W. P. CAREY INC.

Note 1. Business and Organization

W. P. Carey Inc., or (“W. P. Carey,Carey”) is together with its consolidated subsidiaries, a REIT that, provides long-term financing via sale-leaseback and build-to-suit transactions for companies worldwide and manages a global investment portfolio. We investtogether with our consolidated subsidiaries, invests primarily in operationally-critical, single-tenant commercial real estate properties domesticallylocated in the United States and internationally.Northern and Western Europe on a long-term basis. We earn revenue principally by leasing the properties we own to single corporate tenants,companies on a triple-net lease basis, which generally requires each tenant to pay the costs associated with operating and maintaining the property.

Note 2. Basis of Presentation

Our interim consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and, therefore, do not necessarily include all information and footnotes necessary for a faircomplete statement of our consolidated financial position, results of operations, and cash flows in accordance with generally accepted accounting principles in the United States or GAAP.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and the disclosure of contingent amounts in our consolidated financial statements and the accompanying notes. Actual results could differ from those estimates.

Our consolidated financial statements reflect all of our accounts, including those of our controlled subsidiaries and our tenancy-in-common interest as described below.subsidiaries. The portions of equity in consolidated subsidiaries that are not attributable, directly or indirectly, to us are presented as noncontrolling interests. All significant intercompany accounts and transactions have been eliminated.

When we obtain an economic interest in an entity, we evaluate the entity to determine if it should be deemed a variable interest entity, or VIE and, if so, whether we are the primary beneficiary and are therefore required to consolidate the entity. We apply accounting guidance for consolidation of VIEs to certain entitiesThere have been no significant changes in which the equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial supportour VIE policies from other parties. Fixed price purchase and renewal options within a lease, as well as certain decision-making rights within a loan or joint-venture agreement, can cause us to consider an entity a VIE. Limited partnerships and other similar entities that operate as a partnership will be considered a VIE unless the limited partners hold substantive kick-out rights or participation rights. Significant judgment is required to determine whether a VIE should be consolidated. We review the contractual arrangements provided forwhat was disclosed in the partnership agreement or other related contracts to determine whether2021 Annual Report.

Notes to Consolidated Financial Statements (Unaudited)

|

| | | | | | | |

| | September 30, 2017 | | December 31, 2016 (a) |

| Land, buildings and improvements | $ | 910,495 |

| | $ | 886,148 |

|

| Net investments in direct financing leases | 39,897 |

| | 60,294 |

|

| In-place lease and other intangible assets | 265,852 |

| | 245,480 |

|

| Above-market rent intangible assets | 102,432 |

| | 98,043 |

|

| Accumulated depreciation and amortization | (231,323 | ) | | (184,710 | ) |

| Total assets | 1,129,154 |

| | 1,150,093 |

|

| | | | |

| Non-recourse mortgages, net | $ | 128,659 |

| | $ | 406,574 |

|

| Total liabilities | 202,514 |

| | 548,659 |

|

__________

| |

(a) | In 2017, we reclassified certain line items in our consolidated balance sheets, as described below. As a result, prior period amounts for certain line items included within Net investments in real estate have been reclassified to conform to the current period presentation. |

At September 30, 2017,2022 and December 31, 2021, our sevenfive and eight unconsolidated VIEs included our interests in (i) three and six unconsolidated real estate investments, respectively, which we account for under the equity method of accounting and one unconsolidated entity, which we account for under the cost method of accounting and is included within our Investment Management segment. At December 31, 2016, our seven unconsolidated VIEs included our interests in six unconsolidated real estate investments and one unconsolidated entity among our interests in the Managed Programs, all of which we accounted for under the equity method of accounting. We(we do not consolidate these entities because we are not the primary beneficiary and the nature of our involvement in the activities of these entities allows us to exercise significant influence on, but does not give us power over, decisions that significantly affect the economic performance of these entities.entities), and (ii) two unconsolidated investments in equity securities, which we accounted for as investments in shares of the entities at fair value. As of September 30, 20172022, and December 31, 2016,2021, the net carrying amount of our investments in these entities was $152.8$629.8 million and $152.9$581.3 million, respectively, and our maximum exposure to loss in these entities was limited to our investments.

At September 30, 2017, we had an investment in a tenancy-in-common interest in various underlying international properties. Consolidation of this investment is not required as such interest does not qualify as a VIE and does not meet the control

|

| |

| W. P. Carey 9/30/2017 10-Q– 10

|

Notes to Consolidated Financial Statements (Unaudited)

requirement for consolidation. Accordingly, we account for this investment using the equity method of accounting. We use the equity method of accounting because the shared decision-making involved in a tenancy-in-common interest investment provides us with significant influence on the operating and financial decisions of this investment.

At times, the carrying value of our equity investments may fall below zero for certain investments. We intend to fund our share of the jointly owned investments’ future operating deficits should the need arise. However, we have no legal obligation to pay for any of the liabilities of such investments, nor do we have any legal obligation to fund operating deficits. At September 30, 2017, none of our equity investments had carrying values below zero.

On April 20, 2016, we formed a limited partnership, CESH I, for the purpose of developing, owning, and operating student housing properties and similar investments in Europe. CESH I commenced fundraising in July 2016 through a private placement with an initial offering of $100.0 million and a maximum offering of $150.0 million. Prior to August 30, 2016, which is the date that we had collected $14.2 million of net proceeds on behalf of CESH I from limited partnership units issued in the private placement (primarily to independent investors), we had included CESH I’s financial results and balances in our consolidated financial statements. On August 31, 2016, we determined that CESH I had sufficient equity to finance its operations and that we were no longer considered the primary beneficiary, and as a result we deconsolidated CESH I and began to account for our interest in it at fair value by electing the equity method fair value option available under GAAP. As of August 31, 2016, CESH I had assets totaling $30.3 million on our consolidated balance sheet, including $15.4 million in Cash and cash equivalents and $14.9 million in Other assets, net. In connection with the deconsolidation, we recorded offsetting amounts of $14.2 million for the nine months ended September 30, 2016 in Contributions from noncontrolling interests and Deconsolidation of affiliate in the consolidated statements of equity, and in Proceeds from limited partnership units issued by affiliate and Deconsolidation of affiliate in the consolidated statements of cash flows. We recognized a gain on deconsolidation of $1.9 million, which is included in Other income and (expenses) in the consolidated statements of income for the three and nine months ended September 30, 2016. The deconsolidation did not have a material impact on our financial position or results of operations. Following the deconsolidation, we continue to serve as the advisor to CESH I (Note 3).

Out-of-Period Adjustments

During the second quarter of 2016, we identified and recorded out-of-period adjustments related to adjustments to prior period income tax returns. We concluded that these adjustments were not material to our consolidated financial statements for any of the current or prior periods presented. The net adjustment is reflected as a $3.0 million reduction of our Benefit from income taxes in the consolidated statements of income for the nine months ended September 30, 2016.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation.

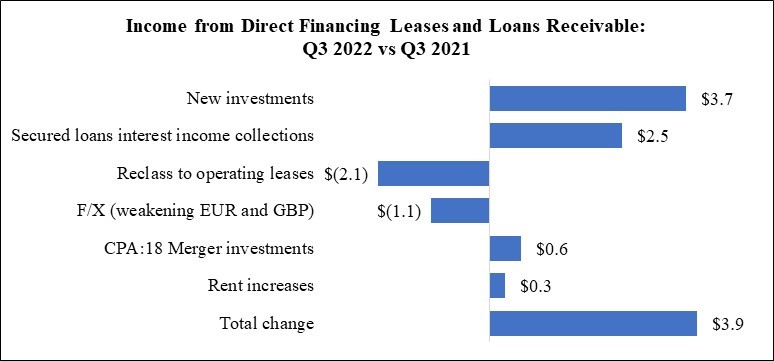

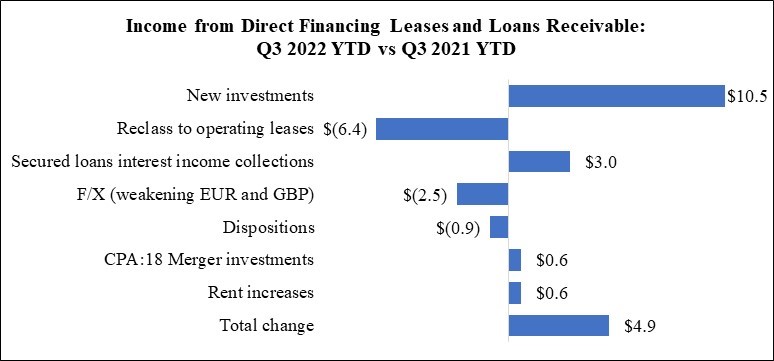

In 2017, we reclassified in-place lease intangible assets, net, below-market ground lease intangible assets, net (previously includedWe currently present Income from direct financing leases and loans receivable on its own line item in Other assets, net), and above-market rent intangible assets, net to bethe consolidated statements of income. Previously, income from direct financing leases was included within Net investmentsLease revenues and income from loans receivable was included within Lease termination income and other in real estate in ourthe consolidated balance sheets. The accumulated amortization on these assets is now included in Accumulated depreciation and amortization in our consolidated balance sheets. statements of income.

We also retitled the line item Real estate tocurrently present Land, buildings and improvements — net lease and other and Land, buildings and improvements — operating properties on separate line items in ourthe consolidated balance sheets. In addition, we included the line item Operating real estate, which had previously appeared in our consolidated balance sheets,Previously, land, buildings and improvements attributable to net lease properties and operating properties were aggregated within Land, buildings and improvements in ourthe consolidated balance sheets. Prior period balancessheets (Note 5).

Revenue Recognition

There have been reclassified to conform to the current period presentation.

As a result ofno significant changes in our Board’s decision to exit all non-traded retail fundraising activities as of June 30, 2017 (Note 1policies for revenue from contracts under Accounting Standards Codification (“ASC”), we have revised how we view and present a component of our two reportable segments. As such, effective since the second quarter of 2017, we include (i) equity in earnings of equity method investments 606 from what was disclosed in the Managed Programs and (ii) equity investments in the Managed Programs in our Investment Management segment. Results of operations and assets by segment for prior periods have been reclassified to conform to the current period presentation.

In connection with our adoption of Accounting Standards Update, or ASU, 2016-09, Improvements to Employee Share-Based Payment Accounting, as described below, we retrospectively reclassified Payments for withholding taxes upon delivery of equity-based awards and exercises of stock options from Net cash provided by operating activities to Net cash used in financing activities within our consolidated statements of cash flows.

|

| |

| W. P. Carey 9/30/2017 10-Q– 11

|

Notes to Consolidated Financial Statements (Unaudited)

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board, or FASB, issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 is a comprehensive new revenue recognition model requiring a company to recognize revenue to depict the transfer of goods or services to a customer at an amount reflecting the consideration it expects to receive in exchange for those goods or services. ASU 2014-092021 Annual Report. ASC 606 does not apply to our lease revenues, which constitute a majority of our revenues, but will primarily applyapplies to revenues generated from our hotel operating properties and our Investment Management business. We will adopt this guidancesegment. Revenue from contracts for our interimReal Estate segment primarily represented hotel operating property revenues of $3.7 million and annual periods beginning January 1, 2018$2.4 million for the three months ended September 30, 2022 and 2021, respectively, and $9.1 million and $4.9 million for the nine months ended September 30, 2022 and 2021, respectively (Note 16). Revenue from contracts under ASC 606 from our Investment Management segment is discussed in Note 4.

Lease revenue (including straight-line lease revenue) is only recognized when deemed probable of collection. Collectibility is assessed for each tenant receivable using various criteria including credit ratings (Note 6), guarantees, past collection issues, and the current economic and business environment affecting the tenant. If collectibility of the contractual rent stream is not deemed probable, revenue will only be recognized upon receipt of cash from the tenant.

Restricted Cash

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the consolidated balance sheets to the consolidated statements of cash flows (in thousands):

| | | | | | | | | | | |

| September 30, 2022 | | December 31, 2021 |

| Cash and cash equivalents | $ | 186,417 | | | $ | 165,427 | |

Restricted cash (a) | 63,596 | | | 52,523 | |

| Total cash and cash equivalents and restricted cash | $ | 250,013 | | | $ | 217,950 | |

__________

(a)Restricted cash is included within Other assets, net on our consolidated balance sheets.

W. P. Carey 9/30/2022 10-Q– 12

Notes to Consolidated Financial Statements (Unaudited)

Note 3. Merger with CPA:18 – Global

CPA:18 Merger

On February 27, 2022, we and certain of our subsidiaries entered into a merger agreement with CPA:18 – Global, pursuant to which CPA:18 – Global would merge with and into one of two methods: retrospective restatementour indirect subsidiaries in exchange for each reporting period presented atshares of our common stock and cash, subject to approval by the stockholders of CPA:18 – Global. The CPA:18 Merger and related transactions were approved by the stockholders of CPA:18 – Global on July 26, 2022 and completed on August 1, 2022.

At the effective time of adoption,the CPA:18 Merger, each share of CPA:18 – Global common stock issued and outstanding immediately prior to the effective time of the CPA:18 Merger was canceled and, in exchange for cancellation of such share, the rights attaching to such share were converted automatically into the right to receive (i) 0.0978 shares of our common stock and (ii) $3.00 in cash, which we refer to herein as the Merger Consideration. Each share of CPA:18 – Global common stock owned by us or retrospectivelyany of our subsidiaries immediately prior to the effective time of the CPA:18 Merger was automatically canceled and retired, and ceased to exist, for no Merger Consideration. In exchange for the 141,099,002 shares of CPA:18 – Global common stock that we and our subsidiaries did not previously own, we paid total merger consideration of approximately $1.6 billion, consisting of (i) the issuance of 13,786,302 shares of our common stock with a fair value of $1.2 billion, based on the closing price of our common stock on August 1, 2022 of $87.46 per share, (ii) cash consideration of $423.3 million, and (iii) cash of $0.1 million paid in lieu of issuing any fractional shares of our common stock. Pursuant to the terms of the definitive merger agreement, in connection with the cumulative effectclosing of initially applying this guidancethe CPA:18 Merger, we waived certain back-end fees that we would have otherwise been entitled to receive from CPA:18 – Global upon its liquidation pursuant to the terms of our pre-closing advisory agreement with CPA:18 – Global.

Immediately prior to the closing of the CPA:18 Merger, CPA:18 – Global’s portfolio was comprised of full or partial ownership interests in 42 leased properties (including seven properties in which we already owned a partial ownership interest), substantially all of which were net leased with a weighted-average lease term of 7.0 years, an occupancy rate of 99.3%, and an estimated contractual minimum annualized base rent (“ABR”) totaling $81.0 million, as well as 65 self-storage operating properties and two student housing operating properties totaling 5.1 million square feet. The related property-level debt was comprised of non-recourse mortgage loans with an aggregate consolidated fair value of approximately $900.2 million with a weighted-average annual interest rate of 5.1% as of August 1, 2022. From the closing of the CPA:18 Merger through September 30, 2022, lease revenues, operating property revenues, and net loss from properties acquired were $16.5 million, $15.4 million, and $0.5 million, respectively.

Two of the net lease properties that we acquired in the CPA:18 Merger were classified as Assets held for sale, with an aggregate fair value of $85.0 million at acquisition (Note 5). From the closing of the CPA:18 Merger through September 30, 2022, lease revenues from these properties totaled $2.1 million. We sold one of these properties in August 2022 for total proceeds, net of selling costs, of $44.5 million, and recognized ata loss on sale of $0.2 million (Note 15).

Purchase Price Allocation

We accounted for the date of initial application. We have not decided whichCPA:18 Merger as a business combination under the acquisition method of adoptionaccounting. After consideration of all applicable factors pursuant to the business combination accounting rules, we will use.were considered the “accounting acquirer” due to various factors, including the fact that our stockholders held the largest portion of the voting rights in the combined company upon completion of the CPA:18 Merger. Costs related to the CPA:18 Merger have been expensed as incurred and classified within Merger and other expenses in the consolidated statements of income, totaling $17.1 million for the nine months ended September 30, 2022.

The purchase price was allocated to the assets acquired and liabilities assumed, based upon their preliminary fair values at August 1, 2022. The following tables summarize the preliminary consideration and estimated fair values of the assets acquired and liabilities assumed in the acquisition, based on the current best estimate of management. We are evaluatingin the impactprocess of finalizing our assessment of the new standardfair value of the assets acquired and have not yet determined if it will have a material impactliabilities assumed. Investments in land, buildings and improvements, net investments in direct financing leases, non-recourse mortgages, and noncontrolling interests were based on preliminary valuation data and estimates.

W. P. Carey 9/30/2022 10-Q– 13

Notes to Consolidated Financial Statements (Unaudited)

| | | | | |

| Preliminary Purchase Price Allocation (in thousands) |

| Total Consideration | |

| Fair value of W. P. Carey shares of common stock issued | $ | 1,205,750 | |

| Cash consideration paid | 423,297 | |

| Cash paid for fractional shares | 138 | |

| Merger Consideration | 1,629,185 | |

| Fair value of our equity interest in CPA:18 – Global prior to the CPA:18 Merger | 88,299 | |

| Fair value of our equity interest in jointly owned investments with CPA:18 – Global prior to the CPA:18 Merger | 28,574 | |

| $ | 1,746,058 | |

| | | | | |

| Preliminary Purchase Price Allocation (in thousands) |

| Assets | |

| Land, buildings and improvements — net lease and other | $ | 881,613 | |

| Land, buildings and improvements — operating properties | 1,000,447 | |

| Net investments in direct financing leases and loans receivable | 38,517 | |

| In-place lease and other intangible assets | 224,458 | |

| Above-market rent intangible assets | 61,090 | |

| Assets held for sale | 85,026 | |

| Cash and cash equivalents and restricted cash | 331,063 | |

| Other assets, net (excluding restricted cash) | 25,229 | |

| Total assets | 2,647,443 | |

| Liabilities | |

| Non-recourse mortgages, net | 900,173 | |

| Accounts payable, accrued expenses and other liabilities | 90,035 | |

| Below-market rent and other intangible liabilities | 16,836 | |

| Deferred income taxes | 52,320 | |

| Total liabilities | 1,059,364 | |

| Total identifiable net assets | 1,588,079 | |

| Noncontrolling interests | (14,367) | |

| Goodwill | 172,346 | |

| $ | 1,746,058 | |

Goodwill

The $172.3 million of goodwill recorded in the CPA:18 Merger was primarily due to the premium we paid over CPA:18 – Global’s estimated fair value. Management believes the premium is supported by several factors, including that the CPA:18 Merger (i) concludes our business or our consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). ASU 2016-02 outlines a new model for accounting by lessees, whereby their rights and obligations under substantially all leases, existing and new, would be capitalized and recorded on the balance sheet. For lessors, however, the accounting remains largely unchangedexit from the current model,non-traded REIT business, (ii) adds a high-quality diversified portfolio of net lease assets that is well-aligned with the distinction betweenour existing portfolio, (iii) enhances certain portfolio metrics, and (iv) adds an attractive portfolio of self-storage operating and financing leases retained, but updated to align with certain changes to the lessee model and the new revenue recognition standard. properties.

The new standard also replaces existing sale-leaseback guidance with a new model applicable to both lessees and lessors. In addition, it also requires lessors to record gross revenues and expenses associated with activities that do not transfer services to the lessee (such as real estate taxes and insurance). Additionally, the new standard requires extensive quantitative and qualitative disclosures. Early application will be permitted for all entities. The new standard must be adopted using a modified retrospective transitionfair value of the new guidance and provides for certain practical expedients. Transition will require application13,786,302 shares of our common stock issued in the CPA:18 Merger as part of the new model atconsideration paid for CPA:18 – Global of $1.6 billion was derived from the beginning of the earliest comparative period presented. We will adopt this guidance for our interim and annual periods beginning January 1, 2019. The ASU is expected to impact our consolidated financial statements as we have certain operating office and land lease arrangements for which we are the lessee. We are evaluating the impact of the new standard and have not yet determined if it will have a material impact on our business or our consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting. ASU 2016-09 amends Accounting Standards Codification, or ASC, Topic 718, Compensation-Stock Based Compensation to simplify various aspects of how share-based payments are accounted for and presented in the financial statements including (i) reflecting income tax effects of share-based payments through the income statement, (ii) allowing statutory tax withholding requirements at the employees’ maximum individual tax rate without requiring awards to be classified as liabilities, and (iii) permitting an entity to make an accounting policy election for the impact of forfeitures on the recognition of expense. ASU 2016-09 is effective for public business entities for annual reporting periods beginning after December 15, 2016, and interim periods within that reporting period, with early adoption permitted.

We adopted ASU 2016-09 as of January 1, 2017 and elected to account for forfeitures as they occur, rather than to account for them based on an estimate of expected forfeitures. This election was adopted using a modified retrospective transition method, with a cumulative effect adjustment to retained earnings. The related financial statement impact of this adjustment is not material. Depending on several factors, such as theclosing market price of our common stock employee stock option exercise behavior,on the acquisition date. As required by GAAP, the fair value related to the assets acquired and corporateliabilities assumed, as well as the shares exchanged, has been computed as of the date we gained control, which was the closing date of the CPA:18 Merger, in a manner consistent with the methodology described above.

Goodwill is not deductible for income tax rates, the excess tax benefits associated with the exercise of stock options and the vesting and delivery of restricted share awards, or RSAs, restricted share units, or RSUs, and performance share units, or PSUs, could generate a significant income tax benefit in a particular interim period, potentially creating volatility in Net income attributable to purposes.

W. P. Carey 9/30/2022 10-Q– 14

Notes to Consolidated Financial Statements (Unaudited)

Equity Investments

During the third quarter of 2022, we recognized a gain on change in control of interests of approximately $22.5 million, which was the difference between the carrying value of approximately $65.8 million and basic and diluted earnings per share between interim periods. Under the former accounting guidance, windfall tax benefits related to stock-based compensation were recognized within Additional paid-in capitalfair value of approximately $88.3 million of our previously held equity interest in 8,556,732 shares of CPA:18 – Global’s common stock.

The CPA:18 Merger also resulted in our consolidated financial statements. Under ASU 2016-09,acquisition of the remaining interests in four investments in which we already had a joint interest and accounted for under the equity method. Upon acquiring the remaining interests in these amounts are reflected as a reduction to Provision for income taxes. For reference, windfall tax benefits related to stock-based compensation recorded in Additional paid-in capitalinvestments, we owned 100% of these investments and thus accounted for the years ended December 31, 2016acquisitions of these interests utilizing the purchase method of accounting. Due to the change in control of the four jointly owned investments that occurred, we recorded a gain on change in control of interests of approximately $11.4 million during the third quarter of 2022, which was the difference between our carrying values and 2015 were $6.7the fair values of our previously held equity interests on August 1, 2022 of approximately $17.2 million and $12.5approximately $28.6 million, respectively. Windfall tax benefitsSubsequent to the CPA:18 Merger, we consolidate these wholly owned investments.

The fair values of our previously held equity interests are based on the estimated fair market values of the underlying real estate and related mortgage debt, both of which were determined by management relying in part on a third party. Real estate valuation requires significant judgment. We determined the significant assumptions to stock-based compensation recordedbe Level 3 with ranges for our previously held equity interests as a deferred tax benefitfollows:

•Market rents ranged from $8.65 per square foot to $21.00 per square foot;

•Discount rates applied to the estimated net operating income of each property ranged from approximately 5.75% to 9.75%;

•Discount rates applied to the estimated residual value of each property ranged from approximately 6.50% to 8.50%;

•Residual capitalization rates applied to the properties ranged from approximately 5.75% to 8.00%;

•The fair market value of the property level debt was determined based upon available market data for comparable liabilities and by applying selected discount rates to the stream of future debt payments; and

•Discount rates applied to the property level debt cash flows ranged from approximately 2.28% to 5.50%.

Pro Forma Financial Information

The following consolidated pro forma financial information has been presented as if the CPA:18 Merger had occurred on January 1, 2021 for the three and nine months ended September 30, 2017 were $0.6 million2022 and $3.6 million, respectively.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments — Credit Losses. ASU 2016-13 introduces a new model for estimating credit losses based on current expected credit losses for certain types of2021. The pro forma financial instruments, including loans receivable, held-to-maturity debt securities, and net investments in direct financing leases, amongst other financial instruments. ASU 2016-13 also modifies the impairment model for available-for-sale debt securities and expands the disclosure requirements regarding an entity’s assumptions, models, and methods for estimating the allowance for losses. ASU 2016-13 will be effective for public business entities in fiscal years beginning after December 15, 2019, including interim periods within

|

| |

| W. P. Carey 9/30/2017 10-Q– 12

|

Notes to Consolidated Financial Statements (Unaudited)

those fiscal years, with early application of the guidance permitted. We are in the process of evaluating the impact of adopting ASU 2016-13 on our consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 intends to reduce diversity in practice for certain cash flow classifications, including, but not limited to (i) debt prepayment or debt extinguishment costs, (ii) contingent consideration payments made after a business combination, (iii) proceeds from the settlement of insurance claims, and (iv) distributions received from equity method investees. ASU 2016-15 will be effective for public business entities in fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, with early application of the guidance permitted. We are in the process of evaluating the impact of adopting ASU 2016-15 on our consolidated financial statements and will retrospectively adopt the standard for the fiscal year beginning January 1, 2018.

In October 2016, the FASB issued ASU 2016-17, Consolidation (Topic 810): Interests Held through Related Parties That Are under Common Control. ASU 2016-17 changes how a reporting entity that is a decision maker should consider indirect interests in a VIE held through an entity under common control. If a decision maker must evaluate whether it is the primary beneficiary of a VIE, it will only need to consider its proportionate indirect interest in the VIE held through a common control party. ASU 2016-17 amends ASU 2015-02, which we adopted on January 1, 2016, and which currently directs the decision maker to treat the common control party’s interest in the VIE as if the decision maker held the interest itself. ASU 2016-17 is effective for public business entities in fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. We adopted ASU 2016-17 as of January 1, 2017 on a prospective basis. The adoption of this standard did not have a material impact on our consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. ASU 2016-18 intends to reduce diversity in practice for the classification and presentation of changes in restricted cash on the statement of cash flows. ASU 2016-18 requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. ASU 2016-18 will be effective for public business entities in fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, with early adoption permitted. We are in the process of evaluating the impact of adopting ASU 2016-18 on our consolidated financial statements and will retrospectively adopt the standard for the fiscal year beginning January 1, 2018.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. ASU 2017-01 intends to clarify the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. Under the current implementation guidance in Topic 805, there are three elements of a business: inputs, processes, and outputs. While an integrated set of assets and activities, collectively referred to as a “set,” that is a business usually has outputs, outputs are not required to be present. ASU 2017-01 provides a screen to determine when a setinformation is not a business. The screen requires that when substantially allnecessarily indicative of what the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. ASU 2017-01 will be effective for public business entities in fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, with early adoption permitted. We elected to early adopt ASU 2017-01 on January 1, 2017 on a prospective basis. While our acquisitions have historically been classified as either business combinations or asset acquisitions, certain acquisitions that were classified as business combinations by us likelyactual results would have been considered asset acquisitions underhad the new standard. As a result, transaction costs are more likelyCPA:18 Merger on that date, nor does it purport to be capitalized since we expect most of our future acquisitions to be classified as asset acquisitions under this new standard. In addition, goodwill that was previously allocated to businesses that were sold or held for sale will no longer be allocated and written off upon sale if future sales were deemed to be sales of assets and not businesses.

In January 2017,represent the FASB issued ASU 2017-04, Intangibles — Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. ASU 2017-04 removes step 2 of the goodwill impairment test, which requires a hypothetical purchase price allocation. A goodwill impairment will now be the amount by which a reporting unit’s carrying value exceeds its fair value, not to exceed the carrying amount of goodwill. All other goodwill impairment guidance will remain largely unchanged. Entities will continue to have the option to perform a qualitative assessment to determine if a quantitative impairment test is necessary. ASU 2017-04 will be effective for public business entities in fiscal years beginning after December 15, 2019, including interim periods within those fiscal years in which a goodwill impairment test is performed, with early adoption permitted. We adopted ASU 2017-04 as of April 1, 2017 on a prospective basis. The adoption of this standard did not have a material impact on our consolidated financial statements.

|

| |

| W. P. Carey 9/30/2017 10-Q– 13

|

Notes to Consolidated Financial Statements (Unaudited)

In February 2017, the FASB issued ASU 2017-05, Other Income — Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20). ASU 2017-05 clarifies that a financial asset is within the scope of Subtopic 610-20 if it meets the definition of an in substance nonfinancial asset. The amendments define the term “in substance nonfinancial asset,” in part, as a financial asset promised to a counterparty in a contract if substantially all of the fair value of the assets (recognized and unrecognized) that are promised to the counterparty in the contract is concentrated in nonfinancial assets. If substantially all of the fair value of the assets that are promised to the counterparty in a contract is concentrated in nonfinancial assets, then all of the financial assets promised to the counterparty are in substance nonfinancial assets within the scope of Subtopic 610-20. This amendment also clarifies that nonfinancial assets within the scope of Subtopic 610-20 may include nonfinancial assets transferred within a legal entity to a counterparty. For example, a parent company may transfer control of nonfinancial assets by transferring ownership interests in a consolidated subsidiary. ASU 2017-05 is effective for periods beginning after December 15, 2017, with early application permitted for fiscal years beginning after December 15, 2016. We are in the process of evaluating the impact of ASU 2017-05 on our consolidated financial statements and will adopt the standard for the fiscal year beginning January 1, 2018.

In May 2017, the FASB issued ASU 2017-09, Compensation — Stock Compensation (Topic 718): Scope of Modification Accounting. ASU 2017-09 clarifies when to account for a change to the terms and conditions of a share-based payment award as a modification. Under the new guidance, modification accounting is required only if the fair value, vesting conditions, or classification of the award (as equity or liability) changes as a result of the change in terms or conditions. ASU 2017-09 will be effective in fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, with early adoption permitted. We are in the process of evaluating the impact of adopting ASU 2017-09 on our consolidated financial statements and will adopt the standard for the fiscal year beginning January 1, 2018.

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. ASU 2017-12 will make more financial and nonfinancial hedging strategies eligible for hedge accounting. It also amends the presentation and disclosure requirements and changes how companies assess hedge effectiveness. It is intended to more closely align hedge accounting with companies’ risk management strategies, simplify the application of hedge accounting, and increase transparency as to the scope and results of hedging programs. ASU 2017-12 will be effective operations for future periods.

(in fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, with early adoption permitted. We are in the process of evaluating the impact of adopting ASU 2017-12 on our consolidated financial statements.thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Pro forma total revenues | $ | 397,915 | | | $ | 372,498 | | | $ | 1,187,887 | | | $ | 1,089,031 | |

|

| |

| W. P. Carey 9/30/2017 10-Q– 14

|

Notes to Consolidated Financial Statements (Unaudited)

Note 3.4. Agreements and Transactions with Related Parties

Advisory Agreements and Partnership Agreements with the Managed Programs

We currently have advisory agreementsarrangements with each of the Managed Programs,CESH, pursuant to which we earn fees and are entitled to receive reimbursement for certain fund management expenses, as well as cash distributions. Theexpenses. Upon completion of the CPA:18 Merger on August 1, 2022 (Note 3), our advisory agreements also entitled us to fees for serving as the dealer manager of the offerings of the Managed Programs. However, as previously noted, as of June 30, 2017,with CPA:18 – Global were terminated, and we ceased all active non-traded retail fundraising activities.earning revenue from CPA:18 – Global. We facilitated the orderly processing of sales of shares of the common stock and limited partnership units of CWI 2 and CESH I, respectively, through July 31, 2017 and closed their respective offerings on that date, and as a result, stopped receiving dealer manager fees after that date. In addition, in August 2017, we resigned as the advisor to CCIF, and our advisory agreement with CCIF was terminated, effective as of September 11, 2017, and as a result, we no longer earned any fees from CCIF after that date. Weraise capital for new or existing funds, but we currently expect to continue to manage all existing Managed ProgramsCESH and earn various fees (as described below) through the end of their respective naturalits life cycles (Notecycle.

W. P. Carey 9/30/2022 10-Q– 15

Notes to Consolidated Financial Statements (Unaudited)

The merger between Carey Watermark Investors Incorporated (“CWI 1”) and Carey Watermark Investors 2 Incorporated (“CWI 2”), two former affiliates (the “CWI 1 and CWI 2 Merger”), closed on April 13, 2020 and is discussed in detail in the 2021 Annual Report. Subsequently, CWI 2 was renamed Watermark Lodging Trust, Inc. (“WLT”). The advisory agreementsIn connection with eachthe CWI 1 and CWI 2 Merger, we entered into a transition services agreement, under which we provided certain transition services at cost to WLT generally for a period of 12 months from closing. On October 13, 2021, all services provided under the Managed REITs have terms of one year, may be renewed for successive one-year periods, and are currently scheduled to expire on December 31, 2017, unless otherwise renewed. The advisorytransition services agreement with CESH I, which commenced June 3, 2016, will continue until terminated pursuant to its terms.were terminated.

The following tables present a summary of revenue earned, and/or cash receivedreimbursable costs, and distributions of Available Cash received/accrued from the Managed Programs and WLT for the periods indicated, included in the consolidated financial statements. Asset management revenue excludes amounts received from third partiesstatements (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

Distributions of Available Cash (a) | $ | 3,345 | | | $ | 1,623 | | | $ | 8,746 | | | $ | 4,949 | |

Asset management revenue (b) (c) | 1,197 | | | 3,872 | | | 8,084 | | | 11,792 | |

Reimbursable costs from affiliates (b) | 344 | | | 1,041 | | | 2,414 | | | 3,050 | |

Interest income on deferred acquisition fees and loans to affiliates (d) | 4 | | | 57 | | | 112 | | | 121 | |

| $ | 4,890 | | | $ | 6,593 | | | $ | 19,356 | | | $ | 19,912 | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Asset management revenue | $ | 17,938 |

| | $ | 15,955 |

| | $ | 53,271 |

| | $ | 45,535 |

|

| Distributions of Available Cash | 12,047 |

| | 10,876 |

| | 34,568 |

| | 32,018 |

|

| Structuring revenue | 9,817 |

| | 12,301 |

| | 27,981 |

| | 30,990 |

|

| Reimbursable costs from affiliates | 6,211 |

| | 14,540 |

| | 45,390 |

| | 46,372 |

|

| Interest income on deferred acquisition fees and loans to affiliates | 447 |

| | 130 |

| | 1,464 |

| | 492 |

|

| Dealer manager fees | 105 |

| | 1,835 |

| | 4,430 |

| | 5,379 |

|

| Other advisory revenue | 99 |

| | 522 |

| | 896 |

| | 522 |

|

| | $ | 46,664 |

| | $ | 56,159 |

| | $ | 168,000 |

| | $ | 161,308 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

CPA:18 – Global | $ | 4,466 | | | $ | 5,608 | | | $ | 17,854 | | | $ | 16,578 | |

| CESH | 424 | | | 909 | | | 1,502 | | | 3,054 | |

| WLT (reimbursed transition services) | — | | | 76 | | | — | | | 280 | |

| $ | 4,890 | | | $ | 6,593 | | | $ | 19,356 | | | $ | 19,912 | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

CPA®:17 – Global | $ | 15,383 |

| | $ | 16,616 |

| | $ | 55,645 |

| | $ | 51,820 |

|

CPA®:18 – Global | 4,042 |

| | 5,259 |

| | 18,361 |

| | 22,851 |

|

| CWI 1 | 11,940 |

| | 7,771 |

| | 26,051 |

| | 26,453 |

|

| CWI 2 | 11,643 |

| | 19,924 |

| | 45,206 |

| | 49,233 |

|

| CCIF | 1,787 |

| | 3,388 |

| | 12,777 |

| | 7,750 |

|

| CESH I | 1,869 |

| | 3,201 |

| | 9,960 |

| | 3,201 |

|

| | $ | 46,664 |

| | $ | 56,159 |

| | $ | 168,000 |

| | $ | 161,308 |

|

(b)Amounts represent revenues from contracts under ASC 606.

(c)Included within Asset management and other revenue in the consolidated statements of income.

(d)Included within Non-operating income in the consolidated statements of income.

|

| |

| W. P. Carey 9/30/2017 10-Q– 15

|

Notes to Consolidated Financial Statements (Unaudited)

The following table presents a summary of amounts included in Due from affiliates in the consolidated financial statements (in thousands):

| | | | | | | | | | | |

| September 30, 2022 | | December 31, 2021 |

| Asset management fees receivable | $ | 352 | | | $ | 494 | |

| Accounts receivable | 159 | | | 336 | |

| Reimbursable costs | 91 | | | 974 | |

| Current acquisition fees receivable | — | | | 19 | |

| Deferred acquisition fees receivable, including accrued interest | — | | | 3 | |

| $ | 602 | | | $ | 1,826 | |

W. P. Carey 9/30/2022 10-Q– 16

Notes to Consolidated Financial Statements (Unaudited)

|

| | | | | | | |

| | September 30, 2017 | | December 31, 2016 |

| Short-term loans to affiliates, including accrued interest | $ | 132,210 |

| | $ | 237,613 |

|

| Deferred acquisition fees receivable, including accrued interest | 10,720 |

| | 21,967 |

|

| Accounts receivable | 5,358 |

| | 5,005 |

|

| Reimbursable costs | 3,943 |

| | 4,427 |

|

| Current acquisition fees receivable | 1,508 |

| | 8,024 |

|

| Asset management fees receivable | 539 |

| | 2,449 |

|

| Organization and offering costs | 58 |

| | 784 |

|

| Distribution and shareholder servicing fees | — |

| | 19,341 |

|

| | $ | 154,336 |

| | $ | 299,610 |

|

Asset Management Revenue

Under the advisory agreements with the Managed Programs, we earn asset management revenue for managing their investment portfolios. The following table presents a summary of our asset management fee arrangements with the Managed Programs:

|

| | | | | | | | | | | | | | | | | | | |

| Managed Program | | Rate | | Payable | | Description |

CPA®:17CPA:18 – Global

| | 0.5% – 1.75%1.5% | | 2016 50% inIn shares of its Class A common stock and/or cash, and 50%at the option of CPA:18 – Global; payable in shares of its common stock; 2017 in shares of itsClass A common stock for 2021 through February 28, 2022; payable in cash from March 1, 2022 to August 1, 2022 (the date of the completion of the CPA:18 Merger) | | Rate dependsdepended on the type of investment and iswas based on the average market or average equity value, as applicable |

CPA®:18 – Global

CESH | | 0.5% – 1.5%1.0% | | In shares of its Class A common stock | | Rate depends on the type of investment and is based on the average market or average equity value, as applicable |

CWI 1 | | 0.5% | | 2016 in cash; 2017 in shares of its common stock | | Rate is based on the average market value of the investment; we are required to pay 20% of the asset management revenue we receive to the subadvisor |

CWI 2 | | 0.55% | | In shares of its Class A common stock | | Rate is based on the average market value of the investment; we are required to pay 25% of the asset management revenue we receive to the subadvisor |

CCIF | | 1.75% – 2.00% | | In cash prior to our resignation as the advisor to CCIF, effective September 11, 2017 (Note 1) | | Based on the average of gross assets at fair value; we were required to pay 50% of the asset management revenue we received to the subadvisor |

CESH I | | 1.0% | | In cash | | Based on gross assets at fair value |

|

| |

| W. P. Carey 9/30/2017 10-Q– 16

|

Notes to Consolidated Financial Statements (Unaudited)

Structuring Revenue

Under the terms of the advisory agreements with the Managed Programs, we earn revenue for structuring and negotiating investments and related financing. We did not earn any structuring revenue from the Managed BDCs. The following table presents a summary of our structuring fee arrangements with the Managed Programs:

|

| | | | | | |

Managed Program | | Rate | | Payable | | Description |

CPA®:17 – Global

| | 1% – 1.75%, 4.5% | | In cash; for non net-lease investments, 1% – 1.75% upon completion; for net-lease investments, 2.5% upon completion, with 2% deferred and payable in three interest-bearing annual installments | | Based on the total aggregate cost of the net-lease investments made; also based on the total aggregate cost of the non net-lease investments or commitments made; total limited to 6% of the contract prices in aggregate |

CPA®:18 – Global

| | 4.5% | | In cash; for all investments, other than readily marketable real estate securities for which we will not receive any acquisition fees, 2.5% upon completion, with 2% deferred and payable in three interest-bearing annual installments | | Based on the total aggregate cost of the investments or commitments made; total limited to 6% of the contract prices in aggregate |

CWI REITs | | 2.5% | | In cash upon completion; however, fees were paid 50% in cash and 50% in shares of CWI 1’s common stock and CWI 2’s Class A common stock for a jointly-owned investment structured on behalf of CWI 1 and CWI 2 in September 2017, with the approval of each CWI REIT’s board of directors | | Based on the total aggregate cost of the lodging investments or commitments made; loan refinancing transactions up to 1% of the principal amount; we are required to pay 20% and 25% to the subadvisors of CWI 1 and CWI 2, respectively; total for each CWI REIT limited to 6% of the contract prices in aggregate |

CESH I | | 2.0% | | In cash upon completion | | Based on the total aggregate cost of investments or commitments made, including the acquisition, development, construction, or re-development of the investments |

|

| |

| W. P. Carey 9/30/2017 10-Q– 17

|

Notes to Consolidated Financial Statements (Unaudited)

Reimbursable Costs from Affiliates

During their respective offering periods, the Managed Programs reimbursedCESH reimburses us for certain costs that we incurred on their behalf, which consisted primarily of broker-dealer commissions, marketing costs, and an annual distribution and shareholder servicing fee, as applicable. The offerings for CWI 2 and CESH I closed on July 31, 2017. The Managed Programs will continue to reimburse usin cash for certain personnel and overhead costs that we incur on their behalf. The following tables present summaries of such fee arrangements:its behalf, based on actual expenses incurred.

Broker-Dealer Selling Commissions

|

| | | | | | |

Managed Program | | Rate | | Payable | | Description |

CWI 2 Class A Shares | | January 1, 2016 through March 31, 2017: $0.70

April 27, 2017 through July 31, 2017: $0.84 (a)

| | In cash upon share settlement; 100% re-allowed to broker-dealers | | Per share sold |

CWI 2 Class T Shares | | January 1, 2016 through March 31, 2017: $0.19

April 27, 2017 through July 31, 2017: $0.23 (a)

| | In cash upon share settlement; 100% re-allowed to broker-dealers | | Per share sold |

CCIF Feeder Funds | | Through September 10, 2017:

0% – 3% (b)

| | In cash upon share settlement; 100% re-allowed to broker-dealers | | Based on the selling price of each share sold; the offering for Carey Credit Income Fund 2016 T (known as Guggenheim Credit Income Fund 2016 T since October 23, 2017), or CCIF 2016 T, closed on April 28, 2017 |

CESH I | | Up to 7.0% of gross offering proceeds (a)

| | In cash upon limited partnership unit settlement; 100% re-allowed to broker-dealers | | Based on the selling price of each limited partnership unit sold |

__________

| |

(a) | After the end of active fundraising by Carey Financial on June 30, 2017, we facilitated the orderly processing of sales in the offerings of CWI 2 and CESH I through July 31, 2017, which then closed their respective offerings on that date. |

| |

(b) | In August 2017, we resigned as the advisor to CCIF, and our advisory agreement with CCIF was terminated, effective as of September 11, 2017. |

|

| |

| W. P. Carey 9/30/2017 10-Q– 18

|

Notes to Consolidated Financial Statements (Unaudited)

Dealer Manager Fees

|

| | | | | | |

Managed Program | | Rate | | Payable | | Description |

CWI 2 Class A Shares | | January 1, 2016 through March 31, 2017: $0.30

April 27, 2017 through July 31, 2017: $0.36 (a)

| | Per share sold | | In cash upon share settlement; a portion may be re-allowed to broker-dealers |

CWI 2 Class T Shares | | January 1, 2016 through March 31, 2017: $0.26

April 27, 2017 through July 31, 2017: $0.31 (a)

| | Per share sold | | In cash upon share settlement; a portion may be re-allowed to broker-dealers |

CCIF Feeder Funds | | Through September 10, 2017: 2.50% – 3.0% (b)

| | Based on the selling price of each share sold | | In cash upon share settlement; a portion may be re-allowed to broker-dealers; CCIF 2016 T’s offering closed on April 28, 2017 |

CESH I | | Up to 3.0% of gross offering proceeds (a)

| | Per limited partnership unit sold | | In cash upon limited partnership unit settlement; a portion may be re-allowed to broker-dealers |

__________

| |

(a) | In connection with the end of active fundraising by Carey Financial on June 30, 2017, CWI 2 and CESH I facilitated the orderly processing of sales through July 31, 2017 and closed their respective offerings on that date. |

| |

(b) | In August 2017, we resigned as the advisor to CCIF, and our advisory agreement with CCIF was terminated, effective as of September 11, 2017. |

Annual Distribution and Shareholder Servicing Fee

|

| | | | | | |

Managed Program | | Rate | | Payable | | Description |

CPA®:18 – Global Class C Shares (a)

| | 1.0% | | Accrued daily and payable quarterly in arrears in cash; a portion may be re-allowed to selected dealers | | Based on the purchase price per share sold or, once it was reported, the net asset value per share, or NAV; cease paying when underwriting compensation from all sources equals 10% of gross offering proceeds |

CWI 2 Class T Shares (a)

| | 1.0% | | Accrued daily and payable quarterly in arrears in cash; a portion may be re-allowed to selected dealers | | Based on the purchase price per share sold or, once it was reported, the NAV; cease paying on the earlier of six years or when underwriting compensation from all sources equals 10% of gross offering proceeds |

CCIF 2016 T (b)

| | 0.9% | | Payable quarterly in arrears in cash; 100% is re-allowed to selected dealers | | Based on the weighted-average net price of shares sold in the public offering; cease paying on the earlier of when underwriting compensation from all sources equals, including this fee, 10% of gross offering proceeds or the date at which a liquidity event occurs |

__________

| |

(a) | In connection with our exit from all non-traded retail fundraising activities as of June 30, 2017, beginning with the payment for the third quarter of 2017 (which was made during the fourth quarter of 2017), the distribution and shareholder servicing fee is now paid directly to selected dealers by the respective funds. As a result, our liability to the selected dealers and the corresponding receivable from the funds were removed during the third quarter of 2017. |

| |

(b) | In connection with our resignation as advisor to CCIF in August 2017, our dealer manager agreement was assigned to Guggenheim. As a result, our liability to the selected dealers and the corresponding receivable from CCIF was removed. |

|

| |

| W. P. Carey 9/30/2017 10-Q– 19

|

Notes to Consolidated Financial Statements (Unaudited)

Personnel and Overhead Costs

|

| | | | |

Managed Program | | Payable | | Description |

CPA®:17 – Global and CPA®:18 – Global

| | In cash | | Personnel and overhead costs, excluding those related to our legal transactions group, our senior management, and our investments team, are charged to the CPA® REITs based on the average of the trailing 12-month aggregate reported revenues of the Managed Programs and us, and are capped at 2.0% and 2.2% of each CPA® REIT’s pro rata lease revenues for 2017 and 2016, respectively; for the legal transactions group, costs are charged according to a fee schedule

|

CWI 1 | | In cash | | Actual expenses incurred, excluding those related to our senior management; allocated between the CWI REITs based on the percentage of their total pro rata hotel revenues for the most recently completed quarter |

CWI 2 | | In cash | | Actual expenses incurred, excluding those related to our senior management; allocated between the CWI REITs based on the percentage of their total pro rata hotel revenues for the most recently completed quarter |

CCIF and CCIF Feeder Funds | | In cash, prior to our resignation as the advisor to CCIF, effective September 11, 2017 (Note 1) | | Actual expenses incurred, excluding those related to their investment management team and senior management team |

CESH I | | In cash | | Actual expenses incurred |

Organization and Offering Costs

|

| | | | |

Managed Program | | Payable | | Description |

CWI 2 (a)

| | In cash; within 60 days after the end of the quarter in which the offering terminates | | Actual costs incurred up to 1.5% of the gross offering proceeds |

CCIF and CCIF Feeder Funds (b)

| | In cash; payable monthly, prior to our resignation as the advisor to CCIF, effective September 11, 2017 (Note 1) | | Up to 1.5% of the gross offering proceeds; we were required to pay 50% of the organization and offering costs we received to the subadvisor |

CESH I (a)

| | N/A | | In lieu of reimbursing us for organization and offering costs, CESH I paid us limited partnership units, as described below under Other Advisory Revenue |

__________

| |

(a) | In connection with the end of active fundraising by Carey Financial on June 30, 2017, CWI 2 and CESH I facilitated the orderly processing of sales through July 31, 2017 and closed their respective offerings on that date. |

| |

(b) | In August 2017, we resigned as the advisor to CCIF, and our advisory agreement with CCIF was terminated, effective as of September 11, 2017. |

Other Advisory Revenue

Under the limited partnership agreement we have with CESH I, we paid all organization and offering costs on behalf of CESH I, and instead of being reimbursed by CESH I on a dollar-for-dollar basis for those costs, we received limited partnership units of CESH I equal to 2.5% of its gross offering proceeds. This revenue, which commenced in the third quarter of 2016, is included in Other advisory revenue in the consolidated statements of income and totaled $0.1 million and $0.7 million for the three and nine months ended September 30, 2017, respectively, and $0.5 million for both the three and nine months ended September 30, 2016, respectively. In connection with the end of active non-traded retail fundraising by Carey Financial on June 30, 2017, we facilitated the orderly processing of sales of CESH I through July 31, 2017, which closed its offering on that date.

|

| |

| W. P. Carey 9/30/2017 10-Q– 20

|

Notes to Consolidated Financial Statements (Unaudited)

Expense Support and Conditional Reimbursements

Under the expense support and conditional reimbursement agreement we had with each of the CCIF Feeder Funds, we and the CCIF subadvisor were obligated to reimburse the CCIF Feeder Funds 50% of the excess of the cumulative distributions paid to the CCIF Feeder Funds’ shareholders over the available operating funds on a monthly basis. Following any month in which the available operating funds exceeded the cumulative distributions paid to its shareholders, the excess operating funds were used to reimburse us and the CCIF subadvisor for any expense payment we made within three years prior to the last business day of such month that had not been previously reimbursed by the CCIF Feeder Fund, up to the lesser of (i) 1.75% of each CCIF Feeder Fund’s average net assets or (ii) the percentage of each CCIF Feeder Fund’s average net assets attributable to its common shares represented by other operating expenses during the fiscal year in which such expense support payment from us and the CCIF’s subadvisor was made, provided that the effective rate of distributions per share at the time of reimbursement was not less than such rate at the time of expense payment. The expense support and conditional reimbursement agreement we had with each of the CCIF Feeder Funds was terminated in connection with our resignation as the advisor to CCIF effective as of September 11, 2017.

Distributions of Available Cash

We arewere entitled to receive distributions of up to 10% of the Available Cash (as defined in the respective advisory agreements)CPA:18 – Global’s partnership agreement) from the operating partnershipspartnership of each of the Managed REITs, as described in their respective operating partnership agreements,CPA:18 – Global, payable quarterly in arrears. We are required to pay 20% and 25%After completion of suchthe CPA:18 Merger on August 1, 2022 (Note 3), we no longer receive distributions to the subadvisors of CWI 1 and CWI 2, respectively.Available Cash from CPA:18 – Global.

Back-End Fees and Interests in the Managed Programs

Under our advisory agreementsarrangements with certain of the Managed Programs,CESH, we may also receive compensation in connection with providing a liquidity eventsevent for their stockholders. For the Managed REITs, the timing and form of such liquidity events are at the discretion of each REIT’s board of directors, andits investors. Such back-end fees or interests include or may include interests in certain instances, we have waived these fees in connection with the liquidity events of prior programs that we managed. Therefore, theredisposition proceeds. There can be no assurance as to whether or when any of these back-end fees or interests will be realized. Pursuant to the terms of the definitive merger agreement, in connection with the closing of the CPA:18 Merger, we waived certain back-end fees that we would have been entitled to receive from CPA:18 – Global upon its liquidation pursuant to the terms of our advisory agreement and partnership agreement with CPA:18 – Global (Note 3).

Other Transactions with Affiliates

Loans to Affiliates

From time to time, our Boardboard of directors has approved the making of secured and unsecured loans or lines of credit from us to certain of the Managed Programs, at our sole discretion, with each loan at a rate equal to the rate at which we are able to borrow funds under our senior credit facility (Note 10), generally for the purpose of facilitating acquisitions or for working capital purposes. The principal outstanding balance on our line of credit to CPA:18 – Global was $16.0 million as of June 30, 2022. No amounts were outstanding as of December 31, 2021. In July 2022, CPA:18 – Global repaid the principal outstanding balance in full. The loan agreement with CPA:18 – Global was terminated upon completion of the CPA:18 Merger on August 1, 2022. No such line of credit with CESH existed during the reporting period.

The following table sets forth certain information regardingOther

At September 30, 2022, we owned interests in ten jointly owned investments in real estate, with the remaining interests held by third parties. We consolidate six such investments and account for the remaining four investments under the equity method of accounting (Note 8). In addition, we owned limited partnership units of CESH at that date. We elected to account for our loans to affiliates (dollarsinvestment in thousands):CESH under the fair value option (Note 8).

W. P. Carey 9/30/2022 10-Q– 17

|

| | | | | | | | | | | | | | | | |

| | | Interest Rate at

September 30, 2017 | | Maturity Date at September 30, 2017 | | Maximum Loan Amount Authorized at September 30, 2017 | | Principal Outstanding Balance at (a) |

| Managed Program | | | | | September 30, 2017 | | December 31, 2016 |

CWI 1 (b) (c) (d) | | LIBOR + 1.00% | | 6/30/2018; 12/31/2018 | | $ | 100,000 |

| | $ | 97,835 |

| | $ | — |

|

CPA®:18 – Global (b) (e) | | LIBOR + 1.00% | | 10/31/2017; 5/15/2018 | | 50,000 |

| | 19,000 |

| | 27,500 |

|

CESH I (b) | | LIBOR + 1.00% | | 5/3/2018; 5/9/2018 | | 35,000 |

| | 14,461 |

| | — |

|

CWI 2 (f) | | N/A | | N/A | | N/A | | — |

| | 210,000 |

|

| | | | | | | | | $ | 131,296 |

| | $ | 237,500 |

|

__________

| |

(a) | Amounts exclude accrued interest of $0.9 million and $0.1 million at September 30, 2017 and December 31, 2016, respectively. |

| |

(b) | LIBOR means London Interbank Offered Rate. |

| |

(c) | We entered into a secured credit facility with CWI 1 in September 2017, comprised of a $75.0 million bridge loan to facilitate an acquisition and a $25.0 million revolving working capital facility. |

|

| |

| W. P. Carey 9/30/2017 10-Q– 21

|

Notes to Consolidated Financial Statements (Unaudited)

| |

(d) | In October 2017, CWI 1 repaid $29.2 million, in aggregate, of the loans outstanding to us at September 30, 2017 (Note 17). |

| |

(e) | In October 2017, CPA®:18 – Global repaid in full the amount outstanding to us at September 30, 2017 (Note 17). |

| |

(f) | In October 2017, we entered into a secured $25.0 million revolving working capital facility with CWI 2 (Note 17). |

Other

At September 30, 2017, we owned interests ranging from 3% to 90% in jointly owned investments in real estate, including a jointly controlled tenancy-in-common interest in several properties, with the remaining interests generally held by affiliates. In addition, we owned stock of each of the Managed REITs and CCIF, and limited partnership units of CESH I. We consolidate certain of these investments and account for the remainder either (i) under the equity method of accounting, (ii) under the cost method of accounting, or (iii) at fair value by electing the equity method fair value option available under GAAP (Note 7).

Note 4.5. Land, Buildings and Improvements and Assets Held for Sale

Land, Buildings and Improvements — Operating LeasesNet Lease and Other

Land and buildings leased to others, which are subject to operating leases, and real estate under construction, are summarized as follows (in thousands):

| | | | September 30, 2017 | | December 31, 2016 | | September 30, 2022 | | December 31, 2021 |

| Land | $ | 1,132,569 |

| | $ | 1,128,933 |

| Land | $ | 2,320,763 | | | $ | 2,151,327 | |

| Buildings | 4,194,213 |

| | 4,053,334 |

| |

| Buildings and improvements | | Buildings and improvements | 10,525,449 | | | 9,525,858 | |

| Real estate under construction | 20,373 |

| | 21,859 |

| Real estate under construction | 16,211 | | | 114,549 | |

| Less: Accumulated depreciation | (578,592 | ) | | (472,294 | ) | Less: Accumulated depreciation | (1,563,622) | | | (1,448,020) | |

| | $ | 4,768,563 |

| | $ | 4,731,832 |

| | $ | 11,298,801 | | | $ | 10,343,714 | |

As discussed in Note 3, we acquired 39 consolidated properties subject to existing operating leases in the CPA:18 Merger, which increased the carrying value of our Land, buildings and improvements — net lease and other by $881.6 million during the nine months ended September 30, 2022.

During the nine months ended September 30, 2017,2022, the U.S. dollar weakenedstrengthened against the euro, as the end-of-period rate for the U.S. dollar in relation to the euro increaseddecreased by 12.0%13.9% to $1.1806$0.9748 from $1.0541.$1.1326. As a result of this fluctuation in foreign currency exchange rates, the carrying value of our Land, buildings and improvements subject to operating leases increased— net lease and other decreased by $160.5$601.1 million from December 31, 20162021 to September 30, 2017.2022.

In connection with changes in lease classifications due to termination of the underlying leases, we reclassified two properties with an aggregate carrying value of $30.5 million from Net investments in direct financing leases and loans receivable to Land, buildings and improvements — net lease and other during the nine months ended September 30, 2022 (Note 6).

Depreciation expense, including the effect of foreign currency translation, on our Land, buildings and improvements subject to operating leases was $36.3$76.0 million and $35.4$70.8 million for the three months ended September 30, 20172022 and 2016,2021, respectively, and $107.5$221.0 million and $107.3$207.2 million for the nine months ended September 30, 20172022 and 2016,2021, respectively. Accumulated depreciation of real estate is included in Accumulated depreciation and amortization in the consolidated financial statements.

In connection with changes in lease classifications dueW. P. Carey 9/30/2022 10-Q– 18

Notes to

extensions of the underlying leases, we reclassified six properties with an aggregate carrying value of $1.6 million from Net investments in direct financing leases to Land, buildings and improvements during the nine months ended September 30, 2017 (Note 5).Consolidated Financial Statements (Unaudited)

AcquisitionAcquisitions of Real Estate

On June 27, 2017, we acquired an industrial facility in Chicago, Illinois, which was deemed to be a real estate asset acquisition, at a total cost of $6.0 million, including land of $2.2 million, building of $2.5 million, and an in-place lease intangible asset of $1.3 million (Note 6). We also committed to fund an additional $3.6 million of building improvements at that facility by June 2018.

Real Estate Under Construction

During the nine months ended September 30, 2017,2022, we capitalizedentered into the following investments, which were deemed to be real estate under constructionasset acquisitions, and which excludes properties acquired in the CPA:18 Merger (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Location(s) | | Number of Properties | | Date of Acquisition | | Property Type | | Total Capitalized Costs |

| Pleasant Prairie, Wisconsin | | 1 | | 1/10/2022 | | Industrial | | $ | 20,024 | |

Various, Spain (a) | | 26 | | 2/3/2022 | | Funeral Home | | 146,364 | |

Various, Denmark (a) (b) | | 8 | | 2/11/2022 | | Retail | | 33,976 | |

Laval, Canada (a) | | 1 | | 2/18/2022 | | Industrial | | 21,459 | |

Chattanooga, Tennessee (c) | | 1 | | 3/4/2022 | | Warehouse | | 43,198 | |

| Various, United States (4 properties), Canada (1 property, and Mexico (1 property) | | 6 | | 4/27/2022; 5/9/2022 | | Industrial | | 80,595 | |

| Various, United States | | 6 | | 5/16/2022 | | Industrial; Warehouse | | 110,381 | |

Various, Denmark (a) (b) | | 10 | | 6/1/2022; 6/30/2022 | | Retail | | 42,635 | |

| Medina, Ohio | | 1 | | 6/17/2022 | | Industrial | | 28,913 | |

Bree, Belgium (a) | | 1 | | 6/30/2022 | | Warehouse | | 96,697 | |

Various, Spain (a) | | 5 | | 7/21/2022 | | Retail | | 19,894 | |

| Various, United States | | 18 | | 7/26/2022 | | Industrial; Warehouse | | 262,061 | |

Various, Denmark (a) (b) | | 8 | | 8/1/2022; 9/28/2022 | | Retail | | 29,644 | |

| Westlake, Ohio | | 1 | | 8/3/2022 | | Warehouse | | 29,517 | |

| Hebron and Strongsville, Ohio; and Scarborough, Canada | | 3 | | 8/10/2022 | | Industrial; Warehouse | | 20,111 | |

| Clifton Park, New York and West Des Moines, Iowa | | 2 | | 8/12/2022 | | Specialty | | 23,317 | |

Orzinuovi, Italy (a) | | 1 | | 8/26/2022 | | Industrial | | 14,033 | |

| | 99 | | | | | | $ | 1,022,819 | |

__________

(a)Amount reflects the applicable exchange rate on the date of transaction.

(b)We also entered into purchase agreements to acquire five additional retail facilities leased to this tenant totaling $43.5$17.7 million including net accrual activity(based on the exchange rate of $6.8 million, primarily related to construction projects on our properties. As ofthe Danish krone at September 30, 2017, we had five construction projects2022), which is expected to be completed in progress, and as2022.

(c)We also committed to fund an additional $21.9 million for an expansion at the facility, which is expected to be completed in the third quarter of December 31, 2016, we had three construction projects in progress. Aggregate unfunded commitments totaled approximately $109.6 million and $135.2 million as of September 30, 2017 and December 31, 2016, respectively.2023.

W. P. Carey 9/30/2022 10-Q– 19

|

| |

| W. P. Carey 9/30/2017 10-Q– 22

|

Notes to Consolidated Financial Statements (Unaudited)

The aggregate purchase price allocation for investments disclosed above is as follows (dollars in thousands):

| | | | | |

| Total Capitalized Costs |

| Land | $ | 129,005 | |

| Buildings and improvements | 751,579 | |

| Intangible assets and liabilities: | |

| In-place lease (weighted-average expected life of 21.4 years) | 133,327 | |

| Below-market rent (expected life of 6.8 years) | (3,379) | |

| Right-of-use assets: | |

Prepaid rent (a) | 12,287 | |

| $ | 1,022,819 | |

__________

(a)Represents prepaid rent for a land lease. Therefore, there is no future obligation on the land lease asset and no corresponding operating lease liability. This asset is included in In-place lease intangible assets and other in the consolidated balance sheets.

Real Estate Under Construction

During the nine months ended September 30, 2022, we capitalized real estate under construction totaling $127.3 million (including $78.3 million related to a student housing development project acquired in the CPA:18 Merger, as discussed below under Land, Buildings and Improvements — Operating Properties). The number of construction projects in progress with balances included in real estate under construction was four and six as of September 30, 2022 and December 31, 2021, respectively. Aggregate unfunded commitments totaled approximately $38.2 million and $55.3 million as of September 30, 2022 and December 31, 2021, respectively.

During the nine months ended September 30, 2017,2022, we capitalized and completed the following construction projects at a total cost(dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Location(s) | | Primary Transaction Type | | Number of Properties | | Date of Completion | | Property Type | | Total Capitalized Costs (a) |

| Hurricane, Utah | | Expansion | | 1 | | 3/8/2022 | | Warehouse | | $ | 20,517 | |

Breda, Netherlands (a) | | Expansion | | 1 | | 3/18/2022 | | Warehouse | | 4,721 | |

| Bowling Green, Kentucky | | Renovation | | 1 | | 4/26/2022 | | Warehouse | | 72,971 | |

Wageningen, Netherlands (a) | | Build-to-Suit | | 1 | | 7/7/2022 | | Research and Development | | 26,054 | |

Radomsko, Poland (a) | | Expansion | | 1 | | 8/1/2022 | | Industrial | | 23,042 | |

| | | | 5 | | | | | | $ | 147,305 | |

__________

(a)Amount reflects the applicable exchange rate on the date of $59.0 million, of which $35.5 million was capitalized during 2016:transaction.

an expansion project at an industrial facility in Windsor, Connecticut in March 2017 at a cost totaling $3.3 million;

an expansion project at an educational facility in Coconut Creek, Florida in May 2017 at a cost totaling $18.2 million;

an expansion project at two industrial facilities in Monarto, Australia in May 2017 at a cost totaling $15.9 million; and

a build-to-suit project for an industrial facility in McCalla, Alabama in June 2017 at a cost totaling $21.6 million.

Dispositions of Properties

During the nine months ended September 30, 2017,2022, we committed to fund two build-to-suit projects for outdoor advertising structures in New Jersey, for an aggregate amount of $3.6 million. We currently expect to complete the projects in the first quarter of 2023.