CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under Part 1 Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

3

OTHER PERTINENT INFORMATION

References in this quarterly report to “we,” “us,” “our,” the “Registrant”“our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and consolidated affiliated entities (“CAE”) unless otherwise indicated by the context.

variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Taiwan, Republic of China.

Unless context indicates otherwise, reference to the “Company” in this quarterly report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (as defined below). Reference to “Anhou” or the “VIE” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan Hong Kong and China using New Taiwanese Dollars (“NT$” or “NTD”), the currency of Taiwan, Hong Kong Dollars (“NTD”HK$” or “HKD”), the currency of Hong Kong, (“HKD”), and RMB, the currency of China, (“RMB”), respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this quarterly report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD.U.S. dollars. These dollar references are based on the exchange rate of NTD, HKDNT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USDU.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

4

Table of ContentsPART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | |

| | September 30, | | December 31, | ||

(Amount in USD) |

| 2022 |

| 2021 | ||

ASSETS | | | | | | |

Current assets | | | | | | |

Cash and cash equivalents | | $ | 14,461,123 | | $ | 18,234,350 |

Time deposits | |

| 71,563,061 | |

| 64,299,176 |

Accounts receivable | |

| 14,499,574 | |

| 26,761,678 |

Contract assets | | | 5,518,599 | | | — |

Marketable securities | | | 753,345 | | | — |

Other current assets | |

| 873,505 | |

| 1,207,496 |

Total current assets | |

| 107,669,207 | |

| 110,502,700 |

| | | | | | |

Right-of-use assets under operating leases | | | 7,455,797 | | | 6,449,182 |

Property and equipment, net | |

| 1,563,003 | |

| 2,061,755 |

Intangible assets, net | |

| 294,088 | |

| 333,118 |

Long-term investments | |

| 2,301,718 | |

| 2,696,812 |

Restricted cash – noncurrent | |

| 14,939 | |

| 88,282 |

Deferred tax assets | | | 1,006,604 | | | 909,032 |

Other assets | |

| 4,164,320 | |

| 4,740,640 |

TOTAL ASSETS | | $ | 124,469,676 | | $ | 127,781,521 |

| | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

|

| |

|

|

Current liabilities | |

|

| |

|

|

Commission payable to sales professionals | | $ | 10,616,215 | | $ | 14,003,541 |

Short-term loans | | | 20,033,483 | | | 18,835,932 |

Contract liabilities - current | | | 87,097 | | | — |

Income tax payable - current | |

| 2,365,627 | |

| 3,893,047 |

Operating lease liabilities - current | | | 3,420,600 | | | 3,059,329 |

Due to related parties | |

| 6,593 | |

| 50,531 |

Other current liabilities | |

| 8,881,520 | |

| 13,997,603 |

Total current liabilities | |

| 45,411,135 | |

| 53,839,983 |

| | | | | | |

Contract liabilities - noncurrent | | | 1,348,875 | | | — |

Income tax payable - noncurrent | |

| 299,797 | |

| 539,636 |

Operating lease liabilities - noncurrent | | | 3,961,006 | | | 3,298,089 |

Net defined benefit liabilities - noncurrent | | | 339,163 | | | 389,198 |

Other liabilities | |

| 472,106 | |

| 541,754 |

TOTAL LIABILITIES | |

| 51,832,082 | |

| 58,608,660 |

| | | | | | |

COMMITMENTS AND CONTINGENCIES | |

| | |

| |

| | | | | | |

STOCKHOLDERS’ EQUITY | |

| | |

| |

Preferred stock, par value $0.00001, 10,000,000 authorized, 1,000,000 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | |

| 10 | |

| 10 |

Common stock, par value $0.00001, 100,000,000 authorized, 30,286,199 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | |

| 303 | |

| 303 |

Additional paid-in capital | |

| 9,296,953 | |

| 9,296,953 |

Statutory reserves | | | 11,091,633 | |

| 11,101,064 |

Retained earnings | |

| 25,162,731 | |

| 13,690,368 |

Accumulated other comprehensive (loss) income | |

| (4,327,301) | |

| 4,664,848 |

Total stockholders’ equity attributable to China United’s shareholders | |

| 41,224,329 | |

| 38,753,546 |

Noncontrolling interests | |

| 31,413,265 | |

| 30,419,315 |

TOTAL STOCKHOLDERS’ EQUITY | |

| 72,637,594 | |

| 69,172,861 |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 124,469,676 | | $ | 127,781,521 |

| September 30, 2017 | December 31, 2016 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 11,663,265 | $ | 20,169,455 | ||||

| Time deposits | 21,475,432 | 5,352,347 | ||||||

| Marketable securities | 32,867 | 2,426,870 | ||||||

| Structured deposit | 1,205,162 | - | ||||||

| Accounts receivable, net | 7,217,051 | 15,774,159 | ||||||

| Other current assets | 2,274,353 | 1,890,551 | ||||||

| Total current assets | 43,868,130 | 45,613,382 | ||||||

| Property, plant and equipment, net | 927,062 | 926,905 | ||||||

| Intangible assets | 747,610 | 784,219 | ||||||

| Goodwill | 2,071,491 | 2,071,491 | ||||||

| Long-term investments | 1,368,950 | 1,285,064 | ||||||

| Other assets | 2,149,619 | 726,482 | ||||||

| TOTAL ASSETS | $ | 51,132,862 | $ | 51,407,543 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Tax payable | $ | 2,356,626 | $ | 2,249,869 | ||||

| Convertible bonds | 200,000 | - | ||||||

| Due to related parties | 646,862 | 400,001 | ||||||

| Other current liabilities | 10,420,828 | 18,639,909 | ||||||

| Total current liabilities | 13,624,316 | 21,289,779 | ||||||

| Convertible bonds - noncurrent | - | 200,000 | ||||||

| Long-term loans | 265,985 | 254,907 | ||||||

| Long-term liabilities | 4,898,335 | 5,315,327 | ||||||

| TOTAL LIABILITIES | 18,788,636 | 27,060,013 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock, par value $0.00001, 10,000,000 authorized, 1,000,000 issued and outstanding | 10 | 10 | ||||||

| Common stock, par value $0.00001, 100,000,000 authorized, 29,452,669 issued and outstanding | 295 | 295 | ||||||

| Additional paid-in capital | 8,190,449 | 8,157,512 | ||||||

| Statutory reserves | 5,054,720 | 3,799,585 | ||||||

| Retained earnings | 6,663,807 | 3,286,562 | ||||||

| Accumulated other comprehensive gain/(loss) | 168,008 | (667,976 | ) | |||||

| Stockholders’ equity attribute to parent’s shareholders | 20,077,289 | 14,575,988 | ||||||

| Noncontrolling interests | 12,266,937 | 9,771,542 | ||||||

| TOTAL STOCKHOLDERS’ EQUITY | 32,344,226 | 24,347,530 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 51,132,862 | $ | 51,407,543 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER

COMPREHENSIVE INCOME / (LOSS)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue | $ | 16,210,334 | $ | 14,951,345 | $ | 50,084,684 | $ | 43,289,113 | ||||||||

| Cost of revenue | 9,071,624 | 9,335,735 | 29,746,059 | 27,986,021 | ||||||||||||

| Gross profit | 7,138,710 | 5,615,610 | 20,338,625 | 15,303,092 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling | 783,120 | 630,255 | 1,481,423 | 2,094,965 | ||||||||||||

| General and administrative | 3,708,037 | 3,359,674 | 10,714,341 | 9,336,015 | ||||||||||||

| Total operating expenses | 4,491,157 | 3,989,929 | 12,195,764 | 11,430,980 | ||||||||||||

| Income from operations | 2,647,553 | 1,625,681 | 8,142,861 | 3,872,112 | ||||||||||||

| Other income (expenses): | ||||||||||||||||

| Interest income | 79,299 | 31,113 | 246,559 | 137,222 | ||||||||||||

| Interest expenses | (8,293 | ) | (1,601 | ) | (24,562 | ) | (11,165 | ) | ||||||||

| Dividend income | 1,391 | 3,633 | 331,140 | 272,522 | ||||||||||||

| Other - net | 89,065 | 21,248 | 136,113 | (46,104 | ) | |||||||||||

| Total other income (expenses) | 161,462 | 54,393 | 689,250 | 352,475 | ||||||||||||

| Income before income tax | 2,809,015 | 1,680,074 | 8,832,111 | 4,224,587 | ||||||||||||

| Income tax expense | 831,878 | 456,828 | 2,345,147 | 1,335,331 | ||||||||||||

| Net income | 1,977,137 | 1,223,246 | 6,486,964 | 2,889,256 | ||||||||||||

| Net income attributable to the noncontrolling interests | 669,490 | 465,501 | 1,854,584 | 1,301,226 | ||||||||||||

| Net income attributable to parent’s shareholders | 1,307,647 | 757,745 | 4,632,380 | 1,588,030 | ||||||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation gain | 48,149 | 260,981 | 793,090 | 378,217 | ||||||||||||

| Other | 175 | - | 42,894 | (1,593 | ) | |||||||||||

| Other comprehensive income attributable to parent’s shareholders | 48,324 | 260,981 | 835,984 | 376,624 | ||||||||||||

| Other comprehensive items attributable to noncontrolling interests | 23,405 | 249,160 | 640,811 | 408,827 | ||||||||||||

| Comprehensive income attributable to parent’s shareholders | $ | 1,355,971 | $ | 1,018,726 | $ | 5,468,364 | $ | 1,964,654 | ||||||||

| Comprehensive income attributable to noncontrolling interests | $ | 692,895 | $ | 714,661 | $ | 2,495,395 | $ | 1,710,053 | ||||||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic | 29,452,669 | 29,452,669 | 29,452,669 | 29,452,669 | ||||||||||||

| Diluted | 30,521,407 | 30,478,667 | 30,521,407 | 30,462,097 | ||||||||||||

| Net income per share attributable to parent’s shareholder: | ||||||||||||||||

| Basic | $ | 0.044 | $ | 0.026 | $ | 0.157 | $ | 0.054 | ||||||||

| Diluted | $ | 0.043 | $ | 0.025 | $ | 0.152 | $ | 0.052 | ||||||||

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | ||||||||

(Amount in USD) |

| 2022 |

| 2021 |

| 2022 |

| 2021 | ||||

Revenue | | $ | 32,648,269 | | $ | 31,629,500 | | $ | 95,284,500 | | $ | 95,133,297 |

Cost of revenue | |

| 20,014,864 | |

| 17,066,959 | |

| 60,354,318 | |

| 59,576,604 |

| | | | | | | | | | | | |

Gross profit | |

| 12,633,405 | |

| 14,562,541 | |

| 34,930,182 | |

| 35,556,693 |

| | | | | | | | | | | | |

Operating expenses (income): | |

| | |

| | |

| | |

| |

Selling | |

| 872,974 | |

| 397,628 | |

| 1,990,805 | |

| 1,073,702 |

General and administrative | |

| 6,351,001 | |

| 7,189,914 | |

| 19,094,349 | |

| 19,470,001 |

Gain on disposal of nonfinancial assets in Jiangsu Law | | | (3,262,890) | | | — | | | (3,262,890) | | | — |

Total operating expense (income), net | |

| 3,961,085 | |

| 7,587,542 | |

| 17,822,264 | |

| 20,543,703 |

| | | | | | | | | | | | |

Income from operations | |

| 8,672,320 | |

| 6,974,999 | |

| 17,107,918 | |

| 15,012,990 |

| | | | | | | | | | | | |

Other income (expenses): | |

| | |

| | |

| | |

| |

Interest income | |

| 232,343 | |

| 116,277 | |

| 498,395 | |

| 330,054 |

Interest expenses | |

| (107,046) | |

| (47,701) | |

| (229,185) | |

| (136,807) |

Foreign currency exchange gain (loss), net | |

| 1,240,704 | |

| (31,341) | |

| 2,682,717 | |

| (130,527) |

Dividend income | | | 7,521 | | | 499 | | | 219,890 | | | 251,827 |

Other - net | |

| 4,574 | |

| 253,960 | |

| 127,855 | |

| 513,569 |

Total other income, net | |

| 1,378,096 | |

| 291,694 | |

| 3,299,672 | |

| 828,116 |

| | | | | | | | | | | | |

Income before income taxes | |

| 10,050,416 | |

| 7,266,693 | |

| 20,407,590 | |

| 15,841,106 |

Income tax expense | |

| (866,461) | |

| (1,908,078) | |

| (3,565,730) | |

| (4,308,482) |

| | | | | | | | | | | | |

Net income | |

| 9,183,955 | |

| 5,358,615 | |

| 16,841,860 | |

| 11,532,624 |

Less: net income attributable to noncontrolling interests | |

| (2,284,110) | |

| (2,338,903) | |

| (5,378,928) | |

| (4,911,643) |

Net income attributable to China United’s shareholders | |

| 6,899,845 | |

| 3,019,712 | |

| 11,462,932 | |

| 6,620,981 |

| | | | | | | | | | | | |

Other comprehensive items, net of tax: | |

| | |

| | |

| | |

| |

Foreign currency translation gain (loss) | |

| (6,711,878) | |

| 208,852 | |

| (13,377,127) | |

| 716,540 |

Other | |

| — | |

| (1) | |

| — | |

| 363 |

Total other comprehensive gain (loss) | | | (6,711,878) | | | 208,851 | | | (13,377,127) | | | 716,903 |

| | | | | | | | | | | | |

Comprehensive income | | | 2,472,077 | | | 5,567,466 | | | 3,464,733 | | | 12,249,527 |

Less: comprehensive income attributable to noncontrolling interests | | | (118,808) | | | (2,404,539) | | | (993,950) | | | (5,163,181) |

| | | | | | | | | | | | |

Comprehensive income attributable to China United’s shareholders | | $ | 2,353,269 | | $ | 3,162,927 | | $ | 2,470,783 | | $ | 7,086,346 |

| | | | | | | | | | | | |

Weighted average shares outstanding: | |

| | |

| | |

| | |

| |

Basic and diluted | |

| 30,286,199 | |

| 29,421,736 | |

| 30,286,199 | |

| 29,421,736 |

| | | | | | | | | | | | |

Earnings per share attributable to common stockholders of China United: | |

| | |

|

| |

| | |

| |

Basic and diluted | | $ | 0.220 | | $ | 0.099 | | $ | 0.366 | | $ | 0.218 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

(Amount in USD) |

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income (loss) |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

Balance June 30, 2022 |

| 30,286,199 | | $ | 303 | | | 1,000,000 | | $ | 10 | | $ | 9,296,953 | | $ | 11,091,448 | | $ | 219,275 | | $ | 18,263,071 | | $ | 38,871,060 | | $ | 31,294,457 | | $ | 70,165,517 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Appropriation of reserves | | — | | | — | | | — | | | — | | | — | | | 185 | | | — | | | (185) | | | — | | | — | | | — |

Foreign currency translation loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (4,546,576) | |

| — | |

| (4,546,576) | |

| (2,165,302) | |

| (6,711,878) |

Other comprehensive income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 6,899,845 | |

| 6,899,845 | |

| 2,284,110 | |

| 9,183,955 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2022 |

| 30,286,199 | | $ | 303 | | | 1,000,000 | | $ | 10 | | $ | 9,296,953 | | $ | 11,091,633 | | $ | (4,327,301) | | $ | 25,162,731 | | $ | 41,224,329 | | $ | 31,413,265 | | $ | 72,637,594 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

(Amount in USD) |

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income (loss) |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

Balance December 31, 2021 |

| 30,286,199 | | $ | 303 | | | 1,000,000 | | $ | 10 | | $ | 9,296,953 | | $ | 11,101,064 | | $ | 4,664,848 | | $ | 13,690,368 | | $ | 38,753,546 | | $ | 30,419,315 | | $ | 69,172,861 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reversal of reserves | | — | | | — | | | — | | | — | | | — | | | (9,431) | | | — | | | 9,431 | | | — | | | — | | | — |

Foreign currency translation loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (8,992,149) | |

| — | |

| (8,992,149) | |

| (4,384,978) | |

| (13,377,127) |

Other comprehensive income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 11,462,932 | |

| 11,462,932 | |

| 5,378,928 | |

| 16,841,860 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2022 |

| 30,286,199 | | $ | 303 | | | 1,000,000 | | $ | 10 | | $ | 9,296,953 | | $ | 11,091,633 | | $ | (4,327,301) | | $ | 25,162,731 | | $ | 41,224,329 | | $ | 31,413,265 | | $ | 72,637,594 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

(Amount in USD) |

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income (loss) |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

Balance June 30, 2021 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 10,731,421 | | $ | 4,211,579 | | $ | 11,431,159 | | $ | 34,564,912 | | $ | 27,354,383 | | $ | 61,919,295 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common stock-based compensation granted | | — | | | — | | | — | | | — | | | 1,106,513 | | | — | | | — | | | — | | | 1,106,513 | | | — | | | 1,106,513 |

Foreign currency translation gain |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 143,215 | |

| — | |

| 143,215 | |

| 65,637 | |

| 208,852 |

Other comprehensive loss |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| (1) | |

| (1) |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 3,019,712 | |

| 3,019,712 | |

| 2,338,903 | |

| 5,358,615 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2021 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 9,296,962 | | $ | 10,731,421 | | $ | 4,354,794 | | $ | 14,450,871 | | $ | 38,834,352 | | $ | 29,758,922 | | $ | 68,593,274 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | | | Additional | | | | | Other | | | | | | | | | | | | | ||

| | Common | | | | | Preferred | | | | | Paid-in | | Statutory | | Comprehensive | | Retained | | | | | Noncontrolling | | Total | |||||||

(Amount in USD) |

| Stock |

| Amount |

| Stock |

| Amount |

| Capital |

| Reserves |

| Income (loss) |

| Earnings |

| Total |

| Interests |

| Equity | ||||||||||

Balance December 31, 2020 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 8,190,449 | | $ | 9,463,903 | | $ | 3,889,429 | | $ | 9,097,408 | | $ | 30,641,493 | | $ | 24,595,741 | | $ | 55,237,234 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Appropriation of reserves | | — | | | — | | | — | | | — | | | — | | | 1,267,518 | | | — | | | (1,267,518) | | | — | | | — | | | — |

Common stock-based compensation granted | | — | | | — | | | — | | | — | | | 1,106,513 | | | — | | | — | | | — | | | 1,106,513 | | | — | | | 1,106,513 |

Foreign currency translation gain |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 465,125 | |

| — | |

| 465,125 | |

| 251,415 | |

| 716,540 |

Other comprehensive income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 240 | | | — | | | 240 | | | 123 | | | 363 |

Net income |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 6,620,981 | |

| 6,620,981 | |

| 4,911,643 | |

| 11,532,624 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance September 30, 2021 |

| 29,421,736 | | $ | 294 | | | 1,000,000 | | $ | 10 | | $ | 9,296,962 | | $ | 10,731,421 | | $ | 4,354,794 | | $ | 14,450,871 | | $ | 38,834,352 | | $ | 29,758,922 | | $ | 68,593,274 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | |

(Amount in USD) | | Nine Months Ended September 30, | ||||

|

| 2022 |

| 2021 | ||

Cash flows from operating activities: | | | | | | |

Net income | | $ | 16,841,860 | | $ | 11,532,624 |

Adjustments to reconcile net income to net cash provided by operating activities | |

| | |

| |

Noncash stock-based compensation | | | — | | | 1,106,513 |

Depreciation and amortization | |

| 847,915 | |

| 880,555 |

Amortization of right-of-use assets | | | 2,772,819 | | | 2,724,822 |

Amortization of bond premium | |

| — | |

| 58 |

Gain on sales of financial assets | |

| — | | | (198,637) |

Loss on valuation of financial assets | |

| 310,244 | | | 224,609 |

Gain on disposal of nonfinancial assets in Jiangsu Law | | | (3,262,890) | | | — |

(Gain) loss on disposals of equipment | | | (3,637) | | | 72 |

Deferred income tax | |

| (369,595) | |

| 103,153 |

Unrealized foreign currency exchange gains | | | (762,517) | | | — |

Net changes in operating assets and liabilities: | |

| | |

| |

Accounts receivable | |

| 9,595,151 | |

| 8,334,483 |

Contract assets | | | (5,991,389) | | | (2,844,090) |

Other current assets | |

| 95,716 | |

| 214,284 |

Other assets | |

| 202,577 | |

| (666,789) |

Commission payable to sales professionals | |

| (1,727,941) | |

| (3,259,115) |

Contract liabilities | | | 1,558,995 | | | — |

Income tax payable | |

| (1,455,124) | |

| (118,475) |

Other current liabilities | |

| (3,323,080) | |

| (5,368,199) |

Other liabilities | |

| — | |

| (558,400) |

Lease liabilities | | | (3,095,389) | | | (3,138,759) |

Net cash provided by operating activities | |

| 12,233,715 | |

| 8,968,709 |

| | | | | | |

Cash flows from investing activities: | |

| | |

| |

Purchases of time deposits | |

| (79,397,492) | |

| (61,420,198) |

Proceeds from maturities of time deposits | |

| 63,299,359 | |

| 56,760,207 |

Acquisition of equity investments under cost method using the measurement alternative | | | — | | | (46,372) |

Purchases of marketable securities | |

| (1,074,416) | |

| (1,158,903) |

Proceeds from sales of marketable securities | | | — | | | 2,246,589 |

Proceeds from sales of long-term investments - REITs | | | — | | | 142,007 |

Proceeds from disposal of nonfinancial assets in Jiangsu Law | |

| 3,262,890 | |

| — |

Purchase of equipment | |

| (503,313) | |

| (561,099) |

Purchase of intangible assets | | | (112,616) | | | (24,200) |

Proceeds from disposal of equipment | | | 25,806 | | | 143 |

Net cash used in investing activities | |

| (14,499,782) | |

| (4,061,826) |

| | | | | | |

Cash flows from financing activities: | |

|

| |

|

|

Proceeds from short-term loans | |

| 40,311,099 | |

| 10,029,560 |

Repayment of short-term loans | |

| (37,827,556) | |

| (6,100,000) |

Repayment of related party borrowings | |

| (37,667) | |

| (43,482) |

Net cash provided by financing activities | | | 2,445,876 | |

| 3,886,078 |

| |

| | | | |

Foreign currency translation | |

| (4,026,379) | |

| 337,555 |

Net (decrease) increase in cash, cash equivalents and restricted cash | |

| (3,846,570) | |

| 9,130,516 |

| | | | | | |

Cash, cash equivalents and restricted cash, beginning balance | |

| 18,322,632 | |

| 9,129,828 |

Cash, cash equivalents and restricted cash, ending balance | | $ | 14,476,062 | | $ | 18,260,344 |

| | | | | | |

SUPPLEMENTARY DISCLOSURE: | | | | | | |

Interest paid | | $ | 218,339 | | $ | 129,927 |

Income tax paid | | $ | 4,839,357 | | $ | 3,588,250 |

SUPPLEMENTARY DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | | | |

Lease liabilities arising from new right-of-use assets | | $ | 3,779,434 | | $ | 2,483,439 |

| Nine Months Ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 6,486,964 | $ | 2,889,256 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Depreciation and amortization | 410,593 | 455,383 | ||||||

| Amortization of bond premium | 193 | - | ||||||

| Gain on settlement of debt | - | (83,425 | ) | |||||

| Gain on valuation of financial assets | 1,372,468 | (10,868 | ) | |||||

| Loss on disposals of property, plant and equipment | 75,121 | 25,568 | ||||||

| Deferred income tax | (20,030 | ) | (65,235 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 9,541,161 | 4,085,141 | ||||||

| Other current assets | (268,864 | ) | 450,406 | |||||

| Other assets | (1,331,414 | ) | 66,823 | |||||

| Tax payable | (35,858 | ) | (112,098 | ) | ||||

| Other current liabilities | (9,339,583 | ) | (3,943,730 | ) | ||||

| Long-term liabilities | (753,022 | ) | 623,579 | |||||

| Net cash provided by operating activities | 6,137,729 | 4,380,800 | ||||||

| Cash flows from investing activities: | ||||||||

| Repayments to pervious shareholders | - | (150,959 | ) | |||||

| Purchases of structured deposit | (1,292,441 | ) | - | |||||

| Purchases of time deposits | (24,572,262 | ) | (7,095,147 | ) | ||||

| Proceeds from maturities of time deposits | 8,888,669 | 8,025,394 | ||||||

| Purchase of marketable securities | (6,231,364 | ) | - | |||||

| Proceeds from disposals of marketable securities | 7,488,976 | - | ||||||

| Purchase of property, plant and equipment | (257,944 | ) | (371,913 | ) | ||||

| Purchase of intangible assets | (88,745 | ) | (437,294 | ) | ||||

| Net cash used in investing activities | (16,065,111 | ) | (29,919 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from related party borrowings | 261,589 | 68,431 | ||||||

| Repayment to related parties | (281 | ) | (623,507 | ) | ||||

| Payment to noncontrolling interest as reduction of cash capital | - | (77,043 | ) | |||||

| Proceeds from third party borrowings | - | 469,028 | ||||||

| Repayment to loans | - | (224,447 | ) | |||||

| Net cash provided by (used in) financing activities | 261,308 | (387,538 | ) | |||||

| Foreign currency translation | 1,159,884 | 596,891 | ||||||

| Net increase (decrease) in cash and cash equivalents | (8,506,190 | ) | 4,560,234 | |||||

| Cash and cash equivalents, beginning balance | 20,169,455 | 13,083,357 | ||||||

| Cash and cash equivalents, ending balance | $ | 11,663,265 | $ | 17,643,591 | ||||

| SUPPLEMENTARY DISCLOSURE: | ||||||||

| Interest paid | $ | 29,806 | $ | 2,324 | ||||

| Income tax paid | $ | 2,298,197 | $ | 1,549,580 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW FOR NON-CASH TRANSACTION: | ||||||||

| Debt forgiveness - related parties | $ | 32,937 | $ | - | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

9

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(Amount in USD)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

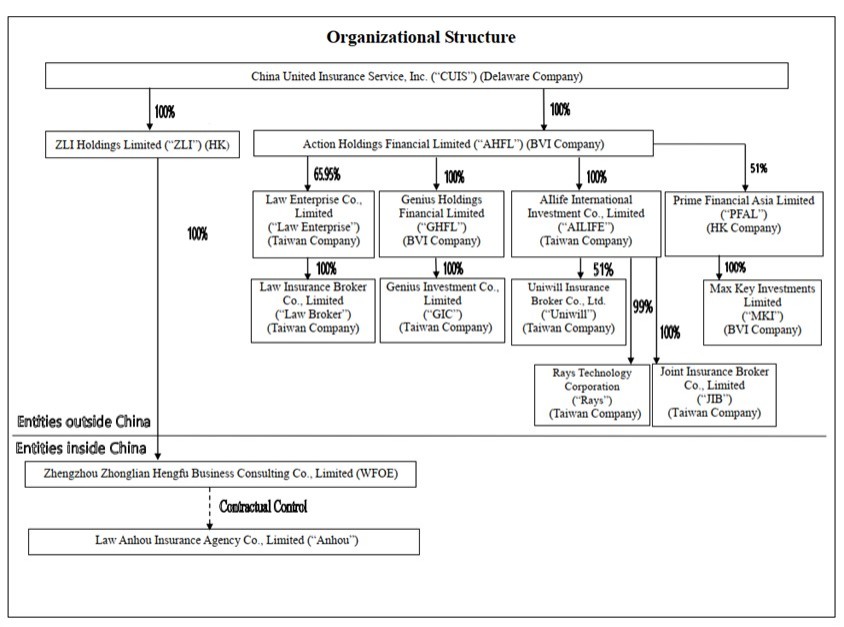

China United Insurance Service, Inc. (“China United,” “CUIS”United” or “CUII”), the subsidiaries and variable-interest entity and its subsidiaries (collectively referred to herein, as the “Company”) is a Delaware corporation organizedprimarily engage in insurance brokerage and insurance agency services. The Company markets and sells to customers, two broad categories of insurance products: life insurance products and property and casualty insurance products, both focused on June 4, 2010meeting the particular insurance needs of individuals. The insurance products are underwritten by Yi Hsiao Mao, a Taiwanese citizen, as a listing vehicle for both ZLI Holdings Limited (“ZLI Holdings”)some of the leading insurance companies in Taiwan and Action Holdings Financial Limited (“AHFL”), which isChina. The Company manages its business through aggregating them into three geographic operating segments, Taiwan, the PRC, and Hong Kong. The Company’s common stock currently quotedtrades over the counter under the ticker symbol “CUII” on the United States Over the Counter Bulletin Board.

OTCQB.

The corporate structure as of September 30, 2017 was2022 is as follows:

On January 31, 2022, Genius Investment Consultant Co., Ltd. (“GIC”), a subsidiary entity of CUII entered into a stock transfer agreement with AIlife International Investment Co., Ltd. (“AIlife”), pursuant to which GIC sold and transferred to AIlife 100% of its equity ownership in Joint Insurance Broker Co., Ltd. (“JIB”), a former wholly-owned subsidiary of GIC, resulting in AIlife owning 100% equity interest in JIB. Such exchange of equity interests between CUII’s subsidiaries are under common control of the Company and therefore, they were accounted for at the carrying amount of the equity interests transferred and there was no impact on consolidated financial statements as of and for the three and nine months ended September 30, 2022, respectively.

10

On February 25, 2022, Law Anhou Insurance Agency Co., Ltd. (“Anhou”), a contractually controlled entity of CUII entered into a Share Purchase Agreement with Jiangsu Law Insurance Brokerage Co., Ltd. (“Jiangsu Law”) and third-party buyers, pursuant to which Anhou sold and transferred 100% of its equity ownership in Jiangsu Law, a wholly owned subsidiary of Anhou, for a total consideration of $3,262,890 (or RMB 21 million). On July 28, 2022, the Hsuchow Regulatory Bureau of the China Banking and Insurance Regulatory Commission (the “CBIRC Jiangsu Regulatory Bureau”) approved the change of shareholders of Jiangsu Law from Anhou to the aforementioned third-party buyers and accordingly, Anhou has transferred out the control over Jiangsu Law. Please refer to Note 3 for more information.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The unaudited accompanying condensed consolidated financial statements include the accounts of China United, the subsidiaries and variable interest entity and its subsidiaries as shown in the organizationcorporate structure in Note 1. All significant intercompany transactions and balances have been eliminated in consolidation. Certain reclassifications have been made to the consolidated financial statements for prior year to the current year’s presentation. Such reclassifications have no effect on net income and the cash flow statements operating activities as previously reported.

Basis of Presentation

The unaudited condensed consolidated financial statements presented herein have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Regulation S-X. Accordingly, the financial statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments, including normal recurring adjustments, considered necessary for a fair presentationstatement of the financial statements have been included. Operating results for the three and nine months ended September 30, 20172022 are not necessarily indicative of the results that may be expected for the year endedending December 31, 2017.

2022.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2016,2021, which were included in the Company’s 20162021 Annual Report on Form 10-K.10-K (“2021 Form 10-K”). The accompanying condensed consolidated balance sheet as of December 31, 2016,2021, has been derived from the Company’s audited consolidated financial statements as of that date.

Use of Estimates

Reclassifications

Certain reclassifications have been madeThe preparation of the Company’s unaudited condensed consolidated financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the prior periods’amounts reported in the consolidated financial statements and notes to conformfootnotes thereto. Actual results may differ from those estimates and assumptions.

Variable Interest Entities

Due to the legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, China United, through its subsidiary, Zhengzhou Zhonglian Hengfu Business Consulting Co., Limited (“WFOE”), entered into Exclusive Business Cooperation Agreement (the “EBCA”), Power of Attorney, Option Agreement, and Share Pledge Agreement (collectively, the “First VIE Agreements”) on January 17, 2011 with Anhou and Anhou original shareholders so as to operate and conduct the insurance agency and brokerage business in the PRC.

Pursuant to the EBCA, (a) WFOE has the right to provide Anhou with complete technical support, business support and related consulting services during the term of the EBCA; (b) Anhou agrees to accept all the consultations and services provided by WFOE. Anhou further agrees that unless with WFOE’s prior written consent, during the term of the EBCA, Anhou shall not directly or indirectly accept the same or any similar consultations and/or services provided by any third party and shall not establish similar cooperation relationship with any third party regarding the matters contemplated by the EBCA; (c) within 90 days after the end of each fiscal year Anhou shall pay an amount to WFOE equal to the shortfall, if any, of the aggregate net income of Anhou for such fiscal; (d) WFOE retains all exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or created during the performance of the EBCA; and (e) the shareholders of Anhou have pledged all of their equity interests in Anhou to WFOE to guarantee Anhou’s performance of its obligations under the EBCA. The term of the EBCA is 10 years and may be extended and determined by WFOE prior to the expiration thereof, and Anhou shall accept such extended term unconditionally.

11

On March 23, 2022, Anhou and WFOE entered into an amendment to the EBCA, pursuant to which the EBCA shall be automatic renewed for successive terms unless WFOE gives a 30-day notice to terminate such agreement, with each term being 10 years.

To extend the business within the PRC, Anhou intended to increase its registered capital to RMB50 million (approximately $8 million) to meet the requirement of the China Insurance Regulatory Commission (the “CIRC”) so that it can set up new branches in any province beyond its current period’s presentation. Such reclassificationsoperations in China. China United increased the investment in Anhou through various loan agreements with the shareholders of Anhou. The aggregate funding provided by WFOE was RMB 40 million. Due to the capital increase, a series of variable interest agreements (the “Second VIE Agreements”), which include Power of Attorneys, Exclusive Option Agreements, Share Pledge Agreements, were signed on October 24, 2013 and entered in the same form as the First VIE Agreements, other than the change of shareholder names and their respective shareholdings. The First VIE Agreements were terminated by and among WFOE, Anhou and Anhou original shareholders on the same date. The EBCA executed by and between WFOE and Anhou on January 17, 2011 remains in full effect.

As a result of the Second VIE Agreements, WFOE is considered the primary beneficiary of Anhou and has effective control over Anhou. Accordingly, the results of operations, assets and liabilities of Anhou and its subsidiaries (collectively, the “Consolidated Affiliated Entities” or the “CAE”) are consolidated from the earliest period presented. The Company reviews the VIE’s status on an annual basis and determines if any events have occurred that could cause its primary beneficiary status to change, which include (a) the legal entity’s governing documents or contractual arrangements are changed in a manner that changes the characteristics or adequacy of the legal entity’s equity investment at risk; (b) the equity investment or some part thereof is returned to the equity investors, and other interests become exposed to expected losses of the legal entity; (c) the legal entity undertakes additional activities or acquires additional assets, beyond those anticipated at the later of the inception of the entity or the latest reconsideration event, that increase the entity’s expected losses; and (d) the legal entity receives an additional equity investment that is at risk, or the legal entity curtails or modifies its activities in a way that decreases its expected losses. For the nine months ended September 30, 2022 and 2021, no event taken place that would change the Company’s primary beneficiary status.

Disposal of Subsidiary

A disposal of a subsidiary is categorized as a discontinued operation as provided by ASC Topic 205-20, Presentation of Financial Statements - Discontinued Operations, if the disposal group is a component of an entity or group of components that meets the held for sale criteria, is disposed of by sale, or is disposed of other than by sale, and represents a strategic shift that has or will have a major effect on an entity’s operations and financial results.

The Company deconsolidates the accounts of a subsidiary as provided by ASC Topic 810, Consolidation, once the Company ceases to have a controlling interest in a subsidiary. The aggregate of the fair value of consideration received, the fair value of any retained noncontrolling investment and the carrying amount of the former subsidiary’s assets and liabilities are recognized as a gain or loss on disposition.

If the transaction involves the sale of an ownership interest in a subsidiary and if substantially all of the fair value of the assets in that subsidiary promised to the counterparty is concentrated in nonfinancial assets, the financial assets in that subsidiary are in substance nonfinancial assets (ISNFA) and are accounted for under ASC 610-20, where the gain or loss recognized upon the derecognition of a nonfinancial asset or an ISNFA is the difference between the amount of consideration measured and allocated to that distinct asset and the carrying amount of the distinct asset.

Marketable Securities

The Company invests part of its excessive cash in equity securities and money market funds. Marketable securities represent trading securities bought and held primarily for sale in the near-term to generate income on short-term price differences and are stated at fair value. Realized and unrealized gains and losses are recorded in other income (expense).

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable includes commission receivables stated at net incomerealizable values. The Company reviews its accounts receivable regularly to determine if a bad debt allowance is necessary at each quarter-end. Management reviews the composition of accounts receivable and analyzes the age of receivables outstanding, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the necessity of making such allowance. No allowance was deemed necessary as previously reported. Please see Note 23, Reclassifications.of September 30, 2022 and December 31, 2021.

12

Foreign Currency Translations

Revenue Recognition

The Company’s revenue is derived from insurance agency and brokerage services with respect to life insurance and property and casualty insurance products. The Company, through its subsidiaries and variable interest entities, sells insurance products provided by insurance companies to individuals, and is compensated in the form of commissions from the respective insurance companies, according to the terms of each service agreement made by and between the Company and the insurance companies. The core revenue recognition principle under ASC 606, the Company considers the contracts with insurance companies contain one performance obligation and consideration should be recorded when performance obligation is satisfied at point in time. The sale of an insurance product by the Company is considered complete when initial insurance premium is paid by an individual and the insurance policy is approved by the respective insurance company. When a policy is effective, the insurance company is obligated to pay the agreed-upon commission to the Company under the terms of its service agreement with the Company and such commission is recognized as revenue.

For the first year commission (FYC), the Company recognizes the revenue when the individuals’ policies are effective. The Company makes the estimation amount to be entitled for annual performance and operating bonus which is based on the FYC. The Company makes an estimation on performance and operation bonus which are based on the accumulated FYC on quarterly basis, and make reconciliation between actual and estimation amount on annual basis. The estimated revenue for the three and nine months ended September 30, 2022 were approximately $2.6 million and $8.4 million, and for the three and nine months ended September 30, 2021, were approximately $1.2 million and $6.8 million, respectively.

Others includes the contingent commissions for subsequent years, the bonus based on persistency ratio bonus, and service allowances, are considered highly susceptible to factors outside the company’s influence and depend on the actions of third parties (i.e., the subsequent premiums paid by individual policyholders), and the uncertainty can be extended for many years. Considering the high uncertainties, the contingent commissions for subsequent years, the bonus based on persistency ratio, and service allowances will be recognized as revenue based on the actual amount received from the insurance companies after the uncertain event is resolved.

For property and casualty insurance products, the Company recognizes the revenue when the individuals’ policies are effective. The revenue from property and casualty insurance products was 5.7% and 6.7% of the Company’s total revenue for the three and nine months ended September 30, 2022, and was 9.0% and 7.4% of the Company’s total revenue for the three and nine months ended September 30, 2021, respectively.

The Company is obligated to pay commissions to its sales professionals when an insurance policy becomes effective. The Company recognizes commission revenue granted from insurance companies on a gross basis, and the commissions paid to its sales professionals are recognized as cost of revenue.

The Company enters into service agreements with insurance companies, which may give rise to contract assets and contract liabilities. When the timing of revenue recognition differs from the timing of payments made by insurance companies, the Company recognizes either contract assets (its performance precedes the billing date) or contract liabilities (customer payment is received in advance of performance).

Foreign Currency Transactions

China United’s financial statements are presented in U.S. dollars ($), which is the Company’sChina United’s reporting and functional currency. The functional currencies of the Company’sChina United’s subsidiaries are NTD, RMBNew Taiwan dollar (“NTD”), China yuan (“RMB”) and HKD. GainsHong Kong dollar (“HKD”). Each subsidiary maintains its financial records in its own functional currency. Transactions denominated in foreign currencies are measured at the exchange rates prevailing on the transaction dates. Monetary assets and liabilities denominated in foreign currencies are remeasured at the exchange rates prevailing at the balance sheet date. Non-monetary items that are measured in terms of historical cost in foreign currency are remeasured using the exchange rates at the dates of the initial transactions. Exchange gains and losses resulting from the translation of foreign currency transactions are reflectedincluded in the consolidated statements of operations and other comprehensive income (loss). Monetary assets and liabilities denominated in foreign currency are translated at the functional currency rate

13

In accordance with ASC 830, Foreign Currency Matters, theThe Company translates the assets and liabilities into U.S. dollars using the rate of exchange prevailing at the balance sheet date and the statements of operations and cash flows are translated at an average rate during the reporting period. Adjustments resulting from the translation from NTD, RMB and HKD into U.S. dollars are recorded in stockholders’ equity as part of accumulated other comprehensive income. Cash flows were also translated at average translation rates for the period and, therefore, amounts reported on the statement of cash flows would not necessarily agree with changes in the corresponding balances on the unaudited condensed consolidated balance sheet. The exchange rates used for interimunaudited condensed consolidated financial statements are as follows:

| Average Exchange Rate for the Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | |||||||||||||

| New Taiwan dollar (NTD) | NTD | 30.505166 | NTD | 32.736000 | ||||||||||

| | | | | | | ||||||||

| | Average Rate for the nine months ended | ||||||||||||

| | September 30, | ||||||||||||

|

| 2022 |

| 2021 | ||||||||||

| | (unaudited) | | (unaudited) | ||||||||||

Taiwan dollar (NTD) | | NTD | 29.26528 |

| NTD | 27.95566 | ||||||||

| China yuan (RMB) | RMB | 6.805734 | RMB | 6.579240 | | RMB | 6.60012 |

| RMB | 6.46939 | ||||

| Hong Kong dollar (HKD) | HKD | 7.787013 | HKD | 7.763280 | | HKD | 7.83293 |

| HKD | 7.76655 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | | $ | 1.00000 |

| $ | 1.00000 | ||||

| Exchange Rate at | ||||||||||||||

| September 30, 2017 | December 31, 2016 | |||||||||||||

| New Taiwan dollar (NTD) | NTD | 30.324000 | NTD | 32.283100 | ||||||||||

| | | | | | | ||||||||

| | Exchange Rate at | ||||||||||||

|

| September 30, 2022 |

| | ||||||||||

| | (unaudited) | | December 31, 2021 | ||||||||||

Taiwan dollar (NTD) | | NTD | 31.77251 |

| NTD | 27.68785 | ||||||||

| China yuan (RMB) | RMB | 6.654500 | RMB | 6.943700 | | RMB | 7.10988 |

| RMB | 6.35877 | ||||

| Hong Kong dollar (HKD) | HKD | 7.811000 | HKD | 7.754340 | | HKD | 7.84968 |

| HKD | 7.79713 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | | $ | 1.00000 | | $ | 1.00000 | ||||

Earnings Per Share

Basic earnings per common share (“EPS”) is computed by dividing net income attributable to the common shareholders of the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except the number of shares includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued.

As the holders of preferred stock of the Company are entitled to share equally with the holders of common stock, on a per share basis, in such dividends and other distributions of cash, property or shares of stock of the Company as may be declared by the board of directors, the preferred stock is treated as a participating security. When calculating the basic earnings per common share, the two-class method is used to allocate earnings to common stock and participating security as required by FASB ASC Topic 260, “Earnings Per Share.” As of September 30, 2022 and 2021, the Company does not have any potentially dilutive instrument.

The following is a reconciliation of the income and share data used in the basic and diluted EPS computations for the three and nine months ended September 30, 2022 and 2021, respectively, under the two-class method.

| | | | | | | | | | | | |

|

| Three Months Ended September 30, | ||||||||||

| | 2022 | | 2021 | ||||||||

Numerator: |

| Common stock |

| Preferred stock |

| Common stock |

| Preferred stock | ||||

Allocation of net income attributable to the Company | | $ | 6,679,305 | | $ | 220,540 | | $ | 2,920,450 | | $ | 99,262 |

| | | | | | | | | | | | |

Denominator: | |

|

| |

|

| |

|

| |

|

|

Weighted average shares of the Company’s common/preferred stock outstanding - basic & diluted | |

| 30,286,199 | |

| 1,000,000 | |

| 29,421,736 | |

| 1,000,000 |

Basic and diluted earnings per share | | $ | 0.220 | | $ | 0.220 | | $ | 0.099 | | $ | 0.099 |

14

| | | | | | | | | | | | |

| | Nine Months Ended September 30, | ||||||||||

| | 2022 | | 2021 | ||||||||

Numerator: |

| Common stock |

| Preferred stock |

| Common stock |

| Preferred stock | ||||

Allocation of net income attributable to the Company | | $ | 11,096,543 | | $ | 366,389 | | $ | 6,403,341 | | $ | 217,640 |

| | | | | | | | | | | | |

Denominator: | |

|

| |

|

| |

|

| |

|

|

Weighted average shares of the Company’s common/preferred stock outstanding - basic & diluted | |

| 30,286,199 | |

| 1,000,000 | |

| 29,421,736 | |

| 1,000,000 |

Basic and diluted earnings per share | | $ | 0.366 | | $ | 0.366 | | $ | 0.218 | | $ | 0.218 |

The participating rights (liquidation and dividend rights) of the holders of the Company’s common stock and preferred stock are identical, except with respect to voting right. As a result, and in accordance with ASC Topic 260, the undistributed earnings for each year are allocated based on the contractual participation rights of the common stock and preferred stock as if the earnings for the year had been distributed. As the liquidation and dividend rights are identical, the undistributed earnings are allocated on a proportionate basis.

Fair ValuesValue of Financial Instruments

Accounting Standards Codification (ASC) 820, Fair Value Measurement, definesvalue accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price at whichthat would be received to sell an asset could be exchanged or paid to transfer a liability transferred in an orderly transaction between knowledgeable, willing partiesmarket participants at the measurement date. This framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

- | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

-Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in the principal or most advantageous marketactive markets, and inputs that are observable for the assetassets or liability. Where available,liabilities, either directly or indirectly, for substantially the full term of the financial instruments.

-Level 3 inputs to the valuation methodology are unobservable and significant to the fair value.

In determining the appropriate levels, the Company performs a detailed analysis of the assets and liabilities that are measured and reported on a fair value basis. At each reporting period, all assets and liabilities for which the fair value measurement is based on observablesignificant unobservable inputs are classified as Level 3.

The following table summarize financial assets and liabilities measured at fair value on a recurring basis as of September 30, 2022 and December 31, 2021:

| | | | | | | | | | | | |

| | September 30, 2022 | ||||||||||

| | Fair Value | | Carrying | ||||||||

|

| Level 1 |

| Level 2 |

| Level 3 |

| Value | ||||

Assets | | | | | | | | | ||||

Marketable securities : | | | | | | | | | | | | |

Stock and mutual funds | | $ | 753,345 | | $ | — | | $ | — | | $ | 753,345 |

Long-term investments: | |

| | |

| | |

| | |

| |

REITs | |

| 1,049,832 | |

| — | |

| — | |

| 1,049,832 |

Total assets measured at fair value | | $ | 1,803,177 | | $ | — | | $ | — | | $ | 1,803,177 |

| | | | | | | | | | | | |

| | December 31, 2021 | ||||||||||

| | Fair Value | | Carrying | ||||||||

|

| Level 1 |

| Level 2 |

| Level 3 |

| Value | ||||

Assets | | | | | | | | | ||||

Long-term investments: | |

| | |

| | |

| | |

| |

REITs | | $ | 1,261,482 | | $ | — | | $ | — | | $ | 1,261,482 |

Total assets measured at fair value | | $ | 1,261,482 | | $ | — | | $ | — | | $ | 1,261,482 |

15

The carrying amounts of current financial assets and liabilities in the consolidated balance sheets for cash equivalents, time deposits, and restricted cash equivalents approximate fair value due to the short-term duration of those instruments, which are considered level 2 fair value measurement.

Marketable securities and long-term investments in REITs – The fair values of mutual funds and REITs were valued based on quoted market prices or derived from such prices. Where observable prices or inputs are not available, valuation models are applied which may involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity. See Note 24, Fair Value Measurement.in active markets.

Concentration of Risk

The Company maintains cash with banks in the USA, People’s Republic of China (“PRC”), Hong Kong, and Taiwan. Should any bank holding the Company’s cash become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose all or part of its cash deposit with that bank; however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts. In Taiwan, a depositor has up to NTD 3,000,000 insured by Central Deposit Insurance Corporation (“CDIC”). In China, a depositor has up to RMB 500,000 insured by the People’s Bank of China Financial Stability Bureau (“FSD”). In Hong Kong, a depositor has up to HKD 500,000 insured by Hong Kong Deposit Protection Board (“DPB”). In the United States, the standard insurance amount is $250,000 per depositor in a bank insured by the Federal Deposit Insurance Corporation (“FDIC”).

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, time deposits, restricted cash, register capital deposit, contract assets and accounts receivable. As of September 30, 2017,2022 and December 31, 2021, approximately $1,467,000$2,257,000 and $2,712,000 of the Company’s cash and cash equivalents, time deposits, and registered capital deposit and restricted cashdeposits held by financial institutions, was insured, and the remaining balance of approximately $32,808,000$86,840,000 and $83,446,000, was not insured.

Three major insurance companies accounted for more than 10% of the Company’s total revenue for the three months ended of September 30, 2017 and 2016. Revenue from these insurance companies were set out as below:

| Three months ended September 30, | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 4,275,654 | 26 | % | $ | 5,291,779 | 35 | % | ||||||||

| Taiwan Life Insurance Co., Ltd. (*) | 1,911,978 | 12 | % | 1,493,069 | 10 | % | ||||||||||

| TransGlobe Life Insurance Inc. | 1,882,461 | 12 | % | (** | ) | (** | ) | |||||||||

For the nine months ended of September 30, 2017 and 2016, the Company’s revenue received from the following companies were set out as below:

| Nine months ended September 30, | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 13,019,656 | 26 | % | $ | 13,969,672 | 32 | % | ||||||||

| Taiwan Life Insurance Co., Ltd. (*) | 5,881,228 | 12 | % | 4,813,813 | 11 | % | ||||||||||

| TransGlobe Life Insurance Inc. | 5,127,561 | 10 | % | (** | ) | (** | ) | |||||||||

| Fubon Life Insurance Co., Ltd. | (*** | ) | (*** | ) | 4,342,377 | 10 | % | |||||||||

As of September 30, 2017 and December 31, 2016, the Company’s accounts receivable from the following companies were set out as below:

| September 30, 2017 | December 31, 2016 | |||||||||||||||

| Amount | % of Total Accounts Receivable | Amount | % of Total Accounts Receivable | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 2,450,793 | 34 | % | $ | 6,503,843 | 41 | % | ||||||||

| Taiwan Life Insurance Co., Ltd (*) | (** | ) | (** | ) | 1,973,410 | 13 | % | |||||||||

| TransGlobe Life Insurance Inc. | 801,832 | 11 | % | (** | ) | (** | ) | |||||||||

| Fubon Life Insurance Co., Ltd | (** | ) | (** | ) | 1,660,685 | 11 | % | |||||||||

With respect to accounts receivable, the Company generally does not have anyrequire collateral and does not have anyan allowance for doubtful accounts.

For the three months ended September 30, 2022 and 2021, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| | | | | | | | | | | |

| | Three Months Ended September 30, | | ||||||||

| | 2022 | | 2021 | | ||||||

| | (unaudited) | | (unaudited) | | ||||||

| | | | | % of Total | | | | | % of Total |

|

|

| Amount |

| Revenue |

| Amount |

| Revenue |

| ||

TransGlobe Life Insurance Inc. | | $ | 10,553,991 |

| 32 | % | $ | 8,043,483 | | 25 | % |

Taiwan Life Insurance Co., Ltd. | |

| 5,164,375 |

| 16 | % |

| 6,733,094 | | 21 | % |

Farglory Life Insurance Co., Ltd. | |

| 3,043,157 |

| 9 | % |

| 3,797,277 | | 12 | % |

For the nine months ended September 30, 2022 and 2021, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| | | | | | | | | | | |

| | Nine Months Ended September 30, | | ||||||||

| | 2022 | | 2021 |

| ||||||

| | (unaudited) | | (unaudited) | | ||||||

| | | | | % of Total | | | | | % of Total |

|

|

| Amount |

| Revenue |

| Amount |

| Revenue |

| ||

TransGlobe Life Insurance Inc. | | $ | 27,702,126 |

| 29 | % | $ | 23,829,160 | | 25 | % |

Taiwan Life Insurance Co., Ltd. | | | 13,244,436 |

| 14 | % | | 19,888,398 | | 21 | % |

Farglory Life Insurance Co., Ltd. | |

| 10,884,853 |

| 11 | % |

| 12,279,101 | | 13 | % |

16

As of September 30, 2022 and December 31, 2021, the Company’s accounts receivable and contract assets from these companies were:

| | | | | | | | | | | |

| | September 30, 2022 | | | | | |

| |||

| | (unaudited) | | December 31, 2021 |

| ||||||

| | | | | % of Total | | | | | % of Total |

|

| | | | | Accounts | | | | | Accounts |

|

| | | | | Receivable | | | | | Receivable | |

|

| Amount |

| and contract assets |

| Amount |

| and contract assets | | ||

TransGlobe Life Insurance Inc. | | $ | 7,524,628 | | 38 | % | $ | 8,569,590 | | 32 | % |

Taiwan Life Insurance Co., Ltd. | | | 2,706,867 | | 14 | % | | 4,483,343 | | 17 | % |

Farglory Life Insurance Co., Ltd. | | | 1,593,213 | | 8 | % | | 2,729,673 | | 10 | % |

The Company’s operations are in Taiwan, the PRC, Taiwan and Hong Kong. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic, foreign currency exchange and legal environments in the PRC, Hong Kong and Taiwan, and Hong Kong, the foreign currency exchange andby the state of each regions.economy. The Company’s results of operations may be adversely affected by changes in the political and social conditions in the PRC, TaiwanHong Kong and Hong Kong,Taiwan, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

Income Taxes

Recent Accounting Pronouncements

In January 2016,The Company records income tax expense using the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-01, “Financial Instruments-Overall (Subtopic 825-10): Recognitionasset-and-liability method of accounting for deferred income taxes. Under this method, deferred taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and Measurement of Financial Assetsliabilities and Financial Liabilities,” which amends the guidance in U.S. GAAPtheir financial reporting amounts at each year-end based on the classificationenacted tax laws and measurement of financial instruments. Changesstatutory tax rates applicable to the current guidance primarilyperiods in which the differences are expected to affect the accounting for equity investments, financial liabilities under the fair value option, and the presentation and disclosure requirements for financial instruments. In addition, the ASU clarifies guidance related to thetaxable income. Deferred tax assets are reduced by a valuation allowance assessment when recognizingif, based on available evidence, it is more likely than not that the deferred tax assets resulting from unrealized losses on available-for-sale debt securities.will not be realized.

When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The new standard is effective for fiscal years and interim periods beginning after December 15, 2017, and upon adoption, an entity should apply the amendments by meansbenefit of a cumulative-effect adjustmenttax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50% likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the balance sheet attaxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the beginningstatements of the first reporting period in which the guidance is effective. Early adoption is not permitted except for the provision to record fair value changes for financial liabilities under the fair value option resulting from instrument-specific credit risk inoperations and other comprehensive income. The Company is currently evaluating the impact of adopting this guidance.income (loss).

New Accounting Pronouncements and Other Guidance

New accounting pronouncements not yet adopted

Credit Losses

In FebruaryJune 2016, the FASB issued ASU 2016-02, Leases (Topic 842). TheNo. 2016-13, (FASB ASC Topic 326), Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments which amends the current accounting guidance inand requires the use of the new forward-looking “expected loss” model, rather than the “incurred loss” model, which requires all expected losses to be determined based on historical experience, current conditions and reasonable and supportable forecasts. This guidance amends the accounting for credit losses for most financial assets and certain other instruments including trade and other receivables, held-to-maturity debt securities, loans and other instruments.

In November 2019, the FASB issued ASU No. 2016-02 supersedes2019-10 to postpone the lease recognition requirements in ASC Topic 840, Leases (Statementeffective date of Financial Accounting Standards No. 13). ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. ASU No. 2016-02 is effective2016-13 for public business entities eligible to be smaller reporting companies defined by the SEC to fiscal years beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the effect this standard will have on its consolidated financial statements.

In March 2016, the FASB issued ASU 2016-07, “Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting.” ASU 2016-07 eliminates the requirement for an investment that qualifies for the use of the equity method of accounting as a result of an increase in the level of ownership or degree of influence to adjust the investment, results of operations and retained earnings retrospectively. ASU 2016-07 will be effective prospectively for the Company for increases in the level of ownership interest or degree of influence that result in the adoption of the equity method that occur during or after the quarter ending December 31, 2017, with early adoption permitted. The impact of this guidance for the Company is dependent on any future increases in the level of ownership interest or degree of influence that result in the adoption of the equity method.

In March 2016, the FASB issued ASU 2016-08, “Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net).” ‘The amendments in this ASU are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations by amending certain existing illustrative examples and adding additional illustrative examples to assist in the application of the guidance. The effective date and transition of these amendments is the same as the effective date and transition of ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606).” Public entities should apply the amendments in ASU No. 2014-09 for annual reporting periods beginning after December 15, 2017,2022, including interim reporting periods therein. The Company is currently in the process of evaluating the impact of the adoption of this accounting standards update on its consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, “Classification of Certain Cash Receipts and Cash Payments (Topic 230) to Statement of Cash Flows.” ASU No. 2016-15 clarifies guidance on the classification of certain cash receipts and payments in the statement of cash flows to reduce diversity in practice with respect to (i) debt prepayment or debt extinguishment costs, (ii) settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing, (iii) contingent consideration payments made after a business combination, (iv) proceeds from the settlement of insurance claims, (v) proceeds from the settlement of corporate-owned life insurance policies, including bank-owned life insurance policies, (vi) distributions received from equity method investees, (vii) beneficial interests in securitization transactions, and (viii) separately identifiable cash flows and application of the predominance principle. ASU No. 2016-15 is effective for interim and annual reporting periods in fiscal years beginning after December 15, 2017, with early adoption permitted. The adoption of this update is not expected to have a significant impact on the Company’s consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash” (“ASU No. 2016-18”), which amends the current accounting guidance.” The amendments in this update require the amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. ASU No. 2016-18 is effective for annual periods beginning after December 15, 2017, and interim periods within those annual periods.fiscal years. The Company believes the adoption of ASU No. 2016-18 is2016-13 will not expected to have a material impact on the Company’s consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-04 “Intangibles – Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment,” which eliminates Step 2 from the goodwill impairment test. Instead, an entity should perform its annual or interim goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount and recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value, not to exceed the total amount of goodwill allocated to the reporting unit. ASU No. 2017-04 is effective for annual or any interim goodwill tests in fiscal years beginning after December 15, 2019. The adoption is not expected to have a material impact on the Company’s consolidated financial statements of the Company.

In July 2017, the FASB issued ASU No. 2017-11, “Earnings Per Share (Topic 260) Distinguishing Liabilities from Equity (Topic 480) Derivatives and Hedging (Topic 815),” which addresses the complexity of accounting for certain financial instruments with down round features. Down round features are features of certain equity-linked instruments (or embedded features) that result in the strike price being reduced on the basis of the pricing of future equity offerings. Current accounting guidance creates cost and complexity for entities that issue financial instruments (such as warrants and convertible instruments) with down round features that require fair value measurement of the entire instrument or conversion option. For public business entities, the amendments in Part I of this Update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. For all other entities, the amendments in Part I of this Update are effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.

In August 2017, the FASB issued ASU 2017-12, “Derivatives and Hedging (Topic 815) Targeted Improvements to Accounting for Hedging Activities.” ASU 2017-12 refines and expands hedge accounting for both financial and commodity risks. This ASU creates more transparency around how economic results are presented, both on the face of the financial statements and in the footnotes. In addition, this ASU makes certain targeted improvements to simplify the application of hedge accounting guidance. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.