UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period endedSeptember 30, 20132014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the transition period from ___________________________________ To _____________________________________

Commission file number:000-31203

NET 1 UEPS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Florida | 98-0171860 |

| (State or other jurisdiction | (IRS Employer |

| of incorporation or organization) | Identification No.) |

President Place, 4th Floor, Cnr. Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg 2196, South Africa

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:27-11-343-2000

Not Applicable

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| [ ] | Large accelerated filer | [X] | Accelerated filer |

| [ ] | Non-accelerated filer | [ ] | Smaller reporting company |

| (do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [X ]

As of November 7, 20134, 2014 (the latest practicable date), 45,735,23646,475,623 shares of the registrant’s common stock, par value $0.001 per share, net of treasury shares, were outstanding.

Form 10-Q

NET 1 UEPS TECHNOLOGIES, INC.

Table of Contents

1

Part I. Financial Information

Item 1. Financial Statements

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Balance Sheets

| Unaudited | (A) | Unaudited | (A) | |||||||||

| September 30, | June 30, | September 30, | June 30, | |||||||||

| 2013 | 2013 | 2014 | 2014 | |||||||||

| (In thousands, except share data) | (In thousands, except share data) | |||||||||||

| ASSETS | ASSETS | ASSETS | ||||||||||

| CURRENT ASSETS | ||||||||||||

| Cash and cash equivalents | $ | 47,670 | $ | 53,665 | $ | 81,185 | $ | 58,672 | ||||

| Pre-funded social welfare grants receivable (Note 2) | 4,263 | 2,934 | 4,863 | 4,809 | ||||||||

| Accounts receivable, net of allowances of – September: $935; June: $4,701 | 118,025 | 102,614 | ||||||||||

| Finance loans receivable, net of allowances of – September: $701; June: $- | 17,338 | 8,350 | ||||||||||

| Accounts receivable, net of allowances of – September: $2,075; June: $1,313 | 136,701 | 148,067 | ||||||||||

| Finance loans receivable, net of allowances of – September: $3,136; June: $3,083 | 53,884 | 53,124 | ||||||||||

| Inventory (Note 3) | 11,063 | 12,222 | 12,200 | 10,785 | ||||||||

| Deferred income taxes | 5,125 | 4,938 | 7,045 | 7,451 | ||||||||

| Total current assets before settlement assets | 203,484 | 184,723 | 295,878 | 282,908 | ||||||||

| Settlement assets (Note 4) | 685,305 | 752,476 | 724,279 | 725,987 | ||||||||

| Total current assets | 888,789 | 937,199 | 1,020,157 | 1,008,895 | ||||||||

| PROPERTY, PLANT AND EQUIPMENT, NET OF ACCUMULATED | ||||||||||||

| DEPRECIATION OF – September: $92,099; June: $84,808 | 48,716 | 48,301 | ||||||||||

| PROPERTY, PLANT AND EQUIPMENT, net of accumulated depreciation of – September: $92,753; June: $91,422 | 48,739 | 47,797 | ||||||||||

| EQUITY-ACCOUNTED INVESTMENTS | 1,270 | 1,183 | 934 | 878 | ||||||||

| GOODWILL (Note 6) | 180,950 | 175,806 | 179,003 | 186,576 | ||||||||

| INTANGIBLE ASSETS, net (Note 6) | 76,915 | 77,257 | 62,148 | 68,514 | ||||||||

| OTHER LONG-TERM ASSETS, including reinsurance assets (Note 7) | 36,150 | 36,576 | ||||||||||

| OTHER LONG-TERM ASSETS, including reinsurance assets (Note 5 and Note 7) | 36,533 | 38,285 | ||||||||||

| TOTAL ASSETS | 1,232,790 | 1,276,322 | 1,347,514 | 1,350,945 | ||||||||

| LIABILITIES | LIABILITIES | LIABILITIES | ||||||||||

| CURRENT LIABILITIES | ||||||||||||

| Accounts payable | 14,036 | 26,567 | 14,941 | 17,101 | ||||||||

| Other payables | 38,802 | 33,808 | 43,346 | 42,257 | ||||||||

| Current portion of long-term borrowings (Note 9) | 15,007 | 14,209 | 14,276 | 14,789 | ||||||||

| Income taxes payable | 9,261 | 2,275 | 13,581 | 7,676 | ||||||||

| Total current liabilities before settlement obligations | 77,106 | 76,859 | 86,144 | 81,823 | ||||||||

| Settlement obligations (Note 4) | 685,305 | 752,476 | 724,279 | 725,987 | ||||||||

| Total current liabilities | 762,411 | 829,335 | 810,423 | 807,810 | ||||||||

| DEFERRED INCOME TAXES | 18,703 | 18,727 | 14,078 | 15,522 | ||||||||

| LONG-TERM BORROWINGS (Note 9) | 70,374 | 66,632 | 61,288 | 62,388 | ||||||||

| OTHER LONG-TERM LIABILITIES, including insurance policy liabilities (Note 7) | 21,499 | 21,659 | 22,396 | 23,477 | ||||||||

| TOTAL LIABILITIES | 872,987 | 936,353 | 908,185 | 909,197 | ||||||||

| COMMITMENTS AND CONTINGENCIES (Note 16) | ||||||||||||

| COMMITMENTS AND CONTINGENCIES (Note 17) | ||||||||||||

| EQUITY | EQUITY | EQUITY | ||||||||||

| COMMON STOCK (Note 10) | ||||||||||||

| Authorized: 200,000,000 with $0.001 par value; Issued and outstanding shares, net of treasury - September: 45,780,513; June: 45,592,550 | 59 | 59 | ||||||||||

| Authorized: 200,000,000 with $0.001 par value; Issued and outstanding shares, net of treasury - September: 46,475,623; June: 47,819,299 | 64 | 63 | ||||||||||

| PREFERRED STOCK | ||||||||||||

| Authorized shares: 50,000,000 with $0.001 par value; Issued and outstanding shares, net of treasury: September: -; June: - | - | - | - | - | ||||||||

| ADDITIONAL PAID-IN-CAPITAL | 161,605 | 160,670 | 210,708 | 202,401 | ||||||||

| TREASURY SHARES, AT COST: September: 13,455,090; June: 13,455,090 | (175,823 | ) | (175,823 | ) | ||||||||

| TREASURY SHARES, AT COST: September: 18,057,228; June: 15,883,212 | (214,520 | ) | (200,681 | ) | ||||||||

| ACCUMULATED OTHER COMPREHENSIVE LOSS | (93,544 | ) | (100,858 | ) | (104,126 | ) | (82,741 | ) | ||||

| RETAINED EARNINGS | 464,214 | 452,618 | 547,222 | 522,729 | ||||||||

| TOTAL NET1 EQUITY | 356,511 | 336,666 | 439,348 | 441,771 | ||||||||

| NON-CONTROLLING INTEREST | 3,292 | 3,303 | (19 | ) | (23 | ) | ||||||

| TOTAL EQUITY | 359,803 | 339,969 | 439,329 | 441,748 | ||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,232,790 | $ | 1,276,322 | $ | 1,347,514 | $ | 1,350,945 | ||||

(A) – Derived from audited financial statements

See Notes to Unaudited Condensed Consolidated Financial Statements

2

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Operations

| Three months ended | Three months ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||

| (In thousands, except per share data) | (In thousands, except per share data) | |||||||||||

| REVENUE | $ | 123,494 | $ | 111,682 | $ | 156,441 | $ | 123,494 | ||||

| EXPENSE | ||||||||||||

| Cost of goods sold, IT processing, servicing and support | 56,559 | 45,101 | 74,406 | 56,559 | ||||||||

| Selling, general and administration | 40,506 | 47,252 | 38,736 | 40,506 | ||||||||

| Depreciation and amortization | 10,029 | 10,004 | 10,174 | 10,029 | ||||||||

| OPERATING INCOME | 16,400 | 9,325 | 33,125 | 16,400 | ||||||||

| INTEREST INCOME | 3,319 | 3,091 | 4,090 | 3,319 | ||||||||

| INTEREST EXPENSE | 1,752 | 2,071 | 1,312 | 1,752 | ||||||||

| INCOME BEFORE INCOME TAX EXPENSE | 17,967 | 10,345 | 35,903 | 17,967 | ||||||||

| INCOME TAX EXPENSE (note 15) | 6,485 | 3,729 | ||||||||||

| INCOME TAX EXPENSE (Note 16) | 11,648 | 6,485 | ||||||||||

| NET INCOME BEFORE EARNINGS FROM EQUITY-ACCOUNTED INVESTMENTS | 11,482 | 6,616 | 24,255 | 11,482 | ||||||||

| EARNINGS FROM EQUITY-ACCOUNTED INVESTMENTS | 103 | 128 | 92 | 103 | ||||||||

| NET INCOME | 11,585 | 6,744 | 24,347 | 11,585 | ||||||||

| (ADD) NET (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTEREST | (11 | ) | - | |||||||||

| LESS (ADD) NET (INCOME) LOSS ATTRIBUTABLE TO NON-CONTROLLING INTEREST | 258 | (11 | ) | |||||||||

| NET INCOME ATTRIBUTABLE TO NET1 | $ | 11,596 | $ | 6,744 | $ | 24,089 | $ | 11,596 | ||||

| Net income per share, in United States dollars(note 12) | ||||||||||||

| Net income per share, in United States dollars(Note 13) | ||||||||||||

| Basic earnings attributable to Net1 shareholders | $ | 0.25 | $ | 0.15 | $ | 0.51 | $ | 0.25 | ||||

| Diluted earnings attributable to Net1 shareholders | $ | 0.25 | $ | 0.15 | $ | 0.51 | $ | 0.25 | ||||

See Notes to Unaudited Condensed Consolidated Financial Statements

3

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Comprehensive Income

| Three months ended | Three months ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||

| (In thousands) | (In thousands) | |||||||||||

| Net income | $ | 11,585 | $ | 6,744 | $ | 24,347 | $ | 11,585 | ||||

| Other comprehensive (loss) income | ||||||||||||

| Net unrealized loss on asset available for sale, net of tax | (255 | ) | - | (226 | ) | (255 | ) | |||||

| Movement in foreign currency translation reserve | 7,569 | 4,255 | (21,185 | ) | 7,569 | |||||||

| Total other comprehensive income, net of taxes | 7,314 | 4,255 | ||||||||||

| Total other comprehensive (loss) income, net of taxes | (21,411 | ) | 7,314 | |||||||||

| Comprehensive income | 18,899 | 10,999 | 2,936 | 18,899 | ||||||||

| Add comprehensive loss attributable to non-controlling interest | 11 | - | ||||||||||

| (Less) Add comprehensive (income) loss attributable to non-controlling interest | (232 | ) | 11 | |||||||||

| Comprehensive income attributable to Net1 | $ | 18,910 | $ | 10,999 | $ | 2,704 | $ | 18,910 | ||||

See Notes to Unaudited Condensed Consolidated Financial Statements

4

NET 1 UEPSTECHNOLOGIES, INC.

UnauditedCondensedConsolidatedStatement ofChanges in Equity for the threemonths endedSeptember 30, 2014 (dollaramounts inthousands)

| Net 1 UEPS Technologies, Inc. Shareholder | |||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||

| Number of | Number of | Additional | other | Non- | |||||||||||||||||||||||||||||

| Number of | Treasury | Treasury | shares, net of | Paid-In | Retained | comprehensive | Total Net1 | controlling | |||||||||||||||||||||||||

| Shares | Amount | Shares | Shares | treasury | Capital | Earnings | (loss) income | Equity | Interest | Total | |||||||||||||||||||||||

| Balance – July 1, 2013 | 59,047,640 | $ | 59 | (13,455,090 | ) | $ | (175,823 | ) | 45,592,550 | $ | 160,670 | $ | 452,618 | $ | (100,858 | ) | $ | 336,666 | $ | 3,303 | $ | 339,969 | |||||||||||

| Restricted stock granted | 187,963 | 187,963 | - | - | |||||||||||||||||||||||||||||

| Stock-based compensation charge | 930 | 930 | 930 | ||||||||||||||||||||||||||||||

| Income tax benefit from vested stock awards | 5 | 5 | 5 | ||||||||||||||||||||||||||||||

| Net income | 11,596 | 11,596 | (11 | ) | 11,585 | ||||||||||||||||||||||||||||

| Other comprehensive income | 7,314 | 7,314 | 7,314 | ||||||||||||||||||||||||||||||

| Balance – September 30, 2013 | 59,235,603 | $ | 59 | (13,455,090 | ) | $ | (175,823 | ) | 45,780,513 | $ | 161,605 | $ | 464,214 | $ | (93,544 | ) | $ | 356,511 | $ | 3,292 | $ | 359,803 | |||||||||||

| Net 1 UEPS Technologies, Inc. Shareholders | |||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||

| Number of | Number of | Additional | other | Non- | |||||||||||||||||||||||||||||

| Number of | Treasury | Treasury | shares, net of | Paid-In | Retained | comprehensive | Total Net1 | controlling | |||||||||||||||||||||||||

| Shares | Amount | Shares | Shares | treasury | Capital | Earnings | loss | Equity | Interest | Total | |||||||||||||||||||||||

| Balance – July 1, 2014 | 63,702,511 | $ | 63 | (15,883,212 | ) | $ | (200,681 | ) | 47,819,299 | $ | 202,401 | $ | 522,729 | $ | (82,741 | ) | $ | 441,771 | $ | (23 | ) | $ | 441,748 | ||||||||||

| Repurchase of common stock (Note 10) | (1,837,432 | ) | (9,151 | ) | (1,837,432 | ) | (9,151 | ) | (9,151 | ) | |||||||||||||||||||||||

| Restricted stock granted (Note 12) | 141,707 | 141,707 | - | - | |||||||||||||||||||||||||||||

| Exercise of stock option (Note 12) | 688,633 | 1 | (336,584 | ) | (4,688 | ) | 352,049 | 5,677 | 990 | 990 | |||||||||||||||||||||||

| Stock-based compensation charge (Note 12) | 916 | 916 | 916 | ||||||||||||||||||||||||||||||

| Income tax benefit from vested stock awards | 483 | 483 | 483 | ||||||||||||||||||||||||||||||

| Transactions with non-controlling interests (Note 10) | 1,231 | 404 | 1,635 | (228 | ) | 1,407 | |||||||||||||||||||||||||||

| Net income | 24,089 | 24,089 | 258 | 24,347 | |||||||||||||||||||||||||||||

| Other comprehensive loss (Note 11) | (21,385 | ) | (21,385 | ) | (26 | ) | (21,411 | ) | |||||||||||||||||||||||||

| Balance – September 30, 2014 | 64,532,851 | $ | 64 | (18,057,228 | ) | $ | (214,520 | ) | 46,475,623 | $ | 210,708 | $ | 547,222 | $ | (104,126 | ) | $ | 439,348 | $ | (19 | ) | $ | 439,329 | ||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements

5

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed Consolidated Statements of Cash Flows

| Three months ended | Three months ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||

| (In thousands) | (In thousands) | |||||||||||

| Cash flows from operating activities | ||||||||||||

| Net income | $ | 11,585 | $ | 6,744 | $ | 24,347 | $ | 11,585 | ||||

| Depreciation and amortization | 10,029 | 10,004 | 10,174 | 10,029 | ||||||||

| Earnings from equity-accounted investments | (103 | ) | (128 | ) | (92 | ) | (103 | ) | ||||

| Fair value adjustments | (133 | ) | (293 | ) | 413 | (133 | ) | |||||

| Interest payable | 972 | 1,192 | 1,159 | 972 | ||||||||

| Profit on disposal of plant and equipment | (1 | ) | - | (122 | ) | (1 | ) | |||||

| Stock-based compensation charge | 930 | 1,116 | 916 | 930 | ||||||||

| Facility fee amortized | 69 | 88 | 82 | 69 | ||||||||

| (Increase) Decrease in accounts receivable, pre-funded social welfare grants receivable | ||||||||||||

| and finance loans receivable | (23,101 | ) | 5,892 | |||||||||

| Decrease (Increase) in inventory | 1,011 | (959 | ) | |||||||||

| Decrease (Increase) in accounts receivable, pre-funded social welfare grants receivable and finance loans receivable | 9,470 | (23,101 | ) | |||||||||

| (Increase) Decrease in inventory | (2,123 | ) | 1,011 | |||||||||

| Decrease in accounts payable and other payables | (8,668 | ) | (1,349 | ) | (10,933 | ) | (8,668 | ) | ||||

| Increase in taxes payable | 6,921 | 5,438 | 6,611 | 6,921 | ||||||||

| Decrease in deferred taxes | (1,187 | ) | (2,016 | ) | (390 | ) | (1,187 | ) | ||||

| Net cash (used in) provided by operating activities | (1,676 | ) | 25,729 | |||||||||

| Net cash provided by (used in) operating activities | 39,512 | (1,676 | ) | |||||||||

| Cash flows from investing activities | ||||||||||||

| Capital expenditures | (5,616 | ) | (6,453 | ) | (9,378 | ) | (5,616 | ) | ||||

| Proceeds from disposal of property, plant and equipment | 48 | 105 | 241 | 48 | ||||||||

| Acquisitions, net of cash acquired | - | (1,913 | ) | |||||||||

| Repayment of loan by equity-accounted investment | - | 3 | ||||||||||

| Proceeds from sale of business (Note 14) | 1,895 | - | ||||||||||

| Other investing activities, net | (1 | ) | - | - | (1 | ) | ||||||

| Proceeds from maturity of investments related to insurance business | - | 545 | ||||||||||

| Net change in settlement assets | 51,773 | 60,779 | (43,054 | ) | 51,773 | |||||||

| Net cash provided by investing activities | 46,204 | 53,066 | ||||||||||

| Net cash (used in) provided by investing activities | (50,296 | ) | 46,204 | |||||||||

| Cash flows from financing activities | ||||||||||||

| Acquisition of treasury stock (Note 10) | (9,151 | ) | - | |||||||||

| Sale of equity to non-controlling interest (Note 10) | 1,407 | - | ||||||||||

| Long-term borrowings utilized | 1,097 | - | ||||||||||

| Proceeds from issue of common stock | - | 240 | 989 | - | ||||||||

| Net change in settlement obligations | (51,773 | ) | (60,779 | ) | 43,054 | (51,773 | ) | |||||

| Net cash used in financing activities | (51,773 | ) | (60,539 | ) | ||||||||

| Net cash provided by (used in) financing activities | 37,396 | (51,773 | ) | |||||||||

| Effect of exchange rate changes on cash | 1,250 | 165 | (4,099 | ) | 1,250 | |||||||

| Net (decrease) increase in cash and cash equivalents | (5,995 | ) | 18,421 | |||||||||

| Net increase (decrease) in cash and cash equivalents | 22,513 | (5,995 | ) | |||||||||

| Cash and cash equivalents – beginning of period | 53,665 | 39,123 | 58,672 | 53,665 | ||||||||

| Cash and cash equivalents – end of period | $ | 47,670 | $ | 57,544 | $ | 81,185 | $ | 47,670 | ||||

See Notes to Unaudited Condensed Consolidated Financial Statements

6

NET 1 UEPS TECHNOLOGIES, INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

for the three months ended September 30, 20132014 and 20122013

(All amounts in tables stated in thousands or thousands of United States Dollars, unless otherwise stated)

1. Basis of Presentation and Summary of Significant Accounting Policies

Unaudited Interim Financial Information

The accompanying unaudited condensed consolidated financial statements include all majority-owned subsidiaries over which the Company exercises control and have been prepared in accordance with US generally accepted accounting principles (“GAAP”) and the rules and regulations of the Securities and Exchange Commission for quarterly reports on Form 10-Q and include all of the information and disclosures required for interim financial reporting. The results of operations for the three months ended September 30, 20132014 and 2012,2013, are not necessarily indicative of the results for the full year. The Company believes that the disclosures are adequate to make the information presented not misleading.

These financial statements should be read in conjunction with the financial statements, accounting policies and financial notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2013.2014. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (consisting only of normal recurring adjustments), which are necessary for a fair representation of financial results for the interim periods presented.

References to the “Company” refer to Net1 and its consolidated subsidiaries, unless the context otherwise requires. References to Net1 are references solely to Net 1 UEPS Technologies, Inc.

Recent accounting pronouncements adopted

In February 2013, the FASB issued guidance regardingReporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income. This guidance requires entities to present (either on the face of the statement of operations or in the notes) the effects on the line items of the statement of operations for amounts reclassified out of accumulated other comprehensive income. The guidance is effective for the Company beginning July 1, 2013 and is applied prospectively. The adoption of this guidance did not have a material impact on the Company’s financial statements.

Recent accounting pronouncements not yet adopted as of September 30, 2013

In March 2013, the FASB issued guidance regardingParent’s Accounting for the Cumulative Translation Adjustment Upon Derecognition of Certain Subsidiaries or Groups of Assets Within a Foreign Entity or of an Investment in a Foreign Entity. This guidance requires that the parent release any related cumulative translation adjustment into net income only if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided. The guidance is effective for the Company beginning July 1, 2014.2014, and is applied prospectively. The adoption of this guidance did not have a material impact on the Company’s financial statements.

Recent accounting pronouncements not yet adopted as of September 30, 2014

In May 2014, the FASB issued guidance regardingRevenue from Contracts with Customers. This guidance requires an entity to recognize revenue when a customer obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The guidance is effective for the Company beginning July 1, 2017. Early adoption is not permitted. The Company expects that this guidance will have a material impact on its financial statements and is currently evaluating the impact of this guidance on its financial statements on adoption.

In August 2014, the FASB issued guidance regardingDisclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern. This guidance requires an entity to perform interim and annual assessments of its ability to continue as a going concern within one year of the date that its financial statements are issued. An entity must provide certain disclosures if conditions or events raise substantial doubt about the entity’s ability to continue as a going concern. The guidance is effective for the Company for beginning July 1, 2017. Early adoption is permitted. The Company is currently assessing the impact of this guidance on its financial statements disclosure.

2. Pre-funded social welfare grants receivable

Pre-funded social welfare grants receivable represents amounts pre-funded by the Company to certain merchants participating in the merchant acquiring system. The October 20132014 payment service commenced on October 1, 2013,2014, but the Company pre-funded certain merchants participating in the merchant acquiring system duringon the last threetwo days of September 2013.2014.

7

3. Inventory

The Company’s inventory comprised the following categories as of September 30, 20132014 and June 30, 2013.2014.

| September 30, | June 30, | ||||||

| 2013 | 2013 | ||||||

| Finished goods | $ | 11,063 | $ | 12,222 | |||

| $ | 11,063 | $ | 12,222 |

| September 30, | June 30, | |||||

| 2014 | 2014 | |||||

| Finished goods | $ | 12,200 | $ | 10,785 | ||

| $ | 12,200 | $ | 10,785 |

7

4. Settlement assets and settlement obligations

Settlement assets comprise (1) cash received from the South African government that the Company holds pending disbursement to beneficiariesrecipient cardholders of social welfare grants (2) cash received from health care plans which the Company disburses to health care service providers once it adjudicates claims and (3)(2) cash received from customers on whose behalf the Company processes payroll payments that the Company will disburse to customer employees, payroll-related payees and other payees designated by the customer.

Settlement obligations comprise (1) amounts that the Company is obligated to disburse to beneficiariesrecipient cardholders of social welfare grants, (2) amounts which are due to health care service providers after claims have been adjudicated and reconciled, provided that the Company shall have previously received such funds from health care plan customers and (3) amounts that the Company is obligated to pay to customer employees, payroll-related payees and other payees designated by the customer.

The balances at each reporting date may vary widely depending on the timing of the receipts and payments of these assets and obligationsobligations.

5. Fair value of financial instruments and equity-accounted investments

Fair value of financial instruments

Initial recognition and measurement

Financial instruments are recognized when the Company becomes a party to the transaction. Initial measurements are at cost, which includes transaction costs.

Risk managementmanagement

The Company seeks to reduce its exposure to currencies other than the South African randRand (“ZAR”) through a policy of matching, to the extent possible, assets and liabilities denominated in those currencies. In addition, the Company uses financial instruments in order to economically hedge its exposure to exchange rate and interest rate fluctuations arising from its operations. The Company is also exposed to equity price and liquidity risks as well as credit risks.

Currency exchange risk

The Company is subject to currency exchange risk because it purchases inventories that it is required to settle in other currencies, primarily the euro and US dollar. The Company has used forward contracts in order to limit its exposure in these transactions to fluctuations in exchange rates between the South African rand,ZAR, on the one hand, and the US dollar and the euro, on the other hand.

The Company’s outstanding foreign exchange contracts are as follows: As of September 30, 2013 None.

As of June 30, 2013

| Fair market | ||||||

| Notional amount | Strike price | value price | Maturity | |||

| USD | 4,000,000 | ZAR | 9.06 | ZAR | 10.1397 | September 30, 2013 |

Translation risk

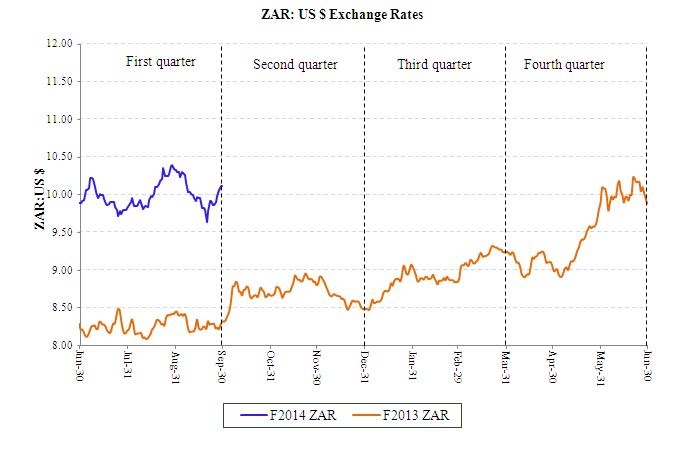

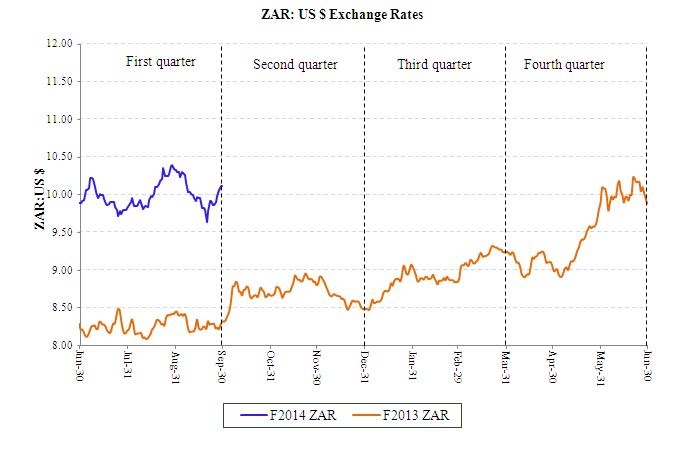

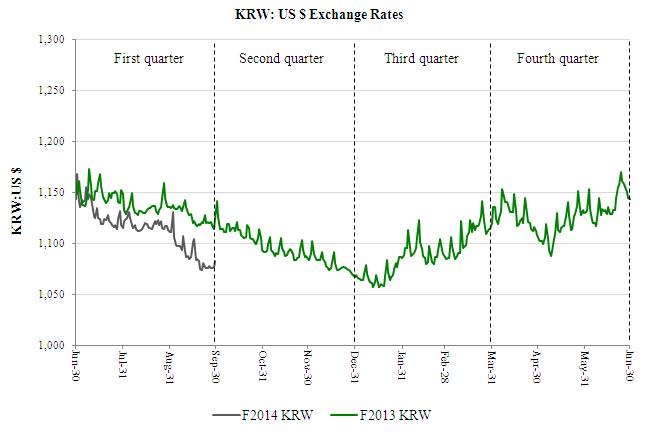

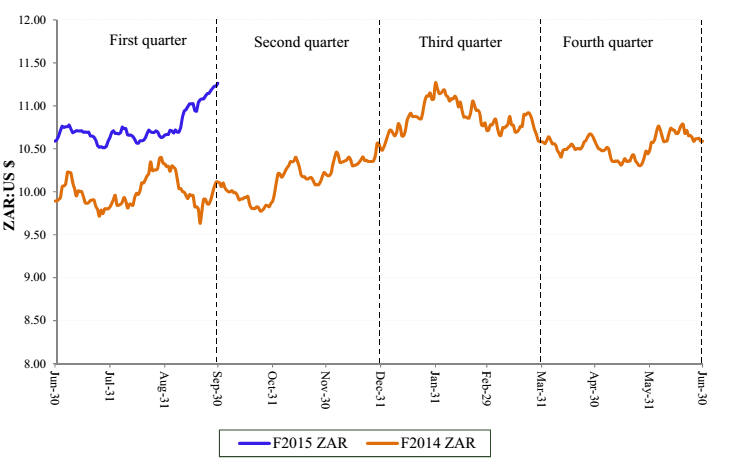

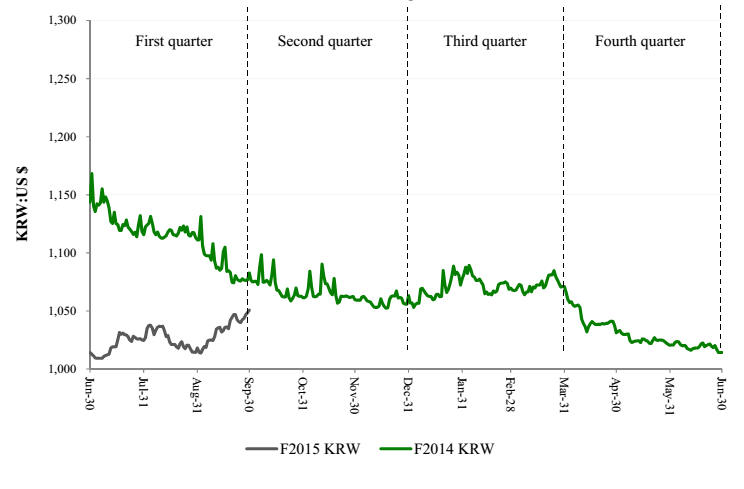

Translation risk relates to the risk that the Company’s results of operations will vary significantly as the US dollar is its reporting currency, but it earns most of its revenues and incurs most of its expenses in ZAR. The US dollar to ZAR exchange rate has fluctuated significantly over the past twothree years. As exchange rates are outside the Company’s control, there can be no assurance that future fluctuations will not adversely affect the Company’s results of operations and financial condition.

Interest rate risk

As a result of its normal borrowing and leasing activities, the Company’s operating results are exposed to fluctuations in interest rates, which it manages primarily through regular financing activities. The Company generally maintains limited investment in cash equivalents and has occasionally invested in marketable securities.

8

5. Fair value of financial instruments and equity-accounted investments (continued)

Fair value of financial instruments (continued)

Risk management (continued)

Credit risk

Credit risk relates to the risk of loss that the Company would incur as a result of non-performance by counterparties. The Company maintains credit risk policies with regard to its counterparties to minimize overall credit risk. These policies include an evaluation of a potential counterparty’s financial condition, credit rating, and other credit criteria and risk mitigation tools as the Company’s management deems appropriate.

With respect to credit risk on financial instruments, the Company maintains a policy of entering into such transactions only with South African and European financial institutions that have a credit rating of BBB or better, as determined by credit rating agencies such as Standard & Poor’s, Moody’s and Fitch Ratings.

UEPS-based microlending credit risk

The Company is exposed to credit risk in its UEPS-based microlending activities, which provides unsecured short-term loans to qualifying customers, primarily its social grant recipient cardholder base.customers. The Company manages this risk by performing an affordability test for each prospective customer and assigns a “creditworthiness score”, which takes into account a variety of factors such as other debts and total expenditures on normal household and lifestyle expenses.

Equity price and liquidity risk

Equity price risk relates to the risk of loss that the Company would incur as a result of the volatility in the exchange-traded price of equity securities that it holds and the risk that it may not be able to liquidate these securities. The market price of these securities may fluctuate for a variety of reasons, consequently, the amount the Company may obtain in a subsequent sale of these securities may significantly differ from the reported market value.

Liquidity risk relates to the risk of loss that the Company would incur as a result of the lack of liquidity on the exchange on which these securities are listed. The Company may not be able to sell some or all of these securities at one time, or over an extended period of time without influencing the exchange traded price, or at all.

Financial instruments

The following section describes the valuation methodologies the Company uses to measure its significant financial assets and liabilities at fair value.

In general, and where applicable, the Company uses quoted prices in active markets for identical assets or liabilities to determine fair value. This pricing methodology applies to Level 1 investments. If quoted prices in active markets for identical assets or liabilities are not available to determine fair value, then the Company uses quoted prices for similar assets and liabilities or inputs other than the quoted prices that are observable either directly or indirectly. These investments are included in Level 2 investments. In circumstances in which inputs are generally unobservable, values typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques. Investments valued using such techniques are included in Level 3 investments.

Asset measured at fair value using significant unobservable inputs – investment in Finbond Group Limited (“Finbond”)

The Company's Level 3 asset represents an investment of 156,788,712 shares of common stock of Finbond, which are exchange-traded equity securities. Finbond’s shares are traded on the JSE LimitedJohannesburg Stock Exchange (“JSE”) and the Company has designated such shares as available for sale investments. The Company has concluded that the market for Finbond shares is not active and consequently has employed alternative valuation techniques in order to determine the fair value of such stock. Currently, the operations of Finbond relate primarily to the provision of microlending products. Finbond was recently issuedissues financial products and services under a mutual banking licence and intends to offer financial products under this licence.also has a microlending offering. In determining the fair value of Finbond, the Company has considered amongst other things Finbond’s historical financial information (including its most recent public accounts), press releases issued by Finbond and its published net asset value. The Company believes that the best indicator of fair value of Finbond is its published net asset value and has used this value to determine the fair value.

9

5. Fair value of financial instruments (continued)

Financial instruments (continued)

Asset measured at fair value using significant unobservable inputs – investment in Finbond Group Limited (“Finbond”) (continued)

The fair value of these securities as of September 30, 2013,2014, represented approximately 1% of the Company’s total assets, including these securities. The Company expects to hold these securities for an extended period of time and it is not concerned with short-term equity price volatility with respect to these securities provided that the underlying business, economic and management characteristics of the company remain sound.

9Derivative transactions - Foreign exchange contracts

As part of the Company’s risk management strategy, the Company enters into derivative transactions to mitigate exposures to foreign currencies using foreign exchange contracts. These foreign exchange contracts are over-the-counter derivative transactions. Substantially all of the Company’s derivative exposures are with counterparties that have long-term credit ratings of BBB or better. The Company uses quoted prices in active markets for similar assets and liabilities to determine fair value (level 2). The Company has no derivatives that require fair value measurement under level 1 or 3 of the fair value hierarchy.

The Company’s outstanding foreign exchange contracts are as follows:

As of September 30, 2014

| Fair market | |||

| Notional amount | Strike price | value price | Maturity |

| EUR 181,570.50 | ZAR 15.5739 | ZAR 14.3053 | October 20, 2014 |

| EUR 181,570.50 | ZAR 15.4316 | ZAR 14.3053 | October 20, 2014 |

| EUR 180,022.50 | ZAR 15.6552 | ZAR 14.3818 | November 20, 2014 |

| EUR 180,022.50 | ZAR 15.5136 | ZAR 14.3818 | November 20, 2014 |

| EUR 180,022.50 | ZAR 15.5970 | ZAR 14.4701 | December 22, 2014 |

| EUR 180,022.50 | ZAR 15.7391 | ZAR 14.4701 | December 22, 2014 |

| EUR 174,424.50 | ZAR 15.8119 | ZAR 14.5511 | January 20, 2015 |

| EUR 174,424.50 | ZAR 15.6729 | ZAR 14.5511 | January 20, 2015 |

As of June 30, 2014

| Fair market | |||

| Notional amount | Strike price | value price | Maturity |

| EUR 182,272.50 | ZAR 15.2077 | ZAR 14.5803 | July 21, 2014 |

| EUR 182,272.50 | ZAR 15.3488 | ZAR 14.5803 | July 21, 2014 |

| EUR 180,022.50 | ZAR 15.4228 | ZAR 14.6542 | August 20, 2014 |

| EUR 180,022.50 | ZAR 15.2819 | ZAR 14.6542 | August 20, 2014 |

| EUR 180,022.50 | ZAR 15.3623 | ZAR 14.7367 | September 22, 2014 |

| EUR 180,022.50 | ZAR 15.5041 | ZAR 14.7367 | September 22, 2014 |

| EUR 181,570.50 | ZAR 15.5739 | ZAR 14.8119 | October 20, 2014 |

| EUR 181,570.50 | ZAR 15.4316 | ZAR 14.8119 | October 20, 2014 |

| EUR 180,022.50 | ZAR 15.6552 | ZAR 14.8982 | November 20, 2014 |

| EUR 180,022.50 | ZAR 15.5136 | ZAR 14.8982 | November 20, 2014 |

| EUR 180,022.50 | ZAR 15.5970 | ZAR 14.9874 | December 22, 2014 |

| EUR 180,022.50 | ZAR 15.7391 | ZAR 14.9874 | December 22, 2014 |

| EUR 174,424.50 | ZAR 15.8119 | ZAR 15.0671 | January 20, 2015 |

| EUR 174,424.50 | ZAR 15.6729 | ZAR 15.0671 | January 20, 2015 |

10

5. Fair value of financial instruments and equity-accounted investments (continued)

The following table presents the Company’s assets and liabilities measured at fair value on a recurring basis as of September 30, 2013,2014, according to the fair value hierarchy:

| Quoted | |||||||||||||

| Price in | |||||||||||||

| Active | Significant | ||||||||||||

| Markets for | Other | Significant | |||||||||||

| Identical | Observable | Unobservable | |||||||||||

| Assets | Inputs | Inputs | |||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | ||||||||||

| Assets | |||||||||||||

| Related to insurance business (included in other long-term assets): | |||||||||||||

| Cash and cash equivalents | $ | 1,816 | $ | - | $ | - | $ | 1,816 | |||||

| Investment in Finbond (available for sale assets included in other long-term assets) | - | - | 8,019 | 8,019 | |||||||||

| Other | - | 155 | - | 155 | |||||||||

| Total assets at fair value | $ | 1,816 | $ | 155 | $ | 8,019 | $ | 9,990 |

| Quoted | ||||||||||||

| Price in | ||||||||||||

| Active | Significant | |||||||||||

| Markets for | Other | Significant | ||||||||||

| Identical | Observable | Unobservable | ||||||||||

| Assets | Inputs | Inputs | ||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | |||||||||

| Assets | ||||||||||||

| Related to insurance business (included in other long-term assets): | ||||||||||||

| Cash and cash equivalents | $ | 1,716 | $ | - | $ | - | $ | 1,716 | ||||

| Investment in Finbond (available for sale assets included in other long-term assets) | - | - | 7,584 | 7,584 | ||||||||

| Other | - | 45 | - | 45 | ||||||||

| Total assets at fair value | $ | 1,716 | $ | 45 | $ | 7,584 | $ | 9,345 | ||||

| Liabilities | ||||||||||||

| Foreign exchange contracts | $ | - | $ | 152 | $ | - | $ | 152 | ||||

| Total liabilities at fair value | $ | - | $ | 152 | $ | - | $ | 152 |

The following table presents the Company’s assets and liabilities measured at fair value on a recurring basis as of June 30, 2013,2014, according to the fair value hierarchy:

| Quoted | |||||||||||||

| Price in | |||||||||||||

| Active | Significant | ||||||||||||

| Markets for | Other | Significant | |||||||||||

| Identical | Observable | Unobservable | |||||||||||

| Assets | Inputs | Inputs | |||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | ||||||||||

| Assets | |||||||||||||

| Related to insurance business (included in other long-term assets): | |||||||||||||

| Cash and cash equivalents | $ | 1,833 | $ | - | $ | - | $ | 1,833 | |||||

| Investment in Finbond (available for sale assets included in other long-term assets) | - | - | 8,303 | 8,303 | |||||||||

| Other | - | 147 | - | 147 | |||||||||

| Total assets at fair value | $ | 1,833 | $ | 147 | $ | 8,303 | $ | 10,283 | |||||

| Liabilities | |||||||||||||

| Foreign exchange contracts | $ | - | $ | 436 | $ | - | $ | 436 | |||||

| Total liabilities at fair value | $ | - | $ | 436 | $ | - | $ | 436 |

| Quoted | ||||||||||||

| Price in | ||||||||||||

| Active | Significant | |||||||||||

| Markets for | Other | Significant | ||||||||||

| Identical | Observable | Unobservable | ||||||||||

| Assets | Inputs | Inputs | ||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | |||||||||

| Assets | ||||||||||||

| Related to insurance business (included in other long-term assets): | ||||||||||||

| Cash and cash equivalents | $ | 1,800 | $ | - | $ | - | $ | 1,800 | ||||

| Investment in Finbond (available for sale assets included in other long-term assets) | - | - | 8,068 | 8,068 | ||||||||

| Other | - | 47 | - | 47 | ||||||||

| Total assets at fair value | $ | 1,800 | $ | 47 | $ | 8,068 | $ | 9,915 | ||||

| Liabilities | ||||||||||||

| Foreign exchange contracts | $ | - | $ | 164 | $ | - | $ | 164 | ||||

| Total liabilities at fair value | $ | - | $ | 164 | $ | - | $ | 164 |

Changes in the Company’s investment in Finbond (Level 3 that are measured at fair value on a recurring basis) were insignificant during the three months ended September 30, 20132014 and 2012,2013, respectively. There have been no transfers in or out of Level 3 during the three months ended September 30, 20132014 and 2012,2013, respectively.

Assets and liabilities measured at fair value on a nonrecurring basis

The Company measures its assets at fair value on a nonrecurring basis when they are deemed to be other-than-temporarily impaired. The Company has no liabilities that are measured at fair value on a nonrecurring basis. The Company reviews the carrying values of its assets when events and circumstances warrant and considers all available evidence in evaluating when declines in fair value are other-than-temporary. The fair values of the Company’s assets are determined using the best information available, and may include quoted market prices, market comparables, and discounted cash flow projections. An impairment charge is recorded when the cost of the assets exceeds its fair value and the excess is determined to be other-than-temporary. The Company has not recorded any impairment charges during the reporting periods presented herein.

1011

6.Goodwill and intangible assets, net

Goodwill

Summarized below is the movement in the carrying value of goodwill for the three months ended September 30, 2013:2014:

| Accumulated | Carrying | ||||||||

| Gross value | impairment | value | |||||||

| Balance as of June 30, 2013 | $ | 218,558 | $ | (42,752) | $ | 175,806 | |||

| Foreign currency adjustment (1) | 5,067 | 77 | 5,144 | ||||||

| Balance as of September 30, 2013 | $ | 223,625 | $ | (42,675) | $ | 180,950 |

| Accumulated | Carrying | |||||||||

| Gross value | impairment | value | ||||||||

| Balance as of June 30, 2014 | $ | 186,576 | $ | - | $ | 186,576 | ||||

| Foreign currency adjustment(1) | (7,573 | ) | - | (7,573 | ) | |||||

| Balance as of September 30, 2014 | $ | 179,003 | $ | 0 | $ | 179,003 |

(1) – the foreign currency adjustment represents the effects of the fluctuations between the South African rand and the Korean won, and the US dollar on the carrying value.

Goodwill has been allocated to the Company’s reportable segments as follows:

| As of | As of | |||||

| September 30, | June 30, | |||||

| 2013 | 2013 | |||||

| SA transaction-based activities | $ | 29,861 | $ | 30,525 | ||

| International transaction-based activities | 120,334 | 113,972 | ||||

| Smart card accounts | - | - | ||||

| Financial services | - | - | ||||

| Hardware, software and related technology sales | 30,755 | 31,309 | ||||

| Total | $ | 180,950 | $ | 175,806 |

| As of | As of | |||||||||

| September 30, | June 30, | |||||||||

| 2014 | 2014 | |||||||||

| South African transaction processing | $ | 26,808 | $ | 28,517 | ||||||

| International transaction processing | 123,993 | 128,427 | ||||||||

| Financial inclusion and applied technologies | 28,202 | 29,632 | ||||||||

| Total | $ | 179,003 | $ | 186,576 |

Intangible assets, net

Carrying value and amortization of intangible assets

�� Summarized below is the carrying value and accumulated amortization of the intangible assets as of September 30, 20132014 and June 30, 2013:2014:

| As of September 30, 2013 | As of June 30, 2013 | ||||||||||||||||||

| Gross | Net | Gross | Net | ||||||||||||||||

| carrying | Accumulated | carrying | carrying | Accumulated | carrying | ||||||||||||||

| value | amortization | value | value | amortization | value | ||||||||||||||

| Finite-lived intangible assets: | |||||||||||||||||||

| Customer relationships | $ | 94,206 | ($32,986 | ) | $ | 61,220 | $ | 90,469 | $ | (29,818 | ) | $ | 60,651 | ||||||

| Software and unpatented | |||||||||||||||||||

| technology | 36,052 | (24,129 | ) | 11,923 | 34,951 | (22,151 | ) | 12,800 | |||||||||||

| FTS patent | 3,789 | (3,789 | ) | - | 3,873 | (3,873 | ) | - | |||||||||||

| Exclusive licenses | 4,506 | (4,506 | ) | - | 4,506 | (4,506 | ) | - | |||||||||||

| Trademarks | 6,755 | (2,983 | ) | 3,772 | 6,611 | (2,805 | ) | 3,806 | |||||||||||

| Customer database | 601 | (601 | ) | - | 614 | (614 | ) | - | |||||||||||

| Total finite-lived intangible assets | $ | 145,909 | ($68,994 | ) | $ | 76,915 | $ | 141,024 | $ | (63,767 | ) | $ | 77,257 | ||||||

| As of September 30, 2014 | As of June 30, 2014 | ||||||||||||||||||

| Gross | Net | Gross | Net | ||||||||||||||||

| carrying | Accumulated | carrying | carrying | Accumulated | carrying | ||||||||||||||

| value | amortization | value | value | amortization | value | ||||||||||||||

| Finite-lived intangible assets: | |||||||||||||||||||

| Customer relationships | $ | 94,844 | $ | (41,881 | ) | $ | 52,963 | $ | 98,676 | $ | (41,273 | ) | $ | 57,403 | |||||

| Software and unpatented | |||||||||||||||||||

| technology | 32,271 | (26,478 | ) | 5,793 | 33,604 | (26,207 | ) | 7,397 | |||||||||||

| FTS patent | 3,402 | (3,402 | ) | - | 3,619 | (3,619 | ) | - | |||||||||||

| Exclusive licenses | 4,506 | (4,506 | ) | - | 4,506 | (4,506 | ) | - | |||||||||||

| Trademarks | 6,583 | (3,191 | ) | 3,392 | 6,890 | (3,176 | ) | 3,714 | |||||||||||

| Total finite-lived intangible assets | $ | 141,606 | $ | (79,458 | ) | $ | 62,148 | $ | 147,295 | $ | (78,781 | ) | $ | 68,514 | |||||

Aggregate amortization expense on the finite-lived intangible assets for the three months ended September 30, 2014 and 2013, was approximately $3.9 million and $3.7 million, (three months ended September 30, 2012, was approximately $4.7 million).respectively.

Future estimated annual amortization expense for the next five fiscal years and thereafter, assuming exchange rates prevailing on September 30, 2013,2014, is presented in the table below. Actual amortization expense in future periods could differ from this estimate as a result of acquisitions, changes in useful lives, exchange rate fluctuations and other relevant factors.

| 2014 | $ | 15,637 | ||||

| 2015 | 15,583 | $ | 15,239 | |||

| 2016 | 11,228 | 11,394 | ||||

| 2017 | 8,896 | 9,080 | ||||

| 2018 | 8,896 | 9,080 | ||||

| 2019 | 8,745 | |||||

| Thereafter | $ | 20,575 | $ | 12,146 | ||

1112

7. Reinsurance assets and policy holder liabilities under insurance and investment contracts

Reinsurance assets and policy holder liabilities under insurance contracts

Summarized below is the movement in reinsurance assets and policy holder liabilities under insurance contracts during the three monthmonths ended September 30, 2013:2014:

| Reinsurance | Insurance | |||||

| assets (1) | contracts (2) | |||||

| Balance as of June 30, 2013 | $ | 19,557 | $ | (19,711 | ) | |

| Foreign currency adjustment(3) | (425 | ) | 428 | |||

| Balance as of September 30, 2013 | $ | 19,132 | $ | (19,283 | ) |

| Reinsurance | Insurance | |||||

| assets (1) | contracts (2) | |||||

| Balance as of June 30, 2014 | $ | 21,062 | $ | (21,478 | ) | |

| Foreign currency adjustment(3) | (1,263 | ) | 1,288 | |||

| Balance as of September 30, 2014 | $ | 19,799 | $ | (20,190 | ) |

(1) Included in other long-term assets.

| ||

| ||

|

The Company has agreements with reinsurance companies in order to limit its losses from large insurance contracts, however, if the reinsurer is unable to meet its obligations, the Company retains the liability.

The value of insurance contract liabilities is based on best estimates assumptions of future experience plus prescribed margins, as required in the markets in which these products are offered, namely South Africa. The process of deriving the best estimates assumptions plus prescribed margins includes assumptions related to future mortality and morbidity (an appropriate base table of standard mortality is chosen depending on the type of contract and class of business), withdrawals (based on recent withdrawal investigations and expected future trends), investment returns (based on government treasury rates adjusted by an applicable margin), expense inflation (based on a 10 year10-year real return on CPI-linked government bonds from the risk-free rate and adding an allowance for salary inflation and book shrinkage of 1% per annum) and claim reporting delays (based on average industry experience).

Assets and policy holder liabilities under investment contracts

Summarized below is the movement in assets and policy holder liabilities under investment contracts during the three months ended September 30, 2013:2014:

| Investment | ||||||

| Assets (1) | contracts (2) | |||||

| Balance as of June 30, 2013 | $ | 953 | $ | (953 | ) | |

| Foreign currency adjustment(3) | (21 | ) | 21 | |||

| Balance as of September 30, 2013 | $ | 932 | $ | (932 | ) |

| Investment | ||||||

| Assets (1) | contracts (2) | |||||

| Balance as of June 30, 2014 | $ | 688 | $ | (688 | ) | |

| Foreign currency adjustment(3) | (41 | ) | 41 | |||

| Balance as of September 30, 2014 | $ | 647 | $ | (647 | ) |

| ||

| ||

|

(1) Included in other long-term assets.

(2) Included in other long-term liabilities.

(3) The foreign currency adjustment represents the effects of the fluctuations between the ZAR against the US dollar.

The Company does not offer any investment products with guarantees related to capital or returns.

8. Short-term credit facility

The Company’s short-term credit facilities are described in Note 12 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2014.

South Africa

As of September 30, 2014, and June 30, 2014, the Company has ahad not utilized any of its ZAR 250250.0 million ($24.722.2 million, translated at exchange rates applicable as of September 30, 2013) short-term South African credit facility from Nedbank Limited (“Nedbank”). As of September 30, 2013, the2014) overdraft rate on this facility was 7.35% . The Company has ceded its investment in Cash Paymaster Services (Proprietary) Limited, a wholly owned South African subsidiary, as security for the facility. As of September 30, 2013,2014, the interest rate on the overdraft facility was 8.10% . At September 30, 2014, the Company had utilized approximately ZAR 130137.2 million ($12.2 million, translated at exchange rates applicable as of this facilitySeptember 30, 2014) of its indirect and derivative facilities to obtain foreign exchange contracts from the bank and to enable the bank providing the short-term credit facility to issue guarantees, including stand-by letters of credit, in order for the Company to honor its obligations to third parties requiring such guarantees (Refer(refer to Note 16)17). As of June 30, 2013,2014, the Company had utilized noneapproximately ZAR 139.0 million ($13.1 million, translated at exchange rates applicable as of this facility.June 30, 2014) of its indirect and derivative facilities.

13

8. Short-term credit facility (continued)

Korea

The Company believes that this facility is sufficient in order to meethad not utilized any of its future obligations as they arise.

12

9.Long-term borrowings

2010 Senior Facilities Agreement

The Company’s KRW 92.410 billion ($85.49.5 million, translated at exchange rates applicable as of September 30, 2013)2014) overdraft facility as of September 30, 2014 and June 30, 2014. As of September 30, 2014, the interest rate on the overdraft facility was 4.71% . The facility expires in January 2015.

9. Long-term borrowings

The Company’s Korean senior secured loan facility is described in Note 13 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2013.2014. The current carrying value as of September 30, 2013,2014, is $85.4$75.6 million. As of September 30, 2013,2014, the carrying amount of the long-term borrowings approximated fair value. The interest rate in effect on September 30, 2013,2014, was 6.76%5.75% .

Interest expense incurred during the three months ended September 30, 2014 and 2013, was $1.1 million and 2012, was $1.4 million, respectively. During each of the three months ended September 30, 2014 and $1.9 million, respectively.2013, respectively, the Company amortized prepaid facility fees of approximately $0.1 million.

The fifth and sixthfirst scheduled principal repayments are $7.5repayment of $14.3 million, each, translated at exchange rates applicable as of September 30, 2013,2014, was paid on October 29, 2014, and havehas been classified as current in the Company’s unaudited condensed consolidated balance sheet. The Company repaid the full amount outstanding of KRW 92.4 billion on October 29, 2013, using a combination of cash on hand and loan proceeds from the new facility described below. The Company has expensed the remaining prepaid facility fees of approximately $0.4 million during the three months ended December 31, 2013. The third scheduled repayment of $7.3 million was paid on October 29, 2012.

2013 Senior Facilities Agreement

On October 28, 2013, the Company signed a new five-year senior secured facilities agreement (the “New Facilities Agreement”) provided by a consortium of Korean banks. The New Facilities Agreement provides for three separate facilities to the Company’s wholly owned subsidiary, Net1 Applied Technologies Korea (“Net1 Korea”): a Facility A loan of up to KRW 60.0 billion ($55.5 million), a Facility B loan of up to KRW 15 billion ($13.9 million) and a Facility C revolving credit facility of up to KRW 10.0 billion ($9.2 million) (all facilities denominated in KRW and translated at exchange rates applicable as of September 30, 2013).

The Facility A and B loans were fully drawn on October 29, 2013, and used to repay KRW 75.0 billion of the KRW 92.4 billion loan outstanding under the 2010 senior facilities agreement. The remaining outstanding balance under the 2010 facility of KRW 17.4 billion was paid from cash on hand on October 29, 2013. In addition, the Company drew KRW 1.1 billion of the revolving credit facility on October 29, 2013, to pay fees and expenses related to the New Facilities Agreement.

Interest on the loans and revolving credit facility is payable quarterly and is based on the Korean CD rate in effect from time to time plus a margin of 3.10% for the Facility A loan and Facility C revolving credit facility; and a margin of 2.90% for the Facility B loan. The CD rate was 2.66% on September 30, 2013. The Company paid facilities fees of approximately KRW 0.9 billion. A commitment fee of 0.3% is payable on any un-drawn and un-cancelled amount of the revolving credit facility.

The Facility A loan is repayable in three scheduled annual installments of KRW 10 billion each beginning 30 months after initial drawdown and one final installment of KRW 30 billion on the maturity date, namely October 29, 2018. The Facility B loan is repayable in full on October 29, 2014. The Facility C revolving credit facility is repayable in full on the maturity date. Prepayment of the revolving credit facility may be withdrawn at any time up to three months before the maturity date.

The loans under the New Facilities Agreement are secured by a pledge by Net1 Korea of its entire equity interest in KSNET and a pledge by the immediate parent of Net1 Korea (also one of the Company’s subsidiaries) of its entire equity interest in Net1 Korea. The Facilities Agreement contains customary covenants that require Net1 Korea to maintain agreed leverage and debt service coverage ratios and restricts Net1 Korea’s ability to make certain distributions with respect to its capital stock, prepay other debt, encumber its assets, incur additional indebtedness, or engage in certain business combinations. The loans under the Facilities Agreement are without recourse to, and the covenants and other agreements contained therein do not apply to, the Company or any of the Company’s subsidiaries (other than Net1 Korea).

10. Capital structure

Common stock repurchases

The Company did not repurchase any of its shares during the three months ended September 30, 2013 and 2012, respectively.

13

10. Capital structure (continued)

The following table presents reconciliation between the number of shares, net of treasury, presented in the unaudited condensed consolidated statement of changes in equity during the three months ended September 30, 20132014 and 2012,2013, respectively, and the number of shares, net of treasury, excluding non-vested equity shares that have not vested during the three months ended September 30, 20132014 and 2012,2013, respectively:

| 2013 | 2012 | 2014 | 2013 | |||||||||

| Number of shares, net of treasury: | ||||||||||||

| Statement of changes in equity | 45,780,513 | 45,600,471 | 46,475,623 | 45,780,513 | ||||||||

| Less: Non-vested equity shares that have not vested | (576,282 | ) | (644,750 | ) | ||||||||

| Less: Non-vested equity shares that have not vested (Note 12) | (453,333 | ) | (576,282 | ) | ||||||||

| Number of shares, net of treasury excluding non-vested equity shares that have not vested | 45,204,231 | 44,955,721 | 46,022,290 | 45,204,231 | ||||||||

Common stock repurchases and transaction with noncontrolling interests

The Company did not repurchase any of its shares during the three months ended September 30, 2014 and 2013, under its share repurchase authorization. However, on August 27, 2014, the Company entered into a Subscription and Sale of Shares Agreement with Business Venture Investments No 1567 Proprietary Limited (RF) (“BVI”), one of the Company’s BEE partners, in preparation for any new potential SASSA tender. Pursuant to the agreement: (i) the Company repurchased BVI’s remaining 1,837,432 shares of the Company’s common stock for approximately ZAR 97.4 million in cash ($9.2 million translated at exchange rates prevailing as of August 27, 2014) and (ii) BVI has subscribed for new ordinary shares of Cash Paymaster Services (Pty) Ltd (“CPS”) representing approximately 12.5% of CPS’ ordinary shares outstanding after the subscription for ZAR 15.0 million in cash (approximately $1.4 million translated at exchange rates prevailing as of August 27, 2014). In connection with transactions described above, the CPS shareholder agreement that was negotiated as part of the original December 2013 Relationship Agreement became effective.

14

11. Accumulated other comprehensive loss

The table below presents the change in accumulated other comprehensive (loss) income per component during the three months ended September 30, 2014:

| Three months ended | ||||||||||

| September 30, 2014 | ||||||||||

| Accumulated | ||||||||||

| Net | ||||||||||

| unrealized | ||||||||||

| Accumulated | income (loss) | |||||||||

| Foreign | on asset | |||||||||

| currency | available for | |||||||||

| translation | sale, net of | |||||||||

| reserve | tax | Total | ||||||||

| ‘000 | ‘000 | ‘000 | ||||||||

| Balance as of June 30, 2014 | $ | (83,359 | ) | $ | $618 | $ | (82,741 | ) | ||

| Movement in foreign currency translation reserve | (21,159 | ) | - | (21,159 | ) | |||||

| Unrealized loss on asset available for sale, net of tax of $88 | - | (226 | ) | (226 | ) | |||||

| Balance as of September 30, 2014 | $ | (104,518 | ) | $ | 392 | $ | (104,126 | ) | ||

There were no reclassifications from accumulated other comprehensive loss to comprehensive (loss) income during the three months ended September 30, 2014 or 2013, respectively.

12. Stock-based compensation

Stock option and restricted stock activity

Options

The following table summarizes stock option activity for the three months ended September 30, 20132014 and 2012:2013:

| Weighted | Weighted | ||||||||||||||

| Weighted | Average | Average | |||||||||||||

| average | Remaining | Aggregate | Grant | ||||||||||||

| exercise | Contractual | Intrinsic | Date Fair | ||||||||||||

| Number of | price | Term | Value | Value | |||||||||||

| shares | ($) | (in years) | ($’000) | ($) | |||||||||||

| Outstanding – June 30, 2013 | 2,648,583 | 15.15 | 5.98 | 313 | |||||||||||

| Granted under Plan: August 2013 | 224,896 | 7.35 | 10.00 | 568 | 2.53 | ||||||||||

| Outstanding – September 30, 2013 | 2,873,479 | 14.54 | 6.06 | 4,841 | |||||||||||

| Outstanding – June 30, 2012 | 2,247,583 | 16.28 | 6.43 | 602 | |||||||||||

| Granted under Plan: August 2012 | 431,000 | 8.75 | 10.00 | 1,249 | 2.90 | ||||||||||

| Exercised | (30,000 | ) | 7.98 | 24 | |||||||||||

| Outstanding – September 30, 2012 | 2,648,583 | 15.15 | 6.74 | 978 |

| Weighted | Weighted | |||||||||||||||

| Weighted | Average | Average | ||||||||||||||

| average | Remaining | Aggregate | Grant | |||||||||||||

| exercise | Contractual | Intrinsic | Date Fair | |||||||||||||

| Number of | price | Term | Value | Value | ||||||||||||

| shares | ($) | (in years) | ($’000) | ($) | ||||||||||||

| Outstanding – June 30, 2014 | 2,710,392 | 14.16 | 5.38 | 3,909 | ||||||||||||

| Granted under Plan: August 2014 | 464,410 | 11.23 | 10.00 | 2,113 | 4.55 | |||||||||||

| Exercised | (688,633 | ) | 8.24 | 3,697 | ||||||||||||

| Outstanding – September 30, 2014 | 2,486,169 | 15.24 | 5.45 | 1,820 | ||||||||||||

| Outstanding – June 30, 2013 | 2,648,583 | 15.15 | 5.98 | 313 | ||||||||||||

| Granted under Plan: August 2013 | 224,896 | 7.35 | 10.00 | 568 | 2.53 | |||||||||||

| Outstanding – September 30, 2013 | 2,873,479 | 14.54 | 6.06 | 4,841 |

The fair value of each option is estimated on the date of grant using the Cox Ross Rubinstein binomial model that uses the assumptions noted in the following table. The estimated expected volatility is calculated based on the Company’s 250 day volatility. The estimated expected life of the option was determined based on historical behavior of employees who were granted options with similar terms. The Company has estimated no forfeitures for options awarded in August 2013 and 2012,2014, respectively.

15

12. Stock-based compensation (continued)

Stock option and restricted stock activity (continued)

Options (continued)

The table below presents the range of assumptions used to value options granted during the three months ended September 30, 20132014 and 2012:2013:

| Three months ended | |||||||||

| September 30, | |||||||||

| 2013 | 2012 | 2014 | 2013 | ||||||

| Expected volatility | 50% | 49% | 60% | 50% | |||||

| Expected dividends | 0% | 0% | 0% | 0% | |||||

| Expected life (in years) | 3 | 3 | 3 | 3 | |||||

| Risk-free rate | 0.9% | 0.3% | 1.0% | 0.9% | |||||

14

11. Stock-based compensation (continued)

Stock option There were no forfeitures during the three months ended September 30, 2014 and restricted stock activity (continued)

Options (continued)2013.

The following table presents stock options vestingvested and expecting to vest as of September 30, 2013:2014:

| Weighted | ||||||||||||

| Weighted | Average | |||||||||||

| average | Remaining | Aggregate | ||||||||||

| exercise | Contractual | Intrinsic | ||||||||||

| Number of | price | Term | Value | |||||||||

| shares | ($) | (in years) | ($’000) | |||||||||

| Vested and expecting to vest – September 30, 2013 | 2,873,479 | 14.54 | 6.06 | 4,841 |

| Weighted | ||||||||||||

| Weighted | Average | |||||||||||

| average | Remaining | Aggregate | ||||||||||

| exercise | Contractual | Intrinsic | ||||||||||

| Number of | price | Term | Value | |||||||||

| shares | ($) | (in years) | ($’000) | |||||||||

| Vested and expecting to vest – September 30, 2014 | 2,486,169 | 15.24 | 5.45 | 1,820 |

These options have an exercise price range of $6.59$7.35 to $24.46.

| Weighted | ||||||||||||

| Average | ||||||||||||

| Weighted | Remaining | Aggregate | ||||||||||

| average | Contractual | Intrinsic | ||||||||||

| Number of | exercise | Term | Value | |||||||||

| shares | price ($) | (in years) | (’000) | |||||||||

| Exercisable | 1,985,250 | $ | 17.07 | 5.05 | $ | 1,963 |

The following table presents stock options that are exercisable as of September 30, 2014:

| Weighted | ||||||||||||

| Average | ||||||||||||

| Weighted | Remaining | Aggregate | ||||||||||

| average | Contractual | Intrinsic | ||||||||||

| Number of | exercise | Term | Value | |||||||||

| shares | price ($) | (in years) | ($’000) | |||||||||

| Exercisable – September 30, 2014 | 1,670,829 | 17.88 | 3.64 | 573 |

During the three months ended September 30, 2014 and 2013, respectively, 273,633 and 2012, respectively, 198,667 and 85,000 stock options became exercisable. Included in the 85,000 stock options are 30,000 stock options with respect to which the Remuneration Committee of the Board agreed to accelerate vesting, in August 2012, prior to the resignation of a non-employee director. During the three months ended September 30, 2012,2014, the Company received approximately $0.2$1.0 million from the 30,000116,395 stock options exercised. The remaining 572,238 stock options were exercised bythrough recipients delivering 336,584 shares of the non-employee director that resigned.Company’s common stock to the Company on September 9, 2014, to settle the exercise price due. No stock options were exercised during the three months ended September 30, 2013. The Company issues new shares to satisfy stock option exercises.

16

12. Stock-based compensation (continued)

Stock option and restricted stock activity (continued)

Restricted stock

The following table summarizes restricted stock activity for the three months ended September 30, 20132014 and 2012:2013:

| Weighted | Weighted | |||||||||||

| Number of | Average | Number of | Average | |||||||||

| Shares of | Grant Date | Shares of | Grant Date | |||||||||

| Restricted | Fair Value | Restricted | Fair Value | |||||||||

| Stock | ($’000) | Stock | ($’000) | |||||||||

| Non-vested – June 30, 2014 | 385,778 | 3,534 | ||||||||||

| Granted – August 2014 | 141,707 | 581 | ||||||||||

| Vested – August 2014 | (74,152 | ) | 828 | |||||||||

| Non-vested – September 30, 2014 | 453,333 | 3,568 | ||||||||||

| Non-vested – June 30, 2013 | 405,226 | $ | 4,393 | 405,226 | 4,393 | |||||||

| Granted – August 2013 | 187,963 | 1,382 | 187,963 | 1,382 | ||||||||

| Vested – August 2013 | (16,907 | ) | 161 | (16,907 | ) | 161 | ||||||

| Non-vested – September 30, 2013 | 576,282 | 5,630 | 576,282 | 5,630 | ||||||||

| Non-vested – June 30, 2012 | 646,617 | 7,061 | ||||||||||

| Granted – August 2012 | 21,569 | 189 | ||||||||||

| Vested – August 2012 | (23,436 | ) | 216 | |||||||||

| Non-vested – September 30, 2012 | 644,750 | $ | 7,021 | |||||||||

Included in the 141,707 shares of restricted stock granted are 127,626 shares of restricted stock granted to employees on August 27, 2014, that will vest in full only on the date, if any, the following conditions are satisfied: (1) the closing price of the Company’s common stock equals or exceeds $19.41 (subject to appropriate adjustment for any stock split or stock dividend) for a period of 30 consecutive trading days during a measurement period commencing on the date that the Company files its Annual Report on Form 10-K for the fiscal year ended 2017 and ending on December 31, 2017 and (2) the recipient is employed by the Company on a full-time basis when the condition in (1) is met. If either of these conditions is not satisfied, then none of the shares of restricted stock will vest and they will be forfeited. The $19.41 price target represents a 20% increase, compounded annually, in the price of the Company’s common stock on Nasdaq over the $11.23 closing price on August 27, 2014.

These 127,626 shares of restricted stock are effectively forward starting knock-in barrier options with a strike price of zero. The fair value of these shares of restricted stock was calculated utilizing an adjusted Monte Carlo simulation discounted cash flow model which was developed for the purpose of the valuation of these shares. For each simulated share price path, the market share price condition was evaluated to determine whether or not the shares would vest under that simulation. The “adjustment” to the Monte Carlo simulation model incorporates a “jump diffusion” process to the standard Geometric Brownian Motion simulation, in order to capture the discontinuous share price jumps observed in the Company’s share price movements on stock exchanges on which it is listed. Therefore, the simulated share price paths capture the idiosyncrasies of the observed Company share price movements.

In scenarios where the shares do not vest, the final vested value at maturity is zero. In scenarios where vesting occurs, the final vested value on maturity is the share price on vesting date. The value of the grant is the average of the discounted vested values. The Company used an expected volatility of 76.01%, an expected life of approximately three years, a risk-free rate of 1.27% and no future dividends in its calculation of the fair value of the restricted stock. The estimated expected volatility was calculated based on the Company’s 30 day VWAP share price using the exponentially weighted moving average of returns.

The fair value of restricted stock vesting during the three months ended September 30, 20132014 and 2012,2013, respectively, was $0.2$0.8 million and $0.2 million. Included in the 23,436 shares of restricted stock that vested in August 2012 are 8,547 shares with respect to which the Remuneration Committee of the Board agreed to accelerate vesting prior to the resignation of a non-employee director.

The fair value of restricted stock is based on the closing price of the Company’s stock quoted on The Nasdaq Global Select Market on the date of grant.

1517

11.12. Stock-based compensation (continued)

Stock-based compensation charge and unrecognized compensation cost

The Company has recorded a stockstock-based compensation charge of $0.9 million and $1.1 million forduring each of the three months ended September 30, 20132014 and 2012,2013, respectively, which comprised:

| Allocated to cost | ||||||||||

| of goods sold, IT | Allocated to | |||||||||

| processing, | selling, general | |||||||||

| Total | servicing and | and | ||||||||

| charge | support | administration | ||||||||

| Three months ended September 30, 2013 | ||||||||||

| Stock-based compensation charge | $ | 930 | $ | - | $ | 930 | ||||

| Total – three months ended September 30, 2013 . | $ | 930 | $ | - | $ | 930 | ||||

| Three months ended September 30, 2012 | ||||||||||

| Stock-based compensation charge | $ | 1,116 | $ | - | $ | 1,116 | ||||

| Total – three months ended September 30, 2012 . | $ | 1,116 | $ | - | $ | 1,116 |

| Allocated to cost | ||||||||||

| of goods sold, IT | Allocated to | |||||||||

| processing, | selling, general | |||||||||

| Total | servicing and | and | ||||||||

| charge | support | administration | ||||||||

| Three months ended September 30, 2014 | ||||||||||

| Stock-based compensation charge | $ | 916 | $ | - | $ | 916 | ||||

| Total – three months ended September 30, 2014 | $ | 916 | $ | - | $ | 916 | ||||

| Three months ended September 30, 2013 | ||||||||||

| Stock-based compensation charge | $ | 930 | $ | - | $ | 930 | ||||

| Total – three months ended September 30, 2013 | $ | 930 | $ | - | $ | 930 |

The stock-based compensation charges have been allocated to selling, general and administration based on the allocation of the cash compensation paid to the employees.

As of September 30, 2013,2014, the total unrecognized compensation cost related to stock options was approximately $1.6$2.8 million, which the Company expects to recognize over approximately three years. As of September 30, 2013,2014, the total unrecognized compensation cost related to restricted stock awards was approximately $4.3$2.2 million, which the Company expects to recognize over approximately threetwo years.

As of each of September 30, 20132014 and June 30, 2013,2014, respectively, the Company has recorded a deferred tax asset of approximately $1.4$1.2 million related to the stock-based compensation charge recognized related to employees and directors of Net1 as it is able to deduct the grant date fair value for taxation purposes in the United States.

12.13. Earnings per share

Basic earnings per share include shares of restricted stock that meet the definition of a participating security because these shares are eligible to receive non-forfeitable dividend equivalents at the same rate as common stock. Basic earnings per share have been calculated using the two-class method and basic earnings per share for the three months ended September 30, 20132014 and 2012,2013, reflects only undistributed earnings. The computation below of basic earnings per share excludes the net income attributable to shares of unvested restricted stock (participating non-vested restricted stock) from the numerator and excludes the dilutive impact of these unvested shares of restricted stock from the denominator.

Diluted earnings per share has been calculated to give effect to the number of shares of additional common stock that would have been outstanding if the potential dilutive instruments had been issued in each period. Stock options are included in the calculation of diluted earnings per share utilizing the treasury stock method and are not considered to be participating securities as the stock options do not contain non-forfeitable dividend rights. The calculation of diluted earnings per share includes the dilutive effect of a portion of the restricted stock granted to employees in February 2012, August 2013 and August 20132014 as these shares of restricted stock are considered contingently returnable shares for the purposes of the diluted earnings per share calculation and the vesting conditions in respect of a portion of the restricted stock had been satisfied. The vesting conditions are discussed in Note 1718 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2013.2014.

1618

12.13. Earnings per share (continued)

The following table presents net income attributable to Net1 (income from continuing operations) and the share data used in the basic and diluted earnings per share computations using the two-class method:

| Three months ended | |||||||

| September 30, | |||||||

| 2013 | 2012 | ||||||

| (in thousands except percent | |||||||

| and | |||||||

| per share data) | |||||||

| Numerator: | |||||||

| Net income attributable to Net1 | $ | 11,596 | $ | 6,744 | |||

| Undistributed earnings | 11,596 | 6,744 | |||||

| Percent allocated to common shareholders (Calculation 1) | 99% | 99% | |||||

| Numerator for earnings per share: basic and diluted | $ | 11,495 | $ | 6,659 | |||

| Denominator: | |||||||

| Denominator for basic earnings per share: weighted-average common | |||||||

| shares outstanding | 45,216 | 44,968 | |||||

| Effect of dilutive securities: | |||||||

| Performance shares related to acquisition | - | - | |||||

| Stock options | 71 | 48 | |||||

| Denominator for diluted earnings per share: adjusted weighted average common shares outstanding and assumed conversion | 45,287 | 45,016 | |||||

| Earnings per share: | |||||||

| Basic | $ | 0.25 | $ | 0.15 | |||

| Diluted | $ | 0.25 | $ | 0.15 | |||

| (Calculation 1) | |||||||

| Basic weighted-average common shares outstanding (A) | 45,216 | 44,968 | |||||

| Basic weighted-average common shares outstanding and unvested | |||||||

| restricted shares expected to vest (B) | 45,613 | 45,544 | |||||

| Percent allocated to common shareholders (A) / (B) | 99% | 99% | |||||

| Three months ended | ||||||

| September 30, | ||||||

| 2014 | 2013 | |||||

| (in thousands except percent | ||||||

| and | ||||||

| per share data) | ||||||

| Numerator: | ||||||

| Net income attributable to Net1 | $ | 24,089 | $ | 11,596 | ||

| Undistributed earnings | 24,089 | 11,596 | ||||

| Percent allocated to common shareholders (Calculation 1) | 99% | 99% | ||||

| Numerator for earnings per share: basic and diluted | $ | 23,847 | $ | 11,495 | ||

| Denominator: | ||||||

| Denominator for basic earnings per share: weighted-average common shares outstanding | 46,751 | 45,216 | ||||

| Effect of dilutive securities: | ||||||

| Stock options | 109 | 71 | ||||

| Denominator for diluted earnings per share: adjusted weighted average common shares outstanding and assumed conversion | 46,860 | 45,287 | ||||

| Earnings per share: | ||||||

| Basic | $ | 0.51 | $ | 0.25 | ||

| Diluted | $ | 0.51 | $ | 0.25 | ||

| (Calculation 1) | ||||||

| Basic weighted-average common shares outstanding (A) | 46,751 | 45,216 | ||||

| Basic weighted-average common shares outstanding and unvested restricted shares expected to vest (B) | 47,226 | 45,613 | ||||

| Percent allocated to common shareholders (A) / (B) | 99% | 99% | ||||