Washington, D.C. 20549

Commvault Systems, Inc.

Commvault Systems, Inc. and its subsidiaries (“Commvault”("Commvault," "we," "us," or the “Company”"our") is a provider of data and information management software applications and related services. The Company develops, markets and sells a suite of software applications and services, primarily in North America, Europe, Australia and Asia, that provides its customers with data protection solutions supporting all major operating systems, applications, and databases on virtual and physical servers, NAS shares, cloud-based infrastructures, and mobile devices; management through a single console; multiple protection methods including backup and archive, snapshot management, replication, and content indexing for eDiscovery; efficient storage management using deduplication for disk, tape and cloud; integration with the industry's top storage arrays; complete virtual infrastructure management supporting multiple hypervisors; security capabilities to limit access to critical data; policy based data management; and an end-user experience that allows them to protect, find and recover their own data using common tools such as web browsers, Microsoft Outlook and File Explorer. In fiscal 2018 the Company also started selling appliances that integrate the Company's software with hardware and address a wide-range of business needs and use cases, ranging from support for remote or branch offices with limited IT staff up to large corporate data centers. The Company also provides its customers with a broad range of professionalcyber resiliency platform that helps them secure, defend and customer support services.recover their most precious asset, their data. We provide these products and services for their data across the following environments: on-premises, hybrid, and multi-cloud. Our cyber resiliency offerings are delivered via self-managed software, software-as-a-service ("SaaS"), integrated appliances, or managed by partners. Customers use our technology to protect themselves from threats like ransomware and recover their data efficiently.

The preparation of financial statements and related disclosures in conformity with U.S. GAAP requires management to make judgments and estimates that affect the amounts reported in the Company’sour consolidated financial statements and the accompanying notes. The Company bases itsWe base our estimates and judgments on historical experience and on various other assumptions that it believeswe believe are reasonable under the circumstances. The amounts of assets and liabilities reported in the Company’sour balance sheets and the amounts of revenues and expenses reported for each of itsour periods presented are affected by estimates and assumptions, which are used for, but not limited to, the accounting for revenue recognition, income taxes and related reserves, stock-based compensationdeferred commissions and accounting for research and development costs.goodwill. Actual results could differ from those estimates.

|

| | | | | | | | | | | |

| | Three Months Ended December 31, 2016 |

| | Unaudited |

| | As Reported | | Adjustments | | Adjusted for Adoption of ASC 606 |

| Revenues: | | | | | |

| Software and products | $ | 77,322 |

| | $ | 1,333 |

| | $ | 78,655 |

|

| Services | 88,519 |

| | (113 | ) | | 88,406 |

|

| Total revenues | 165,841 |

| | 1,220 |

| | 167,061 |

|

| Total cost of revenues | 21,166 |

| | — |

| | 21,166 |

|

| Gross margin | 144,675 |

| | 1,220 |

| | 145,895 |

|

| Total operating expenses | 143,433 |

| | (1,380 | ) | | 142,053 |

|

| Income from operations | 1,242 |

| | 2,600 |

| | 3,842 |

|

| Interest expense | (233 | ) | | — |

| | (233 | ) |

| Interest income | 312 |

| | — |

| | 312 |

|

| Equity in loss of affiliate | (300 | ) | | — |

| | (300 | ) |

| Income before income taxes | 1,021 |

| | 2,600 |

| | 3,621 |

|

| Income tax expense | 1,063 |

| | 599 |

| | 1,662 |

|

| Net income (loss) | $ | (42 | ) | | $ | 2,001 |

| | $ | 1,959 |

|

Commvault Systems, IncInc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Concentration of Credit Risk

We grant credit to customers in a wide variety of industries worldwide and generally do not require collateral. Historically, credit losses relating to these customers have been minimal. |

| | | | | | | | | | | |

| | Nine Months Ended December 31, 2016 |

| | Unaudited |

| | As Reported | | Adjustments | | Adjusted for Adoption of ASC 606 |

| Revenues: | | | | | |

| Software and products | $ | 211,716 |

| | $ | 757 |

| | $ | 212,473 |

|

| Services | 265,871 |

| | (71 | ) | | 265,800 |

|

| Total revenues | 477,587 |

| | 686 |

| | 478,273 |

|

| Total cost of revenues | 63,818 |

| | — |

| | 63,818 |

|

| Gross margin | 413,769 |

| | 686 |

| | 414,455 |

|

| Total operating expenses | 415,832 |

| | (1,933 | ) | | 413,899 |

|

| Income (loss) from operations | (2,063 | ) | | 2,619 |

| | 556 |

|

| Interest expense | (724 | ) | | — |

| | (724 | ) |

| Interest income | 843 |

| | — |

| | 843 |

|

| Equity in loss of affiliate | (544 | ) | | — |

| | (544 | ) |

| Income (loss) before income taxes | (2,488 | ) | | 2,619 |

| | 131 |

|

| Income tax expense | 160 |

| | 676 |

| | 836 |

|

| Net income (loss) | $ | (2,648 | ) | | $ | 1,943 |

| | $ | (705 | ) |

|

| | | | | | | | | | | |

| | March 31, 2017 |

| | Unaudited Balance Sheet Data |

| | As Reported | | Adjustments | | Adjusted for Adoption of ASC 606 |

| Current assets: | | | | | |

| Trade accounts receivable | $ | 132,761 |

| | $ | 7,323 |

| | $ | 140,084 |

|

| Total current assets | $ | 598,736 |

| | $ | 7,323 |

| | $ | 606,059 |

|

| Deferred tax assets, net | $ | 61,018 |

| | $ | (10,790 | ) | | $ | 50,228 |

|

| Deferred commissions | $ | — |

| | $ | 30,378 |

| | $ | 30,378 |

|

| Total assets | $ | 802,967 |

| | $ | 26,911 |

| | $ | 829,878 |

|

| Current Liabilities: | | | | | |

| Deferred revenue | $ | 206,777 |

| | $ | 2,322 |

| | $ | 209,099 |

|

| Total current liabilities | $ | 285,595 |

| | $ | 2,322 |

| | $ | 287,917 |

|

| Other liabilities | $ | 3,934 |

| | $ | 292 |

| | $ | 4,226 |

|

| Accumulated deficit | $ | (239,974 | ) | | $ | 24,297 |

| | $ | (215,677 | ) |

| Total stockholders’ equity | $ | 442,635 |

| | $ | 24,297 |

| | $ | 466,932 |

|

| Total liabilities and stockholders’ equity | $ | 802,967 |

| | $ | 26,911 |

| | $ | 829,878 |

|

Share-Based Compensation

In March 2016,Sales through our distribution agreement with Arrow Enterprise Computing Solutions, Inc. (“Arrow”) totaled 35% and 38% of total revenues for the FASB issued ASU No. 2016-09, Improvements to Employee Share-Based Payment Accounting (Topic 718), which simplifies the accountingthree months ended December 31, 2023 and 2022, respectively, and 36% and 37% for share-based payment transactions, including related accounting for income taxes, forfeitures, and classification in the statement of cash flows. The Company adopted the guidance prospectively effective April 1, 2017.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

The guidance requires excess tax benefits and tax deficiencies to be recorded as income tax benefit or expense in the statement of income when the awards vest or are settled, and eliminates the requirement to reclassify cash flows related to excess tax benefits from operating activities to financing activities on the statement of cash flows. In the nine months ended December 31, 2017, the Company recognized $7,8842023 and 2022, respectively. Arrow accounted for approximately 31% and 34% of such excess tax benefits,total accounts receivable as of December 31, 2023 and pursuantMarch 31, 2023, respectively.

Fair Value of Financial Instruments

The carrying amounts of our cash, cash equivalents, accounts receivable and accounts payable approximate their fair values due to the adopted guidance,short-term maturity of these instruments. Our cash equivalents balance consists primarily of U.S. Treasury Bills with maturities of one month or less.

The following table summarizes the composition of our financial assets measured at fair value at December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Cash equivalents | $ | 24,903 | | | — | | | — | | | $ | 24,903 | |

There were no financial assets measured at fair value on a recurring basis as of December 31, 2022.

Equity Securities Accounted for at Net Asset Value

We held equity interests in private equity funds of $7,154 as of December 31, 2023, which are accounted for under the net loss decreased by $7,884, or $0.17 per basic and diluted share. Amounts previously recorded to Additional paid-in capital related to excess tax benefits prior to April 1, 2017 remain in Stockholders' equity. Cash flows related to excess taxes prior to April 1, 2017 remain classifiedasset value practical expedient as financing cash flows. In addition, the standard allows the Company to repurchase more of an employee’s vesting shares for tax withholding purposes without triggering liability accounting, and provides an accounting policy election to account for forfeitures as they occur. The Company has elected to account for forfeitures as they occur. The cumulative impact of the election to account for forfeitures as they are incurred is included as an adjustment to accumulated deficit.

Leases

In February 2016, the FASB issued ASU 2016-02 “Leases (Topic 842)” (“ASU 2016-02”)permitted under ASC 820, Fair Value Measurement. Under ASU 2016-02, a lessee will recognize in the balance sheet a liability to make lease payments (the lease liability) and a right-to-use asset representing its right to use the underlying asset for the lease term. The amendments of this ASU are effective for the Company's fiscal 2020, with early adoption permitted. The Company is currently assessing the impact the adoption of ASU 2016-02 will have on the financial statements.

Trade and Other Receivables

Trade and other receivables are primarily comprised of trade receivables that are recorded at the invoice amount, net of an allowance for doubtful accounts, which is not material. Unbilled receivables represent amounts for which revenue has been recognized but which have not yet been invoiced to the customer. The current portion of unbilled receivables is included in Trade accounts receivable on the consolidated balance sheet. Long term unbilled receivablesThese investments are included in Other assets.

Sales Tax

other assets in the accompanying consolidated balance sheets. The Company records revenue net asset values of sales tax.

Shippingthese investments are determined using quarterly capital statements from the funds, which are based on our contributions to the funds, allocation of profit and Handling Costs

Shippingloss and handling costschanges in fair value of the underlying fund investments. Changes in fair value as reported on the capital statements are includedrecorded through the consolidated statements of operations as non-operating income or expense. These private equity funds focus on making investments in costkey technology sectors, principally by investing in companies at expansion capital and growth equity stages. We had total unfunded commitments in private equity funds of revenues for all periods presented$3,010 as of December 31, 2023.

Deferred Commissions Cost

Sales commissions, bonuses, and related payroll taxes earned by the Company'sour employees are considered incremental and recoverable costs of obtaining a contract with a customer. The Company’sOur typical contracts include performance obligations related to term-based software licenses, SaaS offerings, perpetual software licenses, software updates, and customer support and other professional services.support. In these contracts, incremental costs of obtaining a contract are allocated to the performance obligations based on the relative estimated standalone selling prices and then recognized on a systematic basis that is consistent with the transfer of the goods or services to which the asset relates. The Company doesWe do not pay commissions on annual renewals of contracts for software updates and customer support contracts for perpetual licenses. The costs allocated to software and products are expensed at the time of sale, when revenue for the functional software license or appliance is recognized. The costs allocated to software updates and customer support for perpetual licenses are amortized ratably over a period of approximately five years, the expected period of benefit of the asset capitalized. The CompanyWe currently estimatesestimate a period of five years is appropriate based on consideration of historical average customer life and the estimated useful life of the underlying software or appliance sold as part of the transaction. The commission paid on the renewal of subscription arrangements is not commensurate with the commission paid on the initial purchase. As a result, the cost of commissions allocated to SaaS offerings, software updates and customer support on the initial term-based software license transactions are amortized over a period of approximately five years, consistent with the accounting for these costs associated with perpetual licenses. The costs of commissions allocated to SaaS offerings, software updates and support for the renewal of term-based software licenses is limited to the contractual period of the arrangement, as we pay a commensurate renewal commission upon the next renewal of the subscription software license and related updates and support.

Commvault Systems, Inc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

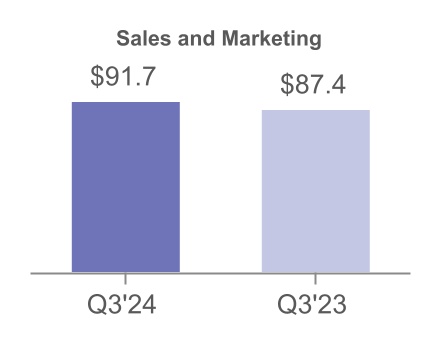

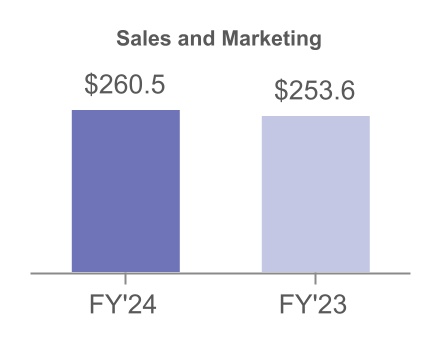

The incremental costs attributable to professional services are generally amortized within one quarter following the date of the related software or appliance sale, which is typicallyover the period the related professional services are provided and revenue is recognized. Amortization expense related to these costs is included in Salessales and marketing expenses in the accompanying condensed consolidated statements of loss.operations.

Costs related to software updates and support for term-based, or subscription software licenses, are limited to the contractual period of the arrangement as the Company intends to pay a commensurate commission upon renewal of the subscription license and related updates and support.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Deferred Revenue

Deferred revenues represent amounts collected from, or invoiced to, customers in excess of revenues recognized. This results primarily from the billing of annual customer support agreements, and billings for other professional services fees that have not yet been performed by the Company. The value of deferred revenues will increase or decrease based on the timing of invoices and recognition of revenue.

Related Party Transactions

During the first quarter of fiscal 2018, one of our Directors, Joseph F. Eazor, was hired as the CEO of Rackspace, Inc ("Rackspace"). Prior to his appointment as CEO, the Company completed the sale of $4,212 of software and related services to Rackspace. Total recognized revenue related to Rackspace in the first nine months of fiscal 2018 was $4,950. The outstanding accounts receivable from this customer as of December 31, 2017 is $1,910.

Concentration of Credit Risk

The Company grants credit to customers in a wide variety of industries worldwide and generally does not require collateral. Credit losses relating to these customers have been minimal.

Sales through the Company’s distribution agreement with Arrow Enterprise Computing Solutions, Inc. (“Arrow”) totaled approximately 37% of total revenues for the nine months ended December 31, 2017 and 2016. Arrow accounted for approximately 40% of total accounts receivable as of both December 31, 2017 and March 31, 2017.

Fair Value of Financial Instruments

The carrying amounts of the Company’s cash and cash equivalents, accounts receivable and accounts payable approximate their fair values due to the short-term maturity of these instruments. The Company’s cash equivalents balance consists primarily of money market funds. The Company’s short-term investments balance consists of U.S. Treasury Bills with maturities of one year or less. The Company accounts for its short-term investments as held to maturity.

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for such asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value should maximize the use of observable inputs and minimize the use of unobservable inputs. To measure fair value, the Company uses the following fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Inputs other than Level 1 that are observable for the asset or liability, either directly or indirectly, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data by correlation or other means.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The following table summarizes the composition of the Company’s financial assets measured at fair value at December 31, 2017 and March 31, 2017:

|

| | | | | | | | | | | | | | |

| December 31, 2017 | | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash equivalents | | $ | 41,672 |

| | — |

| | — |

| | $ | 41,672 |

|

| Short-term investments | | $ | — |

| | 131,457 |

| | — |

| | $ | 131,457 |

|

|

| | | | | | | | | | | | | | |

| March 31, 2017 | | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash equivalents | | $ | 70,190 |

| | — |

| | — |

| | $ | 70,190 |

|

| Short-term investments | | $ | — |

| | 120,989 |

| | — |

| | $ | 120,989 |

|

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Income Taxes

The Company accounts for income taxes in accordance with ASC Topic 740, “Income Taxes” (“ASC 740”). The provision for income taxes and effective tax rates are calculated by legal entity and jurisdiction and are based on a number of factors, including the level of pre-tax earnings, income tax planning strategies, differences between tax laws and accounting rules, statutory tax rates and credits, uncertain tax positions and valuation allowances. The Company uses significant judgment and estimates in evaluating tax positions. The effective tax rate in a given financial statement period may be materially impacted by changes in the mix and level of earnings by taxing jurisdiction.

Under ASC 740, deferred income taxes arise from temporary differences between the tax basis of assets and liabilities and their reported amounts. Valuation allowances are established when, in the Company's judgment, it is more likely than not that deferred tax assets will not be realized. In assessing the need for a valuation allowance, the Company weighs the available positive and negative evidence, including historical levels of pre-tax income, legislative developments, expectations and risks associated with estimates of future pre-tax income, and prudent and feasible tax planning strategies.

3. Revenue

The Company accounts for revenue in accordance with ASC Topic 606, Revenue from Contracts with Customers, which was adopted on April 1, 2017, using the full retrospective method.

The Company derivesWe derive revenues from two primary sources:various sources, including subscriptions, perpetual software licenses, customer support contracts and other services.

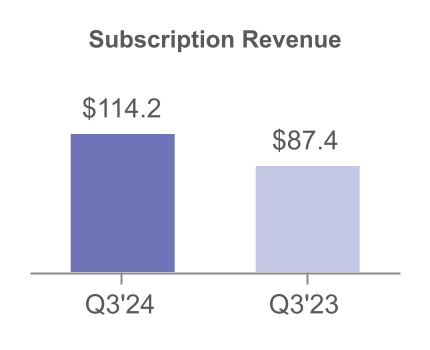

Subscription

Subscription includes the revenues derived from time-based arrangements, including the software portion of term-based licenses and SaaS offerings. The software component of term-based licenses is typically recognized when the software is delivered or made available for download. The term of our subscription arrangements is typically one to three years, but can range between one and five years. For SaaS offerings, revenue is generally recognized ratably over the contract term beginning on the date that the service is made available to the customer.

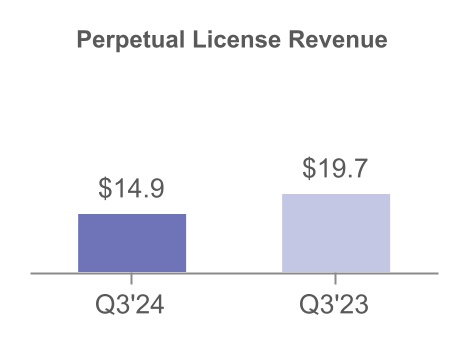

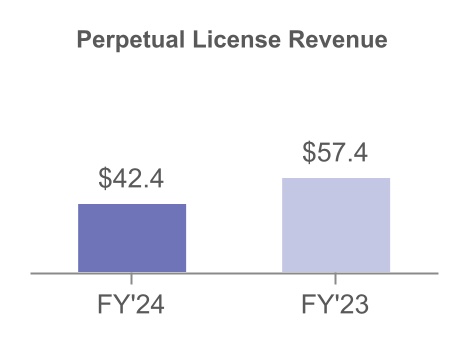

Perpetual License

Perpetual license includes the revenues from the sale of perpetual software licenses. Perpetual software license revenue is typically recognized when the software is delivered or made available for download.

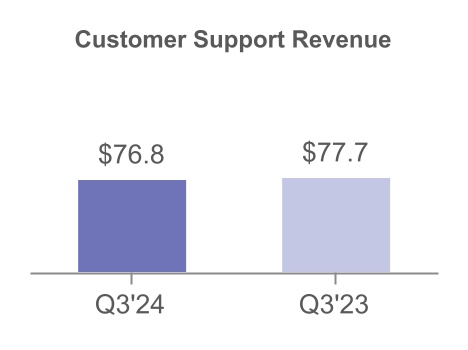

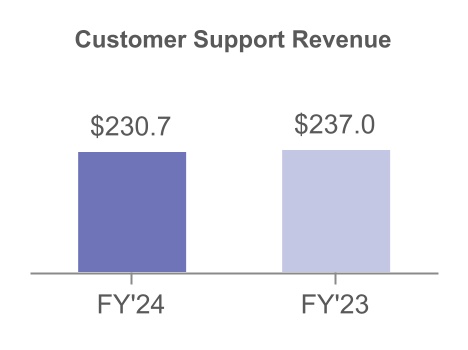

Customer Support

Customer support includes revenues associated with support contracts tied to our software products. Customer support includes software updates on a when-and-if-available basis, telephone support, integrated web-based support, and other premium support offerings, for both subscription software and products, and services. Software and products revenue includes the Company'sperpetual software and integrated appliances that combine the Company's software with hardware. Services includelicense arrangements. We sell our customer support (software updatescontracts as a percentage of net software purchases. Customer support revenue is recognized ratably over the term of the customer support agreement, which is typically one year on our perpetual licenses and technical support), consulting,over the term on our term-based licenses.

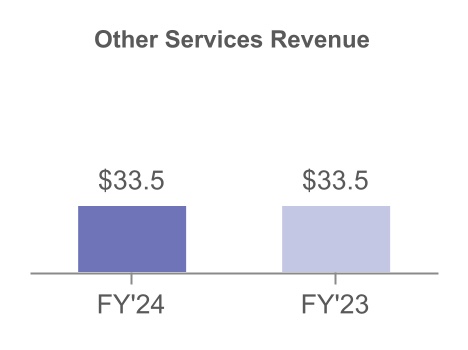

Other Services

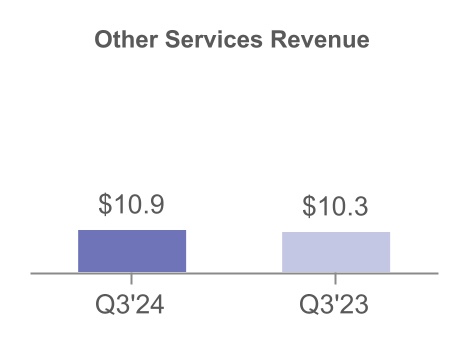

Other services consist primarily of revenues related to professional service offerings, including consultation, assessment and design, services, installation services, and customer education. A typical contract includes both licenses and services.Revenues related to other professional services are typically recognized as the services are performed.

The Company’sWe do not customize our software licenses typically provide for a(both perpetual right to use the Company’s software. The Company also sells term-based software licenses that expire, which are referred to as subscription arrangements. The Company does not customize its softwareand term-based) and installation services are not required. The software isSoftware licenses are delivered before related services are provided and isare functional without professional services, updates and technical support. The Company hasWe have concluded that itsour software license islicenses (both perpetual and term-based) are functional intellectual property that is distinct, as the user can benefit from the software on its own. Software revenue isRevenues for both perpetual and term-based licenses are typically recognized when the software is delivered and/or made available for download as this is the point the user of the software can direct the use of, and obtain substantially all of the remaining benefits from the functional intellectual property. The Company doesWe do not recognize softwaresubscription revenue related to the renewal of that subscription software licenses earlier than the beginning of the new subscription period.

In fiscal 2018, the CompanyWe also started sellingoffer appliances that integrate the Company'sour software with hardware and address a wide-range of business needs and use cases, ranging from support for remote or branch offices with limited IT staff up to large corporate data centers. RevenueOur appliances are almost exclusively sold via a software only model in which we sell software to a third party, which assembles an integrated appliance that is sold to end user customers. As a result, the revenues and costs associated with hardware are usually not included in our financial statements.

Commvault Systems, Inc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Our typical performance obligations include the following:

| | | | | | | | | | | |

| Performance Obligation | When Performance Obligation

is Typically Satisfied | When Payment is

Typically Due | How Standalone Selling Price is

Typically Estimated |

| Subscription |

| Term-based software licenses | Upon shipment or made available for download (point in time) | Within 90 days of shipment except for certain subscription licenses which are paid for over time | Residual approach |

| Software-as-a-service (SaaS) | Ratably over the course of the contract (over time) | Annually or at the beginning of the contract period | Observable in transactions without multiple performance obligations |

| Perpetual License |

| Perpetual software licenses | Upon shipment or made available for download (point in time) | Within 90 days of shipment | Residual approach |

| Customer Support |

| Software updates | Ratably over the course of the support contract (over time) | At the beginning of the contract period | Observable in renewal transactions |

| Customer support | Ratably over the course of the support contract (over time) | At the beginning of the contract period | Observable in renewal transactions |

| Other Services |

| Other professional services (except for education services) | As work is performed (over time) | Within 90 days of services being performed | Observable in transactions without multiple performance obligations |

| Education services | When the class is taught (point in time) | Within 90 days of services being performed | Observable in transactions without multiple performance obligations |

Judgments related to appliances is recognized when control of the appliances passes to the customer; typically upon delivery. Revenue to date related to appliances has not been significant.

Services revenue includes revenue from customer support and other professional services. Customer support includes software updates on a when-and-if-available basis, telephone support, integrated web-based support and bug fixes or patches. The Company sells its customer support contracts as a percentage of net software purchases the support is related to. Customer support revenue is recognized ratably over the term of the customer support agreement, which is typically one year.

The Company’s other professional services include consulting, assessment and design services, installation services and customer education. Customer education services include courses taught by the Company’s instructors or third-party contractors. Revenue related to other professional services and customer education services is typically recognized as the services are performed.

recognition

Most of the Company’sour contracts with customers contain multiple performance obligations. For these contracts, the Company accountswe evaluate and account for individual performance obligations separately if they are determined to be distinct. The transaction price is allocated to the separate performance obligations on a relative standalone selling price basis. Standalone selling prices of software licenses (both perpetual and appliancesterm-based) are typically estimated using the residual approach. Standalone selling prices offor SaaS, customer support contracts, and other services are typically estimated based on observable transactions when these services are sold on a standalone basis. We recognize revenue net of sales tax.

Disaggregation of Revenues

We disaggregate revenues from contracts with customers into geographical regions. Our Americas region includes the United States, Canada, and Latin America. Our International region primarily includes Europe, Middle East, Africa, Australia, India, Southeast Asia, and China.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Americas | $ | 125,052 | | | $ | 108,107 | | | $ | 367,476 | | | $ | 346,907 | |

| International | 91,756 | | | 86,967 | | | 248,479 | | | 234,205 | |

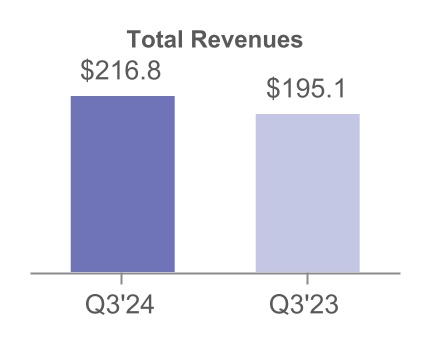

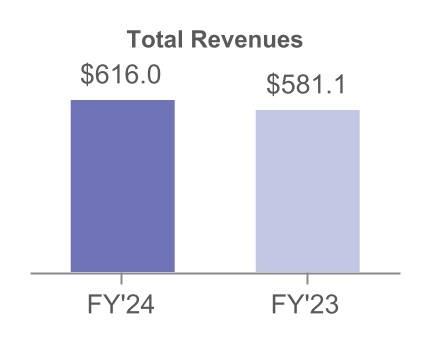

| Total revenues | $ | 216,808 | | | $ | 195,074 | | | $ | 615,955 | | | $ | 581,112 | |

Commvault Systems, IncInc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Remaining Performance Obligations

Remaining performance obligations represent expected future revenues from existing contracts where performance obligations are unsatisfied or partially unsatisfied at the end of the reporting period. As of December 31, 2023, our remaining performance obligations (inclusive of deferred revenues) were $581,346 of which approximately 64% is expected to be recognized as revenue over the next 12 months and the remainder recognized thereafter. The vast majority of these revenues consist of customer support, other services and SaaS arrangements. Other services consists primarily of professional services revenue which is contingent upon a number of factors, including customers' needs and scheduling.

The Company’s typicalamount of revenue recognized in the period that was included in the opening deferred revenue balance was $70,164 and $263,529 for the three and nine months ended December 31, 2023, respectively. The amount of revenue recognized from performance obligations include the following:satisfied in prior periods was not significant.

|

| | | |

Performance Obligation | When Performance Obligation

is Typically Satisfied

| When Payment is

Typically Due

| How Standalone Selling Price is

Typically Estimated

|

Software and Products Revenue |

Software Licenses | Upon shipment or made available for download (point in time) | Within 90 days of shipment except for certain subscription licenses which are paid for over time | Residual approach |

Appliances | When control of the appliances passes to the customer; typically upon delivery | Within 90 days of delivery except for certain subscriptions which are paid for over time | Residual approach |

Customer Support Revenue |

Software Updates | Ratably over the course of the support contract (over time) | At the beginning of the contract period | Observable in renewal transactions |

Customer Support | Ratably over the course of the support contract (over time) | At the beginning of the contract period | Observable in renewal transactions |

Professional Services |

Other Professional Services (except for education services) | As work is performed (over time) | Within 90 days of services being performed | Observable in transactions without multiple performance obligations |

Education Services | When the class is taught (point in time) | Within 90 days of services being performed | Observable in transactions without multiple performance obligations |

Disaggregation of Revenue

The Company disaggregates revenue from contracts with customers into the nature of the products and services and geographical regions. The geographic regions that are tracked are the Americas (United States, Canada, Latin America), EMEA (Europe, Middle East, Africa) and APAC (Australia, New Zealand, Southeast Asia, China). The Company operates in one segment.

|

| | | | | | | | | | | | |

| | Three Months Ended December 31, 2017 |

| | Americas | EMEA | APAC | Total |

| Software and Products Revenue | $ | 40,783 |

| $ | 29,472 |

| $ | 11,188 |

| $ | 81,443 |

|

| Customer Support Revenue | 59,225 |

| 19,478 |

| 9,151 |

| 87,854 |

|

| Professional Services | 6,287 |

| 2,944 |

| 1,838 |

| 11,069 |

|

| Total Revenue | $ | 106,295 |

| $ | 51,894 |

| $ | 22,177 |

| $ | 180,366 |

|

|

| | | | | | | | | | | | |

| | Three Months Ended December 31, 2016 |

| | Americas | EMEA | APAC | Total |

| Software and Products Revenue | $ | 41,804 |

| $ | 26,228 |

| $ | 10,623 |

| $ | 78,655 |

|

| Customer Support Revenue | 54,738 |

| 16,323 |

| 8,079 |

| 79,140 |

|

| Professional Services | 5,385 |

| 2,574 |

| 1,307 |

| 9,266 |

|

| Total Revenue | $ | 101,927 |

| $ | 45,125 |

| $ | 20,009 |

| $ | 167,061 |

|

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

|

| | | | | | | | | | | | |

| | Nine Months Ended December 31, 2017 |

| | Americas | EMEA | APAC | Total |

| Software and Products Revenue | $ | 121,498 |

| $ | 74,293 |

| $ | 32,433 |

| $ | 228,224 |

|

| Customer Support Revenue | 173,619 |

| 55,214 |

| 26,688 |

| 255,521 |

|

| Professional Services | 17,113 |

| 8,248 |

| 5,372 |

| 30,733 |

|

| Total Revenue | $ | 312,230 |

| $ | 137,755 |

| $ | 64,493 |

| $ | 514,478 |

|

|

| | | | | | | | | | | | |

| | Nine Months Ended December 31, 2016 |

| | Americas | EMEA | APAC | Total |

| Software and Products Revenue | $ | 121,527 |

| $ | 61,014 |

| $ | 29,932 |

| $ | 212,473 |

|

| Customer Support Revenue | 162,223 |

| 49,385 |

| 24,237 |

| 235,845 |

|

| Professional Services | 17,770 |

| 8,143 |

| 4,042 |

| 29,955 |

|

| Total Revenue | $ | 301,520 |

| $ | 118,542 |

| $ | 58,211 |

| $ | 478,273 |

|

Information about Contract Balances

Amounts collected in advance of services being provided are accounted for as deferred revenue. Nearly all of the Company'sour deferred revenue balance is related to services revenue, primarily customer support, contracts.SaaS arrangements, and other services.

In some arrangements the Company allowswe allow customers to pay for term basedterm-based software licenses and products over the term of the software license. The Company refers to these as subscription transactions. Amounts recognized as revenue in excess of amounts billed are recorded as unbilled receivables. Unbilled receivables, which are anticipated to be invoiced in the next twelve months, are included in Accountsaccounts receivable on the consolidated balance sheet. Long termsheets. Long-term unbilled receivables are included in Otherother assets. The opening and closing balances of the Company’sour accounts receivable, unbilled receivables, and deferred revenues are as follows:

| | | | | | | | | | | | | | | | | |

| Accounts receivable | Unbilled receivable

(current) | Unbilled receivable

(long-term) | Deferred revenue (current) | Deferred revenue (long-term) |

| Opening balance as of March 31, 2023 | $ | 188,736 | | $ | 21,705 | | $ | 9,867 | | $ | 307,562 | | $ | 174,393 | |

| Increase | 8,829 | | 4,440 | | 5,026 | | 17,938 | | 9,858 | |

| Ending balance as of December 31, 2023 | $ | 197,565 | | $ | 26,145 | | $ | 14,893 | | $ | 325,500 | | $ | 184,251 | |

|

| | | | | | | | | | | | | | | |

| | Accounts Receivable | Unbilled Receivable (current) | Unbilled Receivable (long-term) | Deferred Revenue (current) | Deferred Revenue (long-term) |

| Opening Balance as of March 31, 2017 | $ | 132,711 |

| $ | 7,373 |

| $ | — |

| $ | 209,099 |

| $ | 70,803 |

|

| Increase/(decrease), net | 8,750 |

| (2,084 | ) | 1,419 |

| 18,433 |

| 9,232 |

|

| Ending Balance as of December 31, 2017 | $ | 141,461 |

| $ | 5,289 |

| $ | 1,419 |

| $ | 227,532 |

| $ | 80,035 |

|

The increase in accounts receivable (inclusive of unbilled receivables) is primarily a result of an increase in software and products revenuerevenues relative to the fourth quarter of the prior fiscal year. The increase in deferred revenue is primarily the result of an increase in deferred customer support revenueSaaS contracts which are billed upfront but recognized ratably over the contract period, partially offset by a decrease in professional service contracts.

4. Assets Held for Sale

During the fourth quarter of fiscal 2023, we entered into an exclusive agreement to sell our owned corporate headquarters in Tinton Falls, New Jersey for $40,000 in cash consideration and determined the assets and land related to softwareheadquarters met the criteria for classification as assets held for sale in accordance with ASC 360, Impairment and products revenue transactions and customer support renewals during the first nine monthsDisposal of fiscal 2018, most of which will be recognized over the courseLong-Lived Assets ("ASC 360"). The property's estimated fair value, less estimated costs to sell, is $38,680. Upon closing of the next twelve months.

The amount of revenue recognized in the period that was included in the opening deferred revenue balance was $86,756 and $248,352transaction, we will enter into a lease for the three and nine months ended December 31, 2017, respectively. The vast majority of this revenue consists of customer support arrangements. The amount of revenue recognized from performance obligations satisfied in prior periods was not material.

Remaining Performance Obligations

In addition to the amounts included in deferred revenue as of December 31, 2017, approximately $18,658 of revenue may be recognized from remaining performance obligations, of which $736 was related to software and products. The Company expects the software and products revenue to be recognized next quarter. The majoritya portion of the services revenue is related to other professional services which may be recognized over the next twelve months but is contingent upon a number of factors, including customers’ needs and schedules.premises.

Commvault Systems, IncInc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Subsequent Event

4. PropertyAs of January 31, 2024, the sale of our owned corporate headquarters has not yet been finalized and Equipment

Property and equipment consistthe exclusivity of the following:

|

| | | | | | | | |

| | | December 31, | | March 31, |

| | | 2017 | | 2017 |

| Land | | $ | 9,445 |

| | $ | 9,445 |

|

| Buildings | | 103,244 |

| | 103,244 |

|

| Computers, servers and other equipment | | 38,412 |

| | 35,274 |

|

| Furniture and fixtures | | 15,656 |

| | 14,912 |

|

| Leasehold improvements | | 9,254 |

| | 7,040 |

|

| Purchased software | | 1,494 |

| | 1,335 |

|

| Construction in process | | 749 |

| | 1,147 |

|

| | | 178,254 |

| | 172,397 |

|

| Less: Accumulated depreciation and amortization | | (48,622 | ) | | (40,078 | ) |

| | | $ | 129,632 |

| | $ | 132,319 |

|

The Company recorded depreciationBoard of Directors reconfirmed their approval of the sale at the January 2024 meeting and amortization expensewe believe the sale will be completed in calendar year 2024. All of $8,257the held for sale criteria are still met, and $7,384 for the nine months ended December 31, 2017assets are properly classified as such on the consolidated balance sheets.

Additionally, we have assessed whether there are any indicators of impairment and 2016, respectively.have concluded that the current carrying amount represents the estimated fair value, less estimated costs to sell, and no additional remeasurement should be recorded.

5. Net Income (Loss) per Common Share

Basic net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of common shares during the period. Diluted net income (loss) per share is computed using the weighted average number of common shares and, if dilutive, potential common shares outstanding during the period. Potential common shares consist of the incremental common shares issuable upon the exercise of stock options, vesting of restricted stock units, and shares to be purchased under the Employee Stock Purchase Plan.Plan ("ESPP"), and the exercise of stock options. The dilutive effect of such potential common shares is reflected in diluted earnings per share by application of the treasury stock method.

The following table sets forth the reconciliation of basic and diluted net income (loss) per common share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Nine Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | | $ | 17,140 | | | $ | (310) | | | $ | 42,786 | | | $ | 7,719 | |

| Basic net income (loss) per common share: | | | | | | | | |

| Basic weighted average shares outstanding | | 43,862 | | | 44,712 | | | 43,956 | | | 44,738 | |

| Basic net income (loss) per common share | | $ | 0.39 | | | $ | (0.01) | | | $ | 0.97 | | | $ | 0.17 | |

| Diluted net income (loss) per common share: | | | | | | | | |

| Basic weighted average shares outstanding | | 43,862 | | | 44,712 | | | 43,956 | | | 44,738 | |

| Dilutive effect of stock options and restricted stock units | | 937 | | | — | | | 1,064 | | | 1,072 | |

| Diluted weighted average shares outstanding | | 44,799 | | | 44,712 | | | 45,020 | | | 45,810 | |

| Diluted net income (loss) per common share | | $ | 0.38 | | | $ | (0.01) | | | $ | 0.95 | | | $ | 0.17 | |

| | | | | | | | |

The diluted weighted average shares outstanding exclude outstanding stock options, restricted stock units, performance stock options, performance restricted stock units, and shares to be purchased under the employeeESPP and outstanding stock purchase planoptions totaling approximately 7,247121 and 1,8793,921 for the three months ended December 31, 20172023 and 20162022, respectively, and 7,398505 and 8,346674 for the nine months ended December 31, 20172023 and 2016,2022, respectively, because the effect would have been anti-dilutive.

6. Commitments and Contingencies

We do not believe that we are currently party to any pending legal action that could reasonably be expected to have a material adverse effect on our business or operating results.

Commvault Systems, IncInc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

7. Capitalization

6. CommitmentsOur stock repurchase program has been funded by our existing cash and Contingencies

In the normal course of its business, the Company may be involved in various claims, negotiations and legal actions.

On September 10, 2014, a purported class action complaint was filed in the United States District Court for the District of New Jersey against the Company, its Chief Executive Officer and its Chief Financial Officer. The case is captioned In re Commvault Systems, Inc. Securities Litigation (Master File No. 3:14-cv-05628-MAS-LHG). The suit alleges that the Company made materially false and misleading statements, or failed to disclose material facts, regarding the Company's financial results, business, operations and prospects in violation of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder. The suit is purportedly brought on behalf of purchasers of the Company's common stock during the period from May 7, 2013 through April 24, 2014, and seeks compensatory damages, costs and expenses,cash equivalent balances, as well as equitablecash flows provided by our operations.

On April 20, 2023, the Board of Directors (the "Board") approved an increase of the existing share repurchase program so that $250,000 was available. The Board's authorization has no expiration date. For the nine months ended December 31, 2023, we repurchased $133,655 of our common stock, or other relief. Lead plaintiff,approximately 1,932 shares. The remaining amount available under the Arkansas Teachers Retirement System,current authorization as of December 31, 2023 was appointed on January 12, 2015,$122,311.

8. Stock Plans

The following table presents the stock-based compensation expense included in cost of revenues, sales and on March 18, 2015, an amended complaint was filed bymarketing, research and development, general and administrative and restructuring expenses for the plaintiffs. Onthree and nine months ended December 17, 2015, the defendant’s motion31, 2023 and 2022. Stock-based compensation is attributable to dismiss the case was grantedrestricted stock units, performance-based awards and the case dismissed; however, the plaintiffs were permitted to re-file their claim, which they did on February 5, 2016. Defendants filed another motion to dismiss on April 5, 2016, which was denied by the court on September 30, 2016. Thereafter, discovery commenced. On October 2, 2017, the parties entered into an agreement in principle to settle the action for $12,500. The parties signed a stipulation of settlement on November 30, 2017. The settlement remains subject to court approval. The Company has not recorded an accrual for this matter as the settlement amount is to be funded solely by the Company’s insurers. There can be no assurance that the settlement will ultimately be approved or that it will become final. If the settlement does not occur and litigation against the Company continues, the Company believes that it has meritorious defenses and intends to defend the case vigorously. However, due to the inherent uncertainties of litigation, the Company cannot accurately predict the ultimate outcome of this matter if the litigation continues.ESPP.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Nine Months Ended December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenues | | $ | 1,935 | | | $ | 1,383 | | | $ | 5,224 | | | $ | 3,852 | |

| Sales and marketing | | 10,189 | | | 10,479 | | | 29,834 | | | 32,037 | |

| Research and development | | 5,451 | | | 5,988 | | | 16,183 | | | 23,022 | |

| General and administrative | | 7,027 | | | 5,776 | | | 20,700 | | | 19,850 | |

| Restructuring | | — | | | 1,019 | | | — | | | 2,306 | |

| Stock-based compensation expense | | $ | 24,602 | | | $ | 24,645 | | | $ | 71,941 | | | $ | 81,067 | |

On April 12, 2017, a shareholder derivative complaint was filed in the United States District Court for the District of New Jersey against the Company (nominally), certain of its executive officers and certain members of the board of directors. The complaint is entitled Murashko v. Hammer, et al. (Civ. No. 3:17-cv-02533-PGS-TJB). The plaintiff filed an amended complaint on July 14, 2017. The amended complaint largely repeats the allegations made in the securities litigation also pending in the United States District Court for the District of New Jersey (In re Commvault Systems, Inc. Securities Litigation (Master File No. 3:14-cv-05628-PGS-LHG), claiming that the defendant officers and directors breached their fiduciary duties to the Company by causing, or allowing, the Company to manipulate its financial results and conceal the state of its business prospects. The suit also alleges that certain executive officers engaged in unlawful insider trading in 2013 and/or 2014 based on their knowledge of the information that was supposedly concealed. The allegations asserted in the shareholder derivative action purport to cover a period from 2013 through the present. As a derivative action, the complaint does not seek damages from the Company, but rather seeks to recover from the defendant officers and directors on behalf of the Company compensatory damages, restitution, costs and expenses, as well as equitable or other relief. On August 29, 2017, all of the defendants, including the Company, filed a motion to dismiss the derivative action, and a hearing took place on December 18, 2017. On November 30, 2017, a virtually identical shareholder derivative complaint was filed in state court in New Jersey entitled Lee v. Hammer, et al., Civ. 201-17 (N.J. Super. Ct.). The Lee case has been voluntarily stayed by agreement of the parties pending a ruling on the motion to dismiss in the Murashko complaint. Due to the inherent uncertainties of litigation, the Company cannot accurately predict the ultimate outcome of these matters. The Company is unable at this time to determine whether the outcome of the litigations will have a material impact on its results of operations, financial condition or cash flows. As of December 31, 2017,2023, there was $149,391 of unrecognized stock-based compensation expense that is expected to be recognized over a weighted average period of 1.91 years. We account for forfeitures as they occur. To the Company hasextent that awards are forfeited, stock-based compensation will be different from our current estimate.

Stock option activity was not recorded an accrualsignificant for these matters.

On February 27, 2017, Realtime Data LLC d/b/a/ IXO (“Realtime”), a non-practicing entity, suedboth the Company and Spectra Logic Corporation in the Eastern District of Texas for alleged infringement of four patents: U.S. Patent Nos. 9,054,728, 7,415,530, 9,116,908, and 8,717,204. Realtime dismissed the case in Texas and refiled this case in the District of Delaware on July 10, 2017. Realtime has sued numerous other companies for infringement of these and other patents. Realtime seeks monetary damages and an injunction. The Company responded to the complaint by filing a motion to dismiss on the grounds that the patents are directed to patent-ineligible subject matter. The Court has not yet ruled on this motion. Due to the inherent uncertainties of litigation, the Company cannot accurately predict the ultimate outcome of this matter. The Company is unable at this time to determine whether the outcome of the litigation will have a material impact on its results of operations, financial condition or cash flows. The Company intends to defend itself vigorously. As ofnine months ended December 31, 2017,2023 and 2022.

Restricted Stock Units

Restricted stock unit activity for the Company has not recorded an accrual for this matter.nine months ended December 31, 2023 was as follows:

| | | | | | | | | | | |

| Non-vested Restricted Stock Units | Number of

Awards | | Weighted

Average Grant

Date Fair Value |

| Non-vested as of March 31, 2023 | 2,953 | | | $ | 62.52 | |

| Awarded | 1,436 | | | 69.83 | |

| Vested | (1,398) | | | 59.35 | |

| Forfeited | (257) | | | 64.72 | |

| Non-vested as of December 31, 2023 | 2,734 | | | $ | 67.78 | |

The weighted average fair value of restricted stock units awarded was $71.48 and $69.83 per unit during the three and nine months ended December 31, 2023, respectively, and $66.50 and $63.87 per unit during the three and nine months ended December 31, 2022, respectively. The weighted average fair value of awards includes the awards with a market condition described below.

Commvault Systems, IncInc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

7. Revolving Credit Facility

On June 30, 2014, the Company entered into a five-year $250,000 revolving credit facility (the “Credit Facility”). The Credit Facility is available for share repurchases, general corporate purposes, and letters of credit. The Credit Facility contains financial maintenance covenants including a leverage ratio and interest coverage ratio. The Credit Facility also contains certain customary events of default which would permit the lenders to, among other things, declare all loans then outstanding to be immediately due and payable if such default is not cured within applicable grace periods. The Credit Facility also limits the Company's ability to incur certain additional indebtedness, create or permit liens on assets, make acquisitions, make investments, loans or advances, sell or transfer assets, pay dividends or distributions, and engage in certain transactions with foreign affiliates. Outstanding borrowings under the Credit Facility accrue interest at an annual rate equal to London Interbank Offered Rate plus 1.50% subject to increases based on the Company's actual leverage. The unused balance on the Credit Facility is also subject to a 0.25% annual interest charge subject to increases based on the Company's actual leverage. As of December 31, 2017, there were no borrowings under the Credit Facility and the Company was in compliance with all covenants.

The Company has deferred the expense related to debt issuance costs, which are classified as Other assets, and will amortize the costs into Interest expense over the term of the Credit Facility. Unamortized amounts at December 31, 2017 were $379. The amortization of debt issuance costs was $63 and $189 in the three and nine months ended December 31, 2017 and 2016.

8. Capitalization

During the nine months ended December 31, 2017, the company repurchased $91,309 of common stock (1,691 shares).

Subsequent Event

On January 17, 2018, the Board of Directors extended the expiration date of the share repurchase program to March 31, 2019 and authorized a $100,000 increase to the existing share repurchase program so that $133,749 is now available.

9. Stock Plans

On August 24, 2017, the Company’s shareholders approved an amendment to the Omnibus Incentive Plan (the “2016 Incentive Plan”) to increase the maximum number of shares of common stock that may be delivered under plan to 3,550. The 2016 Incentive Plan authorizes a broad range of awards including stock options, stock appreciation rights, full value awards (including restricted stock, restricted stock units, performance shares or units and other stock-based awards) and cash-based awards.

The following table presents the stock-based compensation expense included in Cost of services revenue, Sales and marketing, Research and development and General and administrative expenses for the three and nine months ended December 31, 2017 and 2016. Stock-based compensation is attributable to stock options, restricted stock units, performance based awards and the employee stock purchase plan.

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Nine Months Ended December 31, |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| Cost of services revenue | | $ | 846 |

| | $ | 1,060 |

| | $ | 2,348 |

| | $ | 2,895 |

|

| Sales and marketing | | 9,464 |

| | 9,100 |

| | 27,888 |

| | 25,061 |

|

| Research and development | | 2,170 |

| | 1,924 |

| | 6,310 |

| | 5,372 |

|

| General and administrative | | 5,273 |

| | 7,026 |

| | 20,592 |

| | 21,825 |

|

| Stock-based compensation expense | | $ | 17,753 |

| | $ | 19,110 |

| | $ | 57,138 |

| | $ | 55,153 |

|

As of December 31, 2017, there was approximately $103,468 of unrecognized stock-based compensation expense related to non-vested stock option and restricted stock unit awards that is expected to be recognized over a weighted average period of 1.21 years. The Company accounts for forfeitures as they occur. To the extent that awards are forfeitured, stock-based compensation will be different from the Company’s current estimate.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Stock Options

Stock Option activity for the nine months ended December 31, 2017 is as follows:

|

| | | | | | | | | | | | | |

| Options | | Number of Options | | Weighted- Average Exercise Price | | Weighted- Average Remaining Contractual Term (Years) | | Aggregate Intrinsic Value |

| Outstanding as of March 31, 2017 | | 5,300 |

| | $ | 44.74 |

| |

| |

|

| Options granted | | — |

| | — |

| |

| |

|

| Options exercised | | (442 | ) | | 29.27 |

| |

| |

|

| Options forfeited | | (20 | ) | | 43.40 |

| |

| |

|

| Options expired | | (25 | ) | | 68.85 |

| |

| |

|

| Outstanding as of December 31, 2017 | | 4,813 |

| | $ | 46.04 |

| | 4.13 | | $ | 66,006 |

|

| Exercisable as of December 31, 2017 | | 4,554 |

| | $ | 46.09 |

| | 3.97 | | $ | 64,086 |

|

The total intrinsic value of options exercised was $1,194 and $12,819 for the three and nine months ended December 31, 2017 and $2,101 and $6,540 for the three and nine months ended December 31, 2016. The Company’s policy is to issue new shares upon exercise of options as the Company does not hold shares in treasury.

Restricted Stock Units

Restricted stock unit activity for the nine months ended December 31, 2017 is as follows:

|

| | | | | | |

| Non-vested Restricted Stock Units | Number of

Awards | | Weighted

Average Grant

Date Fair Value |

| Non-vested as of March 31, 2017 | 2,396 |

| | $ | 45.53 |

|

| Awarded | 1,191 |

| | 59.91 |

|

| Vested | (1,108 | ) | | 58.32 |

|

| Forfeited | (90 | ) | | 46.69 |

|

| Non-vested as of December 31, 2017 | 2,389 |

| | $ | 51.24 |

|

The weighted average fair value of restricted stock units awarded was $59.84 and $59.91 per unit during the three and nine months ended December 31, 2017, and $53.16 and $50.55 per unit during the three and nine months ended December 31, 2016. The weighted average fair value of awards includes the awards with a market condition described below.

Performance Based Awards

In the nine months ended December 31, 2017, the Company2023, we granted 107120 performance restricted stock units ("PSU"PSUs") to certain executives. Vesting of these awards is contingent upon i) the Companyus meeting certain company-wide revenue and non-GAAP performance goals (performance-based) in fiscal 20172024 and ii) the Company'sour customary service periods. The awards vest over three years and have a maximumthe potential to vest atbetween 0% and 200% (214(240 shares) based on actual fiscal 20182024 performance. The vesting quantity of these awards may vary based on actual fiscal 2024 performance. The related stock-based compensation expense is determined based on the value of the underlying shares on the date of grant and is recognized over the vesting term using the accelerated method. During the interim financial periods, management estimates the probable number of PSU’sPSUs that would vest until the ultimate achievement of the performance goals is known. The awards are included in the restricted stock unit table.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Awards with a Market Condition

In the nine months ended December 31, 2017, the Company2023, we granted 88120 market performance stock unitsPSUs to certain executives. The vesting of these awards is contingent upon the Companyus meeting certain total shareholder return ("TSR") levels as compared to athe Russell 3000 market index over the next three years. The awards vest in three annual tranches and have a maximumthe potential to vest atbetween 0% and 200% (176(240 shares) based on TSR performance. The related stock-based compensation expense is determined based on the estimated fair value of the underlying shares on the date of grant and is recognized using the accelerated method over the vesting term. The estimated fair value was calculated using a Monte Carlo simulation model. The fair value of the awards granted during the nine months ended December 31, 20172023 was $78.28.$87.90 per unit. The awards are included in the restricted stock unit table.

Employee Stock Purchase Plan

The Employee Stock Purchase Plan (the “Purchase Plan”)ESPP is a shareholder approved plan under which substantially all employees may purchase the Company’sour common stock through payroll deductions at a price equal to 85% of the lower of the fair market values of the stock as of the beginning or the end of the six-month offering periods. An employee’s payroll deductions under the Purchase PlanESPP are limited to 10% of the employee’s salary and employees may not purchase more than $25 of stock during any calendar year. AsEmployees purchased 96 shares in exchange for $5,164 of proceeds in the nine months ended December 31, 2017, 2,2902023, and 107 shares were reservedin exchange for future issuance under$5,418 of proceeds in the Purchase Plan.nine months ended December 31, 2022. The Purchase PlanESPP is considered compensatory and the fair value of the discount and look back provision are estimated using the Black-Scholes formula and recognized over the six monthsix-month withholding period prior to purchase. The total expense associated with the Purchase PlanESPP for the nine months ended December 31, 2023 and 2022 was $722$2,391 and $2,097 for$2,847, respectively. As of December 31, 2023, there was approximately $364 of unrecognized cost related to the current offering period of our ESPP.

9. Income Taxes

Income tax expense was $5,176 and $17,772 in the three and nine months ended December 31, 20172023, respectively, compared to expense of $5,710 and $632 and $1,966 for$14,550 in the three and nine months ended December 31, 2016.

10. Income Taxes

Income tax expense was $55,282 in the nine months ended December 31, 2017 compared to an expense of $836 in the nine months ended December 31, 2016.2022, respectively. The fiscal year-to-date increase in income tax expense was primarily the result of the combined impact of the lower U.S. corporate income tax rate on net deferred tax assets and recording a full valuation allowance against the remaining value of net deferred tax assets.

Impact of U.S. Tax Reform

The Tax Cuts and Jobs Act (the "Act") was enacted on December 22, 2017. The Act reduces the US federal corporate tax rate from 35% to 21%, requires companies to pay a one-time transition tax on earnings of certain foreign subsidiaries that were previously tax deferred and creates new taxes on certain foreign sourced earnings. As of December 31, 2017, the Company has not completed the accounting for the tax effects of enactment of the Act; however, as described below, it has made a reasonable estimate of the effects on existing deferred tax balances. These amounts are provisional and subject to change. The most significant impact of the legislation for the Company was a $24,300 reduction of the value of the Company's net deferred tax assets (which represent future tax benefits) as a result of lowering the U.S. corporate income tax rate from 35% to 21%. The Act also includes a requirement to pay a one-time transition tax on the cumulative value of earnings and profits that were previously not repatriated for U.S. income tax purposes. The Company has not made sufficient progress on the transition tax analysis to reasonably estimate the effects, and therefore, has not recorded provisional amounts. However, based on analysis to date the one-time transition tax is not expected to be material. No additional income taxes have been provided for any remaining undistributed foreign earnings not subjectcompared to the transition tax, or any additional outside basis difference inherent in these entities, as these amounts continueprior year relates primarily to be indefinitely reinvested in foreign operations.

Valuation Allowance

Net deferred tax assets arise due tocurrent federal and state taxes driven by the recognition of income and expense items for tax purposes, which differ from those used for financial statement purposes. ASC 740, Income Taxes, provides for the recognition of deferred tax assets if realization of such assets is more likely than not. In assessing the need for a valuation allowance in the third quarter of fiscal 2018, the Company considered all available objective and verifiable evidence both positive and negative, including historical levelsincrease of pre-tax income (loss) both on a consolidated basis and tax reporting entity basis, legislative developments, expectations and risks associated with estimates of future pre-tax income, and prudent and feasible tax planning strategies. The Company currently estimates that as of March 31, 2018 bothrelative to the consolidated entity and its U.S. entity will have generated a cumulative three year pre-tax loss. As a result of this analysis,same period in the Company determinedprior year. We believe that it is more likely than not that itwe will not realize the benefits of itsour gross deferred tax assets and therefore has recordedcontinue to record a valuation allowance to reduce the carrying value of these gross deferred tax assets, net of the impact of the reversal of taxable temporary differences, to zero.zero as of December 31, 2023.

Commvault Systems, IncInc.

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

10. Revolving Credit Facility

Other Tax Items

On December 13, 2021, we entered into a five-year $100,000 senior secured revolving credit facility (the “Credit Facility”) with JPMorgan Chase Bank, N.A. The Company conducts business globallyCredit Facility is available for share repurchases, general corporate purposes, and asletters of credit. The Credit Facility contains financial maintenance covenants, including a result, files income tax returnsleverage ratio and interest coverage ratio. The Credit Facility also contains certain customary events of default which would permit the lender to, among other things, declare all loans then outstanding to be immediately due and payable if such default is not cured within applicable grace periods. The Credit Facility also limits our ability to incur certain additional indebtedness, create or permit liens on assets, make acquisitions, make investments, loans or advances, sell or transfer assets, pay dividends or distributions, and engage in certain transactions with foreign affiliates. Outstanding borrowings under the United States and in various state and foreign jurisdictions. InCredit Facility accrue interest at an annual rate equal to the normal course of business, the Company isSecured Overnight Financing Rate plus 1.25% subject to examination by taxing authorities throughoutincreases based on our actual leverage. The unused balance on the world, including such major jurisdictions as the United States, Australia, Canada, Germany, Netherlands and United Kingdom. The yearsCredit Facility is also subject to income tax examination in the Company’s foreign jurisdictions cover the maximum time period with respect to these jurisdictions. Due to net operating loss ("NOL") carryforwards, in some cases the tax years continue to remaina 0.25% annual interest charge subject to examinationincreases based on our actual leverage. As of December 31, 2023, there were no borrowings under the Credit Facility and we were in compliance with respectall covenants.

We have deferred the expense related to such NOLs.debt issuance costs, which are classified as other assets, and will amortize the costs into interest expense over the term of the Credit Facility. Unamortized amounts at December 31, 2023 were $341. The amortization of debt issuance costs and interest expense incurred was $92 and $93 for the three months ended December 31, 2023 and 2022, respectively, and $277 and $278 for the nine months ended December 31, 2023 and 2022, respectively.

Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis along with our consolidated financial statements and the related notes included elsewhere in this quarterly reportQuarterly Report on Form 10-Q. The statements in this discussion regarding our expectations of our future performance, liquidity and capital resources, and other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, changes in demand as well as the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2017.2023. Our actual results may differ materially from those contained in or implied by any forward-looking statements.

Overview

Commvault is a provider of data and information management software applications and related services. Commvault was incorporatedIncorporated in Delaware in 1996, as a Delaware corporation. The Commvault software platform is an enterprise level, integrated data and information management solution, built from the ground up on a single platform and unified code base. All software functionality share the same back-end technologies to deliver the benefits of a holistic approach to protecting, managing, and accessing data. The software addresses many aspects of data management in the enterprise, while providing scalability and control of data and information. In fiscal 2018, we also started selling appliances that integrate the our software with hardware and address a wide-range of business needs and use cases, ranging from support for remote or branch offices with limited IT staff up to large corporate data centers. We also provide ourSystems, Inc. provides its customers with a broad range of professionalcyber resiliency platform that helps them secure, defend and recover their most precious asset, their data. We provide these products and services thatfor their data across the following environments: on-premises, hybrid and multi-cloud. Our cyber resiliency offerings are delivered via self-managed software, SaaS, integrated appliances, or managed by partners. Customers use our worldwide supporttechnology to protect themselves from threats like ransomware and field operations. Asrecover their data efficiently.

Sources of December 31, 2017, we had licensed our software applications to over 26,000 registered customers.Revenues

OurWe generate revenues through subscription arrangements, perpetual software licenses, typically provide for a perpetual right to use our softwarecustomer support contracts and are sold on a per terabyte capacity basis, per-copy, as site licenses or as a solution set. Prior to fiscal 2018, an insignificant amountother services. A significant portion of our total revenues comes from subscription arrangements, which include both sales of term-based licenses and SaaS offerings. We are focused on these types of recurring revenue has beenarrangements.

We expect our subscription arrangements will continue to generate revenues from the renewals of term-based licenses and SaaS offerings sold underin prior years. Any of our pricing models (capacity, instance based, etc.) can be sold via a subscription arrangement, either through term-based licensing or term based,hosted services. In term-based license arrangements. In these arrangements, the customer has the right to use the software over a designated period of time. During fiscal 2018, we expect revenue from subscription arrangements to become a more significant portionThe capacity of our total revenue compared to historical periods.

In recent years, the majority of our softwarelicense is fixed and products have been sold on a capacity basis and we expect this to remain true in the near future. During the nine months ended December 31, 2017, approximately 67% of software and product revenue was sold on a capacity basis. This compares to approximately 69% of software and products revenue was sold on a capacity basis during fiscal 2017. Software licenses sold on a capacity basis provide the customer with unlimited licenses of specified software products based on a defined level of terabytes of data under management. As a result,has made an unconditional commitment to pay. Software revenue in these arrangements is generally recognized when we sell our platform through a capacity license, certain of the various functionalities discussed below are bundled into one capacity based price. Site licenses give the customer the additional right to deploy the software on a limited basis during a specified term.

Our solution sets are generally sold on a per unit basis such as per virtual machine for our virtual machine backup, recovery and cloud management solution set; per mailbox for our email archive solution set, and per user for our endpoint data protection solution set. These solution sets are purpose-builtis delivered. In SaaS offerings, designed to accelerate private, public and hybrid cloud adoption that seamlessly integrate with our single platform software, offering a path towards holistic data management while allowing customers to utilize functionality that addressesrevenue is recognized ratably over the point solution requirements their business dictates. We primarily sell solution sets for virtual machine backup, recovery and cloud management; endpoint data protection; and email archive.

The industry in which we currently operate continues to go through accelerating changes as the result of compounding data growth and the introduction of new technologies. We remain focused on both the data and information management trends in the marketplace and, in fact, a material portion of our existing research and development expenses are utilized toward the development of such new technologies. While we are confident in our ability to meet these changing industry demands with our Commvault suite and potential future releases, the development, release and timing of any features or functionality remain at our sole discretion and our solutions or other technologies may not be widely adopted.

Given the nature of the industry in which we operate, our software applications are subject to obsolescence. We continually develop and introduce updates to our existing software applications in order to keep pace with evolving industry technologies. In addition, we must address evolving industry standards, changing customer requirements and competitive software applications that may render our existing software applications obsolete. For each of our software applications, we provide full support for the current generally available release and one prior release. When we declare a product release obsolete, a customer notice is delivered twelve months prior to the effective date of obsolescence announcing continuation of full product support for the first six months. We provide an additional six months of extended assistance support in which we only provide existing workarounds or fixes that do not require additional development activity. We do not have existing plans to make any of our software products permanently obsolete.

Sources of Revenuescontract period.

We derive a significant portion of our total revenues from sales of licenses of our software applications and products. We do not customize our software for a specific end-user customer. We sell our software applications and products to end-user customers both directly through our sales force and indirectly through our global network of value-added reseller partners, systems integrators, corporate resellers and original equipment manufacturers. Our software and productsSubscription revenue was 44%generated through indirect distribution channels accounted for approximately 90% of our total revenues forsubscription revenue in both the nine months ended December 31, 20172023 and 2016.

In recent fiscal periods, we have2022. Subscription revenue generated through direct distribution channels accounted for approximately three-quarters10% of our software and products revenue from our existing customer base and approximately one-quarter of our software and products revenue from new customers. In addition, our total software and productssubscription revenue in any particular period is, to a certain extent, dependent upon our ability to generate revenues from large customer software and products deals, which we refer to as enterprise transactions. Enterprise transactions (transactions greater than $0.1 million) represented approximately 59% and 55% of our total software and products revenue inboth the nine months ended December 31, 20172023 and 2016, respectively.