Recently Issued Accounting Pronouncements

During the six months ended June 30, 2022, and through August 12, 2022, there were several new accounting pronouncements issued by the Financial Accounting Standards Board (“FASB”). Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe the adoption of any of these accounting pronouncements has had or will have a material impact on the Company’s financial statements.

All other new accounting pronouncements issued but not yet effective or adopted have been deemed not to be operated pursuantrelevant to the terms of the operating and management agreement.us, hence are not expected to have any impact once adopted.

The significant quantitySummary of oil and gas wellsSignificant Accounting Policies

There have been no changes from the Summary of Significant Accounting Policies described in the Barnett Shale of Texas combinedour Annual Report on Form 10-K filed with the presence of produced water (salt water)Securities and other fluids in the production process creates demand for disposal services such as those services provided by us.Exchange Commission on April 14, 2022.

From January 2020, through May 14, 2021,

Liquidity and Capital Resources

At June 30, 2022, the Company was engaged in the developmenthad a cash balance of bioceutical and pharmaceutical products designed to support the well-being of humans and animals that have ailments and diseases, as well as the ownership and operation of its saltwater disposal wells.

Outlook

The Company has several years of history in the operations and development of saltwater disposal wells. Management currently believes the oil and gas industry outlook is positive and increasing activity levels which in turn drives more demand for our saltwater disposal services.

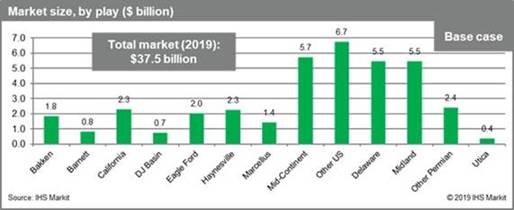

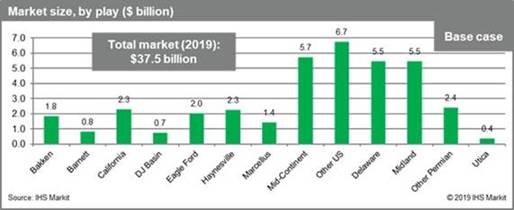

IHS Markit estimates the US oilfield water management to be valued at around $37 billion in 2019, representing a 12% year-on-year (y/y) market growth from 2018; this is mainly driven by water disposal and water logistics. The Permian Basin continues to produce and demand the largest volume of oilfield water among all US onshore regions, with water spending in the region estimated at $13.3 billion in 2019.

Figure 1: Market size, by play ($ billion)

Within the value chain of the water management market, water logistics continues to be the largest segment. Indeed, logistics are expected to make up 60% of spending in 2019 with water hauling services the main driver in that category.

Right behind water logistics is water disposal. As hydrocarbon production continues to increase, mainly due to Permian Basin activities, produced water is projected to follow the same trend. As a result, the water disposal market should continue growing at a 6% compound average growth rate (CAGR) through 2024. However, this growth could be limited if the disposal challenges in the Permian Basin are not addressed by both operators and third-party companies.

Permian water disposal volumes contribute to more than 30% of the total disposed volumes in the onshore US, and in fact they have increased more than 40% between 2010 and 2019. In addition, disposal volumes in West Texas are expected to reach the highest level recorded in the last five years during 2019.

The industry has responded by increasing the recycle/reuse of produced water in fracking operations. Nevertheless, water recycling is not a “silver bullet” since the industry produces five times more water than needed to meet frack water demand.

Looking ahead, the development of the water midstream sector will be key to the development of the market overall. The signs of consolidation in a highly fragmented market could be the first clear step the industry is taking to face the challenges associated with the water lifecycle. Consolidation continues to be a strong industry trend within the water management service sector to reduce costs generally. The active M&A market at the beginning of 2019 involved third-party companies acquiring pipeline and localized water assets to reduce the use of water haulers and to centralize the disposal process. IHS Markit estimates this trend will continue towards the end of the year.

On May 14, 2021, Triccar, Inc. (the “Company”) and Triccar Holdings Inc. (“Holdings”) entered into a Mutual Rescission Agreement and General Release (“Rescission Agreement”), pursuant to which the Reorganization and Stock Purchase Agreement entered into by and between the Company and Holdings on December 12, 2019 was rescinded. Pursuant to the terms of the Rescission Agreement, the 80,000,000 shares that were to be issued to the shareholders of Holdings will not be issued to the prior shareholders of Holdings and in exchange therefor, the prior shareholders of Holdings will own all of the capital stock of Holdings and the Company will disclaim any right, title and/or interest in or to any shares of capital stock of Holdings.

SIGNIFICANT ACCOUNTING POLICIES

The preparation of financial statements in conformity with US Generally Accepted Accounting Principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates. The Company has adopted ASC 842 requiring the recoding of assets and liabilities related to leases on the balance sheet. The Company records rent on straight-line basis over the terms of the underlying leases.

RESULTS OF OPERATIONS

For the nine months ended September 30, 2021, we reported a net loss of $226,436$414,940, as compared to a net losscash balance of $44,050$252,189 at December 31, 2021. The Company incurred negative cash flow from operations of $1,337,249 for the ninesix months ended SeptemberJune 30, 2020.2022, as compared to negative cash flow from operations of $42,961 in the prior year. The componentsincrease in negative cash flow from operations was primarily the result of these resultsincreased compensation costs for additional employees beginning during the current period, added legal and professional fees primarily related to the Company’s growth, acquisition and capital raising plans, inventory purchases and prepaid expenses. Cash flows from financing activities during the six months ended June 30, 2022, totaled $1,500,000 and were the result of proceeds from a loan agreement (see Footnote 4) and $150,000 from the issuance of our common stock. Going forward, the Company expects capital expenditures to increase significantly as operations are explained below.expanded pursuant to its current growth plans. The Company anticipates the requirement to raise significant debt or equity capital in order to fund future operations.

Revenue - No revenueLoan Agreement

On January 11, 2022, the Company entered into a 10% note agreement with P&C Ventures, Inc. in the amount of $1,485,000, pursuant to which we received proceeds of $1,350,000. The note requires quarterly interest payments with the principal due at maturity on January 11, 2023.

| 12 |

Results of Operations

Comparison of the Three Months Ended June 30, 2022 and 2021

For the three months ended June 30, 2022 and 2021, the Company’s revenues totaled $236,690 and $1,584, respectively. The increase of $235,106, or 14,843%, was generateddriven by the Company increasing operations during the current period coupled with the negative impacts of the COVID pandemic during the prior period. We anticipate the Company’s revenues in upcoming quarters to increase as revenues are recognized on projects in progress, including the $1,114,000 in customer deposits, and as we begin projects in our current pipeline.

Gross profit for the three months ended SeptemberJune 30, 2021.2022, totaled $42,744 compared to a gross profit of $729 in the comparable prior year period. The $42,015 increase in gross profit was due to the Company’s increased operations and its growth plans. We anticipate future gross margins to increase from the current level as we commercialize new project sales opportunities, increase revenues, cover more fixed costs within cost of sales and expand our margins.

Expenses -For the three months ended June 30, 2022, our operating expenses increased to $1,444,794 compared to $4,937 for the comparable period in 2021. The componentsincrease of our costs$1,439,857, or 29,165%, was primarily driven by higher legal and professional fees and greater compensation expenses associated with added strategic management and staff commencing during the period ended June 30, 2022. The increased legal and professional fees were incurred primarily in connection with the Company’s acquisition and capital raising programs. Compensation expenses for the three months ended SeptemberJune 30, 20212022 included approximately $327,000 and 2020, are as follows:

| For the Nine Months Ended | % | |||||||||||

| September 30, | September 30, | Increase | ||||||||||

| 2021 | 2020 | (Decrease) | ||||||||||

| Costs and expenses: | ||||||||||||

| Operating costs | $ | 90,147 | $ | 45,000 | 100 | % | ||||||

| General and administrative | 136,289 | 9,050 | 1406 | % | ||||||||

| Total cost and expenses | $ | 226,436 | $ | 54,050 | 319 | % | ||||||

Operating results$179,000 in salaries and wages and the non-cash expenses from stock-based compensation, respectively, compared to no similar expenses in the comparable period in 2021. Additionally, the Company incurred non-cash operating expenses from depreciation and amortization and shares issued for services totaling $15,160 and $500,000, respectively, for the ninethree months ended SeptemberJune 30, 2021 and 2020 reflect a net loss of $226,436 and a net loss of $54,050, respectively. We have not recorded any federal income taxes for the nine months ended September 30, 2021 and 2020 because of our accumulated losses and our net2022 compared to no similar non-cash operating loss carry forwards.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows and Liquidity

As of September 30, 2021, we had total current assets of $9,197. Our total current liabilities as of September 30, 2021 were approximately $311,587. We had a working capital deficit of approximately $302,390 as of September 30, 2021.

As of September 30, 2021, we had $9,197 in cash, an increase of $7,498 from December 31, 2020 due to minimal general administrative expenses and equity contributions.

Capital Expenditures

The Company suspended capital expenditures during the three months ended SeptemberJune 30, 20212021. We anticipate future operating expenses to increase with the expansion of operations, resulting in increased expenses related to wages and compensation, advertising, and insurance partially offset by added contribution margins from anticipated revenue growth.

For the three months ended June 30, 2022, Other Expenses totaled $299,280, compared to $-0- in the comparable period in 2021. This increase in Other Expenses was due to low working capital available.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required for smaller reporting companies.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls$37,623 in added interest expense and Procedures

Our management evaluated, with the participation$261,657 in amortization of debt discount incurred during 2022. We anticipate our Chief Executive Officer (CEO) and Chief Financial Officer (CFO), the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934,Other Expenses to increase as amended (the “Exchange Act”) as of the end of the quarter covered by this quarterly report on Form 10-Q. In making this assessment, the Company used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework.

A material weakness is a deficiency or combination of deficiencies in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the Company’s internal controls.incurs interest from debt and related financing costs to expand its operations.

The activities above resulted in a net loss of $1,701,330 for the three months ended June 30, 2022.

Comparison of the Six Months Ended June 30, 2022 and 2021

For the six months ended June 30, 2022 and 2021, the Company’s management has identifiedrevenues totaled $305,098 and $9,235, respectively. The increase of $295,863, or 3,204%, was driven by the Company increasing operations during the current period coupled with the negative impacts of the COVID pandemic during the prior period. We anticipate the Company’s revenues in upcoming quarters to increase as revenues are recognized on projects in progress, including the $1,114,000 in customer deposits, and as we begin projects in our current pipeline.

Gross profit for the six months ended June 30, 2022, totaled $42,038 compared to a material weaknessgross profit of $5,519 in the effectiveness of internal control over financial reporting related to a shortage of resourcescomparable prior year period. The $36,519 increase in the accounting department required to assure appropriate segregation of duties with employees having appropriate accounting qualifications relatedgross profit was due to the Company’s unique industry accountingincreased operations and disclosure rules. Management has outsourced certain financial functionsits growth plans. We anticipate future gross margins to mitigateincrease from the material weakness in internal control over financial reporting. The Company is reviewing its financecurrent level as we commercialize new project sales opportunities, increase revenues, cover more fixed costs within cost of sales and accounting staffing requirements.expand our margins.

Internal Control Over Financial Reporting

There have not been any changesFor the six months ended June 30, 2022, our operating expenses increased to $2,218,322 compared to $13,234 for the comparable period in 2021. The increase of $2,205,088, or 16,662%, was primarily driven by higher legal and professional fees and greater compensation expenses associated with added strategic management and staff commencing during the six months ended June 30, 2022. The increased legal and professional fees were incurred primarily in connection with the Company’s acquisition and capital raising programs. Compensation expenses for the six months ended June 30, 2022 included approximately $606,000 and $330,000 in salaries and wages and the non-cash expenses of stock-based compensation, respectively, compared to no similar expenses in the Company’s internal control over financial reporting (as such term is definedcomparable period in Rules 13a-15(f)2021. Additionally, the Company incurred non-cash operating expenses from depreciation and 15d-15(f) underamortization and shares issued for services totaling $30,320 and $500,000, respectively, for the Exchange Act)six months ended June 30, 2022 compared to no similar non-cash operating expenses during the fiscal quartersix months ended June 30, 2021. We anticipate future operating expenses to which this report relates that have materially affected, or are reasonably likelyincrease with the expansion of operations, resulting in increased expenses related to materially affect, the Company’s internal control over financial reporting. As a result, no corrective actions were required or undertaken.wages and compensation, advertising, and insurance partially offset by added contribution margins from anticipated revenue growth.

Limitations onFor the Effectivenesssix months ended June 30, 2022, Other Expenses totaled $498,506, compared to $-0- in the comparable period in 2021. This increase in Other Expenses was due to $70,364 in added interest expense and $428,142 in amortization of Controlsdebt discount incurred during 2022. We anticipate our Other Expenses to increase as the Company incurs interest from debt and related financing costs to expand its operations.

Our management, including the CEO, does not expect that its disclosure controls or its internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur