UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended June 30, 20192020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number 1-13953

W RW. R. GRACE & COCO.

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 65-0773649 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

7500 Grace Drive, Columbia, Maryland 21044-4098

(Address of principal executive offices) (Zip Code)

(410) 531-4000

(Registrant’s telephone number, including area code)

|

| | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | GRA | | New York Stock Exchange |

Preferred Stock Purchase Rights | | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | | |

| Class | | Outstanding at July 31, 20192020 |

| Common Stock, $0.01 par value per share | | 66,735,68566,188,621 | shares |

TABLE OF CONTENTS

Notes on references that we use in this Report. Unless the context indicates otherwise, in this Report, the terms “Grace,” the “Company,” “Grace,” “we,” “us,” or “our” mean (i) W. R. Grace & Co. itself, or (ii) W. R. Grace & Co. and/or one or more of its consolidated subsidiaries and affiliates and, in certain cases, their respective predecessors. Unless otherwise indicated, the contents of websites mentioned in this Reportthat we mention are not incorporated by reference or otherwise made a part of this Report.

We refer to the U.S. Securities and Exchange Commission as the “SEC.” We refer to the Financial Accounting Standards Board as the “FASB.” The FASB issues, among other things, the Accounting Standards Codification (which we refer to as “ASC”) and Accounting Standards Updates (which we refer to as “ASU”). We refer to the U.S. Internal Revenue Service as the “IRS.”

Trademarks and other intellectual property that we discuss in this Report. GRACE®, the GRACE® logo (and any other use of the term “Grace” as a tradename)trade name) as well as the other trademarks, service marks, or trade names used in this Report are trademarks, service marks, or trade names of Grace’sGrace or its operating units, except as otherwise indicated herein.indicated. ART® and ADVANCED REFINING TECHNOLOGIES® are trademarks, registered in the United States and/or other countries, of Advanced Refining Technologies LLC.

The Financial Accounting Standards Board is referred to in this Report as the “FASB.” The FASB issues, among other things, Accounting Standards Codifications (which are referred to herein as “ASC”) and Accounting Standards Updates (which are referred to herein as “ASU”). The U.S. Internal Revenue Service is referred to in this Report as the “IRS.”

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Operations (unaudited)

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions, except per share amounts) | 2019 | | 2018 | | 2019 | | 2018 | 2020 | | 2019 | | 2020 | | 2019 |

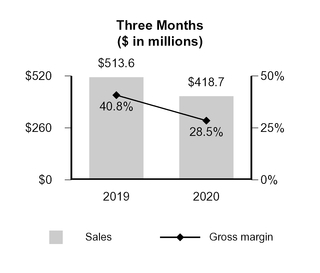

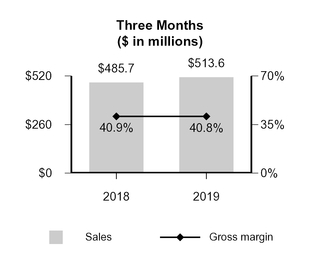

| Net sales | $ | 513.6 |

| | $ | 485.7 |

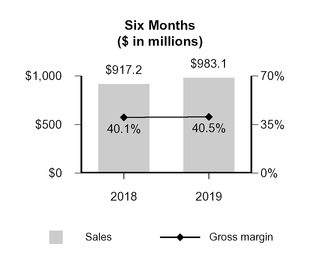

| | $ | 983.1 |

| | $ | 917.2 |

| $ | 418.7 |

| | $ | 513.6 |

| | $ | 840.2 |

| | $ | 983.1 |

|

| Cost of goods sold | 304.2 |

| | 287.0 |

| | 585.1 |

| | 549.0 |

| 299.4 |

| | 304.2 |

| | 561.3 |

| | 585.1 |

|

| Gross profit | 209.4 |

| | 198.7 |

| | 398.0 |

| | 368.2 |

| 119.3 |

| | 209.4 |

| | 278.9 |

| | 398.0 |

|

| Selling, general and administrative expenses | 76.3 |

| | 80.4 |

| | 149.5 |

| | 148.8 |

| 71.9 |

| | 76.3 |

| | 143.0 |

| | 149.5 |

|

| Research and development expenses | 16.3 |

| | 16.1 |

| | 33.3 |

| | 30.8 |

| 16.7 |

| | 16.3 |

| | 33.7 |

| | 33.3 |

|

| Costs related to legacy matters | 1.5 |

| | 2.2 |

| | 48.4 |

| | 4.2 |

| 2.8 |

| | 1.5 |

| | 5.5 |

| | 48.4 |

|

| Equity in earnings of unconsolidated affiliate | (6.0 | ) | | (8.2 | ) | | (10.1 | ) | | (13.6 | ) | (3.4 | ) | | (6.0 | ) | | (4.6 | ) | | (10.1 | ) |

| Restructuring and repositioning expenses | 6.4 |

| | 18.8 |

| | 8.7 |

| | 24.4 |

| 23.9 |

| | 6.4 |

| | 26.6 |

| | 8.7 |

|

| Interest expense and related financing costs | 19.6 |

| | 19.9 |

| | 39.6 |

| | 39.2 |

| 19.2 |

| | 19.6 |

| | 37.5 |

| | 39.6 |

|

| Other (income) expense, net | 0.1 |

| | 5.9 |

| | (2.1 | ) | | 2.6 |

| (8.6 | ) | | 0.1 |

| | (17.4 | ) | | (2.1 | ) |

| Total costs and expenses | 114.2 |

| | 135.1 |

| | 267.3 |

| | 236.4 |

| 122.5 |

| | 114.2 |

| | 224.3 |

| | 267.3 |

|

| Income (loss) before income taxes | 95.2 |

| | 63.6 |

| | 130.7 |

| | 131.8 |

| (3.2 | ) | | 95.2 |

| | 54.6 |

| | 130.7 |

|

| (Provision for) benefit from income taxes | (18.8 | ) |

| (25.0 | ) | | (29.7 | ) | | (49.8 | ) | (6.4 | ) |

| (18.8 | ) | | (22.1 | ) | | (29.7 | ) |

| Net income (loss) | 76.4 |

| | 38.6 |

| | 101.0 |

| | 82.0 |

| (9.6 | ) | | 76.4 |

| | 32.5 |

| | 101.0 |

|

| Less: Net (income) loss attributable to noncontrolling interests | (0.2 | ) | | 0.2 |

| | (0.1 | ) | | 0.4 |

| 2.3 |

| | (0.2 | ) | | 2.2 |

| | (0.1 | ) |

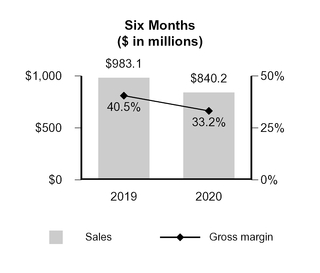

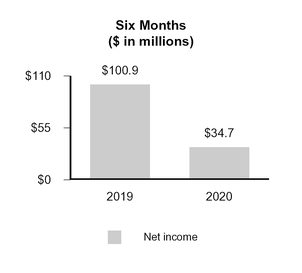

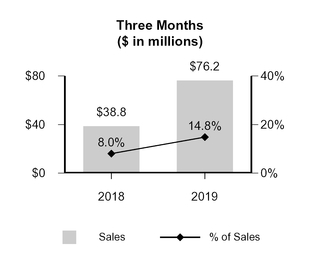

| Net income (loss) attributable to W. R. Grace & Co. shareholders | $ | 76.2 |

| | $ | 38.8 |

| | $ | 100.9 |

| | $ | 82.4 |

| $ | (7.3 | ) | | $ | 76.2 |

| | $ | 34.7 |

| | $ | 100.9 |

|

| Earnings Per Share Attributable to W. R. Grace & Co. Shareholders | | | | | | | | | | | | | | |

| Basic earnings per share: | | | | | | | | | | | | | | |

| Net income (loss) | $ | 1.14 |

| | $ | 0.58 |

| | $ | 1.51 |

| | $ | 1.22 |

| $ | (0.11 | ) | | $ | 1.14 |

| | $ | 0.52 |

| | $ | 1.51 |

|

| Weighted average number of basic shares | 66.8 |

|

| 67.3 |

| | 66.8 |

| | 67.4 |

| 66.2 |

|

| 66.8 |

| | 66.3 |

| | 66.8 |

|

| Diluted earnings per share: | | | | | | | | | | | | | | |

| Net income (loss) | $ | 1.14 |

| | $ | 0.58 |

| | $ | 1.51 |

| | $ | 1.22 |

| $ | (0.11 | ) | | $ | 1.14 |

| | $ | 0.52 |

| | $ | 1.51 |

|

| Weighted average number of diluted shares | 67.0 |

| | 67.4 |

| | 66.9 |

| | 67.5 |

| 66.2 |

| | 67.0 |

| | 66.4 |

| | 66.9 |

|

| Dividends per common share | $ | 0.27 |

| | $ | 0.24 |

| | $ | 0.54 |

| | $ | 0.48 |

| $ | 0.30 |

| | $ | 0.27 |

| | $ | 0.60 |

| | $ | 0.54 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

3

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss) (unaudited)

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions) | 2019 | | 2018 | | 2019 | | 2018 | 2020 | | 2019 | | 2020 | | 2019 |

| Net income (loss) | $ | 76.4 |

| | $ | 38.6 |

| | $ | 101.0 |

| | $ | 82.0 |

| $ | (9.6 | ) | | $ | 76.4 |

| | $ | 32.5 |

| | $ | 101.0 |

|

| Other comprehensive income (loss), net of income taxes: | | | | | | | | | | | | | | |

| Defined benefit pension and other postretirement plans | (0.1 | ) | | (0.2 | ) | | (0.2 | ) | | (0.4 | ) | (0.1 | ) | | (0.1 | ) | | (0.2 | ) | | (0.2 | ) |

| Currency translation adjustments | (6.8 | ) | | 37.9 |

| | 4.9 |

| | 19.7 |

| (7.5 | ) | | (6.8 | ) | | (5.0 | ) | | 4.9 |

|

| Gain (loss) from hedging activities | (6.1 | ) | | (5.2 | ) | | (9.1 | ) | | (3.4 | ) | (0.8 | ) | | (6.1 | ) | | (1.8 | ) | | (9.1 | ) |

| Total other comprehensive income (loss) | (13.0 | ) | | 32.5 |

| | (4.4 | ) | | 15.9 |

| (8.4 | ) | | (13.0 | ) | | (7.0 | ) | | (4.4 | ) |

| Comprehensive income (loss) | 63.4 |

| | 71.1 |

| | 96.6 |

| | 97.9 |

| (18.0 | ) | | 63.4 |

| | 25.5 |

| | 96.6 |

|

| Less: comprehensive (income) loss attributable to noncontrolling interests | (0.2 | ) | | 0.2 |

| | (0.1 | ) | | 0.4 |

| 2.3 |

| | (0.2 | ) | | 2.2 |

| | (0.1 | ) |

| Comprehensive income (loss) attributable to W. R. Grace & Co. shareholders | $ | 63.2 |

| | $ | 71.3 |

| | $ | 96.5 |

| | $ | 98.3 |

| $ | (15.7 | ) | | $ | 63.2 |

| | $ | 27.7 |

| | $ | 96.5 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

4

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Cash Flows (unaudited)

| | | | Six Months Ended June 30, | Six Months Ended June 30, |

| (In millions) | 2019 | | 2018 | 2020 | | 2019 |

| OPERATING ACTIVITIES | | | | | | |

| Net income (loss) | $ | 101.0 |

| | $ | 82.0 |

| $ | 32.5 |

| | $ | 101.0 |

|

| Reconciliation to net cash provided by (used for) operating activities: | | | | | | |

| Depreciation and amortization | 49.8 |

| | 50.9 |

| 50.9 |

| | 49.8 |

|

| Equity in earnings of unconsolidated affiliate | (10.1 | ) | | (13.6 | ) | (4.6 | ) | | (10.1 | ) |

| Costs related to legacy matters | 48.4 |

|

| 4.2 |

| 5.5 |

|

| 48.4 |

|

| Cash paid for legacy matters | (7.8 | ) | | (12.6 | ) | (12.3 | ) | | (7.8 | ) |

| Provision for (benefit from) income taxes | 29.7 |

| | 49.8 |

| 22.1 |

| | 29.7 |

|

| Cash paid for income taxes | (20.3 | ) | | (16.7 | ) | (24.4 | ) | | (20.3 | ) |

| Income tax refunds received | 7.1 |

| | 0.1 |

| 7.3 |

| | 7.1 |

|

| Loss on early extinguishment of debt | — |

| | 4.8 |

| |

| Interest expense and related financing costs | 39.6 |

|

| 39.2 |

| |

| Cash paid for interest | (37.9 | ) | | (39.6 | ) | |

| Defined benefit pension expense | 9.4 |

| | 7.8 |

| 6.6 |

| | 9.4 |

|

| Cash paid under defined benefit pension arrangements | (8.0 | ) | | (57.9 | ) | (8.4 | ) | | (8.0 | ) |

| Loss on disposal of assets | | 20.9 |

| | 1.2 |

|

| Changes in assets and liabilities, excluding effect of currency translation and acquisitions: | | | | |

| | |

|

| Trade accounts receivable | (24.2 | ) | | 14.8 |

| 84.7 |

| | (24.2 | ) |

| Inventories | (37.4 | ) | | (50.8 | ) | 41.7 |

| | (37.4 | ) |

| Accounts payable | 13.1 |

| | 34.0 |

| (38.0 | ) | | 13.1 |

|

| All other items, net | (7.5 | ) | | 22.6 |

| 0.1 |

| | (7.0 | ) |

| Net cash provided by (used for) operating activities | 144.9 |

| | 119.0 |

| 184.6 |

| | 144.9 |

|

| INVESTING ACTIVITIES | | | | | | |

| Cash paid for capital expenditures | (101.5 | ) | | (90.8 | ) | (95.0 | ) | | (101.5 | ) |

| Business acquired, net of cash acquired | (22.8 | ) | | (420.9 | ) | — |

| | (22.8 | ) |

| Other investing activities, net | (3.0 | ) | | 12.7 |

| (24.2 | ) | | (3.0 | ) |

| Net cash provided by (used for) investing activities | (127.3 | ) | | (499.0 | ) | (119.2 | ) | | (127.3 | ) |

| FINANCING ACTIVITIES | | | | | | |

| Borrowings under credit arrangements | 6.9 |

| | 983.2 |

| 9.1 |

| | 6.9 |

|

| Repayments under credit arrangements | (12.3 | ) | | (541.8 | ) | (12.8 | ) | | (12.3 | ) |

| Proceeds from issuance of notes | | 750.0 |

| | — |

|

| Cash paid for debt financing costs | — |

| | (11.8 | ) | (10.3 | ) | | — |

|

| Cash paid for repurchases of common stock | (29.8 | ) | | (49.8 | ) | (40.4 | ) | | (29.8 | ) |

| Proceeds from exercise of stock options | 18.0 |

| | 6.4 |

| — |

| | 18.0 |

|

| Dividends paid to shareholders | (36.6 | ) | | (32.4 | ) | (40.4 | ) | | (36.6 | ) |

| Other financing activities, net | (4.9 | ) | | (3.5 | ) | (4.2 | ) | | (4.9 | ) |

| Net cash provided by (used for) financing activities | (58.7 | ) | | 350.3 |

| 651.0 |

| | (58.7 | ) |

| Effect of currency exchange rate changes on cash, cash equivalents, and restricted cash | — |

| | (1.0 | ) | (1.5 | ) | | — |

|

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (41.1 | ) |

| (30.7 | ) | 714.9 |

|

| (41.1 | ) |

| Cash, cash equivalents, and restricted cash, beginning of period | 201.0 |

| | 163.5 |

| 282.9 |

| | 201.0 |

|

| Cash, cash equivalents, and restricted cash, end of period | $ | 159.9 |

| | $ | 132.8 |

| $ | 997.8 |

| | $ | 159.9 |

|

| | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | |

| Cash paid for interest, net of amounts capitalized | | $ | 32.6 |

| | $ | 34.8 |

|

| Capital expenditures in accounts payable | $ | 34.8 |

| | $ | 38.7 |

| 18.5 |

| | 34.8 |

|

| Expenditures for other investing activities included in accounts payable | | 3.7 |

| | 24.5 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

W. R. Grace & Co. and Subsidiaries

Consolidated Balance Sheets (unaudited)

| | | (In millions, except par value and shares) | June 30,

2019 | | December 31,

2018 | June 30,

2020 | | December 31,

2019 |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | $ | 159.5 |

| | $ | 200.5 |

| $ | 997.6 |

| | $ | 282.5 |

|

| Restricted cash and cash equivalents | 0.4 |

| | 0.5 |

| 0.2 |

| | 0.4 |

|

| Trade accounts receivable, less allowance of $12.3 (2018—$11.6) | 310.0 |

| | 288.5 |

| |

| Trade accounts receivable, less allowance of $15.0 (2019—$13.3) | | 218.6 |

| | 307.0 |

|

| Inventories | 318.2 |

| | 281.1 |

| 267.1 |

| | 309.9 |

|

| Other current assets | 219.6 |

|

| 86.7 |

| 236.1 |

|

| 235.1 |

|

| Total Current Assets | 1,007.7 |

| | 857.3 |

| 1,719.6 |

| | 1,134.9 |

|

| Properties and equipment, net of accumulated depreciation and amortization of $1,487.8 (2018—$1,482.8) | 1,076.7 |

| | 1,011.7 |

| |

| Properties and equipment, net of accumulated depreciation and amortization of $1,484.1 (2019—$1,497.0) | | 1,144.4 |

| | 1,143.8 |

|

| Goodwill | 557.9 |

| | 540.4 |

| 556.8 |

| | 556.9 |

|

| Technology and other intangible assets, net | 353.9 |

| | 356.5 |

| 331.8 |

| | 342.8 |

|

| Deferred income taxes | 520.1 |

| | 529.4 |

| 515.3 |

| | 517.6 |

|

| Investment in unconsolidated affiliate | 165.7 |

| | 156.1 |

| 186.0 |

| | 181.9 |

|

| Other assets | 44.5 |

|

| 113.9 |

| 51.1 |

|

| 54.7 |

|

| Total Assets | $ | 3,726.5 |

| | $ | 3,565.3 |

| $ | 4,505.0 |

| | $ | 3,932.6 |

|

| LIABILITIES AND EQUITY | | | | | | |

| Current Liabilities | | | | | | |

| Debt payable within one year | $ | 23.0 |

| | $ | 22.3 |

| |

| Debt payable within one year (includes $700.0 Senior Notes redeemed on July 13, 2020) | | $ | 724.3 |

| | $ | 23.1 |

|

| Accounts payable | 270.3 |

| | 248.6 |

| 207.6 |

| | 302.3 |

|

| Other current liabilities | 386.2 |

| | 243.5 |

| 428.7 |

| | 419.7 |

|

| Total Current Liabilities | 679.5 |

| | 514.4 |

| 1,360.6 |

| | 745.1 |

|

| Debt payable after one year | 1,960.0 |

| | 1,961.0 |

| 1,993.1 |

| | 1,957.3 |

|

| Unfunded defined benefit pension plans | 365.8 |

| | 366.0 |

| 436.5 |

| | 434.6 |

|

| Underfunded defined benefit pension plans | 68.1 |

| | 67.1 |

| 84.0 |

| | 85.2 |

|

| Other liabilities | 265.8 |

| | 319.8 |

| 281.2 |

| | 308.2 |

|

| Total Liabilities | 3,339.2 |

| | 3,228.3 |

| 4,155.4 |

| | 3,530.4 |

|

| Commitments and Contingencies—Note 8 |

| |

|

| |

|

| Equity | | | | | | |

| Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 66,719,142 (2018—66,792,968) | 0.7 |

| | 0.7 |

| |

| Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 66,188,600 (2019—66,735,913) | | 0.7 |

| | 0.7 |

|

| Paid-in capital | 469.3 |

| | 481.1 |

| 468.6 |

| | 477.9 |

|

| Retained earnings | 741.3 |

| | 676.7 |

| 725.0 |

| | 730.5 |

|

| Treasury stock, at cost: shares: 10,737,491 (2018—10,663,659) | (893.7 | ) | | (895.5 | ) | |

| Treasury stock, at cost: shares: 11,268,033 (2019—10,720,720) | | (920.8 | ) | | (892.2 | ) |

| Accumulated other comprehensive income (loss) | 63.5 |

| | 67.9 |

| 71.8 |

| | 78.8 |

|

| Total W. R. Grace & Co. Shareholders’ Equity | 381.1 |

| | 330.9 |

| 345.3 |

| | 395.7 |

|

| Noncontrolling interests | 6.2 |

| | 6.1 |

| 4.3 |

| | 6.5 |

|

| Total Equity | 387.3 |

| | 337.0 |

| 349.6 |

| | 402.2 |

|

| Total Liabilities and Equity | $ | 3,726.5 |

| | $ | 3,565.3 |

| $ | 4,505.0 |

| | $ | 3,932.6 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Equity (unaudited)

| | | (In millions) | Common Stock and Paid-in Capital | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity | Common Stock and Paid-in Capital | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity |

| Balance, December 31, 2018 | $ | 481.8 |

| | $ | 676.7 |

| | $ | (895.5 | ) | | $ | 67.9 |

| | $ | 6.1 |

| | $ | 337.0 |

| |

| Balance, December 31, 2019 | | $ | 478.6 |

| | $ | 730.5 |

| | $ | (892.2 | ) | | $ | 78.8 |

| | $ | 6.5 |

| | $ | 402.2 |

|

| Net income (loss) | — |

| | 24.7 |

| | — |

| | — |

| | (0.1 | ) | | 24.6 |

| — |

| | 42.0 |

| | — |

| | — |

| | 0.1 |

| | 42.1 |

|

| Repurchase of common stock | — |

| | — |

| | (4.8 | ) | | — |

| | — |

| | (4.8 | ) | — |

| | — |

| | (40.4 | ) | | — |

| | — |

| | (40.4 | ) |

| Payments in consideration of employee tax obligations related to stock-based compensation | (4.3 | ) | | — |

| | — |

| | — |

| | — |

| | (4.3 | ) | (4.1 | ) | | — |

| | — |

| | — |

| | — |

| | (4.1 | ) |

| Stock-based compensation | 1.9 |

| | — |

| | — |

| | — |

| | — |

| | 1.9 |

| 2.9 |

| | — |

| | — |

| | — |

| | — |

| | 2.9 |

|

| Exercise of stock options | (2.2 | ) | | — |

| | 11.4 |

| | — |

| | — |

| | 9.2 |

| |

| Shares issued | (7.4 | ) | | — |

| | 7.1 |

| | — |

| | — |

| | (0.3 | ) | (10.3 | ) | | — |

| | 10.3 |

| | — |

| | — |

| | — |

|

| Dividends declared | — |

| | (18.1 | ) | | — |

| | — |

| | — |

| | (18.1 | ) | — |

| | (20.2 | ) | | — |

| | — |

| | — |

| | (20.2 | ) |

| Other comprehensive (loss) income | — |

| | — |

| | — |

| | 8.6 |

| | — |

| | 8.6 |

| — |

| | — |

| | — |

| | 1.4 |

| | — |

| | 1.4 |

|

| Balance, March 31, 2019 | $ | 469.8 |

| | $ | 683.3 |

| | $ | (881.8 | ) | | $ | 76.5 |

| | $ | 6.0 |

| | $ | 353.8 |

| |

| Balance, March 31, 2020 | | $ | 467.1 |

| | $ | 752.3 |

| | $ | (922.3 | ) | | $ | 80.2 |

| | $ | 6.6 |

| | $ | 383.9 |

|

| Net income (loss) | — |

| | 76.2 |

| | — |

| | — |

| | 0.2 |

| | 76.4 |

| — |

| | (7.3 | ) | | — |

| | — |

| | (2.3 | ) | | (9.6 | ) |

| Repurchase of common stock | — |

| | — |

| | (25.0 | ) | | — |

| | — |

| | (25.0 | ) | |

| Payments in consideration of employee tax obligations related to stock-based compensation | (0.6 | ) | | — |

| | — |

| | — |

| | — |

| | (0.6 | ) | |

| Stock-based compensation | 3.7 |

| | — |

| | — |

| | — |

| | — |

| | 3.7 |

| 2.9 |

| | — |

| | — |

| | — |

| | — |

| | 2.9 |

|

| Exercise of stock options | (2.4 | ) | | — |

| | 11.2 |

| | — |

| | — |

| | 8.8 |

| |

| Shares issued | (0.5 | ) | | — |

| | 1.9 |

| | — |

| | — |

| | 1.4 |

| (0.7 | ) | | — |

| | 1.5 |

| | — |

| | — |

| | 0.8 |

|

| Dividends declared | — |

| | (18.2 | ) | | — |

| | — |

| | — |

| | (18.2 | ) | — |

| | (20.0 | ) | | — |

| | — |

| | — |

| | (20.0 | ) |

| Other comprehensive (loss) income | — |

| | — |

| | — |

| | (13.0 | ) | | — |

| | (13.0 | ) | — |

| | — |

| | — |

| | (8.4 | ) | | — |

| | (8.4 | ) |

| Balance, June 30, 2019 | $ | 470.0 |

| | $ | 741.3 |

| | $ | (893.7 | ) | | $ | 63.5 |

| | $ | 6.2 |

| | $ | 387.3 |

| |

| Balance, June 30, 2020 | | $ | 469.3 |

| | $ | 725.0 |

| | $ | (920.8 | ) | | $ | 71.8 |

| | $ | 4.3 |

| | $ | 349.6 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

7

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Equity (unaudited) (Continued)

| | | (In millions) | Common Stock and Paid-in Capital | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity | Common Stock and Paid-in Capital | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity |

| Balance, December 31, 2017 | $ | 475.5 |

| | $ | 573.1 |

| | $ | (832.1 | ) | | $ | 39.9 |

| | $ | 6.9 |

| | $ | 263.3 |

| |

| Balance, December 31, 2018 | | $ | 481.8 |

| | $ | 676.7 |

| | $ | (895.5 | ) | | $ | 67.9 |

| | $ | 6.1 |

| | $ | 337.0 |

|

| Net income (loss) | — |

| | 43.6 |

| | — |

| | — |

| | (0.2 | ) | | 43.4 |

| — |

| | 24.7 |

| | — |

| | — |

| | (0.1 | ) | | 24.6 |

|

| Repurchase of common stock | — |

| | — |

| | (35.0 | ) | | — |

| | — |

| | (35.0 | ) | — |

| | — |

| | (4.8 | ) | | — |

| | — |

| | (4.8 | ) |

| Payments in consideration of employee tax obligations related to stock-based compensation | (0.7 | ) | | — |

| | — |

| | — |

| | — |

| | (0.7 | ) | (4.3 | ) | | — |

| | — |

| | — |

| | — |

| | (4.3 | ) |

| Stock-based compensation | 3.7 |

| | — |

| | — |

| | — |

| | — |

| | 3.7 |

| 1.9 |

| | — |

| | — |

| | — |

| | — |

| | 1.9 |

|

| Exercise of stock options | (0.4 | ) | | — |

| | 1.2 |

| | — |

| | — |

| | 0.8 |

| (2.2 | ) | | — |

| | 11.4 |

| | — |

| | — |

| | 9.2 |

|

| Shares issued | (1.3 | ) | | — |

| | 1.3 |

| | — |

| | — |

| | — |

| (7.4 | ) | | — |

| | 7.1 |

| | — |

| | — |

| | (0.3 | ) |

| Dividends declared | — |

| | (16.2 | ) | | — |

| | — |

| | — |

| | (16.2 | ) | — |

| | (18.1 | ) | | — |

| | — |

| | — |

| | (18.1 | ) |

| Other comprehensive (loss) income | — |

| | — |

| | — |

| | (16.6 | ) | | — |

| | (16.6 | ) | — |

| | — |

| | — |

| | 8.6 |

| | — |

| | 8.6 |

|

| Effect of adopting ASC 606 | — |

| | 3.2 |

| | — |

| | — |

| | — |

| | 3.2 |

| |

| Balance, March 31, 2018 | $ | 476.8 |

| | $ | 603.7 |

| | $ | (864.6 | ) | | $ | 23.3 |

| | $ | 6.7 |

| | $ | 245.9 |

| |

| Balance, March 31, 2019 | | $ | 469.8 |

| | $ | 683.3 |

| | $ | (881.8 | ) | | $ | 76.5 |

| | $ | 6.0 |

| | $ | 353.8 |

|

| Net income (loss) | — |

| | 38.8 |

| | — |

| | — |

| | (0.2 | ) | | 38.6 |

| — |

| | 76.2 |

| | — |

| | — |

| | 0.2 |

| | 76.4 |

|

| Repurchase of common stock | — |

| | — |

| | (14.8 | ) | | — |

| | — |

| | (14.8 | ) | — |

| | — |

| | (25.0 | ) | | — |

| | — |

| | (25.0 | ) |

| Payments in consideration of employee tax obligations related to stock-based compensation | (2.3 | ) | | — |

| | — |

| | — |

| | — |

| | (2.3 | ) | (0.6 | ) | | — |

| | — |

| | — |

| | — |

| | (0.6 | ) |

| Stock-based compensation | 5.9 |

| | — |

| | — |

| | — |

| | — |

| | 5.9 |

| 3.7 |

| | — |

| | — |

| | — |

| | — |

| | 3.7 |

|

| Exercise of stock options | (3.7 | ) | | — |

| | 9.0 |

| | — |

| | — |

| | 5.3 |

| (2.4 | ) | | — |

| | 11.2 |

| | — |

| | — |

| | 8.8 |

|

| Shares issued | (3.9 | ) | | — |

| | 4.7 |

| | — |

| | — |

| | 0.8 |

| (0.5 | ) | | — |

| | 1.9 |

| | — |

| | — |

| | 1.4 |

|

| Dividends declared | — |

| | (16.3 | ) | | — |

| | — |

| | — |

| | (16.3 | ) | — |

| | (18.2 | ) | | — |

| | — |

| | — |

| | (18.2 | ) |

| Other comprehensive (loss) income | — |

| | — |

| | — |

| | 32.5 |

| | — |

| | 32.5 |

| — |

| | — |

| | — |

| | (13.0 | ) | | — |

| | (13.0 | ) |

| Effect of adopting ASC 606 | — |

| | (0.7 | ) | | — |

| | — |

| | — |

| | (0.7 | ) | |

| Balance, June 30, 2018 | $ | 472.8 |

| | $ | 625.5 |

| | $ | (865.7 | ) | | $ | 55.8 |

| | $ | 6.5 |

| | $ | 294.9 |

| |

| Balance, June 30, 2019 | | $ | 470.0 |

| | $ | 741.3 |

| | $ | (893.7 | ) | | $ | 63.5 |

| | $ | 6.2 |

| | $ | 387.3 |

|

The Notes to Consolidated Financial Statements are an integral part of these statements.

8

Notes to Consolidated Financial Statements

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

W. R. Grace & Co., through its subsidiaries, is engaged in the production and sale of specialty chemicals and specialty materials businesses on a global basis through two2 reportable business segments: Grace Catalysts Technologies, which includes catalysts and related products and technologies used in petrochemical, refining, petrochemical and other chemical manufacturing applications; and Grace Materials Technologies, which includes specialty materials, including silica-based and silica-alumina-based materials, used in consumer/pharma, coatings, and chemical process and coatings applications.

W. R. Grace & Co. conducts all of its business through a single wholly owned subsidiary, W. R. Grace & Co.–Conn. (“Grace–Conn.”). Grace–Conn. owns all of the assets, properties and rights of W. R. Grace & Co. on a consolidated basis, either directly or through subsidiaries.

Basis of Presentation The interim Consolidated Financial Statements presented herein are unaudited and should be read in conjunction with the Consolidated Financial Statements presented in the Company’s 20182019 Annual Report on Form 10-K. Such interim Consolidated Financial Statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented; all such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards as discussed below. All significant intercompany accounts and transactions have been eliminated.

The results of operations for the six-month interim period ended June 30, 2019,2020, are not necessarily indicative of the results of operations to be attained for the year ending December 31, 2019.2020.

Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. Actual amounts could differ from those estimates, and the differences could be material. Changes in estimates are recorded in the period identified. Grace’s accounting measurements that are most affected by management’s estimates of future events are:

The effective tax rate and realization values of net deferred tax assets, which depend on projections of future taxable income;

Pension and postretirement liabilities, which depend on assumptions regarding participant life spans, future inflation, discount rates and total returns on invested funds (see Note 6);

Carrying values of goodwill and other intangible assets, which depend on assumptions of future earnings and cash flows; and

Contingent liabilities, which depend on an assessment of the probability of loss and an estimate of ultimate obligation, such as litigation, environmental remediation, and other legacy liabilities (see Note 8).

Reclassifications Certain amounts in prior years’ Consolidated Financial Statements have been reclassified to conform to the current year presentation. Such reclassifications have not materially affected previously reported amounts in the Consolidated Financial Statements.

Recently Issued Accounting Standards In December 2019, the FASB issued ASU 2019-12 “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes.” This update clarifies and amends existing guidance, including removing certain exceptions to the general principles in Topic 740, and improves consistent application of and simplifies U.S. GAAP for other areas of Topic 740. This update is effective for Grace on January 1, 2021, with early adoption permitted. Grace is currently evaluating the effect and timing of adoption.

Recently Adopted Accounting Standards In March 2020, the FASB issued ASU 2020-04 “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” This update is intended to ease the potential burden in accounting for and recognizing the effects of reference rate reform. It provides optional practical expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform, if certain criteria are met. This update

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

became effective on March 12, 2020, and is available for use through December 31, 2022. Grace expects to utilize the practical expedients provided by this update in accounting for contract modifications and/or hedging transactions during the effective period. Grace expects the update to significantly reduce the effects of reference rate reform on the Consolidated Financial Statements.

In August 2018, the FASB issued ASU 2018-14 “Compensation—Retirement Benefits—Defined Benefit Plans—General (Subtopic 715-20).” This update revises disclosure requirements related to defined benefit pension and other postretirement plans. ThisGrace adopted this update is effective for Grace on January 1, 2021, with early adoption permitted. Grace is currently evaluatingin the timing of adoption2020 first quarter, and doesit did not expect the update to have a material effect on the Consolidated Financial Statements.

In June 2016, the FASB issued ASU 2016-13 “Financial Instruments—Credit Losses (Topic 326) Measurement of Credit Losses on Financial Instruments.” This update requires companies to implement an impairment model based on expected credit losses, rather than probable incurred losses. ThisGrace adopted this update is effective for Grace on January 1,in the 2020 with early adoption permitted. Grace is currently evaluating the timing of adoptionfirst quarter, and doesit did not expect the update to have a material effect on the Consolidated Financial Statements.

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

Recently Adopted Accounting Standards In October 2018, the FASB issued ASU 2018-16 “Derivatives and Hedging (Topic 815): Inclusion of the Secured Overnight Financing Rate (SOFR) Overnight Index Swap (OIS) Rate as a Benchmark Interest Rate for Hedge Accounting Purposes.” This update permits use of the OIS rate based on SOFR as a U.S. benchmark interest rate for hedge accounting purposes under Topic 815. Grace currently carries debt and derivatives that rely on the London Interbank Offered Rate (“LIBOR”) as a benchmark rate. LIBOR is expected to be phased out as a benchmark rate by the end of 2021. Grace expects its debt and financial instruments to continue to use LIBOR until the rate is no longer available. To the extent LIBOR ceases to exist, Grace may need to renegotiate any credit agreements and/or derivative contracts that utilize LIBOR as a factor in determining the interest rate. Grace adopted this update in the 2019 first quarter, and it had no effect on Grace’s Consolidated Financial Statements.

Leases (Topic 842)

In February 2016, the FASB issued ASU 2016-02 “Leases (Topic 842).” This update requires registrants to recognize lease assets and lease liabilities on the balance sheet and disclose key information about leasing arrangements. A lessee is now required to recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term, including payments to be made in optional periods where they are reasonably certain to occur. In July 2018, the FASB issued ASU 2018-11 “Leases (Topic 842): Targeted Improvements,” which provided an additional transition method permitting entities to initially apply the new standard at the adoption date and recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption.

Grace adopted these standards in the 2019 first quarter under the modified retrospective approach permitted by ASU 2018-11. Under this approach, the cumulative effect of the adoption of the standard is recorded at the effective date, with no changes to prior periods. The adoption did not result in an impact to retained earnings. Grace elected to utilize the package of transition practical expedients provided by the standard, which among other things, permit Grace not to reassess expired or existing contracts and leases. Additionally, Grace elected to use the practical expedient provided in ASU 2018-01 “Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842,” which permits Grace to elect not to evaluate under Topic 842 existing or expired land easements not previously accounted for as leases. Prior to the adoption of Topic 842, Grace typically had not evaluated easements for lease accounting. Grace has elected not to recognize in the Consolidated Balance Sheets short-term leases, which are those with an initial term of 12 months or less. Grace has also elected not to separate lease and nonlease components. These elections apply to all asset classes.

Grace leases certain real estate, office space, vehicles, railcars, and plant and office equipment, primarily all of which are accounted for as operating leases. Finance lease costs and sublease income are not material. Many of Grace’s leases contain renewal options, which are exercisable at Grace’s discretion and may be included in lease terms when they are reasonably certain to be exercised. Grace’s lease agreements do not contain material restrictive covenants or material residual value guarantees. Where available, Grace uses the interest rate implicit in the lease to calculate the estimated present value of lease payment obligations. Where such a rate is not available, Grace uses an incremental borrowing rate based on credit-adjusted and term-specific discount rates, using a third-party yield curve.

Adoption of the standard resulted in the recognition of operating lease right-of-use assets, net of accumulated amortization, of $28.1 million and operating lease liabilities of $28.7 million as of June 30, 2019.

|

| | | | | |

| (in millions) | Amount | | Balance Sheet Location |

| Operating lease right of use asset | $ | 28.1 |

| | Other assets |

| Operating lease liability—current | 8.6 |

| | Other current liabilities |

| Operating lease liability—noncurrent | 20.1 |

| | Other liabilities |

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

The following table presents Grace’s costs and cash flow information related to operating leases.

|

| | | | | | | |

| (In millions) | Three Months Ended June 30, 2019 | | Six Months Ended June 30, 2019 |

| Operating lease cost | $ | 3.1 |

| | $ | 6.1 |

|

| Short-term and variable lease cost | 4.9 |

| | 8.3 |

|

| Total lease cost | $ | 8.0 |

| | $ | 14.4 |

|

| | | | |

| Cash payments related to operating leases | $ | 3.1 |

| | $ | 6.1 |

|

| Right-of-use assets obtained in exchange for new operating lease liabilities | 1.2 |

| | 4.8 |

|

The following table presents the weighted average discount rate and weighted average remaining lease term related to Grace’s operating leases.

|

| | |

| June 30,

2019 |

Weighted average discount rate | 6.8 | % |

Weighted average remaining lease term | 7.5 years |

|

The following maturity analysis presents minimum expected operating lease payments at June 30, 2019.

|

| | | |

| | (In millions) |

| 2019 | $ | 5.4 |

|

| 2020 | 8.6 |

|

| 2021 | 5.6 |

|

| 2022 | 3.8 |

|

| 2023 | 2.3 |

|

| Thereafter | 12.0 |

|

| Total undiscounted lease payments | 37.7 |

|

| Less: imputed interest | 9.0 |

|

| Present value of lease liabilities | $ | 28.7 |

|

Notes to Consolidated Financial Statements (Continued)

2. Inventories

Inventories are stated at the lower of cost or net realizable value, and cost is determined using FIFO. Inventories consisted of the following at June 30, 2019,2020, and December 31, 2018:2019:

| | | (In millions) | June 30,

2019 | | December 31,

2018 | June 30,

2020 | | December 31,

2019 |

| Raw materials | $ | 70.0 |

| | $ | 56.3 |

| $ | 60.9 |

| | $ | 64.2 |

|

| In process | 56.5 |

| | 49.1 |

| 41.5 |

| | 55.7 |

|

| Finished products | 157.2 |

| | 144.5 |

| 131.3 |

| | 154.4 |

|

| Other | 34.5 |

| | 31.2 |

| 33.4 |

| | 35.6 |

|

| Total inventory | $ | 318.2 |

| | $ | 281.1 |

| $ | 267.1 |

| | $ | 309.9 |

|

During the three months ended June 30, 2020, Grace implemented changes to its Refining Technologies manufacturing operations to improve capital and operating efficiencies. This included key organizational changes and optimization of plant and manufacturing processes at Grace’s 3 hydroprocessing catalyst manufacturing sites. As a result of these changes, Grace recorded a pre-tax charge of $19.7 million related to a write-off of inventory now deemed obsolete based on the process changes.

Notes to Consolidated Financial Statements (Continued)

3. Debt

Components of Debt

| | | (In millions) | June 30,

2019 | | December 31,

2018 | June 30,

2020 | | December 31,

2019 |

| 2018 U.S. dollar term loan, net of unamortized debt issuance costs of $8.1 (2018—$8.7) | $ | 934.8 |

| | $ | 938.9 |

| |

| 5.125% senior notes due 2021, net of unamortized debt issuance costs of $3.4 (2018—$4.2) | 696.6 |

| | 695.8 |

| |

| 5.625% senior notes due 2024, net of unamortized debt issuance costs of $2.7 (2018—$3.0) | 297.3 |

| | 297.0 |

| |

| 2018 U.S. dollar term loan, net of unamortized debt issuance costs of $6.6 (2019—$7.2) | | $ | 926.8 |

| | $ | 930.9 |

|

| Senior notes due 2027, net of unamortized debt issuance costs of $10.5 | | 739.5 |

| | — |

|

| Senior notes due 2021, net of unamortized debt issuance costs of $1.9 (2019—$2.7) | | 698.1 |

| | 697.3 |

|

| Senior notes due 2024, net of unamortized debt issuance costs of $2.1 (2019—$2.4) | | 297.9 |

| | 297.6 |

|

| Debt payable to unconsolidated affiliate | 47.4 |

| | 48.1 |

| 47.4 |

| | 47.4 |

|

| Other borrowings | 6.9 |

| | 3.5 |

| 7.7 |

| | 7.2 |

|

| Total debt | 1,983.0 |

| | 1,983.3 |

| 2,717.4 |

| | 1,980.4 |

|

| Less debt payable within one year | 23.0 |

| | 22.3 |

| 724.3 |

| | 23.1 |

|

| Debt payable after one year | $ | 1,960.0 |

| | $ | 1,961.0 |

| $ | 1,993.1 |

| | $ | 1,957.3 |

|

| Weighted average interest rates on total debt | 3.8 | % | | 3.9 | % | 3.9 | % | | 3.8 | % |

See Note 4 for a discussion of the fair value of Grace’s debt.

Grace also maintains a $400 million revolving credit facility. As of June 30, 2019,2020, the available credit under this facility was reduced to $370.6$391.8 million by outstanding letters of credit.

The principal maturities of debt outstanding at June 30, 2019,2020, were as follows:

| | | | (In millions) | (In millions) |

| 2019 | $ | 13.2 |

| |

| 2020 | 19.8 |

| |

| Remainder of 2020 | | $ | 713.1 |

|

| 2021 | 715.0 |

| 19.9 |

|

| 2022 | 17.6 |

| 19.1 |

|

| 2023 | 16.6 |

| 17.7 |

|

| 2024 | | 313.8 |

|

| Thereafter | 1,200.8 |

| 1,633.8 |

|

| Total debt | $ | 1,983.0 |

| $ | 2,717.4 |

|

On July 13, 2020, Grace used the net proceeds, together with cash on hand, to redeem the $700.0 million Senior Notes due 2021 for $748.0 million, including $10.1 million of interest accrued through the date of redemption and a $37.9 million make-whole premium. Interest is payable on the Senior Notes due 2027 on each June 15 and December 15, commencing December 15, 2020.

12

Grace may redeem all or a portion of the Senior Notes due 2027 at any time prior to June 15, 2023, at a price equal to 100% of the principal amount of the Senior Notes due 2027 redeemed plus accrued and unpaid

Notes to Consolidated Financial Statements (Continued)

3. Debt (Continued)

interest, if any, to but excluding the redemption date plus a make-whole premium. At any time on or after June 15, 2023, Grace may redeem the Senior Notes due 2027, in whole or in part, at the redemption prices set forth in the Third Supplemental Indenture, in each case plus accrued and unpaid interest, if any, to but excluding the redemption date. The Senior Notes due 2027 will mature on June 15, 2027.

If a change of control occurs while the Senior Notes due 2027 are rated below investment grade, or is followed by a below investment grade rating, subject to certain exceptions, each holder shall have the right to require that the Issuer repurchase all or a portion of such holder’s Senior Notes due 2027 at a purchase price of 101% of the aggregate principal amount thereof, plus accrued and unpaid interest, if any, on the Senior Notes due 2027 repurchased, to but excluding, the date of repurchase.

The Senior Notes due 2027 and guarantees are senior unsecured obligations of the Issuer and the Guarantors, respectively, and will rank equally with all of the existing and future unsubordinated obligations of the Issuer and the Guarantors, respectively. The Senior Notes due 2027 and the guarantees are effectively subordinated to any secured indebtedness to the extent of the value of the assets securing such indebtedness and structurally subordinated to the debt and other liabilities of the Company’s non-guarantor subsidiaries.

The Senior Notes due 2027 were issued subject to covenants that limit the ability of the Company, the Issuer, and certain of the Company’s subsidiaries to: (i) incur liens on assets; (ii) enter into sale and leaseback transactions larger than the greater of $100 million or 2.5% of total assets; and (iii) merge or consolidate with another company; subject to certain exceptions and qualifications. Grace is in compliance with those covenants.

The Senior Notes due 2027 were issued subject to customary events of default, which include (subject in certain cases to customary grace and cure periods), among others, nonpayment of principal or interest; breach of other agreements in the Indenture; failure to pay certain other indebtedness; failure to discharge a final judgment for payment of the greater of (i) $100 million and (ii) 2.5% of Total Assets (as defined in the Indenture) or more (excluding any amounts covered by insurance or indemnities) rendered against the Issuer or any of its significant subsidiaries; and certain events of bankruptcy or insolvency. Generally, if any event of default occurs, the Trustee or the holders of at least 30% in aggregate principal amount of the then outstanding series of Senior Notes due 2027 may declare all the Senior Notes due 2027 of such series to be due and payable immediately.

The foregoing is a summary of the Senior Notes due 2027 and the related indentures, does not purport to be complete, and is qualified in its entirety by reference to the full texts thereof. Grace has filed the full text of such documents with the U.S. Securities and Exchange Commission, or “SEC,” which are readily available on the Internet at www.sec.gov.

4. Fair Value Measurements and Risk

Certain of Grace’s assets and liabilities are reported at fair value on a gross basis. ASC 820 “Fair Value Measurements and Disclosures” defines fair value as the value that would be received at the measurement date in the principal or “most advantageous” market. Grace uses principal market data, whenever available, to value assets and liabilities that are required to be reported at fair value.

Grace has identified the following financial assets and liabilities that are subject to the fair value analysis required by ASC 820:

Fair Value of Debt and Other Financial Instruments Debt payable is recorded at carrying value. Fair value is determined based on Level 2 inputs, including expected future cash flows (discounted at market interest rates), estimated current market prices and quotes from financial institutions.

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

At June 30, 20192020, and December 31, 2018,2019, the carrying amounts, net of unamortized debt issuance costs and discounts (see Note 3), and fair values of Grace’s debt were as follows:

|

| | | | | | | | | | | | | | | |

| | June 30, 2020 | | December 31, 2019 |

| (In millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| 2018 U.S. dollar term loan | $ | 926.8 |

| | $ | 901.3 |

| | $ | 930.9 |

| | $ | 938.1 |

|

| Senior notes due 2027 | 739.5 |

| | 750.8 |

| | — |

| | — |

|

| Senior notes due 2021 | 698.1 |

| | 734.9 |

| | 697.3 |

| | 727.1 |

|

| Senior notes due 2024 | 297.9 |

| | 314.3 |

| | 297.6 |

| | 329.2 |

|

| Other borrowings | 55.1 |

| | 55.1 |

| | 54.6 |

| | 54.6 |

|

| Total debt | $ | 2,717.4 |

| | $ | 2,756.4 |

| | $ | 1,980.4 |

| | $ | 2,049.0 |

|

|

| | | | | | | | | | | | | | | |

| | June 30, 2019 | | December 31, 2018 |

| (In millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| 2018 U.S. dollar term loan(1) | $ | 934.8 |

| | $ | 932.5 |

| | $ | 938.9 |

| | $ | 914.8 |

|

| 5.125% senior notes due 2021(2) | 696.6 |

| | 723.6 |

| | 695.8 |

| | 697.5 |

|

| 5.625% senior notes due 2024(2) | 297.3 |

| | 321.8 |

| | 297.0 |

| | 301.8 |

|

| Other borrowings | 54.3 |

| | 54.3 |

| | 51.6 |

| | 51.6 |

|

| Total debt | $ | 1,983.0 |

| | $ | 2,032.2 |

| | $ | 1,983.3 |

| | $ | 1,965.7 |

|

| |

(1) | Carrying amounts are net of unamortized debt issuance costs and discounts of $8.1 million and $8.7 million as of June 30, 2019 and December 31, 2018, respectively. |

| |

(2) | Carrying amounts are net of unamortized debt issuance costs of $3.4 million and $2.7 million as of June 30, 2019, and $4.2 million and $3.0 million as of December 31, 2018, related to the 5.125% senior notes due 2021 and 5.625% senior notes due 2024, respectively. |

At June 30, 20192020, the recorded values of other financial instruments such as cash equivalents and trade receivables and payables approximated their fair values, based on the short-term maturities and floating rate characteristics of these instruments.

Currency Derivatives Because Grace operates and/or sells to customers in over 7060 countries and in over 30 currencies, its results are exposed to fluctuations in currency exchange rates. Grace seeks to minimize exposure to these fluctuations by matching sales with expenditures in the same currencies, but it is not always possible to do so. From time to time, Grace uses financial instruments such as currency forward contracts, options, swaps, or combinations thereof to reduce the risk of certain specific transactions. However, Grace does not have a policy of hedging all exposures, because management does not believe that such a level of hedging would be cost-effective. Forward contracts with maturities of not more than 36 months are used and designated as cash flow hedges of forecasted repayments of intercompany loans. The effective portion of gains and losses on these currency hedges is recorded in “accumulated other comprehensive income (loss)” and reclassified into “other (income) expense, net” to offset the remeasurement of the underlying hedged loans. Excluded components (forward points) on these hedgesForward points are excluded from the assessment of effectiveness and amortized to income on a systematic basis.

Grace also enters into foreign currency forward contracts and swaps to hedge a portion of its net outstanding monetary assets and liabilities. These forward contracts and swaps are not designated as hedging instruments under applicable accounting guidance, and therefore all changes in their fair value are recorded in “other (income) expense, net,” in the Consolidated Statements of Operations. These forward contracts and swaps are intended to offset the foreign currency gains or losses associated with the underlying monetary assets and liabilities.

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The valuation of Grace’s currency exchange rate forward contracts and swaps is determined using an income approach. Inputs used to value currency exchange rate forward contracts and swaps consist of: (1) spot rates, which are quoted by various financial institutions; (2) forward points, which are primarily affected by changes in interest rates; and (3) discount rates used to present value future cash flows, which are based on the London Interbank Offered Rate (LIBOR) curve or overnight indexed swap rates. Total notional amounts for forward contracts and swaps outstanding as of June 30, 2019,2020, were $201.1$55.1 million.

Cross-Currency Swap Agreements Grace uses cross-currency swaps designated as cash flow hedges to manage fluctuations in currency exchange rates and interest rates on variable rate debt. The effective portion of gainsGains and losses on these cash flow hedges isare recorded in “accumulated other comprehensive income (loss)” and reclassified into “other (income) expense, net” and “interest expense and related financing costs” during the hedged period.

In connection with the 2018 U.S. dollar term loan, Grace entered into cross-currency swaps beginning on April 3, 2018, and maturing on March 31, 2023, to synthetically convert $600.0 million of U.S. dollar-denominated floating rate debt into €490.1 million of euro-denominated debt fixed at 2.0231%. These cross-currency swaps were de-designated and terminated on November 5, 2018, and replaced with new, at-market cross-currency swaps beginning on November 5, 2018, and maturing on March 31, 2023, to synthetically convert $600.0 million of U.S. dollar-denominated floating rate debt into €525.9 million of euro-denominated debt fixed at 1.785%. The valuation of these cross-currency swaps is determined using an income approach, using LIBOR and EURIBOR (Euro Interbank Offered Rate) swap curves, currency basis spreads, and euro/U.S. dollar exchange rates.

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Debt and Interest Rate Swap Agreements Grace uses interest rate swaps designated as cash flow hedges to manage fluctuations in interest rates on variable rate debt. The effective portion of gains and losses on these interest rate cash flow hedges is recorded in “accumulated other comprehensive income (loss)” and reclassified into “interest expense and related financing costs” during the hedged interest period.

In connection with its emergence financing, Grace entered into interest rate swaps beginning on February 3, 2015, and maturing on February 3, 2020, fixing the LIBOR component of the interest on $250.0 million of Grace’s term debt at a rate of 2.393%. These interest rate swaps were de-designated and terminated in April 2018 in connection with Grace’s entry into a new credit agreement.

In connection with the 2018 U.S. dollar term loan, Grace entered into new interest rate swaps beginning on April 3, 2018, and maturing on March 31, 2023, fixing the LIBOR component of the interest on $100.0 million of term debt at 2.775%. The valuation of these interest rate swaps is determined using an income approach, using prevailing market interest rates and discount rates to present value future cash flows based on the forward LIBOR yield curves. Credit risk is also incorporated into derivative valuations.

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the fair value hierarchy for financial assets and liabilities measured at fair value on a recurring basis as of June 30, 20192020, and December 31, 20182019:

| | | | Fair Value Measurements at June 30, 2019, Using | Fair Value Measurements at June 30, 2020, Using |

(In millions) | Total | | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| Assets | | | | | | | | | | | | | | |

| Currency derivatives | $ | 5.4 |

| | $ | — |

| | $ | 5.4 |

| | $ | — |

| $ | 2.0 |

| | $ | — |

| | $ | 2.0 |

| | $ | — |

|

| Variable-to-fixed cross-currency swaps | | 1.0 |

| | — |

| | 1.0 |

| | — |

|

| Total Assets | $ | 5.4 |

| | $ | — |

| | $ | 5.4 |

| | $ | — |

| $ | 3.0 |

| | $ | — |

| | $ | 3.0 |

| | $ | — |

|

| Liabilities | | | | | | | | | | | | | | |

| Currency derivatives | $ | 5.7 |

| | $ | — |

| | $ | 5.7 |

| | $ | — |

| |

| Interest rate derivatives | 3.7 |

| | — |

| | 3.7 |

| | — |

| $ | 6.4 |

| | $ | — |

| | $ | 6.4 |

| | $ | — |

|

| Variable-to-fixed cross-currency derivatives | 10.9 |

| | — |

| | 10.9 |

| | — |

| |

| Total Liabilities | $ | 20.3 |

| | $ | — |

| | $ | 20.3 |

| | $ | — |

| $ | 6.4 |

| | $ | — |

| | $ | 6.4 |

| | $ | — |

|

| | | | Fair Value Measurements at December 31, 2018, Using | Fair Value Measurements at December 31, 2019, Using |

(In millions) | Total | | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| Assets | | | | | | | | | | | | | | |

| Currency derivatives | $ | 3.7 |

| | $ | — |

| | $ | 3.7 |

| | $ | — |

| $ | 6.1 |

| | $ | — |

| | $ | 6.1 |

| | $ | — |

|

| Variable-to-fixed cross-currency derivatives | | 3.4 |

| | — |

| | 3.4 |

| | — |

|

| Total Assets | $ | 3.7 |

| | $ | — |

| | $ | 3.7 |

| | $ | — |

| $ | 9.5 |

| | $ | — |

| | $ | 9.5 |

| | $ | — |

|

| Liabilities | | | | | | | | | | | | | | |

| Currency derivatives | $ | 10.5 |

| | $ | — |

| | $ | 10.5 |

| | $ | — |

| $ | 0.9 |

| | $ | — |

| | $ | 0.9 |

| | $ | — |

|

| Interest rate derivatives | 0.8 |

| | — |

| | 0.8 |

| | — |

| 3.4 |

| | — |

| | 3.4 |

| | — |

|

| Variable-to-fixed cross-currency swaps | 3.6 |

| | — |

| | 3.6 |

| | — |

| |

| Total Liabilities | $ | 14.9 |

| | $ | — |

| | $ | 14.9 |

| | $ | — |

| $ | 4.3 |

| | $ | — |

| | $ | 4.3 |

| | $ | — |

|

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the location and fair values of derivative instruments included in the Consolidated Balance Sheets as of June 30, 20192020, and December 31, 20182019:

| | June 30, 2019

(In millions) | Asset Derivatives | | Liability Derivatives | |

Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value | |

June 30, 2020

(In millions) | | Asset Derivatives | | Liability Derivatives |

| Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value |

| Derivatives designated as hedging instruments under ASC 815: | | | | | | | | | | | | | | |

| Currency contracts | Other current assets | | $ | 1.9 |

| | Other current assets | | $ | (3.0 | ) | Other current assets | | $ | 2.4 |

| | Other current liabilities | | $ | — |

|

| Currency contracts | | Other liabilities | | (0.8 | ) | | Other assets | | — |

|

| Interest rate contracts | | Other current assets | | — |

| | Other current liabilities | | 2.4 |

|

| Interest rate contracts | Other current assets | | — |

| | Other current liabilities | | 0.8 |

| Other assets | | — |

| | Other liabilities | | 4.0 |

|

| Variable-to-fixed cross-currency swaps | Other current assets | | — |

| | Other current assets | | (11.1 | ) | Other current assets | | 1.8 |

| | Other current liabilities | | — |

|

| Currency contracts | Other assets | | 2.7 |

| | Other liabilities | | 8.7 |

| |

| Interest rate contracts | Other assets | | — |

| | Other liabilities | | 2.9 |

| |

| Variable-to-fixed cross-currency swaps | Other liabilities | | — |

| | Other liabilities | | 22.0 |

| Other liabilities | | (0.8 | ) | | Other liabilities | | — |

|

| Derivatives not designated as hedging instruments under ASC 815: | | | | | | | | | | | | | | |

| Currency contracts | Other current assets | | 0.9 |

| | Other current liabilities | | — |

| Other current assets | | 0.6 |

| | Other current liabilities | | — |

|

| Currency contracts | Other current liabilities | | (0.1 | ) | | Other liabilities | | — |

| Other current liabilities | | (0.2 | ) | | Other current liabilities | | — |

|

| Total derivatives | | | $ | 5.4 |

| | | | $ | 20.3 |

| | | $ | 3.0 |

| | | | $ | 6.4 |

|

| | December 31, 2018

(In millions) | Asset Derivatives | | Liability Derivatives | |

Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value | |

December 31, 2019

(In millions) | | Asset Derivatives | | Liability Derivatives |

| Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value |

| Derivatives designated as hedging instruments under ASC 815: | | | | | | | | | | | | | | |

| Currency contracts | Other current assets | | $ | 2.4 |

| | Other current assets | | $ | (2.9 | ) | Other current assets | | $ | 2.1 |

| | Other current assets | | $ | (3.1 | ) |

| Currency contracts | | Other assets | | 4.0 |

| | Other liabilities | | 4.0 |

|

| Interest rate contracts | | Other current assets | | — |

| | Other current liabilities | | 1.0 |

|

| Interest rate contracts | Other current assets | | — |

| | Other current liabilities | | 0.1 |

| Other assets | | — |

| | Other liabilities | | 2.4 |

|

| Variable-to-fixed cross-currency swaps | Other current assets | | — |

| | Other current assets | | (15.4 | ) | Other current assets | | 10.2 |

| | Other current liabilities | | — |

|

| Currency contracts | Other assets | | 1.3 |

| | Other liabilities | | 12.9 |

| |

| Interest rate contracts | Other assets | | — |

| | Other liabilities | | 0.7 |

| |

| Variable-to-fixed cross-currency swaps | Other assets | | — |

| | Other liabilities | | 19.0 |

| Other liabilities | | (6.8 | ) | | Other liabilities | | — |

|

| Derivatives not designated as hedging instruments under ASC 815: | | | | | | | | | | | | | | |

| Currency contracts | Other current assets | | — |

| | Other current assets | | (0.1 | ) | Other current assets | | — |

| | Other current assets | | (0.2 | ) |

| Currency contracts | Other current assets | | — |

| | Other current liabilities | | 0.6 |

| Other current assets | | — |

| | Other current liabilities | | 0.2 |

|

| Total derivatives | | | $ | 3.7 |

| | | | $ | 14.9 |

| | | $ | 9.5 |

| | | | $ | 4.3 |

|

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the location and amount of gains and losses on derivative instruments included in the Consolidated Statements of Operations or, when applicable, gains and losses initially recognized in other comprehensive income (loss) (“OCI”) for the three and six months ended June 30, 20192020 and 20182019:

|

| | | | | | | | | |

Three Months Ended June 30, 2020

(In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income |

| Derivatives in ASC 815 cash flow hedging relationships: | | | | |

| Interest rate contracts | $ | (0.4 | ) | | Interest expense | | $ | (0.3 | ) |

| Currency contracts(1) | 0.2 |

| | Other expense | | 1.9 |

|

| Variable-to-fixed cross-currency swaps | 2.1 |

| | Interest expense | | 1.8 |

|

| Variable-to-fixed cross-currency swaps | (10.1 | ) | | Other expense | | (10.1 | ) |

| Total derivatives | $ | (8.2 | ) | | | | $ | (6.7 | ) |

| | | | | | |

| | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| Derivatives not designated as hedging instruments under ASC 815: | | | | |

| Currency contracts | | Other expense | | $ | 1.1 |

|

| |

| (1) | Amount of gain (loss) recognized in OCI includes $(1.7) million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

|

| | | | | | | | | |

Six Months Ended June 30, 2020

(In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income |

| Derivatives in ASC 815 cash flow hedging relationships: | | | | |

| Interest rate contracts | $ | (3.5 | ) | | Interest expense | | $ | (0.5 | ) |

| Currency contracts(1) | 2.7 |

| | Other expense | | 3.2 |

|

| Variable-to-fixed cross-currency swaps | 5.6 |

| | Interest expense | | 4.3 |

|

| Variable-to-fixed cross-currency swaps | (2.5 | ) | | Other expense | | (2.5 | ) |

| Total derivatives | $ | 2.3 |

| | | | $ | 4.5 |

|

| | | | | | |

| | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| Derivatives not designated as hedging instruments under ASC 815: | | | | |

| Currency contracts | | Other expense | | $ | (0.8 | ) |

| |

| (1) | Amount of gain (loss) recognized in OCI includes $(0.6) million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

|

| | | | | | | | | |

Three Months Ended June 30, 2019

(In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income |

| Derivatives in ASC 815 cash flow hedging relationships: | | | | |

| Interest rate contracts | $ | (1.8 | ) | | Interest expense | | $ | — |

|

| Currency contracts(1) | (0.8 | ) | | Other expense | | (1.3 | ) |

| Variable-to-fixed cross-currency swaps | (2.2 | ) | | Interest expense | | 3.6 |

|

| Variable-to-fixed cross-currency swaps | (5.4 | ) | | Other expense | | (5.4 | ) |

| Total derivatives | $ | (10.2 | ) | | | | $ | (3.1 | ) |

| | | | | | |

| | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| Derivatives not designated as hedging instruments under ASC 815: | | | | |

| Currency contracts | | Other expense | | $ | 0.1 |

|

| |

| (1) | Amount of gain (loss) recognized in OCI includes $0.7 million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

|

| | | | | | | | | |

Three Months Ended June 30, 2018

(In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income |

| Derivatives in ASC 815 cash flow hedging relationships: | | | | |

| Interest rate contracts | $ | 0.3 |

| | Interest expense | | $ | 0.1 |

|

| Currency contracts(1) | 10.4 |

| | Other expense | | 10.2 |

|

| Variable-to-fixed cross-currency swaps | 3.1 |

| | Interest expense | | 3.1 |

|

| Variable-to-fixed cross-currency swaps | 18.3 |

| | Other expense | | 29.3 |

|

| Total derivatives | $ | 32.1 |

| | | | $ | 42.7 |

|

| | | | | | |

| | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| Derivatives not designated as hedging instruments under ASC 815: | | | | |

| Currency contracts | | Other expense | | $ | (1.3 | ) |

| |

(1) | Amount of gain (loss) recognized in OCI includes $0.4 million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

| | Six Months Ended June 30, 2019

(In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income |

| Derivatives in ASC 815 cash flow hedging relationships: | Derivatives in ASC 815 cash flow hedging relationships: | | | | | Derivatives in ASC 815 cash flow hedging relationships: | | | | |

| Interest rate contracts | $ | (2.9 | ) | | Interest expense | | $ | — |

| $ | (2.9 | ) | | Interest expense | | $ | — |

|

| Currency contracts(1) | 0.8 |

| | Other expense | | — |

| 0.8 |

| | Other expense | | — |

|

| Variable-to-fixed cross-currency swaps | (2.1 | ) | | Interest expense | | 7.2 |

| (2.1 | ) | | Interest expense | | 7.2 |

|

| Variable-to-fixed cross-currency swaps | 3.0 |

| | Other expense | | 3.0 |

| 3.0 |

| | Other expense | | 3.0 |

|

| Total derivatives | $ | (1.2 | ) | | | | $ | 10.2 |

| $ | (1.2 | ) | | | | $ | 10.2 |

|

| | | | | | | |

| | | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives | | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| Derivatives not designated as hedging instruments under ASC 815: | Derivatives not designated as hedging instruments under ASC 815: | | | | | Derivatives not designated as hedging instruments under ASC 815: | | | | |

| Currency contracts | Currency contracts | | Other expense | | $ | 0.1 |

| Currency contracts | | Other expense | | $ | 0.1 |

|

| |

| (1) | Amount of gain (loss) recognized in OCI includes $1.4 million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

|

| | | | | | | | | |

Six Months Ended June 30, 2018

(In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | | Amount of Gain (Loss) Reclassified from OCI into Income |

| Derivatives in ASC 815 cash flow hedging relationships: | | | | |

| Interest rate contracts | $ | 1.8 |

| | Interest expense | | $ | (0.1 | ) |

| Currency contracts(1) | 3.8 |

| | Other expense | | 4.1 |

|

| Variable-to-fixed cross-currency swaps | 3.1 |

| | Interest expense | | 3.1 |

|

| Variable-to-fixed cross-currency swaps | 18.3 |

| | Other expense | | 29.3 |

|

| Total derivatives | $ | 27.0 |

| | | | $ | 36.4 |

|

| | | | | | |

| | | Location of Gain (Loss) Recognized in Income on Derivatives | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| Derivatives not designated as hedging instruments under ASC 815: | | | | |

| Currency contracts | | Other expense | | $ | (2.7 | ) |

| |

(1) | Amount of gain (loss) recognized in OCI includes $(0.4) million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the total amounts of income and expense line items presented in the Consolidated Statements of Operations in which the effects of cash flow hedges are reported.

| | | | Three Months Ended June 30, | Three Months Ended June 30, |

| | 2019 | | 2018 | 2020 | | 2019 |

| (In millions) | Interest expense | | Other income (expense) | | Interest expense | | Other income (expense) | Interest expense | | Other income (expense) | | Interest expense | | Other income (expense) |

| Total amounts of income and expense line items in the Consolidated Statements of Operations in which the effects of cash flow hedges are recorded | $ | (19.6 | ) | | $ | (0.1 | ) | | $ | (19.9 | ) | | $ | (5.9 | ) | $ | (19.2 | ) | | $ | 8.6 |

| | $ | (19.6 | ) | | $ | (0.1 | ) |

| Gain (loss) on cash flow hedging relationships in ASC 815 | | | | | | | | | | | | | | |

| Interest rate contracts | | | | | | | | | | | | | | |

| Amount of gain (loss) reclassified from accumulated OCI into income | $ | — |

| | $ | — |

| | $ | 0.1 |

| | $ | — |

| |

| Gain (loss) reclassified from accumulated OCI into income | | $ | (0.3 | ) | | $ | — |

| | $ | — |

| | $ | — |

|