Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand Community Trust Bancorp, Inc. (“CTBI”), our operations, and our present business environment. The MD&A is provided as a supplement to—and should be read in conjunction with—our condensed consolidated financial statements and the accompanying notes thereto contained in Part I, Item 1 of this quarterly report, as well as our consolidated financial statements, the accompanying notes thereto, and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our annual report on Form 10-K for the year ended December, 31, 2021.2022. The MD&A includes the following sections:

| ❖ | Our Business |

| ❖ | Financial Goals and Performance |

| ❖ | Results of Operations and Financial Condition |

| ❖ | Liquidity and Market Risk |

| ❖ | Interest Rate Risk |

| ❖ | Capital Resources |

| ❖ | Impact of Inflation, Changing Prices, and Economic Conditions |

| ❖ | Stock Repurchase Program |

| ❖ | Critical Accounting Policies and Estimates |

Our Business

Through our subsidiaries, CTBI engages in a wide range of commercial and personal banking and trust and wealth management activities, which include accepting time and demand deposits; making secured and unsecured loans to corporations, individuals, and others; providing cash management services to corporate and individual customers; issuing letters of credit; renting safe deposit boxes; and providing funds transfer services. The lending activities of CTB include making commercial, construction, mortgage, and personal loans. Lease-financing, linesLines of credit, revolving lines of credit, term loans, and other specialized loans, including asset-based financing, are also available. Our corporate subsidiaries act as trustees of personal trusts, as executors of estates, as trustees for employee benefit trusts, as paying agents for bond and stock issues, as investment agent, as depositories for securities, and as providers of full servicefull-service brokerage and insurance services. For further information, see Item 1 of our annual report on Form 10-K for the year ended December 31, 2021.2022.

Results of Operations and Financial Condition

We reported earnings for the first quarter 20222023 of $19.7$19.3 million, or $1.11$1.08 per basic share, compared to $19.2$22.4 million, or $1.08$1.26 per basic share, earned during the fourth quarter 20212022 and $23.6$19.7 million, or $1.33$1.11 per basic share, earned during the first quarter 2021. Noninterest income remained relatively flat2022. Total revenue was $0.9 million below prior quarter but $2.6 million above prior year same quarter. Net interest revenue decreased $0.8 million compared to prior quarter but decreased fromincreased $3.9 million compared to prior year same quarter; however, our total revenue declined from both periods, primarily as a result of a decline in interestquarter, and noninterest income on U.S. Small Business Administration (“SBA”) Paycheck Protection Program (“PPP”) loans. Provisiondecreased $0.1 million compared to prior quarter and $1.3 million compared to prior year same quarter. Our provision for loancredit losses for the quarter was $0.9$1.1 million compared to provision of $0.5$1.5 million for the quarter ended December 31, 20212022 and a recovery of provision of $2.5$0.9 million for the first quarter 2021.2022. Noninterest expense increased $1.6 million compared to prior quarter and $2.5 million compared to prior year same quarter. Net income was also impacted quarter over quarter by a $1.0 million increase in income taxes as a result of tax credits taken in the fourth quarter 2022.

As a result of the recent bank failures and turmoil in the banking sector, management has thoroughly reviewed our financial condition, liquidity position, and interest rate risk to ensure there are no issues which raise concern. We are a conservative bank holding company which prudently manages our risk profile to ensure a safe and secure environment. We are very well-capitalized, and our liquidity position is strong. We have not seen a decline in deposit balances as a result of the recent turmoil in the banking industry, nor did we realize loan growth as a direct result of the turmoil. Our deposit growth has remained strong. We are focused on balance sheet strength and stability and intend to maintain our portfolio by remaining competitive in loan and deposit pricing. We have no wholesale funding, and there has been no change in our wholesale debt. We did experience loan growth during the quarter; however, none of this growth could be directly attributable to the current environment. There have been no changes to our underwriting standards, yet we have seen a decrease in delinquencies. We feel comfortable with the conservative nature of our investment portfolio, and we do not expect to make significant changes to the composition of our portfolio or the management of it. The effective duration of our investment portfolio remains low at 4.05 years at March 31, 2023 compared to 4.11 years at December 31, 2022 and 4.16 years at March 31, 2022. We also see no need to raise capital, as our liquidity position is strong, and we do not anticipate any stock repurchases or change in our cash dividend policy in 2023. We have a community bank leverage ratio (“CBLR”) ratio as of March 31, 2023 of 13.71% compared to the required 9.00%.

The Bank Term Funding Program (“BTFP”) was created by the Federal Reserve to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. We have registered and are eligible to use the newly created BTFP, but we do not intend to do so.

Quarterly Highlights

| ❖ | Net interest income for the quarter of |

| ❖ | Provision for |

| ❖ | Our loan portfolio increased |

| ❖ |

45

| ❖ |

| ❖ | Deposits, including repurchase agreements, at $4.8 billion increased |

| ❖ | Shareholders’ equity |

| ❖ | Noninterest income for the quarter ended March 31, |

| ❖ | Noninterest expense for the quarter ended March 31, |

Income Statement Review

| (dollars in thousands) | Change 2022 vs. 2021 | Change 2023 vs. 2022 | ||||||||||||||||||||||||||||||

| Quarter Ended March 31 | 2022 | 2021 | Amount | Percent | ||||||||||||||||||||||||||||

| Three Months Ended March 31 | 2023 | 2022 | Amount | Percent | ||||||||||||||||||||||||||||

| Net interest income | $ | 40,032 | $ | 40,242 | $ | (210 | ) | (0.5 | )% | $ | 43,916 | $ | 40,032 | $ | 3,884 | 9.7 | % | |||||||||||||||

| Provision for credit losses | 875 | (2,499 | ) | 3,374 | (139.0 | )% | 1,116 | 875 | 241 | 27.6 | % | |||||||||||||||||||||

| Noninterest income | 14,965 | 15,577 | (612 | ) | (3.9 | )% | 13,682 | 14,965 | (1,283 | ) | (8.6 | )% | ||||||||||||||||||||

| Noninterest expense | 29,359 | 28,310 | 1,049 | 3.7 | % | 31,890 | 29,359 | 2,531 | 8.6 | % | ||||||||||||||||||||||

| Income taxes | 5,035 | 6,390 | (1,355 | ) | (21.2 | )% | 5,279 | 5,035 | 244 | 4.8 | % | |||||||||||||||||||||

| Net income | $ | 19,728 | $ | 23,618 | $ | (3,890 | ) | (16.5 | )% | $ | 19,313 | $ | 19,728 | $ | (415 | ) | (2.1 | )% | ||||||||||||||

| Average earning assets | $ | 5,134,150 | $ | 4,957,636 | $ | 176,514 | 3.6 | % | $ | 5,131,385 | $ | 5,134,150 | $ | (2,765 | ) | (0.1 | )% | |||||||||||||||

| Yield on average earnings assets, tax equivalent* | 3.46 | % | 3.63 | % | (0.17 | )% | (4.9 | )% | 4.84 | % | 3.46 | % | 1.38 | % | 40.1 | % | ||||||||||||||||

| Cost of interest bearing funds | 0.42 | % | 0.48 | % | (0.06 | )% | (12.3 | )% | 2.06 | % | 0.42 | % | 1.64 | % | 386.9 | % | ||||||||||||||||

| Net interest margin, tax equivalent* | 3.18 | % | 3.31 | % | (0.13 | )% | (3.9 | )% | 3.49 | % | 3.18 | % | 0.31 | % | 9.9 | % | ||||||||||||||||

*Yield on average earning assets and net interest margin are computed on a taxable equivalent basis using a 24.95% tax rate.

Net Interest Income

Percent Change 1Q 2022 Compared to: | ||||||||||||||||||||

(dollars in thousands) Quarterly Periods | Q1 2022 | Q4 2021 | Q1 2021 | Q4 2021 | Q1 2021 | |||||||||||||||

| Components of net interest income | ||||||||||||||||||||

| Income on earning assets, tax equivalent: | ||||||||||||||||||||

| Financial assets | $ | 5,595 | $ | 5,430 | $ | 3,883 | 3.0 | % | 44.1 | % | ||||||||||

| Loans and leases: | ||||||||||||||||||||

| Commercial | 20,698 | 21,613 | 22,634 | (4.2 | )% | (8.6 | )% | |||||||||||||

| Residential | 8,175 | 8,073 | 8,287 | 1.3 | % | (1.4 | )% | |||||||||||||

| Consumer | 9,294 | 9,465 | 9,624 | (1.8 | )% | (3.4 | )% | |||||||||||||

| Total loans and leases | 38,167 | 39,151 | 40,545 | (2.5 | )% | (5.9 | )% | |||||||||||||

| Interest income, tax equivalent | 43,762 | 44,581 | 44,428 | (1.8 | )% | (1.5 | )% | |||||||||||||

| Expense on interest bearing liabilities: | ||||||||||||||||||||

| Deposits, including repurchase agreements | 3,208 | 3,276 | 3,691 | (2.1 | )% | (13.1 | )% | |||||||||||||

| Other financial liabilities | 287 | 265 | 278 | 8.3 | % | 3.1 | % | |||||||||||||

| Interest expense | 3,495 | 3,541 | 3,969 | (1.3 | )% | (11.9 | )% | |||||||||||||

| Net interest income, tax equivalent | $ | 40,267 | $ | 41,040 | $ | 40,459 | (1.9 | )% | (0.5 | )% | ||||||||||

| Average yield and rates paid | ||||||||||||||||||||

| Earnings assets yield | 3.46 | % | 3.45 | % | 3.63 | % | 0.3 | % | (4.9 | )% | ||||||||||

| Rate paid on interest bearing liabilities | 0.42 | % | 0.42 | % | 0.48 | % | 0.5 | % | (12.3 | )% | ||||||||||

| Gross interest margin | 3.04 | % | 3.03 | % | 3.15 | % | 0.3 | % | (3.7 | )% | ||||||||||

| Net interest margin | 3.18 | % | 3.17 | % | 3.31 | % | 0.3 | % | (3.9 | )% | ||||||||||

| Average balances | ||||||||||||||||||||

| Investment securities | $ | 1,486,799 | $ | 1,498,781 | $ | 1,063,773 | (0.8 | )% | 39.8 | % | ||||||||||

| Loans | $ | 3,440,439 | $ | 3,381,206 | $ | 3,548,358 | 1.8 | % | (3.0 | )% | ||||||||||

| Earning assets | $ | 5,134,150 | $ | 5,133,843 | $ | 4,957,636 | 0.0 | % | 3.6 | % | ||||||||||

| Interest-bearing liabilities | $ | 3,350,208 | $ | 3,337,053 | $ | 3,335,206 | 0.4 | % | 0.4 | % | ||||||||||

Consolidated Average Balance Sheets and Taxable Equivalent Income/Expense and Yields/Rates

| For the Quarter Ended | March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||

| (in thousands) | Average Balances | Interest | Average Rate | Average Balances | Interest | Average Rate | ||||||||||||||||||

| Earning assets: | ||||||||||||||||||||||||

| Loans (1)(2)(3) | $ | 3,739,443 | $ | 52,011 | 5.64 | % | $ | 3,662,221 | $ | 49,002 | 5.31 | % | ||||||||||||

| Loans held for sale | 221 | 8 | 14.68 | 266 | 11 | 16.41 | ||||||||||||||||||

| Securities: | ||||||||||||||||||||||||

| U.S. Treasury and agencies | 900,146 | 4,410 | 1.99 | 935,433 | 4,322 | 1.83 | ||||||||||||||||||

| Tax exempt state and political subdivisions (3) | 108,819 | 909 | 3.39 | 109,434 | 929 | 3.37 | ||||||||||||||||||

| Other securities | 245,151 | 2,348 | 3.88 | 241,575 | 2,215 | 3.64 | ||||||||||||||||||

| Federal Reserve Bank and Federal Home Loan Bank stock | 10,373 | 174 | 6.80 | 11,563 | 181 | 6.21 | ||||||||||||||||||

| Federal funds sold | 344 | 3 | 3.54 | 1,151 | 13 | 4.48 | ||||||||||||||||||

| Interest bearing deposits | 124,787 | 1,400 | 4.55 | 115,434 | 1,010 | 3.47 | ||||||||||||||||||

| Other investments | 245 | 0 | 0.00 | 245 | 0 | 0.00 | ||||||||||||||||||

| Investment in unconsolidated subsidiaries | 1,856 | 30 | 6.56 | 1,854 | 24 | 5.14 | ||||||||||||||||||

| Total earning assets | $ | 5,131,385 | $ | 61,293 | 4.84 | % | $ | 5,079,176 | $ | 57,707 | 4.51 | % | ||||||||||||

| Allowance for credit losses | (46,252 | ) | (44,881 | ) | ||||||||||||||||||||

5,085,133 | 5,034,295 | |||||||||||||||||||||||

| Nonearning assets: | ||||||||||||||||||||||||

| Cash and due from banks | 61,911 | 62,042 | ||||||||||||||||||||||

| Premises and equipment and right of use assets, net | 59,949 | 56,819 | ||||||||||||||||||||||

| Other assets | 251,074 | 259,596 | ||||||||||||||||||||||

| Total assets | $ | 5,458,067 | $ | 5,412,752 | ||||||||||||||||||||

| Interest bearing liabilities: | ||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||

| Savings and demand deposits | $ | 2,145,808 | $ | 10,666 | 2.02 | % | $ | 2,104,368 | $ | 8,411 | 1.59 | % | ||||||||||||

| Time deposits | 935,393 | 3,724 | 1.61 | 936,182 | 2,208 | 0.94 | ||||||||||||||||||

| Repurchase agreements and federal funds purchased | 208,987 | 1,616 | 3.14 | 219,156 | 1,284 | 2.32 | ||||||||||||||||||

| Advances from Federal Home Loan Bank | 4,240 | 43 | 4.11 | 2,259 | 19 | 3.34 | ||||||||||||||||||

| Long-term debt | 64,434 | 990 | 6.23 | 57,841 | 761 | 5.22 | ||||||||||||||||||

| Finance lease liability | 3,469 | 40 | 4.68 | 2,108 | 31 | 5.83 | ||||||||||||||||||

| Total interest bearing liabilities | $ | 3,362,331 | $ | 17,079 | 2.06 | % | $ | 3,321,914 | $ | 12,714 | 1.52 | % | ||||||||||||

| Noninterest bearing liabilities: | ||||||||||||||||||||||||

| Demand deposits | 1,398,415 | 1,422,808 | ||||||||||||||||||||||

| Other liabilities | 46,313 | 50,692 | ||||||||||||||||||||||

| Total liabilities | 4,807,059 | 4,795,414 | ||||||||||||||||||||||

| Shareholders’ equity | 651,008 | 617,338 | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 5,458,067 | $ | 5,412,752 | ||||||||||||||||||||

| Net interest income, tax equivalent | $ | 44,214 | $ | 44,993 | ||||||||||||||||||||

| Less tax equivalent interest income | 298 | 248 | ||||||||||||||||||||||

| Net interest income | $ | 43,916 | $ | 44,745 | ||||||||||||||||||||

| Net interest spread | 2.78 | % | 2.99 | % | ||||||||||||||||||||

| Benefit of interest free funding | 0.71 | 0.52 | ||||||||||||||||||||||

| Net interest margin | 3.49 | % | 3.51 | % | ||||||||||||||||||||

(1) Interest includes fees on loans of $0.5 million and $0.4 million in March 31, 2023 and December 31, 2022, respectively.

(2) Loan balances include deferred loan origination costs and principal balances on nonaccrual loans.

(3) Tax exempt income on securities and loans is reported on a fully taxable equivalent basis using a 24.95% rate.

47

The following table illustrates the approximate effect of volume and rate changes on net interest differentials between the three months ended March 31, 2023 and December 31, 2022.

| Net Interest Differential | ||||||||||||

| Total Change | Change Due to | |||||||||||

| (in thousands) | Q1 2023/Q4 2022 | Volume | Rate | |||||||||

| Interest income: | ||||||||||||

| Loans | $ | 3,009 | $ | 16,887 | $ | (13,878 | ) | |||||

| Loans held for sale | (3 | ) | (32 | ) | 29 | |||||||

| U.S. Treasury and agencies | 88 | (2,555 | ) | 2,643 | ||||||||

| Tax exempt state and political subdivisions | (20 | ) | (84 | ) | 64 | |||||||

| Other securities | 133 | 534 | (401 | ) | ||||||||

| Federal Reserve Bank and Federal Home Loan Bank stock | (7 | ) | (285 | ) | 278 | |||||||

| Federal funds sold | (10 | ) | (170 | ) | 160 | |||||||

| Interest bearing deposits | 390 | 1,401 | (1,011 | ) | ||||||||

| Other investments | 0 | 0 | 0 | |||||||||

| Investment in unconsolidated subsidiaries | 6 | 0 | 6 | |||||||||

| Total interest income | 3,586 | 15,696 | (12,110 | ) | ||||||||

| Interest expense: | ||||||||||||

| Savings and demand deposits | 2,255 | 2,714 | (459 | ) | ||||||||

| Time deposits | 1,516 | (30 | ) | 1,546 | ||||||||

| Repurchase agreements and federal funds purchased | 332 | (919 | ) | 1,251 | ||||||||

| Advances from Federal Home Loan Bank | 24 | 317 | (293 | ) | ||||||||

| Long-term debt | 229 | 1,496 | (1,267 | ) | ||||||||

| Finance lease liability | 9 | 273 | (264 | ) | ||||||||

| Total interest expense | 4,365 | 3,851 | 514 | |||||||||

| Net interest income | $ | (779 | ) | $ | 11,845 | $ | (12,624 | ) | ||||

For purposes of the above table, changes which are due to both rate and volume are allocated based on a percentage basis using the absolute values of rate and volume variance as a basis for percentages. Income is stated at a fully taxable equivalent basis, using a 24.95% tax rate.

Net interest income for the quarter ended March 31, 2022 of $40.0$43.9 million was $0.8 million or 1.9%, below prior quarter and $0.2but $3.9 million or 0.5%, below first quarter 2021. Our net interest income excluding PPP loans for the quarter ended March 31, 2022 was $38.6 million compared to $38.3 million for the quarter ended December 31, 2021 and $36.3 million for the quarter ended March 31, 2021.above prior year same quarter. Our net interest margin, on a fully tax equivalent basis, at 3.18% increased 13.49% decreased 2 basis pointpoints from prior quarter but decreased 13increased 31 basis points from prior year same quarter, as ourquarter. Our average earning assets increased $0.3$52.2 million from prior quarter and $176.5but decreased $2.8 million from prior year same quarter. Our yield on average earning assets increased 133 basis pointpoints from prior quarter but decreased 17and 138 basis points from prior year same quarter, and our cost of funds remained unchangedincreased 54 basis points from prior quarter but decreased 6and 164 basis points from prior year same quarter. As discussed more fully below, the impact of the PPP loans to the net interest margin for the first quarter 2022 was 11 basis points.

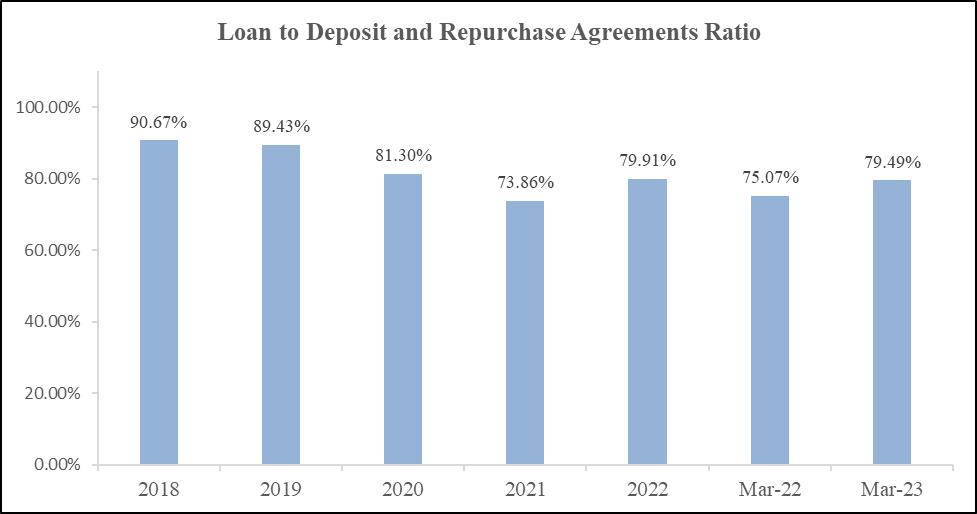

Our ratio of average loans to deposits, including repurchase agreements, was 79.8% for the quarter ended March 31, 2023 compared to 78.2% for the quarter ended December 31, 2022 and 74.2% for the quarter ended March 31, 2022 compared to 73.3% for the quarter ended December 31, 2021 and 79.9% for the quarter ended March 31, 2021.

Provision for Credit Losses

Noninterest Income

Percent Change 1Q 2022 Compared to: | Percent Change | |||||||||||||||||||||||||||||||||||||||

(dollars in thousands) Quarterly Periods | 1Q 2022 | 4Q 2021 | 1Q 2021 | 4Q 2021 | 1Q 2021 | |||||||||||||||||||||||||||||||||||

| Deposit service charges | $ | 6,746 | $ | 7,083 | $ | 6,022 | (4.8 | )% | 12.0 | % | ||||||||||||||||||||||||||||||

| 1Q 2023 Compared to: | ||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 1Q 2023 | 4Q 2022 | 1Q 2022 | 4Q 2022 | 1Q 2022 | |||||||||||||||||||||||||||||||||||

| Deposit related fees | $ | 7,287 | $ | 7,411 | $ | 6,746 | (1.7 | %) | 8.0 | % | ||||||||||||||||||||||||||||||

| Trust revenue | 3,248 | 3,305 | 2,951 | (1.7 | )% | 10.1 | % | 3,079 | 2,959 | 3,248 | 4.0 | % | (5.2 | %) | ||||||||||||||||||||||||||

| Gains on sales of loans | 597 | 1,241 | 2,433 | (51.9 | )% | (75.5 | )% | 121 | 174 | 597 | (30.3 | %) | (79.7 | %) | ||||||||||||||||||||||||||

| Loan related fees | 2,062 | 1,254 | 2,270 | 64.4 | % | (9.2 | )% | 845 | 1,119 | 2,062 | (24.5 | %) | (59.0 | %) | ||||||||||||||||||||||||||

| Bank owned life insurance revenue | 691 | 1,036 | 573 | (33.3 | )% | 20.5 | % | 858 | 572 | 691 | 50.0 | % | 24.2 | % | ||||||||||||||||||||||||||

| Brokerage revenue | 590 | 432 | 457 | 36.5 | % | 29.3 | % | 348 | 344 | 590 | 1.1 | % | (41.0 | %) | ||||||||||||||||||||||||||

| Other | 1,031 | 626 | 871 | 64.8 | % | 18.4 | % | 1,144 | 1,192 | 1,031 | (4.1 | %) | 11.0 | % | ||||||||||||||||||||||||||

| Total noninterest income | $ | 14,965 | $ | 14,977 | $ | 15,577 | (0.1 | )% | (3.9 | )% | $ | 13,682 | $ | 13,771 | $ | 14,965 | (0.6 | %) | (8.6 | %) | ||||||||||||||||||||

Noninterest income for the quarter ended March 31, 20222023 of $15.0$13.7 million was relatively flat to$0.1 million, or 0.6%, below prior quarter but a decrease of $0.6and $1.3 million, or 3.9%8.6%, frombelow prior year same quarter. Decreases from prior quarter in gains on salesThe year over year decrease was primarily the result of loans ($0.6 million) and deposit related fees ($0.3 million) were offset by increasesa $1.2 million decrease in loan related fees ($0.8 million) and securities gains ($0.3 million). The decrease from prior year same quarter included decreases in gains on sales of loans ($1.8 million) and loan related fees ($0.2 million), partially offset by increases in deposit related fees ($0.7 million), trust revenue ($0.3 million), and securities gains ($0.2 million). Gains on sales of loans were impacted by the slowdown in the industry-wide mortgage refinancing boom. Deposit related fees were primarily impacted by debit card income. Loan related fees were primarily impacted bydue to the change in the fair market value of MSRs.our mortgage servicing rights. The primary driver in determining the fair value is the change in interest rates, which resulted in a $1.0 million increase in the first quarter of 2022 and a $0.2 million decrease in the first quarter of 2023.

Noninterest Expense

Percent Change 1Q 2022 Compared to: | Percent Change | |||||||||||||||||||||||||||||||||||||||

(dollars in thousands) Quarterly Periods | 1Q 2022 | 4Q 2021 | 1Q 2021 | 4Q 2021 | 1Q 2021 | |||||||||||||||||||||||||||||||||||

| 1Q 2023 Compared to: | ||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 1Q 2023 | 4Q 2022 | 1Q 2022 | 4Q 2022 | 1Q 2022 | |||||||||||||||||||||||||||||||||||

| Salaries | $ | 11,739 | $ | 11,982 | $ | 11,412 | (2.0 | )% | 2.9 | % | $ | 12,633 | $ | 12,439 | $ | 11,739 | 1.6 | % | 7.6 | % | ||||||||||||||||||||

| Employee benefits | 5,799 | 7,486 | 5,421 | (22.5 | )% | 7.0 | % | 6,275 | 5,433 | 5,799 | 15.5 | % | 8.2 | % | ||||||||||||||||||||||||||

| Net occupancy and equipment | 2,854 | 2,625 | 2,828 | 8.7 | % | 0.9 | % | 3,028 | 2,576 | 2,854 | 17.6 | % | 6.1 | % | ||||||||||||||||||||||||||

| Data processing | 2,201 | 2,099 | 2,159 | 4.8 | % | 1.9 | % | 2,303 | 2,344 | 2,201 | (1.7 | %) | 4.7 | % | ||||||||||||||||||||||||||

| Legal and professional fees | 867 | 868 | 893 | (0.1 | )% | (2.8 | )% | 816 | 931 | 867 | (12.4 | %) | (5.9 | %) | ||||||||||||||||||||||||||

| Advertising and marketing | 752 | 676 | 722 | 11.2 | % | 4.1 | % | 820 | 826 | 752 | (0.7 | %) | 9.0 | % | ||||||||||||||||||||||||||

| Taxes other than property and payroll | 426 | 542 | 370 | (21.3 | )% | 15.2 | % | 432 | 296 | 426 | 45.8 | % | 1.3 | % | ||||||||||||||||||||||||||

| Net other real estate owned expense | 353 | 299 | 318 | 17.8 | % | 11.0 | % | 119 | 18 | 353 | 554.7 | % | (66.6 | %) | ||||||||||||||||||||||||||

| Other | 4,368 | 4,572 | 4,187 | (4.4 | )% | 4.3 | % | 5,464 | 5,396 | 4,368 | 1.3 | % | 25.1 | % | ||||||||||||||||||||||||||

| Total noninterest expense | $ | 29,359 | $ | 31,149 | $ | 28,310 | (5.7 | )% | 3.7 | % | $ | 31,890 | $ | 30,259 | $ | 29,359 | 5.4 | % | 8.6 | % | ||||||||||||||||||||

49

Balance Sheet Review

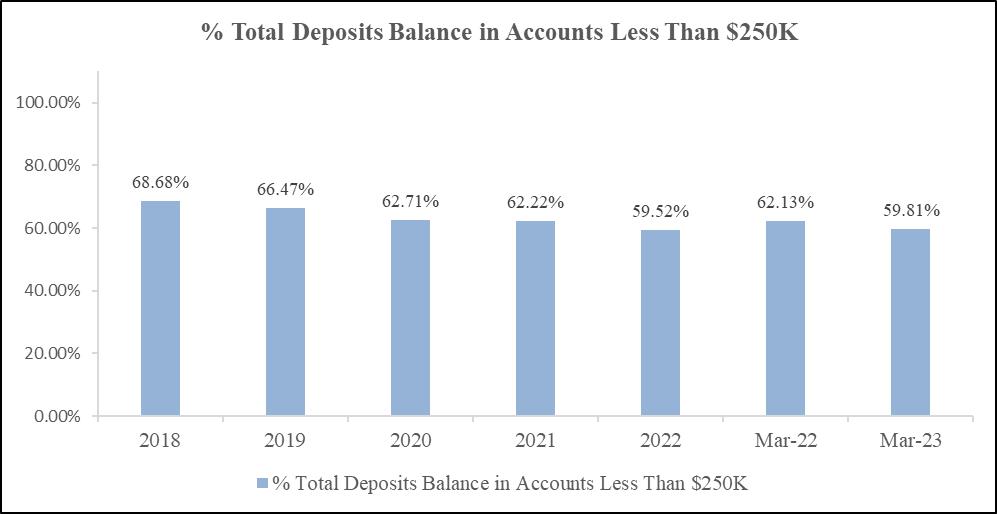

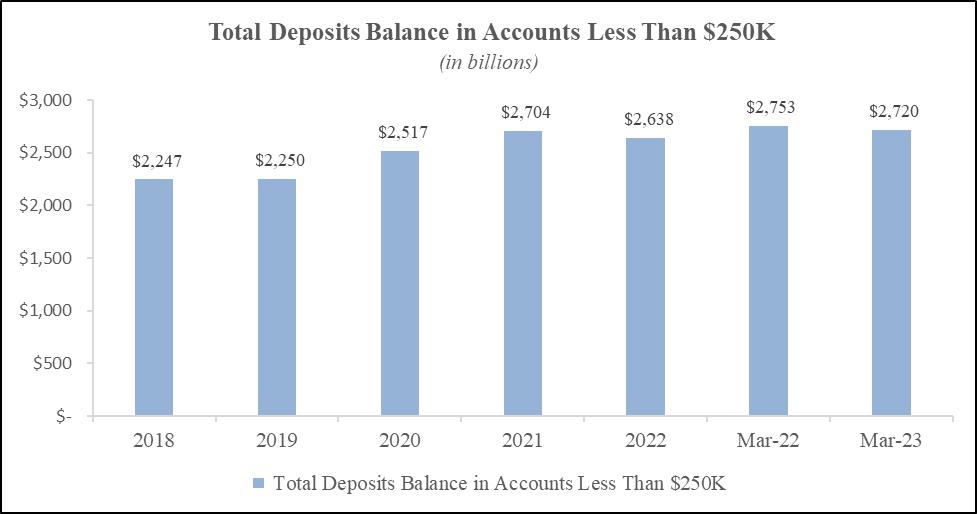

CTBI’s total assets at March 31, 20222023 of $5.4$5.5 billion increased $24.9$149.0 million, or 1.9%11.2% annualized, from December 31, 20212022 and $83.0$86.2 million, or 1.5%1.6%, from March 31, 2021.2022. Loans outstanding at March 31, 20222023 were $3.5$3.8 billion, an increase of $106.7$68.1 million, an annualized 12.7%7.4%, from December 31, 2021 but a decrease of $23.32022 and $261.8 million, or 0.7%7.4%, from March 31, 2021. Loans, excluding PPP2022. The increase in loans increased $131.6 million during thefrom prior quarter with a $71.3included an $8.2 million increase in the commercial loan portfolio, a $46.5$25.0 million increase in the residential loan portfolio, and a $35.2 million increase in the indirect consumer loan portfolio, andoffset partially by a $13.8$0.3 million increasedecrease in the residentialconsumer direct loan portfolio. The PPP loan portfolio declined $24.9 million during the quarter as a result of SBA forgiveness. CTBI’s investment portfolio increased $47.8decreased $14.9 million, or an annualized 13.3%4.8%, from December 31, 20212022 and $348.1$262.1 million, or 30.1%17.4%, from March 31, 2021.2022. Deposits in other banks decreased $159.1increased $97.7 million from prior quarter and $250.3$69.0 million from prior year same quarter. Deposits in other banks were used during the quarter to fund loan growth and additional investments in available-for-sale securities.March 31, 2022. Deposits, including repurchase agreements, at $4.7$4.8 billion increased $67.5$110.6 million, or an annualized 5.9%2.4%, from December 31, 20212022 and $94.9$69.3 million, or 2.1%1.5%, from March 31, 2021.2022. Our uninsured deposits, as defined by the Federal Financial Institutions Examination Council, were 27.6% at March 31, 2023 compared to 27.5% at December 31, 2022 and 25.3% at March 31, 2022.

Shareholders’ equity at March 31, 20222023 was $653.4$656.8 million, a $44.8$28.8 million, or 6.4%, decreaseincrease from the $698.2$628.0 million at December 31, 20212022 and an $8.7a $3.5 million, or 1.3%0.5%, decreaseincrease from the $662.1$653.4 million at March 31, 2021. The decline in shareholders’ equity is due to a $58.1 million net after tax increase during the quarter in2022, as unrealized losses on our securities portfolio.portfolio have begun to decrease. CTBI’s annualized dividend yield to shareholders as of March 31, 20222023 was 3.88%4.64%.

Loans

| (dollars in thousands) | March 31, 2022 | March 31, 2023 | ||||||||||||||||||||||||||||||||||||||

| Loan Category | Balance | Variance from Prior Year | Net (Charge-Offs)/ Recoveries | Nonperforming | ACL | Balance | Variance from Prior Year | Net (Charge-Offs)/ Recoveries | Nonperforming | ACL | ||||||||||||||||||||||||||||||

Commercial: | ||||||||||||||||||||||||||||||||||||||||

Hotel/motel | $ | 274,256 | 6.7 | % | $ | (216 | ) | $ | 0 | $ | 4,711 | $ | 348,876 | 1.5 | % | $ | 0 | $ | 0 | $ | 5,287 | |||||||||||||||||||

Commercial real estate residential | 337,447 | 0.7 | (26 | ) | 418 | 4,070 | 385,328 | 3.3 | 77 | 407 | 5,157 | |||||||||||||||||||||||||||||

Commercial real estate nonresidential | 774,791 | 2.2 | 111 | 4,275 | 9,169 | 750,498 | (1.6 | ) | 144 | 1,844 | 9,010 | |||||||||||||||||||||||||||||

Dealer floorplans | 72,766 | 4.8 | 0 | 0 | 1,519 | 75,443 | (2.7 | ) | 0 | 0 | 1,694 | |||||||||||||||||||||||||||||

Commercial other | 322,109 | 10.9 | (56 | ) | 321 | 4,844 | 316,955 | 1.7 | (87 | ) | 1,535 | 4,782 | ||||||||||||||||||||||||||||

Commercial unsecured SBA PPP | 22,482 | (52.5 | ) | 0 | 8 | 0 | ||||||||||||||||||||||||||||||||||

Total commercial | 1,803,851 | 2.6 | (187 | ) | 5,022 | 24,313 | 1,877,100 | 0.4 | 134 | 3,786 | 25,930 | |||||||||||||||||||||||||||||

Residential: | ||||||||||||||||||||||||||||||||||||||||

Real estate mortgage | 780,453 | 1.7 | (72 | ) | 7,494 | 7,662 | 846,435 | 2.6 | (36 | ) | 7,532 | 7,917 | ||||||||||||||||||||||||||||

Home equity | 107,230 | 0.5 | (14 | ) | 972 | 819 | 124,096 | 3.0 | 2 | 733 | 1,044 | |||||||||||||||||||||||||||||

Total residential | 887,683 | 1.6 | (86 | ) | 8,466 | 8,481 | 970,531 | 2.6 | (34 | ) | 8,265 | 8,961 | ||||||||||||||||||||||||||||

Consumer: | ||||||||||||||||||||||||||||||||||||||||

Consumer direct | 156,620 | (0.0 | ) | 16 | 23 | 1,787 | 157,158 | (0.2 | ) | (53 | ) | 28 | 1,746 | |||||||||||||||||||||||||||

Consumer indirect | 667,387 | 7.5 | (65 | ) | 179 | 7,728 | 772,570 | 4.8 | (461 | ) | 132 | 10,046 | ||||||||||||||||||||||||||||

Total consumer | 824,007 | 6.0 | (49 | ) | 202 | 9,515 | 929,728 | 3.9 | (514 | ) | 160 | 11,792 | ||||||||||||||||||||||||||||

Total loans | $ | 3,515,541 | 3.1 | % | $ | (322 | ) | $ | 13,690 | $ | 42,309 | $ | 3,777,359 | 1.8 | % | $ | (414 | ) | $ | 12,211 | $ | 46,683 | ||||||||||||||||||

50

Total Deposits and Repurchase Agreements

Percent Change 1Q 2022 Compared to: | Percent Change 1Q 2023 Compared to: | |||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | 1Q 2022 | 4Q 2021 | 1Q 2021 | 4Q 2021 | 1Q 2021 | 1Q 2023 | 4Q 2022 | 1Q 2022 | 4Q 2022 | 1Q 2022 | ||||||||||||||||||||||||||||||

| Non-interest bearing deposits | $ | 1,398,529 | $ | 1,331,103 | $ | 1,283,309 | 5.1 | % | 9.0 | % | $ | 1,409,839 | $ | 1,394,915 | $ | 1,398,529 | 1.1 | % | 0.8 | % | ||||||||||||||||||||

| Interest bearing deposits | ||||||||||||||||||||||||||||||||||||||||

| Interest checking | 89,863 | 97,064 | 91,803 | (7.4 | )% | (2.1 | )% | 120,678 | 112,265 | 89,863 | 7.5 | % | 34.3 | % | ||||||||||||||||||||||||||

| Money market savings | 1,200,408 | 1,206,401 | 1,240,530 | (0.5 | )% | (3.2 | )% | 1,408,314 | 1,348,809 | 1,200,408 | 4.4 | % | 17.3 | % | ||||||||||||||||||||||||||

| Savings accounts | 666,874 | 632,645 | 574,181 | 5.4 | % | 16.1 | % | 642,232 | 654,380 | 666,874 | (1.9 | %) | (3.7 | %) | ||||||||||||||||||||||||||

| Time deposits | 1,072,630 | 1,077,079 | 1,043,949 | (0.4 | )% | 2.7 | % | 962,361 | 915,774 | 1,072,630 | 5.1 | % | (10.3 | %) | ||||||||||||||||||||||||||

| Repurchase agreements | 254,623 | 271,088 | 354,235 | (6.1 | )% | (28.1 | )% | 208,777 | 215,431 | 254,623 | (3.1 | %) | (18.0 | %) | ||||||||||||||||||||||||||

| Total interest bearing deposits and repurchase agreements | 3,284,398 | 3,284,277 | 3,304,698 | 0.0 | % | (0.6 | )% | 3,342,362 | 3,246,659 | 3,284,398 | 2.9 | % | 1.8 | % | ||||||||||||||||||||||||||

| Total deposits and repurchase agreements | $ | 4,682,927 | $ | 4,615,380 | $ | 4,588,007 | 1.5 | % | 2.1 | % | $ | 4,752,201 | $ | 4,641,574 | $ | 4,682,927 | 2.4 | % | 1.5 | % | ||||||||||||||||||||

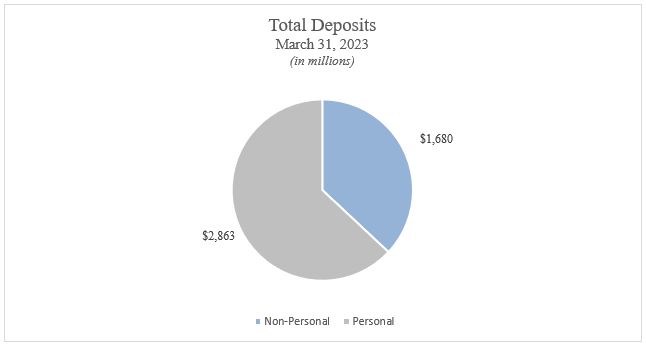

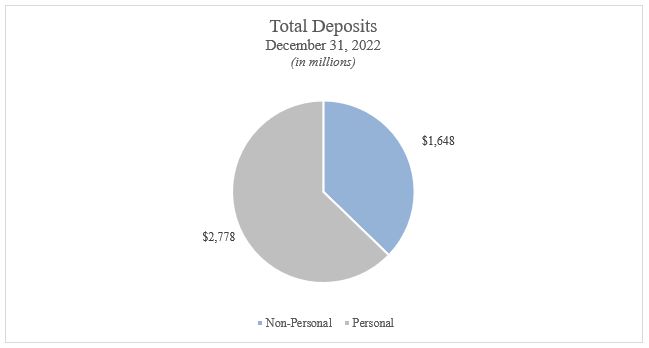

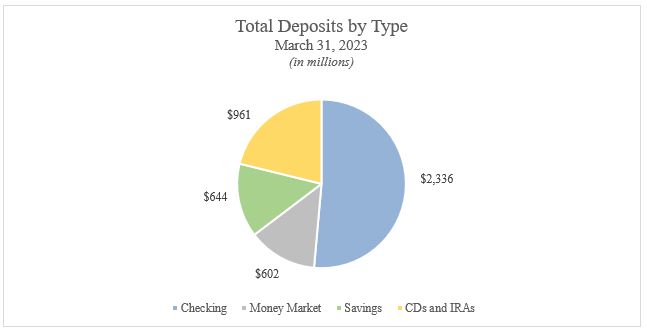

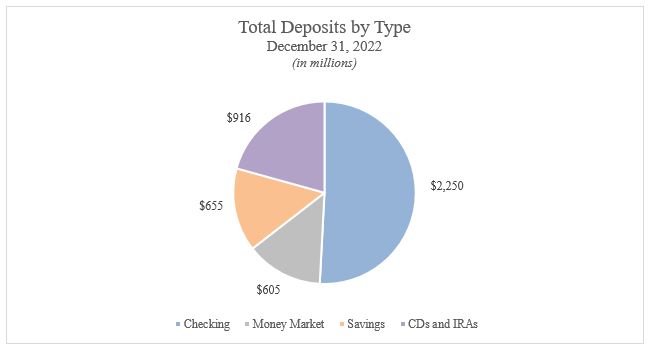

The charts below show a comparison of our deposit composition as of March 31, 2023 compared to December 31, 2022.

| Total Number of Deposit Accounts | ||||||||

| March 31, 2023 | December 31, 2022 | |||||||

| Nonpersonal | 20,535 | 20,430 | ||||||

| Personal | 186,758 | 186,448 | ||||||

| Total | 207,293 | 206,878 | ||||||

51

| Total Number of Deposit Accounts by Type | ||||||||

| March 31, 2023 | December 31, 2022 | |||||||

| Checking | 135,895 | 136,025 | ||||||

| Money market | 2,441 | 2,501 | ||||||

| Savings | 46,716 | 46,698 | ||||||

| CDs & IRAs | 22,144 | 21,565 | ||||||

| NOW accounts | 97 | 89 | ||||||

| Total | 207,293 | 206,878 | ||||||

52

53

Asset Quality

54

For further information regarding nonperforming loans, see noteNote 4 to the condensed consolidated financial statements contained herein.

Our reserve coverage (allowance for credit losses to nonperforming loans) at March 31, 2022 was 309.1% compared to 251.2% at December 31, 2021 and 215.5% at March 31, 2021. Our credit loss reserve as a percentage of total loans outstanding at March 31, 2022 was 1.20% (1.21% excluding PPP loans) compared to 1.22% at December 31, 2021 (1.24% excluding PPP loans) and 1.28% at March 31, 2021 (1.38% excluding PPP loans).

| (dollars in thousands) | |||||||||||||

| Appraisal Aging Analysis | Holding Period Analysis | ||||||||||||

Days Since Last Appraisal | Number of Properties | Current Book Value | Holding Period | Current Book Value | |||||||||

| Up to 3 months | 20 | $ | 1,379 | Less than one year | $ | 499 | |||||||

| 3 to 6 months | 4 | 140 | 1 year | 513 | |||||||||

| 6 to 9 months | 5 | 137 | 2 years | 231 | |||||||||

| 9 to 12 months | 2 | 35 | 3 years | 113 | |||||||||

| 12 to 18 months | 3 | 478 | 4 years | 85 | |||||||||

| 18 to 24 months | 1 | 130 | 5 years | 0 | |||||||||

| Total | 35 | $ | 2,299 | 6 years | 234 | ||||||||

| 7 years | 597 | ||||||||||||

| 8 years | 0 | ||||||||||||

| 9 years | 27 | ||||||||||||

| Total | $ | 2,299 | |||||||||||

Dividends

The following schedule shows the quarterly cash dividends paid for the past six quarters:

| Pay Date | Record Date | Amount Per Share | |||

| April 1, 2022 | March 15, 2022 | $ | 0.400 | ||

| January 1, 2022 | December 15, 2021 | $ | 0.400 | ||

| October 1, 2021 | September 15, 2021 | $ | 0.400 | ||

| July 1, 2021 | June 15, 2021 | $ | 0.385 | ||

| April 1, 2021 | March 15, 2021 | $ | 0.385 | ||

| January 1, 2021 | December 15, 2020 | $ | 0.385 | ||

| Pay Date | Record Date | Amount Per Share | |||

| April 1, 2023 | March 15, 2023 | $ | 0.440 | ||

| January 1, 2023 | December 15, 2022 | $ | 0.440 | ||

| October 1, 2022 | September 15, 2022 | $ | 0.440 | ||

| July 1, 2022 | June 15, 2022 | $ | 0.400 | ||

| April 1, 2022 | March 15, 2022 | $ | 0.400 | ||

| January 1, 2022 | December 15, 2021 | $ | 0.400 | ||

Allowance for Credit Losses

Our reserve coverage (allowance for credit losses to nonperforming loans) at March 31, 2023 was 382.3% compared to 300.4% at December 31, 2022 and 309.1% at March 31, 2022. Our credit loss reserve as a percentage of total loans outstanding at March 31, 2023 remained at 1.24% from December 31, 2022 compared to 1.20% at and March 31, 2022.

55

Liquidity and Market Risk

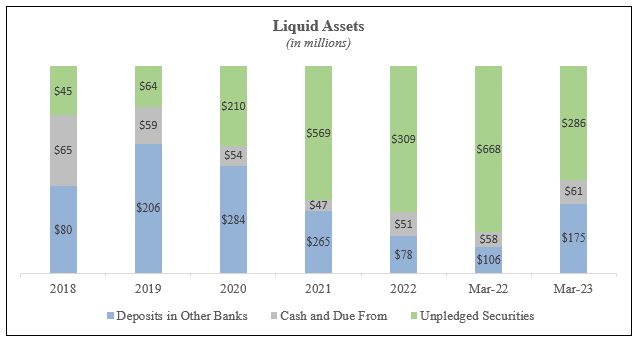

The objective of CTBI’s Asset/Liability management function is to maintain consistent growth in net interest income within our policy limits. This objective is accomplished through management of our consolidated balance sheet composition, liquidity, and interest rate risk exposures arising from changing economic conditions, interest rates, and customer preferences. The goal of liquidity management is to provide adequate funds to meet changes in loan and lease demand or deposit withdrawals. This is accomplished by maintaining liquid assets in the form of cash and cash equivalents and investment securities, sufficient unused borrowing capacity, and growth in core deposits. As of March 31, 2022,2023, we had approximately $164.5$235.9 million in cash and cash equivalents and approximately $1.5 billion$286.4 million in unpledged securities valued at estimated fair value designated as available-for-sale and available to meet liquidity needs on a continuing basis compared to $311.8$128.7 million and $1.5 billion$309.2 million at December 31, 2021.2022. The unpledged securities at March 31, 2023, with an estimated fair value of $286.4 million, have a par value of $317.5 million. The par amount of these securities would be available to be used as collateral in the new Bank Term Funding Program described in the Results of Operations and Financial Condition above. Additional asset-driven liquidity is provided by the remainder of the securities portfolio and the repayment of loans. In addition to core deposit funding, we also have a variety of other short-term and long-term funding sources available. We also rely on Federal Home Loan Bank advances for both liquidity and management of our asset/liability position. Federal Home Loan Bank advances were $0.4 million at March 31, 20222023 and at December 31, 2021.2022. As of March 31, 2022,2023, we had a $490.5$517.6 million available borrowing position with the Federal Home Loan Bank, compared to $484.4$501.0 million at December 31, 2021.2022. We generally rely upon net inflows of cash from financing activities, supplemented by net inflows of cash from operating activities, to provide cash for our investing activities. As is typical of many financial institutions, significant financing activities include deposit gathering, use of short-term borrowing facilities such as repurchase agreements and federal funds purchased, and issuance of long-term debt. At March 31, 2022 and at December 31, 2021,2023 we had $75$50 million in lines of credit with various correspondent banks available to meet any future cash needs.needs compared to $75 million at December 31, 2022. Our primary investing activities include purchases of securities and loan originations. We do not rely on any one source of liquidity and manage availability in response to changing consolidated balance sheet needs. Included in our cash and cash equivalents at March 31, 20222023 were deposits with the Federal Reserve of $103.3$173.2 million, compared to $262.4$72.6 million at December 31, 2021.2022. Additionally, we project cash flows from our investment portfolio to generate additional liquidity over the next 90 days.

The investment portfolio consists of investment grade short-term issues suitable for bank investments. The majority of the investment portfolio is in U.S. government and government sponsored agency issuances. At March 31, 2022,2023, available-for-sale (“AFS”) securities comprised all of the total investment portfolio, and the AFS portfolio was approximately 230%189% of equity capital. Fifty-nineSeventy-seven percent of the pledge-eligible portfolio was pledged.

The charts below show our liquid assets and our liquidity position.

56

| Liquidity | ||||||||||||

At March 31, 2023 (in thousands) | Total Available | Amount Used | Net Availability | |||||||||

| Internal sources | ||||||||||||

| Balance at Federal Reserve | $ | 173,238 | $ | 0 | $ | 173,238 | ||||||

| Cash and due from banks | 60,762 | 60,762 | ||||||||||

| Unpledged AFS securities | 286,398 | 0 | 286,398 | |||||||||

| Lines of credit | ||||||||||||

| Fifth Third Bank | 25,000 | 0 | 25,000 | |||||||||

| PNC Bank | 25,000 | 0 | 25,000 | |||||||||

| Federal Home Loan Bank (repurchase advance line) | 100,000 | 0 | 100,000 | |||||||||

| Federal Home Loan Bank (cash management advance) | 100,000 | 0 | 100,000 | |||||||||

| Total liquidity | $ | 770,398 | $ | 0 | $ | 770,398 | ||||||

Interest Rate Risk

We consider interest rate risk one of our most significant market risks. Interest rate risk is the exposure to adverse changes in net interest income due to changes in interest rates. Consistency of our net interest revenue is largely dependent upon the effective management of interest rate risk. We employ a variety of measurement techniques to identify and manage our interest rate risk, including the use of an earnings simulation model to analyze net interest income sensitivity to changing interest rates. The model is based on actual cash flows and repricing characteristics for on and off-balance sheet instruments and incorporates market-based assumptions regarding the effect of changing interest rates on the prepayment rates of certain assets and liabilities. Assumptions based on the historical behavior of deposit rates and balances in relation to changes in interest rates are also incorporated into the model. These assumptions are inherently uncertain, and as a result, the model cannot precisely measure net interest income or precisely predict the impact of fluctuations in interest rates on net interest income. Actual results will differ from simulated results due to timing, magnitude, and frequency of interest rate changes as well as changes in market conditions and management strategies.

CTBI’s Asset/Liability Management Committee (ALCO), which includes executive and senior management representatives and reports to the Board of Directors, monitors and manages interest rate risk within Board-approved policy limits. Our current exposure to interest rate risks is determined by measuring the anticipated change in net interest income spread evenly over the twelve-month period.

The following table shows our estimated earnings sensitivity profile as of March 31, 2023:

Change in Interest Rates (basis points) | Percentage Change in Net Interest Income (12 Months) |

| +400 | 12.00% |

| +300 | 8.82% |

| +200 | 5.65% |

| +100 | 2.47% |

| -100 | (2.28)% |

| -200 | (4.71)% |

| -300 | (7.12)% |

| -400 | (9.57)% |

57

The following table shows our estimated earnings sensitivity profile as of December 31, 2022:

Change in Interest Rates (basis points) | Percentage Change in Net Interest Income (12 Months) |

| +400 | 9.98% |

| +300 | 7.26% |

| +200 | 4.60% |

| +100 | 1.94% |

| -100 | (1.95)% |

| -200 | (3.92)% |

| -300 | (5.96)% |

| -400 | (7.91)% |

The simulation model used the yield curve spread evenly over a twelve-month period. The measurement at March 31, 2023 estimates that our net interest income in an up-rate environment would increase by 12.00% at a 400 basis point change, increase by 8.82% at a 300 basis point change, increase by 5.65% at a 200 basis point change, and increase by 2.47% at a 100 basis point change. In a down-rate environment, net interest income would decrease 2.28% at a 100 basis point change, decrease by 4.71% at a 200 basis point change, decrease by 7.12% at a 300 basis point change, and decrease by 9.57% at a 400 basis point change over one year. We actively manage our balance sheet and limit our exposure to long-term fixed rate financial instruments, including loans. In order to reduce the exposure to interest rate fluctuations and to manage liquidity, we have developed sale procedures for several types of interest-sensitive assets. Primarily all long-term, fixed rate single family residential mortgage loans underwritten according to Federal Home Loan Mortgage Corporation guidelines are sold for cash upon origination or originated under terms where they could be sold. Periodically, additional assets such as commercial loans are also sold. Proceeds of $4.7 million and $26.2 million were realized on the sale of fixed rate mortgages for quarters ended March 31, 2023 and March 31, 2022, respectively. We focus our efforts on consistent net interest revenue and net interest margin growth through each of the retail and wholesale business lines. We do not currently engage in trading activities.

The preceding analysis was prepared using a rate ramp analysis which attempts to spread changes evenly over a specified time period as opposed to a rate shock which measures the impact of an immediate change. Had these measurements been prepared using the rate shock method, the results would vary.

Capital Resources

We continue to offer a dividend to our shareholders, providing an annualized dividend yield for the quarter ended March 31, 2022 of 3.88%4.64%. Shareholders’ equity decreased 6.4%increased $28.8 million, or an annualized 18.6%, during the quarter and $3.5 million, or 0.5%, from December 31, 2021 to $653.4 million at March 31, 2022, as a result of a $58.1 million net after tax increase during the quarter in unrealized losses on our securities portfolio.portfolio have begun to decrease. Our primary source of capital growth is the retention of earnings. Cash dividends were $0.400$0.44 per share and $0.385$0.40 per share for the three months ended March 31, 20222023 and 2021,2022, respectively. We retained 64.0%59.3% of our earnings for the first three months of 20222023 compared to 71.1%64.0% for the first three months of 2021.2022.

Insured depository institutions are required to meet certain capital level requirements. On October 29, 2019, federal banking regulators adopted a final rule to simplify the regulatory capital requirements for eligible community banks and holding companies that opt-in to the community bank leverage ratio (“CBLR”framework (the “CBLR framework”) framework,, as required by Section 201 of the Economic Growth, Relief and Consumer Protection Act of 2018. Under the final rule, which became effective as of January 1, 2020, community banks and holding companies (which includes CTB and CTBI) that satisfy certain qualifying criteria, including having less than $10 billion in average total consolidated assets and a leverage ratio (referred to as the “community bank leverage ratio”) of greater than 9%, were eligible to opt-in to the CBLR framework. The community bank leverage ratio is the ratio of a banking organization’s Tier 1 capital to its average total consolidated assets, both as reported on the banking organization’s applicable regulatory filings. Accordingly, a qualifying community banking organization that has a community bank leverage ratio greater than 9% will be considered to have met: (i) the risk-based and leverage capital requirements of the generally applicable capital rules; (ii) the capital ratio requirements in order to be considered well-capitalized under the prompt corrective action framework; and (iii) any other applicable capital or leverage requirements.

In April 2020, as directed by Section 4012 of the Coronavirus Aid, Relief, and Economic SecurityCARES Act, the regulatory agencies introduced temporary changes to the CBLR framework.CBLR. These changes, which subsequently were adopted as a final rule, temporarily reduced the CBLR requirement to 8% through the end of calendar year 2020. Beginning in calendar year 2021, the CBLR requirement increased to 8.5% for the calendar year before returning to 9% in calendar year 2022. The final rule also provides for a two-quarter grace period for qualifying community banking organizations whose leverage ratios fall no more than 100 basis points below the applicable CBLR requirement. Management elected to use the CBLR framework for CTBI and CTB. CTBI’s CBLR ratio as of March 31, 20222023 was 13.15%13.71%. CTB’s CBLR ratio as of March 31, 20222023 was 12.53%13.10%. Under either framework, CTBI and CTB would be considered well-capitalized under the applicable guidelines.

As of March 31, 2022,2023, we are not aware of any current recommendations by banking regulatory authorities which, if they were to be implemented, would have, or are reasonably likely to have, a material adverse impact on our liquidity, capital resources, or operations.

Impact of Inflation, Changing Prices, and Economic Conditions

The majority of our assets and liabilities are monetary in nature. Therefore, CTBI differs greatly from most commercial and industrial companies that have significant investment in nonmonetary assets, such as fixed assets and inventories. However, inflation does have an important impact on the growth of assets in the banking industry and on the resulting need to increase equity capital at higher than normal rates in order to maintain an appropriate equity to assets ratio. Inflation also affects other expenses, which tend to rise during periods of general inflation.

We believe one of the most significant impacts on financial and operating results is our ability to react to changes in interest rates. We seek to maintain an essentially balanced position between interest rate sensitive assets and liabilities in order to protect against the effects of wide interest rate fluctuations.

Stock Repurchase Program

CTBI’s stock repurchase program began in December 1998 with the authorization to acquire up to 500,000 shares and was increased by an additional 1,000,000 shares in each of July 2000, May 2003, and March 2020. CTBI repurchased 32,664 shares of its common stock during the first quarter 2020, leaving 1,034,706 shares remaining under our current repurchase authorization. As of March 31, 2022,2023, a total of 2,465,294 shares have been repurchased through this program.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires the appropriate application of certain accounting policies, many of which require us to make estimates and assumptions about future events and their impact on amounts reported in our consolidated financial statements and related notes. Since future events and their impact cannot be determined with certainty, the actual results will inevitably differ from our estimates. Such differences could be material to ourthe consolidated financial statements.

We believe the application of accounting policies and the estimates required therein are reasonable. These accounting policies and estimates are constantly reevaluated, and adjustments are made when facts and circumstances dictate a change. Historically, we have found our application of accounting policies to be appropriate, and actual results have not differed materially from those determined using necessary estimates.

59

Our accounting policies are described in Note 1 to the condensed consolidated financial statements contained herein. We have identified the following critical accounting policies:

Allowance for Credit Losses – CTBI accounts for the allowance for credit losses (“ACL”) and the reserve for unfunded commitments in accordance with Accounting Standards Update (“ASU”) 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, and its related subsequent amendments, commonly known as CECL.

We disaggregate our portfolio loans into portfolio segments for purposes of determining the ACL. Our loan portfolio segments include commercial, residential mortgage, and consumer. We further disaggregate our portfolio segments into classes for purposes of monitoring and assessing credit quality based on certain risk characteristics. For an analysis of CTBI’s ACL by portfolio segment and credit quality information by class, refer to Note 4 to the condensed consolidated financial statements contained herein.

CTBI maintains the ACL to absorb the amount of credit losses that are expected to be incurred over the remaining contractual terms of the related loans. Contractual terms are adjustedEffective January 1, 2023, CTBI implemented ASU 2022-02, Financial Instruments-Credit Losses (Topic 326) Troubled Debt Restructurings and Vintage Disclosures, an amendment to 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The amendments in this ASU eliminate the accounting guidance for expected prepayments but are not extendedtroubled debt restructurings by creditors in Subtopic 310-40, Receivables—Troubled Debt Restructurings by Creditors, while enhancing disclosure requirements for expected extensions, renewals or modifications except in circumstances where CTBI reasonably expects to executecertain loan refinancings and restructurings by creditors when a TDRborrower is experiencing financial difficulty along with the borrower or where certain extension or renewal options are embedded in the original contract and not unconditionally cancellablerequiring that disclosures be added by CTBI.year of origination for gross charge-off information for financing receivables. Accrued interest receivable on loans is presented in ourthe consolidated financial statements as a component of other assets. When accrued interest is deemed to be uncollectible (typically when a loan is placed on nonaccrual status), interest income is reversed. In the event that collection of principal becomes uncertain, CTBI has policies in place to reverse accrued interest in a timely manner. Therefore, CTBI elected ASU 2019-04 which allows that accrued interest would continue to be presented separately and not part of the amortized cost of the loan. For additional information on CTBI’s accounting policies related to nonaccrual loans, refer to Note 1 to the condensed consolidated financial statements contained herein.

Credit losses are charged and recoveries are credited to the ACL. The ACL is maintained at a level CTBI considers to be adequate and is based on ongoing quarterly assessments and evaluations of the collectability of loans, including historical credit loss experience, current and forecasted market and economic conditions, and consideration of various qualitative factors that, in management’s judgment, deserve consideration in estimating expected credit losses. Provisions for credit losses are recorded for the amounts necessary to adjust the ACL to CTBI’s current estimate of expected credit losses on portfolio loans. CTBI’s strategy for credit risk management includes a combination of conservative exposure limits significantly below legal lending limits and conservative underwriting, documentation, and collection standards. The strategy also emphasizes diversification on a geographic, industry, and customer level, regular credit examinations, and quarterly management reviews of large credit exposures and loans experiencing deterioration of credit quality.

CTBI’s methodology for determining the ACL requires significant management judgment and includes an estimate of expected credit losses on a collective basis for groups of loans with similar risk characteristics and specific allowances for loans which are individually evaluated.

60

Larger commercial loans with balances exceeding $1 million that exhibit probable or observed credit weaknesses are individually evaluated for an ACL if such loans,and (i) have a criticized risk rating, (ii) are on nonaccrual status, (iii) are classified as TDRs,have a borrower experiencing financial difficulty with significant payment delay, or (iv) are 90 days or more past due.due, are individually evaluated for an ACL. CTBI considers the current value of collateral, credit quality of any guarantees, the guarantor’s liquidity and willingness to cooperate, the loan structure and other factors when determining the amount of the ACL. Other factors may include the borrower’s susceptibility to risks presented by the forecasted macroeconomic environment, the industry and geographic region of the borrower, size and financial condition of the borrower, cash flow and leverage of the borrower, and our evaluation of the borrower’s management. Significant management judgment is required when evaluating which of these factors are most relevant in individual circumstances, and when estimating the amount of expected credit losses based on those factors. When loans are individually evaluated, allowances are determined based on management’s estimate of the borrower’s ability to repay the loan given the availability of collateral and other sources of cash flow, as well as an evaluation of legal options available to CTBI. Allowances for individually evaluated loans that are collateral-dependent are typically measured based on the fair value of the underlying collateral, less expected costs to sell where applicable. For collateral-dependent financial assets, the credit loss expected may be zero if the fair value less costs to sell exceeds the amortized cost of the loan. Loans shall not be included in both collective assessments and individual assessments. Individually evaluated loans that are not collateral-dependent are measured based on the present value of expected future cash flows discounted at the loan’s effective interest rate. Specific allowances on individually evaluated commercial loans, including TDRs,loans to borrowers experiencing financial difficulty, are reviewed quarterly and adjusted as necessary based on changing borrower and/or collateral conditions and actual collection and charge-off experience. Regardless of an initial measurement method, once it is determined that foreclosure is probable, the allowance for credit lossesACL is measured based on the fair value of the collateral as of the measurement date. As a practical expedient, the fair value of the collateral may be used for a loan when determining the allowance for credit lossesACL for which the repayment is expected to be provided substantially through the operation or sale of the collateral when the borrower is experiencing financial difficulty. The fair value shall be adjusted for selling costs when foreclosure is probable.

Expected credit losses are estimated on a collective basis for loans that are not individually evaluated. These include commercial loans that do not meet the criteria for individual evaluation as well as homogeneous loans in the residential mortgage and consumer portfolio segments. For collectively evaluated commercial loans, CTBI uses a static pool methodology based on our risk rating system. See Note 4 to the condensed consolidated financial statements contained herein for information on CTBI’s risk rating system. Other homogenous loans such as the residential mortgage and consumer portfolio segments derive their ACL from vintage modeling. Vintage modeling was chosen primarily because these loans have fixed amortization schedules, and it allows CTBI to track loans from origination to completion, including repayments and prepayments, and captures net charge-offs by the different vintages providing historical loss rates. These are the two primary models utilized for ACL determination although there are additional models for specific processes in addition. CTBI’s expected credit loss models were developed based on historical credit loss experience and observations of migration patterns for various credit risk characteristics (such as internal credit risk grades, external credit ratings or scores, delinquency status, etc.) over time, with those observations evaluated in the context of concurrent macroeconomic conditions. CTBI developed our models from historical observations capturing a full economic cycle when possible.

CTBI’s expected credit loss models consider historical credit loss experience, current market and economic conditions, and forecasted changes in market and economic conditions if such forecasts are considered reasonable and supportable. Generally, CTBI considers our forecasts to be reasonable and supportable for a period of up to one year from the estimation date. For periods beyond the reasonable and supportable forecast period, expected credit losses are estimated by reverting to historical loss information. CTBI evaluates the length of our reasonable and supportable forecast period, our reversion period, and reversion methodology at least annually, or more often if warranted by economic conditions or other circumstances.

Other qualitative factors are used by CTBI in determining the ACL. These considerations inherently require significant management judgment to determine the appropriate factors to be considered and the extent of their impact on the ACL estimate. Qualitative factors are used to capture characteristics in the portfolio that impact expected credit losses but that are not fully captured within CTBI’s expected credit loss models. These include adjustments for changes in policies or procedures in underwriting, monitoring or collections, lending and risk management personnel, and results of internal audit and quality control reviews. These may also include adjustments, when deemed necessary, for specific idiosyncratic risks such as geopolitical events, natural disasters and their effects on regional borrowers, and changes in product structures. Qualitative factors may also be used to address the impacts of unforeseen events on key inputs and assumptions within CTBI’s expected credit loss models, such as the reasonable and supportable forecast period, changes to historical loss information, or changes to the reversion period or methodology. When evaluating the adequacy of allowances, consideration is also given to regional geographic concentrations and the closely associated effect that changing economic conditions may have on CTBI’s customers.

61

Overall, the collective evaluation process requires significant management judgment when determining the estimation methodology and inputs into the models, as well as in evaluating the reasonableness of the modeled results and the appropriateness of qualitative adjustments. CTBI’s forecasts of market and economic conditions and the internal risk grades assigned to loans in the commercial portfolio segment are examples of inputs to the expected credit loss models that require significant management judgment. These inputs have the potential to drive significant variability in the resulting ACL.

The reserve for unfunded commitments is maintained at a level believed by management to be sufficient to absorb estimated expected credit losses related to unfunded credit facilities and is included in other liabilities in the consolidated balance sheets. The determination of the adequacy of the reserve is based upon expected credit losses over the remaining contractual life of the commitments, taking into consideration the current funded balance and estimated exposure over the reasonable and supportable forecast period. This process takes into consideration the same risk elements that are analyzed in the determination of the adequacy of CTBI’s ACL, as previously discussed. Net adjustments to the reserve for unfunded commitments are included in other noninterest expense in the consolidated statements of income.

Goodwill – Business combinations entered into by CTBI typically include the recognition of goodwill. U.S. generally accepted accounting principles (“GAAP”) require goodwill to be tested for impairment on an annual basis, which for CTBI is October 1, and more frequently if events or circumstances indicate that there may be impairment. Refer to Note 1 to the condensed consolidated financial statements contained herein for a discussion on the methodology used by CTBI to assess goodwill for impairment.

Impairment exists when a reporting unit’s carrying amount of goodwill exceeds its implied fair value. In testing goodwill for impairment, U.S. GAAP permits CTBIcompanies to first assess qualitative factors to determine whether it is more likely than not that its fair value is less than its carrying amount. In this qualitative assessment, CTBI evaluates events and circumstances which may include, but are not limited to, the general economic environment, banking industry and market conditions, the overall financial performance of CTBI, and the performance of CTBI’s common stock, to determine if it is not more likely than not that the fair value is less than its carrying amount. If the quantitative impairment test is required or the decision to bypass the qualitative assessment is elected, CTBI performs the goodwill impairment test by comparing its fair value with its carrying amount, including goodwill. If the carrying amount exceeds its fair value, an impairment loss is recognized in an amount equal to that excess, limited to the total amount of goodwill recorded. A recognized impairment loss cannot be reversed in future periods even if the fair value of the reporting unit subsequently recovers.

The fair value of CTBI is the price that would be received to sell the company as a whole in an orderly transaction between market participants at the measurement date. The determination of the fair value is a subjective process that involves the use of estimates and judgments, particularly related to cash flows, the appropriate discount rates and an applicable control premium. CTBI employs an income-based approach, utilizing forecasted cash flows and the estimated cost of equity as the discount rate. Significant management judgment is necessary in the preparation of the forecasted cash flows surrounding expectations for earnings projections, growth and credit loss expectations, and actual results may differ from forecasted results.

Income Taxes – Income tax liabilities or assets are established for the amount of taxes payable or refundable for the current year. Deferred tax liabilities (“DTLs”) and deferred tax assets (“DTAs”) are also established for the future tax consequences of events that have been recognized in CTBI’s financial statements or tax returns. A DTL or DTA is recognized for the estimated future tax effects attributable to temporary differences and deductions that can be carried forward (used) in future years. The valuation of current and deferred income tax liabilities and assets is considered critical, as it requires management to make estimates based on provisions of the enacted tax laws. The assessment of tax liabilities and assets involves the use of estimates, assumptions, interpretations, and judgments concerning certain accounting pronouncements and federal and state tax codes.

62

Fair Value Measurements – As a financial services company, the carrying value of certain financial assets and liabilities is impacted by the application of fair value measurements, either directly or indirectly. In certain cases, an asset or liability is measured and reported at fair value on a recurring basis, such as available-for-sale investment securities. In other cases, management must rely on estimates or judgments to determine if an asset or liability not measured at fair value warrants an impairment write-down or whether a valuation reserve should be established. Given the inherent volatility, the use of fair value measurements may have a significant impact on the carrying value of assets or liabilities or result in material changes to ourthe consolidated financial statements from period to period. Detailed information regarding fair value measurements can be found in Note 7 to the condensed consolidated financial statements contained herein.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Interest rate risk management focuses on maintaining consistent growth in net interest income within Board-approved policy limits. CTBI uses an earnings simulation model to analyze net interest income sensitivity to movements in interest rates. Given a 200 basis point increase to the yield curve used in the simulation model, it is estimated net interest income for CTBI would increase by 3.99 percent3.83% over one year and 7.46 percent6.30% over two years. A 25200 basis point decrease in the yield curve would decrease net interest income by an estimated 0.54 percent4.74% over one year and 1.02 percent7.04% over two years. For further discussion of CTBI’s market risk, see the Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Market Risk included in the annual report on Form 10-K for the year ended December 31, 2021.2022.

Item 4. Controls and Procedures

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

CTBI’s management is responsible for establishing and maintaining effective disclosure controls and procedures, as defined under Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934. As of the end of the period covered by this report, an evaluation was carried out by CTBI’s management, with the participation of our Vice Chairman, President, and Chief Executive Officer and the Executive Vice President, Chief Financial Officer, and Treasurer, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, management concluded that disclosure controls and procedures as of March 31, 20222023 were effective in ensuring material information required to be disclosed in this quarterly report on Form 10-Q was recorded, processed, summarized, and reported on a timely basis.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There were no changes in CTBI’s internal control over financial reporting that occurred during the three months ended March 31, 20222023 that have materially affected, or are reasonably likely to materially affect, CTBI’s internal control over financial reporting.

63

PART II - OTHER INFORMATION

| Item 1. | Legal Proceedings | None |

| Item 1A. | Risk Factors | None |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | None |

Item 3. | Defaults Upon Senior Securities | None |

Item 4. | Mine Safety Disclosure | Not applicable |

Item 5. | Other Information: | |

| CTBI’s Principal Executive Officer and Principal Financial Officer have furnished to the SEC the certifications with respect to this Form 10-Q that are required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 | ||

| Item 6. | Exhibits: | |

| (1) Certifications Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | ||

| (2) Certifications Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | ||

| (3) XBRL Instance Document – the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL | Exhibit 101.INS | |

| (4) XBRL Taxonomy Extension Schema Document | Exhibit 101.SCH | |

| (5) XBRL Taxonomy Extension Calculation Linkbase | Exhibit 101.CAL | |

| (6) XBRL Taxonomy Extension Definition Linkbase | Exhibit 101.DEF | |

| (7) XBRL Taxonomy Extension Label Linkbase | Exhibit 101.LAB | |

| (8) XBRL Taxonomy Extension Presentation Linkbase | Exhibit 101.PRE | |

| (9) Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) | Exhibit 104 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, CTBI has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| COMMUNITY TRUST BANCORP, INC. | |

| Date: May 9, | By: |

| /s/ Mark A. Gooch | |

| Mark A. Gooch | |

| Vice Chairman, President, and Chief Executive Officer | |

| /s/ Kevin J. Stumbo | |

| Kevin J. Stumbo | |

| Executive Vice President, Chief Financial Officer, | |

| and Treasurer |