UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

þ☒ QUARTERLY REPORT UNDER SECTION 13 OR 15(D)15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: JuneSeptember 30, 2020

or

¨☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-38355

| Nemaura Medical Inc. |

| (Exact name of registrant as specified in its charter) |

| NEVADA | 46-5027260 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

57 West 57th Street Manhattan, NY 10019 | ||||

| (Address of Principal Executive Offices) (Zip Code) | ||||

| 646-416-8000 | ||||

| (Registrant’s Telephone Number, Including Area Code) | ||||

| N/A | ||||

| (Former name, former address and former fiscal year, if changed since last report) | ||||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | NMRD | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ ☒ Noo ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ☒ Noo ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer | |

Non-accelerated filer

| Smaller reporting company Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yeso ☐ Noþ ☒

The number of shares of common stock, par value $0.001 per share, outstanding as of August 14November 9,, 2020 was 22,893,70522,908,705.

| |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements, other than statements of historical fact, included in this Quarterly Report on Form 10-Q regarding development of our strategy, future operations, future financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

The words "believe," "anticipate," "design," "estimate," "plan," "predict," "seek," "expect," "intend," "may," "could," "should," "potential," "likely," "projects," "continue," "will," and "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These factors and the other cautionary statements made in this Quarterly Report on Form 10-Q should be read as being applicable to all related forward-looking statements whenever they appear herein. Except as required by law, we do not assume any obligation to update any forward-looking statement. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

| 2 |

NEMAURA MEDICAL INC.

TABLE OF CONTENTS

| Page | |||

| PART I: FINANCIAL INFORMATION | |||

| ITEM 1 | FINANCIAL STATEMENTS | ||

| Condensed Consolidated Balance Sheets as of | 4 | ||

| Condensed Consolidated Statements of Comprehensive Loss for the Three and Six Months Ended | 5 | ||

| Condensed Consolidated Statements of Changes in Stockholders’ Equity for the Three Months ended | |||

| Condensed Consolidated Statements of Cash Flows for the | |||

| Notes to Condensed Consolidated Financial Statements (unaudited) | |||

| ITEM 2 | �� | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| ITEM 3 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | ||

| ITEM 4 | CONTROLS AND PROCEDURES | ||

| PART II: OTHER INFORMATION | |||

| ITEM 1 | LEGAL PROCEEDINGS | ||

| ITEM 1A | RISK FACTORS | ||

| ITEM 2 | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | ||

| ITEM 3 | DEFAULTS UPON SENIOR SECURITIES | ||

| ITEM 4 | MINE SAFETY DISCLOSURES | ||

| ITEM 5 | OTHER INFORMATION | ||

| ITEM 6 | EXHIBITS | ||

| SIGNATURES | |||

| 3 |

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| NEMAURA MEDICAL INC. |

| Condensed Consolidated Balance Sheets |

As of June 30, 2020 ($) | As of March 31, 2020 ($) | As of September 30, 2020 (Unaudited) | As of March 31, 2020

| |||||||||||||

| (Unaudited) | ($) | ($) | ||||||||||||||

| ASSETS | ||||||||||||||||

| Current assets: | ||||||||||||||||

| Cash | 5,952,934 | 106,107 | 16,948,939 | 106,107 | ||||||||||||

| Stock subscriptions receivable | 1,988,132 | — | ||||||||||||||

| Prepaid expenses and other receivables | 272,271 | 452,463 | 358,404 | 452,463 | ||||||||||||

| Inventory (raw materials) | 339,124 | 286,309 | 411,620 | 286,309 | ||||||||||||

| Total current assets | 8,552,461 | 844,879 | 17,718,963 | 844,879 | ||||||||||||

| Other assets: | ||||||||||||||||

| Property and equipment, net of accumulated depreciation | 149,098 | 162,064 | 152,893 | 162,064 | ||||||||||||

| Intangible assets, net of accumulated amortization | 216,867 | 213,080 | 237,150 | 213,080 | ||||||||||||

| Total other assets | 365,965 | 375,144 | 390,043 | 375,144 | ||||||||||||

| Total assets | 8,918,426 | 1,220,023 | 18,109,006 | 1,220,023 | ||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||||||||||

| Current liabilities: | ||||||||||||||||

| Accounts payable | 190,379 | 293,608 | 155,609 | 293,608 | ||||||||||||

| Liability due to related parties | 544,081 | 830,093 | 153,533 | 830,093 | ||||||||||||

| Other liabilities and accrued expenses | 201,978 | 168,966 | 47,609 | 168,966 | ||||||||||||

| Notes payable, net of unamortized discount | 2,549,668 | — | 2,431,913 | — | ||||||||||||

| Deferred revenue | 94,252 | 93,022 | 96,930 | 93,022 | ||||||||||||

| Total current liabilities | 3,580,358 | 1,385,689 | 2,885,594 | 1,385,689 | ||||||||||||

| Non-current portion of notes payable, net of unamortized discount | 2,234,392 | — | 2,785,515 | — | ||||||||||||

| Non-current portion of deferred revenue | 1,143,208 | 1,147,278 | 1,195,470 | 1,147,278 | ||||||||||||

| Total non-current liabilities | 3,377,600 | 1,147,278 | 3,980,985 | 1,147,278 | ||||||||||||

| Total liabilities | 6,957,958 | 2,532,967 | 6,866,579 | 2,532,967 | ||||||||||||

| Commitments and contingencies | ||||||||||||||||

| Commitments and contingencies: | ||||||||||||||||

| Stockholders’ equity (deficit): | ||||||||||||||||

| Series A convertible preferred stock, $0.001 par value, 200,000 shares authorized; 0 shares issued and outstanding at June 30, 2020 and March 31, 2020 | — | — | ||||||||||||||

| Series A convertible preferred stock, $0.001 par value, 200,000 shares authorized; 0 shares issued and outstanding at September 30, 2020 and March 31, 2020 | — | — | ||||||||||||||

| Common stock, $0.001 par value, | ||||||||||||||||

| 42,000,000 shares authorized and 21,282,133 and 20,850,848 | ||||||||||||||||

| shares issued and outstanding at June 30, 2020 and March 31, 2020, respectively | 21,282 | 20,851 | ||||||||||||||

| 42,000,000 shares authorized and 22,893,705 and 20,850,848 | ||||||||||||||||

| shares issued and outstanding at September 30, 2020 and March 31, 2020, respectively | 22,894 | 20,851 | ||||||||||||||

| Additional paid-in capital | 20,957,486 | 16,589,272 | 31,838,383 | 16,589,272 | ||||||||||||

| Accumulated deficit | (18,686,131 | ) | (17,586,075 | ) | (20,267,348 | ) | (17,586,075 | ) | ||||||||

| Accumulated other comprehensive loss | (332,169 | ) | (336,992 | ) | (351,502 | ) | (336,992 | ) | ||||||||

| Total stockholders’ equity/ (deficit) | 1,960,468 | (1,312,944 | ) | |||||||||||||

| Total stockholders’ equity / (deficit) | 11,242,427 | (1,312,944 | ) | |||||||||||||

| Total liabilities and stockholders’ equity | 8,918,426 | 1,220,023 | 18,109,006 | 1,220,023 | ||||||||||||

See notes to the unaudited condensed consolidated financial statementsstatements.

| 4 |

NEMAURA MEDICAL INC. |

| Condensed Consolidated Statements of Comprehensive Loss |

(Unaudited) (in Dollars, except Share Amounts) |

| Three Months Ended June 30, | Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||||||||||

2020 ($) | 2019 ($) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Revenue: | — | — | — | — | — | — | ||||||||||||||||||

| Total revenue | — | — | — | — | — | — | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Research and development | 315,312 | 556,183 | 456,280 | 462,517 | 771,592 | 1,018,699 | ||||||||||||||||||

| General and administrative | 595,720 | 699,008 | 771,533 | 654,523 | 1,367,253 | 1,353,532 | ||||||||||||||||||

| Total operating expenses | 911,032 | 1,255,191 | 1,227,813 | 1,117,040 | 2,138,845 | 2,372,231 | ||||||||||||||||||

| Loss from operations | (911,032 | ) | (1,255,191 | ) | (1,227,813 | ) | (1,117,040 | ) | (2,138,845 | ) | (2,372,231 | ) | ||||||||||||

| Interest (expense) income | (189,024 | ) | 3,926 | (353,404 | ) | — | (542,428 | ) | 3,926 | |||||||||||||||

| Net loss | (1,100,056 | ) | (1,251,265 | ) | (1,581,217 | ) | (1,117,040 | ) | (2,681,273 | ) | (2,368,305 | ) | ||||||||||||

| Other comprehensive income (loss): | ||||||||||||||||||||||||

| Other comprehensive loss: | ||||||||||||||||||||||||

| Foreign currency translation adjustment | 4,823 | (15,751 | ) | (19,333 | ) | (7,401 | ) | (14,510 | ) | (23,152 | ) | |||||||||||||

| Comprehensive loss | (1,095,233 | ) | (1,267,016 | ) | (1,600,550 | ) | (1,124,441 | ) | (2,695,783 | ) | (2,391,457 | ) | ||||||||||||

| Loss per share | ||||||||||||||||||||||||

| Loss per share: | ||||||||||||||||||||||||

| Basic and diluted | $ | (0.05 | ) | $ | (0.06 | ) | (0.07 | ) | (0.05 | ) | (0.12 | ) | (0.11 | ) | ||||||||||

| Weighted average number of shares outstanding | 20,879,446 | 20,783,636 | 22,390,114 | 20,802,197 | 21,638,907 | 20,792,967 | ||||||||||||||||||

See notes to the unaudited condensed consolidated financial statements

statements.

| 5 |

NEMAURA MEDICAL INC.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

Three Months Ended JuneSeptember 30, 2020 and 2019 (Unaudited)

| Common Stock | ||||||||||||||||||||||||

| Shares | Amount ($) | Additional Paid-in Capital ($) | Accumulated Deficit ($) | Accumulated Other Comprehensive Loss ($) | Total Stockholders’ Equity (Deficit) ($) | |||||||||||||||||||

| Balance at March 31, 2020 | 20,850,848 | 20,851 | 16,589,272 | (17,586,075 | ) | (336,992 | ) | (1,312,944 | ) | |||||||||||||||

| Issuance of common shares under ATM financing, net of offering costs of $122,913 | 393,352 | 393 | 3,973,777 | — | — | 3,974,170 | ||||||||||||||||||

| Exercise of warrants | 37,933 | 38 | 394,437 | — | — | 394,475 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | 4,823 | 4,823 | ||||||||||||||||||

| Net loss | — | — | — | (1,100,056 | ) | — | (1,100,056 | ) | ||||||||||||||||

| Balance at June 30, 2020 | 21,282,133 | 21,282 | 20,957,486 | (18,686,131 | ) | (332,169 | ) | 1,960,468 | ||||||||||||||||

| Balance at March 31, 2019 | 20,765,592 | 20,766 | 15,971,905 | (13,425,879 | ) | (339,888 | ) | 2,226,904 | ||||||||||||||||

| Exercise of warrants | 2,500 | 3 | 25,998 | — | — | 26,001 | ||||||||||||||||||

| Issuance of common shares under ATM financing, net of offering costs of $9,575 | 14,338 | 14 | 142,903 | — | — | 142,917 | ||||||||||||||||||

| Restricted shares issued as stock- based compensation to consultants and investor relations | 19,250 | 19 | 179,553 | — | — | 179,572 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (15,751 | ) | (15,751 | ) | ||||||||||||||||

| Net loss | — | — | — | (1,251,265 | ) | — | (1,251,265 | ) | ||||||||||||||||

| Balance at June 30, 2019 | 20,801,680 | 20,802 | 16,320,359 | (14,677,144 | ) | (355,639 | ) | 1,308,378 | ||||||||||||||||

| Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount ($) | Capital ($) | Deficit ($) | Loss ($) | Equity ($) | |||||||||||||||||||

| Balance at June 30, 2020 | 21,282,133 | 21,282 | 20,957,486 | (18,686,131 | ) | (332,169 | ) | 1,960,468 | ||||||||||||||||

| Issuance of common shares, net of offering costs of $834,280 | 1,601,572 | 1,602 | 10,817,707 | — | — | 10,819,309 | ||||||||||||||||||

| Restricted shares issued as stock-based compensation to consultants and investor relations | 10,000 | 10 | 63,190 | — | — | 63,200 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (19,333 | ) | (19,333 | ) | ||||||||||||||||

| Net loss | — | — | — | (1,581,217 | ) | — | (1,581,217 | ) | ||||||||||||||||

| Balance at September 30, 2020 | 22,893,705 | 22,894 | 31,838,383 | (20,267,348 | ) | (351,502 | ) | 11,242,427 | ||||||||||||||||

| Balance at June 30, 2019 | 20,801,680 | 20,802 | 16,320,359 | (14,677,144 | ) | (355,639 | ) | 1,308,378 | ||||||||||||||||

| Restricted shares issued as stock-based compensation to consultants and investor relations | 1,250 | 1 | 12,375 | — | — | 12,376 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (7,401 | ) | (7,401 | ) | ||||||||||||||||

| Net loss | — | — | — | (1,117,040 | ) | — | (1,117,040 | ) | ||||||||||||||||

| Balance at September 30, 2019 | 20,802,930 | 20,803 | 16,332,734 | (15,794,184 | ) | (363,040 | ) | 196,313 | ||||||||||||||||

See notes to the unaudited condensed consolidated financial statementsstatements.

| 6 |

NEMAURA MEDICAL INC.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

Six Months Ended September 30, 2020 and 2019 (Unaudited)

| Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount ($) | Capital ($) | Deficit ($) | Loss ($) | Equity ($) | |||||||||||||||||||

| Balance at March 31 2020 | 20,850,848 | 20,851 | 16,589,272 | (17,586,075 | ) | (336,992 | ) | (1,312,944 | ) | |||||||||||||||

| Issuance of common shares, net of offering costs of $957,193 | 1,994,924 | 1,995 | 14,791,484 | — | — | 14,793,479 | ||||||||||||||||||

| Restricted shares issued as stock-based compensation to consultants and investor relations | 10,000 | 10 | 63,190 | — | — | 63,200 | ||||||||||||||||||

| Exercise of warrants | 37,933 | 38 | 394,437 | — | — | 394,475 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (14,510 | ) | (14,510 | ) | ||||||||||||||||

| Net loss | — | — | — | (2,681,273 | ) | — | (2,681,273 | ) | ||||||||||||||||

| Balance at September 30, 2020 | 22,893,705 | 22,894 | 31,838,383 | (20,267,348 | ) | (351,502 | ) | 11,242,427 | ||||||||||||||||

| Balance at March 31, 2019 | 20,765,592 | 20,766 | 15,971,905 | (13,425,879 | ) | (339,888 | ) | 2,226,904 | ||||||||||||||||

| Exercise of warrants | 2,500 | 2 | 25,998 | — | — | 26,000 | ||||||||||||||||||

| Issuance of common shares, net of offering costs of $9,575 | 14,338 | 14 | 142,903 | — | — | 142,917 | ||||||||||||||||||

| Restricted shares issued as stock-based compensation to consultants and investor relations | 20,500 | 21 | 191,928 | — | — | 191,949 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (23,152 | ) | (23,152 | ) | ||||||||||||||||

| Net loss | — | — | — | (2,368,305 | ) | — | (2,368,305 | ) | ||||||||||||||||

| Balance at September 30, 2019 | 20,802,930 | 20,803 | 16,332,734 | (15,794,184 | ) | (363,040 | ) | 196,313 | ||||||||||||||||

See notes to the unaudited condensed consolidated financial statements.

| 7 |

NEMAURA MEDICAL INC. |

| Condensed Consolidated Statements of Cash Flows |

| (Unaudited) |

| Three Months Ended June 30, | Six Months Ended September 30, | |||||||||||||||

2020 ($) | 2019 ($) | 2020 ($) | 2019 ($) | |||||||||||||

| Cash Flows From Operating Activities: | ||||||||||||||||

| Net loss | (1,100,056 | ) | (1,251,265 | ) | (2,681,273 | ) | (2,368,305 | ) | ||||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||||||

| Depreciation and amortization | 20,168 | 11,048 | 40,746 | 28,338 | ||||||||||||

| Accretion of debt discount | 188,579 | — | 542,428 | — | ||||||||||||

| Stock-based compensation | 59,000 | 162,254 | 59,000 | 277,664 | ||||||||||||

| Changes in assets and liabilities: | ||||||||||||||||

| Prepaid expenses and other receivables | 152,438 | 197,131 | 94,059 | 263,022 | ||||||||||||

| Inventory | (54,085 | ) | (1,471 | ) | (125,311 | ) | (170,371 | ) | ||||||||

| Accounts payable | (103,135 | ) | 16,886 | (137,999 | ) | 59,010 | ||||||||||

| Liability due to related parties | (284,453 | ) | 135,950 | (676,560 | ) | 100,533 | ||||||||||

| Other liabilities and accrued expenses | 43,950 | 37,309 | (121,357 | ) | (52,608 | ) | ||||||||||

| Net cash used in operating activities | (1,077,594 | ) | (692,158 | ) | (3,006,267 | ) | (1,862,717 | ) | ||||||||

| Cash Flows from Investing Activities: | ||||||||||||||||

| Capitalized patent costs | (10,283 | ) | (10,893 | ) | (27,600 | ) | (28,310 | ) | ||||||||

| Purchase of property and equipment | (1,999 | ) | (76,691 | ) | (14,032 | ) | (133,716 | ) | ||||||||

| Net cash used in investing activities | (12,282 | ) | (87,584 | ) | (41,632 | ) | (162,026 | ) | ||||||||

| Cash Flows from Financing Activities: | ||||||||||||||||

| Costs incurred in relation to ATM equity financing | (61,424 | ) | (9,575 | ) | ||||||||||||

| Costs incurred in relation to equity financing | (957,193 | ) | (9,575 | ) | ||||||||||||

| Commission paid on note payable | (325,000 | ) | — | (325,000 | ) | — | ||||||||||

| Proceeds from issuance of notes | 4,943,074 | — | 5,000,000 | — | ||||||||||||

| Proceeds from issuance of common stock in relation to ATM financing | 2,047,462 | 152,493 | ||||||||||||||

| Proceeds from issuance of common stock in relation to equity financing | 15,750,672 | 152,492 | ||||||||||||||

| Proceeds from warrant exercise | 394,475 | 26,000 | 394,475 | 26,000 | ||||||||||||

| Repayments of note payable | (40,936 | ) | — | (82,555 | ) | — | ||||||||||

| Net cash provided by financing activities | 6,957,651 | 168,918 | 19,780,399 | 168,917 | ||||||||||||

| Net increase (decrease) in cash | 5,867,775 | (610,824 | ) | 16,732,500 | (1,855,826 | ) | ||||||||||

| Effect of exchange rate changes on cash | (20,948 | ) | (61,299 | ) | 110,332 | (113,723 | ) | |||||||||

| Cash at beginning of period | 106,107 | 3,740,664 | 106,107 | 3,740,664 | ||||||||||||

| Cash at end of period | 5,952,934 | 3,068,541 | 16,948,939 | 1,771,115 | ||||||||||||

| Supplemental disclosure of non-cash financing activities: | ||||||||||||||||

| Prepayment of equity compensation | — | 103,034 | — | 85,715 | ||||||||||||

| Increase in stock subscriptions receivable | 1,988,132 | — | ||||||||||||||

See notes to the unaudited condensed consolidated financial statements

statements.

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

Nemaura Medical Inc. (“Nemaura” or the “Company”), through its operating subsidiaries, performs medical device research and manufacturing of a continuous glucose monitoring system (“CGM”), named sugarBEATTM.sugarBEAT™.. The sugarBEATTMsugarBEAT™. device is a non-invasive, wireless device for use by persons with Type I and Type II diabetes and may also be used to screen pre-diabetic patients. The sugarBEATTM sugarBEAT™. device extracts analytes, such as glucose, to the surface of the skin in a non-invasive manner where it is measured using unique sensors and interpreted using a unique algorithm.

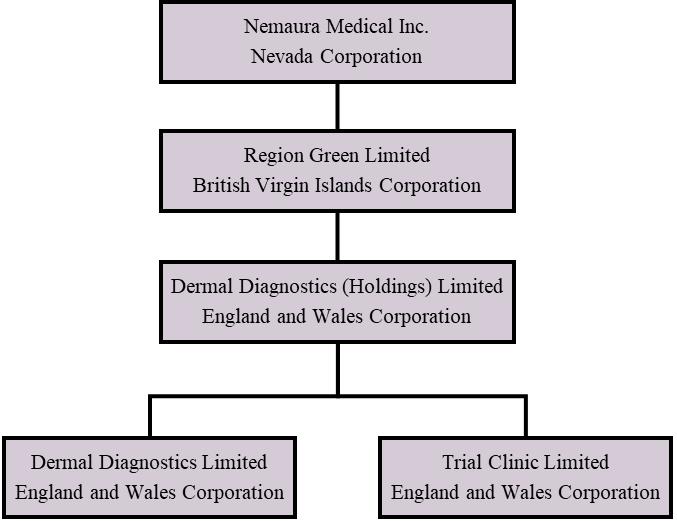

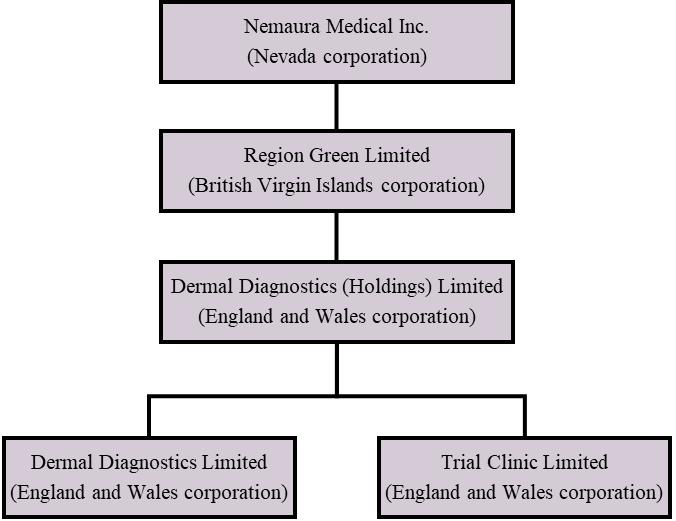

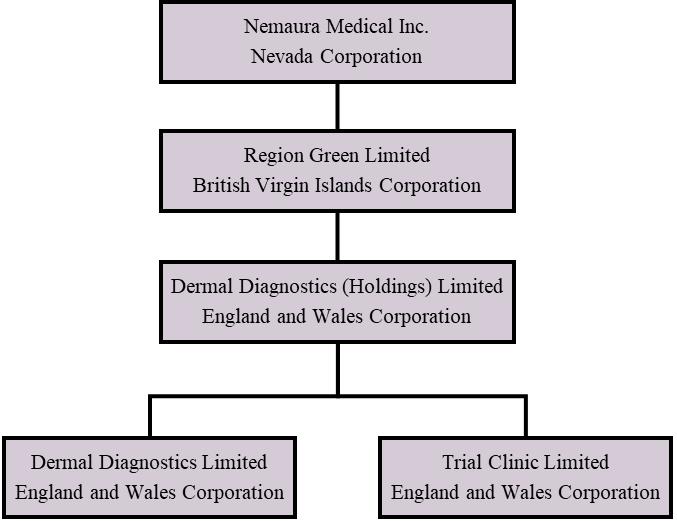

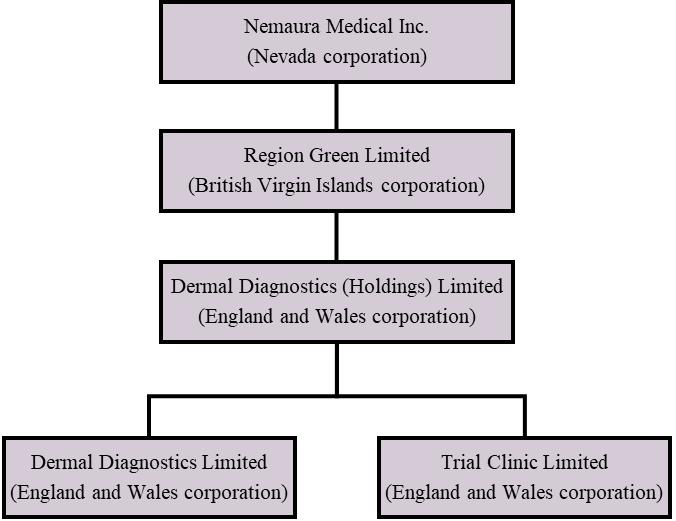

Nemaura is a Nevada holding company organized in 2013. Nemaura owns 100% of Region Green Limited, a British Virgin Islands corporation (“RGL”) formed on December 12, 2013. RGL owns 100% of the stock in Dermal Diagnostic (Holdings) Limited, an England and Wales corporation (“DDHL”) formed on December 11, 2013, which in turn owns 100% of Dermal Diagnostics Limited, an England and Wales corporation formed on January 20, 2009 (“DDL”), and 100% of Trial Clinic Limited, an England and Wales corporation formed on January 12, 2011 (“TCL”).

DDL is a diagnostic medical device company headquartered in Loughborough, Leicestershire, England, and is engaged in the discovery, development and commercialization of diagnostic medical devices. The Company’s initial focus has been on the development of the sugarBEATTM device,sugarBEAT™.device, which consists of a disposable patch containing a sensor, and a non-disposable miniature electronic watchwireless transmitter with a re-chargeable power source, which is designed to enable trending or tracking of blood glucose levels. All of the Company’s operations and assets are located in England.

The following diagram illustrates Nemaura’s corporate structure as of JuneSeptember 30, 2020:

The Company was incorporated in 2013 and has reported recurring losses from operations to date and an accumulated deficit of $18,686,131$20,267,348 as of JuneSeptember 30, 2020. These operations have resulted in the successful completion of clinical programs to support a CE mark (European Union approval of the product) approval, as well as a De Novo 510(k) medical device application to the U.S. Food and Drug Administration (“FDA”) submission.. The Company expects to continue to incur losses from operations until revenues are generated through licensing fees or product sales. However, given the completion of the requisite clinical programs, these losses are expected to be reduced over time. Management has entered into licensing agreements with unrelated third parties relating to the United Kingdom, Europe, Qatar and all countries in the Gulf Cooperation Council.

Management has evaluated the expected expenses to be incurred along with its available cash and has determined that the Company has the ability to continue as a going concern for at least one year subsequent to the date of issuance of these unaudited condensed consolidated financial statements. The Company hadhas an $8 million unsecured senior credit facility made available from certain major stockholders on August 1, 2019. The first $3.5 million became available immediately for draw down, to help fund the Company’s European commercial launch. The credit facility carries anis non-dilutive carrying 8% interest with quarterly interest payments only payments. Theand the principal isbeing due on maturity in 5 years. No draw down has been made to date.

On April 15, 2020, the Company entered into a note purchase agreement resulting in cash proceeds of $4,618,074;$4,675,000; as set out in Note6. 6. The Company has $5,952,934 of readily available$16,948,939 cash on hand at JuneSeptember 30, 2020. The Company believes the cash position as of JuneSeptember 30, 2020, plus the credit facility made available from certain major stockholders, plus funds totaling approximately $11.5 million raised in July 2020 through the sale of shares is adequate for our current level of operations through at least AugustNovember 2021, and for the achievement of certain of our product development milestones. Our plan is to utilize the cash, on hand plus loan draw down if required, to continue establishing commercial manufacturing operations for the commercial supply of the sugarBEATTM devicesugarBEAT™.device and patches now that CE mark approval has been received.

Management's strategic plans include the following:

• obtaining further regulatory approval for the sugarBEATTM device in other countries such as the U.S., Premarket approval (“PMA”) submitted to FDA in early July 2020;

• exploring licensing opportunities, discussions remain ongoing with several multinational companies;

• developing the sugarBEATTM device for commercialization for other applications

NOTE 2 – BASIS OF PRESENTATION

(a)Basis of presentation

| (a) | Basis of presentation |

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), and do not include all of the information and footnotes required by U.S. generally accepted accounting principles (“U.S. GAAP”) for complete financial statements. However, such information reflects all adjustments consisting of normal recurring accruals which are, in the opinion of management, necessary for a fair statement of the financial condition and results of operations for the interim periods. The results for the three months and six months ended JuneSeptember 30, 2020 are not indicative of annual results. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. . It is suggested that these unaudited condensed consolidated financial statements be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s latest stockholders’ annual report (Form 10-K).Annual Report on Form 10-K for the year ended March 31, 2020, as filed with the SEC.

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company and the Company’s subsidiaries. References to “we”, “us”, “our”, or the “Company” refer to Nemaura Medical Inc. and its consolidated subsidiaries. The condensed consolidated financial statements are prepared in accordance with U.S. GAAP, and all significant intercompany balances and transactions have been eliminated in consolidation.

The functional currency for the majority of the Company’s operations is the Great Britain Pound Sterling (“GBP”), and the reporting currency is the USU.S. Dollar (“USD”).

| (b) | Changes to significant accounting policies |

The Company adopted Accounting Standards Update ("ASU") No. 2016-02, Leases, as disclosed below, however thereof April 1, 2020 and the impact of adoption of this ASU on the Company’s consolidated financial statements is not significant. There have been no other material changes to our significant accounting policies asfrom those detailed in ourthe Company’s Annual Report on Form 10-K for the year ended March 31, 2020.2020, as filed with the SEC.

(c) Recently adopted accounting pronouncements

The Company continually assesses any new accounting pronouncements to determine their applicability. When it is determined that a new accounting pronouncement affects the Company's financial reporting, the Company undertakes a study to determine the consequences of the change to its consolidated financial statements and assures that there are proper controls in place to ascertain that the Company's consolidated financial statements properly reflect the change.

In March 2016, the Financial Accounting Standards Board (the “FASB”) ASU No. 2016-02, Leases. The main difference between the provisions of ASU No. 2016-02 and previous U.S. GAAP is the recognition of right-of-use assets and lease liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. ASU No. 2016-02 retains a distinction between finance leases and operating leases, and the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly changed from previous U.S. GAAP. For leases with a term of 12 months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize right-of-use assets and lease liabilities. The accounting applied by a lessor is largely unchanged from that applied under previous U.S. GAAP. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. This ASU is effective for public business entities in fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted as of the beginning of any interim or annual reporting period. The Company adopted this standard on April 1, 2020 and the impact of adoption of this ASU on the Company’s consolidated financial statements is not significant.

This Quarterly Report on Form 10-Q does not discuss recent pronouncements that are not anticipated to have a current and/or future impact on the Company, or are unrelated to the Company’s financial condition, results of operations, cash flows or disclosures.

| 10 |

NOTE 3 – LICENSING AGREEMENTS

United Kingdom and the Republic of Ireland, the Channel Islands and the Isle of Man

In March 2014, the Company entered into an Exclusive Marketing Rights Agreement with an unrelated third party (the “Licensee”), that granted to the third partyLicensee the exclusive right to market and promote the sugarBEATTM devicesugarBEAT™.device and related patches under its own brand in the United Kingdom and the Republic of Ireland, the Channel Islands and the Isle of Man. The Company received a non-refundable, up-front cash payment of GBP 1,000,000 (approximately $1.237$1.292 million and $1.240 million as of JuneSeptember 30, 2020 and March 31, 2020, respectively), which is wholly non-refundable, upon signing the agreement.

AsThe Company is in ongoing dialogue with the Company has continuing performance obligations underLicensee about the agreement,timing of its plans with respect to its product launch. The current expectation is for this to occur in the up-frontthird quarter ending December 31, 2020. The upfront fees received from this agreement have been deferred and will be recorded as income over the term of the commercial licensing agreement. As the Company now expects commercialization of the sugarBEATTM device to occur in the third quarter ending December 31, 2020,Consequently, approximately $94,000$97,000 and $93,000 of the deferred revenue has been classified as a current liability as of JuneSeptember 30, 2020 and March 31, 2020, respectively.

NOTE 4 – RELATED PARTY TRANSACTIONS

Nemaura Pharma Limited (“Pharma”), NDM Technologies Limited (“NDM”) and Black and White Health Care Limited (“B&W”) are entities controlled by the Company’s Chief Executive Officer, interim Chief Financial Officer, President, director and majority stockholder, Dewan F.H. Chowdhury.

In accordance with the SEC Staff Accounting Bulletin 55, theseThese condensed consolidated financial statements are intended to reflect all costs associated with the operations of DDL and TCL. Pharma has a service agreement with DDL to undertake development, manufacture and regulatory approvals under Pharma’s ISO13485 accreditation. In lieu of these services, DDLPharma invoices PharmaDDL on a periodic basis for said services. Services are provided at cost plus a service surcharge amounting to less than 10% of the total costs incurred.

The following istable below provides a summary of activity between the Company and Pharma and NDM for the threesix months ended JuneSeptember 30, 2020 and 2019, and the year ended March 31, 2020. These amounts are unsecured, interest free, and payable on demand.

Three Months Ended June 30, 2020 (unaudited) ($) | Three Months Ended June 30, 2019 (unaudited) ($) | Year Ended March 31, 2020

($) | Six Months Ended September 30, 2020 (unaudited) ($) | Six Months Ended September 30, 2019 (unaudited) ($) | Year Ended March 31, 2020

($) | |||||||||||||||||||

| Liability due to related parties at beginning of period | 830,093 | 964,679 | 964,679 | 830,093 | 964,679 | 964,679 | ||||||||||||||||||

| Amounts invoiced by Pharma to DDL, NM and TCL (1) | 298,999 | 431,416 | 1,800,517 | 698,300 | 966,425 | 1,800,517 | ||||||||||||||||||

| Amounts invoiced by DDL to Pharma | — | — | (10,963 | ) | (7,060 | ) | (814 | ) | (10,963 | ) | ||||||||||||||

| Amounts repaid by DDL to Pharma | (582,089 | ) | (305,060 | ) | (1,897,222 | ) | ||||||||||||||||||

| Amounts paid by DDL to Pharma | (1,388,874 | ) | (867,013 | ) | (1,897,222 | ) | ||||||||||||||||||

| Foreign exchange differences | (2,922 | ) | (22,359 | ) | (26,918 | ) | 21,074 | (56,743 | ) | (26,918 | ) | |||||||||||||

| Liability due to related parties at end of year | 544,081 | 1,072,676 | 830,093 | |||||||||||||||||||||

| Liability due to related parties at end of period | 153,533 | 1,006,534 | 830,093 | |||||||||||||||||||||

| (1) | These amounts are included primarily in research and development expenses charged to the Company by Pharma. |

The Company has an $8 million unsecured senior credit facility made available from certain majority stockholders as of August 1, 2019. The first $3.5 million became available immediately forNo draw down which will help fund the Company’s European commercial launch. The credit facility is non-dilutive carrying 8% interest with quarterly interest only payments. The principal is due on maturity in 5 years. There has been no draw down to date. No decision to date has been made on when the remaining capital will be needed and will be available for draw down.against this facility to date.

The Company routinely reviews its condensed consolidated statements of cash flows presentation of related party transactions for financing or operating classification based on the underlying nature of the item and intended repayment.

| 12 |

NOTE 5 – STOCKHOLDERS’ EQUITY

Reverse stock split

The Company was notified by The NASDAQ Stock Market (“NASDAQ”) on July 15, 2019 that the Company no longer met the requirements of NASDAQ Rule 5550(a)(2) requiring listed securities to maintain a minimum closing bid price of $1.00 per share. Thereafter, the Company effected:

| (i) | A reverse split of the Company’s issued and outstanding common stock |

| (ii) | A decrease in the Company’s authorized number of shares of common stock on the same basis from 420,000,000 shares of common stock to 42,000,000 shares of common |

The reverse stock split and decrease in authorized common stock were effective on December 5, 2019. On December 19, 2019, the Company received confirmation from NASDAQ that the Company had regained compliance with the Minimum Bid Price RuleNASDAQ’s minimum bid price rule and the matter is now resolved. Amounts are retroactively restated for the period ended June 30, 2019.

Other equity transactionsall periods presented.

Other equity transactions

On October 19, 2018, the Company entered into an Equity Distribution Agreement (the “Distribution Agreement”) with Maxim Group LLC, as sales agent (“Maxim”), pursuant to which the Company may offer and sell, from time to time, through Maxim (the “Offering”), up to $20,000,000 in shares of its common stock (the “Shares”).stock. During the threesix monthperiod ended JuneSeptember 30, 2020, a total of 393,352408,718 shares were issued under the Distribution Agreement, generating gross proceeds of $4,097,083$4,250,676 with associated costs of $122,913. $1,986,038 was received net of ATM financing costs through June 30, 2020 and $1,988,132 is presented as stock subscriptions receivable as of June 30, 2020 and was collected on July 1, 2020.$127,520.

DuringOn August 8, 2020, pursuant to the three month period ended June 30, 2020, 37,933 warrants were exercised, generating $394,475 in additional funds. At June 30, 2020 there were 147,637 warrants outstanding.

Duringterms of the three month period ended June 30, 2019, 2,500 warrants were exercised, generating $26,001 in additional funds.

Effective December 18, 2018,Distribution Agreement, as amended, between the Company issued a unit purchase optionand Maxim, the Company provided notice of termination of the Distribution Agreement, as amended, to Maxim. Accordingly, the placement agent to purchase 9,710 shares and 9,710 warrants. The Company has classified this optionDistribution Agreement, as equity. The unit purchase option has a term of three years and an exercise price of $13.00.amended, terminated on August 18, 2020.

On July 28, 2020, the Company entered into a placement agency agreement with Kingswood Capital Markets, a division of Benchmark Investments, Inc. (“Kingswood” or the “Placement Agent”), with respect to the issuance and sale of an aggregate of 1,586,206 shares of the Company’s common stock, and warrants to purchase up to 793,103 shares of common stock (the “Placement Agency Agreement”).stock. Each share of common stock and accompanying one-half of a warrant were sold for a combined purchase price of $7.25, for a total deal size of approximately $11.5 million, not including any future proceeds from the exercise of the warrants and before deducting the Placement Agentfees and offering expenses. Each whole warrant is immediately exercisable at a price of $8.00 per share, subject to adjustment in certain circumstances, and will expire five years from the date of issuance. The shares of common stock were offered together with the warrants, but the securities were issued separately and are separately transferable.

The closing of the offering took place on July 30, 2020 and the net proceeds from the sale of the common stock and warrants were approximately $10.7 million after deducting the PlacementAgent commission and estimated offeringother expenses paidincurred by the Company.Company as a result of the offering.

During the six month period ended September 30, 2020, 37,933 warrants were exercised, generating $394,475 in additional funds; no warrants were exercised in the three month period ended September 30, 2020. During the six month period ended September 30, 2019, 2,500 warrants were exercised generating funds of $26,000, all of which were exercised during the three month period ended September 30, 2019.

At September 30, 2020, there were 940,740 warrants outstanding.

Effective December 18, 2018, the Company issued a unit purchase option to the Placement Agent to purchase 9,710 shares and 9,710 warrants. The Company intends to use the net proceeds from the offering for general corporate purposes, which include, but are not limited to, the commercial launchhas classified this option as equity. The unit purchase option has a term of a subscription based service for the U.S. under the Wellness category, lactatemonitor development for launch, glucose monitoring product launch in Europethree years and the developmentan exercise price of a second generation of sugarBEATTM.$13.00.

| 13 |

Loss per share

The following table sets forth the computation of basic and diluted loss per share for the periods indicated.

| Three months ended June 30, | ||||||||

| 2020 | 2019 | |||||||

| ($) | ($) | |||||||

| Net loss attributable to common stockholders | (1,100,056 | ) | (1,251,265 | ) | ||||

| Weighted average basic and diluted shares outstanding | 20,879,446 | 20,783,636 | ||||||

| Basic and diluted loss per share: | (0.05 | ) | (0.06 | ) | ||||

| Three months ended September 30, | Six months ended September 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Net loss attributable to common stockholders ($) | (1,581,217 | ) | (1,117,040 | ) | (2,681,273 | ) | (2,368,305 | ) | ||||||||

| Weighted average basic and diluted shares outstanding | 22,390,114 | 20,802,197 | 21,638,907 | 20,792,967 | ||||||||||||

| Basic and diluted loss per share ($): | (0.07 | ) | (0.05 | ) | (0.12 | ) | (0.11 | ) | ||||||||

The Company excludes warrants outstanding, which are anti-dilutive given the Company is in a loss position, from the basic and diluted loss per share calculation.

Basic loss per share is computed by dividing loss available to common stockholders by the weighted-averageweighted average number of common shares outstanding during the period. For the three and six month periods ended JuneSeptember 30, 2020 and 2019, warrants to purchase one million shares of common stock were anti-dilutive and were excluded from the calculation of diluted loss per share. share. For the three and six month periods ended JuneSeptember 30, 2020, and June 30, 2019, warrants to purchase 147,637 and 185,570940,740 shares of common stock, respectively, and a unit purchase option to purchase 9,710 shares of common stock as well as 9,710 warrants were considered anti-dilutive and were also excluded from the calculation of diluted loss per share. For the three and six month periods ended September 30, 2019, the equivalent number of warrants excluded from this calculation was 185,570 and the unit purchase option was 9,710.

NOTE 6 – NOTES PAYABLE

On April 15, 2020, the Company entered into a note purchase agreement (the “Note Purchase Agreement”) by and among the Company, DDL, TCL andwith Chicago Venture Partners, L.P. (the “Investor”).

Pursuant to the terms of the Note Purchase Agreement, the Company agreed to issue and sell to the Investor and the Investor agreed to purchase from the Company, a secured promissory note (the “Secured Note”) in the original principal amount of $6,015,000. In consideration thereof, on April 15, 2020 (the closing date), (i) the Investor (a) paid $1,000,000 in cash, (b) issued to the Company (1) Investor Note #1 in the principal amount of $2,000,000 (“Investor Note #1”), and (2) Investor Note #2 in the principal amount of $2,000,000 (“Investor Note #2” and together with Investor Note #1, the “Investor Notes”), and (ii) the Company delivered the Secured Note on behalf of the Company, to the Investor, against delivery of the Purchase Price. For these purposes, the “Purchase Price” means the Investor’s initial cash purchase price, together with the sum of the initial principal amounts of the Investor Notes.

The Secured Note is secured by all patents and related rights and items as defined in the Collateral.related security agreement within the Secured Note. The Secured Note carries an original issue discount (“OID”) of $1,000,000. In addition, the Company agreed to pay $15,000 to the Investor to cover the Investor’s legal fees, accounting costs, due diligence, monitoring and other transaction costs incurred in connection with the purchase and sale of the Secured Note (the “Transaction Expense Amount”), all of which amount is included in the initial principal balance of the Secured Note. The Purchase Price for the Secured Note is $5,000,000, computed as follows: $6,015,000 original principal balance, less the OID, less the commission expense of $325,000, less the other Transaction Expense Amounts, resulting in cash proceeds of $4,618,074.$4,675,000. The debt less the discount will be accreted over the 24 month24-month term of the Secured Note using the effective interest method. The effective interest rate was 38.8%is 34.3%. Accretion for the 3 months ended June 30, 2020 was $188,579.

The borrowing period is 24 months, aA monitoring fee equal to 0.833% of the outstanding balance will automatically be added to the outstanding balance on the first day of each month. Accretion for the three and six month periods ended September 30, 2020 was $188,579 and $542,428, respectively.

NOTE 7 – OTHER ITEMS

(a) Investor relations agreementsCOVID-19 Pandemic

The Companyoutbreak of COVID-19 originating in Wuhan, China, in December 2019 has entered into contractssince rapidly increased its exposure globally. On March 11, 2020, the World Health Organization declared the outbreak a pandemic. We continue to monitor the global outbreak of COVID-19 and are working with several investor relations specialistsour customers, employees, suppliers and other stakeholders to help supportmitigate the ongoing financing activitiesrisks posed by its spread, COVID-19 is not expected to have any long-term detrimental effect on the Company’s success. While key suppliers have not been accessible throughout the whole period of the business.

Duringoutbreak, we have been able to be flexible in our priorities and respond favorably to the three month periods ended June 30, 2020,challenges faced during the outbreak. We have also seen a surge in the uptake of technologies for remote and 2019, fees paid to an investor relations company were $21,000patient self-monitoring, which therefore potentially enhances the prospects for the likes of the Company and $20,000, respectively.its CGM product and planned digital healthcare offering.

(b) Management consultancy agreements

For

During the six month period ended September 30, 2020, $59,000 in stock-based compensation was shown as expense in relation to a management consulting company as a result of a release of prepaid expenses. This stock-based compensation was issued in the three month period ended JuneSeptember 30, 2020, cash expense was $13,261 and share expense was $59,000 relating to a management consulting company. For2020.

Total stock-based compensation recognized during the three and six month periodperiods ended June 30, 2019, cash expense was $36,667 and share expense was $144,366.

During the three month period ended June 30, 2020, the Company did not issue any restricted common stock to the investor relations and management consultants. Stock based compensation expense during the threemonth period ended of $59,000 related to the release of prepayments and accrued expenses at June 30, 2020. Total cash expense for the three month period to June 30, 2020 was $34,261. Total stock based compensation expense for the three month period endedJuneSeptember 30, 2019 was $162,254.$115,410 and $277,644, respectively.

(c) Subsequent events

July 2020 Offering

As set out in Note 5, on July 28, 2020, the Company entered into a sale of common stock and warrants and received approximately $10.7 million after deducting the placement agent commission and offering expenses paid by the Company.None noted for disclosure.

Termination of Maxim Distribution Agreement

On August 8, 2020, pursuant to the terms of the Distribution Agreement, as amended, between the Company and Maxim, the Company provided notice of termination of the Distribution Agreement, as amended, to Maxim. Accordingly, the Agreement, as amended, will terminate on August 18, 2020.

ITEM 2: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a medical technology company developing sugarBEATTMsugarBEAT™., a non-invasive, affordable and flexible continuous glucose monitoring system for adjunctive use by persons with diabetes. sugarBEATTM consistssugarBEAT™.consists of a disposable adhesive skin-patch connected to a rechargeable wireless transmitter that displays glucose readings at regular five minute intervals via a mobile app. sugarBEATTMsugarBEAT™. works by extracting glucose from the skin into a chamber in the patch that is in direct contact with an electrode-based sensor. The transmitter sends the raw data to a mobile app where it is processed by an algorithm and displayed as a glucose reading, with the ability to track and trend the data over days, weeks and months. While sugarBEATTM requiressugarBEAT™.requires once per day calibration by the patient using a blood sample obtained by a finger stick, we believe sugarBEATTM willsugarBEAT™.will be adopted by non-insulin dependent persons with diabetes alongside insulin-injecting persons with diabetes who all perform multiple daily finger sticks to manage their disease.

CE approval was granted by the European Notified Body BSI in May 2019, allowing the product to be made available for commercial sale. The Company commenced a phase 1 launch whereby devices were made available to limited cohorts of users to gauge their feedback so that any fine-tuning could be completed prior to a mass market launch. A mass-market launch is due to commence in the UK in the coming months via its UK licensee DB Ethitronix, whereby the sugarBEATTM willsugarBEAT™.will be available via a number of subscription models that are yet to be determined. In July 2020, Nemaura filed a PMA application with the FDA to use sugarBEATTMsugarBEAT™. as an adjunct to finger prick testing for blood glucose trending. In addition it has been pursuing the possibility of launching the sugarBEATTM undersugarBEAT™.under the FDA Wellness guidance which would preclude it from an FDA assessment and allow the product to be launched in the U.S. for Wellness use, to provide prompts and educate users on factors affecting their blood sugar profiles. Further to discussions with the FDA Nemaura established that sugarBEATTM cansugarBEAT™.can be classified under the Wellness guidance when it is used according to the FDA Wellness guidance notes. Nemaura plans to launch this in the U.S. under the brand proBEAT™. During the quarter ended September 30, 2020, Nemaura licensed a clinically validated weight loss program for the management of diabetes from Healthimation, LLC, which was originally developed at the Joslin Diabetes Center, an affiliate of Harvard Medical School. This program, together with proBEAT™. is now expediting a commercialplanned for launch in the U.S. underin December 2020, aimed at the Wellness guidance.management or reversal of Type 2 diabetes.

We believe there are additional applications for sugarBEATTM andsugarBEAT™.and the underlying BEAT technology platform, which may include:

| · | a web-server accessible by physicians and diabetes professionals to track the condition remotely, thereby reducing healthcare costs and managing the condition more effectively; |

| · | a complete virtual doctor that monitors a person's vital signs and transmits results via the web; |

| · | other patches using the BEAT technology platform to measure alternative analytes, including lactate, uric acid, lithium and drugs. This would be a step-change in the monitoring of conditions, particularly in the hospital setting. Lactate monitoring is currently used to determine the relative fitness of professional athletes and we completed preliminary studies demonstrating the application of the BEAT technology for continuous lactate monitoring; |

| · | a continuous temperature monitoring system which could have various applications, including use for individuals to monitor their temperature in connection with diagnosis and monitoring of symptoms of novel coronavirus (COVID-19); |

| · | monitoring disease progression in COVID-19 patients using continuous lactate monitoring (CLM). |

The Company has experienced recurring losses and negative cash flows from operations. At JuneSeptember 30, 2020, the Company had cash balances of $5,952,934,$16,948,939, working capital of $4,972,103,$14,833,369, total stockholders' equity of $1,960,468$11,242,427 and an accumulated deficit of $18,686,131.$20,267,348. To date, the Company has in large part relied on equity financing to fund its operations. Additional funding has come from related party contributions. The Company expects to continue to incur losses from operations for the near-term and these losses could be significant as product development, regulatory activities, clinical trials and other commercial and product development related expenses are incurred.

| 16 |

Management's strategic assessment includes the following potential options:

·obtaining further regulatory approval for the sugarBEATTM device in other countries such as the U.S.;

| · | obtaining further regulatory approval for the sugarBEAT™.device in other countries such as the U.S.; |

| · | pursuing capital raising opportunities; |

·exploring licensing opportunities; and

·developing the sugarBEATTM device for commercialization for other applications.

| · | exploring licensing opportunities; and |

| · | developing the sugarBEAT™.device for commercialization for other applications. |

COVID-19 Pandemic

The outbreak of COVID-19 originating in Wuhan, China, in December 2019 has since rapidly increased its exposure globally. On March 11, 2020, the World Health Organization declared the outbreak a pandemic. We continue to monitor the global outbreak of COVID-19 and are working with our customers, employees, suppliers and other stakeholders to mitigate the risks posed by its spread, as a consequence the impact of COVID-19 is not expected to have any long-term detrimental effect on the Company’s success. While key suppliers have not been accessible throughout the whole period of the outbreak, we have been able to be flexible in our priorities and respond favorably to the challenges faced during the outbreak. We have also seen a surge in the uptake of technologies for remote and patient self- monitoring,self-monitoring, which therefore potentially enhances the prospects for the likes of the Company and its CGM product and planned digital healthcare offering.

Results of Operations

Comparative Results for the ThreeSix Months Ended JuneSeptember 30, 2020 and 2019

Revenue

Revenue

There was no revenue recognized in the threesix months ended JuneSeptember 30, 2020 and 2019. In 2014, we received an upfront non-refundable cash payment of approximately GBP 1 million (approximately $1.237$1.292 million and $1.240$1.240 million as of JuneSeptember 30, 2020 and March 31, 2020, respectively) in connection with an Exclusive Marketing Rights Agreement with an unrelated third party that provides the third party the exclusive right to market and promote the sugarBEATTM devicesugarBEAT™.device and related patch under its own brand in the United Kingdom and the Republic of Ireland. We have deferred this licensing revenue until sales are due to commence, and we expect to record the revenue as income over an approximately 10-year term from the date sales commence. Although the revenue is deferred at JuneSeptember 30, 2020, the cash payment became immediately available and has been used to fund our operations, including research and development costs associated with successfully obtaining the CE mark approval.

Research and Development Expenses

Research and development expenses were $315,312$771,592 and $556,183$1,018,699 for the threesix months ended JuneSeptember 30, 2020 and 2019, respectively. This amount consisted primarily of expenditures on wages and sub-contractor activities consultancy fees and wages and continuing expendituresincurred for improvements made to the sugarBEATTMsugarBEAT™. device. The decrease of $240,871$247,107 is due to a decrease in these costs as the sugarBEATTM productsugarBEAT™.product is nearing commercial launch.

General and Administrative Expenses

General and administrative expenses were $595,720$1,367,253 and $699,008$1,353,532 for the threesix months ended JuneSeptember 30, 2020 and 2019, respectively. These consisted of fees for legal, professional, consultancy, audit services, investor relations, insurance and wages. The decrease of $103,288 was due to decreases in investor relations activities and insurance expenses, due to a decreased level of insurance purchased. We expect general and administrative expenses to remain at similar levels going forward, in the long term, as we anticipate that most of these costs will need to be incurred for the day to day running of the Company.

| 17 |

Other Comprehensive Loss

For the threesix months ended JuneSeptember 30, 2020 and 2019, other comprehensive income (loss)loss was $4,823$14,510 and $(15,751),$23,152, respectively, arising from foreign currency translation adjustments.

Comparative Results for the Three Months Ended September 30, 2020 and 2019

Revenue

As noted above, the business is currently pre-revenue. As such, no revenue was recognized in the three months ended September 30, 2020 and 2019.

Research and Development Expenses

Research and development expenses were $456,280 and $462,517 for the three month periods ended September 30, 2020 and 2019, respectively. This continues to be largely composed of expenditure on wages and sub-contractor activities incurred in finalizing the product design for the sugarBEAT™.device in order to enable scaling of the production ability.

General and Administrative Expenses

General and administrative expenses were $771,533 and $654,523 for the three month periods ended September 30, 2020 and 2019, respectively. Given the nature of the Company’s activities has remained unchanged, the cost drivers in this area have also remained consistent and are largely representative of fees for legal, professional, consultancy, audit services, investor relations, insurance and wages. We expect general and administrative expenses to remain at similar levels going forward, as we anticipate that most of these costs will need to be incurred for the day to day running of the Company.

Other Comprehensive Loss

For the three months ended September 30, 2020 and 2019, other comprehensive loss was $19,333 and $7,401, respectively, arising from foreign currency translation adjustments.

Liquidity and Capital Resources

We have experienced net losses and negative cash flows from operations since our inception. We have sustained cumulative losses of $18,686,131$20,267,348 through JuneSeptember 30, 2020. We have historically financed our operations through the issuances of equity and contributions of services from related entities.

At JuneSeptember 30, 2020, the Company had net working capital of $4,972,103$14,833,369 which included cash balances of $5,952,934.$16,948,939. The Company reported a net loss of $1,100,056 for the three monthsand six month periods ended JuneSeptember 30, 2020.

2020 of $1,581,217 and $2,681,273, respectively.

We have completed clinical studies required for FDA submission and in July 2020, we submitted an application to the FDA for approval of the device in July 2019, and thereforedevice. Therefore we expect that research and development costs for glucose monitoring will be reduced. The Company had an $8 million unsecured senior credit facility made available from certain major stockholders on August 1, 2019. The first $3.5 million became available immediately for draw down, to help fund the Company’s European commercial launch. The credit facility is non-dilutive carrying 8% interest with quarterly interest only payments. The principal is due on maturity in 5 years. No draw down has been made to date.

On April 15, 2020, the Company entered into a note purchase agreement (the “Note Purchase Agreement”) by and among the Company, DDL, TCL andwith Chicago Venture Partners, L.P. (the “Investor”).

| 18 |

Pursuant to the terms of the Note Purchase Agreement, the Company agreed to issue and sell to the Investor and the Investor agreed to purchase from the Company a secured promissory note (the “Secured Note”) in the original principal amount of $6,015,000. In consideration thereof, on April 15, 2020 (the closing date), (i) the Investor (a) paid $1,000,000 in cash, (b) issued to the Company (1) Investor Note #1 in the principal amount of $2,000,000 (“Investor Note #1”), and (2) Investor Note #2 in the principal amount of $2,000,000 (“Investor Note #2” and together with Investor Note #1, the “Investor Notes”), and (ii) the Company delivered the Secured Note on behalf of the Company, to the Investor, against delivery of the Purchase Price. For these purposes, the “Purchase Price” means the Investor’s initial cash purchase price, together with the sum of the initial principal amounts of the Investor Notes.

The Secured Note is secured by all patents and related rights and items as defined in the Collateral (as defined therein).related security agreement within the Secured Note. The Secured Note carries an original issue discount (“OID”) of $1,000,000. In addition, the Company agreed to pay $15,000 to the Investor to cover the Investor’s legal fees, accounting costs, due diligence, monitoring and other transaction costs incurred in connection with the purchase and sale of the Secured Note (the “Transaction Expense Amount”), all of which amount is included in the initial principal balance of the Secured Note. The Purchase Price for the Secured Note is $5,000,000, computed as follows: $6,015,000 original principal balance, less the OID, less the Transaction Expense Amount.

The borrowing period is 24 months, and the Company shall pay the outstanding balance and all fees on maturity. A monitoring fee equal to 0.833% of the outstanding balance will automatically be added to the outstanding balance on the first day of each month. The debt less the discount will be accreted over the term of the Secured Note using the effective interest method.

We believe the cash position as of JuneSeptember 30, 2020 plus the credit facility made available from certain major stockholders, plus funds raised in July 2020 through the sale of common stock is adequate for our current level of operations through at least AugustNovember 2021, and for the achievement of certain of our product development milestones. We believe that our cash on hand will be sufficient to continue establishing commercial manufacturing operations for the commercial supply of the sugarBEATTM devicesugarBEAT™.device and patches now that CE mark approval has been received.

Cash Flows

Net cash used in operating activities for the threesix months ended JuneSeptember 30, 2020 was $1,077,594 which reflected our$3,006,267, with the key drivers being: net loss of $1,100,056,$2,681,273 which includes a non-cash amount of $542,428 in relation to the accretion of debt discount, $188,579,non-cash stock-based compensation of $59,000, a decrease in prepaid expenses of $152,438,$94,059, an increase in inventory of $125,311, a decrease in accruals of $43,950, non-cash stock-based compensation of $59,000,$121,357, a decrease in liability due to related parties of $284,453$676,560 and a decrease in accounts payable of $103,135.$137,999.

Net cash used in operating activities for the threesix months ended JuneSeptember 30, 2019 was $692,158 which reflected our$1,862,717, with the key drivers being: net loss of $1,251,265, a decrease in prepayments of $197,131, an increase in accruals of $37,309,$2,368,305, non-cash stock-based compensation of $162,254,$277,664, a decrease in prepaid expenses of $263,022, an increase of inventory of $170,371, an decrease in accruals of $52,608, an increase in liability due to related parties of $135,950,$100,533, and an increase in accounts payable of $16,886.$59,010.

Net cash used in investing activities was $12,282$41,632 for the threesix months ended JuneSeptember 30, 2020, which reflected patent filing costs of $10,283$27,600 and the purchase of property and equipment of $1,999.$14,032.

Net cash used in investing activities was $87,584$162,026 for the threesix months ended JuneSeptember 30, 2019, which reflected patent filing costs of $10,893$28,310 and the purchase of property and equipment of $76,691.$133,716.

Net cash provided by financing activities for the threesix months ended JuneSeptember 30, 2020 was $6,957,651. The ATM facility$19,780,399. Shares issued during the period delivered proceeds of $2,047,462$15,750,672 via a combination of the ATM facility and proceeds from issuance of notes totalled $4,943,074 less commission expense of $325,000. In addition,the placement facilitated by Kingswood, with costs directly associated with these activities totalling $957,193. $394,475 was also raised in relation to the exercise of 37,933 warrants.warrants and proceeds were also received from the issuance of notes totalling $5,000,000 less commission expense of $325,000.

Net cash provided by financing activities for the threesix months ended JuneSeptember 30, 2019 was $168,918.$168,917. The ATM facility delivered proceeds of $152,493.$152,492. In addition, $26,000 was raised in relation to the exercise of 25,000 warrants. The Company also incurred direct costs of $9,575 related to the ATM financing.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements, including unrecorded derivative instruments that have or are reasonably likely to have a current or future material effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

When we prepare our condensed consolidated financial statements and accompanying notes in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), we must make estimates and assumptions about future events that affect the amounts we report. Certain of these estimates result from judgements that can be subjective and complex. As a result of that subjectivity and complexity, and because we continuously evaluate these estimates and assumptions based on a variety of factors, actual results could materially differ from our estimates and assumptions if changes in one or more factors require us to make accounting adjustments. We believe our critical accounting policies affect our more significant judgments and estimates used in the preparation of the unaudited condensed consolidated financial statements.During the threesix months ended JuneSeptember 30, 2020, we have made no material changes or additions with regard to such policies and estimates.

| 20 |

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Foreign Exchange Risk

Our foreign currency exposure gives rise to market risk associated with exchange rate movements against the U.S. dollar, our reporting currency. Currently, the majoritymost of our expenses and cash are denominated in Great Britain Pounds Sterling (“GBP”), with the remaining portion denominated in U.S. dollars. Fluctuations in exchange rates, primarily the U.S. dollar against the GBP, will affect our financial position. At JuneSeptember 30, 2020, the Company held approximately $1.65$2.925 million in GBP-denominated bank accounts. Based on this balance, a 1% depreciation of the GBP against the U.S. dollar would cause an approximate $16,000$29,250 reduction in cash account balances.

We have not utilized any hedging instruments in order to mitigate the foreign currency risk.

Inflation

Historically, with UK inflation rates having been low in recent years, inflation has not had a significant effect on our business in the UK, the location of the substantial part of our activities.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Dr. Dewan F.H. Chowdhury, ourBased on their evaluation as of September 30, 2020, the Company’s Chief Executive Officer and Interim Chief Financial Officer has evaluatedhave concluded that, as of September 30, 2020, the effectiveness of ourCompany’s disclosure controls and procedures as of the end of the period covered by this Quarterly Report on Form 10-Q. The term "disclosure controls and procedures," as(as defined in Rules 13a-15(e) and 15d-15(e)13a-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to a company's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost benefit relationship of possible controls and procedures. Based on this evaluation, our Chief Executive Officer and Interim Chief Financial Officer concluded that our disclosure controls and procedures) were not effective as of June 30, 2020, at the reasonable assurance level, due to a material weakness in ourthe Company’s internal control over financial reporting.

Changes in Internal Control over Financial Reporting

There were noIn connection with the evaluation during the quarter ended September 30, 2020, as required by Rule 15d-15 promulgated under the Exchange Act, the Chief Executive Officer and Chief Financial Officer identified certain changes, as identified in ourthis paragraph, in the Company’s internal control over financial reporting during the period ended June 30, 2020 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting. On September 15, 2020, the Company’s Board of Directors appointed Justin Mclarney to serve as the Company’s Chief Financial Officer. Mr. Mclarney has significant experience building and maintaining accounting and business functions compliant with the Sarbanes-Oxley Act of 2002, as amended. Prior to Mr. Mclarney’s appointment, Mr. Chowdhury, the Company’s Chief Executive Officer, President and member of the Company’s Board of Directors, also served as interim Chief Financial Officer. Following Mr. Mclarney’s appointment, Mr. Chowdhury continues to serve as the Company’s Chief Executive Officer, President and director. In addition, the Company hired Mazars, LLP, to provide third party internal audit support to facilitate the creation and maintenance of an internal control environment to remediate the material weakness identified.

As a result of the onboarding of a permanent Chief Financial Officer, in combination with the on-going work that the Company has been undertaking with the guidance of Mazars, LLP, we believe that our internal control over financial reporting.reporting has improved significantly during the quarter ended September 30, 2020. However, the changes and improvement made were not sufficiently embedded during the quarter ended September 30, 2020, to enable the Company to conclude that the material weakness noted above had been fully remediated.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None.

ITEM 1A. RISK FACTORS

None.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

The exhibits listed on the Exhibit Index below are filed as part of this report.

| Exhibit No. | Document Description |

| 31.1 | Certification of the Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of the Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of the Principal Executive Officer |

| 101.INS | XBRL Instance Document |

| 101.SCH | XBRL Taxonomy Extension Schema |

| 101.CAL | XBRL Taxonomy Extension Calculation |

| 101.DEF | XBRL Taxonomy Extension Definition |

| 101.LAB | XBRL Taxonomy Extension Labels |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Reportreport to be signed on its behalf by the undersigned thereunto duly authorized.

| NEMAURA MEDICAL INC. | ||

| | By: | /s/ Dewan F.H. Chowdhury |

| Dewan F.H. Chowdhury Chief Executive | ||

| Date: November 13, 2020 | By: | /s/ Justin J. Mclarney |

Justin J. Mclarney Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | ||