UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 10-Q

_____________________

|

|

|

| (Mark One) |

|

☑

| þQUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Quarterly Period Ended SeptemberJune 30, 20172021

or

|

|

|

☐

| ¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

| OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ___________ to ___________ |

|

Commission File Number: 000-29959

_______________

Pain Therapeutics,Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

| Delaware | 91-1911336 |

|

(State or other jurisdiction of

| (Stateorotherjurisdictionof | (I.R.S.Employer |

|

incorporation or organization)

| incorporationororganization) | IdentificationNumber) |

|

7801 N. Capital of Texas Highway, Suite 260, Austin, TX 78731

(512) 501-2444

(Address, including zip code, of registrant'sregistrant’s principal executive offices and

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

0 |

|

|

|

|

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, $0.001 par value |

| SAVA |

| NASDAQ Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☑þ No☐¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☑þ No☐¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smalla smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

| Large accelerated filer ☐Accelerated Filer ¨ | Accelerated filer ☐Filer ¨ |

| Non-accelerated filer ☐Filer þ | Smaller reporting company ☑Reporting Company þ |

|

| Emerging growth company ☐Growth Company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act .☐Act.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐¨ No☑þ

Indicate the number of shares outstanding of each of the issuer's issuer’s classes of common stock, as of the latest practicable date.

|

|

|

|

|

|

|

|

| Common Stock, $0.001 par value | 6,595,50940,014,695

|

|

|

| Shares Outstanding as of October 27, 2017August 2, 2021 |

|

PAIN THERAPEUTICS,CASSAVA SCIENCES, INC.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

| | | | |

|

|

|

|

|

|

| | | | |

|

|

|

|

|

|

PAIN THERAPEUTICS, INC. | |

CASSAVA SCIENCES, INC. | | CASSAVA SCIENCES, INC. |

| | | | |

|

|

|

|

|

|

BALANCE SHEETS | |

(in thousands, except share and per share data) | |

CONDENSED BALANCE SHEETS | | CONDENSED BALANCE SHEETS |

(Unaudited, in thousands, except share and par value data) | | (Unaudited, in thousands, except share and par value data) |

| | | | |

|

| September 30, | December 31, |

|

|

| 2017 | 2016 | June 30, 2021 |

|

| December 31, 2020 |

|

| | | | |

|

|

|

|

|

|

ASSETS | ASSETS | ASSETS |

Current assets: | | | | |

|

|

|

|

|

|

Cash and cash equivalents | $ | 11,916 | $ | 16,615 | $ | 278,254 |

| $ | 93,506 |

|

Marketable securities | | — | | 2,099 | |

Other current assets | | 288 | | 356 | |

Prepaid expenses and other current assets | |

| 1,304 |

|

| 488 |

|

Total current assets | | 12,204 | | 19,070 |

| 279,558 |

|

| 93,994 |

|

Operating lease right-of-use assets | |

| 252 |

|

| 295 |

|

Property and equipment, net | | 173 | | 232 |

| 75 |

|

| 11 |

|

Other assets | |

| 1,420 |

|

| — |

|

Total assets | $ | 12,377 | $ | 19,302 | $ | 281,305 |

| $ | 94,300 |

|

| | | | |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY | LIABILITIES AND STOCKHOLDERS' EQUITY | LIABILITIES AND STOCKHOLDERS' EQUITY |

Current liabilities: | | | | |

|

|

|

|

|

|

Accounts payable | $ | 712 | $ | 303 | $ | 1,912 |

| $ | 911 |

|

Accrued development expense | | — | | 27 |

| 2,462 |

|

| 719 |

|

Accrued compensation and benefits | | 298 | | 335 |

| 120 |

|

| 83 |

|

Operating lease liabilities, current | |

| 93 |

|

| 58 |

|

Other current liabilities | |

| 50 |

|

| 94 |

|

Total current liabilities | | 1,010 | | 665 |

| 4,637 |

|

| 1,865 |

|

Noncurrent liabilities | | — | | — | |

Operating lease liabilities, non-current | |

| 188 |

|

| 235 |

|

Total liabilities | | 1,010 | | 665 |

| 4,825 |

|

| 2,100 |

|

Commitments and contingencies | | | | | |

Commitments and contingencies (Notes 6 and 8) | |

| |

|

| |

|

Stockholders' equity: | | | | |

|

|

|

|

|

|

Preferred stock | | — | | — | |

Common stock | | 7 | | 7 | |

Preferred stock, $0.001 par value; 10,000,000 shares authorized, NaN issued and outstanding | |

| — |

|

| — |

|

Common stock, $0.001 par value; 120,000,000 shares authorized; 40,011,894 and 35,237,987 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively | |

| 40 |

|

| 35 |

|

Additional paid-in capital | | 166,342 | | 164,118 |

| 460,012 |

|

| 267,086 |

|

Accumulated other comprehensive income | | — | | — | |

Accumulated deficit | | (154,982) | | (145,488) |

| (183,572) |

|

| (174,921) |

|

Total stockholders' equity | | 11,367 | | 18,637 |

| 276,480 |

|

| 92,200 |

|

Total liabilities and stockholders' equity | $ | 12,377 | $ | 19,302 | $ | 281,305 |

| $ | 94,300 |

|

| | | | |

|

|

|

|

|

|

See accompanying notes to condensed financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASSAVA SCIENCES, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED STATEMENTS OF OPERATIONS |

(Unaudited, in thousands, except per share data) |

|

|

| Three months ended |

| Six months ended |

|

| June 30, |

| June 30, |

|

| 2021 |

| 2020 |

| 2021 |

| 2020 |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net of grant reimbursement |

| $ | 3,901 |

| $ | 591 |

| $ | 6,430 |

| $ | 1,135 |

General and administrative |

|

| 1,237 |

|

| 818 |

|

| 2,241 |

|

| 1,596 |

Gain on sale of property and equipment |

|

| — |

|

| (246) |

|

| — |

|

| (346) |

Total operating expenses |

|

| 5,138 |

|

| 1,163 |

|

| 8,671 |

|

| 2,385 |

Operating loss |

|

| (5,138) |

|

| (1,163) |

|

| (8,671) |

|

| (2,385) |

Interest income |

|

| 13 |

|

| 27 |

|

| 20 |

|

| 99 |

Net loss |

| $ | (5,125) |

| $ | (1,136) |

| $ | (8,651) |

| $ | (2,286) |

Net loss per share, basic and diluted |

| $ | (0.13) |

| $ | (0.05) |

| $ | (0.22) |

| $ | (0.09) |

Shares used in computing net loss per share, basic and diluted |

|

| 39,953 |

|

| 24,779 |

|

| 38,843 |

|

| 24,630 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | |

| | | | | | | | | | | |

PAIN THERAPEUTICS, INC. |

| | | | | | | | | | | |

STATEMENTS OF OPERATIONS |

(in thousands, except per share data) |

| | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2017 | | 2016 | | 2017 | | 2016 |

Operating expenses: | | | | | | | | | | | |

Research and development | $ | 1,619 | | $ | 2,657 | | $ | 6,071 | | $ | 7,841 |

General and administrative | | 977 | | | 884 | | | 3,455 | | | 4,573 |

Total operating expenses | | 2,596 | | | 3,541 | | | 9,526 | | | 12,414 |

Operating loss | | (2,596) | | | (3,541) | | | (9,526) | | | (12,414) |

Interest income | | 6 | | | 23 | | | 33 | | | 86 |

Net loss | $ | (2,590) | | $ | (3,518) | | $ | (9,493) | | $ | (12,328) |

Net loss per share, basic and diluted | $ | (0.40) | | $ | (0.54) | | $ | (1.45) | | $ | (1.89) |

Shares used in computing net loss per share, basic and diluted | | 6,538 | | | 6,535 | | | 6,537 | | | 6,515 |

| | | | | | | | | | | |

See accompanying notes to condensed financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

CASSAVA SCIENCES, INC. |

|

|

|

|

|

|

CONDENSED STATEMENTS OF CASH FLOWS |

(Unaudited, in thousands) |

|

|

|

|

|

|

|

|

| Six months ended June 30, |

| 2021 |

| 2020 |

Cash flows from operating activities: |

|

|

|

|

|

Net loss | $ | (8,651) |

| $ | (2,286) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

Stock-based compensation |

| 665 |

|

| 522 |

Depreciation and amortization |

| 9 |

|

| 20 |

Gain on sale of property and equipment |

| — |

|

| (346) |

Changes in operating assets and liabilities: |

|

|

|

|

|

Prepaid and other assets |

| (2,236) |

|

| 82 |

Operating lease right-of-use assets and liabilities |

| 31 |

|

| — |

Accounts payable |

| 1,001 |

|

| (37) |

Accrued development expense |

| 1,743 |

|

| (22) |

Accrued compensation and benefits |

| 37 |

|

| 26 |

Other current liabilities |

| (44) |

|

| 5 |

Net cash used in operating activities |

| (7,445) |

|

| (2,036) |

Cash flows from investing activities: |

|

|

|

|

|

Purchase of property and equipment |

| (73) |

|

| — |

Proceeds from sale of property and equipment |

| — |

|

| 360 |

Net cash (used in) provided by investing activities |

| (73) |

|

| 360 |

Cash flows from financing activities: |

|

|

|

|

|

Proceeds from exercise of stock options |

| 1,749 |

|

| — |

Proceeds from exercise of common stock warrants |

| 692 |

|

| 3,849 |

Proceeds from registered direct offering, net of issuance costs |

| 189,825 |

|

| — |

Net cash provided by financing activities |

| 192,266 |

|

| 3,849 |

Net increase in cash and cash equivalents |

| 184,748 |

|

| 2,173 |

Cash and cash equivalents at beginning of period |

| 93,506 |

|

| 23,081 |

Cash and cash equivalents at end of period | $ | 278,254 |

| $ | 25,254 |

|

|

|

|

|

|

| | | | | | | | | | | | |

| | | | | | | | | | | | |

PAIN THERAPEUTICS, INC. |

| | | | | | | | | | | | |

STATEMENTS OF COMPREHENSIVE INCOME (LOSS) |

(in thousands) |

| | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

Net loss | | $ | (2,590) | | $ | (3,518) | | $ | (9,493) | | $ | (12,328) |

Other comprehensive income (loss): | | | | | | | | | | | | |

Net unrealized gains (losses) on marketable securities | | | — | | | 1 | | | — | | | 1 |

Comprehensive loss | | $ | (2,590) | | $ | (3,517) | | $ | (9,493) | | $ | (12,327) |

| | | | | | | | | | | | |

See accompanying notes to condensed financial statements.

Cassava Sciences, Inc.

| | | | | |

| | | | | |

PAIN THERAPEUTICS, INC. |

| | | | | |

STATEMENTS OF CASH FLOWS |

(in thousands) |

| | | | | |

| Nine months ended |

| September 30, |

| 2017 | | 2016 |

Cash flows from operating activities: | | | | | |

Net loss | $ | (9,493) | | $ | (12,328) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

Non-cash stock-based compensation | | 2,223 | | | 3,489 |

Depreciation and amortization | | 51 | | | 41 |

Non-cash net interest income | | (2) | | | (3) |

Changes in operating assets and liabilities: | | | | | |

Other current assets | | 68 | | | (18) |

Accounts payable | | 417 | | | 49 |

Accrued development expense | | (27) | | | (150) |

Accrued compensation and benefits | | (37) | | | (283) |

Net cash used in operating activities | | (6,800) | | | (9,203) |

Cash flows from investing activities: | | | | | |

Purchases of property and equipment | | — | | | (76) |

Purchases of marketable securities | | (399) | | | (2,046) |

Sales of marketable securities | | 400 | | | — |

Maturities of marketable securities | | 2,100 | | | 1,500 |

Net cash provided (used in) investing activities | | 2,101 | | | (622) |

Cash flows from financing activities: | | | | | |

Cash used for statutory taxes for net exercise of Performance Awards | | — | | | (214) |

Deferred financing costs | | — | | | (46) |

Net cash used in financing activities | | — | | | (260) |

Net decrease in cash and cash equivalents | | (4,699) | | | (10,085) |

Cash and cash equivalents at beginning of period | | 16,615 | | | 31,299 |

Cash and cash equivalents at end of period | $ | 11,916 | | $ | 21,214 |

| | | | | |

See accompanying notes to condensed financial statements.

PAIN THERAPEUTICS, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 1. General and Liquidity

Pain Therapeutics,Cassava Sciences, Inc. (the “Company”) discovers and develops proprietary drugspharmaceutical product candidates that may offer significant improvements to patients and healthcare professionals. WeThe Company generally focus our drugfocuses its discovery and product development efforts on disorders of the nervous system.

In the course of our development activities, we have sustained cumulative operating losses. There are no assurances that additional financing will be available on favorable terms, or at all.

We have prepared theThe accompanying unaudited condensed financial statements of Pain Therapeutics, Inc.the Company have been prepared in accordance with accounting principles generally accepted accounting principlesin the United States (“GAAP”) for interim financial information and pursuant to the instructions to the Quarterly Report on Form 10-Q and Article 10 of Regulation S-X. Accordingly, the condensed financial statements do not include all of the information and footnotes required by generally accepted accounting principlesGAAP for complete financial statements. In ourthe opinion of management of the Company, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation have been included. Operating results for the three and ninesix months ended SeptemberJune 30, 20172021 are not necessarily indicative of the results that may be expected for any other interim period or for the year 20172021. For further information, refer to the consolidated financial statements and footnotes thereto included in our annual reportthe Company’s Annual Report on Form 10-K for the year ended December 31, 2016. 2020.

On November 16, 2016, we receivedCoronavirus Disease 2019 (COVID-19)

The widespread outbreak of a letter fromnovel infectious disease called Coronavirus Disease 2019, or COVID-19, has not significantly impacted the Listing Qualifications staffCompany’s operations or financial condition as of Nasdaq (the “Staff”) notifying us that, forAugust 4, 2021. However, this pandemic has created a dynamic and uncertain situation in the previousnational economy. The Company continues to closely monitor the latest information to make timely, informed business decisions and public disclosures regarding the potential impact of pandemic on its operations and financial condition. The scope of pandemic is unprecedented and its long-term impact on the Company’s operations and financial condition cannot be reasonably estimated at this time.

Liquidity

The Company has incurred significant net losses and negative cash flows since inception, and as a result has an accumulated deficit of $183.6 million at June 30, consecutive business days,2021. The Company expects its cash requirements to be significant in the bid price for our common stock had closed below the minimum $1.00 per share requirement (the “Minimum Price Requirement”) under NASDAQ’s Listing Rule 5450(a)(1) for continued listing onfuture. The Nasdaq Global Market. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), if during the 180 calendar days following the date of the notification, or prior to May 15, 2017, the closing bid price of our common stock is at or above $1.00 for a minimum of 10 consecutive business days, the Staff will provide us with written confirmation of compliance. On May 24, 2017, we received a letter from the Staff indicating that we had regained compliance with the $1.00 minimum closing bid requirement following completion of the reverse stock split described below.

On May 4, 2017, following stockholder approval, our board of directors approved a reverse stock split ratio of 7-for-1. On May 4, 2017, we filed with the Secretary of State of the State of Delaware a Certificate of Amendmentamount and timing of the Company’s Amendedfuture cash requirements will depend on regulatory and Restated Certificatemarket acceptance of Incorporationits product candidates and the resources it devotes to effectresearching and developing, formulating, manufacturing, commercializing and supporting its products. The Company may seek additional funding through public or private financing in the 7-for-1 reverse stock split of our outstanding shares of common stock. The number of outstanding shares of common stockfuture, if such funding is available and on terms acceptable to the date ofCompany. There are no assurances that additional financing will be available on favorable terms, or at all. However, management believes that the reverse split was reduced from 46.1 millioncurrent working capital position will be sufficient to 6.6 million shares. Our common stock began trading onmeet the NASDAQ Global Market on a split-adjusted basis whenCompany’s working capital needs for at least the market opened for trading on May 10, 2017. As a result, all common stock share amounts included in these condensed consolidated financial statements have been retroactively reduced by a factor of seven, and all common stock per share amounts have been increased by a factor of seven, with the exception of our common stock par value.next 12 months.

We have evaluated subsequent events through the date of filing this Form 10-Q.

Note 2. Significant Accounting Policies

Use of Estimates

We makeThe Company makes estimates and assumptions in preparing ourits condensed financial statements in conformity with accounting principles generally accepted in the United States of America.GAAP. These estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed financial statements and the reported amount of revenue earned and expenses incurred during the reporting period. The Company evaluates its estimates on an ongoing basis, including those estimates related to manufacturing agreements and research collaborations. Actual results could differ from these estimates and assumptions.

Cash and Cash Equivalents Marketable Securities and Concentration of Credit Risk

We investThe Company invests in cash equivalents and marketable securities. We consider highly-liquidcash equivalents. The Company considers highly liquid financial instruments with original maturities of three months or less to be cash equivalents. Our marketable securitiesHighly liquid investments that are considered

cash equivalents include interest-bearing financial instruments, generally consistingmoney market accounts and funds, certificates of corporate or governmentdeposits, and U.S. Treasury securities.

Our investment policy allows for investments in marketable securities with active secondary or resale markets, establishes diversification The Company maintains its cash and credit quality requirements and limits investments by maturity and issuer. We maintain our investmentscash equivalents at one financial institution.

A changeFair Value Measurements

The Company recognizes financial instruments in prevailing interest rates may causeaccordance with the authoritative guidance on fair value measurements and disclosures for financial assets and liabilities. This guidance defines fair value, establishes a framework for measuring fair value in accordance with GAAP, and expands disclosures about fair value measurements. The guidance also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include:

Level 1 includes quoted prices in active markets.

Level 2 includes significant observable inputs, such as quoted prices for identical or similar securities, or other inputs that are observable and can be corroborated by observable market data for similar securities. The Company uses market pricing and other observable market inputs obtained from third-party providers. It uses the bid price to establish fair value where a bid price is available. The Company does not have any financial instruments where the fair value of the investment to fluctuate. We don’t recognize an impairment charge related to this type of fluctuation because the fluctuation is temporary and eliminatedbased on Level 2 inputs.

Level 3 includes unobservable inputs that are supported by the time an investment matures. We would recognize an impairment charge if and when we determine that a decline inlittle or no market activity. The Company does not have any financial instruments where the fair value belowis based on Level 3 inputs.

If a financial instrument uses inputs that fall in different levels of the amortized costhierarchy, the instrument will be categorized based upon the lowest level of an investmentinput that is other-than-temporary. We consider various factors in determining whethersignificant to recognize an impairment charge, including any adverse changes in the investees’ financial condition, how long the fair value has been below the amortized costcalculation. The fair value of cash and whether it is more likely than not that we would elect to or be required to sell the marketable security before its anticipated recovery.

We may elect to sell marketable securities before they mature. We hold these investments as “available for sale” and include these investments in our Balance Sheets as current assets, even though the contractual maturity of a particular investment may be beyond one year.

Fair Value Measurements

We report our cash equivalents and marketable securities at fair value aswas based on Level 1 Level 2 or Level 3 using the following inputs:inputs at June 30, 2021 and December 31, 2020.

| ·

| | Level 1 includes quoted prices in active markets. We base the fair value of money market funds and U.S. treasury securities on Level 1 inputs.

|

| ·

| | Level 2 includes significant observable inputs, such as quoted prices for identical or similar investments, or other inputs that are observable and can be corroborated by observable market data for similar securities. We use market pricing and other observable market inputs obtained from third-party providers. We use the bid price to establish fair value where a bid price is available. We base the fair value of our marketable securities on Level 2 inputs.

|

| ·

| | Level 3 includes unobservable inputs that are supported by little or no market activity. We do not have any investments where the fair value is based on Level 3 inputs.

|

We include unrealized gains or losses on our investments as Accumulated other comprehensive loss in the Stockholders’ equity section of our Balance Sheets. We include changes in net unrealized gains or losses in our Statements of Comprehensive Income. We would recognize significant realized gains and losses on a specific identification basis as other income in our Statements of Operations.

Proceeds from Grants

During the ninethree months ended SeptemberJune 30, 20172021 and 2016, we2020, the Company received reimbursements totaling $0.9 million and $1.3$1.1 million respectively, pursuant to a grant from the National Institutes of Health or(“NIH”) research grants, respectively. During the six months ended June 30, 2021 and 2020, the Company received reimbursements totaling $1.5 million and $2.4 million pursuant to NIH that we recordedresearch grants, respectively. The Company records the proceeds from these grants as a reductionreductions to ourits research and development expenses.

Non-cash Stock-based Compensation

We recognizeThe Company recognizes non-cash expense for the fair value of all stock options and other share-based awards. We useThe Company uses the Black-Scholes option valuation model (“Black-Scholes”) to calculate the fair value of stock options, using the single-option award approach and straight-line attribution method. For all options granted, to employees and directors, we recognizeit recognizes the resulting fair value as expense on a straight-line basis over the vesting period of each respective stock option, generally four years. For options granted to non-employees, we remeasure the fair value expense using Black-Scholes each reporting period.

We haveThe Company has granted share-based awards that vest upon achievement of certain performance criteria or (“Performance Awards. We multiplyAwards”). The Company multiplies the number of Performance Awards by the fair market value of ourits common stock on the date of grant to calculate the fair value of each award. We estimateIt estimates an implicit service period for achieving performance criteria for each award. We recognizeThe Company recognizes the resulting fair value as expense over the implicit service period when we concludeit concludes that achieving the performance criteria is probable. WeIt periodically reviewreviews and updateupdates as appropriate ourits estimates of implicit service periods and conclusions on achieving the performance criteria. Performance Awards vest and common stock is issued upon achievement of the performance criteria.

Net Loss per Share

We computeThe Company computes basic net loss per share on the basis of the weighted-average number of common shares outstanding for the reporting period. We compute dilutedDiluted net loss per share is computed on the basis of the weighted-average number of common shares outstanding plus potential dilutive common shares outstanding using the treasury-stock method. Potential dilutive common shares consist of outstanding common stock options.options and warrants. There is no difference between the Company’s net loss and comprehensive loss.

We includeThe Company included the following in the calculation of basic and diluted net loss per share (in thousands, except per share data):

| | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

| | Three months ended | | Nine months ended | |

| Three months ended |

| Six months ended |

| | September 30, | | September 30, | |

| June 30, |

| June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | |

| 2021 |

| 2020 |

| 2021 |

| 2020 |

Numerator: | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss | | $ | (2,590) | | $ | (3,518) | | $ | (9,493) | | $ | (12,328) | |

| $ | (5,125) |

| $ | (1,136) |

| $ | (8,651) |

| $ | (2,286) |

Denominator: | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing net loss per share, basic and diluted | | | 6,538 | | | 6,535 | | | 6,537 | | | 6,515 | |

|

| 39,953 |

|

| 24,779 |

|

| 38,843 |

|

| 24,630 |

Net loss per share, basic and diluted | | $ | (0.40) | | $ | (0.54) | | $ | (1.45) | | $ | (1.89) | |

| $ | (0.13) |

| $ | (0.05) |

| $ | (0.22) |

| $ | (0.09) |

Dilutive common shares excluded from net loss per share, diluted | | | 2,436 | | | 2,432 | | | 2,414 | | | 2,565 | | |

| | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

Dilutive common stock options excluded from net loss per share, diluted | |

|

| 2,129 |

|

| 2,294 |

|

| 2,163 |

|

| 2,177 |

Common stock warrants excluded from net loss per share, diluted | |

|

| — |

|

| 1,427 |

|

| — |

|

| 1,427 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

WeThe Company excluded common stock options and warrants outstanding from the calculation of net loss per share, diluted, because the effect of including options and warrants outstanding would have been anti-dilutive.

Income TaxesFair Value of Financial Instruments

Financial instruments include accounts payable and accrued liabilities. The estimated fair value of certain financial instruments may be determined using available market information or other appropriate valuation methodologies. However, considerable judgment is required in interpreting market data to develop estimates of fair value; therefore, the estimates are not necessarily indicative of the amounts that could be realized or would be paid in a current market exchange. The effect of using different market assumptions and/or estimation methodologies may be material to the estimated fair value amounts. The carrying amounts of accounts payable and accrued liabilities are at cost, which approximates fair value due to the short maturity of those instruments.

We make

Research Contract Costs and Accruals

The Company has entered into various research and development contracts with research institutions and other third-party vendors. These agreements are generally cancelable, and related payments are recorded as research and development expenses as incurred. The Company records accruals for estimated ongoing research costs. When evaluating the adequacy of the accrued liabilities, the Company analyzes progress of the studies including the phase or completion of events, invoices received and contracted costs. Significant judgments and estimates and judgmentsare made in determining the needaccrued balances at the end of any reporting period. Actual results could differ from the Company’s estimates. The Company’s historical accrual estimates have not been materially different from actual costs.

Incentive Bonus Plan

In 2020, the Company established the 2020 Cash Incentive Bonus Plan (the “Plan”) to incentivize Plan participants. Awards under the Plan are accounted for as liability awards under Accounting Standards Codification (ASC) 718 “Stock-based Compensation”. The fair value of each potential Plan award will be determined once a provisiongrant date occurs and will be remeasured each reporting period. Compensation expense associated with the Plan will be recognized over the expected achievement period for each Plan award, when a Performance Condition is considered probable of being met. See Note 8 for further discussion of the Plan.

Leases

The Company recognizes assets and liabilities that arise from leases. For operating leases, the Company is required to recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments during the lease term, in the condensed balance sheets. The Company elected the short-term lease recognition exemption for all leases that qualify. This means, for those leases that qualify, the Company does not recognize right-of-use assets or lease liabilities. As the Company`s leases do not provide an implicit rate, it uses its incremental borrowing rate based on the information available at the commencement date in determining the present value of lease payments. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

Income Taxes

The Company accounts for income taxes includingunder the estimationasset and liability method. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of our taxable income or loss for each full fiscal year.

We haveexisting assets and liabilities and their respective tax bases. Deferred tax balances are adjusted to reflect tax rates based on currently enacted tax laws, which will be in effect in the years in which the temporary differences are expected to reverse. The Company has accumulated significant deferred tax assets that reflect the tax effects of net operating loss and tax credit carryovers and temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Realization of certain deferred tax assets is dependent upon future earnings. We areThe Company is uncertain about the timing and amount of any future earnings. Accordingly, we offsetthe Company offsets these deferred tax assets with a valuation allowance.

We mayThe Company accounts for uncertain tax positions in accordance with ASC 740, “Income Taxes”, which clarifies the accounting for uncertainty in tax positions. These provisions require recognition of the impact of a tax position in the future determineCompany’s condensed financial statements only if that certain deferredposition is more likely than not of being sustained upon examination by taxing authorities, based on the technical merits of the position. Any interest and penalties related to uncertain tax assetspositions will likely be realized, in which case we will reduce our valuation allowance in the period in which such determination is made. If the valuation allowance is reduced, we may recognizereflected as a benefit fromcomponent of income taxes in our Statement of Operations in that period.tax expense.

We classify interest recognized pursuant to our deferred tax assets as interest expense, when appropriate.

Note 3. Cash, Cash EquivalentsPrepaid and Marketable SecuritiesOther Assets

Prepaid and Assets Measuredother assets at Fair Value

Our cash, cash equivalents and marketable securities at SeptemberJune 30, 20172021 and December 31, 2016 were as follows2020 consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Cash, Cash Equivalents and Marketable Securities |

| Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Estimated Fair Value | | Accrued Interest | | Total Value |

September 30, 2017 | | | | | | | | | | | | | | | | | |

Cash | $ | 451 | | $ | — | | $ | — | | $ | 451 | | $ | — | | $ | 451 |

Cash equivalents | | 11,465 | | | — | | | — | | | 11,465 | | | — | | | 11,465 |

Commercial paper | | — | | | — | | | — | | | — | | | — | | | — |

| $ | 11,916 | | $ | — | | $ | — | | $ | 11,916 | | $ | — | | $ | 11,916 |

Reported as: | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | $ | 11,916 | | | — | | | — | | $ | 11,916 | | $ | — | | $ | 11,916 |

Marketable securities | | — | | | — | | | — | | | — | | | — | | | — |

| $ | 11,916 | | $ | — | | $ | — | | $ | 11,916 | | $ | — | | $ | 11,916 |

Maturities: | | | | | | | | | | | | | | | | | |

Matures in one year or less | $ | 11,916 | | $ | — | | $ | — | | $ | 11,916 | | $ | — | | $ | 11,916 |

Matures one to three years | | — | | | — | | | — | | | — | | �� | — | | | — |

| $ | 11,916 | | $ | — | | $ | — | | $ | 11,916 | | $ | — | | $ | 11,916 |

| | | | | | | | | | | | | | | | | |

December 31, 2016 | | | | | | | | | | | | | | | | | |

Cash | $ | 1,434 | | $ | — | | $ | — | | $ | 1,434 | | $ | — | | $ | 1,434 |

Cash equivalents | | 12,783 | | | — | | | — | | | 12,783 | | | — | | | 12,783 |

Commercial paper | | 4,497 | | | — | | | — | | | 4,497 | | | — | | | 4,497 |

| $ | 18,714 | | $ | — | | $ | — | | $ | 18,714 | | $ | — | | $ | 18,714 |

Reported as: | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | $ | 16,615 | | | — | | | — | | $ | 16,615 | | $ | — | | $ | 16,615 |

Marketable securities | | 2,099 | | | — | | | — | | | 2,099 | | | — | | | 2,099 |

| $ | 18,714 | | $ | — | | $ | — | | $ | 18,714 | | $ | — | | $ | 18,714 |

Maturities: | | | | | | | | | | | | | | | | | |

Matures in one year or less | $ | 18,714 | | $ | — | | $ | — | | $ | 18,714 | | $ | — | | $ | 18,714 |

Matures one to three years | | — | | | — | | | — | | | — | | | — | | | — |

| $ | 18,714 | | $ | — | | $ | — | | $ | 18,714 | | $ | — | | $ | 18,714 |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

| June 30, 2021 |

| December 31, 2020 |

Prepaid insurance | $ | — |

| $ | 457 |

Contract research organization deposit |

| 1,166 |

|

| — |

Other |

| 138 |

|

| 31 |

Total prepaid expenses and other current assets | $ | 1,304 |

| $ | 488 |

|

|

|

|

|

|

Contract research organization deposit | $ | 1,420 |

| $ | — |

Total other assets | $ | 1,420 |

| $ | — |

|

|

|

|

|

|

We did not realize any material gains or losses on our investments in marketable securities during the nine months ended September 30, 2017 and 2016. To date we have not recorded any impairment charges on marketable securities related to other-than-temporary declines in market value.

Our assets measured at fair value on a recurring basis are as follows (in thousands):

| | | | | | | | | | | |

| | | | | | | | | | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

September 30, 2017 | | | | | | | | | | | |

Cash and cash equivalents | $ | 11,916 | | $ | — | | $ | — | | $ | 11,916 |

Commercial paper | | — | | | — | | | ��— | | | — |

| $ | 11,916 | | $ | — | | $ | — | | $ | 11,916 |

December 31, 2016 | | | | | | | | | | | |

Cash and cash equivalents | $ | 14,217 | | $ | — | | $ | — | | $ | 14,217 |

Commercial paper | | — | | | 4,497 | | | — | | | 4,497 |

| $ | 14,217 | | $ | 4,497 | | $ | — | | $ | 18,714 |

| | | | | | | | | | | |

The transfers between Level 1 and Level 2 during the nine months ended September 30, 2017 was primarily due to the sale of the marketable securities.

Note 4. Stockholders’ Equity and Stock-Based Compensation Expense

Stockholders’ equity activity in 2017Equity Activity during the Six Months Ended June 30, 2021 and 2020

During the ninesix months ended SeptemberJune 30, 2017, our2021 and 2020, the Company’s common stock outstanding and stockholders’ equity

(in thousands) changed as follows:

| | | | |

| Common Stock | | Stockholders' equity

(in thousands) |

Balance at December 31, 2016 | 6,591,705 | | $ | 18,637 |

Non-cash stock-related compensation for: | | | | |

Stock options for employees | — | | | 2,212 |

Stock options for non-employees | — | | | 11 |

Issuance of common stock pursuant to 7 for 1 Reverse Stock Split | 3,804 | | | — |

Net loss | — | | | (9,493) |

Balance at September 30, 2017 | 6,595,509 | | $ | 11,367 |

| | | | |

|

|

|

|

|

| Common Stock |

| Stockholders' equity

(in thousands) |

Balance at December 31, 2019 | 21,841,810 |

| $ | 22,099 |

Stock-based compensation for: |

|

|

|

|

Stock options for employees | — |

|

| 261 |

Stock options for non-employees | — |

|

| 9 |

Proceeds from exercise of common stock warrants | 2,888,092 |

|

| 3,613 |

Net loss | — |

|

| (1,150) |

Balance at March 31, 2020 | 24,729,902 |

| $ | 24,832 |

|

|

|

|

|

Stock-based compensation for: |

|

|

|

|

Stock options for employees | — |

|

| 249 |

Stock options for non-employees | — |

|

| 3 |

Proceeds from exercise of common stock warrants | 189,431 |

|

| 236 |

Net loss | — |

|

| (1,136) |

Balance at June 30, 2020 | 24,919,333 |

| $ | 24,184 |

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2020 | 35,237,987 |

| $ | 92,200 |

Stock-based compensation for: |

|

|

|

|

Stock options for employees | — |

|

| 249 |

Stock options for non-employees | — |

|

| 1 |

Proceeds from exercise of common stock warrants | 554,019 |

|

| 692 |

Exercise of stock options | 135,015 |

|

| 1,746 |

Proceeds from registered direct offering of common stock | 4,081,633 |

|

| 189,825 |

Net loss | — |

|

| (3,526) |

Balance at March 31, 2021 | 40,008,654 |

| $ | 281,187 |

|

|

|

|

|

Stock-based compensation for: |

|

|

|

|

Stock options for employees | — |

|

| 410 |

Stock options for non-employees | — |

|

| 5 |

Exercise of stock options | 3,240 |

|

| 3 |

Net loss | — |

|

| (5,125) |

Balance at June 30, 2021 | 40,011,894 |

| $ | 276,480 |

|

|

|

|

|

2021 Registered Direct Offering

On February 12, 2021, the Company completed a common stock offering pursuant to which certain investors purchased 4,081,633 shares of common stock at a price of $49.00 per share. Net proceeds of the offering were approximately $189.8 million after deducting offering expenses.

At-the-Market Common Stock optionOffering

In March 2020, the Company established an at-the-market offering program (“ATM”) to sell, from time to time, shares of Company common stock having an aggregate offering price of up to $100 million in transactions pursuant to a shelf registration statement that was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on May 5, 2020. The Company is obligated to pay a commission of 3.0% of the gross proceeds from the sale of shares of common stock in the offering. The Company is not obligated to sell any shares in the offering.

There were 0 common stock sales under the ATM during the three and six months ended June 30, 2021 and 2020.

Common Stock Warrants

In August 2018, the Company issued warrants to purchase up to an aggregate of 9.1 million shares of its common stock in conjunction with an offering of its common stock.

The Company did 0t receive any proceeds from exercise of common stock warrants during the three months ended June 30, 2021. During the three months ended June 30, 2020, the Company received proceeds of $0.2 million from the exercise of 0.2 million shares pursuant to warrants.

During the six months ended June 30, 2021, the Company received proceeds of $0.7 million from the exercise of 0.6 million shares pursuant to warrants. During the six months ended June 30, 2020, the Company received proceeds of $3.8 million from the exercise of 3.1 million shares pursuant to warrants.

There were 0 remaining common stock warrants outstanding as of June 30, 2021.

Stock Option and Performance Award activityActivity in 20172021

During the ninesix months ended SeptemberJune 30, 2017,2021, stock options and unvested Performance Awards outstanding under our 2008 Equity Incentive Planthe Company’s stock option plans changed as follows:

| | | | | |

| | | | | |

| | Stock Options | | | Performance Awards |

Outstanding as of December 31, 2016 | | 2,435,249 | | | 222,060 |

Granted | | 653,210 | | | — |

Vested Performance Awards | | — | | | — |

Forfeited/expired | | (417,059) | | | (14,723) |

Outstanding as of September 30, 2017 | | 2,671,400 | | | 207,337 |

| | | | | |

|

| Stock Options |

|

| Performance Awards |

Outstanding as of December 31, 2020 |

| 2,817,504 |

|

| 138,055 |

Options granted |

| 85,000 |

|

| — |

Options exercised |

| (234,994) |

|

| — |

Options forfeited/canceled |

| (9,338) |

|

| — |

Outstanding as of June 30, 2021 |

| 2,658,172 |

|

| 138,055 |

|

|

|

|

|

|

The weighted average exercise price of options outstanding at SeptemberJune 30, 20172021 was $18.92.$11.40. As outstanding options vest over the current remaining vesting period of 3.22.2years, we expectthe Company expects to recognize non-cashstock-based compensation expense of $5.2$6.7 million. If and when outstanding Performance Awards vest, we wouldthe Company will recognize non-cashstock-based compensation expense of $4.4$2.3 million over the implicit service period.

During the three months ended June 30, 2021, there were 71,596 stock options exercised. Of the stock options exercised, 68,356 stock options were net settled in satisfaction of the exercise price, with 0 cash proceeds received. Cash proceeds to the Company totaled $3,000 during the three months ended June 30, 2021.

During the six months ended June 30, 2021, there were 234,994 stock options exercised. Of the stock options exercised, 98,739 stock options were net settled in satisfaction of the exercise price, with 0 cash proceeds received. Cash proceeds to the Company totaled $1,749,000 during the six months ended June 30, 2021.

There were 0 stock options exercised during the three and six months ended June 30, 2020.

Subsequent to June 30, 2021, there were 2,801 stock options exercised for cash proceeds of $57,000.

Stock-based Compensation Expense in 20172021

During the three and ninesix months ended SeptemberJune 30, 20172021 and 2016, our non-cash stock-related2020, the Company’s stock-based compensation expenses wereexpense was as follows (in thousands):

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

Research and development | | | | | | | | | | | | |

Vesting of stock options | | $ | 286 | | $ | 318 | | $ | 887 | | $ | 997 |

Vesting of Performance Awards | | | — | | | — | | | — | | | 430 |

| | | 286 | | | 318 | | | 887 | | | 1,427 |

General and administrative | | | | | | | | | | | | |

Vesting of stock options | | | 402 | | | 527 | | | 1,336 | | | 1,658�� |

Vesting of Performance Awards | | | — | | | — | | | — | | | 404 |

| | | 402 | | | 527 | | | 1,336 | | | 2,062 |

Total non-cash stock-based compensation expenses | | | | | | | | | | | | |

Vesting of stock options | | | 688 | | | 845 | | | 2,223 | | | 2,655 |

Vesting of Performance Awards | | | — | | | — | | | — | | | 834 |

| | $ | 688 | | $ | 845 | | $ | 2,223 | | $ | 3,489 |

| | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three months ended |

| Six months ended |

|

|

| June 30, |

| June 30, |

|

|

| 2021 |

| 2020 |

| 2021 |

| 2020 |

|

Research and development |

| $ | 295 |

| $ | 111 |

| $ | 415 |

| $ | 226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

| 120 |

|

| 141 |

|

| 250 |

|

| 296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stock-based compensation expense |

| $ | 415 |

| $ | 252 |

| $ | 665 |

| $ | 522 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital on Demand Sales Agreement2018 Equity Incentive Plan

In December 2015, we entered intoJanuary 2018, the Company’s Board of Directors (the “Board”) approved the Company’s 2018 Omnibus Incentive Plan (the “2018 Plan”). The Board or a Capital on Demand™ Sales Agreementdesignated committee of the Board is responsible for administration of the 2018 Plan and determines the terms and conditions of each option granted, consistent with JonesTrading Institutional Services, or the ATM Agreement, relatingterms of the 2018 Plan. The Company’s employees, directors, and consultants are eligible to receive awards under the offering2018 Plan, including grants of stock options and Performance Awards. Share-based awards generally expire 10 years from the date of grant. The 2018 Plan provides for issuance of up to 10.0 million1,000,000 shares of our Common Stockcommon stock, par value $0.001 per share, subject to adjustment as provided in “at the market” offerings. We did not issue any2018 Plan.

When stock options or Performance Awards are exercised net of the exercise price and taxes, the number of shares underof stock issued is reduced by the ATM Agreement duringnumber of shares equal to the nine monthsamount of 2017 or 2016. In March 2017,taxes owed by the ATM Agreement expiredaward recipient and was not renewed.that number of shares are cancelled. The Company then uses its cash to pay tax authorities the amount of statutory taxes owed by and on behalf of the award recipient.

Note 5. Income Taxes

WeThe Company did not provide for income taxes during the three and ninesix months ended SeptemberJune 30, 20172021, because we haveit has projected a net loss for the full year 2017.2021 for which any benefit will be offset by an increase in the valuation allowance. There was also 0 provision for income taxes for the three and six months ended June 30, 2020.

Note 6. Commitments

We conduct ourRight-of-use Asset and Liability

The Company has a non-cancelable operating lease for approximately 6,000 square feet of office space in Austin, Texas that expires on April 30, 2024. The Company also has a short-term lease agreement for an additional 3,600 square feet of office space in Austin, Texas that expires on April 30, 2022. Future lease payments as of June 30, 2021 are as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

Future lease payments |

| 2021 | 2022 | 2023 | 2024 | Total future lease payments | Less: imputed interest |

| Total |

Operating leases | $ | 50 | 102 | 107 | 36 | 295 | (14) | $ | 281 |

Short-term operating lease | $ | 32 | 21 | — | — | 53 | — | $ | 53 |

Rent expense for the three months ended June 30, 2021 and 2020 totaled $34,000 and $25,000, respectively.

Rent expense for the six months ended June 30, 2021 and 2020 totaled $57,000 and $50,000, respectively.

Cash paid for operating lease liabilities during the three months ended June 30, 2021 and 2020 totaled $27,000 and $25,000, respectively. Cash paid for operating lease liabilities during the six months ended June 30, 2021 and 2020 totaled $27,000 and $50,000, respectively.

Other Commitments

The Company conducts its product research and development programs through a combination of internal and collaborative programs that include, among others, arrangements with universities, contract research organizations and clinical research sites. We haveThe Company has contractual arrangements with these organizations that are cancelable. OurThe Company’s obligations under these contracts are largely based on services performed. The Company also had non-cancellable commitments for the manufacture of simufilam totaling approximately $1.9 million at June 30, 2021.

We have a non-cancelable operating lease for approximately 6,000 square feet of office space in Austin, Texas that expires in December 2017. Minimum lease payments are as follows (in thousands):

| | | | | |

| | | | | |

| 2017 | | Total |

Minimum lease payments | $ | 148 | | $ | 148 |

| | | | | |

Note 7. Sale of Property and Equipment

There were no sales of property and equipment during the three and six months ended June 30, 2021.

During the three months ended June 30, 2020, the Company sold surplus manufacturing equipment to a third party and received proceeds totaling $260,000. During the six months ended June 30, 2020, the Company sold surplus manufacturing equipment to a third party and received proceeds totaling $360,000. The original cost of the property and equipment was $892,000 and accumulated depreciation was $878,000, resulting a gain on sale of property and equipment of $246,000 and $346,000, respectively, during the three and six months ended June 30, 2020.

Note 8. 2020 Cash Incentive Bonus Plan

On August 26, 2020, the Board approved the Plan. The Plan was established to promote the long-term success of the Company by creating an “at-risk” cash bonus program that rewards Plan participants with additional cash compensation in lockstep with significant increases in the Company’s market capitalization. The Plan is considered “at-risk” because Plan participants will not receive a cash bonus unless the Company’s market capitalization increases significantly and certain other conditions specified in the Plan are met. Specifically, Plan participants will not be paid any cash bonuses unless (1) the Company completes a merger or acquisition transaction that constitutes a sale of ownership of the Company or its assets (a Merger Transaction) or (2) the Compensation Committee of the Board (the Compensation Committee) determines the Company has sufficient cash on hand, as defined in the Plan. Because of the inherent discretion and uncertainty regarding these requirements, the Company has concluded that a Plan grant date has not occurred as of June 30, 2021.

Plan participants will be paid all earned cash bonuses in the event of a Merger Transaction.

The Company’s market capitalization for purposes of the Plan is determined based on either (1) the Company’s closing price of one share on the Nasdaq Capital Market multiplied by the total issued and outstanding shares and options to purchase shares of the Company, or (2) the aggregate consideration payable to security holders of the Company in a Merger Transaction. This constitutes a market condition under applicable accounting guidance.

The Plan triggers a potential cash bonus each time the Company’s market capitalization increases significantly, up to a maximum $5 billion in market capitalization. The Plan specifies 14 incremental amounts between $200 million and $5 billion (each increment, a “Valuation Milestone”). Each Valuation Milestone triggers a potential cash bonus award in a pre-set amount defined in the Plan. Each Valuation Milestone must be achieved and maintained for no less than 20 consecutive trading days for Plan participants to be eligible for a potential cash bonus award. Approximately 58% of each cash bonus award associated with a Valuation Milestone is subject to adjustment and approval by the Compensation Committee. Any amounts not awarded by the Compensation Committee are no longer available for distribution.

If the Company were to exceed a $5 billion market capitalization for no less than 20 consecutive trading days, all Valuation Milestones would be deemed achieved, in which case cash bonus awards would range from a minimum of $139.1 million up to a hypothetical maximum of $322.3 million. Payment of cash bonuses is deferred until such time as (1) the Company completes a Merger Transaction, or (2) the Compensation Committee determines the Company has sufficient cash on hand to render payment (each, a “Performance Condition”), neither of which may ever occur. Accordingly, there can be no assurance that Plan participants will ever be paid a cash bonus that is awarded under the Plan, even if the Company’s market capitalization increases significantly.

The Plan is accounted for as a liability award. The fair value of each Valuation Milestone award will be determined once a grant date occurs and will be remeasured each reporting period. Compensation expense associated with the Plan will be recognized over the expected achievement period for each of the 14 Valuation Milestones, when a Performance Condition is considered probable of being met.

On October 13, 2020, the Company achieved the first Valuation Milestone. Subsequently, the Compensation Committee approved a potential cash bonus award of $7.3 million in total for all Plan participants, subject to future satisfaction of a Performance Condition.

During the six months ended June 30, 2021, the Company achieved 10 Valuation Milestones triggering potential Company obligations to all Plan participants from a minimum of $81.0 million up to a hypothetical maximum of $195.0 million, to be determined by the Compensation Committee. However, 0 compensation expense has been recorded since no grant date has occurred and no Performance Conditions are considered probable of being met. There is no continuing service requirement for Plan participants once the Compensation Committee approves a cash bonus award.

Subsequent to June 30, 2021, the Company achieved one additional Valuation Milestone triggering potential Company obligations to all Plan participants from a minimum of $12.7 million up to a hypothetical maximum of $30.0 million, to be determined by the Compensation Committee and contingent upon future satisfaction of a Performance Condition.

NaN actual cash payments were authorized or made to participants under the Plan through June 30, 2021.

Note 9. Recently Issued Accounting Pronouncements

We reviewed recentlyIn December 2019, the FASB issued Accounting Standards Update (“ASU”) No. 2019-12, Income Taxes (Topic 740) Simplifying Accounting for Income Taxes, as part of its initiative to reduce complexity in the accounting pronouncementsstandards. The guidance amended certain disclosure requirements that had become redundant, outdated or superseded. Additionally, this guidance amends accounting for the interim period effects of changes in tax laws or rates, and have adopted or plan to adopt those that are applicable to us. We do not expectsimplifies aspects of the accounting for franchise taxes. The guidance is effective for annual periods beginning after December 15, 2020, including interim periods therein. The adoption of these pronouncements toASU 2019-12 in the first quarter of 2021 did not have a material impact on ourthe Company’s condensed financial position, resultsstatements.

Note 10. Subsequent Event

On August 4, 2021, the Company completed the purchase of a two-building office complex in Austin, Texas, which will serve as its new corporate headquarters. This property is intended to accommodate the Company’s anticipated significant growth and expansion of its operations orin the coming years. Company management expects to be hands-off with regards to property management. Maintenance, physical facilities, leasing, property management and other key responsibilities around property ownership will all be assumed by professional real-estate managers under long-term contract with the Company. The property purchase price was $21.9 million, exclusive of closing costs, funded with cash flows. on hand. The office complex measures approximately 90,000 rentable square feet. The property is currently 59% leased, before the effect of the Company occupying approximately 25% of the property in the near future. The seller is an independent third party not affiliated with the Company.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion and analysis should be read in conjunction with ourCassava Sciences, Inc.’s (the “Company,”, “we,” “us,” or “our”) condensed financial statements and accompanying notes included elsewhere in this quarterly report.Quarterly Report on Form 10-Q. Operating results are not necessarily indicative of results that may occur in future periods.

This quarterly reportQuarterly Report on Form 10-Q contains certain statements that are considered forward-looking statements within the meaning of the Private Securities Reform Act of 1995. We intend that such statements be protected by the safe harbor created thereby. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Forward-looking statements involve risks and uncertainties and our actual results and the timing of events may differ significantly from the results discussed in the forward-looking statements. Examples of such forward-looking statements include, but are not limited to statements about:

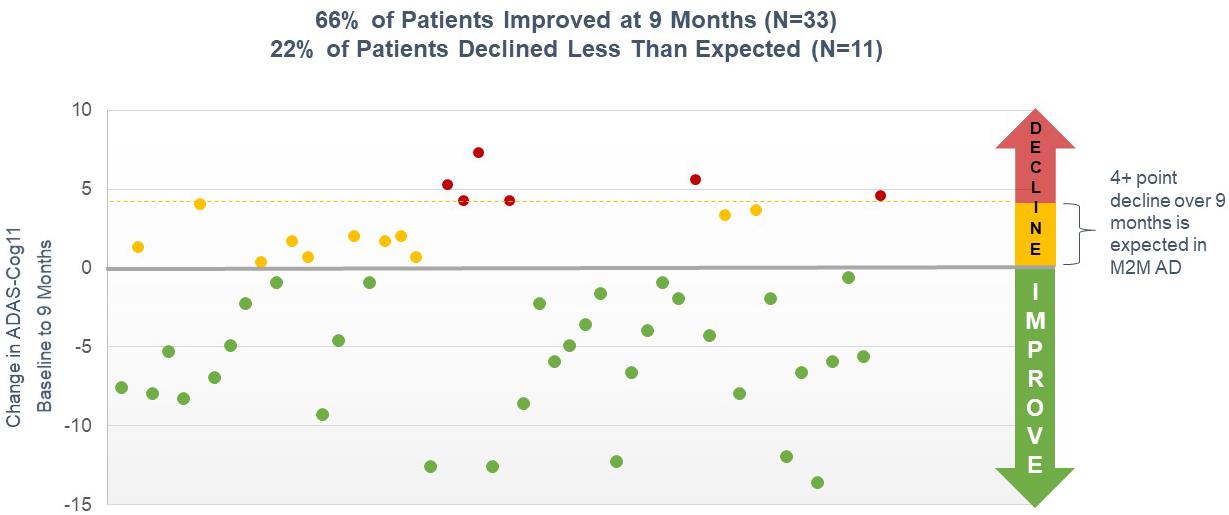

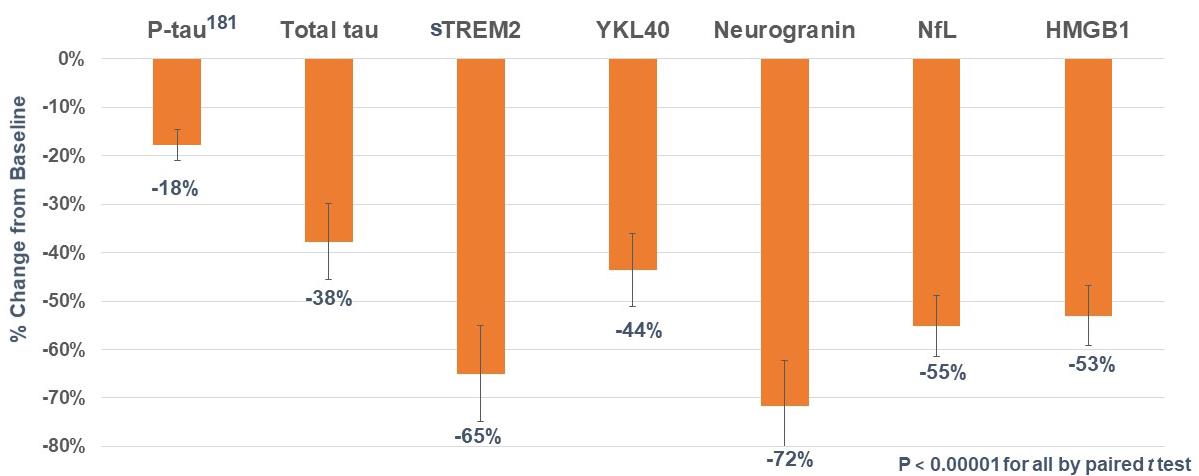

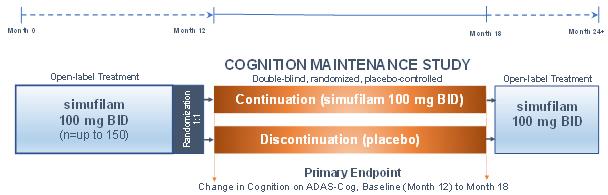

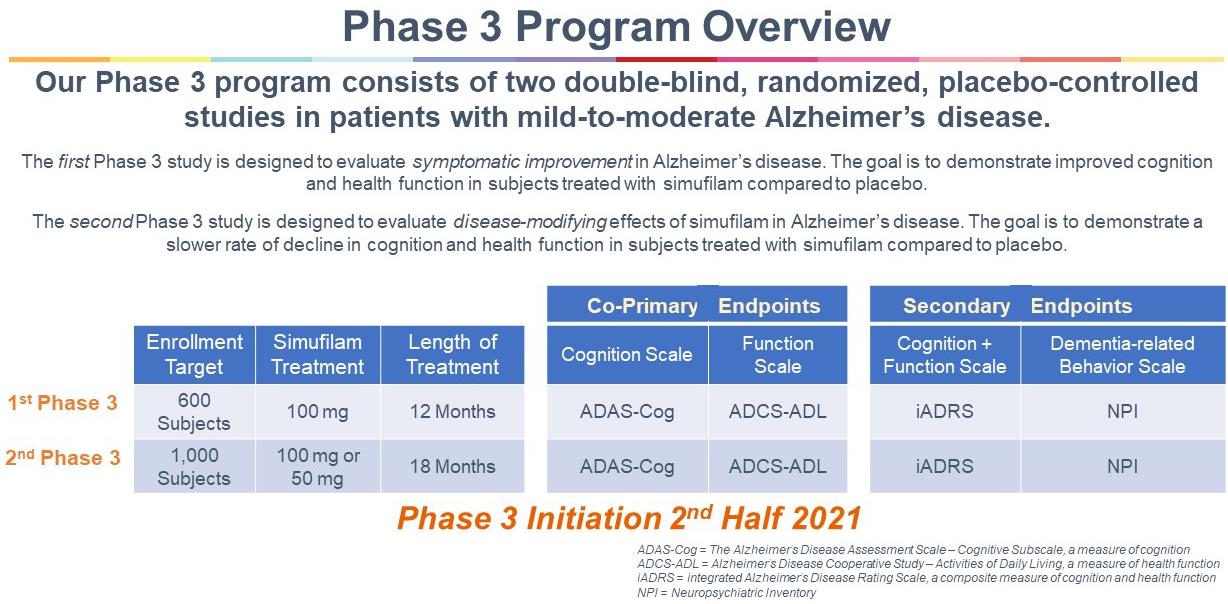

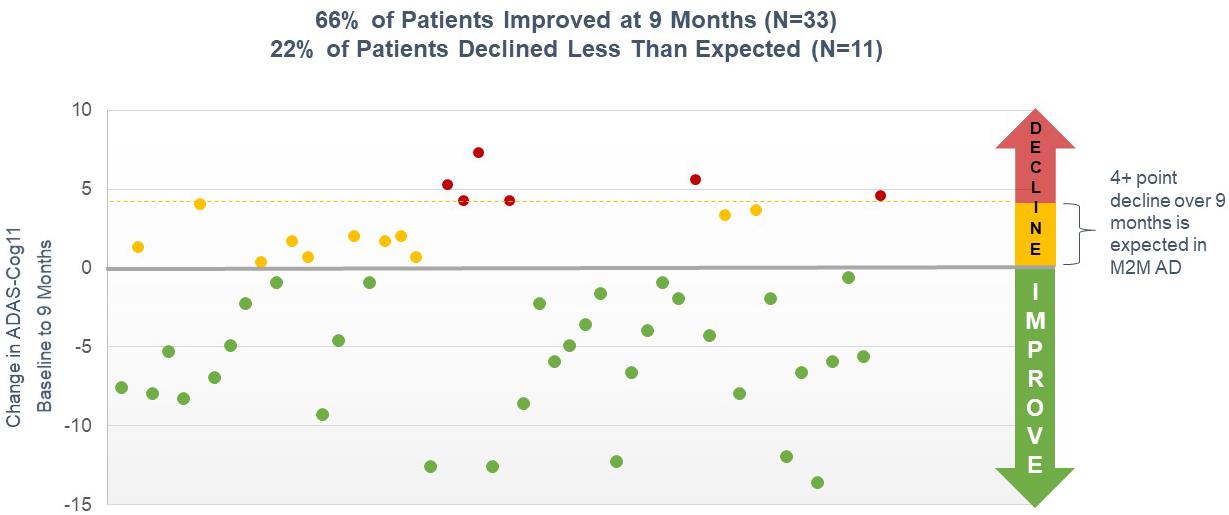

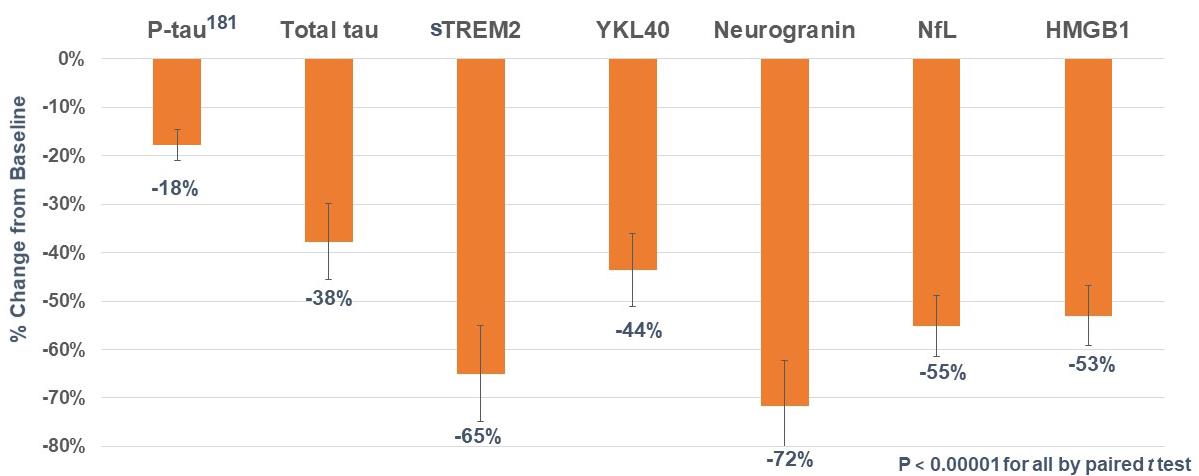

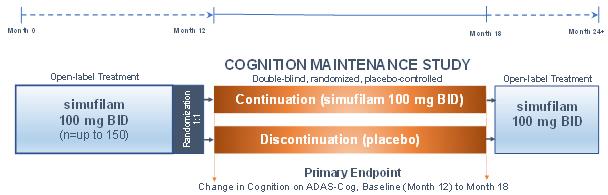

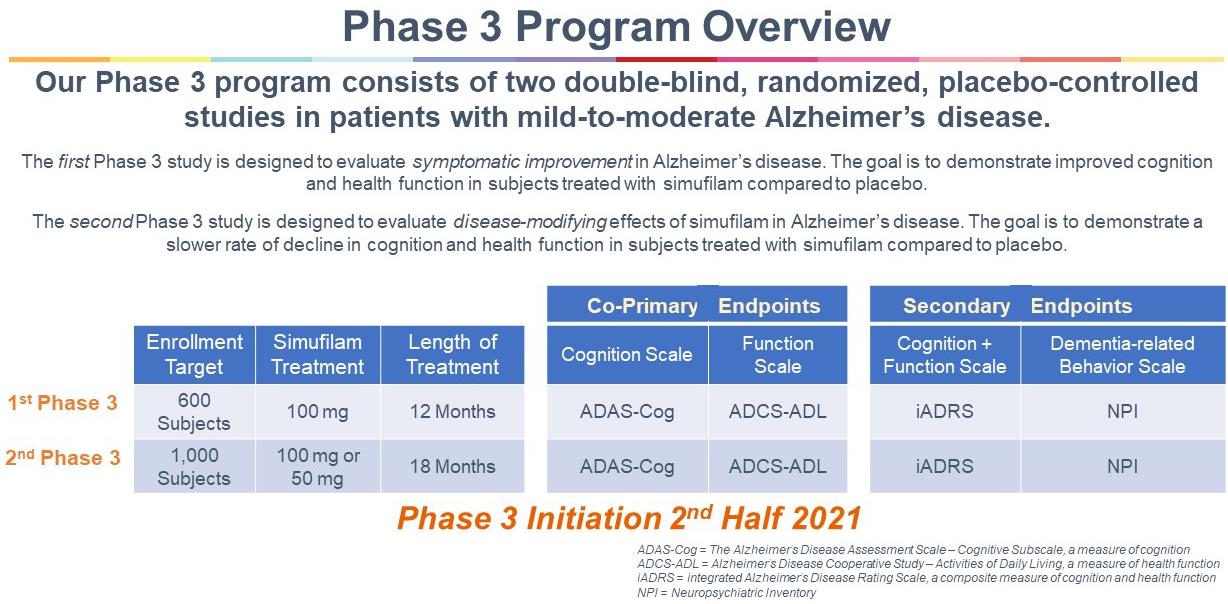

our intention to initiate a pivotal Phase 3 clinical program with simufilam in Alzheimer’s disease, the anticipated scope of Phase 3 studies and our estimated timeline for doing so; our reliance on third-party contractors to make drug supply on a large-scale for our Phase 3 clinical program, or their ability to do so on-time or on-budget; limitations around the interpretation of cognitive results from a long-term open-label study design, as compared to efficacy results from a fully completed, randomized controlled study design; the expected rate of cognitive decline over time in untreated Alzheimer’s patients; the ability of the Alzheimer's Disease Assessment Scale-Cognitive Subscale (ADAS-cog), Alzheimer’s Disease Cooperative Study – Activities of Daily Living (ADCS-ADL), Neuropsychiatric Inventory (NPI), CANTAB or other clinical scales to assess cognition or health in our trials of Alzheimer’s disease; announcements or plans regarding any future interim analyses of our open-label study of simufilam and our estimated timeline for doing so; any significant changes we have made, or anticipate making, to the design of an on-going open-label study of simufilam; announcements regarding an End-of-Phase 2 meeting with the U.S. Food and Drug Administration (FDA); our ability to initiate, conduct or analyze additional clinical and non-clinical studies with our product candidates targeted at Alzheimer’s disease and other neurodegenerative diseases; the interpretation of results from our Phase 2 clinical studies; our estimated timeline for publishing in a peer-reviewed technical journal clinical results of our Phase 2b study of simufilam; our plans to further develop SavaDx, our investigational blood-based diagnostic, and our estimated timeline for doing so; the safety, efficacy, or potential therapeutic benefits of our product candidates; | ·

| | actions and studies that are needed to potentially support obtaining approval of the New Drug Application, or NDA for REMOXY (oxycodone capsules CII) with label claims on routes of abuse, by the U.S. Food and Drug Administration, or FDA;

|

| ·

| | our plans to rely on third parties, including Durect Corporation, or Durect, Noramco, Inc., or Noramco, and Mallinckrodt, Inc., or Mallinckrodt, to supply us with excipients and active pharmaceutical ingredients and to manufacture REMOXY;

|

| ·

| | discussions with potential strategic partners for the development and commercialization of REMOXY;

|

| ·

| | expectations with regard to the data, materials and information provided to us by Pfizer Inc., or Pfizer, related to Pfizer’s development activities with respect to REMOXY;

|

| ·

| | the outcome of research and development activities, including, without limitation, development activities for FENROCK™ and potential formulation of additional dosage forms of our drug candidates;

|

| ·

| | the potential benefits of our drug candidates;

|

| ·

| | the utility of protection of our intellectual property;

|

| ·

| | expected future sources of revenue and capital and increasing cash needs;

|

| ·

| | potential competitors or competitive products;

|

| ·

| | market acceptance of our drug candidates and potential drug candidates;

|

| ·

| | expectations regarding trade secrets, technological innovations, licensing agreements and outsourcing of certain business functions;

|

| ·

| | expenses increasing, interest income decreasing or fluctuations in our operating results;

|

| ·

| | operating losses and anticipated operating and capital expenditures;

|

| ·

| | expected uses of capital resources;

|

| ·

| | expectations regarding the issuance of shares of common stock to employees pursuant to equity compensation awards net of employment taxes;

|

| ·

| | anticipated hiring and development of our internal systems and infrastructure;

|

| ·

| | the sufficiency of our current resources to fund our operations over the next twelve months; and

|

| ·

| | assumptions and estimates used for our disclosures regarding stock-based compensation.

|

the utility of protection, or the sufficiency, of our intellectual property;

our potential competitors or competitive products;

expected future sources of revenue and capital and increasing cash needs;

our use of Clinical Research Organizations (CROs) to conduct clinical studies of our product candidates;

expectations regarding trade secrets, technological innovations, licensing agreements and outsourcing of certain business functions;

our expenses increasing or fluctuations in our financial or operating results;

our operating losses and anticipated operating and capital expenditures;

expectations regarding the issuance of shares of common stock to employees pursuant to equity compensation awards, net of employment taxes;

the development and maintenance of our internal information systems and infrastructure;

our need to hire additional personnel and our ability to attract and retain such personnel;

existing regulations and regulatory developments in the United States and other jurisdictions;

our need to expand the size and scope of our physical facilities;

the sufficiency of our current resources to continue to fund our operations;

the accuracy of our estimates regarding expenses, capital requirements, and needs for additional financing;

assumptions and estimates used for our disclosures regarding stock-based compensation; and

the long-term impact of COVID-19, a novel coronavirus first detected in 2019, on our operations and financial condition.

Such forward-looking statements and our business involve risks and uncertainties, including, but not limited to those risks and uncertainties relating to:the following:

| ·

| | difficulties or delays in completing development activities needed to potentially obtain regulatory approval of the NDA for REMOXY, including the potential for requests by the FDA for additional data which may require an extended period of time to obtain and submit;

|

| ·

| | having or obtaining sufficient resources for the successful development and commercialization of REMOXY;

|

| ·

| | the quantity, quality or sufficiency of the data, materials and information transferred to us by Pfizer regarding the REMOXY development program;

|

| ·

| | continuing discussions with potential strategic partners for the development and commercialization of REMOXY;

|

| ·

| | the successful development of other drug candidates, independently as well as pursuant to our other collaboration agreements, and the continuation of such agreements;

|

| ·

| | difficulties or delays in development, testing, clinical trials (including patient enrollment), regulatory authorization or approval, production and commercialization of our drug candidates;

|

| ·

| | unexpected adverse side effects or inadequate therapeutic efficacy of our drug candidates that could slow or prevent product approval (including the risk that current and past results of clinical trials are not indicative of future results of clinical trials) or potential post-approval market acceptance;

|

| ·

| | the uncertainty of protection of our intellectual property rights or trade secrets;

|

| ·

| | potential infringement of the intellectual property rights of third parties;

|

| ·

| | pursuing in-license and acquisition opportunities;

|

| ·

| | maintenance or third party funding of our collaboration and license agreements;

|

| ·

| | legislation or regulatory actions affecting product pricing, reimbursement or access;

|

| ·

| | significant breakdown or interruption of our information technology and infrastructure;

|

| ·

| | significant issues that may arise related to outsourcing certain preclinical studies, clinical trials and formulation and manufacturing activities;

|

| ·

| | hiring and retaining personnel; and

|

| ·

| | our financial position and our ability to obtain additional financing if necessary.

|

In addition, such statementsWe are subject to the risks and uncertainties discussed in the "Risk Factors" sectionearly stages of clinical drug development and elsewherehave a limited operating history in this document.our business targeting Alzheimer’s disease and no products approved for commercial sale.

We have incurred significant net losses in each period since our inception and anticipate that we will continue to incur net losses for the foreseeable future.

Research and development of biopharmaceutical products is a highly uncertain undertaking and involves a substantial degree of risk and our business is heavily dependent on the successful development of our product candidates.

OverviewWe may need to obtain substantial additional financing to complete the development and any commercialization of our product candidates.

We may not be successful in our efforts to continue to develop product candidates or commercially successful products.

Pain Therapeutics, Inc. develops proprietary drugs that offer significant improvementsWe may not be successful in our efforts to patientsexpand indications for product candidates.

We are concentrating a substantial portion of our research and healthcare professionals. We generally focus our drug development efforts on disordersthe diagnosis and treatment of Alzheimer’s disease, an area of research that has recorded many clinical failures.

We may encounter substantial delays in our clinical trials or may not be able to conduct or complete our clinical trials on the timelines we expect, if at all.

Our clinical trials may fail to demonstrate evidence of the nervous system.

Our expertise consists of developing new drug candidatessafety and guiding these through various regulatory and development pathways in preparation for their eventual commercialization. By necessity, the conduct of drug development is complex, lengthy, expensive and risky. The FDA has not yet established the safety or efficacy of our drugproduct candidates, which would prevent, delay, or limit the scope of regulatory approval and the commercialization of our product candidates.

We may be unable to protect our intellectual property rights or trade secrets.

For over a decade, we have pioneered technology, tools and techniques that enableWe may be subject to third-party claims of intellectual property infringement.

We may not succeed in our maintenance or pursuit of licensing rights or third-party intellectual property necessary for the development of Abuse-Deterrent Formulations,our product candidates.

Enacted or ADFs. ADFsfuture legislation or regulatory actions may adversely affect our product pricing, or limit the reimbursement we may receive for our products.

A significant breakdown, security breach or interruption affecting our internal computer systems, or those used by our third-party research collaborators, may compromise the confidentiality of our financial or proprietary information, result in material disruptions of our products and operations and adversely affect our reputation.

We may be unsuccessful at hiring and retaining qualified personnel.

Adverse circumstances caused by disease epidemics or pandemics, such as Coronavirus Disease 2019, or COVID-19, a novel coronavirus first detected in 2019;

Please also refer to the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as such risk factors may be amended, updated or modified periodically in our reports filed with the U.S. Securities and Exchange Commission (the “SEC”) for further information on these and other risks affecting us.

We caution you not to place undue reliance on forward-looking statements because our future results may differ materially from those expressed or implied by them. We do not intend to update any forward-looking statement, whether written or oral, relating to the matters discussed in this Quarterly Report on Form 10-Q, except as required by law.

Our research programs in neurodegeneration benefit from longstanding scientific and financial support from the National Institutes of Health (“NIH”). The contents of this Quarterly Report on Form 10-Q are intendedsolely our responsibility and do not necessarily represent any official views of NIH.

Overview

Cassava Sciences, Inc. is a clinical-stage biotechnology company based in Austin, Tx. Our mission is to make opioid drugs difficult to abuse yet provide steady pain relief when used appropriately by patients. ADFs are intended to helpdetect and treat neurodegenerative diseases, such as Alzheimer’s disease. Our novel science is based on stabilizing – but not removing – a critical protein in the fight against prescription drug abuse.brain.