CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under Part 1 Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

3

OTHER PERTINENT INFORMATION

References in this quarterly report to “we,” “us,” “our,” the “Registrant”“our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and consolidated affiliated entities (“CAE”) unless otherwise indicated by the context.

variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Taiwan, Republic of China.

Unless context indicates otherwise, reference to the “Company” in this quarterly report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (as defined below). Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan Hong Kong and China using New Taiwanese Dollars (“NT$” or “NTD”), the currency of Taiwan, Hong Kong Dollars (“NTD”HK$” or “HKD”), the currency of Hong Kong, (“HKD”), and RMB, the currency of China, (“RMB”), respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this quarterly report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD.U.S. dollars. These dollar references are based on the exchange rate of NTD, HKDNT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USDU.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

4

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | |

|

| September 30, 2020 |

| December 31, 2019 | ||

(Amount in USD) | | (Unaudited) | | | | |

ASSETS | | | | | | |

Current assets | | | | | | |

Cash and cash equivalents | | $ | 13,571,935 | | $ | 12,615,008 |

Time deposits | |

| 46,890,005 | |

| 38,731,658 |

Accounts receivable | |

| 15,309,244 | |

| 22,541,558 |

Contract assets | | | 3,593,536 | | | — |

Marketable securities | | | 1,214,712 | | | 290,153 |

Other current assets | |

| 1,751,824 | |

| 1,810,962 |

Total current assets | |

| 82,331,256 | |

| 75,989,339 |

| | | | | | |

Property and equipment, net | |

| 2,176,044 | |

| 1,402,866 |

Right-of-use assets under operating leases | | | 5,791,689 | | | 5,522,665 |

Intangible assets, net | |

| 387,986 | |

| 518,264 |

Long-term investments | |

| 2,784,188 | |

| 2,693,082 |

Restricted cash – noncurrent | |

| 63,779 | |

| 43,492 |

Deferred tax assets | | | 1,016,388 | | | 441,364 |

Other assets | |

| 3,776,728 | |

| 2,631,350 |

TOTAL ASSETS | | $ | 98,328,058 | | $ | 89,242,422 |

| | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |

|

| |

|

|

Current liabilities | |

|

| |

|

|

Short-term loans | | $ | 13,466,184 | | $ | 8,100,000 |

Commissions payable to sales professionals | | | 10,466,205 | | | 12,545,730 |

Contract liabilities - current | | | 1,609,155 | | | 1,781,975 |

Income tax payable - current | |

| 2,583,652 | |

| 2,389,304 |

Operating lease liabilities - current | | | 2,740,054 | | | 2,242,034 |

Due to related parties | |

| 190,933 | |

| 462,859 |

Other current liabilities | |

| 7,306,157 | |

| 9,875,209 |

Total current liabilities | |

| 38,362,340 | |

| 37,397,111 |

| | | | | | |

Contract liabilities - noncurrent | | | 271,375 | | | 1,049,258 |

Income tax payable - noncurrent | |

| 719,515 | |

| 815,451 |

Operating lease liabilities - noncurrent | | | 3,008,155 | | | 3,048,632 |

Other liabilities | |

| 1,365,689 | |

| 1,180,478 |

TOTAL LIABILITIES | |

| 43,727,074 | |

| 43,490,930 |

| | | | | | |

COMMITMENTS AND CONTINGENCIES | |

| | |

| |

| | | | | | |

STOCKHOLDERS’ EQUITY | |

| | |

| |

Preferred stock, par value $0.00001, 10,000,000 authorized, 1,000,000 issued and outstanding | |

| 10 | |

| 10 |

Common stock, par value $0.00001, 100,000,000 authorized, 29,421,736 issued and outstanding | |

| 294 | |

| 294 |

Additional paid-in capital | |

| 8,190,449 | |

| 8,190,449 |

Statutory reserves | |

| 8,228,904 | |

| 8,228,904 |

Retained earnings | |

| 12,191,120 | |

| 9,402,294 |

Accumulated other comprehensive income | |

| 1,715,678 | |

| 417,015 |

Total stockholders' equity attribute to the Company's shareholders | |

| 30,326,455 | |

| 26,238,966 |

Noncontrolling interests | |

| 24,274,529 | |

| 19,512,526 |

TOTAL STOCKHOLDERS' EQUITY | |

| 54,600,984 | |

| 45,751,492 |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 98,328,058 | | $ | 89,242,422 |

| September 30, 2017 | December 31, 2016 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 11,663,265 | $ | 20,169,455 | ||||

| Time deposits | 21,475,432 | 5,352,347 | ||||||

| Marketable securities | 32,867 | 2,426,870 | ||||||

| Structured deposit | 1,205,162 | - | ||||||

| Accounts receivable, net | 7,217,051 | 15,774,159 | ||||||

| Other current assets | 2,274,353 | 1,890,551 | ||||||

| Total current assets | 43,868,130 | 45,613,382 | ||||||

| Property, plant and equipment, net | 927,062 | 926,905 | ||||||

| Intangible assets | 747,610 | 784,219 | ||||||

| Goodwill | 2,071,491 | 2,071,491 | ||||||

| Long-term investments | 1,368,950 | 1,285,064 | ||||||

| Other assets | 2,149,619 | 726,482 | ||||||

| TOTAL ASSETS | $ | 51,132,862 | $ | 51,407,543 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Tax payable | $ | 2,356,626 | $ | 2,249,869 | ||||

| Convertible bonds | 200,000 | - | ||||||

| Due to related parties | 646,862 | 400,001 | ||||||

| Other current liabilities | 10,420,828 | 18,639,909 | ||||||

| Total current liabilities | 13,624,316 | 21,289,779 | ||||||

| Convertible bonds - noncurrent | - | 200,000 | ||||||

| Long-term loans | 265,985 | 254,907 | ||||||

| Long-term liabilities | 4,898,335 | 5,315,327 | ||||||

| TOTAL LIABILITIES | 18,788,636 | 27,060,013 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock, par value $0.00001, 10,000,000 authorized, 1,000,000 issued and outstanding | 10 | 10 | ||||||

| Common stock, par value $0.00001, 100,000,000 authorized, 29,452,669 issued and outstanding | 295 | 295 | ||||||

| Additional paid-in capital | 8,190,449 | 8,157,512 | ||||||

| Statutory reserves | 5,054,720 | 3,799,585 | ||||||

| Retained earnings | 6,663,807 | 3,286,562 | ||||||

| Accumulated other comprehensive gain/(loss) | 168,008 | (667,976 | ) | |||||

| Stockholders’ equity attribute to parent’s shareholders | 20,077,289 | 14,575,988 | ||||||

| Noncontrolling interests | 12,266,937 | 9,771,542 | ||||||

| TOTAL STOCKHOLDERS’ EQUITY | 32,344,226 | 24,347,530 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 51,132,862 | $ | 51,407,543 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME / (LOSS)

(UNAUDITED)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue | $ | 16,210,334 | $ | 14,951,345 | $ | 50,084,684 | $ | 43,289,113 | ||||||||

| Cost of revenue | 9,071,624 | 9,335,735 | 29,746,059 | 27,986,021 | ||||||||||||

| Gross profit | 7,138,710 | 5,615,610 | 20,338,625 | 15,303,092 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling | 783,120 | 630,255 | 1,481,423 | 2,094,965 | ||||||||||||

| General and administrative | 3,708,037 | 3,359,674 | 10,714,341 | 9,336,015 | ||||||||||||

| Total operating expenses | 4,491,157 | 3,989,929 | 12,195,764 | 11,430,980 | ||||||||||||

| Income from operations | 2,647,553 | 1,625,681 | 8,142,861 | 3,872,112 | ||||||||||||

| Other income (expenses): | ||||||||||||||||

| Interest income | 79,299 | 31,113 | 246,559 | 137,222 | ||||||||||||

| Interest expenses | (8,293 | ) | (1,601 | ) | (24,562 | ) | (11,165 | ) | ||||||||

| Dividend income | 1,391 | 3,633 | 331,140 | 272,522 | ||||||||||||

| Other - net | 89,065 | 21,248 | 136,113 | (46,104 | ) | |||||||||||

| Total other income (expenses) | 161,462 | 54,393 | 689,250 | 352,475 | ||||||||||||

| Income before income tax | 2,809,015 | 1,680,074 | 8,832,111 | 4,224,587 | ||||||||||||

| Income tax expense | 831,878 | 456,828 | 2,345,147 | 1,335,331 | ||||||||||||

| Net income | 1,977,137 | 1,223,246 | 6,486,964 | 2,889,256 | ||||||||||||

| Net income attributable to the noncontrolling interests | 669,490 | 465,501 | 1,854,584 | 1,301,226 | ||||||||||||

| Net income attributable to parent’s shareholders | 1,307,647 | 757,745 | 4,632,380 | 1,588,030 | ||||||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation gain | 48,149 | 260,981 | 793,090 | 378,217 | ||||||||||||

| Other | 175 | - | 42,894 | (1,593 | ) | |||||||||||

| Other comprehensive income attributable to parent’s shareholders | 48,324 | 260,981 | 835,984 | 376,624 | ||||||||||||

| Other comprehensive items attributable to noncontrolling interests | 23,405 | 249,160 | 640,811 | 408,827 | ||||||||||||

| Comprehensive income attributable to parent’s shareholders | $ | 1,355,971 | $ | 1,018,726 | $ | 5,468,364 | $ | 1,964,654 | ||||||||

| Comprehensive income attributable to noncontrolling interests | $ | 692,895 | $ | 714,661 | $ | 2,495,395 | $ | 1,710,053 | ||||||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic | 29,452,669 | 29,452,669 | 29,452,669 | 29,452,669 | ||||||||||||

| Diluted | 30,521,407 | 30,478,667 | 30,521,407 | 30,462,097 | ||||||||||||

| Net income per share attributable to parent’s shareholder: | ||||||||||||||||

| Basic | $ | 0.044 | $ | 0.026 | $ | 0.157 | $ | 0.054 | ||||||||

| Diluted | $ | 0.043 | $ | 0.025 | $ | 0.152 | $ | 0.052 | ||||||||

| | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | ||||||||

|

| 2020 |

| 2019 |

| 2020 |

| 2019 | ||||

(Amount in USD) | | | | | | |

| | | | | |

Revenue | | $ | 33,235,952 | | $ | 23,266,852 | | $ | 91,200,916 | | $ | 64,449,994 |

Cost of revenue | |

| 21,269,044 | |

| 14,374,811 | |

| 63,261,959 | |

| 41,805,241 |

| | | | | | | | | | | | |

Gross profit | |

| 11,966,908 | |

| 8,892,041 | |

| 27,938,957 | |

| 22,644,753 |

| | | | | | | | | | | | |

Operating expenses: | |

| | |

| | |

| | |

| |

Selling | |

| 926,004 | |

| 744,429 | |

| 1,783,692 | |

| 1,741,372 |

General and administrative | |

| 5,705,115 | |

| 4,706,802 | |

| 18,614,446 | |

| 12,934,838 |

Total operating expense | |

| 6,631,119 | |

| 5,451,231 | |

| 20,398,138 | |

| 14,676,210 |

| | | | | | | | | | | | |

Income from operations | |

| 5,335,789 | |

| 3,440,810 | |

| 7,540,819 | |

| 7,968,543 |

| | | | | | | | | | | | |

Other income (expenses): | |

| | |

| | |

| | |

| |

Interest income | |

| 100,266 | |

| 138,408 | |

| 325,168 | |

| 356,896 |

Interest expenses | |

| (33,443) | |

| (64,372) | |

| (153,703) | |

| (144,515) |

Dividend income | |

| 2,368 | |

| (720) | |

| 321,603 | |

| 309,903 |

Other - net | |

| 23,648 | |

| (180,560) | |

| 94,796 | |

| 134,122 |

Total other income (expense), net | |

| 92,839 | |

| (107,244) | |

| 587,864 | |

| 656,406 |

| | | | | | | | | | | | |

Income before income taxes | |

| 5,428,628 | |

| 3,333,566 | |

| 8,128,683 | |

| 8,624,949 |

Income tax expense | |

| (1,364,725) | |

| (933,985) | |

| (2,893,297) | |

| (2,254,086) |

| | | | | | | | | | | | |

Net income | |

| 4,063,903 | |

| 2,399,581 | |

| 5,235,386 | |

| 6,370,863 |

Less: net income attributable to noncontrolling interests | |

| (1,277,587) | |

| (1,071,427) | |

| (2,446,560) | |

| (2,557,603) |

Net income attributable to the Company's shareholders | |

| 2,786,316 | |

| 1,328,154 | |

| 2,788,826 | |

| 3,813,260 |

| | | | | | | | | | | | |

Other comprehensive income (loss) items: | |

| | |

| | |

| | |

| |

Foreign currency translation gain (loss) | |

| 1,106,349 | |

| (186,331) | |

| 2,066,175 | |

| (782,667) |

Other | |

| (201) | |

| 0 | |

| (317) | |

| 0 |

Total other comprehensive income (loss) | | | 1,106,148 | | | (186,331) | | | 2,065,858 | | | (782,667) |

| | | | | | | | | | | | |

Comprehensive income | | | 5,170,051 | | | 2,213,250 | | | 7,301,244 | | | 5,588,196 |

Less: comprehensive income attributable to noncontrolling interests | | | (1,709,453) | | | (1,044,640) | | | (3,213,755) | | | (2,311,894) |

| | | | | | | | | | | | |

Comprehensive income attributable to the Company's shareholders | | $ | 3,460,598 | | $ | 1,168,610 | | $ | 4,087,489 | | $ | 3,276,302 |

| | | | | | | | | | | | |

Weighted average shares outstanding | |

| | |

| | |

| | |

| |

Basic and diluted | | | 29,421,736 | | | 29,421,736 | | | 29,421,736 | | | 29,432,047 |

| | | | | | | | | | | | |

Earnings per share attributable to the Company's shareholders | |

| | |

|

| |

| | |

| |

Basic and diluted | | $ | 0.092 | | $ | 0.044 | | $ | 0.092 | | $ | 0.125 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWSCHANGES IN STOCKHOLDERS' EQUITY

(UNAUDITED)

| Nine Months Ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 6,486,964 | $ | 2,889,256 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | 410,593 | 455,383 | ||||||

| Amortization of bond premium | 193 | - | ||||||

| Gain on settlement of debt | - | (83,425 | ) | |||||

| Gain on valuation of financial assets | 1,372,468 | (10,868 | ) | |||||

| Loss on disposals of property, plant and equipment | 75,121 | 25,568 | ||||||

| Deferred income tax | (20,030 | ) | (65,235 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 9,541,161 | 4,085,141 | ||||||

| Other current assets | (268,864 | ) | 450,406 | |||||

| Other assets | (1,331,414 | ) | 66,823 | |||||

| Tax payable | (35,858 | ) | (112,098 | ) | ||||

| Other current liabilities | (9,339,583 | ) | (3,943,730 | ) | ||||

| Long-term liabilities | (753,022 | ) | 623,579 | |||||

| Net cash provided by operating activities | 6,137,729 | 4,380,800 | ||||||

| Cash flows from investing activities: | ||||||||

| Repayments to pervious shareholders | - | (150,959 | ) | |||||

| Purchases of structured deposit | (1,292,441 | ) | - | |||||

| Purchases of time deposits | (24,572,262 | ) | (7,095,147 | ) | ||||

| Proceeds from maturities of time deposits | 8,888,669 | 8,025,394 | ||||||

| Purchase of marketable securities | (6,231,364 | ) | - | |||||

| Proceeds from disposals of marketable securities | 7,488,976 | - | ||||||

| Purchase of property, plant and equipment | (257,944 | ) | (371,913 | ) | ||||

| Purchase of intangible assets | (88,745 | ) | (437,294 | ) | ||||

| Net cash used in investing activities | (16,065,111 | ) | (29,919 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from related party borrowings | 261,589 | 68,431 | ||||||

| Repayment to related parties | (281 | ) | (623,507 | ) | ||||

| Payment to noncontrolling interest as reduction of cash capital | - | (77,043 | ) | |||||

| Proceeds from third party borrowings | - | 469,028 | ||||||

| Repayment to loans | - | (224,447 | ) | |||||

| Net cash provided by (used in) financing activities | 261,308 | (387,538 | ) | |||||

| Foreign currency translation | 1,159,884 | 596,891 | ||||||

| Net increase (decrease) in cash and cash equivalents | (8,506,190 | ) | 4,560,234 | |||||

| Cash and cash equivalents, beginning balance | 20,169,455 | 13,083,357 | ||||||

| Cash and cash equivalents, ending balance | $ | 11,663,265 | $ | 17,643,591 | ||||

| SUPPLEMENTARY DISCLOSURE: | ||||||||

| Interest paid | $ | 29,806 | $ | 2,324 | ||||

| Income tax paid | $ | 2,298,197 | $ | 1,549,580 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW FOR NON-CASH TRANSACTION: | ||||||||

| Debt forgiveness - related parties | $ | 32,937 | $ | - | ||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

|

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

(Amount in USD) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance June 30, 2020 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,228,904 | | $ | 1,041,396 | | $ | 9,404,804 | | $ | 26,865,857 | | $ | 22,565,076 | | $ | 49,430,933 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Foreign currency translation gain |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 674,414 | |

| — | |

| 674,414 | |

| 431,935 | |

| 1,106,349 |

Other comprehensive loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (132) | |

| — | |

| (132) | |

| (69) | |

| (201) |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 2,786,316 | |

| 2,786,316 | |

| 1,277,587 | |

| 4,063,903 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2020 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,228,904 | | $ | 1,715,678 | | $ | 12,191,120 | | $ | 30,326,455 | | $ | 24,274,529 | | $ | 54,600,984 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

|

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

(Amount in USD) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2019 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,228,904 | | $ | 417,015 | | $ | 9,402,294 | | $ | 26,238,966 | | $ | 19,512,526 | | $ | 45,751,492 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Compensation cost in connection with issuance of preferred stock on the Company’s subsidiary, Uniwill, to nonemployees | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,547,229 | | | 1,547,229 |

Business acquisition |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 1,019 | |

| 1,019 |

Foreign currency translation gain |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 1,298,872 | |

| — | |

| 1,298,872 | |

| 767,303 | |

| 2,066,175 |

Other comprehensive loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (209) | |

| — | |

| (209) | |

| (108) | |

| (317) |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 2,788,826 | |

| 2,788,826 | |

| 2,446,560 | |

| 5,235,386 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2020 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,228,904 | | $ | 1,715,678 | | $ | 12,191,120 | | $ | 30,326,455 | | $ | 24,274,529 | | $ | 54,600,984 |

7

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

|

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Loss |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

(Amount in USD) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance June 30, 2019 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,058,094 | | $ | (548,732) | | $ | 8,999,362 | | $ | 24,699,477 | | $ | 17,648,448 | | $ | 42,347,925 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Appropriation of reserves | | — | | | — | | | — | | | — | | | — | | | (1,760) | | | — | | | 1,760 | | | — | | | — | | | — |

Acquisition of noncontrolling interest |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (30,150) | |

| (30,150) |

Foreign currency translation loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (159,544) | |

| — | |

| (159,544) | |

| (26,787) | |

| (186,331) |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 1,328,154 | |

| 1,328,154 | |

| 1,071,427 | |

| 2,399,581 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2019 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,056,334 | | $ | (708,276) | | $ | 10,329,276 | | $ | 25,868,087 | | $ | 18,662,938 | | $ | 44,531,025 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

|

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Loss |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

(Amount in USD) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2018 |

| 29,452,669 | | $ | 295 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 7,299,123 | | $ | (171,318) | | $ | 7,273,227 | | $ | 22,591,786 | | $ | 16,351,044 | | $ | 38,942,830 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Appropriation of reserves | | — | |

| — | |

| — | |

| — | |

| — | |

| 757,211 | | | — | | | (757,211) | | | — | | | — | | | — |

Foreign currency translation loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (536,958) | |

| — | |

| (536,958) | |

| (245,709) | |

| (782,667) |

Retirement of common stock | | (30,933) | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | | | (1) | | | — | | | (1) |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 3,813,260 | |

| 3,813,260 | |

| 2,557,603 | |

| 6,370,863 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2019 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 8,056,334 | | $ | (708,276) | | $ | 10,329,276 | | $ | 25,868,087 | | $ | 18,662,938 | | $ | 44,531,025 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | |

| | Nine Months Ended | ||||

| | September 30, | ||||

(Amount in USD) |

| 2020 |

| 2019 | ||

Cash flows from operating activities: | | | | | | |

Net income | | $ | 5,235,386 | | $ | 6,370,863 |

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

| |

Compensation cost in connection with issuance of preferred stock on the Company’s subsidiary, Uniwill, to nonemployees | | | 1,547,229 | | | 0 |

Depreciation and amortization | |

| 694,862 | |

| 498,178 |

Amortization of bond premium | |

| 202 | |

| 0 |

Gain on sales of marketable securities | | | (104,208) | | | (18,970) |

Gain on valuation of financial assets | | | (48,904) | | | (24,296) |

Loss on disposal of equipment | | | 45,306 | | | 20,733 |

Loss on disposal of a subsidiary | | | 5,645 | | | 0 |

Deferred income tax | |

| (98,596) | |

| (66,746) |

Changes in operating assets and liabilities: | |

| | |

| |

Accounts receivable | |

| 7,775,347 | |

| 4,473,238 |

Contract assets | | | (3,494,823) | | | (3,304,938) |

Other current assets | |

| 234,614 | |

| (265,401) |

Other assets | |

| (1,512,399) | |

| (3,126,292) |

Commissions payable to sales professionals | |

| (2,439,637) | |

| (735,625) |

Contract liabilities | | | (1,019,695) | | | (335,879) |

Income tax payable | |

| 33,874 | |

| 169,161 |

Other current liabilities | |

| (2,565,675) | |

| 22,573 |

Other liabilities | |

| 140,468 | |

| 80,562 |

Net cash provided by operating activities | |

| 4,428,996 | |

| 3,757,161 |

| | | | | | |

Cash flows from investing activities: | |

| | |

|

|

Cash received from issuance of preferred stock on the Company’s subsidiary, Uniwill, to nonemployees | | | 371 | | | 0 |

Purchases of time deposits | |

| (53,753,884) | |

| (41,901,757) |

Proceeds from maturities of time deposits | |

| 47,141,011 | |

| 31,802,019 |

Purchases of marketable securities | |

| (950,791) | |

| (315,442) |

Proceeds from sales of marketable securities | |

| 215,832 | |

| 364,748 |

Purchase of equipment | | | (1,250,361) | | | (454,612) |

Proceeds from disposal of equipment | | | 3,008 | | | 22,557 |

Purchase of intangible assets | |

| (51,797) | |

| (71,568) |

Net cash used in investing activities | |

| (8,646,611) | |

| (10,554,055) |

| | | | | | |

Cash flows from financing activities: | |

|

| |

|

|

Proceeds from short-term loans | |

| 38,774,384 | |

| 21,539,897 |

Repayment of short-term loans | |

| (33,560,000) | |

| (19,542,276) |

Proceeds from related party borrowing | |

| (275,573) | |

| 116,581 |

Net cash provided by financing activities | | | 4,938,811 | |

| 2,114,202 |

| |

| | | | |

Foreign currency translation | |

| 256,018 | |

| (366,421) |

Net decrease in cash, cash equivalents and restricted cash | |

| 977,214 | |

| (5,049,113) |

| | | | | | |

Cash, cash equivalents and restricted cash, beginning balance | |

| 12,658,500 | |

| 20,639,771 |

Cash, cash equivalents and restricted cash, ending balance | | $ | 13,635,714 | | $ | 15,590,658 |

| | | | | | |

SUPPLEMENTARY DISCLOSURE: | | | | | | |

Interest paid | | $ | 160,978 | | $ | 151,011 |

Income tax paid | | $ | 3,298,391 | | $ | 2,023,938 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

9

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Unaudited)

(Amount in USD)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

China United Insurance Service, Inc. (“China United,” “CUIS”United”, “CUII”, or the “Company”) is a Delaware corporation, organized on June 4, 2010 by Yi HsiaoYi-Hsiao Mao, a TaiwaneseTaiwan citizen, as a listing vehicle for both ZLI Holdings Limited (“ZLI Holdings”CU Hong Kong”) and Action Holdings Financial Limited (“AHFL”), which isAHFL,” a company incorporated in the British Virgin Islands). The Company primarily engages in brokerage and insurance agency services by providing two broad categories of insurance products, life insurance products and property and casualty insurance products, and manages its business through aggregating them into three geographic operating segments, Taiwan, PRC, and Hong Kong. The Company’s common stock currently quotedtrades over the counter under the ticker symbol “CUII” on the United States OverOTC Pink market.

In May 2019, AHFL entered into an agreement to make capital contributions of $485,909 (NTD15,000,000) to AIlife International Investment Co., Limited (“AIlife”, formerly known as “Ilife”). After the Counter Bulletin Board.transaction, the Company owned 93.75% of AIlife. In July 2019, AHFL acquired the remaining 6.25% shares of AIlife, which became the Company's wholly owned subsidiary. The business objective of AIlife is to obtain a non-exclusive license covering certain information technology systems from Law Broker and generate revenues from marketing and making the technologies available to insurance intermediary companies.

O June 4, 2019, AIlife entered into an acquisition agreement with the selling shareholder of Uniwill Insurance Broker Co., Ltd (“Uniwill”). Pursuant to the acquisition agreement, AIlife agreed to pay $14,535 (NTD 450,000) in exchange for the insurance brokerage licenses issued to Uniwill by the Taiwanese government, along with right to the Uniwill company name and $6,455 (NTD 200,000) of legal deposits. The Company has no intention of operating the Uniwill existing brokerage business nor retaining any of its sales personnel. Therefore, the acquisition is accounted as an assets purchase.

On November 15, 2019, AIlife, Cyun-Jhan Enterprise Co., Ltd. (“Cyun-Jhan”), and Jian-Zao International Industrial Co., Ltd. (“Jian-Zao” and, collectively with AIlife and Cyun-Jhan, the “Parties”) entered into a Joint Venture Agreement (the “JV Agreement”). Under the terms of the JV Agreement, the Parties agreed to invest funds, labor and technology into Uniwill. Under the terms of the JV Agreement, the paid-in capital of Uniwill should increase to an aggregate amount of $13.3 million (NTD 400 million) by AIlife, provided that the other two parties achieve performance goals no later than December 31, 2021. On August 15, 2019, AIlife increased and completed the capital injections in Uniwill to the amount of $3.3 million.

Uniwill issued a total of 9,608 preferred shares to Cyun-Jhan and Jian-Zao for cash and recognized compensation cost of $1,547,229 after the performance goals of the first stage were achieved on February 10, 2020 (the "Grant Date"). The holders of 9,608 shares of preferred stocks participate in daily operating and entitle to have the rights of share 50% of earnings of Uniwill. Each share of the preferred stock issued has 1,000 voting rights in shareholder's meeting. In addition, the holders of the preferred stocks are eligible to convert the preferred stocks to common stocks of Uniwill at a ratio of 1 preferred share to 1,000 common shares upon the achievement of the performance goals of stage two set forth in the JV Agreement. As of September 30, 2020, the performance goals of the second stage was not fulfilled.

On May 27, 2020, the Company completed the acquisition of Rays Technology Corporation ("Rays") for its 90% equity interest. The consideration to acquire 27,000 shares of Ray was US$9,177 (NTD 270,000). The acquisition is accounted as a business purchase. The Company did not recognize any goodwill or gain on bargain purchase as a result of the net asset value acquired approximating to the consideration paid.

On July 2, 2020, the Company had liquidated a subsidiary in the PRC, Prime Management Consulting (Nanjing) Co., Limited and recognized a loss on disposal of a subsidiary of $5,645 for the three and nine months ended September 30, 2020.

10

In January 2020, the World Health Organization declared an outbreak of the coronavirus (COVID-19) to be a Public Health Emergency of International Concern, subsequently declared COVID-19 a global pandemic, and recommended containment and mitigation measures worldwide on March 11, 2020. We had experienced some adverse impacts on our business in the PRC Segment, such as limited access to our staff in the PRC in the beginning of the outbreak and restrictions on business travel within the PRC and between Taiwan and the PRC. Even though the operations in the PRC segment fully resumed in the second quarter of 2020, the pandemic has created global economic uncertainties and led to negative impact on the financial markets. The extent of the COVID-19 impact to the Company will depend on numerous factors and developments related to COVID-19. Consequently, any potential impacts of COVID-19 remain highly uncertain and cannot be predicted with confidence.

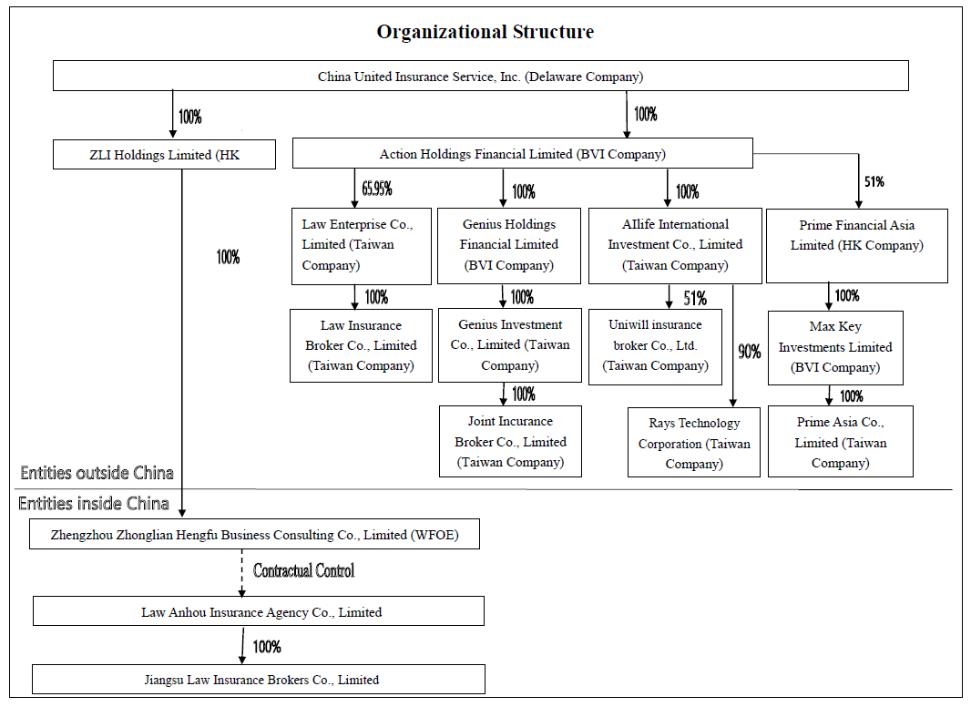

The corporate structure as of September 30, 2017 was2020 is as follows:

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The unaudited accompanying condensed consolidated financial statements include the accounts of China United, and its subsidiaries and variable interest entities as shown in the organizationcorporate structure in Note 1. All significant intercompany transactions and balances have been eliminated in consolidation. Certain reclassifications have been made to the consolidated financial statements for prior year to the current year’s presentation. Such reclassifications have no effect on net income as previously reported.

11

Basis of Presentation

The unaudited condensed consolidated financial statements presented herein have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Regulation S-X. Accordingly, the financial statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments, including normal recurring adjustments, considered necessary for a fair presentationstatement of the financial statements have been included. Operating results for the three and nine months ended September 30, 20172020 are not necessarily indicative of the results that may be expected for the year endedending December 31, 2017.

2020.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2016,2019, which were included in the Company’s 20162019 Annual Report on Form 10-K.10-K (“2019 Form 10-K”). The accompanying condensed consolidated balance sheet as of December 31, 2016,2019, has been derived from the Company’s audited consolidated financial statements as of that date.

Use of Estimates

Reclassifications

Certain reclassifications have been madeThe preparation of the Company’s condensed consolidated financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the prior periods’amounts reported in the consolidated financial statements and notesfootnotes thereto. Actual results may differ from those estimates and assumptions.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable includes commission receivables stated at net realizable values. The Company reviews its accounts receivable regularly to conformdetermine if a bad debt allowance is necessary at each quarter-end. Management reviews the composition of accounts receivable and analyzes the age of receivables outstanding, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the current period’s presentation. Such reclassifications have no effect on net incomenecessity of making such allowance. No allowance was deemed necessary as previously reported. Please see Note 23, Reclassifications.of September 30, 2020 and December 31, 2019.

Foreign Currency Translations

Transactions

The Company’s financial statements are presented in U.S. dollars ($), which is the Company’s reporting and functional currency. The functional currencies of the Company’s subsidiaries are NTD, RMB and HKD. The resulting translation adjustments are reported under other comprehensive income in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 220 (“ASC 220”), “Reporting Comprehensive Income”. Gains and losses resulting from the translation of foreign currency transactions are reflected in the consolidated statements of operations and other comprehensive income (loss). Monetary assets and liabilities denominated in foreign currency are translated at the functional currency using the rate of exchange prevailing at the balance sheet date. Any differences are taken to profit or loss as a gain or loss on foreign currency translation in the consolidated statements of operations. operations and other comprehensive income (loss).

In accordance with ASC 830, Foreign Currency Matters, theThe Company translates the assets and liabilities into U.S. dollars using the rate of exchange prevailing at the balance sheet date and the statements of operations and cash flows are translated at an average rate during the reporting period. Adjustments resulting from the translation from NTD, RMB and HKD into U.S. dollars are recorded in stockholders’ equity as part of accumulated other comprehensive income. The exchange rates used for interimcondensed consolidated financial statements are as follows:

| Average Exchange Rate for the Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | ||||||||||||||

| | | | | | | | ||||||||

| | Average Rate for the Nine Months Ended | | ||||||||||||

| | September 30, | | ||||||||||||

|

| 2020 |

| 2019 | | ||||||||||

| New Taiwan dollar (NTD) | NTD | 30.505166 | NTD | 32.736000 | | NTD | 29.770854 |

| NTD | 31.032055 | | ||||

| China yuan (RMB) | RMB | 6.805734 | RMB | 6.579240 | | RMB | 6.994085 |

| RMB | 6.861782 | | ||||

| Hong Kong dollar (HKD) | HKD | 7.787013 | HKD | 7.763280 | | HKD | 7.757236 |

| HKD | 7.837965 | | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | | $ | 1.000000 |

| $ | 1.000000 | | ||||

| Exchange Rate at | ||||||||

| September 30, 2017 | December 31, 2016 | |||||||

| New Taiwan dollar (NTD) | NTD | 30.324000 | NTD | 32.283100 | ||||

| China yuan (RMB) | RMB | 6.654500 | RMB | 6.943700 | ||||

| Hong Kong dollar (HKD) | HKD | 7.811000 | HKD | 7.754340 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | ||||

12

| | | | | | | |

| | Exchange Rate at | | ||||

|

| September 30, 2020 |

| December 31, 2019 | | ||

New Taiwan dollar (NTD) | | NTD | 28.953074 |

| NTD | 29.953143 | |

China yuan (RMB) | | RMB | 6.801266 |

| RMB | 6.966764 | |

Hong Kong dollar (HKD) | | HKD | 7.749884 |

| HKD | 7.787223 | |

United States dollar ($) | | $ | 1.000000 | | $ | 1.000000 | |

Earnings Per Share

Basic earnings per common share (“EPS”) is computed by dividing net income attributable to the common shareholders of the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except the number of shares includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued.

As the holders of preferred stock of the Company are entitled to share equally with the holders of common stock, on a per share basis, in such dividends and other distributions of cash, property or shares of stock of the Company as may be declared by the board of directors, the preferred stock is treated as a participating security. When calculating the basic earnings per common share, the two-class method is used to allocate earnings to common stock and participating security as required by FASB ASC Topic 260, “Earnings Per Share”. As of September 30, 2020 and 2019, the Company did not have any potentially dilutive instrument.

Fair ValuesValue of Financial Instruments

Accounting Standards Codification (ASC) 820, Fair Value Measurement, definesvalue accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price at whichthat would be received to sell an asset could be exchanged or paid to transfer a liability transferred in an orderly transaction between knowledgeable, willing parties inmarket participants at the principal or most advantageous market for the asset or liability. Where available,measurement date. This framework provides a fair value is basedhierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

13

The following fair value hierarchy tables present information about the Company's assets and liabilities measured at fair value on observable market prices or derived from such prices. Where observable prices or inputs are not available, valuation models are applied which may involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity. See Note 24, Fair Value Measurement.

Concentration of Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents and accounts receivable. Asa recurring basis as of September 30, 2017, approximately $1,467,000 of the Company’s cash and cash equivalents, time deposits, registered capital deposit and restricted cash held by financial institutions was insured, and the remaining balance of approximately $32,808,000 was not insured.

Three major insurance companies accounted for more than 10% of the Company’s total revenue for the three months ended of September 30, 2017 and 2016. Revenue from these insurance companies were set out as below:

| Three months ended September 30, | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 4,275,654 | 26 | % | $ | 5,291,779 | 35 | % | ||||||||

| Taiwan Life Insurance Co., Ltd. (*) | 1,911,978 | 12 | % | 1,493,069 | 10 | % | ||||||||||

| TransGlobe Life Insurance Inc. | 1,882,461 | 12 | % | (** | ) | (** | ) | |||||||||

For the nine months ended of September 30, 2017 and 2016, the Company’s revenue received from the following companies were set out as below:

| Nine months ended September 30, | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 13,019,656 | 26 | % | $ | 13,969,672 | 32 | % | ||||||||

| Taiwan Life Insurance Co., Ltd. (*) | 5,881,228 | 12 | % | 4,813,813 | 11 | % | ||||||||||

| TransGlobe Life Insurance Inc. | 5,127,561 | 10 | % | (** | ) | (** | ) | |||||||||

| Fubon Life Insurance Co., Ltd. | (*** | ) | (*** | ) | 4,342,377 | 10 | % | |||||||||

As of September 30, 20172020 and December 31, 2016, the Company’s accounts receivable from the following companies were set out as below:2019:

| September 30, 2017 | December 31, 2016 | |||||||||||||||

| Amount | % of Total Accounts Receivable | Amount | % of Total Accounts Receivable | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 2,450,793 | 34 | % | $ | 6,503,843 | 41 | % | ||||||||

| Taiwan Life Insurance Co., Ltd (*) | (** | ) | (** | ) | 1,973,410 | 13 | % | |||||||||

| TransGlobe Life Insurance Inc. | 801,832 | 11 | % | (** | ) | (** | ) | |||||||||

| Fubon Life Insurance Co., Ltd | (** | ) | (** | ) | 1,660,685 | 11 | % | |||||||||

| | | | | | | | | | | | |

| | September 30, 2020 | ||||||||||

| | Fair Value | | Carrying | ||||||||

|

| Level 1 |

| Level 2 |

| Level 3 |

| Value | ||||

Assets | | | | | | | | | ||||

Total time deposits |

| $ | 46,890,005 | | $ | — | | $ | — | | $ | 46,890,005 |

Marketable securities : | | | | | | | | | | | | |

Mutual funds | |

| 1,214,712 | |

| — | |

| — | |

| 1,214,712 |

Long-term investments: | |

| | |

| | |

| | |

| |

Government bonds held for available-for-sale | |

| — | |

| 104,165 | |

| — | |

| 104,165 |

REITs | | | 1,352,533 | | | — | | | — | | | 1,352,533 |

Total assets measured at fair value | | $ | 49,457,250 | | $ | 104,165 | | $ | — | | $ | 49,561,415 |

| | | | | | | | | | | | |

| | December 31, 2019 | ||||||||||

| | Fair Value | | Carrying | ||||||||

|

| Level 1 |

| Level 2 |

| Level 3 |

| Value | ||||

Assets | | | | | | | | | ||||

Total cash equivalents and time deposits |

| $ | 40,194,850 | | $ | — | | $ | — | | $ | 40,194,850 |

Marketable securities : | | | | | | | | | | | | |

Mutual funds | |

| 290,153 | |

| — | |

| — | |

| 290,153 |

Long-term investments: | |

| | |

| | |

| | |

| |

Government bonds held for available -for -sale | |

| — | |

| 101,203 | |

| — | |

| 101,203 |

REITs | | | 1,308,711 | | | — | | | — | | | 1,308,711 |

Total assets measured at fair value | | $ | 41,793,714 | | $ | 101,203 | | $ | — | | $ | 41,894,917 |

With respect to accounts receivable, the Company generally does not have any collateral and does not have any allowance for doubtful accounts.

The Company’s operations are in the PRC, Taiwan and Hong Kong. Accordingly, the Company’s business,carrying amounts of current financial condition and results of operations may be influenced by the political, economic, and legal environments in the PRC, Taiwan and Hong Kong, the foreign currency exchange and the state of each regions. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, Taiwan and Hong Kong, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

Recent Accounting Pronouncements

In January 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-01, “Financial Instruments-Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities,” which amends the guidance in U.S. GAAP on the classification and measurement of financial instruments. Changes to the current guidance primarily affect the accounting for equity investments, financial liabilities under the fair value option, and the presentation and disclosure requirements for financial instruments. In addition, the ASU clarifies guidance related to the valuation allowance assessment when recognizing deferred tax assets resulting from unrealized losses on available-for-sale debt securities. The new standard is effective for fiscal years and interim periods beginning after December 15, 2017, and upon adoption, an entity should apply the amendments by means of a cumulative-effect adjustment to the balance sheet at the beginning of the first reporting period in which the guidance is effective. Early adoption is not permitted except for the provision to record fair value changes for financial liabilities under the fair value option resulting from instrument-specific credit risk in other comprehensive income. The Company is currently evaluating the impact of adopting this guidance.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The guidance in ASU No. 2016-02 supersedes the lease recognition requirements in ASC Topic 840, Leases (Statement of Financial Accounting Standards No. 13). ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. ASU No. 2016-02 is effective for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the effect this standard will have on its consolidated financial statements.

In March 2016, the FASB issued ASU 2016-07, “Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting.” ASU 2016-07 eliminates the requirement for an investment that qualifies for the use of the equity method of accounting as a result of an increase in the level of ownership or degree of influence to adjust the investment, results of operations and retained earnings retrospectively. ASU 2016-07 will be effective prospectively for the Company for increases in the level of ownership interest or degree of influence that result in the adoption of the equity method that occur during or after the quarter ending December 31, 2017, with early adoption permitted. The impact of this guidance for the Company is dependent on any future increases in the level of ownership interest or degree of influence that result in the adoption of the equity method.

In March 2016, the FASB issued ASU 2016-08, “Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net).” ‘The amendments in this ASU are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations by amending certain existing illustrative examples and adding additional illustrative examples to assist in the application of the guidance. The effective date and transition of these amendments is the same as the effective date and transition of ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606).” Public entities should apply the amendments in ASU No. 2014-09 for annual reporting periods beginning after December 15, 2017, including interim reporting periods therein. The Company is currently in the process of evaluating the impact of the adoption of this accounting standards update on its consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, “Classification of Certain Cash Receipts and Cash Payments (Topic 230) to Statement of Cash Flows.” ASU No. 2016-15 clarifies guidance on the classification of certain cash receipts and payments in the statement of cash flows to reduce diversity in practice with respect to (i) debt prepayment or debt extinguishment costs, (ii) settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing, (iii) contingent consideration payments made after a business combination, (iv) proceeds from the settlement of insurance claims, (v) proceeds from the settlement of corporate-owned life insurance policies, including bank-owned life insurance policies, (vi) distributions received from equity method investees, (vii) beneficial interests in securitization transactions, and (viii) separately identifiable cash flows and application of the predominance principle. ASU No. 2016-15 is effective for interim and annual reporting periods in fiscal years beginning after December 15, 2017, with early adoption permitted. The adoption of this update is not expected to have a significant impact on the Company’s consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash” (“ASU No. 2016-18”), which amends the current accounting guidance.” The amendments in this update require the amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. ASU No. 2016-18 is effective for annual periods beginning after December 15, 2017, and interim periods within those annual periods. The adoption of ASU No. 2016-18 is not expected to have a material impact on the Company’s consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-04 “Intangibles – Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment,” which eliminates Step 2 from the goodwill impairment test. Instead, an entity should perform its annual or interim goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount and recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value, not to exceed the total amount of goodwill allocated to the reporting unit. ASU No. 2017-04 is effective for annual or any interim goodwill tests in fiscal years beginning after December 15, 2019. The adoption is not expected to have a material impact on the Company’s consolidated financial statements of the Company.

In July 2017, the FASB issued ASU No. 2017-11, “Earnings Per Share (Topic 260) Distinguishing Liabilities from Equity (Topic 480) Derivatives and Hedging (Topic 815),” which addresses the complexity of accounting for certain financial instruments with down round features. Down round features are features of certain equity-linked instruments (or embedded features) that result in the strike price being reduced on the basis of the pricing of future equity offerings. Current accounting guidance creates cost and complexity for entities that issue financial instruments (such as warrants and convertible instruments) with down round features that require fair value measurement of the entire instrument or conversion option. For public business entities, the amendments in Part I of this Update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. For all other entities, the amendments in Part I of this Update are effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.

In August 2017, the FASB issued ASU 2017-12, “Derivatives and Hedging (Topic 815) Targeted Improvements to Accounting for Hedging Activities.” ASU 2017-12 refines and expands hedge accounting for both financial and commodity risks. This ASU creates more transparency around how economic results are presented, both on the face of the financial statements and in the footnotes. In addition, this ASU makes certain targeted improvements to simplify the application of hedge accounting guidance. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.

In September 2017, the FASB issued ASU 2017-13, “Revenue Recognition (Topic 605), Revenue from Contracts with Customers (Topic 606), Leases (Topic 840), and Leases (Topic 842),” which provides additional implementation guidance on the previously issued ASU 2016-02 Leases (Topic 842). The revenue standard is effective for annual periods beginning after December 15, 2017. ASU 2016-02 requires a lessee to recognize assets and liabilities on the balance sheet for leases with lease terms greater than 12 months. ASU 2016-02 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2018, and early adoption is permitted. Based on a preliminary assessment, the Company expects the adoption of this guidance to have a material impact on its assets and liabilities due to the recognition of right-of-use assets and lease liabilities on its consolidated balance sheet at the beginning of the earliest period presented. The Company is continuing its assessment, which may identify additional impacts this guidance will have on its consolidated financial statements and disclosures.

There were other updates recently issued. The management does not believe that other than disclosed above, the recently issued, but not yet adopted, accounting pronouncements will have a material impact on its financial position results of operations or cash flows.

Going Concern Assessment

The Company has assessed its ability to continue as a going concernsheets for a period of one year from the date of the issuance of these financial statements. Substantial doubt about an entity’s ability to continue as a going concern exists when relevant conditions and events, considered in the aggregate, indicate that it is probable that the entity will be unable to meet its obligations as they become due within one year from the financial statement issuance date. The Company determined that there are no conditions or events that raise substantial doubt about its ability to continue as a going concern as of the date of the issuance of these financial statements.

NOTE 3 – CASH AND CASH EQUIVALENTS AND TIME DEPOSITS

Cash and cash equivalents and time deposits consistedapproximate fair value due to the short-term duration of the following as of September 30, 2017 and December 31, 2016:those instruments.

| September 30, 2017 | December 31, 2016 | |||||||

| Cash and cash equivalents: | ||||||||

| Cash in bank and on hand | $ | 11,663,265 | $ | 17,713,744 | ||||

| Bank time deposits (*) | - | 2,455,711 | ||||||

| 11,663,265 | 20,169,455 | |||||||

| Bank time deposits (**) | 21,475,432 | 5,352,347 | ||||||

| Total cash and cash equivalents and time deposits | $ | 33,138,697 | $ | 25,521,802 | ||||

The Company considers cash on hand, cash in bank, and bank time deposits with maturities of three months or less to be cash and cash equivalents.

NOTE 4 – MARKETABLE SECURITIES

Marketable securities represent investment in equity securities of listed stocks and funds, which are classified as follows:

| September 30, 2017 | ||||||||||||

| Cost | Gross Unrealized Losses | Total Fair Value | ||||||||||

| Trading: | ||||||||||||

| Funds | $ | 33,117 | $ | (250 | ) | $ | 32,867 | |||||

| $ | 33,117 | $ | (250 | ) | $ | 32,867 | ||||||

| December 31, 2016 | ||||||||||||

| Fair Value at | Gross | |||||||||||

| December 31, | Unrealized | Total | ||||||||||

| 2015 | Gains | Fair Value | ||||||||||

| Trading: | ||||||||||||

| Stocks | $ | 28,863 | $ | 9,900 | $ | 38,763 | ||||||

| Funds | 2,340,219 | 47,888 | 2,388,107 | |||||||||

| $ | 2,369,082 | $ | 57,788 | $ | 2,426,870 | |||||||

NOTE 5 – STRUCTURED DEPOSIT

On July 7, 2017, the Company entered into an agreement with Cathy United Bank to purchase a 185-days structured deposit in effective on July 7, 2017 and mature on January 8, 2018. Principal of the structured deposit is RMB 8,000,000 and the structured deposit with an embedded foreign exchange option linked to US Dollar to China Yuan offshore exchange rate (“USDCNH”). Strike price of the structured deposit is set as 7.3 USDCNH and the fixing date is on January 4, 2018. Yield rate will be at 4.1% per annum when the USDCNH is above or equal strike price on the fixing date, or at 3.9% per annum when blow.

| September 30, 2017 | ||||||||||||

| Cost | Gross Unrealized Losses | Total Fair Value | ||||||||||

| Structured deposit | $ | 1,278,551 | $ | (73,389 | ) | $ | 1,205,162 | |||||

| $ | 1,278,551 | $ | (73,389 | ) | $ | 1,205,162 | ||||||

NOTE 6 – OTHER CURRENT ASSETS

Other current assets consisted of the following as of September 30, 2017 and December 31, 2016:

| September 30, 2017 | December 31, 2016 | |||||||

| Loan receivable | $ | 1,477,060 | $ | 1,486,846 | ||||

| Prepaid expenses | 228,193 | 64,678 | ||||||

| Prepaid rent and rent deposits | 186,745 | 199,022 | ||||||

| Other receivable | 176,386 | 50,683 | ||||||

| Refundable business tax | 117,848 | 17,441 | ||||||

| Deferred tax assets-current | 58,041 | 59,233 | ||||||

| Interest receivable | 30,080 | 12,648 | ||||||

| Total other current assets | $ | 2,274,353 | $ | 1,890,551 | ||||

On October 24, 2016, the Company entered into a loan agreement with third party, Rich Fountain Limited (“RFL”), which was incorporated under the laws of Samoa. The Company provided a short-term loan amount of NTD 48,000,000 ($1,486,846) to RFL. The short-term loan bears an interest rate of 4.5% per annum and the principal and interest are due on April 23, 2017. On April 21, 2017, the Company and RFL entered a supplemental agreement to extend the loan to October 23, 2017. As of September 30, 2017, the outstanding balance of the loan receivable is NTD44,790,360 ($1,477,060). On November 1 and November 2, 2017, the Company received the interest payment of this loan amount of NTD 300,000 (approximately $9,800) and $23,832, respectively. The management has evaluated RFL's business operation and ability to repay the loan in the future and determine that RFL will be able to repay the loan per newly negotiated terms and assessed that there is no impairment loss on the loan. Therefore, the Company is willing to extend the payment period of RFL loan.

NOTE 7 – PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment consisted of the following as of September 30, 2017 and December 31, 2016:

| September 30, 2017 | December 31, 2016 | |||||||

| Office equipment | $ | 1,234,505 | $ | 1,070,061 | ||||

| Office furniture | 101,123 | 168,658 | ||||||

| Leasehold improvements | 733,225 | 581,964 | ||||||

| Transportation equipment | 139,226 | 132,344 | ||||||

| Other equipment | 89,868 | 87,302 | ||||||

| Total | 2,297,947 | 2,040,329 | ||||||

| Less: accumulated depreciation | (1,370,885 | ) | (1,113,424 | ) | ||||

| Total property, plant and equipment, net | $ | 927,062 | $ | 926,905 | ||||

Depreciation expense was $78,972 and $81,267 for the three months ended September 30, 2017 and 2016, respectively. Depreciation expense was $235,093 and $231,414 forDuring the nine months ended September 30, 2017 and 2016, respectively.

NOTE 8 – INTANGIBLE ASSETS

As of September 30, 2017 and December 31, 2016, the Company’s intangible2020, there were 0 assets consistedor liabilities that were transferred between any of the following:levels.

| September 30, 2017 | December 31, 2016 | |||||||

| Software | $ | 1,686,544 | $ | 1,500,339 | ||||

| Less: accumulated amortization | (938,934 | ) | (716,120 | ) | ||||

| Total intangible assets | $ | 747,610 | $ | 784,219 | ||||

Estimated future intangible amortization as of September 30, 2017 is as follows:

| Periods ending September 30, | Amount | |||

| 2018 | $ | 238,905 | ||

| 2019 | 214,913 | |||

| 2020 | 184,439 | |||

| 2021 | 90,116 | |||

| 2022 | 18,140 | |||

| Thereafter | 1,097 | |||

| Total | $ | 747,610 | ||

Amortization expense was $59,533Marketable securities and $71,328 for the three months ended September 30, 2017 and 2016, respectively. Amortization expense was $175,500 and $223,969 for the nine months ended September 30, 2017 and 2016, respectively.

NOTE 9 – LONG-TERM INVESTMENTS

As of September 30, 2017 and December 31, 2016, the Company’s long-term investments consistedin REITs – The fair values of mutual funds and REITs were valued based on quoted market prices in active markets.

Government bonds – The fair value of government bonds is valued based on theoretical bond price in the following:

| September 30, 2017 | December 31, 2016 | |||||||

| Equity investment | $ | 1,267,475 | $ | 1,190,558 | ||||

| Government bonds | 101,475 | 94,506 | ||||||

| Total | $ | 1,368,950 | $ | 1,285,064 | ||||

As of September 30, 2017 and December 31, 2016, the Company had the following equity investment:

| Type | Investee | Ownership | September 30, 2017 | December 31, 2016 | ||||||||||

| Cost Method | Genius Insurance Broker Co., Ltd. | 15.64 | % | $ | 1,267,475 | $ | 1,190,558 | |||||||

Taipei Exchange.

According to Taiwan Regulations Governing Deposit of Bond and Acquirement of Insurance by Insurance Agents, Insurance Brokers and Insurance Surveyors (“RGDBAI”) Article 3 requirement,and 4, Law Insurance Broker Co., Ltd. (“Law Broker”) is required to maintain a minimum of NTD3,000,000NTD 3,000,000 ($98,932103,616 and $92,928$100,156 as of September 30, 20172020 and December 31, 2016,2019, respectively) restricted balance in a separate account. RGDBAI Article 4 is required to deposited a minimum amount in the form of cashaccount or book entry to government bondbonds issued by the central government. Therefore, Law Broker used such amountsgovernment in order to purchasemaintain its insurance license. The government bonds will mature on March 17, 2021 and the amortized cost of the bonds is $103,742 (NTD 3,003,650) and $100,479 (NTD 3,009,674) as of September 30, 2020 and December 31, 2019, respectively. The Company will purchase a similar investment after the maturity of the bonds to maintain the insurance license.

Concentration of Risk

The Company maintains cash with banks in the USA, People’s Republic of China (“PRC" or "China”), Hong Kong, and Taiwan. Should any bank holding cash become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose the cash with that bank; however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts. In Taiwan, a depositor has up to NTD3,000,000 insured by Central Deposit Insurance Corporation (“CDIC”). In China, a depositor has up to RMB500,000 insured by the rightPeople’s Bank of China Financial Stability Bureau (“FSD”). In Hong Kong, a depositor has up to trade such bonds with other debt or equity instruments.HKD500,000 insured by Hong Kong Deposit Protection Board (“DPB”). In the United States, the standard insurance amount is $250,000 per depositor in a bank insured by the Federal Deposit Insurance Corporation (“FDIC”).

| September 30, 2017 | ||||||||||||

| Fair Value at | Gross | Fair Value at | ||||||||||

| December 31, | Unrealized | September 30, | ||||||||||

| 2016 | Gains | 2017 | ||||||||||

| Available-for-sale: | ||||||||||||

| Government bonds | 94,506 | 6,969 | 101,475 | |||||||||

| $ | 94,506 | $ | 6,969 | $ | 101,475 | |||||||

| December 31, 2016 | ||||||||||||

| Fair Value at | Gross | Fair Value at | ||||||||||

| December 31, | Unrealized | December 31, | ||||||||||

| 2015 | Gains | 2016 | ||||||||||

| Available-for-sale: | ||||||||||||

| Government bonds | 94,381 | 125 | 94,506 | |||||||||

| $ | 94,381 | $ | 125 | $ | 94,506 | |||||||

14

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, time deposits, restricted cash, register capital deposits and accounts receivable. As of September 30, 2020 and December 31, 2019, approximately $2,483,000 and $2,293,000 of the Company’s cash and cash equivalents, time deposits, restricted cash equivalents and register capital deposits held by financial institutions, was insured, and the remaining balance of approximately $60,540,000 and $50,108,000, was not insured. With respect to accounts receivable, the Company generally does not require collateral and does not have an allowance for doubtful accounts.

NOTE 10 – OTHER ASSETSFor the three months ended September 30, 2020 and 2019, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| | | | | | | | | | | |

| | Three Months Ended September 30, | | ||||||||

| | 2020 | | 2019 |

| ||||||

| | | | | % of Total | | | | | % of Total |

|

|

| Amount |

| Revenue |

| Amount |

| Revenue |

| ||

Taiwan Life Insurance Co., Ltd. | | $ | 8,435,924 |

| 25 | % | $ | 6,048,897 | | 26 | % |

TransGlobe Life Insurance Inc. | | | 8,160,190 |

| 25 | % | | 2,952,262 | | 13 | % |

Farglory Life Insurance Co., Ltd. | |

| 4,157,250 |

| 13 | % |

| 3,662,473 | | 16 | % |

For the nine months ended September 30, 2020 and 2019, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| | | | | | | | | | | |

| | Nine Months Ended September 30, | | ||||||||

| | 2020 | | 2019 | | ||||||

| | | | | % of Total | | | | | % of Total |

|

|

| Amount |

| Revenue |

| Amount |

| Revenue |

| ||

TransGlobe Life Insurance Inc. | | $ | 20,012,602 |

| 22 | % | $ | 7,927,576 | | 12 | % |

Taiwan Life Insurance Co., Ltd. | |

| 19,656,521 |

| 22 | % |

| 13,589,908 | | 21 | % |

Farglory Life Insurance Co., Ltd. | |

| 11,120,320 |

| 12 | % |

| 12,347,817 | | 19 | % |

As of September 30, 2020 and December 31, 2019, the Company’s accounts receivable from these companies were:

| | | | | | | | | | | |

| | September 30, 2020 | | December 31, 2019 |

| ||||||

| | | | | % of Total | | | | | % of Total |

|

| | | | | Accounts | | | | | Accounts |

|

|

| Amount |

| Receivable |

| Amount |

| Receivable | | ||

TransGlobe Life Insurance Inc. | | $ | 3,668,147 |

| 24 | % | $ | 4,239,621 |

| 19 | % |

Taiwan Life Insurance Co., Ltd | |

| 2,938,229 |

| 19 | % |

| 4,012,914 |

| 18 | % |

Farglory Life Insurance Co., Ltd. | |

| 2,111,619 |

| 14 | % |

| 2,664,140 |

| 12 | % |

AIA International Limited Taiwan Branch | | | 1,472,303 | | 10 | % | | 2,447,051 | | 11 | % |

Shin Kong Life Insurance Co., Ltd. | |

| 743,251 |

| 5 | % |

| 3,586,795 |

| 16 | % |

The Company’s operations are in the PRC, Hong Kong and Taiwan. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic, foreign currency exchange and legal environments in the PRC, Hong Kong and Taiwan, and by the state of each economy. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, Hong Kong and Taiwan, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

15

Stock-Based Compensation

The Company accounts for equity-based compensation cost in accordance with ASC 718, Compensation-Stock Compensation after adoption of ASC 2018-07, which requires the measurement and recognition of compensation expense related to the fair value of equity-based compensation awards that are ultimately expected to vest. Stock-based compensation expense recognized includes the compensation cost for all share-based compensation payments granted to employees and nonemployees, net of estimated forfeitures, over the employees requisite service period or the non-employee performance period based on the grant date fair value estimated in accordance with the provisions of ASC 718. ASC 718 is also applied to awards modified, repurchased, or cancelled during the periods reported.

Income Taxes

The Company records income tax expense using the asset-and-liability method of accounting for deferred income taxes. Under this method, deferred taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Deferred tax assets are reduced by a valuation allowance if, based on available evidence, it is more likely than not that the deferred tax assets will not be realized.