UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR |

For the quarterly period ended |

or

o | TRANSITION REPORT UNDER SECTION 13 OR |

For the transition period from __________________ to __________________________ |

Commission file number: |

LOTUS PHARMACEUTICALS, INC. |

(Name of registrant as specified in its charter) |

NEVADA | 20-0507918 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

16 Cheng Zhuang Road, Feng Tai District, Beijing100071 People’s Republic of China | N/A | |

(Address of principal executive offices) | (Zip Code) |

86-10-63899868 |

( |

N/A |

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes xNo o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer” and "smaller“smaller reporting company"company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer o (Do not check if smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes oNo x

Indicated the number of shares outstanding of each of the issuer'sissuer’s classes of common stock, as of the latest practicable date, 42,420,239 shares of common stock are issued and outstanding as of AugustNovember 14, 2008.

TABLE OF CONTENTS

Page No. | ||||

PART I. - FINANCIAL INFORMATION | ||||

Item 1. | Financial | 4 | ||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 28 | ||

Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 44 | ||

Item 4T | Controls and Procedures. | 44 | ||

PART II - OTHER INFORMATION | ||||

Item 1. | Legal Proceedings. | 45 | ||

Item 1A. | Risk Factors. | 45 | ||

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 45 | ||

Item 3. | Defaults Upon Senior Securities. | 46 | ||

Item 4. | Submission of Matters to a Vote of Security Holders. | 46 | ||

Item 5. | Other Information. | 46 | ||

Item 6. | Exhibits. | 46 | ||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this report contain or may contain forward-looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, our ability to enforce the Contractual Arrangements, Lotus East'sEast’s strategic initiatives, economic, political and market conditions and fluctuations, U.S. and Chinese government and industry regulation, interest rate risk, U.S., Chinese and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety together with our Annual Report on Form 10-K for the year ended December 31, 2007 as filed with the SEC, including the risks described in Item 1A. Risk Factors. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

We maintain a web site at www.lotuseast.com. Information on this web site is not a part of this report.

CERTAIN DEFINED TERMS USED IN THIS PROSPECTUS

Unless specifically set forth to the contrary, when used in this report the terms:

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

• |

|

PART 1. - FINANCIAL INFORMATION

Item 1.

Financial Statements.LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

| September 30, |

| December 31, |

| ||

|

| 2008 |

| 2007 |

| ||

ASSETS |

| (Unaudited) |

|

|

| ||

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash |

| $ | 2,656,770 |

| $ | 4,557,957 |

|

Accounts receivable, net of allowance for doubtful accounts and sale returns |

|

| 13,882,298 |

|

| 20,430,827 |

|

Inventories, net of reserve for obsolete inventory |

|

| 8,621,880 |

|

| 3,410,739 |

|

Prepaid expenses |

|

| 77,440 |

|

| 1,009,382 |

|

Deferred debt costs |

|

| 563,928 |

|

| 29,340 |

|

|

|

|

|

|

|

|

|

Total Current Assets |

|

| 25,802,316 |

|

| 29,438,245 |

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT - Net |

|

| 7,679,960 |

|

| 6,169,966 |

|

|

|

|

|

|

|

|

|

OTHER ASSETS |

|

|

|

|

|

|

|

Deposit on patent license |

|

| 2,917,536 |

|

| — |

|

Deposit on land use right |

|

| 17,120,100 |

|

| — |

|

Intangible assets, net of accumulated amortization |

|

| 1,266,020 |

|

| 1,291,322 |

|

|

|

|

|

|

|

|

|

Total Assets |

| $ | 54,785,932 |

| $ | 36,899,533 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

Convertible debt, net of debt discount |

| $ | — |

| $ | 2,561,645 |

|

Accounts payable and accrued expenses |

|

| 1,845,398 |

|

| 764,491 |

|

Value-added and service taxes payable |

|

| 3,303,152 |

|

| 572,200 |

|

Advances from customers |

|

| — |

|

| 34,531 |

|

Unearned revenue |

|

| 629,084 |

|

| 530,063 |

|

Due to related parties |

|

| 1,355,077 |

|

| 323,178 |

|

|

|

|

|

|

|

|

|

Total Current Liabilities |

|

| 7,132,711 |

|

| 4,786,108 |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

Due to related parties |

|

| 656,446 |

|

| 738,300 |

|

Notes payable - related parties |

|

| 5,055,787 |

|

| 4,738,508 |

|

Series A convertible redeemable preferred stock, $.001 par value; 10,000,000 shares authorized; 5,747,118 and -0- shares issued and outstanding at September 30, 2008 and December 31, 2007, respectively |

|

| 3,559,941 |

|

| — |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

| 16,404,885 |

|

| 10,262,916 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

Common stock ($.001 par value; 200,000,000 shares authorized; 42,420,239 and 41,794,200 shares issued and outstanding at September 30, 2008 and December 31, 2007, respectively) |

|

| 42,420 |

|

| 41,794 |

|

Additional paid-in capital |

|

| 11,277,143 |

|

| 8,095,848 |

|

Statutory reserves |

|

| 3,022,992 |

|

| 2,161,505 |

|

Retained earnings |

|

| 19,883,460 |

|

| 14,355,913 |

|

Other comprehensive gain - cumulative foreign currency translation adjustment |

|

| 4,155,032 |

|

| 1,981,557 |

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity |

|

| 38,381,047 |

|

| 26,636,617 |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity |

| $ | 54,785,932 |

| $ | 36,899,533 |

|

See notes to unaudited consolidated financial statements

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

| For the Three Months Ended |

| For the Nine Months Ended |

| ||||||||

|

| September 30, |

| September 30, |

| ||||||||

|

| 2008 |

| 2007 |

| 2008 |

| 2007 |

| ||||

|

|

|

| (As Restated) |

|

|

| (As Restated) |

| ||||

NET REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale |

| $ | 13,818,369 |

| $ | 11,429,926 |

| $ | 40,749,696 |

| $ | 25,715,018 |

|

Retail |

|

| 1,203,698 |

|

| 1,643,501 |

|

| 2,606,091 |

|

| 3,244,739 |

|

Other revenues |

|

| 1,681,817 |

|

| 3,480,922 |

|

| 4,442,886 |

|

| 8,689,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Revenues |

|

| 16,703,884 |

|

| 16,554,349 |

|

| 47,798,673 |

|

| 37,649,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF SALES |

|

| 8,219,358 |

|

| 9,856,382 |

|

| 25,684,501 |

|

| 22,738,456 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

| 8,484,526 |

|

| 6,697,967 |

|

| 22,114,172 |

|

| 14,910,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

| 4,293,704 |

|

| 1,441,950 |

|

| 11,291,590 |

|

| 2,864,746 |

|

Research and development |

|

| 12,448 |

|

| 1,255,844 |

|

| 1,193,916 |

|

| 1,549,132 |

|

General and administrative |

|

| 420,716 |

|

| 912,546 |

|

| 1,589,176 |

|

| 2,631,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

| 4,726,868 |

|

| 3,610,340 |

|

| 14,074,682 |

|

| 7,045,234 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

| 3,757,658 |

|

| 3,087,627 |

|

| 8,039,490 |

|

| 7,865,646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt issuance costs |

|

| (99,516 | ) |

| (58,679 | ) |

| (261,919 | ) |

| (146,699 | ) |

Registration rights penalty |

|

| — |

|

| — |

|

| (650 | ) |

| (110,000 | ) |

Interest income |

|

| 9,032 |

|

| — |

|

| 11,620 |

|

| — |

|

Interest expense |

|

| (453,498 | ) |

| (807,608 | ) |

| (1,399,507 | ) |

| (1,508,781 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income (Expense) |

|

| (543,982 | ) |

| (866,287 | ) |

| (1,650,456 | ) |

| (1,765,480 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES |

|

| 3,213,676 |

|

| 2,221,340 |

|

| 6,389,034 |

|

| 6,100,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAXES |

|

| — |

|

| — |

|

| — |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

| $ | 3,213,676 |

| $ | 2,221,340 |

| $ | 6,389,034 |

| $ | 6,100,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

| $ | 3,213,676 |

| $ | 2,221,340 |

| $ | 6,389,034 |

|

| 6,100,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation gain |

|

| 127,833 |

|

| 180,895 |

| $ | 2,173,475 |

|

| 552,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME |

| $ | 3,341,509 |

| $ | 2,402,235 |

| $ | 8,562,509 |

| $ | 6,652,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | 0.08 |

| $ | 0.05 |

| $ | 0.15 |

| $ | 0.15 |

|

Diluted |

| $ | 0.07 |

| $ | 0.05 |

| $ | 0.13 |

| $ | 0.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 42,420,239 |

|

| 41,356,483 |

|

| 42,269,997 |

|

| 41,317,461 |

|

Diluted |

|

| 48,167,357 |

|

| 44,356,483 |

|

| 48,017,115 |

|

| 44,317,461 |

|

| June 30, | December 31 | ||||||

| 2008 | 2007 | ||||||

| ASSETS | (Unaudited) | ||||||

| CURRENT ASSETS: | |||||||

| Cash | $ | 3,401,444 | $ | 4,557,957 | |||

| Accounts receivable, net of allowance for doubtful accounts and sale returns | 20,786,631 | 20,430,827 | |||||

| Inventories, net of reserve for obsolete inventory | 7,086,895 | 3,410,739 | |||||

| Prepaid expenses | 284,819 | 1,009,382 | |||||

| Deferred debt costs | 398,067 | 29,340 | |||||

| Total Current Assets | 31,957,856 | 29,438,245 | |||||

| PROPERTY AND EQUIPMENT - Net | 6,551,138 | 6,169,966 | |||||

| OTHER ASSETS | |||||||

| Deposit on patent license | 2,910,446 | - | |||||

| Deposit on land use right | 6,033,353 | - | |||||

| Intangible assets, net of accumulated amortization | 1,298,038 | 1,291,322 | |||||

| Deferred debt costs | 265,377 | - | |||||

| Total Assets | $ | 49,016,208 | $ | 36,899,533 | |||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||

| CURRENT LIABILITIES: | |||||||

| Convertible debt, net of debt discount | $ | - | $ | 2,561,645 | |||

| Accounts payable and accrued expenses | 1,027,999 | 764,491 | |||||

| Value-added and service taxes payable | 2,030,543 | 572,200 | |||||

| Advances from customers | - | 34,531 | |||||

| Unearned revenue | 641,162 | 530,063 | |||||

| Due to related parties | 1,272,153 | 323,178 | |||||

| Total Current Liabilities | 4,971,857 | 4,786,108 | |||||

| LONG-TERM LIABILITIES: | |||||||

| Due to related parties | 654,850 | 738,300 | |||||

| Notes payable - related parties | 5,043,500 | 4,738,508 | |||||

| Series A convertible redeemable preferred stock, $.001 par value; 10,000,000 shares | |||||||

| authorized; 5,747,118 and -0- shares issued and outstanding at June 31, 2008 | |||||||

| and December 31, 2007, respectively | 3,305,813 | - | |||||

| Total Liabilities | 13,976,020 | 10,262,916 | |||||

| SHAREHOLDERS' EQUITY: | |||||||

| Common stock ($.001 par value; 200,000,000 shares authorized; | |||||||

| 42,420,239 and 41,794,200 shares issued and outstanding | |||||||

| at June 30, 2008 and December 31, 2007, respectively) | 42,420 | 41,794 | |||||

| Additional paid-in capital | 11,277,143 | 8,095,848 | |||||

| Statutory reserves | 2,616,019 | 2,161,505 | |||||

| Retained earnings | 16,081,308 | 14,355,913 | |||||

| Other comprehensive gain - cumulative foreign currency translation adjustment | 5,023,298 | 1,981,557 | |||||

| Total Shareholders' Equity | 35,040,188 | 26,636,617 | |||||

| Total Liabilities and Shareholders' Equity | $ | 49,016,208 | $ | 36,899,533 | |||

See notes to unaudited consolidated financial statements

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

| For the Nine Months Ended |

| ||||

|

| September 30, |

| ||||

|

| 2008 |

| 2007 |

| ||

|

|

|

| (As Restated) |

| ||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

Net income |

| $ | 6,389,034 |

| $ | 6,100,166 |

|

Adjustments to reconcile net income from operations to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 469,455 |

|

| 422,055 |

|

Amortization of deferred debt issuance costs |

|

| 261,545 |

|

| 146,699 |

|

Amortization of debt discount |

|

| 208,355 |

|

| 1,041,774 |

|

Amortization of discount on convertible redeemable preferred stock |

|

| 592,966 |

|

| — |

|

Stock based compensation |

|

| 392,341 |

|

| 239,200 |

|

Warrant repricing |

|

| 74,593 |

|

| — |

|

Decrease in allowance for doubtful accounts and sales returns |

|

| (490,310 | ) |

| (1,723,258 | ) |

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

| 8,244,225 |

|

| (6,327,758 | ) |

Inventories |

|

| (4,880,418 | ) |

| 2,390,052 |

|

Prepaid expenses and other current assets |

|

| 1,080,576 |

|

| 251,225 |

|

Accounts payable and accrued expenses |

|

| 1,032,245 |

|

| (101,796 | ) |

Value-added and service taxes payable |

|

| 2,637,331 |

|

| 1,298,344 |

|

Unearned revenue |

|

| 62,225 |

|

| 122,924 |

|

Advances from customers |

|

| (36,086 | ) |

| (170,971 | ) |

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

| 16,038,077 |

|

| 3,688,656 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

Collections from related party advances |

|

| — |

|

| 801,238 |

|

Deposit on patent right |

|

| (2,857,608 | ) |

| — |

|

Deposit on land use right |

|

| (16,768,445 | ) |

| — |

|

Purchase of intangible asset |

|

| (3,429 | ) |

| — |

|

Purchase of property and equipment |

|

| (1,430,894 | ) |

| (384,198 | ) |

|

|

|

|

|

|

|

|

NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES |

|

| (21,060,376 | ) |

| 417,040 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

Net proceeds (payments) from convertible debt |

|

| (2,520,000 | ) |

| 2,950,000 |

|

Proceeds from sale of convertible redeemable peferred stocks |

|

| 5,000,000 |

|

| — |

|

Payment of debt issuance costs |

|

| (468,568 | ) |

| (231,526 | ) |

Proceeds from related party advances |

|

| 860,916 |

|

| — |

|

Repayments of related party advances |

|

| — |

|

| (863,480 | ) |

Repayments of notes payable - related parties |

|

| — |

|

| (1,971,772 | ) |

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES |

|

| 2,872,348 |

|

| (116,778 | ) |

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE ON CASH |

|

| 248,764 |

|

| 116,228 |

|

|

|

|

|

|

|

|

|

NET (DECREASE) INCREASE IN CASH |

|

| (1,901,187 | ) |

| 4,105,146 |

|

|

|

|

|

|

|

|

|

CASH - beginning of period |

|

| 4,557,957 |

|

| 2,089,156 |

|

|

|

|

|

|

|

|

|

CASH - end of period |

| $ | 2,656,770 |

| $ | 6,194,302 |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

|

Interest |

| $ | 103,250 |

| $ | 1,582,393 |

|

Income taxes |

| $ | — |

| $ | — |

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

Warrants issued for prepaid financing costs |

| $ | 327,565 |

| $ | — |

|

Warrants issued for consulting |

| $ | 178,187 |

| $ | — |

|

Common stock issued for compensation |

| $ | 318,551 |

| $ | — |

|

Common stock issued for conversion of convertible debt |

| $ | 250,000 |

| $ | — |

|

Debt discount for grant of warrants and beneficial conversion feature |

| $ | 2,033,025 |

| $ | — |

|

See notes to unaudited consolidated financial statements.

| For the Three Months Ended | For the Six Months Ended | ||||||||||||

| June 30, | June 30, | ||||||||||||

| 2008 | 2007 | 2008 | 2007 | ||||||||||

| (As Restated) | (As Restated) | ||||||||||||

| NET REVENUES: | |||||||||||||

| Wholesale | $ | 17,161,230 | $ | 9,819,373 | $ | 26,931,327 | $ | 14,993,316 | |||||

| Retail | 718,645 | 516,594 | 1,402,393 | 893,014 | |||||||||

| Other revenues | 1,505,737 | 2,469,485 | 2,761,069 | 5,208,657 | |||||||||

| Total Net Revenues | 19,385,612 | 12,805,452 | 31,094,789 | 21,094,987 | |||||||||

| COST OF SALES | 9,696,718 | 7,311,471 | 17,465,143 | 12,974,387 | |||||||||

| GROSS PROFIT | 9,688,894 | 5,493,981 | 13,629,646 | 8,120,600 | |||||||||

| OPERATING EXPENSES: | |||||||||||||

| Selling expenses | 5,875,549 | 791,784 | 6,997,886 | 1,422,796 | |||||||||

| Research and development | 471,243 | 109,153 | 1,181,468 | 200,975 | |||||||||

| General and administrative | 542,043 | 988,233 | 1,168,460 | 1,718,810 | |||||||||

| Total Operating Expenses | 6,888,835 | 1,889,170 | 9,347,814 | 3,342,581 | |||||||||

| INCOME FROM OPERATIONS | 2,800,059 | 3,604,811 | 4,281,832 | 4,778,019 | |||||||||

| OTHER INCOME (EXPENSE): | |||||||||||||

| Debt issuance costs | (99,517 | ) | (58,680 | ) | (162,403 | ) | (88,020 | ) | |||||

| Registration rights penalty | - | (56,000 | ) | (110,000 | ) | ||||||||

| Interest income | 2,027 | - | 2,588 | - | |||||||||

| Interest expense | (522,660 | ) | (448,606 | ) | (946,009 | ) | (701,173 | ) | |||||

| Total Other Income (Expense) | (620,150 | ) | (563,286 | ) | (1,105,824 | ) | (899,193 | ) | |||||

| INCOME BEFORE INCOME TAXES | 2,179,909 | 3,041,525 | 3,176,008 | 3,878,826 | |||||||||

| INCOME TAXES | - | - | - | - | |||||||||

| NET INCOME | $ | 2,179,909 | $ | 3,041,525 | $ | 3,176,008 | $ | 3,878,826 | |||||

| COMPREHENSIVE INCOME: | |||||||||||||

| NET INCOME | $ | 2,179,909 | $ | 3,041,525 | $ | 3,176,008 | 3,878,826 | ||||||

| OTHER COMPREHENSIVE INCOME: | |||||||||||||

| Unrealized foreign currency translation gain | 1,587,538 | 248,403 | $ | 3,041,741 | 371,920 | ||||||||

| COMPREHENSIVE INCOME | $ | 3,767,447 | $ | 3,289,928 | $ | 6,217,749 | $ | 4,250,746 | |||||

| NET INCOME PER COMMON SHARE: | |||||||||||||

| Basic | $ | 0.05 | $ | 0.07 | $ | 0.08 | $ | 0.09 | |||||

| Diluted | $ | 0.05 | $ | 0.07 | $ | 0.07 | $ | 0.09 | |||||

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | |||||||||||||

| Basic | 42,352,139 | 41,389,362 | 42,194,048 | 41,297,531 | |||||||||

| Diluted | 48,099,257 | 44,389,262 | 47,941,166 | 44,297,531 | |||||||||

| For the Six Month Ended | |||||||

| June 30, | |||||||

| 2008 | 2007 | ||||||

| (As Restated) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||

| Net income | $ | 3,176,008 | $ | 3,878,826 | |||

| Adjustments to reconcile net income from operations to net cash | |||||||

| provided by (used in) operating activities: | |||||||

| Depreciation and amortization | 307,713 | 275,197 | |||||

| Amortization of deferred debt issuance costs | 162,029 | 88,020 | |||||

| Amortization of debt discount | 208,355 | 433,735 | |||||

| Amortization of discount on convertible redeemable preferred stock | 338,838 | - | |||||

| Stock base compensation | 270,245 | 55,650 | |||||

| Warrant repricing | 74,593 | - | |||||

| Decrease in allowance for doubtful accounts and sales returns | (14,101 | ) | (1,567,166 | ) | |||

| Changes in assets and liabilities: | |||||||

| Accounts receivable | 946,083 | (524,467 | ) | ||||

| Inventories | (3,358,488 | ) | 1,201,912 | ||||

| Prepaid expenses and other current assets | 986,132 | 113,540 | |||||

| Other receivable | - | - | |||||

| Accounts payable and accrued expenses | 224,627 | 78,398 | |||||

| Value-added and service taxes payable | 1,381,155 | 921,996 | |||||

| Unearned revenue | 74,796 | 132,461 | |||||

| Advances from customers | (35,710 | ) | (145,138 | ) | |||

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 4,742,275 | 4,942,964 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||

| Collections from related party advances | - | 521,930 | |||||

| Deposit on patent right | (2,827,814 | ) | - | ||||

| Deposit on land use right | (5,862,059 | ) | - | ||||

| Purchase of property and equipment | (217,982 | ) | (376,201 | ) | |||

| NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES | (8,907,855 | ) | 145,729 | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

| Net proceeds (payments) from convertible debt | (2,520,000 | ) | 2,950,000 | ||||

| Proceeds from sale of convertible redeemable peferred stocks | 5,000,000 | - | |||||

| Payment of debt issuance costs | (468,568 | ) | (231,526 | ) | |||

| Proceeds from related party advances | 774,571 | 2,866 | |||||

| Repayments of related party advances | - | (719,302 | ) | ||||

| Repayments of notes payable - related parties | - | (846,781 | ) | ||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 2,786,003 | 1,155,257 | |||||

| EFFECT OF EXCHANGE RATE ON CASH | 223,064 | 107,929 | |||||

| NET (DECREASE) INCREASE IN CASH | (1,156,513 | ) | 6,351,879 | ||||

| CASH - beginning of period | 4,557,957 | 2,089,156 | |||||

| CASH - end of period | $ | 3,401,444 | $ | 8,441,035 | |||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||||

| Cash paid for: | |||||||

| Interest | $ | 56,557 | $ | 267,438 | |||

| Income taxes | $ | - | $ | - | |||

| Non-cash operting, investing and financing activities: | |||||||

| Warrants issued for prepaid financing costs | $ | 327,565 | $ | - | |||

| Warrants issued for prepaid consulting | $ | 178,187 | - | ||||

| Common stock issued for compensation | $ | 318,551 | - | ||||

| Common stock issued for conversion of convertible debt | $ | 250,000 | $ | - | |||

| Debt discount for grant of warrants and beneficial conversion feature | $ | 2,033,025 | $ | - | |||

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Lotus Pharmaceuticals, Inc. (“Lotus” or the “Company”), formerly S.E. Asia Trading Company, Inc. (“SEAA”), was incorporated on January 28, 2004 under the laws of the State of Nevada. SEAA operated as a retailer of jewelry, framed art and home accessories. In December 2006, SEAA changed its name to Lotus Pharmaceuticals, Inc.

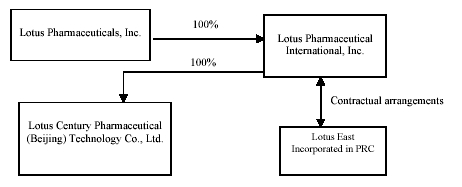

On September 6, 2006, the Company entered into a definitive Share Exchange Agreement with Lotus Pharmaceutical International, Inc. (“Lotus International”), whereby the Company acquired all of the outstanding common stock of Lotus International in exchange for newly-issued stock of the Company to Lotus International’s shareholders. On September 28, 2006 (the closing date), Lotus International became a wholly-owned subsidiary of the Company and Lotus International’s shareholders became the owners of the majority of the Company’s voting stock. The acquisition of Lotus International by the Company was accounted for as a reverse merger because on a post-merger basis, the former shareholders of Lotus International hold a majority of the outstanding common stock of the Company on a voting and fully-diluted basis. As a result, Lotus International is deemed to be the acquirer for accounting purposes.

Lotus International was incorporated under the laws the State of Nevada on August 28, 2006 to develop and market pharmaceutical products in the People’s Republic of China (“PRC” or “China”). PRC law currently has limits on foreign ownership of certain companies. To comply with these foreign ownership restrictions, Lotus operates its pharmaceutical business in China through Beijing Liang Fang Pharmaceutical Co., Ltd. (“Liang Fang”) and an affiliate of Liang Fang, Beijing En Zhe Jia Shi Pharmaceutical Co., Ltd. (“En Zhe Jia”), both of which are pharmaceutical companies headquartered in the PRC and organized under the laws of the PRC (hereinafter, referred to together as “Lotus East”). Lotus International has contractual arrangements with Lotus East and its shareholders pursuant to which Lotus International will provide technology consulting and other general business operation services to Lotus East. Through these contractual arrangements, Lotus International also has the ability to substantially influence Lotus East’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result of these contractual arrangements, which enable Lotus International to control Lotus East, Lotus International is considered the primary beneficiary of Lotus East. Accordingly, the consolidated financial statements include the accounts of Lotus Pharmaceuticals, Inc. and its wholly-owned subsidiary, Lotus International and companies under its control (Lotus East).

On September 6, 2006, Lotus International entered into the following contractual arrangements:

Operating Agreement. Pursuant to the operating agreement among Lotus, Lotus East and the shareholders of Lotus East, (collectively “Lotus East’s Shareholders”), Lotus provides guidance and instructions on Lotus East’s daily operations, financial management and employment issues. The shareholders of Lotus East must designate the candidates recommended by Lotus as their representatives on Lotus East’s Board of Directors. Lotus has the right to appoint senior executives of Lotus East. In addition, Lotus agreed to guarantee Lotus East’s performance under any agreements or arrangements relating to Lotus East’s business arrangements with any third party. Lotus East, in return, agreed to pledge its accounts receivable and all of its assets to Lotus. Moreover, Lotus East agreed that without the prior consent of Lotus, Lotus East would not engage in any transaction that could materially affect the assets, liabilities, rights or operations of Lotus East, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement is ten (10) years from September 6, 2006 and may be extended only upon Lotus’s written confirmation prior to the expiration of the this agreement, with the extended term to be mutually agreed upon by the parties.

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

Equity Pledge Agreement. Under the equity pledge agreement between the shareholders of Lotus East and Lotus, the shareholders of Lotus East pledged all of their equity interests in Lotus East to Lotus to guarantee Lotus East’s performance of its obligations under the technology consulting agreement. If Lotus East or Lotus East’s Shareholders breaches its respective contractual obligations, Lotus, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. Lotus East’s Shareholders also agreed that upon occurrence of any event of default, Lotus shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of Lotus East’s Shareholders to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that Lotus may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. The shareholders of Lotus East agreed not to dispose of the pledged equity interests or take any actions that would prejudice Lotus’ interest. The equity pledge agreement will expire two (2) years after Lotus East’s obligations under the exclusive consulting services agreements have been fulfilled.

Option Agreement. Under the option agreement between the shareholders of Lotus East and Lotus, the shareholders of Lotus East irrevocably granted Lotus or its designated person an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in Lotus East for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. Lotus or its designated person has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is 10 years from September 6, 2006 and may be extended prior to its expiration by written agreement of the parties.

Proxy Agreement.. Pursuant to the proxy agreement among Lotus and Lotus East’s Shareholders, Lotus East’s Shareholders agreed to irrevocably grant a person to be designated by Lotus with the right to exercise Lotus East’s Shareholders’ voting rights and their other rights, including the attendance at and the voting of Lotus East’s Shareholders’ shares at the shareholders’ meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and its Article of Association, including but not limited to the rights to sell or transfer all or any of his equity interests of Lotus East, and appoint and vote for the directors and Chairman as the authorized representative of the shareholders of Lotus East. The term of this Proxy Agreement is ten (10) years from September 6, 2006 and may be extended prior to its expiration by written agreement of the parties.

Liang Fang is a Chinese limited liability company and was formed under laws of the People’s Republic of China on June 21, 2000. Liang Fang is engaged in the production, trade and retailing of pharmaceuticals. Further, Liang Fang is focused on development of innovative medicines and investing strategic growth to address various medical needs for patients worldwide. Liang Fang’s operations are based in Beijing, China.

As of JuneSeptember 30, 2008, Liang Fang owns and operates 10 drug stores throughout Beijing, China. These drugstores sell Western and traditional Chinese medicines, and medical treatment accessories.

Liang Fang’s affiliate, En Zhe Jia is a Chinese limited liability company and was formed under laws of the People’s Republic of China on September 17, 1999. En Zhe Jia is the sole manufacturer for Liang Fang and maintains facilities for the production of medicines, patented Chinese medicine, as well as the research and production of other new medicines.

As a result of the management agreements between Lotus International and Lotus East, Lotus East was deemed to be the acquirer of Lotus International for accounting purposes. Accordingly, the financial statement data presented are those of Lotus East for all periods prior to the Company’s acquisition of Lotus International on September 28, 2006, and the financial statements of the consolidated companies from the acquisition date forward.

On May 29, 2007, the Company formed a new entity, Lotus Century Pharmaceutical (Beijing) Technology Co., Ltd. (‘‘Lotus Century’’), a wholly foreign-owned enterprise (“WFOE”) organized under the laws of the Peoples’ Republic of China. Lotus Century is a Chinese limited liability company and a wholly-owned subsidiary of Lotus Pharmaceutical International, Inc. Lotus Century intends to be engaged in development of innovative medicines, medical technology consulting and outsourcing services, and related training services.

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

Basis of presentation

The interim consolidated financial statements included herein have been prepared by the Company, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in an annual financial statement prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) have been condensed or omitted pursuant to such rules and regulations. In the opinion of management, the interim consolidated financial statements reflect all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the statement of the results for the interim periods presented. These interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto, as well as the accompanying Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2007 included in its Annual Report on Form 10-K. Interim financial results are not necessarily indicative of the results that may be expected for a full year.

The Company has adopted FASB Interpretation No. 46R “Consolidation of Variable Interest Entities” (“FIN 46R”), an Interpretation of Accounting Research Bulletin No. 51. FIN 46R requires a Variable Interest Entity (VIE) to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. VIEs are those entities in which the Company, through contractual arrangements, bears the risks of, and enjoys the rewards normally associated with ownership of the entities, and therefore the Company is the primary beneficiary of these entities. As a VIE, Lotus East’s revenues are included in the Company’s total revenues, its income from operations is consolidated with the Company’s, and the Company’s net income includes all of Lotus East’s net income.

The accompanying unaudited consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”). The consolidated statements include the accounts of Lotus Pharmaceuticals, Inc. and its wholly-owned subsidiaries, Lotus and Lotus Century and variable interest entities under its control (Liang Fang and En Zhe Jia). All significant inter-company balances and transactions have been eliminated.

The Company has adopted FASB Interpretation No. 46R "Consolidation of Variable Interest Entities" ("FIN 46R"), an Interpretation of Accounting Research Bulletin No. 51. FIN 46R requires a Variable Interest Entity (VIE) to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE's residual returns. VIEs are those entities in which the Company, through contractual arrangements, bears the risks of, and enjoys the rewards normally associated with ownership of the entities, and therefore the Company is the primary beneficiary of these entities. As a VIE, Lotus East’s revenues are included in the Company’s total revenues, its income from operations is consolidated with the Company’s, and the Company’s net income includes all of Lotus East’s net income.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Significant estimates in 2008 and 2007 include the allowance for doubtful accounts, the allowance for obsolete inventory, the useful life of property and equipment and intangible assets, and accruals for taxes due.

Fair value of financial instruments

The carrying amounts reported in the balance sheet for cash, accounts receivable, accounts payable and accrued expenses, convertible debt, customer advances, and amounts due to related parties approximate their fair market value based on the short-term maturity of these instruments.

Cash and cash equivalents

For purposes of the consolidated statements of cash flows, the Company considers all highly liquid instruments purchased with a maturity of three months or less and money market accounts to be cash equivalents. The Company maintains cash and cash equivalents with various financial institutions mainly in the PRC and the United States. Balances in the United States are insured up to $100,000 at each bank.

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

Accounts receivable

The Company records accounts receivable, net of an allowance for doubtful accounts and sales returns. The Company maintains allowances for doubtful accounts for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, customer’s historical payment history, its current credit-worthiness and current economic trends. The amount of the provision, if any is recognized in the consolidated statement of operations within “General and administrative expenses”. Accounts are written off after exhaustive efforts at collection. The Company policy regarding sales returns is discussed below. The activity in the allowance for doubtful accounts and sales returns accounts for accounts receivable for the periods ended JuneSeptember 30, 2008 and December 31, 2007 are as follows:

|

| Allowance for doubtful accounts |

| Allowance for sales returns |

| Total |

| |||

Balance - December 31, 2006 |

| $ | 539,627 |

| $ | 2,297,399 |

| $ | 2,837,026 |

|

Reductions |

|

| (26,617) |

|

| (2,354,720) |

|

| (2,381,337) |

|

Foreign currency translation adjustments |

|

| 35,073 |

|

| 57,321 |

|

| 92,394 |

|

Balance - December 31, 2007 |

|

| 548,083 |

|

| - |

|

| 548,083 |

|

Reductions (unaudited) |

|

| (490,310) |

|

| - |

|

| (490,310) |

|

Foreign currency translation adjustments (unaudited) |

|

| 26,416 |

|

| - |

|

| 26,416 |

|

Balance - September 30, 2008 (unaudited) |

| $ | 84,189 |

| $ | - |

| $ | 84,189 |

|

| Allowance for doubtful accounts | Allowance for sales returns | Total | ||||||||

| Balance - December 31, 2006 | $ | 539,627 | $ | 2,297,399 | $ | 2,837,026 | ||||

| Reductions | (26,617 | ) | (2,354,720 | ) | (2,381,337 | ) | ||||

| Foreign currency translation adjustments | 35,073 | 57,321 | 92,394 | |||||||

| Balance - December 31, 2007 | 548,083 | - | 548,083 | |||||||

| Reductions | (14,101 | ) | - | (14,101 | ) | |||||

| Foreign currency translation adjustments | 34,865 | - | 34,865 | |||||||

| Balance - June 30, 2008 | $ | 568,847 | $ | - | $ | 568,847 | ||||

NOTE 1 - InventoriesORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Inventories, consisting of raw materials and finished goods related to the Company’s products are stated at the lower of cost or market utilizing the weighted average method. An allowance is established when management determines that certain inventories may not be saleable. If inventory costs exceed expected market value due to obsolescence or quantities in excess of expected demand, the Company will record reserves for the difference between the cost and the market value. These reserves are recorded based on estimates and reflected in cost of sales.

Property and equipment

Property and equipment are carried at cost and are depreciated on a straight-line basis over the estimated useful lives of the assets. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. In accordance with Statement of Financial Accounting Standards (SFAS) No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the Company examines the possibility of decreases in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

ImpairmentImpairment of long-lived assets

In accordance with Statement of Financial Accounting Standards (SFAS) No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the Company periodically reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. The Company did not consider it necessary to record any impairment charges during the year ended December 31, 2007 and during the sixnine months ended JuneSeptember 30, 2008.

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

Advances from customers

Income taxes

The Company is governed by the Income Tax Law of the People’s Republic of China and the United States. Income taxes are accounted for under Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes,” which is an asset and liability approach that requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been recognized in the Company’s financial statements or tax returns.

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Basic earnings per share is computed by dividing net earnings by the weighted average number of shares of common stock outstanding during the period. Diluted income per share is computed by dividing net income by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive common shares consist of the common shares issuable upon the conversion of convertible debt (using the if-converted method). The following table presents a reconciliation of basic and diluted earnings per share:

|

| For the Three Months Ended September 30, |

| ||||

|

| 2008 |

| 2007 |

| ||

Net income for basic and diluted earnings per share |

| $ | 3,213,676 |

| $ | 2,221,340 |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

| 42,420,239 |

|

| 41,356,483 |

|

Effect of dilutive securities: |

|

|

|

|

|

|

|

Unexercised warrants |

|

| — |

|

| — |

|

Convertible debentures |

|

| — |

|

| 3,000,000 |

|

Convertible redeemable preferred shares |

|

| 5,747,118 |

|

| — |

|

Weighted average shares outstanding- diluted |

|

| 48,167,357 |

|

| 44,356,483 |

|

Earnings per share - basic |

| $ | 0.08 |

| $ | 0.05 |

|

Earnings per share - diluted |

| $ | 0.07 |

| $ | 0.05 |

|

|

| For the Nine Months Ended September 30, |

| ||||

|

| 2008 |

| 2007 |

| ||

Net income for basic and diluted earnings per share |

| $ | 6,389,034 |

| $ | 6,100,166 |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

| 42,269,997 |

|

| 41,317,461 |

|

Effect of dilutive securities: |

|

|

|

|

|

|

|

Unexercised warrants |

|

| — |

|

| — |

|

Convertible debentures |

|

| — |

|

| 3,000,000 |

|

Convertible redeemable preferred shares |

|

| 5,747,118 |

|

| — |

|

Weighted average shares outstanding- diluted |

|

| 48,017,115 |

|

| 44,317,461 |

|

Earnings per share - basic |

| $ | 0.15 |

| $ | 0.15 |

|

Earnings per share - diluted |

| $ | 0.13 |

| $ | 0.14 |

|

For the Three Months Ended June 30, | |||||||

2008 | 2007 | ||||||

| Net income for basic and diluted earnings per share | $ | 2,179,909 | $ | 3,041,525 | |||

| Weighted average shares outstanding - basic | 42,352,139 | 41,389,362 | |||||

| Effect of dilutive securities: | |||||||

| Unexercised warrants | — | — | |||||

| Convertible debentures | — | 3,000,000 | |||||

| Convertible redeemable preferred shares | 5,747,118 | — | |||||

| Weighted average shares outstanding- diluted | 48,099,257 | 44,389,362 | |||||

| Earnings per share - basic | $ | 0.05 | $ | 0.07 | |||

| Earnings per share - diluted | $ | 0.05 | $ | 0.07 | |||

For the Six Months Ended June 30, | |||||||

2008 | 2007 | ||||||

| Net income for basic and diluted earnings per share | $ | 3,176,008 | $ | 3,878,826 | |||

| Weighted average shares outstanding - basic | 42,194,048 | 41,297,531 | |||||

| Effect of dilutive securities: | |||||||

| Unexercised warrants | — | — | |||||

| Convertible debentures | — | 3,000,000 | |||||

| Convertible redeemable preferred shares | 5,747,118 | — | |||||

| Weighted average shares outstanding- diluted | 47,941,166 | 44,297,531 | |||||

| Earnings per share - basic | $ | 0.08 | $ | 0.09 | |||

| Earnings per share - diluted | $ | 0.07 | $ | 0.09 | |||

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

At JuneSeptember 30, 2008 and 2007, a total of 5,166,999 and 1,500,000 outstanding warrants have not been included in the calculation of diluted earnings per shares as the effect would be anti-dilutive. The closing market price of the Company on JuneSeptember 30, 2008 and 2007 was lower than the exercise price of all outstanding warrants. Because of that, the Company assumes that none of the outstanding warrants at that date would have been exercised and therefore none were included in the computation of the diluted earnings per share for period ended JuneSeptember 30, 2008 and 2007. Accordingly, the Company has excluded any effect of outstanding warrants as their effect would be anti-dilutive.

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Product sales

Product sales are generally recognized when title to the product has transferred to customers in accordance with the terms of the sale. The Company recognizes revenue in accordance with the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin (SAB) No. 101, “Revenue Recognition in Financial Statements”as amended by SAB No. 104 (together, “SAB 104”), and Statement of Financial Accounting Standards (SFAS) No. 48 “Revenue Recognition When Right of Return Exists.”SAB 104 states that revenue should not be recognized until it is realized or realizable and earned. In general, the Company records revenue when persuasive evidence of an arrangement exists, services have been rendered or product delivery has occurred, the sales price to the customer is fixed or determinable, and collectability is reasonably assured.

SFAS No. 48 states that revenue from sales transactions where the buyer has the right to return the product shall be recognized at the time of sale only if the seller’s price to the buyer is substantially fixed or determinable at the date of sale, the buyer has paid the seller, or the buyer is obligated to pay the seller and the obligation is not contingent on resale of the product, the buyer’s obligation to the seller would not be changed in the event of theft or physical destruction or damage of the product, the buyer acquiring the product for resale has economic substance apart from that provided by the seller, the seller does not have significant obligations for future performance to directly bring about resale of the product by the buyer, and the amount of future returns can be reasonably estimated.

The Company’s net product revenues represent total product revenues less allowances for returns.

Allowance for returns

The Company accounts for sales returns in accordance with Statements of Financial Accounting Standards (SFAS) No. 48, Revenue Recognition When Right of Return Exists, by establishing an accrual in an amount equal to its estimate of sales recorded for which the related products are expected to be returned. The Company determines the estimate of the sales return accrual primarily based on historical experience regarding sales returns, but also by considering other factors that could impact sales returns. These factors include levels of inventory in the distribution channel, estimated shelf life, product discontinuances, and price changes of competitive products, introductions of generic products and introductions of competitive new products. In general, for wholesale sales, the Company provides credit for product returns that are returned six months prior to and up to six months after the product expiration date. Upon sale, the Company estimates an allowance for future product returns. The Company provides additional reserves for contemporaneous events that were not known and knowable at the time of shipment. In order to reasonably estimate future returns, the Company analyzed both quantitative and qualitative information including, but not limited to, actual return rates, the level of product manufactured by the Company, the level of product in the distribution channel, expected shelf life of the product, current and projected product demand, the introduction of new or generic products that may erode current demand, and general economic and industry wide indicators. The Company also utilizes the guidance provided in SAB 104 in establishing its return estimates. At JuneThe Company’s allowance for sales return was zero both at September 30, 2008 and December 31, 2007, the Company’s allowance for returns was $0 and $0, respectively.2007.

LOTUS PHARMACEUTICALS, INC. AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

Other revenues

Other revenues consist of (i) leasing revenues received for the lease of retail space to various retail merchants; (ii) advertising revenues from the lease of counter space at the Company’s retail locations; (iii) leasing revenue from the lease of retail space to licensed medical practitioners; (iv) revenues received by the Company for research and development projects and lab testing jobs conducted on behalf of third party companies, and; (v) revenues received for performing third party contract manufacturing projects. In connection with third-party manufacturing, the customer supplies the raw materials and the Company is paid a fee for manufacturing their product and revenue is recognized at the completion of the manufacturing job. The Company recognizes revenues from leasing of space and advertising revenues as earned from contracting third parties. The Company recognizes revenues upon performance of any research or lab testing jobs. Revenues received in advance are reflected as deferred revenue on the accompanying balance sheet. Additionally, the Company receives income from the sale of developed drug formulas. Income from the sale of drug formulas are recognized upon performance of all of the Company’s obligations under the respective sales contract and are included in other income on the accompanying consolidated statement of operations.

Concentrations of credit risk

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of the Company’s cash is maintained with state-owned banks within the People’s Republic of China of which no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts. A significant portion of the Company’s sales are credit sales which are primarily to customers whose ability to pay is dependent upon the industry economics prevailing in these areas; however, concentrations of credit risk with respect to trade accounts receivables is limited due to generally short payment terms. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk.

Shipping costs

Shipping costs arerelated to costs of goods sold were included in costselling expenses with a total of sales$208,997 and totaled $206,818 and $505,697$590,000 for the sixnine months ended JuneSeptember 30, 2008 and 2007, respectively.

AAdvertisingdvertising

Advertising is expensed as incurred. Advertising expenses were included in general and administrative expenses amounted to $155,530$175,086 and $263,529$964,448 for the sixnine months ended JuneSeptember 30, 2008 and 2007, respectively.

Research and development

Research and development costs are expensed as incurred. These costs primarily consist of cost of material used and salaries paid for the development of the Company’s products and fees paid to third parties. For the sixnine months ended JuneSeptember 30, 2008 and 2007, the Company expensed $1,181,468$1,193,916 and $200,975$1,549,132 as research and development expense, respectively, and paid for future research and development services in the amount of $0 and $769,742 at JuneSeptember 30, 2008 and December 31, 2007, respectively, which has been included in prepaid expenses on the accompanying balance sheets. The December 31, 2007 prepaid research and development expense has been fully expensed during the period ended JuneSeptember 30, 2008.

NOTE 1 - ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

The reporting currency of the Company is the U.S. dollar. The functional currency of the Company is the local currency, the Chinese Renminbi (“RMB”). Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. The cumulative translation adjustment and effect of exchange rate changes on cash for the sixnine months ended JuneSeptember 30, 2008 and 2007 was $223,064$4,155,032 and $107,929,$1,981,557, respectively. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

Asset and liability accounts at JuneSeptember 30, 2008 and December 31, 2007 were translated at 6.87186.8551 RMB to $1.00 USD and at 7.3141 RMB to $1.00 USD, respectively. Equity accounts were stated at their historical rate. The average translation rates applied to income statements for the sixnine months ended JuneSeptember 30, 2008 and 2007 were 7.07266.99886 RMB and 7.73007.67576 RMB to $1.00 USD, respectively. In accordance with Statement of Financial Accounting Standards No. 95, "Statement“Statement of Cash Flows,"” cash flows from the Company'sCompany’s operations is calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Accumulated other comprehensive income

Accumulated other comprehensive income consisted of unrealized gains on currency translation adjustments from the translation of financial statements from Chinese RMB to US dollars. As of JuneSeptember 30, 2008 and December 31, 2007, accumulated other comprehensive income was $5,023,298$4,155,032 and $1,981,557, respectively.

Reclassifications

Certain accounts and amounts in the period ended JuneSeptember 30, 2007 financial statements have been reclassified in order to conform withto the period ended JuneSeptember 30, 2008 presentation. These reclassifications have no effect on net income.

Recent Accounting Pronouncements

In February 2007, the FASB issued SFAS No. 159,“”The Fair Value Option for Financial Assets and Financial Liabilities, Including an Amendment of FASB Statement No. 115” , under which entities will now be permitted to measure many financial instruments and certain other assets and liabilities at fair value on an instrument-by-instrument basis. This Statement is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provisions of SFAS 157. The adoption of this interpretation did not have an impact on the Company’s financial position, results of operations, or cash flows.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141R, Business Combinations (SFAS 141R) and Statement of Financial Accounting Standards No. 160, Accounting and Reporting of Non-controlling Interests in Consolidated Financial Statements, an amendment of ARB No. 51 (SFAS 160). These two standards must be adopted in conjunction with each other on a prospective basis. The most significant changes to business combination accounting pursuant to SFAS 141R and SFAS 160 are the following: (a) recognize, with certain exceptions, 100 percent of the fair values of assets acquired, liabilities assumed and non-controlling interests in acquisitions of less than a 100 percent controlling interest when the acquisition constitutes a change in control of the acquired entity, (b) acquirers’ shares issued in consideration for a business combination will be measured at fair value on the closing date, not the announcement date, (c) recognize contingent consideration arrangements at their acquisition date fair values, with subsequent changes in fair value generally reflected in earnings, (d) the expensing of all transaction costs as incurred and most restructuring costs, (e) recognition of pre-acquisition loss and gain contingencies at their acquisition date fair values, with certain exceptions, (f) capitalization of acquired in-process research and development rather than expense recognition, (g) earn-out arrangements may be required to be re-measured at fair value and (h) recognize changes that result from a business combination transaction in an acquirer’s existing income tax valuation allowances and tax uncertainty accruals as adjustments to income tax expense. Should we decide to enter future business combinations, these new standards will significantly affect the Company’s accounting for future business combinations following adoption on January 1, 2009.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities (“SFAS 161”). This statement requires companies to provide enhanced disclosures about (a) how and why they use derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect a company’s financial position, financial performance, and cash flows. SFAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The Company will adopt the new disclosure requirements on or before the required effective date and thus will provide additional disclosures in its consolidated financial statements when adopted.

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

In April 2008, FASB Staff Position No. 142-3, Determination of the Useful Life of Intangible Assets (FSP 142-3)(“FSP 142-3”) was issued. This standard amends the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset under FASB Statement No. 142, Goodwill and Other Intangible Assets. FSP 142-3 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early adoption is prohibited. The Company has not determined the impact on its financial statements of this accounting standard.

In May 2008, the Financial Accounting Standards Board (FASB”(“FASB”) issued FASB Staff Position (FSP”(“FSP”) APB 14-1, Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement) . FSP APB 14-1 clarifies that convertible debt instruments that may be settled in cash upon either mandatory or optional conversion (including partial cash settlement) are not addressed by paragraph 12 of APB Opinion No. 14, Accounting for Convertible Debt and Debt issued with Stock Purchase Warrants . Additionally, FSP APB 14-1 specifies that issuers of such instruments should separately account for the liability and equity components in a manner that will reflect the entity’s nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. FSP APB 14-1 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. We will adopt FSP APB 14-1 beginning in the first quarter of fiscal 2010, and this standard must be applied on a retrospective basis. We are evaluating the impact the adoption of FSP APB 14-1 will have on our consolidated financial position and results of operations.

In May 2008, the FASB issued Statement of Financial Accounting Standards (SFAS”(“SFAS”) No. 162, The Hierarchy of Generally Accepted Accounting Principles . This standard is intended to improve financial reporting by identifying a consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial statements that are presented in conformity with generally accepted accounting principles in the United States for non-governmental entities. SFAS No. 162 is effective 60 days following approval by the U.S. Securities and Exchange Commission (SEC”(“SEC”) of the Public Company Accounting Oversight Board’s amendments to AU Section 411, The Meaning of Present Fairly in Conformity with Generally Accepted Accounting Principles . We do not expect SFAS No. 162 to have a material impact on the preparation of our consolidated financial statements.

On June 16, 2008, the FASB issued final Staff Position (FSP)(“FSP”) No. EITF 03-6-1, Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities” to address the question of whether instruments granted in share-based payment transactions are participating securities prior to vesting. The FSP determines that unvested share-based payment awards that contain rights to dividend payments should be included in earnings per share calculations. The guidance will be effective for fiscal years beginning after December 15, 2008. We are currently evaluating the requirements of (FSP)FSP No. EITF 03-6-1.

NOTE 2 - ACCOUNTS RECEIVABLE

At JuneSeptember 30, 2008 and December 31, 2007, accounts receivable consisted of the following:

|

| September 30, 2008 |

| December 31, 2007 |

| ||

Accounts receivable |

| $ | 13,966,487 |

| $ | 20,978,910 |

|

Less: allowance for doubtful accounts |

|

| (84,189) |

|

| (548,083) |

|

|

| $ | 13,882,298 |

| $ | 20,430,827 |

|

June 30, 2008 | December 31, 2007 | ||||||

| Accounts receivable | $ | 21,355,478 | $ | 20,978,910 | |||

| Less: allowance for doubtful accounts | (568,847 | ) | (548,083 | ) | |||

| $ | 20,786,631 | $ | 20,430,827 | ||||

LOTUS PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2008

NOTE 3 - INVENTORIES

At JuneSeptember 30, 2008 and December 31, 2007, inventories consisted of the following:

|

| September 30, 2008 |

| December 31, 2007 |

| ||

Raw materials |

| $ | 2,163,247 |

| $ | 2,312,111 |

|

Work in process |

|

| 0 |

|

| 279,759 |

|

Packaging materials |

|

| 14,414 |

|

| 52,967 |

|

Finished goods |

|

| 6,489,622 |

|

| 808,456 |

|

|

|

| 8,667,283 |

|

| 3,453,293 |

|

Less: reserve for obsolete inventory |

|

| (45,403) |

|

| (42,554) |

|

|

| $ | 8,621,880 |

| $ | 3 ,410,739 |

|

June 30, 2008 | December 31, 2007 | ||||||

| Raw materials | $ | 2,231,592 | $ | 2,312,111 | |||

| Work in process | 310,768 | 279,759 | |||||

| Packaging materials | 24,721 | 52,967 | |||||

| Finished goods | 4,565,107 | 808,456 | |||||

| 7,132,188 | 3,453,293 | ||||||

| Less: reserve for obsolete inventory | (45,293 | ) | (42,554 | ) | |||

| $ | 7,086,895 | $ | 3 ,410,739 | ||||

NOTE 4 - PROPERTY AND EQUIPMENT

At JuneSeptember 30, 2008 and December 31, 2007, property and equipment consist of the following:

|

| Useful Life |

| September 30, 2008 |

| December 31, 2007 | |||

Office equipment and furniture |

|

| 5-8 Years |

| $ | 242,688 |

| $ | 154,488 |

Manufacturing equipment |

|

| 10 - 15 Years |

|

| 5,571,015 |

| 5,032,601 | |

Building and building improvements |

|

| 20 - 40 Years |

|

| 3,135,752 |

| 2,938,966 | |

Construction in progress |

|

|

|

|

| 1,181,602 |

| - | |

|

|

|

|

|

| 10,131,057 |

| 8,126,055 | |

Less: accumulated depreciation |

|

|

|

|

| (2,451,097) |

| (1,956,089) | |

|

|

|

|

| $ | 7,679,960 |

| $ 6,169,966 | |

| Useful Life | June 30, 2008 | December 31, 2007 | |||||||||||

| Office equipment and furniture | 5-8 Years | $ | 170,500 | $ | 154,488 | ||||||||

| Manufacturing equipment | 10 - 15 Years | 5,574,805 | 5,032,601 | ||||||||||

| Building and building improvements | 20 - 40 Years | 3,128,131 | 2,938,966 | ||||||||||

| 8,873,436 | 8,126,055 | ||||||||||||

| Less: accumulated depreciation | (2,322,298 | ) | (1,956,089) | ||||||||||

| $ | 6,551,138 | $ 6,169,966 | |||||||||||

For the sixnine months ended JuneSeptember 30, 2008, construction in progress amounted to $1,181,602, representing construction for a new manufacturing plant located in Cha Ha Er Industrial Garden District in Inner Mongolia, China. The amount included costs for road, electrical, sewage, heating and water pipes constructions.

For the nine months ended September 30, 2008 and 2007, depreciation expense amounted to $233,483$356,556 and $209,512,$315,000 of which $226,593$346,151 and $188,209$301,850 is included in cost of sales, respectively.