We granted stock options with a two-year vesting period and a seven-year term in the first and third quarters of 2006 (none were granted in the second quarter of 2006). The assumptions used to determine the estimated fair value of options granted under the Black-Scholes options pricing model, the number of stock options granted, and the estimated fair value of options granted are as follows:

| | |

| Assumptions Used in Determining Compensation Expense for Stock Options Granted in 2006 & Other Data | |

| Dividend yield | | | 1.1 | % | | Stock options granted (number of shares): | | | | |

| Expected volatility percentage | | | 37.3%-39.1 | % | | Officers | | | 97,500 | |

| Weighted-average volatility | | | 38.4 | % | | Management | | | 330,800 | |

| Weighted average risk-free interest rate | | | 4.7 | % | | Other employees | | | - | |

| Expected holding period (years): | | | | | | Total | | | 428,300 | |

| Officers | | | 6.0 | | | | | | | |

| Management | | | 5.0 | | | Estimated weighted average fair value of | | | | |

| Other employees | | | n/a | | | options per share at date of grant: | | | | |

| Estimated weighted-average annual forfeiture rate | | | | | | Officers | | $ | 6.22 | |

| at date of grant: | | | | | | Management | | | 5.64 | |

| Officers | | | 2.0 | % | | Other employees | | | - | |

| Management | | | 5.0 | % | | | | | | |

| Weighted average exercise prices at date of grant: | | | | | | | | | | |

| Officers | | $ | 15.11 | | | Total estimated fair value of stock | | | | |

| Management | | $ | 15.18 | | | options granted (in thousands) | | $ | 2,472 | |

The dividend yield is the dividend yield on our common stock at the date of grant, which we believe is a reasonable estimate of the expected yield during the holding period. We calculate expected volatility based on the historical volatility of our common stock using a sequential period of historical data equal to the expected holding period of the option. We have no reason to believe that future volatility is likely to differ from the past. The assumed risk-free interest rate is based on observed interest rates (zero coupon U.S. Treasury debt securities) appropriate for the expected holding period. The expected holding period and forfeiture assumptions are based on historical experience. Estimated forfeiture assumptions are reviewed through the vesting period. Adjustments are made if actual forfeitures differ from previous estimates. The cumulative effect of a change in estimated forfeitures is recognized in the period of the change.

A summary of our stock options outstanding at September 30, 2006 and December 31, 2005 and changes during the nine months and year ended, respectively, is presented below:

| | | | | | |

| | | | | Option Exercise Price/Share | |

| | | Number of Options | | Range | | Wgted. Ave. | |

| Outstanding at 12/31/04 | | | 2,661,990 | | $ | 4.17 | | | to | | $ | 46.63 | | $ | 22.01 | |

| Granted | | | - | | | n/a | | | to | | | n/a | | | n/a | |

| Forfeited and Expired | | | (274,575 | ) | | 13.95 | | | to | | | 46.63 | | | 21.90 | |

| Exercised | | | (137,075 | ) | | 4.17 | | | to | | | 16.55 | | | 7.51 | |

| Outstanding at 12/31/05 | | | 2,250,340 | | | 7.38 | | | to | | | 46.63 | | | 22.90 | |

| Granted | | | 428,300 | | | 15.11 | | | to | | | 16.48 | | | 15.16 | |

| Forfeited and Expired | | | (765,975 | ) | | 7.38 | | | to | | | 46.63 | | | 31.47 | |

| Exercised | | | (107,510 | ) | | 7.38 | | | to | | | 14.56 | | | 11.01 | |

| Outstanding at 9/30/06 | | | 1,805,155 | | $ | 13.95 | | | to | | $ | 29.94 | | $ | 18.14 | |

The following table summarizes additional information about stock options outstanding and exercisable and non-vested restricted stock outstanding at September 30, 2006:

| | | | | | |

| | | Options Outstanding at | | Options Exercisable at | |

| | | September 30, 2006 | | September 30, 2006 | |

| | | | | | | | | Weighted Average | | Aggregate | | | | | | Aggregate | |

| | | | | | | | | Remaining | | | | Intrinsic | | | | Weighted | | Intrinsic | |

| | | | | | | | | Contract- | | | | Value | | | | Average | | Value | |

| Range of | | | | ual Life | | Exercise | | (In | | | | Exercise | | (In | |

| Exercise Prices | | Shares | | (Years) | | Price | | Thousands) | | Shares | | Price | | Thousands) | |

$ 13.95 | | | to | | $ | 17.88 | | | 840,550 | | | 4.3 | | $ | 15.18 | | $ | 1,317 | | | 461,750 | | $ | 15.20 | | $ | 718 | |

17.89 | | | to | | | 19.75 | | | 667,650 | | | 1.5 | | | 19.22 | | | - | | | 667,650 | | | 19.22 | | | - | |

| 19.76 | | | to | | | 25.65 | | | 216,300 | | | 0.4 | | | 21.95 | | | - | | | 216,300 | | | 21.95 | | | - | |

| 25.66 | | | to | | | 29.94 | | | 80,655 | | | 1.7 | | | 29.85 | | | - | | | 80,655 | | | 29.85 | | | - | |

$ 13.95 | | | to | | $ | 29.94 | | | 1,805,155 | | | 2.7 | | $ | 18.14 | | $ | 1,317 | | | 1,426,355 | | $ | 18.93 | | $ | 718 | |

| | | | | | |

| Non-vested Restricted Stock | | Number of Shares | | Wgtd. Ave. Grant Date Fair Value/Sh. | |

| Outstanding at 12/31/05 | | | 109,000 | | $ | 13.88 | |

| Granted | | | - | | | - | |

| Vested | | | (17,333 | ) | | 13.95 | |

| Forfeited | | | (24,167 | ) | | 13.80 | |

| Outstanding at 9/30/06 | | | 67,500 | | $ | 13.90 | |

The total intrinsic value of stock options exercised during the three and nine months ended September 30, 2006 was $62,000 and $471,000, respectively. The grant-date fair value of stock option-based awards vested during the nine months ended September 30, 2006 was $1.3 million (no awards vested during the third quarter). As of September 30, 2006, there was $1.5 million and $366,000 of unrecognized compensation cost related to stock option-based awards and non-vested restricted stock, respectively. This cost is expected to be recognized over the remaining weighted average period of 1.45 years for stock option-based awards and 2.54 years for non-vested restricted stock. Compensation costs for non-vested restricted stock is subject to accelerated vesting based on meeting certain financial targets.

| 7. | The components of net periodic benefit income (cost) for our pension and other post-retirement benefit programs are shown below: |

| |

| |

|

|---|

| | | Pension

Benefits for 3 Months

Ended June 30 | | Other Post-Retirement

Benefits for 3 Months

Ended June 30 | |

|---|

| | |

| |

|

|---|

| | (In Thousands) | 2006 | | 2005 | | 2006 | | 2005 | |

|---|

| |

|

|---|

| | Service cost | $ | (1,491 | ) | $ | (1,524 | ) | $ | (22 | ) | $ | (29 | ) |

| | Interest cost | | (3,411 | ) | | (3,145 | ) | | (135 | ) | | (145 | ) |

| | Employee contributions | | — | | | — | | | — | | | — | |

| | Other | | (36 | ) | | (29 | ) | | — | | | — | |

| | Expected return on plan assets | | 5,430 | | | 5,512 | | | — | | | — | |

| | Amortization of prior service costs, gains or

losses and net transition asset | | (1,194 | ) | | (146 | ) | | 4 | | | — | |

| |

|

|---|

| | Net periodic benefit (cost) income | $ | (702 | ) | $ | 668 | | $ | (153 | ) | $ | (174 | ) |

| |

|

|---|

| |

|---|

| |

|

|---|

| | | Pension

Benefits for 6 Months

Ended June 30 | | Other Post-Retirement

Benefits for 6 Months

Ended June 30 | |

|---|

| | |

| |

|

|---|

| | (In Thousands) | 2006 | | 2005 | | 2006 | | 2005 | |

|---|

| |

|

|---|

| | Service cost | $ | (2,888 | ) | $ | (3,048 | ) | $ | (44 | ) | $ | (58 | ) |

| | Interest cost | | (6,667 | ) | | (6,291 | ) | | (271 | ) | | (292 | ) |

| | Employee contributions | | — | | | — | | | — | | | — | |

| | Other | | (57 | ) | | 68 | | | — | | | — | |

| | Expected return on plan assets | | 10,668 | | | 11,024 | | | — | | | — | |

| | Amortization of prior service costs, gains or

losses and net transition asset | | (2,433 | ) | | (292 | ) | | 9 | | | — | |

| |

|

|---|

| | Net periodic benefit (cost) income | $ | (1,377 | ) | $ | 1,461 | | $ | (306 | ) | $ | (350 | ) |

| |

|

|---|

| |

| We expect required contributions to our pension plans to be about $800,000 for the year ending December 31, 2006. We fund our other post-retirement benefits (life insurance and health benefits) on a claims-made basis, which were $645,000 and $525,000 for the years ended December 31, 2005 and 2004, respectively. |

| | | | | | |

| | | Pension Benefits for 3 Months Ended Sept. 30 | | Other Post-Retirement Benefits for 3 Months Ended Sept. 30 | |

| (In Thousands) | | 2006 | | 2005 | | 2006 | | 2005 | |

| Service cost | | $ | (1,425 | ) | $ | (1,616 | ) | $ | (22 | ) | $ | (23 | ) |

| Interest cost | | | (3,384 | ) | | (3,172 | ) | | (135 | ) | | (116 | ) |

| Employee contributions | | | - | | | 113 | | | - | | | - | |

| Other | | | (36 | ) | | (29 | ) | | - | | | - | |

| Expected return on plan assets | | | 5,434 | | | 5,526 | | | - | | | - | |

| Amortization of prior service costs, gains or losses and net transition asset | | | (1,111 | ) | | (185 | ) | | 4 | | | 1 | |

| Net periodic benefit (cost) income | | $ | (522 | ) | $ | 637 | | $ | (153 | ) | $ | (138 | ) |

| | | | | | |

| | | Pension Benefits for 9 Months Ended Sept. 30 | | Other Post-Retirement Benefits for 9 Months Ended Sept. 30 | |

| (In Thousands) | | 2006 | | 2005 | | 2006 | | 2005 | |

| Service cost | | $ | (4,313 | ) | $ | (4,892 | ) | $ | (66 | ) | $ | (80 | ) |

| Interest cost | | | (10,051 | ) | | (9,463 | ) | | (406 | ) | | (407 | ) |

| Employee contributions | | | - | | | 340 | | | - | | | - | |

| Other | | | (93 | ) | | 40 | | | - | | | - | |

| Expected return on plan assets | | | 16,102 | | | 16,550 | | | - | | | - | |

| Amortization of prior service costs, gains or losses and net transition asset | | | (3,544 | ) | | (476 | ) | | 13 | | | (1 | ) |

| Net periodic benefit (cost) income | | $ | (1,899 | ) | $ | 2,099 | | $ | (459 | ) | $ | (488 | ) |

We expect required contributions to our pension plans to be about $800,000 for the year ending December 31, 2006. We fund our other post-retirement benefits (life insurance and health benefits) on a claims-made basis, which were $645,000 and $525,000 for the years ended December 31, 2005 and 2004, respectively.

On October 26, 2006, we announced changes to our U.S. defined benefit (pension) and savings plans covering salaried and certain other employees. The changes will have no impact on our net income or earnings per share in 2006. We expect that the changes relating to the pension plan will reduce our projected benefit obligation by approximately $10 million as of December 31, 2006. In 2007, the changes to the pension plan are expected to reduce our service cost, interest cost and amortization of prior service cost components of pension expense by approximately $600,000, $600,000 and $1.5 million, respectively, and the savings plan changes are expected to increase charges for company matching contributions by approximately $700,000.

| 8. | Information by business segment is reported below. There are no accounting transactions between segments and no allocations to segments. There have been no significant changes to identifiable assets by segment. Net sales (sales less freight) and operating profit from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker of each segment for purposes of assessing performance. |

| |

| Tredegar Corporation

Net Sales and Operating Profit by Segment

(In Thousands)

(Unaudited) |

| |

| | | Three Months

Ended June 30 | | Six Months

Ended June 30 | |

|---|

| | |

| |

| |

|---|

| | | 2006 | | 2005 | | 2006 | | 2005 | |

|---|

| | |

| |

| |

| |

| |

|---|

| | Net Sales | | | | | | | | | | | | | |

| | Film Products | | $ | 121,405 | | $ | 111,244 | | $ | 247,736 | | $ | 227,955 | |

| | Aluminum Extrusions | | | 153,836 | | | 125,963 | | | 288,995 | | | 235,929 | |

| | AFBS (formerly Therics) | | | — | | | 115 | | | — | | | 252 | |

| | |

| |

| |

| |

| |

|---|

| | Total net sales | | | 275,241 | | | 237,322 | | | 536,731 | | | 464,136 | |

| | Add back freight | | | 7,250 | | | 6,402 | | | 13,724 | | | 12,345 | |

| | |

| |

| |

| |

| |

|---|

| | Sales as shown in the Consolidated Statements of Income | | $ | 282,491 | | $ | 243,724 | | $ | 550,455 | | $ | 476,481 | |

| | |

| |

| |

| |

| |

|---|

| | | | | | | | | | | | | | | |

| | Operating Profit | | | | | | | | | | | | | |

| | Film Products: | | | | | | | | | | | | | |

| | Ongoing operations | | $ | 13,264 | | $ | 11,396 | | $ | 28,841 | | $ | 22,974 | |

| | Plant shutdowns, asset impairments and restructurings,

net of gain on sale of assets and related income from

LIFO inventory liquidations | | | 768 | | | 44 | | | (815 | ) | | 413 | |

| | | | | | | | | | | | | | | |

| | Aluminum Extrusions: | | | | | | | | | | | | | |

| | Ongoing operations | | | 5,674 | | | 7,221 | | | 10,540 | | | 10,218 | |

| | Plant shutdowns, asset impairments and restructurings | | | (405 | ) | | (202 | ) | | (514 | ) | | (840 | ) |

| | | | | | | | | | | | | | | |

| | AFBS (formerly Therics): | | | | | | | | | | | | | |

| | Ongoing operations | | | — | | | (1,644 | ) | | — | | | (3,467 | ) |

| | Loss on investment in Therics, LLC | | | — | | | — | | | (25 | ) | | — | |

| | Restructurings | | | — | | | (10,049 | ) | | — | | | (10,049 | ) |

| | |

| |

| |

| |

| |

|---|

| | | | | | | | | | | | | | | |

| | Total | | | 19,301 | | | 6,766 | | | 38,027 | | | 19,249 | |

| | Interest income | | | 285 | | | 142 | | | 507 | | | 240 | |

| | Interest expense | | | 1,468 | | | 1,093 | | | 2,900 | | | 2,056 | |

| | Gain on sale of corporate assets | | | — | | | 61 | | | 56 | | | 61 | |

| | Stock option-based compensation costs | | | 282 | | | — | | | 493 | | | | |

| | Corporate expenses, net | | | 3,002 | | | 2,339 | | | 6,761 | | | 4,735 | |

| | |

| |

| |

| |

| |

|---|

| | Income before income taxes | | | 14,834 | | | 3,537 | | | 28,436 | | | 12,759 | |

| | Income taxes | | | 5,584 | | | 1,405 | | | 10,971 | | | 5,077 | |

| | |

| |

| |

| |

| |

|---|

| | Net income | | $ | 9,250 | | $ | 2,132 | | $ | 17,465 | | $ | 7,682 | |

| | |

| |

| |

| |

| |

|---|

Net Sales and Operating Profit by Segment

(In Thousands)

(Unaudited)

| | | Three Months Ended Sept. 30 | | Nine Months Ended Sept. 30 | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

Net Sales | | | | | | | | | |

| Film Products | | $ | 134,961 | | $ | 116,350 | | $ | 382,697 | | $ | 344,305 | |

| Aluminum Extrusions | | | 154,030 | | | 118,085 | | | 443,025 | | | 354,014 | |

| AFBS (formerly Therics) | | | - | | | - | | | - | | | 252 | |

| Total net sales | | | 288,991 | | | 234,435 | | | 825,722 | | | 698,571 | |

| Add back freight | | | 7,265 | | | 6,281 | | | 20,989 | | | 18,626 | |

| Sales as shown in the Consolidated Statements of Income | | $ | 296,256 | | $ | 240,716 | | $ | 846,711 | | $ | 717,197 | |

| | | | | | | | | | | | | | |

Operating Profit | | | | | | | | | | | | | |

| Film Products: | | | | | | | | | | | | | |

| Ongoing operations | | $ | 13,770 | | $ | 13,822 | | $ | 42,611 | | $ | 36,796 | |

| Plant shutdowns, asset impairments and restructurings, net of gain on sale of assets and related income from LIFO inventory liquidations | | | 1,022 | | | (1,225 | ) | | 207 | | | (812 | ) |

| | | | | | | | | | | | | | |

| Aluminum Extrusions: | | | | | | | | | | | | | |

| Ongoing operations | | | 5,407 | | | 4,362 | | | 15,947 | | | 14,580 | |

| Plant shutdowns, asset impairments and restructurings | | | (920 | ) | | (406 | ) | | (1,434 | ) | | (1,246 | ) |

| | | | | | | | | | | | | | |

| AFBS (formerly Therics): | | | | | | | | | | | | | |

| Ongoing operations | | | - | | | - | | | - | | | (3,467 | ) |

| Loss on investment in Therics, LLC | | | - | | | (91 | ) | | (25 | ) | | (91 | ) |

| Plant shutdowns, asset impairments and restructurings | | | (494 | ) | | - | | | (494 | ) | | (10,049 | ) |

| | | | | | | | | | | | | | |

| Total | | | 18,785 | | | 16,462 | | | 56,812 | | | 35,711 | |

| Interest income | | | 315 | | | 146 | | | 822 | | | 386 | |

| Interest expense | | | 1,331 | | | 1,196 | | | 4,231 | | | 3,252 | |

| Gain on sale of corporate assets | | | - | | | - | | | 56 | | | 61 | |

| Stock option-based compensation costs | | | 215 | | | - | | | 708 | | | - | |

| Corporate expenses, net | | | 3,148 | | | 3,290 | | | 9,909 | | | 8,025 | |

| Income before income taxes | | | 14,406 | | | 12,122 | | | 42,842 | | | 24,881 | |

| Income taxes | | | 4,716 | | | 4,465 | | | 15,687 | | | 9,542 | |

| Net income | | $ | 9,690 | | $ | 7,657 | | $ | 27,155 | | $ | 15,339 | |

| 9. | In JulySeptember 2006, the Financial Accounting Standards Board (FASB) affirmed its previous decision to make the recognition provisionsissued Statement of its proposed standard,Employers’Financial Accounting Standards No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No 87, 88, 106 and 132(R),effective forpublic companies for fiscal years ending after December 15, 2006. Accordingly, we will be required to recognize the funded status of our pension plans in our December 31, 2006 financial statements. The funded status of our pension plans at December 31, 2005 was plan assets at fair value in excess of benefit obligations of $18.6 million.million ($28.6 million on a pro forma basis including the pension plan changes discussed in Note 7). On a pro forma basis at December 31, 2005 (including the pension plan changes discussed in Note 7), we estimate that the new standard would have resulted in a decrease in prepaid pension cost of $67$57 million (included in “Other assets and deferred charges” in the consolidated balance sheet), a decrease in non-current deferred income tax liabilities of $24$20 million and a decrease in shareholders’ equity of $43$37 million. Adjustments from the new standard are not expected to impact our debt covenant computations since our credit agreement allows us to elect to use generally accepted accounting principles in effect when the agreement was signed. |

| |

| In July 2006, the FASB issued FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes, clarifying the accounting for uncertain tax positions. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation is effective for fiscal years beginning after December 15, 2006 with earlier application encouraged. We are evaluating the interpretation and have not determined whether or not it will have a material effect on our financial position or results of operations. |

In September 2006, the FASB issued FASB Staff Position ("FSP") No. AUG AIR-1, Accounting for Planned Major Maintenance Activities. The FSP is effective for the first fiscal year beginning after December 31, 2006. The FSP eliminates the accrual method of accounting for major maintenance activities, but continues to permit the use of the direct expensing, built-in overhaul and deferral methods. The FSP also continues to require accruals or deferrals for interim periods of annual costs that clearly benefit two or more interim periods. We are evaluating the FSP and have not determined whether or not it will have a material effect on our financial position or results of operations.

In July 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, clarifying the accounting for uncertain tax positions. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation is effective for fiscal years beginning after December 15, 2006 with earlier application encouraged. We are evaluating the interpretation and have not determined whether or not it will have a material effect on our financial position or results of operations.

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations.Forward-looking and Cautionary Statements

Some of the information contained in this quarterly report on Form 10-Q may constitute “forward-looking statements” within the meaning of the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995. When we use words such as “believe,” “hope,” “expect,” “are likely,” “project” and similar expressions, we do so to identify forward-looking statements. Such statements are based on our then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. Risk factors that may cause such a difference are summarized on pages 31-33 and are incorporated herein.

Executive Summary

Second-quarter 2006 net income was $9.3 million (24 cents per share) compared with $2.1 million (5 cents per share) in the second quarter of 2005. Net income was $17.5 million (45 cents per share) for the first six months of 2006 compared with $7.7 million (20 cents per share) for the first six months of 2005. Gains on the sale of assets and other items and losses related to plant shutdowns, assets impairments and restructurings are described in Note 2 on page 6. The business segment review is provided below and beginning on page 22.

Second-quarter net sales in Film Products were $121.4 million, up 9.2% from $111.2 million in the second quarter of 2005 while operating profit from ongoing operations rose 16.7% to $13.3 million from $11.4 million. The increase in sales and operating profit over last year’s second quarter was primarily due to continued growth in the sale of higher value surface protection films, elastic materials and new apertured topsheets. Profits also benefited from the lag in the pass-through of lower average resin costs (estimated impact of $500,000). Customer inventory adjustments did not have as significant an impact on profits as initially expected. Volume was 61.9 million pounds compared with 64.3 million pounds in the second quarter of 2005. Volume declines were mainly due to lower sales of certain barrier films that are being discontinued in conjunction with the shutdown of the plant in LaGrange, Georgia.

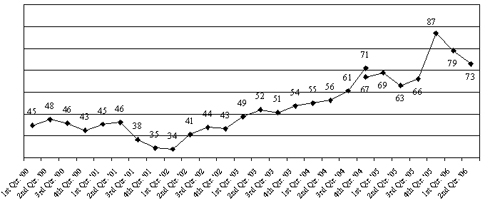

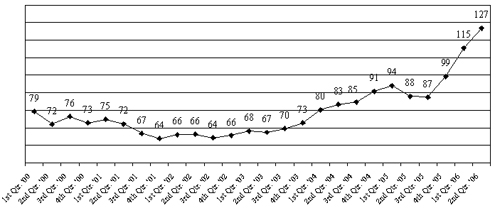

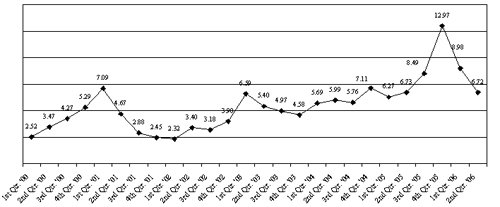

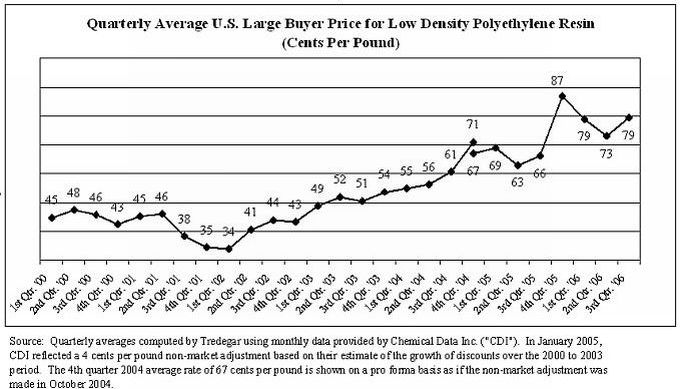

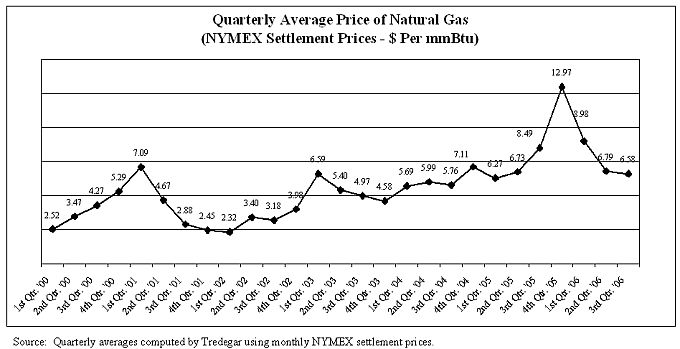

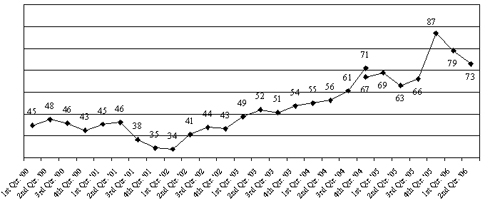

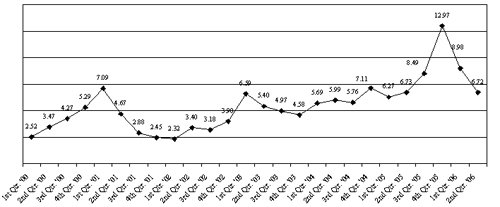

Film Products has index-based pass-through raw material agreements for the majority of its business. However, under certain agreements, changes in resin prices are not passed through for an average period of 90 days. Average quarterly prices of low-density polyethylene resin (“LDPE”) in the U.S. decreased 8 and 6 cents per pound in the first and second quarters of 2006, respectively, after increasing 21 cents per pound or 32% in the fourth quarter of 2005. LDPE prices in the U.S. increased in June 2006 by 6 cents per pound (the price of LDPE in the U.S. declined by 4 cents per pound in each month from December 2005 to April 2006 and was flat in May 2006). Average LDPE prices in Europe and Asia increased 2 to 4 cents per pound in the second quarter of 2006. Since 2002, U.S. LDPE prices have more than doubled. Resin prices in Europe, Asia and South America have also increased significantly during this time.

We estimate that the lag in the pass-through to customers of changes in resin prices had a positive impact on first- and second- quarter 2006 results of $2 million and $500,000, respectively, compared with a negative impact on fourth-quarter 2005 results of $5.5 million (net of the favorable effect of a decline in inventories accounted for under the last-in first-out method). There was no significant resin pass-through lag in the first quarter of 2005. In the second quarter of 2005, lower average resin prices resulted in a positive pass-through lag impact of approximately $1.5 million.

Net sales were $247.7 million in the first six months of 2006, up 8.6% versus $228.0 million in 2005. Operating profit from ongoing operations was $28.8 million in the first six months of 2006, up 25.2% compared to $23.0 million in 2005. Year-to-date volume decreased to 126.4 million pounds from

|

Forward-looking and Cautionary Statements

Some of the information contained in this quarterly report on Form 10-Q may constitute “forward-looking statements” within the meaning of the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995. When we use words such as “believe,” “hope,” “expect,” “are likely,” “project” and similar expressions, we do so to identify forward-looking statements. Such statements are based on our then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. Risk factors that may cause such a difference are summarized on pages 32-34 and are incorporated herein.

Executive Summary

General. Third-quarter 2006 net income was $9.7 million (25 cents per share) compared with $7.6 million (20 cents per share) in the third quarter of 2005. Net income was $27.2 million (70 cents per share) for the first nine months of 2006 compared with $15.3 million (40 cents per share) for the first nine months of 2005. Gains on the sale of assets and other items and losses related to plant shutdowns, assets impairments and restructurings are described in Note 2 on page 6. The business segment review is provided below and beginning on page 22.

Film Products. Third-quarter net sales in Film Products were $135.0 million, up 16.0% from $116.4 million in the third quarter of 2005 while operating profit from ongoing operations was flat at $13.8 million. Profits were adversely affected by the lag in the pass-through of higher average resin costs (estimated negative impact of $1.5 million in the third quarter of 2006 versus none in the third quarter of 2005). The increase in sales and operating profit excluding the resin pass-through lag over last year’s third quarter was primarily due to continued growth in the sale of higher value surface protection films, elastic materials and new apertured topsheets. Volume was 64.4 million pounds compared with 66.1 million pounds in the third quarter of 2005. Volume declines were mainly due to lower sales of certain barrier films that are being discontinued in conjunction with the shutdown of the plant in LaGrange, Georgia. Net sales, operating profit and volume in the second quarter of 2006 were $121.4 million, $13.3 million ($12.8 million excluding the estimated positive resin pass-through lag of $500,000) and 61.9 million pounds, respectively.

Film Products has index-based pass-through raw material cost agreements for the majority of its business. However, under certain agreements, changes in resin prices are not passed through for an average period of 90 days. Average quarterly prices of low-density polyethylene resin (“LDPE”) in the U.S. increased 6-7 cents per pound in the third quarter of 2006 after decreasing 8 and 6 cents per pound in the first and second quarters of 2006, respectively. LDPE prices in the U.S. decreased in September 2006 by 2-3 cents per pound. Average LDPE prices in Europe and Asia also increased in the third quarter of 2006. Since 2002, U.S. LDPE prices have more than doubled. Resin prices in Europe, Asia and South America have also increased significantly during this time.

Net sales were $382.7 million in the first nine months of 2006, up 11.2% versus $344.3 million in 2005. Operating profit from ongoing operations was $42.6 million in the first nine months of 2006, up 15.8% compared to $36.8 million in 2005. Year-to-date volume decreased to 190.8 million pounds from 197.8 million pounds in 2005. Net sales, operating profit and volume changes for the first nine months of 2006 compared with 2005 were primarily due to the factors noted above in the third quarter analysis.

Film Products continues to expand capacity to support growth in new products. Capital expenditures were $26.1 million in the first nine months of 2006 and are expected to be approximately $40 million for the year versus $50 million last year. Approximately half of the forecasted capital expenditures relates to expanding the production capacity for surface protection films. Other planned capital expenditures include capacity additions for elastic materials and a new information system, which is currently being rolled out in U.S. locations. Depreciation expense was $23.5 million in the first nine months of 2006 compared with $19.2 million in the first half of last year, and is projected to increase by approximately $5 million to $32 million for the year.

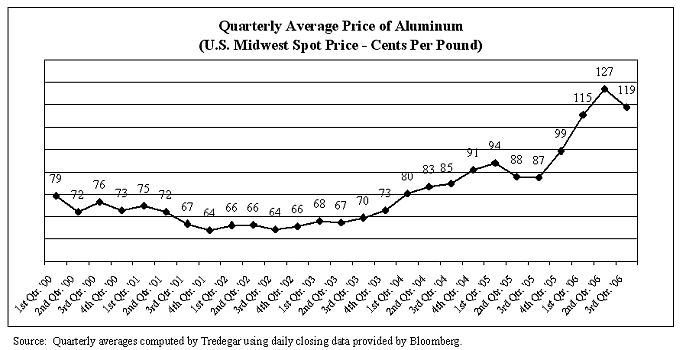

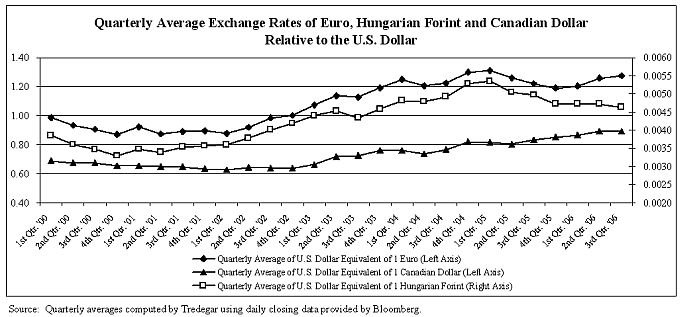

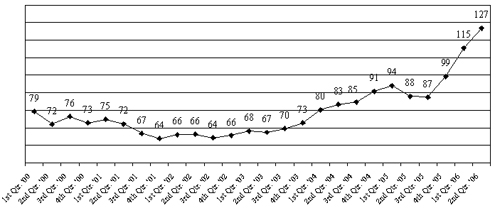

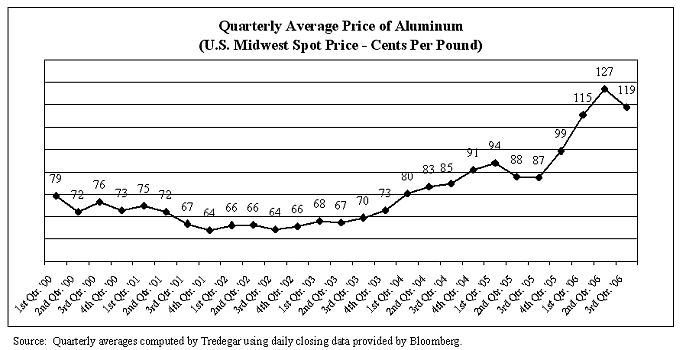

Aluminum Extrusions. Third-quarter net sales in Aluminum Extrusions were $154.0 million, up 30.4% from $118.1 million in the third quarter of 2005 primarily due to improved volume and higher selling prices. Operating profit from ongoing operations increased to $5.4 million, up 23% from $4.4 million in the third quarter of 2005. The increase in operating profit was mainly due to higher volume (up 7.1%). Lower energy costs of approximately $1 million and higher selling prices partially offset the adverse impact of appreciation of the Canadian Dollar (approximately $1 million), charges for possible uncollectible accounts ($800,000) and sales mix changes. Volume increased to 68.4 million pounds versus 63.9 million pounds in the third quarter of 2005. Growth in shipments continued to be driven by demand for extrusions used in commercial construction and hurricane protection products. However, we are concerned about near-term performance based on a recent slow down in orders in most markets that appears to be more significant than normal seasonal factors.

Net sales were $443.0 million in the first nine months of 2006, up 25.1% versus $354.0 million in 2005. Operating profit from ongoing operations was $15.9 million in the first nine months of 2006, up 8.9% compared to $14.6 million in 2005. Year-to-date volume increased to 201.5 million pounds, up 8.5% compared to 185.7 million pounds in 2005. Year-to-date net sales improved due to higher volume and higher selling prices. The increase in operating profit during the first nine months was primarily due to higher volume and selling prices, partially offset by appreciation of the Canadian Dollar ($2.7 million), charges for possible uncollectible accounts ($1.2 million), margin compression caused by rapidly increasing aluminum costs (adverse impact estimated of $1.1 million) and higher energy costs ($1 million). We believe margin compression from rapid movements in aluminum costs should be mitigated for extruded products in the future since pricing on normal customer orders has changed from the order date to the shipment date.

Capital expenditures in Aluminum Extrusions in the first nine months of 2006 were $5.6 million and are expected to be approximately $8 million for the year.

Other Developments. Consolidated net pension expense was $1.9 million in the first nine months of 2006, an increase of $4.0 million (7 cents per share after taxes) from the net pension income of $2.1 million recognized in the first nine months of 2005. We expect net pension expense of $2.5 million in 2006, an unfavorable change of $5.2 million (9 cents per share after taxes) versus 2005. Most of this change relates to a pension plan that is reflected in “Corporate expenses, net” in the segment operating profit table on page 22. We expect required contributions to our pension plans to be about $800,000 in 2006.

On October 26, 2006, we announced changes to our U.S. defined benefit (pension) and savings plans covering salaried and certain other employees. The changes will have no impact on our net income or earnings per share in 2006. We expect that the changes relating to the pension plan will reduce our projected benefit obligation by approximately $10 million as of December 31, 2006. In 2007, the changes to the pension plan are expected to reduce our service cost, interest cost and amortization of prior service cost components of pension expense by approximately $600,000, $600,000 and $1.5 million, respectively, and the savings plan changes are expected to increase charges for company matching contributions by approximately $700,000.

During the first quarter of 2006, we adopted Statement of Financial Accounting Standards No. 123(R), Share-Based Payment (“SFAS 123(R)”), which requires all stock-based compensation to be expensed and accounted for using a fair value-based method. The adoption of SFAS 123(R) and the granting of stock options in 2006 resulted in first-, second- and third- quarter pretax charges for stock option-based compensation of $211,000, $282,000 and $215,000, respectively. We expect to recognize stock option-based compensation costs under the new standard of approximately $1 million in 2006 (2 cents per share after taxes).

Consolidated net capitalization and other credit measures are provided in the liquidity and capital resources section beginning on page 23.

Critical Accounting Policies

In the ordinary course of business, we make a number of estimates and assumptions relating to the reporting of results of operations and financial position in the preparation of financial statements in conformity with generally accepted accounting principles. We believe the estimates, assumptions and judgments described in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies” of our Annual Report on Form 10-K for the year ended December 31, 2005, have the greatest potential impact on our financial statements, so we consider these to be our critical accounting policies. These policies include our accounting for impairment of long-lived assets and goodwill, pension benefits and income taxes. These policies require management to exercise judgments that are often difficult, subjective and complex due to the necessity of estimating the effect of matters that are inherently uncertain. Actual results could differ materially from those estimates under different assumptions and conditions. We believe the consistent application of these policies enables us to provide readers of our financial statements with useful and reliable information about our operating results and financial condition. There has been no significant change in these policies except for the accounting for stock-based compensation discussed in the executive summary. See Note 2 on page 6 for losses related to plant shutdowns, assets impairments and restructurings occurring during 2006 and the comparable period in 2005.

Recently Issued Accounting Standards

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No 87, 88, 106 and 132(R), effective forpublic companies for fiscal years ending after December 15, 2006. Accordingly, we will be required to recognize the funded status of our pension plans in our financial statements for the fiscal year ending December 31, 2006. The funded status of our pension plans at December 31, 2005 was plan assets at fair value in excess of benefit obligations of $18.6 million ($28.6 million on a pro forma basis including the pension plan changes discussed in the executive summary). On a pro forma basis at December 31, 2005 (including the pension plan changes discussed in the executive summary), we estimate that the new standard would have resulted in a decrease in prepaid pension cost of $57 million (included in “Other assets and deferred charges” in the consolidated balance sheet), a decrease in non-current deferred income tax liabilities of $20 million and a decrease in shareholders’ equity of $37 million. Adjustments from the new standard are not expected to impact our debt covenant computations since our credit agreement allows us to elect to use generally accepted accounting principles in effect when the agreement was signed.

In September 2006, the FASB issued FASB Staff Position ("FSP") No. AUG AIR-1, Accounting for Planned Major Maintenance Activities. The FSP is effective for the first fiscal year beginning after December 31, 2006. The FSP eliminates the accrual method of accounting for major maintenance activities, but continues to permit the use of the direct expensing, built-in overhaul and deferral methods. The FSP also continues to require accruals or deferrals for interim periods of annual costs that clearly benefit two or more interim periods. We are evaluating the FSP and have not determined whether or not it will have a material effect on our financial position or results of operations.

In July 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, clarifying the accounting for uncertain tax positions. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation is effective for fiscal years beginning after December 15, 2006 with earlier application encouraged. We are evaluating the interpretation and have not determined whether or not it will have a material effect on our financial position or results of operations.

Results of Operations

Third Quarter 2006 Compared with Third Quarter 2005

Overall, sales in the third quarter of 2006 increased by 23.1% compared with 2005. Net sales (sales less freight) increased 16.0% in Film Products primarily due to growth in higher value-added products, including surface protection, elastic and apertured materials. Net sales in Film Products also increased from higher selling prices, which were driven by higher raw material costs. Net sales increased 30.4% in Aluminum Extrusions due to higher volume (up 7.1%) and selling prices. For more information on net sales and volume, see the executive summary beginning on page 15.

Consolidated gross profit (sales minus cost of goods sold and freight) as a percentage of sales decreased to 12.2% in the third quarter of 2006 from 13.5% in 2005 due to a decline in the gross profit margin in Film Products. The gross profit margin in Film Products declined as a result of higher average selling prices to cover higher average resin costs over the last 12 months and the lag in the pass-through of higher average resin costs in the third quarter compared with the second quarter of 2006, partially offset by a gain of $1.2 million for LIFO inventory liquidations (included in "Cost of goods sold" in the consolidated statements of income) related to the shutdown of the facility in LaGrange, Georgia. The estimated resin pass-through lag was negative $1.5 million in the third quarter of 2006 versus none in the third quarter of 2005.

As a percentage of sales, selling, general and administrative (“SG&A”) expenses decreased to 6.1% in the third quarter of 2006 compared with 6.5% in 2005 due primarily to higher sales.

R&D expenses increased to $2.0 million in the third quarter of 2006 from $1.9 million in 2005 and relate entirely to Film Products.

Plant shutdowns, asset impairments and restructurings and related items in the third quarter of 2006 shown in the segment operating profit table on page 22 include:

131.7 million pounds in 2005. Net sales, operating profit and volume changes for the first six months of 2006 compared with 2005 were primarily due to the factors noted above in the second quarter analysis.

Film Products continues to expand capacity to support growth in new products. Capital expenditures were $21.7 million in the first six months of 2006 and are expected to be $45 million for the year. Approximately half of the forecasted capital expenditures relates to expanding the production capacity for surface protection films. Other planned capital expenditures include capacity additions for elastic materials and a new information system, which is currently being rolled out in U.S. locations. Depreciation expense was $15.7 million in the first six months of 2006 compared with $12.4 million in the first half of last year, and is projected to increase by approximately $5 million to $32 million for the year.

Second-quarter net sales in Aluminum Extrusions were $153.9 million, up 22.1% from $126.0 million in the second quarter of 2005 primarily due to improved volume and higher selling prices. Operating profit from ongoing operations decreased to $5.7 million, down 20.8% from $7.2 million in the second quarter of 2005. The decrease in operating profit was mainly due to appreciation of the Canadian Dollar (adverse impact estimated of $1.3 million), margin compression caused by rapidly increasing aluminum costs (adverse impact estimated of $650,000) and a charge for a possible uncollectible account ($375,000). We believe margin compression from rapid movements in aluminum costs should be mitigated for extruded products in the future since pricing on normal customer orders has changed from the order date to the shipment date. Volume was up 9.5% to 69.4 million pounds versus 63.4 million pounds in the second quarter of 2005. Growth in shipments continued to be driven by demand for extrusions used in commercial construction and hurricane protection products.

Net sales were $289.0 million in the first six months of 2006, up 22.5% versus $235.9 million in 2005. Operating profit from ongoing operations was $10.5 million in the first six months of 2006, up 2.9% compared to $10.2 million in 2005. Year-to-date volume increased to 133.0 million pounds, up 9.2% compared to 121.8 million pounds in 2005. Year-to-date net sales improved due to higher volume and higher selling prices. The increase in operating profit during the first six months was primarily due to higher volume and selling prices, partially offset by appreciation of the Canadian Dollar ($1.6 million), higher energy costs ($2 million), margin compression caused by rapidly increasing aluminum costs (adverse impact estimated of $1.3 million) and a charge for a possible uncollectible account ($375,000).

Capital expenditures in Aluminum Extrusions in the first six months of 2006 were $3.2 million and are expected to be approximately $10 million for the year.

Consolidated net pension expense was $1.4 million in the first six months of 2006, an increase of $2.9 million (5 cents per share after taxes) from the net pension income of $1.5 million recognized in the first six months of 2005. We expect net pension expense of $2.8 million in 2006, an unfavorable change of $5.4 million (9 cents per share after taxes) versus 2005. Most of this change relates to a pension plan that is reflected in “Corporate expenses, net” in the operating profit by segment table on page 22. We expect required contributions to our pension plans to be about $800,000 in 2006.

During the first quarter of 2006, we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123R,Share-Based Payment, which requires all stock-based compensation to be expensed and accounted for using a fair value-based method. The adoption of SFAS No. 123R and the granting of stock options on March 7, 2006 resulted in first- and second- quarter pretax charges for stock option-based compensation of $211,000 and $282,000, respectively. We expect to recognize stock option-based compensation costs under the new standard of approximately $1.1 million in 2006 (2 cents per share after taxes).

Consolidated net capitalization and other credit measures are provided in the liquidity and capital resources section beginning on page 23.

|

Critical Accounting Policies

In the ordinary course of business, we make a number of estimates and assumptions relating to the reporting of results of operations and financial position in the preparation of financial statements in conformity with generally accepted accounting principles. We believe the estimates, assumptions and judgments described in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies” of our Annual Report on Form 10-K for the year ended December 31, 2005, have the greatest potential impact on our financial statements, so we consider these to be our critical accounting policies. These policies include our accounting for impairment of long-lived assets and goodwill, pension benefits and income taxes. These policies require management to exercise judgments that are often difficult, subjective and complex due to the necessity of estimating the effect of matters that are inherently uncertain. Actual results could differ significantly from those estimates under different assumptions and conditions. We believe the consistent application of these policies enables us to provide readers of our financial statements with useful and reliable information about our operating results and financial condition. There has been no significant change in these policies. See Note 2 on page 6 for losses related to plant shutdowns, assets impairments and restructurings occurring during 2006 and the comparable period in 2005.

Recently Issued Accounting Standards

In July 2006, the Financial Accounting Standards Board (FASB) affirmed its previous decision to make the recognition provisions of its proposed standard,Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No 87, 88, 106 and 132(R),effective for public companies for fiscal years ending after December 15, 2006. Accordingly, we will be required to recognize the funded status of our pension plans in our December 31, 2006 financial statements. The funded status of our pension plans at December 31, 2005 was plan assets at fair value in excess of benefit obligations of $18.6 million. On a pro forma basis at December 31, 2005, we estimate that the new standard would have resulted in a decrease in prepaid pension cost of $67 million (included in “Other assets and deferred charges” in the consolidated balance sheet), a decrease in non-current deferred income tax liabilities of $24 million and a decrease in shareholders’ equity of $43 million. Adjustments from the new standard are not expected to impact our debt covenant computations since our credit agreement allows us to elect to use generally accepted accounting principles in effect when the agreement was signed.

In July 2006, the FASB issued FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes, clarifying the accounting for uncertain tax positions. The interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation is effective for fiscal years beginning after December 15, 2006 with earlier application encouraged. We are evaluating the interpretation and have not determined whether or not it will have a material effect on our financial position or results of operations.

Results of Operations

Second Quarter 2006 Compared with Second Quarter 2005

Overall, sales in the second quarter of 2006 increased by 15.9% compared with 2005. Net sales (sales less freight) increased 9.2% in Film Products primarily due to growth in higher value-added products, including surface protection, elastic and apertured materials. Net sales in Film Products also increased from higher selling prices, which were driven by higher raw material costs. Net sales increased 22.1% in Aluminum Extrusions due to higher volume (up 9.5%) and selling prices. For more information on net sales and volume, see the executive summary beginning on page 15.

|

Consolidated gross profit (sales minus cost of goods sold and freight) as a percentage of sales decreased to 12.6% in the second quarter of 2006 from 13.6% in 2005 due to a decline in the gross profit margin in Aluminum Extrusions. At Film Products, a higher gross profit margin was driven primarily by growth in higher value-added products, including surface protection, elastic and apertured materials and a gain of $1.4 million for LIFO inventory liquidation (included in “Cost of goods sold” in the consolidated statements of income) related to the shutdown of the facility in LaGrange, Georgia. At Aluminum Extrusions, the decline in gross margin was primarily due to margin compression caused by rapidly increasing aluminum costs and higher selling prices to cover higher aluminum costs.

As a percentage of sales, selling, general and administrative (“SG&A”) expenses decreased to 5.7% in the second quarter of 2006 compared with 6.7% in 2005 due primarily to higher sales and the divestiture of substantially all of our interest in AFBS, Inc. (formerly known as Therics, Inc.) at the end of the second quarter of 2005.

R&D expenses declined to $2.2 million in the second quarter of 2006 from $2.6 million in 2005 primarily due to the divestiture of substantially all of our interest in AFBS.

Plant shutdowns, asset impairments and restructurings and related items in the second quarter of 2006 shown in the segment operating profit table on page 22 include:

|

| |

| •· | A net pretax gain of $822,000$1 million associated with the shutdown of the films manufacturing facility in LaGrange, Georgia, including a gain of $1.4$1.2 million for related LIFO inventory liquidations (included in “Cost"Cost of goods sold”sold" in the consolidated statements of income), partially offset by severance and other shutdown-related costs of $567,000;$198,000; |

| · | A pretax charge of $920,000 related to expected future environmental costs at the aluminum extrusions facility in Newnan, Georgia (included in "Cost of goods sold" in the consolidated statements of income); and |

| | | · | A pretax charge of $494,000 related to the estimated loss on the sub-lease of a portion of the AFBS (formerly Therics) facility in Princeton, New Jersey. |

Plant shutdowns, asset impairments and restructurings and related items in the third quarter of 2005 shown in the segment operating profit table on page 22 include:

| •· | Pretax charges of $459,000$906,000 for severance and other employee-related costs in connection with restructurings in Film Products ($514,000), Aluminum Extrusions ($405,000)207,000), and Film Productsat corporate headquarters ($54,000). |

|

Plant shutdowns, asset impairments and restructurings and related items185,000; included in the second quarter of 2005 shown"Corporate expenses, net" in the segment operating profit table on page 22 include:

|

| table); |

| | • | A pretax charge of $10 million related to the sale or assignment of substantially all of Therics’ assets, including asset impairment charges of $5.6 million, lease-related losses of $3 million and severance and other transaction-related costs of $1.4 million; |

| | |

| • | A pretax gain of $653,000 related to the shutdown of the films manufacturing facility in Carbondale, Pennsylvania, including a $630,000 gain on the sale of the facility (included in “Other income (expense), net” in the consolidated statements of income), and the reversal to income of certain shutdown-related accruals of $23,000; |

| | |

| • | Pretax charges of $500,000 related to severance and other employee-related costs associated with restructurings in Film Products ($227,000) and Aluminum Extrusions ($273,000); |

| | |

| • | A pretax gain of $71,000 related to the shutdown of the aluminum extrusions facility in Aurora, Ontario, including the reversal to income of certain severance and employee-related accruals of $474,000, partially offset by other shutdown-related costs of $403,000; |

| | |

| •· | A net pretax charge of $250,000$595,000 related to severance and other employee-related costs associated with the restructuring of the research and development operations in Film Products (of this amount, $346,000$657,000 in pretax charges for employee relocation and recruitment is included in “Selling, R&D"Selling, general and general expenses”administrative expenses" in the consolidated statements of income); |

| | |

| | •· | A pretax charge of $198,000 related to the shutdown of the aluminum extrusions facility in Aurora, Ontario; and |

| · | Pretax charges of $105,000$117,000 for accelerated depreciation related to restructurings in Film Products; andProducts. |

| | |

Interest income, which is included in “Other income (expense), net” in the consolidated statements of income, was $315,000 in the third quarter of 2006 and $146,000 in 2005. Interest expense increased to $1.3 million in the third quarter of 2006 compared with $1.2 million in 2005. Average debt outstanding and interest rates were as follows:

| | | | |

| | | Three Months Ended Sept. 30 | |

| (In Millions) | | 2006 | | 2005 | |

| Floating-rate debt with interest charged on a rollover basis at one-month LIBOR: | | | | | |

| Average outstanding debt balance | | $ | 83.8 | | $ | 112.0 | |

| Average interest rate | | | 6.2 | % | | 4.8 | % |

| Fixed-rate and other debt: | | | | | | | |

| Average outstanding debt balance | | $ | 3.8 | | $ | 5.8 | |

| Average interest rate | | | 4.0 | % | | 5.8 | % |

| Total debt: | | | | | | | |

| Average outstanding debt balance | | $ | 87.6 | | $ | 117.8 | |

| Average interest rate | | | 6.1 | % | | 4.8 | % |

The effective tax rate declined to 32.7% in the third quarter of 2006 compared with 36.8% in 2005 primarily due to favorable adjustments aggregating $658,000 (4.6% of income before income taxes for the third quarter of 2006) for income tax rate changes relating to deferred income tax assets and liabilities, an investment tax credit refund claim in Canada and accrual-to-return adjustments.

First Nine Months of 2006 Compared with First Nine Months of 2005

Overall, sales in the first nine months of 2006 increased by 18.1% compared with 2005. Net sales (sales less freight) increased 11.2% in Film Products primarily due to growth in higher value-added products, including surface protection, elastic and apertured materials, and higher selling prices, which were driven by higher raw material costs. Net sales increased 25.1% in Aluminum Extrusions due to higher volume (up 8.5%) and selling prices. For more information on net sales and volume, see the executive summary beginning on page 15.

Consolidated gross profit (sales minus cost of goods sold and freight) as a percentage of sales decreased to 12.6% in the first nine months of 2006 from 13.1% in 2005. At Film Products, an overall higher gross profit margin was driven primarily by growth in higher value-added products, including surface protection, elastic and apertured materials. Margins also benefited from a favorable lag in the pass-through to customers of changes in resin costs (about $1 million in the first nine months of 2006 compared with $1.5 million in 2005) and a gain of $2.6 million for LIFO inventory liquidations (included in "Cost of goods sold" in the consolidated statements of income) related to the shutdown of the facility in LaGrange, Georgia. At Aluminum Extrusions, gross profit increased but the gross profit margin percentage declined primarily due to higher selling prices to cover higher aluminum costs and margin compression caused by rapidly increasing aluminum costs.

As a percentage of sales, selling, general and administrative (“SG&A”) expenses decreased to 6.0% in the first nine months of 2006 compared with 6.9% in 2005 due primarily to higher sales and the divestiture of substantially all of our interest in AFBS, Inc. (formerly known as Therics, Inc.) at the end of the second quarter of 2005.

R&D expenses declined to $6.1 million in the first nine months of 2006 from $7.2 million in 2005 primarily due to the divestiture of substantially all of our interest in AFBS.

Plant shutdowns, asset impairments and restructurings and related items in the first nine months of 2006 shown in the segment operating profit table on page 22 include:

| | • | A pretax charge of $27,000 related to severance and other employee-related costs associated with the shutdown of the films manufacturing facility in New Bern, North Carolina. |

|

In the three months ended June 30, 2005, a pretax gain on the sale of corporate real estate of $61,000 (proceeds of $151,000) is included in “Other income (expense), net” in the consolidated

|

statements of income and “Gain on the sale of corporate assets” in the operating profit by segment table on page 22.

Interest income, which is included in “Other income (expense), net” in the consolidated statements of income, was $285,000 in the second quarter of 2006 and $142,000 in 2005. Interest expense increased to $1.5 million in the second quarter of 2006 compared with $1.1 million in 2005. Average debt outstanding and interest rates were as follows:

|

|

| |

| |

|---|

| | | Three Months

Ended June 30 | | |

|---|

| | |

| |

|---|

| | (In Millions) | 2006 | | 2005 | | |

|---|

|

| |

|---|

| | Floating-rate debt with interest charged on a

rollover basis at one-month LIBOR: | | | | | | | |

| | Average outstanding debt balance | $ | 101.5 | | $ | 112.9 | | |

| | Average interest rate | | 5.9 | % | | 4.3 | % | |

| | Fixed-rate and other debt: | | | | | | | |

| | Average outstanding debt balance | $ | 5.3 | | $ | 5.6 | | |

| | Average interest rate | | 6.3 | % | | 5.2 | % | |

| |

| |

|---|

| | Total debt: | | | | | | | |

| | Average outstanding debt balance | $ | 106.8 | | $ | 118.5 | | |

| | Average interest rate | | 5.9 | % | | 4.3 | % | |

| |

| |

|---|

|

The effective tax rate declined to 37.6% in the second quarter of 2006 compared with 39.7% in 2005 primarily due to the absence of state income tax benefits accrued or expected on losses associated with AFBS, Inc. (formerly known as Therics, Inc.) in 2005.

First Six Months of 2006 Compared with First Six Months of 2005

Overall, sales in the first six months of 2006 increased by 15.5% compared with 2005. Net sales (sales less freight) increased 8.6% in Film Products primarily due to growth in higher value-added products, including surface protection, elastic and apertured materials, and higher selling prices, which were driven by higher raw material costs. Net sales increased 22.5% in Aluminum Extrusions due to higher volume (up 9.2%) and selling prices. For more information on net sales and volume, see the executive summary beginning on page 15.

Consolidated gross profit (sales minus cost of goods sold and freight) as a percentage of sales decreased to 12.8% in the first six months of 2006 from 13.0% in 2005. At Film Products, an overall higher gross profit margin was driven primarily by growth in higher value-added products, including surface protection, elastic and apertured materials. Margins also benefited from a favorable lag in the pass-through to customers of changes in resin costs (about $2.5 million in the first six months of 2006 compared with $1.5 million in 2005) and a gain of $1.4 million for LIFO inventory liquidations (included in “Cost of goods sold” in the consolidated statements of income). At Aluminum Extrusions, gross profit increased but the gross profit margin percentage declined primarily due to higher selling prices to cover higher aluminum costs and margin compression caused by rapidly increasing aluminum costs.

As a percentage of sales, selling, general and administrative (“SG&A”) expenses decreased to 5.9% in the first six months of 2006 compared with 7.0% in 2005 due primarily to higher sales and the divestiture of substantially all of our interest in AFBS, Inc. (formerly known as Therics, Inc.) at the end of the second quarter of 2005.

R&D expenses declined to $4.1 million in the first six months of 2006 from $5.4 million in 2005 primarily due to the divestiture of substantially all of our interest in AFBS.

|

Plant shutdowns, asset impairments and restructurings and related items in the first six months of 2006 shown in the segment operating profit table on page 22 include: |

|

| • · | A net pretax gain of $418,000$1.4 million associated with the shutdown of the films manufacturing facility in LaGrange, Georgia, including a gain of $1.4$2.6 million for related LIFO inventory liquidations (included in “Cost"Cost of goods sold”sold" in the consolidated statements of income), partially offset by severance and other costs of $841,000$1 million and asset impairment charges of $130,000; |

| | | |

| • · | Pretax charges of $1 million for asset impairments in Film Products; and |

| | · | A pretax charge of $920,000 related to expected future environmental costs at the aluminum extrusions facility in Newnan, Georgia (included in "Cost of goods sold" in the consolidated statements of income); |

| | • · | Pretax charges of $727,000 for severance and other employee-related costs in connection with restructurings in Film Products ($213,000) and Aluminum Extrusions ($514,000).; and |

Plant shutdowns, asset impairments and restructurings and related items in the first six months of 2005 shown in the segment operating profit table on page 22 include:

|

| | · | A pretax charge of $494,000 related to the estimated loss on the sub-lease of a portion of the AFBS (formerly Therics) facility in Princeton, New Jersey. |

Plant shutdowns, asset impairments and restructurings and related items in the first nine months of 2005 shown in the segment operating profit table on page 22 include:

| •· | A pretax charge of $10 million related to the sale or assignment of substantially all of Therics’Therics' assets, including asset impairment charges of $5.6 million, lease-related losses of $3 million and severance and other transaction-related costs of $1.4 million; |

| | | · | Pretax charges of $1.8 million related to severance and other employee-related costs associated with restructurings in Film Products ($991,000), Aluminum Extrusions ($648,000) and at corporate headquarters ($185,000; included in “Corporate expenses, net” in the segment operating profit table); |

| •· | A pretax gain of $1.6 million related to the shutdown of the films manufacturing facility in New Bern, North Carolina, including a $1.8 million gain on the sale of the facility (included in “Other"Other income (expense), net”net" in the consolidated statements of income), partially offset by shutdown-related expenses of $225,000; |

| | |

| •· | A pretax charge of $1 million for process reengineering costs associated with the implementation of a new information system in Film Products (included in “Costs"Costs of goods sold”sold" in the consolidated statements of income); |

| | |

| · | • | Pretax chargesA net pretax charge of $918,000$725,000 related to severance and other employee-related costs associated with restructuringsthe restructuring of the research and development operations in Film Products ($477,000)(of this amount, $1.2 million in pretax charges for employee relocation and Aluminum Extrusions ($441,000)recruitment is included in "Selling, general and administrative expenses" in the consolidated statements of income); |

| | |

| • | A pretax charge of $399,000 related to the shutdown of the aluminum extrusions facility in Aurora, Ontario, including $873,000 of shutdown-related costs, partially offset by the reversal to income of certain severance and employee-related accruals of $474,000; |

| | |

| •· | A pretax gain of $653,000 related to the shutdown of the films manufacturing facility in Carbondale, Pennsylvania, including a $630,000 gain on the sale of the facility (included in “Other"Other income (expense), net”net" in the consolidated statements of income), and the reversal to income of certain shutdown-related accruals of $23,000; |

| | |

| •· | A pretax gain of $508,000 for interest receivable on tax refund claims (included in “Corporate expenses, net” in the net sales and operating profit by segment table and “Other income (expense), net” in the consolidated statements of income); |

| | |

| • | A net pretax charge of $130,000$597,000 related to the shutdown of the aluminum extrusions facility in Aurora, Ontario, including $1.1 million of shutdown-related costs, partially offset by the reversal to income of certain severance and other employee-related costs associated with the restructuringaccruals of the research and development operations in Film Products (of this amount, $545,000 in pretax charges for employee relocation and recruitment is included in “Selling, R&D and general expenses” in the consolidated statements of income);$474,000; and |

| | |

| •· | Pretax charges of $205,000$322,000 for accelerated depreciation related to restructurings in Film Products. |

|

In the six months ended June 30, 2006, a pretax gain on the sale of public equity securities of $56,000 (proceeds also of $56,000) is included in “Other income (expense), net” in the consolidated statements of income and “Gain on the sale of corporate assets” in the operating profit by segment table on page 22. In the six months ended June 30, 2005, a pretax gain on the sale of corporate real estate of $61,000 (proceeds of $151,000) is included in “Other income (expense), net” in the consolidated statements of income and “Gain on the sale of corporate assets” in the operating profit by segment table on page 22. In the six months ended June 30, 2005, a pretax gain for interest receivable on tax refund claims

|

of $508,000 is included in “Other income (expense), net” in the consolidated statements of income and “Corporate expenses, net” in the operating profit by segment table on page 22.

Interest income, which is included in “Other income (expense), net” in the consolidated statements of income, was $507,000 in the first six months of 2006 and $240,000 in 2005. Interest expense increased to $2.9 million in the first six months of 2006 compared with $2.1 million in 2005. Average debt outstanding and interest rates were as follows:

|

|

|

| |

|---|

| | Six Months

Ended June 30 | | |

|---|

| |

| |

|---|

| (In Millions) | 2006 | | 2005 | | |

|---|

|

| |

|---|

| | Floating-rate debt with interest charged on a

rollover basis at one-month LIBOR: | | | | | | | |

| | Average outstanding debt balance | $ | 105.5 | | $ | 109.7 | | |

| | Average interest rate | | 5.6 | % | | 4.1 | % | |

| | Fixed-rate and other debt: | | | | | | | |

| | Average outstanding debt balance | $ | 5.5 | | $ | 5.7 | | |

| | Average interest rate | | 6.5 | % | | 5.2 | % | |

|

| |

|---|

| | Total debt: | | | | | | | |

| | Average outstanding debt balance | $ | 111.0 | | $ | 115.4 | | |

| | Average interest rate | | 5.6 | % | | 4.2 | % | |

|

| |

|---|

|

The effective tax rate declined to 38.6% in the first six months of 2006 compared with 39.8% in 2005 primarily due to the absence of state income tax benefits accrued or expected on losses associated with AFBS, Inc. (formerly known as Therics, Inc.) in 2005.

|

In the nine months ended September 30, 2006, a pretax gain on the sale of public equity securities of $56,000 (proceeds also of $56,000) is included in “Other income (expense), net” in the consolidated statements of income and “Gain on the sale of corporate assets” in the segment operating profit table on page 22. In the nine months ended September 30, 2005, a pretax gain on the sale of corporate real estate of $61,000 (proceeds of $151,000) is included in “Other income (expense), net” in the consolidated statements of income and “Gain on the sale of corporate assets” in the segment operating profit table on page 22. In the nine months ended September 30, 2005, a pretax gain for interest receivable on tax refund claims of $508,000 is included in "Other income (expense), net" in the consolidated statements of income and "Corporate expenses, net" in the segment operating profit table on page 22.

Interest income, which is included in “Other income (expense), net” in the consolidated statements of income, was $822,000 in the first nine months of 2006 and $386,000 in 2005. Interest expense increased to $4.2 million in the first nine months of 2006 compared with $3.3 million in 2005. Average debt outstanding and interest rates were as follows:

| | | | |

| | | Nine Months Ended Sept. 30 | |

| (In Millions) | | 2006 | | 2005 | |

| Floating-rate debt with interest charged on a rollover basis at one-month LIBOR: | | | | | |

| Average outstanding debt balance | | $ | 98.2 | | $ | 110.5 | |

| Average interest rate | | | 5.8 | % | | 4.3 | % |

| Fixed-rate and other debt: | | | | | | | |

| Average outstanding debt balance | | $ | 4.9 | | $ | 5.9 | |

| Average interest rate | | | 5.9 | % | | 5.3 | % |

| Total debt: | | | | | | | |

| Average outstanding debt balance | | $ | 103.1 | | $ | 116.4 | |

| Average interest rate | | | 5.8 | % | | 4.4 | % |

Business Segment Review

The following tables present Tredegar’s net sales and operating profit by segment for the three and six months ended June 30, 2006 and 2005:

|

|

Tredegar Corporation

Net Sales and Operating Profit by Segment

(In Thousands)

(Unaudited) |

| | | | | | |

|---|

| | Three Months

Ended June 30 | | Six Months

Ended June 30 | |

|---|

| |

| |

| |

|---|

| | 2006 | | 2005 | | 2006 | | 2005 | |

|---|

| |

| |

| |

| |

| |

|---|

| Net Sales | | | | | | | | | | | | | |

| Film Products | | $ | 121,405 | | $ | 111,244 | | $ | 247,736 | | $ | 227,955 | |

| Aluminum Extrusions | | | 153,836 | | | 125,963 | | | 288,995 | | | 235,929 | |

| AFBS (formerly Therics) | | | — | | | 115 | | | — | | | 252 | |

| |

| |

| |

| |

| |

|---|

| Total net sales | | | 275,241 | | | 237,322 | | | 536,731 | | | 464,136 | |

| Add back freight | | | 7,250 | | | 6,402 | | | 13,724 | | | 12,345 | |

| |

| |

| |

| |

| |

|---|

Sales as shown in the Consolidated

Statements of Income | | $ | 282,491 | | $ | 243,724 | | $ | 550,455 | | $ | 476,481 | |

| |

| |

| |

| |

| |

|---|

| | | | | | | | | | | | | | |

| Operating Profit | | | | | | | | | | | | | |

| Film Products: | | | | | | | | | | | | | |

| Ongoing operations | | $ | 13,264 | | $ | 11,396 | | $ | 28,841 | | $ | 22,974 | |

Plant shutdowns, asset impairments and

restructurings, net of gain on sale of

assets and related income from LIFO

inventory liquidations | | | 768 | | | 44 | | | (815 | ) | | 413 | |

| | | | | | | | | | | | | | |

| Aluminum Extrusions: | | | | | | | | | | | | | |

| Ongoing operations | | | 5,674 | | | 7,221 | | | 10,540 | | | 10,218 | |

Plant shutdowns, asset impairments and

restructurings | | | (405 | ) | | (202 | ) | | (514 | ) | | (840 | ) |

| | | | | | | | | | | | | | |

| AFBS (formerly Therics): | | | | | | | | | | | | | |

| Ongoing operations | | | — | | | (1,644 | ) | | — | | | (3,467 | ) |

| Loss on investment in Therics, LLC | | | — | | | — | | | (25 | ) | | — | |

| Restructurings | | | — | | | (10,049 | ) | | — | | | (10,049 | ) |

| |

| |

| |

| |

| |

|---|

| | | | | | | | | | | | | | |

| Total | | | 19,301 | | | 6,766 | | | 38,027 | | | 19,249 | |

| Interest income | | | 285 | | | 142 | | | 507 | | | 240 | |

| Interest expense | | | 1,468 | | | 1,093 | | | 2,900 | | | 2,056 | |

| Gain on sale of corporate assets | | | — | | | 61 | | | 56 | | | 61 | |

| Stock option-based compensation costs | | | 282 | | | — | | | 493 | | | | |

| Corporate expenses, net | | | 3,002 | | | 2,339 | | | 6,761 | | | 4,735 | |

| |

| |

| |

| |

| |

|---|

| Income before income taxes | | | 14,834 | | | 3,537 | | | 28,436 | | | 12,759 | |

| Income taxes | | | 5,584 | | | 1,405 | | | 10,971 | | | 5,077 | |

| |

| |

| |

| |

| |

|---|

| Net income | | $ | 9,250 | | $ | 2,132 | | $ | 17,465 | | $ | 7,682 | |

| |

| |

| |

| |

| |

|---|

The effective tax rate declined to 36.6% in the first nine months of 2006 compared with 38.4% in 2005 primarily due to favorable adjustments aggregating $658,000 (1.5% of income before income taxes for the first nine months of 2006) for income tax rate changes relating to deferred income tax assets and liabilities, an investment tax credit refund claim in Canada and accrual-to-return adjustments.

Net sales (sales less freight) and operating profit from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker of each segment for purposes of assessing performance.

Film Products

See the executive summary beginning on page 15 for discussion of operating results and planned capital expenditures for Film Products.

Aluminum Extrusions

See the executive summary beginning on page 15 for discussion of operating results and planned capital expenditures for Aluminum Extrusions.

AFBS

On June 30, 2005, substantially all of the assets of AFBS, Inc., a wholly-owned subsidiary of Tredegar (formerly known as Therics, Inc.), were sold or assigned to a newly-created limited liability company, Therics, LLC, controlled and managed by an individual not affiliated with Tredegar. AFBS received a 17.5% equity interest in Therics, LLC, valued at $170,000 and a 3.5% interest in Theken Spine, LLC, valued at $800,000, along with potential future payments based on the sale of certain products by Therics, LLC. AFBS retained substantially all of its liabilities in the transaction, which included customary indemnification provisions for pre-transaction liabilities. Tredegar has no obligation or intent to fund any future losses that may occur at Therics, LLC or Theken Spine, LLC. The ownership interest in Therics, LLC is accounted for under the equity method of accounting with losses limited to its initial carrying value of $170,000. The ownership interest in Theken Spine, LLC is accounted for under the cost method, with an impairment loss recognized and a new cost basis established for any write-down to estimated fair value, if necessary. The potential future payments due from Therics, LLC based on the sale of certain products will be recognized as income when earned.

Liquidity and Capital Resources

Changes in operating assets and liabilities from December 31, 2005 to June 30, 2006 are summarized below:

|

|

Business Segment Review

The following tables present Tredegar’s net sales and operating profit by segment for the three and nine months ended September 30, 2006 and 2005:

| | | Three Months Ended Sept. 30 | | Nine Months Ended Sept. 30 | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

Net Sales | | | | | | | | | |

| Film Products | | $ | 134,961 | | $ | 116,350 | | $ | 382,697 | | $ | 344,305 | |

| Aluminum Extrusions | | | 154,030 | | | 118,085 | | | 443,025 | | | 354,014 | |

| AFBS (formerly Therics) | | | - | | | - | | | - | | | 252 | |

| Total net sales | | | 288,991 | | | 234,435 | | | 825,722 | | | 698,571 | |

| Add back freight | | | 7,265 | | | 6,281 | | | 20,989 | | | 18,626 | |

| Sales as shown in the Consolidated Statements of Income | | $ | 296,256 | | $ | 240,716 | | $ | 846,711 | | $ | 717,197 | |

| | | | | | | | | | | | | | |

Operating Profit | | | | | | | | | | | | | |

| Film Products: | | | | | | | | | | | | | |

| Ongoing operations | | $ | 13,770 | | $ | 13,822 | | $ | 42,611 | | $ | 36,796 | |

| Plant shutdowns, asset impairments and restructurings, net of gain on sale of assets and related income from LIFO inventory liquidations | | | 1,022 | | | (1,225 | ) | | 207 | | | (812 | ) |

| | | | | | | | | | | | | | |

| Aluminum Extrusions: | | | | | | | | | | | | | |

| Ongoing operations | | | 5,407 | | | 4,362 | | | 15,947 | | | 14,580 | |

| Plant shutdowns, asset impairments and restructurings | | | (920 | ) | | (406 | ) | | (1,434 | ) | | (1,246 | ) |

| | | | | | | | | | | | | | |

| AFBS (formerly Therics): | | | | | | | | | | | | | |

| Ongoing operations | | | - | | | - | | | - | | | (3,467 | ) |

| Loss on investment in Therics, LLC | | | - | | | (91 | ) | | (25 | ) | | (91 | ) |

| Plant shutdowns, asset impairments and restructurings | | | (494 | ) | | - | | | (494 | ) | | (10,049 | ) |

| | | | | | | | | | | | | | |

| Total | | | 18,785 | | | 16,462 | | | 56,812 | | | 35,711 | |

| Interest income | | | 315 | | | 146 | | | 822 | | | 386 | |

| Interest expense | | | 1,331 | | | 1,196 | | | 4,231 | | | 3,252 | |

| Gain on sale of corporate assets | | | - | | | - | | | 56 | | | 61 | |

| Stock option-based compensation costs | | | 215 | | | - | | | 708 | | | - | |

| Corporate expenses, net | | | 3,148 | | | 3,290 | | | 9,909 | | | 8,025 | |

| Income before income taxes | | | 14,406 | | | 12,122 | | | 42,842 | | | 24,881 | |