UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| (Mark One) | |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20172018 |

| OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File No. 1-15371

iStar Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Maryland (State or other jurisdiction of incorporation or organization) | | 95-6881527 (I.R.S. Employer Identification Number) |

1114 Avenue of the Americas, 39th Floor | | |

New York, NY (Address of principal executive offices) | | 10036 (Zip code) |

Registrant's telephone number, including area code: (212) 930-9400

Indicate by check mark whether the registrant: (i) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports); and (ii) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o | | Emerging growth company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

As of August 3, 2017,1, 2018, there were 72,190,31267,968,039 shares, $0.001 par value per share, of iStar Inc. common stock outstanding.

TABLE OF CONTENTS

PART I. CONSOLIDATED FINANCIAL INFORMATION

Item 1. Financial Statements

iStar Inc.

Consolidated Balance Sheets

(In thousands, except per share data)

(unaudited)

| | | | As of | As of |

| | June 30, 2017 (unaudited) | | December 31,

2016 | June 30, 2018 | | December 31,

2017 |

| ASSETS | | | | | | |

| Real estate | | | | | | |

| Real estate, at cost | $ | 1,710,915 |

| | $ | 1,740,893 |

| $ | 2,255,537 |

| | $ | 1,629,436 |

|

| Less: accumulated depreciation | (367,933 | ) | | (353,619 | ) | (340,538 | ) | | (347,405 | ) |

| Real estate, net | 1,342,982 |

| | 1,387,274 |

| 1,914,999 |

| | 1,282,031 |

|

| Real estate available and held for sale | 68,045 |

| | 237,531 |

| 37,597 |

| | 68,588 |

|

| Total real estate | 1,411,027 |

| | 1,624,805 |

| 1,952,596 |

| | 1,350,619 |

|

| Land and development, net | 855,497 |

| | 945,565 |

| 641,627 |

| | 860,311 |

|

| Loans receivable and other lending investments, net | 1,170,565 |

| | 1,450,439 |

| 1,052,872 |

| | 1,300,655 |

|

| Other investments | 276,821 |

| | 214,406 |

| 293,017 |

| | 321,241 |

|

| Cash and cash equivalents | 954,279 |

| | 328,744 |

| 1,039,591 |

| | 657,688 |

|

| Accrued interest and operating lease income receivable, net | 10,501 |

| | 11,254 |

| 10,994 |

| | 11,957 |

|

| Deferred operating lease income receivable, net | 88,944 |

| | 88,189 |

| 88,080 |

| | 86,877 |

|

| Deferred expenses and other assets, net | 147,121 |

| | 162,112 |

| 279,390 |

| | 141,730 |

|

| Total assets | $ | 4,914,755 |

| | $ | 4,825,514 |

| $ | 5,358,167 |

| | $ | 4,731,078 |

|

| LIABILITIES AND EQUITY | | | | | | |

| Liabilities: | | | | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 230,259 |

| | $ | 211,570 |

| $ | 249,494 |

| | $ | 238,004 |

|

| Loan participations payable, net | 107,442 |

| | 159,321 |

| 14,709 |

| | 102,425 |

|

| Debt obligations, net | 3,368,113 |

| | 3,389,908 |

| 3,869,576 |

| | 3,476,400 |

|

| Total liabilities | 3,705,814 |

| | 3,760,799 |

| 4,133,779 |

| | 3,816,829 |

|

| Commitments and contingencies (refer to Note 11) | — |

| | — |

|

|

| |

|

|

| Redeemable noncontrolling interests (refer to Note 5) | 3,585 |

| | 5,031 |

| |

| Redeemable noncontrolling interests | | 11,814 |

| | — |

|

| Equity: | | | | | | |

| iStar Inc. shareholders' equity: | | | | | | |

| Preferred Stock Series D, E, F, G and I, liquidation preference $25.00 per share (refer to Note 13) | 22 |

| | 22 |

| |

| Preferred Stock Series D, G and I, liquidation preference $25.00 per share (refer to Note 13) | | 12 |

| | 12 |

|

| Convertible Preferred Stock Series J, liquidation preference $50.00 per share (refer to Note 13) | 4 |

| | 4 |

| 4 |

| | 4 |

|

| Common Stock, $0.001 par value, 200,000 shares authorized, 72,190 and 72,042 shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | 72 |

| | 72 |

| |

| Common Stock, $0.001 par value, 200,000 shares authorized, 67,968 and 68,236 shares issued and outstanding as of June 30, 2018 and December 31, 2017, respectively | | 68 |

| | 68 |

|

| Additional paid-in capital | 3,603,981 |

| | 3,602,172 |

| 3,350,750 |

| | 3,352,665 |

|

| Retained earnings (deficit) | (2,431,123 | ) | | (2,581,488 | ) | |

| Retained deficit | | (2,325,291 | ) | | (2,470,564 | ) |

| Accumulated other comprehensive income (loss) (refer to Note 13) | (3,678 | ) | | (4,218 | ) | (2,233 | ) | | (2,482 | ) |

| Total iStar Inc. shareholders' equity | 1,169,278 |

| | 1,016,564 |

| 1,023,310 |

| | 879,703 |

|

| Noncontrolling interests | 36,078 |

| | 43,120 |

| 189,264 |

| | 34,546 |

|

| Total equity | 1,205,356 |

| | 1,059,684 |

| 1,212,574 |

| | 914,249 |

|

| Total liabilities and equity | $ | 4,914,755 |

| | $ | 4,825,514 |

| $ | 5,358,167 |

| | $ | 4,731,078 |

|

Note - Refer to Note 2 for details on the Company's consolidated variable interest entities ("VIEs").

The accompanying notes are an integral part of the consolidated financial statements.

iStar Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

(unaudited)

| | | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues: | | | | | | | | | | | | | | |

| Operating lease income | $ | 47,002 |

| | $ | 49,975 |

| | $ | 94,349 |

| | $ | 100,470 |

| $ | 44,609 |

| | $ | 47,002 |

| | $ | 90,407 |

| | $ | 94,349 |

|

| Interest income | 28,645 |

| | 34,400 |

| | 57,703 |

| | 67,620 |

| 25,212 |

| | 28,645 |

| | 51,909 |

| | 57,703 |

|

| Other income | 139,510 |

| | 10,096 |

| | 151,374 |

| | 21,636 |

| 20,823 |

| | 139,510 |

| | 36,142 |

| | 151,374 |

|

| Land development revenue | 132,710 |

| | 27,888 |

| | 152,760 |

| | 42,835 |

| 80,927 |

| | 132,710 |

| | 357,356 |

| | 152,760 |

|

| Total revenues | 347,867 |

| | 122,359 |

| | 456,186 |

| | 232,561 |

| 171,571 |

| | 347,867 |

| | 535,814 |

| | 456,186 |

|

| Costs and expenses: | | | | | | | | | | | | | | |

| Interest expense | 48,807 |

| | 56,047 |

| | 99,952 |

| | 113,068 |

| 43,172 |

| | 48,807 |

| | 88,353 |

| | 99,952 |

|

| Real estate expense | 34,684 |

| | 35,328 |

| | 70,274 |

| | 69,572 |

| 37,043 |

| | 34,684 |

| | 73,224 |

| | 70,274 |

|

| Land development cost of sales | 122,466 |

| | 17,262 |

| | 138,376 |

| | 28,838 |

| 83,361 |

| | 122,466 |

| | 306,768 |

| | 138,376 |

|

| Depreciation and amortization | 13,171 |

| | 13,673 |

| | 25,451 |

| | 27,581 |

| 10,767 |

| | 13,171 |

| | 21,878 |

| | 25,451 |

|

General and administrative | 27,218 |

| | 19,665 |

| | 52,392 |

| | 42,768 |

| 23,228 |

| | 27,218 |

| | 52,041 |

| | 52,392 |

|

| (Recovery of) provision for loan losses | (600 | ) | | 700 |

| | (5,528 | ) | | 2,206 |

| |

| Provision for (recovery of) loan losses | | 18,892 |

| | (600 | ) | | 18,037 |

| | (5,528 | ) |

| Impairment of assets | 10,284 |

| | 3,012 |

| | 14,696 |

| | 3,012 |

| 6,088 |

| | 10,284 |

| | 10,188 |

| | 14,696 |

|

| Other expense | 16,276 |

| | 3,182 |

| | 18,145 |

| | 3,922 |

| 3,716 |

| | 16,276 |

| | 4,882 |

| | 18,145 |

|

| Total costs and expenses | 272,306 |

| | 148,869 |

| | 413,758 |

| | 290,967 |

| 226,267 |

| | 272,306 |

| | 575,371 |

| | 413,758 |

|

| Income (loss) before earnings from equity method investments and other items | 75,561 |

| | (26,510 | ) | | 42,428 |

| | (58,406 | ) | (54,696 | ) | | 75,561 |

| | (39,557 | ) | | 42,428 |

|

| Loss on early extinguishment of debt, net | (3,315 | ) | | (1,457 | ) | | (3,525 | ) | | (1,582 | ) | (2,164 | ) | | (3,315 | ) | | (2,536 | ) | | (3,525 | ) |

| Earnings from equity method investments | 5,515 |

| | 39,447 |

| | 11,217 |

| | 47,714 |

| |

| Income (loss) from continuing operations before income taxes | 77,761 |

| | 11,480 |

| | 50,120 |

| | (12,274 | ) | |

| Income tax (expense) benefit | (1,644 | ) | | 1,190 |

| | (2,251 | ) | | 1,604 |

| |

| Income (loss) from continuing operations | 76,117 |

| | 12,670 |

| | 47,869 |

| | (10,670 | ) | |

| Earnings (losses) from equity method investments | | (7,278 | ) | | 5,515 |

| | (3,946 | ) | | 11,217 |

|

| Gain on consolidation of equity method investment | | 67,877 |

| | — |

| | 67,877 |

| | — |

|

| Income from continuing operations before income taxes | | 3,739 |

| | 77,761 |

| | 21,838 |

| | 50,120 |

|

| Income tax expense | | (128 | ) | | (1,644 | ) | | (249 | ) | | (2,251 | ) |

| Income from continuing operations | | 3,611 |

| | 76,117 |

| | 21,589 |

| | 47,869 |

|

| Income from discontinued operations | 173 |

| | 3,633 |

| | 4,939 |

| | 7,214 |

| — |

| | 173 |

| | — |

| | 4,939 |

|

| Gain from discontinued operations | 123,418 |

| | — |

| | 123,418 |

| | — |

| — |

| | 123,418 |

| | — |

| | 123,418 |

|

| Income tax expense from discontinued operations | (4,545 | ) | | — |

| | (4,545 | ) | | — |

| — |

| | (4,545 | ) | | — |

| | (4,545 | ) |

Income from sales of real estate(1) | 844 |

| | 43,484 |

| | 8,954 |

| | 53,943 |

| |

Income from sales of real estate(2) | | 56,895 |

| | 844 |

| | 73,943 |

| | 8,954 |

|

| Net income | 196,007 |

| | 59,787 |

| | 180,635 |

| | 50,487 |

| 60,506 |

| | 196,007 |

| | 95,532 |

| | 180,635 |

|

| Net (income) loss attributable to noncontrolling interests | (5,710 | ) | | (8,825 | ) | | (4,610 | ) | | (7,883 | ) | |

| Net income attributable to noncontrolling interests | | (9,509 | ) | | (5,710 | ) | | (9,604 | ) | | (4,610 | ) |

| Net income attributable to iStar Inc. | 190,297 |

| | 50,962 |

| | 176,025 |

| | 42,604 |

| 50,997 |

| | 190,297 |

| | 85,928 |

| | 176,025 |

|

| Preferred dividends | (12,830 | ) | | (12,830 | ) | | (25,660 | ) | | (25,660 | ) | (8,124 | ) | | (12,830 | ) | | (16,248 | ) | | (25,660 | ) |

Net (income) loss allocable to Participating Security holders(2) | — |

| | (20 | ) | | — |

| | (11 | ) | |

| Net income allocable to common shareholders | $ | 177,467 |

| | $ | 38,112 |

| | $ | 150,365 |

| | $ | 16,933 |

| $ | 42,873 |

| | $ | 177,467 |

| | $ | 69,680 |

| | $ | 150,365 |

|

| Per common share data: | | | | | | | | | | | | | | |

| Income attributable to iStar Inc. from continuing operations: | | | | | | | | | | | | | | |

| Basic | $ | 0.81 |

| | $ | 0.47 |

| | $ | 0.37 |

| | $ | 0.13 |

| $ | 0.63 |

| | $ | 0.81 |

| | $ | 1.03 |

| | $ | 0.37 |

|

| Diluted | $ | 0.69 |

| | $ | 0.34 |

| | $ | 0.35 |

| | $ | 0.13 |

| $ | 0.54 |

| | $ | 0.69 |

| | $ | 0.89 |

| | $ | 0.35 |

|

| Net income attributable to iStar Inc.: | | | | | | | | | | | | | | |

| Basic | $ | 2.46 |

| | $ | 0.52 |

| | $ | 2.09 |

| | $ | 0.22 |

| $ | 0.63 |

| | $ | 2.46 |

| | $ | 1.03 |

| | $ | 2.09 |

|

| Diluted | $ | 2.04 |

| | $ | 0.37 |

| | $ | 1.76 |

| | $ | 0.22 |

| $ | 0.54 |

| | $ | 2.04 |

| | $ | 0.89 |

| | $ | 1.76 |

|

| Weighted average number of common shares: | | | | | | | | | | | | | | |

| Basic | 72,142 |

| | 73,984 |

| | 72,104 |

| | 75,522 |

| 67,932 |

| | 72,142 |

| | 67,922 |

| | 72,104 |

|

| Diluted | 88,195 |

| | 118,510 |

| | 88,156 |

| | 75,872 |

| 83,694 |

| | 88,195 |

| | 83,682 |

| | 88,156 |

|

| |

| (1) | For the three months ended June 30, 2018 and 2017, includes $2.2 million and $2.9 million, respectively, of equity-based compensation associated with iPIP Plans (refer to Note 14). For the six months ended June 30, 2018 and 2017, includes $10.2 million and $7.9 million, respectively, of equity-based compensation associated with iPIP Plans (refer to Note 14). These plans are liability-based plans which are marked-to-market quarterly and such marks are based upon the performance of the assets underlying the plans as of the quarterly measurement dates; however, actual amounts cannot be determined until the end date of the plans and the ultimate repayment or monetization of the related assets. |

| |

| (2) | Income from sales of real estate represents gains from sales of real estate that do not qualify as discontinued operations. |

| |

(2) | Participating Security holders are non-employee directors who hold common stock equivalents ("CSEs") and restricted stock awards granted under the Company's Long Term Incentive Plans that are eligible to participate in dividends (refer to Note 14 and Note 15). |

The accompanying notes are an integral part of the consolidated financial statements.

iStar Inc.

Consolidated Statements of Comprehensive Income (Loss)

(In thousands)

(unaudited)

| | | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2018 | | 2017 | | 2018 | | 2017 |

| Net income | $ | 196,007 |

| | $ | 59,787 |

| | $ | 180,635 |

| | $ | 50,487 |

| $ | 60,506 |

| | $ | 196,007 |

| | $ | 95,532 |

| | $ | 180,635 |

|

| Other comprehensive income (loss): | | | | | | | | | | | | | | |

Reclassification of (gains)/losses on cash flow hedges into earnings upon realization(1) | (313 | ) | | 118 |

| | (191 | ) | | 375 |

| |

| Unrealized gains/(losses) on available-for-sale securities | 583 |

| | 446 |

| | 566 |

| | 465 |

| |

| Unrealized gains/(losses) on cash flow hedges | (146 | ) | | (357 | ) | | 394 |

| | (1,319 | ) | |

| Unrealized gains/(losses) on cumulative translation adjustment | 172 |

| | 30 |

| | (229 | ) | | (10 | ) | |

| Impact from adoption of new accounting standards (refer to Note 3) | | — |

| | — |

| | 276 |

| | — |

|

Reclassification of (gains)/losses on cumulative translation adjustment into earnings upon realization(1) | | 721 |

| | — |

| | 721 |

| | — |

|

Reclassification of losses on cash flow hedges into earnings upon realization(2) | | (1,795 | ) | | (313 | ) | | (1,786 | ) | | (191 | ) |

| Unrealized gains (losses) on available-for-sale securities | | 15 |

| | 583 |

| | (956 | ) | | 566 |

|

| Unrealized gains (losses) on cash flow hedges | | 7 |

| | (146 | ) | | 2,358 |

| | 394 |

|

| Unrealized gains (losses) on cumulative translation adjustment | | (256 | ) | | 172 |

| | (364 | ) | | (229 | ) |

| Other comprehensive income (loss) | 296 |

| | 237 |

|

| 540 |

| | (489 | ) | (1,308 | ) | | 296 |

|

| 249 |

| | 540 |

|

| Comprehensive income | 196,303 |

| | 60,024 |

| | 181,175 |

| | 49,998 |

| 59,198 |

| | 196,303 |

| | 95,781 |

| | 181,175 |

|

| Comprehensive (income) loss attributable to noncontrolling interests | (5,710 | ) | | (8,825 | ) | | (4,610 | ) | | (7,883 | ) | |

| Comprehensive (income) attributable to noncontrolling interests | | (9,509 | ) | | (5,710 | ) | | (9,604 | ) | | (4,610 | ) |

| Comprehensive income attributable to iStar Inc. | $ | 190,593 |

| | $ | 51,199 |

| | $ | 176,565 |

| | $ | 42,115 |

| $ | 49,689 |

| | $ | 190,593 |

| | $ | 86,177 |

| | $ | 176,565 |

|

| |

| (1) | ReclassifiedAmounts were reclassified to "Earnings from equity method investments" in the Company's consolidated statements of operations. |

| |

| (2) | Amounts reclassified to "Interest expense" in the Company's consolidated statements of operations are $30 and $60 for the three and six months ended June 30, 2017, respectively, and $23 and $183respectively. Amount reclassified to "Gain on consolidation of equity method investment" in the Company's consolidated statements of operations is $1,876 for the three and six months ended June 30, 2016, respectively. Reclassified2018. Amounts reclassified to "Earnings from equity method investments" in the Company's consolidated statements of operations are $81 and $90 for the three and six months ended June 30, 2018, respectively, and $70 and $164 for the three and six months ended June 30, 2017, respectively, and $95 and $192 for the three and six months ended June 30, 2016, respectively. |

The accompanying notes are an integral part of the consolidated financial statements.

iStar Inc.

Consolidated Statements of Changes in Equity

For the Six Months Ended June 30, 20172018 and 20162017

(In thousands)

(unaudited)

| | | | | iStar Inc. Shareholders' Equity | | | | | | iStar Inc. Shareholders' Equity | | | | |

| | | | Preferred Stock(1) | | Preferred Stock Series J(1) | | Common Stock at Par | | Additional Paid-In Capital | | Retained Earnings (Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity |

| Balance as of December 31, 2017 | | | $ | 12 |

| | $ | 4 |

| | $ | 68 |

| | $ | 3,352,665 |

| | $ | (2,470,564 | ) | | $ | (2,482 | ) | | $ | 34,546 |

| | $ | 914,249 |

|

| Dividends declared—preferred | | | — |

| | — |

| | — |

| | — |

| | (16,248 | ) | | — |

| | — |

| | (16,248 | ) |

| Issuance of stock/restricted stock unit amortization, net | | | — |

| | — |

| | 1 |

| | 6,388 |

| | — |

| | — |

| | — |

| | 6,389 |

|

Net income for the period(2) | | | — |

| | — |

| | — |

| | — |

| | 85,928 |

| | — |

| | 9,604 |

| | 95,532 |

|

| Change in accumulated other comprehensive income (loss) | | | — |

| | — |

| | — |

| | — |

| | — |

| | (27 | ) | | — |

| | (27 | ) |

| Repurchase of stock | | | — |

| | — |

| | (1 | ) | | (8,303 | ) | | — |

| | — |

| | — |

| | (8,304 | ) |

| Contributions from noncontrolling interests | | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 9 |

| | 9 |

|

| Distributions to noncontrolling interests | | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (43,174 | ) | | (43,174 | ) |

| Change in noncontrolling interest attributable to consolidation of equity method investment (refer to Note 7) | | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 188,279 |

| | 188,279 |

|

| Impact from adoption of new accounting standards (refer to Note 3) | | | — |

| | — |

| | — |

| | — |

| | 75,593 |

| | 276 |

| | — |

| | 75,869 |

|

| Balance as of June 30, 2018 | | | $ | 12 |

| | $ | 4 |

| | $ | 68 |

| | $ | 3,350,750 |

| | $ | (2,325,291 | ) | | $ | (2,233 | ) | | $ | 189,264 |

| | $ | 1,212,574 |

|

| | | Preferred Stock(1) | | Preferred Stock Series J(1) | | Common Stock at Par | | Additional Paid-In Capital | | Retained Earnings (Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interests | | Total Equity | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2016 | | $ | 22 |

| | $ | 4 |

| | $ | 72 |

| | $ | 3,602,172 |

| | $ | (2,581,488 | ) | | $ | (4,218 | ) | | $ | 43,120 |

| | $ | 1,059,684 |

| | $ | 22 |

| | $ | 4 |

| | $ | 72 |

| | $ | 3,602,172 |

| | $ | (2,581,488 | ) | | $ | (4,218 | ) | | $ | 43,120 |

| | $ | 1,059,684 |

|

| Dividends declared—preferred | | — |

| | — |

| | — |

| | — |

| | (25,660 | ) | | — |

| | — |

| | (25,660 | ) | | — |

| | — |

| | — |

| | — |

| | (25,660 | ) | | — |

| | — |

| | (25,660 | ) |

| Issuance of stock/restricted stock unit amortization, net | | — |

| | — |

| | — |

| | 1,699 |

| | — |

| | — |

| | — |

| | 1,699 |

| | — |

| | — |

| | — |

| | 1,699 |

| | — |

| | — |

| | — |

| | 1,699 |

|

Net income for the period(2) | | — |

| | — |

| | — |

| | — |

| | 176,025 |

| | — |

| | 5,946 |

| | 181,971 |

| | — |

| | — |

| | — |

| | — |

| | 176,025 |

| | — |

| | 5,946 |

| | 181,971 |

|

| Change in accumulated other comprehensive income (loss) | | — |

| | — |

| | — |

| | — |

| | — |

| | 540 |

| | — |

| | 540 |

| |

| Change in accumulated other comprehensive income | | | — |

| | — |

| | — |

| | — |

| | — |

| | 540 |

| | — |

| | 540 |

|

| Change in additional paid in capital attributable to redeemable noncontrolling interest | | — |

| | — |

| | — |

| | 110 |

| | — |

| | — |

| | — |

| | 110 |

| | — |

| | — |

| | — |

| | 110 |

| | — |

| | — |

| | — |

| | 110 |

|

| Distributions to noncontrolling interest | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (12,988 | ) | | (12,988 | ) | |

| Distributions to noncontrolling interests | | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (12,988 | ) | | (12,988 | ) |

| Balance as of June 30, 2017 | | $ | 22 |

| | $ | 4 |

| | $ | 72 |

| | $ | 3,603,981 |

| | $ | (2,431,123 | ) | | $ | (3,678 | ) | | $ | 36,078 |

| | $ | 1,205,356 |

| | $ | 22 |

| | $ | 4 |

| | $ | 72 |

| | $ | 3,603,981 |

| | $ | (2,431,123 | ) | | $ | (3,678 | ) | | $ | 36,078 |

| | $ | 1,205,356 |

|

| | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2015 | | $ | 22 |

| | $ | 4 |

| | $ | 81 |

| | $ | 3,689,330 |

| | $ | (2,625,474 | ) | | $ | (4,851 | ) | | $ | 42,218 |

| | $ | 1,101,330 |

| |

| Dividends declared—preferred | | — |

| | — |

| | — |

| | — |

| | (25,660 | ) | | — |

| | — |

| | (25,660 | ) | |

| Issuance of stock/restricted stock unit amortization, net | | — |

| | — |

| | — |

| | 1,371 |

| | — |

| | — |

| | — |

| | 1,371 |

| |

Net income for the period(2) | | — |

| | — |

| | — |

| | — |

| | 42,604 |

| | — |

| | 10,520 |

| | 53,124 |

| |

| Change in accumulated other comprehensive income (loss) | | — |

| | — |

| | — |

| | — |

| | — |

| | (489 | ) | | — |

| | (489 | ) | |

| Repurchase of stock | | — |

| | — |

| | (9 | ) | | (91,826 | ) | | — |

| | — |

| | — |

| | (91,835 | ) | |

| Change in additional paid in capital attributable to redeemable noncontrolling interest | | — |

| | — |

| | — |

| | 460 |

| | — |

| | — |

| | — |

| | 460 |

| |

| Contributions from noncontrolling interests | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 444 |

| | 444 |

| |

Change in noncontrolling interest(3) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (7,292 | ) | | (7,292 | ) | |

| Balance as of June 30, 2016 | | $ | 22 |

| | $ | 4 |

| | $ | 72 |

| | $ | 3,599,335 |

| | $ | (2,608,530 | ) | | $ | (5,340 | ) | | $ | 45,890 |

| | $ | 1,031,453 |

| |

| |

| (1) | Refer to Note 13 for details on the Company's Preferred Stock. |

| |

| (2) | For the six months ended June 30, 2017, and 2016, net income (loss) shown above excludes $(1,336) and $(2,637) of net loss attributable to redeemable noncontrolling interests. |

| |

(3) | Includes a payment to acquire a noncontrolling interest (refer to Note 5). |

The accompanying notes are an integral part of the consolidated financial statements.

iStar Inc.

Consolidated Statements of Cash Flows

(In thousands)

(unaudited)

| | | | For the Six Months Ended June 30, | For the Six Months Ended June 30, |

| | 2017 | | 2016 | 2018 | | 2017 |

| Cash flows from operating activities: | | | | | | |

| Net income | $ | 180,635 |

| | $ | 50,487 |

| $ | 95,532 |

| | $ | 180,635 |

|

| Adjustments to reconcile net income to cash flows from operating activities: | | | | | | |

| (Recovery of) provision for loan losses | (5,528 | ) | | 2,206 |

| |

| Provision for (recovery of) loan losses | | 18,037 |

| | (5,528 | ) |

| Impairment of assets | 14,696 |

| | 3,012 |

| 10,188 |

| | 14,696 |

|

| Depreciation and amortization | 26,352 |

| | 29,182 |

| 21,878 |

| | 26,352 |

|

| Non-cash expense for stock-based compensation | 9,796 |

| | 6,211 |

| 12,593 |

| | 9,796 |

|

| Amortization of discounts/premiums and deferred financing costs on debt obligations, net | 6,615 |

| | 8,901 |

| 7,900 |

| | 6,615 |

|

| Amortization of discounts/premiums on loans, net | (6,978 | ) | | (7,237 | ) | |

| Deferred interest on loans, net | (1,290 | ) | | 4,631 |

| |

| Amortization of discounts/premiums on loans and deferred interest on loans, net | | (18,487 | ) | | (31,445 | ) |

| Deferred interest on loans received | | 39,254 |

| | 23,177 |

|

| Gain from consolidation of equity method investment | | (67,877 | ) | | — |

|

| Gain from discontinued operations | (123,418 | ) | | — |

| — |

| | (123,418 | ) |

| Earnings from equity method investments | (11,217 | ) | | (47,714 | ) | |

| (Earnings) losses from equity method investments | | 3,946 |

| | (11,217 | ) |

| Distributions from operations of other investments | 35,502 |

| | 31,479 |

| 6,745 |

| | 35,502 |

|

| Deferred operating lease income | (3,204 | ) | | (4,993 | ) | (3,752 | ) | | (3,070 | ) |

| Income from sales of real estate | (9,462 | ) | | (53,943 | ) | (73,943 | ) | | (9,462 | ) |

| Land development revenue in excess of cost of sales | (14,384 | ) | | (13,997 | ) | (50,588 | ) | | (14,384 | ) |

| Loss on early extinguishment of debt, net | 775 |

| | 1,582 |

| 2,536 |

| | 3,525 |

|

Debt discount on repayments of debt obligations

| (5,745 | ) | | (5,369 | ) | |

| Other operating activities, net | 9,770 |

| | 2,651 |

| 3,281 |

| | 10,606 |

|

| Changes in assets and liabilities: | | | | | | |

| Changes in accrued interest and operating lease income receivable, net | 2,881 |

| | 4,436 |

| |

| Changes in accrued interest and operating lease income receivable | | 1,530 |

| | 2,798 |

|

| Changes in deferred expenses and other assets, net | (6,821 | ) | | 1,677 |

| (2,426 | ) | | (7,567 | ) |

| Changes in accounts payable, accrued expenses and other liabilities | 3,941 |

| | (13,052 | ) | (27,483 | ) | | 3,941 |

|

| Cash flows provided by operating activities | 102,916 |

| | 150 |

| |

| Cash flows provided by (used in) operating activities | | (21,136 | ) | | 111,552 |

|

| Cash flows from investing activities: | | | | | | |

| Originations and fundings of loans receivable, net | (130,701 | ) | | (158,262 | ) | (294,476 | ) | | (130,701 | ) |

| Capital expenditures on real estate assets | (16,346 | ) | | (35,674 | ) | (17,805 | ) | | (16,346 | ) |

| Capital expenditures on land and development assets | (53,894 | ) | | (58,961 | ) | (61,577 | ) | | (53,894 | ) |

| Acquisitions of real estate assets | — |

| | (3,915 | ) | (3,390 | ) | | — |

|

| Repayments of and principal collections on loans receivable and other lending investments, net | 367,028 |

| | 202,014 |

| 552,696 |

| | 367,028 |

|

| Net proceeds from sales of real estate | 154,291 |

| | 247,956 |

| 238,834 |

| | 154,291 |

|

| Net proceeds from sales of land and development assets | 146,713 |

| | 33,660 |

| 170,662 |

| | 146,713 |

|

| Net proceeds from sales of other investments | — |

| | 39,810 |

| |

| Cash, cash equivalents and restricted cash acquired upon consolidation of equity method investment | | 13,608 |

| | — |

|

| Distributions from other investments | 11,275 |

| | 8,632 |

| 22,296 |

| | 11,275 |

|

| Contributions to other investments | (139,139 | ) | | (8,283 | ) | |

| Changes in restricted cash held in connection with investing activities | 1,757 |

| | 3,220 |

| |

| Contributions to and acquisition of interest in other investments | | (53,012 | ) | | (139,139 | ) |

| Other investing activities, net | 5,317 |

| | (5,677 | ) | (1,357 | ) | | 5,317 |

|

| Cash flows provided by investing activities | 346,301 |

| | 264,520 |

| 566,479 |

| | 344,544 |

|

| Cash flows from financing activities: | | | | | | |

| Borrowings from debt obligations | 854,637 |

| | 646,401 |

| |

| Borrowings from debt obligations and convertible notes | | 332,746 |

| | 854,637 |

|

| Repayments and repurchases of debt obligations | (626,492 | ) | | (991,184 | ) | (412,215 | ) | | (632,237 | ) |

| Proceeds from loan participations payable | — |

| | 22,844 |

| |

| Preferred dividends paid | (25,660 | ) | | (25,660 | ) | (16,248 | ) | | (25,660 | ) |

| Repurchase of stock | — |

| | (90,481 | ) | (8,304 | ) | | — |

|

| Payments for deferred financing costs | (12,243 | ) | | (8,003 | ) | (4,921 | ) | | (12,243 | ) |

| Payments for withholding taxes upon vesting of stock-based compensation | (511 | ) | | (1,203 | ) | (4,008 | ) | | (511 | ) |

| Payments for debt prepayment or extinguishment costs | | — |

| | (3,637 | ) |

Distributions to noncontrolling interests

| | (43,174 | ) | | (12,759 | ) |

| Other financing activities, net | (13,420 | ) | | (7,144 | ) | 8 |

| | (661 | ) |

| Cash flows provided by (used in) financing activities | 176,311 |

| | (454,430 | ) | (156,116 | ) | | 166,929 |

|

| Effect of exchange rate changes on cash | 7 |

| | 22 |

| 30 |

| | 7 |

|

| Changes in cash and cash equivalents | 625,535 |

| | (189,738 | ) | |

| Cash and cash equivalents at beginning of period | 328,744 |

| | 711,101 |

| |

| Cash and cash equivalents at end of period | $ | 954,279 |

| | $ | 521,363 |

| |

| Changes in cash, cash equivalents and restricted cash | | 389,257 |

| | 623,032 |

|

| Cash, cash equivalents and restricted cash at beginning of period | | 677,733 |

| | 354,627 |

|

| Cash, cash equivalents and restricted cash at end of period | | $ | 1,066,990 |

| | $ | 977,659 |

|

| Supplemental disclosure of non-cash investing and financing activity: | | | | | | |

Fundings and repayments of loan receivables and loan participations, net

| $ | (52,406 | ) | | $ | 12,267 |

| $ | (87,800 | ) | | $ | (52,406 | ) |

| Accounts payable for capital expenditures on land and development assets | 2,984 |

| | 5,575 |

| 12,473 |

| | 2,984 |

|

| Accounts payable for capital expenditures on real estate assets | 1,488 |

| | — |

| — |

| | 1,488 |

|

Receivable from sales of real estate and land parcels

| 3,139 |

| | 1,741 |

| — |

| | 3,139 |

|

| Developer fee payable | — |

| | 6,438 |

| |

| Accruals for repurchase of stock | — |

| | 2,260 |

| |

| Acquisitions of land and development assets through foreclosure | | 4,600 |

| | — |

|

| Financing provided on sales of land and development assets, net | | 142,639 |

| | — |

|

| Increase in net lease assets upon consolidation of equity method investment | | 844,550 |

| | — |

|

| Increase in debt obligations upon consolidation of equity method investment | | 464,706 |

| | — |

|

| Increase in noncontrolling interests upon consolidation of equity method investment | | 200,093 |

| | — |

|

The accompanying notes are an integral part of the consolidated financial statements.

iStar Inc.

Notes to Consolidated Financial Statements

(unaudited)

Note 1—Business and Organization

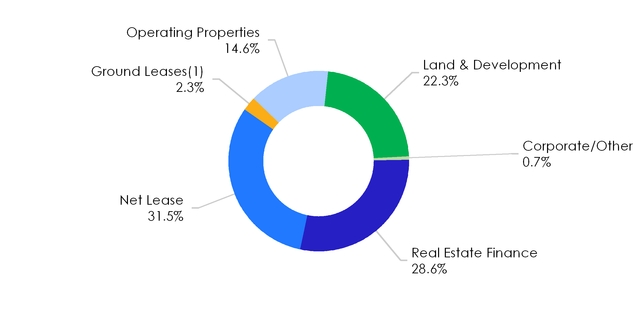

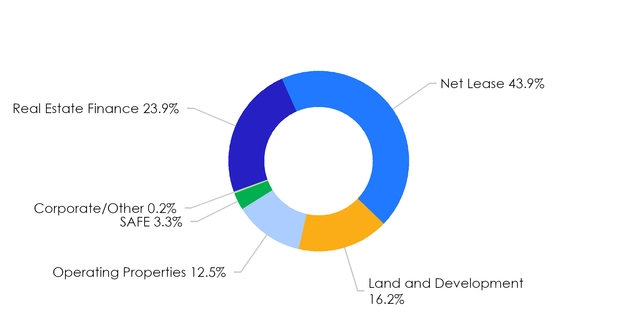

Business—iStar Inc. (the "Company"), doing business as "iStar," finances, invests in and develops real estate and real estate related projects as part of its fully-integrated investment platform. The Company also provides management services for its ground lease equity method investment and net lease equity method investmentsjoint ventures (refer to Note 7). The Company has invested more than $35approximately $40 billion of capital over the past two decades and is structured as a real estate investment trust ("REIT") with a diversified portfolio focused on larger assets located in major metropolitan markets. The Company's primary reportable business segments are real estate finance, net lease, operating properties and land and development (refer to Note 17).

Organization—The Company began its business in 1993 through the management of private investment funds and became publicly traded in 1998. Since that time, the Company has grown through the origination of new investments as well as throughand corporate acquisitions.

Note 2—Basis of Presentation and Principles of Consolidation

Basis of Presentation—The accompanying unaudited consolidated financial statements have been prepared in conformity with the instructions to Form 10-Q and Article 10-01 of Regulation S-X for interim financial statements. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles in the United States of America ("GAAP") for complete financial statements. These unaudited consolidated financial statements and related notes should be read in conjunction with the consolidated financial statements and related notes included in the Company's Annual Report on Form 10-K for the year ended December 31, 20162017 (the "2016"2017 Annual Report").

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

In the opinion of management, the accompanying consolidated financial statements contain all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the results for the interim periods presented. Such operating results may not be indicative of the expected results for any other interim periods or the entire year. Certain prior year amounts have been reclassified in the Company's consolidated financial statements and the related notes to conform to the current period presentation.

Principles of Consolidation—The consolidated financial statements include the financial statements of the Company, its wholly owned subsidiaries, controlled partnerships and variable interest entities ("VIEs")VIEs for which the Company is the primary beneficiary. All significant intercompany balances and transactions have been eliminated in consolidation. The Company's involvement with VIEs affects its financial performance and cash flows primarily through amounts recorded in "Operating lease income," "Interest income," "Earnings from equity method investments," "Real estate expense" and "Interest expense" in the Company's consolidated statements of operations. The Company has not provided no financial support to those VIEs that it was not previously contractually required to provide.

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

Consolidated VIEs—As of June 30, 2017, theThe Company consolidates VIEs for which it is considered the primary beneficiary. As of June 30, 2017, the total assets of these consolidated VIEs were $326.9 million and total liabilities were $68.9 million. The classifications of these assets are primarily within "Land and development, net" and "Real estate, net" on the Company's consolidated balance sheets. The classifications of liabilities are primarily within "Accounts payable, accrued expenses and other liabilities" and "debt obligations, net" on the Company's consolidated balance sheets. The liabilities of these VIEs are non-recourse to the Company and can only be satisfied from each VIE's respective assets. The Company did not have any unfunded commitments related to consolidated VIEs as of June 30, 2017.2018. The following table presents the assets and liabilities of the Company's consolidated VIEs as of June 30, 2018 and December 31, 2017 ($ in thousands):

|

| | | | | | | |

| | As of |

| | June 30, 2018 | | December 31,

2017 |

| ASSETS | | | |

| Real estate | | | |

| Real estate, at cost | $ | 817,979 |

| | $ | 47,073 |

|

| Less: accumulated depreciation | (4,593 | ) | | (2,732 | ) |

| Real estate, net | 813,386 |

| | 44,341 |

|

| Land and development, net | 242,213 |

| | 212,408 |

|

| Other investments | 88 |

| | — |

|

| Cash and cash equivalents | 12,918 |

| | 10,704 |

|

| Accrued interest and operating lease income receivable, net | 557 |

| | 230 |

|

| Deferred expenses and other assets, net | 179,129 |

| | 29,929 |

|

| Total assets | $ | 1,248,291 |

| | $ | 297,612 |

|

| LIABILITIES | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 99,784 |

| | $ | 38,616 |

|

| Debt obligations, net | 464,706 |

| | — |

|

| Total liabilities | 564,490 |

| | 38,616 |

|

Unconsolidated VIEs—As of June 30, 2017, theThe Company has investments in VIEs where it is not the primary beneficiary and accordingly the VIEs have not been consolidated in the Company's consolidated financial statements. As of June 30, 2017,2018, the Company's maximum exposure to loss from these investments does not exceed the sum of the $56.6$88.5 million carrying value of the investments, which are classified in "Other investments" and "Loans receivable and other lending investments, net" on the Company's consolidated balance sheets, and $53.8$22.7 million of related unfunded commitments.

Note 3—Summary of Significant Accounting Policies

The following paragraphs describe the impact on the Company's consolidated financial statements from the adoption of Accounting Standards Updates ("ASUs") on January 1, 2018.

ASU 2014-09—ASU 2014-09, Revenue from Contracts with Customers ("ASU 2014-09"), stipulates that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Certain contracts with customers, including lease contracts and financial instruments and other contractual rights, are not within the scope of the new guidance. The Company's revenue within the scope of the guidance is primarily ancillary income related to its operating properties. The Company adopted ASU 2014-09 using the modified retrospective approach and the adoption did not have a material impact on the Company's consolidated financial statements.

ASU 2016-01 and ASU 2018-03—ASU 2016-01, Financial Instruments - Overall: Recognition and Measurement of Financial Assets and Financial Liabilities("ASU 2016-01"), addressed certain aspects of recognition, measurement, presentation and disclosure of financial instruments. ASU 2018-03, Technical Corrections and Improvements to Financial Instruments - Overall: Recognition and Measurement of Financial Assets and Financial Liabilities, provided technical corrections and improvements to ASU 2016-01. ASU 2016-01 requires entities to measure equity investments not accounted for under the equity method at fair value and recognize changes in fair value in net income. For equity investments without readily determinable fair values, entities may elect a measurement alternative that will allow those investments to be recorded at cost, less impairment, and adjusted for

subsequent observable price changes. Upon adoption, entities must record a cumulative-effect adjustment to the balance sheet as of the beginning of the first reporting period in which the standard is adopted. ASU 2016-01 also eliminated the requirement for public business entities to disclose the methods and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance sheet. The adoption of ASU 2016-01 and ASU 2018-03 did not have a material impact on the Company's consolidated financial statements.

ASU 2016-15—ASU 2016-15, Statement of Cash Flows: Classification of Certain Cash Receipts and Cash Payments ("ASU 2016-15"), was issued to reduce diversity in practice in how certain cash receipts and cash payments, including debt prepayment or debt extinguishment costs, distributions from equity method investees, and other separately identifiable cash flows, are presented and classified in the statement of cash flows. The adoption of ASU 2016-15 was retrospective and resulted in an increase to cash flows provided by operating activities of $9.3 million and a decrease to cash flows provided by financing activities of $9.3 million for the six months ended June 30, 2017, primarily resulting from the reclassification of cash payments made related to the extinguishment of debt.

ASU 2016-18—ASU 2016-18, Statement of Cash Flows: Restricted Cash ("ASU 2016-18"), requires that restricted cash be included with cash and cash equivalents when reconciling beginning and ending cash and cash equivalents on the statement of cash flows and requires disclosure of what is included in restricted cash. The adoption of ASU 2016-18 did not have a material impact on the Company's consolidated financial statements. The adoption of ASU 2016-18 was retrospective and resulted in a decrease to cash flows provided by operating activities of $0.7 million and a decrease to cash flows provided by investing activities of $1.8 million for the six months ended June 30, 2017.

The following table provides a reconciliation of the cash and cash equivalents and restricted cash reported in the Company's consolidated balance sheets that total to the same amount as reported in the consolidated statements of cash flows (in thousands):

|

| | | | | | | | | | | | | | | | |

| | | June 30, 2018 | | December 31, 2017 | | June 30, 2017 | | December 31, 2016 |

| Cash and cash equivalents | | $ | 1,039,591 |

| | $ | 657,688 |

| | $ | 954,279 |

| | $ | 328,744 |

|

Restricted cash included in deferred expenses and other assets, net(1) | | 27,399 |

| | 20,045 |

| | 23,380 |

| | 25,883 |

|

| Total cash, cash equivalents and restricted cash reported in the consolidated statements of cash flows | | $ | 1,066,990 |

| | $ | 677,733 |

| | $ | 977,659 |

| | $ | 354,627 |

|

| |

| (1) | Restricted cash represents amounts required to be maintained under certain of the Company's debt obligations, loans, leasing, land development, sale and derivative transactions. |

ASU 2017-01—The adoption of ASU 2017-01, Business Combinations: Clarifying the Definition of a Business ("ASU 2017-01"), did not have a material impact on the Company's consolidated financial statements. Under ASU 2017-01, certain transactions previously accounted for as business combinations under the former accounting guidance will be accounted for as asset acquisitions under ASU 2017-01. As a result, the Company expects more transaction costs to be capitalized relating to real estate acquisitions as a result of ASU 2017-01.

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

Note 3—Summary of Significant Accounting Policies

On January 1, 2017, the Company adopted Accounting Standards Update ("ASU") 2016-09, Compensation—Stock Compensation: Improvements to Employee Share-Based Payment Accounting ("ASU 2016-09") which was issued to simplify several aspects of the accounting for share-based payment transactions, including income tax, classification of awards as either equity or liabilities and classification on the statement of cash flows. The adoption of ASU 2016-09 did not have a material impact on the Company's consolidated financial statements.

As of June 30, 2017, the remainder of the Company's significant accounting policies, which are detailed in the Company's 2016 Annual Report, have not changed materially.

New Accounting Pronouncements2017-05—In February 2017, the Financial Accounting Standards Board ("FASB") issued ASU 2017-05, Other Income—Income - Gains and Losses from the Derecognition of Nonfinancial Assets ("("ASU 2017-05") to clarify the scope of Subtopic 610-20, Other Income—Gains and Losses from the Derecognition of Nonfinancial Assets, and to add guidance for partial sales of nonfinancial assets. The amendments in ASU 2017-05 simplify, simplifies GAAP by eliminating several accounting differences between transactions involving assets and transactions involving businesses. The amendments in ASU 2017-05 require an entity to initially measure a retained noncontrolling interest in a nonfinancial asset at fair value consistent with how a retained noncontrolling interest in a business is measured. Also, if an entity transfers ownership interests in a consolidated subsidiary that is within the scope of ASC 610-20 and continues to have a controlling financial interest in that subsidiary, ASU 2017-05 requires the entity to account for the transaction as an equity transaction, which is consistent with how changes in ownership interests in a consolidated subsidiary that is a business are recorded when a parent retains a controlling financial interest in the business. The Company adopted ASU 2017-05 is effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is permitted beginningusing the modified retrospective approach which was applied to all contracts. On January 1, 2017. Management is evaluating2018, the impactCompany recorded a step-up in basis to fair value of its retained noncontrolling interest relating to the guidancesale of its ground lease business (refer to Note 4) and other transactions where the Company sold or contributed real estate to a venture and previously recognized partial gains. Prior to the adoption of ASU 2017-05, the Company was required to recognize gains on only the portion of its interest transferred to third parties and was precluded from recognizing a gain on its retained noncontrolling interest which was carried at the Company’s historical cost basis. The adoption of ASU 2017-05 had the following impact on the Company's consolidated financial statements (in thousands):

|

| | | | | | | | | | | | |

| | | | | Impact from ASU 2017-05 on January 1, 2018 | | |

| | | December 31, 2017 | | | January 1, 2018 |

| Other investments | | $ | 321,241 |

| | $ | 75,869 |

| | $ | 397,110 |

|

| Total assets | | 4,731,078 |

| | 75,869 |

| | 4,806,947 |

|

| | | | | | | |

| Retained earnings (deficit) | | $ | (2,470,564 | ) | | $ | 75,869 |

| | $ | (2,394,695 | ) |

| Total equity | | 914,249 |

| | 75,869 |

| | 990,118 |

|

ASU 2017-12—ASU 2017-12, Derivatives and expectsHedging - Targeted Improvements to adoptAccounting for Hedging Activities ("ASU 2017-12"), was issued to better align an entity’s risk management activities and financial reporting for hedging relationships through changes to both the retrospective approach, which would requiredesignation and measurement guidance for qualifying hedging relationships and the Company to recast revenuepresentation of hedge results. ASU 2017-12 expands and expensesrefines hedge accounting for all prior periods presentedboth nonfinancial and financial risk components and aligns the recognition and presentation of the effects of the hedging instrument and the hedged item in the year of adoption of the new standard.financial statements. The Company expects that transactions in assetsadopted ASU 2017-12 on January 1, 2018 and businesses in which the Company retains an ownership interest, such as the sale of a controlling interest in its GL business (refer to Note 4), will be impacted by this guidance. As a result, under the retrospective approach, in 2018, the Company expects to record an incremental gain of $55.5 million in its consolidated statements of operations for the three and six months ended June 30, 2017, bringing the Company's full gain on the sale of its GL business to approximately $178.9 million.

In January 2017, the FASB issued ASU 2017-01, Business Combinations: Clarifying the Definition of a Business ("ASU 2017-01") to provide a more robust framework to use in determining when a set of assets and activities is a business. The amendments provide more consistency in applying the guidance, reduce the costs of application, and make the definition of a business more operable. The Company's real estate acquisitions have historically been accounted for as a business combination or an asset acquisition. Under ASU 2017-01, certain transactions previously accounted for as business combinations under the existing guidance would be accounted for as asset acquisitions under the new guidance. As a result, the Company expects more transaction costs to be capitalized under real estate acquisitions and less transaction costs to be expensed under business combinations. ASU 2017-01 is effective for interim and annual reporting periods beginning after December 15, 2017. Early application is permitted under certain conditions. Management is evaluating the impact of the guidance on the Company's consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows: Restricted Cash ("ASU 2016-18") which requires that restricted cash be included with cash and cash equivalents when reconciling beginning and ending cash and cash equivalents on the statement of cash flows. In addition, ASU 2016-18 requires disclosure of what is included in restricted cash. ASU 2016-18 is effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is permitted. Management doesdid not believe the guidance will have a material impact on the Company's consolidated financial statements.

In August 2016New Accounting Pronouncements, —theFASB issued ASU 2016-15, Statement of Cash Flows: Classification of Certain Cash Receipts and Cash Payments ("ASU 2016-15") which was issued to reduce diversity in practice in how certain cash receipts and cash payments, including debt prepayment or debt extinguishment costs, distributions from equity method investees, and other separately identifiable cash flows, are presented and classified in the statement of cash flows. ASU 2016-15 is effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is permitted. Management does not believe the guidance will have a material impact on the Company's consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Instruments - Credit Losses:Measurement of Credit Losses on Financial Instruments ("("ASU 2016-13"), which was issued to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments held by a reporting entity. This amendment replaces the

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

incurred loss impairment methodology in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The Company currently records a general reserve that covers performing loans and reserves for loan losses are recorded whenwhen: (i) available information as of each balance sheet date indicates that it is probable a loss has occurred in the portfolioportfolio; and (ii) the amount of the loss can be reasonably estimated. The formula-based general reserve is derived from estimated principal default probabilities and loss severities applied to groups of loans based upon risk ratings assigned to loans with similar risk characteristics during our quarterly loan portfolio assessment. The Company estimates loss rates based on historical realized losses experienced within its portfolio and take into account current economic conditions affecting the commercial real estate market when establishing appropriate time frames to evaluate loss experience. The Company believes this general reserve component of its total loan loss reserves should minimize the impact of ASU 2016-13. ASU 2016-13 is effective for interim and annual reporting periods beginning after December 15, 2019. Early adoption is permitted for interim and annual reporting periods beginning after December 15, 2018. Management does not believe the guidance will have a material impact on the Company's consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, LeasesLeases ("ASU 2016-02"), which requires the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases. For operating leases, a lessee will be required to do the following: (i) recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position; (ii) recognize a single lease cost, calculated so that the cost of the lease is allocated over the lease term on a generally straight-line basisbasis; and (iii) classify all cash payments within operating activities in the statement of cash flows. In July 2018, the FASB issued ASU 2018-11, Leases (“ASU 2018-11”), to address two requirements of ASU 2016-02. ASU 2018-11 allows entities to recognize a cumulative-effect adjustment from the application of ASU 2016-02 to the opening balance of retained earnings in the period of adoption. In addition, ASU 2018-11 provides lessors with a practical expedient to not separate

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

non-lease components from the associated lease component if certain conditions are met. For operating lease arrangements for which the Company is the lessee, primarily the lease of office space, the Company expects the impact of ASU 2016-02 to be the recognition of a right-of-use asset and lease liability on its consolidated balance sheets. The accounting applied by the Company as a lessor will be largely unchanged from that applied under previous GAAP. However, in certain instances, a new long-term lease of land subsequent to adoption could be classified as a sales-type lease, which could result in the Company derecognizing the underlying asset from its books and recording a profit or loss on sale and the net investment in the lease. ASU 2016-02 is effective for interim and annual reporting periods beginning after December 15, 2018. Early adoption is permitted. Management is evaluating the impact of the guidance on the Company's consolidated financial statements.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Overall:Recognition and Measurement of Financial Assets and Financial Liabilities ("ASU 2016-01"), which addresses certain aspects of recognition, measurement, presentation and disclosure of financial instruments. ASU 2016-01 is effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is not permitted. Management is evaluating the impact of the guidance on the Company's consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers ("ASU 2014-09") which supersedes existing industry-specific guidance, including ASC 360-20, Real Estate Sales. The new standard is principles-based and requires more estimates and judgment than current guidance. Certain contracts with customers, including lease contracts and financial instruments and other contractual rights, are not within the scope of the new guidance. Although most of the Company's revenue is operating lease income generated from lease contracts and interest income generated from financial instruments, certain other of the Company's revenue streams will be impacted by the new guidance. The Company currently expects that income from the sale of residential condominiums, land development revenue and other income will be impacted by ASU 2014-09. The Company does not expect income from the sales of net lease or commercial operating properties to be impacted by ASU 2014-09. In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers - Deferral of the Effective Date, to defer the effective date of ASU 2014-09 by one year. ASU 2014-09 is now effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is permitted beginning January 1, 2017. Management is evaluating the impact of the guidance on the Company’s consolidated financial statements and expects to adopt the full retrospective approach, which would require the Company to recast revenue and expenses for all prior periods presented in the year of adoption of the new standard.

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

Note 4—Real Estate

The Company's real estate assets were comprised of the following ($ in thousands):

| | | | Net Lease(1) | | Operating Properties | | Total | Net Lease(1) | | Operating Properties | | Total |

| As of June 30, 2017 | | | | | | |

| As of June 30, 2018 | | | | | | |

| Land, at cost | $ | 227,231 |

| | $ | 211,057 |

| | $ | 438,288 |

| $ | 335,926 |

| | $ | 181,973 |

| | $ | 517,899 |

|

| Buildings and improvements, at cost | 950,548 |

| | 322,079 |

| | 1,272,627 |

| 1,495,393 |

| | 242,245 |

| | 1,737,638 |

|

| Less: accumulated depreciation | (314,373 | ) | | (53,560 | ) | | (367,933 | ) | (298,730 | ) | | (41,808 | ) | | (340,538 | ) |

| Real estate, net | 863,406 |

| | 479,576 |

| | 1,342,982 |

| 1,532,589 |

| | 382,410 |

| | 1,914,999 |

|

Real estate available and held for sale (2) | 924 |

| | 67,121 |

| | 68,045 |

| — |

| | 37,597 |

| | 37,597 |

|

| Total real estate | $ | 864,330 |

| | $ | 546,697 |

| | $ | 1,411,027 |

| $ | 1,532,589 |

| | $ | 420,007 |

| | $ | 1,952,596 |

|

| As of December 31, 2016 | | | | | | |

| As of December 31, 2017 | | | | | | |

| Land, at cost | $ | 231,506 |

| | $ | 211,054 |

| | $ | 442,560 |

| $ | 219,092 |

| | $ | 203,278 |

| | $ | 422,370 |

|

| Buildings and improvements, at cost | 987,050 |

| | 311,283 |

| | 1,298,333 |

| 888,959 |

| | 318,107 |

| | 1,207,066 |

|

| Less: accumulated depreciation | (307,444 | ) | | (46,175 | ) | | (353,619 | ) | (292,268 | ) | | (55,137 | ) | | (347,405 | ) |

| Real estate, net | 911,112 |

| | 476,162 |

| | 1,387,274 |

| 815,783 |

| | 466,248 |

| | 1,282,031 |

|

Real estate available and held for sale (2) | 155,051 |

| | 82,480 |

| | 237,531 |

| — |

| | 68,588 |

| | 68,588 |

|

| Total real estate | $ | 1,066,163 |

| | $ | 558,642 |

| | $ | 1,624,805 |

| $ | 815,783 |

| | $ | 534,836 |

| | $ | 1,350,619 |

|

| |

| (1) | In 2014,On June 30, 2018, the Company partnered with a sovereign wealth fund to form a venture to acquire and develop net lease assets (the "Net Lease Venture") and gave a right of first refusal toconsolidated the Net Lease Venture on all new net lease investments (refer to Note 7 for more information7) and recorded $743.6 million to "Real estate, net" on the Net Lease Venture). The Company is responsible for sourcing new opportunities and managing the Net Lease Venture and its assets in exchange for a promote and management fee.Company's consolidated balance sheet. |

| |

| (2) | As of December 31, 2016, net lease includes the Company's ground lease ("GL") assets that were reclassified to "Real estate available and held for sale" (refer to "Dispositions" below). As of December 31, 2016, the carrying value of the Company's GL assets were previously classified as $104.5 million in "Real estate, net," $37.5 million in "Deferred expenses and other assets, net," $8.2 million in "Deferred operating lease income receivable, net" and $3.5 million in "Accrued interest and operating lease income receivable, net" on the Company's consolidated balance sheet. As of June 30, 20172018 and December 31, 2016,2017, the Company had $67.1$36.7 million and $82.5$48.5 million, respectively, of residential propertiescondominiums available for sale in its operating properties portfolio. |

Real Estate Available and Held for Sale—During the six months ended June 30, 2017, the Company transferred one net lease asset with a carrying value of $0.9 million to held for sale due to an executed contract with a third party. During the six months ended June 30, 2016, the Company transferred one net lease asset with a carrying value of $0.7 million and one commercial operating property with a carrying value of $16.1 million to held for sale due to executed contracts with a third parties.

Acquisitions—During the six months ended June 30, 2016, the Company acquired land for $3.9 million and simultaneously entered into a 99 year ground lease with the seller.

Disposition of Ground Lease Business—In April 2017, institutional investors acquired a controlling interest in the Company's GLground lease business through the merger of a Company subsidiary and related transactions (the "Acquisition Transactions"). Ground leases generally represent ownership of the land underlying commercial real estate projects that is triple net leased by the fee owner of the land to the owners/operators of the real estate projects built thereon ("Ground Lease"). The Company's GLGround Lease business was a component of the Company's net lease segment and consisted of 12 properties subject to long-term net leases including seven GLsGround Leases and one master lease (covering five properties). The acquiring entity was a newly formed unconsolidated entity named Safety, Income and& Growth Inc. ("SAFE"). The carrying value of the Company's GLGround Lease assets was approximately $161.1 million. Shortly before the Acquisition Transactions, the Company completed the $227.0 million 2017 Secured Financing on its GLGround Lease assets (refer to Note 10). The Company received all of the proceeds of the 2017 Secured Financing. The Company received an additional $113.0 million of proceeds in the Acquisition Transactions, including $55.5 million that the Company contributed to SAFE in its initial capitalization. As a result of the Acquisition Transactions, the Company deconsolidated the 12 properties and the associated 2017 Secured Financing. The Company accounts for its investment in SAFE as an equity method investment (refer to Note 7). The Company accounted for this transaction as an in substance sale of real estate and recognized a gain of $123.4 million, reflecting the aggregate gain less the fair value of the Company's retained interest in SAFESAFE. As a result of the adoption of ASU 2017-05 (refer to Note 2 - Summary3), on January 1, 2018, the Company recorded an increase to retained earnings of Significant Accounting Policies). The carrying value of$55.5 million, bringing the 12 properties is classified in "Real estate available and held for sale"Company's aggregate gain on the Company's consolidated balance sheet assale of December 31, 2016 and the gain was recorded in "Gain from discontinued operations" in the Company's consolidated statements of operations.its Ground Lease business to approximately $178.9 million.

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

Discontinued Operations—The transactions described above involving the Company's GLGround Lease business qualified for discontinued operations and the following table summarizes income from discontinued operations for the three and six months ended June 30, 2017 and 2016 ($ in thousands)(1)(2):

| | | | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | | | | | |

| | | 2017 | | 2016 | | 2017 | | 2016 | | Three Months Ended June 30, 2017 | | Six Months Ended June 30, 2017 |

| Revenues | | $ | 678 |

| | $ | 4,543 |

| | $ | 6,430 |

| | $ | 8,986 |

| | $ | 678 |

| | $ | 5,922 |

|

| Expenses | | (505 | ) | | (910 | ) | | (1,491 | ) | | (1,772 | ) | | (505 | ) | | (1,491 | ) |

| Income from sales of real estate | | | — |

| | 508 |

|

| Income from discontinued operations | | $ | 173 |

| | $ | 3,633 |

| | $ | 4,939 |

| | $ | 7,214 |

| | $ | 173 |

| | $ | 4,939 |

|

| |

| (1) | The transactions closed on April 14, 2017 and revenues, expenses and income from discontinued operations excludes the period from April 14, 2017 to June 30, 2017. Revenues primarily consisted of operating lease income and expenses primarily consisted of depreciation and amortization and real estate expense. |

| |

| (2) | For the six months ended June 30, 2017, cash flows provided by operating activities and cash flows used in investing activities from discontinued operations was $5.7 million and $0.5 million, respectively. For |

Other Dispositions—The following table presents the net proceeds and income recognized for properties sold, by property type ($ in millions):

|

| | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2018 | | 2017 |

| Operating Properties | | | | |

Proceeds(1) | | $ | 196.2 |

| | $ | 17.6 |

|

Income from sales of real estate(1) | | 49.0 |

| | 2.7 |

|

| | | | | |

| Net Lease | | | | |

Proceeds(2) | | $ | 38.4 |

| | $ | 19.5 |

|

Income from sales of real estate(2) | | 24.9 |

| | 6.2 |

|

| | | | | |

| Total | | | | |

| Proceeds | | $ | 234.6 |

| | $ | 37.1 |

|

| Income from sales of real estate | | 73.9 |

| | 8.9 |

|

| |

| (1) | During the six months ended June 30, 2016, cash flows provided by2018, the Company sold four operating activitiesproperties and cash flows usedrecognized $49.0 million of gains in investing activities"Income from discontinuedsales of real estate" in the Company's consolidated statements of operations, of which $9.8 million was $9.4attributable to a noncontrolling interest at one of the properties. |

| |

| (2) | During the six months ended June 30, 2018, the Company sold three net lease assets and recognized $24.9 million and $4.6 million, respectively.of gains in "Income from sales of real estate" in the Company's consolidated statements of operations. |

Other Dispositions—Impairments—During the six months ended June 30, 2017 and 2016,2018, the Company sold residential condominiums for totalrecorded aggregate impairments of $8.9 million resulting from the exercise of a below-market lease renewal option related to a net proceeds of $17.6 millionlease asset and $59.2 million, respectively, and recorded income from sales ofa real estate totaling $2.7 million and $18.8 million, respectively. Duringasset held for sale due to contracts to sell the six months ended June 30, 2017 and 2016,remaining four condominium units at the Company sold net lease assets for net proceeds of $19.5 million and $30.2 million, respectively, resulting in gains of $6.2 million and $9.2 million, respectively. During the six months ended June 30, 2016, the Company also sold three commercial operating properties for net proceeds of $158.9 million resulting in gains of $25.9 million. The gains are recorded in "Income from sales of real estate" in the Company's consolidated statements of operations.

Impairments—property. During the six months ended June 30, 2017, the Company recorded an impairment of $4.4 million on a real estate asset held for sale due to shifting demand in the local condominium market along with a change in the Company's exit strategy. During the six months ended June 30, 2016, the Company recorded an impairment of $3.0 million on a residential operating property resulting from a slowdown in the local condominium real estate market.

Tenant Reimbursements—The Company receives reimbursements from tenants for certain facility operating expenses including common area costs, insurance, utilities and real estate taxes. Tenant expense reimbursements were $5.0 million and $10.6 million for the three and six months ended June 30, 2018, respectively. Tenant expense reimbursements were $5.2 million and $10.7 million for the three and six months ended June 30, 2017, respectively. Tenant expense reimbursements were $5.9 million and $12.1 million for the three and six months ended June 30, 2016, respectively. These amounts are included in "Operating lease income" in the Company's consolidated statements of operations.

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

Allowance for Doubtful Accounts—As of June 30, 20172018 and December 31, 2016,2017, the allowance for doubtful accounts related to real estate tenant receivables was $1.4$1.3 million and $1.3 million, respectively, and the allowance for doubtful accounts related to deferred operating lease income was $1.1$1.5 million and $1.3 million as of June 30, 20172018 and December 31, 2016,2017, respectively. These amounts are included in "Accrued interest and operating lease income receivable, net" and "Deferred operating lease income receivable, net," respectively, on the Company's consolidated balance sheets.

Note 5—Land and Development

The Company's land and development assets were comprised of the following ($ in thousands):

| | | | As of | As of |

| | June 30, | | December 31, | June 30, | | December 31, |

| | 2017 | | 2016 | 2018 | | 2017 |

Land and land development, at cost | $ | 862,774 |

| | $ | 952,051 |

| $ | 649,783 |

| | $ | 868,692 |

|

| Less: accumulated depreciation | (7,277 | ) | | (6,486 | ) | (8,156 | ) | | (8,381 | ) |

| Total land and development, net | $ | 855,497 |

| | $ | 945,565 |

| $ | 641,627 |

| | $ | 860,311 |

|

| |

| (1) | During the six months ended June 30, 2018, the Company funded capital expenditures on land and development assets of $61.6 million. |

iStar Inc.

Notes to Consolidated Financial Statements (Continued)

(unaudited)

$4.6 million and had previously served as collateral for loans receivable held by the Company. No gain or loss was recorded in connection with this transaction.

Dispositions—During the six months ended June 30, 2018 and 2017, the Company sold one land parcel totaling 1,250 acres (see following paragraph)parcels and residential lots and units and recognized land development revenue of $357.4 million and $152.8 million, from itsrespectively. In connection with the sale of two land and development portfolio.parcels totaling 93 acres during the six months ended June 30, 2018, the Company originated an aggregate $145.0 million of financing to the buyers. $81.2 million was repaid in the second quarter 2018. During the six months ended June 30, 2016, the Company sold residential lots2018 and units and recognized land development revenue of $42.8 million from its land and development portfolio. During the six months ended June 30, 2017, and 2016, the Company recognized land development cost of sales of $138.4$306.8 million and $28.8$138.4 million, respectively, from its land and development portfolio.

In connection with the resolution of litigation involving a dispute over the purchase and sale of approximately 1,250 acres of land in Prince George’s County, Maryland, ("Bevard"), during the three and six months ended June 30, 2017, the Company recognized $114.0 million of land development revenue and $106.3 million of land development cost of sales (refer to Note 11). In 2016, the Company acquired an additional 10.7% interest in Bevard for $10.8 million and owns 95.7% of Bevard as of June 30, 2017.sales.

Impairments—During the six months ended June 30, 2018, the Company recorded an impairment of $1.3 million on a land and development asset based upon market comparable sales. During the six months ended June 30, 2017, the Company recorded an impairment of $10.1 million on a land and development asset due to a change in the Company's exit strategy.

Redeemable Noncontrolling Interest—The Company has a majority interest in a strategic venture that provides the third party minority partner an option

iStar Inc.