UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31,September 30, 2019

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission File Number 1-11921

E TRADE Financial Corporation

TRADE Financial Corporation E*TRADE Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

|

| | |

| Delaware |

| 94-2844166 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

11 Times Square, 32nd Floor, New York, New York10036

(Address of principal executive offices and Zip Code)

(646) (646) 521-4300

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | ETFC | The NASDAQ Stock Market LLC |

| NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. |

| | | | | |

Large accelerated filer | x | | Accelerated filer | | ¨☐ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company | | ¨☐ |

Emerging growth company ¨

| | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ ☐ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of April 30,October 29, 2019, there were 244,670,688225,915,870 shares of common stock outstanding.

E*TRADE FINANCIAL CORPORATION

FORM 10-Q QUARTERLY REPORT

For the Quarter Ended March 31,September 30, 2019

|

| | |

| PART I | FINANCIAL INFORMATION | |

| | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| Part II | OTHER INFORMATION | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | | |

E*TRADE Q1Q3 2019 10-Q | Page i

Unless otherwise indicated, references to "the Company," "we," "us," "our," "E*TRADE" and "E*TRADE Financial" mean E*TRADE Financial Corporation and its subsidiaries, and references to the parent company mean E*TRADE Financial Corporation but not its subsidiaries.

E*TRADE, E*TRADE Financial, E*TRADE Bank, E*TRADE Savings Bank, the Converging Arrows logo, Power E*TRADE, Equity Edge Online, Trust Company of America, (TCA), now E*TRADE Advisor Services, E*TRADE Advisor Network, and Liberty are trademarks or registered trademarks of E*TRADE Financial Corporation in the United States and in other countries. All other trademarks are the property of their respective owners.

E*TRADE Q1Q3 2019 10-Q | Page ii

PART I

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. These statements discuss, among other things:

our future plans, objectives, outlook, strategies, expectations and intentions relating to our business and future financial and operating results and the assumptions that underlie these matters

our capital plan initiatives

the timing and payment of dividends on our common and preferred stock

the payment of dividends from our subsidiaries to our parent company

the management of our legacy mortgage and consumer loan portfolio

our ability to comply with future changes to government regulations

our ability to maintain required regulatory capital ratios

continued repurchases of our common stock

our ability to meet upcoming debt obligations

the integration and related restructuring costs of past and any future acquisitions

the expected outcome of existing or new litigation

our ability to execute our business plans and manage risk

future sources of revenue, expense and liquidity

the ability of our technology solution for advisors and our referral program to attract and retain customers seeking specialized services and sophisticated advice

the expected impact of the adoption of the amended accounting and disclosure guidance governing the accounting for credit losses

the expected impact from and responses to the elimination of retail commissions for online US listed stock, exchange-traded funds (ETF), and options trades

any other statement that is not historical in nature

These statements may be identified by the use of words such as "assume," "expect," "believe," "may," "will," "should," "anticipate," "intend," "plan," "estimate," "continue" and similar expressions.

We caution that actual results could differ materially from those discussed in these forward-looking statements. Important factors that could contribute to our actual results differing materially from any forward-looking statements include, but are not limited to:

changes in business, economic or political conditions

performance, volume and volatility in the equity and capital markets

changes in interest rates or interest rate volatility

our ability to manage our balance sheet size and capital levels

disruptions or failures of our information technology systems or those of our third partythird-party service providers

cyber security threats, system disruptions and other potential security breaches or incidents

customer demand for financial products and services

our ability to continue to compete effectively and respond to aggressive competition within our industry, such as the elimination of retail commissions for online US listed stock, ETF and options trades

E*TRADE Q3 2019 10-Q | Page 1

our ability to participate in consolidation opportunities in our industry, to complete consolidation transactions and to realize synergies or implement integration plans

our ability to manage our significant risk exposures effectively

the occurrence of risks associated with our advisory services

our ability to manage credit risk with customers and counterparties

our ability to service our corporate debt and, if necessary, to raise additional capital

E*TRADE Q1 2019 10-Q | Page 1

changes in government regulation, including interpretations, or actions by our regulators, including those that may result from the implementation and enforcement of regulatory reform legislation

adverse developments in any investigations, disciplinary actions or litigation

changes in actual or forecasted assumptions impacting the measurement of expected credit losses upon adoption of the amended guidance governing the accounting for credit losses

By their nature forward-looking statements are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Actual future results may vary materially from expectations expressed or implied in this report or any of our prior communications. Investors should also consider the risks and uncertainties described elsewhere in this report, including under Part II. Item 1A. Risk Factors and Part I. Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations of this Quarterly Report and Part I. Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2018, as amended by Amendment No. 1 on Form 10-K/A (the 2018 Annual Report), filed with the Securities and Exchange Commission (SEC), which are incorporated herein by reference. The forward-looking statements contained in this report reflect our expectations only as of the date of this report. Investors should not place undue reliance on forward-looking statements, as we do not undertake to update or revise forward-looking statements, except as required by law.

E*TRADE Q1Q3 2019 10-Q | Page 2

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

The following discussion should be read in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this document and with the 2018 Annual Report. Company Overview

E*TRADE is a financial services company that provides brokerage and related products and services for traders, investors, stock plan administrators and participants, and registered investment advisors (RIAs). Founded on the principle of innovation, we aim to enhance the financial independence of customers through a powerful digital offering that includes tools and educational materials, complemented by professional advice and support, catering to the complex and unique needs of customers to help meet their near- and long-term investing goals. We provide these services through our digital platforms and network of industry-licensed customer service representatives and financial consultants, over the phone, by email and online via two national financial centers and in-person at 30 regional financial centers across the United States. We operate directly and through several subsidiaries, many of which are overseen by governmental and self-regulatory organizations. Our most important subsidiaries are described below:

E*TRADE Securities LLC (E*TRADE Securities) is a registered broker-dealer that clears and settles customer transactions

E*TRADE Bank is a federally chartered savings bank that provides Federal Deposit Insurance Corporation (FDIC) insurance on certain qualifying amounts of customer deposits and provides other banking and cash management capabilities

E*TRADE Savings Bank, a subsidiary of E*TRADE Bank, is a federally chartered savings bank that provides FDIC insurance on certain qualifying amounts of customer deposits and provides custody solutions for RIAs

E*TRADE Financial Corporate Services, Inc. (E*TRADE Financial Corporate Services) is a provider of software and services for managing equity compensation plans to our corporate clients

E*TRADE Futures LLC (E*TRADE Futures) is a registered non-clearing Futures Commission Merchant (FCM) that provides retail futures transaction capabilities for our customers

E*TRADE Capital Management LLC (E*TRADE Capital Management) is an RIA that provides investment advisory services for our customers

Delivering a powerful digital offering for our customers is a core pillar of our business strategy and we believe our focus on being a digital leader in the financial services industry is a competitive advantage. We offer a broad range of products and services to customers through the following customer channels:

| |

| • | Retail: Our retail channel includes retail brokerage and banking customers that utilize our web, mobile and/or active trading platforms to meet trading, investing and/or banking needs. |

| |

| • | Institutional: Our institutional channels include Corporate Services and Advisor Services. We provide stock plan administration services for public and private companies globally through our corporate services channel. We also provide custody services to independent RIAs through our advisor services channel. |

E*TRADE Q1Q3 2019 10-Q | Page 3

Strategy

Our business strategy is focused on leveraging our brand, hybrid support model, and technology to grow our retail and institutional channels while generating robust earnings growth and exceptional returns for the benefit of our shareholders.maximizing shareholder returns.

Leverage our brand, hybrid support model, and leading technology for scale and growth

E*TRADE's unrivaled and tech-forward brand is synonymous with digital brokerage and drives outsized awareness and consideration among business-to-customer and business-to-business audiences. We are able to serve peak volumes across channels with capacity for growth and acquisition through our strong and scalable infrastructure. Our customers benefit from digitally led experiences, complemented by professional advice and support. We cater to the complex and unique needs of traders, investors, stock plan administrators and participants, and independent RIAs.

Empower self-directed retail customers through a powerful digital offering and professional guidance

E*TRADE has three core digital offerings for the retail investor—trading, investing, and banking. With trading, we maintain a leading position among active and derivatives traders through the Power E*TRADE web-based platform and support model. On the investing front we connect customers with a range of easy-to-use wealth management solutions. We are also advancing digital banking capabilities to help increase engagement with customers and prospects.

Capitalize on symbiotic institutional channels to drive growth

E*TRADE's corporate services and advisor services channels are critical for growth. We aim to expand on our #1 position in stock plan administration through innovative digital solutions and expert support—driving growth in retail and institutional relationships. We plan to leverage the power of E*TRADE's brand, digital ethos, and our broad customer base to grow the advisor services channel. We also plan to connect retail customers and stock plan participants seeking higher touch services to top-tier advisors through our recently launched referral network—driving asset growth and retention.

Generate robust earnings growth and returns

We aim to deliver superior returns on customer assets by capturing the full value of our retail and institutional relationships and leveraging E*TRADE's highly scalable model to expand operating margin and generate robust earnings growth. We aim to return a significant portion of our earnings to shareholdersgrowth and expand return on equity over time.maximize shareholder returns.

E*TRADE Q1Q3 2019 10-Q | Page 4

Products and Services

Our hybrid delivery model is available through the following award-winning digital platforms which are complemented by professional advice and support. |

| | | | |

| | Platforms for Retail Channel(1) | Platforms for Institutional Channel(1) |

| | | | | |

| | | Web | | Equity Edge Online(1)(2) |

| | Our easy-to-use site is the primary channel to interact with customers and prospects | Equity Edge Online is the #1 rated platform in the stock plan administration industry that offers automation and flexibility |

| |

| |

| | | | |

| | | Mobile(2)(3) | | Liberty |

| | Our top-rated mobile applications are industry leading and include integrations with leading artificial intelligence assistants | Liberty is intuitive technology built for RIAs that simplifies the investment and management of client assets |

| |

| |

| | | | | |

| | | Active Trading Platforms | | |

| | Active trading platforms include sophisticated trading tools, advanced portfolio and market tracking, and idea generation and analysis | |

| | |

| | |

| | | | | |

| | Complemented by professional advice and support |

| | | | | |

| | | Customer Service | | Financial Consultants |

| | Customer service is available 24/7 via phone, email or chat from industry licensed representatives. White glove service is available for our highest-tiered customers | Financial consultants are available by phone or at branches to provide one-on-one investing advice |

| |

| |

| | | | | |

| | | | Active Trader Services | | Corporate Services |

| | | | ProvidesActive trader services support includes specialized support for sophisticated customers with advanced knowledge and skill |

| Corporate services support includes personalized service on a global scale driven by dedicated relationship and service managers backed by comprehensive training and education |

| | |

| |

| | | | | |

| | Advisor Services | | |

| Advisor services support includes dedicated relationship managers who act as a single point of contact for specialized support | |

|

|

| |

| (1) | E*TRADE was rated #1 online broker in Kiplinger's 2019 Best Online Brokers review. |

| |

| (2) | In September 2019, Equity Edge Online was rated #1 in Loyalty and Overall Satisfaction for the eighth consecutive year in the 2018, 2017, 2016, 2015, 2014, and 2013 Group Five Stock Plan Administration Industry Report.Benchmark Study. |

| |

(2)(3) | E*TRADE was awarded the #1 Mobile Trading award in StockBrokers.com's 2019 Online Broker Review of 17 firms across 284 different variables. |

E*TRADE Q1Q3 2019 10-Q | Page 5

We deliver a broad range of products and services through theour retail and institutional customer channels across the following five product areas: Trading, Investing, Banking and Cash Management, Corporate Services and Advisor Services.

Trading

The Company delivers automated trade order placement and execution services, offering our customers a full range of investment vehicles, including US equities, exchange-traded funds (ETFs),ETFs, options, bonds, futures, American depositary receipts and non-proprietary mutual funds. We also offer margin accounts, enabling qualifying customers to borrow against their securities, supported by robust tools enabling customers to analyze their positions and easily understand collateral requirements. The Company also offers a fully paid lending program which allows customers to earn income on certain securities held in cash accounts when they permit us to lend thosethese securities.

The Company markets trading products and services to active traders and self-directed investors. Products and services are delivered through web, desktop and mobile platforms. Trading and investing tools are supported by guidance, including fixed income, options and futures specialists available on-call for customers. Other tools and resources include independent research and analytics, live and on-demand education, market commentary, and strategies, trading ideas and screeners for major asset classes.

Investing

The Company endeavors to help investors build wealth and address their long-term investing needs through a variety of products and services, a suite of managed products, and asset allocation models. These include our Core Portfolios, Blend Portfolios, Dedicated Portfolios, and Fixed Income Portfolios. The Company also offers self-directed digital tools across web and mobile platforms, including mutual fund and ETF screeners, All StarAll-Star Lists, a collection of pre-built ETF or mutual fund portfolios based on time frame and risk tolerance, an assortment of planning and allocation tools, thematic investing opportunities, education and editorial content. Investors also have access to a wide selection of ETFs and mutual funds, including more than 250 commission-free2,300 ETFs and more than 4,4004,700 no-load, no-transaction fee mutual funds.

The Company also offers guidance through a team of licensed financial consultants and Chartered Retirement Planning CounselorsSM at our 30 regional financial centers and through our two national financial centers by phone, email and online. Customers can receive complimentary portfolio reviews and personalized investment recommendations.

Banking and Cash Management Capabilities

The Company's banking and cash management capabilities include deposit accounts insured by the FDIC, which are fully integrated into customer brokerage accounts. Among other features, E*TRADE Bank's customers are able tocan transfer to and from accounts at E*TRADE and elsewhere for free and checking account customers have access to debit cards with ATM fee refunds, online and mobile bill pay, and mobile check deposits. E*TRADE Bank's savings account offerings include the Premium Savings Account, which provides a higher yield to savings account customers as compared to our other deposit products. The E*TRADE Line of Credit program allows customers to borrow against the market value of securities pledged as collateral.

E*TRADE Q1Q3 2019 10-Q | Page 6

Corporate Services

Through our industry-leading platform, Equity Edge Online, we serve approximately 20% of S&P 500 companies, including nearly 40% of technology companies and over 50% of healthcare companies within the S&P 500 index. The Company offers management of employee stock option plans, employee stock purchase plans, and restricted stock plans with fully-automated stock plan administration. Accounting, reporting and scenario modeling tools are also available. The integrated stock plan solutions include multi-currency settlement and delivery, and streamlined tax calculation. Additionally, corporate clients are offered 10b5-1 plan design and implementation, along with SEC filing assistance and automated solutions. Through our platform, participants have enhanced visibility into the creation and approval of their plan through digital tools and resources. Participants have full access to E*TRADE's robust investing and trading capabilities, including tailored education and planning tools, and dedicated stock plan service representatives. Of companies that offer equity plans to employees, we serve approximately 50% of US publicly traded technology and healthcare companies, and more than 20% of companies within the S&P 500 index.

Corporate Services is an important driver of account and asset growth, serving as a conduit to the retail channel. Over the lasttrailing 12 months, ending March 31, 2019, there were $99approximately $100 billion of gross inflows into our corporate services channel, primarily driven by $26$25 billion of new corporate client implementations and $73 billion of new grants and employee stock purchase plan transactions. Over this same 12 month period, domestic stock plan participants generated $27$30 billion of net proceeds through transactions of vested assets. These participant proceeds represent a key source of net new assets for the retail customer channel.

Advisor Services

Through our proprietary technology platform, Liberty, the Company offers sophisticated modeling, rebalancing, reporting, and practice management capabilities that are fully customizable for the RIA. E*TRADE's financial consultants can refer retail customers to pre-qualified RIAs on our custody platform through our referral program, the E*TRADE Advisor Network.Network, which is operational at our two national and 30 regional financial centers. We expect the E*TRADE Advisor Network will improve the Company's ability to drive asset growth and retain customers seeking specialized services and sophisticated advice.

E*TRADE Q3 2019 10-Q | Page 7

Significant Events

Rated #1 online broker in Kiplinger's annual Best Online Brokers review

In August 2019, E*TRADE was awarded first place overall and "Best for Mutual Fund Investors" in Kiplinger's annual Best Online Brokers Review of 10 firms across seven categories. We also received high marks for user experience, investment choices, advisory services, and mobile as part of the review.

Completed $1 billion share repurchase program; progress made on $1.5 billion program

The Company repurchased 3.6 million shares for $157 million during the third quarter to complete repurchases under its previous $1 billion share repurchase program. The Company also repurchased 9.8 million shares for $409 million under its $1.5 billion share repurchase program during the third quarter. We have the ability to complete this program by the third quarter of 2020; however we retain flexibility to deploy capital in the most accretive way possible.

Eliminated commission rates for equity and options trades

On October 2, 2019, we announced the elimination of retail commissions for online US listed stock, ETF and options trades. We also reduced the options contract charge to $0.65 per contract for all traders while maintaining our active trader pricing at $0.50 per contract. The Company estimates that the annual revenue impact of these changes, which became effective on October 7, 2019, would be approximately $300 million based on operating results in the second quarter of 2019. We expect the majority of commissions revenue in future periods will be driven from options contract charges and futures trading activity.

Financial Performance

Our net revenue is generated primarily from net interest income, commissions and fees and service charges:

Net interest income is largely impacted by the size of our balance sheet, our balance sheet mix, and average yields on our assets and liabilities. Net interest income is driven primarily from interest earned on investment securities, margin receivables, securities lending, and our legacy loan portfolio, less interest incurred on interest-bearing liabilities, including deposits, customer payables, corporate debt and other borrowings.

Commissions revenue is generated by customer trades and is largely impacted by trade volume, trade type, and commission rates. With the elimination of retail commissions for online US listed stock, ETF and options trades, we expect the majority of commissions revenue in future periods will be driven from options contract charges and futures trading activity.

Fees and service charges revenue is primarily impacted by order flow revenue, fees earned on off-balance sheet customer cash and other assets, advisor management and custody fees, and mutual fund service fees.

Our net revenue is offset by non-interest expenses, the largest of which are compensation and benefits and advertising and market development.

E*TRADE Q1Q3 2019 10-Q | Page 78

Key Performance Metrics

Management monitors customer activity and corporate metrics to evaluate the Company’s performance. The most significant of these are displayed below.

In the first quarter of 2019, the Company updated the structure of its customer activity metrics to better align to its retail and institutional customer channels. Additionally, the Company has refined the presentation of certain customer activity metrics, as follows:

| |

| • | Commissionable trades: The definition of trades was updated to capture only commissionable trades (this impacts DARTs,daily average revenue trades (DARTs), derivative DARTs percentage, and average commission per trade). |

| |

| • | Customer accounts: The definition of accounts was updated to align the minimum threshold for gross new and end of period retail accounts to $25. The definition for gross new retail accounts sourced from Corporate Services was also updated to include only those accounts which maintain a minimum balance of $25 at the end of the reporting period or trade within the reporting period. |

These updates have been reflected in the customer activity metrics for all periods presented and did not have an impact on the Company’s financial statements.

E*TRADE Q1Q3 2019 10-Q | Page 89

Customer Activity Metrics

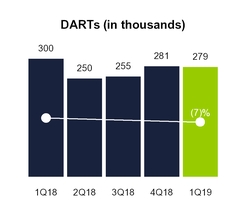

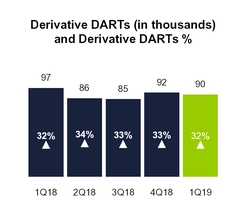

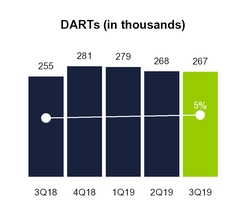

Daily Average Revenue Trades (DARTs)is an important measure of customer trading activity, and is a key driver of commissions revenue. DARTs were 279,405266,935 and 299,673271,514 for the three and nine months ended March 31,September 30, 2019, respectively, compared to 255,139 and 2018, respectively.267,985 for the same periods in 2018.

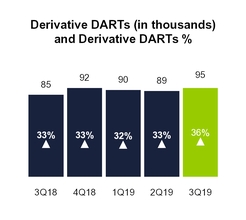

Derivative DARTs, a key component of overall DARTs that represents advanced trading activities by our customers, is the daily average number of options and futures trades, and Derivative DARTs percentage is the mix of options and futures trades as a component of total DARTs. Derivative DARTs were 90,04294,895 and 96,80691,470 for the three and nine months ended March 31,September 30, 2019, respectively, compared to 84,978 and 2018, respectively.89,164 for the same periods in 2018. Derivative DARTs represented 32%36% and 34% of total DARTs for both the three and nine months ended March 31,September 30, 2019, andrespectively, compared to 33% for the same periods in 2018.

Average commission per trade is an indicator of changes in our customer mix, product mix and/or product pricing. Average commission per trade was $7.17$7.18 and $7.51$7.16 for the three and nine months ended March 31,September 30, 2019, respectively, compared to $7.34 and 2018, respectively.$7.47 for the same periods in 2018.

Margin receivables represent credit extended to customers to finance their purchases of securities by borrowing against securities they own and is a key driver of net interest income. Margin receivables were $10.3$9.9 billion and $10.5$11.2 billion at March 31,September 30, 2019 and 2018, respectively.

E*TRADE Q1Q3 2019 10-Q | Page 910

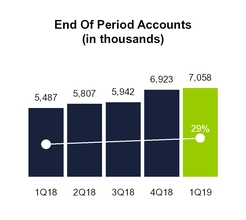

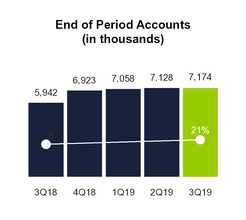

End of period accounts and net new accounts are indicators of our ability to attract and retain customers. The following table presents end of period accounts by channel: | | | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 | | 2Q 2018 | | 1Q 2018 | 3Q 2019 | | 2Q 2019 | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 |

| End of period retail accounts | 5,088,597 |

| | 5,007,767 |

| | 4,056,416 |

| | 3,992,575 |

| | 3,955,131 |

| 5,130,138 |

| | 5,122,669 |

| | 5,088,597 |

| | 5,007,767 |

| | 4,056,416 |

|

| End of period advisor services accounts | 151,222 |

| | 151,241 |

| | 150,063 |

| | 147,640 |

| | — |

| 150,401 |

| | 151,275 |

| | 151,222 |

| | 151,241 |

| | 150,063 |

|

| End of period corporate services accounts | 1,817,983 |

| | 1,763,829 |

| | 1,735,675 |

| | 1,666,354 |

| | 1,532,329 |

| 1,893,881 |

| | 1,853,875 |

| | 1,817,983 |

| | 1,763,829 |

| | 1,735,675 |

|

| End of period accounts | 7,057,802 |

| | 6,922,837 |

| | 5,942,154 |

| | 5,806,569 |

| | 5,487,460 |

| 7,174,420 |

| | 7,127,819 |

| | 7,057,802 |

| | 6,922,837 |

| | 5,942,154 |

|

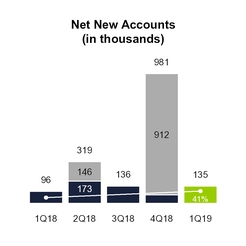

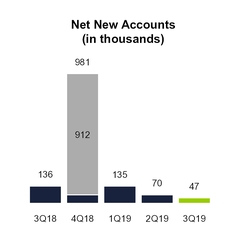

The following table presents net new accounts and annualized growth rates by channel: | | | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 | | 2Q 2018 | | 1Q 2018 | 3Q 2019 | | 2Q 2019 | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 |

| Net new retail accounts | 80,830 |

| | 951,351 |

| | 63,841 |

| | 37,444 |

| | 55,909 |

| 7,469 |

| | 34,072 |

| | 80,830 |

| | 951,351 |

| | 63,841 |

|

| Net new advisor services accounts | (19) |

| | 1,178 |

| | 2,423 |

| | 147,640 |

| | — |

| (874) |

| | 53 |

| | (19) |

| | 1,178 |

| | 2,423 |

|

| Net new corporate services accounts | 54,154 |

| | 28,154 |

| | 69,321 |

| | 134,025 |

| | 39,953 |

| 40,006 |

| | 35,892 |

| | 54,154 |

| | 28,154 |

| | 69,321 |

|

| Net new accounts | 134,965 |

| | 980,683 |

| | 135,585 |

| | 319,109 |

| | 95,862 |

| 46,601 |

| | 70,017 |

| | 134,965 |

| | 980,683 |

| | 135,585 |

|

| | | | | | | | | | | | | | | | | | | |

| Net new retail account growth rate | 6.5 | % | | 93.8 | % | | 6.4 | % | | 3.8 | % | | 5.7 | % | 0.6 | % | | 2.7 | % | | 6.5 | % | | 93.8 | % | | 6.4 | % |

| Net new advisor services account growth rate | (0.1 | )% | | 3.1 | % | | 6.6 | % | | 100.0 | % | | — | % | (2.3 | )% | | 0.1 | % | | (0.1 | )% | | 3.1 | % | | 6.6 | % |

| Net new corporate services account growth rate | 12.3 | % | | 6.5 | % | | 16.6 | % | | 35.0 | % | | 10.7 | % | 8.6 | % | | 7.9 | % | | 12.3 | % | | 6.5 | % | | 16.6 | % |

| Net new total account growth rate | 7.8 | % | | 66.0 | % | | 9.3 | % | | 23.3 | % | | 7.1 | % | 2.6 | % | | 4.0 | % | | 7.8 | % | | 66.0 | % | | 9.3 | % |

We added 1,057,956 net new accounts as part of acquisitions during the year ended December 31, 2018, including 145,891 advisor services accounts related to the TCATrust Company of America (TCA) acquisition in the three months ended June 30, 2018 and 912,065 retail accounts related to the Capital One account acquisition in the three months ended December 31, 2018.

E*TRADE Q1Q3 2019 10-Q | Page 1011

Total customer assets is an indicator of the value of our relationship with our customers. An increase generally indicates that the use of our products and services is expanding. Changes in this metric are also driven by changes in the valuations of our customers' underlying securities. The following table presents the significant components of total customer assets (dollars in millions)billions):

| | | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 | | 2Q 2018 | | 1Q 2018 | 3Q 2019 | | 2Q 2019 | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 |

| Security holdings | $ | 279,289 |

| | $ | 241,921 |

| | $ | 274,469 |

| | $ | 257,637 |

| | $ | 226,823 |

| $ | 284.7 |

| | $ | 286.6 |

| | $ | 279.3 |

| | $ | 242.0 |

| | $ | 274.4 |

|

| Cash and deposits | 61,691 |

| | 60,198 |

| | 58,376 |

| | 57,676 |

| | 56,854 |

| 65.0 |

| | 62.2 |

| | 61.7 |

| | 60.2 |

| | 58.4 |

|

| Retail and advisor services assets | 340,980 |

| | 302,119 |

| | 332,845 |

| | 315,313 |

| | 283,677 |

| 349.7 |

| | 348.8 |

| | 341.0 |

| | 302.2 |

| | 332.8 |

|

| Corporate services vested assets | 140,637 |

| | 111,977 |

| | 139,994 |

| | 125,341 |

| | 109,092 |

| 138.9 |

| | 142.3 |

| | 140.6 |

| | 111.9 |

| | 140.0 |

|

| Retail, advisor services, and corporate services vested assets | 481,617 |

| | 414,096 |

| | 472,839 |

| | 440,654 |

| | 392,769 |

| 488.6 |

| | 491.1 |

| | 481.6 |

| | 414.1 |

| | 472.8 |

|

| Corporate services unvested holdings | 115,386 |

| | 94,360 |

| | 119,469 |

| | 107,956 |

| | 95,345 |

| 115.4 |

| | 117.0 |

| | 115.4 |

| | 94.4 |

| | 119.5 |

|

| Total customer assets | $ | 597,003 |

| | $ | 508,456 |

| | $ | 592,308 |

| | $ | 548,610 |

| | $ | 488,114 |

| $ | 604.0 |

| | $ | 608.1 |

| | $ | 597.0 |

| | $ | 508.5 |

| | $ | 592.3 |

|

Customer cash and deposits is a significant component of total customer assets as it is a key driver of net interest income as well as fees and service charges revenue, which includes fees earned on customer cash held by third parties. The following table presents the significant components of total customer cash and deposits (dollars in millions)billions): | | | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 | | 2Q 2018 | | 1Q 2018 | 3Q 2019 | | 2Q 2019 | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 |

| Sweep deposits | $ | 38,639 |

| | $ | 39,322 |

| | $ | 37,998 |

| | $ | 37,794 |

| | $ | 37,927 |

| $ | 30.8 |

| | $ | 31.7 |

| | $ | 38.6 |

| | $ | 39.3 |

| | $ | 38.0 |

|

| Customer payables | 10,600 |

| | 10,117 |

| | 10,534 |

| | 9,959 |

| | 8,947 |

| 11.2 |

| | 10.6 |

| | 10.6 |

| | 10.1 |

| | 10.5 |

|

| Savings, checking and other banking assets | 7,689 |

| | 5,991 |

| | 5,076 |

| | 4,870 |

| | 4,975 |

| 9.6 |

| | 8.6 |

| | 7.7 |

| | 6.0 |

| | 5.1 |

|

| Total on-balance sheet cash | 56,928 |

| | 55,430 |

| | 53,608 |

| | 52,623 |

| | 51,849 |

| 51.6 |

| | 50.9 |

| | 56.9 |

| | 55.4 |

| | 53.6 |

|

| Sweep deposits at unaffiliated financial institutions | 3,011 |

| | 3,009 |

| | 3,007 |

| | 3,505 |

| | 3,444 |

| 11.7 |

| | 9.6 |

| | 3.0 |

| | 3.0 |

| | 3.0 |

|

| Money market funds and other | 1,752 |

| | 1,759 |

| | 1,761 |

| | 1,552 |

| | 1,561 |

| 1.7 |

| | 1.7 |

| | 1.8 |

| | 1.8 |

| | 1.8 |

|

Total customer cash held by third parties(1) | 4,763 |

| | 4,768 |

| | 4,768 |

| | 5,057 |

| | 5,005 |

| 13.4 |

| | 11.3 |

| | 4.8 |

| | 4.8 |

| | 4.8 |

|

| Total customer cash and deposits | $ | 61,691 |

| | $ | 60,198 |

| | $ | 58,376 |

| | $ | 57,680 |

| | $ | 56,854 |

| $ | 65.0 |

| | $ | 62.2 |

| | $ | 61.7 |

| | $ | 60.2 |

| | $ | 58.4 |

|

| |

| (1) | Customer cash held by third parties is maintained at unaffiliated financial institutions. Customer cash held by third parties is not reflected in the Company's consolidated balance sheet and is not immediately available for liquidity purposes. |

E*TRADE Q1Q3 2019 10-Q | Page 1112

Net new retail and advisor services assets equals total inflows to new and existing retail and advisor services accounts less total outflows from closed and existing retail and advisor services accounts. The net new retail and advisor services assets metric is a general indicator of the use of our products and services by new and existing retail and advisor services customers. Net new retail and advisor services assets were $4.7$2.8 billion and $5.3$9.1 billion for the three and nine months ended March 31,September 30, 2019, respectively, compared to $3.4 billion and 2018, respectively.$29.7 billion for the same periods in 2018. The following table presents annualized net new retail and advisor services assets growth rates: | | | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 | | 2Q 2018 | | 1Q 2018 | 3Q 2019 | | 2Q 2019 | | 1Q 2019 | | 4Q 2018 | | 3Q 2018 |

| Net new retail assets growth rate | 6.8 | % | | 25.2 | % | | 4.2 | % | | 3.3 | % | | 7.6 | % | 3.4 | % | | 2.1 | % | | 6.8 | % | | 25.2 | % | | 4.2 | % |

| Net new advisor services assets growth rate | (3.5 | )% | | 3.9 | % | | 7.6 | % | | 100.0 | % | | — | % | 0.8 | % | | (1.2 | )% | | (3.5 | )% | | 3.9 | % | | 7.6 | % |

| Net new retail and advisor services assets growth rate | 6.2 | % | | 24.0 | % | | 4.4 | % | | 29.5 | % | | 7.6 | % | 3.2 | % | | 1.9 | % | | 6.2 | % | | 24.0 | % | | 4.4 | % |

We added $33.5 billion in net new retail and advisor services assets as part of acquisitions during the year ended December 31, 2018, including $18.4 billion in advisor services assets related to the TCA acquisition during the three months ended June 30, 2018 and $15.1 billion in retail assets related to the acquisition of customer accounts from Capital One during the three months ended December 31, 2018.

Corporate Metrics:

Earnings per diluted common share is the portion of a company's profit allocated to each diluted share of common stock and is a key indicator of the Company's profitability. Earnings per diluted share was $1.09$1.08 and $0.88$3.07 for the three and nine months ended September 30, 2019, respectively, compared to $1.00 and $2.82 for the same periods in 2018. Earnings per diluted share includes $80 million of losses from our balance sheet repositioning in June 2019, which had an after-tax impact of $59 million, or $0.24 per diluted share for the three months ended March 31,June 30, 2019 and 2018, respectively.the nine months ended September 30, 2019.

Operating margin is the percentage of net revenue that results in income before income taxes and is an indicator of the Company's profitability. Operating margin was 50% and 48% for the three and nine months ended September 30, 2019, respectively, compared to 52% and 47%49% for the same periods in 2018. Income before income tax expense and net revenue, the numerator and denominator in the operating margin calculation, include $80 million of losses from our balance sheet repositioning in June 2019, which resulted in a 6 percentage point and a 2 percentage point reduction in operating margin for the three months ended March 31,June 30, 2019 and 2018,the nine months ended September 30, 2019, respectively.

Adjusted operating margin is a non-GAAP measure that provides useful information about our ongoing operating performance by excluding the provision (benefit) for loan losses and losses on early extinguishment of debt, which isare not viewed as a key factorfactors governing our investment in the business and isare excluded by management when evaluating operating margin performance. Adjusted operating margin was 50%48% and 44%47% for the three and nine months ended September 30, 2019, respectively, compared to

E*TRADE Q3 2019 10-Q | Page 13

48% and 46% for the same periods in 2018. Adjusted income before income tax expense and net revenue, the numerator and denominator in the adjusted operating margin calculation, include $80 million of losses from our balance sheet repositioning in June 2019, which resulted in a 6 percentage point and a 2 percentage point reduction in adjusted operating margin for the three months ended March 31,June 30, 2019 and 2018,the nine months ended September 30, 2019, respectively. See MD&A—Earnings Overview for a reconciliation of adjusted operating margin to operating margin.

E*TRADE Q1 2019 10-Q | Page 12

Capital return to shareholders represents the amount of earnings returned to shareholders through share repurchases and common stock dividends and Capital return percentage to shareholders is capital returned to shareholders as a percentage of net income available to common shareholders. Capital return to shareholders was $155 million$1.0 billion and $1.2 billion for the threenine months ended March 31,September 30, 2019 and the year ended December 31, 2018, respectively. Capital return percentage to shareholders was 57%136% and 116% for the threenine months ended March 31,September 30, 2019 and the year ended December 31, 2018, respectively. The Company's balance sheet repositioning in the second quarter 2019 generated additional capital to support share repurchases. In addition, the Company also returned capital to shareholders in the form of shares withheld for taxes of $16$20 million and $28 million for the threenine months ended March 31,September 30, 2019 and the year ended December 31, 2018, respectively.

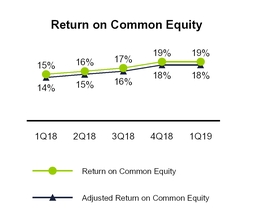

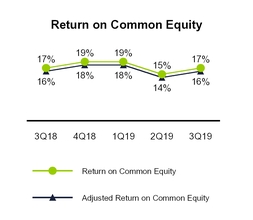

Return on common equity is calculated by dividing net income available to common shareholders by average common shareholders' equity, which excludes preferred stock. Return on common equity was 19%17% for both the three and 15%nine months ended September 30, 2019, respectively, compared to 17% and 16% for the same periods in 2018. Net income available to common shareholders includes $80 million of losses from our balance sheet repositioning in June 2019, which had an after-tax impact of $59 million and resulted in a 4 percentage point and one percentage point reduction in return on common equity for the three months ended March 31,June 30, 2019 and 2018,the nine months ended September 30, 2019, respectively.

Adjusted return on common equity is a non-GAAP measure calculated by dividing adjusted net income available to common shareholders by average common shareholders' equity, which excludes preferred stock. Adjusted net income available to common shareholders is a non-GAAP measure which excludes the provision (benefit) for loan losses and losses on early extinguishment of debt, which isare not viewed as a key factorfactors governing our investment in the business and isare excluded by management when evaluating return on common equity performance. Adjusted return on common equity was 18%16% for both the three and 14%nine months ended September 30, 2019 compared to 16% and 15% for the three months ended March 31, 2019 and 2018, respectively.same periods in 2018. See MD&A—Earnings Overview for a reconciliation of adjusted net income available to common shareholders to net income and adjusted return on common equity to return on common equity. Adjusted net income available to common shareholders includes $80 million of losses from our balance sheet repositioning in June 2019, which had an after-tax impact of $59 million and resulted in a 4 percentage point and 2 percentage point reduction in adjusted return on common equity for the three months ended June 30, 2019 and the nine months ended September 30, 2019, respectively.

E*TRADE Q1Q3 2019 10-Q | Page 1314

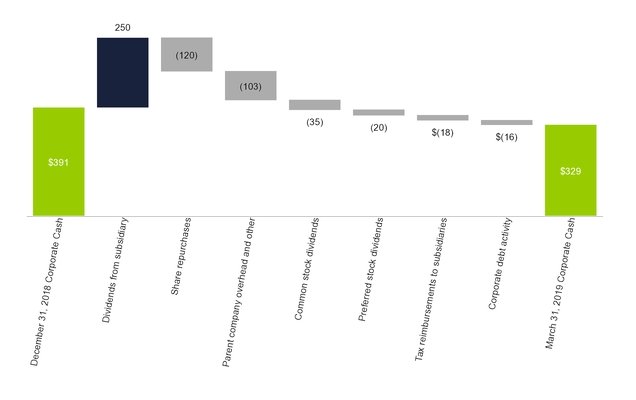

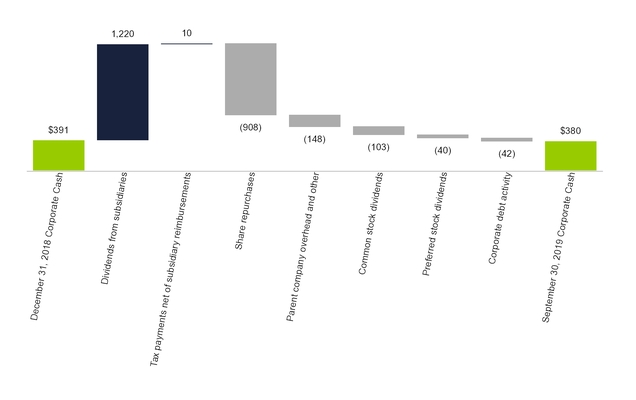

Corporate cash, a non-GAAP measure, is a component of cash and equivalents and represents the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. Cash and equivalents was $523$493 million and $498$596 million at March 31,September 30, 2019 and 2018, respectively, while corporate cash was $329$380 million and $439$517 million for the same periods. See MD&A—Liquidity and Capital Resources for a reconciliation of corporate cash to cash and equivalents.

Average interest-earning assets, along with net interest margin, are indicators of our ability to generate net interest income. Average interest-earning assets were $61.0$55.4 billion and $59.8$59.3 billion for the three and nine months ended March 31,September 30, 2019, respectively, compared to $60.1 billion and 2018, respectively.$60.0 billion for the same periods in 2018.

Net interest margin is a measure of the net yield on our average interest-earning assets. Net interest margin is calculated for a given period by dividing the annualized sum of net interest income by average interest-earning assets. Net interest margin was 3.23%3.28% and 2.97%3.23% for the three and nine months ended March 31,September 30, 2019, respectively, compared to 3.10% and 2018, respectively.3.03% for the same periods in 2018.

E*TRADE Q1Q3 2019 10-Q | Page 1415

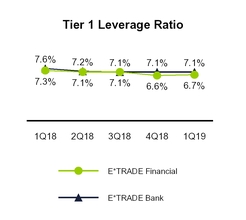

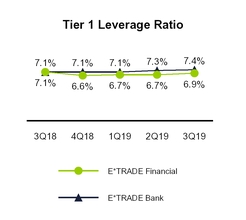

Tier 1 leverage ratio is an indicator of capital adequacy for E*TRADE Financial and E*TRADE Bank. Tier 1 leverage ratio is Tier 1 capital divided by adjusted average assets for leverage capital purposes. E*TRADE Financial's Tier 1 leverage ratio was 6.7%6.9% and 7.3%7.1% at March 31,September 30, 2019 and 2018, respectively. E*TRADE Bank's Tier 1 leverage ratio was 7.4% and 7.1% and 7.6% at March 31,September 30, 2019 and 2018, respectively. The internal threshold for E*TRADE Financial's Tier 1 leverage ratio is 6.5% and the internal threshold for E*TRADE Bank's Tier 1 leverage ratio is 7.0%. See MD&A—Liquidity and Capital Resources for additional information, including the calculation of regulatory capital ratios.

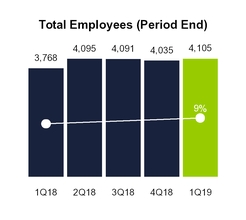

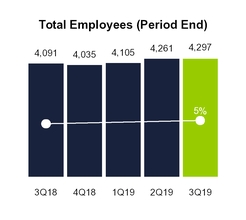

Total employees is the key driver of compensation and benefits expense, our largest non-interest expense category. Total employees were 4,1054,297 and 3,7684,091 at March 31,September 30, 2019 and 2018, respectively.

E*TRADE Q1Q3 2019 10-Q | Page 1516

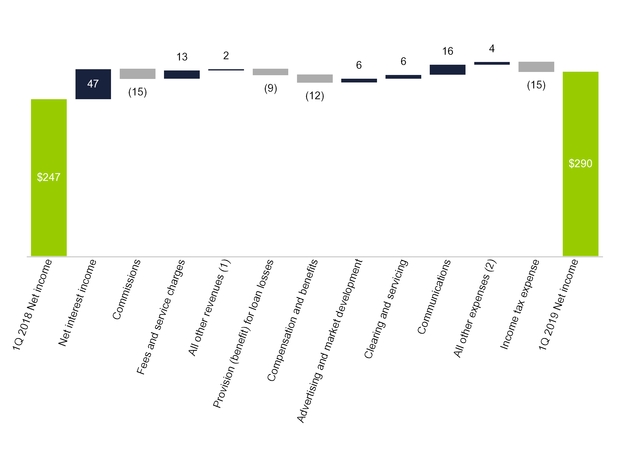

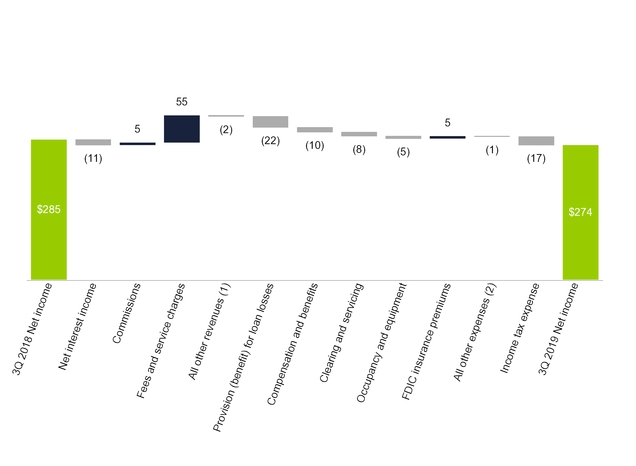

We generated net income of $290$274 million and $783 million on total net revenue of $755$767 million and $2.2 billion for the three and nine months ended March 31, 2019.September 30, 2019, respectively. The following chart presents a reconciliation of net income for the three months ended March 31,September 30, 2018 to net income for the three months ended March 31,September 30, 2019 (dollars in millions):

| |

| (1) | Includes gains (losses) on securities and other, net and other revenue. |

| |

| (2) | Includes advertising and market development, professional services, occupancy and equipment,communications, depreciation and amortization, FDIC insurance premiums, amortization of other intangibles, restructuring and acquisition-related activities, losses on early extinguishment of debt and other non-interest expenses. |

E*TRADE Q1Q3 2019 10-Q | Page 1617

The following table presents significant components of the consolidated statement of income (dollars in millions, except per share amounts): | | | | Three Months Ended March 31, | | Variance | Three Months Ended September 30, | | Variance | | Nine Months Ended September 30, | | Variance |

| | | 2019 vs. 2018 | | 2019 vs. 2018 | | 2019 vs. 2018 |

| | 2019 | | 2018 | | Amount | | % | 2019 | | 2018 | | Amount | | % | | 2019 | | 2018 | | Amount | | % |

| Net interest income | $ | 492 |

| | $ | 445 |

| | $ | 47 |

| | 11 | % | $ | 455 |

| | $ | 466 |

| | $ | (11 | ) | | (2 | )% | | $ | 1,437 |

| | $ | 1,364 |

| | $ | 73 |

| | 5 | % |

| Total non-interest income | 263 |

| | 263 |

| | — |

| | — | % | 312 |

| | 254 |

| | 58 |

| | 23 | % | | 770 |

| | 774 |

| | (4 | ) | | (1 | )% |

| Total net revenue | 755 |

| | 708 |

| | 47 |

| | 7 | % | 767 |

| | 720 |

| | 47 |

| | 7 | % | | 2,207 |

| | 2,138 |

| | 69 |

| | 3 | % |

| Provision (benefit) for loan losses | (12 | ) | | (21 | ) | | 9 |

| | (43 | )% | (12 | ) | | (34 | ) | | 22 |

| | (65 | )% | | (32 | ) | | (74 | ) | | 42 |

| | (57 | )% |

| Total non-interest expense | 375 |

| | 395 |

| | (20 | ) | | (5 | )% | 399 |

| | 380 |

| | 19 |

| | 5 | % | | 1,172 |

| | 1,159 |

| | 13 |

| | 1 | % |

| Income before income tax expense | 392 |

| | 334 |

| | 58 |

| | 17 | % | 380 |

| | 374 |

| | 6 |

| | 2 | % | | 1,067 |

| | 1,053 |

| | 14 |

| | 1 | % |

| Income tax expense | 102 |

| | 87 |

| | 15 |

| | 17 | % | 106 |

| | 89 |

| | 17 |

| | 19 | % | | 284 |

| | 271 |

| | 13 |

| | 5 | % |

| Net income | $ | 290 |

| | $ | 247 |

| | $ | 43 |

| | 17 | % | $ | 274 |

| | $ | 285 |

| | $ | (11 | ) | | (4 | )% | | $ | 783 |

| | $ | 782 |

| | $ | 1 |

| | — | % |

| Preferred stock dividends | 20 |

| | 12 |

| | 8 |

| | 67 | % | 20 |

| | 24 |

| | (4 | ) | | (17 | )% | | 40 |

| | 36 |

| | 4 |

| | 11 | % |

| Net income available to common shareholders | $ | 270 |

| | $ | 235 |

| | $ | 35 |

| | 15 | % | $ | 254 |

| | $ | 261 |

| | $ | (7 | ) | | (3 | )% | | $ | 743 |

| | $ | 746 |

| | $ | (3 | ) | | — | % |

| Diluted earnings per common share | $ | 1.09 |

| | $ | 0.88 |

| | $ | 0.21 |

| | 24 | % | $ | 1.08 |

| | $ | 1.00 |

| | $ | 0.08 |

| | 8 | % | | $ | 3.07 |

| | $ | 2.82 |

| | $ | 0.25 |

|

| 9 | % |

Net income increased 17%decreased 4% to $290$274 million or $1.09$1.08 per diluted share and slightly increased to $783 million or $3.07 per diluted share, for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018. Net income available to common shareholders was $270$254 million and $743 million for the three and nine months ended September 30, 2019, respectively, which reflects payments of $20 million and $40 million in preferred stock dividends, respectively. This compares to $261 million and $746 million for the same periods in 2018, which reflects payments of $24 million and $36 million in preferred stock dividends, respectively.

The decrease in net income for the three months ended March 31,September 30, 2019 which reflects payment of $20 million in preferred stock dividends, comparedwas primarily driven by lower benefit for loan losses and higher non-interest and income tax expenses, partially offset by higher non-interest income primarily due to $235 millionhigher revenue earned on customer cash held by third parties. The increase for the same period in 2018, which reflects payment of $12 million in preferred stock dividends. The increase in net incomenine months ended September 30, 2019 was primarily driven by higher net interest income, due to a larger average balance sheet, an improvement in net interest margin and higher fees and service charges, that were offset by decreased commissions revenue driven by lower trading volume. Lower non-interest expense also contributed to increased net income, which was driven by lower advertising and market development, clearing and servicing and communications expense, partially offset by increased compensation and benefits expense. These drivers of increased net income were partially offset by a lower benefit for loan losses during the three months ended March 31, 2019.and higher non-interest and income tax expenses.

Net Revenue

The following table presents the significant components of total net revenue (dollars in millions): | | | | Three Months Ended March 31, | | Variance | Three Months Ended September 30, | | Variance | | Nine Months Ended September 30, | | Variance |

| | | 2019 vs. 2018 | | 2019 vs. 2018 | | 2019 vs. 2018 |

| | 2019 | | 2018 | | Amount | | % | 2019 | | 2018 | | Amount | | % | | 2019 | | 2018 | | Amount | | % |

| Net interest income | $ | 492 |

| | $ | 445 |

| | $ | 47 |

| | 11 | % | $ | 455 |

| | $ | 466 |

| | $ | (11 | ) | | (2 | )% | | $ | 1,437 |

| | $ | 1,364 |

| | $ | 73 |

| | 5 | % |

| Commissions | 122 |

| | 137 |

| | (15 | ) | | (11 | )% | 122 |

| | 117 |

| | 5 |

| | 4 | % | | 365 |

| | 375 |

| | (10 | ) | | (3 | )% |

| Fees and service charges | 118 |

| | 105 |

| | 13 |

| | 12 | % | 163 |

| | 108 |

| | 55 |

| | 51 | % | | 407 |

| | 323 |

| | 84 |

| | 26 | % |

| Gains on securities and other, net | 11 |

| | 10 |

| | 1 |

| | 10 | % | |

| Gains (losses) on securities and other, net | | 16 |

| | 17 |

| | (1 | ) | | (6 | )% | | (37 | ) | | 42 |

| | (79 | ) | | * |

|

| Other revenue | 12 |

| | 11 |

| | 1 |

| | 9 | % | 11 |

| | 12 |

| | (1 | ) | | (8 | )% | | 35 |

| | 34 |

| | 1 |

| | 3 | % |

| Total non-interest income | 263 |

| | 263 |

| | — |

| | — | % | 312 |

| | 254 |

| | 58 |

| | 23 | % | | 770 |

| | 774 |

| | (4 | ) | | (1 | )% |

| Total net revenue | $ | 755 |

| | $ | 708 |

| | $ | 47 |

| | 7 | % | $ | 767 |

| | $ | 720 |

| | $ | 47 |

| | 7 | % | | $ | 2,207 |

| | $ | 2,138 |

| | $ | 69 |

| | 3 | % |

Net Interest Income

Net interest income increased 11% to $492 million for the three months ended March 31, 2019 compared to the same period in 2018. Net interest income is earned primarily through investment securities, margin receivables and our legacy mortgage and consumer loan portfolio, offset by funding costs.

| |

| * | Percentage not meaningful. |

E*TRADE Q1Q3 2019 10-Q | Page 1718

Net Interest Income

Net interest income decreased 2% to $455 million and increased 5% to $1.4 billion for the three and nine months ended September 30, 2019, respectively, compared to the same periods in 2018. Net interest income is earned primarily through investment securities, margin receivables, securities lending, and our legacy mortgage and consumer loan portfolio, offset by funding costs.

The following table presentstables present average balance sheet data and interest income and expense data, as well as related net interest margin, yields, and rates (dollars in millions):

| | | | Three Months Ended March 31, | Three Months Ended September 30, |

| | 2019 | | 2018 | 2019 | | 2018 |

| | Average Balance | | Interest Inc./Exp. | | Average Yield/ Cost | | Average Balance | | Interest Inc./Exp. | | Average Yield/ Cost | Average Balance | | Interest Inc./Exp. | | Average Yield/ Cost | | Average Balance | | Interest Inc./Exp. | | Average Yield/ Cost |

| Cash and equivalents | $ | 607 |

| | $ | 3 |

| | 2.31 | % | | $ | 803 |

| | $ | 3 |

| | 1.42 | % | $ | 429 |

| | $ | 2 |

| | 2.11 | % | | $ | 471 |

| | $ | 2 |

| | 1.84 | % |

| Cash segregated under federal or other regulations | 986 |

| | 6 |

| | 2.63 | % | | 795 |

| | 3 |

| | 1.62 | % | 1,073 |

| | 7 |

| | 2.41 | % | | 836 |

| | 4 |

| | 2.15 | % |

| Investment securities | 46,968 |

| | 365 |

| | 3.10 | % | | 45,194 |

| | 290 |

| | 2.57 | % | 41,326 |

| | 324 |

| | 3.13 | % | | 44,773 |

| | 315 |

| | 2.82 | % |

| Margin receivables | 9,766 |

| | 126 |

| | 5.24 | % | | 9,466 |

| | 103 |

| | 4.41 | % | 9,880 |

| | 120 |

| | 4.83 | % | | 10,902 |

| | 130 |

| | 4.74 | % |

Loans(1) | 2,058 |

| | 28 |

| | 5.48 | % | | 2,629 |

| | 33 |

| | 5.07 | % | 1,812 |

| | 25 |

| | 5.58 | % | | 2,332 |

| | 32 |

| | 5.38 | % |

| Broker-related receivables and other | 632 |

| | 4 |

| | 2.24 | % | | 950 |

| | 4 |

| | 1.55 | % | 918 |

| | 5 |

| | 2.02 | % | | 798 |

| | 4 |

| | 2.02 | % |

| Total interest-earning assets | 61,017 |

| | 532 |

| | 3.50 | % | | 59,837 |

| | 436 |

| | 2.92 | % | 55,438 |

| | 483 |

| | 3.47 | % | | 60,112 |

| | 487 |

| | 3.24 | % |

Other interest revenue(2) | — |

| | 23 |

| | | | — |

| | 32 |

| | | — |

| | 38 |

| | | | — |

| | 27 |

| | |

| Total interest-earning assets | 61,017 |

| | 555 |

| | 3.65 | % | | 59,837 |

| | 468 |

| | 3.14 | % | 55,438 |

| | 521 |

| | 3.74 | % | | 60,112 |

| | 514 |

| | 3.41 | % |

| Total non-interest-earning assets | 4,991 |

| | | | | | 4,787 |

| | | | | 5,859 |

| | | | | | 4,291 |

| | | | |

| Total assets | $ | 66,008 |

| | | | | | $ | 64,624 |

| | | | | $ | 61,297 |

| | | | | | $ | 64,403 |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Sweep deposits | $ | 38,433 |

| | $ | 20 |

| | 0.21 | % | | $ | 38,299 |

| | $ | 2 |

| | 0.02 | % | $ | 30,559 |

| | $ | 11 |

| | 0.14 | % | | $ | 37,550 |

| | $ | 14 |

| | 0.15 | % |

| Savings deposits | 4,968 |

| | 15 |

| | 1.22 | % | | 2,833 |

| | — |

| | 0.01 | % | 7,533 |

| | 27 |

| | 1.44 | % | | 2,972 |

| | 2 |

| | 0.26 | % |

| Other deposits | 1,785 |

| | — |

| | 0.03 | % | | 2,046 |

| | — |

| | 0.02 | % | 1,614 |

| | — |

| | 0.03 | % | | 1,934 |

| | — |

| | 0.03 | % |

| Customer payables | 10,462 |

| | 9 |

| | 0.34 | % | | 9,556 |

| | 1 |

| | 0.06 | % | 10,915 |

| | 7 |

| | 0.27 | % | | 10,352 |

| | 8 |

| | 0.30 | % |

| Broker-related payables and other | 999 |

| | 1 |

| | 0.49 | % | | 1,566 |

| | 1 |

| | 0.20 | % | 1,241 |

| | 2 |

| | 0.51 | % | | 1,880 |

| | 3 |

| | 0.53 | % |

| Other borrowings | 269 |

| | 2 |

| | 3.81 | % | | 932 |

| | 7 |

| | 3.12 | % | 102 |

| | 1 |

| | 4.77 | % | | 752 |

| | 6 |

| | 2.95 | % |

| Corporate debt | 1,409 |

| | 14 |

| | 3.91 | % | | 991 |

| | 9 |

| | 3.62 | % | 1,410 |

| | 14 |

| | 3.86 | % | | 1,408 |

| | 13 |

| | 3.90 | % |

| Total interest-bearing liabilities | 58,325 |

| | 61 |

| | 0.42 | % | | 56,223 |

| | 20 |

| | 0.14 | % | 53,374 |

| | 62 |

| | 0.46 | % | | 56,848 |

| | 46 |

| | 0.32 | % |

Other interest expense(3) | — |

| | 2 |

| | | | — |

| | 3 |

| | | — |

| | 4 |

| | | | — |

| | 2 |

| | |

| Total interest-bearing liabilities | 58,325 |

| | 63 |

| | 0.44 | % | | 56,223 |

| | 23 |

| | 0.17 | % | 53,374 |

| | 66 |

| | 0.49 | % | | 56,848 |

| | 48 |

| | 0.33 | % |

| Total non-interest-bearing liabilities | 1,183 |

| | | | | | 1,329 |

| | | | | 1,251 |

| | | | | | 859 |

| | | | |

| Total liabilities | 59,508 |

| | | | | | 57,552 |

| | | | | 54,625 |

| | | | | | 57,707 |

| | | | |

| Total shareholders' equity | 6,500 |

| | | | | | 7,072 |

| | | | | 6,672 |

| | | | | | 6,696 |

| | | | |

| Total liabilities and shareholders' equity | $ | 66,008 |

| | | | | | $ | 64,624 |

| | | | | $ | 61,297 |

| | | | | | $ | 64,403 |

| | | | |

| Excess interest earning assets over interest bearing liabilities/net interest income/net interest margin | $ | 2,692 |

| | $ | 492 |

| | 3.23 | % | | $ | 3,614 |

| | $ | 445 |

| | 2.97 | % | $ | 2,064 |

| | $ | 455 |

| | 3.28 | % | | $ | 3,264 |

| | $ | 466 |

| | 3.10 | % |

| |

| (1) | Nonaccrual loans are included in the average loan balances. Interest payments received on nonaccrual loans are recognized on a cash basis in interest income until it is doubtful that full payment will be collected, at which point payments are applied to principal. |

| |

| (2) | Other interest revenue is earned on certain securities loaned balances. Interest expense incurred on other securities loaned balances is presented on the broker-related payables and other line item above. |

| |

| (3) | Other interest expense is incurred on certain securities borrowed balances. Interest income earned on other securities borrowed balances is presented on the broker-related receivables and other line item above. |

E*TRADE Q3 2019 10-Q | Page 19

|

| | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2019 | | 2018 |

| | Average Balance | | Interest Inc./Exp. | | Average Yield/ Cost | | Average Balance | | Interest Inc./Exp. | | Average Yield/ Cost |

| Cash and equivalents | $ | 497 |

| | $ | 8 |

| | 2.26 | % | | $ | 601 |

| | $ | 7 |

| | 1.60 | % |

| Cash segregated under federal or other regulations | 977 |

| | 19 |

| | 2.55 | % | | 795 |

| | 11 |

| | 1.91 | % |

| Investment securities | 45,202 |

| | 1,057 |

| | 3.12 | % | | 44,979 |

| | 908 |

| | 2.69 | % |

| Margin receivables | 9,910 |

| | 376 |

| | 5.08 | % | | 10,225 |

| | 351 |

| | 4.59 | % |

Loans(1) | 1,929 |

| | 81 |

| | 5.60 | % | | 2,475 |

| | 98 |

| | 5.25 | % |

| Broker-related receivables and other | 738 |

| | 12 |

| | 2.15 | % | | 898 |

| | 12 |

| | 1.76 | % |

| Total interest-earning assets | 59,253 |

| | 1,553 |

| | 3.50 | % | | 59,973 |

| | 1,387 |

| | 3.09 | % |

Other interest revenue(2) | — |

| | 83 |

| | | | — |

| | 84 |

| | |

| Total interest-earning assets | 59,253 |

| | 1,636 |

| | 3.68 | % | | 59,973 |

| | 1,471 |

| | 3.27 | % |

| Total non-interest-earning assets | 5,318 |

| | | | | | 4,479 |

| | | | |

| Total assets | $ | 64,571 |

| | | | | | $ | 64,452 |

| | | | |

| | | | | | | | | | | | |

| Sweep deposits | $ | 35,429 |

| | $ | 49 |

| | 0.18 | % | | $ | 38,012 |

| | $ | 23 |

| | 0.08 | % |

| Savings deposits | 6,292 |

| | 65 |

| | 1.39 | % | | 2,857 |

| | 3 |

| | 0.11 | % |

| Other deposits | 1,709 |

| | — |

| | 0.03 | % | | 2,008 |

| | — |

| | 0.02 | % |

| Customer payables | 10,658 |

| | 24 |

| | 0.30 | % | | 9,817 |

| | 13 |

| | 0.18 | % |

| Broker-related payables and other | 1,098 |

| | 4 |

| | 0.49 | % | | 1,885 |

| | 7 |

| | 0.49 | % |

| Other borrowings | 227 |

| | 7 |

| | 3.94 | % | | 837 |

| | 21 |

| | 3.28 | % |

| Corporate debt | 1,410 |

| | 42 |

| | 3.94 | % | | 1,149 |

| | 32 |

| | 3.75 | % |

| Total interest-bearing liabilities | 56,823 |

| | 191 |

| | 0.45 | % | | 56,565 |

| | 99 |

| | 0.23 | % |

Other interest expense(3) | — |

| | 8 |

| | | | — |

| | 8 |

| | |

| Total interest-bearing liabilities | 56,823 |

| | 199 |

| | 0.47 | % | | 56,565 |

| | 107 |

| | 0.25 | % |

| Total non-interest-bearing liabilities | 1,152 |

| | | | | | 939 |

| | | | |

| Total liabilities | 57,975 |

| | | | | | 57,504 |

| | | | |

| Total shareholders' equity | 6,596 |

| | | | | | 6,948 |

| | | | |

| Total liabilities and shareholders' equity | $ | 64,571 |

| | | | | | $ | 64,452 |

| | | | |

| Excess interest earning assets over interest bearing liabilities/net interest income/net interest margin | $ | 2,430 |

| | $ | 1,437 |

| | 3.23 | % | | $ | 3,408 |

| | $ | 1,364 |

| | 3.03 | % |

| |

| (1) | Nonaccrual loans are included in the average loan balances. Interest payments received on nonaccrual loans are recognized on a cash basis in interest income until it is doubtful that full payment will be collected, at which point payments are applied to principal. |

| |

| (2) | Other interest revenue is earned on certain securities loaned balances. Interest expense incurred on other securities loaned balances is presented on the broker-related payables and other line item above. |

| |

| (3) | Other interest expense is incurred on certain securities borrowed balances. Interest income earned on other securities borrowed balances is presented on the broker-related receivables and other line item above. |

Average interest-earning assets increased 2%decreased 8% to $61.0$55.4 billion and 1% to $59.3 billion for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018. The fluctuation in interest-earning assets is generally driven by changes in interest-bearing liabilities, primarily deposits and customer payables. Average interest-bearing liabilities decreased 6% to $53.4 billion and slightly increased 4% to $58.3$56.8 billion for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018 due to the following:

| |

| • | Deposits and customer payables: The increase to savings deposits was primarily driven by higher deposits, as we assumed deposits as part of the acquisition of TCA and retail accounts from Capital One, and from the growth in the Premium Savings Account product first introduced in the second quarter of 2018. These increasesThe decrease in sweep deposits was primarily driven by the balance sheet repositioning during the second quarter of 2019, as we moved $6.6 billion of deposits to third-party banks. The deposits and customer payables balances were partially offsetalso impacted by customer net buying, which reflected net buying of $3.3$3.4 billion during the threenine months ended March 31,September 30, 2019, compared to net buying of $6.9$12.0 billion in the same period in 2018. |

E*TRADE Q1Q3 2019 10-Q | Page 1820

| |

| • | Other interest-bearing liabilities: The increasedecrease in customer payables resulted in lower utilization of broker-related payables and other forborrowings was driven by customer activity, including short-term liquidity management.needs at E*TRADE Bank and E*TRADE Securities. In addition, net proceeds from the June 2018 issuance of corporate debt were used to redeem the Company's trust preferred securities in the third quarter of 2018, resulting in the increase in corporate debt partially offset by thea decrease in other borrowings.borrowings and an offsetting increase to corporate debt as compared to the nine months ended September 30, 2018. |

Net interest margin increased 2618 basis points to 3.28% and 20 basis points to 3.23% for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018. Net interest margin is driven by the mix of average asset and liability balances and the interest rates earned or paid on those balances. The increase during the three and nine months ended March 31,September 30, 2019, compared to the same periodperiods in 2018, is due to higher interest rates earned on higher margin receivables, and investment securities, and loans balances as well as higher securities lending revenues, partially offset by increased funding costs due to increased rates paid on deposits, including the Premium Savings Account product, and customer payables during the three months ended March 31, 2019.product. The increase in rates was largely driven by the four increases in federal funds rates that occurred during 2018.2018 partially offset by the two federal funds rate cuts during 2019. Our net interest margin was also impacted by the continued run-off of our higher yielding legacy mortgage and consumer loan portfolio.

Commissions

Commissions revenue decreased 11%increased 4% to $122 million and decreased 3% to $365 million for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018. The primary factors that affect commissions revenue are DARTs, average commission per trade and the number of trading days. With the elimination of retail commissions for online US listed stock, ETF and options trades, which became effective on October 7, 2019, we expect the majority of commissions revenue in future periods will be driven from options contract charges and futures trading activity. For additional information see MD&A—Overview.

DARTs volume decreased 7%increased 5% to 279,405266,935 and 1% to 271,514 for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018. DARTs volume is impacted by market sentiment as well as volatility of the equity markets. Derivative DARTs volume decreased 7%increased 12% to 90,04294,895 and 3% to 91,470 for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018.

Average commission per trade decreased 5%2% to $7.17$7.18 and 4% to $7.16 for the three and nine months ended March 31,September 30, 2019, respectively, compared to the same periodperiods in 2018. Average commission per trade is impacted by trade mix and differing commission rates on various trade types (e.g. equities, derivatives, corporate services and mutual funds).

E*TRADE Q3 2019 10-Q | Page 21

Fees and Service Charges

The following table presents the significant components of fees and service charges (dollars in millions): | | | | Three Months Ended March 31, | | Variance | Three Months Ended September 30, | | Variance | | Nine Months Ended September 30, | | Variance |

| | | 2019 vs. 2018 | | 2019 vs. 2018 | | 2019 vs. 2018 |

| | 2019 | | 2018 | | Amount | | % | 2019 | | 2018 | | Amount | | % | | 2019 | | 2018 | | Amount | | % |

Money market funds and sweep deposits revenue(1) | | $ | 62 |

| | $ | 18 |

| | $ | 44 |

| | 244 | % | | $ | 106 |

| | $ | 53 |

| | $ | 53 |

| | 100 | % |

| Order flow revenue | $ | 43 |

| | $ | 47 |

| | $ | (4 | ) | | (9 | )% | 46 |

| | 40 |

| | 6 |

| | 15 | % | | 134 |

| | 130 |

| | 4 |

| | 3 | % |

Money market funds and sweep deposits revenue(1) | 21 |

| | 17 |

| | 4 |

| | 24 | % | |

| Advisor management and custody fees | 18 |

| | 11 |

| | 7 |

| | 64 | % | 19 |

| | 19 |

| | — |

| | — | % | | 56 |

| | 46 |

| | 10 |

| | 22 | % |

| Mutual fund service fees | 12 |

| | 11 |

| | 1 |

| | 9 | % | 13 |

| | 13 |

| | — |

| | — | % | | 38 |

| | 36 |

| | 2 |

| | 6 | % |

| Foreign exchange revenue | 8 |

| | 8 |

| | — |

| | — | % | 8 |

| | 7 |

| | 1 |

| | 14 | % | | 24 |

| | 21 |

| | 3 |

| | 14 | % |

| Reorganization fees | 6 |

| | 3 |

| | 3 |

| | 100 | % | 5 |

| | 3 |

| | 2 |

| | 67 | % | | 18 |

| | 10 |

| | 8 |

| | 80 | % |

| Other fees and service charges | 10 |

| | 8 |

| | 2 |

| | 25 | % | 10 |

| | 8 |

| | 2 |

| | 25 | % | | 31 |

| | 27 |

| | 4 |

| | 15 | % |

| Total fees and service charges | $ | 118 |

| | $ | 105 |

| | $ | 13 |

| | 12 | % | $ | 163 |

| | $ | 108 |

| | $ | 55 |

| | 51 | % | | $ | 407 |

| | $ | 323 |

| | $ | 84 |

| | 26 | % |

| |

| (1) | Includes revenue earned on average customer cash held by third parties based on the federal funds rate or LIBOR plus a negotiated spread or other contractual arrangements with the third partythird-party institutions. |

Fees and service charges increased 51% to $163 million and 26% to $407 million for the three and nine months ended September 30, 2019, respectively, compared to the same periods in 2018. These increases were primarily driven by higher money market funds and sweep deposits revenue driven by larger balances as a result of the balance sheet repositioning in June 2019 and a higher yield of approximately 195 and 180 basis points for the three and nine months ended September 30, 2019, respectively, compared to 145 and 140 basis points for the same periods in 2018. Advisor management and custody fees for the nine months ended September 30, 2019 also increased as a result of the acquisition of TCA in the second quarter of 2018.

E*TRADE Q1Q3 2019 10-Q | Page 1922

Fees and service charges increased 12% to $118 million for the three months ended March 31, 2019 compared to the same period in 2018 primarily driven by increased advisor management and custody fees as a result of the acquisition of TCA and increased money market funds and sweep deposits revenue driven by a higher yield of approximately 165 basis points for the three months ended March 31, 2019 compared to 135 basis points for the same period in 2018. These increases were partially offset by decreased order flow revenue driven by lower trade volume.

Gains (Losses) on Securities and Other, Net

The following table presents the significant components of gains (losses) on securities and other, net (dollars in millions): |

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Variance |

| | | 2019 vs. 2018 |

| | 2019 | | 2018 | | Amount | | % |

| Gains on available-for-sale securities | $ | 11 |

| | $ | 11 |

| | $ | — |

| | — | % |

| Equity method investment income (loss) and other | — |

| | (1 | ) | | 1 |

| | (100 | )% |

| Gains on securities and other, net | $ | 11 |

| | $ | 10 |

| | $ | 1 |

| | 10 | % |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Variance | | Nine Months Ended September 30, | | Variance |

| | | 2019 vs. 2018 | | | 2019 vs. 2018 |

| | 2019 | | 2018 | | Amount | | % | | 2019 | | 2018 | | Amount | | % |

| Gains (losses) on available-for-sale securities, net: | | | | | | | | | | | | | | | |

Gains on available-for-sale securities(1)(2) | $ | 14 |

| | $ | 65 |

| | $ | (51 | ) | | (78 | )% | | $ | 40 |

| | $ | 87 |

| | $ | (47 | ) | | (54 | )% |

Losses on available-for-sale securities(1)(2) | — |

| | (54 | ) | | 54 |

| | (100 | )% | | (80 | ) | | (54 | ) | | (26 | ) | | 48 | % |

| Subtotal | 14 |

| | 11 |

| | 3 |

| | 27 | % | | (40 | ) | | 33 |

| | (73 | ) | | * |

|

Equity method investment income and other(3) | 2 |

| | 6 |

| | (4 | ) | | (67 | )% | | 3 |

| | 9 |

| | (6 | ) | | (67 | )% |

| Gains (losses) on securities and other, net | $ | 16 |

| | $ | 17 |

| | $ | (1 | ) | | (6 | )% | | $ | (37 | ) | | $ | 42 |

| | $ | (79 | ) | | * |

|

| |

| * | Percentage not meaningful. |

| |

| (1) | In June 2019, the Company sold $4.5 billion of lower-yielding investment securities at losses as it repositioned its balance sheet. See MD&A—Balance Sheet Overview and Note 5—Available-for-Sale and Held-to-Maturity Securities for additional information. |

| |