SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 1-9924

Citigroup Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 52-1568099 (I.R.S. Employer Identification No.) |

399 Park Avenue, New York, New York 10043

(Address of principal executive offices) (Zip Code)

(212) 559-1000

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý Accelerated filer o Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock as of the latest practicable date:

Common stock outstanding as of September 30, 2006: 4,913,666,826March 31, 2007: 4,946,439,087

Available on the Web at www.citigroup.com

| | | Page No. | ||

|---|---|---|---|---|

| Part I—Financial Information | ||||

Item 1. | Financial Statements: | |||

Consolidated Statement of Income (Unaudited) | ||||

Consolidated Balance | ||||

Consolidated Statement of Changes in Stockholders' Equity (Unaudited) | ||||

Consolidated Statement of Cash Flows (Unaudited) | ||||

Consolidated Balance Sheet—Citibank, N.A. and Subsidiaries | ||||

Notes to Consolidated Financial Statements (Unaudited) | ||||

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 4 - | ||

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 57 - | ||

102 - | ||||

Item 4. | Controls and Procedures | |||

Part II—Other Information | ||||

Item 1. | Legal Proceedings | |||

Item 1A. | Risk Factors | |||

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |||

Item 4. | Submission of Matters to a Vote of Security Holders | 124 | ||

Item 6. | Exhibits | |||

Signatures | ||||

Exhibit Index | ||||

Citigroup Inc. (Citigroup orand, together with its subsidiaries, the Company) is a diversified global financial services holding company whosecompany. Our businesses provide a broad range of financial services to consumer and corporate clients.customers. Citigroup has somemore than 200 million clientcustomer accounts and does business in more than 100 countries. Citigroup was incorporated in 1988 under the laws of the State of Delaware.

The Company is a bank holding company within the meaning of the U.S. Bank Holding Company Act of 1956 registered with, and subject to examination by, the Board of Governors of the Federal Reserve System (FRB). Some of the Company's subsidiaries are subject to supervision and examination by their respective federal and state authorities.

This quarterly report on Form 10-Q should be read in conjunction with Citigroup's 20052006 Annual Report on Form 10-K.

The principal executive offices of the Company are located at 399 Park Avenue, New York, New York 10043,10043. The headquarters' telephone number 212-559-1000.is 212 559 1000. Additional information about Citigroup is available on the Company's Web site atwww.citigroup.com. Citigroup's annual report on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K, and all amendments to these reports are available free of charge through the Company's Webweb site by clicking on the "Investor Relations" page and selecting "SEC Filings." The Securities and Exchange Commission (SEC) Webweb site contains reports, proxy and information statements, and other information regarding the Company atwww.sec.gov.

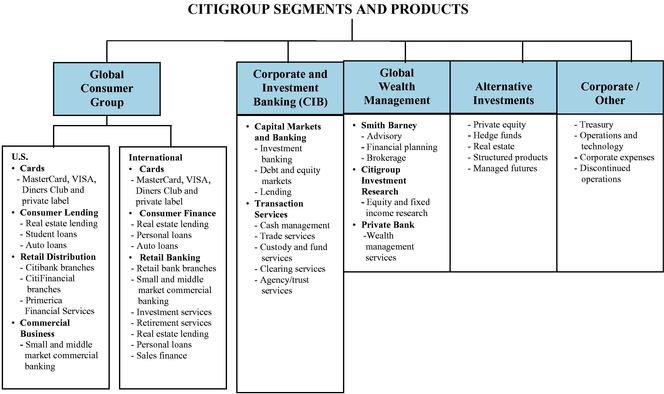

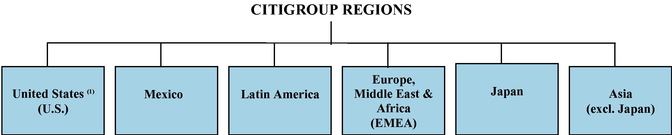

Citigroup is managed along the following segment and product lines:

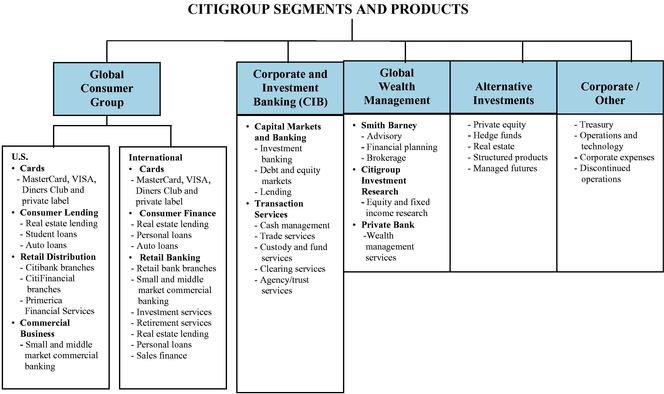

The following are the six regions in which Citigroup operates. The regional results are fully reflected in the product results.

CITIGROUP INC. AND SUBSIDIARIES

SUMMARY OF SELECTED FINANCIAL DATA

| | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended March 31, | | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | % Change | % Change | ||||||||||||||||||||||||

In millions of dollars, except per share amounts | Three Months Ended March 31, | % Change | ||||||||||||||||||||||||

| 2006 | 2005(1) | % Change | 2006(1) | 2005(1) | % Change | |||||||||||||||||||||

| Net interest revenue | $ | 9,828 | $ | 9,695 | % | $ | 29,449 | $ | 29,572 | $ | 10,570 | $ | 9,766 | 8 | % | |||||||||||

| Non-interest revenue | 11,594 | 11,803 | (2 | ) | 36,338 | 33,291 | 9 | % | 14,889 | 12,417 | 20 | |||||||||||||||

| Revenues, net of interest expense | $ | 21,422 | $ | 21,498 | — | $ | 65,787 | $ | 62,863 | 5 | % | $ | 25,459 | $ | 22,183 | 15 | % | |||||||||

| Operating expenses | 11,936 | 11,413 | 5 | % | 38,063 | 33,789 | 13 | |||||||||||||||||||

| Restructuring expense | 1,377 | — | — | |||||||||||||||||||||||

| Other operating expenses | 14,194 | 13,358 | 6 | |||||||||||||||||||||||

| Provisions for credit losses and for benefits and claims | 2,117 | 2,840 | (25 | ) | 5,607 | 6,902 | (19 | ) | 2,967 | 1,673 | 77 | |||||||||||||||

| Income from continuing operations before taxes and minority interest | $ | 7,369 | $ | 7,245 | 2 | % | $ | 22,117 | $ | 22,172 | — | $ | 6,921 | $ | 7,152 | (3 | )% | |||||||||

| Income taxes | 2,020 | 2,164 | (7 | ) | 5,860 | 6,827 | (14 | )% | 1,862 | 1,537 | 21 | |||||||||||||||

| Minority interest, net of taxes | 46 | 93 | (51 | ) | 137 | 511 | (73 | ) | 47 | 60 | (22 | ) | ||||||||||||||

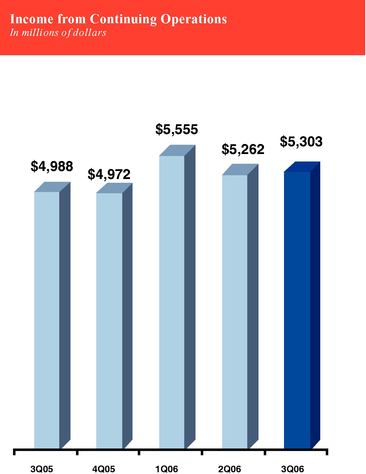

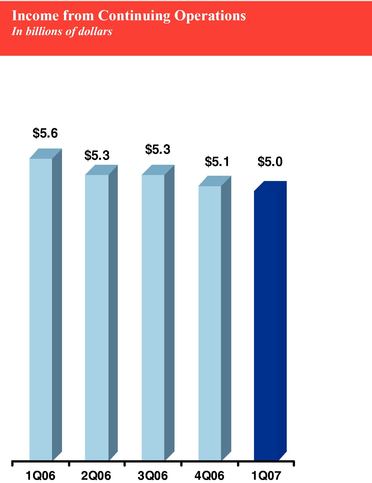

| Income from continuing operations | $ | 5,303 | $ | 4,988 | 6 | % | $ | 16,120 | $ | 14,834 | 9 | % | $ | 5,012 | $ | 5,555 | (10 | )% | ||||||||

| Income from discontinued operations, net of taxes(2) | 202 | 2,155 | (91 | ) | 289 | 2,823 | (90 | ) | ||||||||||||||||||

| Income from discontinued operations, net of taxes(1) | — | 84 | NM | |||||||||||||||||||||||

| Net Income | $ | 5,505 | $ | 7,143 | (23 | )% | $ | 16,409 | $ | 17,657 | (7 | )% | $ | 5,012 | $ | 5,639 | (11 | )% | ||||||||

| Earnings per share | ||||||||||||||||||||||||||

| Basic earnings per share: | ||||||||||||||||||||||||||

| Basic: | ||||||||||||||||||||||||||

| Income from continuing operations | $ | 1.08 | $ | 0.98 | 10 | % | $ | 3.28 | $ | 2.90 | 13 | % | $ | 1.02 | $ | 1.13 | (10 | )% | ||||||||

| Net income | 1.13 | 1.41 | (20 | ) | 3.34 | 3.45 | (3 | ) | 1.02 | 1.14 | (11 | ) | ||||||||||||||

| Diluted earnings per share: | ||||||||||||||||||||||||||

| Diluted: | ||||||||||||||||||||||||||

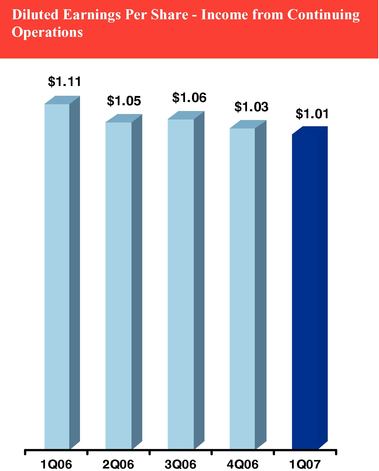

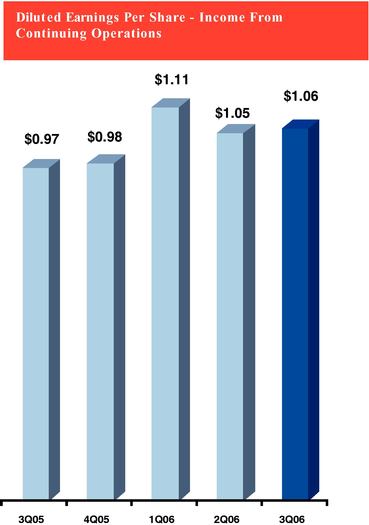

| Income from continuing operations | 1.06 | 0.97 | 9 | 3.22 | 2.85 | 13 | 1.01 | 1.11 | (9 | ) | ||||||||||||||||

| Net income | 1.10 | 1.38 | (20 | ) | 3.28 | 3.39 | (3 | ) | 1.01 | 1.12 | (10 | ) | ||||||||||||||

| Dividends declared per common share | $ | 0.49 | $ | 0.44 | 11 | $ | 1.47 | $ | 1.32 | 11 | $ | 0.54 | $ | 0.49 | 10 | |||||||||||

| At September 30, | ||||||||||||||||||||||||||

| At March 31: | ||||||||||||||||||||||||||

| Total assets | $ | 1,746,248 | $ | 1,472,793 | 19 | % | $ | 2,020,966 | $ | 1,586,201 | 27 | % | ||||||||||||||

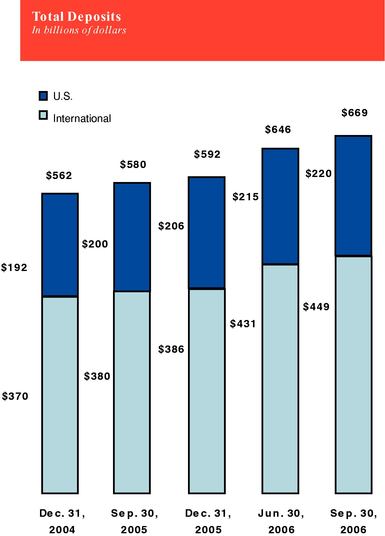

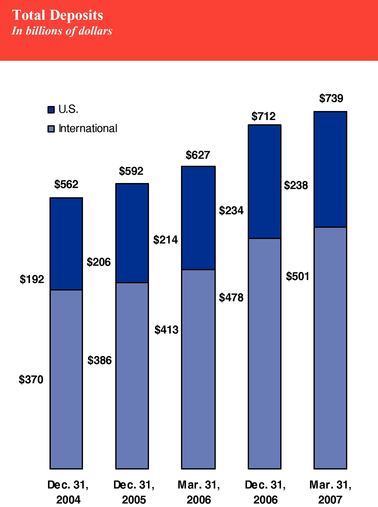

| Total deposits | 669,278 | 580,436 | 15 | 738,521 | 627,358 | 18 | ||||||||||||||||||||

| Long-term debt | 260,089 | 213,894 | 22 | 310,768 | 227,165 | 37 | ||||||||||||||||||||

| Mandatorily redeemable securities of subsidiary trusts | 9,440 | 6,166 | 53 | |||||||||||||||||||||||

| Common stockholders' equity | 116,865 | 110,712 | 6 | 121,083 | 113,418 | 7 | ||||||||||||||||||||

| Total stockholders' equity | 117,865 | 111,837 | 5 | 122,083 | 114,418 | 7 | ||||||||||||||||||||

| Ratios: | ||||||||||||||||||||||||||

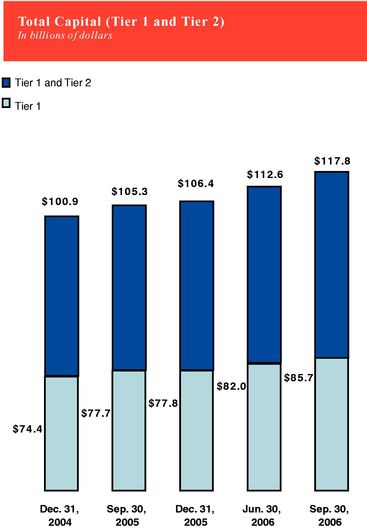

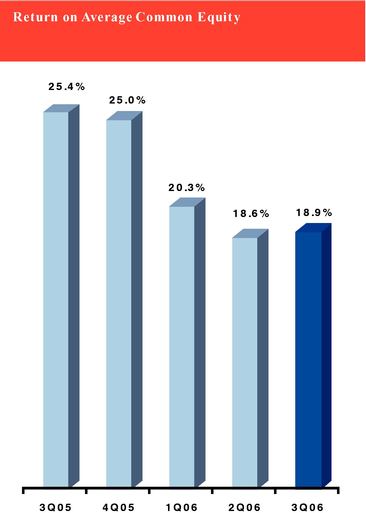

| Return on common stockholders' equity(3) | 18.9 | % | 25.4 | % | 19.3 | % | 21.4 | % | ||||||||||||||||||

| Return on risk capital(4) | 37 | % | 37 | % | 39 | % | 38 | % | ||||||||||||||||||

| Return on invested capital(4) | 19 | % | 25 | % | 19 | % | 21 | % | ||||||||||||||||||

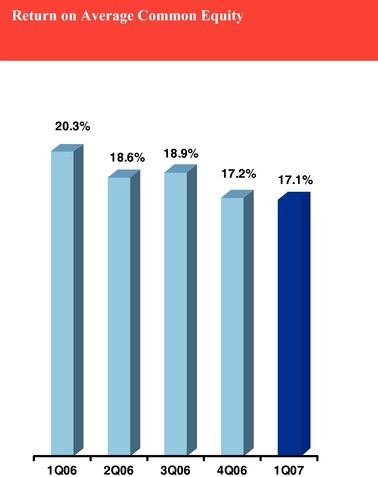

| Return on common stockholders' equity(2) | 17.1 | % | 20.3 | % | ||||||||||||||||||||||

| Return on risk capital(3) | 31 | % | 41 | % | ||||||||||||||||||||||

| Return on invested capital(3) | 17 | % | 20 | % | ||||||||||||||||||||||

| Tier 1 capital | 8.64 | % | 9.12 | % | 8.64 | % | 9.12 | % | ||||||||||||||||||

| Total capital | 11.88 | % | 12.37 | % | 11.88 | % | 12.37 | % | ||||||||||||||||||

| Leverage(5) | 5.24 | % | 5.53 | % | 5.24 | % | 5.53 | % | ||||||||||||||||||

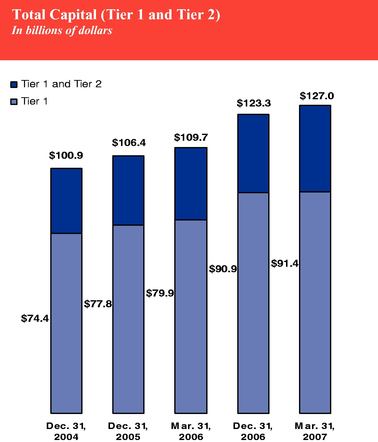

| Tier 1 Capital | 8.26 | % | 8.60 | % | ||||||||||||||||||||||

| Total Capital | 11.48 | 11.80 | ||||||||||||||||||||||||

| Leverage(4) | 4.84 | 5.22 | ||||||||||||||||||||||||

| Common stockholders' equity to assets | 6.69 | % | 7.52 | % | 5.99 | % | 7.15 | % | ||||||||||||||||||

| Total stockholders' equity to assets | 6.75 | % | 7.59 | % | ||||||||||||||||||||||

| Dividends declared ratio(6) | 44.5 | % | 31.9 | % | 44.8 | % | 38.9 | % | ||||||||||||||||||

| Dividends declared(5) | 53.5 | % | 43.8 | % | ||||||||||||||||||||||

| Ratio of earnings to fixed charges and preferred stock dividends | 1.49x | 1.74x | 1.54x | 1.84x | 1.39x | 1.58x | ||||||||||||||||||||

MANAGEMENT'S DISCUSSION AND ANALYSIS

MANAGEMENT SUMMARY

Income from continuing operations of $5.303$5.012 billion in the 2006 thirdfirst quarter of 2007 was up 6%down 10% from the 2005 third quarter.first quarter of 2006. Diluted EPS from continuing operations was updown 9%, with. Results for 2007 include an $871 million after-tax (or $0.17 per share) restructuring charge related to the increment inCompany's Structural Expense Review completed during the growth rate reflecting the benefit from our share repurchase program. Net income, which includes discontinued operations, was $5.505 billion in the quarter, down 23% from the 2005 third quarter.

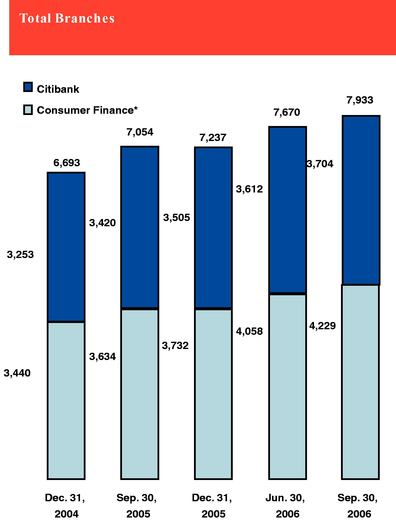

During the 2006 third quarter, we continued to execute on our key strategic initiatives, including the opening of a record 277 new Citibank and CitiFinancial branches (176 in International and 101 in the U.S.).

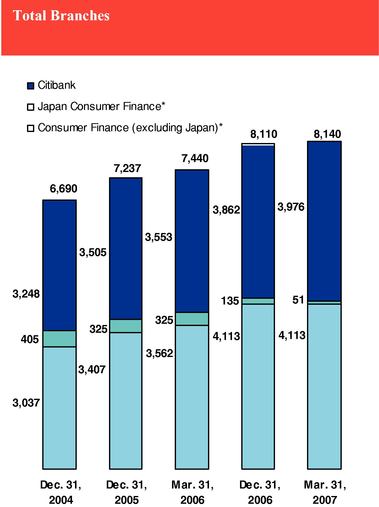

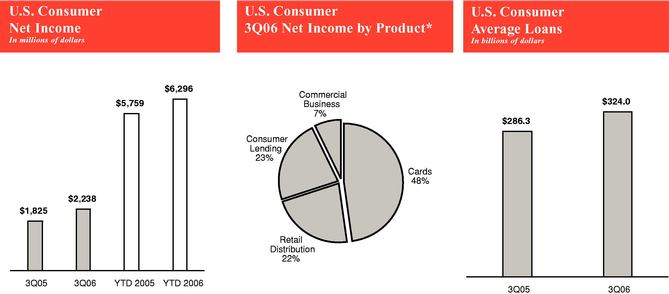

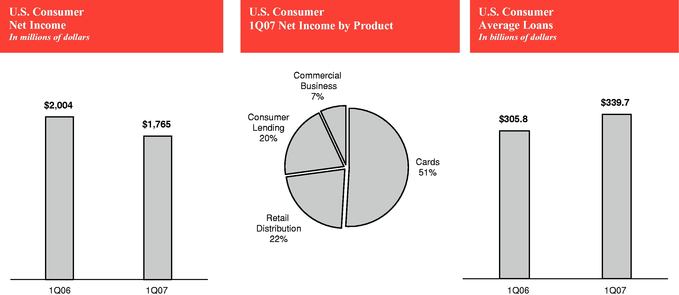

Customer volume growth was strong, with average loans up 15%14%, average deposits up 18% and19%, average interest-earning assets up 16%25%, and client assets under fee-based management up 12% from year-ago levels. U.S. debt, equity and equity-related underwriting increased 21% from year-ago levels. Branch activity included the opening of 99 branches during the quarter (48 internationally and 51 in the U.S.).U.S. Cards accounts were up 27%14% and purchase sales were up 9%6%. Citibank Direct,

During the first quarter of 2007, we continued to invest in expanding our Internet bank, has raised almost $8 billion in deposits.distribution and enhancing our technology as we build a broad, strong foundation for future growth. We successfully completed our tender offer to become the majority (over 60%) shareholder of Nikko Cordial and closed several acquisitions, consistent with our efforts to drive growth through a balance of organic investment and targeted acquisitions and to expand internationally.

|   |

* Excludes Japan Automated Loan Machines (ALMs).

Revenues were approximately even with the 2005 third quarter, at $21.4 billion.a record $25.5 billion, up 15% from a year ago, driven by Markets & Banking, up 23%. Our international operations recorded revenue growth of 11%18% in the quarter, with International Consumer up 9%14%, International CIBMarkets & Banking up 12%20%, and International Global Wealth Management up 33%32%. U.S. Consumer revenues grew 1%6%, while CIB and Alternative Investments revenues declined 6% and 54%, respectively.17%.

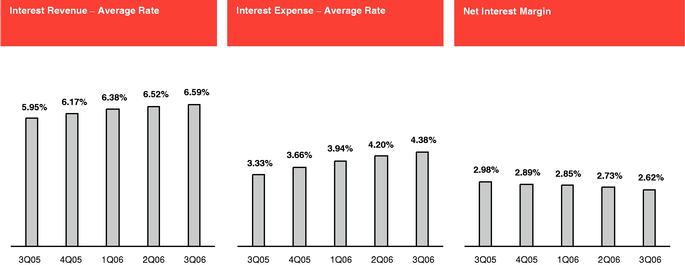

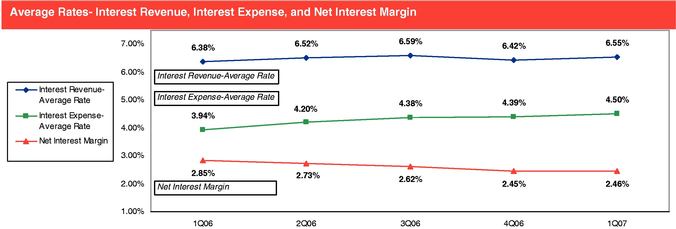

Net interest revenue increased 1%8% from last year as higher deposit and loan balances were offset by pressure on net interest margins. Net interest margin in the 2006 thirdfirst quarter of 2007 was 2.62%2.46%, down 3639 basis points from the 2005 thirdfirst quarter and down 11 basis points from theof 2006 second quarter. The largest driver of the decline from the 2006 second quarter was trading activities (see discussion of net interest margin on page 67)63).

Operating expenses increased 5%17% from the 2005 third quarter; this was comprisedfirst quarter of 3 percentage points from an increase2006. Excluding the restructuring charge in investment spending2007 and 2 percentage points due tothe 2006 initial adoption of SFAS 123(R) accruals. Excluding investment spending and SFAS 123(R) accruals,, expenses were flat withup 12% from the prior year. Expenses were down $833 million fromThe relationship between revenue growth and expense growth, excluding the 2006 secondaforementioned impact of restructuring and SFAS 123(R), improved during the quarter. As our Structural Expense Review takes shape, we expect the pace of year-over-year expense growth (excluding acquisitions) to continue to moderate through 2007.

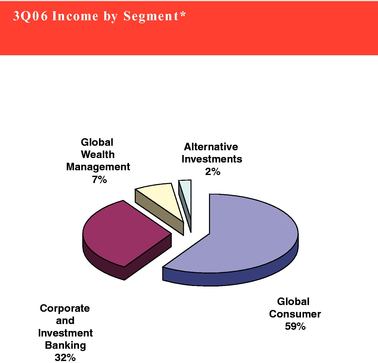

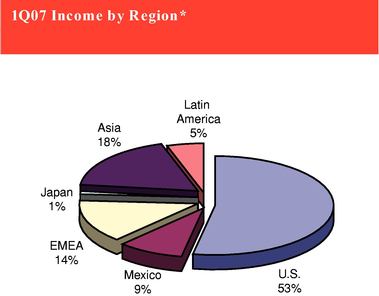

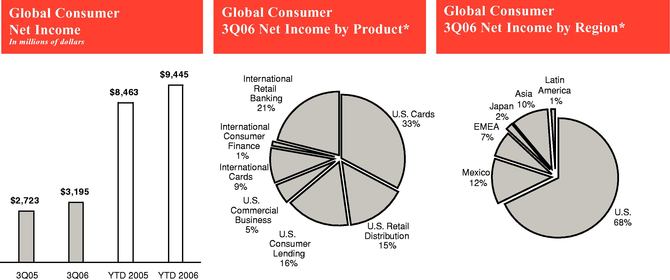

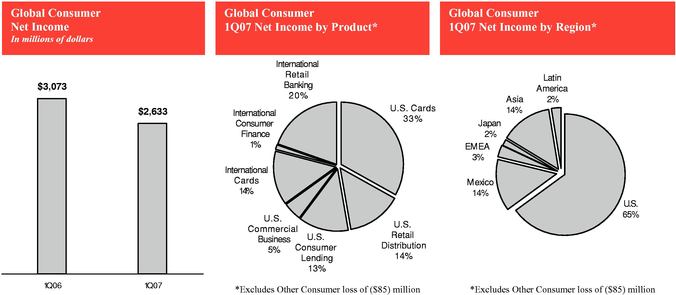

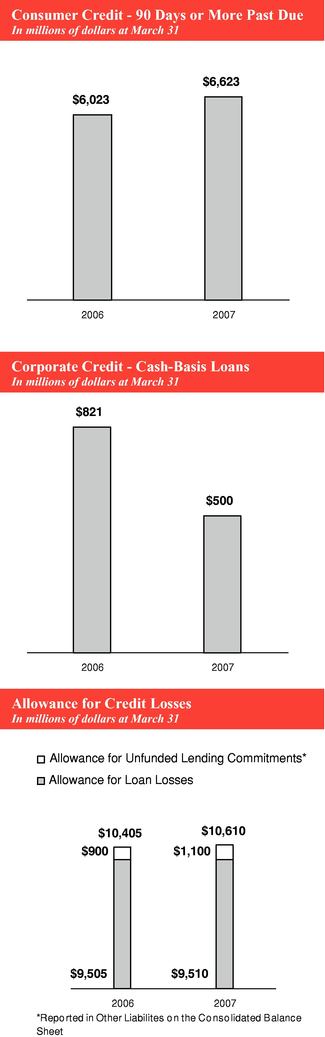

Income was diversified by segment and region, as shown in the charts below.

|   | |

| * Excludes Corporate/ | * Excludes Corporate/Other loss of $912 million and Alternative Investments |

Credit costs increased $1.3 billion from a year ago, primarily driven by an increase in net credit losses of $509 million and a net charge of $597 million to build loan loss reserves. The U.S. credit environment remained stable; this, as well as significantly lower consumer bankruptcy filings,$597 million net build compares to a net reserve release of $154 million in the absenceprior-year period. The build was primarily due to increased reserves to reflect: a change in estimate of loan losses inherent in the initial tenor portion of the 2005 third quarter $490 million pretax charge relatedConsumer Loan Portfolio; portfolio growth, and increased delinquencies in second mortgages, in theU.S. Consumer Lending mortgage portfolio; and portfolio growth in Markets & Banking, which includes higher commitments to the EMEA consumer write-off policy change,leveraged transactions and an asset mix shift, drove a $782 million decreaseincrease in credit costs compared to year-ago levels.average loan tenor. The Global Consumer loss rate was 1.49%1.69%, a 119 basis point decline23 basis-point increase from the 2006 thirdfirst quarter reflecting the absence of the 2005 third quarter $1.153 billion write-off related to the policy change in EMEA and significantly lower bankruptcy filings. Corporate cash-basis loans declined 13% from June 30, 2006 to $692 million.2006.

The effective income tax rate on continuing operations declinedwas 26.9% in the first quarter of 2007, reflecting the impacts of the restructuring charge and $131 million in tax benefits for the initial application under APB 23 relating to 27.4%, primarily reflecting a $237 millioncertain foreign subsidiaries' ability to indefinitely reinvest their earnings abroad. The 21.5% effective tax reserve releaserate in the first quarter of 2006 includes the tax benefit related to the resolution of the New YorkFederal Tax Audits. The effective tax rate for the 2006 third quarter would have been 30.6% without the tax reserve release.Audit.

Our stockholders' equity capital base and trust preferred securities grew to $125.9$131.5 billion at September 30, 2006.March 31, 2007. Stockholders' equity increased by $2.4$2.3 billion during the quarter to $117.9$122.1 billion. We distributed $2.5$2.7 billion in dividends to shareholders and repurchased $2.0 billion$645 million of common stock during the quarter.

As a result of the Company's recent acquisitions, the successful Nikko tender offer, and other growth opportunities, it is anticipated that we will not resume our share repurchase program during the remainder of the year. Return on common equity was 18.9%17.1% for the quarter. Citigroup maintained its "well-capitalized" position with a Tier 1 Capital Ratio of 8.64%8.26% at September 30, 2006. On September 26, 2006, Moody's upgraded Citibank, N.A.'s Credit Rating to "Aaa" from "Aa1."

As we move into the fourth quarter, our priorities remain clear: to execute our strategic initiatives to drive organic revenue and net income growth, to make targeted acquisitions, to maintain expense discipline and to generate superior returns for our owners.

|  |

EVENTS IN 2006 and 2005March 31, 2007.

Certain of the statements belowabove are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. See "Forward-Looking Statements" on page 84.78.

|  |

Structural Expense Review

During the first quarter of 2007, the Company completed a review of its structural expense base in a Company-wide effort to create a more streamlined organization, reduce expense growth, and provide investment funds for future growth initiatives.

As a result of the review, a pretax restructuring charge of $1.4 billion ($871 million after-tax) was recorded in Corporate/Other during the first quarter of 2007. Additional pretax restructuring charges of $200 million are anticipated to be recognized by the end of 2007. Separate from the restructuring charge, additional implementation costs of approximately $100 million pretax are expected throughout 2007.

See Note 7 on page 92 for additional information.

Adoption of SFAS 157—Fair Value Measurements

The Company elected to early-adopt SFAS No. 157,"Fair Value Measurements" (SFAS 157), as of January 1, 2007. SFAS 157 defines fair value, establishes a consistent framework for measuring fair value and expands disclosure requirements about fair value measurements. SFAS 157 requires, among other things, Citigroup's valuation techniques used to measure fair value to maximize the use of observable inputs and minimize the use of unobservable inputs. In addition, SFAS 157 precludes the use of block discounts for instruments traded in an active market, which were previously applied to large holdings of publicly-traded equity securities, and requires the recognition of trade-date gains related to certain derivative trades that use unobservable inputs in determining the fair value. This guidance supersedes the guidance in EITF Issue No. 02-3, which prohibited the recognition of day-one gains on certain derivative trades when determining the fair value of instruments not traded in an active market. The cumulative effect of these two changes resulted in an increase to retained earnings of $75 million.

As a result of maximizing observable inputs as required by SFAS 157, Citigroup began to reflect external credit ratings as well as other observable inputs when measuring the fair value of our derivative positions. The cumulative effect of making this derivative valuation adjustment was a gain of $250 million after-tax ($402 million pre-tax, which was recorded in the Markets & Banking business), or $0.05 per diluted share, included in 2007 first quarter earnings. The primary drivers of this change were the requirement that Citigroup include its own credit rating in pricing derivatives and the elimination of a valuation adjustment, which is no longer necessary under SFAS 157.

See Note 16 on page 105 for additional information.

Adoption of SFAS 159—Fair Value Option

In conjunction with the adoption of SFAS 157, the Company early-adopted SFAS 159,"The Fair Value Option for Financial Assets and Financial Liabilities" (SFAS 159), as of January 1, 2007. SFAS 159 provides an option for most financial assets and liabilities to be reported at fair value on an instrument-by-instrument basis with changes in fair value reported in earnings. After the initial adoption, the election is made at the acquisition of a financial asset, financial liability, or a firm commitment and it may not be revoked. Under the SFAS 159 transition provisions, the Company has elected to report certain financial instruments and other items at fair value on a contract-by-contract basis, with future changes in value reported in earnings. SFAS 159 provides an opportunity to mitigate volatility in reported earnings that was caused by measuring hedged assets and liabilities that were previously required to use an accounting method other than fair value, while the related economic hedges were reported at fair value.

The adoption of SFAS 159 resulted in an after-tax decrease to January 1, 2007 retained earnings of $99 million ($157 million pretax).

��See Note 16 on page 105 for additional information.

Sale of MasterCard Shares

During the first quarter of 2007, the Company recorded a $171 million after-tax gain ($268 million pretax) on the sale of approximately 2.955 million of the 4.947 million MasterCard Class B shares which were received by Citigroup as a part of the MasterCard initial public offering completed in June 2006. The after-tax gain was recorded in the following businesses:

| In millions of dollars | Total | ||

|---|---|---|---|

| U.S. Cards | $ | 103 | |

| International Cards | 42 | ||

| International Retail Banking | 26 | ||

| Total | $ | 171 | |

Credit Reserves

During the first quarter of 2007, the Company recorded a net build of $597 million to its credit reserves, consisting of a net build of $311 million in Global Consumer and a net build of $286 million in Markets & Banking.

The build of $311 million in Global Consumer was primarily due to increased reserves to reflect: a change in estimate of loan losses inherent in the initial tenor portion of the Consumer Loan portfolio; increased delinquencies in second mortgages, and portfolio growth in theU.S. Consumer Lending mortgage portfolio. Additionally, market expansion in Mexico Cards and the integration of the Credicard portfolio in Brazil added to the increase.

The build of $286 million in Markets & Banking was primarily inSecurities and Banking, which had a $300 million reserve increase during the quarter due to portfolio growth which includes higher commitments to leveraged transactions and an increase in average loan tenor.

During the first quarter of 2006, the Company recorded a net release/utilization of its credit reserves of $154 million, consisting of a net release/utilization of $187 million in Global Consumer and Global Wealth Management, and a net build of $33 million in Markets & Banking.

Acquisition of Bisys

On May 2, 2007, the Company announced an agreement to acquire Bisys Group, Inc. (Bisys) for $1.45 billion. At closing, Citigroup will sell the Retirement and Insurance Services Divisions of Bisys to affiliates of J.C. Flowers & Co. LLC, making the net cost of the transaction to Citigroup approximately $800 million. Citigroup will retain the Investment Services Division of Bisys, which provides administrative services for hedge funds, mutual funds and private equity funds. The transaction is expected to close in the second half of 2007 and is subject to Bisys shareholder approval and to regulatory approvals in the U.S., Ireland and Bermuda. Bisys will be included within Citigroup'sTransaction Services business.

Tender Offer for Nikko Cordial

On April 26, 2007, Citigroup completed its successful tender offer to become the majority shareholder of Nikko Cordial Corporation in Japan. Approximately 541 million shares were tendered for approximately $7.7 billion. Following the May 9, 2007 scheduled closing date Citigroup will own a total ownership stake in excess of 60%. Once the tender offer is closed, Citigroup will consolidate Nikko and its operations with the minority stake disclosed as Minority Interest.

This acquisition accelerates Citigroup's growth strategy in the world's second largest economy and is intended to provide a broad base of global products and services to Nikko Cordial's client network.

Agreement to Acquire Old Lane Partners, L.P.

On April 13, 2007, the Company announced a definitive agreement to acquire 100% of the outstanding partnership interests in Old Lane Partners, L.P. and Old Lane Partners, GP, LLC (Old Lane). Old Lane is the manager of a global, multi-strategy hedge fund and a private equity fund with total capital under management and private equity commitments of approximately $4.5 billion. Old Lane will operate as part of Citigroup's Alternative Investments (CAI) business. Following the completion of the transaction, Old Lane's Vikram Pandit will become Chief Executive Officer of CAI. The transaction is subject to customary regulatory reviews and is expected to close in the third quarter of 2007.

Acquisition of ABN AMRO Mortgage Group

On March 1, 2007, Citigroup acquired ABN AMRO Mortgage Group (AAMG), a subsidiary of LaSalle Bank Corporation and ABN AMRO Bank N.V. AAMG is a national originator and servicer of prime residential mortgage loans. As part of this acquisition, Citigroup purchased approximately $12 billion in assets, including $3 billion of mortgage servicing rights. The acquisition of AAMG added approximately 1.5 million servicing customers to theU.S. Consumer Lendingportfolio.

Asia Acquisitions

Acquisition of Bank of Overseas Chinese

On April 9, 2007, Citigroup announced the agreement to acquire 100% of Bank of Overseas Chinese (BOOC) in Taiwan for approximately $427 million, subject to certain closing adjustments. BOOC offers a broad suite of corporate banking, consumer and wealth management products and services to more than one million clients through 55 branches in Taiwan.

This transaction will strengthen Citigroup's presence in Asia making it the largest international bank and 13th largest by total assets among all domestic Taiwan banks. Citigroup's acquisition of BOOC is subject to shareholder and U.S. and Taiwanese regulatory approvals and is expected to close during the second half of 2007.

Strategic Investment and Cooperation Agreement with Guangdong Development Bank

On December 17, 2006, a Citigroup-led consortium acquired an 85.6% stake in Guangdong Development Bank ("GDB"). Citigroup's share is 20% of GDB and its investment of approximately $725 million is accounted for under the equity method.

In accordance with the parties' agreement, Citigroup will have significant management influence at GDB to enhance GDB's management team and corporate governance standards, instill operational and lending best practices, improve risk management and internal controls, upgrade GDB's information technology infrastructure, and further develop GDB's customer service and product offerings.

U.K. Market Expansion

Egg

On May 1, 2007, Citigroup completed its acquisition of Egg Banking plc (Egg), the world's largest pure online bank and one of the U.K.'s leading online financial services providers, from Prudential PLC for approximately $1.127 billion. Egg has more than three million customers and offers various financial products and services including online payment and account aggregation services, credit cards, personal loans, savings accounts, mortgages, insurance and investments.

Quilter

On March 1, 2007, the Company completed the acquisition of Quilter, a U.K. wealth advisory firm with over $10.9 billion of assets under management, from Morgan Stanley. Quilter has more than 18,000 clients and 300 staff located in 10 offices throughout the U.K., Ireland and the Channel Islands. Quilter's results are included within Global Wealth Management.

Central American Acquisitions

Grupo Cuscatlan

On December 13, 2006, Citigroup announced the agreement to acquire the subsidiaries of Grupo Cuscatlan for $1.51 billion in cash and stock from Corporacion UBC Internacional S.A. Grupo Cuscatlan is one of the leading financial groups in Central America, with assets of $5.4 billion, loans of $3.5 billion, and deposits of $3.4 billion. Grupo Cuscatlan has operations in El Salvador, Guatemala, Costa Rica, Honduras and Panama. This acquisition is subject to local country regulatory approvals and is expected to close during the second quarter of 2007.

Grupo Financiero Uno

On October 27, 2006,March 5, 2007, Citigroup announced that it had reached a definitive agreement to acquirecompleted its acquisition of Grupo Financiero Uno (GFU), the largest credit card issuer in Central America, and its affiliates.

The acquisition of GFU, with $2.1$2.2 billion in assets, will expandexpands the presence of Citigroup's Latin America consumer franchise, enhancingenhances its credit card business in the region and establishingestablishes a platform for regional growth in consumer financeConsumer Finance and retail banking.Retail Banking.

GFU is privately held and has more than one million retail clients, representing 1.1 million credit card accounts, $1.2$1.3 billion in credit card receivables and $1.3$1.5 billion in deposits in Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica and Panama as of September 30, 2006.Panama. GFU operates a distribution network of 75 branches and more than 100 mini- branchesmini-branches and points of sale.

The transaction, which is subject to regulatory approvals in the United States and each of the six countries, is anticipated to close in the 2007 first quarter.

Sale of AvantelEMEA Expansion

On October 26, 2006, the Company agreed to sell Avantel, a leading telecom service provider in Mexico, to Axtel. The transaction is expected to result in an approximately $140 million after-tax gain ($310 million pretax). The transaction is expected to close in the 2006 fourth quarter, subject to Mexican regulatory and Axtel shareholder approvals. Avantel was acquired by Citigroup as part of its acquisition of Banamex in 2001.

Purchase of 20% Equity Interest in Akbank

On October 17, 2006, the Company announced that it had signed a definitive agreement for theJanuary 9, 2007, Citigroup completed its purchase of a 20% equity interest in Akbank for approximately $3.1 billion. Akbank, the second-largest privately-ownedprivately owned bank by assets in Turkey, is a premier, full-service retail, commercial, corporate and private bank.

Sabanci Holding, a 34% owner of Akbank shares, and its subsidiaries have granted Citigroup a right of first refusal or first offer over the sale of any of their Akbank shares in the future. Subject to certain exceptions, including purchases from Sabanci Holding and its subsidiaries, Citigroup has otherwise agreed not to acquire additional sharesincrease its percentage ownership in Akbank.

The transaction, which is subject to shareholder and regulatory approvals, is expected to close during the 2006 fourth quarter or 2007 first quarter and will be accounted for under the equity method.

Final Payment from the SaleResolution of the Asset Management BusinessFederal Tax Audit

In SeptemberMarch 2006, the Company received a notice from the final closing adjustment payment related toInternal Revenue Service (IRS) that they had concluded the sale of its Asset Management business to Legg Mason, Inc. (Legg Mason). This payment resulted in an additional after-tax gain of $51 million ($83 million pretax), recorded in Discontinued Operations.

Final Settlement of the Travelers Life & Annuity Sale

In July 2006, the Company received the final closing adjustment payment related to the sale of Citigroup's Travelers Life & Annuity and substantially all of its international insurance businesses to MetLife, Inc. (MetLife). This payment resulted in an after-tax gain of $75 million ($115 million pretax), recorded in Discontinued Operations.

Settlement of New York State and New York City Tax Audits

In September 2006, Citigroup reached a settlement agreement with the New York State and New York City taxing authorities regarding various tax liabilitiesaudit for the years 1998 - 20051999 through 2002 (referred to above and hereinafter as the "resolution of the New YorkFederal Tax Audits"Audit").

For the first quarter of 2006, third quarter, the Company released $254a total of $657 million from its tax contingency reserves which resulted in increasesrelated to the resolution of $237 million in after-tax income from continuing operations and $17 million in after-tax income from discontinued operations.the Federal Tax Audit.

The following table summarizes the 2006 thirdfirst quarter tax benefit,benefits, by business, from the resolution of the New YorkFederal Tax Audits:Audit:

| In millions of dollars | 2006 Third Quarter | ||

|---|---|---|---|

| U.S. Cards | $ | 39 | |

| U.S. Retail Distribution | 4 | ||

| U.S. Consumer Lending | 10 | ||

| U.S. Commercial Business | 1 | ||

Total U.S. Consumer | $ | 54 | |

| International Cards | 5 | ||

| International Consumer Finance | 1 | ||

| International Retail Banking | 18 | ||

| Total International Consumer | $ | 24 | |

| Consumer Other | 1 | ||

| Global Consumer | $ | 79 | |

| Capital Markets and Banking | 97 | ||

| Transaction Services | 19 | ||

Corporate & Investment Banking | $ | 116 | |

| Smith Barney | 31 | ||

| Private Bank | 3 | ||

Global Wealth Management | $ | 34 | |

Alternative Investments | — | ||

Corporate/Other | 8 | ||

| Continuing Operations | $ | 237 | |

| Discontinued Operations | 17 | ||

| Total | $ | 254 | |

MasterCard Initial Public Offering

In June 2006, MasterCard conducted a series of transactions consisting of: (i) an IPO of new Class A stock, (ii) an exchange of its old Class A stock held by its member banks for shares of its new Class B and Class M stocks, and (iii) a partial redemption of the new Class B stock held by the member banks. Citigroup, as one of MasterCard's member banks, received 4,946,587 shares of Class B stock, 48 shares of Class M stock, and $123 million in cash as a result of these transactions. An after-tax gain of $78 million ($123 million pretax) was recognized in the 2006 second quarter related to the cash redemption of shares.

Sale of Upstate New York Branches

On June 30, 2006, Citigroup sold the Upstate New York Financial Center Network consisting of 21 branches in Rochester, N.Y. and Buffalo, N.Y. to M&T Bank (referred to hereinafter as the "Sale of New York Branches"). Citigroup received a premium on deposit balances of approximately $1 billion. An after-tax gain of $92 million ($163 million pretax) was recognized in the 2006 second quarter.

Consolidation of Brazil's Credicard

In April 2006, Citigroup and Banco Itau dissolved their joint venture in Credicard, a Brazil consumer credit card business. In accordance with the dissolution agreement, Banco Itau received half of Credicard's assets and customer accounts in exchange for its 50% ownership, leaving Citigroup as the sole owner of Credicard.

Beginning April 30, 2006, Credicard's financial statements were consolidated with Citigroup. Previously, Citigroup reported its interest in Credicard using the equity method of consolidation. Accordingly, our net investment was included in Other assets.

Acquisition of Federated Credit Card Portfolio and Credit Card Agreement With Federated Department Stores

In June 2005, Citigroup announced a long-term agreement with Federated Department Stores, Inc. (Federated) under which the companies partner to manage approximately $6.2 billion of Federated's credit card receivables, including existing and new accounts, executed in three phases.

For the first phase, which closed in October 2005, Citigroup acquired Federated's receivables under management, totaling approximately $3.3 billion. For the second phase, which closed in May 2006, additional Federated receivables totaling approximately $1.9 billion were transferred to Citigroup from the previous provider. For the final phase, in the 2006 third quarter, Citigroup acquired approximately $1.0 billion credit card receivable portfolio of The May Department Stores Company (May), which merged with Federated.

Citigroup paid a premium of approximately 11.5% to acquire these portfolios. The multi-year agreement also provides Federated the ability to participate in the portfolio performance, based on credit sales and certain other performance metrics.

The Federated and May credit card portfolios comprise a total of approximately 17 million active accounts.

| In millions of dollars | Total | ||

|---|---|---|---|

| Global Consumer | $ | 290 | |

| Markets & Banking | 176 | ||

| Global Wealth Management | 13 | ||

| Alternative Investments | 58 | ||

| Corporate/Other | 61 | ||

| Continuing Operations | $ | 598 | |

| Discontinued Operations | 59 | ||

| Total | $ | 657 | |

AdoptionCredit Reserves

During the first quarter of 2007, the Company recorded a net build of $597 million to its credit reserves, consisting of a net build of $311 million in Global Consumer and a net build of $286 million in Markets & Banking.

The build of $311 million in Global Consumer was primarily due to increased reserves to reflect: a change in estimate of loan losses inherent in the initial tenor portion of the AccountingConsumer Loan portfolio; increased delinquencies in second mortgages, and portfolio growth in theU.S. Consumer Lending mortgage portfolio. Additionally, market expansion in Mexico Cards and the integration of the Credicard portfolio in Brazil added to the increase.

The build of $286 million in Markets & Banking was primarily inSecurities and Banking, which had a $300 million reserve increase during the quarter due to portfolio growth which includes higher commitments to leveraged transactions and an increase in average loan tenor.

During the first quarter of 2006, the Company recorded a net release/utilization of its credit reserves of $154 million, consisting of a net release/utilization of $187 million in Global Consumer and Global Wealth Management, and a net build of $33 million in Markets & Banking.

Acquisition of Bisys

On May 2, 2007, the Company announced an agreement to acquire Bisys Group, Inc. (Bisys) for Share-Based Payments$1.45 billion. At closing, Citigroup will sell the Retirement and Insurance Services Divisions of Bisys to affiliates of J.C. Flowers & Co. LLC, making the net cost of the transaction to Citigroup approximately $800 million. Citigroup will retain the Investment Services Division of Bisys, which provides administrative services for hedge funds, mutual funds and private equity funds. The transaction is expected to close in the second half of 2007 and is subject to Bisys shareholder approval and to regulatory approvals in the U.S., Ireland and Bermuda. Bisys will be included within Citigroup'sTransaction Services business.

Tender Offer for Nikko Cordial

On April 26, 2007, Citigroup completed its successful tender offer to become the majority shareholder of Nikko Cordial Corporation in Japan. Approximately 541 million shares were tendered for approximately $7.7 billion. Following the May 9, 2007 scheduled closing date Citigroup will own a total ownership stake in excess of 60%. Once the tender offer is closed, Citigroup will consolidate Nikko and its operations with the minority stake disclosed as Minority Interest.

This acquisition accelerates Citigroup's growth strategy in the world's second largest economy and is intended to provide a broad base of global products and services to Nikko Cordial's client network.

Agreement to Acquire Old Lane Partners, L.P.

On April 13, 2007, the Company announced a definitive agreement to acquire 100% of the outstanding partnership interests in Old Lane Partners, L.P. and Old Lane Partners, GP, LLC (Old Lane). Old Lane is the manager of a global, multi-strategy hedge fund and a private equity fund with total capital under management and private equity commitments of approximately $4.5 billion. Old Lane will operate as part of Citigroup's Alternative Investments (CAI) business. Following the completion of the transaction, Old Lane's Vikram Pandit will become Chief Executive Officer of CAI. The transaction is subject to customary regulatory reviews and is expected to close in the third quarter of 2007.

Acquisition of ABN AMRO Mortgage Group

On March 1, 2007, Citigroup acquired ABN AMRO Mortgage Group (AAMG), a subsidiary of LaSalle Bank Corporation and ABN AMRO Bank N.V. AAMG is a national originator and servicer of prime residential mortgage loans. As part of this acquisition, Citigroup purchased approximately $12 billion in assets, including $3 billion of mortgage servicing rights. The acquisition of AAMG added approximately 1.5 million servicing customers to theU.S. Consumer Lendingportfolio.

Asia Acquisitions

Acquisition of Bank of Overseas Chinese

On April 9, 2007, Citigroup announced the agreement to acquire 100% of Bank of Overseas Chinese (BOOC) in Taiwan for approximately $427 million, subject to certain closing adjustments. BOOC offers a broad suite of corporate banking, consumer and wealth management products and services to more than one million clients through 55 branches in Taiwan.

This transaction will strengthen Citigroup's presence in Asia making it the largest international bank and 13th largest by total assets among all domestic Taiwan banks. Citigroup's acquisition of BOOC is subject to shareholder and U.S. and Taiwanese regulatory approvals and is expected to close during the second half of 2007.

Strategic Investment and Cooperation Agreement with Guangdong Development Bank

On December 17, 2006, a Citigroup-led consortium acquired an 85.6% stake in Guangdong Development Bank ("GDB"). Citigroup's share is 20% of GDB and its investment of approximately $725 million is accounted for under the equity method.

In accordance with the parties' agreement, Citigroup will have significant management influence at GDB to enhance GDB's management team and corporate governance standards, instill operational and lending best practices, improve risk management and internal controls, upgrade GDB's information technology infrastructure, and further develop GDB's customer service and product offerings.

U.K. Market Expansion

Egg

On May 1, 2007, Citigroup completed its acquisition of Egg Banking plc (Egg), the world's largest pure online bank and one of the U.K.'s leading online financial services providers, from Prudential PLC for approximately $1.127 billion. Egg has more than three million customers and offers various financial products and services including online payment and account aggregation services, credit cards, personal loans, savings accounts, mortgages, insurance and investments.

Quilter

On March 1, 2007, the Company completed the acquisition of Quilter, a U.K. wealth advisory firm with over $10.9 billion of assets under management, from Morgan Stanley. Quilter has more than 18,000 clients and 300 staff located in 10 offices throughout the U.K., Ireland and the Channel Islands. Quilter's results are included within Global Wealth Management.

Central American Acquisitions

Grupo Cuscatlan

On December 13, 2006, Citigroup announced the agreement to acquire the subsidiaries of Grupo Cuscatlan for $1.51 billion in cash and stock from Corporacion UBC Internacional S.A. Grupo Cuscatlan is one of the leading financial groups in Central America, with assets of $5.4 billion, loans of $3.5 billion, and deposits of $3.4 billion. Grupo Cuscatlan has operations in El Salvador, Guatemala, Costa Rica, Honduras and Panama. This acquisition is subject to local country regulatory approvals and is expected to close during the second quarter of 2007.

Grupo Financiero Uno

On March 5, 2007, Citigroup completed its acquisition of Grupo Financiero Uno (GFU), the largest credit card issuer in Central America, and its affiliates.

The acquisition of GFU, with $2.2 billion in assets, expands the presence of Citigroup's Latin America consumer franchise, enhances its credit card business in the region and establishes a platform for regional growth in Consumer Finance and Retail Banking.

GFU has more than one million retail clients, representing 1.1 million credit card accounts, $1.3 billion in credit card receivables and $1.5 billion in deposits in Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica and Panama. GFU operates a distribution network of 75 branches and more than 100 mini-branches and points of sale.

EMEA Expansion

Purchase of 20% Equity Interest in Akbank

On January 1, 2006,9, 2007, Citigroup completed its purchase of a 20% equity interest in Akbank for approximately $3.1 billion. Akbank, the Company adopted Statementsecond-largest privately owned bank by assets in Turkey, is a premier, full-service retail, commercial, corporate and private bank.

Sabanci Holding, a 34% owner of Financial Accounting Standards (SFAS) 123 (revised 2004), "Share-Based Payment" (SFAS 123(R)), which replacesAkbank shares, and its subsidiaries have granted Citigroup a right of first refusal or first offer over the existing SFAS 123 and supersedes Accounting Principles Board (APB) 25. SFAS 123(R) requires companies to measure and record compensation expense for stock options and other share-based payments based on the instruments' fair value, reduced by expected forfeitures.

In adopting this standard, the Company conformed to recent accounting guidance that restricted stock awards issued to retirement-eligible employees who meet certain age and service requirements must be either expensed on the grant date or accrued over a service period prior to the grant date. This charge consistedsale of $398 million after-tax ($648 million pretax) for the immediate expensingany of awards granted to retirement-eligible employees in January 2006.

The following table summarizes the SFAS 123(R) impact, by segment, on the 2006 first quarter pretax compensation expense for stock awards granted to retirement-eligible employees in January 2006:

| In millions of dollars | 2006 First Quarter | ||

|---|---|---|---|

| Global Consumer | $ | 121 | |

Corporate and Investment Banking | 354 | ||

Global Wealth Management | 145 | ||

Alternative Investments | 7 | ||

Corporate/Other | 21 | ||

| Total | $ | 648 | |

The following table summarizes the quarterly SFAS 123(R) impact on 2006 pretax compensation expense (and after-tax impact) for the quarterly accrual of the estimated awards that will be granted in January 2007:

| In millions of dollars | Pretax | After-tax | ||||

|---|---|---|---|---|---|---|

| First quarter 2006 | $ | 198 | $ | 122 | ||

| Second quarter 2006 | 168 | 104 | ||||

| Third quarter 2006 | 195 | 127 | ||||

| Year-to-date 2006 | $ | 561 | $ | 353 | ||

The Company changed the plan's retirement eligibility for the January 2007 management awards, which affected the amount of the accrualtheir Akbank shares in the 2006 secondfuture. Subject to certain exceptions, including purchases from Sabanci Holding and third quarters.its subsidiaries, Citigroup has otherwise agreed not to increase its percentage ownership in Akbank.

Additional information can be found in Notes 1 and 8 to the Consolidated Financial Statements on pages 91 and 100, respectively. The Company will continue to accrue for the estimated awards that will be granted in January 2007 in the 2006 fourth quarter.

SettlementResolution of IRSFederal Tax Audit

In March 2006, the Company received a notice from the Internal Revenue Service (IRS) that they had concluded the tax audit for the years 1999 through 2002 (referred to hereinafter as the "resolution of the Federal Tax Audit"). For the 2006 first quarter of 2006, the Company released a total of $657 million from its tax contingency reserves related to the resolution of the Federal Tax Audit.

The following table summarizes the 2006 first quarter tax benefitbenefits, by segment ofbusiness, from the resolution of the Federal Tax Audit:

| In millions of dollars | 2006 First Quarter | ||

|---|---|---|---|

| Global Consumer | $ | 290 | |

Corporate and Investment Banking | 176 | ||

Global Wealth Management | 13 | ||

Alternative Investments | 58 | ||

Corporate/Other | 61 | ||

| Continuing Operations | $ | 598 | |

Discontinued Operations | 59 | ||

| Total | $ | 657 | |

Sale of Asset Management Business

On December 1, 2005, the Company completed the sale of substantially all of its Asset Management Business to Legg Mason in exchange for Legg Mason's broker-dealer business, $2.298 billion of Legg Mason's common and preferred shares (valued as of the closing date), and $500 million in cash. This cash was obtained via a lending facility provided by Citigroup CIB. The transaction did not include Citigroup's asset management business in Mexico, its retirement services business inLatin America (both of which are now included inInternational Retail Banking) or its interest in the CitiStreet joint venture (which is now included inSmith Barney). The total value of the transaction at the time of closing was approximately $4.369 billion, resulting in an after-tax gain to Citigroup of approximately $2.082 billion ($3.404 billion pretax).

Concurrently, Citigroup sold Legg Mason's Capital Markets business to Stifel Financial Corp. (The transactions described in these two paragraphs are referred to as the "Sale of the Asset Management Business.")

Upon completion of the Sale of the Asset Management Business, Citigroup added 1,226 financial advisors in 124 branch offices from Legg Mason to its Global Wealth Management business.

During March 2006, Citigroup sold 10.3 million shares of Legg Mason stock through an underwritten public offering. The net sale proceeds of $1.258 billion resulted in a pretax gain of $24 million.

Additional information can be found in Note 3 to the Consolidated Financial Statements on page 94.

Sale of Travelers Life & Annuity

On July 1, 2005, the Company completed the sale of Citigroup's Travelers Life & Annuity and substantially all of Citigroup's international insurance businesses to MetLife. The businesses sold were the primary vehicles through which Citigroup engaged in the Life Insurance and Annuities business.

Citigroup received $1.0 billion in MetLife equity securities and $10.830 billion in cash, which resulted in an after-tax gain of approximately $2.120 billion ($3.386 billion pretax), which is included in discontinued operations.

In July 2006, Citigroup recognized an $85 million after-tax gain from the sale of MetLife shares. This gain was reported within Income from continuing operations in the Alternative Investments business.

The transaction encompassed Travelers Life & Annuity's U.S. businesses and its international operations, other than Citigroup's life insurance business in Mexico (which is now included withinInternational Retail Banking). (The transaction described in the preceding three paragraphs is referred to as the "Sale of the Life Insurance and Annuities Business").

Additional information can be found in Note 3 to the Consolidated Financial Statements on page 94.

| In millions of dollars | Total | ||

|---|---|---|---|

| Global Consumer | $ | 290 | |

| Markets & Banking | 176 | ||

| Global Wealth Management | 13 | ||

| Alternative Investments | 58 | ||

| Corporate/Other | 61 | ||

| Continuing Operations | $ | 598 | |

| Discontinued Operations | 59 | ||

| Total | $ | 657 | |

Credit Reserves

During the three months ended September 30, 2006,first quarter of 2007, the Company recorded a net build of $597 million to its credit reserves, of $37 million, consisting of a net release/utilizationbuild of $79$311 million in Global Consumer and a net build of $116$286 million in CIB.Markets & Banking.

The net release/utilizationbuild of $311 million in Global Consumer was primarily due to lower bankruptcy filings andincreased reserves to reflect: a continued overall improvementchange in estimate of loan losses inherent in the U.S. consumer portfolio. Partially offsettinginitial tenor portion of the net releases was a build of $112 millionConsumer Loan portfolio; increased delinquencies in second mortgages, and portfolio growth in theJapanU.S. Consumer Lending relatingmortgage portfolio. Additionally, market expansion in Mexico Cards and the integration of the Credicard portfolio in Brazil added to the consumer lending industry (see discussion on page 33).increase.

The net build of $116$286 million in CIBMarkets & Banking was primarily comprised of $109 million inCapital MarketsSecurities and Banking, which includedhad a $48$300 million reserve increase for unfunded lending commitments. The net build reflectedduring the quarter due to portfolio growth which includes higher commitments to leveraged transactions and an increase in loans and unfunded commitments and a change in credit rating of certain counterparties.average loan tenor.

ForDuring the nine months ended September 30,first quarter of 2006, the Company recorded a net release/utilization of $327its credit reserves of $154 million, consisting of a net release/utilization of $594$187 million in Global Consumer and Global Wealth Management, and a net build of $267$33 million in CIB.

Credit Reserve Builds (Releases/Utilization)(1)

| | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| In millions of dollars | 2006 | 2005 | 2006 | 2005 | |||||||||

| By Product: | |||||||||||||

U.S. Cards | $ | (122 | ) | $ | 30 | $ | (354 | ) | $ | 30 | |||

| U.S. Retail Distribution | (29 | ) | 275 | (115 | ) | 258 | |||||||

| U.S. Consumer Lending | (8 | ) | (56 | ) | (114 | ) | (56 | ) | |||||

| U.S. Commercial Business | (38 | ) | 13 | (84 | ) | (5 | ) | ||||||

International Cards | 59 | 24 | 179 | 37 | |||||||||

| International Consumer Finance | 135 | (10 | ) | 136 | (9 | ) | |||||||

| International Retail Banking | (93 | ) | (649 | ) | (275 | ) | (639 | ) | |||||

Smith Barney | (1 | ) | 7 | (1 | ) | 11 | |||||||

| Private Bank | 17 | 24 | 34 | 14 | |||||||||

| Consumer Other | 1 | — | — | (1 | ) | ||||||||

| Total Consumer | $ | (79 | ) | $ | (342 | ) | $ | (594 | ) | $ | (360 | ) | |

| Capital Markets and Banking | 109 | 158 | 258 | 125 | |||||||||

| Transaction Services | 7 | 9 | 9 | 13 | |||||||||

| Other CIB | — | (3 | ) | — | (3 | ) | |||||||

| Total CIB | $ | 116 | $ | 164 | $ | 267 | $ | 135 | |||||

| Total Citigroup | $ | 37 | $ | (178 | ) | $ | (327 | ) | $ | (225 | ) | ||

| By Region: | |||||||||||||

U.S. | $ | (134 | ) | $ | 407 | $ | (447 | ) | $ | 443 | |||

| Mexico | 6 | 26 | 51 | (69 | ) | ||||||||

| EMEA | 83 | (620 | ) | 41 | (493 | ) | |||||||

| Japan | 115 | 22 | 91 | 22 | |||||||||

| Asia | (70 | ) | 3 | (120 | ) | (43 | ) | ||||||

| Latin America | 37 | (16 | ) | 57 | (85 | ) | |||||||

| Total Citigroup | $ | 37 | $ | (178 | ) | $ | (327 | ) | $ | (225 | ) | ||

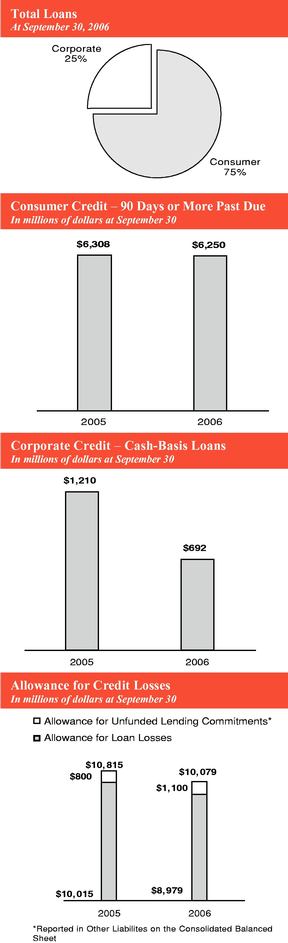

Allowance for Credit Losses

| In millions of dollars | Sept. 30, 2006 | Dec. 31, 2005 | Sept. 30, 2005 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Allowance for loan losses | $ | 8,979 | $ | 9,782 | $ | 10,015 | |||

| Allowance for unfunded lending commitments | 1,100 | 850 | 800 | ||||||

| Total allowance for loan losses and unfunded lending commitments | $ | 10,079 | $ | 10,632 | $ | 10,815 | |||

Hurricane Katrina

In the 2005 third quarter, the Company recorded a $222 million after-tax charge $(357 million pretax) for the estimated probable losses incurred from Hurricane Katrina. This charge consisted primarily of additional credit costs inU.S. Cards,U.S. Commercial Business, U.S. Consumer Lending andU.S. Retail Distribution businesses, based on total credit exposures of approximately $3.6 billion in the Federal Emergency Management Agency (FEMA) Individual Assistance designated areas. This charge did not include an after-tax estimate of $75 million $(109 million pretax) for fees and interest due from related customers that were waived during 2005.

Change in EMEA Consumer Write-off Policy

Prior to the third quarter of 2005, certain Western European consumer portfolios were granted an exception to Citigroup's global write-off policy. The exception extended the write-off period from the standard 120-day policy for personal installment loans, and was granted because of the higher recovery rates experienced in these portfolios. During 2005, Citigroup observed lower actual recovery rates, stemming primarily from a change in bankruptcy and wage garnishment laws in Germany and, as a result, rescinded the exception to the global standard. The net charge was $332 million $(490 million pretax) resulting from the recording of $1.153 billion of write-offs and a corresponding utilization of $663 million of reserves in the 2005 third quarter.

These write-offs did not relate to a change in the portfolio credit quality but rather to a change in environmental factors due to law changes and consumer behavior that led Citigroup to re-evaluate its estimates of future long-term recoveries and their appropriateness to the write-off exception.

United States Bankruptcy Legislation

On October 17, 2005, the Bankruptcy Reform Act (or the Act) became effective. The Act imposes a means test to determine if people who file for Chapter 7 bankruptcy earn more than the median income in their state and could repay at least $6,000 of unsecured debt over five years. Bankruptcy filers who meet this test are required to enter into a repayment plan under Chapter 13, instead of canceling their debt entirely under Chapter 7. As a result of these more stringent guidelines, bankruptcy claims accelerated prior to the effective date. The incremental bankruptcy losses over the Company's estimated baseline in 2005 that was attributable to the Act inU.S. Cards business was approximately $970 million on a managed basis $(550 million in the Company's on-balance portfolio and $420 million in the securitized portfolio). In addition, theU.S. Retail Distribution business incurred incremental bankruptcy losses of approximately $90 million during 2005.

Homeland Investment Act Benefit

The Company's 2005 third quarter results from continuing operations include a $185 million $(198 million for the 2005 full year) tax benefit from the Homeland Investment Act provision of the American Jobs Creation Act of 2004, net of the impact of remitting income earned in 2005 and prior years that would otherwise have been indefinitely invested overseas. The amount of dividends that were repatriated relating to this benefit is approximately $3.2 billion.

Copelco Litigation Settlement

In 2000, Citigroup purchased Copelco Capital, Inc., a leasing business, from Itochu International Inc. and III Holding Inc. (formerly known as Copelco Financial Services Group, Inc.) (collectively referred to herein as "Itochu") for $666 million. During 2001, Citigroup filed a lawsuit asserting breach of representations and warranties, among other causes of action, under the Stock Purchase Agreement entered into between Citigroup and Itochu in March of 2000. During the 2005 third quarter, Citigroup and Itochu signed a settlement agreement that mutually released all claims, and under which Itochu paid Citigroup $185 million.

Mexico Value Added Tax (VAT) Refund

During the 2005 third quarter, Citigroup Mexico received a $182 million refund of VAT taxes from the Mexican Government related to the 2003 and 2004 tax years as a result of a Mexico Supreme Court ruling. The refund was recorded as a reduction of $140 million (pretax) in other operating expense and $42 million (pretax) in other revenue.

Divestiture of the Manufactured Housing Loan Portfolio

On May 1, 2005, Citigroup completed the sale of its manufactured housing loan portfolio, consisting of $1.4 billion in loans, to 21st Mortgage Corp. The Company recognized a $109 million after-tax loss $(157 million pretax) in the 2005 first quarter related to the divestiture.

Repositioning Charges

The Company recorded a $272 million after-tax $(435 million pretax) charge during the 2005 first quarter for repositioning costs. The repositioning charges were predominantly severance-related costs recorded in CIB $(151 million after-tax) and in Global Consumer $(95 million after-tax). These repositioning actions were consistent with the Company's objectives of controlling expenses while continuing to invest in growth opportunities.

Resolution of Glendale Litigation

During the 2005 first quarter, the Company recorded a $72 million after-tax gain $(114 million pretax) following the resolution ofGlendale Federal Bank v. United States,an action brought by Glendale Federal Bank, a predecessor to Citibank (West), FSB, against the United States government.Markets & Banking.

Acquisition of First AmericanBisys

On May 2, 2007, the Company announced an agreement to acquire Bisys Group, Inc. (Bisys) for $1.45 billion. At closing, Citigroup will sell the Retirement and Insurance Services Divisions of Bisys to affiliates of J.C. Flowers & Co. LLC, making the net cost of the transaction to Citigroup approximately $800 million. Citigroup will retain the Investment Services Division of Bisys, which provides administrative services for hedge funds, mutual funds and private equity funds. The transaction is expected to close in the second half of 2007 and is subject to Bisys shareholder approval and to regulatory approvals in the U.S., Ireland and Bermuda. Bisys will be included within Citigroup'sTransaction Services business.

Tender Offer for Nikko Cordial

On April 26, 2007, Citigroup completed its successful tender offer to become the majority shareholder of Nikko Cordial Corporation in Japan. Approximately 541 million shares were tendered for approximately $7.7 billion. Following the May 9, 2007 scheduled closing date Citigroup will own a total ownership stake in excess of 60%. Once the tender offer is closed, Citigroup will consolidate Nikko and its operations with the minority stake disclosed as Minority Interest.

This acquisition accelerates Citigroup's growth strategy in the world's second largest economy and is intended to provide a broad base of global products and services to Nikko Cordial's client network.

Agreement to Acquire Old Lane Partners, L.P.

On April 13, 2007, the Company announced a definitive agreement to acquire 100% of the outstanding partnership interests in Old Lane Partners, L.P. and Old Lane Partners, GP, LLC (Old Lane). Old Lane is the manager of a global, multi-strategy hedge fund and a private equity fund with total capital under management and private equity commitments of approximately $4.5 billion. Old Lane will operate as part of Citigroup's Alternative Investments (CAI) business. Following the completion of the transaction, Old Lane's Vikram Pandit will become Chief Executive Officer of CAI. The transaction is subject to customary regulatory reviews and is expected to close in the third quarter of 2007.

Acquisition of ABN AMRO Mortgage Group

On March 1, 2007, Citigroup acquired ABN AMRO Mortgage Group (AAMG), a subsidiary of LaSalle Bank Corporation and ABN AMRO Bank N.V. AAMG is a national originator and servicer of prime residential mortgage loans. As part of this acquisition, Citigroup purchased approximately $12 billion in assets, including $3 billion of mortgage servicing rights. The acquisition of AAMG added approximately 1.5 million servicing customers to theU.S. Consumer Lendingportfolio.

Asia Acquisitions

Acquisition of Bank of Overseas Chinese

On April 9, 2007, Citigroup announced the agreement to acquire 100% of Bank of Overseas Chinese (BOOC) in Taiwan for approximately $427 million, subject to certain closing adjustments. BOOC offers a broad suite of corporate banking, consumer and wealth management products and services to more than one million clients through 55 branches in Taiwan.

This transaction will strengthen Citigroup's presence in Asia making it the largest international bank and 13th largest by total assets among all domestic Taiwan banks. Citigroup's acquisition of BOOC is subject to shareholder and U.S. and Taiwanese regulatory approvals and is expected to close during the second half of 2007.

Strategic Investment and Cooperation Agreement with Guangdong Development Bank

On March 31, 2005,December 17, 2006, a Citigroup-led consortium acquired an 85.6% stake in Guangdong Development Bank ("GDB"). Citigroup's share is 20% of GDB and its investment of approximately $725 million is accounted for under the equity method.

In accordance with the parties' agreement, Citigroup will have significant management influence at GDB to enhance GDB's management team and corporate governance standards, instill operational and lending best practices, improve risk management and internal controls, upgrade GDB's information technology infrastructure, and further develop GDB's customer service and product offerings.

U.K. Market Expansion

Egg

On May 1, 2007, Citigroup completed its acquisition of FirstEgg Banking plc (Egg), the world's largest pure online bank and one of the U.K.'s leading online financial services providers, from Prudential PLC for approximately $1.127 billion. Egg has more than three million customers and offers various financial products and services including online payment and account aggregation services, credit cards, personal loans, savings accounts, mortgages, insurance and investments.

Quilter

On March 1, 2007, the Company completed the acquisition of Quilter, a U.K. wealth advisory firm with over $10.9 billion of assets under management, from Morgan Stanley. Quilter has more than 18,000 clients and 300 staff located in 10 offices throughout the U.K., Ireland and the Channel Islands. Quilter's results are included within Global Wealth Management.

Central American BankAcquisitions

Grupo Cuscatlan

On December 13, 2006, Citigroup announced the agreement to acquire the subsidiaries of Grupo Cuscatlan for $1.51 billion in Texas (FAB).cash and stock from Corporacion UBC Internacional S.A. Grupo Cuscatlan is one of the leading financial groups in Central America, with assets of $5.4 billion, loans of $3.5 billion, and deposits of $3.4 billion. Grupo Cuscatlan has operations in El Salvador, Guatemala, Costa Rica, Honduras and Panama. This acquisition is subject to local country regulatory approvals and is expected to close during the second quarter of 2007.

Grupo Financiero Uno

On March 5, 2007, Citigroup completed its acquisition of Grupo Financiero Uno (GFU), the largest credit card issuer in Central America, and its affiliates.

The transaction established Citigroup's retail branch presence in Texas, giving Citigroup 106 branches, $4.2acquisition of GFU, with $2.2 billion in assets, and approximately 120,000 new customersexpands the presence of Citigroup's Latin America consumer franchise, enhances its credit card business in the state at the timeregion and establishes a platform for regional growth in Consumer Finance and Retail Banking.

GFU has more than one million retail clients, representing 1.1 million credit card accounts, $1.3 billion in credit card receivables and $1.5 billion in deposits in Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica and Panama. GFU operates a distribution network of the transaction's closing. The results75 branches and more than 100 mini-branches and points of FAB are includedsale.

EMEA Expansion

Purchase of 20% Equity Interest in the Consolidated Financial Statements from March 2005 forward.

Divestiture of CitiCapital's Transportation Finance BusinessAkbank

On January 31, 2005,9, 2007, Citigroup completed its purchase of a 20% equity interest in Akbank for approximately $3.1 billion. Akbank, the Company completedsecond-largest privately owned bank by assets in Turkey, is a premier, full-service retail, commercial, corporate and private bank.

Sabanci Holding, a 34% owner of Akbank shares, and its subsidiaries have granted Citigroup a right of first refusal or first offer over the sale of CitiCapital's Transportation Finance Businessany of their Akbank shares in the future. Subject to certain exceptions, including purchases from Sabanci Holding and its subsidiaries, Citigroup has otherwise agreed not to increase its percentage ownership in Akbank.

Resolution of Federal Tax Audit

In March 2006, the Company received a notice from the Internal Revenue Service (IRS) that they had concluded the tax audit for the years 1999 through 2002 (referred to hereinafter as the "resolution of the Federal Tax Audit"). For the first quarter of 2006, the Company released a total of $657 million from its tax contingency reserves related to the resolution of the Federal Tax Audit.

The following table summarizes the 2006 first quarter tax benefits, by business, from the resolution of the Federal Tax Audit:

| In millions of dollars | Total | ||

|---|---|---|---|

| Global Consumer | $ | 290 | |

| Markets & Banking | 176 | ||

| Global Wealth Management | 13 | ||

| Alternative Investments | 58 | ||

| Corporate/Other | 61 | ||

| Continuing Operations | $ | 598 | |

| Discontinued Operations | 59 | ||

| Total | $ | 657 | |

Adoption of the Accounting for Share-Based Payments

On January 1, 2006, the Company adopted Statement of Financial Accounting Standards (SFAS) No. 123 (revised 2004),"Share-Based Payment" (SFAS 123(R)), which replaced the existing SFAS 123 and superseded Accounting Principles Board (APB) Opinion No. 25. SFAS 123(R) requires companies to measure and record compensation expense for stock options and other share-based payments based in Dallason the instruments' fair value, reduced by expected forfeitures.

In adopting this standard, the Company conformed to recent accounting guidance that restricted or deferred stock awards issued to retirement-eligible employees who meet certain age and Torontoservice requirements must be either expensed on the grant date or accrued over a service period prior to GE Commercial Finance for total cash considerationthe grant date. This charge consisted of approximately $4.6 billion. The sale resulted in an$398 million after-tax gain of $111 million $(161($648 million pretax). for the immediate expensing of awards granted to retirement-eligible employees in January 2006.

The following table summarizes the SFAS 123(R) impact, by segment, on the 2006 first quarter pretax compensation expense for stock awards granted to retirement-eligible employees in January 2006 ("the 2006 initial adoption of SFAS 123(R)"):

| In millions of dollars | 2006 First Quarter | ||

|---|---|---|---|

| Global Consumer | $ | 121 | |

| Markets & Banking | 354 | ||

| Global Wealth Management | 145 | ||

| Alternative Investments | 7 | ||

| Corporate/Other | 21 | ||

| Total | $ | 648 | |

The Company recorded the quarterly accrual for the stock awards that were granted in January 2007 during each of the quarters in 2006. During the first quarter of 2007, the Company recorded the quarterly accrual for the estimated stock awards that will be granted in January 2008.

SEGMENT, PRODUCT AND REGIONAL NET INCOME

The following tables show the net income (loss) for Citigroup's businesses on a segment and product view and on a regional view:

Citigroup Net Income—Segment and Product View

| | | Three Months Ended September 30, | % | Nine Months Ended September 30, | % | | First Quarter | % Change | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

In millions of dollars | In millions of dollars | |||||||||||||||||||||||||||||

| In millions of dollars | 2006 | 2005(1) | Change | 2006 | 2005(1) | Change | 2007 | 2006(1) | 1Q07 vs. 1Q06 | |||||||||||||||||||||

| Global Consumer | Global Consumer | Global Consumer | ||||||||||||||||||||||||||||

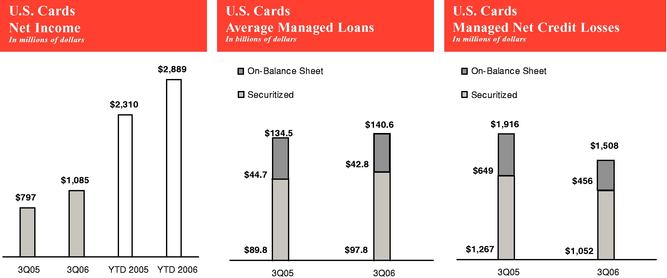

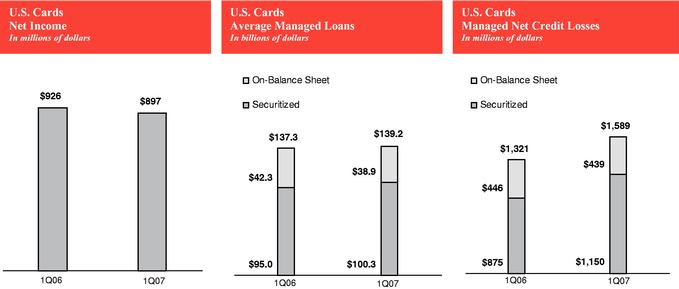

| U.S. Cards | $ | 1,085 | $ | 797 | 36 | % | $ | 2,889 | $ | 2,310 | 25 | % | U.S. Cards | $ | 897 | $ | 926 | (3 | )% | |||||||||||

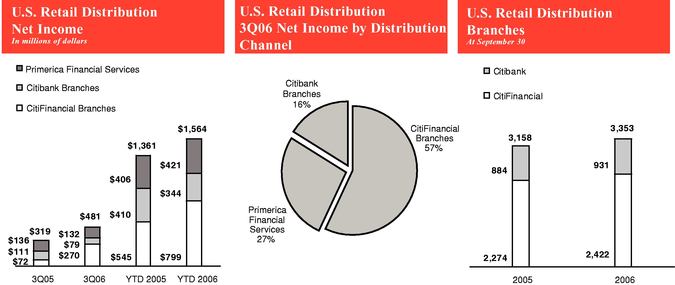

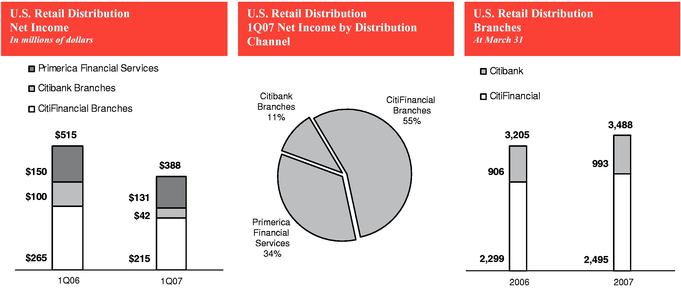

| U.S. Retail Distribution | 481 | 319 | 51 | 1,564 | 1,361 | 15 | U.S. Retail Distribution | 388 | 515 | (25 | ) | |||||||||||||||||||

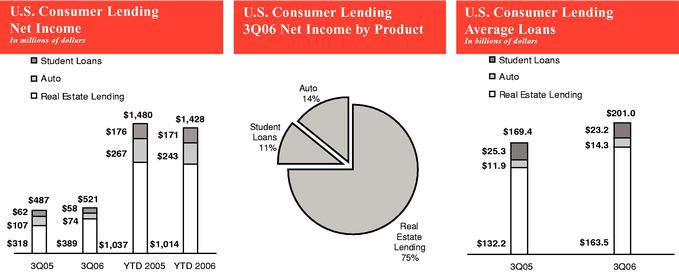

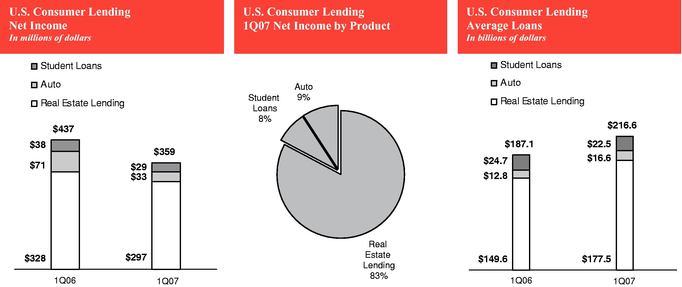

| U.S. Consumer Lending | 521 | 487 | 7 | 1,428 | 1,480 | (4 | ) | U.S. Consumer Lending | 359 | 437 | (18 | ) | ||||||||||||||||||

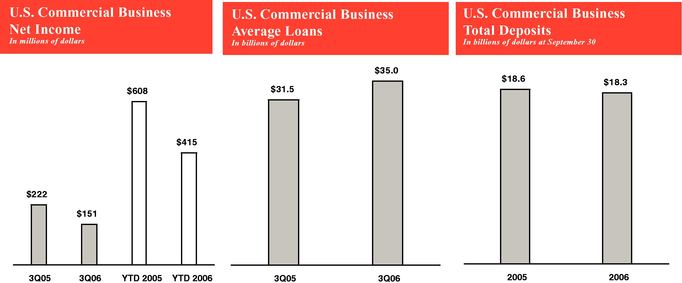

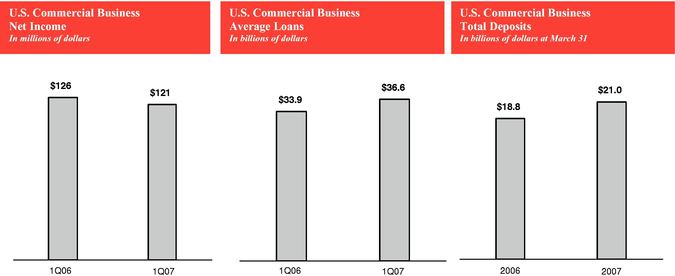

| U.S. Commercial Business | 151 | 222 | (32 | ) | 415 | 608 | (32 | ) | U.S. Commercial Business | 121 | 126 | (4 | ) | |||||||||||||||||

| Total U.S. Consumer(2) | $ | 2,238 | $ | 1,825 | 23 | % | $ | 6,296 | $ | 5,759 | 9 | % | Total U.S. Consumer(2) | $ | 1,765 | $ | 2,004 | (12 | )% | |||||||||||

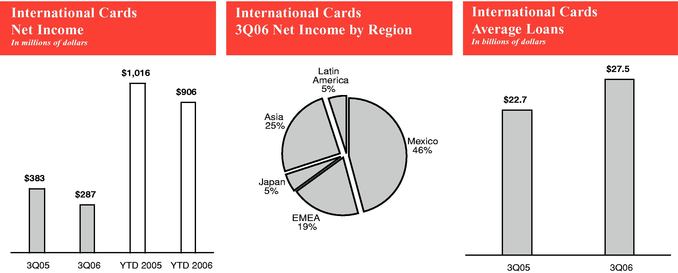

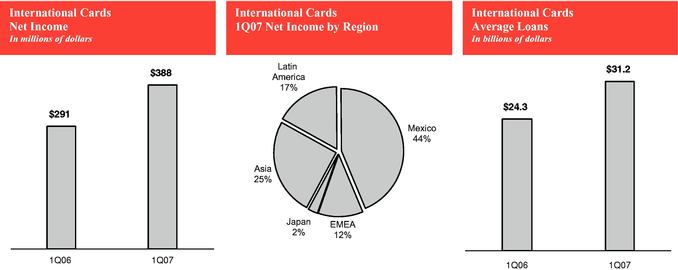

International Cards | $ | 287 | $ | 383 | (25 | )% | $ | 906 | $ | 1,016 | (11 | )% | International Cards | $ | 388 | $ | 291 | 33 | % | |||||||||||

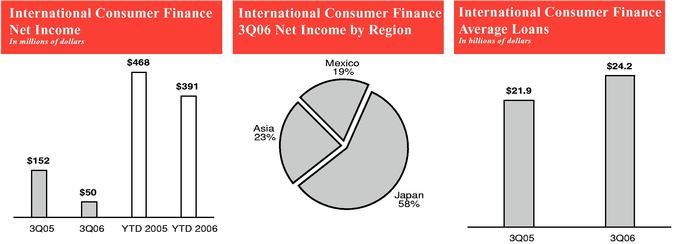

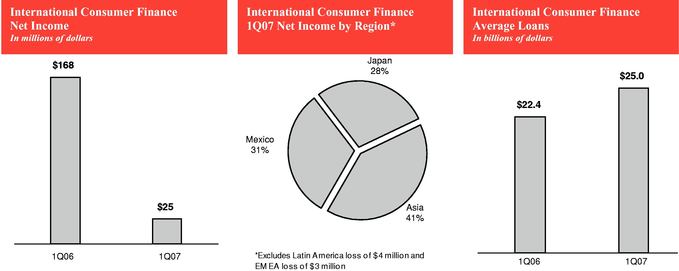

| International Consumer Finance | 50 | 152 | (67 | ) | 391 | 468 | (16 | ) | International Consumer Finance | 25 | 168 | (85 | ) | |||||||||||||||||

| International Retail Banking | 701 | 427 | 64 | 2,092 | 1,518 | 38 | International Retail Banking | 540 | 677 | (20 | ) | |||||||||||||||||||

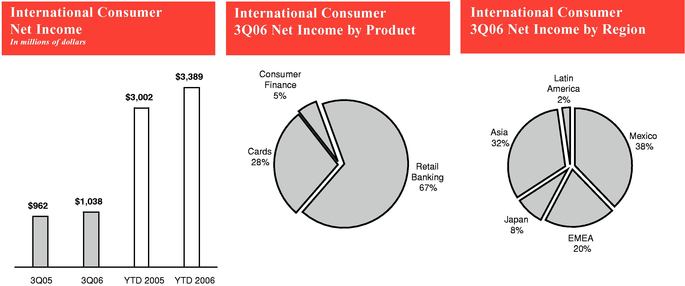

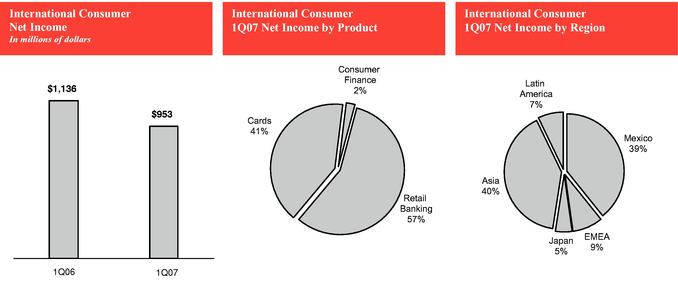

| Total International Consumer | $ | 1,038 | $ | 962 | 8 | % | $ | 3,389 | $ | 3,002 | 13 | % | Total International Consumer | $ | 953 | $ | 1,136 | (16 | )% | |||||||||||

Other | $ | (81 | ) | $ | (64 | ) | (27 | )% | $ | (240 | ) | $ | (298 | ) | 19 | % | Other | $ | (85 | ) | $ | (67 | ) | (27 | )% | |||||

| Total Global Consumer | $ | 3,195 | $ | 2,723 | 17 | % | $ | 9,445 | $ | 8,463 | 12 | % | Total Global Consumer | $ | 2,633 | $ | 3,073 | (14 | )% | |||||||||||

Corporate and Investment Banking | ||||||||||||||||||||||||||||||

Markets & Banking | Markets & Banking | |||||||||||||||||||||||||||||

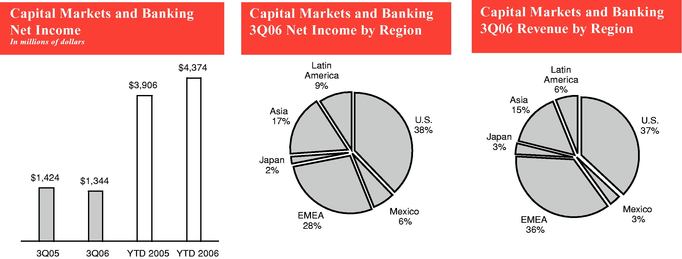

| Capital Markets and Banking | $ | 1,344 | $ | 1,424 | (6 | )% | $ | 4,374 | $ | 3,906 | 12 | % | Securities and Banking | $ | 2,173 | $ | 1,618 | 34 | % | |||||||||||

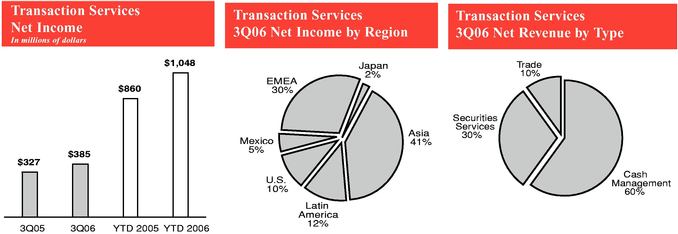

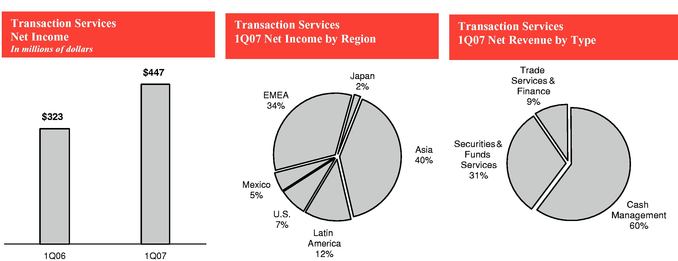

| Transaction Services | 385 | 327 | 18 | 1,048 | 860 | 22 | Transaction Services | 447 | 323 | 38 | ||||||||||||||||||||

| Other | (8 | ) | 46 | NM | (49 | ) | 82 | NM | Other | 1 | (12 | ) | NM | |||||||||||||||||

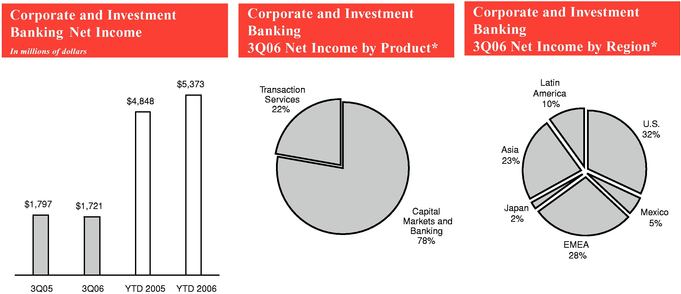

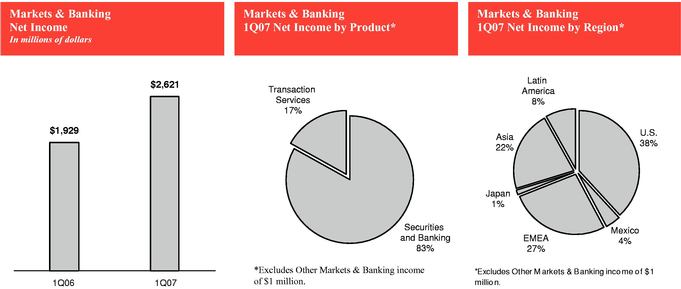

| Total Corporate and Investment Banking | $ | 1,721 | $ | 1,797 | (4 | )% | $ | 5,373 | $ | 4,848 | 11 | % | Total Markets & Banking | $ | 2,621 | $ | 1,929 | 36 | % | |||||||||||

Global Wealth Management | Global Wealth Management | Global Wealth Management | ||||||||||||||||||||||||||||

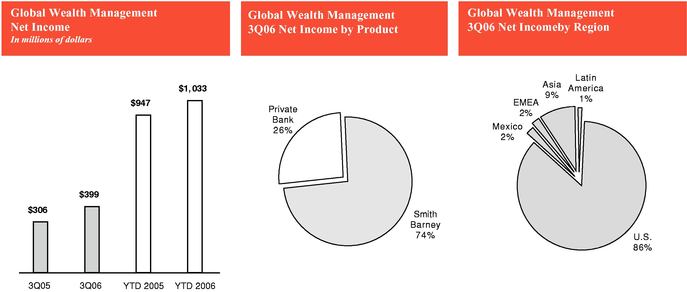

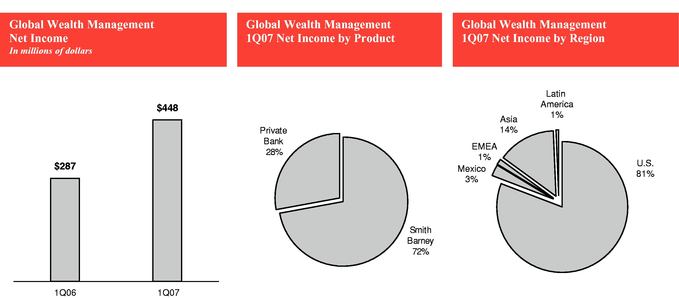

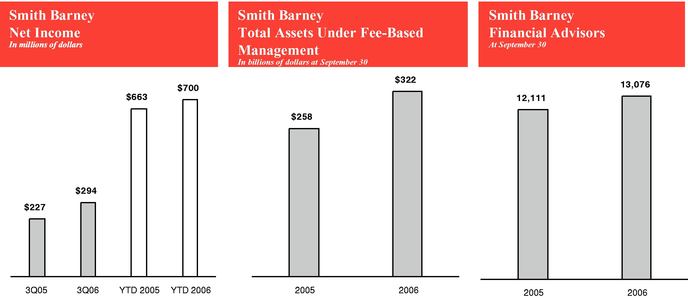

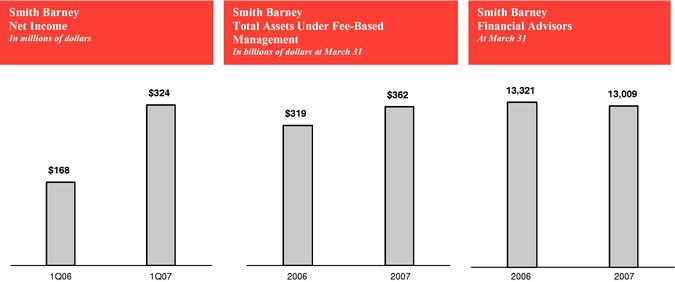

| Smith Barney | $ | 294 | $ | 227 | 30 | % | $ | 700 | $ | 663 | 6 | % | Smith Barney | $ | 324 | $ | 168 | 93 | % | |||||||||||

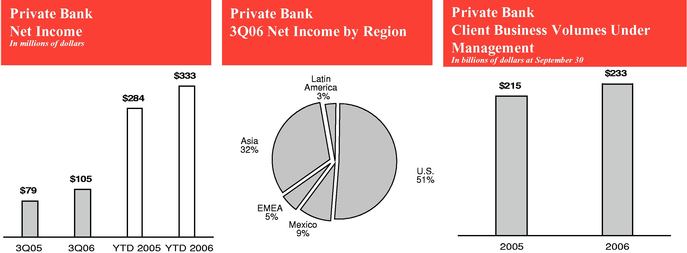

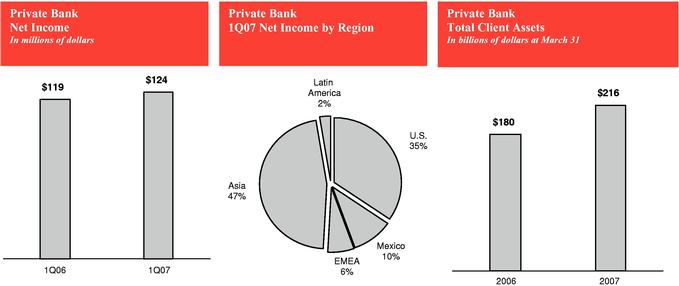

| Private Bank | 105 | 79 | 33 | 333 | 284 | 17 | Private Bank | 124 | �� | 119 | 4 | |||||||||||||||||||

| Total Global Wealth Management | $ | 399 | $ | 306 | 30 | % | $ | 1,033 | $ | 947 | 9 | % | Total Global Wealth Management | $ | 448 | $ | 287 | 56 | % | |||||||||||

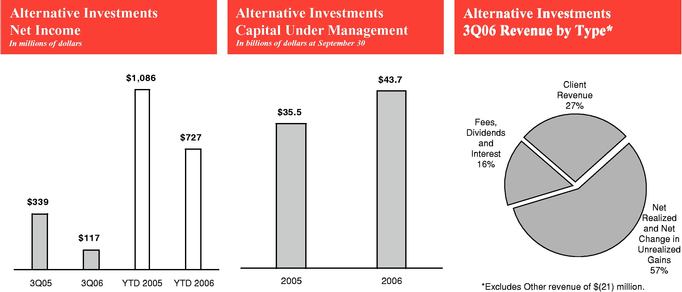

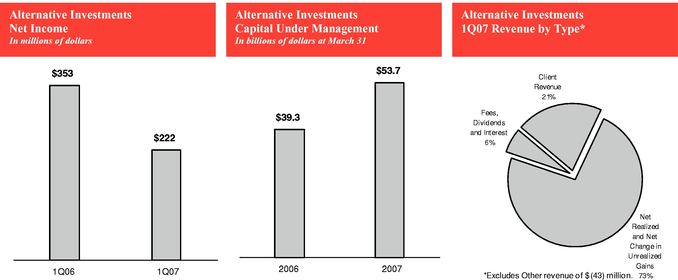

Alternative Investments | Alternative Investments | $ | 117 | $ | 339 | (65 | )% | $ | 727 | $ | 1,086 | (33 | )% | Alternative Investments | $ | 222 | $ | 353 | (37 | )% | ||||||||||

Corporate/Other | Corporate/Other | (129 | ) | (177 | ) | 27 | (458 | ) | (510 | ) | 10 | Corporate/Other | (912 | ) | (87 | ) | NM | |||||||||||||

| Income from Continuing Operations | Income from Continuing Operations | $ | 5,303 | $ | 4,988 | 6 | % | $ | 16,120 | $ | 14,834 | 9 | % | Income from Continuing Operations | $ | 5,012 | $ | 5,555 | (10 | )% | ||||||||||

| Income from Discontinued Operations(3) | Income from Discontinued Operations(3) | 202 | 2,155 | (91 | ) | 289 | 2,823 | (90 | ) | Income from Discontinued Operations(3) | — | 84 | NM | |||||||||||||||||

| Total Net Income | Total Net Income | $ | 5,505 | $ | 7,143 | (23 | )% | $ | 16,409 | $ | 17,657 | (7 | )% | Total Net Income | $ | 5,012 | $ | 5,639 | (11 | )% | ||||||||||

Citigroup Net Income—Regional View

| | | Three Months Ended September 30, | % | Nine Months Ended September 30, | % | | First Quarter | % Change | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

In millions of dollars | In millions of dollars | |||||||||||||||||||||||||||||

| In millions of dollars | 2006 | 2005(1) | Change | 2006 | 2005(1) | Change | 2007 | 2006(1) | 1Q07 vs. 1Q06 | |||||||||||||||||||||

| U.S.(2) | U.S.(2) | U.S.(2) | ||||||||||||||||||||||||||||

| Global Consumer | $ | 2,157 | $ | 1,761 | 22 | % | $ | 6,056 | $ | 5,461 | 11 | % | Global Consumer | $ | 1,680 | $ | 1,937 | (13 | )% | |||||||||||

| Corporate and Investment Banking | 540 | 637 | (15 | ) | 1,802 | 1,992 | (10 | ) | Markets & Banking | 999 | 515 | 94 | ||||||||||||||||||

| Global Wealth Management | 342 | 288 | 19 | 860 | 876 | (2 | ) | Global Wealth Management | 361 | 228 | 58 | |||||||||||||||||||

| TotalU.S. | $ | 3,039 | $ | 2,686 | 13 | % | $ | 8,718 | $ | 8,329 | 5 | % | TotalU.S. | $ | 3,040 | $ | 2,680 | 13 | % | |||||||||||

Mexico | Mexico | Mexico | ||||||||||||||||||||||||||||

| Global Consumer | $ | 395 | $ | 511 | (23 | )% | $ | 1,128 | $ | 1,156 | (2 | )% | Global Consumer | $ | 372 | $ | 358 | 4 | % | |||||||||||

| Corporate and Investment Banking | 95 | 177 | (46 | ) | 261 | 336 | (22 | ) | Markets & Banking | 114 | 78 | 46 | ||||||||||||||||||

| Global Wealth Management | 9 | 12 | (25 | ) | 27 | 35 | (23 | ) | Global Wealth Management | 12 | 8 | 50 | ||||||||||||||||||