UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017March 31, 2020

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-14287

Centrus Energy Corp.

|

| |

| Delaware | 52-2107911 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

6901 Rockledge Drive, Suite 800, Bethesda, Maryland 20817

(301) 564-3200

Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Class A Common Stock, par value $0.10 per share | LEU | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically, and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

| Large accelerated filer | o | | Smaller reporting company | ý |

| Accelerated filer | o | | Non-accelerated filer | ý |

| Smaller reporting company | ý | | Emerging growth company | o |

Non-accelerated filer | o | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ýNo o

As of November 1, 2017,April 20, 2020, there were 7,632,6698,783,189 shares of the registrant’s Class A Common Stock, par value $0.10 per share, and 1,406,082719,200 shares of the registrant’s Class B Common Stock, par value $0.10 per share, outstanding.

TABLE OF CONTENTS

|

| | |

| | | Page |

| | PART I – FINANCIAL INFORMATION | |

| | |

| | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | | |

| | PART II – OTHER INFORMATION | |

| | |

| | |

| | |

| |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, including Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2, contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 - that is, statements related to future events.1934. In this context, forward-looking statements mean statements related to future events,

may address our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will”, “should”, “could”, “would” or “may” and other words of similar meaning. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For Centrus Energy Corp., particular risks and uncertainties that could cause our actual future results to differ materially from those expressed in our forward-looking statements include but are not limited to the following, which may be amplified by the novel coronavirus (COVID-19) pandemic: risks related to our significant long-term liabilities, including material unfunded defined benefit pension plan obligations and postretirement health and life benefit obligations; risks relating to our outstanding 8.0% paid-in-kind (“PIK”) toggle8.25% notes (the “8% PIK Toggle“8.25% Notes”) maturing in September 2019, our 8.25% notes maturing in February 2027 (the “8.25% Notes”) and our Series B Senior Preferred Stock (the “Series B Preferred Stock”), including the potential termination of the guarantee by United States Enrichment Corporation (“Enrichment Corp.”) of the 8% PIK Toggle Notes; risks related to the limited trading markets in our securities; risks related to our ability to maintain the listing of our Class A Common Stock on the NYSE American LLC; risks related to decisions made by our Class B stockholders regarding their investment in the Company based upon factors that are unrelated to the Company’s performance;Stock; risks related to the use of our net operating lossesloss (“NOLs”) carryforwards and net unrealized built-in losses (“NUBILs”) to offset future taxable income and the use of the Rights Agreement (as defined herein) to prevent an “ownership change” as defined in Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”) and our ability to generate taxable income to utilize all or a portion of the NOLs and NUBILs prior to the expiration thereof; risks related to the limited trading markets in our securities; risks related to our ability to maintain the listing of our Class A Common Stock on the NYSE American LLC (the “NYSE American”); risks related to decisions made by our Class B stockholders and our Series B Senior Preferred stockholders regarding their investment in the Company based upon factors that are unrelated to the Company’s performance; risks related to the Company’s capital concentration; risks related to natural and other disasters, including the continued impact of the March 2011 earthquake and tsunami in Japan on the nuclear industry and on our business, results of operations and prospects; the impact and potential extended duration of the current supply/demand imbalance in the market for low-enriched uranium (“LEU”);our dependence on others fordeliveries of LEU including deliveries from the Russian governmentgovernment-owned entity Joint StockTENEX, Joint-Stock Company “TENEX” (“TENEX”), under a commercial supply agreement with TENEX and deliveries under a long-term supply agreement with Orano Cycle (“Orano”); risks related to existing or new trade barriers and contract terms that limit our ability to deliver LEU to customers; risks related to actions, including government reviews, that may be taken by the United States government, the Russian government or other governments that could affect our ability to perform under our contract obligations or the ability of our sources of supply to perform under their contract obligations to us, including the imposition of sanctions, restrictions or other requirements, and risks relating to the potential expiration of the 1992 Russian Suspension Agreement (“RSA”) and/or a renewal of the RSA on

TENEX (the “Russian Supply Agreement”);terms not favorable to us or legislation imposing new or increased limits on imports of Russian LEU; risks related to our ability to sell the LEU we procure pursuant to our purchase obligations under our supply agreements, including the Russian Supply Agreement;agreements; risks relating to our sales order book, including uncertainty concerning customer actions under current contracts and in future contracting due to market conditions and lack of current production capability; risks related to financial difficulties experienced by customers, including possible bankruptcies, insolvencies or any other inability to pay for our products or services or delays in making timely payment; pricing trends and demand in the uranium and enrichment markets and their impact on our profitability; movement and timing of customer orders; risks related to the value of our intangible assets related to the sales order book and customer relationships; risks associated with our reliance on third-party suppliers to provide essential products and services to us; pricing trends and demand in the uranium and enrichment markets and their impact on our profitability; movement and timing of customer orders; risks related to trade barriers and contract terms that limit our ability to deliver LEU to customers; risks related to actions that may be taken by the U.S. government, the Russian government or other governments that could affect our ability or the ability of our sources of supply to perform under their contract obligations to us, including the imposition of sanctions, restrictions or other requirements; the impact of government regulation including by the U.S. Department of Energy (“DOE”) and the U.S. Nuclear Regulatory Commission; uncertainty regarding our ability to commercially deploy competitive enrichment technology; risks and uncertainties regarding funding for deployment of the American Centrifuge projecttechnology and our ability to perform and absorb costs under our agreement with UT-Battelle, LLC,DOE to demonstrate the managementcapability to produce high assay low enriched uranium (“HALEU”) and operating contractorour ability to obtain and/or perform under other agreements; risks relating to whether or when government or commercial demand for Oak Ridge National Laboratory, for continued research and development of the American Centrifuge technology;HALEU will materialize; the potential for further demobilization or termination of theour American Centrifuge project;work; risks related to our ability to perform and receive timely payment under agreements with DOE or other government agencies, including risk and uncertainties related to the current demobilization of portionsongoing funding of the American Centrifuge project,government and potential audits; the competitive bidding process associated with obtaining a federal contract; risks related to our ability to perform fixed-price and cost-share contracts, including risksthe risk that the schedule could be delayed and costs could be higher than expected; risks that we will be unable to obtain new business opportunities or achieve market acceptance of our products and services or that products or services provided by others will render our products or services obsolete or noncompetitive; risks that we will not be able to timely complete the work that we are obligated to perform; failures or security breaches of our information technology systems; risks related to pandemics and other health crises, such as the global COVID-19 pandemic; potential strategic transactions, which could be difficult to implement, disrupt our business or change our business profile significantly; the outcome of legal proceedings and other contingencies (including lawsuits and government investigations or audits); thecompetitive environment for our products and services; changes in the nuclear energy industry; the impact of financial market conditions on our business, liquidity, prospects, pension assets and insurance facilities; the risks of revenue and operating results can fluctuatefluctuating significantly from quarter to quarter, and in some cases, year to year; and other risks and uncertainties discussed in this and our other filings with the Securities and Exchange Commission, including under Part 1. Item1A - “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016.2019.

These factors may not constitute all factors that could cause actual results to differ from those discussed in any forward-looking statement. Accordingly, forward-looking statements should be not be relied upon as a predictor of actual results. Readers are urged to carefully review and consider the various disclosures made in this report and in our other filings with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances that may arise after the date of this Quarterly Report on Form 10-Q, except as required by law.

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Unaudited; in millions, except share and per share data)

| | | | September 30,

2017 | | December 31,

2016 | March 31,

2020 | | December 31,

2019 |

| ASSETS | | | | | | |

| Current assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | $ | 135.9 |

| | $ | 260.7 |

| $ | 109.2 |

| | $ | 130.7 |

|

| Accounts receivable | 14.2 |

| | 19.9 |

| 17.5 |

| | 21.1 |

|

| Inventories | 124.1 |

| | 177.4 |

| 67.9 |

| | 64.5 |

|

| Deferred costs associated with deferred revenue | 94.5 |

| | 89.3 |

| 144.1 |

| | 144.1 |

|

| Other current assets | 15.6 |

| | 13.3 |

| 7.8 |

| | 9.2 |

|

| Total current assets | 384.3 |

| | 560.6 |

| 346.5 |

| | 369.6 |

|

| Property, plant and equipment, net | 5.2 |

| | 6.0 |

| |

| Deposits for surety bonds | 29.6 |

| | 29.5 |

| |

| Property, plant and equipment, net of accumulated depreciation of $2.3 as of March 31, 2020 and $2.2 as of December 31, 2019 | | 3.6 |

| | 3.7 |

|

| Deposits for financial assurance | | 5.7 |

| | 5.7 |

|

| Intangible assets, net | 87.6 |

| | 93.3 |

| 68.1 |

| | 69.5 |

|

| Other long-term assets | 15.2 |

| | 24.1 |

| 6.9 |

| | 7.4 |

|

| Total assets | $ | 521.9 |

| | $ | 713.5 |

| $ | 430.8 |

| | $ | 455.9 |

|

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | |

| |

| | |

|

| Current liabilities | |

| | |

| |

| Current liabilities: | | |

| | |

|

| Accounts payable and accrued liabilities | $ | 50.7 |

| | $ | 46.4 |

| $ | 50.7 |

| | $ | 50.7 |

|

| Payables under SWU purchase agreements | 17.3 |

| | 59.6 |

| 6.1 |

| | 8.1 |

|

| Inventories owed to customers and suppliers | 22.1 |

| | 57.5 |

| 7.4 |

| | 5.6 |

|

| Deferred revenue | 131.7 |

| | 123.6 |

| |

| Decontamination and decommissioning obligations | 16.6 |

| | 38.6 |

| |

| Deferred revenue and advances from customers | | 243.0 |

| | 266.3 |

|

| Current debt | | 6.1 |

| | 6.1 |

|

| Total current liabilities | 238.4 |

| | 325.7 |

| 313.3 |

| | 336.8 |

|

| Long-term debt | 157.5 |

| | 234.1 |

| 111.0 |

| | 114.1 |

|

| Postretirement health and life benefit obligations | 170.0 |

| | 171.3 |

| 134.7 |

| | 138.6 |

|

| Pension benefit liabilities | 175.0 |

| | 179.9 |

| 137.2 |

| | 141.8 |

|

| Advances from customers | | 29.4 |

| | 29.4 |

|

| Other long-term liabilities | 35.6 |

| | 38.6 |

| 30.6 |

| | 32.1 |

|

| Total liabilities | 776.5 |

| | 949.6 |

| 756.2 |

| | 792.8 |

|

| Commitments and contingencies (Note 12) |

|

| |

|

| |

| Stockholders’ deficit | | | | |

| Commitments and contingencies (Note 11) | |

|

| |

|

|

| Stockholders’ deficit: | | | | |

| Preferred stock, par value $1.00 per share, 20,000,000 shares authorized | | | | | | |

| Series A Participating Cumulative Preferred Stock, none issued | — |

| | — |

| — |

| | — |

|

| Series B Senior Preferred Stock, 7.5% cumulative, 104,574 shares issued and outstanding and an aggregate liquidation preference of $109.6 million as of September 30, 2017 | 4.6 |

| | — |

| |

| Class A Common Stock, par value $0.10 per share, 70,000,000 shares authorized, 7,632,669 and 7,563,600 shares issued and outstanding as of September 30, 2017 and December 31, 2016 | 0.8 |

| | 0.8 |

| |

| Class B Common Stock, par value $0.10 per share, 30,000,000 shares authorized, 1,406,082 and 1,436,400 shares issued and outstanding as of September 30, 2017 and December 31, 2016 | 0.1 |

| | 0.1 |

| |

| Series B Senior Preferred Stock, 7.5% cumulative, 104,574 shares issued and outstanding and an aggregate liquidation preference of $129.2 as of March 31, 2020 and $127.2 as of December 31, 2019 | | 4.6 |

| | 4.6 |

|

| Class A Common Stock, par value $0.10 per share, 70,000,000 shares authorized, 8,783,189 and 8,347,427 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | | 0.8 |

| | 0.8 |

|

| Class B Common Stock, par value $0.10 per share, 30,000,000 shares authorized, 719,200 and 1,117,462 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | | 0.1 |

| | 0.1 |

|

| Excess of capital over par value | 59.8 |

| | 59.5 |

| 61.8 |

| | 61.5 |

|

| Accumulated deficit | (320.0 | ) | | (296.7 | ) | (393.7 | ) | | (405.0 | ) |

| Accumulated other comprehensive income, net of tax | 0.1 |

| | 0.2 |

| 1.0 |

| | 1.1 |

|

| Total stockholders’ deficit | (254.6 | ) | | (236.1 | ) | (325.4 | ) | | (336.9 | ) |

| Total liabilities and stockholders’ deficit | $ | 521.9 |

| | $ | 713.5 |

| $ | 430.8 |

| | $ | 455.9 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) AND COMPREHENSIVE INCOME (LOSS)

(Unaudited; in millions, except share and per share data)

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | Three Months Ended

March 31, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2020 | | 2019 |

| Revenue: | | | | | | | | | | |

| Separative work units | $ | 43.5 |

| | $ | 14.1 |

| | $ | 82.2 |

| | $ | 128.3 |

| $ | 30.7 |

| | $ | 12.4 |

|

| Uranium | — |

| | — |

| | — |

| | 14.3 |

| — |

| | 22.7 |

|

| Contract services | 6.8 |

| | 7.3 |

| | 19.3 |

| | 32.2 |

| |

| Technical solutions | | 14.3 |

| | 3.6 |

|

| Total revenue | 50.3 |

| | 21.4 |

| | 101.5 |

| | 174.8 |

| 45.0 |

| | 38.7 |

|

| Cost of Sales: | | | | | | | | | | |

| Separative work units and uranium | 32.4 |

| | 15.9 |

| | 76.8 |

| | 130.7 |

| 13.3 |

| | 38.3 |

|

| Contract services | 6.3 |

| | 7.6 |

| | 19.9 |

| | 24.9 |

| |

| Technical solutions | | 12.1 |

| | 5.9 |

|

| Total cost of sales | 38.7 |

| | 23.5 |

| | 96.7 |

| | 155.6 |

| 25.4 |

| | 44.2 |

|

| Gross profit (loss) | 11.6 |

| | (2.1 | ) | | 4.8 |

| | 19.2 |

| 19.6 |

| | (5.5 | ) |

| Advanced technology license and decommissioning costs | 4.5 |

| | 21.9 |

| | 15.0 |

| | 38.6 |

| |

| Advanced technology costs | | 0.9 |

| | 6.6 |

|

| Selling, general and administrative | 11.0 |

| | 10.7 |

| | 33.1 |

| | 34.6 |

| 8.5 |

| | 8.1 |

|

| Amortization of intangible assets | 2.5 |

| | 1.7 |

| | 5.7 |

| | 7.6 |

| 1.4 |

| | 1.1 |

|

| Special charges for workforce reductions and advisory costs | 2.4 |

| | 0.6 |

| | 7.1 |

| | 1.2 |

| |

| Gains on sales of assets | (0.6 | ) | | (0.3 | ) | | (2.3 | ) | | (1.0 | ) | |

| Operating loss | (8.2 | ) | | (36.7 | ) | | (53.8 | ) | | (61.8 | ) | |

| Gain on early extinguishment of debt | — |

| | — |

| | (33.6 | ) | | (16.7 | ) | |

| Special charges (credits) for workforce reductions | | (0.1 | ) | | (0.1 | ) |

| Gain on sales of assets | | — |

| | (0.4 | ) |

| Operating income (loss) | | 8.9 |

| | (20.8 | ) |

| Nonoperating components of net periodic benefit expense (income) | | (2.2 | ) | | (0.1 | ) |

| Interest expense | 0.7 |

| | 4.7 |

| | 4.3 |

| | 14.8 |

| 0.1 |

| | 1.0 |

|

| Investment income | (0.4 | ) | | (0.1 | ) | | (1.0 | ) | | (0.5 | ) | (0.4 | ) | | (0.7 | ) |

| Loss before income taxes | (8.5 | ) | | (41.3 | ) | | (23.5 | ) | | (59.4 | ) | |

| Income tax benefit | — |

| | — |

| | (0.2 | ) | | (0.6 | ) | |

| Net loss | (8.5 | ) | | (41.3 | ) | | (23.3 | ) | | (58.8 | ) | |

| Income (loss) before income taxes | | 11.4 |

| | (21.0 | ) |

| Income tax expense (benefit) | | 0.1 |

| | (0.1 | ) |

| Net income (loss) and comprehensive income (loss) | | 11.3 |

| | (20.9 | ) |

| Preferred stock dividends - undeclared and cumulative | 2.0 |

| | — |

| | 5.0 |

| | — |

| 2.0 |

| | 2.0 |

|

| Net loss allocable to common stockholders | $ | (10.5 | ) | | $ | (41.3 | ) | | $ | (28.3 | ) | | $ | (58.8 | ) | |

| Net income (loss) allocable to common stockholders | | $ | 9.3 |

| | $ | (22.9 | ) |

| | | | | | | | | | | |

| Net loss per common share – basic and diluted | $ | (1.15 | ) | | $ | (4.54 | ) | | $ | (3.12 | ) | | $ | (6.46 | ) | |

| Average number of common shares outstanding – basic and diluted (in thousands) | 9,103 |

| | 9,096 |

| | 9,081 |

| | 9,102 |

| |

| Net income (loss) per common share: | |

|

| |

|

|

| Basic | | $ | 0.97 |

| | $ | (2.40 | ) |

| Diluted | | $ | 0.95 |

| | $ | (2.40 | ) |

| Average number of common shares outstanding (in thousands): | |

|

| |

|

|

| Basic | | 9,619 |

| | 9,532 |

|

| Diluted | | 9,839 |

| | 9,532 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)CASH FLOWS

(Unaudited; in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net loss | $ | (8.5 | ) | | $ | (41.3 | ) | | $ | (23.3 | ) | | $ | (58.8 | ) |

| Other comprehensive loss, before tax (Note 13): | | | | | | | |

| Amortization of prior service credits, net | — |

| | (0.1 | ) | | (0.1 | ) | | (0.2 | ) |

| Other comprehensive loss, before tax | — |

| | (0.1 | ) | | (0.1 | ) | | (0.2 | ) |

| Income tax benefit related to items of other comprehensive income | — |

| | — |

| | — |

| | — |

|

| Other comprehensive loss, net of tax benefit | — |

| | (0.1 | ) | | (0.1 | ) | | (0.2 | ) |

| Comprehensive loss | $ | (8.5 | ) | | $ | (41.4 | ) | | $ | (23.4 | ) | | $ | (59.0 | ) |

|

| | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| OPERATING | | | |

| Net income (loss) | $ | 11.3 |

| | $ | (20.9 | ) |

| Adjustments to reconcile net loss to cash used in operating activities: | | | |

| Depreciation and amortization | 1.5 |

| | 1.3 |

|

| PIK interest on paid-in-kind toggle notes | — |

| | 0.4 |

|

| Gain on sales of assets | — |

| | (0.4 | ) |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 3.6 |

| | 11.2 |

|

| Inventories, net | 0.1 |

| | 25.6 |

|

| Accounts payable and other liabilities | 1.3 |

| | 1.2 |

|

| Payables under SWU purchase agreements | (1.9 | ) | | (46.0 | ) |

| Deferred revenue and advances from customers, net of deferred costs | (23.3 | ) | | — |

|

| Accrued loss on long-term contract | (3.5 | ) | | — |

|

| Pension and postretirement benefit liabilities | (8.6 | ) | | (4.2 | ) |

| Other, net | 1.0 |

| | (0.1 | ) |

| Cash used in operating activities | (18.5 | ) | | (31.9 | ) |

| | | | |

| INVESTING | — |

| | — |

|

| | | | |

| FINANCING | | | |

| Payments for deferred financing costs | (0.1 | ) | | — |

|

| Exercise of stock options | 0.2 |

| | — |

|

| Payment of interest classified as debt | (3.1 | ) | | (3.1 | ) |

| Cash used in financing activities | (3.0 | ) | | (3.1 | ) |

| | | | |

| Decrease in cash, cash equivalents and restricted cash | (21.5 | ) | | (35.0 | ) |

| Cash, cash equivalents and restricted cash, beginning of period (Note 4) | 136.6 |

| | 159.7 |

|

| Cash, cash equivalents and restricted cash, end of period (Note 4) | $ | 115.1 |

| | $ | 124.7 |

|

| | | | |

| Supplemental cash flow information: | | | |

| Interest paid in cash | $ | — |

| | $ | 0.4 |

|

| Non-cash activities: | | | |

| Conversion of interest payable-in-kind to debt | $ | — |

| | $ | 0.7 |

|

| Deferred financing costs included in accounts payable and accrued liabilities | $ | (0.5 | ) | | $ | — |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)STOCKHOLDERS’ DEFICIT

(Unaudited; in millions)millions, except per share data)

|

| | | | | | | |

| | Nine Months Ended

September 30, |

| | 2017 | | 2016 |

| Operating Activities | | | |

| Net loss | $ | (23.3 | ) | | $ | (58.8 | ) |

| Adjustments to reconcile net loss to cash used in operating activities: | | | |

| Depreciation and amortization | 6.6 |

| | 8.1 |

|

| PIK interest on paid-in-kind toggle notes | 1.2 |

| | 9.7 |

|

| Gain on early extinguishment of debt | (33.6 | ) | | (16.7 | ) |

| Gain on sales of assets | (2.3 | ) | | (1.0 | ) |

| Inventory valuation adjustments | — |

| | 3.0 |

|

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 14.5 |

| | 18.4 |

|

| Inventories, net | 17.9 |

| | 45.8 |

|

| Payables under SWU purchase agreements | (42.3 | ) | | (68.9 | ) |

| Deferred revenue, net of deferred costs | 2.9 |

| | 5.8 |

|

| Accounts payable and other liabilities | (35.3 | ) | | 2.2 |

|

| Other, net | (1.9 | ) | | 0.5 |

|

| Cash used in operating activities | (95.6 | ) | | (51.9 | ) |

| | | | |

| Investing Activities | | | |

| Capital expenditures | (0.3 | ) | | (3.0 | ) |

| Proceeds from sales of assets | 2.1 |

| | 1.2 |

|

| Deposits for surety bonds - net decrease | — |

| | 0.3 |

|

| Cash provided by (used in) investing activities | 1.8 |

| | (1.5 | ) |

| | | | |

| Financing Activities | | | |

| Payment of interest classified as debt | (3.4 | ) | | — |

|

| Repurchase of debt | (27.6 | ) | | (9.8 | ) |

| Cash used in financing activities | (31.0 | ) | | (9.8 | ) |

| | | | |

| Decrease in cash and cash equivalents | (124.8 | ) | | (63.2 | ) |

| Cash and cash equivalents at beginning of period | 260.7 |

| | 234.0 |

|

| Cash and cash equivalents at end of period | $ | 135.9 |

| | $ | 170.8 |

|

| | | | |

| Supplemental cash flow information: | | | |

| Interest paid in cash | $ | 4.2 |

| | $ | 6.5 |

|

| Non-cash activities: | | | |

| Conversion of interest payable-in-kind to long-term debt | $ | 0.4 |

| | $ | 3.4 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock, Series B | | Common Stock, Class A, Par Value $.10 per Share | | Common Stock, Class B, Par Value $.10 per Share | | Excess of Capital Over Par Value | | Accumulated Deficit | | Accumulated Other Comprehensive Income (Loss) | | Total |

| | | | | | | | | | | | | | |

| Balance at December 31, 2018 | $ | 4.6 |

| | $ | 0.8 |

| | $ | 0.1 |

| | $ | 61.2 |

| | $ | (388.5 | ) | | $ | (0.1 | ) | | $ | (321.9 | ) |

| Net loss for the three months ended March 31, 2019 | — |

| | — |

| | — |

| | — |

| | (20.9 | ) | | — |

| | (20.9 | ) |

| Issuance and amortization of restricted stock units and stock options | — |

| | — |

| | — |

| | 0.1 |

| | — |

| | — |

| | 0.1 |

|

| Balance at March 31, 2019 | 4.6 |

| | 0.8 |

| | 0.1 |

| | 61.3 |

| | (409.4 | ) | | (0.1 | ) | | (342.7 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2019 | $ | 4.6 |

| | $ | 0.8 |

| | $ | 0.1 |

| | $ | 61.5 |

| | $ | (405.0 | ) | | $ | 1.1 |

| | $ | (336.9 | ) |

| Net income for the three months ended March 31, 2020 | — |

| | — |

| | — |

| | — |

| | 11.3 |

| | — |

| | 11.3 |

|

| Issuance and amortization of restricted stock units and stock options | — |

| | — |

| | — |

| | 0.3 |

| | — |

| | (0.1 | ) | | 0.2 |

|

| Balance at March 31, 2020 | 4.6 |

| | 0.8 |

| | 0.1 |

| | 61.8 |

| | (393.7 | ) | | 1.0 |

| | $ | (325.4 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT (Unaudited)

(in millions, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock, Series B | | Common Stock, Class A, Par Value $.10 per Share | | Common Stock, Class B, Par Value $.10 per Share | | Excess of Capital Over Par Value | | Accumulated Deficit | | Accumulated Other Comprehensive Income | | Total |

| | | | | | | | | | | | | | |

| Balance at December 31, 2015 | $ | — |

| | $ | 0.8 |

| | $ | 0.1 |

| | $ | 59.0 |

| | $ | (229.7 | ) | | $ | 4.1 |

| | $ | (165.7 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | (58.8 | ) | | — |

| | (58.8 | ) |

| Other comprehensive loss, net of tax benefit (Note 13) | — |

| | — |

| | — |

| | — |

| | — |

| | (0.2 | ) | | (0.2 | ) |

| Restricted stock units and stock options issued, net of amortization | — |

| | — |

| | — |

| | 0.4 |

| | — |

| | — |

| | 0.4 |

|

| Balance at September 30, 2016 | $ | — |

| | $ | 0.8 |

| | $ | 0.1 |

| | $ | 59.4 |

| | $ | (288.5 | ) | | $ | 3.9 |

| | $ | (224.3 | ) |

| | | | | | | | | | | | | | |

| Balance at December 31, 2016 | $ | — |

| | $ | 0.8 |

| | $ | 0.1 |

| | $ | 59.5 |

| | $ | (296.7 | ) | | $ | 0.2 |

| | $ | (236.1 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | (23.3 | ) | | — |

| | (23.3 | ) |

| Issuance of preferred stock | 4.6 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 4.6 |

|

| Other comprehensive loss, net of tax benefit (Note 13) | — |

| | — |

| | — |

| | — |

| | — |

| | (0.1 | ) | | (0.1 | ) |

| Restricted stock units and stock options issued, net of amortization | — |

| | — |

| | — |

| | 0.3 |

| | — |

| | — |

| | 0.3 |

|

| Balance at September 30, 2017 | $ | 4.6 |

| | $ | 0.8 |

| | $ | 0.1 |

| | $ | 59.8 |

| | $ | (320.0 | ) | | $ | 0.1 |

| | $ | (254.6 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

CENTRUS ENERGY CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

1. BASIS OF PRESENTATION

Basis of Presentation and Principles of Consolidation

The unaudited condensed consolidated financial statements of Centrus Energy Corp. (“Centrus” or the “Company”), which include the accounts of the Company, its principal subsidiary, United States Enrichment Corporation, (“Enrichment Corp.”) and its other subsidiaries, as of September 30, 2017,March 31, 2020, and for the three and nine months ended September 30, 2017March 31, 2020 and 2016,2019, have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). The condensed consolidated balance sheet as of December 31, 2016,2019, was derived from audited consolidated financial statements, but does not include all disclosures required by generally accepted accounting principles in the United States (“GAAP”). TheIn the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments, that are, in the opinion of management,including normal recurring adjustments, necessary for a fair statement of the financial results for the interim period. Certain prior year amounts have been reclassified for consistency with the current year presentation. Certain information and notes normally included in financial statements prepared in accordance with GAAP have been omitted pursuant to such rules and regulations. All material intercompany transactions have been eliminated. The Company’s components of comprehensive income for the three months ended March 31, 2020 and 2019 are insignificant.

Operating results for the three and nine months ended September 30, 2017,March 31, 2020, are not necessarily indicative of the results that may be expected for the year ending December 31, 2017.2020. The unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes and Management's Discussion and Analysis of Financial Condition and Results of Operations included in the Annual Report on Form 10-K for the year ended December 31, 2016.2019.

New Accounting Standards

Recently Adopted Accounting Standards

In May 2014,June 2016, the Financial Accounting StandardsStandard Board (the “FASB”(“FASB”) issued Accounting Standards Update (“ASU”) 2014-09,2016-13, Revenue from Contracts with Customers (Topic 606)Measurement of Credit Losses on Financial Instruments., which requires estimating all expected credit losses for certain types of financial instruments, including trade receivables, held at the reporting date based on historical experience, current conditions and reasonable and supportable forecasts. ASU 2014-09 introduces a new five-step revenue recognition model in which an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU 2014-09 also requires disclosures sufficient to enable users to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers, including qualitative and quantitative disclosures about contracts with customers, significant judgments and changes in judgments, and assets recognized from the costs to obtain or fulfill a contract. The FASB has since issued amendments that clarify a number of specific issues as well as require additional disclosures. The revenue recognition standard will become2016-13 is effective for the Companyfiscal years beginning with the first quarter of 2018.after December 15, 2019, including interim periods within those fiscal years. The Company has started an implementation process, including a review of customer contracts, to evaluate the effectadopted this standard will have on its consolidated financial statements and related disclosures. The Company continues to assess the potential impacts of the new standard on its consolidated financial statements, including substantive new disclosures. The Company plans to select the modified retrospective transition method upon adoption effective January 1, 2018.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which requires lessees to recognize a right-of-use asset and lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting expense recognition in the statement of operations. ASU 2016-02 will become effective for the Company beginning in the first quarter of 2019, with early adoption permitted,fiscal 2020 and is to be applied using a modified retrospective approach. The Company is evaluating the effect that the provisions of ASU 2016-02 will have on its consolidated financial statements.there was no material impact.

In March 2016, the FASB issued ASU 2016-09, Stock Compensation - Improvements to Employee Share-Based Payment Accounting (Topic 718). ASU 2016-09 simplifies several aspects of the accounting for share-based payment transactions, including income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. ASU 2016-09 became effective for the CompanyStandards Effective in the first quarter of 2017. Under ASU 2016-09, entities are permitted to make an accounting policy election to either estimate forfeitures on share-based payment awards, as previously required, or to recognize forfeitures as they occur. The Company has elected to recognize forfeitures as they occur. The adoption of ASU 2016-09 did not have a material impact on the Company’s consolidated financial statements.Future Periods

In August 2016,2018, the FASB issued ASU 2016-15,2018-14, Statement of Cash Flows (Topic 230): Classification of Certain Cash ReceiptsCompensation - Retirement Benefits - Defined Benefit Plans - General (Subtopic 715-20), which modifies the disclosure requirements for employers that sponsor defined benefit pension plans and Cash Payments.other postretirement plans. ASU 2016-15 addresses the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. It2018-14 is intended to reduce diversity in practice by providing guidance on eight specific cash flow issues. ASU 2016-15 will become effective for the Companypublic companies for fiscal years, and interim periods within those fiscal years, beginning in the first quarter of 2018, with early adoption permitted, andafter December 15, 2020. The standard is to be applied usingon a retrospective approach. The Company is evaluating the effect that the provisions of ASU 2016-15 will have on its consolidated financial statements.

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory, requiring an entitybasis to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. ASU 2016-16 will become effective for the Company beginning in the first quarter of 2018, withall periods presented and early adoption is permitted. The Company is evaluating the effect that the provisions of ASU 2016-162018-14 will have on its consolidated financial statements.

In November 2016,Significant Accounting Policies

The accounting policies of the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. ASU 2016-18 requires thatCompany are set forth in Note 1 to the statement of cash flows explain the change during the periodConsolidated Financial Statements contained in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. ASU 2016-18 is to be applied retrospectively for each period presented, and will become effectiveCompany’s Annual Report on Form 10-K for the Company beginning in the first quarter of 2018, with early adoption permitted. The Company is evaluating the effect that the provisions of ASU 2016-18 will have on its consolidated financial statements.

In March 2017, the FASB issued ASU 2017-07, Compensation-Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost. ASU 2017-07 requires changes to the presentation of the components of net periodic benefit cost on the statement of operations by requiring service cost to be presented with other employee compensation costs and other components of net periodic benefit cost to be presented outside of any subtotal of operating income. ASU 2017-07 also stipulates that only the service cost component of net benefit cost is eligible for capitalization in assets. The guidance will become effective for the Company beginning in the first quarter of 2018, with early adoption permitted. The Company is evaluating the effect that the provisions of ASU 2017-07 will have on its consolidated financial statements.year ended December 31, 2019.

2. SPECIAL CHARGESREVENUE AND CONTRACTS WITH CUSTOMERS

Evolving Business NeedsDisaggregation of Revenue

Evolving business needs haveThe following table presents revenue from separative work units (“SWU”) and uranium sales disaggregated by geographical region based on the billing addresses of customers (in millions):

|

| | | | | | | |

| | Three Months Ended

March 31, |

| | 2020 | | 2019 |

| United States | $ | 7.3 |

| | $ | 35.1 |

|

| Foreign | 23.4 |

| | — |

|

| Revenue - SWU and uranium | $ | 30.7 |

| | $ | 35.1 |

|

Refer to Note 12, Segment Information, for disaggregation of revenue by segment. Disaggregation by end-market is provided in Note 12 and the condensed consolidated statements of operations. SWU sales are made primarily to electric utility customers and uranium sales are primarily made to other nuclear fuel related companies. Technical solutions revenue resulted primarily from services provided to the government and its contractors. SWU and uranium revenue is recognized at point of sale and technical solutions revenue is generally recognized over time.

Accounts Receivable

|

| | | | | | | | |

| | | March 31, 2020 | | December 31, 2019 |

| | | ($ millions) |

| Accounts receivable: | | | | |

| Billed | | $ | 7.5 |

| | $ | 13.2 |

|

| Unbilled * | | 10.0 |

| | 7.9 |

|

| Accounts receivable | | $ | 17.5 |

| | $ | 21.1 |

|

| | | | | |

| * Billings under certain contracts in the technical services segment are invoiced based on approved provisional billing rates. Unbilled revenue represents the difference between actual costs incurred and invoiced amounts. The Company expects to invoice and collect the unbilled amounts after actual rates are submitted to the customer and approved. Unbilled revenue also includes unconditional rights to revenue that are not yet billable under applicable contracts pending the compilation of supporting documentation. |

Contract Liabilities

The following table presents changes in workforce reductions since 2013.contract liability balances (in millions):

|

| | | | | | | | | | | | |

| | | March 31, 2020 | | December 31, 2019 | | Year-To-Date Change |

| Accrued loss on HALEU Contract: | | | | | | |

Current - Accounts payable and accrued liabilities | | $ | 9.7 |

| | $ | 10.0 |

| | $ | (0.3 | ) |

Noncurrent - Other long-term liabilities | | $ | 5.6 |

| | $ | 8.3 |

| | $ | (2.7 | ) |

| Deferred revenue - current | | $ | 243.0 |

| | $ | 243.0 |

| | $ | — |

|

| Advances from customers - current | | $ | — |

| | $ | 23.3 |

| | $ | (23.3 | ) |

| Advances from customers - noncurrent | | $ | 29.4 |

| | $ | 29.4 |

| | $ | — |

|

LEU Segment

The SWU component of LEU is typically bought and sold under long-term contracts with deliveries over several years. The Company’s agreements for natural uranium sales are generally shorter-term, fixed-commitment contracts. The Company’s order book of sales under contract in the low-enriched uranium (“LEU”) segment (“order book”) extends to 2030. As of March 31, 2020, and December 31, 2019, the order book was $1.0 billion. The order book represents the estimated aggregate dollar amount of revenue for future SWU and uranium deliveries under contract and includes $0.3 billion of Deferred Revenue and Advances from Customers. Refer to Contract Liabilities table above.

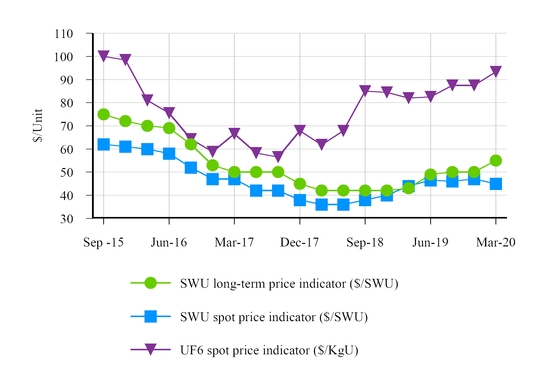

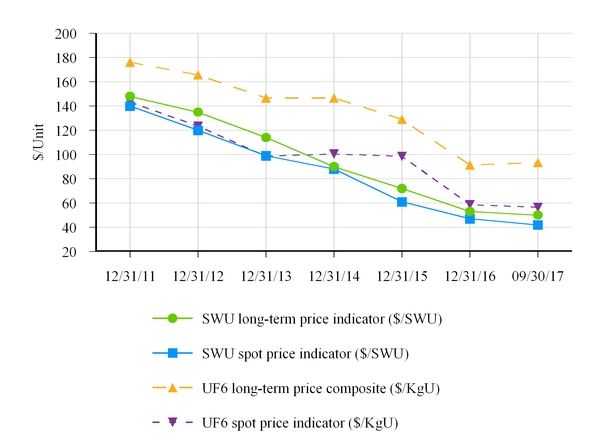

Most of the Company’s contracts provide for fixed purchases of SWU during a given year. The Company’s order book is partially based on customers’ estimates of the timing and size of their fuel requirements and other assumptions that are subject to change. For example, depending on the terms of specific contracts, the customer may be able to increase or decrease the quantity delivered within an agreed range. The Company’s order book estimate is also based on the Company’s estimates of selling prices, which may be subject to change. For example, depending on the terms of specific contracts, prices may be adjusted based on escalation using a general inflation index, published SWU price indicators prevailing at the time of delivery, and other factors, all of which are variable. The Company uses external composite forecasts of future market prices and inflation rates in its pricing estimates.

Under the terms of certain contracts with customers in the LEU segment, the Company will accept payment in the form of uranium. Revenue from the sale of SWU under such contracts is recognized at the time LEU is delivered and is based on the fair value of the uranium at contract inception, or as the quantity of uranium is finalized, if variable. In the nine months ended September 30, 2017, special charges included estimated employee termination benefits of $2.2 million, including $0.7 million in the three months ended September 30, 2017. Centrus expects to makeMarch 31, 2020, SWU revenue of $23.4 million was recognized under such contracts based on the fair market value of uranium acquired in exchange for SWU delivered. Uranium received from customers as advance payments primarilyfor the future sales of SWU totaled $29.4 million as of March 31, 2020. The advance payments are included in Advances from Customers, Noncurrent, based on the fourth quarter of 2017anticipated SWU sales period.

In the three months ended March 31, 2020, the Company borrowed SWU inventory valued at $1.7 million from a customer under terms that require repayment within 48 months. The Company recorded the SWU and the related liability for the borrowing using an average purchase price over the borrowing period. The cumulative liability to the $1.4customer of $10.8 million balance payable at September 30, 2017.for borrowed inventory is included in Other Liabilities, which is included in noncurrent liabilities.

InTechnical Solutions Segment

Revenue for the second quarter of 2016,technical solutions segment, representing the Company’s technical, manufacturing, engineering, procurement, construction and operations services offered to public and private sector customers, is recognized over the contractual period as services are rendered.

On October 31, 2019, the Company commencedsigned a projectthree-year cost-share contract with the U.S. Department of Energy (“DOE”) (“the HALEU Contract”) to align its corporate structuredeploy a cascade of centrifuges to demonstrate production of high-assay, low-enriched uranium (“HALEU”) for advanced reactors. HALEU is a component of an advanced nuclear reactor fuel that is not commercially available today and may be required for a number of advanced reactor and fuel designs currently under development in both the scale of its ongoing business operationscommercial and government sectors. The program has been under way since May 31, 2019, when the Company and DOE signed a preliminary letter agreement that allowed work to update related information technology systems. The Company incurred advisory costs of $0.3 million and $0.8 million related tobegin while the reengineering project in the three and nine months ended September 30, 2016, respectively. The Company incurred advisory costs of $1.7 million and $5.0 million in the three and nine months ended September 30, 2017, respectively.

Piketon Demonstration Facilityfull contract was being finalized.

In September 2015, Centrus completed a successful three-year demonstrationUnder the HALEU Contract, DOE agreed to reimburse the Company for 80% of its American Centrifuge technology at its facilitycosts incurred in Piketon, Ohio.performing the contract, up to a maximum of $115 million. The demonstration effort was primarily funded byCompany’s cost share is the U.S. government. Ascorresponding 20% and any costs incurred above these amounts. Costs under the HALEU Contract include program costs, including direct labor and materials and associated indirect costs that are classified as Cost of Sales, and an allocation of corporate costs supporting the program that are classified as Selling, General and Administrative Expenses. Services to be provided

over the three-year contract include constructing and assembling centrifuge machines and related infrastructure in a resultcascade formation. When estimates of reducedremaining program funding, Centruscosts to be incurred for such an integrated, construction-type contract exceed estimates of total revenue to be earned, a special chargeprovision for the remaining loss on the contract is recorded to Cost of Sales in the third quarterperiod the loss is determined. The Company’s corporate costs supporting the program are recognized as expense as incurred over the duration of 2015 for estimated employee termination benefits. Ofthe contract term. As of December 31, 2019, the portion of the Company’s anticipated cost share under the HALEU Contract representing the Company’s share of remaining projected program costs was recognized in Cost of Sales as an accrued loss of $18.3 million. The accrued loss on the contract is being adjusted over the remaining $4.9contract term based on actual results and remaining program cost projections. As of March 31, 2020, the accrued contract loss balance was $15.3 million, liability asconsisting of September 30, 2017, $2.8$9.7 million is classified as current and included in Accounts Payable and Accrued Liabilitiesin the condensed consolidated balance sheet. The remaining $2.1 million is included in Other Long-Term Liabilities and is expected to be paid through 2019.

A summary of termination benefit activity and related liabilities follows (in millions):

|

| | | | | | | | | | | | | | | | | |

| | | Liability December 31, 2016 | | Nine Months Ended

September 30, 2017 | | Liability

September 30,

2017 | |

| | | | Charges for Termination Benefits | | Paid/ Settled | | |

| Workforce reductions: | | | | | | | | | |

| Evolving business needs | | $ | 0.1 |

| | $ | 2.2 |

| | $ | (0.9 | ) | | $ | 1.4 |

| |

| Piketon demonstration facility | | 5.4 |

| | 0.1 |

| | (0.6 | ) | | 4.9 |

| |

| | | $ | 5.5 |

| | $ | 2.3 |

| | $ | (1.5 | ) | | $ | 6.3 |

| |

3. CONTRACT SERVICES AND ADVANCED TECHNOLOGY LICENSE AND DECOMMISSIONING COSTS

The contract services segment includes Revenue and Cost of Sales for engineering and testing work Centrus performs on the American Centrifuge technology under a government contract with UT-Battelle, LLC (“UT-Battelle”), the operator of Oak Ridge National Laboratory (“ORNL”). The recently completed fixed priced contract between Centrus and UT-Battelle (the “2017 ORNL Contract”) was for the period from October 1, 2016, through September 30, 2017 and generated revenue of approximately $25 million. On October 26, 2017, the parties executed a new fixed priced contract for the period from October 1, 2017, through September 30, 2018, that is expected to generate total revenue of approximately $16$5.6 million upon completion of defined milestones. The ORNL contracts have been funded incrementally. Funding for the program is provided to UT-Battelle by the U.S. government which is currently operating under a continuing resolution.

The 2017 ORNL Contract provided for payments for monthly reports of deliverables of approximately $2.0 million per month and additional aggregate payments of $1.0 million based on completion of defined milestones.

The Company’s contract with UT-Battelle that ended September 30, 2016 (the “2016 ORNL Contract”), provided for payments for monthly reports of deliverables of approximately $2.7 million per month. The 2016 ORNL Contract, which was signed in March 2016, provided for payments for reports related to work performed since October 1, 2015. Revenue in the nine months ended September 30, 2016, includes $24.2 million for reports on work performed in the nine months ended September 30, 2016, and $8.1 million for March 2016 reports on work performed in the three months ended December 31, 2015. Expenses for contract work performed in the nine months ended September 30, 2016, are included in Cost of Sales. Expenses for work performed in the three months ended December 31, 2015, before entering into the 2016 ORNL Contract, were included in Advanced Technology License and Decommissioning Costs in 2015.

American Centrifuge expenses that are outside of the Company’s contracts with UT-Battelle are included in Advanced Technology License and Decommissioning Costs, including ongoing costs to maintain the demobilized Piketon facility and our licenses from the U.S. Nuclear Regulatory Commission (“NRC”) at that location. In the second quarter of 2016, the Company commenced the decontamination and decommissioning (“D&D”) of the Piketon facility in accordance with the requirements of NRC and the U.S. Department of Energy (“DOE”). Refer to Note 12, Commitments and Contingencies, for additional details.

4. RECEIVABLES

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| | (in millions) |

| Utility customers and other | $ | 9.1 |

| | $ | 15.3 |

|

| Contract services, primarily DOE | 5.1 |

| | 4.6 |

|

| Accounts receivable | $ | 14.2 |

| | $ | 19.9 |

|

Centrus formerly performed site services work under contracts with DOE at the former Portsmouth and Paducah gaseous diffusion plants. Overdue receivables from DOE of $14.2 million as of September 30, 2017, and $22.8 million as of December 31, 2016, are included in Other Long-Term Assets based on the extended timeframe expected to resolve the Company’s claims for payment.

Centrus has unapplied payments from DOE that may be used, at DOE’s direction, (a) to pay for future services provided by the Company, or (b) to reduce outstanding receivables balances due from DOE. The balance of unapplied payments of $19.3 million as of September 30, 2017, and December 31, 2016, is included in Other Long-Term Liabilities pending resolution. Cost of sales in the three months ended March 31, 2020 was reduced by $3.0 million for previously accrued contract losses attributable to work performed in the first quarter of 2020.

The HALEU Contract is incrementally funded and DOE is currently obligated for costs up to approximately $53.2 million of the long-term$115 million. The Company has received aggregate cash payments of $19.0 million through March 31, 2020.

Centrus and DOE have yet to fully settle the Company’s claims for reimbursements for certain pension and postretirement benefits costs related to past contract work performed for DOE. There is the potential for additional income to be recognized for this work pending the outcome of legal proceedings related to the Company’s claims for payment and the potential release of previously established valuation allowances on receivables. As a result of the application of fresh start accounting following the Company’s emergence from Chapter 11 bankruptcy on September 30, 2014, the receivables from DOE described above.related to the Company’s claims for payment are carried at fair value as of September 30, 2014, which is net of the valuation allowances. Refer to Note 11, Commitments and Contingencies.

3. SPECIAL CHARGES (CREDITS)

Special charges (credits) in both the three months ended March 31, 2020 and 2019 consisted of income of $0.1 million for the reversal of accrued termination benefits related to unvested employee departures. The remaining balance of termination benefits of $0.2 million is expected to be paid within twelve months and is classified in Accounts Payable and Accrued Liabilities in the condensed consolidated balance sheet.

A summary of termination benefit activity and the accrued liability follows (in millions):

|

| | | | | | | | | | | | | | | | |

| | | Liability December 31, 2019 | | Three Months Ended

March 31, 2020 | | Liability

March 31, 2020 |

| | | | Charges (Credits) for Termination Benefits | | Paid/ Settled | |

| Workforce reductions: | | | | | | | | |

| Corporate functions | | $ | 1.2 |

| | $ | (0.1 | ) | | $ | (1.1 | ) | | $ | — |

|

| Piketon facility | | 0.2 |

| | — |

| | — |

| | 0.2 |

|

| Total | | $ | 1.4 |

| | $ | (0.1 | ) | | $ | (1.1 | ) | | $ | 0.2 |

|

4. CASH, CASH EQUIVALENTS AND RESTRICTED CASH

The following table summarizes the Company’s cash, cash equivalents and restricted cash as presented on the condensed consolidated balance sheet to amounts on the condensed consolidated statement of cash flows (in millions):

|

| | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| | | | |

| Cash and cash equivalents | $ | 109.2 |

| | $ | 130.7 |

|

| Deposits for financial assurance - current | 0.2 |

| | 0.2 |

|

| Deposits for financial assurance - noncurrent | 5.7 |

| | 5.7 |

|

| Total cash, cash equivalents and restricted cash | $ | 115.1 |

| | $ | 136.6 |

|

The Company has provided financial assurance to states in which it was previously self-insured for workers’ compensation in accordance with each state’s requirements in the form of a surety bond or deposit that are fully cash collateralized by Centrus. As each state determines that the likelihood of further workers’ compensation obligations related to the period of self-insurance is reduced, the surety bond or deposit are subject to reduction and/or cancellation and the Company would receive the cash collateral.

5. INVENTORIES

Centrus holds uranium at licensed locations in the form of natural uranium and as the uranium component of low enriched uranium (“LEU”).LEU. Centrus also holds separative work units (“SWU”)SWU as the SWU component of LEU at licensed locations (e.g., fabricators) to meet book transfer requests by customers. Fabricators process LEU into fuel for use in nuclear reactors. Components of inventories followare as follows (in millions):

| | | | September 30, 2017 | | December 31, 2016 | March 31, 2020 | | December 31, 2019 |

| | Current Assets | | Current Liabilities (a) | | Inventories, Net | | Current Assets | | Current Liabilities (a) | | Inventories, Net | Current Assets | | Current Liabilities (a) | | Inventories, Net | | Current Assets | | Current Liabilities (a) | | Inventories, Net |

| Separative work units | $ | 73.7 |

| | $ | 3.2 |

| | $ | 70.5 |

| | $ | 115.8 |

| | $ | 15.2 |

| | $ | 100.6 |

| $ | 9.2 |

| | $ | 2.8 |

| | $ | 6.4 |

| | $ | 7.8 |

| | $ | — |

| | $ | 7.8 |

|

| Uranium | 50.2 |

| | 18.9 |

| | 31.3 |

| | 61.4 |

| | 42.3 |

| | 19.1 |

| 58.7 |

| | 4.6 |

| | 54.1 |

| | 56.7 |

| | 5.6 |

| | 51.1 |

|

| Materials and supplies | 0.2 |

| | — |

| | 0.2 |

| | 0.2 |

| | — |

| | 0.2 |

| |

| | $ | 124.1 |

| | $ | 22.1 |

| | $ | 102.0 |

| | $ | 177.4 |

| | $ | 57.5 |

| | $ | 119.9 |

| |

| Total | | $ | 67.9 |

| | $ | 7.4 |

| | $ | 60.5 |

| | $ | 64.5 |

| | $ | 5.6 |

| | $ | 58.9 |

|

| |

| (a) | Inventories owed to customers and suppliers, included in current liabilities, include SWU and uranium inventories owed to fabricators. |

6. PROPERTY, PLANT AND EQUIPMENT

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| | (in millions) |

| Property, plant and equipment, gross | 6.9 |

| | 6.8 |

|

| Accumulated depreciation | (1.7 | ) | | (0.8 | ) |

| Property, plant and equipment, net | $ | 5.2 |

| | $ | 6.0 |

|

7.6. INTANGIBLE ASSETS

Intangible assets originated from the Company’s reorganization and application of fresh start accounting as of the date the Company emerged from bankruptcy, September 30, 2014, and reflect the conditions at that time. The intangible asset related to the sales order book is amortized as the order book existing at emergence is reduced, principally as a result of deliveries to customers. The intangible asset related to customer relationships is amortized using the straight-line method over the estimated average useful life of 15 years. Amortization expense is presented below gross profit on the condensed consolidated statements of operations. Intangible asset balances are as follows (in millions):

| | | | September 30, 2017 | | December 31, 2016 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | (in millions) | | | | | March 31, 2020 | | December 31, 2019 |

| | Gross Carrying Amount | | Accumulated Amortization | | Net Amount | | Gross Carrying Amount | | Accumulated Amortization | | Net Amount | Gross Carrying Amount | | Accumulated Amortization | | Net Amount | | Gross Carrying Amount | | Accumulated Amortization | | Net Amount |

| Sales order book | $ | 54.6 |

| | $ | 22.1 |

| | $ | 32.5 |

| | $ | 54.6 |

| | $ | 19.9 |

| | $ | 34.7 |

| $ | 54.6 |

| | $ | 30.1 |

| | $ | 24.5 |

| | $ | 54.6 |

| | $ | 29.9 |

| | $ | 24.7 |

|

| Customer relationships | 68.9 |

| | 13.8 |

| | 55.1 |

| | 68.9 |

| | 10.3 |

| | 58.6 |

| 68.9 |

| | 25.3 |

| | 43.6 |

| | 68.9 |

| | 24.1 |

| | 44.8 |

|

| Total | $ | 123.5 |

| | $ | 35.9 |

| | $ | 87.6 |

| | $ | 123.5 |

| | $ | 30.2 |

| | $ | 93.3 |

| $ | 123.5 |

| | $ | 55.4 |

| | $ | 68.1 |

| | $ | 123.5 |

| | $ | 54.0 |

| | $ | 69.5 |

|

7. DEBT

A summary of long-term debt is as follows (in millions):

|

| | | | | | | | | |

| | Maturity | | September 30, 2017 | | December 31, 2016 |

| 8.25% Notes: | Feb. 2027 | | | | |

| Principal | | | $ | 74.3 |

| | $ | — |

|

| Interest | | | 58.1 |

| | — |

|

| 8.25% Notes | | | 132.4 |

| | — |

|

| 8% PIK Toggle Notes | Sep. 2019 (a) | | 31.3 |

| | 234.6 |

|

| Subtotal | | | 163.7 |

| | 234.6 |

|

| Less deferred issuance costs | | | 0.1 |

| | 0.5 |

|

| Total debt | | | 163.6 |

| | 234.1 |

|

| Less current portion | | | 6.1 |

| | — |

|

| Long-term debt | | | $ | 157.5 |

| | $ | 234.1 |

|

(a) Maturity can be extended to September 2024 upon the satisfaction of certain funding conditions described below.

Note Exchange

On February 14, 2017, pursuant to an exchange offer and consent solicitation, Centrus exchanged $204.9 million principal amount of the Company’s 8% paid-in-kind (“PIK”) toggle notes (the “8% PIK Toggle Notes”) for $74.3 million principal amount of 8.25% notes due February 2027 (the “8.25% Notes”), 104,574 shares of Series B Preferred Stock with a liquidation preference of $1,000 per share, and $27.6 million of cash. The exchange is accounted for as a troubled debt restructuring (a “TDR”) under Accounting Standards Codification Subtopic 470-60, Debt-Troubled Debt Restructurings by Debtors. For an exchange classified as a TDR, if the future undiscounted cash flows of the newly issued debt and other consideration are less than the net carrying value of the original debt, a gain is recorded for the difference and the carrying value of the newly issued debt is adjusted to the future undiscounted cash flow amount and no future interest expense is recorded. All future interest payments on the newly issued debt reduce the carrying value. Accordingly, the Company recognizes the 8.25% Notes on the condensed consolidated balance sheet as the sum of the principal balance and all future interest payments. The Company recognized a gain of $33.6 million related to the note exchange for the quarter ended March 31, 2017, which is net of transaction costs of $9.0 million and previously deferred issuance costs related to the 8% PIK Toggle Notes of $0.4 million. Refer to Note 13, Stockholders’ Equity for details related to the newly issued preferred stock.

8.25% Notes |

| | | | | | | | | | | | | | | | | |

| | | | March 31, 2020 | | December 31, 2019 |

| | Maturity | | Current | | Long-Term | | Current | | Long-Term |

| 8.25% Notes: | Feb. 2027 | | | | | | | | |

| Principal | | | $ | — |

| | $ | 74.3 |

| | $ | — |

| | $ | 74.3 |

|

| Interest | | | 6.1 |

| | 36.7 |

| | 6.1 |

| | 39.8 |

|

| Total | | | $ | 6.1 |

| | $ | 111.0 |

| | $ | 6.1 |

| | $ | 114.1 |

|

Interest on the 8.25% Notes is payable semi-annually in arrears as of February 28 and August 31 based on a 360-day year consisting of twelve 30-day months. The 8.25% Notes mature on February 28, 2027. As describedshown in the table above, all future interest payment obligations on the 8.25% Notes are included in the carrying value of the 8.25% Notes. As a result, the Company’s reported interest expense will be less than its contractual interest payments throughout the term of the 8.25% Notes. As of September 30, 2017,March 31, 2020, and December 31, 2019, $6.1 million of interest is recorded as current and classified as Accounts Payable and Accrued LiabilitiesCurrent Debt in the condensed consolidated balance sheet.

The 8.25% Notes rank equally in right of payment with all of our existing Additional terms and future unsubordinated indebtedness other than our Issuer Senior Debt and our Limited Secured Acquisition Debt (each as defined below). The 8.25% Notes rank senior in right of payment to all of our existing and future subordinated indebtedness and to certain limited secured acquisition indebtedness of the Company (the “Limited Secured Acquisition Debt”). The Limited Secured Acquisition Debt includes (i) any indebtedness, the proceeds of which are used to finance all or a portion of an acquisition or similar transaction if any lender’s lien is solely limited to the assets acquired in such a transaction and (ii) any indebtedness, the proceeds of which are used to finance all or a portion of the American Centrifuge project or another next generation enrichment technology if any lender’s lien is solely limited to such

assets, provided that a lien securing the 8.25% Notes that is junior with respect to the lien securing such indebtedness, will be effected for the 8.25% Notes, which will be limited to the assets acquired with such Limited Secured Acquisition Debt.

The 8.25% Notes are subordinated in right of payment to certain indebtedness and obligations of the Company, as described in the 8.25% Notes Indenture (the “Issuer Senior Debt”), including (i) any indebtedness of the Company (inclusive of any indebtedness of Enrichment Corp.) under a future credit facility up to $50 million with a maximum net borrowing of $40 million after taking into account any minimum cash balance (unless a higher amount is approved with the consent of the holders of a majority of the aggregate principal amountconditions of the 8.25% Notes then outstanding)are described in Note 9, Debt, (ii) any revolving credit facility to finance inventory purchases and related working capital needs, and (iii) any indebtedness of the Company to Enrichment Corp. under the secured intercompany notes.

The 8.25% Notes are guaranteed on a subordinated and limited basis by, and secured by substantially all of the assets of, Enrichment Corp. The Enrichment Corp. guarantee is a secured obligation and ranks equally in right of payment with all existing and future unsubordinated indebtedness of Enrichment Corp. (other than Designated Senior Claims (as defined below) and Limited Secured Acquisition Debt) and senior in right of payment to all existing and future subordinated indebtedness of Enrichment Corp. and Limited Secured Acquisition Debt. The Enrichment Corp. guarantee is subordinated in right of payment to certain obligations of, and claims against, Enrichment Corp. describedconsolidated financial statements in the 8.25% Notes Indenture (collectively, the “Designated Senior Claims”), including obligations and claims:

under a future credit facility up to $50 million with a maximum net borrowing of $40 million after taking into account any minimum cash balance;

under any revolving credit facility to finance inventory purchases and related working capital needs;

held by orCompany’s Annual Report on Form 10-K for the benefit of the Pension Benefit Guaranty Corporation (“PBGC”) pursuant to any settlement (including any required funding of pension plans); and

under surety bonds or similar obligations held by or on behalf of the U.S. government pursuant to regulatory requirements.

The liens securing the Enrichment Corp. guarantee of the 8% PIK Toggle Notes and the 8.25% Notes are pari passu with each other, and are junior in priority with respect to the lien securing Limited Secured Acquisition Debt, which is limited to the assets acquired with such Limited Secured Acquisition Debt.

8% PIK Toggle Notes

Interest on the 8% PIK Toggle Notes is payable semi-annually in arrears on Marchyear ended December 31, and September 30 based on a 360-day year consisting of twelve 30-day months. The principal amount is increased by any payment of interest in the form of PIK payments. The Company has the option to pay up to 5.5% per annum of interest due on the 8% PIK Toggle Notes in the form of PIK payments. For the semi-annual interest periods ended March 31, 2017, and September 30, 2017, the Company elected to pay interest in the form of PIK payments at 5.5% per annum.

Financing costs for the issuance of the 8% PIK Toggle Notes were deferred and are being amortized on a straight-line basis, which approximates the effective interest method, over the life of the 8% PIK Toggle Notes.

The 8% PIK Toggle Notes mature on September 30, 2019. However, the maturity date can be extended to September 30, 2024, upon the satisfaction of certain funding conditions described in the Indenture relating to the funding, under binding agreements, of (i) the American Centrifuge project or (ii) the implementation and deployment of a National Security Train Program utilizing American Centrifuge technology.

The 8% PIK Toggle Notes rank equally in right of payment with all existing and future unsubordinated indebtedness of the Company (other than the Issuer Senior Debt) and are senior in right of payment to all existing and future subordinated indebtedness of the Company. The 8% PIK Toggle Notes are subordinated in right of payment to the Issuer Senior Debt.

The 8% PIK Toggle Notes are guaranteed and secured on a subordinated, conditional, and limited basis by Enrichment Corp. Enrichment Corp. will be released from its guarantee without the consent of the holders of the 8% PIK Toggle Notes upon the occurrence of certain termination events (other than with respect to an unconditional interest claim), including (i) the involuntary termination by the PBGC of any of the qualified pension plans of the Company or Enrichment Corp., (ii) the cessation of funding prior to completion of our ongoing American Centrifuge test programs or (iii) both a decision by the Company to abandon American Centrifuge technology and either (1) the efforts by the Company to commercialize another next generation enrichment technology funded at least in part by new capital provided or to be provided by Enrichment Corp. have been terminated or are no longer being pursued or (2) the attainment of capital necessary to commercialize another next generation enrichment technology with respect to which the Company is involved which does not include new capital provided or to be provided by Enrichment Corp.

The Enrichment Corp. guarantee ranks equally in right of payment with all existing and future unsubordinated indebtedness of Enrichment Corp. (other than Designated Senior Claims and Limited Secured Acquisition Debt) and senior in right of payment to all existing and future subordinated indebtedness of Enrichment Corp. and Limited Secured Acquisition Debt. The Enrichment Corp. guarantee is subordinated in right of payment to Designated Senior Claims.

As explained above, the liens securing the Enrichment Corp. guarantee of the 8% PIK Toggle Notes and the 8.25% Notes are pari passu with each other, and are junior in priority with respect to the lien securing Limited Secured Acquisition Debt, which is limited to the assets acquired with such Limited Secured Acquisition Debt.

9.8. FAIR VALUE

Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value of assets and liabilities, the following hierarchy is used in selecting inputs, with the highest priority given to Level 1, as these are the most transparent or reliable:

Level 1 – quoted prices for identical instruments in active markets.

Level 2 – quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets.

Level 3 – valuations derived using one or more significant inputs that are not observable.

Financial Instruments Recorded at Fair Value (in Millions)millions):

| | | | September 30, 2017 | | December 31, 2016 | March 31, 2020 | | December 31, 2019 |

| | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 135.9 |

| | $ | — |

| | $ | — |

| | $ | 135.9 |

| | $ | 260.7 |

| | $ | — |

| | $ | — |

| | $ | 260.7 |

| $ | 109.2 |

| | $ | — |

| | $ | — |

| | $ | 109.2 |

| | $ | 130.7 |

| | $ | — |

| | $ | — |

| | $ | 130.7 |

|

| Deferred compensation asset (a) | 1.3 |

| | — |

| | — |

| | 1.3 |

| | 1.1 |

| | — |

| | — |

| | 1.1 |

| 1.5 |

| | — |

| | — |

| | 1.5 |

| | 1.8 |

| | — |

| | — |

| | 1.8 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

|

| Deferred compensation obligation (a) | 1.3 |

| | — |

| | — |

| | 1.3 |

| | 1.1 |

| | — |

| | — |

| | 1.1 |

| $ | 1.5 |

| | $ | — |

| | $ | — |

| | $ | 1.5 |

| | $ | 1.8 |

| | $ | — |

| | $ | — |

| | $ | 1.8 |

|

| |

| (a) | The deferred compensation obligation represents the balance of deferred compensation plus net investment earnings. The deferred compensation plan is funded through a rabbi trust. Trust funds are invested in mutual funds for which unit prices are quoted in active markets and are classified within Level 1 of the valuation hierarchy. |

There were no transfers between Level 1, 2 or 3 during the periods presented.

Other Financial Instruments

As of September 30, 2017March 31, 2020, and December 31, 2016,2019, the balance sheet carrying amounts for Accounts Receivable, Accounts Payable and Accrued Liabilities (excluding the deferred compensation obligation described above), and payablesPayables under SWU purchase agreementsPurchase Agreements approximate fair value because of thetheir short-term nature of the instruments.nature.

The carrying value and estimated fair value of long-term debt followare as follows (in millions):

|

| | | | | | | | | | | | | |

| | September 30, 2017 | | December 31, 2016 |

| | Carrying Value | | Estimated Fair Value (a) | | Carrying Value | | Estimated Fair Value (a) |

| 8.25% Notes | $ | 138.5 |

| (b) | $ | 59.7 |

| | - |

| | - |

|

| 8% PIK Toggle Notes | 31.3 |

| | 24.0 |

| | 234.6 |

| | 107.4 |

|

|