NeuBase Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

For the Three Months Ended December 31, 2021 and 2020

(Unaudited)

| | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-In | | Accumulated | | Total Stockholders’ | ||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Equity | ||||

Balance as of September 30, 2020 |

| 23,154,084 | | $ | 2,315 | | $ | 74,850,935 | | $ | (43,558,602) | | $ | 31,294,648 |

Stock-based compensation expense | | — | | | — | | | 1,176,585 | | | — | | | 1,176,585 |

Issuance of restricted stock for services | | 1,931 | | | — | | | — | | | — | | | — |

Exercise of stock options | | 21,576 | | | 2 | | | 112,444 | | | — | | | 112,446 |

Net loss | | — | | | — | | | — | | | (4,066,431) | | | (4,066,431) |

Balance as of December 31, 2020 | | 23,177,591 | | $ | 2,317 | | $ | 76,139,964 | | $ | (47,625,033) | | $ | 28,517,248 |

| | | | | | | | | | | | | | |

Balance as of September 30, 2021 | | 32,721,493 | | $ | 3,272 | | $ | 123,034,404 | | $ | (68,967,903) | | $ | 54,069,773 |

Stock-based compensation expense | | — |

| | — | |

| 793,204 | |

| — | |

| 793,204 |

Issuance of restricted stock for services | | 4,441 | | | — | | | — | | | — | | | — |

Exercise of stock options | | 42,250 | | | 4 | | | 38 | | | — | | | 42 |

Net loss | | — |

| | — | |

| — | |

| (7,728,816) | |

| (7,728,816) |

Balance as of December 31, 2021 | | 32,768,184 | | $ | 3,276 | | $ | 123,827,646 | | $ | (76,696,719) | | $ | 47,134,203 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

3

NeuBase Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ EquityCash Flows

For the Three and Six Months Ended March 31, 2021 and 2020(Unaudited)

(Unaudited)

| | | | | | |

| | Three Months Ended | ||||

| | December 31, | ||||

|

| 2021 |

| 2020 | ||

Cash flows from operating activities | | |

| | | |

Net loss | | $ | (7,728,816) | | $ | (4,066,431) |

Adjustments to reconcile net loss to net cash used in operating activities | |

| | |

| |

Stock-based compensation | |

| 793,204 | |

| 1,176,585 |

Change in fair value of warrant liabilities | |

| 0 | |

| (630,112) |

Depreciation and amortization | |

| 181,490 | |

| 68,117 |

Loss on marketable securities | | | 30 | | | 14,970 |

Loss on disposal of fixed assets | |

| 7,595 | |

| 0 |

Equity in losses on equity method investment | |

| 415,744 | |

| 25,412 |

Non-cash expense from right-of-use assets | | | 103,599 | | | 0 |

Changes in operating assets and liabilities | |

| | |

| |

Prepaid insurance, other prepaid expenses and current assets | |

| 877,266 | |

| (25,132) |

Long-term prepaid insurance | | | 0 | | | 48,417 |

Security deposit | |

| 0 | |

| (253,565) |

Other long-term assets | |

| 160,423 | |

| 0 |

Accounts payable | | | (680,142) | | | (327,087) |

Accrued expenses and other current liabilities | |

| 665,134 | |

| 187,965 |

Operating lease liability | | | (63,973) | | | 0 |

Net cash used in operating activities | |

| (5,268,446) | |

| (3,780,861) |

Cash flows from investing activities | |

| | |

| |

Purchase of laboratory and office equipment | |

| (123,876) | |

| (193,571) |

Purchase of marketable securities | | | (14,986,818) | | | (15,003,771) |

Sale of marketable securities | | | 14,986,788 | | | 14,988,801 |

| | | | | | |

Net cash used in investing activities | |

| (123,906) | |

| (208,541) |

Cash flows from financing activities | |

| | |

| |

Principal payment of financed insurance | | | (148,385) | | | (138,557) |

Principal payment of finance lease liability | | | (26,632) | | | 0 |

Proceeds from exercise of stock options | |

| 42 | |

| 112,446 |

Net cash used in financing activities | |

| (174,975) | |

| (26,111) |

Net decrease in cash and cash equivalents | |

| (5,567,327) | |

| (4,015,513) |

Cash and cash equivalents, beginning of period | | | 52,893,387 | | | 31,992,283 |

Cash and cash equivalents, end of period | | $ | 47,326,060 | | $ | 27,976,770 |

| |

|

| |

|

|

Supplemental disclosure of cash flow information: | | | | | | |

Cash paid for interest | | $ | 0 | | $ | 10,400 |

Cash paid for income taxes | | $ | 0 | | $ | 0 |

Non-cash investing and financing activities: | | | | | | |

Purchases of laboratory and office equipment in accounts payable | | $ | 65,970 | | $ | 0 |

| Common Stock | Additional | Total | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Accumulated Deficit | Stockholders’ Equity | ||||||||||||||||

| Balance as of December 31, 2020 | 23,177,591 | $ | 2,317 | $ | 76,139,964 | $ | (47,625,033 | ) | $ | 28,517,248 | ||||||||||

| Stock-based compensation expense | - | - | 942,108 | - | 942,108 | |||||||||||||||

| Issuance of restricted stock for services | 2,433 | - | - | - | - | |||||||||||||||

| Net loss | - | - | - | (5,521,569 | ) | (5,521,569 | ) | |||||||||||||

| Balance as of March 31, 2021 | 23,180,024 | $ | 2,317 | $ | 77,082,072 | $ | (53,146,602 | ) | $ | 23,937,787 | ||||||||||

| Common Stock | Additional | Total | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Accumulated Deficit | Stockholders’ Equity | ||||||||||||||||

| Balance as of September 30, 2020 | 23,154,084 | $ | 2,315 | $ | 74,850,935 | $ | (43,558,602 | ) | $ | 31,294,648 | ||||||||||

| Stock-based compensation expense | - | - | 2,118,693 | - | 2,118,693 | |||||||||||||||

| Issuance of restricted stock for services | 4,364 | - | - | - | - | |||||||||||||||

| Exercise of stock options | 21,576 | 2 | 112,444 | - | 112,446 | |||||||||||||||

| Net loss | - | - | - | (9,588,000 | ) | (9,588,000 | ) | |||||||||||||

| Balance as of March 31, 2021 | 23,180,024 | $ | 2,317 | $ | 77,082,072 | $ | (53,146,602 | ) | $ | 23,937,787 | ||||||||||

| Common Stock | Additional | Total | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Accumulated Deficit | Stockholders’ Equity | ||||||||||||||||

| Balance as of December 31, 2019 | 17,077,873 | $ | 1,708 | $ | 37,705,984 | $ | (30,679,632 | ) | $ | 7,028,060 | ||||||||||

| Stock-based compensation expense | - | - | 1,339,410 | - | 1,339,410 | |||||||||||||||

| Issuance of restricted stock for services | 2,752 | - | - | - | - | |||||||||||||||

| Net loss | - | - | - | (4,378,270 | ) | (4,378,270 | ) | |||||||||||||

| Balance as of March 31, 2020 | 17,080,625 | $ | 1,708 | $ | 39,045,394 | $ | (35,057,902 | ) | $ | 3,989,200 | ||||||||||

| Common Stock | Additional | Total | ||||||||||||||||||

| Shares | Amount | Paid-In Capital | Accumulated Deficit | Stockholders’ Equity | ||||||||||||||||

| Balance as of September 30, 2019 | 17,077,873 | $ | 1,708 | $ | 36,201,758 | $ | (26,174,082 | ) | $ | 10,029,384 | ||||||||||

| Stock-based compensation expense | - | - | 2,843,636 | - | 2,843,636 | |||||||||||||||

| Issuance of restricted stock for services | 2,752 | - | - | - | - | |||||||||||||||

| Net loss | - | - | - | (8,883,820 | ) | (8,883,820 | ) | |||||||||||||

| Balance as of March 31, 2020 | 17,080,625 | $ | 1,708 | $ | 39,045,394 | $ | (35,057,902 | ) | $ | 3,989,200 | ||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

4

NeuBase Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| Six Months ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (9,588,000 | ) | $ | (8,883,820 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Stock-based compensation | 2,118,693 | 2,843,636 | ||||||

| Change in fair value of warrant liabilities | (720,709 | ) | 624,190 | |||||

| Depreciation and amortization | 151,418 | 199,500 | ||||||

| Loss on marketable security | 15,006 | - | ||||||

| Loss on disposal of fixed asset | - | 3,230 | ||||||

| Equity in losses on equity method investment | 61,539 | 117,351 | ||||||

| Gain on sale of intellectual property | (316,724 | ) | - | |||||

| Changes in operating assets and liabilities | ||||||||

| Prepaid insurance, other prepaid expenses and current assets | 122,878 | 214,698 | ||||||

| Long-term prepaid insurance | 96,834 | 96,833 | ||||||

| Security deposit | (253,565 | ) | - | |||||

| Accounts payable | 436,646 | 186,911 | ||||||

| Accrued expenses and other current liabilities | 574,460 | 340,288 | ||||||

| Net cash used in operating activities | (7,301,524 | ) | (4,257,183 | ) | ||||

| Cash flows from investing activities | ||||||||

| Purchase of laboratory and office equipment | (402,890 | ) | (161,916 | ) | ||||

| Purchase of marketable securities | (29,996,904 | ) | - | |||||

| Sale of marketable securities | 29,981,898 | - | ||||||

| Net cash used in investing activities | (417,896 | ) | (161,916 | ) | ||||

| Cash flows from financing activities | ||||||||

| Principal payment of financed insurance | (138,557 | ) | (122,919 | ) | ||||

| Proceeds from exercise of stock options | 112,446 | - | ||||||

| Net cash used in financing activities | (26,111 | ) | (122,919 | ) | ||||

| Net decrease in cash and cash equivalents | (7,745,531 | ) | (4,542,018 | ) | ||||

| Cash and cash equivalents, beginning of period | 31,992,283 | 10,313,966 | ||||||

| Cash and cash equivalents, end of period | $ | 24,246,752 | $ | 5,771,948 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | 10,400 | $ | 1,668 | ||||

| Non-cash investing and financing activities: | ||||||||

| Deferred offering costs, accrued but not yet paid | $ | - | $ | 196,724 | ||||

| Purchases of laboratory and office equipment in accounts payable | $ | 234,104 | $ | - | ||||

| Preferred shares in DepYmed received as consideration for sale of intellectual property | $ | 316,724 | $ | - | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements(Unaudited)

(Unaudited)

1. Organization and Description of Business

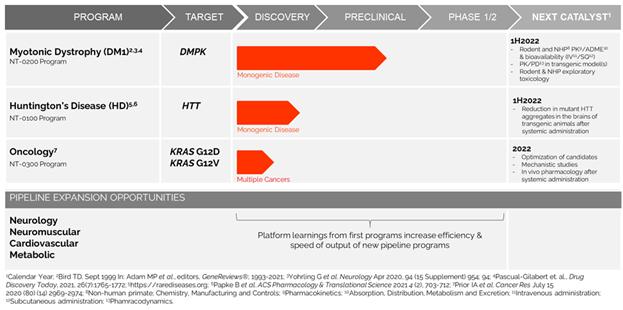

NeuBase Therapeutics, Inc. and subsidiaries (the “Company” or “NeuBase”) is developing a modular peptide-nucleic acid (“PNA”) antisense oligo (“PATrOL™”) platform to address genetic diseases, with a single, cohesive approach. The PATrOL™-enabled anti-gene therapies are designed to improve upon current genetic medicine strategies by combining the advantages of synthetic approaches with the precision of antisense technologies. NeuBase plans to use its platform to address diseases which have a genetic source, with an initial focus on Myotonic Dystrophy Type 1 (“DM1”) and, Huntington’s Disease (“HD”), as well as other genetic disorders and cancer.

oncology applications.

NeuBase is a pre-clinical-stagepreclinical-stage biopharmaceutical company and continues to develop its clinical and regulatory strategy with its internal research and development team with a view toward prioritizing market introduction as quickly as possible. NeuBase’s lead programs are NT0100NT-0100 in HD, NT-0200 in DM1 and NT0200.

The NT0100 program is a PATrOL™-enabled therapeutic program being developed to target the mutant expansionNT-0300 in the HD messenger ribonucleic acid (“mRNA”). The NT0100 program includes proprietary PNAs which have the potential to be highly selective for the mutant transcript vs. the wild-type transcribed allele and the expectation to be applicable for all HD patients as it directly targets the expansion itself, and has the potential to be delivered systemically. PATrOL™-enabled drugs also have the unique ability to open RNA secondary structures and bind to either the primary nucleotide sequences or the secondary and/or tertiary structures. KRAS-driven cancers:

| ● | The NT-0100 program is a PATrOL™-enabled therapeutic program being developed to target the mutant expansion in the HD messenger ribonucleic acid (“mRNA”). The NT-0100 program includes proprietary PNAs which have the potential to be highly selective for the mutant transcript vs. the wild-type transcribed allele and the expectation to be applicable for all HD patients as it directly targets the expansion itself and has the potential to be delivered systemically. PATrOL™-enabled drugs also have the unique ability to open RNA secondary structures and bind to either the primary nucleotide sequences or the secondary and/or tertiary structures. |

| ● | The NT-0200 program is a PATrOL™-enabled therapeutic program being developed to target the mutant expansion in the DM1 disease mRNA. The NT-0200 program includes several proprietary PNAs which have the potential to be highly selective for the mutant transcript versus the wild-type transcribed allele and the expectation to be effective for nearly all DM1 patients as it directly targets the expansion itself. |

| ● | The NT-0300 program is a PATrOL™-enabled therapeutic program being developed to target the mutated KRAS gene. The program is comprised of candidate compounds that target two activating mutations in the KRAS gene: G12D and G12V. NeuBase believes these candidate compounds, and subsequent further optimized compounds, have the potential to inhibit transcription and/or translation of the oncogenic mutations and slow or stop tumor growth. |

NeuBase believes the NT0100 program addresses anits three aforementioned programs address unmet needneeds for a disease whichdiseases that currently hashave no effective therapeutics that target the core etiologyetiologies of the condition.these conditions. NeuBase further believes there is a large opportunity in the U.S. and European markets for drugs in this space.these areas.

Liquidity

The NT0200 program isCompany has had no revenues from product sales and has incurred operating losses since inception. As of December 31, 2021, the Company had $47.3 million in cash and cash equivalents, and during the three months ended December 31, 2021, incurred a PATrOL™-enabled therapeutic program being developednet loss of $7.7 million and used $5.3 million of cash in operating activities.

The Company expects to targetcontinue to incur significant operating losses for the mutant expansion inforeseeable future and may never become profitable. As a result, the DM1 disease mRNA. The NT0200 program includes several proprietary PNAs which haveCompany will likely need to raise additional capital through one or more of the potentialfollowing: the issuance of additional debt or equity or the completion of a licensing transaction for one or more of the Company’s pipeline assets. Management believes it has sufficient working capital on hand to fund operations through at least the next twelve months from the date these consolidated financial statements were available to be highly selective forissued. There can be no assurance that the mutant transcript versusCompany will be successful in acquiring additional funding, that the wild-type transcribed alleleCompany’s projections of its future working capital needs will prove accurate, or that any additional funding would be sufficient to continue operations in future years.

5

NeuBase Therapeutics, Inc. and the expectationSubsidiaries

Notes to be effective for nearly all DM1 patients as it directly targets the expansion itself. NeuBase believes the NT0200 program addresses an unmet need for a disease which currently has no effective therapeutics that target the core etiology of the condition. NeuBase believes there is a large opportunity in the U.S. and European markets for drugs in this space.Condensed Consolidated Financial Statements

(Unaudited)

2. Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto as of and for the year ended September 30, 20202021 included in the Company’s Annual Report on Form 10-K (the “Annual Report”) filed with the U.S. Securities and Exchange Commission (“SEC”) on December 23, 2020.2021. The consolidated financial statements include the accounts of the Company and its wholly ownedwholly-owned subsidiaries. All intercompany accounts and transactions have been eliminated during the consolidation process. The Company manages its operations as a single segment for the purposes of assessing performance and making operating decisions. The accompanying unaudited condensed consolidated financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted. In the opinion of management, the accompanying unaudited condensed consolidated financial statements for the periods presented reflect all adjustments, consisting of only normal, recurring adjustments, necessary to fairly state the Company’s financial position, results of operations and cash flows. The unaudited condensed consolidated financial statements for the interim periods are not necessarily indicative of results for the full year. The preparation of these unaudited condensed consolidated financial statements requires the Company to make estimates and judgments that affect the amounts reported in the financial statements and the accompanying notes. The Company’s actual results may differ from these estimates under different assumptions or conditions.

5

NeuBase Therapeutics, Inc. and SubsidiariesNotes to Condensed Consolidated Financial Statements(Unaudited)

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. The most significant estimates in the Company’s unaudited condensed consolidated financial statements relate to the valuation of stock-based compensation, the valuation of licenses, the fair value of warrant liabilities and the valuation allowance of deferred tax assets resulting from net operating losses. These estimates and assumptions are based on current facts, historical experience and various other factors believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the recording of expenses that are not readily apparent from other sources.

The Company assesses and updates estimates each period to reflect current information, such as the economic considerations related to the impact that the novel coronavirus disease (“COVID-19”) could have on its significant accounting estimates (see Part II, Item 1A – Risk Factors—“Our operations may be adversely affected by the coronavirus outbreak, and we face risks that could impact our business” in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2020 for further discussion of the effect of the COVID-19 pandemic on the Company’s operations).estimates. Actual results may differ materially and adversely from these estimates. To the extent there are material differences between the estimates and actual results, the Company’s future results of operations will be affected.

Fair Value Measurements

Fair value measurements are based on the premise that fair value is an exit price representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, the following three-tier fair value hierarchy has been used in determining the inputs used in measuring fair value:

Level 1 – Quoted prices in active markets for identical assets or liabilities on the reporting date.

6

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Level 2 – Pricing inputs are based on quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Pricing inputs are generally unobservable and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require management’s judgment or estimation of assumptions that market participants would use in pricing the assets or liabilities. The fair values are therefore determined using factors that involve considerable judgment and interpretations, including but not limited to private and public comparables, third-party appraisals, discounted cash flow models, and fund manager estimates.

Financial instruments measured at fair value are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Management’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability. The use of different assumptions and/or estimation methodologies may have a material effect on estimated fair values. Accordingly, the fair value estimates disclosed, or initial amounts recorded may not be indicative of the amount that the Company or holders of the instruments could realize in a current market exchange.

6

NeuBase Therapeutics, Inc. and SubsidiariesNotes to Condensed Consolidated Financial Statements(Unaudited)

Marketable Securities

Marketable securities are classified as trading and are carried at fair value. The Company’s marketable securities consist of corporate bonds and highly liquid mutual funds and exchange-traded &and closed-end funds which are valued at quoted market prices. The Company had no0 marketable securities as of MarchDecember 31, 2021 and September 30, 2020.2021.

Net Loss Per Share

Basic net loss per share is computed by dividing net loss applicable to common stockholders by the weighted average number of shares of common stock outstanding during each period. Diluted net loss per share includes the dilutive effect, if any, from the potential exercise or conversion of securities, such as convertible debt, warrants and stock options that would result in the issuance of incremental shares of common stock. In computing the basic and diluted net loss per share applicable to common stockholders, the weighted average number of shares remains the same for both calculations due to the fact that when a net loss exists, dilutive shares are not included in the calculation as the impact is anti-dilutive.

The following potentially dilutive securities outstanding as of MarchDecember 31, 2021 and 2020 have been excluded from the computation of diluted weighted average shares outstanding, as they would be anti-dilutive:

| As of March 31, | ||||||||||||

| 2021 | 2020 | |||||||||||

| | | | | ||||||||

| | As of December 31, | ||||||||||

|

| 2021 |

| 2020 | ||||||||

| Common stock purchase options | 6,552,884 | 6,506,966 |

| 7,197,404 | | 6,633,554 | ||||||

| Unvested restricted stock | - | 3,125 | ||||||||||

Restricted stock units |

| 10,000 | | — | ||||||||

| Common stock purchase warrants | 820,939 | 715,939 |

| 875,312 | | 820,939 | ||||||

| 7,373,823 | 7,226,030 | |||||||||||

| | 8,082,716 | | 7,454,493 | ||||||||

Recent Accounting Pronouncements

In December 2019, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2019-12, “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes” (“ASU 2019-12”), which is intended to simplify various aspects related to accounting for income taxes. ASU 2019-12 removes certain exceptions to the general principles in Topic 740 and also clarifies and amends existing guidance to improve consistent application. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020, with earlyThe adoption permitted. The Company is currently evaluating the impact of this standard on itsas of October 1, 2021, did not impact the Company's consolidated financial statements and related disclosures.

In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments- Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”). This guidance introduces a new model for recognizing credit losses on financial

7

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

instruments based on an estimate of current expected credit losses. ASU 2016-13 also provides updated guidance regarding the impairment of available-for-sale debt securities and includes additional disclosure requirements. The new guidance is effective for public business entities that meet the definition of a Smaller Reporting Company as defined by the Securities and Exchange CommissionSEC for interim and annual periods beginning after December 15, 2022. Early adoption is permitted. The Company is currently evaluating the impact of this standard on its consolidated financial statements and related disclosures.

7

NeuBase Therapeutics, Inc.In May 2021, the FASB issued ASU No. 2021-04, “Earnings Per Share (Topic 260), Debt-Modifications and SubsidiariesNotesExtinguishments (Subtopic 470-50), Compensation-Stock Compensation (Topic 718), and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40)” (“ASU 2021-04”). This guidance reduces diversity in an issuer’s accounting for modifications or exchanges of freestanding equity-classified written call options (for example, warrants) that remain equity classified after modification or exchange. ASU 2021-04 provides guidance for a modification or an exchange of a freestanding equity-classified written call option that is not within the scope of another Topic. It specifically addresses: (1) how an entity should treat a modification of the terms or conditions or an exchange of a freestanding equity-classified written call option that remains equity classified after modification or exchange; (2) how an entity should measure the effect of a modification or an exchange of a freestanding equity-classified written call option that remains equity classified after modification or exchange; and (3) how an entity should recognize the effect of a modification or an exchange of a freestanding equity-classified written call option that remains equity classified after modification or exchange. ASU 2021-04 will be effective for all entities for fiscal years beginning after December 15, 2021. An entity should apply the amendments prospectively to Condensed Consolidated Financial Statements(Unaudited)

3. Liquidity

modifications or exchanges occurring on or after the effective date of the amendments. Early adoption is permitted, including adoption in an interim period. The Company expects to continue to incur significant operating losses foris currently evaluating the foreseeable future and may never become profitable. As a result, the Company will likely need to raise additional capital through one or moreimpact of the following: issuance of additional debt or equity, or complete a licensing transaction for one or more of the Company’s pipeline assets. Management believes that it has sufficient working capitalthis standard on hand to fund operations through at least the next twelve months from the date these unaudited condensedits consolidated financial statements were available to be issued. There can be no assurance that the Company will be successful in acquiring additional funding, that the Company’s projections of its future working capital needs will prove accurate, or that any additional funding would be sufficient to continue operations in future years.and related disclosures.

4.

3. Other Prepaid Expenses and Other Current Assets

The Company’s prepaid expenses and other current assets consisted of the following:

| As of March 31, | As of September 30, | |||||||||||||

| 2021 | 2020 | |||||||||||||

| | | | | | | ||||||||

| | As of December 31, | | As of September 30, | ||||||||||

|

| 2021 |

| 2021 | ||||||||||

| Prepaid research and development expense | $ | 29,422 | $ | 205,641 | | $ | 453,706 | | $ | 583,267 | ||||

| Prepaid rent | 301,481 | - | | | — | | | 172,518 | ||||||

| Other prepaid expenses and other current assets | 105,491 | 88,999 | |

| 390,698 | |

| 780,401 | ||||||

| Total | $ | 436,394 | $ | 294,640 | | $ | 844,404 | | $ | 1,536,186 | ||||

5.

4. Equipment

The Company’s equipment consisted of the following:

| As of March 31, | As of September 30, | |||||||||||||

| 2021 | 2020 | |||||||||||||

| | | | | | | ||||||||

| | As of December 31, | | As of September 30, | ||||||||||

|

| 2021 |

| 2021 | ||||||||||

| Laboratory equipment | $ | 1,825,393 | $ | 1,319,123 | | $ | 2,909,472 | | $ | 2,737,390 | ||||

| Office equipment | 137,201 | 6,477 | |

| 259,978 | |

| 259,978 | ||||||

Leasehold improvements | | | 10,128 | | | — | ||||||||

| Total | 1,962,594 | 1,325,600 | |

| 3,179,578 | |

| 2,997,368 | ||||||

| Accumulated depreciation | (310,084 | ) | (158,666 | ) | |

| (714,935) | |

| (533,486) | ||||

| Property, plant and equipment, net | $ | 1,652,510 | $ | 1,166,934 | | $ | 2,464,643 | | $ | 2,463,882 | ||||

Depreciation expense for the three months ended MarchDecember 31, 2021 and 2020 was approximately $0.08$0.2 million and $0.03$0.1 million, respectively. Depreciation expense for the six months ended March 31, 2021 and 2020 was approximately $0.15 million and $0.05 million, respectively.

8

NeuBase Therapeutics, Inc. and SubsidiariesNotes to Condensed Consolidated Financial Statements(Unaudited)5. Investment

6. Investment

The Company owns common and preferred shares of DepYmed Inc. (“DepYmed”), which in aggregate represents approximately 13%15% ownership of DepYmed. In addition, the Company is entitled

8

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to hold one of the six seats on DepYmed’s board of directors.Condensed Consolidated Financial Statements

(Unaudited)

In February 2021, the Company sold certain intellectual property to DepYmed in exchange for shares of Series A-4 preferred stock. The Company recognized a gain of $0.3 million related to the sale, which was recorded in Other income (expense) on the Company’s unaudited condensed consolidated statement of operations for the three and six months ended March 31, 2021.

The Company accounts for its investment in DepYmed common shares using the equity method of accounting and records its proportionate share of DepYmed’s net income and losses in the accompanying unaudited condensed consolidated statements of operations. Equity in losses for the three months ended March 31, 2021 and 2020 were approximately $0.04 million and $0.1 million, respectively. Equity in losses for the six months ended March 31, 2021 and 2020 were approximately $0.06 million and $0.1 million, respectively.

The Company accounts for its investment in preferred shares of DepYmed at cost, less any impairment, as the Company determined the preferred stock did not have a readily determinable fair value.

The carrying value of the Company’s investment in DepYmed common shares was reduced to zero, therefore, during the three months ended December 31, 2021, the Company recorded its share of equity losses to the extent of its investment in preferred shares of DepYmed. The Company will continue to monitor the operating results of DepYmed and will record equity in earnings when the equity in earnings exceeds the Company’s previously unrecognized losses.

As of MarchEquity in losses for the three months ended December 31, 2021 and September 30, 2020 thewere approximately $0.4 million and $0.03 million, respectively.

The carrying amountvalue of the Company’s aggregatetotal investment in DepYmed was $0.6 million and $0.3 million, respectively.is as follows:

| | | | | | |

| | As of December 31, | | As of September 30, | ||

|

| 2021 |

| 2021 | ||

Carrying value of DepYmed common shares | | $ | — | | $ | — |

| | | | | | |

Fair value of DepYmed preferred shares assumed in connection with acquisition of Ohr Pharmaceutical, Inc., a Delaware corporation that completed a Merger with NeuBase Therapeutics (“Ohr”) | |

| — | |

| 99,020 |

DepYmed preferred shares received in sale of intellectual property | |

| — | |

| 316,724 |

Total Investment | | $ | — | | $ | 415,744 |

7.

6. Accrued Expenses and Other Current Liabilities

The Company’s accrued expenses and other current liabilities consisted of the following:

| As of March 31, | As of September 30, | |||||||||||||

| 2021 | 2020 | |||||||||||||

| | | | | | | ||||||||

| | As of December 31, | | As of September 30, | ||||||||||

|

| 2021 |

| 2021 | ||||||||||

| Accrued compensation and benefits | $ | 153,688 | $ | 88,527 | | $ | 1,095,617 | | $ | 880,707 | ||||

| Accrued consulting settlement | 250,000 | - | | | 300,000 | | | 200,000 | ||||||

| Accrued professional fees | 167,829 | 241,755 | |

| 203,816 | |

| 299,557 | ||||||

| Accrued research and development | 217,701 | 41,313 | |

| 720,875 | |

| 297,047 | ||||||

| Accrued franchise tax | 79,088 | 155,865 | | | 77,120 | | | 30,720 | ||||||

| Accrued patent expenses | 258,331 | 24,716 | ||||||||||||

| Other accrued expenses | 3,706 | 3,707 | |

| 15,452 | |

| 39,715 | ||||||

| Total | $ | 1,130,343 | $ | 555,883 | | $ | 2,412,880 | | $ | 1,747,746 | ||||

8. Fair Value

7. Notes Payable

Insurance Note Payable

The following tables present the Company’s fair value hierarchy for its warrant liabilities measured at fair value on a recurring basis at MarchAs of December 31, 2021 and September 30, 2020:2021, the Company had the following insurance note payable outstanding:

| Fair Value Measurements as of March 31, 2021 | ||||||||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | |||||||||||||

| Liabilities | ||||||||||||||||

| Warrant liabilities | $ | - | - | 229,442 | $ | 229,442 | ||||||||||

| | | | | | | | | | | | | |

| | | | Stated | | | | | Balance at | | Balance at | ||

| | Maturity | | Interest | | Original | | December 31, | | September 30, | |||

|

| Date |

| Rate |

| Principal |

| 2021 |

| 2021 | |||

Insurance Note Payable |

|

|

|

|

| |

|

| |

|

| |

|

2021 Insurance Note |

| January 2022 |

| 4.99 | % | $ | 391,625 | | $ | — | | $ | 148,385 |

| Fair Value Measurements as of September 30, 2020 | ||||||||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | |||||||||||||

| Liabilities | ||||||||||||||||

| Warrant liabilities | $ | - | - | 950,151 | $ | 950,151 | ||||||||||

9

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

8. Leases

In October 2020, the Company entered into a ten-year operating lease agreement with annual escalating rental payments for approximately 14,189 square feet of office and laboratory space in Pittsburgh, Pennsylvania. The leased premises will serve as the Company’s headquarters. The first and second amendments to the lease agreement were executed in December 2020 and April 2021, respectively (collectively with the lease agreement, referred to herein as the “Lease”). In November 2020, the Company prepaid rent of $0.3 million and paid a security deposit of $0.3 million for the Lease. The Lease commenced on May 1, 2021, and the Company was obligated to begin making rental payments on this date. The Company applied the prepaid amount toward the rental payments through December 2021. The Company is also entitled to use half of the security deposit towards rental payments in May and June 2022. The Company measured and recognized an initial right-of-use (“ROU”) asset and operating lease liability upon lease commencement. The Company has the right to extend the term of the Lease for an additional five-year term; however, this extension has not been included in the calculation of the lease liability and ROU asset at the lease inception as the exercise of the option was not reasonably certain.

The Company continued to operate under its operating lease in Pittsburgh until the Company moved into its new headquarters and laboratory space, which occurred in June 2021. The Company’s prior office and operating space was leased under operating leases with original terms of less than 12 months which expired at various dates through November 2021; therefore, the Company’s previous operating leases are not recognized as ROU assets on the consolidated balance sheet. The Company also maintained a short-term rental of office space in San Diego and New York, which expired in November 2021. . In October 2021, the Company commenced a one-year lease for the rental of office space in Boston, which extends through October 2022.

In August 2021, the Company entered into a two-year finance lease for certain laboratory equipment. The Company measured and recognized an initial right-of-use (“ROU”) asset and finance lease liability upon lease commencement.

At December 31, 2021 and September 30, 2021, ROU assets and lease liabilities were as follows:

| | | | | | | | |

| | | | As of December 31, | | As of September 30, | ||

|

| |

| 2021 |

| 2021 | ||

Assets: |

| Classification | | | | | | |

Operating lease right-of-use-asset |

| Operating lease asset | | $ | 5,841,696 | | $ | 5,945,295 |

Financing lease right-of-use-asset |

| Equipment, net | |

| 188,252 | |

| 216,490 |

| | | | $ | 6,029,948 | | $ | 6,161,785 |

| | | | | | | | |

Liabilities: | |

| |

|

| |

|

|

Current | | Classification | |

|

| |

|

|

Operating | | Operating lease liability | | $ | 429,507 | | $ | 382,576 |

Financing | | Financing lease liability | |

| 111,513 | |

| 107,632 |

Long-term | |

| |

|

| |

|

|

Operating | | Long-term portion of operating leases liability | |

| 5,683,192 | |

| 5,794,096 |

Financing | | Long-term portion of financing leases liability | |

| 78,987 | |

| 109,500 |

| | | | $ | 6,303,199 | | $ | 6,393,804 |

10

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The following tables summarize quantitative information about the Company’s leases for the three months ended December 31, 2021 and 2020:

| | | | | | |

|

| Three Months Ended December 31, | ||||

|

| 2021 |

| 2020 | ||

Operating cash flows - operating lease | | | 176,578 | | $ | 0 |

Operating cash flows - financing leases | | | 3,807 | | | 0 |

Financing cash flows - financing leases | | | 26,632 | | | 0 |

| | | | | | |

Right-of-use asset obtained in exchange for operating lease liabilities | | | 0 | |

| 0 |

Finance lease assets obtained in exchange for finance lease liabilities | | | 0 | | | 0 |

| | | |

| | As of December 31, | |

| 2021 | ||

Weighted-average remaining lease term – operating lease (in years) | 9.58 | | |

Weighted-average discount rate – operating lease | 7.3 | % | |

Weighted-average remaining lease term - financing leases (in years) | | 1.7 | |

Weighted-average discount rate - financing leases | | 7.3 | % |

| | | | | | |

| | Three Months Ended | ||||

| | December 31, | ||||

|

| 2021 |

| 2020 | ||

Operating leases |

| |

|

| |

|

Operating lease cost | | $ | 216,204 | | $ | 0 |

Variable lease costs | | | 0 | | | 0 |

Operating lease cost | | | 216,204 | | | 0 |

Short-term lease rent expense | |

| 13,716 | |

| 28,026 |

Financing leases | | | | | | |

Amortization of leased assets | | | 28,238 | | | 0 |

Interest on lease liabilities | | | 3,807 | | | 0 |

Financing lease cost | | | 32,045 | | | 0 |

Net lease cost | | $ | 261,965 | | $ | 28,026 |

As of December 31, 2021, future minimum lease payments under the non-cancelable leases were as follows:

| | | | | | |

| | Operating | | Financing | ||

|

| Lease | | Leases | ||

Nine Months Ending September 30, 2022 | | | 646,083 | | | 121,752 |

Year Ending September 30, 2023 | |

| 867,367 | | | 111,606 |

Year Ending September 30, 2024 | |

| 874,320 | | | 0 |

Year Ending September 30, 2025 | |

| 881,391 | | | 0 |

Year Ending September 30, 2026 | |

| 888,627 | | | 0 |

Thereafter | |

| 4,401,029 | | | 0 |

Total | |

| 8,558,817 | | | 233,358 |

Less present value discount | |

| (2,446,118) | | | (42,858) |

Operating lease liabilities | | $ | 6,112,699 | | $ | 190,500 |

11

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

9. Fair Value

As of December 31, 2021 and September 30, 2021, the fair value of warrants measured at fair value was $0. The fair value of the warrant liabilities werewas determined using level 3 inputs and the Black-Scholes option pricing model. The following assumptions were used in determining the fair value of the warrant liabilities:

| | | | |

| | As of December 31, | | As of September 30, |

|

| 2021 |

| 2021 |

Remaining contractual term (years) |

| 0.3 | | 0.2 - 0.5 |

Common stock price volatility |

| 62.5% | | 60.6% - 62.5% |

Risk-free interest rate |

| 0.1% | | 0.04% |

Expected dividend yield |

| — | | — |

| As of March 31, | ||||||||

| 2021 | 2020 | |||||||

| Remaining contractual term (years) | 0.7 - 1.0 | 1.7 - 2.0 | ||||||

| Common stock price volatility | 69.5% - 71.4% | 89.6% - 92.5%* | ||||||

| Risk-free interest rate | 0.07 | % | 0.23 | % | ||||

| Expected dividend yield | - | - | ||||||

During the three and six months ended March 31, 2021, the Company utilized its historical volatility in the valuation of warrant liabilities as it had sufficient trading history.

The change in fair value of the warrant liabilities for the three and six months ended MarchDecember 31, 2021 and 2020 is as follows:

| Fair value as of September 30, 2020 | $ | 950,151 | ||

| Change in fair value | (630,112 | ) | ||

| Fair value as of December 31, 2020 | 320,039 | |||

| Change in fair value | (90,597 | ) | ||

| Fair value as of March 31, 2021 | $ | 229,442 |

| Fair value as of September 30, 2019 | $ | 496,343 | ||

| Change in fair value | 694,134 | |||

| Fair value as of December 31, 2019 | 1,190,477 | |||

| Change in fair value | (69,944 | ) | ||

| Fair value as of March 31, 2020 | $ | 1,120,533 |

was $0.6 million.

As of MarchDecember 31, 2021 and September 30, 2020,2021, the carrying value of cash and cash equivalents, accounts payable and the insurance note payable approximate fair value due to the short-term nature of these instruments.

9.10. Stockholders’ Equity

Warrants

Warrants

Below is a summary of the Company’s issued and outstanding warrants as of MarchDecember 31, 2021:

| | | | | | ||||||||

| | | | | Warrants | ||||||||

| Expiration date | Exercise Price | Warrants Outstanding |

| Exercise Price |

| Outstanding | |||||||

| December 13, 2021 | $ | 55.00 | 20,627 | ||||||||||

| April 10, 2022 | 20.00 | 695,312 | | $ | 20.00 |

| 695,312 | ||||||

| July 6, 2023 | 8.73 | 105,000 | |

| 8.73 |

| 105,000 | ||||||

| 820,939 | |||||||||||||

September 20, 2024 | | | 6.50 | | 75,000 | ||||||||

| |

| | | 875,312 | ||||||||

| | | | | | | |

| | | | | | | Weighted |

| | | | Weighted | | Average | |

| | | | Average | | Remaining | |

| | | | Exercise | | Contractual Life | |

|

| Warrants |

| Price |

| (in years) | |

Outstanding as of September 30, 2021 | | 895,939 | | $ | 18.35 | | |

Expired | | (20,627) | | | 55.00 | | |

Outstanding as of December 31, 2021 | | 875,312 | | | 17.49 | | 0.6 |

Exercisable as of December 31, 2021 | | 837,812 | | $ | 17.98 | | 0.5 |

10

12

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements(Unaudited)

| Warrants | Weighted Average Exercise Price | Weighted Average Remaining Contractual Life (in years) | ||||||||||

| Outstanding as of September 30, 2020 | 820,939 | $ | 19.44 | |||||||||

| Outstanding as of March 31, 2021 | 820,939 | 19.44 | 1.2 | |||||||||

| Exercisable as of March 31, 2021 | 820,939 | 19.44 | 1.2 | |||||||||

(Unaudited)

10.

11. Stock-Based Compensation

As of MarchDecember 31, 2021, an aggregate of 4,709,2776,018,136 shares of common stock were authorized under the Company’s 2019 Stock Incentive Plan (the “2019 Plan”), subject to an “evergreen” provision that will automatically increase the maximum number of shares of common stock that may be issued under the term of the 2019 Plan. As of MarchDecember 31, 2021, 1,294,9561,869,770 common shares were available for future grants under the 2019 Plan. As of MarchDecember 31, 2021, 291,667 shares of common stock were authorized under the Company’s 2016 Consolidated Stock Incentive Plan (the “2016 Plan”) and 147,041 common shares were available for future grants under the 2016 Plan.

The Company recorded stock-based compensation expense in the following expense categories of its unaudited condensed consolidated statements of operations for the three and six months ended MarchDecember 31, 2021 and 2020:

| Three Months ended March 31, | Six Months ended March 31, | |||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| | | | | | | ||||||||||||||||

| | Three Months Ended December 31, | ||||||||||||||||||||

|

| 2021 |

| 2020 | ||||||||||||||||||

| General and administrative | $ | 448,880 | $ | 954,241 | $ | 1,291,159 | $ | 2,067,352 | | $ | 327,131 | | $ | 842,279 | ||||||||

| Research and development | 493,228 | 385,169 | 827,534 | 776,284 | |

| 466,073 | |

| 334,306 | ||||||||||||

| Total | $ | 942,108 | $ | 1,339,410 | $ | 2,118,693 | $ | 2,843,636 | | $ | 793,204 | | $ | 1,176,585 | ||||||||

Stock Options

Below is a table summarizing the options issued and outstanding as of and for the sixthree months ended MarchDecember 31, 2021:

| Stock Options | Weighted Average Exercise Price | Weighted Average Remaining Contractual Life (in years) | Total Aggregate Intrinsic Value | |||||||||||||||||||||||

| Outstanding at September 30, 2020 | 6,190,790 | $ | 2.76 | |||||||||||||||||||||||

| | | | | | | | | | | ||||||||||||||||

| | | | | | | Weighted | | | | ||||||||||||||||

| | | | Weighted | | Average | | Total | ||||||||||||||||||

| | | | Average | | Remaining | | Aggregate | ||||||||||||||||||

| | | | Exercise | | Contractual Life | | Intrinsic | ||||||||||||||||||

|

| Stock Options |

| Price |

| (in years) |

| Value | ||||||||||||||||||

Outstanding at September 30, 2021 | | 7,397,154 | | $ | 3.13 | |

| | |

| ||||||||||||||||

| Granted | 534,340 | 7.59 | | 105,000 | | | 3.59 | |

| | |

| ||||||||||||||

| Exercised | (21,576 | ) | 5.21 | | (42,250) | | | 0.00 | | | | | | |||||||||||||

| Forfeited | (150,670 | ) | 5.68 | | (262,500) | | | 5.07 | | | | | | |||||||||||||

| Outstanding at March 31, 2021 | 6,552,884 | 3.08 | 8.1 | $ | 29,219,357 | |||||||||||||||||||||

| Exercisable as of March 31, 2021 | 4,575,375 | 1.65 | 7.7 | $ | 26,884,291 | |||||||||||||||||||||

Outstanding at December 31, 2021 | | 7,197,404 | | | 3.08 | | 6.9 | | $ | 9,185,031 | ||||||||||||||||

Exercisable as of December 31, 2021 | | 5,360,067 | | $ | 2.33 | | 6.2 | | $ | 9,184,698 | ||||||||||||||||

11

NeuBase Therapeutics, Inc. and SubsidiariesNotes to Condensed Consolidated Financial Statements(Unaudited)

As of MarchDecember 31, 2021, unrecognized compensation costs associated with the stock options of $4.8$3.5 million will be recognized over an estimated weighted-average amortization period of 1.31.4 years.

The intrinsic value of options exercised during the three months ended December 31, 2021 and 2020 was $0.1 million and $0.1 million, respectively.

The weighted average grant date fair value of options granted during the sixthree months ended MarchDecember 31, 2021 and 2020 was $5.32$2.33 and $4.78,$5.20, respectively.

13

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Key assumptions used to estimate the fair value of the stock options granted during the sixthree months ended MarchDecember 31, 2021 and 2020 included:

| Six Months ended March 31, | ||||||||||||

| 2021 | 2020 | |||||||||||

| | | | | ||||||||

| | Three Months Ended December 31, | ||||||||||

|

| 2021 |

| 2020 | ||||||||

| Expected term of options (years) | 5.5 - 7.0 | 7.0 | | 5.1 - 6.1 | | 6.0 | ||||||

| Expected common stock price volatility | 83% - 83.3% | 78% - 83.5% | | 73.8% - 74.5% | | 83.1% - 83.3% | ||||||

| Risk-free interest rate | 0.6% - 1.3% | 0.9% - 1.8% | | 1.1% - 1.4% | | 0.6% - 0.7% | ||||||

| Expected dividend yield | - | - | | — | | — | ||||||

During the six monthsfiscal year ended March 31,September 30, 2021, the Company granted a stock option to purchase 225,000 shares to a consultant, which was cancelled and reissued in June 2021 in recognition of future service to the Company as an employee. The exercisability and vesting of the stock optionsoption are subject to the consultant’s effective date of employment with the Company, which hashad not yet occurred as of MarchDecember 31, 2021, and as a result, the grant-date of such option has not occurred under GAAP. Therefore, the number and fair value of the shares subject to this option are not reflected in the table summarizing the options issued and outstanding as of and for the sixthree months ended MarchDecember 31, 2021, and did not have an impact on unrecognized compensation costs or the estimated weighted-average amortization period above as of MarchDecember 31, 2021.

Restricted Stock

A summary of the changes in the unvested restricted stock during the sixthree months ended MarchDecember 31, 2021 is as follows:

| Unvested Restricted Stock | Weighted Average Grant Date Fair Value Price | |||||||||||||

| Unvested as of September 30, 2020 | - | $ | - | |||||||||||

| | | | | | | ||||||||

| | | | | Weighted Average | |||||||||

| | | | | Grant Date | |||||||||

|

| Unvested Restricted |

| Fair Value | ||||||||||

| | Stock | | Price | ||||||||||

Unvested as of September 30, 2021 |

| | 0 | | $ | 0 | ||||||||

| Granted | 4,364 | 9.17 | | | 4,441 | | | 3.94 | ||||||

| Vested | (4,364 | ) | 9.17 |

| | (4,441) | |

| 3.94 | |||||

| Unvested as of March 31, 2021 | - | - | ||||||||||||

Unvested as of December 31, 2021 |

| | 0 | | | 0 | ||||||||

Total unrecognized expense remaining | | $ | 0 | |

|

| ||||||||

Weighted-average years expected to be recognized over | |

| — | |

|

| ||||||||

11. CommitmentsRestricted Stock Units

Below is a table summarizing the restricted stock units granted and Contingencies

Operating Leases

In October 2020, the Company entered into a ten-year lease agreement with annual escalating rental payments for approximately 14,189 square feetoutstanding as of office and laboratory space in Pittsburgh, Pennsylvania. The first and second amendments to the lease agreement were executed in December 2020 and April 2021, respectively (collectively with the lease agreement, referred to herein as the “Lease”). The leased premises will serve as the Company’s headquarters upon the commencement of the lease. The initial term of the Lease commenced on May 1, 2021. On such date, the Company is obligated to begin making rental payments, provided that the Company may be entitled to a rental credit for certain periods based on the date the Landlord delivers possession of the office space and biology lab within the leased premises to the Company and the date the landlord substantially completes tenant improvements. The initial term of the Lease will extend approximately ten years from delivery of the leased premises to the Company, unless earlier terminated in accordance with the lease. The Company has the right to extend the term of the Lease for an additional five-year term. The Company will pay an escalating base rent over the life of the Lease of approximately $71,000 to $78,000 per month, and the Company will pay its pro rata portion of property expenses and operating expenses for the property. The Company will measure and recognize the right-of-use (“ROU”) asset and operating lease liability upon lease commencement. During the sixthree months ended MarchDecember 31, 2021, the Company prepaid rent of $0.3 million and paid a security deposit of $0.3 million for this Lease.2021:

12

| | | | | | |

| | | | | Weighted Average | |

| | | | | Grant Date | |

| | Restricted Stock | | Fair Value | ||

|

| Units |

| Price | ||

Unvested as of September 30, 2021 |

| | 10,000 | | $ | 5.09 |

Granted |

| | — | |

| |

Unvested as of December 31, 2021 |

| | 10,000 | |

| 5.09 |

Total unrecognized expense remaining | | $ | 35,580 | | | |

Weighted-average years expected to be recognized over | |

| 1.7 | | | |

14

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(Unaudited)12. Commitments and Contingencies

The Company currently leases its existing office and operating space under operating leases with original terms of less than 12 months and which expire at various dates through November 2021; therefore, the Company’s operating leases are not recognized as ROU assets on the unaudited condensed consolidated balance sheet as of March 31, 2021.

Rent expense under the Company’s operating leases totaled approximately $0.03 million and $0.02 million for the three months ended March 31, 2021 and 2020, respectively. Rent expense under the Company’s operating leases totaled approximately $0.06 million and $0.04 million for the six months ended March 31, 2021 and 2020, respectively.

The Company continues to operate under its current operating lease in Pittsburgh on a month-to-month basis and will continue to operate under the lease until the Company completes the move into its new headquarters and laboratory space, which is expected to occur in June 2021. All terms and conditions remain the same from the current lease.

In November 2020, the Company extended the term of its rental of office space in New York until November 2021.

Litigation

The Company has become involved in certain legal proceedings and claims which arise in the normal course of business. The Company believes that an adverse outcome is unlikely, and it cannot reasonably estimate the potential loss at this point. If an unfavorable ruling were to occur, there exists the possibility of a material adverse impact on the Company’s results of operations, prospects, cash flows, financial position and brand. Costs associated with the Company’s involvement in legal proceedings are expensed as incurred.

Securities Class Action Lawsuit

On February 14, 2018, plaintiff Jeevesh Khanna, commenced an action in the Southern District of New York, against Ohr Pharmaceutical, Inc. (“Ohr”) (which was the name of the Company prior to the completion of the merger with NeuBase Therapeutics, Inc., a Delaware corporation (“Legacy NeuBase”), in accordance with the terms of the Agreement and Plan of Merger and Reorganization entered into on January 2, 2019, as amended, pursuant to which (i) Ohr Acquisition Corp., a subsidiary of Ohr, merged with and into Legacy NeuBase, with Legacy NeuBase (renamed as “NeuBase Corporation”) continuing as a wholly-owned subsidiary of Ohr and the surviving corporation of the merger and (ii) Ohr was renamed as “NeuBase Therapeutics, Inc.” (the “Merger”)) and several current and former officers and directors, alleging that they violated federal securities laws between June 24, 2014 and January 4, 2018. On August 7, 2018, the lead plaintiffs, now George Lehman and Insured Benefit Plans, Inc., filed an amended complaint, stating the class period to be April 8, 2014 through January 4, 2018. The plaintiffs did not quantify any alleged damages in their complaint, but, in addition to attorneys’ fees and costs, they seek to maintain the action as a class action and to recover damages on behalf of themselves and other persons who purchased or otherwise acquired Ohr common stock during the putative class period and purportedly suffered financial harm as a result. We and the individuals dispute these claims and intend to defend the matter vigorously. On September 17, 2018, Ohr filed a motion to dismiss the complaint. On September 20, 2019, the district court entered an order granting the defendants’ motion to dismiss. On October 23, 2019, the plaintiffs filed a notice of appeal of that order dismissing the action and other related orders by the district court. After full briefing and oral argument, on October 9, 2020, the U.S. Court of Appeals for the Second Circuit issued a summary order affirming the district court’s order granting the motion to dismiss and remanding the action to the district court to make a determination on the record related to plaintiffs’ request for leave to file an amended complaint. On October 16, 2020, the district court requested the parties’ positions as to how they proposed to proceed in light of the Second Circuit’s decision. After letter briefing on this issue and plaintiffs’ alternative request for leave to file a second amended complaint, on November 16, 2020,remand, the district court denied plaintiffs’ subsequent request to amend and dismissed with prejudice plaintiffs’ claims. On December 16, 2020, plaintiffs filed a notice of appeal of that order denying plaintiffs leave to amend. Briefing onOn December 16, 2021, the Second Circuit affirmed the decision and order of the district court denying plaintiffs’ motion for leave to amend, thereby dismissing the appeal is currently dueand action in its entirety. Plaintiffs have not sought reconsideration of the first half of 2021. This litigation could result in substantial costs and a diversion of management’s resources and attention, which could harm the Company’s businessSecond Circuit’s decision, and the valuecurrent deadline for plaintiffs to file a writ of certiorari for review by the Supreme Court of the Company’s common stock.United States is March 15, 2022.

Derivative Lawsuit

On May 3, 2018, plaintiff Adele J. Barke, derivatively on behalf of Ohr, commenced an action against certain former directors of Ohr, including Michael Ferguson, Orin Hirschman, Thomas M. Riedhammer, June Almenoff and Jason S. Slakter in the Supreme Court, State of New York, alleging that the action was brought in the right and for the benefit of Ohr seeking to remedy their “breach of fiduciary duties, corporate waste and unjust enrichment that occurred between June 24, 2014 and the present.” It does not quantify any alleged damages. We and the individuals dispute these claims and intend to defend the matter vigorously. Such litigation has been stayed pursuant to a stipulation by the parties, which has been so ordered by the court, pending athe exhaustion of all appeals from the decision inof the Southern District case onof New York dismissing the motion to dismiss, but that status could change. This litigationKhanna action discussed above. These matters could result in substantial costs and a diversion of management’s resources and attention, which could harm our business and the value of our common stock.

13

15

NeuBase Therapeutics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements(Unaudited)

(Unaudited)

Joint Proxy Statement Lawsuit

On March 20, 2019, a putative class action lawsuit was filed in the United States District Court for District of Delaware naming as defendants Ohr and its board of directors, Legacy NeuBase, and Ohr Acquisition Corp., captioned Wheby v. Ohr Pharmaceutical, Inc., et al., Case No. 1:19-cv-00541-UNA (the “Wheby Action”). The plaintiffs in the Wheby Action allege that the preliminary joint proxy/prospectus statement filed by Ohr with the SEC on March 8, 2019, contained false and misleading statements and omitted material information in violation of Section 14(a) of the Exchange Act and SEC Rule 14a-9 promulgated thereunder, and further that the individual defendants are liable for those alleged misstatements and omissions under Section 20(a) of the Exchange Act. The complaint in the Wheby Action has not been served on, nor was service waived by, any of the named defendants in that action. The action seeks, among other things, to rescind the Merger or an award of damages, and an award of attorneys’ and experts’ fees and expenses. The defendants dispute the claims raised in the Wheby Action. Management believes that the likelihood of an adverse decision from the sole remaining action is unlikely; however, the litigation could result in substantial costs and a diversion of management’s resources and attention, which could harm our business and the value of our common stock.

12.

Note 13. Subsequent Events

Common Stock Offering

On April 26,Subsequent to December 31, 2021, the Company closed an underwritten public offering of 9,200,000 shares of its commongranted approximately 1.3 million stock (inclusive of 1,200,000 shares that were sold pursuantoptions to the underwriters’ full exercise of their option to purchase additional sharesofficers and employees of the Company’s common stock), at a price to the public of $5.00 per share. The Company received net proceeds from the offering of approximately $42.6 million, after deducting the underwriting discounts and commissions and other estimated offering expenses payable by the Company.

Asset Purchase Agreement

On January 27, 2021, the Company entered into an Asset Purchase Agreement by and among the Company, NeuBase Corporation, its wholly owned subsidiary, and Vera Therapeutics, Inc. (“Vera”) as amended by the Amendment to Asset Purchase Agreement, dated as of April 20, 2021, by and between the Company and Vera (collectively, the “APA”) and the transaction closed on April 26, 2021. Pursuant to the terms of the APA, the Company acquired infrastructure, materials, and intellectual property for peptide-nucleic acid (“PNA”) scaffolds from Vera for total consideration of approximately $0.8 million in cash and 308,635 shares of common stock (of which 146,375 were to be issued to Vera and 162,260 will be held in escrow and released to Vera in accordance with the terms2019 Plan. The grants have a weighted average exercise price of an escrow agreement between NeuBase Corporation$2.07 per option and, Vera).a contractual term of 10 years.

14

16

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Disclosures Regarding Forward-Looking Statements

The following should be read in conjunction with the unaudited condensed consolidated financial statements and the related notes that appear elsewhere in this report as well as in conjunction with the Risk Factors section in our Annual Report on Form 10-K for the fiscal year ended September 30, 20202021, as filed with the United States Securities and Exchange Commission (“SEC”) on December 23, 2020.2021. This report and our Form 10-K include forward-looking statements made based on current management expectations pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended.

This report includes “forward-looking statements” within the meaning of Section 21E of the Exchange Act. Those statements include statements regarding the intent, belief or current expectations of the Company and its subsidiaries and our management team. Any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those projected in the forward-looking statements. These risks and uncertainties include but are not limited to those risks and uncertainties set forth in Part II, Item 1A – Risk Factors of this Quarterly Report and in Part I, Item 1A – Risk Factors of our Annual Report on Form 10-K. In light of the significant risks and uncertainties inherent in the forward-looking statements included in this Quarterly Report on Form 10-Q and in our Annual Report on Form 10-K, the inclusion of such statements should not be regarded as a representation by us or any other person that our objectives and plans will be achieved. Further, these forward-looking statements reflect our view only as of the date of this report. Except as required by law, we undertake no obligations to update any forward-looking statements and we disclaim any intent to update forward-looking statements after the date of this report to reflect subsequent developments. Accordingly, you should also carefully consider the factors set forth in other reports or documents that we file from time to time with the SEC.

Summary

OverviewNeuBase Therapeutics, Inc. (“NeuBase”, “Company”, “we”, “us” and “our”) is a biotechnology company focused on significantly reducing the burden of untreatable morbidity and mortality across the globe caused by rare and common diseases.

Recent Developments

December 2020 AnnouncementTo achieve this goal, we have designed, built, and validated a new precision genetic medicines platform technology able to uniquely drug the double-stranded human genome and address disease at the root of Positive Preclinical Data

On December 16, 2020, we announced additional positive preclinical data on our platform and DM1 program. In vitro data highlights in DM1 patient-derived fibroblasts include activity of an anti-gene (Compound A) that targets the CUG repeat in DM1:

15

In vivo data highlights in the HSALR transgenic mouse model of DM1 that expresses high levels of mutant CUG-repeat-containing mRNA (ACTA1) in skeletal muscle:

Description of the Company

limitations of early precision genetic medicine technologies.

We are a biotechnology company working towards acceleratingpoised to file our first Investigational New Drug (“INDs”) applications with the genetic revolution by developing a new class of synthetic medicines. Our modular peptide-nucleic acid antisense oligo (“PATrOL™”) platform which outputs “anti-gene” candidate therapies is designed to combine the specificity of genetic sequence-based target recognition with a modularity that enables use of various in vivo delivery technologies to enable broad and also selective tissue distribution capabilities. Given that every human disease may have a genetic component, we believe that our differentiated platform technology has the potential for broad impact by increasing, decreasing or changing gene function at either the DNA or RNA levels to resolve the progression to disease, as appropriate, in a particular indication. We plan to use our platform to address diseases driven by genetic variation and mutation, and we are initially focused on myotonic dystrophy type 1 (“DM1”) and Huntington’s disease (“HD”).

Globally, there are thousands of genetic diseases, most of which lack any therapeutic options. In addition, rare genetic diseases are often particularly severe, debilitating or fatal. Traditionally, therapeutic development for each rare genetic disorder has been approached with a unique strategy, which is inefficient, as there are thousands of diseases that need treatment solutions. The collective population of people with rare diseases stands to benefit profoundly from the emergence of a scalable and modular treatment development platform that allows for a more efficient discovery and delivery of drug product candidates to address these conditions cohesively.

Mutated proteins resulting from errors in deoxyribonucleic acid (“DNA”) sequences cause many rare genetic diseases and cancer. DNA in each cell of the body is transcribed into pre-RNA, which is then processed (spliced) into mRNA which is exported into the cytoplasm of the cell and translated into protein. This is termed the “central dogma” of biology. Therefore, when errors in a DNA sequence occur, they are propagated to RNAs and can become a damaging protein.

The field has learned that antisense oligonucleotides (“ASOs”) can inactivate target RNAs before they can produce harmful proteins by binding them in a sequence-specific manner, which can delay disease progression or even eliminate genetic disease symptoms. ASOs designed by others to target known disease-related mutant RNA sequences have been shown to be able to degrade these transcripts and have a positive clinical impact. Similarly, applications in modifying splicing of pre-RNA in the nucleus of the cell have been developed by others to exclude damaging exons from the final mRNA product and have been approved by theU.S. Food and Drug Administration (“FDA”). beginning in calendar year 2022 and intend to scale into additional indications with increasing speed and efficiency.

Overview

Most diseases remain undruggable with current therapeutic modalities, leaving millions of patients with limited options. These include rare diseases, cancers, common chronic and infectious diseases. Most diseases are genetic, in whole or in part, underscoring the critical importance of new medicines that can drug the human genome for the future of health. Yet the genome has been difficult to target with therapies due to its double-stranded structure, which evolved to protect the fidelity of this essential blueprint of life.

The complexity associated with drugging proteins, each of which is a unique and often dynamic molecular entity, has resulted in a drug development process that is commonly inefficient, time-consuming, and expensive with low probabilities of success. This strategy has, in part, resulted in high drug prices and a high remaining burden of unmet patient need.

These issues could potentially be resolved by targeting the genetic material itself instead of downstream protein products. Precision genetic medicines represent a relatively new class of therapies that target genetic sequences that are the root cause of diseases.

17

We planhave designed, built, and validated a new technology platform that can uniquely Drug the Genome™ to extend upon these conceptual breakthroughsaddress the three disease-causing mechanisms (i.e., gain-of-function, change-of-function, or loss-of-function of a gene), without the limitations of early precision genetic medicines. The technology is predicated on synthetic peptide-nucleic acid (“PNA”) chemistry and can directly engage the genome in a sequence-specific manner and address root causality of diseases. These compounds operate by utilizingtemporarily engaging the genome (or single and double-stranded RNA targets, if desired) and interfering with cellular machinery that process mutant genes to halt their ability to manifest a disease. We have repeatedly demonstrated, in proof-of-concept preclinical animal studies across FY2020 and FY2021, the ability to address multiple disease-causing genes, and different causal mechanisms, to resolve the disease state without the limitations of early genetic medicine technologies. These limitations, and the data that illustrate that we have likely engineered them out of our platform to potentially unlock broad impact across many diseases, are:

| ● | Delivery. Most early precision genetic medicine technologies are large and heavily negatively charged, making it difficult for them to broadly distribute throughout the body to address tissues that are affected by many diseases. This often requires them to be locally injected such as into the brain, likely limiting their ability for broad-based impact. We have designed and developed a proprietary delivery technology that allows its small, neutral-charge and water-soluble compounds to be administered using a patient-friendly route such as subcutaneous injection and achieve broad biodistribution, including into the deep brain and nuclei of cells. |

| ● | Tolerability. Most early precision genetic medicine technologies trigger the innate and/or acquired immune system, limiting their ability to achieve pharmacologic doses or to be used repeatedly. For example, delivery of negatively charged nucleic acid therapies often trigger the innate immune system and delivery of proteins often trigger the acquired immune system. Our technology is comprised of fully synthetic compounds that have been shown to be “immunologically inert”, potentially allowing them to be administered chronically to temporarily Drug the Genome™ over a patient’s lifetime. |

| ● | Selectivity. Many technologies in the early precision genetic medicines industry cannot discriminate between mutant gene sequences and their healthy (“wild-type”) counterparts, nor between other highly similar target sequences in the cell. This potentially limits these technologies in their ability to address small disease-causing mutations such as single nucleotide changes (“point mutations”), which account for a large fraction of disease-causing mutations and functional variants. Our technology can discriminate point mutations, which increases the opportunity space. This capability comes from the “rigid” nature of the backbone which does not tolerate imperfect target engagement. In addition, this single-base selectivity reduces the likelihood that our compounds will engage with genes elsewhere in the genome that are similar but not identical, potentially reducing any adverse events triggered by off-target engagement (“OTEs”). |

| ● | Manufacturability. Many technologies in the early precision genetic medicines industry require significant investments in custom manufacturing infrastructure, and thus are limited in their potential impact and scalability. Our technology utilizes established and fully commoditized manufacturing processes, both for small molecule and synthetic peptide synthesis (the combination of which are required to manufacture our compounds) that are available with high redundancy and at commercial scale. |

| ● | Durability. Many technologies in the early precision genetic medicines industry can only be dosed a single time, are often cleared by the immune system, or are otherwise not durable in their efficacy. |

| ● | Scalability. Many technologies in the early precision genetic medicines industry are not truly scalable across a variety of indications, for the reasons described above. As our goal is to provide solutions to those suffering from a wide variety of diseases across the globe, we have purpose-built a scalable platform. We always address a single target type for all therapeutic programs (the genome), utilize the same delivery shuttle enabling similar pharmacokinetics (“PK”), absorption distribution metabolism and excretion (“ADME”), dose, route and regimens across programs, utilize predominantly the same chemistry yielding similar therapeutic indices, are able to predict OTEs a priori using bioinformatics and engineer around them before beginning development, and leverage manufacturing process development across programs such that ongoing platform learnings have already created increasing speed and efficiency. |

As further validation of our PATrOL™ platform’s capabilities, in FY2021, we described data illustrating that our first-in-class platform technology which produces investigational therapies which are similarcan address various types of causal insults by Drugging the Genome™ in structure to ASOs in that they are comprisedanimal models of a backbone onto which are tethered nucleobases that engagevariety of human diseases after patient-friendly routes of administration and does so in a genetic sequencewell-tolerated manner.

18