UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one)

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended SeptemberJune 30, 20202021

Or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14037

____________________

Moody’s Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 13-3998945 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

7 World Trade Center at 250 Greenwich Street, New York, New York 10007

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code:

(212) 553-0300

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | MCO | | New York Stock Exchange |

| 1.75% Senior Notes Due 2027 | | MCO 27 | | New York Stock Exchange |

| 0.950% Senior Notes Due 2030 | | MCO 30 | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months, or for such shorter period that the registrant was required to submit such files. Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | |

| Large Accelerated Filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

| | |

Shares Outstanding at SeptemberJune 30, 20202021 |

187.8186.2 million |

| | | | | | | | |

| MOODY’S CORPORATION

INDEX TO FORM 10-Q

| |

| Page(s) |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Exhibits Filed Herewith | |

| | |

31.1 | Chief Executive Officer Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

31.2 | Chief Financial Officer Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

32.1 | Chief Executive Officer Certification Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

32.2 | Chief Financial Officer Certification Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

101.INS | Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document) | |

101.SCH | Inline XBRL Taxonomy Extension Schema Document | |

101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |

101.DEF | Inline XBRL Definitions Linkbase Document | |

101.LAB | Inline XBRL Taxonomy Extension Labels Linkbase Document | |

101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) | |

GLOSSARY OF TERMS AND ABBREVIATIONS

The following terms, abbreviations and acronyms are used to identify frequently used terms in this report:

| | | | | |

| TERM | DEFINITION |

ABS Suite | Business acquired by the Company in October 2019 which includes a software platform used by issuers and trustees for administration of asset-backed and mortgage-backed securities programs |

Acquisition-Related Amortization | Amortization of definite-lived intangible assets acquired by the Company from all business combination transactions |

| Acquire Media (AM) | Business acquired by the Company in October 2020; an aggregator and distributor of curated adverse real-time news, multimedia, data, and alerts.alerts |

Acquisition-Related ExpensesIntangible Amortization Expense | ConsistsAmortization of expenses incurred to complete and integratedefinite-lived intangible assets acquired by the acquisition of Bureau van Dijk for which the integration will be a multi-year effortCompany from all business combination transactions |

| |

| Adjusted Diluted EPS | Diluted EPS excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

| Adjusted Net Income | Net Income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

| Adjusted Operating Income | Operating income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

| Adjusted Operating Margin | Adjusted Operating Income divided by revenue |

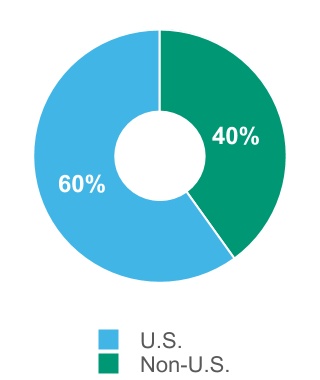

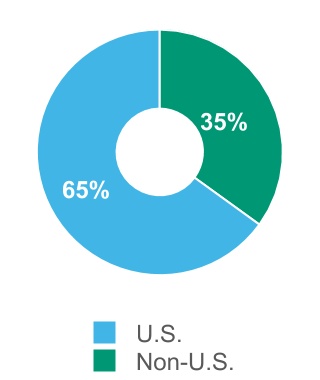

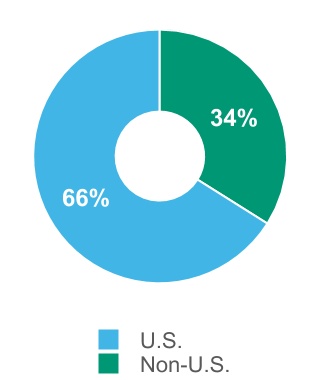

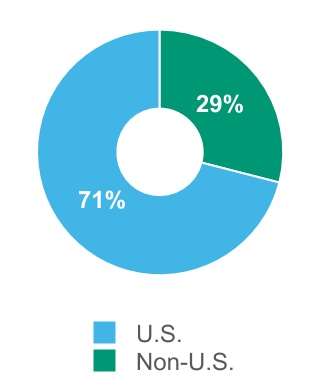

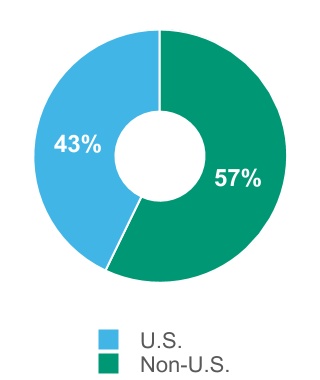

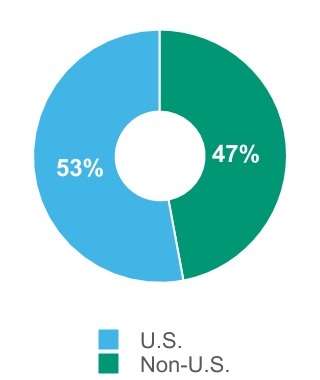

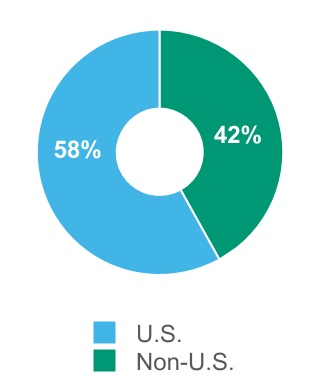

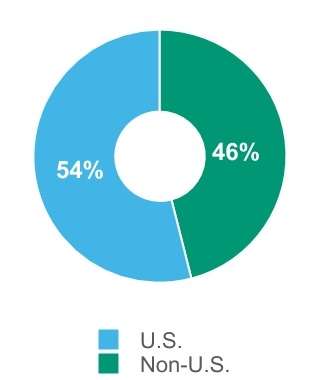

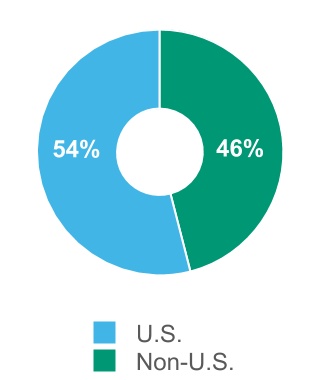

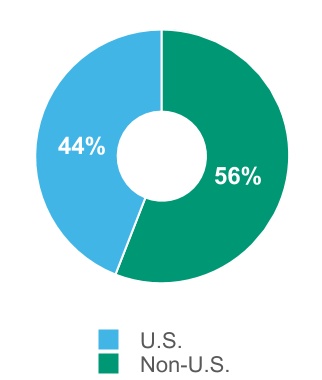

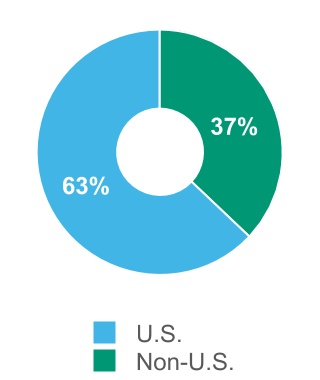

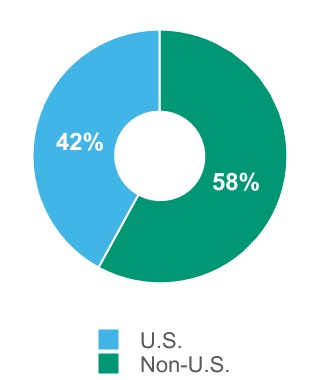

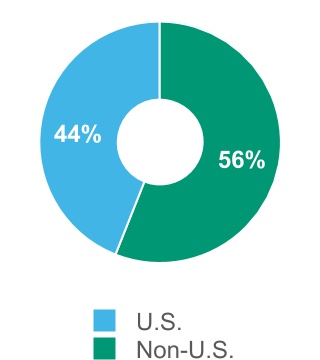

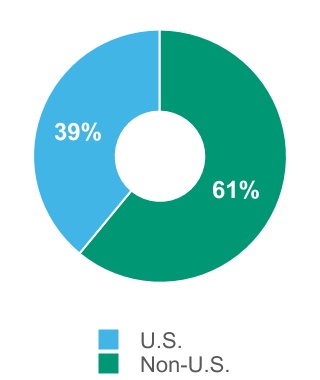

| Americas | Represents countries within North and South America, excluding the U.S. |

AOCLAOCI(L) | Accumulated other comprehensive income/loss; a separate component of shareholders’ equity |

| ASC | The FASB Accounting Standards Codification; the sole source of authoritative GAAP as of July 1, 2009 except for rules and interpretive releases of the SEC, which are also sources of authoritative GAAP for SEC registrants |

| Asia-Pacific | Represents Australia and countries in Asia including but not limited to: China, India, Indonesia, Japan, Korea, Malaysia, Singapore, Sri Lanka and Thailand |

ASR | Accelerated Share Repurchase |

| ASU | The FASB Accounting Standards Update to the ASC. It also provides background information for accounting guidance and the bases for conclusions on the changes in the ASC. ASUs are not considered authoritative until codified into the ASC |

| Board | The board of directors of the Company |

| BPS | Basis points |

| Bureau van Dijk | Bureau van Dijk Electronic Publishing, B.V., a global provider of business intelligence and company information; acquired by the Company on August 10, 2017 via the acquisition of Yellow Maple I B.V., an indirect parent of Bureau van Dijk |

| Catylist | A provider of commercial real estate (CRE) solutions for brokers; acquired by the Company on December 30, 2020 |

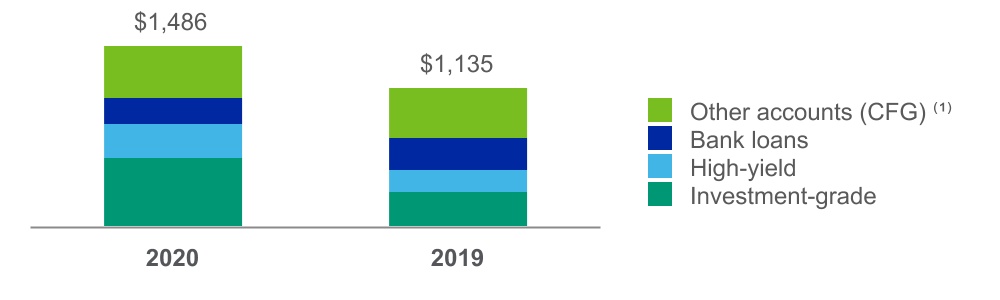

| CFG | Corporate finance group; an LOB of MIS |

| CLO | Collateralized loan obligation |

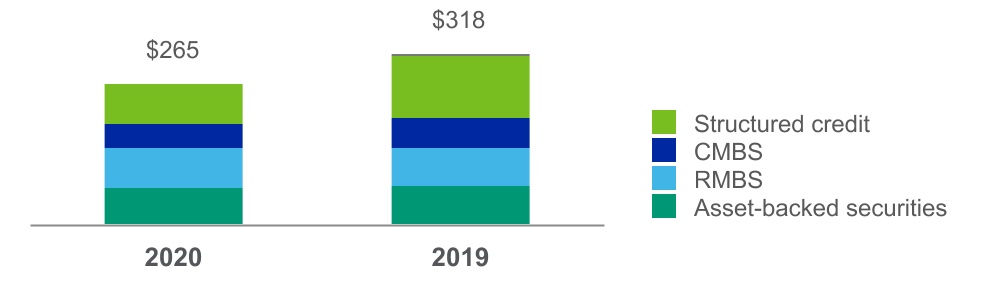

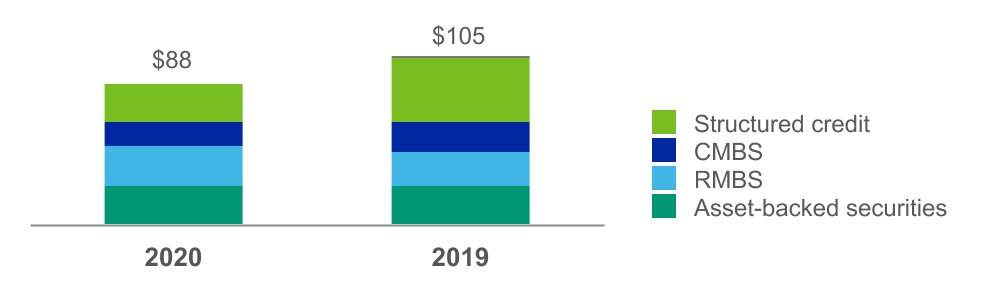

| CMBS | Commercial mortgage-backed securities; an asset class within SFG |

| COLI | Corporate-Owned Life Insurance |

| Common Stock | The Company’s common stock |

| Company | Moody’s Corporation and its subsidiaries; MCO; Moody’s |

Content | |

| Cortera | A reporting unit within the MA segment that offers subscription-based research,provider of North American credit data and analytical products, including credit ratings produced by MIS, credit research, quantitative credit scores and other analytical tools, economic research and forecasts, business intelligence and company information products, and commercial real estate data and analytical toolsworkflow solutions; the Company acquired Cortera in March 2021 |

| COVID-19 | An outbreak of a novel strain of coronavirus resulting in an international public health crisis and a global pandemic |

| CP | Commercial Paper |

| | | | | |

TERM | DEFINITION |

| CP Program | A program entered into on August 3, 2016 allowing the Company to privately place CP up to a maximum of $1 billion for which the maturity may not exceed 397 days from the date of issue and which is backstopped by the 2018 Facility |

| CRAs | Credit rating agencies |

DBPPDBPPs | Defined benefit pension plans |

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act |

| EMEA | Represents countries within Europe, the Middle East and Africa |

| EPS | Earnings per share |

| | | | | |

| TERM | DEFINITION |

| ERS | The Enterprise Risk Solutions LOB within MA, which offers risk management software solutions as well as related risk management advisory engagements services |

| ESG | Environmental, Social, and Governance |

| ESMA | European Securities and Markets Authority |

| ETR | Effective tax rate |

| EU | European Union |

| EUR | Euros |

| EURIBOR | The Euro Interbank Offered Rate |

| Excess Tax Benefits | The difference between the tax benefit realized at exercise of an option or delivery of a restricted share and the tax benefit recorded at the time the option or restricted share is expensed under GAAP |

| Exchange Act | The Securities Exchange Act of 1934, as amended |

| External Revenue | Revenue excluding any intersegment amounts |

| FASB | Financial Accounting Standards Board |

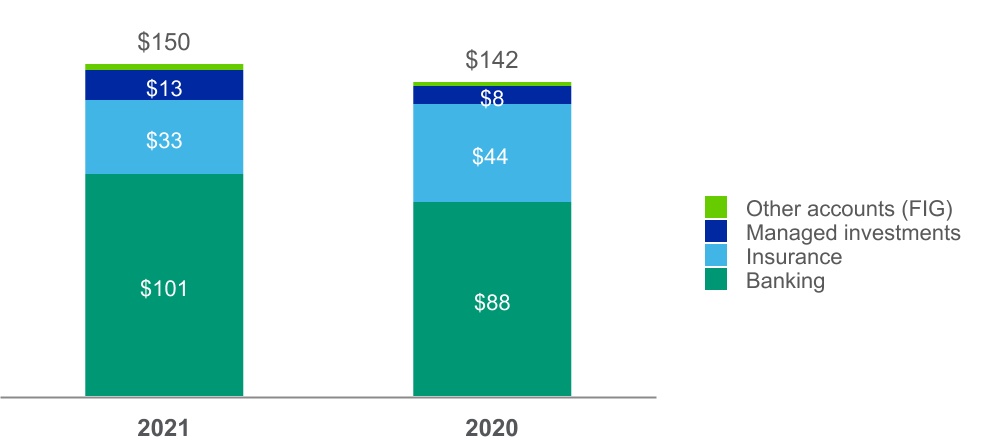

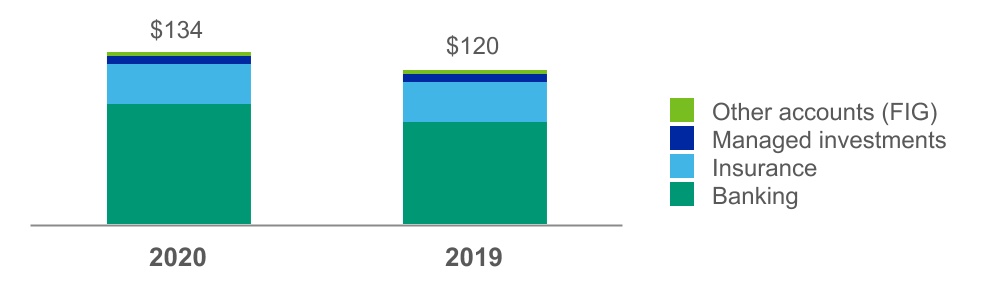

| FIG | Financial institutions group; an LOB of MIS |

Four Twenty Seven | A provider of data, intelligence, and analysis related to physical climate risks; acquired by the Company in July 2019 |

| Free Cash Flow | Net cash provided by operating activities less cash paid for capital additions |

| |

| FX | Foreign exchange |

| GAAP | U.S. Generally Accepted Accounting Principles |

| GBP | British pounds |

| ICRA | ICRA Limited; a provider of credit ratings and research in India. ICRA is a public company with its shares listed on the Bombay Stock Exchange and the National Stock Exchange of India. The Company previously held 28.5% equity ownership and in June 2014, increased that ownership stake to over 50% through the acquisition of additional shares |

IRS | Internal Revenue Service |

IT | Information technology |

| |

| |

| KIS Pricing | Korea Investors Service Pricing, Inc; a Korean provider of fixed income securities pricing and consolidated subsidiary of the Company |

| KIS Research | Korea Investors Service Research; a Korean provider of financial research and consolidated subsidiary of the Company |

| Korea | Republic of South Korea |

| LIBOR | London Interbank Offered Rate |

| LOB | Line of business |

| MA | Moody’s Analytics - a reportable segment of MCO which provides a wide range of products and services that support financial analysis and risk management activities of institutional participants in global financial markets; consists of two LOBs - RD&A and ERS |

Make Whole Amount | The prepayment penalty amount relating to the 2017 Senior Notes due 2021 and 2018 Senior Notes due 2021 which is a premium based on the excess, if any, of the discounted value of the remaining scheduled payments over the prepaid principal |

| | | | | |

TERM | DEFINITION |

| MAKS | Moody’s Analytics Knowledge Services; formerly known as Copal Amba; provided offshore research and analytic services to the global financial and corporate sectors; business was divested in the fourth quarter of 2019 and was formerly part of the PS LOB and a reporting unit within the MA reportable segment |

MALS | Moody’s Analytics Learning Solutions; a reporting unit within the MA segment that includes on-line and classroom-based training services as well as credentialing and certification services |

| MCO | Moody’s Corporation and its subsidiaries; the Company; Moody’s |

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| MIS | Moody’s Investors Service - a reportable segment of MCO; consists of five LOBs - SFG, CFG, FIG, PPIF and MIS Other |

| MIS Other | Consists of non-ratings revenue from ICRA, KIS Pricing, KIS Research and revenue from providing ESG research, data and assessments. These businesses are components of MIS; MIS Other is an LOB of MIS |

| Moody’s | Moody’s Corporation and its subsidiaries; MCO; the Company |

| MSS | Moody's Shared Services; primarily consists of information technology and support staff such as finance, human resources and legal that support both MIS and MA. |

| |

| |

| Net Income | Net income attributable to Moody’s Corporation, which excludes net income from consolidated noncontrolling interests belonging to the minority interest holder |

| | | | | |

| TERM | DEFINITION |

| New Credit Losses Accounting Standard | Updates to the ASC pursuant to ASU No. 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. This new accounting guidance requires the use of an “expected credit loss” impairment model for most financial assets reported at amortized cost, which will require entities to estimate expected credit losses over the lifetime of the instrument. |

New Internal Use Software Accounting Standard | Updates to the ASC pursuant to ASU No. 2018-15, “Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement that is a Service Contract”. This new accounting guidance requires implementation costs incurred by customers in cloud computing arrangements (i.e., hosting arrangements) to be capitalized under the same premises of authoritative guidance for internal-use software. |

| |

| NM | Percentage change is not meaningful |

| Non-GAAP | A financial measure not in accordance with GAAP; these measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s performance, facilitate comparisons to competitors’ operating results and to provide greater transparency to investors of supplemental information used by management in its financial and operational decision making |

| NRSRO | Nationally Recognized Statistical Rating Organization, which is a credit rating agency registered with the SEC. |

| OCI | Other comprehensive income (loss); includes gains and losses on cash flow and net investment hedges, unrealized gains and losses on available for sale securities (in periods prior to January 1, 2018), certain gains and losses relating to pension and other retirement benefit obligations and foreign currency translation adjustments |

| |

| Operating segment | Term defined in the ASC relating to segment reporting; the ASC defines an operating segment as a component of a business entity that has each of the three following characteristics: i) the component engages in business activities from which it may recognize revenue and incur expenses; ii) the operating results of the component are regularly reviewed by the entity’s chief operating decision maker; and iii) discrete financial information about the component is available |

| Other Retirement Plan | The U.S. retirement healthcare and U.S. retirement life insurance plans |

| |

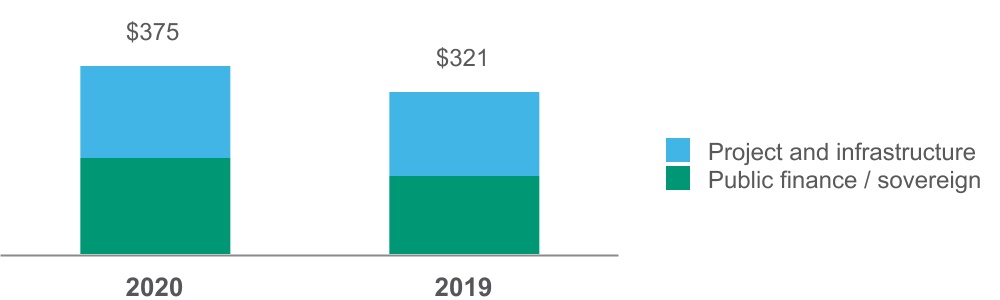

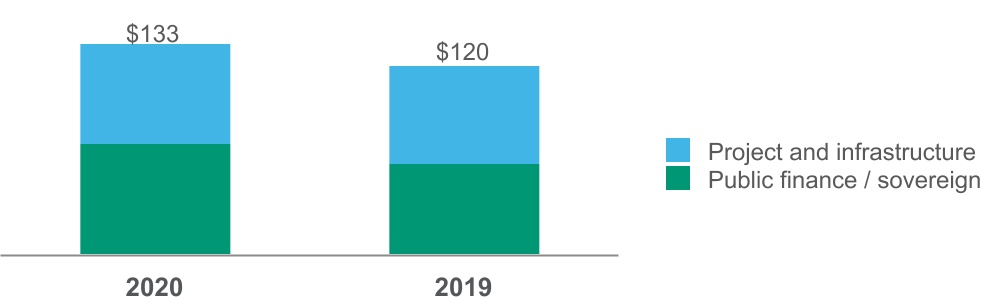

| PPIF | Public, project and infrastructure finance; an LOB of MIS |

| Profit Participation Plan | Defined contribution profit participation plan that covers substantially all U.S. employees of the Company |

| | | | | |

TERM | DEFINITION |

PS | Professional Services, a former LOB within MA which consisted of MAKS and MALS that provided offshore analytical and research services as well as learning solutions and certification programs. Subsequent to the divestiture of MAKS in 2019, revenue from the MALS reporting unit, which previous to 2020 was reported in the PS LOB, is now reported as part of the RD&A LOB. Prior periods have not been reclassified as the amounts were not material. |

RBA International (RBA) | A provider of online retail bank training and certifications; the Company acquired RBA in March 2020 |

| RD&A | An LOB within MA that offers subscription-based research, data and analytical products, includingincluding: credit ratings produced by MIS,MIS; credit research,research; quantitative credit scores and other analytical tools,tools; economic research and forecasts,forecasts; business intelligence and company information products, andproducts; commercial real estate data and analytical toolstools; learning solutions |

Redeemable Noncontrolling Interest | Represents minority shareholders' interest in entities which are controlled but not wholly-owned by Moody's and for which Moody's obligation to redeem the minority shareholders' interest is represented by a put/call relationship |

Reform Act | Credit Rating Agency Reform Act of 2006 |

Regulatory DataCorp Inc. (RDC) | A global leader in risk and compliance intelligence; the Company acquired RDC in February 2020 |

Reis, Inc. (Reis) | A provider of U.S. commercial real estate data; acquired by the Company in October 2018 |

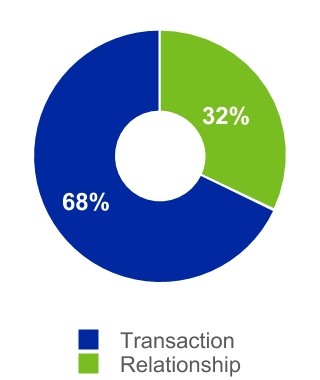

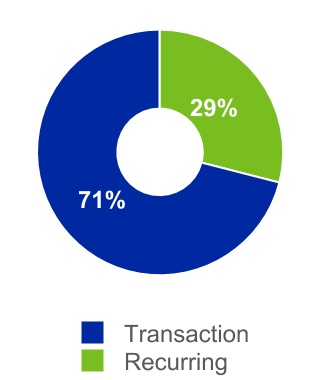

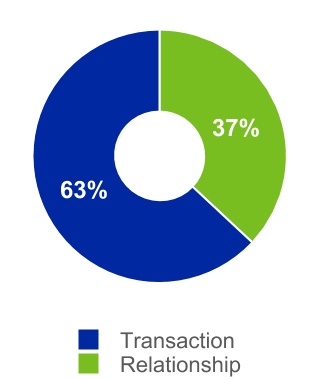

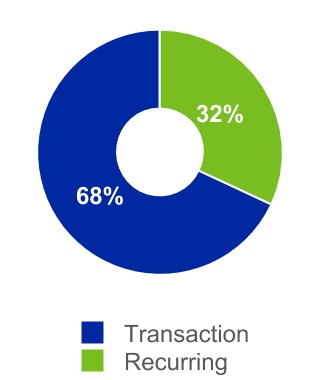

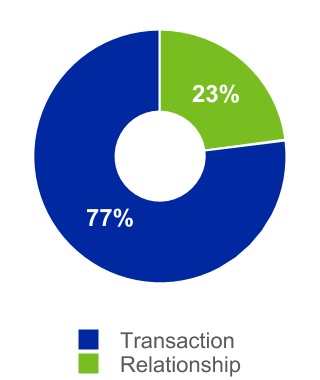

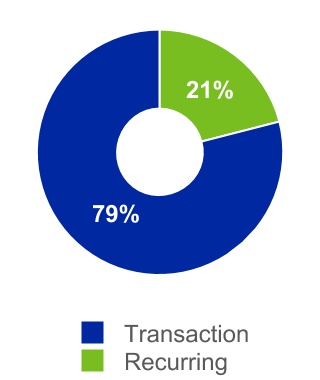

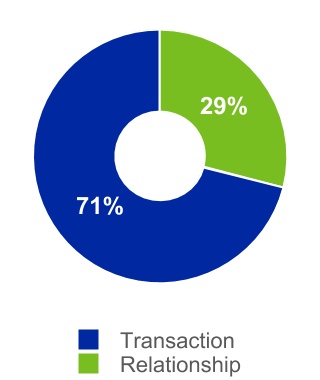

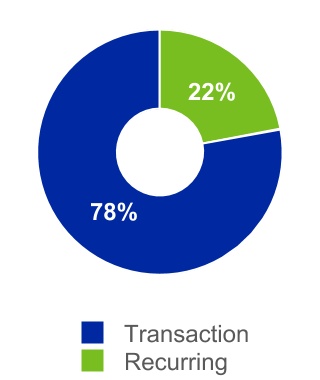

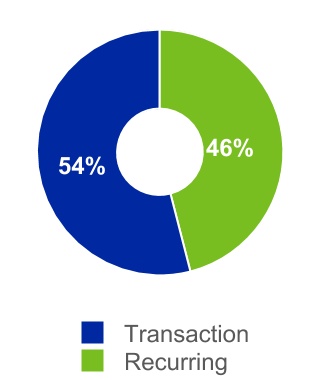

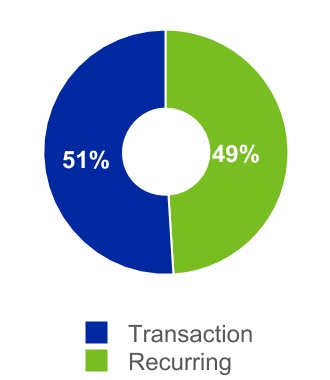

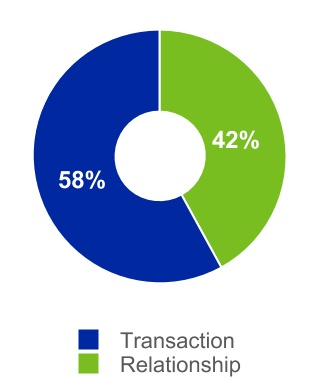

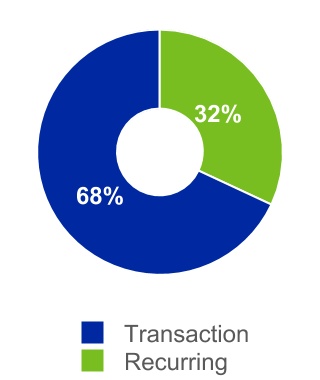

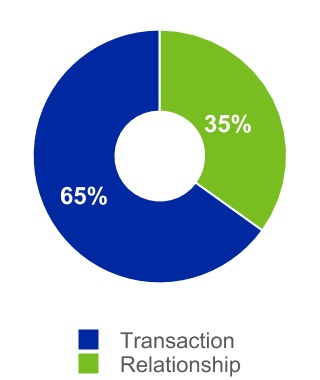

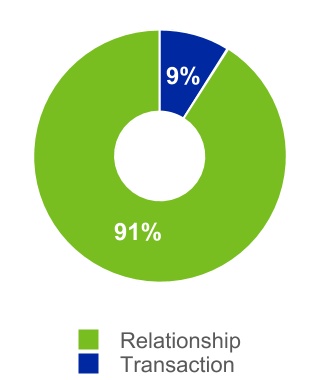

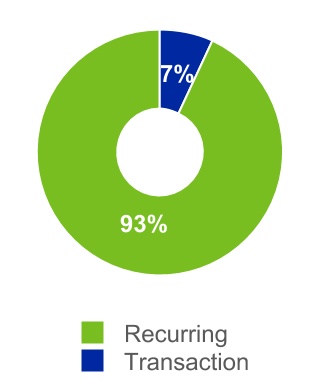

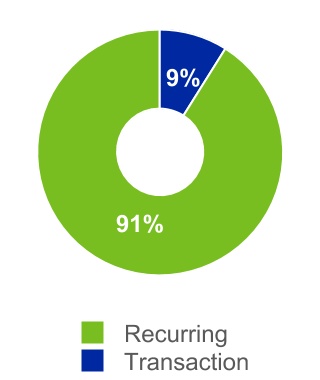

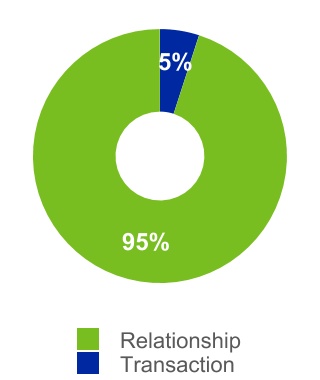

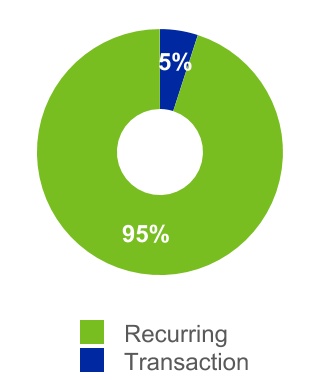

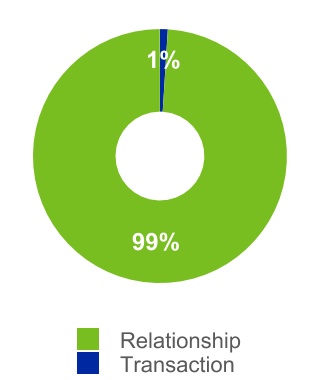

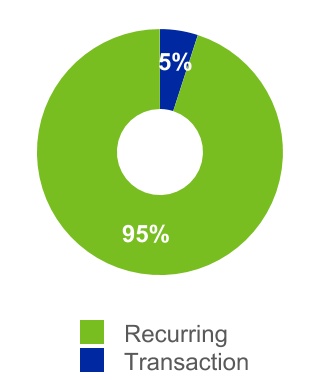

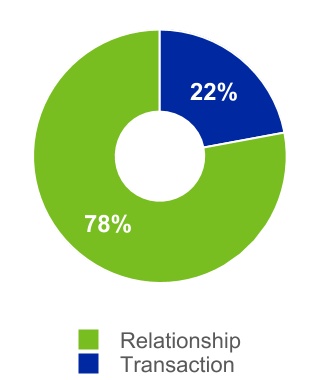

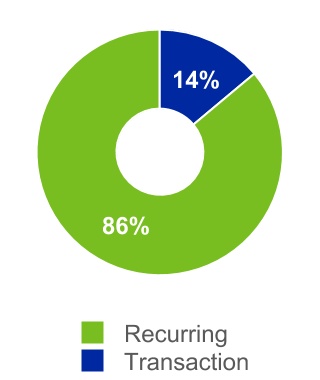

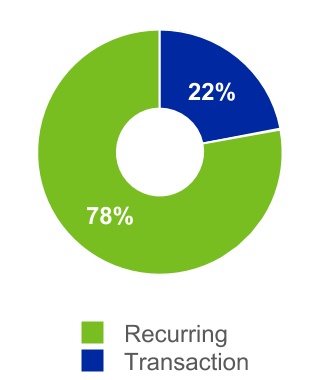

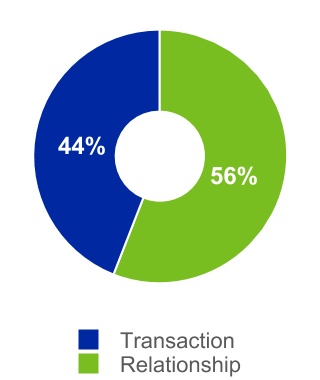

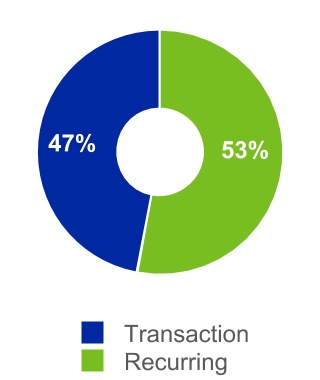

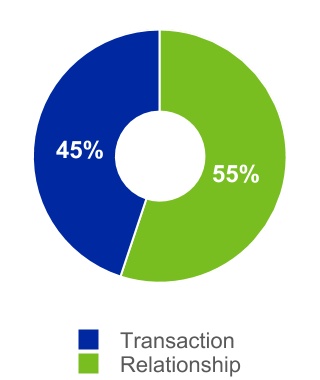

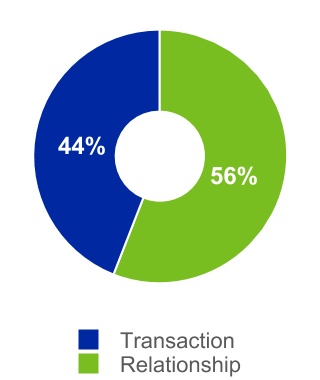

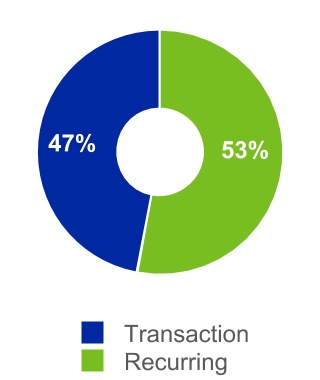

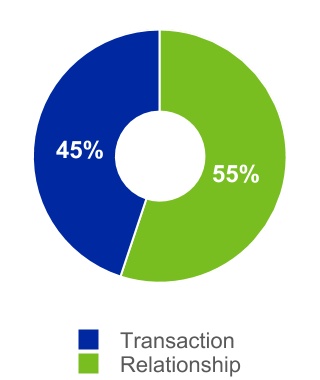

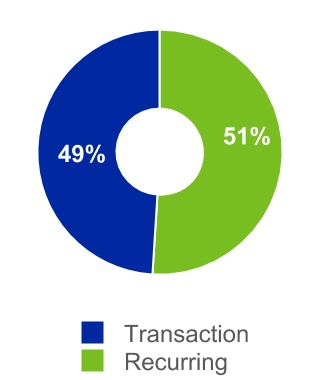

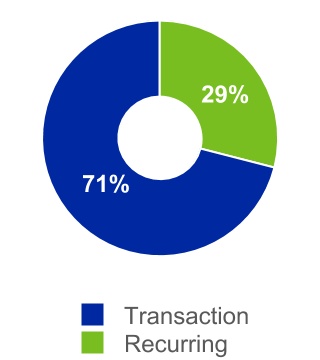

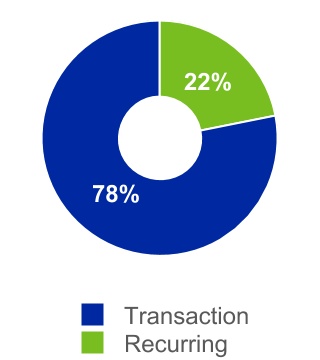

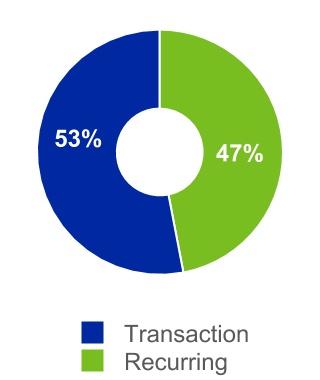

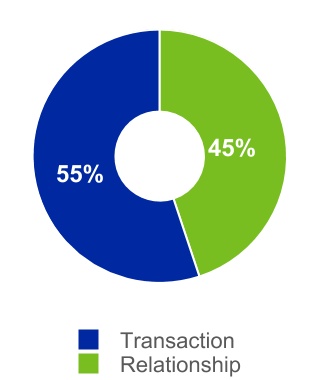

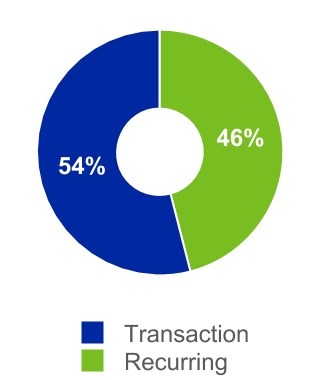

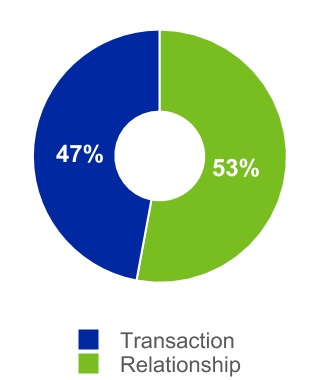

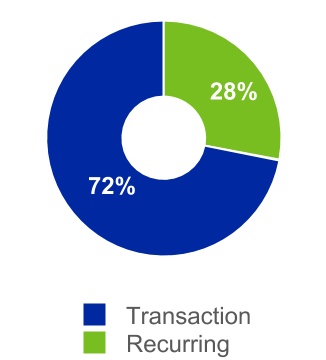

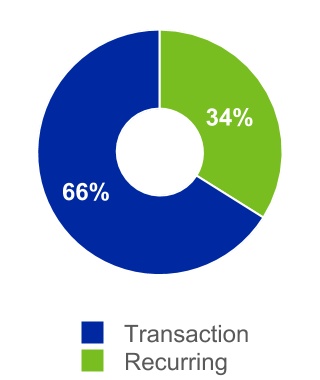

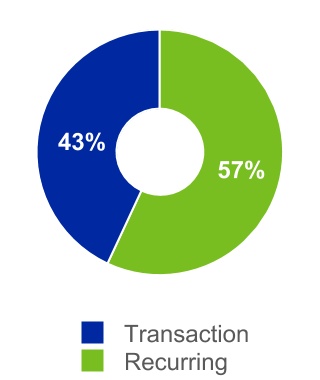

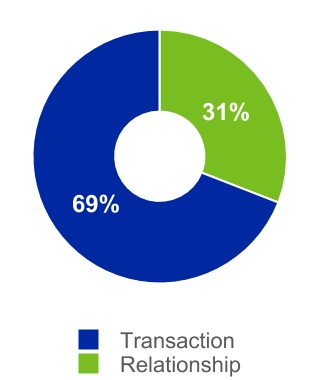

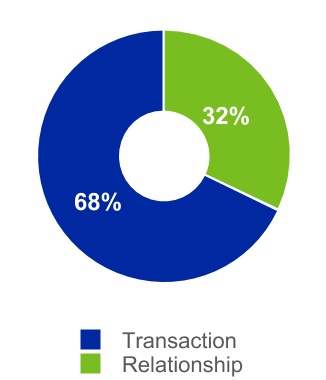

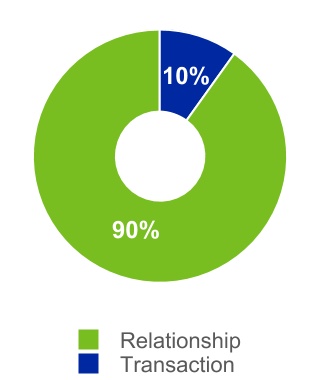

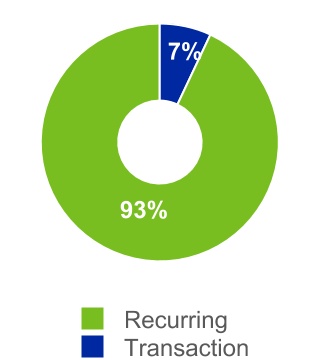

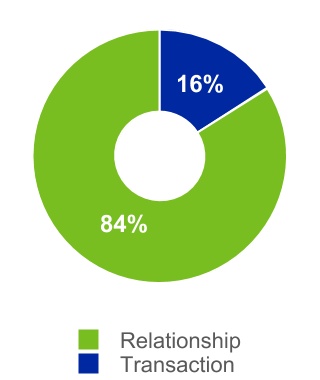

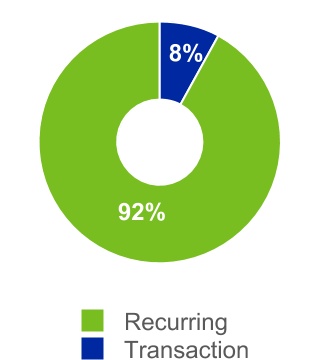

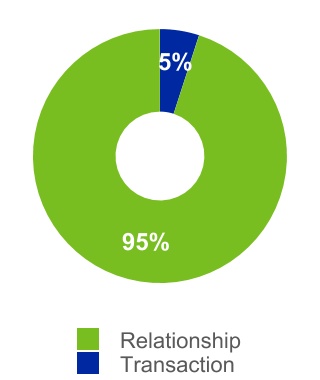

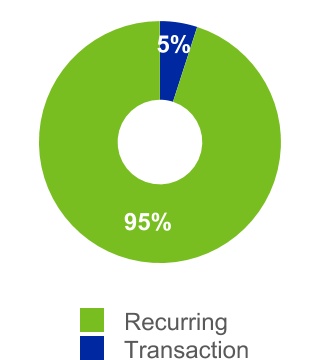

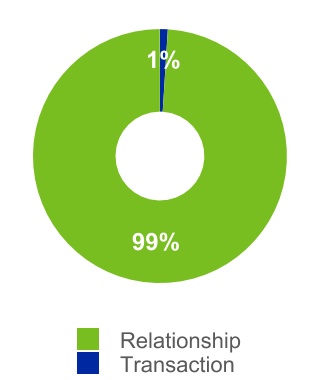

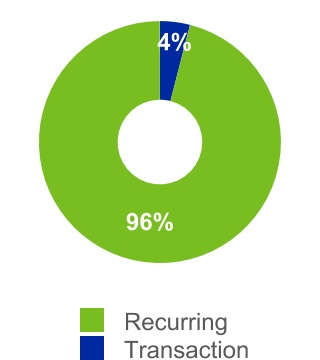

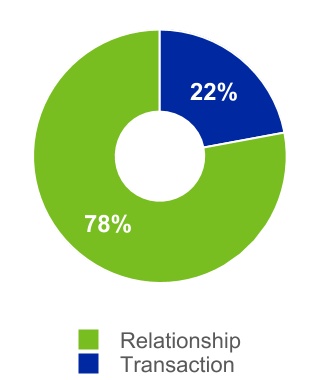

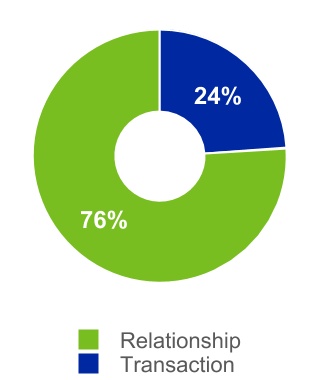

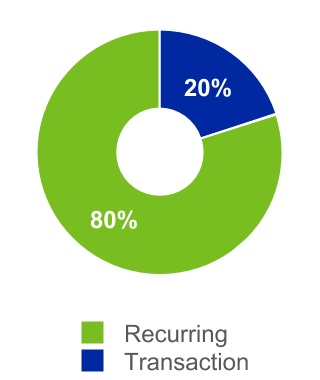

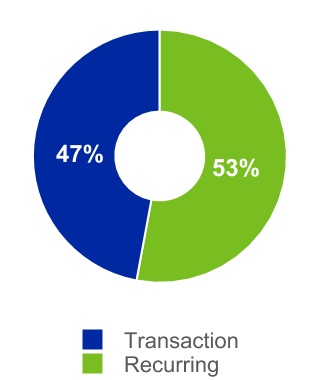

RelationshipRecurring Revenue | For MIS, represents recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations, as well as revenue from programs such as commercial paper, medium-term notes and shelf registrations. For MIS Other, represents subscription-based revenue. For MA, represents subscription-based revenue and software maintenance revenue |

| Reform Act | Credit Rating Agency Reform Act of 2006 |

| Regulatory DataCorp Inc. (RDC) | A global leader in risk and compliance intelligence; the Company acquired RDC in February 2020 |

| |

| |

| Reporting unit | The level at which Moody’s evaluates its goodwill for impairment under U.S. GAAP; defined as an operating segment or one level below an operating segment |

| Retirement Plans | Moody’s funded and unfunded pension plans, the healthcare plans and life insurance plans |

| Revenue Accounting Standard | Updates to the ASC pursuant to ASU No. 2014-09, “Revenue from Contracts with Customers (ASC Topic 606)”. This new accounting guidance significantly changes the accounting framework under U.S. GAAP relating to revenue recognition and to the accounting for the deferral of incremental costs of obtaining or fulfilling a contract with a customer |

RiskFirst | A company providing risk analytic solutions for the asset management and pension fund communities; acquired by the Company in July 2019 |

| RMBS | Residential mortgage-backed securities; an asset class within SFG |

ROU Asset | Assets recorded pursuant to the New Lease Accounting Standard which represent the Company’s right to use an underlying asset for the term of a lease |

| SEC | U.S. Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| SFG | Structured finance group; an LOB of MIS |

| SG&A | Selling, general and administrative expenses |

| Tax Act | The “Tax Cuts and Jobs Act” enacted into U.S. law on December 22, 2017 which significantly amends the tax code in the U.S. |

| |

| | | | | |

| TERM | DEFINITION |

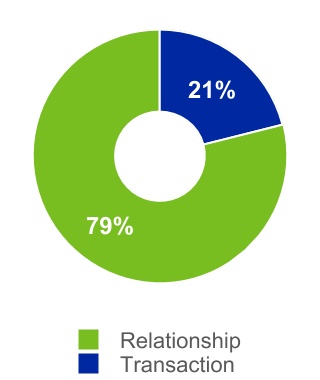

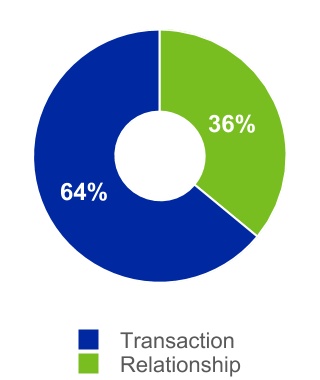

| Transaction Revenue | For MIS, represents the initial rating of a new debt issuance as well as other one-time fees. For MIS Other, represents revenue from professional services as well as data services, research and analytical engagements. For MA, represents perpetual software license fees and revenue from software implementation services, risk management advisory projects, training and certification services, and research and analytical engagements |

| U.K. | United Kingdom |

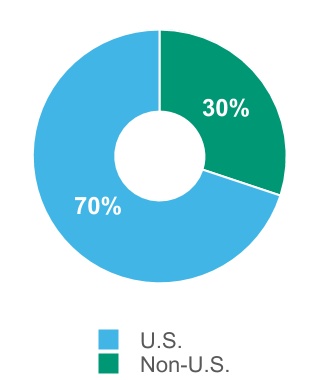

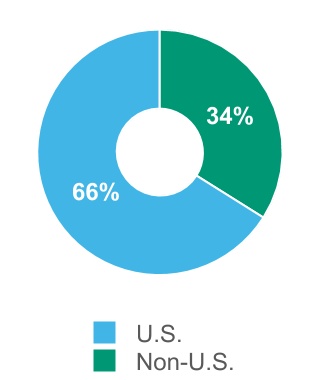

| U.S. | United States |

| USD | U.S. dollar |

| UTPs | Uncertain tax positions |

| | | | | |

TERMYTD | DEFINITIONYear-To-Date |

Vigeo EirisZM Financial Systems (ZMFS) | A provider of in ESG research, datarisk and assessments;financial management software for the U.S. banking sector; acquired by the Company on April 12, 2019in December 2020 |

2018 | |

| 2020 MA Strategic Reorganization Restructuring Program | Restructuring program approved by the chief executive officer of Moody’s on October 26, 2018. This program included relocation of certain functions from high-cost to lower-cost jurisdictions, a reduction of staff, including from acquisitions and pursuant to a review of the business criticality of certain positions, and the rationalization and exit of certain real estate leases due to consolidation of various business activities. |

2020 Restructuring Program | Restructuring program approved by the chief executive officer of Moody’s on July 29,December 22, 2020, primarilyrelating to a strategic reorganization in response to the COVID-19 pandemic which revolves around the rationalization and exit of certain real estate leases.MA reportable segment |

| |

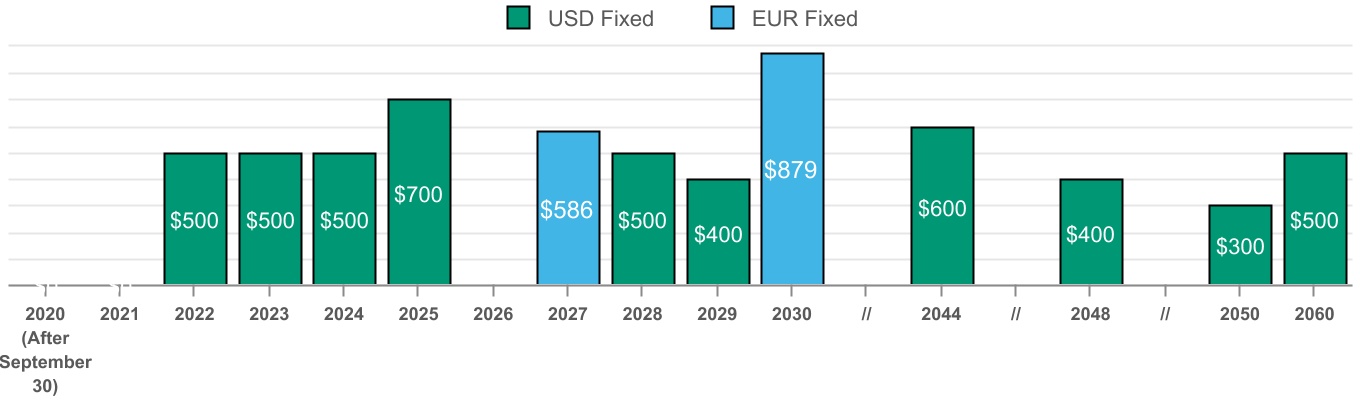

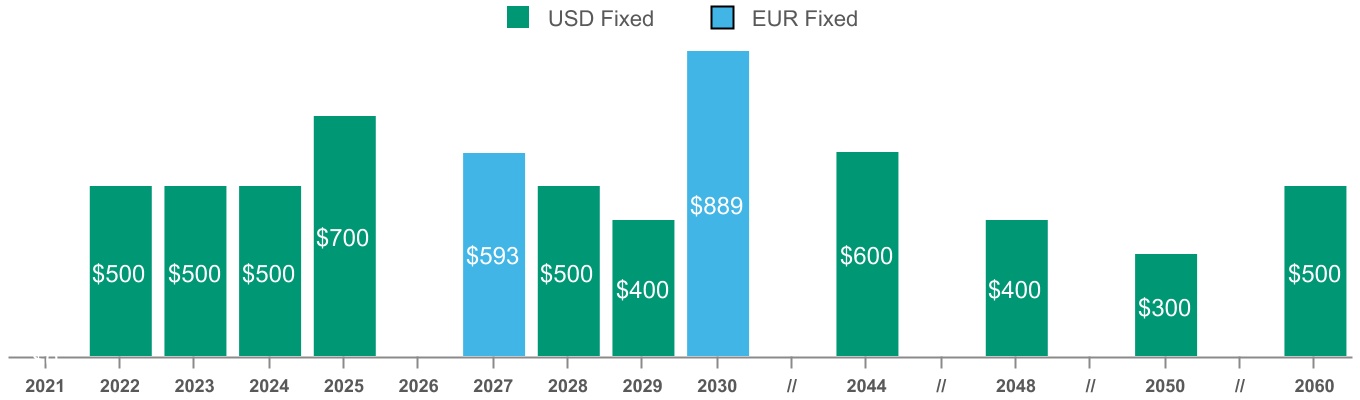

| 2012 Senior Notes due 2022 | Principal amount of $500 million, 4.50% senior unsecured notes due in September 2022 |

| 2013 Senior Notes due 2024 | Principal amount of the $500 million, 4.875% senior unsecured notes due in February 2024 |

2014 Senior Notes (30-Year)due 2044 | Principal amount of $600 million, 5.25% senior unsecured notes due in July 2044 |

| 2015 Senior Notes due 2027 | Principal amount of €500 million, 1.75% senior unsecured notes due in March 2027 |

2017 Senior Notes Duedue 2023 | Principal amount of $500 million, 2.625% senior unsecured notes due January 15, 2023 |

2017 Senior Notes Duedue 2028 | Principal amount of $500 million, 3.250% senior unsecured notes due January 15, 2028 |

2017 Senior Notes Due 2021 | Principal amount of $500 million, 2.75% senior unsecured notes originally due in December 2021, but early repaid by the Company in 2020. |

| 2018 Facility | Five-year unsecured revolving credit facility, with capacity to borrow up to $1 billion; backstops CP issued under the CP Program |

2018 Senior Notes | Principal amount of $300 million, 3.25% senior unsecured notes originally due in June 2021, but early repaid by the Company in 2020. |

2018 Senior Notes (10-year)due 2029 | Principal amount of $400 million, 4.25% senior unsecured notes due February 1, 2029 |

2018 Senior Notes (30-year)due 2048 | Principal amount of $400 million, 4.875% senior unsecured notes due December 17, 2048 |

| 2019 Senior Notes due 2030 | Principal amount of €750 million, 0.950% senior unsecured notes due February 25, 2030 |

2020 Senior Notes Duedue 2025 | Principal amount of $700 million, 3.75% senior unsecured notes due March 24, 2025 |

2020 Senior Notes Duedue 2050 | Principal amount of $300 million, 3.25% senior unsecured notes due May 20, 2050 |

2020 Senior Notes Duedue 2060 | Principal amount of $500 million, 2.55% senior unsecured notes due August 18, 2060 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share data)

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 | | 2021 | | 2020 |

| Revenue | Revenue | $ | 1,356 | | | $ | 1,240 | | | $ | 4,081 | | | $ | 3,596 | | Revenue | $ | 1,553 | | | $ | 1,435 | | | $ | 3,153 | | | $ | 2,725 | |

| Expenses | Expenses | | | | | | | | Expenses | | | | | | | |

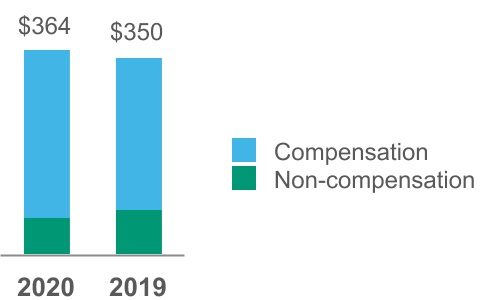

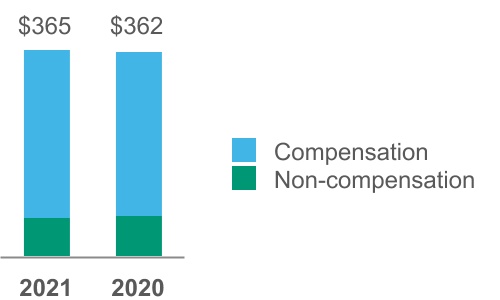

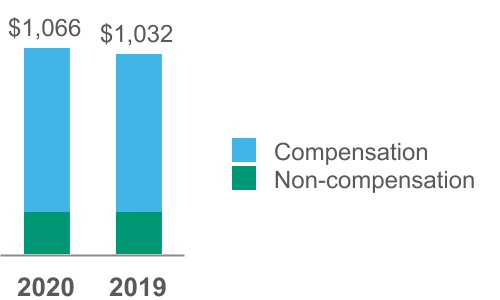

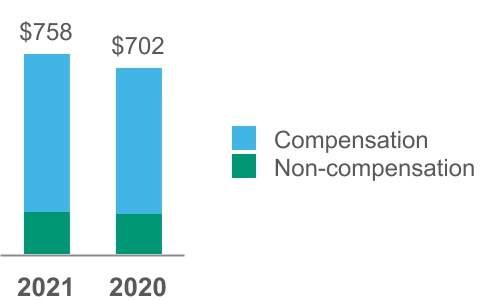

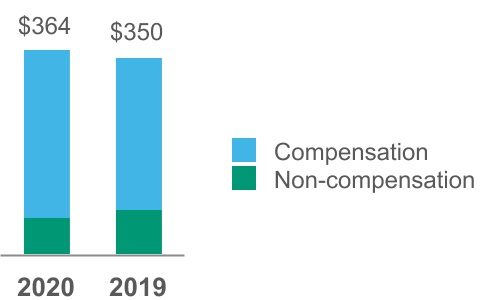

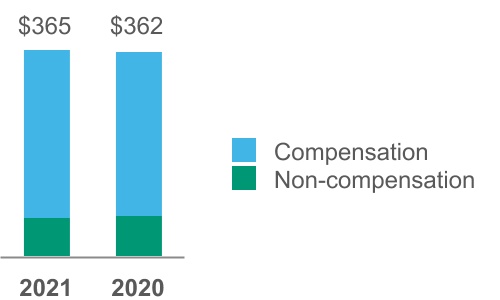

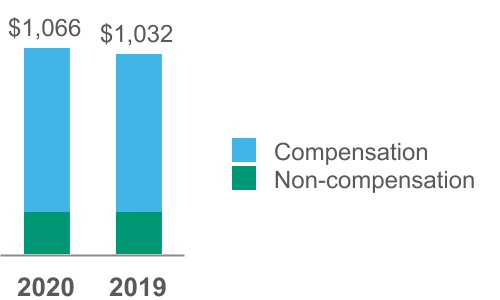

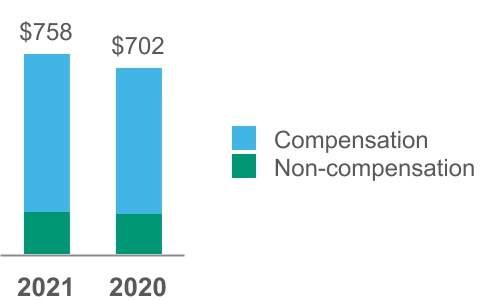

| Operating | Operating | 364 | | | 350 | | | 1,066 | | | 1,032 | | Operating | 365 | | | 362 | | | 758 | | | 702 | |

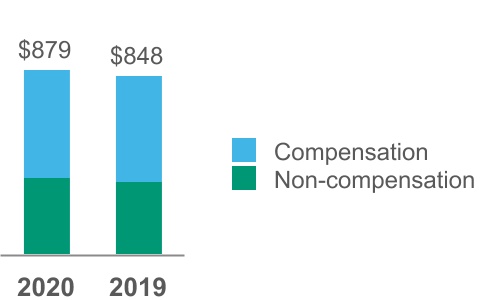

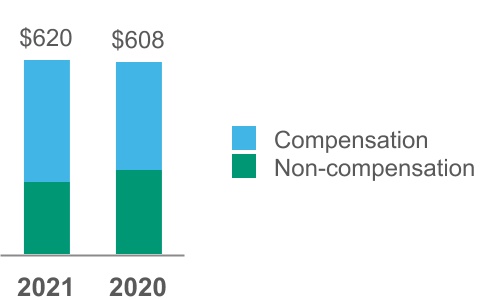

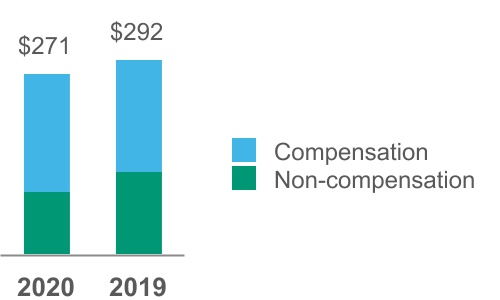

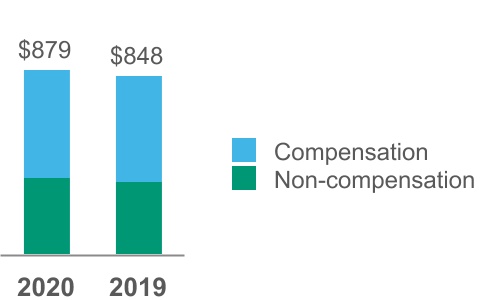

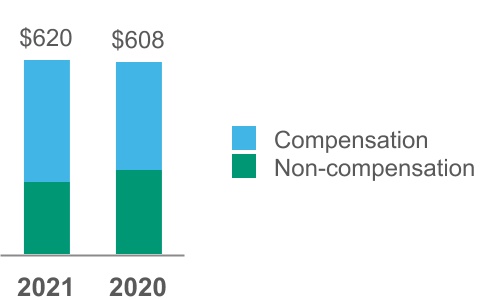

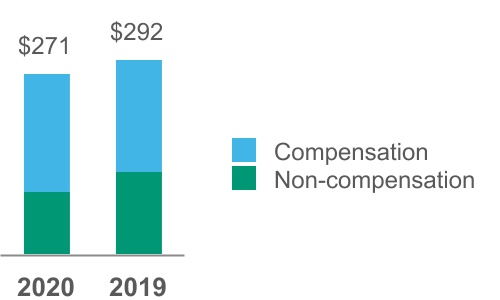

| Selling, general and administrative | Selling, general and administrative | 271 | | | 292 | | | 879 | | | 848 | | Selling, general and administrative | 327 | | | 307 | | | 620 | | | 608 | |

| Depreciation and amortization | | Depreciation and amortization | 60 | | | 58 | | | 119 | | | 107 | |

| Restructuring | Restructuring | 23 | | | (1) | | | 20 | | | 58 | | Restructuring | 0 | | | (2) | | | 2 | | | (3) | |

| Depreciation and amortization | 56 | | | 48 | | | 163 | | | 150 | | |

| Acquisition-Related Expenses | 0 | | | 0 | | | 0 | | | 3 | | |

| | Loss pursuant to the divestiture of MAKS | Loss pursuant to the divestiture of MAKS | 0 | | | 2 | | | 9 | | | 11 | | Loss pursuant to the divestiture of MAKS | 0 | | | 0 | | | 0 | | | 9 | |

| Total expenses | Total expenses | 714 | | | 691 | | | 2,137 | | | 2,102 | | Total expenses | 752 | | | 725 | | | 1,499 | | | 1,423 | |

| Operating income | Operating income | 642 | | | 549 | | | 1,944 | | | 1,494 | | Operating income | 801 | | | 710 | | | 1,654 | | | 1,302 | |

| Non-operating (expense) income, net | Non-operating (expense) income, net | | | | | | | | Non-operating (expense) income, net | | | | | | | |

| Interest expense, net | Interest expense, net | (53) | |

| (46) | |

| (153) | |

| (149) | | Interest expense, net | (49) | | | (60) | | | (56) | | | (100) | |

| Other non-operating income, net | Other non-operating income, net | 10 | |

| 10 | |

| 38 | |

| 12 | | Other non-operating income, net | 6 | | | 16 | | | 22 | | | 28 | |

| Total non-operating expense, net | (43) | | | (36) | | | (115) | | | (137) | | |

| Income before provisions for income taxes | 599 | | | 513 | | | 1,829 | | | 1,357 | | |

| Total non-operating (expense) income, net | | Total non-operating (expense) income, net | (43) | | | (44) | | | (34) | | | (72) | |

| Income before provision for income taxes | | Income before provision for income taxes | 758 | | | 666 | | | 1,620 | | | 1,230 | |

| Provision for income taxes | Provision for income taxes | 132 | | | 130 | | | 366 | | | 290 | | Provision for income taxes | 181 | | | 157 | | | 307 | | | 234 | |

| Net income | Net income | 467 | | | 383 | | | 1,463 | | | 1,067 | | Net income | 577 | | | 509 | | | 1,313 | | | 996 | |

| Less: Net (loss) income attributable to noncontrolling interests | 0 | | | 3 | | | (1) | | | 5 | | |

| Less: Net income (loss) attributable to noncontrolling interests | | Less: Net income (loss) attributable to noncontrolling interests | 0 | | | 0 | | | 0 | | | (1) | |

| Net income attributable to Moody's | Net income attributable to Moody's | $ | 467 | | | $ | 380 | | | $ | 1,464 | | | $ | 1,062 | | Net income attributable to Moody's | $ | 577 | | | $ | 509 | | | $ | 1,313 | | | $ | 997 | |

| Earnings per share attributable to Moody's common shareholders | Earnings per share attributable to Moody's common shareholders | | | | | | | | Earnings per share attributable to Moody's common shareholders | | | | | | | |

| Basic | Basic | $ | 2.49 | |

| $ | 2.01 | |

| $ | 7.80 | |

| $ | 5.60 | | Basic | $ | 3.09 | | | $ | 2.71 | | | $ | 7.02 | | | $ | 5.31 | |

| Diluted | Diluted | $ | 2.47 | |

| $ | 1.99 | |

| $ | 7.73 | |

| $ | 5.54 | | Diluted | $ | 3.07 | | | $ | 2.69 | | | $ | 6.98 | | | $ | 5.27 | |

| Weighted average number of shares outstanding | Weighted average number of shares outstanding | | | | | | | | Weighted average number of shares outstanding | | | | | | | |

| Basic | Basic | 187.8 | |

| 189.0 | |

| 187.6 | |

| 189.6 | | Basic | 186.7 | | | 187.7 | |

| 187.0 | | | 187.6 | |

| Diluted | Diluted | 189.3 | |

| 191.1 | |

| 189.3 | |

| 191.8 | | Diluted | 187.9 | | | 189.0 | |

| 188.2 | | | 189.3 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(Amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2021 | | Three Months Ended

June 30, 2020 |

| |

| Pre-tax

amounts | | Tax

amounts | | After-tax

amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts |

| Net Income | | | | | $ | 577 | | | | | | | $ | 509 | |

| Other Comprehensive Income (Loss): | | | | | | | | | | | |

| Foreign Currency Adjustments: | | | | | | | | | | | |

| Foreign currency translation adjustments, net | $ | 37 | | | $ | (2) | | | 35 | | | $ | 78 | | | $ | 1 | | | 79 | |

| Net losses on net investment hedges | (41) | | | 12 | | | (29) | | | (97) | | | 24 | | | (73) | |

| Net investment hedges - reclassification of gains included in net income | (1) | | | 1 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | |

| Cash Flow Hedges: | | | | | | | | | | | |

| Net losses on cash flow hedges | 0 | | | 0 | | | 0 | | | (20) | | | 6 | | | (14) | |

| | | | | | | | | | | |

| Pension and Other Retirement Benefits: | | | | | | | | | | | |

| Amortization of actuarial losses/prior service costs and settlement charge included in net income | 10 | | | (2) | | | 8 | | | 1 | | | 0 | | | 1 | |

| Net actuarial gains (losses) and prior service costs | 0 | | | 0 | | | 0 | | | 9 | | | (2) | | | 7 | |

| Total other comprehensive income (loss) | $ | 5 | | | $ | 9 | | | 14 | | | $ | (29) | | | $ | 29 | | | 0 | |

| Comprehensive income | | | | | 591 | | | | | | | 509 | |

| Less: comprehensive (loss) income attributable to noncontrolling interests | | | | | (1) | | | | | | | (11) | |

| Comprehensive Income Attributable to Moody's | | | | | $ | 592 | | | | | | | $ | 520 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, 2020 | | Three Months Ended

September 30, 2019 |

| Pre-tax amounts | | Tax amounts | | After-tax amounts | | Pre-tax amounts | | Tax amounts | | After-tax amounts |

| Net Income | | | | | $ | 467 | | | | | | | $ | 383 | |

| Other Comprehensive Income (loss): | | | | | | | | | | | |

| Foreign Currency Adjustments: | | | | | | | | | | | |

| Foreign currency translation adjustments, net | $ | 204 | | | $ | (17) | | | 187 | | | $ | (194) | | | $ | 0 | | | (194) | |

| Net (losses) gains on net investment hedges | (191) | | | 48 | | | (143) | | | 136 | | | (34) | | | 102 | |

| Net investment hedges - reclassification of gains included in net income | 0 | | | 0 | | | 0 | | | (1) | | | 0 | | | (1) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Pension and Other Retirement Benefits: | | | | | | | | | | | |

| Amortization of actuarial losses and prior service costs included in net income | 2 | | | 0 | | | 2 | | | 1 | | | 0 | | | 1 | |

| Net actuarial (losses) gains and prior service costs | (9) | | | 2 | | | (7) | | | 0 | | | 0 | | | 0 | |

| Total other comprehensive income (loss) | $ | 6 | | | $ | 33 | | | $ | 39 | | | $ | (58) | | | $ | (34) | | | $ | (92) | |

| Comprehensive income | | | | | 506 | | | | | | | 291 | |

| Less: comprehensive income attributable to noncontrolling interests | | | | | 1 | | | | | | | 3 | |

| Comprehensive Income Attributable to Moody's | | | | | $ | 505 | | | | | | | $ | 288 | |

| | | | | | | | | | | |

| | | Nine Months Ended

September 30, 2020 | | Nine Months Ended

September 30, 2019 | | Six Months Ended

June 30, 2021 | | Six Months Ended

June 30, 2020 |

| | | Pre-tax amounts | | Tax amounts | | After-tax amounts | | Pre-tax amounts | | Tax amounts | | After-tax amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts |

| Net Income | Net Income | | | | | $ | 1,463 | | | | | | | $ | 1,067 | | Net Income | | | | | $ | 1,313 | | | | | | | $ | 996 | |

| Other Comprehensive Income (loss): | | | | | |

| Other Comprehensive Income (Loss): | | Other Comprehensive Income (Loss): | | | | |

| Foreign Currency Adjustments: | Foreign Currency Adjustments: | | | Foreign Currency Adjustments: | | |

| Foreign currency translation adjustments, net | Foreign currency translation adjustments, net | $ | 107 | | | $ | (11) | | | 96 | | | $ | (179) | | | $ | 0 | | | (179) | | Foreign currency translation adjustments, net | $ | (110) | | | $ | 4 | | | (106) | | | $ | (97) | | | $ | 6 | | | (91) | |

| Net (losses) gains on net investment hedges | (169) | | | 42 | | | (127) | | | 130 | | | (33) | | | 97 | | |

| Net gains on net investment hedges | | Net gains on net investment hedges | 134 | | | (30) | | | 104 | | | 22 | | | (6) | | | 16 | |

| Net investment hedges - reclassification of gains included in net income | | Net investment hedges - reclassification of gains included in net income | (2) | | | 1 | | | (1) | | | 0 | | | 0 | | | 0 | |

| | Net investment hedges - reclassification of gains included in net income | 0 | | | 0 | | | 0 | | | (1) | | | 0 | | | (1) | | |

| Cash Flow Hedges: | Cash Flow Hedges: | | Cash Flow Hedges: | |

| Net losses on cash flow hedges | Net losses on cash flow hedges | (68) | | | 18 | | | (50) | | | 0 | | | 0 | | | 0 | | Net losses on cash flow hedges | 0 | | | 0 | | | 0 | | | (68) | | | 18 | | | (50) | |

| Reclassification of losses included in net income | Reclassification of losses included in net income | 1 | | | 0 | | | 1 | | | 0 | | | 0 | | | 0 | | Reclassification of losses included in net income | 1 | | | 0 | | | 1 | | | 1 | | | 0 | | | 1 | |

| Pension and Other Retirement Benefits: | Pension and Other Retirement Benefits: | | Pension and Other Retirement Benefits: | |

| Amortization of actuarial losses and prior service costs included in net income | 5 | | | (1) | | | 4 | | | 3 | | | (1) | | | 2 | | |

| Amortization of actuarial losses/prior service costs and settlement charge included in net income | | Amortization of actuarial losses/prior service costs and settlement charge included in net income | 13 | | | (3) | | | 10 | | | 3 | | | (1) | | | 2 | |

| Net actuarial gains (losses) and prior service costs | Net actuarial gains (losses) and prior service costs | (1) | | | 0 | | | (1) | | | (2) | | | 1 | | | (1) | | Net actuarial gains (losses) and prior service costs | 0 | | | 0 | | | 0 | | | 8 | | | (2) | | | 6 | |

| Total other comprehensive (loss) income | $ | (125) | | | $ | 48 | | | (77) | | | $ | (49) | | | $ | (33) | | | (82) | | |

| Total other comprehensive income (loss) | | Total other comprehensive income (loss) | $ | 36 | | | $ | (28) | | | 8 | | | $ | (131) | | | $ | 15 | | | (116) | |

| Comprehensive income | Comprehensive income | | | | | 1,386 | | | | | | | 985 | | Comprehensive income | | | | | 1,321 | | | | | | | 880 | |

| Less: comprehensive (loss) income attributable to noncontrolling interests | | (12) | | | 15 | | |

| Less: comprehensive income (loss) attributable to noncontrolling interests | | Less: comprehensive income (loss) attributable to noncontrolling interests | | 1 | | | (13) | |

| Comprehensive Income Attributable to Moody's | Comprehensive Income Attributable to Moody's | | $ | 1,398 | | | $ | 970 | | Comprehensive Income Attributable to Moody's | | $ | 1,320 | | | $ | 893 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | |

| September 30, 2020 | | December 31, 2019 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,492 | | | $ | 1,832 | |

| Short-term investments | 96 | | | 98 | |

| Accounts receivable, net of allowance for credit losses of $41 in 2020 and $20 in 2019 | 1,360 | | | 1,419 | |

| Other current assets | 333 | | | 330 | |

| | | |

| Total current assets | 4,281 | | | 3,679 | |

| Property and equipment, net of accumulated depreciation of $907 in 2020 and $839 in 2019 | 282 | | | 292 | |

| Operating lease right-of-use assets | 410 | | | 456 | |

| Goodwill | 4,282 | | | 3,722 | |

| Intangible assets, net | 1,717 | | | 1,498 | |

| Deferred tax assets, net | 232 | | | 229 | |

| Other assets | 468 | | | 389 | |

| Total assets | $ | 11,672 | | | $ | 10,265 | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 712 | | | $ | 773 | |

| Current portion of operating lease liabilities | 91 | | | 89 | |

| | | |

| | | |

| Deferred revenue | 918 | | | 1,050 | |

| | | |

| Total current liabilities | 1,721 | | | 1,912 | |

| Non-current portion of deferred revenue | 102 | | | 112 | |

| Long-term debt | 6,363 | | | 5,581 | |

| Deferred tax liabilities, net | 385 | | | 357 | |

| Uncertain tax positions | 471 | | | 477 | |

| Operating lease liabilities | 439 | | | 485 | |

| Other liabilities | 498 | | | 504 | |

| Total liabilities | 9,979 | | | 9,428 | |

| Contingencies (Note 19) | | | |

| Redeemable noncontrolling interest | 5 | | | 6 | |

| Shareholders' equity: |

| Preferred stock, par value $0.01 per share; 10,000,000 shares authorized; 0 shares issued and outstanding | 0 | | | 0 | |

| Series Common Stock, par value $0.01 per share; 10,000,000 shares authorized; 0 shares issued and outstanding | 0 | | | 0 | |

| Common stock, par value $0.01 per share; 1,000,000,000 shares authorized; 342,902,272 shares issued at September 30, 2020 and December 31, 2019, respectively. | 3 | | | 3 | |

| Capital surplus | 699 | | | 642 | |

| Retained earnings | 10,804 | | | 9,656 | |

| Treasury stock, at cost; 155,064,080 and 155,215,143 shares of common stock at September 30, 2020 and December 31, 2019 | (9,505) | | | (9,250) | |

| Accumulated other comprehensive loss | (504) | | | (439) | |

| Total Moody's shareholders' equity | 1,497 | | | 612 | |

| Noncontrolling interests | 191 | | | 219 | |

| Total shareholders' equity | 1,688 | | | 831 | |

| Total liabilities, noncontrolling interests and shareholders' equity | $ | 11,672 | | | $ | 10,265 | |

| | | | | | | | | | | |

| June 30, 2021 | | December 31, 2020 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,809 | | | $ | 2,597 | |

| Short-term investments | 88 | | | 99 | |

| Accounts receivable, net of allowance for credit losses of $32 in 2021 and $34 in 2020 | 1,458 | | | 1,430 | |

| Other current assets | 379 | | | 383 | |

| | | |

| Total current assets | 4,734 | | | 4,509 | |

| Property and equipment, net of accumulated depreciation of $969 in 2021 and $928 in 2020 | 282 | | | 278 | |

| Operating lease right-of-use assets | 357 | | | 393 | |

| Goodwill | 4,590 | | | 4,556 | |

| Intangible assets, net | 1,784 | | | 1,824 | |

| Deferred tax assets, net | 249 | | | 334 | |

| Other assets | 556 | | | 515 | |

| Total assets | $ | 12,552 | | | $ | 12,409 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 816 | | | $ | 1,039 | |

| Current portion of operating lease liabilities | 92 | | | 94 | |

| | | |

| | | |

| Deferred revenue | 1,142 | | | 1,089 | |

| | | |

| Total current liabilities | 2,050 | | | 2,222 | |

| Non-current portion of deferred revenue | 93 | | | 98 | |

| Long-term debt | 6,355 | | | 6,422 | |

| Deferred tax liabilities, net | 422 | | | 404 | |

| Uncertain tax positions | 406 | | | 483 | |

| Operating lease liabilities | 386 | | | 427 | |

| Other liabilities | 460 | | | 590 | |

| Total liabilities | 10,172 | | | 10,646 | |

| Contingencies (Note 18) | 0 | | 0 |

| Shareholders' equity: |

| Preferred stock, par value $0.01 per share; 10,000,000 shares authorized; 0 shares issued and outstanding | 0 | | | 0 | |

| Series common stock, par value $0.01 per share; 10,000,000 shares authorized; 0 shares issued and outstanding | 0 | | | 0 | |

| Common stock, par value $0.01 per share; 1,000,000,000 shares authorized; 342,902,272 shares issued at June 30, 2021 and December 31, 2020, respectively. | 3 | | | 3 | |

| Capital surplus | 784 | | | 735 | |

| Retained earnings | 12,094 | | | 11,011 | |

| Treasury stock, at cost; 156,723,618 and 155,808,563 shares of common stock at June 30, 2021 and December 31, 2020 | (10,270) | | | (9,748) | |

| Accumulated other comprehensive loss | (425) | | | (432) | |

| Total Moody's shareholders' equity | 2,186 | | | 1,569 | |

| Noncontrolling interests | 194 | | | 194 | |

| Total shareholders' equity | 2,380 | | | 1,763 | |

| Total liabilities, noncontrolling interests and shareholders' equity | $ | 12,552 | | | $ | 12,409 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Amounts in millions)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2020 | | 2019 |

| Cash flows from operating activities | |

| Net income | $ | 1,463 | | | $ | 1,067 | |

| Reconciliation of net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 163 | | | 150 | |

| Stock-based compensation | 110 | | | 103 | |

| Deferred income taxes | (1) | | | (22) | |

| ROU Asset impairment & other non-cash restructuring/impairment charges | 23 | | | 38 | |

| Loss pursuant to the divestiture of MAKS | 9 | | | 11 | |

| Settlement of treasury rate lock | (68) | | | 0 | |

| Prepayment penalty relating to early redemption of debt | 24 | | | 0 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 73 | | | 36 | |

| Other current assets | (8) | | | (8) | |

| | | |

| Other assets | (89) | | | (32) | |

| | | |

| | | |

| Accounts payable and accrued liabilities | (28) | | | (100) | |

| Deferred revenue | (171) | | | (96) | |

| Unrecognized tax benefits and other non-current tax liabilities | (9) | | | (17) | |

| Other liabilities | (3) | | | 66 | |

| Net cash provided by operating activities | 1,488 | | | 1,196 | |

| Cash flows from investing activities |

| Capital additions | (83) | | | (61) | |

| Purchases of investments | (130) | | | (111) | |

| Sales and maturities of investments | 57 | | | 139 | |

| | | |

| Cash paid for acquisitions, net of cash acquired | (699) | | | (121) | |

| Receipts from settlements of net investment hedges | 2 | | | 4 | |

| Net cash used in investing activities | (853) | | | (150) | |

| Cash flows from financing activities | | | |

| Issuance of notes | 1,491 | | | 0 | |

| Repayment of notes | (800) | | | (450) | |

| Issuance of commercial paper | 789 | | | 1,307 | |

| Repayment of commercial paper | (792) | | | (1,310) | |

| Proceeds from stock-based compensation plans | 41 | | | 37 | |

| Repurchase of shares related to stock-based compensation | (101) | | | (76) | |

| Treasury shares | (253) | | | (728) | |

| Dividends | (315) | | | (284) | |

| Debt issuance costs, extinguishment costs and related fees | (39) | | | 0 | |

| Dividends to noncontrolling interest | (1) | | | (1) | |

| Payment to acquire noncontrolling interests | (17) | | | (12) | |

| | | |

| Net cash provided by (used in) financing activities | 3 | | | (1,517) | |

| Reclassification of cash to assets held for sale | 0 | | | (11) | |

| Effect of exchange rate changes on cash and cash equivalents | 22 | | | (25) | |

| Increase (decrease) in cash and cash equivalents | 660 | | | (507) | |

| Cash and cash equivalents, beginning of period | 1,832 | | | 1,685 | |

| Cash and cash equivalents, end of period | $ | 2,492 | | | $ | 1,178 | |

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2021 | | 2020 |

| Cash flows from operating activities | |

| Net income | $ | 1,313 | | | $ | 996 | |

| Reconciliation of net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 119 | | | 107 | |

| Stock-based compensation | 86 | | | 72 | |

| Deferred income taxes | 59 | | | 46 | |

| | | |

| Loss pursuant to the divestiture of MAKS | 0 | | | 9 | |

| | | |

| | | |

| Settlement of treasury rate lock | 0 | | | (68) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (29) | | | 11 | |

| Other current assets | 17 | | | (45) | |

| | | |

| Other assets | (23) | | | (39) | |

| | | |

| | | |

| Accounts payable and accrued liabilities | (182) | | | 31 | |

| Deferred revenue | 49 | | | (60) | |

| Unrecognized tax benefits and other non-current tax liabilities | (75) | | | (13) | |

| Other liabilities | (64) | | | (70) | |

| Net cash provided by operating activities | 1,270 | | | 977 | |

| Cash flows from investing activities |

| Capital additions | (44) | | | (62) | |

| Purchases of investments | (109) | | | (108) | |

| Sales and maturities of investments | 85 | | | 45 | |

| | | |

| Cash paid for acquisitions, net of cash acquired | (138) | | | (698) | |

| Receipts from settlements of net investment hedges | 2 | | | 0 | |

| Payments for settlements of net investment hedges | (47) | | | 0 | |

| Net cash used in investing activities | (251) | | | (823) | |

| Cash flows from financing activities | | | |

| Issuance of notes | 0 | | | 995 | |

| Repayment of notes | 0 | | | (300) | |

| Issuance of commercial paper | 0 | | | 789 | |

| Repayment of commercial paper | 0 | | | (792) | |

| Proceeds from stock-based compensation plans | 23 | | | 29 | |

| Repurchase of shares related to stock-based compensation | (79) | | | (100) | |

| Treasury shares | (503) | | | (253) | |

| Dividends | (232) | | | (210) | |

| Debt issuance costs, extinguishment costs and related fees | 0 | | | (17) | |

| Dividends to noncontrolling interest | (1) | | | (1) | |

| Payment to acquire noncontrolling interests | 0 | | | (17) | |

| | | |

| Net cash (used in) provided by financing activities | (792) | | | 123 | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (15) | | | (10) | |

| Increase in cash and cash equivalents | 212 | | | 267 | |

| Cash and cash equivalents, beginning of period | 2,597 | | | 1,832 | |

| Cash and cash equivalents, end of period | $ | 2,809 | | | $ | 2,099 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Total Moody's Shareholders' Equity | | Non- Controlling Interests | | Total Shareholders' Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at June 30, 2019 | 342.9 | | | $ | 3 | | | $ | 575 | | | $ | 9,108 | | | (153.7) | | | $ | (8,887) | | | $ | (446) | | | $ | 353 | | | $ | 222 | | | $ | 575 | |

| Net income | | | | | | | 380 | | | | | | | | | 380 | | | 3 | | | 383 | |

| Dividends ($0.50 per share) | | | | | | | (97) | | | | | | | | | (97) | | | 0 | | | (97) | |

| Stock-based compensation | | | | | 33 | | | | | | | | | | | 33 | | | | | 33 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | 0 | | | | | 0.2 | | | 7 | | | | | 7 | | | | | 7 | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased | | | | | 0 | | | | | (0.7) | | | (113) | | | | | (113) | | | | | (113) | |

Currency translation adjustment, net of net investment hedge activity (net of tax of $34 million) | | | | | | | | | | | | | (92) | | | (92) | | | 0 | | | (92) | |

| | | | | | | | | | | | | | | | | | | |

| Amortization of prior service costs and actuarial losses | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

| Balance at September 30, 2019 | 342.9 | | | $ | 3 | | | $ | 608 | | | $ | 9,391 | | | (154.2) | | | $ | (8,993) | | | $ | (537) | | | $ | 472 | | | $ | 225 | | | $ | 697 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at March 31, 2020 | 342.9 | | | $ | 3 | | | $ | 616 | | | $ | 10,041 | | | (155.4) | | | $ | (9,524) | | | $ | (554) | | | $ | 582 | | | $ | 217 | | | $ | 799 | |

| Net income | | | | | | | 509 | | | | | | | | | 509 | | | 1 | | | 510 | |

| Dividends ($0.56 per share) | | | | | | | (108) | | | | | | | | | (108) | | | 0 | | | (108) | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | 35 | | | | | | | | | | | 35 | | | | | 35 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | 2 | | | | | 0.2 | | | 11 | | | | | 13 | | | | | 13 | |

| Purchase of noncontrolling interest | | | | | (2) | | | | | | | | | | | (2) | | | (15) | | | (17) | |

| | | | | | | | | | | | | | | | | | | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $25 million) | | | | | | | | | | | | | 18 | | | 18 | | | (12) | | | 6 | |

| Net actuarial gains and prior service cost (net of tax of $2 million) | | | | | | | | | | | | | 7 | | | 7 | | | | | 7 | |

| Amortization of prior service costs and actuarial losses | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

| Net realized and unrealized loss on cash flow hedges (net of tax of $6 million) | | | | | | | | | | | | | (14) | | | (14) | | | | | (14) | |

| Balance at June 30, 2020 | 342.9 | | | $ | 3 | | | $ | 651 | | | $ | 10,442 | | | (155.2) | | | $ | (9,513) | | | $ | (542) | | | $ | 1,041 | | | $ | 191 | | | $ | 1,232 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity | | | |

| Shares | | Amount | | | Shares | | Amount | | | | |

| Balance at December 31, 2019 | 342.9 | | | $ | 3 | | | $ | 642 | | | $ | 9,656 | | | (155.2) | | | $ | (9,250) | | | $ | (439) | | | $ | 612 | | | $ | 219 | | | $ | 831 | | | | |

| Net income | | | | | | | 997 | | | | | | | | | 997 | | | — | | | 997 | | | | |

| Dividends ($1.12 per share) | | | | | | | (209) | | | | | | | | | (209) | | | — | | | (209) | | | | |

| Adoption of New Credit Losses Accounting Standard | | | | | | | (2) | | | | | | | 0 | | (2) | | | | | (2) | | | | |

| Stock-based compensation | | | | | 72 | | | | | | | | | | | 72 | | | | | 72 | | | | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (61) | | | | | 1.1 | | | (10) | | | | | (71) | | | | | (71) | | | | |

| Purchase of noncontrolling interest | | | | | (2) | | | | | | | | | | | (2) | | | (15) | | | (17) | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased | | | | | 0 | | | | | (1.1) | | | (253) | | | | | (253) | | | | | (253) | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Currency translation adjustment, net of net investment hedge activity | | | | | | | | | | | | | (62) | | | (62) | | | (13) | | | (75) | | | | |

| Net actuarial gains and prior service costs (net of tax of $2 million) | | | | | | | | | | | | | 6 | | | 6 | | | | | 6 | | | | |

| Amortization of prior service costs and actuarial losses (net of tax of $1 million) | | | | | | | | | | | | | 2 | | | 2 | | | | | 2 | | | | |

| Net realized and unrealized loss on cash flow hedges (net of tax of $18 million) | | | | | | | | | | | | | (49) | | | (49) | | | | | (49) | | | | |

| Balance at June 30, 2020 | 342.9 | | | $ | 3 | | | $ | 651 | | | $ | 10,442 | | | (155.2) | | | $ | (9,513) | | | $ | (542) | | | $ | 1,041 | | | $ | 191 | | | $ | 1,232 | | | | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling Interests | | Total

Shareholders'

Equity | | | |

| Shares | | Amount | | | Shares | | Amount | | | | |

| Balance at December 31, 2018 | 342.9 | | | $ | 3 | | | $ | 601 | | | $ | 8,594 | | | (151.6) | | | $ | (8,313) | | | $ | (426) | | | $ | 459 | | | $ | 197 | | | $ | 656 | | | | |

| Net income | | | | | | | 1,062 | | | | | | | | | 1,062 | | | 5 | | | 1,067 | | | | |

| Dividends ($1.50 per share) | | | | | | | (285) | | | | | | | | | (285) | | | (1) | | | (286) | | | | |

| Adoption of ASU 2018-02, relating to the Tax Act | | | | | | | 20 | | | | | | | (20) | | | 0 | | | | | 0 | | | | |

| Stock-based compensation | | | | | 103 | | | | | | | | | | | 103 | | | | | 103 | | | | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (71) | | | | | 1.5 | | | 32 | | | | | (39) | | | | | (39) | | | | |

| Purchase of noncontrolling interest | | | | | (9) | | | | | | | | | | | (9) | | | (3) | | | (12) | | | | |

| Non-controlling interest resulting from majority acquisition of Vigeo Eiris | | | | | | | | | | | | | | | 0 | | | 17 | | | 17 | | | | |

| Treasury shares repurchased | | | | | (16) | | | | | (4.1) | | | (712) | | | | | (728) | | | | | (728) | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Currency translation adjustment, net of net investment hedge activity (net of tax of $33 million) | | | | | | | | | | | | | (92) | | | (92) | | | 10 | | | (82) | | | | |

| Net actuarial gains and prior service cost | | | | | | | | | | | | | (1) | | | (1) | | | | | (1) | | | | |

| Amortization of prior service costs and actuarial losses (net of tax of $1 million) | | | | | | | | | | | | | 2 | | | 2 | | | | | 2 | | | | |

| Balance at September 30, 2019 | 342.9 | | | $ | 3 | | | $ | 608 | | | $ | 9,391 | | | (154.2) | | | $ | (8,993) | | | $ | (537) | | | $ | 472 | | | $ | 225 | | | $ | 697 | | | | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at June 30, 2020 | 342.9 | | | $ | 3 | | | $ | 651 | | | $ | 10,442 | | | (155.2) | | | $ | (9,513) | | | $ | (542) | | | $ | 1,041 | | | $ | 191 | | | $ | 1,232 | |

| Net income | | | | | | | 467 | | | | | | | | | 467 | | | 0 | | | 467 | |

| Dividends ($0.56 per share) | | | | | | | (105) | | | | | | | | | (105) | | | (1) | | | (106) | |

| Stock-based compensation | | | | | 38 | | | | | | | | | | | 38 | | | | | 38 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | 10 | | | | | 0.1 | | | 8 | | | | | 18 | | | | | 18 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $31 million) | | | | | | | | | | | | | 43 | | | 43 | | | 1 | | | 44 | |

| Net actuarial gains and prior service cost (net of tax of $2 million) | | | | | | | | | | | | | (7) | | | (7) | | | | | (7) | |

| Amortization of prior service costs and actuarial losses | | | | | | | | | | | | | 2 | | | 2 | | | | | 2 | |

| | | | | | | | | | | | | | | | | | | |

| Balance at September 30, 2020 | 342.9 | | | $ | 3 | | | $ | 699 | | | $ | 10,804 | | | (155.1) | | | $ | (9,505) | | | $ | (504) | | | $ | 1,497 | | | $ | 191 | | | $ | 1,688 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at March 31, 2021 | 342.9 | | | $ | 3 | | | $ | 739 | | | $ | 11,632 | | | (155.7) | | | $ | (9,904) | | | $ | (440) | | | $ | 2,030 | | | $ | 195 | | | $ | 2,225 | |

| Net income | | | | | | | 577 | | | | | | | | | 577 | | | — | | | 577 | |

| Dividends ($0.62 per share) | | | | | | | (115) | | | | | | | | | (115) | | | — | | | (115) | |

| Stock-based compensation | | | | | 41 | | | | | | | | | | | 41 | | | | | 41 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | 4 | | | | | 0.1 | | | 5 | | | | | 9 | | | | | 9 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased | | | | | | | | | (1.1) | | | (371) | | | | | (371) | | | | | (371) | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $11 million) | | | | | | | | | | | | | 7 | | | 7 | | | (1) | | | 6 | |

| | | | | | | | | | | | | | | | | | | |

| Amortization of prior service costs/actuarial losses and settlement charge (net of tax of $2 million) | | | | | | | | | | | | | 8 | | | 8 | | | | | 8 | |

| | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2021 | 342.9 | | | $ | 3 | | | $ | 784 | | | $ | 12,094 | | | (156.7) | | | $ | (10,270) | | | $ | (425) | | | $ | 2,186 | | | $ | 194 | | | $ | 2,380 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at December 31, 2019 | 342.9 | | | $ | 3 | | | $ | 642 | | | $ | 9,656 | | | (155.2) | | | $ | (9,250) | | | $ | (439) | | | $ | 612 | | | $ | 219 | | | $ | 831 | |

| Net income | | | | | | | 1,464 | | | | | | | | | 1,464 | | | 0 | | | 1,464 | |

| Dividends ($1.68 per share) | | | | | | | (314) | | | | | | | | | (314) | | | (1) | | | (315) | |

| Adoption of New Credit Losses Accounting Standard | | | | | | | (2) | | | | | | | | | (2) | | | | | (2) | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | 110 | | | | | | | | | | | 110 | | | | | 110 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (51) | | | | | 1.2 | | | (2) | | | | | (53) | | | | | (53) | |

| Purchase of noncontrolling interest | | | | | (2) | | | | | | | | | | | (2) | | | (15) | | | (17) | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased | | | | | | | | | (1.1) | | | (253) | | | | | (253) | | | | | (253) | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $31 million) | | | | | | | | | | | | | (19) | | | (19) | | | (12) | | | (31) | |

| Net actuarial losses and prior service cost | | | | | | | | | | | | | (1) | | | (1) | | | | | (1) | |

| Amortization of prior service costs and actuarial losses (net of tax of $1 million) | | | | | | | | | | | | | 4 | | | 4 | | | | | 4 | |

| Net realized and unrealized gain on cash flow hedges (net of tax of $18 million) | | | | | | | | | | | | | (49) | | | (49) | | | | | (49) | |

| Balance at September 30, 2020 | 342.9 | | | $ | 3 | | | $ | 699 | | | $ | 10,804 | | | (155.1) | | | $ | (9,505) | | | $ | (504) | | | $ | 1,497 | | | $ | 191 | | | $ | 1,688 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at December 31, 2020 | 342.9 | | | $ | 3 | | | $ | 735 | | | $ | 11,011 | | | (155.8) | | | $ | (9,748) | | | $ | (432) | | | $ | 1,569 | | | $ | 194 | | | $ | 1,763 | |

| Net income | | | | | | | 1,313 | | | | | | | | | 1,313 | | | — | | | 1,313 | |

| Dividends ($1.24 per share) | | | | | | | (230) | | | | | | | | | (230) | | | (1) | | | (231) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | 86 | | | | | | | | | | | 86 | | | | | 86 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (37) | | | | | 0.7 | | | (19) | | | | | (56) | | | | | (56) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased | | | | | | | | | (1.6) | | | (503) | | | | | (503) | | | | | (503) | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $25 million) | | | | | | | | | | | | | (4) | | | (4) | | | 1 | | | (3) | |

| | | | | | | | | | | | | | | | | | | |

| Amortization of prior service costs/actuarial losses and settlement charge (net of tax of $3 million) | | | | | | | | | | | | | 10 | | | 10 | | | | | 10 | |

| Net realized and unrealized gain on cash flow hedges | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

| Balance at June 30, 2021 | 342.9 | | | $ | 3 | | | $ | 784 | | | $ | 12,094 | | | (156.7) | | | $ | (10,270) | | | $ | (425) | | | $ | 2,186 | | | $ | 194 | | | $ | 2,380 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

MOODY’S CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(tabular dollar and share amounts in millions, except per share data)

NOTE 1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Moody’s is a provider of (i) credit ratingsglobal integrated risk assessment firm that empowers organizations and assessment services; (ii) credit, capital markets and economic research, data and analytical tools; (iii) software solutions that support financial risk management activities; (iv) quantitatively derived credit scores; (v) learning solutions and certification services; and (vi) company information and business intelligence products.investors to make better decisions. Moody’s reports in 2 reportable segments: MIS and MA.

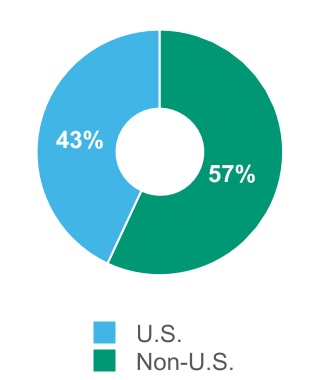

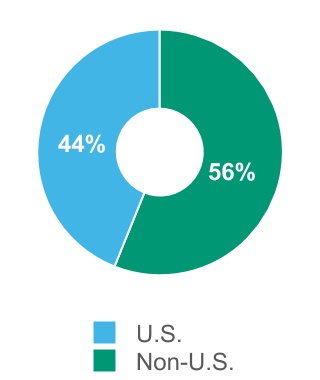

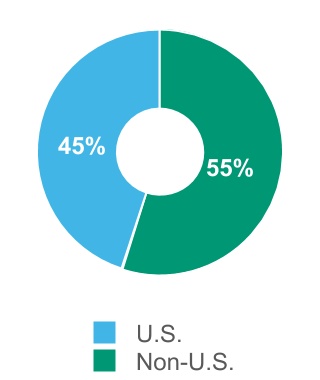

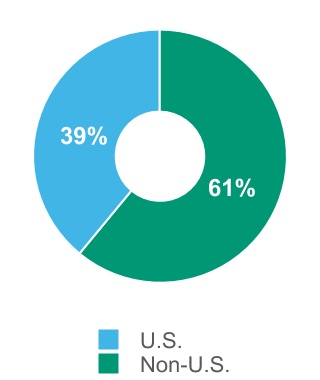

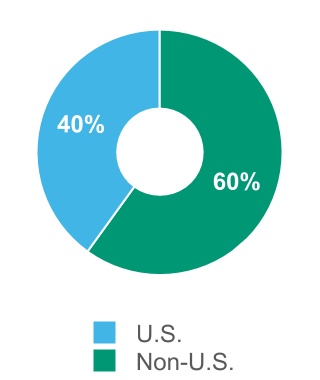

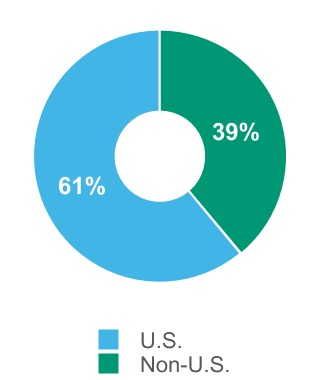

MIS the credit rating agency, publishes credit ratings and provides assessment services on a wide range of debt obligations and the entities that issue such obligations in markets worldwide. Revenue is primarily derived from the originators and issuers of such transactions who use MIS ratings in the distribution of their debt issues to investors. Additionally, MIS earns revenue from certain non-ratings-related operations which consist primarily of financial instrument pricing services in the Asia-Pacific region, revenue from ICRA’s non-ratings operations and revenue from providing ESG research, data and assessments.assessments and revenue from ICRA’s non-ratings operations. The revenue from these operations is included in the MIS Other LOB and is not material to the results of the MIS segment.

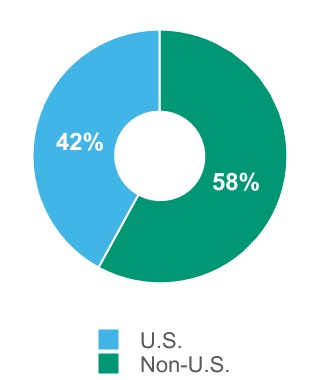

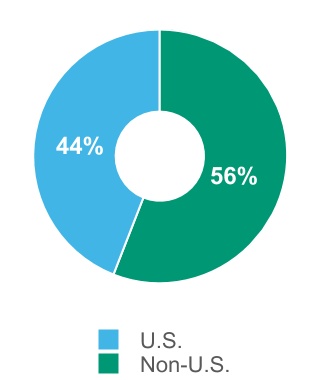

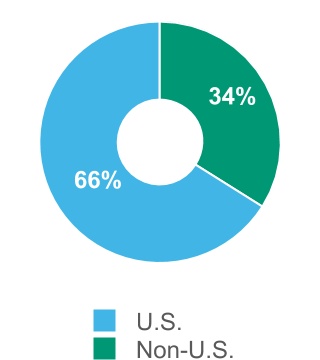

MA provides financial intelligenceis a global provider of data and analytical tools to assist businesses in makinganalytic solutions which help companies make better and faster decisions. MA’s portfolio ofanalytic models, industry insights, software tools and proprietary data assets allow companies to inform and perform many critical business activities with trust and confidence. MA’s approach to aggregating, broadening and deepening available data, research, analytic tools and software solutions consists of specialized research, data, software,fosters a more integrated and professional services, which are assembledefficient delivery to support the financial analysisMA's customers resulting in better decisions around risks and risk management activities of institutional customers worldwide.opportunities.

These interim financial statements have been prepared in accordance with the instructions to Form 10-Q and should be read in conjunction with the Company’s consolidated financial statements and related notes in the Company’s 20192020 annual report on Form 10-K filed with the SEC on February 24, 2020.22, 2021. The results of interim periods are not necessarily indicative of results for the full year or any subsequent period. In the opinion of management, all adjustments (including normal recurring accruals) considered necessary for a fair presentation of financial position, results of operations and cash flows at the dates and for the periods presented have been included. The year-end consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America.

Certain reclassifications have been made to prior period amounts to conform to the current presentation.

Adoption of New Accounting Standards

On January 1, 2020,2021, the Company adopted ASU No. 2016-13, “Financial2019-04, “Codification Improvements to Topic 326, Financial Instruments—Credit Losses, (Topic 326): Measurement of Credit Losses onTopic 815, Derivatives and Hedging, and Topic 825 Financial Instruments.” The Company has implemented policiesThis ASU clarifies and procedures in compliance with the “expected credit loss” impairment model, which included (1) refinement of the grouping of receivables with similar risk characteristics; and (2) processes to identify information that can be used to develop reasonable and supportable forecasts of factors that could affect the collectability of the reported amount of the receivable. As the Company's accounts receivable are short-term in nature, the adoption of this ASU did not have a material impactimproves guidance related to the Company's allowance for bad debts or its policies and procedures for determining the allowance. Refer to Note 2 for further informationrecently issued standards updates on how the Company determines its reserves for expected credit losses. The Company recorded a $2 million cumulative-effect adjustment to retained earnings to increase its allowance for credit losses, upon adoption.

On January 1, 2020, the Company adopted ASU No. 2018-15, “Intangibles—Goodwillhedging, and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement that is a Service Contract.” This ASU requires implementation costs incurred by customers in cloud computing arrangements (i.e., hosting arrangements) to be capitalized under the same provisionsrecognition and measurement of authoritative guidance for internal-use software, and amortized over the non-cancellable term of the cloud computing arrangements plus any option renewal periods that are reasonably certain to be exercised by the customer or for which the exercise is controlled by the service provider. The Company will be required to present the amortization of capitalized implementation costs in the same line item in the statement of operations as the fees associated with the hosting service (i.e. operating and SG&A expense) and classify the related payments in the statement of cash flows in the same manner as payments made for fees associated with the hosting service (i.e. cash flows from operating activities). This ASU also requires capitalization of implementation costs in the balance sheet to be consistent with the location of prepayment of fees for the hosting element (i.e. within other current assets or other assets).financial instruments. The Company adopted this ASU prospectively to all implementation costs incurred after the date of adoption and it did not have a material impact on the Company's current financial statements. The future impact

On January 1, 2021, the Company adopted ASU No. 2019-12, "Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes." This ASU simplifies the accounting for income taxes by eliminating certain exceptions to the general principles in Topic 740, Income Taxes, and clarifies certain aspects of the existing guidance to promote consistency among reporting entities. Most amendments within this ASU are required to be applied on a prospective basis, while certain amendments must be applied on a retrospective or modified retrospective basis. The Company adopted this ASU prospectively and it did not have a material impact on the Company's current financial statements will relate to the aforementioned classification of these capitalized costs and related amortization.statements.

Recently Issued Accounting Standards In March 2020,January 2021, the FASB issued ASU 2021-01, “Reference Rate Reform - Scope,” which clarified the scope and application of the original guidance, ASU No. 2020-04, "Facilitation of the Effects of Reference Rate Reform on Financial Reporting". The ("ASU No. 2020-04"), issued in March 2020. ASU No. 2020-04 provides temporary optional expedients and exceptions to the U.S. GAAP guidance on contract modifications and hedge accounting to ease the financial reporting burdens related to the expected market transition from the London Interbank Offered Rate (LIBOR) and other interbank offered rates to alternative reference rates. This guidance wasBoth ASU's were effective beginning on March 12, 2020,upon issuance, and the Company may elect to apply the amendments prospectively through December 31, 2022 as the transition from LIBOR is completed.

COVID-19

The Company is closely monitoring the impact of the COVID-19 pandemic has not had a material adverse impact on all aspects ofthe Company's reported results to date and is currently not expected to have a material adverse impact on its business. While the Company has selectively reopened certain of its offices, Moody’s continues to require remote work for most employees globally. The Company continues to monitor regional developments relating to the COVID-19 pandemic to inform decisions on office re-openings.

The Company experienced disruption in certain sectors of its business beginning late in the first quarter of 2020 resulting from market volatility associated with the COVID-19 crisis.near-term outlook. However, at the date of the filing of this quarterly report on Form 10-Q, the CompanyMoody's is unable to predict either the potential near-term or longer-term impact that the COVID-19 crisispandemic may have on its business, future results of operations, financial position and operating resultsor cash flows due to numerous uncertainties regarding the duration and severityuncertainties.

In the nine months ended September 30, 2020, in order to maximize liquidity and to increase available cash on hand through this period of uncertainty, the Company increased its long-term borrowings by $700 million and began borrowing under its CP Program as more fully discussed in Note 17. At September 30, 2020, the Company had repaid all CP outstanding. In addition, the Company reduced discretionary spending, including temporarily suspending its share repurchase program beginning late in the first quarter of 2020 and spanning through the third quarter. The Company anticipates resuming its share repurchase program in the fourth quarter of 2020.

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was enacted on March 27, 2020 in the United States. The Company is utilizing certain provisions in the CARES Act and other IRS guidance which permit the deferral of certain income and payroll tax remittances.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

On January 1, 2020,Pursuant to a strategic reorganization in the MA operating segment which was completed in the second quarter of 2021, the Company adopted the New Credit Losses Accounting Standardrealigned its MA reporting units used in assessing goodwill for impairment as more fully discussed in Note 1.of June 30, 2021. Accordingly, the Company revised its accounts receivable allowances accounting policy for goodwill to reflect the provisions of the new standard,change in MA's reporting units, which is discussed below along with the capitalized software accounting policy, which was also updated to reflect the New Internal Use Software Accounting Standard.below. All other significant accounting policies described in the Form 10-K for the year ended December 31, 20192020 remain unchanged.

Accounts Receivable Allowances

On January 1, 2020, the Company adopted ASU No. 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” as more fully described in Note 1. As the Company's accounts receivable are short-term in nature, the adoption of this ASU This reorganization did not haveresult in a material impactchange to the Company's allowancereportable segments.

Goodwill

Moody’s evaluates its goodwill for bad debtsimpairment at the reporting unit level, defined as an operating segment (i.e., MIS and MA), or its policies and procedures for determining the allowance.

In order to determineone level below an estimateoperating segment (i.e., a component of expected credit losses, receivables are segmented based on similar risk characteristics including historical credit loss patterns and industryan operating segment), annually as of July 31 or class of customers to calculate reserve rates. The Company uses an aging method for developing its allowance for credit losses by which receivable balances are stratified based on aging category. A reserve rate is calculated for each aging category which is generally based on historical information. The reserve rate is adjusted, when necessary, for current conditions (e.g., macroeconomic or industry related) and reasonable and supportable forecasts about the future. The Company also considers customer specific information (e.g., bankruptcy or financial difficulty) when estimating its expected credit losses, as well as the economic environment of the customers, both from an industry and geographic perspective,more frequently if impairment indicators arise in evaluating the need for allowances. Expected credit losses are reflected as additions to the accounts receivable allowance. Actual uncollectible account write-offs are recorded against the allowance.