UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

X.

[X]QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended SeptemberJune 30, 20162017

OR

.

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 033-02783-S001-38015

Sigma Labs, Inc. |

(Exact name of registrant as specified in its charter) |

NEVADA |

| 27-1865814 |

(State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) |

3900 Paseo del Sol |

Santa Fe, NM 87507 |

(Address of principal executive offices) |

(505) 438-2576 |

(Registrant’s telephone number) |

(Former Name or Former Address, if Changed Since Last Report |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X. [X] No .[ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X. [X] No .[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

| Accelerated Filer |

| |

Non-accelerated filer (do not check if a smaller reporting company) |

|

| Smaller reporting company |

|

Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.[ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes .[ ] No X. [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of NovemberAugust 14, 2016,2017, the issuer had 6,267,5774,569,688 shares of common stock outstanding.

SIGMA LABS, INC.

For the quarter ended SeptemberJune 30, 20162017

FORM 10-Q

TABLE OF CONTENTS

PART I |

|

|

|

ITEM 1. FINANCIAL STATEMENTS | 3 |

|

|

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

|

|

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

|

|

ITEM 4. CONTROLS AND PROCEDURES |

|

|

|

PART II |

|

|

|

ITEM 1. LEGAL PROCEEDINGS |

|

|

|

ITEM 1A. RISK FACTORS |

|

|

|

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. |

|

|

|

ITEM 3. DEFAULTS UPON SENIOR SECURITIES |

|

|

|

ITEM 4. MINE SAFETY DISCLOSURES |

|

|

|

ITEM 5. OTHER INFORMATION |

|

|

|

ITEM 6. EXHIBITS |

|

|

|

SIGNATURES | 18 |

2

PART I

ITEM 1. FINANCIAL STATEMENTS.

Sigma Labs, Inc. | Sigma Labs, Inc. | Sigma Labs, Inc. | ||||||

Condensed Balance Sheets | Condensed Balance Sheets | Condensed Balance Sheets | ||||||

(Unaudited) | (Unaudited) | (Unaudited) | ||||||

|

|

|

|

|

|

|

|

|

|

| September 30, 2016 |

| December 31, 2015 |

|

|

|

|

|

|

|

|

|

| June 30, 2017 |

| December 31, 2016 |

|

|

|

|

| ||||

ASSETS |

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

| ||||

Current Assets: |

|

|

|

| ||||

Cash | $ | 137,702 | $ | 1,539,809 | $ | 3,384,499 | $ | 398,391 |

Accounts Receivable, net |

| 119,599 |

| 280,222 |

| 235,467 |

| 288,236 |

Note Receivable, net |

| 762,034 |

| - | ||||

Inventory |

| 84,659 |

| 20,129 |

| 227,827 |

| 187,241 |

Prepaid Assets |

| 34,097 |

| 38,687 |

| 37,176 |

| 36,056 |

Total Current Assets |

| 376,057 |

| 1,878,847 |

| 4,647,003 |

| 909,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Other Assets |

|

|

|

| ||||

Other Assets: |

|

|

|

| ||||

Property and Equipment, net |

| 609,782 |

| 714,754 |

| 491,188 |

| 564,933 |

Intangible Assets, net |

| 222,674 |

| 167,644 |

| 241,978 |

| 226,450 |

Investment in Joint Venture |

| 500 |

| 9,222 |

| 500 |

| 500 |

Prepaid Stock Compensation |

| 208,848 |

| 418,547 |

| 111,070 |

| 167,562 |

Total Other Assets |

| 1,041,804 |

| 1,310,167 |

| 844,736 |

| 959,445 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS | $ | 1,417,861 | $ | 3,189,014 | $ | 5,491,739 | $ | 1,869,369 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

| ||||

Current Liabilities: |

|

|

|

| ||||

Accounts Payable | $ | 143,217 | $ | 38,393 | $ | 137,605 | $ | 112,175 |

Notes Payable, net of original issue discount $30,297 at June 30, 2017 and net of original issue discount $69,703 and net of debt discount $358,280 at December 31, 2016 |

| 969,703 |

| 561,834 | ||||

Accrued Expenses |

| 96,322 |

| 71,523 |

| 165,336 |

| 125,116 |

Total Current Liabilities |

| 239,539 |

| 109,916 |

| 1,272,644 |

| 799,125 |

|

|

|

|

| ||||

Long-Term Liabilities |

|

|

|

| ||||

Derivative Liability |

| - |

| 93,206 | ||||

Total Long-Term Liability |

| - |

| 93,206 | ||||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

| 239,539 |

| 109,916 |

| 1,272,644 |

| 892,331 |

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

Preferred Stock, $0.001 par; 10,000,000 shares authorized; None issued and outstanding |

| - |

| - |

| - |

| - |

Common Stock, $0.001 par; 15,000,000 shares authorized; 6,267,577 and 6,239,073 issued and outstanding at September 30, 2016 and December 31, 2015, respectively |

| 6,268 |

| 6,239 | ||||

Common Stock, $0.001 par; 7,500,000 shares authorized; 4,570,199 and 3,133,789 issued and outstanding at June 30, 2017 and 2016, respectively |

| 4,570 |

| 3,135 | ||||

Additional Paid-In Capital |

| 10,668,007 |

| 10,636,979 |

| 15,908,185 |

| 10,734,857 |

Accumulated Deficit |

| (9,495,953) |

| (7,564,120) |

| (11,693,660) |

| (9,760,954) |

Total Stockholders' Equity |

| 1,178,322 |

| 3,079,098 |

| 4,219,095 |

| 977,038 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,417,861 | $ | 3,189,014 | $ | 5,491,739 | $ | 1,869,369 |

The accompanying notes are an integral part of these condensed financial statements.statements

3

Sigma Labs, Inc. | ||||||||

Condensed Statements of Operations | ||||||||

(Unaudited) | ||||||||

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| Six Months Ended | ||||

|

| June 30, 2017 |

| June 30, 2016 |

| June 30, 2017 |

| June 30, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues | $ | 290,553 | $ | 93,824 | $ | 440,756 | $ | 452,279 |

|

|

|

|

|

|

|

|

|

COST OF REVENUE |

| 111,412 |

| 30,904 |

| 185,946 |

| 138,485 |

|

| - |

|

|

|

|

|

|

GROSS PROFIT |

| 179,141 |

| 62,920 |

| 254,810 |

| 313,794 |

|

|

|

|

|

|

|

|

|

EXPENSES: |

|

|

|

|

|

|

|

|

Other General and Administration |

| 594,193 |

| 480,697 |

| 1,237,988 |

| 876,185 |

Payroll Expense |

| 300,661 |

| 252,895 |

| 677,282 |

| 468,484 |

Stock-Based Compensation |

| 166,773 |

| 59,362 |

| 306,405 |

| 130,913 |

Research and Development |

| 118,853 |

| 11,907 |

| 167,615 |

| 50,978 |

Total Expenses |

| 1,180,480 |

| 804,861 |

| 2,389,290 |

| 1,526,560 |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

Interest Income |

| 12,598 |

| 95 |

| 12,941 |

| 253 |

Other Income |

| - |

| - |

| 152,068 |

| - |

Other Income-Decrease in fair value of derivative liabilities |

| - |

| - |

| 93,206 |

| - |

Other Expense - Debt discount amortization |

| - |

| - |

| (56,441) |

| - |

Total Other Income |

| 12,598 |

| 95 |

| 201,774 |

| 253 |

|

| - |

|

|

|

|

|

|

LOSS BEFORE PROVISION FOR INCOME TAXES |

| (988,741) |

| (741,846) |

| (1,932,706) |

| (1,212,513) |

|

| - |

| - |

| - |

| - |

Provision for income Taxes |

| - |

| - |

| - |

| - |

|

| - |

| - |

| - |

| - |

Net Loss | $ | (988,741) | $ | (741,846) | $ | (1,932,706) | $ | (1,212,513) |

|

|

|

|

|

|

|

|

|

Net Loss per Common Share - Basic and Diluted | $ | (0.24) | $ | (0.24) | $ | (0.46) | $ | (0.38) |

|

|

|

|

|

|

|

|

|

Weighted Average Number of Shares |

|

|

|

|

|

|

|

|

Outstanding - Basic and Diluted |

| 4,570,199 |

| 3,117,851 |

| 4,207,116 |

| 3,117,851 |

Sigma Labs, Inc. | ||||||||

Condensed Statements of Operations | ||||||||

(Unaudited) | ||||||||

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| Nine Months Ended | ||||

|

| September 30, 2016 |

| September 30, 2015 |

| September 30, 2016 |

| September 30, 2015 |

|

|

|

|

|

|

|

|

|

INCOME |

|

|

|

|

|

|

|

|

Services | $ | 189,951 | $ | 266,566 | $ | 642,230 | $ | 648,515 |

Total Revenue |

| 189,951 |

| 266,566 |

| 642,230 |

| 648,515 |

|

|

|

|

|

|

|

|

|

COST OF SERVICE REVENUE |

| 69,259 |

| 25,250 |

| 207,744 |

| 138,379 |

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

| 120,693 |

| 241,316 |

| 434,486 |

| 510,136 |

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

Other General and Administration |

| 437,873 |

| 293,187 |

| 1,345,576 |

| 886,965 |

Payroll Expense |

| 259,011 |

| 191,399 |

| 727,494 |

| 338,533 |

Stock-Based Compensation |

| 105,630 |

| 221,500 |

| 236,554 |

| 478,500 |

Research and Development |

| 37,532 |

| 122,517 |

| 88,504 |

| 206,545 |

Total Expenses |

| 840,046 |

| 828,603 |

| 2,398,128 |

| 1,910,543 |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

Interest Income |

| 35 |

| 265 |

| 288 |

| 1,137 |

Other Income |

| - |

| - |

| 31,626 |

| - |

Loss on Investment in Joint Venture |

| (3) |

| (108) |

| (105) |

| (108) |

Total Other Income (Expense) |

| 32 |

| 157 |

| 31,809 |

| 1,029 |

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAXES |

| (719,320) |

| (587,130) |

| (1,931,833) |

| (1,399,378) |

|

|

|

|

|

|

|

|

|

Provision for income Taxes |

| - |

| - |

| - |

| - |

|

|

|

|

|

|

|

|

|

Net Loss | $ | (719,320) | $ | (587,130) | $ | (1,931,833) | $ | (1,399,378) |

|

|

|

|

|

|

|

|

|

Loss per Common Share - Basic and Diluted | $ | (0.11) | $ | (0.09) | $ | (0.31) | $ | (0.22) |

|

|

|

|

|

|

|

|

|

Weighted Average Number of Shares |

|

|

|

|

|

|

|

|

Outstanding - Basic and Diluted |

| 6,259,349 |

| 6,234,834 |

| 6,243,642 |

| 6,224,939 |

The accompanying notes are an integral part of these condensed financial statements.statements

4

Sigma Labs, Inc. | ||||

Condensed Statements of Cash Flows | ||||

(Unaudited) | ||||

|

|

|

|

|

|

| Six Months ended | ||

|

| 2017 |

| 2016 |

OPERATING ACTIVITIES |

|

|

|

|

Net Loss | $ | (1,932,706) | $ | (1,212,513) |

Adjustments to reconcile Net Income (Loss) to Net Cash used in operating activities: |

|

|

|

|

Noncash Expenses: |

|

|

|

|

Amortization |

| 6,526 |

| 5,764 |

Depreciation |

| 85,125 |

| 87,054 |

Stock Compensation |

| 307,445 |

| 130,913 |

Loss on Joint Venture |

| - |

| 103 |

Revaluation of derivative liability and debt discount related to notes payable |

| (93,206) |

| - |

Note payable original issue discount |

| 49,589 |

| - |

Note payable debt discount amortization |

| 56,441 |

| - |

Change in assets and liabilities: |

|

|

|

|

Accounts Receivable |

| 52,769 |

| 27,564 |

Inventory |

| (40,586) |

| (70,765) |

Prepaid Assets |

| (1,120) |

| 7,344 |

Accounts Payable |

| 25,430 |

| 63,974 |

Accrued Expenses |

| 40,220 |

| 46,006 |

NET CASH USED IN OPERATING ACTIVITIES |

| (1,444,073) |

| (914,556) |

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

Purchase of Furniture and Equipment |

| (11,380) |

| (25,430) |

Purchase of Intangible Assets |

| (22,054) |

| (46,835) |

Notes receivable |

| (762,034) |

| - |

NET CASH USED IN INVESTING ACTIVITIES |

| (795,468) |

| (72,265) |

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

Proceeds from issuance of common stock and warrants |

| 5,225,649 |

| - |

NET CASH PROVIDED BY FINANCING ACTIVITIES |

| 5,225,649 |

| - |

|

|

|

|

|

NET CASH DECREASE FOR PERIOD |

| 2,986,108 |

| (986,821) |

|

|

|

|

|

CASH AT BEGINNING OF PERIOD |

| 398,391 |

| 1,539,809 |

|

|

|

|

|

CASH AT END OF PERIOD | $ | 3,384,499 | $ | 552,988 |

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

Cash paid during the period for: |

|

|

|

|

Interest | $ | 50,418 | $ | - |

Income Taxes | $ | - | $ | - |

|

|

|

|

|

Supplemental Schedule of Noncash Investing and Financing Activities: |

|

|

|

|

Issuance of Common Stock for services | $ | 51,408 | $ | 44,998 |

Sigma Labs, Inc. and Subsidiaries | ||||

Condensed Statements of Cash Flows | ||||

(Unaudited) | ||||

|

|

|

|

|

|

| Nine Months Ended |

| Nine Months Ended |

|

| September 30, 2016 |

| September 30, 2015 |

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

|

Net Loss | $ | (1,931,833) | $ | (1,399,378) |

Adjustments to reconcile Net Income (Loss) to Net Cash provided (used) by operations: |

|

|

|

|

Noncash Expenses: |

|

|

|

|

Amortization |

| 6,526 |

| 1,731 |

Depreciation |

| 131,879 |

| 123,205 |

Stock Compensation |

| 240,756 |

| 478,500 |

Change in assets and liabilities: |

|

|

|

|

Accounts Receivable |

| 160,623 |

| (55,107) |

Allowance for Doubtful Accounts |

| - |

| (4,884) |

Inventory |

| (64,530) |

| (55,678) |

Prepaid Assets |

| 4,590 |

| 20,709 |

Accounts Payable |

| 104,824 |

| (227,508) |

Customer Deposits |

| - |

| 62,393 |

Accrued Expenses |

| 24,799 |

| 17,024 |

NET CASH USED BY OPERATING ACTIVITIES |

| (1,322,366) |

| (1,038,993) |

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

Purchase of Furniture and Equipment |

| (26,907) |

| (64,334) |

Purchase of Intangible Assets |

| (61,556) |

| (11,995) |

Investment in Joint Venture |

| 8,617 |

| (10,000) |

Loss on Investment in Joint Venture |

| 105 |

| 108 |

NET CASH USED BY INVESTING ACTIVITIES |

| (79,741) |

| (86,221) |

|

|

|

|

|

NET CASH DECREASE FOR PERIOD |

| (1,402,107) |

| (1,125,214) |

|

|

|

|

|

CASH AT BEGINNING OF PERIOD |

| 1,539,809 |

| 2,962,069 |

|

|

|

|

|

CASH AT END OF PERIOD | $ | 137,702 | $ | 1,836,855 |

|

|

|

|

|

Supplemental Disclosure for Cash Flow Information: |

|

|

|

|

Cash paid during the period for: |

|

|

|

|

Interest | $ | - | $ | - |

Income Taxes | $ | - | $ | - |

|

|

|

|

|

Supplemental Schedule of Noncash Investing and Financing Activities: |

|

|

|

|

|

|

|

|

|

Issuance of Common Stock for services | $ | 152,265 | $ | 225,189 |

The accompanying notes are an integral part of these condensed financial statements.statements

5

SIGMA LABS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

SeptemberJune 30, 20162017

NOTE 1 – Summary of Significant Accounting Policies

Nature of Business –On September 13, 2010 Sigma Labs, Inc., formerly named Framewaves, Inc., a Nevada corporation, acquired 100% of the shares of B6 Sigma, Inc. by exchanging 6.67 shares of Framewaves, Inc. restricted common stock for each issued and outstanding share of B6 Sigma, Inc. The acquisition has been accounted for as a “reverse purchase”merger” and, accordingly, the operations of Framewaves, Inc. prior to the date of acquisition have been eliminated. Unless otherwise indicated or the context otherwise requires, the term “B6 Sigma” refers to B6 Sigma, Inc., a Delaware corporation, which, until the short-form merger referenced below, was our wholly-owned, operating company acquired in September 2010; the terms the “Company,” “Sigma,” “we,” “us” and “our” refer to Sigma Labs, Inc., together with B6 Sigma, Inc. Prior to December 29, 2015, we conducted substantially all of our operations through B6 Sigma. On December 29, 2015, we completed a short-form merger of B6 Sigma into Sigma. As a result, B6 Sigma became part of Sigma and no longer exists as a subsidiary.

B6 Sigma, Inc., incorporated February 5, 2010, was founded by a group of scientists, engineers and businessmen to develop and commercialize novel and unique manufacturing and materials technologies. The Company believes that some of these technologies will fundamentally redefine conventional quality assurance and process control practices by embedding them into the manufacturing processes in real time, enabling process intervention and ultimately leading to closed loop process control. The Company anticipates that its core technologies will allow its clientele to combine advanced manufacturing quality assurance and process control protocols with novel materials to achieve breakthrough product potential in many industries including aerospace, and defense, manufacturing, oil and gas, bio-medical, and energy manufacturing, bio-medical manufacturing, automotive manufacturing, and other markets such as firearms and recreational equipment.power generation.

Basis of Presentation – The accompanying financial statements have been prepared by the Company in accordance with Article 8 of U.S. Securities and Exchange Commission Regulation S-X. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows at SeptemberJune 30, 20162017 and 20152016 and for the periods then ended have been made. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles have been condensed or omitted. The Company suggests these condensed financial statements be read in conjunction with the December 31, 20152016 audited financial statements and notes thereto included in the Company’s Form 10-K. The results of operations for the periods ended SeptemberJune 30, 20162017 and 20152016 are not necessarily indicative of the operating results for the full year.

Reclassification – Certain amounts in prior-period financial statements have been reclassified for comparative purposes to conform to presentation in the current-period financial statements.

Loss Per Share –The computation of loss per share is based on the weighted average number of shares outstanding during the period in accordance with ASC Topic No. 260, “Earnings Per Share.”

Recently Enacted Accounting Standards – The FASB established the Accounting Standards Codification (“Codification” or “ASC”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in accordance with generally accepted accounting principles in the United States (“GAAP”). Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) issued under authority of federal securities laws are also sources of GAAP for SEC registrants.

Recent Accounting Standards Updates (“ASU”) through ASU No. 2015-01 contain technical corrections to existing guidance or affects guidance to specialized industries or situations. The Company has evaluated recently issued technical pronouncements and has determined that these updates have no current applicability to the Company or their effect on the financial statements would not have been significant.

Accounting Estimates - The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities, the disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimated by management. Significant accounting estimates that may materially change in the near future are impairment of long-lived assets, values of stock compensation awards and stock equivalents granted as offering costs, and allowance for bad debts and inventory obsolescence.

6

NOTE 2 – Stockholders’ Equity

Common Stock

Effective March 17, 2016, our Amended and Restated Articles of Incorporation were amended pursuant to a Certificate of Change Pursuant to Nevada Revised Statutes 78.209 (the “Certificate of Change”) filed with the Nevada Secretary of State. The Certificate of Change provided for both a reverse stock split of the outstanding shares of our common stock on a 1-for-100 basis (the “Reverse Stock Split”), and a corresponding decrease in the number of shares of our common stock that we are authorized to issue (the “Share Decrease”).

As a result of the Reverse Stock Split, the number of issued and outstanding shares of our common stock on March 17, 2016 decreased from 622,969,835 pre-Reverse Stock Split shares to 6,229,710 post-Reverse Stock Split shares (after adjustment for any fractional shares). Pursuant to the Share Decrease, the number of authorized shares of our common stock decreased from 750,000,000 to 7,500,000 shares of common stock. All amounts shown for common stock included in these financial statements are presented post-Reverse Stock Split.

On April 28, 2016, the Company's Amended and Restated Articles of Incorporation were amended to increase the number of authorized shares of the Company's common stock from 7,500,000 to 15,000,000 shares of common stock.

Effective February 15, 2017, our Amended and Restated Articles of Incorporation were amended pursuant to a Certificate of Change Pursuant to Nevada Revised Statutes 78.209 (the “Certificate of Change”) filed with the Nevada Secretary of State. The Certificate of Change provided for both a reverse stock split of the outstanding shares of our common stock on a 1-for-2 basis (the “Reverse Stock Split”), and a corresponding decrease in the number of shares of our common stock that we are authorized to issue (the “Share Decrease”).

As a result of the Reverse Stock Split, the number of issued and outstanding shares of our common stock on February 15, 2017 decreased from 6,307,577 pre-Reverse Stock Split shares to 3,153,801 post-Reverse Stock Split shares (after adjustment for any fractional shares). Pursuant to the Share Decrease, the number of authorized shares of our common stock decreased from 15,000,000 to 7,500,000 shares of common stock, $0.001 par value per share. As of September 30, 2016,March 31, 2017, the Company had 15,000,0007,500,000 shares of authorized common stock, $0.001 par value per share.

In January, 2017, the Company issued 20,000 shares of common stock to two directors in equal amounts of 10,000 shares each, valued at $1.72 per share, or $34,404.

In February, 2016,2017, the Company issued 6255,232 shares of common stock to a new employee,director valued at $4.82$3.25 per share, or $3,012.$17,004.

In March 2016,On February 14, 2017, The NASDAQ Stock Market LLC informed the Company issued 3,080 sharesthat it had approved the listing of the Company’s common stock to a consultant, valued at $4.87 per share, or $14,999.

In April 2016, the Company issued 3,529 sharesThe NASDAQ Capital Market, effective as of February 15, 2017. The Company’s common stock to a consultant, valued at $4.25 per share, or $15,000.

In May 2016,ceased trading on the Company issued 2,459 shares ofOTCQB on February 15, 2017, and on such date the common stock to a consultant, valued at $3.05 per share, or $7,499.commenced trading on The NASDAQ Capital Market under the ticker symbol “SGLB”.

In June 2016, the Company issued 2,515 shares of common stock to a consultant, valued at $2.982 per share, or $7,498.

In July 2016, the Company issued 4,167 shares of common stock to a consultant, valued at $3.00 per share, or $12,501.

In July 2016, the Company issued 31,000 shares of common stock to an employee, valued at $2.97 per share, or $91,760.

As of SeptemberJune 30, 2017 and 2016, there were 6,267,5774,570,199 and 3,133,789 shares of common stock issued and outstanding, including 62,250respectively.

Preferred Stock

The Company is authorized to issue 10,000,000 shares of preferred stock, $0.001 par value. No shares of preferred stock were issued but unvested shares pursuantand outstanding at June 30, 2017 and 2016.

Stock Options

On April 19, 2017, the Company granted a stock option to the Company's 2011 Equity Incentive Plan (the “2011 Plan”) and the Company's 2013 Equity Incentive Plan (the “2013 Plan”). Asan officer to purchase up to of December 31, 2015, there were 6,239,07320,000 shares of common stock, issued and outstanding, including 12,500 and 32,500 issued but unvested shares pursuantat an exercise price equal to $3.27 per share, which was the 2011 Plan and the 2013 Plan. On April 28, 2016, at the Annual Meeting of Stockholders of the Company, the Company's stockholders approved an amendment to the 2013 Plan to increase the number of shares of the Company's common stock reserved for issuance under the 2013 Plan by 638,538 sharesclosing market price of our common stock on April 19, 2017 (i.e., the date of grant), which option is subject to a total of 750,000 shares (on a post-Reverse Stock Split basis). As of September 30, 2016, an aggregate of 1,500 shares and 601,712 shares of common stock were reserved for issuance under the 2011 Plan and the 2013 Plan, respectively.vesting.

7

Stock Options

During 2016, the Company granted a total of 137,375 options to nine employees with vesting periods ranging from three to four years beginning November 17, 2016. As of September 30, 2016, stock option compensation expense of $136,787 was recognized during the nine months ended September 30, 2016 for these options and other options granted in 2015. The weighted average period over which total the compensation cost of the options of $660,500$62,857 ($327,50410,476 in 2015)2017) will be recognized is 3.024 years. The weighted average exercise price of all outstanding options as of June 30, 2107 is $4.21$3.94 and the weighted average fair value of the options on the grant dates was $3.23.$2.86. The estimated fair value of the options was determined using the Black-Scholes pricing model using the following assumptions:

Expected term: | 1.5 - 10 years |

Volatility: | 67.3 – 159.3% |

Dividend yield: | 0.00% |

Risk-free interest rate: | .79 - 2.32% |

Expected term:Warrants

5 - 10 years

Volatility:

67.3 - 81.7%

Dividend yield:

0.00%

Risk-free interest rate:

1.13 - 2.32%

Warrants

As of SeptemberJune 30, 2017, the Company had outstanding warrants to purchase a total of 80,000 shares of common stock at an exercise price of $4.13 per share. If not exercised, the warrants to purchase the 80,000 shares will expire on October 17, 2019. In addition, as of June 30, 2017, the Company had outstanding warrants to purchase a total of 1,621,500 shares of common stock at an exercise price of $4.00 per share. If not exercised, the warrants to purchase the 1,621,500 shares will expire on February 21, 2022. The 1,621,500 warrants trade on The NASDAQ Capital Market under the ticker symbol “SGLBW”.

Unit Purchase Option

On February 15, 2017, Sigma Labs, Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Dawson James Securities, Inc., as underwriter (the “Underwriter”) in connection with a public offering (the “Offering”) of the Company’s securities. Pursuant to the Underwriting Agreement, the Company has granted the Underwriter the right to purchase from the Company 70,500 Units at an exercise price equal to 125% of the public offering price of the Units in the Offering, or $5.1625 per Unit. The Unit Purchase Option has a term of five years and is not redeemable by us. A “Unit” is defined as of one share of the Company’s common stock, par value $0.001 per share and one warrant to purchase one share of the Company’s common stock, par value $0.001 per share, at an exercise price of $4.00 per share.

NOTE 3 – Note Receivable

On May 1, 2017, the Company completed funding a loan in the principal amount of $250,000 to Jaguar Precision Machine, LLC, a New Mexico limited liability company, pursuant to a Secured Convertible Promissory Note dated May 1, 2017 delivered by Jaguar to the Company. The loan bears interest at the rate of 7% per annum, is due and payable in full on May 1, 2018, is secured by certain assets of Jaguar, and is convertible at the Company’s option into 10% of the outstanding shares of the common stock of Jaguar unless Jaguar exercises its right under specified circumstances to repay all principal and accrued interest on the loan. The purpose of the loan is to provide working capital to Jaguar to, among other things, stand up a metallugical laboratory and become ASM9100 certified for contracts related to AM of high-precision aerospace and defense components, in furtherance of our strategic alliance. Sigma will receive from Jaguar priority for use of certain machines and services of Jaguar.

On March 27, 2017, the Company completed funding a loan in the principal amount of $500,000 to Morf3D, Inc., an Illinois corporation, pursuant to a Secured Convertible Promissory Note dated March 27, 2017 delivered by Morf3D to the Company. The loan bears interest at the rate of 7% per annum, is due and payable in full on March 27, 2018, is secured by certain assets of Morf3D, and is convertible at the Company’s option into 10% of the outstanding shares of the common stock of Morf3D unless Morf3D exercises its right under specified circumstances to repay all principal and accrued interest on the loan. The purpose of the loan is to provide working capital to Morf3D to, among other things, lease an EOS M 400 system for Morf3D for Morf3D to expand production for contracts related to AM of high-precision aerospace and defense components, in furtherance of our strategic alliance and in contemplation of a possible acquisition of or merger with Morf3D (although discussions regarding a possible acquisition of or merger with Morf3D are not currently ongoing).

NOTE 4– Notes Payable

Effective October 17, 2016, the Company had no outstanding warrants.entered into a Securities Purchase Agreement with two accredited investors (the “Investors”) for the private placement by the Company of Secured Convertible Notes in the aggregate principal amount of $1,000,000 (the "Notes") and warrants (the "Warrants") to purchase up to 80,000 shares (the "Warrant Shares") of the Company's common stock ("Common Stock") (subject to adjustment in certain circumstances), for aggregate gross proceeds, before expenses, to the Company of $900,000 (the “Financing Transaction”).

8

The Notes carry a one-time upfront interest charge of a total of $100,000, which is being expensed to interest expense monthly over the 1-year term of the Notes and correspondingly increases in the Notes Payable balance each period. As of June 30, 2017, the Notes Payable balance is $969,703. However, the effective Notes Payable balance is $1 million since that is the amount we would have to pay in order to payoff the note anytime between now and the maturity date of October 17, 2017, in addition to accrued interest and a 15% pre-payment penalty.

The Notes carry an interest rate of 10% per annum, calculated on the basis of a 360-day year, based on the $1 million Notes Payable effective balance. Such interest is payable every three months in cash, or, at the holder’s option, in unrestricted shares of Common Stock, if a registration statement is then in effect for such shares of common stock.

In connection with the Financing Transaction, the Company entered into a Registration Rights Agreement, dated October 17, 2016, with the Investors, pursuant to which the Company filed a registration statement related to the Financing Transaction with the Securities and Exchange Commission (“SEC”) covering the resale of (i) the shares of Common Stock that will be issued to the Investors upon conversion of the Notes, and (ii) the Warrant Shares that will be issued to the Investors upon exercise of the Warrants.

The Notes are secured by the assets of the Company pursuant to a Security Agreement, dated October 17, 2016, between the Company and the "collateral agent" (as defined in the Notes) for the benefit of itself and each of the Investors.

The Notes are convertible into shares of Common Stock at a conversion price equal to the lesser of (i) the final unit price of the Company’s proposed public offering initially filed with the SEC on July 28, 2016, and (ii) 150% of the closing price of the Common Stock as reported by the OTC Markets Group, Inc. on the date of issuance of the Notes (subject to adjustment as provided therein). As such, as of June 30, 2017, the conversion price of the Notes was $4.13, which is the final unit price of the Company’s public offering.

Each Warrant has an exercise price equal to the lesser of (i) the final unit price of the Company’s proposed public offering initially filed with the SEC on February 17, 2017, and (ii) 150% of the closing price of the Common Stock as reported by the OTC Markets Group, Inc. on the date of issuance of the Warrants (subject to adjustment as provided therein), which Warrants may be exercised on a cashless basis as provided in the Warrants. As such, as of June 30, 2017, the exercise price of the Warrants was $4.13, which is the final unit price of the Company’s public offering.

NOTE 35 - Continuing Operations

The Company has sustained losses and has negative cash flows from operating activities since its inception. However, the Company has had increasing revenues in recent periods. In addition, the Company has raised significant equity capital and is currently developing new product lines to increase future revenues. TheOn February 21, 2017, the Company closed an underwritten public offering of equity securities resulting in net proceeds of approximately $5.25 million, after deducting underwriting discounts and commissions and other offering expenses payable by the Company.As such, the Companybelieves it has adequate working capital and cash to fund operations through 2016, and has entered into significant revenue contracts that are expected to generate cash flow in the near term.2017.

NOTE 46 – Loss Per Share

The following data show the amounts used in computing loss per share and the weighted average number of shares of dilutive potential common stock for the periods ended SeptemberJune 30, 20162017 and 2015:2016:

| Three Months Ending |

| Nine Months Ending |

| 6 Months Ending | ||||||||||

| Sept. 30, 2016 |

| Sept. 30, 2015 |

| Sept. 30, 2016 |

| Sept. 30, 2015 |

| 6-30-17 |

| 6-30-16 | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations available to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stockholders (numerator) | $ | (719,320) |

| $ | (587,130) |

| $ | (1,931,833) |

| $ | (1,399,378) | $ | (1,932,706) | $ | (1,212,513) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

common shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

used in loss per share during |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the Period (denominator) |

| 6,259,349 |

|

| 6,234,834 |

|

| 6,243,642 |

|

| 6,224,939 |

| 4,207,116 |

| 3,117,851 |

Dilutive loss per share was not presented as the Company had no common equivalent shares for all periods presented that would affect the computation of diluted loss per share or its effect is anti-dilutive.

9

NOTE 57– Subsequent Events

Effective October 17, 2016, the CompanyOn August 8, 2017, we entered into a Securities Purchase Agreementan “at will” unwritten employment arrangement with two accredited investors (the “Investors”) for the private placement by the CompanyJohn Rice, effective as of Secured Convertibles Notes in the aggregate principal amount of $1,000,000 (the "Notes") and warrants (the "Warrants") to purchase up to 160,000 shares (the "Warrant Shares") of the Company's common stock ("Common Stock") (subject to adjustment in certain circumstances), for aggregate gross proceeds, before expenses, to the Company of $900,000 (the “Financing Transaction”). The closing of the Financing Transaction (the “Closing”) occurred on October 19, 2016.

In connection with the Financing Transaction, the Company entered into a Registration Rights Agreement, dated October 17, 2016, with the Investors (the “Registration Rights Agreement”),August 1, 2017, pursuant to which Mr. Rice serves as our interim Chief Executive Officer. Under his employment arrangement, Mr. Rice is entitled to receive a monthly salary of $9,000, and is eligible to receive medical and dental benefits, life insurance, and long-term and short-term disability coverage. Further, Mr. Rice is eligible under his employment arrangement to participate in the Company’s 2013 Equity Incentive Plan, with equity compensation to Mr. Rice to be determined by the Company’s Compensation Committee at a later date. Effective as of Mr. Rice's July 24, 2017 appointment as interim Chief Executive Officer, Mr. Rice is no longer entitled to receive compensation for his service as a director of the Company.

On August 8, 2017, Dennis Duitch was appointed to the Company’s Board of Directors. Mr. Duitch was also appointed to serve as Chairman of the Audit Committee and interim Chairman of the Compensation Committee and the Nominating and Corporate Governance Committee. In conjunction with Mr. Duitch's appointment as a director, the Company agreed to file a registration statement related to the Financing Transaction with the Securities and Exchange Commission (“SEC”) covering the resale of (i) theissued Mr. Duitch 7,489 shares of Common Stock that will be issued to the Investors upon conversion of the Notes (the "Conversion Shares"), and (ii) the Warrant Shares that will be issued to the Investors upon exercise of the Warrants. The Notes are secured by the assetscommon stock of the Company, pursuant to a Security Agreement, dated October 17, 2016, betweenwhich shares will vest in four equal (as closely as possible), successive quarterly installments beginning on the Company andfirst quarterly anniversary of the "collateral agent" (as definedgrant date, provided that Mr. Duitch remains in the Notes) forCompany’s continuous service as a director through the benefit of itself and each of the Investors.applicable quarterly anniversary date.

10

Each Warrant has an initial exercise price equal to the lesser of (i) the final unit price of the Company’s proposed public offering initially filed with the SEC on July 28, 2016, and (ii) 150% of the closing price of the Common Stock as reported by the OTC Markets Group, Inc. on the date of issuance of the Warrants (subject to adjustment as provided therein), which Warrants may be exercised on a cashless basis as provided in the Warrants.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Forward-looking statements

This Quarterly Report, including any documents which may be incorporated by reference into this Report, contains “Forward-Looking Statements.” All statements other than statements of historical fact are “Forward-Looking Statements” for purposes of these provisions, including any projections of revenue or other financial items, any statements of the plans and objectives of management for future operations, any statements concerning proposed new products or services, any statements regarding future economic conditions or performance, and any statements of assumptions underlying any of the foregoing. All Forward-Looking Statements included in this document are made as of the date hereof and are based on information available to us as of such date. We assume no obligation to update any Forward-Looking Statement. In some cases, Forward-Looking Statements can be identified by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “potential,” or “continue,” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the Forward-Looking Statements contained herein are reasonable, there can be no assurance that such expectations or any of the Forward-Looking Statements will prove to be correct, and actual results could differ materially from those projected or assumed in the Forward-Looking Statements. Future financial condition and results of operations, as well as any Forward-Looking Statements are subject to inherent risks and uncertainties, including any other factors referred to in our press releases and reports filed with the Securities and Exchange Commission ("SEC"). All subsequent Forward-Looking Statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Additional factors that may have a direct bearing on our operating results are described under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 20152016 and elsewhere in this report.

Overview

Sigma Labs, Inc. (the "Company," "we," "us," or "Sigma") is a software company that has developed quality assurance software known as PrintRite3D® (aka, real-time computer-aided inspection (“CAI”)), which Sigma believes solves the major problems that have prevented large-scale metal part production using 3D printers. GE Aviation for example, has stated that it plans to commit $3.5 billion by 2020 to, among other things, build a metal 3D production facility for its Leap engine and other engines to produce the applicable 3D printed parts. However, withoutunless companies that utilize a 3D production facility like GE Aviation effectively beingare able to effectively check each part for shape, density, strength and consistency in-processreal-time during the manufacturing process, we believe that such companies will not be able to addresssimplify the major problems currently preventing large-scalequalification of printed parts with an in-process monitoring method and therefore will be unable to improve the workflow of 3D printing functional metal 3D production.parts. We believe that our software, which is positioned “inside” the 3D metal printer, solves these problems by assuring each part is being made to the specifications of the computer fileas itsuch part is being made. We enable 3D prototyping to become 3D manufacturing. Instead of performing quality assurance (“QA”) post production, our PrintRite3D® software couldhas been designed to fundamentally redefine conventional QA by embedding quality assurance and process control into the manufacturing process in real time. We have filed patent applications directed to our In-Process Quality Assurance™ (“IPQA®”) procedure for advanced manufacturing. In addition, we anticipate that our core PrintRite3D® software will enable our customers to combine their advanceddigital manufacturing technologies with our 3D manufacturing QA to achieve both cost savings and stronger parts. Vertical markets that we believe would benefit from our technology and software include aerospace, defense, bio-medical, power generation, and oil & gas industries. We provide our software products to customers in the form of Software as a Service (“SaaS”).

About 3D Printing

3D printing (“3DP”) or additive manufacturing (“AM”) is changing the world by going directly from computer graphics to realactual parts. 3D printing has been applied to the manufacture of plastic parts for several years.decades. 3D manufacturing of metal parts involves directing a laser or other energy source at a layer of powdered metal and melting it. These layers become melted together from the bottom up. RevenuesWorldwide revenues attributable to 3D manufacturing for metal products are estimated to be between $4 and $6 billion by 2020.were $88.1 million in 2015 (Wohlers Report 2015,2016, 3D Printing and Additive Manufacturing State of the Industry – Annual Worldwide Progress Report).

The application of 3D printing to high-tolerance, precision manufactured metal parts has only recently emerged. 3D printing of metal parts today represents only a minor percentage of all 3D manufacturing. However, we believe the greatest future growth for 3D printing appears to be in metal parts, given the interest and investment being made by Fortune 100 companies, Federal government laboratories and agencies as well as university-based institutions. Emphasis from these high-end manufacturers and technology leaders is strongly focused on qualityhelping the transformation of analog manufacturing of precision, high-tolerance parts in the U.S. today to a digital enterprise of tomorrow complete with automation, robotics and precision manufacturing for high-tolerance parts.closed-loop process control. We believe that the on-going success of 3D printing for metal parts will be highly dependent upon the evolution of digital quality assurance procedureprocedures used, such as our PrintRite3D® methodology.process control.

11

About Quality Assurance in 3D Printing

Current methods for providing quality in 3DP are generally cost prohibitive because up toan estimated approximately 25% of parts produced by 3D printing need to beare destroyed in the post-production quality control process. Additional costs aremay be incurred by using non-traditional x-ray scanning technology on these parts. We offer our clients the ability to use in-processreal-time sensors to track each layer, and our software continuously analyzes the part so that when it is finished we know if it is of production quality. We believe our PrintRite3D® software could reduce inspection costs by a factor of 10 and development time for new parts by 50% or more. Most importantly is the ability of our software to reduce risk associated with the qualification of printed parts.

By using PrintRite3D® software, a high-precision manufacturer would have the ability to offer its customers on an exclusive basis, product guarantees and assurances that its product wasprinted parts were produced in compliance with stringent quality requirements. Initial ordersOrders for our software have been received from GE Aviation, Honeywell Aerospace, Aeroject Rocketdyne, Woodward, Siemens, Pratt and Siemens.Whitney, and Solar Turbines.

We believe there is potential for our PrintRite3D® software to be incorporated into a majority of 3D metal printing devices made by companies like Electro-Optical Systems (“EOS”), Additive Industries, Concept Lasers, Trumpf Lasers, Renishaw, Sentrol, Farsoon, Desktop Metal and others.

Sigma’s Cloud-Based IIoT Solutions

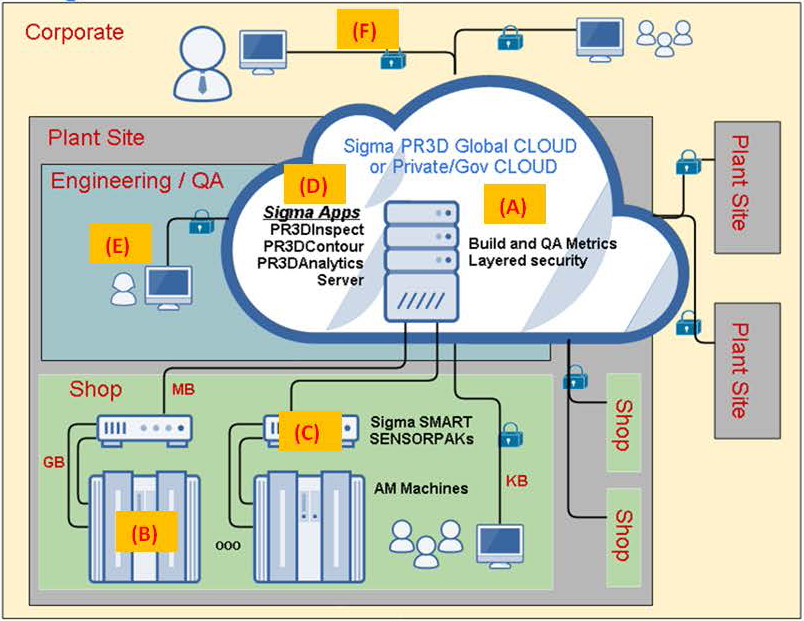

The process of making a 3D printed part could start with our customers loading a CAD/CAMcomputer aided design (“CAD”) model of the part into the Cloud as shown in “A” in Figure 1. Next, computer aided engineering (“CAE”) and/or computer aided manufacturing (“CAM”) instructions are sent to the 3D printer (see “B”, as shown in Figure 1). Metal powder in the machine is then deposited onto the build platform where a laser beam, or other energy source, focused onto the build platform melts each successive layer of powder in 20-50 micron increments. Our CAI sensors (see “C” in Figure 1) detect, record, analyze and compare the part as it is being made layer-by-layer against the CAD/CAM specifications and physical reference points for quality assurance during the manufacturing. Our software certifies the shape, strength, and internal density of each part, which eliminates the need to: (1) destroy a large percentage of the parts during process validationqualification and in post-production quality assurance; and (2) retain all of the metal as opposed to cutting pieces and wasting metal.

Our PrintRite3D® CAI web-based software (see “D” in Figure 1) is being designed to reside in the Cloud (see “A” in Figure 1) of the Industrial Internet of Things (“IIoT”). We enable manufacturing engineers to assure the part quality layer-by-layer, provide for manufacturing statistical process control and harvest, aggregate, and analyze Big Data from the manufacturing in-processreal-time data collected from our PrintRite3D® SENSORPAK™ (see “C” in Figure 1), as well as post-process manufacturing data collected by our customers (see “E” in Figure 1).

Our specialized sensor suite (see “C” in Figure 1), known as PrintRite3D® SENSORPAK™, is an IIoT-compliant computing device. It contains the modular hardware and software necessary to connect to “cyber-physical” objects (see “B” in Figure 1) living on the manufacturing floor. It allows for bi-directional information flow between the manufacturing floor and the Cloud (see “A” in Figure 1). It starts a million-fold data reduction that finishes with our PrintRite3D® software,Digital Quality Record (“DQR”) and report, which provides customers with product guarantees and assurances that parts were produced in compliance with stringent quality standards. It can collect, analyze, aggregate, filter, and then further communicate data from the manufacturing floor to the Cloud (see “A” in Figure 1) and enable links to other areas (see “F” in Figure 1) of the IIoT.

12

Figure 1. Sigma’s Industrial IoT /PrintRite 3D®PrintRite3D® Cloud Architecture

Business Activities and Industry Applications

Our principal business activities include the continued development and commercialization of our PrintRite3D® suite of software applications, with our main focus currently on the 3DP and the AM industry as well as making operational the contract additive manufacturing business for metal 3DP. Our strategy is to continue to leverage our advanced manufacturing knowledge, experience and capabilities through the following means:

·

Identify, develop and commercialize our quality assurance software Apps for advanced manufacturing technologies designed to assure part quality in real time as the part is being made and improve process control practices for a variety of industries;

·

Provide manufacturingmaterials and process engineering consulting services in respect of our PrintRite3D® CAI quality assurance software Apps for advanced manufacturing to customers that have needs in developing next-generation technologies for advanceddigital manufacturing technologies; and

·

Build and run a contract manufacturing division for metal 3DP beginning with our EOS M290 state-of-the-art metal printer.

We are presently engaged in the following industry sectors:

·

Aerospace and defense manufacturing; and

·

Energy and power generation.

We also seek to be engaged in the following industry sectors and have begun to develop relationships with leading manufacturers in each such sector:

·

Bio-medical manufacturing;

·

Automotive manufacturing; and

·

Other markets such as firearms and recreational equipment.

13

We generate revenues through PrintRite3D® hardware and sensor sales andCAI software licensing of our PrintRite3D® technology to customers that seek to improve their manufacturing production processes, and through ongoing annual software upgrades and maintenance fees. Additionally, we generate revenues from our contract manufacturing activities in metal AM. By running a contract AM services operation, we are able to understand the current needs of our customers and where they are going with their next-generation product development efforts. Contract AM further allows us a means for continuing/self-funding our IPQA®-enabled R&D and product development activities for PrintRite3D®.CAI software. We provide our AM contract manufacturing services to customers in the form of Quality as a Service (“QaaS”). Starting with our PrintRite3D® cloud-based SaaS model, customers will contract with us for CAE, CAM and CAI services to generate and establish a digital quality record (“DQR”)DQR for AM built parts. Each DQR is cloud-based and allows for archiving and storage of quality data, access to our big data ANALYTICS™ software App for continuous quality monitoring and improvement, and automatic industry benchmarking while maintaining firewalls between company-specific data.

In late 2015, we launched two programs − an Early Adopter Program (“EAP”(“EAP”) and an Original Equipment Manufacturer (“OEM”(“OEM”) Partner Program − designed to broaden our market presence and speed adoption of our PrintRite3D® technology. The EAP was designed to attract early adopterend user customers who have an existing, installed base of 3D metal printers and to offer them incentivized pricing in return for feedback on initialengineering and beta releases of our PrintRite3D® software Apps. Our OEM Partner Program was specifically designed for AM machine manufacturers seeking to embed our PrintRite3D® quality assurance software Apps directly into their machines for customers purchasing a turnkey solution for their new AM machine purchases.

We possess the resident expertise to provide manufacturing materials &and process (M&P)(“M&P”) engineering services and support to companies using our PrintRite3D® software Apps for metal AM. Accordingly, in addition to our primary business focus, we intend to generate revenues by providing such manufacturing M&P engineering services and support to businesses licensing our PrintRite3D® software Apps.

Our President and Chief Technology Officer has worked at or with the Edison Welding Institute, the United States Department of Energy (“DOE”) national laboratories (including the Knolls Atomic Power Laboratory, Bettis Atomic Power Laboratory, Los Alamos National Laboratory and Sandia National Laboratory) over the past 34 years. Due to his work with the DOE, our President and Chief Technology Officer has developed extensive relationships with the DOE and its network of national laboratories. Accordingly, we expect to leverage these relationships in connection with licensing and developing technologies created at such national laboratories for commercialization in the private sector.

Corporate Information

Our principal executive offices are located at 3900 Paseo del Sol, Santa Fe, New Mexico 87507, and our current telephone number at that address is (505) 438-2576. Our website address is www.sigmalabsinc.com. The Company’s annual reports, quarterly reports, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act, and other information related to the Company, are available, free of charge, on that website as soon as we electronically file those documents with, or otherwise furnish them to, the SEC. The Company’s website and the information contained therein, or connected thereto, are not and are not intended to be incorporated into this Quarterly Report on Form 10-Q.

We incorporated as Messidor Limited in Nevada on December 23, 1985 and changed our name to Framewaves Inc. in 2001. On September 27, 2010, we changed our name from Framewaves Inc. to Sigma Labs, Inc.

Recent Developments (in reverse chronological order)

On November August 3, 2017, we announced signing Jeta Enterprises as a new manufacturer’s representative for sales of Sigma contract printing and AM services in the Northwest region of the U.S., including Oregon and Washington states. Jeta’s strong customer base in Aerospace and Medical Devices coupled with its expertise in custom-engineered components positions it to serve a growing base of demand for advanced component manufacturing with Sigma's suite of products and services.

On July 27, 2017, we announced changes in senior management. Mr. Cola, who serves as President, was appointed as Sigma's Chief Technology Officer, responsible for building and implementing the Sigma technological strategy and guiding key technical advancements towards digitalization in the context of the Industrial Internet of Things (IIoT). Together with our executive team members, Mr. Cola will seek to expand and grow the Company through next-generation products and key customer development in a broad range of industries. John Rice, who has served as Chairman of the Board of the Company since his appointment in April 2017, replaced Mr. Cola as Chief Executive Officer effective as of July 24, 2017. As Chairman of the Board and interim Chief Executive Officer, Mr. Rice will oversee our implementation of internal and external growth, with an emphasis on internal focus technology, sales, and efficiency, and externally, reaching into the marketplace to expand the Company’s digital technical bandwidth with respect to our IPQA® technology and additive manufacturing. Mr. Rice brings substantial operating and investment experience to these tasks, including with respect to operations of startup and emerging companies, corporate finance, and mergers and acquisitions.

14

On July 20, 2017, we announced the June 30, 2016 publication of our U.S. Patent Application No. US 2016/0185048; Multi-Sensor Quality Inference and Control For Additive Manufacturing Processes. This patent application is related to real-time quality analysis during AM processes and the characterization of material properties using acoustic signals emitted during AM which can be used in addition to optical signals to simplify the qualification of printed parts.

On July 6, 2017, we announced that we entered into an agreementthe Company has signed a Technology Development Agreement ("TDA") with Siemens Industrial Turbomachinery AB (“SIT”) of Finspång, Sweden,OXYS Corporation, a unit of Siemens AG (SIEGn.DE), for PrintRite3D® INSPECT®technology company in Cambridge, MA working in the Industrie 4.0 space. The first project to be installed onexecuted under the TDA will be a metal printernew architecture platform for evaluation and testing purposes. Specifically, wethe Company's PrintRite3D® INSPECT. The Company expects that the completed project will installed ourallow for miniaturization of the sensor/hardware PrintRite3D® product, enhancements to the level of hardware/software integration moving it towards board-level integration, as well as broaden the market reach of the Company's PrintRite3D® technology at SIT in Finspong, Sweden. SIT providesto the world with gas turbinesSmart Factory and gas turbine based solutions for the sustainable and cost efficient production of electricity, steam and heat. In February 2016, SIT opened a dedicated workshop for additive manufacturing, development and repairs. The facility specializes in making turbomachinery components for high temperature applications, where accuracy and quality are critical to ensure operational performance. Siemens is a pioneer in the use of Selective Laser Melting (SLM) technology for the manufacture of high-performance metal parts. larger Digital Enterprise, including polymer-based 3D printing.

On October 20, 2016,June 28, 2017, we announced that our PrintRite3D® INSPECT® software Version 2.0 was recently installed at Honeywell Aerospace in Honeywell's Advanced Manufacturing Engineering Center in Phoenix, AZ, in connection with Sigma Labs' ongoing participation in the Honeywell lead, DARPA Phase III.

On June 6, 2017, we closed on October 19, 2016 a private placementannounced that the Company has entered into agreements with two additional, non-exclusive sales agents in the Asia Pacific region, driven by strong customer interest in the region for PrintRite3D®. One such agent, Enervision Inc., will target the high growth expectations in the South Korean AM market, driven by the CompanyKorean government's announcement in April 2017 of Secured Convertible Notesa $37 million investment to accelerate the development of 3D printing across the country. Our other new sales agent is Beijing Yida Sifang Technology Co., Ltd, a leading metal AM reseller with multiple offices in China, will assist Sigma Labs with its expansion into the aggregate principal amount of $1,000,000 (the "Notes") and three-year warrants to purchase up to 160,000 shares of the Company's common stock (the "Warrants"), under a Securities Purchase Agreement with certain accredited investors. Aggregate gross proceeds, before expenses, to the Company were $900,000. China AM market.

On September 29, 2016,May 9, 2017, we announced the unveiling of our PrintRite3D® INSPECT™ V.2.0 quality assurance software at RAPID + TCT 2017 (www.rapid3devent.com), North America's preeminent event for discovery, innovation, and networking in 3D manufacturing.

On April 18, 2017, we announced the receipt of a contract from Honeywell Aerospace under the previously-announced “America Makes” additive manufacturing (“AM”) research project with GE Aviation. The program, funded by the National Additive Manufacturing Innovation Institute (NAMII), uses our proprietary In-Process Quality Assurance™ (IPQA®) software for advanced AM monitoring and inspection. Under this contract, Sigma and HoneywellSolar Turbines, Incorporated, a subsidiary of Catepillar Inc. (NYSE: CAT). Solar Turbines will further demonstrate the benefits of IPQA® using our PrintRite3D® software.

On August 24, 2016, we announced the launch of PrintRite3D® INSPECT™ software v1.3.2, the next-generation ofimplement our In-Process Quality Assurance™ (IPQA®) technology for the production of gas turbine components using metal AM. The division makes mid-size industrial turbines for use in electric power generation, gas compression, and pumping systems. We planto initially install our PrintRite3D® software on a 3D Systems’ ProX300 machine, with the potential for additive manufacturing. The latest version of INSPECT™ provides an enhanced user experience that incorporates feedback from our Early Adopter Program customers – resulting inmultiple system orders as the addition of alloy-specific temperature correction algorithms, improved reporting, and enhanced graphics both layer-by-layer and part-by-part.company ramps up to full serial production.

On July 21, 2016,April 5, 2017, we announced that we hired Murray Williamsannouncedthe release of our OEM Developers Kit for PrintRite3D® INSPECT™ quality assurance software version 2.0. The Company has placed its alpha version with a European OEM partner for test, evaluation and incorporation into its additive manufacturing 3D printers. The Developers Kit allows an OEM to serve as our Chief Financial Officer, effective asseamlessly and quickly embed PrintRite3D® technology directly into their OEM solutions allowing for rapid entry of July 18, 2016. Williams, who has served ontheir products into the board of directors of fifteen public and private companies, was one of the founders of Buy.com – where he served as its Chief Financial Officer and Vice President of Business Development. In addition, he founded and is the President and CEO of FA Corp, a consulting firm that specializes in taking companies public and managing their accounting, finance, legal and SEC financial reporting functions.

On July 6, 2016, we announced that Woodward, Inc. joined our EAP. Woodward obtained a non-exclusive license to use the complete suite of PrintRite3D® software modules – INSPECT™, CONTOUR™ and ANALYTICS™ – for one price, with preferred rates for future product license purchases.market place.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported assets, liabilities, sales and expensesamounts in the accompanying consolidated financial statements and related notes. These estimates and assumptions have a significant impact on our consolidated financial statements. Actual results could differ materially from those estimates. Critical accounting policies are those that require the most subjective and complex judgments, often employing the use of estimates about the effect of matters that are inherently uncertain. Such criticalOur significant accounting policies including the assumptions and judgments underlying them, are disclosed in Note 1 to the Consolidated Financial Statements included in this Quarterly Report.our Annual Report Dated December 31, 2016. However, we do not believe that there are any alternative methods of accounting for our operations that would have a material effect on our financial statements.

15

Results of Operations

We expect to generate revenue primarily through the sale ofby selling and licensing our PrintRite3D® hardwaremanufacturing and sensors, through software licensing of our PrintRite3D® technologymaterials technologies to customersbusinesses that seek to improve their manufacturing production processes and/or manipulate and through ongoing annual software upgradesimprove the most functional characteristics of the materials and maintenance fees. Additionally, weother input components used in their business operations. We also expect to generate revenue from ourrevenues though contract AM manufacturing activities in metal AM using our in-house metal 3D printing capability. However, we presently make limited sales of these technologies and services.services, which include limited sales of non-exclusive licenses to use our PrintRite3D® technologies, including under our recently established Early Adopter Program and OEM Partner Program, as described above. Our ability to generate revenuerevenues in the future will depend on our ability to further commercialize and increase market presence of our PrintRite3D® technologies and scale up our contract AM services business.technologies.

During the three and ninesix months ended SeptemberJune 30, 2016,2017, we recognized revenue of $189,951 and $642,230, respectively,$440,756, as compared to $266,566 and $648,515$452,279 in revenue that we generatedrecognized during the same periodsperiod in 2015.2016. The decrease in revenue was primarily due to a reductionthe completion of the GEA America Makes Program in work under contracts as compared to the prior year. Our2016 that generated three months of revenue in 2016 but no revenue in 2017. We financed our operations during the ninesix months ended SeptemberJune 30, 2017 and 2016 was primarily generated from PrintRite3D® system sales, Darpa and Aerojet programs, engineering consulting services we provided to third parties during this period.these periods and through sales of our common stock and debt securities. We expectanticipate that our revenue will increase in future periods as we seek to further commercialize and expand our market presence for our PrintRite3D®-related technologies, and obtain new contract manufacturing orders in connection with our contract AM services business,EOS M290 metal printer, as well as further perform on our engineering consulting contracts for the GE Aviation lead National Additive Manufacturing Innovation InstituteAerojet Rocketdyne Booster Propulsion program and continue to provide our similar services under our contract with Honeywell Aerospace for the DARPA Period 3 program.Phase III and Plus up efforts. Our cost of service revenue for the three and nine months ended SeptemberJune 30, 20162017 was $69,259 and $207,744, respectively,$185,946 as compared to $25,250 and $138,379$138,485 for the same periodsperiod in 2015.2016. The $47,461 increase is attributable to generating more commercial revenue in 2017 that resulted in lower margins versus generating more programmatic and engineering consulting revenue in 2016 that resulted in higher margins.

Our general and administrative expenses for the three and ninesix months ended SeptemberJune 30, 20162017, were $437,873 and $1,345,576, respectively,$1,237,988, as compared to $293,187 and $886,965$876,185 for the same periodsperiod in 2015.2016. Our payroll expenses for the three and ninesix months ended SeptemberJune 30, 20162017 were $259,011 and $727,494, respectively,$677,282, as compared to $191,399 and $338,533$468,484 for the same periodsperiod in 2015.2016. Our expenses relating to stock-based compensation for the three and ninesix months ended SeptemberJune 30, 20162017 were $105,630 and $236,554, respectively,$306,405 as compared to $221,500 and $478,500$130,913 for the same periodsperiod in 2015.2016. Our research and development expenses for the three and ninesix months ended SeptemberJune 30, 20162017 were $37,532 and $88,504, respectively,$167,615 as compared to $122,517 and $206,545$50,978 for the same periodsperiod in 2015.2016.

General and administrative expenses principally include operating expenses and outside service fees, the largest component of which consists of services in connection with our obligations as an SEC reporting company, in addition to other legal, accounting, marketing and investor relations fees. The net increase in general and administrative expenses for the three and ninesix months ended SeptemberJune 30, 20162017 as compared to the same periodsperiod in 20152016 is principally the result of increased investor relations expenditures and consultant services providedfees relating to us due to an increaseour February 2017 public offering that resulted in our overall business activities, including ournet proceeds of approximately $5,250,000, fees incurred in connection with investing in strategic partners, along with the continued development of our IPQA®-enabled PrintRite3D® technologies and our related efforts to expand our services. The net increase in payroll expenses for the three and ninesix months ended SeptemberJune 30, 20162017 as compared to the same periodsperiod in 20152016 is principally the result of our hiring of nine employeesadditional software development staff to assist in acceleration of our IPQA®-enabled PrintRite3D® technologies since September 2015.March 2016. The net decreaseincrease in research and development expenses for the three and ninesix months ended SeptemberJune 30, 20162017 as compared to the same periodsperiod in 20152016 is principally the result of the shift in operations from researchcontinued development and development to moreimprovements of a production company.our software and technology. The net decreaseincrease in stock-based compensation costs is due to issuing lessthe fact that the majority of stock options were granted after June 30, 2016, thus more stock option vesting occurred in 2016 for compensationthe first quarter of 2017 than we issuedthe same period in 2015 for compensation.2016.

As a result of our increased operating activities, including as we seek further commercialization of our IPQA®-enabled PrintRite3D® technologies, and our increased marketing and sales efforts associated with such technologies, including with respect to our EAP and OEM Partner Program, and our contract manufacturing activities, our general and administrative expenses in the future are expected to continue to increase. Similarly, we anticipate that our payroll and non-cash compensation expenses will continue to increase as we engage more employees and consultantsother service providers to support our efforts to grow our business.

Our net loss for the three and ninesix months ended SeptemberJune 30, 20162017 increased over the prior year period and totaled $719,320 and $1,931,833, respectively,$1,932,706 as compared to $587,130 and $1,399,378$1,212,513 for the same periodsperiod in 2015. Our revenue decreased and we experienced a larger net2016. This increase in expenses.net loss was attributable to a decrease in revenue and an increase in expenses as noted above.

Liquidity and Capital Resources

As of SeptemberJune 30, 2016,2017, we had $137,702$3,384,499 in cash and had a working capital surplus of $136,518,$3,374,359, as compared with $1,539,809$398,391 in cash and a working capital surplus of $1,768,931$110,799 as of December 31, 2015. 2016.