| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||||||||||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||||||||

| Emerging growth company | ☐ | |||||||||||||

| Title of each class | Outstanding at | Trading Symbol | Name of each exchange on which registered | |||||||||||||||||

Common Stock, $0.001 par value per share |

| SUPN | The Nasdaq Global Market | |||||||||||||||||

| |||||

| Page No. | |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

| |||||

|

| March 31, |

| December 31, |

| ||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

|

|

| ||

Assets |

|

|

|

|

| ||

Current assets |

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 122,778 |

| $ | 192,248 |

|

Marketable securities |

| 170,165 |

| 163,770 |

| ||

Accounts receivable, net |

| 79,950 |

| 102,922 |

| ||

Inventories, net |

| 26,518 |

| 25,659 |

| ||

Prepaid expenses and other current assets |

| 20,556 |

| 8,888 |

| ||

Total current assets |

| 419,967 |

| 493,487 |

| ||

Long term marketable securities |

| 522,551 |

| 418,798 |

| ||

Property and equipment, net |

| 4,226 |

| 4,095 |

| ||

Intangible assets, net |

| 30,063 |

| 31,368 |

| ||

Lease assets |

| 20,049 |

| — |

| ||

Deferred income taxes |

| 27,967 |

| 29,683 |

| ||

Other assets |

| 625 |

| 380 |

| ||

|

|

|

|

|

| ||

Total assets |

| $ | 1,025,448 |

| $ | 977,811 |

|

|

|

|

|

|

| ||

Liabilities and stockholders’ equity |

|

|

|

|

| ||

Current liabilities |

|

|

|

|

| ||

Accounts payable |

| $ | 7,240 |

| $ | 3,195 |

|

Accrued product returns and rebates |

| 88,200 |

| 107,063 |

| ||

Accrued expenses and other current liabilities |

| 36,607 |

| 36,535 |

| ||

Income taxes payable |

| 17,233 |

| 12,377 |

| ||

Non-recourse liability related to sale of future royalties, current portion |

| 2,426 |

| 2,183 |

| ||

Total current liabilities |

| 151,706 |

| 161,353 |

| ||

Convertible notes, net |

| 333,310 |

| 329,462 |

| ||

Non-recourse liability related to sale of future royalties, long term |

| 21,957 |

| 22,575 |

| ||

Lease liabilities, long term |

| 27,824 |

| — |

| ||

Other non-current liabilities |

| 10,633 |

| 11,398 |

| ||

Total liabilities |

| 545,430 |

| 524,788 |

| ||

|

|

|

|

|

| ||

Stockholders’ equity |

|

|

|

|

| ||

Common stock, $0.001 par value, 130,000,000 shares authorized 52,374,248 and 52,316,583 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively |

| 52 |

| 52 |

| ||

Additional paid-in capital |

| 373,707 |

| 369,637 |

| ||

Accumulated other comprehensive earnings (loss), net of tax |

| 1,427 |

| (3,158 | ) | ||

Retained earnings |

| 104,832 |

| 86,492 |

| ||

Total stockholders’ equity |

| 480,018 |

| 453,023 |

| ||

|

|

|

|

|

| ||

Total liabilities and stockholders’ equity |

| $ | 1,025,448 |

| $ | 977,811 |

|

data)

| March 31, | December 31, | ||||||||||

| 2020 | 2019 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 225,767 | $ | 181,381 | |||||||

| Marketable securities | 175,104 | 165,692 | |||||||||

| Accounts receivable, net | 119,195 | 87,332 | |||||||||

| Inventories, net | 24,418 | 26,628 | |||||||||

| Prepaid expenses and other current assets | 12,564 | 11,611 | |||||||||

| Total current assets | 557,048 | 472,644 | |||||||||

| Long term marketable securities | 534,712 | 591,773 | |||||||||

| Property and equipment, net | 18,011 | 17,068 | |||||||||

| Intangible assets, net | 23,579 | 24,840 | |||||||||

| Lease assets | 21,911 | 21,279 | |||||||||

| Deferred income taxes | 34,067 | 32,063 | |||||||||

| Other assets | 538 | 615 | |||||||||

| Total assets | $ | 1,189,866 | $ | 1,160,282 | |||||||

| Liabilities and stockholders’ equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | 3,124 | $ | 10,141 | |||||||

| Accrued product returns and rebates | 119,453 | 107,629 | |||||||||

| Accrued expenses and other current liabilities | 33,003 | 37,130 | |||||||||

| Income taxes payable | 9,097 | 2,443 | |||||||||

| Nonrecourse liability related to sale of future royalties, current portion | 3,658 | 3,244 | |||||||||

| Total current liabilities | 168,335 | 160,587 | |||||||||

| Convertible notes, net | 349,232 | 345,170 | |||||||||

| Nonrecourse liability related to sale of future royalties, long term | 18,369 | 19,248 | |||||||||

| Lease liabilities, long term | 30,804 | 30,440 | |||||||||

| Other liabilities | 9,743 | 9,409 | |||||||||

| Total liabilities | 576,483 | 564,854 | |||||||||

| Stockholders’ equity | |||||||||||

| Common stock, $0.001 par value; 130,000,000 shares authorized; 52,537,159 and 52,533,348 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | 53 | 53 | |||||||||

| Additional paid-in capital | 392,430 | 388,410 | |||||||||

| Accumulated other comprehensive earnings (loss), net of tax | (166) | 7,417 | |||||||||

| Retained earnings | 221,066 | 199,548 | |||||||||

| Total stockholders’ equity | 613,383 | 595,428 | |||||||||

| Total liabilities and stockholders’ equity | $ | 1,189,866 | $ | 1,160,282 | |||||||

|

| Three Months ended March 31, |

| ||||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||

|

|

|

|

|

| ||

Revenues |

|

|

|

|

| ||

Net product sales |

| $ | 83,099 |

| $ | 89,120 |

|

Royalty revenues |

| 2,375 |

| 1,309 |

| ||

Total revenues |

| 85,474 |

| 90,429 |

| ||

|

|

|

|

|

| ||

Costs and expenses |

|

|

|

|

| ||

Cost of product sales |

| 3,684 |

| 3,278 |

| ||

Research and development |

| 15,394 |

| 18,908 |

| ||

Selling, general and administrative |

| 40,968 |

| 36,849 |

| ||

|

|

|

|

|

| ||

Total costs and expenses |

| 60,046 |

| 59,035 |

| ||

|

|

|

|

|

| ||

Operating earnings |

| 25,428 |

| 31,394 |

| ||

|

|

|

|

|

| ||

Other expenses, net |

| (1,189 | ) | (212 | ) | ||

|

|

|

|

|

| ||

Earnings before income taxes |

| 24,239 |

| 31,182 |

| ||

|

|

|

|

|

| ||

Income tax expense |

| 5,899 |

| 4,830 |

| ||

Net earnings |

| $ | 18,340 |

| $ | 26,352 |

|

|

|

|

|

|

| ||

Earnings per share |

|

|

|

|

| ||

Basic |

| $ | 0.35 |

| $ | 0.51 |

|

Diluted |

| $ | 0.34 |

| $ | 0.49 |

|

|

|

|

|

|

| ||

Weighted-average shares outstanding |

|

|

|

|

| ||

Basic |

| 52,336,443 |

| 51,536,474 |

| ||

Diluted |

| 53,985,385 |

| 53,788,346 |

| ||

| Three Months ended March 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Net product sales | $ | 92,490 | $ | 83,099 | |||||||||||||||||||||||||

| Royalty revenues | 2,486 | 2,375 | |||||||||||||||||||||||||||

| Total revenues | 94,976 | 85,474 | |||||||||||||||||||||||||||

| Costs and expenses | |||||||||||||||||||||||||||||

| Cost of goods sold | 4,152 | 3,684 | |||||||||||||||||||||||||||

| Research and development | 18,937 | 15,394 | |||||||||||||||||||||||||||

| Selling, general and administrative | 42,875 | 40,968 | |||||||||||||||||||||||||||

| Total costs and expenses | 65,964 | 60,046 | |||||||||||||||||||||||||||

| Operating earnings | 29,012 | 25,428 | |||||||||||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||||||||

| Interest expense | (5,755) | (5,870) | |||||||||||||||||||||||||||

| Interest income, net | 5,777 | 4,681 | |||||||||||||||||||||||||||

| Total other income (expense) | 22 | (1,189) | |||||||||||||||||||||||||||

| Earnings before income taxes | 29,034 | 24,239 | |||||||||||||||||||||||||||

| Income tax expense | 7,516 | 5,899 | |||||||||||||||||||||||||||

| Net earnings | $ | 21,518 | $ | 18,340 | |||||||||||||||||||||||||

| Earnings per share | |||||||||||||||||||||||||||||

| Basic | $ | 0.41 | $ | 0.35 | |||||||||||||||||||||||||

| Diluted | $ | 0.40 | $ | 0.34 | |||||||||||||||||||||||||

| Weighted-average shares outstanding | |||||||||||||||||||||||||||||

| Basic | 52,534,787 | 52,336,443 | |||||||||||||||||||||||||||

| Diluted | 53,581,051 | 53,985,385 | |||||||||||||||||||||||||||

|

| Three Months ended March 31, |

| ||||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||

|

|

|

|

|

| ||

Net earnings |

| $ | 18,340 |

| $ | 26,352 |

|

Other comprehensive earnings (loss) |

|

|

|

|

| ||

Unrealized gain (loss) on marketable securities, net of tax |

| 4,585 |

| (1,544 | ) | ||

Other comprehensive earnings (loss) |

| 4,585 |

| (1,544 | ) | ||

|

|

|

|

|

| ||

Comprehensive earnings |

| $ | 22,925 |

| $ | 24,808 |

|

| Three Months ended March 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Net earnings | $ | 21,518 | $ | 18,340 | |||||||||||||||||||||||||

| Other comprehensive (loss) earnings | |||||||||||||||||||||||||||||

| Unrealized (loss) gain on marketable securities, net of tax | (7,583) | 4,585 | |||||||||||||||||||||||||||

| Other comprehensive (loss) earnings | (7,583) | 4,585 | |||||||||||||||||||||||||||

| Comprehensive earnings | $ | 13,935 | $ | 22,925 | |||||||||||||||||||||||||

2019

|

| Common Stock |

| Additional |

| Accumulated Other |

| Retained |

| Total |

| |||||||

|

| Shares |

| Amount |

| Paid-in Capital |

| Earnings (Loss) |

| Earnings |

| Equity |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Balance, December 31, 2018 |

| 52,316,583 |

| $ | 52 |

| $ | 369,637 |

| $ | (3,158 | ) | $ | 86,492 |

| $ | 453,023 |

|

Share-based compensation |

| — |

| — |

| 3,287 |

| — |

| — |

| 3,287 |

| |||||

Exercise of stock options |

| 57,665 |

| — |

| 783 |

| — |

| — |

| 783 |

| |||||

Net earnings |

| — |

| — |

| — |

| — |

| 18,340 |

| 18,340 |

| |||||

Unrealized gains on marketable securities, net of tax |

| — |

| — |

| — |

| 4,585 |

| — |

| 4,585 |

| |||||

Balance, March 31, 2019 |

| 52,374,248 |

| $ | 52 |

| $ | 373,707 |

| $ | 1,427 |

| $ | 104,832 |

| $ | 480,018 |

|

|

| Common Stock |

| Additional |

| Accumulated Other |

| Retained |

| Total |

| |||||||

|

| Shares |

| Amount |

| Paid-in Capital |

| Loss |

| Deficit) |

| Equity |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Balance, December 31, 2017 |

| 51,314,850 |

| $ | 51 |

| $ | 294,999 |

| $ | (747 | ) | $ | (26,823 | ) | $ | 267,480 |

|

Cumulative-effect of adoption of ASC 606 |

| — |

| — |

| — |

| — |

| 2,322 |

| 2,322 |

| |||||

Balance, January 1, 2018 |

| 51,314,850 |

| 51 |

| 294,999 |

| (747 | ) | (24,501 | ) | 269,802 |

| |||||

Share-based compensation |

| — |

| — |

| 2,635 |

| — |

| — |

| 2,635 |

| |||||

Exercise of stock options |

| 319,141 |

| 1 |

| 2,857 |

| — |

| — |

| 2,858 |

| |||||

Equity component of convertible notes, net of tax |

| — |

| — |

| 56,215 |

| — |

| — |

| 56,215 |

| |||||

Purchase of convertible note hedges, net of tax |

| — |

| — |

| (70,137 | ) | — |

| — |

| (70,137 | ) | |||||

Issuance of warrants |

| — |

| — |

| 65,688 |

| — |

| — |

| 65,688 |

| |||||

Net earnings |

| — |

| — |

| — |

| — |

| 26,352 |

| 26,352 |

| |||||

Unrealized loss on marketable securities, net of tax |

| — |

| — |

| — |

| (1,544 | ) | — |

| (1,544 | ) | |||||

Balance, March 31, 2018 |

| 51,633,991 |

| $ | 52 |

| $ | 352,257 |

| $ | (2,291 | ) | $ | 1,851 |

| $ | 351,869 |

|

| j | Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Earnings (Loss) | Retained Earnings | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2019 | 52,533,348 | $ | 53 | $ | 388,410 | $ | 7,417 | $ | 199,548 | $ | 595,428 | ||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 3,988 | — | — | 3,988 | |||||||||||||||||||||||||||||||||||

| Exercise of stock options | 3,811 | — | 32 | — | — | 32 | |||||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | 21,518 | 21,518 | |||||||||||||||||||||||||||||||||||

| Unrealized loss on marketable securities, net of tax | — | — | — | (7,583) | — | (7,583) | |||||||||||||||||||||||||||||||||||

| Balance, March 31, 2020 | 52,537,159 | $ | 53 | $ | 392,430 | $ | (166) | $ | 221,066 | $ | 613,383 | ||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Earnings (Loss) | Retained Earnings | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2018 | 52,316,583 | $ | 52 | $ | 369,637 | $ | (3,158) | $ | 86,492 | $ | 453,023 | ||||||||||||||||||||||||||||||

| Share-based compensation | — | — | 3,287 | — | — | 3,287 | |||||||||||||||||||||||||||||||||||

| Exercise of stock options | 57,665 | — | 783 | — | — | 783 | |||||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | 18,340 | 18,340 | |||||||||||||||||||||||||||||||||||

| Unrealized gain on marketable securities, net of tax | — | — | — | 4,585 | — | 4,585 | |||||||||||||||||||||||||||||||||||

| Balance, March 31, 2019 | 52,374,248 | $ | 52 | $ | 373,707 | $ | 1,427 | $ | 104,832 | $ | 480,018 | ||||||||||||||||||||||||||||||

|

| Three Months ended March 31, |

| ||||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||

Cash flows from operating activities |

|

|

|

|

| ||

Net earnings |

| $ | 18,340 |

| $ | 26,352 |

|

|

|

|

|

|

| ||

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|

| ||

Realized loss on sales of securities |

| (8 | ) | — |

| ||

Depreciation and amortization |

| 1,679 |

| 1,707 |

| ||

Amortization of operating lease assets |

| 879 |

| — |

| ||

Amortization of deferred financing costs and debt discount |

| 3,848 |

| 612 |

| ||

Amortization of premium/discount on marketable securities |

| (1,094 | ) | 89 |

| ||

Non-cash interest expense |

| 1,437 |

| 701 |

| ||

Non-cash royalty revenue |

| (1,576 | ) | (1,300 | ) | ||

Share-based compensation expense |

| 3,287 |

| 2,635 |

| ||

Deferred income tax (benefit) provision |

| 279 |

| (1,120 | ) | ||

Changes in operating assets and liabilities: |

|

|

|

|

| ||

Accounts receivable |

| 23,013 |

| (798 | ) | ||

Inventories |

| (859 | ) | (2,771 | ) | ||

Prepaid expenses and other current assets |

| (1,799 | ) | (62 | ) | ||

Other non-current assets |

| (196 | ) | (342 | ) | ||

Accounts payable |

| 4,045 |

| (3,440 | ) | ||

Accrued product returns and rebates |

| (18,863 | ) | 4,691 |

| ||

Accrued expenses and other current liabilities |

| (3,177 | ) | (1,132 | ) | ||

Income taxes payable |

| 4,856 |

| 327 |

| ||

Other non-current liabilities |

| (1,098 | ) | 984 |

| ||

Net cash provided by operating activities |

| 32,993 |

| 27,133 |

| ||

|

|

|

|

|

| ||

Cash flows from investing activities |

|

|

|

|

| ||

Purchases of marketable securities |

| (150,167 | ) | (57,757 | ) | ||

Sales and maturities of marketable securities |

| 47,143 |

| 7,343 |

| ||

Purchases of property and equipment |

| (221 | ) | (253 | ) | ||

Deferred legal fees |

| (1 | ) | (343 | ) | ||

Net cash used in investing activities |

| (103,246 | ) | (51,010 | ) | ||

|

|

|

|

|

| ||

Cash flows from financing activities |

|

|

|

|

| ||

Proceeds from issuance of convertible notes |

| — |

| 402,500 |

| ||

Convertible notes issuance financing costs |

| — |

| (10,435 | ) | ||

Proceeds from issuance of warrants |

| — |

| 65,688 |

| ||

Purchases of convertible note hedges |

| — |

| (92,897 | ) | ||

Proceeds from issuance of common stock |

| 783 |

| 2,857 |

| ||

Net cash provided by financing activities |

| 783 |

| 367,713 |

| ||

|

|

|

|

|

| ||

Net change in cash and cash equivalents |

| (69,470 | ) | 343,836 |

| ||

Cash and cash equivalents at beginning of year |

| 192,248 |

| 100,304 |

| ||

Cash and cash equivalents at end of period |

| $ | 122,778 |

| $ | 444,140 |

|

|

|

|

|

|

| ||

Supplemental cash flow information |

|

|

|

|

| ||

Cash paid for interest on convertible notes |

| $ | 1,258 |

| $ | — |

|

Income taxes paid |

| $ | 800 |

| $ | 5,623 |

|

Cash paid for amounts included in the measurement of lease liabilities |

|

|

|

|

| ||

Operating cash flows from operating leases |

| $ | 1,313 |

| $ | 1,385 |

|

|

|

|

|

|

| ||

Non-cash investing and financing activities |

|

|

|

|

| ||

Deferred legal fees included in accounts payable and accrued expenses |

| $ | 250 |

| $ | 304 |

|

Lease assets and tenant receivable obtained for new operating leases |

| $ | 17,136 |

| $ | — |

|

| Three Months ended March 31, | |||||||||||||||||

| 2020 | 2019 | ||||||||||||||||

| (unaudited) | |||||||||||||||||

| Cash flows from operating activities | |||||||||||||||||

| Net earnings | $ | 21,518 | $ | 18,340 | |||||||||||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||||||||||||

| Share-based compensation expense | 3,988 | 3,287 | |||||||||||||||

| Depreciation and amortization | 1,732 | 1,679 | |||||||||||||||

| Amortization of premium/discount on marketable securities | (451) | (1,102) | |||||||||||||||

| Amortization of deferred financing costs and debt discount | 4,061 | 3,848 | |||||||||||||||

| Noncash interest expense | 1,366 | 1,437 | |||||||||||||||

| Noncash royalty revenue | (1,567) | (1,576) | |||||||||||||||

| Noncash operating lease cost | 991 | 879 | |||||||||||||||

| Deferred income tax benefit | 538 | 279 | |||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||

| Accounts receivable | (31,823) | 23,013 | |||||||||||||||

| Inventories | 2,210 | (859) | |||||||||||||||

| Prepaid expenses and other current assets | (454) | (1,799) | |||||||||||||||

| Other noncurrent assets | — | (196) | |||||||||||||||

| Accounts payable | (7,017) | 4,045 | |||||||||||||||

| Accrued product returns and rebates | 11,824 | (18,863) | |||||||||||||||

| Accrued expenses and other current liabilities | (3,634) | (3,177) | |||||||||||||||

| Income taxes payable | 6,654 | 4,856 | |||||||||||||||

| Other liabilities | (1,020) | (1,098) | |||||||||||||||

| Net cash provided by operating activities | 8,916 | 32,993 | |||||||||||||||

| Cash flows from investing activities | |||||||||||||||||

| Purchases of marketable securities | (15,382) | (150,167) | |||||||||||||||

| Sales and maturities of marketable securities | 53,357 | 47,143 | |||||||||||||||

| Purchases of property and equipment | (2,537) | (221) | |||||||||||||||

| Deferred legal fees | — | (1) | |||||||||||||||

| Net cash provided by (used in) investing activities | 35,438 | (103,246) | |||||||||||||||

| Cash flows from financing activities | |||||||||||||||||

| Proceeds from issuance of common stock | 32 | 783 | |||||||||||||||

| Net cash provided by financing activities | 32 | 783 | |||||||||||||||

| Net change in cash and cash equivalents | 44,386 | (69,470) | |||||||||||||||

| Cash and cash equivalents at beginning of year | 181,381 | 192,248 | |||||||||||||||

| Cash and cash equivalents at end of period | $ | 225,767 | $ | 122,778 | |||||||||||||

| Supplemental cash flow information | |||||||||||||||||

| Cash paid for interest on convertible notes | $ | 1,258 | $ | 1,258 | |||||||||||||

| Income taxes paid | $ | 324 | $ | 800 | |||||||||||||

| Noncash investing and financing activities | |||||||||||||||||

| Deferred legal fees and fixed assets included in accounts payable and accrued expenses | $ | 708 | $ | 250 | |||||||||||||

| Property and equipment additions from utilization of tenant improvement allowance | $ | — | $ | 282 | |||||||||||||

significant unmet medical needs and market opportunities.

Revenue Recognition

There were no contract assets or liabilities recorded as of March 31, 2019.

other adverse factors.

The Company’s products are distributed through a third party fulfillment center.

Customer orders are generally fulfilled within a few days of receipt, resulting in minimal order backlog. The Company does not adjust revenue for any financing effects, in transactions where the Company expects the period between the transfer of the goods or services and collection to be less than one year. There are no minimum product purchase requirements with customers.

Variabilitydiscounts. These are collectively considered "sales deductions."

are recorded.

Sales deductions are primarily comprised of rebates, product returns and sales discounts.

·

Both types of rebates vary over time.

Becausepharmacies, but as of the end of the reporting period, from the date on which the prescription is filledthis product has not been dispensed to the date the Company receives and pays the invoice varies, thea patient.

The sensitivity of the Company’s estimates can vary by program and by type of customer. If actual rebates vary from estimated amounts, the Company may need to adjust the balances of such accrued rebates to reflect actual expenditures with respect to these programs. These changes could materially affect net product sales and earnings in the period of adjustment.rates under each specific program. The Company records an estimated liability for rebates at the time the customer takes title to the product (i.e., at the time of sale to wholesalers/distributors), and records this liability as a reduction to gross product sales andsales. This liability is recorded as an increase in

·liabilities on our condensed consolidated balance sheets.

The Company estimates the liability for returns based on the actual returns experience for its two commercial products, in conjunction with industry experience for return of similar products (i.e., ambient temperature storage for oral formulations). Because the Company’s products have not reached maturity, the return rate of its products has and is expected to continue to vary.

liabilities on our condensed consolidated balance sheets. The Company’s estimatedCompany estimates the liability for product returns is also affected by price increases taken subsequent tobased primarily on the date of sale. Theactual returns experience for its 2 commercial products.

· Those adjustments may be material to our financial results.

The Company accounts for these discounts at the time of sale, as a reduction to gross product sales, and records these amountsdiscounts as an a valuation allowance against

Customer orders are generally fulfilled within a few days of receipt, resulting in minimal order backlog. Open purchase orders for products from customers are expected to be fulfilled within

condensed consolidated balance sheets.

Company and its licensee.

Revenue associated with future milestones will be recognized when the related event occurs or sales-based target is achieved.

Consequent to this agreement, the Company recorded a nonrecourse liability related to this transaction, and amortizes this amount as noncash royalty revenue.

Preclinical Studyagreements.

Development Expense and Related Accrued Research and Development Expenses

Self-insurance Liabilities

As

The Company recorded self-insurance liability of approximately $515,000U.S. Treasury Note rate, as of March 31, 2019 in Accrued expenses and other current liabilities in the condensed consolidated balance sheets.

week the award is issued, with a term that most closely resembles the expected term of the award.

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016-02, “Leases (Topic 842)” and its related amendments (New Lease Standard). The New Lease Standard requires a lessee to recognize a right-of-use (ROU) lease asset and a corresponding lease liability on the balance sheet. The Company adopted the New Lease Standard on January 1, 2019 using the modified retrospective method, which applies the provision of the New Lease Standard at the effective date without adjusting comparative periods presented. In addition, the Company elected the package of practical expedients permitted under the transition guidance within the New Lease Standard which, among other things, allowed the Company to carry forward the historical lease classification.

The adoption of the New Lease Standard resulted in the recognition of lease assets and lease liabilities for operating leases as of January 1, 2019 of approximately $4.0 million. Financial reporting for periods on or after January 1, 2019 are presented under the new guidance. Prior period amounts are not adjusted and continue to be reported in accordance with previous guidance. The standard did not materially impact the Company’s condensed consolidated net earnings and had no impact on cash flows (see Note 14, Leases).

New Accounting Pronouncements Not Yet Adopted

In June 2016, the FASB issued

| Three Months ended March 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Net product sales | |||||||||||||||||||||||||||||

| Trokendi XR | $ | 68,551 | $ | 63,693 | |||||||||||||||||||||||||

| Oxtellar XR | 23,939 | 19,406 | |||||||||||||||||||||||||||

| Total net product sales | $ | 92,490 | $ | 83,099 | |||||||||||||||||||||||||

| Royalty revenues | 2,486 | 2,375 | |||||||||||||||||||||||||||

| Total revenues | $ | 94,976 | $ | 85,474 | |||||||||||||||||||||||||

3.multi-year period. However, in the first quarter of 2020, the return rate for the final blister pack lots of Trokendi XR produced in 2017 exhibited a return rate significantly higher than had been experienced with all previous lots. The lots for which a higher return rate was observed are the last lots which were produced and distributed.

·

·

·

| Fair Value Measurements at March 31, 2020 (unaudited) | |||||||||||||||||||||||

| Total Fair Value at March 31, 2020 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | |||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Cash and cash equivalents | |||||||||||||||||||||||

| Cash | $ | 19,911 | $ | 19,911 | $ | — | |||||||||||||||||

| Money market funds | 205,856 | 205,856 | |||||||||||||||||||||

| Marketable securities | |||||||||||||||||||||||

| Corporate debt securities | 174,939 | — | 174,939 | ||||||||||||||||||||

| Municipal debt securities | 165 | — | 165 | ||||||||||||||||||||

| Long term marketable securities | |||||||||||||||||||||||

| Corporate debt securities | 524,683 | 255 | 524,428 | ||||||||||||||||||||

| U.S. government agency debt securities | 10,029 | — | 10,029 | ||||||||||||||||||||

| Other noncurrent assets | |||||||||||||||||||||||

| Marketable securities - restricted (SERP) | 342 | 8 | 334 | ||||||||||||||||||||

| Total assets at fair value | $ | 935,925 | $ | 226,030 | $ | 709,895 | |||||||||||||||||

| Fair Value Measurements at December 31, 2019 (unaudited) | |||||||||||||||||||||||

| Total Fair Value at December 31, 2019 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | |||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Cash and cash equivalents | |||||||||||||||||||||||

| Cash | $ | 78,912 | $ | 78,912 | $ | — | |||||||||||||||||

| Money market funds | 102,469 | 102,469 | — | ||||||||||||||||||||

| Marketable securities | |||||||||||||||||||||||

| Corporate debt securities | 165,527 | — | 165,527 | ||||||||||||||||||||

| Municipal debt securities | 165 | — | 165 | ||||||||||||||||||||

| Long term marketable securities | |||||||||||||||||||||||

| Corporate debt securities | 571,828 | 254 | 571,574 | ||||||||||||||||||||

| U.S. government agency and municipal debt securities | 19,945 | — | 19,945 | ||||||||||||||||||||

| Other noncurrent assets | |||||||||||||||||||||||

| Marketable securities - restricted (SERP) | 418 | 3 | 415 | ||||||||||||||||||||

| Total assets at fair value | $ | 939,264 | $ | 181,638 | $ | 757,626 | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | ||||||||||

| (unaudited) | |||||||||||

| Corporate and U.S. government agency and municipal debt securities | |||||||||||

| Amortized cost | $ | 710,072 | $ | 747,598 | |||||||

| Gross unrealized gains | 5,362 | 10,031 | |||||||||

| Gross unrealized losses | (5,618) | (164) | |||||||||

| Total fair value | $ | 709,816 | $ | 757,465 | |||||||

| March 31, 2020 | |||||

| (unaudited) | |||||

| Less than 1 year | $ | 175,104 | |||

| 1 year to 2 years | 181,141 | ||||

| 2 years to 3 years | 199,207 | ||||

| 3 years to 4 years | 154,364 | ||||

| Greater than 4 years | — | ||||

| Total | $ | 709,816 | |||

|

| March 31, 2019 |

| December 31, 2018 |

| ||||||||

|

| (unaudited) |

|

|

|

|

| ||||||

|

| Carrying Value |

| Fair Value |

| Carrying Value |

| Fair Value |

| ||||

2023 Notes |

| $ | 333,310 |

| $ | 388,664 |

| $ | 329,462 |

| $ | 375,834 |

|

thousands):

| March 31, 2020 | December 31, 2019 | ||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||

| Carrying Value | Fair Value (Level 2) | Carrying Value | Fair Value (Level 2) | ||||||||||||||||||||||||||||||||

| 2023 Notes | $ | 349,232 | $ | 328,038 | $ | 345,170 | $ | 366,023 | |||||||||||||||||||||||||||

Unrestricted available-for-sale marketable securities held by the Company are as follows, in thousands of dollars:

|

| March 31, 2019 |

| December 31, 2018 |

| ||

|

| (unaudited) |

|

|

| ||

Corporate and government debt securities |

|

|

|

|

| ||

Amortized cost |

| $ | 690,853 |

| $ | 586,726 |

|

Gross unrealized gains |

| 2,905 |

| 55 |

| ||

Gross unrealized losses |

| (1,042 | ) | (4,213 | ) | ||

Total fair value |

| $ | 692,716 |

| $ | 582,568 |

|

The contractual maturities of the unrestricted available-for-sale marketable securities held by the Company are as follows, in thousands of dollars:

|

| March 31, |

| |

|

| 2019 |

| |

|

| (unaudited) |

| |

|

|

|

| |

Less than 1 year |

| $ | 170,165 |

|

1 year to 2 years |

| 170,246 |

| |

2 years to 3 years |

| 181,872 |

| |

3 years to 4 years |

| 170,433 |

| |

Greater than 4 years |

| — |

| |

Total |

| $ | 692,716 |

|

The Company has not experienced any other-than-temporary losses on its marketable securities.

4. Inventories

Inventories consist of the following, in thousands of dollars:

|

| March 31, |

| December 31, |

| ||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

|

|

| ||

|

|

|

|

|

| ||

Raw materials |

| $ | 5,377 |

| $ | 5,742 |

|

Work in process |

| 5,661 |

| 7,275 |

| ||

Finished goods |

| 15,480 |

| 12,642 |

| ||

Total |

| $ | 26,518 |

| $ | 25,659 |

|

traders.

Property and equipment consists of the following, in thousands of dollars:

|

| March 31, |

| December 31, |

| ||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

|

|

| ||

|

|

|

|

|

| ||

Lab equipment and furniture |

| $ | 9,056 |

| $ | 8,995 |

|

Leasehold improvements |

| 3,014 |

| 2,731 |

| ||

Software |

| 2,197 |

| 2,181 |

| ||

Computer equipment |

| 1,313 |

| 1,313 |

| ||

Construction-in-progress |

| 238 |

| 94 |

| ||

|

| 15,818 |

| 15,314 |

| ||

Less accumulated depreciation and amortization |

| (11,592 | ) | (11,219 | ) | ||

Total |

| $ | 4,226 |

| $ | 4,095 |

|

Depreciation and amortization expense on property and equipment was approximately $0.4 million for both three month periods ended March 31, 2019 and 2018.

The Company performs its annual impairment assessment in the fourth quarter, or earlier if impairment indicators exist. As of March 31, 2019, there were no identified indicators of impairment.

6. Intangible Assets

Intangible assets consist of patent defense costs, which are legal fees incurred in conjunction with defending patents for Oxtellar XR and Trokendi XR. The Company amortizes those costs over the useful life of the respective patents.

The following sets forth the gross carrying amount and related accumulated amortization of the intangible assets, in thousands of dollars:

|

| Weighted- |

| March 31, |

| December 31, |

| ||

|

| Average Life |

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||||

|

|

|

|

|

|

|

| ||

Capitalized patent defense costs |

| 3.75 - 8.00 years |

| $ | 44,725 |

| $ | 44,724 |

|

Less accumulated amortization |

|

|

| (14,662 | ) | (13,356 | ) | ||

Total |

|

|

| $ | 30,063 |

| $ | 31,368 |

|

Amortization expense on intangible assets was approximately $1.3 million for both three month periods ended March 31, 2019 and 2018.

The Company performs its annual impairment assessment in the fourth quarter, or earlier, if impairment indicators exist. As of March 31, 2019, there were no identified indicators of impairment.

7. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consist of the following, in thousands of dollars:

|

| March 31, |

| December 31, |

| ||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

|

|

| ||

|

|

|

|

|

| ||

Accrued clinical trial and clinical supply costs |

| $ | 15,420 |

| $ | 14,034 |

|

Accrued compensation |

| 11,545 |

| 13,546 |

| ||

Accrued professional fees |

| 3,336 |

| 3,706 |

| ||

Accrued interest expense |

| — |

| 650 |

| ||

Accrued product costs |

| 751 |

| 38 |

| ||

Lease liabilities, current |

| 3,250 |

| — |

| ||

Other accrued expenses |

| 2,305 |

| 4,561 |

| ||

Total |

| $ | 36,607 |

| $ | 36,535 |

|

8. Accrued Product Returns and Rebates

Accrued product returns and rebates consist of the following, in thousands of dollars:

|

| March 31, |

| December 31, |

| ||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

|

|

| ||

|

|

|

|

|

| ||

Accrued rebates |

| $ | 66,090 |

| $ | 85,003 |

|

Accrued product returns |

| 22,110 |

| 22,060 |

| ||

Total |

| $ | 88,200 |

| $ | 107,063 |

|

9. Convertible Senior Notes Due 2023

The total principal amount of 2023 Notes is $402.5 million.

noteholders may require the Company to repurchase their 2023 Notes at a cash repurchase price equal to the principal amount of the 2023 Notes to be repurchased, plus accrued and unpaid interest, if any.

adjustment.

|

| March 31, |

| December 31, |

| ||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

|

|

| ||

Principal amount of the 2023 Notes |

| $ | 402,500 |

| $ | 402,500 |

|

Debt discount |

| (76,434 | ) | (76,434 | ) | ||

Deferred financing costs |

| (8,452 | ) | (8,452 | ) | ||

Accretion of debt discount and deferred financing costs |

| 15,696 |

| 11,848 |

| ||

Total carrying value |

| $ | 333,310 |

| $ | 329,462 |

|

Nothousands):

| March 31, 2020 | December 31, 2019 | ||||||||||

| (unaudited) | |||||||||||

| 2023 Notes | $ | 402,500 | $ | 402,500 | |||||||

| Unamortized debt discount and deferred financing costs | (53,268) | (57,330) | |||||||||

| Total carrying value | $ | 349,232 | $ | 345,170 | |||||||

10. Other Expenses

Other expenses consist of the following, in thousands of dollars:

|

| Three Months ended March 31, |

| ||||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||

|

|

|

|

|

| ||

Interest income |

| $ | 4,681 |

| $ | 1,206 |

|

Interest expense |

| (4,710 | ) | (717 | ) | ||

Interest expense-nonrecourse liability related to sale of future royalties |

| (1,160 | ) | (701 | ) | ||

|

|

|

|

|

| ||

Total |

| $ | (1,189 | ) | $ | (212 | ) |

Interest expense includes non-cash interest expense relates to amortization of deferred financing costs and debt discount in the amount of $3.8 million and $0.6 million for the three month periods ended March2020 or December 31, 2019 and 2018, respectively.

11.2019.

| Three Months ended March 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Research and development | $ | 681 | $ | 574 | |||||||||||||||||||||||||

| Selling, general and administrative | 3,307 | 2,713 | |||||||||||||||||||||||||||

| Total | $ | 3,988 | $ | 3,287 | |||||||||||||||||||||||||

|

| Number of |

| Weighted- |

| Weighted- |

| |

|

|

|

|

|

|

|

| |

Outstanding, December 31, 2018 |

| 3,916,963 |

| $ | 19.98 |

| 7.10 |

|

Granted (unaudited) |

| 831,835 |

| $ | 36.75 |

|

|

|

Exercised (unaudited) |

| (57,665 | ) | $ | 13.57 |

|

|

|

Forfeited (unaudited) |

| (10,437 | ) | $ | 30.69 |

|

|

|

Outstanding, March 31, 2019 (unaudited) |

| 4,680,696 |

| $ | 23.01 |

| 7.40 |

|

|

|

|

|

|

|

|

| |

As of December 31, 2018: |

|

|

|

|

|

|

| |

Vested and expected to vest |

| 3,916,963 |

| $ | 19.98 |

| 7.10 |

|

Exercisable |

| 1,889,947 |

| $ | 12.47 |

| 5.96 |

|

|

|

|

|

|

|

|

| |

As of March 31, 2019: |

|

|

|

|

|

|

| |

Vested and expected to vest (unaudited) |

| 4,680,696 |

| $ | 23.01 |

| 7.40 |

|

Exercisable (unaudited) |

| 2,605,591 |

| $ | 15.33 |

| 6.22 |

|

12.

| Number of Options | Weighted- Average Exercise Price (per share) | Weighted- Average Remaining Contractual Term (in years) | |||||||||||||||

| Outstanding, December 31, 2019 | 4,606,559 | $ | 23.05 | 6.66 | |||||||||||||

| Granted | 1,105,925 | $ | 23.99 | ||||||||||||||

| Exercised | (3,811) | $ | 8.33 | ||||||||||||||

| Forfeited | (25,275) | $ | 28.12 | ||||||||||||||

| Outstanding, March 31, 2020 (unaudited) | 5,683,398 | $ | 23.22 | 7.08 | |||||||||||||

| As of December 31, 2019: | |||||||||||||||||

| Vested and expected to vest | 4,606,559 | $ | 23.05 | 6.66 | |||||||||||||

| Exercisable | 2,598,112 | $ | 15.68 | 5.48 | |||||||||||||

| As of March 31, 2020: | |||||||||||||||||

| Vested and expected to vest | 5,683,398 | $ | 23.22 | 7.08 | |||||||||||||

| Exercisable | 3,394,315 | $ | 18.71 | 5.75 | |||||||||||||

|

| Three Months ended March 31, |

| ||

|

| 2019 |

| 2018 |

|

|

| (unaudited) |

| ||

|

|

|

|

|

|

Warrants to purchase common stock |

| 7,966,488 |

| 1,752,793 |

|

Convertible notes |

| 239,272 |

| 22,634 |

|

Convertible notes hedges |

| 240 |

| 23 |

|

Stock options, SAR and ESPP awards |

| 608,948 |

| 208,661 |

|

anti-dilutive:

| Three Months ended March 31, | ||||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||

| Stock options, RSUs, PSUs | 3,034,099 | 608,948 | ||||||||||||||||||||||||

|

| Three Months ended March 31, |

| ||||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||

|

|

|

|

|

| ||

Numerator, in thousands: |

|

|

|

|

| ||

Net earnings used for calculation of basic and diluted EPS |

| $ | 18,340 |

| $ | 26,352 |

|

|

|

|

|

|

| ||

Denominator: |

|

|

|

|

| ||

Weighted average shares outstanding, basic |

| 52,336,443 |

| 51,536,474 |

| ||

|

|

|

|

|

| ||

Effect of dilutive potential common shares: |

|

|

|

|

| ||

Stock options and SAR |

| 1,648,942 |

| 2,251,872 |

| ||

Total dilutive potential common shares |

| 1,648,942 |

| 2,251,872 |

| ||

Weighted average shares outstanding, diluted |

| 53,985,385 |

| 53,788,346 |

| ||

|

|

|

|

|

| ||

Earnings per share, basic |

| $ | 0.35 |

| $ | 0.51 |

|

Earnings per share, diluted |

| $ | 0.34 |

| $ | 0.49 |

|

13.amounts):

| Three Months ended March 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Numerator, dollars in thousands: | |||||||||||||||||||||||||||||

| Net earnings | $ | 21,518 | $ | 18,340 | |||||||||||||||||||||||||

| Denominator: | |||||||||||||||||||||||||||||

| Weighted average shares outstanding, basic | 52,534,787 | 52,336,443 | |||||||||||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||||||||

| Stock options, PSU, RSU and SAR | 1,046,264 | 1,648,942 | |||||||||||||||||||||||||||

| Weighted average shares outstanding, diluted | 53,581,051 | 53,985,385 | |||||||||||||||||||||||||||

| Earnings per share, basic | $ | 0.41 | $ | 0.35 | |||||||||||||||||||||||||

| Earnings per share, diluted | $ | 0.40 | $ | 0.34 | |||||||||||||||||||||||||

Tax Expense

|

| Three Months ended March 31, |

| ||||

|

| 2019 |

| 2018 |

| ||

|

| (unaudited) |

| ||||

|

|

|

|

|

| ||

Income tax expense |

| $ | 5,899 |

| $ | 4,830 |

|

Effective tax rate |

| 24.34 | % | 15.49 | % | ||

The income tax expense for the three month period ended March 31, 2019 was attributable to U.S. federal and state income taxes.

For the three month periodmonths ended March 31, 2020 and 2019, the Company recorded $5.9 million of income tax expense, an increase from $4.8 million as compared to the same period of 2018. (dollars in thousands):

| Three Months ended March 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||

| Income tax expense | $ | 7,516 | $ | 5,899 | |||||||||||||||||||||||||

| Effective tax rate | 25.9 | % | 24.3 | % | |||||||||||||||||||||||||

The Company recorded income tax benefits relatedthe more significant provisions which are expected to exercisesimpact the

14. Leases

does not expect interest expense to be limited. The Company determines if an arrangement is a lease at inception. Some leases include options to terminate or to extend for one or more years. These options are included in the lease term when it is reasonably certain that the option will be exercised.

The Company has lease arrangements that contain lease components (e.g., minimum rent payments) and non-lease components (e.g., maintenance, labor charges, etc.) and accounts for these components as a single lease component. The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

Operating leases are included in Lease assets, Accrued expenses and other current liabilities, and Lease liabilities, long term on the condensed consolidated balance sheets. Operating lease assets and lease liabilities are recognized at the commencement date, based on the present valueultimate impact of the future minimum lease payments overCARES Act may differ from this estimate due to changes in interpretations and assumptions, guidance that may be issued and actions the lease term. Lease expense for operating leasesCompany may take in response to the CARES Act. The CARES Act is recognized as an operating cost.highly detailed and the Company will continue to assess the impact that various provisions will have on its business.

arrangement, the Company applies a portfolio approach to effectively account for the operating lease assets and liabilities.

Lease assets, lease-related assets and

| March 31, 2020 | December 31, 2019 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Lease assets | $ | 21,911 | $ | 21,279 | |||||||

| Liabilities | |||||||||||

| Accrued expenses and other current liabilities | |||||||||||

| Lease liabilities, current | $ | 3,456 | $ | 2,825 | |||||||

| Non-current | |||||||||||

| Lease liabilities, long term | 30,804 | 30,440 | |||||||||

| Total lease liabilities | $ | 34,260 | $ | 33,265 | |||||||

| Weighted-average remaining lease term (years) | 12.1 | 12.5 | |||||||||

| Weighted-average discount rate | 4.3 | % | 4.4 | % | |||||||

|

|

|

| March 31, |

| |

|

|

|

| 2019 |

| |

|

|

|

| (unaudited) |

| |

Assets |

| Balance Sheet Classification |

|

|

| |

Operating leases |

| Lease assets |

| $ | 20,049 |

|

Tenant receivable |

| Prepaid expenses and other current assets |

| 10,151 |

| |

Total lease and lease-related assets |

|

|

| $ | 30,200 |

|

|

|

|

|

|

| |

Liabilities |

|

|

|

|

| |

Current |

|

|

|

|

| |

Operating leases |

| Accrued expenses and other current liabilities |

| $ | 3,250 |

|

Non-current |

|

|

|

|

| |

Operating leases |

| Lease liabilities, long term |

| 27,824 |

| |

Total lease liabilities |

|

|

| $ | 31,074 |

|

Lease costs for the three month period ended March 31, 2019thousands):

| Three Months ended March 31, | |||||||||||||||||||||||||||||||||||

| 2020 | 2019 | ||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||

| Fixed lease cost | $ | 1,497 | $ | 1,032 | |||||||||||||||||||||||||||||||

| Variable lease cost | 627 | 465 | |||||||||||||||||||||||||||||||||

| Total operating lease cost | $ | 2,124 | $ | 1,497 | |||||||||||||||||||||||||||||||

|

| Three Months ended |

| |

|

| March 31, 2019 |

| |

|

| (unaudited) |

| |

|

|

|

| |

Operating leases cost |

|

|

| |

Fixed lease cost |

| $ | 1,032 |

|

Variable lease cost |

| 465 |

| |

Total operating leases cost |

| $ | 1,497 |

|

Weighted average lease term and discount rate for the three month period ended March 31, 2019 are as follows:

| |||

| |||

| |||

| |||

|

| ||

| |||

|

|

|

thousands):

| Three Months ended March 31, | |||||||||||||||||

| 2020 | 2019 | ||||||||||||||||

| (unaudited) | |||||||||||||||||

| Cash paid for operating leases | $ | 1,261 | $ | 1,313 | |||||||||||||

| Lease assets and tenant receivables obtained for new operating leases | $ | 1,715 | $ | 17,136 | |||||||||||||

| 2020 (remaining) | $ | 3,672 | |||

| 2021 | 4,760 | ||||

| 2022 | 4,226 | ||||

| 2023 | 2,537 | ||||

| 2024 | 2,587 | ||||

| Thereafter | 26,784 | ||||

| Total future minimum lease payments | $ | 44,566 | |||

Less: Imputed interest (1) | (10,306) | ||||

| Present value of lease liabilities | $ | 34,260 | |||

|

| Operating leases |

| |

Year ending December 31: |

|

|

| |

2019 (remaining) |

| $ | 2,512 |

|

2020 |

| 2,938 |

| |

2021 |

| 2,527 |

| |

2022 |

| 2,486 |

| |

2023 |

| 2,536 |

| |

Thereafter |

| 29,371 |

| |

Total future minimum lease payments |

| $ | 42,370 |

|

Less: Imputed interest (1) |

| 11,296 |

| |

Present value of lease liabilities |

| $ | 31,074 |

|

(1)Calculated using the interest rate for each lease.

Year ending December 31: 2019 $ 3,400 2020 2,287 Thereafter 1,840 Total $ 7,527 Three Months ended March 31, 2019 2018 (unaudited) Net product sales Trokendi XR $ 63,693 $ 70,555 Oxtellar XR 19,406 18,565 Total net product sales 83,099 89,120 Royalty revenues 2,375 1,309 Total revenues $ 85,474 $ 90,429 Trokendi XR. The Company agreement. February 28, 2020. have access to liquidity. product candidates and proprietary drug technologies. We expect to incur significant expenses as we: invest in research and development related to the continued development of each of our product candidates through intellectual property portfolio. We believe a once-daily dosing regimen improves compliance, making it more probable that patients take their medication and maintain sufficient levels of medication in their bloodstream. Trokendi XR's unique smooth pharmacokinetic profile results in lower peak plasma concentrations, higher trough plasma concentrations, and slower plasma uptake rates. This results in smoother and more consistent plasma concentrations than immediate release topiramate formulations. We believe that such a profile mitigates blood level fluctuations that are frequently associated with many side effects, thereby reducing the likelihood of breakthrough seizures or migraine headaches that patients can suffer when taking immediate release products. Side effects associated with immediate release products may lead patients to skip doses, which could place them at higher risk for breakthrough seizures or migraine headaches. FDA. Candidate U.S. product profile. 2021. completed. incurred, with minimal adjustments to expense in the subsequent periods. 2019 The following table provides information regarding our revenues during the periods indicated, Three Months ended March 31, Increase Percent 2019 2018 (Decrease) Change (%) Net product sales Trokendi XR $ 63,693 $ 70,555 $ (6,862 ) -10 % Oxtellar XR 19,406 18,565 841 5 % Total net product sales 83,099 89,120 (6,021 ) -7 % Royalty revenues 2,375 1,309 1,066 81 % Total revenues $ 85,474 $ 90,429 $ (4,955 ) -5 % for the three months ended March 31, 2020 as compared to the prior year, is primarily due to the favorable impact of the 8% price increase taken January 1, 2020, favorable unit prescription growth for Oxtellar XR and the adverse impact of the pipeline inventory reduction in 2019. These effects were partially offset by unfavorable changes in net sales deductions. This sales. Accrued Liabilities Product Allowance for Rebates Returns Sales Discounts Total Balance at December 31, 2018 $ 85,003 $ 22,060 $ 11,548 $ 118,611 Provision Provision for sales in current year 63,941 1,724 11,214 76,879 Adjustments relating to prior year sales (844 ) (42 ) (43 ) (929 ) Total provision $ 63,097 $ 1,682 $ 11,171 $ 75,950 Less: Actual payments/credits (82,010 ) (1,632 ) (14,909 ) (98,551 ) Balance at March 31, 2019 $ 66,090 $ 22,110 $ 7,810 $ 96,010 Accrued Liabilities Product Allowance for Rebates Returns Sales Discounts Total Balance at December 31, 2017 $ 49,460 $ 18,883 $ 8,892 $ 77,235 Provision Provision for sales in current year 53,837 2,354 12,208 68,399 Adjustments relating to prior year sales (1,681 ) 29 (3 ) (1,655 ) Total provision $ 52,156 $ 2,383 $ 12,205 $ 66,744 Less: Actual payments/credits (49,086 ) (762 ) (11,739 ) (61,587 ) Balance at March 31, 2018 $ 52,530 $ 20,504 $ 9,358 $ 82,392 2020. This increase was driven by prescription volume growth. Supernus records noncash royalty based on these product sales. Goods Sold Three Months ended March 31, Percent 2019 2018 Increase Change (%) Cost of product sales $ 3,684 $ 3,278 $ 406 12 % year over year increase in prescriptions, as well as the aforementioned reduction in channel level inventory which occurred in the first quarter of 2019. Three Months ended March 31, Percent 2019 2018 Decrease Change (%) Research and development $ 15,394 $ 18,908 $ (3,514 ) -19 % 2019. Three Months ended March 31, Percent 2019 2018 Increase Change (%) Selling and marketing $ 30,749 $ 26,676 $ 4,073 15 % General and administrative 10,219 10,173 46 0 % Total $ 40,968 $ 36,849 $ 4,119 11 % $1.0 million. higher occupancy-related costs, and $0.9 million increase in professional and consulting fees. Income (Expense) Three Months ended March 31, Percent 2019 2018 Increase Change (%) Interest income $ 4,681 $ 1,206 $ 3,475 288 % Interest expense (4,710 ) (717 ) 3,993 557 % Interest expense-nonrecourse liability related to sale of future royalties (1,160 ) (701 ) 459 65 % Total $ (1,189 ) $ (212 ) Three Months ended March 31, Percent 2019 2018 Increase Change (%) Income tax expense $ 5,899 $ 4,830 $ 1,069 22 % Effective tax rate 24.34 % 15.49 % Oxtellar XR. We were cash flow positive and profitable from operations in 2019. initiatives. We will continue to actively manage our capital structure and to consider all financing opportunities that could strengthen our long-term financial profile. Any such capital raises may or may not be similar to transactions in which we have engaged in the past. There can be no assurance that any such financing opportunities will be available on acceptable terms, if at all. Three Months ended March 31, Increase 2019 2018 (Decrease) Net cash provided by (used in): Operating activities Operating earnings $ 27,071 $ 29,676 $ (2,605 ) Working capital 5,922 (2,543 ) 8,465 Total operating activities 32,993 27,133 5,860 Investing activities (103,246 ) (51,010 ) (52,236 ) Financing activities 783 367,713 (366,930 ) Net (decrease) increase in cash and cash equivalents $ (69,470 ) $ 343,836 $ (413,306 ) settlement of payables, as described below. Three Months ended March 31, 2019 2018 Explanation of Change (Increase) Decrease in: Accounts receivable $ 23,013 $ (798 ) Timing of cash collections; decreased receivables due to higher fourth quarter of 2018 sales as a result of higher fourth quarter of 2018 channel inventory levels. Inventories (859 ) (2,771 ) Increased inventory volume to support increased product demand. Prepaid expenses, other current assets and other non-current assets (1,995 ) (404 ) Timing differences related to deposit for equipment purchase; progress of clinical trials. Increase (Decrease) in: Accounts payable and accrued other non-current liabilities 868 (4,572 ) Timing of vendor payments. Accrued product returns and rebates (18,863 ) 4,691 Increased provision directly related to growth in prescriptions, the growth in Medicaid rebates consequent taking price increases and higher levels of patient co-pay assistance. Income taxes payable 4,856 327 Timing of income tax payments. Other (1,098 ) 984 Timing of compensation payments. $ 5,922 $ (2,543 ) thousands): 2019. 2020, subject to certain conditions, including the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and other customary conditions. 31.2 32.1 32.2 The cover page of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, formatted in Inline XBRL DATED: May By: /s/ Jack A. Khattar Jack A. Khattar /s/ Gregory S. Patrick Gregory S. PatrickDislcosure Related to Periods Prior to Adoption leased vehicles for the years ended December 31, 2018, 2017 and 2016 was2019, the Company recorded allowances of approximately $3.6 million, $2.7$10.3 million and $2.7$11.0 million, respectively.Future minimum lease payments under non-cancelable operating leases as of December 31, 2018 are as follows, in thousands of dollars:15. Accounts ReceivableThe Company recorded an allowance of approximately $7.8 million and $11.5 millionrespectively, for expected sales discounts and allowances related to prompt pay discounts and contractual service fees for service arrangements withpaid to the Company’s customers, who are primarily pharmaceutical wholesalers and distributors, ascustomers.March 31,

2020December 31,

2019(unaudited) Raw materials $ 4,331 $ 4,582 Work in process 8,221 11,428 Finished goods 11,866 10,618 Total $ 24,418 $ 26,628 20192020 and December 31, 2018, respectively.16. Disaggregated RevenuesThe following table summarizes2019, the disaggregation of revenues by nature, in thousands of dollars:The majorityCompany did not capitalize any pre-launch inventory costs.Company’s product sales are with pharmaceutical wholesalersfollowing (dollars in thousands):March 31,

2020December 31,

2019(unaudited) Lab equipment and furniture $ 11,538 $ 11,053 Leasehold improvements 14,974 14,217 Software 2,225 2,225 Computer equipment 2,013 1,839 Construction-in-progress 431 433 31,181 29,767 Less accumulated depreciation and amortization (13,170) (12,699) Total $ 18,011 $ 17,068 distributors who, in turn, sell the products to chainamortization expense on property and independent pharmacies, hospitalsequipment was approximately $0.5 million and other customers. Three pharmaceutical wholesalers/distributors collectively accounted for more than 90% of the Company’s total net product sales and accounts receivables as of and$0.4 million for the three month periodsmonths ended March 31, 2020 and 2019, respectively.2018.recognized non-cash royalty revenueamortizes these costs over the useful life of $1.6the respective patents.Weighted-

Average Life

(Years)March 31,

2020December 31,

2019(unaudited) Capitalized patent defense costs 2.76 - 7.01 years $ 43,375 $ 43,375 Less accumulated amortization (19,796) (18,535) Total $ 23,579 $ 24,840 and $1.3 for theboth three month periods ended March 31, 2020 and 2019, respectively.2018, respectively.Other Current LiabilitiesMarch 31,

2020December 31,

2019(unaudited) $ 11,224 $ 13,285 Accrued compensation 9,549 11,223 Accrued professional fees 4,706 3,936 Lease liabilities, current 3,456 2,825 Other accrued expenses 4,068 5,861 Total $ 33,003 $ 37,130 No milestone revenue was recordedMarch 31,

2020December 31,

2019(unaudited) Accrued product rebates $ 94,612 $ 88,811 Accrued product returns 24,841 18,818 Total $ 119,453 $ 107,629 Three Months ended March 31, 2020 2019 (unaudited) Interest income $ 5,777 $ 4,681 Interest expense (4,693) (4,710) Interest expense on nonrecourse liability related to sale of future royalties (1,062) (1,160) Total $ 22 $ (1,189) month periodsmonths ended March 31, 2020 and 2019, and 2018, respectively.For the three month period ended March 31, 2019, revenues recognized from performance obligations related to prior periods (e.g., due to changes in transaction price) were not material in the aggregate to Net Product Sales and Royalty Revenues.certaindefined milestones. TheIf these products are ultimately commercialized, the Company is also obligated to pay royalties to third parties, as percentage of net product sales, for each respective product under a license agreement, if these products are ultimately commercialized.a $30.0 million payment pursuant to a Royalty Interest Acquisition Agreement related to the purchase by HC Royalty of certain of the Company’s rights under the Company’s agreement with United Therapeutics, related to the commercialization of Orenitram (treprostinil) Extended-Release Tablets. The Company will retain fullFull ownership of the royalty rights will revert to the Company if and when a certain cumulative payment threshold is reached, per the terms of the agreement.agreement (see Note 2, Note 3 and Note 16).recordedwill bear all development costs incurred by either the Company or Navitor up to a non-recourse liability relatedmaximum of $50 million. The Development Agreement provides Navitor an option to request that the Company pay certain development costs in excess of $50 million once expenses reach this threshold and grants the Company a right of first refusal to negotiate for rights to develop and commercialize any composition of matter that has a similar mechanism of action as NV-5138.amortizes this amount as non-cash royalty revenue.other customary conditions.also recognizes non-cash interest expense relatedis currently reviewing the details of this Notice Letter and intends to this liability and accrues at an effective interest rate. That rate is determined based on projectionsvigorously enforce its intellectual property rights relating to Oxtellar XR.20182019 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 1, 2019.diseasesdiseases. We have a portfolio of commercial products and product candidates.neurologytreatment-resistant depression.psychiatry.We market twoPurchase Agreement to acquire the CNS portfolio of US WorldMeds Partners, LLC. With the acquisition, the Company will add three established, marketed products Oxtellar XR and Trokendi XR,a product candidate in late-stage development to its portfolio.United States (U.S.). WeSPN-812 adult trial; adverse impact on selling and marketing efforts as a result of temporarily halting in-person interactions by our sales force with healthcare providers; adverse impact on net product sales as a result of decreased new prescriptions due to fewer patient visits to physician’s offices to begin or to maintain treatment; potential changes in payer segment mix; and increased use of co-pay programs due to rising unemployment. Financial effects could include impairment of intangible and long-lived assets, increased reserves for sales deductions that could impact our net product sales; and adjustments for market volatility for items subject to fair value measurement, such as marketable securities.throughit has also not negatively impacted our own sales force and seek strategic collaborations with other pharmaceutical companiesliquidity position in a material way. We expect to commercializecontinue to generate cash flows to meet our products outside of the U.S. via license agreements.In addition, we are developing multiple proprietary product candidates in the CNS market to address significant unmet medicalshort-term liquidity needs and market opportunities.

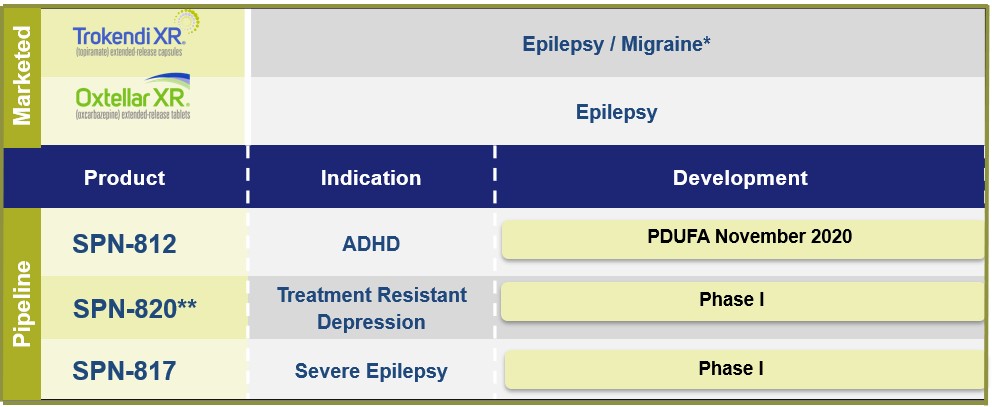

Initial program is for Impulsive Aggression (IA) in patients with ADHD, with plans SPN-820 = NV-5138 (Navitor Partnership)add other indications, such as IA in patients with autism, PTSD, bipolar disorder, Alzheimer’sresearch and other formsdevelopment of dementia.FDAU.S. Food and Drug Administration (FDA) approval or until the program terminates; expand product indications for approved products; invest in sales and marketing resources for existing and new products; enter into agreements to purchase products, product candidates or other companiescompanies; and invest in support forof our business, technology, regulatory and legal matters. the following two commercial products and one product candidate for the treatment of neurological diseases.the adjunctive treatment of partial onset seizures of epilepsy. During the first quarterWith its novel pharmacokinetic profile showing lower peak plasma concentrations, a slower rate of 2019,plasma input, and smoother and more consistent blood levels as compared to immediate release products, we launchedbelieve Oxtellar XR improves the tolerability of oxcarbazepine and thereby reduces side effects. In addition, Oxtellar XR once-per-day dosing is designed to improve patient compliance compared to the current immediate release products that must be taken multiple times per day.Three Months ended