0001069157 us-gaap:CertificatesOfDepositMemberCreditRiskContractMember us-gaap:FairValueHedgingMember us-gaap:DesignatedAsHedgingInstrumentMember us-gaap:InterestExpenseMember 2018-04-01 2018-06-30 0001069157 srt:MultifamilyMember us-gaap:CommercialPortfolioSegmentMember us-gaap:RealEstateLoanMember 2019-04-01 2019-06-30NondesignatedMember 2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2019March 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 000-24939

EAST WEST BANCORP, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

95-4703316

(I.R.S. Employer Identification No.)

135 North Los Robles Ave., 7th Floor, Pasadena, California 91101

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:

(626) 768-6000

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | | EWBC | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Number of shares outstanding of the issuer’s common stock on the latest practicable date: 145,546,642141,486,290 shares as of July 31, 2019April 30, 2020.

TABLE OF CONTENTS

PART I — FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS

EAST WEST BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

($ in thousands, except shares)

(Unaudited)

| | | | | | June 30,

2019 | | December 31,

2018 | | March 31,

2020 | | December 31,

2019 |

| | | (Unaudited) | | | | (Unaudited) | | |

| ASSETS | | | | | | | | |

| Cash and due from banks | | $ | 425,949 |

| | $ | 516,291 |

| | $ | 427,415 |

| | $ | 536,221 |

|

| Interest-bearing cash with banks | | 3,195,665 |

| | 2,485,086 |

| | 2,652,627 |

| | 2,724,928 |

|

| Cash and cash equivalents | | 3,621,614 |

| | 3,001,377 |

| | 3,080,042 |

| | 3,261,149 |

|

| Interest-bearing deposits with banks | | 150,273 |

| | 371,000 |

| | 293,509 |

| | 196,161 |

|

| Securities purchased under resale agreements (“resale agreements”) | | 1,010,000 |

| | 1,035,000 |

| | 860,000 |

| | 860,000 |

|

| Securities: | | | | | | | | |

| Available-for-sale investment securities, at fair value (includes assets pledged as collateral of $493,693 in 2019 and $435,833 in 2018) | | 2,592,913 |

| | 2,741,847 |

| |

| Available-for-sale (''AFS'') debt securities, at fair value (amortized cost of $3,660,413 in 2020; includes assets pledged as collateral of $742,410 in 2020 and $479,432 in 2019) | | | 3,695,943 |

| | 3,317,214 |

|

| Restricted equity securities, at cost | | 78,093 |

| | 74,069 |

| | 78,745 |

| | 78,580 |

|

| Loans held-for-sale | | 3,879 |

| | 275 |

| | 1,594 |

| | 434 |

|

| Loans held-for-investment (net of allowance for loan losses of $330,625 in 2019 and $311,322 in 2018; includes assets pledged as collateral of $21,056,804 in 2019 and $20,590,035 in 2018) | | 33,399,752 |

| | 32,073,867 |

| |

| Loans held-for-investment (net of allowance for loan losses of $557,003 in 2020 and $358,287 in 2019; includes assets pledged as collateral of $23,107,287 in 2020 and $22,431,092 in 2019) | | | 35,336,390 |

| | 34,420,252 |

|

| Investments in qualified affordable housing partnerships, net | | 198,466 |

| | 184,873 |

| | 198,653 |

| | 207,037 |

|

| Investments in tax credit and other investments, net | | 210,387 |

| | 231,635 |

| | 268,330 |

| | 254,140 |

|

| Premises and equipment (net of accumulated depreciation of $125,887 in 2019 and $118,547 in 2018) | | 121,498 |

| | 119,180 |

| |

| Premises and equipment (net of accumulated depreciation of $120,156 in 2020 and $116,790 in 2019) | | | 115,393 |

| | 118,364 |

|

| Goodwill | | 465,697 |

| | 465,547 |

| | 465,697 |

| | 465,697 |

|

| Operating lease right-of-use assets | | 109,032 |

| | — |

| | 101,381 |

| | 99,973 |

|

| Other assets | | 930,754 |

| | 743,686 |

| | 1,452,868 |

| | 917,095 |

|

| TOTAL | | $ | 42,892,358 |

| | $ | 41,042,356 |

| | $ | 45,948,545 |

| | $ | 44,196,096 |

|

| LIABILITIES | | | | | | | | |

| Deposits: | | | | | | | | |

| Noninterest-bearing | | $ | 10,599,088 |

| | $ | 11,377,009 |

| | $ | 11,833,397 |

| | $ | 11,080,036 |

|

| Interest-bearing | | 25,878,454 |

| | 24,062,619 |

| | 26,853,561 |

| | 26,244,223 |

|

| Total deposits | | 36,477,542 |

| | 35,439,628 |

| | 38,686,958 |

| | 37,324,259 |

|

| Short-term borrowings | �� | 19,972 |

| | 57,638 |

| | 66,924 |

| | 28,669 |

|

| Federal Home Loan Bank (“FHLB”) advances | | 745,074 |

| | 326,172 |

| | 646,336 |

| | 745,915 |

|

| Securities sold under repurchase agreements (“repurchase agreements”) | | 50,000 |

| | 50,000 |

| | 450,000 |

| | 200,000 |

|

| Long-term debt and finance lease liabilities | | 152,506 |

| | 146,835 |

| | 152,162 |

| | 152,270 |

|

| Operating lease liabilities | | 117,448 |

| | — |

| | 109,356 |

| | 108,083 |

|

| Accrued expenses and other liabilities | | 595,223 |

| | 598,109 |

| | 933,824 |

| | 619,283 |

|

| Total liabilities | | 38,157,765 |

| | 36,618,382 |

| | 41,045,560 |

| | 39,178,479 |

|

| COMMITMENTS AND CONTINGENCIES (Note 12) | |

|

| |

|

| |

| COMMITMENTS AND CONTINGENCIES (Note 10) | | |

|

| |

|

|

| STOCKHOLDERS’ EQUITY | | | | | | | | |

| Common stock, $0.001 par value, 200,000,000 shares authorized; 166,532,188 and 165,867,587 shares issued in 2019 and 2018, respectively | | 166 |

| | 166 |

| |

| Common stock, $0.001 par value, 200,000,000 shares authorized; 167,091,420 and 166,621,959 shares issued in 2020 and 2019, respectively | | | 167 |

| | 167 |

|

| Additional paid-in capital | | 1,808,896 |

| | 1,789,811 |

| | 1,833,617 |

| | 1,826,345 |

|

| Retained earnings | | 3,414,901 |

| | 3,160,132 |

| | 3,695,759 |

| | 3,689,377 |

|

| Treasury stock, at cost — 20,985,619 shares in 2019 and 20,906,224 shares in 2018 | | (479,398 | ) | | (467,961 | ) | |

| Treasury stock, at cost — 25,656,321 shares in 2020 and 20,996,574 shares in 2019 | | | (633,439 | ) | | (479,864 | ) |

| Accumulated other comprehensive loss (“AOCI”), net of tax | | (9,972 | ) | | (58,174 | ) | | 6,881 |

| | (18,408 | ) |

| Total stockholders’ equity | | 4,734,593 |

| | 4,423,974 |

| | 4,902,985 |

| | 5,017,617 |

|

| TOTAL | | $ | 42,892,358 |

| | $ | 41,042,356 |

| | $ | 45,948,545 |

| | $ | 44,196,096 |

|

|

See accompanying Notes to Consolidated Financial Statements.

3

EAST WEST BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME

($ and shares in thousands, except per share data)

| | | | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | | Three Months Ended March 31, |

| | | 2019 | | 2018 | | 2019 | | 2018 | | 2020 | | 2019 |

| INTEREST AND DIVIDEND INCOME | | | | | | |

| | |

| | | | |

| Loans receivable, including fees | | $ | 434,450 |

| | $ | 365,555 |

| | $ | 857,984 |

| | $ | 703,459 |

| | $ | 411,869 |

| | $ | 423,534 |

|

| Available-for-sale investment securities | | 15,685 |

| | 15,059 |

| | 31,433 |

| | 30,515 |

| |

| AFS debt securities | | | 20,142 |

| | 15,748 |

|

| Resale agreements | | 7,343 |

| | 7,182 |

| | 15,189 |

| | 14,116 |

| | 5,565 |

| | 7,846 |

|

| Restricted equity securities | | 505 |

| | 800 |

| | 1,218 |

| | 1,434 |

| | 446 |

| | 713 |

|

| Interest-bearing cash and deposits with banks | | 16,861 |

| | 11,715 |

| | 32,331 |

| | 22,660 |

| | 11,168 |

| | 15,470 |

|

| Total interest and dividend income | | 474,844 |

| | 400,311 |

| | 938,155 |

| | 772,184 |

| | 449,190 |

| | 463,311 |

|

| INTEREST EXPENSE | | | | | | |

| | |

| | | | |

| Deposits | | 97,964 |

| | 51,265 |

| | 189,969 |

| | 90,401 |

| | 76,403 |

| | 92,005 |

|

| Federal funds purchased and other short-term borrowings | | 361 |

| | 124 |

| | 977 |

| | 131 |

| | 556 |

| | 616 |

|

| FHLB advances | | 4,011 |

| | 2,552 |

| | 6,990 |

| | 4,812 |

| | 4,166 |

| | 2,979 |

|

| Repurchase agreements | | 3,469 |

| | 3,042 |

| | 6,961 |

| | 5,348 |

| | 3,991 |

| | 3,492 |

|

| Long-term debt and finance lease liabilities | | 1,713 |

| | 1,649 |

| | 3,471 |

| | 3,120 |

| | 1,367 |

| | 1,758 |

|

| Total interest expense | | 107,518 |

| | 58,632 |

| | 208,368 |

| | 103,812 |

| | 86,483 |

| | 100,850 |

|

| Net interest income before provision for credit losses |

| 367,326 |

| | 341,679 |

| | 729,787 |

| | 668,372 |

|

| 362,707 |

| | 362,461 |

|

| Provision for credit losses | | 19,245 |

| | 15,536 |

| | 41,824 |

| | 35,754 |

| | 73,870 |

| | 22,579 |

|

| Net interest income after provision for credit losses | | 348,081 |

| | 326,143 |

| | 687,963 |

| | 632,618 |

| | 288,837 |

| | 339,882 |

|

| NONINTEREST INCOME | | | | | | |

| | |

| | | | |

| Lending fees | | 16,242 |

| | 14,692 |

| | 31,038 |

| | 28,705 |

| | 15,773 |

| | 14,969 |

|

| Deposit account fees | | 9,788 |

| | 10,140 |

| | 19,429 |

| | 20,570 |

| | 10,447 |

| | 9,468 |

|

| Foreign exchange income | | 7,286 |

| | 6,822 |

| | 12,301 |

| | 7,992 |

| | 7,819 |

| | 5,015 |

|

| Wealth management fees | | 3,800 |

| | 4,501 |

| | 7,612 |

| | 7,454 |

| | 5,357 |

| | 3,812 |

|

| Interest rate contracts and other derivative income | | 10,398 |

| | 6,570 |

| | 13,614 |

| | 13,260 |

| | 7,073 |

| | 3,216 |

|

| Net gains on sales of loans | | 15 |

| | 2,354 |

| | 930 |

| | 3,936 |

| | 950 |

| | 915 |

|

| Net gains on sales of available-for-sale investment securities | | 1,447 |

| | 210 |

| | 3,008 |

| | 2,339 |

| |

| Net gain on sale of business | | — |

| | — |

| | — |

| | 31,470 |

| |

| Net gains on sales of AFS debt securities | | | 1,529 |

| | 1,561 |

|

| Other investment income | | | 1,921 |

| | 1,202 |

|

| Other income | | 3,783 |

| | 2,979 |

| | 6,958 |

| | 6,986 |

| | 3,180 |

| | 1,973 |

|

| Total noninterest income | | 52,759 |

| | 48,268 |

| | 94,890 |

| | 122,712 |

| | 54,049 |

| | 42,131 |

|

| NONINTEREST EXPENSE | | | | | | |

| | |

| | | | |

| Compensation and employee benefits | | 100,531 |

| | 93,865 |

| | 202,830 |

| | 189,099 |

| | 101,960 |

| | 102,299 |

|

| Occupancy and equipment expense | | 17,362 |

| | 16,707 |

| | 34,680 |

| | 33,587 |

| | 17,076 |

| | 17,318 |

|

| Deposit insurance premiums and regulatory assessments | | 2,919 |

| | 5,832 |

| | 6,007 |

| | 12,105 |

| | 3,427 |

| | 3,088 |

|

| Legal expense | | 2,355 |

| | 2,837 |

| | 4,580 |

| | 5,092 |

| | 3,197 |

| | 2,225 |

|

| Data processing | | 3,460 |

| | 3,327 |

| | 6,617 |

| | 6,728 |

| | 3,826 |

| | 3,157 |

|

| Consulting expense | | 2,069 |

| | 5,120 |

| | 4,128 |

| | 7,472 |

| | 1,217 |

| | 2,059 |

|

| Deposit related expense | | 3,338 |

| | 2,922 |

| | 6,842 |

| | 5,601 |

| | 3,563 |

| | 3,504 |

|

| Computer software expense | | 6,211 |

| | 5,549 |

| | 12,289 |

| | 10,603 |

| | 6,166 |

| | 6,078 |

|

| Other operating expense | | 22,679 |

| | 20,779 |

| | 44,968 |

| | 38,386 |

| | 21,119 |

| | 22,289 |

|

| Amortization of tax credit and other investments | | 16,739 |

| | 20,481 |

| | 41,644 |

| | 37,881 |

| | 17,325 |

| | 24,905 |

|

| Total noninterest expense | | 177,663 |

| | 177,419 |

| | 364,585 |

| | 346,554 |

| | 178,876 |

| | 186,922 |

|

| INCOME BEFORE INCOME TAXES | | 223,177 |

| | 196,992 |

| | 418,268 |

| | 408,776 |

| | 164,010 |

| | 195,091 |

|

| INCOME TAX EXPENSE | | 72,797 |

| | 24,643 |

| | 103,864 |

| | 49,395 |

| | 19,186 |

| | 31,067 |

|

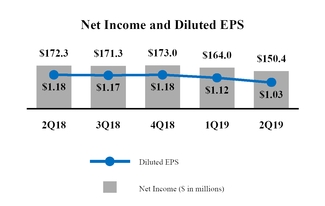

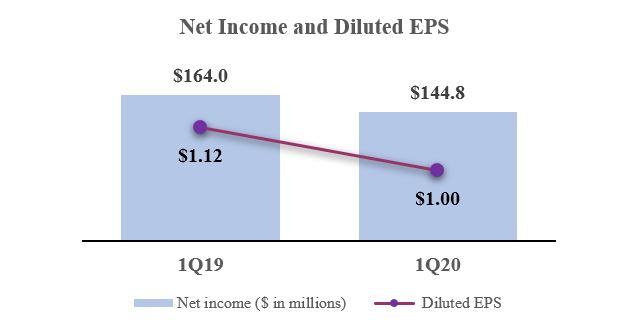

| NET INCOME | | $ | 150,380 |

| | $ | 172,349 |

| | $ | 314,404 |

| | $ | 359,381 |

| | $ | 144,824 |

| | $ | 164,024 |

|

| EARNINGS PER SHARE (“EPS”) | | | | | | | | | | | | |

| BASIC | | $ | 1.03 |

| | $ | 1.19 |

| | $ | 2.16 |

| | $ | 2.48 |

| | $ | 1.00 |

| | $ | 1.13 |

|

| DILUTED | | $ | 1.03 |

| | $ | 1.18 |

| | $ | 2.15 |

| | $ | 2.46 |

| | $ | 1.00 |

| | $ | 1.12 |

|

| WEIGHTED-AVERAGE NUMBER OF SHARES OUTSTANDING | | | | | | | | | | | | |

| BASIC | | 145,546 |

| | 144,899 |

| | 145,402 |

| | 144,782 |

| | 144,814 |

| | 145,256 |

|

| DILUTED | | 146,052 |

| | 146,091 |

| | 146,016 |

| | 146,046 |

| | 145,285 |

| | 145,921 |

|

|

See accompanying Notes to Consolidated Financial Statements.

4

EAST WEST BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

($ in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| Net income | | $ | 150,380 |

| | $ | 172,349 |

| | $ | 314,404 |

| | $ | 359,381 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | |

| Net changes in unrealized gains (losses) on available-for-sale investment securities | | 29,027 |

| | (8,841 | ) | | 51,038 |

| | (27,653 | ) |

| Foreign currency translation adjustments | | (6,016 | ) | | (6,822 | ) | | (2,836 | ) | | (24 | ) |

| Other comprehensive income (loss) | | 23,011 |

| | (15,663 | ) | | 48,202 |

| | (27,677 | ) |

| COMPREHENSIVE INCOME | | $ | 173,391 |

| | $ | 156,686 |

| | $ | 362,606 |

| | $ | 331,704 |

|

| |

|

| | | | | | | | |

| |

| | | Three Months Ended March 31, |

| | | 2020 | | 2019 |

| Net income | | $ | 144,824 |

| | $ | 164,024 |

|

| Other comprehensive income (loss), net of tax: | | | | |

| Net changes in unrealized gains on AFS debt securities | | 27,453 |

| | 22,011 |

|

| Foreign currency translation adjustments | | (2,164 | ) | | 3,180 |

|

| Other comprehensive income | | 25,289 |

| | 25,191 |

|

| COMPREHENSIVE INCOME | | $ | 170,113 |

| | $ | 189,215 |

|

| |

See accompanying Notes to Consolidated Financial Statements.

5

EAST WEST BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

($ in thousands, except shares)

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Common Stock and

Additional Paid-in Capital | | Retained

Earnings | | Treasury

Stock | | AOCI,

Net of Tax | | Total

Stockholders’

Equity |

| | | Shares | | Amount | | | | |

| BALANCE, APRIL 1, 2018 | | 144,872,525 |

| | $ | 1,761,653 |

| | $ | 2,740,179 |

| | $ | (467,273 | ) | | $ | (55,804 | ) | | $ | 3,978,755 |

|

| Net income | | — |

| | — |

| | 172,349 |

| | — |

| | — |

| | 172,349 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | (15,663 | ) | | (15,663 | ) |

| Net activity of common stock pursuant to various stock compensation plans and agreements | | 32,104 |

| | 8,385 |

| | — |

| | (215 | ) | | — |

| | 8,170 |

|

| Cash dividends on common stock ($0.20 per share) | | — |

| | — |

| | (29,327 | ) | | — |

| | — |

| | (29,327 | ) |

| BALANCE, JUNE 30, 2018 | | 144,904,629 |

| | $ | 1,770,038 |

| | $ | 2,883,201 |

| | $ | (467,488 | ) | | $ | (71,467 | ) | | $ | 4,114,284 |

|

| BALANCE, APRIL 1, 2019 | | 145,501,301 |

| | $ | 1,799,124 |

| | $ | 3,305,054 |

| | $ | (479,265 | ) | | $ | (32,983 | ) | | $ | 4,591,930 |

|

| Net income | | — |

| | — |

| | 150,380 |

| | — |

| | — |

| | 150,380 |

|

| Other comprehensive income | | — |

| | — |

| | — |

| | — |

| | 23,011 |

| | 23,011 |

|

| Net activity of common stock pursuant to various stock compensation plans and agreements | | 45,268 |

| | 9,938 |

| | — |

| | (133 | ) | | — |

| | 9,805 |

|

| Cash dividends on common stock ($0.275 per share) | | — |

| | — |

| | (40,533 | ) | | — |

| | — |

| | (40,533 | ) |

| BALANCE, JUNE 30, 2019 | | 145,546,569 |

| | $ | 1,809,062 |

| | $ | 3,414,901 |

| | $ | (479,398 | ) | | $ | (9,972 | ) | | $ | 4,734,593 |

|

| |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Common Stock and

Additional Paid-in Capital | | Retained

Earnings | | Treasury

Stock | | AOCI,

Net of Tax | | Total

Stockholders’

Equity |

| | | Shares | | Amount | | | | |

| BALANCE, JANUARY 1, 2018 | | 144,543,060 |

| | $ | 1,755,495 |

| | $ | 2,576,302 |

| | $ | (452,327 | ) | | $ | (37,519 | ) | | $ | 3,841,951 |

|

Cumulative effect of change in accounting principle related to marketable equity securities (1) | | — |

| | — |

| | (545 | ) | | — |

| | 385 |

| | (160 | ) |

Reclassification of tax effects in AOCI resulting from the new federal corporate income tax rate (2) | | — |

| | — |

| | 6,656 |

| | — |

| | (6,656 | ) | | — |

|

| Net income | | — |

| | — |

| | 359,381 |

| | — |

| | — |

| | 359,381 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | (27,677 | ) | | (27,677 | ) |

| Net activity of common stock pursuant to various stock compensation plans and agreements | | 361,569 |

| | 14,543 |

| | — |

| | (15,161 | ) | | — |

| | (618 | ) |

| Cash dividends on common stock ($0.40 per share) | | — |

| | — |

| | (58,593 | ) | | — |

| | — |

| | (58,593 | ) |

| BALANCE, JUNE 30, 2018 | | 144,904,629 |

| | $ | 1,770,038 |

| | $ | 2,883,201 |

| | $ | (467,488 | ) | | $ | (71,467 | ) | | $ | 4,114,284 |

|

| BALANCE, JANUARY 1, 2019 | | 144,961,363 |

| | $ | 1,789,977 |

| | $ | 3,160,132 |

| | $ | (467,961 | ) | | $ | (58,174 | ) | | $ | 4,423,974 |

|

Cumulative effect of change in accounting principle related to leases (3) | | — |

| | — |

| | 14,668 |

| | — |

| | — |

| | 14,668 |

|

| Net income | | — |

| | — |

| | 314,404 |

| | — |

| | — |

| | 314,404 |

|

| Other comprehensive income | | — |

| | — |

| | — |

| | — |

| | 48,202 |

| | 48,202 |

|

| Warrants exercised | | 180,226 |

| | 1,711 |

| | — |

| | 2,732 |

| | — |

| | 4,443 |

|

| Net activity of common stock pursuant to various stock compensation plans and agreements | | 404,980 |

| | 17,374 |

| | — |

| | (14,169 | ) | | — |

| | 3,205 |

|

| Cash dividends on common stock ($0.505 per share) | | — |

| | — |

| | (74,303 | ) | | — |

| | — |

| | (74,303 | ) |

| BALANCE, JUNE 30, 2019 | | 145,546,569 |

| | $ | 1,809,062 |

| | $ | 3,414,901 |

| | $ | (479,398 | ) | | $ | (9,972 | ) | | $ | 4,734,593 |

|

| |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Common Stock and

Additional Paid-in Capital | | Retained

Earnings | | Treasury

Stock | | AOCI,

Net of Tax | | Total

Stockholders’

Equity |

| | | Shares | | Amount | | | | |

| Balance, January 1, 2019 | | 144,961,363 |

| | $ | 1,789,977 |

| | $ | 3,160,132 |

| | $ | (467,961 | ) | | $ | (58,174 | ) | | $ | 4,423,974 |

|

Cumulative-effect of change in accounting principle related to leases (1) | | — |

| | — |

| | 14,668 |

| | — |

| | — |

| | 14,668 |

|

| Net income | | — |

| | — |

| | 164,024 |

| | — |

| | — |

| | 164,024 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | 25,191 |

| | 25,191 |

|

| Warrants exercised | | 180,226 |

| | 1,711 |

| | — |

| | 2,732 |

| | — |

| | 4,443 |

|

| Net activity of common stock pursuant to various stock compensation plans and agreements | | 359,712 |

| | 7,436 |

| | — |

| | (14,036 | ) | | — |

| | (6,600 | ) |

| Cash dividends on common stock ($0.23 per share) | | — |

| | — |

| | (33,770 | ) | | — |

| | — |

| | (33,770 | ) |

| BALANCE, MARCH 31, 2019 | | 145,501,301 |

| | $ | 1,799,124 |

| | $ | 3,305,054 |

| | $ | (479,265 | ) | | $ | (32,983 | ) | | $ | 4,591,930 |

|

| Balance, January 1, 2020 | | 145,625,385 |

| | $ | 1,826,512 |

| | $ | 3,689,377 |

| | $ | (479,864 | ) | | $ | (18,408 | ) | | $ | 5,017,617 |

|

Cumulative-effect of change in accounting principle related to credit losses (2) | | — |

| | — |

| | (97,967 | ) | | — |

| | — |

| | (97,967 | ) |

| Net income | | — |

| | — |

| | 144,824 |

| | — |

| | — |

| | 144,824 |

|

| Other comprehensive income | | — |

| | — |

| | — |

| | — |

| | 25,289 |

| | 25,289 |

|

| Net activity of common stock pursuant to various stock compensation plans and agreements | | 281,396 |

| | 7,272 |

| | — |

| | (7,609 | ) | | — |

| | (337 | ) |

| Repurchase of common stock pursuant to the Stock Repurchase Program | | (4,471,682 | ) | | — |

| | — |

| | (145,966 | ) | | — |

| | (145,966 | ) |

| Cash dividends on common stock ($0.275 per share) | | — |

| | — |

| | (40,475 | ) | | — |

| | — |

| | (40,475 | ) |

| BALANCE, MARCH 31, 2020 | | 141,435,099 |

| | $ | 1,833,784 |

| | $ | 3,695,759 |

| | $ | (633,439 | ) | | $ | 6,881 |

| | $ | 4,902,985 |

|

| |

| |

| (1) | Represents the impact of the adoption of Accounting Standards Update (“ASU”) 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities in the first quarter of 2018. |

| |

(2) | Represents amounts reclassified from AOCI to retained earnings due to the early adoption of ASU 2018-02, Income Statement — Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income in the first quarter of 2018.

|

| |

(3) | Represents the impact of the adoption of ASU 2016-02, Leases (Topic 842) and subsequent related ASUs in the first quarter of 2019.

|

| |

| (2) | Represents the impact of the adoption of ASU 2016-13, Financial Instruments - Credit Losses (Topic 326) in the first quarter of 2020. Refer to Note 2 — CurrentSummary of Significant Accounting Developments and Note 11 —LeasesPolicies to the Consolidated Financial Statements in this Quarterly Report on Form 10-Q (“this Form 10-Q”) for additional information. |

See accompanying Notes to Consolidated Financial Statements.

6

EAST WEST BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

($ in thousands)

(Unaudited)

| | | | | | Six Months Ended June 30, | | Three Months Ended March 31, |

| | | 2019 | | 2018 | | 2020 | | 2019 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| Net income | | $ | 314,404 |

| | $ | 359,381 |

| | $ | 144,824 |

| | $ | 164,024 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

| | |

| | |

|

| Depreciation and amortization | | 72,113 |

| | 62,329 |

| | 31,186 |

| | 39,498 |

|

| Accretion of discount and amortization of premiums, net | | (9,817 | ) | | (9,910 | ) | | (4,519 | ) | | (4,414 | ) |

| Stock compensation costs | | 15,525 |

| | 13,215 |

| | 7,209 |

| | 7,444 |

|

| Deferred income tax (benefit) expense | | (2,110 | ) | | 1,320 |

| |

| Deferred income tax expense (benefit) | | | 28 |

| | (406 | ) |

| Provision for credit losses | | 41,824 |

| | 35,754 |

| | 73,870 |

| | 22,579 |

|

| Net gains on sales of loans | | (930 | ) | | (3,936 | ) | | (950 | ) | | (915 | ) |

| Net gains on sales of available-for-sale investment securities | | (3,008 | ) | | (2,339 | ) | |

| Net gains on sales of fixed assets | | — |

| | (2,200 | ) | |

| Net gain on sale of business | | — |

| | (31,470 | ) | |

| Net gains on sales of AFS debt securities | | | (1,529 | ) | | (1,561 | ) |

| Net loss on sales of fixed assets | | | 3 |

| | — |

|

| Loans held-for-sale: | | | | | | | | |

| Originations and purchases | | (3,339 | ) | | (11,547 | ) | | (5,802 | ) | | (2,167 | ) |

| Proceeds from sales and paydowns/payoffs of loans originally classified as held-for-sale | | 3,632 |

| | 10,759 |

| | 4,657 |

| | 2,454 |

|

| Proceeds from distributions received from equity method investees | | 1,538 |

| | 1,814 |

| | 973 |

| | 1,150 |

|

| Net change in accrued interest receivable and other assets | | (150,154 | ) | | (32,226 | ) | | (462,766 | ) | | (27,639 | ) |

| Net change in accrued expenses and other liabilities | | 10,320 |

| | 44,016 |

| | 304,680 |

| | (60,806 | ) |

| Other net operating activities | | 3 |

| | (93 | ) | | (161 | ) | | — |

|

| Total adjustments | | (24,403 | ) | | 75,486 |

| | (53,121 | ) | | (24,783 | ) |

| Net cash provided by operating activities | | 290,001 |

| | 434,867 |

| | 91,703 |

| | 139,241 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES | | |

| | |

| | |

| | |

|

| Net (increase) decrease in: | | |

| | |

| | |

| | |

|

| Investments in qualified affordable housing partnerships, tax credit and other investments | | (61,555 | ) | | (41,444 | ) | | (27,581 | ) | | (33,261 | ) |

| Interest-bearing deposits with banks | | 222,387 |

| | 28,525 |

| | (115,419 | ) | | 245,375 |

|

| Resale agreements: | | | | | | | | |

| Proceeds from paydowns and maturities | | 50,000 |

| | 175,000 |

| | 250,000 |

| | — |

|

| Purchases | | (25,000 | ) | | (100,000 | ) | |

| Available-for-sale investment securities: | | | | | |

| AFS debt securities: | | | | | |

| Proceeds from sales | | 375,102 |

| | 256,875 |

| | 306,463 |

| | 151,339 |

|

| Proceeds from repayments, maturities and redemptions | | 117,325 |

| | 211,303 |

| | 308,620 |

| | 55,712 |

|

| Purchases | | (316,740 | ) | | (235,360 | ) | | (987,130 | ) | | (69,805 | ) |

| Loans held-for-investment: | | | | | | | | |

| Proceeds from sales of loans originally classified as held-for-investment | | 170,174 |

| | 274,785 |

| | 110,945 |

| | 92,887 |

|

| Purchases | | (326,456 | ) | | (389,912 | ) | | (133,185 | ) | | (147,938 | ) |

| Other changes in loans held-for-investment, net | | (1,196,094 | ) | | (1,147,156 | ) | | (1,116,358 | ) | | (409,930 | ) |

| Premises and equipment: | | |

| | |

| | |

| | |

|

| Purchases | | (4,414 | ) | | (7,612 | ) | | (916 | ) | | (3,336 | ) |

| Payment on sale of business, net of cash transferred | | — |

| | (503,687 | ) | |

| Proceeds from sales of other real estate owned (“OREO”) | | — |

| | 3,595 |

| | 295 |

| | — |

|

| Proceeds from distributions received from equity method investees | | 3,636 |

| | 1,725 |

| | 374 |

| | 1,005 |

|

| Other net investing activities | | (5,516 | ) | | (2,200 | ) | | (1,438 | ) | | (729 | ) |

| Net cash used in investing activities | | (997,151 | ) | | (1,475,563 | ) | | (1,405,330 | ) | | (118,681 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES | | |

| | |

| | |

| | |

|

| Net increase in deposits | | 1,035,650 |

| | 1,195,796 |

| | 1,374,287 |

| | 800,053 |

|

| Net (decrease) increase in short-term borrowings | | (38,107 | ) | | 59,895 |

| |

| Net increase (decrease) in short-term borrowings | | | 39,962 |

| | (19,514 | ) |

| FHLB advances: | | | | | | | | |

| Proceeds | | 1,500,000 |

| | — |

| | — |

| | 300,000 |

|

| Repayment | | (1,082,000 | ) | | — |

| | (99,999 | ) | | (282,000 | ) |

| Repayment of long-term debt and finance lease liabilities | | (435 | ) | | (10,000 | ) | |

| Repayment of long-term debt and lease liabilities | | | (289 | ) | | (217 | ) |

| Common stock: | | | | | | | | |

| Proceeds from issuance pursuant to various stock compensation plans and agreements | | 1,894 |

| | 1,328 |

| |

| Stock tendered for payment of withholding taxes | | (14,169 | ) | | (15,161 | ) | |

| Repurchase of common stock pursuant to the Stock Repurchase Program | | | (145,966 | ) | | — |

|

| Stocks tendered for payment of withholding taxes | | | (7,609 | ) | | (14,036 | ) |

| Cash dividends paid | | (74,949 | ) | | (59,243 | ) | | (41,358 | ) | | (34,916 | ) |

| Net cash provided by financing activities | | 1,327,884 |

| | 1,172,615 |

| | 1,119,028 |

| | 749,370 |

|

| Effect of exchange rate changes on cash and cash equivalents | | (497 | ) | | (9,040 | ) | | 13,492 |

| | 14,018 |

|

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | 620,237 |

| | 122,879 |

| |

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | | | (181,107 | ) | | 783,948 |

|

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | | 3,001,377 |

| | 2,174,592 |

| | 3,261,149 |

| | 3,001,377 |

|

| CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 3,621,614 |

| | $ | 2,297,471 |

| | $ | 3,080,042 |

| | $ | 3,785,325 |

|

|

See accompanying Notes to Consolidated Financial Statements.

7

EAST WEST BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

($ in thousands)

(Unaudited)

(Continued)

| | | | | | Six Months Ended June 30, | | Three Months Ended March 31, |

| | | 2019 | | 2018 | | 2020 | | 2019 |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | 203,577 |

| | $ | 99,176 |

| | $ | 88,520 |

| | $ | 97,930 |

|

| Income taxes, net | | $ | 76,153 |

| | $ | 67,431 |

| | $ | 2,904 |

| | $ | 303 |

|

| Noncash investing and financing activities: | | |

| | |

| | | | |

| Loans transferred from held-for-investment to held-for-sale | | $ | 173,394 |

| | $ | 285,631 |

| | $ | 110,223 |

| | $ | 92,228 |

|

| Loans transferred to OREO | | | $ | 19,504 |

| | $ | — |

|

| | | | | | |

See accompanying Notes to Consolidated Financial Statements.

8

EAST WEST BANCORP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 — Basis of Presentation

East West Bancorp, Inc. (referred to herein on an unconsolidated basis as “East West” and on a consolidated basis as the “Company”) is a registered bank holding company that offers a full range of banking services to individuals and businesses through its subsidiary bank, East West Bank and its subsidiaries (“East West Bank” or the “Bank”). The unaudited interim Consolidated Financial Statements in this Form 10-Q include the accounts of East West, East West Bank and East West’s subsidiaries. Intercompany transactions and accounts have been eliminated in consolidation. As of June 30, 2019,March 31, 2020, East West also has six6 wholly-owned subsidiaries that are statutory business trusts (the “Trusts”). In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 810, Consolidation, the Trusts are not included on the Consolidated Financial Statements. East West also owns East West Insurance Services, Inc. (“EWIS”). In the third quarter of 2017, the Company sold the insurance brokerage business of EWIS, which remains a subsidiary of East West and continues to maintain its insurance broker license. In the first quarter of 2019, the Company acquired Enstream Capital Markets, LLC, a non-publicprivate broker dealer entity, asand also established East West Investment Management LLC, a registered investment adviser. Both East West Markets, LLC and East West Investment Management LLC are wholly-owned subsidiarysubsidiaries of the Company.East West.

The unaudited interim Consolidated Financial Statements are presented in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”), applicable guidelines prescribed by regulatory authorities, and general practices in the banking industry. They reflect all adjustments that, in the opinion of management, are necessary for fair statement of the interim period Consolidated Financial Statements. Certain items on the Consolidated Financial Statements and notes for the prior periods have been reclassified to conform to the current period presentation.

The current period’s results of operations are not necessarily indicative of results that may be expected for any other interim period or for the year as a whole. While the COVID-19 outbreak had a material impact on our provision for credit losses, the Company is unable to fully predict the impact that COVID-19 will have on its financial position and results of operations due to numerous uncertainties, and will continue to assess the potential impacts on its financial position and results of operations. Events subsequent to the Consolidated Balance Sheet date have been evaluated through the date the Consolidated Financial Statements are issued for inclusion in the accompanying Consolidated Financial Statements. The unaudited interim Consolidated Financial Statements should be read in conjunction with the audited Consolidated Financial Statements and notes thereto, included in the Company’s annual report on Form 10-K for the year ended December 31, 2018,2019, filed with the United StatesU.S. Securities and Exchange Commission on February 27, 20192020 (the “Company’s 20182019 Form 10-K”).

Note 2 — Current Accounting Developments and Summary of Significant Accounting Policies

New Accounting Pronouncements Adopted

|

| | | |

| Standard | Required Date of Adoption | Description | Effect on Financial Statements |

Standards Adopted in 2019 |

ASU 2016-02, Leases (Topic 842) and subsequent related ASUs

| January 1, 2019 for leases standards other than ASU 2019-01.

January 1, 2020 for ASU 2019-01

Early adoption is permitted.

| ASC Topic 842, Leases, supersedes ASC Topic 840, Leases. This ASU requires lessees to recognize right-of-use assets and related lease liabilities for all leases with lease terms of more than 12 months on the Consolidated Balance Sheet, and provide quantitative and qualitative disclosures regarding key information about the leasing arrangements. For short-term leases with a term of 12 months or less, lessees can make a policy election not to recognize lease assets and lease liabilities. The recognition, measurement and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance or operating lease. Lessee accounting for finance leases, as well as lessor accounting are largely unchanged. The standard may be adopted using a modified retrospective approach through a cumulative-effect adjustment. In addition, the FASB issued ASU 2018-11, Leases (Topic 842) Targeted Improvements, which provides companies the option to continue to apply the legacy guidance in ASC 840, Leases, including its disclosure requirements, in the comparative periods presented in the year they adopt ASU 2016-02. Companies that elect this transition option can recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption rather than in the earliest period presented.

| The Company adopted all the new lease standards on January 1, 2019 using the alternative transition method, which allows the adoption of the accounting standard prospectively without revising comparable prior periods’ financial information.

On January 1, 2019, the Company recognized $109.1 million and $117.7 million increase in right-of-use assets and associated lease liabilities, respectively, based on the present value of the expected remaining operating lease payments. In addition, the Company also recognized a cumulative-effect adjustment of $14.7 million to increase beginning balance of retained earnings as of January 1, 2019 related to the deferred gains on our prior sale and leaseback transactions that occurred prior to the date of adoption. The adoption of the new leases standards did not have a material impact on the Company’s Consolidated Statement of Income. Disclosures related to leases are included in Note 11 — Leases to the Consolidated Financial Statements in this Form 10-Q.

|

ASU 2018-16, Derivatives and Hedging (Topic 815): Inclusion of the Secured Overnight Financing Rate (“SOFR”) Overnight Index Swap (“OIS”) Rate as a Benchmark Interest Rate for Hedge Accounting Purposes

| January 1, 2019

Early adoption (including adoption in an interim period) is permitted for entities that already adopted ASU 2017-12. | This ASU amends ASC Topic 815, Derivatives and Hedging, by adding the OIS rate based on SOFR to the list of United States (“U.S.”) benchmark interest rates that are eligible to be hedged to facilitate the London Interbank Offered Rate to SOFR transition. The guidance should be applied prospectively for qualifying new or redesignated hedging relationships entered into on or after the date of adoption.

| The Company adopted ASU 2018-16 prospectively on January 1, 2019. The adoption of this guidance did not impact existing hedges but may impact new hedge relationships that are benchmarked against the SOFR OIS rate. |

Recent Accounting Pronouncements

|

| | | |

Standard | Required Date of Adoption | Description | Effect on Financial Statements |

Standards Not Yet Adopted |

ASU 2016-13, Financial Instruments — Credit Losses (Topic(Topic 326): Measurement of Credit Losses on Financial Instrumentsand subsequent related ASUs | January 1, 2020

Early adoption is permitted on January 1, 2019.

| The ASU introduces a new current expected credit loss (“CECL”) impairment model that applies to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loan receivables, available-for-saleAFS and held-to-maturity debt securities, net investments in leases and off-balance sheet credit exposures. The CECL model utilizes a lifetime “expected credit loss” measurement objective for the recognition of credit losses at the time the financial asset is originated or acquired. The expected credit losses are adjusted in each period for changes in expected lifetime credit losses. ASU 2016-13 also eliminates the guidance for purchased credit impaired (“PCI”) loans, but requires an allowance for loan losses for purchased financial assets with more than an insignificant deterioration of credit since origination. The ASU also modifies the other-than-temporary impairment (“OTTI”) model for AFS debt securities to require an allowance for credit losses instead of a direct write-down. A reversal of the allowance for credit losses is allowed in future periods based on improvements in credit performance expectations. This ASU also expands the disclosure requirements regarding an entity’s assumptions, models and methods for estimating the allowance for loan and lease losses, and requires disclosure of the amortized cost balance for each class of financial asset by credit quality indicator, disaggregated by the year of origination (i.e., by vintage year). The guidance should be applied using a modified retrospective approach through a cumulative-effect adjustment to retained earnings as of the beginning of the reporting period of adoption.

In April 2019, the FASB issued ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments-Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments, which clarifies The new guidance also allows optional relief for certain aspects of accounting for credit losses, hedging activities, and financial instruments. The amendments related to credit losses (addressed by ASU 2016-13) clarify the scope of the credit losses standard and address issues related to accrued interest receivable balances, recoveries, variable interest rates, prepayments and contractual extensions and renewals, among other things.

In May 2019, the FASB issued ASU 2019-05, Financial Instruments-Credit Losses (Topic 326), which amends ASU 2016-13 to allow companiesinstruments measured at amortized cost with an option to irrevocably elect upon adoption of ASU 2016-13, the fair value option on financial instruments that were previously recorded at amortized cost and are within the scope of ASC 326-20 if the instruments are eligible for the fair value option under ASC 825-10.Topic 825,

| The Company’s implementation efforts include, but are not limited to, identifying and evaluating key interpretive issues, assessing, and modifying system and process requirements against the new guidance. The Company has completed model development and is undergoing validation and implementation. Additionally, the Company has started to analyze model results, review qualitative factors and update the allowance documentation. The Company will continue to address any gaps from recently issued interpretations and in data and operational processes arising from internal reviews, model validation and parallel runs during the second half of 2019.

The Company expects to adopt thisadopted ASU 2016-13 using a modified retrospective approach on January 1, 2020 without electing the fair value option on eligible financial instruments. Whileinstruments under ASU 2019-05. The Company has completed its implementation efforts, which includes the Company is still evaluatingimplementation of new processes and controls over the impact on its Consolidated Financial Statements,new credit and loss aggregation models, completion of parallel runs, updates to the Company expects thatallowance documentation, policies and reporting processes.

The adoption of this ASU may result inincreased the allowance for loan losses by $125.2 million, and allowance for unfunded credit commitments by $10.5 million. The Company also recorded an after-tax decrease to opening retained earnings of $98.0 million on January 1, 2020. The increase into allowance for loan losses was primarily related to the commercial and industrial (“C&I”) and commercial real estate (“CRE”) loan portfolios. The Company did not record an allowance for credit losses due to the following factors: 1) the allowance for credit losses provides for expected credit losses over the remaining expected life of the loan portfolio and 2) the nonaccretable difference on the purchased credit-impaired (“PCI”) loans willCompany’s AFS debt securities as a result of this adoption. Disclosures for periods after January 1, 2020 are presented in accordance with ASC 326 while prior period amounts continue to be recognized as an allowance, offset by an increasereported in accordance with previously applicable standards and the accounting policies described in the carrying valueCompany’s 2019 Form 10-K.

The Company has elected the CECL phase-in option provided by regulatory capital rules, which delays the impact of the PCI loans. The ultimate effect of this ASU will also dependCECL on the composition and credit quality of the portfolio and economic conditions at the time of adoption.regulatory capital for two years, followed by a three-year transition period. |

ASU 2017-04, Intangibles — Goodwill and Other(Topic (Topic 350): : Simplifying the Test for Goodwill Impairment | January 1, 2020

Early adoption is permitted for interim or annual goodwill impairment tests with measurement dates after January 1, 2017. | The ASU simplifies the accounting for goodwill impairment. Under this guidance, an entity will no longer perform a hypothetical purchase price allocation to measure goodwill impairment. Instead, an impairment loss will be recognized when the carrying amount of a reporting unit exceeds its fair value. The guidance also eliminates the requirement to perform a qualitative assessment for any reporting units with a zero or negative carrying amount. This guidance should be applied prospectively. | The Company does not expect theadopted this guidance on January 1, 2020. The adoption of this guidance todid not have a material impact on the Company’s Consolidated Financial Statements. The Company expects to adopt this ASU |

New Accounting Pronouncements Adopted

|

| | | |

| Standard | Required Date of Adoption | Description | Effect on January 1, 2020.Financial Statements |

| Standards Adopted in 2020 |

ASU 2018-15,Intangibles — Goodwill and Other — Internal-Use Software (Subtopic(Subtopic 350-40) Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract | January 1, 2020

Early adoption is permitted. | The ASU amends ASC Topic 350-40 to align the accounting for costs incurred in a cloud computing arrangement with the guidance on developing internal use software. Specifically, if a cloud computing arrangement is deemed to be a service contract, certain implementation costs are eligible for capitalization. The new guidance prescribes the balance sheet and income statement presentation and cash flow classification for the capitalized costs and related amortization expense. The amendments in this ASU should be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. | The Company does not expect theadopted this guidance on a prospective basis on January 1, 2020. The adoption of this guidance todid not have a material impact on the Company’s Consolidated Financial Statements. |

Recent Accounting Pronouncements

|

| | | |

| Standard | Required Date of Adoption | Description | Effect on Financial Statements |

| Standard Not Yet Adopted |

ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting

| Effective for all entities as of March 12, 2020 through December 31, 2022. | In March 2020, the FASB issued a new accounting standard related to contracts or hedging relationships that reference LIBOR or other reference rates that are expected to be discontinued due to reference rate reform. This ASU provide optional expedients and exceptions regarding the accounting related to the modification of certain contracts, hedging relationships and other transactions that are affected by the reference rate reform. The guidance permits the Company not to apply modification accounting or remeasure lease payments in lease contracts if the changes to the contract are related to the discontinuation of the reference rate. If certain criteria are met, the amendments also allow exceptions to the dedesignation criteria of the hedging relationship and the assessment of hedge effectiveness during the transition period. This one time election may be made at any time after March 12, 2020, but no later than December 31, 2022. | The Company expectshas not yet made a determination on whether it will make this election and is currently tracking the exposure as of each reporting period and assessing the significance of impact towards implementing any necessary modification in consideration of the election of this amendment. We will continue to adopt this ASU on January 1, 2020.assess the impact as the reference rate transition occurs over the next two years. |

Summary of Significant Accounting Policies

Note 3 — DispositionsThe Company has revised the following significant accounting policies as a result of the adoption of ASU 2016-13.

On March 17, 2018,Allowance for Loan Losses — The allowance for loan losses is established as management’s estimate of expected credit losses inherent in the Bank completedCompany’s lending activities and increased by the saleprovision for credit losses and decreased by net charge-offs. Subsequent recoveries, if any, are credited to the allowance for loan losses. The allowance for loan losses is evaluated quarterly by management based on periodic review of the collectability of the loans, and more often if deemed necessary. The Company develops and documents the allowance for loan losses methodology at the portfolio segment level —commercial loan portfolio comprising C&I, CRE, multifamily residential, and construction and land loans; and the consumer loan portfolio comprising single-family residential, home equity lines of credit (“HELOC”) and other consumer loans.

The allowance for loan losses represents the portion of the loan’s amortized cost basis that the Company does not expect to collect due to anticipated credit losses over the loan’s contractual life. The Company measures the expected loan losses on a collective pool basis when similar risk characteristics exist. Models consisting of quantitative and qualitative components are designed for each pool to develop the expected credit loss estimates. Reasonable and supportable forecast periods vary by loan portfolio. The collectively evaluated loans include non-classified and classified loans that have been determined as not impaired. The Company has adopted lifetime loss rate models for the portfolios, which use historical loss rates and forecast economic variables to calculate the expected credit losses for each loan pool.

When the loans do not share similar risk characteristics, the Company evaluates the loan for expected credit losses on an individual basis (e.g., impaired loans). The Company considers loans to be impaired if, based on current information and events, it is probable that the Company will be unable to collect all amounts due according to the original contractual terms of the loan agreement. For loans determined to be impaired, three different asset valuation measurement methods are available: (1) the present value of expected future cash flows, (2) the fair value of collateral less costs to sell, and (3) the loan's observable market price. The allowance for loan losses for collateral-dependent loans is determined based on the fair value of the collateral less costs to sell. For loans that are not collateral-dependent, the Company applies the present value of expected future cash flows valuation or the market value of the loan. When the loan is deemed uncollectible, the Company’s policy is to promptly charge off the estimated impaired amount.

The amortized cost of loans held-for-investment excludes accrued interest, which is included in Other assets on the Consolidated Balance Sheet. The Company has made an accounting policy election not to recognize an allowance for credit losses for accrued interest receivables on nonaccrual loans since the Company timely reverses any previously accrued interest when the borrower remains in default for an extended period.

The allowance for loan losses is reported separately on the Consolidated Balance Sheet and the Provision for credit losses is reported on the Consolidated Statement of Income.

Allowance for Unfunded Credit Commitments — The allowance for unfunded credit commitments includes reserves provided for unfunded loan commitments, letters of credit, standby letters of credit (“SBLCs”) and recourse obligations for loans sold. The Company estimates the allowance for unfunded credit commitments over the contractual period in which the entity is exposed to credit risk via a present contractual obligation to extend credit. Within the period of credit exposure, the estimate of credit losses will consider both the likelihood that funding will occur, and an estimate of the expected credit losses on the commitments that are expected to fund over their estimated lives.

The allowance for unfunded credit commitments is maintained at a level believed by management to be sufficient to absorb estimated expected credit losses related to unfunded credit facilities. The determination of the adequacy of the allowance is based on periodic evaluations of the unfunded credit facilities. For all off-balance-sheet instruments and commitments, including unfunded lending commitments, letters of credit, SBLCs and recourse obligations for loans sold, the unfunded credit exposure is calculated using utilization assumptions based on the Company's historical utilization experience in related portfolio segments. Loss rates are applied to the calculated exposure balances to estimate the allowance for unfunded credit commitments. Other elements such as credit risk factors for loans outstanding, terms and expiration dates of the unfunded credit facilities, and other pertinent information are considered to determine the adequacy of the allowance.

The allowance for unfunded credit commitments is included in Accrued expenses and other liabilities on the Consolidated Balance Sheet. Changes to the allowance for unfunded credit commitments are included in Provision for credit losses on the Consolidated Income Statements.

Allowance for Credit Losses on Available-for-Sale Debt Securities — ASU 2016-13 modifies the impairment model for AFS debt securities. For each reporting period, AFS debt securities that are in an unrealized loss position are individually analyzed as part of the Company’s ongoing assessments to determine whether a decline in fair value below the amortized cost basis has resulted from a credit loss or other factors. The initial indicator of impairment is a decline in fair value below the amortized cost, excluding accrued interest, of the AFS debt security. In determining whether an impairment is due to credit related factors, the Company considers the severity of the decline in fair value, the financial condition of the issuer, changes in the AFS debt securities’ ratings and other qualitative factors, as well as whether the Company either plans to sell the debt security or it is more-likely-than-not that it will be required to sell the debt security before recovery of the amortized cost. ASU 2016-13 removes the ability to consider the length of time the debt security has been in an unrealized loss position as a factor, either by itself or in combination with other factors, to conclude that a credit loss does not exist.

When the Company does not intend to sell the impaired AFS debt security and it is more-likely-than-not that the Company will not be required to sell the impaired debt security prior to recovery of its eight Desert Community Bank (“DCB”) branches located inamortized cost basis, the High Desert area of Southern California to Flagstar Bank, a wholly-owned subsidiary of Flagstar Bancorp, Inc. The assets and liabilitiescredit component of the DCB branches that were soldunrealized loss of the impaired AFS debt security is recognized as an allowance for credit losses, with a corresponding Provision for credit losses on the Consolidated Statement of Income and the non-credit component is recognized in this transaction primarily consistedOther comprehensive income (loss), net of $613.7 million of deposits, $59.1 million of loans, $9.0 million of cash and cash equivalents and $7.9 million of premises and equipment. The transaction resulted in a net cash payment of $499.9 million byapplicable taxes. At each reporting period, the Company increases or decreases the allowance for credit losses as appropriate, while limiting reversals of the allowance for credit losses to Flagstar Bank. After transaction costs, the sale resulted inextent of the amounts previously recorded. If the Company intends to sell the impaired debt security or it is more-likely-than-not that the Company will be required to sell the impaired debt security prior to recovering its amortized cost basis, the entire impairment amount is recognized as an adjustment to the debt security’s amortized cost basis, with a pre-tax gain of $31.5 millioncorresponding Provision for the six months ended June 30, 2018, which was reported as Net gain on sale of businesscredit losses on the Consolidated Statement of Income.

The amortized cost of the Company’s AFS debt securities excludes accrued interest, which is included in Other assets on the Consolidated Balance Sheet. The Company has made an accounting policy election not to measure an allowance for credit losses for accrued interest receivables on AFS debt securities since the Company timely reverses any previously accrued interest when the debt security remains in default for an extended period. As each AFS debt security has a unique security structure, where the accrual status is clearly determined when certain criteria listed in the terms are met, the Company assesses the default status of each security as defined by the debt security’s specific security structure.

Collateral-Dependent Financial Assets— A financial asset is considered collateral-dependent if repayment is expected to be provided substantially through the operation or sale of the collateral. The allowance for credit losses is measured on an individual basis for collateral-dependent financial assets and determined by comparing the fair value of the collateral, minus the cost to sell, to the amortized cost basis of the related financial asset at the reporting date. Other than impaired loans, collateral-dependent financial assets could also include resale agreements. In arrangements in which the borrower must continually adjust the collateral securing the asset to reflect changes in the collateral’s fair value (e.g., resale agreements), the Company estimates the expected credit losses on the basis of the unsecured portion of the amortized cost as of the balance sheet date. If the fair value of the collateral is equal to or greater than the amortized cost of the resale agreement, the expected losses would be zero. If the fair value of the collateral is less than the amortized cost of the asset, the expected losses are limited to the difference between the fair value of the collateral and the amortized cost basis of the resale agreement.

Purchased Credit Deteriorated Assets — ASU 2016-13 replaces the concept of PCI accounting under ASC 310-30 Receivables - Loans and Debt Securities Acquired with Deteriorated Credit Quality with the concept of purchased financial assets with credit deterioration (“PCD”). The Company adopted ASU 2016-13 using the prospective transition approach for PCD that were previously classified as PCI assets. PCD financial assets are defined as acquired individual financial assets (or groups with similar risk characteristics) that as of the date of acquisition, have experienced a more-than-insignificant deterioration in credit quality since origination. For PCD debt securities and PCD loans, the company records the allowance for credit losses by grossing up the initial amortized cost, which includes the purchase price and the allowance for credit losses. The expected credit losses of PCD debt securities are measured at the individual security level. The expected credit losses for PCD loans are measured based on the loan’s unpaid principal balance. Beginning January 1, 2020, for any asset designated as a PCD asset at the time of acquisition, the Company estimates and records an allowance for credit losses, which is added to the purchase price to establish the initial amortized cost basis of the financial asset. Hence, there is no income statement impact on the acquisition. Subsequent changes in the allowance for credit losses on PCD assets will be recognized in Provision for credit losses on the Consolidated Statement of Income. The noncredit discount or premium will be accreted to interest income based on the effective interest rate on the PCD assets determined after the gross-up for the allowance for credit losses.

Note 43 — Fair Value Measurement and Fair Value of Financial Instruments

Fair Value Determination

Fair value is defined as the price that would be received to sell an asset or the price that would be paid to transfer a liability in an orderly transaction between market participants at the measurement date. In determining the fair value of financial instruments, the Company uses various methods including market and income approaches. Based on these approaches, the Company utilizes certain assumptions that market participants would use in pricing an asset or a liability. These inputs can be readily observable, market corroborated or generally unobservable. The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. The fair value hierarchy noted below is based on the quality and reliability of the information used to determine fair value. The fair value hierarchy gives the highest priority to quoted prices available in active markets and the lowest priority to data lacking transparency. The fair value of the Company’s assets and liabilities is classified and disclosed in one of the following three categories:

Level 1 — Valuation is based on quoted prices for identical instruments traded in active markets.

Level 2 — Valuation is based on quoted prices for similar instruments traded in active markets; quoted prices for identical or similar instruments traded in markets that are not active; and model-derived valuations whose inputs are observable and can be corroborated by market data.

Level 3 — Valuation is based on significant unobservable inputs for determining the fair value of assets or liabilities. These significant unobservable inputs reflect assumptions that market participants may use in pricing the assets or liabilities.

The classification of assets and liabilities within the hierarchy is based on whether inputs to the valuation methodology used are observable or unobservable, and the significance of those inputs in the fair value measurement. The Company’s assets and liabilities are classified in their entirety based on the lowest level of input that is significant to their fair value measurements.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following section describes the valuation methodologies used by the Company to measure financial assets and liabilities on a recurring basis, as well as the general classification of these instruments pursuant to the fair value hierarchy.

Available-for-Sale InvestmentDebt Securities — When available, the Company uses quoted market prices to determine the fair value of available-for-sale investmentAFS debt securities, which are classified as Level 1. Level 1 available-for-sale investmentAFS debt securities are primarily comprised of U.S. Treasury securities. The fair value of other available-for-sale investmentAFS debt securities is generally determined by independent external pricing service providers who have experience in valuing these securities or by taking the average quoted market prices obtained from independent external brokers. The valuations provided by the third-party pricing service providers are based on observable market inputs, which include benchmark yields, reported trades, issuer spreads, benchmark securities, bids, offers, prepayment expectation and reference data obtained from market research publications. Inputs used by the third-party pricing service providers in valuing collateralized mortgage obligations and other securitization structures also include new issue data, monthly payment information, whole loan collateral performance, tranche evaluation and “To Be Announced” prices. In valuations ofvaluing securities issued by state and political subdivisions, inputs used by the third-party pricing service providers also include material event notices.

On a monthly basis, the Company validates the pricingvaluations provided by the third-party pricing service providers to ensure that the fair value determination is consistent with the applicable accounting guidance and the assetsfinancial instruments are properly classified in the fair value hierarchy. To perform this validation, the Company evaluates the fair values of securities by comparing the fair values provided by the third-party pricing service providers to prices from other available independent sources for the same securities. When variances in prices are identified, the Company further compares inputs used by different sources to ascertain the reliability of these sources. On a quarterly basis, the Company reviews the documentation received from the third-party pricing service providers regarding the valuation inputs and methodology used for each category of securities.

TheWhen pricing is unavailable from third-party pricing service providers may not provide pricing for all securities. Under such circumstances,certain securities, the Company requests market quotes from various independent external brokers and utilizes the average quoted market quotes.prices. These valuations are viewed asbased on observable inputs in the current marketplace and are classified as Level 2. The Company periodically communicates with the independent external brokers to validate their pricing methodology. Information such as pricing sources, pricing assumptions, data inputs and valuation technique are reviewed.

Equity Securities — Equity securities were comprisedconsisted of mutual funds as of both June 30, 2019March 31, 2020 and December 31, 2018.2019. The Company uses net asset valueNet Asset Value (“NAV”) information to determine the fair value of these equity securities. When NAV is available periodically and the equity securities can be put back to the transfer agents at the publicly available NAV, the fair value of the equity securities is classified as Level 1. When NAV is available periodically but the equity securities may not be readily marketable at its periodic NAV in the secondary market, the fair value of these equity securities is classified as Level 2.

Interest Rate Contracts — The Company enters into interest rate swap and option contracts with its borrowers to lock in attractive intermediate and long-term interest rates, resulting in the customer obtaining a synthetic fixed ratefixed-rate loan. To economically hedge against the interest rate risks in the products offered to its customers, the Company enters into mirrored offsetting interest rate contracts with third-party financial institutions. The Company also enters into interest rate swap contracts with institutional counterparties to hedge against certificates of deposit issued. The fair value of the interest rate swaps is determined using the market standard methodology of netting the discounted future fixed cash payments (or receipts) and the discounted expected variable cash receipts (or payments). The fair value of the interest rate options, which consist of floors and caps, is determined using the market standard methodology of discounting the future expected cash receipts that would occur if variable interest rates fall below (rise above) the strike rate of the floors (caps). In addition, to comply with the provisions of ASC 820, Fair Value Measurement, the Company incorporates credit valuation adjustments to appropriately reflect both its own nonperformance risk and the respective counterparty’s nonperformance risk in the fair value measurements of its derivatives. The credit valuation adjustments associated with the Company’s derivatives utilize model-derived credit spreads, which are Level 3 inputs. As of June 30, 2019March 31, 2020 and December 31, 2018,2019, the Company has assessed the significance of the impact of the credit valuation adjustments on the overall valuation of these interest rate contracts and has determined that the credit valuation adjustments arewere not significant to the overall valuation of its derivative portfolios. As a result, the Company classifies these derivative instruments as Level 2 due to the observable nature of the significant inputs utilized.

Foreign Exchange Contracts — The Company enters into foreign exchange contracts to accommodate the business needs of its customers. For a majority of the foreign exchange contracts entered into with its customers, the Company entered into offsetting foreign exchange contracts with third-party financial institutions to manage its exposure. The Company also utilizes foreign exchange contracts that are not designated as hedging instruments to mitigate the economic effect of fluctuations in certain foreign currency on-balance sheet assets and liabilities, primarily foreign currency denominated deposits that it offers to its customers. The fair value is determined at each reporting period based on changes in the foreign exchange rates. These are over-the-counter contracts where quoted market prices are not readily available. Valuation is measured using conventional valuation methodologies with observable market data. Due to the short-term nature of the majority of these contracts, the counterparties’ credit risks are considered nominal and result in no adjustments to the valuation of the foreign exchange contracts. Due to the observable nature of the inputs used in deriving the fair value of these contracts, the valuation of foreign exchange contracts are classified as Level 2. TheAs of March 31, 2020 and December 31, 2019, the Company held foreign currency non-deliverable forward contracts as of June 30, 2019 and held foreign swap contracts as of December 31, 2018 to hedge its net investment in its China subsidiary, East West Bank (China) Limited, a non-U.S. dollar (“USD”) functional currency subsidiary in China. These foreign currency non-deliverable forward and swap contracts were designated as net investment hedges. The fair value of foreign currency contracts is valueddetermined by comparing the contracted foreign exchange rate to the current market foreign exchange rate. Key inputs of the current market exchange rate include spot rates and forward rates of the contractual currencies. Foreign exchange forward curves are used to determine which forward rate pertains to a specific maturity. Due to the observable nature of the inputs used in deriving the estimated fair value, these instruments are classified as Level 2.

Credit Contracts — The Company may periodically enter into credit risk participation agreements (“RPAs”) to manage the credit exposure on interest rate contracts associated with the syndicated loans. The Company may enter into protection sold or protection purchased RPAs with institutional counterparties. The fair value of RPAs is calculated by determining the total expected asset or liability exposure of the derivatives to the borrowers and applying the borrowers’ credit spread to that exposure. Total expected exposure incorporates both the current and potential future exposure of the derivatives, derived from using observable inputs, such as yield curves and volatilities. The majority of the inputs used to value the RPAs are observable. Accordingly, RPAs fall within Level 2.

Equity Contracts — TheAs part of the loan origination process, from time to time, the Company obtains equity warrants to purchase preferred andand/or common stock of technology and life sciences companies as part of the loan origination process.it provides loans to. As of June 30, 2019March 31, 2020 and December 31, 2018,2019, the warrants included on the Consolidated Financial Statements were from both public and private companies. The Company values these warrants based on the Black-Scholes option pricing model. For equity warrants from public companies, the model uses the underlying stock price, stated strike price, warrant expiration date, risk-free interest rate based on a duration-matched U.S. Treasury rate and market-observable company-specific option volatility as inputs to value the warrants. Due to the observable nature of the inputs used in deriving the estimated fair value, warrants from public companies are classified as Level 2. For warrants from private companies, the model uses inputs such as the offering price observed in the most recent round of funding, stated strike price, warrant expiration date, risk-free interest rate based on duration-matched U.S. Treasury rate and option volatility. The Company applies proxy volatilities based on the industry sectors of the private companies. The model values are then adjusted for a general lack of liquidity due to the private nature of the underlying companies. Due to the unobservable nature of the option volatility and liquidity discount assumptions used in deriving the estimated fair value, warrants from private companies are classified as Level 3. Since both option volatility and liquidity discount assumptions are subject to managementmanagement’s judgment, measurement uncertainty is inherent in the valuation of private companies’ equity warrants. Given that the Company holds long positions in all equity warrants, an increase in volatility assumption would generally result in an increase in fair value measurement.value. A higher liquidity discount would result in a decrease in fair value measurement.value. On a quarterly basis, the changes in the fair value of warrants from private companies are reviewed for reasonableness, and a measurement uncertainty analysis on the option volatility and liquidity discount assumptions is performed.