CMS Energy Corporation

Consumers Energy Company

Quarterly Reports on Form 10-Q to the Securities and Exchange Commission for the Period Ended September 30, 2016March 31, 2017

2 | ||

7 | ||

7 | ||

7 | ||

11 | ||

11 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

Certain terms used in the text and financial statements are defined below.

20082016 Energy Law

Comprehensive energy reform package enacted in Michigan in 20082016

20152016 Form 10-K

Each of CMS Energy’s and Consumers’ Annual Report on Form 10-K for the year ended December 31, 20152016

ABATE

Association of Businesses Advocating Tariff Equity

AOCI

Accumulated other comprehensive income (loss)

ARO

Asset retirement obligation

ASU

Financial Accounting Standards Board Accounting Standards Update

Bay Harbor

A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002

bcf

Billion cubic feet

Cantera Gas Company

Cantera Gas Company LLC, a non-affiliated company, formerly known as CMS Field Services

Cantera Natural Gas, Inc.

Cantera Natural Gas, Inc., a non-affiliated company that purchased CMS Field Services

CCR

Coal combustion residual

CEO

Chief Executive Officer

CERCLA

Comprehensive Environmental Response, Compensation, and Liability Act of 1980

CFO

Chief Financial Officer

Clean Air Act

Federal Clean Air Act of 1963, as amended

Clean Water Act

Federal Water Pollution Control Act of 1972, as amended

CMS Capital

CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy

CMS Energy

CMS Energy Corporation and its consolidated subsidiaries, unless otherwise noted; the parent of Consumers and CMS Enterprises

CMS Enterprises

CMS Enterprises Company, a wholly owned subsidiary of CMS Energy

CMS Field Services

CMS Field Services, Inc., a former wholly owned subsidiary of CMS Gas Transmission Company, a wholly owned subsidiary of CMS Enterprises

CMS Land

CMS Land Company, a wholly owned subsidiary of CMS Capital

CMS MST

CMS Marketing, Services and Trading Company, a wholly owned subsidiary of CMS Enterprises, whose name was changed to CMS Energy Resource Management Company in 2004

Consumers

Consumers Energy Company and its consolidated subsidiaries, unless otherwise noted; a wholly owned subsidiary of CMS Energy

CSAPR

The Cross-State Air Pollution Rule

DB Pension Plan

Defined benefit pension plan of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries

DB SERP

Defined Benefit Supplemental Executive Retirement Plan

DIG

Dearborn Industrial Generation, L.L.C., a wholly owned subsidiary of Dearborn Industrial Energy, L.L.C., a wholly owned subsidiary of CMS Energy

Dodd-Frank Act

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

DTIA

Distribution-Transmission Interconnection Agreement dated April 1, 2001 between METC and Consumers, as amended

EBITDA

Earnings before interest, taxes, depreciation, and amortization

EnerBank

EnerBank USA, a wholly owned subsidiary of CMS Capital

EPAenergy waste reduction

The reduction of energy consumption through energy efficiency and demand-side energy conservation, as established under the 2016 Energy Law

Entergy

Entergy Corporation, a non-affiliated company

EPA

U.S. Environmental Protection Agency

EPS

Earnings per share

Exchange Act

Securities Exchange Act of 1934

FDIC

Federal Deposit Insurance Corporation

FERC

The Federal Energy Regulatory Commission

FMBForsite

First Mortgage BondForsite Development, Inc. and its subsidiaries, each a non-affiliated company

FTR

Financial transmission right

GAAP

U.S. Generally Accepted Accounting Principles

Gas AMR

Consumers’ gas automated meter reading project, which involves the installation of communication modules to allow drive-by meter reading

GCR

Gas cost recovery

Genesee

Genesee Power Station Limited Partnership, a variable interest entity in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent50-percent interest

kWh

Kilowatt-hour, a unit of energy equal to one thousand watt-hours

Ludington

Ludington pumped-storage plant, jointly owned by Consumers and DTE Electric Company, a non-affiliated company

MATS

Mercury and Air Toxics Standards, which limit mercury, acid gases, and other toxic pollution from coal-fueled and oil-fueled power plants

MD&A

Management’s Discussion and Analysis of Financial Condition and Results of Operations

MDEQ

Michigan Department of Environmental Quality

METC

Michigan Electric Transmission Company, LLC, a non-affiliated company

MGP

Manufactured gas plant

Michigan Mercury Rule

Michigan Air Pollution Control Rules, Part 15, Emission Limitations and Prohibitions – Mercury, addressing mercury emissions from coal-fueled electric generating units

MISO

Midcontinent Independent System Operator, Inc.

mothball

To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts

MPSC

Michigan Public Service Commission

MW

Megawatt, a unit of power equal to one million watts

NAAQS

National Ambient Air Quality Standards

NAV

Net asset value

NERC

The North American Electric Reliability Corporation, a non-affiliated company responsible for developing and enforcing reliability standards, monitoring the bulk power system, and educating and certifying industry personnel

NPDES

National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act

NREPA

Part 201 of the Michigan Natural Resources and Environmental Protection Act, a statute that covers environmental activities including remediation

NSR

New Source Review, a construction-permitting program under the Clean Air Act

OPEB

Other Post-Employment Benefits

OPEB Plan

Postretirement health care and life insurance plans of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries

Palisades

Palisades nuclear power plant, sold by Consumers to Entergy in 2007

PCB

Polychlorinated biphenyl

PPA

Power purchase agreement

PSCR

Power supply cost recovery

RECRCRA

The Federal Resource Conservation and Recovery Act of 1976

REC

Renewable energy credit established under the 2008 Energy Law

ROA

Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to a Michigan statute enacted in 2000

SEC

U.S. Securities and Exchange Commission

securitization

A financing method authorized by statute and approved by the MPSC which allows a utility to sell its right to receive a portion of the rate payments received from its customers for the repayment of securitization bonds issued by a special-purpose entity affiliated with such utility

Sherman Act

Sherman Antitrust Act of 1890

Smart Energy

Consumers’ Smart Energy grid modernization project, which includes the installation of smart meters that transmit and receive data, a two-way communications network, and modifications to Consumers’ existing information technology system to manage the data and enable changes to key business processes

This combined Form 10-Q is separately filed by CMS Energy and Consumers. Information in this combined Form 10-Q relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries. None of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers) has any obligation in respect of Consumers’ debt securities and holders of such debt securities should not consider the financial resources or results of operations of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers’ debt securities. Similarly, neither Consumers nor any other subsidiary of CMS Energy has any obligation in respect of debt securities of CMS Energy.

This report should be read in its entirety. No one section of this report deals with all aspects of the subject matter of this report. This report should be read in conjunction with the consolidated financial statements and related notes and with MD&A included in the 20152016 Form 10-K.

CMS Energy’s internet address is www.cmsenergy.com. CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution. Information contained on CMS Energy’s website is not incorporated herein.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This Form 10-Q and other CMS Energy and Consumers disclosures may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of “might,” “may,” “could,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “forecasts,” “predicts,” “assumes,” and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy’s and Consumers’ businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy’s and Consumers’ actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

· the impact of new regulation by the MPSC, FERC, and other applicable governmental proceedings and regulations, including any associated impact on electric or gas rates or rate structures

· potentially adverse regulatory treatment or failure to receive timely regulatory orders affecting Consumers that are or could come before the MPSC, FERC, or other governmental authorities

· changes in the performance of or regulations applicable to MISO, METC,Michigan Electric Transmission Company, LLC, pipelines, railroads, vessels, or other service providers that CMS Energy, Consumers, or any of their affiliates rely on to serve their customers

· the adoption of federal or state laws or regulations or challenges to federal or state laws or regulations, or changes in applicable laws, rules, regulations, principles, or practices, or in their interpretation, such as those related to energy

policy and ROA, infrastructure integrity or security,

gas pipeline safety, gas pipeline capacity, energy efficiency,waste reduction, the environment, regulation or deregulation, reliability, health care reforms (including comprehensive health care reform enacted in 2010), taxes, accounting matters, climate change, air emissions, renewable energy, potential effects of the Dodd-Frank Act, and other business issues that could have an impact on CMS Energy’s, Consumers’, or any of their affiliates’ businesses or financial results

· factors affecting operations, such as costs and availability of personnel, equipment, and materials; weather conditions; natural disasters; catastrophic weather-related damage; scheduled or unscheduled equipment outages; maintenance or repairs; environmental incidents; failures of equipment or materials; and electric transmission and distribution or gas pipeline system constraints

· increases in demand for renewablesrenewable energy by customers seeking to meet sustainability goals

· the ability of Consumers to execute its cost-reduction strategies

· potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before the MDEQ, EPA, and/or U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Bay Harbor or Consumers’ routine maintenance, repair, and replacement classification under NSR regulations

· changes in energy markets, including availability and price of electric capacity and the timing and extent of changes in commodity prices and availability and deliverability of coal, natural gas, natural gas liquids, electricity, oil, and certain related products

· the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market conditions, and the effect of these market conditions on CMS Energy’s and Consumers’ interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or any of their affiliates

· the investment performance of the assets of CMS Energy’s and Consumers’ pension and benefit plans, the discount rates used in calculating the plans’ obligations, and the resulting impact on future funding requirements

· the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets on CMS Energy’s, Consumers’, or any of their affiliates’ revenues, ability to collect accounts receivable from customers, or cost and availability of capital

· changes in the economic and financial viability of CMS Energy’s and Consumers’ suppliers, customers, and other counterparties and the continued ability of these third parties, including those in bankruptcy, to meet their obligations to CMS Energy and Consumers

· population changes in the geographic areas where CMS Energy and Consumers conduct business

· national, regional, and local economic, competitive, and regulatory policies, conditions, and developments

· loss of customer demand for electric generation supply to alternative energyelectric suppliers, increased use of distributed generation, or energy efficiencywaste reduction

· federal regulation of electric sales and transmission of electricity, including periodic re-examination by federal regulators of CMS Energy’s and Consumers’ market-based sales authorizations

· the impact of credit markets, economic conditions, and any new banking and consumer protection regulations on EnerBank

· the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of Consumers to recover the costs of any insurance from customers

· the effectiveness of CMS Energy’s and Consumers’ risk management policies, procedures, and strategies, including strategies to hedge risk related to future prices of electricity, natural gas, and other energy-related commodities

· factors affecting development of electric generation projects and gas and electric transmission and distribution infrastructure replacement, conversion, and expansion projects, including factors related to project site identification, construction material pricing, schedule delays, availability of qualified construction personnel, permitting, acquisition of property rights, and government approvals

· potential disruption to, interruption of, or other impacts on facilities, utility infrastructure, or operations due to accidents, explosions, physical disasters, cyber incidents, vandalism, war, or terrorism, and the ability to obtain or maintain insurance coverage for these events

· changes or disruption in fuel supply, including but not limited to supplier bankruptcy and delivery disruptions

· potential costs, lost revenues, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption in connection with a cyber attack or other cyber incident

· technological developments in energy production, storage, delivery, usage, and metering

· the ability to implement technology successfully

· the impact of CMS Energy’s and Consumers’ integrated business software system and its effects on their operations, including utility customer billing and collections

· adverse consequences resulting from any past, present, or future assertion of indemnity or warranty claims associated with assets and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on or to impose environmental liability associated with past operations or transactions

· the outcome, cost, and other effects of any legal or administrative claims, proceedings, investigations, or settlements

· the reputational impact on CMS Energy and Consumers of operational incidents, violations of corporate policies, regulatory violations, inappropriate use of social media, and other events

· restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances

· earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts or interest rate contracts

· changes in financial or regulatory accounting principles or policies

· other matters that may be disclosed from time to time in CMS Energy’s and Consumers’ SEC filings, or in other public documents

All forward-looking statements should be considered in the context of the risk and other factors described above and as detailed from time to time in CMS Energy’s and Consumers’ SEC filings. For additional details regarding these and other uncertainties, see Part I—Item 1. Financial Statements—MD&A—Outlook and Notes to the Unaudited Consolidated Financial Statements—Note 2, Regulatory Matters and Note 3, Contingencies and Commitments; and Part II—Item 1A. Risk Factors.

INDEX TO FINANCIAL STATEMENTS

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 12 | |

CMS Energy Consolidated Financial Statements |

| |

| ||

| ||

| ||

| ||

| ||

Consumers Consolidated Financial Statements |

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

63 | ||

| ||

CMS Energy Corporation

Consumers Energy Company

Management’s Discussion and Analysis of Financial Condition and Results of Operations

This MD&A is a combined report of CMS Energy and Consumers.

EXECUTIVE OVERVIEW

CMS Energy is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility, and CMS Enterprises, primarily a domestic independent power producer. Consumers’ electric utility operations include the generation, purchase, transmission, distribution, and sale of electricity, and Consumers’ gas utility operations include the purchase, transmission, storage, distribution, and sale of natural gas. Consumers’ customer base consists of a mix of residential, commercial, and diversified industrial customers. CMS Enterprises, through its subsidiaries and equity investments, owns and operates power generation facilities.

CMS Energy and Consumers manage their businesses by the nature of services each provides. CMS Energy operates principally in three business segments: electric utility; gas utility; and enterprises, its non-utility operations and investments. Consumers operates principally in two business segments: electric utility and gas utility.

CMS Energy and Consumers earn revenue and generate cash from operations by providing electric and natural gas utility services; electric distribution, transmission, and generation; gas transmission, storage, and distribution; and other energy-related services. Their businesses are affected primarily by:

· regulation and regulatory matters

· economic conditions

· weather

· energy commodity prices

· interest rates

· their securities’ credit ratings

The key elements of CMS Energy’s and Consumers’ business strategy are depicted below:

CMS Energy and Consumers are focused on the “triple bottom line”: people, planet, and profit, underpinned by performance. They are committed to sustainable business practices and to pursuing the goals of safe and excellent operations, a strong ethical culture, environmental quality, and social responsibility. Consumers’ 2016 Sustainability Report, which is available to the public, provides an overview of Consumers’ efforts to continue meeting Michigan’s energy needs safely, efficiently, affordably, and reliably. The report also highlights Consumers’ commitment to Michigan businesses, its corporate citizenship, and its role in reducing the state’s air emissions. In a 2016 report published by Sustainalytics, a global leader in sustainability research and analysis, CMS Energy scored the highest among 54 U.S. utilities in environmental, social, and governance performance.

Safe, Excellent Operations

The safety of employees, customers, and the general public remains a priority of CMS Energy and Consumers. Accordingly, CMS Energy and Consumers have worked to integrate a set of safety principles into their business operations and culture. These principles include complying with applicable safety, health, and security regulations and implementing programs and processes aimed at continually improving safety and security conditions. In 2015, Consumers reduced recordable safety incidents by 29 percent compared with 2014. The number of recordable safety incidents in 20152016 was the lowest in Consumers’ history. For the nine months ended September 30, 2016, Consumers reduced recordable safety incidents by a further 21 percent compared with the same period in 2015.

Customer Value

Consumers continues to placeplaces a high priority on customer value. Consumers’ capital investment program is aimed at improving safety and increasing electric and gas reliability, which has resulted in measureable improvements in customer satisfaction.

Additionally, Consumers has undertaken several initiatives to keep electricity and natural gas affordable for its customers. These initiatives include the adoption of a lean operations model that is focused on completing work safely and correctly the first time, thus minimizing rework and waste, while delivering services on time. Other cost-saving initiatives undertaken by Consumers include accelerated pension funding, employee and retiree health care cost sharing, replacement of coal-fueled generation with more efficient gas-fueled generation, targeted infrastructure investment, including the installation of smart meters, negotiated labor agreements, information and control system efficiencies, and productivity improvements. In addition, Consumers’ gas commodity costs declined by 6468 percent from 20052006 through 2015,2016, due not only to a decrease in partmarket prices but also to Consumers’ improvements to its gas infrastructure and optimization of its gas purchasing and storage strategy. These savings are all passed on to customers.

In December 2016, Consumers and Entergy reached an agreement to terminate their PPA in May 2018, four years ahead of schedule. Under the PPA, Consumers purchases virtually all of the capacity and energy produced by Palisades, up to the annual average capacity of 798 MW. The prices that Consumers pays under the PPA, and which it recovers from its electric customers, are presently higher than the cost to purchase electricity from the market. Under the agreement, Consumers will make a termination payment of $172 million to Entergy. Consumers expects that, as a result of terminating the PPA, its electric customers will realize substantial savings from lower future energy and capacity costs. Actual savings will depend on market conditions. The agreement is contingent on the MPSC’s approval of Consumers’ recovery in electric rates of the termination payment. The MPSC has indicated that it will make a final determination on this recovery by September 2017, after full evaluation of the prudency of the termination payment and of how the termination will impact Michigan’s electric reliability and resource adequacy.

Utility Investment

Consumers expects to make capital investments of about $17$18 billion from 20162017 through 2025.2026. While Consumersit has substantially more investment opportunities that would add customer value, Consumers has limited its capital investment program to those investments it believes are needed to provide safe, reliable, and efficient service to its customers. Consumers’ capital investment program is expected to result in annual rate-base growth of six to eight percent. This rate-base growth, together with Consumers’ cost-control initiatives, should allow Consumers to maintain sustainable customer base rate increases (excluding PSCR and GCR charges) at or below the rate of inflation.

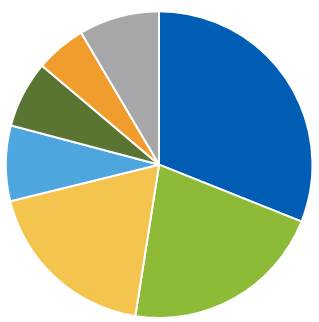

Presented in the following illustration are planned capital investments of about $8.5$9.0 billion that Consumers expects to make in 2016from 2017 through 2020:2021:

| ||

| Electric base ($2.6 billion) | |

| Gas base ($ | |

| Gas reliability enhancements | |

| Electric reliability | |

|

| |

|

| |

|

| |

|

| |

| Environmental ($0.5 billion) | |

| Smart Energy and Gas AMR ($0.3 billion) | |

| Other ($1.1 billion) |

Consumers’ planned base capital investments of $4.4$4.6 billion represent projects to maintain Consumers’its system and comprise $2.6 billion at the electric utility to preserve reliability and capacity and $1.8$2.0 billion at the gas utility to sustain deliverability and enhance pipeline integrity. An additional $2.3$2.5 billion of planned reliability investments at Consumers are aimed at reducing outages and improving customer satisfaction; these investments comprise $1.6$1.8 billion at the gas utility to replace mains and enhance transmission and storage systems and $0.7 billion at the electric utility to strengthen circuits and substations and replace poles. Consumers also expects to spend $0.6$0.5 billion on environmental investments needed to comply with state and federal laws and regulations.

Consumers’ Smart Energy program also represents a major capital investment. TheConsumers began the full-scale deployment of advanced metering infrastructure beganfor electric and combination customers in 2012 and is plannedplans to continue throughcomplete it by the end of 2017. Consumers has spent $0.5$0.6 billion through 20152016 on its Smart Energy program, and expects to spend an additional $0.3$0.1 billion following a phased approach, throughin 2017. In addition, Consumers expects to spend $0.2 billion through 2019 in deploying Gas AMR technology beginning in 2017.for gas-only customers.

Regulation

Regulatory matters are a key aspect of CMS Energy’s and Consumers’ businesses, particularly Consumers’ rate cases and regulatory proceedings before the MPSC. Important regulatory events and developments are summarized below.

· 2016 Electric Rate Case:In March 2016, Consumers filed an application with the MPSC seeking an annual rate increase of $225 million, based on a 10.7 percent authorized return on equity. The filing also seeks approval of an investment recovery mechanism that would provide for additional annual rate increases of $38 million beginning in 2017, $92 million beginning in 2018, and $92 million beginning in 2019 for incremental investments that Consumers plans to make in those years, subject to reconciliation. In September 2016, Consumers self-implemented an annual rate increase of $170 million, subject to refund with interest. The MPSC issued an order in February 2017, authorizing an annual rate increase of $113 million, based on a 10.1 percent authorized return on equity.

·2017 Electric Rate Case: In March 2017, Consumers filed an application with the MPSC seeking an annual rate increase of $173 million, based on a 10.5 percent authorized return on equity.

· Gas Rate Case: In August 2016, Consumers filed an application with the MPSC seeking an annual rate increase of $90 million, based on a 10.6 percent authorized return on equity. The largest component of the request is anIn March 2017, Consumers reduced its requested annual revenue requirement of $84 million relatedrate increase to new investments that will allow Consumers to strengthen infrastructure and improve system capacity and deliverability.

$80 million. The filing also seeks approval of two rate adjustment mechanisms: one that would reconcile annually Consumers’ actual nonfuel revenues with the revenues approved by the MPSC, and another that would provide for additional annual rate increases of $35 million beginning in 2018 and another $35 million beginning in 2019 for incremental investments that Consumers plans to make in those years, subject to reconciliation. These future investments are intendedThe MPSC issued an order in January 2017, limiting Consumers’ self-implementation to help ensure adequate system capacity and deliverability.an annual rate increase of $20 million. Accordingly, in January 2017, Consumers self-implemented an annual rate increase of $20 million, subject to refund with interest.

In 2015, Michigan’s governor outlined several key goals for the state’s energy policy, with a focus on increasing the use of clean energy sources, reducing Michigan’s reliance on coal, deploying smart meters, investing in the power grid and pipeline system, eliminating energy waste, and ensuring affordable, reliable, and adaptable energy while protecting the environment. The Michigan Senate and House of Representatives are considering two separate but similar pieces of legislation to address energy policy. Consumers is unable to predict the form and timing of any final legislation. While most of the proposed changes represent potential benefits to Consumers’ customers, Consumers’ business plan assumes no changes to the existing law.

In SeptemberDecember 2016, Michigan’s governor signed the 2016 Energy Law, which became effective in April 2017. Among other things, the 2016 Energy Law:

·raises the renewable energy standard from the present ten-percent requirement to 12.5 percent by 2019 and MISO announced15 percent by 2021

·establishes a goal of 35 percent combined renewable energy and energy waste reduction by 2025

·authorizes incentives for demand response programs and expands existing incentives for energy efficiency programs

·authorizes incentives for new PPAs with non-affiliates

·establishes an integrated planning process for new generation resources

·shortens from twelve months to ten months the time by which the MPSC must issue a final order in general rate cases, but prohibits electric and gas utilities from filing general rate cases for increases in rates more often than once every twelve months

·eliminates utilities’ self-implementation of rates under general rate cases

·requires the MPSC to implement equitable cost-of-service rates for customers participating in a net metering program

The 2016 Energy Law also establishes a path to ensure that MISO will submit a proposal to FERCforward capacity is secured for all electric customers in November 2016 that would impose capacity requirements onMichigan, including customers served by alternative electric suppliers operating in Michigan. Presently, under the 2008 Energy Law,ROA. Under existing Michigan law, electric customers in Consumers’ service territory are allowed to buy electric generation service from alternative electric suppliers in an aggregate amount up to ten percent of Consumers’ weather-adjusted retail sales for the preceding calendar year. UnderThe 2016 Energy Law retains the joint proposal,ten percent cap on ROA, with certain exceptions. The new law also authorizes the MPSC to ensure that alternative electric suppliers would be required to procurehave procured enough capacity to cover their anticipated capacity

requirements for the subsequent three-yearfour-year forward period. IfIn March 2017, the MPSC indicated that it plans to achieve this objective through the use of a state reliability mechanism. Under such a mechanism, if an alternative electric supplier did not procure enoughdemonstrate that it had procured its capacity itsrequirements for the four-year forward period, ROA customers would then pay a charge to the utility for capacity charge setthat is not provided by the MPSC. The capacity charge would be determined in a separate proceeding in 2017, should FERC approve MISO’s proposal. Consumers cannot predict the outcome of this proposal.alternative electric supplier.

Environmental and health and safety regulations are other areas of importance for CMS Energy and Consumers, and they are monitoring numerous legislative and regulatory initiatives, including those to regulate greenhouse gases, and related litigation. CMS Energy and Consumers believe that these laws and regulations related to their operations will continue to become more stringent and require them to make additional substantial capital expenditures for emissions control equipment, CCR disposal and storage, cooling water intake equipment, effluent treatment, PCB remediation, and gas pipeline safety. Present and reasonably anticipated state and federal environmental statutes and regulations including but not limited to the Clean Air Act, including the Clean Power Plan, as well as the Clean Water Act, the Federal Resource Conservation and Recovery Act of 1976, CERCLA, and the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011, will continue to have a material effect on CMS Energy and Consumers.

Financial Performance

For the ninethree months ended September 30, 2016,March 31, 2017, CMS Energy’s net income available to common stockholders was $474$199 million and diluted EPS were $1.70.$0.71. This compares with net income available to common stockholders of $417$164 million and diluted EPS of $1.51$0.59 for the ninethree months ended September 30, 2015.March 31, 2016. Among the primary factors contributing to CMS Energy’s increased earnings in 20162017 were benefits from electric and gas rate increases, and higher electric sales due mainly to warmer-than-normal summer weather.deliveries, a property tax settlement, and cost reductions. These changes were offset partially by higher depreciation and property

taxes on increased plant in service and by lower gas deliveries, reflecting the second-warmest winter in Consumers’ history.service.

Consumers’ utility operations are seasonal. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment, while peak demand for natural gas occurs in the winter due to colder temperatures and the resulting use of natural gas as heating fuel. In addition, Consumers’ electric rates, which follow a seasonal rate design, are higher in the summer months than in the remaining months of the year. A more detailed discussion of the factors affecting CMS Energy’s and Consumers’ performance can be found in the Results of Operations section that follows this Executive Overview.

Consumers expects that a continued rise in industrial production in its service territory will drive its total electric deliveries to increase annually by about one-half percent on average through 2020.2021. Excluding the impacts of energy efficiencywaste reduction programs, Consumers expects its total electric deliveries to increase by about one percent annually through 2020.2021. Consumers is projecting that its gas deliveries will remain stable through 2020.2021. This outlook reflects growth in gas demand offset by energy efficiency and conservation.

As Consumers seeks to continue to receive fair and timely regulatory treatment, delivering customer value will remain a key strategic priority. In order to minimize increases in customer base rates, Consumers has set goalswill continue to achieve further annual productivity improvements. Additionally, Consumerspursue cost savings through its lean operations model, and will strivecontinue to give priority to capital investments that increase customer value or lower costs.

Consumers expects to continue to have sufficient borrowing capacity to fund its investment-based growth plans. CMS Energy also expects its sources of liquidity to remain sufficient to meet its cash requirements. To identify potential implications for CMS Energy’s and Consumers’ businesses and future financial needs, the companies will continue to monitor developments in the financial and credit markets, as well as government policy responses to those developments.

RESULTS OF OPERATIONS

CMS Energy Consolidated Results of Operations

|

| In Millions, Except Per Share Amounts |

| ||||||||||||||||

|

| Three Months Ended |

| Nine Months Ended |

| ||||||||||||||

September 30 |

| 2016 |

| 2015 |

| Change |

| 2016 |

| 2015 |

| Change |

| ||||||

Net Income Available to Common Stockholders |

| $ | 186 |

| $ | 148 |

| $ | 38 |

| $ | 474 |

| $ | 417 |

| $ | 57 |

|

Basic Earnings Per Share |

| $ | 0.67 |

| $ | 0.53 |

| $ | 0.14 |

| $ | 1.71 |

| $ | 1.51 |

| $ | 0.20 |

|

Diluted Earnings Per Share |

| $ | 0.67 |

| $ | 0.53 |

| $ | 0.14 |

| $ | 1.70 |

| $ | 1.51 |

| $ | 0.19 |

|

|

| In Millions, Except Per Share Amounts |

| ||||||||||||||||||||||||||||||

Three Months Ended March 31 | Three Months Ended March 31 |

| 2017 |

| 2016 |

| Change |

| |||||||||||||||||||||||||

Net Income Available to Common Stockholders | Net Income Available to Common Stockholders |

| $ | 199 |

| $ | 164 |

| $ | 35 |

| ||||||||||||||||||||||

Basic Earnings Per Share | Basic Earnings Per Share |

| $ | 0.71 |

| $ | 0.59 |

| $ | 0.12 |

| ||||||||||||||||||||||

Diluted Earnings Per Share | Diluted Earnings Per Share |

| $ | 0.71 |

| $ | 0.59 |

| $ | 0.12 |

| ||||||||||||||||||||||

|

| In Millions |

|

|

|

| |||||||||||||||||||||||||||

|

| Three Months Ended |

| Nine Months Ended |

|

| In Millions |

| |||||||||||||||||||||||||

September 30 |

| 2016 |

| 2015 |

| Change |

| 2016 |

| 2015 |

| Change |

| ||||||||||||||||||||

Three Months Ended March 31 | Three Months Ended March 31 |

| 2017 |

| 2016 |

| Change |

| |||||||||||||||||||||||||

Electric utility |

| $ | 191 |

| $ | 166 |

| $ | 25 |

| $ | 395 |

| $ | 342 |

| $ | 53 |

| Electric utility |

| $ | 124 |

| $ | 91 |

| $ | 33 |

| |||

Gas utility |

| 3 |

| (7 | ) | 10 |

| 102 |

| 115 |

| (13 | ) | Gas utility |

| 87 |

| 81 |

| 6 |

| ||||||||||||

Enterprises |

| 8 |

| 3 |

| 5 |

| 17 |

| 10 |

| 7 |

| Enterprises |

| 12 |

| 6 |

| 6 |

| ||||||||||||

Corporate interest and other |

| (16 | ) | (14 | ) | (2 | ) | (40 | ) | (50 | ) | 10 |

| Corporate interest and other |

| (24 | ) | (14 | ) | (10 | ) | ||||||||||||

Net Income Available to Common Stockholders |

| $ | 186 |

| $ | 148 |

| $ | 38 |

| $ | 474 |

| $ | 417 |

| $ | 57 |

| Net Income Available to Common Stockholders |

| $ | 199 |

| $ | 164 |

| $ | 35 |

| |||

Presented in the following table are specific after-tax changes to net income available to common stockholders:

|

| In Millions |

|

| In Millions |

| ||||||||||||||

|

| September 30, 2016 better/(worse) than 2015 |

|

| March 31, 2017 better/(worse) than 2016 |

| ||||||||||||||

Reasons for the change |

| Three Months Ended |

| Nine Months Ended |

|

| Three Months Ended |

| ||||||||||||

Consumers electric utility and gas utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weather |

| $ 29 |

|

|

|

|

| $ 19 |

|

|

|

|

|

| $ (2) |

|

|

|

|

|

Non-weather |

| 7 |

| $ 36 |

|

|

| 15 |

| $ 34 |

|

|

|

| 8 |

| $ 6 |

|

|

|

Gas sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weather |

| (1 | ) |

|

|

|

| (48 | ) |

|

|

|

|

| (2) |

|

|

|

|

|

Non-weather |

| 1 |

| - |

|

|

| 12 |

| (36 | ) |

|

|

| 1 |

| (1) |

|

|

|

Electric rate increase |

|

|

| 7 |

|

|

|

|

| 43 |

|

|

|

|

|

| 20 |

|

|

|

Gas rate increase |

|

|

| 2 |

|

|

|

|

| 14 |

|

|

|

|

|

| 4 |

|

|

|

Property tax settlement |

|

|

| 7 |

|

|

| |||||||||||||

Operating and maintenance costs |

|

|

| 19 |

|

|

|

|

| 26 |

|

|

|

|

|

| 5 |

|

|

|

Employee benefit costs |

|

|

| 6 |

|

|

|

|

| 18 |

|

|

| |||||||

Depreciation and property taxes, net |

|

|

| (22 | ) |

|

|

|

| (50 | ) |

|

|

|

|

| (17) |

|

|

|

Voluntary separation program costs |

|

|

| (7 | ) |

|

|

|

| (7 | ) |

|

| |||||||

Other |

|

|

| (6 | ) | $ 35 |

|

|

| (2 | ) | $ 40 |

| |||||||

Other, including intercompany gain |

|

|

| 15 |

| $ 39 |

| |||||||||||||

Enterprises |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsidiary earnings |

|

|

|

|

| 5 |

|

|

|

|

| 7 |

|

|

|

|

|

| 6 |

|

Corporate interest and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michigan tax settlement |

|

|

|

|

| - |

|

|

|

|

| 5 |

| |||||||

EnerBank earnings |

|

|

|

|

| - |

|

|

|

|

| 2 |

| |||||||

Elimination of intercompany gain |

|

|

|

|

| (9) |

| |||||||||||||

Other |

|

|

|

|

| (2 | ) |

|

|

|

| 3 |

|

|

|

|

|

| (1) |

|

Total change |

|

|

|

|

| $ 38 |

|

|

|

|

| $ 57 |

|

|

|

|

|

| $ 35 |

|

Consumers Electric Utility Results of Operations

|

|

|

| In Millions |

| ||||||||||||||||||||||||

|

| Three Months Ended |

| Nine Months Ended |

| ||||||||||||||||||||||||

September 30 |

| 2016 |

| 2015 |

| Change |

| 2016 |

| 2015 |

| Change |

| ||||||||||||||||

In Millions | In Millions | ||||||||||||||||||||||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| |||||||||||||||||||||||||

Net Income Available to Common Stockholders |

| $ | 191 |

| $ | 166 |

| $ | 25 |

| $ | 395 |

| $ | 342 |

| $ | 53 |

|

| $ | 124 |

| $ | 91 |

| $ | 33 |

|

Reasons for the change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Electric deliveries and rate increases |

|

|

|

|

| $ | 45 |

|

|

|

|

| $ | 88 |

|

|

|

|

|

|

|

| $ | 45 |

| ||||

Power supply costs and related revenue |

|

|

|

|

| (3 | ) |

|

|

|

| (3 | ) | ||||||||||||||||

Maintenance and other operating expenses |

|

|

|

|

| 15 |

|

|

|

|

| 36 |

|

|

|

|

|

|

|

|

| 3 |

| ||||||

Depreciation and amortization |

|

|

|

|

| (6 | ) |

|

|

|

| (16 | ) |

|

|

|

|

|

|

|

| (13) |

| ||||||

General taxes |

|

|

|

|

| (3 | ) |

|

|

|

| (9 | ) |

|

|

|

|

|

|

|

| 9 |

| ||||||

Other income, net of expenses |

|

|

|

|

| (2 | ) |

|

|

|

| (8 | ) |

|

|

|

|

|

|

|

| 6 |

| ||||||

Interest charges |

|

|

|

|

| (3 | ) |

|

|

|

| (5 | ) |

|

|

|

|

|

|

|

| (1) |

| ||||||

Income taxes |

|

|

|

|

| (18 | ) |

|

|

|

| (30 | ) |

|

|

|

|

|

|

|

| (16) |

| ||||||

Total change |

|

|

|

|

| $ | 25 |

|

|

|

|

| $ | 53 |

|

|

|

|

|

|

|

| $ | 33 |

| ||||

Following is a discussion of significant changes to net income available to common stockholders.

Electric Deliveries and Rate Increases: For the three months ended September 30, 2016,March 31, 2017, electric delivery revenues increased $45 million compared with 2015.2016. This change reflected a $52$32 million rate increase, $9 million in higher deliveries, and a $4 million increase in sales due primarily to favorable weather. Additionally, revenues increased $14 million due to a rate increase self-implemented in September 2016. These increases were offset partially by a $15 million decrease resulting from lower summer rates as authorized in the December 2015 rate order and a $6 million decrease in other revenues associated with securitization bonds that Consumers issued in 2001 and retired in October 2015.revenues. Deliveries to end-use customers were 10.79.2 billion kWh in 20162017 and 10.19.1 billion kWh in 2015.2016.

For the nine months ended September 30, 2016, electric delivery revenues increased $88 million compared with 2015. This change reflected $59 million from a December 2015 rate increase and a September 2016 self-implemented rate increase, $46 million from an increase in sales due primarily to favorable weather, and a $9 million increase associated with energy efficiency programs. These increases were offset partially by a $26 million decrease in revenue associated with securitization bonds that Consumers issued in 2001 and retired in October 2015. Deliveries to end-use customers were 28.9 billion kWh in 2016 and 28.4 billion kWh in 2015.

Maintenance and Other Operating Expenses: For the three months ended September 30, 2016,March 31, 2017, maintenance and other operating expenses decreased $15$3 million compared with 2015.2016. This change was due to a $10reflected the absence, in 2017, of $7 million decrease in expenses at the seven coal-fueledcoal-fuel electric generating units that Consumers retired in April 2016 and a $6 million decrease in2016. Additionally, postretirement benefit costs attributable primarily to the change todecreased by $3 million, reflecting a full-yield-curve approach to calculate the service cost and interest expense components of net periodic benefit costs for the DB Pension and OPEB Plans. Also contributing to the change were a $4$5 million reduction in service restoration expenses andassociated with the early adoption of a $1 million decrease in other operating and maintenance costs. These reductions werenew accounting standard, offset partially by a $6$2 million charge associated with a voluntary separation program.

of cost increases. For additional details on the nine months ended September 30, 2016, maintenance and other operating expenses decreased $36 million compared with 2015. This change was due to a $21 million decrease in expenses at the seven coal-fueled electric generating units that Consumers retired in April 2016, a $19 million decrease in

postretirement benefit costs attributable primarily to the change to a full-yield-curve approach to calculate the service cost and interest expense componentsimplementation of net periodic benefit costs for the DB Pension and OPEB Plans, and a $10 million decrease in uncollectible accounts expense. Also contributing to the change was a $4 million decrease associated with a State of Michigan use tax settlement reached in June 2016.this standard, see Note 1, New Accounting Standards. These decreases were offset partially by a $9$7 million increase associated with energy efficiency programs, a $6 million chargein maintenance and other operating expenses, resulting primarily from higher service restoration costs associated with a voluntary separation program, and a $3 million increase in forestry expenses.March 2017 wind storm.

Depreciation and Amortization: For the three months ended September 30, 2016,March 31, 2017, depreciation and amortization expense increased $6$13 million compared with 2015. This change reflected a $27 million increase in depreciation expense related2016, due primarily to increased plant in service and an increase in depreciation rates that became effective in December 2015, offset partially by a $21 million decrease in amortization of securitized assets, reflecting the conclusion in October 2015 of Consumers’ 2001 securitization program.service.

For the nine months ended September 30, 2016, depreciation and amortization expense increased $16 million compared with 2015. This change reflected a $72 million increase in depreciation expense related to increased plant in service and an increase in depreciation rates that became effective in December 2015, offset partially by a $56 million decrease in amortization associated primarily with securitized assets, reflecting the conclusion in October 2015 of Consumers’ 2001 securitization program.

General Taxes: For the ninethree months ended September 30, 2016,March 31, 2017, general taxes increaseddecreased $9 million compared with 2015. This change was2016, due primarilylargely to an $8 million increase inthe settlement of a property taxes, reflecting higher capital spending, and a $1 million increase to payroll taxestax appeal related to a voluntary separation program.Consumers’ Zeeland plant.

Other Income, Net of Expenses: For the ninethree months ended September 30, 2016,March 31, 2017, other income, net of expenses, decreased $8increased $6 million compared with 2015.2016. This decrease reflected the absence, in 2016, ofchange was due to a $6$9 million gain related toon a donation of CMS Energy stock by Consumers. The gainConsumers, which was eliminated on CMS Energy’s consolidated statements of income. The decrease also reflectedincome, and a $2$1 million charitable contribution madeincrease in 2016.

Interest Charges: For the nine months ended September 30, 2016, interest charges increased $5 million compared with 2015.other income, net of expenses. These changesincreases were due primarily to higher average debt levels.

Income Taxes: For the three months ended September 30, 2016, income taxes increased $18 million compared with 2015. This change was attributable primarily to higher electric utility earnings.

For the nine months ended September 30, 2016, income taxes increased $30 million compared with 2015. This increase reflected $34 million related to higher electric utility earnings, offset partially by a $4 million decrease due to a changereduction in the treatment of excess tax benefits on restricted stock awards as a result ofnonoperating retirement benefit credits associated with the early adoption of a new accounting standard. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

Income Taxes: For the three months ended March 31, 2017, income taxes increased $16 million compared with 2016. This change reflected a $19 million increase attributable to higher electric utility earnings, offset partially by a $3 million reduction of other income taxes.

Consumers Gas Utility Results of Operations

|

|

|

| In Millions |

| ||||||||||||||||||||||||

|

| Three Months Ended |

| Nine Months Ended |

| ||||||||||||||||||||||||

September 30 |

| 2016 |

| 2015 |

| Change |

| 2016 |

| 2015 |

| Change |

| ||||||||||||||||

Net Income (Loss) Available to Common Stockholders |

| $ | 3 |

| $ | (7 | ) | $ | 10 |

| $ | 102 |

| $ | 115 |

| $ | (13 | ) | ||||||||||

In Millions | In Millions | ||||||||||||||||||||||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| |||||||||||||||||||||||||

Net Income Available to Common Stockholders |

| $ | 87 |

| $ | 81 |

| $ | 6 |

| |||||||||||||||||||

Reasons for the change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Gas deliveries and rate increases |

|

|

|

|

| $ | 8 |

|

|

|

|

| $ | (27 | ) |

|

|

|

|

|

|

| $ | 10 |

| ||||

Maintenance and other operating expenses |

|

|

|

|

| 9 |

|

|

|

|

| 22 |

|

|

|

|

|

|

|

|

| 10 |

| ||||||

Depreciation and amortization |

|

|

|

|

| (3 | ) |

|

|

|

| (15 | ) |

|

|

|

|

|

|

|

| (11) |

| ||||||

General taxes |

|

|

|

|

| (1 | ) |

|

|

|

| (4 | ) |

|

|

|

|

|

|

|

| (3) |

| ||||||

Other income, net of expenses |

|

|

|

|

| - |

|

|

|

|

| (1 | ) |

|

|

|

|

|

|

|

| 2 |

| ||||||

Income taxes |

|

|

|

|

| (3 | ) |

|

|

|

| 12 |

|

|

|

|

|

|

|

|

| (2) |

| ||||||

Total change |

|

|

|

|

| $ | 10 |

|

|

|

|

| $ | (13 | ) |

|

|

|

|

|

|

| $ | 6 |

| ||||

Following is a discussion of significant changes to net income available to common stockholders.

Gas Deliveries and Rate Increases: For the three months ended September 30, 2016,March 31, 2017, gas delivery revenues increased $8$10 million compared with 2015.2016. This change reflected a $4 million increase from a January 20162017 self-implemented rate increase of $6 million and a $4 million increase in other revenues. Deliveries to end-use customers were 26119 bcf in 20162017 and 27121 bcf in 2015.2016.

For the nine months ended September 30, 2016, gas delivery revenues decreased $27 million compared with 2015. This change reflected a $50 million decrease in sales due primarily to milder winter weather. This decrease was offset partially by $23 million related to a January 2016 rate increase. Deliveries to end-use customers were 196 bcf in 2016 and 223 bcf in 2015.

Maintenance and Other Operating Expenses: For the three months ended September 30, 2016,March 31, 2017, maintenance and other operating expenses decreased $9$10 million compared with 2015.2016. This change was due to a $4decrease reflects $6 million decrease in postretirement benefit costs attributable primarily to the change to a full-yield-curve approach to calculate the service costof lower gas distribution and interestcustomer operations expense components of net periodic benefit costs for the DB Pension and OPEB Plans and a $2 million decreasereduction in uncollectible accounts expense. Also contributing to the change was a $7 million reduction in other gas distribution operating and maintenance expenses, offset partially by a $4 million charge associated with a voluntary separation program.

For the nine months ended September 30, 2016, maintenance and other operating expenses decreased $22 million compared with 2015. This change was due to a $12$2 million decrease in postretirement benefit costs, attributable primarily to the change toreflecting a full-yield-curve approach to calculate the service cost and interest expense components of net periodic benefit costs for the DB Pension and OPEB Plans and a $6 million decrease in uncollectible accounts expense. Additionally, there was an $8$4 million reduction in other gas distribution operating and maintenance expenses. These decreases wereassociated with the early adoption of a new accounting standard, offset partially by a $4$2 million charge associated with a voluntary separation program.of cost increases. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

Depreciation and Amortization: For the ninethree months ended September 30, 2016,March 31, 2017, depreciation and amortization expense increased $15$11 million compared with 2015,2016, due primarily to increased plant in service.

General Taxes: For the ninethree months ended September 30, 2016,March 31, 2017, general taxes increased $4$3 million compared with 2015,2016, due primarily to increased property taxes, reflecting higher capital spending.

Other Income, Taxes: Net of Expenses:For the ninethree months ended September 30, 2016,March 31, 2017, other income, taxes decreased $12net of expenses, increased $2 million compared with 2015.2016. This change reflected a $10 million reduction related to lower gas utility earnings and a $2 million decreasewas due to a change$5 million gain on a donation of CMS Energy stock by Consumers, which was eliminated on CMS Energy’s consolidated statements of income. This increase was offset partially by a $3 million reduction in the treatment of excess tax benefits on restricted stock awards as a result ofnonoperating retirement benefit credits associated with the early adoption of a new accounting standard. For additional details on the implementation of this standard, see Note 1, New Accounting Standards.

Income Taxes: For the three months ended March 31, 2017, income taxes increased $2 million compared with 2016, attributable to higher gas utility earnings.

Enterprises Results of Operations

|

| In Millions |

| ||||||||||||||||

|

| Three Months Ended |

| Nine Months Ended |

| ||||||||||||||

September 30 |

| 2016 |

| 2015 |

| Change |

| 2016 |

| 2015 |

| Change |

| ||||||

Net Income Available to Common Stockholders |

| $ | 8 |

| $ | 3 |

| $ | 5 |

| $ | 17 |

| $ | 10 |

| $ | 7 |

|

In Millions | ||||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| ||||||

Net Income Available to Common Stockholders |

| $ | 12 |

| $ | 6 |

| $ | 6 |

|

For the three months ended September 30, 2016,March 31, 2017, net income of the enterprises segment increased $5$6 million compared with 2015,2016, due primarily to higher prices for capacity and demand revenue from DIG and $1 million resulting from delays in planned maintenance at equity method investees.

For the nine months ended September 30, 2016, net income of the enterprises segment increased $7 million compared with 2015, due primarily to higher prices for capacity and demand revenue from DIG and $2 million resulting from lower maintenance expenses at equity method investees.DIG.

Corporate Interest and Other Results of Operations

|

| In Millions |

| ||||||||||||||||||||||||||

|

| Three Months Ended |

| Nine Months Ended |

| ||||||||||||||||||||||||

September 30 |

| 2016 |

| 2015 |

| Change |

| 2016 |

| 2015 |

| Change |

| ||||||||||||||||

In Millions | In Millions | ||||||||||||||||||||||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| |||||||||||||||||||||||||

Net Income (Loss) Available to Common Stockholders |

| $ | (16 | ) | $ | (14 | ) | $ | (2 | ) | $ | (40 | ) | $ | (50 | ) | $ | 10 |

|

| $ | (24) |

| $ | (14) |

| $ | (10) |

|

For the three months ended September 30, 2016,March 31, 2017, corporate interest and other net expenses increased $2 million compared with 2015, due primarily to higher fixed charges reflecting higher debt levels, offset partially by lower average interest rates.

For the nine months ended September 30, 2016, corporate interest and other net expenses decreased $10 million compared with 2015,2016, due primarily to a settlement reached with the Michigan Department of Treasury that resulted in after-tax reductions of $2 million in general taxes and $3 million in income tax expense. Also contributing to the change were the absence, in 2016,elimination of a $5$9 million intercompany charge related to aafter-tax gain resulting from the donation of CMS Energy stock by Consumers and $2 million of higher net earnings at EnerBank. These decreases were offset partially by higher fixed charges.Consumers.

For additional details on the settlement with the Michigan Department of Treasury, see Note 3, Contingencies and Commitments—Other Contingencies.

CASH POSITION, INVESTING, AND FINANCING

At September 30, 2016,March 31, 2017, CMS Energy had $367$463 million of consolidated cash and cash equivalents, which included $28$30 million of restricted cash and cash equivalents. At September 30, 2016,March 31, 2017, Consumers had $49$212 million of consolidated cash and cash equivalents, which included $28$30 million of restricted cash and cash equivalents.

Operating Activities

Presented in the following table are specific components of net cash provided by operating activities for the ninethree months ended September 30, 2016March 31, 2017 and 2015:2016:

|

| In Millions |

| |||||||||||||||||

Nine Months Ended September 30 |

| 2016 |

| 2015 |

| Change |

| |||||||||||||

In Millions | In Millions |

| ||||||||||||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| ||||||||||||||||

CMS Energy, including Consumers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net income |

| $ | 475 |

| $ | 418 |

| $ | 57 |

|

| $ | 199 |

| $ | 164 |

| $ | 35 |

|

Non-cash transactions1 |

| 870 |

| 898 |

| (28 | ) |

|

| 373 |

| 327 |

|

| 46 |

| ||||

Changes in core working capital2 |

| 62 |

| 239 |

| (177 | ) |

|

| 198 |

| 242 |

|

| (44) |

| ||||

Postretirement benefits contributions |

| (6 | ) | (35 | ) | 29 |

|

|

| (5) |

| (2) |

|

| (3) |

| ||||

Changes in other assets and liabilities, net |

| (160 | ) | (100 | ) | (60 | ) |

|

| (119) |

| (99) |

|

| (20) |

| ||||

Net cash provided by operating activities |

| $ | 1,241 |

| $ | 1,420 |

| $ | (179 | ) |

| $ | 646 |

| $ | 632 |

| $ | 14 |

|

Consumers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net income |

| $ | 499 |

| $ | 459 |

| $ | 40 |

|

| $ | 211 |

| $ | 172 |

| $ | 39 |

|

Non-cash transactions1 |

| 857 |

| 709 |

| 148 |

|

|

| 351 |

| 316 |

|

| 35 |

| ||||

Changes in core working capital2 |

| 76 |

| 244 |

| (168 | ) |

|

| 202 |

| 261 |

|

| (59) |

| ||||

Postretirement benefits contributions |

| (4 | ) | (33 | ) | 29 |

|

|

| (3) |

| (1) |

|

| (2) |

| ||||

Changes in other assets and liabilities, net |

| (140 | ) | 48 |

| (188 | ) |

|

| (113) |

| (83) |

|

| (30) |

| ||||

Net cash provided by operating activities |

| $ | 1,288 |

| $ | 1,427 |

| $ | (139 | ) |

| $ | 648 |

| $ | 665 |

| $ | (17) |

|

1 Non-cash transactions comprise depreciation and amortization, changes in deferred income taxes, postretirement benefits expense, and other non-cash operating activities.activities and reconciling adjustments.

2 Core working capital comprises accounts receivable, notes receivable, accrued revenue, inventories, accounts payable, and accrued rate refunds.

For the ninethree months ended September 30, 2016,March 31, 2017, net cash provided by operating activities at CMS Energy decreased $179increased $14 million compared with 20152016 and net cash provided by operating activities at Consumers decreased $139$17 million compared with 2015. These decreases were due primarily to lower collections from customers, including collections2016. At both CMS Energy and Consumers, higher net income, net of GCR underrecoveries and gas sold at lower prices in 2016, and higher energy optimization spending. These changes werenon-cash transactions, was offset partially by reduced customer collections, attributable to lower gas

prices and sales volumes. The change at Consumers also reflected a decreasereimbursement received from CMS Energy in 2016 for a prior-year postretirement benefits contributions, gas purchases at lower prices in 2016, and higher net income. At Consumers, the greater impact from changes in other assets and liabilities and the increase in non-cash transactions reflected an increase in the deferred income tax liability and expense associated with bonus depreciation on higher capital expenditures.contribution.

Investing Activities

Presented in the following table are specific components of net cash used in investing activities for the ninethree months ended September 30, 2016March 31, 2017 and 2015:2016:

| In Millions |

| ||||||||||||||||||

Nine Months Ended September 30 |

| 2016 |

| 2015 |

| Change |

| |||||||||||||

In Millions | In Millions |

| ||||||||||||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| ||||||||||||||||

CMS Energy, including Consumers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Capital expenditures |

| $ | (1,224 | ) | $ | (1,102 | ) | $ | (122 | ) |

| $ | (365) |

| $ | (407) |

| $ | 42 |

|

Increase in EnerBank notes receivable |

| (87 | ) | (186 | ) | 99 |

| |||||||||||||

Decrease (increase) in EnerBank notes receivable |

|

| 14 |

| (16) |

|

| 30 |

| |||||||||||

Proceeds from the sale of EnerBank notes receivable |

| - |

| 48 |

| (48 | ) |

|

| 19 |

| - |

|

| 19 |

| ||||

DB SERP fund contributions |

| - |

| (25 | ) | 25 |

| |||||||||||||

Costs to retire property and other investing activities |

| (94 | ) | (75 | ) | (19 | ) |

|

| (14) |

| (21) |

|

| 7 |

| ||||

Net cash used in investing activities |

| $ | (1,405 | ) | $ | (1,340 | ) | $ | (65 | ) |

| $ | (346) |

| $ | (444) |

| $ | 98 |

|

Consumers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Capital expenditures |

| $ | (1,214 | ) | $ | (1,093 | ) | $ | (121 | ) |

| $ | (361) |

| $ | (406) |

| $ | 45 |

|

DB SERP fund contributions |

| - |

| (17 | ) | 17 |

| |||||||||||||

Costs to retire property and other investing activities |

| (95 | ) | (76 | ) | (19 | ) |

|

| (21) |

| (19) |

|

| (2) |

| ||||

Net cash used in investing activities |

| $ | (1,309 | ) | $ | (1,186 | ) | $ | (123 | ) |

| $ | (382) |

| $ | (425) |

| $ | 43 |

|

For the ninethree months ended September 30, 2016,March 31, 2017, net cash used in investing activities at CMS Energy increased $65decreased $98 million compared with 20152016 and net cash used in investing activities at Consumers increased $123decreased $43 million compared with 2015.2016. These changes were due primarily to higherlower capital expenditures and costs to retire property at Consumers, offset partially by the absence, in 2016, of DB SERP fund contributions.Consumers. The change at CMS Energy was also due to the absence,slower growth in 2016, of proceeds fromEnerBank consumer lending and the sale of EnerBank notes receivable and was offset partially by slower growth in EnerBank consumer lending.receivable.

Financing Activities

Presented in the following table are specific components of net cash provided by (used in)used in financing activities for the ninethree months ended September 30, 2016March 31, 2017 and 2015:2016:

|

| In Millions |

| |||||||

Nine Months Ended September 30 |

| 2016 |

| 2015 |

| Change |

| |||

CMS Energy, including Consumers |

|

|

|

|

|

|

| |||

Issuance of debt |

| $ | 775 |

| $ | 100 |

| $ | 675 |

|

Issuance of common stock |

| 69 |

| 40 |

| 29 |

| |||

Proceeds from EnerBank certificates of deposit, net |

| 64 |

| 135 |

| (71 | ) | |||

Payment of dividends on common and preferred stock |

| (260 | ) | (241 | ) | (19 | ) | |||

Retirement of debt |

| (215 | ) | (148 | ) | (67 | ) | |||

Increase (decrease) in notes payable |

| (174 | ) | 8 |

| (182 | ) | |||

Payment of capital leases and other financing activities |

| (22 | ) | (31 | ) | 9 |

| |||

Net cash provided by (used in) financing activities |

| $ | 237 |

| $ | (137 | ) | $ | 374 |

|

Consumers |

|

|

|

|

|

|

| |||

Issuance of debt |

| $ | 446 |

| $ | - |

| $ | 446 |

|

Stockholder contribution from CMS Energy |

| 275 |

| 150 |

| 125 |

| |||

Payment of dividends on common and preferred stock |

| (362 | ) | (360 | ) | (2 | ) | |||

Retirement of debt |

| (185 | ) | (48 | ) | (137 | ) | |||

Increase (decrease) in notes payable |

| (174 | ) | 8 |

| (182 | ) | |||

Payment of capital leases and other financing activities |

| (8 | ) | (19 | ) | 11 |

| |||

Net cash used in financing activities |

| $ | (8 | ) | $ | (269 | ) | $ | 261 |

|

In Millions |

| |||||||||

Three Months Ended March 31 | 2017 | 2016 | Change |

| ||||||

CMS Energy, including Consumers |

|

|

|

|

|

|

|

|

|

|

Issuance of debt |

| $ | 923 |

| $ | 30 |

| $ | 893 |

|

Issuance of common stock |

|

| 3 |

|

| 63 |

|

| (60) |

|

Net increase (decrease) in EnerBank certificates of deposit |

|

| (29 | ) |

| 14 |

|

| (43) |

|

Payment of dividends on common stock |

|

| (94 | ) |

| (86) |

|

| (8) |

|

Retirement of debt |

|

| (475 | ) |

| (30) |

|

| (445) |

|

Decrease in notes payable |

|

| (398 | ) |

| (249) |

|

| (149) |

|

Payment of capital leases and other financing activities |

|

| (24 | ) |

| (12) |

|

| (12) |

|

Net cash used in financing activities |

| $ | (94 | ) | $ | (270) |

| $ | 176 |

|

Consumers |

|

|

|

|

|

|

|

|

|

|

Issuance of debt |

| $ | 349 |

| $ | - |

| $ | 349 |

|

Stockholder contribution from CMS Energy |

|

| 250 |

|

| 150 |

|

| 100 |

|

Payment of dividends on common stock |

|

| (148 | ) |

| (155) |

|

| 7 |

|

Retirement of debt |

|

| (250 | ) |

| - |

|

| (250) |

|

Decrease in notes payable |

|

| (398 | ) |

| (249) |

|

| (149) |

|

Payment of capital leases and other financing activities |

|

| (9 | ) |

| (1) |

|

| (8) |

|

Net cash used in financing activities |

| $ | (206 | ) | $ | (255) |

| $ | 49 |

|

For the ninethree months ended September 30, 2016,March 31, 2017, net cash provided byused in financing activities at CMS Energy increased $374decreased $176 million compared with 20152016 and net cash used in financing activities at Consumers decreased $261$49 million compared with 2015. At2016. Higher debt issuances and, at Consumers, an increased stockholder contribution from CMS Energy the change was due to an increase in debt and common stock issuances. These changes were offset partially by higher debt retirements and higher repayments under Consumers’ commercial paper program and an increase in debt retirements.program.

At Consumers, the change was due primarily to an increase in debt issuances and contributions from CMS Energy, offset partially by higher debt repayments under the commercial paper program and an increase in debt retirements.

CAPITAL RESOURCES AND LIQUIDITY