UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

xQUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2020March 31, 2022

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. Number: 001-39635

Surrozen, Inc.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 98-1556622 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

| |

171 Oyster Point Blvd, Suite 400, South San Francisco, California | 94080 | |

(Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number, including area code: (650) 489-9000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| SRZN | The Nasdaq Capital Market | ||

Redeemable warrants, each whole warrant exercisable for one | SRZNW | The Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx ☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yesx ☒ No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):. Yes x☐ No ¨☒

As of January 4, 2021,May 9, 2022, there were 9,634,000 Class A ordinary35,125,886 shares $0.0001of common stock, par value per share, and 2,300,000 Class B ordinary shares, $0.0001 par value per share, issued and outstanding.

Table of Contents

CONSONANCE-HFW ACQUISITION CORP.

FORM 10-Q FOR THE QUARTER ENDED SEPTEMBER 30, 2020

TABLE OF CONTENTS

i

i

PART I- I—FINANCIAL INFORMATION

Item 1. Interim Financial Statements

SURROZEN, INC.

CONSONANCE-HFW ACQUISITION CORP.Condensed Consolidated Balance Sheets

CONDENSED BALANCE SHEET(In thousands, except per share amounts)

SEPTEMBER 30, 2020

|

| March 31, |

|

| December 31, 2021 |

| ||

|

| (Unaudited) |

|

|

|

| ||

Assets |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 14,305 |

|

| $ | 33,091 |

|

Short-term marketable securities |

|

| 78,209 |

|

|

| 68,760 |

|

Prepaid expenses and other current assets |

|

| 3,165 |

|

|

| 3,338 |

|

Total current assets |

|

| 95,679 |

|

|

| 105,189 |

|

|

|

|

|

|

|

| ||

Property and equipment, net |

|

| 4,672 |

|

|

| 4,794 |

|

Operating lease right-of-use assets |

|

| 4,215 |

|

|

| 4,582 |

|

Long-term marketable securities |

|

| 11,780 |

|

|

| 21,655 |

|

Restricted cash |

|

| 405 |

|

|

| 405 |

|

Other assets |

|

| 904 |

|

|

| 549 |

|

Total assets |

| $ | 117,655 |

|

| $ | 137,174 |

|

|

|

|

|

|

|

| ||

Liabilities and stockholders’ equity |

|

|

|

|

|

| ||

Current liabilities: |

|

|

|

|

|

| ||

Accounts payable |

| $ | 1,045 |

|

| $ | 2,718 |

|

Accrued and other liabilities |

|

| 4,927 |

|

|

| 8,662 |

|

Lease liabilities, current portion |

|

| 2,143 |

|

|

| 2,193 |

|

Total current liabilities |

|

| 8,115 |

|

|

| 13,573 |

|

|

|

|

|

|

|

| ||

Lease liabilities, noncurrent portion |

|

| 5,074 |

|

|

| 5,600 |

|

Warrant liabilities |

|

| 1,804 |

|

|

| 8,301 |

|

Total liabilities |

|

| 14,993 |

|

|

| 27,474 |

|

|

|

|

|

|

|

| ||

Commitments and contingencies (Note 7) |

|

|

|

|

|

| ||

|

|

|

|

|

|

| ||

Stockholders’ equity: |

|

|

|

|

|

| ||

Preferred stock, $0.0001 par value, 10,000 shares authorized; 0 shares |

|

| 0 |

|

|

| 0 |

|

Common stock, $0.0001 par value, 500,000 shares authorized as of |

|

| 4 |

|

|

| 4 |

|

Additional paid-in capital |

|

| 253,683 |

|

|

| 252,464 |

|

Accumulated other comprehensive loss |

|

| (429 | ) |

|

| (119 | ) |

Accumulated deficit |

|

| (150,596 | ) |

|

| (142,649 | ) |

Total stockholders’ equity |

|

| 102,662 |

|

|

| 109,700 |

|

Total liabilities and stockholders’ equity |

| $ | 117,655 |

|

| $ | 137,174 |

|

(Unaudited)

| ASSETS | | |||

| Deferred offering costs | $ | 50,689 | ||

| TOTAL ASSETS | $ | 50,689 | ||

| LIABILITIES AND SHAREHOLDER’S EQUITY | | |||

| Current liabilities | | |||

| Accrued offering costs | $ | 30,000 | ||

| Promissory note – related party | 650 | |||

| Total Current Liabilities | 30,650 | |||

| Commitments | | |||

| Shareholder’s Equity | | |||

| Preferred shares, $0.0001 par value; 1,000,000 shares authorized; none issued and outstanding | — | |||

| Class A ordinary shares, $0.0001 par value; 350,000,000 shares authorized; none issued and outstanding | — | |||

| Class B ordinary shares, $0.0001 par value; 150,000,000 shares authorized; 2,300,000 shares issued and outstanding (1)(2) | 230 | |||

| Additional paid-in capital | 24,770 | |||

| Accumulated deficit | (4,961 | ) | ||

| Total Shareholder’s Equity | 20,039 | |||

| TOTAL LIABILITIES AND SHAREHOLDER’S EQUITY | $ | 50,689 |

The accompanying notes are an integral part of thethese unaudited condensed consolidated financial statements.

1

1

CONSONANCE-HFW ACQUISITION CORP.SURROZEN, INC.

CONDENSED STATEMENT OF OPERATIONSCondensed Consolidated Statements of Operations and Comprehensive Loss

FOR THE PERIOD FROM AUGUST 21, 2020 (INCEPTION) THROUGH SEPTEMBER 30, 2020(Unaudited)

(Unaudited)(In thousands, except per share amounts)

| Formation costs | $ | 4,961 | ||

| Net Loss | (4,961 | ) | ||

| Weighted average shares outstanding, basic and diluted (1)(2) | 2,300,000 | |||

| Basic and diluted net loss per ordinary shares | $ | (0.00 | ) |

|

| Three Months Ended March 31, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

Operating expenses: |

|

|

|

|

|

| ||

Research and development |

| $ | 9,371 |

|

| $ | 8,601 |

|

General and administrative |

|

| 5,122 |

|

|

| 4,430 |

|

Total operating expenses |

|

| 14,493 |

|

|

| 13,031 |

|

Loss from operations |

|

| (14,493 | ) |

|

| (13,031 | ) |

Interest income |

|

| 49 |

|

|

| 9 |

|

Other income |

|

| 6,497 |

|

|

| 0 |

|

Net loss |

|

| (7,947 | ) |

|

| (13,022 | ) |

Unrealized loss on marketable securities, net of tax |

|

| (310 | ) |

|

| 0 |

|

Comprehensive loss |

| $ | (8,257 | ) |

| $ | (13,022 | ) |

|

|

|

|

|

|

| ||

Net loss per share attributable to common |

| $ | (0.23 | ) |

| $ | (0.72 | ) |

|

|

|

|

|

|

| ||

Weighted-average shares used in computing net |

|

| 34,863 |

|

|

| 18,154 |

|

The accompanying notes are an integral part of thethese unaudited condensed consolidated financial statements.

CONSONANCE-HFW ACQUISITION CORP.2

CONDENSED STATEMENT OF CHANGES IN SHAREHOLDER’S EQUITYSURROZEN, INC.

FOR THE PERIOD FROM AUGUST 21, 2020 (INCEPTION) THROUGH SEPTEMBER 30, 2020Condensed Consolidated Statements of Redeemable Convertible Preferred Stock and Stockholders’ Equity

(Unaudited)

Class B Ordinary Shares | Additional Paid-in | Accumulated | Total Shareholder’s | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance – August 21, 2020 (inception) | — | $ | — | $ | — | $ | — | $ | — | |||||||||||

| Issuance of Class B ordinary shares to Sponsor (1)(2) | 2,300,000 | 230 | 24,770 | — | 25,000 | |||||||||||||||

| Net loss | — | — | — | (4,961 | ) | (4,961 | ) | |||||||||||||

| Balance – September 30, 2020 | 2,300,000 | $ | 230 | $ | 24,770 | $ | (4,961 | ) | $ | 20,039 | ||||||||||

(In thousands)

|

|

|

|

|

|

|

| Additional |

|

| Accumulated |

|

|

|

|

| Total |

| ||||||

|

| Common stock |

|

| paid-in |

|

| comprehensive |

|

| Accumulated |

|

| stockholders’ |

| |||||||||

|

| Shares |

|

| Amount |

|

| capital |

|

| loss |

|

| deficit |

|

| equity |

| ||||||

Balance at December 31, 2021 |

|

| 35,034 |

|

| $ | 4 |

|

| $ | 252,464 |

|

| $ | (119 | ) |

| $ | (142,649 | ) |

| $ | 109,700 |

|

Issuance of common stock under Equity Purchase Agreement |

|

| 100 |

|

|

| — |

|

|

| 273 |

|

|

| — |

|

|

| — |

|

|

| 273 |

|

Repurchase of early exercised stock options |

|

| (8 | ) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Vesting of early exercised stock options |

|

| — |

|

|

| — |

|

|

| 30 |

|

|

| — |

|

|

| — |

|

|

| 30 |

|

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 916 |

|

|

| — |

|

|

| — |

|

|

| 916 |

|

Other comprehensive loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (310 | ) |

|

| — |

|

|

| (310 | ) |

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (7,947 | ) |

|

| (7,947 | ) |

Balance at March 31, 2022 |

|

| 35,126 |

|

| $ | 4 |

|

| $ | 253,683 |

|

| $ | (429 | ) |

| $ | (150,596 | ) |

| $ | 102,662 |

|

|

| Redeemable convertible |

|

|

|

|

|

|

|

| Additional |

|

| Accumulated |

|

|

|

|

| Total |

| |||||||||||

|

| preferred stock |

|

| Common stock |

|

| paid-in |

|

| comprehensive |

|

| Accumulated |

|

| stockholders’ |

| ||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| capital |

|

| loss |

|

| deficit |

|

| equity |

| ||||||||

Balance at December 31, 2020, as previously reported |

|

| 95,290 |

|

| $ | 133,097 |

|

|

| 8,649 |

|

| $ | 1 |

|

| $ | 2,196 |

|

| $ | 0 |

|

| $ | (88,001 | ) |

| $ | (85,804 | ) |

Retroactive application of recapitalization |

|

| (95,290 | ) |

|

| (133,097 | ) |

|

| 9,608 |

|

|

| 1 |

|

|

| 133,096 |

|

|

| — |

|

|

| — |

|

|

| 133,097 |

|

Balance at December 31, 2020, after effect of Business |

|

| — |

|

|

| — |

|

|

| 18,257 |

|

|

| 2 |

|

|

| 135,292 |

|

|

| — |

|

|

| (88,001 | ) |

|

| 47,293 |

|

Exercises of stock options |

|

| — |

|

|

| — |

|

|

| 76 |

|

|

| — |

|

|

| 196 |

|

|

| — |

|

|

| — |

|

|

| 196 |

|

Restricted stock granted |

|

| — |

|

|

| — |

|

|

| 123 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Reclassification to liability for early exercised stock |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (120 | ) |

|

| — |

|

|

| — |

|

|

| (120 | ) |

Vesting of early exercised stock options |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 30 |

|

|

| — |

|

|

| — |

|

|

| 30 |

|

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 475 |

|

|

| — |

|

|

| — |

|

|

| 475 |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (13,022 | ) |

|

| (13,022 | ) |

Balance at March 31, 2021, after effect of Business |

|

| — |

|

| $ | — |

|

|

| 18,456 |

|

| $ | 2 |

|

| $ | 135,873 |

|

| $ | 0 |

|

| $ | (101,023 | ) |

| $ | 34,852 |

|

The accompanying notes are an integral part of thethese unaudited condensed consolidated financial statements.

CONSONANCE-HFW ACQUISITION CORP.

CONDENSED STATEMENT OF CASH FLOWS3

FOR THE PERIOD FROM AUGUST 21, 2020 (INCEPTION) THROUGH SEPTEMBER 30, 2020SURROZEN, INC.

(Unaudited)Condensed Consolidated Statements of Cash Flows

| Cash Flows from Operating Activities: | ||||

| Net loss | $ | (4,961 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||

| Payment of formation costs through issuance of Class B ordinary shares | 4,961 | |||

| Net cash provided by operating activities | — | |||

| Cash Flows from Financing Activities: | ||||

| Proceeds from promissory note - related party | 650 | |||

| Payment of offering costs | (650 | ) | ||

| Net cash used in financing activities | — | |||

| Net Change in Cash | — | |||

| Cash – Beginning | — | |||

| Cash – Ending | $ | — | ||

| Non-cash investing and financing activities: | ||||

| Deferred offering costs paid directly by Sponsor from proceeds from issuance of Class B ordinary shares | $ | 20,039 | ||

| Deferred offering costs included in accrued offering costs | $ | 30,000 |

(Unaudited)

(In thousands)

| Three Months Ended March 31, |

| |||||

| 2022 |

|

| 2021 |

| ||

Operating activities: |

|

|

|

|

| ||

Net loss | $ | (7,947 | ) |

| $ | (13,022 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

| ||

Depreciation |

| 534 |

|

|

| 511 |

|

Stock-based compensation |

| 916 |

|

|

| 475 |

|

Non-cash operating lease expense |

| 367 |

|

|

| 309 |

|

Amortization of premium on marketable securities, net |

| 116 |

|

|

| 0 |

|

Change in fair value of warrant liabilities |

| (6,497 | ) |

|

| 0 |

|

Changes in operating assets and liabilities: |

|

|

|

|

| ||

Prepaid expenses and other current assets |

| 274 |

|

|

| (328 | ) |

Other assets |

| (24 | ) |

|

| (1 | ) |

Accounts payable |

| (1,755 | ) |

|

| 431 |

|

Accrued and other liabilities |

| (3,782 | ) |

|

| 1,800 |

|

Operating lease liabilities |

| (576 | ) |

|

| (507 | ) |

Net cash used in operating activities |

| (18,374 | ) |

|

| (10,332 | ) |

|

|

|

|

|

| ||

Investing activities: |

|

|

|

|

| ||

Purchases of property and equipment |

| (412 | ) |

|

| (343 | ) |

Purchases of marketable securities |

| 0 |

|

|

| (1,099 | ) |

Net cash used in investing activities |

| (412 | ) |

|

| (1,442 | ) |

|

|

|

|

|

| ||

Financing activities: |

|

|

|

|

| ||

Proceeds from exercise of stock options |

| 0 |

|

|

| 196 |

|

Net cash provided by financing activities |

| 0 |

|

|

| 196 |

|

|

|

|

|

|

| ||

Net decrease in cash, cash equivalents and restricted cash |

| (18,786 | ) |

|

| (11,578 | ) |

Cash, cash equivalents and restricted cash at beginning of period |

| 33,496 |

|

|

| 35,387 |

|

Cash, cash equivalents and restricted cash at end of period | $ | 14,710 |

|

| $ | 23,809 |

|

|

|

|

|

|

| ||

Supplemental disclosure of noncash investing and financing activities: |

|

|

|

|

| ||

Deferred costs related to Equity Purchase Agreement included in accounts | $ | 432 |

|

| $ | 0 |

|

Transaction costs in Business Combination included in accrued liabilities | $ | 0 |

|

| $ | 267 |

|

Purchases of property and equipment included in accounts payable | $ | 0 |

|

| $ | 37 |

|

Vesting of early exercises of stock options | $ | 30 |

|

| $ | 30 |

|

Reclassification of early exercised stock options to liability | $ | 0 |

|

| $ | 120 |

|

The following table presents a reconciliation of the Company’s cash, cash equivalents and restricted cash in the Company’s unaudited condensed consolidated balance sheets:

| March 31, |

| |||||

| 2022 |

|

| 2021 |

| ||

Cash and cash equivalents | $ | 14,305 |

|

| $ | 23,404 |

|

Restricted cash |

| 405 |

|

|

| 405 |

|

Cash, cash equivalents and restricted cash | $ | 14,710 |

|

| $ | 23,809 |

|

The accompanying notes are an integral part of thethese unaudited condensed consolidated financial statements.

4

SURROZEN, INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

4

Note 1. Organization and Business

CONSONANCE-HFW ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTSOrganization

SEPTEMBER 30, 2020

(Unaudited)

NOTE 1. DESCRIPTION OF ORGANIZATION AND BUSINESS OPERATIONS

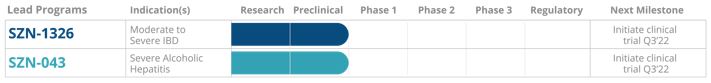

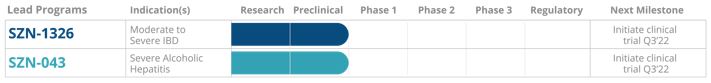

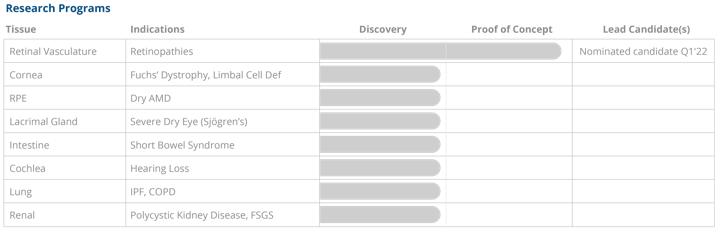

Surrozen, Inc., or the Company, formerly known as Consonance-HFW Acquisition Corp. (the “Company”), or Consonance, is a preclinical stage biotechnology company committed to discovering and developing drug candidates to selectively modulate the Wnt pathway, a critical mediator of tissue repair, in a broad range of organs and tissues, for human diseases. The Company, a Delaware corporation, is located in South San Francisco, California.

Business Combination and Private Investment in Public Entity Financing

Consonance was a blank check company incorporated as a Cayman Islands exempted company on August 21, 2020. The CompanyIt was formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses (“businesses.

On August 11, 2021, Consonance consummated a business combination, or the Business Combination”).Combination, among Consonance, Perseverance Merger Sub Inc., a subsidiary of Consonance, and Surrozen, Inc., or Legacy Surrozen, a Delaware company incorporated on August 12, 2015. Upon closing of the Business Combination, Consonance became a Delaware corporation and was renamed to Surrozen, Inc., Legacy Surrozen, was renamed to Surrozen Operating, Inc., and Legacy Surrozen continued as a wholly-owned subsidiary of the Company. See Note 3, "Recapitalization" for additional details.

Liquidity

The Company is not limited to a particular industry or geographic region for purposes of completing a Business Combination. The Company is an early stagehas incurred net operating losses each period since inception. During the three months ended March 31, 2022 and emerging growth company and, as such,2021, the Company is subject to allincurred a net loss of $7.9 million and $13.0 million, respectively. During the risks associated with early stagethree months ended March 31, 2022 and emerging growth companies.

2021, the Company used $18.4 million and $10.3 million of cash in operations. As of September 30, 2020,March 31, 2022, the Company had not commenced any operations. All activity foran accumulated deficit of approximately $150.6 million. The Company expects operating losses to continue in the period from August 21, 2020 (inception) through September 30, 2020 relatesforeseeable future because of additional costs and expenses related to the research and development activities. As of March 31, 2022, the Company had cash, cash equivalents and marketable securities of $104.3 million.

In February 2022, the Company entered into a purchase agreement, or the Equity Purchase Agreement, and a registration rights agreement with Lincoln Park Capital Fund, LLC, or Lincoln Park, pursuant to which Lincoln Park is obligated to purchase up to $50.0 million of the Company’s formation and the initial public offering (“Initial Public Offering”), which is described below. The Company will not generate any operating revenues until after the completion of a Business Combination,common stock from time to time at the earliest. The Company will generate non-operating income in the form of interest income from the proceeds derived from the Initial Public Offering. The Company has selected December 31 as its fiscal year end.

The registration statement for the Company’s Initial Public Offering became effectivesole discretion over a 36-month period commencing on November 18, 2020. On November 23, 2020, the Company consummated the Initial Public Offering of 8,000,000 units (the “Units” and, with respect to the Class A ordinary shares included in the Units sold, the “Public Shares”), at $10.00 per Unit, generating gross proceeds of $80,000,000 which is described in Note 3.

Simultaneously with the consummation of the Initial Public Offering, the Company consummated the sale of 410,000 units (the “Private Placement Units”) at a price of $10.00 per Private Placement Unit in a private placement to Consonance Life Sciences (the “Sponsor”), generating gross proceeds of $4,100,000, which is described in Note 4.

Transaction costs amounted to $4,998,864, consisting of $1,600,000 of underwriting fees, $2,800,000 of deferred underwriting fees and $598,864 of other offering costs. In addition, at November 23, 2020, cash of $1,507,989 was held outside of the Trust Account (as defined below) and is available for the payment of offering expenses and for working capital purposes.

Following the consummation of the Initial Public Offering on November 23, 2020, an amount of $80,000,000 ($10.00 per Unit) from the net proceeds of the sale of the Units in the Initial Public Offering and the sale of the Private Placement Units was placed in a trust account (the “Trust Account”) and invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), with a maturity of 185 days or less, or in any open-ended investment company that holds itself out as a money market fund meeting certain conditions of Rule 2a-7 of the Investment Company Act, as determined by the Company, until the earlier of: (i) the completion of a Business Combination and (ii) the distribution of the funds in the Trust Account to the Company’s shareholders, as described below.

On December 1, 2020, the underwriters fully exercised their over-allotment option, resulting in an additional 1,200,000 Units issued for an aggregate amount of $12,000,000. In connection with the underwriters’ full exercise of their over-allotment option, the Company also consummated the sale of an additional 24,000 Private Placement Units at $10.00 per Private Placement Unit, generating total proceeds of $12,240,000. A total of $12,000,000 was deposited into the Trust Account, bringing the aggregate proceeds held in the Trust Account to $92,000,000April 27, 2022 (see Note 8).

The Company’s management has broad discretion with respect toManagement believes that the specific application of the net proceeds of the Initial Public Offeringexisting cash, cash equivalents, and the sale of the Private Placement Units, although substantially all of the net proceedsmarketable securities are intended to be applied generally toward completing a Business Combination. The Company must complete its initial Business Combination with one or more target businesses that together have a fair market value equal to at least 80% of the net assets held in the Trust Account (excluding any deferred underwriting commissions held in the Trust Account and taxes payable on the interest earned on the Trust Account) at the time of the agreement to enter into a Business Combination. The Company will only complete a Business Combination if the post-Business Combination company owns or acquires 50% or more of the issued and outstanding voting securities of the target or otherwise acquires a controlling interest in the target business sufficient for it not to be required to register as an investment company under the Investment Company Act. There is no assurance that the Company will be able to successfully effect a Business Combination.

The Company will provide its shareholders with the opportunity to redeem all or a portion of their Public Shares upon the completion of a Business Combination either (i) in connection with a shareholder meeting called to approve the Business Combination or (ii) by means of a tender offer. The decision as to whether the Company will seek shareholder approval of a Business Combination or conduct a tender offer will be made by the Company. The shareholders will be entitled to redeem their shares for a pro rata portion of the amount held in the Trust Account (initially $10.00 per share), calculated as of two business days prior to the completion of a Business Combination, including any pro rata interest earned on the funds held in the Trust Account and not previously released to the Company to pay its tax obligations. There will be no redemption rights uponcontinue operating activities for at least the completion of a Business Combination with respect to the Company’s warrants.

CONSONANCE-HFW ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2020

(Unaudited)

Risks and Uncertainties

Management continues to evaluate the impact of the COVID-19 pandemic and has concluded that while it is reasonably possible that the virus could have a negative effect on the Company’s financial position and/or search for a target company, the specific impact is not readily determinable as ofnext 12 months from the date of theissuance of its unaudited condensed consolidated financial statements. The condensed financial statements do not include any adjustments that mightHowever, if the Company’s anticipated cash burn is greater than anticipated, the Company could use its capital resources sooner than expected which may result fromin the outcome of this uncertainty.need to reduce future planned expenditures and/or raise additional capital to continue to fund the operations.

Note 2. Summary of Significant Accounting Policies

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanyingCompany’s unaudited condensed consolidated financial statements and accompanying notes have been prepared in accordance with generally accepted accounting principles generally accepted in the United States of America, (“GAAP”) for interim financial informationor GAAP, and in accordance withpursuant to the instructions to Form 10-Q and Article 8regulations of Regulation S-X of the U.S. Securities and Exchange Commission, (the “SEC”). Certainor SEC. As permitted under those rules, certain footnotes or other financial information or footnote disclosuresthat are normally included in condensed financial statements prepared in accordance withrequired by GAAP have been condensed or omitted, pursuant toand accordingly the rules and regulationscondensed consolidated balance sheet as of December 31, 2021 has been derived from the SEC for interimCompany’s audited consolidated financial reporting. Accordingly, they dostatements at that date but does not include all of the information required by GAAP for complete consolidated financial statements. These unaudited condensed consolidated financial statements have been prepared on the same basis as the Company’s annual consolidated financial statements and, footnotes necessary for a complete presentation of financial position, results of operations, or cash flows. Inin the opinion of management, the accompanying unaudited condensed financial statements includereflect all adjustments consisting(consisting of a normal recurring nature, whichadjustments) that are necessary for a fair presentation of the Company’s consolidated financial position, operatingstatements. The results and cash flowsof operations for the periods presented.

The accompanying unaudited condensed financial statements should be read in conjunction with the Company’s prospectus for its Initial Public Offering as filed with the SEC on November 18, 2020, as well as the Company’s Current Reports on Form 8-K, as filed with the SEC on November 25, 2020 and November 30, 2020. The interim results for the period from August 21, 2020 (inception) through September 30, 2020three months ended March 31, 2022 are not necessarily indicative of the results to be expected for the year endingended December 31, 20202022 or for any other interim period or for any other future periods.year.

5

Emerging Growth Company

The Company is an “emerging growth company,” as defined in Section 2(a)unaudited condensed consolidated financial statements include the accounts of the Securities ActCompany and its subsidiary. All intercompany transactions and balances have been eliminated.

The Business Combination discussed in Note 1 was accounted for as a reverse recapitalization with Legacy Surrozen as the accounting acquirer and Consonance as the acquired company for accounting purposes. Accordingly, all historical financial information presented in the unaudited condensed consolidated financial statements represents the accounts of 1933,Legacy Surrozen at their historical cost as amended (the “Securities Act”), as modified byif Legacy Surrozen is the Jumpstart Ourpredecessor to the Company. The unaudited condensed consolidated financial statements following the closing of the Business Startups ActCombination reflect the results of 2012 (the “JOBS Act”),the combined entity’s operations. All issued and it may take advantageoutstanding common stock, redeemable convertible preferred stock and stock awards of certain exemptions from various reporting requirements that are applicableLegacy Surrozen and per share amounts contained in the unaudited condensed consolidated financial statements for the periods presented prior to other public companies that are not emerging growth companies including, but not limitedthe closing of the Business Combination have been retroactively restated to not being required to complyreflect the exchange ratio established in the Business Combination. See Note 3, “Recapitalization” for additional details.

The accompanying condensed consolidated financial statements and related financial information should be read in conjunction with the independent registered public accounting firm attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in its periodic reports and proxyaudited consolidated financial statements and exemptions from the requirements of holding a nonbinding advisory voterelated notes thereto for the year ended December 31, 2021 included in the Company’s Annual Report on executive compensation and shareholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to complyForm 10-K, filed with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of the Company’s condensed financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.SEC on March 28, 2022.

Use of Estimates

The preparation of theunaudited condensed consolidated financial statements in conformity with GAAP requires requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities atas of the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period.

Making Significant estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the condensed financial statements, which management considered in formulating its estimate, could change in the near term due to one or more future confirming events. Accordingly, the actual results could differ significantly from those estimates.

CONSONANCE-HFW ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2020

(Unaudited)

Cash and Cash Equivalents

The Company considers all short-term investments with an original maturity of three months or less when purchased to be cash equivalents. The Company did not have any cash equivalents as of September 30, 2020.

Deferred Offering Costs

Offering costs consist of legal, accounting and other costs incurred through the balance sheet date that are directly related to the Initial Public Offering. Offering costs amounting to $4,998,864 were charged to shareholders’ equity upon the completion of the Initial Public Offering (see Note 1). As of September 30, 2020, there were $50,689 of deferred offering costs recordedassumptions made in the accompanying unaudited condensed balance sheet.

Income Taxes

The Company accountsconsolidated financial statements include, but are not limited to, certain accruals for research and development activities, the fair value of common stock prior to the Business Combination, stock-based compensation expense and income taxestaxes. Management bases its estimates on historical experience and on various other market-specific and relevant assumptions that are believed to be reasonable under ASC 740, “Income Taxes” (“ASC 740”). ASC 740 requires the recognitioncircumstances, the results of deferred tax assets and liabilitieswhich form the basis for bothmaking judgments about the expected impact of differences between the condensed financial statement and tax basiscarrying value of assets and liabilities that are not readily apparent from other sources. Actual results could materially differ from those estimates.

Concentration of Credit Risk

Financial instruments, which potentially subject the Company to significant concentration of credit risk, consist of cash, cash equivalents and marketable securities. The Company's cash is held by one financial institution that management believes is creditworthy. Such deposits held with the financial institution may at times exceed federally insured limits, however, its exposure to credit risk in the event of default by the financial institution is limited to the extent of amounts recorded on the unaudited condensed consolidated balance sheets. The Company performs evaluations of the relative credit standing of these financial institutions to limit the amount of credit exposure. The Company's policy is to invest cash in institutional money market funds and marketable securities with high credit quality to limit the amount of credit exposure. The Company currently maintains a portfolio of cash equivalents and marketable securities in a variety of securities, including money market funds, U.S. government bonds, foreign bonds, commercial paper and corporate debt securities. The Company has not experienced any losses on its cash equivalents and marketable securities.

Marketable Securities

The Company invests its excess cash in marketable U.S. government bonds, foreign bonds, commercial paper and corporate debt securities. All marketable securities have been classified as available-for-sale and are carried at estimated fair value as determined based upon quoted market prices or pricing models for similar securities. The Company does not buy or hold securities principally for the expected future tax benefitpurpose of selling them in the near future. The Company’s policy is focused on the preservation of capital, liquidity, and return. From time to be derived from taxtime, the Company may sell certain securities, but the objectives are generally not to generate profits on short-term differences in price.

Short-term marketable securities have maturities less than or equal to one year as of the balance sheet date. Long-term marketable securities have maturities greater than one year as of the balance sheet date. These marketable securities are carried at estimated fair value with unrealized holding gains and losses included in accumulated other comprehensive loss in stockholders’ equity until realized. Gains and tax credit carry forwards. ASC 740 additionally requireslosses on marketable security transactions are reported on the specific-identification method. Interest income is recognized in the unaudited condensed consolidated statements of operations and comprehensive loss when earned.

The Company periodically evaluates its available-for-sale marketable securities for impairment. When the fair value of a valuation allowancemarketable security is below its amortized cost, the amortized cost is reduced to be established whenits fair value if it is more likely than not that allthe Company is

6

required to sell the impaired security before recovery of its amortized cost basis, or a portionthe Company has the intention to sell the security. If neither of deferred tax assets willthese conditions are met, the Company determines whether the impairment is due to credit losses by comparing the present value of the expected cash flows of the security with its amortized cost basis. The amount of impairment recognized is limited to the excess of the amortized cost over the fair value of the security. An allowance for credit losses for the excess of amortized cost over the expected cash flows is recorded in other income on the unaudited condensed consolidated statements of operations. Impairment losses that are not be realized.credit-related are included in accumulated other comprehensive loss in stockholders’ equity.

Warrant Liabilities

ASC 740 also clarifiesThe Company's Public Warrants, Private Placement Warrants and PIPE Warrants were classified as liabilities (see Note 8). At the accounting for uncertaintyend of each reporting period, any changes in income taxesfair value during the period are recognized in an enterprise'sother income within the unaudited condensed financialconsolidated statements of operations and prescribes a recognition threshold and measurement process for condensed financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. For those benefits to be recognized, a tax position must be more-likely-than-not to be sustained upon examination by taxing authorities.comprehensive loss. The Company recognizes accrued interest and penalties relatedwill continue to unrecognized tax benefits as income tax expense. There were no unrecognized tax benefits and no amounts accruedadjust the warrant liabilities for interest and penalties as of September 30, 2020. The Company is currently not aware of any issues under review that could result in significant payments, accruals or material deviation from its position. The Company is subject to income tax examinations by major taxing authorities since inception.

The Company is considered an exempted Cayman Islands company and is presently not subject to income taxes or income tax filing requirementschanges in the Cayman Islandsfair value until the earlier of a) the exercise or expiration of the United States. Aswarrants or b) the redemption of the warrants, at which time such warrants will be reclassified to additional paid-in capital.

Net Loss Per Share

Basic net loss per share is calculated by dividing the Company's tax provision was zeronet loss attributable to common stock by the weighted-average number of shares of common stock outstanding for the period, presented.

Net Loss per Ordinary Share

Netwithout consideration for potential dilutive securities. Since the Company was in a loss position for the periods presented, basic net loss per ordinary share is computed by dividing net loss by the weighted average number of ordinary shares outstanding during the period, excluding ordinary shares subject to forfeiture. Weighted average shares were reduced for the effect of an aggregate of 300,000 ordinary shares, that were subject to forfeiture if the over-allotment option was not exercised by the underwriter (see Note 5). At September 30, 2020, the Company did not have any dilutive securities and other contracts that could, potentially, be exercised or converted into ordinary shares and then share in the earnings of the Company. As a result, diluted loss per common share is the same as basicdiluted net loss per share as the effects of potentially dilutive securities are antidilutive. The following table presents the potential common stock outstanding that were excluded from the computation of diluted net loss per share of common stock as of the periods presented because including them would have been antidilutive (in thousands):

|

| March 31, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

|

|

|

|

|

|

| ||

Options outstanding |

|

| 3,336 |

|

|

| 1,537 |

|

Unvested restricted stock |

|

| 143 |

|

|

| 119 |

|

Unvested common stock subject to repurchase |

|

| 53 |

|

|

| 115 |

|

Warrants to purchase common stock |

|

| 1,804 |

|

|

| 0 |

|

Total |

|

| 5,336 |

|

|

| 1,771 |

|

Note 3. Recapitalization

On August 11, 2021, Consonance consummated the Business Combination (see Note 1). Immediately after the consummation of the Business Combination, certain investors subscribed for the period presented.

Concentrationand purchased an aggregate of Credit Risk

Financial instruments that potentially subject the Company to concentrations12.0 million units, each consisting of credit risk consist of a cash account in a financial institution which, at times may exceed the Federal Depository Insurance Coverage of $250,000. The Company has not experienced losses on this account and management believes the Company is not exposed to significant risks on such account.

Fair Value of Financial Instruments

The fair valueone share of the Company’s assets and liabilities, which qualify as financial instruments under ASC Topic 820, “Fair Value Measurement,” approximates the carrying amounts represented in the accompanying condensed balance sheet, primarily due to their short-term nature.

Recent Accounting Standards

Management does not believe that any recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on the accompanying condensed financial statements.

CONSONANCE-HFW ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTS

SEPTEMBER 30, 2020

(Unaudited)

NOTE 3. INITIAL PUBLIC OFFERING

Pursuant to the Initial Public Offering, the Company sold 8,000,000 Units at a purchase price of $10.00 per Unit. Each Unit consists of one Class A ordinary sharecommon stock and one-third of one redeemable warrant, (“for a purchase price of $10.00 per unit through a private investment in public entity financing, or PIPE Financing. In connection with the Business Combination and PIPE Financing, Legacy Surrozen received the aggregate cash consideration of $128.8 million, after deducting the transaction fees incurred by Consonance. The cash consideration was comprised of $8.6 million in proceeds from issuance of common stock upon the closing of the Business Combination and $120.2 million in proceeds from the PIPE Financing. The Company incurred transaction costs of $6.3 million, consisting of legal, accounting and other professional services directly related to the Business Combination, $0.4 million of which were allocated to the warrant liabilities assumed and recognized as other expenses when incurred. The remaining $5.9 million were recorded as a reduction of additional paid-in capital in the unaudited condensed consolidated balance sheet. Legacy Surrozen was deemed the accounting acquirer in the Business Combination and the Business Combination was accounted for as a reverse recapitalization based on the following predominant factors:

Accordingly, for accounting purposes, the reverse recapitalization was treated as the equivalent of Legacy Surrozen issuing stock for the net assets of Consonance, accompanied by a recapitalization. The net assets of Consonance are stated at historical cost, with 0 goodwill or other intangible assets recorded.

7

Pursuant to the Business Combination Agreement, upon the closing of the Business Combination, (i) each share of redeemable convertible preferred stock of Legacy Surrozen (on an as converted to common stock basis) and each share of common stock of Legacy Surrozen, whether vested or unvested, was converted into 0.175648535 shares of the Company’s common stock and (ii) each outstanding option to purchase common stock of Legacy Surrozen was converted into an option to purchase shares of the Company’s common stock based on an exchange ratio of 0.175648535, or the Exchange Ratio, with corresponding adjustments to the exercise price. All issued and outstanding common stock, preferred stock and stock awards of Legacy Surrozen and corresponding capital amounts contained in the unaudited condensed consolidated financial statements for the periods presented prior to the closing of the Business Combination have been retroactively restated to reflect the conversion.

Note 4. Fair Value Measurement

The following tables summarize the Company’s financial assets and liabilities that are measured at fair value on a recurring basis (in thousands):

|

| March 31, 2022 |

| |||||||||||||

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Money market funds(1) |

| $ | 11,565 |

|

| $ | — |

|

| $ | 0 |

|

| $ | 11,565 |

|

Commercial paper |

|

| — |

|

|

| 49,161 |

|

|

| 0 |

|

|

| 49,161 |

|

Corporate bonds |

|

| 0 |

|

|

| 19,309 |

|

|

| 0 |

|

|

| 19,309 |

|

Government bonds |

|

| — |

|

|

| 17,833 |

|

|

| 0 |

|

|

| 17,833 |

|

Foreign bonds |

|

| — |

|

|

| 3,686 |

|

|

| 0 |

|

|

| 3,686 |

|

Total financial assets measured at fair value |

| $ | 11,565 |

|

| $ | 89,989 |

|

| $ | 0 |

|

| $ | 101,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Liabilities(2): |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Public Warrants |

| $ | 767 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 767 |

|

Private Placement Warrants |

|

| — |

|

|

| 36 |

|

|

| 0 |

|

|

| 36 |

|

PIPE Warrants |

|

| — |

|

|

| 1,001 |

|

|

| 0 |

|

|

| 1,001 |

|

Total financial liabilities measured at fair value |

| $ | 767 |

|

| $ | 1,037 |

|

| $ | 0 |

|

| $ | 1,804 |

|

|

| December 31, 2021 |

| |||||||||||||

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Money market funds(1) |

| $ | 32,310 |

|

| $ | — |

|

| $ | — |

|

| $ | 32,310 |

|

Commercial paper |

|

| — |

|

|

| 49,136 |

|

|

| — |

|

|

| 49,136 |

|

Corporate bonds |

|

| — |

|

|

| 19,480 |

|

|

| — |

|

|

| 19,480 |

|

Government bonds |

|

| — |

|

|

| 18,082 |

|

|

| — |

|

|

| 18,082 |

|

Foreign bonds |

|

| 0 |

|

|

| 3,717 |

|

|

| 0 |

|

|

| 3,717 |

|

Total financial assets measured at fair value |

| $ | 32,310 |

|

| $ | 90,415 |

|

| $ | 0 |

|

| $ | 122,725 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Liabilities(2): |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Public Warrants |

| $ | 3,527 |

|

| $ | — |

|

| $ | — |

|

| $ | 3,527 |

|

Private Placement Warrants |

|

| — |

|

|

| 166 |

|

|

| — |

|

|

| 166 |

|

PIPE Warrants |

|

| — |

|

|

| 4,608 |

|

|

| — |

|

|

| 4,608 |

|

Total financial liabilities measured at fair value |

| $ | 3,527 |

|

| $ | 4,774 |

|

| $ | — |

|

| $ | 8,301 |

|

There were 0 changes to the valuation methods utilized and there were no transfers of financial instruments between Level 1, Level 2, and Level 3 during the three months ended March 31, 2022.

Corporate bonds, commercial paper, foreign bonds and government bonds are classified as Level 2 as they were valued based upon quoted market prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant inputs are observable in the market or can be corroborated by observable market data for substantially the full term of the assets.

8

The Public Warrants are classified as Level 1 due to the use of an observable market quote in an active market. The Private Placement Warrants and PIPE Warrants are classified as Level 2 due to the use of observable market data for identical or similar liabilities. The fair value of each Private Placement Warrant and PIPE Warrant was determined to be consistent with that of a Public Warrant because the Private Placement Warrants and PIPE Warrants are also subject to the make-whole redemption feature, which allows the Company to redeem both types of warrants on similar terms when the stock price is in the range of $10 to $18 per share.

The following tables provide the Company’s marketable securities by security type (in thousands):

|

| March 31, 2022 |

| |||||||||||||

|

| Amortized Cost |

|

| Gross Unrealized Gains |

|

| Gross Unrealized Losses |

|

| Fair Value |

| ||||

Commercial paper |

| $ | 49,161 |

|

| $ | 0 |

|

| $ | — |

|

| $ | 49,161 |

|

Corporate bonds |

|

| 19,422 |

|

|

| 0 |

|

|

| (113 | ) |

|

| 19,309 |

|

Government bonds |

|

| 6,135 |

|

|

| 0 |

|

|

| (82 | ) |

|

| 6,053 |

|

Foreign bonds |

|

| 3,705 |

|

|

| 0 |

|

|

| (19 | ) |

|

| 3,686 |

|

Total short-term marketable securities |

| $ | 78,423 |

|

| $ | 0 |

|

| $ | (214 | ) |

| $ | 78,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Government bonds |

| $ | 11,995 |

|

| $ | 0 |

|

| $ | (215 | ) |

| $ | 11,780 |

|

Total long-term marketable securities |

| $ | 11,995 |

|

| $ | 0 |

|

| $ | (215 | ) |

| $ | 11,780 |

|

|

| December 31, 2021 |

| |||||||||||||

|

| Amortized Cost |

|

| Gross Unrealized Gains |

|

| Gross Unrealized Losses |

|

| Fair Value |

| ||||

Commercial paper |

| $ | 49,136 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 49,136 |

|

Corporate bonds |

|

| 15,920 |

|

|

| 4 |

|

|

| (17 | ) |

|

| 15,907 |

|

Foreign bonds |

|

| 3,725 |

|

|

| 0 |

|

|

| (8 | ) |

|

| 3,717 |

|

Total short-term marketable securities |

| $ | 68,781 |

|

| $ | 4 |

|

| $ | (25 | ) |

| $ | 68,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Government bonds |

| $ | 18,165 |

|

| $ | 0 |

|

| $ | (83 | ) |

| $ | 18,082 |

|

Corporate bonds |

|

| 3,588 |

|

|

| 0 |

|

|

| (15 | ) |

|

| 3,573 |

|

Total long-term marketable securities |

| $ | 21,753 |

|

| $ | 0 |

|

| $ | (98 | ) |

| $ | 21,655 |

|

The following table indicates the length of the time that individual securities have been in a continuous unrealized loss position as of March 31, 2022 (dollars in thousands):

|

|

|

|

|

|

| Less Than 12 Months |

| ||||||

|

|

|

| Number of Investments |

|

| Fair Value |

|

| Unrealized Losses |

| |||

Corporate bonds |

|

|

|

| 7 |

|

| $ | 19,309 |

|

| $ | 113 |

|

Government bonds |

|

|

|

| 3 |

|

|

| 17,833 |

|

|

| 297 |

|

Foreign bonds |

|

|

|

| 2 |

|

|

| 3,686 |

|

|

| 19 |

|

|

|

|

|

| 12 |

|

| $ | 40,828 |

|

| $ | 429 |

|

As of March 31, 2022 and December 31, 2021, all short-term marketable securities had maturities of one year or less. All long-term marketable securities as of March 31, 2022 and December 31, 2021 had maturities of greater than one year but less than two years. There have been no significant realized gains or losses on the short-term and long-term marketable securities during the three months ended March 31, 2022 and 2021. The Company periodically reviews the available-for-sale investments for other-than-temporary impairment loss. All investments with unrealized losses have been in a loss position for less than 12 months. The Company determined that the unrealized loss was primarily attributed to changes in current market interest rates and not to credit quality. The Company does not intend to sell the marketable securities that are in an unrealized loss position, nor is it more likely than not that the Company will be required to sell the marketable securities before the recovery of the amortized cost basis, which may be at maturity. As a result, the Company did not recognize any other-than-temporary impairment losses as of March 31, 2022.

9

Note 5. Balance Sheet Components

Accrued and Other Liabilities

Accrued and other liabilities consist of the following (in thousands):

|

| March 31, |

|

| December 31, 2021 |

| ||

Accrued research and development expenses |

| $ | 1,920 |

|

| $ | 3,666 |

|

Accrued payroll and related expenses |

|

| 1,793 |

|

|

| 2,887 |

|

Accrued professional service fees |

|

| 373 |

|

|

| 1,520 |

|

Liability for early exercised stock options |

|

| 167 |

|

|

| 205 |

|

Other |

|

| 674 |

|

|

| 384 |

|

Accrued and other liabilities |

| $ | 4,927 |

|

| $ | 8,662 |

|

Note 6. License Agreements

Stanford License Agreements

In March 2016, the Company entered into a license agreement with Stanford University, or the 2016 Stanford Agreement, which was amended in July 2016, October 2016 and January 2021, pursuant to which the Company obtained from Stanford a worldwide, exclusive, sublicensable license under certain patents, rights, or licensed patents and technology related to its engineered Wnt surrogate molecules to make, use, import, offer to sell and sell products that are claimed by the licensed patents or that use or incorporate such technology, or licensed products, for the treatment, diagnosis and prevention of human and veterinary diseases. The Company agreed to pay Stanford an aggregate of up to $0.9 million for the achievement of specified development and regulatory milestones, and an aggregate of up to $5.0 million for achievement of specified sales milestones. Stanford is also entitled to receive royalties from the Company equal to a very low single digit percentage of the Company’s and its sublicensees’ net sales of licensed products that are covered by a valid claim of a licensed patent. Additionally, the Company agreed to pay Stanford a low double-digit percentage of non-royalty sublicense consideration received by the Company in connection with any sublicense granted to a third-party and, if the Company is acquired, a one-time change of control fee in the low six figures.

In June 2018, the Company entered into another license agreement with Stanford, or the 2018 Stanford Agreement, pursuant to which the Company obtained from Stanford a worldwide, exclusive, sublicensable license under certain patent rights related to its surrogate R-spondin proteins, or the licensed patents, to make, use, import, offer to sell and sell products that are claimed by the licensed patents, or licensed products, for the treatment, diagnosis and prevention of human and veterinary diseases, or the exclusive field. Additionally, Stanford granted the Company a worldwide, non-exclusive, sublicensable license under the licensed patents to make and use licensed products for research and development purposes in furtherance of the exclusive field and a worldwide, non-exclusive license to make, use and import, but not to offer to sell or sell, licensed products in any other field of use. The Company agreed to pay Stanford an aggregate of up to $0.4 million for the achievement of specified development and regulatory milestones. Stanford is also entitled to receive royalties from the Company equal to a sub-single digit percentage of the Company’s and its sublicensees’ net sales of licensed products. Additionally, the Company agreed to pay Stanford a one-time payment in the low six figures for each sublicense of the licensed patents that the Company grants to a third party and, if the Company is acquired, a one-time nominal change of control fee.

For the three months ended March 31, 2022 and 2021, the Company incurred de minimis research and development expenses under the Stanford agreements. NaN milestones have been achieved as of March 31, 2022.

UCSF License and Option Agreements

In September and October 2016, the Company entered into two separate license and option agreements with The Regents of the University of California, or the UCSF Agreements, pursuant to which the Company obtained exclusive licenses from UCSF for internal research and antibody discovery purposes and an option to negotiate with UCSF to obtain an exclusive license under UCSF’s rights in the applicable library to make, use, sell, offer for sale and import products incorporating antibodies identified or resulting from the Company’s use of such library, or licensed products.

In January 2020, the Company amended and restated the UCSF Agreements to provide non-exclusive licenses to make and use a certain human Fab naïve phage display library and to make and use a certain phage display llama VHH single domain antibody library for internal research and antibody discovery purposes and an option to negotiate with UCSF to obtain a non-exclusive commercial license under UCSF’s rights in the applicable library to make, use, sell, offer for sale and import products incorporating antibodies identified or resulting from the Company’s use of such library, or licensed products.

10

In March 2022, the Company exercised the option under the UCSF Agreements and entered into a non-exclusive commercial license agreement to make and use licensed products derived from the phage display llama VHH single domain antibody library. Under the commercial license agreement, the Company paid UCSF a nominal license issue fee and agreed to pay a nominal annual license maintenance fee, five- to six-digit payments per licensed product upon achievement of a regulatory milestone, nominal minimum annual royalties, and earned royalties equal to a sub-single digit percentage of the Company’s and the Company’s sublicensees’ net sales of licensed products.

For the three months ended March 31, 2022 and 2021, the Company incurred de minimis research and development expenses under the UCSF Agreements and the commercial license agreement. NaN milestones have been achieved as of March 31, 2022.

Distributed Bio Subscription Agreement

In September 2016, the Company entered into, and in January 2019, the Company amended, an antibody library subscription agreement with Charles River Laboratories International, Inc., formerly known as Distributed Bio, or the Distributed Bio Agreement, in which the Company obtained from Distributed Bio a non-exclusive license to use Distributed Bio’s antibody library to identify antibodies directed to an unlimited number of the Company’s proprietary targets and to make, use, sell, offer for sale, import and exploit products incorporating the antibodies that the Company identifies, or licensed products. The Company agreed to pay Distributed Bio an annual fee in the low six figures after the first three years. Additionally, the Company agreed to pay Distributed Bio an aggregate of $5.9 million for each licensed product that achieves specified development, regulatory and commercial milestones and royalties equal to a very low single digit percentage of the Company’s and its sublicensees’ net sales of licensed products. The Company’s obligation to pay royalties will end for each licensed product ten years after its first commercial sale.

For the three months ended March 31, 2022 and 2021, the Company incurred de minimis research and development expenses under the Distributed Bio Agreement. NaN milestones have been achieved during the three months ended March 31, 2022.

Note 7. Commitments and Contingencies

Lease Agreements

In August 2016, the Company entered into a lease agreement for office and lab space, which consists of approximately 32,813 square feet of rental space in South San Francisco, California. The office space lease is classified as an operating lease. The initial lease term commenced in May 2017 and ends in April 2025, with rent payments escalating each year. The Company has options to extend the lease for additional years, but the exercise of the option was not reasonably certain. In connection with the lease, the Company maintains a letter of credit for the benefit of the landlord in the amount of $0.4 million, which is recorded as restricted cash in the unaudited condensed consolidated balance sheets.

In January 2020, the Company entered into a lease agreement for a term of 18 months for approximately 6,478 square feet of office space. This office space lease, which commenced in June 2020, is classified as an operating lease and the rent payments escalate after 14 months. In September 2021, the Company amended the lease to extend the lease term until June 2022.

The operating lease expense for the three months ended March 31, 2022 and 2021 was $0.5 million, respectively.

Aggregate future minimum rental payments under the operating leases as of March 31, 2022, were as follows (in thousands):

Remaining nine months ending December 31, 2022 |

| $ | 2,014 |

|

Year ending December 31, 2023 |

|

| 2,596 |

|

Year ending December 31, 2024 |

|

| 2,670 |

|

Year ending December 31, 2025 |

|

| 891 |

|

Total lease payments |

|

| 8,171 |

|

Less: Imputed interest |

|

| (954 | ) |

Operating lease liabilities |

| $ | 7,217 |

|

11

Note 8. Stockholders’ Equity

Equity Purchase Agreement

In February 2022, the Company entered into the Equity Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park is obligated to purchase up to $50.0 million of the Company’s common stock with a maximum of 7,003,383 shares from time to time at the Company’s sole discretion over a 36-month period commencing on April 27, 2022. The Company also entered into a registration rights agreement with Lincoln Park pursuant to which the Company filed with the SEC the registration statement to register for resale under the Securities Act of 1933, as amended, the shares of common stock that have been or may be issued to Lincoln Park under the Equity Purchase Agreement. The registration statement was effective on April 5, 2022.

Upon execution of the Equity Purchase Agreement, the Company issued 0.1 million shares of common stock to Lincoln Park with the fair value of $0.3 million as consideration for Lincoln Park’s commitment to purchase the Company’s common stock. The Company incurred the costs of $0.5 million, primarily consisting of the commitment shares issued and the legal fees related to the Equity Purchase Agreement, that were recorded as deferred charges included in other assets on the unaudited condensed consolidated balance sheet and will be recognized against the proceeds from the sale of common stock under the Equity Purchase Agreement. In the event that the Company sells its common stock under the Equity Purchase Agreement for an aggregate price equal to or greater than $30.0 million, the Company shall pay the additional commitment fee of $0.1 million to Lincoln Park.

As contemplated by the Equity Purchase Agreement, and so long as the closing price of the Company’s common stock exceeds $1.00 per share, the Company may direct Lincoln Park, at its sole discretion, to purchase up to 30,000 shares of its common stock, or the Regular Purchase Share Limit, on any business day at a purchase price per share equal to the lower of: (i) the lowest price of the Company’s common stock on the applicable purchase date and (ii) the average of the 3 lowest closing prices of the Company’s common stock during the 10 consecutive business days preceding such purchase date. The Regular Purchase Share Limit may be increased to up to 35,000 shares and 40,000 shares if the closing price of the Company’s common stock is not below $10.00 per share and $12.00 per share, respectively. Any single purchase of the Company’s common stock shall not exceed $3.5 million.

The Company may also direct Lincoln Park to purchase additional shares no less than the Regular Purchase Share Limit and no greater than 500,000 shares at a purchase price per share equal to 96% of the lower of (i) the closing price of the Company’s common stock on the purchase date and (ii) the weighted average price of the Company’s common stock on the purchase date.

As of March 31, 2022, the Company has 0t sold any shares of common stock under the Equity Purchase Agreement.

Note 9. Common Stock Warrants

In connection with the Business Combination, Legacy Surrozen, as the accounting acquirer, was deemed to assume warrants held by Consonance’s stockholders, or the Public Warrants, and warrants held by Consonance's sponsor, or the Private Placement Warrants. In addition, in the PIPE Financing, certain investors subscribed for and purchased an aggregate of 12.0 million units, each consisting of one share of the Company’s common stock and one-third of one redeemable warrant, or PIPE Warrants. All of these warrants were outstanding as of March 31, 2022. The following table sets forth the common stock warrants outstanding as of March 31, 2022 (in thousands, except exercise price per warrant):

Type |

| Classification |

| Expiration Date |

| Exercise Price per Warrant |

|

| Number of Warrants |

|

| Fair Value |

| |||

Public Warrants |

| Liability |

| August 12, 2026 |

| $ | 11.50 |

|

|

| 3,067 |

|

| $ | 767 |

|

Private Placement Warrants |

| Liability |

| August 12, 2026 |

|

| 11.50 |

|

|

| 145 |

|

|

| 36 |

|

PIPE Warrants |

| Liability |

| August 12, 2026 |

|

| 11.50 |

|

|

| 4,007 |

|

|

| 1,001 |

|

Total |

|

|

|

|

|

|

|

|

| 7,219 |

|

| $ | 1,804 |

| |

Public Warrants

Each whole Public Warrant entitles the holder to purchase one Class A ordinary share at an exercise price of $11.50 per share, subject to adjustment (see Note 7).

On December 1, 2020, the underwriters fully exercised their over-allotment option, resulting in an additional 1,200,000 Units issued for an aggregate amount of $12,000,000. In connection with the underwriters’ full exercise of their over-allotment option, the Company also consummated the sale of an additional 24,000 Private Placement Units at $10.00 per Private Placement Unit, generating total proceeds of $12,240,000. A total of $12,000,000 was deposited into the Trust Account, bringing the aggregate proceeds held in the Trust Account to $92,000,000 (see Note 8).

NOTE 4. PRIVATE PLACEMENT

Simultaneously with the consummation of the Initial Public Offering, the Sponsor purchased an aggregate of 410,000 Private Placement UnitsCompany’s common stock at a price of $10.00$11.50 per Private Placement Unit, for an aggregate purchase price of $4,100,000. On December 1, 2020, as a result of the underwriters’ election to fully exercise their over-allotment option, the Sponsor purchased an additional 24,000 Private Placement Units, at a price of $10.00 per Private Placement Unit, or $240,000 in the aggregate (see Note 8). Each Private Placement Unit consists of one Class A ordinary share (“Private Placement Share” or, collectively, “Private Placement Shares”) and one-third of one redeemable warrant (each, a “Private Placement Warrant”). Each whole Private Placement Warrant is exercisable for one Class A ordinary share, at a price of $11.50 per share, subject to adjustment (see Note 7). The proceeds from the sale of the Private Placement Units were added to the net proceeds from the Initial Public Offering held in the Trust Account. If the Company does not complete a Business Combination within the Combination Period, the proceeds from the sale of the Private Placement Units held in the Trust Account will be used to fund the redemption of the Public Shares (subject to the requirements of applicable law) and the Private Placement Units and all underlying securities will expire worthless.

NOTE 5. RELATED PARTY TRANSACTIONS

Founder Shares