1.

Summary of Significant Accounting Policies and Business Operations

Business Operations

Thunder Mountain Gold, Inc. (“Thunder Mountain”, “THMG”, or “the Company”) was originally incorporated under the laws of the State of Idaho on November 9, 1935, under the name of Montgomery Mines, Inc. In April 1978, the Montgomery Mines Corporation was obtained by a group of the Thunder Mountain property holders and changed its name to Thunder Mountain Gold, Inc., with the primary goal to further develop their holdings in the Thunder Mountain Mining District, located in Valley County, Idaho. Thunder Mountain Gold, Inc. takes its name from the Thunder Mountain Mining District, where its principal lode mining claims were located. For several years, the Company’s activities were restricted to maintaining its property position and exploration activities. During 2005, the

The Company sold its holdings in the Thunder Mountain Mining District. DuringDistrict in 2005 and began the process of acquiring and developing another project. In 2007, the Company acquired the South Mountain Mines property in Owyhee County, located in southwest Idaho, and initiated exploration activities on that property, which continue today. The Company also acquired additional claims on prospective ground in the Reese River Valley, 20 miles south of Battle Mountain, in Lander County Nevada.

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp. Under the terms of the BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of South Mountain Mines, Inc. (“SMMI”) from Thunder Mountain Resources, Inc. (“TMRI”), both wholly owned subsidiaries of the Company. The term of the agreement is for two years, with an option to extend to three years, with BeMetals conducting a preliminary economic assessment ("PEA") completed by a mutually agreed third-party engineering firm. Over its term, this agreement requires cash payments to the Company of $1,350,000; $1,100,000 in cash and $250,000 in exchange for shares of the Company’s common stock. For the six months ended June 30, 2020, the Company recognized $150,000 in management services income. In the event that BeMetals decides not to proceed with the South Mountain Project, BeMetals will not be obligated to make any additional payments. See Note 3 for further information.

Basis of Presentation and Going Concern

The accompanyingThese unaudited interim consolidated financial statements have been prepared by the management of the Company in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information, as well as the instructions to the Form 10-Q.information. Accordingly, the financial statementsthey do not include all of the information and footnotes required by U.S. GAAPgenerally accepted accounting principles for complete consolidated financial statements. In the opinion of ourthe Company’s management, all adjustments (consisting of only normal recurring accruals) considered necessary for a fair presentation of the interim consolidated financial statements have been included.

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and expenses during the reporting period. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of the Company's financial statements; accordingly, it is possible that the actual results could differ from these estimates and assumptions, which could have a material effect on the reported amounts of the Company's financial position and results of operations. Operating results for the nine-month periodsix months ended SeptemberJune 30, 20172020 are not necessarily indicative of the results that may be expected for the full year ending December 31, 2017. 2020.

For further information refer to the financial statements and the footnotes thereto in our Annual Report on Form 10-Kthe Company’s audited financial statements for the year ended December 31, 2016.2019 as filed with the Securities and Exchange Commission.

The accompanying consolidated financial statements have been prepared under the assumption that the Company will continue as a going concern. The Company is an exploration stage company and has historically incurred losses, and does not have sufficient cash at September 30, 2017 to fund normal operations forhowever, under the next 12 months. TheBeMetals Option Agreement (Note 3), the Company now has noa recurring source of revenue, and its ability to continue as a going concern is no longer dependent on equity capital raises and borrowings. However, if necessary, the Company’s

Company continues to have the ability to raise additional capital in order to fund its future exploration and working capital requirements. The Company’s plans for the long-term return to and continuation as a going concern include financingoperating on the Company’s future operations through sales of its common stock and/or debtcash flows and consideration payments provided under the eventual profitable exploitation of its mining properties. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company is currently investigating a number of alternatives for raising additional capital with potential investors, lessees and joint venture partners.BeMetals Option Agreement.

The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis was not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

Reclassifications

Certain reclassifications have been made to conform prior period’s data to the current presentation. These reclassifications have no effect on previously reported operations, stockholders’ equity (deficit) or cash flows.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company; its wholly owned subsidiaries, Thunder Mountain Resources, Inc. (“TMRI”) and South Mountain Mines, Inc. (“SMMI”); and effective November 6, 2016, a company in which the Company owns 75% and has majority control, Owyhee Gold Trust, LLC (“OGT”). Intercompany accounts are eliminated in consolidation.

The Company has established 75% ownership and full management of OGT. Thus, OGT’s financial information is included 100% in the Company’s consolidated financial statements since November 6, 2016. The Company’s consolidated financial statements reflect the other investor’s 25% non-controlling, capped interest in OGT. See Note 3 for further information. Intercompany accounts are eliminated in consolidation.

Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The more significant areas requiring the use of management estimates and assumptions include the carrying value of properties and mineral interests, environmental remediation liabilities, deferred tax assets, stock

6

based compensation and the fair value of financial and derivative instruments.stock-based compensation. Management’s estimates and assumptions are based on historical experience and other assumptions believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Cash and cash equivalentsRevenue Recognition

For the purposes of the balance sheet and statement of cash flows,Management service revenue is recognized when the Company considers all highly liquid investments withhas satisfied its performance obligation required under its management contract. Such obligation is satisfied over time as work is performed and the Company has a maturity of three months or less when purchasedcontractual right to be a cash equivalent.payment.

Income Taxes

The Company recognizes deferred income tax liabilities or assets at the end of each period using the tax rate expected to be in effect when the taxes are actually paid or recovered. A valuation allowance is recognized on deferred tax assets when it is more likely than not that some or all of the deferred tax assets will not be realized.

Cash and Cash Equivalents

For the purposes of the balance sheet and statement of cash flows, the Company considers all highly liquid investments with a maturity of three months or less when purchased to be a cash equivalent.

Fair Value Measurements

When required to measure assets or liabilities at fair value, the Company uses a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used. The Company determines the level within the fair value hierarchy in which the fair value measurements in their entirety fall. The categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Level 1 uses quoted prices in active markets for identical assets or liabilities, Level 2 uses significant other observable inputs, and Level 3 uses significant unobservable inputs. The amount of the total gains or losses for the period are included in earnings that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still held at the reporting date. At June 30, 2020, the Company has one financial asset, an investment in marketable equity security, that is adjusted to fair value on a recurring basis for which the fair value is determined based on Level 1 inputs as the equity security is traded on a stock exchange. The Company has no financial assets or liabilities that are adjusted to fair value on a recurring basis.

Financial Instruments

The Company’s financial instruments include cash and cash equivalents, investment in equity security and related party notes payable the carrying value of which approximates fair value based on the nature of those instruments.

Investments

The Company determines the appropriate classification of investments at the time of acquisition and re-evaluates such determinations at each reporting date. Equity securities determined to be marketable are carried at fair value determined using Level 1 fair value measurement inputs with the change in fair value recognized as unrealized gain (loss) in the consolidated statement of operations each reporting period. Gains and losses on the sale of securities are recognized on a specific identification basis.

Mineral Interests

The Company capitalizes costs for acquiring mineral interests, and expenses costs to maintain mineral rights and leases as incurred. Exploration costs are expensed in the period in which they occur. Should a property reach the production stage, these capitalized costs would be amortized using the units-of-production method based on the basis of periodic estimates of ore reserves. Mineral propertiesinterests are periodically assessed for impairment of value and any subsequent losses are charged to operations at the time of impairment.

If a propertymineral interest is abandoned or sold, its capitalized costs are charged to operations.

Property and Equipment

Property and equipment are stated at cost. Depreciation and amortization are based on Consideration received by the estimated useful livesCompany pursuant to joint ventures or purchase option agreements is applied against the carrying value of the assetsrelated mineral interest. When and are computed using straight-line or units-of-production methods. The expected useful livesif payments received exceed the carrying value, the excess amount is recognized as a gain in the consolidated statement of most ofoperations in the Company’s equipment ranges between 3 and 10 years. When assets are retired or sold,period the costs and related allowances for depreciation and amortization are eliminated from the accounts and any resulting gain or lossconsideration is reflected in operations.received.

Investments in Joint Venture

The Company’s accounting policy for joint ventures is as follows:

1.

The Company uses the cost method when it does not have joint control or significant influence in a joint venture. Under the cost method, these investments are carried at cost. If other than temporary impairment in value is determined, it would then be charged to current net income or loss.

2.

If the Company enters into a joint venture in which there is joint control between the parties or the Company has significant influence, the equity method is utilized whereby the Company’s share of the ventures’venture’s earnings and losses is included in the statement of operations as earnings in joint ventures and its investments therein are adjusted by a similar amount. If other than temporary impairment in value is determined, it would then be charged to current net income or loss.

3.

In a joint venture where the Company holds more than 50% of the voting interest and has significant influence, the joint venture is typically consolidated with the presentation of non-controlling interest. In determining whether significant influences exist, the Company considers its participation in policy-making decisions and its representation on the

7

venture’s management committee. See Note 3 regarding the Company’s accounting for its investment in Owyhee Gold Trust, LLC,LLC.

Reclamation and Remediation

The Company’s operations have been, and are subject to, standards for mine reclamation that have been established by various governmental agencies. The Company would record the fair value of an asset retirement obligation as a liability in the period in which the Company incurred a legal obligation for the retirement of tangible long-lived assets. A corresponding asset would also be recorded and depreciated over the life of the asset.

After the initial measurement of the asset retirement obligation, the liability is adjusted at the end of each reporting period to reflect changes in the estimated future cash flows underlying the obligation.

Determination of any amounts recognized upon adoption is based upon numerous estimates and assumptions, including future retirement costs, future inflation rates and the credit-adjusted risk-free interest rates.

For non-operating properties, the Company accrues costs associated with environmental remediation obligations when it is probable that such costs will be incurred, and they are reasonably estimable. Such costs are based on management’s estimate of amounts expected to be incurred when the remediation work is performed.

Share-Based Compensation

Share-based payments to employees and directors, including grants of employee stock options, are measured at fair value and expensed in the consolidated statement of operations over the vesting period.

Recent Accounting Pronouncements

Accounting Standards Updates Adopted

In November 2015,August 2018, the Financial Accounting Standards Board ("FASB")FASB issued Accounting Standards Update (“ASU”)ASU No. 2015-17 Income Taxes2018-13 Fair Value Measurement (Topic 820): Disclosure Framework - Balance Sheet Classification of Deferred Taxes (Topic 740).Changes to the Disclosure Requirements for Fair Value Measurement. The update is designedremoves, modifies and makes additions to reduce complexity of reporting deferred income tax liabilities and assets into current and non-current amounts in a statement of financial position. ASU No. 2015-17 requires the presentation of deferred income taxes, changes to deferred tax liabilities and assets be classified as non-current in the statement of financial position.disclosure requirements on fair value measurements. The update is effective for fiscal years beginning after December 15, 2016.2019, with early adoption permitted. The adoptionCompany evaluated the new standard in the first quarter of this update on January 1, 2017 had no2020 and determined that ASU 2018-13 did not have an impact on the Company’s consolidated financial statements.statement disclosures.

Accounting Standards Updates to Become Effective in Future Periods

In March 2016,December 2019, the FASB issued ASU No. 2016-09 Compensation - Stock Compensation2019-12 Income Taxes (Topic 718)740): Improvements to Employee Share-Based Payment Accounting.Simplifying the Accounting for Income Taxes. The update simplifiescontains a number of provisions intended to simplify the accounting for stock-based compensation, including income tax consequences and balance sheet and cash flow statement classification of awards.taxes. The update is effective for fiscal years beginning after December 15, 2016,2020, with early adoption permitted. The adoptionManagement is evaluating the impact of this update on January 1, 2017 had no impact on the Company’s consolidated financial statements.

In August 2016, the FASB issued ASU No. 2016-15 Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The update provides guidance on classification for cash receipts and payments related to eight specific issues. The update is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years, with early adoption permitted. The Company is currently evaluating the impact of implementing this update on the consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-01 Business Combinations (Topic 805): Clarifying the Definition of a Business. The update clarifies the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The update is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. The Company will apply the provisions of the update to potential future acquisitions occurring after the effective date.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its financial condition, results of operations, cash flows or disclosures.

8

Net Income (Loss) Per Share

The Company is required to have dual presentation of basic earnings per share (“EPS”) and diluted EPS. Basic EPS is computed as net income (loss) divided by the weighted average number of common shares outstanding for the period. Diluted EPS is calculated based on the weighted average number of common shares outstanding during the period plus the effect of potentially dilutive common stock equivalents, including options and warrants to purchase the Company’s common stock. As of September 30, 2017, and 2016, potentiallyThe potential dilutive common stock equivalents for each period are as follows:

For the six months ended June 30, 2020, stock options of 5,705,000 are excluded from the calculation of diluted income per share as the options’ exercise prices was not includedlower than the average share price during the period.

For the six months ended June 30, 2019, stock options of 5,035,000 are excluded in the calculation of diluted earningsincome per share as their effect would have been anti-dilutive are:the options’ exercise prices was not lower than the average share price during the period

| | |

| 2017 | 2016 |

Stock options | 4,700,000 | 4,515,000 |

Warrants | - | 3,590,000 |

Total possible dilution | 4,700,000 | 8,105,000 |

2. Mineral Interest Commitments

Commitments

During 2008 and 2009, threeThe Company has two lease arrangements were made with land ownerslandowners that own land parcels adjacent to the Company’s South Mountain patented and unpatented mining claims. The leases were originally for a seven-year period, with annual payments based onof $20 per acre. The leases were renewed for an additional 10 years at $30 per acre paid annually, theseannually; committed payments are listed in the table below. The lease paymentsleases have no work requirements.

| |

| Annual Payment |

Acree Lease (June) | $3,390 |

Lowry Lease (October) | 11,280 |

Idaho South Mountain LLC Lease (April)

| 1,680

|

Total | $16,35014,670 |

On March 21, 2011, the Company signed an exploration agreement with Newmont Mining Corporation (“Newmont”) on the Trout Creek Project that significantly expands the Trout Creek target area. Newmont’s private mineral package added to the Project surrounds the Company’s South Mountain claim group and consists of about 9,565 acres within a thirty-square mile Area of Influence defined in the agreement. Under the terms of the agreement, the Company is responsible for conducting the exploration program and is obligated to expend a minimum of $150,000 over the ensuing two years, with additional expenditures possible in future years.

On October 1, 2015, the Company signed an Amendment with Newmont USA Limited that modifies and extends the original Trout Creek Joint Exploration Agreement. The extension allows the Company modified work commitments on the project reducing the annual amount to $150,000 of work obligations by October 31, 2016.

On October 27, 2016, the Company decided to terminate the exploration agreement with Newmont. The Company still retainshas 78 unpatented claims (1,600 acres) in the Trout Creek area and 21 unpatented claims in the South Mountain area. The claim fees are paid on these unpatented claims annually as follows:

Target Area | 2020 |

Trout Creek -State of Nevada | $12,090 |

Trout Creek -Lander County, Nevada | 940 |

South Mountain-State of Idaho | 3,255 |

Total | $16,285 |

3.South Mountain Project

BeMetals Option Agreement:

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp., a British Columbia corporation (“BeMetals”), and BeMetals USA Corp., a Delaware corporation (“BMET USA”), a wholly owned subsidiary of BeMetals. Under the terms of the target area.BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of SMMI from TMRI, both wholly owned subsidiaries of the Company. SMMI is the Company’s subsidiary that holds the Company’s investment in the South Mountain project mineral interest. The Company pays annual feesterm of the agreement is for two years with BeMetals completing a preliminary economic assessment ("PEA") completed by a mutually agreed third-party engineering firm.

Pursuant to BLMthe BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of $3,255the outstanding shares of SMMI from TMRI if the following obligations are satisfied:

·Tranche 1: cash payment of $100,000 to TMRI within 1 business day of delivery of voting support agreements from shareholders of THMG who hold or control shares carrying more than 50% of the voting rights attached to all outstanding THMG Shares. Payment was received on March 5, 2019 and Lander County $940 feesis nonrefundable.

·Tranche 2: Tranche 2 conditions were completed on June 10, 2019. issuance of 10 million common shares in maintaining the property.capital of BMET USA to TMRI (received on June 10, 2019 with a fair value on that date of $1,883,875; and

·BMET USA purchase of 2.5 million shares of THMG common stock at a price of $0.10 per share, for an aggregate purchase price of $250,000, on a private placement basis (received June 2019).

·Tranche 3: cash payment of $250,000 on or before the 6-month anniversary of the Tranche 2. Payment was received on December 10, 2019 and is nonrefundable.

·Tranche 4: cash payment of $250,000 on or before the 15-month anniversary of the Tranche 2, which is September 10, 2020.

·Tranche 5: cash payment of $250,000 on or before the 21-month anniversary of the Tranche 2, which is March 10, 2021.

·Tranche 6: cash payment of $250,000 plus an additional payment paid in cash, BMET USA common shares or a combination of both, due on or before the 27-month anniversary of Tranche 2, which is September 10, 2021. The calculation of the additional payment is an amount equal to the lesser of 50% of the market capitalization of BeMetals at the time, and the greater of either $10 million; or 20% the net present value of the South Mountain Project as calculated in a PEA.

On November 4, 2016,May 18, 2020, the Company agreedextended the BMET Option Agreement by three months from the existing BeMetals Option Agreement date, due to the COVID-19 pandemic, and business conditions surrounding restricted international travel, and corresponding access to capital markets. The Company’s financial position was not significantly impacted due to the extension.

Concurrent with the BeMetals Option Agreement, BMET USA and SMMI entered into a management contract whereby BeMetals will pay its former partner $5,000 per year in advanced royalties on$25,000 monthly to SMMI for management services to enable BMET to perform exploration and development work with respect to the South Mountain Project. See Note 3 regarding royalty requirementsManagement service income of $75,000 per quarter for a total of $150,000 was recognized for the South Mountain Project.three and six periods ended June 30, 2020, respectively. Management service income of $50,000 was recognized for the three- and six-month periods ended June 30, 2019.

3.

South Mountain Project

On November 8, 2012, the Company, through its wholly-owned subsidiary South Mountain Mines, Inc., (“SMMI”), and Idaho State Gold Company II, LLC (“ISGC II”) formed the Owyhee Gold Trust, LLC, (“OGT”) a limited liability company. In 2015 and through November 2016, disagreements betweenBeMetals provides funding to SMMI and ISGC II resulted in litigation about the status of OGT. In November 2016, the parties entered into judicially-confirmed Settlement Agreement and Release that resolved outstanding disagreements, and provided for a new operating agreement by which SMMI obtained an option to acquired 100% of OGT’s interest in the South Mountain Project.

ongoing project expenses, including office lease payments. Under the newterms of the Option Agreement, SMMI’s management provides BeMetals a request for fund monthly to cover the upcoming month’s expenses. At June 30, 2020 and December 31, 2019, advances received from BeMetals that have not yet been spent totaled $7,356 and $78,539, respectively.

SMMI Joint Venture – OGT, operating agreement,LLC

The Company’s wholly owned subsidiary SMMI is the sole manager and pays all expenses for exploration and development of the property. SMMI and ISGC II have 75% and 25% ownership, respectively,South Mountain Project in OGT. SMMI and OGT haveits entirety through a separate Mining Lease with Option to Purchase (“Lease Option”) under which SMMI has an option to purchasewith the South Mountain mineral interest forCompany’s majority-owned subsidiary OGT. The Lease Option includes a capped $5 million less net returns royalties paid through the date of exercise. The Lease Option expires

9

in November 2026. If SMMI exercises the option, the option payment of $5 million less advance royalties will be distributed 100% by OGT to ISGC II.OGT’s minority member. Under the Lease Option, SMMI pays aan advance $5,000 net returns royalty to OGT annually on November 4.4 which is distributed to OGT’s minority member.

During 2015 and through

4. Investment in Equity Security

In June 2019 in connection with the settlement date (November 6, 2016)BeMetals Option Agreement (see Note 3), the Company managedreceived 10,000,000 shares of BeMetals Corp. common stock that had a fair value of $1,883,875 when received. At June 30, 2020, and December 31, 2019, the South Mountain mineral interests and recognized expenses as Company expenses.

The carryingfair value of the mineral propertyshares is $479,477 at$2,349,971 and $1,735,830, respectively. For the six-and three months ended June 30, 2020, the Company recognized an unrealized gain for the change in fair value of the investment of $614,141, and $1,400,412, respectively. For the six-and three months ended June 30, 2019, the Company recognized an unrealized loss for the change in fair value of the investment of $50,726 for both September 30, 2017 and December 31, 2016.periods.

4.5. Property and Equipment

The Company’s property and equipment are as follows:

| | |

| | June 30, 2020 | | December 31, 2019 |

Vehicles | $ | 22,441 | | $22,441 |

Buildings | | 65,071 | | 65,071 |

Construction Equipment | | 36,447 | | 36,447 |

Mining Equipment | | 58,646 | | 58,646 |

| | 182,605 | | 182,605 |

Accumulated Depreciation | | (167,172) | | (156,694) |

| | 15,433 | | 25,911 |

Land | | 280,333 | | 280,333 |

Total Property and Equipment | $ | 295,766 | | $306,244 |

6. SBA PPP Loan

| | | | |

| | September 30, 2017 | | December 31, 2016 |

Vehicles | $ | 22,441 | $ | 22,441 |

Buildings | | 65,071 | | 65,072 |

Construction Equipment | | 36,447 | | 87,806 |

Mining Equipment | | 58,646 | | 58,646 |

| | 182,605 | | 233,965 |

Accumulated Depreciation | | (63,291) | | (15,047) |

| | 119,314 | | 218,918 |

Land | | 280,333 | | 280,333 |

Total Property and Equipment | $ | 399,647 | $ | 499,251 |

On August 22, 2017,March 27, 2020, the Company’s boardCoronavirus Aid, Relief, and Economic Security (the “CARES Act”) Act was signed into United States law.

In April 2020, the Company received a loan of directors approved a resolution$48,000 pursuant to sell a Caterpillar 950G loader to a construction companythe Paycheck Protection Program (the “PPP”) under Division A, Title I, Section 1102 and 1106 of the CARES Act. The loan, which was in the form of a promissory note, as amended, dated April 21, 2020 issued by the Company (the “Note”); the Note matures on April 13, 2022 and bears interest at a rate of 1% per annum, payable monthly commencing on August 13, 2021. The Note may be prepaid by the Company at any time prior to maturity with no prepayment penalties. Under the terms of the PPP, certain amounts of the loan may be forgiven if they are used for qualifying expenses as described in the CARES Act. Qualifying expenses include payroll costs, costs used to continue group health care benefits, mortgage payments, rent, and utilities. The Company intends to use the entire loan amount of $41,000 cash. This asset had a carrying value of $42,021 resulting in a loss on sale of equipment of $1,021.for qualifying expenses, but there is no guarantee that the loan will be forgiven.

5. 7.Related Parties Notes Payable

At January 1, 2016,June 30, 2020, and December 31, 2019 the Company had notes payable balances of $84,268$66,768 and $86,808$39,808 with Eric Jones, the Company’s President and Chief Executive Officer and Jim Collard,Collord, the Company’s Vice President and Chief Operating Officer, respectively.

On January 18, 2016, the Company initiated a private offering for an aggregate 6,700,000 shares of common stock. In connection with this offering, Jim Collord and Eric Jones exchanged $25,000 each of their related notes payables for a total of 1 million shares. On November 15, 2016, Jim Collord exchanged an additional $2,000 to exercise warrants and received 20,000 shares of common stock.

On July 8, 2016, the Company executed two new promissory notes payable to Eric Jones and Jim Collord. The amount of the notes was $15,000 and $10,000, respectively, for a total of $25,000. The terms of these note are a 2% interest rate accrued per month for a term of two months. During the year ended December 31, 2016, the Company paid $17,500 on Mr. Jones’ outstanding note balance. At September 30, 2017 and December 31, 2016, the notes payable balances were $56,768 and $69,808 for Mr. Jones and Mr. Collord, respectively. These notes, as amended, bear interest at 1.0% to 2.0% per month and are due December 31, 20172020.

On June 21, 2017, the Company originated a short term promissory notes payable to a Director of the Company, Paul Beckman. The note has a principal amount of $20,000 with simple interest calculated at 1% per month. On July 19, 2017, Mr. Beckman exercised stock options for 275,000 shares of common stock for total consideration of $28,275 which was in the form of the balance due on his note and accrued interest payable of $20,000 and $125, respectively, and $8,150 in cash.

6.

8.Related Party Transactions:Transactions

In addition to the related parties notes payable discussed in Note 5,7, the Company had the following related party transactions.transactions:

Three of the Company’s officers arebegan deferring compensation for services. At Septemberservices on April 1, 2015. On July 31, 2018, the Company stopped expensing and deferring compensation for the three Company officers in the interest of marketing the SMMI project. As part of the BeMetals agreement (Note 3), the Company resumed compensation for these officers on May 15, 2019. The officers deferred compensation balances at June 30, 2017,2020 and December 31, 2019 represent the amounts due thembalances deferred prior to the BeMetals agreement and are as follows: Eric Jones, President and Chief Executive Officer - $320,000 (December 31, 2016 – $230,000),$420,000; Jim Collord, Vice President and Chief Operating Officer - $320,000 (December 31, 2016 - $230,000),

10

$420,000; and Larry Thackery, Chief Financial Officer - $162,500 (December 31, 2016 - $108,500). Compensation expense for services performed by these related parties was $78,000 and $78,000 during the quarters ended September 30, 2017 and 2016, respectively and $234,000 and $231,000 during the nine months ended September 30, 2017 and 2016, respectively. $201,500.

The Company engaged Baird Hanson LLP (“Baird”), a company owned by one of the Company’s directors, to provide legal services.services in 2018. In advance of the BeMetals transaction Mr. Baird had no legal expenses in 2017. Legal expenseswithdrew Baird Hanson LLP as counsel to avoid any appearance of $54,000 were incurred duringa conflict with the nine months ended Septemberthen-proposed BeMetals Corp. transaction. At June 30, 2016. At September 30, 20172020 and December 31, 2016,2019, the balance due to Baird is $181,313. was $206,685 and $216,685 respectively.

DuringSince 2017, Jim Collord and Eric Jones havehas advanced funds to the Company for operating expenses. The balances due them on Septemberbalance of Mr. Jones’ advances at June 30, 2017 were $5,0352020 and $10,971, respectively, and areDecember 31, 2019 was $17,146; the balance is included in Accountsaccounts payable and other accrued liabilities on the consolidated balance sheet. At June 30, 2020 and December 31, 2019, the Company has a payable to Jim Collord of $20,476, attributed to reimbursement of expenses for the SMMI project. The balance is included in accounts payable and other accrued liabilities on the consolidated balance sheet.

7.

9. Stockholders’ Equity

The Company’s common stock has a par value of $0.001 with 200,000,000 shares authorized. The Company also has 5,000,000 authorized shares of preferred stock with a par value of $0.0001.

In January 2016, the Company sold 5,700,000 shares of common stock at a rate of $0.05 for $285,000. In addition, Mr. Jones and Mr. Collord exchanged $50,000 of their notes outstanding (see Note 4) into 1,000,000 shares of common stock at the same rate of $0.05 per share. There were no warrants issued with the shares.

On May 12, 2016, the Company extended the expiration 4,365,000 outstanding warrants issued during 2014 for an additional six months to November 24, 2016. The Company also reduced the exercise price from $0.15 to $0.10.

In 2016, warrant holders exercised 3,590,000 warrants for shares of common stock at a price of $0.10 per share for proceeds of $359,000. In addition, warrants for 203,030 shares of common stock were exercised at $0.10 in exchange for accounts payable balances totaling $20,434. As disclosed in Note 4, Jim Collard exercised warrants for 20,000 shares of common stock in exchange for a $2,000 payment towards his note payable balance. At September 30, 2017, the Company has no outstanding warrants.10.Stock Options

8.

Stock Options

The Company has established a Stock Option Incentive Plan (“SIP”(the “SIP”) to authorizethat provides for the grantinggrant of stock options, upincentive stock options, stock appreciation rights, restricted stock awards, and incentive awards to 10 percenteligible individuals including directors, executive officers and advisors that have furnished bona fide services to the Company not related to the sale of securities in a capital-raising transaction.

On March 27, 2020, the Company granted 1,630,000 stock options to officers and directors of the total number of issued and outstanding shares of common stock to employees, directors and consultants. Upon exercise of options, shares are issued from the available authorized sharesCompany. The fair value of the Company.options was determined to be $159,740 using the Black Scholes model. The options are

Option awards are generally granted withexercisable on or before March 29, 2025 and have an exercise price equal toof $0.099. The options were fully vested upon grant and the entire fair market value ofwas recognized as compensation expense during the Company’s stock at the date of grant. quarter ended March 31, 2020.

EffectiveIn March 21, 20172019 the Company granted 600,0001,325,000 stock options to officers andthree Directors directors of the Company.The options are exercisable on or before March 31, 2022 at a25, 2024 and have an exercise price of $0.10 for 200,000 shares, and at a price of $0.09 for the remaining 400,000 shares. After this grant, the Company has 5,115,000 outstanding stock options that represent 9.4% of the issued and outstanding shares of common stock.$0.09. The fair value of the options was determined to be $53,558$117,088 using the Black Scholes model. The options were fully vested upon grant and the entire fair value was recognized as compensation expense during the quarter ended March 31, 2017.2019.

On July 19, 2017, Paul Beckman exercised stock options representing 275,000 shares of common stock for total consideration of $28,275 which was in the form of the balance due on his note and accrued interest payable of $20,000 and $125, respectively, and $8,150 in cash. Additionally, Larry Thackery exercised stock options for 140,000 shares of common stock for $12,400 in cash.

The fair value of each option award was estimated on the date of the grant using the assumptions noted in the following table:

| |

Number of Options

| 600,000

|

Stock price

| $0.09

|

Exercise price

| $0.09 to $0.10

|

Expected volatility

| 235.5%

|

Expected dividends

| -

|

Expected terms (in years)

| 5.0

|

Risk-free rate

| 1.96%

|

| March 27, 2020 | March 25, 2019 |

Stock price | $0.099 | $0.09 |

Exercise price | $0.099 | $0.09 |

Expected volatility | 218.6% | 209.5% |

Expected dividends | - | - |

Expected terms (in years) | 5.0 | 5.0 |

Risk-free rate | 0.39% | 2.21% |

11

The following is a summary of the Company’s options issued and outstanding under the Stock Option Incentive Plan:SIP:

| | | |

| Shares | | Weighted Average Exercise Price |

Outstanding and exercisable at December 31, 2015 | 3,990,000 | | 0.17 |

Expired | (2,000,000) | | (0.27) |

Granted | 2,525,000 | | 0.10 |

Outstanding and exercisable at December 31, 2016 | 4,515,000 | | $ 0.08 |

Granted | 600,000 | | 0.09 |

Exercised | (415,000) | | 0.10 |

Outstanding and exercisable at September 30, 2017 | 4,700,000 | | $0.08 |

| Shares | | Weighted Average Exercise Price |

Outstanding and exercisable at December 31, 2018 | 3,710,000 | | 0.09 |

Granted | 1,325,000 | | 0.09 |

Outstanding and exercisable at December 31, 2019 | 5,035,000 | | $0.09 |

Granted | 1,630,000 | | $0.099 |

Expired | (960,000) | | (0.06) |

Outstanding and exercisable at June 30, 2020 | 5,705,000 | | $0.10 |

The average remaining contractual term of the options outstanding and exercisable at SeptemberJune 30, 20172020 was 3.232.91 years. As of SeptemberJune 30, 2017,2020, options outstanding and exercisable had a $589,098no aggregate intrinsic value based on the Company’s stock price of $0.21.

9.

Subsequent Events

On October 25, 2017, the Company borrowed $100,000 from Paul Beckman in the form of a note payable. The note bears simple interest of 1% per month, has a term of six months, and contains a conversion option at $0.18 per common share.

12

value.

Item 2. Management's Discussion and Analysis or Plan of Operation

The following Management’s Discussion and Analysis of Financial Condition and Results of Operation (“MD&A”) is intended to help the reader understand our financial condition. MD&A is provided as a supplement to, and should be read in conjunction with, our financial statements and the accompanying integral notes (“Notes”) thereto. The following statements may be forward-looking in nature and actual results may differ materially.

COVID-19

In March 2020, COVID-19 was declared a pandemic by the World Health Organization and the Centers for Disease Control and Prevention. Its rapid spread around the world and throughout the United States prompted many countries, including the United States, to institute restrictions on travel, public gatherings and certain business operations. These restrictions disrupted economic activity in the Company’s business related to raising capital. As of June 30, 2020, the disruption did not materially impact the Company’s financial statements. However, if the severity of the economic disruptions increase as the duration of the COVID-19 pandemic continues, the negative financial impact due to the BeMetals Option Agreement could be significantly greater in future periods.

The effects of the continued outbreak of COVID-19 and related government responses could have disruptions to the Company`s Option Agreement with BeMetals Corp. Under the terms of the BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of South Mountain Mines, Inc. (“SMMI”) from the Company. The term of the agreement is for two years starting June 10, 2019, with an option to extend an additional year, with BeMetals conducting a preliminary economic assessment ("PEA") completed by a mutually agreed third-party engineering firm. Over its term, this agreement requires cash payments to the Company of $1,350,000; $1,100,000 in cash and $250,000 in exchange for shares of the Company’s common stock. In the event that BeMetals decides not to proceed with the South Mountain Project, BeMetals will not be obligated to make any additional payments. The COVID-19 outbreak could have a variety of adverse impacts to the Company, including their ability to continue operations of their exploration under the BeMetals Operation Agreement. Thunder Mountain Gold evaluated these impairment considerations and determined that no such impairments occurred as of June 30, 2020.

COVID-19 Additional Precautions

Thunder Mountain Gold Inc. has also taken steps to mitigate the potential risks to employees and suppliers posed by the spread of COVID-19. The Company has taken extra precautions for employees who work under the terms of the BeMetals Operation Agreement and have implemented work from home policies where appropriate.

As of June 30, 2020, there has been no material adverse impact to the BeMetals Operation Agreement. Management will continue to review and modify plans as conditions change. Despite efforts to manage these impacts to the Company, the ultimate impact of COVID-19 also depends on factors beyond management’s knowledge or control, including the duration and severity of this outbreak as well as third-party actions taken to contain its spread and mitigate its public health effects. Therefore, management cannot estimate the potential future impact to financial position, results of operations and cash flows, but the impacts could be material.

Plan of Operation:

FORWARD LOOKING STATEMENTS: The following discussion may contain forward-looking statements that involve a number of risks and uncertainties. Factors that could cause actual results to differ materially include the following: inability to locate property with mineralization, lack of financing for exploration efforts, competition to acquire mining properties; risks inherent in the mining industry, and risk factors that are listed in the Company's reports and registration statements filed with the Securities and Exchange Commission.

The Company’s financial position remained unchanged during the first nine months of 2017, as metals commodity markets seem to have improved during this period. Junior mining equity markets may strengthen periodically in response to favorable price movements in certain metals during 2017 and 2018, providing some companies with the opportunity to take advantage of short periods of positive sentiment in the market. However, until capital markets in the Junior Mining space become favorable, equity financing in the mining industry will remain challenging. Analyst estimates for the remainder of 2017 and first half of 2018 are for stabilizing precious metals markets, along with stable and improving prices for zinc, copper and lead.

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp. Under the terms of the BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of South Mountain Mines, Inc. (“SMMI”) from Thunder Mountain Resources, Inc. (“TMRI”), both wholly owned subsidiaries of the Company. The term of the agreement is for two years with BeMetals

completing a PEA completed by a mutually agreed third-party engineering firm. Over its term, this agreement requires cash payments to the Company continuedof $1,350,000; $1,100,000 in cash and $250,000 in exchange for shares of the Company’s common stock. Through June 30, 2020, cash proceeds of $350,000 and $250,000 in exchange for shares of the Company’s common stock have been received. In the event that BeMetals decides not to operate on a limited budget during 2017 while funding the maintenance ofproceed with the South Mountain Project, during whichBeMetals will not be obligated to make any additional financing is being sought for the Project. payments.

The Company’s plan of operation for the next twelve months subject to business conditions, will be to continueprovide support to developBeMetals Corp. during their option period and help ensure that the South Mountain ProjectPEA is completed on schedule and complete an industry standard Economic Analysis. The Company has engaged SRK Consulting (Reno)within budget.

While South Mountain is the Company`s main focus, work to oversee and complete this work. Work onadvance the Trout Creek Project will also continue in 2017, although the South Mountain Project will still remain the focus. occur as time and available capital allows.

South Mountain Project, Owyhee County, Idaho

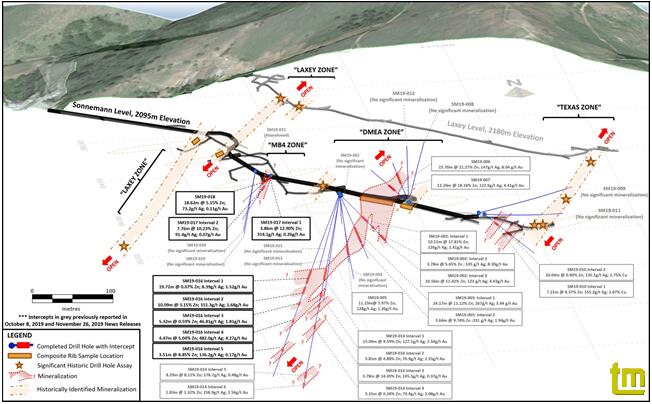

Under the BeMetals Corporation (TSX-V: BMET) Option Agreement, BeMetals and Thunder Mountain Gold formed a project team early in 2019 that is focused on advancing the South Mountain Project. This Boise Idaho-based team includes key management of Thunder Mountain Gold Inc., who have coordinated re-establishment of the Project site prior to the start of drilling. In addition, BeMetals appointed a project manager and project geologist for this team, along with technical and underground support.

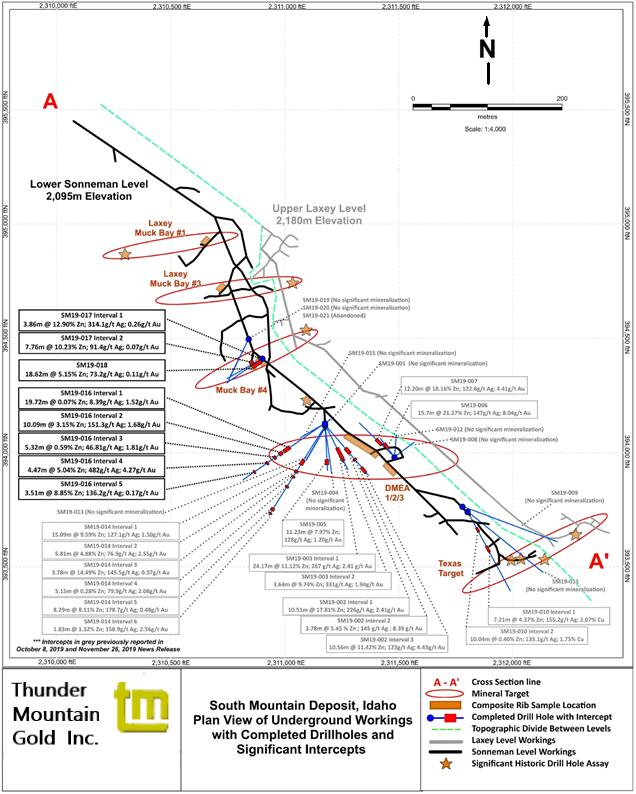

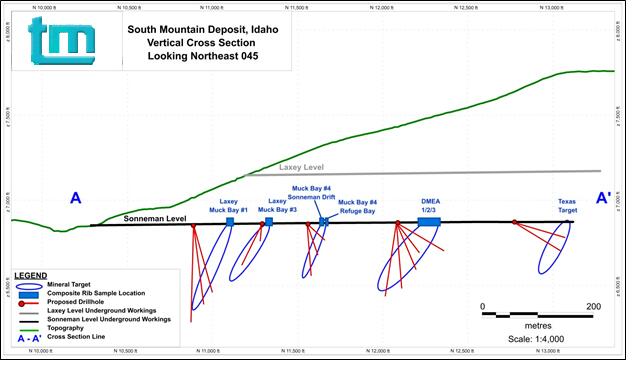

BeMetals (BMET) commenced drilling at South Mountain in July of 2019 and drilled twenty-one holes totaling 7,517 feet (2,290 meters) from five underground drilling stations within the Sonneman level. The drilling program was designed to test potential down plunge extensions, and overall continuity to the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource. All of the drill core recovered from the drilling was logged on site and assayed by ALS Chemex. Selected intervals and results are summarized below in Tables 1 and 2.

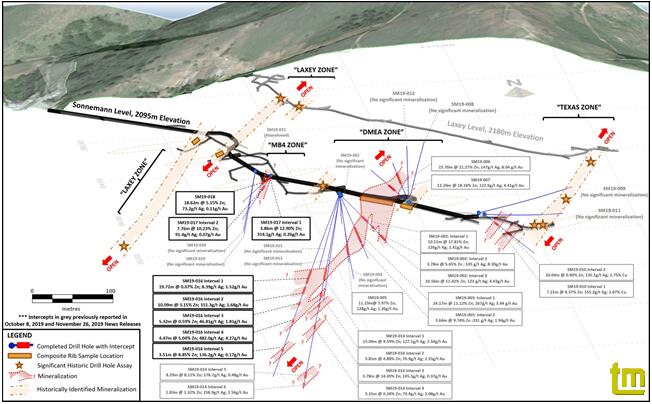

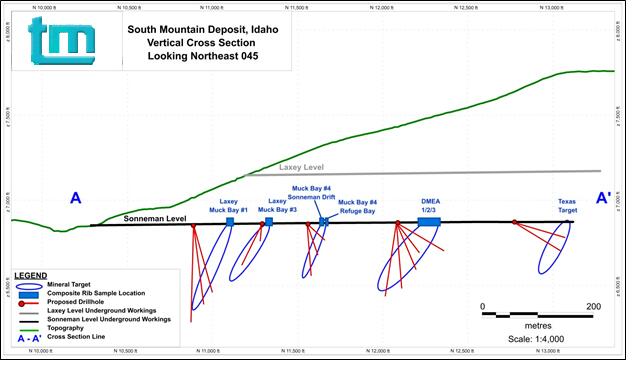

Long Section of Sonneman Level, (Looking northeast), showing Phase One 21 borehole locations

South Mountain Project - Background

The South Mountain Project is considered an advanced stage, high-grade zinc-silver-gold exploration or pre-development project. The land package at South Mountain consists of a total of approximately 1,518 acres, consisting of (i) 17 patented mining claims (326 acres)encompassing approximately 326 acres, 21 unpatented mining lode claims covering approximately 290 acres, and approximately 489 acres of leased private land. In addition, the project owns 360 acres of private land; (ii) lease on private ranch land (542 acres); and, (iii) 21 unpatented lode(mill site) not

contiguous with the mining claims on BLM managed land (290 acres).claims. All holdings are located in the South Mountain Mining District, Owyhee County, Idaho.

The property is located approximately 70 air miles southwest of Boise, Idaho and approximately 24 miles southeast of Jordan Valley, Oregon. It is accessible by highway 95 driving south from the Boise area to Jordan Valley Oregon, then by traveling southeast approximately 22 miles back into Idaho, via Owyhee County road that is dirt and improved to within 4 miles of historic mine site. The last 4 miles up the South Mountain Mine road are unimproved dirt road. The property is accessible year-round to within 4 miles of the property, where the property is accessible from May thru October without plowing snow. There is power distribution within 4 miles of the site as well. The climate is considered high desert. The Company has water rights on the property, and there is a potable spring on the property that once supplied water to the main camp.

PropertySouth Mountain Mine History

The limited historic production peaked during World War II when, based on smelter receipts, the production of direct shipped ore totaled as follows:

Metal | Grade | Total Metal |

Zinc | 14.5% | 15,593,100 lbs (7,072,900 Kg) |

Silver | 10.6 opt (363.4 g/t) | 566,440 ozs (17,618,200 grams) |

Gold | 0.058 opt (1.99 g/t) | 3,120 ozs (96,980 grams) |

Copper | 1.4% | 1,485,200 lbs (6,320 Kg) |

Lead | 2.4% | 2,562,300 lbs (1,162,250 Kg) |

Anaconda Smelter – Toole Utah - Crude Ore Shipment Head Grades

1941-1953 Total Tons:53,653 tons containing 3,118 ounces of gold, 566,439 ounces of silver, 13,932 pounds of copper, 2,562,318 pounds of lead and 15,593,061 pounds of zinc. (48,670 tonnes)

In addition to the direct-ship ore, a flotation mill was constructed and operated during the late-1940s and early-1950s.

From the 1954 South Mountain Mill report, recoveries were reported as follows:

13

| | |

Metal

| Grade

| Total Metal

|

Gold

Silver

Copper

Lead

Zinc

| 0.058 opt

10.6 opt

1.4%

2.4%

14.5%

| 3,120 ozs

566,440 ozs

1,485,200 lbs

2,562,300 lbs

15,593,100 lbs

|

Anaconda Crude Ore Shipments: 1941-1953 Total Tons: 53,6531954 South Mountain Historic Mill Report:

Metal | Head Grades | Recovery |

Zinc | 6.7% | 80% |

Silver | 17.5 opt (600 g/t) | 85% |

Gold | 0.02 opt (0.7 g/t) | 75% |

Copper | 3.2% | 90% |

Lead | 1% | 90% |

These are historic grades and recoveries not confirmed by the Company, but reportedly

mined from a small 39,600-ton (35,900 tonnes) copper rich block in the Texas zone.

South Mountain Mines Inc. (an Idaho Corporation) owned the patented claims from 1975 to the time the Company purchased the entity in 2007. They conducted extensive exploration work including extending the Sonneman Level by approximately 1,500 feet to intercept the down-dip extension of the Texas sulfide mineralization mined on the Laxey Level approximately 400 feet up-dip from the Sonneman. High grade sulfide mineralization was intercepted and confirmed on the Sonneman Extension. In 1985 South Mountain Mines Inc. completed a feasibility study based on historic and newly developed ore zones exposed in their underground workings and drilling. This resulted in a historic resource of approximately 470,000 tons containing 23,500 ounces of gold, 3,530,000 ounces of silver, 8,339,000 pounds of copper, 13,157,000 pounds of lead and 91,817,000 pounds of zinc. Although they determined positive economics, and that the resource was still open at depth with a large upside potential, the project was shut downidled and placed into care and maintenance.

In 2008, the Company contracted Kleinfelder, Inc., a nationwide engineering and consulting firm, to complete a technical report “Resources Data Evaluation, South Mountain Property, South Mountain Mining District, Owyhee County, Idaho”. The technical report was commissioned by Thunder Mountain Resources, Inc. to evaluate all the existing data available on the South Mountain property. Kleinfelder utilized a panel modeling method using this data to determine potential mineralized material remaining and to make a comparison with the resource determined by South Mountain Mines in the mid-1980s.

Additional drilling and sampling will be necessary before the resource can be classified as a mineable reserve, but Kleinfelder’s calculations provided a potential resource number that is consistent with South Mountain Mines’ (Bowes 1985) historic reserve model.

Late inIn 2009, the Company contracted with Northwestern Groundwater & Geology to incorporatea third-party consulting firm that incorporated all the new drill and sampling data into an NI 43-101 Technical Report. This report was completed as part of the Company’s dual listing on the TSX Venture Exchange in 2010. The Company is also traded in the U.S. on the OTCQB under ticker THMG.

In January of 2018, the Company engaged Hard Rock Consulting LLC (HRC) from Denver, Colorado to update the South Mountain Project 43-101. HRC concluded that significant potential exists to increase the known mineral resource with additional drilling, as well as to upgrade existing mineral resource classifications with additional infill drilling. HRC also determined that the conceptual geologic model is sound, and, in conjunction with drilling results, indicates that mineralization is essentially open in all directions, and is continuous between underground levels and extends to the surface.

Hard Rock Consulting also noted that:

·THMG technical staff has thorough understanding of the geology of the South Mountain Project, and that the appropriate deposit model is being applied for exploration.

·Because the Project is largely located on and surrounded by private land, it greatly simplifies Project approvals compared to mining projects involving public lands.

·Initial metallurgical testing demonstrates that the South Mountain massive sulfide mineralization is amenable to differential flotation and concentration.

·The current mineral resource at the South Mountain Project is more than sufficient to warrant continued planning and development to further advance the Project.

Gold Breccia

HRC also reviewed the data on the anomalous gold-bearing multi-lithic breccia that was identified by THMG conducting reconnaissance work at South Mountain. In 2010, five holes were drilled in the anomaly for a total footage of 3,530 feet, and 705 total samples taken every five feet of drill hole. Of the 705 samples taken, 686 samples contained anomalous gold, or 97% of the samples. The highest-grade intercept ran 0.038 ounce per ton. HRC reviewed the reports done on the breccia completed by both Kinross and Newmont; of note was Newmont’s comparison of the geology to the Battle Mountain Complex in Nevada.

The Technical Report was authored by Ms. J.J. Brown, P.G., SME-RM, Mr. Jeffrey Choquette, P.E., and Mr. Randy Martin, SME-RM, all of Hard Rock Consulting, each of whom is an independent qualified person for the purposes of NI 43-101 The NI 43-101 Technical Report has an effective date of April 7, 2018 and has been filed in Canada on SEDAR in accordance with NI 43-101. The Report can be reviewed on the Company`s website at www.thundermountaingold.com, or on www.SEDAR.com.www.thundermountaingold.com.

2012 through 2017

Note to United States investors concerning estimates of measured, indicated and inferred resources. Disclosure of the NI-43-101 has been prepared in accordance with the requirements of Canadian securities laws, including Canadian National Instrument 43-101 (“NI 43-101”), which differ from the current requirements of the U.S. Securities and Exchange Commission (“SEC”) set out in Industry Guide 7. The Highlights of South Mountain drillingNI-43-101 section refers to “mineral resources,” “measured mineral resources,” “indicated mineral resources,” and development work:

The assay results from 2012 through 2014 pre-development work confirm“inferred mineral resources.” While these categories of mineralization are recognized and required by Canadian securities laws, they are not recognized by Industry Guide 7 and are not normally permitted to be disclosed in SEC filings. United States investors are cautioned not to assume that thereall or any of measured, indicated or inferred mineral resources will ever be converted into mineral reserves. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the mineralization can be economically or legally extracted at the time the “reserve” determination is significant upsidemade. "Inferred mineral resources" have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian reporting standards; however, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute "reserves" by Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Accordingly,

information contained in this 10-Q containing descriptions of South Mountain’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the resource. The results further reinforce the exceptional continuityreporting and disclosure requirements of high-grade zinc/silver mineralizationIndustry Guide 7.

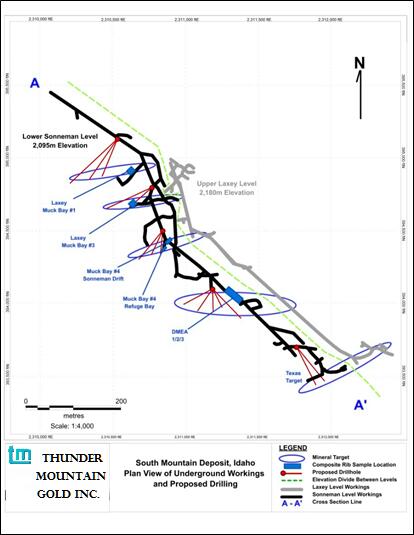

Phase I Drilling at South Mountain along the strikeunder BeMetals Option Agreement

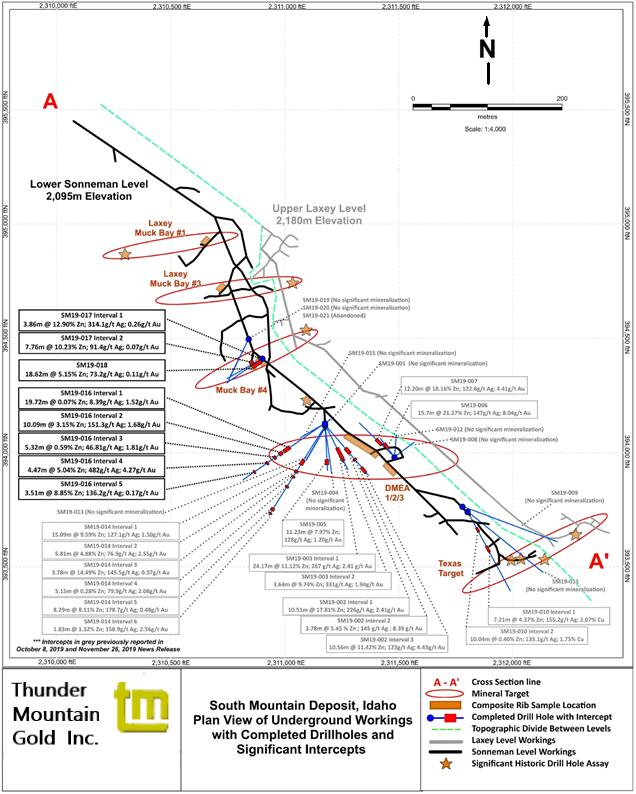

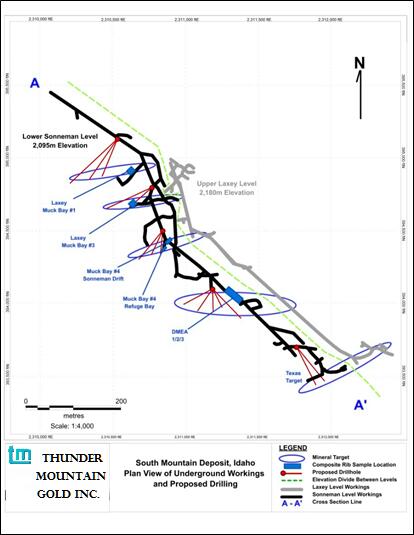

The principal objectives of the well-mineralized trend. BothPhase 1 work plan at South Mountain was to test for potential extensions of the uppermineralized zones and confirm the grade distribution of the current polymetallic mineral resource estimate. The Company has now successfully completed the phase 1 program comprised of 20 underground drill holes for a total of approximately 2,290 meters. Geological logging and sampling of all drill holes have now been completed with all analytical results received. These results have been compiled into the Project’s geological database and will be used to design the phase 2 drilling program for 2020. Following a planned phase 2 drilling program, all new results will be integrated into an updated mineral resource estimation for the Project, expected to be completed towards the end of this year. Further expansion and definition of the DMEA, Texas, and the DMEA ore shoots were drilled to define the continuityMB4 zones, as well as other targets within reach of up- and down-dip sulfide mineralization. Although additional definition drilling is necessary, positive results showed excellent grades and continuity. Additionally, the Sonneman and Laxey levels of the mine were opened and refurbished, with 2,700 feet of 14 X 14-foot development-ready drifts andunderground drill stations developed ontesting from the Sonneman level, alongprovide excellent exploration upside for the 2020 program.

Table 1. BeMetal`s Analytical and Assay Results for the Phase 1 Drilling Program

Drill Hole ID, Zone & Interval | From (m) | To (m) | Core Interval (m) | Zn % | Ag g/t | Au g/t | Pb % | Cu % |

DMEA Zone | | | | | | | | |

SM19-002 | | | | | | | | |

Interval 1 | 46.88 | 57.39 | 10.51 | 17.81 | 226 | 2.41 | 1.59 | 0.16 |

Interval 2 | 67.85 | 71.63 | 3.78 | 5.45 | 145 | 8.39 | 0.58 | 0.15 |

Interval 3 | 85.83 | 96.39 | 10.56 | 11.42 | 123 | 4.43 | 0.36 | 0.52 |

| | | | | | | | |

SM19-003 | | | | | | | | |

Interval 1 | 51.18 | 75.35 | 24.17 | 11.12 | 267 | 3.44 | 3.75 | 0.29 |

Including | 51.18 | 60.78 | 9.60 | 11.74 | 437 | 5.99 | 8.68 | 0.38 |

Including | 62.09 | 75.35 | 13.26 | 11.77 | 169 | 1.88 | 0.54 | 0.25 |

Interval 2 | 77.60 | 81.24 | 3.64 | 9.74 | 331 | 1.94 | 1.11 | 0.34 |

SM19-005 | 75.13 | 86.37 | 11.23 | 7.97 | 128 | 1.20 | 0.91 | 0.24 |

| | | | | | | | |

SM19-006 | 28.01 | 43.71 | 15.70 | 21.27 | 147 | 8.04 | 0.77 | 0.30 |

| | | | | | | | |

SM19-007 | 26.97 | 39.17 | 12.20 | 18.16 | 122.6 | 4.41 | 1.55 | 0.16 |

| | | | | | | | |

SM19-014 | | | | | | | | |

Interval 1 | 105.31 | 120.40 | 15.09 | 9.59 | 127.1 | 1.50 | 0.69 | 0.28 |

Interval 2 | 138.07 | 143.88 | 5.81 | 4.88 | 76.9 | 2.55 | 0.21 | 0.12 |

Interval 3 | 155.17 | 158.95 | 3.78 | 14.49 | 145.5 | 0.37 | 0.25 | 0.48 |

Interval 4 | 184.40 | 189.56 | 5.15 | 0.28 | 79.9 | 2.08 | 0.15 | 0.06 |

Interval 5 | 250.65 | 258.94 | 8.29 | 8.11 | 178.7 | 0.48 | 0.57 | 1.73 |

Interval 6 | 266.33 | 268.16 | 1.83 | 1.32 | 158.9 | 2.56 | 0.56 | 0.11 |

Texas Zone | | | | | | | | |

SM19-010 | | | | | | | | |

Interval 1 | 24.41 | 31.62 | 7.21 | 4.37 | 155.2 | 0.13 | 0.03 | 2.07 |

Interval 2 | 53.11 | 63.15 | 10.04 | 0.40 | 135.1 | 0.07 | 0.01 | 1.75 |

* Note: 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is

equal to 0.032 ounces per ton (oz/t, or o.p.t.)

Table 2 below shows the latest results received from holes SM19-016, SM19-017 and SM19-018:

Table 2. Drill Holes SM19-016, SM19-017 and SM19-018: Analytical and Assay Results

Drill Hole ID: Zone & Interval | From (m) | To (m) | Core Interval (m) | Zn % | Ag g/t | Au g/t | Pb % | Cu % |

DMEA Zone | | | | | | | | |

SM19-016 | | | | | | | | |

Interval 1 | 112.33 | 132.05 | 19.72† | 0.07 | 8.39 | 1.52 | 0.01 | 0.002 |

Interval 2 | 136.55 | 146.64 | 10.09 | 3.15 | 151.3 | 1.68 | 0.66 | 0.22 |

Interval 3 | 158.27 | 163.59 | 5.32† | 0.59 | 46.8 | 1.81 | 0.11 | 0.04 |

Interval 4 | 184.18 | 188.64 | 4.47† | 5.04 | 482.0 | 4.27 | 5.80 | 0.43 |

Interval 5 | 227.32 | 230.83 | 3.51 | 8.85 | 136.2 | 0.17 | 1.25 | 1.67 |

MB4 Target Zone | | | | | | | | |

SM19-017 | | | | | | | | |

Interval 1 | 1.37 | 5.23 | 3.86* | 12.90 | 314.1 | 0.26 | 0.88 | 1.08 |

Interval 2 | 16.32 | 24.08 | 7.76* | 10.23 | 91.4 | 0.07 | 0.36 | 0.55 |

SM19-018 | | | | | | | | |

Interval 1 | 0.00 | 18.62 | 18.62* | 5.15 | 73.2 | 0.11 | 0.02 | 0.41 |

Including | 8.53 | 18.62 | 10.09* | 8.06 | 97.0 | 0.15 | 0.02 | 0.68 |

Note: Reported widths in tables 1 & 2 are drilled core lengths as true widths are unknown at this time. It is estimated based upon current data that true widths might range between 60-80% of the drilled intersection. For drill holes SM19-017* and SM19-018* true widths are unknown as these are the first drill intersections of the MD4 target. Intervals cut offs are based upon visual contacts of massive sulfide units with 720no more than 1.75 meters of internal skarn. For SM19-010 a nominal 0.5% copper cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 1.4m of internal dilution. For SM19-016†(intervals 1, 3 and 4) a nominal 0.46 g/t gold cut off has been applied to determine the boundaries of the intersections with no internal dilution. For SM19-017 & 018 a nominal 2.4% zinc cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 2m of internal dilution.(Note: See details below in QA/QC section).1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.)

The above drill holes returned significant intersections of 10’ X 10’ drift rehabilitation onboth massive sulfide and skarn styles of mineralization. Important sulfide minerals are pyrrhotite, sphalerite, galena, arsenopyrite and chalcopyrite. During the Laxey Level.planned phase 2 campaign at South Mountain, the Company will carry out mineralogy and metallurgical test work studies to confirm historical other previous high-grade results.

Drill holes SM19-015, SM19-019, SM19-020 deviated from the target and did not return the anticipated drill intercepts. However, this information is valuable in determining to the design and target areas of mineralization in the 2020 phase 2 program. Drill hole SM19-021 was terminated at 10 meters with a significant drill rig break down near the planned conclusion of the phase 1 program.

Figure 1: 3D Perspective View inclined at 20 degrees looking north-north-east, showing locations of rib-sampling, priority target zones, and the phase 1 drill holes and highlighted the recent SM19-016, SM19-017 and SM19-018

Underground core holes DM2UC13-13 through DM2UC13-18 have further confirmed the continuity of the DMEA down-dip, enabling the connection between the open visible massive sulfide on the Sonneman, with the earlier core hole intercept drilled some 400 feet below the Sonneman Level from the surface.

Managementdrilling is very encouraged with the positive drilling results at South Mountain. With the drift rehabilitation underground, tremendous down dip potential of these high-grade zinc, silver, gold, copper,being conducted to extend and lead zones, has emerged, with polymetallic mineralization that could be incorporated into the early years ofupgrade the South Mountain mine

14

plan. Givenresource - testing the associated economic upsidecontinuity and down-dip extensions of such a scenario, the high-grade polymetallic massive sulfide zones. The Company plans to aggressively delineate the full extent of the mineralization at South Mountain.

![[thmg10qnov1017003.jpg]](https://capedge.com/proxy/10-Q/0001052918-17-000539/thmg10qnov1017003.jpg)

Figure 2. Typical long section along strike showing the orientation of the massive sulfide replacement zones at South Mountain, along with and in relation to the two main drifts.

Assays show that rib sampling on the Sonneman reported during the development of the Sonneman Level during 2012-2013 several massive sulfide mineralized zones were mined through. HIGHLIGHT: Rib Sample Results on Sonneman: 80 Feet of 21.9% Zinc, 0.147 opt Gold, 4.76 opt Silver, 0.38% Copper and 0.51% Lead.

Detailed rib sampling along some of these massive sulfide zones yielded the following results:

| | | | | | | |

Location / Ore Shoot | Mineralized Length (Feet) | Drift Station (ft) | Gold (ozs/ton) | Silver (ozs/ton) | Zinc | Copper | Lead |

| | | | | | | |

DMEA 2 | 80 | 2100 | 0.147 opt | 4.76 opt | 21.9% | 0.38% | 0.51% |

DMEA 3 | 15 | 2200 | 0.354 opt | 5.63 opt | 20.2% | 2.71% | 0.60% |

Muck Bay 4 | 30 | 1480 | 0.005 opt | 6.30 opt | 1.9% | 1.00% | 0.50% |

Muck Bay 4 B | 15 | 1500 | 0.005 opt | 6.71 opt | 14.1% | 2.30% | 0.59% |

Muck Bay 3 | 30 | 1078 | Tr | 6.23 opt | 7.5% | 0.36% | 3.77% |

Laxey Shaft Rind | 25 | 778 | 0.02 opt | 15.0 opt | 18.5% | 0.41% | 1.03% |

Note: Sample channel lengths were 5 to 10 feet. All samples were analyzed by ALS Chemex.

15

A detailed underground fanadditional core drilling program commenced as soon as the surface drilling program was completed. Drilling on the DMEA 2 and Texas Ore Shoot were planned in order to define a mineable resource, but unfortunately the program was terminated after the first fan was drilled in the DMEA 2 down dip target. The results ofand Laxey zones to complete the drillingconfirmation and extensional drilling. In addition, there are summarized below:

| | | | | | | | |

DMEA 2 Core Hole | Length | Dip | Intercept Footage | Gold | Silver | Zinc | Copper | Lead |

| | | | | | | | |

DM2UC13-13 | 329 | -24 | 162-184 (22) | 0.086 opt | 4.72 opt | 12.31% | 0.48% | 1.56% |

DM2UC13-14 | 363 | -17 | 163.5-256.5 (93) | .082 opt | 12.77 opt | 13.79% | 0.45% | 7.07% |

DM2UC13-14 | | | 301-331 (30) | 0.127 opt | 3.17 opt | 14.46% | 0.29% | 0.67% |

DM2UC13-15 | 298 | -31 | 98-108 (10) | 0.01 opt | 6.84 opt | 8.30% | 1.88% | 0.16% |

DM2UC13-16 | 306 | -36 | 85-111 (26) | 0.01 opt | 5.40 opt | 3,89% | 1.55% | 0.34% |

DM2UC13-17 | 347 | -12 | 210-322 (112) | 0.07 opt | 2.31 opt | 9.84% | 0.36% | 0.28% |

DM2UC13-18 | 347 | -47 | 95-103 (8) | Tr | 0.53 opt | 2.60% | minor | 0.28% |

Results from the first drill fan testing the down dip extension of the historic DMEA ore zones.

plans to retrieve bulk samples for metallurgical test work. More than 15,000 feet (4,500 meters) have been drilled at South Mountain and included in the model. The South Mountain historic ore zones remain open down-dip on all of the zones encountered (see Figure 2).encountered. The continuingsuccessful drilling successes provesand development work prove that the South Mountain resource continues to grow with potential to increase the resource substantially. A new resource estimate for

Figure 2: Plan View of the Sonneman & Laxey Levels, South Mountain Deposit, showing locations of rib-sampling, priority target zones, and drill holes SM19-016, SM19-017 and SM19-018

Figure 3: Plan View of Sonneman & Laxey Levels, showing locations of previously reported rib sampling

Underground Pre-Development Work Completed in 2012 thru 2014

The reconstruction of the Sonneman and Laxey drifts continued successfully until January 2014 when the Project went into care and maintenance. The Sonneman Level advanced 2,711 feet from the portal and is expectedconstructed to 12 feet by 12 feet for future development and mining. Approximately 350 feet of drift remains to be readyrehabilitated to reach the historic Texas massive sulfide zone located at the end of the old workings. This advance through this zone will allow for the drill stations and underground drilling to further define the high-grade resource encountered by William Bowes group in September 2017. SRK Consultingthe 1980s.

The historic 2,200-foot long Laxey Level drift has been engagedrehabilitated to 10 feet by 10 feet for approximately 720 feet. At that location the old drift had become unstable at an intrusive dike and preparations were being made to advance through the caved area. This old tunnel was rehabilitated and accessed along its full length in April to complete2008, at which point it intercepted the PEA at South Mountain.Texas massive sulfide zone, one of many that had limited mining during and after the World War II period. High-grade massive sulfide is exposed in this area, and the core drilling during 2013 proved its continuity between the Laxey Level and the surface, an up-dip distance of nearly 400 feet.

Two underground core rigs are planned

During the development of the Sonneman Level during 2012-2013 several massive sulfide mineralized zones were mined through. Detailed rib sampling along some of these zones yielded the following results:

Highlights from 2013-2014 Rib-Sampling Program

• DMEA Zones 1/2/3; 130 ft. (39.62m) @ 16.76% Zinc (“Zn”), 4.11 ounces per ton (“o.p.t.”) (140.91 grams per tonne (“g/t”)) Silver (“Ag”), 0.089 o.p.t. (3.08 g/t Gold) (“Au”), 0.78% Copper (“Cu”) and 0.38% Lead (“Pb”)

• Muck Bay #4 Zone; 23 ft. (7.01m) @ 14.69% Zn, 7.18 o.p.t. (246.17 g/t) Ag, 0.34% Cu and 0.65% Pb

• Laxey Zone; 40 ft. (12.19m) @ 16.44% Zn, 13.97 o.p.t. (478.97 g/t) Ag, 0.020 o.p.t. (0.68 g/t) Au, 0.70% Cu and 0.86% Pb

(Results previously reported in the Company`s annual / quarterly reports; news releases; and the May 2019 independent technical report titled, “National Instrument 43-101 Technical Report Updated Mineral Resource Estimate for extending the South Mountain resource,Project Owyhee County, Idaho, USA.” 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.))

QUALITY ASSURANCE AND QUALITY CONTROL PROCEDURES

The South Mountain Project employs a rigorous QC/QA program that includes blanks, duplicates and testingappropriate certified standard reference material. All samples are introduced into the high-priority historic ore zones. Onesample stream prior to sample handling/crushing to monitor analytical accuracy and precision. The insertion rate for the combined QA/QC samples is 10 percent or more depending upon batch sizes. ALS Global completed the analytical work with the core drill will begin onsamples processed at their preparation facility in Reno, Nevada, U.S.A. All analytical and assay procedures are conducted in the DMEA and Laxey zonesALS facility in North Vancouver, BC. The samples are processed by the following methods as appropriate to completedetermine the confirmation and extensional drilling, while the other core drill will focus primarily on the Texas zone to extend resources at depth beyond the current inferred resource area. In Addition, bulk samples will be mined for metallurgical test work, which will be orchestrated in part by SRK Consulting. grades; Au-AA23-Au 30g fire assay with AA finish, ME-ICP61-33 element four acid digest with ICP-AES finish, ME-OG62-ore grade elements, four acid with ICP-AES finish, Pb-OG62-ore grade Pb, four acid with ICP-AES finish, Zn-OG62-ore grade Zn, four acid digest with ICP-AES finish, Ag-GRA21-Ag 30g fire assay with gravimetric finish.

Qualified Person – Edward D. FieldsLarry Kornze is the Qualified Person as defined by National Instrument 43-101 responsible for the technical data reported in this news release.report.

This property is without known reserves and the proposed program is exploratory in nature according to Instruction 3 to paragraph (b)(5) of Industry Guide 7. There are currently no permits required for conducting exploration in accordance with the Company`s current board approved exploration plan.

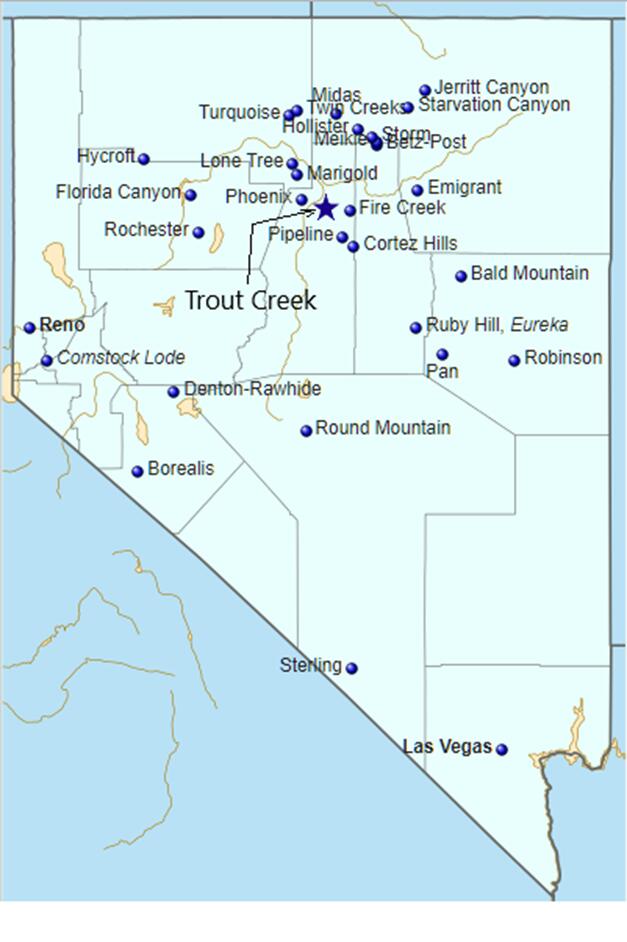

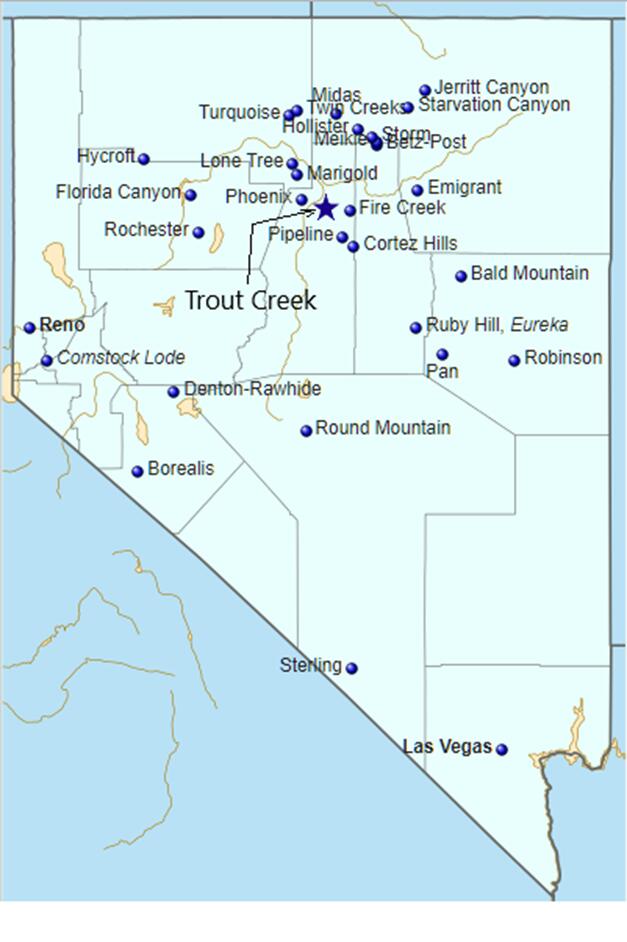

Trout Creek Project, Lander County, Nevada

The Trout Creek gold exploration project is a pedimenthighly prospective gold exploration target located along the western flank of the Shoshone Mountain Range in the Reese River Valley in Lander County, Nevada. The claim package consists of 78 unpatented mining claims (approximately 1560 acres) that are situated along a recognizable structural zone in the Eureka-Battle Mountain mineralized gold trend. Because the project is surrounded by Newmont Mining`s land package, Thunder Mountain maintainedstruck a joint venture agreement with Newmont Mining on some of their adjoining mineral rights sections and aliquot parcels from 2011 thru 2016. On October 27, 2016 the Company terminated the exploration agreement with Newmont Mining Corporation in order to concentrate their efforts on the South Mountain Project. The Company retained the 78-claim package by paying annual fees to BLM of $3,255 and Lander County $940 fees.

The Project is located approximately 155 air miles northeast of Reno, Nevada, or approximately 20 miles south of Battle Mountain, Nevada, in Sections 10, 11, 14, 16, 21, 22, 27; T.29N.; R.44E. Mount Diablo Baseline & Meridian, Lander County, Nevada. Latitude: 40 23’ 36” North, Longitude: 117 00’ 58” West. The property is generally accessible year-round by traveling south from Battle Mountain Nevada on state highway 305, which is paved. The project is generally accessible year-round and there are no improvements on the property.

16

The Trout Creek target is anchored by a regional gravity anomaly on a well-defined northwest-southeast trending break in the alluvial fill thickness and underlying bedrock. Previous geophysical work in the 1980s revealed an airborne magnetic anomaly associated with the same structure, and this was further verified and outlined in 2008 by Company personnel, with consultation from Jim Wright – Wright Geophysics using a ground magnetometer. The target is covered by alluvial fan deposits of generally unknown thickness, shed from the adjacent Shoshone Range, a fault block mountain range composed of Paleozoic sediments of both upper and lower plate rocks of the Roberts Mountains thrust.

An extensive data package on the area was made available to Thunder Mountain Gold by Newmont during the joint exploration agreement period (2011-2016) that significantly enhanced the target area. This, along with fieldwork consisting of mapping and sampling the altered and mineralized structures that can be followed through the Shoshone Range. Of importance is that these structures align with the Cortez-Pipeline deposits and the Phoenix deposit (part of the Eureka-Battle Mountain-Getchell Trend).