0001084580 jef:EpicGasMember 2018-10-01 2018-12-31false--11-30Q320200001084580085000000133000000P1YP30DP60DP60D2465800000340200027883160000.050.060.58P3D250000000us-gaap:AccountingStandardsUpdate201602Member1546000149300011540006290000.010.051250.048500.04150.068750.065000.064500.062500.023750.02250137000003390000357300006000002094000015000012058522000127930800000135020000

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended August 31, 20192020

OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14947

JEFFERIES GROUP LLC

(Exact name of registrant as specified in its charter)

|

| | | | | |

| | Delaware | | 95-4719745 |

| | (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| | 520 Madison Avenue, | New York, | New York | | 10022 |

| | (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 284-2550

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| | Large accelerated filer | ☐ | | Accelerated filer | ☐ | |

| | Non-accelerated filer | ☒ | | Smaller reporting company | ☐ | |

| | | | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| 4.850% Senior Notes Due 2027 | JEF/27A | New York Stock Exchange |

| 5.125% Senior Notes Due 2023 | JEF/23 | New York Stock Exchange |

The Registrant is a wholly-owned subsidiary of Jefferies Financial Group Inc. and meets the conditions set forth in General Instructions H(1)(a) and (b) of Form 10-Q and is therefore filing this Form 10-Q with a reduced disclosure format as permitted by Instruction H(2).

JEFFERIES GROUP LLC

INDEX TO QUARTERLY REPORT ON FORM 10-Q

August 31, 20192020

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

(In thousands)

| | | | August 31, 2019 | | November 30, 2018 | August 31, 2020 | | November 30, 2019 |

| ASSETS | | | | | | |

| Cash and cash equivalents ($1,151 and $1,096 at August 31, 2019 and November 30, 2018, respectively, related to consolidated VIEs) | $ | 4,665,490 |

| | $ | 5,145,886 |

| |

| Cash and cash equivalents (includes $629 and $1,154 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | $ | 6,749,706 |

| | $ | 5,567,903 |

|

| Cash and securities segregated and on deposit for regulatory purposes or deposited with clearing and depository organizations | 658,335 |

| | 707,960 |

| 986,117 |

| | 796,797 |

|

| Financial instruments owned, at fair value (including securities pledged of $12,087,982 and $13,059,802 at August 31, 2019 and November 30, 2018, respectively; and $339 and $380 at August 31, 2019 and November 30, 2018, respectively, related to consolidated VIEs) | 16,370,912 |

| | 16,399,526 |

| |

| Financial instruments owned, at fair value (includes securities pledged of $12,793,080 and $12,058,522 at August 31, 2020 and November 30, 2019, respectively; and $3,573 and $339 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | 17,555,720 |

| | 16,363,374 |

|

| Loans to and investments in related parties | 943,174 |

| | 997,524 |

| 892,987 |

| | 944,509 |

|

| Securities borrowed | 7,895,149 |

| | 6,538,212 |

| 7,268,413 |

| | 7,624,642 |

|

| Securities purchased under agreements to resell (includes $25,000 and $0 at fair value at August 31, 2019 and November 30, 2018, respectively) | 4,499,995 |

| | 2,785,758 |

| |

| Securities purchased under agreements to resell (includes $0 and $25,000 at fair value at August 31, 2020 and November 30, 2019, respectively) | | 5,327,391 |

| | 4,299,598 |

|

| Securities received as collateral, at fair value | | 4,413 |

| | 9,500 |

|

| Receivables: | | | | | | |

| Brokers, dealers and clearing organizations | 2,927,789 |

| | 3,218,984 |

| |

| Brokers, dealers and clearing organizations ($13,502 and $0 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | 2,748,993 |

| | 3,007,949 |

|

| Customers | 1,686,214 |

| | 2,017,090 |

| 956,821 |

| | 1,490,876 |

|

| Fees, interest and other | 350,663 |

| | 327,083 |

| 350,261 |

| | 323,067 |

|

| Premises and equipment | 323,510 |

| | 304,026 |

| 863,522 |

| | 350,433 |

|

| Goodwill | 1,638,574 |

| | 1,642,170 |

| 1,644,044 |

| | 1,643,599 |

|

| Other assets ($2 at both August 31, 2019 and November 30, 2018, related to consolidated VIEs) | 1,133,783 |

| | 1,084,554 |

| |

| Other assets ($150 and $0 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | 1,312,060 |

| | 1,093,868 |

|

| Total assets | $ | 43,093,588 |

| | $ | 41,168,773 |

| $ | 46,660,448 |

| | $ | 43,516,115 |

|

| LIABILITIES AND EQUITY | | | | | | |

| Short-term borrowings | $ | 518,914 |

| | $ | 387,492 |

| |

| Financial instruments sold, not yet purchased, at fair value | 10,296,315 |

| | 9,478,944 |

| |

| Short-term borrowings (includes $21,829 and $20,981 at fair value at August 31, 2020 and November 30, 2019, respectively) | | $ | 805,381 |

| | $ | 548,490 |

|

| Financial instruments sold, not yet purchased, at fair value ($2,094 and $0 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | 10,994,445 |

| | 10,532,460 |

|

| Collateralized financings: | | | | | | |

| Securities loaned | 2,182,865 |

| | 1,838,688 |

| 1,929,737 |

| | 1,525,140 |

|

| Securities sold under agreements to repurchase | 8,236,981 |

| | 8,643,069 |

| 7,258,972 |

| | 7,504,670 |

|

| Other secured financings (includes $1,820,800 and $881,472 at August 31, 2019 and November 30, 2018, respectively, related to consolidated VIEs) | 1,821,425 |

| | 881,472 |

| |

| Other secured financings (includes $3,402 at fair value at August 31, 2020; and $2,788,316 and $2,465,800 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | 2,791,718 |

| | 2,467,819 |

|

| Obligation to return securities received as collateral, at fair value | | 4,413 |

| | 9,500 |

|

| Payables: | | | | | | |

| Brokers, dealers and clearing organizations | 2,253,033 |

| | 2,448,059 |

| 2,546,494 |

| | 2,555,178 |

|

| Customers | 3,599,564 |

| | 3,176,727 |

| 3,936,811 |

| | 3,808,609 |

|

| Accrued expenses and other liabilities ($1,306 and $642 at August 31, 2019 and November 30, 2018, respectively, related to consolidated VIEs) | 1,227,798 |

| | 1,585,635 |

| |

| Long-term debt (includes $1,014,509 and $686,170 at fair value at August 31, 2019 and November 30, 2018, respectively) | 6,767,163 |

| | 6,546,283 |

| |

| Lease liabilities | | 573,563 |

| | — |

|

| Accrued expenses and other liabilities (includes $1,493 and $1,546 at August 31, 2020 and November 30, 2019, respectively, related to consolidated VIEs) | | 2,326,026 |

| | 1,431,144 |

|

| Long-term debt (includes $1,522,105 and $1,215,285 at fair value at August 31, 2020 and November 30, 2019, respectively) | | 6,988,434 |

| | 7,003,358 |

|

| Total liabilities | 36,904,058 |

| | 34,986,369 |

| 40,155,994 |

| | 37,386,368 |

|

| EQUITY | | | | | | |

| Member’s paid-in capital | 6,387,097 |

| | 6,376,662 |

| 6,615,771 |

| | 6,329,677 |

|

| Accumulated other comprehensive income (loss): | | | | | | |

| Currency translation adjustments | (220,080 | ) | | (185,804 | ) | (142,080 | ) | | (179,378 | ) |

| Changes in instrument specific credit risk | 20,805 |

| | (5,728 | ) | 19,586 |

| | (18,889 | ) |

| Cash flow hedges | — |

| | 470 |

| |

| Additional minimum pension liability | (4,693 | ) | | (4,761 | ) | (5,939 | ) | | (6,079 | ) |

| Available-for-sale securities | 231 |

| | (346 | ) | 552 |

| | 141 |

|

| Total accumulated other comprehensive loss | (203,737 | ) | | (196,169 | ) | (127,881 | ) | | (204,205 | ) |

| Total Jefferies Group LLC member’s equity | 6,183,360 |

| | 6,180,493 |

| 6,487,890 |

| | 6,125,472 |

|

| Noncontrolling interests | 6,170 |

| | 1,911 |

| 16,564 |

| | 4,275 |

|

| Total equity | 6,189,530 |

| | 6,182,404 |

| 6,504,454 |

| | 6,129,747 |

|

| Total liabilities and equity | $ | 43,093,588 |

| | $ | 41,168,773 |

| $ | 46,660,448 |

| | $ | 43,516,115 |

|

See accompanying notes to consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED)

(In thousands)

| | | | Three Months Ended

August 31, | | Nine Months Ended

August 31, | Three Months Ended

August 31, | | Nine Months Ended

August 31, |

| | 2019 | | 2018 | | 2019 | | 2018 | 2020 | | 2019 | | 2020 | | 2019 |

| Revenues: | | | | | | | | | | | | | | |

| Commissions and other fees | $ | 171,003 |

| | $ | 162,700 |

| | $ | 493,843 |

| | $ | 482,194 |

| $ | 204,313 |

| | $ | 171,003 |

| | $ | 627,115 |

| | $ | 493,843 |

|

| Principal transactions | 148,873 |

| | 143,308 |

| | 632,002 |

| | 498,583 |

| 560,665 |

| | 148,873 |

| | 1,399,850 |

| | 632,002 |

|

| Investment banking | 412,533 |

| | 465,326 |

| | 1,128,216 |

| | 1,405,614 |

| 615,837 |

| | 412,533 |

| | 1,595,330 |

| | 1,128,216 |

|

| Asset management fees | 3,340 |

| | 5,184 |

| | 14,559 |

| | 16,130 |

| |

| Asset management fees and revenues | | 6,772 |

| | 4,220 |

| | 23,068 |

| | 16,350 |

|

| Interest | 383,596 |

| | 305,347 |

| | 1,163,022 |

| | 870,490 |

| 195,960 |

| | 383,596 |

| | 702,569 |

| | 1,163,022 |

|

| Other | 22,286 |

| | 6,420 |

| | 79,354 |

| | 58,678 |

| 11,526 |

| | 21,406 |

| | (6,020 | ) | | 77,563 |

|

| Total revenues | 1,141,631 |

| | 1,088,285 |

| | 3,510,996 |

| | 3,331,689 |

| 1,595,073 |

| | 1,141,631 |

| | 4,341,912 |

| | 3,510,996 |

|

| Interest expense | 364,472 |

| | 310,670 |

| | 1,146,268 |

| | 910,271 |

| 211,629 |

| | 364,472 |

| | 753,405 |

| | 1,146,268 |

|

| Net revenues | 777,159 |

| | 777,615 |

| | 2,364,728 |

| | 2,421,418 |

| 1,383,444 |

| | 777,159 |

| | 3,588,507 |

| | 2,364,728 |

|

| Non-interest expenses: | | | | | | | | | | | | | | |

| Compensation and benefits | 411,936 |

| | 428,033 |

| | 1,261,506 |

| | 1,327,760 |

| 725,555 |

| | 411,936 |

| | 1,932,332 |

| | 1,261,506 |

|

| Non-compensation expenses: | | | | | | | | | | | | | | |

| Floor brokerage and clearing fees | 54,247 |

| | 45,745 |

| | 168,698 |

| | 135,808 |

| 66,744 |

| | 54,247 |

| | 204,943 |

| | 168,698 |

|

| Technology and communications | 86,649 |

| | 76,877 |

| | 247,464 |

| | 222,335 |

| 102,635 |

| | 86,649 |

| | 287,413 |

| | 247,464 |

|

| Occupancy and equipment rental | 29,300 |

| | 25,559 |

| | 87,587 |

| | 75,143 |

| 27,053 |

| | 29,300 |

| | 78,951 |

| | 87,587 |

|

| Business development | 36,526 |

| | 39,733 |

| | 103,430 |

| | 124,233 |

| 7,637 |

| | 36,526 |

| | 45,953 |

| | 103,430 |

|

| Professional services | 42,379 |

| | 35,316 |

| | 117,372 |

| | 101,715 |

| 41,173 |

| | 42,379 |

| | 127,832 |

| | 117,372 |

|

| Underwriting costs | 14,647 |

| | 20,528 |

| | 36,045 |

| | 47,832 |

| 29,071 |

| | 14,647 |

| | 59,085 |

| | 36,045 |

|

| Other | 18,400 |

| | 18,723 |

| | 41,828 |

| | 54,888 |

| 20,175 |

| | 18,400 |

| | 80,351 |

| | 41,828 |

|

| Total non-compensation expenses | 282,148 |

| | 262,481 |

| | 802,424 |

| | 761,954 |

| 294,488 |

| | 282,148 |

| | 884,528 |

| | 802,424 |

|

| Total non-interest expenses | 694,084 |

| | 690,514 |

| | 2,063,930 |

| | 2,089,714 |

| 1,020,043 |

| | 694,084 |

| | 2,816,860 |

| | 2,063,930 |

|

| Earnings before income taxes | 83,075 |

| | 87,101 |

| | 300,798 |

| | 331,704 |

| 363,401 |

| | 83,075 |

| | 771,647 |

| | 300,798 |

|

| Income tax expense | 18,250 |

| | 26,923 |

| | 79,789 |

| | 234,337 |

| 95,870 |

| | 18,250 |

| | 203,855 |

| | 79,789 |

|

| Net earnings | 64,825 |

| | 60,178 |

| | 221,009 |

| | 97,367 |

| 267,531 |

| | 64,825 |

| | 567,792 |

| | 221,009 |

|

| Net earnings (loss) attributable to noncontrolling interests | (143 | ) | | (4 | ) | | 140 |

| | (1 | ) | (531 | ) | | (143 | ) | | (4,397 | ) | | 140 |

|

| Net earnings attributable to Jefferies Group LLC | $ | 64,968 |

| | $ | 60,182 |

| | $ | 220,869 |

| | $ | 97,368 |

| $ | 268,062 |

| | $ | 64,968 |

| | $ | 572,189 |

| | $ | 220,869 |

|

See accompanying notes to consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(In thousands)

| | | | Three Months Ended

August 31, | | Nine Months Ended

August 31, | Three Months Ended August 31, | | Nine Months Ended August 31, |

| | 2019 | | 2018 | | 2019 |

| 2018 | 2020 | | 2019 | | 2020 | | 2019 |

| Net earnings | $ | 64,825 |

| | $ | 60,178 |

| | $ | 221,009 |

| | $ | 97,367 |

| $ | 267,531 |

| | $ | 64,825 |

| | $ | 567,792 |

| | $ | 221,009 |

|

| Other comprehensive income (loss), net of tax: | | | | | | | | | | | | | | |

| Currency translation adjustments and other (1) | (28,023 | ) | | (26,050 | ) | | (34,208 | ) | | (71,219 | ) | 74,960 |

| | (28,023 | ) | | 37,438 |

| | (34,208 | ) |

| Changes in instrument specific credit risk (2) | 5,889 |

| | 1,067 |

| | 26,533 |

| | 8,971 |

| (133,259 | ) | | 5,889 |

| | 38,475 |

| | 26,533 |

|

| Cash flow hedges (3) | — |

| | 85 |

| | (470 | ) | | 1,382 |

| 0 |

| | 0 |

| | 0 |

| | (470 | ) |

| Unrealized gain on available-for-sale securities (4) | 198 |

| | — |

| | 577 |

| | — |

| |

| Total other comprehensive loss, net of tax (5) | (21,936 | ) | | (24,898 | ) | | (7,568 | ) | | (60,866 | ) | |

| Unrealized gain (loss) on available-for-sale securities (4) | | (22 | ) | | 198 |

| | 411 |

| | 577 |

|

| Total other comprehensive income (loss), net of tax (5) | | (58,321 | ) | | (21,936 | ) | | 76,324 |

| | (7,568 | ) |

| Comprehensive income | 42,889 |

| | 35,280 |

| | 213,441 |

| | 36,501 |

| 209,210 |

| | 42,889 |

| | 644,116 |

| | 213,441 |

|

| Net earnings (loss) attributable to noncontrolling interests | (143 | ) | | (4 | ) | | 140 |

| | (1 | ) | (531 | ) | | (143 | ) | | (4,397 | ) | | 140 |

|

| Comprehensive income attributable to Jefferies Group LLC | $ | 43,032 |

| | $ | 35,284 |

| | $ | 213,301 |

| | $ | 36,502 |

| $ | 209,741 |

| | $ | 43,032 |

| | $ | 648,513 |

| | $ | 213,301 |

|

| |

| (1) | The amounts include income tax expenses of approximately $(25.6) million and $(13.7) million during the three and nine months ended August 31, 2020, respectively, and income tax benefits of $8.9 million and $10.6 million during the three and nine months ended August 31, 2019, include income tax benefits of $8.9 million and $10.6 million respectively, compared with $2.8 million in both the three and nine months ended August 31, 2018, related to the impact of certain discrete items related to tax planning for our non-U.S. subsidiaries in connection with the Tax Cuts and Jobs Act (the “Tax Act”). The amount during the nine months ended August 31, 2018 includes $5.3 million related to the transfer of the German Pension Plan, which was reclassified to Compensation and benefits expenses within the Consolidated Statements of Earnings and ($0.8) million related to the Tax Act, which was reclassified to Member’s paid-in capital and a gain of $20.5 million related to foreign currency gains, which was reclassified to Other revenues within the Consolidated Statements of Earnings.respectively. |

| |

| (2) | The amounts include income tax benefits (expenses) of approximately $45.5 million and $(13.1) million during the three and nine months ended August 31, 2020, respectively, and income tax expenses of approximately $2.0 million and $9.0 million for the three and nine months ended August 31, 2019, respectively, and income tax expenses of approximately $0.3 million and $11.0 million forrespectively. The amounts during the three and nine months ended August 31, 2018, respectively.2020 also include net gains (losses) of $0.6 million and $(0.9) million, respectively, net of income tax (expenses) benefits of $(0.2) million and $0.3 million, respectively, related to changes in instrument specific risk, which were reclassified to Principal transactions revenues in our Consolidated Statements of Earnings. The amount during the nine months ended August 31, 2019 also includes gainsa net gain of $0.5 million, net of taxes of $0.2 million, related to changes in instrument specific risk, which was reclassified to Principal transactions revenues within thein our Consolidated Statements of Earnings. The amounts during the three and nine months ended August 31, 2018 also include gains of $0.1 million and $0.4 million, net of taxes of $0.1 million, respectively, related to changes in instrument specific risk, which was reclassified to Principal transactions revenues within the Consolidated Statements of Earnings. The amount during the nine months ended August 31, 2018 includes ($6.5) million related to the Tax Act, which was reclassified to Member’s paid-in capital. |

| |

| (3) | The amount during the nine months ended August 31, 2019 includes income tax benefits of $0.2 million. The cashCash flow hedge losslosses of $0.5 million during the nine months ended August 31, 2019 waswere reclassified to Other revenues within the Consolidated Statement of Earnings due to the sale of all of our common shares of Epic Gas Ltd. (“Epic Gas”). Refer to Note 9, Investments for further information. The amount during the nine months ended August 31, 2018 includes income tax expenses of $0.7 million. The amount during the nine months ended August 31, 2018 also includes ($0.2) million related to the Tax Act, which was reclassified to Member’s paid-in capital.Earnings. |

| |

| (4) | The amountamounts include income tax expenses of $0.2 million during the nine months ended August 31, 2019 includes2020, and income tax expense of approximately $0.2 million.million during the nine months ended August 31, 2019. |

| |

| (5) | None of the components of other comprehensive lossincome (loss) are attributable to noncontrolling interests. |

See accompanying notes to consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

(In thousands)

| | | | Three Months Ended

August 31, | | Nine Months Ended

August 31, | Three Months Ended

August 31, | | Nine Months Ended

August 31, |

| | 2019 | | 2018 | | 2019 | | 2018 | 2020 | | 2019 | | 2020 | | 2019 |

| Member’s paid-in capital: | | | | | | | | | | | | | | |

| Balance, beginning of period | $ | 6,354,613 |

| | $ | 5,715,628 |

| | $ | 6,376,662 |

| | $ | 5,895,601 |

| $ | 6,481,740 |

| | $ | 6,354,613 |

| | $ | 6,329,677 |

| | $ | 6,376,662 |

|

| Cumulative effect of the adoption of the new revenue standard, net of tax | — |

| | — |

| | — |

| | (6,121 | ) | |

| Net earnings attributable to Jefferies Group LLC | 64,968 |

| | 60,182 |

| | 220,869 |

| | 97,368 |

| 268,062 |

| | 64,968 |

| | 572,189 |

| | 220,869 |

|

| Distributions to Jefferies Financial Group Inc. | (32,484 | ) | | (30,091 | ) | | (210,434 | ) | | (248,684 | ) | (134,031 | ) | | (32,484 | ) | | (286,095 | ) | | (210,434 | ) |

| Tax Cuts and Jobs Act adjustment | — |

| | — |

| | — |

| | 7,555 |

| |

| Balance, end of period | $ | 6,387,097 |

| | $ | 5,745,719 |

| | $ | 6,387,097 |

| | $ | 5,745,719 |

| $ | 6,615,771 |

| | $ | 6,387,097 |

| | $ | 6,615,771 |

| | $ | 6,387,097 |

|

| Accumulated other comprehensive income (loss), net of tax: | | | | | | | | | | | | | | |

| Balance, beginning of period | $ | (181,801 | ) | | $ | (172,747 | ) | | $ | (196,169 | ) | | $ | (136,779 | ) | $ | (69,560 | ) | | $ | (181,801 | ) | | $ | (204,205 | ) | | $ | (196,169 | ) |

| Currency translation adjustments and other | (28,023 | ) | | (26,050 | ) | | (34,208 | ) | | (71,219 | ) | 74,960 |

| | (28,023 | ) | | 37,438 |

| | (34,208 | ) |

| Changes in instrument specific credit risk | 5,889 |

| | 1,067 |

| | 26,533 |

| | 8,971 |

| (133,259 | ) | | 5,889 |

| | 38,475 |

| | 26,533 |

|

| Cash flow hedges | — |

| | 85 |

| | (470 | ) | | 1,382 |

| 0 |

| | 0 |

| | 0 |

| | (470 | ) |

| Unrealized gain on available-for-sale securities | 198 |

| | — |

| | 577 |

| | — |

| |

| Unrealized gain (loss) on available-for-sale securities | | (22 | ) | | 198 |

| | 411 |

| | 577 |

|

| Balance, end of period | $ | (203,737 | ) | | $ | (197,645 | ) | | $ | (203,737 | ) | | $ | (197,645 | ) | $ | (127,881 | ) | | $ | (203,737 | ) | | $ | (127,881 | ) | | $ | (203,737 | ) |

| Total Jefferies Group LLC member’s equity | $ | 6,183,360 |

| | $ | 5,548,074 |

| | $ | 6,183,360 |

| | $ | 5,548,074 |

| $ | 6,487,890 |

| | $ | 6,183,360 |

| | $ | 6,487,890 |

| | $ | 6,183,360 |

|

| Noncontrolling interests: | | | | | | | | | | | | | | |

| Balance, beginning of period | $ | 6,313 |

| | $ | 750 |

| | $ | 1,911 |

| | $ | 737 |

| $ | 17,598 |

| | $ | 6,313 |

| | $ | 4,275 |

| | $ | 1,911 |

|

| Net earnings (loss) attributable to noncontrolling interests | (143 | ) | | (4 | ) | | 140 |

| | (1 | ) | (531 | ) | | (143 | ) | | (4,397 | ) | | 140 |

|

| Contributions | — |

| | — |

| | 6,600 |

| | 10 |

| 1,000 |

| | 0 |

| | 18,405 |

| | 6,600 |

|

| Distributions | — |

| | — |

| | (2,481 | ) | | — |

| (1,503 | ) | | 0 |

| | (1,719 | ) | | (2,481 | ) |

| Consolidation of asset management entity | — |

| | 8,316 |

| | — |

| | 8,316 |

| |

| Balance, end of period | $ | 6,170 |

| | $ | 9,062 |

| | $ | 6,170 |

| | $ | 9,062 |

| $ | 16,564 |

| | $ | 6,170 |

| | $ | 16,564 |

| | $ | 6,170 |

|

| Total equity | $ | 6,189,530 |

| | $ | 5,557,136 |

| | $ | 6,189,530 |

| | $ | 5,557,136 |

| $ | 6,504,454 |

| | $ | 6,189,530 |

| | $ | 6,504,454 |

| | $ | 6,189,530 |

|

See accompanying notes to consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In thousands)

| | | | Nine Months Ended

August 31, | Nine Months Ended

August 31, |

| | 2019 | | 2018 | 2020 | | 2019 |

| Cash flows from operating activities: | | | | | | |

| Net earnings | $ | 221,009 |

| | $ | 97,367 |

| $ | 567,792 |

| | $ | 221,009 |

|

| Adjustments to reconcile net earnings to net cash used in operating activities: | | | | |

| Adjustments to reconcile net earnings to net cash provided by (used in) operating activities: | | | | |

| Depreciation and amortization | 24,626 |

| | 10,208 |

| 49,450 |

| | 24,626 |

|

| Income on loans to and investments in related parties | (71,615 | ) | | (30,687 | ) | |

| Goodwill impairment | | 3,000 |

| | 0 |

|

| (Income) loss on loans to and investments in related parties | | 25,524 |

| | (71,615 | ) |

| Distributions received on investments in related parties | 126,504 |

| | 2,330 |

| 35,949 |

| | 126,504 |

|

| Other adjustments | 81,362 |

| | (96,359 | ) | 218,431 |

| | 81,362 |

|

| Net change in assets and liabilities: | | | | | | |

| Securities deposited with clearing and depository organizations | (153 | ) | | 64,890 |

| (20,955 | ) | | (153 | ) |

| Receivables: | | | | | | |

| Brokers, dealers and clearing organizations | 268,337 |

| | (27,967 | ) | 265,354 |

| | 268,337 |

|

| Customers | 330,869 |

| | (388,076 | ) | 534,057 |

| | 330,869 |

|

| Fees, interest and other | (27,007 | ) | | 64,563 |

| (25,628 | ) | | (27,007 | ) |

| Securities borrowed | (1,410,295 | ) | | 309,722 |

| 382,907 |

| | (1,410,295 | ) |

| Financial instruments owned | (102,577 | ) | | (1,115,411 | ) | (1,115,993 | ) | | (102,577 | ) |

| Securities purchased under agreements to resell | (1,772,192 | ) | | (53,020 | ) | (979,989 | ) | | (1,772,192 | ) |

| Other assets | (74,840 | ) | | 117,440 |

| (235,829 | ) | | (74,840 | ) |

| Payables: | | | | | | |

| Brokers, dealers and clearing organizations | (169,021 | ) | | (260,193 | ) | (16,565 | ) | | (169,021 | ) |

| Customers | 422,840 |

| | 523,611 |

| 128,167 |

| | 422,840 |

|

| Securities loaned | 387,016 |

| | (275,629 | ) | 387,692 |

| | 387,016 |

|

| Financial instruments sold, not yet purchased | 921,282 |

| | 52,196 |

| 366,626 |

| | 921,282 |

|

| Securities sold under agreements to repurchase | (346,031 | ) | | 1,250,575 |

| (260,144 | ) | | (346,031 | ) |

| Accrued expenses and other liabilities | (323,548 | ) | | (392,471 | ) | 835,964 |

| | (323,548 | ) |

| Net cash used in operating activities | (1,513,434 | ) | | (146,911 | ) | |

| Net cash provided by (used in) operating activities | | 1,145,810 |

| | (1,513,434 | ) |

| Cash flows from investing activities: | | | | | | |

| Contributions to loans to and investments in related parties | (26,849 | ) | | (1,918,500 | ) | (1,338,499 | ) | | (26,849 | ) |

| Distributions from loans to and investments in related parties | 24,629 |

| | 1,873,000 |

| |

| Capital distributions from investments and repayments of loans from related parties | | 1,328,392 |

| | 24,629 |

|

| Net payments on premises and equipment | (71,392 | ) | | (52,699 | ) | (82,651 | ) | | (71,392 | ) |

| Consolidation of asset management entity | — |

| | 130 |

| |

| Net cash used in investing activities | (73,612 | ) | | (98,069 | ) | (92,758 | ) | | (73,612 | ) |

Continued on next page.

JEFFERIES GROUP LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS – CONTINUED (UNAUDITED)

(In thousands)

| | | | Nine Months Ended

August 31, | Nine Months Ended

August 31, |

| | 2019 | | 2018 | 2020 | | 2019 |

| Cash flows from financing activities: | | | | | | |

| Proceeds from short-term borrowings | 1,418,000 |

| | 616,283 |

| 1,563,800 |

| | 1,418,000 |

|

| Payments on short-term borrowings | (1,221,000 | ) | | (669,466 | ) | (1,269,851 | ) | | (1,221,000 | ) |

| Proceeds from issuance of long-term debt, net of issuance costs | 908,332 |

| | 1,321,714 |

| 521,170 |

| | 908,332 |

|

| Repayment of long-term debt | (756,614 | ) | | (1,025,563 | ) | (675,909 | ) | | (756,614 | ) |

| Distributions to Jefferies Financial Group Inc. | (208,647 | ) | | (218,593 | ) | (164,644 | ) | | (208,647 | ) |

| Net proceeds from other secured financings | 939,953 |

| | 282,714 |

| 323,899 |

| | 939,953 |

|

| Net change in bank overdrafts | (9,028 | ) | | 2,369 |

| (37,758 | ) | | (9,028 | ) |

| Proceeds from contributions of noncontrolling interests | 6,600 |

| | 10 |

| 18,405 |

| | 6,600 |

|

| Payments on distributions to noncontrolling interests | (2,481 | ) | | — |

| (1,719 | ) | | (2,481 | ) |

| Net cash provided by financing activities | 1,075,115 |

| | 309,468 |

| 277,393 |

| | 1,075,115 |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (18,243 | ) | | (16,084 | ) | 19,723 |

| | (18,243 | ) |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (530,174 | ) | | 48,404 |

| 1,350,168 |

| | (530,174 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | 5,819,027 |

| | 5,642,776 |

| 6,329,712 |

| | 5,819,027 |

|

| Cash, cash equivalents and restricted cash at end of period | $ | 5,288,853 |

| | $ | 5,691,180 |

| $ | 7,679,880 |

| | $ | 5,288,853 |

|

| | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | |

| Cash paid during the period for | | | | | | |

| Interest | $ | 1,205,380 |

| | $ | 1,001,307 |

| $ | 834,180 |

| | $ | 1,205,380 |

|

| Income taxes, net | 72,925 |

| | 152,600 |

| 56,906 |

| | 72,925 |

|

The following presents our cash, cash equivalents and restricted cash by category within thein our Consolidated Statements of Financial Condition (in thousands):

| | | | August 31, 2019 | | November 30, 2018 | August 31, 2020 | | November 30, 2019 |

| Cash and cash equivalents | $ | 4,665,490 |

| | $ | 5,145,886 |

| $ | 6,749,706 |

| | $ | 5,567,903 |

|

| Cash and securities segregated and on deposit for regulatory purposes with clearing and depository organizations | 623,363 |

| | 673,141 |

| 930,174 |

| | 761,809 |

|

| Total cash, cash equivalents and restricted cash | $ | 5,288,853 |

| | $ | 5,819,027 |

| $ | 7,679,880 |

| | $ | 6,329,712 |

|

See accompanying notes to consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Index

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

Note 1. Organization and Basis of Presentation

Organization

Jefferies Group LLC is the largest independent U.S.-headquartered global full service, integrated securitiesinvestment banking and investment bankingsecurities firm. The accompanying Consolidated Financial Statements represent the accounts of Jefferies Group LLC and all our subsidiaries (together “we” or “us”). The subsidiaries of Jefferies Group LLC include Jefferies LLC, Jefferies International Limited, Jefferies Hong Kong Limited, Jefferies Financial Services, Inc., Jefferies Funding LLC, Jefferies Leveraged Credit Products, LLC and all other entities in which we have a controlling financial interest or are the primary beneficiary.

Jefferies Group LLC is a direct wholly owned subsidiary of publicly traded Jefferies Financial Group Inc. (“Jefferies”). Jefferies does not guarantee any of our outstanding debt securities. Jefferies Group LLC is a Securities and Exchange Commission (“SEC”) reporting company, filing annual, quarterly and periodic financial reports. Richard Handler, our Chief Executive Officer and Chairman, is the Chief Executive Officer of Jefferies, as well as a Director of Jefferies. Brian P. Friedman, our Chairman of the Executive Committee, is Jefferies’ President and a Director of Jefferies.

On October 1, 2018, Jefferies transferred its 50% interest in Berkadia Commercial Mortgage Holding LLC (“Berkadia”) and investments in certain separately managed accounts and funds to us. On November 1, 2018, we purchased Leucadia Investment Management Limited, an investment advisory company, from Leucadia Asset Management Holding LLC, a subsidiary of Jefferies. These transfers were accomplished as capital contributions from Jefferies of approximately $598.2 million and total cash payments of $76.0 million to Jefferies during the fourth quarter of 2018. In connection with these transfers, related deferred tax liabilities of approximately $50.9 million were transferred to us, for which Jefferies has indemnified us.

We operate in 2 reportable business segments,segments: (1) Investment Banking and Capital Markets and (2) Asset Management. For further information on our reportable business segments, refer to Note 18,19, Segment Reporting.

Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and should be read in conjunction with our consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended November 30, 2018.2019. Certain footnote disclosures included in our Annual Report on Form 10-K for the year ended November 30, 20182019 have been condensed or omitted from the consolidated financial statements as they are not required for interim reporting under U.S. GAAP. The Consolidated Financial Statements reflect all adjustments of a normal, recurring nature that are, in the opinion of management, necessary for the fair presentation of the results for the interim period. The results presented in theour Consolidated Financial Statements for interim periods are not necessarily indicative of the results for the entire year.

We have made a number of estimates and assumptions relating to the reporting of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses during the reporting period to prepare these consolidated financial statements in conformity with U.S. GAAP. The most important of these estimates and assumptions relate to fair value measurements, compensation and benefits, goodwill and intangible assets, the ability to realize certain deferred tax assets and the recognition and measurement of uncertain tax positions. Although these and other estimates and assumptions are based on the best available information, actual results could be materially different from these estimates.

During the third quarter of 2019, we have reclassified the presentation of certain other fees, primarily related to prime brokerage services offered to clients. These fees were previously presented as Other revenues in our Consolidated Statements of Earnings and are now presented within Commissions and other fees. Previously reported results are presented on a comparable basis. This change had the impact of increasing Commissions and other fees and reducing Other revenues by $7.2 million and $20.6 million for the three and nine months ended August 31, 2018, respectively. There is no impact on Total revenues as a result of this change in presentation.

Consolidation

Our policy is to consolidate all entities that we control by ownership of a majority of the outstanding voting stock. In addition, we consolidate entities that meet the definition of a variable interest entity (“VIE”) for which we are the primary beneficiary. The primary beneficiary is the party who has the power to direct the activities of a VIE that most significantly impact the entity’s economic performance and who has an obligation to absorb losses of the entity or a right to receive benefits from the entity that could potentially be significant to the entity. For consolidated entities that are less than wholly owned, the third party’s holding of equity interest is presented as Noncontrolling interests in our Consolidated Statements of Financial Condition and Consolidated Statements of Changes in Equity. The portion of net earnings attributable to the noncontrolling interests is presented as Net earnings (loss) attributable to noncontrolling interests in our Consolidated Statements of Earnings.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

In situations in which we have significant influence, but not control, of an entity that does not qualify as a VIE, we apply either the equity method of accounting or fair value accounting pursuant to the fair value option election under U.S. GAAP, with our portion of net earnings or gains and losses recorded in Other revenues or Principal transactions revenues, respectively. We also have formed nonconsolidated investment vehicles with third-party investors that are typically organized as partnerships or limited liability companies and are carried at fair value. We act as general partner or managing member for these investment vehicles and have generally provided the third-party investors with termination or “kick-out” rights.

Intercompany accounts and transactions are eliminated in consolidation.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

Note 2. Summary of Significant Accounting Policies

For a detailed discussion about the Company’s significant accounting policies, see Note 2, Summary of Significant Accounting Policies, in our consolidated financial statements included in Part II, Item 8 of our Annual Report on Form 10-K for the year ended November 30, 2018.2019.

During the nine months ended August 31, 2020, other than the following, there were no significant changes made to the Company’s significant accounting policies. The accounting policy changes are attributable to the adoption of the Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) No. 2016-02, Leases (the “new lease standard”) on December 1, 2019. These lease policy updates are applied using a modified retrospective approach. Reported financial information for the historical comparable period was not revised and continues to be reported under the accounting standards in effect during the historical periods.

For leases with an original term longer than one year, lease liabilities are initially recognized on the lease commencement date based on the present value of the future minimum lease payments over the lease term, including non-lease components such as fixed common area maintenance costs and other fixed costs for generally all leases. A corresponding right-of-use (“ROU”) asset is initially recognized equal to the lease liability adjusted for any lease prepayments, initial direct costs and lease incentives. The ROU assets are included in Premises and equipment and the lease liabilities are included in Lease liabilities in our Consolidated Statement of Financial Condition.

The discount rates used in determining the present value of leases represent our collateralized borrowing rate considering each lease’s term and currency of payment. The lease term includes options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Certain leases have renewal options that can be exercised at the discretion of the Company. Lease expense is generally recognized on a straight-line basis over the lease term and included in Occupancy and equipment rental expense in our Consolidated Statement of Earnings.

Refer to Note 3, Accounting Developments, and Note 13, Leases, for further information.

Note 3. Accounting Developments

Accounting Standards to be Adopted in Future Periods

Reference Rate Reform. In March 2020, the FASB issued ASU No. 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. This guidance provides optional exceptions for applying U.S. GAAP to contracts, hedge accounting relationships or other transactions affected by reference rate reform. The optional exceptions can be elected through December 31, 2022. We are currently evaluating the impact of applying the optional exceptions on our consolidated financial statements.

Income Taxes. In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The objective of the guidance is to simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740 and to provide more consistent application to improve the comparability of financial statements. The guidance is effective in the first quarter of fiscal 2022. We are currently evaluating the impact of the new guidance on our consolidated financial statements.

Consolidation. In October 2018, the Financial Accounting Standards Board (“FASB”)FASB issued Accounting Standards Update (“ASU”)ASU No. 2018-17, Consolidation: Targeted Improvements to Related Party Guidance for Variable Interest Entities. The guidance requires indirect interests held through related parties under common control arrangements be considered on a proportional basis for determining whether fees paid to decision makers and service providers are variable interests. The guidance is effective in the first quarter of fiscal 2021. We are currently evaluating the impact of the new guidance on our consolidated financial statements.

Internal-Use Software. In August 2018, the FASB issued ASU No. 2018-15, Intangibles—Goodwill and Other—Internal-Use Software: Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. The guidance amends the definition of a hosting arrangement and requires that the customer in a hosting arrangement that is a service contract capitalize certain implementation costs as if the arrangement was an internal-use software project. The guidance is effective in the first quarter of fiscal 2021. We are currently evaluating the impact of the new guidance on our consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

Defined Benefit Plans. In August 2018, the FASB issued ASU No. 2018-14, Compensation—Retirement Benefits—Defined Benefit Plans—General: Disclosure Framework—Changes to the Disclosure Requirements for Defined Benefit Plans. The objective of the guidance is to improve the effectiveness of disclosure requirements on defined benefit pension plans and other postretirement plans. The guidance is effective in the first quarter of fiscal 2021. We do not believe the new guidance will have a material impact on our consolidated financial statements.

Derivatives and Hedging. In August 2017, the FASB issued ASU No. 2017-12, Derivatives and Hedging: Targeted Improvements to Accounting for Hedging Activities. The objective of the guidance is to improve the financial reporting of hedging relationships to better portray the economic results of an entity’s risk management activities in its financial statements. The guidance is effective in the first quarter of fiscal 2020. We do not believe the new guidance will have a material impact on our consolidated financial statements.

Goodwill. In January 2017, the FASB issued ASU No. 2017-04, Simplifying the Test for Goodwill Impairment, which simplifies goodwill impairment testing. The guidance is effective in the first quarter of fiscal 2021. We do not believe the new guidance will have a material impact on our consolidated financial statements.

Financial Instruments—Credit Losses. In June 2016, the FASB issued ASU No. 2016-13, Measurement of Credit Losses on Financial Instruments. The guidance provides for estimating credit losses on certain types of financial instruments by introducing an approach based on expected losses. The guidance is effective in the first quarter of fiscal 2021. We are currently evaluating the impact of the new guidance on our consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

Leases. Leases. We adopted the new lease standard on December 1, 2019 using a modified retrospective transition approach. Accordingly, reported financial information for historical comparable periods is not revised and continues to be reported under the accounting standards in effect during those historical periods. We elected not to reassess whether existing contracts are or contain leases, or the lease classification and initial direct costs of existing leases upon transition. At transition on December 1, 2019, the adoption of this standard resulted in the recognition of operating ROU assets of $519.9 million and operating lease liabilities of $586.3 million reflected in Premises and equipment and Lease liabilities in our Consolidated Statement of Financial Condition, respectively. Finance lease ROU assets and finance lease liabilities were not material and are reflected in Premises and equipment and Lease liabilities in our Consolidated Statement of Financial Condition, respectively.

Derivatives and Hedging.In February 2016,August 2017, the FASB issued ASU No. 2016-02, Leases (“ASU 2016-02”).2017-12, Derivatives and Hedging: Targeted Improvements to Accounting for Hedging Activities. The guidance affects the accounting for leases and provides for a lessee model that brings substantially all leases that are longer than one year onto the balance sheet, which will result in the recognition of a right of use asset and a corresponding lease liability. The right of use asset and lease liability will be measured initially using the present valueobjective of the remaining rental payments. The populationguidance is to improve the financial reporting of contracts that will be subjecthedging relationships to recognition on our Consolidated Statementsbetter portray the economic results of Financial Condition has been identified; however,an entity’s risk management activities in its financial statements. We adopted the initial measurement of the contracts still remains under evaluation. We are currently modifying our lease accounting systems to enable us to comply with the accounting requirements of this guidance. In July 2018, the FASB issued ASU No. 2018-11, Leases: Targeted Improvements. The guidance allows an entity to recognize a cumulative-effect adjustment to the opening balance of retained earnings upon adoption of ASU 2016-02. We plan on adopting both lease ASUs in the first quarter of fiscal 2020 withand the adoption did not have a cumulative-effect adjustment to opening member’s equity in the period of adoption. We are currently evaluating thematerial impact of the new guidance on our consolidated financial statements.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

Note 4. Fair Value Disclosures

The following is a summary of our financial assets and liabilities that are accounted for at fair value on a recurring basis, excluding Investments at fair value based on net asset value (“NAV”) of $573.5$920.3 million and $322.9$570.3 million at August 31, 20192020 and November 30, 2018,2019, respectively, by level within the fair value hierarchy (in thousands):

| | | | August 31, 2019 | August 31, 2020 |

| | Level 1 | | Level 2 | | Level 3 | | Counterparty and Cash Collateral Netting (1) | | Total | Level 1 | | Level 2 | | Level 3 | | Counterparty and Cash Collateral Netting (1) | | Total |

| Assets: | | | | | | | | | | | | | | | | | | |

| Financial instruments owned: | | | | | | | | | | | | | | | | | | |

| Corporate equity securities | $ | 2,388,213 |

| | $ | 162,382 |

| | $ | 50,600 |

| | $ | — |

| | $ | 2,601,195 |

| $ | 2,446,810 |

| | $ | 63,256 |

| | $ | 77,830 |

| | $ | — |

| | $ | 2,587,896 |

|

| Corporate debt securities | — |

| | 2,892,471 |

| | 9,288 |

| | — |

| | 2,901,759 |

| 0 |

| | 2,720,581 |

| | 23,269 |

| | — |

| | 2,743,850 |

|

| Collateralized debt obligations and collateralized loan obligations | — |

| | 114,045 |

| | 21,135 |

| | — |

| | 135,180 |

| 0 |

| | 68,287 |

| | 27,936 |

| | — |

| | 96,223 |

|

| U.S. government and federal agency securities | 2,115,452 |

| | 204,076 |

| | — |

| | — |

| | 2,319,528 |

| 3,164,472 |

| | 92,036 |

| | 0 |

| | — |

| | 3,256,508 |

|

| Municipal securities | — |

| | 706,375 |

| | — |

| | — |

| | 706,375 |

| 0 |

| | 358,292 |

| | 0 |

| | — |

| | 358,292 |

|

| Sovereign obligations | 1,521,540 |

| | 1,088,927 |

| | — |

| | — |

| | 2,610,467 |

| 1,686,522 |

| | 877,334 |

| | 0 |

| | — |

| | 2,563,856 |

|

| Residential mortgage-backed securities | — |

| | 1,405,246 |

| | 17,929 |

| | — |

| | 1,423,175 |

| 0 |

| | 975,166 |

| | 28,317 |

| | — |

| | 1,003,483 |

|

| Commercial mortgage-backed securities | — |

| | 373,319 |

| | 5,462 |

| | — |

| | 378,781 |

| 0 |

| | 1,091,406 |

| | 4,663 |

| | — |

| | 1,096,069 |

|

| Other asset-backed securities | — |

| | 490,055 |

| | 34,598 |

| | — |

| | 524,653 |

| 0 |

| | 48,734 |

| | 63,337 |

| | — |

| | 112,071 |

|

| Loans and other receivables | — |

| | 1,460,982 |

| | 75,563 |

| | — |

| | 1,536,545 |

| 0 |

| | 2,112,437 |

| | 105,434 |

| | — |

| | 2,217,871 |

|

| Derivatives | 9,258 |

| | 2,954,937 |

| | 16,024 |

| | (2,494,475 | ) | | 485,744 |

| 2,897 |

| | 2,060,960 |

| | 52,195 |

| | (1,611,815 | ) | | 504,237 |

|

| Investments at fair value | — |

| | 41,548 |

| | 132,505 |

| | — |

| | 174,053 |

| 0 |

| | 45,156 |

| | 49,881 |

| | — |

| | 95,037 |

|

| Total financial instruments owned, excluding Investments at fair value based on NAV | $ | 6,034,463 |

| | $ | 11,894,363 |

| | $ | 363,104 |

| | $ | (2,494,475 | ) | | $ | 15,797,455 |

| $ | 7,300,701 |

| | $ | 10,513,645 |

| | $ | 432,862 |

| | $ | (1,611,815 | ) | | $ | 16,635,393 |

|

| Securities purchased under agreements to resell | $ | — |

| | $ | — |

| | $ | 25,000 |

| | $ | — |

| | $ | 25,000 |

| |

| Securities received as collateral | | $ | 4,413 |

| | $ | 0 |

| | $ | 0 |

| | $ | — |

| | $ | 4,413 |

|

| | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | |

| Financial instruments sold, not yet purchased: | | | | | | | | | | | | | | | | | | |

| Corporate equity securities | $ | 2,750,131 |

| | $ | 7,097 |

| | $ | 211 |

| | $ | — |

| | $ | 2,757,439 |

| $ | 2,295,391 |

| | $ | 12,533 |

| | $ | 4,367 |

| | $ | — |

| | $ | 2,312,291 |

|

| Corporate debt securities | — |

| | 1,803,666 |

| | 1,202 |

| | — |

| | 1,804,868 |

| 0 |

| | 1,448,558 |

| | 148 |

| | — |

| | 1,448,706 |

|

| U.S. government and federal agency securities | 1,922,145 |

| | — |

| | — |

| | — |

| | 1,922,145 |

| 2,722,907 |

| | 0 |

| | 0 |

| | — |

| | 2,722,907 |

|

| Sovereign obligations | 1,281,332 |

| | 853,882 |

| | — |

| | — |

| | 2,135,214 |

| 1,452,399 |

| | 1,096,176 |

| | 0 |

| | — |

| | 2,548,575 |

|

| Commercial mortgage-backed securities | — |

| | — |

| | 35 |

| | — |

| | 35 |

| 0 |

| | 0 |

| | 35 |

| | — |

| | 35 |

|

| Loans | — |

| | 1,097,178 |

| | 16,630 |

| | — |

| | 1,113,808 |

| 0 |

| | 1,432,113 |

| | 46,594 |

| | — |

| | 1,478,707 |

|

| Derivatives | 7,327 |

| | 3,087,898 |

| | 66,787 |

| | (2,599,206 | ) | | 562,806 |

| 1,031 |

| | 2,207,254 |

| | 74,620 |

| | (1,799,681 | ) | | 483,224 |

|

| Total financial instruments sold, not yet purchased | $ | 5,960,935 |

| | $ | 6,849,721 |

| | $ | 84,865 |

| | $ | (2,599,206 | ) | | $ | 10,296,315 |

| $ | 6,471,728 |

| | $ | 6,196,634 |

| | $ | 125,764 |

| | $ | (1,799,681 | ) | | $ | 10,994,445 |

|

| Short-term borrowings | | $ | 0 |

| | $ | 21,829 |

| | $ | 0 |

| | $ | — |

| | $ | 21,829 |

|

| Other secured financings | | $ | 0 |

| | $ | 0 |

| | $ | 3,402 |

| | $ | — |

| | $ | 3,402 |

|

| Obligation to return securities received as collateral | | $ | 4,413 |

| | $ | 0 |

| | $ | 0 |

| | $ | — |

| | $ | 4,413 |

|

| Long-term debt | $ | — |

| | $ | 666,446 |

| | $ | 348,063 |

| | $ | — |

| | $ | 1,014,509 |

| $ | 0 |

| | $ | 891,845 |

| | $ | 630,260 |

| | $ | — |

| | $ | 1,522,105 |

|

| |

| (1) | Represents counterparty and cash collateral netting across the levels of the fair value hierarchy for positions with the same counterparty. |

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

| | | | November 30, 2018 | November 30, 2019 |

| | Level 1 | | Level 2 | | Level 3 | | Counterparty and Cash Collateral Netting (1) | | Total | Level 1 | | Level 2 | | Level 3 | | Counterparty and Cash Collateral Netting (1) | | Total |

| Assets: | | | | | | | | | | | | | | | | | | |

| Financial instruments owned: | | | | | | | | | | | | | | | | | | |

| Corporate equity securities | $ | 1,907,945 |

| | $ | 118,681 |

| | $ | 51,040 |

| | $ | — |

| | $ | 2,077,666 |

| $ | 2,325,116 |

| | $ | 218,403 |

| | $ | 58,301 |

| | $ | — |

| | $ | 2,601,820 |

|

| Corporate debt securities | — |

| | 2,683,180 |

| | 9,484 |

| | — |

| | 2,692,664 |

| 0 |

| | 2,472,213 |

| | 7,490 |

| | — |

| | 2,479,703 |

|

| Collateralized debt obligations and collateralized loan obligations | — |

| | 72,949 |

| | 25,815 |

| | — |

| | 98,764 |

| 0 |

| | 124,225 |

| | 20,081 |

| | — |

| | 144,306 |

|

| U.S. government and federal agency securities | 1,789,614 |

| | 56,592 |

| | — |

| | — |

| | 1,846,206 |

| 2,101,624 |

| | 158,618 |

| | 0 |

| | — |

| | 2,260,242 |

|

| Municipal securities | — |

| | 894,253 |

| | — |

| | — |

| | 894,253 |

| 0 |

| | 742,326 |

| | 0 |

| | — |

| | 742,326 |

|

| Sovereign obligations | 1,769,556 |

| | 1,043,409 |

| | — |

| | — |

| | 2,812,965 |

| 1,330,026 |

| | 1,405,827 |

| | 0 |

| | — |

| | 2,735,853 |

|

| Residential mortgage-backed securities | — |

| | 2,163,629 |

| | 19,603 |

| | — |

| | 2,183,232 |

| 0 |

| | 1,069,066 |

| | 17,740 |

| | — |

| | 1,086,806 |

|

| Commercial mortgage-backed securities | — |

| | 819,406 |

| | 10,886 |

| | — |

| | 830,292 |

| 0 |

| | 424,060 |

| | 6,110 |

| | — |

| | 430,170 |

|

| Other asset-backed securities | — |

| | 239,381 |

| | 53,175 |

| | — |

| | 292,556 |

| 0 |

| | 303,847 |

| | 42,563 |

| | — |

| | 346,410 |

|

| Loans and other receivables | — |

| | 2,056,593 |

| | 46,985 |

| | — |

| | 2,103,578 |

| 0 |

| | 2,395,211 |

| | 64,240 |

| | — |

| | 2,459,451 |

|

| Derivatives | 12,186 |

| | 2,524,988 |

| | 5,922 |

| | (2,412,486 | ) | | 130,610 |

| 2,809 |

| | 1,812,659 |

| | 14,889 |

| | (1,432,806 | ) | | 397,551 |

|

| Investments at fair value | — |

| | — |

| | 113,831 |

| | — |

| | 113,831 |

| 0 |

| | 32,688 |

| | 75,738 |

| | — |

| | 108,426 |

|

| Total financial instruments owned, excluding Investments at fair value based on NAV | $ | 5,479,301 |

| | $ | 12,673,061 |

| | $ | 336,741 |

| | $ | (2,412,486 | ) | | $ | 16,076,617 |

| $ | 5,759,575 |

| | $ | 11,159,143 |

| | $ | 307,152 |

| | $ | (1,432,806 | ) | | $ | 15,793,064 |

|

| Securities purchased under agreements to resell | | $ | 0 |

| | $ | 0 |

| | $ | 25,000 |

| | $ | — |

| | $ | 25,000 |

|

| Securities received as collateral | | $ | 9,500 |

| | $ | 0 |

| | $ | 0 |

| | $ | — |

| | $ | 9,500 |

|

| | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | |

| Financial instruments sold, not yet purchased: | | | | | | | | | | | | | | | | | | |

| Corporate equity securities | $ | 1,685,071 |

| | $ | 1,444 |

| | $ | — |

| | $ | — |

| | $ | 1,686,515 |

| $ | 2,755,601 |

| | $ | 7,438 |

| | $ | 4,487 |

| | $ | — |

| | $ | 2,767,526 |

|

| Corporate debt securities | — |

| | 1,505,618 |

| | 522 |

| | — |

| | 1,506,140 |

| 0 |

| | 1,471,142 |

| | 340 |

| | — |

| | 1,471,482 |

|

| U.S. government and federal agency securities | 1,384,295 |

| | — |

| | — |

| | — |

| | 1,384,295 |

| 1,851,981 |

| | 0 |

| | 0 |

| | — |

| | 1,851,981 |

|

| Sovereign obligations | 1,735,242 |

| | 661,095 |

| | — |

| | — |

| | 2,396,337 |

| 1,363,475 |

| | 941,065 |

| | 0 |

| | — |

| | 2,304,540 |

|

| Commercial mortgage-backed securities | | 0 |

| | 0 |

| | 35 |

| | — |

| | 35 |

|

| Loans | — |

| | 1,371,630 |

| | 6,376 |

| | — |

| | 1,378,006 |

| 0 |

| | 1,600,228 |

| | 9,463 |

| | — |

| | 1,609,691 |

|

| Derivatives | 26,471 |

| | 3,585,249 |

| | 27,536 |

| | (2,511,605 | ) | | 1,127,651 |

| 871 |

| | 2,066,064 |

| | 92,057 |

| | (1,631,787 | ) | | 527,205 |

|

| Total financial instruments sold, not yet purchased | $ | 4,831,079 |

| | $ | 7,125,036 |

| | $ | 34,434 |

| | $ | (2,511,605 | ) | | $ | 9,478,944 |

| $ | 5,971,928 |

| | $ | 6,085,937 |

| | $ | 106,382 |

| | $ | (1,631,787 | ) | | $ | 10,532,460 |

|

| Short-term borrowings | | $ | 0 |

| | $ | 20,981 |

| | $ | 0 |

| | $ | — |

| | $ | 20,981 |

|

| Obligation to return securities received as collateral | | $ | 9,500 |

| | $ | 0 |

| | $ | 0 |

| | $ | — |

| | $ | 9,500 |

|

| Long-term debt | $ | — |

| | $ | 485,425 |

| | $ | 200,745 |

| | $ | — |

| | $ | 686,170 |

| $ | 0 |

| | $ | 735,216 |

| | $ | 480,069 |

| | $ | — |

| | $ | 1,215,285 |

|

| |

| (1) | Represents counterparty and cash collateral netting across the levels of the fair value hierarchy for positions with the same counterparty. |

The following is a description of the valuation basis, including valuation techniques and inputs, used in measuring our financial assets and liabilities that are accounted for at fair value on a recurring basis:

Corporate Equity Securities

| |

| • | Exchange-Traded Equity Securities: Exchange-traded equity securities are measured based on quoted closing exchange prices, which are generally obtained from external pricing services, and are categorized within Level 1 of the fair value hierarchy, otherwise they are categorized within Level 2 of the fair value hierarchy. To the extent these securities are actively traded, valuation adjustments are not applied. |

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

| |

| • | Non-Exchange-Traded Equity Securities: Non-exchange-traded equity securities are measured primarily using broker quotations, pricing data from external pricing services and prices observed from recently executed market transactions and are categorized within Level 2 of the fair value hierarchy. Where such information is not available, non-exchange-traded equity securities are categorized within Level 3 of the fair value hierarchy and measured using valuation techniques involving quoted prices of or market data for comparable companies, similar company ratios and multiples (e.g., price/Earnings before interest, taxes, depreciation and amortization (“EBITDA”), price/book value), discounted cash flow analyses and transaction prices observed from subsequent financing or capital issuance by the company. When using pricing data of comparable companies, judgment must be applied to adjust the pricing data to account for differences between the measured security and the comparable security (e.g., issuer market capitalization, yield, dividend rate, geographical concentration). |

| |

| • | Equity Warrants: Non-exchange-traded equity warrants are measured primarily using pricing data from external pricing services, prices observed from recently executed market transactions and broker quotations and are categorized within Level 2 of the fair value hierarchy. Where such information is not available, non-exchange-traded equity warrants are generally categorized within Level 3 of the fair value hierarchy and arecan be measured using the Black-Scholes model with key inputs impacting the valuation including the underlying security price, implied volatility, dividend yield, interest rate curve, strike price and maturity date. |

Corporate Debt Securities

| |

| • | Investment Grade Corporate Bonds: Investment grade corporate bonds are measured primarily using pricing data from external pricing services and broker quotations, where available, prices observed from recently executed market transactions and bond spreads or credit default swap spreads of the issuer adjusted for basis differences between the swap curve and the bond curve. Investment grade corporate bonds measured using these valuation methods are categorized within Level 2 of the fair value hierarchy. If broker quotes, pricing data or spread data is not available, alternative valuation techniques are used including cash flow models incorporating interest rate curves, single name or index credit default swap curves for comparable issuers and recovery rate assumptions. Investment grade corporate bonds measured using alternative valuation techniques are categorized within Level 2 or Level 3 of the fair value hierarchy and are a limited portion of our investment grade corporate bonds. |

| |

| • | High Yield Corporate and Convertible Bonds: A significant portion of our high yield corporate and convertible bonds are categorized within Level 2 of the fair value hierarchy and are measured primarily using broker quotations and pricing data from external pricing services, where available, and prices observed from recently executed market transactions of institutional size. Where pricing data is less observable, valuations are categorized within Level 3 of the fair value hierarchy and are based on pending transactions involving the issuer or comparable issuers, prices implied from an issuer’s subsequent financing or recapitalization, models incorporating financial ratios and projected cash flows of the issuer and market prices for comparable issuers. |

Collateralized Debt Obligations and Collateralized Loan Obligations

Collateralized debt obligations (“CDOs”) and collateralized loan obligations (“CLOs”) are measured based on prices observed from recently executed market transactions of the same or similar security or based on valuations received from third-party brokers or data providers and are categorized within Level 2 or Level 3 of the fair value hierarchy depending on the observability and significance of the pricing inputs. Valuation that is based on recently executed market transactions of similar securities incorporates additional review and analysis of pricing inputs and comparability criteria, including, but not limited to, collateral type, tranche type, rating, origination year, prepayment rates, default rates and loss severity.

U.S. Government and Federal Agency Securities

| |

| • | U.S. Treasury Securities: U.S. Treasury securities are measured based on quoted market prices obtained from external pricing services and categorized within Level 1 of the fair value hierarchy. |

| |

| • | U.S. Agency Debt Securities: Callable and non-callable U.S. agency debt securities are measured primarily based on quoted market prices obtained from external pricing services and are generally categorized within Level 1 or Level 2 of the fair value hierarchy. |

Municipal Securities

Municipal securities are measured based on quoted prices obtained from external pricing services and are generally categorized within Level 2 of the fair value hierarchy.

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

Sovereign Obligations

Sovereign government obligations are measured based on quoted market prices obtained from external pricing services, where available, or recently executed independent transactions of comparable size. Sovereign government obligations, with consideration given to the country of issuance, are generally categorized within Level 1 or Level 2 of the fair value hierarchy.

Residential Mortgage-Backed Securities

| |

| • | Agency Residential Mortgage-Backed Securities (“RMBS”): Agency RMBS include mortgage pass-through securities (fixed and adjustable rate), collateralized mortgage obligations and principal-only and interest-only (including inverse interest-only) securities. Agency RMBS are generally measured using recent transactions, pricing data from external pricing services or expected future cash flow techniques that incorporate prepayment models and other prepayment assumptions to amortize the underlying mortgage loan collateral and are categorized within Level 2 or Level 3 of the fair value hierarchy. We use prices observed from recently executed transactions to develop market-clearing spread and yield curve assumptions. Valuation inputs with regard to the underlying collateral incorporate factors such as weighted average coupon, loan-to-value, credit scores, geographic location, maximum and average loan size, originator, servicer and weighted average loan age. |

| |

| • | Non-Agency RMBS: The fair value of non-agency RMBS is determined primarily using discounted cash flow methodologies and securities are categorized within Level 2 or Level 3 of the fair value hierarchy based on the observability and significance of the pricing inputs used. Performance attributes of the underlying mortgage loans are evaluated to estimate pricing inputs, such as prepayment rates, default rates and the severity of credit losses. Attributes of the underlying mortgage loans that affect the pricing inputs include, but are not limited to, weighted average coupon; average and maximum loan size; loan-to-value; credit scores; documentation type; geographic location; weighted average loan age; originator; servicer; historical prepayment, default and loss severity experience of the mortgage loan pool; and delinquency rate. Yield curves used in the discounted cash flow models are based on observed market prices for comparable securities and published interest rate data to estimate market yields. In addition, broker quotes, where available, are also referenced to compare prices primarily on interest-only securities. |

Commercial Mortgage-Backed Securities

| |

| • | Agency Commercial Mortgage-Backed Securities (“CMBS”): Government National Mortgage Association (“GNMA”) project loan bonds are measured based on inputs corroborated from and benchmarked to observed prices of recent securitization transactions of similar securities with adjustments incorporating an evaluation of various factors, including prepayment speeds, default rates and cash flow structures, as well as the likelihood of pricing levels in the current market environment.structures. Federal National Mortgage Association (“FNMA”) Delegated Underwriting and Servicing (“DUS”) mortgage-backed securities are generally measured by using prices observed from recently executed market transactions to estimate market-clearing spread levels for purposes of estimating fair value. GNMA project loan bonds and FNMA DUS mortgage-backed securities are categorized within Level 2 of the fair value hierarchy. |

| |

| • | Non-Agency CMBS: Non-agency CMBS are measured using pricing data obtained from external pricing services, prices observed from recently executed market transactions or based on expected cash flow models that incorporate underlying loan collateral characteristics and performance. Non-Agency CMBS are categorized within Level 2 or Level 3 of the fair value hierarchy depending on the observability of the underlying inputs. |

Other Asset-Backed Securities

Other asset-backed securities (“ABS”) include, but are not limited to, securities backed by auto loans, credit card receivables, student loans and other consumer loans and are categorized within Level 2 or Level 3 of the fair value hierarchy. Valuations are primarily determined using pricing data obtained from external pricing services, broker quotes and prices observed from recently executed market transactions. In addition, recent transaction data from comparable deals is deployed to develop market clearing yields and cumulative loss assumptions. The cumulative loss assumptions are based on the analysis of the underlying collateral and comparisons to earlier deals from the same issuer to gauge the relative performance of the deal.

Loans and Other Receivables

| |

| • | Corporate Loans: Corporate loans categorized within Level 2 of the fair value hierarchy are measured based on market consensus pricing service quotations. Where available, market price quotations from external pricing services are reviewed to ensure they are supported by transaction data. Corporate loans categorized within Level 3 of the fair value hierarchy are measured based on price quotations that are considered to be less transparent, market prices for debt securities of the same creditor and estimates of future cash flows incorporating assumptions regarding creditor default and recovery rates and consideration of the issuer’s capital structure. |

JEFFERIES GROUP LLC AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(Unaudited)

| |

| • | Participation Certificates in Agency Residential Loans: Valuations of participation certificates in agency residential loans are based on observed market prices of recently executed purchases and sales of similar loans and data provider pricing. The loan participation certificates are categorized within Level 2 of the fair value hierarchy given the observability and volume of recently executed transactions and availability of data provider pricing. |

| |

| • | Project Loans and Participation Certificates in GNMA Project and Construction Loans: Valuations of participation certificates in GNMA project and construction loans are based on inputs corroborated from and benchmarked to observed prices of recent securitizations with similar underlying loan collateral to derive an implied spread. Securitization prices are adjusted to estimate the fair value of the loans to account for the arbitrage that is realized at the time of securitization. The measurements are categorized within Level 2 of the fair value hierarchy given the observability and volume of recently executed transactions. |

| |

| • | Consumer Loans and Funding Facilities: Consumer and small business whole loans and related funding facilities are valued based on observed market transactions and incorporating valuation inputs including, but not limited to, delinquency and default rates, prepayment rates, borrower characteristics, loan risk grades and loan age. These assets are categorized within Level 2 or Level 3 of the fair value hierarchy. |

| |

| • | Escrow and Claim Receivables: Escrow and claim receivables are categorized within Level 3 of the fair value hierarchy where fair value is estimated based on reference to market prices and implied yields of debt securities of the same or similar issuers. Escrow and claim receivables are categorized within Level 2 of the fair value hierarchy where fair value is based on recent observations in the same receivable. |

Derivatives

| |

| • | Listed Derivative Contracts: Listed derivative contracts that are actively traded are measured based on quoted exchange prices, broker quotes or vanilla option valuation models, such as Black-Scholes, using observable valuation inputs from the principal market or consensus pricing services. Exchange quotes and/or valuation inputs are generally obtained from external vendors and pricing services. Broker quotes are validated directly through observable and tradeable quotes. Listed derivative contracts that use unadjusted exchange close prices are generally categorized within Level 1 of the fair value hierarchy. All other listed derivative contracts are generally categorized within Level 2 of the fair value hierarchy. |

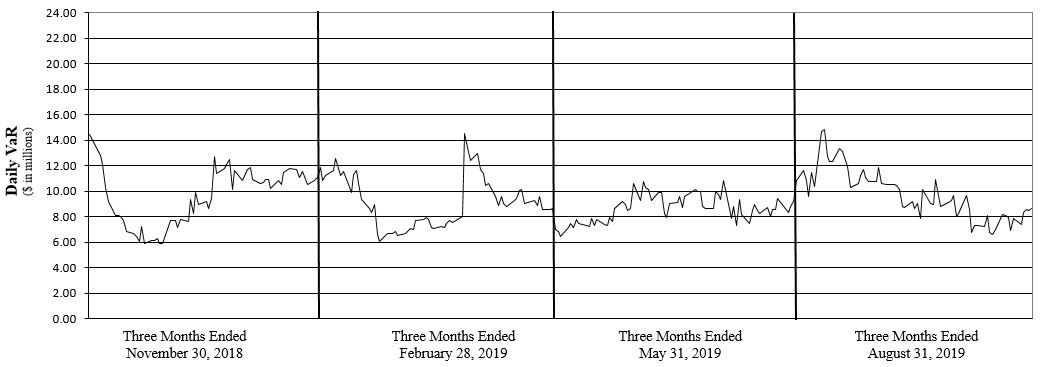

| |