CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain statements in this Quarterly Report on Form10-Q may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report may include, for example, statements about: the benefits of the Business Combination; our financial and business performance; changes in our strategy, future operations, financial position, estimated revenues, forecasts, projected costs, prospects and plans; changes in applicable laws or regulations, including with respect to health plans and payors and our relationships with such plans and payors, and provisions that impact Medicare and Medicaid programs; our ability to realize expected results with respect to patient membership, revenue and earnings; our ability to enter into new markets and success of acquisitions; the risk that we may not be able to procure sufficient space as we continue to grow and open additional medical centers; our predictions about need for our wellness centers after theCOVID-19 pandemic, including the attractiveness of our offerings and member retention rates; competition in our industry, the advantages of our products and technology over competing products and technology existing in the market, and competitive factors including with respect to technological capabilities, cost and scalability; the impact of health epidemics, including theCOVID-19 pandemic, on our business and industry and the actions we may take in response thereto; expectations regarding the time during which we will be an emerging growth company under the JOBS Act; our future capital requirements and sources and uses of cash; our business, expansion plans and opportunities; anticipated financial performance, including gross margin, and the expectation that our future results of operations will fluctuate on a quarterly basis for the foreseeable future; our expected capital expenditures, cost of revenue and other future expenses, and the sources of funds to satisfy liquidity needs; our ability to maintain proper and effective internal controls; and the outcome of any known and unknown litigation and regulatory proceedings

These forward-looking statements are based on information available to us at the time of this Quarterly Report on Form10-Q and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties, and other factors. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include: the ability to maintain the listing of our Class A common stock and warrants on the New York Stock Exchange (“NYSE”); the price of our securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which we operate, variations in performance across competitors, changes in laws and regulations affecting our business and changes in our capital structure; the risk of downturns and the possibility of rapid change in the highly competitive industry in which we operate; the risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; the risk that we experience difficulties in managing our growth and expanding operations; other risks and uncertainties described in this Quarterly Report on Form10-Q, including those under the section entitled “.”

Our business is subject to numerous risks and uncertainties, including those described in Part II, Item 1A. “Risk Factors” in this Quarterly Report on Form 10-Q. This summary should be read in conjunction with the risk factors detailed more fully below and should not be relied upon as an exhaustive summary of the material risks facing our business. Under most of our agreements with health plans, we assume some or all of the risk that the cost of providing services will exceed our compensation. Our revenues and operations are dependent upon a limited number of key existing payors and our continued relationship with those payors, and disruptions in those relationships (including renegotiation, non-renewal or termination of capitation agreements) or the inability of such payors to maintain their contracts with the Centers for Medicare and Medicaid Services could adversely affect our business. COVID-19 or other pandemic, epidemic, or outbreak of an infectious disease may have an adverse effect on our business, results of operations, financial condition and cash flows, the nature and extent of which are highly uncertain and unpredictable. Reductions in the quality ratings of the health plans we serve or our Medicare Risk Adjustment scores could have a material adverse effect on our business, results of operations, financial condition and cash flows. Our medical centers are concentrated in certain geographic regions, which makes us sensitive to regulatory, economic, environmental and competitive conditions in those regions. We primarily depend on reimbursements by third-party payors, which could lead to delays and uncertainties in the reimbursement process. We have a history of net losses, we anticipate increasing expenses in the future, and we may not be able to achieve or maintain profitability. We depend on our senior management team and other key employees, and the loss of one or more of these employees or an inability to attract and retain other highly skilled employees could harm our business. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service and member satisfaction or adequately address competitive challenges. We may not be able to identify suitable de novo expansion opportunities, engage with payors in new markets to continue extension of financial risk-sharing model agreements that have proved successful in our existing markets or cost-effectively develop, staff and establish such new medical centers in new markets. We conduct business in a heavily regulated industry, and if we fail to comply with applicable state and federal healthcare laws and government regulations or lose governmental licenses, we could incur financial penalties, become excluded from participating in government healthcare programs, be required to make significant operational changes or experience adverse publicity, which could harm our business.

We may not be able to identify suitable acquisition candidates, complete acquisitions or successfully integrate acquisitions, and acquisitions may not produce the intended results or may expose us to unknown or contingent liabilities. Reductions in Medicare reimbursement rates or changes in the rules governing the Medicare program could have a material adverse effect on our financial condition and results of operations. Our business could be harmed if the Affordable Care Act (“ACA”) is overturned or by any legislative, regulatory or industry change that reduces healthcare spending or otherwise slows or limits the transition to more assumption of risk by healthcare providers. Our use, disclosure, and other processing of personally identifiable information, including health information, is subject to the regulations implementing the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, and their implementing regulations (“HIPPA”), and other federal and state privacy and security regulations. If we suffer a data breach or unauthorized disclosure, we could incur significant liability including government and private investigations and claims of privacy and security non-compliance. We could also suffer significant reputational harm as a result and, in turn, a material adverse effect on our member base and revenue. We may be subject to legal proceedings and litigation, including intellectual property, privacy and medical malpractice disputes, which are costly to defend and could materially harm our business and results of operations. Our existing indebtedness could adversely affect our business and growth prospects. The terms of the Credit Agreement (defined herein) restrict our current and future operations, particularly our ability to respond to changes or to take certain actions. If we are unable to adequately address these and other risks we face, our business, results of operations, financial condition and prospects may be harmed.

PART I. FINANCIAL INFORMATION CANO HEALTH, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS | | | September 30, 2020 | | | December 31, 2019 | | | | | (unaudited) | | | | | | ASSETS | | | | | | | | | | Current assets | | | | | | | | | | Cash | | $ | 1,675,265 | | | $ | — | | | Prepaid expense and other current assets | | | 255,508 | | | | — | | | Total Current Assets | | | 1,930,773 | | | | — | | | | | | | | | | | | | Deferred offering costs | | | — | | | | 45,568 | | | Cash and marketable securities held in Trust Account | | | 690,192,093 | | | | — | | | TOTAL ASSETS | | $ | 692,122,866 | | | $ | 45,568 | | | | | | | | | | | | | LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | | | | | | | | | | Current liabilities | | | | | | | | | | Accrued expenses | | $ | 27,866 | | | $ | 5,288 | | | Accrued offering costs | | | — | | | | 45,568 | | | Total Current Liabilities | | | 27,866 | | | | 50,856 | | | | | | | | | | | | | Deferred underwriting fee payable | | | 24,150,000 | | | | — | | | Total Liabilities | | | 24,177,866 | | | | 50,856 | | | | | | | | | | | | | Commitments and Contingencies (Note 5) | | | | | | | | | | | | | | | | | | | | Ordinary shares subject to possible redemption, 66,294,499 shares at $10.00 per share redemption value as of September 30, 2020 | | | 662,944,994 | | | | — | | | | | | | | | | | | | Shareholders’ Equity (Deficit) | | | | | | | | | | Preference shares, $0.0001 par value; 1,000,000 shares authorized; no shares issued and outstanding | | | — | | | | — | | | Class A ordinary shares, $0.0001 par value; 400,000,000 shares authorized; 2,705,501 and no shares issued and outstanding (excluding 66,294,499 and no shares subject to possible redemption) as of September 30, 2020 and December 31, 2019, respectively | | | 271 | | | | — | | | Class B ordinary shares, $0.0001 par value; 40,000,000 shares authorized; 17,250,000 and 1 share(s) issued and outstanding as of September 30, 2020 and December 31, 2019, respectively | | | 1,725 | | | | — | | | Additional paid-in capital | | | 5,129,416 | | | | — | | | Accumulated deficit | | | (131,406 | ) | | | (5,288 | ) | | Total Shareholders’ Equity (Deficit) | | | 5,000,006 | | | | (5,288 | ) | | TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | | $ | 692,122,866 | | | $ | 45,568 | |

| | | | | | | | | (in thousands, except share and per share data) | | | | | | | | | | | | | | | | | | | | | | | | | Cash, cash equivalents and restricted cash | | $ | 319,277 | | | $ | 33,807 | | Accounts receivable, net of unpaid service provider costs (Related parties comprised $123 and $50,015 as of June 30, 2021 and December 31, 2020, respectively) | | | 131,831 | | | | 76,709 | | | | | 1,176 | | | | 922 | | Prepaid expenses and other current assets | | | 20,105 | | | | 8,937 | | | | | | | | | | | | | | | 472,389 | | | | 120,375 | | Property and equipment, net (Related parties comprised $15,683 and $22,659 as of June 30, 2021 and December 31, 2020, respectively) | | | 46,358 | | | | 38,126 | | | | | 546,312 | | | | 234,328 | | | | | 395,185 | | | | 189,570 | | | | | 194,315 | | | | 36,785 | | | | | 4,654 | | | | 4,362 | | | | | | | | | | | | | | $ | 1,659,213 | | | $ | 623,546 | | | | | | | | | | | | Liabilities and stockholder’s equity | | | | | | | | | | | | | | | | | | Current portion of notes payable | | $ | 5,488 | | | $ | 4,800 | | Current portion of equipment loans | | | 324 | | | | 314 | | Current portion of capital lease obligations | | | 978 | | | | 876 | | Current portion of contingent consideration | | | 12,347 | | | | — | | Accounts payable and accrued expenses (Related parties comprised $112 | | | 46,465 | | | | 33,180 | | Deferred revenue (Related parties comprised $988 as of December 31, 2020) | | | 1,313 | | | | 988 | | Current portions due to sellers | | | 22,020 | | | | 27,129 | | Other current liabilities | | | 3,734 | | | | 1,333 | | | | | | | | | | | | Total current liabilities | | | 92,669 | | | | 68,620 | | Notes payable, net of current portion and debt issuance costs | | | 525,830 | | | | 456,745 | | | | | 123,843 | | | | — | | Equipment loans, net of current portion | | | 891 | | | | 873 | | Capital lease obligations, net of current portion | | | 1,667 | | | | 1,580 | | Deferred rent (Related parties comprised $92 as of December 31, 2020) | | | 4,868 | | | | 3,111 | | Deferred revenue, net of current portion (Related parties comprised $4,277 as of December 31, 2020) | | | 4,623 | | | | 4,277 | | Due to sellers, net of current portion | | | — | | | | 13,976 | |

The accompanying notes are an integral part of these unaudited condensed financial statements.Condensed Consolidated Financial Statements

CANO HEALTH, INC. AND SUBSIDIARIES CONDENSED STATEMENTS OF OPERATIONS(Unaudited)

| | | Three Months

Ended

September 30, | | | Nine Months

Ended September 30, | | | | | 2020 | | | 2020 | | | Operating costs | | $ | 236,302 | | | $ | 318,211 | | | Loss from operations | | | (236,302 | ) | | | (318,211 | ) | | | | | | | | | | | | Other income: | | | | | | | | | | Interest earned on investments held in Trust Account | | | 137,366 | | | | 192,093 | | | | | | | | | | | | | Net loss | | $ | (98,936 | ) | | $ | (126,118 | ) | | | | | | | | | | | | Weighted average shares outstanding of Class A redeemable ordinary shares | | | 69,000,000 | | | | 69,000,000 | | | Basic and diluted net income per share, Class A | | $ | 0.00 | | | $ | 0.00 | | | | | | | | | | | | | Weighted average shares outstanding of Class B non-redeemable ordinary shares | | | 17,250,000 | | | | 17,250,000 | | | Basic and diluted net loss per share, Class B | | $ | (0.01 | ) | | $ | (0.02 | ) |

CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | | | | | | | — | | | | 5,172 | | Other liabilities (Related parties comprised $8,142 as of December 31, 2020) | | | 16,471 | | | | 11,648 | | | | | | | | | | | | | | | 770,862 | | | | 566,002 | | Stockholders’ Equity / Members’ Capital | | | | | | | | | Shares of Class A common stock $0.0001 par value (authorized 6,000,000,000 shares with 170,299,189 shares issued and 170,299,189 shares outstanding at June 30, 2021) | | | 17 | | | | — | | Shares of Class B common stock $0.0001 par value (authorized 1,000,000,000 shares with 306,843,662 shares issued and 306,843,662 shares outstanding at June 30, 2021) | | | 31 | | | | — | | | | | — | | | | 157,591 | | | | | 389,892 | | | | | | | | | (37,640 | ) | | | (99,913 | ) | Notes receivable, related parties | | | (136 | ) | | | (134 | ) | | | | | | | | | | | | Total Stockholders’ Equity / Members’ Capital | | | 352,164 | | | | 57,544 | | | | | 536,187 | | | | — | | | | | | | | | | | | Total Stockholders’ Equity / Members’ Capital | | | 888,351 | | | | 57,544 | | | | | | | | | | | | Total Liabilities and Stockholders’ Equity / Members’ Capital | | $ | 1,659,213 | | | $ | 623,546 | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed financial statements.Condensed Consolidated Financial Statements

CANO HEALTH, INC AND SUBSIDIARIES CONDENSED STATEMENTCONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)(Unaudited)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020

| | | Class A Ordinary

Shares | | | Class B Ordinary

Shares | | | Additional Paid in | | | Accumulated | | | Total Shareholders’

(Deficit) | | | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | | | Balance – January 1, 2020 | | | — | | | $ | — | | | | 1 | | | $ | — | | | $ | — | | | $ | (5,288 | ) | | $ | (5,288 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Cancellation of Class B ordinary share | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Issuance of Class B ordinary shares to Sponsor | | | — | | | | — | | | | 17,250,000 | | | | 1,725 | | | | 23,275 | | | | — | | | | 25,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (3,413 | ) | | | (3,413 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance – March 31, 2020 | | | — | | | | — | | | | 17,250,000 | | | | 1,725 | | | | 23,275 | | | | (8,701 | ) | | | 16,299 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Sale of 69,000,000 Units, net of underwriting discounts and offering costs | | | 69,000,000 | | | | 6,900 | | | | — | | | | — | | | | 652,244,506 | | | | — | | | | 652,251,406 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Sale of 10,533,333 Private Placement Warrants | | | — | | | | — | | | | — | | | | — | | | | 15,800,000 | | | | — | | | | 15,800,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ordinary shares subject to possible redemption | | | (66,304,393 | ) | | | (6,630 | ) | | | — | | | | — | | | | (663,037,300 | ) | | | — | | | | (663,043,930 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (23,769 | ) | | | (23,769 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance – June 30, 2020 | | | 2,695,607 | | | $ | 270 | | | | 17,250,000 | | | $ | 1,725 | | | $ | 5,030,481 | | | $ | (32,470 | ) | | $ | 5,000,006 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Change in value of ordinary shares subject to possible redemption | | | 9,894 | | | | 1 | | | | — | | | | — | | | | 98,935 | | | | — | | | | 98,936 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (98,936 | ) | | | (98,936 | ) | | Balance – September 30, 2020 | | | 2,705,501 | | | $ | 271 | | | | 17,250,000 | | | $ | 1,725 | | | $ | 5,129,416 | | | $ | (131,406 | ) | | $ | 5,000,006 | |

OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| | |

| | ( in thousands, except share and per share data ) | | | | | | | | | | | | | | Revenue: | | | | | | | | | | | | | | | | | Capitated revenue (Related parties comprised $150,479 and $97,438 , and $335,383 and $107,747, in the three months ended June 30, 2021 and 2020, and in the six months ended June 30, 2021 and 2020, respectively) | | $ | 379,210 | | | $ | 163,927 | | | $ | 646,261 | | | $ | 291,643 | | and other revenue (Related parties comprised $219 and $213, and $631 and $344, in the three months ended June 30, 2021 and 2020, and in the six months ended June 30, 2021 and 2020, respectively) | | | 13,953 | | | | 7,279 | | | | 27,037 | | | | 14,861 | | | | | | | | | | | | | | | | | | | | | | | 393,163 | | | | 171,206 | | | | 673,298 | | | | 306,504 | | | Operating expenses: | | | | | | | | | | | | | | | | | Third-party medical costs (Related parties comprised $115,975 and $70,555 , and $249,819 and $76,943, in the three months ended

June 30, 2021 and 2020, and in the six months ended June 30, 2021 and 2020, respectively) | | | 291,816 | | | | 112,040 | | | | 486,862 | | | | 197,353 | | Direct patient expense (Related parties comprised $64 and $448 , and $1,488 and $1,223 , in the three months ended June 30, 2021 and 2020, and in the six months ended June 30, 2021 and 2020, respectively) | | | 43,782 | | | | 22,554 | | | | 78,069 | | | | 40,333 | | Selling, general, and administrative expenses (Related parties comprised $1,600 and $1,133, and $3,112 and $1,939, in the three months ended June 30, 2021 and 2020, and in the six months ended June 30, 2021 and 2020, respectively) | | | 46,574 | | | | 21,859 | | | | 81,422 | | | | 42,843 | | Depreciation and amortization expense | | | 7,945 | | | | 3,977 | | | | 13,791 | | | | 7,362 | | Transaction costs and other (Related parties comprised $1,465 and $4,209, and $1,483 and $5,369, in the three months ended June 30, 2021 and 2020, and in the six months ended June 30, 2021 and 2020, respectively) | | | 16,374 | | | | 15,687 | | | | 25,613 | | | | 22,138 | | | | | | | | | | | | | | | | | | | | | | | 406,491 | | | | 176,117 | | | | 685,757 | | | | 310,029 | | | | | | | | | | | | | | | | | | | | | | | (13,328 | ) | | | (4,911 | ) | | | (12,459 | ) | | | (3,525 | ) | Other income and expense: | | | | | | | | | | | | | | | | | | | | (9,714 | ) | | | (5,717 | ) | | | (20,340 | ) | | | (9,382 | ) | | Interest income (Related parties comprised $79 and $157, in the three months ended June 30, 2020, and in the six months ended June 30, 2020, respectively) | | | 1 | | | | 79 | | | | 2 | | | | 159 | |

The accompanying notes are an integral part of these unaudited condensed financial statements.Condensed Consolidated Financial Statements

CANO HEALTH, INC AND SUBSIDIARIES CONDENSED STATEMENTCONSOLIDATED STATEMENTS OF CASH FLOWSNINE MONTHS ENDED SEPTEMBER 30, 2020

(Unaudited)

| Cash Flows from Operating Activities: | | | | | | Net loss | | $ | (126,118 | ) | | Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | Interest earned on marketable securities held in Trust Account | | | (192,093 | ) | | Formation costs paid by Sponsor | | | 3,413 | | | Changes in operating assets and liabilities: | | | | | | Prepaid expense and other current assets | | | (228,708 | ) | | Accrued expenses | | | 27,866 | | | Net cash used in operating activities | | | (515,640 | ) | | | | | | | | Cash Flows from Investing Activities: | | | | | | Investment of cash in Trust Account | | | (690,000,000 | ) | | Net cash used in investing activities | | | (690,000,000 | ) | | | | | | | | Cash Flows from Financing Activities: | | | | | | Proceeds from sale of Units, net of underwriting discounts paid | | | 677,100,000 | | | Proceeds from sale of Private Placement Warrants | | | 15,800,000 | | | Repayment of promissory note – related party | | | (274,059 | ) | | Payments of offering costs | | | (435,036 | ) | | Net cash provided by financing activities | | | 692,190,905 | | | | | | | | | Net Change in Cash | | | 1,675,265 | | | Cash – Beginning | | | — | | | Cash – Ending | | $ | 1,675,265 | | | | | | | | | Non-Cash Investing and Financing Activities: | | | | | | Payment of prepaid expenses through promissory note – related party | | $ | 26,800 | | | Initial classification of ordinary shares subject to possible redemption | | $ | 663,057,700 | | | Change in value of ordinary shares subject to possible redemption | | $ | (112,706 | ) | | Deferred underwriting fee payable | | $ | 24,150,000 | | | Deferred offering costs paid directly by Sponsor from proceeds of issuance of Class B ordinary shares | | $ | 25,000 | | | Payment of offering costs through promissory note – related party | | $ | 238,558 | | | Payment of accrued expenses through promissory note – related party | | $ | 5,288 | |

OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | (in thousands, except share and per share data) | | | | | | | | | | | | | Loss on extinguishment of debt | | | (13,225 | ) | | | — | | | | (13,225 | ) | | | — | | Change in fair value of embedded derivative | | | — | | | | (306 | ) | | | — | | | | (306 | ) | Change in fair value of warrant liabilities | | | 39,215 | | | | — | | | | 39,215 | | | | — | | | | | (25 | ) | | | (150 | ) | | | (25 | ) | | | (150 | ) | | | | | | | | | | | | | | | | | | | Total other income (expense) | | | 16,252 | | | | (6,094 | ) | | | 5,627 | | | | (9,679 | ) | | | | | | | | | | | | | | | | | | | Net income (loss) before income tax benefit | | | 2,924 | | | | (11,005 | ) | | | (6,832 | ) | | | (13,204 | ) | | | | 2,023 | | | | 19 | | | | 1,309 | | | | 32 | | | | | | | | | | | | | | | | | | | | | Net income (loss) | | | | | | | | | | | | | | | | | Net loss attributable to non-controlling interests | | | (4,533 | ) | | | — | | | | (15,003 | | | | — | | | | | | | | | | | | | | | | | | | | | Net income attributable to Class A common stockholders | | $ | 9,480 | | | $ | — | | | $ | | | | $ | — | | | | | | | | | | | | | | | | | | | | | Net income per share to Class A common stockholders, basic | | $ | 0.06 | | | | N/A | | | $ | 0.06 | | | $ | N/A | | | | | | | | | | | | | | | | | | | | Net loss per share to Class A common stockholders, diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Weighted-average shares used in computation of earnings per share: | | | | | | | | | | | | | | | | | | Basic | | | | | | | | | | | | | | | N/A | | | | | | | | | | | | | | | | | | | | | | | 168,884,315 | | | | N/A | | | | 167,571,198 | | | | N/A | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed financial statements.Condensed Consolidated Financial Statements

CANO HEALTH, INC AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY / MEMBERS’ CAPITAL | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Three Months Ended June 30, 2021 | | (in thousands, except shares) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 14,629,533 | | | $ | 157,662 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | (135 | ) | | $ | (110,383 | ) | | $ | 0 | | | $ | 47,144 | | Retrospective application

of reverse

recapitalization | | | 292,214,129 | | | | (157,631 | ) | | | | | | | | | | | | | | | | | | | 157,631 | | | | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ADJUSTED

BALANCE—March 31,

2021 | | | 306,843,662 | | | $ | 31 | | | | | | | $ | | | | | | | | $ | | | | $ | 157,631 | | | $ | (135 | ) | | $ | (110,383 | ) | | $ | 0 | | | $ | 47,144 | | Net loss prior to business

combination | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Business combination and PIPE financing | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Stock-based

compensation

expense | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 3,168 | | | | — | | | | — | | | | — | | | | 3,168 | | Issuance of common

stock for

acquisitions | | | — | | | | — | | | | 4,055,698 | | | | — | | | | — | | | | — | | | | 60,000 | | | | — | | | | | | | | | | | | 60,000 | | Interest on notes

receivable | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | (1 | ) | | | | — | | | $ | — | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 9,480 | | | $ | 17,075 | | | | 26,555 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | — | | | | 170,299,189 | | | | 17 | | | | 306,843,662 | | | | 31 | | | | 389,892 | | | | (136 | ) | | | (37,640 | ) | | | 536,187 | | | | 888,351 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements CANO HEALTH, INC AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY / MEMBERS’ CAPITAL | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Three Months Ended June 30, 2020 | | ( in thousands, except shares) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | $ | 137,881 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | (131 | ) | | $ | (27,227 | ) | | $ | 392 | | | $ | 110,915 | | | | | — | | | | 91,321 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 91,321 | | Stock-based compensation expense | | | — | | | | 58 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 58 | | Issuance of common stock for acquisitions | | | — | | | | 30,300 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 30,300 | | Issuance of common stock for due to seller s balance | | | — | | | | 2,158 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,158 | | Interest on note s receivable | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1 | ) | | | — | | | | — | | | | (1 | ) | | | | — | | | $ | — | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (10,986 | ) | | $ | — | | | $ | (10,986 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | $ | 261,718 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | (132 | ) | | $ | (38,213 | ) | | $ | 392 | | | $ | 223,765 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

CANO HEALTH, INC AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY / MEMBERS’ CAPITAL | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Six Months Ended June 30, 2021 | | (in thousands except shares) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance—December 31, 2020 | | | 14,629,533 | | | $ | 157,591 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | (134 | ) | | $ | (99,913 | ) | | $ | — | | | $ | 57,544 | | Retrospective application of reverse recapitalization | | | 292,214,129 | | | | (157,560 | ) | | | — | | | | — | | | | — | | | | — | | | | | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ADJUSTED BALANCE—December 31, 2020 | | | 306,843,662 | | | $ | 31 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | 157,560 | | | $ | (134 | ) | | $ | (99,913 | ) | | $ | — | | | $ | 57,544 | | Net loss prior to business

combination | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (32,078 | ) | | | — | | | | (32,078 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 85,663 | | | | | | | | | | Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 3,239 | | | | — | | | | — | | | | — | | | | 3,239 | | Issuance of common stock for acquisitions | | | — | | | | — | | | | 4,055,698 | | | | — | | | | — | | | | — | | | | 60,000 | | | | — | | | | (792 | ) | | | 792 | | | | 60,000 | | Interest on note s receivable | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) | | | — | | | | — | | | | (2 | ) | | | | — | | | $ | — | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 9,480 | | | $ | 17,075 | | | | 26,555 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | BALANCE—June 30, 2021 | | | — | | | $ | — | | | | 170,299,189 | | | $ | 17 | | | | 306,843,662 | | | $ | 31 | | | $ | 389,892 | | | $ | (136 | ) | | $ | (37,640 | ) | | $ | 536,187 | | | $ | 888,351 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements CANO HEALTH, INC AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY / MEMBERS’ CAPITAL | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Six Months Ended June 30, 2020 | | (in thousands, except shares) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Balance—December 31, 2019 | | | — | | | $ | 123,242 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | (130 | ) | | $ | (25,041 | ) | | $ | 392 | | | $ | 98,463 | | | | | — | | | | 101,906 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 101,906 | | Stock - based compensation expense | | | — | | | | 112 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 112 | | Issuance of common stock for acquisitions | | | — | | | | 34,300 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 34,300 | | Issuance of common stock for due to seller s balance | | | — | | | | 2,158 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,158 | | Interest on note s receivable | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2 | ) | | | — | | | | — | | | | (2 | ) | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (13,172 | ) | | | 0 | | | | (13,172 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | $ | 261,718 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | — | | | $ | (132 | ) | | $ | (38,213 | ) | | $ | 392 | | | $ | 223,765 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

CANO HEALTH, INC. and SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | |

| | | | | | | | | Cash Flows from Operating Activities: | | | | | | | | | | | $ | (5,523 | ) | | $ | (13,172 | ) | Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | | Depreciation and amortization expense | | | 13,791 | | | | 7,362 | | Change in fair value of contingent consideration | | | (211 | ) | | | — | | Change in fair value of embedded derivative | | | — | | | | 306 | | Change in fair value of warrant liabilities | | | (39,215 | ) | | | — | | Loss on extinguishment of debt | | | 13,225 | | | | — | | Amortization of debt issuance costs | | | 8,540 | | | | | | Equity-based compensation | | | 3,239 | | | | 112 | | Paid in kind interest expense | | | — | | | | 1,188 | | Changes in operating assets and liabilities: | | | | | | | | | | | | (54,973 | ) | | | (17,806 | ) | | | | (254 | ) | | | (273 | ) | | | | (5,925 | ) | | | (20 | ) | Prepaid expenses and other current assets | | | (16,790 | ) | | | (268 | ) | Accounts payable and accrued expenses (Related parties comprised $123 and $(52) as of June 30, 2021 and 2020, respectively) | | | 23,407 | | | | 9,033 | | Deferred rent (Related parties comprised $115 as of June 30, 2021) | | | 1,757 | | | | 564 | | | Deferred revenue (Related parties comprised $671 as of June 30, 2021) | | | 671 | | | | — | | | Other liabilities (Related parties comprised $456 as of June 30, 2021) | | | 1,681 | | | | (1,258 | ) | | | | | | | | | | | Net cash used in operating activities | | | (56,580 | ) | | | (13,143 | ) | | | | | | | | | | | Cash Flows from Investing Activities: | | | | | | | | | Purchase of property and equipment (Related parties comprised $2,864 and $1,025 as of June 30, 2021 and 2020, respectively) | | | (7,730 | ) | | | (3,971 | ) | Acquisitions of subsidiaries including non-compete intangibles, net of cash acquired | | | (617,576 | ) | | | (205,325 | ) | | | | (23,963 | ) | | | (36,628 | ) | Advances to related parties | | | — | | | | (2 | ) | | | | | | | | | | | Net cash used in investing activities | | | (649,269 | ) | | | (245,926 | ) | | | | | | | | | | | Cash Flows from Financing Activities: | | | | | | | | | Contributions from member | | | — | | | | 101,906 | | Business combination and PIPE financing | | | 935,362 | | | | — | | Interest accrued due to seller s | | | 957 | | | | — | | Payments of long-term debt | | | (402,572 | ) | | | (338 | ) | | | | (11,274 | ) | | | (11,356 | ) | Proceeds from long-term debt | | | 295,000 | | | | 150,000 | | Proceeds from delayed draw term loan | | | 175,000 | | | | — | | Repayments of delayed draw term loan | | | (2,350 | ) | | | — | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

CANO HEALTH, INC. and SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | |

| | | | | | | | | Proceeds from revolving credit facility | | | — | | | | 9,700 | | Repayments of revolving credit facility | | | — | | | | (9,700 | ) | Proceeds from insurance financing arrangements | | | 4,355 | | | | 2,599 | | Payments of principal on insurance financing arrangements | | | (2,941 | ) | | | (1,567 | ) | Repayments of equipment loans | | | (154 | ) | | | (187 | ) | Repayments of capital lease obligations | | | (64 | ) | | | (464 | ) | | | | | | | | | | | Net cash provided by financing activities | | | 991,319 | | | | 240,593 | | | | | | | | | | | | Net increase (decrease) in cash, cash equivalents and restricted cash | | | 285,470 | | | | (18,476 | ) | Cash, cash equivalents and restricted cash at beginning of year | | | 33,807 | | | | 29,192 | | | | | | | | | | | | Cash, cash equivalents and restricted cash at end of period | | $ | 319,277 | | | $ | 10,716 | | | | | | | | | | | | Supplemental cash flow information: | | | | | | | | | | | $ | (11,925 | ) | | $ | (8,294 | ) | Non-cash investing and financing activities: | | | | | | | | | Issuance of securities by Cano Health, Inc. in connection with acquisitions | | $ | 60,000 | | | | — | | Issuance of securities in PCIH in connection with acquisitions | | | — | | | | 34,300 | | Contingent consideration in connection with acquisitions | | | 9,600 | | | | — | | Due to seller s in connection with acquisitions | | | 295 | | | | 16,288 | | Humana Affiliate Provider clinic leasehold improvements | | | 2,864 | | | | 1,025 | | Capital lease obligations entered into for property and equipment | | | 52 | | | $ | 482 | | Equipment loan obligations entered into for property and equipment | | | 183 | | | | 103 | | Issuance of security in exchange for balance due to seller s | | | — | | | | 2,158 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS SEPTEMBER

| NATURE OF BUSINESS AND OPERATIONS |

Cano Health, Inc. (“Cano Health”, or the “Company”), formerly known as Primary Care (ITC) Intermediate Holdings, LLC, provides value-based medical care for its members through a network of primary care physicians across the U.S. and Puerto Rico. The Company focuses on high-touch population health and wellness services to Medicare Advantage, Medicare Global and Professional Direct Contracting (“DC”) and Medicaid capitated members, particularly in underserved communities by leveraging a pr oprietary technology platform to deliver high-quality health care services, resulting in superior clinical outcomes at competitive costs. As of June 30, 2020(Unaudited)

Note 1 — Description2021, the Company provided services through its network of Organization

90 owned medical centers and Business OperationsJaws Acquisition Corp. (the “Company”) was incorporatedover

providers (physicians, nurse practitioners, and physician assistants), and maintained affiliate relationships with over 800 physicians. The Company also operates pharmacies in the Cayman Islands on December 27, 2019. The Company was formednetwork for the purpose of effectingproviding a merger, share exchange, asset acquisition, share purchase, reorganization or similarfull range of managed care services to its members. On June 3, 2021 (the “Closing Date”), Jaws Acquisition, Corp. (“Jaws”), consummated the previously announced business combination with one or more businesses or entities (the “Business Combination”) .The Company is not limited pursuant to a particular industry or geographic region for purposes of consummating a Business Combination. The Company is an early stage and emerging growth company and, as such, the Company is subject to allterms of the risks associated with early stageBusiness Combination Agreement, dated as of November 11, 2020 (as amended, the “Business Combination Agreement”) by and emerging growth companies.

Asamong Jaws Jaws Merger Sub, LLC, a Delaware limited liability company (“Merger Sub”), Primary Care (ITC) Intermediate Holdings, LLC (“PCIH”), and PCIH’s sole member, Primary Care (ITC) Holdings, LLC (“Seller” or “Parent”). Upon the closing of September 30, 2020, the Company had not commenced any operations. All activity through September 30, 2020 relatesBusiness Combination, Jaws was reincorporated in the State of Delaware and changed its name to “Cano Health, Inc.”

Unless the context requires “the Company”, “we”, “us”, and “our” refer, for periods prior to the Company’s formation,completion of the initial public offering (the “Initial Public Offering”), which is described below,Business Combination, to PCIH and identifying a target companyits consolidated subsidiaries, and for a Business Combination. The Company will not generate any operating revenues untilperiods upon or after the completion of its initialthe Business Combination, atto Cano Health, Inc. and its consolidated subsidiaries, including PCIH, LLC and its subsidiaries. Pursuant to the earliest. The Company generates non-operating incomeBusiness Combination Agreement, on the Closing Date, Jaws contributed cash to PCIH in the form of interest income from the proceeds derived from the Initial Public Offering.The registration statementexchange for the Company’s Initial Public Offering was declared effective on May 13, 2020. On May 18, 2020, the Company consummated the Initial Public Offering of 69,000,000 69.0 million common

units (the “Units” and, with respect (“PCIH Common Units”) equal to the number of shares of Jaws’ Class A ordinary shares included inoutstanding on the Units being offered, the “Public Shares”), which includes the full exerciseClosing Date as well as 17.25 million Class B ordinary shares owned by the underwriters of their over-allotment option in the amount of 9,000,000 Units, at $10.00 per Unit, generating gross proceeds of $690,000,000 which is described in Note 3.Simultaneously with the closing of the Initial Public Offering, the Company consummated the sale of 10,533,333 warrants (the “Private Placement Warrants”) at a price of $1.50 per warrant in a private placement to Jaws Sponsor, LLC (the “Sponsor”). In connection with the Business Combination, the Company issued 306.8 million shares of the Company’s Class B common stock to existing shareholders of PCIH. The Company also issued 80.0 million shares of the Company’s Class A common stock in a private placement for $800.0 million (the “PIPE Investors”).

Following the consummation of the Business Combination, substantially all of the Company’s assets and operations are held and conducted by PCIH and its subsidiaries. As the Company is a holding company with no material assets other than its ownership of PCIH Common Units and its managing member interest in PCIH, the Company has no independent means of generating revenue or cash flow. The Company’s ability to pay taxes and pay dividends depend on the financial results and cash flows of PCIH and the distributions it receives from PCIH. The Company’s only assets are equity interests in PCIH, which represented a 35.1% and 35.7% controlling ownership

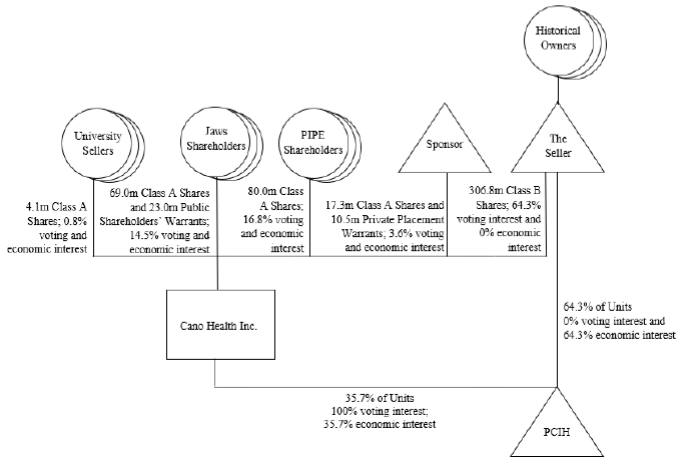

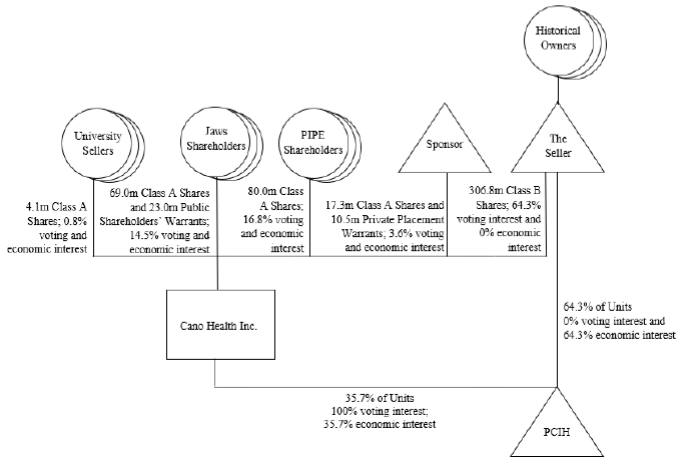

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS as of the Closing Date and June 30, 2021, respectively. Certain members of PCIH who retained their common unit interests in PCIH held the remaining 64.9% and 64.3%non-controlling ownership interests as of the Closing Date and June 30, 2021, respectively. These members hold common unit interests of PCIHCommon Units and a corresponding number ofnon-economic Class B common stock, which enables the holder to one vote per share. The following table represents the structure of the combined company upon the completion of the Business Combination and inclusive of the subsequent acquisition of University Health Care and its affiliates (“University”), generating gross proceeds of $15,800,000, which is describedas shown in Note 4.Transaction costs amounted to $37,748,594, consisting of $12,900,000 of underwriting fees (including an aggregate amount of $900,000 reimbursed by3, “

”:  Our organizational structure following the underwriters for application towards the Company’s offering expenses), $24,150,000 of deferred underwriting fees and $698,594 of other offering costs. In addition, at September 30, 2020, cash of $1,675,265 was held outsidecompletion of the Trust Account (as defined below)Business Combination, as shown above, is commonly referred to as an umbrella partnership-C (or Up-C) corporation structure. This organizational structure allowed the Seller, the former sole owner and managing member of PCIH, to retain its equity ownership in PCIH, an entity that is availableclassified as a partnership for working capitalU.S. federal income tax purposes, in the form of PCIH Common Units. The former stockholders of Jaws and the PIPE Investors who, prior to the Business Combination, held Class A ordinary shares or Class B ordinary shares of Jaws, by contrast, received equity ownership in Cano Health, Inc., a Delaware corporation that is a domestic corporation for U.S. federal income tax purposes. Subject to the terms and conditions set forth in the Business Combination Agreement, the Seller and its equity holders received aggregate consideration with a value equal to $3,534.9 million, which consisted of (i) $466.5 million of cash and (ii) 3,068.4 million shares of Cano Health, Inc.’s common stock or 306.8 million shares of Class B common stock based on a reference stock price of $10.00 per share.

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Following the closing of the Initial Public Offering on May 18, 2020,Business Combination, Class Astockholders owned direct controlling interests in the combined results of PCIH and Cano Health, Inc. while the Seller as the sole Class Bstockholder owned indirect economic interests in PCIH shown as non-controlling interests in the condensed consolidated financial statements of Cano Health, Inc. The indirect economic interests are held by the Seller in the form of PCIH Common Units that can be redeemed for Class A common stock together with the cancellation of an amountequal number of $690,000,000 ($10.00 per Unit)shares of Class B common stock in Cano Health, Inc. The non-controlling interests will decrease as shares of Class B common stock and PCIH Common Units are exchanged for shares of Class non-controlling interests in Cano Health, Inc. and PCIH were 35.1% and 64.9% resulting from the net proceedsc losing of the saleBusiness Combination.On June 11, 2021, PCIH acquired University for a total consideration of million. The equity issued on the acquisition close date equated to 4.1 million sharesof Class A common stock in Cano Health, Inc. based on ashare price of $14.79 per share. As noted above, following this acquisition, the respective controlling interest andnon-controlling interests in Cano Health, Inc. and PCIH was 35.7% and 64.3%, respectively. The following table reconciles the elements of the Units inBusiness Combination to the Initial Public Offeringcondensed consolidated statements of cash flows and the salecondensed consolidated statements of changes in equity for the three and six months ended June 30, 2021: | | | | | | | | | Cash - Jaws’ trust and cash, net of redemptions | | $ | 690,705 | | | | | 800,000 | | Less: transaction costs and advisory fees paid | | | (88,745 | ) | Less: Distribution to PCIH shareholders | | | (466,598 | ) | | | | | | | Net Business Combination and PIPE financing | | | 935,362 | | Plus: Non-cash net assets assumed | | | 96 | | Plus: Accrued transaction costs | | | 8,860 | | Less: Capitalized transaction costs | | | (8,167 | ) | Less: Warrant liability assumed | | | (163,058 | ) | | | | | | | Net contributions from Business Combination and PIPE financing | | $ | 773,093 | | | | | | | |

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS The number of shares of common stock issued immediately following the consummation of the Private Placement Warrants was placed in a trust account (the “Trust Account”) which will be invested in U.S. government securities, withinBusiness Combination is as follows: | | | | | | | | | | | | | | | | | Common stock outstanding prior to Business Combination | | | 69,000,000 | | | | — | | Less: redemption of Jaws shares | | | (6,509 | ) | | | — | | | | | | | | | | | | | | | 68,993,491 | | | | — | | | | | 17,250,000 | | | | — | | Shares issued in PIPE financing | | | 80,000,000 | | | | — | | | | | | | | | | | | Business Combination and PIPE financing shares | | | 166,243,491 | | | | — | | Shares to PCIH shareholders | | | — | | | | 306,843,662 | | | | | | | | | | | | Total shares of common stock outstanding immediately after the Business Combination | | | 166,243,491 | | | | 306,843,662 | | | | | | | | | | | |

Principles of Consolidation The condensed consolidated financial statements include the meaning set forth in Section 2(a)(16)accounts of the Investment Company Actand its wholly-owned subsidiaries. The portion of 1940, as amended (the “Investment Company Act”), with a maturity of 185 days or less or in any open-ended investment company that holds itself out as a money market fund selectedan entity not wholly-owned by the Company meeting the conditions of Rule 2a-7is presented asnon-controlling interest. All significant intercompany balances and transactions are eliminated in consolidation. The financial statements of the Investment Company Act, as determined by the Company, until the earlier of (i) the completion of a Business Combination and (ii) the distributionCompany’s subsidiaries are prepared using accounting policies consistent with those of the funds heldCompany. The Company has interests in various entities and considers itself to control an entity if it is the Trust Account, as described below.majority owner of or has voting control over such entity. The Company’s management has broad discretion with respect toCompany also assesses cont r ol through means other than voting rights (“variable interest entities” or “VIEs”) and determines which business entity is the specific applicationprimary beneficiary of the net proceeds of the Initial Public Offering and the sale of Private Placement Warrants, although substantially all of the net proceeds are intended to be applied generally toward consummating a Business Combination. So long as the Company’s securities are then listed on the NYSE, the Company’s initial Business Combination must be with one or more target businesses that together have a fair market value of at least 80% of the net assets held in the Trust Account (excluding the amount of deferred underwriting discounts and taxes payable on the income earned) at the time of the signing of the agreement to enter into a Business Combination.VIE. The Company will only complete a Business Combination if the post business combination company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires a controlling interest in the target sufficient forconsolidates VIEs when it not to be required to register as an investment company under the Investment Company Act. There is no assurancedetermined that the Company will be able to complete a Business Combination successfully.The Company will provideis the holdersprimary beneficiary of its issued and outstanding Public Shares (the “public shareholders”) with the opportunity to redeem all or a portionVIE. Included in the consolidated results of their Public Shares upon the completion of a Business Combination either (i) in connection with a shareholder meeting called to approve the Business Combination or (ii) by means of a tender offer. The decision as to whether the Company will seek shareholder approval of a Business Combination or conduct a tender offer will be made by the Company, solely in its discretion. The public shareholders will be entitled to redeem their Public Shares for a pro rata portion of the amount then in the Trust Account ($10.00 per Public Share, plus any pro rata interest earned on the funds held in the Trust Accountare Cano Health Texas, PLLC and not previously released to the Company to pay income taxes). The per-share amount to be distributed to Public Shareholders who redeem their Public Shares will not be reduced by the deferred underwriting commissions the Company will pay to the underwriters (as discussed in Note 5). There will be no redemption rights upon the completion of a Business Combination with respect to the Company’s warrants.

JAWS ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2020

(Unaudited)

The Company will proceed with a Business Combination if the Company has net tangible assets of at least $5,000,001 upon such consummation of a Business Combination and, only if a majority of the ordinary shares, represented in person or by proxy and entitled to vote thereon and who vote at a shareholder meeting, are voted in favor of the Business Combination. If a shareholder vote is not required by law and the Company does not decide to hold a shareholder vote for business or other reasons, the Company will, pursuant to its Amended and Restated Memorandum and Articles of Association, conduct the redemptions pursuant to the tender offer rules of the U.S. Securities and Exchange Commission (the “SEC”) and file tender offer documents with the SEC prior to completing a Business Combination. If, however, shareholder approval of the transactions is required by law, or the Company decides to obtain shareholder approval for business or reasons, the Company will offer to redeem shares in conjunction with a proxy solicitation pursuant to the proxy rules and not pursuant to the tender offer rules. Additionally, each public shareholder may elect to redeem their Public Shares irrespective of whether they vote for or against the proposed transaction or vote at all. If the Company seeks shareholder approval in connection with a Business Combination, the Sponsor, executive officers and directors (the “initial shareholders”) have agreed to vote their Founder Shares (as defined in Note 4) and any Public Shares purchased during or after the Initial Public Offering in favor of approving a Business Combination.

Notwithstanding the above, if the Company seeks shareholder approval of a Business Combination and it does not conduct redemptions pursuant to the tender offer rules, the Amended and Restated Memorandum and Articles of Association provides that a public shareholder, together with any affiliate of such shareholder or any other person with whom such shareholder is acting in concert or as a “group” (as defined under Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), will be restricted from redeeming its shares with respect to more than an aggregate of 15% of the Public Shares, without the prior consent of the Company.

The initial shareholders have agreed to waive their redemption rights with respect to any Founder Shares and Public Shares held by them in connection with (i) the completion of the Company’s initial Business Combination and (ii) a shareholder vote to approve an amendment to the Company’s Amended and Restated Memorandum and Articles of Association (A) that would modify the substance or timing of the Company’s obligation to provide holders of the Public Shares the right to have their shares redeemed in connection with the Company’s initial Business Combination or to redeem 100% of the Public Shares if the Company does not complete its initial Business Combination within the Combination Period (defined below) or (B) with respect to any other provision relating to the rights of holders of the Public Shares.

The Company will have until May 18, 2022 to complete a Business Combination (the “Combination Period”). If the Company has not completed a Business Combination within the Combination Period, the Company will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible, but not more than ten business days thereafter, redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account including interest earned on the funds held in the Trust Account and not previously released to the Company to pay income taxes (less up to $100,000 of interest to pay dissolution expenses), divided by the number of then issued and outstanding Public Shares, which redemption will completely extinguish public shareholders’ rights as shareholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining shareholders and the Company’s board of directors, dissolve and liquidate, subject in the case of clauses (ii) and (iii) to the Company’s obligations under Cayman Islands law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless if the Company fails to complete a Business Combination within the Combination Period.

The initial shareholders have agreed to waive their liquidation rights with respect to the Founder Shares if the Company fails to complete a Business Combination within the Combination Period. However, if the initial shareholders acquire Public Shares in or after the Initial Public Offering, such Public Shares will be entitled to liquidating distributions from the Trust Account if the Company fails to complete a Business Combination within the Combination Period. The underwriters have agreed to waive their rights to their deferred underwriting commission (see Note 5) held in the Trust Account in the event the Company does not complete a Business Combination within the Combination Period and, in such event, such amounts will be included with the other funds held in the Trust Account that will be available to fund the redemption of the Public Shares. In the event of such distribution, it is possible that the per-share value of the assets remaining available for distribution will be less than the Initial Public Offering price per Unit ($10.00).

In order to protect the amounts held in the Trust Account, the Sponsor has agreed to be liable to the Company if and to the extent any claims by a third party for services rendered or products sold to the Company, or a prospective target business withCano Health Nevada, PLLC, which the Company has discussed entering into a transaction agreement, reduce the amountsconcluded are both VIEs. All material intercompany accounts and transactions have been eliminated in consolidation.

Emerging Growth Company Status The Company is an emerging growth company, as defined in the Trust AccountJumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to below the lesser of (i) $10.00 per Public Share and (ii) the actual amount per Public Share held in the Trust Account if less than $10.00 per Public Share due to reductions in the valueenactment of the trust assets. This liability will notJOBS Act until such time as those standards apply with respect to any claims by a third party who executed a waiver of any and all rights to seek access to the Trust Account nor to any claims under the Company’s indemnityprivate companies. The JOBS Act provides that an emerging growth company can take advantage of the underwritersextended transition period for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Company has elected to use this extended transition period until the Company is no longer an emerging growth company or until the Company affirmatively and irrevocably opts out of the Initial Public Offering against certain liabilities, including liabilitiesextended transition period. Accordingly, our condensed consolidated financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates. The Company could be an emerging growth company for up to five years after the first sale of our Class A common stock pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”). Moreover,If, however, certain events occur prior to the end of such five-year period, including if the Company becomes a “large accelerated filer,” our annual gross

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS revenue exceeds $1.07 billion or the Company issues more than $1.0 billion ofnon-convertible debt securities in any three-year period, the Company would cease to be an emerging growth company prior to the end of such five-year period. It is currently anticipated that the Company may lose its “emerging growth company” status as of the end of the year ending December 31, 2021. After the Company loses its “emerging growth company” status, the Company will incur legal, accounting and other expenses that the Company did not previously incur. As of June 30, 2021, the Company’s coverage area is primarily in the eventState of Florida. Given this concentration, the Company is subject to adverse economic, regulatory, or other developments in the State of Florida that an executed waivercould have a material adverse effect on the Company’s financial conditions and operations. In addition, federal, state and local laws and regulations concerning healthcare affect the healthcare industry. The Company’s long-term success is deemeddependent on the ability to be unenforceable against a third party, the Sponsor will not be responsible to the extent of any liability for such third-party claims.successfully generate revenues; maintain or reduce operating costs; obtain additional funding when needed; and ultimately, achieve profitable operations. The Company is not able to predict the content or impact of future changes in laws and regulations affecting the healthcare industry; however, management believes that its existing cash position will seekbe sufficient to reducefund operating and capital expenditure requirements through at least twelve months from the possibility that the Sponsor will have to indemnify the Trust Account due to claimsdate of creditors by endeavoring to have all vendors, service providers (except for the Company’s independent registered public auditors), prospective target businesses or other entities with which the Company does business, execute agreements with the Company waiving any right, title, interest or claimissuance of any kind in or to monies held in the Trust Account.JAWS ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2020

(Unaudited)

Note 2 — Summary of Significant Accounting Policies

these condensed consolidated financial statements. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation The accompanying unaudited condensed

These financial statements have been prepared in accordance with U.S. generally accepted accounting principles generally accepted in the United States of America (“ U.S. GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 8 of Regulation S-X of the SEC. Certain information or footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted, pursuant to the rules and regulations of the SEC for interim financial reporting.information. Accordingly, they do not include all of the information and footnotes necessaryrequired by U.S. GAAP for a complete presentation of financial position, results of operations, or cash flows.statements. In the opinion of management, the accompanying unaudited condensed interim financial statements include all adjustments consisting(consisting of a normal recurring nature, which areaccruals) considered necessary for a fair presentation of the financial position operatingof the Company at June 30, 2021 and December 31, 2020, and the results of operations, cash flows and changes in equity for the three and six months ended June 30, 2021 and 2020 have been included. The results of operations and cash flows for the periods presented.The accompanyingthree and six months ended June 30, 2021 are not necessarily indicative of the results of operations and cash flows that may be reported for the remainder of 2021 or any other future periods. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s prospectusaudited consolidated financial statements for the year ended December 31, 2020.

The Company was deemed the accounting acquirer in the Business Combination of Jaws based on an analysis of the criteria outlined in Accounting Standards Codification (“ASC”) Topic 805, “(“ASC 805”), as the Company’s former owner retained control after the Business Combination. Refer to Note 1, “, for details surrounding the Business Combination. Accordingly, for accounting purposes, the Business Combination was treated as the equivalent of the Company issuing stock for the net assets of Jaws, accompanied by a recapitalization. The net assets of Jaws were stated at historical cost, with no goodwill or other intangible assets recorded.

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS While Jaws was the legal acquirer in the Business Combination, because the Company was deemed the accounting acquirer, the historical financial statements of PCIH became the historical financial statements of the combi ned company upon the consummation of the Business Combination. As a result, the condensed consolidated financial statements reflect the historical operating results of PCIH prior to the Business Combination, the combined results of Jaws and the Company following the close of the Business Combination, the assets and liabilities of the Company at their historical cost, and the Company’s equity structure for all periods presented. The Company assumed 23.0 million public warrants (“Public Warrants”) and 10.53million private placement warrants (“Private Placement Warrants”) upon the consummation of the Business Combination. The Company may issue or assume common stock warrants that are recorded as either liabilities or equity in accordance with the respective accounting guidance. Warrants recorded as equity are recorded at their relative fair value or fair value determined at the issuance date and remeasurement is not required. Warrants recorded as liabilities are recorded at their fair value, within warrant liability on the condensed consolidated balance sheets, and remeasured on each reporting date with changes recorded in revaluation of warrant liability on the Company’s condensed consolidated statements of operations. The Public Warrants became exercisable 30 days after the consummation of the Business Combination, which occurred on June 3, 2021. The Public Warrants will expire five years after the consummation of the Business Combination, or earlier upon redemption or liquidation. The Private Placement Warrants are identical to the Public Warrants, except that so long as the Private Placement Warrants are held by the Sponsor or any of its permitted transferees, the Private Placement Warrants: (i) may be exercised for cash or on a “cashless basis”, (ii) may not be transferred, assigned or sold until thirty (30) days after the completion of the initial Business Combination, (iii) shall not be redeemable by the Company when the Class A ordinary shares equal or exceed $18.00, and (iv) shall only be redeemable by the Company when the Class A ordinary shares are less than $18.00 per share, subject to certain adjustments. The Company evaluated the Public Warrants and Private Placement Warrants and concluded that they do not meet the criteria to be classified as shareholders’ equity in accordance withASC 815-40, “Derivatives and Hedging–Contracts in Entity’s Own Equity sheets , with changes in their respective fair values recognized in the statement of operations at each reporting date. In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)No. 2014-09 “Revenue from Contracts with Customers”,

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Under ASC 606, the Company recognizes revenue when a customer obtains control of the promised goods or services. The amount of revenue that is recorded reflects the consideration that the Company expects to receive in exchange for those goods or services. The Company applies the following five-step model in order to determine this amount: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the Company satisfies a performance obligation. The Company only applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled to in exchange for the goods or services the Company transfers to the customer (i.e. patient). At contract inception, once the contract is determined to be within the scope of ASC 606, management reviews the contract to determine which performance obligations must be satisfied and which of these performance obligations are distinct. The Company recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when the performance obligation is satisfied. The Company derives its revenue primarily from its capitated fees for medical services provided under capitated arrangements,arrangements, and revenue from the sale of pharmaceutical drugs. Capitated revenue is derived from fees for medical services provided by the Company under capitated arrangements with health maintenance organizations’ (“HMOs”) health plans. Capitated revenue consists of revenue earned through Medicare as well as through commercial and othernon-Medicare governmental programs, such as Medicaid, which is captured as other capitated revenue. The Company is required to deliver primary care physician services to the enrolled member population and is responsible for medical expenses related to healthcare services required by that patient group, including services not provided by the Company. Since the Company controls the primary care physician services provided to enrolled members, the Company acts as a principal. The gross fees under these contracts are reported as revenue and the cost of provider care is included in third-party medical costs. Neither the Company nor any of its affiliates is a registered insurance company because state law in the states in which they operate does not require such registration for risk-bearing providers. Since contractual terms across these arrangements are similar, the Company groups them into one portfolio. The Company identifies a single performance obligation to stand-ready to provide healthcare services to enrolled members. Capitated revenuesis recognized in the month in which the Company is obligated to provide medical care services. The transaction price for the services provided depends upon the pricing established by the Centers for Medicare & Medicaid (“CMS”) and includes rates that are based on the cost of medical care within a local market and the average utilization of healthcare services by the members enrolled. The transaction price is variable since the rates are risk adjusted for projected health status (acuity) of members and demographic characteristics of the enrolled members. The risk adjustment to the transaction price is presented as the Medicare Risk Adjustment (“MRA”) within accounts receivable on the accompanying condensed consolidated balance sheets. The fees are paid on an interim basis based on submitted enrolled member data for the previous year and are adjusted in subsequent periods after the final data is compiled by the CMS. In 2020, the Company entered into multi-year agreements with Humana, Inc. (“Humana”), a managed care organization, to provide services only to members covered by Humana in certain centers. The agreements contain an administrative

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS payment from Humana in exchange for the Company providing certain care coordination services during the contract term. The care coordination payments are refundable to Humana on apro-rata basis if the Company ceases to provide services at the centers within the specified contract term. The Company identified one performance obligation to stand-ready to provide care coordination services to patients and will recognize revenue ratably over the contract term. Care coordination revenues is included in other revenue along with other ancillary healthcare revenues. revenue is generated from primary care services provided in the Company’s medical centers. During an office visit, a patient may receive a number of medical services from a healthcare provider. These healthcare services are not separately identifiable and are combined into a single performance obligation. The Company recognizesrevenue at the net realizable amount at the time the patient is seen by a provider, and the Company’s performance obligation to the patient is complete. Pharmacy revenues is generated from the sales of prescription medication to patients. These contracts contain a single performance obligation. The Company satisfies its performance obligation and recognizes revenue at the time the patient takes possession of the merchandise. The Company’s revenue from its revenue streams described in the preceding paragraphs for the three and six months ended June 30, 2021 and 2020 was as follows: | | | | | | | | | | | | | | | | | | | | Three Months Ended June 30, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 334,700 | | | | 85.1 | % | | $ | 129,385 | | | | 75.6 | % | | | | 44,510 | | | | 11.4 | % | | | 34,542 | | | | 20.2 | % | | | | | | | | | | | | | | | | | | | | | | 379,210 | | | | 96.5 | % | | | 163,927 | | | | 95.8 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 4,389 | | | | 1.1 | % | | | 1,246 | | | | 0.7 | % | | | | 8,217 | | | | 2.1 | % | | | 5,718 | | | | 3.3 | % | | | | 1,347 | | | | 0.3 | % | | | 315 | | | | 0.2 | % | | | | | | | | | | | | | | | | | | | | | | 13,953 | | | | 3.5 | % | | | 7,279 | | | | 4.2 | % | | | | | | | | | | | | | | | | | | | | | $ | 393,163 | | | | 100.0 | % | | $ | 171,206 | | | | 100.0 | % | | | | | | | | | | | | | | | | | | |

CANO HEALTH, INC. AND SUBSIDIARIES NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | | | | | | | | | | | | | | | | | | | | Six Months Ended June 30, | | | | | | | | | | | | | | | | | | | | | | | | Capitated revenue: | | | | | | | | | | | | | | | | | | | $ | 561,079 | | | | 83.3 | % | | $ | 235,395 | | | | 76.8 | % | | | | 85,182 | | | | 12.7 | % | | | 56,248 | | | | 18.4 | % | | | | | | | | | | | | | | | | | | | | | | 646,261 | | | | 96.0 | % | | | 291,643 | | | | 95.2 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,937 | | | | 1.3 | % | | | 3,011 | | | | 1.0 | % | | | | 15,523 | | | | 2.3 | % | | | 11,054 | | | | 3.6 | % | | | | 2,577 | | | | 0.4 | % | | | 796 | | | | 0.2 | % | | | | | | | | | | | | | | | | | | | | | | 27,037 | | | | 4.0 | % | | | 14,861 | | | | 4.8 | % | | | | | | | | | | | | | | | | | | | | | $ | 673,298 | | | | 100.0 | % | | $ | 306,504 | | | | 100.0 | % | | | | | | | | | | | | | | | | | | |